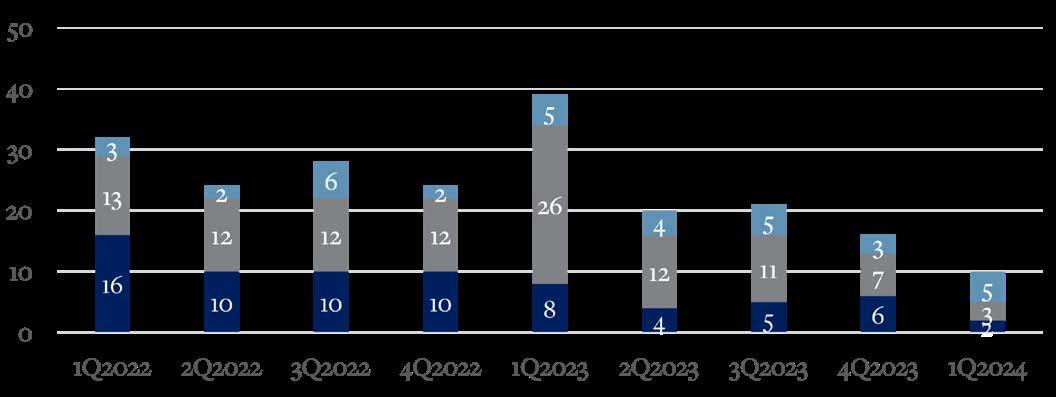

The market continues to send mixed signals in real estate, with buyers confronting tight inventory and rising rates and sellers confronting buyers who are trying to stretch into houses or overpricing their properties sending buyers to the sidelines to wait. This resulted in another very slow quarter where some properties - that are perfectly positioned in several selling points - are selling instantly (sometimes with multiple offers and over list price) while other very nice properties are sitting for an extended period of time. The 107 deals that closed this quarter are down over 28% from this quarter last year and off over 40% from the 10 year average for this time of year.

Somewhat surprisingly, the regions outside of the core Pebble Beach, Carmel and Pacific Grove regions had the strongest rebound this quarter, posting gains over last quarter. This is mostly due to buyers having to shift their focus away from the prime locations due to a lack of inventory. As such, we saw 7 sales in Monterra and Tehama this quarter, which was the most we’ve seen since the middle of 2022. The Preserve also posted 3 sales and Carmel Valley Ranch picked up with 5. Carmel and Pacfic Grove both had slow quarters, posting 28 and 23 deals, respectively. Pebble Beach, plagued by some of the tightest inventory we’ve ever seen, was down to just 10 deals this quarter, compared to the 39 we saw in 1Q23. There continues to be strong demand for Pebble - just not the supply to support it. Monterey has held steady with 27 sales this quarter with continued demand for homes priced below $2M.

As buyers get fussier, days on market is starting to lag from the past few years. However, when the home is priced effectively, the listing moves. For those sales this quarter that didn’t need a price adjustment, average days on market is just 19. However, those homes that have moved their price have gone into escrow in 139 days. We anticipate this trend to continue as the active inventory currently has an average days on market of 91, with listings that have already had one price adjustment stretching out to 133.

The hottest topic in real estate is how the new regulations around buyer agent compensation will impact deal flow and pricing strategy. As of right now, we’re not seeing an immediate adjustment to practices in this area with sellers continuing to offer an incentive to buyers to cover agent compensation. The approach to conversations between the buyer and agent has already begun to evolve and it seems inevitable that the real estate buying experience will shift as buyers will need to be accountable for more costs up front. But it’s too soon to predict exactly how it will play out in this area.

With the start of a new year, there were a few notable changes in Pebble Beach – the first being the format of the famed AT&T Pro-Amateur tournament, which has become a signature event for the PGA Tour that drew the best field of professional golfers in the event’s history. The second being the anticipated closure of the storied equestrian center, which will be closing its doors this Summer. One thing that has not changed since 2021 is the lack of homes available for home buyers seeking to make a move into this exclusive community.

Inventory levels have hovered at razor-thin levels for nearly four years (averaging 30 active listings at any given quarter), which has created stiff competition for highly sought after homes or locations. Case in point, 5 out of the 10 sales that closed this quarter sold over list price with the average percentage above asking price at nearly +6%.

As buyers competed against one another for choice properties, overall home values in Pebble Beach rose to $3.18M – up 8.7% from the previous quarter. The highest sale this quarter was 3179 Del Ciervo ($5.575M) - a mid-century modern home designed by Will Shaw. With expansive views of Stillwater Cove, Carmel Bay and beyond, properties on the highly coveted Del Ciervo Rd rarely come available, which is why this property drew multiple offers and sold well over its asking price.

If you’re planning to bring your home to market this Spring, there are a couple important things to consider:

1) Interview multiple agents to determine who is best suited to represent you on this important sales process.

2) Finding the right list price for the property will generate the most amount of interest and ultimately sell the fastest at your desired sales price.

3) Utilizing innovative marketing strategies: In today's competitive market, a strategic approach to marketing is essential. Leveraging cutting-edge marketing strategies will help ensure your property receives maximum exposure while showcasing it in its best light.

4) Getting ahead of the due diligence process (I.E: getting inspections and determining what repairs or improvements to be made prior to coming to market). Recent analytics and trends have shown that the more proactive Sellers are in preparing their home, the more likely they’ll receive their desired offer price and terms.

Buyers are getting increasingly aggressive to win deals.

Carmel held a steady pace this quarter with 28 sales bringing in a total of $120M. Although this is slower than what is standard for downtown Carmel, it’s still a healthy pace as buyers are responding quickly to new inventory. It’s also encouraging to see the top of the market continue to build momentum going into the summer. We had two sales on Scenic out on Carmel Point, including one that booked off market at $18.9M. This is a good example of a sale where the target property ticked enough boxes for the buyer to be willing to pay a premium for it. It is an oversized house that went street-to-street with nice views but does need some updating. The other Scenic sale was a house overlooking River Beach that had been renovated recently and closed for $15.25M (up considerably from the $6.59M they paid for it in 2018). There are several marquee properties on Scenic coming to the market in the near future - reach out if you have any interest in moving frontline.

Demand continues to be strong across all regions in Carmel, with Carmel Point, the Golden Rectangle and Northeast Carmel having a particularly strong quarter. The Point had 4 sales including the two mentioned above on Scenic, plus one on Valley View (that also went street-to-street) that sold for $7.25M and one over on Isabella that sold for $4.95M. The top sale in the Rectangle was a mixed-use property on Lincoln & Ocean that sold for $7.5Mdown from the original list price of $9M. This is a good example of the market waiting for the list price to come down to what the market values it at; this listing has been on and off the market since 2020. The Northeast Carmel saw 9 sales this quarter, including 3130 Pico Avenue, which was recently renovated and closed above list price for $4M.

As we approach our peak selling season, we anticipate new inventory to come to the market starting in mid-May and staying strong through September. However, the buyer pipeline is very strong right now so we anticipate prices continuing to climb slightly through the year.

831.238.5535

Scenic 6 SW of Ocean | Carmel-by-the-Sea Scenic6SWofOcean.com | Offered at $9,000,000

Carmel Point Golden Rectangle

Hatton Fields

Northeast Carmel Northwest Carmel Southeast Carmel

Average

off list price 1Q2024 Sales 2% Demand for homes close to the beach will increase as we enter the summer.

During the first quarter of 2024, the Carmel Highlands (and Carmel Meadows) experienced limited traction in terms of real estate activity. With only a handful of listings to start the year, the pace of transactions remained modest and on par with the expected lull the first quarter of the year tends to bring.

As the first quarter of the year ended, there were 5 active listings in the Carmel Highlands ranging from a $1.6M partial ownership listing to a $25M Otter Cove property that’s currently under construction. And while both of those properties are still looking for buyers, two key Carmel Highlands sales to note during the first quarter were 9 Yankee Point Drive and 32684 Coastridge Drive, with both set to close in the first part of the second quarter. In the Carmel Meadows neighborhood, the first quarter finally saw 2615 Ribera Road go into escrow after 175 days on the market; similarly, it is set to close early April.

Despite the slower start to the year, the allure of the Carmel Highlands remains undeniable, attracting buyers drawn to its unique blend of natural beauty, tranquility, and exclusivity. As the days grow longer and the spring flowers begin to bloom, we anticipate a positive shift in momentum in the Carmel Highlands. With an active pipeline of upcoming listings and a market that tends to evolve with the changing seasons, keep an eye out.

Carmel Highlands

Carmel Highlands

The winter proved to be much milder this year than last - something we’re all grateful for.

The Quail market warmed up with the weather with two houses closing over on River Place this quarter. 8006 River closed for just above list price at $3.2M and had 4 bedrooms and 3.5 baths with approximately 2,900 sqft - much larger than the typical Quail Lodge house. The other sale was 8008 River Place which needed a lot of updating and closed for $2.335M. We’ve also seen a couple of new listings and sales in April, but those will be included in the 2Q report. There’s one condo in the 7020 Valley Greens complex that’s available for $1.6M; feel free to reach out for more information on that unit.

Quail Meadows opened up this quarter with 3 houses coming to the market and one already getting multiple offers and going into escrow. 5461 Quail Meadows Drive hit the market at $5.25M and immediately went into escrow. This home had been renovated recently with a new kitchen, laundry room and opened up floorplan - improvements that the market responded very well to. 5462 Quail Way came back to the market at $5.95M after updating two of the bathrooms and replacing the roof (to make insurance much easier). 5481 Covey Court also came to the market at $10.5M, which would be the most expensive sale in the history of Quail Meadows.

Spring has historically been the peak season for families to look for homes and we’ve seen a strong increase in demand from people looking to move from the Bay Area to Carmel for the schools, so we anticipate seeing this trend continuing until the Summer, when we get more buyers looking for vacation houses. As such, we anticipate demand to continue to hold steady and grow throughout the Spring, Summer and Fall, which will keep prices high for most of this year. The election this fall has the potential to distract buyers and sellers, so deal flow may fall off at the end of the year, but that’s an anomaly in the overall trends for Quail Lodge.

Buyers need to expect to pay north of $3M for Quail Lodge now.

The first quarter in The Preserve brought more seasonal rains than in the past, however, that didn’t stop buyers and sellers from transacting at a faster rate than normal. In the winter months, we have experienced buyers from the Northern United States seeking refuge in the Preserve due to our more moderate climate and endless world-class amenities, whether it be golf, hiking, horses, food, or just an understated elegant lifestyle.

As we review real estate sales activity in 2023, it appears that we are poised to have an exciting 2024 ahead of us. In 2023, there were only 2 finished homes that closed all year, and 5 closed lots. This year is proving to be off to a good start already with 2 home sales (one was off market), 2 homes currently in escrow and 2 closed lot sales.

The 1st quarter’s 2 home sales ($4.22M and $7.85M) had an average sale price of $6,136,000 and average of 69 Days on Market (DOM), and 2 lot sales at an average sales price of $6,140,000. There were no finished home sales in the last quarter of 2023, and only 1 lot sale that closed, so sales activity is definitely trending upward. There are currently 4 homes listed for sale – two are Active, and 2 are in escrow with asking prices of $8,000,000 and $7,500,000.

Historically, election years and the period leading up to April 15th have proven to be on the slow side, but we are not experiencing that trend in 2024. We anticipate an increase in sales activity as we have several amazing finished homes coming to the market in the next month or so and lots of buyers circling.

Brian Keck preserve specialist831.238.8730

*Indicates a Canning Properties Group Sale

Did you know? Our office building in Pacific Grove holds a fascinating piece of history. Originally constructed in 1904 by architect W.H. Weeks, it served as the Bank of Pacific Grove and stands as the only example of Romanesque Revival architecture on the Monterey Peninsula. Since the mid-1950s, it has housed various real estate companies, starting with Lewis Real Estate. Sotheby’s International Realty took over operations in 2013, and we're excited to continue our legacy in this beautiful and historic building. Conveniently located at 574 Lighthouse Avenue, our office offers the best spot in downtown Pacific Grove. Feel free to drop by anytime – we'd love to show you around!

1Q, 2024 presented notable challenges for Pacific Grove homebuyers due to limited inventory. With just 27 homes sold, including a standout $3.8 million sale in Beach Tract, buyers faced stiff competition. The average time on market was 43 days, with many buyers often paying over list price. The median sale price climbed to $1.6M In contrast, 4Q2023 saw 38 sales, with a $5.95M sale in Asilomar. The median price was $1.38M, 19% lower than 1Q-2024. Market dynamics will be interesting to watch next quarter.

In Pacific Grove, there are currently 15 single-family homes for sale. The highest-priced listing, located in the Beach Tract, is listed at $2.3M, featuring 3 bedrooms and 2 baths. Our median list price stands at $1.599M. Currently, 8 homes are in escrow, with the highest list price at $2.499M. Interest rates remain around 7%, with anticipation for a rate reduction by the Fed in early summer. Limited inventory is expected to persist, driving up buyer demand in the near future.

Home values are on the rise across all neighborhoods in Pacific Grove. In 1Q-24, Forest Hill and Del Monte Park witnessed notable sales at $2.3M and $1.9M, respectively. We're consistently setting higher standards for value, particularly for updated homes. Properties in dated or original condition tend to linger on the market and are less sought after. Out of town buyers tend to be the trend, looking for a 2nd home with hopes for retirement to PG soon. The most desirable locations continue to be Asilomar, Beach Tract, and streets below Central.

Arleen Hardenstein pacific grove specialist831.915.8989

Beach/Asilomar

Downtown PG

Washington Park/Pine Candy Cane Lane

Country Club/Forest Hill/ Del Monte Park

Proximity to downtown & the beach continues to be big draws for Buyers right now

Monterey's blend of history and beauty creates a magnificent place to live, as well as a desirable destination for all who visit. Monterey Bay Aquarium is celebrating 40 years of inspiring conservation of the ocean and oceanic wonder. The Aquarium is always creating new and exciting exhibits and is as innovative today as when they first opened in 1984. Through the end of 2023, Monterey Bay Aquarium has hosted more than 70 million visits. This has had an incredibly positive impact, putting Monterey on the map over the past 40 years!

Let’s move on to real estate for Monterey: there were 27 sales in 1Q2024 for a total of $34.6M. Although the market is slowing, down from 31 deals last quarter and $36.5M in sales last quarter, the tight inventory is keeping prices high. Median prices climbed back above $1.2M this quarter to $1.28M, which is up from $1.19M last quarter and $908K in 2Q23.

After reviewing the inventory, the bulk of the inventory and sales have been in the New Monterey neighborhood, with days on market at 28. The majority of sales closed above list price, especially when the property had bay or ocean views – which are bountiful in New Monterey. Many buyers were from the Bay Area or the Central Valley.

A specific property sale that stood out to me this quarter was located in my very own neighborhood of New Monterey. 580 Filmore Street, Monterey – with an 11,000+_ sq ft lot, 4 bedrooms and 3 baths, this property is ready for a dream renovation. The property sale included nearly-approved plans designed for a stunning modern home by M. Designs Architects to capture the beauty with incredible views of Monterey Bay and the northern Santa Lucia Mountains. The property sold for $1.6M and had multiple strong offers.

The Monterey market is heading in an exciting direction, with home values increasingly at a gradual pace, an uptick in properties coming to the market giving buyers an opportunity to purchase their dream home. The Spring weather certainly brings out the visitors with children on Spring Break, the casual conversations about properties and the market, and the overall excitement of longer days ahead!

831. 238.8688

Alta Mesa/Peter's Gate

Golf Course/Flats

Old Town/New Monterey

Monte Vista/Skyline Average % off list price 1Q2024 Sales 3% Sellers can be willing to negotiate if other terms in the offer are attractive.

2024 has launched with extra vigor in Carmel Valley Ranch. There were a total of 5 home sales, one of which sold for over ask. That’s a 63% increase YoY. We have not seen this vibrant of a first quarter since 1Q2021. Currently, there are 3 active homes on the market, and 1 pending which is set to close in early April. The average days on market was 83, although I’d like to highlight the sale at 28057 Hawk Court did go into escrow the quickest after just 11 days on the market. This was a beautifully updated property and priced right. One thing to point out is this house did not sell right at list price. It closed in less than 30 days. If you have the right agent working for you and come to the negotiating table with strong terms, even though the offer might be below list price, a deal can still successfully come together; and this is a perfect example.

A noteworthy sale was 9927 Club Place Lane where we had the privilege of representing the buyers. After being on the market for 105 days, this ended up getting multiple offers and our clients came in $25,000 over asking and were able to successfully get the deal done. What this also illustrates is when inventory is scarce and demand is high, buyers may have to pay a premium to secure a property. In addition, we’re seeing a very strong buyer pool at properties under $2 million.

Demand continues to remain strong for well-priced homes in desirable locations. It will be interesting to see how the rest of the year plays out while looking at macroeconomics and the current buyer demand and seller’s motivation. We’re seeing the market lean towards Carmel Valley Ranch as it continues to serve as an in-demand community due to the attractive price point, while also having resort-like amenities.

Colijn carmel & carmel valley ranch specialist831.710.1655

Paige

Paige

We've seen a strong rebound in sales this quarter, especially with sellers that are a bit flexible with price.

After experiencing no homes and only one lot selling in 2023, sales of homes and land in Tehama have remained rather flat, with the exception of an amazing home we listed for sale on Alta Madera. We have seen strong interest at this property and expect it to go quickly.

Typically, the first quarter is a slow time of year with tax preparation activities and the election coming which will likely cause Buyers to pause in the second half of the year. We find interest and showing requests for vacant land has increased a bit since the fourth quarter of 2023. There are 11 lots currently listed for sale on MLS, with prices ranging from $1.975M to $4M. The median list price is $2.75M with an average days on market (DOM) of 306 days.

Overall, the real estate market is still fairly robust here on the Monterey Peninsula as inventory in all areas remains low, especially for finished homes that are priced well and in move-in condition. Now that spring is here and the landscape has greened up beautifully, we look forward to an active 2nd quarter in 2024 with more people showing a renewed interest in Tehama as we bring another finished home to the market.

Brian Keck preserve specialist831.238.8730

$2.5 m

2023 Sales Price for Tehama Lots

In Tehema, land prices continue to be at a premium for the valley.

As we welcomed 2024, we are happy to report the first quarter of the year saw a remarkable increase in sales activity of both homes and land in Monterra.

Monterra recorded three home sales already this year at a median sales price of $5M at an average of $1,096 per sq.ft. and averaged 35 Days on Market (DOM). There was only one home sale in the last quarter of 2023 that sold at $4.55M at $1,152 per square foot. Currently there are two Monterra homes actively listed for sale – one brand new build on Manjares is listed at $6.895M ($1,665/sq,ft.) and a resale on Alturas is listed for $5.495M ($1,228/sq.ft.). Both really great properties, with an average DOM of 142 days so theoretically, they should sell soon.

Interest in vacant land has also increased in the first quarter of 2024. There were three vacant land sales with an average sale price of $709,667 totaling $2.129M (1 lot without water sold for just $180,000), with an average days on market for the sales of 279 days. There are currently 10 lots listed on MLS (Canning Properties Group has 6 of them). We have had some great showings and are expecting to receive an offer on one of our lots any day now. List prices currently range from $619K to $2.75M (for one of the Ranch Lots), with an average DOM of 397 days.

With spring upon us, everything has greened up and looks amazing in Monterra. Soon tax time will be behind us, and we can look forward to an active 2nd quarter with more buyers showing a renewed interest in the community.

Brian Keck preserve specialist

*Indicates a Canning Properties Group Sale

The market welcomed new inventory with a surge in sales this quarter.

Monterra Lots

Monterra Lots

Market Expertise:

With years of experience in the Pebble Beach area, we have a deep understanding of the local trends, property values and emerging opportunities.

Personalized Service:

We take pride in offering personalized and attentive service to our clients. Your goals are our priority, and we are committed to tailoring our approach to meet your specific needs.

Proven Track Record:

Our track record speaks for itself. We have successfully assisted numerous clients in your area achieve their real estate objectives, while delivering results that exceed expectations.

Innovative Marketing Strategies:

In today’s competitive market, a strategic approach to marketing is essential. We leverage cutting-edge marketing strategies to ensure your property receives maximum exposure.