Momentum Builds Into Key Selling Season

2Q 2024 | Market Update

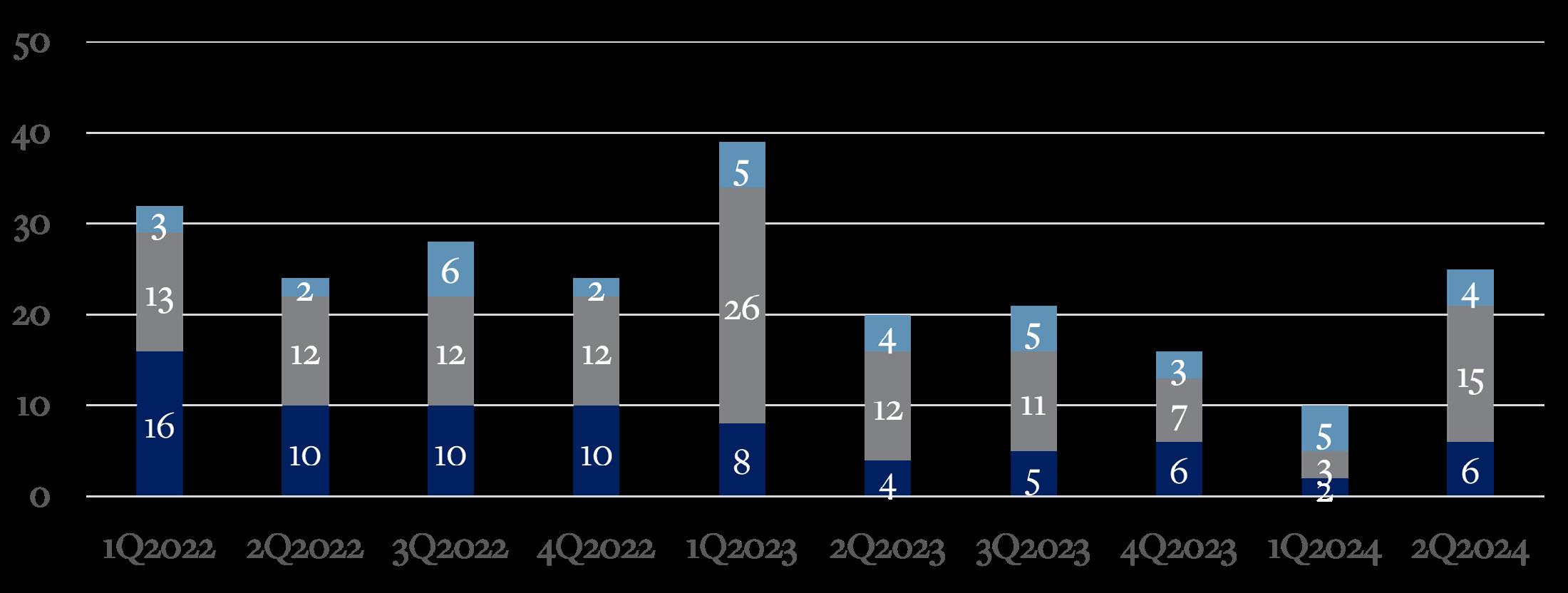

The markets across the Monterey Peninsula bounced back in the second quarter with 181 deals closing for over $458M, which is up an incredible 67% from the investments that we saw last quarter. This surge in investments was consistent across all regions and particularly prevalent in the middle price brackets. This is welcome news to sellers as we see buyers start to re-enter the market after a big drop in deal-flow last year. While we’re still not at historic norms, it is good to see the momentum shift back toward a more balanced market.

Pebble Beach surged back to life this quarter with 25 deals closing for $92M, which is over triple what we saw last quarter ($22M), a big move in an important market in this area. Carmel continued to build momentum this quarter with 39 deals closing for $165M, which is up almost 50% from this quarter last year. As a beach town, we always get a surge of investments in downtown Carmel during the summer and early fall, so we anticipate this trend continuing at least through the key selling season. Monterey roared to life this quarter with 61 deals closing for just north of $75M – despite higher interest rates, the demand for homes in this area below $2M continues to be very strong. Pacific Grove continues to benefit from that strong demand with 32 deals closing for $53M. The Quail Lodge area posted a strong quarter with 7 sales coming in at $22M, which came from a combination of both Quail Lodge and Quail Meadows sales, which lifted the total invested this quarter. The Preserve, Carmel Highlands and Carmel Valley Ranch each had 5 deals close this quarter, which was a nice rebound for the Preserve and Highlands, while the Ranch held it’s steady pace. Monterra continued to show strength with 2 more sales this quarter, bringing the total annual home sales to 7 for this year, as that area continues to benefit from strong demand for move-in ready homes.

Buyers are needing to be more competitive and move faster to get their deals right now as days-on-market has dropped from 54 to 42 this quarter (compared to last) and there’s less negotiating room with deals closing at just 1% off list price now. Part of this new market traction is sellers recalibrating their approach to the market as prices have dipped just a bit, which is getting buyers off the sidelines. The median sales price overall this quarter was $1.688M, which is down slightly from last quarter which was $1.75M. However, this is still up considerably from pre-2019 era as tight inventory levels have continued to prop up pricing across the board.

While there continue to be headwinds in the market, including uncertainty around the election, there’s considerable momentum going into the second half of the year with softening interest rates and more demand than ever for people to live and work in this area.

Total Annual Sales 2Q 2024 Update

Quarterly Sales by Region

Median Sales Price ($M)

Historic Sales Averages by Price Range

Pebble Beach

Market Overview

As our area transitioned from spring to summer, we saw the traditional rise in deal-flow throughout Pebble Beach – closing this quarter with 25 sales, more than doubling the total sales from the 1st quarter. Additionally, total investments for this quarter came in at $91.8M – more than tripling the total from 1Q.

Interestingly, even as the rising deal flow absorbed some of the listings in 2Q, there was also a build-up in inventory, which climbed to the highest totals (42 active listings) in the past 4 years. Of the active listings, there are 9 offered above $10M, 5 listed between $5M-$10M, and the remainder (26) are asking below $5M. Also of note, the largest geographical concentration of listings is in the Central Pebble Beach area, which makes up for nearly half of all active listings.

Overall, home values continued to climb upward in Pebble Beach, closing the quarter at an average of $2.8M – up 27% from the previous quarter. All three sub-markets (MPCC, Central Pebble and Upper Forest areas) made positive gains as steady demand outpaced supplies – especially for the lower priced homes. Condo sales aside, the entry ticket for owning a home in the coveted Pebble Beach community remains well above the $1M threshold and this trend has been holding steadily above $1.25M since Summer of ’23.

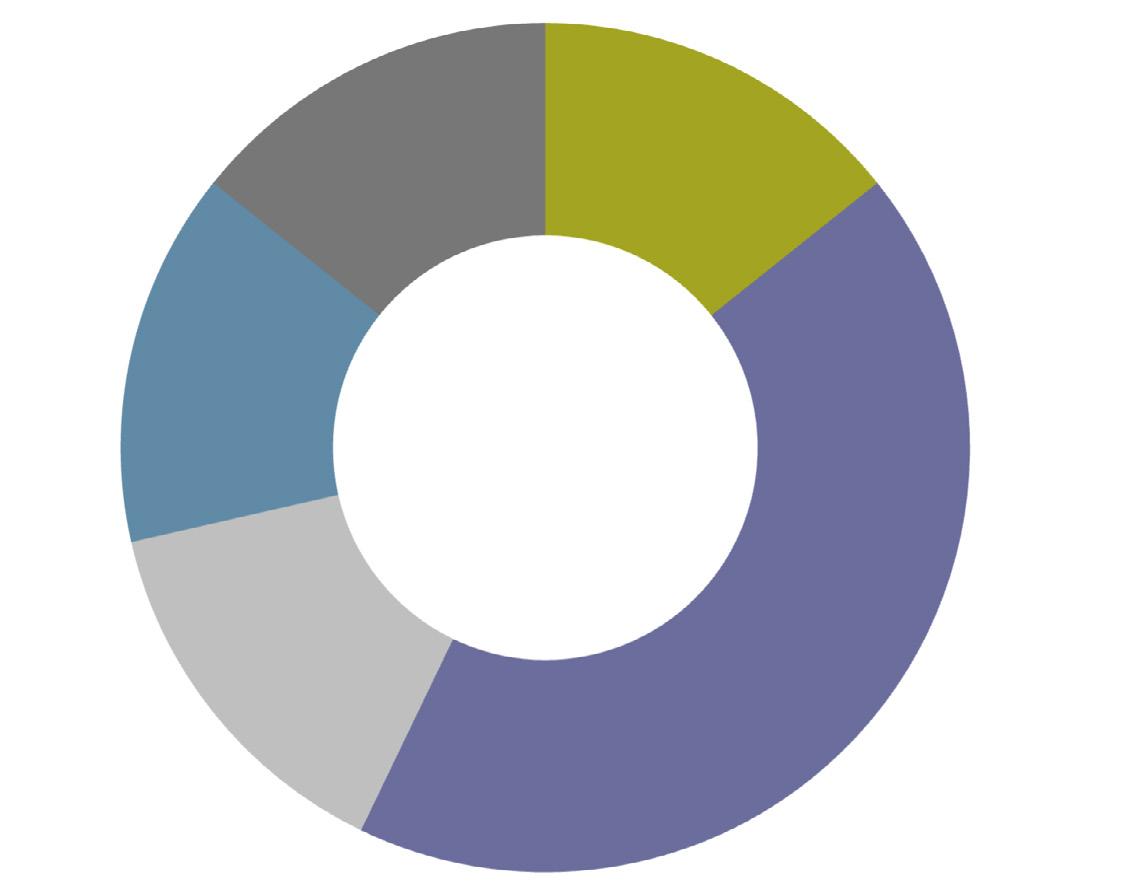

So, who is purchasing homes in Pebble Beach right now? In review of the 2nd Quarter’s sales, 42% of buyers came from the Bay Area; 16% were located in the San Juaquin Valley; 16% from Southern CA; 11% were local residents and the remaining 15% came from Northern CA, Arizona and Texas. Another interesting stat is that the sales were evenly split between primary and secondary home buyers, which reinforced the trend over the past couple years that more buyers are seeking full-time residences in Pebble Beach.

Looking ahead to the remainder of the summer selling season, there are currently 8 deals in escrow that are due to close in the 3rd quarter – all of which are listed below the $5M threshold. As mortgage rates show signs of dropping this year, we anticipate the lower price points in Pebble Beach to remain very competitive as loan-based buyers re-enter the marketplace.

2Q 2024 Pebble Beach Update

Pebble Beach

2Q 2024 Top Pebble Beach Sales

The combination of limited

and high

has created a

Carmel

Market Overview

Carmel surged this quarter with 39 sales for a total of $165M, which is up about 40% from last quarter. The rebound was particularly strong north of $3M, which represented more than half the deals this quarter. Demand for ocean view and frontline properties continues to be strong with the top sale going this quarter to a large estate on Scenic where we represented the buyer for $28M. While this is the highest price sale in the history of Scenic, the property did have over 5,500 sq. ft. on a 12,600 ft. lot. This is a good example of a larger trend that we’re seeing in Carmel – the demand for oversized properties is stronger than ever. All of the sales above $6M were for houses with over 2,000 sq. ft.

The overarching trend facing buyers right now is a significant lack of inventory, which continues to be the case for buyers looking to pick up something special in downtown Carmel. It looks like the bottom of the market of this particular cycle came in 4Q23 when it took 61 days to sell a house and the median sales price was down to $2.525M. This quarter, houses were selling in 47 days and the median sales price was $4.2M.

As new inventory has come to the market on the west side of Carmel, we’ve seen activity slow on the east side. There were 10 deals that closed in the Golden Rectangle (up from 7 last quarter) and 5 that closed on Carmel Point (up from 4). Northwest Carmel continues to benefit from the new ocean views that appeared after the Eucalyptus grove was taken down, with activity holding strong with 8 deals this quarter. Hatton had just 3 deals close this quarter, Northeast Carmel held steady at 9 deals and Southeast Carmel closed just 4 deals.

Overall, demand for a little beach house continues to be strong, especially with our clean air and nice weather, so we anticipate the market to continue to build through the fall.

2Q 2024 Carmel Update

2Q2024 Top Carmel Sales

Scenic 4 SE of 8th*

26250 Ocean View Avenue

NWC of Carmelo & 8th

26255 Ocean View Avenue

Monte Verde 3NW of 8th

Camino Real 2NW of 8th

Monte Verde 3SW of 7th

Lincoln 7SW 13th

Dolores 2 SE of 13th*

Oak Knoll 3SE of Forest Avenue

Lincoln 3SW of 10th

Casanova 4NW of 13th

Camino Real 3NE of 3rd

$28,000,000

$7,780,000

$7,225,000

$6,500,000

$6,300,000

$5,600,000

$4,850,000

$4,800,000

$4,600,000

$4,450,000

$4,395,000

$4,360,000

$4,260,000

NEC of Torres Street & 8th

$4,200,000 Carmelo 2NE of Ocean

$3,998,000

3 SW of 10th $3,825,000

of Monte Verde & 7th $3,650,000

With more inventory coming to the market, pricing is critical to get the highest and best number for your home.

Carmel Highlands

Market Overview

The Carmel Highlands marketplace saw a rise in activity in the second quarter with 5 sales that totaled just over $25M in investments. These totals rose substantially from the first quarter, which posted only 2 sales for a combined total of $10.4M. The highest sale in the Highlands this quarter was an ocean-front property located on the west side of Ribera Rd in the serene enclave of Carmel Meadows that sold for $9.95M. Worth noting that this sale drew multiple offers before being purchased by a developer and it will likely come back to market within 2 years as an updated, turn-key property.

Other noteworthy sales and activity along the Highlands and Big Sur coastline include:

ɖ An exclusive ocean-front estate in Big Sur adjacent to the Post Ranch Inn that closed off market at $31.8M, which is the second highest sale in the past 4 years for these coastal areas.

ɖ As the ultra-wealthy continue to seek shelter and privacy along the Highlands and Big Sur coastlines, there were two more properties along the iconic Hwy 1 that went into escrow this quarter - with asking prices of $25M and $21.5M respectively. Both are due to close in the 3rd quarter, and we’ll be reporting on these sales as they close later this summer.

With the arrival of summer and our peak selling season, there was an anticipated rise in active listings (15 total) in the Highlands marketplace. There is only 1 currently available in the Carmel Meadows area, which is offered at $10.1M. The remainder of available listings are located in the Highlands area and host a range in prices from $25M for an oceanfront modern-style home in Otter Cove down to a ranch-style home on the east side of Hwy 1 on Corona Rd that is listed for $2.79M. We anticipate more listings to come to market (and activity to follow) in the coming weeks as we approach the highly attended Car Week in early August.

If you are a homeowner contemplating selling during this unique market phase that continues to favor sellers or are interested in learning more about our listing process, please feel free to contact us directly or visit our website at CanningProperties.com.

For those buyers seeking options not currently available on the market, visit our discreetly available section of our website to gain access to CPG exclusive properties, upcoming listings and key insights on current market trends.

2Q 2024 Carmel Highlands Update

Quail Lodge/Meadows

Market Overview

Quail surged to life this quarter with 7 sales closing for a total of $22M this quarter, including 5 sales in Quail Lodge and 2 more in Quail Meadows. The two sales in the Meadows included our listing at 5461 Quail Meadows, which closed for $5.1M and received three offers and, 5480 Quail Meadows (right across the street) that closed for $3.899M. The $3-5M range is particularly strong in the Valley right now, which clearly benefits both Quail Meadows and Quail Lodge.

Remarkably, Quail Lodge has seen some of the greatest appreciation rates on the Monterey Peninsula over the past decade, as the median sales price has crested $3M in Quail Lodge, which is triple what it was in 2015. Overall median sales prices across the Monterey Peninsula only doubled in value over the same time period. In fact, the two condos that sold this quarter (for $1.4M and $1.5M) are higher than the median sales price for a house in 2015.

The three home sales in Quail Lodge this quarter included 7064 Valley Greens Circle, that closed for $3.85M, $200K over what they paid for it in 2022; 7073 Fairway Place also closed for $3.085M this quarter, up from the $2.4M that they paid for the house in June 2023. Finally, 8022 River Place closed for $2.725M, which was a fixer over along the driving range that originally sold for $1.9M in 2021.

Overall, demand continues to outstrip supply in Quail Lodge and the Meadows and although buyers are getting pickier in this market, demand is still strong and we anticipate that to continue through the next year.

Santa Lucia Preserve

Market Overview

The second quarter in The Preserve brought more beautiful weather this year. As we review real estate sales activity in the second quarter of 2024, it appears that there are a lot of folks making moves in The Preserve.

The 2nd of quarter of 2024 finished with a total of 5 sales, a 67% increase quarter-overquarter, and 400% increase year-over-year. One home sold at a sale price of $8,200,000 after spending only 25 days on the market (DOM) at $1,601/sq.ft. There were 4 lot sales ranging from $525,000 to $2,425,000 with a median sale price of $1,222,500 and average DOM of 96 days.

There are currently 43 Active lots listed, ranging from $325K to $2,995,999, no lots in escrow, and 9 homes listed for sale ranging from $16,000,000 to $8,849,000, with a median list price of $6,800,000 and average DOM of 58 days. Average price for sq.ft. of these homes is $1,424. There are two homes currently in escrow, both in the $7,500,000 price range. These homes were only on the market for 12 days before the Sellers accepted an offer.

We anticipate an increase in sales activity as the weather heats up and residents from warmer areas look to seek some relief from the dry, hot summer heat in the valley, Texas, southern California, and other areas of the U.S. that are experiencing extreme heat, and we are happy to be able to offer them a wide variety of options whether they are looking to build the home of their dreams or buy a finished home. Club membership is almost full so the Hacienda and Ranch Club are thriving and busy as ever.

Brian Keck Santa Lucia preserve specialist

831.238.8730

Sophisticated Modern Sanctuary

54 RANCHO SAN CARLOS ROAD | SANTA LUCIA PRESERVE

54RANCHOSANCARLOS.COM | OFFERED AT $6,250,000

2Q 2024 Santa Lucia Preserve Update

Pacific Grove

Market Overview

Every day is a good day when you are in Pacific Grove. We had a lovely spring and it’s wonderful to see locals and visitors enjoying our beautiful surroundings and mild weather.

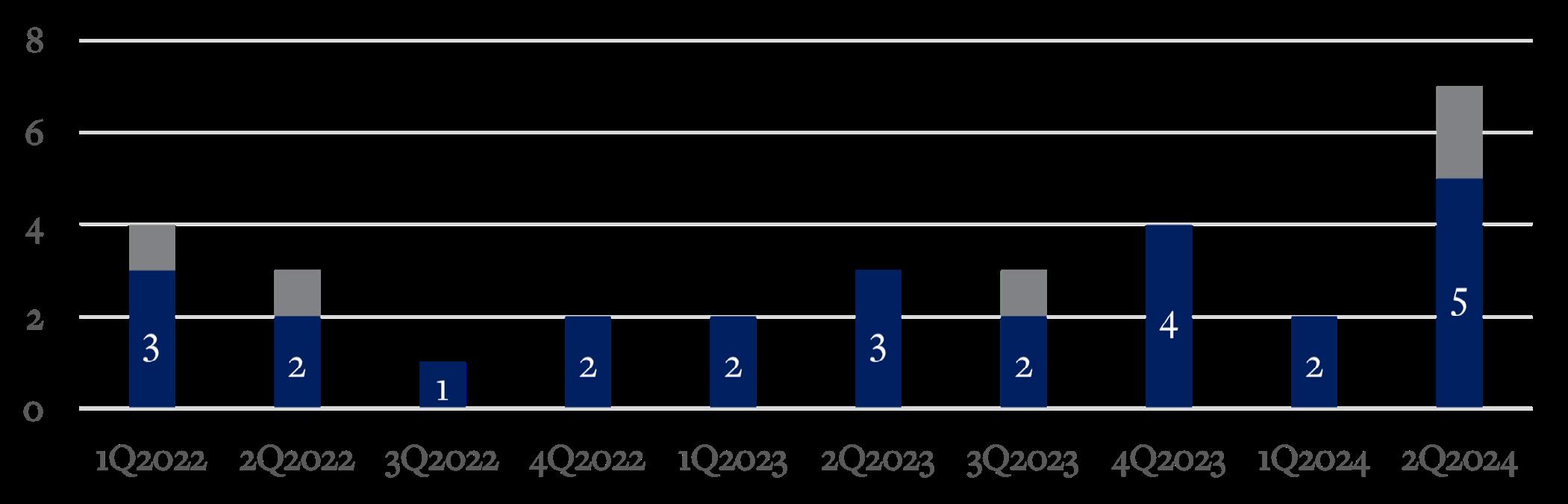

The Pacific Grove real estate market in Q2 2024 showed notable fluctuations in single family home sales, reflecting a dynamic environment. Months’ supply of inventory (MSI) is an important real estate metric that indicates how many months it would take to sell all the current homes on the market given the current sales pace. In Pacific Grove, the MSI varied significantly, peaking at 5.2 months in April and hitting a low of 1.4 months in May and then ending the quarter in June at 4.2 months. May noted 14 sales and an average of 20 active listings. April and June had higher active listings (26 and 25, respectively) and both April and June had fewer sales (5 and 6), suggesting a change in buyers’ purchasing habits.

The average sales prices followed a downward trend in Q2 from April's high at $1,709,257 to $1,626,733 in June. Year-over-year average sales price in Pacific Grove continues an upward trend as Q2 2024’s average sales price ($1,673,425) was higher than Q2 2023 ($1,482,000).

Compared to Q1, Q2 experienced sharper changes. Q1 had more stable inventory levels, while Q2 saw upward shifts, especially in April and June. Sales activity in Q2 had pronounced peaks and troughs, unlike the gradual increases in Q1. The days to sell metric showed quicker transactions towards the end of Q2.

Q2 2024 in Pacific Grove was marked by fluctuations in inventory, sales, and days on market, alongside a decline in average sales prices. These dynamics suggest a market in transition, influenced by broader economic factors. We continue to see demand from buyers, although location, condition and price have become even more important in one’s search for the right home.

Arleen Hardenstein pacific grove specialist

831.915.8989

2Q 2024 Pacific Grove Update

Grove

Quarterly Sales by Region

A dynamic market with fluctuating inventory, swift sales, and adjusting prices.

Pricing Trends

Monterey

Market Overview

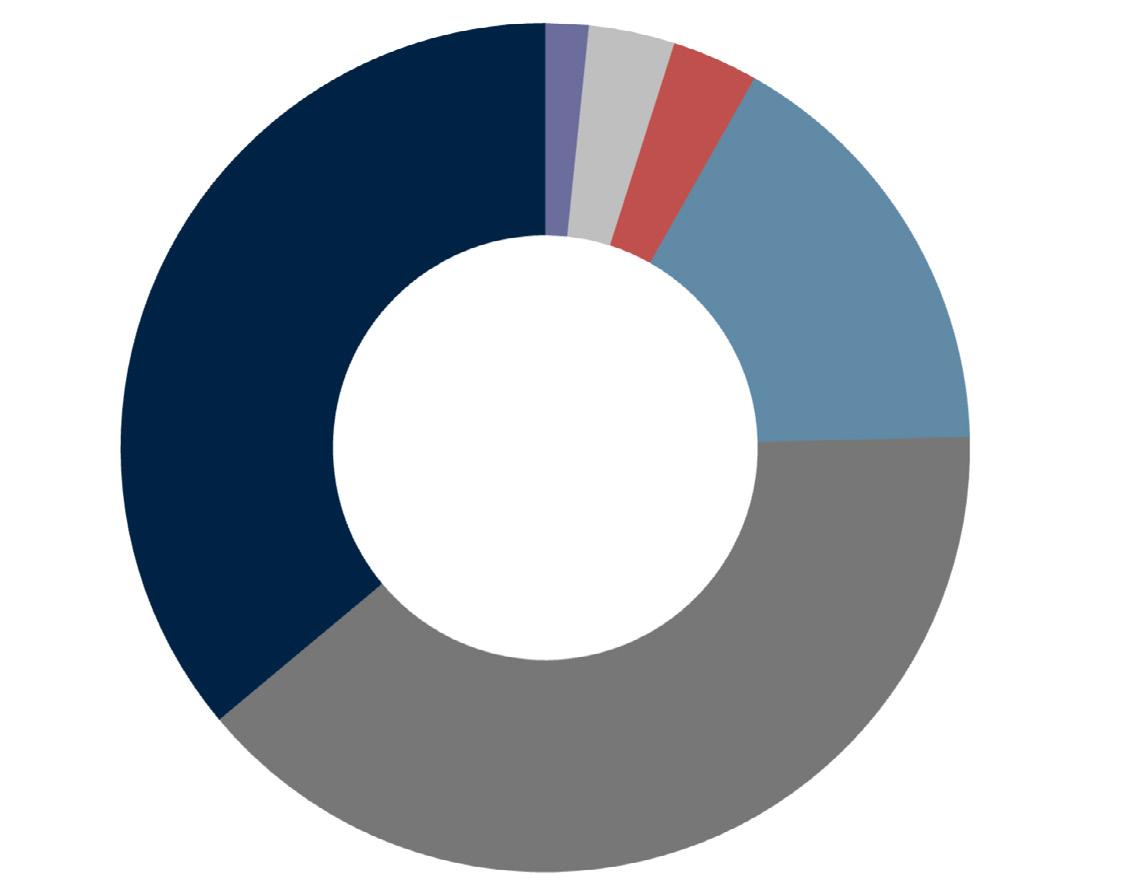

As anticipated, the second quarter of the year experienced a significant rebound from the typical first-quarter slowdown in the Monterey market. The most notable rebound from Q2 2024 in Monterey was the 61 total home sales, which eclipsed any quarterly home sales total we have seen since 2021. Of those 61 home sales, nearly a third came from the Old Town and New Monterey regions, both of which continue to be highly desirable areas amidst a competitive buyer’s market.

In addition to the impressive sales in Old Town and New Monterey, the Monte Vista and Skyline areas also saw significant property transactions, further demonstrating the robust activity across various regions in the Monterey market. And, while sales were significantly up, the days on market were significantly down – with homes taking an average of 21 days to sell during Q2, down 34% from Q1 while down 12% YoY.

Surprisingly, amidst the significant increase in home sales during the second quarter, the median sales price in Monterey decreased by 4% from Q1, with the median sales price at $1.23M to finish the second quarter. However, despite the slight decrease from the first quarter, YoY the median sales price is up 36% from the same quarter last year.

As the second quarter of 2024 came to an end, the usual lull in the first quarter gave way to an unexpected surge – exceeding market expectations and signaling a strong recovery. This positive trend indicates that despite concerns about a struggling market and external impacts, there is clear momentum in the Monterey housing market as we segue into the third quarter of 2024.

Spiro Pettas

831.214.3377

Alecia Hull

831.238.8688

2Q 2024 Monterey Update

2Q2024

Quarterly Sales by Region

Alta Mesa/Peter's Gate

Monte Vista/Skyline

Average % off list price 2Q 2024 Sales 0%

Golf Course/Flats

Old Town/New Monterey

Tight inventory levels paired with robust demand is keeping competitivelynegotiations close to list price

Pricing Trends

Carmel Valley Ranch

Market Overview

Spring has sprung this quarter in Carmel Valley Ranch with 5 sold properties, 1 active, and 1 pending. Similar to 1Q2024, this quarter we have seen a very quick turnaround for properties priced competitively. We’re continuing to see properties priced under $2 million have shorter days-on-market and selling close to, if not right at, full asking price. The average list price discount stayed steady at 3%, which is on par for the last two quarters.

A few notable sales were 9919 Club Place Lane, 28096 Barn Way and 10472 Fairway Place. Club Place Lane went into escrow the day it came to the market. Barn Way went into escrow in 5 days and Fairway Place sold at list price for $1,950,000 after being on the market for 46 days. Compared to 1Q2024, there was a 47% decrease in days-on-market this quarter, showcasing that the well-priced homes are moving quickly.

For Sellers, this proves the point that pricing is key to get your home sold for the highest number in the shortest amount of time. When you price your home right, history has proven that the sale of the home will be quicker. Listing your home for a premium number, especially in The Ranch, can end up having a negative impact, keeping your house on the market longer and likely resulting in having to do price reductions, thus costing the homeowner more money in the end. For Buyers, these sales show that the market is strong in this price point and it’s important to bring the best offer possible to have a higher chance of winning the bid.

Demand continues to remain strong for well-priced homes in desirable locations like Carmel Valley Ranch. Who you hire matters and having an experienced, knowledgeable, well-respected agent is critical to having a successful and smooth home buying and selling process. It will be interesting to see how the next half of 2024 unfolds while looking at macroeconomics and the current buyer demand and sellers’ motivation. We’re seeing the market lean towards Carmel Valley Ranch as it continues to serve as an attractive community due to the appealing price point and offering resort-like amenities.

Colijn

2Q 2024 Carmel Valley Ranch Update

Teháma

Market Overview

The real estate market for finished homes that are priced strategically continues to generate interest, offers and sales here on the Monterey Peninsula. Inventory has increased in all areas, which is encouraging to Buyers who are considering making a move to a more temperate climate.

After experiencing no home sales and only one lot selling in Teháma in the 2nd quarter of 2023 (at $2,500,000), sales of homes and land in Tehama have remained fairly flat. There was an “off market” sale of one of the developer lots that sold for $3,900,000, and there are two finished homes listed for sale in Tehama – one for $11,250,000 and another for $8,250,000, with an average price per sq. ft. of $1,603.57 and 62 Days on Market (DOM).

Typically, the second quarter experiences an increase in sales activity as folks have completed their tax preparation process, celebrated graduations, etc. and this year appears to be moving in the same direction , with a slight increase of showing requests for properties in Tehama. We also find interest and showing requests for vacant land has increased a bit since the first quarter of 2024. There are 11 lots currently listed for sale on MLS, with prices ranging from $1,975,000 to $5,750,000. The median list price is $2,750,000, average (DOM) of 254 days.

With more Buyers coming here from the Central Valley to escape rising temperatures, we expect to see an increase in interest in both vacant land and finished homes in Tehama. The primary challenge facing Buyers is the ability to obtain affordable fire insurance, which continues to plague certain areas of the Peninsula, Tehama included, causing Buyers to appear to be reluctant and somewhat fearful of investing in property here. The good news is there are approximately 20 homes here in Tehama that are in various stages of construction which benefits the community, the club membership, landscapes and our neighborhoods.

Brian Keck Teháma specialist

831.238.8730

2Q 2024 Teháma Update

2Q 2024 Sales by Price Range

$8M+ 0

$6.0M-$8.0M 0

$4.0M-$6.0M 0

$3.0M-$4.0M 0

$2.5M-$3.0M 0

$2.0M-$2.5M 0

$1.5M-$2.0M 0

$1.0M-$1.5M 0 <$1.0M 0

Tehama 5 Year Home Sales

10 Alta Madera Avenue*

27 Teháma

24825 Via Malpaso*

24825 Via Malpaso*

8275 Carina*

25560 Via Malpaso

50 Marguerite

24 Teháma (Lot 10)*

$8,500,000

$6,350,000

$5,500,000

$5,250,000

$4,995,000

$3,395,000

$2,750,000

$2,500,000

Yearly Sales by Type

This quarter had little movement, but we anticipate seeing more activity in the coming months.

Monterra

Market Overview

In the second quarter of 2024, Monterra recorded 2 lot sales, one on Monterra Road and one at 7590 Paseo Vista (Lot 77). While the 2 sales this quarter is down from last quarter, when 7 deals closed, overall the market is very strong in Monterra with several homes closing at or above $5M this year. Additionally, the two sales this quarter were vacant lots that sold for a combined $3.525M which is down from last quarter but still very high in this market.

On average, properties sold at a 7% discount off the list price during this quarter which shows that sellers need to be ready to negotiate off list price, but when priced well, lots and homes sell. The average number of days properties spent on the market in Q2 2024 was 276 days. This is a 51% increase from the previous quarter.

While the number of sales and total sales price saw substantial decreases from the previous quarter, the year-over-year comparison paints a more positive picture with significant growth. There are currently 9 lots listed for sale on MLS. List prices range from $619,000 to $2,750,000 (one of the Ranch Lots).

As we move forward, monitoring these trends will be crucial for strategic planning and adjusting to market conditions. With summer in full swing and as interior areas of the state (and the country!) heat up, buyers are flocking to the Central Coast as they consider relocating to Monterey County, where they will experience more temperate weather patterns. There are approximately 20 homes in various stages of construction here which is exciting to say the least. It’s great to see folks making moves to Monterra.

Brian Keck Monterra specialist

831.238.8730

2Q 2024 Monterra Update

Why Us?

Market Expertise:

With years of experience in the Pebble Beach area, we have a deep understanding of the local trends, property values and emerging opportunities.

Personalized Service:

We take pride in offering personalized and attentive service to our clients. Your goals are our priority, and we are committed to tailoring our approach to meet your specific needs.

Proven Track Record:

Our track record speaks for itself. We have successfully assisted numerous clients in your area achieve their real estate objectives, while delivering results that exceed expectations.

Innovative Marketing Strategies:

In today’s competitive market, a strategic approach to marketing is essential. We leverage cuttingedge marketing strategies to ensure your property receives maximum exposure.