2024 National Conference & Awards Edition

FEATURING:

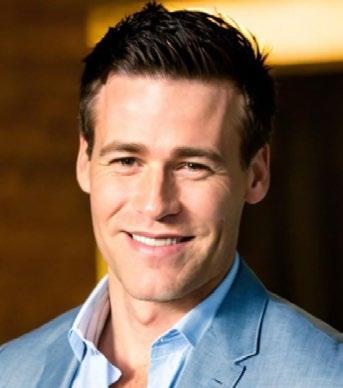

l Credit Professional of the Year: Flourence Matimati MICM CCE (cover photo)

l 2024 Awards Recipients

l Navigating Today’s Undercurrents with the Right Data

l Industry Focus: Hospitality & Construction Recovery

l Regional Australia Driving Economic Growth

Our 2024 supporters

National partners

Divisional partners

Divisional supporting sponsors

Debbie Leo Hannah Griffiths

Kawalsky

Barrett Hasseldine

Peter Morgan Alex Caruana

ISSN 2207-6549

DIRECTORS

Julie McNamara MICM CCE – Australian President

Lou Caldararo LICM CCE – Victoria/Tasmania & Australian VP

Troy Mulder FICM CCE – Western Australia/Northern Territory

Rob Jackson MICM CCE – South Australia

Theresa Brown MICM CCE – New South Wales

Steven Staatz MICM CCE – Queensland

Daniel Taylor MICM – Co-opted Director

CHIEF EXECUTIVE OFFICER

Nick Pilavidis FICM CCE

Level 3, Suite 303, 1-9 Chandos Street, St Leonards NSW 2065

PO Box 64, St Leonards NSW 1590

Tel: (02) 8317 5085, Fax: (02) 9906 5686

Email: nick@aicm.com.au

PUBLISHER

Nick Pilavidis FICM CCE | Email: nick@aicm.com.au

CONTRIBUTING EDITORS

NSW – Gary Poslinsky MICM

Qld – Emma Purcival MICM CCE

SA – Clare Venema MICM CCE, Maria Scacchitti MICM

WA/NT – Jeremy Coote MICM CCE

Vic/Tas – Alex Hawtin MICM

EDITOR/ADVERTISING

Claire Kasses, General Manager

Tel Direct: 02 9174 5727 or Mob: 0499 975 303

Email: claire@aicm.com.au

EDITING and PRODUCTION

Anthea Vandertouw | Ferncliff Productions

Tel: 0408 290 440 | Email: ferncliff1@bigpond.com

THE EDITOR reserves the right to alter or omit any article or advertisement submitted and requires idemnity from the advertisers and contributors against damages or liabilities that may arise from material published. CREDIT MANAGEMENT IN AUSTRALIA is published by the Australian Institute of Credit Management, Level 3, Suite 303, 1-9 Chandos Street, St Leonards NSW 2065. The views expressed in CREDIT MANAGEMENT IN AUSTRALIA are not necessarily those of Australian Institute of Credit Management, which does not expect or invite any person to act or rely on any statement, opinion or advice contained herein (whether in the form of an advertisement or editorial) and neither the Institute or any of its employees, agents or contributors shall be liable for any opinion contained herein. © The Australian Institute of Credit Management, 2025.

Editor, Level 3, Suite 303, 1-9 Chandos Street, St Leonards NSW 2065 or email: aicm@aicm.com.au

Qld: Maria Tisdell MICM from NCI (Brokers) Pty Ltd speaking at the

Vic/Tas: VIC/TAS YCPA winner Amanda Rothwell Hiscock MICM.

Cheri Bowater MICM CCE and

Melissa Sharpe MICM.

NSW: Celebrating Membership milestones Christopher Hadley MICM, Robert Byrnes MICM, Patrick Coghlan MICM.

SA: 2024 National YCPA winner Hudson Pitt MICM & Janice Riley MICM.

Julie McNamara FICM CCE National President

Hello everyone and welcome to the November edition of the AICM magazine. Thank you to all our National and Divisional partners and sponsors without the support of whom, this would not be possible.

In this edition of our Credit Management in Australia Magazine, we carry the flavour “Evolving for Tomorrow: Crafting the Future Credit Team”. This theme is drawn from the AICM National Conference, which was held in Melbourne 16th -18th October 2024.

In today’s rapidly changing business environment, the need for credit teams to continuously evolve has never been more important.

Lou Caldararo LICM CCE

This November edition is dedicated to guiding credit professionals on their journey towards excellence and innovation. This will serve as a celebration and reflection on the National Conference highlighting key insights, memorable moments and the collective wisdom shared during the event.

As we celebrate the success of another fantastic year of seminars, WINC luncheons and webinars please remember recordings are saved and available on the Member portal and are a great resource to utilise. We are all very excited as we start planning the 10th year anniversary of the WINC initiative in 2025.

Thank you to all our members who have invested in their future and renewed their AICM

AICM Board annoucement

Following the recent AGM, we are pleased to announce the re-election of Julie McNamara FICM CCE as National President and Rob Jackson MICM CCE as Vice President. The Board extends its gratitude to Lou Caldararo FICM CCE, who departs the Board following the completion of his term. Lou has served with dedication since 2018, making significant contributions across various portfolios, including as Vice President and in advancing the CCE program. We thank Lou for his commitment and leadership and look forward to continuing our work under Julie and Rob’s guidance.

from the president

“As we celebrate the success of another fantastic year of seminars, WINC luncheons and webinars please remember recordings are saved and available on the Member portal and are a great resource to utilise.”

membership for FY25. I encourage you all to take full advantage of the many benefits and resources available to us all.

To name a few, we have:

l The AICM Special Interest Groups, SIGs, which are exclusive to members. To date covering such topics as “Customer Engagement & Support” and “Personal & Team Development” I would encourage you all to participate if you have not already done so and support the SIGs to come in 2025.

l Our hugely popular webinars throughout the year with our most recent being the 3rd of the WINC series held on the 23rd of October “Tools for women to achieve balance and fulfillment” professionally and personally featuring our presenter Amber Owen and facilitator Lisa Plag MICM. This webinar delved into the unique challenges women face in maintaining work life balance. It was a very successful webinar and a great way to close off our 2024 series.

l The Credit Nexus Series is about to start, see your state calendars for details on where and when to participate.

l Also, the many learning and training opportunities, Toolboxes, Workshops, qualifications such as Certificate III in Mercantile Agents, Certificate IV in Credit Management and our Diploma of Credit Management.

What an amazing National Conference we just experienced held at The Pullman at the Park in Melbourne! Thank you once again to the Vic/Tas council for hosting.

Yet another amazing three days of learning,

networking and celebrating our industry. What a fantastic range of speakers and panels sharing their insight and experience with us all.

A huge thank you to the Conference Premium Sponsors Equifax, President’s Dinner sponsor Blackline, Welcome Reception Sponsor Opypro and CCE lunch sponsor National Collection Services, together with all our exhibitors who, with their knowledge, expert advice and tools, contribute to the advancement of the credit function.

Congratulations to our award winners:

l 2024 Young Credit Professional of the Year –Hudson Pitt MICM (SA)

l 2024 Credit Professional of the Year –Flourence Matimati MICM CCE (NSW)

l 2024 Credit Team of the Year – Metro Finance

l 2024 CCE Dux – Brigid Nichols MICM CCE (TAS)

l 2024 Student of the Year – Hayley Hawke MICM (NSW)

l Our newly accredited and recertified CCE’s.

l And last but never least the President’s trophy winner, South Australia!

Congratulations to Janice and the SA council for all your hard work and achievements for 2024. Congratulations also to all the states who put in a huge effort! I can’t wait to see all the friendly rivalry leading up to next year!

In finishing, I am excited to confirm, the National Conference for 2025 will be held at the JW Mariott Gold Coast Resort & Spa (Surfers Paradise) from Wednesday 15th to Friday 17th October 2025… Lock it in your calendars and see you there!

Julie McNamara FICM CCE National President

Collaboration technology in the credit sector

Digital technologies have come to the forefront of our lives changing the way we work and educate. It has provided both convenience and comfort to our work/life balance but has also imposed its own set of challenges for the sector.

As with other with other industries, the credit sector has taken new direction, thanks to the emergence of modern technology. Technology already allows you to get an online loan with just a few taps on your mobile device. Companies now have their commercial credit application forms on their web sites for online procedures. This is very different to even a decade ago when options were somewhat limited to getting access to credit.

This is only one scenario that shows that credit has become much more flexible and responsive to all types and needs of customers. Let’s delve into this further.

Digital technologies

The credit industry recognises the importance of digital technologies as a powerful lever to improve their profits, improve regulatory compliance, and transform their customer

experience. The latter imperative has taken on heightened importance in the COVID-19 crisis, as remote and mobile access have shifted from conveniences to necessities for many millions of customers. Going forward, expect digitisation to play an even more central role, as the industry finds innovative ways to serve their customers during and after the crisis.

Digital proficiency involves a range of capabilities including advanced analytics, intelligent process automation, and digitisation. While customer-facing products and touchpoints have become more digitised (e.g., online interactivity with customers and mobile payments), business processes are less so Embedding digital collaboration into business process workflows promises to open up steep improvements in employee productivity, leading to significant value creation for the industry.

Collaboration technology has quickly become a necessity for businesses in every industry. The ability to streamline communication and collaboration efforts between in-house and remote teams provides companies with multiple benefits that equate to greater success. Collaboration technology enables teams to work

together in real-time – despite their locations –to solve problems and perform vital tasks. Let’s examine some of the benefits collaboration tech provides businesses.

Flexibility

In today’s globalised marketplace, both employees and clients demand flexibility. The number of remote workers is on the rise, and with the help of collaboration technology, these remote workers are now able to perform the vital tasks of their jobs from wherever they are. Collaboration technology enables employees to communicate and share ideas whenever – and wherever – their best ideas come to them.

Increased productivity

Increasing employee productivity leads to greater profits and more improved business functions from top to bottom. Collaboration technology – when used correctly – decreases the feeling of isolation among workers and improves employee productivity. Implementing collaboration technology correctly gives employees the tools necessary to feel more engaged with tasks, and increases productivity among both in-house and remote workers. In fact, remote teams using collaboration

technology often outperform co-located teams. How? Collaboration technology provides the backbone for efficient and effective communication, which leads to greater engagement and increased productivity.

Reduces costs

Collaboration technology allows businesses to forgo the expensive of travel by implementing visual communication tools. For example, video conferencing is a great example of the type of collaboration technology that allows companies to cut back on travel costs. Video conferencing allows real-time, face-to-face conversations to take place anywhere.

Competitive edge

Globalisation in the marketplace has led to greater competition, not only for new clients, but also for talent acquisition. Collaboration tech will give companies the edge they need to stay competitive. Recruiting high-talent employees, finding new clients, and retaining existing clients are all made possible with the use of collaboration tech. Collaboration technologies have the ability to make distance disappear and can foster better relationships with business partners.

AICM recent graduates

AICM would like to congratulate its recent graduates:

FNS51522 – Diploma in Credit Management

Rana Berry Queensland General Mills Australia Pty Ltd

Nathan McCormack South Australia Classroom

NOVEMBER 2024

Are you navigating today’s undercurrents with the right data?

By Debbie Leo MICM*

The current economic climate presents a complex picture. While overall confidence is slowly improving, persistent undercurrents of uncertainty necessitate a proactive, datadriven approach to credit risk assessment. Leveraging comprehensive data sources to understand these trends will help credit professionals mitigate risk as adverse rates, mortgage stress, arrears and insolvencies all trend upward in the third quarter of this year.

Undercurrents amidst stability

Overall commercial demand nationwide has remained relatively stable throughout this year, improving by +0.7% yearon-year in Q3 2024. However, in Victoria, a drop in commercial enquiries in the construction, manufacturing and financial

services sector, has led to a -2.0% decline in total commercial demand.

Notable undercurrents include a -6.8% year-on-year decrease in asset finance demand in the third quarter, particularly pronounced across the eastern states. Sales of new commercial vehicles in Q3 2024 have also reduced -0.9% yearon-year1 due to tighter lending conditions and lowering of the instant asset write-off threshold in FY24 by the ATO.

Long-term business loan demand continues to trend downward from levels observed in 2021, while short term business loan demand has improved +4.5% since Q3 2023, led by SA, QLD and NSW. Industries such as financial services (+21%), hospitality (+14%), healthcare (+11%) and retail (+7%) contributed to the short term increase.

Debbie Leo MICM

Source: Equifax Commercial Insights Report, Q3 2024

Source: Equifax Commercial Insights Report, Q3 2024

The long-term trends for trade credit demand have been largely stable, yet Q3 2024 saw a -4.1% reduction compared with the same period the previous year. This was more pronounced in the Eastern states of VIC, QLD and NSW which saw a lowering in trade credit volumes from construction (-5%), wholesale trade (-4%) and hospitality (-3%).

Customer application quality

The average quality of customers in the bureau remains largely stable in Q3 2024 with an average score of 820. Business loan customers have the highest

quality applications, particularly those from the financial services and hospitality sectors.

Trade credit applications have the lowest score, with the risk profile varying depending on the

sector. Hospitality trade credit applications have deteriorated by -2.0%, while financial services and professional services have improved by +26% and +19% respectively.

Source: Equifax Commercial Insights Report, Q3 2024

Source: Equifax Commercial Insights Report, Q3 2024

Customer quality changes by product, 2024 Q3 vs 2023 Q3

Source: Equifax Commercial Insights Report, Q3 2024

Industries with High Adverse Rates, July 2023-August 2024

Source: Equifax Commercial Insights Report, Q3 2024

Regional insolvency change, 24 Q3 vs. 23 Q3

Rise in adverse filings and insolvencies

The proportion of commercial enquiries with some form of adverse filing is currently at a 24-month peak, rising to +1.4% of total enquiries by August 2024. Worsening market conditions have resulted in +42% more adverse filings in August 2024 compared to 12 months ago.

Source: Equifax Commercial Insights Report, Q3 2024

Insolvency volume trend by Industry (2020-Present)

Source: Equifax Commercial Insights Report, Q3 2024

Intrinsically, each industry has different levels of adverse associated with applications. The hospitality sector, which also saw strong credit demand growth this quarter, currently has the highest adverse rates. In the last 12 months, 2.4% of hospitality enquiries included some form of adverse filing, followed by real estate services (2.0%), mining (1.9%) and construction (1.9%).

High insolvency rates have been observed across all regions, with 3,568 insolvencies registered in Q3 20242, a +43% increase compared to the same period last year. Victoria and Queensland have reported the highest insolvency volumes in the last four years, with volumes growing at a faster rate in Victoria than any other region.

NSW continues as an insolvency frontrunner, with the highest number of insolvencies for year-to-date (as at 2nd Oct 2024) and contributing to 40% of national insolvencies. Businesses across all industry sectors in Victoria have elevated insolvency levels compared to other commercial centers in the same period last year.

While the construction sector maintains the lead in volume of insolvencies, the

hospitality sector is starting to close the gap with a +40% increase in Q3 2024 compared to the previous quarter3 Victoria drives this growth with a +260% jump in insolvencies in hospitality. Construction industry insolvencies are regiondependent, while NSW, SA and WA had reduced insolvencies, QLD and VIC increased moderately vs. Q3 2023.

DBT trends

While average days beyond terms (DBT) in the bureau at the end of Q3 2024 are marginally higher than a year ago, they remain low at 4.2 days, down from a peak of 4.8 days in Q4 2023.

The construction and retail sectors continue to improve, with DBT decreasing for the fourth consecutive quarter in Q3 2024. However, the hospitality sector has seen DBT rise to 1.4 days higher than levels observed in the same period two years ago.

Impact on consumer finance

In this complex landscape, mastering the use of data is paramount for credit professionals. Leveraging diverse data sources, including consumer credit bureau data, provides businesses with a more comprehensive view of applicants’ credit history and overall financial stability.

Examining connections to a business owner or director’s consumer files can reveal additional financial stress not evident in a purely commercial file. For example, mortgage

stress among business owners is a growing concern. Business owners in key sectors like hospitality, construction and retail experienced higher mortgage stress levels in Q3 2024 compared to other industries. The consumer mortgage arrears rate peaked in April 2024 with 0.78% of accounts in arrears, with business owners in the hospitality sector experiencing the most mortgage arrears over the last 24 months.

Historically, mortgage arrears rates amongst self-employed

individuals were lower than the average consumer, as business owners tend to have better cash flow and income. However, as market conditions worsened, self-employed individuals in sectors with a high reliance on credit – such as construction, retail, and hospitality – began falling behind on mortgage repayments at a higher rate than other sectors. This trend suggests operators may be diverting funds toward business operations, impacting their ability to meet mortgage obligations.

Visibility of Adverse proportion of applications up to Q3 2024 (%)

Source: Equifax

Average days beyond terms trend (2022-Present)

Source: Equifax Commercial Insights Report, Q3 2024

Risk Management

Self-employed business owners are also experiencing mounting early-stage (30+ days) arrears on unsecured credit, with the rate accelerating in the last six months. While credit card arrears rates for self-employed individuals in hospitality and construction have historically been up to

30% lower than those in other commercial sectors, arrear rates for both credit cards and personal loans have increased sharply since January 2024 for hospitality, construction and retail. Personal loan arrears for self-employed individuals in the construction sector are +17% higher than other sectors.

Self Employed Mortgage Arrears (30+)

Navigating the undercurrents

By understanding the complex interplay of economic factors, consumer behavior, and industry-specific risks, credit teams can make more informed credit decisions. Leveraging diverse data sources enables you to anticipate shifts and

Source: Equifax Commercial Insights Report, Q3 2024

Source: Equifax Commercial Insights Report, Q3 2024

Self Employed Credit Card Arrears (30+)

identify emerging risks more accurately. There is a wealth of credit bureau data that can augment adverse data to provide a more comprehensive view of an applicant’s credit history and overall financial stability.

The power of comprehensive data

When evaluating any single data source, credit professionals must consider factors like completeness, consistency and timeliness. It’s not simply about having data; it’s about the quality and depth, and intelligent use of that data. For example, ATO default data offers valuable insights but requires careful interpretation due to its volatility and the complexities of the ATO’s data collection and default removal processes.

Also, adverse data should be treated as one piece of a complex puzzle. Other factors, such as the frequency and types of credit inquiries, can also indicate elevated risk. The bottom line: no single metric can address every challenge in this uncertain economic climate.

Mitigating risk with a 360-degree view

Limited data sources and datasets lacking relevant detail increase the likelihood of missing critical pieces of the credit story, potentially leading to inaccurate conclusions. The graph below illustrates this point: as a company nears external administration, the likelihood of an adverse event appearing on its file increases. However, it’s important to note that a majority

of companies (57%) still fail without any prior adverse events recorded.

As Australia’s largest commercial and consumer credit bureau, Equifax offers a unique advantage: the ability to merge an individual’s consumer profile with comprehensive commercial credit data, creating a holistic 360-degree view of credit risk. Leveraging insights from consumer credit files, for instance, can significantly enhance the value of adverse data, with the potential for a +4% or greater uplift, depending on the industry.

A strong bureau score is built on a broad and deep foundation of data sources, integrating predictive elements into a single, reliable view. Credit professionals can effectively use credit scoring alongside other relevant attributes to enhance risk assessments, tailored to the nuances of the specific industry and credit usage patterns.

This amalgamation of multifaceted insights becomes a

powerful tool for monitoring customer cash flow stability and informing contract negotiations, particularly when enriched with director information, linking a company’s trading history, its directors and its shareholders. Within this framework, proprietorship data – covering sole traders and partnerships –becomes an essential compass for managing risk and gaining a deeper understanding of the financial health of customers and suppliers.

Contact us today to learn more about the reliability and predictiveness of Equifax data.

*Debbie Leo MICM

General

Manager Corporate and Government Equifax www.equifax.com.au

FOOTNOTES:

1 Federal Chamber of Automotive Industries, Sept 2024 New Vehicles Sales

2 Based on ASIC Insolvency Statistics to October 2, 2024

3 Based on ASIC Insolvency Statistics to October 2, 2024

Source: Equifax

Construction recovers, while regional Australia drives economy

By Barrett Hasseldine MICM*

The latest data released by credit bureau illion, now an Experian company, reveals that business failure risk has continued to improve over the last quarter. The improvement is not uniform across industries and regions, however, with some still deteriorating.

In this article, illion’s Head of Modelling, Barrett Hasseldine, outlines key findings in the company’s September quarter Commercial Risk Barometer, and suggests what all of this could mean for AICM members and the broader industry.

Construction industry turns corner

Most notably, Barrett says the data shows the Construction industry has improved, where business failure risk was down 0.2% in the September quarter, suggesting that more favourable trading conditions are beginning

to appear in what has been a long period of economic fragility for the sector.

“We found that trading growth in this sector is now outpacing inflation, which may finally translate into more stable cash flows and fewer construction businesses in financial stress,” said Barrett.

illion’s data showed the Construction sector’s annual growth significantly outpaced inflation, rising by more than 10% year on year. Rising trade activity from higher consumption contributed to this growth, suggesting that businesses are beginning to see more positive cash flows again.

Improvement in the failure risk of construction businesses may be attributed to better servicing of invoice payments, reducing the risk of insolvencies.

“We are seeing a 6% improvement in the time

“The latest data released... reveals that business failure risk has continued to improve over the last quarter.”

Barrett Hasseldine MICM

taken to pay invoices, and this is also coinciding with greater trading activity,” Barrett added. We therefore believe that the Construction sector may now be operating with more stable and sustainable cash flows, which is great news. Hopefully this translates into lower insolvency rates through 2025, contingent on the state of the broader economy.

“Although a small percentage of construction businesses are still struggling to meet their financial obligations, the majority are doing better than they were.”

Other sectors a mixed bag

In other sectors, Mining and Wholesale trade have also continued to go from strength to strength, each now being more than 40% lower risk than the national average. Growth in the Mining sector rose a huge 16% year-on-year, where ‘wholesale trade’ improved a very respectable 12%.

“Improvement in the failure risk of construction businesses may be attributed to better servicing of invoice payments, reducing the risk of insolvencies.”

“The Mining and Agriculture sectors have contributed to business failure risk in regional Australia being lower than metro Australia,” Barrett added.

However, illion’s data did show that other sectors are of concern. The Utility sector has deteriorated somewhat, with illion’s analysis showing that its failure risk rose by 1.4% in the September quarter, due in part to a 10% reduction in consumer spending and the payment of trade invoices taking 5% longer.

“The lower consumer spending may simply be due to lower energy tariffs, but if consumption were to fall beyond normal seasonal variations, the failure risk of Utility businesses could rise in 2025; especially as

overdue invoices are already on the rise in this sector.” Barrett added. “Any indication of further deterioration would therefore need to be closely monitored.”

illion’s Commercial Risk Barometer highlighted that sectors such as the Food Services industry also continue to struggle, with the business failure risk remaining 40% higher than the national average.

The data showed that although the sector has experienced a 10% rise in consumer spending over the September quarter, this has made little impact, with the sector also seeing a 20% rise in the time taken to pay late invoices. This has gone from 16 days on average in June 2024,

Economic Update

Business Growth (Percentage) – Year to September 2024 (Year on Year)

Business Failure Risk by State and Geographical Region – Percentage Higher/Lower than National Average

to 19 days in Sept 2024. “While it might not sound a lot, it makes a big difference – in addition, the sector has also seen a 1% rise in failure risk over Q3,” said Barrett.

“While higher spending is a promising sign of business activity, the challenges that the Food Services sector faces with invoice payments suggests that a proportion of its businesses may unfortunately continue to find themselves in hard times.”

Overall, illion’s data shows that some industries are seeing a rise in business activity while others are delaying payment of overdue invoices. The risk of Food Services, Transport and Utility companies may be of particular concern in 2025, therefore requiring particularly close monitoring.

Mining, Professional Services and Agriculture may continue to offer better opportunities for investment and lending, with

Construction also possibly eyeing a recovery.

Regional Australia winning, while metro is dragging Geographically, businesses in metropolitan Sydney, Melbourne, and Adelaide have the highest risk of business failure, currently around 7% higher than the national average. This may be largely because of higher living costs and stressed budgets

impacting on household consumption.

Conversely, businesses in regional Australia and in metropolitan centres, whose growth is influenced by regional and rural activity, appear to be faring better.

“For example, when compared to the national average, businesses in metro QLD and WA have 10% and 13% lower than average failure risk, while regional WA, SA, and QLD have 20%, 15% and 10% lower than average failure risk,” Barrett added. “Even businesses in regional NSW and VIC are faring better than the national average.

“This lower risk is directly related to regional Australia’s relationship with the mining and agricultural sectors – these being 45% and 30% lower risk when compared to the average over all sectors.”

More promising times may lie ahead for some business sectors, and Australia might be beginning to turn the economic corner in terms of construction activity, although this is qualified optimism, as business confidence still appears to be erratic and metro services businesses still showing some signs of stress. illion continues to monitor closely.

*Barrett Hasseldine MICM Head of Modelling illion www.illion.com.au

About illion and Experian illion, an Experian company, is a leading provider of trusted data and analytics products and services in Australia and New Zealand.

Experian is a global data and technology company, powering opportunities for people and businesses around the world. We help to redefine lending practices, uncover and prevent fraud, simplify healthcare, deliver digital marketing solutions, and gain deeper insights into the automotive market, all using our unique combination of data, analytics and software. We also assist millions of people to realise their financial goals and help them to save time and money.

We operate across a range of markets, from financial services to healthcare, automotive, agribusiness, insurance, and many more industry segments.

We invest in talented people and new advanced technologies to unlock the power of data and innovate. As a FTSE 100 Index company listed on the London Stock Exchange (EXPN), we have a team of 22,500 people across 32 countries.

Our corporate headquarters are in Dublin, Ireland. Learn more at experianplc.com

CreditorWatch rates

16.2% of hospitality businesses as high risk or above; Forecast closure rate of 8.9% over next 12 months for the sector

By Ivan Colhoun*

Colhoun

CreditorWatch’s latest industry risk ratings reveal businesses in the hospitality sector are currently exhibiting an extremely high level of risk compared to other sectors.

CreditorWatch currently rates 16.2 per cent of businesses in the food and beverage services sector as ‘high’ or ‘very high’ risk, significantly higher than second ranked Administrative and Support Services at 7.2 per cent and Arts and Recreation Services at 7.0 per cent.

Businesses in the food and beverage services are currently struggling under the higher interest rate regime, increased input costs, energy price rises, reduced visitation in CBD locations, and lower consumer demand due to cost of living pressures.

At the other end of the scale, it is the Wholesale Trade sector that has the highest proportion

of businesses rated at ‘low’ and ‘very low’ risk (58.6 per cent), followed by Manufacturing (57.8 per cent) and Agriculture, Forestry and Fishing (51.3 per cent). Just 18.2 per cent of Food and Beverage businesses are rated low and very low risk. In fact, just 0.6 per cent are rated very low risk.

There are some common characteristics among sectors rated low risk. On the lower risk ratings side, unsurprisingly, there is a predominance of government or effectively government-funded business categories.

It will be interesting to see to what extent there is movement in risk ratings in the Education and Training sector over the next year, given the well-publicised changes to federal government policy in respect of higher education and immigration caps.

Ivan

Hospitality and arts forecast to see highest business closure rates

CreditorWatch forecasts the Food and Beverage Services and Arts and Recreation Services sectors to have the highest closure rates over the next 12 months, followed by Financial and Insurance Services.

CreditorWatch defines the business closure rate as voluntary and involuntary administrations, ASIC strike-offs and closures of solvent businesses.

CreditorWatch’s models are predicting increased business failures in four industry sectors: Food and Beverage Services;

Financial and Insurance Services; Rental, Hiring and Real Estate Services; and Agriculture, Forestry and Fishing.

Three of the four sectors forecast to show deterioration likely reflect the lagged impact of tighter monetary policy on what are relatively interest sensitive and/or discretionary spending sectors of the economy.

Food and Beverage Services is also likely being impacted by reduced CBD visitation in many cities, with failure rates and arrears rates across most states higher for businesses in cities than for firms in nonmetropolitan regions.

“On the lower risk ratings side, unsurprisingly, there is a predominance of government or effectively governmentfunded business categories.”

Financial and Insurance Services and Rental, Hiring and Real Estate Services are also predicted to experience increased business closure. Neither sector is currently showing a significant rise in companies in the ‘very high’ or ‘high’ risk categories of CreditorWatch’s Risk Ratings, however, it’s not unreasonable to expect some increased pressure in these areas given the current restrictive setting of monetary policy and the likelihood that interest rates will not be reduced before early 2025 in light of slow progress reducing inflation and continuing strength in the labour market.

The models forecast a modest increase in failure rates for companies in Agriculture, Forestry and Fishing. While higher interest rates are likely to be part of the story, lower

Economic Update

commodity prices, especially for beef, in the face of escalated costs, are a more likely driver. Again, from a macro perspective, it would also not be surprising to see some increase in Education and Training business closures as a result of changes to federal government policies on foreign students and immigration.

Company insolvencies at record highs

ASIC reports that 1225 companies entered insolvency for the first time in September 2024. In seasonally adjusted terms, the number was slightly higher but not significantly so. At face value, this data leads to the headline “company insolvencies at record highs” as the number of insolvencies is

indeed higher than the previous peaks during and after the Global Financial Crisis and in the slow period for economic growth that followed the end of the mining boom.

However, the number of registered companies has risen substantially between 2008 and today – indeed at 3.4m, there were twice as many registered companies in September 2024 as there were at the start of 2009. Scaling the number of monthly insolvencies to the number of companies registered presents a somewhat different perspective of the record high number of insolvencies.

While it’s true that insolvencies are rising, the overall proportion is not as high as during either of the previous periods. There’s also

some uncertainty about the extent to which the resumption of ATO collections activity may be creating some bunching or catch-up in insolvencies after the significant reduction in enforcement over the COVID period thereby potentially overstating the underlying trend somewhat.

Outlook

Overall, restrictive monetary policy and several COVID aftereffects (ATO enforcement actions, migration and foreign student policy changes) are combining to increase the risk of business failure, with interest sensitive/consumer discretionary sectors most at risk.

The rate of insolvencies is not yet especially high and the enforcement actions of the ATO

Data sources: CreditorWatch and ASIC

Australia – Companies Entering Insolvency for the First Time (ASIC Series 1, Seasonally Adjusted)

Data sources: CreditorWatch, ASIC and Macrobond

Australia – Insolvencies as a Share of Total Company Registrations (Mthly, Seas. Adj.)

Data sources: CreditorWatch, ASIC and Macrobond

are currently obscuring the underlying trend. CreditorWatch modelling expects a further lift in insolvency rates, though

expected interest rate cuts in the first half of 2025 and the beneficial aspects of recent tax cuts should prove a support.

*Ivan Colhoun CreditorWatch E: ivan.colhoun@creditorwatch.com.au

Update from across the ditch: Kiwi credit trends point to challenging summer period

By Monika Lacey MICM*

As we enter the final quarter of 2024, it’s clear many households and businesses in Aotearoa New Zealand have struggled with the cost-ofliving crisis and tight economic conditions.

However, are we about to see Christmas come early for our economy?

The Reserve Bank of New Zealand has reported a decrease in inflation to 2.2% for the September 2024 quarter, down from 3.3% in the June quarter,

now comfortably within the bank’s target range of 1% to 3%.

In light of this inflation outlook, economists anticipate a shift towards a more neutral monetary policy, potentially lowering the official cash rate (OCR) to 3.5% from the current 4.75%.

While these developments suggest positive economic trends, recent credit insights indicate challenges remain for consumers and businesses nationwide.

Consumer Arrears Trends

Monika Lacey MICM

The number of New Zealanders falling behind on payments in September 2024 fell slightly to 458,000, a reduction of 3,000 month-on-month.

However, this figure is still 3.5% higher year-on-year, surpassing levels seen in 2018. An increase in arrears is expected during the summer months due to seasonal spending patterns.

Data on new credit users shows that Buy Now Pay Later (BNPL) options have been the most popular first credit product since 2018, though uptake peaked in 2021 and is now declining as interest in telco products resurges.

Despite a slight month-onmonth decrease in consumer financial hardship cases (down by 400), there has been an overall increase since November 2022.

This trend may appear concerning; however, it reflects consumers taking proactive measures, such as filing for financial hardship, to secure their financial futures.

On the business side, a more troubling scenario emerges. Credit defaults have risen by an average of 16%, particularly affecting the transport and construction sectors.

Company liquidations have surged by 25% year-onyear, marking the highest monthly total in a decade, with construction seeing the highest proportion of these liquidations.

The hospitality sector has also faced difficulties, with liquidations increasing by 34% over the past year, severely impacting cafes, restaurants, pubs, and clubs.

Consumer Arrears Trends by Days Past Due

Personal Loan & BNPL Arrears

Credit Card & Auto Loan Arrears

As the festive season approaches, we know from our data these significant challenges are likely to persist. It is crucial for both businesses and consumers to prepare for these tough times by assessing their current situations and seeking guidance from trusted advisors as needed.

Arrears decline, but remain above pre-pandemic levels

The number of individuals behind on payments has slightly decreased to 458,000, which represents 12.12% of the creditactive population, down by 3,000 from the previous month.

However, this figure is 3.5% higher compared to the same time last year.

Among those in arrears, 156,000 consumers are 30 or more days past due, with 74,000 of these being at least 90 days overdue.

Across specific categories, vehicle loan arrears rose in September, up to 6.4%,

Consumer Credit Demand: 2020 – 2024

Telco & Utility Arrears Home Loan Arrears

“Among those in arrears, 156,000 consumers are 30 or more days past due, with 74,000 of these being at least 90 days overdue.”

Credit Demand by Product Type

compared to 5.4% for the same month last year, while credit card arrears decreased slightly month-on-month to 4.2%, and remaining unchanged yearon-year. Personal loan arrears held steady at 8.9%, while retail energy arrears remained at 4.7%.

Notably, BNPL arrears dropped to 6.1%, marking the lowest level since January 2022, and telco/communication account arrears stayed flat at 9.7%.

Mortgage arrears experienced a slight increase, with 21,200 home loans past due, reflecting a year-onyear rise of 13%. Conversely,

First Credit Product for New to Credit Customers

Annual Change in Financial Hardship Cases

Financial Hardship by Product Type

mortgage applications rose by 4% compared to the same period last year, suggesting early signs of recovery in the housing market during spring.

Overall credit demand remains steady, credit card demand climbs

Overall, consumer credit demand has decreased by 2% compared to last year, though the decline is slowing. Interestingly, credit card demand is rebounding, with a 13% increase from the previous year. Conversely, vehicle finance demand has dropped significantly, down 16% year-overyear.

A notable trend is the rise of consumers new to credit, who are starting to take up credit products for the first time, helping them build their credit profiles.

In 2023, around 160,000 consumers opened their first credit products, with another 110,000 doing so in 2024 so far.

Since 2018, BNPL has become the most popular choice for firsttime credit users, surpassing traditional options like telco and utility accounts.

In 2023 and 2024, 32% of newto-credit consumers chose BNPL as their initial credit product. However, this figure has declined from its peak in 2021, as BNPL accounts become prevalent and the rate of new consumers declines.

Financial hardships point to proactive consumer behaviour

Financial hardship remains a significant issue in the consumer credit landscape, with 13,300 accounts currently reported

as experiencing difficulties. However, there has been a modest decrease of 400 cases in the past month, suggesting a potential shift towards improvement.

This trend suggests that consumers are taking proactive measures to address their financial challenges. By formally declaring financial hardship, individuals are showing a commitment to managing their financial situations and seeking appropriate assistance.

This proactive approach is a positive step towards long-term financial stability and resilience.

Year-over-year comparisons reveal a 19% increase in financial hardship accounts. Notably, nearly half (47%) of these cases are linked to mortgage payment challenges, while credit card debt accounts for 29%, and

Company Liquidations Up 25% YoY

Economic Update

personal loan repayment issues make up 15% of the total.

Since November 2022, the overall trend has shown an upward trajectory in financial hardship instances, but the growth rate is now decelerating.

Geographically, the highest concentrations of financial hardship cases are found in the major urban centres of Auckland and Wellington, indicating that economic pressures may be more pronounced in these highcost metropolitan areas.

Kiwi businesses continue to struggle

New Zealand’s business sector is facing notable financial challenges, with a 16% year-onyear increase in credit defaults across all industries in September 2024.

The transport sector has been most affected, experiencing

a 35% rise in credit defaults compared to the previous year, followed closely by the construction industry at 33%.

The retail sector, while impacted, shows the least increase with only a 3% rise in credit defaults.

Company liquidations have surged by 25% year-on-year, reaching a 10-year high with 306 liquidations in the most recent month.

The construction industry accounts for the largest share of these liquidations, representing 28% of the total in Q3 2024, with 199 construction companies failing during this period.

Over the past year, the businesses most vulnerable to liquidation have been property operators, residential building construction companies, and cafes/takeaway food establishments.

This trend underscores

the specific challenges these sectors are facing in the current economic climate.

To 2025 and beyond

It’s encouraging to see inflation returning to more regular levels and we hope to see this continue to level out as we head into the new year.

Unfortunately, we know the summer and Christmas period can be challenging for consumers and businesses alike at the best of times.

The current climate will no doubt be stressful for many across Aotearoa New Zealand. As such, it’s important for households and businesses to make smart financial decisions for their long term wellbeing.

*Monika Lacey MICM

Chief Operating Officer

Centrix Credit Bureau of New Zealand www.centrix.co.nz

NZ Company Liquidations by Industry

If you aspire to achieve greater heights in your credit career or want to get the best from your credit staff, then a qualification course can help you achieve your targets. Offered nation wide, you can study in your own time (24/7), with support available. If you have industry experience or prior education, you may be eligible for Recognition of Prior Learning (RPL) credits to fast-track your qualification. If you’re an employer, you may qualify for a training grant. Talk to AICM today to discover your course options.

The rise of the API economy

By Neill Borg MICM*

In the digital age, new tools to develop the economy are no longer restricted by physical innovation but by the limitations of imagination, knowledge capital, or financial resources. This era marks one of the greatest opportunities to drive change, influencing what we consume, how we invest, who we trade with, and how we manage our lives.

The vast collection of data in isolation is growing at an accelerating rate, and when combined with global communication and sophisticated connectivity, it’s clear that the API economy will increasingly shape how consumers and markets behave.

Many readers might be unsure about what an API is, how it drives the economy, or how it might affect them personally or in business. In short, the first published Application Programming Interface (API) specification was introduced by David Wheeler, David Wilks, and Stanley Gill in their 1951 book, The Preparation of Programs for an Electronic Digital Computer This set the early foundation for system interactions in computing. However, according to API Evangelist, the first web API was introduced by Salesforce. com on February 7th, 2000, and since then, the use of APIs in commerce has exploded.

For most consumers or business units, the technical mechanics of APIs aren’t a primary concern – they simply want seamless digital interactions. To put this in context, most people don’t care about the mechanics of a car or how it works; they just want to reach their destination.

However, the impact of APIs is significant. Early adopters

have leveraged APIs to gain a competitive edge. For example, Netflix’s shift from DVD rentals to a global streaming platform was powered by API connectivity, allowing for simple, user-friendly experiences. In 2000, Netflix had $5 million in revenue compared to Blockbuster’s $4.5 billion, but by 2010, Blockbuster had filed for bankruptcy, illustrating how APIs can drive innovation and disrupt markets.

APIs are fuelling economic growth by enabling the development of user-centric applications aligned with business goals. By leveraging APIs, microservices, and thirdparty data, DecisionOK by Credisense has created an innovative, scalable platform that delivers personalised customer experiences while empowering credit executives to make comprehensive and informed risk decisions.

We’ve embraced the power of the API economy by creating an expansive integration ecosystem that connects thousands of crucial data points such as local

“APIs are fuelling economic growth by enabling the development of usercentric applications aligned with business goals.”

Neill Borg MICM

and international credit bureaus, KYC/AML solutions, ID verification and biometrics, property data, addressing tools, valuations, government registries, digital signature services, payment gateways, vehicle data, PPSR, open banking and live bank data analysis, accounting and financial data analysis, and advanced anti-fraud tools.

As the market evolves, our API ecosystem grows, and we are continuously adding new integrations to address emerging demands. With the flick of a switch, our customers can instantly access these features, empowering credit teams and businesses to stay ahead of industry trends and lead in innovation. Our platform delivers unmatched flexibility and access to cutting-edge data and services, keeping businesses at the forefront of their industry.

Recently, we’ve added new fraud detection services that use Artificial Intelligence and Machine Learning to detect document tampering and document fraud, as well as consumer digital footprint assessments. These assessments analyse applicants’ email addresses, social media profiles, online behaviour, mobile numbers, device usage patterns, and IP addresses (including VPN/ Dark web browser usage) to build an application fraud score. This allows businesses to better protect themselves from fraudulent activity and make better informed risk decisions.

In today’s fast-paced digital economy, agility and foresight are essential. APIs have evolved beyond being mere technical tools – they are the gateway to future growth, competitiveness, and long-term sustainability.

The businesses that will succeed are those willing to adapt and evolve alongside the changing technological landscape. By harnessing the power of APIs and embracing seamless connectivity, these businesses will gain the ability to innovate, streamline operations, and deliver exceptional customer experiences. Staying ahead of the curve with cutting-edge solutions like those offered by DecisionOK by Credisense gives organisations the competitive edge they need to not only survive but thrive in a rapidly evolving market. The choice is clear: embrace the API economy or risk becoming obsolete in an increasingly connected world.

*Neill Borg MICM Country Manager – AU DecisionOK T: +61 401 066 624 E: neill.borg@credisense.io www.decisionok.com.au

Trends in credit and AR technology for 2025 – Part 1

Artificial Intelligence (AI) is on every Business Leader’s radar as we leave 2024 behind but process workflow, data interrogation and connectivity are the topics taking centre stage.

By Lynne Walton MICM*

Access Intell works with businesses of every size, in every industry sector, and with every problem, limitation or restriction possible across its portfolio of clients. They are well placed to see what’s happening in detail across the industry. Not surprisingly, Access Intell CEO and Founder Lynne Walton sees ‘best in class’ credit and finance teams implementing highly connective, integrated solutions that place data access, information flow and interpretation front and centre in their quest to perfect internal processes and controls.

In this article series, Lynne will explore some of the modular components she sees most often and examine some of the reasoning behind their

introduction. Part 1 of 3 examines the first stage – customer onboarding – where innovation is having a real impact on productivity.

Businesses are forever seeking opportunities to gain a competitive edge and the current buzz around AI is evident all around – but most are watching and waiting. The pace of change is so quick that shiny new things can quickly become obsolete, perhaps replaced with something even better that has substance and longevity. Picking through short-lived innovations to identify technology that can have a lasting impact often comes down to implementing practical solutions that can save time, reduce cost and optimise efficiency across the AR journey – but that can be enhanced with

“Businesses are forever seeking opportunities to gain a competitive edge and the current buzz around AI is evident all around...”

Lynne Walton MICM

“How and what a business sells, legacy systems, legislative constraints, labour resources and a hundred other factors all create intricacies that offer both opportunities to optimise performance and barriers to progress when it comes to installing the right technology.”

AI as it develops and proves its reliability.

They differ so vastly that a ‘one size fits all’ approach could never work. What is critically important in one credit process might not even need to be considered in another. For example, if you are supplying large items of machinery on credit, PPSR is vital and being able to process credit card payments won’t feature. If you are selling fish to 700 restaurants every week, processing credit card

payments quickly and easily will be vitally important and PPSR won’t.

How and what a business sells, legacy systems, legislative constraints, labour resources and a hundred other factors all create intricacies that offer both opportunities to optimise performance and barriers to progress when it comes to installing the right technology. Low or no code connectivity is a key consideration to support information flow into CRMs, ERPs, accounting systems,

insurance brokers, debt collectors and many more of the connection points we see in modern processes. That’s why modular approaches have emerged as the way progressive businesses are introducing improvements. The reasoning is simple.

l Processes can be divided into component parts making the workload manageable

l Issues can be tackled in stages, minimising disruption

l ‘Tech spikes’ ensure API connections are possible

and data being consumed is available in the format needed

l Processes can be isolated and tested before deployment, minimising failure

l The risk of choosing the wrong solution is reduced

l Confidence in the new provider grows with each component deployment

l Cost can be spread across multiple periods in line with budgets.

The illustration below details some of the modular components in many Credit/AR processes. Some of the improvements made possible to the new customer onboarding process are:

1. CRM integration and improving sales conversion

Credit information delivered into a CRM is of significant value to a sales team. It helps focus effort on converting customers that

“Technology can improve relations by giving sales teams visibility over the progress of applications and understanding of the decision process to better understand why credit is declined.”

would be approved for credit rather than wasting time on those unlikely to get an account.

2. Sales and Credit – Making friends with the old foe Credit and Sales Team conflict is old news. It’s refreshing to encounter businesses where both understand each other’s challenges and work together to find a wise way forward to approve more accounts. Problems tend to stem from a lack of communication and understanding of each other’s objectives. Technology can improve relations by giving sales teams visibility over the progress of applications and understanding of the decision process to better understand why credit is declined.

3. Digital applications

The customer experience should be an important aspect of onboarding. Speed and ease are paramount. Access Intell sees digital applications that are 12 stages long and Terms and Conditions of Trade that require microscopes to read them. Our advice is to keep it short and simple. If you can get information elsewhere, don’t ask the applicant. The customer should be able to apply in less than 2 minutes – 3 if there is a Director’s Guarantee – while standing in a field of crops or in a hair salon waiting for a colour to take. If they can’t you might want to re-consider your solution.

4. Identifying customers

Verifying customers are who they say they are is an important part of the onboarding process. We are seeing a rise in bigger and better biometric facial recognition and verification products with 3D, 4D and 5D solutions emerging. Businesses that operate Trade Counters may need this solution, but Access Intell is finding that a combination of ingenious methods are being deployed across businesses that are less invasive and more effective.

5. E-signatures

Document signatures for the execution of Deeds of Guarantee (in the States that allow it) and the acceptance of Terms & Conditions of Trade are becoming the norm. E-sign technology has come a long way. Customers expect to be able to transact with suppliers

“Verifying customers are who they say they are is an important part of the onboarding process. We are seeing a rise in bigger and better biometric facial recognition and verification products with 3D, 4D and 5D solutions emerging.”

digitally for ease and speed. If your business has not yet implemented a solution, and you trade in a sector that expects it, you may be creating an unfavourable customer impression.

6. Assessing new accounts

Then we arrive at the point in the process when a decision is needed. Approval may be requested for:

z new customers processed via an online application completing paper applications an ABN delivered by a centralised unit overseas via a sales person an individual at a trade counter z existing customers seeking a limit increase with changed circumstances including new owners or trade credit insurance withdrawal Many of the same considerations are required irrespective of the situation. Traditionally, credit teams have relied on one credit bureau or source of information, but this can limit understanding of the opportunity or risk.

Advancements in technological solutions now enable multiple sources of data to be aggregated and automatic selection of which source or combination of sources is most appropriate for the risk. This approach has been found to reduce cost by up to a third* and improve prediction accuracy by 48%*. Additionally, systemising the decisioning process (not so much in making the decision but being able to record it) allows businesses to maintain consistency and exert control over exposure risk.

Stay tuned for Part 2 in the next edition, covering the second stage – PPSR and Monitoring Risk.

*Source – Access Intell Data 2024

Lynne Walton MICM is the founder and CEO of Access Intell. Lynne was an Insolvency Practitioner for 15 years with Ernst & Young and KPMG in Scotland and BDO and PPB Advisory in Australia. She left the insolvency profession in 2010 to specialise in the PPSA and PPSR and founded the EDX (QLD) business which became Access Intell in 2018.

Access Intell helps businesses make wise credit decisions, manage risk and ensure they get paid. The Access Intell platform transforms globally sourced data into risk intelligence to help businesses extend credit safely. Their cost-effective products support processes at every stage of the customer life cycle, from onboarding and assessment to PPSR and ongoing monitoring.

Fostering resilience and excellence in credit management teams

By Peter Morgan FICM CCE*

Introduction

As the Managing Director of a Specialist Executive Search and Accounting and Finance Recruitment company for the last 15 years, and having had the opportunity to serve as the Finance Director on the AICM board for over four years, I’ve had the privilege of witnessing and being part of an organisation shaping the dynamic landscape of credit management. At this year’s upcoming National Conference, a recurring theme that resonated deeply is building the strength and resilience of teams. Here, I share insights and strategies on building robust teams that not only navigate but thrive in the complex world of credit.

The foundation of team strength

In my experience, the foundation of a strong credit management team lies in three pillars: selection, training, and culture.

Selection

The process begins with attracting the right talent. We look for individuals who not only

possess analytical acumen but also exhibit a deep empathy for client relationships and an intrinsic motivation towards continuous learning.

Training

Once onboarded, continuous training is crucial. This isn’t limited to technical skills in credit assessment and analysis but extends to understanding market trends, legal updates, and soft skills like negotiation and emotional intelligence.

Culture

A culture that fosters open communication, accountability, and innovation is paramount. It’s about creating an environment where team members feel empowered to voice ideas, take calculated risks, and learn from failures.

Leadership and team dynamics

Leading by example is not just a cliché; it’s a necessity. As leaders, we set the tone for the team’s morale and productivity. During challenging economic climates,

Peter Morgan FICM CCE

“A culture that fosters open communication, accountability, and innovation is paramount.”

maintaining team morale was often about showing vulnerability – admitting what we didn’t know and learning together. This approach not only built trust but also encouraged innovation, as everyone felt included in solving problems.

Innovative practices

Technology plays an increasingly significant role in team dynamics. Implementing AI for credit risk assessment or data analytics for enhanced debtor profiling has required not just technical training but also a shift in mindset. Teams needed to be comfortable with change, which was facilitated through workshops focusing on digital literacy and case studies on successful tech integrations.

Evolution of best practices

Over my tenure, the best practices in team management have evolved. Where once

the focus was heavily on individual performance, today’s successful teams operate on a collaborative model. This shift was evident in how we handled the adoption of remote work – teams that were previously location-bound transformed into flexible, resilient units capable of functioning seamlessly from anywhere.

Personal leadership lessons

Reflecting on my time leading and helping to build high performing teams, one of the profound lessons was the strength of empowerment. Teams that were given autonomy to manage their projects, within defined frameworks, showed higher satisfaction and productivity. This autonomy wasn’t about relinquishing control but about trusting the team’s ability to make informed decisions, fostering a sense of ownership.

Conclusion

Building a strong credit management team isn’t about assembling a group of skilled individuals; it’s about creating a synergy where each member’s strengths are amplified through collective effort. As we look forward, the focus must remain on adaptability, technological integration, and above all, a human-centric approach to leadership. My journey has taught me that in credit management, as in life, the strength of the team is the heart of success.

*Peter Morgan FICM CCE

Director

Byron Thomas Recruitment

T: +61 2 8677 3020 | +61 432 561 999

E: petermorgan@byronthomas.com.au www.byronthomas.com.au

Peter has over 20 years combined Executive Search, board level, and senior management experience, offering an in-depth insight into building and fostering successful teams through talent acquisition, executive sourcing, employee engagement and career development.

The best debt collection tool is people (The story unfolds)

By Alex Caruana MICM*

The best debt collection tool on the planet is not technology or data, it is good people using technology and data. But what truly makes people the most effective tool in debt recovery? It boils down to their ability to communicate – using both their mouth and ears.

In debt collection, the words we say are vital. They convey the message, set expectations, and guide negotiations. But what is often overlooked is the equal, if not greater, importance of listening. Without truly hearing and understanding what the customer is saying, the spoken words lose their impact. Effective debt collection requires a balance saying the right words at the right time,

but more importantly, listening and understanding the customers situation.

Why listening matters

Recent Australian studies highlight the significance of active listening in debt recovery. According to research by RFi Group Australia (2022), 85% of

“Effective debt collection requires a balance saying the right words at the right time, but more importantly, listening and understanding the customers situation.”

Alex Caruana MICM

“...reports that businesses with a strong focus on listening and empathy in customer interactions see a 20-30% improvement in customer satisfaction a crucial factor in maintaining cooperative relationships with customers.”

consumers are more likely to cooperate with a debt collection agency when they feel understood

This sense of being heard creates a more collaborative environment, where the customer is more inclined to engage positively with the collector.

Additionally, Customer Service Institute of Australia (CSIA) reports that businesses

with a strong focus on listening and empathy in customer interactions see a 20-30% improvement in customer satisfaction a crucial factor in maintaining cooperative relationships with customers. In debt collection, this translates into higher recovery rates, as customers who feel understood are more likely to adhere to payment agreements.

The power of words

What you say also plays a significant role in debt collection, but it needs to be more than just compliance scripts or protocols. In ASIC’s 2021 report on debt collection practices, it was noted that collectors who demonstrate empathy and adjust their language to reflect the customers circumstances achieve higher levels of cooperation and payment compliance.

This highlights the need for flexibility in conversations, rather than a one-size-fits-all approach. For instance, instead of simply stating, “Your payment is overdue,” a more empathetic approach could be, “I understand you may be going through some challenges, and I’m here to help find a solution that fits your situation.” This minor shift in language, backed by active listening, opens the door to more productive conversations and, as the ASIC study found, can lead to a 15-20% increase in debt repayment agreements

Evidence from Australian studies

Several recent Australian studies provide strong evidence that listening, and empathy are key to successful debt recovery. A 2020 study by Prospa Insights Australia showed that businesses adopting a more empathetic, customer-focused strategy saw a 25% improvement in early-stage debt recovery rates. In this study, customers were more willing to engage and collaborate when they felt the collector was genuinely interested in understanding their financial situation.

Additionally, an in-depth 2021 survey by the Australian Institute of Credit Management (AICM) found that 63% of customers are more likely to respond positively when they feel their circumstances are acknowledged and respected. This highlights the importance of not just hearing the words, but actively engaging with the customers underlying concerns and adapting the recovery strategy accordingly.

Listening is not just hearing – it is understanding

One of the key takeaways from recent Australian research is that effective listening goes beyond just hearing the words. It is about understanding the customers situation, emotions, and challenges. Active listening involves asking open-ended questions that invite the customer to share more about their situation, such as: l “Can you walk me through what led to your current financial situation?”

l “What kind of payment structure would work for you given your current circumstances?”

“One of the key takeaways from recent Australian research is that effective listening goes beyond just hearing the words. It is about understanding the customers situation, emotions, and challenges. It is about understanding the customers situation, emotions, and challenges..”

These types of questions not only gather valuable information but also show that the collector is truly invested in finding a solution that benefits both parties. A survey by IBISWorld Australia (2021) showed that customers who feel engaged and listened to are 30% more likely to adhere to payment plans compared to those who feel rushed or misunderstood.

“Australian research consistently shows that communication must be tailored to the customer’s specific circumstances. ... Rural customers typically prefer more personal interactions, such as phone calls, whereas urban customers are more likely to respond to digital communication like SMS or emails. ”

Tailored communication is key Australian research consistently shows that communication must be tailored to the customer’s specific circumstances. Roy Morgan’s 2022 Financial Hardship Report found that customers from rural areas, for example, often have different communication preferences compared to those in urban settings. Rural customers typically prefer more personal interactions, such as phone calls, whereas urban customers are more likely to respond to digital communication like SMS or emails. This report highlighted that customising the communication method based on the customer’s lifestyle can lead to a 20% increase in engagement

Similarly, when debt collectors acknowledge cultural differences, such as language barriers or different attitudes toward debt, they can foster better cooperation. Deloitte Australia’s 2021 Collection Practices Study found that debt recovery agencies that offer multilingual support and culturally sensitive communication see a 35% increase in successful debt resolutions

People are the best tool –but only if they listen

In debt collection, the most valuable tool is the human element. But to be truly effective, collectors must balance what they say with how well they listen. The ability to engage, empathise, and adapt communication strategies to the customers unique situation is what sets successful collectors apart.

Australian studies overwhelmingly show that listening – truly understanding the customers challenges leads to better outcomes. Whether it is higher recovery rates, faster resolutions, or maintaining longterm relationships, listening

and empathy are the keys to successful debt collection.

It is not just about compliance; it is about connection.

*Alex Caruana

MICM Director – Business Development CCSG

T: 02 8568 6539

M: +61 (0) 466 228 387

E: alexcaruana@ccsgroup.com.au www.ccsg.com.au

Alex Caruana MICM is an accomplished professional in debt recovery and field services with over 35 years of industry experience. As Director – Business Development at Credit Collection Services Group (CCSG), Alex is at the forefront of industry engagement, bridging the gap between theory and practice. Drawing from his extensive experience across all sectors, Alex leads initiatives that enhance partner relationships and drives innovative solutions for clients and their customers.

Case update: Federal Court delivers judgment on creditor-defeating disposition against third party restructuring advisor

By Hannah Griffiths RITP and Phoebe Martin RITP*

The Federal Court of Australia recently delivered judgment against a third party restructuring adviser (and a company director) for breaching the creditor-defeating disposition (CDD) provisions, and other provisions of the Corporations Act 2001 (Cth) (Act) and awarded compensation and damages under ss 1317H and 588M(2) of the Act: Connelly (liquidator) v Papadopoulos, in the matter of TSK QLD Pty Ltd (in liq) [2024] FCA 888.

Takeaways

l Gather information from external accountants engaged or associated with the company in external administration, through conducting public examinations or issuing statutory notices available under the Act, to consider potential CDD claims and other claims early in an appointment.

l An adviser need not have had direct involvement in the transfer of company property subject of the CDD claim – it is sufficient for an adviser to have developed or knowingly assisted in the CDD scheme under which the transactions were effected.

Background

The director of TSK QLD Pty Ltd (in liquidation) (TSK) caused $10.3 million to be withdrawn from TSK’s accounts and paid to himself, the external accountant who acted as the specialist restructuring adviser (Adviser), certain individuals in senior management, and their associated corporate entities. The scheme underpinning the CDD was planned by the Adviser. It involved:

1. a sham “Sale Agreement” by which TSK “sold” its business and its accounts receivable to Torquejobs Pty Ltd (Torquejobs), an entity controlled by an individual in senior management, and 2. a “Debt Collection Scheme” whereby TSK allegedly appointed ‘Innovant’ (associated with the Adviser) pursuant to an Agency Agreement to collect TSK’s debts.

The Adviser prepared these documents and valued the assets of TSK at nil.

The Adviser and his associated entities adduced no evidence to contradict the evidence served by the liquidators and TSK, and they submitted that judgment should be entered against them

Phoebe Martin RITP

Hannah Griffiths RITP

immediately, however only in the amount of $431,000.

The Court considered this as tantamount to acceptance that the liquidators and TSK had established liability of the adviser and his associated entities.

The relevant question for determination by the Court centred around the value of the loss and damages that should be awarded in favour of the liquidators and TSK.

Assessment of loss and damages

In assessing the claim for loss and damages, the Court applied a “payments made” assessment, by considering the payments made by TSK pursuant to the CDD scheme. Under this assessment, an expert opinion as to valuation was not required (whereas it would be under a “sale agreement valuation” assessment). The impugned transactions comprised of a group of payments.

There were five payments made by TSK to Torquejobs totalling $2,016,623.74 (Payments) under the Sale Agreement. Those funds were received by TSK from Scottish Pacific Finance (ScotPac), representing debts ScotPac had collected on behalf of TSK.

In cross-examination, the Adviser gave evidence that Payments were conducted by the “internal accounting team” at Torquejobs and that he otherwise had no knowledge and played no part in making the Payments. The Court did not accept that evidence and found that it was “plain from the scheme devised” by the Adviser that “all of the cash held in the banks of TSK as at 24 October

2021 was to be paid to Torquejobs pursuant Sale Agreement, and that is what occurred”.

This finding was corroborated by a handwritten note of the Adviser, which contained a diagram depicting the transfer of $2 million from TSK to Torquejobs titled, “Debtors”.

The Court accepted that the reference to $2 million was “very close to the total of the amounts which were in fact transferred” and otherwise noted that the Adviser gave no evidence to explain the diagram.

The Court highlighted that it was not relevant that the Adviser did not know (or had no direct involvement with) the transactions under the CDD scheme, but rather that it was sufficient that the Adviser knew of all the essential facts of his formulated CDD scheme.

The Court found (and the parties agreed) that the amount awarded to the liquidators and TSK should be reduced by the value of the employee entitlements that were assumed by Torquejobs pursuant to the Sale Agreement.

The Court accepted and preferred the expert evidence of the liquidators and TSK as to the correct value of the employee entitlements (valued at $1,202,000), over the documents prepared by the Adviser and produced during his examination (which valued entitlements at $2,206,858.46).

Settlement deed

Prior to the hearing, the liquidators and TSK executed a settlement deed with Torquejobs and an individual from senior

management of TSK. Under that deed, instalment payments totalling $4.2 million were to be paid to the liquidators and TSK until 2029.

The Adviser submitted that a significant amount of the loss and damage suffered by TSK was remedied by the payments under the settlement deed, although not enough to give rise to issues of any ‘unjust enrichment’.