BUILD BIG

TANK FLEET GROWS AGAIN TO MEET RISING DEMAND

GETTING TO WORK ON 2025 REGULATIONS

ENERGY TRANSITION ENERGISES TERMINALS SERVICE PROVIDERS CATCH UP

THE INFORMATION SOURCE FOR THE INTERNATIONAL DANGEROUS GOODS PROFESSIONAL SINCE 1980 MONTHLY MAY 2023

IN PARTNERSHIP WITH TSA Tank Storage Associa on

Globe Sales Contact:

NO.159 Chenggang Road, Nantong, Jiangsu, China 226003

Tel: +86-513-85066022 (Sales)

+86-513-85066888 (Switchboard)

www.cimctank.com

E-mail: tanks@cimc.com

Europe Sales Contact:

Middenweg 6 (Harbour nr.397-399) 4782 PM

Moerdijk , The Netherlands

Tel: +31 880 030 860

www.cimctankcontainers.nl

E-mail: info@cimctankcontainers.nl

AFTER SALES DEPOT SERVICES

CIMC SAFEWAY TANK SERVICE CO., LTD.

MANUFACTURE SERVICE TECHNOLOGY

BURG SERVICE B.V.

Middenweg 6, 4782 PM, Moerdijk, The Netherlands

Tel: +31 88 00 30 800

Fax: +31 88 00 30 882

www.burgservice.nl

E-mail: info@burgservice.nl

CIMC SAFE WAY TANK SERVICE (Jiaxing) CO., LTD.

No. 318 , Washan Road, Port Authorities, Jiaxing, Zhejiang Province, China 314201

Tel: +86 15806290956

E-mail: ning.li@cimc.com

CIMC SAFEWAY TANK SERVICE (Lianyun gang) CO., LTD.

Safety and Environmental Management Center, Xuwei New Chemical Park, Lianyungang, Jiangsu, China 222047

Tel: +86 13814742170

E-mail: lichunfeng@cimc.com

TECHNOLOGY

Telematics

Tankmiles

Tel: +86 15262722292

www.tankmiles.com

E-mail: tankmiles@cimc.com

Cleaning Maintenance Testing Repair Modification Data Collection Global Monitoring IOT Platfrom Digital Display Sensor Temperature Pressure Liquid Level ··· Temperature Control E-heating System Glycol Refrigeration & Heating System

Tank Container Manufacture After Sales Depot Services Smart Devices BUSINESS

PORTFOLIO

EDITOR’S LETTER

The move towards a decarbonised world is accelerating fast. Our annual review of storage terminal expansion projects, featured in this issue, reveals just how large a proportion of operators’ capital investment is targeted at projects that will enable them to play a role in delivering new energies to consumers, especially in the more developed industrial markets. Northern Europe in particular is awash with new plans, often supported – or even driven – by port authorities keen to play a role in helping their countries, their clients and themselves meet the targets and priorities set by the Paris Agreement and the UN’s Sustainable Development Goals. But it is not just Europe where the action is. There are several major projects in the Gulf coast states of the US, where low-carbon and renewable sources of energy can be used to create new fuels that, with carbon capture and re-use/ sequestration, can be zero-carbon themselves. West coast states are also very keen on renewables. And new projects are coming forward in other areas of the world, including southeast Asia

As has been pointed out in these pages before, established storage terminal operators will often find themselves in the right place to meet the new demand for the movement of new energy streams, as the customers for decarbonised energy will largely be the same as those for traditional hydrocarbon energy; that does not mean that changes will not have to be made, nor that the sources of those new energies will be in the same part of the world as hydrocarbon resources – though in fact some of them are, especially those oil producing parts of the Middle East and North Africa that are also blessed with regular sunshine.

What strikes me about the way that things are moving is that the new supply chains for hydrogen, ammonia, methanol and the other energy vectors being touted as the future are being developed in an holistic way. In this they mirror the original development of the LNG business, where pretty much all projects were inaugurated with the collaborative participation of producers, consumers, terminals and shipping interests.

Now, in very much the same way, new energy projects involve not only the upstream producers (and, where relevant, the suppliers of raw feedstock) and the receivers but also those providers of storage capacity at either end, shipping companies and distributors to move the product to the end user. That final leg may follow on from a conversion point, for instance when ammonia or an LOHC is used to ‘carry’ hydrogen in a more stable form.

Likewise, those who will be involved in the downstream distribution of clean energy are looking to get their own decarbonisation projects going. After all, there is no point in moving carbon-free or low-carbon energy halfway around the world if the final leg relies on transport fuelled by old-fashioned hydrocarbons. Shipowners, both in the shortsea and inland sectors, are already investing in cleaner-burning vessels and road haulage companies, many of which are currently helping build the new downstream supply chains, are also buying new vehicles that can run on hydrogen, electricity or liquefied biogas. There are those out there who think the energy transition is a chimera; there are others too who think industry is not doing enough. Both are wrong – the future is already becoming apparent.

Peter Mackay

Peter Mackay

UP FRONT 01 WWW.HCBLIVE.COM

Wherever in the world hazardous materials are being manufactured, stored, transported, and used, CHEMTREC is available 24/7 to provide support needed to manage incidents.

We are always here, always ready, whenever and wherever you need us.

WWW.HCBLIVE.COM Fellow celebrants ILTA gets to 40 too 11 Prime mover Seaco and the tank container business 12 Change is a challenge Exis and its roots in HCB 14 Who calls the tune? TT Club and the role of insurers 16 DIGITISATION All over the world IMT’s solar-powered solution 20 On a mission Chemical Express rides the digital wave 22 Get connected Implico links truck to terminal 23 Keep on tracking Savvy extends connectivity 24 Caps get smart Packwise ready to roll 26 Get with the program ICHCA wants port harmonisation 28 STORAGE TERMINALS Dedicated to fuel Inter improves Gothenburg terminal 35 Building resilience Oikos responds to diesel changes 36 News bulletin – storage terminals 38 SUSTAINABILITY Pulling together Antwerp cluster targets CO² reductions 41 Deep in data Abbey finds the upside of lockdown 42 Better get ready ABS looks at the future for fuels 44 Flex those specs Stena Bulk reduces emissions again 45 Green river Batteries for barges 46 CHEMICAL DISTRIBUTION Rebooting Responsible Care Fecc offers tools for implementation 48 Editor–in–Chief Peter Mackay, dgsa Email: peter.mackay@hcblive.com Tel: +44 (0) 7769 685 085 Commercial Director Ben Newall Email: ben.newall@hcblive.com Tel: +44 (0) 208 371 4036 HCB Monthly is published by Cargo Media Ltd. While the information and articles in HCB are published in good faith and every effort is made to check accuracy, readers should verify facts and statements directly with official sources before acting upon them, as the publisher can accept no responsibility in this respect. Cargo Media Ltd Marlborough House 298 Regents Park Road London N3 2SZ Campaigns Director Craig Vye Email: craig.vye@hcblive.com Tel: +44 (0) 208 371 4014 Production Manager Binita Wilton Email: binita.wilton@hcblive.com Tel: +44 (0) 208 371 4041 Managing Editor Stephen Mitchell Email: stephen.mitchell@hcblive.com Tel: +44 (0) 208 371 4045 Designer Jochen Viegener ISSN 2059-5735 www.hcblive.com Incident Log 58 Master plan Labelmaster gets the data straighter 60 News bulletin – safety 62 REGULATIONS Testing, testing GHS experts stay in line 64 BACK PAGE Not otherwise specified 72 NEXT MONTH North America special issue - Storage terminals - Land transport - Inland waterways - Regulations 50+ YEARS assisting the hazmat and dangerous goods industry Learn more at chemtrec.com/hcb Our Worldwide Services Emergency Response • L1 Emergency Phone Number • (Local and Global) • L2/L3 Services Battery Compliance • L1 Emergency Response • CRITERION® Battery Test Summary Service • Online Training Incident Reporting • 5800 Form • Incident Report Distribution Consulting Solutions • Crisis Management • Business Continuity SDS Solutions • Access • Distribution • Authoring • Indexing Training • Online Hazmat Training By the NUMBERS 24X7 WORLDWIDE SUPPORT CUSTOMERS IN 120+ COUNTRIES SUPPORT 14,000+ GLOBAL BUSINESSES ANNUALLY HANDLE OVER

CALLS AND

MEDICAL CALLS COVER ALL 9 CLASSES OF HAZARDOUS MATERIALS INTERPRETER SERVICES FOR 240+ LANGUAGES

100,000

4,000+

Managing Editor

Peter Mackay, dgsa

Email: peter.mackay@chemicalwatch.com

Tel: +44 (0) 7769 685 085

Advertising sales

Sarah Smith

Email: sarah.smith@chemicalwatch.com

Tel: +44 (0) 203 603 2113

Publishing Manager

Sarah Thompson

Email: sarah.thompson@chemicalwatch.com

Tel: +44 (0) 20 3603 2103

Publishing Assistant

Francesca Cotton Designer

Petya Grozeva

Chief Operating Officer

Stuart Foxon

Chief Commercial Officer

Richard Butterworth

CW Research Ltd Talbot House Market Street Shrewsbury SY1 1LG

ISSN 2059-5735

www.hcblive.com

HCB Monthly is published by CW Research Ltd.

While the information and articles in HCB are published in good faith and every effort is made to check accuracy, readers should verify facts and statements directly with official sources before acting upon them, as the publisher can accept no responsibility in this respect.

©2023 CW Research Ltd. All rights reserved

UP FRONT 03 WWW.HCBLIVE.COM CONTENTS VOLUME 44 • NUMBER 05 Battery safety in the maritime world 57 News bulletin – safety 58 REGULATIONS Out of the blocks Joint Meeting starts work on RID/ADR/ADN60 BACK PAGE Not otherwise specified 68 NEXT MONTH Chemical tanker fleet review Chemical distribution in Europe Digitalisation projects Sustainability and new energies UP FRONT Letter from the editor 01 30 Years Ago 04 Learning by Training 05 TANKS & LOGISTICS Whole lotta tanks ITCO survey shows yet more growth 07 Back and forth Passing the tank baton at Leschaco 14 Out into the world Talke plans for international growth 18 Special delivery Sahreej handles tank for Teal 20 Quick update Kube & Kubenz adds to tank storage 22 News bulletin – tanks and logistics 24 STORAGE TERMINALS The next steps Annual review of terminal expansions 28 Pressing on Advario finds room in Rotterdam 40 Bright ideas New projects from Exolum 42 The big pay-off Odfjell benefits from digitalisation 43 It’s a start HEH offers stepping stone 44 Robot reboot Square Robot aims for low-flash applications 46 Eyes in the skies Leak detection by drone 47 News bulletin – storage terminals 48 TSA Insight The quarterly magazine of the 43 Tank Storage Association NEW ENERGIES Cleaner sailing Wärtsilä’s engines for decarbonisation 50 H2 to go Floating hydrogen terminals by Provaris 51 News bulletin – new energies 52 COURSES & CONFERENCES Conference diary 55 SAFETY Incident Log 56 Not on our watch

30 YEARS AGO

A LOOK BACK AT MAY 1993

THIRTY YEARS AGO, the grand plan for regulatory harmonisation was beginning to come together. The UN Committee of Experts on the Transport of Dangerous Goods (which later became the Sub-committee of Experts once it had to share space with the GHS experts) had finalised the eighth revised edition of the UN Model Regulations in December 2022 and the modal authorities – ICAO, IMO and RID/ADR – were working hard to align their various modal rulebooks with the new edition on the same day, 1 January 1995.

That process was not without its problems, however. In particular, a great deal of the UN Committee’s work over the previous biennium had involved a revision of Chapter 9 of the Orange Book, which covered packaging. Since the previous revision in 1982, the UN package performance testing scheme had become mandatory around the world and it was expected that the intervening decade would have raised serious deficiencies. In the event, few problems had been encountered.

However, as Martin Castle, then chief officer, dangerous goods at Pira, the UK’s packaging certification competent authority, explained, transposing those new provisions into the modal regulations was proving problematic. Legislation for national quality assurance programmes would have to be put in place; the concept of ‘test report’ still had to be defined; there was a lack of guidance on drop tests and ‘cold drop’ tests; there was no specific size for packaging markings; the position regarding remanufactured drums required clarification; and there was no allowance for boxes to feature holes. Clearly the path to modal and international harmonisation was going to be a long one.

In the UK, planned implementation of ADR in 1995 was raising the spectre of additional costs for operators, especially in terms of the replacement of non-UN certified packagings. The issue was highlighted by the British Chemical Distributors and Traders Association (BCDTA), now the Chemical Business Association (CBA). Ironically, perhaps, nearly thirty years after the UK joined in with other countries in Europe in applying ADR to domestic transport, CBA was lobbying hard on behalf of its members to persuade the British government to provide assistance in complying with new requirements imposed as a result of Brexit.

Industry – and not just in the UK – was facing another emerging cost in the 1990s as a result of growing pressure (and legislation) to reduce the volume of emissions of volatile organic compounds (VOCs) during product transfer operations. At the time there were several different technologies being developed, variously suitable for use in bulk liquids storage tanks, at marine docks, at road tanker loading points and at fuelling stations. These now seem normal but back then the world was a rather different place.

Or maybe not. The May 1993 issue of HCB had an interesting item reporting on a call from the US National Transportation Safety Board (NTSB) for tougher inspection programmes for the nation’s 104,000-strong fleet of rail tank cars. NTSB had realised that hydrostatic and visual testing at arbitrary intervals was not an effective way to detect structural defects, which had been responsible for 41 of the 91 accidental releases of hazmat from rail tank cars in the five years to 1991. There were changes but, as the recent incident in East Palestine, Ohio demonstrates, regulators have failed to completely remove the risk of releases.

04 HCB MONTHLY | MAY 2023

LEARNING BY TRAINING

by Arend van Campen

TANK TERMINAL SUSTAINABILITY: CAN INFORMATION THEORY HELP US REACH OUR GOALS?

THE QUESTION IS no longer: is it sustainable? But: how can we ensure non-harmful functionality?

StocExpo was back in 2023 with two separate conference streams, one exploring big picture tank storage, and the other on health and safety and the practicalities of terminal operations.

On day two of the Terminal Operations and Safety conference stream, Arend Van Campen, founder of the Tank Storage Sustainability Initiative and Tank Terminal Training spoke about how tank terminals can realistically minimise their social and environmental impact using information theory.

Here’s a taster…

It’s incredibly hard for the tank storage sector to minimise its impact on the environment in a significant and wholesale way. There are different levels of regulation, infrastructure, and desire to tackle the environmental impact of tank terminals from country to country. But even on an individual level, sustainability represents a huge challenge to terminal operators.

This is partly because most individuals understand sustainability in a very shallow way. We want more green technology, we want to reach the slightly abstract goal of Net Zero, but predicting all the knock-on effects and consequences down the line is beyond most of us.

The fact of the matter is that sustainability is an extremely complex goal with lots of moving parts. Small tweaks to complex systems can have a colossal and almost unpredictable impact; that impact can be positive, but it is just as likely to be negative if done without an eye on the bigger picture.

Tank terminal operators need to therefore conceptualise sustainability in terms of information theory. Information theory is the

study of the quantification, communication and storage of information. It has been instrumental in NASA’s Voyager mission, the creation of the internet, and the viability of mobile phones. Similarly, information theory can have a profound impact on tank terminal sustainability.

With an information theory-led approach, tank terminal sustainability becomes far easier to understand and measure, and therefore far easier to manage and improve. At StocExpo 2023, Arend explained how information theory points towards a new approach to technology, seeking non-harmful functionality over simply reducing the impact of normal tank terminal processes.

With this new approach, it becomes much easier to say what is actually achievable in terms of sustainability, and also produce a roadmap to achieve it. I simply apply the two laws of thermodynamics to test functionality within the limitations of reality (Realimiteit) a.k.a. the natural boundaries of and for functionality which can only be ‘steered’ and ‘navigated’ with information. Our reality no longer consists of only matter and energy, but also of information.

World-leading experts from a variety of fields joined Arend in speaking at StocExpo in Rotterdam this March. The event also hosted hundreds of industry-leading organisations from across the world, many of whom were launching new technologies and products or announcing company updates to the international audience.

And Arend elaborated more about the natural and scientific criteria for non-harmful functionality of all man-made systems.

This is the latest in a monthly series of articles by Arend van Campen, founder of TankTerminalTraining, who can be contacted at arendvc@ tankterminaltraining.com. More information on the company’s activities can be found at www.tankterminaltraining.com.

UP FRONT 05 WWW.HCBLIVE.COM

TAILORED LOGISTICS.

On proven paths and new ways.

As one of the world‘s leading logistics services providers in handling and transporting liquid products, we are the first point of contact for the chemicals, gas, mineral oil and foodstuffs industries. By road, rail and sea, from road tankers to IBCs, from equipment leasing to intelligently networked Smart Tanks, we will find the optimum solution for you. We do this by using our expertise to pioneer our own new pathways that take you forward in a customised way. How can we help you?

www.hoyer-group.com

06 HCB MONTHLY | MAY 2023

WHOLE LOTTA TANKS

FLEETS • GROWING DEMAND FOR TANK CONTAINERS MADE 2022 A GOOD YEAR FOR ALL THOSE IN THE BUSINESS, ACCORDING TO ITCO’S LATEST FLEET SURVEY. CAN THOSE GOOD TIMES CONTINUE?

EVER SINCE THE International Tank Container Organisation (ITCO) began collating its annual Global Tank Container Fleet Survey, records seem to tumble every year. This should come as no surprise, as HCB found much the same when it carried out its own annual attempt to put numbers to the anecdotal evidence.

This year, for instance, ITCO reports that the global tank container fleet reached a total of 801,800 units by the start of 2023, up by 8.65 per cent compared to the figure of 737,935 recorded a year earlier; tank manufacturers produced 67,865 units during the year, another record figure and more than 27 per cent higher than in the previous year.

Tank containers are, it seems, in great demand; they have benefitted more than any other mode of transport for liquid cargoes from the disruption to supply chains caused by the rolling Covid-related lockdowns, the war in Ukraine, global recessionary and

inflationary pressures, and volatility in end user demand and prices that have all played their part.

For instance, during the height of the Covid pandemic, port and terminal closures in different parts of the world at different times (as well as the closure of the Suez Canal

during the Ever Given grounding) caused backlogs into and out of major ports; receivers could not be certain when their next consignment would arrive, prompting them to bring in buffer stocks that, in many cases, were kept in the tank containers in which they arrived. This was good news for tank container operators, who saw their income levels boosted by demurrage payments, and also for manufacturers who enjoyed more confident newbuild orders. Leasing companies also did well, being able to offer operators the tanks they needed at short notice.

WHO’S GOT THE TANKS?

As a result of those trends, the number of tank containers in the fleets of operators (both

GLOBAL TANK CONTAINER FLEET (AT START OF YEAR)

TANKS & LOGISTICS 07

2019 2020 2021 2022 2023 Operator fleets 381,750 418,500 443,110 489,895 568,760 Lessor fleets 286,000 305,615 316,710 322,950 360,925 Other fleets* 180,165 188,010 199,140 211,285 199,110 Total fleet 604,700 652,350 686,650 737,935 801,800 Year-on-year growth (%) 10.8 7.9 5.3 7.3 8.7 TABLE

*shipper, military and other Source: ITCO WWW.HCBLIVE.COM

1

owned and leased in) increased by 28.4 per cent to 568,760; the total fleet owned by lessors increased by 11.8 per cent to 360,925 but the number of tanks on lease to operators, shippers and other interests increased by 14.0 per cent to 323,995 as the number of idle tanks dropped.

Oddly, perhaps, the number tank containers owned and leased by other parties, including shippers/beneficial cargo owners, the military, railway companies and the oil and mining industry, actually fell over the course of 2022. ITCO also offers an estimate of the number of tanks that were scrapped over the year; it suggests an increase over the previous year to 4,000 units, though this is well down on the figures reported a few years earlier. While there are now a lot of older tanks still in operation that might be heading for scrap, the high level of demand seen last year made it viable to keep these tanks working, despite

age-related problems and, usually, a higher tare weight compared to newer tanks. It has also become more attractive to remanufacture old tanks, given the high prices of newbuilds at present, reflecting both the level of demand and the price of steel.

This year’s survey, to no great surprise, shows that tank container manufacturing is even more concentrated in China, with CIMC Safeway still accounting for more than half of all new tanks built last year. JJAP doubled production in 2022 to keep up with demand and the other major producers also increased output. Overall, Chinese manufacturers were responsible for just over 90 per cent of new tanks in 2022, though Welfit Oddy in South Africa was also able to take advantage of demand with a 25 per cent increase in output.

In the list of major operators, there are a few moves this year, with Hoyer taking over second spot in the rankings from NewPort, though still well behind the leader, Stolt Tank Containers. Den Hartogh has overtaken Bulkhaul into sixth position in the list but, given its pace of expansion, Malaysia-based E-Way may well leapfrog them both by the time next year’s ITCO survey is produced. Further down the rankings, UK-based Bulk Tainer Logistics has seen a substantial growth in its tank container fleet over the past five

TANK CONTAINER MANUFACTURER OUTPUT

08 HCB MONTHLY | MAY 2023 C M Y CM MY CY CMY K

2018 2019 2020 2021 2023 CIMC Safeway 29,500 27,000 18,000 29,525 34,000 JJAP 1,500 3,310 3,000 5,600 11,250 Nantong Tank 8,500 8,500 6,000 9,000 10,250 Singamas 5,500 3,500 1,300 2,150 3,000 Dalian CRRC 3,600 2,000 2,800 1,510 2,115 CXIC 2,500 2,000 500 750 Welfit Oddy 4,850 5,150 2,200 4,000 5,000 Van Hool 750 680 500 500 500 Other manufacturers* 3,000 3,000 1,500 1,000 1,000 Total 59,700 54,650 35,800 53,285 67,865 TABLE 2 *estimate Source: ITCO

Tailor made tank container solutions

Telematics

Telematics solutions for enhanced product traceability and supply chain management.

Sustainable Solutions

Sustainable solutions for reducing the carbon footprint of ISO tank operations.

Fleet Management

Fleet management services for reduced operational costs.

24/7

Fleet info

24/7 Cloud-based accessibility to fleet information and documentation.

Advice

Expert advice on product compatibility.

With more than 30 years experience in ISO container tank leasing, Peacock offers global availability of standard and special ISO tanks for a wide variety of petrochemicals, liquid food products, bitumen, liquefied gases and cryogenic gases.

10 HCB MONTHLY | MAY 2023

Swap body Standard

Specialized

Bitumen Cryogenic Gas RENTAL • LEASING • SALES Singapore The Netherlands China USA info@peacock.eu www.peacockcontainer.com www.tankcontainer-sales.com 2023

MAJOR TANK CONTAINER OPERATOR FLEETS (START OF YEAR)

years, while Lanfer Logistik has also seen a significant expansion in its tank fleet in the past two years.

The full list of operators with more than 1,000 tanks in the ITCO survey, includes yet more new names, mainly in Asia and often offering niche services. Perhaps as a result of that, the top ten operators at the start of 2023 accounted for 50.5 per cent of the total number of tanks in operators’ fleets; the comparable figure a year earlier was 54.4 per cent.

Among the leading lessors, sister companies Eurotainer and Raffles Lease would top the rankings were their fleets to be combined but, separately, they still lag some way behind Exsif Worldwide and, in Raffles’ case, also behind Seaco Global and CS Leasing. However, Raffles Lease added nearly 10,000 tanks to its fleet last year, taking it ahead of GATX-owned Trifleet Leasing. Peacock Container has also witnessed substantial growth in its fleet since its acquisition by investment fund manager Arcus Infrastructure Partners and its takeover of GEM Containers in early 2021. The leasing

TANKS & LOGISTICS 11

2019 2020 2021 2022 2023 Stolt Tank Containers 39,156 40,500 40,330 43,000 47,000 Hoyer 33,881 34,700 35,500 35,500 39,900 NewPort 31,800 32,000 37,500 37,500 38,500 Bertschi 23,300 25,000 26,400 28,300 31,100 China Railway 20,879 20,879 23,200 27,500 27,500 Den Hartogh 20,000 20,000 20,000 23,000 24,500 Bulkhaul 22,500 23,000 24,000 24,000 23,000 Intermodal Tank 13,500 17,000 17,000 19,000 20,000 E-Way 6,000 9,000 14,000 20,000 NRS Ocean Logistics 11,683 11,820 12,200 14,700 15,750 Suttons International 8,500 9,000 9,500 14,115 13,900 Eagletainer 8,860 10,120 10,500 12,000 12,800 Bulk Tainer Logistics 2,654 2,654 5,350 8,735 10,250 Nichicon 8,000 8,000 9,000 10,000 10,000 M&S Logistics 8,050 8,400 8,443 9,365 9,725 JOT Japan Oil Transport 9,000 Lanfer 1,200 1,200 1,200 8,500 8,500 TABLE 3

WWW.HCBLIVE.COM

Source: ITCO

sector is more concentrated than the operator market, with the top ten lessors accounting for some 83 per cent of the total lessorowned fleet.

TAKE THIS MODEL FORWARD

Optimists in the tank container industry are now looking back at the past three years and hoping that the critical role played by tanks in ensuring that critical products kept moving will have an impact on the next round of contracting. ITCO says that some of its tank operator members do report that they are seeing a greater emphasis on the part of shippers of the value of relationships as a way to ensure a dependable supply of tanks and negotiations are less focused on price. After all, tank containers enabled shippers and receivers to move from the embedded ‘just-in-time’ model to a ‘just-in-case’ approach during the supply chain disruption; this certainly drove more cash into the tank operators’ pockets but the extremely

MAJOR TANK CONTAINER LESSOR FLEETS (START OF YEAR)

high prices being asked (and paid) were more a reflection of the prices being charged (and profits being made) by the liner shipping operators.

There is always talk of switching the balance of power between shippers and carriers; right now, carriers have the upper hand in the chemical tanker market, for example, but those who hope for the same in the tank container business may end up being disappointed – and not for the first time. Large numbers of tanks that had been in use for static storage during the pandemic have been coming back into the market and operators are suddenly finding themselves with a surplus of empty tanks just as recessionary pressures are cutting into volumes. Tank operators and leasing companies – as well as tank depots – are having to work very hard to maximise utilisation.

ITCO’s 2023 Global Tank Container Fleet Survey can be downloaded free of charge from the ITCO website at https://international-tankcontainer.org/storage/uploads/ITCO_2023_ Global_Fleet_Report-1.pdf.

12 HCB MONTHLY | MAY 2023

2019 2020 2021 2022 2023 Exsif Worldwide 58,500 64,000 66,476 71,350 70,000 Eurotainer 48,000 48,500 49,500 51,500 55,000 Seaco Global 43,000 42,000 43,000 42,000 43,000 CS Leasing 10,120 15,500 18,030 23,450 29,150 Raffles Lease 13,240 15,100 16,000 20,500 30,000 Trifleet Leasing 16,100 17,784 19,031 20,190 22,360 Peacock Container 3,900 6,250 7,500 17,500 20,000 GEM Containers 9,200 9,800 11,500 Triton International 13,500 12,500 13,000 11,400 12,200 Albatross Tank Leasing 9,500 9,500 7,500 9,500 9,900 TWS Tankcontainer 8,360 8,300 7,465 7,660 7,690 International Equipment 6,000 6,000 7,100 7,600 8,150 NRS Group 7,000 7,000 7,000 7,000 5,000

TABLE 4

Source: ITCO

BACK AND FORTH

management did not take the decision to nominate our tank container division as a core business alongside our freight forwarding activities as early as the 1990s. We have lost precious years of growth.

HCB: You have grown the business unit from the first tank container in 1976. How does if feel now that you are passing it on to the next generation?

HW: Even if I was not active in our tank container business from the very beginning, it has been more than 30 years that I have been active in the area, the last 20 of which as managing director. It was not that easy for me to hand over this responsibility but, with Maximilian Nause as my successor and Katrin Behrens responsible for the procurement of our fleet, the new generation is ready and has already proven itself.

We often continue to exchange ideas and my advice is sought but the decisions are no longer mine. It was and is important to me that this business represents added value for Leschaco - that has always been the case over the past 20 years and I am convinced that this will continue.

HCB: What are the success factors in succession planning?

LESCHACO SHIPPED ITS first tanker on overseas trade in 1976. HCB spoke to Holger Warnecke (HW)(above, right), who looks back at more than 50 years’ experience in the industry, to discuss how the business has changed, and to Maximilian Nause (MN)(left), who took over responsibility for Leschaco’s tank container fleet in 2022 and gives some insights about the path of future growth.

HCB: What have been the major milestones in Leschaco’s tank container history?

HW: With the shipment of ten tank containers from BASF’s Ludwigshafen plant to New Orleans in November 1976, Leschaco was one of the pioneers in the development of the international transport of tank containers.

After years as a niche operator, in 2005 our owner and I set ourselves the goal of growing the business. Two figures illustrate the success of that ambition: in 2005 we had a

fleet of less than 600 tank containers but by 2018 it was more than 5,000 for the first time – now there are around 5,600.

We expanded geographically too. After the countries in Central Europe, the US and Japan from the early days, we are now active with tank containers in all countries in Asia, including India, as well as the Middle East, South Africa, Mexico and Brazil, to name just the major countries.

Finally, I would like to mention that, in the tank container business unit, we are also increasingly concentrating on the transport and fleet management of customer-owned tank containers, a field that fits perfectly with Leschaco’s worldwide freight forwarding and customs clearance activities.

HCB: Are there any specific decisions that you now regret?

HW: Not really, but I regret that our

HW: I thought about succession planning for key functions in my area of responsibility at an early stage - including my own succession. I consider it ideal and successful when young colleagues, who inevitably lack experience, are accompanied for a year and the outgoing manager is available to provide advice as needed. The personal connections that have grown over the years are worth their weight in gold, and passing on these connections to a successor cannot be done by passing on a cell phone number or e-mail address.

HCB: What about you, Maximilian, what have been the successes for you in the transition?

MN: The transition period was both challenging and exciting. One major key success driver is to take time to listen to your team about their expectations and concerns and learn from their experience. Communicate clearly with the team about

14

PROFILE • LESCHACO’S HOLGER WARNECKE LOOKS BACK ON THE DEVELOPMENT OF THE COMPANY’S TANK CONTAINER BUSINESS AS HE HANDS THE REINS OVER TO HIS SUCCESSOR

HCB MONTHLY | MAY 2023

common goals, and vision for the future. Holger was a great mentor during the transition period, who helped me to navigate any challenges and granted access to his well-established network. He was always transparent and never withheld information that would let me understand business processes quickly.

In addition, it’s important to take ownership of the new role and responsibilities. This means being accountable for actions and decisions, as well as taking responsibility for the outcomes of my team. Don’t be afraid to take decisions, always strive to learn and improve. Lead by example and demonstrate the behaviours and values you want to see from your team. Finally, stay positive during the transition period. Even if there are challenges or setbacks, maintain a positive attitude.

HCB: What have been the biggest changes in the tank container market in the past 40 years?

HW: As everywhere in freight forwarding, IT solutions have made administrative processes more efficient for tank container transports. But the greatest changes have been seen in the tank container itself. The first 20 years were characterised by engineering work to adapt the tank container to all user requirements. Major challenges were encountered with the first polyurethane insulation that released fluorocarbon, which led to stress corrosion, to name just one example of many.

While in the first 25 years the manufacture of tank containers was mainly in Europe, the standard tank container has been built almost exclusively in China for the past 15 years and prices have fallen by more than half during that time.

What remains unchanged, however, is that the goods in the tank container are to be transported from the producer to the consignee using various modes of transport.

HCB: Looking to the future, what topics are at the top of your agenda?

MN: Our people. People are priority at Leschaco and we invest heavily in a professional and personal growth mindset to become an exceptional place to work. We deploy training exchange programmes and online, on-demand e-learnings, regular professional webinars taking place and trainers have just started to travel around the Leschaco offices to spread tank container knowledge across our teams.

We develop green product solutions to strengthen our position on the decarbonisation of supply chains. Driven by corporate green logistic targets, we recognise a conversion from, for example, flexibags and drums to tank containers. This will add to our growth potential in the years to come.

Leschaco supports the defined UN sustainability goals and recently achieved Ecovadis silver status again.

Most notably for sensitive products, real-time tracking and transparency along the customer’s supply chain is demanded so telematics, standardised data exchange and the integration of the vendor environment are Leschaco’s key drivers to provide end-to-end visibility in the future.

We are investing in fleet management systems and deploy a digital customer platform to increase transparency of information. New technologies such as Artificial Intelligence and machine learning algorithms are applied to improve the overall efficiency and reduce operational costs of the business. Tank container operators must have a clear strategic direction for their digital transformation to generate competitive advantages in the future.

We are growing our fleet size significantly and increasing fleet diversity, aiming to be one of the leading deep sea tank container operators in the market as part of our strategy roadmap 2030.

HCB: How does Leschaco differentiate itself from others?

TANK & LOGISTICS 15

WWW.HCBLIVE.COM

LESCHACO’S STRATEGY FOR THE REMAINDER OF THIS DECADE AIMS TO SEE IT BECOME ONE OF THE LEADING DEEPSEA TANK CONTAINER OPERATORS

MN: We strive to become a leader for customised supply chain solutions by offering integrated logistics services and a full stack product portfolio. We combine tank container operations with complex inland haulages including heating, customs clearance and related freight forwarding services. Aside from being a tank container operator, Leschaco is active in the fields of sea and air freight and contract logistics, where we operate warehouses, including storage capabilities for hazardous products in key markets. In cooperation with our corporate venture Logward we offer 4PL control tower and supply chain management solutions.

We continue to enhance our global presence in key and new markets by leveraging our expertise in chemicals and dangerous goods, and for other demanding industries. Today we operate our own Leschaco offices in almost every important market in the world by using a uniform IT framework worldwide which leads to high data quality standards.

HCB: Clearly Leschaco still believes in the tank container. What is the growth direction compared to other business models?

MN: The owner family believes in the tank container business model and continues to support an expansion in the coming years. The market is expected to continue growing steadily until 2030, driven by a combination of factors such as technological advancements and integrations, stricter environmental and safety regulations, and intra-regional market developments. To remain competitive and successful in a volatile market, Leschaco follows a strategy roadmap 2030, which focuses on innovation, fleet optimisation, and the ability to adapt to changing regulations and regional dynamics. The company strives for significant growth in the tank container segment in the years to come.

HCB: How do you assess the risk that shipping lines may invest in tank container operations?

HW: In the early years of the deepsea tank container business, some regional shipping lines, but also Hapag-Lloyd, acquired their own fleets; however, they all eventually stopped their activities in this field. Tank container transports require an infrastructure that cannot be equated with box container transports, and the expense is too great for shipping lines from my point of view. It would be conceivable that a shipping line with its currently outstanding profits would come up with the idea of buying a tank container operator, but whether the customers would honour this, I have my doubts as this operator would concentrate its shipments to one shipping line. MN: The shipping lines would need to conduct a thorough feasibility study to assess the risk of investing in tank container operations. The limited market potential and economies of scale, fragmented infrastructure, the need for highly knowledgeable operators, and related systems create a high market barrier. Of

course, high profits in the last two years as well as the new integrator approach can lead to some speculations.

HCB: Will there be consolidation among tank container operators?

HW: I don’t see any wave of consolidation in the near future. Many operators are in private hands and takeovers are generally more difficult. Look at Leschaco – our tank container activities represent one of five core business areas and can hardly be sold in isolation.

MN: Most of the global leading tank container operators are privately owned. They are driving their own strategic direction and focusing on sustainable, organic growth so we therefore do not foresee major M&A activities. Although the global tank container fleet has grown by around 10 per cent per year in the last 10 years, we see the number of tank container operators has more than doubled. This can likely lead to a consolidation among less competitive, niche operators which have missed the market development recently.

www.leschaco.com

16 HCB MONTHLY | MAY 2023

IN RECENT YEARS LESCHACO HAS INVESTED IN A SIGNIFICANT EXPANSION OF ITS TANK CONTAINER FLEET, WITH FURTHER GROWTH EXPECTED IN THE COMING YEARS

MAKE SMART CHOICES WHEN CARRYING LIQUIDS

In public relations, you live with the reality that not every disaster can be made to look like a misunderstood triumph.

Christopher Buckley

International Tank Container Organisation (ITCO)

Reduce, Re-use, Recycle with an ISO Tank

“ ”

OUT INTO THE WORLD

STRATEGY

TALKE REPORTS A “significant increase in global sales” in 2022 compared to 2021 and that it is “satisfied” with the result, which was achieved in the face of significant global uncertainties. In particular, its growth in overseas business exceeded its expectations and made a positive contribution to the group’s earnings. Conversely, Talke sees challenges for its home market in Germany as a result of the energy crisis in Europe and the impact it has had on the chemical industry.

Talke marked its 75th anniversary in 2022 and took that opportunity to undertake a critical review of its operations, as well as its mission statement and strategy. The company has now defined ‘responsibility’ as one of the key pillars of its strategy, alongside ‘customer

centricity’ and ‘problem-solving expertise’, and has confirmed that change with the assignment of dedicated management resources.

Talke’s sustainability framework, ‘Crafting Responsible Logistics’, covers four areas of action, which the company is progressively fleshing out and implementing. The company has also forged ahead with its digitalisation initiatives and has introduced real-time tracking in the transport area and automated processes through various SAP extensions.

TROUBLE AT HOME

Like many other companies, especially in the chemical industry, Talke finds itself in a challenging economic environment in its

domestic market. As a partner of the largest companies in the chemical industry, Talke is affected by their negative development and relocation decisions. Consequently, Talke’s business in Germany has experienced very inconsistent growth. While some locations and business segments have shown resilience, others have been impacted by, in some cases, significant declines in volume. Businesses involved in basic chemicals and the automotive sector in particular were unable to buck the overall industry trend. In contrast, growth was experienced in parts of the specialty chemicals and consumer chemicals sectors in defiance of the general trend. For example, Talke has won important new customers in the battery chemicals sector and expanded its on-site logistics business. However, Talke’s German operations failed to meet overall expectations and, to address this, the company has now launched a performance programme. This includes increasing process efficiency, further expanding sales activities, and better integrating individual solutions for greater customer focus. Talke is also exploring new approaches to the structure of its Transport

18

• TALKE NAVIGATED THE PROBLEMS 2022 THREW AT IT BUT ALSO TOOK TIME TO THINK ABOUT HOW IT CAN PROSPER IN THE FUTURE, AND HAS PUT PLANS IN PLACE TO GROW ABROAD

HCB MONTHLY | MAY 2023

Division, which will, among other things, include increasing the use of intermodal transport operations.

LEVERAGING EXPERTISE

Perhaps it is not surprising, then, that much of Talke’s focus is currently on expansion and investment in other parts of the world. It has, for example, already expanded its presence in Spain, via the Global-Talke joint venture, with the opening of the first phase of a new logistics centre on a 40,000-m2 site in Tarragona. In addition, Global-Talke has recently taken over a tank cleaning facility in Zaragoza, which will both increase the regional tank cleaning capacity and, Talke says, improve the quality of service.

That investment also provides a pointer to where Talke is looking to expand its service offering and it says it sees “great market potential worldwide” for its services in the planning, engineering, procurement and construction of logistics facilities. To that end, it plans to develop a new global ‘Engineering Solutions & Projects’ division to bring together its international expertise and apply it locally, tailored to the specific needs of each customer.

Talke has already completed one project in this area, designing and constructing a logistics facility for polypropylene pellets in Poland. The project included the construction of 60 silos and integrated packaging systems, which form the core of the facility.

Similarly, Talke has completed its chemical hub in Dubai, which includes a fully automated filling line connected directly to the hazardous materials warehouse. It has now decided to go ahead with construction of a second multiuser logistics centre on a 300,000-m2 site at the Jubail Commercial Port in Saudi Arabia. The new distribution centre will be used by the surrounding industry and offers a comprehensive, integrated range of services.

ELSEWHERE IN THE WORLD

Talke has had a subsidiary in the US since 2016 but last year operations in the country took a big leap forward with the opening of a new Business & Transportation Centre in Mont Belvieu, near Houston, Texas. This branch serves as the base of operations for a

fleet of more than 100 trucks and equipment, and also as the new administrative headquarters of Talke in the US, where it now employs some 400 people.

Talke is also expanding in the Asia-Pacific region and is currently building a new chemical logistics centre in Port Klang, Malaysia’s largest port. The facility was designed and is being built in accordance with the latest sustainability standards and meets the ‘Silver’ level of the Leadership in Energy and Environmental Design (LEED) certification process developed by the US Green Building Council. The hazardous materials warehouse is scheduled to begin operations in the next few months.

The Port Klang logistics centre, which is located in a strategically advantageous position to act as a hub for Asia-Pacific operations, is regarded by Talke as offering great potential for the development of an integrated facility for the handling of polymers

and liquid chemicals. It is convinced that the region will be of strategic importance to many customers in the chemical and petrochemical industries in the future. Moreover, it regards its commitment in Malaysia as a launch pad for further investments and developments in the wider region.

Summing up Talke’s current position, Alfred Talke, managing partner of the firm, says: “2022 was a turbulent year, in which the global uncertainties impacted different regions to varying extents. With our business activities around the world, we have shown that we are well prepared for the future.

“We continue to see challenges for our business in the domestic market, but also many opportunities due to the changes in the market,” he continues. “We are addressing these challenges with our performance programme, which will help us to further expand our business on a sound footing.” www.talke.com

TANKS & LOGISTICS 19

WWW.HCBLIVE.COM

SPECIAL DELIVERY

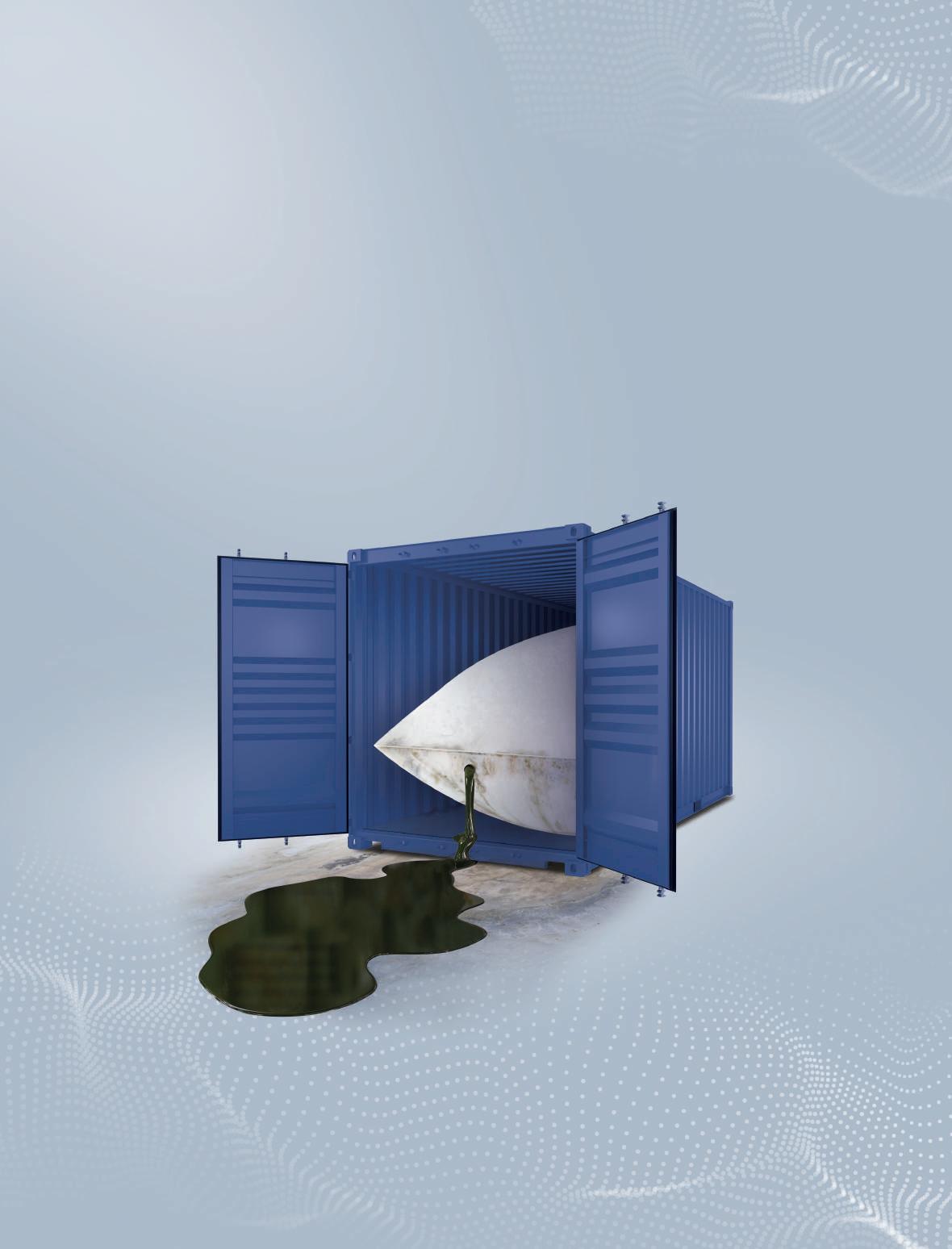

DEPOTS • SAHREEJ IS LEADING THE WAY IN THE PROVISION OF TANK CLEANING AND REPAIR SERVICES IN THE MIDDLE EAST. THE LATEST STRONG TO ITS BOW IS DEALING WITH TEAL TANKS

SAUDI ARABIA’S KANOO Tank Services (Sahreej) prides itself on being a one-stopshop for tank container services and continues to raise the bar in Saudi Arabia in terms of both quality and the range of services it provides. Sahreej, a joint venture between the world’s largest tank container operator, Stolt Tank Containers, and the Saudi conglomerate YBA Kanoo, operates three depots in Saudi Arabia, one at its head office in Jubail and others in Dammam and Jeddah.

Sahreej already offers an extensive range of tank services, including the cleaning of hazardous and non-hazardous cargoes as well as demanding products such as isocyanides (MDI/TDI) and a range of resins including latex. Sahreej also cleans IBCs and road tankers and runs supplementary services such as on-hire/off-hire, nitrogen

services, cross-loading, heating and emergency services.

So, when Sahreej received an enquiry regarding neutralising and statutory testing of T21 tank containers in triethylaluminium (Teal) service, it took it upon itself to study and evaluate the associated risks with the process. The Sahreej philosophy in relation to tank containers and chemical liquid handling, according to general manager Mike Tunstall, is: “if it’s needed, we do it or we will find a way to do it”.

OUT OF THE ORDINARY

Tunstall explains that such an inquiry was out of the ordinary as no depot in the region provides such services, but Sahreej rose to the challenge of meeting the customer’s need. Sahreej was confident that its special projects

team, led by technical manager Sarfaraz Selani, could assure the customer that with the right planning and preparation Teal could be added to its line of services.

As triethylaluminium is a highly flammable and reactive chemical and a dangerous fire and explosion hazard when exposed to air or moisture, a detailed risk assessment was developed by HSE manager and Dangerous Goods Adviser Faris Al Shali to highlight potential risks, mitigating procedures and generating the required personal protective equipment and other safety systems.

With the risk analysis completed, Selani set about preparing a detailed procedure with welcome contributions from the customer. Once the procedure was approved, Selani designed a dedicated skid that provides all services and safety requirements to sit on the tank with lifting equipment stationed overhead to remove the pressure/vacuum (PV) valve and syphon tube assembly. The skid and all engineering work was completed by Sahreej’s in-house maintenance team.

With this completed, a dedicated ‘Teal Team’ was set up and given in-depth training; the team was to operate as a single unit with each member knowing their specific task, relationship to other team members and emergency procedures. Keeping the level of

20

HCB MONTHLY | MAY 2023

product awareness in mind is key to sustaining safety in handling Teal, and that is where the Sahreej training programme delivers the necessary information to the Sahreej team.

Several dry runs were performed to ensure all possibilities had been covered, understood and the risks mitigated. Once Sahreej had confirmed all correct mitigation and operation controls were in place, the tank owners were invited to witness the neutralisation phase of the process, where they expressed their appreciation of Sahreej and confirmed that Sahreej had in fact exceeded their expectations.

WE ALL WANT TO BE SPECIAL

It is clear now that more customers are requiring special services for this type of product as Sahreej continues to receive

inquiries, Tunstall explains. Customers need a safe and professional service when handling, cleaning, and testing a dedicated Teal T21 tanks and that is exactly what Sahreej delivers.

Since its formation in 2015, Sahreej has continually developed its service line to cover more products. Adding triethylaluminium to the list of products cleaned is yet another celebratory achievement. Next Sahreej is looking to overcome the issue of obtaining de-gassing certificates in Saudi Arabia, which will enable Sahreej to add T50 gas tanks to its services range. This and road tanker statutory testing are the next nearterm goal for Sahreej.

Sahreej keeps its promise of being the premier supplier of all tank container needs in Saudi Arabia, by committing to provide special services required by its customers. This

promise is based on continual training, expertise in all areas and highest regards for staff safety, well-being and towards the environment.

With the growing demand for carbon footprint reduction and product sustainability, Sahreej plays its part in the sustainability of tank containers by safely cleaning, repairing and certifying them for safe operation. Given that tanks - when correctly handled - can have a life span of over thirty years carrying food, non-hazardous and hazardous product, it is easy to see how they cannot be compared to a single-use plastics (‘Flexi’) bag.

Sahreej continues to grow in terms of services, quality and revenue, and adding Teal services will help Sahreej continue on its upward trajectory – the company is already working on plans for 2024!

www.sahreej.com

TANKS & LOGISTICS 21

WWW.HCBLIVE.COM

QUICK UPDATE

TANK STORAGE • KUBE & KUBENZ HAS RESPONDED TO GROWING DEMAND FOR THE STORAGE OF FILLED TANK CONTAINERS WITH AN EXPANSION OF ITS BERGHEIM FACILITY NEAR KÖLN

PRODUCERS AND TRADERS in the Rhineland chemical region of Germany have had more storage capacity available for filled tank containers since this spring. The liquid bulk logistics company Kube & Kubenz, which operates throughout Europe, recently expanded the storage area of its branch in Bergheim to cater to this business. Safety infrastructure at the location east of Köln was also upgraded.

As part of the investment, the company created 120 new storage spaces for filled tank containers of hazardous material of Classes 3, 8 and 9. “Expanding this location makes us even more attractive to our customers in the chemicals industry because our secure tank containers, monitored 24/7, shorten and make logistics chains more efficient. At the same time, these investments are ensuring jobs at this location in the long term,” says Olaf Fügemann, manager of Kube & Kubenz‘s branch in Bergheim.

There are 25 Kube & Kubenz employees organising multimodal transport and storage services for resilient supply chains in the chemical industry at this conveniently located site. Designed to meet the most stringent safety standards and located near a federal motorway, the site serves as a transhipment hub, meeting the needs of one of the largest chemical regions in the European Single Market and handling incoming tanks from all over the world.

Existing storage capacity for unclassified goods will be available to Kube & Kubenz’s customers in Bergheim as usual. The site’s portfolio also includes 250 storage spaces for empty tank containers and 40 tractor units

“Together with our storage space in the city of Worms, our first storage location for tank containers, we are now even better equipped to meet the needs of our clients from the chemical industry,” says Konstantin Kubenz, managing partner of Kube & Kubenz. “The

expansion and modernisation of our Bergheim branch will allow us to perfectly meet the requirements of hazardous materials logistics while at the same time reaching our own growth targets in the coming years.”

A BRIEF HISTORY

The Bergheim branch was opened in March 2016 when Kube & Kubenz relocated from the Knapsack Chemical Park a few kilometres away. At its opening, the site offered forwarding, warehousing and maintenance and repair services for box and tank containers on an 18,000-m2 site, complete with office buildings.

The location was chosen for its proximity to the A1, A4 and A61 motorways as well as a rail connection at the Köln Eifeltor terminal; it is also conveniently located to supply the needs of chemical manufacturers in the Leverkusen, Dormagen and Wesseling centres.

At the time of its opening, Michael Kubenz, former managing director and father of Konstantin Kubenz, explained that the move to the larger site was a response to “excellent business development” in the region in the previous few years, which made it important for the company to be able to continue to offer the best service possible and flexible logistics solutions for liquid and gaseous chemicals.

www.kubekubenz.com

22 TANKS & LOGISTICS HCB MONTHLY | MAY 2023

The largest independent ISO Tank Haulier and Tankwash operator in the UK.

With Transport depots across the country and Tankwash facilities covering the North East, Humberside, Immingham, Felixstowe and the South East of England.

Customs and Import/Export Services

We can assist with customs formalities and offer import/ export services for all goods. Own account operations in the following ports:

Teesport

Felixstowe

Liverpool

Hull

Tilbury P&O

Killingholme

Goole

Logistics Services include:

Transport of Bulk Liquids & Packaged Goods

Transhipment Services

Tank Container Fleet

Immingham

Barrow

Gunness

London Gateway

Southampton

Portsmouth

Dover

Depot Facilities include:

Tank Storage

Tank Heating

Maintenance & Repair

Bagging & De-Bagging

Tank Off-Hire Service

WWW.HCBLIVE.COM Freightways www.hpfreightways.co.uk I www.tankclean.org

NEWS BULLETIN

prompted customers to return tanks more quickly, reducing demurrage revenue.

Operating profit for the period also fell, from $44.9m in the fourth quarter 2022 to $39.3m. Lower revenues were offset to some degree by the continued decrease in ocean freight costs as well as inland trucking costs. Utilisation dropped from 67.0 per cent to 64.7 per cent as volumes out of Europe weakened. Nevertheless, Niels G Stolt-Nielsen, CEO of parent company Stolt-Nielsen Ltd, says: “The tank container market has been holding up remarkably well. However, our expectation in the coming months is that we will move towards normalised market conditions.”

www.stolt-nielsen.com

BEST YEAR FOR DEN HARTOGH

Den Hartogh achieved record results in 2022, despite “depressing global economic events” and the war in Ukraine, as well as the climate emergency and supply chain disruptions, the company reports. Revenues rose by 29.5 per cent compared to 2021 to reach €741m and EBITDA was up by 46.2 per cent at €98m.

During 2022, Den Hartogh increased its investment to €61m, focusing on expanding its owned tank container fleet and expanding its reach with new gas tanks, chassis, LNG trucks, ultra-light trailer equipment and other activities to improve efficiency and safety. The acquisition of the Muto Group at the end of 2021 proved successful, Den Hartogh reports, and its acquisition of Hedenskogs in Sweden enabled it to create its own hub in the Gothenburg area, including storage, heating, cleaning, and a home base for trucking activities.

Commenting on the results, managing director Pieter den Hartogh says: “We started the year still impacted by Covid, but volumes increased rapidly. We were forced to adapt to circumstances we never thought would happen. Looking back, I can say that we did adapt, as

one team working together. We finished the year with a historically low percentage of customer complaints. This showed that our service level and communication were under control, a tremendous effort given the turbulent and volatile times. We are increasingly able to connect with our customers at a tactical and strategic level to resolve their supply chain challenges together.

“Overall, 2022 was a year we can all be extremely proud of,” he adds. “Together, we provided a solid backbone to further accelerate sustainable growth in the years to come and achieve our ambitious goals. We continue to make a difference for our customers every day, something I very much look forward to doing.”

www.denhartogh.com

STOLT SEES NORMALISATION

Stolt Tank Containers has reported revenues of $193.9m for the first quarter of its financial year, to end-February, down from $228.5m in the previous period. Although there was a slight increase in shipments, transport rates dropped in line with container liner rates; in addition, an easing of logistics bottlenecks has

COMBINED CLEANING

Boasso Global’s merger with Quala was completed last month, creating a specialist in the tank container and tank trailer cleaning, repair and maintenance sector, with more than 150 locations in North America and Europe and upwards of 2,400 employees.

“We are embarking on an exciting journey together,” the two companies state. “This strategic combination will further enhance our connectivity to customers, expand our global footprint and bring new opportunities for our team members as part of a larger combined organisation.”

For now at least, the two companies will continue under their existing brands.

www.boassoglobal.com

ODYSSEY SELLS LINDEN BULK

Odyssey Logistics & Technology Corp has sold its bulk tank truck subsidiary, Linden Bulk Transportation, to Boasso Global for an undisclosed sum. Odyssey says it is focusing on meeting the complex logistics needs of chemical suppliers and that the sale of Linden is “aligned with Odyssey’s forward-focused

24 HCB MONTHLY | MAY 2023

TANKS & LOGISTICS

strategy of providing neutral-to-transport solutions, allowing the company to utilize the full universe of carriers for the benefit of its customers”.

Glenn Riggs, chief strategy officer at Odyssey, explains more: “Boasso Global is an excellent home for Linden’s employees and customers. Moving forward, Odyssey will continue to focus on growing our adaptive multimodal logistics offerings on a global scale through customer-centric relationships, an expansive multimodal freight network and specialized modern technology.”

In other news, Odyssey has named Hans Stig Moller as its new CEO. Moller has more than 20 years of experience in global logistics, having started with Maersk, where he led the spin-off of Bridge Terminal Transport and acted as CEO until Bridge was acquired by XPO. Moller stayed as president of XPO Drayage.

“Odyssey has a reputation of excellence within the industry and is well positioned to take share in the rapidly changing supply chain landscape,” Moller says. “Going forward, I will be focused on Odyssey’s business expansion, employee development, service integrations and continued dedication to serving our customers’ needs.” www.odysseylogistics.com

NEXXIOT ADDS RAIL SENSORS

Nexxiot has released a new multipurpose Vector sensor for the rail industry, offering the ability to monitor the condition of brakes, hatches and doors on rail cars. The sensor complements a growing portfolio of Nexxiot Asset Intelligence technology, which is used by transport companies to remove uncertainty and risks associated with safety and cargo quality.

The design of Vector sensor creates optionality for clients to address multiple use cases with one versatile architecture and is connects wirelessly to the Nexxiot Globehopper

gateway, providing easy access to data to enhance decision-making capabilities.

“Both rail operators and cargo owners benefit from this innovation,” says Paul Wielsch, CTO of Nexxiot. “With increased attention on safety, compliance, and resource security, Vector sensor offers multiple stakeholders the opportunity to monitor processes and demonstrate to their clients that they take maximum care when it comes to safety and cargo quality.” nexxiot.com

RHENUS WINS IN PHARMA

Rhenus has won a contract from SkyCell, a Switzerland-based manufacturer of temperaturecontrolled containers, to handle reverse logistics around the globe. The deal is an extension of the two companies’ existing cooperation, under which Rhenus operates service centres for SkyCell in the UK and Germany.

Rhenus is also expanding its range of services for its customers through the cooperation arrangement. The latest technology for hybrid packaging solutions, for example, enables secure transportation for critical medicines, including vaccines, and other temperature-controlled goods.

In addition, Rhenus has completed a new 20,600-m2 temperature-controlled warehouse in Strasbourg, which is already serving customers in the healthcare products sector. The facility includes three cells with differing temperature ranges and was built in keeping with new technical and environmental standards.

“In Alsace, Rhenus has invested heavily in logistics for the region’s local and international industrial companies, in order to support their growth. Our expertise in healthcare logistics is based on our employees’ broad range of skills, as evidenced by specific certifications in the healthcare field,” says Laurent Schuster, CEO of Rhenus Logistics France. “We’ll be continuing our investment strategy to support our customers’ economic development over the coming years, with future real estate projects in the pipeline, both in Alsace and in the rest of France.”

www.rhenusgroup.com

PICK UP THE FORT VALE REMOTE

Fort Vale has announced a new remote closure system for this year. Building on Fort Vale’s reputation for the highest safety standards, the system removes the need for tank operators to be on top of the tank while opening valves, radically reducing the changes of a mishap should they slip.

Among other benefits are the system’s compact design and stainless steel construction; its 180° operation and low-friction cable that make it easier to operation; lockable for added security; ambidextrous design to give increased flexibility during fitting; and operating housing suitable for a range of valve sizes, rather than separate housings for different valve sizes; a bearing-guided operating cable rod for stable operation, protected by a housing to minimise damage; and clear ‘open/closed’ indication.

www.fortvale.com

TANKS & LOGISTICS 25

WWW.HCBLIVE.COM

NEWS BULLETIN

prompted customers to return tanks more quickly, reducing demurrage revenue.

Your tank container experts

TWS has more than 25 years of experience in renting out standard and special tank containers for liquid products to the chemical and food industries. TWS also provides various sizes of spill troughs. Customers rely on the outstanding quality of its fleet and value its flexibility in terms of volume and technical features. For more information: E-mail: tws@tws-gmbh.de and web: www.tws-gmbh.de

BEST YEAR FOR DEN HARTOGH

Den Hartogh achieved record results in 2022, despite “depressing global economic events” and the war in Ukraine, as well as the climate emergency and supply chain disruptions, the company reports. Revenues rose by 29.5 per cent compared to 2021 to reach €741m and EBITDA was up by 46.2 per cent at €98m.

During 2022, Den Hartogh increased its investment to €61m, focusing on expanding its owned tank container fleet and expanding its reach with new gas tanks, chassis, LNG trucks, ultra-light trailer equipment and other activities to improve efficiency and safety. The acquisition of the Muto Group at the end of 2021 proved successful, Den Hartogh reports, and its acquisition of Hedenskogs in Sweden enabled it to create its own hub in the Gothenburg area, including storage, heating, cleaning, and a home base for trucking activities.

Commenting on the results, managing director Pieter den Hartogh says: “We started the year still impacted by Covid, but volumes increased rapidly. We were forced to adapt to circumstances we never thought would happen. Looking back, I can say that we did adapt, as

one team working together. We finished the year with a historically low percentage of customer complaints. This showed that our service level and communication were under control, a tremendous effort given the turbulent and volatile times. We are increasingly able to connect with our customers at a tactical and strategic level to resolve their supply chain challenges together.

“Overall, 2022 was a year we can all be extremely proud of,” he adds. “Together, we provided a solid backbone to further accelerate sustainable growth in the years to come and achieve our ambitious goals. We continue to make a difference for our customers every day, something I very much look forward to doing.”

www.denhartogh.com

STOLT SEES NORMALISATION

Stolt Tank Containers has reported revenues of $193.9m for the first quarter of its financial year, to end-February, down from $228.5m in the previous period. Although there was a slight increase in shipments, transport rates dropped in line with container liner rates; in addition, an easing of logistics bottlenecks has

$44.9m in the fourth quarter 2022 to $39.3m. Lower revenues were offset to some degree by the continued decrease in ocean freight costs as well as inland trucking costs. Utilisation dropped from 67.0 per cent to 64.7 per cent as volumes out of Europe weakened. Nevertheless, Niels G Stolt-Nielsen, CEO of parent company Stolt-Nielsen Ltd, says: “The tank container market has been holding up remarkably well. However, our expectation in the coming months is that we will move towards normalised market conditions.”

www.stolt-nielsen.com

COMBINED CLEANING

Boasso Global’s merger with Quala was completed last month, creating a specialist in the tank container and tank trailer cleaning, repair and maintenance sector, with more than 150 locations in North America and Europe and upwards of 2,400 employees.

“We are embarking on an exciting journey together,” the two companies state. “This strategic combination will further enhance our connectivity to customers, expand our global footprint and bring new opportunities for our team members as part of a larger combined organisation.”

For now at least, the two companies will continue under their existing brands.

www.boassoglobal.com

ODYSSEY QUITS TRUCKING

Odyssey Logistics & Technology Corp has sold its bulk tank truck subsidiary, Linden Bulk Transportation, to Boasso Global for an undisclosed sum. Odyssey says it is focusing on meeting the complex logistics needs of chemical suppliers and that the sale of Linden is “aligned with Odyssey’s forward-focused

HCB MONTHLY | MAY 2023

TWS_180x124_Kombi_ENG_NEU.indd 1 23.06.16 12:23

strategy of providing neutral-to-transport solutions, allowing the company to utilize the full universe of carriers for the benefit of its customers”.

Glenn Riggs, chief strategy officer at Odyssey, explains more: “Boasso Global is an excellent home for Linden’s employees and customers. Moving forward, Odyssey will continue to focus on growing our adaptive multimodal logistics offerings on a global scale through customer-centric relationships, an expansive multimodal freight network and specialized modern technology.”

In other news, Odyssey has named Hans Stig Moller as its new CEO. Moller has more than 20 years of experience in global logistics, having started with Maersk, where he led the spin-off of Bridge Terminal Transport and acted as CEO until Bridge was acquired by XPO. Moller stayed as president of XPO Drayage.

“Odyssey has a reputation of excellence within the industry and is well positioned to take share in the rapidly changing supply chain landscape,” Moller says. “Going forward, I will be focused on Odyssey’s business expansion, employee development, service integrations and continued dedication to serving our customers’ needs.” www.odysseylogistics.com

NEXXIOT ADDS RAIL SENSORS

Nexxiot has released a new multipurpose Vector sensor for the rail industry, offering the ability to monitor the condition of brakes, hatches and doors on rail cars. The sensor complements a growing portfolio of Nexxiot Asset Intelligence technology, which is used by transport companies to remove uncertainty and risks associated with safety and cargo quality.

The design of Vector sensor creates optionality for clients to address multiple use cases with one versatile architecture and connects wirelessly to the Nexxiot Globehopper

gateway, providing easy access to data to enhance decision-making capabilities.

“Both rail operators and cargo owners benefit from this innovation,” says Paul Wielsch, CTO of Nexxiot. “With increased attention on safety, compliance, and resource security, Vector sensor offers multiple stakeholders the opportunity to monitor processes and demonstrate to their clients that they take maximum care when it comes to safety and cargo quality.” nexxiot.com

RHENUS WINS IN PHARMA

Rhenus has won a contract from SkyCell, a Switzerland-based manufacturer of temperaturecontrolled containers, to handle reverse logistics around the globe. The deal is an extension of the two companies’ existing cooperation, under which Rhenus operates service centres for SkyCell in the UK and Germany.

Rhenus is also expanding its range of services for its customers through the cooperation arrangement. The latest technology for hybrid packaging solutions, for example, enables secure transportation for critical medicines, including vaccines, and other temperature-controlled goods.

In addition, Rhenus has completed a new 20,600-m2 temperature-controlled warehouse in Strasbourg, which is already serving customers in the healthcare products sector. The facility includes three cells with differing temperature ranges and was built in keeping with new technical and environmental standards.

“In Alsace, Rhenus has invested heavily in logistics for the region’s local and international industrial companies, in order to support their growth. Our expertise in healthcare logistics is based on our employees’ broad range of skills, as evidenced by specific certifications in the healthcare field,” says Laurent Schuster, CEO of Rhenus Logistics France. “We’ll be continuing our investment strategy to support our customers’ economic development over the coming years, with future real estate projects in the pipeline, both in Alsace and in the rest of France.”

www.rhenusgroup.com

PICK UP THE FORT VALE REMOTE

Fort Vale has announced a new remote closure system for this year. Building on Fort Vale’s reputation for the highest safety standards, the system removes the need for tank operators to be on top of the tank while opening valves, radically reducing the changes of a mishap should they slip.

Among other benefits are the system’s compact design and stainless steel construction; its 180° operation and low-friction cable that make it easier to operation; lockable for added security; ambidextrous design to give increased flexibility during fitting; and operating housing suitable for a range of valve sizes, rather than separate housings for different valve sizes; a bearing-guided operating cable rod for stable operation, protected by a housing to minimise damage; and clear ‘open/closed’ indication.

www.fortvale.com

TANKS & LOGISTICS 27

WWW.HCBLIVE.COM

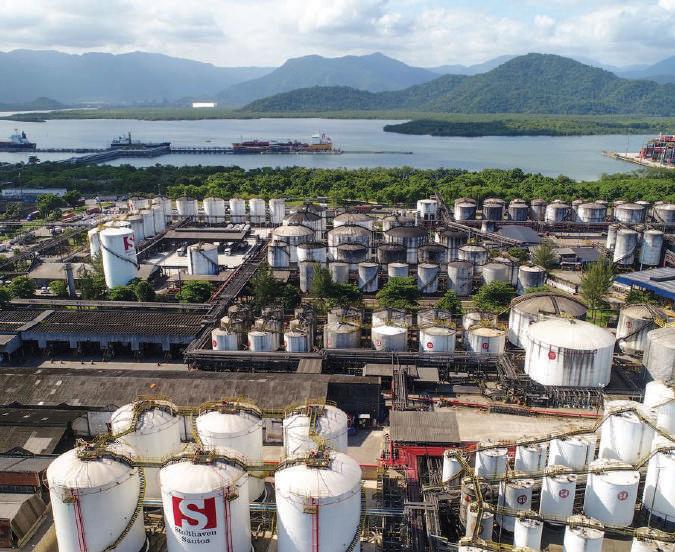

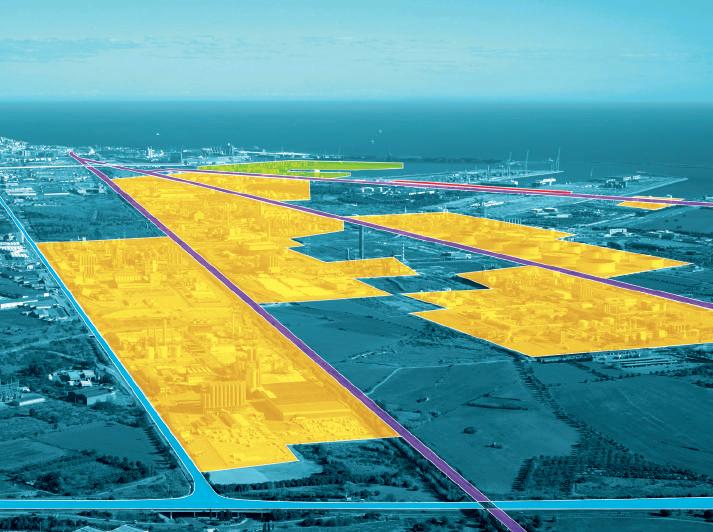

THE NEXT STEPS

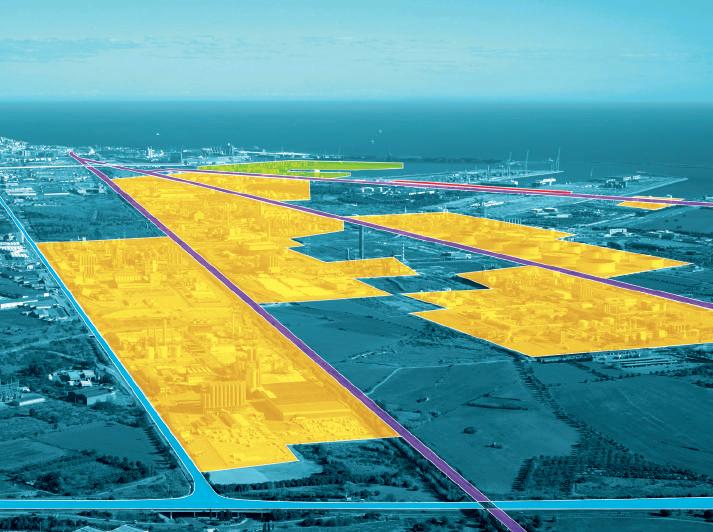

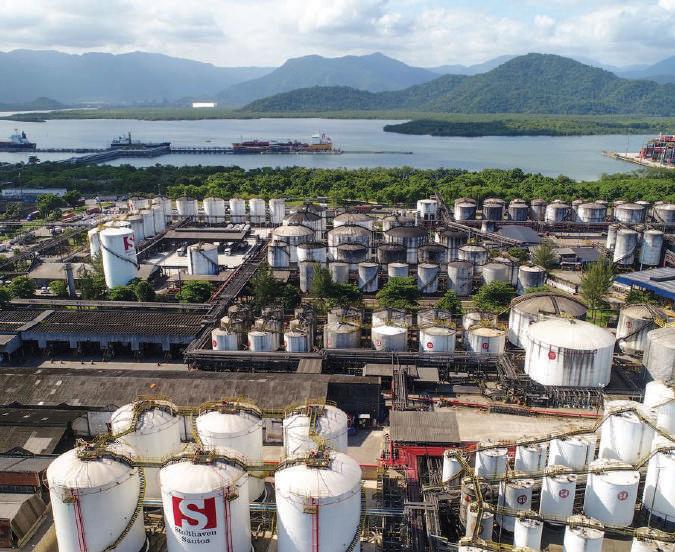

EXPANSIONS • THE GLOBAL ENERGY TRANSITION IS HAVING A BIG IMPACT ON THE BULK LIQUIDS STORAGE MARKET, WITH NEW TRENDS EMERGING IN THIS YEAR’S SURVEY OF CONSTRUCTION ACTIVITY

WHEN THE OIL industry began, there was no need for bulk liquids storage terminals. It was only later, as barrels gave way to bulk, that producers (especially exporters) needed somewhere to collect their product prior to shipment.

The new energy industry is taking a different tack. For a start, the movement of clean, low- or zero-carbon fuels over long distances will only make economic sense if it can take place on a large scale. As a result, those interests promoting or actively developing new long-haul supply chains to bring clean fuels (often ammonia) into northern Europe are almost always including storage terminal operators in their list of partners; without commitment to provide the appropriate storage capacity (right tanks, right place)

these supply chains will not succeed.

Another emerging issue is the need to dispose of carbon dioxide collected from industrial activity (including, in fact, the production of low-carbon fuels); again, those who are taking an interest in being part of that supply chain are involving shipping and storage interests in the process.

The picture is somewhat different in North America, as it looks likely that the production of clean fuels will be largely fed by local availability of appropriate feedstocks. Nevertheless, here too there is a need for terminal and pipeline operators to play a part in the development of the sector.

The outcome of these trends is that, while this year’s annual survey of terminal expansion activity is as long as ever, some of the bigger

projects are long-term investments involving upstream and downstream interests alongside port authorities and terminal operators (sometimes more than one per project).

An interesting aspect of this work in northern Europe is that Germany seems to be keen to bypass the crowded ports of the ARA region (where there are plenty of projects in hand, with major support from the port authorities) and develop its own import facilities for green energies. It may be that the recent focus on fast-tracking new LNG import sites on its northern coastline, to reduce the country’s reliance on Russian natural gas, has reminded Germany that in fact it does have some major ports facing the North Sea that can play a role in the energy transition.

NORTH AMERICA

BUCKEYE, CANADA

Buckeye Partners has closed the acquisition of Bear Head Energy, which is developing a large-scale green hydrogen and ammonia production, storage and export project in Point Tupper, Nova Scotia.