City Rail Link Limited Statement of Performance Expectations for Financial Year 2023 - 2024

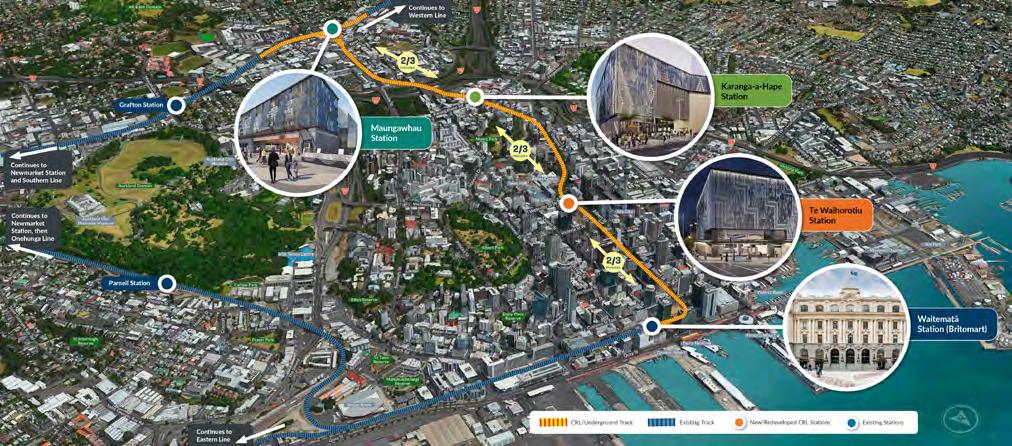

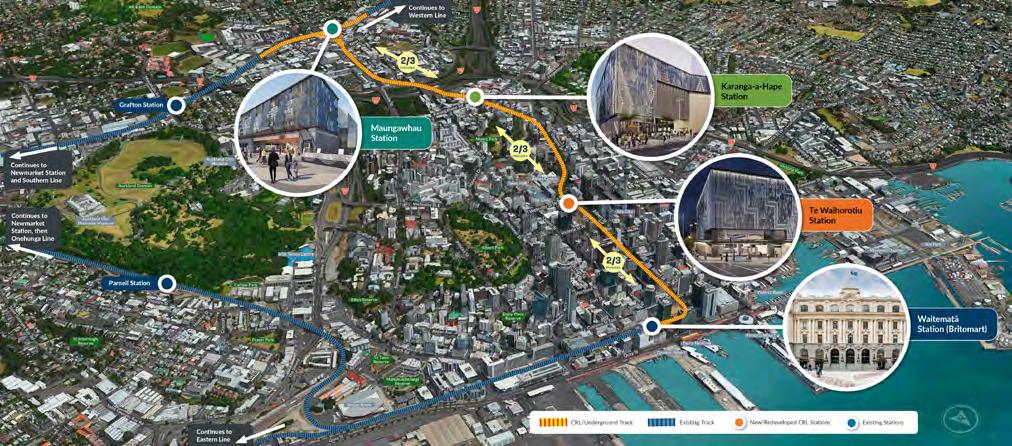

This Statement of Performance Expectations acknowledges that the New Zealand Geographic Board Ngā Pou Taunaha o Aotearoa has formally adopted te reo Māori names for the four stations connecting City Rail Link.

The official station names are:

• Maungawhau Station

• Karanga-a-Hape Station

• Te Waihorotiu Station

• Waitematā Station - this station will be called “Waitematā Station (Britomart)” until it is fully operational.

The te reo Māori names were gifted to the project by CRL Ltd’s Mana Whenua Forum. The names more accurately reflect the geographic locations of the stations and acknowledge mana whenua’s historic ties to Tāmaki Makaurau/Auckland. The te reo Māori names align with striking final designs for the Maungawhau Station, Karanga-a-Hape Station and Te Waihorotiu Station which embed mana whenua’s culture and kaitiaki values.

City Rail Link Limited Statement of Performance Expectations 2 Contents Statement of Responsibility 3 Project Overview 4 Objectives of the City Rail Link project 9 Targets and Measures 11 Statement of Forecast Comprehensive Revenue and Expenses 17 Statement of Forecast Financial Position 18 Statement of Forecast Changes in Equity 19 Statement of Forecast Cash Flows 20 Notes to the Forecast Financial Statements 21 Appendix: Directory 24

Statement of Responsibility

CRL Ltd is responsible for the statements contained in this document, including the appropriateness of the business assumptions underlying them. CRL Ltd is also responsible for internal control systems that provide reasonable assurance as to the integrity of its financial reporting.

John Bridgman - Chair

Anne Urlwin - Director

2 June 2023

This Statement of Performance Expectations (SPE) sets out the performance expected of City Rail Link Limited (CRL Ltd) for the period 1 July 2023 to 30 June 2024.

City Rail Link Limited Statement of Performance Expectations 3

Sean Sweeney, Chief Executive of CRL Ltd at the ‘Meet Your Stations’ event

City Rail Link (CRL or the Project) will contribute to a vibrant Auckland by transforming how people travel, live, work, visit and enjoy our city.

CRL is New Zealand’s largest transport infrastructure project and a game-changer for Auckland.

The project will deliver a much more efficient rail network with more trains and faster journeys to meet the demands of a growing international city.

City Rail Link’s scope includes:

• Building twin 3.45-kilometre-long tunnels connecting Britomart to Mt Eden, with tunnel depths of up to 42 metres below ground

• Building two new stations - Te Waihorotiu Station under Albert Street with entrances at Wellesley and Victoria Streets, and Karanga-a-Hape Station under Karangahape Road with entrances at Beresford Square and Mercury Plaza

• Transforming the existing Waitematā Station (Britomart) into a two-way through station, and major redevelopment of the Maungawhau Station in Mt Eden

• Capacity for nine-car electric trains providing more seats and up to 48 trains per hour (24 in each direction) in the peak when CRL is fully operational

• Preparing stations and key urban surrounds to enable work by Kāinga Ora and Eke Panuku Development Auckland for the construction of new homes, community spaces and workplaces

• Streetscape enhancement around stations and along Albert Street

• Wider rail network improvements at The Strand, Ōtāhuhu and Newmarket.

4 City Rail Link Limited Statement of Performance Expectations

CRL joins the rail network and adds new stations

The Crown and Auckland Council (CRL Ltd’s Sponsors) have agreed to co-fund and partner to deliver the Project. The Sponsors collaborate on other initiatives to achieve a number of overarching objectives. These include creating significant travel time savings and better connections for Auckland.

Once built, CRL will double the number of people living within 30 minutes travel of Auckland’s city centre and allow for a train at least every 10 minutes during peak when fully operational.

The Covid-19 pandemic, lockdowns and associated impacts have led to the revision of cost and time required to complete the Project.

Auckland endured two level four lockdowns and a further 280 days of restricted working conditions (plus more under the Covid traffic light system). More than 800 people working on CRL were infected with the virus.

The cost of the Project is now estimated to be $5.493bn, a $1.074bn increase on the previous estimate of $4.419 billion (which was approved by the Sponsors in May 2019).

Construction of the stations and supporting rail infrastructure is now expected to be completed by Link Alliance by November 2025. The preCovid-19 completion date was the end of 2024.

Day 1 opening for passenger services will be dependent on satisfaction of all requirements for the commencement of operations as managed by Auckland Transport and KiwiRail Holdings Limited.

CRL will drive investment in businesses, employment, and housing around CRL stations and along Auckland’s rail corridors, supporting a more sustainable and productive city.

Station areas will become bustling urban destinations that open up the surrounding streets creating ideal places to live, work and socialise.

CRL Ltd works constructively with local businesses, residents and stakeholders to proactively ensure that disruption is minimised whenever possible. The Targeted Hardship Fund (THF) continues to function well with funding being provided to businesses in a timely manner.

As of 31 March 2023, a total of $4,515,325 has been paid to affected businesses from the THF. Out of 320 applications, 266 have been paid or approved. Thirty-nine have been declined due to not meeting the eligibility criteria and the remainder are pending or being processed.

CRL Ltd’s collaboration with KiwiRail and Auckland Transport has always been vital to the successful completion of the Project and its ultimate operation.

Our valued partnership with mana whenua ensures CRL benefits from Māori mātauranga (knowledge) across all relevant stages.

World class stations, designed in collaboration with mana whenua, will be unique to New Zealand and will recognise the cultural and historic ties of iwi to Tāmaki Makaurau.

Health and Safety will always be a priority for CRL Ltd. CRL will continue to work closely with WorkSafe to find ways to utilise the project to raise the overall standard of Health and Safety in the New Zealand construction industry.

5 City Rail Link Limited Statement of Performance Expectations

Inside the second eastern tunnel at Maungawhau Station

CRL Ltd’s delivery role

CRL Ltd is a Crown Entity established to manage the delivery of the City Rail Link – the largest transport infrastructure project ever undertaken in New Zealand.

CRL Ltd was established as an operating company on 1 July 2017. Establishment followed an agreement by the New Zealand Government (Crown) and Auckland Council to jointly fund the Project. Previously, Auckland Council and Auckland Transport – a Council Controlled Organisation –were responsible for the delivery of CRL. CRL Ltd is not a Council Controlled Organisation.

Incorporated under the Companies Act 1993, CRL Ltd is a majority-Crown-owned entity and is listed under Schedule 4A of the Public Finance Act 1989 and Part 2 of Schedule 1 of the Ombudsman Act 1975. In addition, the Public Finance Act 1989 applies several provisions of the Crown Entities Act 2004 to CRL Ltd, as if it were a Crown entity under that Act.

CRL Ltd’s shareholders are the Crown, acting by and through the Ministers of Finance and Transport, and Auckland Council. The Crown holds 51 per cent of the voting shares, and Auckland Council holds the remaining 49 per cent. Each shareholder contributes 50 per cent of the cost of the Project by way of equity contribution. The company’s Board has five non-executive directors appointed by the shareholders, following Cabinet and Auckland Council Governing Body approval.

The Board is committed to a high standard of corporate governance and regulatory compliance in guiding and monitoring CRL Ltd’s activities. It carries out its accounting, reporting and risk management responsibilities in accordance with legislation. The directors comply with their obligations under the Companies Act 1993, the Crown Entities Act 2004, the Public Finance Act 1989 and other relevant legislation.

6 City Rail Link Limited Statement of Performance Expectations

Te Waihorotiu Station platforms looking south toward Karanga-a-Hape Station

To aid the directors, CRL Ltd’s Board has two standing committees:

• Audit and Risk Committee, which provides recommendations, counsel and information on accounting, reporting, risk management and responsibilities under legislation

• People and Remuneration Committee, which provides advice and recommendations on remuneration and human resources policies for CRL Ltd.

CRL Ltd’s Chief Executive, who is accountable to the Board, has responsibility for the management, operation and administration of CRL Ltd. The Chief Executive has appointed a leadership team to provide direction and oversight of the project, which is managed through a series of workstreams. A suite of policies that underpin the company’s objectives and mandate also provide a link to day-to-day company operations.

CRL Ltd reports regularly to its Sponsors as set out in the Project Delivery Agreement (PDA).

CRL Ltd and its contractors collaborate with key stakeholders representing local government, transport, business, and mana whenua to deliver a successful project. The company contributes to wider social, sustainability and economic outcomes in line with the PDA and is also mindful of the impact construction has on immediate neighbours.

CRL Ltd continues to work closely with Auckland Transport and KiwiRail Holdings Ltd to ensure the project once completed can meet their operational requirements. This collaboration extends to transfer of discrete assets prior to practical completion.

CRL Ltd’s construction progress is reported to stakeholders (including the public) through various channels including CRL Ltd’s website, social media, events, site tours and a monthly community newsletter.

7 City Rail Link Limited Statement of Performance Expectations

Waitematā (Britomart) Station platform on northern side

Maungawhau Station site looking north west

Maungawhau Station site looking north west

What CRL Ltd intends to achieve in 2023-2024

In conjunction with the Statement of Intent, the SPE describes key focus areas in 2023/2024 to help the Project achieve key performance targets. These targets support the objectives of the Project and CRL Ltd. CRL Ltd will report on its performance in implementing these activities in its 2023/2024 Annual Report.

The table below highlights those contracts and contractors CRL Ltd is working with to deliver the Project and meet the performance targets and measures outlined for 2023-24.

Contract Contractor Scope

C3 Link Alliance (Vinci, Downer, Soletanche Bachy, WSP, AECOM, Tonkin+Taylor, CRL Ltd)

The design, supply, construction, and installation management of key work disciplines across the full geographic area of CRL from just south of Wyndham St to the North Auckland Line (NAL) at Mt Eden and two new central underground stations. Works include design and construction of tunnels and the underground stations, connection of tunnels into the existing NAL live rail corridor environment, the installation and integration of rail systems, and testing and commissioning from Waitematā Station (Britomart) to Maungawhau Station. C5 and C7 are included in the C3 Alliance.

C5 Link Alliance (Awarded as part of expanded C3 contract)

C7 Link Alliance (Awarded as part of expanded C3 contract)

C8 Newmarket Junction (KiwiRail Holdings Limited)

C9 Britomart East (KiwiRail Holdings Limited, Martinus Rail NZ Ltd and Martinus Holdings Pty Limited)

Connection of tunnels into the existing North Auckland Line live rail corridor environment

Rail systems, integration testing and commissioning from Waitematā Station (Britomart) to Maungawhau Station

New crossover and associated signalling equipment at Newmarket

Remodelling of Britomart East junction to increase trains per hour capacity including structural alterations

CRL Ltd will work with the Ministry of Transport to meet the Government’s expectations around national security risks and interests in its procurement framework and processes.

9 City Rail Link Limited Statement of Performance Expectations

CRL Ltd’s Reportable Outputs

This section describes CRL Ltd’s outputs for the period 1 July 2023 to 30 June 2024 which are reportable under section 149E(1)(a) of the Crown Entities Act 2004.

Per the appropriation, CRL Ltd’s reportable output is to “Deliver the Auckland City Rail Link project by 2025”. Per section 149E(1)(c) of the Crown Entities Act 2004, CRL Ltd does not propose to supply any class of outputs in the 2023-2024 financial year that is a non-reportable class of outputs.

The expected revenue and expense for each reportable output for the financial year 2024 is as follows:

Deliver the City Rail Link Project Revenue ($’000) Expenditure ($’000)

Deliver the Auckland City Rail Link project by 2025 6,130

184,815

Administer the Targeted Hardship Fund (THF) $6,000,000 revenue and expenditure. THF cashflow nets off to nil in the CRL Ltd Financial Statements.

The performance of the output will be measured through the Output Measures noted below.

CRL Ltd’s Output Classes for the fiscal year 2024 relate to Health and Safety, Project Delivery, Funding Envelope, Sustainability and Social Outcomes, and Community and Stakeholder Engagement.

Oversite Development: whilst there is no specific target for 2023/24, development work continues, led by Kāinga Ora and Eke Panuku Development Auckland (and supported by CRL Ltd) on this important value creation and capture opportunity for Auckland and as a financial contributor to CRL Ltd.

10 City Rail Link Limited Statement of Performance Expectations

Karanga-a-Hape Station below Mercury Lane looking south toward completed TBM Tunnel

Statement of Performance Expectations

Targets and Measures for 2023-24

The performance targets and measures (performance targets) for 2023-24 have been established by CRL Ltd management with input from the CRL Ltd Board and Sponsors. These performance targets are considered relevant in providing stakeholders and readers of this Statement of Performance Expectations a strong indication of the progress of the Project across both construction and non-construction activities.

CRL Ltd has one output class and six output areas consistent with those set out in the Statement of Intent (SOI). The SOI outlines the purpose of CRL Ltd, which is to manage the delivery of a 3.45km long underground railway and two new stations to improve public transport in Auckland and contribute to the growth and prosperity of both the country’s largest city and wider New Zealand.

The SPE and SOI were prepared at different times and whilst the performance targets established for the SPE are largely aligned with the SOI there are some targets which are different, for example, delivery targets are specific to each reporting period. For the performance targets related to approved appropriation (i.e. funding) for (i) CRL and (ii) the THF, these are consistent with the Estimates within the Transport Vote for FY23 and those proposed for FY24.

Disclosure of judgements and assumptions

In preparing the Statement of Performance Expectations, CRL Ltd has made judgements on the application of the reporting standards including PBE FRS 48 and has made estimates and assumptions concerning the future. The estimates and assumptions may differ from the subsequent actual results.

CRL Ltd has selected performance targets to reflect material and important milestones in construction progress of the CRL. Consideration has been given to likely areas of interest for the wide range of

stakeholders in the Project, including ratepayers, the local community and New Zealanders generally.

There are conditions that may impact CRL Ltd’s performance targets and result in a variation from the anticipated or forecast results. As was seen over 2020-2022 with Covid-19, these events are often outside the control of CRL Ltd. These events can include changes in international travel restrictions, global and domestic economic conditions and international policy that may impact areas such as recruitment, availability of critical materials and supplies and any other unforeseen circumstances.

Performance Measures

We discuss below some of the changes to the performance targets from the prior year and in particular new performance targets. We note which of the targets below are externally verified and any linkages between financial statements and service reporting. CRL Ltd monitors progress against performance targets through its monthly and quarterly reporting to the CRL Ltd Board and Sponsors. Service reporting is also addressed in CRL Ltd’s Annual Report through the comprehensive Project Overview.

Project Delivery

With Project Delivery, the performance targets reflect the build stage of the Project with early works contracts now complete and with most major works being delivered by Link Alliance (C3/5/7), apart from the C8 Newmarket and C9 Britomart East works. Project delivery performance targets all relate to Link Alliance works with practical completion expected in late 2025. C8 and C9 works completion is expected in mid-late 2024. As the majority of Link Alliance works are only fully complete towards the end of the Project, we have selected key milestones within each of the station works that are expected to be completed within FY24. Measuring interim key milestones helps

11 City Rail Link Limited Statement of Performance Expectations

provide a useful indication of project momentum within the overall construction programme.

We note that all the delivery milestones relate to physical works and hence are verifiable by CRL Ltd. Two of the delivery performance targets for FY24 (Normanby Road bridge and Karanga-a-Hape Station: Mercury Lane and Beresford Square superstructure works) were carried over from FY23. Superstructure includes completion of internal structures for example block walls, stairs, tunnel lining and panels for the façade. They were not completed in FY23 due to delays in design progress and the impacts of Covid-19.

Certain works when completed are then transferred by the Sponsors to the ultimate asset owner, which in most cases will be Auckland Transport or KiwiRail Holdings Limited. For FY24, these works include the transfer of the Normanby Road and Mt Eden Road bridges and Fenton Street footbridge. The C9 works (stages 1, 2a & 3a, 4-6) will also transfer to the ultimate asset owner. The remaining delivery performance targets are part of the larger station and tunnel assets which are only handed over when the project reaches practical completion.

Health & Safety

Health and safety is fundamental to the Project’s activities. The Health and Safety Performance Index (HSPI) provides CRL Ltd and Link Alliance with an overall metric to measure a number of leading and lagging Health and Safety indicators. These are combined to provide an overall indication of performance. The HSPI was developed in the UK and is used on other major international projects. The chosen score of 80 (out of 100) is based off international standards and represents a stretch target for the NZ construction industry. The HSPI target for FY23 was also 80. The supporting data for the HSPI score is provided by Link Alliance and reviewed by CRL Ltd.

In addition, CRL Ltd are targeting an increased number of areas achieved in the risk management maturity model (RM3) for the Link Alliance works. RM3 provides a system to assess and facilitate continuous improvement of our construction partners’ health & safety management systems, with results externally reviewed. The RM3 model and progress will be detailed in the CRL Ltd Annual Report.

12 City Rail Link Limited Statement of Performance Expectations

The Link Alliance civils team constructing the Maungawhau Station building

For FY24 we have lowered the Total Recordable Injury Frequency Rate (TRIFR) to “at or below six injuries per million hours worked” from the “seven injuries per million hours worked” in FY23. This change reflects consistency in health & safety performance by Link Alliance. The Project’s actual TRIFR performance in FY22 was 4.6 injuries per million hours worked.

Funding Envelope

The Funding Envelope targets are unchanged. The appropriation of $346m represents the Crown’s 50 per cent share of the total budgeted funding for FY24 of $692m. In FY23, the funding budget was $1,028bn (appropriation $514m) but actual funding requested was $909m (lower than budget by 13 per cent). This reduction in required funding was in part due to delays with design finalisation and the residual impacts of Covid-19. It also highlights the difficulty in forecasting accurately construction spend over a 12-month period. The actual project funding is recorded in the CRL Ltd financial statements Statement of Cashflow. It is also important that CRL Ltd continues to maintain a tight discipline over corporate costs.

Sustainability and Social Outcomes

Sustainability and Social Outcomes measures are consistent with prior years with CRL Ltd continuing to work towards sustainability excellence but now fully focused on the Project Alliance Agreement with Link Alliance for the C3 works. The Project’s sustainability performance is externally verified using the Infrastructure Sustainability Council (ISC) rating tool, which has been adapted in partnership with mana whenua to respond to Aotearoa’s unique cultural context. Link Alliance achieved a Leading IS Design rating. This metric has been updated to reference the IS As Built (completed works) rating which will be sought on practical completion.

The waste target has also been updated to exclude spoil to reflect the completion of civil works.

A final As Built rating will be sought on practical completion. In the interim, key sustainability measures continue to relate to the reduction of construction and operational energy-related

emissions, the embodied carbon of the materials used and construction and demolition waste.

CRL Ltd’s commitment to leaving a positive legacy of social outcomes continues with the Project focused on enhancing opportunities for mana whenua, Māori, Pasifika, youth, and social enterprises. These initiatives include CRL Ltd’s flagship Progressive Employment Programme (PEP); a 16-week training programme helping rangatahi (young people) into employment.

CRL Ltd’s implementation of Career Development Plans (CDP) reflects its continued commitment to the broader community and to making a real difference when viewed cumulatively over the duration of the Project. The ≥50 per cent CDP target (an exceptional level for this performance indicator) is an especially important metric at this stage of the Project, as it ensures focus group employees (Māori, Pasifika and youth) have a clear career plan as they move forward into other work.

With most procurement now complete, the focus has shifted to maintaining whanaungatanga (relationships) with the Māori and Pasifika businesses already awarded contracts. Together with Link Alliance, CRL Ltd is proud of the achievements in all these areas to-date, and they remain key targets until completion of the Project.

Community and Stakeholder Engagement

CRL Ltd is committed to being a good neighbour and works hard to manage construction impacts on local communities. Our Communications and Stakeholder Engagement team ensures the Project’s multiple stakeholders are kept informed about CRL’s benefits and potential impacts during construction.

The team also plays an integral part in ensuring the satisfactory operation of the Targeted Hardship Fund (THF) meeting the requirements set out by our Sponsors.

As outlined in CRL Ltd’s Statement of Intent (SOI), special importance continues to be placed on the Project’s 10 year partnership with mana whenua.

13 City Rail Link Limited Statement of Performance Expectations

Waitematā Station (Britomart) under Albert St North

Waitematā Station (Britomart) under Albert St North

Strategic area Outcome Performance Targets and Measures

Health and Safety Build an underground rail link that is safe for constructors, operators, maintainers, and users

• An externally validated maturity assessment of the Link Alliance HSE Management System using the Risk Management Maturity Model (RM3) will achieve Level 3 (Standardised), and Level 4 (Predictable) in sixteen or more areas by 30 June 2024

• Total Recordable Injury Frequency Rate (TRIFR) at or below six injuries per million hours worked

• HSPI score of ≥80 on average over a 12-month period

• Publish an annual safety assurance summary report by 30 June 2024 reporting on safety for operations, maintenance, and users

Project Delivery Deliver a safe, operable, quality underground rail link in a timely manner

• Normanby Road, Mt Eden Road bridges and Fenton Street footbridge completed* by December 2023

• Karanga-a-Hape Station: Mercury Lane and Beresford Square superstructure works completed* by December 2023

• Rail Tracks and Overhead Electrification Installation completion by April 2024

• Britomart East C9 contract with KiwiRail for stages 4 to 6 including signalling works complete by June 2024

Funding Envelope

Achieve financial efficiency

• Project spend of at least 90 per cent of approved Appropriation ($346m)**

• Monthly financial and variance reporting of project costs on a cost to complete basis and to budget

• Operate CRL Ltd’s corporate functions within the approved budget

Sustainability and Social Outcomes

Achieve sustainability excellence including social outcomes

• C3 to maintain a self-assessed projected Infrastructure Sustainability (IS) As Built score ≥ 65 (equivalent to an ‘Excellent’ (IS) rating)

• C3 to achieve 15 per cent reduction (versus design base-case) in embodied carbon of materials

• C3 to achieve 25 per cent reduction (versus design base-case) in construction and operational energy-related emissions

• 95 per cent of construction demolition waste diverted from landfill

• Deliver the “Progressive Employment Programme” with ≥six rangatahi graduating and in employment

• ≥50 per cent focus group (Māori, Pasifika and Youth) Other Alliance Participant employees with Career Development Plans

Community and Stakeholder Engagement

Deliver a high level of communication and engagement

• Achieve total over 12 months of >4,000 likes on social media posts, >15,000 direct views of videos, and 25 media releases

• Increased public participation through events (target 8) and site tours (target 25)

• Targeted Hardship Fund: payments made to applicants within 30 days of CRL Ltd receiving a completed application

The above is explained in detail in the Outcomes, Target Areas, and Measures section of the Statement of Intent.

* Completion means the works are completed (subject to the 12-24 month defect liability period) and the asset involved is available for use.

** Appropriation reflects the Crown’s 50 per cent contribution to FY24 project funding.

15 City Rail Link Limited Statement of Performance Expectations

Forecast Financial Statements

The forecast financial statements (on pages 17-20) include a Statement of Forecast Comprehensive Revenue and Expenses, Statement of Forecast Financial Position, Statement of Forecast Changes in Equity and Statement of Forecast Cash Flows for the 2023-2024 financial year.

CRL Ltd is funded by the Sponsors to deliver the Project. Under the terms set out in the PDA, funding is recognised as share capital. Other funding received by CRL Ltd is primarily interest on surplus cash balances. These items will be recorded as revenue in the Statement of Forecast Comprehensive Revenue and Expenses.

CRL Ltd incurs expenditure as part of its activities. Operating expenditure (i.e., the day-to-day running of CRL Ltd) and project expenditure (i.e., unable to be capitalised) is recorded in the Statement of Forecast Comprehensive Revenue and Expenses. Project expenditure that is capital in nature is recorded on the Statement of Forecast Financial Position as Capital Work in Progress. Assets are transferred to the stakeholders (primarily Auckland Transport and KiwiRail Holdings Ltd) as construction is completed for each asset.

16 City Rail Link Limited Statement of Performance Expectations

Maungawhau Station site looking north east toward portal wall

City Rail Link Statement of Forecast Comprehensive Revenue and Expenses

For the year ending 30 June

17 City Rail Link Limited Statement of Performance Expectations

Forecast 2022/23 $000 Budget 2023/24 $000 Revenue Rental and other revenue 989 1,130 Interest revenue 3,976 5,000 Total revenue 4,965 6,130 Expenditure Employment expenses 3,939 4,097 Professional services 722 893 IT expenses 617 607 General expenses 2,479 2,561 Insurance expenses 8,103 8,237 Lease payments 3,685 3,997 Third party works 37,082 33,402 Capital expenditure writeoffs 2Vested asset expense 174,000 131,000 Depreciation and amortisation expenses 67 21 Total expenditure 230,696 184,815 Deficit for the year (225,731) (178,685)

City Rail Link Statement of Forecast Financial Position

For the year ending 30 June

18 City Rail Link Limited Statement of Performance Expectations

Forecast 2022/23 $000 Budget 2023/24 $000 Assets Cash and cash equivalents 29,003 29,620 Prepayments 6,989 2,768 Trade and other receivables 12,328 5,645 Total current assets 48,320 38,033 Capital work in progress 2,855,385 3,331,064 Prepayments 11,963 8,484 Subterranean land 13,064 15,064 Property, plant and equipment 117,243 117,309 Intangibles 7 4 Total non-current assets 2,997,662 3,471,925 Total assets 3,045,982 3,509,958 Liabilities Accounts payable and accruals 94,722 45,353 Current employee entitlements 1,020 1,050 Total current liabilities 95,742 46,403 Total liabilities 95,742 46,403 Net assets 2,950,240 3,463,555 Equity Contributed capital 3,823,280 4,515,280 Retained earnings (873,040) (1,051,725) Total equity 2,950,240 3,463,555

City Rail Link Statement of Forecast Changes in Equity

For the year ending 30 June

19 City Rail Link Limited Statement of Performance Expectations

Budget Capital $000 Budget Accumulated Losses $000 Budget Total 2023/24 $000 Balance as at 30 June 2023 3,823,280 (873,040) 2,950,240 Total comprehensive revenue and expenses for the year Deficit for the year (178,685) (178,685) Other comprehensive income and expenses -Total comprehensive income and expenses (178,685) (178,685) Owner transactions Funding received for B class share issues 692,000 - 692,000 Balance as at 30 June 2024 4,515,280 (1,051,725) 3,463,555

City Rail Link Statement of Forecast Cash Flows

For the year ending 30 June

20 City Rail Link Limited Statement of Performance Expectations

Forecast 2022/23 $000 Budget 2023/24 $000 Cash flows from operating activities Rental and other revenue 2,271 1,130 Interest received 3,976 5,000 Employee costs (13,203) (12,291) KiwiSaver contributions (338) (344) Suppliers (41,546) (43,308) Other receipts/(payments) (582) 6,682 Net cash flow from operating activities (49,422) (43,131) Cash flows from investing activities Acquisition of capital work in progress (869,072) (646,167) Acquisition of property, plant & equipment (15) (2,068) Acquisition of intangibles (43) (17) Net cash flows from investing activities (869,130) (648,252) Cash flows from financing activities Proceeds from issue of share capital 909,000 692,000 Net cash flows from financing activities 909,000 692,000 Net increase/(decrease) in cash & cash equivalents (9,552) 617 Cash & cash equivalents at beginning of period 38,555 29,003 Cash & cash equivalents at end of period 29,003 29,620

Notes to the Forecast Financial Statements for the year ending 30 June 2024

Reporting Entity

City Rail Link Limited (‘CRL Ltd’ or the ‘Company’) is a Crown Entity, registered under schedule 4A of the Public Finance Act 1989, and is domiciled in New Zealand. The Company was incorporated on 13 April 2017. CRL Ltd is jointly owned by the Crown, and Auckland Council.

The Company’s purpose is to govern and manage the delivery of the Project.

CRL Ltd commenced operations with effect from 1 July 2017.

Basis of Preparation

These prospective financial statements have been prepared for the purpose of providing information on CRL Ltd’s future operating intentions and financial position, against which it must report and be formally audited at the end of the financial year. These prospective financial statements have been prepared:

• In accordance with the Crown Entities Act 2004, which include the requirement to comply with New Zealand generally accepted accounting practice (NZGAAP) and the Companies Act 1993

• In accordance with PBE FRS42 and NZGAAP as it relates to prospective financial statements

• The Company reports under Tier 1 Public Benefit Entity (PBE) standards and as such the prospective financial statements have been prepared on that basis

• In New Zealand ‘000 Dollars ($), which is the Company’s functional currency, unless separately identified

• The information in these financial statements may not be suitable for another purpose.

Statement of Significant Underlying Assumptions

Funding from the Sponsors

Funding from the Sponsors is based on the expenditure programme for the Project, assuming sufficient funding is available for the Project. Funding requirements are assessed monthly and the funding application to the Sponsors and approval by the Sponsors is completed before the beginning of every quarter. For successful funding applications, the majority of funds are received at the beginning of the new quarter.

Personnel costs Forecast costs assume the current organisational structure will be in place throughout the period. A proportion of personnel cost which is directly attributable to the Project is capitalised and recognised as Capital Work in Progress in the Statement of Forecast Financial Position.

Capital CRL Ltd is undertaking a programme of capital spending aimed at delivering the CRL Project. Projected costs and timing of expenditure are based on plans and quotations that were current when these forecasts were prepared.

Opening equity

Estimated opening equity assumes 2022/23 net deficit of $225.7 million. This impacts on estimated amounts of cash in hand and net assets.

21 City Rail Link Limited Statement of Performance Expectations

Notes to the Forecast Financial Statements for the year ending 30 June 2024

Significant Accounting Policies

The financial statements contained in this document are prospective and, by their nature, contain assumptions which may lead to material differences between the prospective financial statements and the actual financial results prepared in future reporting periods. CRL Ltd has undertaken a review of its financial models, and believes they remain fit for purpose in assisting CRL Ltd in preparing prospective financial statements. The prospective statements for CRL Ltd are subject to significant management judgement relating to the timing and quantum of the investments, and the prospective information reflects the best information available to management.

Project Funding

Project costs, which are capital in nature and create an asset for CRL Ltd, as well as operating costs for CRL Ltd’s day-to-day running and management, and are funded by a share issue to the Crown and Auckland Council. This funding is not recognised as revenue in the forecast financial statements.

Rental Revenue

Other revenue generated by CRL Ltd is from rental income from properties required for the project to enable the build but not yet decommissioned and will be recorded as revenue.

Interest Income

Interest revenue is calculated on a proportion basis for the surplus cash balances throughout the forecast.

General Expenses

General expenses include costs such as operating leases, rates, directors’ fees, telecommunications, and other office operating costs.

Foreign Currency Transactions

Foreign currency transactions are translated into NZ$ (the functional currency) using the spot exchange rates at the date of the transactions. Foreign exchange gains and losses resulting from

the settlement of such transactions and from the translation at year-end exchange rates of monetary assets and liabilities denominated in foreign currency are recognised in the surplus or deficit.

As at 30 April 2023, there were no outstanding foreign currency transactions reflecting the end of major procurement by Link Alliance.

Goods and Service Tax

Items in the financial statements are presented exclusive of GST, except for receivables and payables, which are presented on a GST inclusive basis. Where GST is not recoverable as input tax, it is recognised as part of the related asset or expense.

Income Tax

CRL Ltd is a Public Authority in accordance with the Income Tax Act 2007 and consequently is exempt from the payment of income tax. Accordingly, no provision has been made for income tax.

Property, Plant & Equipment

Property, plant, and equipment consists of land, building, subterranean land, furniture and fittings, computer hardware, software, and office equipment.

Recognition and Measurement

Property, plant, and equipment is measured initially at cost. Cost includes expenditure that is directly attributable to the acquisition of the items. The cost of an item of property plant and equipment is recognised only when it is probable that future economic benefit or service potential associated with the item will flow to CRL Ltd, and if the item’s cost can be measured reliably.

The majority of capital expenditure will remain as ‘Capital Work in Progress’ for the duration of the Project.

Work in progress is recognised at cost less impairment and is not depreciated.

22 City Rail Link Limited Statement of Performance Expectations

Maungawhau Station site looking north west

Maungawhau Station site looking north west

Waitematā Station (Britomart) under Albert St North

Waitematā Station (Britomart) under Albert St North

Maungawhau Station tunnel looking north toward Karanga-a-Hape Station

Maungawhau Station tunnel looking north toward Karanga-a-Hape Station

The final breakthrough of TBM Dame Whina Cooper at Te Waihorotiu Station

The final breakthrough of TBM Dame Whina Cooper at Te Waihorotiu Station