April 2023 FCC: 2023 FOOD MANUFACTURING MARGINS UNDER PRESSURE meatbusinesspro.com $7.99 THE BEEF, PORK & POULTRY INDUSTRY DIGITAL MAGAZINE Canada Gains Access to Japanese Beef Market Eggflation: What Happens After Egg Prices Reach Historic Highs CCA: Canada Fails to Met Beef Industry Needs with CPTPP Deal CMC: Discouraged by Access for Meat Products in Latest CPTPP Deal Shake Shack Expanding into Canada in 2024 Agriculture in the 2023 Federal Budget

https://www.yesgroup.ca

2 MEATBUSINESSPRO April 2023 meatbusinesspro.com

April 2023

5 6 8 12 16

Vlad and Dad Team Up with A&W

Canada Gains Access to Japanese Beef Market

FCC: 2023 Food Manufacturing Margins Under Pressure

Eggflation: What Happens After Egg Prices Reach Historic Highs

17 18 20 22

CCA: Canada Fails to Meet Beef Industry Needs with CPTPP Deal

Shake Shack Expanding into Canada in 2024

Sustainable Canadian Agricultural Partnership launched April 1

Producers Increasingly Confident in Use of Digital Data

Agriculture in the 2023 Federal Budget

https://www.yesgroup.ca

INDUSTRY DIGITAL MAGAZINE

April 2023

PUBLISHER

Ray Blumenfeld ray@meatbusiness.ca

MANAGING EDITOR

Scott Taylor publishing@meatbusiness.ca

DIGITAL MEDIA EDITOR

Cam Patterson cam@meatbusiness.ca

CONTRIBUTING WRITERS

Patterson,

CREATIVE DIRECTOR Patrick Cairns

Meat Business Pro is published 12 times a year by We Communications West Inc

VLAD AND DAD TEAM UP WITH A&W

We Communications West Inc. 106-530 Kenaston Boulevard Winnipeg, MB, Canada R3N 1Z4

Phone: 204.985.9502 Fax: 204.582.9800

Toll Free: 1.800.344.7055

E-mail: publishing@meatbusiness.ca

Website: www.meatbusinesspro.com

Meat Business Pro subscriptions are available for $28.00/year or $46.00/two years and includes the annual Buyers Guide issue.

©2020 We Communications West Inc. All rights reserved.

The contents of this publication may not be reproduced by any means in whole or in part, without prior written consent from the publisher. Printed in Canada. ISSN 1715-6726

As A&W's most loaded burger ever, the Ringer Burger comes topped with A&W's famous onion rings, a delicious grass-fed beef patty, smoky BBQ sauce, bacon and provolone cheese, as well as fresh red onion, lettuce, tomato and pickle.

The Ringer Burger is also available as a two-patty Ringer Papa Burger®, making the father-son collaboration even more fitting.

"When I started at A&W, I wanted to create a burger that incorporates our onion rings with a dreamy BBQ sauce that would knock it out of the park," says Karan Suri, A&W Canada's Director of Menu Development. "We have been working on creating a smoky, spicy, sweet and lip smacking BBQ sauce for a couple years now. This partnership with the Blue Jays felt like the perfect moment to offer this dream burger. Paired with smoky BBQ sauce, bacon and provolone cheese, the Ringer burger is crowned with our signature onion rings for the ultimate crunch".

Blue Jays fans can enjoy the taste of the Ringer Burger while cheering on Canada's MLB team as the Ringer Burger drops at A&W locations across Canada starting in April, in time for the start of the new MLB season.

For more information, visit aw.ca.

5 meatbusinesspro.com April 2023 MEATBUSINESSPRO

A&W Canada has teamed up with the legendary baseball father-son duo: Blue Jays', Vladimir Guerrero Jr., and his father, Vladimir Guerrero Sr., MLB Hall of Famer to announce the new Ringer Burger

Volume

Number 4

24

W

CO MMUNICATIONS

EST IN C

THE BEEF, PORK & POULTRY

Cam

Scott Taylor, Taylor Brown, Nan-Dirk Mulder, Kyle Burak

CANADA GAINS ACCESS TO JAPANESE BEEF MARKET

It was announced in late March that for the first time in two decades, Japan is reopening its doors to Canadian processed beef.

This accomplishment ushers in a new era for Canada and its second-largest market for beef and beef products: expanding market access for Canadian exporters -- while also benefiting Japanese consumers who will have greater access to Canada's high-quality beef products.

Nathan Phinney, President of the Canadian Cattle Association stated, "Cattle producers are grateful for the removal of trade barriers for processed beef in Japan, our second-largest export market for beef. Our industry will continue to support global food security by providing some of the most sustainable and highest quality beef in the world. We look forward to continuing to work with the Government of Canada to further remove remaining trade barriers and expanding our trade capacity in the Indo-Pacific region."

The development also removes the last restrictions on Canadian beef that Japan put in place in 2003, after the discovery of a case of bovine spongiform encephalopathy (BSE) in Alberta.

Under the new Indo-Pacific Strategy, the Government committed to seizing economic opportunities for Canada by strengthening its regional partnerships, including with Japan. The Canadian Food Inspection Agency, with the support of Agriculture and Agrifood Canada, has worked tirelessly over the past few years to assert the highest production standards and quality assurance of Canadian beef in order to reopen full access in key markets, like Japan.

Japan is an important market for Canada and the world. In 2022, the Japanese market for Canadian beef and beef products had an estimated value of $518 million, largely due to Canada's preferential access under the Comprehensive and Progressive Agreement for TransPacific Partnership (CPTPP).

6 MEATBUSINESSPRO April 2023 meatbusinesspro.com

"The Canadian Meat Council is very pleased to see this expansion of our beef access to Japan. Our members view this as a critical market for their products, including processed beef and beef patties. This agreement will allow our industry to further build on the recent successes they have enjoyed in Japan since the CPTPP was ratified. Thank you to Ministers Bibeau and Ng, and the hard work done by CFIA to achieve this new opportunity,” said Christopher White, President and CEO of the Canadian Meat Council.

This expanded market access opportunity follows another loosening of restrictions in 2019, when Japan approved imports of Canadian beef from cattle older than 30 months.

• Japan is Canada's third-largest market for agriculture and food.

• Under CPTPP, Japan's 38.5% tariff on beef imports (including primary processed products like ground beef patties) will decrease to 23.35% by April 1, 2023, and will go down to 9% by 2033. Tariffs on further processed beef products will be reduced even more and in some cases – eliminated altogether. This change provides Canadian exporters with a clear tariff advantage over our key competitors.

• According to Statistics Canada, the total value of Canadian beef exports to all countries in 2022 was over $4.6 billion.

7 meatbusinesspro.com April 2023 MEATBUSINESSPRO

VEMAG REPLACEMENT PARTS https://www.dhenryandsons.com

QUICK FACTS

FCC: 2023 FOOD MANUFACTURING MARGINS UNDER PRESSURE

By Kyle Burak, Farm Credit Canada Senior Economist

By Kyle Burak, Farm Credit Canada Senior Economist

The annual FCC Food and Beverage Report reviews last year’s economic environment and highlights opportunities and risks for Canadian food and beverage manufacturers for 2023. It includes projections of annual industry sales and new gross margin index forecasts by sector.

INDUSTRIES FEATURED IN THE REPORT ARE:

• Grain and oilseed milling

• Sugar and confectionery products

• Fruit, vegetable preserving and specialty food

• Dairy products

• Meat products

• Seafood preparation

• Bakery and tortilla products

• Soft drinks and alcoholic beverages

KEY TAKEAWAYS

Inflationary pressures hit the Canadian economy in 2022, and the food sector was not immune to their effects. Significant increases in commodity prices amid pressures on supply chains and labour shortages led to higher input costs and wage increases. In response to inflation, the Bank of Canada raised its benchmark interest rate numerous times, applying further pressures on profit margins in 2023; many of these challenges persist while demand challenges emerge. Here are three key observations from this year’s report.

SALES GROWTH WAS STRONG IN 2022; PROJECTED TO GROW MODESTLY IN 2023

Food and beverage manufacturing sales rose 10.6% to $156 billion in 2022 (Figure 1). Growth largely resulted from selling price inflation in the face of higher costs, but we did see healthy volume trends in certain industries. Meat product sales growth is estimated to have come primarily from higher foodservice volumes. Baked goods were one of the only categories to see volume growth at the grocery store despite elevated retail prices.

8 MEATBUSINESSPRO April 2023 meatbusinesspro.com

Sales growth decelerated in Q4 2022, with several categories reporting sales declines YoY in December. This deterioration in growth is injecting uncertainty into our projections. FCC Economics forecasts food manufacturing sales to increase 2.2% YoY in 2023 to $160B. Any rebound in the deceleration observed at the end of 2022 could lift these projections. We expect the larger industries covered in this report, like grain and oilseed milling and meat product manufacturing, to outperform, while animal food, plant-based protein products, seasonings/dressings and snack products (not covered) to record declines.

FOOD AND BEVERAGE MANUFACTURING SALES INCREASED

OVER 10% IN 2022

MARGINS HAVE DETERIORATED IN THE FACE OF HIGHER INPUT AND LABOUR COSTS

Higher costs pressured food and beverage manufacturing margins. Gross margins as a percent of sales fell to their lowest level in over 20 years in 2022

Manufacturers have always struggled to pass on higher costs in 2022. FCC Economics is forecasting gross margins to improve slightly in 2023. Important to note that trends in margins differ widely across different industries.

GROSS MARGINS DECLINED TO RECORD LOWS IN 2022; THEY’RE FORECASTED TO SEE SMALL GAINS IN 2023

Continued on page 10

https://www.yesgroup.

9 meatbusinesspro.com April 2023 MEATBUSINESSPRO

FOOD IMPORTS GAINED MARKET SHARE IN CANADA IN 2022

As the year progressed, higher food prices and declining savings led consumers to cut back on discretionary spending. This meant fewer purchases of premiumpriced foods, including smaller-batch and locally-made foods for which manufacturers couldn’t lower costs and control prices. Consumption of Canadian-made food in 2022 (measured in dollars relative to total consumption) reverted to the trend observed before the pandemic. A larger percentage of food dollars spent in Canada was allocated toward imported foods (Figure 3). Several economic and demographic factors dictated an opportunity for domestic food manufacturers. FCC Economics estimates that, had Canadian manufacturers been able to meet the same level of domestic demand as in 2021, total sales would have been over $2.3 billion higher in 2022.

BOTTOM LINE: LET’S NOT LOSE SIGHT OF OPPORTUNITIES

Despite these recent challenges and weaker margins, the food and beverage manufacturing sector remains healthy and has a positive long-term outlook. We are seeing promising innovations and technology implemented in food manufacturing plants, and global demand for Canadian-produced food is growing rapidly. Canada is uniquely positioned to expand its reach into new, growing and very profitable food industries.

10 MEATBUSINESSPRO April 2023 meatbusinesspro.com

CANADIANS CONSUMED MORE IMPORTED MANUFACTURED FOOD IN 2022

https://www.beaconmetals.com

EGGFLATION: WHAT HAPPENS AFTER EGG PRICES REACH HISTORIC HIGHS

By Nan-Dirk Mulder, Senior Analyst, Rabobank

By Nan-Dirk Mulder, Senior Analyst, Rabobank

Global egg prices have reached historic high levels and this has a big impact on the egg supply worldwide. How long will this situation last and are there ways to stabilize supply? We expect prices to stay relatively high throughout 2023, especially in markets heavily impacted by avian flu, high costs, and regulatory changes. In other markets there will be some drop in prices, but not to pre-2021 levels, as lingering high input costs are keeping prices higher. One of the main tools to stabilize markets is better value chain cooperation, especially greater commitment from buyers to offset farmers’ high production risks. The other main strategy is to better control avian flu in heavily affected countries.

HIGH PRICES SHAKING UP GLOBAL EGG SUPPLY CHAINS

Egg prices have reached record-high price levels in many markets. Rabobank’s global egg price monitor reached a new record in Q1 2023, with the index now peaking above 250, which means prices are 2.5 times higher than the reference year of 2007, and have increased more than 100% since this time last year. Between Q1 2022 and Q1 2023 prices in the US and EU increased by 155% and 62%, respectively, while egg prices in Japan reached JPY 235 in March, their highest level since 2003.

Prices in many other markets have reached historic highs as well, including in Thailand, the Philippines, Israel, New Zealand, Nigeria, Kenya, Brazil, Mexico, and Argentina. These sudden price increases have a big impact on players in the egg supply chain – from breeders to producers and further along to customers in retail, foodservice, and food processing.

Historically, egg prices have roughly followed the FAO Food Price Index. Some periods have seen divergences, such as 2007 to 2013, when the industry struggled to pass on high and volatile feed prices. And in 2013 to 2019, egg prices were slightly higher than index’s movements, as demand for eggs was relatively strong while feed costs normalized.

Egg prices followed the food price index when feed prices rose in 2021 and accelerated in 2022, after Russia invaded Ukraine. Since then, egg prices and the food price index have again diverged: Egg prices have kept rising while food prices have started to drop. Some markets, like China and India, are less bullish (so far), with prices up by only 15% to 20%. In Brazil, potential future avian influenza (AI) outbreaks – given cases reported in nearby Argentina, Uruguay, and Bolivia where there is a high concentration of egg production, is hit.

12 MEATBUSINESSPRO April 2023 meatbusinesspro.com

WHAT DRIVES EGGFLATION?

These high global egg prices reflect a combination of six supply and demand factors. The relevance of each factor differs a bit by region, but in most markets currently facing peaking prices, a combination of the following factors is affecting prices.

1. Upward movements in feed costs. Feed represents 60% to 70% of a layer farmer’s costs. Any change – and especially any uncertainty – surrounding feed costs affects egg prices. Global feed prices doubled between mid-2020 and mid-2022. This has had a big impact on the egg industry, as it has been difficult for producers to pass on these higher costs to customers.

2. The impact of avian influenza outbreaks. AI pressure has been very high over the past two years. In the US, more than 40m layers were depopulated during 2022. In Japan, more than 15m layers have been affected, and in Europe the laying hen flock is down by 3% to 5%.

3. The aftermath of Covid-19 market disruptions. Many operations scaled down after Covid-19 measures restricted people’s movement, which highly impacted demand.

4. Regulations. The introduction of male chick culling at the hatchery level in Germany in 2012, for example, has had a big impact on the market. According to market data agency MEG, Germany lost 20% of its laying hens due to this restriction. As Germany is Europe’s largest importer of eggs, this affects the wider EU egg market. Similarly, the introduction of a cage ban for producers in New Zealand has led to a 5%-to-12% drop in laying hens in the country.

THE BEST DEFENSE A STRONG OFFENSE

PROMOTING THE HEALTH BENEFITS

5. Changing consumer behavior. Pressure on consumer spending power due to low economic growth and high inflation during the economic downturn has seen consumers trading down and looking for cheaper protein sources, lifting demand for eggs.

By Ronnie P. Cons

Red meat is often wrongly portrayed as being unhealthy. some in the media as unhealthy or not environmentally friendly.

6. Tight supply caused by uncertainty. Producers are experiencing a lot of uncertainty. Restocking hens on a farm represents a commitment of more than one year of production. This has become more risky, as many buyers do not want to offer volume and price contracts to offset some of producers’ risks. As a result, the lower number of hens restocked by farmers has led to low supply in many markets.

Vegan, fish and other non-meat diets have been proposed as healthier alternatives. The result of this onslaught of negative meat messages has influenced many families to cut back on their meat and poultry purchases. Perceptions may reality but truth trumps misinformation. Parents and other consumers

liver, 625 spinach. Iron found found absorption.

2. Eat Being linked Dr. Charlotte California, Zinc is preserves

3. Boost Due to antibodies chronic

4. Power The protein Muscles building The protein growth

5. Meat Meat contains body cannot isoleucine, threonine, protein.

mg of iron, she would need just 300 grams of cooked bovine

Continued on page 14

6. Eat Meat contains production functioning Say ‘hello’ acid, vitamin The line only apply meat health Facts’ and poultry. education Ronnie P. meat and

https://www.mmequip.com

13 meatbusinesspro.com April 2023 MEATBUSINESSPRO 22 CANADIAN MEAT BUSINESS September/October 2017

WHAT’S NEXT FOR EGGS?

The egg industry can generally count on the following rule: Price peaks tend to lead to similar price drops one to two years later. This is usually caused by producers’ response to periods of higher margins. They typically increase hen numbers to try to tap into higher prices, thus creating oversupply. We saw this trend in 2009 following Germany’s ban on conventional cages; in 2012 after the introduction of the EU’s conventional cage ban; in 2015 after the US industry’s AI crisis; and in 2017 after the Netherlands’ fipronil crisis.

Can we expect a similar trend this year? We think prices will go down in countries and regions with extreme price peaks like the US, Europe, and Japan, but likely not to the sorts of lows we have seen following other crises. This is due to a few factors that are different today.

In general, we expect egg prices to stay relatively high throughout 2023. However, there will be differences between countries. Prices will remain high in countries with persistent AI pressure, restrictions on grandparent stock or breeding stock imports, financing challenges such as a large number of farms with limited access to finance or the US dollar, and countries undergoing regulatory change (like Germany). The fast spread of AI in Latin America, for example, has had a big impact, with prices spiking in the countries most affected by outbreak.

Other countries will likely see a move back to historical price and volatility levels following these price peaks. Still, ongoing high input costs will mean prices will not return to the low levels seen before 2021.

There is currently great concern about high prices impacting the affordability of eggs for low-income consumers, especially in emerging markets. For these groups, eggs are an important staple food and source of protein and nutrients like vitamins B6, B12, and D. In these markets, eggs are positioned as the most affordable protein and are easy to distribute, as cold chain transport is not needed. If eggs become more expensive and less available for these consumers, it could pose major social and health risks.

For more information, visit https://www.rabobank.com/

14 MEATBUSINESSPRO April 2023 meatbusinesspro.com

https://www.cfib.ca

CCA: CANADA FAILS TO MEET BEEF INDUSTRY NEEDS WITH CPTPP DEAL

Following is a statement from the Canadian Cattle Association (CCA) regarding the revised Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP):

“The Canadian Cattle Association (CCA) is disappointed the Government of Canada announced that Canada has reached a market access agreement that will form the basis for the United Kingdom (UK) to join the Comprehensive and Progressive Agreement for TransPacific Partnership (CPTPP) without achieving viable access for Canadian beef to the UK.

“While full details of the deal remain unavailable at this time, we are aware that other members of the CPTPP have achieved unlimited beef access in their bilateral agreements with the UK. We have been informed that similar access for Canada is “off the table”. There is also no current progress being made to address the main obstacle to the UK market – the full acceptance of Canada’s meat hygiene system which is widely recognized as one of the finest in the world. CCA will draw a hard line that this barrier must be addressed in Canada’s bilateral agreement with the UK.

“Yesterday’s announcement of the UK’s accession to the CPTPP further disadvantages Canadian beef producers and is fundamentally unjust,” said Nathan Phinney, CCA President. “If the Government of Canada brings a ratification bill to Parliament without addressing the UK barriers to Canadian beef, CCA will approach all Parliamentarians to defeat that bill.”

“At present, the terms of access for Canada-UK beef trade are those inherited from the Comprehensive Economic and Trade Agreement (CETA) established between Canada and the European Union (EU) in 2017. When the UK departed the EU, a temporary agreement

was reached to continue to apply the CETA provisions to Canada-UK trade until a permanent agreement could be reached.

“Under these continuing terms, British beef has access to Canada at a 0 per cent tariff in unlimited quantities; Canadian beef has access to the UK at a 0 per cent tariff within the limits of a tariff rate quota. The TRQ limits on Canadian beef are 2708 tonnes fresh and 1161 tonnes frozen annually.

“For 2021, the UK exported 2733 tonnes of beef valued at C$16.3 million to Canada. For 2022, UK beef exports to Canada grew to 4414 tonnes for C$33.2 million. By contrast, Canada exported 657 tonnes of beef valued at C$7.6 million to the UK in 2021 and zero in 2022.

“To date, CCA has supported negotiations with the UK to rectify the lop-sided benefits that British beef producers enjoy under the pre-existing agreement to ensure true reciprocity and access to each other’s markets to create a win-win for both industries and consumers across both markets.

“The CPTPP has been an excellent agreement thus far with the initial participants implementing a high standard for trade liberalization. CCA believes that an agreement with the UK that leaves a significant barrier in place does not meet the standard of the CPTPP and the UK’s bid to join should be rejected until they can do better to meet the progressive trade principles of the CPTPP.”

16 MEATBUSINESSPRO April 2023 meatbusinesspro.com

SHAKE SHACK EXPANDING INTO CANADA IN 2024

According to a recent news release from Shake Shack Inc., the company will enter the Canadian market in 2024 with a flagship location in Toronto.

The New York-based restaurant chain’s expansion will be undertaken through partnerships with two Torontobased investment companies, Osmington Inc. and Harlo Entertainment Inc.

Osmington is a private commercial real estate and investment company, with experience operating quickservice restaurants both nationally and internationally. Harlo Entertainment is part of Harlo Group and invests in properties in the hospitality space.

Michael Kark, the chief global licensing officer of Shake Shack, said the partnership will look to open 35 Shake Shack locations in Canada by 2035.

“We have been eyeing this incredible opportunity in Canada for quite some time and are elated to have found exceptional partners to serve Shack classics and bespoke Canada-exclusive items to our sophisticated neighbours to the north,” Kark said in the release.

Shake Shack started out as a single hot dog cart in New York City’s Madison Square Park over 20 years ago has become one of the biggest names in fast-casual restaurants.

The original Shack opened in 2004 in the famous NYC park and the brand currently operates 440 locations including over 290 restaurants in 32 US States and the District of Columbia and over 150 international locations in places such as London, Hong Kong, Singapore, Mexico City, Istanbul, Dubai, and more.

17 meatbusinesspro.com April 2023 MEATBUSINESSPRO

SUSTAINABLE CANADIAN AGRICULTURAL PARTNERSHIP LAUNCHED APRIL 1

The Sustainable Canadian Agricultural Partnership (Sustainable CAP) officially went into effect on April 1, 2023. The federal, provincial and territorial governments collaborated in the renewal of this important five-year policy framework to ensure that there is no gap between the end of the former agreement and this new one, benefitting farmers and processors across all of Canada.

This agreement has set $1 billion in federal programs and activities, and $2.5 billion in cost-shared programs and activities funded by federal, provincial and territorial governments, up 25% from the 2018-2023 agreement.

The renewed federally funded programs to support sector growth under Sustainable CAP were launched on March 6, 2023. Details and applications are available online for AgriAssurance, AgriCompetitiveness, AgriDiversity, AgriInnovate, AgriMarketing and AgriScience.

In addition to these programs, the Sustainable CAP includes $2.5 billion in cost-shared programming that will be delivered by provincial and territorial governments. Bilateral agreements between the Government of Canada and the provincial and territorial governments are in the process of being finalized.

Sustainable CAP includes, among other things, a new $250 million Resilient Agricultural Landscape Program to support ecological goods and services offered by the agricultural sector.

Canadian producers will also have access to an enhanced suite of business risk management programs to help them manage significant risks that threaten the viability of their farms and are beyond their capacity to manage, including an increase of the reference margins from 70% to 80% in AgriStability.

18 MEATBUSINESSPRO April 2023 meatbusinesspro.com

The Sustainable CAP will help position Canada for continued success as a global leader in sustainable agriculture, economically, environmentally and socially. It will also enable the sector to be an innovative, productive and internationally competitive so that it can continue to feed Canada and a growing global population.

QUICK FACTS

• Sustainable CAP focuses on the five key priority areas agreed to in The Guelph Statement:

o Building sector capacity, growth and competitiveness

o Climate change and environment

o Science, research and innovation

o Market development and trade

o Resiliency and public trust

NEW SURREY SLAUGHTERHOUSE ‘WOULD OPEN DOOR’ TO NEW BEEF MARKETS

Proposed 30,000-square-foot beef abattoir in Cloverdale would be B.C.’s largest such facility

A federally licensed beef processing facility is in the works the ability to not have to ship an animal to Alberta to have

Agricultural and Food Sustainability Advisory Committee.”

Agricultural Land Reserve at 5175 184th St. The planned 30,000-square foot abattoir in

• Federal, provincial and territorial governments consulted with a wide range of stakeholders, including producers, processors, Indigenous communities, women, youth, and small and emerging sectors to ensure Sustainable CAP was focused on the issues that matter most to them.

so as to not emit odours. And while there is an operational 6,000-square-foot abattoir on the property now, it’s can only process a limited number of cattle.

Chris Les is general manager of Meadow Valley Meats, the company behind the project. Meadow Valley Meats is seeking a Canadian Food Inspection Agency license for the proposed abattoir, to become a federally registered meat establishment and expand the operation. This would allow the meat products to be transported beyond B.C.’s boundaries.

• The agriculture and agri-food value chain continues to be an economic engine driving Canada’s economy, contributing nearly $135 billion of national GDP, and responsible for more than 2 million jobs (1 in 9 jobs) in Canada.

“Our focus is on trying to bring a more efficient, sustainable local product to the market, realizing we can do that now in a very limited sense,” said Les. “I caution people when talking to them and they say, ‘What a big plant, that’s going to go allow you to go mainstream.’ Well, yes, if you look in the context of B.C., but this is still a very niche plant and we’ll serve a niche industry for producers and for the market. It’s certainly not going to be a monstrosity of a plant but it’ll be a big upgrade from the site currently.”

• Exports of agriculture, agri-food, fish and seafood products grew to $92.7 billion in 2022, compared to $82.4 billion in 2021.

Continued on page 32

https://www.tcextrade.com

19 meatbusinesspro.com April 2023 MEATBUSINESSPRO

Cloverdale would process up

small by industry standards, compared to the largest meat

The proposed facility would be fully enclosed and designed

PRODUCERS INCREASINGLY CONFIDENT IN USE OF DIGITAL DATA

Canadian agriculture producers are becoming more comfortable with the adoption of digital data tools and farm management software, bolstering their trust in the technology according to a RealAgristudies survey.

The survey shows how farmers are adopting digital tools and managing data, including how those practices have evolved since AgExpert conducted a survey on the same topic in 2018. In the RealAgristudies survey, 66% of respondents said they feel the companies that handle their data are doing a good or excellent job. That’s a 31% increase from the survey conducted by AgExpert four years ago that asked the same question.

“There was tremendous uptake by respondents to this survey which signals that digital farm management is top of mind for producers,” said Justin Funk, Agri Studies Inc. managing partner. “We learned that farmers are not just using data but are making it a priority to do more with it in the future as they make important farm management decisions.”

“While cutting costs is important, farmers may be beginning to see more holistic benefits as well,” said Funk. “They are also seeing increased efficiency, better organization and increased profitability, which all contribute to a well-run operation.”

Compared to the 2018 AgExpert survey, the 2022 RealAgristudies survey indicated that many farmers feel more comfortable sharing their data; however, some feel less comfortable.

Over 90% of respondents said they use some form of data to manage production on the farm and 60% say they are moderate or extensive users of farm data. Survey respondents cited the ability to make better decisions and to help manage costs as the top benefits of using digital data.

“Companies that ranked as the most trustworthy by customers are also certified as Ag Data Transparent,” explained Funk. “That is a group that subscribes to a set of core principles around the collection, use, storing and sharing of farm data. It speaks to the role the digital data industry has in earning the trust of farmers by being transparent and working with customers to help them understand how their information is used.”

The RealAgristudies survey suggests those who are the biggest users of farm digital data platforms and technology are also the most confident in its safety.

20 MEATBUSINESSPRO April 2023 meatbusinesspro.com

was the first in Atlantic Canada to be involved in the TESA program.

DF: Yes, I think we were the first farm east of Ontario as far as I understand. I’m not sure why the eastern associations wouldn’t have previously nominated anybody because there are many farms here on PEI doing every bit as much as we are as to attain a high level of sustainability. Anyway, we were very surprised when the PEI Cattleman’s Association nominated our farm.

CMB: And then you were attending the Canadian Beef conference in Calgary and you won.

“With today’s rising costs, producers are wisely looking at how to be more efficient. Using any digital data tool can help producers benefit from time, labour and cost efficiencies.” said Krista Kilback, manager, Farm Credit Canada (FCC) AgExpert. “Once you identify where you want to find an efficiency, you can find a tool to match. For example, one customer wants to keep track of grain in the bin; that is the best efficiency on their farm and there is technology for that. Another farmer found AgExpert accounting software brought him the accurate financial information he needed in real time instead of having to sift through books and not have information when he needed it.”

DF: Yeah! That was a very nice moment for us. But I don’t like to use the word win actually. However, being recognized for our commitment was a real honour. If you want to know the truth, it was a pretty humbling experience. As I said to CBC when they phoned me after the conference, I was just floored, really couldn’t believe it.

The benefits are well documented. When farmers see profitability by the acre, they can fully understand their cost of production, develop specialized seeding plans, and run scenarios to know how to make the most advantageous decisions. The shareability of records also means quicker, more precise communication with farm partners.

CMB: So now that you have been recognized, do you think that will draw more attention and garner more nominations out of Atlantic Canada going forward?

The survey suggests Canadian producers are on a trajectory towards increased use and trust of digital farm management, positioning the industry for continued stability and growth in the future as individual operations adopt the agricultural management practices that are right for them.

DF: Absolutely. We’ve gotten a lot of good press highlighting the island cattle industry. I’m positive you’ll see more farms in our neck of the woods nominated next year. And I have to give the Canadian Cattleman’s Association recognition for choosing a farm from Prince Edward Island. We are small players in the national beef industry and I think it was a real credit to their organization to recognize us. They treated all the nominees royally and it was a real class act. It was a wonderful experience.

The survey was conducted in November 2022 using the RealAgristudies Insights Panel, along with AgExpert subscribers. The survey is accurate +/- 4% with 95% confidence. RealAgristudies is a partnership between the AgMedia company, RealAgriculture and Agri Studies.

https://www.yesgroiup.ca

21 meatbusinesspro.com April 2023 MEATBUSINESSPRO September/October 2017 CANADIAN MEAT BUSINESS 17 meatbusiness.ca

AGRICULTURE IN THE 2023 FEDERAL BUDGET

Budget season has finally come to an end! Provinces and territories saw their budgets announced in February and March, and similarly, the federal budget was announced Tuesday, March 28. The Canadian Federation of independent Business (CFIB) had the opportunity to attend provincial and the federal budget pre-screenings to get a first-hand look at what is in store for agri-businesses, while representing their interests and connecting with policymakers.

HERE ARE SOME IMPORTANT POINTS IN THE 2023 FEDERAL BUDGET THAT MAY AFFECT YOUR AGRIBUSINESS:

As we expected, amendments are quickly on the way for Bill C-208: An Act to amend the Income Tax Act (transfer of small business, family farm, or fishing corporation). However, the details of the amendments remain vague in how they intend to ensure that small business transfers are legitimate in the eyes of the federal government. What we do know is that these changes have already passed as they were included into the 2023 budget itself. The changes will affect transfers that happen on or after January 1, 2024. For further clarification on the changes, CFIB has reached out to government officials.

Although there was not much in the 2023 federal budget for small businesses in general, what was in there did show that the federal government has begun listening to what small agri-businesses actually need in policy.

Starting in the 2024 tax year, business owners can transfer their business to a group of their employees much easier thanks to the tax changes coming to facilitate the creation of an Employee Ownership Trust. This is good news for 75 per cent of our CFIB ag members who are in support of this, and something that we have been lobbying for in government.

Next, the federal government has committed $34.1 million over the next 3 years to Agriculture and AgriFood Canada’s On-Farm Climate Action Fund to support the adoption of nitrogen management practices by Eastern Canadian farmers to reduce the need for imported nitrogen fertilizers. This comes on the heels of last year’s fertilizer emissions reduction targets debacle, where CFIB pushed for the government to make the targets non-mandatory and regionally adapted, while the government remained silent on their plans.

22 MEATBUSINESSPRO April 2023 meatbusinesspro.com

There is hope that this targeted funding to help farmers in the East who rely more heavily on nitrogen fertilizers will mean that it is less plausible for the reduction targets to be mandated and that there will be funding for a voluntary transition away from nitrogen fertilizers.

[Infographic]

“The government should not set nitrogen limits. Instead, they should be looking at how each farmer is producing crops in certain regions and that they can justify the amount of nitrogen fertilizer being applied”Livestock farmer, ON.

Lastly, the federal budget included additional funding will be provided to increase the interest-free limit for loans under the Advance Payment Program from $250,000 to $350,000, making it slightly easier for agribusinesses to invest in more costly inputs.

Overall, the budget seems to provide some stability and support for the agriculture sector. We are now keeping a close eye on whether these new budget items will provide agri-businesses with clarity, support, and improve the ease and cost of doing business.

There are a few other large policy plans coming for the agriculture sector. This includes the new $3.5 billion, 5-year, federal-provincial-territorial Sustainable Canadian Agricultural Partnership (previously titled the Canadian Agricultural Partnership) that came into effect April 1st and expires at the end of March 2028. Additionally, new strategies have recently been announced from the federal Standing Committee of Agriculture and Agri-Food (AGRI Committee) that focus on supporting agri-businesses across the country.

CFIB is working closely with members of the AGRI Committee to ensure that the positive strategies the Committee is looking at (previously lobbied for by CFIB, directly from our ag membership) actually make it into policy, helping your agri-business.

For more information on the federal budget and how it impacts small businesses, read CFIB’s news release: Federal Budget makes progress in lowering credit card fees for small business, available on the CFIB website in both English and French. Not a member? JOIN CFIB today for more help and information.

Taylor Brown is the Senior Policy Analyst, National Affairs & Agri-Business for the Canadian Federation of Independent Business (CFIB).

CFIB is Canada’s largest association of small and medium-sized businesses with 97,000 members (6,000 agri-business members) across every industry and region. CFIB is dedicated to increasing business owners’ chances of success by driving policy change at all levels of government, providing expert advice and tools, and negotiating exclusive savings. Learn more at cfib.ca.

23 meatbusinesspro.com April 2023 MEATBUSINESSPRO

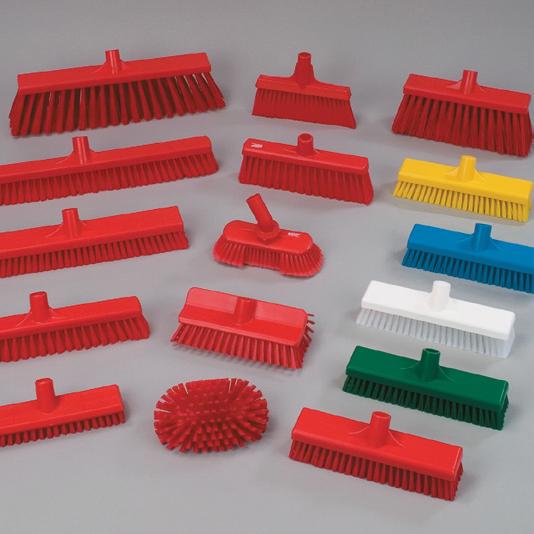

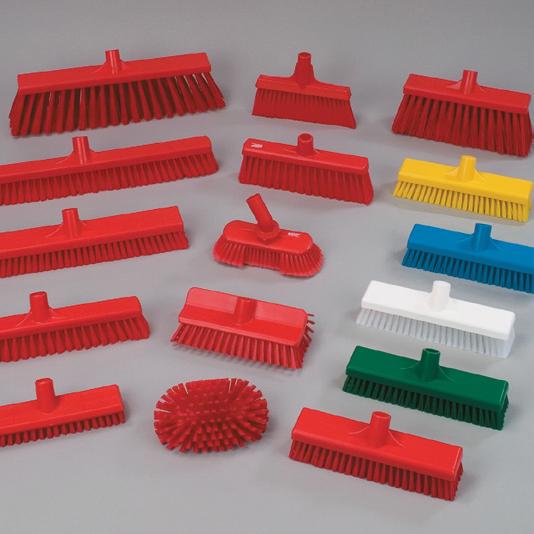

Remco and The Yes Group Protecting

Remco products are colour-coded to help divide the production cycle into different zones. By identifying these zones as different cleaning areas, the movement of bacteria around the production area can be blocked.

Our products were developed with the Hazard Analysis Critical Control Point (HACCP) in mind.

No matter what colour-coding plan is implemented, Remco Products from The Yes Group provides significant added value at no additional cost. From scoops to squeegees, from brushes to shovels, we have the products and the colours to enhance any professional quality assurance program.

24 MEATBUSINESSPRO April 2023 meatbusinesspro.com meatbusinesspro.com 31 September/October 2018

201 Don

Unit 1, Markham, Ontario, L3R 1C2 Phone:

1-800-465-3536 Fax: 905-470-8417 Website: www.yesgroup.ca email:

Park Road

905-470-1135

sales@yesgroup.ca

your Customers https://www.yesgroup.ca

By Kyle Burak, Farm Credit Canada Senior Economist

By Kyle Burak, Farm Credit Canada Senior Economist

By Nan-Dirk Mulder, Senior Analyst, Rabobank

By Nan-Dirk Mulder, Senior Analyst, Rabobank