The Marine Insurer

MARKETS

Triple whammy hits marine world: Brexit; The Russian invasion of Ukraine; Coronavirus

l Rogue vessels: Ships going dark to break sanctions

l Engine failure: Risks of problems post-yard

l Cargo liquefaction : Mitigating the risk for vessels and crew

l Digitilisation: Ground work essential in finding the right solutions

l Hygiene: Keeping your vessel safe and healthy essential

ISSUE 13 | APRIL 2023 NAVIGATING NEWS & ANALYSIS IN THE MARINE

Examining why a vessel’s engine

Cup half full?

I AM in general an optimist but that can be a hard thing to maintain, particularly if you are a marine insurer working in 2023.

Launched as a new entity on the P&I industry’s 20 February renewal date, with an enhanced rating from S&P Global

As our authors explain, the triple whammy of Brexit, the Ukraine war and Covid-19 has turned the world that we know upside down. Whether it be waves of sanctions, soaring inflation or supply chain challenges, the insurance markets have been hit from all sides. We also take a look at that bleak dark world of rule-breakers and the way that the industry is using technology to track vessels which have deliberately gone dark to avoid the sanctions ruled being applied to Russia.

However, as an optimist, I would like to think the green shoots of recovery may appear this year. There are small signs that the inflation rates are falling and also that the supply chain disruption is diminishing. Sadly, it seems we are also getting used to the new normal of a war in Europe and the sanctions environment that has erupted around it.

So, how do we look ahead with optimism? It seems that insurers are also recognising a wealth of emerging opportunities. The renewables space continues to be a hotbed of innovation – wind power is hardly new for the marine world but the latest applications are none the less intriguing.

There is also a concerted effort to improve casualty rates through prevention – and in this issue we take another look at liquefaction and how to prevent the problem occurring. We also take a look at engine failure, after a spell in a repair yard. This problem is all too frequent but can lead to long and costly disputes – another event best avoided wherever possible.

Technology overall continues to play its part in the evolution of the market but, as we hear, without the proper ground work it is never going to be the solution that truly delivers. Technology no doubt will be playing its part as two giants of the P&I world come together and start work as a new combined entity, promising some stability and resilience for their clients in the years ahead.

Finally, we hear the importance of keeping your vessel clean and safe – something that surely should be obvious but is clearly not. A simple message that insurers can share with their insureds and potentially prevent yet another claim.

In all, it seems there is plenty of good work going on….I think I can remain a cup half full type for now.

Enjoy the read

Liz Booth Editor, The Marine Insurer

The Marine Insurer | April 21023 CONTENTS | EDITORIAL 03 Editor Liz Booth liz@lizbooth.co.uk Assistant Editor Adrian Ladbury ladburya@gmail.com Art Editor Rob Crotty rob@greenlightpartners.co.uk Commercial Director Daniel Creasey daniel@cannonevents.com tel: +44 07702 835831 Publishing Director Grant Attwell grant@cannonevents.com tel: +44 07905 933252 All rights reserved. No part of this publication maybe reproduced, stored in a retrieval system, or transmitted in any form or by any means, electrical, mechanical, photocopying, recording or otherwise without the prior written permission of the publishers. The views expressed in The Marine Insurer Magazine are not necessarily shared by the publisher, Cannon Events limited. The views expressed are those of the individual contributors. No liability is accepted by Cannon Events Limited for any loss to any person, legal or physical as a result of any statement figure or fact contained in this title. The publication of advertisements does not reflect any endorsement by the publisher. Published by Cannon Events and Publications © Cannon Events Limited 2022 Pictures: Adobe Stock Comment Highlights 38 Builders’ risks insurance Builders’ risks coverage offers the widest ranging conditions but with some key limitations 41 Turkish Commercial Code How the Turkish Commercial Code (TCC), which came into force in 2012, allowed direct legal actions against insurers 44 Air quality onboard Looking at how to ensure crews live, work and breathe healthily while onboard vessels 48 Parametric insurance Why parametric products can coincide with marine cargo policies to offer a full supply chain insurancesolution 50 Club profile Shipowners’ Club’s team is pleased to be stable, consistent and even boring in a world of ever-rising rising risk levels 26 Risk outlook How the industry is collectively responding to the key challenges in the marine sector 04 London market How the London market is adapting to the changes due to the pandemic and the Ukraine war 08 Lessons for the (re)insurance market The key lessons learnt from the ongoing conflict in Ukraine 10 Maritime sanctions How AI platforms are helping to tackle sanctions breakers at sea 12 AI future Why the insurance market should embrace an AIS tool to reduce the risk of collisions 14 Digital solutions How rapidly evolving digitised solutions can help organisations best manage them 16 Customer-centricity Insurers could and should pursue true digital customer-centricity to the benefit of all 19 Wind propulsion

huge potential offered by wind propulsion for the shipping sector 22 Cargo liquefaction How to mitigate the risks of cargo liquefaction for the maritime industry 28 Engine failure

would fail right after an overhaul 30 Wreck removal Factors that salvors must consider when costing wreck removal projects 34 NorthStandard merger

The

a

FEATURES 28 14

Evolution: The time is now

With a four year lead up to the UK’s trading withdrawal from Europe it was reasonable to expect that the necessary preparations would have been made for the fundamental change in the UK/EEA relationship as of 23:00hrs on 31 January 2020. Regrettably it did not seem like they had. The UK government appeared to pay little (if any) heed to the financial services industry (of which insurance is a part, and London is a global centre) leaving it to fend for itself in an evolving environment which struggled to identify the operating parameters.

Everybody muddled through with various ad hoc measures to enable the flow of business both from and to Europe. The basics have become more established as both parties identify the boundaries and despite early confusion the framework has settled into place.

Some brokers have yet to create the bridge between Europe and the UK, and perhaps some will not bother and no longer participate, but the bulk of the market is fully able to transact.

Has it been a seamless transition? Absolutely not. Are we still trading with Europe? Yes, and we always will.

RUSSIAN AGRESSION

The strength of Russia’s action towards Ukraine in late February 2022 caught many by surprise. While aggression between the two countries has been ongoing since 2014, the crossing of the border and aerial engagement took matters on to an international stage.

The conflict that has ensued, and the reaction of the Western world and other countries sympathetic to Ukraine’s plight, has brought about sanctions. These have required careful policing since trade with Russia continues.

Much activity has ensued within the shipping world/markets. Methods to release trapped vessels were examined and corridors established through which the Ukrainian exports can occur, as well as allowing non-sanctioned cargoes to still be carried into certain Russian ports.

With the conflict ongoing the markets have settled into established patterns of cover for permitted maritime trades. Or so it seemed until the end of 2022 when the reinsurance market reacted with restrictions designed to reduce their aggregated exposure.

Turmoil resulted and many marine markets no longer

MARINE | London market evolution In association with Ed Broking The Marine Insurer | April 2023 04

Covid-19, the Russian invasion of Ukraine and Brexit have all combined to force the pace of evolution at Lloyd’s. Patrick Jordan , Managing Director, Head of Marine, at Ed Broking says the market has adapted well but still has some big defining decisions to make

have the breadth of reinsurance cover they previously enjoyed. Smaller participating lines are now normal and, while cover can still be assembled, the feeling is that our market is no longer as deep as it previously was.

The London market’s USP has always been the size of capacity it can bring to complex risk. Even in the current form the capacity remains large. But if the trend of declining covered risks continues then how long will it be before the London capability mostly mirrors that of it’s US, European and Far East competitors? At which point will it still hold a primary position in the wider world?

PANDEMIC RAMIFICATIONS

The ramifications of the pandemic on an industry so focused upon face-to-face discussion were always going to be sorely felt.

The closure of the Room in Lloyd’s for long stretches tested broker and underwriter relationships. These have survived well, carrying the business with them.

There is great pleasure in once again being in front of someone and the cut and thrust of negotiation is absolutely the better for it. As is so often the case, the testing of

relationships has strengthened them. The common bond forged through maintaining the business under extreme circumstances has led to a greater appreciation of the personal touch.

Difficult conversations still occur and always will, but the joint experience of talking from remote locations has increased the goodwill between parties now that the camera is not the only means of visual contact. Long may that continue.

An essential part of the structure which got us through the office closures has been our systems.

Pre-existent trading platforms (PPL, Whitespace, ECF), communications (E-mail, WhatsApp, SMS) and the old-fashioned telephone have allowed us to prove to our clients’ satisfaction that the market is not quite as 19th century as it might have pretended to be.

Tales of quills being used to sign slips at the box in Lloyd’s will always bring a smile, but the truth is that the market has been digital in so many ways as everyone has moved forward at a rate of knots.

The very fact that the same problem confronted all parties at exactly the same time invested everybody in finding and quickly adopting the solution. Thus, what might have taken two or three decades of fractured steps between parties with differing agendas has actually occurred in two years and the market now has the most solid electronic base it has ever had.

HYBRID WORKING

With a return to the Room and face-to-face representation has come an intense discussion of what hybrid working should be. The cry of “Everybody Back!!” has gone up in

MARINE | London market evolution In association with Ed Broking 05 The Marine Insurer | April 2023

“If underwriting seats are adjusted to reflect modern use then what is to stop Lloyd’s offering brokers and other associated companies desk and workspace on floors two and three? If successful, then maybe the break clause would not need to apply and the thinking can extend beyond 2031 since this would reinforce the idea of Lloyd’s as the epicentre.’’

many quarters. Which prompts two particular questions: How and why?

Few companies have maintained their office space in a fashion which is untouched since 2019. Understandably, many cut back on space during lockdowns. There is no obvious prospect of more lockdowns and so views need to be taken on how to accommodate a workforce returning to the City.

If office and desk space have been shrunk by meaningful percentages then there is a need to increase both to provide the required workspace. Not all companies seem willing to engage with this and real estate savings achieved since 2020 are hard to let go from balance sheets.

Something has to give though. Either provide the desks or stop pushing the office agenda so loudly. Hot desking might look and sound like the answer but experience suggests that it really isn’t unless planned with military precision.

One obvious exception to this is, of course, the Room. Here there are desks in abundance (many of them noticeably still empty) and a lease signed through to at least 2026.

If underwriting seats are adjusted to reflect postpandemic use then what is to stop Lloyd’s offering brokers and other associated companies desk and workspace on floors two and three?

If successful, then maybe the thinking can extend to and beyond 2031 with Lloyd’s re-established as the epicentre. This would surely also be useful given the notable exodus to the company markets of late.

If the “How” can perhaps be answered, then the “Why” still remains.

Remote working has been an almost universal success. Unlike some other industries it is hard to bring to mind any core businesses within ours that have had to close their doors due to pandemic issues.

Most would admit to having seen productivity increase because employees are less constrained by commutes and less distracted by office environments. The laptop at home has somewhat re-defined traditional working hours.

Ultimately, the employer has benefitted. The employee has had wins also with greater balance between home and the office. As familiarity and trust in the systems has embedded, so have efficiencies. The understanding has thus grown that a desk in the Square Mile is no longer an essential requirement for work interaction and productivity.

DIVIDED OPINION

Is a wholehearted return to the City required? It appears to depend on who is asked.

The senior and junior groups tend towards “Yes”, with the middle (larger) group more in the “No” camp.

From the senior perspective this seems to predominantly represent the indoctrinated view that it was always done this way and always should be. The younger view appreciates the benefits of in-person contact and the ability to learn faster

that way, including by osmosis.

The middle group’s view is mainly born from the comfort of having already gained a better sense of their place in the industry and working with established relationships, along with certain family pressures which inevitably arrive at that stage of life.

Is it impossible to accommodate all? Surely not, but for that to succeed the decision-making must be vested across all the participants rather than laying squarely in one group. While a recent EY report showed good progress with female board representation it also confirmed that there were no board members under 40 in any of the UK’s top financial services firms.

And here we return to the title. As referred to in the comment on the speed of development of electronic platforms, the industry is confronting potentially rapid evolutionary changes.

Are we willing to fully address them? We stand in a moment which presents an opportunity to re-engineer some parts of how we do what we do. The decisions made in this time will affect the path towards the next 30 years. Who should make them?

MARINE | London market evolution In association with Ed Broking The Marine Insurer | April 2023 06

“Remote working has been an almost universal success. Unlike some other industries it is hard to bring to mind any core businesses within ours that have had to close their doors due to pandemic issues.”

Patrick Jordan, Ed Broking

Globally number one in Shipping and continuing to make waves RECYCLING & DECOMMISSIONING Bkna s P&I Clubs Shipyards Government s C h a r sreret Brokers Shipowners Underwriters MarineInsurance International Agencies Bulk Gas Offshore Tankers Yachts Contai n e r s Cruise&Ferry Supporting the whole of the shipping lifecycle hfw.com/shipping #thefutureofshipping © 2023 Holman Fenwick Willan LLP. All rights reserved. Americas | Europe | Middle East | Asia Pacific

Conflict in Ukraine: Lessons for the marine insurance market

acknowledge the evolving risk landscape and note that what is required for the market’s ability to function successfully both today and in the future may be markedly different to what worked in the past.

More than a year into this tragic war, and after just one annual reinsurance renewal cycle, there are already lessons to be learnt in how we can improve as a (re)insurance marketplace to help future-proof our products so that they remain able to meet the challenges thrown up by any future conflicts.

Fourteen months since the start of Russia’s invasion of Ukraine, the effects on global supply chains have been felt across the world, from the industrialised west to Africa and other emerging markets.

With 90% of traded goods transported by sea, the marine insurance market has been impacted but has also assisted in global efforts to keeping trade moving.

While focusing on the wider repercussions of this war we must remember that the harshest effects by far are being felt by the people of Ukraine. As Olena Zelenska, Ukraine’s first lady, commented in a BBC interview six months into the fighting, while the UK’s population is “counting pennies” as energy costs soared, Ukraine is counting casualties.

The response of countries indirectly affected by war is a challenging balance for leaders who must weigh up humanitarian considerations with potential political and economic consequences abroad and at home. However, the importance of sustainable global financial markets, including (re)insurance, that can absorb the shock of war and provide the hope of economic viability in more peaceful days ahead, is a measure of a mature and well-functioning economic system.

COGS OF GLOBAL TRADE

The London insurance market is in many ways at the heart of the machine, with a responsibility to help keep the cogs of global trade moving by ensuring that coverage is available to protect assets when stakes are high and to be there to pay claims when losses occur.

For marine (re)insurers to continue doing this, we need to

The time to adopt better data and analytics is now. We all know the major role that data and digital tech will play in improving our understanding of risk, but as a market, whether that be as a (re)insurer, (re)insurance broker or customer, we need to knuckle down and harness it sooner rather than later.

Through the past decade there has been undoubted progress with many of the above parties and insurtechs developing technology in this sphere. However, as a market, have we moved fast enough in adopting data driven solutions?

The squeeze in (re)insurance capacity for exposures in the Black Sea and other areas because of the Ukraine conflict should be the wakeup call for the market to reinvigorate itself.

Further research, investment and adoption of data and technology so that underwriters can accurately track vessels and cargoes in real time would free up capacity in restricted areas and allow the market to better service its customers.

IMPROVED COMMUNICATION

There are obstacles to overcome, particularly to do with managing proprietary data, but none are insurmountable with good communication.

Insurers need better communication with customers. As the need grows, greater use of automated technology that enables (re)insurers to extract more data to help them model and price risk more accurately is unlikely to be too far into the future.

In the meantime, customers and their brokers that are prepared to work with underwriters to adopt new working practices to provide enhanced, and more timely information, ultimately will allow the market to provide better solutions for their particular needs.

MARINE | Ukraine conflict In association with AXIS The Marine Insurer | April 2023 08

John Owen , Head of Marine & Political Risks, AXIS, identifies some of the key lessons learnt from the ongoing conflict in Ukraine and what the (re)insurance market needs to focus on to help keep the cogs of trade moving

At all points in the (re)insurance value chain, the new working practices will need all parties to communicate their requirements and have the confidence to challenge and ask difficult questions.

This may become even more pressing if escalation of geo-political tensions elsewhere in the world leads to a contraction in (re)insurance supply in more areas than already face a shortage of available reinsurance. Insurers need to improve communication with their reinsurers. After a particularly challenging 1/1 renewal season many insurance carriers are now in a position from which they will have different outwards insurance coverage – and presumably different pricing – from their reinsurance panels, particularly for exposures in Russia, Ukraine and Belarus (RUB).

LEADERSHIP CHALLENGES

Indeed, the 2023 reinsurance renewals saw a new issue emerge in the marine world – the move away from the historic norm of reinsurers coalescing around one leader who sets the wording and pricing. This is obviously not ideal for primary insurers but perhaps it is a scenario that could have been predicted a few weeks or indeed months in advance of January 1.

The magnitude of the exposures and potential claims brought to light by the Ukraine conflict, in several specialty insurance lines and not just marine, mean that many reinsurance underwriters are having to adhere to board mandated edicts regarding current and future assumed

exposures and contract wordings.

While contract language on sanctions matters needs to be watertight, in previous years there has been latitude granted to reinsurers’ line underwriters to negotiate individual clauses. For 2023 that has seemingly been taken away from many for RUB clauses.

While in most cases there is negligible difference in coverage afforded by the wordings, inevitably in certain scenarios carriers may find a potential for discrepancies in coverage afforded by different reinsurers on the same panel.

Perhaps in more certain times ahead, we can hope for discrepancies in respect of RUB exposures to lessen. However, with sadly no prospect of an imminent end to conflict in Ukraine and given the rise of global geo-political tensions elsewhere, primary insurers are now acutely aware that when reinsurers’ boards issue underwriting edicts there is minimal room for their underwriters to negotiate wordings. Greater clarity in communication within the market will help all parties to continue to keep global trade flowing.

MARINE | Ukraine conflict In association with AXIS 09 The Marine Insurer | April 2023

“More than a year into this tragic war, and after just one annual reinsurance renewal cycle there are already lessons to be learnt in how we can improve as a (re)insurance marketplace to help future-proof our products so that they remain able to meet the challenges thrown up by any future conflicts.’’

Maritime sanctions

Charles Cormack , Intelligence Analyst at Synmax, explains how Theia,

firm’s maritime domain awareness platform, is tackling sanctions breakers at sea

Synmax founded in 2021 by energy trader Bill Perkins and quantitative analyst Eric Anderson, has a vision to bring transparency and accountability to the energy and maritime industries by combining the objective proof afforded by satellite imagery with the scalability of machine learning and artificial intelligence (AI).

Currently in operation is the Synmax Energy product Hyperion, launched in May 2022, while Theia, a maritime domain intelligence product is due to go live in the first half of 2023.

To say that recent years have seen a redistribution in the balance of regional and global power would be an understatement.

A symptom and a driving factor is the reshuffling of oil flows between producers and consumers. States have been forced to shore up energy supplies and infrastructure in the face of market and geopolitical turbulence, with east and west using oil as an economic weapon to project power.

UNINTENDED CONSEQUENCES

Sanctions have been levied in response to political, economic and security concerns by the US and the European Union against Russia and Iran, among others, and the entities with which they do business.

An unintended consequence of sanctions is the large-scale expansion of shadow fleets of ‘grey’ (AIS switched off, some trackable signals such as radio frequencies transmitted) and ‘dark’ oil tankers (all emitted signals turned off, only trackable at scale via Theia).

Industry experts estimate the size of this shadow fleet at approximately 600 vessels, or roughly 10% of large tankers globally.

To carry out trade with pariah states such as Iran and Russia, these shadow vessels employ clandestine tactics to escape the vigilance of regulatory bodies.

By going dark and ‘spoofing’ their locations (illegally turning off and synthetically projecting their automatic identification system (AIS) locations, akin to using a VPN to mask an IP address), vessels have, until now, been able to carry out illicit oil pick-ups, transfers and drop-offs obscured by the vastness of the oceans and without overview or reprisal.

MILITARY-GRADE ANALYTICS

Theia, Synmax’s maritime domain awareness platform, however, sees through spoofing attempts by using proprietary machine learning and AI in conjunction with daily global satellite imagery and military-grade analytics.

By drawing on whole earth observation data, AIS and other signals intelligence, Theia can automatically identify and attribute any vessel over 30 meters regardless of its emission state and visually track its journey at scale.

On March 8 2023, Theia placed and tracked 22,000 vessels in the South China Sea alone, bringing unparalleled and otherwise unimaginable capacity to analysts and regulatory bodies.

In addition to live tracking, Theia can retrospectively view a vessel’s historical movements, ensuring that past infractions are exposed and can be used evidentially in a court of law.

China’s importance as an oil consumer in influencing global power dynamics cannot be overstated. Wherever oil sanctions have been imposed, and legal trade throttled back, China has swooped in to fill the gap, taking advantage of artificially low prices.

Iran is China’s third largest oil provider, after Russia and Saudi Arabia. In the three months leading up to January 2023, it is estimated that it increased its oil exports by more than 1.2 million barrels per day.

Since the imposition of the G-7 price cap on Russian oil following the invasion of Ukraine, Russian oil sells for at least $25 less than Brent crude (as of January 6 2023), with Iranian oil selling for even less.

Indeed, an economist at the Vienna Institute for International Economic Studies stated: “China benefits at least by 25% of Brent oil in terms of discount, which is enormous in the scale of 1.2 million barrels per day only for Iran’s oil.”

In doing so, China maintains an enormous economic advantage compared to countries that do abide by sanctions. However, they must pay a premium to vessels engaged in sanctions running, massively incentivising oil tankers to run the gauntlet of reprisals.

One vessel that was identified as breaking Iranian sanctions by Theia, at the request of a private client, was the BERG 1.

On August 27 2022 the vessel was observed via satellite imagery transiting north into the Persian Gulf, where she began to spoof her AIS data in an attempt to conceal her true position.

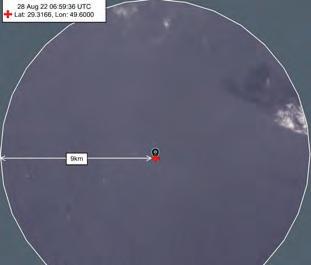

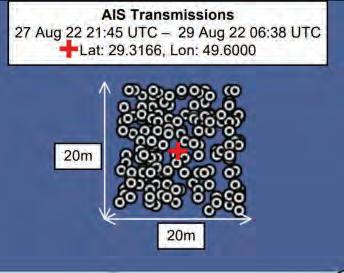

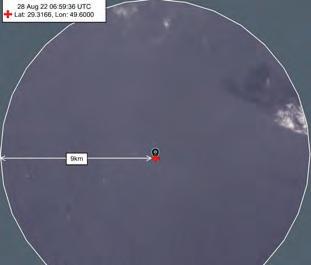

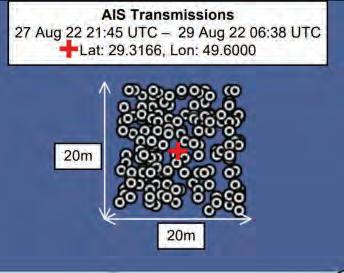

According to AIS data, the BERG 1 stayed in a 20m x 20m box at Lat: 29.3166, Lon: 49.6000 from approximately 27th August 2022, 21:45 UTC until 29th August 2022, 06:38 UTC (see Fig 1). However, an inspection of satellite imagery reveals

MARINE | Maritime sanctions In association with Synmax The Marine Insurer | April 2023 10

the

by

this to be a fabrication (see Fig 2).

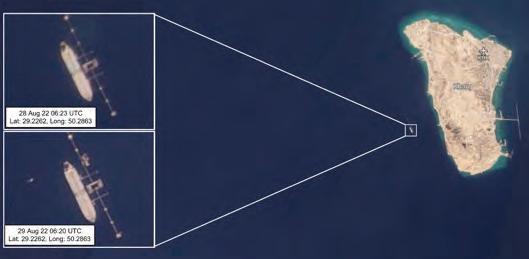

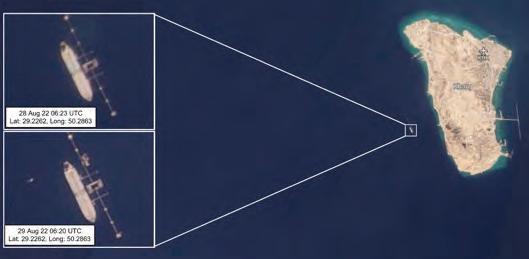

The BERG 1’s true location was observed via satellite imagery at the Kharg Island Oil Terminal in Iranian waters approximately 67.5km east of its transmitted location on both August 28 at 06:23 UTC and August 29 at 06:20 UTC (see Fig 3).

On August 29, at 06:57 UTC, BERG 1 was seen transiting south from Kharg Island Oil Terminal, where it resumed transmitting its true AIS location at approximately 10:47 UTC. At 11:58 UTC the vessel’s draught increased from 11m to 20.5m, leading to the assessment that oil product had been onboarded during its time alongside Kharg Island.

On leaving Kharg Island, BERG 1 transited to the Eastern Outer Port Limits (EOPL). She remained at the

EOPL anchorage point from September 15 until October 31 2022, when she began her voyage to Qingdao Oil Port, China (see Fig 4). She arrived on November 20, where she is assessed to have offloaded product, with her draught decreasing from 20m to 16m.

US AWARENESS

The US is aware of increased levels of trade in oil between Iran and China. US Secretary of State Blinken stated in March that the US is: “Committed to significantly reducing Iranian energy exports and will sanction those facilitating Iran’s petroleum and petrochemical trade.”

To that end, US Special Envoy for Iran Robert Malley reported that the US has “been in contact with Chinese authorities, and we will continue to sanction those who are involved in the import of Iranian oil.”

By identifying sanctions breaches using objective, evidential data capable of being used in a court of law with no possibility of bias or manipulation, vessel operators can be financially penalized and illicit behaviour disincentivised.

Theia is not only a new tool in the arsenal of regulatory bodies, but can also be employed by insurers and other industry bodies as part of their proper due diligence, ensuring they are not inadvertently implicated and penalized as a result of sanctions breaches.

MARINE | Maritime sanctions In association with Synmax 11 The Marine Insurer | April 2023

20m box.

Fig 4: On leaving Kharg Island, Iran, BERG 1 transited, after a short stop-over, to Qingdao Oil Port, China, arriving on 20th Nov 2022. Imagery provided by Planet Labs.

Fig 2: However, as is made clear by satellite imagery of the area at the time, BERG 1 is nowhere to be found. Imagery provided by Planet Labs.

Fig 3: BERG 1 located at Kharg Island Oil Terminal approximately 67.5km east of its transmitted location. Imagery provided by Planet Labs.

The problem of ‘going dark’

Marine of global broker Lockton explain

Recent press reports have suggested that vessels may be switching off the automated tracking system (AIS) to disguise the vessel’s location to cover up illegal fishing activity or to breach sanctions. Such actions present a safety risk for the marine sector.

The AIS displays other vessels in the vicinity with information on identity, type, position, speed, navigational status and other safety-related information.

It also enables the exchange of data with shore-based facilities as coast stations can use the AIS channels to send information on tides, notice to mariners (NTMs) and local weather conditions.

THE IMO RULES

Regulation on the use of AIS is very clear. The IMO Convention for the Safety Of Life At Sea (SOLAS)

Regulation V/19 requires all vessels of 300 gross tonnage (GT) and upwards engaged on international voyages (500 GT for cargo ships not engaged on international voyages) and all passenger ships, irrespective of size, to carry AIS

onboard.

Furthermore, the IMO Resolution A.1106(29) adopted on 2 December 2015 states that AIS should always be in operation when ships are underway or at anchor except where international agreements, rules or standards provide for the protection of navigational information.

This means that the AIS may be switched off if the master believes that the continual operation of AIS might compromise the safety or security of their ship or where security incidents are imminent.

However, there are very few legitimate reasons for an AIS signal to ‘go dark’ —protection against piracy in notorious areas being one of them — and the master should restart the AIS as soon as the source of danger has disappeared.

Actions of this nature should always be recorded in the ship’s logbook together with the reason for doing so, as well as passed on to the competent authority unless this could compromise the ship’s safety or security.

Deliberately turning off the transmitter signal without legitimate reason represents a breach of SOLAS and puts the ship in breach of flag state regulations.

MARINE | AIS In association with Lockton The Marine Insurer | April 2023 12

The automatic identification system (AIS) is a tried and tested tool to reduce the risk of collisions. The insurance market should make it clear that its use, as mandated by the International Maritime Organization (IMO), is a pre-condition for cover and challenge clients that switch it off without valid reason or manipulate the data.

Stephen Hawke, (top left) Managing DirectorLondon, Lockton PL Ferrari and Tom Midttun, (left)Head of Production - Lockton

AIS IN INSURANCE POLICIES

The current Nordic Plan’s position is that AIS is a safety precaution and therefore a seperate usage warranty is a requirement of cover.

As a result, a separate warranty is not deemed required. However, insurers must prove that illegal activity was occurring at the time of an event to refuse a claim.

Inference of illegal activity from AIS usage remains untested in the courts. Unless criminality is proven, the cover remains in place for any claim where there is no causality between switching off the AIS and the claim.

Arguably, a UK style warranty mandating AIS usage would be more effective. But this would still not address the wider issue of potentially providing coverage for criminal actors, rather than specific incidents of criminality, where of course, if proved, an insurance policy would not respond. Commercial expulsions from shipping registrations would facilitate broker and insurer client due diligence in this respect.

BREACHING THE RULES

The International Group of P&I Clubs has not only warned

about the practice of turning off the AIS signal to breach sanctions but also about the ability to manipulate the AIS data.

While AIS transponders have built-in security features to prevent them from transmitting falsified data, these can sometimes be circumvented for example to breach sanctions. Furthermore, a user can purchase multiple AIS transponders, creating more than one digital AIS identity for a single vessel.

Switching the AIS off or tampering with the AIS system impacts the safety of the maritime world. To end issues of illegal fishing and sanction breaches it may be necessary for the insurance industry to view switching off the AIS system itself as an illegal act, thus denying cover regardless of any loss causation unless the insured can offer a valid reason.

Ships that need to switch off the AIS system temporarily for legitimate safety and/or security concerns should be obliged to notify insurers as soon as practically possible with the justification thereof.

Tampering with the AIS system is not acceptable under any circumstances. AIS data is used for a variety of other purposes beyond sanctions and territorial compliance orders, such as the calculation of CO2 emissions.

In addition to promoting the safety of the sector, AIS also helps create the operational transparency that is so critical to maintaining trust and support in the sector.

MARINE | AIS In association with Lockton 13 The Marine Insurer | April 2023

“While AIS transponders have built-in security features to prevent them from transmitting falsified data, these can sometimes be circumvented for example to breach sanctions. Furthermore, a user can purchase multiple AIS transponders, creating more than one digital AIS identity for a single vessel.’’

Navigating choppy waters

The average cost of a hull claim between 2010 and 2020 didn’t change a great deal. In 2020, however, it increased by 10% — the same again in 2022. The main reasons given for the inflation were:

> The rising cost of raw materials. Steel has risen sharply in cost, which had a huge impact on the price of structural repairs;

> Covid-19. The pandemic restricted movement of ships and seafarers. That, together with quarantine and closures, resulted in heightened costs;

> The closure of China. China was always the most cost-effective place to go for repairs. Its closure meant repairs had to be done in other, more expensive, regions; and,

> Cuts in manpower. Shipowners’ efforts to reduce costs led to them cutting down on manpower. Lack of competent crew led to more accidents and more severe damage of vessels.

Due to these issues and the continued conflict in Ukraine, the prediction for 2023 is a further 15% in claims inflation.

While claims frequency has reduced, the costs of like-for-like claims are likely to have increased by 40% compared to 2020.

WAR AND CONFISCATIONS

The Ukraine war has likely changed the market permanently. Notably, the confiscation of aircraft, while foreseeable as a risk, very much caught the market by surprise and has led to significant losses.

This led the market to look for other assets that could also be confiscated such as vessels. The reinsurance market has reacted by increasing rates, reducing (or in some cases removing) cover and demanding visibility of risks written directly and via facilities.

From a cargo perspective, Chris McGill from Ascot Group recently highlighted a collaboration with Marsh, to provide cover for grain shipments out of Ukraine. This was contemplated by the market anticipating that a safe corridor would likely open. As soon as this was the case Marsh and Ascot were able to react and offer an insurance product in a few short weeks. While this was entirely retained in the insurers in the early days, this has now become a more

MARINE | Digital solutions In association with Concirrus The Marine Insurer | April 2023 14

It would be no overstatement to say that the current conditions facing the marine insurance industry are unprecedented. The sea of issues is contributing to feelings of insecurity and unpredictability. Russia shows no signs of relenting in its war against Ukraine, and increasing tensions in Southeast Asia are causing nervousness throughout the industry. Add to that declining freight rates, low cargo volumes and slower vessel turnarounds, and the outlook does seem somewhat bleak. Here, Andrew Yeoman , CEO of Concirrus, looks at the current issues concerning the market and how rapidly evolving digitised solutions can help organisations best manage them

widespread product.

This proactive and swift action belied the media’s prediction that the insurance industry would be the last to respond, potentially scuppering any benefits of the deal.

INCREASED VISIBILITY

Lack of transparency of exposures remains a sticking point across the industry, and some in the profession believe that more pressure should be put on the customers and the wider market to share their data.

Digitalisation is seen as the answer to improving the transparency issue.

Recent 1/1 reinsurance renewals have irrevocably changed the market in terms of visibility with reinsurers now demanding to know the risks associated with vessels.

It is difficult to look back and understand why we could not do that before. However, the switch has now flipped and it [1/1] will certainly change some of the facilities and how they operate.

As technology marches on, the challenge is for insurance products to keep up. Data is going to drive visibility, which will force innovation in the insurance/reinsurance product to speed up.

ESG - DATA DRIVING VISIBILITY

Many would say that signing up to the Poseidon Principles was a leap into the unknown, however, the framework is a good foundation on which to build an environment, social and governance (ESG) strategy.

The greatest challenge the industry is seeing when it comes to collating data on CO2 emissions and vessel locations, is the time it takes to gather it directly from shipowners – certainly an exercise in customers’ willingness to cooperate.

Another hurdle was the efficiency in dealing with the data and what to do with it once gathered.

Questions have been raised over the extent of regulations the insurance industry may face when it came to the carbon output of their portfolio and whether tricky decisions would have to be made on profit versus principles.

Motivations for signatories included accepting that change was inevitable. This was a good place to start and then onto a stage where measurements could ultimately help customers reduce their carbon to secure more favourable benefits and pricing.

IMPROVEMENTS IN INSIGHT

Better insights through digitalisation are the only way that the marine insurance market will achieve its goals of maximising visibility, vastly improving risk assessment capabilities and meeting ESG requirements.

Investments in digitised products are leading to vast improvements in the volume of meaningful data, outcomes and visibility not to mention the reliability of predictions and analyses.

Spending time lamenting the negatives facing our industry will do nothing to help us counteract the challenges we face nor ensure we are in a place to meet the future head-on. Instead, we must look at digital progressions and how they will help put our market in a stronger position. Technology must be at the beating heart of the future if this industry is to flourish.

MARINE | Digital solutions In association with Concirrus 15 The Marine Insurer | April 2023

“The greatest challenge the industry is seeing when it comes to collating data on CO2 emissions and vessel locations, is the time it takes to gather it directly from shipowners – certainly an exercise in customers’ willingness to cooperate.’’

Andrew Yeoman, Concirrus

The Ukraine war (inset) has likely changed the market permanently. Notably, the confiscation of aircraft. This led the market to look for other assets that could also be confiscated such as the cargo ship above in the Port of Odessa.

The customer remains King

Ronny Reppe , CEO of Noria,

Many leaders in the insurance space know that they need their organisation to be more customer-centric, but are failing to undertake the operational groundwork required to make it a success as the customer journey becomes increasingly digital.

Attempting to create a traditional customer-centric culture or mindset is important, but these efforts will be a lot less effective unless you also deliver a customer-centric digital experience. Without the right digital foundation in place, your customer-centricity initiatives will ultimately be ineffectual and provide little added value.

Before we explore how to create a customer-centric architecture, let’s review the meaning and benefits of traditional customer-centricity in insurance.

TRADITIONAL CUSTOMER-CENTRICITY

A customer-centric approach will improve customer loyalty because customers will feel that their insurer truly understands their needs. In turn, this leads to improved customer satisfaction and increased revenue through positive referrals and repeat business.

The satisfaction goes both ways – employees who feel they are making a positive difference for customers will feel more engaged, motivated and invested in their work.

Here’s what the research has found:

> 66% of customers expect companies to understand their needs (Salesforce);

> Customers will spend an average of 10% more for a good experience (Forbes); and,

> Customer-centric companies are 60% more profitable than companies that are not (Brightlocal).

Done well, customer-centricity can become your organisation’s competitive advantage and enable you to stand out in a crowded marketplace.

A sharp focus on the needs of customers can also help insurers identify new opportunities for innovation, leading to new revenue streams and continued growth.

MARINE | Customer-centricity In association with Noria The Marine Insurer | April 2023 16

explains how insurers could and should pursue and achieve true digital customer-centricity to the benefit of all

WHAT DOES CUSTOMER-CENTRICITY LIKE IN INSURANCE?

Customer-centricity in insurance involves a focus on meeting the needs and expectations of policyholders and providing excellent customer service. Here are some specific examples of what traditional customer-centricity looks like in insurance:

> Understanding customer needs: Insurers need to have a deep understanding of their customers’ needs, pain points, and risk profiles. They collect feedback and use data analytics to identify trends and offer tailored insurance solutions that meet each customer’s unique requirements.

> Making insurance easy to understand and purchase: Customers should be able to manage their policies and make claims quickly and easily.

> Offering customised solutions: Recognising that every customer has unique needs and providing tailored insurance solutions that meet their specific requirements.

> Providing exceptional customer service: Providing a personalised, responsive service and being available to answer customers’ questions and concerns promptly.

> Being transparent: Transparency is critical to building trust with customers. Insurers should be transparent about their policies, pricing and claims processes.

> Offering value-added services: Insurers can differentiate themselves by offering additional valueadded services beyond traditional insurance coverage such as offering risk-management advice or providing educational resources.

DIGITAL CUSTOMER CENTRICITY

But as the customer journey moves to the digital realm at an accelerating pace, insurers that lack the data and tools required to drive digital customer-centricity will struggle to provide the services listed above beyond the most basic level.

In other words, claiming to have a “customer-centric culture” without the right architecture in place is nothing more than an empty promise. Does your organisation:

> Provide customers with the option to use self-service portals with excellent UX?

> Have a 360-degree view of the customer to provide great service and value-add?

> Leverage the power of a cutting-edge solutions back-office?

If not, it is clear that your customer-centric approach must evolve to meet the needs of the digital customer journey. But where should insurers begin? With the data.

CUSTOMER-CENTRIC DATA MODELLING

Without having your structured data in a single source, it is impossible to undertake a 360-degree analysis of each

MARINE | Customer-centricity In association with Noria 17 The Marine Insurer | April 2023

“There’s an unfortunate mindset among some insurers that make it complex for customers to contact the helpdesk, often making it very difficult to even find a phone number. For me, that’s digitisation gone wrong. You need to be immediately available to solve any customer need manually if their digital experience fails to deliver.’’

customer. Larger insurers often have customer data spread across several different core systems (administrative systems, spreadsheets, emails) and have a significant task ahead of them to remove siloes and unify this data into a single view.

The single data source should not only involve your own customer data, but, incorporate external data from various sources that can be matched up with your internal data on the customer.

Having a unified data source enables you to equip your solutions back office with the tools they need to take customer-centricity to the next level.

Most of us have experienced the frustration involved in calling a helpdesk and having to spend half an hour explaining who we are, what we’re trying to do and the challenge we’re facing.

A customer-centric data model will provide the visibility needed to remove this step. For example, if the policy-holder was filling out an online form and became stuck at a certain point, the helpdesk should have the visibility to see this straight away and provide a solution without the need for any lengthy explanation.

Imagine that a policyholder calls your helpdesk. Is your employee able to:

> Access a single view of the customer without having to dig into several data sources?;

> See a summary of all the different conversations held with the customer?;

> See all the solutions offered to the customer in the past?;

> See all the historic and current insurance products they have with you?;

> See historic claims, transactions, documentation and email history?;

> Access customer-specific analytics/insights?; and,

> Understand the customer’s challenge without the need for lengthy explanation?

At Noria, we have created that 360-degree view. Our customer-centric platform enables insurers to proactively leverage their collected customer data and lessens their dependency on external resources to prepare and hand over data when they need it fast.

SELF-SERVICE AND CUSTOMERCENTRICITY: MUTUALLY EXCLUSIVE?

One of the misconceptions about customer-centricity is that it requires a high-touchpoint approach with bigger helpdesks and more time on the phone with customers.

This can be difficult to reconcile with the accelerating trend towards digitisation and the key part that self-service plays in the digital customer journey.

How can we provide customer-centricity if we are leaving the customer to help themselves?

The answer is to balance the digital customer journey

with being available to provide personalised, expert help when needed. There’s an unfortunate mindset among some insurers that make it complex for customers to contact the helpdesk, often making it very difficult to even find a phone number. For me, that’s digitisation gone wrong. You need to be immediately available to solve any customer need manually if their digital experience fails to deliver.

Providing a seamless digital customer journey and a self-service approach frees up more time for your team to talk with and assist customers. Having the right architecture in place means they will also have the tools to help them efficiently and effectively while providing highly personalised service. If you can get it right, “customer centricity by design” is where the magic happens in balanced digitisation.

MARINE | Customer-centricity In association with Noria The Marine Insurer | April 2023 18

“Attempting to create a traditional customer-centric culture or mindset is important, but these efforts will be a lot less effective unless you also deliver a customer-centric digital experience.

Without the right digital foundation in place, your customer-centricity initiatives will ultimately be ineffectual and provide little added value.”

Ronnie Reppe, Noria

Opportunities and new risks

Gard was founded in 1907 by shipowners who were unwilling to expose themselves, through a mutual insurance arrangement, to the perceived new risks of steam propulsion. Now the wheel is turning full circle and increasingly shipowners are looking to retrofit or buy newbuilds incorporating wind propulsion technology. But what risks might that new equipment pose and how will marine insurers react to them?

Shipowners are operating under a host of regulations and market pressures to reduce CO2 emissions. There is the IMO target of a 50% reduction in total CO2 emissions by 2050 as compared to 2008, that may be amended to net zero at the forthcoming MEPC 80.

On 1 January 2023, the Carbon Intensity Indicator came into force. It will rank vessels from A-E, based on the carbon intensity of their operations. Negotiations at IMO-level to introduce a carbon-based fuel levy are progressing.

It is likely that from 1 January 2024 vessels calling in Europe will need to purchase carbon credits under the EU Emissions Trading Scheme (ETS). More generally, there is increasing pressure from companies to reduce their Scope 3 emissions, including those from transportation.

Aside from the promise of alternative fuels in the future, there are a range of efficiency measures that can be implemented right now. These include rerating of engines, air lubrication, more frequent hull cleaning, fitting redesigned propellers and wind propulsion.

MARINE | Wind propulsion In association with Gard 19

Neil Henderson, (left) Industry Liaison, and Paul Grehan , (right) Senior Underwriter, Gard (UK) review the

huge potential offered by wind propulsion for the shipping sector and challenges faced by marine insurers as they support the sector in the transition

The Marine Insurer | April 2023

Kite sails involve tethering a large kite to the bow of a vessel, similar in design to those used by kiteboarders. Pic: SkySails

It is only wind propulsion that offers an entirely new and carbon-free form of propulsion once installed on the vessel. In their Maritime Decarbonisation Strategy 2022, the Mærsk Mc-Kinney Møller Center for Zero Carbon Shipping identified that wind propulsion is a key part of the decarbonisation of the global fleet, with a potential overall ‘efficiency gain’ of 1%-8% per ship.

These efficiency gains mean significant reductions in operating costs, as well as an improved carbon footprint. It is no wonder therefore that shipowners are looking at these options seriously.

There are three principal types of wind propulsion technology: the Flettner rotor, the kite sail and the vertical deck-mounted sail, of which the wing sail is probably the most well-known.

THE TECHNOLOGY

The Flettner rotor is a large cylinder mounted vertically and mechanically rotated around its axis, creating thrust through the so-called Magnus Effect. The technology was invented in the 1920s but has had limited use since then. More recently interest has revived.

An example is the bulk carrier Afros (2018-built, 64,000 dwt), delivered as a newbuild with four moveable rotors fitted by Anemoi Marine Technologies. These showed a 12.5% fuel savings on a return voyage between Nantong and Vancouver. Rotors fitted by Norsepower to a variety of different ship types, have shown fuel consumption savings of 5%-20%.

Kite sails involve tethering a large kite to the bow of a vessel, similar in design to those used by kiteboarders. An early prototype was the MS Onego Duesto (2007-built, 9,831 dwt), equipped with a 160m2 kite. It showed an average fuel saving of 5%, increasing to 10%-12% on North Atlantic and North Pacific routes.

This year, testing of a 500m2 kite began on the Airbus chartered, Louis Dreyfus Armateurs operated RORO vessel Ville de Bordeaux (2004-built, 5,200 dwt) on its monthly transatlantic route.

Wing sails are solid aeroplane-like wings, mounted vertically and trimmed depending on the wind direction. High oil prices in the early 1980s sparked interest in this technology but never adopted beyond prototypes. It is now being actively developed.

One such company is BAR Technologies, a UK-based spin-out of the British Americas Cup Team run by Ben Ainslie. The company and Yara Marine Technologies are working with MC Shipping and their charterer, Cargill, and with Berge Bulk to instal wing sails on their respective bulk carriers, the Pyxis Ocean (2017-built, 80,962 dwt) and the Berge Olympus (2018-built, 210,000 dwt). BAR Technologies anticipates a daily fuel saving of approximately 1.5 mt per wing sail.

Although the equipment has a high degree of automation, alongside the physical fitting of the new equipment the master and crew will require additional training on the navigational software to optimise efficient sailing, as well as on the safe operation of the systems installed.

INSURANCE PERSPECTIVE

What does this new technology mean from a marine insurer’s perspective?

For H&M insurance, the installed equipment will be considered part of the vessel’s equipment. H&M and loss of hire insurers will be concerned with the loss or damage of equipment, and consequential damage to other parts of the vessel.

The specialist nature of the repairs and the scarcity of spare parts will likely lead to higher value claims and longer repair periods.

MARINE | Wind propulsion In association with Gard The Marine Insurer | April 2023 20

There are currently 23 large commercial vessels fitted with wind propulsion equipment.

To mitigate against extended periods of repair, shipowners may look to take out extended loss of hire insurance, as they did with early exhaust gas cleaning systems. Likewise, shipowners may consider cyber insurance for the risks associated with the software-dependent operation of the equipment.

From a P&I perspective, the equipment may affect the risk of collision with other vessels and port infrastructure, or injury to crew during its operation.

Ordinarily, insurers rely heavily on classification societies and flag state inspection regimes to assess the risks associated with the build quality and the standard of maintenance of vessels they cover, only surveying only a sample of vessels.

Mandatory class approval is only required for the fastening of wind propulsion equipment to the vessel’s hull, but the assured can request voluntary class approval for the equipment itself.

There is already some general guidance, such as Bureau Veritas’s NR206 Wind Propulsion Systems notation. The more widespread deployment of Flettner rotors means there is specialist guidance; for example, Lloyd’s Register has specific Guidance Notes for Flettner Rotor Approval (2015).

But real-world experience of fitting wind propulsion equipment to large merchant vessels is still limited.

Until more operational experience and claims data becomes available and class societies have developed more detailed requirements and guidelines, marine insurers will need to be more hands-on in assessing the risks.

This will mean engaging with manufacturers of the equipment at the design and testing stages and assessing the training received by crews in the operation of the equipment and how to respond if problems occur.

While marine insurers may be cautious about embracing these new risks, the reality facing shipping is that wind offers an inexhaustible carbon-free means of propulsion. It is inevitable that shipowners will increasingly adopt this technology to reduce their carbon emissions and they will need the support of their insurers in their transition to a decarbonised future.

The Marine Insurer | April 2023 MARINE | Wind propulsion In association with Gard 21

“The Flettner rotor is a large cylinder mounted vertically and mechanically rotated around its axis, creating thrust through the so-called Magnus Effect. The technology was invented in the 1920s but has had limited use since then. More recently interest has revived. An example is the bulk carrier Afros (2018built, (above) 64,000 dwt), delivered as a newbuild with four moveable rotors fitted by Anemoi Marine Technologies.”

Cargo Liquefaction – Mitigating the risk

Jessica Ng, specialist in cargo liquefaction at global forensic investigation company Hawkins, Hong Kong office, explains how to prevent and mitigate the risk of cargo liquefaction

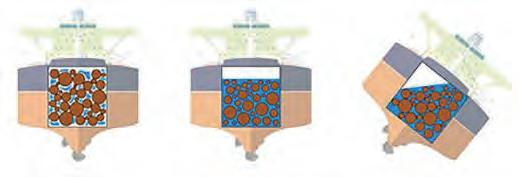

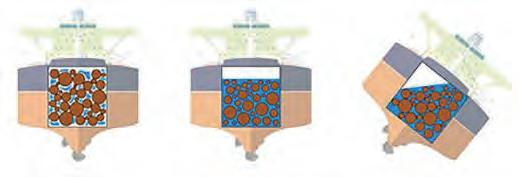

Cargo liquefaction takes place when a dry bulk cargo with high moisture content loses its strength and transforms from a solid dry state to an almost fluid state. As the cargo starts to behave like a liquid when the ship is moving, it can shift rapidly in the hold of a ship, making the ship unstable (Fig 1) and causing it to capsize resulting not only

in the potential loss of a vessel but also the loss of life. Cargo can be exposed to agitation through loading from a height, during a voyage because the vessel encounters rough seas, or merely because of vessel vibrations resulting in compaction of the cargo, which in turn, can lead to liquefaction. Commonly known cargoes that pose this type of hazard are iron ore fines and mineral concentrates.

MARINE | Cargo Liquefaction In association with Hawkins The Marine Insurer | April 2023 22

Main image and (inset) shows liquefaction has occurred.

Source; https://www.amsa.gov.au/vessels-operators/cargoes-and-dangerous-goods/dynamic-separation-cargoes

GOVERNING LEGISLATION

A ‘Group A’ cargo is one which may liquefy if shipped at a moisture content (MC) more than its transportable moisture limit (TML) and mitigation measures are required to reduce the risk of liquefaction. The International Maritime Solid Build Cargoes provides information and instructions that should be followed to help facilitate the safe stowage and transport of these Group A cargoes.

The IMSBC Code is mandatory and provides specific guidance on how cargo should be stored, loaded and transported. Key requirements include:

> The shipper shall provide the master with a signed certificate of the TML, and a signed certificate or declaration of the MC, each issued by an entity recognised by the competent authority of the port of loading;

> The certificate of TML shall contain, or be accompanied by, the result of the test for determining the TML; and,

> The Code requires that the time between testing for the MC and loading shall be no more than seven days.

The testing date and raw data to evidence the tests should also be disclosed, as, without this, it is not possible to determine the accuracy of the results and whether the requirements of the IMSBC Code have been complied with.

THE CAN-TEST

The Can-test is a supplementary ad-hoc test that can be conducted on board or at the dockside to help determine if a cargo might be unsafe or if the cargo might “flow”. The test is to put some cargo in a can, bang it on the ground or on the side of the can and then check to see if the contents start to flow. To assist the crew/surveyor in determining the above, it is prudent that the Can-test is conducted on samples regularly.

Masters should be familiar with the Can-test and whilst a simple process, the IMSBC Code provides instruction on how to conduct this correctly for accurate results.

RISK MITIGATION

The most effective way to reduce the risk posed by Group A cargoes is to follow the Code accordingly. Owners should also take the initiative to request additional information from Shippers to ensure that they are fully aware of the condition of the cargo when it is loaded on to the ship.

Sampling/testing

According to the IMSBC Code, the test to determine the TML of the cargo should be conducted within six months prior to the date of loading and the test to determine the MC should be carried out no more than seven days prior to the date of loading. To ensure that the TML and MC values are reliable it is crucial that representative samples are taken from the stockpiles where the cargo is being stored and that the sampling/tests are carried out by an

MARINE | Cargo Liquefaction In association with Hawkins 23 The Marine Insurer | April 2023

“As the cargo starts to behave like a liquid when the ship is moving, it can shift rapidly in the hold of a ship, making the ship unstable (Fig 1) and causing it to capsize resulting not only in the potential loss of a vessel but also the loss of life.’’

Jessica Ng, Hawkins

Fig 1: Liquefaction impact on a vessel

accredited third-party laboratory.

The certificates issued by the laboratory should provide details of:

> when and how the samples were taken (including any internal sampling report);

> details of when and how the TML test was undertaken;

> details of when and how the MC was determined;

> raw data supporting the results.

Weather logs for the anchorage/stockpile/mine and loading port should also be provided for the seven days prior

to loading and if precipitation or rain was noted during this period, then the cargo should be re-sampled and tested prior to loading. Owners should also request that shippers have provisions to protect the cargo from rain during loading and ensure that the barges carrying the cargo have proper water-draining facilities.

Loading cargo

Owners should appoint a reputable and competent surveyor to oversee the loading process and an expert to supervise and provide technical support to the surveyor throughout loading.

Prior to loading, the Code requires that the bilge wells are clean, dry, and covered as appropriate, to prevent ingress of the cargo. The bilge system should be tested to ensure that it is working, and the crew should also sound the bilges during loading for evidence of water draining. During loading, the surveyor should perform regular Can-tests of the cargo. The surveyor should describe in detail how the tests are being undertaken and take videos of the tests to ensure that they are being conducted according to the Code.

The surveyor should also take high-resolution photographs of the sample before and after conducting the test to allow comparison of the results. If loading takes place through the night, the surveyor should also designate a crew member to assist as Can-tests need to be conducted periodically.

Warning signs are:

> A Can-test showing a pancake appearance with a glossy surface or free water;

MARINE | Cargo Liquefaction In association with Hawkins The Marine Insurer | April 2023 24

“Cargo can be exposed to agitation through loading from a height, during a voyage because the vessel encounters rough seas, or merely because of vessel vibrations resulting in compaction of the cargo, which in turn, can lead to liquefaction.”

Fig 2: Cargo must be adequately protected from the elements prior to loading

> Following the Can-tests, the cargo clumps together instead of crumbling apart; and,

> The cargo can be moulded by hand like a modelling clay and retains a compressed shape. (Fig 3)

The surveyor should look for signs of splattering during loading, and instances where the cargo sticks to the grab’s jaws (if loading uses a grab).

Special attention should be given if the grabs are lowered to the bottom of the hold before the jaws are opened as this is a common practice when loading wet cargo.

The surveyor should note down all instances of cargo wetting by rain and ensure that no loading takes place when it rains. The cargo on the barge or in the stockpile should be covered with tarpaulins and the crew should close the hatch covers during rain and beforehand if sufficient weather data is available to indicate the likely onset of rain.

If the cargo has been exposed to rain, it is prudent that further laboratory tests rather than Can-tests are conducted to ensure that the MC is still below the TML. Until a new MC (from an accredited laboratory) has been provided by shippers, the master should ensure that no loading operations take place. Owners should also ensure that shippers provide a new MC certificate if the testing date on the certificate initially provided has exceeded seven days.

The voyage

Following loading, the cargo should be trimmed to reduce the likelihood of the cargo shifting.

The Code also requires that the appearance of the surface of the cargo is checked regularly during the voyage. As such, it is highly recommended that the crew conducts daily voyage inspections of the cargo (weather permitting), takes photos of the cargo, and keep records of the cargo condition.

The crew should also take daily cargo hold bilge records and ensure that water is drained from the hold if the bilge wells become full.

To protect owners from any cargo shortage claims which may be presented by receivers, it is recommended that a record is made of the amount of water pumped from the bilges during the voyage.

If the cargo appears to liquefy during the voyage, then the master should inform owners immediately and then either the master or owner should take the following steps:

> contact the nearest coastal state authority;

> contact their P&I Club; and,

> consider calling at the nearest port or place of refuge.

In the meantime, the master should also consider reducing the ship’s motion/vibration.

Cargo liquefaction continues to be a major concern for the shipping industry. However, the risk can be minimised greatly if attention is paid to the guidance of the Code and appropriate action is taken prior to and during the loading of Grade A cargoes.

HELP AT HAND

At Hawkins, we can provide advice on suitable sampling methods and appropriate laboratory conduct, both of which will assist in determining whether the cargo is safe for loading.

We can attend onboard vessels to witness the sampling and at laboratories to witness the testing of the samples. If attendance is not possible (for example due to Covid-19 and its associated travel restrictions), we can also liaise with local surveyors and help supervise the whole loading process remotely to ensure that Can-tests are performed regularly and accurately.

The Marine Insurer | April 2023 MARINE | Cargo Liquefaction In association with Hawkins 25

“The most effective way to reduce the risk posed by Group A cargoes is to follow the Code accordingly. Owners should also take the initiative to request additional information from shippers to ensure that they are fully aware of the condition of the cargo when it is loaded on to the ship.”

Fig 3: An example of a Can-test showing cargo which has retained a compressed shape

Calmer waters ahead?

Shipping companies, their customers, insurance brokers and insurers are hoping for calmer waters in 2023 after several years of high seas. Neil Atkinson , Head of Marine, UK Company, CNA Hardy, looks at the key challenges in the marine sector and outlines how the industry is collectively responding

In recent months an unprecedented combination of events has made global trade harder, with the war in Ukraine, soaring inflation and the Omicron variant of Covid which have led to supply chain disruption. This in turn has led to an increase in delays and risk of deterioration of sensitive cargoes, further compounded by an increased fire hazard on board vessels.

This year some pressure points appear to be easing, though there is no end to geopolitical and economic turmoil in sight.

For insureds and their brokers, the good news is that new capacity in the $18.9bn global premium cargo market has kept rates in check, for the moment.

However, the fly in the ointment is reinsurance, with global reinsurance capital falling by 17% or $115bn in 2023 according to Aon. Many risk players are pulling capacity altogether or hardening their stance with exclusions and tougher conditions. Insurers are likely to be left with higher retentions and additional costs to bear.

Physical capacity for cargo is a different story. For almost

MARINE | Risk outlook In association with CNA Hardy The Marine Insurer | April 2023 26

three years, securing slots on container ships has been challenging and expensive, with breakbulk expanding in response. The latter is a riskier method of transport and comes against a backdrop of rising damaged-goods claims. Will the container capacity squeeze continue? Moody’s in October predicted that container supply would exceed demand as it downgraded its shipping sector forecast to negative.

However, Reuters recently suggested that freight rates will not normalise for months, even though spot rates as of early January were down 80% from a September peak above $20,000 for a 40-foot container. Rates continue to be above pre-pandemic levels boosted by higher labour costs and continued Covid in China .

New ship orders, including from Mediterranean Shipping and A.P. Moller-Maersk, will help. However, if demand falls shipping companies will adjust capacity accordingly.

UKRAINE AND SUPPLY CHAIN

The Ukraine war has trounced the pandemic as the major global trade disrupter, triggering port closures, stranded vessels and, most notably, surging commodity prices. Many manufacturers, meanwhile, have been forced to find new suppliers in a hurry or to stockpile goods, both of which have insurance ramifications.

Brokers have been monitoring the supply chain disruption closely. Distribution upsets - what AJG last spring called a “chain of chaos” - have highlighted shortcomings of standard 15-day duration provisions, created instances of significant under insurance and made monitoring goods’ location harder.

AJG has also noted a rise in attritional losses around perishable goods.

Another major issue on the radar of brokers has been increased value accumulation, as stockpiles up at ports and other hubs.

Worried shippers chartering vessels or huge swathes of them to ensure capacity are also increasing values at risk, while ever larger vessel sizes – such as the 400m long, 61.5m wide Ever Ace – and mammoth single port sites exacerbate such concentrations.

EASING SUPPLY-CHAIN PROBLEMS

Sea-Intelligence, the marine-focused data analytics firm, found that global schedule reliability in November, at 56.6%, was well up on the same period in 2021 and 2020. The company predicted a return to normal levels of shipping congestion in March.

The Ukraine conflict is clouding the outlook, as is Covid in China, home to seven of the world’s 10 largest ports. China recently eased Covid-related port restrictions, and infection rates are surging.

Navigating sanctions against Russia has created difficulties for insurers and the recent G7/EU/US oil price

MARINE | Risk outlook In association with CNA Hardy 27 The Marine Insurer | April 2023

“Mis-declared cargo and the transport of lithium-ion batteries are among the drivers. It is possible that Lithium-ion batteries were responsible for the fire and sinking last year of the Felicity Ace, (left) which was transporting several hundred million dollars-worth of electric vehicles.’’

Finding the fault

Bruce Swales , Managing Director –

Asia-Pacific, Envista

Forensics, asks the key question of why did this vessel’s engine fail right after an overhaul

Picture this, a vessel owner seeking to overhaul the engine in a vessel engages a shipyard to carry out the overhaul. The engine is overhauled and during post-overhaul sea trials the engine fails. The vessel is returned to the yard, and the vessel owner is up for either the repair of the engine (best case) or worst case, the replacement of the engine.

Vessel owners and insurers frequently ask: Why did this vessel’s engine fail right after an overhaul? Because of that, Envista has investigated such failures multiple times.

In Envista’s experience, there are two common reasons for the above scenario frequently playing out. The first is using non-OEM parts (third-party manufactured parts, often referred to as spurious parts) and the second is poor workmanship by the workers carrying out the overhaul work.

USE OF NON-OEM PARTS

Non-OEM manufactured spare parts can seem financially attractive as they typically cost significantly less than genuine OEM parts. However, it is important to note that the quality and reliability of these parts can vary greatly and may not be held to the same standards as genuine OEM parts. The risks when using non-OEM parts include the following:

a) Lack of compatibility and poor fit;

b) Potential for lower quality and reliability, as well as reduced durability;

c) Lack of OEM support;

MARINE | Engine Failure In association with Envista Forensics The Marine Insurer | April 2023 28

The owner now faces extended vessel downtime and accuses the yard or the yard’s subcontractor of causing damage to the engine. The yard (or subcontractor) notifies their insurer that there may be a claim made against them by the vessel owner or insurer, and so it goes.

d) Warranty concerns;

e) Potential for decreased engine performance; and,

f) Compatibility with future upgrades/repairs.

Point a), lack of compatibility and poor fit, has been the cause of several engine failures that Envista has investigated. Typically, a main or big end bearing does not have the correct tolerances. Often, the part is manufactured from inferior quality materials, which can cause it to wear out much quicker or fail outright.

POOR WORKMANSHIP

Poor workmanship is a common occurrence seen by Envista, not just with third-party overhaul companies but also with OEM service technicians.

Common problems include bolts not being torqued to the correct tightness, wrong tolerance parts installed, incorrectly installed bearing shells, dirt on bearing surfaces and defective or leaking injectors re-installed.

Surprisingly, even very basic workmanship issues occur. A good example of this is a failure Envista investigated in Asia involving oil starvation caused by service technicians forgetting to remove rags pushed into oilways during engine disassembly to stop foreign particles from entering the oilways.

The engine was reassembled, started and left idling. Not long after, the engine shut down because of a low oil pressure alarm, but not before damage occurred to bearings and journals. Investigations found rags still in the oilways.

This happened not just on one engine but on two simultaneously being overhauled in the same vessel. This case was particularly surprising because service technicians from the OEM carried out the overhaul work.

FIVE WAYS TO MINIMISE THE RISK OF FAILURE

First, while cost is important, one of the factors associated with such failures is the push to carry out overhauls at a very low cost. Unfortunately, this carries significant risks associated with workmanship and the use of spurious parts.

Second, engage only reputable shipyards to carry out the overhaul and vet their overhaul team or subcontractor if a subcontractor is being used regarding their specific experience with your engine model. Better still, engage the OEM or the OEM’s authorised service agent to carry out the overhaul (although, as per the oilway rag example above, even OEM service teams can make fundamental mistakes).