l The growing significance of ESG factors in credit risk management

l Economic update: Stronger start to 2025 for Australian businesses but tariff uncertainty looms

l Focus on Good360: WINC Charity Partner for 2025

l The growing significance of ESG factors in credit risk management

l Economic update: Stronger start to 2025 for Australian businesses but tariff uncertainty looms

l Focus on Good360: WINC Charity Partner for 2025

National partners

Divisional partners

Divisional supporting sponsors

Monika Lacey MICM

Stronger start to 2025 for Australian businesses but

tariff uncertainty looms

Ivan Colhoun

The growing significance of Environmental, Social, and 22 Governance (ESG) factors in credit risk management

Neill Borg MICM

Covington

ISSN 2207-6549

DIRECTORS

Julie McNamara FICM CCE – Australian President

Mary Petreski FICM CCE – Victoria/Tasmania

Troy Mulder FICM CCE – Western Australia/Northern Territory

Rob Jackson MICM CCE – South Australia

Theresa Brown MICM CCE – New South Wales

Steven Staatz MICM CCE – Queensland

Daniel Taylor MICM – Co-opted Director

CHIEF EXECUTIVE OFFICER

Nick Pilavidis FICM CCE

Level 3, Suite 303, 1-9 Chandos Street, St Leonards NSW 2065

PO Box 64, St Leonards NSW 1590

Tel: (02) 8317 5085, Fax: (02) 9906 5686

Email: nick@aicm.com.au

PUBLISHER

Nick Pilavidis FICM CCE | Email: nick@aicm.com.au

CONTRIBUTING

EDITORS

NSW – Gary Poslinsky MICM

Qld – Emma Purcival MICM CCE

SA – Maria Scacchitti MICM

WA/NT – Jeremy Coote MICM CCE

Vic/Tas – Alex Hawtin MICM

Claire Kasses, General Manager

Tel Direct: 02 9174 5727 or Mob: 0499 975 303

Email: claire@aicm.com.au

EDITING and PRODUCTION

Anthea Vandertouw | Ferncliff Productions

Tel: 0408 290 440 | Email: ferncliff1@bigpond.com

THE EDITOR reserves the right to alter or omit any article or advertisement submitted and requires idemnity from the advertisers and contributors against damages or liabilities that may arise from material published. CREDIT MANAGEMENT IN AUSTRALIA is published by the Australian Institute of Credit Management, Level 3, Suite 303, 1-9 Chandos Street, St Leonards NSW 2065. The views expressed in CREDIT MANAGEMENT IN AUSTRALIA are not necessarily those of Australian Institute of Credit Management, which does not expect or invite any person to act or rely on any statement, opinion or advice contained herein (whether in the form of an advertisement or editorial) and neither the Institute or any of its employees, agents or contributors shall be liable for any opinion contained herein. © The Australian Institute of Credit Management, 2025.

CONTRIBUTIONS SHOULD BE SENT TO:

Editor, Level 3, Suite 303, 1-9 Chandos Street, St Leonards NSW 2065 or email: aicm@aicm.com.au

Julie McNamara FICM CCE National President

Hello everyone and welcome to the February edition of the AICM magazine, the first for 2025.

Welcome back and a big thank you to all our national and divisional partners and sponsors without the support of whom, this would not be possible.

We have started the year off with a bang and all systems are a go with a great line up of events for 2025 in the AICM calendar.

Firstly, we have the Risk and Economic series, together with our WINC series and great social events currently being organised in all states.

This year’s WINC series has just been launched with a well-deserved charity announced for 2025: “Good 360”. Good360 is focused on connecting businesses with surplus goods to people in need. By working with charities, disadvantaged schools, and vulnerable

communities across Australia, they redistribute unsold, excess, or disaster recovery goods, helping reduce waste and supporting people facing hardship.

Where has the time gone? This year we will be celebrating 10 years of WINC!

For those of us who have been involved with WINC from the start, I am sure you would agree we have come a long way from our humble beginnings where the goal was to reach 100 guests at each state WINC to what it was in 2024, a highly successful sell out event series raising an amazing $25K across Australia for our chosen charity.

I am so excited to say we are all looking forward to the 2025 WINC webinars and luncheons and reflecting on 10 years of impact within the credit community. Don’t hesitate to register for the webinars and book your tables

“We have started the year off with a bang and all systems are a go with a great line up of events for 2025 in the AICM calendar.”

for the luncheons, tickets are available for the celebrations!

We are also looking forward to the launch of our CKH, Credit Knowledge Hub in the next few weeks which is a major development for AICM and will provide our members with tools to advance and continue to learn and develop their credit teams. More information to be released as we get closer.

Our Special Interest groups are also growing in popularity and are a designed to enhance your professional development and foster stronger connections within our community. These groups will offer a unique platform to dive deep into niche topics, share best practices, and discuss the day-to-day challenges and triumphs of our profession. It is a free member service. To register, please check the member portal.

I am very excited about the 2025 AICM Awards

program with the Credit Team of the Year award now open for applications, this will close on 31st March. Thank you to Equifax for their support.

Stay tuned for the YCP and CP awards campaign, these will kick off in April 2025.

If you haven’t already achieved CCE status, this is the year to “go for it”! The next CCE assessment will be held in March and details are available on our website.

And finally, we have National Conference on The Gold Coast this year at the JW Mariott Gold Coast Resort & Spa (Surfers Paradise) for three days of amazing networking, learning and celebrations of all things credit, the highlight of our calendar from 15th – 17th October 2025.

Lock it in your diaries! I look forward to seeing you all there!

Julie McNamara FICM CCE National President

The Australian Institute of Credit Management is thrilled to announce the upcoming launch of the Credit Knowledge Hub (CKH), a revolutionary subscription based online platform designed to elevate your career in credit management.

Why the CKH is a Game-changer

Imagine having 24/7 access to the best practice knowledge and training content you need to become a leading credit professional.

The CKH offers:

l Unlimited access to AICM credit content: Dive into a wealth of resources anytime, anywhere.

l Nationally recognised qualifications: Enhance your credentials with certifications that matter.

The CKH is not just another online platform; it’s a comprehensive tool to help you:

l Develop a unique skill set: Align with the AICM Learning & Development framework to stay ahead in the industry.

l Adapt to evolving needs: Stay responsive to the rapidly changing credit management landscape.

l Ensure compliance: Protect your organisation’s reputation and revenue by staying compliant with legislation and regulations.

l Set a standard: Implement best practices to safeguard your organisation.

l Support team growth: Help your team adapt, grow, and excel.

l Career development: Provide a clear pathway for career advancement within your team.

The CKH is designed to help you achieve your professional goals:

l Learn or refresh on the fundamentals: Keep your knowledge up-to-date.

l Obtain a qualification: Choose from Cert III in Mercantile Agents, Cert IV in Credit Management, or a Diploma of Credit Management.

l Become a Certified Credit Executive (CCE): Take your career to the next level.

l Assign units to staff: Use the CKH for induction and performance development planning.

l Address knowledge gaps: Help team members step up to new roles with targeted learning.

Stay tuned for the launch of the CKH and get ready to transform your career in credit management. The future of credit knowledge is here, and it’s more accessible than ever.

AICM would like to congratulate its recent graduates:

FNS51522 Diploma of credit management

Kaye Scott NSW

FNS30420 Certificate III in Mercantile Agents

Abhishek Arora India

Genpact

eInvoicing: 4 March 2025 – Dive into the latest in electronic invoicing through the Peppol Framework. Register Now

Personal Insolvency: 14 March 2025 – Explore trends, scenarios, and legislative changes. Register Now

Commercial Credit KPI’s: 25 March 2025 – Discuss trends, causes, and initiatives to improve KPI’s. Register Now

Complaints and Disputes: 15 April 2025 – Share best practice insights, legislative updates, and industry trends. Register Now

Click

l Share and Learn: Exchange insights on what strategies work and what don’t, gaining valuable knowledge from peers.

l Answer Known and Unknown Questions: Find answers to your questions and discover new ones through engaging discussions.

l Deep Dive into Practical Aspects: Explore the practical, day-to-day aspects of our work in greater detail.

l Explore Complex Issues: Understand how others approach areas where there are no clear blackand-white answers so you can implement the best solution for your scenario.

l Tap Community Knowledge: Access the collective wisdom of the community and understand the credit profession’s day-to-day realities.

l Understand Best Practices: Learn and implement industry best practices shared by fellow professionals.

l Professional Growth: Gain new ideas for improvement and stay ahead of trends.

l Contribute to Advocacy: Play a role in AICM advocacy efforts and shape the future of our profession.

l Membership Benefits: Enhance your membership experience and build valuable professional relationships.

We are excited to announce the launch of our new member only Special Interest Groups (SIGs), designed to enhance your professional development and foster stronger connections within our community. These groups will offer a unique platform to dive deep into niche topics, share best practices, and discuss the day-to-day challenges and triumphs of our profession.

Personal and Team Development: 6 May 2025 – Focus on recent trends challenges and achievements. Register Now

Customer Engagement and Support: 13 May 2025 –Discuss recent trends, hardship, vulnerability, and resolving payment disputes. Register Now

Corporate Insolvency: 10 June 2025 – Share scenarios, discuss legislative proposals, and drivers of insolvency trends. Register Now

eInvoicing: 17 June 2025 – Dive into the latest in electronic invoicing through the Peppol Framework. Register Now

l Quarterly Zoom Meetings: Join interactive sessions with audio and video.

l Pre-Meeting Surveys: Share your initial views, questions and comments before the meeting to help shape the discussion.

l Facilitated Discussions: Engage in open forums led by experienced chairs.

l Ongoing Engagement: Continue the conversation post-meeting via the AICM LinkedIn Group.

l There will be at least two SIGs each month, with each session lasting one hour.

l Topics will initially be held quarterly which may increase or decrease based on developments in the area.

l Registration is open now for the upcoming sessions.

l SIGs are a member only benefit.

We look forward to your active participation in these groups. Together, let’s shape the future of our profession and strengthen our community.

By Monika Lacey MICM*

With 2025 well and truly in motion, it’s clear New Zealand households and businesses are ready for more financial stability against the current backdrop of global and local economic uncertainty.

After all, while Stats NZ reported a 2.2% rise in the Consumer Price Index for the December 2024 quarter, this is unlikely to delay an Official Cash Rate cut.

Looking to recent credit insight movements may shed some light on the economic path

ahead for Kiwi consumers and businesses.

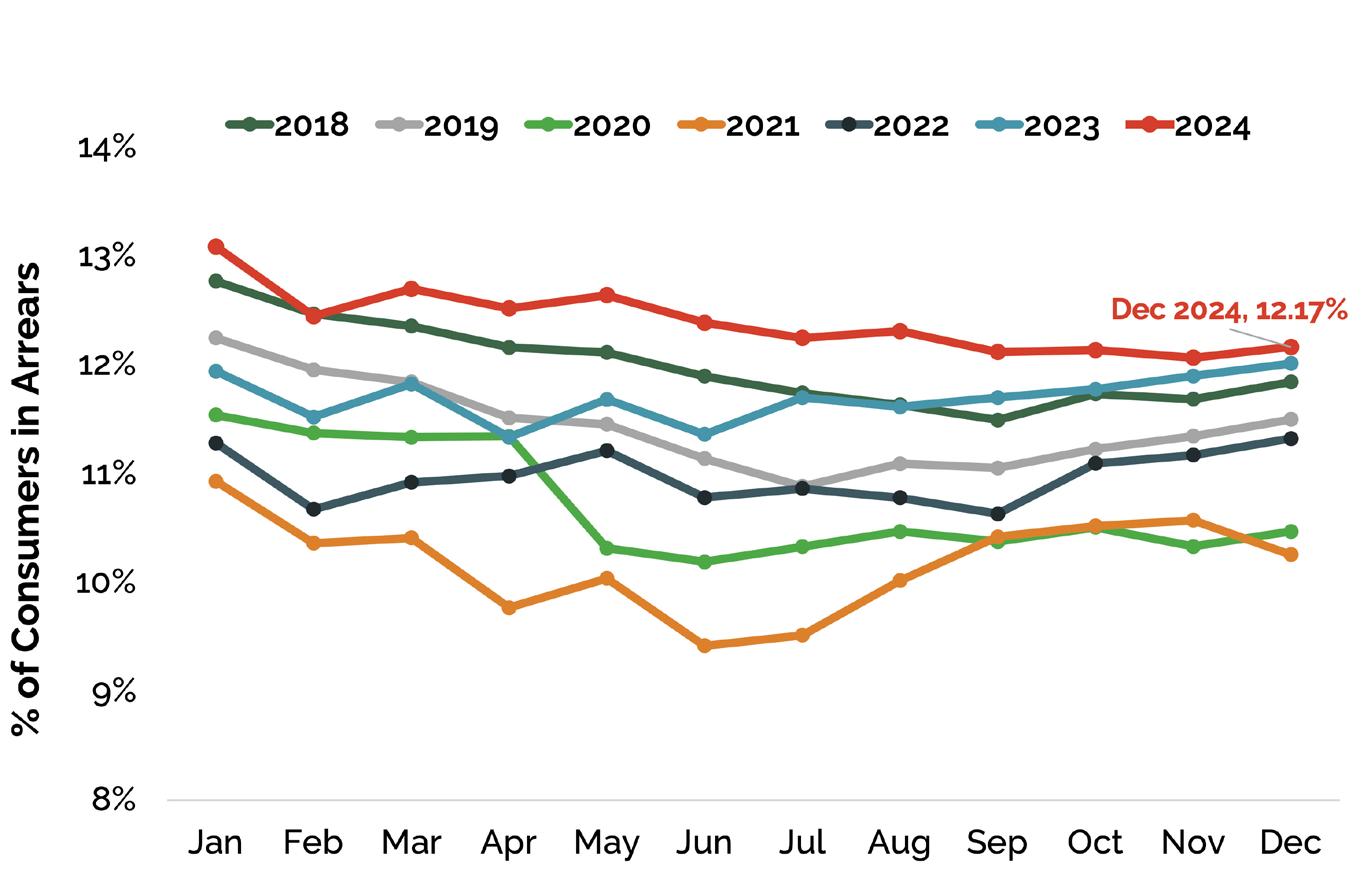

Financial strain remains evident, with many households and businesses feeling the pressure. Consumer arrears saw a seasonal rise post-holiday, as reliance on credit increased.

Personal loan arrears climbed to 9.2% in December (up from 8.1% in November), while Buy Now Pay Later (BNPL) arrears inched up to 8.2%, though slightly lower than the previous year’s (8.4%).

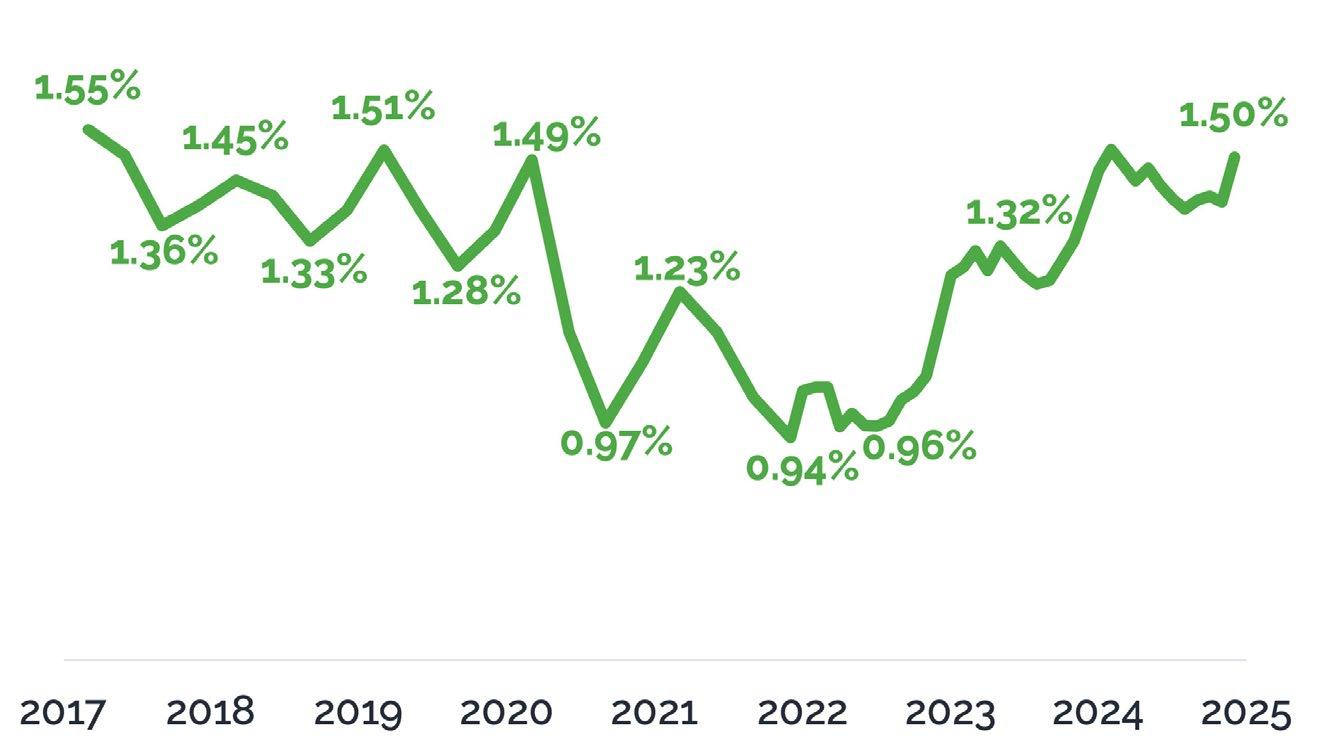

The number of mortgages

Consumer Arrears Trends

“Financial strain remains evident, with many households and businesses feeling the pressure.”

in arrears rose while financial hardship cases increased 19%, with nearly half tied to mortgage repayments.

Despite these challenges, lending activity continued to increase.

New mortgage lending was up 13.4% year-on-year, supported by lower interest rates and eased lending restrictions. Additionally, non-mortgage lending rose 1.5%, driven by holiday spending on credit cards, vehicle and personal loans, BNPL, and overdrafts.

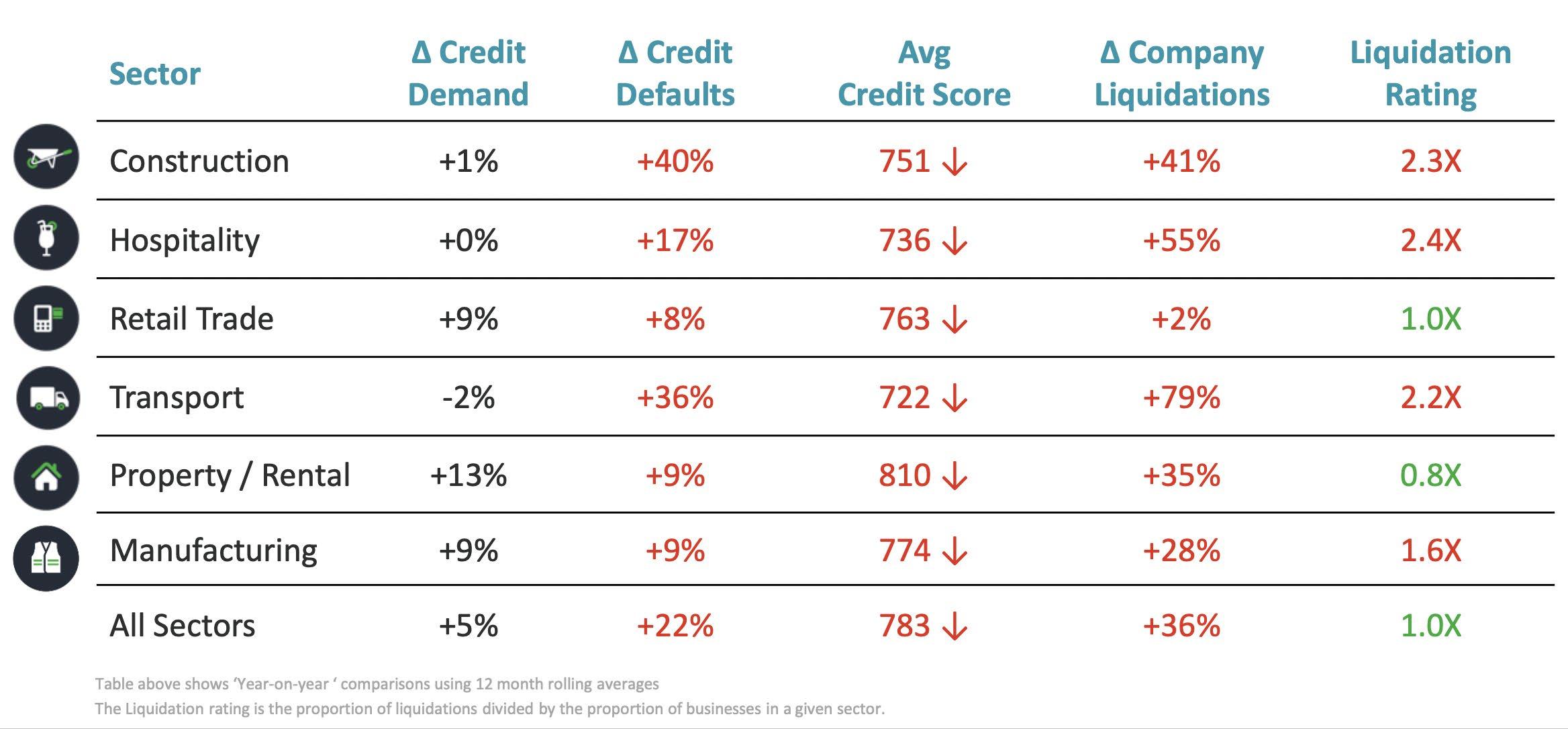

Businesses faced continued financial stress – particularly in construction, where defaults and liquidations jumped 40% and 41%, respectively.

Residential home builders recorded 235 liquidations over the year. The transport sector also saw a sharp 79% rise in liquidations, with 131 companies affected.

Despite hopes for relief, the economic outlook for 2025 remains uncertain for Kiwi households and businesses.

In line with seasonal trends, arrears are up across all the different categories we measure for the month of December 2024.

General consumer arrears are up 6,000 month on month,

reaching 470,000, equating to a current arrears level 1.3% higher year-on-year. This rate has moderated, however, in recent months. In fact, consumers that are 30+ days in arrears have improved by 5.4% year-on-year.

Mortgage arrears also rose to 1.50% in December, up from 1.41% in November 2024, sitting 7% higher year-on-year.

Meanwhile, credit card arrears rose slightly month-on-month in December, however are 5% lower year-on-year.

Looking at the other specific categories, personal loan arrears also increased in December, to 9.2%, up from 8.1% the month prior – however remained stable year-on-year. BNPL arrears also rose to 8.2% in December, although this remains lower than December 2023 (8.4%).

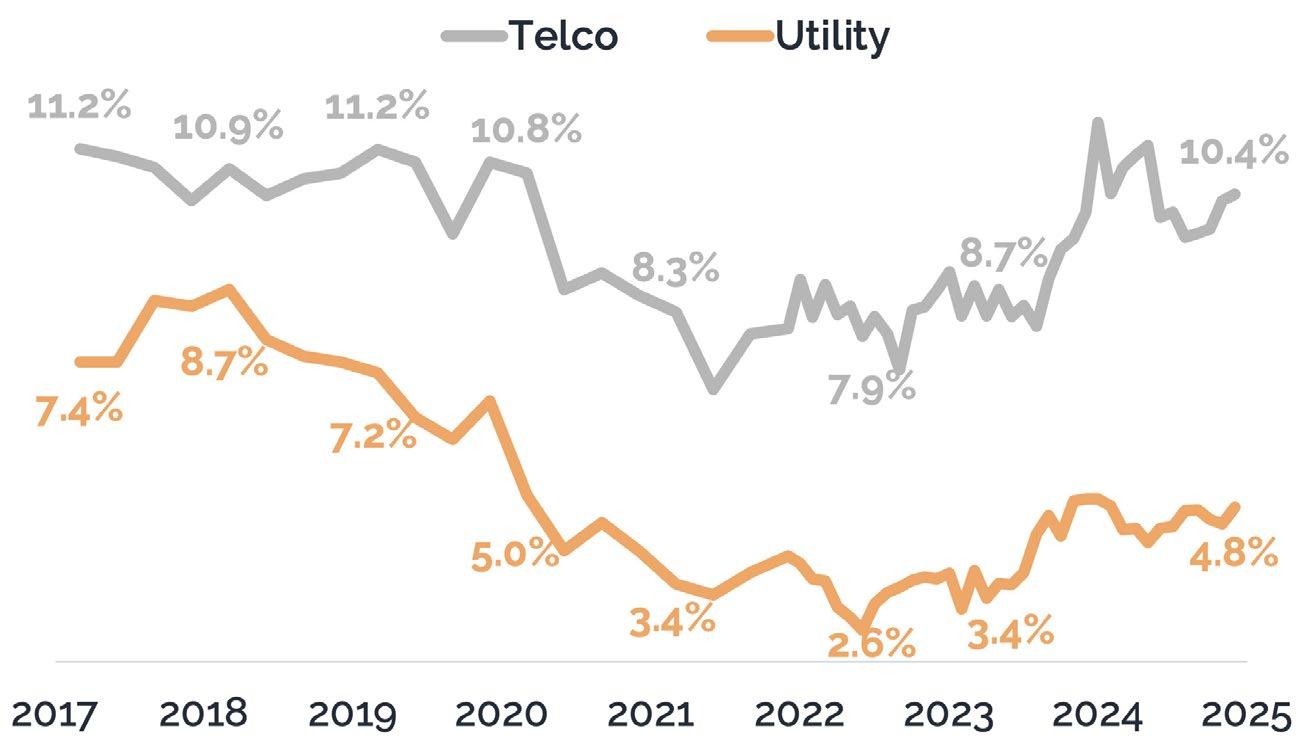

The number of households behind on retail energy

“Consumer credit demand began 2025 1% lower compared to the same period last year. However, festive spending drove increased demand for credit cards, personal loans and BNPL services.”

payments rose slightly month on month to 4.8% in December (3% lower year-on-year), whilst the percentage of telco / communication accounts reported past due was 10.4% in December, up slightly year-on-year.

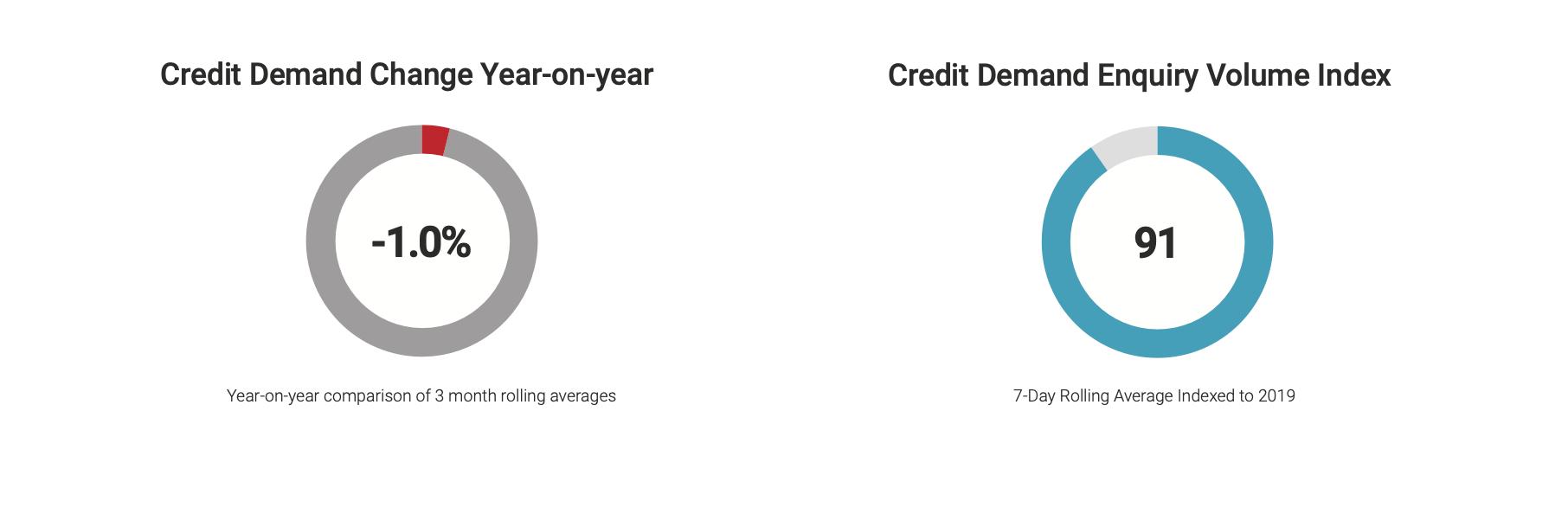

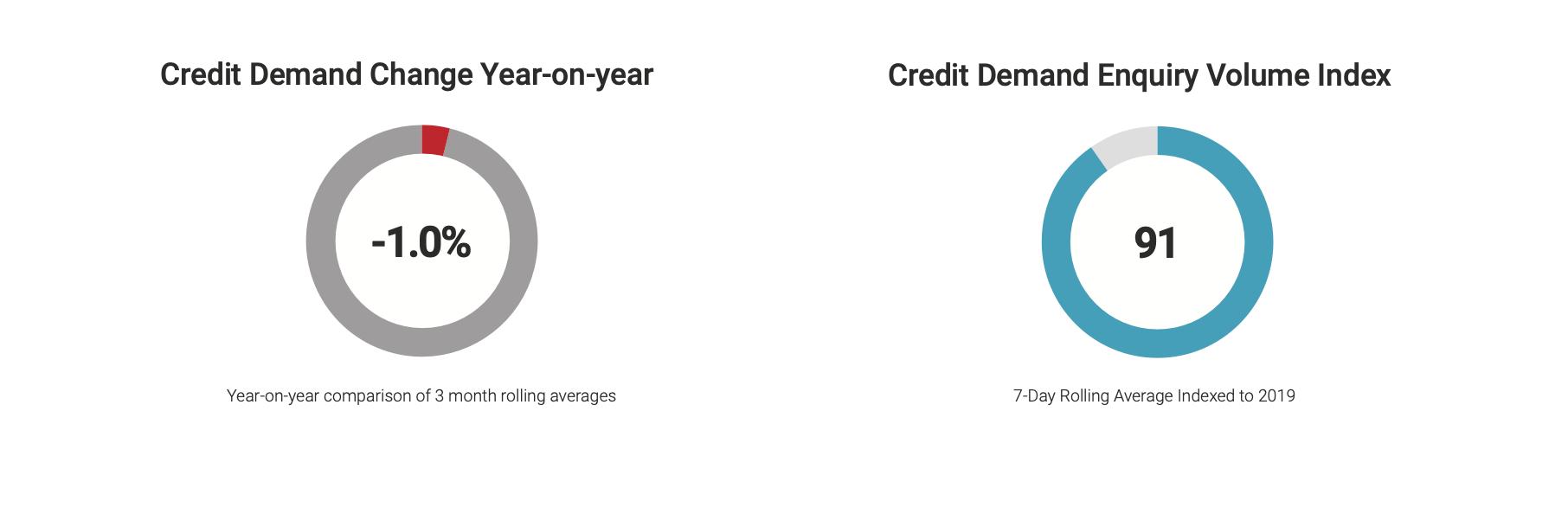

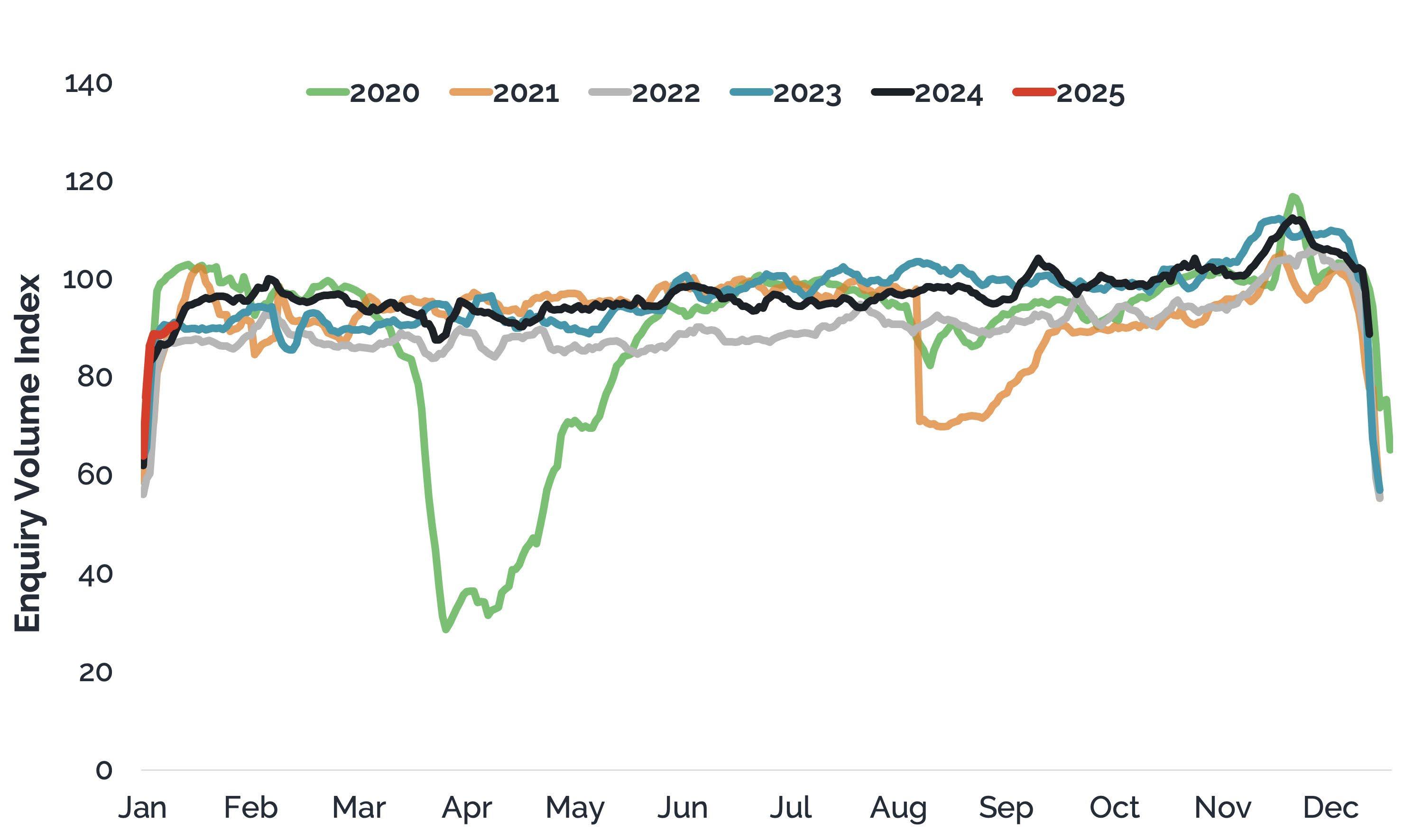

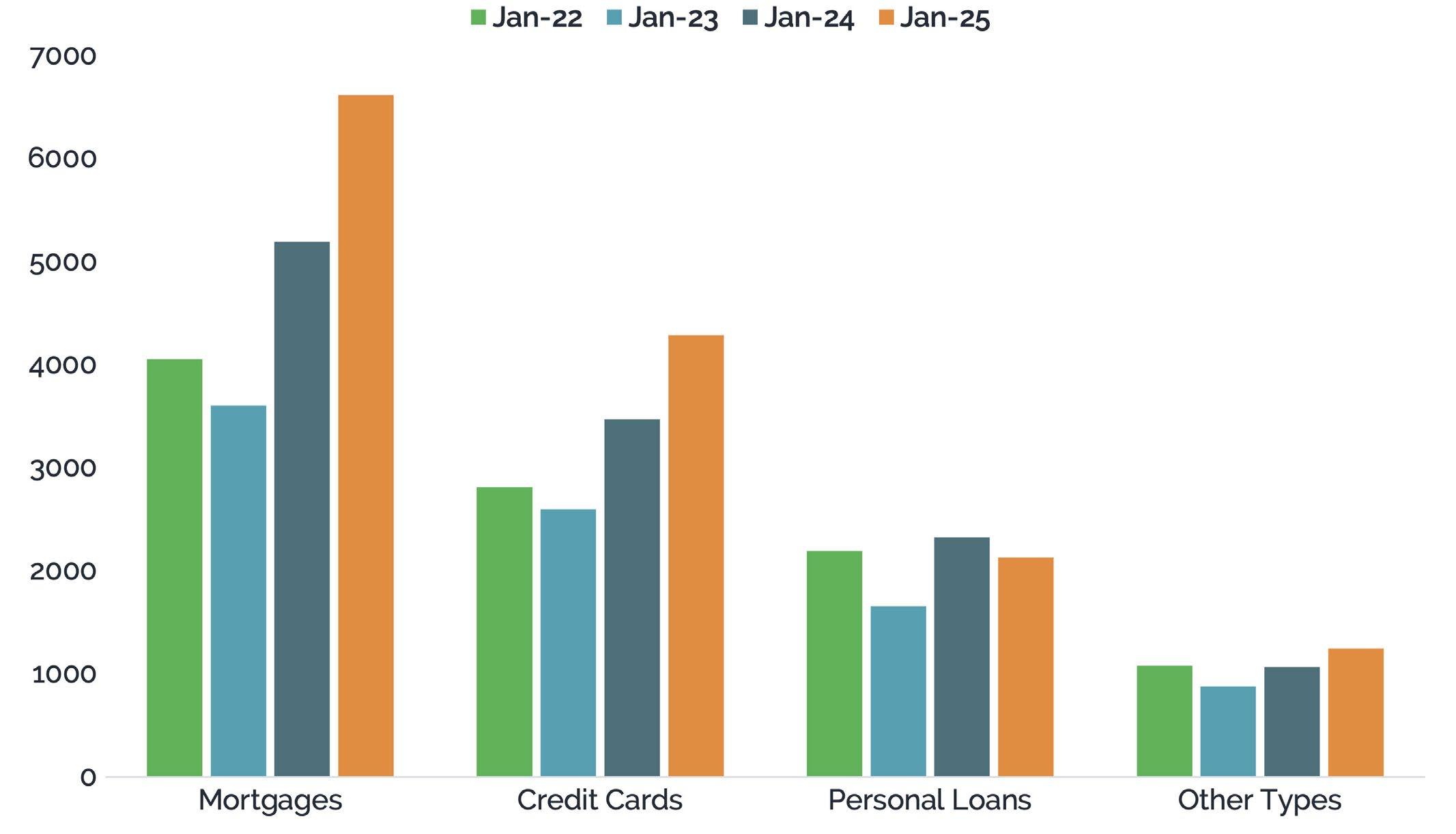

Credit demand and new approved lending on the rise

Consumer credit demand began 2025 1% lower compared to the same period last year. However, festive spending drove increased demand for credit cards, personal loans and BNPL services.

Examining specific credit demand, credit card demand was up 22% year-on-year, whilst demand for auto loans fell 8.4% in January 2025.

Total new, approved household lending grew 12.4% year-on-year, fuelled by rises in both mortgage and non-mortgage lending.

Financial

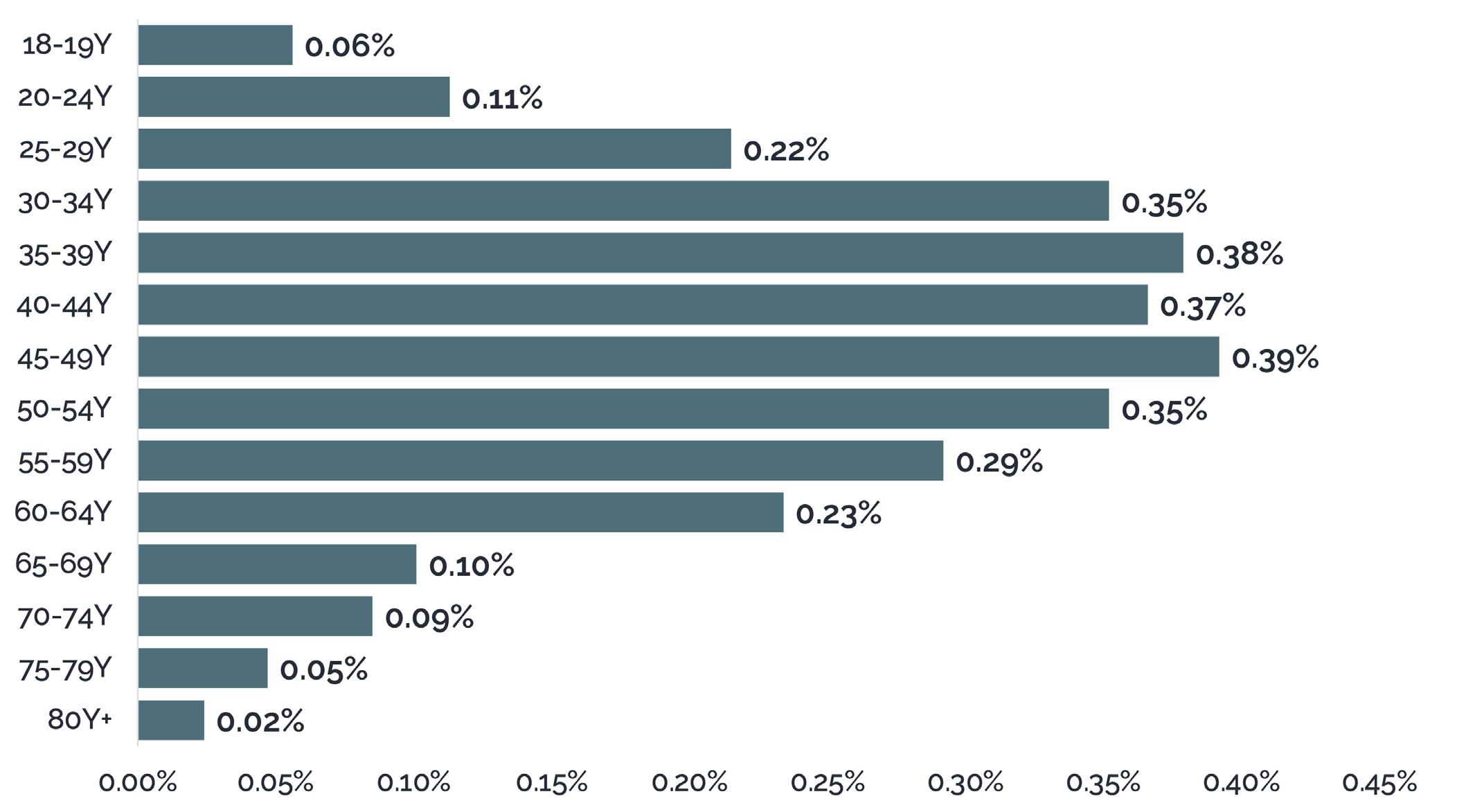

Financial Hardship by Age

New residential mortgage lending increased 13.4% compared to last year but remains 14% below 2021 levels when the property market was at its peak.

Meanwhile, non-mortgage lending – including credit cards, vehicle and personal loans, BNPL, and overdrafts –rose 1.5% year-on-year, largely due to heightened demand during the holiday spending period.

Rising financial hardship cases point to ongoing consumer hardships

Financial hardship remains a significant issue in the credit landscape. Currently, 14,300 accounts are recorded in

financial hardship, marking a 19% increase from the previous year. Nearly half (46%) of these cases involve difficulties with mortgage repayments.

Additionally, 30% of hardship cases stem from credit card debt, while 15% are linked to personal loan repayments.

The highest financial hardship rates are among individuals aged 35 to 49, an age group more likely to have mortgage obligations.

Kiwi businesses continue to bear the brunt of tough economic conditions

New Zealand businesses are continuing to do it tough in the face of turbulent economic headwinds, with business

credit defaults remaining high year-on-year in December 2024.

The sectors most acutely affected include construction, with credit defaults up 40% year-on-year, and the transport industry, with credit defaults up 36% year-on-year. The retail sector, while impacted, shows the least increase with an 8% rise in credit defaults.

Overall company liquidations increased by 36% year-on-year in December 2024. Construction companies continue to face significant challenges, with nearly 200 building firms liquidated in Q4.

Across the board, residential new home builders, restaurants, and property developers

“Overall company liquidations increased by 36% year-onyear in December 2024. Construction companies continue to face significant challenges, with nearly 200 building firms liquidated in Q4.”

have experienced the highest volumes of company collapses during 2024.

This liquidations trend continues to serve as a barometer for the specific economic challenges facing businesses across the country.

While many Kiwis were holding out for economic relief, at this stage it’s unclear exactly what the rest of 2025 has in store for households and businesses.

Looking at the latest credit

trends one thing is clear, some respite would be welcome for many across Aotearoa New Zealand.

*Monika Lacey MICM Chief Operating Officer Centrix Credit Bureau

of New Zealand www.centrix.co.nz

By Ivan Colhoun*

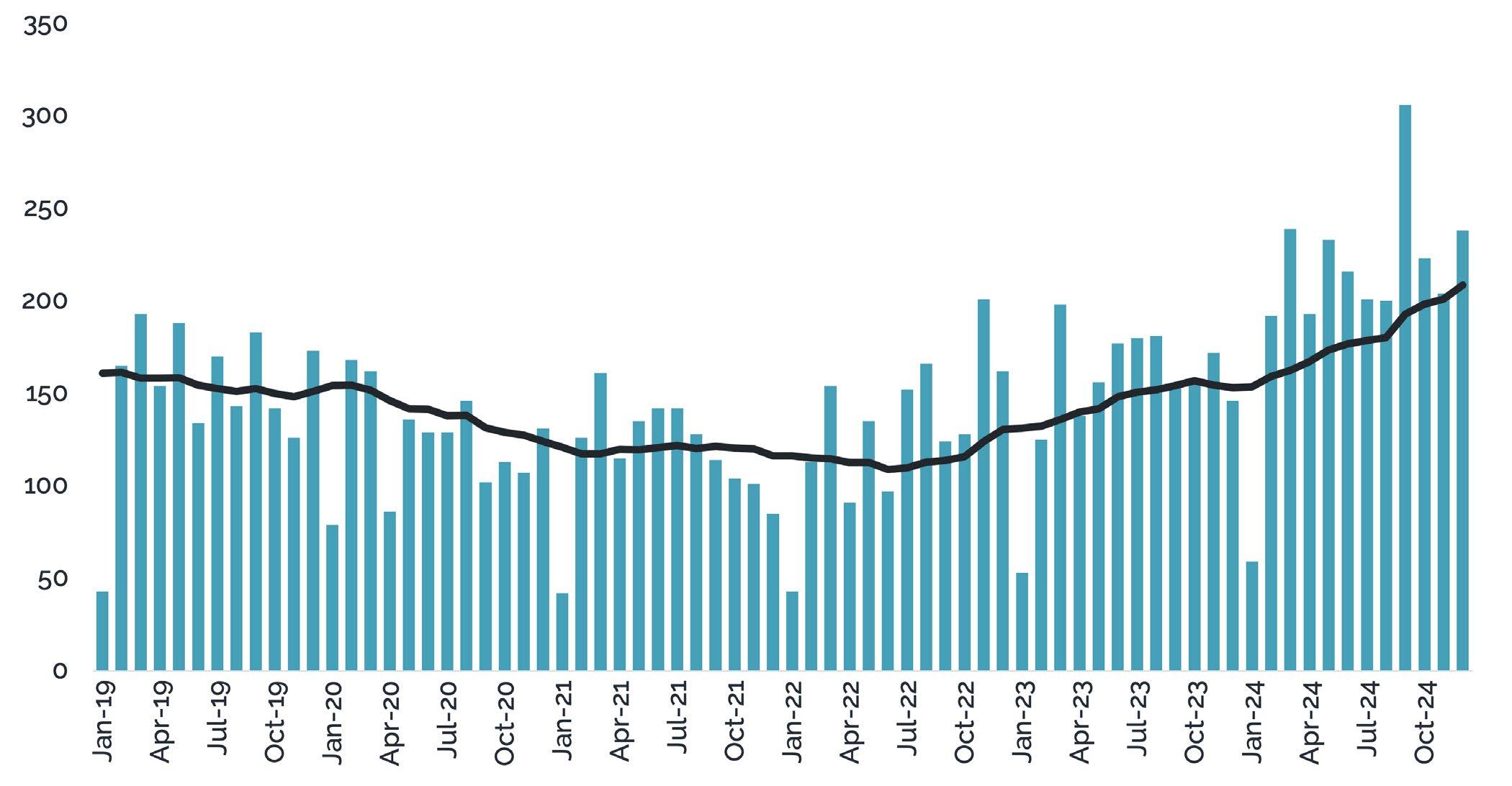

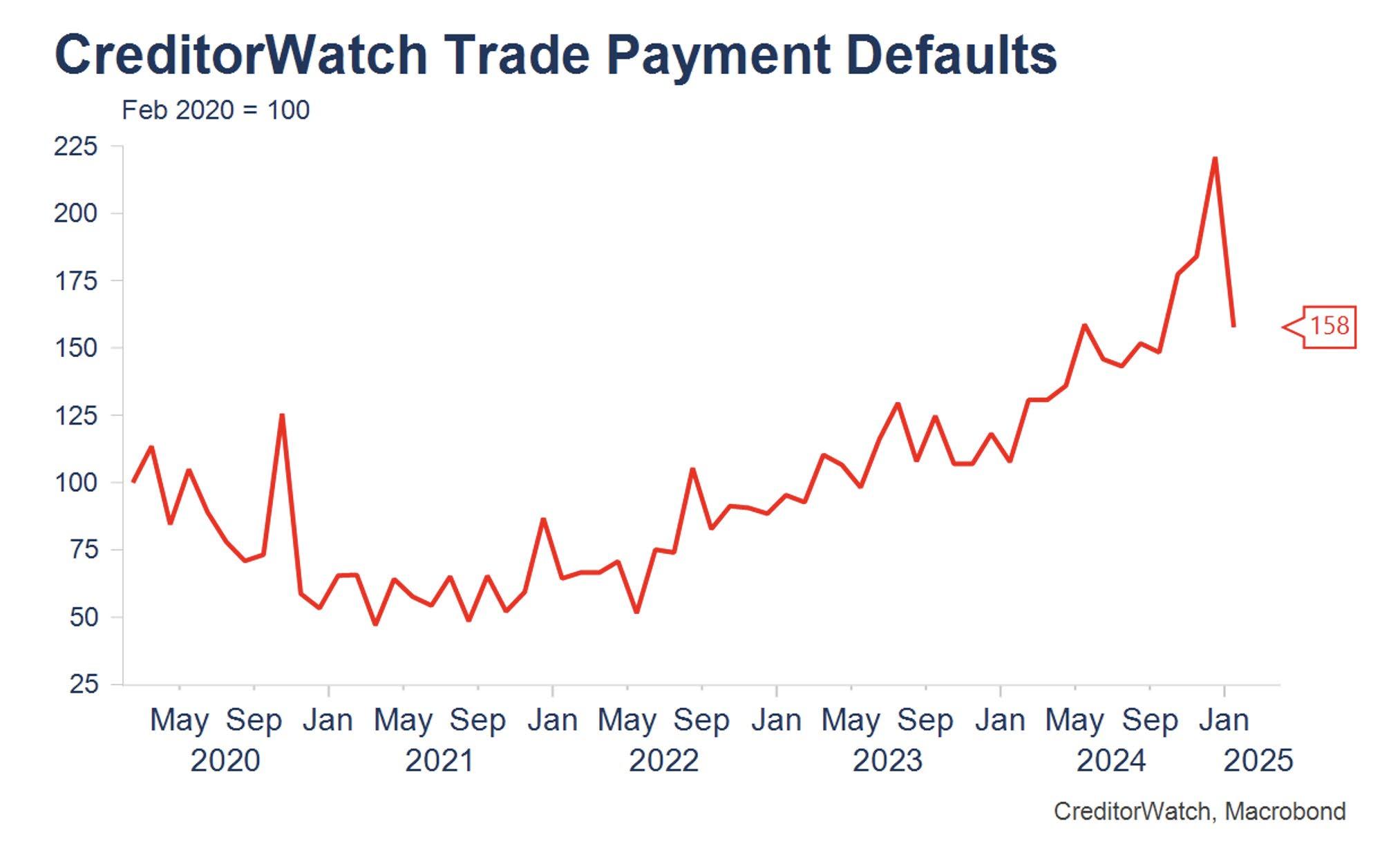

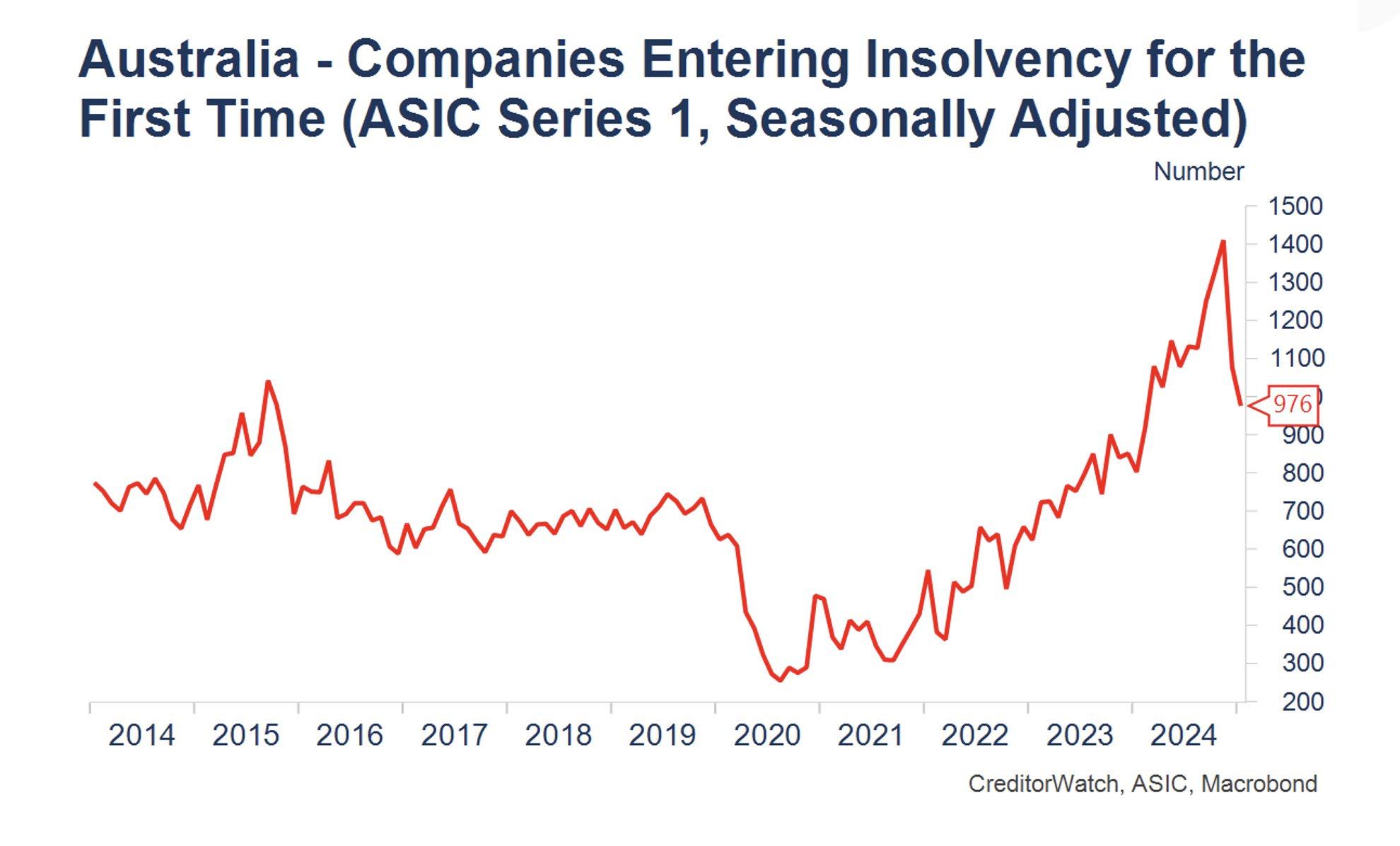

CreditorWatch, has released the January results for its Business Risk Index (BRI), revealing positive signs for Australian businesses at the end of 2024 and early 2025. However, the improvements are likely to be short lived, with the proposed tariff regime of the Trump administration expected to hinder growth, particularly for export-reliant sectors such as manufacturing and transport.

Both CreditorWatch’s proprietary trade payments defaults series (B2B reports of non-payment) and the number of first-time insolvencies reported by ASIC dropped relatively sharply in January, after adjustment for seasonality. Trade payment defaults were at

the lowest level since September last year, while first-time insolvencies were the lowest since February 2024.

After tough conditions during much of 2024, during which insolvencies, late payment times and trade payment defaults all rose, the data suggests Australian businesses had a slightly better end to year.

Positive developments in recent months include a strengthening in retail sales and consumer confidence, likely reflecting the continuing flow-through of the 1 July 2024 tax cuts to the economy, cost of living support and an ongoing strong labour market.

This week’s 25 basis point rate

“Positive developments in recent months include a strengthening in retail sales and consumer confidence, likely reflecting the

continuing flow-through of the 1 July 2024 tax cuts to the economy...

”

cut to 4.1%, the first in five years, will also benefit both consumers and businesses. Despite these positive developments, and a moderation in the rate of inflation, the cost of living for consumers, and of trading for businesses, has not dropped. This will therefore continue to be a pressure for many and is expected to keep insolvencies near recent highs in the near term.

This, of course, is all before the impacts of President Trump’s tariff policies are felt by Australian businesses – and businesses across the globe.

Tariffs – to the extent they are implemented on any country’s goods – act to raise prices for the levying country’s consumers and businesses

(initially in a one-off way) and reduce demand for the foreign producer’s goods in favour of boosting domestic production. The currency of the country levying the tariff tends to increase and the foreign country’s currency tends to fall.

President Trump’s proposed tariff regime is extremely broad, with very high tariff rates. If large and broad-based tariffs are enacted for an extended period (still to be seen), the impact will be higher prices in the US, a stronger US dollar and some switch to domestic production. Other countries will see a reduction in demand for their goods from the US and face weaker currencies.

It is hoped that Australia will avoid much of the direct tariff imposition given we have a trade deficit with the US and are a

strong ally in the Pacific region. This, however, doesn’t mean that we won’t see the goods of other tariffed countries ending up in our markets, potentially at lower prices, and of course the Australian dollar would remain generally weaker in this scenario. Supply chains and trade flows may also reroute significantly over time, potentially adding to shipping costs. All of this has the potential to create additional pressure on manufacturing, wholesale and transport businesses, not to mention the inconvenience for business owners.

It’s too early to be definitive on the scale of the impact because the policies are still being rolled out, however they are generally expected to add to uncertainty and costs at the expense of weaker growth.

The RBA and economists are forecasting a near perfect soft landing for the economy this year. Inflation should moderate sufficiently to allow interest rates to be reduced moderately, which in turn should see growth pick up modestly and ensures the unemployment rate remains very low by historical standards.

Slower population growth, as a result of the government’s policies on foreign students and migration, is likely to act as a drag on growth against the positives of lower interest rates and continuing flow through of the July 2024 tax cuts into the economy.

As noted earlier, the largest uncertainty for businesses and the economic outlook is the effects of Mr Trump’s policies,

“...the largest uncertainty for businesses and the economic outlook is the effects of Mr Trump’s policies, especially his proposed major imposition of tariffs very broadly.”

especially his proposed major imposition of tariffs very broadly. These have the potential to slow growth globally and raise prices in the US, preventing or delaying further interest rate cuts there. They could even reverse previous cuts if inflation re-accelerates in a sustained way.

Supply chains and shipping costs could be significantly impacted, while other major countries might divert some goods subject to US tariffs to other markets including

Australia at discount prices for a time. Overall, added uncertainty and, potentially, cost increases are the likely outcomes if the proposed widescale tariff policy is enacted. That will add additional pressures on some businesses especially in the manufacturing sector.

*Ivan Colhoun Chief Economist CreditorWatch

E: ivan.colhoun@creditorwatch.com.au www.creditorwatch.com.au

By Neill Borg MICM*

Introduction

This white paper explores the growing significance of Environmental, Social, and Governance (ESG) factors in credit risk management. As financial markets evolve, ESG considerations are becoming essential for assessing corporate creditworthiness. The transition from voluntary ESG practices to mandatory climate-related disclosures in Australia marks a pivotal shift. This paper examines the development of ESG frameworks, their impact on risk assessments, and the regulatory landscape shaping the future of credit decisioning.

As climate change and social responsibility gain prominence, investors and lenders are increasingly scrutinising companies’ environmental, social, and governance (ESG)

practices. Once an abstract concept confined to activist circles, ESG has evolved into a critical factor in assessing business creditworthiness. ESG scoring now offers lenders a broader risk profile to consider alongside traditional financial metrics. With mandatory climate-related disclosures on the horizon in Australia, credit risk management is poised for a significant transformation.

Character, one of the 5 Cs of Credit, has traditionally been assessed through a borrower’s reputation, integrity, and track record of financial responsibility. However, in today’s evolving financial landscape, ESG factors are becoming a key extension of character, providing a deeper understanding of a borrower’s ethical and sustainable business practices. Creditors are increasingly recognising that a company’s commitment to ESG principles reflects its long-term stability, risk profile, and overall trustworthiness.

Businesses that prioritise sustainability – such as reducing carbon emissions, managing waste responsibly, and adhering to climate policies -demonstrate forward-thinking governance that mitigates operational and financial risks. Social responsibility, including fair labour practices, diversity and inclusion, and community engagement, speaks to the ethical foundation of a company, reinforcing its reliability as a borrower. Strong governance, characterised by transparency, anti-corruption policies, and regulatory compliance, directly impacts how a creditor perceives a business’s integrity.

Originating in the 1990s through the efforts of activists, nongovernmental organisations (NGOs), and socially responsible

“As climate change and social responsibility gain prominence, investors and lenders are increasingly scrutinising companies’ environmental, social, and governance (ESG) practices.”

investors, ESG frameworks initially aimed to exclude businesses whose operations conflicted with ethical values. Over time, stakeholders recognised that ESG factors could positively influence financial performance, particularly in markets prioritising sustainability and ethical practices.

The 2015 adoption of the United Nations’ 17 Sustainable Development Goals (SDGs) marked a pivotal moment for ESG’s global adoption. These goals offered businesses a framework to address global challenges such as poverty,

inequality, and environmental degradation. ESG gained further traction as major credit rating agencies like Moody’s, S&P, and Fitch began incorporating ESG-related assessments into their credit ratings. This shift allowed lenders to evaluate risk holistically, considering environmental impact, human rights, and corporate governance.

In Australia, regulatory focus on ESG has intensified. Starting 1 January 2025, many large Australian businesses will be required to produce mandatory climate-related disclosures under new government standards. Based on the International

Sustainability Standards Board (ISSB) framework, these measures aim to enhance corporate transparency around climate risks and opportunities. The Australian Securities and Investments Commission (ASIC) has emphasised that climaterelated risks are not only environmental concerns but also material financial risks relevant to investors and lenders.

ESG scores evaluate a company’s impact in three core areas: environmental, social, and governance. These scores reflect factors such as environmental

footprint, employee and community treatment, and corporate governance integrity. Specific metrics can include carbon emissions, board diversity, employee wages, and executive pay.

The World Economic Forum’s ESG metrics are grouped into four categories:

l Governance

l Planet

l People

l Prosperity

Despite their potential, ESG scores face challenges, particularly the lack of standardisation. Different organisations and rating agencies use varying methodologies, leading to

inconsistencies. However, mandatory reporting requirements like those in Australia are expected to drive standardisation, improving the quality of ESG data. These disclosures will require businesses to report climaterelated risks, greenhouse gas emissions, and strategies to address these issues, providing creditors with consistent and reliable information to evaluate environmental risk.

and Credit Risk: A Growing

Incorporating ESG factors into credit assessments has profound implications for risk management. ESG scores help

“Incorporating ESG factors into credit assessments has profound implications for risk management. ESG scores help businesses identify risks not apparent through traditional credit and financial analysis.”

“With mandatory climate reporting in Australia and similar initiatives globally, ESG’s role in assessing financial stability and long-term viability will only grow. Businesses must adapt to these evolving expectations...”

businesses identify risks not apparent through traditional credit and financial analysis. For instance, a company with a poor environmental record may face regulatory fines, reputational damage, or operational disruptions, all of which can impact debt repayment. Similarly, a company neglecting social issues like human rights or employee satisfaction might encounter workforce instability, affecting productivity and financial health.

Mandatory climate disclosures will enhance these assessments by ensuring companies report their exposure to climaterelated risks and opportunities transparently. This will help creditors identify companies well-prepared for the lowcarbon economy transition and flag those facing significant challenges. For instance, businesses heavily reliant on fossil fuels or with poor environmental practices may struggle to secure credit as businesses incorporate longterm risks into their evaluations.

While ESG scores offer valuable insights into a company’s long-term viability, they should complement, not replace, traditional practices. Credit professionals must continue to assess financial health, market trends, and operational stability alongside

ESG factors. For example, a company with a high ESG score may still face financial challenges due to mismanagement or adverse market conditions.

The future of ESG in credit risk management will likely feature increased regulation and standardised reporting. Initiatives like Australia’s mandatory climate-related disclosures aim to prevent “greenwashing” and ensure ESG data accurately reflects risks and opportunities. Standardised frameworks will provide credit professionals with reliable and comparable data for informed decision-making.

Globally, governments and regulatory bodies are driving the establishment of common ESG standards. In Australia, ASIC’s recognition of climate-related risks as material financial risks underscores the importance of addressing ESG factors. These mandatory disclosures, aligned with international standards, are expected to serve as models for other jurisdictions, accelerating global transparency and standardisation.

As ESG becomes integral to credit risk analysis, businesses failing to meet expectations may face significant challenges. Such companies risk exclusion from financing opportunities, higher

capital costs, and reputational damage. Conversely, businesses embracing sustainability and social responsibility are better positioned for long-term success.

ESG has transitioned from a niche concern to a fundamental component of credit risk management. With mandatory climate reporting in Australia and similar initiatives globally, ESG’s role in assessing financial stability and long-term viability will only grow. Businesses must adapt to these evolving expectations, and credit professionals must integrate ESG factors into traditional risk frameworks.

As regulation and standardisation improve, ESG will increasingly shape access to finance and risk evaluation. Integrating ESG into credit assessments enables financial professionals to navigate the evolving landscape responsibly. For businesses, adapting to ESG expectations is no longer optional – it is essential for securing capital and ensuring sustainable growth.

*Neill Borg MICM Country Manager – AU DecisionOK

T: +61 401 066 624

E: neill.borg@credisense.io www.decisionok.com.au

In 2025 we celebrate a remarkable milestone – 10 years of impact and positive change for the Women in the Credit community!

By Debbie Leo MICM, General Manager Sales, Corporate Accounts, Equifax

Since its inception, I have been proud to sponsor the Women in Credit series with my employer, Equifax. Reflecting on the journey thus far fills me and the Equifax team with pride for the progress we have made and the positive changes we have achieved.

In 2025, we celebrate a remarkable milestone – 10 years of impact and positive change for the Women in Credit community. Our theme, “Celebrating 10 Years of Impact,” encapsulates our journey and achievements over this period.

We have been united by a shared vision: empowering, uniting, educating, and creating lasting impact in the lives of our Women in Credit community, while supporting fabulous charities with women at the forefront. Together, we have shown that when passion meets purpose, extraordinary things can happen.

We celebrate not only the successes of the past years but also the incredible people – like you – who have made this journey possible. A special thank you to our supporting sponsors, Anna Taylor from Results, and Lisa Plag from

NCI, as well as the wonderful Councils and WINC committee who make this success possible.

As we look back at the lives touched and the barriers broken, we also look forward – with excitement and renewed commitment. Here’s to a decade of difference – and to many more to come!

Good360

AICM is proud to announce that Good360 Australia is our charity partner for 2025. This year, both Good360 and AICM’s Women In Credit (WINC) initiative are celebrating 10 years of making a meaningful impact – an exciting milestone that makes this partnership even more significant.

Good360 is focused on connecting businesses with surplus goods to people in need. By working with charities, disadvantaged schools, and vulnerable communities across Australia, they redistribute unsold, excess, or disaster recovery goods, helping reduce waste and supporting people facing hardship.

Save the date: WINC Luncheons

VIC 2025 Women in Credit Luncheon

16 May 2025

RACV City Club, 501 Bourke Street, Melbourne VIC 3000

TAS 2025 Women in Credit Luncheon

23 May 2025

Bellerive Yacht Club, 64 Cambridge Rd, Bellerive TAS 7018

WA 2025 Women in Credit Luncheon

6 June 2025

Doubletree Hilton, Waterfront, 1 Barrack Square, Perth WA 6000

SA 2025 Women in Credit Luncheon

20 June 2025

Kooyonga Golf Club, May Terrace, Lockleys, South Australia

NSW 2025 Women in Credit Luncheon

18 July 2025

Strangers Room, NSW Parliament House, 6 Macquarie Street, Sydney

QLD 2025 Women in Credit Luncheon

22 August 2025

Rivershed and Deck, Howard Smith Wharves, 5 Boundary Street, Brisbane City, Qld 4000

Good360 Australia is proud to be named the Australian Institute of Credit Management’s (AICM) charity partner for 2025.

This year, both Good360 and AICM’s Women in Credit (WINC) initiative are celebrating 10 years of making a meaningful impact – an exciting milestone that makes this partnership even more significant.

Who is Good360 Australia?

Good360 is a not-for-profit focused on connecting businesses with surplus goods to people in need. By working with charities, disadvantaged schools, and vulnerable communities across Australia, we redistribute unsold, excess, or disaster recovery goods, helping reduce waste and supporting people facing hardship.

Our mission is simple: ensure that surplus goods and services of businesses reach people in need, rather than being wasted or sent to landfill. The result is a “Circle of Good” that reduces both need and waste, benefiting people and our planet.

Founded in 2015 by Alison Covington AM, Good360 Australia was inspired by the US based model, which has been operating since 1983. Alison discovered the concept in 2012 and was struck by its potential. “The Good360 model ticked all the boxes for me,” says Alison. “It was innovative, efficient, technologically advanced and could make a real difference

“Our mission is simple: ensure that surplus goods and services of businesses reach people in need, rather than being wasted or sent to landfill. The result is a “Circle of Good” that reduces both need and waste, benefiting people and our planet.”

in Australia. It allowed me to leverage my corporate skills for a cause that could support everyone.”

Why we do what we do: reducing need and waste

In Australia, a staggering $2.5 billion worth of household goods are wasted each year, according to a Deloitte Access Economics report commissioned by Good360 Australia. At the

same time, 1 in 8 Australians live below the poverty line, and the rising cost of living is putting more people into financial distress, creating greater need.

How we make a difference Good360 provides a smart solution to surplus inventory by helping businesses redirect excess goods to people in need. Goods range from seasonal stock, outdated branding, to

items with minor packaging damage – all of which are still fit for purpose. These products include clothing, homewares, hygiene items, toys, games, and even digital devices. By reducing waste and supporting people in need, Good360 helps create a circular economy, ensuring that products are used as long as possible while meeting the needs of vulnerable communities.

Since launching in 2015, Good360 has partnered with leading Australian brands to distribute over 43 million new items to 4.6 million people across four key areas of need: Education, Home, Hygiene, and Play. With a network of over 4,700 registered charities and disadvantaged schools, including Domestic Violence, Homelessness and

Mental Health, we ensure that these essential goods reach the right people, at the right time.

Alison’s leadership has been instrumental in Good360’s growth. In 2021, she was recognised with several prestigious awards, including Western Sydney Woman of the Year and NPF’s Third Sector CEO of the Year. In 2022, she was appointed a Member of the Order of Australia (AM) for

“Since launching in 2015, Good360 has partnered with leading Australian brands to distribute over 43 million new items to 4.6 million people across four key areas of need: Education, Home, Hygiene, and Play.”

her service to social welfare and sustainability, and in 2024, she received the Jennifer Westacott AO Woman of Western Sydney Award.

Reflecting on the last decade, Alison says, “It’s been a journey of hard work, collaboration, and learning, but we’re changing the way people think about giving.”

Looking to the future, Good360 remains committed to creating a country where nothing goes to waste and everyone has access to the essentials they need. There is plenty to go around, and we believe that by working together, we can make a meaningful difference. You can join our Circle of Good by donating surplus goods, volunteering, or making a financial contribution. Every $1 donated delivers $20 worth of goods for people in need.

Don’t miss the opportunity to hear Alison speak at your local Women in Credit (WINC) event in the coming months. Alison’s story of turning passion into action is a powerful reminder of what we can achieve when we come together to make a difference. She will inspire you to take action in the communities where you live and work, challenge the status quo, and show how each of us has the power to create positive change. Join us and discover how you can play a part in building a more sustainable, supportive future –for people and our planet.

Find out more about Good360 Australia by visiting our website at good360.org.au

By Alex Caruana MICM*

Debt collection in Australia has evolved significantly over the past few decades, shaped by the changing needs and expectations of different generations. From Generation X to Generation Alpha, shifts in technology, economic conditions, and regulatory frameworks have driven major transformations in how debt recovery is approached. This article explores the journey of debt collection through each generation.

GENERATION X AND EARLY MILLENNIALS: THE 1980s AND 1990s

The 1980s and early 1990s were challenging economic times for Australia, marked by periods

of high inflation, interest rates, and recessions. In the 1981-1982 recession, rising unemployment put pressure on households, resulting in increased debt defaults. By the mid-1990s, the economy began to recover, driven by consumer spending, but with that came a rise in household debt, particularly from credit cards.

In the 1980s, debt collection heavily relied on traditional communication channels, such as landline phone calls and written letters. Demand letters were frequently used to formalise debt recovery, often delivered by post. Field agents were commonly dispatched for in-person visits, particularly for larger debts or unresponsive

“From Generation X to Generation Alpha, shifts in technology, economic conditions, and regulatory frameworks have driven major transformations in how debt recovery is approached.”

“In the 1980s, debt collection heavily relied on traditional communication channels, such as landline phone calls and written letters. Demand letters were frequently used to formalise debt recovery, often delivered by post.”

customers. Debt collection technology was still basic, relying on manual processes like typewriters and manual dialling for phone calls.

As Australia entered the 1990s, technology began to shift. While phone calls and letters remained the primary methods of communication, the rise of early mobile phones and email started to change how debtors were contacted. Field agents continued to be used for large or critical debts, and outsourcing debt collection to specialised agencies grew in popularity. By the end of the

90s, fax machines began to decline in use as newer digital methods, including early CRM systems and automated diallers, took hold.

The late 1980s saw the introduction of basic computer systems and early databases for tracking debts, though paper-based systems were still prevalent. The Privacy Act 1988 introduced important guidelines for handling personal information, influencing how debt collectors stored and

managed customer data. The establishment of the Australian Collection Services Association (ACSA) in 1983 formalised ethical standards within the industry. By the 1990s, debt collection technology had improved. Simple databases and CRM systems became widespread, allowing agencies to automate some processes, such as dialling and managing communication. The Trade Practices Act saw amendments throughout the 90s, with more formal consumer protection measures and state-based licensing for debt collection agencies.

During both the 1980s and 1990s, debt collection practices were assertive, often prioritising swift recovery. Legal action or repossession was common for larger debts, especially in sectors like automotive finance and commercial debt. In the 1990s, this aggressive approach continued, with legal action escalating quickly for larger accounts. However, by the end of the decade, hardship arrangements started to surface in sectors like utilities and banking, acknowledging the need for more flexibility in handling customer financial difficulties.

The 2000s brought economic growth in Australia, but the Global Financial Crisis (GFC) in 2008 led to a surge in defaults and financial hardship. Many consumers faced unemployment or reduced incomes, highlighting the need for more empathetic and flexible debt collection strategies. In response, tighter regulations were introduced to protect vulnerable consumers from overly aggressive debt recovery practices.

The 2000s saw a shift in how debt collectors communicated with customers. Email and SMS became the primary methods of contact, especially for younger generations like Millennials, who were more comfortable with digital communication.

Phone calls were still important, but digital tools, such as online portals, began to replace traditional methods for initial contact and payment arrangements. SMS became a popular tool to reach hard-tocontact customers and prompt payments, and while field agents were still used, they were typically reserved for high-priority accounts.

“The 2000s brought economic growth in Australia, but the Global Financial Crisis (GFC) in 2008 led to a surge in defaults and financial hardship. Many consumers faced unemployment or reduced incomes, highlighting the need for more emphathetic and flexible debt collection strategies.”

The rise of advanced computer systems, the internet, and customer relationship management (CRM) software allowed debt collection agencies to operate far more efficiently. Data analytics began playing a role in debt collection, helping agencies target customers more effectively and improve recovery rates. Debt collection portals and selfservice platforms emerged, allowing customers to manage their accounts and make payments online.

Following the GFC, the National Consumer Credit Protection Act 2009 introduced stricter regulations around responsible lending and debt collection practices. Debt collectors were required to offer

flexible repayment options to customers facing hardship. The Australian Competition and Consumer Commission (ACCC) and the Australian Securities and Investments Commission (ASIC) increased their oversight, ensuring transparency and fairness in debt collection practices.

Debt collection strategies in the 2000s shifted toward negotiation and flexibility. Many agencies began offering hardship programs to help struggling customers manage their obligations. Automation became widely adopted for routine communication, with automated messages and payment reminders becoming standard practice. The aggressive legal tactics of earlier decades became less common, as agencies were encouraged to work with customers to find manageable solutions.

AND GENERATION Z: THE 2010s

Australia experienced steady economic growth and low interest rates throughout much of the 2010s, but high household debt remained an ongoing challenge. New credit products, such as Buy Now Pay Later (BNPL) services, emerged, introducing more complex types of consumer debt that required new strategies in debt recovery. The gig economy also became prominent,

“Technological advances like artificial intelligence (AI), machine learning, and data analytics transformed debt collection in the 2010s. Online self-service portals became more sophisticated...”

making income streams more unpredictable and debt collection more challenging.

During the 2010s, email and SMS became the most common methods for contacting customers, particularly younger generations like Millennials and Generation Z. Social media and mobile apps were explored as additional communication channels, though privacy and compliance concerns limited their widespread adoption. Field

visits became less frequent, as digital tools allowed for more effective remote communication and resolution. However, field agents were still used for larger or more difficultto-reach customers.

Technological advances like artificial intelligence (AI), machine learning, and data analytics transformed debt collection in the 2010s. Online self-service portals became

more sophisticated, allowing customers to manage their accounts, negotiate payments, and set up arrangements without human intervention. Mobile apps and real-time communication, such as text messaging systems, improved customer engagement and response rates. AI-powered chatbots also began handling routine inquiries and account updates.

ASIC and the ACCC continued to enforce fair debt collection practices, with a particular focus on vulnerable consumers. Data privacy regulations became more stringent, and debt collection agencies had to ensure compliance with the Privacy Act 1988 and subsequent

amendments. New customercentric guidelines encouraged agencies to prioritise ethical debt recovery practices, emphasising empathy and customer wellbeing.

Debt collection in the 2010s became increasingly flexible and empathetic. Agencies focused on understanding individual customer circumstances and tailoring repayment plans accordingly. Legal action was used only as a last resort, while datadriven approaches helped agencies determine the best communication timing and recovery strategies to maximise results.

As we move into 2024 and beyond, the Australian economy faces ongoing challenges, such as inflation, fluctuating interest rates, and uncertainties in global markets. Cryptocurrencies, fintech, and decentralised finance (DeFi) are also emerging as new financial tools, adding complexity to debt collection. Household debt remains high, and new credit models, such as BNPL and peer-to-peer lending, complicate traditional debt collection methods.

Communication with customers is increasingly automated, with AI-driven chatbots, SMS, and app notifications dominating contact methods, especially for Generation Z and Generation Alpha, who expect seamless, mobile-first interactions. Personalised digital outreach has become critical, with collectors tailoring messages to individual customer behaviour and preferences. Self-service portals, mobile apps, and real-time payment tracking have become essential tools for customer engagement and providing flexible repayment options.

“Debt collection in the 2010s became increasingly flexible and empathetic. Agencies focused on understanding individual customer circumstances and tailoring repayment plans accordingly.”

AI, machine learning, and big data analytics are expected to dominate the debt collection landscape, allowing agencies to predict customer behaviour and optimise engagement.

Automation handles most routine communication, freeing human collectors to focus on more complex cases. Blockchain and decentralised technologies are also likely to influence debt management and recovery, improving transparency and security in financial transactions.

Consumer protection laws continue to evolve, with a strong focus on data privacy, ethical debt recovery, and supporting vulnerable individuals.

Regulators like ASIC and the ACCC are increasing their focus on ensuring that AI-driven communication complies with legal and ethical standards. Environmental, Social, and Governance (ESG) considerations are expected to play a larger role in shaping responsible and fair debt collection practices.

Empathy, personalisation, and flexibility will be key to future debt collection practices. AI will play a larger role in determining

“As we move into 2024 and beyond, the Australian economy faces ongoing challenges, such as inflation, fluctuating interest rates, and uncertainties in global markets. Cryptocurrencies, fintech, and decentralised finance (DeFi) are also emerging as new financial tools...”

the best times and methods to contact customers, offering personalised settlements or payment plans based on individual circumstances.

Proactive communication, supported by data analytics, will be essential for successful debt recovery, ensuring that customer well-being remains a top priority.

This journey through the evolution of debt collection shows how changing economic conditions, technological advances, and generational expectations have shaped the industry’s approach. Each generation has brought new

challenges and opportunities, driving the evolution of more flexible, empathetic, and technologically driven debt recovery practices.

By embracing change we can learn from the past and plan for the future ensuring we engage in the most effective and appropriate manner that ultimately will lead to a successful outcome for both industry and consumers.

*

Alex

Caruana MICM

Director – Business Development

Credit Collections Services Group Pty Ltd

E: alexcaruana@ccsgroup.com.au www.ccsg.com.au

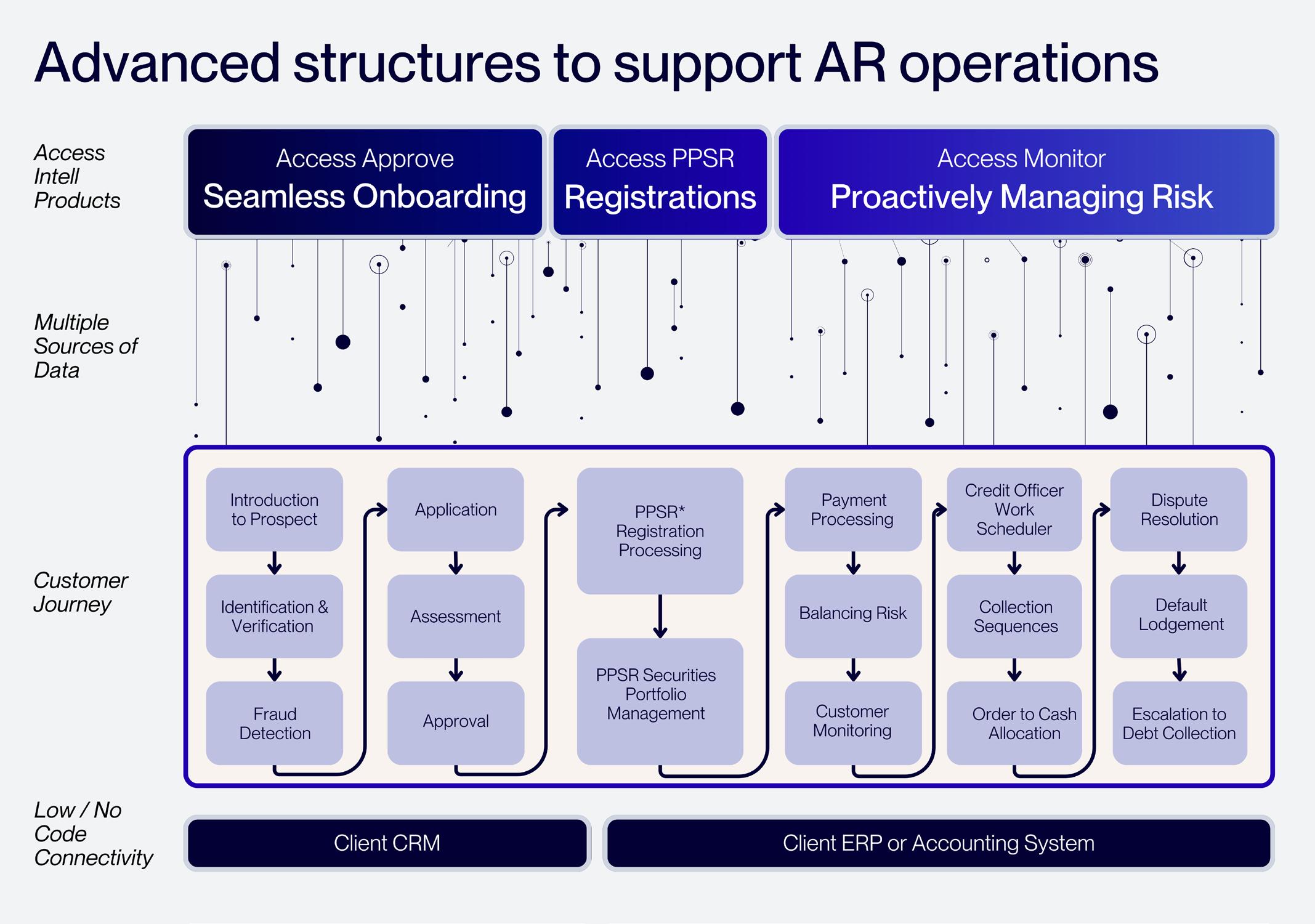

With insolvency levels as they are, PPSR Processing and Risk Monitoring are topics regularly on the credit agenda. In this, Part 2 of our Trends in Credit and AR Technology, Lynne Walton MICM examines how workflow automation, data integration and connectivity are improving speed and efficiency and reducing risk and cost in top performing trade credit management processes.

Access Intell partners with businesses of all sizes, across a range of industries, and addresses a wide range of challenges, limitations, and restrictions within its diverse client portfolio. This broad experience gives them a unique perspective on industry trends.

Access Intell’s CEO and Founder, Lynne Walton, finds it no surprise that top-performing credit and finance teams are embracing highly connected, integrated solutions that prioritise data configuration, information flow, interpretation and automated action to streamline processes and enhance controls.

In this three-part article series, Lynne delves into some of the solutions being adopted and discusses some key considerations required before installing systems to automate processes. Part 2 focuses on the second stage of a customer journey – PPSR Processing and Risk Monitoring – and outlines the innovative solutions driving improvements in productivity and efficiency.

PPSR – cost versus benefit

Not every business sees value in registering on PPSR. For service businesses there probably is little value but for all others there are benefits – some significant.

“Not every business sees value in registering on PPSR. For service businesses there probably is little value but for all others there are benefits –some significant.”

“The PPSA greatly improves the position of suppliers who use retention of title as part of their risk management framework.”

For equipment finance, hire or rental businesses, there is considerable risk which needs to be mitigated by registration or by imposing operational restrictions. For suppliers of goods subject to retention of title (‘ROT’), the decision involves measuring the cost (and not just the monetary outlay) of compliance against the benefit derived from becoming a secured creditor.

First, let’s look at the benefits. The PPSA greatly improves the position of suppliers who use retention of title as part of their risk management framework. As a secured creditor, suppliers of goods can expect to have:

1. Legal priority rights to goods delivered which have not been paid for,

2. Rights in manufactured

goods, co-mingled goods or goods affixed to other personal property,

3. Priority rights to proceeds derived from the sale of goods,

4. Defence against a voidable preference claim by a liquidator, and,

5. A solution to prevent ‘absconding’ debtors selling their business and leaving your debt unpaid.

PPSA can be of tremendous benefit to ROT suppliers, but the benefit must be considered alongside the cost.

The cost to a business of registering on PPSR is rarely just a monetary one. There is administrative time likely to be spent in processing registrations, dealing with queries and in

enforcing rights as a secured party. There may also be legal fees associated with the process. Having considered all this and made the decision to register, suppliers are then faced with the challenge of processing hundreds and often thousands of registrations to PPSR. Many falter, finding the task arduous, but it need not be. Technology to minimise the initial upload task is available. A word of caution – make sure the data is being cleansed to append the correct PPSR grantor identifier and that the upload profile is correct to avoid a costly error. Once the initial upload is completed, many systems can process registrations automatically upon new account approval to minimise the ongoing work involved.

Having taken the decision to register, there are PPSR portfolio management tasks that need to be undertaken including processing renewals as registrations move towards their expiry date.

Two advances in PPSR technology in recent times have been in:

l compliance monitoring – ensuring registrations processed are correct and enforceable, and l automated active account renewal processing – digitally ensuring accounts are active before automatically processing PPSR renewals.

To further explain, the most common PPSR errors found are for serial numbered goods (errors in VINs), profile errors (ticking the incorrect boxes) and grantor identification errors.

One PPSR system is now able to identify and flag errors in registrations to enable users to correct the registration (where PPSR allows) or take alternative action to restore security in another way. This revolutionary advancement will make PPSR errors a thing of the past.

Monitoring customer risk to many means the receipt of hundreds and sometimes

thousands of ‘alert’ emails into an inbox every week signifying that ‘increased risk’ exists. These could be triggered by significant events such as the business becoming reportable under the ATO Disclosure of Business Tax Debts regime or an external administrator being appointed.

However, they are more likely to be insignificant e.g. the business has lodged an annual return, or a director has changed their address.

Credit professionals are demanding much more advanced solutions than this and technology providers are listening and innovating.

Three areas where risk monitoring technology has advanced is in:

l Configuration and choice – gone are the days when businesses chose one source of information, such as a credit bureau, to make decisions. Potentially missing out on critical information held by another bureau. Today’s credit professionals are demanding choice and configuration alongside automation. When it comes to deciding what information is relevant to its industry sector, customer type or exposure values and what can be ignored, technology providers are putting the control where it belongs.

l Visualisation – fragmented information delivered into email inboxes is no longer acceptable to forward focussed credit teams. They want to see where their risks and opportunities lie in their debtor book, and they want to see why.

l Action – historically, customer risk monitoring systems stood alone. Their job was to notify users of risk in a fixed customer list and their task ended

when they sent the alert email. Advancements in system integrations mean that risk detection can be dynamic and can trigger action steps to flow into diaries, CRMs, ERPs, finance systems, credit officer workbenches, external providers and many others. These can be customised to suit the customer group, be automated or manual and sit inside or outside a dunning cycle.

In summary, technology and automation in trade credit management is advancing at great speed. Credit professionals can take advantage of these developments in modular form – meaning they can implement solutions needed today (for example PPSR and monitoring) to suit urgent needs and plan what is next

in a staged approach to meet the future aspirations of the business. These are exciting times to be in credit.

Stay tuned for Part 3 in the next edition, covering Payments, Cash Allocation and Collections.

Lynne Walton MICM is the founder and CEO of Access Intell. Lynne was an Insolvency Practitioner for 15 years with Ernst & Young and KPMG in Scotland and BDO and PPB Advisory in Australia. She left the insolvency profession in 2010 to specialise in the PPSA and PPSR and founded the EDX (QLD) business which became Access Intell in 2018.

Access Intell helps businesses make wise credit decisions, manage risk and ensure they get paid using advanced process automation. The Access Intell platform transforms globally sourced data into risk intelligence to help businesses extend credit safely. Their cost-effective products deliver awareness and automation at every stage of the customer life cycle, from onboarding and assessment to PPSR and ongoing monitoring.

“One PPSR system is now able to identify and flag errors in registrations to enable users to correct the registration (where PPSR allows) or take alternative action to restore security in another way.”

President’s Report

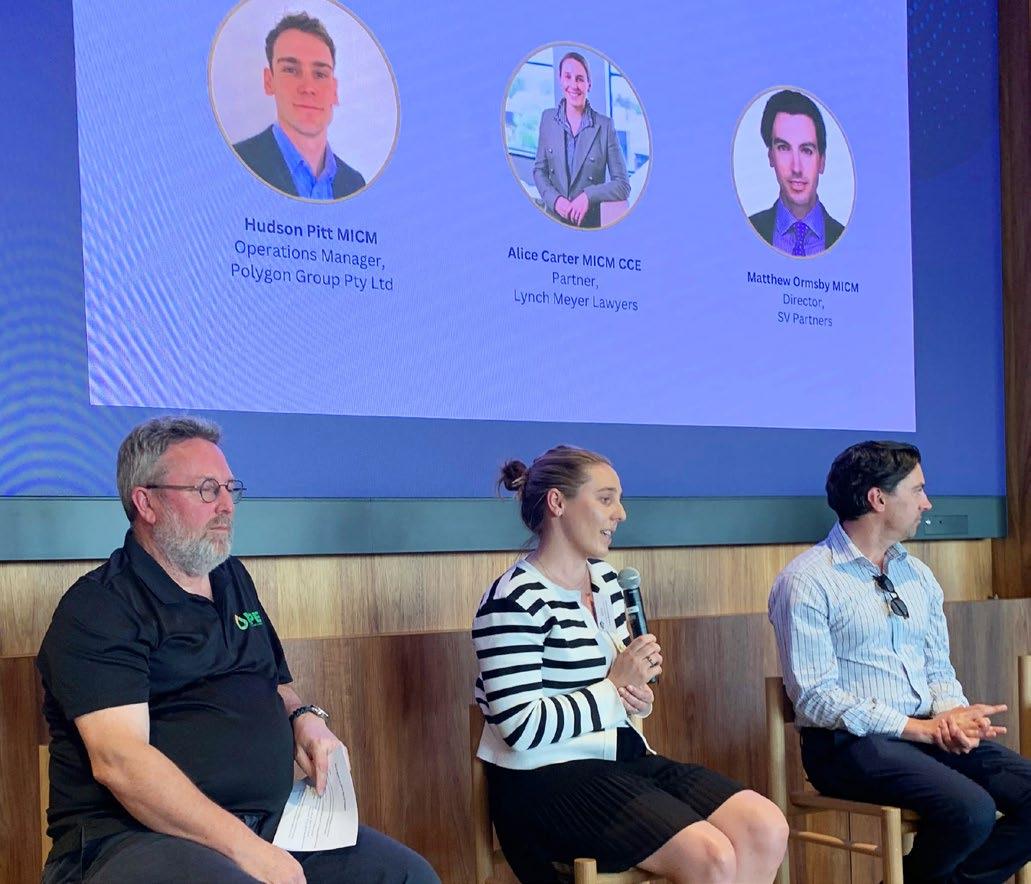

2024 was an outstanding year for the SA Division Council. Hudson Pitt from The Polygon Group was honoured with the 2024 National YCPA Award and the SA Council proudly took home the Presidents Trophy for 2024. These accolades highlight the Council’s unwavering dedication to the AICM and the promotion of credit management in South Australia.

The final event of the year, the Credit Nexus, was held at Coopers Brewery in Regency Park on 21 November 2024. A big thank you to Lisa Anderson and Elizabeth Dobbie for their exceptional organisation of this event. Attendees were inspired by Mel Cooper’s story, the first female and fifth-generation member to be permanently employed at Coopers Brewery. Mel shared the trials and triumphs of the brewery, making it a memorable conclusion to the year’s events.

at Lynch Meyers Lawyers, Adrian Stewart, who stepped in at the last moment, and Matthew Ormsby, Director of SV Partners. The discussion emphasised the importance of resilient customer relationships and proactive measures in credit management during challenging economic times.

The Credit Panel discussion was both engaging and insightful, facilitated by Robin Matters, the panel featured Alice Carter, Partner

A special recognition was given to James Neate from Lynch Meyer Lawyers, narrated by Trevor Goodwin. James has been a cornerstone of the AICM and SA Council and his dedication

was celebrated with numerous stories from past years. Rob Jackson presented James with a 30-year recognition award, marking an honourable occasion.

Additional awards were presented to Alice Carter who was elevated to Fellow of the AICM (FICM) and Debra Foster MICM, who was recognised for 20 years of membership.

The first event of 2025 is the SA Division Barefoot Bowls on March 14th at Torrensville Bowling Club.

This event promises fun with attendees showcasing their bowling skills and winning fantastic prizes. A BBQ will be included, ensuring no one goes

hungry. We look forward to networking and meeting all attendees.

An exciting lineup of events is planned for 2025, including the SA Economic Update – Risk Seminar in March, the WINC Luncheon in May, the SA Trivia Night in July, and the YCP and CP Awards night in August. We encourage all emerging talented YCPs and seasoned professionals to apply for the awards as it is a great opportunity to gain recognition for their achievements. These events will also provide a wonderful platform for credit professionals to come together and celebrate each other’s successes.

We eagerly anticipate another successful year in 2025!

Elizabeth Dobbie MICM

My career in credit began at Westpac where I worked in Collections and Hardship, assisting clients with their mortgage and credit card repayments. I later advanced to a team leader position where I took great satisfaction in mentoring my team and contributing to the development of projects that streamlined the collections process. In my current role at NCI I have found both challenges and rewards that have allowed me to expand my skillset. NCI has allowed

me to draw on my previous background in client service and portfolio management focusing on building strong relationships and helping clients protect their businesses.

What is your biggest professional accomplishment to date?

My most significant career accomplishment has been being named a Division Finalist for the Young Credit Professional of the Year. This recognition has deepened my passion for credit and reinforced my commitment to helping clients protect their businesses. I am also motivated to serve as a mentor for young professionals, particularly young women in the workforce. I am dedicated to ensuring that sustainability and environmental considerations are at the forefront of our work, alongside a strong emphasis on excellent customer service and sound credit practices.

What advice can you give to emerging credit professionals?

My key advice is to find your rhythm, seek out mentors, and never hesitate to ask questions. Cultivate your passion and pursue your goals with determination. With a wealth of knowledge available and many experienced role models around us there is an endless opportunity to learn. Embrace as much as you can and identify a cause or area that inspires you. I firmly believe that when we are passionate about our work, we excel in it.

What has been your biggest professional challenge to date?

My most significant career challenge to date occurred during the COVID-19 pandemic in 2020, when I was forced to make a complete career transition. Like many others, this period represented a significant upheaval in my life. I transitioned from client service and management in the travel industry, which was severely impacted by border closures and travel restrictions, to the finance sector, taking on a role in Collections and Hardship at a bank. Although the shift in industry was drastic, I applied my own advice: I focused on finding my rhythm and an area of passion within the finance industry. I embraced this challenge as an opportunity to develop new skills and transformed a time of uncertainty into a defining moment in my career.

What has being a member of the AICM done for you?

Being a member of AICM has significantly expanded my horizons in terms of knowledge, professional relationships, and opportunities. It has introduced me to a wealth of resources, information, and courses that have enhanced my skills and expertise. I’ve also forged valuable connections with other members who I appreciate both professionally and personally. This community has allowed me to connect with like-minded individuals in my field providing me with mentors and confidants I can rely on for guidance and support.

For fun, I’m obsessed with my dog, my family and my chosen family (my friends). I have a very active social life but when I am not spending time with any of the aforementioned, I am at the beach, reading my books, or dancing in Choo La La on stage (which coincidentally involves my friends). Good food, better wine and the best company are how my weekends are usually spent.

The Australian Institute of Credit Management welcomes our Partners for 2025 National Partners

Division Supporting Sponsors

Our National, Divisional and Professional Partners support and work with the AICM to promote the Institute’s activities, represent the Credit Industry and develop the careers of all Credit Professionals. As these organisations support your Institute and your Industry please consider them when you require assistance.

To all of our valued Members,

As we step into 2025, I want to take this opportunity to warmly welcome you all to another year with our professional credit management community. Reflecting on 2024, it was a year of both challenges and achievements. The economic landscape in Western Australia presented its fair share of complexities, yet through resilience, adaptability, and professional dedication, we have navigated these obstacles together.

Credit professionals play a critical role in the financial ecosystem, and in the face of economic uncertainty, your expertise and commitment have ensured stability and progress. I want to acknowledge each and every one of you for your perseverance, professionalism, and contributions to the industry.

Looking ahead, we are committed to supporting you throughout 2025. The AICM will continue to provide opportunities for professional development, networking, and knowledge-sharing. Through our seminars, industry events, and recognition programs, we aim to keep you informed of the latest trends, regulatory changes, and market dynamics that impact our profession.

This year, we encourage you to take full advantage of the events and resources available. Whether it’s attending our Risk & Economic Seminar, participating in the WA Awards Night, or joining discussions on cybercrime and fraud prevention, there will be ample opportunities to engage with peers, expand your expertise, and strengthen your professional network.

Credit management is evolving rapidly, and

6 June 2025

Thursday, 14 August

staying informed is key to success. As an Institute, we remain dedicated to equipping you with the knowledge and connections necessary to thrive in an ever-changing environment. Our community is built on collaboration and support, and together, we will continue to elevate the standards of our profession.

I look forward to seeing you at our upcoming events and working alongside you in the year ahead. Thank you for your continued commitment to the credit management industry. Here’s to a successful and rewarding 2025!

– Cheri Bowater MICM CCE WA Division President

As we step into the new year, AICM are excited to present a lineup of exceptional events designed to bring together professionals in the credit management community in WA. These gatherings will provide valuable insights, networking opportunities, and industry recognition.

Mark your calendars and join us for another year of learning, collaboration, and celebration!

March: Risk & Economic Seminar

This seminar is a cornerstone event for those in the credit and finance sectors, offering an

in-depth analysis of the current economic landscape. Attendees will hear from local industry experts on the latest trends in credit risk, legal developments, and insolvency updates. With dedicated networking sessions, this event provides an excellent opportunity to connect with peers, exchange ideas, and discuss strategies for navigating economic challenges.

A much-anticipated event, the Annual Golf Day offers an enjoyable mix of competition and camaraderie. Whether you’re an experienced golfer or picking up a club for the first time, this day provides a fantastic way to engage with colleagues and industry professionals outside of the office. Prizes, refreshments, and a relaxed atmosphere make it a must-attend social event.

This luncheon celebrates the invaluable contributions of women in the credit management field. The event will feature distinguished speakers sharing insights into leadership, career growth, and industry advancements. It is an empowering and inspiring gathering, offering an excellent chance for networking and recognising the achievements of women who make a difference in the profession.

One of the premier highlights of the year, the WA Awards Night honours the outstanding achievements of our professionals in the credit industry. The event will recognise both the Young Credit Professional of the Year and the Credit Professional of the Year in WA. With a formal dinner, guest speakers, and an engaging awards ceremony, this is a prestigious event that celebrates excellence, hard work, and dedication in the field.

With cyber threats on the rise, staying informed is crucial. This breakfast session, presented in collaboration with the WA Police, will cover the latest in cybercrime and fraud prevention. Attendees will learn about emerging threats, best practices for safeguarding financial data, and

strategies to prevent fraudulent activities. This is an essential event for anyone looking to enhance their knowledge and preparedness in an increasingly digital world.

The perfect way to close out the year, the End of Year WA Sundowner is a relaxed and enjoyable networking event. It’s an opportunity to reflect on the year’s achievements, strengthen professional relationships, and unwind in a casual setting. With great company, drinks, and entertainment, this event is an ideal way to celebrate the hard work and successes of the credit management community.

We look forward to seeing you throughout the year at these fantastic events. Stay tuned for more details and be sure to save the dates!

The Australian Institute of Credit Management welcomes our Partners for 2025

Our National, Divisional and Professional Partners support and work with the AICM to promote the Institute’s activities, represent the Credit Industry and develop the careers of all Credit Professionals. As these organisations support your Institute and your Industry please consider them when you require assistance.

Welcome to 2025! It is with great excitement that I step into the role of VIC/TAS President in 2025.

I would like to take this opportunity to acknowledge and thank Mary Petreski for her dedication and leadership as former President. While Mary has stepped down from this role, we are fortunate to have Mary’s expertise continue as she takes on the position of VIC/TAS Director on the AICM National Board.

This year is shaping up to be an exciting one for our division, with a fantastic calendar of events ahead for both our Vic and Tas members. The ever-so popular golf day is fast approaching in February, providing a great opportunity to connect with industry peers in a fun and relaxed environment. This will be followed by the Risk seminar in March, an essential seminar for staying ahead of the latest trends and developments in risk management.

I encourage all members to check the AICM events calendar and register early to secure your

“This year is shaping up to be an exciting one for our division, with a fantastic calendar of events ahead for both our Vic and Tas members.”

spot at these valuable networking and learning opportunities.

Planning for WINC 2025 is already underway, marking the 10th anniversary of the WINC events. Stay updated via the AICM website and LinkedIn for further announcements.

As your new president, I look forward to meeting and engaging with you all throughout the year. Let’s make 2025 a year of growth, collaboration, and success for the VIC/TAS division!

– Amanda Rothwell-Hiscock MICM VIC/TAS Division President

Nunzio Settinelli MICM CCE

With nearly three decades of experience in credit management, Nunzio has built a career marked by adaptability, deep industry knowledge, and a passion for continuous learning.

From his early days in accounting to holding senior credit management roles across various industries, Nunzio has witnessed firsthand the evolution of credit practices, the challenges that come with managing risk, and the importance of strong customer relationships. In this article, Nunzio sat down with us to share his insights into his journey into credit, what keeps him engaged in the industry, and the changes he’s seen over the years.

landed a role doing costing for a small family business and because it was a small operation, I found myself doing all sorts of duties, from making deliveries to unloading containers. One day the accountant asked me to review a list of customers who hadn’t paid and to give them a call. That was my introduction to credit management. I remember thinking, “This is a pretty cool gig. I wonder if there’s a career in this.”

I then applied for a Credit Controller role in early 1995 and got a job with Wormald Security. Over time, I worked my way up to Assistant Credit Manager and then transitioned to a National Credit Manager role in the paper industry. That experience set the stage for future opportunities, including a Regional Credit Manager role at Tyco, looking after Victoria, Tasmania and South Australia. Over the years, I moved into senior credit positions, adapting to industry changes and restructures, but credit has always been at the heart of my career.

How did you originally get into credit?

I kind of fell into it. I studied to become an accountant and completed my Diploma in Accounting. When I started looking for a job, I

What do you love about credit?

I love that it allows you to interact with people and understand how businesses operate. Unlike traditional accounting roles that focus primarily

on numbers, credit management involves strategy, customer engagement, and risk assessment.

One of my favourite aspects is setting up processes. I enjoy going into a company and streamlining their credit operations – introducing automation, updating payment systems, and refining procedures. For example, when I joined Ruralco, they were still printing and manually mailing statements. Within three months, we moved to an automated system that significantly improved efficiency.

Each industry has its unique challenges. In agriculture, for instance, you’re dealing with farmers who might be waiting to sell livestock or harvest crops before they can pay. In electrical wholesale, you encounter customers who sometimes stretch the truth about payments. The variability keeps the job interesting.

What are the biggest changes you’ve seen in credit over the years?

Technology has completely transformed the industry. When I started, we used to print trial balances on A3 sheets and track followups on handwritten index cards, filing them alphabetically or numerically. Everything was manual.

Then systems like Pronto came along, allowing us to take notes and follow up online. Credit card payments also evolved – we went from processing them through physical terminals to using various online gateways. Automation has been a gamechanger, making processes more efficient and reducing errors. Regulatory changes have also

“One of my favourite aspects is setting up processes. I enjoy going into a company and streamlining their credit operations – introducing automation, updating payment systems, and refining procedures.”

been significant. I remember attending an AICM conference in 2001 when the Personal Property Securities Register (PPSR) was first introduced. It was a major learning curve for the entire industry. More recently, COVID-19 and tax enforcement measures have impacted businesses, affecting credit limits and risk assessments.

What is the value of the AICM?