In the 4th Quarter of 2022, even while mortgage rates were peaking at over 7%, and people were busy enjoying the holidays… about 3 to 3.5 homes per day SOLD in Huntington Beach.

The New Year has arrived, and people will begin putting homes on the market for potential buyers to consider. Just like last year, the pace of home sales will increase as we head into the late winter and spring.

Spring of 2022 was the peak of the market in Huntington Beach. The peak prices were the result of “once-in-a-lifetime” pandemic subsidized mortgage rates in the 2.75-3.0% range. The Average price per square foot hit $795 and average sale price reached $1,776,000. Buyers paid more for homes because they could… but now they cannot (because mortgage rates have more than doubled).

Today is a good time to put your home on the market because it will still sell for ridiculously more than it would have before the pandemic.

Just know the “panic buy” is over. Your home is not going to bring the “same price as that home” which sold in your neighborhood a year ago which you labeled “crazy” at the time.

If you are having thoughts of selling, let’s talk. I can help you get to where you want to go.

www.HBneighborhoodNews.com

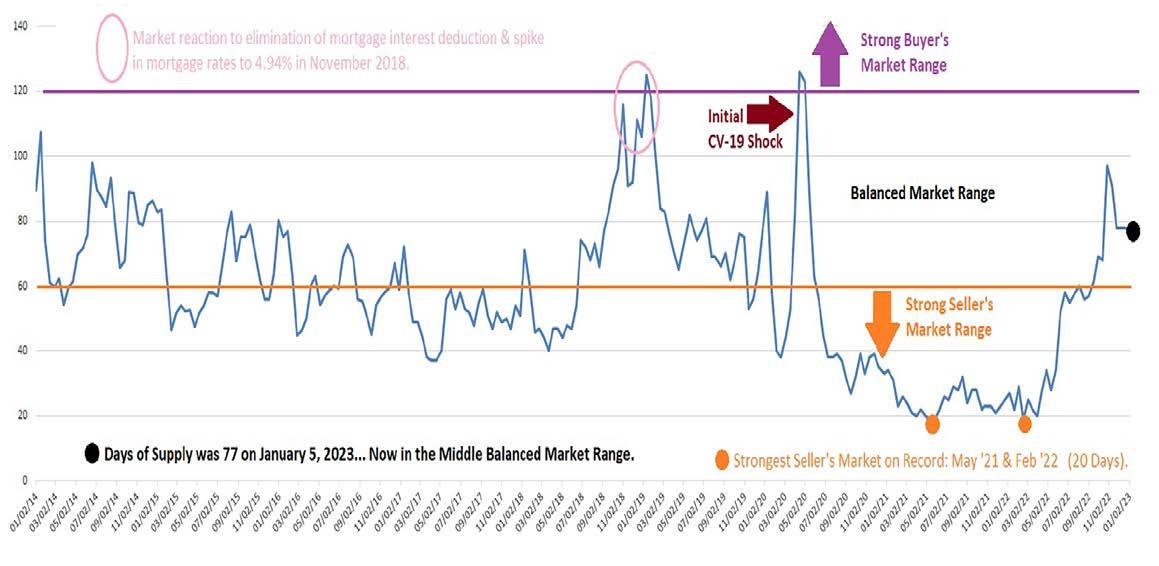

The “Days of Supply” is the best indicator of market conditions. It is defined as the number of days to sell all homes on the market at the present rate of home sales.

The Days of Supply reading jumped from a record low of 20 days in February 2022 up to a peak of 97 days on October 27th 2022 indicating a rapid shift from strong “Seller’s Market” conditions to a level approaching a “Buyers Market” as mortgage rates spiked to 7.08% in October 2022. The level has since dropped back to 77 on January 5, 2023 indicating “Balanced Market Conditions” as we started 2023.

The below Days of Supply graph illustrates market conditions over the last eight years. In pink, the reaction to rising mortgage rates and the elimination of the mortgage interest deduction can be seen in Q4 2018 and Q1 2019. The immediate “CV-19 Shock” is visible in April-May 2020…followed by the Strongest Seller’s Market conditions ever seen due to once-in-a-lifetime low mortgage rates. Expect to see Days of Supply to remain in the balanced market range in 2023 as decreasing inflation allows mortgage rates to fall.

• Professional Photographer with years of experience

• High Dynamic Range Enhancement for all Still Photos

• Dramatic Aerials captured with 4K drone camera

• Lifelike Walk-Thru 3D Tour with “Live Scot” option & upgrade links

• Detailed 2D Floorplan Drawing to illustrate the layout of the home

• YouTube Video with an assortment of “moving still” photographs

Coastal Orange County is a desirable second home destination for international buyers and others who live in Los Angeles County, Nevada, Arizona, and Northern California.

Many of the prospective purchasers in today’s market live outside of the immediate area or they are frequently traveling. And, there are many potential buyers who are very busy in their day-to-day even though they live nearby.

The home at 17931 Wellbank Lane shows how a powerful listing image package can produce the results that seller’s want most: “A quick, full price sale… with a nice smooth escrow”.

The image package was available for the property the moment it was published in the Realtor MLS. Immediately buyers & agents began viewing the imagery and requesting appointments. There were 159 “views” of the walk-through 3D tour, and 20 “in person” showings to qualified buyers.

The seller received multiple written bids, and selected a full price cash offer. The escrow was smooth, and all parties were very pleased with the outcome.

Whether out of area or just very busy… buyers get excited when one of Scot Campbell’s listings meets their needs.

They can see the general layout thanks to the 2D Floorplan, the Aerial Drone Photos illustrate the location, and the HDRI Enhanced Still photos & walkthrough 3D tour allow buyers to immerse themselves in the experience offered by the home.

Buyers can decide quickly if it would be “worth while” to schedule an “in person” viewing, and then either make the drive or book their flight to see the property. These extra showing count because it takes just one “good buyer” to sell a home… and, if a buyer takes time from their busy schedule to see a home, often there is a good chance for a sale.

Clearly, there is a difference when you list your home… choose Scot Campbell and get all the showings your property deserves!

To see more of Scot’s Listings with HDRi Photography, 3D Tour, & 2D Floorplans

Visit: www.MyCurrentListings.com

January 9, 2023 – Source: Steven

Thomas/Reports on HousingDays of Supply (the number of days to sell all Orange County listings at the current buying pace) increased from 76 to 84 days in the past couple of weeks. But, it remains in the “Balance Market Range”

• Last year the Expected Market Time was at 25 days… the “panic buy was on”.

• The 3-year average prior to COVID was 104 days, a slightly slower pace compared to today.

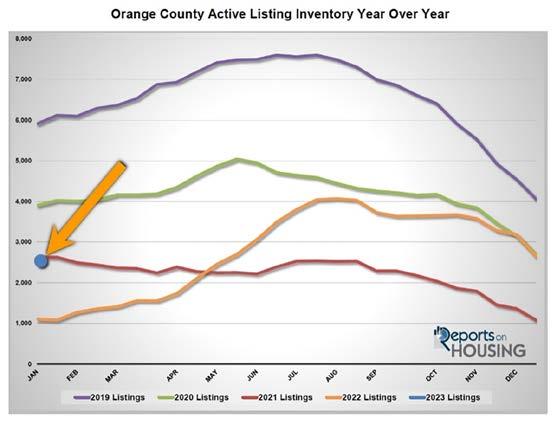

Active Listing Inventory in the past couple of weeks decreased by 112 homes, down 4%, and now sits at 2,530 homes. Typically, In January the number of homes listed doubles from December. It remains elevated in February and then ramps up again from March through July with May being the peak for new listings. This year will likely be no different.

• Last year, the inventory was at 1,100, 57% lower, or 1,430 fewer.

• The 3-year average prior to COVID (2017 to 2019) is 4,506, an extra 1,976 homes, or 78% more. There were a lot more choices back then.

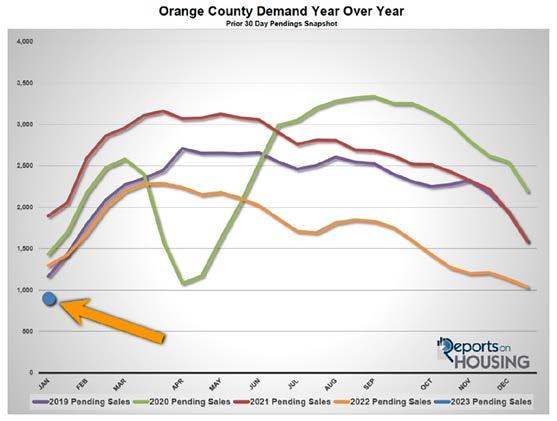

Demand the number of pending sales decreased from 1,038 to 900 in the past couple of weeks, down 13%. This low demand reading is due to the combination of bad weather, high mortgage rates, and very few homes available on the market. As more homes come on the market, expect demand levels to climb. It will dramatically improve over the course of the next two months and will continue to climb until peaking in late spring.

• Last year, demand was at 1,295, 44% more than today, or an extra 395.

• The 3-year average prior to COVID (2017 to 2019) was at 1,349 pending sales, 50% more than today, or an extra 49. Inflation has been falling, and as rates fall below 6%, the demand for homes will improve. There is plenty of latent demand… buyers who want to purchase. The lower rates go, the more demand will recover.

January 12, 2023

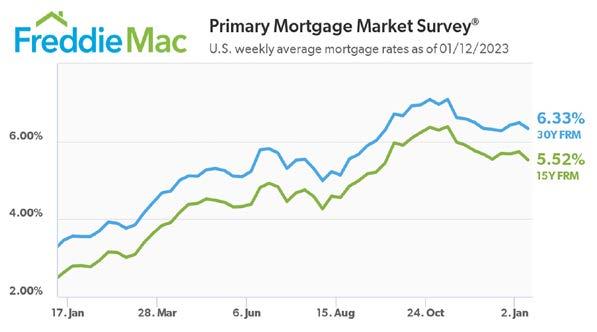

While mortgage rates have resumed their decline, the market remains hypersensitive to rate movements, with purchase demand experiencing large swings relative to small changes in rates.

Over the last few weeks latent demand has been on display with buyers jumping in and out of the market as rates move.

SOLD for $1,550,000 with Seller Financing

3.95% Interest Rate | 15-Year Amortization

48% Down | Balloon Payment End of Year 5

Attached | 3 BR | 2.5 BA | 2266 SqFt | Built 1980

Problem: The seller of this Downtown Huntington Beach rental property owned it for over 30 years and was no longer interested in being a landlord. The basis was extremely low, so a standard sale with pr oceeds received at closing would have resulted in a very big capital gain tax liability. However, he did not know a safer place to invest (secure) the funds than the property itself

Solution: The seller sold the property using an installment sale. With a $750,000 down payment received from the buyer. The seller was able to pay off the existing mortgage and capital gains taxes due, plus he put cash in the bank for a rainy day.

The principal & interest payments received over the next five years spreads out the taxable gain, which offers a nice income to supplement retirement and lowers the tax rate on the funds. Until the loan is paid off, the seller earns interest on money which would have been paid in taxes at year one… this effectively boosts the seller’s yield well above the interest rate being paid by banks.

Safe & Secure: What investment is more comfortable than holding a mortgage on a house in Huntington Beach with 48% down payment, highly qualified buyer, and fully documented loan which meets government standards?

COLDWELL BANKER Campbell Realtors

1720 Pacific Coast Hwy, Suite 101 Huntington Beach, CA 92648

Read Monthly HB Market Report at: www.HowisTheHBmarket.com

In addition to Neighborhood News & Market Reports, you can now search all current listings in the Realtor MLS for most areas of Southern California.

For your convenience, I created listings by neighborhood in the “For Sale in HB Menu”. You are one click away from seeing what is for sale in several Huntington Beach areas: Downtown Huntington Beach, Seacliff, Edwards Hill, Huntington Harbour, Brightwater, Surfside/Sunset Beach, Beachwalk, Summerlane, Pacific Ranch, The Waterfront, Bolsa Landmark, Pacific Shores, Huntington Court/Place, Meredith Gardens, & Huntington Landmark (Age 55+).

In the OC Homes menu, there are saved “Lifestyle Category” listing searches including: Homes with Boat Docks, Golf Course View, On-the-Sand, Horse Property, Single Stories, Homes with Pools, Starter Homes, New Construction, and more!

It has never been easier to get the real estate information you want, take a look at www.ScotCampbell.com

Local Postal Customers

Local Postal Customers