by Canning Properties Group Mike Canning | Jessica Canning | Nic Canning | Ellen Armstrong | Brian Keck

Reese | Paige Colijn | Kelly Savukinas | Caroline Garcia | Seth Reese | Anita Jones | Spiro Pettas

2Q2023 Market Update Presented

Dave

The Monterey Peninsula market continued to rebound this quarter with 142 sales, which is up slightly from last quarter but still down from this time last year. However, it's looking increasingly likely that the bottom is behind us, with a strong rebound in our horizon. Read the Pebble Beach section for more details on this.

The bottom of the market has continued to show strong demand, despite rising interest rates, with a steady drumbeat of sales under $2M continuing through this quarter. The top of the market slowed considerably this year, with just 12 sales above $6M, compared to 35 in the first half of last year. Carmel is showing the earliest signs of revival with two sales in Carmel going above $6M, plus the Butterfly House going into escrow and set to close in July. However, Pebble is building momentum and traction in showings this month, so we anticipate an even stronger improvement next quarter across all regions.

Monterey had a nice uptick in sales this quarter, with 42 deals bringing in $44M in sales, which is up 17% from last quarter. Pacific Grove also held strong this quarter with 35 sales closing for a total of $52M (outselling even Pebble Beach). Carmel climbed a bit with 31 sales bringing in $109M, which is up a solid 11% from last quarter. Pebble Beach had just 20 sales this quarter, down about 38% from last quarter and with the top of the market so quiet, only closing $71M. As the top of the market gains momentum, we anticipate this changing quickly in both Pebble and Carmel. Quail Lodge has only strengthened coming out of COVID with 3 sales closing this quarter for $8M, all above list price. Carmel Valley Ranch also had a strong rebound with 5 sales this quarter, surpassing both last quarter and the first half of 2022. The Highlands had 2 closed escrows this quarter for about $6M, which is down historically speaking but, this market is particularly dependent on inventory levels, so we think this quarter is an anomaly. We also see a lot of buyers come look at the Highlands from the Central Valley once they hit 100 degrees, so we anticipate this market heating up as the summer marches on. The Preserve had just 1 sale this quarter which is low compared to the past couple of years, but that’s mostly related to extremely tight inventory levels up there as that community has really hit its stride and is growing nicely. Tehama and Monterra also had a steady quarter with 3 sales closing for a total of $4.7M.

More important than ever is pricing strategy right now. If a home is priced perfectly, it moves quickly. This quarter, even with the slow movement in the market, we saw 6 of the 9 markets we track have sales prices go over list price. This is frequently a remnant of buyers who missed out repeatedly during the past couple of years, but it’s worth noting. Overall, it appears that the market is transitioning back to a slow, steady growth that we’ve known over the past few decades as a healthy balance of buyers and sellers have returned to the market. The days when every house sells immediately with multiple offers and all contingencies released are over, with a return to a healthy, balanced market already taking over.

Canning

-Jessica

Overview Cover Home: 907 Laureles Grade, Carmel Valley CarmelValleyJewel.com

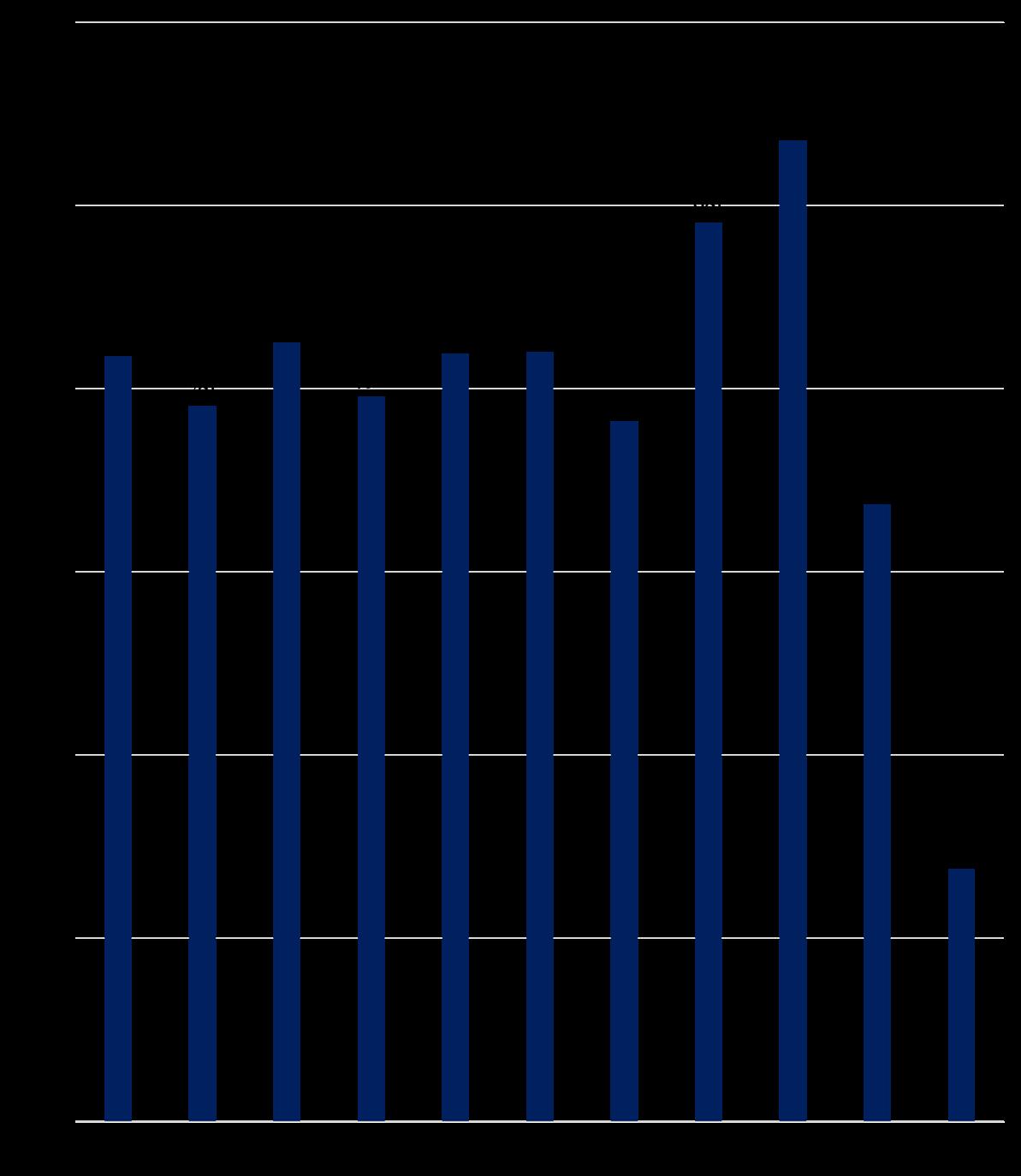

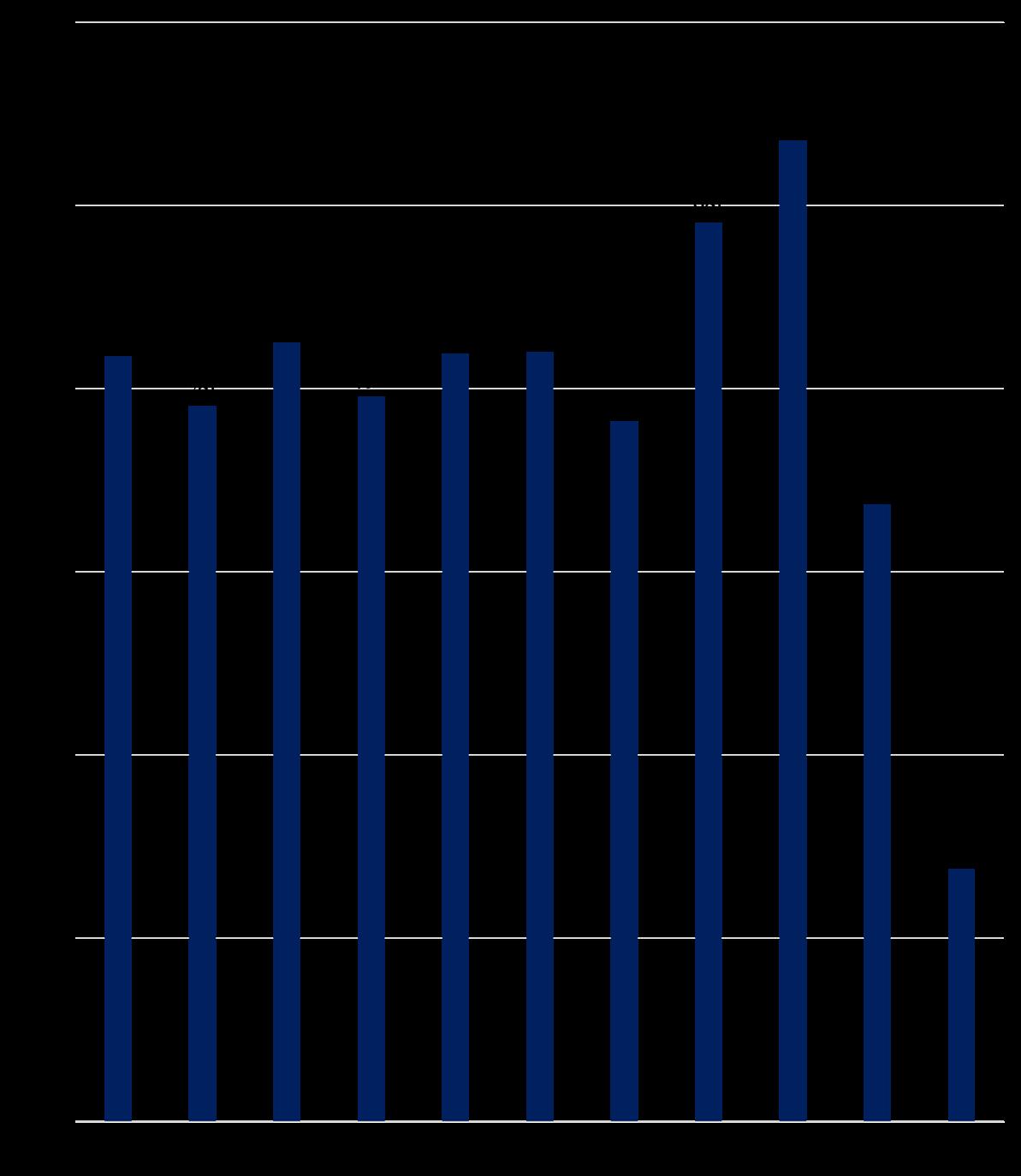

Median Sales Price ($M)

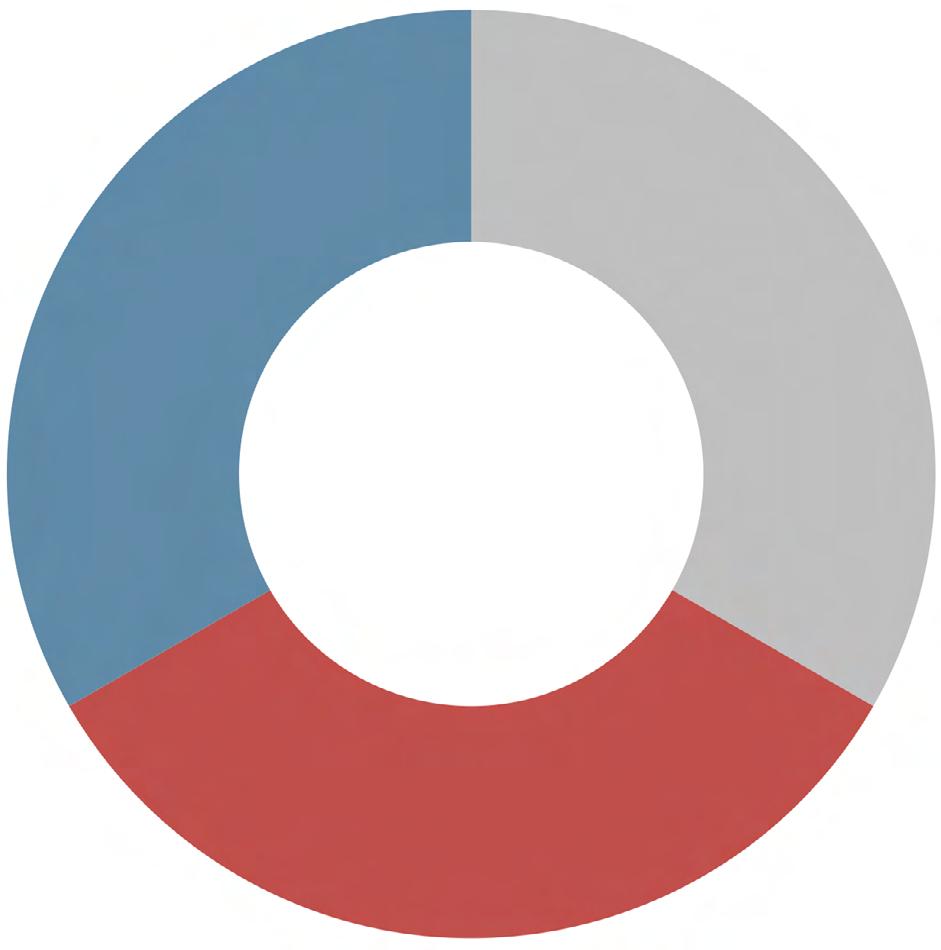

2Q2023 Sales by Price Range

Average Sales Price ($M)

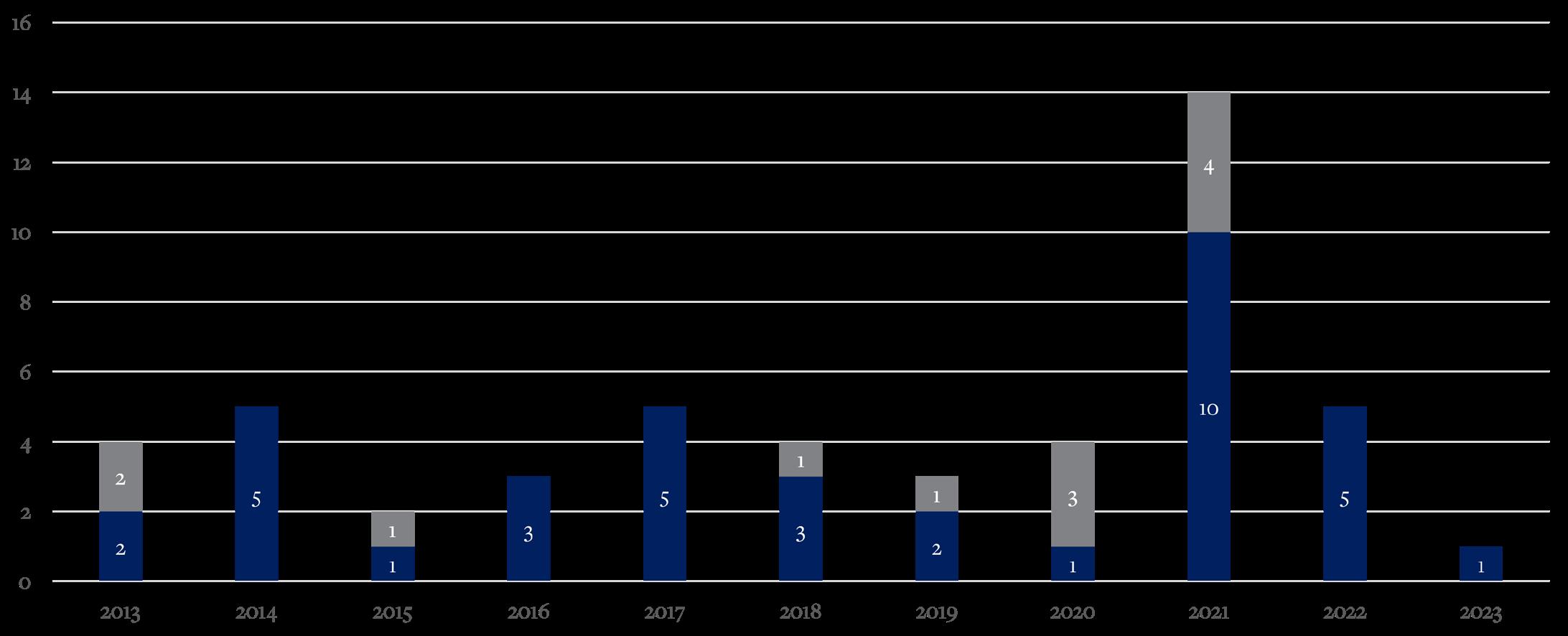

Total Annual Sales

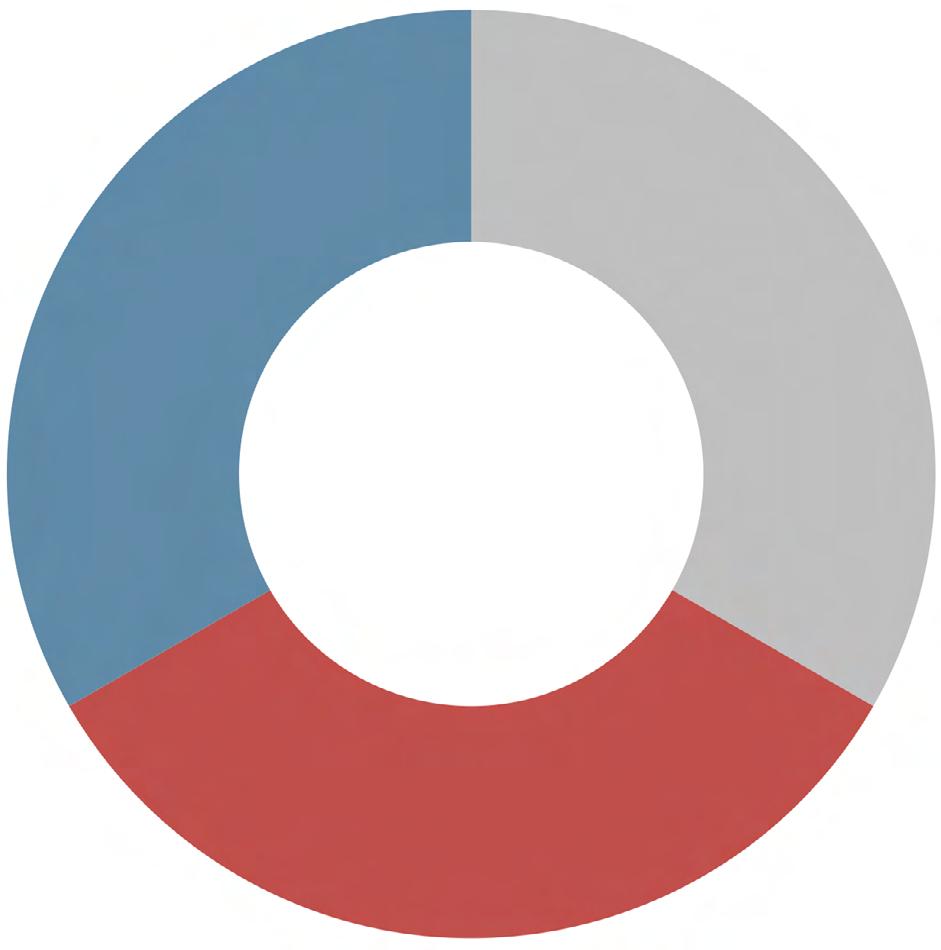

142 Total Sales

$8M+ 2 $6.0M-$8.0M 6 $4.0M-$6.0M 8 $3.0M-$4.0M 15 $2.5M-$3.0M 12 $2.0M-$2.5M 12 $1.5M-$2.0M 26 $1.0M-$1.5M 29 <$1.0M 32 Information believed to be reliable as obtained from the Monterey County Association of Realtors database and known off-market transactions.

2Q2023 Area YoY % Change $3.52 Carmel 12% $2.95 Carmel Highlands -46% $3.75 Pebble Beach -27% $2.69 Quail -41% $6.60 Preserve 27% $1.52 Pacific Grove 1% $2.50 Carmel Valley Ranch 53% $1.05 Monterey -18% N/A Tehama/Monterra N/A $2.23 Overall -17%

2Q2023 Area YoY % Change $3.13 Carmel 8% $2.95 Carmel Highlands -43% $2.74 Pebble Beach -13% $3.28 Quail -10% $6.60 Preserve 27% $1.47 Pacific Grove 7% $2.55 Carmel Valley Ranch 59% $0.91 Monterey -26% N/A Tehama/Monterra N/A $1.60 Overall -16%

Insight ALL REGIONS

Market

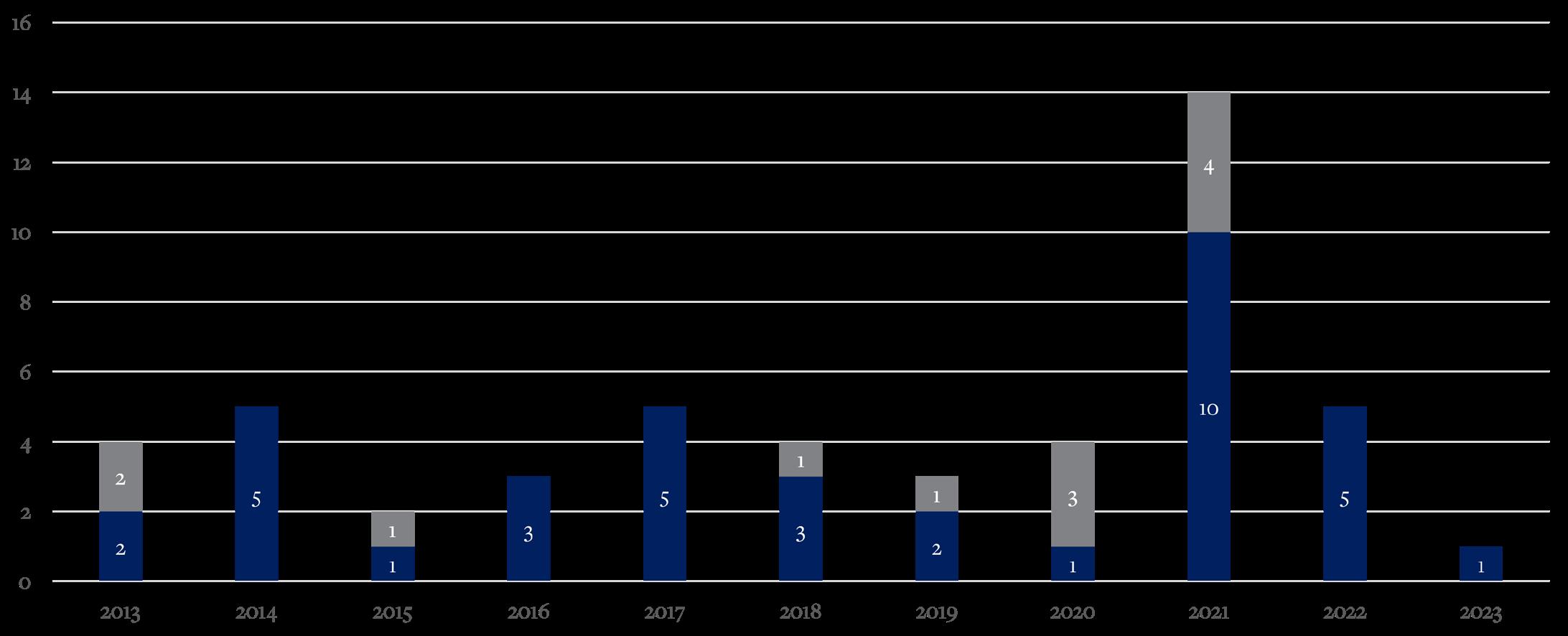

Quarterly Sales by Region

2Q2023 Update ALL REGIONS Sales Price Range 2Q2022 2Q2023 1H22 1H23 10 Year Average 2Q Sales 10 Year 1H Average <$1.0M 32 32 65 53 88 160 $1.0M-$1.5M 48 29 91 60 48 88 $1.5M-$2.0M 26 26 53 48 27 49 $2.0M-$2.5M 25 12 42 25 15 26 $2.5M-$3.0M 10 12 30 24 10 20 $3.0M-$4.0M 25 16 47 34 14 25 $4.0M-$6.0M 10 8 23 21 8 16 $6.0M-$8.0M 5 6 13 6 3 7 $8M+ 10 2 22 6 5 8 Total Sales 191 143 386 277 217 399

Quail Monterey Pebble Beach Preserve Pacific Grove Carmel # of Sales Monterra & Tehama Carmel Valley Ranch Carmel Highlands

Pebble Beach Market Overview

The Pebble Beach marketplace saw a more substantial cooling in the 2nd quarter than we typically see through tax season as both total sales and dollar volumes saw significant dips. In the 2nd quarter, there were a total of 20 sales invested in $70.9M - just above half of the 1st quarter which produced 32 sales and $108M. Reflecting on historical dip trendlines, when Pebble’s market has seen these dramatic slowdowns (13 sales in 2Q01 and 11 sales in 2Q07), the deal flow then rebounded the following quarter (+61% QoQ in 3Q01 and +136% QoQ in 3Q07). It will be interesting to see if this summer’s selling season follows those historical trends.

Similar to the 1st quarter, the majority of sales this quarter were concentrated between the $2M-$2.5M and $2.5M-$3M price brackets and took place in the MPCC East and Upper Forest areas. Deal flow in the upper price points remained subdued with only 3 sales above $6M, bringing the total for the first half of the year to just 6 sales (-68% YoY). As Buyer behavior patterns become more cautious in the upper price points, accurate pricing during this shifting market will be increasingly important for Sellers.

Reflecting the above mentioned trendlines, the median sales prices dropped in the Central Pebble Beach to $6.54M (-19.9% QoQ) while MPCC buoyed at $2.62M (+0.4% QoQ). The median sales prices reflect the softness at the top, with Central Pebble Beach dropping to $6.6M (-33% QoQ). But strong demand below $3M is driving up medians in MPCC and the Upper Forest to $3.34M (+24% QoQ) and $2M (+5.8%QoQ) respectively). Interestingly though, the Upper Forest had an uptick in median sales price too –bolstered by two sales of premium properties with ocean views along the more desired western rim of the Upper Forest. With the current inventory priced below $1.95M, I anticipate these numbers for the Upper Forest to return below $2M in the 3rd quarter.

With the slowdown in demand, we’re seeing a rise in the average days on market (DOM) for active listings, which stretched to 138 in Central Pebble Beach, 58 in MPCC and 86 in the Upper Forest. For sold properties this quarter, the average DOM rose as well to 54.4 (+51% QoQ) as Buyers are being more selective and patient for the right property that fits their needs to come along.

Some of the highlights this quarter include:

» 3 225 17 Mile Dr ($10M): A beautiful Mediterranean style home with filtered ocean views located nearby the Lone Cypress

» 966 Coral Dr ($6.7): A traditional style home located on the coveted 17th fairway of MPCC’s shore course that drew numerous offers and sold 20% over list price.

» 3223 Stevenson Dr ($7.7M): A French-Country style home privately situated around the corner from the Lodge at Pebble Beach.

With the rainy season behind us and summer arriving, the Pebble Beach forest is in full bloom and both the courses and trails are shining vibrant green. With a global audience for this event plus the Concours d'Elegance in August, I anticipate to see new and renewed interest from buyers seeking to own a part of this special community. We’ll keep an eye on these trendlines and will keep you posted on how the balance of the summer season evolves.

Featured Property Photo: 3348 Ondulado Road, Pebble Beach 3348Ondulado.com Nic Canning pebble specialist 831.241.4458

Sales by Price Range

$8M+ 1 $6.0M-$8.0M 2 $4.0M-$6.0M 4 $3.0M-$4.0M 1 $2.5M-$3.0M 4 $2.0M-$2.5M 3 $1.5M-$2.0M 1 $1.0M-$1.5M 1 <$1.0M 3 3225 17 Mile Drive $10,000,000 3323 Stevenson Drive $7,700,000 966 Coral Drive $6,700,000 2817 17 Mile Drive $5,500,000 3893 Ronda Road $5,398,000 1063 Mission Road $4,050,000 3172 Palmero Way $3,280,000 2823 Congress Road $2,800,000 3053 Strawberry Hill Road $2,740,000 42 Spanish Bay Circle $2,500,000 2Q2023

4041 Los Altos Drive $2,500,000 4021 El Bosque Drive $2,450,000 3060 Aztec Road $2,200,000 2967 Cormorant Road $2,189,000 4083 Los Altos Drive $1,550,000 2845 Forest Lodge Road $1,400,000 2821 Congress Road $850,000 6 Shepherds Knoll $815,000 2825 Congress Road $800,000

20 Total Sales 43% increase from 2Q22 $70.9M Total Dollar Volume 20 Units Sold in 2Q2023 54 Average Days on Market Get Smart 2Q2023 Snapshot 17% decrease from 2Q22 34% decrease from 1Q23 38% decrease from 2Q22 56% increase from 1Q23 38% decrease from 1Q23 2Q2023 Update PEBBLE BEACH

Top Pebble Beach Sales

2Q2023

Quarterly Sales by Region

The market is strengthening, with median sales prices climbing over the last quarter as buyers absorb inventory.

Average Home Sales Price ($M)

PEBBLE BEACH Quarter Median YoY % Change 2Q2023 $2.74 -13% 1Q2023 $2.67 -21% 4Q2022 $2.80 5% 3Q2022 $2.57 -12% 2Q2022 $3.14 -10%

Quarter Average YoY % Change 2Q2023 $3.75 -27% 1Q2023 $3.53 -55% 4Q2022 $4.97 24% 3Q2022 $4.00 -13% 2Q2022 $5.13 12%

Increase in median sales price from 1Q2023

# of Sales

Median Home Sales Price ($M)

3%

Central Pebble Beach MPCC Upper Forest

2Q2023 Update

Carmel Market Overview

Carmel rebounded nicely in the second quarter with 32 deals closing for $112M, which is up about 14% from last quarter. We're still well below 2Q22, but it's encouraging to see the market bounce back, both in deal flow and across the price spectrum. Although the majority of deals were below $3M, we did see 9 deals close from $3-4M and 4 north of $6M.

The buyer pipeline also increased this quarter, although most are new to the market and getting familiar with pricing and expectations. As such, they’re taking a thoughtful approach to their efforts, which has stretched out days on market to 36 this quarter, up from 16 at this time last year. The combination of tight inventory and slower buyers has impacted all of the areas in Carmel, fairly evenly. Northern Carmel continues to benefit from strong demand in the $2-3.5M range, with 15 deals closing for $41M across Northwest and Northeast Carmel. The Golden Rectangle had a decent quarter with 8 closed escrows for $43M which is up nicely from last quarter. Southeast Carmel had 6 sales bring in $17M. Carmel Point had just 2 sales for $10.8M, which included 26285 Valley View which closed for $7.5M, up just a bit from the $7.35M that they paid in 2021 but down considerably from their original list price of $8.995M. Somewhat surprisingly, Hatton Fields didn’t have any sales this quarter, but that’s most likely just an anomaly and unique to this quarter as that area continues to be in demand.

Overall median pricing climbed this quarter to $3.13M, which is actually up over last quarter and this year. However, sellers are having to come off their stretch prices as the current discount off list price is 3%, closer to historic averages for downtown Carmel. It looks increasingly like the contraction in the market is behind us and we're returning to classic Carmel fundamentals.

Featured Property Photo: 2579 14th Avenue, Carmel CarmelCottageon14th.com Jessica Canning carmel

831.238.5535

specialist

2Q2023 Sales by Price

Top Carmel Sales

$8M+ 1 $6.0M-$8.0M 3 $4.0M-$6.0M 3 $3.0M-$4.0M 9 $2.5M-$3.0M 4 $2.0M-$2.5M 6 $1.5M-$2.0M 3 $1.0M-$1.5M 2 <$1.0M 0 Scenic Road 4 NW of 10th Avenue $8,672,000 26285 Valley View Avenue $7,500,000 SWC of Carmelo & 7th Avenue $6,550,000 San Antonio 2SE of 11th Avenue $6,500,000 NEC Camino Real & 8th $5,995,000 Carmelo 4 SE of 13th $5,300,000 SEC Lincoln & 3rd Street $4,700,000 Lincoln 3 SE of 10th Avenue $3,965,000 24410 S San Luis Avenue $3,935,000 Casanova 3 SE of 4th Avenue $3,825,000

Lincoln 3 SW of 11th $3,725,000 5 SW of 8th on Junipero $3,562,500 NEC Santa Rita & 5th Street $3,454,500 2633 16th Avenue $3,275,000 Crespi Ave 2 SW of Mountain View $3,200,000 Mission 8 SE of 8th Avenue $3,125,000 24681 Guadalupe Street $2,850,000 Mission 2NW of 1st Street $2,675,000 San Carlos 2 SW of 2nd $2,500,000 San Carlos 3 SE of 11th $2,437,606

2Q2023

Range 31 Total Sales *Bold Indicates a Canning Properties Group Sale 118% increase from 2Q22 $109M Total Dollar Volume 31 Units Sold in 2Q2023 36 Average Days on Market Get Smart 2Q2023 Snapshot 39% decrease from 2Q22 11% increase from 1Q23 32% decrease from 2Q22 77% increase from 1Q23 19% increase from 1Q23 2Q2023 Update CARMEL

CARMEL Quarter Median YoY % Change 2Q2023 $3.13 8% 1Q2023 $3.02 9% 4Q2022 $2.90 -7% 3Q2022 $2.60 5% 2Q2022 $2.90 16% Median Home Sales Price ($M) Quarter Average YoY % Change 2Q2023 $3.52 12% 1Q2023 $3.92 13% 4Q2022 $3.83 6% 3Q2022 $3.17 5% 2Q2022 $3.14 7% Average Home Sales Price ($M) Average % off list price 2Q2023 Sales 3% # of Sales

Central Pebble Beach MPCC Upper Forest Quarterly Sales by Region 2Q2023 Update Northeast Carmel Northwest Carmel Southeast Carmel

With some negotiations,thoughtful sellers are still getting strong sales prices, albeit off their list price.

Carmel Highlands

Historically, the second quarter in both the Carmel Highlands and Carmel Meadows markets is slow, but 2Q23 has set a new 10-year low, with only 2 properties selling during the entire quarter in these two areas combined. Canning Properties Group is honored to have represented the sellers of the only home sold last quarter in the Highlands—20 Mentone Road—which closed at the asking price of $4,150,000 in less than a week on the market. On the other hand, the only property sold in the “Meadows” area was the sale of 27302 Highway 1, which is something of an outlier in that it is not in the actual Carmel Meadows neighborhood, making it hard to place as far as stats are concerned. This home sold after almost a year on the market (originally listing at $2.4M) for $1.75M.

Considering the current market in each of these areas separately, there are 9 homes listed for sale in the Carmel Highlands, averaging about 170 days on market (DOM) with an average asking price of just under $7.5M. Canning Properties Group is excited to be representing the sellers of one of these 9 listings: 32684 Coast Ridge Drive—a beautiful, retreatlike property, exuding a Zen ethos and Pacific Ocean views—offered at $4.25M. In the Carmel Meadows market, after over a year without a single listing (and therefore no sales), there are now 2 brand new listings on highly sought after Ribera Road with an average asking price of $3.9M.

Though the market has undeniably slowed, luxury properties in our area are still in demand as evidenced by the May 26th sale of 35678 Highway 1—just south of the Highlands on the Big Sur coast—for an impressive $24.5M. Furthermore, 2 of the 3 new high-end, custom home projects in progress on Spindrift Road are nearing completion and will both be significant additions to the prestige of an already exclusive and unique real estate market. So while 2Q23 was not strong compared to recent market quarters, we expect the Highlands and Meadows areas to remain in demand for discerning buyers seeking high-end properties and the experience of coastal living in Central California.

Featured Property Photo: 32684 Coast Ridge Drive, Carmel Highlands 32684CoastRidge.com Dave Reese highlands specialist 831.272.2172

Market Overview

$8M+ 0 $6.0M-$8.0M 0 $4.0M-$6.0M 1 $3.0M-$4.0M 0 $2.5M-$3.0M 0 $2.0M-$2.5M 0 $1.5M-$2.0M 1 $1.0M-$1.5M 0 <$1.0M 0 20 Mentone Road $4,150,000 27302 Highway 1 $1,750,000 2Q2023 Top Area Sales

Sales

Price Range

Total Sales *Bold Indicates a Canning Properties Group Sale 86% decrease from 2Q22 $5.9M Total Dollar Volume 2 Units Sold in 2Q2023 21 Average Days on Market Get Smart 2Q2023 Snapshot 83% decrease from 2Q22 60% decrease from 1Q23 91% decrease from 2Q22 68% decrease from 1Q23 60% decrease from 1Q23 2Q2023 Update

2Q2023

by

2

CARMEL HIGHLANDS

Quarterly Sales by Region

2Q23 set a new 10-year low, with only 1 property selling during the quarter (which we are honored to have represented the sellers).

Average Home Sales Price ($M)

CARMEL HIGHLANDS Quarter Median YoY % Change 2Q2023 $2.95 -43% 1Q2023 $3.06 -23% 4Q2022 $5.10 62% 3Q2022 $3.75 46% 2Q2022 $5.20 -29%

Price ($M) Quarter Average YoY % Change 2Q2023 $2.95 -46% 1Q2023 $3.23 -50% 4Q2022 $5.10 27% 3Q2022 $10.64 263% 2Q2022 $5.50 -26%

Days on Market for Active Listings in the Carmel Highlands 170+ # of Sales

Median Home Sales

2Q2023 Update

Carmel Highlands Carmel Meadows

Quail Lodge/Meadows

Quail Lodge continues to prove itself as one of the most coveted communities in Carmel and is increasingly known for its serene surroundings, pristine golf amenities and ideal weather. With so much demand to be a part of this community, home values in Quail Lodge continues to surpass other highly sought after communities like Monterey Peninsula Country Club (MPCC). In fact, for the third quarter in a row, Quail Lodge has posted a higher median sales prices than MPCC ($3.28M vs $2.5M)

The area's desirability has resulted in a scarcity of available properties, with zero active listings currently on the market. These razor-thin inventory levels continue to favor sellers - pushing prices higher, keeping negotiations competitive and driving some buyers to pursue off-market opportunities. Despite the shortage, the real estate market in Quail Lodge has witnessed five sales in 2023 so far. Notably, these sales include the successful transactions of 7026 Valley Greens Circle #4, a beautifully renovated condominium that sold above asking price for $1.5M after only six days on the market, as well as 7036 Valley Greens Circle, which sold off-market for $3.27M, and 7007 Valley Green Circle, which sold within one day for over asking price at $3.29M. With an average days on market of just 2, these swift sales exemplify the high demand and quick turnover in this soughtafter area. Sellers have also achieved an average of 3% above the asking price, indicating a strong market and the willingness of buyers to invest at a premium in this desirable location.

Looking ahead to the next quarter, residents and prospective buyers can look forward to a range of exciting developments. The ongoing improvements in Quail Lodge include the planned re-paving of all the roads which will enhance accessibility and convenience for residents. Additionally, the highly anticipated event, "The Quail," taking place in August, will attract automotive enthusiasts from around the world. This event showcases rare and exceptional automobiles, luxury lifestyle exhibits and fine cuisine, further augmenting the allure of the Quail Lodge community.

Considering the prevailing real estate trends and the upcoming Car Week this August, we anticipate this sub-market to remain strong and competitive throughout the summer selling season. Buyers can anticipate more competition and should be prepared to act quickly when listings do come to market. Whether you are contemplating selling or seeking more information on current market trends, our dedicated team is here to assist you.

Visit DiscreetProperties.com to view all upcoming and off market listings.

Jessica Canning quail specialist 831.238.5535

Market Overview

2Q2023 Sales by Price

$8M+ 0 $6.0M-$8.0M 0 $4.0M-$6.0M 0 $3.0M-$4.0M 2 $2.5M-$3.0M 0 $2.0M-$2.5M 0 $1.5M-$2.0M 1 $1.0M-$1.5M 0 <$1.0M 0 7007 Valley Greens Circle $3,292,200 7036 Valley Greens Circle $3,275,000 7026 Valley Greens Circle #4 $1,500,000 2Q2023 Quail Lodge & Meadows Sales

3 Total Sales 90% decrease from 2Q22 $8.1M Total Dollar Volume 3 Units Sold in 2Q2023 2 Average Days on Market Get Smart 2Q2023 Snapshot Even with 2Q22 82% increase from 1Q23 41% decrease from 2Q22 82% decrease from 1Q23 50% increase from 1Q23 2Q2023 Update QUAIL LODGE / MEADOWS

Range

Quarterly Sales by Region

QUAIL LODGE / MEADOWS Quarter Median YoY % Change 2Q2023 $3.28 -10% 1Q2023 $2.21 -43% 4Q2022 $3.39 -26% 3Q2022 $3.00 90% 2Q2022 $3.65 52% Median Home Sales Price ($M) Quarter Average YoY % Change 2Q2023 $2.69 -41% 1Q2023 $2.21 -36% 4Q2022 $3.39 -25% 3Q2022 $3.00 22% 2Q2022 $4.53 116% Average Home Sales Price ($M) Average % above list price 2Q2023 3% # of Sales

Demand continues to outstrip supply, with the market searching for single level and move-in ready homes.

2Q2023 Update

Quail Lodge Quail Meadows

Pacific Grove Market Overview

Pacific Grove, known for its Victorian Inns, B&B’s and rolling purple carpet along the coastline continues to bring visitors and buyers, even through the June gloom. In the second quarter of 2023, the housing market in Pacific Grove continued to experience steady sales, although there was a leveling out in sales prices, with price reductions throughout the area. With the uncertainty of inflation, rising interest rates and tight inventory, the housing market continues to face challenges that can impact both buyers and sellers.

Pacific Grove saw consistent sales activity throughout the second quarter. In April, there were 10 sales, with an average price of $1.4M. May saw a slight increase in sales, with 14 properties sold at an average sales price of $1.5M. June, however, experienced a decrease in sales, with only 8 properties sold and an average sales price of $1.3M. This trend can be attributed to rising interest rates and market uncertainty.

Inventory levels remained relatively flat compared to the previous quarter of 2023. Tight inventory continues to sustain home prices as buyers compete for a limited number of available properties. The average sales price in 2Q2023 remained flat compared to Q1. The sum of home sale prices for the second quarter was $52.3M.

The average days-on-market decreased to 32 days in 2Q2023. This indicates a 38% decrease from Q1, suggesting a steady amount of time on the market and a healthy market for buyers.

The Forest Avenue area had the highest number of sales, totaling 12 with Washington Park closely following with 7 sales. The highest priced sale for Q2 was $3.1M on Del Monte Boulevard.

Overall, the second quarter remained steady for the housing market in Pacific Grove, with the biggest change in a decrease in days on market. With higher interest rates and tight inventory, it’s crucial for buyers to be well prepared and proactive, ready to position themselves when the right opportunity becomes available. If you are considering buying or selling in the Pacific Grove area, I would be happy to walk you through the process!

Featured Property Photo: 2853 Ransford Avenue Pacific Grove 2853RansfordAve.com Kelly Savukinas pacific grove specialist 831. 238.8443

$8M+ 0 $6.0M-$8.0M 0 $4.0M-$6.0M 0 $3.0M-$4.0M 1 $2.5M-$3.0M 2 $2.0M-$2.5M 1 $1.5M-$2.0M 12 $1.0M-$1.5M 12 <$1.0M 7 1218 Del Monte Boulevard $3,150,000 542 Lighthouse Avenue #401 $2,899,000 1244 Surf Avenue $2,508,000 706 Hillcrest Avenue $2,499,000 222 Wood Street $1,949,000 416 9th Street $1,850,000 817 Congress Avenue $1,850,000 311 Chestnut Street $1,795,000 307 Stuart Avenue $1,770,150 1007 Benito Avenue $1,700,000

318 18th Street $1,700,000 641 Eardley Avenue $1,630,000 957 Syida Drive $1,575,000 409 Congress Avenue $1,575,000 501 Eardley Avenue $1,505,000 1156 Devisadero Street $1,500,000 514 7th Street $1,493,005 238 Crocker Avenue $1,450,000 405 Gibson Avenue $1,336,000 910 Short Street $1,300,000 4Q2022 Sales

Price Range 35 Total Sales *Bold Indicates a Canning Properties Group Sale 149% increase from 2Q22 $52.3M Total Dollar Volume 35 Units Sold in 2Q2023 32 Average Days on Market Get Smart 2Q2023 Snapshot 26% decrease from 2Q22 3% decrease from 1Q23 25% decrease from 2Q22 38% decrease from 1Q23 6% increase from 1Q23 2Q2023 Update PACIFIC GROVE

2Q2023 Top Pacific Grove Sales

by

Quarterly Sales by Region

PACIFIC GROVE Quarter Median YoY % Change 2Q2023 $1.47 7% 1Q2023 $1.47 -8% 4Q2022 $1.15 -8% 3Q2022 $1.38 6% 2Q2022 $1.38 14% Median Home Sales Price ($M) Quarter Average YoY % Change 2Q2023 $1.52 1% 1Q2023 $1.68 -1% 4Q2022 $1.41 -11% 3Q2022 $1.55 3% 2Q2022 $1.50 7% Average Home Sales Price ($M) Average % over list price 2Q2023 Sales 3% # of Sales

The PG market continues to show steady sales in Q2 with higher demand and fewer days on market.

2Q2023 Update Beach/Asilomar Central Ave/Downtown Downtown PG Washington Park/Pine Candy Cane Lane Country Club/Forest Hill/Del Monte Park

With the first half of 2023 behind us, it seems as if the weather and the housing market have been working in tandem – leaving many of us longing for sunnier skies and just a sliver of predictability in the housing market, where stability and reliable trends can provide a sense of reassurance and confidence to homeowners and prospective buyers alike. Luckily, summer has brought about a positive change in the weather and it’s encouraging to see the housing market starting to follow suit.

Amidst the challenge of paltry inventory levels throughout the Peninsula during the second quarter of 2023, Monterey home sales saw a significant jump (42), surpassing the previous three quarters' sales while paving the way for promising things ahead. Additionally, during the second quarter of 2023, the Days on Market (24) dropped just a fraction from the previous quarter, but was right in line with Days on Market from the same quarter last year.

The combination of limited inventory and high demand has created an atmosphere of exclusivity and allure in the Monterey housing market. With median home prices dropping below $1M for the first time in over a year and showcasing a downward trajectory (-26% YoY), the appeal of this sophisticated coastal enclave becomes even more enticing. Amidst this upscale market, it's important to note that Monterey still caters to diverse tastes and budgets – providing a range of housing options that embody elegance and luxury at a wide array of price points. Whether you're seeking a breathtaking seaside retreat or a stylish forest oasis, Monterey offers the perfect blend of sophistication and affordability.

As we enter the second half of 2023, it's essential to embrace the cyclical nature of real estate markets with optimism and a proactive mindset. These cycles, characterized by periods of ups and downs, are natural and present opportunities for both buyers and sellers. During times of economic growth, there is a vibrant seller's market, where motivated buyers and favorable mortgage rates create a thriving environment. It's important to remember that even during economic downturns, opportunities arise. A buyer's market allows for more negotiating power and potential for finding great deals. By staying informed, adapting strategies, and embracing the different phases of the economy both buyers and sellers can navigate the real estate market successfully and make the most of the opportunities presented. With resilience and a positive outlook, the ever-changing nature of the real estate market becomes an exciting journey filled with possibilities.

Featured Property Photo: 817 Via Mirada, Monterey 817ViaMirada.com Spiro Pettas monterey specialist 831. 214.3377

Monterey Market Overview

$8M+ 0 $6.0M-$8.0M 0 $4.0M-$6.0M 0 $3.0M-$4.0M 0 $2.5M-$3.0M 0 $2.0M-$2.5M 2 $1.5M-$2.0M 6 $1.0M-$1.5M 12 <$1.0M 22 1225 Aguajito Road $2,050,000 538 Watson Street $2,005,000 1580 Irving Avenue $1,850,000 280 Soledad Drive $1,702,000 1611 Hoffman Avenue $1,600,000 20 Cuesta Vista Drive $1,585,000 933 Fountain Avenue $1,505,000 1 Abinante Way $1,500,000 14 Cielo Vista Terrace $1,400,000 1684 Via Isola $1,375,000

22 Via Buena Vista Drive $1,325,000 676 Lottie Street $1,300,000 134 San Bernabe Drive $1,300,000 1250 Harrison Street $1,264,000 10 Greenwood Rise $1,240,000 140 Shady Lane $1,225,000 1184 Josselyn Canyon Road $1,210,000 549 Mar Vista Drive $1,200,000 721 Oak Street $1,030,000 514 Toyon Drive $1,000,000 2Q2023

42 Total Sales 5% decrease from 2Q22 $44M Total Dollar Volume 42 Units Sold in 2Q2023 24 Average Days on Market Get Smart 2Q2023 Snapshot 5% increase from 2Q22 17% increase from 1Q23 10% decrease from 2Q22 1% decrease from 1Q23 40% increase from 1Q23 2Q2023 Update MONTEREY

2Q2023 Top Monterey Sales

Sales by Price Range

Median

Quarterly Sales by Region

0%

The combination of limited inventory and high demand has created an atmosphere of exclusivity in the Monterey market.

Average

MONTEREY Quarter Median YoY % Change 2Q2023 $0.91 -26% 1Q2023 $1.25 11% 4Q2022 $1.12 10% 3Q2022 $1.14 21% 2Q2022 $1.22 29%

Home Sales Price ($M) Quarter Average YoY % Change 2Q2023 $1.05 -18% 1Q2023 $1.27 6% 4Q2022 $1.10 -4% 3Q2022 $1.18 15% 2Q2022 $1.28 21%

Home

Price ($M)

2Q2023 Sales

# of Sales

Sales

No Discounts given for

2Q2023 Update Monte Vista/Skyline New Monterey

Golf Course/Flats Old Town

Alta Mesa/Peter's Gate

Carmel Valley Ranch

As we started to finally feel relief from the winter storms and enjoy some sunnier days, 2Q2023 kicked off with both sellers and buyers eager to make some moves in the real estate market.

Carmel Valley Ranch experienced a notable surge in activity this quarter compared to the start of this year, with 5 home sales, 1 currently pending in escrow and 3 active listings. Three significant sales took place, including 9932 Holt Road, which sold for an impressive $100 K over the list price at $3.3 M , 10058 Oak Branch Circle for $3.1 M , and 9502 Alder Court for $2.55 M . Additionally, 9909 Club Place Lane fetched $3 M .

The average days on the market for The Ranch stood at 35, indicating a swift turnaround for properties. The total in sales for 2Q2023 was $12.494 M which, when compared YoY is an impressive 585% higher in overall total dollar volume. Comparing these figures to the same quarter last year, we observe a 433% increase in home sales, which brings positive news for the Valley.

The Ranch offers an exceptional quality of life, combining natural beauty, recreational activities, a favorable climate, and a strong sense of community. Whether it's enjoying the stunning landscapes, indulging in outdoor pursuits, or embracing the region's cultural offerings, living here provides an idyllic and enriching experience. The desirability of the area, limited inventory, and stable market conditions further contribute to Carmel Valley's reputation as an attractive destination for home buyers.

If you have any interest in selling your home or are simply curious about its current market value, I invite you to reach out to me. I am here to address any inquiries you may have and discuss your specific situation. My team and I are dedicated to delivering exceptional service and catering to all your real estate needs!

Featured Property Photo: 907 Laureles Grade, Carmel Valley CarmelValleyJewel.com Paige Colijn carmel & carmel valley ranch specialist 831.710.1655

Overview

Market

$8M+ 0 $6.0M-$8.0M 0 $4.0M-$6.0M 0 $3.0M-$4.0M 2 $2.5M-$3.0M 1 $2.0M-$2.5M 0 $1.5M-$2.0M 2 $1.0M-$1.5M 0 <$1.0M 0 9932 Holt Road $3,300,000 10058 Oak Branch Circle $3,100,000 9502 Alder Court $2,550,000 28093 Barn Way $1,999,000 9909 Club Place Lane $1,545,000 2Q2023 Top Carmel

Range 5 Total Sales 29% decrease from 2Q22 $12.5M Total Dollar Volume 5 Units Sold in 2Q2023 35 Average Days on Market Get Smart 2Q2023 Snapshot 433% increase from 2Q22 168% increase from 1Q23 585% increase from 2Q22 22% decrease from 1Q23 220% increase from 1Q23 2Q2023 Update

Valley Ranch Sales 2Q2023 Sales by Price

CARMEL VALLEY RANCH

Quarterly Sales

CARMEL VALLEY RANCH Quarter Median YoY % Change 2Q2023 $2.55 59% 1Q2023 $2.15 -12% 4Q2022 $0.00 -100% 3Q2022 $2.05 12% 2Q2022 $1.60 -14% Median Home Sales Price ($M) Quarter Average YoY % Change 2Q2023 $2.50 53% 1Q2023 $2.16 -12% 4Q2022 $0.00 -100% 3Q2022 $1.92 4% 2Q2022 $1.63 -10% Average Home Sales Price ($M) Average % off list price 2Q2023 Sales 2% # of Sales

list

Demand for properties in The Ranch remains high with little negotiating room off

price.

2Q2023 Update

Carmel Valley Ranch

Santa Lucia Preserve Market Overview

Mild spring and early summer temperatures have brought wildflowers, outdoor activities, and the purest golf playing conditions to the Preserve. The Ladies’ Roundup Invitational just concluded, the Fandango Equestrian event is just around the corner and memebers are enjoying making memories at Moore’s Lake, the Polo Pool, and the pickleball courts.

It was a second slow quarter in a row with no homesite sales and one impressive, finished home sale at 42 Rancho San Carlos Road for full price at $6.595M. This same home was on the market in 2017-2018 for $4.9M when it didn’t sell and this time around, sold at full price in just 3 days after many showings leaving a few buyers who missed out. It remains a good time to sell as this sale was 13.2% above the 2022 median price.

Although no homes are actively listed, we have a new construction Vucina build coming soon with 3 beds | 3.5 baths just under 3,900 square feet, contemporary farmhouse design for $4.9 M . We also have a few others off market for $5 M and $10 M - please inquire for more details.

Although no homesites sold, we have one of the best golf course view lots in escrow at 33 Pronghorn Run near $2 M and the best available lot on the Peninsula at 12 Rancho San Carlos Road with approved Studio Schichetanz plans, white water views of Pebble Beach and Point Lobos, helicopter, agriculture, and livestock rights on over 171 acres.

We were honored to represent both the buyer and seller of the beautiful Hart|Howerton 5 bedrooms, 4 full & 3 half baths, 5,780 square foot design at 42 Rancho San Carlos Road.

Featured Propety Photo: 12 Rancho San Carlos Road, Carmel 12RanchoSanCarlos.com

Brian Keck preserve specialist 831.238.8730

2Q2023 Sales by Price Range

$8M+ 0 $6.0M-$8.0M 1 $4.0M-$6.0M 0 $3.0M-$4.0M 0 $2.5M-$3.0M 0 $2.0M-$2.5M 0 $1.5M-$2.0M 0 $1.0M-$1.5M 0 <$1.0M 0

1 Total Sales *Bold Indicates a Canning Properties Group Sale 99% decrease from 2Q22 $6.59M Total Dollar Volume 1 Units Sold in 2Q2023 3 Average Days on Market Get Smart 2Q2023 Snapshot 67% decrease from 2Q22 1047% increase from 1Q23 5% increase from 2Q22 100% decrease from 1Q23 Even with 1Q23 2Q2023 Update

PRESERVE 2Q2023 Preserve Sales Homes Lots 42 Rancho San Carlos $6,595,000 No Lots Sold This Quarter

SANTA LUCIA

SANTA LUCIA PRESERVE Quarter Median YoY % Change 2Q2023 $6.60 27% 1Q2023 $0.00 N/A 4Q2022 $6.38 18% 3Q2022 $5.90 -8% 2Q2022 $5.20 38% Median Home Sales Price ($M) Quarter Average YoY % Change 2Q2023 $6.60 27% 1Q2023 $0.00 N/A 4Q2022 $6.38 18% 3Q2022 $5.90 -6% 2Q2022 $5.20 33% Average Home Sales Price ($M) Average % off list price 2Q2023 Sales 0% # of Sales

2Q2023 Update Preserve Lots Preserve Houses

Demand continues to be very strong for homes in the Preserve, with little negotiating room on off market options.

Quarterly Sales by Region

Home and land sales in Tehama slowed significantly in the second quarter of 2023, much as they have throughout the Monterey Peninsula which is fairly typical for this quarter. This is a common trend we see year-after-year as we enter the summer season.

There were no Tehama home sales recorded in the second quarter of 2023. The one home that is listed for sale for $11.95M has been on the market for 273 days. Lot sales were limited to one closed transaction in the same time period. This stunning lot was on the market for 151 days at a list price of $2.75M, and sold for $2.5M.

There are currently 10 lots listed for sale in Tehama that range in price from $2.595M to $4M. Canning Properties Group represents the sellers of four of those lots. The majority of the remaining lots are developer owned lots that came back to the market mid-May. There has been some renewed activity with the reintroduction of the developer lots, but nothing has gone into contract as of this date.

As you may have heard, homeowner’s insurance has created some challenges for us in the last month or so now that Allstate is no longer writing new policies in California, but we have access to Brokers who are able to provide coverage through other vendors at fairly competitive rates. Tehama continues to be vigilant in their quest to provide a “fire safe” community and is to be commended for their efforts in that regard.

There have been some improvements made to the Clubhouse these last few months and now that summer has arrived and the days are longer, we look forward to increased activity and renewed interest in the Tehama community.

Featured Property Photo: 7935 Cinquenta (Lot 96), Carmel 7935Cinquenta.com

tehama

Brian Keck

specialist 831.238.8730 Tehama Market Overview

1 Total Sales

2Q2023 Sales by Price Range

$2.5M

Total Dollar Volume in 2Q23

1 Units Sold in 2Q23

151 Average Days on Market in 2Q23

82% decrease from 2022

80% decrease from 2022

66% decrease from 2022

2Q2023 Tehama Sales

No Home Sales This Quarter

Lots Homes Lots

24 Tehama (Lot 10) $2,500,000

$8M+ 0 $6.0M-$8.0M 0 $4.0M-$6.0M 0 $3.0M-$4.0M 0 $2.5M-$3.0M 1 $2.0M-$2.5M 0 $1.5M-$2.0M 0 $1.0M-$1.5M 0 <$1.0M 0

*Bold Indicates a Canning Properties Group Sale 2Q2023 Update TEHAMA

TEHAMA Average % off list price 2Q2023 Sales 9% # of Sales We expect to see more activity in Tehama with developer lots coming back on the market. Tehama

Quarterly Sales by Region 2Q2023 Update 2Q2023 Update *Bold Indicates a Canning Properties Group Sale 10 Alta Madera Avenue $8,500,000 27 Tehama $6,350,000 24825 Via Malpaso $5,500,000 24825 Via Malpaso $5,250,000 8275 Carina $4,995,000 25560 Via Malpaso $3,395,000 50 Marguerite $2,750,000 Tehama 5 Year Home Sales

Homes Tehama Lots

Home and land sales in Monterra Ranch slowed significantly in the second quarter of 2023, much as they have throughout the Monterey Peninsula, which is fairly typical for this quarter. This is a common trend we see year-after-year during tax season, and as families are focused on celebrating graduations.

There were no home sales in the second quarter of 2023. Monterra lot sales were limited to two closed transactions in the second quarter - one for a lot with two garages, paver motor court and driveway on Monterra Ranch Road that we listed for $995K and sold for $1M in 8 days. There was a lot of renewed interest in the community generated by that listing that settled down in May and June. The other lot sale was an “off market” lot on Paseo Venado that sold for $1.2M. Asking price was $1.295M.

There are currently 13 lots listed for sale ranging between $795K and $2.75M. Canning Properties Group represents the sellers of eight of those lots. There is one single family home on the market listed for sale at $4.995M. This property was orginally listed for $4.345M and went into escrow in just a little over a week, but cancelled two weeks later and came back on the market at the higher price.

As reported in our 2023 1st quarter Market Overview, there are several properties in Monterra that are investor owned, being developed or are under construction. We expect to see two or three of them to be completed by the end of summer with list prices in the $5-6M range.

As you may have heard, homeowner’s insurance has created some challenges for us in the last month or so now that Allstate is no longer writing new policies in California, but we have access to Brokers who are able to provide coverage through other vendors at fairly competitive rates. Now that summer has arrived and the days are longer, we look forward to increased activity and renewed interest in the Monterra community.

Featured Property Photo: 8375 Monterra Views, Monterey 8375MonterraViews.com Brian Keck

831.238.8730

monterra specialist

Monterra Market Overview

2Q2023 Sales by Price Range

4

$8M+ 0 $6.0M-$8.0M 0 $4.0M-$6.0M 0 $3.0M-$4.0M 0 $2.5M-$3.0M 0 $2.0M-$2.5M 0 $1.5M-$2.0M 0 $1.0M-$1.5M 4 <$1.0M 0

Total Sales *Bold Indicates a Canning Properties Group Sale 2Q2023 Update MONTERRA $4.9M Total Dollar Volume in 2023 4 Units Sold in 2023 113 Average Days on Market in 2023 23% decrease from 2022 4% decrease from 2022 56% decrease from 2022 Lots Homes Lots No Home Sales This Quarter 7580 Monterra Ranch Road $1,350,000 7765 Paseo Venado $1,350,000 7725 Paseo Venado $1,200,000 7548 Monterra Ranch Road $1,000,000

MONTERRA Average % off list price 2Q2023 Sales 8% # of Sales We look forward to increased activity as spec homes hit the market this summer. Quarterly Sales by Region 2Q2023 Update Homes Lots 7553 Canada Vista Court $5,500,000 7835 Monterra Oaks Road $5,233,500 8320 Vista Monterra $4,925,000 7557 Canada Vista Court $4,500,000 7635 Mills Road $4,500,000 24253 Via Malpaso $4,350,000 24319 Monterra Woods Road $4,300,000 24316 Monterra Woods Road $4,175,000 7410 Alturas Court $4,100,000 7574 Paseo Vista Place $3,995,000 7564 Paseo Vista Place $3,900,000 8120 Manjares $3,875,000 8320 Vista Monterra $3,850,000 7568 Paseo Vista $3,700,000 7571 Paseo Vista $3,650,000 7578 Paseo Vista $3,575,000 7422 Alturas Court $3,475,000 7635 Mills Road $3,450,000 7625 Mills Road $3,400,000 24279 Via Malpaso $3,400,000 7418 Alturas Court $3,300,000 7820 Monterra Oaks Road $3,200,000 7548 Monterra Ranch Road $3,150,000 24255 Via Malpaso $2,950,000 7579 Paseo Vista $2,550,000 7579 Paseo Vista $2,500,000 Monterra

Year Home Sales

5

CPG Estate Management

A New Division

Properties do not take care of themselves. Whether it is the natural elements or unwatched systems, your home needs oversight and proactive care. Canning Properties Group has been selling the very best in Carmel and Pebble Beach for 3 decades and our experience with high-caliber properties uniquely qualifies us to manage yours with the highest level of service. We understand this asset-class, and we have longtime relationships with the best vendors and service providers in the area. It would be an honor for us to take care of your home.

If you are interested in learning more about our Estate Management team and services, please reach out and we’d be delighted to meet with you.

properties .com Dave

TH E B EST OF TH E M O N YERET P E N I N ALUS ● E S T . 1 9 88 ●

Seth Reese 831.298.9909 seth@canning

Reese 831.272.2172 dave@canningproperties.com

Canning Properties Group | 831.238.9718 | CanningProperties.com VIEW THE FULL MARKET REPORT FOR ALL REGIONS AT 2Q2023.COM

© 2023 Sotheby’s International Realty. All Rights Reserved. Sotheby’s International Realty® is a registered trademark and used with permission. Each Sotheby’s International Realty office is independently owned and operated, except those operated by Sotheby’s International Realty, Inc. All offerings are subject to errors, omissions, changes including price or withdrawal without notice. Equal Housing Opportunity. Mike Canning DRE #01004964, Jessica Canning DRE #01920034, Nic Canning DRE #01959355, Ellen Armstrong DRE #02046046, Brian Keck DRE #02070480, Dave Reese DRE #02121762, Kelly Savukinas DRE #02053030, Paige Colijn DRE #02168140, Anita Jones DRE #01926760, Seth Reese DRE #02202742, & Spiro Pettas DRE #02066568. Work with a team. Work with the best.