l Why PPSR Guidance is Needed During Insolvency Surge

l Strategies for Supporting Customers Facing Financial Difficulties

l 5 emerging trends impacting credit management teams ALSO IN THIS EDITION:

l Why PPSR Guidance is Needed During Insolvency Surge

l Strategies for Supporting Customers Facing Financial Difficulties

l 5 emerging trends impacting credit management teams ALSO IN THIS EDITION:

National partners

Divisional partners

Divisional supporting sponsors

ISSN 2207-6549

DIRECTORS

Julie McNamara MICM CCE – Australian President

Lou Caldararo LICM CCE – Victoria/Tasmania & Australian VP

Troy Mulder FICM CCE – Western Australia/Northern Territory

Rob Jackson MICM CCE – South Australia

Theresa Brown MICM CCE – New South Wales

Steven Staatz MICM CCE – Queensland

Daniel Taylor MICM – Co-opted Director

CHIEF EXECUTIVE OFFICER

Nick Pilavidis FICM CCE

Level 3, Suite 303, 1-9 Chandos Street, St Leonards NSW 2065

PO Box 64, St Leonards NSW 1590

Tel: (02) 8317 5085, Fax: (02) 9906 5686

Email: nick@aicm.com.au

PUBLISHER

Nick Pilavidis FICM CCE | Email: nick@aicm.com.au

CONTRIBUTING EDITORS

NSW – Gary Poslinsky MICM

Qld – Emma Purcival MICM CCE

SA – Clare Venema MICM CCE, Maria Scacchitti MICM

WA/NT – Jeremy Coote MICM CCE

Vic/Tas – Alex Hawtin MICM

EDITOR/ADVERTISING

Claire Kasses, General Manager

Tel Direct: 02 9174 5727 or Mob: 0499 975 303

Email: claire@aicm.com.au

EDITING and PRODUCTION

Anthea Vandertouw | Ferncliff Productions Tel: 0408 290 440 | Email: ferncliff1@bigpond.com

THE EDITOR reserves the right to alter or omit any article or advertisement submitted and requires idemnity from the advertisers and contributors against damages or liabilities that may arise from material published. CREDIT MANAGEMENT IN AUSTRALIA is published by the Australian Institute of Credit Management, Level 3, Suite 303, 1-9 Chandos Street, St Leonards NSW 2065. The views expressed in CREDIT MANAGEMENT IN AUSTRALIA are not necessarily those of Australian Institute of Credit Management, which does not expect or invite any person to act or rely on any statement, opinion or advice contained herein (whether in the form of an advertisement or editorial) and neither the Institute or any of its employees, agents or contributors shall be liable for any opinion contained herein. © The Australian Institute of Credit Management, 2024.

Editor, Level 3, Suite 303, 1-9 Chandos Street, St Leonards NSW 2065 or email: aicm@aicm.com.au

Julie McNamara FICM CCE National President

Hello everyone and welcome to the August edition of the AICM magazine.

Thank you for your continued support and renewed confidence in the Australian Institute of Credit Management. As we embark on the 2024/2025 calendar year, we are thrilled to see our membership base growing stronger. Your commitment to AICM is truly appreciated.

Our recent partnership with DecisionOK is an exciting development, and we eagerly anticipate connecting with DecisionOK, our national and divisional partners, sponsors and all our supporters at the upcoming National Conference in October. If you’ve never attended a National Conference before, this year is the perfect opportunity to experience it firsthand. The National Conference offers a unique blend of learning, networking, and inspiration. From insightful sessions to connecting with industry peers, you’ll gain valuable insights and create lasting memories.

Don’t miss out – register now and be part of an unforgettable event!

The Awards season is in full swing, and we extend our congratulations to all the divisional winners. The Credit Team of the Year Award promises to be a highlight,

with top-quality applications vying for recognition.

Equifax’s support for this initiative, along with our esteemed panel of judges – Debbie Leo from Equifax, Rhys Buzza from Reece, and Jane Hay from BGW Group – ensures a fair and rigorous evaluation process.

As we gear up for the National Conference, we encourage you to explore our newly launched ‘member only’ Special Interest Groups (SIGs). These SIGs provide a valuable platform for professional development and peer collaboration across seven niche topics. Dive deep into discussions, share best practices, and tackle the challenges of our field alongside fellow members.

Lastly, the WINC luncheon season is drawing to a close, and we’re excited to share the impact of our fundraising efforts for Orange Sky and the AICM Education Foundation. Join us for the final WINC webinar on October 23, 2024.

Once again, thank you for your renewed membership and unwavering support.

We look forward to a successful year ahead!

Julie McNamara FICM CCE National President

“The National Conference offers a unique blend of learning, networking, and inspiration. From insightful sessions to connecting with industry peers, you’ll gain valuable insights and create lasting memories.”

PROUDLY SPONSORED BY

The National Credit Team of the Year Award (CTOY) is an opportunity for credit teams to be recognised for the outstanding work, results, culture and learning they undertake.

Since 2008 the Credit Team of Year Award has recognised the outstanding culture, skills and achievements of Australia’s leading credit teams. Past participants rate this process as one of the most rewarding and fulfilling times in their careers when they take the time to reflect on their team’s achievements.

This year, we had some amazing applications from a diverse range of brands, and have narrowed the finalists down to the top 5, including:

Recoveriescorp: who in their application, described their team culture that is built on a foundation of transparency, collaboration, and mutual support.

Fletcher Building: who in their application, stated that they pride themselves on being subject matter experts in the credit, debt recovery and related systems space.

Metro Finance: who in their application, stated that they’re a small but mighty team, modelling their strength, values and achievements on their core values of Reliable, Resourceful, Results.

Cement Australia: who in their application, wrote about their natural curiosity for problem solving as issues present themselves, as true credit professionals that relish in the challenge of getting any issues resolved in a timely manner.

Randstad: who in their application, described their team’s exceptional communication skills and problem-solving abilities, enabling them to effectively collect payment.

These national finalists have won a $1,000 team development grant, and are now going on to prepare a 30 minute presentation to the judging panel to discuss how they have used the grant.

Following this process, two national finalists will be selected as nominees for the national winner.

Thank you to Equifax for supporting this award, and this amazing opportunity to celebrate the achievements of Australia’s leading credit teams.

Online courses offer a great opportunity for learners to experience a collaborative learning environment. Collaborative learning is an important way to help learners gain experience in interaction and develop important skills in critical thinking, selfreflection, and construction of knowledge which helps busy credit professionals.

In a collaborative learning environment, knowledge and understanding of the subject are shared and transmitted among leaners as they work toward common learning goals or a solution to a problem. Learners gain interactive experiences as they participate in discussions, search for information, and exchange opinions.

A high-quality collaborative learning environment provides learners with opportunities to engage in interactive and collaborative activities and to get better learning outcomes including the development of higherorder thinking skills.

For those who find this challenging, here are some top tips and great features to assist you in a smooth transition to online education with AICM.

“In a collaborative learning environment, knowledge and understanding of the subject are shared and transmitted among leaners as they work toward common learning goals or a solution to a problem.”

Planning is a great way to help you reinvigorate your motivation to study online. The best way to do this is to utilise an effective calendar system and create a study plan.

At the beginning of each week make a to-do list of everything you need to accomplish for the days ahead. Allocate time to each task and try to stick to this schedule. Not only will this implement self-discipline in your work, it will also allow you to prioritise your tasks in order of importance, an excellent skill to have when studying online.

Incorporating a consistent calendar into your learning habits is a great way to reduce anxiety within your studies, whilst improving your time management and organisational skills.

No one enjoys cramming a whole lot of work in one night, however it is a route most students take. Regularly revising sections within the course notes you have studied, will not only improve your memory, but it will also boost your understanding of the key credit concepts. A great way to maintain this is to revisit a subject or unit once a week.

It is important to ask for help, because you never know who else might be having the same problem. Ongoing feedback from your AICM trainer/mentor can be advantageous and may prompt you to ask any problematic questions.

Sometimes when it is just you and your computer, the motivation is not always there. That is why it is important to stay connected

“Regularly revising sections within the course notes you have studied, will not only improve your memory, but it will also boost your understanding of the key credit concepts.”

and collaborate with your peers and AICM trainers regularly. A good way to do this is to utilise the learner forums, email and other social media platforms to remain connected.

Reward yourself for your achievements

It may not seem like a priority, but it is important to acknowledge your achievements when studying online. This promotes enjoyment and motivation in your learning ability. Looking after your mental health and wellbeing, begins with being proud of your accomplishments.

Create a work-life balance

It is essential to maintain a solid worklife balance. Too much of something, can often lead to you feeling overwhelmed and unmotivated. Spend time doing what you love and ensure that you make time for your health and wellbeing. Getting enough sleep, eating the right things, and setting yourself up to look forward to things can help improve your balance. Finding ways to escape from your daily grind will improve your overall functionality and motivation to get the best out of your learning!

AICM would like to congratulate its recent graduates:

FNS40122 – Certificate IV in Credit Management

Hayley Hawke New South Wales Baiada

If you aspire to achieve greater heights in your credit career or want to get the best from your credit staff, then a qualification course can help you achieve your targets. Offered nation wide, you can study in your own time (24/7), with support available. If you have industry experience or prior education, you may be eligible for Recognition of Prior Learning (RPL) credits to fast-track your qualification. If you’re an employer, you may qualify for a training grant. Talk to AICM today to discover your course options.

Sponsored by

Congratulations to our divisional winners and finalists!

The Young Credit Professional of the Year Award (YCPA) is the largest and most prestigious youth credit award in Australia and provides a unique opportunity for young credit professionals to gain recognition both for themselves and their employers. We are delighted to announce the winners of the VIC/TAS, QLD, NSW and WA winners and recognise the incredible talent and high calibre of all the 2024 finalists. Our SA winner will be announced at the upcoming SA Awards Night on 29 August.

Finalist’s comments:

Elizabeth Dobbie MICM (CLIENT SERVICE OFFICER, NCI)

Elizabeth spoke well, and shows she is organised and passionate. She shows a passion for credit and helping people through her role, and shows a passion for learning and growth. Elizabeth gave detailed responses and brought great energy and preparation to her interview.

Hudson Pitt MICM (OPERATIONS MANAGER, POLYGON GROUP)

Hudson showed that he is a team builder, with great knowledge, and understands challenges well. Hudson was engaging and poised, very mature, and knows his role inside and out. Hudson provided very detailed answers and has a clear passion about his role.

Jamie Mead (INSOLVENCY ANALYST, ORACLE INSOLVENCY SERVICES):

Jamie was very bubbly, confident and relaxed. She has a great deal of life experience, having studied and played baseball in Florida. Jamie is very natural and personable.

Winner to be announced at the SA Awards Night on 29 August 2024

Finalist comments:

Greg Laycock (INSURANCE BROKER, NCI)

Greg was super articulate, and had a strong understanding of credit and receivables, management functions and principles and had a confident and personable manner.

Lucas Henley MICM (BUSINESS ANLAYST & USER ANALYST TESTER, FAIR GO FINANCE)

Lucas is extremely knowledgeable in all areas of credit and receivables management. Lucas is a very smart individual and has a wealth of knowledge.

Winner comments:

Greg presented very well with confidence beyond his years. WA is extremely proud to have Greg represent the division at the National Finals. Congratulations Greg Laycock. AND THE WINNER IS: Greg Laycock

Sponsored by

Finalist comments:

Amanda Rothwell-Hiscock MICM (PARALEGAL AND LAW GRADUATE, ROTHWELL LAWYERS)

Amanda has shown tenacity in progressing in her career, having started as a legal receptionist, then completing courses and progressing to work as a paralegal. She has since gone on to complete many areas of practice including instructing counsel, debt recovery matters, and managing her own client base. Amanda had solid responses to the judges’ questions and was very well-spoken. Amanda was confident and showed her passion to bring a young perspective to the credit profession.

Annabel Darvall (PERFORMANCE MANAGER, RECOVERIESCORP)

Annabel is an experienced people manager with a strong background in strategy, compliance and client management. She is adept at sourcing and producing actionable trend-analyses to support process improvements, and has a proven record of meeting and exceeding performance targets. Annabel showed a passion for credit and creating a safe space for clients. Annabel was confident and presented good answers to the judges’ questions. Annabel clearly enjoys the challenges of the credit profession, and is sure to have a long and bright future in the industry.

Eloise Cowan MICM (CLIENT SERVICE MANAGER, NCI)

Eloise is a hard-working, enthusiastic and proactive individual, a fast learner, and a strong team player, presenting professionally and communicates confidently with ease. Eloise demonstrated that she is a passionate and energetic professional and is driven for her future. Eloise showed that she is passionate about the community through her role as Team Leader of the Sustainability Team and believes in building good relationships with debtors and has future aspirations of becoming a Certified Credit Executive.

James Short MICM (CREDIT & NEW ACCOUNTS TEAM LEADER, REECE)

James is a dedicated, hardworking person with a background in banking and finance, which has allowed him to transition into credit with a wealth of knowledge. James showed that he is a forward-thinking credit professional and had strong industry knowledge. James has great life experience, having worked in London for a year. James showed that he is keen to become more involved with the AICM and would be a great asset to the association.

AND THE WINNER IS: Amanda Rothwell-Hiscock MICM

Winner comments:

Amanda was confident and approachable and is sure to be a great mentor for future young credit professionals. Her objective is to continue to pursue the best standard she can, and the judges are confident that she will continue to do this when she progresses to the national finals. Congratulations Amanda Rothwell-Hiscock.

Sponsored by

Finalist comments:

Shaun Ellem (CLIENT ACCOUNT EXECUTIVE – TRADE CREDIT SOLUTIONS, AON)

The judges commented that Shaun had a true understanding of exceptional customer service and had great empathy for assisting his clients. Shaun was confident and chatty through his responses to the judges.

Maja Dunimaglovska MICM (CLIENT ENGAGEMENT MANAGER – EQUIFAX)

The judges commented that Maja had great engagement and showed amazing professionalism. Maja’s responses to all questions showed her exceptional credit knowledge, along with her passion and empathy in assisting clients.

Jenn Doan MICM (RISK UNDERWRITER, ATRADIUS)

Jenn was at ease with the judges, and was able to demonstrate knowledge in her field. Jenn manages the Atradius Internship program, and it’s no surprise she was the Atradius Employee of the year in 2021.

Henali Kumar (CREDIT & COLLECTIONS ANALYST, TYRO PAYMENTS)

Henali is a quiet achiever and displayed great achievements in her current role. Henali was very impressive in her interview, and she was able to talk through her answers and talked about her experience. Henali showed empathy and great professionalism through her interview.

Arian Bahmiyari MICM (SOLICITOR, HOLMAN WEBB)

Arian greeted the judges with his infectious smile and settled in quickly for the interview. Arian talked through the judges questions and demonstrated good credit general knowledge and had great responses to every answer. Arian displayed an ambition to learn more in the credit industry.

Alexander McNeill-Bate (SENIOR RISK ANALYST, LUMI)

Alex entered the room and greeted the judges with a strong handshake. Alex presented with impressive responses to each question that the judges had for him. The judges were keen to hear his experience and innovations

Michael Grintzelis (CEO, AUSTRALIAN COLLECTIONS GROUP)

The judges commented that Michael has charisma, showed maturity and was able to give great insight on credit through his experience.

AND THE WINNER IS: Michael Grintzelis

Winner comments:

Michael showed an openness to learn more in credit, showing his commitment to the credit industry. The judges can’t wait to see what Michael will bring at the national finals and are confident that Michael is a strong candidate.

Sponsored by

Finalist comments:

Saki Nojuri (CREDIT OFFICER, ENDEAVOUR FOUNDATION)

Working in credit in a not-for-profit organisation means walking a fine line of managing organisational and public expectations, while also performing a credit function. Saki impressed the judges with the level of care and consideration she applies within her role at the Endeavour foundation and presented as a personable candidate within the interview process.

Jasmine Law MICM (LAW GRADUATE, AGILITY LAW GROUP):

Jasmine was an impressive candidate, answering her questions clearly and succinctly while also being able to show a deep understanding that far outweighed her experience in the credit industry. Her plans for the future demonstrated a passion for credit beyond her current role and a desire to make a positive impact on the credit industry.

Caitlin O’Dwyer (BUSINESS IMPROVEMENT LEAD, COLLECTIONS & FINANCIAL ASSISTANCE, BOQ)

Caitlin illustrated a great depth of experience in the consumer credit industry during her interview, providing numerous examples of innovation that she has driven in her role.

Kimberly Ho MICM (LAW GRADUATE, AGILITY LAW GROUP)

Kimberly showed a high level of understanding during her interview discussing insolvency practices in great detail while also being able to extrapolate her experience to questions on the wider credit industry and economic factors with great success. She articulated her ideas well, demonstrating a considered nature to ensure she answered her questions to the best of her ability.

Winner comments:

Caitlin was incredibly impressive throughout her interview process. She was calm, collected, and confident with each question and answered thoroughly providing well thought out examples from her own experience. Her passion for the credit industry was obvious from the deep understanding she displayed and her ambitious plans for future career progression. The judging panel were also impressed with the high level of problem-solving skills she showed, helping to drive creative and innovative solutions to problems within the business. From the roll out of these solutions she was able to identify not only positive impacts, but also how to improve these processes further and how to better contribute to similar projects in future.

Sponsored by

Congratulations to our divisional winners and finalists!

The Credit Professional Awards provide the unique opportunity to recognise the experience, skills, professionalism, contribution, and dedication of accomplished credit professionals across Australia. We are delighted to announce the winners of the VIC/TAS, QLD, NSW and WA awards and recognise the incredible talent and high calibre of all 2024 finalists. Our SA winner will be announced at the upcoming SA Awards Night on 29 August.

Finalist’s comments:

Troy Hills MICM, BUSINESS SERVICE MANAGER AT TOTAL BUILDING SYSTEMS PTY LTD

Troy impressed the judges with his passion and his rapid career progression, which is a clear indication of his high level of skills and ability to learn quickly. Troy is a firm but fair leader, and is a great teacher of his team to improve efficiency.

Lisa Anderson FICM CCE, CREDIT & CUSTOMER SERVICE MANAGER AT COOPER’S BREWERY

Lisa showed the judges that she is a strong leader, led by the guiding principles of respect, passion, responsibility, consistency and care. Lisa has been a great asset to the SA Council in her roles as events chair, and has an open door policy with her staff. Lisa showed the judges that she is clearly passionate about her staff, and imparting knowledge on her staff to help them prosper.

Adrian Stewart MICM CCE, CREDIT MANAGER AT NATIONAL PUMP AND ENERGY

Adrian impressed the judges with his depth of credit knowledge, and the confidence and detail in which he communicated it. Adrian has many years of experience, and he clearly demonstrated the positive impact he’s had at National Pump and Energy in a relatively short time. He builds bridges between departments, and brings the whole organisation with him on the credit journey.

Winner to be announced at the SA Awards Night on 29 August 2024

Finalist comments:

Carole Aird MICM, GROUP CREDIT MANAGER, KEE GROUP

Carole demonstrated to the judges that she is always striving to improve, and the judges were impressed by the fact that she believes in making ongoing business improvements to align with the credit journey.

Melissa Sharpe MICM, FINANCE AND ADMIN MANAGER, TURNER ENGINEERING WA PTY LTD

The judges commented that Melissa is very analytical and improved aged receivables from 26% to 67% on-time payments. The judges were impressed by Melissa’s confidence and that she is always seeking advice and knowledge.

AND THE WINNER IS: Melissa Sharpe

Winner comments:

Melissa impressed the judges with her integrity, which shone through in her manner of speaking. The judges commented that Melissa is a person who seems to lead by example and is very level-headed. Her Good communication with Sales Department seems to be her strong point where she has been successful in getting customers back on track. She has improved the processes and brought her staff skill levels up with constant training and support.

Finalist’s comments:

Tony Truong MICM, CHIEF CREDIT OFFICER, BIZCAP

Tony came with a proven history in commercial credit underwriting for industries in both secured and unsecured lending space. With experiences gained through working for large multi-national corporation and in a startup fintech, Tony is able to make sound commercial decisions weighing the risk versus reward model and executing solid commercial strategy. Tony demonstrated to the judges that throughout his career, he has been committed to bettering himself and his staff. Tony consistently looks for opportunities to coach and mentor and leads by example.

David Haysom MICM CCE, APAC REGIONAL PROCESS EXPERT, FUCHS LUBRICANTS

David is an accomplished professional with a proven track record, and brings a unique blend of skills and experience to the table through years of working in Credit Management across several Industry Sectors. His expertise lies in technology adoption, change management, team leadership, and fostering strong relationships. The judges were impressed by David’s passion for his role, through means such as riding along with sales, seeing customers, and going out the back to see how the manufacturing is done. David doesn’t accept the status quo, is a sounding board for his employees, and encourages his team members development.

Paul Canavan MICM CCE, APAC ACCOUNTS RECEIVABLE TEAM LEADER, SIMPLOT

Paul is experienced Credit Manager with a demonstrated capacity to turn around an organisations debtor’s ledger. Paul as a credit manager, has capacity to develop effective, highly motivated credit and collection teams. Paul presented extremely well, and is passionate about training his team. Paul also demonstrated that he manages successful delinquency arrangements.

Darren Tran MICM, HEAD OF RISK AND COMPLIANCE, MONEY PLACE

Darren leads the Risk and Compliance department at Money Place, ensuring adherence to regulatory requirements and internal policies. He oversees risk assessment processes and implementing risk mitigation strategies. Darren showed that he really gets behind his team to help develop them, however, also allows his team the space to work matters out on their own.

Winner comments:

Darren impressed the judges through his demonstrated empathy for clients. The judges are really excited for Darren to bring his unique experience in his profession to the national stage, and his passion for his staff and empathy for his clients is something to celebrate.

Sponsored by

Finalist comments:

Flourence Matimati MICM CCE, NATIONAL CREDIT MANAGER, VEOLIA ENVIRONMENTAL SERVICES

The judges commented that Flourence is a good all-round credit manager with a high level of credit knowledge and team management skills.

Frank Kemp MICM, COLLECTIONS FINANCE MANAGER ANZ, IRON MOUNTAIN

Frank came with a great deal of experience, having achieved a Master’s Degree in Fraud and Financial Crime. Frank manages the implementation and ongoing execution of leading practice cash collection processes, and ensures that key stakeholder relationships are maintained and there is strong communication and interaction between key business unit stakeholders and Collections.

Shane Fink MICM, NATIONAL CREDIT MANAGER, SNAP-ON TOOLS

Shane Fulfills the role of a Credit Manager superbly with good credit knowledge and ideas, strong implementation and understands how to get the best out of his team.

Nikola Razmovski FICM CCE, CREDIT MANAGER, CREDIT MANAGER AT CALL

The judges commented that Nikola is Well qualified with comprehensive expertise and experience in all aspects of credit management

Susan Day MICM CCE, NATIONAL CREDIT MANAGER, BRICKWORKS BUILDING PRODUCTS PTY LTD

The judges commented that Sue presents well, has good experience, and projects a strong passion for credit.

Marie Fellows MICM CCE, CREDIT MANAGER, TRANSURBAN

The judges commented that Marie is a good communicator, and is able to manage and get the best out of a large team effectively.

Georgia Barbera MICM CCE, REGIONAL MANAGER CREDIT & ACCOUNTS RECEIVABLE, ARISTOCRAT TECHNOLOGIES AUSTRALIA

The judges commented that Georgia is an Excellent candidate with good knowledge and experience in all facets of credit management.

AND THE WINNER IS: Flourence Matimati

Winner comments:

The judges commented that Flourence is results-focussed, and can’t wait to see her bring this energy to the national finals, and is sure to make NSW proud.

Sponsored by

Each finalist demonstrated a profound love for their teams and a commitment to ensuring the voice of Credit is both heard and valued across the broader business landscape. Their ability to inspire and motivate those around them is a testament to their leadership and unwavering dedication to the profession. These remarkable women have not only embraced technology but have also shown an incredible appreciation for it, even in instances where their companies were not yet able to implement new tech solutions. Their forward-thinking mindset and adaptability highlight their commitment to innovation and excellence in the credit profession. Each finalist’s ability to balance technological advancements with team cohesion and business integration underscores why they are truly deserving of recognition as finalists for the Credit Professional of the Year award.

Finalist comments:

Monique Barton MICM, CREDIT MANAGER, ENDEAVOUR FOUNDATION

Monique exemplifies the spirit of collaboration and unity, operating seamlessly as one team with her colleagues. Her approach ensures that every voice is heard and valued, fostering a work environment where collective effort drives success.

Mary Owens MICM CCE, CREDIT MANAGER, CEMENT AUSTRALIA

Mary brings a wealth of experience and an abundance of heart to her role as a Credit Manager. Her deep love for her team is evident in her supportive leadership style, which cultivates a motivated and cohesive unit dedicated to excellence.

Maureen Greaves MICM CCE, FINANCE AND ADMINISTRATION MANAGER, HARRINGTON BOBCATS & EXCAVATION

Maureen is a pillar of adaptability and continuous learning in the credit profession. Her tech-savvy nature and comprehensive approach allow her to navigate and implement innovative solutions, making her an invaluable asset to her team.

Pauline Dey MICM CCE, HEAD OF CREDIT, BDO AUSTRALIA

Pauline stands out for her innovative mindset and her ability to harness the unique strengths of her team. She consistently introduces creative strategies that not only solve problems but also enhance the overall performance and morale of her colleagues.

Winner comments:

Mary brings a wealth of experience and an abundance of heart to her role as a Credit Manager. Her journey is as inspiring as her achievements; she initially started out as a chef, and transitioning into the world of credit was a significant change that she embraced and overcame with remarkable resilience and determination. Mary, your dedication, innovative mindset, and heartfelt leadership have not only earned you this prestigious award but have also set a remarkable example for all of us in the credit profession. Congratulations on this well-deserved recognition!

South Australian Winner to be announced at the Adelaide Awards Night on 29 August 2024

Sponsored by

By Craig Brooks MICM*

As credit managers and risk professionals focus their thinking on the financial year ahead, illion has found a common theme emerging – everyone wants to gain customers, grow revenue, and manage risk.

Here are six questions we’re commonly asked by our clients, along with some insights to help.

1. How can I create a faster path to ‘yes’ for customer loan applications?

To accelerate approvals, prioritise quality data from the start. Align your sales, finance, and credit teams and ensure your customers are updated throughout the process. Effective risk assessment and a streamlined application process contribute significantly to a smoother experience.

How can I improve customer experience?

B2B clients expect the same

modern, straightforward experience as consumers. Ensure your processes are streamlined and user-friendly, while providing opportunities for personal interactions throughout. A friendly, communicative approach can make all the difference.

How do I stay on top of delinquency and late payments?

Monitor your customers proactively. Leverage both internal and external data to assess risk continuously. Utilising alert systems can keep you informed and ready to act before issues escalate.

How can I reduce my operational costs?

Focus on smarter, more efficient processes that enhance productivity without increasing headcount. Automate where possible but maintain your business’s risk profile. Choosing

“Effective risk assessment and a streamlined application process contribute significantly to a smoother experience.”

the right data sources and using them effectively can yield significant savings.

How can I minimise fraud?

Balance applicant information with reliable external data sources. Be vigilant and alert in your decision-making processes to stay ahead of potential fraud while maintaining a high-quality customer experience.

How do I keep clients I’ve worked hard to get?

Provide great service and integrate external data with internal insights for a full picture. Using the right systems, filter this information into regular alerts to identify potential issues early and step in when needed. Doing this allows appropriate conversations that build stronger

client relationships and set you up for success.

For more information, or to have a conversation about how you can set yourself up for success this year, please don’t hesitate to contact me or one of the Account Managers at illion.

*Craig Brooks MICM Head of Growth illion

E: craig.brooks@illion.com.au

Disclaimer: The content in this article is provided by illion as general information and does not contain any form of professional, legal or financial advice. illion makes no representations that this content is correct, current or complete. illion owns (or has appropriate licences for) all intellectual property rights in this article

By Malcolm Poslinsky FICM CCE*

86% of credit professionals responding to a Credit Pulse survey conducted by Equifax say the greatest benefit of the PPSR is the increased likelihood of recovering goods or payments when customers become insolvent.

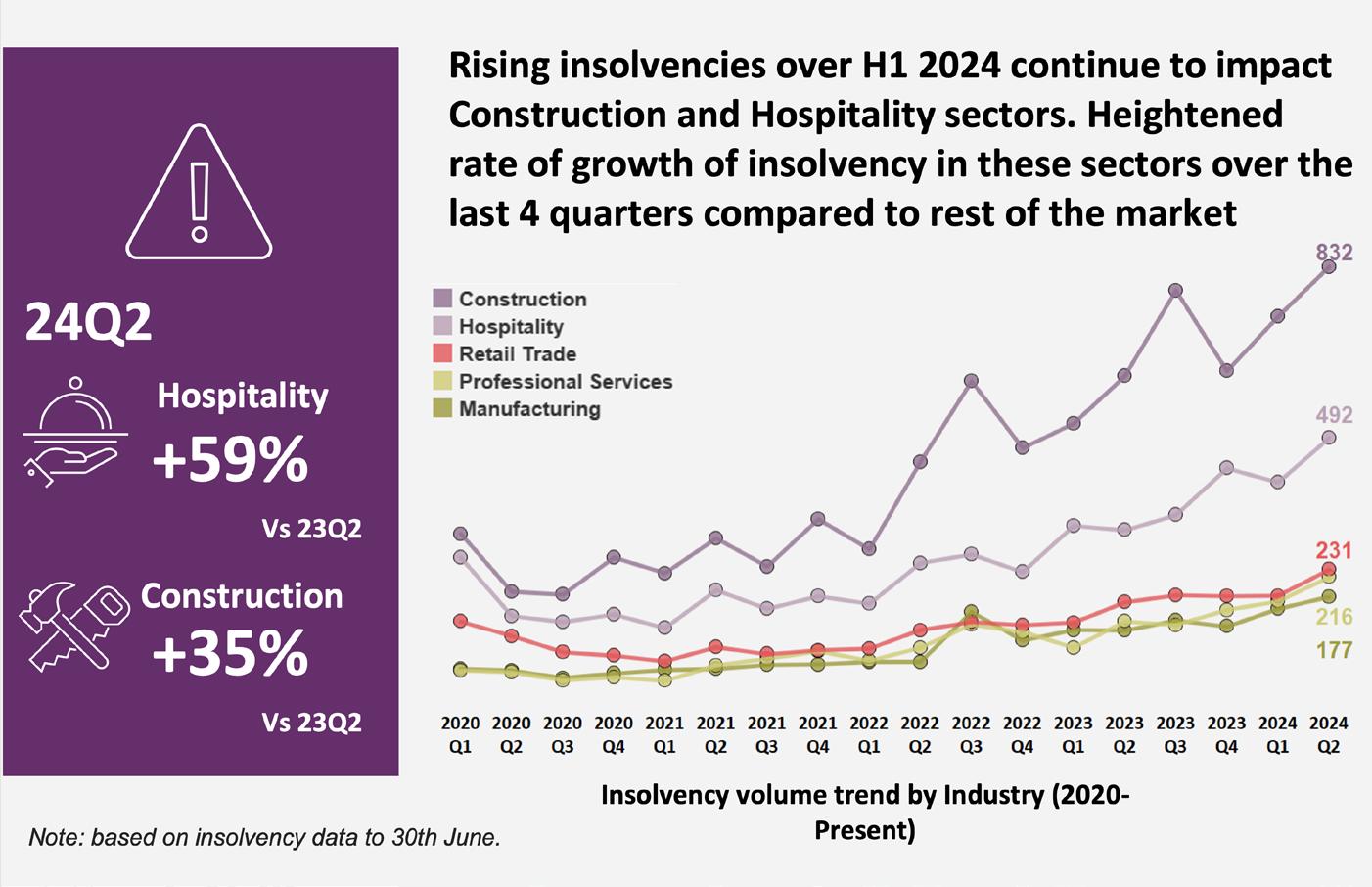

With insolvency rates rising 46% in the second quarter of this year compared with the same period the previous year, there is a new urgency to registering on the Personal Property Securities Register (PPSR).

For trade creditors or those leasing, hiring or financing equipment, PPS registrations are vital for securing your business interests during an insolvency. Without it, businesses risk losing millions to untraceable and unrecoverable assets or money during an insolvency claim.

This article explores case

studies demonstrating how businesses have successfully used the PPSR to recover goods or money when a customer goes bust. We simplify the process which ensures compliance with key PPSR timing requirements because let’s be honest, if it takes too long it will be too late or forgotten.

But first let’s look at the most recent insolvency trends, which are at their highest levels since the Covid-19 pandemic.

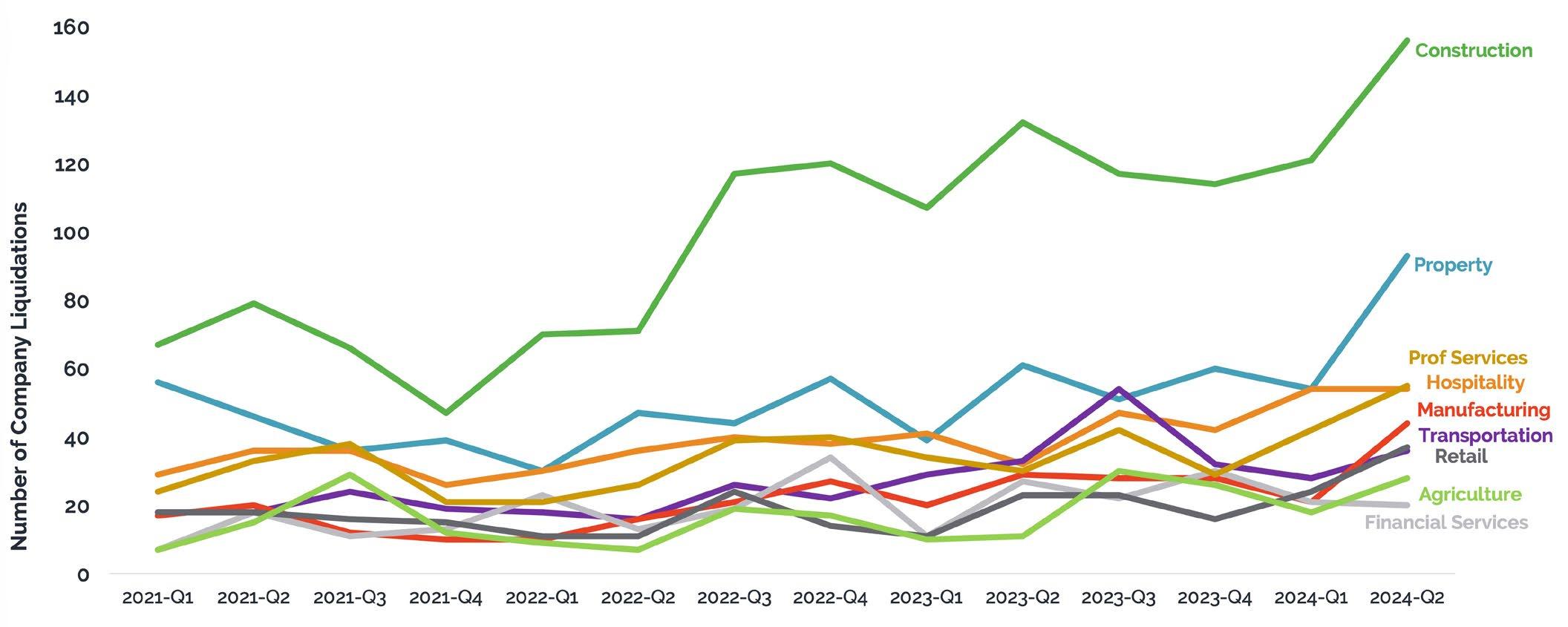

Increased operating costs, shrinking consumer spending and a tougher lending market has contributed to 5,961 insolvencies in the first half of 2024.

The construction and hospitality sectors remain the hardest hit, with insolvencies up 35% and 59% respectively in Q2 2024 compared to the

“With insolvency rates rising 46% in the second quarter of this year compared with the same period the previous year, there is a new urgency to registering on the PPSR.”

“Increased operating costs, shrinking consumer spending and a tougher lending market has contributed to 5,961 insolvencies in the first half of 2024”

same period the previous year. Insolvency rates for these sectors have grown faster than any other industry over the past four quarters.

These insolvency figures align with credit demand data, which shows that asset finance demand was particularly low in

Victoria and Queensland. This was due to lower enquiries from borrowers across a number of sectors – including hospitality and construction.

In Victoria, tight competition, decreasing demand and higher operating costs have contributed to major feasibility

challenges. Queensland is dealing with an increasingly tight labour market, partially driven by large infrastructure projects, which again is putting pressure on some operators. These are not factors that can be resolved quickly and the construction industry is likely to remain highly impacted by insolvencies for the foreseeable future.

The following case studies illustrate how EDX, a subsidiary of Equifax, has assisted companies in protecting their security interests when interacting with insolvency practitioners to safeguard creditor rights.

CASE STUDY #1: Air Conditioning supplier and insolvency practitioner align interests for optimal debt recovery

An EDX from Equifax client is facing a situation where they are owed over $600k by a customer who has recently become insolvent. Initially, the management team thought they would be writing off the debt. However, after a review of the relevant documentation and invoices, we identified approximately $180k worth of supplies that are likely to be classified as

accessions. These items can be repossessed even though they are currently attached to the property. Our client installed various components, including air conditioners, ducts, and compressors.

Notably, four large compressors are secured to the site with bolts, making them relatively easy to remove.

If a satisfactory negotiated payment isn’t achieved, nearly all items – except for the ducts – could be repossessed. Additionally, our client may be able to claim for the value of work completed, although this will depend on further discussions between the developer and the insolvency practitioner. It’s quite possible that will result in our client getting a payment for the ‘proceeds’ of what they have delivered at full value.

The good news is that both the insolvency practitioner and creditors are aligned in their interests. If the insolvency practitioner can successfully argue that the developer owes for the work done, our client could receive a significantly higher payment.

Our client’s senior leadership team initially underestimated the benefits of PPSR compliance. Fortunately, their credit team had been diligent about registering for PPSR over the years.

This foresight could prove invaluable; just one PPSR registration by the accounts receivable team could potentially save them hundreds of thousands.

fixes

2,000 invalid registrations

An equipment finance company engaged EDX from Equifax to review their 5,000 PPSR registrations. The review uncovered over 2,000 errors, many involving incorrect grantor information, which could lead to substantial financial losses in the event of customer defaults.

EDX conducted a thorough assurance review of the company’s PPSR registrations and provided a detailed report with recommendations for enhancing policies and procedures to better protect their interests. Although the company initially attempted to rectify the errors manually, a subsequent review a couple of years later revealed an additional 1,700 potentially invalid registrations.

To address these persistent issues, EDX advised the company to undertake a bulk remediation process, excluding low-value, lowrisk accounts to manage costs effectively. EDX recommended adopting the ESIS software for accurate new registrations, leading the company to use this tool to process remediation files and align them with internal records.

The EDX review also identified strategies to reduce costs related to registration duration and the number of listings per customer, which will enhance financial protection and operational efficiency.

A materials handling company encountered significant difficulties reclaiming rented equipment when two customers became insolvent, revealing errors in their PPSR registrations. Prior to reaching out to EDX from Equifax, this company completed 2,617 PPSR registrations on their own accord, many of which contained mistakes. When their customers went into administration, these errors prevented the recovery of equipment worth up to $800,000 each.

Realising the need for expert intervention, the company enlisted EDX for comprehensive PPSR support that included policy advice, managing bulk registrations and implementing ongoing processing using ESIS software to minimise errors and simplify operations.

An assurance review identified numerous mistakes in existing registrations, including incorrect selections and identifiers. EDX remediated these issues through a bulk upload of amendments and new registrations.

EDX established new processes to ensure all registrations were handled correctly and the materials handling company now manages hundreds of registrations, amendments, and discharges each month with ESIS software.

Here are the key takeaways from the Equifax July Credit Pulse survey1, which asked credit professionals to share their opinions on the PPSR.

The majority of survey respondents (85%) regularly register on the PPSR, with a small minority doing so occasionally or not at all.

Two-thirds of respondents (66%) value third party assistance for optimising PPSR use and making it easier to integrate with other products and services, simplifying their workloads. 34% prefer to manage the PPSR themselves.

Sale of goods on credit is the predominant use of the PPSR by respondents (85%). Other transactions include secured loans, asset protection, personal or corporate guarantees, equipment on hire/lease and equipment finance.

The majority of respondents (86%) believe the No.1 benefit of the PPSR is to increase the likelihood of getting their goods back or getting paid when customers become insolvent. In second place (73%) is the opportunity to negotiate with insolvency practitioners as a secured creditor when customers go bust. Protection against unfair preferences is in third place at 59%.

Other benefits include the opportunity to achieve the number one ranking over other creditor’s claims (45%), protection over the business assets on lease/hire/bailment (25%) and preventing the sale of assets registered by serial number (16%). We prefer to manage the PPSR ourselves 3rd parties help us get the most out of the PPSR 3rd parties make it

What type of transactions does your business typically use the PPSR for? (Check all that apply)

What benefits do you believe PPSR offers? (Select all that are important to you)

Goods/money back after customer insolvency

Negotiate with insolvency practitioner

Achieve No.1 ranking over other creditors

Protection over assets on lease/hire/ bailment/consign Protection

Preventing sale of

Do you know what the prerequisites are in order to correctly register your customers? (Select all that you are confident in)

The majority of respondents (74%) believe that the PPSR has taken on greater importance in this climate of rising insolvencies. Only 26% report their view as unchanged and none of the respondents reported that PPSR as less important. It’s vital to know your company is using the PPSR correctly when searching the register or generating, amending or discharging registrations. Yet with the above chart showing ‘1’ as very confident and ‘5’ as very unconfident, it’s evident that most respondents were

As insolvency levels rise, how does this impact your view on the importance of the PPSR for your business?

On a scale of 1 to 5, how confident are you that your company’s PPSR is exactly right when you:

not confident this was the case. Timing may be a problem which can render your registrations on the PPSR largely worthless (see The Importance of Timing for the PPSR in the July AICM newsletter), so it is interesting to note that only 77% of respondents were confident in understanding timing requirements. A greater number were confident of other prerequisites like registration details (91%), documentation containing a security interest (84%) and grantor identification requirements (77%).

*Malcolm Poslinsky FICM CCE PPSR Specialist, EDX from Equifax M: 0401 991 917 E: malcolmp@edxppsr.com.au www.edxppsr.com.au

FOOTNOTE:

1 The Equifax July 2024 Credit Pulse Survey had 46 respondents.

About EDX EDX, an Equifax subsidiary, simplifies PPS registrations for businesses. With deep expertise in insolvency and credit management, EDX helps companies protect their security interests and negotiate with insolvency practitioners to safeguard creditor rights.

DISCLAIMER: This communication is provided for general guidance only and should not be construed as legal advice. As we are not lawyers this is not legal advice and we take no responsibility for any policy decisions.

16 - 18 OCTOBER 2024

AICM's National Conference is where credit professionals meet to connect, update and further their understanding of best practices in credit management. The annual conference has been held for over 20 years and is Australia's largest gathering of credit and finance professionals.

By Anneke Thompson MICM*

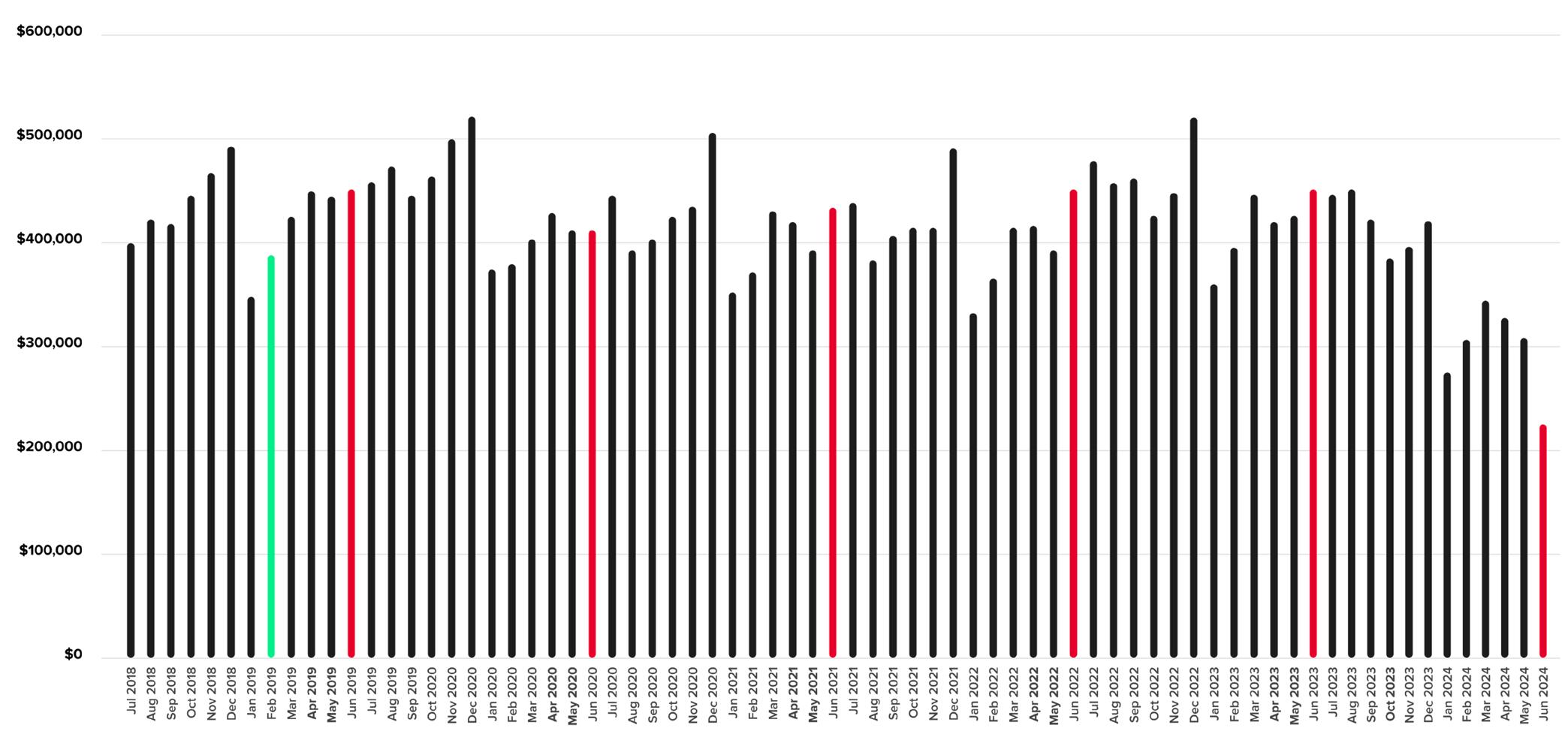

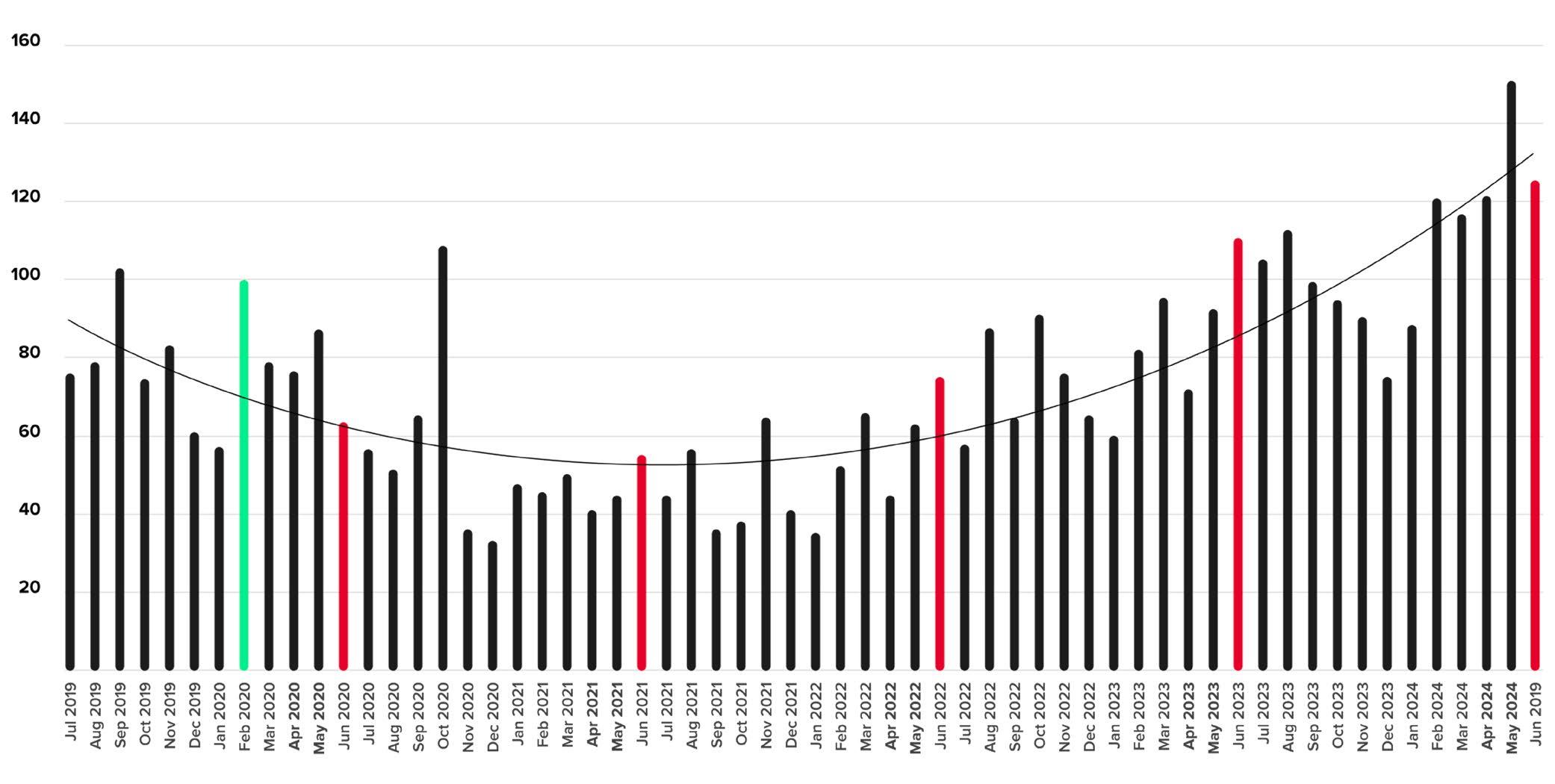

CreditorWatch’s June results for its Business Risk Index (BRI) reveal a dramatic and concerning drop in the value of invoices held by Australian businesses as declining consumer demand forces cuts to inventory.

CreditorWatch has increased its 12-month forecast for hospitality failures to 9.1 per cent – one in 11 businesses –as conditions for consumers and businesses continue to deteriorate.

Business orders values at record low – down 49.9% YoY

The average value of invoices held by businesses has fallen 49.9 per cent over the year to June 2024 reflecting a drop in order values as businesses are forced to wind back inventory due to higher prices and declining demand in the economy.

Compounding this problem is rising invoice payment defaults, which have been trending up since mid-2021. This indicates

that businesses are finding it increasingly difficult to pay their suppliers despite lower order values.

Another of CreditorWatch’s key metrics, the business failure rate, is also deteriorating with an 8.8 per cent increase across all industries over the past 12 months.

One in 11 hospitality businesses to fail over next year

The outlook has worsened for businesses in the hospitality industry with CreditorWatch now forecasting the failure to increase from 7.5 per cent to 9.1 per cent –that’s one in 11 businesses.

This is well above the forecast for Arts and Recreation Services and Transport, Postal and Warehousing which are ranked second and third with forecast failure rates of 5.7 per cent and 5.5 per cent respectively. The average forecast for all industries in 5.1 per cent.

Hospitality has a significantly higher failure rate forecast

Data sources: CreditorWatch trade receivables data (accounting software integration)

Data source: CreditorWatch Business Risk Index

than other industries primarily because of its heavy reliance on discretionary spending, which has dried up as consumers tighten their belts to cover increases in mortgage payments, rents, power bills and other essentials.

Business payment invoice defaults dipped from May to June but have been trending up since the middle of 2021 and are well above pre-COVID levels. Rising costs and declining

demand have conspired to squeeze businesses, making it more difficult to pay suppliers.

CreditorWatch has identified a strong correlation between a B2B payment default and the chance of a business failing over the following months.

Other Key Business Risk Index insights for June:

l Court actions are trending strongly upward with a 37 per cent increase for the year to June 2024. They are now sitting well above pre-COVID levels.

l Credit enquiries dropped from May to June and remain flat across 2024, reflecting the subdued trading conditions in the Australian economy.

l Food and Beverage Services is the top ranked industry for outstanding ATO tax debts above $100,000, with a rate of 1.65 per cent. Construction and Electricity, Gas, Water and Waste Services are next at 1.18 per cent and 0.94 per cent respectively.

l Adelaide has the best performing capital city CBD by a considerable margin. It is

followed by Perth, Melbourne, Brisbane and Sydney.

l The regions with the lowest risk of business failure are concentrated around regional Victoria, inner-Adelaide and North Queensland. NorwoodPayneham-St Peters in South Australia, is the top-ranked region (3.48 per cent chance of default), followed by Unley, also in South Australia, and Ballarat in Victoria.

l The regions with the highest risk of business failure are around Western Sydney (six of the top 10) and South-East Queensland, with BringellyGreen Valley (NSW) the topranked region (7.63 per cent chance of default), followed by Merrylands-Guildford and Canterbury, all in Western Sydney.

We are now well and truly in the toughest phase of the monetary

policy cycle. The high cost of debt is compounding the problems wrought by inflation, that is still too high in some areas.

Monetary policy decisions usually lag what is happening in the broader economy, as data takes time to filter through to the RBA, and the RBA also wants to see a few months’ worth of data to be more certain that their decisions taken at board meetings are the correct ones.

While this approach is sound theoretically, in practice it means businesses have to endure high interest rates long after consumer demand has plummeted, and discretionary spending has significantly weakened.

CreditorWatch CEO, Patrick Coghlan, says conditions are becoming truly dire for Australian businesses.

“The combination of declining order values and increasing payment defaults is a major concern as it indicates more businesses are experiencing both cost and demand pressures,” he says.

“With another rate increase becoming increasingly likely, we expect both metrics to deteriorate even further.

“It is small businesses that are hurting the most as they are more vulnerable to adverse economic conditions than larger businesses. They operate on tighter margins and are less able to take measures to cut costs.”

CreditorWatch’s Business Risk Index June 2024 data indicates that monetary policy settings, combined with continued rising prices in the services, utilities and insurance sector and record low consumer confidence are having severe negative impacts on Australian small businesses.

The impact is not spread evenly through the economy –areas with younger populations and businesses in the hospitality sector have been hardest hit. This trend will continue well in to 2025, which is the earliest realistic time we

can expect the RBA to have cut the cash rate a few times.

As a result, businesses will fail at an alarmingly high rate, and it is inevitable that unemployment will rise, albeit off a low base.

Low unemployment and good job security has been one of the few positives that Australian households have benefitted from over the past few years and, sadly, it looks like even these positive measures will soon come to an end.

*Anneke Thompson MICM Chief Economist CreditorWatch www.creditorwatch.com.au

“Hospitality has a significantly higher failure rate forecast than other industries primarily because of its heavy reliance on discretionary spending, which has dried up as consumers tighten their belts to cover increases in mortgage payments, rents, power bills and other essentials.”

By Monika Lacey MICM*

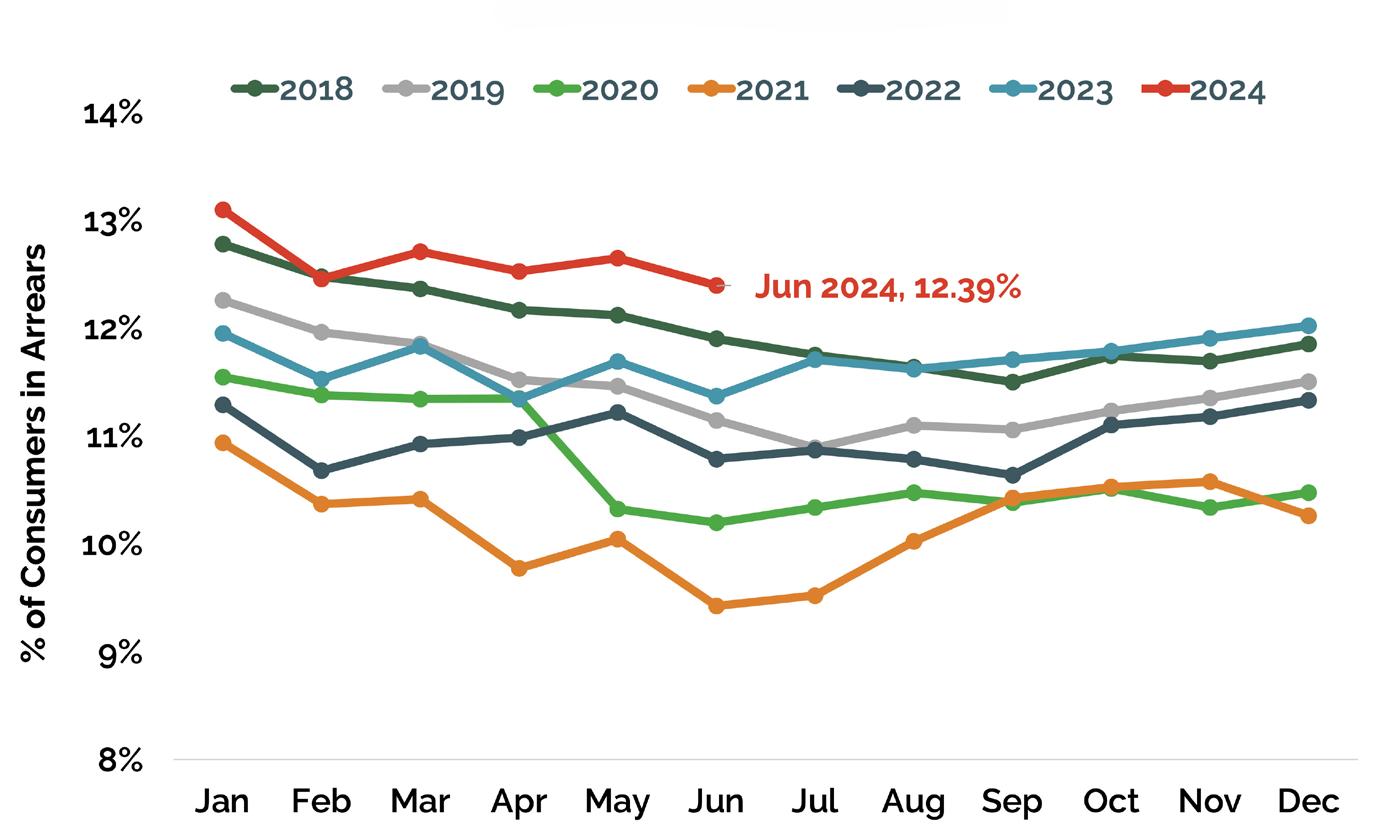

Times are undoubtedly tough for both Kiwi businesses and consumers alike as the costof-living crisis and tough economic conditions to bite.

In a positive sign however, inflation eased in New Zealand to its lowest level in three years at the midpoint in July, with the consumer price index (CPI) increasing by 0.4% over the three months ending in June.

Meanwhile, the annual inflation rate decreased to 3.3% –

down from 4% – the lowest since June 2021, but still above the Reserve Bank’s target.

At present, economists across the country have mixed predictions on the chances of an early reduction in interest rates.

When looking at consumer and business credit insights, a mixed picture also emerges.

Overall arrear volumes eased in June, with 465,000 people behind on payments, down 9,000 month-on-month, but still

up 9% year-on-year. Consumer arrears are stable with only slight month-to-month changes.

However, consumer utility arrears have worsened over the past year due to economic tightening, and the cost-of-living crisis coupled with the cooler winter months.

Mortgage delinquencies improved in June, with 21,500 home loans past due, down 500 from the previous month, but still 11% higher year-on-year.

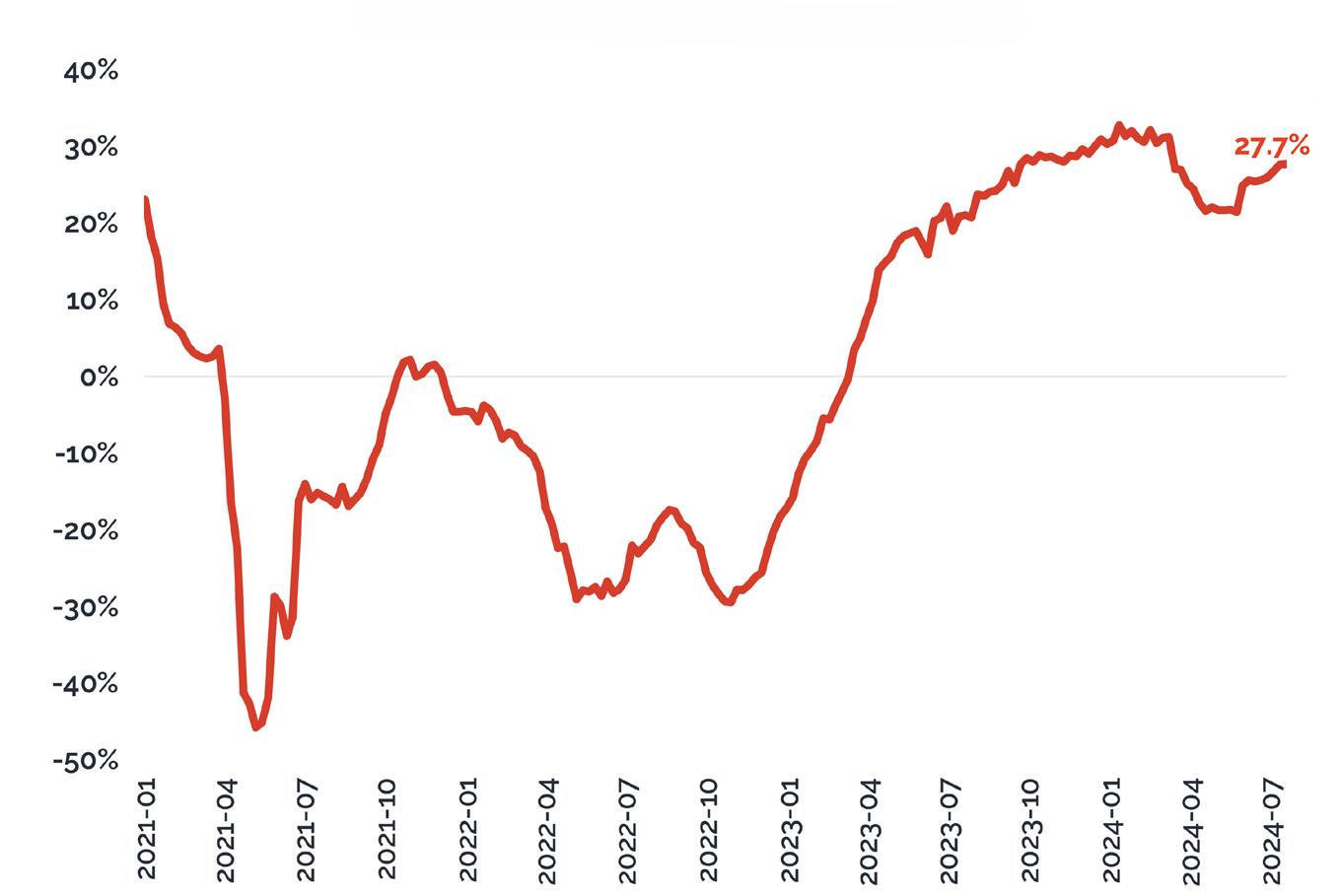

Financial hardships rose 27.7% year-on-year, with 13,500 accounts in financial hardship, nearly half related to mortgage payments.

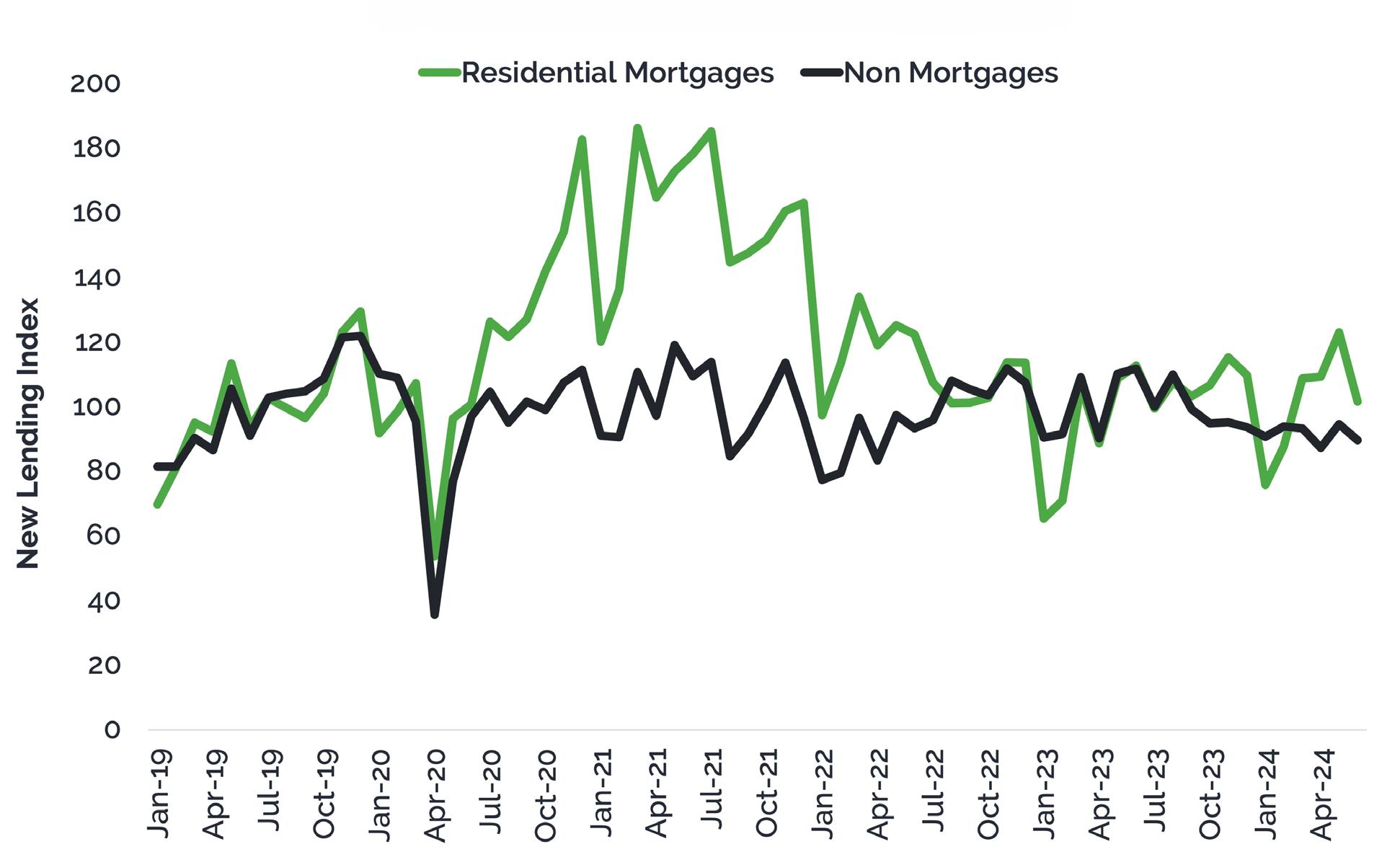

New lending trends showed consumer credit demand flat compared to 2023 but 4% below the long-term average. Approved new mortgage lending increased by 7.7% year-on-year in June, while new non-mortgage lending decreased by 13%.

Business credit insights revealed a 19% increase in company liquidations over the past year, especially in the construction and property sectors.

In fact, Q2 2024 saw the highest quarterly total of company liquidations (93) in over 10 years, with property company liquidations increasing by 28%.

Overall, consumers have fared better than businesses in Q2, with stabilising arrears despite year-on-year increases.

Businesses, however, have faced significant challenges, as indicated by the recent increase in liquidations, reflecting a New Zealand economy struggling in the face of the cost-of-living crisis.

Arrears stabilise overall, yet utility costs cut deep When looking at Q2 as a whole, arrears have stabilised overall, with the number of consumers behind on their payments down 9,000 month-on-month to 465,000.

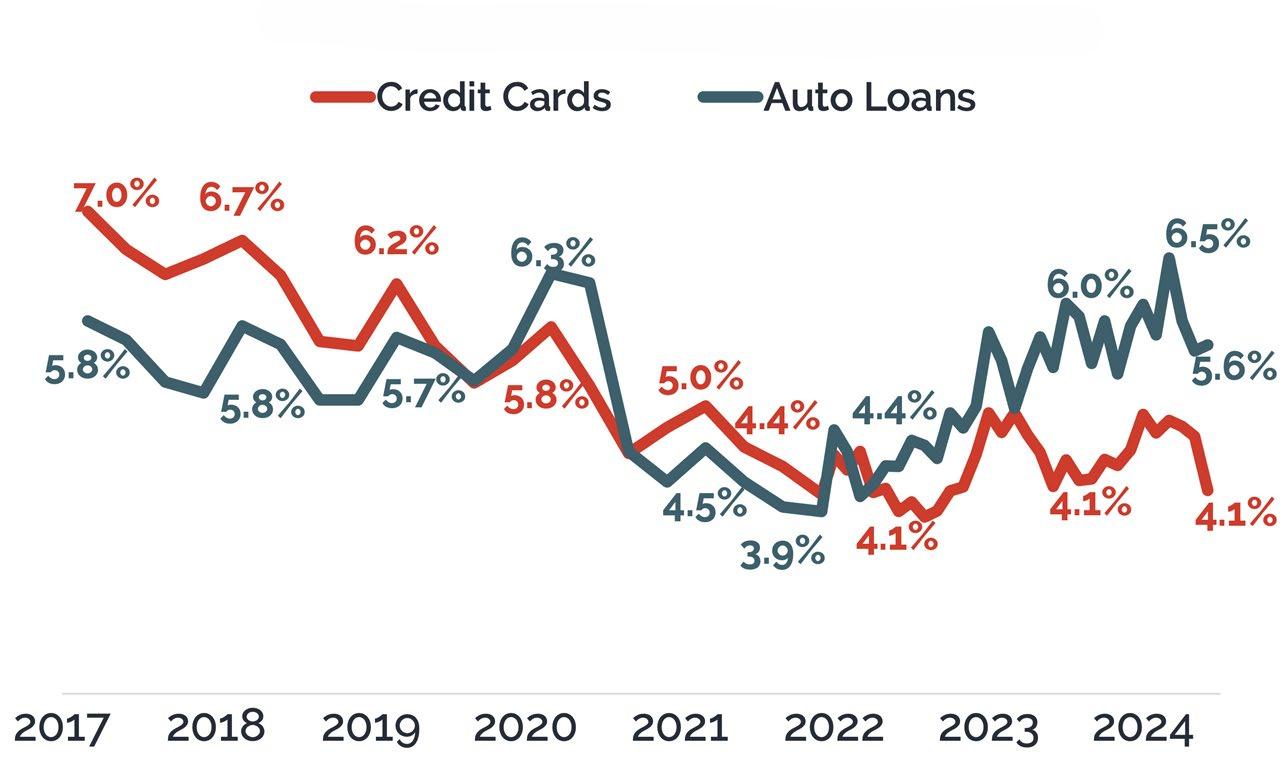

Turning to product types in particular, arrears have improved for most, excluding retail energy (utilities) and auto loans, which are up 30% and 4% respectively year-on-year.

Worryingly, however, utilities arrears have worsened over the last 12 months sitting at 4.4% compared to 3.4% for the same period last year.

This is an indication of Kiwi households falling behind on their power repayments in winter and struggling to heat their homes.

Within this arrears sector, early arrears (less than 30 days past due) have increased the most over the last 12 months (up from 1.9% to 2.7%). Furthermore, 30+ days arrears at 12 months on the books, have also risen from 2.2% to 3.3% since the beginning of 2020.

This paints a concerning economic picture and indicates an increasing number of Kiwis are struggling to pay their heating bills during the tough winter months amid the ongoing

cost-of-living crisis.

Mortgage delinquencies improved in June, with 21,500 home loans reported as past due, down 500 from May.

However, mortgage accounts past due are tracking 11% higher year-on-year, despite residential mortgage arrears reported in arrears falling to 1.44% in June, which is comparable to 2019 levels.

Furthermore, credit card arrears also dropped to 4.1% in June, the lowest reported arrears level since September 2022, while vehicle loan arrears rose by 0.2% compared to June last year.

Non-mortgage lending is down 13% in the June quarter compared to the same time period last year.

Meanwhile, new residential mortgage lending for the June quarter was 7.7% higher than the same period last year, but still 35% lower than the same period in 2021 during the property market boom.

There has been a 28% increase in financial hardship reports yearon-year, indicating more and more borrowers are seriously falling behind on their debt repayments.

The proportion of credit application enquiries returning financial hardship alerts has risen to 0.5% for the first time since August 2020.

Of all financial hardship cases, 45% relate to mortgage payment difficulties, with 29% and 18% relating to credit card debt

Note:

and

Business credit demand, defaults and liquidations

Business credit demand is up 11% year-on-year, with credit demand rising 17% for the property sector and 15% for hospitality over the last 12 months.

Business credit defaults are up 5% year-on-year overall, with the transport industry up 18%, closely followed by the construction sector defaults up17%, indicating the sector is experienced prolonged economic pain.

Overall, only the hospitality sector saw credit defaults fall, showing a decrease of 6% yearon-year, which could suggest slight signs of improvement.

Company liquidations across the country are up 19% yearon-year in June, in another distressing sign for the New Zealand economy.

Of all the country’s company liquidations, 24% (156) came from the construction industry, whilst 14% (93) originated from the property sector – with

both industries bearing the brunt of the cost-of-living crisis and consumers increasingly tightening their purse strings.

With the cost-of-living crisis continuing to impact Kiwi consumers and businesses across most key credit markers, all eyes remain on the

government and the Reserve Bank to see what they will do to help ease the economic pain being felt by many.

The announcement of New Zealand’s official cash rate (OCR) in mid-August will provide some clarity on the direction travel regarding national inflation rates.

Beyond the uncontrollable, it’s important that New Zealand

households and businesses seeking to effectively plan for their future seek out advice early to best safeguard their financial wellbeing from the current tough economic conditions.

*Monika Lacey MICM Chief Operating Officer Centrix Credit Bureau of New Zealand www.centrix.co.nz

By Lisa Morrissey*

Proposed reforms to Australia’s bankruptcy system were announced by the Attorney General in July 2024. It is said that the objective of the reforms is to “ensure Australia’s bankruptcy system is fairer and operates in the best interests of all Australians” 1 .

The key changes to be introduced are:

l increasing the threshold for creditor petitions from $10,000 to $20,000 (with the threshold to also be indexed each year);

l increasing the timeframe for compliance with a bankruptcy notice from 21 days to 28 days.

l reducing the period a discharged bankruptcy is publicly recorded on the National Personal Insolvency Index to 7 years following discharge (currently the listing is permanent)

l removing the proposal or acceptance of a debt agreement as an act of bankruptcy under the Act.

There is no immediate proposal to shorten the automatic discharge period of bankruptcy from 3 years to 1 year, however this is something that has been continually flagged as a potential change so is expected to be looked at more closely in the future.

The government has also announced a consultation process to be commenced on a Minimal Asset Procedure, which is based on a similar regime which currently exists in New Zealand. The concept is designed to “clear a person’s debts and allow a fresh start sooner than a bankruptcy”

The process would last for 12 months with a 4 year post discharge public listing on the NPII.

The regime would be available to debtors who:

l have maximum debts of $50,000 or less

l have no more than $10,000 in assets (with an exception for tools of trade and a vehicle”

“There is no immediate proposal to shorten the automatic discharge period of bankruptcy from 3 years to 1 year however this is something that has been continually flagged as a potential change...”

A maximum income is yet to be determined. The process would only be available once to debtors.

The “no asset procedure” (NOA) has been in place in New Zealand since 2007. It is available to debtors who owe less than $50,000 with no assets available. In the financial year 2022/2023, 476 applications were accepted under the New Zealand process. In 2023/2024, 413 applications were accepted2. Approximately 24% of applications made were rejected (presumably as not meeting the eligibility requirements).

The regime, similar to the small business restructuring regime introduced in 2021, is designed to offer debtors with

“The government has also announced a consultation process to be commenced on a Minimal Asset Procedure, which is based on a similar regime which currently exists in New Zealand.”

minimal debts a fresh start without the cost of formal bankruptcy which often result in minimal return to creditors and are costly to administer. It is suggested that it will have minimal impact on creditors who would likely not have received any return in a formal bankruptcy scenario and reduce overall administration costs which are borne by the Australian Financial Security Authority.

*Lisa Morrissey Turks

T: (02) 8257 5721

M: 0417 236 786

E: lisa.morrissey@turkslegal.com.au www.turkslegal.com.au

FOOTNOTES:

1 Media release www.ministers.ag.gov. au/media-centre/bankruptcy-lawreforms-08-07-2024

2 www.insolvency.govt.nz/about/ statistics/insolvency-procedurestatistics/no-asset-procedurestatistics

By Eric Maisonhaute MICM*

Introduction

AR department

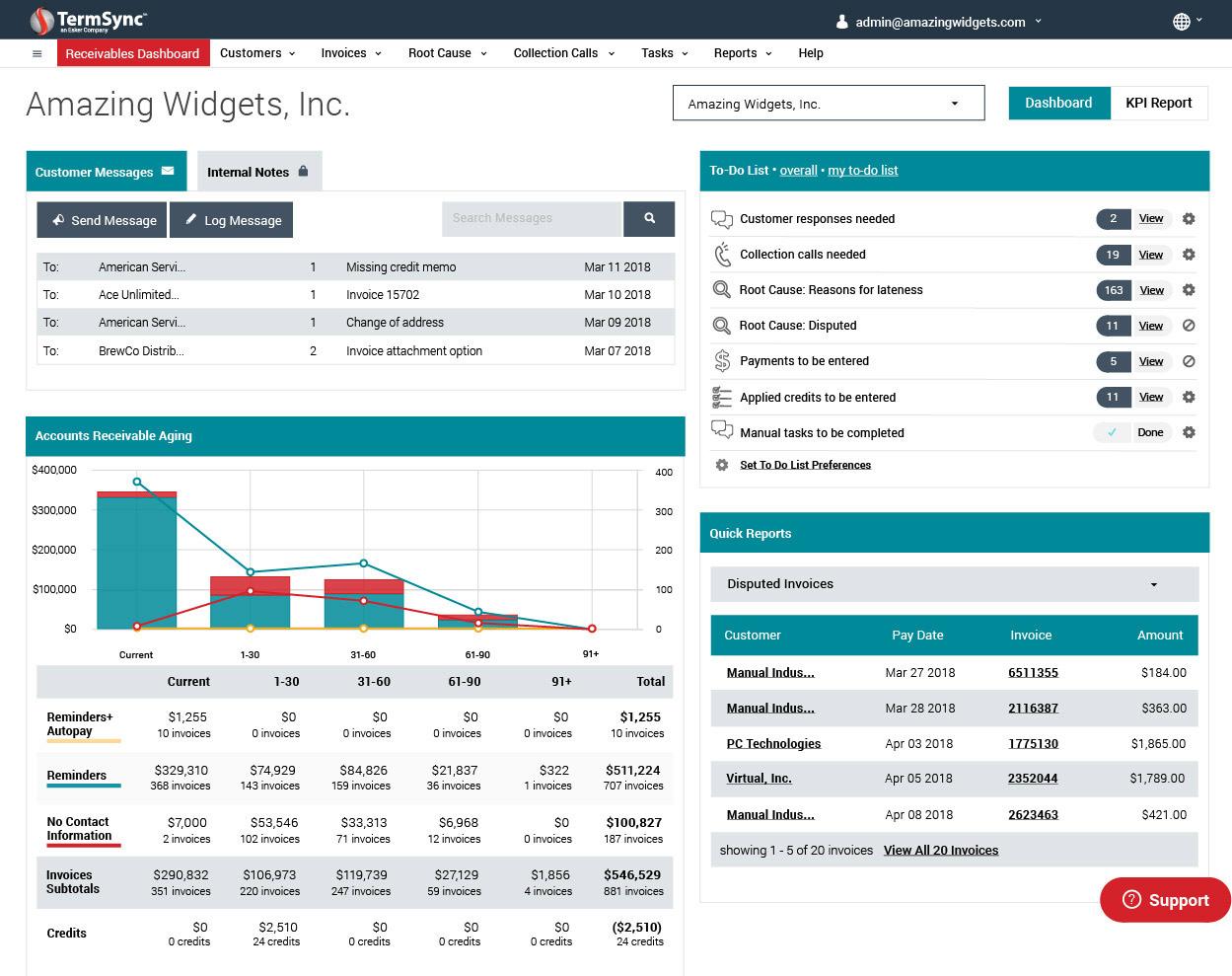

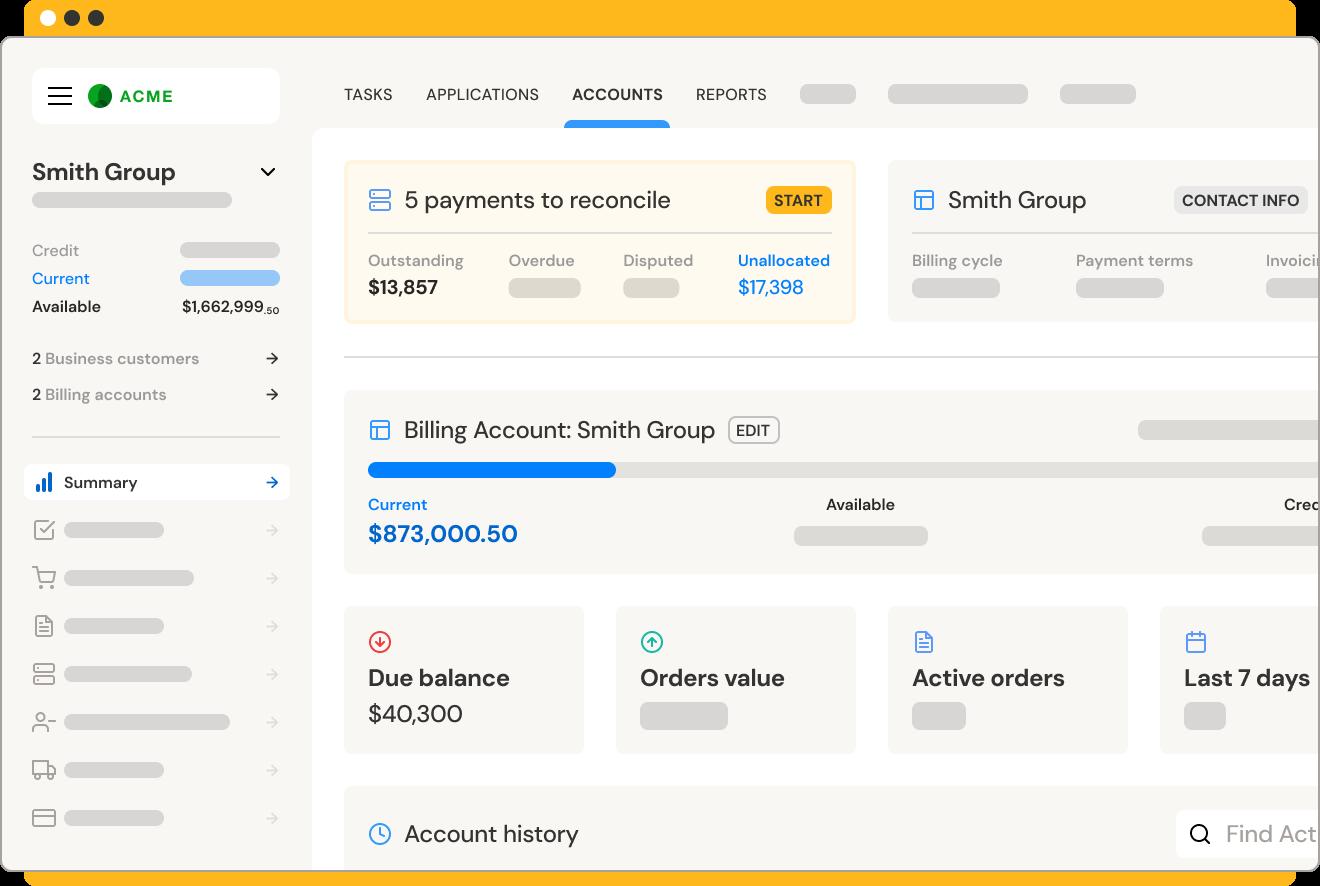

On paper, accounts receivable (AR) is a simple process: Services are rendered, invoices are sent and payments are received. However, the reality is far more complex, as today’s AR teams must perform their job facing a barrage of operational inefficiencies, external pressures, emerging technologies, and a set of ever-evolving customer and employee expectations.

propelled AR teams into a more strategic role within the enterprise – acting as lead navigator of cashflow and other financial challenges.

Yet, despite 8 out of 10 businesses seeing AR as “more crucial” to company success in recent months, less than half of them (44%) believe their AR teams have the skills, tools and resources needed to contend in the current landscape.1

disruptions in supply-chain dynamics, interest rates and economic outlooks have propelled AR a more strategic role within the enterprise — acting as lead navigator of cashflow and other challenges.

of high DSO

This article aims to give AR and Finance leaders some much-needed clarity to their challenges and five practical strategies for addressing them – all with the goal of reducing DSO, improving cashflow and empowering every stakeholder, from Collections Specialist to Office of the CFO.

despite 8 out of 10 businesses seeing AR as “more crucial” to company success in recent months, half of them (44%) believe their AR teams have the skills, tools and resources needed to contend current landscape.1

of AR teams are behind schedule on collections1

tried-and-true barometers of a business’s AR performance and financial well-being is Days Outstanding (DSO). Not only does DSO measure the average number of days it takes to collect from customers after a sale, reflects important customer information (satisfaction levels, payment patterns, creditworthiness, etc.) that helps inform decision-making.

The new AR department

consistently high DSO can have many unintended consequences, including:

Eric Maisonhaute MICM

that lower a business’s liquidity and prohibit future growth investments

Ongoing disruptions in supplychain dynamics, interest rates and economic outlooks have

One of the tried-and-true barometers of a business’s AR performance and financial wellbeing is Days Sales Outstanding (DSO). Not only does DSO

“Ongoing disruptions in supply-chain dynamics, interest rates and economic outlooks have propelled AR teams into a more strategic role within the enterprise – acting as lead navigator of cashflow and other financial challenges.”

measure the average number of days it takes to collect from customers after a sale, it also reflects important customer information (satisfaction levels, payment patterns, creditworthiness, etc.) that helps inform decision-making.

A consistently high DSO can have many unintended consequences, including:

l Cashflow challenges that lower a business’s liquidity and prohibit future growth investments

l Poor forecasting due to uncertainty and inconsistencies around when you will get paid

l Increased operating expenses related to the cost of personnel, overhead, hiring more staff, etc.

l Staff frustrations stemming from tedious, unfulfilling activities and expanded work schedules

DSO is not the end-all-be-all

When it comes to analysing cashflow performance, the importance of DSO can’t be overstated. However, it has its limitations. Be sure to keep this in mind when comparing your DSO against other companies and/or industries and always evaluate what additional metrics would be beneficial to measure alongside DSO.

Improving AR performance goes a long way in the quest for better DSO. Unfortunately, AR can’t control the inefficiencies in other processes (e.g., order management) that also affect DSO. Should you opt to pursue digital solutions, consider providers with robust capabilities that extend beyond AR.

There’s never a wrong time to implement the strategies

outlined in this article. However, their impact is maximised when all elements involved are harmonised. For example, if your AR team is motivated and aligned to improve, but your internal processes are outdated, reaching your goals may prove more difficult.

Let’s share five simple ways to improve DSO and cashflow within your AR department (along with some helpful “tech tips” for good measure)

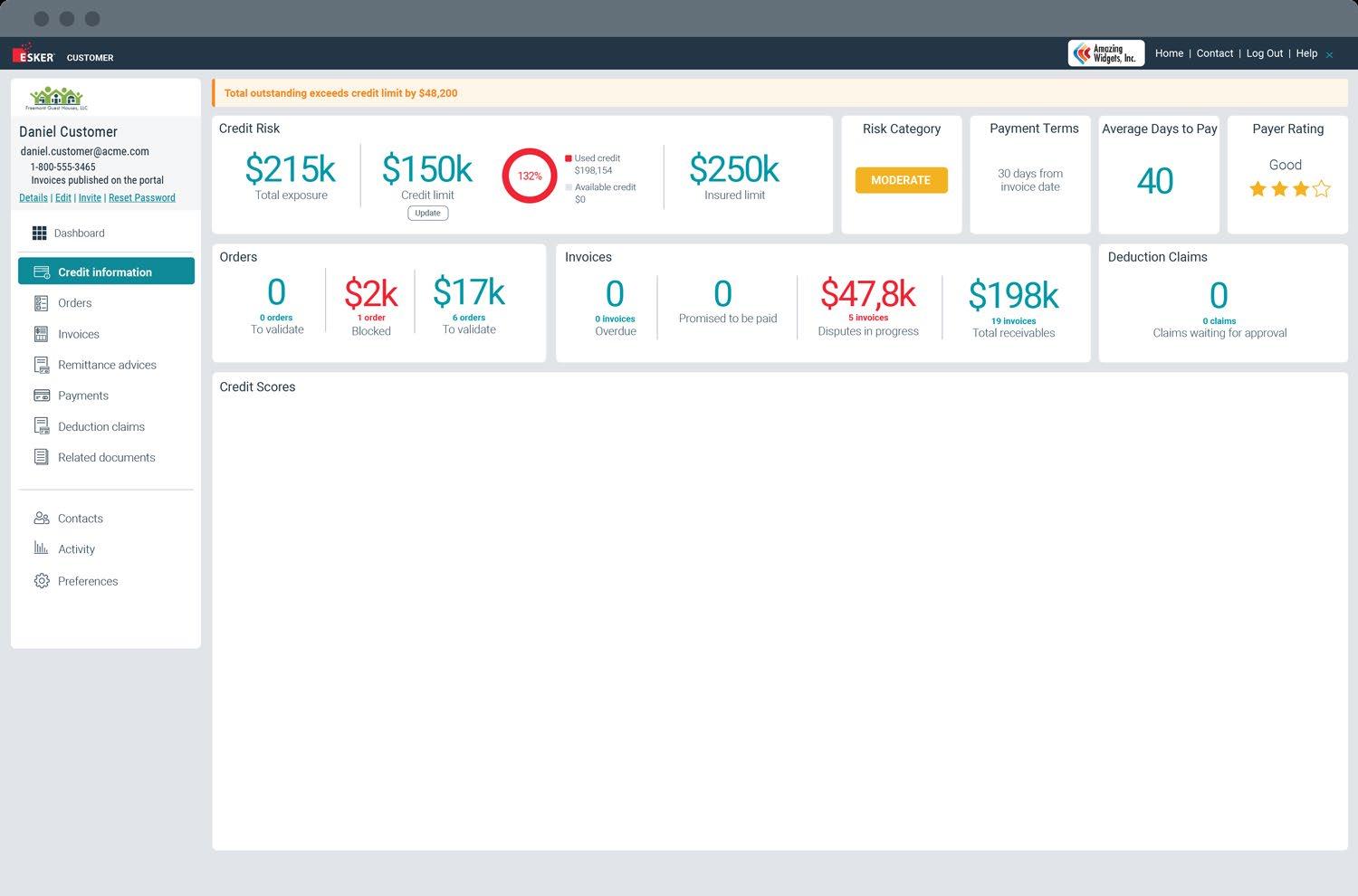

The importance of credit management – the process of extending credit to customers and assessing their creditworthiness – can’t be overstated. A lackadaisical approach to internal credit management procedures can have catastrophic effects on AR’s ability to stabilise cash inflow, keep DSO in check and safeguard their business from financial risks.

Here’s a simple yet effective checklist to help your AR team tighten its credit management practices and foster long-term financial success:

Knowing your customers

✔ When onboarding new customers, be sure to thoroughly assess their creditworthiness and provide them the right terms and right amount given their payment history from credit bureaus.

✔ Ensure that internal credit management policies are adhered to and reviewed at least annually (and more frequently for accounts with high exposure).

✔ Create an internal, standardised credit scoring model to facilitate better risk assessment and credit decisions across your entire team.

Performing ongoing assessments

✔ Set defined timeframes to perform routine, periodic reviews.

✔ Be diligent about managing limits to lessen company exposure (adjust as needed based on economic changes).

✔ Create criteria that alerts team members when a review of creditworthiness is necessary (e.g., A customer’s average days to pay has changed: Does this put us at an increased risk?).

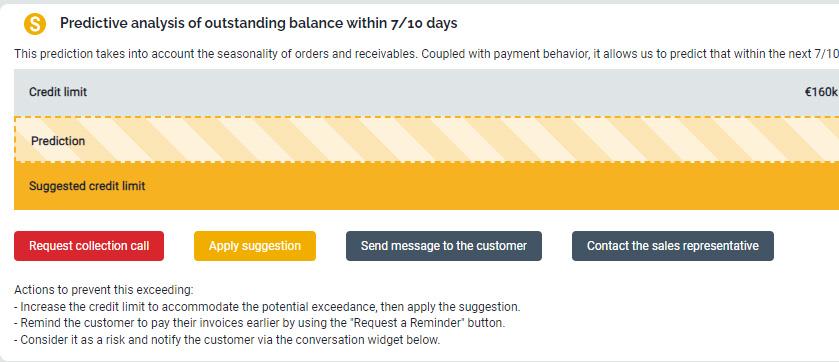

Don’t discount the benefits of automation in the credit management process. With so much unpredictability and volatility riding on credit risk, the right solution can make a difference in terms of lowering DSO and securing receivables for credit management. Here are some standout capabilities your team could take advantage of:

l Predictive & prescriptive AI tools that: { Project future credit needs

or changes in risk profile

{ Provide suggestions of credit terms

{ Predict and anticipate the risk of blocked orders and facilitate their release

l Real-time alerts to trigger actional events both internally (e.g., current payment behaviours) or externally (e.g., insights from credit bureaus)

“[Automation] made so

many aspects of AR easier for us — whether it’s giving our team daily snapshots of what accounts they should be calling or getting more credit reviews done of existing accounts.”

– Director of Credit, Temperature Equipment Corporation (TEC)

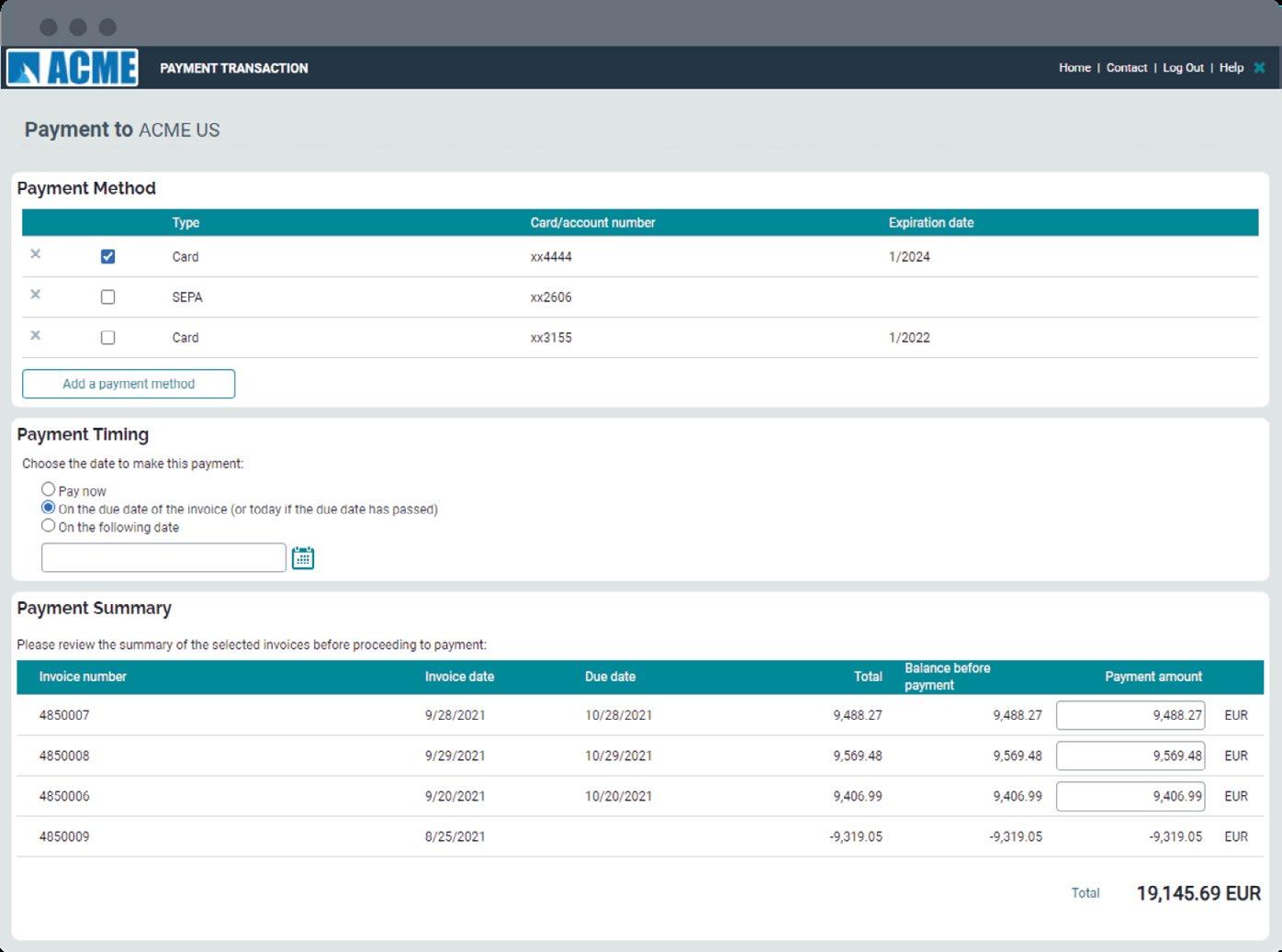

Make payment a top priority Naturally, an essential step to getting paid is the payment process itself. To ensure timely invoice payment, today’s businesses need to understand the mindset of modern B2B customers – they expect convenience, transparency and, most importantly, options. Translation: If you’re not easy to do business with, they won’t be either.

Try these two tips for better payment processing:

✔ Transition customers to e-payments – cash hits your account sooner!

✔ Be more aggressive: If you accept cards at net 30, for example, start doing it at net 10 (or accept cards and surcharge).

Automated payment solutions help your customers help you by providing a faster, more convenient and transparent

WHAT’S BEHIND AI’S USE IN AR DEPARTMENTS?

More AR teams are recognising that AI – a once novel technology that’s become ubiquitous in our lives – can be quite useful in the AR setting. However, rather than replacing workers, AI can be used as a discrete, digital assistant for everything from extracting data and supplying analytics to making predictions and even recommendations.

buying experience. This is thanks to a customer portal that enables customers to make payments without delay, including credit and debit card payment and direct debit (ACH, SEPA, BACS, ACSS, etc.). Dynamic surcharging in these instances can also help your business recover the potential costs associated with accepting card payments.

WHAT KIND OF AI TECH IS BEING USED – IS IT SAFE?

Machine learning (ML), deep learning (DL), natural language processing (NLP) and generative AI (GenAI) are AI technologies that fit well in typical AR environments. Best-in-class providers ensure that any AI used in their solutions is done so in a safe, trustworthy and ethical way. For example, your private data would never be used by a public entity.

Let’s pause...

To talk about AI

You may have noticed this article mentions AR automation solutions that use a mix of AI technologies. Naturally, this may stir some uneasiness among receivables teams. Before going any further, let’s briefly talk about AI’s use in AR and address some lingering anxieties.

WHAT’S THE RISK IN NOT ADOPTING AI IN AR?

While it’s true that AI tech might not be for every AR team, the trend line is clear: AI is the future. With the right provider on your side, its impact on productivity, decision-making, cashflow, CX and employee satisfaction is nothing short of indispensable — especially in an era of economic uncertainty and digital transformation.

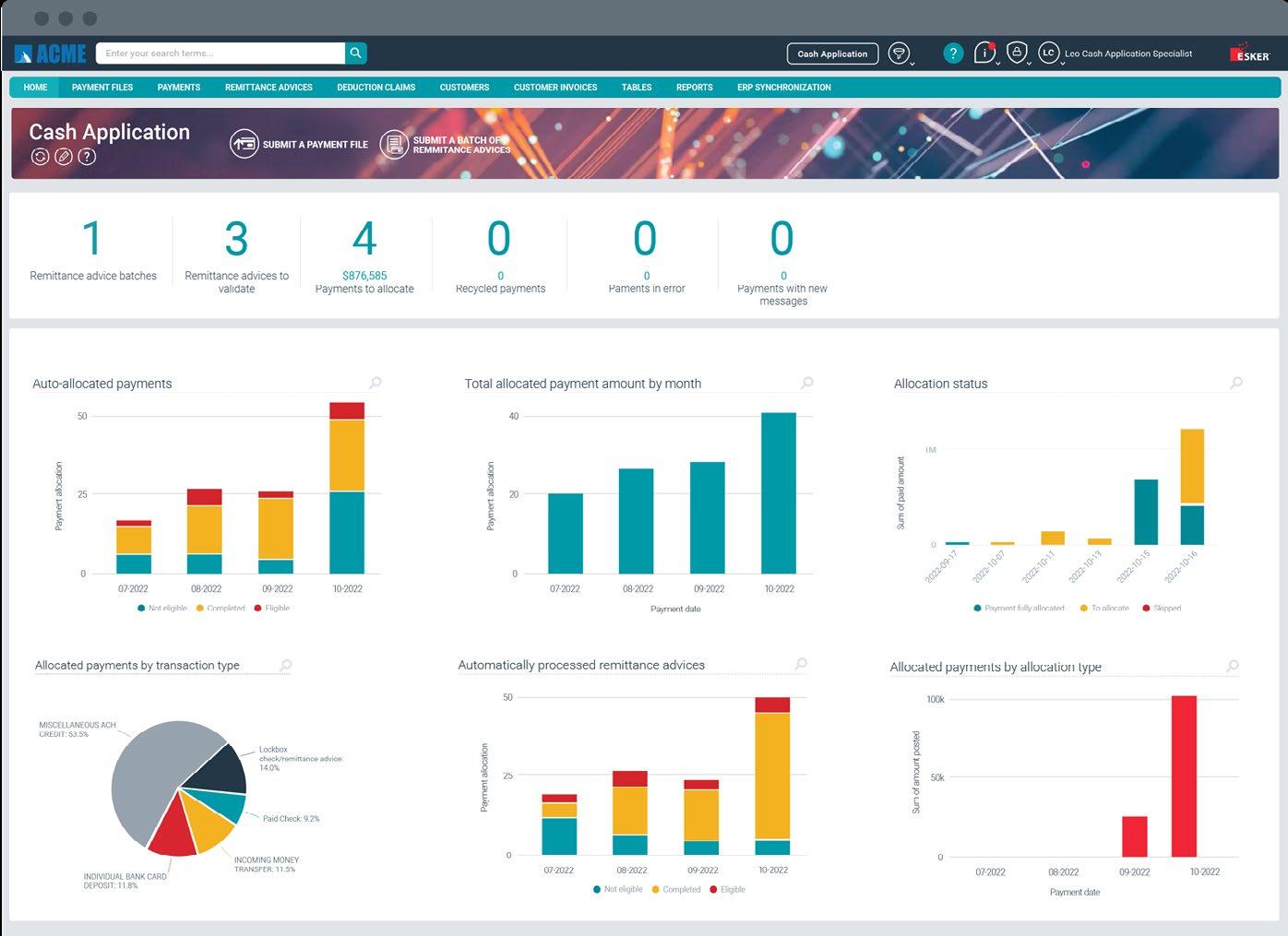

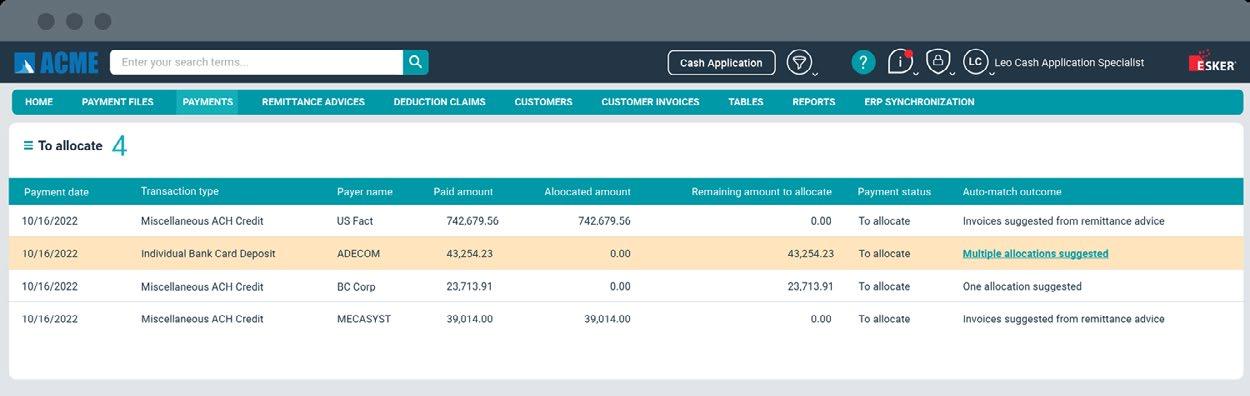

Cash application is a process that involves matching incoming payments to outstanding invoices and the proper account. Only once this information is verified can the payment be used to fund payroll, make investments or disburse profits to shareholders. The faster the cash is applied, the faster your company can use it. Inaccuracies within cash application are tied to inefficient credit and collections performance which, in turn, directly affect DSO. Unfortunately, several factors can bring chaos to the cash app process, including incomplete and/or inaccurate remittance advice, invoice/payment amount discrepancies, and deductions. If quick-and-easy cash app improvement is what you’re looking for, start with these three strategies:

✔ Make sure there’s no “spill over” to the following day to apply cash (i.e., same-day application).

✔ Require all customers to provide remits (i.e., when making a payment, customers must specify what the payment is for).

✔ Follow up on unapplied cash ASAP.

If any AR process was primed for automation, it’s cash application. Best-in-class solution providers offer several amazing functionalities to accelerate payment processing and control cashflow in real time. These include:

“...several factors can bring chaos to the cash app process, including incomplete and/or inaccurate remittance advice, invoice/payment amount discrepancies, and deductions.”

l AI-powered remittance management, which automatically extracts and routes data from complex remittances, even when seen for the first time

l Automated payment allocation using 2- or 3-way matching, which auto-learns from users and improves its performance over time

l Intelligent suggestions powered by AI to facilitate better decision-making for your team

l Configurable rules to automate specific cases and eliminate time-consuming exceptions

“[Automation] has significantly reduced processing time for large remittances with 800+ line items from 2+ hours to mere minutes.”

– National Credit Manager, Fletcher Steel

Don’t sleep on deductions Discrepancies in the amount on the customer invoice vs. what the customer actually pays are of major importance for AR departments. Not only does deductions management affect your team’s workload (time spent validating disputes, amending invoices, issuing credit notes, etc.), when done poorly, it can lead to delayed or inaccurate payment postings, strain customer relationships, and lead to financial losses (the average margin loss for written-off amounts is 3.7%).2

Here’s where to focus your attention:

✔ Stringent policy adherence. Make sure it’s clear who needs to review deductions (and when) to resolve in a timely fashion. This may include creating resolution timeframes.

✔ Strong terms and conditions. Institute clear policies on what’s allowed and what’s not for short pays and enforce penalties if necessary. However, orchestrating this back and forth via email can be messy (i.e., you losing money).

Given its complexity, it should come as no surprise that automation is a welcome addition to any deductions management process thanks to capabilities like:

l Automated work list of open deductions, providing instant visibility into who’s working

on what, where it’s at in the process, etc.

l Predetermined criteria to generate automated workflow (customers, sales, amounts, products, etc.)

l Automated approvals (i.e., if it hits these criteria, it gets approved)

l Aggregation of all details (invoices, remittance, promotion sheet, etc.) to ensure a quick, “researchready” resolution.

Be diligent when it comes to collections management

It should go without saying: Collections management plays a vital role reducing DSO and maintaining a healthy cashflow. During extended periods of uncertainty and economic angst, however, customers are more willing to

wait until full term to pay or even paying late to hold on to their cash longer.

Of course, this doesn’t mean your collections team is helpless or doomed to a ceaseless fate of late payments. Below are five simple and practical practices you can institute immediately as a way to curb slow- or latepaying customers and help your team work more efficiently:

✔ Send dunning or payment reminders BEFORE invoices are due.

✔ Send statements on a routine basis with the right details needed to remit payment –leave no room for excuses! Beyond the invoice and amount, you can also include the PO number or any other piece of information that removes any doubt or confusion in the customers’ eyes.

✔ Follow up on promise-to-pays (e.g., calling them the day before).

✔ Accept payments for credit card to avoid delinquent payments (instead of waiting until customers have the funds)

✔ Formalise a dispute process so you can respond to resolve them quickly.

The most efficient collections process is one that’s adapted to your organisation, customers and unique needs. Automated solutions allow you to do just that thanks to a myriad of powerful, easy-to-use collections tools such as:

l Automated dunning statements

a backdrop of an uncertain economic outlook, inflated interest rates and ongoing labor shortages, cashflow optimization has moved up the priority list of the Office of the CFO. This has put more pressure on AR teams to contain costs, reduce DSO and preserve customer relationships. despite these seismic challenges, there’s reason to be optimistic.

l AI-driven prioritisation of which accounts to contact based on payment predictions and risk level

l Risk classification based on payment behaviour, helping your team determine who to prioritise

Sources

l Suggested responses powered by GenAI

ebook has shown, improving receivables can start small — instituting a few practical strategies can go a long way in terms of impacting overall invoice-to-cash performance. Automated solutions, particularly those powered by AI technologies, play a significant role in helping these strategies succeed, while opening the door for other, more future-defining improvements.

of businesses saw their DSO improve after automating their processes3

*Eric Maisonhaute MICM

Meeting the Growing Need for AR Modernization. (B2B and Digital Payments Tracker® Series). October 2023. PYMNTS Intelligence.

l Automated task creation for disputed invoices to route for resolution, with SLAs and reminders.

Against a backdrop of an uncertain economic outlook, inflated interest rates and ongoing labour shortages, cashflow optimisation has moved up the priority list of the Office of the CFO. This has put even more pressure on AR teams to contain costs, reduce DSO and preserve customer relationships. Yet, despite these seismic challenges, there’s reason to be optimistic.

Director – Accounts Receivable Solutions, Esker Australia Pty Ltd

T: 02 8596 5126, M: 0479 089 668

Automating the Management of Customer Deductions Reduced Time, Complexity and Cost in Accounts Receivable. 2018.

E: eric.maisonhaute@esker.com.au www.esker.com.au

CFOs Can Take a Holistic View to Transform the Finance Function. December 2, 2022. EY Global.