FLEXIBLE, HIGH PRECISION SOLUTIONS FROM R&D TO END OF LINE

Battery cell, module and pack level charge/discharge cycle testing solutions designed to provide high accuracy measurement with advanced features. Regenerative systems recycle energy sourced by the battery back to the channels in the system or to the grid.

Battery simulation for testing battery connected devices in all applications to confirm if the device under test in performing as intended. Battery state is simulated which eliminates waiting for the charge/discharge of an actual battery. Real time test results include voltage, current, power, SOC%, charge/discharge state and capacity.

To learn more about our Battery Test Solutions visit chromausa.com

Rheinmetall receives 250-million-euro order for 900-volt EV contactors

Infinitum unveils Aircore Mobility electric motor with PCB stator technology

Kia EVs to use onsemi’s silicon carbide power module for traction inverters

Wolfspeed and ZF partner to develop silicon carbide semiconductors

Marposs offers a new system for checking pouch cell battery welds

Proterra begins producing EV batteries at new South Carolina factory

Renesas launches new generation of automotive Intelligent Power Devices

Rincon Power launches new 600 A, 1,000 V manual battery disconnect

Rice University announces new process to revive lithium-battery anodes for reuse

Hyundai-Kia lauds Eaton’s Breaktor technology

ZF reaches milestone: two million EV motors produced

MAHLE receives 1.4 million euros in e-compressor orders

KMD launches constant-velocity driveshafts for EVs

Maserati’s first fully-electric car powered by three Marelli 800 V motors

Cummins tests new ePowertrain on track at Millbrook Proving Ground

LEM’s new UL-certified bidirectional DC meter for fast EV chargers

Tesla to open up its US Supercharger network, double the number of chargers

Electrify America will power its entire charging network with solar energy

Emporia Energy unveils new low-priced Level 2 charger

ABB E-mobility announces new Terra Home residential charger

TravelCenters to deploy 1,000 Electrify America fast chargers at 200 locations

AMPECO raises $16 million for its EV charging management platform

EverCharge’s load balancing enables large-scale EV charging at Houston airport

Volkswagen and Enel X Way to deploy 3,000 high-power charging points in Italy

EV charging station data provider Eco-Movement closes Series A funding round

Electreon to deploy public wireless EV charging road in Germany

Shell to acquire EV charging network Volta for $169 million

Enphase Energy demonstrates bidirectional EV charger technology

Leviton’s new EV charging stations integrate with smart home tech

Publisher

Christian Ruoff

Contributing Writers

Jeffrey Jenkins

Charles Morris

For Letters to the Editor, Article Submissions, & Advertising Inquiries Contact: Info@ChargedEVs.com

Associate Publisher

Laurel Zimmer

Senior Editor

Charles Morris

Account Executives

Jeremy Ewald

Cover Image Courtesy of Special Thanks to

Christian Ruoff

John Voelcker

Stellantis

Kelly Ruoff

Technology Editor

Graphic Designers

Jeffrey Jenkins

Tomislav Vrdoljak

Sebastien Bourgeois

ETHICS STATEMENT AND COVERAGE POLICY AS THE LEADING EV INDUSTRY PUBLICATION, CHARGED ELECTRIC VEHICLES MAGAZINE OFTEN COVERS, AND ACCEPTS CONTRIBUTIONS FROM, COMPANIES THAT ADVERTISE IN OUR MEDIA PORTFOLIO. HOWEVER, THE CONTENT WE CHOOSE TO PUBLISH PASSES ONLY TWO TESTS: (1) TO THE BEST OF OUR KNOWLEDGE THE INFORMATION IS ACCURATE, AND

(2) IT MEETS THE INTERESTS OF OUR READERSHIP. WE DO NOT ACCEPT PAYMENT FOR EDITORIAL CONTENT, AND THE OPINIONS EXPRESSED BY OUR EDITORS AND WRITERS ARE IN NO WAY AFFECTED BY A COMPANY’S PAST, CURRENT, OR POTENTIAL ADVERTISEMENTS. FURTHERMORE, WE OFTEN ACCEPT ARTICLES AUTHORED BY “INDUSTRY INSIDERS,” IN WHICH CASE THE AUTHOR’S CURRENT EMPLOYMENT, OR RELATIONSHIP TO THE EV INDUSTRY, IS CLEARLY CITED. IF YOU DISAGREE WITH ANY OPINION EXPRESSED IN THE CHARGED MEDIA PORTFOLIO AND/OR WISH TO WRITE ABOUT YOUR PARTICULAR VIEW OF THE INDUSTRY, PLEASE CONTACT US AT CONTENT@CHARGEDEVS.COM. REPRINTING IN WHOLE OR PART IS FORBIDDEN EXPECT BY PERMISSION OF CHARGED ELECTRIC VEHICLES MAGAZINE.

Our 70 years experience in Surface Treatment is ready for the E-Mobility market.

Research, innovation, development. In 70 years, our vision towards the future has never stopped. Today, Tecnofirma provides quality to the electric market which is the most evolving technology in the automotive industry. Our impregnation, cleaning and painting plants are the result of the constant commitment to o er cutting-edge solutions and products anytime, anywhere.

e EV news is coming so hot and heavy these days that we can hardly keep up with it. (We’re making a valiant e ort—you’ve probably noticed that we’ve added more online feature articles and expanded our coverage.)

Chinese EVs are becoming common sights on the streets of Europe, and they’re headed for the US (see this issue’s Charging Forward column, page 82). A Vietnamese automaker is also delivering product, and hopes to establish production in the States. Tesla has begun to open its Supercharger network to all brands in the US—and by the way, announced plans to support bidirectional charging, hinted at a future wireless charging option and said it will build a new Gigafactory in Mexico. e US Postal Service, a er years of dithering, has placed a substantial order for electric delivery vans. ere are signs that industry laggard Toyota may nally begin to electrify. Game-changing V2X technology is on the cusp of moving from the pilot phase into commercial deployment (see our feature on e Mobility House in this issue, page 72).

Every one of these recent news items is a blockbuster, with huge potential to advance the cause of electri cation. However, the biggest ongoing story of all is the massive support that Western governments are getting ready to funnel into electri cation and renewable energy. e US In ation Reduction Act and Bipartisan Infrastructure Law (silly names, but nobody asked us), along with similar legislation in the EU, seem to be a part of every conversation about EVs these days. Large pots of money are available for public charging infrastructure, school bus electri cation, battery production and much more—and companies are moving quickly to take advantage of the opportunities.

One important—and controversial—aspect of policies on both sides of the pond is a major push to establish domestic extraction and processing of raw materials for batteries. is is a global earthquake—automakers will have to rebuild their entire supply chains—and these goals won’t be achieved quickly, or without pain. However, when the dust settles, the auto industry will be far greener and more resilient.

Is this all too good to be true? Could changes in Washington shut down the EV revolution in the US? Certainly the anti-EV forces are powerful (and they have allies in both parties), but we’re cautiously optimistic that at least the main initiatives set in motion by the IRA/BIL will continue to move forward. If there’s one thing that politicians of all stripes love, it’s JOBS, and the scramble to establish domestic battery production promises to create plenty. Billions worth of investment is headed for the Battery Belt, which runs through southeastern deep red states, and local politicians are happily cutting ribbons and hailing the new technology. (One study found that red states are slated to receive far more in per-capita climate investments under the IRA than blue states.)

Another promising sign that EVs are getting depoliticized: All 50 states quickly established Electric Vehicle Infrastructure Deployment Plans, unlocking $1.5 billion in funding under the National Electric Vehicle Infrastructure (NEVI) program. at’s something that doesn’t always happen with federal programs (Medicaid expansion, for example). Another small but symbolic victory: A Wyoming bill that would have banned the sale of EVs was soundly rejected, with nary a Democrat in sight.

At Charged, we’ve always believed that EVs make much better cars, in many different ways—and advancing the best technology by encouraging new engineering breakthroughs should never be a partisan political issue.

German automotive and arms manufacturer Rheinmetall has received an order for contactors worth over a quarter-billion euros from an undisclosed German automaker.

Contactors ensure that EVs can be safely switched on and o , especially in emergencies like an accident or system failure.

Rheinmetall has a new type of contactor that’s designed for the coming 900-volt generation of EVs, and it will be available starting in 2025.

e new 900-volt technology poses challenges for the contactors’ design, particularly concerning the cut-o performance under high short-circuit currents.

e company says its new product platform combines low weight with high performance, and that low contact resistances guarantee lower power losses. Rheinmetall’s contactors function without volatile quenching gases, which reduces production costs, improves longevity and enables higher operating temperatures with a signi cantly lower risk of bursting.

Electric motor manufacturer In nitum introduced its new electric traction and propulsion motor, Aircore Mobility, at CES 2023.

Aircore Mobility is an axial ux motor designed to power a wide range of electric vehicles. It’s engineered to operate with high e ciency over a wide range of speeds and load conditions, expanding vehicle range and reducing energy loss in the process, according to In nitum.

e Aircore Mobility motor replaces the heavy iron found in traditional units with a lightweight, printed circuit board (PCB) stator that’s 10% more e cient, 50% smaller and lighter, uses 66% less copper, and is ten times more reliable, according to the company.

In nitum says Aircore Mobility can achieve up to four to ve times the current density of a conventional liquid-cooled motor, using a liquid cooling technology that allows the coolant to be in direct contact with the stator, mitigating heat across a larger surface area, enabling high overload capability and extended life.

“Our Aircore motor topology eliminates core losses and delivers a broader range of speeds and load conditions in which the motor can operate at high-e ciency levels,” says Paulo Guedes-Pinto, VP of Technology for In nitum. “ e Aircore Mobility motor o ers a new avenue in extending the range for Class 1-8 vehicles, aerospace, marine, construction and agricultural machines.”

onsemi has announced that its EliteSiC family of silicon carbide power modules has been selected for Kia’s EV6 GT model.

onsemi says its power module enables high-e ciency power conversion from the DC 800 V of the battery to the AC drive for the rear axle. It also delivers package technology to minimize parasitics and thermal resistance, and o ers package reliability using interconnects. ese innovations, says onsemi, lead to reduced power losses in DC-AC conversion, as well as reduced size and weight of the traction inverter, potentially improving performance and EV range by as much as 5%.

e company reports that it plans to continue collaborating with Hyundai and Kia to use the EliteSiC technology for the automakers’ upcoming EVs based on the Electric Global Modular Platform (E-GMP).

PyroThin cell-to-cell barriers can perform as combined fire barriers and compression pads.

Tunable platform to meet thermal, compression and thickness requirements.

Ultrathin and lightweight to support maximum volumetric cell-to-pack ratio

US silicon carbide specialist Wolfspeed (NYSE: WOLF) and German automotive supplier ZF have announced a strategic partnership that includes the creation of a joint innovation lab and the construction of silicon carbide device fabrication facility in Germany. Both the lab and the fab are planned as part of the Important Project of Common European Interest for Microelectronics and Communication Technologies framework, and are dependent upon state aid approval from the European Commission.

e joint research facility will focus on e-mobility and renewable energy. e goal of the collaboration is to develop breakthrough innovations for silicon carbide applications, covering the full value chain from chips to complete systems. Additional partners will be invited to participate, with the goal of establishing an end-to-end European silicon carbide innovation network.

Also, Wolfspeed plans to build a fully automated 200 mm wafer fabrication facility in Saarland, Germany. ZF will support the project by making an investment “in the hundreds of millions of dollars” in exchange for Wolfspeed common stock.

“ ese initiatives are a signi cant step towards a successful industrial transformation,” said Dr. Holger Klein, CEO of ZF. “ ey strengthen European supply resilience and support the European Green Deal and the strategic goals for Europe’s Digital Decade.”

“ZF brings industry-leading experience in scaling components for electric mobility as well as the aptitude to accelerate innovation in silicon carbide systems and power devices,” said Gregg Lowe, President and CEO of Wolfspeed. “I am con dent this partnership will li silicon carbide semiconductor technology to a new level of global impact.”

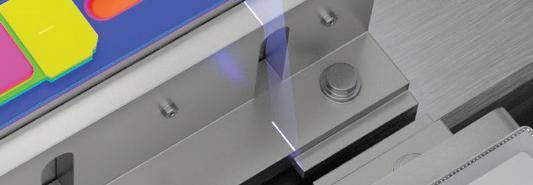

Marposs, a designer and manufacturer of measurement, inspection and testing products, has announced a new system for checking the welding joints of pouch cell batteries within the production process, consisting of interferometric sensors and the company’s NCG (non-contact gauge) controller.

e system works by splitting light into two beams that travel di erent optical paths and are later combined to produce interference, which can identify refractive changes and surface irregularities.

Pouch cell batteries are typically sealed using impulse or contact welding (heat sealing), which fuses the plastic layers together. e thickness of this joint is a key indicator of the quality of the seal, and must be measured while the material is still so . Marposs says its system is able to check the thickness right a er the welding process using the non-contact interferometric technology.

e solution can measure thin external plastic layers starting at 1 µm, and can accommodate thickness variations due to the presence of the tabs in parts of the welding seam. It comes with a measuring snap with two interferometric sensors that enable the simultaneous measurement of the total thickness of the welding seam and the thickness of the two external plastic layers. Each sensor has a measuring eld of 900/1.8 mm and o ers a repeatability range within 1 mm of the application thickness.

Proterra (NASDAQ: PTRA) is a commercial electric vehicle OEM, and it has two related businesses: Proterra Energy, which o ers turnkey charging services to eets; and Proterra Powered, which provides battery packs to other vehicle manufacturers.

Now the company has produced the rst Proterra Powered EV battery at its new Powered 1 battery manufacturing plant in Greer, South Carolina. Proterra expects to begin deliveries of Proterra Powered battery systems from the new factory in the rst quarter of 2023. Powered 1 has also started production of drivetrains and other ancillary systems such as high-voltage junction boxes.

Powered 1 brings battery production closer to Proterra’s customers on the East Coast and in Europe, and to its own electric bus manufacturing operations in Greenville, South Carolina. e 327,000-square-foot battery plant will eventually have “multiple gigawatt-hours of annual production capacity.”

“Achieving this important milestone at Powered 1 a little over a year a er announcing our plans for the factory is a re ection on the talent, innovation, and collaboration of our incredible team,” said Proterra CEO Gareth Joyce. “At full scale, we believe Powered 1 will be the largest battery manufacturing facility in the US dedicated exclusively to electric commercial vehicles.”

at’s a laudable ambition, but Proterra might just have some competition for the “largest” title—so many new battery plants are planned for the US Southeast that some are starting to call it the Battery Belt.

Japanese semiconductor manufacturer Renesas Electronics has revealed a new automotive Intelligent Power Device (IPD) that’s designed to safely and exibly control power distribution within vehicles.

e new RAJ2810024H12HPD is available in a small TO-252-7 package and reduces the mounting area by about 40% compared to the conventional TO-263 package product.

Renesas also says that the advanced current detection function of the new device allows highly accurate detection of abnormal currents such as overcurrent. Since the new IPD detects abnormal currents even at low loads, it allows engineers to design power control systems that can detect even the smallest abnormalities.

Key features of the new RAJ2810024H12HPD IPD:

• Single-channel high-side IPD

• Small TO-252-7 package (6.10 x 6.50 mm, excluding pins)

• Low on-resistance (Ron) of 2.3 mΩ at 25° C (typical)

• Highly accurate current detection at low loads

• Built-in charge pump

• Self-diagnostic feedback by load current sense

• Protection functions such as load short-circuit, overheat detection, sense current output and GND open protection

• Supports 3.3 V / 5 V logic interface

• Low standby current

• Battery reverse connection protection with self-turnon

• Compliant with AEC-Q100 and RoHS automotive standards

Electronic parts manufacturer Rincon Power has announced a new line of battery disconnect switches, the HVBD6Axx series. is hermetically sealed switch serves to isolate a high-voltage system in a compact and robust package.

According to the company, the HVBD6Axx o ers 600 A continuous current carry in applications ranging from 12 to 1,000 V DC. e single-pole, single-throw switch features optional auxiliary contacts which can be used as part of a high-voltage safety circuit. Low contact resistance (averaging less than 0.1 mΩ) ensures limited heat generation and energy losses.

e hermetic seal allows the unit to be operated in virtually any environment, while also ensuring that there is no contact oxidation over the life of the switch. e handle features a lock-out hasp for OSHA-complaint lock-out/tag-out functionality.

“Our 600A HVBD Battery Disconnect o ers an attractive solution for physically isolating high-voltage systems while allowing for a visual indication that the switch is turned o ,” said Markus Beck, Rincon Power’s VP of Sales. “ e HVBD series has been successfully implemented in a wide range of applications including electric buses, o -road equipment, electric marine and a wide range of high-voltage battery systems.”

Rice University scientists have reported what they believe to be a partial solution to the mounting disposal problem of worn-out lithium-ion batteries. It relies on a unique “ ash” Joule heating process they have developed to produce graphene from waste.

e lab of Rice chemist James Tour is said to have recon gured the process to quickly regenerate graphite anode materials found in Li-ion batteries, removing impurities so they can be repeatedly reused. Powdered anodes from commercial batteries are “ ashed” for a few seconds with a jolt of high energy, decomposing their inorganic salts, including lithium, cobalt, nickel and manganese, which can then be recovered by processing them with dilute hydrochloric acid. e reported cost is about $118 to recycle one ton of untreated anode waste.

“We’re claiming our process can recover critical metals and recondition anodes in a far more environmentally and economically friendly manner,” says Tour.

Hyundai-Kia has named Eaton’s Breaktor circuit protection technology “Best Technology” in its electri cation category.

Power management company Eaton developed Breaktor as a circuit protection system for EVs that combines the functions of fuses, pyro switches and contactors into one coordinated device.

“Our technology lls a unique need in the growing EV market,” said Kevin Calzada, Eaton’s Global Product Strategy and Marketing Manager.

According to Eaton, as EV power levels increase, its proprietary technology solves the coordination challenge between fuses and contactors and provides fast, reliable protection for high-power battery, fast-charge and inverter systems.

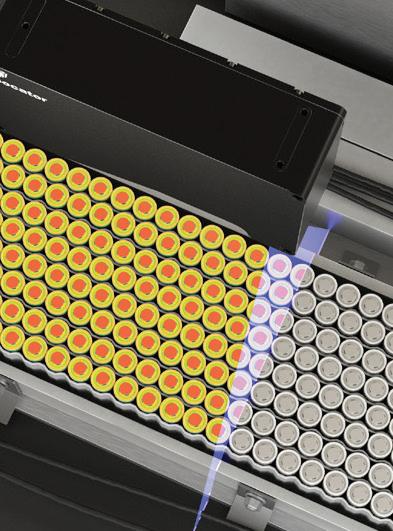

Our trusted Gocator smart 3D laser profilers solve a wide range of universal EV Battery manufacturing quality control applications including scanning electrode coating thickness; cylindrical and prismatic battery surface inspection; cell, module, and pack dimensional measurement (LxWxH); battery weld seam inspection; and final battery installation inspection.

Powered by Silicon Mobility OLEA® T222 FPCU & OLEA® APP INVERTER Software

3-Phase SiC MOSFET Intelligent Power Modules

• Up to 1200V/350kW

• Integrated SiC Gate Driver

• Low-ESL DC-Link Capacitor

• Reference Liquid Cooler

Motor Control Board & Software

• ISO 26262 ASIL-D

• OLEA® T222 FPCU chip

This optimal mechanical & electrical integration of a 3-Phase Silicon Carbide MOSFET Intelligent Power Module from CISSOID together with OLEA® control solution and application software from Silicon Mobility accelerates the development of Compact and Efficient e-Motor Drives! www.cissoid.com

• Advanced control algorithms & software libraries for e-motors

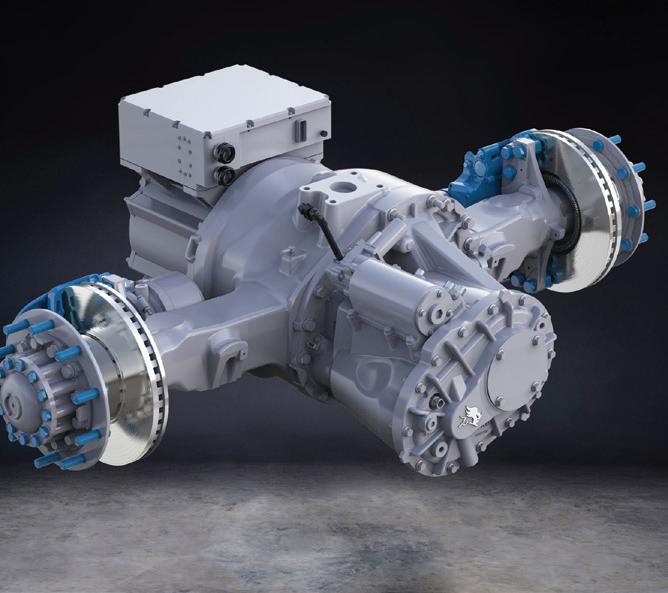

is year, automotive supplier ZF reached the milestone of two million electric motors produced.

To keep pace with the global increase in demand for EVs, the company has been continuously accelerating production at its lead plant in Schweinfurt, Germany. It has also commissioned major production lines in Serbia and China. Another plant in North America will go into operation in 2023.

Recently the company has begun focusing on a new technology: hairpin winding, which enables wires to be packed tighter together, resulting in increased power, speed and torque while using the same amount of space.

According to ZF, there is even more innovation potential for electric motors—for example, sophisticated cooling solutions.

“Currently we are developing a solution with oil owing past—to directly cool the copper wire, which is the main heat source in electric motors,” explains VP Roland Hintringer. e company also develops electric motors with magnets that are almost free of heavy rare earth metals. Another potential future technology: separately excited electric motors that don’t need any magnets at all.

In view of globally increasing volume and the high demand for electric powertrain technology, ZF expects to reach the next production milestone soon. “Our order books are well lled,” says Hintringer. “ e next two million units of electric motors will probably be produced in less than two years.”

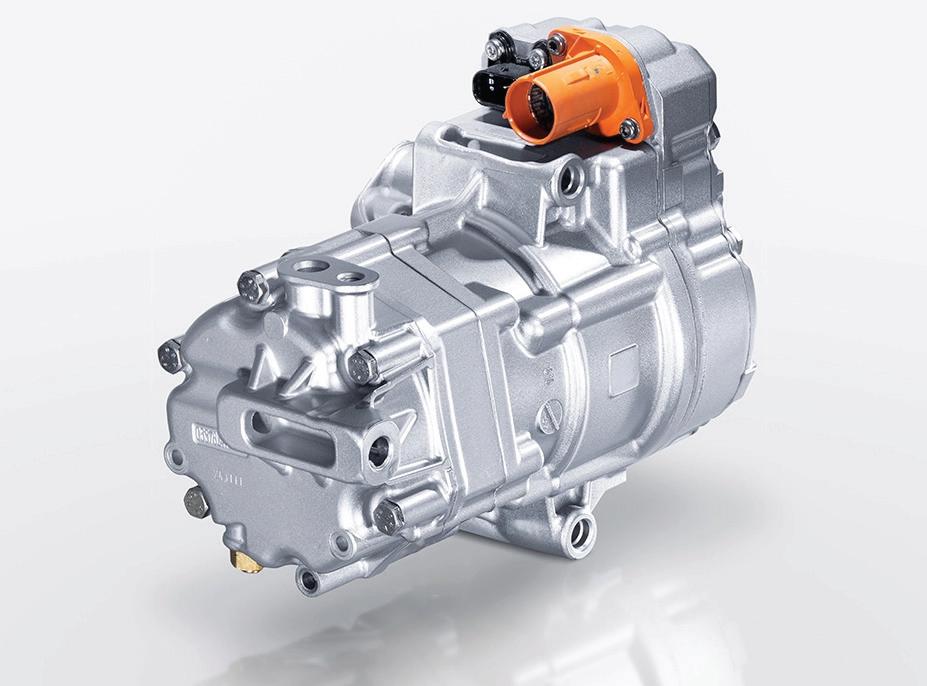

German auto parts manufacturer MAHLE is increasingly becoming an e-mobility supplier. e company says its electric AC compressor is particularly sought-a er thanks to its peak power of 18 kW, which makes it the most powerful e-compressor on the market at the moment.

e company says it has already secured numerous series orders in the passenger and commercial vehicle sectors, amounting to approximately 1.4 billion euros.

E-compressors are one of the key components in EV thermal management. ey regulate the temperature of the electric drivetrain, and are thus crucial for the service life, charging speed and cruising range of the battery.

In addition to e-compressors for e-mobility, MAHLE develops and produces electric actuators, auxiliary components, engine accessories, auxiliary aggregates, electronics and so ware, as well as entire thermal management systems. According to the company, between 2022 and 2026, more than 20 electri ed vehicle platforms from leading passenger and commercial vehicle manufacturers will be launched on the market that rely on its technology and products. MAHLE says it already generates over 60% of its sales independently of ICE vehicles, a share that it hopes to increase to 75% by 2030.“MAHLE will continue to expand its role as a complete system supplier for air conditioning in EVs,” said Arnd Franz, CEO of the MAHLE Group.

Kalyani Mobility Drivelines (KMD), a manufacturer of driveline components, has introduced a lineup of constant-velocity (CV) drivesha s for EVs and other specialty vehicles.

KMD’s CV drivesha s are designed using high-strength steel for optimal performance under high torque generated by EVs, military, specialty and motorsports vehicles, and are engineered for a range between 7,000 and 16,000 Nm of torque at speeds up to 8,000 rpm.

e company says its drivesha s o er design exibility with no need for the equal angle alignment required by cardan designs.

ey’re also designed to provide smooth operation and long life, even under the most extreme operating conditions faced by military and specialty vehicles.

“EVs and other vehicles that create high torque put tremendous stress on driveline components. We engineer our CV drivesha s to survive under loads that would cause other drivesha s to fail,” said Dave Moore, Engineering Manager at KMD.

Italian automotive supplier Marelli developed and manufactured the three e-motors used in the new Maserati GranTurismo Folgore, and also provided its proprietary Adaptive Driving Beam Matrix LED headlamps and Telematic Control Unit connectivity system.

e 800 V motors, which were developed over a twoyear span and produced at Marelli’s Modugno plant in Bari, Italy, supply a total installed power of 1,200 hp in a compact pro le. ere are two motors mounted on the front axle and one on the rear, and they deliver a powerto-weight ratio of 9.2 kW/kg and total torque of 1,350 Nm.

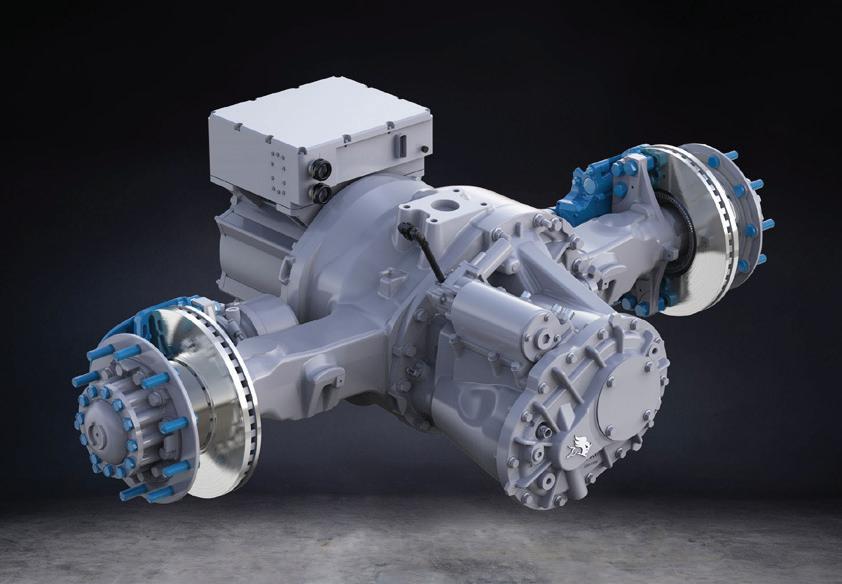

Cummins, which has been building diesel engines for heavy-duty vehicles since 1919, is methodically moving into the electric age. Now the company has successfully demonstrated a new ePowertrain for heavy-duty vehicles, using a test truck at Millbrook Proving Ground in Bedfordshire, England.

Solid conductors in the hairpin windings of the stator, Marelli says, result in improved electromagnetic and thermal performance and a greater than 80% lling factor. e company also says that its choice of rotor geometry and the use of speci c segmented magnets, as well as optimized skew of the laminate stack, reduce noise, vibration and magnetic cogging. Its cryogenic cooling process used in rotor production, reaching about -200° C, ensures perfect t of the sha into the stack.

e integrated 17Xe ePowertrain, developed by Meritor (now part of Cummins) with Advanced Propulsion Centre (APC) consortium partners Editron and Electra, features output capacity of 430 kW continuous power. It’s designed to power heavy-duty trucks and buses in 6×2 or 4×2 con gurations, and is available in a range of ratios and with three-speed transmission capabilities. Danfoss’s Editron division developed and supplied the electric motor and silicon carbide inverter powering the axle. e motor is based on a patented architecture and thermal management methodology that exceeds the APC’s 2035 Roadmap targets for power density. As a result, only one motor will be required in the electric powertrain—Cummins says current alternatives usually need two motors to meet this product segment’s power requirements.

APC Senior Project Delivery Lead Sunil Maher called the demonstration a major milestone. “Seeing this prototype vehicle in operation is a signi cant step to addressing net-zero transport challenges in the UK. I look forward to the next stage of development, which will see technical improvements and further product variation, to deliver solutions for heavy-duty and commercial vehicles.”

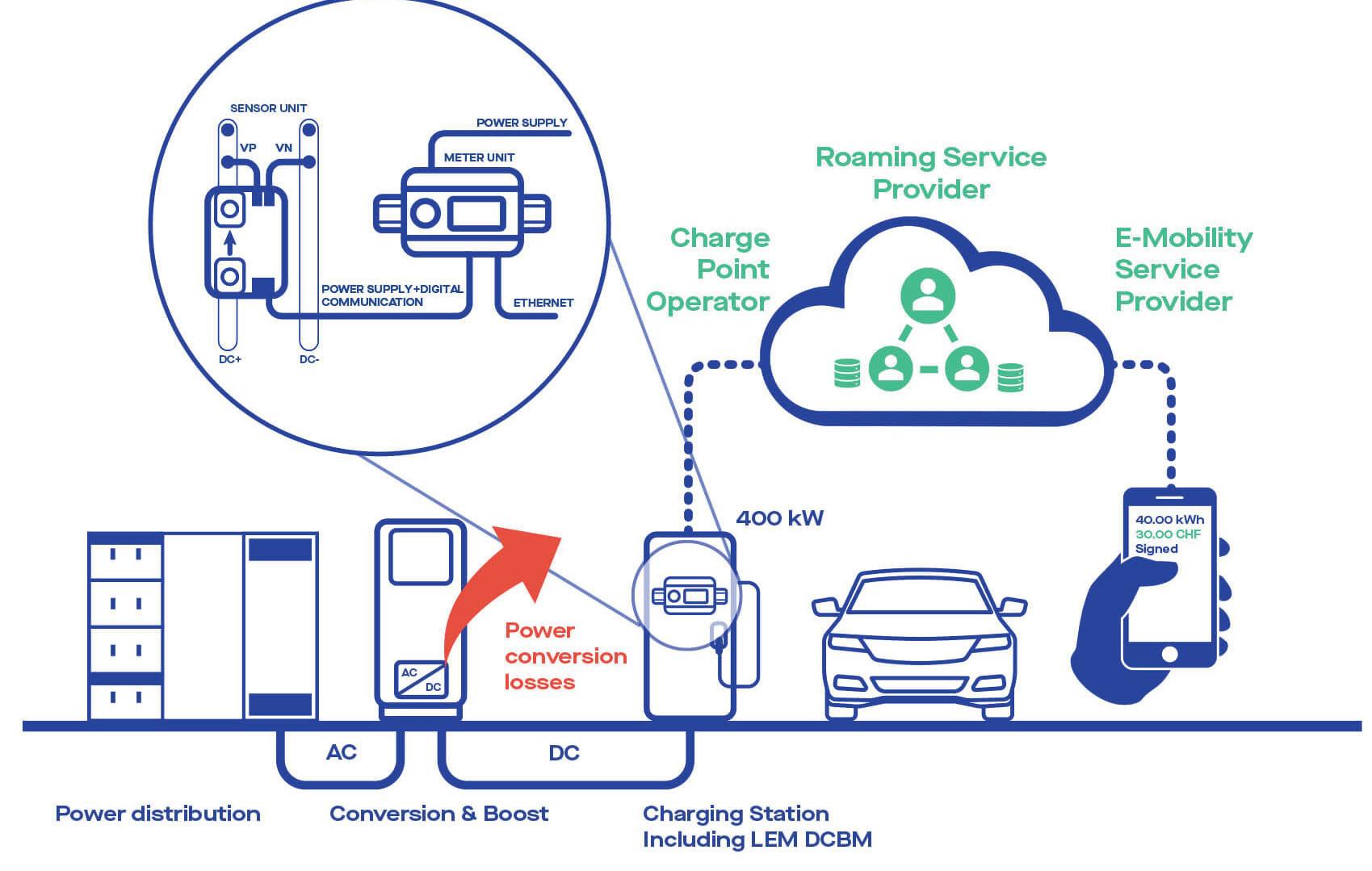

e public charging industry is moving towards per-kilowatt-hour (as opposed to time-based) billing, and manufacturers will increasingly be required to incorporate certi ed DC meters into their charging stations.

To meet this need, electrical measurement specialist LEM has introduced the DCBM, a UL-listed bidirectional DC meter for fast EV chargers.

e DCBM “will enable makers of EV charging stations to accelerate their certi cation for DC metering requirements following Certi ed Test and Evaluation Professional/National Type Evaluation Program (CTEP/NTEP) certi cation,” says LEM. “ e DCBM will simplify the process of the manufacturers having to qualify their own charging stations for UL certi cation and, for extra peace of mind, will undergo a fresh audit every quarter.”

e new meter is capable of monitoring current, voltage, temperature and energy usage, and has been designed with data security and exibility in mind. e DCBM 400/600 complies with the UL 61010 and UL 810 standards in the FTRZ category for EV applications. To achieve this certi cation, the meter had to pass reinforced insulation tests, temperature testing of all its components and sub-assemblies, testing for protection against electric shock, durability of markings tests, equipment temperature limit tests, and resistance to heat/ re risk tests.

e DCBM is designed for DC chargers from 25 kW to 400 kW, and integrates the signed billing data sets according to the Open Charge Metering Format (OCMF) protocol. It can be retro tted to existing charging stations, and has a moveable measuring element for use with any type of charging station architecture. It is accurate in temperatures of -40° to 185° F, and has an IP20-rated casing.

Other features include Ethernet support and bidirectional energy metering, which makes it compatible with V2G (vehicle-to-grid) and V2X (vehicle-to-everything) applications.

“ e US and Canadian markets for EVs are continually expanding, but this growth could be held back by insu cient access to rapid DC charging stations,” said Claude Champion, General Manager at LEM USA. “LEM understands exactly what the sector needs, and has worked closely with EVCS manufacturers and installers when developing solutions like the DCBM 400/600.”

Image courtesy of LEM

Image courtesy of LEM

By Jeffrey Jenkins

By Jeffrey Jenkins

In my very rst article for Charged over 10 years ago, I opined that the Switched Reluctance Motor, or SRM, would eventually come to dominate the EV traction market, if for no other reason than the fact that it is almost as cheap as dirt to manufacture. I won’t sprain my shoulder patting myself on the back for a prediction that took 10 years to (partially) come true, but it does seem that the days of the Permanent Magnet Synchronous Motor, or PMSM, and the AC Induction Motor, or ACIM, dominating EV traction applications are coming to a close, with both Toyota and even stalwart ACIM fan Tesla introducing reluctance motors into the mix (albeit not ones that purely employ magnetic reluctance, but more on that below).

Despite the fact that the PMSM and ACIM types dominate the EV traction market, neither technology

is particularly well-suited to the job, mainly because of their limited overload and starting torque capabilities. Torque is a function of the magnetic eld strength of the motor’s eld structure, and that is obviously xed in a PMSM, because its eld is being supplied by literal magnets, but it is also limited in the ACIM, because its eld is induced into its rotor via transformer action, and like any electromagnetic structure employing a high-permeability core material, it is subject to saturation, or the point at which a further increase in current fails to increase the magnetic eld strength thus developed. Since traction applications require maximum torque at 0 rpm (to overcome both the inertia and static friction, or stiction, of the load), having a hard and fast torque limit is de nitely a downside. Furthermore, the PMs invariably employed in the PMSM are rare earth types—which, as the name implies, tend to be

expensive—and most avors of these magnets—particularly the neodymium type—have a very low upper temperature limit before they start to lose their ability to resist demagnetization (in some cases as low as 80° C), an especially unfortunate weakness, because the only way to extend the constant power speed range of a PMSM is with eld-weakening, in which an opposing (i.e. demagnetizing) eld is applied to the eld magnets to reduce the back EMF, or the voltage produced by the rotation of the rotor, to below that of the battery voltage. at brings up another potential downside to the PMSM: since BEMF is proportional to rpm, if the rotor is spinning fast enough to require eld-weakening

and the inverter shuts down (or misjudges the timing of the stator currents) for any reason, then it (and possibly the motor) will almost certainly be destroyed from the huge jump in BEMF causing an equally huge jump in current from the now rapidly-braking motor (a situation that is somewhat euphemistically termed uncontrolled generation). is failure mode can’t occur with the ACIM, of course, because the rotor’s eld can only exist through the action of the stator currents (and a di erence in the relative rpm of both), but the ACIM is much less power-dense than the PMSM (especially the interior PM version), so achieving a given power output requires a much larger motor, and that’s a signi cant drawbacks itself in an EV traction application. With all these downsides of both technologies, it’s fair to wonder how the PMSM and ACIM ever came to be used in EVs in the rst place—much less how they became the most popular choices—and a good chunk of the reason is that they both use the same inverter hardware that has been used to control the speed and torque of industrial motors for decades, with only minor di erences in the so ware and rotor position feedback to better adapt them to traction service.

e least-radical alternative motor type—and one which has already been used by BMW, in fact—is the wound-rotor synchronous motor, or WRSM. ere

The permanent magnets invariably employed in the Permanent Magnet Synchronous Motor are rare earth types—which, as the name implies, tend to be expensive—and most flavors of these magnets have a very low upper temperature limit.Interior Permanent Magnet Synchronous Motor, or IPM-SM Rotor Stator Stator Winding Permanent Magnets

is some irony in this, both because supplying current to the rotor requires brushes and a slip ring, which is almost anathema to those EV purists who shun the king of all traction motors, the series eld DC type, because of its brushes and commutator (to be fair, the latter wears out far more quickly), but also because it is downright ancient technology, predating even the induction type. Basically, the PMs of the PMSM are replaced by electromagnet coils in the rotor, which means the strength of the eld can be directly controlled, something that isn’t possible with xed-strength permanent magnets, of course. is makes eld-weakening to achieve high rpms a non-event, rather than something akin to juggling chainsaws, and makes minimizing the amount of reactive current that would otherwise slosh back and forth between the inverter and motor possible (this current does no useful work, but does use up some of the RMS current rating of the inverter’s semiconductor switches and cause heating from I2R loss). e downsides to the WRSM are a somewhat lower power density and a higher assembly cost for the rotor (a lower material cost, however, since copper is likely to remain much less expensive than any of the rare earths used in high-strength magnets). Also, of course, the eld needs a separate power stage to supply it, and the controller so ware is a bit more complex, but this is well-established technology, and the WRSM is eminently suitable for 4-quadrant traction applications (i.e. motoring and braking in forward and reverse).

Being able to use the rich ecosystem of existing electronic components, so ware and knowledge behind every industrial variable frequency drive, or VFD, is a huge advantage that cannot be overstated, and this is no doubt one of the major reasons that the axial- ux variation of the PMSM has received any attention, because it is de nitely a contender for the “most expensive way to construct a motor” award. As the name implies, the

axial- ux PMSM orients its eld magnets parallel to the output sha on a disc that is sandwiched between the stator phase windings (and the “back iron” to complete the magnetic path, if necessary). is naturally results in a motor with a relatively large diameter-to-length ratio, and since torque is proportional to the square of rotor diameter, but only directly proportional to rotor length, a wide-in-diameter but short-in-length motor—a disc shape—is optimal for high-torque applications, such as EV traction. Securing the eld magnets in a disc-

The least-radical alternative motor type—and one which has already been used by BMW, in fact—is the Wound-Rotor Synchronous Motor, or WRSM.Wound-Rotor Synchronous Motor, or WRSM AXIAL FLUX Flux is produced axially along the axis of the rotor RADIAL FLUX Flux is produced radially along the sideways of the rotor DC supply (slip rings) Rotor 3 phase supply

shaped rotor requires some form of banding on the circumference of the disc, so it is arguably about as prone to disintegration at high rpm as the surface PM construction, but it is undeniably less e ective than burying the magnets, as in the IPM construction. Furthermore, the push and pull of the magnetic elds from the stator poles exert torsional, or wave-like twisting, forces on the axial- ux rotor, and resisting these forces is not the strong suit of a disc shape. Consequently, the parts of the rotor that hold the eld magnets in place must have a very high strength-toweight ratio, which basically means using exotic (read: expensive!) materials like woven carbon ber composite. e combination of exotic construction materials and rare earth magnets in the rotor is the reason that the axial- ux con guration is one of the most expensive types being considered for EV use, and there doesn’t seem to be much that can be done to lower its cost in the future. For a more in-depth explanation of the axial- ux PMSM construction, see my article in the May/June 2020 issue of Charged. For those wondering if there is an axial- ux analog to the ACIM; well, it’s theoretically possible, but doesn’t really o er any compelling advantages over its conventional radial- ux counterpart.

Another alternative motor construction that leverages the existing VFD ecosystem is the Interior Permanent Magnet-Synchronous Reluctance Motor

Multiphysics simulation helps in the development of innovative battery technology by providing insight into mechanisms that impact battery operation, safety, and durability. The ability to run virtual experiments based on multiphysics models, from the detailed cell structure to battery pack scale, helps you make accurate predictions of real-world battery performance.

» comsol.com/feature/battery-design-innovation

(IPM-SynRM), which combines the buried magnets of the Interior PM Synchronous Motor (aka IPM-SM) with the rotor structure of the reluctance motor. Basically, the IPM-SynRM behaves pretty much like the IPM-SM as far as the inverter is concerned, but with a signi cant contribution from reluctance torque (more on what that is below). In both the IPM-SynRM and IPM-SM, burying the rotor magnets also partially shields them from heat as well as demagnetization from the stator (during overloads and eld weakening) and also eliminates the risk of being ung o the rotor at high rpm, as is the invariable case for the surface PM construction (that, to be fair, is rarely used in EVs these days). Both Toyota and Tesla have reportedly started using this type of motor, albeit not exclusively.

Moving along the continuum from the pure synchronous motor to the IPM-SM, then the IPM-SynRM, we nally come to the pure reluctance motor, which operates only on the attraction between electromagnets in the stator and a magnetically-so iron or steel rotor. Reluctance is the magnetic analog to resistance, so a magnetic circuit with minimum reluctance occurs when magnetic eld lines can freely ow from the North to South poles. is condition occurs in a reluctance motor when a diametrically-opposed pair of electromagnets on the stator align with a matching pair of projecting teeth on the rotor (maximum reluctance occurs when the rotor teeth are between two pairs of stator poles). By constructing the rotor with fewer teeth (or salient poles)

than the stator (e.g. 4 rotor poles to 6 stator poles), it can be ensured that when some salient poles are aligned with the stator electromagnets, some will be in between them. Sequentially energizing the stator electromagnets—switching from one pole pair to the next, hence the more common name of Switched Reluctance Motor—will cause the rotor to rotate in much the same fashion as in a PMSM or ACIM. One crucial di erence in the SRM, however, is that the stator electromagnets are supplied with a trapezoidal but unipolar (DC) current waveform, rather than a bipolar (AC) one. is means there are no iron losses in the rotor, which is a huge plus, but the torque output has a lot of ripple, and this subjects the rotor to immense tension and compression, which can then cause vibration and noise. It also means that the classic half-bridge power stage used for each phase in an inverter/VFD isn’t the best choice here; rather, a two-switch, two-diode power stage is preferred,

One crucial difference in the SRM is that the stator electromagnets are supplied with a trapezoidal, but unipolar (DC), current waveform, rather than a bipolar (AC) one.

as it can rapidly increase the winding current, and just as rapidly decrease it (while recycling any energy still stored in the winding inductance back to the battery).

Another issue that has hampered the adoption of reluctance motors until recently is the fact that the current through the stator electromagnets must be ramped up rapidly and with precise timing as a given rotor pole pair comes into alignment with a stator pole pair, then held at a de ned level for a few degrees of rotation, and then rapidly ramped down again as that rotor pole pair rotates out of alignment. is requires very accurate knowledge of the rotor position, which generally means a relatively expensive (and relatively delicate) absolute encoder, and as if that weren’t enough, the inductance of the stator electromagnets increases as a rotor pole pair comes into alignment (because the reluctance drops, and inductance is inversely proportional to reluctance), which makes increasing the current that much more di cult, especially given the fact that the dI/ dt (i.e. rate of change in current over time) must be carefully controlled for optimum torque production. is requires a lot of computing power, but fortunately, modern microcontrollers and Field-Programmable Gate Arrays (FPGAs) have more than sucient grunt for the task. Consequently, the SRM is bound to be the dominant EV traction motor of the future… Any day now, I’m sure…

Power levels in electric vehicles are increasing. EVs need to drive farther and charge faster. What does this mean for system safety? Expertise is critical when managing, distributing and protecting electrical systems. Eaton’s advanced battery disconnect units (BDUs) feature integrated Breaktor® circuit protection technology, enabling EV manufacturers around the globe to deliver the safest vehicle systems possible.

Because that’s what matters.

Engineering firm NI has been significantly expanding its EV battery testing capabilities over the past few years. The company reports an industrywide recognition that test data is an underutilized asset and that many systems need to be rebuilt to take better advantage of very rich data sets.

Christian Ruoff

Christian Ruoff

Tpalpable as it undergoes the transition to EVs. Governments have been implementing stricter emissions regulations for about a decade now and, more recently, they’re upending supply chain plans and forcing automakers to source and build locally. ere is also a growing sense that a few EV winners could take all. Whoever can iterate the fastest to deliver popular and pro table products could gain an insurmountable competitive advantage and reap all the rewards, leaving behind those who fail to adapt fast enough. e EV shi represents a signi cant challenge for the legacy industry, and requires a rethinking of everything, including design protocols, manufacturing processes, supply chains and business models.

One of the biggest bottlenecks to iterating in the EV

space is—obviously—batteries. From building up battery development and validation labs to securing raw materials supply to massively expanding production lines, there is an enormous amount of work to be done.

One company at the center of many of those new challenges is NI (formerly known as National Instruments). e Austin-based company—widely known for its engineering so ware platforms such as LabVIEW, and hardware products including data acquisition devices— has been making a lot of headlines as it announces new EV test solutions and acquires other companies in the battery testing industry.

Charged recently chatted with NI CEO Eric Starklo to learn more about the company’s expanding EV-testing focus.

Q Charged: We’ve been writing about EV battery testing technology for over a decade, and in the past few years, we’ve noticed a lot of new activity from NI. When did you decide to lean into the EV space?

A Eric Starklo : We have broad-based technologies that serve many things related to electrical and mechani-

cal engineering, so automotive has always been a segment for us for the long history of the company. About ve or six years ago, we started transitioning our strategy as a company to be more application-oriented.

e idea was to take that broad-based technology that we’ve built up over so many years and tune it to applications where our customers needed more complete capability. And in automotive, that was active safety systems and electric vehicles.

If you think back six or seven years ago, the prevailing point of view was that autonomy was closer than electrication. But then that ipped. We heard that loud and clear from our customers and we started to see them really accelerate EV plans. ey began making commitments externally for new models of EVs and trying to build up their battery and electronics technology, so we rapidly increased our organic investment.

And then, over the last couple of years, we augmented that with a series of acquisitions. We found that there were a lot of companies that have been around for a long time with some of the technologies that were now being used for EV testing. For example, very high-voltage stimulus and measurement—those products have been around for decades in other smaller industries, like the electric grid or certain aerospace testing applications. But then that technology intersected with a much bigger and rapidly moving industry in automotive. So what we’ve been doing is building our own technology, augmenting with these acquired companies to build system-level capability that helps our customers accelerate their paths to bringing EV technology to market and building it.

I can disclose that this is the fastest growing part of our company, and it’s an area we’ve done a lot to improve in, so it’s very exciting from our business point of view. And, personally, I’m almost 10 years into owning EVs. I’ve been a believer in the technology over that period and have seen it personally develop as a consumer, but also we’re working with all these leading-edge companies and we see how things are progressing. It’s a cool space.

Q Charged: You’ve been with NI for a large part of your career, correct?

A Eric Starklo : Yes, I’m an electrical engineer by education and background, and came to NI 25 years ago as a support engineer. I supported our customers here in the US and Sweden for a while, and then went into

product management and built up some of our early set of products. I launched PXI, which is still going strong these days as a modular hardware platform, and created the PXI Systems Alliance, which is the consortium that still governs that speci cation twenty years later. I also spent a lot of my time on our so ware products. And then I’ve had roles all over the company—sales and marketing, R&D—and created some business units to get more focused on vertical applications for our customers. en in 2020, right as COVID took hold, I took over as CEO. It’s an amazing company and I’m proud to lead it.

Q Charged: Five or six years ago, when you started to build up the EV testing vertical, what were some of the big problems you found that you thought you could solve for the automotive world?

A Eric Starklo : A couple of things. One is that our specialty as a company is really around automating measurement systems, and more and more of what you do with the data. e two principal things that we’re solving for, which really line up well with this industry, are predominantly about quality and performance. So our products and systems are typically used in validation and R&D to ensure the quality and performance of a design.

And then e ciency and cost. We typically associate that with manufacturing. Our systems—and the automation of our systems—are used to improve the e ciency of production, which helps scale the cost down. And we’re involved in this area as well.

To give you some other examples on the production side, we’re involved in very high-volume applications like semi-electronics, where we test in production the products that are sold in billions. And also in consumer electronics, the highest volume of consumer electronics products that we all use, we’ve been involved in that kind of testing for a long time.

So what we saw in the EV area was that the intensity of

development is the highest with batteries. e need for customers to get more high-quality data in validation to use to improve quality and performance is really intense. And the automation and measurement technology we have is right at the center of that. And over time we’ve added high-voltage electronics that are needed when you’re dealing with hundreds of amps and thousands of volts, that’s a di erent kind of front-end technology that’s needed.

And then, increasingly, we’re focused on data analytics. We found with batteries, as we’ve seen in other industries, it’s all about the data. If you look at the quality and performance side, for example, our customers are trying to gure out, “How’s our battery design going to perform in a variety of operating conditions? How’s it going to perform over di erent charge and discharge cycles? What are the best ways to charge and discharge the battery to improve its range and longevity?”

All the answers to those questions are in the data that comes from the test systems that we create with our customers. at’s what’s used for feedback into the design of the vehicle, it’s used to create the speci cations to ensure a long life on that battery, etc. All of those really, really critical things for the vehicle owner.

A massive amount of data comes from those tests, and being able to store, manage and analyze it has become more and more critical. You may have seen that we’re collaborating with GM, for example, on their data storage and management and analytics, and they’re really leaning into that point, as are others. But, broadly, for most other companies, it’s still a big problem. We’ve

surveyed our customers and found that more than half of them don’t even collect the data in a way that lends itself to determining the kind of information and insight that they want to get from that data. More than half of them really aren’t able to use that data upstream to improve the design, which is the ultimate goal. So we think there’s a huge amount of opportunity and innovation, especially as this EV application scales as is expected at a tremendous rate over the next few years.

Q Charged: We’ve interviewed quite a few people recently who have said that building new battery labs quickly is a big problem for many companies. Are you nding that as well?

A Eric Starklo : Right now, most of the intensity in our industry is exactly that. It’s building labs to be able to test all kinds of di erent variations at the cell, module, pack level, to determine the performance and other important characteristics. It’s kind of a gating capability to the ultimate competitiveness of EV platforms versus each other and versus non-EV platforms.

As time goes on, the challenges will change, and the speed of being able to produce cells, modules, packs, that’s going to be more and more important. To do things like scale the costs down, measurement is a big part of that. e time it takes to do a measurement, for example. We’ve seen this play out in other industries in the past. Like with semiconductors, because that’s such a high-volume industry, the optimization that’s occurred over the last couple of decades to ensure the quality, and test semiconductor devices, has been tremendous. And it’s been required, because, again, that becomes a gating function to the speed of producing semiconductors and the cost. In some semiconductor applications, half the cost can be testing costs.

I think in EV components, as they scale up to very high volumes compared to where they are today, that’s going to become a more and more important characteristic, the speed of testing and how it ts into manufacturing e ciency.

Q Charged: When you say that half the production costs can be testing the semiconductors, do you mean end-of-line testing to validate that the unit is working perfectly?

We’ve surveyed our customers and more than half of them don’t even collect the data in a way that lends itself to determining the kind of information and insight that they want to get from that data...to use that data upstream to improve the design, which is the ultimate goal.

”

A Eric Starklo : Yeah, that’s for end-of-line testing. As I said, most of the intensity for us right now is still in the earlier-stage battery validation labs, like what we’re doing with GM and others. Over time, we expect production testing to grow, and at the cell production level, that’s a particularly challenging area that has sort of massive scale and parallelism. And we are working on some innovative things there that we can talk more about in the future.

e value that we’ve delivered in production testing to other industries is in test time. e instrumentation that we build, because we’re an automated test-focused company, it’s optimized for the speed of the measurement, from everything from how quickly data goes over a backplane to how quickly you process the measurement data. And then the other area that has become more and more important is the integration of data analytics and the measurement system itself. A lot of times we think of data analytics as improving the design, where we take insight from the battery pack performance data to gure out how to improve its design. at’s classically done in validation.

In production, however, what we’re doing in the highest-volume applications is using the real-time data on a measurement system to improve the speed of the measurement system itself. So there are real-time optimizations that you can do based on the data that continue to make the automated system perform better, and it uses all the fancy technologies that people talk about, like machine learning, to ultimately improve performance. So those are the kind of technologies we invest in to improve performance and end-of-line production.

Q Charged: Is the challenge with the data—in battery validation, for example—the amount of it? Or do most people just not know how to analyze it? Or does it take too long to process it all?

A Eric Starklo : Yeah, it’s multiple things. It starts with many companies having a lot of unstructured data in lots of disparate systems. ey have measurement data, but it’s in di erent formats and stored in di erent places. So obviously, there’s this vision that I’d love to be able to take simulation data from my design, and take real-world measurements, and even take in-use data, and I’d like to be able to see deltas and patterns across those. at, itself, is quite challenging.

Data in di erent systems in di erent formats is not easily associated across a ow. Now, we have technology that helps do that, that can help create ingestion and structure so that those data sources can be brought together, and then you can start to do great things. Like comparing my actual performance to my design, that should be a base-level simple thing, but for a lot of people, it’s not easy to do that. en, of course, there are more sophisticated analytics, like anomaly detection and looking for patterns and data that might not be clearly obvious to the engineer that is looking at it manually.

In our opinion—informed by lots and lots of work with customers on this—the data challenge starts with acquiring the data itself, the quality of the acquired data, the way that it’s processed and stored. As I mentioned, more than half of the people we surveyed industry-wide said that the way that they capture and store data limits their ability to actually get insights from it. So the data problem starts there in the system that’s acquiring it.

But then beyond that, everyone I talk to in the industry recognizes that the test data is an underutilized asset. ey’ve got to be able to get more information from this very rich set of data about all the performance characteristics of their battery or their inverter, for example. So that, I believe, is one of the challenges in the industry that’s fairly nascent still. And the amount of data that’s being produced is going up exponentially because of the ramp-up of the technology. And everyone is asking themselves, “How do we incorporate all this data—billions of points of in-use data? How can that help us improve our processes and our technology, and so forth?” I think that’s the number one issue.

And then as I alluded to, the speed of automation as this industry scales, and we’ve seen it happen time and time again, e ciency becomes more and more important, how e ciently you can produce something. And in

I’d love to be able to take simulation data from my design, and take realworld measurements, and even take in-use data, and I’d like to be able to see deltas and patterns across those. That, itself, is quite challenging.

our industry, that typically means the speed of a measurement system is the thing that contributes to e ciency. So we think that our automation framework is an important thing we bring to help try to solve that.

Q Charged: Can you give us details of your recent acquisitions in the EV testing space, and how they t into your system?

A Eric Starklo : Yes, we’ve done a few. I’ll actually go back to one that people think of as outside this space— back in 2020, we acquired a company called Optimal+, which is a very sophisticated data analytics company that was, at the time, primarily focused on semiconductors. Most of the world’s semiconductor components that are produced, the data from those components runs through this system to enhance the performance of their production and ensure quality and yield. Our logic in buying that company was actually to use the technology as a general-purpose data analytics platform. So we are extending that technology, along with some of our own organic technology, to help solve this issue of data storage and analytics. e basis of those technologies is used in what we’re doing with GM, for example, for battery analytics. So that’s an acquisition we did that complemented some internal technology.

Another acquisition that is classically thought of as very EV-focused is NH Research. ey’re in the area of high-voltage electronics testing. We were already partnering with NHR in those kinds of applications and we were doing the lower voltage, or what we call the signal-level measurement and core so ware for a lot of those combined systems. So this acquisition enabled us to deliver to a customer a holistic capability that goes from the signal coming into and out of the battery, for example, all the way through the measurement and quality and so ware. So that was the rst company in this space.

Around the same time, we also acquired a carve-out of a German company called Heinzinger that is in a similar space, and served more of the European market with similar capability, while NHR served North American and Asia. Many of our customers want to have standard solutions with a big global scale. ey want to build battery labs in lots of di erent places and have systems that can support that. So bringing those technologies together was important. Both of those companies give us this system-level capability that goes all the way from very high-voltage stimulus and measurement all the way through the measurements and the so ware and the data.

And then the last company that we acquired was the test systems business of Kratzer Automation, also a German company. Kratzer was in the same ecosystem, with application-speci c EV so ware and integration capabilities. ey would integrate the full system consisting of a cycler, the high-voltage cycler from a company like Heinzinger or NHR. It will include measurement components from what NI has delivered. And then in addition, Kratzer has some unique so ware speci cally for running test programs around batteries speci cally. ose systems will o en have a battery pack that is going through temperature cycles and charge/discharge cycles, and characterizing its performance over that full range. e so ware is designed to run through those ramp pro les and control all of the equipment and deliver that. And Kratzer was already working with many of the large European OEMs, but also already had a footprint in North America and China with some of that capability.

So we are continuing to expand to be able to serve customers building these full integrated systems, particularly for battery labs. You can think of it as Kratzer building integrated systems that consist of all of those components that we’re bringing together and the soware and analytics.

Q Charged: How do you decide to acquire one of these companies versus building up the technology inhouse?

A Eric Starklo : We have a really disciplined process on that, and the term we use is a “strategy accelerator.” It iterates over time, because markets change, but we have a clear view of, “Here’s what we think are the most important customer problems that we have unique technology

to help solve. Here are the gaps between where we think the needs are going and what we currently have today.” And then we go to ll that. We are an engineering company with hundreds of millions of dollars spent each year on R&D, so nine times out of ten, our development roadmap and most of our investment goes into our own engineering.

But when there’s an opportunity to accelerate the roadmap by acquiring existing capability and expertise, that’s when it’s kind of a build-versus-buy decision for us. And accelerating the plan is especially important in a space like EVs, where the speed and the urgency of our customers is really high to get this technology ramped and at a high quality. And o en the conversation begins because we had some existing relationship with the companies because we were partnering with them on a gap that they were lling, and then we decided that we could get there much faster through acquisition.

It’s not just the products they have today, but they have the engineering expertise to do these things. e high-voltage design is a kind of unique expertise in the Kratzer case. ere’s some very specialized expertise. Kratzer had people, now we have the people, that are onsite engineering teams with the large OEMs that are e ectively the validation experts for their battery technology. at’s a really important and very unique skill set. So in large part, we’re acquiring the skills that would take us a lot longer to build if we were to do it organically. at is how we make that call.

Any space where you’ve got this high degree of urgency on technology development, the value of integrated capability is very, very high. In other words, a higher-level starting point so that I can rapidly get this battery lab up and running becomes very, very important. A core tenet of our value proposition is actually the openness of the system. Because of our customer’s urgency, they want a pretty complete solution-level capability, because they don’t have a lot of time and talent to put the systems together. ey also fully recognize, because of the speed of the market and the technology, the openness and exibility of the platform becomes very critical, because they can’t anticipate the new cell technology that they’re going to want to put in. ere are new innovations happening at module and pack level and battery control systems. So their system has to be able to be upgraded and expanded over time, and that’s our core value proposition. Open interfaces in so ware,

open interfaces in hardware, third-party components can be integrated. It’s not a bespoke system where the only way you can change it is to come back to us.

Recently, one of our battery supply customers, Northvolt, shared the criticality of owning their test strategy to achieve their sustainable goals. By working with an open technology partner like NI, they’re able to quickly implement the features they need in order to challenge the existing supply chain.

So having that integration capability is really important. And having a company at our scale that can deploy and support those kinds of systems all around the world is something that is really important to big automotive companies that are making a bet on EVs.

Q Charged: Can you talk about your test systems for other EV systems? Are you in the development lab for EV motors and power electronics? Are you in production testing?

A Eric Starklo : We’re a pretty ubiquitous kind of measurement platform—we do a little in all of those applications. e battery’s the biggest focus area. e next would be the inverter. A lot of this has to do with, “What are the most important technologies to our customers? Where are the critical things that de ne the performance of the vehicle?” at inverter system is really important, so we do both validation and production testing on the inverter system.

And then charging infrastructure as well. We’ve released a new capability fairly recently for charging infrastructure testing. You can imagine there’s some similar technology because to test a charger, you have to behave like a battery; to test a battery, you behave like a charger. It’s a little more complicated than that, but there is symmetry in the technologies. So that’s another application that we now serve with ramping volumes.

Accelerating the plan is especially important in a space like EVs, where the speed and the urgency of our customers is really high to get this technology ramped and at a high quality.

”

By Tom Lombardo

By Tom Lombardo

Thermal runaway occurs inside a battery cell through a fault, a crash scenario or some other defect that causes the cell to release thermal energy through chemical reactions. That thermal energy increases the temperature of the cell, the increased temperature drives faster kinetics, and more heat is released, further driving up the temperature.

Eventually, you can get to a tipping point and, essentially, the cell catches on re. ermal propagation occurs when that rst cell in thermal runaway causes its neighbors to also tip over into thermal runaway, which then spills over into the cells next to them.

Speaking at the recent Charged Virtual Conference on EV Engineering, John Williams, Vice President of Technical Services at Aspen Aerogels, gave an excellent overview of cutting-edge techniques to delay or prevent thermal propagation scenarios.

First, a little background. In China, the standard for thermal propagation delay is ve minutes, explained Williams. What that means is that, from the moment of detection of a hazardous situation in the battery pack, you must have a ve-minute delay before there’s a dangerous situation in the passenger compartment. ose ve minutes allows the driver to nd a place to park, exit the vehicle, and get a safe distance away.

“A ve-minute thermal propagation delay is essentially the table stakes now for manufacturers of electric vehicles,” said Williams. “As electric vehicles become more common, that ve minutes will almost certainly ratchet up to longer durations until, eventually, we would reach the promised land of having no thermal propagation at all.”

e ultimate goal is that one cell can go into thermal runaway and that’s it. It will be a maintenance event and

not a safety event. But we’re not there yet, and Williams explained why.

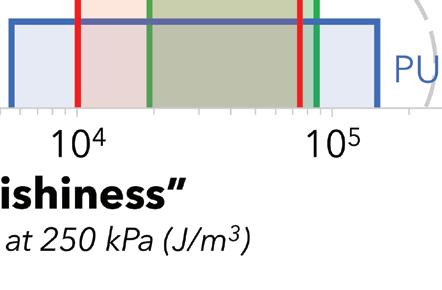

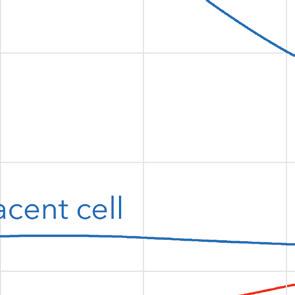

e physics of thermal propagation involve multiple pathways for heat to transfer from a cell in runaway to its neighbors, Figure 1. e rst and most important is cellto-cell conduction, and Williams is an expert in this particular pathway. Aspen Aerogels manufactures a barrier material, called Pyro in, designed to prevent cell-to-cell conduction. But that is not the only thermal pathway. ere is also gas release, both primary combustion, in which the reactants come from within the cell, and secondary combustion, in which the fuel inside the cell reacts with the external environment. ese gas ows and reactions drive a lot of the behaviors inside a pack

Better C2C insulation extends time-at-temperature

Secondary combustion (internal & external reactants): depends on gas-management

during a thermal propagation event. ere are also hot particulates being ejected during the initial phase of the thermal runaway. ere are secondary conductive pathways, such as busbars, cooling plates and structural interconnects between cells. ese are essentially thermal bridges—conductive pathways around a cell-to-cell barrier. Also, heat may be transferred through natural convection across air gaps that allow hot gases to spread throughout the battery pack.

“Active cooling can help draw down the energy of a cell in thermal runaway,” explained Williams, “although many times you can’t count on it, especially a er a crash scenario.”

A thermal barrier material between the cells can reduce heat transfer through cell-to-cell conduction. Barriers in prismatic and pouch packages serve two purposes: mechanical and thermal. e ideal barrier acts as both a mechanical compression pad and a thermal insulator, but there’s a trade-o : materials that make very good compression pads o en provide little thermal resistance, and those that act as good thermal and gas barriers tend to be

“A fi ve-minute thermal propagation delay is essentially the table stakes now for manufacturers of electric vehicles.”Figure 1: Heat transfer mechanisms during a thermal runaway

too sti to serve as compression pads.

Cells will swell as they age, and breathe as they go through charge-discharge cycles. Compression pads absorb the resulting cell movement. Swelling with age occurs over extended time scales, but the breathing that occurs over a short time interval has to be absorbed by the cell-to-cell barrier in order to maintain consistent pressure. Polyurethane and silicone foams are very e ective compression pads, but, as low-temperature materials, they simply cannot withstand thermal runaway situations. ey may delay thermal propagation a bit, but rarely enough to achieve even the ve-minute standard, and certainly not more than that. A good barrier is a exible material that’s also capable of withstanding high temperatures. ose two attributes— exibility and high-temperature tolerance—are o en mutually exclusive.

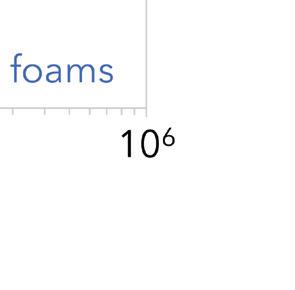

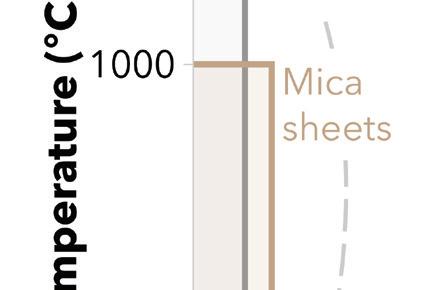

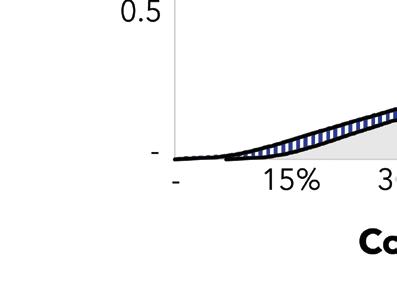

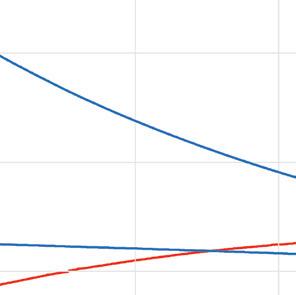

Figure 2 shows potential cell-to-cell barrier materials, with the Y-axis representing the maximum exposure temperature that a material can withstand and the X-axis indicating how much strain energy a material can absorb.

e right-hand side of the graph shows that materials commonly used as compression pads, such as silicone foams and polyurethane, can absorb a lot of strain energy, but their temperature tolerances max out around 100-300° C. On the le side of the graph, we see that metals and mica sheets are very resistant to high temperatures, but aren’t good at absorbing mechanical energy. e Holy Grail of barrier materials would reside in the upper-right corner of the graph, providing heat resistance ve times greater than silicone foam and mechanical absorption four orders of magnitude above that of mica sheets. According to Williams, Aspen Aerogels’ Pyro in ts the bill.

“ e universe of possible things that can live in that neighborhood is very, very small,” said Williams. “One of them is an aerogel such as our Pyro in, which is engineered speci cally to be a unitary material inside a cell-to-cell barrier, providing both the mechanical function of a compression pad and the thermal function of a re barrier.”

Aspen Aerogels has been in the aerogel business for more than 20 years, primarily focused on optimizing energy e ciency and passive re protection for industrial energy facilities. e company is now transferring its experience to the EV segment, with the goal of developing

The ideal barrier acts as both a mechanical compression pad and a thermal insulator, but there’s a tradeoff: materials that make very good compression pads often provide little thermal resistance, and vice versa.

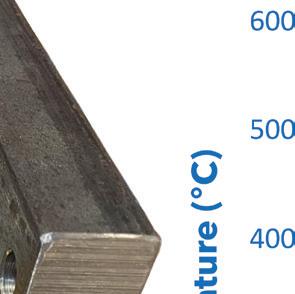

the world’s best cell-to-cell barriers. Aspen’s testing shows that a two-millimeter sheet of Pyro in material can withstand exposure to a propane torch at 1,000° C, and absorb the strain energy from cell breathing and swelling. Williams claims that Aspen’s aerogels are the thinnest insulating materials available, and that they o er the best possible thermal insulation properties.

An aerogel is produced when complex polymer chains of silica molecules form through a sol-gel process. is process is similar to making gelatin, but using silica and ethanol instead of sugar and water. A wet phase of suspended silica starts out with the viscosity of water; in about two minutes, the suspension turns gelatinous. In the process, the silica self-assembles into long polymeric chains, which house tiny nano-pores.

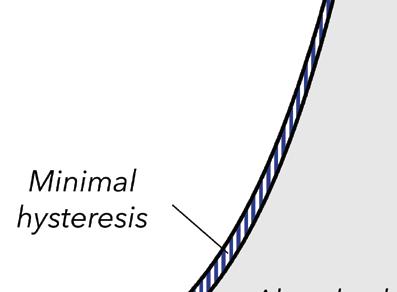

“ at nano-porosity is the secret in an e ective thermal insulation material,” said Williams. “An aerogel’s pores are 10,000 times smaller than that of any other insulation material. In that four orders-of-magnitude di erence,

the physics completely changes. Now you have a material that has a thermal conductivity lower than still air, which means that when you compress it and squeeze out the air, the thermal conductivity can actually get better, [see Figure 3]. Under the same conditions, almost every other insulation material will get worse.”

Figure 4 shows the relationship between compressive stress and strain—the area under the curve represents the amount of strain energy the material can absorb reversibly. Williams says that Aspen’s newer M-grade materials will continue to absorb strain energy over the life of a vehicle with minimal compression set or fatigue.

“An aerogel’s pores are 10,000 times smaller than that of any other insulation material. In that four ordersof-magnitude difference, the physics completely changes.”

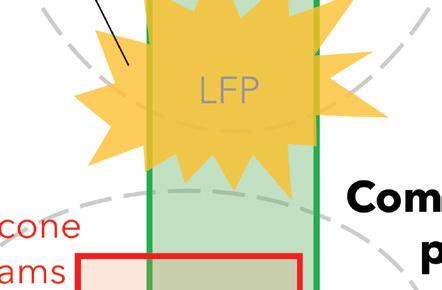

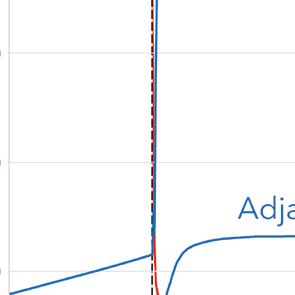

To test how materials behave during a thermal event, Aspen’s engineers subject the materials to mini-module testing. For example, they put a thermal barrier between two cells and triggered one cell with a heating pad to see if the barrier would prevent thermal propagation from one cell to the other.

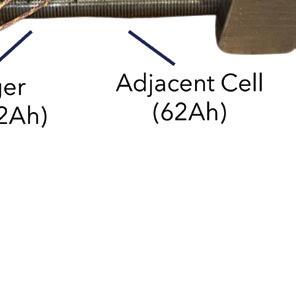

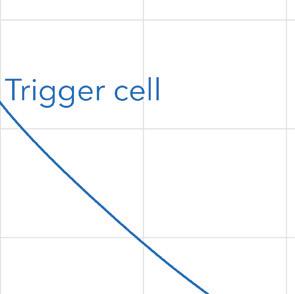

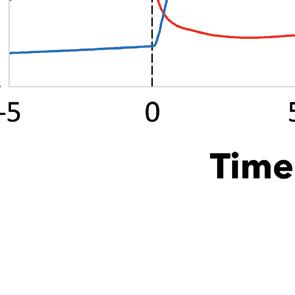

e test setup in Figure 5 includes two o -the-shelf prismatic cells compressed inside of a jig, allowing the experimenters to control the cell-face pressure. e pressure at the end of a cell’s life tends to be higher than at the beginning of its life, so Aspen conducts a worstcase scenario test by arti cially creating higher pressure inside the jig. e graph on the right shows that the elevated temperature of the trigger cell (right) is absorbed by the barrier material, keeping the temperature of the adjacent cell (le ) at a safe level.

is mini-module experiment has limitations, however. In a real battery pack, other pathways—secondary conduction, hot particulates and convection—also a ect the system. is test merely demonstrates that thermal

runaway can be stopped at the cell-to-cell level, allowing designers to focus on isolating the other mechanisms. Pyro in has about the same density as urethane foam, but the latter isn’t a thermal barrier. Urethane foam coupled with a thermal barrier will typically be heavier than a comparable part that’s made with Pyro in alone. Because Pyro in is both lighter and thinner than other thermal/mechanical barriers, battery designers can pack more cells into the same space, increasing vehicle range.

Apsen’s customers include General Motors, which has chosen PyroThin as the cell-to-cell barrier for Ultium, the modular battery and drivetrain platform that will power more than 30 new EV models.

Aspen concentrates on Li-ion cells in prismatic and pouch packages because the aerogel material naturally lends itself to at, rectangular objects. In cylindrical cells, the interstitial space is a lot more complex, so other materials may perform better than Pyro in as cell-to-cell barriers. In those situations, Williams says that Pyro in is still suitable for pack covers, sidewall covers and other at geometries.

Some of the company’s customers have successfully used Pyro in with lithium-metal batteries, which tend to burn hotter than Li-ion cells, sometimes reaching 1,200 to 1,400° C. Lithium-metal batteries employ di erent grades of Pyro in, depending on the temperature requirement.

Aspen Aerogels currently o ers consulting services through its global engineering support team, which includes engineers in Asia, Europe and North America who will answer questions about battery pack and barrier designs. e company’s customers include General Motors, which has chosen Pyro in as the cellto-cell barrier for Ultium, the modular battery and drivetrain platform that will power more than 30 new EV models.

To learn more about thermal barriers, check out Aspen Aerogel’s presentation at the Charged Virtual Conference: ChargedEVs.co/AA-Webinar