REPORT OVERDUE CREDIT

AICM

2023

INDEX

AICM OVERDUE CREDIT INDEX REPORT 2023

Publisher: Nick Pilavidis FICM CCE

Chief Executive Officer

Australian Institute of Credit Management

Editor: Claire Kasses

General Manager

Australian Institute of Credit Management

Direct: 02 9174 5727

Mob: 0499 975 303

Design: Anthea Vandertouw

Ferncliff Productions

T: 0408 290 440

E: ferncliff1@bigpond.com

Australian Institute of Credit Management

Level 3, Suite 303, 1-9 Chandos Street

St Leonards NSW 2065

T: 1300 560 996

E: aicm@aicm.com.au

www.aicm.com.au

AICM Overdue Credit Index Report 2023 FOREWORD 2 Nick Pilavidis FICM CCE EXECUTIVE SUMMARY 3 RATIONALE AND INDEX CONSTRUCTION 4 DATA ANALYSIS INSIGHTS – 1 July 2019 to 1 August 2022 6 Index of overdue mortgage accounts ................................................................................................................... 4 Index of overdue credit card accounts 7 Index of overdue personal loan accounts ...................................................................................................... 10 Index of deferred mortgages 13 STAKEHOLDER INTERVIEW INSIGHTS 16 Theme 1. Post pandemic emerging trends 16 Theme 2. Hardship provision is complex ......................................................................................................... 17 Theme 3. The role of technology in customer support 18 Theme 4. Credit professionals’ skills .................................................................................................................. 19 RESEARCH TEAM 21 CONTRIBUTORS 26 Contents

FOREWORD

Nick Pilavidis FICM CCE Chief Executive Officer

Nick Pilavidis FICM CCE Chief Executive Officer

Managing overdue credit, specifically customers experiencing financial hardship is the number one pressure facing consumer credit professionals and their teams. The peaks and troughs in levels of overdue credit impacts credit teams’ ability to achieve organisational objectives and support customers in financial distress.

A key determinant in resourcing and overall support of team’s ability to engage with customers in need of financial assistance is whether the number of contacts or expected number of contacts, is changing and what is an appropriate level of support for these front-line staff could be.

To inform credit professionals and the discussion on the levels of financial hardship the AICM commissioned this research project with the aim of developing indices that measure levels of overdue credit.

This first of its kind research is based on aggregate data of reported account repayment history across a variety of finance products in the Australian market leveraging data provided by Equifax and illion.

To understand the impact of the trends presented by the indices, specifically on financial distress, 10 professionals from a range of consumer credit providers and other stakeholders were interviewed by the research team.

The report provides a baseline which we aim to monitor in future projects.

On behalf of the AICM I thank the research team Andrew Grant and Luke Deer, Academics at The University of Sydney Business School and the professionals who contributed their insights to the report.

Nick Pilavidis FICM CCE Chief Executive Officer Australian Institute of Credit Management

2 AICM Overdue Credit Index Report 2023

Executive SUMMARY

This report presents an Overdue Credit Index based on aggregate data of reported repayment history credit accounts in Australia. The index covers mortgages, credit cards, and unsecured personal loans, using data from Equifax and illion.

The need for an Overdue Credit Index arises from the extensive demands placed on credit professionals when dealing with customers who are in financial difficulty. The Index also aims to provide transparency around consumer credit in Australia.

The Index shows that the circumstances surrounding the COVID-19 pandemic led to a reduction in the level of overdue credit, particularly with temporary loan deferrals. However, the end of mandated support, rising prices, and interest rate hikes may increase arrears in 2023.

The report also includes insights from interviews with credit professionals and financial counsellors

to understand their practices in handling overdue payments and hardship requests. Credit professionals require a broad set of skills and a delicate approach when dealing with hardship requests, as they often stem from challenging circumstances.

Some of the implications of the research are:

z Skilled credit professionals are needed to interact with customers in a genuine, open, and respectful way. Thus, credit teams to be resourced with people skills and require continual improvement to handle challenging situations faced by consumers.

z The economic pressures and forecasts indicate that the need for financial assistance is likely to grow over the short to medium term.

z Therefore, all credit providers should prioritise projects that maximise their credit teams’ ability to engage with customers.

AICM Overdue Credit Index Report 2023 3

Rational and index CONSTRUCTION

This report presents a measure of overdue credit (an Overdue Credit Index) based on aggregate data of reported repayment history for credit accounts across mortgages, credit cards and unsecured personal loans in the Australian market using data provided by two Credit Reporting Bodies (CRBs) – Equifax and illion.

Managing overdue credit and specifically financial hardship (whether explicitly reported or dealing with signs of borrower financial distress) is the number one pressure facing consumer credit professionals and their teams and is a growing pressure for commercial credit professionals with exposure to small business.

Analysts construct indexes to measure changes in sets of economic or financial data over time. Common indexes (or indices as they are also known) include the Consumer Price Index, which tracks consumer price inflation, the ASX indices, which tracks the performance stock market securities, and Australian Performance of Manufacturing Index, which tracks manufacturing activity in Australia. Indices provide a benchmark against which performance or changes in the measure of interest can be evaluated.

A key determinant in resourcing and overall support of teams is whether the number of

contacts, or expected number of contacts, is changing and what is an appropriate level of support for these front-line staff could be. Having an index allows credit managers to express their performance and resourcing relative to a benchmark.

Overdue rates on credit cards, for instance, appear to be leading indicator of financial hardship and overdue rates in other products.1 The Overdue Credit Index provides insight into patterns of overdue credit and hardship requests in other products.

Financial hardship increased sharply during the COVID-19 pandemic. Starting in March 2020, for example, the banking regulator APRA encouraged authorised deposit-taking institutions (ADIs) to grant relief to borrowers impacted by COVID-19 by granting temporary loan repayment deferrals. By July 31, 2020, bank data submitted by all ADIs to APRA showed that $167 billion worth of mortgage loans had been granted temporary repayment deferrals – which was close to 10% of total mortgages outstanding.2

For credit professionals, the sharp increase in temporary loan deferrals due to COVID-19 represented a sharp increase in workload over this period.

The AICM invited the Credit Reporting Bodies (CRBs) Equifax and illion to contribute as data partners to the project. Equifax and illion provided aggregate account level mortgage data and unsecured loan data (credit cards and personal loans), which together covered the period from 1 July 2019 to 1 August 2022.

4 AICM Overdue Credit Index Report 2023

“For credit professionals, the sharp increase in temporary loan deferrals due to COVID-19 represented a sharp increase in workload over this period.”

RATIONALE AND INDEX CONSTRUCTION

The data includes aggregate data on:

z The number of open mortgage accounts, credit card and personal loan accounts and the number of accounts 30-days or more past due.

z Coverage of all credit providers, including the big four banks, regional banks, mutuals, international banks, fintechs, alternative lenders, and large non-bank lenders.

z Account level data reported by geographical area – specifically, by the ABS (2016) Statistical Area Level 4 (SA4), which is comprised of eighty-nine geographical regions covering the whole of Australia.3

One of the CRBs also provided estimates of the number of mortgage accounts from the big 4 banks which were ‘deferred’ under temporary repayment deferrals. While there was no credit reporting flag for ‘deferred’ accounts in the period covered by this report, ‘deferred’ accounts were inferred by the Body as accounts whose repayments had been paused and were not therefore overdue. The estimate does correspond to the scale of temporary loan repayment deferrals reported by the banking regulator APRA.

Whereas the APRA data reported total deferrals from all ADI’s, this report shows estimates for the change in deferrals over time and their breakdown by ABS Statistical Area (SA4). Deferrals were concentrated specific geographic areas.

FOOTNOTES:

1 See, for example: Andersson, Fredrik, Souphala Chomsisengphet, Dennis Glennon, and Feng Li. 2013. ‘The Changing Pecking Order of Consumer Defaults’. Journal of Money, Credit and Banking 45 (2–3): 251–75., Fulford, Scott, and Joanna Stavins. 2021. ‘Does Getting a Mortgage Affect Consumer Credit Use?’ Review of Economics of the Household, February. https://doi.org/10.1007/s11150021-09550-1.

2 The Australian Prudential Regulation Authority (APRA). 2020. ‘Temporary Loan Repayment Deferrals Due to COVID-19, July 2020’. APRA. September 2020. https://www.apra.gov.au/ temporary-loan-repayment-deferrals-due-tocovid-19-july-2020/

3 ABS. 2021. ‘Statistical Area Level 4’. Australian Body of Statistics. https://www.abs.gov.au/statistics/ standards/australian-statistical-geographystandard-asgs-edition-3/jul2021-jun2026/mainstructure-and-greater-capital-city-statistical-areas/ statistical-area-level-4.

AICM Overdue Credit Index Report 2023 5

Data INSIGHTSanalysis 1 July 2019 to 1 August 2022

Indices of overdue mortgages and overdue unsecured credit (credit cards and personal loans) for the period from 1 July 2019 to 1 August 2022 are presented below.

Index of overdue mortgage accounts

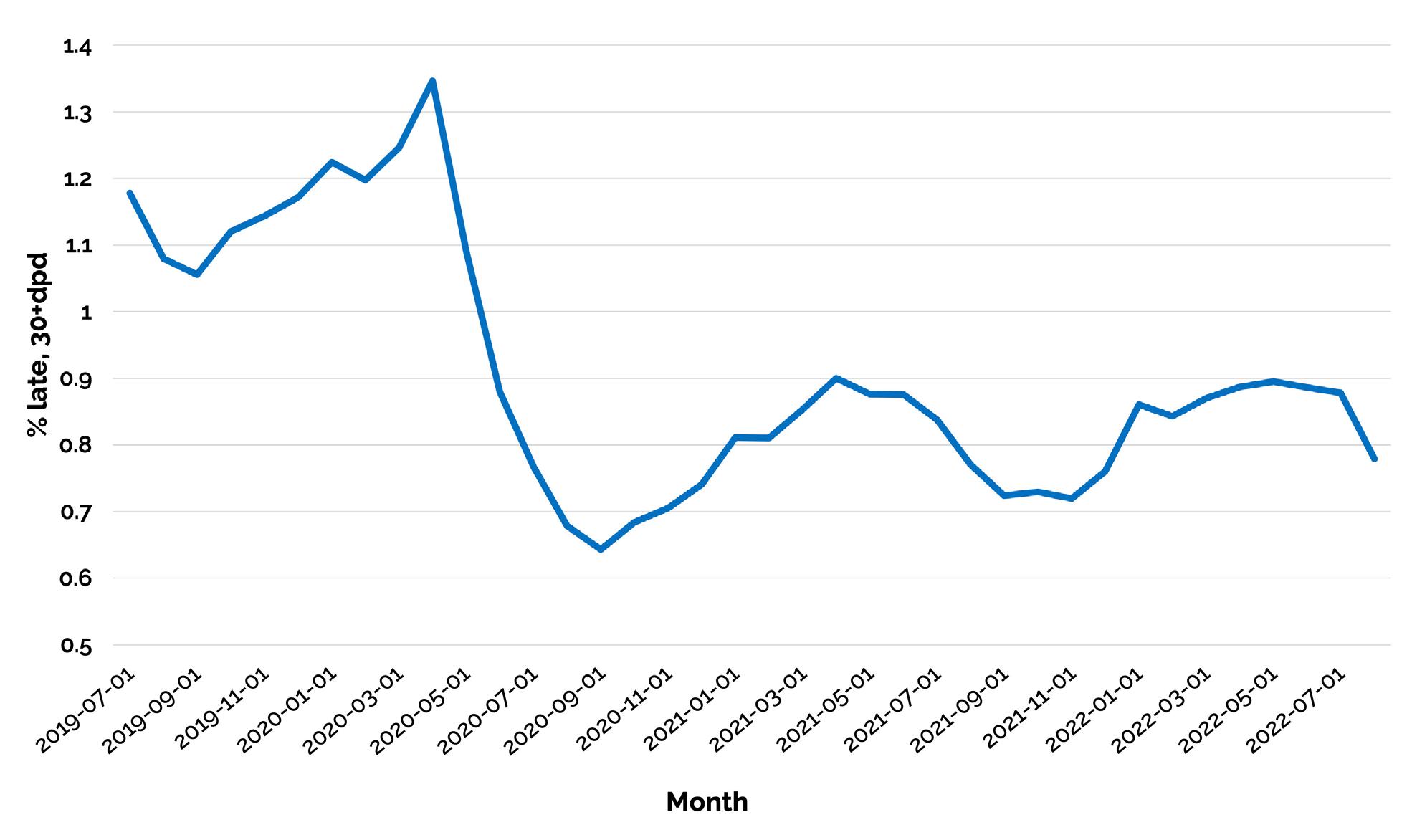

Figure 1 shows the index of overdue mortgage accounts based on aggregate monthly account level mortgage data reported from all mortgage providers from 1 July 2019 to 1 August 2022. The index is constructed from the national share of mortgage accounts with payments past 30 days due over the number of open accounts. In the last months of 2019, prior to the first of COVID-19 pandemic lockdowns in Australia, around 1% of mortgage accounts were overdue. This is likely be the benchmark overdue rate over time.

Figure 1 shows the sharp fall in the index of overdue mortgages from a high 0.98% in April 2020 to a low of 0.62% in August 2022. Temporary loan deferrals (a proxy for financial hardship arrangements) during the pandemic, sharply reduced the level of overdue mortgages. According to APRA data, almost 10% of mortgage account holders had taken up temporary loan deferrals by July 2020.1 Generally increasing property prices and low interest rates at the time also saw a spike in home loan refinancing.

6 AICM Overdue Credit Index Report 2023

FIGURE 1. Index of overdue mortgage accounts (30+dpd), July 2019 to August 2022

The index data shown in Figure 1 ends in August 2022 and it did not yet show an increase in the level of overdue mortgage accounts. The end of regulatory support for temporary loan deferrals, consumer price rises and nine interest rate hikes since May 2022 will likely lead to increases in subsequent quarters. The decreased levels of overdue credit surrounding the pandemic has also coincided with households increasing their ‘buffers’ against mortgage payment difficulties. As such, some households took the opportunity to increase balances in offset accounts or make extra repayments, and so the consequences of rising interest rates may not be felt in the short-term.

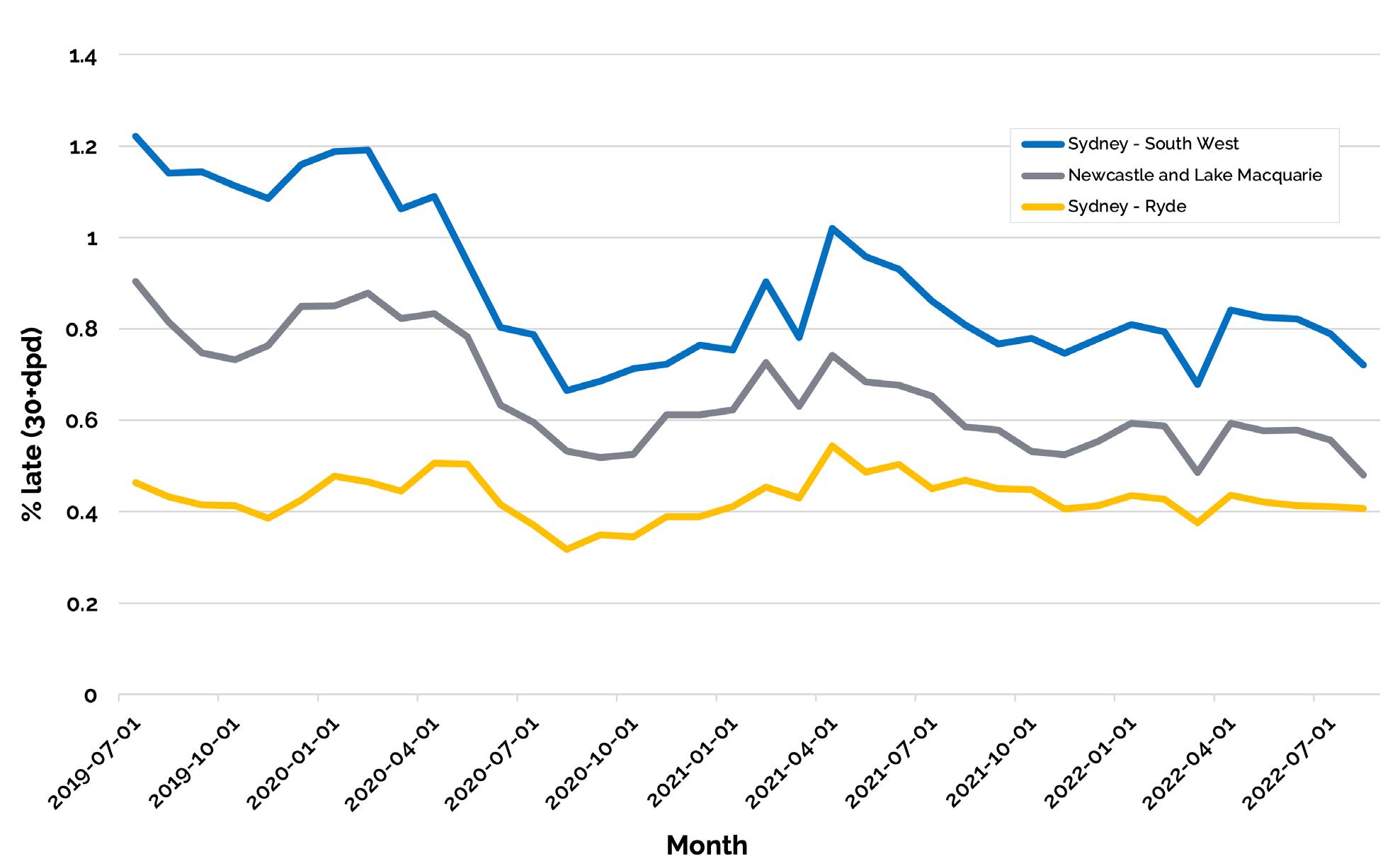

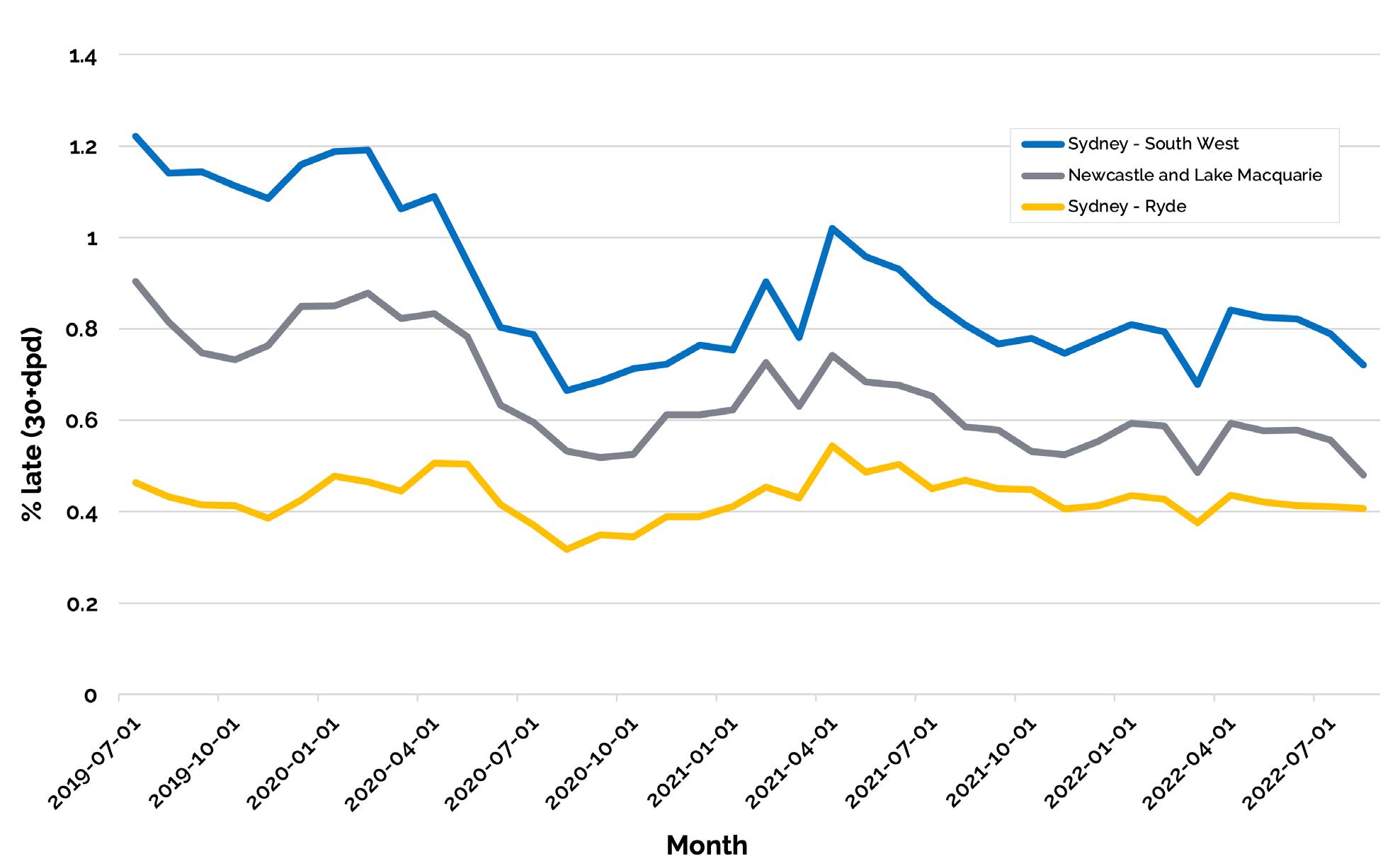

Figure 2 compares indexes of overdue mortgage accounts by three urban SA4 areas in NSW – Sydney’s Southwest, the regional area of Newcastle and Lake Macquarie and the Ryde area in Sydney. The comparison shows structural

“Across these three areas, Sydney’s Southwest had the highest level of overdue accounts prior to the pandemic (1.22 %) and the sharpest fall in overdue accounts during the pandemic, to a low of (0.66%).”

differences in the level of overdue credit between these three SA4 areas, as well as co-movements in arrears across areas.

Across these three areas, Sydney’s Southwest had the highest level of overdue accounts prior to the pandemic (1.22 %) and the sharpest fall in overdue accounts during the pandemic, to a low of (0.66%). The Ryde area had the lowest

AICM Overdue Credit Index Report 2023 7

DATA ANALYSIS INSIGHTS – 1 JULY 2019 TO 1 AUGUST 2022

FIGURE 2. Index of overdue mortgage accounts by selected SA4 areas, New South Wales

level of overdue mortgage accounts before the pandemic (0.46), during and after the pandemic (0.4%) of accounts.

The level of overdue accounts in Newcastle and Lake Macquarie changed in a similar pattern to arrears in Southwest Sydney but at lower level of arrears overall – 0.90% prior to the pandemic, falling to a low of 0.51% during 2020 and trending down to 0.48 % in August 2022.

Across all areas, those SA4 areas with highest arrears rates prior to pandemic had the largest fall in arrears during the pandemic. Temporary loan deferrals allowed most mortgage account holders who faced pandemic induced shocks to reduce or avoid arrears, while also providing relief for previously vulnerable borrowers. It is likely that

these regions will see a deterioration greater than the national average as the impact of COVID-support ends, especially for consumers with high debt-to-income ratios, or in more insecure labour markets.

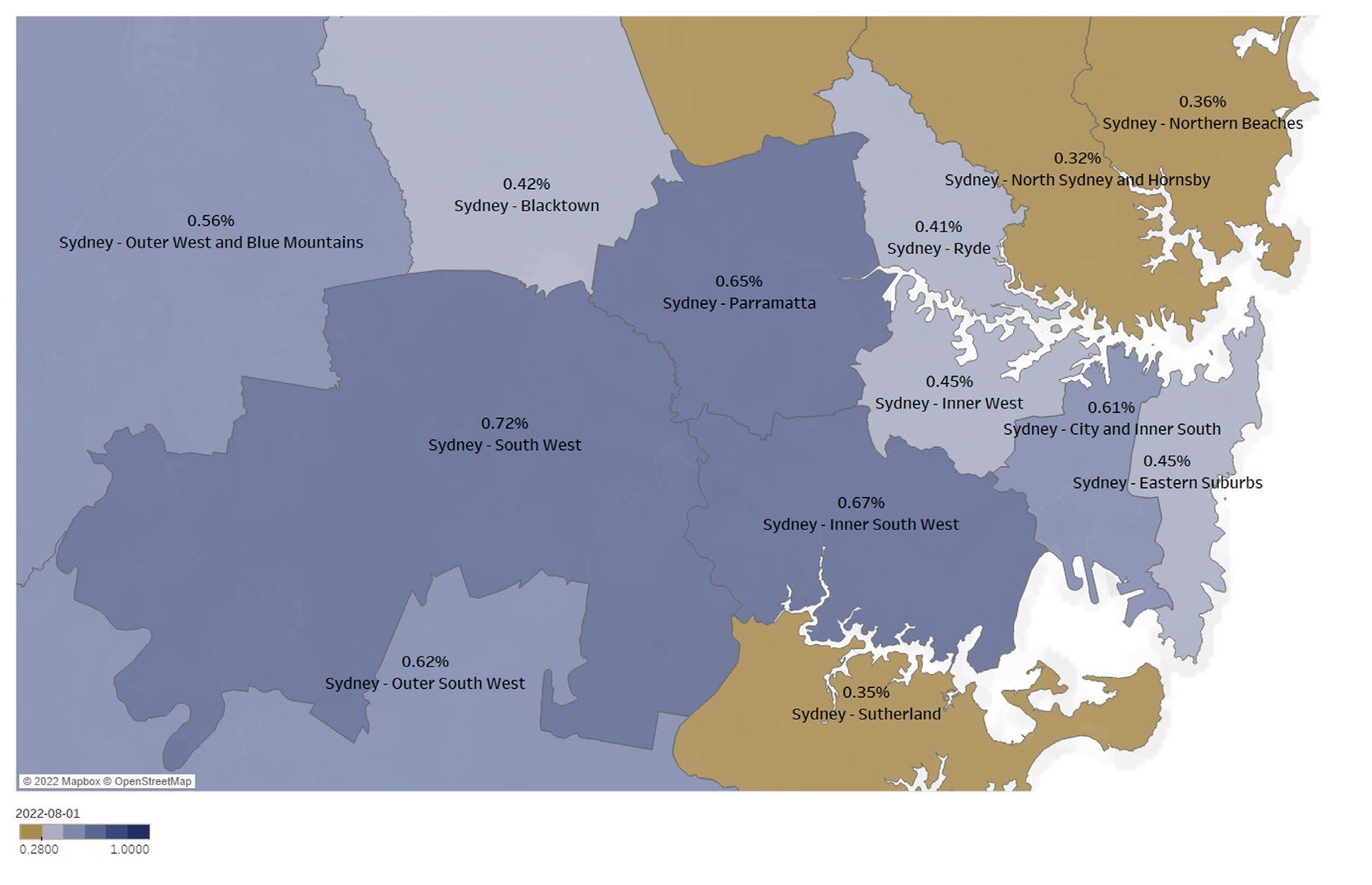

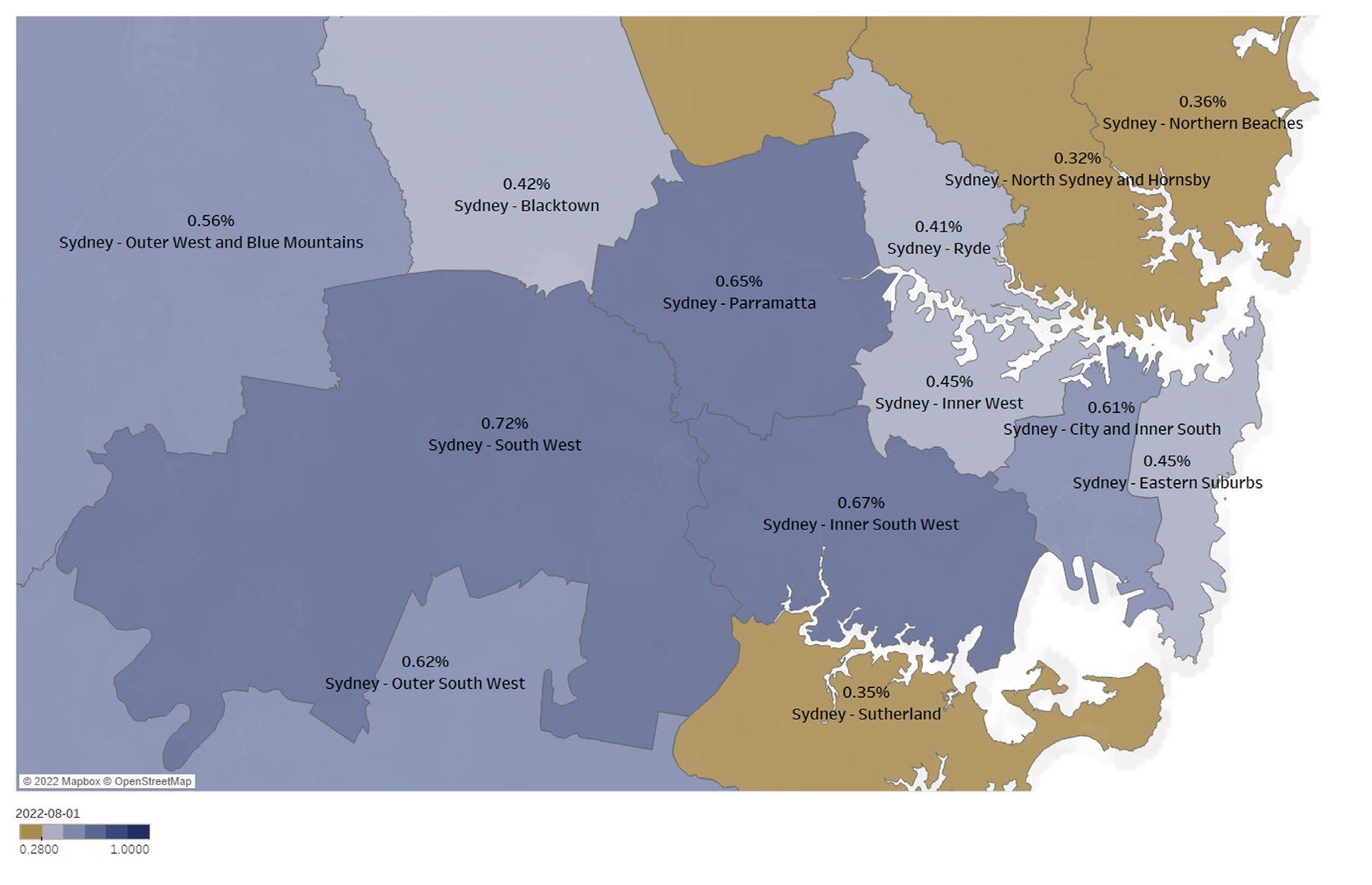

Figure 3 shows a map the percentage point share of overdue mortgage accounts by SA4 areas in Greater Sydney in the month of August 2022. There are clear structural differences in the level of overdue accounts between areas. The level of arrears for instance in Sydney’s Northern Beaches, Northern Sydney and Hornsby, and Sutherland are between 0.32% and 0.36%. This was about half the level of arrears in Sydney’s City and Inner South (0.6.%), Inner, South West, Parramatta and in Sydney’s South West (0.7%) and Outer South West.

8 AICM Overdue Credit Index Report 2023

DATA ANALYSIS INSIGHTS – 1 JULY 2019 TO 1 AUGUST 2022

FIGURE 3. Index of overdue mortgage accounts by Greater Sydney SA4 areas in August 2022

Index of overdue credit card accounts

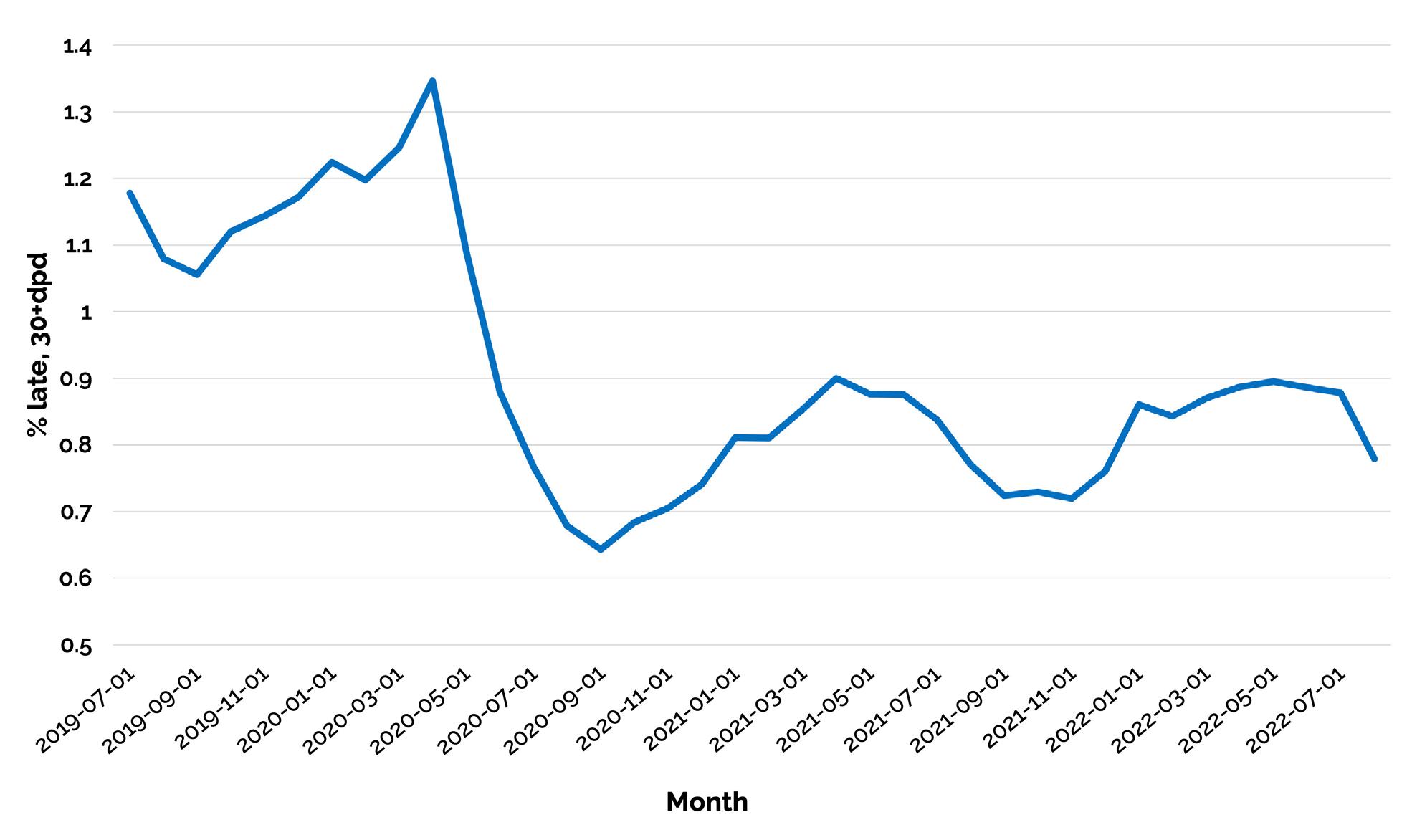

Figure 4 is a national index of overdue credit card accounts. The credit card account data includes reported data on credit cards and personal loans from all reporting credit providers, including the big four banks, regional banks, mutuals, international banks, fintechs, alternative lenders, and large non-bank lenders.

The index shows the percentage point share of overdue (30+dpd) credit card accounts over the total number of open credit card accounts. The national index of overdue credit card accounts showed a rise in overdue accounts from 1.06% in September 2019 to 1.35% in April 2020. The increase in overdue credit card accounts in the months prior to the impact of COVID-19 was likely driven by a combination of a rise in unemployment, a slowing business cycle, seasonal demand for credit card debt.

However, the percentage point share of overdue credit card accounts fell by over half from its peak of 1.35% overdue in April 2020 to a low of 0.64% by September 2020. Borrowers were able to pay down their credit card debt because the extended COVID-19 lockdowns and the uptake of temporary loan deferrals on mortgages accounts left many borrowers with surplus income, which allowed consumers to reduce credit card debt.

AICM Overdue Credit Index Report 2023 9 DATA ANALYSIS INSIGHTS – 1 JULY 2019 TO 1 AUGUST 2022

FIGURE 4. Index of overdue credit cards, 30+dpd, national

“The increase in overdue credit card accounts in the months prior to the impact of COVID-19 was likely driven by a combination of a rise in unemployment, a slowing business cycle, seasonal demand for credit card debt.”

The index of overdue credit card accounts rose by about one third towards the end of 2020, before falling and rising again – while remaining just over half the level it was prior to pandemic. There were 0.78% of credit card accounts in arrears (30+dpd) in August 2022, prior to full impact of recent price rises on household balance sheets.

The lower level of overdue credit card accounts and the reduced number of credit card accounts

overall, points to reduced levels of consumer credit card debt compared to the period prior to the pandemic, although this may be changing in early 2023. The impact of the Buy-Now, Pay-Later wave has reduced consumer demand for credit cards, and it is possible that overdue credit has shifted accordingly.

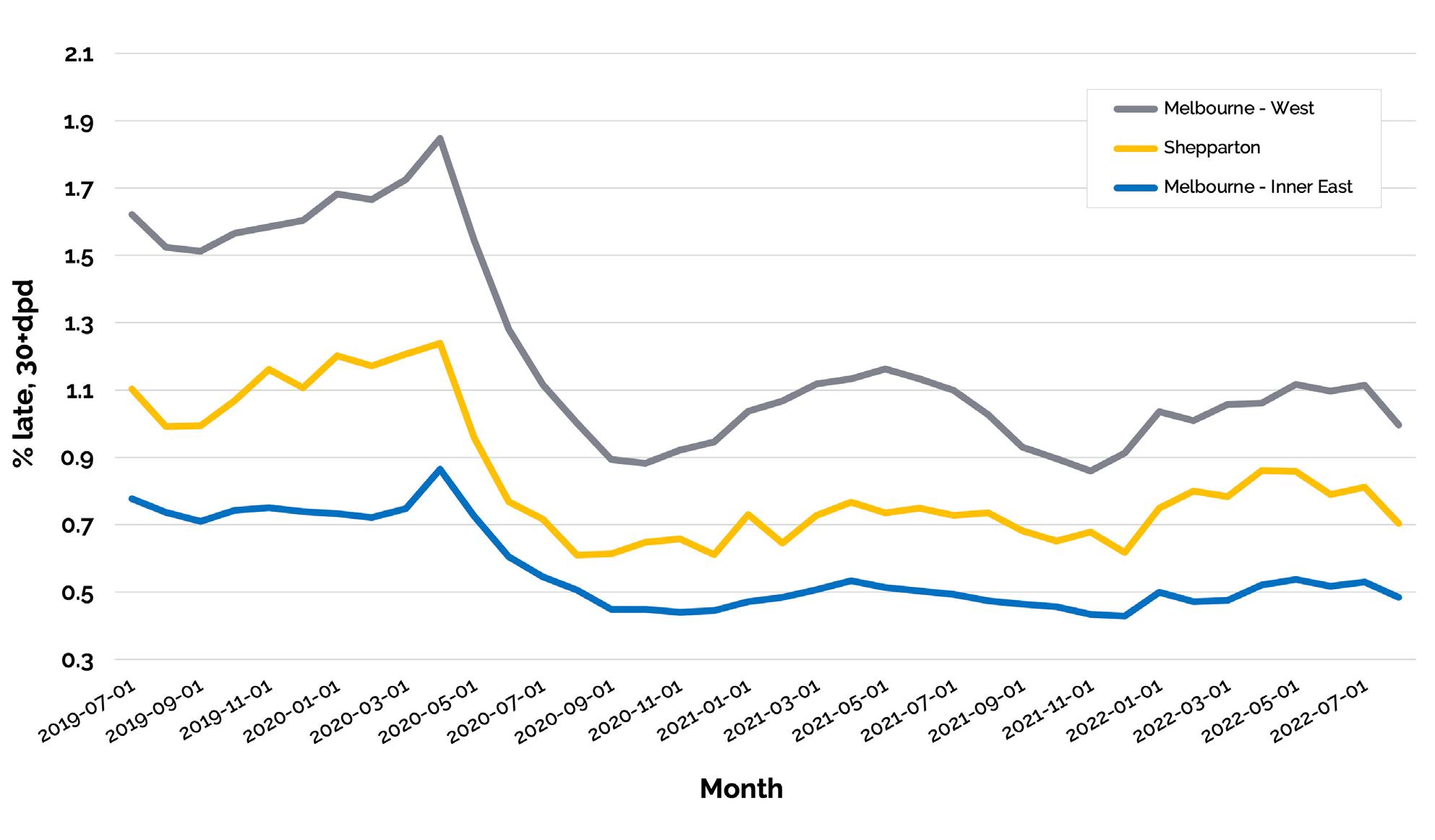

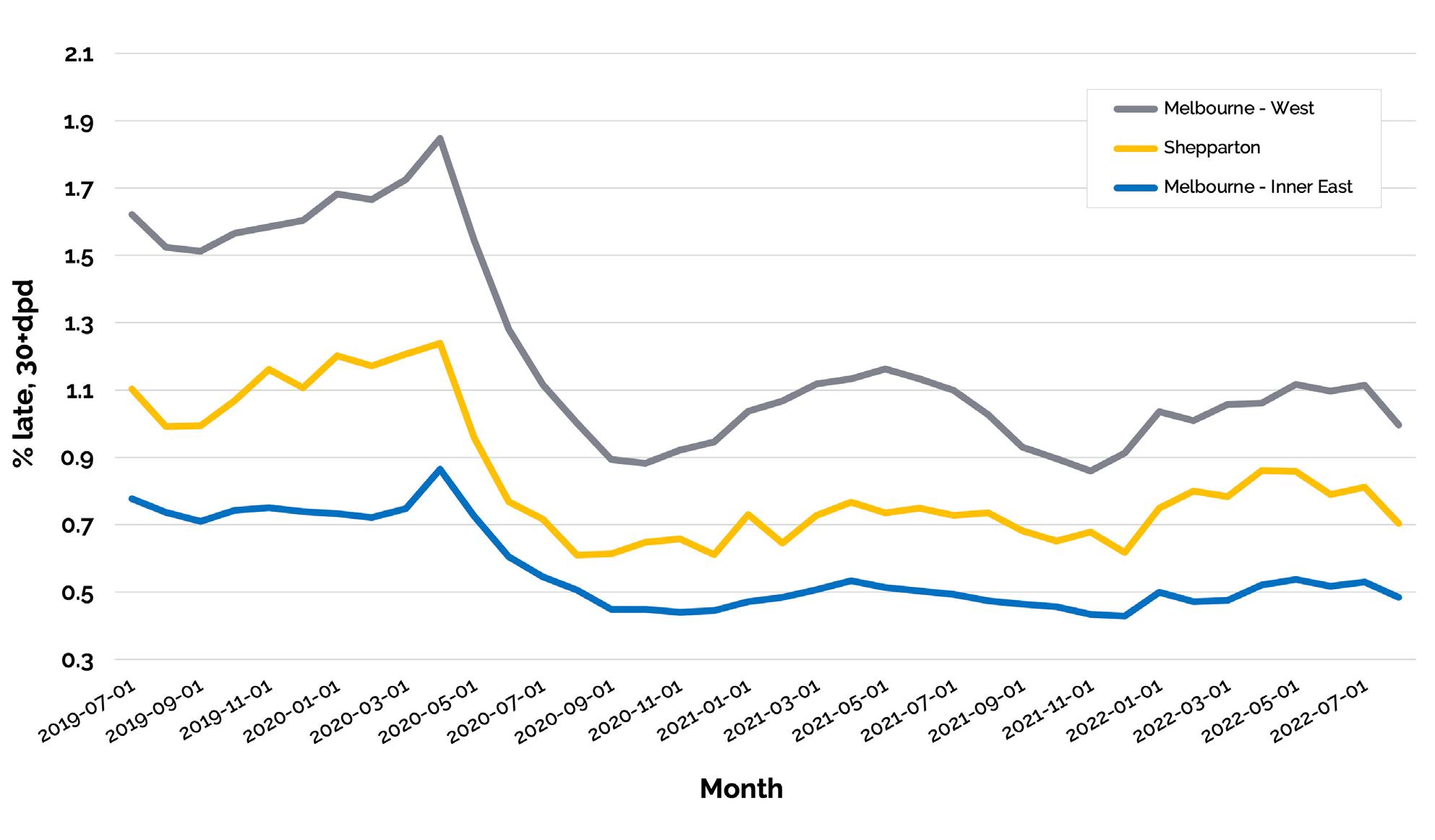

Figure 5 compares indexes of overdue credit card accounts by three SA4 areas in Victoria – Melbourne West, the regional area of Shepparton and Melbourne’s Inner East. Melbourne West had the highest level of overdue accounts prior to the pandemic (1.6% in July 2019), peaking at 1.85% of accounts in April 2020 at the start of the first lockdown. Melbourne’s West also had the sharpest fall in overdue credit card account levels – down to 0.89% of accounts in September 2020 after several months of lockdown.

10 AICM Overdue Credit Index Report 2023

DATA ANALYSIS INSIGHTS – 1 JULY 2019 TO 1 AUGUST 2022

FIGURE 5. Index of overdue credit cards by selected SA4 areas, Victoria

“The impact of the Buy-Now, Pay-Later wave has reduced consumer demand for credit cards, and it is possible that overdue credit has shifted accordingly.”

As of August 2022, 0.96% of credit card accounts in Melbourne’s West were overdue (30+dpd – about half the level of arrears before the pandemic. Melbourne’s Inner East had the lowest level of overdue credit card accounts before (0.78%), prior to the first lockdown (0.86%) and after the pandemic (0.48%) in August 2022.

The level of overdue accounts in the regional areas of Shepparton showed a similar pattern to Melbourne’s West but with a lower level of arrears – 1.24% in April 2022 and falling to 0.61% in August 2020.

In general, the areas with the highest levels of overdue credit card accounts prior to the pandemic were more responsive to the support measures put in place during the pandemic and are likely to be more sensitive to new shocks going forward.

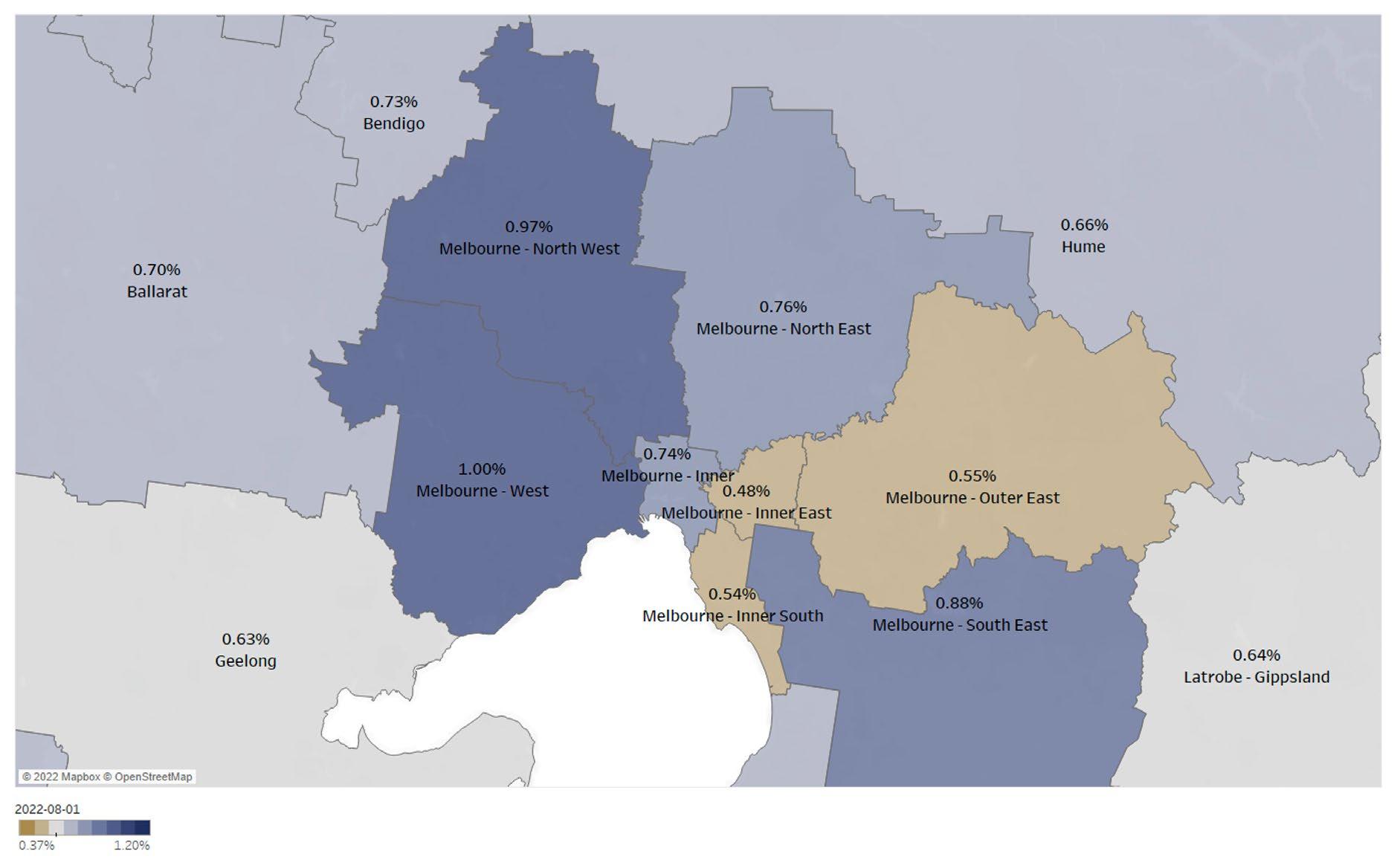

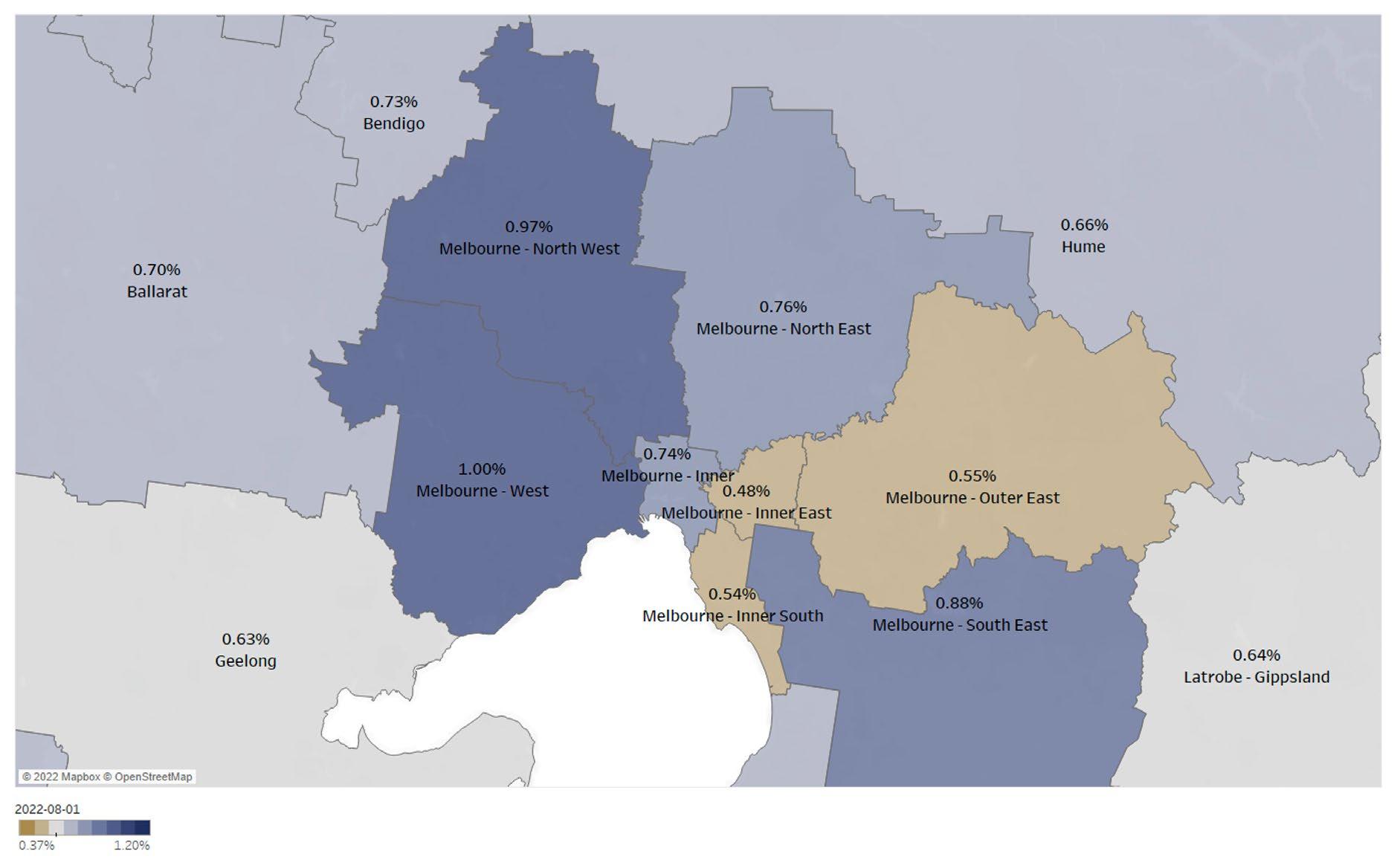

Figure 6 below shows structural differences in overdue credit cards accounts as of August 2022, by Melbourne and adjacent regional Victorian SA4 areas. Arrears (30+dpd) on credit card accounts in Melbourne’s North West (0.96%), and Melbourne’s West (0.99%), were around double the arrears rates in Melbourne’s Inner East (0.48%) and Inner South (0.54%).

AICM Overdue Credit Index Report 2023 11

DATA ANALYSIS INSIGHTS – 1 JULY 2019 TO 1 AUGUST 2022

FIGURE 6. Index of overdue credit cards in Melbourne and regional Victoria SA4 areas, August 2022

“In general, the areas with the highest levels of overdue credit card accounts prior to the pandemic were more responsive to the support measures put in place during the pandemic and are likely to be more sensitive to new shocks going forward.”

12 AICM Overdue Credit Index Report 2023 DATA ANALYSIS INSIGHTS – 1 JULY 2019 TO 1 AUGUST 2022

FIGURE 7. Index of overdue personal loan accounts, 30+dpd, national.

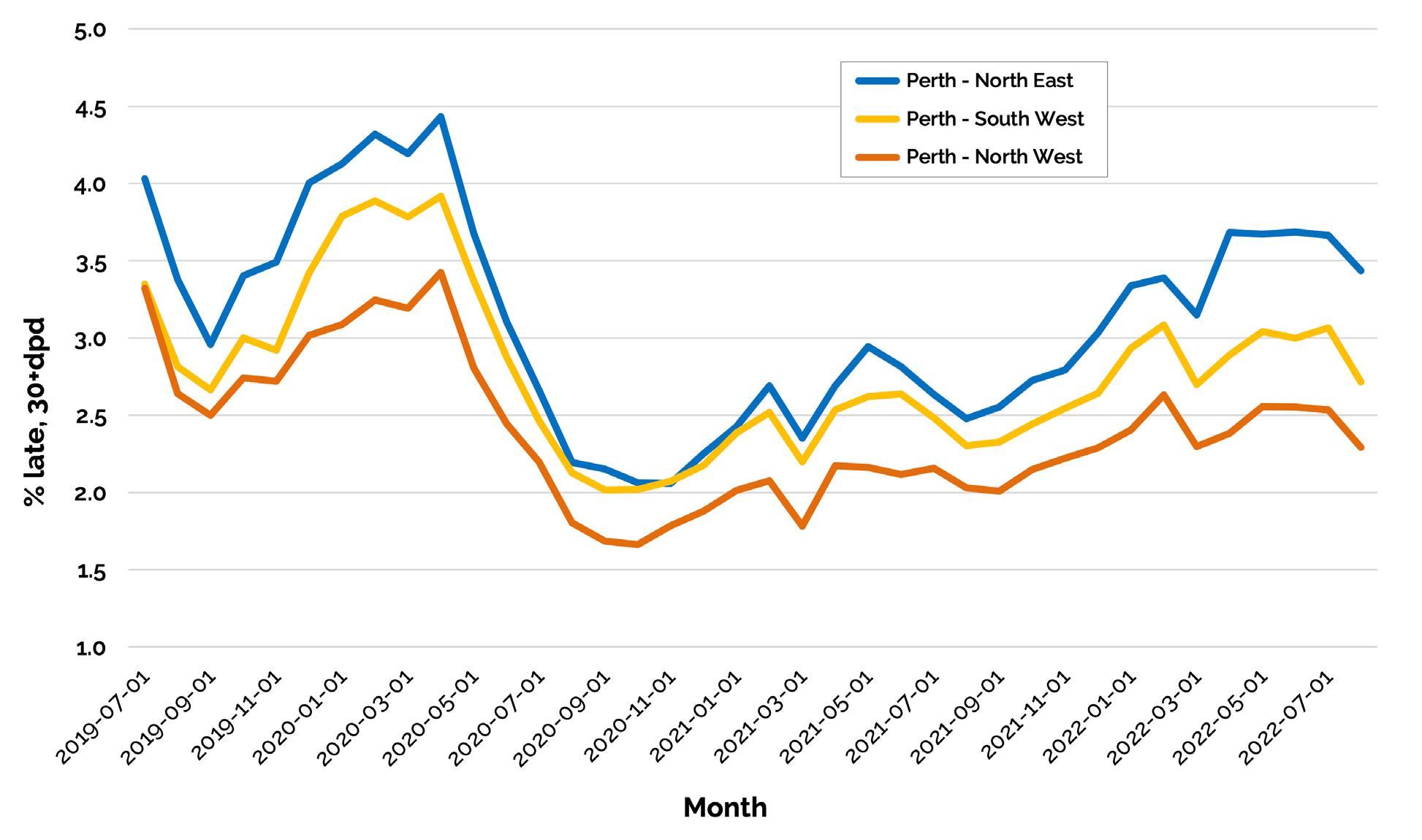

FIGURE 8. Index of overdue personal loans by selected SA4 areas, Perth, WA.

Index of overdue personal loan accounts

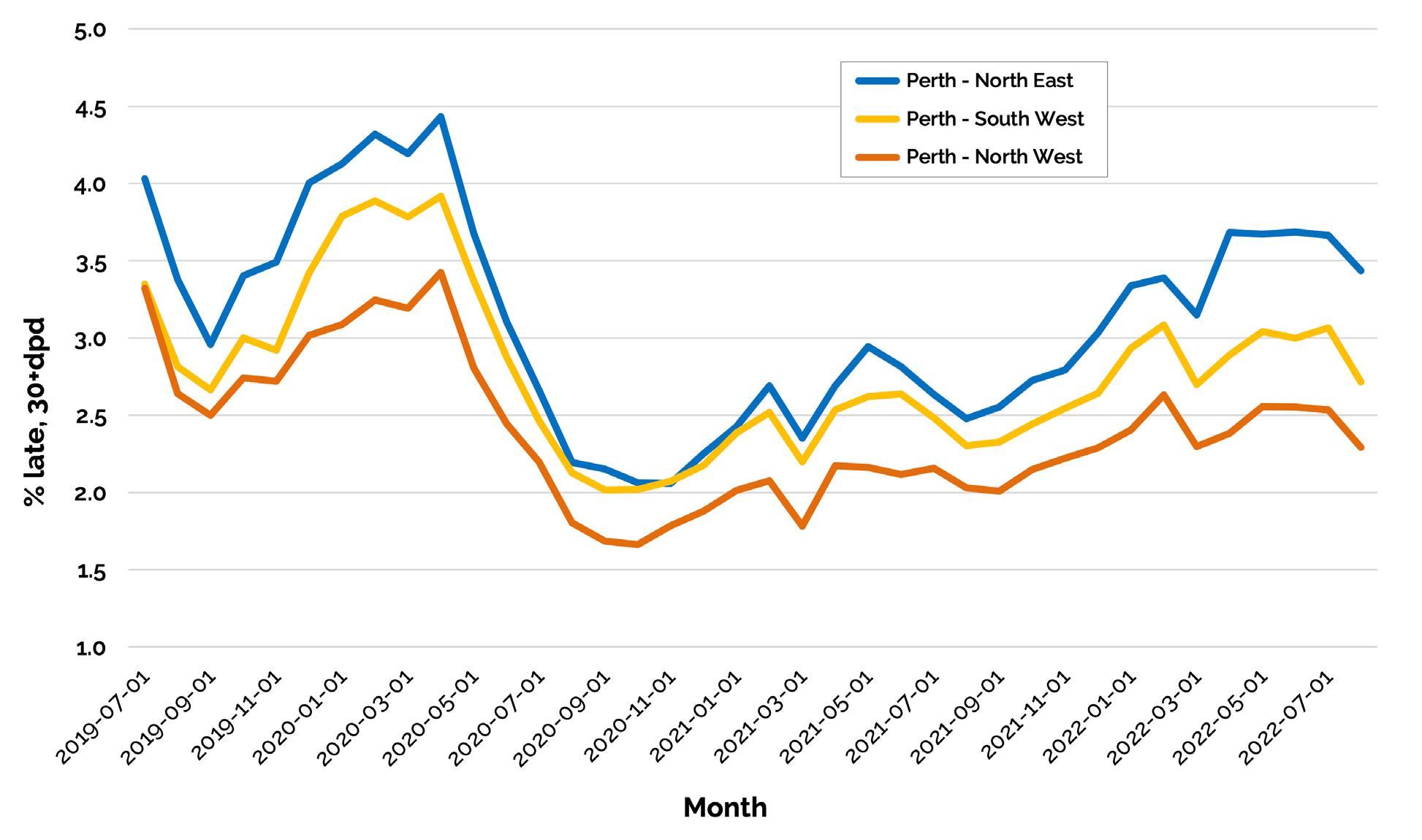

Figure 7 shows an index of overdue personal loans (30+dpd) from July 2019 to August 2022. The index shows a similar pattern to mortgage and credit card products prior to and during the pandemic, as well as similar geographical dispersion in overdue accounts. Unlike overdue mortgage and credit card accounts, however, whose arrear rates did not increase over the first half of 2022, the index of overdue personal loan accounts clearly rose consistently over the same period

and reached 3.3% in August 2022. This suggests increased personal loan account arrears may have been an early indicator of increased financial stress among unsecured borrowers in 2022.2

Figure 8 shows the index of overdue personal loan accounts by selected SA4 areas in Perth, Western Australia. Again, the index shows slight structural differences in arrears between comparable SA4 areas, as well as a similar pattern of co-movement across areas.

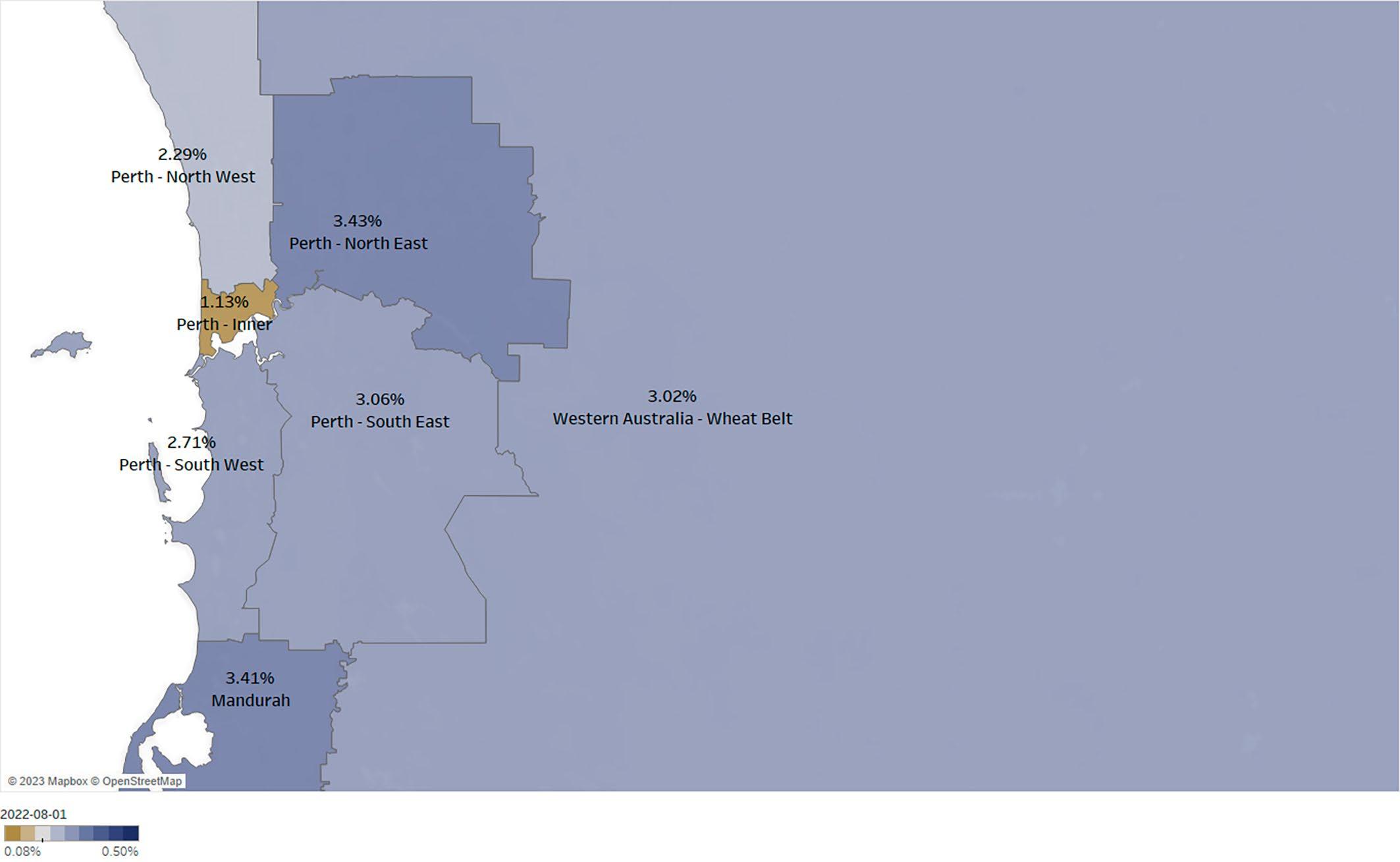

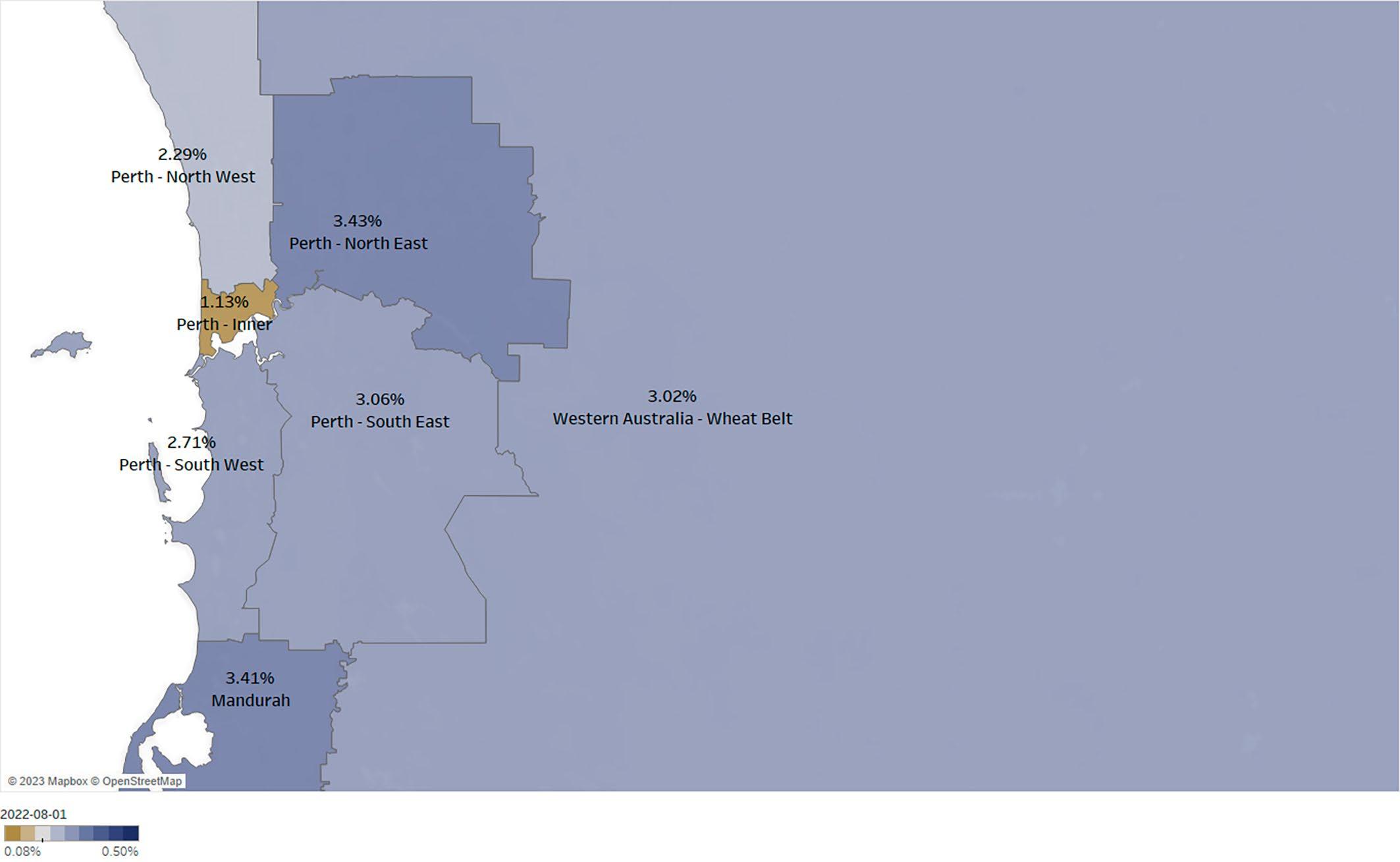

Figure 9 shows the index of overdue personal loans accounts across Perth and adjacent regional areas as of August 2022. The rate of overdue personal loan account in Perth’s Inner Perth (1.1%) was less than half of those in Perth’s Northwest (2.3%) and South West (2.7%) and a third of Perth’s North East (3.4%) and South East (3.1%).

AICM Overdue Credit Index Report 2023 13 DATA ANALYSIS INSIGHTS – 1 JULY 2019 TO 1 AUGUST 2022

FIGURE 9. Index of overdue personal loans by SA4 Area, Perth and regional Western Australia, August 2022

“

...increased personal loan account arrears may have been an early indicator of increased financial stress among unsecured borrowers in 2022.”

Figure

Adelaide

regional areas as of August 2022. Arrears rates (30+dpd) on personal loan accounts in Adelaide North (3.6%) were over two and half times the arrears rates in Adelaide Central and Hills (1.4%) and double those in Adelaide South (1.9%).

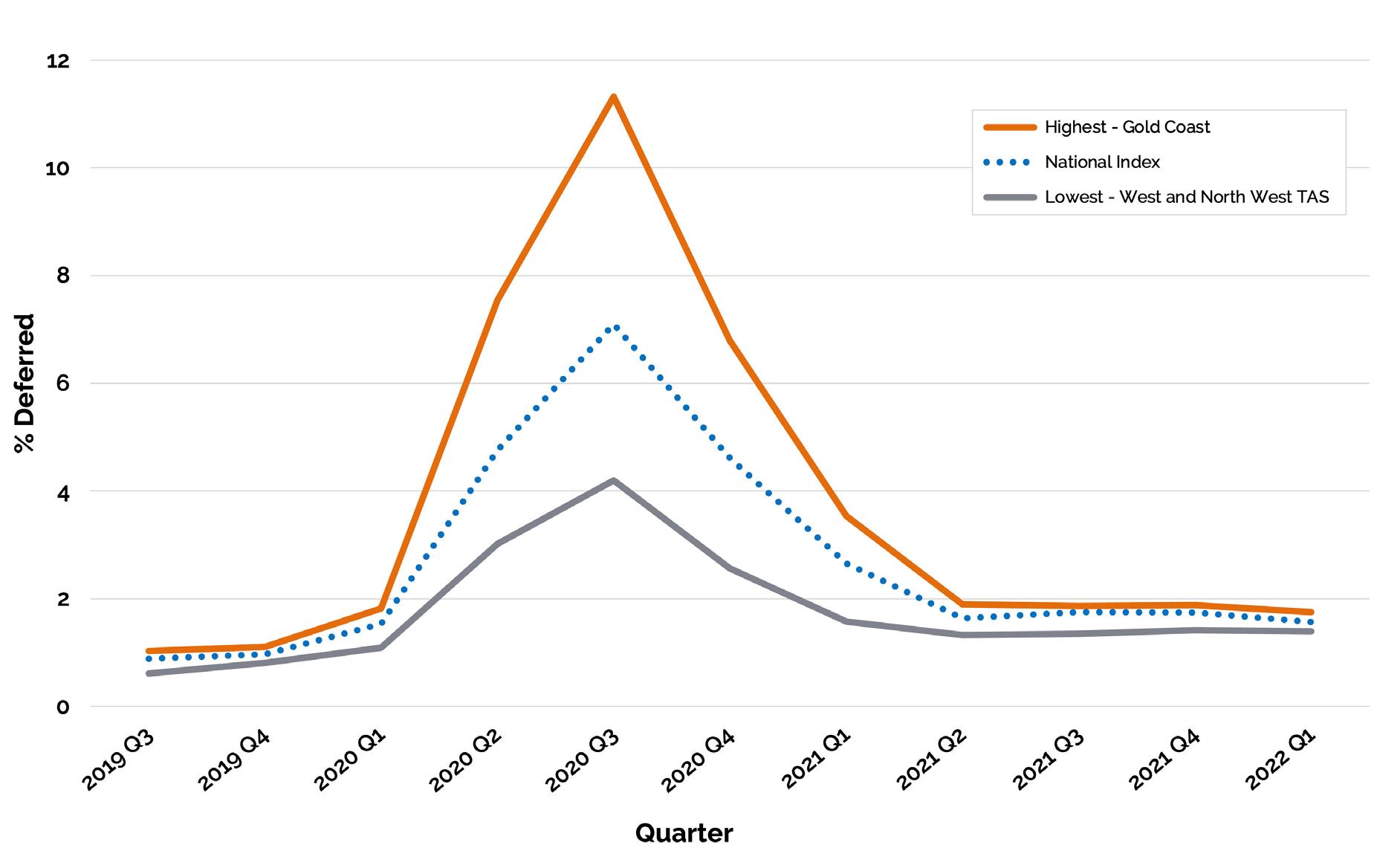

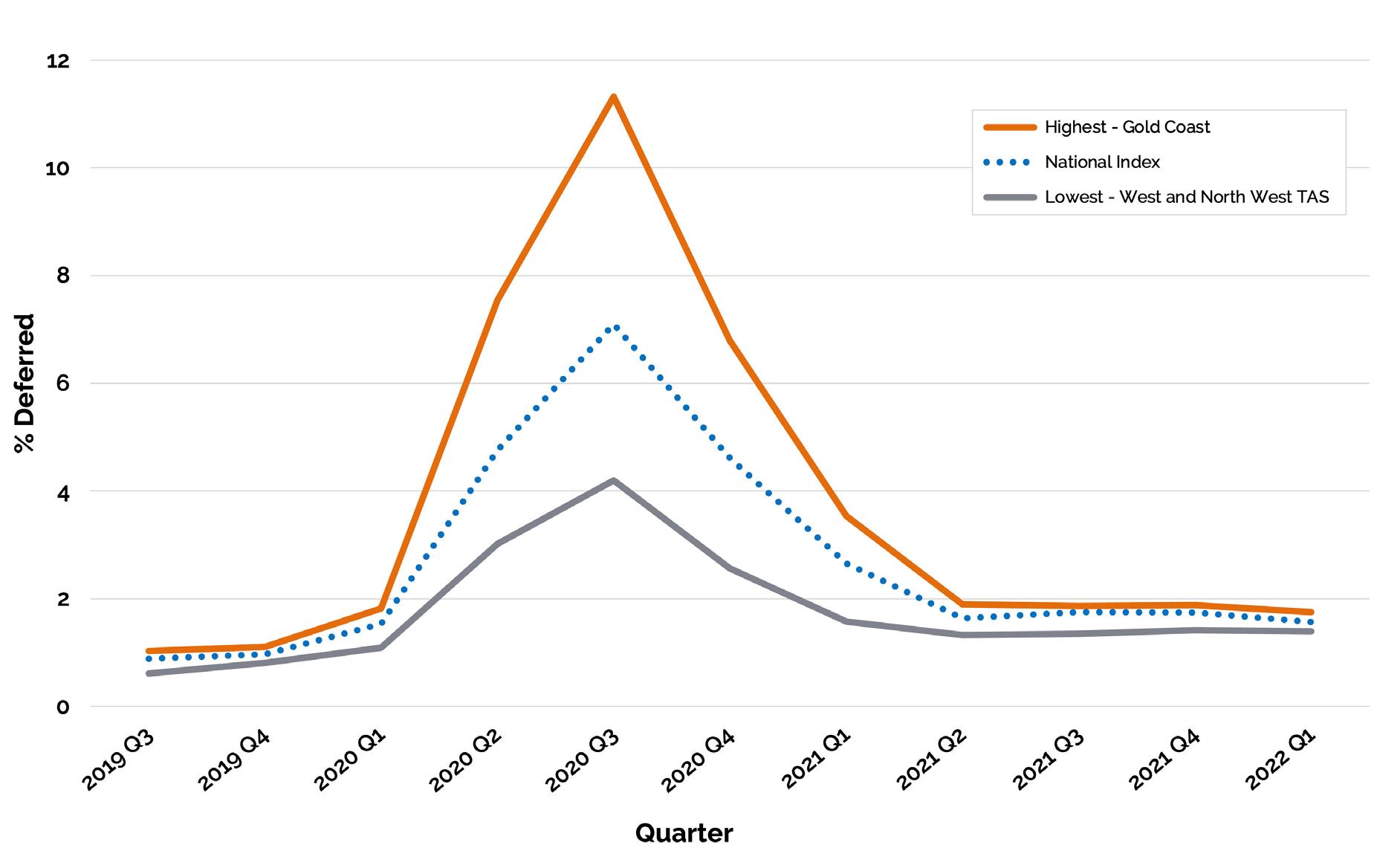

Index of deferred mortgages

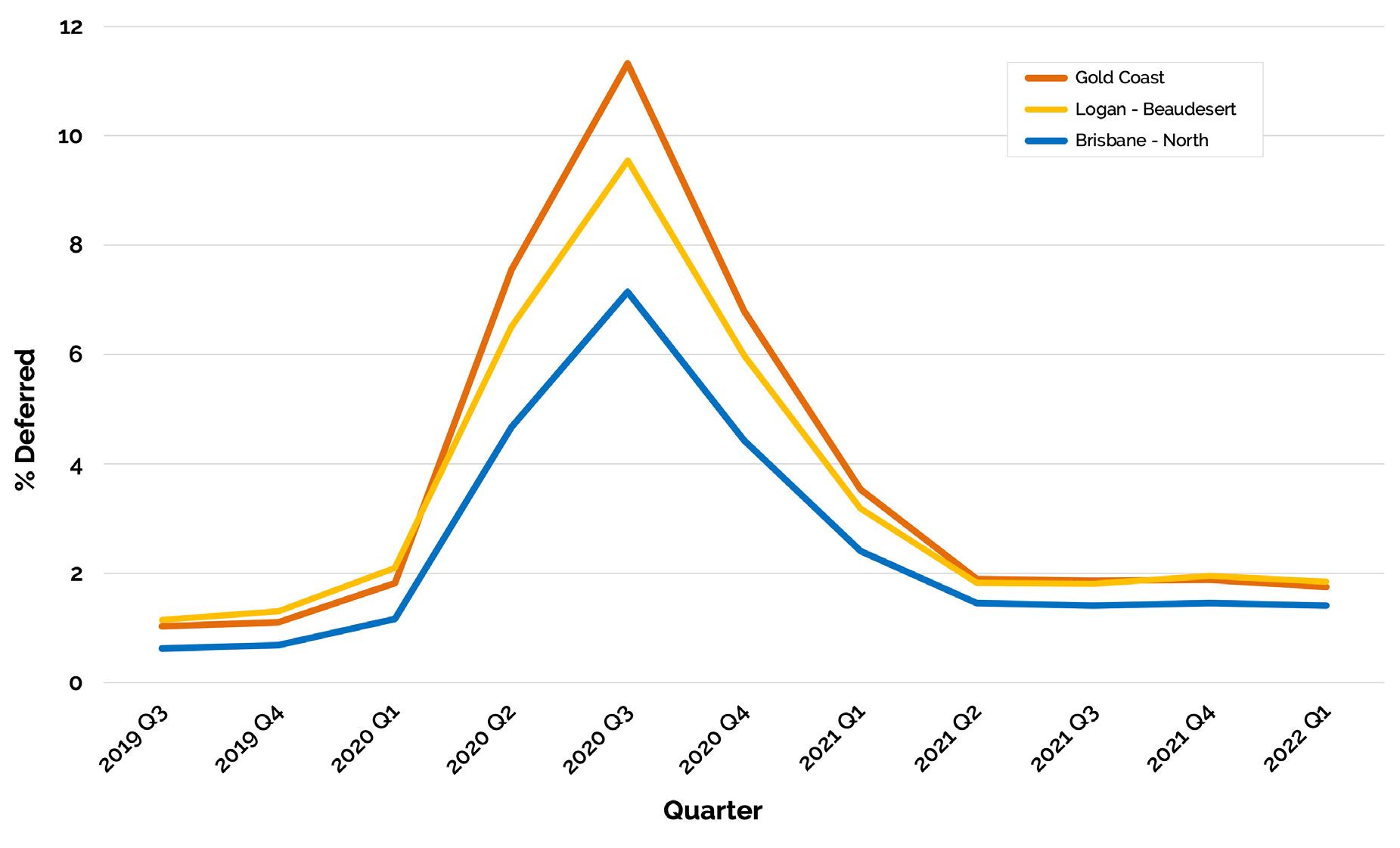

Figure 11 shows an index of deferred mortgages between 2019 Q3 and 2022 Q1. According to the index, mortgage deferrals rose from a low of 0.9% pre-pandemic to a peak of over 7.1% of accounts in the third quarter of 2020, before falling back to a low of 1.6% accounts in Q2 2021. According to data reported to APRA over the same period 10% of mortgage account holders deferred their loans between March and July 2020 – similar in scale to the estimated deferrals shown in Figure 11.

As of the Q1 2022 the index of mortgages deferrals was nearly double those after COVID (1.6%) as before (0.9%). This trend was evident across all geographical areas.

Figure 11 also shows strong regional variation in temporary loan deferrals, again due to economic sensitivity to the pandemic shocks. The Gold Coast in QLD had the highest level of estimated mortgage deferrals – reaching 11.3% in Q3 2020 – almost 60 percent higher than the national average due to the Gold Coast’s reliance on tourism. By contrast, the national index of mortgage deferrals peaked at 7.1% of accounts. West and North West Tasmania was the SA area with the lowest rate of deferrals (4.2%).

14 AICM Overdue Credit Index Report 2023

FIGURE 10. Index of overdue personal loans by SA4 Area, Adelaide and regional South Australia, August 2022

10 shows the index of overdue personal loans accounts across

and adjacent

DATA ANALYSIS INSIGHTS – 1 JULY 2019 TO 1 AUGUST 2022

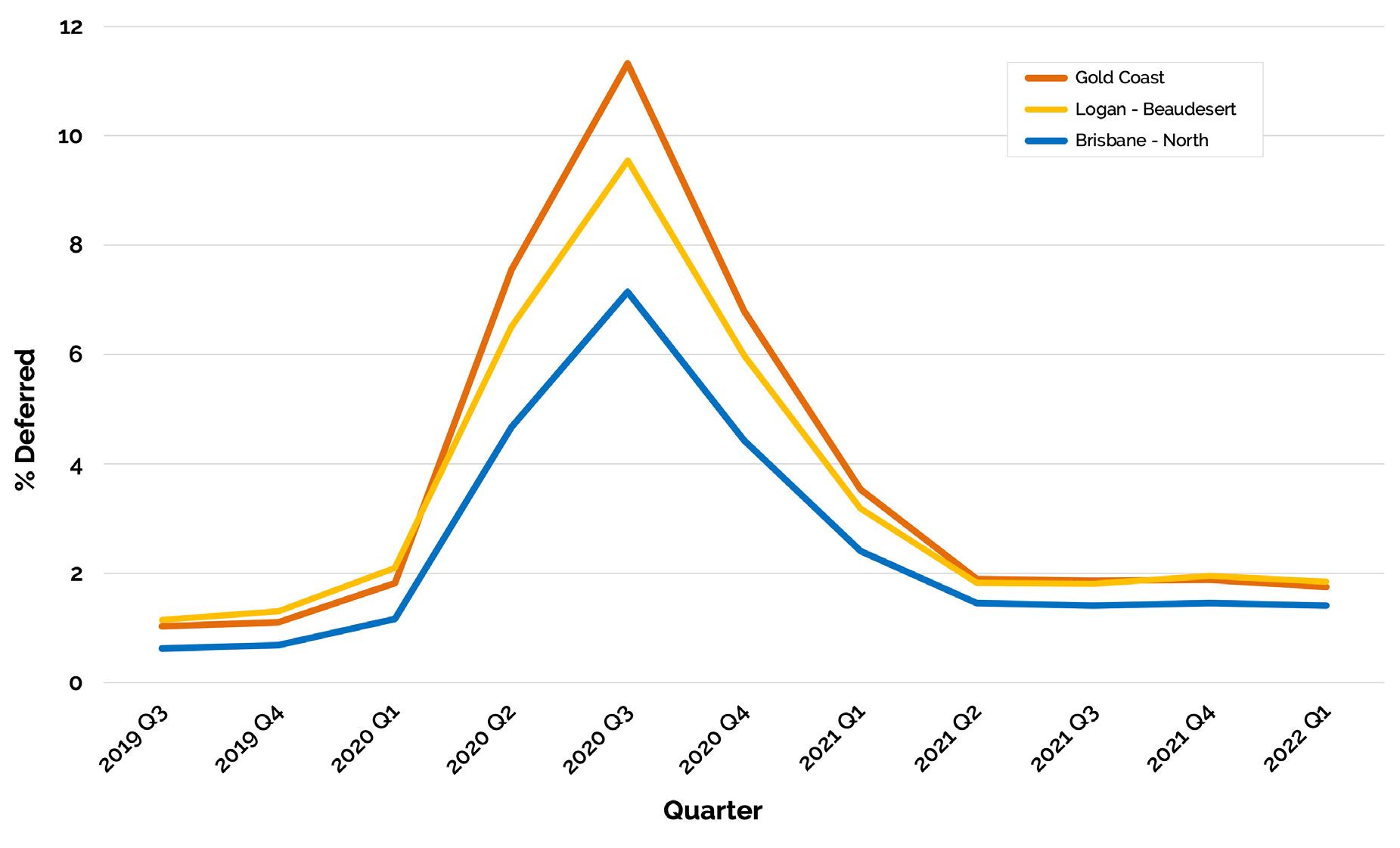

Figure 12 compares mortgage account deferrals in three SA4 areas in Queensland – the Gold Coast, Logan-Beaudesert, and Brisbane North.

AICM Overdue Credit Index Report 2023 15

FIGURE 12. Index of deferred mortgage accounts, by selected Queensland SA4 areas Q3 2020

DATA ANALYSIS INSIGHTS – 1 JULY 2019 TO 1 AUGUST 2022

FIGURE 11. Index of deferred mortgage accounts by selected SA4 areas, peak at Q3 2020

The Gold Coast had the highest percentage point share of mortgage deferrals (11.3% in Q3 2020) of anywhere in Queensland. SA4 areas that rely heavily on tourism and retail employment, such as Cairns and the Sunshine Coast were similarly affected with the highest set of deferral rates in the Queensland. Mortgage deferrals peaked at 9.45% in Logan-Beaudesert and reached 7.14% in Brisbane North in Q3 2020. Each of these areas had a higher share of accounts in deferral in 2021 than they did before the pandemic.

FOOTNOTES:

1 The banking regulator APRA allowed banks to grant temporal loan deferrals from March 2020 to distressed mortgage and SME borrowers in response to the COVID-19 pandemic. APRA waived the requirement on banks that they report these temporary loan deferrals as impaired loans.

2 Previous research from illion and the University of Sydney Business School indicated that consumers who hold both a personal loan and a credit card were more likely to default on their credit card first. These findings are at an aggregate level, rather than the individual level, and do not consider the sample of only credit card and personal loan holders.

16 AICM Overdue Credit Index Report 2023

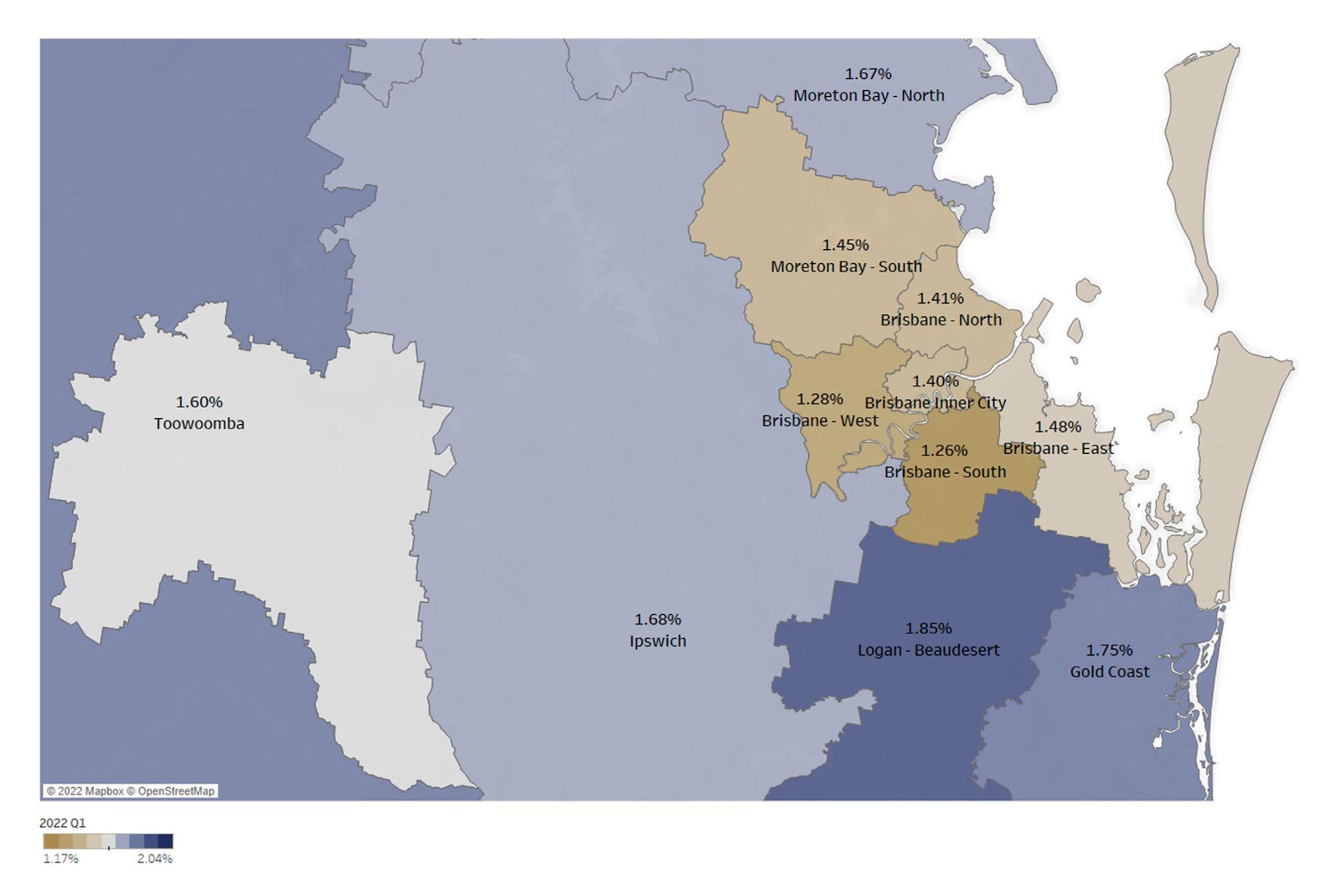

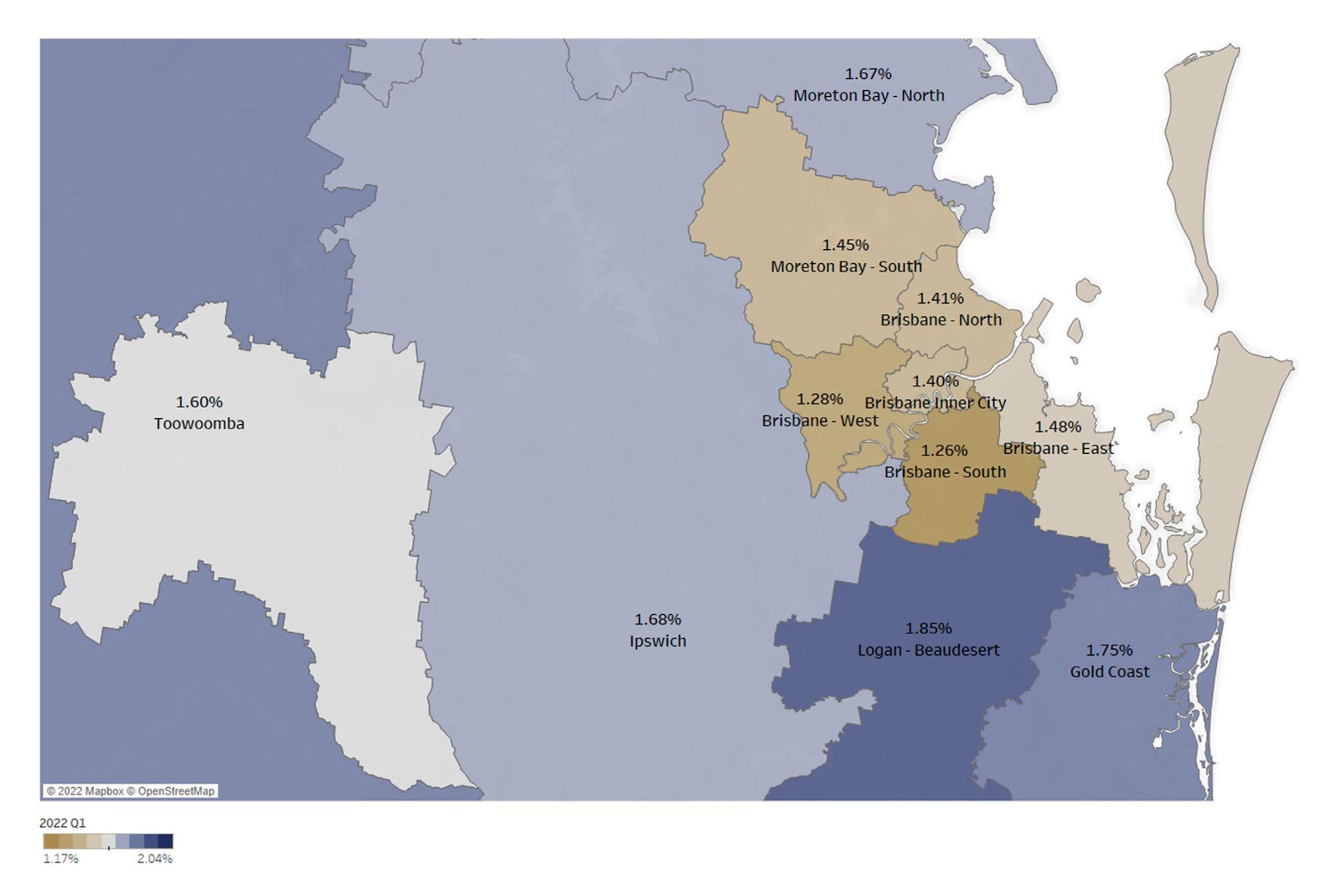

Figure 13 shows the index map of deferred mortgages by SA4 areas in Brisbane and adjacent regional areas as of Q1 2022.

DATA ANALYSIS INSIGHTS – 1 JULY 2019 TO 1 AUGUST 2022

FIGURE 13. Index of deferred mortgage accounts by SA4 areas in Brisbane and regions

Stakeholder INTERVIEW INSIGHTS

The research team also conducted interviews with credit professionals over a period of three months from July to September 2022 across a broad range of roles – management, consultants, financial counsellors, and external advisors.

The aim of the interviews was to obtain insights into the practices of organisations involved in collections and hardship processes. The research team used data from interviews to supplement the information about credit delinquency supplied by credit bureaus.

Theme 1. Post pandemic emerging trends

“During COVID, lenders widely offered deferral and hardship assistance to customers, including halting enforcement activities such as selling assets. However, in recent months, it has been difficult for these lenders to return to pre-COVID collection practices which is starting to result in higher rates of arrears.”

– Steve Johnson, Kadre Consulting. Director

“One of the biggest changes for credit managers during COVID-19 was the way they communicated. The focus is now on engagement rather than dollars collected and the look and feel of communication is much softer. We commissioned a linguistic expert to rewrite our letter suites to make sure customers felt safe.”

– Brooke Lawrence, Recoveries Corp. Group Manager Client Services.

The research team conducted structured interviews with a set of 14 questions. Respondents were asked questions about expectations and processes about overdue credit, financial hardship, professional skills, as well as technology and automation.

The report authors collated the Interview responses and analysed the text to extract key themes that emerged from the discussions.

Key themes and insights from interview participants are presented below.

“Demand for financial counselling reduced by around 30% during COVID due to increased unemployment benefits and forbearance from creditors. Now, levels are returning to pre-COVID in some agencies, but not yet at that level at the National Debt Helpline. We expect things to worsen as the economy struggles with rising interest rates and cost of living pressures.”

– Fiona Guthrie, Financial Counselling Australia. Chief Executive Officer.

AICM Overdue Credit Index Report 2023 17

The pandemic changed expectations around overdue credit and financial hardship in Australia. The pandemic saw a marked reduction in levels of overdue credit as well as a reduction in requests for hardship assistance. First, respondents viewed stimulus packages such as JobKeeper or early access to superannuation as helpful for consumers in paying down outstanding debts.

Second, participants believed that moves to offer payment arrangements during the pandemic were likely to have changed consumer awareness of hardship. The banking regulator, APRA, required financial institutions to offer payment

deferral during the pandemic. A reported $7.2 billion of loans were deferred (0.5% of housing loans outstanding). While the deferral program ended in 2021, interviewees believed there was a greater education of consumers around the use temporary loan deferrals. This may lead to a higher ongoing level of hardship requests from consumers.

Third, the economic and social circumstances created by the pandemic led many credit providers to soften their stance towards consumer hardship requests. Credit professionals, and particularly those in collections/hardship strategy teams, experienced the impact of Covid-

18 AICM Overdue Credit Index Report 2023 STAKEHOLDER INTERVIEW INSIGHTS

“

The pandemic changed expectations around overdue credit and financial hardship in Australia. The pandemic saw a marked reduction in levels of overdue credit as well as a reduction in requests for hardship assistance.”

related hardship and became more empathetic towards future requests. Financial counsellors pointed out that nature of Covid showed anyone could be vulnerable and may be unable to make payments on their financial obligations.

With the more relaxed stance adopted towards hardship during the pandemic, some participants raised concerns about ‘return to normal’ in customer management. For example, some consumers may have become accustomed to the more straightforward approach to hardship approval that was instituted during the pandemic, and thus reluctant to comply with more stringent processes.

Additionally, the pandemic may have led to the misclassification of hardship requests. Consumers with more long-term repayment issues (e.g., due to loss of employment or healthrelated problems) may have been ‘lumped in’ with requests related to temporary Covid-relief measures.

The credit professionals we spoke with expect the level of overdue credit and hardship requests to increase over the next year due to increased cost-of-living pressures and the end of temporary hardship and payment deferral arrangements across providers, but only after the savings buffers built up by consumers during the COVID-19 period are reduced.

Theme 2. Hardship provision is complex

“The financial hardship faced by many individuals is deeply tied to societal issues such as the treatment of women and families. Most of the contacts in Customer Payments Support Operations are from individuals experiencing domestic violence or coercion. This is not exclusive to the telco industry and addressing these issues through education and societal change is crucial.”

– Ross Charles, Optus. Collection Manager

“Credit providers have a responsibility to consider vulnerable consumers and their social license to operate. To move towards a more preventative approach, businesses should rethink their role and consider how they can spend their resources proactively rather than reactively.”

– Vanessa Herskope, Uniting. Training and Development Consultant

“We want to provide the right support to customers whilst collecting money on behalf of our clients. We have updated our quality framework focussing on customer discovery, education, and finding the best outcome for the customer, the first time. This approach ensures we build rapport and trust with customers or their representatives and in turn reduces the need for frequent contact and stress. Our approach is to share customer outcome options they may not be aware of or understand. We liaise with industry leaders regularly to adopt best practice.”

– Hannah Cook, Recoveries Corp. Operations Manager - Hardship

AICM Overdue Credit Index Report 2023 19

STAKEHOLDER INTERVIEW INSIGHTS

“

...the pandemic may have led to the misclassification of hardship requests. Consumers with more long-term repayment issues ... may have been ‘lumped in’ with requests related to temporary Covid-relief measures.”

“Good industry practice for dealing with customers in financial difficulty is to have proactive contact with them. This can be done by identifying triggers that indicate financial difficulty and reaching out to the customer before they reach out to you. The clients that I am currently working with aim to prevent customers from reaching the point of formal hardship by offering them appropriate debt management solutions before they move beyond early arrears.”

– Steve Johnson, Kadre.

While credit professionals often deal with overdue payments and customers at various stages of the collections process, hardship requests are unique and require specialist training, skills, and knowledge. Hardship requests often stem from extremely challenging circumstances (relationship breakdown, loss of employment, health problems), and the associated external stressors are likely to affect the decision-making capabilities of consumers.

One respondent explained that the average hardship-related call would take a credit professional around five times as long to resolve than a standard collections call. Accordingly, performance evaluation metrics based on call times are likely to be inappropriate when dealing with hardship requests. Most respondents reported a shift away from reliance on traditional volume-based metrics (e.g., dollars collected) towards customer-centric outcomes and qualitative factors, although the content of these varied across organsiations.

Customers experiencing extraordinary circumstances, such as domestic violence for example, may not be able to interact directly with creditor requests. Such cases may require assistance from third-party counsellors who can negotiate for the customer (with due respect for privacy considerations).

Credit professionals dealing with complex circumstances need to be able to respond with empathy – believing and understanding the situation faced by a borrower was viewed as paramount by financial counsellors. On the flipside, hardship-related calls may also be stressful for the credit professional. Staff may need to take a break, or even require counselling, following particularly intense conversations with consumers. Strategies for managing staff mental health to avoid frequent occurrences of burnout or high turnover rates are likely to prove beneficial in this case.

Debriefing sessions and roundtables following complex calls are likely to help drive strategies for the management of hardship cases.

Theme 3. The role of technology in customer support

“Although we have a portal for people to selfserve, take-up rates are low when it comes to hardship and telephone communication is still the preferred method. This is where arrangements are made, and data shows that people are more likely to stick to these arrangements when made via telephone call rather than self-serving.”

– Brooke Lawrence, Recoveries Corp.

“I know that many people in the debt collection industry have had great uptake of automated processes because many people prefer them.

20 AICM Overdue Credit Index Report 2023

STAKEHOLDER INTERVIEW INSIGHTS

“Customers experiencing extraordinary circumstances, such as domestic violence for example, may not be able to interact directly with creditor requests.”

However, from a financial counselling perspective, it can be difficult to only communicate through email. Sometimes, picking up the phone and talking to someone is necessary, but if you can’t get through or don’t get a response, it feels like hitting a brick wall. This lack of access is not only an issue but a missed opportunity, as a phone call can lead to better outcomes for both parties.”

– Fiona Guthrie, Financial Counselling Australia

“We don’t have any self-service for hardship, and we try to address it in a personalized way because when it comes to hardship, there is no one-size fits all. We provide a comprehensive hardship pack to each student who have indicated they are in hardship. We also do training around hardship and have implemented voice key word recognition triggers in our system to identify hardship behaviours that haven’t been communicated yet.”

– Ricky Forster, formerly Zeefi, General Manager Financial Services

“While some hardship requests require specialised handling, some requests are more straightforward and could be processed by consumers themselves. ‘Self-service’ provision of hardship requests, such as through an online form, may aid consumers in making near-timely payments...”

While some hardship requests require specialised handling, some requests are more straightforward and could be processed by consumers themselves. ‘Self-service’ provision of hardship requests, such as through an online form, may aid consumers in making near-timely payments (such as when there is a temporary mismatch between a consumer’s payday and a bill payment is due).

AICM Overdue Credit Index Report 2023 21

STAKEHOLDER INTERVIEW INSIGHTS

Self-service may also help consumers avoid feeling uncomfortable describing their personal circumstances and allow for a more efficient allocation of credit professional resources –although care was expressed to ensure its use only at early-stage delinquencies. In-person conversations, usually via phone, were viewed as ‘opportunities to connect’ for some participants. Self-service was viewed as particularly promising when dealing with younger consumers, who are viewed as disliking contact via SMS or email.

Secondly, technology was viewed as offering potential for earlier-stage customer intervention.

For example, some credit professionals use artificial intelligence (AI) to identify specific keywords or key phrases during customer conversations (e.g., ‘I have lost my job,’ ‘gambling.’) While such software can assist phone operators, it is still relatively nascent technology and requires support from management for implementation. Similarly, the growing role of AI in receivables management may offer decisionmakers with the necessary tools to identify customers who may need additional support and direct trained skills credit professionals to support those customers. The use of Comprehensive Credit Reporting (CCR) data provides a potential avenue for early-stage interventions – consumers predictably fall behind on credit card or personal loan payments before other products.

Theme 4. Credit professionals’ skills

“In terms of skills, collections officers need to be able to communicate, but they need to be able to communicate with the customer base that they’re dealing with. It would not be effective to place someone from Metro Perth in a hardship officer role in Broome.”

– Troy Mulder, Horizon Power, Retail Operations Manager

“Proper training and mentoring are crucial to placing the right people in the right roles. Being resilient, articulate, and respectful in communication is essential, and diminishing people is not tolerated. In our training, we have a rule that if a statement is not non-judgmental, inquiring, or respectful, it should not be said. When designing quality assurance frameworks for organizations, it’s important to focus on the intent of the conversation as well as compliance requirements.”

– Sue Fraser, Uniting Senior Manager, Enterprise Partnerships

22 AICM Overdue Credit Index Report 2023

STAKEHOLDER INTERVIEW INSIGHTS

“...technology was viewed as offering potential for earlier-stage customer intervention. For example, some credit professionals use artificial intelligence (AI) to identify specific keywords or key phrases during customer conversations (e.g., ‘I have lost my job,’ ‘gambling.’)”

STAKEHOLDER INTERVIEW INSIGHTS

“The skills required to manage the complexities of hardship today, which includes mental, physical and financial health, is vastly different from someone who is solely incentivised to collect money. It’s that broader skill set that we need.”

– Brooke Lawrence, Recoveries Corp

“We are heavily reliant on data and analytics in our credit profession. We need professionals who can analyze customer data, understand changes in regulations, and evaluate self-service usage to understand customer needs and changing circumstances.”

– Rohit Dhingra, Optus, Customer Payments Support Operations

Credit professionals require a broad set of skills, particularly when managing hardship processes. Complex cases entail difficult conversations for

both consumers and the credit professional. The approach taken in working with the customer can not only make a difference to the firm’s bottom line, but also the wellbeing of the consumer. A common theme among the interviewees was that managing the process requires a high level of empathy and specialised training to help credit professionals cope with potentially distressed customers. In some cases, the burnout of credit professionals was cited as overly common, and internal support within an organisation to help is desirable.

Building on this, buy-in from management to empower credit professionals was viewed as essential. Firstly, when on a complex call, delegated authority to offer a payment plan or deferral directly, rather than after consultation is viewed as favourable – allowing for consumers to receive a known outcome would ease their stress. Secondly, whether the collections process

AICM Overdue Credit Index Report 2023 23

“Credit professionals require a broad set of skills, particularly when managing hardship processes. Complex cases entail difficult conversations for both consumers and the credit professional.”

is viewed by management in terms of a ‘cost centre’ vs a ‘customer service’ role is important. Too heavy a focus on the dollar amount collected, rather than a satisfactory outcome for all parties can be detrimental to the overall business. After all, disgruntled consumers were more likely to represent a reputational risk to the business, and more likely to complain to the relevant ombudsman.

Key Performance Indicators (KPIs) associated with customer satisfaction, rather than collection rates, may provide greater overall or long-term value to an organisation.

Best practice around the hardship process requires ongoing discussions with other professionals. Many participants, especially counsellors, viewed training and roundtable discussions as a valuable

resource. Complex circumstances require careful maneuvering, with some level of judgement being needed in hardship assessments. Mock cases, or team reads of transcripts, alongside linguistic training to develop call scripts may benefit all hardship professionals.

Some of the implications of the research are:

z Skilled credit professionals are needed to interact with customers in a genuine, open, and respectful way. Thus, credit teams to be resourced with people skills and require continual improvement to handle challenging situations faced by consumers.

z The economic pressures and forecasts indicate that the need for financial assistance is likely to grow over the short to medium term.

z Therefore, all credit providers should prioritise projects that maximise their credit teams’ ability to engage with customers.

The research team would like to extend its thanks to each of the interview participants for sharing their time and insights towards this report.

24 AICM Overdue Credit Index Report 2023

STAKEHOLDER INTERVIEW INSIGHTS

“Best practice around the hardship process requires ongoing discussions with other professionals. Many participants, especially counsellors, viewed training and roundtable discussions as a valuable resource.”

Research TEAM

In collaboration with Nick Pilavidis from The Australian Institute of Credit Management, the research team was led by Dr. Andrew Grant and Dr. Luke Deer, academics at the University of Sydney Business School.

Sydney Business School

AICM Overdue Credit Index Report 2023 25

Dr Andrew Grant Academic The University of

Dr Luke Deer Academic The University of Sydney Business School

Nick Pilavidis FICM CCE CEO AICM

CONTRIBUTORS

26 AICM Overdue Credit Index Report 2023

Marcus Bruhn GM Data Science A/NZ Equifax

Carrie Cheung Head of Insights Equifax

Tonny Lim Data Evangelist Equifax

Louis Tsang (B.Com, B.Sc., MBA, CAMS, MICM) Head of Analytics & Data Services illion Australia

Justin Moy Analytics Lead illion Australia

Michael Landgraf Manager, Bureau Analytics illion Australia

CONTRIBUTORS

AICM Overdue Credit Index Report 2023 27

Steve Johnson Credit Advisory Kadre

Brooke Lawrence MICM Group Manager – Client Services recoveriescorp

Troy Mulder MICM CCE Manager, Retail Operations Horizon Power

Susan Fraser OAM Senior Manager Enterprise Partnerships + Development Uniting Kildonan

Fiona Guthrie CEO Financial Counselling Australia

Vanessa Herskope MICM Acting Manager/Training and Development Consultant. Enterprise Partnerships & Development – Kildonan and Lentara Cluster

Hannah Cook MICM Operations Manager – Hardship & Vulnerability recoveriescorp

Rohit Dhingra MICM Group Credit Risk, Complex Customer Support Manager –Customer Payment Support Optus

Ricky Forster MICM CCE General Manager – Financial Services Zeefi

Level 3, Suite 303 1-9 Chandos Street St Leonards NSW 2065 PO Box 64 St Leonards NSW 1590 Tel: 1300 560 996 Fax: (02) 9906 5686 www.aicm.com.au

Nick Pilavidis FICM CCE Chief Executive Officer

Nick Pilavidis FICM CCE Chief Executive Officer