Blind Memo Project Hypercar

June 2023

Blind Memo – Project Hypercar – June 2023 Strictly Private and Confidential 1

Disclaimer

This document is confidential and has been prepared exclusively for internal use and purposes by the recipient.

The document cannot therefore be reproduced or forwarded without the previous written authorization of C-Team Srl.

The information represented in this document has been collected from internal and external sources without any independent review by C-Team Srl in relation to the accuracy, truthfulness and completeness of the information.

The document exclusively aims to provide a preliminary overview about an investment opportunity.

C-Team Srl cannot in any way be considered responsible for any adverse consequences arising from any decisions taken subsequent to the reading of this document.

Blind Memo – Project Hypercar – June 2023 Strictly Private and Confidential 2

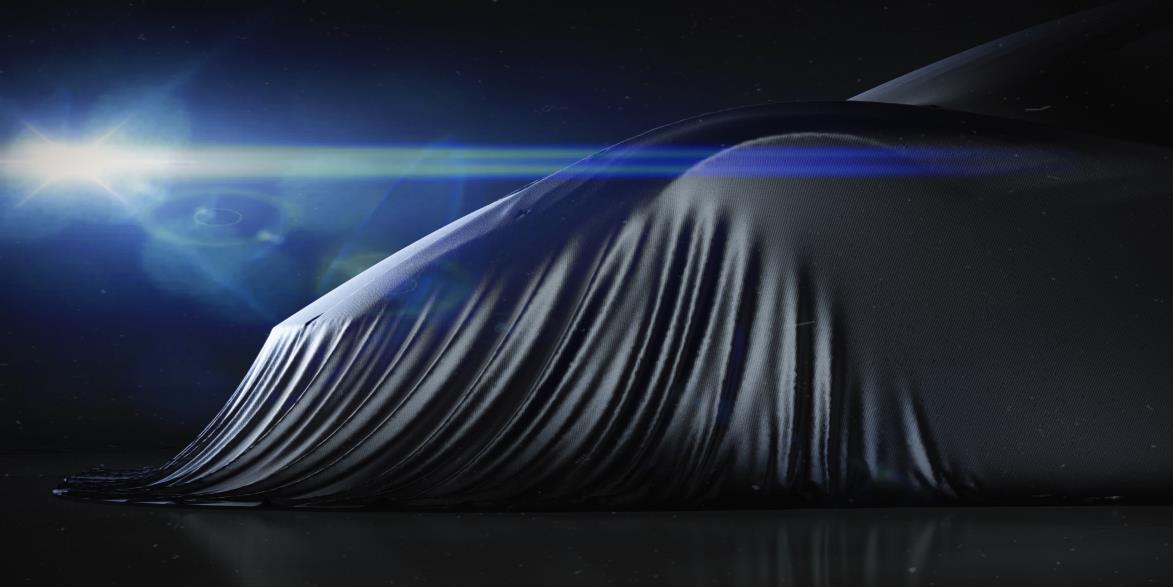

Project Hypercar at A Glance

Company Overview

• A Modena based start-up company in the heart of Italy's Motor Valley, specialized in designing and manufacturing of high-end electric vehicles. The company's owners and managers are professionals with more than 30 years of experience in the automotive industry with focus on electric power train systems.

• Thanks to the long-standing and consolidated network of its shareholders and managers, the company works closely with leading partners of international reputation and proven track-record. Through these collaborations, the company has successfully completed research and development activities, and identified the ideal materials and components to guarantee the highest level of quality and safety of the vehicle.

• The company will debut on the market producing two versions of its first model (Coupe and Roadster), using an exclusive battery pack (100kWh, recharge in 15min) that will unleash a power generation of 1.5MW (2.040 horsepower). Additionally, this will allow high speed performance (0-320 km/h < 10seconds) and an estimated range of 520km.

Investment Highlights

• For the distribution and sale of the vehicles worldwide, the company has already received availability from major points of interest for HWNIs, such as the Fairmont Monte Carlo. Moreover, the company is developing its virtual showroom in the Monte Carlo. Agents and area managers will complete the sales and marketing network.

• In the medium term, the company has already planned to expand the vehicle line-up to new models, such as a four-seat hypercar, attracting new markets and customers, with the purpose of diversifying the business and reducing the implied risk.

• The business plan will develop in a progressive and sustainable way: the company expects to sell 60 units of the first model by Year 6, while the second one will be launched in the Roadster version starting from Year 3.

Main Partners

• Leading British engineering company and manufacturer of electric power train components

• Italian company specializing in the assembly and customization of high performance cars

• International company producing tires, with experience in racing and supercars

• East-European battery systems developer specializing in designing custom battery-packs

• Motor Valley based design/engineering company with 20 years of experience

• California-based company specialized in additive manufacturing of solid state cells

• US company developer of advanced AI based software for battery management.

• Italian company leader in the production of sports car light wheels

• Turin-based design studio specializing in the automotive sector

• Israeli company specialising in cybersecurity applied to the automotive sector

• European firm specialized in high-end wind simulations for studies and aerodynamics

• German leading company active in additive manufacturing and 3D printed metal parts

Growth Plan and Investment Opportunity

• The shareholders are willing to offer a minority stake to the market looking for a financial or strategic partner, in order to collect the financial resources necessary for the finalization of the first running hypercar and for the brand promotion in EMEA and North America through dedicated specific high-end events, road and track days and others, for which has been estimated an initial financial need of about 4mln €. For the successful launch of the business is planned a comprehensive investment of about 10 mln €.

• Given the scalability of the business, depending on the amount of commitment raised, the company could develop its growth plan more aggressively by anticipating the launch of new models in the market.

Blind Memo – Project Hypercar – June 2023 Strictly Private and Confidential 3

Medium Case (mln €) Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Vehicles sold (units) 4 12 14 16 18 20 22 Sales 8,2 24,7 29,3 33,9 38,5 44,1 50,6 EBITDA (1,1) 3,3 4,9 6,7 8,4 10,4 13,8 Ebitda Margin % (14%) 13% 17% 20% 22% 24% 27%

Technical Data & Main Partnership

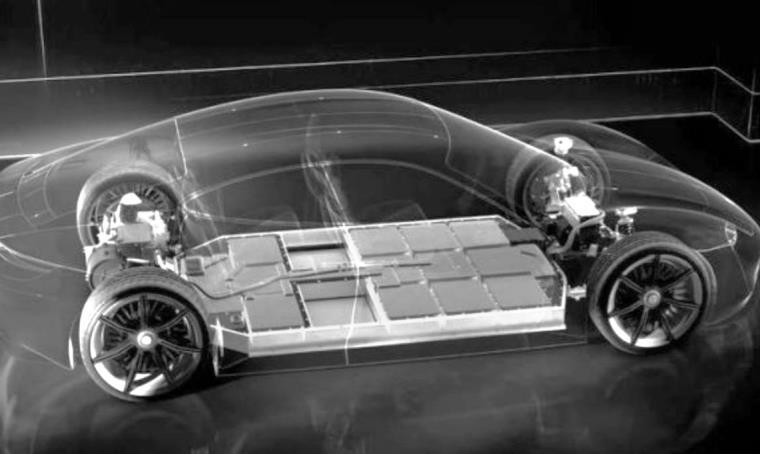

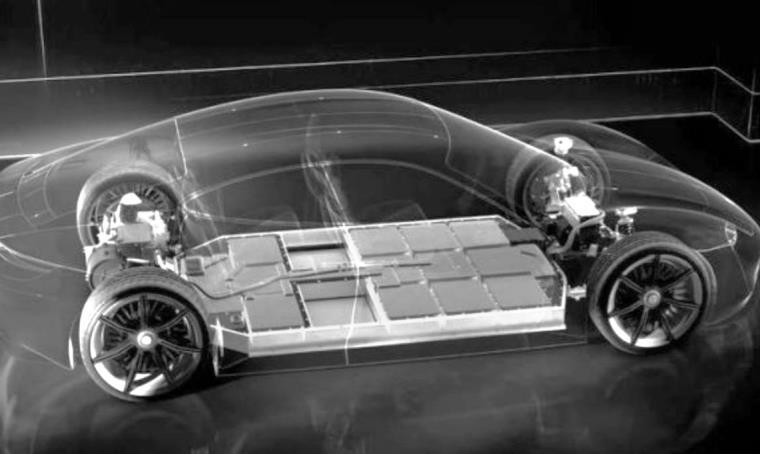

The company’s research team has designed the world's first hypercar to use a hybrid battery pack that combines lithium-ion cells with solid-state electrolytes and ultracapacitors. Some of the know-how and components used are exclusively available to the company, based on agreements for the use of international patents.

Powertrain:

Full-Electric

Power: 1,5 MW (2.040cv)

AWD: Torque Vectoring

Battery capacity: >100 kWh

Weight

Company specialized in AI and Machine Learning applied in the Automotive and Aerospace sector

International company specialized in developing the best battery packs for electric vehicles

Israeli company specialising in cybersecurity applied to the automotive sector

Length

European firm specialized in high end wind simulations for studies and aerodynamics

Modenese company among leading experts in Supercar design and engineering consulting

British automaker ranked first in inverter production

MW

Turin based company specialized in the production and customization of high performance vehicles that will assist the entire project

American company producing solid state cells through 3D printing technology

Well know Turin based design studio for automotive & yachts

German leading company active in additive manufacturing and 3D printed metal parts

Blind Memo – Project Hypercar – June 2023 Strictly Private and Confidential 4

Recharge HPC DC: 10%80% < 15 min 4.683 mm Height Width

1.1148 mm 2.052 mm < 10 s 0 – 320 km/h 520 km 325 mi 1,5

1.500 kg (3.300 lb) 2.040 cv

Worldwide tire supplier recognized for quality and high performance

Italian company mong the market leaders in the production of ultra light wheels

Growth Plan

• For the placement and sale of the vehicles, the company has already received availability for the exhibition of its first model at the Fairmont Monte Carlo as well as other exclusive locations in North America and in the Middle East. Moreover, the company is working on the creation of its own virtual showroom in the first Monte Carlo Multiverse.

• The company will use as its main sales channel for the models, its own sales network of agents and area managers, among the most renown and established in the industry, implementing it when necessary.

• The promotion of the brand will be carried out through participation at high-end dedicated exclusive events in EMEA and North America, and also by organizing road & track days to demonstrate the vehicle’s potential.

• In addition to the sale of vehicles, the company ensures an after-sales service with remote diagnosis of the main components. If an on-site service will be required, a team of technicians will be available (“flying doctors”)

• Furthermore, the Company has already planned the future expansion of the range by adding new models to the current product range, such as the four-seater hypercar SUV, which will diversify and expand the offer.

• Thanks to the sale of 60 examples of the first Coupe model, and with the sales of the Roadster ones, the company will evaluate the entry into the market of the SUV version, scheduled for Year 6 which will allow it to stabilize margins and increase future revenues. The extensive outsourcing of the main key components allow the company to keep fix costs low while ensuring a flexible and streamlined structure.

Private and Confidential 5

Strenghts & Opportunities Analysis Investment Highlights

Competitive advantages: internal factors

Market’s opportunities: external factors

Technical partners involved in the design and production of components of primary standing

+14% CAGR 2021-31

hypercar market growth (value > €500k)

Source: Expert interviews; IHS Markit; McKinsey Center for Future Mobility; McKinsey analysis

Management with years of experience in the traditional and electric drive automotive industry

+7,8% High Worth Net Individuals growth registered in the 2021

Source: worldwealthreport.com

International network of dealers and agents in major luxury automobile markets

High technological barriers to entry related to high R&D costs to ensure efficiency and safety

+21,7% CAGR 2022-2030

EV market growth

Source: outlookindia.com/top-5-reasons-why-electric-vehicles-are-the-future-of-driving-in-2022

+3,7% CAGR 2022-2027

luxury market growth

Source: statista.com/in-depth-report-luxury-goods

Blind Memo – Project Hypercar – June 2023 Strictly Private and Confidential 6

Expected Key Financials (7 years business plan)

Blind Memo – Project Hypercar – June 2023 Strictly Private and Confidential 0,82 0,60 0,57 0,48 0,37 0,28 0,23 3,39 2,44 1,29 0,32 -0,19 -0,46 -0,61 19,9% 17,7% 18,3% 18,4% 18,7% 18,7% 18,8% 16% 17% 18% 19% 20% 21% -1,00 0,00 1,00 2,00 3,00 4,00 Net non-current Assets/NIC NFP/BV NWC/Sales 8.244.000 24.732.000 29.332.000 33.932.000 38.532.000 44.088.000 50.600.000 -1.125.100 3.337.200 4.914.301 6.701.402 8.443.503 10.437.406 13.793.110 -14% 13% 17% 20% 22% 24% 27% -20% -15% -10% -5% 0% 5% 10% 15% 20% 25% 30% -10.000.000 0 10.000.000 20.000.000 30.000.000 40.000.000 50.000.000 60.000.000 Sales EBITDA EBITDA % 7

Income Statement (€mln) Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Sales 8,2 24,7 29,3 33,9 38,5 44,1 50,6 EBITDA (1,1) 3,3 4,9 6,7 8,4 10,4 13,8 % Sales (14%) 13% 17% 20% 22% 24% 27% EBIT (1,9) 1,8 3,1 4,7 6,3 8,8 12,8 % Sales (22%) 7% 10% 14% 16% 20% 25% EBT (2) 1,4 2,8 4,4 6,1 8,6 12,6 Net Income (Loss) (2) 1 2 3,2 4,4 6,3 9,2 Balance Sheet (€mln) Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Net non-current Assets 7,2 6,3 6,5 5,2 3,8 2,9 2,6 Net Working Capital 1,6 4,4 5,4 6,2 7,2 8,2 9,5 Total Funds (0,1) (0,2) (0,4) (0,5) (0,6) (0,8) (1) Net Invested Capital 8,7 10,5 11,5 10,9 10,4 10,3 11,1 Net Financial Position 6,8 7,4 6,5 2,7 (2,4) (8,7) (17,1) Book Value 1,9 3,1 5 8,2 12,8 19 28,2 Total Sources 8,7 10,5 11,5 10,9 10,4 10,3 11,1

Investment Opportunity & Use of proceeds

• The management has estimated a financial requirement of about €4 million to start the business. In fact, based on the business plan reported therein, around €8 million of investments have been planned within the next months regarding the engineering work for the production tools, aerodynamic and track tests and assemble the first models as well as to cover all current costs. Thus, a total of about €10 million of financial needs are expected to cover the last phase of development and part of the operating expenses, which can be obtained through the sale of minority stake and issuing new debt. Given the scalability of the business, depending on the amount of commitment raised, the company could develop its growth plan more aggressively by anticipating the launch of new models to the market.

• It is reported that, thanks to the use of exclusive and world-leading know-how, both internal to the company and in partnership with its suppliers, the value of R&D activities and components produced so far would have an intrinsic value of about €18 million on the market, based on various offers submitted to the management by leading engineering companies, for the tout-court development of the project.

€4m through the sale of a minority stake of capital (value estimated on a corporate valuation between €40 and €50m for 100%)

• Molding and purchase of equipment

• Completion of internal technical tests

• Aerodynamics and wind tunnel tests

• Engineering tests for chassis and powertrain

€6m from financial institutions who have already shown interest in the project

• Purchase of components (Bill of Material)

• Final practical test of the battery pack

• Showroom set-up

• Preparation of 2 assembly units

• Assembling of the first demonstrator for exhibition

• Individual Vehicle Approval and certifications

€18m already invested

• Intangible value of research and development and component production activities out until early 2023, based on equal turnkey offers received

Blind Memo – Project Hypercar – June 2023 Strictly Private and Confidential

8

C-Team Srl HQ: SALERNO Control Rooms: MILAN – NOVARA – MONZA P.IVA 06090550655 info@calibra-t.com

Osvaldo Baione osvaldobaione@calibra-t.com

Nicola D’Elia nicoladelia@calibra-t.com

Gerardo Murano gerardomurano@calibra-t.com

Lisa Dixit Dominus lisadixitdominus@calibra-t.com

Alfonso Seno alfonsoseno@calibra-t.com

Francesco Rosso francescorosso@calibra-t.com