2024 AICM REPORT RISK

AICM RISK REPORT 2024

Publisher: Nick Pilavidis FICM CCE

Chief Executive Officer

Australian Institute of Credit Management

Editor: Claire Kasses

General Manager

Australian Institute of Credit Management

Direct: 02 9174 5727

Mob: 0499 975 303

Design: Anthea Vandertouw

Ferncliff Productions

T: 0408 290 440

E: ferncliff1@bigpond.com

Australian Institute of Credit Management

Level 3, Suite 302, 1-9 Chandos Street

St Leonards NSW 2065

T: 1300 560 996

E: aicm@aicm.com.au

www.aicm.com.au

ECONOMIC UPDATE

HOW TO MANAGE RISK

AICM Risk Report 2024 Contents WELCOME Nick Pilavidis FICM CCE 2 Julie McNamara MICM CCE 3 Our supporters 4 OVERVIEW Navigating New Realities: AICM’s Risk Outlook on Evolving Credit and 6 Insolvency Trends

‘Small business Australia’ hollows out as business risk failure hits 10 Barrett Hasseldine MICM Businesses brace for a challenging year ahead 14 Anneke Thompson MICM Update from across the ditch: 2023’s credit shadow lingers into 2024 18 Monika Lacey MICM The Impact of the ATO on Insolvencies 24 Patrick Schweizer MICM

Breached! Are you ready? 28 Suellen Heintz Instincts and double-checks help credit managers combat cyber crime 34 Michael Parrant and Barbara Cestaro MICM The factors keeping you up at night and the secret tonic to remedy it! 38 Kirk Cheesman MICM Interacting with an Insolvency Practitioner 42 Simon Read MICM OUR PEOPLE 48

Julie McNamara MICM CCE National President

Julie McNamara MICM CCE National President

Welcome to the 2024 AICM Risk Report

As we embark on the fifth issue of our risk report, we find ourselves navigating uncharted waters. The pressures faced by individuals and businesses have intensified, and credit professionals are at the forefront of managing these challenges.

Since our inaugural report in early 2020, our journey has been one of continuous evolution. Each edition provides a deeper understanding of the past 12 months’ experiences, equipping credit professionals with the foresight needed for the coming year.

Our 2023 report was a milestone. Insights gleaned from a survey of nearly 100 credit professionals, coupled with contributions from respected thought leaders, shaped its content. We dissected risk scenarios, explored emerging trends, and dissected the impact of global events on credit landscapes.

Now, in 2024, we face a complex landscape. Geopolitical shifts, technological disruptions, and environmental challenges intersect with economic uncertainties. Credit professionals must recalibrate their risk compasses. Our report dives into these complexities, offering practical strategies to mitigate risks.

At the heart of our efforts lies the AICM community – a resilient anchor for credit professionals. Our annual risk seminars and this report exemplify how we empower individuals. We share knowledge, foster collaboration, and build resilience.

A heartfelt thank you to the AICM national office, division councillors, and authors who have contributed their expertise. Together, we forge a path toward financial health and resilience.

Let’s navigate these uncharted waters with determination and adaptability.

Warm regards,

Julie McNamara MICM CCE National President, AICM

2 AICM Risk Report 2024

Welcome

Nick Pilavidis FICM CCE Chief Executive Officer

Nick Pilavidis FICM CCE Chief Executive Officer

As we navigate through the ever-evolving landscape of credit management, the role of credit professionals remains paramount in safeguarding the financial health of our organisations. In the face of dynamic economic conditions, changing regulatory environments, and shifting consumer behaviours, our ability to manage risk and ensure timely payments is more critical than ever.

The 2024 Risk Report serves as a beacon of insight, drawing from the collective wisdom of AICM members, Certified Credit Executives and industry thought leaders. Through a comprehensive survey, we delve into the challenges and opportunities shaping our profession, offering valuable perspectives on how recent and anticipated economic conditions impact our risk management strategies.

Despite the unprecedented challenges of the past year, our community has demonstrated resilience, with the vast majority of credit professionals maintaining steady collections performance. However, as we look ahead, the specter of increased insolvency levels looms large, fuelled by factors such as rising interest rates and inflationary pressures.

The findings of our report reflect the sentiments of our members, with a significant majority anticipating a continuation of challenging conditions and escalation of insolvencies. Yet, amidst these projections, there remains a sense of preparedness and confidence among credit professionals, as evidenced by the minority expecting a deterioration in results.

AICM Risk Report 2024 3

Welcome

Our 2024 SUPPORTERS

National partners

4 AICM Risk Report 2024

Our 2024 SUPPORTERS

AICM Risk Report 2024 5

Divisional partners

CREDIT MANAGEMENT SOFTWARE

Divisional supporting sponsors

Navigating New Realities: AICM’s Risk Outlook on Evolving Credit and Insolvency Trends

As the landscape of credit management continues to evolve under shifting economic conditions, the Australian Institute of Credit Management (AICM) provides a crucial update in its latest Risk Outlook. This comprehensive report delves into the pressing challenges and strategic responses shaping the field following the COVID-19 pandemic and subsequent economic fluctuations.

The report is informed by industry data and the AICM’s Risk survey which polled members on how the current conditions are impacting their operations. The detailed results of the survey were presented during the 2024 Risk seminars.

How did performance compare to last year

Economic pressures and impact on credit management

The enduring pressures of inflation and the rising cost of living are showing the first signs of impacting results on credit operations.

In the AICM’s latest Risk Survey there was an increase in respondents who reported a deterioration of credit performance in the past year of 20% increasing from 14% in our 2023 survey.

Inflation, increasing insolvencies and uncertainty are the factors most sighted as impacting

Factors contributing to deterioration in collections/DSO?

6 AICM Risk Report 2024

0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% Stayed the same Improved 2023 2024 Deteriorated

0 10 20 30 40 50 60 70 80 Internalissues/problems Other WorkforceshortagesGeneraluncertaintyIncreaseininsolvenciesInflationandcost oflivingpressures

Overview

performance, with several respondents commenting an increase in customers seeking to increase standard payment times.

These economic pressures are prompting credit managers to adapt their approaches, particularly in managing customer expectations and payment capabilities.

While customers are experiencing more pressure, engagement with creditors remains high with 50% of respondents seeing an increase in requests for payment assistance, a positive finding as engagement enables creditors and customers to work collaboratively to avoid insolvency and to minimise impacts on all stakeholders.

Corporate and personal insolvency trends

Last financial year there was 7,942 entities entering a corporate insolvency process which is in line with the pre-covid base level of 7,939 per year and a 61% increase on the prior year.

As we look to the current year, insolvencies to March 2024 have already reached 7,742, with on average each month being 39% up on the prior year.

This trend of increasing corporate insolvencies seems driven by a catch up from the pandemic

ASIC Series 1

AICM Risk Report 2024 7

0% 10% 20% 30% 40% 50% 60% 70% No About the same Yes How did performance compare to last year OVERVIEW 0 2,000 4,000 6,000 8,000 10,000 12,000 FY 21 Base level Ave FY 17, 18 & 19 FY 24 FY 23 FY 22 FY 20

Source – ASIC Series 1 data “The first time a company enters external administration or has a controller appointed” accessed 15 April 2024. Note Red area inferred by AICM.

levels, businesses relenting to financial pressures and the ATO’s increasingly firm approach to debt recovery.

If insolvencies maintain this average, we could expect to see 10,236 appointments.

Considering the significant increase in insolvencies is not matched with a significant deterioration in credit teams results, it seems that the insolvencies are predictable, have incurred less debt, or directors are triggering the insolvency earlier than they were preCOVID; driven by the threat of personal liability or succumbing to the pressures of operating a business at the brink of insolvency.

In contrast, personal insolvencies, though rising, are not expected to return to pre-pandemic levels soon.

The 2023 financial year saw a negligible growth of 4% on the prior year with 9,923 individuals entering a personal insolvency process compared to 9,550 in the 2022 financial year.

So far in the 2024 financial year, there has been an 18% average monthly increase on the

prior year. If this rate is continued, personal insolvencies of 11,697 could be expected by the end of the 2024/25 financial year, still well below the 21,079 seen in the 2020 financial year.

In addition to a delay in the pressures on corporate entities being felt by individuals, the lower levels of personal insolvency could be attributed to the earlier action of directors to avoid personal liability and strong household balance sheets that have been used to adjust to the spike in interest rates and inflation.

The Australian Financial Security Authority (AFSA) who is responsible for the personal insolvency system, forecasts an increasing level of Personal Insolvencies rising to around 14,750 in the 2025 financial year but still below the long-term average of 23,100 per year.

Emerging issues

Members have reported that their future focus is on a range of issues including:

z Technological Advancements and Fraud Detection

The integration of advanced technologies such as automation and artificial intelligence

8 AICM Risk Report 2024

OVERVIEW

2023/24 2022/23 2021/22 2020/21 2019/20 0 5,000 10,000 15,000 20,000 25,000 Individuals entering insolvency: Financial year Data sourced from Australian Financial Security Authority monthly insolvency statistics

Individuals entering insolvency: Financial year

“The AFSA ... forecasts an increasing level of Personal Insolvencies rising to around 14,750 in the 2025 financial year ...”

is revolutionising credit management. Credit professionals are rapidly adopting these tools to help manage larger workloads and improve customer engagement.

z Fraud mitigation

Over 60% of members reported experiencing fraud that directly impacted their credit operation, thankfully only a minority had significant financial impact. However, the time absorbed in diagnosing and responding has been significant. Members reported a significant increase in efforts to detect and mitigate from fraud over the last 12 months.

z Customer Engagement and Support Strategies

With rising requests for payment assistance, the report emphasises the importance of effective customer engagement strategies. Credit managers are increasingly facilitating

these requests through flexible payment terms and debt restructuring, which are crucial for maintaining healthy customer relationships and preventing defaults.

The 2024 AICM Risk Outlook presents a clear outcome – that credit professionals are facing increasing complexity and challenges to maintain strong results for their business. They are responding by leveraging technology and ensuring they are up to date with market conditions and best practice processes and procedures to ensure their teams are able to engage with customers and mitigate the risks.

By staying informed and proactive, credit managers can better navigate the complexities of today’s economic landscape, ensuring resilience and stability in their operations.

AICM Risk Report 2024 9

OVERVIEW

Prediction interval Forecast Observed Total personal insolvencies Financial year GFC Basel III reform COVID-19 economic response Hayne Royal Commission commences 40,000 35,000 30,000 25,000 20,000 15,000 10,000 5,000 0 2003-04 2004-05 2005-06 2006-07 2007-08 2008-09 2009-10 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 2016-17 2017-18 2018-19 2019-20 2020-21 2021-22 2022-23 2023-24 2024-25

Source: AFSA. State of the Insolvency Report

UPDATE Economic

‘Small business Australia’ hollows out as business risk failure hits

Barrett Hasseldine MICM Head of Modelling, illion

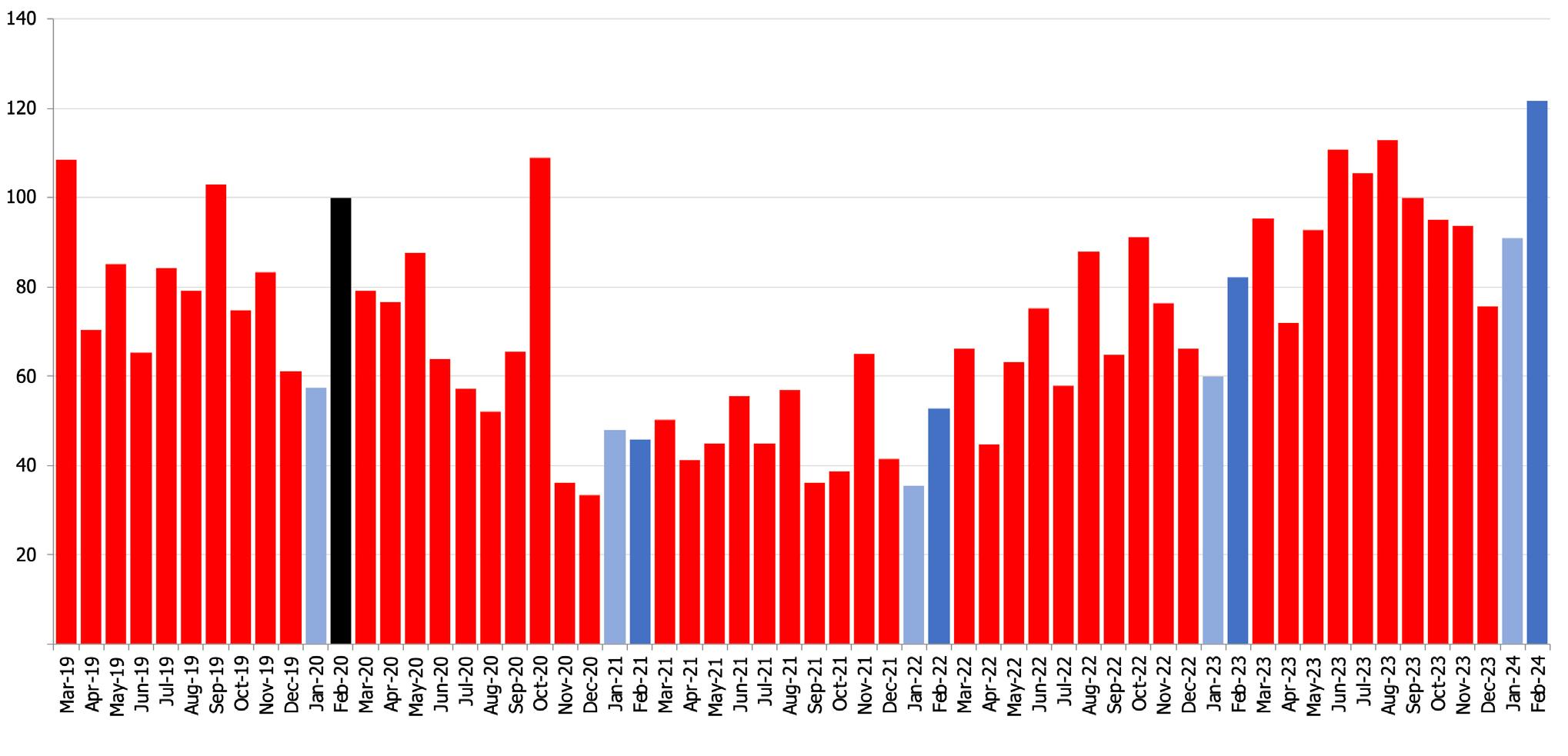

With the Christmas quarter appearing to be a false dawn, new data released this week by illion credit bureau, as part of its Commercial Risk Barometer, reveals that business conditions have deteriorated significantly in the year to March 2024.

Year on year, the failure risk has risen: by more than 5% by the end of March 2024, and near 6.5% since the beginning of 2023 – the largest deterioration noted post-COVID. As a result, the

Barrett Hasseldine MICM

Barrett Hasseldine MICM

number of businesses at imminent risk of failing is now 80% higher than 15 months ago.

“There are likely a number of reasons for this”, said Barrett Hasseldine, illion’s Head of Modelling.

“It may be due, in part, to lower levels of government support for business and ‘zombie companies’ are now finally toppling over. Equally, it may be due to creditors, lenders, and government offices such as the ATO calling a halt to amnesties on the repayment of liabilities. And a third option is that it is a consequence of significantly lower levels of consumer confidence and spending in 2023, as Australians struggled with their household budgets.”

Deterioration in business conditions has followed a similar change to consumer credit risk, consumer spending, and consumer confidence; with worsening business activity showing as a

“... 2024 is likely to see a material rise in businesses becoming insolvent, being liquidated, and being deregistered after litigation by creditors.”

10 AICM Risk Report 2024

“Our data shows the change in business failure risk is not uniform across all sizes of businesses.”

three-to-six-month lag after economic conditions impacted consumer behaviour.

This general rise in business failure risk has led to a significant increase in the number of businesses that are at imminent risk of failure. As such, 2024 is likely to see a material rise in businesses becoming insolvent, being liquidated, and being deregistered after litigation by creditors.

Industries most at risk

Retail and food services businesses and businesses operating in construction and transport appear to be most at risk, with these industries likely to have the largest rise in business failures in 2024. This rise comes on the back of their already high baseline risk in 2023.

“Our data shows the change in business failure

risk is not uniform across all sizes of businesses”, Barrett added.

“In the retail and food sectors especially, there appears to be a two-speed economy, with smaller retailers suffering hardest, and large corporations such as supermarkets and department stores able to withstand the headwinds – possibly through pricing power and/or economies of scale.”

While business failure risk has been broadly higher in the year to March 2024 (5% higher), smaller businesses have suffered the most, with larger businesses remaining stable. For small businesses (up to $10 million turnover), failure risk has risen by up to a massive 20% in the year to the end of March 2024. This compared to the risk of medium-sized businesses (up to $100 million turnover) deteriorating by a much smaller 10%.

AICM Risk Report 2024 11 ECONOMIC UPDATE

An even starker contrast is the failure risk of larger companies and corporations. This has improved significantly – more than 20% improvement for businesses with a turnover above $250 million.

“Smaller businesses are at significant risk of ‘going to the wall’ while larger businesses are benefitting from a possible change in consumer spending habits during these harder economic conditions. Pricing power matters most in times of fiscal tightening”, added Barrett.

“Spending in supermarkets, which has been up 5%, has been to the detriment of butchers, down one 1%, and greengrocers, down 2.5%. Spending with department stores that has been broadly

“Spending in supermarkets, which has been up 5%, has been to the detriment of butchers, down one 1%, and greengrocers, down 2.5%.”

stable has been at odds with spending in retail clothing stores, down eight 8%”.

State differences

Victoria and New South Wales lead the way, with the highest levels of business failure risk nationally, most likely due to a higher rent and mortgage burden (from historically higher property prices) that have been sapping spending habits.

“Businesses in New South Wales and Victoria have the highest level of stress – 4% to 5% higher than the national average”, Barrett added, “although this has remained broadly flat in Victoria over 18 months, which was in bottom place”.

Now New South Wales has seen significant deterioration, from 2% to 4% above the national average, so it is nearly equal bottom with Victoria.

12 AICM Risk Report 2024

ECONOMIC UPDATE

Alongside consumer stress driven by housing costs, these states might also be suffering from higher commercial property costs, and higher wages and utilities costs.

“There is also a material rise in the default risk of credit card holders in both Victoria and New South Wales”, Barrett said.

illion data has also shown a recent deterioration in South Australia – which has traditionally held a lower level of failure risk – from 7% lower than the national average in January 2023 to 2% higher in March 2024.

“In contrast, while we’ve seen some volatility in Queensland and Western Australia, businesses in both states are at much lower risk – 8% lower than the national average in March 2024”, Barrett said.

High-risk industries continue to be food services, construction, and transport businesses. The food services sector (comprising restaurants, bars, cafes, and pubs) has a massive 140% higher percentage of businesses at severe risk of failure today, when compared to the national average. The construction and transport sectors have 70% more businesses at risk of imminent failure. This is followed by the retail and rental sectors with 10% more businesses than the national average.

At the other extreme, the financial services and professional services sectors have the lowest percentage of businesses at risk of imminent failure when compared to the national average, with 50% fewer and 25% fewer insolvencies respectively.

“There is no clear sign that the ‘at risk’ industries are likely to experience a turnaround in the shortterm”, Barrett adds.

“Australian businesses have suffered significant financial strain in 2023 and into 2024, with trade

“High-risk industries continue to be food services, construction, and transport businesses. The food services sector ... has a massive 140% higher percentage of businesses at severe risk of failure today, when compared to the national average.”

payment obligations generally being paid 25% later than 12 months ago.

“Food services businesses are now paying invoices 18 days late on average, construction firms and retail businesses 14 days late, and the transport sector 12 days late.”

Barrett Hasseldine MICM Head of Modelling

illion

www.illion.com.au

About the data

The index is created by modelling leading indicators against subsequent business performance. These indicators include:

z Current and historical legal actions taken out on businesses and their directors.

z Current and historical debt collection activity on businesses.

z Changes in trading activity including the aggregate value of business invoice payments.

z Changes in financial stress through the late payment of trading obligations.

z The underlying risk of the business’s profile – e.g. industry and geographic level of the business profile.

z Credit risk of business directors on their business and consumer credit holdings – including their credit exposure and payment delinquency.

Additional insights into business trading activity, business and director legal actions, industry risk, business size, consumer confidence and expenditure patterns may be incorporated to show trends that are likely to have an impact on the failure risk of businesses. The data used to create the risk index is derived from illion’s proprietary commercial databases, comprising the largest commercial information bureau and trade credit payment program available on Australia’s 2.5 million + active businesses.

About illion

illion is a leading independent provider of trusted data and analytics products and services in Australia and New Zealand. The company’s consumer and commercial registries represent a core element of Australasia’s financial infrastructure, and illion leverages its extensive consumer and commercial credit bureaus to provide end-to-end customer management solutions to clients in the telecommunications, financial services, utilities, and government sectors. These bureaus comprise data on more than 24 million individuals and 2.5 million + active commercial entities. illion is led by CEO John Banfield and a respected senior leadership group. John kickstarted a successful career with American Express more than 30 years ago. Prior to illion, he led the BPAY Group on its journey to being recognised as one of Australia’s most innovative companies by the AFR. He is passionate about providing the vision and oversight that are an essential part of innovation and expansion, while fostering partnerships with key organisations across Australia and New Zealand.

AICM Risk Report 2024 13

ECONOMIC UPDATE

Businesses brace for a challenging year ahead

Anneke Thompson MICM Chief Economist CreditorWatch

Anneke Thompson MICM Chief Economist CreditorWatch

It was a huge relief to both household and business borrowers around Australia that the Reserve Bank of Australia (RBA) chose to keep the cash rate on hold at its March meeting. December quarter inflation, which fell sharply from 5.4 per cent to 4.1 per cent, indicated that the monetary policy measures the RBA had taken to date were now working well to bring down inflation.

However, the February 2024 labour force data revealed a very surprising 0.4 percentage point fall in the seasonally adjusted unemployment rate, to 3.7 per cent. While this figure was positive for job seekers, in that there still appeared to be plenty of work available, it does mean that the RBA is likely going to hold the cash rate at its current 4.35 per cent for longer, as it may be concerned about what this very

Average B2B Value of Invoices per Data Supplier

Source: CreditorWatch BRI, February 2024

14 AICM Risk Report 2024

ECONOMIC UPDATE

“We are unlikely to see a recovery in discretionary consumer spending until the RBA has cut the cash rate three or four times, and we are unlikely to be at this stage of the monetary policy

cycle until

around this time next year.”

low unemployment rate means for wage growth and, in turn, inflation.

The good news is that, on a trend basis, the unemployment rate has remained steady at 3.8 per cent for six months now. This is because both employment and migration have grown at roughly the same rate, which effectively means we are creating enough jobs in Australia to cater for the record levels of migration.

Retail trade and consumer confidence

On a trend basis, spending at cafes and restaurants and on takeaway food peaked in August 2023, and has been on a slight downward trend since then. This is highly unusual in

Australia as we typically spend more in this sector over the Christmas and summer holiday period.

Spending in this sector had very steeply increased since the end of lockdowns around September 2021 – Australians were very keen to get out and enjoy themselves, so spending in this sector continued to rise long after we slowed down spending on household goods and clothing and footwear. Clearly, Australian households are now feeling the impact of high interest rates, rents and the inflationary impact on everyday nondiscretionary goods and services.

We are unlikely to see a recovery in discretionary consumer spending until the RBA has cut the cash rate three or four times, and we are unlikely to be at this stage of the monetary policy cycle

AICM Risk Report 2024 15

ECONOMIC UPDATE

“Consumers surveyed after the RBA’s March cash rate decision were more pessimistic than consumers surveyed before, probably due to the downgrade in expectations of the timing of future rate cuts.”

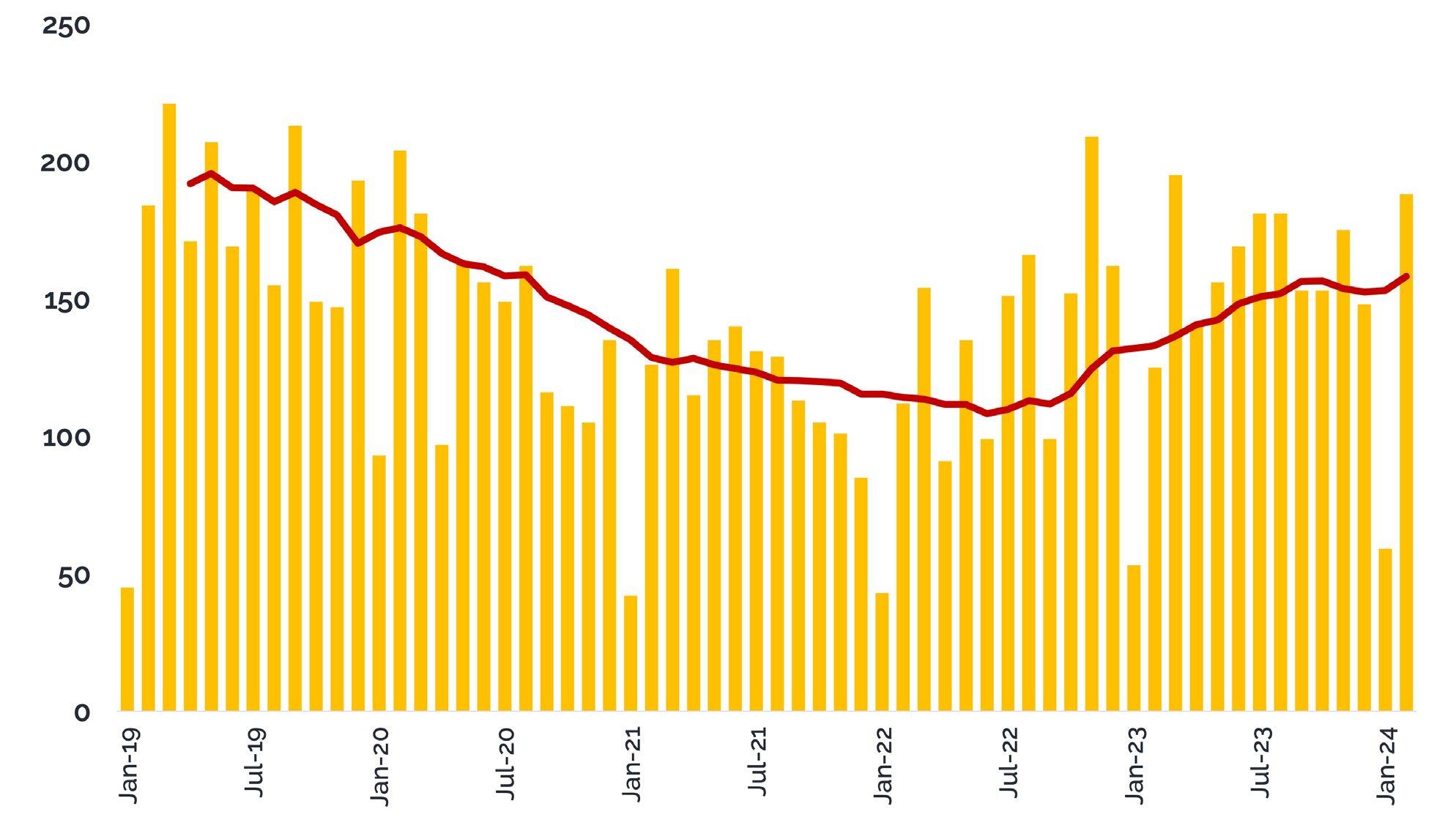

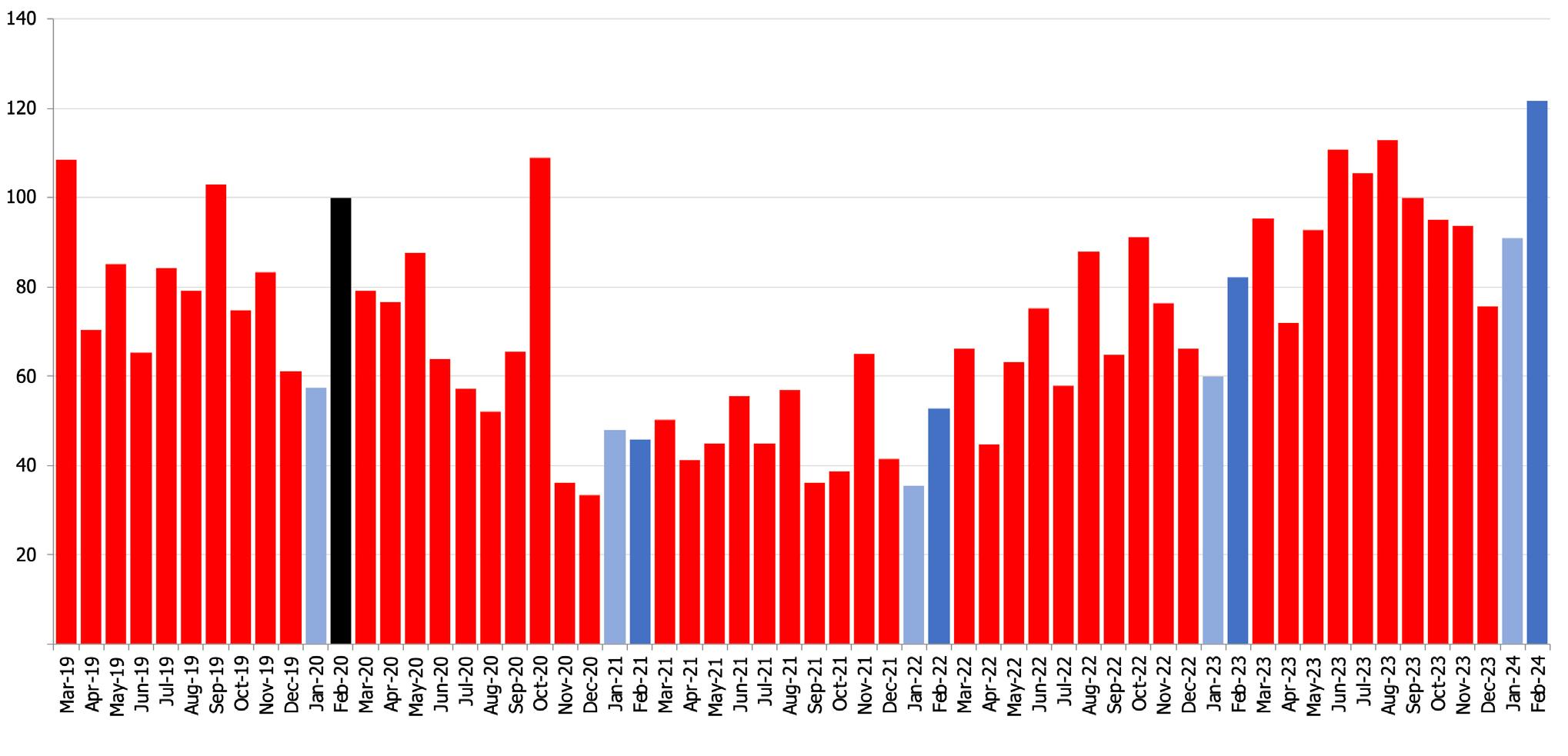

B2B Trade Payment Default Index

Source: CreditorWatch BRI, February 2024

until around this time next year. Westpac’s consumer confidence index for March dipped by 1.8 per cent1, following a promising improvement in February. Despite this February improvement, consumer confidence remains extremely low by historic standards, and at 84.4, is well below the long run average of 100.7. Consumers surveyed after the RBA’s March cash rate decision were more pessimistic than consumers surveyed before, probably due to the downgrade in expectations of the timing of future rate cuts.

Business conditions and outlook

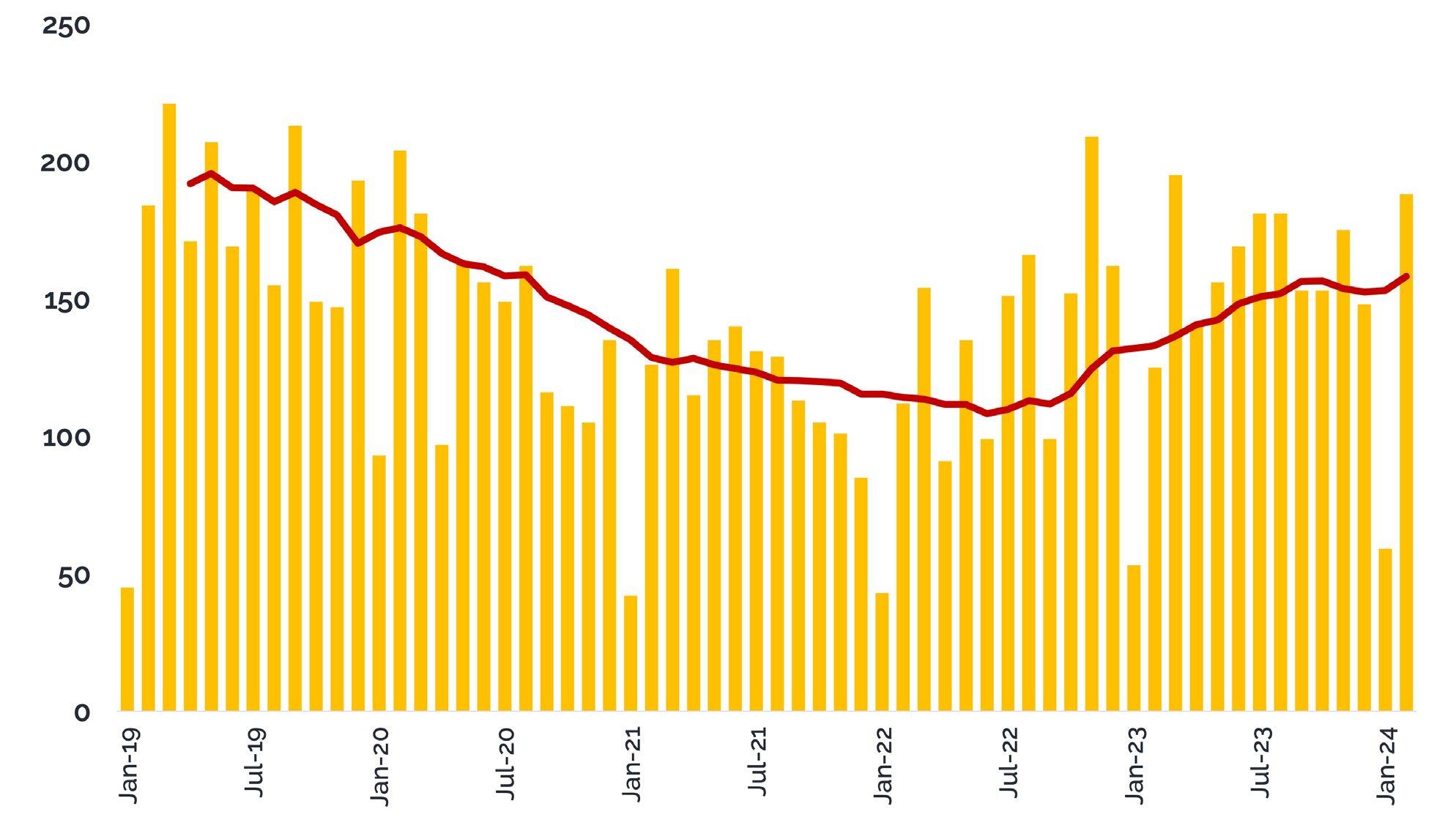

CreditorWatch’s own Business Risk Index (BRI) data shows that the average value of B2B invoices has been rapidly trending lower over 2023 and is continuing into 2024. This trend

has now also been reflected in the December quarter Australian National Accounts. Gross Domestic Product (GDP) grew by a very slow 0.2 per cent over the December quarter, taking the annual growth rate to 1.5 per cent. It is also reflected in the ABS’s Business Indicators, which show businesses are winding down inventory in preparation for a tough year ahead.

In per capita terms, GDP has been negative for three straight quarters, which means Australia is in a ‘per capita’ recession. The sustained fall in the average value of invoices over 2023 was a very good leading indicator of the overall slowing of the economy.

In addition to the concerning slowdown in the value of invoices (CreditorWatch) and GDP

16 AICM Risk Report 2024

ECONOMIC UPDATE

growth (ABS National Accounts) is the record number of business-to-business (B2B) Trade Payment Defaults in February 2024. A default is recorded by CreditorWatch when one business lodges one against another when an invoice is more than 60 days overdue and above $100 in value. This figure being at record high levels means there is both a large number of overdue invoices among our customers, and also that the number of businesses that are running out of patience with late payers is increasing.

CreditorWatch research shows a strong correlation between payment defaults and business failures. Businesses with one default have a 24 per cent chance of going insolvent in the next 12 months. This rises to 42 per cent for

two defaults against two businesses and 62 per cent for three defaults against three businesses.

We unfortunately expect an increase in external administrations over the remainder of 2024 as a result of the continued challenging business operating conditions, as well as the large number of trade payment defaults recorded.

Anneke Thompson MICM Chief Economist CreditorWatch

www.creditorwatch.com.au

FOOTNOTES:

1 Westpac Melbourne Institute Consumer Sentiment, March 2024

“We unfortunately expect an increase in external administrations over the remainder of 2024 as a result of the continued challenging business operating conditions...”

AICM Risk Report 2024 17

ECONOMIC UPDATE

Update from across the ditch: 2023’s credit shadow lingers into 2024

Monika Lacey MICM Centrix COO

Monika Lacey MICM Centrix COO

Rising inflation creating a cost-of-living crisis and the uncertainty of an election year drove financial apprehension across New Zealand in 2023, that has continued into early 2024. New Zealand’s Official Cash Rate has remained unchanged at 5.5% since May 2023, and hopes of early rates cuts have been whisked away.

As more and more homeowners experience rate hikes while refixing their mortgages, we have a recipe for more financial hardship ahead.

Credit trends emerged as a crucial indicator of financial stability, revealing many people struggling to obtain credit and meet repayment obligations.

The question now to what extent will these challenges persist, particularly following Stats NZ announcement that New Zealand’s experienced a double dip recession in 2023? Then, what should businesses and consumers be doing to navigate the times ahead?

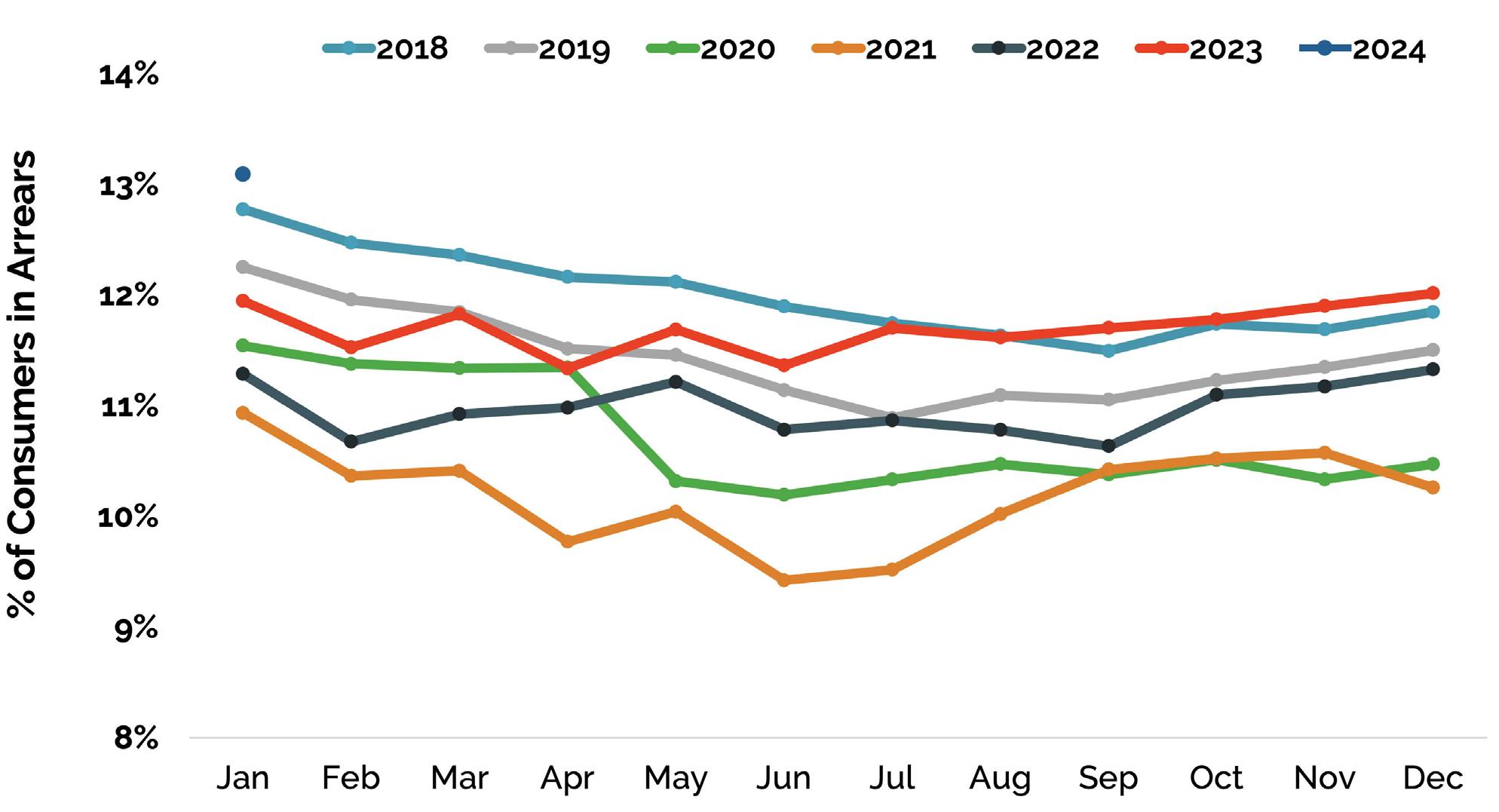

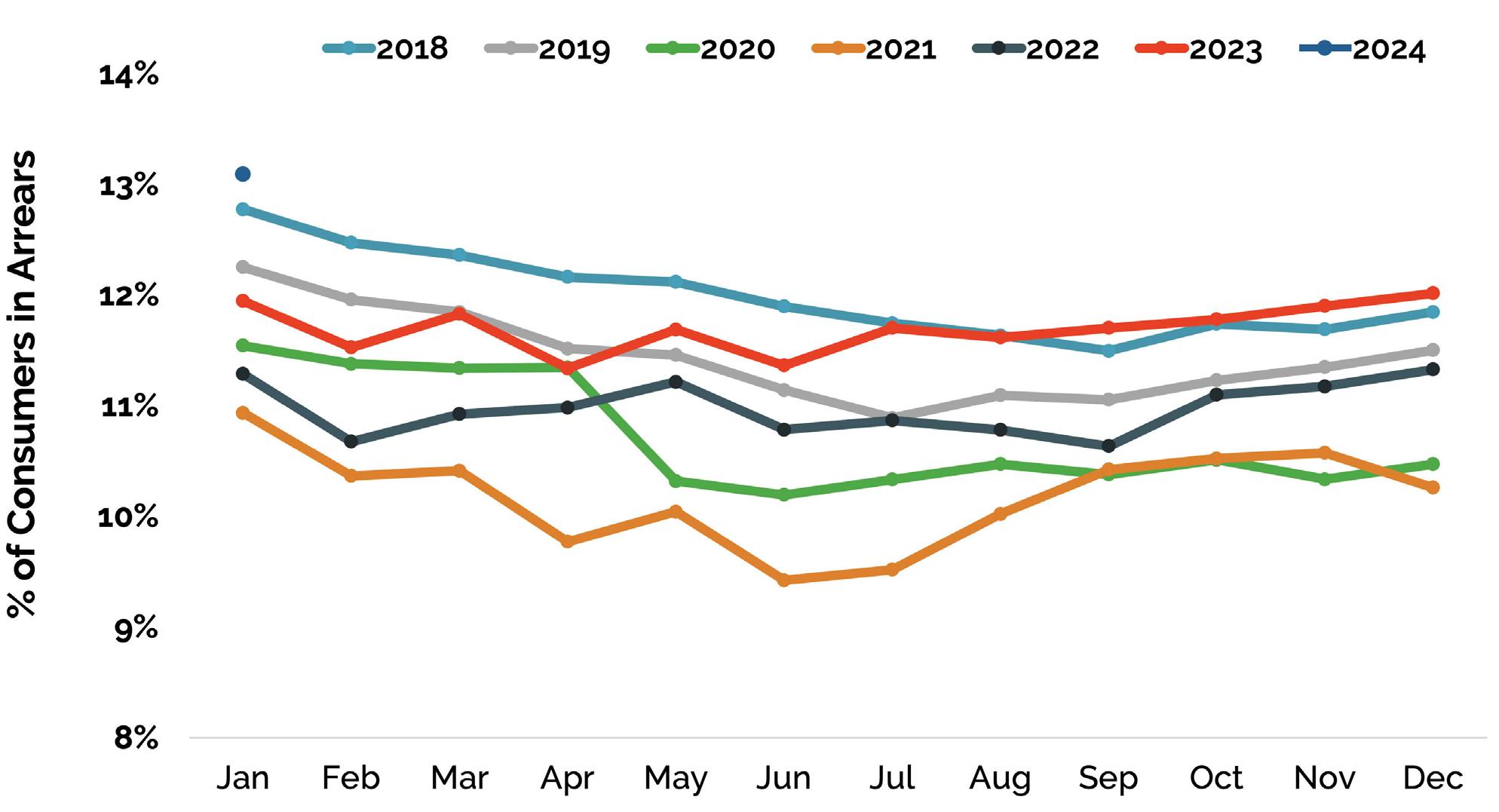

Rising arrears

The main credit narrative of 2023 revolved around the increasing arrears. Following a decline to artificially low levels in 2020, arrears have gradually risen again.

The number of Kiwi households behind on credit repayments climbed in January 2024, reaching the highest level of arrears reported since February 2017. Throughout 2023, mortgage arrears steadily rose, coming off artificially low trends observed driven by COVID-19.

In December 2023 alone, there were over 20,800 mortgages past due, marking a 21% year-on-year increase. The percentage of mortgages in arrears then climbed to 1.47% in January 2024, reaching the highest level reported since pre-COVID. Additionally, the proportion of active telco/communication accounts reported past due climbed to 11.7%

“Credit trends emerged as a crucial indicator of financial stability, revealing many people struggling to obtain credit and meet repayment obligations.”

18 AICM Risk Report 2024

ECONOMIC UPDATE

Consumer Arrears Trends

Home Loan Arrears

in early 2024 as Kiwi households fell behind on meeting their repayment obligations – up 30% year-on-year.

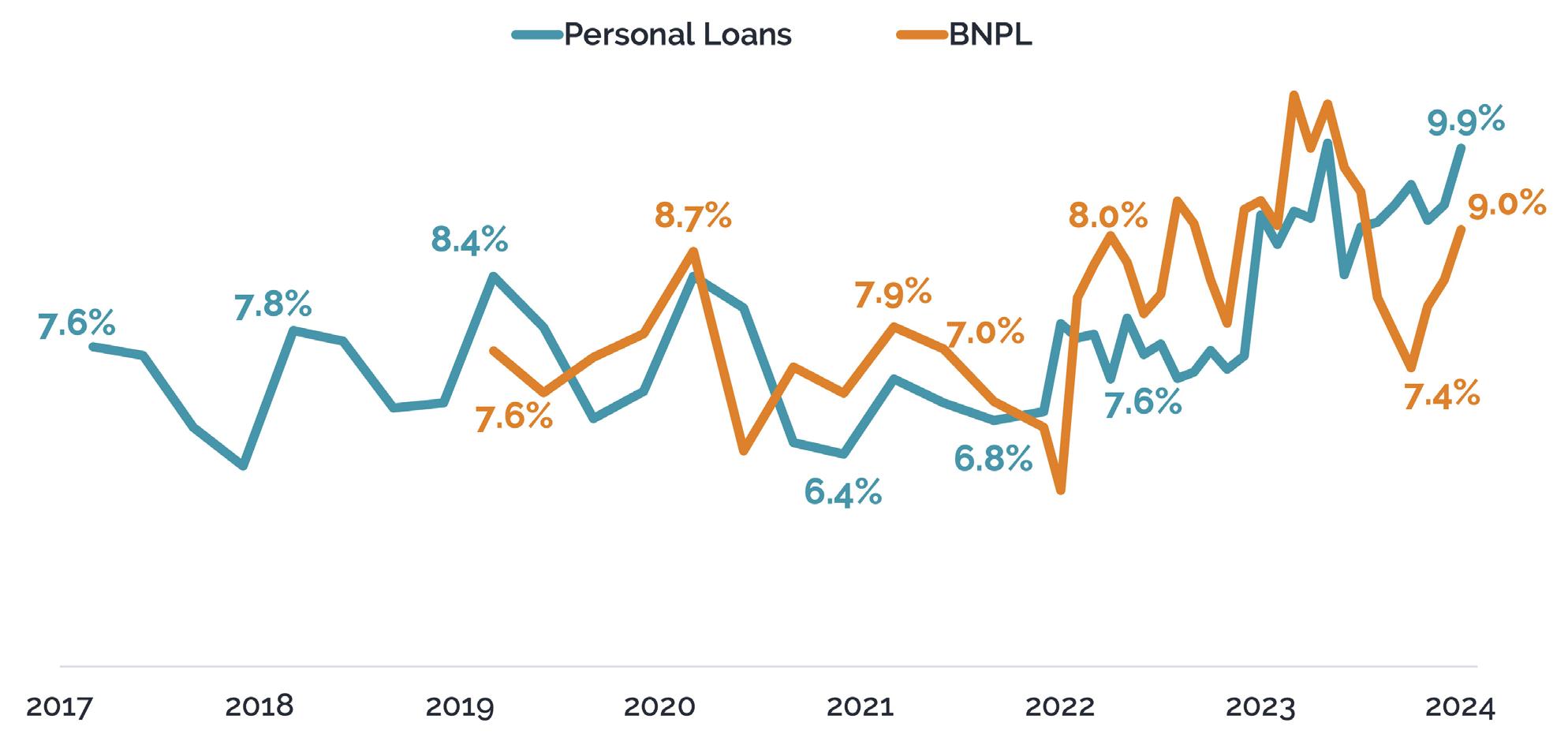

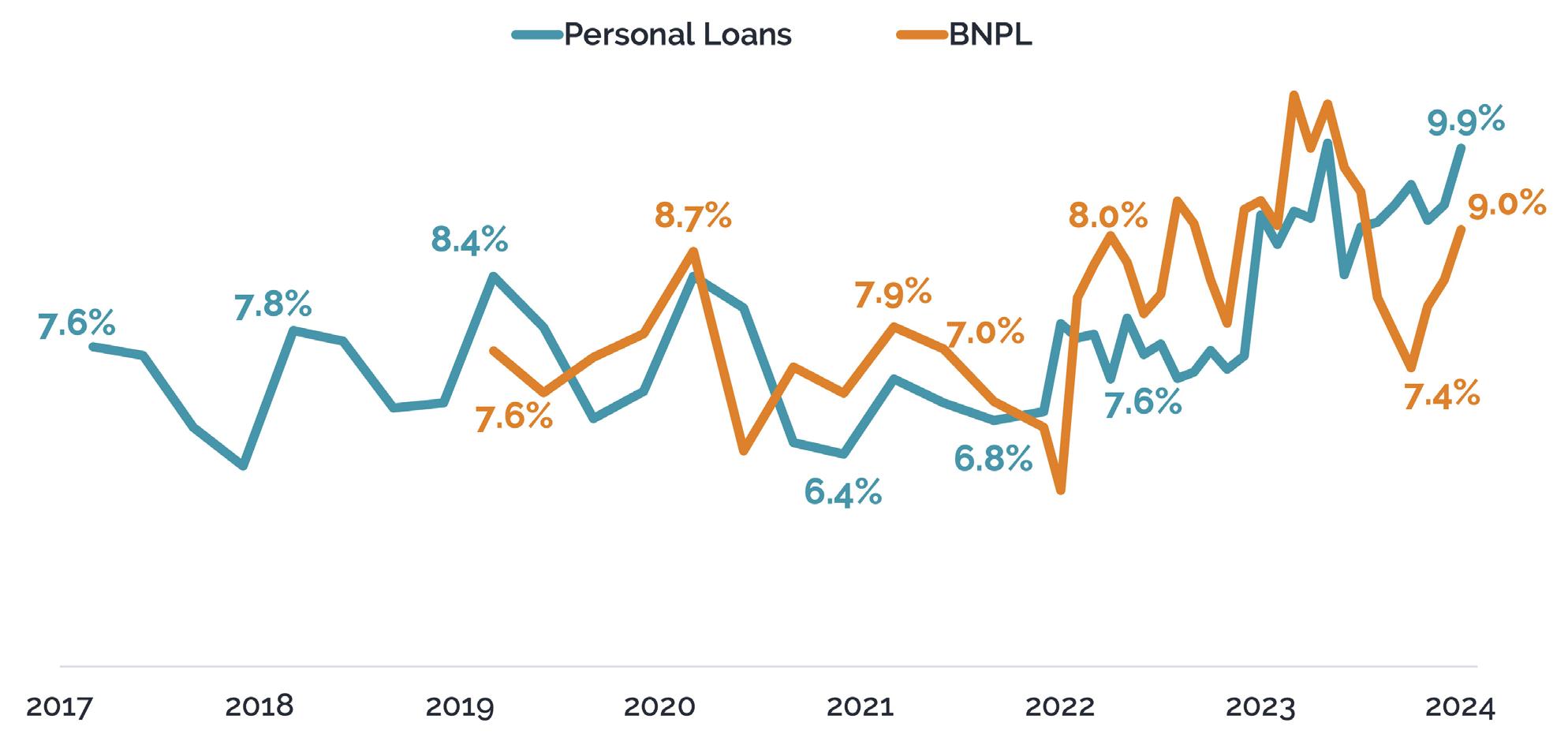

Discretionary arrears revealed an interesting picture throughout 2023. Both Buy Now Pay Later (BNPL) products and personal loans reached

“In December 2023 alone, there were over 20,800 mortgages past due, marking a 21% yearon-year increase. The percentage of mortgages in arrears then climbed to 1.47% in January 2024...”

record highs at the midpoint of last year and then then hit 9.0% and 9.9% in early 2024, respectively.

This might suggest Kiwi households are resorting to these products to help ease the current strain of the cost-of-living crisis, and subsequently failing to meet their repayment obligations.

AICM Risk Report 2024 19

ECONOMIC UPDATE

“Discretionary arrears revealed an interesting picture throughout 2023. Both Buy Now Pay Later (BNPL) products and personal loans reached record highs at the midpoint of last year and then then hit 9.0% and 9.9% in early 2024, respectively.”

Telco & Utility Arrears

Personal Loan & BNPL Arrears

20 AICM Risk Report 2024 ECONOMIC UPDATE

Credit demand and lending trends

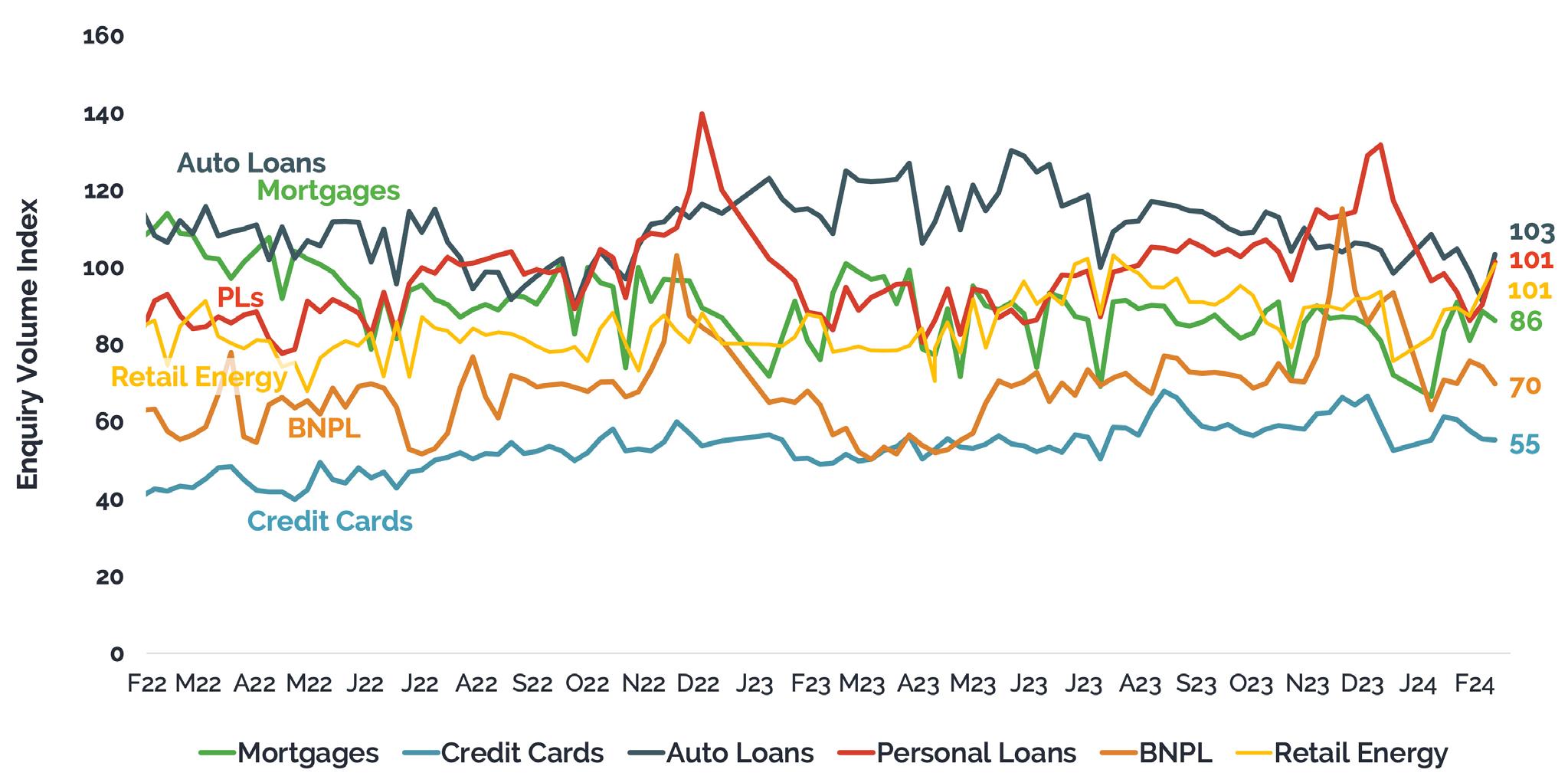

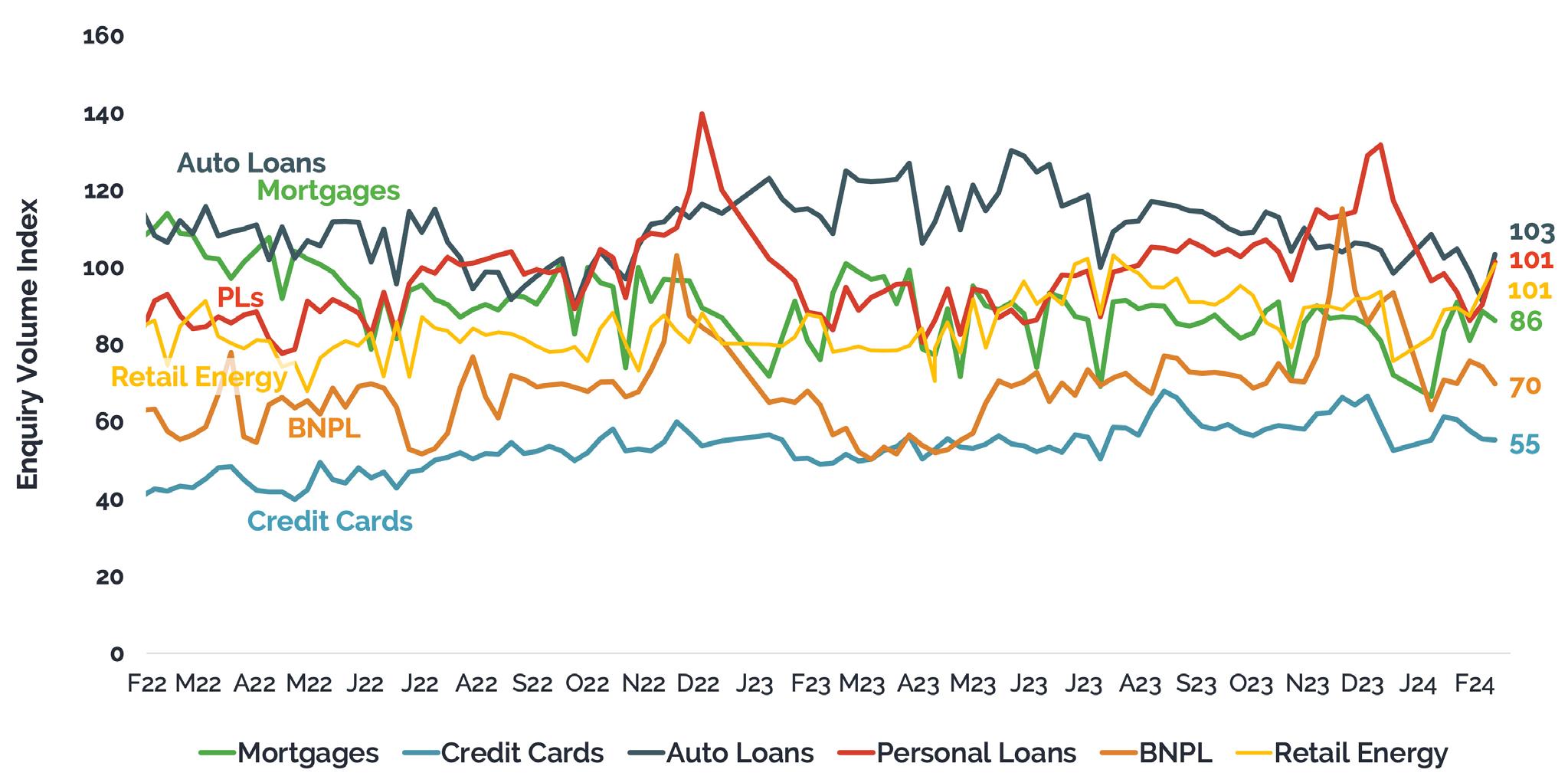

Around the end of 2023 we saw demand for personal loans and BNPL products spike, and this increased again in early 2024.

Overall consumer credit demand was up 6.0% year-on-year in February 2024, driven by an increased demand for credit cards (up 15%) and Buy Now Pay Later products (14.1%).

During 2023 we observed relatively restrained demand for mortgages in comparison to 2022, reflecting the subdued state of the housing market. But by February this year, mortgage enquiries were up 4.0% year-on-year, which could be a sign of recovery in the real estate sector.

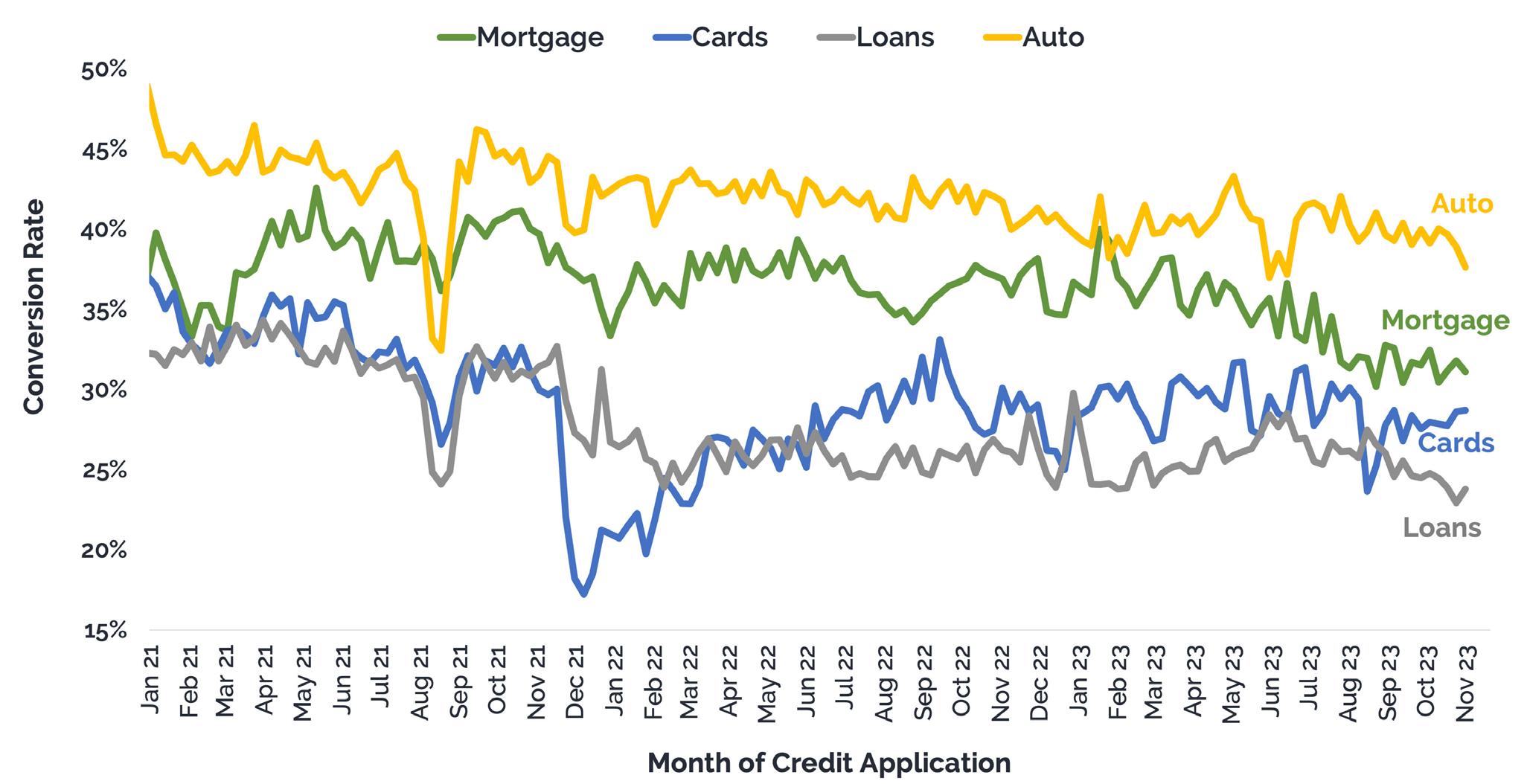

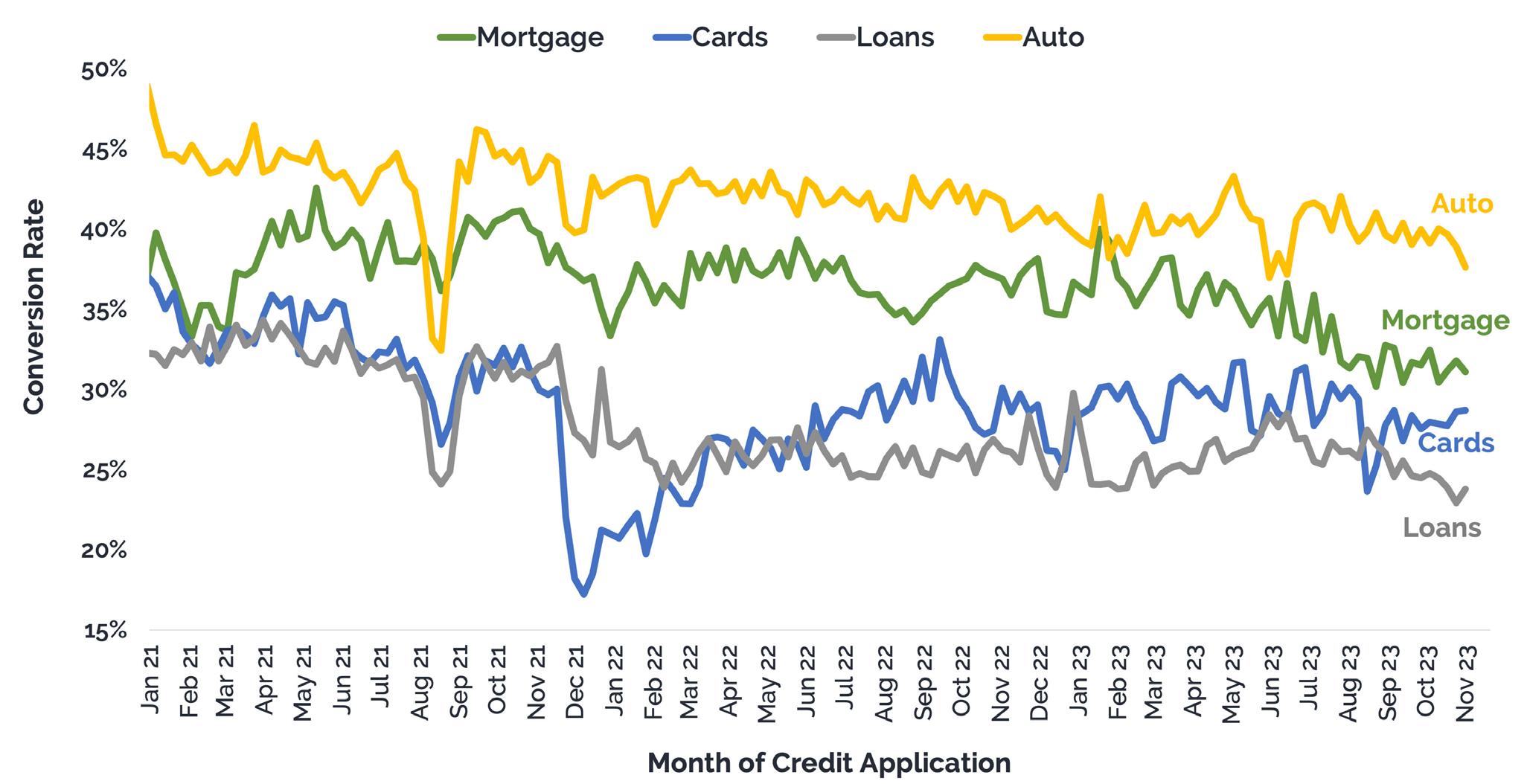

CCCFA trends

Since the CCCFA changes came into effect in December 2021, conversion rates have been on the decline, with overall credit conversion rates down 11% in 2023 compared to 2021.

This had a notable effect on credit cards and personal loans, although these sectors have stablised over the past year.

Since his election, Commerce and Consumer Affairs Minister, Andrew Bayly, has overhauled the CCCFA to narrow the expenses considered by lenders, to exclude discretionary expenses more explicitly and provide more flexibility for lenders about how certain repayments may be calculated.

These changes come into effect from 4 May 2023. So, we will have to see how successful this is at increasing access to credit, while maintaining strong levels of consumer protection.

Business defaults and liquidation trends

In 2023, it wasn’t just consumers experiencing financial strain. Kiwi businesses also encountered challenges as households tightened their budgets due to the rising cost in living.

Credit Demand by Product Type

AICM Risk Report 2024 21

ECONOMIC UPDATE

Conversion Rates by Credit Type

Company liquidations up 16% year-on-year

“In 2023, it wasn’t just consumers experiencing financial strain. Kiwi businesses also encountered challenges as households tightened their budgets due to the rising cost in living.”

22 AICM Risk Report 2024 ECONOMIC UPDATE

Business credit defaults saw a noticeable increase, which started towards the end of 2022 and persisted throughout 2023 and into 2024.

Overall business defaults were up 28% year-onyear in January 2024, while company liquidations were up 16% over the same period. It’s important to note that credit defaults are lagging indicators, often occurring several months after payments have been missed.

During the course of 2023, the construction industry felt the brunt of the difficult economic climate. This industry were more than twice as likely (2.2x) to fail that the average New Zealand business, with 26% of all company liquidations in 2023 coming from this sector.

But by early 2024, this trend shifted and retail trade saw the largest proportion of company liquidations, followed by construction, hospitality and transport.

“Overall business defaults were up 28% year-on-year in January 2024...”

Looking ahead

The new coalition Government has initiated measures to streamline regulations and reduce red tape to support economic growth. However, focus remains firmly on when the Reserve Bank will reduce New Zealand’s Official Cash Rate.

As we progress through 2024, financial uncertainty for Kiwi households and businesses lingers, and the remainder of the year could be tough for many. Therefore, it’s essential to extend understanding and offer support to those struggling to meet their repayment commitments.

For anyone unsure about how they will pay their bills, it’s vital they contact their creditors and discuss alternative repayment methods. But it’s also essential for businesses to credit check new customers and monitor existing ones to put themselves in the best position to ensure they will get paid on time.

Monika Lacey MICM Chief Operating Officer Centrix Credit

Bureau of New Zealand www.centrix.co.nz

AICM Risk Report 2024 23 ECONOMIC UPDATE

Sector ∆ Credit ∆ Credit Avg Credit ∆ Company Liquidation Demand Defaults Score Liquidations Rating Construction +1% +21% 763 +23% 2.2X Hospitality +16% +6% 745 +18% 2.3X Retail Trade +9% +30% 774 +60% 1.3X Transport +8% +35% 734 +17% 1.7X Property/ -4% +68% 821 +7% 0.8X Rental All Sectors +3% +28% 791 +16% 1.0X

Note: The above table shows change on a year-on-year basis

The Impact of the ATO on Insolvencies

Patrick Schweizer MICM Director Alares

Patrick Schweizer MICM Director Alares

The Current Landscape

During the height of COVID in 2020 and 2021 we saw a sharp decline in business insolvencies. Much of this drop was attributed to the ATO giving businesses a prolonged “free pass” for meeting their tax obligations, both in terms of lodging and remitting GST, PAYG and income tax.

In 2022 insolvencies began to steadily trend upwards, and in 2023 total numbers slightly exceeded pre-COVID levels. The upward trend has accelerated so far in 2024 with Feb and Mar insolvencies ~50% higher than pre-COVID totals.

Insolvencies by Year

The Impact of the ATO

Unsurprisingly, the increase in business insolvencies since 2022 has coincided with a much more active ATO seeking to collect on record levels of outstanding tax debts.

The ATO has a number of levers it can pull, and has done so to various degrees in the past two years:

z Winding up and bankruptcy petitions

z Disclosure of tax debts to credit reporting bodies

z Director’s penalty notices (DPNs)

Insolvencies by Month

24 AICM Risk Report 2024 2018 2019 2020 2021 2022 2023 ECONOMIC UPDATE

1,200 1,100 1,000 900 800 700 600 500 400 300 200 100 0 Pre-COVID COVID Jan Feb Mar n Pre-COVID n 2024 10,000 9,000 8,000 7,000 6,000 5,000 4,000 3,000 2,000 1,000 0 *Pre-COVID is an average of 2017 to 2019

Months Between ATO Winding Up and Insolvency

z Phone calls and letters warning of the possibility of any or all of the above.

Winding Up and Bankruptcy Petitions

Historically, the ATO has accounted for nearly half of all winding up petitions and ~20% of all creditor-initiated bankruptcy petitions. During 2020 and 2021 the ATO’s Court activity effectively fell to zero, before some minor activity at the end of 2022, and then a steady increase in 2023 to

“... the ATO has accounted for nearly half of all winding up petitions and ~20% of all creditor-initiated bankruptcy petitions.”

levels approaching historical numbers. While not all ATO winding up petitions result in insolvency as businesses are sometimes able to trade out of difficulties, a large percentage do directly lead to insolvency.

From the start of 2017 to Mar 2023, the ATO issued ~6,000 winding up petitions. Of these, ~3,900 businesses (65%) entered insolvency within 12 months of the ATO petition. And nearly 80% of these insolvencies occurred within the first 3 months after the petition.

AICM Risk Report 2024 25 ECONOMIC UPDATE

n Bankruptcy n Winding Up Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar

the ATO 2019 2020 2024 250 200 150 100 50 0 2021 2022 2023

Court Actions Filed by

2,000 1,800 1,600 1,400 1,200 1,000 800 600 400 200 0

1 2 3 4 5 6 7 8 9 10 11 12 >13

Months after ATO Winding Up Application

Disclosure of Tax Debts

In addition to direct Court action, the ATO also discloses outstanding business tax debts that meet the following criteria:

z One or more tax debts of at least $100,000 overdue by more than 90 days.

z The business is not engaging with the ATO to manage the tax debt.

z The business does not have an active complaint lodged about the ATO’s intent to report the tax debt.

The ATO’s disclosure list currently includes ~25,000 businesses, including ~10,000 companies, with the remainder being sole traders, partnerships and trusts. Of the 10,000 companies, ~600 are currently insolvent with ~75% of these

“Insolvency practitioners commonly report that most SBRs include tax debt, and in many instances the ATO is the single largest creditor.”

entering insolvency within the first 6 months of the tax debt being disclosed.

Directors Penalty Notices

While the exact number of DPNs issued by the ATO is hard to come by, reports from various media outlets suggest that DPNs (and letters warning of pending DPNs) number in the thousands, if not tens of thousands.

Small Business Restructuring

The small business restructuring process (SBR) has emerged as a popular option for small business owners and directors to deal with outstanding tax obligations and the spectre of DPNs. Insolvency practitioners commonly report that most SBRs include tax debt, and in many instances the ATO is the single largest creditor.

In the second half of 2023 and so far in 2024 (March in particular) we have seen a significant uptick in the take-up of SBRs. The graph below shows both the initial SBR practitioner

Appointment of Restructuring Practitioner

26 AICM Risk Report 2024 ECONOMIC UPDATE

n Appointment of Practitioner n Restructuring Plan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar 200 180 160 140 120 100 80 60 40 20 0 2021 2022 2023

“The small business restructuring process (SBR) has emerged as a popular option for small business owners and directors to deal with outstanding tax obligations and the spectre of DPNs.”

Restructuring Appointments as Percentage of All Insolvencies

appointment (orange bars) and the subsequent restructuring plan (blue bars) with a typical ~2month timeline between the appointment and the plan.

While the SBR process is only viable for smaller businesses, we are seeing SBRs account for a steadily increasing percentage of all insolvencies –

What Can Credit Providers do to Manage Their Risk?

A more active ATO has significantly changed the landscape of insolvencies with insolvencies currently tracking well above pre-COVID times. While this can present a significant risk for credit providers, help is available.

Data is Your Best Friend

In times of increased risk, credit providers need to be vigilant and take heed of early warning signs. As part of your risk management process, make sure you receive timely reports and alerts on ATO winding up petitions and ATO disclosure of text debts – both of these data points are increasingly driving more insolvencies, and often in the first few months. Timely notification is essential to be on the front foot to effectively manage risk.

Patrick Schweizer MICM Director, Alares

M: +61 418 739 921 E: patrick@alares.com.au www.alares.com.au

“Timely notification is essential to be on the front foot to effectively manage risk.”

AICM Risk Report 2024 27

ECONOMIC UPDATE

Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar 18.0% 16.0% 14.0% 12.0% 10.0% 8.0% 6.0% 4.0% 2.0% 0.0% 2021 2022 2023

MANAGE RISK How to

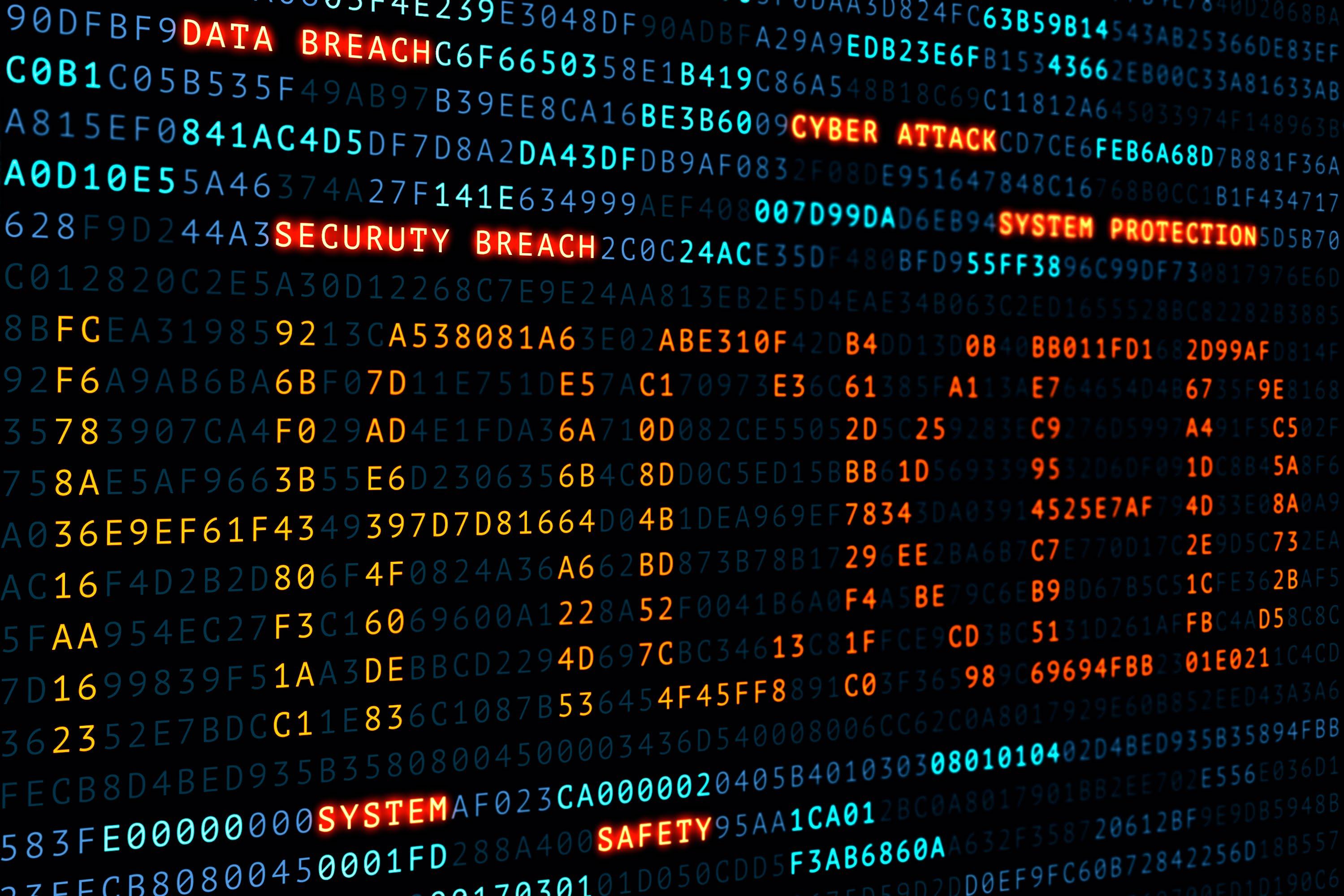

Breached!

Are you ready?

Suellen Heintz General Manager - Digital & Breach Solutions Equifax

It’s not if a data breach will happen; it’s when. Breaches are becoming increasingly commonplace, yet companies are still not prepared enough when they become the target of cybercriminals.

A recent KPMG1 survey reveals that Australian business leaders rank cyber risk as their primary concern. Given the escalating frequency and severity of data breaches, it’s no surprise that these leaders consider protecting against and dealing with cyber risk to be the paramount priority for organisations this year and for the next 3 to 5 years.

“Responding to breaches is no longer solely the domain of IT departments; it’s now a crossfunctional concern that demands a multi-layered approach to response and mitigation.”

The 2022-23 financial year saw a staggering 23% surge in reported cybercrime incidents across Australia2 – an average of one report every six minutes. In the six months leading up to December 2023, breaches notified to the OAIC surged by 19% from the first half of the year3.

No sector escaped unscathed, with health service providers, finance and insurance industries bearing the brunt of most breaches4.

Mopping up

Responding to breaches is no longer solely the domain of IT departments; it’s now a cross-functional concern that demands a multi-layered approach to response and mitigation. Depending on your company’s size and nature, finance teams, including credit managers, may join experts from forensics, legal, information security, operations, human resources and communications in mopping up.

28 AICM Risk Report 2024

“It’s not if a data breach will happen; it’s when. Breaches are becoming increasingly commonplace, yet companies are still not prepared enough when they become the target of cybercriminals.”

When preparation has been inadequate, the aftermath of a breach can be daunting. The fallout from unauthorised access to confidential data can linger for months or even years, inflicting severe financial and reputational repercussions.

The impact of such attacks on cash flow and credit risk is of particular concern to credit managers. Beyond the direct costs of investigation and remediation, operational disruptions and downtime can precipitate serious cash flow and liquidity challenges. For trade credit managers, this could manifest as delays in order processing, payments or collections. Over time, the reputational harm inflicted by an attack can lead to sustained operational and financial

instability, affecting a company’s risk profile and potentially resulting in increased credit risk.

Research5 indicates that the average global cost to a company of a data breach now stands at around AU$6.8 million – an uptick of 15% over the past three years. Detection and escalation expenses represent the costliest category6, encompassing activities that enable a company to reasonably detect a breach, such as forensic audits, crisis management and communication to executives and boards. These expenses ballooned to approximately AU$2.4 million in 2023, a 9.7% increase from the previous year.

Failing to recover swiftly from a major incident can severely damage an organisation’s ability

AICM Risk Report 2024 29 HOW TO MANAGE RISK

to resume operations post-cyber attack. Foreign exchange firm Travelex collapsed into administration seven months after falling victim to ransomware hackers. In the wake of weeks of operational turmoil, during which staff could not use computers for currency trading, the business began unravelling from significant losses and irreparable damage to its brand reputation.

The cost of a slow response

Time is of the essence when handling a data breach and mitigating its financial toll. Prompt action is crucial to forestall further unauthorised access or data loss and help safeguard customers and employees from identity theft.

On average, it takes nine months7 for a company to detect and contain a data breach. During this time, significant damage can occur. Cybercriminals often employ sophisticated tactics to evade detection, remaining hidden for extended periods.

The SolarWinds breach is a high-profile example of a hack that went undetected for nearly a year, employing advanced operational security measures and anti-forensic techniques to infiltrate networks of major corporations like Microsoft and government agencies. Closer to home, Queensland’s largest regional water supplier, Sunwater, fell victim to hackers, their breach undetected for nine months.

“On average, it takes nine months7 for a company to detect and contain a data breach. During this time, significant damage can occur. Cybercriminals often employ sophisticated tactics to evade detection, remaining hidden for extended periods.”

30 AICM Risk Report 2024 HOW TO MANAGE RISK

“The SolarWinds breach is a highprofile example of a hack that went undetected for nearly a year, employing advanced operational security measures ...”

The longer it takes to identify and contain a breach, the greater the financial impact on a company. According to the 2023 IBM Cost of Data Breach report, a breach lifecycle extending beyond 200 days results in an average cost increase of 23% for organisations.

Your response to a data breach can be the difference between containment and reputation-destroying headlines. Swift and strategic action offers the best chance of minimising damage, controlling the narrative, and facilitating rapid recovery. Establishing a response plan well in advance of an incident is essential.

While it’s impossible to anticipate every attack, preparation can streamline the response process from weeks to days, significantly mitigating potential damage.

The cost of notifications

Effective communication with affected parties – employees, customers, and business partners – is a crucial element of your response strategy. Clear communication can mitigate the reputational fallout of a breach,

particularly in today’s fast-paced 24/7 news cycle, where any delays or communication missteps can result in loss of control over the narrative.

A data breach reverberates throughout an organisation, impacting internal and external stakeholders. Managing the response involves coordinating with internal teams, such as customer service, operations, and PR, as well as external entities like media and regulatory agencies.

For businesses subject to the Privacy Act, notifying affected individuals and the Office of the Australian Information Commissioner (OAIC) is mandatory under the Notifiable Data Breaches scheme in cases where the breach involves personal information and is likely to cause serious harm to a person.

The expense of notifying affected parties, regulatory bodies and other stakeholders increased by 19.4% in 2023 compared to the previous year8. This cost is anticipated to rise further as ASIC advocates for enhanced organisational resilience in responding to and recovering from cyber incidents9

AICM Risk Report 2024 31 HOW TO MANAGE RISK

How to prepare

Without an adequate plan, a reactive approach to cyber security incidents can lead to communication breakdowns, delays, reputational harm, and the risk of regulatory non-compliance.

According to the 2023 ASIC cyber pulse survey of cyber resilience, one-third of surveyed organisations lacked a cyber incident response plan. Additionally, over half did not test cyber security incident responses with critical suppliers, and had limited or no capability to adequately protect confidential information.

“... one-third of surveyed organisations lacked a cyber incident response plan ... over half did not test cyber security incident responses with critical suppliers ...”

The report recommends adopting the following ‘better practices’ to enhance cyber incident recovery:

z Transparent communication with all stakeholders, including updates on recovery progress.

z Offering support and resources to affected individuals, customers and partners to aid in their recovery and rebuild trust.

z Implementing a reputation management plan to demonstrate the organisation’s commitment to security.

z Collaborating with government agencies to minimise incident impact through regulatory consultation.

z Incorporating lessons learned into cyber security frameworks and incident response plans.

Equifax data, analytics, and technology solutions offer credit managers and organisations proactive measures to prepare for and manage

32 AICM Risk Report 2024 HOW TO MANAGE RISK

the aftermath of a cyber attack. From cleaning and validating customer data with updated contact information, to swiftly deploying tailored communications at scale across multiple channels, Equifax provides a multi-layered approach to building resilience.

The Equifax Protect credit and identity monitoring service enables businesses to shield their customers from further distress and financial loss post-breach. Offering complimentary subscriptions to Equifax Protect demonstrates to customers and regulators that proactive steps are being taken to limit damage. Additionally, Equifax offers Employee Protect, helping safeguard staff against identity theft and fraud.

Both services include Identity Protection, powered by Norton™, which uses a specialised web browser to patrol private forums, social media, and the deep web. Subscribers receive alerts to suspicious activities, empowering swift action to mitigate identity theft threats.

Individuals are also notified of changes to their credit report, including fraudulent credit applications, enabling immediate action to mitigate the potential fallout. Complimentary insurance is included with Equifax Protect to assist individuals in restoring their identity in case of identity theft.

Over half a century as Australia’s leading credit reporting agency has allowed Equifax to build a depth and coverage of data unmatched in the industry. Following a cybersecurity breach in the US, Equifax overhauled its security program and invested substantially in rebuilding its security and IT systems from the ground up. Leveraging insights gained, Equifax now leads in security, integrating these learnings into developing and innovating its cyber risk solutions.

“Without an adequate plan, a reactive approach to cyber security incidents can lead to communication breakdowns, delays, reputational harm, and the risk of regulatory noncompliance.”

Suellen Heintz

Equifax

FOOTNOTES:

REGISTER HERE for “Preparing for a Data Breach” Webinar, 7 May 2024.

General Manager - Digital & Breach Solutions

1 Top 5 issues facing Australian business leaders in 2024, KPMG,

2 ASD Cyber Threat Report 2022-2023

3 Notifiable data breaches report July to Dec 2023, OAIC

4 Notifiable data breaches report July to December 2023

5 Cost of a Data Breach Report 2023, IBM

6 As above

7 Cost of a Data Breach Report 2023, IBM

8 Cost of a Data Breach Report 2023, IBM

9 Cyber risk: Be prepared, ASIC

AICM Risk Report 2024 33 HOW TO MANAGE RISK

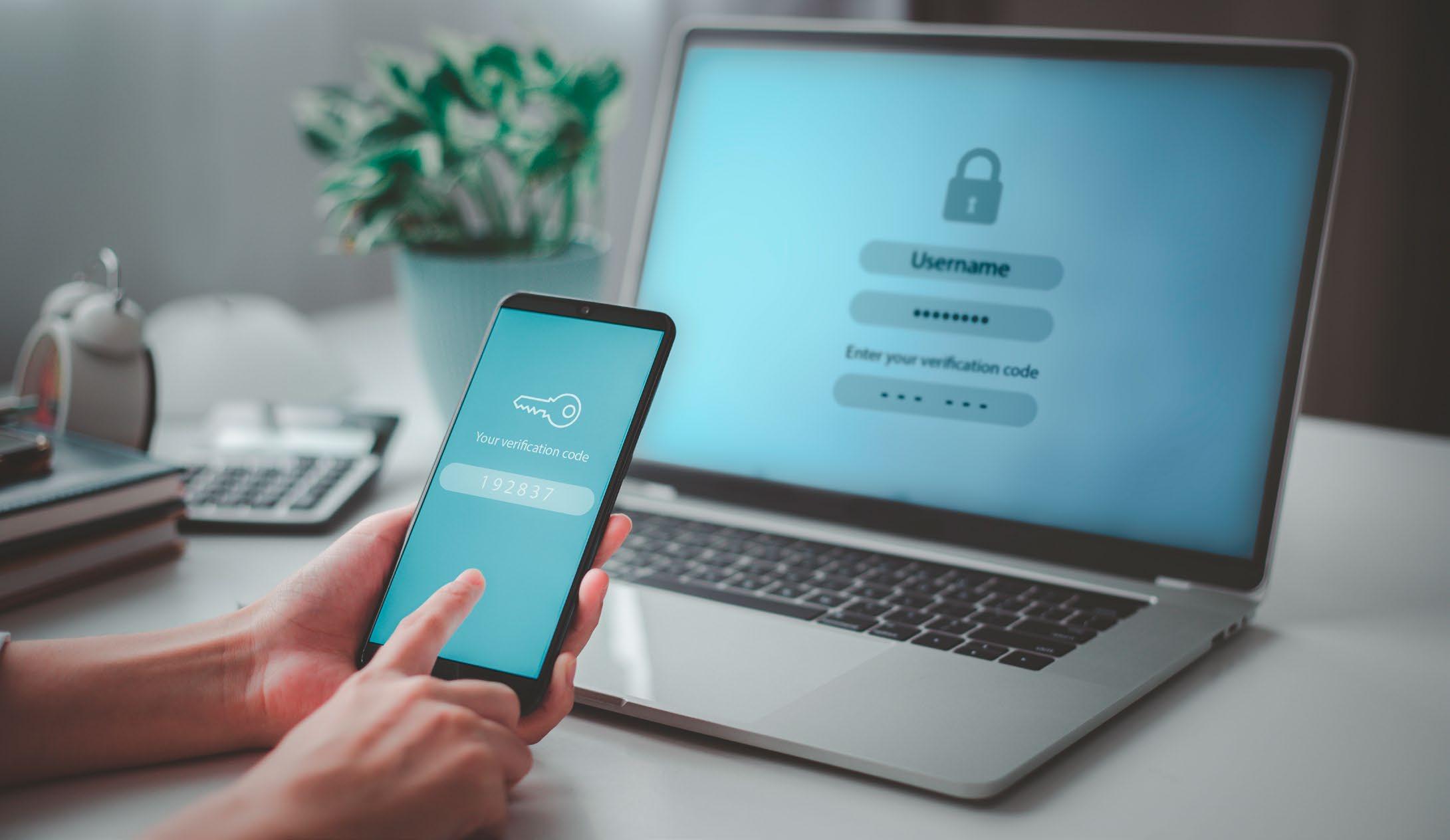

Instincts and double-checks help credit managers combat cyber crime

Michael Parrant Australian Cyber Practice Leader Aon

Barbara Cestaro MICM Client Manager, Credit Solutions Aon

Snapshot

z Cyber crime and AI have reached a nexus making it increasingly difficult to spot an attack.

z Credit managers need to be especially diligent to verify identities when assessing credit applications, and to protect the valuable information they hold.

z Understanding relevant legislation and trusting your instincts can help.

Cyber attack is a top risk for Australian organisations

The risk of cyber attacks and data breaches took the top spot in Aon’s most recent Global Risk Management Survey, both for risks facing organisations today and in the future. As attacks tend to follow those who are involved with money management, the role of credit manager is one that can be in the cross-hairs.

In Australia, a cyber security report was made to law enforcement through ReportCyber every six minutes during the 2022-2023 financial year1 However, it is not just the volume of attacks that are worrying; AI has enabled increasingly

sophisticated breaches, making it even more crucial that credit managers become more active in the management and justification for the data they hold, as well as being able to pick fraudulent credit applications.

We’re at a nexus now where financial barriers to cyber attacks are falling, and the use of AI in cyber crime is increasing. AI has become a very sophisticated tool at what we refer to as social engineering style crimes.

For example, a recent attack involved an employee apparently receiving a request from their CEO to join a WebEx chat with four other people, however it was all fabricated; the

34 AICM Risk Report 2024 HOW TO MANAGE RISK

“AI has enabled increasingly sophisticated breaches, making it even more crucial that credit managers become more active in the management and justification for the data they hold, as well as being able to pick fraudulent credit applications.”

employee ended up sending a significant sum to the criminals. While this would have taken some time to set up, once these crimes have been perpetrated, they become mainstream fast.

Credit managers especially may receive instructions from someone posing as their manager, but it’s may actually be an AI-enabled criminal asking you to approve credit and providing you with fake details. Once this method is weaponised and standardised, it may become difficult to discern truth.

It is important that credit managers ensure that the increasing use of automation in their role

is matched with the correct levels of security, and that consideration is given not only to the benefits of automatic processes, but also the risks.

Consider additional training and clear procedures for credit managers, and work through processes to ensure responsibility for cyber security doesn’t fall to only one person in the team.

It is not necessarily your responsibility as a credit manager to bear all the risk. But you need to at least confirm that your company has a plan. Obviously, insurance is the ultimate, less risky option, but there’s are a lot of other steps

AICM Risk Report 2024 35

HOW TO MANAGE RISK

you can take in between, including having an external assessment to decrease your risk of a breach.

Third-party credit agencies can help verify information provided by potential clients; one of the most common risks is when a director moves from one company and re-emerges in another but is operating behind a relative’s name for example; this can make it difficult to know exactly who you are evaluating.

However, the biggest risk facing credit managers overall is failure to protect the personal information that is provided to attain credit.

It is vital that credit managers understand the risks of holding all this information. People in the role in global organisations are usually covered by clear policies and procedures, but we suspect

many smaller companies don’t really see how big this risk could potentially be. Especially if you don’t have a legal department, you need to be aware of legislative changes that impact the way you retain the information. The type of information you hold is extremely attractive to cyber criminals.

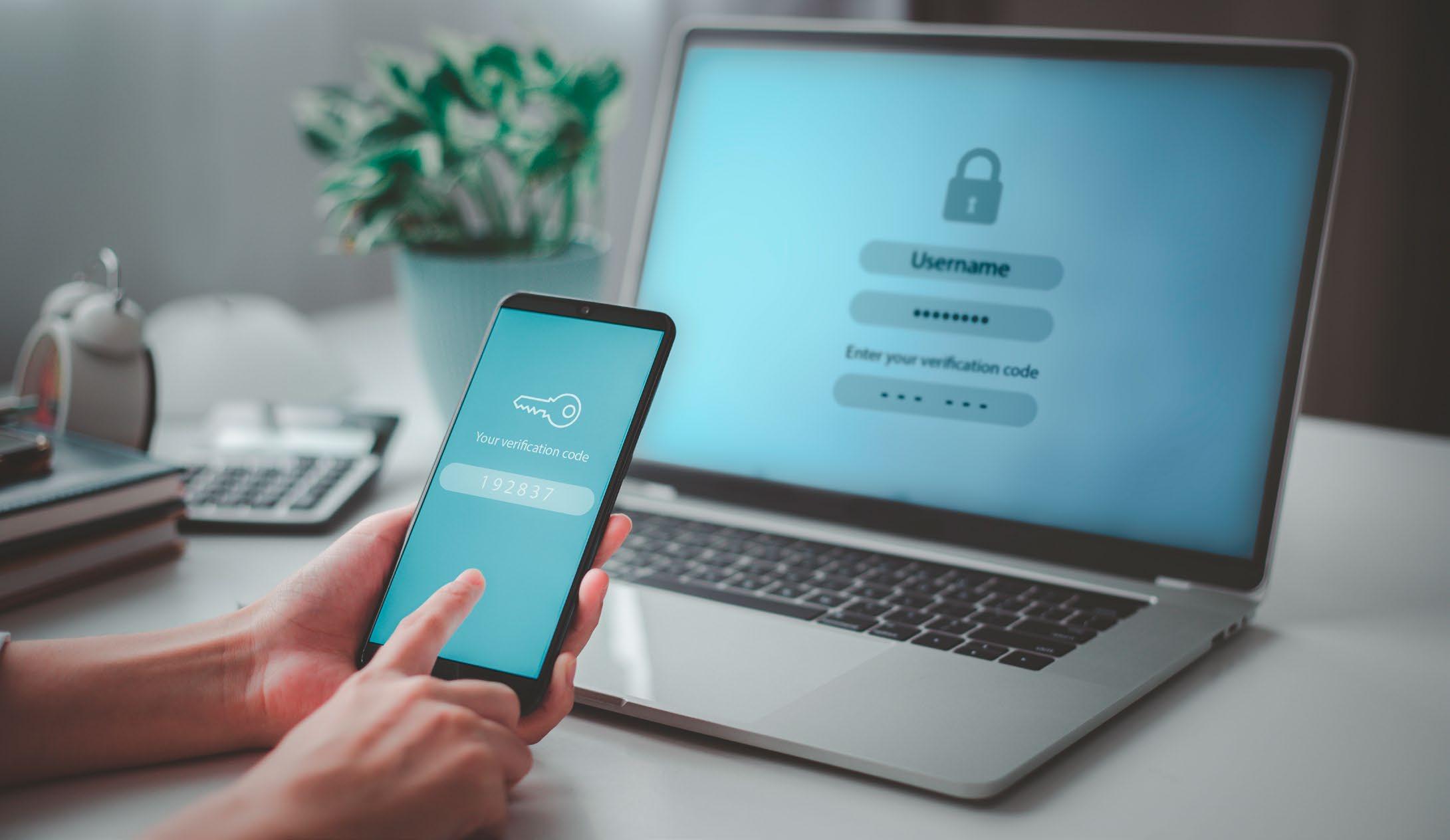

To help protect against the risks of credit fraud and data hacking, look at strengthening your core principles. For example, your multi-factor authentication may need to be reviewed, considered and adapted. There may need to be extra checks and measures in place any time money is being moved or credit is being offered, certainly above any preset thresholds.

And don’t discount human interaction. If you’re in the office, and your boss makes a request of you online that sounds out-of-character, walk around

“To help protect against the risks of credit fraud and data hacking, look at strengthening your core principles. For example, your multi-factor authentication may need to be reviewed, considered and adapted.

36 AICM Risk Report 2024

” HOW TO MANAGE RISK

“Gut instinct is a useful tool. If you receive an email with instructions, before acting on it, consider not only the content of the email, but also the emotion it provokes. Is it putting you under pressure to do something that doesn’t sit quite right with you? That’s a sign to take extra precautions.”

to them and confirm in person, or call them directly.

Gut instinct is a useful tool. If you receive an email with instructions, before acting on it, consider not only the content of the email, but also the emotion it provokes. Is it putting you under pressure to do something that doesn’t sit quite right with you? That’s a sign to take extra precautions.

Aon has helped thousands of organisations around the world audit and address the risks around credit. They can help you understand the potential losses that could be suffered by a cyber attack and ways to minimise the impact.

Michael Parrant Australian Cyber Practice Leader Aon

E: michael.j.parrant@aon.com

Barbara Cestaro MICM

Client Manager – Credit Solutions

Aon

E: barbara.cestaro@aon.com

FOOTNOTES:

1 ‘ASD Cyber Threat Report 2022-2023’ https://www. cyber.gov.au/about-us/reports-and-statistics/asdcyber-threat-report-july-2022-june-2023, published 14/11/23.

© 2024 Aon Risk Services Australia Limited ABN 17 000 434 720 | AFSL 241141 (Aon).

The information provided in this article is current as at the date of publication and subject to any qualifications expressed. Whilst Aon has taken care in the production of the article and the information contained in this has been obtained from sources that Aon believes to be reliable, Aon does not make any representation as to the accuracy of information received from third parties and is unable to accept liability for any loss incurred by anyone who relies on it. The information contained herein is intended to provide general insurance related information only. It is not intended to be comprehensive, nor should it under any circumstances, be construed as constituting legal or professional advice. You should seek independent legal or other professional advice before acting or relying on the content of this information. Aon will not be responsible for any loss, damage, cost or expense you or anyone else incurs in reliance on or use of any information in this article.

AICM Risk Report 2024 37

HOW TO MANAGE RISK

The factors keeping you up at night, and the secret tonic to remedy it!

Kirk Cheesman MICM Group Managing Director National Credit Insurance (Brokers) Pty Ltd

Kirk Cheesman MICM Group Managing Director National Credit Insurance (Brokers) Pty Ltd

Prudent credit management in Financial Year 2025 will be critical for business success. There are many macro factors that have been contributing to increased uncertainty, including a rise in interest rates, a slowing economic environment and more conscious consumer spending. All of

this is affecting businesses’ ability to sell goods and services to generate revenue.

At NCI, we have been experiencing an increase in credit insurance claims and collection actions, reflected in our early preview of the Q1 Trade Credit Risk Index (TCRI). These are two vital data points that help us assess and forecast the sentiment around trade.

On a broader scale, we can delve into our insurer partners’ actions on credit limits and identify where their risk appetite is, this all flows down and can impact how businesses trade with their customers.

Taking a closer look at the TCRI, despite the fall in the December quarter, it has risen again and is greater than it was 12 months earlier. However, the talking point is the rise in seriously overdue accounts generating the spike in collection actions, which are up 29.5 per cent YoY and an astonishing 45 per cent from the December quarter.

This increase tells us that businesses are desperately trying to reign in their overdue debts and that they are willing to escalate it to a third party to get it done. While these statistics show

38 AICM Risk Report 2024 HOW TO MANAGE RISK

Q1 2023 Index Score: 692

“Taking a closer look at the TCRI, despite the fall in the December quarter, it has risen again and is greater than it was 12 months earlier.”

“Further analysis of the industry trends continued to show the largest number and highest value of claims have been in the ‘building and hardware’ sector.”

From which industries did claims come in Q1 2024?

us what is happening at this point in time, our data suggests that this trend will continue for the remainder of 2024.

Analysing insurer actions to restrict their exposure, these have increased by just 5 per cent compared to 12 months earlier and have dropped by 1 per cent on the previous quarter. So, despite the warning signs, Trade Credit Insurers

are continuing to grow the “credit limit pool” and continue to protect their policyholders.

Further analysis of the industry trends continued to show the largest number and highest value of claims have been in the ‘building and hardware’ sector. The housing/ construction sector has seen trouble in 2023 and so far in 2024 – high cost of materials,

AICM Risk Report 2024 39 HOW TO MANAGE RISK

Note: The NCI Trade Credit risk Index score is based on an aggregate of claims data, collection activity, credit limit decisions and overdue accounts. 400 500 600 700 800 900 1000 1100 1200 Q1 2024 Q4 2023 Q3 2023 Q2 2023 Q1 2023 Q4 2022 Q3 2022 Q2 2022 Q1 2022 Q4 2021 Q3 2021 Q2 2021 Q1 2021 Q4 2020 Q3 2020 Q2 2020 Q1 2020 Q4 2019 Q3 2019 Q2 2019 Q1 2019 Index Score Trade Credit Risk Index Score

0 1,000,000 2,000,000 3,000,000 4,000,000 5,000,000 6,000,000 7,000,000 8,000,000 Timber FreightForwarders ManufacturingFood/Provisions Agriculture Finance Electrical Building/Hardware 0 14 28 41 55 69 83 96 110 Value Number Value Number

External Administrations and NCI Claims (2018-2023)

labour shortages and rising interest rates have seen a series of high-profile business failures.

New South Wales accounted for 34 per cent of claims, followed by Victoria with 32 per cent and Queensland with 9 per cent. Claims in South Australia, Tasmania, the ACT and the Northern Territory were very low or even zero.

What are the key steps in mitigating credit risks in FY25 so you can sleep better at night?

The Secret Tonic!

There is no better time to review your credit management processes, starting at the beginning with your Credit Application and the pre-credit checks that you conduct. Ensure that you know who you are trading with so if there is an issue (like a collection action

mentioned above) then you will be in the best place to recoup that outstanding debt.

Additionally, have an escalation strategy in place for each step of the process, if something isn’t progressing as it should, then be ready with a contingency plan.

Get paid faster

Conduct an evaluation of your procedures for issuing, following-up and escalating outstanding invoices. There are many products available (like easyAR from NCI) that will help automate these processes for you, not only will they help you get paid faster by offering easy payment options and reducing obstacles for your clients, but it will also save you and your credit teams many hours of chasing and reconciling each month.

“Ensure that you know who you are trading with so if there is an issue (like a collection action mentioned above) then you will be in the best place to recoup that outstanding debt.”

40 AICM Risk Report 2024 HOW TO MANAGE RISK

# Companies Entering EXAD NCI Gross Claims Value Number 0 50 100 150 200 250 Feb-24 Jan-24 Dec-23 Nov-23 Oct-23 Sep-23 Aug-23 Jul-23 Jun-23 May-23 Apr-23 Mar-23 Feb-23 Jan-23 Dec-22 Nov-22 Oct-22 Sep-22 Aug-22 Jul-22 Jun-22 May-22 Apr-22 Mar-22 Feb-22 Jan-22 Dec-21 Nov-21 Oct-21 Sep-21 Aug-21 Jul-21 Jun-21 May-21 Apr-21 Mar-21 Feb-21 Jan-21 Dec-20 Nov-20 Oct-20 Sep-20 Aug-20 Jul-20 Jun-20 May-20 Apr-20 Mar-20 Feb-20 Jan-20 Dec-19 Nov-19 Oct-19 Sep-19 Aug-19 Jul-19 Jun-19 May-19 Apr-19 Mar-19 Feb-19 Jan-19 Dec-18 Nov-18 Oct-18 Sep-18 Aug-18 Jul-18 Jun-18 May-18 Apr-18 Mar-18 Feb-18 Jan-18 0 200 400 600 800 1,000 ASIC

If all else fails, ensure you have contingencies in place

Given the increase in insolvencies and overall credit risk, there really is just one way to protect your business from a bad debt and that’s with Trade Credit Insurance. Insuring your customers so, if all else fails and they cannot pay, you can claim on the policy and get up to 90% back of the money that you are owed. Trade Credit Insurance really is the ultimate protection against nonpayment.

While in most aspects credit risk are rising, Australian businesses have shown their resilience through some unusual trading conditions over the past few years. The data shows a clear trend of rising credit risk in 2024, with businesses increasingly looking to collect debts that have become overdue. This highlights the importance of prudent credit management for businesses in the coming year, particularly in sectors like building and hardware that have been heavily impacted. Information like the TCRI

will increasingly become valuable in helping to assess risk and navigate the uncertain economic environment.

For quarterly updates and insight, subscribe for free to the NCI Trade Credit Risk Index distribution list via info@nci.com.au

Kirk Cheesman MICM Group Managing Director

National Credit Insurance (Brokers) Pty Ltd

E: kirk.cheesman@nci.com.au

T: 1300 654 500 www.nci.com.au

“While in most aspects credit risk are rising, Australian businesses have shown their resilience through some unusual trading conditions over the past few years.”

AICM Risk Report 2024 41 HOW TO MANAGE RISK

Interacting with an Insolvency Practitioner

Simon Read MICM Founder and Director PPSAdvisory

Like death and taxes, dealing with an Insolvency Practitioner is an inevitable part of business life. Hopefully this article will help you through the process, whether you’re attempting to recover goods/debt or provide ongoing supply.

As an Insolvency Practitioner for almost 30 years, I was very good at taking property; I then switched sides and for the past decade I’ve helped protect my clients’ property from insolvent customers and their appointed Insolvency Practitioners. The poacher has become the gamekeeper

The introduction of the Personal Property Securities Act (PPSA) has much improved the priority and often the outcome for hitherto unsecured suppliers. Personally, I think it is a wonderful piece of legislation, with the capacity to significantly enhance the financial recovery from an insolvent customer.

Compliance really could not be simpler or more cost effective. To be able to preserve your security

“The introduction of the Personal Property Securities Act (PPSA) has much improved the priority and often the outcome for hitherto unsecured suppliers.”

for $6 for each customer, over a 7-year trading period should make compliance with the PPSA a ‘no brainer’.

When it comes to enforcing your security once an Insolvency Practitioner has been appointed to an insolvent customer, I have some advice which might assist.

Challenges with Insolvency Practitioners

We all understand the situation well and most of you will have first-hand experience of dealing with insolvent customers and Insolvency Practitioners.

Unfortunately, the actions of some Insolvency Practitioners has become a concern to me, with Insolvency Practitioner’s engaging in questionable conduct, particularly in how they choose to interpret the PPSA.

The complicating factor is the Insolvency Practitioner’s will have possession of your goods and/or equipment, making recovery or negotiation efforts challenging.

The lack of extensive legal precedent for the PPSA adds to the overall uncertainty.

42 AICM Risk Report 2024 HOW TO MANAGE RISK

“Taking on an Insolvency Practitioner is no simple task, particularly when you add the complexity of the PPSA and the differing interpretations as to how it operates.”

Taking on an Insolvency Practitioner is no simple task, particularly when you add the complexity of the PPSA and the differing interpretations as to how it operates. An Insolvency Practitioner’s rejection of your security leaves you with few options other than to commence a legal action or walk away.

Rights and obligations for Insolvency Practitioners under the Corporations Act

Understanding the rights and obligations of an Insolvency Practitioner is useful.

We’ll assume the appointment of a Voluntary Administrator as it is a common form of appointment:

z During the period of the Voluntary

Administration, creditors, including some secured creditors, are prohibited from taking any action against the insolvent company to recover debts, enforce security interests or have the company wound up.

z Owners of goods subject to retention of title are prohibited from seizing or reclaiming their goods without the Administrator’s consent or the Court’s authority.

Keep in mind the Administrator is not able to deal with the goods or any property subject to a security interest unless it is in the ordinary course of business or with the consent of the owner or the leave of the Court. The Administrator will usually seek the consent of the owner and agree to payment for the use of those goods.

z Owners of equipment leased/hired to the

AICM Risk Report 2024 43 HOW TO MANAGE RISK

insolvent company cannot recover their equipment without the Administrator’s consent or the Court’s authority.

The Voluntary Administrator has 5 business days to form a view of whether he/she will continue with a lease of equipment/property. Whilst a decision not to continue with the lease of equipment/property usually results in its return, it may not. It’s important to keep in mind that the Administrator’s notice is simply that they will not accept any personal liability for any lease payments. That liability remains with the insolvent company.

z The Voluntary Administrator is personally liable for any liability they incur during their appointment. This means that if the Voluntary Administrator incurs debts for the purchase of goods or services, hiring, leasing equipment or property during the administration, they are paid from the available assets of the insolvent company as costs of the Voluntary Administration. If the company does not have the funds to pay such debts, the Administrator is personally liable to pay them.

It’s important you follow the Administrator’s advice regarding any ongoing trading, in particular the provision of authorised purchase orders from the Administrator.

Ongoing trading with an Administrator offers a much-reduced level of credit risk.

“... if the Voluntary Administrator incurs debts for the purchase of goods or services, hiring, leasing equipment or property during the administration, they are paid from the available assets of the insolvent company ...”

z Your right to rely on ‘ipso facto’ terms in your agreement with the insolvent customer is stayed during the period of administration. These are provisions in the agreement providing the contractual right to terminate the agreement upon an ‘insolvency event’ occurring, such as the appointment of a Voluntary Administrator.

Rights and Actions for Creditors under the PPSA

Compliance with the PPSA ensures you can exercise your security and because the nature of your security often provides you a priority secured creditor position, you advance from the back of the queue to the front.

Keep in mind if you’ve sold goods subject to retention of title, you have security for payment. If you’ve hired equipment, you’ll have security in the equipment itself. You have the highest levels of security with priority over all other creditors, including banks and financiers.

You now have a place at the table with the Insolvency Practitioner to sort out your claim. And because of the high priority of your security, you will be the first creditors to be dealt with by the Insolvency Practitioner, particularly if it is intended to trade on the insolvent business.

It’s important to keep in mind you have the highest priority claim over:

z Your property (the goods/equipment you’ve sold or hired to your customer); and,

z The Proceeds of your property (any debts due to your insolvent customer that arise from their sale of your property).

It’s important you act quickly to secure the recovery of any property held by your customer. The Insolvency Practitioner will search the PPS

44 AICM Risk Report 2024 HOW TO MANAGE RISK

“Keep in mind

if you’ve sold

goods subject to retention of title, you have security for payment.

If you’ve hired equipment, you’ll

have security in the

equipment itself. You have the highest

levels of security with priority over all other

creditors...”

Register and identify your PPS registrations. You will need to supply the Insolvency Practitioner with information so he/she can determine whether you have a continuing interest in your property. You will need to provide the following:

z A copy of each Security Agreement – your hire/ sale agreement with your customer. Check to ensure the PPSR registration either existed or was performed within 20 business days of the date of the agreement and before the property was supplied to your customer.

z A copy of the customer’s initial acceptance of your terms of trade (usually when they signed your Credit Application). It’s important you supply documents indicating your customer’s acceptance of your trading terms.

z Details of the amount of debt you’re owed.

z An itemised listing of your property. Provide as specific a list of the property you’ve supplied, as you can. Do not place any values on your property.

You should also request from the Insolvency Practitioner:

z Their acknowledgement of your continuing Security Interest in any of your property and proceeds they hold;

z Details of any stock count, specifically the quantity of your property on hand and permission to attend the customer’s premises to inspect your property;

z The location of your property and its intended use (particularly whether the Insolvency Practitioner intends to continue any equipment hire arrangements);

AICM Risk Report 2024 45 HOW TO MANAGE RISK

z Confirmation the Insolvency Practitioner has insurance cover in place and your property is included under it; and,

z An indication of whether they intend to return your property to you.

In my experience acting swiftly and forcefully is the key, you have legal rights but the “squeaky wheel gets oiled”, so make a fuss. Insolvency Practitioners have a lot to do at the commencement of an administration, make their job easy by supplying all the relevant information, making a clear claim and engaging with them directly.

And if you need it, get qualified support, speak with your lawyer or business adviser and get on the front foot with the Insolvency Practitioner.

“In my experience acting swiftly and forcefully is the key, you have legal rights but the “squeaky wheel gets oiled”, so make a fuss.”

Some real-world examples

Several years ago, I helped Acme Goods (not their real name) recover their property from an insolvent customer. This offers a good example of the sometimes lack of responsiveness from an Administrator.