announced at

Network 10AGL WoolworthsEFM Logistics The Publication for Credit and Financial Professionals IN AUSTRALIA l Collections and vulnerability – a considered approach l Top 5 myths around legal entities – debunked l Happily ever AfterPay? Volume 27, No 1 October 2019

the NATIONAL CONFERENCE

Message From the President

Credit Management

insurance claims

By Kirk Cheesman

being caught in

By Patrick Coghlan

flow

5 myths around legal entities

By Michael Criss

By Michael Criss

to choose the right

By Stephanie Hughes

Credit Managers

By Guy Saxelby

Data & Technology

is money

Damian Arena

is King, long live the King!

By Richard Vaughan

Credit

& Vulnerability

By Nikki Dennis

CreditSmart:

By Michael Blyth

Ever AfterPay?

a population of

By Clare Venema

the new

the “buy now, pay later”

Update

By Roger Mendelson

ways

Daniel Turk

October 2019 • CREDIT MANAGEMENT IN AUSTRALIA 1 Volume 27, Number 1 – October 2019 Contents

4

Credit

up; What does this mean? 6

Avoid

the

on effects of economic 8 uncertainty

Top

– debunked! 12

How

Debt Collection agency? 14

How

stand to benefit from Early 16 Payment Programs

Time

18 By

Data

20

Consumer

Collections

– A considered approach 22

Being

navigating

world of 28 comprehensive credit reporting

Happily

Is

sensation 30 cultivating

debtors?

Legislation

Compulsory changes to Warranty Clauses 34

Simple

trade suppliers can improve securities 36 By

Richard Vaughan Nikki Dennis

20 22

Guy Saxelby Damian Arena

16 18

Michael Criss Stephanie Hughes

12 14

Kirk Cheesman Patrick Coghlan

6 8

Michael

Blyth

Clare Venema

28 30 Roger Mendelson Daniel Turk 34 36

ISSN 2207-6549

DIRECTORS

Trevor Goodwin LICM CCE – Australian President

Julie McNamara MICM CCE – Queensland and Australian VP

Lou Caldararo LICM CCE – Victoria/Tasmania

Rowan McClarty MICM CCE – Western Australia/Northern Territory

Gail Crowder MICM – South Australia

Peter Morgan MICM CCE – New South Wales

Debbie Leo MICM – Consumer

CHIEF EXECUTIVE OFFICER

Nick Pilavidis FICM CCE

Level 3, Suite 303, 1-9 Chandos Street, St Leonards NSW 2065

PO Box 64, St Leonards NSW 1590

Tel: (02) 8317 5085, Fax: (02) 9906 5686 Email: nick@aicm.com.au

PUBLISHER

Nick Pilavidis FICM CCE | Email: nick@aicm.com.au

CONTRIBUTING EDITORS

NSW – Sev Indrele MICM CCE

Qld – Carly Rae MICM

SA – Lisa Anderson MICM CCE

WA/NT – Rowan McClarty MICM CCE Vic/Tas – Michelle Carruthers MICM

EDITOR/ADVERTISING

Andrew Le Marchant LICM CCE Phone Direct 02 8317 5052 or Mob 0418 250 504 Email: andrew@aicm.com.au

EDITING and PRODUCTION

Anthea Vandertouw | Ferncliff Productions

Tel: 0408 290 440 | Email: ferncliff1@bigpond.com

THE EDITOR reserves the right to alter or omit any article or advertisement submitted and requires idemnity from the advertisers and contributors against damages or liabilities that may arise from material published. CREDIT MANAGEMENT IN AUSTRALIA is published by the Australian Institute of Credit Management, Level 3, Suite 303, 1-9 Chandos Street, St Leonards NSW 2065. The views expressed in CREDIT MANAGEMENT IN AUSTRALIA are not necessarily those of Australian Institute of Credit Management, which does not expect or invite any person to act or rely on any statement, opinion or advice contained herein (whether in the form of an advertisement or editorial) and neither the Institute or any of its employees, agents or contributors shall be liable for any opinion contained herein. © The Australian Institute of Credit Management, 2019.

JOIN US ON LINKEDIN

Insolvency

– what’s in it for creditors?

By Tim Cole

My customer has gone into external administration,

“oh s#%t!” but it aint over, until it’s over …

By Andrew Spring

Personal Property Security Act

2020: Future-proofing the PPSR

By Gavin McCosker

Legal

It’s a matter of (trust) money

(and how to follow the money trail) – Part 2

By Natalie Ledlin, Terry Ledlin and Peter Mills

am I paying you for something that I legally

own? The imposition of levies by insolvency practitioners for the recovery of PMSI stock

By Nicholas Boyce

EDITORIAL CONTRIBUTIONS SHOULD BE SENT TO:

The Editor, Level 3, Suite 303, 1-9 Chandos Street, St Leonards NSW 2065 or email: aicm@aicm.com.au

Graduates and Training calendar

the AICM

Pilavidis CEO and now FICM

CREDIT MANAGEMENT IN AUSTRALIA • October 2019

Bankruptcy

40

42

Beyond

44

46

Why

52

Training Recent

54 From

Nick

56 Contents

Andrew Spring

Natalie

Ledlin

Gavin McCosker

Terry

Ledlin Peter Mills

Tim

Cole

42 46 44 46 46 40

Click Here

October 2019 • CREDIT MANAGEMENT IN AUSTRALIA 3 Contents For advertising opportunities in Credit Management In Australia Contact: Andrew Le Marchant Ph: (02) 8317 5052 | E: andrew@aicm.com.au Around the States New South Wales 58 Queensland 62 South Australia 68 Victoria/Tasmania 72 Western Australia/Northern Territory 77 New Members 81 Credit Marketplace 83 58 62 68 72 77 NSW: YCP finalists Laura McCulloch, Ceyda Sert, Nathan Abellanoza and Chris Lagana. Qld: YCP Finalists: David Tharp (Tradelink), Chad

San

Giorgio (DHL), Ashleigh Mason (NCS), Talitha Bere (Tradelink), Edward Sklavos (Nexxa) and Damian Crowley (Choice Mercantile). SA: YCP Finalists – Clare Venema (Worrells), Craig Brooks (illion), Edwina Tideman and Tammy Ktisti (both NCI).

Vic/Tas: YCPA finalists Henry Liew (NAB) Martina Vucak (Kingspan), Farhan Hossain (recoveriescorp), Natasha Clarkson (Dulux Group) and Quan Le (Department of Justice).

WA/NT: WA

State Finalists: Charis Ludemann, Alex Cimetta, Melissa McVey, Alex Ramsay and Alex Fenna.

Volume 27, Number 1 – October 2019

Trevor Goodwin LICM CCE National President

This issue of our Credit Management magazine is the only hard copy magazine of the five editions the Institute issues each year. Its release coincides with our premium event of the year, the National Conference.

This year we return to the Marriott Hotel on the Gold Coast which has always been an exceptional conference venue impressing our delegates, presenters and sponsors. During the conference I look forward to speaking to many of you and sharing our credit experiences and stories.

The conference is the single largest education and networking event for professionals in the various sectors within the credit industry. We have an excellent program encompassing both commercial and consumer credit with presentations of the highest quality which will only enhance the Institute’s reputation further amongst credit professionals.

On behalf of your board I thank all delegates who are attending the conference and the service providers who support us with their exhibition booths that help keep us up to date with the latest products and services. In particular, I acknowledge and thank Equifax, our Premium Sponsor for the 2019 AICM National Conference.

There will be numerous presentations at the conference including the announcements of the winner of the Young Credit Professional award which is sponsored by illion, and the Credit Team of Year sponsored by Equifax. We will present certificates to our new Certified Credit Executives including the Dux award donated by National Credit insurance (Brokers) and an acknowledgment of CCE’s who have recertified. In addition, we will also announce the winner of the Student Award of the Year and the Presidents Trophy for the best performing State Division.

For those members who cannot attend I hope to see you a conference next year or in years to come.

Much has happened since our last conference 12 months ago in Melbourne. Our membership numbers have remained strong, indicative of our members support for the Institute and our ongoing relevance and importance to education, training and legislation advocacy for members.

I am proud to say your Board and National office team have implemented and worked tirelessly on a number of initiatives this past year. The Constitution and By-Laws have been rewritten and policy documents are being reviewed. We are introducing an Education Foundation to further our focus on quality training to our members.

We have also recently appointed our first Board appointed Director, Debbie Leo, to further our involvement in the consumer credit sectors.

aicm From the President 4 CREDIT MANAGEMENT IN AUSTRALIA • October 2019

From the President aicm

We are also looking to introduce a mentoring program along with a number of other initiatives developed from feedback from the wide range of stakeholders who like me are passionate about their industry.

The Board continues to plan for the future to seek out new opportunities and initiatives, and to implement our key strategic priorities to ensure we continue to grow and maintain our position as thought leaders and point of reference for all credit professionals.

Recently the Board held a strategy planning day to develop key strategies for the future based around 8 pillars of where we wish to be in the short and long term.

The Board and National Office team are well supported by the Councils in each division which consist of hardworking volunteers who continue to provide excellent education and network events for members and their colleagues. If you are interested in working with our local divisions on a sub committee please speak with a councillor in your State who will be happy to chat to you about the role you can play.

I can’t speak more strongly as to how working in a team assists you with your career and personal development and with networking opportunities. In addition it is extremely rewarding.

Upcoming events in your local divisions include economic breakfasts, an insolvency roadshow, credit toolboxes and half day seminars as well as the Pinnacles awards in each of the divisions.

The Institutes training programs are providing excellent education to our many members with a variety of options at every price point, including Registered Training Organisation Certificates and Diploma, seminars, the Conference and our Credit Toolboxes and Workshops.

The Institute will continue to grow into the future to ensure our relevance, position and posterity. But we should not to forget our past and I encourage members that may have old AICM photos or items to send them into National office so as we can save them and remember our past.

Finally, in closing I thank all volunteers who are involved in organising our events including the highly successful WINC event, our YCP judges and facilitators, and the presenters at our various education events. Without you we cannot be the successful Institute we are.

Trevor Goodwin LICM CCE National President

October 2019 • CREDIT MANAGEMENT IN AUSTRALIA 5

Credit insurance claims up; What does this mean?

By Kirk Cheesman*

2019 has been an interesting year so far with both consumer and business confidence wavering due to many factors; global economic conditions, Brexit, local competition, global trade ‘wars’ and political uncertainty.

What we have seen at NCI is a steady demand for trade credit insurance cover, which indicates businesses are concerned about their credit risk and are being proactive in protecting themselves.

Premium rates have remained steady while we have seen slight increases in turnover. Backing this

confidence approaching the end of the calendar year.

It is not just our claims figures that have been setting records. The combination of collection actions, claims received, credit limit decisions and overdue accounts is at a threeyear high with our trade credit risk index reaching 838. Claims received in the second quarter came in at 419 with a value of $22.4 million. Around the country, New South Wales and Queensland have both received their fair share of claims with 27.25% and 27% respectively. This is followed not too far behind by Victoria with 21.75% and then Western Australia and South Australia.

Kirk Cheesman

up is an increase in claim volumes. May was the highest ever number of claims received in one month. The flow-on effect of this was that in August, the number of claims paid was at an all-time high.

There have been some notable statistics released recently, starting with Australia’s GDP growing at just 1.4%, against a projection of 2.75% the slowest in 10 years. The Reserve Bank of Australia holding the official interest rate at 1% would suggest that it will take some time for the economy to get back to a position of significant growth. Hopefully, this can shift consumer and business

Alarmingly, all these negative indicators have increased over the past 12 months. As we head into the fourth quarter, could we expect to see a further rise due to increased spending around Christmas? Drilling down into the claims we received, labour hire and electrical were number one and two followed closely by building and construction.

An industry sector which has been hit hard recently is the agriculture industry with notable insolvencies such as Special One Grain, GrainPro, All Commodities, Lempriere and Dalgrains all entering external administration. For businesses that operate on extended credit terms and low margins, insolvencies such as these can be devastating for the

Credit Management 6 CREDIT MANAGEMENT IN AUSTRALIA • October 2019

“There have been some notable statistics released recently, starting with Australia’s GDP growing at just 1.4%, against a projection of 2.75%”

industry and especially for one that is in

midst of drought.

In summary, questions should be asked of all businesses, large and small, what would be the impact on the business if their largest customer was unable to pay?

Unfortunately, there are many businesses throughout Australia that would be in great difficulty if that situation was to arise, statistics referred to earlier would suggest that there will be more insolvencies and more difficulties for the remainder of 2019.

So, now is a good time to review

top customers

Credit Management October 2019 • CREDIT MANAGEMENT IN AUSTRALIA 7

the

your

and gauge what effects the current economic conditions may have on them and your business. *Kirk Cheesman MICM Managing Director National Credit Insurance Brokers P:1300 654 500, E: kirk.cheesman@nci.com.au W: www.nci.com.au 0.75% 14.00% 1.25% 7.00% 27.00% 27.25% 21.75% w Contact us today for a free 30-minute consultation 1800 954 418 | enquiries@kpr.com.au | www.kpr.com.au With over 70 years of combined experience we have the skills, expertise and resources to recover monies owed to you as quickly, efficiently and cost effectively as possible. Our customer promise to you is if no money is collected, no commission is paid. We offer the following debt recovery & legal services: • Debt recovery • Credit management • Commercial litigation • Field calls • Repossessions • Process servicing • Strata levy arrears collections Kemps Petersons help Australian businesses stay in business Our experienced team recovers 85% of debt without taking legal action.

Avoid being caught in the flow on effects of economic uncertainty

By Patrick Coghlan*

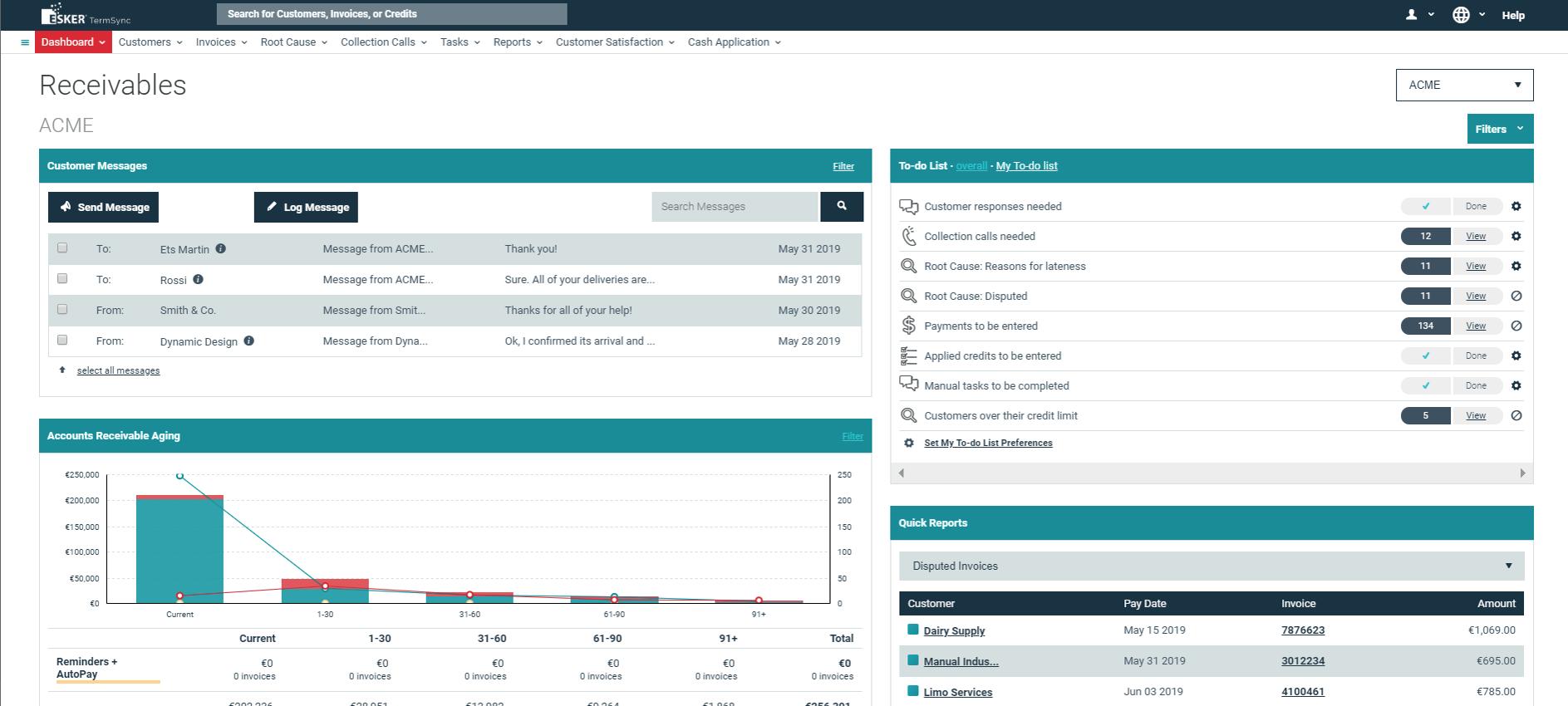

If the headlines in the media are enough to go by, the state of the economy has entered uncertain times. Every day it seems as though there is a new collapse and a company is entering administration.

According to the Sydney Morning Herald, the economy may be set to record its worst annual result in two decades and JP Morgan stated that there is the real possibility of another negative quarter. Two negative quarters in a row would push Australia into a recession.

CreditorWatch’s recent Small Business Risk Review, showed that court actions increased in financial year 2019 across all states and there has been a steady increase since December 2018. Despite this, insolvencies and bankruptcies have fallen but that doesn’t mean that the next wave of insolvencies won’t start presenting themselves soon off the back of the court actions. It will be interesting to watch these trends over the next few quarters.

An Industry Insights report also conducted by CreditorWatch for the 2019 financial year, showed the top three worst performing industries according to court actions were (in order):

1. Construction

2. Professional, Scientific and Tech Services

3. Retail Trade

Patrick Coghlan

New South Wales saw the highest construction risk and Victoria came

in second place. To many, this may be of no surprise.

One of AICM’s longest standing members of 20+ years, Treacy Sheehan, was caught out by the construction industry. As a resident of the Mascot Towers and a small business owner herself, she is now facing the flow on effects of the poor performing construction industry. While it is still unclear what happened with the Mascot Towers, Treacy is now staying in temporary living arrangements and has had to contribute thousands for repairs.

Treacy and 132 other owners of units in the Mascot Towers are caught up in the flow on effects of poor due diligence in the construction industry. “I run a small recruitment business, Trace Personnel, and being caught in this mess affects revenue, its an absolute flow on effect. The IGA that operated at the bottom of the Mascot Towers has lost hundreds of thousands in stock. Yet, our mortgages still need to be paid, interest still needs to be paid, and if the building is unacceptable, what happens to the owners’, our investments and our credit, where do we go from here?”

“The situation with the construction industry is endemic with at least 3 other buildings in Sydney facing a similar situation,” said Treacy. There is constant news of construction company collapses as of late. According to the Australian Bureau of Statistics, as of June

Credit Management 8 CREDIT MANAGEMENT IN AUSTRALIA • October 2019

2019, the trend estimates for total construction work done fell 2.7% this quarter and has fallen for four quarters. Building work also fell 2.2% this quarter and has fallen for three quarters. Residential and nonresidential also fell. Construction work in New South Wales and Victoria has fallen for the last three quarters. The value of total work completed has also fallen by 2.7%.

The CreditorWatch Industry Insights report also found that the most amount of insolvency notices were given to Professional, Scientific and Tech services, with Construction in second and Retail in third. The headlines match these statistics with some notable collapses:

l Professional, Scientific and Tech Services – RCR Tomlinson, an engineering firm, collapsed owing $630 million. ECM, an electrical engineering contracting business, collapsed, leaving 400 employees with two weeks’ pay and out of jobs.

l Construction – Ralan Group collapsed owing $500 million. J.M. Kelly Group saw a $33 million collapse. Strongbuild collapsed owing $7 million and JBP Holding collapsed owing $6.4 million l Retail Trade – It’s no surprise that retail has been struggling for a while. Recently, Australia saw the collapse of big names such as TopShop, ToysRUs, Roger David and recently, Karen Millen Big W is closing 30 stores around the country and department stores are voicing their struggle.

On top of all this, you need to be aware of illegal phoenix operators. The Phoenix Taskforce, which comprises 37 federal, state and territory government agencies, found that “it can occur in any industry or location. However, illegal phoenix activity is particularly prevalent in major centres in building and construction, labour hire, payroll services, security services, cleaning, computer consulting, cafés and

restaurants, and childcare services.

We also see it in regional Australia in mining, agriculture, horticulture and transport. There is an emerging trend in intermediaries who promote or facilitate illegal phoenix behaviour.”

The ATO, ASIC and the Fair Work Ombudsman commissioned PwC to measure the current impacts of illegal phoenix activity.

Annual costs of Phoenix Activity from the 2018 report found:

l Annual direct impact of illegal phoenix activity to be between $2.85 billion and $5.13 billion

l The cost to business from unpaid trade creditors is between $1,162 million to $3,171 million

l The cost to employees, lost through unpaid entitlements is between $31 million to $298 million

l The cost to government from unpaid taxes and compliance costs is around $1,660 million.

Xero released an explosive Small Business Insights report which highlighted that there was $115 billion in late payments throughout financial year 2018 and that $7 billion was owed from larger businesses. There could be many reasons for this but often we see larger businesses paying their larger customers first and it’s the smaller businesses that get paid late, or not at all.

While the state of the economy may seem worrisome, it is not all doom and gloom. Small businesses and larger businesses alike can see this point in time as an opportunity to reset their knowledge and processes around due diligence and who they do business with. By keeping the following tips in mind, businesses can mitigate risk, improve management of cash flow and reduce the impact of becoming part of a flow on effect.

Invest in onboarding your customers correctly

One of the most important things a business can do to protect their cash flow is to invest in onboarding their customers correctly. Allocating spend and taking the time to improve the onboarding process will actually save a business money in the long term. While we’d like to trust everyone, it’s just not possible to do that. If a customer goes into liquidation, it can affect your business’ cash flow and there is a flow on effect from there.

We live in a digital age where technology is more accessible than people think. One way to significantly improve the onboarding process is to switch to technology that can streamline and automate your processes, saving you both time and money. ➤

Credit Management October 2019 • CREDIT MANAGEMENT IN AUSTRALIA 9

Small Business Risk Review

Review

Court Actions by Volume FY2018-FY2019

Court actions increased in FY2019 in comparison to FY2018 across all states with the exception of WA, which decreased by 18%. We saw an overall increase of 18%.

Australia had the least amount, with a consistent decrease.

South Australia significantly peaked in court action s in July 2017 and again in February 2019

YOY% TOTAL 18%

Actions

Highest

Victoria took the lead each year with the highest amount of court actions

saw its highest court actions in August 2018

New South Wales had the second highest amount of court actions each year

New South Wales peaked in August 2017 and peaked again in May 2019 with the highest amounts.

Court Actions by Dollar Amount FY2018-FY2019

Dollar Amounts increased in FY2019 in comparison to FY2018 across all states with the exception of WA, which decreased by 5%. There

an overall increase of 13% across Australia.

Western Australia had the highest dollar amounts in July 2017 and again in January 2019

South Australia peaked in dollar amounts in July 2017 and again in April 2019

had the highest dollar amounts in August 2017 and peaked again in May 2019

YOY% TOTAL 13%

Construction Risk Across Australia

Notices

by

Victoria peaked in dollar amounts in July 2017 and again in May 2019 New South Wales had the highest dollar amounts in August 2017 and peaked again in May 2019

New South Wales had the second highest amount of court actions each year

New South Wales peaked in August 2017 and peaked again in May 2019 with the highest amounts.

Credit Management 10 CREDIT MANAGEMENT IN AUSTRALIA • October 2019 Annual

FY2018 vs FY2019

14% 28%

Western

Victoria

26% 1%

55% 10% -5%

QLD

23% 38%

was

Court

Nationwide July 2018 - June 2019 Top 5 Industries of

Risk 23% Construction Retail Trade Manufacturing Transport, Postal and Warehousing Professional, Scientific and Technical Services 11% 8% 7% 11%

9% 9% 3% 33% 27% 19% Construction is the riskiest industry across NSW, QLD, SA, VIC, WA and TAS. NSW is the worst performing state by 33% Professional, Scientific and Tech Services RCR Tomlinson $630 million collapse; ECM 400 employees jobless Construction Ralan Group $500 million collapse; J.M. Kelley Group $33 million collapse Retail Trade TopShop, ToysRUs, Roger David , Karen Millen ASIC

Generated

Industry July 2018 - June 2019 20% Professional, Scientific and Technical Services Retail Manufacturing Accommodation and Food Services Construction 10% 7% 6% 16% Payment Defaults by Industry July 2018 - June 2019 29% Construction Retail Professional Scientific & Technical Services Accommodation & Food Services Manufacturing 12% 10% 8% 12% 1% Court Actions Nationwide (July 2018- June 2019) Lowest Risk: Electricity, Gas, Water and Waste Services 5 Riskiest Industries by Average Days Overdue July 2018 - June 2019 Administrative and Support Services Arts and Recreation Services Electricity, Gas, Water and Waste Services Construction Professional, Scientific and Technical Services 90+ DAYS 90+ DAYS 90+ DAYS 87 DAYS 88 DAYS

Software like CreditorWatch and its integration with its online credit application, ApplyEasy, can greatly improve the onboarding process. Customers information will be checked for accuracy and will be run through a credit check with a recommended decision provided in seconds. If you think that the customer’s information doesn’t matter, think again. A great example is PPSR. Without the correct ABN, ACN, name or address, registrations can become void. ApplyEasy also integrates with PPSR Logic, for streamlined registrations.

It is important to agree upon the correct payment terms as well. If a customer has a history of payment defaults, slow payment times or court actions, consider placing them on cash on delivery (COD) for a while. You might also want to shorten the payment terms than you usually would to allow for the average 7 days late period. Consider switching your accounts receivables to an online platform. Xero found that businesses who used online invoicing increased their payment times by 55%.

Know exactly who you are dealing with

Another crucial step to keep in mind is really getting to know your customer, especially if they operate in a highrisk industry or have adverse data on their credit report. Identify who is the underlying guarantor and ask for a trust deed if dealing with a trust.

Directors are essential to pay attention to. A director cannot be operating a business if they are bankrupt, but some fall through the cracks. It is important to look at cross directorships as well. For examples, if the director of construction Company A has adverse action registered against their Company B, you’ll want to be across it as past and present director behaviour is a great indicator as to how they will run a business: l A director with a payment default is 5 times more likely to experience another one

l A director with a court action is 2 times as likely to have another one l A director with a failed business is 2 times more likely to fail again

If a director has experienced insolvency and sets up another company afterwards with a slight name change, this could indicate illegal phoenix activity.

“It’s important to perform due diligence when dealing with the construction industry,” explained Treacy. “You need to check if the builder, developers, strata management companies and engineers are still in business, and get to know who you are dealing with from the ground roots. It’s the same for a business. Make sure you do your homework on who you’re dealing with.”

The process of KYC (Know Your Customer) is handy for those not just in legislated industries like finance, if a customer operates in risky industries like construction or retail utilising KYC tools are very handy. These tools help identify higher risk entities and enable you to perform better due diligence, identifying those people who ultimately control a company regardless of whether they are a director or not.

Pay attention to the canaries in the coal mines

Subscribing to monitoring and alerts can help you to stay across adverse data in real time with 24/7 alerts highlighting insolvencies, mercantile inquiries, court actions, payment defaults, ABN/ACN changes, and more.

Companies that go into

administration, generally show signs of stress before that happens. If a company can’t make payments to their smaller suppliers, they can only realistically maintain that for about six months. Then, when they stop supplying their largest suppliers, that’s when they typically collapse or are wound up.

Have an action plan in place

Review your current debt collection plan and if you don’t have one, now is the time to make one. Establish a process for each stage of a late payment and your follow up response to it. Collection software has come a long way in recent years allowing you to automate a number of these follow ups. And of course, don’t forget about the power of a payment default!

Review your customer database

It is vital to review your customer database regularly. Performing a Datawash can assist and help to identify any changes to your customer circumstances such as ABNs, ACNs, address changes and more. Consider placing the customers who have poor credit scores, court actions and payment defaults into a quarterly or 6-month review.

The above tips will help you to stay on top of your customer base, mitigate risk to your business and stay proactive in times of uncertainty.

CreditorWatch

Ph: 1300 50 13 12 www.creditorwatch.com.au

Credit Management October 2019 • CREDIT MANAGEMENT IN AUSTRALIA 11

*Patrick Coghlan MICM Managing Director

“We live in a digital age where technology is more accessible than people think. One way to significantly improve the onboarding process is to switch to technology that can streamline and automate your processes, saving you both time and money.”

Top 5 myths around legal entities

– debunked!

By Michael Criss*

Reducing exposure to risk is a priority for credit managers offering commercial credit. Here we debunk some commonly held misconceptions when it comes to assessing risk for different entity types.

Most of these false beliefs relate to the credit agreement entered into with new customers. For robust protection of your financial interests, it’s important to know from the start the type of legal entity your applicant is. Are they a sole trader, a partnership, a company or a trust? There are other corporate structures but in the majority of cases this is what most credit professionals would expect to see. You need to know these facts as the liability behind these structures can impact your ability to collect an outstanding debt in the event something goes wrong.

The recent 2019 Equifax National Credit Managers Survey showed that 73% of credit managers experienced a rise in credit demand in 2019, compared with 2018. With this increased credit activity, it’s more important than ever to protect your business from bad debt.

Beware of these myths which might weaken your knowledge of who you are doing business with and

make it harder to recover any debts which may arise.

Myth #1: A trust registry database is a reliable way to identify trust applicants.

TRUTH: A Trust Deed is the only source of truth to accurately assess the credit risk associated with your application.

The Equifax Credit Managers survey showed that trusts make up 25% or less of the customer base for most respondents, yet they often cause an automated assessment process to become manual. If your customer applies as a trust, it’s vital to identify the legal entity behind this structure. A trust is not a legal entity it holds assets, but it doesn’t control these assets. Control, or ‘legal title’, is in the hands of the trustee or the appointer, which could either be a company or one or more individuals.

Because it’s not easy to sort out who the legal entity is in a trust, the idea of a trust registry database is understandably attractive. After all, who wouldn’t like to swap a manual process with an automated solution for linking trust applicants to the individuals behind them? The problem

Credit Management 12 CREDIT MANAGEMENT IN AUSTRALIA • October 2019

Michael Criss

“Beware of these myths which might weaken your knowledge of who you are doing business with and make it harder to recover any debts which may arise.”

with this scenario is that trust deeds change. In Australia there is no legal requirement for trustees to notify a government registry of changes to the trust deed. As such, there’s no regulated central register to refer to when processing trust applications, and no guarantee the information held in a trust register is up to date.

The only way to reliably find out who is the legal entity behind a trust is to look at the trust deed at the point of application. It’s here that you will be able to identify who is the trustee or appointer. And it is this entity, not the trust, who is personally liable for any debts.

Myth #2: An ABN search is sufficient when gathering information about a company.

TRUTH: An ACN search is far more insightful and is the correct number to rely on when assessing credit risk.

For most respondents in the Equifax Credit Managers Survey, the largest portion of their customer base is stated to be companies. For 71% of respondents, companies consist of more than half of their customer base. So for many credit managers, verifying company information when entering into a credit agreement is a routine task. But it’s a task not always performed correctly.

When gathering information about a company, it’s far better to search for the Australian Company Number (ACN) rather than the Australian Business Number (ABN).

If your customer is registered to trade under a company structure in Australia, they will have an ACN issued by the Australian Securities and Investments Commission (ASIC). An ACN assists ASIC to monitor company activities because it is a unique identity code within the structure of the Corporations Act 2001 (Cth).

Myth #3: A trading name or a business name is a legal entity.

TRUTH: The legal entity is the individual behind the trading/ business name.

What’s in a name? A business registered with the Australian Business Register is no more a legal entity than a company with a trading name. It’s the individual behind the business who holds the title of ‘legal entity’, and that is with whom you should be dealing.

To fully understand the risk and exposure of doing business with a new customer, it’s important to investigate the background of the legal entity. A company credit report or consumer file are great places to start.

Myth #4: When dealing with a trust on the PPSR, only register against the trust.

TRUTH: It’s best practice to register against both the trust and the trustee.

When asked about future plans in The Equifax Credit Managers Survey, 16% of respondents said they were going to register their security interests this coming year. Two-thirds of respondents had already registered on the Personal Property Securities Register (PPSR), with the majority feeling confident their entries were correct. The unfortunate reality is this confidence might be misplaced, especially when it comes to trust registrations.

When registering security interests over trust assets on the PPSR, don’t

make the mistake of only registering against the trust. Instead, take out two registrations one against the trust and the other against the trustee. Remember the trust doesn’t control the assets, the trustee does.

Where a trust is the grantor of a security interest and has an ABN, register against the ABN. Also, register against the trustee’s ACN. You will need to obtain the correct identifying information for the grantor; otherwise, there is a risk the PPSR registration will be deemed incorrect or invalid. We recommend seeking specialised advice.

Myth #5: It’s not essential to identify the correct legal entity.

TRUTH: If you don’t identify the correct legal entity from the start, it limits your recourse for debt collection.

Over the coming 12 months, 65% of credit managers plan to increase or tighten credit activity, according to The Equifax Credit Managers Survey. A crucial part of mitigating risk is to identify the correct legal entity when extending credit. If a customer fails to repay their debt and you haven’t been trading with a legal entity, this may seriously impede the success of your debt collection activities. There is a clear correlation between getting the correct legal entity right and lessening your chance of needing to collect through a third party down the track.

*Michael Criss

Head of Commercial

Ph: (02) 9278 7699

Email: michael.criss@equifax.com

Disclaimer: The information contained in this article is general in nature and does not take into account your personal objectives, financial situation or needs. Therefore, you should consider whether the information is appropriate to your circumstance before acting on it, and where appropriate, seek professional advice from a finance professional such as an adviser.

Credit Management October 2019 • CREDIT MANAGEMENT IN AUSTRALIA 13

In Australia, as of 30 June 2019, there were: 375,000+ new business name registrations 220,000+ new company registrations Source: ASIC Small Business 2018-19 Infographic

How to choose the right Debt Collection agency?

By Stephanie Hughes*

Debt collection, whether commercial or consumer, is one vital part of a comprehensive credit risk management system. When we hear the words “credit risk management,” or “Cash Flow” we may have a general idea of the meaning, but for the record, a comprehensive credit risk management system will use a wide range of “before and after” credit risk products, services, systems and solutions that will fulfill three objectives for a company:

l To safeguard its assets cash, accounts receivables and inventory

l To support its sales and marketing goals

l To strengthen the internal risk management system

In view of these goals, I would like to take a moment to explain what to look for when choosing a debt

collection agency as one vital part of strengthening your company’s credit risk management system.

First, I am a believer that if you do not have an internal collection department that can efficiently handle your slow paying and outstanding accounts, (I see this with a number of clients as they lack resource and spend in this area) then by all means outsourcing the collection function to a qualified collection agent is a very prudent business decision.

Our experience is that we usually deploy around 60% additional resources on the same volume usually being managed in a credit department

Before even trying to understand if a collection agency is a good fit, you should step back and understand if your collection needs come under commercial, consumer or both within your business.

1. How do you know that the agency you are dealing with is a legally and professionally legitimate company?

This idea is no different than trying to understand the creditworthiness of your customers. Since you need to obtain proof that the agency is LICENCED to provide their collection services, don’t be bashful about asking the agency to send you a copy of it’s license and certificate of insurance. You certainly don’t want to be held responsible should a legal problem arise in the course of the agency’s efforts to collect a debt on your behalf. In addition, inquire as to whether the agency has been involved in any lawsuits or paid any fines due to some wrongful collection activities.

Stephanie Hughes

If your collection requirement is for large volumes of cases against individuals, your needs will best be fulfilled by using a call centre type agency that specialises in handling these types of cases. Conversely, if your collection needs are commercial cases for mining equipment with balances in larger values, you would benefit by using a collection agency that specialises in this type of work. If you have a good mix between all aspects from consumers, SMEs through to large commercial you need to ask yourself how does the company segment these? What do they offer for each segment? How will they maximise my ROI?

2. Does the agency already service your industry and is it possible for you to call one or two of their other customers to get their impression?

Talking with other companies, especially those in the same industry, will give you one of the best assurances for the performance and reliability of this agency, after all referrals are paramount?

3. What are your present internal collection policies and procedures, and do you normally outsource to an agency when an account becomes delinquent?

Understanding at what point you need to place an account with an agency will result in how well the agency can perform on your behalf. For example, let’s say that you have one collector

Credit Management 14 CREDIT MANAGEMENT IN AUSTRALIA • October 2019

at your company who is trying to collect on a couple of hundred cases per month. If under your present system your collector cannot manage the accounts efficiently then best to sit down with your agency, segment the pool of accounts to be placed, and then place them with the agency on a timely basis that will allow the agency to support you to the fullest. Too often, companies wait months before they outsource an account. A rule of thumb is that an account that is already six months delinquent only has a 50% chance of being collected and at one year only a 20% chance. Every company has to decide at what it point it will be more cost effective to place the account with an agency rather than attempt to collect it in-house. From many years in the industry the more streamlined the process the better the collection rate. The companies that adopt a culture that the collection agency is an extension of their department have reaped better results.

4. Are you selling a complicated service that requires time to deliver?

The more complicated the product that you are selling, the higher the skill the collector needs to have in dealing with the collection issues. Depending on industry, some debts can be disputed. Disputes require a high level of capabilities and knowledge to resolve, meaning the agency needs to understand how to best deal with disputes to ensure that the client’s costs don’t spiral out of control and the debt is settled as soon as possible with minimal reputational damage

and least expense possible. I have personally witnessed this many times where the costs have outweighed the recovery, no outcome reached, and the levels of communications have broken down between the agency and client. Make sure your agency is proactive, thinks outside the box and has experience in your industry or similar.

5. What are the overall collection capabilities of the agency?

This entails confirming the total number of collectors, the type of training they would receive to handle your accounts, the number of accounts handled per collector per month, the technology being used to support the collector and the average overall collection rate.

6. What are the analytical reporting capabilities and Innovation?

This comprises the ability of the agency to give you an update of any account at any time that you have passed to it for collection. These days, many agencies have developed collection systems that allow clients to access the system through the internet by password. The collection system should allow you to see the status of each account, confirm how much has been collected to date, show the past payment remittances to your company, and allow you to understand every aspect of the service of your accounts, from placement through collection.

How are the collection agency contacting my debtors? Letters?

Recent studies have shown that letters take 3 days to read, emails 12 hours and SMS 3 minutes. These are powerful stats, so the question to ask is: “how is my agency reaching my customers to obtain payments”? Or are they reaching them at all?

These are all valued questions in your selection process?

7. Finally, what is the agency’s ability to communicate with you?

Every agency should have one person at the company who will respond

to your inquiries and requests on a regular basis with another person able to back them up. Many agencies these days don’t even know their customers and there can often be a very impersonal feeling when one calls to the agency. Is your agency proactive in communication? From experience a company you engage with should be an extension of your brand?

A quick cheat sheet?

When deciding on a collection agency ask yourself?

l What are some examples of innovation you have implemented in your business?

l How will you apply analytics to my portfolio?

l What unique service approach do you employ in debt recovery to make you stand out?

l Where you serve in panel arrangements, how are you positioned against your competitors?

l How can you demonstrate your company’s commitment to the personal and career development of your staff?

l How does your agency handle complaints to better protect your clients’ brand image?

l Will your operators be trained on our specific collection requirements?

l Do you have a leading-edge propriety owned IT infrastructure to effectively manage referrals?

l Is the agency able to tailor solutions specifically to our business recovery needs?

Asking these questions will assist you in determining which agency is ‘best fit’ for your recovery needs and increasing your customer engagement and net return.

*Stephanie Hughes

National Sales Manager

Cloud Payment Group

Ph: 08 6444 9366

Mob: 0491 099 676 Email:Stephanie@cloudpg.com.au www.cloudpg.com.au

Credit Management October 2019 • CREDIT MANAGEMENT IN AUSTRALIA 15

“Talking with other companies, especially those in the same industry, will give you one of the best assurances for the performance and reliability...”

How Credit Managers stand to benefit from Early Payment Programs

By Guy Saxelby*

As the person primarily responsible for managing credit risk in their organisation, Credit Managers must be able to demonstrate the value of their workplace contributions against specific metrics to senior management.

The VUCA (Volatility, Uncertainty, Complexity and Ambiguity) nature of today’s business environment drives companies to keep tight controls around both accounts payable and accounts receivable. Credit resources are limited and expectations for seasoned credit professionals to do more with less has become the new norm. Reductions in DSO, customer collections, credit risk management, AR, disputes, profit margin protection and sales engagement to identify growth opportunities are typically all measures within a credit manager’s remit.

In many organisations, Credit functions are often seen as blockers by Sales departments, and Sales are seen by Credit as discount brandishing cowboys. This trend has resulted in organisational growth and risk management becoming conflicting ideologies. The age old battle between Credit and Sales however need not always exist. Practises have evolved where the two can work harmoniously to help achieve company revenue goals without damaging an organisation’s ability to manage risk and control payment delinquency to acceptable levels. Early Payment Programs are just one of these practises.

One of the best ways to improve a company’s cash flow and achieve a reduction in DSO is to speed up payment times for the payment of customer invoices. Traditionally, invoice factoring has been one method for achieving this however it is unlikely that organisations will want it known to their customers that they are soliciting the services of factoring companies. Should an invoice remain unpaid at the expiration of payment terms for an extended period of time, factoring companies have the potential to seek payment directly from the credit originator’s customer.

As participants in these programs, suppliers stand to gain from the following benefits:

l A significant reduction in DSO (cash flow)

l On-demand payment whenever approved invoices are available (cash flow)

l Reduced cost of borrowing to ensure business operations remain sustainable (prosperity)

l Identification of potential growth opportunities through limit increases with accounts being paid down sooner, and a true opportunity for positive collaboration between credit and sales teams (revenue)

l Invoice portal visibility, removing the need for additional phone calls and emails to understand when invoices are going to be paid (resourcing).

The big macro trend upon which Earlytrade was founded is that you no longer need to be a financial intermediary to shift credit between different tiers in a supply chain. Technology is disrupting traditional financial services by connecting buyers and suppliers allowing credit to flow seamlessly between trading partners.

Guy Saxelby

One debt free alternative to invoice factoring are technology driven Early Payment Programs. These are generally offered by large corporates to their supplier base to drive EBITDA growth and improve supplier relationships by offering early payment in exchange for a small discount.

The adoption of newer alternatives to invoice factoring and traditional payment terms is on the rise. If the numbers stack up, it could be worth a conversation with your key customers to determine whether they have the capacity to offer early payment programs to their suppliers.

*Guy Saxelby Co-Founder and CEO, Earlytrade www.earlytrade.com

Credit Management 16 CREDIT MANAGEMENT IN AUSTRALIA • October 2019

A Comprehensive Accounts Receivables Solution

Request a Demo

Create, manage and renew your PPSR registrations

Customer on-boarding

Due diligence & Monitoring Analysis

Access commercial credit reports to assess credit risk

Assess individuals behind a business and their cross-directorships

Monitor customers to be alerted when important changes occur

Our suite of KYC tools ensures you remain compliant with legislation

Cleanse and append data for a healthier database

Analyse your entire customer portfolio to identify credit risks and prioritise collections

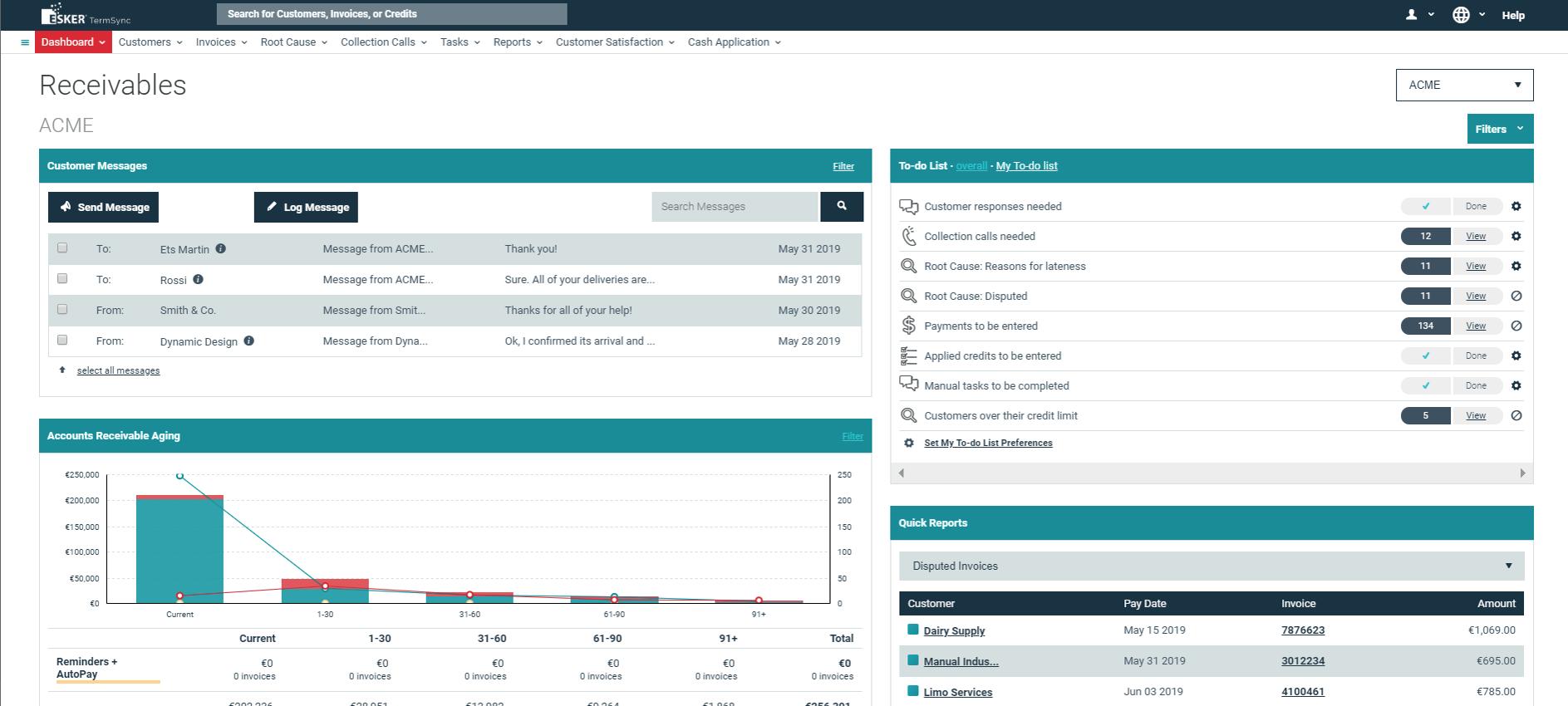

Time is money

By Damian Arena*

Let’s face it, we live in a cost-cutting climate, with most executives holding a strict mandate to plug the drain of unnecessary expenses in their businesses. When on a cost reduction rampage, an obvious place to first take aim at is the countless hours wasted by businesses chasing unpaid invoices. A recent Financial Review survey revealed that Australian businesses hold a staggering $115 billion of unpaid invoices and spend over 18 million hours a year chasing debtors. It couldn’t be clearer that in this environment of reduced margins, stricter lending conditions, automation of the accounts receivable process is a sure way to free up working capital and streamline payments.

For a business to leave growth opportunities on the table in any economic context is a confounding proposition. Yet in this era of near zero interest rates, where growth is a coveted novelty, a failure to have payment delivered for services already rendered is a maddening thought. Businesses have already earned this income; the contract has been won but payment is delayed for various reasons. This missing, hard earned cash could be invested in new equipment, R&D or even used to pay off a business’s own debt.

Of course, to have an “accounts receivable” process is not a revolutionary notion. As such, it is not in the documentation of unpaid invoices that businesses fall by the wayside, but rather in enforcement. A robust means of collection of unpaid invoices is paramount in ensuring timely payment. Businesses who fail to actively collect what they are owed are essentially providing their debtors with free finance.

The extent of the capital wastage riddling business balance sheets in the form of unpaid invoices is frightening. Moreover, when simple and effective automation tools exist to optimise the accounts receivable process, the drain of outstanding debtors screams even louder. Even more concerning is that these costs to business are not always accounted for. They may be fleetingly considered in business planning on an intuitive level, yet in most instances they are simply ignored. To ignore debtors beyond 60 days is worrying, but when that number creeps to 90, or worse still 120, dire consequences can befall businesses.

The solution to this “free finance” trap lies in automation. Automation systems exist whereby businesses can trigger the distribution of payment reminders before an invoice is due and then every 7 days until it becomes paid, queried or sent to a recovery agency. Automation is key to businesses saving precious resources and man hours. With simply the touch of a button, a business can send out thousands of invoices via SMS or email, and check when the invoice is opened, actioned, queried or paid.

The ingenuity of an automated system doesn’t end with the efficiency it provides, transparency is yet another deliverable that is offered. Without doubt, the collection from debtors is a process

18 CREDIT MANAGEMENT IN AUSTRALIA • October 2019 Data and Technology

“The solution to this “free finance” trap lies in automation. Automation systems exist whereby businesses can trigger the distribution of payment reminders before an invoice is due and then every 7 days until it becomes paid, queried or sent to a recovery agency.”

Damian Arena

packed with potential regulation breaches. Automation mitigates such risks with a wholly transparent audit trail, and that’s not to mention the immediate availability of reports and analytics.

Technology lies at the heart of plugging the hole unpaid accounts leave in businesses’ profit margins.

In utilising automation, businesses can save time, money and resources. This capability gives businesses the

much-needed opportunity to redirect their resources toward what is most crucial for longevity that being growth and development. Surprisingly this automation is not expensive, it is very easy to use, links seamlessly to existing software and can be implemented in around 30 days!

With Credit Managers being asked to do more with less, automation maybe the answer you have been looking for.

*Damian Arena Co-Founder, Director of Business Development IODM Limited P: +61 3 8396 5891 M: 0419 106 176 Email: damian@iodm.com.au www.iodm.com.au

FOOTNOTES: 1 Financial Review Survey 24/6/1

October 2019 • CREDIT MANAGEMENT IN AUSTRALIA 19 Data and Technology

An illustration of automation Manual System With Automation Number of invoices 5,000 5,000 Average time to follow up 1 invoice 5 minutes n/a Total follow up time 416 hours 1-hour max Piecing together solutions for finances in a distressed state or under pressure 1300 766 563 www.VINCENTS.com.au corporate insolvencies | personal insolvencies turnaround solutions

Data is King, long live the King!

By Richard Vaughan*

It all starts with data. Our core business is providing Customer Communication Management (CCM) in a Business to Business environment. All of our solutions are dependent upon having accurate and relevant data, lots of it. In the business process of producing transactional communications, we would receive, enrich, merge, sort, process and reconcile many sources of data even before one invoice or statement is created.

Once the documents are generated, we then distribute the communications via email, sms, print/mail and digitally archive. This generates more data such as delivered/undelivered and bounce back reports, what device is used to view, when and how the customer has interacted with the digital communication. This is valuable data which can then be

used by other departments such as marketing, operations as well as credit professionals.

We have seen an increase in the amount of data that is sent to us and data that is generated by us and we believe that using this data for process improvements is key to our future direction and innovation.

CCM has had to change and develop as both the business and customer requirements have evolved over time at a quick pace. A significant increase in the use of Application Programming Interfaces (APIs) as part of the CCM solution has led us to invest in software development capabilities in house, mainly due to the amount of data used in providing a CCM solution.

Our recent investment in and collaboration with Cloud Collections is important to Zipform Digital as we look to develop Intellectual Property between CCM and collections solutions. Imagine having the transactional history and communications available to the end customer at a click of a button, when a sms reminder is received. We are able to: l enrich the collection data with transactional information, l provide a secure link to the PDF of the unpaid statement/Invoice, l enrich with the media preferences of the customer, l refer to credit limits,

l communicate the customer account manager contact details, l manage the delivery of the communication, l take care of the necessary bounce back and undelivered work processes, l data visualisation and trend analysis and; l reconcile the process in a secure and compliant environment.

With the increased amount of data in use and stored to deliver an efficient CCM solution, security and data privacy best practices are extremely important. The constant threat from cyber-attack or a breach in security protocol presents a high risk to businesses that need to be proactively managed in the current landscape.

In addition to our current ISO9001 certification, we are in the process of attaining ISO27001 certification, which will enhance our reputation and the trust of our customers as it provides the best practice framework of policy and procedures for IT security management.

It is clear that the more data provided results in an improved customer experience, more efficient processes and a better return on investment. It all starts with data and that is not going to change.

*Richard Vaughan General Manager, Zipform Digital Ph: 08 9232 0192, www.zipformdigital.com.au

20 CREDIT MANAGEMENT IN AUSTRALIA • October 2019 Data and Technology

“

We have seen an increase in the amount of data that is sent to us and data that is generated by us and we believe that using this data for process improvements is key to our future direction and innovation.” Richard Vaughan

Collections & Vulnerability

– A considered approach

By Nikki Dennis*

Not so long ago those two words ‘Collections’ and ‘Vulnerability’ would rarely have been seen in the same sentence and yet they are inextricably linked. Often the first inkling an organisation will have that a customer is in a vulnerable situation is that they are indebted, it stands to reason therefore that the credit team will be in a prime position to better identify and support these customers.

Yet it doesn’t stop there. Recent regulatory changes within Australia across the Energy, Water, Banking & Telecommunication sectors, calling for better identification and support of vulnerable customers, mean that debt is no longer just the domain of the credit team but is now everyone’s business.

More organisations are now looking to upskill frontline staff in early intervention strategies. Such practice can help stop debt escalating for customers and assist staff to recognise any red flags that may point to a customer experiencing vulnerability.

Credit and specialist teams are honing their skills to become better at assisting and supporting customers experiencing varying vulnerabilities that may affect their ability to repay debt.

consumer debt. However, whilst most of the focus of vulnerability up until now has been within the mass market consumer space, it is also very relevant to individual business owners who can experience similar levels of difficulties requiring acknowledgement, assistance and support from their creditors.

So, knowing that all of us across a wide variety of industry sectors will be affected by this; let’s look at why there is a focus on vulnerability, what is vulnerability and what does it really mean for organisations within a collection’s context?

Why the focus on vulnerability?

According to the 2018 Poverty in Australia Report, over 3 million people are living below the poverty line of 50% of median income within Australia, including nearly 750,000 children1

Between 2009 and 2018, power prices have increased by 75% on average, with Victoria and South Australia experiencing the greatest increases (104% and 112% respectively).2

Nikki Dennis

Meanwhile, organisations within the commercial business-to-business sector would be forgiven for thinking that this issue applies solely to companies dealing with personal

Rising house prices and high rental costs mean housing affordability further exacerbates this problem for many Australians. Add to that the findings from the July 2018 ASIC report3 Australians owe $45 billion in credit card debt and more than one in six consumers is struggling to repay their credit card debt and it’s not hard to understand this

Consumer Credit 22 CREDIT MANAGEMENT IN AUSTRALIA • October 2019

an escalating problem

What is vulnerability?

Dr Brene Brown, a research professor who has spent the past two decades studying courage, vulnerability, shame and empathy, defines vulnerability as “uncertainty, risk and emotional exposure” meaning that merely “to be human is to be in vulnerability”.

However, in the context of customer vulnerability within collections, we are not talking about the vulnerability of an individual in general terms but more their vulnerability towards being further disadvantaged by a credit provider.

There needs to be a definition that considers multiple factors such as a customer’s individual circumstances, the deeds and actions of the credit provider and whether either or both have put the customer at a disadvantage.

A useful definition of Customer Vulnerability comes from the Financial Conduct Authority in the UK;

“A vulnerable consumer is someone who, due to their personal circumstances, is especially susceptible to detriment, particularly when a firm is not acting with appropriate levels of care”.

It is further recognised by the FCA that each and everyone of us is potentially vulnerable to detriment, but organisations need to think

about individuals that may be ‘currently vulnerable’ and ‘particularly vulnerable’. People can go in and out of vulnerability or it can be more permanent. These considerations are important in supporting customers facing a variety of challenges.

Collections and vulnerability abroad

The UK have been focussing a lot on vulnerability in debt collection in recent years and host the first Collections & Vulnerability Summit later this year. Often trends in the UK are reflected here in Australia a short time later and understanding the journey credit providers have taken in the UK may help us prepare in Australia in the coming months/years.

‘Vulnerability a guide for debt collection’, is the first published report following new research funded by the Finance and Leasing Association and The UK Cards Association4 It provides interesting data and insights as well as recommendations for organisations working with customers that owe debt. In summary, this research involved data being collected from

Consumer Credit October 2019 • CREDIT MANAGEMENT IN AUSTRALIA 23 National Credit Insurance (Brokers) Pty Ltd ABN 68 008 090 702 | AFS Licence No 233817 TRADE CREDIT SOLUTION SPECIALISTS CONNECT WITH THE Navagating credit risk management requires expert advice. THAT’S WHAT YOU’LL GET WITH NCI. To find out how we can assist you and your clients, contact us today. WWW.NCI.COM.AU 1300 654 500 INFO@NCI.COM.AU • 30 years experience • National coverage is

leaving many Australians only a couple of pay checks away from experiencing financial difficulty.

“in the context of customer vulnerability within collections, we are not talking about the vulnerability of an individual in general terms but more their vulnerability towards being further disadvantaged by a credit provider.”

➤

over 1,600 staff working in in-house collections team, UK debt collection agencies and debt purchase agencies.

The following was found:

l positive attitudes and practices were found among staff towards customers with mental health problems; of the 27 surveyed organisations, six firms participated in both the 2010 and 2016 surveys an analysis of data from these firms indicates marked and positive

l improvements were found in disclosure management, attitudes, and practices.

l organisations need to take more action to respond to customer disclosures of suicide. In the last year, 1 in 4 frontline staff spoke to at least one customer they seriously believed might kill themselves

l more frontline and specialist staff reported difficulties in talking about addiction be it to gambling, alcohol, or drugs than any other type of vulnerable situation

l when encountered, terminal illness is an issue that staff can find difficult between 24-33% of frontline and specialist staff report that they haven’t received sufficient training in this area

l identifying customers in vulnerable situations is one of the most difficult challenges that staff report

l supporting customers in vulnerable situations requires more than ‘breathing space’ instead, staff require a framework for organising all the key information about a customer’s situation to identify the support needed

l staff also require support in particular, qualitative data from the survey details the emotional, health, and professional impact of working with customers in vulnerable situations

The message within the guide is

clear developing effective training for better identification and support of vulnerable customers is key but this needs to go beyond ‘general awareness’. It needs to deal with the tasks that staff encounter day-inday-out; to provide real strategies and language that can be applied to get the best outcomes for both the customer and the organisations that serve them, and for the staff in terms of emotional well-being and resilience.

Australian Regulatory Changes in response to Customer Vulnerability

Whilst it is interesting to view and learn from findings within the UK, back in Australia we are already embarking on our own journey of vulnerability within the credit industry and there are key differences, including a focus on family violence and elder and adolescent abuse as indicators of vulnerability. Several regulatory changes have occurred within this topic here in Australia over the past 2 years, across many key industry sectors. Let’s look at some of these and their impacts on the respective industries.

Energy/Water

l Essential Services Commission’s (ESC) Payment Difficulty Framework (PDF) The ESC implemented the PDF earlier this year challenging Energy retailers in Victoria, and potentially Water retailers in the years to come, to rethink and improve how they assist customers facing financial difficulty.

It seeks to do away with the labelling of customers in ‘hardship’ and the premise that customers must ‘qualify’ to enter a hardship program to be able to receive any type of assistance. Instead, the PDF asserts that all customers can experience payment difficulty and as such standard and tailored assistance should be made available to avoid getting into arrears and reduce risk of being disconnected.

l Australian Energy Regulators

(AER) Customer Hardship Policy -

The AER’s Customer Hardship Policy Guideline was published in March 2019 and creates binding, enforceable obligations on retailers across other Australian states to strengthen protections for customers experiencing payment difficulties due to hardship. It is less prescriptive than the PDF but moves towards more standardised hardship policies amongst retailers with an emphasis on offering flexible payment options and early identification of customers experiencing hardship.

l ESC Family Violence Guidelines

Further regulatory changes for Energy and Water have been seen in the area of Family Violence Guidelines and the Better Practice Guide responding to family violence was issued by the ESC earlier this month. These guidelines were implemented across Water last year and the final paper for Energy was released in May for a January 2020

Consumer Credit 24 CREDIT MANAGEMENT IN AUSTRALIA • October 2019

“... developing effective training for better identification and support of vulnerable customers is key but this needs to go beyond ‘general awareness’. It needs to deal with the tasks that staff encounter day-in-day-out..”

implementation. The guideline calls for better identification and support of customers that may be facing a family violence situation. It recognises that financial abuse often ends in the customer having accumulated a large amount of debt at the hands of the perpetrator and stresses the importance of privacy and protecting their information.

Banking and Finance

l Banking Code & ABA Customer

Vulnerability Guideline – The new banking code was released July this year on the back of the final findings of the Royal Commission in February. In chapter 14, section 38 of the code it states; We are committed to taking extra care with vulnerable customers including those who are experiencing: age-related impairment; cognitive impairment; elder abuse; family or domestic violence; financial abuse; mental illness; serious illness; or any other personal, or financial, circumstance causing significant detriment.

With such a strong focus on better identification and support of vulnerable customers, the Australian Bankers Association is currently in consultation with stakeholders to produce a new Vulnerable Customer Guideline for the industry to be implemented in 2020.

Telecommunications

l Telco Consumer Protection Code

Similarly, the Communications Alliance Ltd’s, Telecommunication Consumer Protection Code has a big focus on vulnerability, stating; ‘Disadvantaged and vulnerable consumers will be assisted and protected by appropriate Supplier policies and practices.’

Commercial Sector

Much of the focus so far in Australia and abroad has been on the consumer rather the commercial SME space and yet individuals running small businesses are just as likely find themselves in a vulnerable situation as personal consumers. Given the importance of small business to the Australian economy, we should really be doing what we can to help small businesses thrive, which includes understanding vulnerability in the context of a small business owner.

The new Banking Code goes someway to offering further support to small business and farmers with new guidelines on loan repayments, following up on defaults and taking enforcement proceedings. In a similar vein the ESC has extended the family violence guidelines and responsibility of the retailer to assisting small business owners that may be in a family violence situation. In light of this, it is only a matter of time until the commercial sector needs to focus more on vulnerability in a collections context.

Debt Collection Agencies and Debt Purchasing Companies

Debt collection agencies, as an extension of the organisations they partner with, should also familiarise themselves with recent legislation and regulation across the different sectors. ASIC’s Debt Collection Guideline protects against ‘unconscionable conduct’ with disadvantaged debtors but forward-thinking collection agencies will already have more detailed processes in place for potentially vulnerable customers such as individual case management and full access to a variety of support services. Guidelines such as the ESC’s one on family violence stipulate that a retailer still has a duty of care to past customers that have been disconnected. In many cases these accounts would be sitting with a collection agency, and as such,

retailers will want to know that their collection agents also have the right training, systems and processes in place to ensure better identification and support of their vulnerable customers.

What this means for organisations?

Organisations are looking for training solutions that strike the balance between the commercial outcomes they seek and the social needs of the customer and importantly, provide resilience building and self-help strategies for staff.

In addition, for best outcomes it is critical that any training is supported by a meaningful quality framework and coaching program.

1 Get Top Down Buy In – It is important that executives at the highest level recognise that debt is now everyone’s business and that support services and assistance for vulnerable customers need to extend beyond the traditional reaches of the credit and hardship teams. Consistency in approach across an organisation is critical. Departments need to work collectively together to ensure that IT systems and processes support organisational wide policy changes and that each customer facing team comes together to create delegation matrixes for effective transfer of calls to specialist teams.

2 Early Intervention Strategies

– Train frontline staff for early intervention strategies. Some organisations have invested in effective collections training for frontline staff to assist with early intervention goals to avoid debt ➤

Consumer Credit October 2019 • CREDIT MANAGEMENT IN AUSTRALIA 25

considerations for organisations when addressing vulnerability in a collection’s context;

increasing for the customer and other adverse events such as energy disconnection, water restriction, default listing and legal action. At the very least, these staff will need to be upskilled to recognise triggers or red flags so that vulnerability can be identified early, and calls transferred swiftly to the team that can help them the most.

3 Know your customers –

The customer is the expert in their own story, organisations need to listen to seek to understand. Customers experiencing hardship or vulnerabilities want to be heard, acknowledged and afforded the right assistance and support to help them to get back on track. By applying behavioural psychology techniques, staff in specialist teams can be trained to use the right language, ask the right questions, know when and how to apply empathy and purpose statements and learn how to keep a call grounded whilst ensuring the customer gets the help they need.

4 Know the triggers – Upskill all customer facing staff in recognising red flags. Rarely do customers disclose straight away that they are in hardship or a vulnerable situation. Staff need to recognise the triggers and follow up on this whether it be through a swift transfer through to a specialised team or following up with more questions to ensure a customer’s safety and ascertain the right assistance.

5 Invest in your leaders –

Emotional intelligence in leadership is so important. Consider that in many organisations up to 60% of Team Leaders have only been in the job less than 12 months and yet manage up to 80% of your staff. The benefits of investing in training for your leaders are clear, resulting in increased motivation, higher retention rates and increased customer service.

Benefits of organisations improving their approach towards vulnerability

A common question when looking at the implementation of hardship and vulnerability programs and strategies is, ‘but what about the people that play the system?’ Will there be people that claim hardship/ vulnerability simply to get away with not paying their bills? The simple answer is ‘absolutely there will’. Will this significantly affect your bottom line? Probably not.

If we look again at the UK study discussed earlier, it was estimated that no more than 7% of people receiving assistance due to suspected hardship/ vulnerability were disingenuous.

Similar observations within Australian organisations that have implemented hardship programs generally suggest between 5%-10% may not be genuine.

Is 5-10% enough reason to neglect the many customers that are really experiencing a tough time?

No doubt there is an ethical question at play here in terms of doing the right thing for your customer but importantly that doesn’t have to come at the expense of your commercial outcomes. Results always need to be the measure of any successful training program. Organisations that have invested in comprehensive training around collections and vulnerability often report the following;

According to UK research conducted in May 2018, businesses are losing £10.8 billion a year through poor customer service5 Hands down, bad customer service costs more than good customer service. Have you considered your approach to Collections & Vulnerability training within your organisation yet? More importantly, can you afford not to?

*Nikki Dennis MICM is a Consultant with eMatrix Training ‘Collections & Vulnerability Training Specialists’.

She can be contacted on 0437 652 562 or nikki@ematrixtraining.com.au. You can follow her on www.linkedin.com/in/nikki-dennis.

FOOTNOTES: