Overview

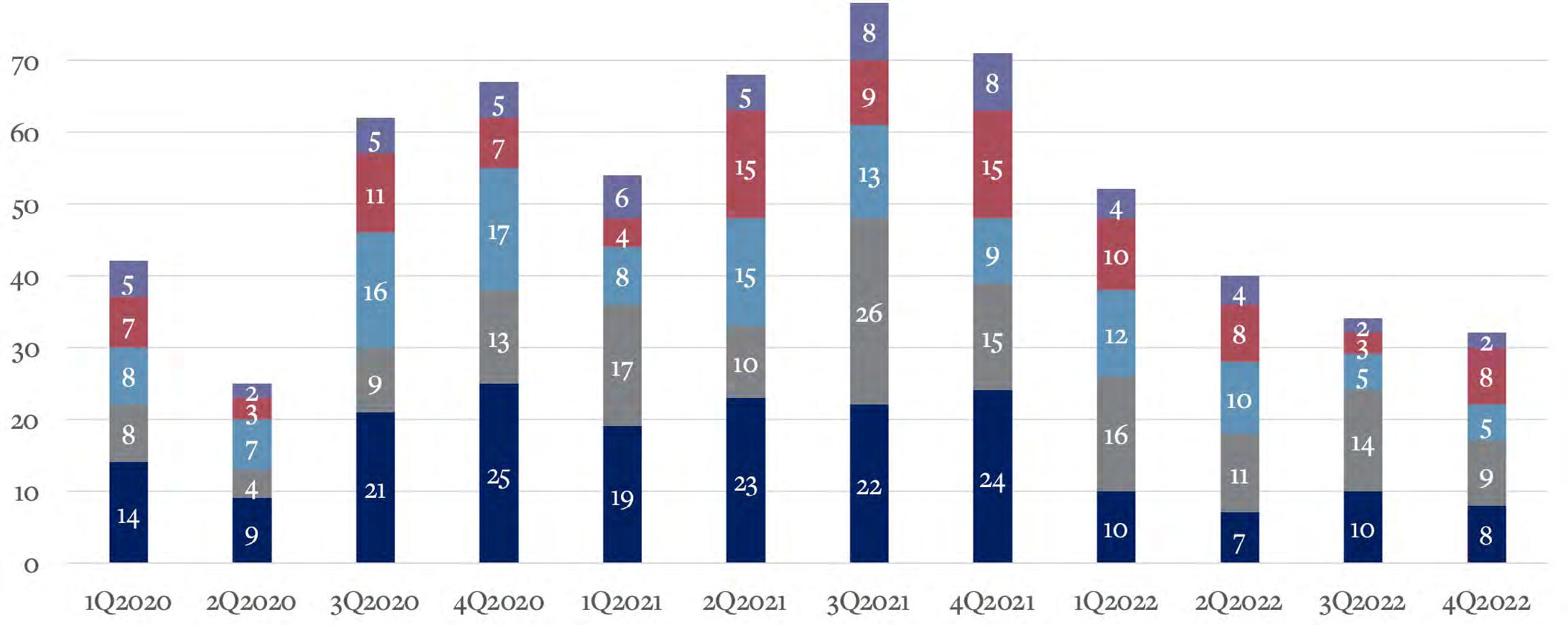

The old adage that real estate is all about location, location, location, is playing true to how the market is emerging from the COVID surge followed by the Fed’s interest rate jolts. Across the country, deal flow tightened with each rate hike as buyers reevaluated the landscape and sellers held out for more money, hoping the market would recover. Around here, buyers were the quickest to adjust expectations regarding what they can buy, but the price for sellers to move also doubled, so with each rate hike inventory tightened further. That is not the case in the places that saw the fastest appreciation rates in the COVID years; these areas are seeing large spikes in inventory and therefore prices are softening. As such, the drop in prices that we’re reading about in national headlines aren't directly translating to our area. We did see the median sales price dip to $1.66M this quarter, down from the first quarter but still well above last year.

For those who have read our quarterly updates for a long time, we’re very excited to announce that we’re now adding specialists in Pacific Grove, Monterey, Tehama, Monterra and Carmel Valley Ranch. We added these areas in response to demands from clients and because we’ve seen a lot of growth and overlap of clients moving throughout the area, beyond just Pebble Beach and Carmel. We’ve updated our historical charts to account for these regions, so some of these numbers may look different from before - they’re more comprehensive about this community and shows more insight across all price spectrums.

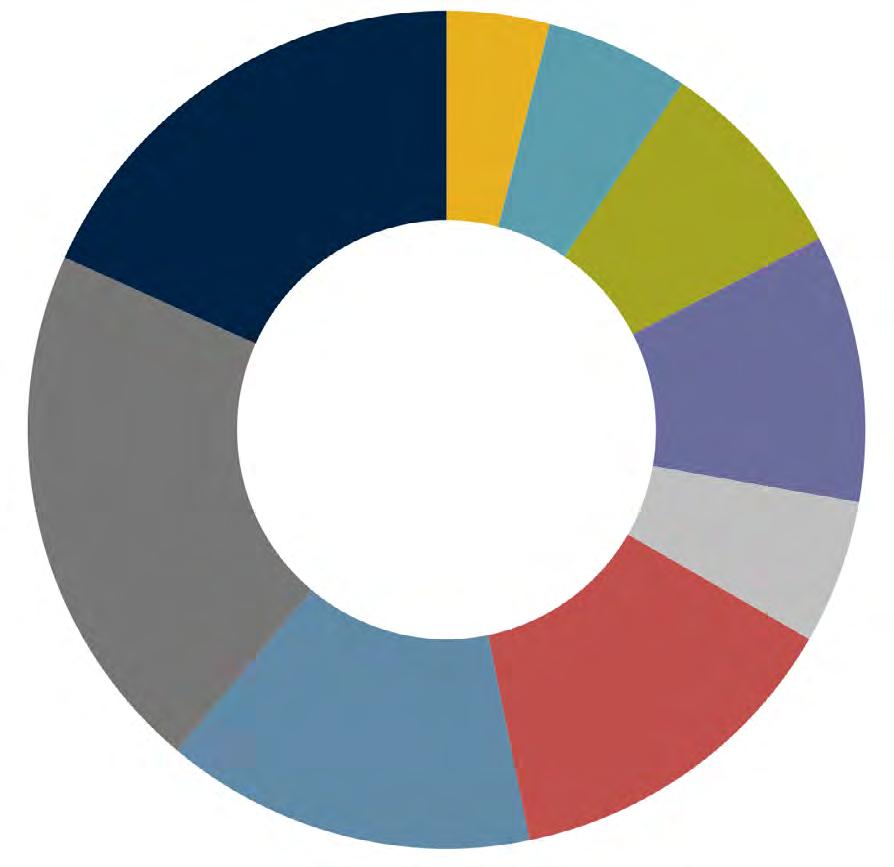

The fourth quarter brought in just 126 deals for $252M, which is the slowest quarter since the last market correction in 2008 and far below historic averages (204 deals and $385M). The second half of the year also dragged the 2022 numbers to just 679 sales, a 37% drop in activity from last year and the slowest year in over a decade. However, the tight inventory has held prices up, so the total invested came in at $1.9B which is just 24% off last year and actually 39% higher than 2019. For those sellers who do bring their house to the market, this area has gone back to standard practice of negotiating off list price. Rather than assuming you’ll get multiple offers and sell well above list, buyers are now more thoughtful and slower moving, resulting in an average of 3% off list pricehistorically standard from this area.

All things considered, this market continues to be strong and steady, and we anticipate this to continue throughout 2023. We’ll likely see our usual uptick in new listings after the New Year - especially in the summer - but we don’t anticipate seeing a plunge in prices like many buyers hope for. It’s looking increasingly likely that the prices set during the past couple of years will hold through the next market cycle.

4Q2022

$8M+ 5 $6.0M-$8.0M 7 $4.0M-$6.0M 10 $3.0M-$4.0M 13 $2.5M-$3.0M 7 $2.0M-$2.5M 17 $1.5M-$2.0M 18 $1.0M-$1.5M 26 <$1.0M 23

Pebble Beach Market Overview

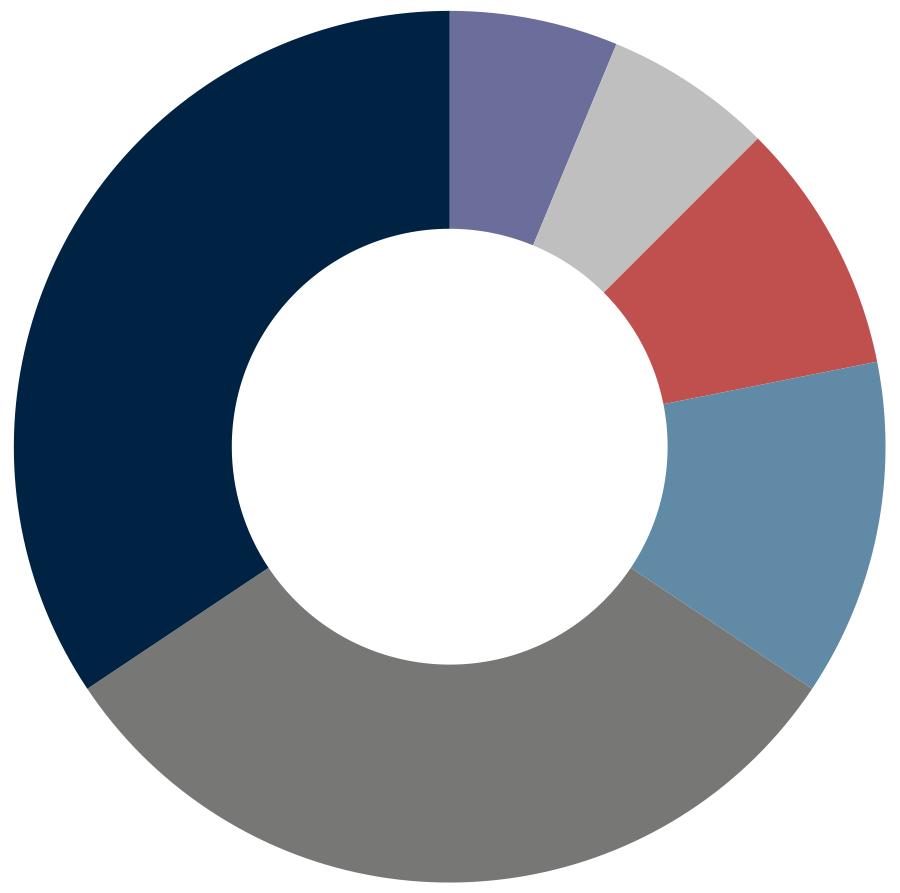

The Pebble Beach market continued its cooling trend as forecasted in the 4th quarter of 2022 with slower deal flow than the previous quarter (-25%) as well as its seasonally adjusted averages (-36%). Even with this downward trend in activity throughout the 2nd half of the year, Pebble Beach closed out ‘22 with 109 sales invested in a total of $576.20M, which is the third highest on record for Pebble Beach.

Bolstered by a strong undercurrent of demand for top-tier properties in Pebble Beach, median sales prices in the ocean-view driven area of Central Pebble rose to $7.62M (+14.6% QoQ) while the Monterey Peninsula Country Club (MPCC) and Upper Forest areas dipped slightly to $2.26M (-0.6% QoQ) and $1.79M (-9.6% QoQ) respectively. The slight drop in values for the MPCC area was not a representation of demand, but rather a reflection of the properties that sold this quarter in the lower price points for that area. With a substantial (and growing) waitlist to join MPCC, we anticipate there to be ample demand continuing into 2023 – in particular for the coveted golf front properties in the Country Club West area.

The luxury market ($8M+) in Pebble Beach capped off a strong year with 3 closed escrows in the 4th quarter ($28M, $10.9M and $9.275M), bringing the total transactions to 19 sales, just shy of the record 23 sales posted in 2021. The middle price brackets ($4M-$6M and $6M-$8M) slightly outperformed seasonally adjusted averages (+16.7%) in the final quarter as demand for quality product outpaced thinning supplies in these price points. The lower price brackets (<$2.5M) experienced a substantial dip in sales – well below seasonal adjusted averages (-57%) – as razor thin inventory levels struggled to keep up with demand for Pebble’s entry-level market. Interestingly, Pebble Beach has yet to see a strong influence of rising interest rates as it remained a predominantly cash-based market throughout 2022. In fact, less than 15% of the deals that occurred in the 4th quarter involved a loan.

As we begin to shift away from the heavily favored Sellers’ market that occurred over the course of the pandemic and approach more balanced market conditions, there will be a transitionary period over the winter months with differing expectations on values between Sellers and Buyers. On the sell side, some Sellers will be reluctant to adjust their pricing strategies down from the pandemic peaks while others will adapt to the current market norms – thus attracting more Buyers and potentially cultivating deals. On the buy side, Buyers will become increasingly price sensitive and will be seeking more leverage at the negotiation table - putting downward pressure on list and sales prices. We’ll continue to track these evolving market trends heading into 2023, but one trend from the pandemic appears to be here to stay: the work-from home lifestyle, which continues to positively influence our local markets.

Featured Property Photo: 3364 17 Mile Drive, Pebble Beach 336417Mile.com

$8M+ 3

3 $3.0M-$4.0M 2 $2.5M-$3.0M 2 $2.0M-$2.5M 8 $1.5M-$2.0M 3 $1.0M-$1.5M 1

17% decrease from 3Q22

54% decrease from4Q21

4% increase from 3Q22 42% decrease from 4Q21 21% increase from 3Q22

4Q2022 $2.62 -2%

3Q2022 $2.57 -12%

2Q2022 $3.14 -10%

4Q2022 $5.07 26%

3Q2022 $4.00 -13%

2Q2022 $5.13 12%

Carmel Market Overview

Carmel deal flow has been increasingly squeezed by tight inventory levels, resulting in a slower quarter than when the market shut down in 2Q20 for the COVID lockdowns. We saw just 28 deals close in 4Q, which is less than half what we saw this quarter last year (59).

As always, the Golden Rectangle had another strong quarter with 9 sales, leading all other regions. Northeast Carmel had a surprising drop in activity to just 5 deals, down from 13 last quarter. We think this is an anomaly as the other regions were only down slightly or even with last quarter. Hatton Fields continues to benefit from the work from home demographic, with 4 deals closing this quarter and strong demand for this combination of location and house size. Northwest and Southeast Carmel had just 3 deals each, which is low historically, but this is due to tight inventory. Carmel Point had just 3 deals this quarter but continues to have the highest median sales price in all of Carmel ($4.6M).

Carmel closed $107M this quarter, which is down 3% from last quarter and less than half that of 4Q21 ($210M). This dip in invested dollars isn’t surprising considering the deal flow levels. The median price for a house in Carmel is up to $2.69M, which is a 50% climb from 2019. What’s somewhat remarkable is that all regions in Carmel are now averaging above $2M for a house - even for fixers. In 2012, the median sales price was just $1.14M and below a million in Hatton Fields and Northeast Carmel, both of which have tripled in value over the past decade. We’re continuing to see strong demand across the entire price spectrum, with deal flow evenly distributed across all price brackets. There were 5 sales north of $6M and 6 sales below $2M, which shows healthy demand across all regions and prices.

Pricing and willingness to negotiate are paramount for sellers right now. Even with tight inventory and some buyers circling, average days on market has stretched up to 40 for houses that closed this quarter. That’s almost triple what it was in 2Q22 (15). Buyers also need to appreciate that although we are getting to negotiate again, it’s not going to be the fire sale they’re hoping for. Overall, this market is proving its strength and resiliency and we anticipate seeing that continue, albeit slowly, throughout next year.

Visit DiscreetProperties.com to view all upcoming and off market listings.

Jessica Canning carmel specialist4Q2022 Sales by Price Range

$8M+ 2 $6.0M-$8.0M 3 $4.0M-$6.0M 3 $3.0M-$4.0M 6 $2.5M-$3.0M 3 $2.0M-$2.5M 5 $1.5M-$2.0M 5 $1.0M-$1.5M 1 <$1.0M 0

$107.4M

3% decrease from 3Q22 49% decrease from 4Q21

20% decrease from 3Q22 40

Average Days on Market

4Q2022

Scenic 6 SE of 8th $13,700,000

San Antonio 2 NW of 11th $9,400,000

Dolores 7 SW 13th $6,928,000

Lincoln 4 NW of Santa Lucia $6,500,000

26357 Scenic Road $6,250,000

Lopez 12 NE of 4th $5,775,000

2836 Santa Lucia Avenue $4,495,000

Monte Verde 3 NE of 13th $4,000,000 26277 Isabella Avenue $3,995,000

10th Avenue 3 SE of San Carlos $3,650,000

53% decrease from 4Q21

23% increase from 3Q22 1% increase from 4Q21

SWC of Lincoln & 8th $3,500,000 N Casanova 4 SE of 2nd $3,400,000 Casanova 2 SW of 8th $3,290,000 Mission 2NW of Vista $3,200,000 2 NE 1st Avenue $2,900,000

NWC Casanova & 12th $2,700,000

NEC Sterling & Perry Newberry Way $2,500,000 Junipero 5NE of 10th $2,480,000 3511 Mesa Court $2,400,000 5th Ave 2SW of Juniper $2,300,000

4Q2022

Carmel Highlands Market Overview

The Carmel Meadows and Carmel Highlands real estate markets have always been atypical for the general Monterey Peninsula area, but the last half of 2022 in these two markets has been a display of extremes. Some examples are:

» The Carmel Meadows area had a strong start to the year with 5 sales—4 of those within the second quarter—but the area has not seen one sale, let alone a single listing, since 2Q22.

» The Carmel Highlands set the record for the highest priced sale in Monterey County this year with the off-market acquisition of the D L James House by actor Brad Pitt for a reported $40M.

» After averaging 8 sales a quarter for the last 3 years, the Highlands only had 2* sales last quarter, making 4Q22 the slowest quarter for real estate dealflow since 1Q20.

» Even removing the anomaly of the $40M Brad Pitt sale from the mix, the average sold price in the Highlands this past year sits at a little over $6M (with a median of $4M). This compared to $4.5M (with a median of $3.2M) for 2021 and $3.5M (with a median of 2.8M) for 2020.

» There are currently 8 homes actively listed and 1 contingent in the Highlands with an average list price of over $8M.

Even with the wild swings and seemingly discordant stats, one clear trend in the Highlands and Meadows markets over the last year is that home prices continue to rise. And with the geographically determined, limited inventory of these areas, we expect prices to remain strong even as other area markets soften in 2023. This past year has shown us that buyers who want to be in the Carmel Meadows and Highlands are willing to pay premium prices to be there.

If you currently own in the Carmel Highlands or Carmel Meadows areas, regular maintenance and capital improvements have proved to be wise investments for your neighbors who have seen significant returns from the market over the last couple of years. If you’d like to discuss the value of your property or listing it for sale, please reach out and we will schedule time to meet with you at your earliest convenience. Also, keep an eye out for some exciting new listings we anticipate bringing to market early next year!

*Canning Properties is honored to have represented the sellers of 1 of the only 2 properties that sold last quarter in the Highlands

$8M+ 0 $6.0M-$8.0M 1 $4.0M-$6.0M 0 $3.0M-$4.0M 1 $2.5M-$3.0M 0 $2.0M-$2.5M 0 $1.5M-$2.0M 0 $1.0M-$1.5M 0 <$1.0M 0 126% increase from 4Q21

Quarter

4Q2022 $5.10 62%

3Q2022 $3.71 44%

2Q2022 $5.20 -29%

1Q2022 $4.00 30%

Quarter

4Q2022 $5.10 27%

3Q2022 $5.74 96%

2Q2022 $5.50 -26%

Quail Lodge/Meadows Market Overview

Quail was perhaps the best positioned market in this area to benefit from the COVID bump. Combining equally easy access to town and nature, while being located in perfect weather, it’s truly hard to beat and the market now appreciates it. However, the 13 sales that happened in 2Q21 are likely never to be seen again and it’s understandable to move back down to 2 sales this quarter, which is closer to the historic average for this area. What is remarkable is that the median sales price for Quail Lodge is up to $3.33M this year, which is over twice last year ($1.77M) and 398% higher than it was a decade ago. Prices in Quail Lodge are now surpassing that of MPCC (median of $2.29M this year). Given the world-renowned nature of Pebble Beach, this really is remarkable. Quail Lodge may be benefitting from the prestige and market awareness that comes with the Quail Motorsports event each year.

The two sales this quarter were both in Quail Lodge: 8072 Lake Place closed for $3.775M and 8004 River Place sold for $3.0M. The Lake Place home was bought back in 2020 for $2.1M and underwent an extensive renovation. This house is a bit larger than most homes in Quail Lodge, with over 3,200 sq.ft., so the higher price is to be expected. 8004 River Place last sold for $1.881M in 2018 and had been partially updated. However, this house only has 2 bedrooms, which is below average for this area and factored into the pricing.

Quail Meadows didn’t have any sales this quarter, although we are seeing strong demand for move-in homes in the valley, so we anticipate that to change after the New Year.

There are currently no active listings in Quail Lodge or the Meadows, including condos and lots. However, demand is much weaker now than it was during 2020-2021. So, sellers should be ready to come a bit off list price (an average of 5% this quarter) and be patient as we all adjust back to our old pace of sales and inventory around here.

Canning quail specialistVisit DiscreetProperties.com to view all upcoming and off market listings.

Jessica

Jessica

$8M+ 0 $6.0M-$8.0M 0 $4.0M-$6.0M 0 $3.0M-$4.0M 2 $2.5M-$3.0M 0 $2.0M-$2.5M 0 $1.5M-$2.0M 0 $1.0M-$1.5M 0 <$1.0M 0

Pacific Grove Market Overview

As we close out 2022, we are once again seeing solid sales in the town of Pacific Grove. We are still experiencing trends of low inventory, but with prices holding steady. Last month, the median sales price was $1.37M, up 28% from 2021. The MSI (Month’s Supply Inventory) for November was 23, up 21% from September.

When looking back on 2022, Pacific Grove had a lower number of total sales, with slightly lower median and sales prices than 2021. The year started out strong, with tight inventory and multiple offers coming in over list price. Going into Q2, we started seeing interest rates increase slightly, a few reductions in price, but still low days on market and multiple offers. As we got closer to Q3, over half of the inventory was being reduced and pricing was the name of the game. We started hearing the term “market correction” and buyers started to pay attention. This brings us to Q4, with tight inventory (14 listings currently active) we can continue to see Pacific Grove being competitive for buyers.

Reviewing sales in Q4, we are seeing most activity in the areas of Washington Park (12 sales to date) and the area of Forest Avenue (8 sales to date). Total sales to date are 30 to include all areas of Pacific Grove, compared to 45 sales in Q4 2021.

Let’s take a step back and review some highlights from Q4 2022 for Pacific Grove:

» Q4 average DOM was 35 days with a total of 30 sales, averaging $1.4.

» 2021 median sales price for Q4 was $1.2M compared to median 2022 Q4 median sales price of $1.15M.

» Highest price sale in Q4 was $3.2M on Ocean View Blvd, Central Ave area.

Pacific Grove sparkles and shines with new restaurants and shops, lots of local activities and festive events. It’s a great time to walk the quaint streets and enjoy what the small town has to offer. Looking ahead at 2023, we see inflation and interest rates falling (how far and fast is tough to call) which should help buyers and allow more sellers to consider selling. Inventory is predicted to remain tight, but houses will likely stay on the market longer. Negotiating will be key for buyers and pricing will be important for sellers.

Please contact me if you would like a market analysis for your home or if you are looking to move to Pacific Grove, please reach out. Our team would love to walk you through our process! Happy Holidays!

Savukinas pacific grove specialist

Savukinas pacific grove specialist

Visit DiscreetProperties.com to view all upcoming and off market listings.

Kelly4Q2022 Sales by Price Range 32

Total Sales

$8M+ 0 $6.0M-$8.0M 0 $4.0M-$6.0M 0 $3.0M-$4.0M 2 $2.5M-$3.0M 2 $2.0M-$2.5M 3 $1.5M-$2.0M 4 $1.0M-$1.5M 10 <$1.0M 11

$46.8M

Total Dollar Volume

Get Smart

4Q2022 Snapshot

38% decrease from 3Q22 34% decrease from 4Q21

32

Units Sold in 4Q2022 35 Average Days on Market

36% decrease from 3Q22 29% decrease from 4Q21

27% decrease from 3Q22

4Q2022 Top Pacific Grove Sales

193 Ocean View Boulevard $3,200,000 106 Grand Avenue $3,100,000 1124 Balboa Avenue $2,750,000 923 14th Street $2,630,000 640 Gibson Avenue $2,372,000 187 Sloat Avenue $2,250,000 704 Granite Street $2,120,000 1289 Bishop Place $1,700,000 1132 Pico Avenue $1,695,000 138 9th Street $1,670,000 816 Maple Street $1,525,000

16% increase from 4Q21

608 Congress Avenue $1,499,000 511 Gibson Avenue $1,482,500 56 Country Club Gate Drive #56 $1,426,000 502 Platt Court $1,315,000 1117 Presidio Boulevard $1,150,000 111 19th Street $1,150,000 156 Forest Avenue $1,140,000 642 Sunset Drive $1,100,000 524 Crocker Avenue $1,016,000 309 9th Street $1,000,000

4Q2022 $1.15 -8%

3Q2022 $1.38 6%

2Q2022 $1.39 15%

1Q2022 $1.60 14% 4Q2021 $1.25 16%

Quarter

4Q2022 $1.42 -10%

3Q2022 $1.55 3%

2Q2022 $1.51 8%

Monterey Market Overview

As 2022 came to a close, looming uncertainty about the economy and what lies ahead seemed to be a holiday topic impossible to avoid. With interest rates at 3.22% to start the year and more than double that as 2022 came to an end, it’s safe to say we’re all trying to wrap our heads around what 2023 will bring. While the last few years have forced us to accept a new “normal” in many capacities, the housing market volatility we saw during the prime of the pandemic appears to be stabilizing as the Monterey market is experiencing a much-needed calibration.

The Monterey market started to see inventory levels taper off in the 4th quarter of 2022, with fewer homes for sale (-35%) than we saw the previous quarter and nearly half as many listings as the 4th quarter of 2021. During the final quarter of the year, we finally started to see homes consistently selling for less than asking in all parts of Monterey. The average sale price was at least (-2%) below the list price, while during the same quarter last year the average sale price was (1%) above asking.

Move-in ready homes and those with ocean views remained in high demand throughout most of 2022, with strategically priced properties in Monterey’s more desirable neighborhoods continuing to sell even as the available supply leveled off. Properties caught in the market swing that were mispriced as the market began adjusting grappled with finding Buyers and were driven to reduce their original listing price to meet the new demand…or lack thereof. This is a healthy sign for those who struggled to find the right buy during the bidding frenzy we experienced the last few years.

Ultimately, during the 4th quarter of 2022 there were 32 home sales throughout the core of the Monterey market. This is a meager 2 less home sales than the previous quarter while a drastic decrease compared to the 4th quarter last year when we had 71 home sales to end 2021. However, these sales numbers and current inventory levels are much more in line with historical averages and the anticipated market trajectory that was expected prior to the housing boom caused by the pandemic.

As the market continues to correct in 2023, we expect both Sellers and Buyers to be more value conscious and discerning with their transactions. Knowing the market and pricing accordingly will be more imperative than years past, as interest rates remain speculative and inventory levels tighten across the entire Peninsula.

Spiro Pettas monterey specialistVisit DiscreetProperties.com to view all upcoming and off market listings.

4Q2022

$8M+ 0 $6.0M-$8.0M 0 $4.0M-$6.0M 0 $3.0M-$4.0M 0 $2.5M-$3.0M 0 $2.0M-$2.5M 0 $1.5M-$2.0M 6 $1.0M-$1.5M 14 <$1.0M 12

4Q2022

Carmel Valley Ranch Market Overview

Hello! My name is Paige Colijn and I’m excited to introduce myself. I’m a Monterey Peninsula native and an agent with Canning Properties Group, honored to represent the stunning Carmel Valley Ranch region. Carmel Valley Ranch offers an incredible lifestyle that is very attractive and desirable.

For a refresher of what took place during 2021, the Ranch had a total of 25 sales with an average sales price of $1.78M and the average days on market was 25. Looking at 2022 with a total of 9 home sales, we’ve seen a 64% decrease in units sold and a 62% decrease in total dollars transacted. The average sales price for 2022 was $1.88M with an average of 27 days on market, which is fascinating because even with extremely limited inventory, home sale prices in your area still saw a 5.6% increase.

As we close out 2022 for the 4th Quarter, Carmel Valley Ranch had low activity with zero sales as there were no active listings on the market. This information is valuable if you’re thinking of selling as demand remains strong as this area is very attractive to many buyers, both locally and those from out of town.

Looking ahead in 2023, with zero homes currently on the market or pending, this is proving to still be a seller’s market and they’ll continue to have negotiating power given the demand. Due to the lack of sales this quarter, the analysis that follows is a more comprehensive look at the market over the past several years.

On behalf of myself and the Canning Team, we’re pleased to provide this analysis about your community and always welcome any feedback or questions. If you are curious on your home’s value, I would be pleased to meet with you and provide you with a Comparable Market Analysis and discuss any of your real estate needs. Feel free to reach out and I genuinely look forward to connecting with you.

Paige Colijn carmel & carmel valley ranch specialist$8M+

Year

Santa Lucia Preserve Market Overview

An eventful Autumn season concluded with vibrant Community activities including the Annual Mushroom Hunt, the 31st Annual Stocker Cup, Inaugural NCAA Cal Poly Men’s Golf Invitational, Princeton A Capella Concert, equestrian clinics, pickle ball socials, paint and sip, K9 hikes and many more fun activities. With ~ 141 built homes, ~ 19 under construction, and over 40 in the design and permit process, demand remains high, the Club remains very healthy, and scarcity has set in with finished homes and should as well with vacant land.

With 2 home and 3 homesite sales, 4Q22 had a very strong quarter with $19.45M invested in the Preserve (up 163% QoQ and up 25% YoY). The 5 total home sales for the year equaled $29.55M (down 64% YoY) and the 15 homesite sales equaled $19.14M (down 34% YoY). Due to low inventory levels, total sales were down, however, prices continue to move up with 4Q22 median home prices at $6.38M (up 8.1% QoQ and up 17.5% YoY). The market is not homogenous, however, as a variety of styles, sizes, views, and locations can heavily sway the discounts or premiums and days on market, i.e. there were three offers, two over ask in just 9 days with the final sale going 5% over ask at beautiful 5 Touche Pass, while the other home sale took 179 days and sold at a 13% discount.

Vacant land sales also had a strong finish to the year yielding $6.7M in total sales (up 346.6% QoQ and up 43.3% YoY) including the notable 8 & 10 Rancho San Carlos “Animus 2” parcel for $5.1M. Discounts however grew a few percentage points to 16% off ask, but days on market significantly shrunk to just an average of 52 days, including an off-market sale at beautiful 35 Pronghorn Run for $1.6M.

Our team is once again honored to be the top Preserve broker and represented both the buyer and seller at 14 San Clemente Trail, 5 Touche Pass, both 8 & 10 Rancho San Carlos Road, and the buyer at 35 Pronghorn Run. We currently have the only house listed (at 19 Long Ridge for $13M) and will continue to work hard to serve the Community’s real estate needs.

After the buyer’s frenzy of the past two years, buying up years of inventory, we have seen deal flow plateau and begin to taper in line with lower inventory; however, demand remains strong for quality homes on the smaller side with views located near the Clubs or front gate regions. We anticipate prices to remain flat to slightly increasing, but don’t forget, they are elevated 30%+ from three years ago.

Keck preserve specialist Featured Property Photo: 19 Longridge Trail, Carmel 19Longridge.com Brian$8M+ 0 $6.0M-$8.0M 1 $4.0M-$6.0M 2 $3.0M-$4.0M 0 $2.5M-$3.0M 0 $2.0M-$2.5M 0 $1.5M-$2.0M 1 $1.0M-$1.5M 0 <$1.0M 0

Median

4Q2022 $6.38 18%

3Q2022 $5.90 -8%

2Q2022 $5.20 38%

1Q2022 $0.00 -100%

Accurately

homes will

Home Sales Price ($M) # of Sales Preserve Lots Preserve Houses

Quarter

Average YoY % Change

3Q2022 $5.90 -6%

2Q2022 $5.20 33%

1Q2022 $0.00 -100%

Tehama Market Overview

Tehama continues to be an attractive option for both local and out of town Buyers who appreciate living behind secure gates in a nature-rich environment beyond the fog, and enjoy the many social activities, dining options and exercise opportunities associated with a social membership to Tehama Golf Club and Fitness Center.

After a robust 2021 that recorded over $23M in sales of vacant land, sales of lots in Tehama tapered off as the year progressed this year with two developer lots and two resale lots closing in the first quarter for 2022. One lot with caretaker’s quarters closed escrow in the fourth quarter.

Canning Properties Group currently has five active vacant lots listed for sale from a $2,100,000 8-acre parcel with Monterey Bay and Santa Cruz Mountain views to a $5,500,000 parcel on 5.45-acres on the golf course with water views as well.

2021 recorded two home sales in Tehama – one for $6,200,000 and the other for $5,193,000. There were no home sales in 2022. Demand is and always has been strong for finished homes in Tehama, but inventory is historically lacking since most people who build in Tehama, stay in Tehama. There is one home currently listed for sale for $11,950,000 that has been on the market since September.

After a slow third quarter, interest in vacant land increased significantly in the fourth quarter of 2022. With better weather than the coast and proximity to area amenities, we look forward to more people choosing Tehama as the place they want to call home in 2023.

Featured Property Photo: 8350 Tres Paraiso (Lot 73), Carmel Brian Keck tehama specialist$8M+ 0 $6.0M-$8.0M 0 $4.0M-$6.0M 0 $3.0M-$4.0M 1 $2.5M-$3.0M 2 $2.0M-$2.5M 2 $1.5M-$2.0M 0 $1.0M-$1.5M 0 <$1.0M 0

$13.6M

Demand for finished

remains strong.

Monterra Market Overview

Home and land sales in Monterra Ranch continued to flourish in 2022 as both investors and end users chose to live or develop here in an environment surrounded by open space, inspiring natural beauty, underground utilities and a true sense of community. Both local and out of area buyers who appreciate living behind secure gates in a sun-drenched environment enjoy the social activities, dining venues and exercise opportunities associated a social membership to Tehama Golf Club and Fitness Center that is included with the purchase of most properties here.

Due to a lower entry level initial investment and apparent ease of supply chain delays, Monterra lot sales continued steadily throughout the year with nine lots closing between $550,000 and $1,275,000. Canning Properties Group currently has eight lots listed for sale, one of which is in escrow. List prices of Monterra lots range from $795,000 to $1,775,000.

Monterra had five home sales in 2022 ranging from $3,650,000 to $4,925,000 for the year which is typical for the community. Average price per square foot increased from $624 per square foot in 2021 to $785 in 2022 which indicates the demand is very strong for finished homes. There are several properties in Monterra that are investor owned, being developed or are under construction, many of which will be available for sale in the next few months. Two homes under construction are currently listed for sale for $4,495,000 and $5,500,000 and expect to be completed by June 1st with more to follow.

Interest in vacant land has increased significantly in the fourth quarter of 2022 and into 2023. We look forward to more people considering elevating their current lifestyle circumstances and deciding Monterra is the ideal place for them. It’s a great place to live.

Brian Keck monterra specialist

Brian Keck monterra specialist

Featured Property Photo: 7745 Paseo Venado (Lot 83), Monterey

Featured Property Photo: 7745 Paseo Venado (Lot 83), Monterey

Total Sales

2022 Sales by Price Range

$8M+ 0 $6.0M-$8.0M 0 $4.0M-$6.0M 2 $3.0M-$4.0M 3 $2.5M-$3.0M 0 $2.0M-$2.5M 0 $1.5M-$2.0M 0 $1.0M-$1.5M 1 <$1.0M 9

Homes Lots

$6.9M $20.8M

2022 Monterra Sales

Homes Lots

8320 Vista Monterra $4,925,000

7635 Mills Road $4,500,000

7564 Paseo Vista Place $3,900,000

8120 Manjares $3,875,000

7571 Paseo Vista $3,650,000

7569 Paseo Vista Place (Lot 50) $1,275,000

7755 Paseo Venado (Lot 84) $795,000 7760 Paseo Venado (Lot 86) $735,000

7572 Paseo Vista Place (Lot 52) $660,000

7586 Paseo Vista (Lot 78) $625,000

0 Paseo Venado (Lot 116) $600,000 7570 Paseo Vista (Lot 55) $575,000

7552 Monterra Ranch Road (Lot 57) $575,000 8130 Manjares (Lot 126) $550,000

CPG Estate Management

A New Division

We are excited to announce Canning Properties Group is expanding with a new estate management division!

Properties do not take care of themselves. Whether it is the natural elements or unwatched systems, your home needs oversight and proactive care. Canning Properties Group has been selling the very best in Carmel and Pebble Beach for 3 decades and our experience with high-caliber properties uniquely qualifies us to manage yours with the highest level of service. We understand this asset-class, and we have longtime relationships with the best vendors and service providers in the area. It would be an honor for us to take care of your home.

If you are interested in learning more about our Estate Management team and services, please reach out and we’d be delighted to meet with you.

Dave Reese

(831) 272.2172

Seth Reese

(831) 298.9909