Dear Readers,

The March 2025 issue of Celerity Supply Chain Tribe captures the dynamic transformation unfolding across India’s supply chain ecosystem. Our Cover Story dives deep into the warehousing revolution, where automation, sustainability, and infrastructure advancements are reshaping India’s logistics backbone. From smart warehouses to multi-modal hubs, we explore how innovation is unlocking new efficiencies.

Fresh from the resounding success of Celerity presents SCALE Supply Chain Leadership Summit, we bring you exclusive snapshots from the event, capturing the insights, energy, and collaboration that define our industry’s future.

In our Special Report, we spotlight India’s monumental Maritime Development Fund (MDF)—a ₹25,000 crore ($2.9 billion) initiative set to propel India’s shipping and shipbuilding industries into a new era. This fund marks a pivotal step in strengthening India’s global maritime presence.

Through Focus, we chart India’s journey from solar milestones to self-sufficiency and global leadership. As the country expands its renewable energy footprint, we analyse the policies, innovations, and market shifts that are powering this remarkable transition.

As India continues its ascent as a global supply chain powerhouse, we remain committed to bringing you the latest insights and trends shaping the industry. Let’s navigate this transformative journey together!

Happy Reading!

Charulata Bansal Publisher Charulata.bansal@celerityin.com

www.supplychaintribe.com

by:

Edited by: Prerna Lodaya e-mail: prerna.lodaya@celerityin.com

Designed by: Lakshminarayanan G e-mail: lakshdesign@gmail.com

Logistics Partner: Blue Dart Express Limited

In the heart of Delhi, where the echoes of history blend seamlessly with the rhythm of modern commerce, the Celerity SCALE Supply Chain Leadership Summit 2025 stood as a beacon of transformation, bringing together visionaries, pioneers, and change-makers who are redefining the very essence of supply chain leadership. This photo feature offers a few glimpses from the event, capturing key moments and highlights.

In a monumental stride towards maritime excellence, India has unveiled the Maritime Development Fund (MDF), a ₹25,000 crore ($2.9 billion) initiative poised to revolutionize the nation’s shipping and shipbuilding landscape. This Special Report presents exclusive first-hand insights from leading subject-matter experts on the topic.

Warehousing Excellence: Optimize, Automate & Dominate

In today’s fast-paced logistics landscape, efficient warehousing is the backbone of supply chain success. A well-optimized warehouse not only boosts productivity but also enhances accuracy, reduces costs, and ensures seamless order fulfilment. By leveraging cutting-edge technology, streamlining processes, and adopting smart inventory strategies, businesses can transform their warehouses into high-performance hubs. From automation and AI-driven insights to sustainable practices and workforce optimization, mastering warehousing excellence is the key to staying competitive in an evolving market. This cover story, enriched with expert insights, delves into strategies that can take your warehouse operations to the next level.

India’s Fast Evolving Solar Soft Power –From Milestone to Self-Reliance and Global Leadership

Through this article, Vanshaj Srivastava, Senior Manager – SCM Strategy and Ops, Reliance Industries Ltd., explores India’s journey from milestones to self-sufficiency and global leadership in the solar sector through a supply chain lens.

‘To Learn, Unlearn and Relearn is the Mantra I follow’ –Vickram Srivastava, Head of Supply Chain – North America, Sun Pharma

as having the

of, or being binding in any way on, the author, editors, publishers who do not take any responsibility whatsoever for any loss, damage or distress to any person on account of any action taken or not taken on the basis of this publication. Despite all the care taken, errors or omissions may have crept inadvertently into this publication. The publisher shall be obliged if any such error or omission is brought to her notice for possible correction in the next edition.

The views expressed here are solely those of the author in his private/professional capacity and do not in any way represent the views of the publisher. All trademarks, products, pictures, copyrights, registered marks, patents, logos, holograms and names belong to the respective owners. The publication will entertain no claims on the above. No part of this publication can be reproduced or transmitted in any form or by any means, without prior permission of the publisher. All disputes are subject to the exclusive jurisdiction of competent courts and forums in Mumbai only.

In the heart of Delhi, where the echoes of history blend seamlessly with the rhythm of modern commerce, the Celerity presents SCALE Supply Chain Leadership Summit 2025 stood as a beacon of transformation, bringing together visionaries, pioneers, and change-makers who are redefining the very essence of supply chain in the country today. This grand congregation was more than just an event; it was a testament to the relentless spirit of innovation and the boundless pursuit of excellence. This photo feature offers a few glimpses from the event, capturing key moments and highlights.

FROM the moment industry stalwarts, tech innovators, and supply chain experts gathered under one roof, the air buzzed with energy and inspiration. The summit was a melting pot of perspectives, a confluence where the brightest minds unraveled the complexities of modern supply chain management with a shared mission—to build a resilient, sustainable, and technologically advanced future. The quiz acted as a perfect interlude between the knowledge sessions, fostering

a strong connection with the audience.

At the core of every discussion, one truth resonated—great supply chains are not just about efficiency; they are about visionary leadership. Today’s leaders are not merely operators; they are architects of possibility, weaving together technology, sustainability, and human ingenuity to craft supply chains that drive economies and empower communities.

The event opened with the lighting of lamps by our august luminaries including Umesh Madhyan, Chief Operating Officer, LEAP India; Chetan Kumria, Founder & MD, Xcell Supply Chain Solutions; Dharmesh Srivastava, VP - Supply Chain, Agro Tech Foods; Ashish Mendiratta, Founder, Advanchainge Pvt Ltd.; and Charulata Bansal, Founder & Publisher, Celerity. Just as the lamps illuminated the room, today’s conversations illuminated the path forward for a more innovative, resilient, and collaborative supply chain. This ceremony set the tone for a day of insightful discussions, where we explored cutting-edge technologies, sustainability initiatives, and new strategies to address the challenges of modern logistics.

The very first panel of the conference explored how modern supply chains can evolve from traditional cost centers into strategic revenue-generating assets. The expert panel delved into the importance of customer centricity and how logistics can transcend its role as merely a fulfillment function, creating additional value through On-Time, In-Full, with Sustainability and Growth (OTIFSG). Insights shared during the session offered actionable strategies to enhance customer satisfaction, embrace sustainable practices, and drive long-term growth in supply chain operations. The panel was moderated by Chetan Kumria, Founder & MD, Xcell Supply Chain Solutions.

The panel discussion focused on exploring how advanced technologies and eco-friendly practices are reshaping value chains. The event brought together industry leaders, experts, and thought leaders to delve into strategies that improve efficiency, reduce environmental impacts, and foster new growth opportunities. The overarching theme was building resilient and sustainable value chains in the context of an ever-evolving global landscape. This panel was moderated by Shammi Dua, VP, Kearney.

Speakers:

t Anirban Sanyal, Sr. GM – Supply Chain & National Logistics, Century Ply

t Ashish Bhatnagar, Director and Head of Procurement, Bimbo Bakeries India

Speakers:

t Dharmesh Srivastava, VP - Supply Chain, Agro Tech Foods

t Nitin Saini, Director Supply Chain, Kohler Co. India

t Sudip Gupta, Senior Director, Manufacturing and Supply Chain of South Asia, Cargill

t Umesh Madhyan, President- SCALE and Chief Operating Officer, LEAP India

t Venu Vashista, VP- Supply Chain, Altius Infra

t Prof. Jitender Madaan, Chair - Operations and SCM, IIT Delhi

t Kapil Premchandani, Founder & MD, KD Supply Chain Solutions

t Umesh Madhyan, Chief Operating Officer, LEAP India

In a world of intricate supply chain networks, visibility is the key to navigating complexity with confidence. The panel discussion explored how organizations can leverage real-time data to empower their decision-making processes. The focus was on enhancing transparency, optimizing operations, and enabling agility in business strategies. The session was moderated by Mandar Shirsavakar, Founder & CEO, Translytics Business Services.

Speakers:

t Deepika Arora, Global Logistics Transformation Lead, TE Connectivity

t Deepak Jain, Director India, Argon & Co

t Kaushik Mitra, Vice PresidentIndia Business, Celonis

t Prashant Patel, Global Sourcing Leader, GE Vernova

t Vaibhav Dhawan, CTO,Prozo

This engaging panel discussion delved into the evolving landscape of procurement, focusing on how businesses are navigating global sustainability goals, leveraging advanced technologies, and building resilient supplier networks. Panelists explored how businesses are rethinking their procurement practices to align with global sustainability goals. They discussed how sustainable sourcing, eco-friendly packaging,

and responsible production are becoming non-negotiable standards in procurement, pushing companies to go beyond compliance and embrace circular economy principles. Anoop Bansal, Co-founder, UNPAUSE Consulting Pvt. Ltd., was the moderator of the session.

Speakers

t Ajay Kumar, Chief Purchasing Officer, MT-AutoCraft

t Ashish Mendiratta, Founder, Advanchainge Pvt Ltd.

t Kirat Mohan Singh, Director Fulfillment, Asia Pacific, Vantive

t Shilpa Prashar, Head Procurement, Air India Express

The panel on how customer expectations are reshaping the order-to-delivery experience in Q-Commerce and E-Commerce provided valuable insights from industry leaders on the strategies driving faster, more personalized, and reliable experiences while maintaining operational efficiency. This panel highlighted the importance of staying ahead of consumer expectations and the critical role that technology and data play in shaping the future of Q-Commerce and E-Commerce. Moving forward, the challenge will be maintaining this balance of speed, personalization, and reliability while continuously improving operational efficiency. The session was moderated by Ashish Pande, Operations Strategy Consultant.

t Kapil Makhija, MD & CEO, Unicommerce

t Nitin Nair, Senior Vice President, ONDC - Open Network for Digital Commerce

t Siddharth Burman, Sr GMOperations and Logistics, API Holdings (Pharmeasy)

t Shonik Goyal, President & Head Supply Chain, Sheela Foam Ltd. (Sleepwell)

t Varun Gupta, Supply Chain Director, Nestlé South Asia Region

We were delighted to honor the remarkable individuals who have made extraordinary contributions to the supply chain industry. The evening celebrated not only their professional accomplishments but also their dedication to driving innovation, sustainability, and excellence within the sector. Their leadership sets a high standard for future generations and serves as an inspiration for the entire supply chain community.

The Honourees were…

t Deepak P Joshi, Chief Operating Officer, Hamdard Laboratories India

t Gaurav Dua, Former Head – Global Supply Chain Development, Pernod Ricard

t Dr Radha Mohan Gupta, ex-SVP – Supply Chain, Devyani International

t Yashpal Singh Negi, Executive Director, Global Autotech Ltd.

As the curtains fall on this illustrious summit, one thing is certain—the journey of supply chain transformation is just the beginning. The wisdom exchanged, the connections forged, and the innovations unveiled will continue to shape the industry’s trajectory. Looking ahead, we envision an even more powerful and immersive gathering for the next season, where the spirit of leadership will shine brighter, and the pursuit of excellence will scale greater heights.

In today’s fast-paced logistics landscape, efficient warehousing is the backbone of supply chain success. A well-optimized warehouse not only boosts productivity but also enhances accuracy, reduces costs, and ensures seamless order fulfillment. By leveraging cutting-edge technology, streamlining processes, and adopting smart inventory strategies, businesses can transform their warehouses into high-performance hubs. From automation and AI-driven insights to sustainable practices and workforce optimization, mastering warehousing excellence is the key to staying competitive in an evolving market. This cover story, enriched with expert insights, delves into strategies that can take your warehouse operations to the next level.

How do you define excellence in warehouse operations, whether in your own business or across the industry? Can you share some examples of the same?

Gopala Krishna, National Head –Supply Chain, Big Basket: Achieving excellence in warehousing operations, especially in e-commerce and quick commerce, is now a fundamental necessity. Over the past 12 years, I’ve witnessed this transformation firsthand at Big Basket, starting from the day we launched our first warehouse. Technology has become the backbone of the entire warehousing process today.

When we initially launched a warehouse, especially in Tier 1 cities, we were focusing on next-day and sameday deliveries. Over time, this shifted to two-hour deliveries, and eventually, we expanded to include 50-60 dark stores. Now, we’re offering deliveries in as little as 10 minutes, with around 500 stores in operation. Each area, from the main distribution center to the dark stores, is crucial. Technology is playing a vital role across every aspect, from reducing labour intensity to optimizing space, managing inventory, and ensuring availability.

In the context of e-commerce, excellence might be defined as delivering within two or three days, or the next day. But in the case of quick commerce, where we aim for 10-minute deliveries, the definition shifts to one of speed and efficiency.

When you think about e-commerce, there’s a bit more time to work with, allowing for a slower, more steady process. But in quick commerce, it’s all about speed. In dark stores, you often have only a minute or two to pick, pack, and hand over the order to delivery.

Sometimes, you may even have less than a minute. For five-minute delivery windows, you may only have about 30 seconds to pick and pack an order. Time is absolutely critical in ensuring excellence in this business.

Tannistha Ganguly, Global Head –Supply Chain WMS (IT), KimberlyClark: I would say that a combination of Strategic Planning, Efficient Resource Management and Effective Utilization of Technology are key to achieving excellence in warehouse operations. While we are all aware of the growing role of technology in warehouse operations across India and other emerging markets, we also must realize that digital transformation in warehousing is not solely about large-scale overhauls; rather it involves optimization of space, processes, resources and ensures greater synchronization. Considering the rapidly increasing volume of goods being handled across supply chains in India, technology is used to timely dispatch and shipping, labour management, warehouse space and occupancy etc. i.e. it is integral to Strategic and Tactical Planning as well as Resource Management.

For instance, in my current sector (FMCG), KPIs such as Pick Efficient and On-Time, In-Full (OTIF) Delivery are critical. If workforce turnover is recurring, then constant training of staff in warehouse processes adds to delays and cost overruns, as compared to implementing advanced routing algorithms and layout optimization tools that ensure continuity and effective cost management. By leveraging intelligent systems, businesses can achieve greater accuracy in order fulfilment, reduce

Customer expectations have shifted significantly, especially with Gen Z leading the way. Speed is definitely a key factor now, with even small delays becoming a point of frustration. Customers today not only want quick delivery but also expect reliability and convenience. For them, it’s about how quickly and dependably a service can meet their needs, and how easily they can access it. Looking ahead, the pace of change in e-commerce and quick commerce will continue to drive innovation. This shift is also creating lots of opportunities in the industry, not just for businesses, but for people looking to contribute to this growing space. There’s a greater thrust on agility and flexibility, and it’s exciting to think about how this will shape both operational processes and customer experiences in the next decade.

turnaround times, and improve overall warehouse productivity. Ultimately, the integration of technology in warehousing is no longer optional but a necessity for businesses seeking to maintain competitiveness and operational excellence.

Rajan Ekambaram, Partner, Qwixpert Consulting: In today’s dynamic supply chain landscape, warehousing and fulfilment centers have evolved from being cost centers to strategic enablers of customer satisfaction and business growth. On-Time In-Full (OTIF) is the single most critical metric, ensuring that the right product, in the right condition, reaches customers within the promised time frame. Companies that accurately measure and continuously optimize OTIF—while maintaining cost efficiency—are the ones truly excelling in warehouse operations.

A prime example is Quick Commerce, where warehouses operate with nearinstantaneous precision. Orders are picked, packed, and handed over to delivery personnel in under two minutes, ensuring 10-minute deliveries with exceptional accuracy. This level of operational excellence is achieved by leveraging technology, streamlined material flow, and robust fulfilment strategies.

In the B2B segment, customer expectations around service levels vary by industry. However, the core principle remains the same—customercentric KPIs such as on-time delivery, order accuracy, and quality must take precedence over a purely cost-driven approach.

Warehousing is evolving toward a hybrid model, balancing dark store setups with large fulfillment centers to optimize efficiency. Predictive inventory management using AI will further reduce overstocking and unstacked inventory issues, while decentralized sourcing models, are expected to minimize reliance on large distribution centers. Additionally, sustainability and cost optimization will play a critical role, with a strong focus on vehicle utilization and inter-hub cost control.

Kapil Premchandani, FounderDirector, KD Supply Chain Solutions: Warehousing has undergone significant evolution over time. Its primary function is to ensure that products ordered by customers are delivered accurately and on time, but delivery timelines can differ from one industry to another. Each industry has its own unique set of needs. For instance, ordering and delivery patterns in apparel differ from those in groceries. Over time, these processes have become more sophisticated, especially as our country transitions from traditional B2B (business-to-business) warehousing to B2C (business-to-consumer) models. This shift is making warehousing operations and delivery timelines even more crucial. As consumers, we care not just about how fast our orders arrive, but also about getting exactly what we ordered. If the products are incorrect or delayed, it indicates that warehousing operations aren’t running efficiently. To me, this is the essence of excellence— guaranteeing the timely delivery of the correct product to the right customer.

How do you leverage data to improve your warehouse operations?

Gopala Krishna: In the fast-paced world of quick commerce (Q-Commerce), where every second counts, automation and data-driven insights are pivotal to success. Quick commerce, the model that focuses on ultra-fast deliveries within minutes, can only thrive when integrated with robust automation and real-time data management systems. While full automation may not be feasible in every part of the process—especially in

a country like India—the adoption of automation in critical aspects remains essential.

At the heart of quick commerce operations, automation facilitates speed and accuracy. For instance, in the picking process, a key factor for success is minimizing the time taken from when an order is placed to when it is picked. With an operational goal of picking in two minutes, relying on manual methods such as paper tracking or manual data entry becomes impractical. Automated systems allow orders to be relayed directly to the picker the moment a customer places an order. This instant data transfer ensures that pickers can fulfill orders swiftly and efficiently, meeting the strict time constraints that are characteristic of quick commerce.

However, despite these advancements, challenges remain. While software and technology have automated many aspects of quick commerce— especially in dark stores—there are still areas where manual processes dominate. Hardware solutions, like robots for picking or automated sorters, are not yet widespread. Thus, a balance must be struck between automation and human intervention in the current scenario.

Data serves as the backbone of effective quick commerce operations. With real-time data analysis, businesses can make informed decisions that ensure operational efficiency. Demand forecasting, for example, plays a critical role in managing stock levels, particularly during peak seasons like Diwali. Predicting customer demand accurately is essential, as businesses must strike a fine balance between maintaining sufficient stock to

meet demand and avoiding overstocking, which can lead to wasted inventory.

Real-time inventory tracking is another crucial aspect where data provides value. While stock levels may be planned in advance, real-time monitoring helps prevent stockouts. If inventory is running low, the system can alert the team to replenish stock before it becomes an issue. This type of proactive approach ensures that businesses can keep pace with customer expectations without facing supply shortages.

Efficient operations are made possible through the use of real-time dashboards. These dashboards allow managers to monitor the time taken for each step in the order fulfillment process, whether it’s picking, packing, or stacking. By tracking these metrics in real-time, businesses can identify any delays and address them promptly. For example, if a picker takes longer than the expected time to pick an order, management can investigate and make adjustments to streamline the process.

Moreover, space management is a growing challenge as the number of SKUs (Stock Keeping Units) continues to rise. In the early days of e-commerce, warehouses might have handled 5,000–6,000 SKUs, but today that number can easily reach 10,000–15,000. Effective space management is vital in this scenario, as businesses cannot continue to expand their storage space indefinitely. Efficient use of available space ensures that stock can be accommodated within existing infrastructure, without incurring unnecessary costs associated with expanding warehouse capacity.

In short, for quick commerce to

succeed, automation and data analytics must work together. While complete automation may not be a reality in all regions or industries today, adopting automation in key areas can significantly improve operational efficiency. Meanwhile, leveraging data to forecast demand, track inventory, and monitor performance ensures that businesses can act swiftly to maintain high standards of service. As the quick commerce sector continues to grow, these technologies will play an even more prominent role in shaping the future of delivery services.

Tannistha Ganguly: In my opinion, companies in the Supply Chain sector should focus on Data Awareness and Data Strategy if they are to fully capitalize on available resources. Typically, warehouses are integrated with ERPs (creating a link in the B2B context) and as such, large volumes of data flow between ERPs and Warehouse Management Systems (WMS). Most companies in our sector are still focussed on pure report generation and KPI tracking, instead of exploring insight generation from enterprise data. With AI-based technologies figuratively barging into every sector, the time is ripe for the Supply Chain players to define their enterprise Data Vision and formulate and implement Data Strategies (and not just Technology Stacks).

For example, at my current organization, when I initiated a project to compare KPIs and reports between two regional WMS, I found notable discrepancies. While one warehouse was manually processing data via MS XLS with a turnaround period of one week and many errors, the other claimed to have generated real-time insights via

I see greater handshaking between efficiency and innovation and expect some ‘wild’ technological disruptions. Some of the trends that I keep my eye on are around Smart Operations (Inventory Tracking, Warehouse Automation), Wearables and Immersive Reality. Smart Wearables, like VR glasses and voice picking devices will play a major role in inventory management, dispatch and shipping, wastage and dumping reduction, cost-effective heavy equipment training (through simulation) among countless other applications. Sustainability will also gain prominence, with increase in renewable energy consumption at warehouses (with solar panels), usage of compostable pallet wraps, bio-degradable plastics, etc.

Power BI based dashboards. A deep dive into their data showed that the data was 3-4 days old (not real-time), therefore raising questions on which KPIs need to be reported real-time in the first place (turns out 4 or 5 out of 44). While this does have direct IT cost implications, it also raises a bigger question on data awareness and utilization within the organization and points to the need for a balanced Data Strategy.

Rajan Ekambaram: For companies to improve warehouse efficiency, the right digital infrastructure is the foundation. This begins with implementing an ERP and a high-end WMS that not only manages daily operations but also captures granular, actionable data for continuous improvement.

Once a strong digital footprint is in place, companies should focus on harnessing historical and real-time data to drive key operational decisions. Datadriven insights can significantly optimize warehouse operations in the areas of

Product slotting & picking strategies to reduce travel time and improve order fulfilment

Wave management for efficient batch processing of orders.

Real-time visibility of order boards, enabling dynamic dispatch and resource planning.

Cross-docking & dock management, ensuring faster truck turnarounds

Resource allocation & workforce planning, optimizing labour utilization based on Skill matrix.

Beyond operational efficiency, datadriven decision-making plays a pivotal role in warehouse design and automation strategies. Advanced analytics can identify opportunities to redesign layouts, enhance storage density, and introduce automation in infrastructure, leading to substantial efficiency gains.

Warehouse operations have evolved with technology, but the biggest hurdle in adopting Industry 4.0 isn’t access to tech or funds—it’s resistance to change among ground staff. How can we overcome this?

Gopala Krishna: Warehouse operations have significantly evolved over the last few decades, primarily due to advancements in technology and new processes. However, one of the biggest challenges in adopting practices like Industry 4.0 in warehouse operations is not access to technology, finances, or even mindset, but rather resistance to change within the operations model, particularly among the ground staff and operators.

Overcoming resistance to change in warehouse operations, particularly among ground staff and operators, requires a structured approach. At Big Basket , successful transitions have been achieved through pilotbased implementation, ensuring new processes like Type-Based Picking and Zone Controllers were introduced gradually. Training and upskilling have been key to helping Leadership and our Workforce understand the benefits of process improvements, while leadership buy-in and real-time monitoring have ensured smooth adoption. Additionally,

data-backed decision-making has played a crucial role in showcasing tangible improvements, such as better fill rates, stock accuracy, and reduced write-offs, thereby building confidence in the new systems.

Tannistha Ganguly: Considering that supply chain has historically been and continues to be a labour-intensive sector, resistance to change, whether to operational models or introduction of new technology, should not come as a surprise. Socio-political influences, misinformation, fearmongering add significantly to this classic project management and change management dilemma. The primary fear of the workforce would be loss of jobs and skills becoming redundant due to new technology. Empathy and transparency are key to building confidence in the workforce about the benefits of technology adoption. Effective change management strategies that include continuous communication and feedback systems, active listening, prior planning of (distributive) training programs (like ‘Train the Trainer’), clear guidelines on new responsibilities and fair compensation are keys to success. It is very important to take the personnel along in this digital transformation, ensure that adequate and empathic handholding be provided during the transition and recognize (and communicate) his/her contribution to the enterprise vision.

Rajan Ekambaram: Many businesses prefer manual operations due to high initial investment and difficulty in justifying ROI, especially when labour is readily available. Additionally, the lack of skilled workforce makes it difficult to implement and sustain automation. While factory warehouses are seeing

adoption due to space constraints and labour reduction needs, broader implementation remains selective based on business requirements.

To overcome these challenges, companies must shift from cost-driven to value-driven decision-making, considering long-term ROI. Upskilling the workforce, phased implementation of automation, and targeted investments in high-impact areas like high-volume warehouses can improve adoption.

Kapil Premchandani: That’s an excellent question, and I encounter this issue regularly. I often tell my team about our journey with warehouse operations. We used to run warehouses where we worked from Monday to Saturday. But now, we manage warehouses for e-commerce and other companies that operate 24/7, 365 days a year. There was a time in my career when national holidays like the 15th August and 26th January were considered off-days, and companies had to pay double overtime to get workers to show up. People were also reluctant to work in warehouses, which was a reality I lived through.

I’ve always told my team, “Let’s stop thinking of warehouses as just warehouses. They’re essential services, just like hospitals or fire brigades.” The truth is that most warehouses today are operating 24/7, 365 days a year, because that’s the direction the market is heading. E-commerce has played a huge role in shifting this mindset, especially with customers expecting deliveries even during festivals like Diwali or Holi. Products are only delivered to homes when warehouse operations are running on those days.

There’s also a shift in the mindset of administrators and authorities. For example, when the pandemic hit, the

government officials reached out to us to make sure our warehouses were running smoothly so that products get delivered without any hassle. This is a significant shift. However, it’s gradual, as big warehouses are often located in rural areas. Migration and the influx of migrant workers have helped this change, but we’re also building a sentiment within our teams that warehouses are not just operational spaces—they’re essential like hospitals and malls. They are becoming extensions of retail spaces, and this shift in perspective is key to overcoming the resistance to change.

What crucial details should be considered during the warehouse design stage?

Gopala Krishna: At the warehouse design stage, several key factors must be considered. Optimized process flow is essential for seamless FIFO and FEFO-based stocking, while dedicated unstacked and staging areas help prevent inventory discrepancies. Automation integration should be planned from the start, including any RFID/barcode scanning, conveyor systems, and robotic picking, to avoid expensive retrofits. Scalability must also be accounted for, ensuring the infrastructure can handle seasonal SKU pullbacks and format transitions across different store models. Additionally, compliance and safety measures should be embedded into the design to minimize damage write-offs and improve storage efficiency.

Rajan Ekambaram: A data-driven, scientific approach to warehouse design is essential to achieving longterm efficiency and scalability. Beyond immediate operational needs, companies must design warehouses with a 3-5 year horizon, factoring in business growth

Collaboration with suppliers and customers enhances agility, as stronger communication can lead to better forecasting and planning. Cloud-based platforms further support coordination and enable quick access to vital information across all parties involved.

To make warehousing more agile and responsive, companies must first define clear operational boundaries and expectations. A warehouse designed for a threeday fulfillment cycle cannot suddenly shift to a 24-hour model without structural changes. Therefore, an outcome-driven approach—where design, implementation, and operations align with business objectives—is essential. Additionally, investing in the right technology and leveraging data-driven decision-making enhances agility. A flexible operating model that adapts to demand fluctuation, through scalable infrastructure, dynamic slotting, and workforce optimization ensures warehouses remain efficient and responsive to changing business needs.

projections in terms of volume, product mix, and customer demands. This ensures the warehouse remains resilient and adaptable to evolving requirements.

An optimal warehouse design integrates four critical elements:

Infrastructure – Selecting the right storage systems (racks, mezzanines, AS/RS) and material handling equipment based on storage density and throughput needs.

Layout – Streamlining space utilization with efficient flow paths for receiving, put-away, picking, and dispatch, minimizing congestion and travel time.

Processes – Standardizing workflows such as order picking strategies, replenishments, and dock operations to enhance productivity.

Systems & Technology – Leveraging WMS, automation, and real-time data analytics for visibility, accuracy, and continuous improvement.

A holistic design approach is crucial—many companies focus on isolated elements, leading to suboptimal warehouse performance. By integrating all four elements cohesively, businesses can achieve higher throughput, reduced operational costs, and superior service levels.

Kapil Premchandani: When selecting a warehouse, its design plays a crucial role in making the right decision. Often, companies focus too much on the rental price, but this narrow focus can lead to costly mistakes in the long run. While rental cost is an obvious factor, it’s equally important to consider other key elements like the approach and

apron roads in front of the property. These roads are vital for maneuvering containers efficiently.

Opting for a warehouse with a lower rental price—say ₹16-18 per square foot—may seem like a good deal. However, this often results in compromised efficiency. Such properties might not be optimized for operations, leading to higher long-term costs. On the other hand, a Grade A warehouse, typically priced at ₹23-24 per square foot, offers better infrastructure, leading to greater efficiency in the long run.

This brings us to the broader issue of cost: it’s not just about the acquisition cost but also the operational and maintenance costs. It’s essential to factor in these ongoing expenses when choosing a warehouse. Another often overlooked consideration is the roof’s collateral load capacity. Many businesses prioritize sustainability but fail to check whether the warehouse roof can support additional weight, such as solar panels. Without sufficient load capacity— typically around 55 kg per square meter plus an extra 30 kg—implementing solar solutions could become impractical. This lack of foresight can put companies at a competitive disadvantage, especially when 3PLs in India struggle to meet the complexities of such demands.

The industry must evolve towards a more collaborative and detail-oriented approach. Over the past 15 years, the logistics sector has undergone significant transformation. A case in point is IndoSpace, which faced challenges attracting FMCG clients in the past. However, in the last 5-6 years, this has changed as warehouses themselves have evolved into more sophisticated, manufacturing-like facilities. This shift underscores the growing importance

of warehouse design and the need to approach it with a more nuanced understanding, as the demands of modern logistics continue to evolve. The design and functionality of warehouses are no longer secondary considerations; they are central to the efficiency and competitiveness of the entire supply chain.

How much automation should you implement? Is there a return on investment (ROI) for automation? How do you determine the right balance between automation and human labour?

Gopala Krishna: Striking the right balance between automation and human intervention is crucial. At Big Basket, automation has been deployed selectively where it delivers a high ROI, such as TMS tracking for crate logistics, Automated Planogram, etc. Over-automation without a strong business case can lead to excessive costs without proportional gains. Ultimately, warehouse automation should align with a cost-benefit analysis, operational complexity, and long-term scalability, ensuring that investments lead to measurable efficiency improvements.

Kapil Premchandani: The distinction between a warehouse and a mall is not just physical but deeply ingrained in the nature of the workforce. It’s a reflection of the urban-rural divide that we see so clearly today. People, understandably, are more inclined to work in malls — the bustling, customer-facing environment — while there’s a growing scarcity of individuals willing to step into the quieter, more industrial world of warehouses. To address this challenge, we’re increasingly looking to tier III and IV cities, where we can find the workforce needed to keep

things running smoothly. However, the true challenge lies not only in filling these roles, but in making workers realize the significance of their labour. Their work is not just a job; it’s a vital cog in the larger machinery of modern commerce. After all, without their effort in picking, sorting, and preparing orders, the products we promise to customers would never make it to their doorsteps. It’s this deeper connection to purpose that we cultivate within our teams — ensuring that every person understands their role in bringing light and convenience into people’s homes.

The advent of automation is not merely a response to the shortage of labour; it is also a necessity born from the escalating cost of land. What was once an affordable 10-12 rupees per square foot rental has now surged to 18-30 rupees per square foot, creating an undeniable pressure to maximize the value of every inch of space. Warehouses are evolving. What was once a horizontal landscape of vast open shelves is now transforming into vertical, multi-layered structures that utilize every available square foot. This shift represents a prime example of automation at work — an elegant solution to an economic reality.

Moreover, the very nature of logistics has transformed. Gone are the days of the simplistic B2B model, where goods moved in bulk from one point to another. Now, we’ve entered an era of precision — where each item is handled with the utmost care and delivered directly to the consumer. The margin for error has all but evaporated; whereas once shipments could be routed to distributors, now

each item must be delivered directly, accurately, and without fail. To meet these exacting standards, we rely on the cutting-edge tools that technology and automation provide.

In my view, the world of warehouses is no longer a realm of simple blackand-white efficiency. There is, in fact, a vast spectrum of grey — a nuanced interplay of human effort, technological innovation, and logistical complexity. And it’s precisely in this gray space where automation and technology shine the brightest, helping us transform ambiguity into streamlined, sophisticated operations. This, I believe, is the future we are boldly stepping into.

Why is there a perception built that 3PLs in the country can’t live upto users’ expectations? Where are the gaps lying and how can they be ironed out?

Kapil Premchandani: The decision between managing your own supply chain or outsourcing it to third-party logistics (3PL) providers is often a matter of balancing control and cost. Running your own warehouses offers complete control over processes, inventory, and operations, whereas outsourcing can help keep costs competitive while offering flexibility to respond to varying demand.

The key advantage of outsourcing lies in its flexibility. Demand patterns can be unpredictable, and there are regulatory complexities to consider. For example, operating large warehouses or regional distribution centers often requires multiple licenses—sometimes as many as eight or nine. When

launching a new product, do you want to navigate the intricacies of obtaining these licenses, or would you prefer to work with experts who can handle this for you? Outsourcing allows you to focus on your core competencies while leaving regulatory challenges in the hands of professionals.

Consider an example from a company like Mondelez, which faces demand surges during peak seasons, such as Diwali. These spikes require additional warehousing capacity. Managing this internally can stretch resources, but a 3PL provider offers the necessary flexibility to scale operations efficiently. These providers specialize in managing such fluctuations, ensuring smooth and seamless operations during highdemand periods.

The optimal approach can vary by industry. For instance, industries like FMCG (Fast-Moving Consumer Goods) and automotive are highly structured, with processes thoroughly documented and minimal returns. In contrast, sectors like e-commerce, particularly apparel, face higher return rates, which requires a different logistics strategy.

Outsourcing your logistics allows you to focus on your core expertise— such as marketing and branding—while entrusting supply chain management to specialists. Warehouses are typically located in rural areas where manufacturing facilities are set up, and managing these facilities requires substantial expertise. It may be more effective to rely on experienced professionals rather than trying to develop this capability in-house.

In response to your second question

The world of warehouses is no longer a realm of simple black-and-white efficiency. There is, in fact, a vast spectrum of gray — a nuanced interplay of human effort, technological innovation, and logistical complexity. And it’s precisely in this gray space where automation and technology shine the brightest, helping us transform ambiguity into streamlined, sophisticated operations. This, I believe, is the future we are boldly stepping into. What was once a horizontal landscape of vast open shelves is now transforming into vertical, multi-layered structures that utilize every available square foot. This shift represents a prime example of automation at work — an elegant solution to an economic reality.

An agile fulfillment strategy that includes multi-channel fulfillment and decentralized warehousing enables faster delivery and the ability to meet demands from various sales channels. Incorporating continuous improvement practices like lean management and Kaizen ensures that the warehouse is constantly refining its processes to reduce waste and improve efficiency.

regarding whether 3PLs can manage the complexities of modern supply chains: While many 3PL providers are highly competent, challenges remain. For example, when handling perishable goods like fruits and vegetables, logistics become more intricate. Products such as tomatoes can experience weight fluctuations as they ripen, raising questions about who bears the cost of these variations. The key to solving such challenges lies in selecting reliable 3PL partners, fostering strong collaboration, and establishing clear standards to ensure smooth operations.

What strategies can be implemented to make warehousing more agile and responsive to changing demands?

Gopala Krishna: Customer expectations have shifted significantly, especially with Gen Z leading the way. Speed is definitely a key factor now, with even small delays becoming a point of frustration. Customers not only want quick delivery but also expect reliability and convenience. For them, it’s about how quickly and dependably a service can meet their needs, and how easily they can access it. Looking ahead, the pace of change in e-commerce and

quick commerce will continue to drive innovation. This shift is also creating lots of opportunities in the industry, not just for businesses, but for people looking to contribute to this growing space. There’s a big focus on agility and flexibility, and it’s exciting to think about how this will shape both operational processes and customer experiences in the next decade.

Tannistha Ganguly: As I understand it, warehouse responsiveness is the effect of which agility would be the cause. The more obvious strategies to improve warehouse responsiveness to changing demands (and periodic disruptions)

would be closer integration of the order side of supply chain, improving demand forecasting accuracy and building costeffective contingencies (to ensure consistent supply chain continuity). Agility in the basic 3Ps – People, Process and Platforms – will help achieve these. Supply Chain players will need to invest in deepening and widening of warehouse data and process awareness, through development of intelligent, transparent, and cross-functional data systems, quick adoption of advanced Warehouse Management Systems (WMS) and continuous upskilling/re-skilling of personnel as well as learning to embrace continuous change.

As an example, to improve responsiveness and accuracy of Picking and Put-Away processes, we will be adding Automated Guided Vehicles (AGV) or Autonomous Mobile Robots (AMR) to warehouse operations (agility). To achieve this, we are undertaking not just platform and process changes, but also training our workforce to work alongside the AGV / AMR to improve technology awareness. Warehouse personnel can now focus better on delivering greater value-added services to our customers and drive process and technology change from within warehouse operations.

Rajan Ekambaram: To make warehousing more agile and responsive, companies must first define clear operational boundaries and expectations. A warehouse designed for a three-day fulfillment cycle cannot suddenly shift to a 24-hour model without structural changes. Therefore, an outcome-driven approach—where design, implementation, and operations align with business objectives—is essential. Additionally, investing in the right technology and leveraging data-driven decision-making enhances agility. A flexible operating model that adapts to demand fluctuation, through scalable infrastructure, dynamic slotting, and workforce optimization ensures warehouses remain efficient and responsive to changing business needs.

Where do you foresee the warehousing dynamics shaping up from here on?

Gopala Krishna: Looking ahead,

warehousing is evolving toward a hybrid model, balancing dark store setups with large fulfillment centers to optimize efficiency. Predictive inventory management using AI will further reduce overstocking and unstacked inventory issues, while decentralized sourcing models, are expected to minimize reliance on large distribution centers. Additionally, sustainability and cost optimization will play a critical role, with a strong focus on vehicle utilization and inter-hub cost control, as seen in Big Basket’s transportation efficiency initiatives.

Tannistha Ganguly: Interesting days ahead, I must admit. I see greater handshaking between efficiency and innovation and expect some ‘wild’ technological disruptions. Some of the trends that I keep my eye on are around Smart Operations (Inventory Tracking, Warehouse Automation), Wearables and Immersive Reality. Smart Wearables, like VR glasses and voice picking devices will play a major role in inventory management, dispatch and shipping, wastage and dumping reduction, costeffective heavy equipment training (through simulation) among countless other applications. Sustainability will also gain prominence, with increase in renewable energy consumption at warehouses (with solar panels), usage of compostable pallet wraps, bio-degradable plastics, etc.

In the immediate future, I see the expansion of hubs, multi-modal transport networks, cold-storage infrastructure and sharpening of focus on technologydriven last-mile delivery. I expect larger, more tech-savvy talent pool to join the supply chain sector due to increasing skilling opportunities. Long term capital investments by GoI on infrastructure like Dedicated Freight Corridors, Sagar Mala Projects, Gati Shakti, National Logistics Policy are rapidly improving possibilities for the Supply Chain sector in India. I am optimistic about increased investments, digital innovation, and sustainability initiatives in this sector in 2025-26.

Rajan Ekambaram: Warehousing operations are evolving rapidly, driven by improved road connectivity, increasing supply chain complexity,

and rising business expectations. As a result, warehousing is becoming more sophisticated in infrastructure and technology adoption to enhance efficiency, scalability, and service excellence. Three key trends are shaping this transformation:

Shift Towards Grade-A Warehousing & Intra-Logistics Investments: The rise of Grade-A warehouses—developed by real estate firms—is improving infrastructure standards, with a focus on better safety, sustainability, and operational efficiency. Additionally, businesses are investing in intra-logistics solutions tailored to industry-specific needs.

Increased Adoption of Automation at Factory locations: Companies are integrating Automated Storage & Retrieval Systems (AS/RS), Autonomous Mobile Robots (AMRs), and conveyors—especially at factory locations—to streamline material movement, reduce labour dependency, and enhance speed of operations.

Expansion of Micro-Fulfillment Centers & Dark Stores: The quick commerce revolution is driving demand for microfulfillment centers and dark stores, strategically located in high-density urban areas. These enable hyperlocal deliveries, ensuring rapid order fulfillment within minutes.

As warehousing operations continue to mature, companies that proactively invest in infrastructure, automation, and data-driven strategies will gain a competitive edge.

Disclaimer: The views and opinions expressed by the experts are solely their own and do not reflect those of any company, organization, or institution.

In a monumental stride towards maritime excellence, India has unveiled the Maritime Development Fund (MDF), a ₹25,000 crore ($2.9 billion) initiative poised to revolutionize the nation’s shipping and shipbuilding landscape. This visionary fund, announced in the Union Budget 2025, aims to provide longterm, affordable financing to invigorate the shipping, shipbuilding, and port infrastructure sectors, with an ambitious target of attracting investments up to ₹1.5 lakh crore by 2030. The government’s commitment to contribute 49% of the corpus, complemented by private sector participation, underscores a collaborative endeavour to fortify India’s maritime prowess. Coupled with a revamped Shipbuilding Financial Assistance Policy and extended customs duty exemptions, the MDF is set to propel India towards self-reliance, fostering innovation, and positioning the nation as a formidable force in global trade. This Special Report presents exclusive first-hand insights from leading subject-matter experts on the topic.

The Union Budget 2025-26 proposes a ₹25,000 crore Maritime Development Fund with 49% government contribution. How do you envision this fund impacting India's maritime infrastructure and shipbuilding capabilities? How can the Maritime Development Fund be utilized to promote competition within the maritime industry?

Rajesh Menon, Associate Director – Maritime, PM Gati Shakti: The Maritime Development Fund is a financial support model adopted to help the shipping and maritime industry

gain easy access to capital. It is a pool of money pooled from central government resources, ports, and the private sector, managed by a fund manager as a sectoral funding mechanism. The objective is to facilitate easy access to capital for various activities such as shipbuilding, purchasing ships, and commercial maritime activities. The need for such a funding mechanism arose from the lack of financing options available through established capital finance institutions like banks, which have traditionally viewed the shipping sector as a highrisk category. Data also indicates that

only a small percentage of infrastructure financing has been allocated to the maritime and shipping sectors.

In this context, this fund will empower the industry to pursue its entrepreneurial goals proactively. Sustaining our growth momentum and achieving developed nation status by 2047 is possible if our shipping sector, in terms of floating and non-floating assets, grows to become competitive in performance and productivity. This means we should increase the number of Indian-flagged ships, enhance port infrastructure, and invest in sustainable, fuel-efficient

modern vessels. Since over 90% of our merchandise EXIM trade, in volume, and nearly 70%, in value, is conducted via the seas—alongside our rich 7,500 km coastline—we must cultivate a competitive maritime ecosystem for trade. The availability of accessible financing will facilitate investments in the sector, enabling the construction of new port infrastructure, the building and acquisition of additional ships, and ultimately reducing our shipping costs to enhance the competitiveness of our products in the international market. It will also encourage more participants to enter competitive trade and ultimately create competition and reduce our logistic costs.

Arun Kumar, President, AMTOI (Association of Multimodal Transport Operators of India):

The proposed ₹25,000 crore Maritime Development Fund (MDF) with 49% government contribution is a significant step toward strengthening India’s maritime infrastructure and shipbuilding capabilities. Here’s how it could impact the sector:

✦ Strengthening Port Infrastructure

✦ Boosting Shipbuilding & Repair Capabilities

✦ Promoting Coastal Shipping & Inland Waterways

Maritime Development Fund in a Nutshell

The ₹25,000 crore Maritime Development Fund (MDF) will serve as a dedicated financial vehicle to:

Provide long-term, affordable financing to the shipping and shipbuilding industry.

Encourage port development, maritime logistics, and coastal infrastructure projects.

Reduce India's dependence on foreign shipping finance and promote self-reliance in the sector.

Support the expansion of India's merchant fleet, which currently lags behind global competitors.

✦ Enhancing Maritime Security & Digitalization

If executed well, the MDF can help India become a global maritime hub, improve logistics competitiveness, and reduce dependency on foreign shipping services. This would also require the government to streamline its regulatory framework to create an environment for growth of the sector.

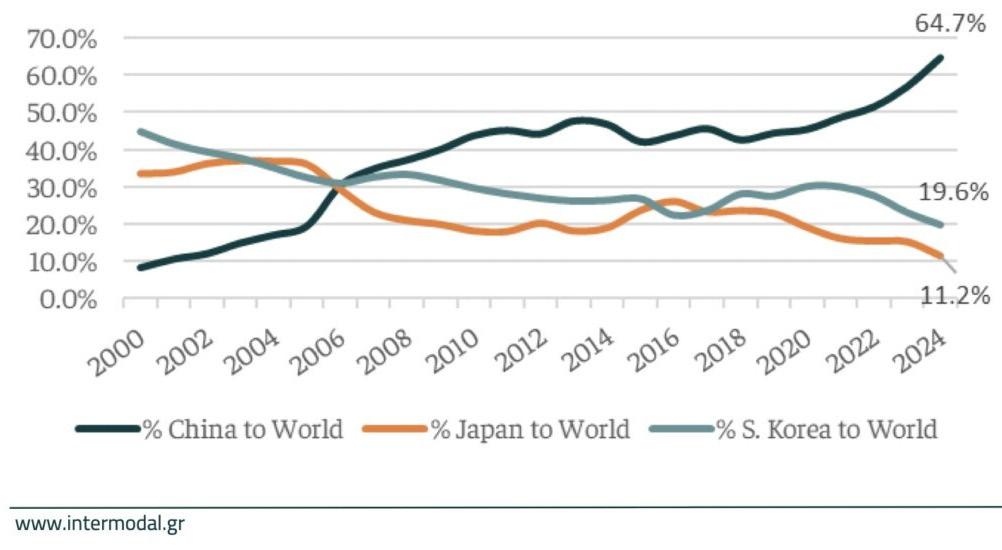

Ashish Tripathi, General Manager – Global Sourcing, Logistics & Agency, TORM: Let’s try understanding the global shipbuilding countries & their market share globally. The global shipbuilding industry is dominated by China (65%), South Korea (20%), and Japan (11%), while India's share remains below 1% of the total market.

✦ China (65%) is the undisputed leader, backed by strong government support, subsidies, and economies of scale. Major yards: CSSC, CSIC, COSCO

✦ South Korea (20%) specializes in high-tech, fuel-efficient vessels (LNG carriers, tankers). Key players: Hyundai Heavy Industries, Samsung Heavy Industries, Daewoo Shipbuilding

✦ Japan (11%) focuses on high-quality, energy-efficient vessels. Major yards: Imabari Shipbuilding, Mitsubishi Heavy Industries

With 49% equity investment from the Centre and the remainder 51% will be from Major Ports, financial institutions, private investors, sovereign funds, among others. Subsidized financing will boost domestic shipbuilding, technology adoption, and repair facilities, positioning India as a global player as currently India ranks 22nd globally. MDF will also help in upgrade major and minor ports with green port initiatives, improving efficiency and trade capacity. Apart from shipbuilding MDF will support vessel financing, attract FDI, and strengthen India's role in global supply chains.

How will the proposed shipbuilding clusters enhance the competitiveness quotient of the sector in the overall infrastructural development of the country and more so the Gati Shakti mission?

Rajesh Menon: India has currently a

smaller number of commercial ships floating under its flag. This means we need more ships to be made. Moreover, modern ships should be able to be fuelled by nonconventional energy or lowsulphur bunker fuels. Hence, expecting this demand for modern ships, we need to have enhanced capacities for ship manufacturing. Shipbuilding is a labour-intensive sector where we have an advantage, and by improving the skills and technology that go into the manufacture of modern ships through a clustered approach of manufacturing, we can build economies of scale, reduce the cost of manufacturing and improve the quality of the product. In a cluster, as in the case of automobiles, both suppliers, vendors, original equipment manufacturers, and service providers, all being in a single location, will enable cost competitiveness.

Arun Kumar: The proposed shipbuilding clusters have the potential to significantly enhance the competitiveness of India’s maritime sector and contribute to the broader Gati Shakti National Master Plan (NMP) in multiple ways:

✦ Integrated Maritime Hubs: Shipbuilding clusters will integrate design, manufacturing, maintenance, and supply chain components, reducing dependency on foreign yards.

✦ Economies of Scale: By colocating shipbuilders, component manufacturers, and service providers, costs can be lowered, making Indian shipbuilding globally competitive.

✦ Attracting Investment: Strategic partnerships with global players can bring in advanced technologies, improving productivity and quality standards.

✦ Port-Shipyard Integration: Improved connectivity between ports and shipyards will accelerate shipbuilding projects and reduce logistics bottlenecks.

With strategic execution, India can leverage the budgetary push to modernize its maritime sector, lower logistics costs, and attract global trade. By focusing on infrastructure, technology, and sustainability, India can establish itself as a global maritime hub and reduce its reliance on foreign shipping.

Positioning Indian Ports as Transshipment Hubs

✦ Develop world-class transshipment hubs (e.g., Vizhinjam, Ennore) to compete with Colombo, Singapore, and Jebel Ali.

✦ Offer incentives to global shipping lines to shift transshipment operations to Indian ports.

Strengthening Public-Private Partnerships (PPPs)

✦ Encourage foreign investment in shipbuilding, repair yards, and logistics infrastructure.

✦ Invite global players to set up manufacturing bases within maritime clusters.

Enhancing India’s Role in Global Supply Chains

✦ Align with initiatives like India-Middle East-Europe Corridor (IMEC) to boost connectivity.

✦ Develop Free Trade Warehousing Zones (FTWZs) near ports to attract international logistics firms.

Maritime Skill Development & R&D Investments

✦ Set up Maritime Skill Universities to train a world-class workforce.

✦ Invest in R&D for indigenous ship design and emerging tech like AIpowered port operations.

Expanding India’s Fleet for Global Trade

✦ Provide tax incentives for Indian shipowners to expand the national fleet.

✦ Encourage leasing and financing schemes for Made-in-India ships, reducing foreign vessel dependency.

✦ Seamless Freight Movement: Efficient shipbuilding and a strong maritime fleet will enhance coastal shipping and inland waterways, reducing dependency on road and rail.

✦ Dedicated Freight Corridors (DFCs): Strengthening multimodal linkages will ensure seamless transport of shipbuilding materials (steel, machinery, etc.) to shipyards, reducing lead times and costs.

✦ Fleet Modernization: Shipbuilding clusters will facilitate faster production of cost-effective, energyefficient vessels for domestic and international trade.

✦ Lower Logistics Costs: A robust domestic fleet will reduce reliance on foreign vessels, cutting shipping costs for Indian exporters and importers.

✦ Support for Ro-Ro and Ro-Pax Services: Enhanced shipbuilding capacity can accelerate coastal passenger and freight transport initiatives, aligning with Gati Shakti’s multimodal vision.

✦ Employment Generation: Clusters will create jobs in shipbuilding, component manufacturing, design, and repair services.

✦ Skill Development Centers: Training institutes within clusters will develop a highly skilled maritime workforce, reducing dependence on foreign expertise.

✦ Indigenous Green Vessels: Incentives for research and development (R&D) in green shipbuilding (LNG/hydrogen-

powered ships) will align with India’s decarbonization goals.

✦ Circular Economy: Efficient recycling and scrapping policies within clusters can position India as a global hub for eco-friendly ship disposal.

By integrating shipbuilding clusters with the Gati Shakti mission, India can transform its maritime sector, making logistics faster, more efficient, and costeffective while strengthening its position in the global supply chain.

Ashish Tripathi: PM Gati Shakti is a nationwide infrastructure blueprint designed to enhance multi-modal connectivity, streamline logistics, and drive economic growth. It brings together 16 ministries on a unified digital platform to improve coordination and accelerate project execution. So, the dream of Indian becoming a $30 trillion economy by 2047 is closely tied to the development of its maritime

India has currently a smaller number of commercial ships floating under its flag. This means we need more ships to be made. Moreover, modern ships should be able to be fuelled by nonconventional energy or low-sulphur bunker fuels. Hence, expecting this demand for modern ships, we need to have enhanced capacities for ship manufacturing. Shipbuilding is a labourintensive sector where we have an advantage, and by improving the skills and technology that go into the manufacture of modern ships through a clustered approach of manufacturing, we can build economies of scale, reduce the cost of manufacturing and improve the quality of the product. In a cluster, as in the case of automobiles, both suppliers, vendors, original equipment manufacturers, and service providers, all being in a single location, will enable cost competitiveness.

sector, particularly shipbuilding. The Union Budget has given a significant boost to domestic shipbuilding with the creation of mega shipbuilding clusters aimed at enhancing the country’s global competitiveness.

Why are shipbuilding Clusters important?

Capacity Expansion & Infrastructure Development: Helping in to establish new shipbuilding clusters with a capacity of 1.0 to 1.2 million Gross Tonnage (GT) each. This will also Provide governmentfunded support for breakwater construction and capital dredging. And help to Develop critical infrastructure,

including roads, utilities, and sewage treatment facilities, to facilitate largescale shipbuilding operations.

Public-Private Partnership (PPP) Model: To attract private sector investments to drive modernization and expansion of shipbuilding facilities. Also change instance of India as not just a normal ship builder but early adapter & to Promotion of eco-friendly and green shipbuilding technologies. In the process also foster global collaborations to enhance technical expertise and innovation in the sector.

Strengthening India’s Position as a Global Maritime Hub: Increased shipbuilding capacity will reduce reliance on foreignbuilt vessels. Also help in Expansion of repair and maintenance services to cater to global shipping fleets.

Boost to Domestic & Global Trade: Growth in shipbuilding will enhance coastal shipping, inland waterways, and global export capabilities. This, in turn, will result in improved maritime infrastructure will align with and support India’s Sagarmala and PM Gati Shakti initiatives.

What are the challenges that the

maritime sector is facing at the moment and how can they be ironed out?

Rajesh Menon: The major challenge that the maritime sector is facing is the geopolitical conflicts affecting internal trade and global supply chains. For a country like India, nearly 45% of our exports are done by the small and medium-term industries which gets easily affected by the rice in freight cost that results from geo-political uncertainties. Secondly, we as a nation are getting year-on-year more containerized, which means our dependence on containers is increasing. However, we still don't have an ecosystem that will enable the production of cheaper containers and hence we are importing containers from China. So, with freight dependencies and container dependencies, we are having a major challenge. This needs to be addressed through Indigenous manufacturing of containers, and ships and also create a domestic container line for EXIM trade.

Arun Kumar: The Indian maritime sector, despite its growth potential, faces several challenges that hinder its competitiveness. Addressing these issues strategically can unlock its true potential. Listed below are some of the major challenges…

✦ High Port Handling Costs

✦ Inadequate Shipbuilding & Repair Infrastructure

✦ Over-Reliance on Foreign Shipping

✦ Weak Coastal & Inland Waterways Connectivity

✦ Regulatory Bottlenecks & Bureaucratic Hurdles

✦ Skilled Manpower Shortage

✦ Sustainability & Environmental Concerns

By addressing these challenges through targeted policies, infrastructure investments, and regulatory reforms, India can unlock its maritime potential, reduce logistics costs, and strengthen its position as a global maritime hub.

Ashish Tripathi: India’s maritime sector is a critical driver of trade and economic growth. However, inefficiencies in infrastructure, financing constraints, high logistics costs, and sustainability challenges hinder its global competitiveness. Addressing these issues through policy reforms, investment, and modernization is key to positioning India as a leading maritime hub.

✦ High Dwell Time: Cargo clearance at Indian ports takes 2-3 days, compared to less than a day in global hubs like Singapore, Rotterdam, and Shanghai.

✦ Inefficient Customs & Documentation: Delays in approvals and lack of endto-end digitization slow down trade.

✦ Limited Deep-Draft Ports: India has few ports capable of handling ultralarge vessels, increasing reliance on transshipment hubs like Colombo and Singapore.

Solutions:

✦ Benchmarking Global Best Practices: Adopting fully automated cargo clearance and paperless customs processing (as seen in Singapore, where clearance takes a few hours).

✦ Port Modernization under Sagarmala: Investments in automation, AI-driven cargo tracking, and multimodal connectivity.

✦ Expansion of Deep-Draft Ports: Developing transshipment hubs (e.g., Vizhinjam, Enayam) to compete with global shipping routes.

✦ Limited Access to Low-Cost Capital: Indian shipowners and operators face higher borrowing costs compared to global counterparts.

✦ Lack of Dedicated Maritime Finance Institutions: Countries like China and South Korea have governmentbacked shipbuilding funds, whereas Indian shipyards struggle with financing.

✦ High Insurance & Compliance Costs: Indian ship financing lacks riskmitigating incentives, making vessel procurement costly.

Solutions:

✦ Maritime Development Fund (MDF): A ₹6,100 crore allocation to modernize shipyards and encourage domestic shipbuilding.

✦ Public-Private Partnerships (PPP): Attracting private investors to finance port and logistics infrastructure.

✦ Tax Incentives & Subsidies: Similar to South Korea’s Shipbuilding Industry Promotion Act, which provides tax breaks and easy credit.

India’s maritime sector is a critical driver of trade and economic growth. However, inefficiencies in infrastructure, financing constraints, high logistics costs, and sustainability challenges hinder its global competitiveness. To position itself as a global maritime leader, India must tackle port inefficiencies, high logistics costs, financing challenges, and sustainability goals. By benchmarking global best practices, investing in infrastructure and technology, and incentivizing green shipping, India can enhance trade efficiency, reduce costs, and achieve its long-term maritime vision.

While China, Korea, and Japan lead in shipbuilding scale, financing, and technology, India’s internal demand, budget focus, and policy support can help it close the gap. By expanding shipbuilding capacity, supporting Indian-flagged vessels, and reducing costs through PPP investments, India can emerge as a strong maritime player. The road is tough, but not impossible, given the right policy execution.

INDIA’S HIGH LOGISTICS COSTS VS GLOBAL COMPETITORS

Challenges:

✦ India’s Logistics Cost (13-14% of GDP) is higher than China (8%) and the US (9%), reducing export competitiveness.

✦ Expensive Road & Rail Freight: Over 60% of India’s cargo moves by road, which is costly compared to China’s high reliance on rail and waterways.

✦ Limited Coastal & Inland Waterways Usage: Despite a 7,500 km coastline, India underutilizes coastal shipping compared to Europe and China.

Solutions:

✦ Expanding Coastal Shipping & Inland Waterways: Boosting Ro-Ro services, multimodal logistics parks, and riverine ports to reduce costs.

✦ PM Gati Shakti for Freight Optimization: Integrating ports with rail and road corridors for efficient cargo movement.

✦ Digitization & Cargo Visibility: AIdriven logistics platforms for better freight tracking and cost reduction.

SUSTAINABILITY & INDIA’S 2070 NET ZERO TARGET Challenges:

✦ High Maritime Carbon Emissions: Shipping contributes 3% of global CO₂ emissions, and India’s share is growing.

✦ Slow Adoption of Green Technologies: Lack of infrastructure for LNG bunkering, shore power, and lowemission vessels.

✦ Global Decarbonization Targets:

EU: Net Zero by 2050

China: Net Zero by 2060

India: Net Zero by 2070 due to economic and developmental priorities.

Solutions:

✦ Investment in Green Ports: Electrification of port operations and adoption of alternative fuels (LNG,

hydrogen, biofuels).

✦ Incentives for Green Shipbuilding: Financial support for LNG-powered and hybrid vessels to reduce emissions.

✦ International Collaboration: Aligning with IMO’s Green Shipping Initiatives to reduce carbon footprint.

To position itself as a global maritime leader, India must tackle port inefficiencies, high logistics costs, financing challenges, and sustainability goals. By benchmarking global best practices, investing in infrastructure and technology, and incentivizing green shipping, India can enhance trade efficiency, reduce costs, and achieve its long-term maritime vision.

In what ways will the budget's maritime initiatives enhance India's position in the global shipping industry? How can India leverage these budgetary provisions to become a preferred destination for global maritime trade?

Rajesh Menon: India has a cherished history of being the world's largest maritime nation, since ancient times. However, by the modern age we have lost that glory and today our share of global trade is less than 1.5%. However, we have now reversed this process by continuously growing and becoming the first largest economy. We are expected to cross the 3rd largest economy mark by 2030. With 90% of our trade being through the sea, such a growth also requires enhanced capacities. Through the budget initiatives, the shipping sector has found a pathway to this objective. Considering our entrepreneurial and trading legacy and capacities we will be able to utilise this opportunity and facilitate creating a VIksit and Atma Nirbhar Bharat by 2047.

Arun Kumar: The Union Budget 202526 introduces key maritime initiatives that can significantly enhance India’s

China 42M GT (2023) 47% $15B shipbuilding fund, tax rebates, low-cost financing

South Korea 15M GT (2023) 30%

Japan 10M GT (2023) 15%

Subsidized R&D, LNG & hydrogen-powered vessels, shipyard automation

Industry consolidation, state-backed shipbuilding finance

India <1M GT <1% ₹6,100 Cr budget for new shipbuilding clusters, PPP investment

position in the global shipping industry. If strategically implemented, these initiatives can help India become a preferred destination for global maritime trade. Again, I would like to stress upon the fact that besides monetary support the sector has significant challenges in the regulatory framework, therefore while the budgetary support in terms of monetary allocation is essential, it has to be complemented with trade friendly ecosystem and regulatory support.

Maritime Development Fund (MDF): With ₹25,000 crore allocated, Indian shipbuilding, ship repair, and fleet expansion will receive a major boost.

Port Infrastructure Modernization: Budgetary focus on deep-draft ports, transshipment hubs, and multimodal connectivity under Sagarmala and Gati Shakti.

Coastal & Inland Waterways Expansion: Investments in coastal shipping corridors and inland waterways to reduce logistics costs.

Digitalization & Automation: Introduction of blockchain-based port logistics systems, AI-driven cargo tracking, and single-window customs clearance.

Maritime Security & Sustainability: Budget provisions for IMO-compliant green shipping and LNG bunkering stations.

Ashish Tripathi: India is making a strategic push to strengthen its shipbuilding industry and maritime trade, but it faces stiff competition from China, South Korea, and Japan, which dominate global shipbuilding. Despite challenges, India’s internal demand, budget allocations, and government focus provide a pathway for growth.

Comparative Shipbuilding Investment & Market Share: China dominates due to

state-backed cheap financing & bulk orders for domestic shipping. South Korea leads in high-tech vessels (LNG, hydrogen, smart ships) with R&D incentives. Japan focuses on automation & shipyard consolidation to remain competitive. India lags due to limited scale, lack of financing, and reliance on imported vessels but aims to catch up.

Trade Mismatch: Foreign Flags & India's Lost Opportunity: Over 70% of India’s EXIM cargo is carried on foreign ships due to a small domestic fleet. Shipping lines register vessels in tax-friendly nations (Panama, Liberia, Marshall Islands) instead of India. Lack of ship financing & high operating costs make Indian-flagged ships uncompetitive.

Impact:

✦ India loses freight revenue to foreign operators.

✦ Higher costs for Indian businesses as they depend on international shipping lines.

✦ Weakens India’s control over maritime trade routes.

Solutions & Government Focus:

✦ Maritime Development Fund (MDF) to support Indian shipowners.

✦ Incentives for Indian-flagged vessels to boost local ownership.

✦ Ease of ship registration & tax reforms to make India a competitive ship registry.

Why the Road is Difficult but Not Impossible Challenges

Higher Cost of Shipbuilding:

✦ Indian shipyards lack economies of scale compared to China & Korea.

✦ Steel & components cost 20-30% more in India.

Limited Ship Financing & Leasing:

✦ No dedicated low-cost maritime finance institutions like in China & Korea.

✦ High borrowing costs make fleet expansion difficult.

Skilled Workforce & Technology Lag:

✦ Limited expertise in LNG, hydrogen, and autonomous shipping.

✦ Need for greater R&D investment & foreign collaboration.

Opportunities: Government Focus & Internal Demand

Budget & Policy Support:

✦ ₹6,100 crore allocation for shipbuilding clusters with tax breaks.

✦ PPP-driven expansion of ports & shipyards.

✦ Incentives for green shipping & LNG bunkering.

Internal Demand as a Growth Engine:

✦ Growing domestic trade & Sagarmala push for coastal shipping.