Our PFA Lined Cleanlift, bottom discharge valve has a shear groove (unlike some of our competitors). The shear groove is not a dance music classification, but a significant feature of these types of valve. It protects the tank in the case of an impact or incident, and complies with EN 14433:2014. Ideally suited for tank containers where space is limited in the ISO frame, with the PFA lining offering maximum protection against highly corrosive cargos, it’s simple to maintain and uses many of the components to be found on our standard footvalves - making spare parts supply much, much easier. We know accidents can, and will happen. Successful and profitable tank operation relies upon the technical integrity of each and every component. That’s why we ensure precision throughout, so that you can rely on the performance of our valves and your tanks.

FORT VALE. FOLLOW THE LEADER. Visit us at www.fortvale.com

December traditionally offers the ideal time to look backwards and assess the year just about to end. And 2022 has been an – ahem – interesting year, with many of those in the chemical logistics arena who have ridden its choppy waters coming out of it very nicely, while others have flailed and failed.

One salient feature of the year has been a great shift in values. The value of oil and gas in the ground remains high, leading the big integrated energy firms to record multi-billion dollar quarterly profits – much to the annoyance of motorists who only see their brands when they fill their fuel tanks with high-cost gasoline and diesel. Expensive assets – such as oil tankers and LNG carriers – have seen their secondhand values rocket, with newbuilding slots scarce and uncertainty over future marine propulsion choices in light of environmental legislation. Even the chemical tanker market has been enjoying a welcome recovery this year.

Those container liner operators who filled their boots in 2021 seem to have learned how to manage the market better and have brought down ocean freight costs, the better to keep hold of their market. But some of them have also been using their windfalls to expand aggressively, both within and outside their existing spheres of operation. Supply chain disruptions over the past two years have shown the value of cargo – it is the life blood of all logistics operators, after all – and the importance of being able to better control access to that cargo.

It will be interesting to see how that plays out over the course of 2023; recent pronouncements by analysts indicate that the current global economic gloom is likely to keep demand depressed, hitting trade volumes. Operators will probably

respond by idling existing tonnage, even at a time when the orderbook is large by historic standards.

Others who have benefitted over the past year include engineering firms, suppliers and logistics providers with expertise in handling those products that present options in the path towards decarbonisation, notably ammonia, hydrogen and methanol but also carbon dioxide, the latter in terms of capture and sequestration or re-use. Those have involved, for instance, industrial gas specialists such as Air Products and Air Liquide, LPG tanker operators (Exmar, Navigator Gas and many others), methanol specialists (Methanex, Waterfront Shipping, MOL, Proman and its partner Stena Bulk, etc) and bulk liquid terminal operators, many of which have been looking to adapt or expand capacity.

There is an awful lot of work going on, at enormous cost (some of which may be covered by grants) but it will be necessary if the UN’s Sustainable Development Goals are to be met. For northern Europe, to take one example, that will mean developing the infrastructure and supply chains necessary to deliver the new clean fuels into the region at a reasonable price; existing infrastructure, developed to handle imports of traditional liquid hydrocarbon fuels, took decades to mature but the new energies will need to leapfrog that process.

This has all been new stuff but I think it is time we retired use of the word ‘unprecedented’ from the pages of HCB – it has been over-used this year, and I suspect there have been many times in the past when pestilence, war and hunger have coincided. Maybe a less interesting 2023 is what we need.

Peter Mackay

VOLUME 43 • NUMBER 11

Letter from the Editor 01

30 Years Ago 04

Learning by Training 05

Let’s talk tanks

ITCO members get back together 06 Back to basics

Goodrich provides tank training 10

Foot in the door

Bertschi opens up in China 11

News bulletin – tanks and logistics 12

SUSTAINABILITY

The green carrier

Amsterdam plans LOHC network 14

Driven to be clean

Hoyer grasps the nettle 15 Washing whiter

Treating ship waste ashore 16 News bulletin – sustainability 18

Low slung

BASF, Stolt address low water 20 A rising tide

Odfjell enjoys market upturn 21 News bulletin – tanker shipping 22

The quarterly magazine of the Tank Storage Association

Getting tougher

CBA reports weakening market 25 Pressing ahead

Brenntag extends transformation 26 News bulletin – chemical distribution 28

INSURANCE

Work that data

Munch Re works with NCB, USCG 30 Keep it open

Reinvigorating Lloyd’s Open Form 31

SAFETY

Incident Log 34

Splash and burn

TT Club alert on lithium batteries 36 Use it or lose it

Avoiding containership fires 37

REGULATIONS

A clean slate

Joint Meeting gets back to work 38 Small change

What’s new in the IMDG Code 45

NEXT MONTH

What’s new in storage terminals Building an alternative supply chain North American regulations Industrial packaging update

Email: peter.mackay@chemicalwatch.com

Tel: +44 (0) 7769 685 085 Advertising

Email: sarah.smith@chemicalwatch.com Tel: +44 (0) 203 603 2113 Publishing

Email: sarah.thompson@chemicalwatch.com Tel: +44 (0) 20 3603 2103

ISSN 2059-5735 www.hcblive.com

HCB Monthly is published by CW Research Ltd. While the information and articles in HCB are published in good faith and every effort is made to check accuracy, readers should verify facts and statements directly with official sources before acting upon them, as the publisher can accept no responsibility in this respect. ©2022 CW Research Ltd. All rights

THE DECEMBER 1992 issue of HCB appeared just prior to the arrival of the European Single Market, which raised both promise of easier trade and concerns over what it might mean for chemical producers and logistics operators in the UK. However, HCB had chosen this month to run a special focus on North America, with the cover declaring: ‘Product stewardship in, Cowboys out’.

That comment of course reflected the growing attention being paid to Responsible Care and ISO 9000 but also changes in the structure of the emerging tank container (or ‘ISO tank’ in the local parlance) sector in the region. In particular, many of those companies that had invested heavily in one-stop-shop tank repair and cleaning stations had found their new facilities under-utilised and rationalisation was on the cards – perhaps not something that would help support the growth of the tank container concept.

Attention was also being paid more closely to raising safety and operational standards in the bulk liquids terminalling sector, and HCB reported on some presentations on the subject during the ILTA International Operating Conference in Houston in June. HCB noted that legislation was “being used as an uncompromising tool” in forcing safety improvements but also that, while new legislation was generally accepted as providing a common standard, “many argue that plain common sense and good housekeeping have as much to do with accident prevention” as environmental legislation.

The US was also providing much-needed work for deepsea chemical tankers at the time, given that freight rates were still recovering from a lengthy lull, and rising exports and, more particularly, imports of chemicals were giving some support. Here too, though, legislation was beginning to generate problems, with many operators concerned

in particular at the lack of uniformity in new rules, especially the unilateral US initiative of the Oil Pollution Act of 1990, which followed the Exxon Valdez incident in Alaska.

EV Vine of Dorval Shipping commented that, while industry could appreciate the difficulties states were working under, especially in light of the public’s perception of environmental risk, “it would be helpful if countries, particularly the US, could harmonise their legislation with the requirements agreed internationally by bodies such as the IMO”. Quite aside from OPA 90, the US had introduced stricter requirements for vapour control systems and slop disposal ashore, and shipowners were facing additional insurance costs, particularly for the carriage of persistent oils.

It was not just in the US that such moves were taking place; atmospheric emissions controls were just a part of a series of recent environmental legislation to have taken effect in Europe and storage terminals across the region were busy investing in vapour control equipment. While vapour combustion was being preferred by US terminals, especially those handling gasoline, in Europe a wider range of technology was being investigated, including carbon scrubbers and filters, adsorption units and condensation systems.

In those days, HCB’s December issue celebrated the coming Christmas break in many forms, including the popular Yule Log feature, which wrapped up some more-or-less hazardous incidents from the year. In 1992 one item from the Philippines reported on a police action against smugglers, whose ship arrived with 100 tonnes of contraband garlic. Not only were the usual sniffer dogs not required, customs officials had to approach from upwind.

Men dying and women crying If you breathe air, you’ll die Perhaps you wonder the reason why? Are you ready?

Sound familiar? Recently, when Russia retaliated for the attack on the Crimea bridge, people died and were maimed. Is this good or not good? You will know the answer. Perhaps you add; ‘but the Russians are terrorists’, or you can argue, ‘what about the harm done to the Russian speaking population in the Donbass by the Ukrainians?’ Was that good or not so good?

My column for this month is about collateral damage caused when a so-called tipping point has been reached beyond the point of no return. The only way left to go is downhill at an accelerating speed. Based on an objective observation the Western world is collapsing in its own footprint. The school of Athens had four main goals: “Seek Knowledge of Causes”, “Divine Inspiration”, “Knowledge of Things Divine”, “To Each What Is Due”. We will explore the first one.

Let’s seek the cause for the war in Ukraine. Because of the constant fake and false news, the propaganda machine by the mainstream media, it is very difficult to decide what is true or untrue by the general public. So, the first question philosophers of this school would ask: ‘Cui Bono?’ Who benefits? When you analyse and answer this question it becomes more easy to do so.

A second question asked would be: ‘Is it good or bad that collateral damage is ignored by politicians?’ I use the rhetorical questioning

method on purpose so your conscience automatically will answer. Perhaps your energy company is the one ‘Cui Bono’ by taking advantage of the current disturbance in the gas and electricity supply markets? Ordinary people and businesses are billed more than they can afford which results in poverty and business closures. Is that good or bad business for the long term? When an energy supplier destroys their own client base because of charging too much, the inevitable result will be self-destruction because when there can’t be any more buyers, there can’t be any more sales.

A philosopher from the School of Athens would ask: is it honourable or ethical to destabilise the social contract and cohesion? I believe your conscience will answer that question too. Jean Jacques Rousseau wrote about the social contract: “It follows that when any government usurps the power of the people, the social contract is broken; and not only are the citizens no longer compelled to obey, but they also have an obligation to rebel.”

Social Cohesion enables us to live together in a just and equal society. The wise thing to do is not taking away the basic comforts of life for the 99 per cent. What we now observe is that through an amalgamation of media, big business and authoritarian politics, even the last cents of ordinary man are being taken from him. Is eliminating the vulnerable social contract good or not so good for business?

This is the latest in a monthly series of articles by Arend van Campen, founder of TankTerminalTraining, who can be contacted at arendvc@ tankterminaltraining.com. More information on the company’s activities can be found at www.tankterminaltraining.com.

MEETING REPORT

THE APPETITE AMONG tank container professionals to get together again after the easing of Covid restrictions was evident from the crowd of more than 200 people who gathered in Amsterdam on 25 October for the annual Members Meeting of the International Tank Container Organisation (ITCO), the first in three years and the largest conference organised by the Organisation in its 24-year history.

And there was plenty for attendees to see and hear, with a range of presentations covering all sides of the tank container business. After an introduction by Patrick Hicks, ITCO’s secretary, Reg Lee, its president, gave an update on recent developments. He noted that he had visited the Shipping Training College (STC) in Rotterdam the week before the meeting, to finalise arrangements for including tank containers in its curriculum.

STC was planning a training day on 20 December, with 80 students given the opportunity to have classroom training and to see a tank container close up. Hoyer’s demonstration tank was being taken to the college and all 80 students were to take ITCO’s e-learning course.

The programme at STC mirrors that already established at Shanghai Maritime University (SMU) but, due to ongoing Covid restrictions in China, that is currently not being delivered. The situation is to be reviewed after the Chinese New Year in late January 2023. Jarno Weps, maintenance and repair manager, Europe, for Exsif Worldwide, himself a former STC student, gave some more details of the new course in Rotterdam as part of his presentation on ‘Inspiring a New Generation’.

The tank container industry, like many others, is suffering from an ageing workforce and a

lack of new entrants – as well as a lack of appropriate training. It makes sense, therefore, for industry to help colleges promote the sector.

First up to give his views on the current industry was Hans Augusteijn, installed this past February as president of Stolt Tank Containers, who sketched in the business environment this year, with its overheated demand, increasing costs, labour shortages and global conflict. This has come at a time when customer expectations are getting tougher, while there is a new focus on decarbonising supply chains and the need to invest in the digital transformation.

On the upside, Augusteijn felt there is still plenty of potential for more business for tank containers. Containerisation in general has proven itself over the last five decades, to the point where 99 per cent of non-bulk cargo is carried in freight containers; that figure is around 90 per cent for refrigerated goods but only some 25 per cent for liquid bulk cargo –there is plenty of conversion left in this sector.

That potential has certainly been recognised by industry; Augusteijn noted that the global tank container fleet has grown by an average of 10 per cent per year for the past decade,

SECTOR IS FACING SOME SERIOUS CHALLENGES. ITCO’S MEMBERS MEETING HEARD ABOUT SOME INITIATIVES THAT COULD BE OF HELP TO THEM ALL

As one of the world‘s leading logistics services providers in handling and transporting liquid products, we are the first point of contact for the chemicals, gas, mineral oil and foodstuffs industries. By road, rail and sea, from road tankers to IBCs, from equipment leasing to intelligently networked Smart Tanks, we will find the optimum solution for you. We do this by using our expertise to pioneer our own new pathways that take you forward in a customised way. How can we help you?

www.hoyer-group.com

twice the rate of dry containers, while the number of active operators has tripled over the same period to more than 310. Somewhere between 2.3m and 2.8m tank container shipments are made every year, again growing at an annual rate of more than 10 per cent. He predicted that the sector will continue to outpace chemical production growth as the shift from bulk to tanks goes on.

The future will not be plain sailing though and there are some uncertainties and challenges coming. “Adopting new strategies, tactics and innovative technologies will be essential to overcome challenges and capture opportunities,” Augusteijn concluded.

Challenges are also being experienced by service providers to the sector and Colin Garnett, senior vice-president, mergers and acquisitions at Boasso Global, gave some indication of how operators are responding. The most pressing problem is the shortage of drivers – Europe (including the UK) is short by around 500,000 drivers right now, and the US needs another 240,000. In response, haulage firms have increased salaries – with the support of shippers – and introduced more flexible working conditions and better training. It is not just drivers, though – Garnett noted that industry needs to work together to attract new entrants to work as maintenance crew, engineers, operators and office staff.

Looking ahead, there may be more changes for tank service providers; the tank depot sector remains highly fragmented, with plenty of small and often family-owned operators, and may present capacity constraints as development lags behind demand growth; there is now the need for change – which presents opportunities.

The afternoon session, moderated by consultant (and HCB contributor) Paul Gooch, focused on safety in the tank container industry, with four panellists drawn from different sides of the business reporting on their initiatives and activities to encourage and promote the safe use of tank containers.

Benjamin Reinke, technical manager at Bureau Veritas (BV) Industry Services, outlined safety procedures for working in third-party premises such as tank depots, and how BV trains personnel for tank entry and those who issue tank cleaning documents, including tank entry permits. A clear message from his presentation was that all those who see unsafe practices should stop working and get the situation rectified.

Roger Gloor, deputy head of Bertschi’s technical department, explained that all the company’s tank containers are equipped with full walkways and handrails and also went

into Bertschi’s ‘Stop at Risk’ policy. This is based on a training programme, covering behaviour-based safety, along with defined actions to achieve uniform safety and quality principles across the company. Internal safety and quality processes are regularly monitored and assessed, with the evaluation feeding into an action plan according to the principles of ISO audits and SQAS assessments to improve safety and quality protocols.

Across the Bertschi group, that approach results in more than 3,500 staff training days, 60 driver training days and 3,000 safety checks each year.

Jonas Fiers, QESSH manager at Van Moer Logistics, presented a case study on the relationship between safety culture and safety performance; for example, while every company should provide effective fall protection, it must also inculcate a safety culture to ensure that its personnel understand the importance of that protection and use it correctly, all the time. Van Moer uses visualisation techniques to reinforce the safety message and has an ongoing QESSH dashboard to track safety performance.

This approach has this year delivered a very significant reduction in the number of accidents at Van Moer’s sites and also a sharp fall in the severity of those accidents. The next step is to spread that safety culture to newly acquired businesses and to external drivers, review the key performance indicators and set targets for 2023.

Finally, Mike Yarwood, TT Club’s managing director of loss prevention, explained what operators can look for from their insurance provider in terms of promoting safe tank operation. He also explained the concept of ‘insured risk’ and gave advice on operational and contractual risks in terms of insurance cover.

The final session of the day was given over to David Bailey, design and development director at Fort Vale Engineering, who gave an update on the work that ITCO and its members are doing to head off the problems that could arise if the regulatory authorities in Europe and North America carry through with their

plans to restrict or ban the manufacture and use of perfluoroalkyl and polyfluoroalkyl substances (collectively known as ‘PFAS’). For the tank container sector, the main issue would be in terms of seals and gaskets, which rely on PFAS materials for their operational performance across a wide temperature range as well as their compatibility with most substances carried in tank containers.

ITCO has now put together a case study on the subject (reviewed in HCB October 2022, page 10), which has been submitted to the authorities and calls for PFAS used in seals and gaskets to be designated as ‘materials of essential use’. ITCO has also initiated a pilot project being undertaken at Stolt’s Moerdijk depot on the disposal and, it is to be hoped, recycling of used sealing elements and Bailey appealed for other operators and depots to join in.

The meeting concluded with a toast to the memory of David Jenkins, who as head of Multistar had been one of the founding members of ITCO in 1998 and who died earlier this year. His commitment to the organisation and to the industry in general was recognised by Reg Lee.

Looking to 2023, ITCO’s four divisions will hold meetings online in February and the Organisation is planning a number of other webinars over the course of the year covering such topics as sustainability, safety, efficiency and technical developments. The next big gathering will take place in May, when ITCO will once again take its ‘Tank Container Village’ to the Transport Logistic event in Munich. The Village will comprise 64 stands, of which 46 had already been reserved by the end of October. www.itco.org

TANK CONTAINERS TRAVERSE the world by all modes of transport; along the way they need to be repaired, maintained and cleaned, while being operated to a consistently high standard. The concept of the tank container appears fairly straightforward, but it is important to understand how a tank must be handled and operated.

Goodrich Maritime, the Mumbai-based international logistics firm, certainly takes its tank container operations seriously. Its liquid cargo activities include the operation of tank containers for foodgrade, chemical and gaseous products, as well as swap bodies for domestic operation, alongside chemical storage and blending facilities, tank container

cleaning and flexitank business. Keeping those assets moving, whether it is on international trade lanes by container vessel, land transport within India and the Middle East, or multimodal routes into central Asia and Africa, is vital to its market position.

This past October, Goodrich organised a week of ‘DG Training on Technical, Safety and Regulatory Requirements for Operation of an ISO Tank’ for its employees and clients in Mumbai. The event was also attended by members of the Indian Chemical Council (ICC) and Nicer Globe, ICC’s initiative to promote Responsible Care and the establishment of standards for chemical transport safety, security and emergency response. The

facilitator for the week’s proceedings was Paul Sireci, a seasoned professional in the sector who has worked with Goodrich on similar programmes in the past, the latest being in 2019 at Baroda, Gujarat.

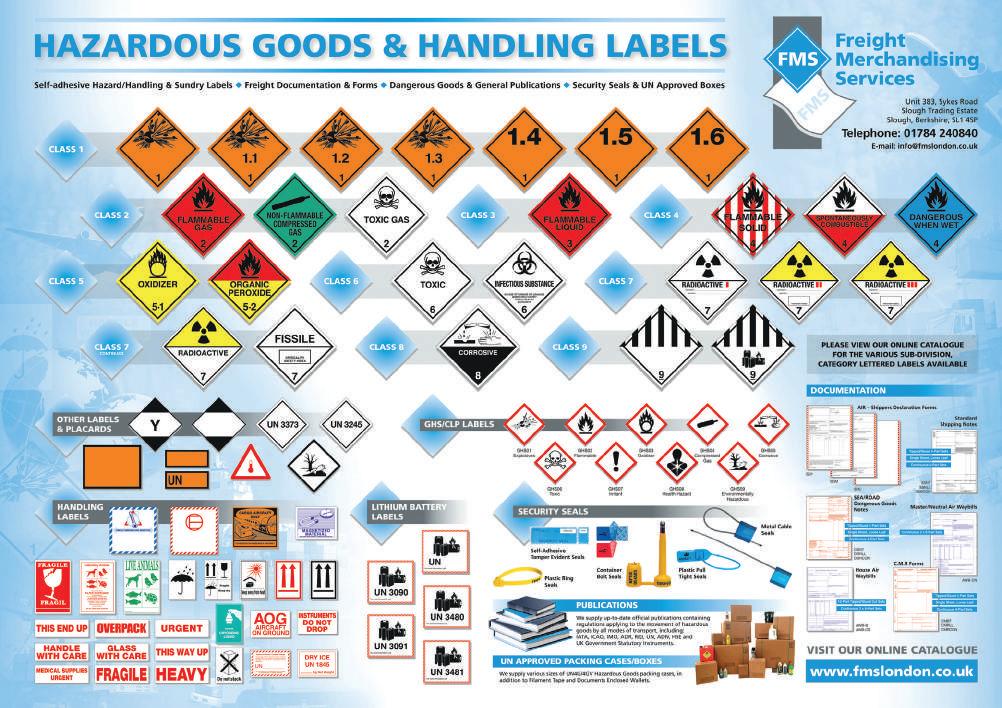

The week was split into two halves, beginning with a theoretical session for Goodrich’s own chemical logistics employees on the first two days, which was repeated for the company’s clients on the next two. This session covered a variety of topics, including the design and construction of tank containers, safety, common hazards, industry standards, dangerous goods transport regulations, the International Maritime Dangerous Goods (IMDG) Code, CSC certification under the International Convention for Safe Containers, tank compatibility, filling, cleanliness, testing and other matters.

On the final day of the event, both groups, numbering more than 50 people, were taken to the Oceanglobe tank container depot in Taloja in Navi Mumbai, where Paul Sireci introduced the ‘Goodrich Training Tank’ to employees and customers.

Interacting with Paul, who has nearly 50 years of experience in the tank industry, proved to be highly captivating to the majority of those in attendance, who included customers as well as Goodrich personnel from its factory, logistics and supply chain department and other offices, including many ‘young Goodrichians’. They also enjoyed a brief tour of the Oceanglobe depot, with demonstrations of tank container cleaning and maintenance.

The week’s programme is only part of the process to improve tank container safety within the Goodrich organisation. “This is simply the beginning of another long journey for the Goodrich chemical logistics team,” the company says. goodrich.co

TRAINING • THOSE INVOLVED IN TANK CONTAINER OPERATIONS AND MAINTENANCE NEED TO KNOW WHAT THEY ARE DOING. GOODRICH IS PROVIDING ITS EMPLOYEES WITH THE TOOLS THEY NEED

CHINA • BERTSCHI’S NEW CHEMICAL HUB, ITS LARGEST INVESTMENT TO DATE, HAS STARTED WORK AND IS RAMPING UP TO HELP THE COMPANY FURTHER DEVELOP ITS CHINESE TANK CONTAINER BUSINESS

THE FIRST TRUCKS aarrived at the Bertschi Zhangjiagang (BZJG) chemical hub at the end of August. Switzerland-based Bertschi has invested some $45m in the new site, which covers some 62,400 m2 and includes a large tank container storage and heating area, a drumming facility and warehouses for all classes of dangerous goods, allowing it to offer a fully integrated logistics service to its local and international chemical clients.

The location in the Yangtze River International Chemical Park, close to Shanghai, puts the BZJG liquids hub in close proximity to several existing and other

potential customers for Bertschi’s services. The company aims to offer its clients an international door-to-door service and having this regional hub is a cornerstone in its global network, which now numbers 30 intermodal terminals around the world.

Zhangjiagang is also an important location in terms of domestic transport, making intermodal connections with inland waterways. Jemmy Wu, managing director of the Bertschi Group in China, notes that this mirrors company facilities elsewhere in the world, such as that at Duisburg. And having the ability to move dangerous goods on the

water avoids the need to move them by road through the densely populated and congested Shanghai area. Wu also notes that the local authorities in Zhangjiagang have a lot of experience with the chemical industry and a good understanding of the importance of having an integrated chemical logistics hub.

In the Chinese market, being able to offer an integrated service is important for European shippers; without facilities such as this, chemicals are likely to move from Europe to China in drums or intermediate bulk containers (IBCs) for domestic distribution. The BZJG hub now allows them to move product in tank containers, which offer a higher payload per 20-foot container slot, and then to store the tank container prior to onward delivery to the consignee or to decant the product into drums or IBCs.

This offers efficiency gains for Bertschi’s clients but it is also cost-effective and improves service quality. Having product in storage close to the end customer provides security of supply and ensures on-time delivery, while repacking as late as possible in the supply chain avoids unnecessary costs. Overall, for the client, this means the end-to-end cost is reduced and flexibility is increased.

But Bertschi has got a lot to do if it is to spread the word about the efficiencies offered by intermodal transport within the Chinese market. As Wu points out, rail transport is not yet widely used for the domestic movement of chemicals in China, although Bertschi has been actively involved in the ‘Belt and Road’ project, having been moving chemicals by rail from China to Germany since 2015.

Furthermore, rail operator Hupac, in which Bertschi is a significant shareholder, opened its own operation in China, Hupac International Logistics (Shanghai), in 2016 with the aim of developing traffic between Europe and China.

BZJG is unlikely to be Bertschi’s last investment in China; Wu says the company’s strategy in the country is long-term but also that the BZJG hub will become the benchmark for the chemical logistics sector in China and create a solid foundation for further growth.

www.bertschi.com

Grammer Logistics, an Indiana-based transport and logistics firm specialising in chemicals, ammonia, industrial gases and other hazardous materials, has acquired Logistics Management Resources (LMR), which provides transport services to a similar clientele from its base in Baton Rouge, Louisiana. The deal significantly expands Grammer’s footprint, service offering and operational capabilities, continuing its growth under the ownership of Stellex Capital Management and Mill Rock Capital.

“LMR is a highly-respected leader in the chemicals logistics market,” says Scott Dobak, CEO of Grammer. “We are thrilled to welcome their team into the Grammer family. This acquisition supports our strategy of providing a diversified offering of both asset and non-asset services to our growing customer base. We believe this integrated approach is the future of chemicals logistics.”

LMR’s personnel will remain with the operation and its president/CEO, Heston Hodges, will lead Grammer’s transport

management division. He says of the deal: “By combining the expertise of both companies, it creates a win-win combination. All stakeholders will benefit from the additional services that LMR and Grammer will jointly offer to the marketplace. Our clients gain access to an internal fleet of highly specialised drivers and equipment, and the strong carrier relationships we have developed over years will be further supported by the additional opportunities available through the combined platform.”

www.grammerlogistics.com

Neele-Vat has commissioned a new warehouse and distribution centre in Hazeldonk in southern Netherlands, close to the Belgian border and midway between Rotterdam and Antwerp. The 11,000-m2 facility will, the company says, support its growth strategy for warehousing, customs, air and sea freight and European distribution. The brownfield development is also said to complement

Neele-Vat’s other distribution facilities at the same business park. www.neelevat.com

Rinchem is nearing completion of its first dangerous goods warehouse in Malaysia and its third in the Asia-Pacific region. The new 4,200m2 facility, due to open for business in the second quarter of 2023, will have 3,100 pallet positions and offer multiple temperature zones.

“As the semiconductor industry continues to experience immense growth in response to various global governmental incentives, Rinchem is uniquely positioned to support both chemical and semiconductor manufacturers’ expansions,” says Matt Jensen, Rinchem’s vice-president of warehousing operations. “Rinchem has over 45 years of experience in managing the most complex supply chains in the world – every warehouse we build is optimised for safety and efficiency in accordance with our global standards.” www.rinchem.com

Talke has added two CNG-powered trucks to its vehicle fleet in Germany, as part of its broader aims to reduce its CO2 emissions. Talke says it has opted for CNG over the currently fashionable LNG option as the price of CNG is much more stable. It burns more cleanly than diesel, reducing CO2 emissions by up to 20 per cent, while bio-CNG, which is becoming more widely available, can cut CO2 emissions by as much as 90 per cent.

“We have been dealing with alternative drive technologies for a long time. On the one hand, we want to have a positive impact on our own carbon footprint and, on the other hand, we want to support our customers in achieving their climate targets,” says Christoph Grunert, who is responsible for sustainability on the

Talke management board. “We are aware that gas-powered trucks are not yet the final solution to today’s challenges. Nevertheless, CNG is indispensable today as a practical bridging technology.” www.talke.com

Wibax has rebranded its operations in Finland, following the acquisition of Baltic Tank and JJ Kuljetus over the past two years. Those two deals brought the Swedish company’s full service offering to Finland for the first time, as Tero Väyrynen, CEO of Wibax Finland, explains: “Wibax’s unique concept of storage and transportation means that we can offer our customers cost-efficient logistics solutions. It of course feels great that we can now show our true colours. The continued expansion in Finland means that we will also be recruiting new staff, both administrative staff and drivers. Wibax’s total solutions concept has been well received on the Finnish market and we see continued potential for major growth.”

Wibax Finland operates 15 vehicles, which are all being given a makeover. www.wibax.com

VTG has decided to discontinue its Russian business activities, which include wagon leasing

and project logistics, and has sold them to international investors. “We have reached a geopolitical turning point that is bringing terrible suffering to the people of Ukraine, but that is also bringing fundamental change on the global political stage and to the world’s economy. As a company, we too must face up to this new reality,” says Oksana Janssen, COO Eurasia & Far East at VTG. “It is important that we play our part in upholding the founding principles that define the European Union as a place of peace, democracy and human rights, and that this commitment is also reflected in our business activities.” www.vtg.com

Heniff Transportation Systems has acquired Coal City Cob Company, continuing its growth in the chemical transport sector in the US. The acquisition includes 230 drivers and 500 trailers operating from nine terminals across the country, along with a “significant” rail-to-truck bulk transfer yard and tank wash facility at Coal City Cob’s headquarters site in Waxahachie, Texas.

“Given the complementary nature of the two operations, we believe strongly that this combination will create value for all our stakeholders and offer real service enhancements to our respective customers,”

says Bob Heniff, founder and CEO of Heniff Transportation.

Alan Goldstein, president of Coal City Cob, adds: “As we enter this new relationship, I could not be more convinced that both companies are committed to preserving the same shared values, which start and end with taking care of people. I’m excited for our organisation to join the Heniff team and improve our abilities to provide our customers with creative solutions and excellent service. Of equal importance, I believe our existing drivers will discover meaningful economic opportunities by gaining access to Heniff’s expansive footprint and uniquely diversified service offerings.” www.heniff.com

Quantix, a leading provider of chemical transport services in North America formerly known as A&R Logistics, has further expanded its footprint in the Gulf Coast region with the acquisition of five fleet owner companies and the appointment of a new agent, LD McCloud Transportation. Altogether, the deals add more than 140 trucks and ancillary equipment to the company’s liquids and plastics transport division.

The acquired companies are Dobbins Enterprises, C&S Express, Chancelor Transportation, T&K Chancelor Enterprises and Templet Transit. “Quantix continues to scale our services in Texas and the Gulf Coast regions, and these new assets strengthen our ability to do so,” says Chris Ball, president/ CEO of Quantix. “Greater capacity means better service for our customers, which remains the guiding purpose of our continued growth.”

These latest acquisitions follow from the purchase in October of G&W Tanks, which specialises in tank container transport, repair, cleaning and storage (HCB November 2022, page 14).

quantixscs.com

toluene can be handled like a fossil liquid fuel within existing infrastructure, at ambient pressure and temperature. After dehydrogenation, it can be reused many hundreds of times to bind hydrogen.

The realisation of a LOHC import terminal and a plant for the continuous, large-scale release of hydrogen are important additions to other planned activities in the port. Such activities include the development of the regional and national backbone and various planned projects for hydrogen production in the North Sea Canal Area.

The next phase of this initiative will focus on exploring the spatial, infrastructural, and financial requirements to establish the terminal over the next years. The objective is to have the first plants for delivery of hydrogen to local off-takers in operation before 2028, with the potential of further upscale. In total, the handled LOHC volumes will be at least 1m tonnes per annum.

THE PORT OF Amsterdam has signed a Memorandum of Understanding (MoU) with tank storage provider Evos and liquid organic hydrogen carrier (LOHC) pioneer Hydrogenious, with the aim of developing large-scale hydrogen import facilities in the port. The plan includes an LOHC dehydrogenation plant to produce between 100 t and 500 t per day, as well as related storage and handling facilities. All three parties to the agreement are founding members of the H2A platform, which focuses on the development of green hydrogen import infrastructure in the port of Amsterdam.

“We have been building and supporting the H2A platform from the beginning, working with our partners on green hydrogen imports via the port of Amsterdam,” says Ramon

Ernst, managing director of Evos Amsterdam. “We see a promising future in LOHC technology as it is intrinsically safe and fits with the port’s existing logistics infrastructure. We operate two large tank terminals that are perfectly suited for the storage and handling of LOHC. We are delighted to have teamed up with two exceptionally strong partners and look forward to working on concrete next steps.”

The liquid organic hydrogen carrier used by Hydrogenious, thermal oil benzyl toluene (LOHC-BT), is already well established in the industry as a heat transfer medium and, the partners say, has ideal properties for safe handling in ports. Due to its characteristics as a flame retardant and non-explosive carrier with a high volumetric energy density, benzyl

“The location of the port of Amsterdam, and the companies operating here and in the wider North Sea Canal Area, make our port ideally suited for such a terminal and plant,” says Koen Overtoon, CEO of Port of Amsterdam. “This region also offers large potential for offtake, with our connection to Schiphol Airport and the presence of large industrial clusters. Additionally, we collaborate with duisport to facilitate the distribution of hydrogen to the German and European hinterland, further increasing the offtake potential. We are thrilled about this new, key step, which will strengthen the position of the port of Amsterdam as a hydrogen hub, for import, storage, transhipment and distribution to the wider hinterland.”

“The H2A consortium has focused on LOHC technology that can rely on existing oil handling and storage capacities and significantly reduces potential risks of handling molecular hydrogen or other derivatives,” adds Dr Daniel Teichmann, founder and CEO of Hydrogenious. “For a port and industrial region like the Port of Amsterdam, that is located very closely to the city, this is of paramount importance.” www.portofamsterdam.com

HYDROGEN • NORTH-WEST EUROPE WILL NEED HYDROGEN IF IT IS TO MEET EMISSIONS REDUCTIONS TARGETS. AMSTERDAM IS LAYING PLANS TO PROVIDE AN IMPORT ROUTE FOR LOHC

TRANSPORT • LOGISTICS FIRMS ARE TAKING SUSTAINABILITY SERIOUSLY, NOT JUST FOR THEMSELVES BUT ALSO FOR THEIR CUSTOMERS. HOYER EXPLAINS HOW IT IS GOING ABOUT REDUCING ITS ENVIRONMENTAL IMPACTS

“FOR HOYER, SUSTAINABILITY aspects play an essential role at all stages of the supply chain,” says Björn Schniederkötter, CEO of the Hoyer Group. “With solid improvements over the last ten years, we have already achieved good progress towards our goal of minimising our carbon footprint.”

Last year, for example – and for the first time in the company’s history – more than 80 per cent of the kilometres travelled by Hoyer vehicles were undertaken using intermodal transport, a less CO2-intensive mode of operation. And for the remainder, 95 per cent

of Hoyer’s truck fleet is powered by lowemission Euro 6 engines.

For a company like Hoyer, with its pedigree of family ownership and leadership, “thinking in generations” is quite normal. “Keeping an eye on our employees’ welfare and managing the company sustainably and in the long term are self-evident for the Hoyer Group,” says Schniederkötter. “We will play a leading, forward-looking role in overcoming the current ecological challenges. Our solid financial situation enables us to continue making long-term strategic decisions and investments that support our sustainable vision and the values and business strategies of the Hoyer Group.”

The company has now defined some ambitious new medium- and long-term emissions and safety targets for 2025 and 2030. Meeting those targets will require a

strategic mix of measures, including testing further alternative fuels and the creation of a New Energies project group.

By 2025, transport-related CO2 emissions, which have already been reduced by 29 per cent since 2010, are targeted to reduce by at least a further 10 per cent - and emissions from non-transport operations to reduce by 27 per cent. The logistics company aims to reduce its transport-related tank-to-wheel CO2 emissions by a further 15.6 per cent to a total 25.6 per cent reduction by 2030.

To achieve its medium- and long-term sustainability goals, Hoyer has opted for a mix of measures that will involve further optimisation of logistical and operational processes throughout the whole company. In road transport Hoyer already has additional CNG and LNG trucks in operation and has started trialling HVO biodiesel. Earlier this year Hoyer said it was already testing alternative drive systems and it is in constant dialogue with well-known truck manufacturers to examine new developments.

A specifically composed project group with internal experts keeps a constant eye on the direction in which research into new energies is developing - so the international business has a finger on the pulse of the times. Furthermore, the logistics specialist is switching to electricity from renewable energy sources in plant operations in its non-transport sector.

Sustainability is, though, more than just about counting emissions. Taking care of the planet is one thing but people need to be protected and nurtured too – especially when it is so difficult to recruit and retain drivers.

Hoyer now offers training sessions and further education courses to honour its social responsibility, with a special focus on driver training. That includes preventative driving skills, derived from analysis of forward-facing safety cameras in the cabs that allows the company to get an insight into the risks facing its drivers every day. This and other training initiatives have helped to reduce the accident rate by more than 40 per cent over a ten-year period, Hoyer says.

www.hoyer-group.com

WASTEWATER • ALL SHIPS, PARTICULARLY TANKERS, CREATE WASTE DURING THEIR OPERATION. TWO PROJECTS SHOW THAT THERE ARE WAYS TO RECOVER AND TREAT THIS WASTE ASHORE

STOLTHAVEN TERMINALS HAS been operating onsite biological wastewater treatment plants at its terminals in Houston and New Orleans for more than 20 years, initially for its own use but, after an expansion and modernisation that was commissioned in 2018, for third parties as well. The treatment plants operate around the clock, using bacteria and other microorganisms to degrade organic contaminants to produce readily usable water that can be safely released into waterways.

Now, in a pioneering move, Stolthaven has set up a partnership with its sister company Stolt Tankers for the removal and sustainable treatment of wastewater from ships docked in Houston. Stolt Tankers was looking for a way to achieve its own sustainability targets and fulfil its commitment to the UN Sustainable Development Goal 14 to conserve and sustainably use the oceans, seas and marine

resources. Discharging washwater ashore rather than at sea is one step towards that commitment. This is not a legal requirement, other than for washwater from toxic cargoes.

“This idea was initially thought to be too complicated, expensive and, ultimately, unworkable,” explains Paul O’Brien, deepsea operations manager at Stolt Tankers Houston. “But we are passionate about this topic and started thinking about how we could do it and we knew where to start: Stolthaven Houston has a state-of-the-art treatment facility and, better yet, they’re part of the same company.”

In June 2021 the two companies began a pilot programme to identify and balance the challenges, costs and benefits of treating washwater from ships at the Houston plant. There was one obvious cost saving: until that

point, Stolt Tankers’ ships, like all others, would dock in Houston, discharge their tanks and then steam back down the Houston Ship Channel to clean their tanks and discharge the washwater, before returning to the port to reload.

On the flip side, there was the very real possibility that demurrage costs and delays to onward journeys could be incurred due to the extra time spent at dock to discharge the washwater. “Essentially, we were adding a dock to each ship’s time in port, which is counterintuitive to anyone in the shipping or logistics business,” says O’Brien. “The trick was to figure out how we could manage that without adding any time or costs. We had to think differently to find the savings – or at least the break-even point – for this to be feasible from a business perspective.”

Daniel Styrdom, general manager of Stolthaven Houston, explains: “Stolt Innovation was our first vessel and she discharged approximately 1,700 m3 of washwater. The initial calculations showed that we could execute the discharge within the vessel operations window and that it made sense financially. Since then, we have received multiple vessels and – through a lot of testing and data analysis with Stolt Tankers – we can see the benefits to both

businesses from a financial, operational and environmental perspective.”

During the first year, the project in Houston reduced the amount of washwater discharged to sea by more than 8,000 m3, saved more than 200 tonnes of fuel and reduced CO2 emissions by some 600 tonnes.

“Both businesses have been highly committed to this project,” says O’Brien. “It has all been additional work on something that is not mandatory but done for the sake of doing something good. The great news is we have been able to do it at no additional cost and people have happily invested their time because this benefits the marine environment.”

One factor that was important in the project was the logistical benefits of having a spare dock at the Stolthaven Houston terminal. Dock 11 was commissioned in 2017 but, as yet, does not have any shore tanks alongside. “Eventually, of course, our plan is to expand our storage facilities to this space, but for now, the dock is not in regular use,” explains Henrik Olsson, regional commercial manager,

US for Stolthaven Terminals. “When we started this project with Stolt Tankers, we knew that it could be the ideal layby space for ships to discharge wastewater.”

Stolt Tankers is now looking to expand its onshore discharge programme to other ports that have wastewater or water-reclamation facilities. “We are currently rolling out training to our port teams around the world and having conversations with operators in other regions,” says O’Brien. “We’re looking to extend the project to Stolthaven New Orleans next and, wherever possible, we will look to use Stolthaven Terminals’ facilities.

“From Stolt Tankers’ perspective, this has been one of the best cross-business projects we have worked on. Together with Stolthaven Terminals we have pooled our expertise and innovative thinking to achieve something new in the industry and positive for the environment. We have proven this is a method of opportunity for shipping and terminals.”

Styrdom adds: “This has been, and will continue to be, a successful partnership. Stolthaven Terminals and Stolt Tankers are now leading the way in terms of using our

facility to discharge and treat washwater onshore. Just as importantly, we have integrated our teams and operations to make a positive impact on the environment.”

Stolthaven Terminals is not the only terminal operator looking to use its expertise to help reduce the impact of vessel operations.

Spain-based Exolum has announced a plan to invest €30m in the construction of a hydrocarbon treatment and recovery plant in Algeciras, which will handle oily water from ships, minimising the environmental impact of these products in the oceans and also recovering and recycling hydrocarbons so they can be re-used. Exolum has set up a new subsidiary, Garbium, to develop the project and is collaborating with Bilbao-based shipping company Naviera Murueta.

The plant will have the capacity to treat 550,000 tonnes of product per year and is expected to be operational at the beginning of 2025. The project, which has already obtained environmental approvals and is currently in the detail engineering stage, will occupy a 21,500m2 plot where the receipt tanks for the residue consisting of 90 per cent water and 10 per cent hydrocarbon waste will be built. The plant will also be equipped with settling tanks for oil/ water separation, as well as end product tanks from which the recovered fuel will be dispatched. A water treatment unit will also be installed for the treatment of recovered water, thus ensuring it is delivered in compliance with environmental quality requirements.

With this project, Exolum intends to provide a service that is in high demand by the ships that operate in the area by enabling them to comply with the provisions of the International Convention for the Prevention of Pollution from Ships (MARPOL). By using high-capacity resources that offer an outstanding performance, they will be able to use these services without incurring excessive delays.

Furthermore, for Exolum it is part of a broader strategy to develop the circular economy, minimise toxic emissions and waste and increase the lifecycle of products treated at the plant.

exolum.com www.stolt-nielsen.com

Hafnia has announced a collaboration with Clean Hydrogen Works (CHW) to explore the development of a global-scale clean hydrogen/ ammonia production and export project, Ascension Clean Energy (ACE), to be located on the Mississippi River in Ascension Parish, Louisiana. The project will aim to capture up to 98 per cent of CO2 emissions from its processes and will also explore additional technologies that could result in zero-carbon or even carbon-negative production.

The partners are targeting first production by late 2027, with first exports to commence in 2028.

Mikael Skov, CEO of Hafnia, says: “As the world’s leading product tanker company transporting energy worldwide, Hafnia is well positioned to transport this clean fuel safely and efficiently to markets across the globe. We look forward to our continued collaboration with CHW and its partners in bringing this transformational project to Louisiana – in a strategically significant initiative aligned with furthering our overall sustainability objectives.”

“We are proud to work with project shareholder Hafnia, the world’s leading product tanker company, to bring the Ascension Clean Energy project to Louisiana,” adds Mitch Silver, COO of CHW. “An industry leader and proven innovator, Hafnia’s established track record of transporting hydrocarbons safely and sustainably around the world, as well as its stated priority to reduce carbon emissions, are fully aligned with ACE’s goals to meet the world’s growing demand for clean and affordable energy.”

hafniabw.com

ETT, VTTI’s terminal in Rotterdam, has picked up a contract to store sustainable aviation fuel (SAF) for one of its customers.

“The contract marks ETT’s further diversification into low-carbon fuels, and builds on the terminal’s ambition to become a key hub for the handling and storage of SAF, enabling the energy transition and helping to build the emerging renewable value chain in the Port of Rotterdam,” says VTTI. “Handling and storing

SAF is a perfect fit for VTTI as the company scales up its efforts to help achieve decarbonisation and moves towards reducing greenhouse gas emissions.”

www.vtti.com

Martin Midstream Partners has agreed to take a 10 per cent holding in the DSM Semichem joint venture alongside Samsung C&T America and Dongjin USA, to produce and distribute electronic-grade sulfuric acid (ELSA). Martin Midstream will use existing assets in Plainview, Texas and additional facilities as needed to provide feedstocks to the new production plant as well as provide land transport of finished product through its affiliate Martin Transport. The ELSA produced by the partners will be used by semiconductor manufacturers.

“We are excited to partner with Samsung C&T America and Dongjin USA in this unique opportunity to capitalise on the diverse and complementary skillsets, operating expertise, and vast market knowledge of the three parties,” says Bob Bondurant, president/ CEO of Martin Midstream. “The new facilities will incorporate technology currently being utilised to produce ELSA in Taiwan, which exceeds the quality of sulfuric acid being produced in the United States today.

“This strategic alliance allows the Partnership to capitalise on our existing asset base to participate in the manufacturing and transportation supply chain of the most advanced and power-efficient chip technology to date,” Bondurant adds. “ELSA supply presently sourced in the US does not meet current domestic demand, and with announced new fabrication and existing fabrication facility expansions, we anticipate an attractive market for the ELSA produced in Plainview.” mmlp.com

Furetank’s dual-fuel tanker Fure Valö has performed the first voyage using a new fuel blend, supplied by charterer Equinor, that contains 30 per cent used cooking oil with standard marine gasoil. Based on early indications of the test voyage, the fuel maintains the same level of performance as conventional gasoil.

The initial voyage involved a round trip between Mongstad in Norway, where the bunkers were supplied, and Reykjavik, Iceland. Another five or six round trips are planned on the same route to prove performance in the harsh weather experienced in the North Atlantic, as well as the fuel’s handling over time.

“Acting as test pilots for this new loweremission fuel is an important and honourable mission for us,” says Furetank CEO Lars Höglund. “Even if we primarily run our dual-fuel vessels on LNG/LBG or gasoil today, they are designed to be flexible, future-proof and easily converted to run on any fuel that will prove to be the right choice for the future.” www.furetank.se

Mitsui OSK Lines (MOL) and JERA have signed a memorandum of understanding to launch a study into the transport of ammonia for use as fuel, including shipments to JERA’s ammonia-fuelled power station due to open in Aichi prefecture, Japan in the late 2020s. MOL notes that, at present, ammonia is used mainly as a raw material for fertilisers and there is an established maritime trade, but as ammonia emerges as a next-generation clean energy source, large-scale demand for ammonia and for its transport by sea is expected in the future.

MOL and JERA will now look to develop a large ammonia carrier design, suitable for serving thermal power plants and receiving terminals; install and operate propulsion

systems using ammonia as a marine fuel; and work with related parties to foster the development of rules for the reception of fuel ammonia.

Greater use of ammonia as a marine fuel is one element of MOL’s environmental vision to achieve net-zero greenhouse gas emissions by 2050, under which it has targeted the introduction of some 110 net-zero oceangoing vessels by 2035. www.mol.co.jp

Leading specialty chemical and ingredients distributor IMCD Group has become a member of Together for Sustainability (TfS), a member-driven initiative that aims to raise standards of corporate social responsibility throughout the chemical value chain.

“The sustainability challenges we face today can only be tackled in collaboration. It is about working together, being transparent and

sharing knowledge,” says Marcus Jordan, COO of IMCD. “We believe that joining TfS brings us a step closer towards improving our sustainability performance and accelerating the sustainability journey of our customers and suppliers. We are looking forward to working closely with TfS and its members to create solutions and share knowledge and expertise in the supply chain.”

“I am very proud to welcome IMCD Group to the TfS family,” adds Bertrand Conquéret, president of TfS. “The arrival of IMCD Group expands our reach and increases our impact on the sustainability performance in chemical supply chains around the world. As the need for sustainable businesses only intensifies, TfS is the crucial enabler to make supply chains and businesses at large more sustainable and resilient, and contribute to developing a better world.” www.imcdgroup.com www.tfs-initiative.com

THE HULL OF The new inland tank barge Stolt Ludwigshafen has arrived in Rotterdam after a seven-week sea voyage from its building yard, Mercurius Shipping in Yangzhou, China. It will now be fitted out and, once the engine, electrical systems, wheelhouse, piping and crew accommodation are finalised, it is due to go into service in the spring of 2023.

The arrival of the new vessel marks a milestone in a plan hatched by BASF three years ago, after it had experienced difficulty moving its products on the Rhine as a result of

low water – a phenomenon that happened again this year. Along with Stolt Tankers, BASF developed a concept for a tank barge that would be able to operate even in extreme low-water conditions and ensure that the transport of its products, especially between its major production sites in Ludwigshafen and Antwerp, would not be affected by future low-water events.

Uwe Liebelt, president, European Verbund Sites, for BASF, explains more: “Following the unprecedented low water levels of the Rhine

in 2018, I am pleased that, with our robust contingency measures already taken, we were able to manage the challenges of this year’s low water period quite well. The innovative design of the new Stolt Ludwigshafen will be another crucial element for further increasing the supply security and thereby competitiveness of our largest manufacturing site in the world.”

The main objective of this project was to create a barge with a high load-bearing capacity and a shallow draught, while always ensuring safe operations and full manoeuvrability even in extreme low-water situations through the use of a hydrodynamically optimised hull shape and an adapted propulsion based on three electric motors fed by high-efficiency diesel generators.

The new tank barge is 135 metres long with a beam of 17.5 metres, considerably larger than traditional tank barge designs. It will have a transport capacity of some 2,500 tonnes in ten stainless steel tanks, again much larger than standard designs, and under extreme low water conditions it will still be able to pass the critical point in the Rhine near Kaub while carrying 650 tonnes of product.

The concept was put together by BASF in collaboration with a consortium consisting of Duisburger Entwicklungszentrum für Schiffstechnik und Transportsysteme (DST), Technolog Services and Agnos Consulting, which specialise in various aspects of shipbuilding. The detailed design was completed in partnership with Stolt Tankers, which then placed the order for the barge and will operate it exclusively for BASF.

“I am proud of what we have achieved during this exciting partnership with BASF, which supports our commitment to developing new technologies and ship designs for a greener maritime industry,” says Lucas Vos, president of Stolt Tankers. “Our team is primed and ready to start the next, crucial stage of the building process. We are looking forward to operating the Stolt Ludwigshafen exclusively for BASF and seeing a considerable period of planning and preparation brought to life!” www.stolt-nielsen.com

THE CHEMICAL TANKER MARKET AS IT EMERGES FROM A LONG DOWNTURN. ODFJELL BELIEVES THERE IS FURTHER UPSIDE POTENTIAL

ODFJELL HAS REPORTED timecharter earnings from its tanker shipping operations of $171.3m in the third quarter, up from $159.9m in the previous period and $125.0m in third quarter 2021. “We are pleased to report another strong quarter for Odfjell,” says CEO Harald Fotland. “The results are driven by a robust chemical tanker market. We continue to perform well both operationally and commercially, capturing the ongoing momentum in our markets. The improved cash flow generation enables us to strengthen our balance sheet and also secures attractive returns to our shareholders. We expect continued strong spot rates across most trade lanes, and foresee slightly improved TCE results in fourth quarter 2022.”

Along with an improved contribution from Odfjell Terminals, Odfjell achieved a net profit of $50.2m in the third quarter, continuing an upward trend over the past year and contributing more than half the $91.2m made in the first three quarters.

Commenting on the results, Odfjell says that there has been further reduction in the volume of swing tonnage working in the core chemical and vegoil trades; moreover, less sophisticated chemical tonnage has been swinging into clean petroleum products (CPP), leading to tight supply across the market.

“The ongoing energy crisis is also driving strong demand for energy-related chemicals and biofuels,” Odfjell adds.

Odfjell has responded to the improving chemical tanker market by reducing its participation in pool arrangements, a plan it announced along with its half-year figures.

That has had the effect of reducing the overall volume of cargo carried and, following the re-delivery of coated pool vessels, an increase in the proportion of chemicals in the cargo mix, which further boosted the company’s returns.

More pool vessels are due for re-delivery in the fourth quarter, which will also result in the

closure of the Handy pool. Given the state of the market right now, Odfjell does not expect this to have a significant impact on its earnings.

Odfjell is also taking advantage of high freight rates to reap benefits in the contract of affreightment (COA) segment; it renewed 6 per cent of its COA portfolio during the quarter at an average increase of 9 per cent. Odfjell also reports increasing demand from charterers to enter into COAs, while there is limited availability in the market. As such, it expects continued strong momentum in contract rates during the peak renewal season in the fourth quarter.

To compensate for the loss of pool capacity, Odfjell is also actively looking to grow its fleet; it will take eight 25,000-dwt stainless steel newbuildings on timecharter, the first two of which have already been delivered, with the last due to arrive in 2025. Overall, the chemical tanker orderbook remains remarkably low, considering the high freight rates being earned in the current market; newbuilding prices are high and there is uncertainty over future environmental regulations and what that will mean for the choice of propulsion systems and sailing speeds.

That means, Odfjell says, that the market can be expected to remain very strong in the near term and, over the next three years, growth in tonne-mile demand will exceed fleet growth, leading to a strong chemical tanker cycle. That will support the spot market and the appetite for COAs and Odfjell expects a further increase in earnings in the fourth quarter.

www.odfjell.com

Seapeak has struck a deal to acquire gas shipping specialist Evergas from Jaccar Holdings for some $700m in cash. Evergas owns and operates two very large ethane carriers (VLECs) and eight ‘Multigas’ carriers, all on fixed-rate timecharters to Eneos and all dual-fuel; it also controls six LPG carriers under leases that expire in 2024.

“Acquiring Evergas is another big step in Seapeak’s evolution as a leading owner and operator of liquefied gas carriers,” says Mark Kremin, Seapeak’s CEO. “Just as we’re bullish on LNG, we’re also bullish on NGLs, especially given the even greener nature of NGLs. Already a world leader in NGLs, Ineos is now growing in LNG, and we are thrilled to be adding them as a key customer, further diversifying our portfolio. Together, Ineos and Evergas are vital to America’s liquefied gas export story and their collaboration to develop CO2 carrier trades will be vital to decarbonising Europe.”

“At Evergas we are pleased to complete the sales process and become part of Seapeak – one

of the gas industry’s biggest players, which also brings us significant financial strength,” adds Steffen Jacobsen, CEO of Evergas. “This will provide a solid platform on which we can continue to grow our businesses in NGLs and CO2, where we see outstanding potential for growth.”

For Jaccar, the sale of Evergas is part of its deleveraging plan agreed with its creditors. The sale is subject to standard closing conditions and is expected to close by the end of this year. www.seapeak.com

Petredec has formed a new company, Fortitude Shipping, to take over its 11 handysize LPG carriers. The fleet comprises eight ethane/ ethylene-capable vessels, two semi-refrigerated units and one fully refrigerated ship. With an average age of four years, the Fortitude fleet is, Petredec says, the youngest and most fuelefficient in the sector.

The London-based company will focus on the transport of ethane, olefins and ammonia as well as the group’s core LPG trade. Petredec

says Fortitude is also well placed to benefir from the emerging transition to cleaner marine fuels.

“The majority of the Petredec Group’s verticals have each achieved a level of scale that now warrants operation as standalone business units to better focus on performance and growth,” says Giles Fearn, Petredec Group CEO. “The latest of these, Fortitude Shipping, is our wholly owned subsidiary dedicated to the movement of NGLs, which includes the second largest and youngest ethane/ethylene capable fleet in the sector. With an efficient modern fleet and industry-leading team operating the business, Fortitude is well placed going into an exciting period in shipping as we navigate towards a low-emission society.” www.petredec.com

Furetank and Algoma Central have doubled the size of their joint venture, FureBear, adding another four dual-fuel product tanker newbuilding contracts at China Merchants Jinling. Two of the four Vinga-series ships were ordered by Furetank in September and will now transfer to FureBear; the two additional orders are due for delivery in 2025.

“The expansion of our FureBear investment with Algoma is exciting news”, says Lars Höglund, CEO of Furetank. “This is yet another endorsement of the environmental benefits and innovative design of our Vinga series. I look forward to delivering on these benefits with our partner and working together to fulfil the need for modern and efficient tonnage in the markets we serve.” www.furetank.se

Kirby Corp has reported third quarter revenues of $745.8m, up from $598.9m a year ago, with net earnings rising from $10.3m (adjusted for

one-off items) to $39.1m. David Grzebinski, president/CEO of Kirby, says: “I am pleased with Kirby’s third quarter results and the improvement in both of our segments. During the third quarter, our inland marine transportation business delivered strong results with significant sequential and year-over-year improvement in profitability. Tight market conditions in inland led to sequential increases in spot market rates in the high single digits, and term contract pricing that continued to push higher. Overall, higher demand and pricing improvements helped to improve inland operating margins into the low double digits during the quarter.

“Coastal marine transportation also delivered improved financial performance with steady gains in revenue and operating income,”Grzebinski adds. “Market conditions were favourable in the quarter, with our barge utilisation in the low to mid-90 per cent range and modest increases in spot prices. These factors coupled with continued cost discipline resulted in further improvement in operating income for our coastal business during the third quarter.”

Grzebinski is also bullish about the near term outlook: “Refinery activity remains at high levels, our barge utilisation is strong in both inland and coastal, and rates are steadily increasing. While we expect some near-term headwinds related to record low water conditions on the Mississippi River, increasing delay days due to normal seasonal weather conditions, and high levels of shipyard activity in coastal, our outlook in the marine market remains strong.”

kirbycorp.com

Exmar has reported third quarter revenues of $95.6m, down from $136.1m for the same period last year, largely due to the sale of its Tango floating LNG unit. Exmar’s shipping

activities have been on the firm side of stable all year, with average timecharter equivalent rates higher during the first three quarters than they were in 2021.

Prospects for the midsize gas carrier market, where Exmar is a major player, look positive for the rest of the year despite uncertainties in the ammonia trades resulting from the conflict in Ukraine. Higher LPG production in the US and alternative ammonia exports from the Middle East and Far East are adding to tonne-mile demand, which should help soak up the large number of newbuildings due to enter the fleet next year. In the pressurised markets, refinery cuts and demand destruction in the Far East put pressure on rates but the sanctioning of Russian LPG exports in Europe once more increased tonne-mile demand and continues to support market rates. exmar.be

BW STAYS STRONG

BW LPG has reported third-quarter timecharter equivalent earnings of $130.0m, 24

per cent up on last year, with EBITDA ahead by 42 per cent at $92.8m and after-tax profit up 58 per cent at $46.4m. The improvement reflects higher spot rates in the LPG market along with improved fleet utilisation following the completion of the dual-fuel propulsion retrofitting programme.

BW LPG’s planned acquisition of Vilma Oil’s LPG trading operations, announced in August, has now received regulatory approval and is expected to be completed by the end of the year. During the third quarter BW LPG also sold and delivered the 2007-built VLGC BW Prince to new owners, generating some $44.2m in cash and a net book gain of $2.3m.

Looking ahead, BW LPG remains optimistic for 2023, despite growing macroeconomic concerns and continued geopolitical uncertainties. The US is delivering record volumes of natural gas production and there has been significant growth in LPG exports from the Middle East, helping meet strong demand in Europe. www.bwlpg.com

Insight is published by the Tank Storage Association, the voice of the UK’s bulk storage and energy infrastructure sector.

To contact the editorial team, please email info@ tankstorage.org.uk

TSA Insight Team

Peter Davidson, Jamie Walker, Nunzia Florio

CONNECT WITH US @UK_TSA TSA

Tank Storage Association @uk_tsa

CONTACT

Tank Storage Association

Devonshire Business Centre Works Road Letchworth Garden City Herts. SG6 1GJ United Kingdom

Telephone: 01462 488232 www.tankstorage.org.uk

TSA has used reasonable endevours to ensure that the information provided in this magazine is accurate and up to date. TSA disclaims all liability to the maximum extent permitted by law in relation to the magazine and does not give any warranties (including any statutory ones) in relation to its content. Any copying, redistribution or republication of the TSA magazine(s), or the content thereof, for commercial gain is strictly prohibited unless permission is sought in writing from TSA. Claims by advertisers within this magazine are not necessarily those endorsed by TSA. TSA acknowledges all trademarks and licensees.

Peter Davidson Executive Director, TSAWelcome to the winter edition of Insight. November saw world leaders gather in Egypt for the 27th session of the Conference of the Parties (COP 27) with a view to building on previous successes and paving the way for future ambition to effectively tackle the global challenge of climate change. The bulk storage and energy infrastructure sector in the UK has been vocal in its commitment to supporting the achievement of the Government’s climate neutrality targets. In this issue, we explore our sector’s ambitions, innovations and transformative journey as it plays its part to ensure the UK can meet its Net Zero target. We also explore the role of education and training as we prepare for the future and ensure that future skills needs will be met. I hope you enjoy this new edition of Insight and don’t forget to follow us on social media for all our latest news.

David McCausland, Head of Rating at Farebrother, examines the Autumn Statement and 2023 Rating Revaluation.

06 Reducing oil storage terminal emissions through digitalisation

Remote thief hatch monitoring helps terminals identify any unsealed hatches quickly, which can significantly reduce emissions.

10 UM Terminals passes quality audits with flying colours

Continually meeting customer expectations is firmly at the top of the agenda for UM Terminals’ dedicated team.

12 Understanding natural hazards risks to your site

RAS Safety Consultants explore risk reduction and preparedness for natural hazards.

14 Stanlow Terminals is transforming for tomorrow and is ready to lead the energy transition: in conversation with Michael Gaynon

Michael Gaynon, Chief Executive Officer at Stanlow Terminals, discusses the energy transition and future opportunities for the bulk storage and energy infrastructure sector.

17 Celebrating 20,000 process safety champions

The UK and global high hazard industries celebrate a significant milestone.

18 Benefits of NonDestructive Testing (NDT) for lead based coatings

Integrity Support Solutions explore the benefits of NDT for lead based coatings.

21 GRP – the alternative to steel grating

Marine applications create a wide array of challenges for construction materials.

22 How new career pathways will ensure bulk liquid storage drives our greener future

There has never been a more pressing need to give apprentices and employees alike transferable, futureproof skills.

25 UM Terminals appoints new Managing Director Phil McEvoy takes up the role of Managing Director at UM Terminals.

26 Mobile and environmental-friendly emissions reduction services for every application

ENDEGS explains how reducing industrial emissions requires modern and reliable technologies.

News:

Ita sundit adit accabo. Nequas et, te laut vent, voluptas dellatibusa volo qui abo. Caeptam fugit, que volorecabo. Ut verum in reicae nim qui consequ assunt.

The following meetings will take place online:

Volupta exerate verovit lita sequas re etument pliti berrore iciati quiaeperiae volupta tatate nonem. Ro issi consequis parum aut liamusam exerae cuptum, untis dem re quidem eaquuntota sum nos acias dit aut eatem earum quatemporem aped quatquaes dunt eumquibus, as et que nonsequis dit venia vid qui sererorro blametur? Ehenisquasim veni doloreroremo blatur?

• 6 December 2022: TSA Energy Transition Committee

• 8 December 2022: TSA Council

TSA’s

• 15 December 2022: TSA SHE Committee

Obist, architatur? Qui re deritas volore necum imporisqui doluptate porem exeris endi dolenihilia de et fugiaspient.

For more information on TSA’s meetings, write to info@tankstorage. org.uk

Business Rates bills are all based on the product of a Rateable Value and a Multiplier. On 17th November 2022 in his Autumn Statement, Chancellor Jeremy Hunt confirmed that the 2023 Rating Revaluation in England and Wales would proceed, with a valuation date of 1st April 2021. This is the first Revaluation since 2017, which had a valuation date of 1st April 2015. This six-year gap is very unfortunate. The proposed 2022 Revaluation was changed to be from 2021 which was then cancelled altogether due to the Covid pandemic. The Devolved Administrations in Scotland and Northern Ireland are now expected to confirm their own 2023 Revaluations.

New Rating Assessments come into force from 1st April 2023, but there are important differences in the valuation dates. In England and Wales, the valuation date is 1st April 2021, a date chosen by the Government to allow the impact of the Covid pandemic to be considered. This followed a law change ruling out any Rating Appeals citing Covid as a “Material Change in Circumstances”. In Scotland, the valuation date is 1st April 2022. In Northern Ireland, the 2023 valuation date is 1st October 2021, with their last Revaluation having taken place in 2020, with a valuation date of 1st April 2018.