renault-trucks.co.uk

Entering the city is key for your business but as more restrictions are introduced only the quietest, cleanest vehicles will be welcome. Choose the all-electric Renault Trucks E-Tech range to future proof your business and help everyone in the city enjoy clean and peaceful commute. For more information visit our website.

#SwitchToElectric

Probably the most significant story in this issue of Destination Net Zero is the frank admission by DAF Trucks managing director Laurence Drake that, as things stand in the UK, batteryelectric trucks are a poor business choice when compared to their modern, clean and efficient diesel counterparts.

There are diverse reasons for this. The capital costs are higher, and promises from lobbyists that battery costs would fall in five years have been heard for over a decade. There is no sign that battery costs have fallen, and I’d challenge anyone to produce hard evidence that they ever will. Scaling up volumes will reduce production costs on the one hand, but increased volumes mean greater demand for materials, which are in finite supply, so cost overall will go up, rather than down.

So far, so predictable. But what was not so predictable was the steep rise in the cost of wholesale electricity, which was triggered by Putin’s invasion of Ukraine and a consequent rise in gas prices. In the UK, for reasons that aren’t clear, electricity prices are hard-linked to gas prices…or that was the explanation when the price of both was going up.

The strange thing was, even customers of the so-called green generators, who were selling only electricity produced by solar and wind, found their prices going up too. And, even stranger, the price of wholesale gas has now dropped to below what it was before Putin had his rush of blood to the brain, yet there is no sign of the price of electricity to the end user falling.

So, we are stuck with a situation that sees purchasers of electric trucks facing a higher capital cost, a less-than-certain residual value, and absolutely no saving on the operating cost, because in terms of pence-per-mile an electric vehicle is up there with a diesel one. Nevertheless, the Government’s net zero ambitions remain intact.

But this really isn’t a situation where Government can expect the market to provide a solution without intervention. There are grants for the purchase of electric vans and trucks, but they are paltry when compared to the financial and operational burden that these vehicles will place on their operators if current trends continue.

Yes, there are advantages in running electric vehicles: but these are mostly societal rather than financial. If low or no carbon electricity can be sourced then the world benefits from the reduction in fossil fuel combustion, but that won’t pay the bills. Equally there are immediate improvements in local air quality from the removal of combustion engines, although road traffic is by no means the only (or even the biggest) contributor to atmospheric pollution to be found in most cities, and any benefit to the operator is marginal.

So, what’s to be done?

One solution would be to swing the balance back in favour of electric vehicles by increasing fuel duty: the old ‘make the polluter pay’ approach. But, what would the consequences be? Transport operators run on slim margins, and initially the response would be to pass

the increased cost on to customers. These increases would be particularly felt in the food sector, hitting the poorest hardest, and further fuelling inflation at a time when increased agricultural input costs and failed harvests in Spain and Morocco (where record low temperatures are being reported) are already stoking prices. Eventually, there would be some interest in replacing diesel vehicles with electrics, but financial constraints would mean that most operators would hold on to their existing vehicles for as long as they could. So that’s not going to work.

What might work, however, would be financial incentives to vehicle operators to go electric. Getting a grip of the electricity pricing mechanism would be one way of reducing the running cost of electric trucks. Another way might be for Government to offer an incentive to purchase electric trucks by offering so sort of guaranteed residual value or buy-back. This would give operators the confidence to buy (or at least lease at lower monthly payments) battery trucks. And, this might end up not actually costing the Government anything at all. Encouragement of early adoption of electric trucks would drive the construction of a charging infrastructure, which would in turn remove one of the current constraints on demand (I can’t use an electric truck because I can’t charge it).

If the electric truck parc reaches a certain critical mass, it may just be enough to swing the pendulum away from diesel for good. But it won’t happen without intervention.

Matthew Eisenegger, Publisher

INFORMATION

EDITORIAL

Publisher: Matthew Eisenegger

Managing Editor: Richard Simpson

Designer: Harold Francis Callahan

Editorial Address: Commercial Vehicle Media & Publishing Ltd, 4th Floor 19 Capesthorne Drive, Eaves Green, Chorley, Lancashire. PR7 3QQ

Telephone: 01257 231521

Email: matthew@cvdriver.com

ADVERTISING

Advertising Sales: David Johns

Telephone: 01388 517906

Mobile: 07590 547343

Email: sales@cvdriver.com

DESIGN

Art Editor: Harold Francis Callahan

Telephone: 01257 231521

Email: design@cvdriver.com

CONTRIBUTORS

Steve Banner Grahame Neagus

Jack Sunderland Harrison Thomas Pip Dunn

PUBLISHED BY Commercial Vehicle Media & Publishing Ltd, 4th Floor, 19 Capesthorne Drive, Eaves Green, Chorley, Lancashire. PR7 3QQ

Telephone: 01257 231521

NOTE The publisher makes every effort to ensure the magazine’s contents are correct. All material published in Destination Net Zero magazine is copyright and unauthorised reproduction is forbidden. The Editors and Publisher of this magazine give no warranties, guarantees or assurances and make no representations regarding any goods or services advertised in this edition.

Destination Net Zero magazine is published under a licence from Commercial Vehicle Media & Publishing Ltd. All rights in the licensed material belong to Matthew Eisenegger or Commercial Vehicle Media and Publishing Ltd and may not be reproduced whether in whole or in part, without their prior written consent. Destination Net Zero Magazine is a registered trademark.

Laurence Drake, managing director of DAF Trucks in the United Kingdom, has warned that current levels of Government support are insufficient to make electric trucks financially viable in the UK.

Celebrating a record share of the truck market in 2022, Drake hailed the success of DAF’s XF, FG and XG+ trucks in the UK’s growing tractor sector, but warned that when it came to persuading operators to begin the transition to electric vehicles the outlook was grim.

While there are a number of valuable Government initiatives, such as the Battery Electric Truck Trial and the planned Zero Emission Road Freight Trial, both designed to help encourage operators to start the transition, more needs to be done,“ said Drake, “Compared to other countries, where incentives can cover as much as 80 per cent of the cost delta between diesel and battery electric trucks, the UK Battery Electric Truck Grant is modest and, with the current high wholesale electricity costs,

electric trucks simply can’t compete against today’s most efficient diesels in terms of total cost of ownership.

“DAF Trucks is investing heavily in electric trucks,” he said, “DAF dealers are investing in the tools, training and facilities to support those trucks and many DAF customers are keen. However, they need support to help the transition. The cost of moving to electric is not just about the truck, it’s also about the charging infrastructure and the need to adapt operations and schedules. If the industry is to meet the end-of-sale dates for non-zero emission vehicles, there needs to be more financial support for early adopters to really kick-start the use of electric trucks in the UK.”

Last year saw the creation of the DAF EV & Sustainability team within the DAF Trucks UK organisation, whilst all DAF Truck Sales locations in the UK and Ireland will be enhanced to the status of DAF Electric Truck Centres by the end of 2023.

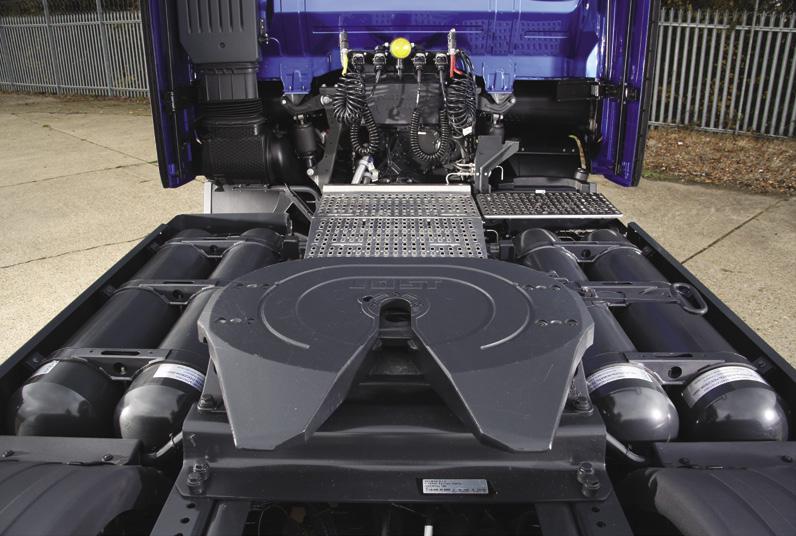

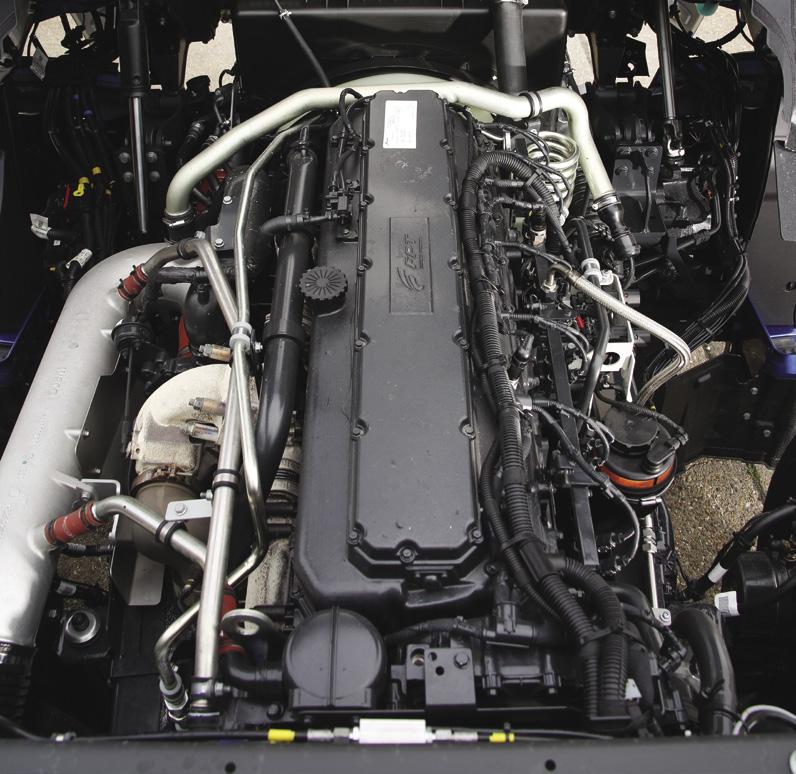

JCB has successfully installed a hydrogen-powered internal combustion engine in a 7.5-tonne Mercedes Atego truck. The farm and construction machinery specialist completed the retrofit in just days. The internal combustion engine used in the truck is the same as those already powering JCB prototype hydrogen construction and agricultural machines as part of the company’s £100 million hydrogen project, and is based on a common bottom-end shared with the successful JCB diesel engines. Major modifications include a spark ignition system, lower-compression pistons and a larger turbocharger.

JCB chairman Lord Bamford said: “This is a giant leap forward for JCB and the rest of the world because we all have one goal: to reduce emissions. The hydrogen engine we have installed in the truck is the same as those already powering prototype JCB machines, so there is no reason we should not see hydrogen combustion engines in vehicles used on the roads in the future, including cars.”

The British company has already manufactured 50 hydrogen internal combustion engines in a project involving 150 engineers and they now power prototype JCB backhoe loader and Loadall telescopic handler machines.

The truck at the centre of the latest project was formerly dieselpowered and the switch to hydrogen is a breakthrough which underlines that this form of power could represent a quick way to reach global CO2 emissions targets without the massive and expensive re-engineering required for fuel cell and battery electrics.

JCB developed the world’s first working hydrogen-powered construction and agricultural machines. Last year JCB revealed another industry first – a mobile hydrogen refueller which provides a quick and straightforward way to refuel machines on site. JCB’s hydrogen internal combustion engines are manufactured at JCB Power Systems in Derbyshire.

The European Commission has demanded far tougher than expected future targets for CO2 exhaust output reductions from heavy commercial vehicles, causing consternation among truck manufacturers who point to a lack of co-ordination with the proposed Euro VII regulations on toxic emissions.

It proposes reductions of 45 per cent CO2 from 2030, 65 per cent from 2035 and 90 per cent from 2040 from a 2019 baseline. The limits are technology-agnostic: the EC says that manufacturers themselves must choose from electrification, hydrogen fuel cells or hydrogen combustion, but warns that renewable and low-carbon pour-in alternatives to fossil fuel such as HVO and other synthetic fuels are unlikely to be available for road transport as the aviation industry will be given first call on them.

The CO2 limits are averaged across a manufacturer’s entire vehicle output: so selling a quantity of zero-emission trucks would allow greater latitude for producing some specialist trucks with powerful and thirsty diesel engines.

Industry had been working to a 15 per cent reduction in 2025 and a 30 per cent reduction by 2030. But the reduction demanded is now 45 per

cent by 2030 which has been described by Martin Lundstedt, ACEA’s commercial vehicle board chairman and CEO of Volvo Group as “highly ambitious.”

ACEA calculates that this reduction can only be achieved if 400,000 zero-emissions trucks are on the road by 2030, with at least 100,000 being registered annually. Even if the manufacturing side can achieve this, then creating a suitable charging network would mean installing 50,000 publically-accessible truck chargers across Europe with 35,000 being high-capacity megawatt chargers. ACEA said 700 hydrogencharging stations would also be required.

ACEA’s director-general, Sigrid de Vries, warned: “Given that charging stations that are suited to the specific needs of trucks are almost completely missing today, the challenge ahead is enormous.

“We are concerned that only vehicle manufacturers will face high penalties if other stakeholders do not fulfil their role in making this possible – especially given the low level of ambition that members states are showing on the Alternative Fuels Infrastructure Regulation (AFIR).”

Visit

Full-electric commercial vehicle manufacturer and services provider Volta Trucks has announced a strong start to 2023 by confirming customer production orders for the first 300 manufacturing slots of its full-electric Volta Zero, with an associated revenue of more than €85 million.

Series production Volta Zeros are due to start rolling off the line of the company’s contract manufacturing facility in Steyr, Austria, in early Q2 2023, with the plant ready to meet the strong customer demand for its purpose-built full-electric medium duty urban delivery truck.

Chief executive officer Essa Al-Saleh said: “Volta Trucks has made important progress in the first few weeks of 2023, confirming more than 300 customer truck orders for the first vehicles off our production line in Austria. This covers a meaningful portion of our 2023 production targets, before customers have pilot tested the vehicles. This is a major achievement and demonstrates the compelling features of the Volta Zero and the trust that our customers have in our ability to deliver.

“Volta Trucks is poised for a successful first year of sales and production. We are confident and focused on delivering on our strategic ambitions and purpose to decarbonise and improve the safety of city-centres,” he concluded.

Bridgestone has made its strongest-ever case for the fuel saving and CO2 reducing capabilities of its Duravis and Ecopia tyre ranges, after completing a four-month academic study with Coventry University in response to the ongoing cost-of-living crisis.

Business Analytics masters graduate Sreyas Sunil Kunnappally accepted the challenge and embarked on a painstaking project to arrive at a definitive conclusion. The 24-year-old discovered that up to 40,000 tonnes of CO2 could be saved across the UK’s haulage sector per year if every long-haul HGV ran on Ecopia H002 tyres This equates to between £2,200 and £3,200 in fuel per truck (between 1,100 litres and 1,600 litre.

The data was categorised into regional (Duravis tyre range) and long haul (Ecopia tyre range). Only HGVs above 8 tonnes were considered for the market split, with 90 per cent weightage given for regional and 10 per cent for long haul.

The results were calculated on the premise that all vehicles would be running on tyres with D Class fuel economy EC tyre ratings and would be swapping to the A class Ecopia range on all axles, referencing diverse sources including official Department for Transport statistics.

The same equation was applied to all regional HGVs running on Bridgestone’s B class Duravis range, where up to 3 million metric tonnes of CO2 would be saved per year, with a fuel saving per-regional truck of between £1,300 and £1,900 (between 650 litres and 950 litres).

The study is Bridgestone’s most comprehensive piece of product research commissioned since the tyres were brought onto the market in 2018.

Leading tool and equipment hire specialist Speedy Services has taken a big step towards a sustainable customer delivery model by commissioning its first two zero-emission Fuso eCanters.

The battery-electric trucks are now transporting products from the company’s comprehensive range. One is based at a depot near Whitehaven, Cumbria, which supplies contractors working at the Sellafield former nuclear power and fuel reprocessing site. The other works from a branch in Warrington, where it serves a client base comprised largely of building firms.

Everything you need to know from the last two months

A new electric powertrain produced by Cummins for heavy-duty vehicles is testing at Millbrook Proving Ground in Bedfordshire. The 17Xe ePowertrain, developed by Meritor (now part of Cummins) with Advanced Propulsion Centre consortium partners Danfoss’ Editron division and Electra, is being successfully demonstrated in a test Volvo FH 4x2 tractor unit and differs from the majority of current electric heavy trucks by using a eAxle, with the traction motor, which drives through a differential, integrated into the structure of the drive axle.

With output capabilities of 430kW continuous power (equivalent to 576 hp), the integrated 17Xe ePowertrain will power heavy-duty

trucks and buses in 6x2 or 4x2 configurations. It is available in a range of ratios and with three-speed transmission capabilities. Danfoss’ Editron division developed and supplied the high-power electric motor and high-efficiency silicon carbide inverter powering the axle. The electric motor is based on a patented architecture and thermal management methodology exceeding the Advanced Propulsion Centre’s 2035 Roadmap targets for power density. Only one motor will be required in the electric powertrain design, marking a significant step forward for the industry, as current alternatives usually need two motors to meet this product segment’s power requirements.

The layout of the eAxle, with its integrated drive motor, creates additional chassis space, which could either accommodate additional batteries or an unpowered steer or pusher axle. Batteryelectric tractor units which retain a conventional driveline layout are difficult to engineer as 6x2s, because the second axle takes up space needed for batteries.

www.truckfile.co.uk

Leading media and entertainment company Sky has purchased 11 new Mercedes-Benz eVito electric panel vans – as part of its drive to go net zero carbon by 2030. Sky opted for the latest eVito van, featuring a 66kWH battery with rapid DC charging, thanks to its 162-mile range and versatility.

The vans will be used by engineers to service TV and broadband customers across the UK. All 11 vehicles have been converted by Leicestershire-based Bott to incorporate the bespoke racking and telematics systems required by Sky and impressive graphic wraps recognisable to the public.

“The installation of Truckfile into our workshop and fleet has been a real breath of fresh air and is helping the whole operation to run much more smoothly.”

Compliance. Done digitally.

Eaton’s Vehicle Group has formed a new ePowertrain business unit, which will focus on products from Eaton’s electrified vehicle (EV) transmission, reduction gearing and differential portfolios. The company said that combining the product lines into a new ePowertrain business unit creates synergy among Eaton’s powertrain and EV experts and allows the Vehicle Group to offer its global customers solutions for commercial vehicles and light-duty EVs.

Eaton’s portfolio of multispeed EV transmissions includes two-, four- and six-speed electrified commercial vehicle transmissions based on proven, robust and efficient layshaft architecture typical of automated manual transmissions (AMTs) and shifting is synchronized without a clutch using a traction motor. Unlike the direct-drive transmissions normal in EVs, Eaton’s transmission portfolio offers significantly greater efficiency at high speeds as well as increased torque at launch and low speeds. The EV transmissions incorporate a lightweight countershaft gearbox that boasts a range of torque capacities and electric gearshift actuation, allowing use of smaller electric motors.

“It’s one of the best things we’ve ever done.”

Chris Thompson, General Manager at James Shaw & Son

Driver Check, Fleet & Workshop Management

Brakes the food service specialist has put its first DAF LF Electric truck on the road as parent company Sysco seeks to end the acquisition of diesel trucks by 2030. Sysco expects an annual CO2 saving of 52 tonnes from replacing a diesel vehicle with the LF Electric, Payload parity with a diesel 18-tonner is achieved by the LF Electric thanks to the one-tonne alternative fuel allowance that enables it to run at 19-tonnes GVW. Brakes’ new DAF LF Electric has been specified in partnership with Solomon Commercials which supplied and installed dual-compartment bodywork, and Frigoblock with its ‘FK2’ refrigeration unit to provide two-zone temperature control; frozen at the front, and chilled at the rear of the body, giving a payload of around eight tonnes. The FK2 unit draws energy directly from the battery pack and will alone contribute an annual 17-tonne CO2 saving.

Powered by an electric motor developing 250kW nominal power (370kW peak) and nominal torque of 1,200Nm (3,700Nm peak) the LF Electric features DAF’s latest LFP batteries providing a gross energy content of 282kWh (254 kWh effective) to give a single charge range of 280 km, ideal for urban distribution applications. The LFP battery pack comes with the peace-of-mind of a six-year warranty, and contains no cobalt or magnesium, offering further sustainability credentials.

Close Brothers Asset Finance has a strong history of helping businesses meet their emission targets by either upgrading or converting their vehicles. The people responsible for this is the National Accounts & ESG team, who are a team of asset finance experts who work with businesses across the UK, specialising in dealer and manufacturer relationships with a focus on new and emerging technology in the Transport sector.

They look at Alternative Fuel Vehicles (AFV), including EV and Hydrogen, Last Mile Delivery Solutions, Charging and refuelling infrastructure and other low emission alternatives to the traditional ICE markets. According to Andrew New, Head of National Accounts & ESG, early engagement with new and developing technology is key, as they strive to understand the challenges the sector is facing.

“We work closely with manufacturer and vendor partners to create bespoke funding solutions and increase sales to the end user markets with Hire Purchase, Finance Lease and Operating Lease structures.

“We assist in the purchase cycle by dealing directly with the end user customers to create a bespoke solution that matches their requirements.

“We focus on the traditional ‘heritage’ markets, as well as the new and emerging technologies in both established vehicle classes, along with the new to market products that are being produced to be compatible with the net zero targets for the UK and Europe.”

The team offers flexible finance solutions to help businesses convert or upgrade

their fleet of vehicles to meet emission requirements.

Vehicle conversions – the team can help businesses who are looking to convert their current vehicles to meet the requirements. They can make this possible with tailormade, practical refinance options.

“Refinancing allows you to quickly release funds from your existing vehicles and reinvest this into the conversion,” explained Andrew. “We also provide flexible finance solutions to help businesses purchase new, compliant vehicles.

“Our people are experts in asset finance and consider all relevant aspects of a business to create tailor-made, flexible repayment schedules to suit most situations.”

For more information, please visit closeasset.co.uk/esg.

Contact

Meeting emission targets is an increasing focus for vehicle and fleet owners across all sectors, and is something Close Brothers Asset Finance has strongly focused on. In this Q&A with Andrew New, Head of the National Accounts & ESG team, we find out more about him and the team.

I have over 25 years’ experience in the asset finance sector and established the National Accounts team in April 2017, taking on the additional remit of leading our work in ESG within the commercial transport sector in January 2022.

The National Accounts and ESG team is responsible for developing and maintaining relationships with manufacturers and dealers across the UK to provide funding solutions to end user customers who are looking to acquire increasingly expensive, but essential, assets for day-to-day business use.

We focus on the traditional ‘heritage’ markets, as well as the new and emerging technologies in both established vehicle classes, along with the new to market products that are being produced to be compatible with the net zero targets for the UK and Europe.

To have a market-leading team that can assist with both established and new applications for the sector, working closely with product offerings that are already available. We also want to work closely with all manufacturers as new and bespoke solutions are being developed to have a full and firm understanding of not only the ‘now’, but also the future.

At Close Brothers Asset Finance, we strive to be experts in all our fields and have proven to be so in the Transport sector for over 35 years. This is a trend we intend to continue as the whole market goes through the most profound change since the introduction of the ICE engine.

By immersing ourselves we will be able to advise and guide both our partners and our customers as they undertake the change to zero emission logistics.

“We focus on the traditional ‘heritage’ markets, as well as the new and emerging technologies”

Read the press in 2023 and you will see that the is world harnessing electromobility across many sectors and now across an increasing array of vehicle weight categories, too. Against a backdrop of decades of diesel technology and usage, we are heading into a decade of total change as conventional ICE powertrains are gradually phased out. The elephant in the room is infrastructure and the continuity of power to meet the new rising demand.

Recent reports in the media highlight the huge growth in EV cars, which has happened at a faster rate than infrastructure provision, meaning that quick and effective public charging is not always the experience of owners, coupled with patchy charger availability.

For commercial vehicles, increased ranges of electric LCVs and HGVs means that most return-to-base or multi depot based operators will not require public charging. For these operators, the challenge is ensuring that you are planning sufficiently with your infrastructure partner, and that the DNO local infrastructure is in place and working before your vehicles arrive. As we know, lead times on vehicles from all OEMs have been challenging in recent months, but some

forward-thinking clients have used this time to start talking, procuring and installing the necessary infrastructure into their operations ahead of new electric vehicles arriving. This whole transition, especially in those operations who have made a definite commitment in volume, is not just a five minute exercise and can take up to twelve months or more from initial discussions to being fully operational, taking into account possible civil works and negotiations with internal stakeholders and landlords.

The Renault Trucks approach is to work collaboratively with operators and introduce third-party expert partners at appropriate stages. At every Renault Trucks dealer across the UK, customers are supported throughout their entire journey to switch to

electric by our fully trained Energy Transition Specialists (ETS). We specify a vehicle to suit the application and then introduce charging partners who will assess the energy available on site for charging the first, and hopefully subsequent electric vehicles. After this assessment we will recommend charging solutions which reflect the immediate and ongoing operational needs of the customer. This is a vitally important part of the whole ‘journey to electric’ jigsaw but the numbers of operators who are only just starting out is in some cases, frighteningly low depending on the sector. Yet as more towns and cities become ever more stringent on what types of commercial vehicles they allow into the urban environments, the need to get on board with electromobility is getting ever more of a necessity.

Wherever you are on your decarbonisation journey, it is vital to be having these forwardthinking conversations. And because the world is evolving and changing at pace, it is worth looking further ahead as to what size of provision you need especially around the delivery capacity of the infrastructure you are considering. Not that long ago a 50kWh charger was considered fast. Today 150kwh, 350kwh are considered the expected norm in the HGV sector and looking beyond this to the large MegaWatt systems for ultra fast charging of the electric tractor units.

For some operations, such as trunking, public charging will have to step up to the plate. Currently here in the UK there are very few public charging points designed for a 26 tonne three axle rigid let alone a 4x2 artic combination. Businesses like GridServe are already upgrading their new facilities to make provision for HGVs but the sector still has a long way to go and certainly Government incentivisation is key in helping the decarbonisation of freight transport.

Leading the way, in 2022, a number of truck OEMs, including Volvo Group of which Renault Trucks is part, agreed as part of a joint venture to install and operate at least 1,700 high-performance green energy charge points on, and close to, highways as well as at logistics hubs across Europe. The parties are committing to invest EUR500 million in total, which is assumed to be by far the largest charging infrastructure investment in the European heavy-duty truck industry to date. As Volvo Group President and CEO Martin Lundstedt stated, “This is a long-awaited and major step towards achieving the required charging infrastructure for the roll-out and success of battery-electric long-haul trucks and coaches. We are making what would be impossible for one actor alone to accomplish - this strong partnership is a significant milestone and accelerator towards carbon neutral transport in Europe by 2050.” It is through a strong collaborative team of likeminded organisations that such advances can be made.

And proving that it can already be done, one of our Swiss dealers recently ran two electric Renault Trucks vehicles (a 3.5 tonne E-Tech Master and a 26 tonne E-Tech D Wide 6x2) from Switzerland across Germany, all the way up through Norway and into the Arctic Circle in bitter, inhospitable conditions. Why? Well, to prove that not only can these vehicles operate in harsh winter conditions, but also that across Europe, in places like Norway, using public charging for trucks can power such an epic adventure. We need our Government to recognise and support this here in the UK.

A clean and emission free future is coming, ready or not. Today you can already order electric commercial vehicles from a small van through to a 44 tonne electric truck from manufacturers like Renault Trucks. The hardware is here, that’s a fact. But here’s the burning question, is your strategy and operation also ready to take advantage and move forward?

gas engine that can run on liquified biogas has entered the market, giving operators the option of specifying a 500hp gas-powered heavy truck for the first time.

The new engine has been launched by Volvo Trucks – which previously only offered 420hp and 460hp gas variants – but believe the availability of the 500hp option will mean fleets can carry out more demanding, longer distance journeys, whilst still reducing overall CO2 emissions. The launch comes five years after Volvo Trucks launched its first trucks that can run on liquified biomethane, often called bio-LNG, which is a renewable fuel that can be produced from many types of organic waste, including food waste. The fuel can also reduce CO2 emissions by up to 100%.

“Biomethane is a great complement to electric transport solutions, helping hauliers with their sustainability ambitions and aims towards climate neutral transport,” says Daniel Bergstrand, Product Manager for gas-powered trucks at Volvo Trucks.

The new engine is being offered in both the Volvo FH and FM model ranges but can also be specified for the on/off-road FMX upon request. Across the range, Volvo’s 420hp and 460hp gas engines also benefit from the same major technical upgrades to help make them up to 4% more fuel efficient than the previous generation, which together with the availability of a new 10% larger gas tank on certain models, contributes to a longer range.

These changes have seen the gas engines completely updated, with the increased efficiency obtained by new injectors and pistons for lowered friction, together with a new turbo, variable oil pump, and crank case ventilation that handles unfiltered oil.

“Our efficient gas-powered trucks have a performance comparable to their diesel equivalents. Fuelling is almost as fast as a diesel truck and

“Biomethane is a great complement to electric transport solutions”

the growing network of more than 600 fuel stations for both bioLNG and LNG in Europe makes them ideal for long-haul work,” adds Bergstrand.

Commenting on the launch, James Westcott, Chief Commercial Officer for UK fuel supplier Gasrec, says: “This is a big statement from Volvo, and reinforces the importance of biomethane-fuelled trucks for the country’s decarbonisation strategy. For some fleets which have always run 500hp diesels and wouldn’t consider any less power for their operation, it’s putting a far more sustainable option on the table for them; with a driving experience which is almost identical.

“Demand for biomethane in road transport is currently higher than at any point previously; last year we saw the volume of gas we supplied to customers increase by more than a third, versus the previous 12 months. So much so that at our largest open-access refuelling facility at the Daventry International Rail Freight Terminal, we have had to add additional LNG dispensers in recent months. That’s where we’re seeing the greatest demand.”

Volvo Trucks says its strengthened gas-powered line-up fits well with its three-path strategic roadmap to reach net zero emissions: battery electric trucks, fuel cell trucks and combustion engines that run on renewable fuels like biogas, HVO or even green hydrogen.

“Several technical solutions are needed because the availability of energy and fuel infrastructure differs greatly between countries and regions, and also because the requirements for each transport assignment can vary,” says Bergstrand.

European production of bio-LNG is expected to ramp up quickly to shift away from the use of fossil LNG. The EU Commission has put forward a plan called REPower EU, where the focus is on creating greatly increased domestic production capacity for different kinds of energy. The plan is to boost annual biogas production 10 times by 2030 and the sector has already started a rapid growth phase. Outside of Europe the potential for biogas is also gaining interest.

Bio-LNG is a renewable fuel that is liquid biogas (biomethane). Any organic waste can be digested to produce biogas, for example sludge from treatment plants, food waste, manure and other residual products, whereas LNG is a fossil gas (methane) which is extracted from underground or undersea reserves.

The process for liquifying biogas is the same as for LNG; the gas is cooled down to –162 °C. The fuel then takes significantly less space, which makes it possible to bring a much larger amount of energy onboard the truck, which increases the range significantly.

thas long

been synonymous with Stoke-on-Trent, but few probably realise that sitting just outside the city centre is one of the most advanced truck and bus tyre retreading facilities in the world, with the capacity to manufacture up to 300,000 retread tyres annually.

For the most environmentally and cost-conscious fleets this is significant because a retread truck tyre uses 70% fewer raw materials in the manufacturing process, making it significantly cheaper than a new tyre and contributing to the drive for sustainable transport.

The site’s presence – just a stone’s throw from J15 of the M6 - also supports UK manufacturing with the majority of the tyres manufactured in Stoke remaining in the domestic market.

Azeem Khan, Michelin’s UK & Ireland Retread Manager, says: “We believe in a future where every truck rolls on fuel-efficient tyres, offering multiple lives in service. That’s why we’re so focused on manufacturing quality retread tyres as this approach directly supports the government’s target of reaching net zero transport emissions by 2050.”

Michelin says its Remix tyres (the name it gives to a retread tyre it produces on a first life Michelin casing) will give the same mileage potential as a brand new Michelin tyre, albeit the cost is around 35% less. And for this saving, operators can unlock a 100% increase in mileage potential from the same casing, whilst also reducing the waste sent for recycling by around 50kg per tyre.

Commenting on market demand, Khan explains: “More and more fleets are talking to us about the benefits of retreads – even those businesses which have previously always run a new-only policy.”

But that’s not the only factor driving up demand. The other, Khan says, is consolidation amongst 3PLs.

“Larger fleets tend to place much greater focus on sustainability, and as more small- to medium-sized operators are acquired by the bigger players, so their fleets grow, and the demand for retreads rises.

“In many cases it’s being driven by the big blue-chip customers putting pressure on the 3PLs to drive down carbon footprints at every stage. Put simply, they want reassurance that their logistics operations are being run as sustainably as possible.”

But unlike buying a new tyre, an operator can’t just call up a truck tyre dealer and buy a quality retread. Most manufacturers, Michelin included, operate a casing bank, requiring customers to deposit a worn casing in the bank for retreading, before taking a finished retread tyre back out.

You also don’t get the same casing back again – but given Michelin’s rigorous casing verification process, which includes x-ray imaging and shearography to check the casing for damage, before the Remix process begins – there’s no need to either. If any damage is detected, the majority of it can be repaired by Michelin’s skilled team – with any casings declined for retreading being recycled.

During the complex, multi-stage, Remix process, Michelin will strip the original tread away to leave between 2-3mm of tread above the protective steel cords, before the new rubber is reapplied using materials which match those for new tyres. The curing process then follows with the retread tyres being

baked for about an hour and a half with temperatures as high as 200 degrees Centigrade.

So retreading aside, how else can fleets adjust their tyre policy to unlock improvements in fuel efficiency and sustainability? Steve Chadwick, Brand Manager at Michelin, says: “The minimum legal tread depth for truck tyres is 1mm, but we still see fleets which change tyres at around 4mm as they wrongly believe it is safer.

“As a business we’ve invested hundreds of millions of Euros into R&D, to ensure our tyres deliver reliable performance right down to the last millimetre of legal tread. And crucially, it’s these final few millimetres which deliver the most fuel-efficient performance.

“Our advice is that once a tyre is worn to around 3-4mm of tread, it should be regrooved to unlock around 25% more tyre life. And then the regrooved tyre can be safely managed to a 1-2mm removal, bringing tangible savings on fuel and tyre costs.”

So does this mean every truck fleet should be retreading and regrooving its tyres?

“The larger fleets are leading the way, but the fact remains there’s not a single haulage operation I can think of where we wouldn’t recommend fitting retreads,” adds Khan.

“Of course, it needs to be a quality retread where the casing is rigorously inspected and the manufacturing is to the same high standards as a new, premium tyre.”

Indeed, the only difference between using a new and a Remix tyre is that, in line with long-standing recommendations from the BRMA trade organisation, Michelin advises against the use of Remix tyres on the steer axle.

When Michelin defines a new tyre policy for a customer, it will typically prescribe new tyres for the steer axle, as they wear the fastest, and also for the rearmost trailer axle, as they endure the most lateral scrub.

“This strategy works well for most businesses. With Remix tyres you need a flow of product to feed your casing bank, so by fitting new tyres on the steer and rear trailer axle, you should always have a supply of Remix for your drive axles and first and second trailer axles. It’s the perfect way to make your tyre policy more efficient, and more sustainable.”

“We believe in a future where every truck rolls on fuel-efficient tyres”

end

The economic headwinds facing fleets in 2023 are considerable – from recession and supply chain disruption to inflation and rising interest rates.

Although decarbonisation may remain high on business agendas, against this backdrop, cost control will, for many, have become the number one priority.

These financial and sustainability business objectives, however, should not be viewed as mutually exclusive – they are peas in a ‘mutually beneficial’ pod that have a symbiotic relationship.

Smoother driving inputs and effective vehicle maintenance, for example, are integral to reductions in fuel spend. At the same time, they are equally important for reducing associated carbon emissions.

Transitioning to electric fleet vehicles (EVs), meanwhile, can not only contribute to saving the planet, for appropriate fleets with effective charging policies, the move can also result in significant monetary savings.

As fleets strive to navigate the challenging and volatile economic waters, initiatives designed to cut fuel and SMR spend should ultimately result in greener fleet operations, while investments in EVs may also lead to lower whole-life running costs.

Today’s fleet manager can ill-afford to take a reactionary approach to business intelligence. Data insights are the catalyst for greener and more cost-effective operations.

By focusing on how vehicles are used, improvements in both sustainability and cost control can be delivered no matter the size, nature and make-up of a fleet.

Fleets need little reminding that drivers remain the biggest factor in fuel savings,

accounting for around 30 per cent of the total cost of ownership (TCO) of a vehicle, and that measurement of mpg underpins the potential savings in this area. Other crucial areas for measurement include vehicle idling, speeding and incidences of poor driving style, such as harsh steering or braking.

Advanced telematics solutions, such as Webfleet, deliver such performance intelligence in real time. This enables fleet managers to initiate evidence-based improvement programmes, whilst providing in-vehicle coaching to drivers, empowering them to make meaningful changes to their driving style.

Implementation of smart job allocation and scheduling can also have a notable impact on mileage costs and carbon footprint. But dispatching the most appropriate mobile workers to jobs requires, once again, accurate management information. This will range from assessing the urgency and priority of jobs to the location of employees and traffic flow en route.

A fleet’s carbon footprint can be monitored with information available for every vehicle

and journey, whilst the latest in dedicated EV management tools now offer insights to ease the electric transition and support the on-going operation of electric fleets – minimising cost and optimising performance.

Using EV solutions, fleet managers can access information on real time battery levels, remaining driving ranges and energy usage, alongside insights into charging processes and vehicle charge levels.

The ‘carpe diem’ message for fleet decision-makers – many of whom will have an increasingly important role to play in business success and survival the weeks and months ahead – is clear.

Telematics technology is a pre-requisite to harnessing and actioning the fleet intelligence needed to deliver on 2023’s most pressing strategic goals. Moreover, with appropriate digital solutions in place, they are not only able to drive change, but be demonstratively accountable for helping secure a greener and more profitable future.

Webfleet is at the forefront of EV adoption, giving you the right tools to get the full value from your electric vehicles. Our comprehensive platform is continuously evolving to help you effectively oversee your EV fleet operation for the long term. With Webfleet, you can continue confidently towards a goal of net-zero emissions.

is essential to help address the climate crisis, and the commercial vehicle industry has its part to play. Iveco has led the way in the world of gas propulsion for over 25 years, providing a viable alternative to operators seeking a cleaner means of running a fleet while completing their demanding missions.

Compressed Natural Gas (CNG) vehicles are not only highly efficient, but overall emissions are greatly reduced. In fact, when fueled with biomethane Iveco’s CNG models can reduce CO2 emissions by up to 95% versus the equivalent diesel model. Other harmful pollutants are also greatly reduced, including NOx and other PM. Cleaner vehicles mean cleaner air for everyone.

There are several methods of obtaining natural gas, and while some are greener than others, there’s a clear environmental benefit at the point of vehicle operation. A great form of natural gas is biomethane. This gas comes from an anaerobic digester that breaks down animal and plant waste to collect the gas to be used as a fuel. By utilising what would otherwise be a waste product, biomethane is a sustainable and environmentally conscious source of gas. Many operators that run CNG vehicles have been able to create a circular economy with their business and the environment benefiting greatly. A partnership between McCulla Transport and Lidl in Northern Ireland does just that with food waste from 41 stores. Deposited into McCulla’s very own anaerobic digester, its fleet of Iveco S-Way Natural Gas vehicles are running totally on gas that has been generated in house at the same time helping Lidl manage its food waste.

Iveco has invested heavily to ensure that all of its core models have a gas-powered option, allowing operators to lower emissions without compromising their mission. While the future of heavy goods transportation continues to evolve and develop, CNG is available today and provides a cost-effective solution that operators can leverage.

The Iveco Daily CNG retains its unrivaled cargo volumes and 3.5 tonne

towing capacity, the highly versatile Eurocargo is a great solution for many businesses in CNG form, and the Iveco S-Way Natural Gas balances strong 2000Nm performance with all the benefits CNG offers.

All of these Iveco vehicles are free to roam Ultra Low Emissions Zones without penalty – a great benefit to operators regularly running in these spaces. Iveco’s Natural Gas vehicles are also considerate of their environment in other ways. Quieter than a diesel model by 3dBA, their reduced running noise is perfect when operating in urban environments and at night.

Powering trucks on natural gas is part of the transport industry’s gradual move away from its reliance on diesel. Words: Iveco

“Iveco has invested heavily to ensure that all of its core models have a gas-powered option”

Steve Powell, Iveco Country Product Manager and Alternative Propulsion Lead said: “Gas vehicles will play an important role in decarbonisation alongside battery electric and fuel cell vehicles. In 2022 Iveco UK gas vehicle sales grew, highlighting the viability and benefits being reaped by operators of CNG models. Iveco’s allencompassing range of CNG vehicles gives almost every operator the opportunity to substantially lower fleet emissions” Running a CNG fleet doesn’t mean a business needs to make a huge investment in infrastructure. While some might see the benefits of having a hub and spoke model where vehicles are refueled at a central base, the number of UK CNG fuel stations is growing with more set to open this year - many located along main trucking routes and key industrial hubs. This will open up gas to operators on long-distance routes that don’t go back to base. The geopolitical landscape in 2022 heavily influenced the price of gas, however, it has once again stabilised with operators potentially enjoying a 40% fuel saving over the lifetime of the vehicle versus a conventional diesel truck. The start of February 2023 has seen slightly lower average prices of £1.20 per Kg, with the current daily price at the time of writing being £1.18 per Kg.

It’s a similar story when it comes to maintenance. All of Iveco’s CNG vehicles share a common platform with traditional models, and so regular servicing can be taken care of by flagship Iveco Truck Station dealerships. Commonality of parts also means availability is good and the cost of these components in-line with existing diesel vehicles.

The number of Natural Gas powered trucks in the UK doubled last year with businesses looking to rapidly decarbonize their fleets according to CNG Fuels research.

A recent Iveco marketing event saw a distinctive Iveco Daily CNG tour the UK, stopping at 24 iconic locations around the country and covering over 2,400 miles without touching a drop of conventional fuel. In addition to completing its objective of highlighting the strength and agility of the Iveco Daily, this CNG van also highlighted that range anxiety need not be an issue for operators.

Gareth Lumsdaine Truck Business Line Director said: “CNG will be an important component for operators for many years to come in lowering emissions for fleets. Iveco sees Natural Gas vehicles playing their part in decarbonization alongside future alternative propulsions based on a

number of factors including their mission. The Iveco S-Way Natural Gas offers the strengths of the diesel model while delivering on reduced emissions and TCO.”

Hermes UK is one of many operators who have embraced gas alternatives.

‘Sustainability is a huge focus for us as we recognise our responsibility as one of the UK’s largest consumer delivery companies,” said David Landy, head of fleet at Hermes UK.

“We are committed to putting sustainability at the heart of every aspect of our business, through innovative products and processes. As such we were an early adopter of CNG as an alternative fuel and are continuing to increase its presence in our fleet, to drive down emissions.”

As the world looks to greatly reduce emissions and increase air quality, CNG vehicles are the perfect solution for fleets that are going green thanks to there being little in the way of compromise. The future of low emission vehicles will likely be a mix of propulsion methods, with CNG having a big role to play.

could well be the firm’s last diesel heavy truck, certainly for Western Europe as by the time it is due for replacement, diesel engines should be in the minority, and legislation will slowly kill them off. Accordingly, every manufacturer is looking at alternative fuels, be it gas, electric or hydrogen.

Electric trucks are improving, but are still in their infancy and currently too expensive, too heavy and have inadequate range.

One alternative fuel is gas – either Liquid Natural Gas (LNG) or Compressed Natural Gas (CNG). Iveco has been a big proponent of gas trucks and it has steadily improved its gas offerings.

Until relatively recently, the best it could do for the heavies was a 4x2 Stralis with a 400hp output, not really ideal for 44 tonnes. But four years ago, it unveiled its 460hp Stralis 6x2 with an LNG option, perfect for 44 tonnes.

On LNG, the range for a 4x2 went up to about 700 miles between fills, and the only issue with a 6x2 was the reduced fuel tanks, which limited the range compared with a 4x2 to about 450 miles. For CNG, only available as a 4x2 the range is about 400 miles.

The biggest issue with gas trucks is availability of fuel as the network for gas stations is still woefully inadequate and likely to be the biggest factor to put people off gas trucks. But it is slowly improving.

For the right type of operation, gas trucks are a viable alternative to diesel, but some firms are opting to set up their own filling capabilities and keep their gas trucks on a very tight rein.

I took a new S-Way 460NP 4x2 running on CNG - out for a day’s drive to see how it performed and to see if it can sway the mind of even the most ardent diesel-head.

From the outside there’s not a lot to tell you the truck runs on gas, apart from the NP badge. Look closer and you’ll notice the fuel tank is different. Instead of the more cylindrical diesel tank, the CNG relies on a number of smaller cylinders hidden behind a panel while makes the truck look like it has side skirts. On LNG trucks, there is one larger cylinder instead of the normal diesel tank. Under high roof twin bunk sleeper cab, the same Cursor 13 12.9-litre straight six engine is used, it merely uses gas as opposed to diesel to power it. Ivecos’ gas engines are either the Cursor 9 8.7-litre in 340 and 400hp outputs or this, the bigger engine at 460hp.

Iveco has CNG versions of its new S-Way models which are gaining popularity – but you need to make sure it’s right for your operation. Words: Pip Dunn

However, in CNG form the 12.9-litre engine only develops 460hp and 2,000 Nm of torque, the same as the diesel Cursor 11 at the same output so there is a weight penalty to consider there. The overall weight – always very favourable on any Iveco – is still 7,875kg, which for a high roof 4x2 tractor is impressive.

The gearbox is Iveco’s Hi-Tronix 12-speed automated which is easy to use and performs very well. The cruise control is easy to use and effective, and like all Ivecos, the five-stage engine brake is superb and easy to use, and above all, effective.

Is there any difference in performance of a gas truck over a diesel? In fairness there isn’t. 460hp is more than adequate, but if you want more oompf, then that is not available. But the reality is 460hp is adequate for pretty much every operator at 40-44 tonnes so it should not be an issue. I had it loaded at close to 40 tonnes and I took it on a circular trip, including a visit to a gas station at Crick where I topped it up, not because the truck especially needed it, but to see the practice in operation.

I enjoyed a mix of motorway, dual carriageway and single carriageway roads and on the latter, there was plenty of twisting and turning on the ‘back roads’, and it performed admirably.

So, in terms of performance you really won’t notice much difference. It did seem a bit noisier, but the sound insulating inside the cab drowned that out. It did emit a bit of steam when it was fired up but that soon cleared and was never an issue.

Filling up is easy, but there are staff on standby at the filling stations to run you through the procedure and do it for you if you so desire. You have to be shown how to use the gas pumps safely and effectively but once trained, it’s simple.

“If you want a gas truck, then the Iveco is close to top of the pile”

As a truck, it really isn’t any different to a diesel. It’s the support that is the biggest factor in making the switch. Should you go gas? Well, like anything, especially something new, there are plenty of pros and plenty of cons.

The pros are its better for the environment, there are tax advantages and LEZ charge advantages. The fuel is – generally - cheaper to buy, and it works out about 10p a mile less to operate a gas truck, which saves you typically anything up to £10,000 a year.

The cons are the truck itself is more expensive to buy (or lease), and operators of CNG trucks say they are “typically about £30,000” more expensive compared with a diesel equivalent. With that in mind, you only start to make that money back on year three or four. So, you need to do you sums right. It needs to be used on the right operation as well – and double shifting can definitely a winner.

The biggest factor is the infrastructure, and this will probably be the driver in making the switch. If you have no gas stations near your yard, then it could be a nonstarter. But if you have one or two on your routes then its less of a hassle. If you have the ability to fuel at your yard, then it’s much easier. And that is where gas trucks – currently – come into their own – on ‘repeat itinerary’ regular runs, on dedicated contracts where there is the scope to fill up regularly.

The biggest worry for any driver of a gas truck is running out of gas, and a closed gas stations can be a nightmare if you regularly use it, so it’s all about the planning.

Gas trucks might also be restricted. If you do have a gas fleet and a diesel fleet, and the former is tied in to a particular job, it might not be possible, or at least wise, to chuck a gas truck out on a diesel truck’s job.

As a truck the S-Way NP is nice to drive, the cab is excellent. It’s a stunning truck and lends itself to superb liveries.

Back up remains less extensive with Ivecos on the whole, but it doesn’t have too much competition on the gas market, especially in the tractor market, and the brand is typically cheaper.

The biggest factor will be simple – it is suitable for your operation or are you leaving yourself open to issues if you can’t get the gas? That needs to be the biggest concern and the driving factor, because as a product there’s not a lot to fault it on. You also need to think about how you acquire the vehicle. Given technology is moving fast – both in gas and other alternative fuels, leasing might be a better option as you’ll need it for at least four years, but at the end of that period, what else will be on the market? And more importantly will there be a market for secondhand gas trucks if they are in anyway obsolete, outdated or simply not a match for new products? Worth thinking about.

In short, as a gas truck the S-Way NP is a lovely truck to drive, it has appeal both in looks and its green credentials. The biggest factor is the infrastructure and the chance gas trucks could get overtaken in the technological advancements of other forms of propulsion, such as electric. That is unlikely to happen in the life of the truck were you to buy one tomorrow, but long term it might be an issue on the residuals.

If you want a gas truck, then the Iveco is close to top of the pile. But you need to know if it’s suitable for your operation. General UK tramping, then it probably isn’t. Ringfenced, repeat work on a set route and job, provided there is the gas fuelling infrastructure nearby, then it most definitely is.

Design GVW: 40 tonnes

Chassis: 3800mm wheelbase

Front axles: 7,500kg capacity. 315/70R22.5

Michelin XFA Energy tyres

Rear axle: single-reduction axle, 13,000kg. 1:3.7 ratio

Gearbox: 12TX 2010 TO 12-speed automatic

Engine: Cursor 13 12.9-litre straight six

Max power: 460hp @ 1,900rpm

Max torque: 2,000Nm @ 1,100-1,600rpm

Cab: AS high roof double sleeper

External pressure guage gives accurate fuel level

He was our big mouth - he’d always have

answer

why he should still

Present:

Bi-fuel evolutions of LEVC’s TX and VN5

Present:

Bi-fuel evolutions of LEVC’s TX and VN5

Displacing fossil fuel petrol for the range extender engine with:

Displacing fossil fuel petrol for the range extender engine with:

CNG 20% lower carbon emissions

CNG 20% lower carbon emissions

LPG 10% lower carbon emissions

LPG 10% lower carbon emissions

These can be substituted for drop in replacement net zero carbon emission renewable fuels of :

These can be substituted for drop in replacement net zero carbon emission renewable fuels of :

Biomethane

99% lower carbon emissions

Biomethane

99% lower carbon emissions

Biopropane

99% lower carbon emissions

Biopropane

99% lower carbon emissions

30-50% lower operating costs using these fuels for the range extender engine

30-50% lower operating costs using these fuels for the range extender engine

Further cost savings possible as biomethane & biopropane production volumes ramp up.

Further cost savings possible as biomethane & biopropane production volumes ramp up.

www.bi-fuel-taxis-lcvs.com

www.bi-fuel-taxis-lcvs.com

On the road to zero carbon

On the road to zero carbon

ULTRA LOW EMISSION FUEL

DIESEL ENGINES RUN CLEAN AND GREEN ON Gd+HVO

JOIN OUR HERO CLIENTS HELPING THE PLANET