The properties

Good

The properties

With

M 2 TOTAL

The tenants

With builders

The transaction

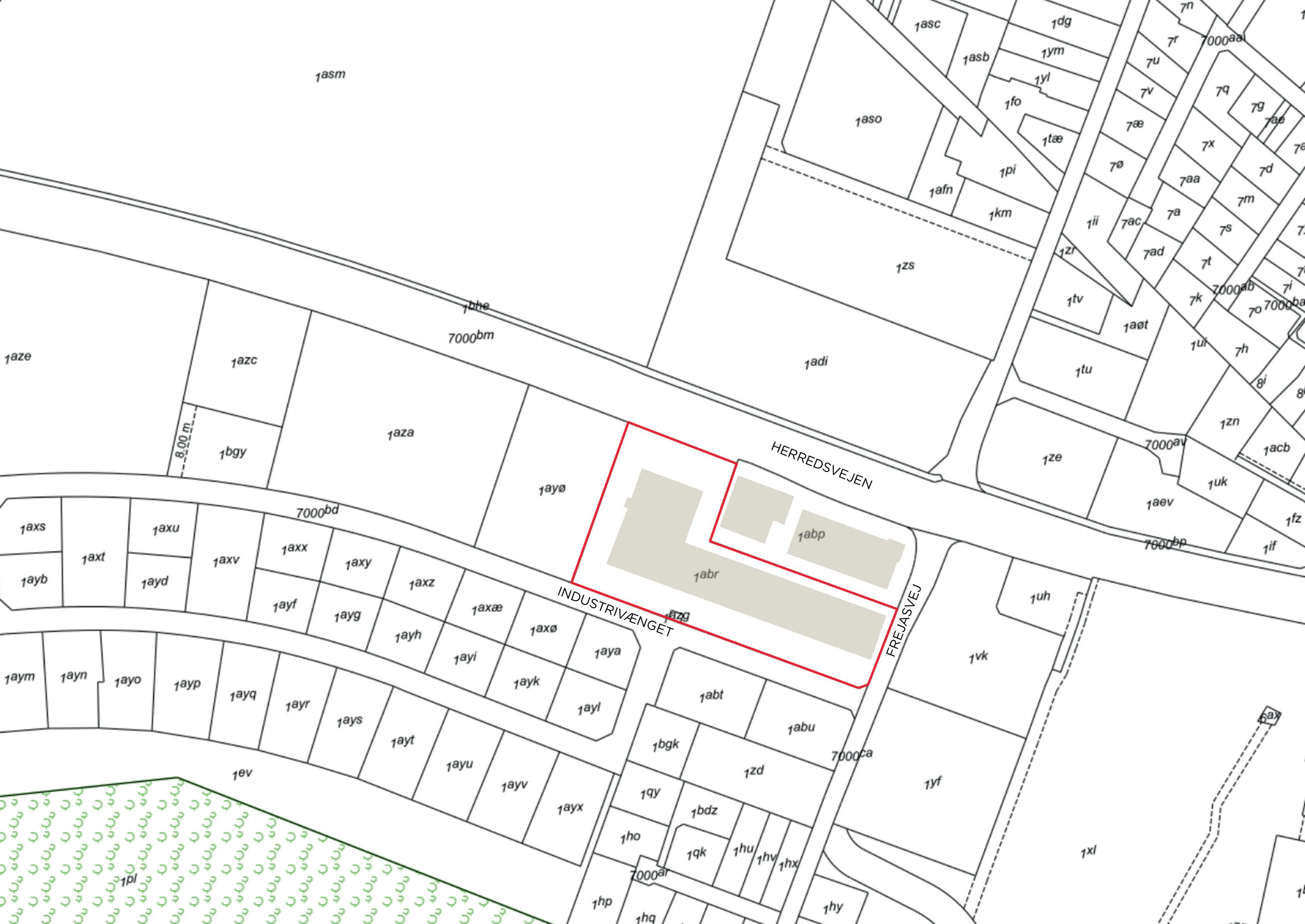

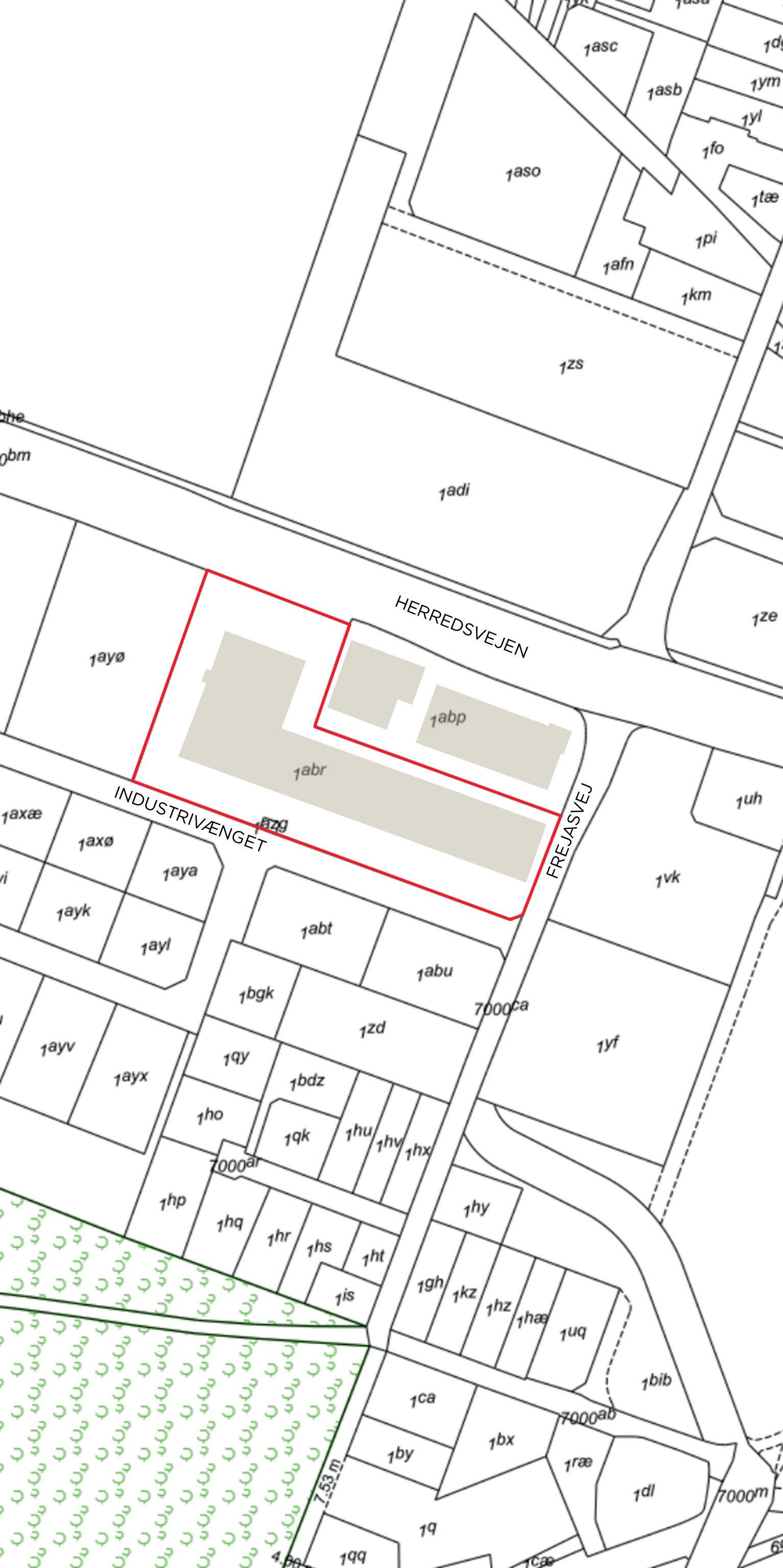

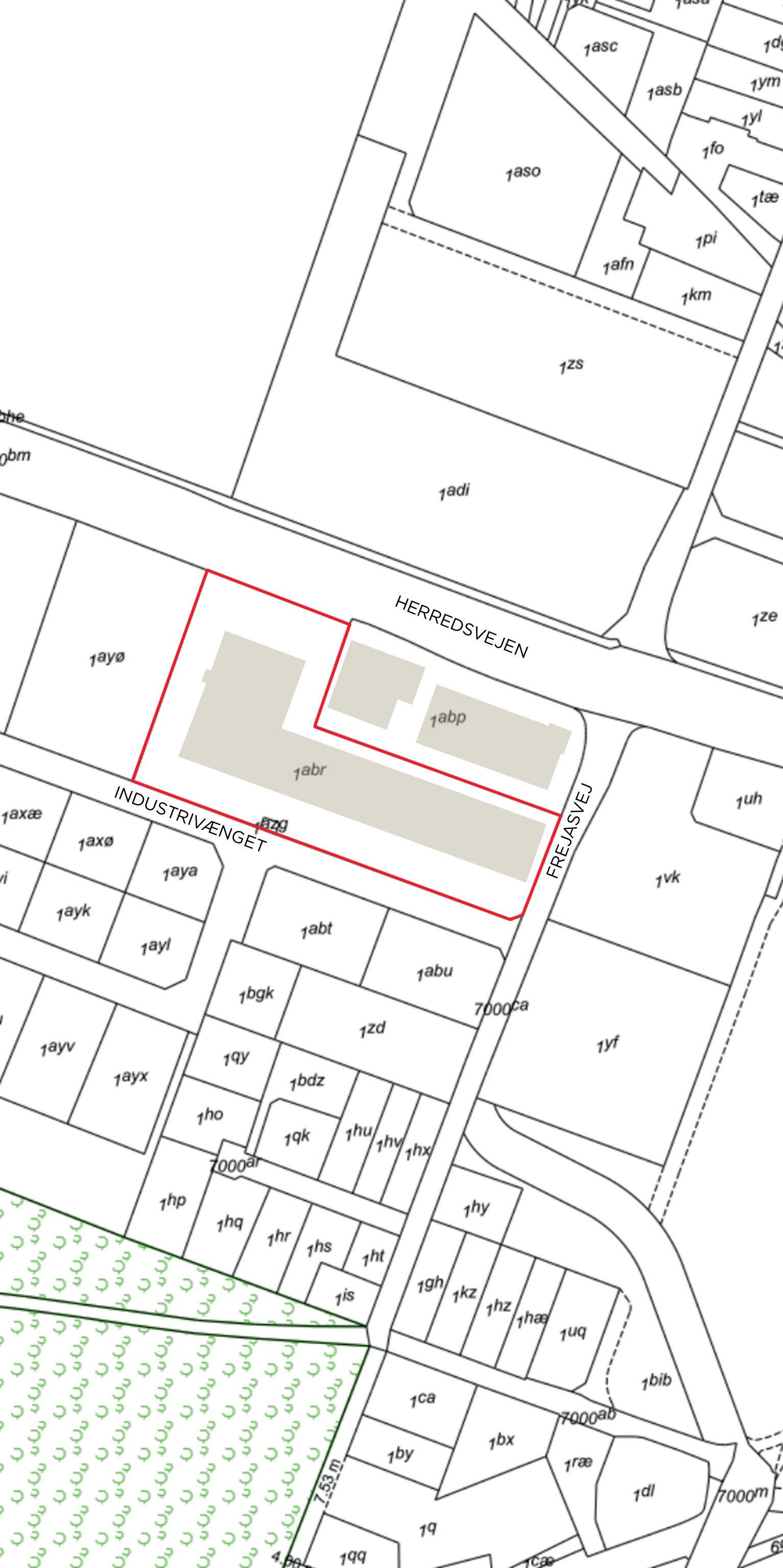

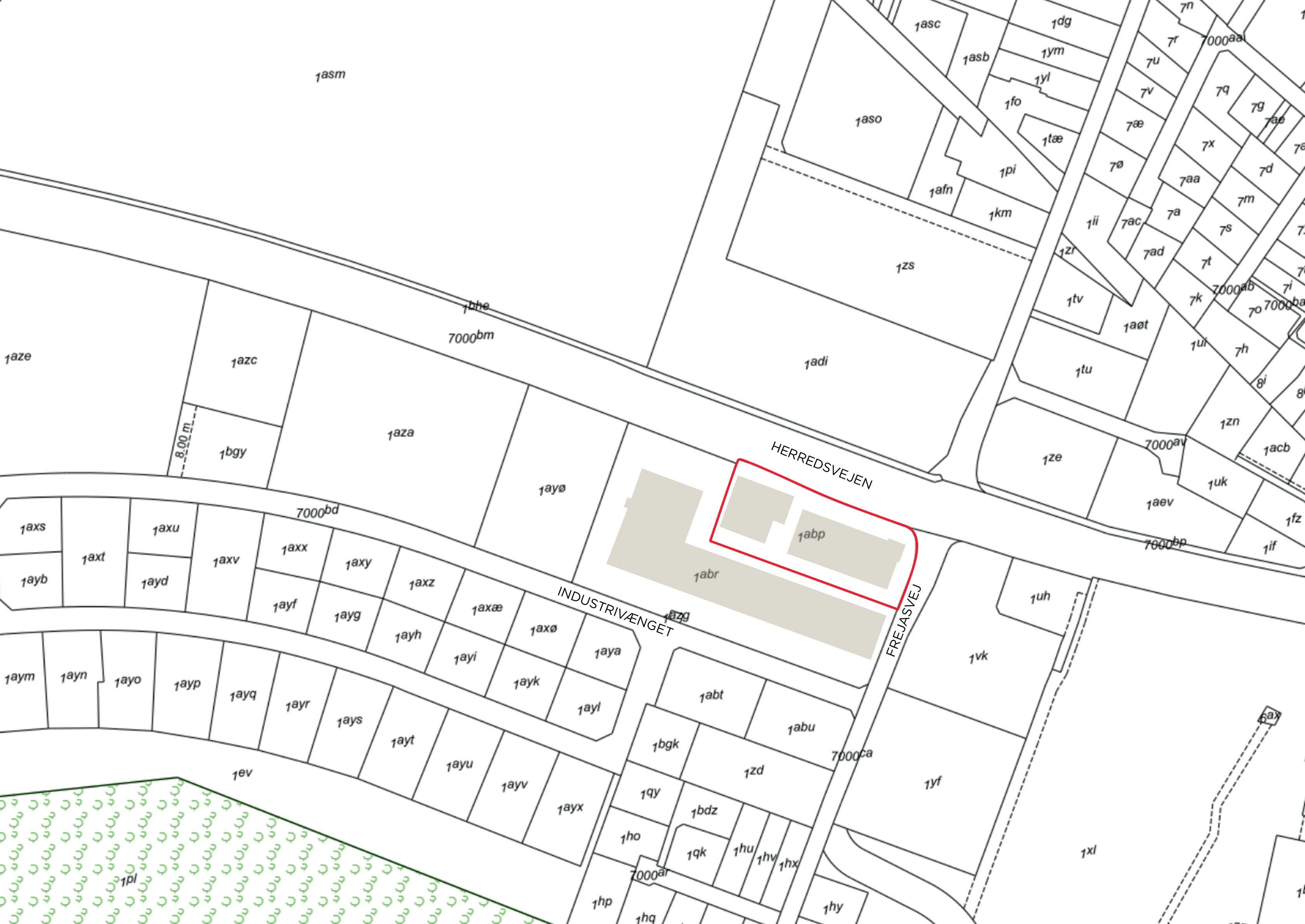

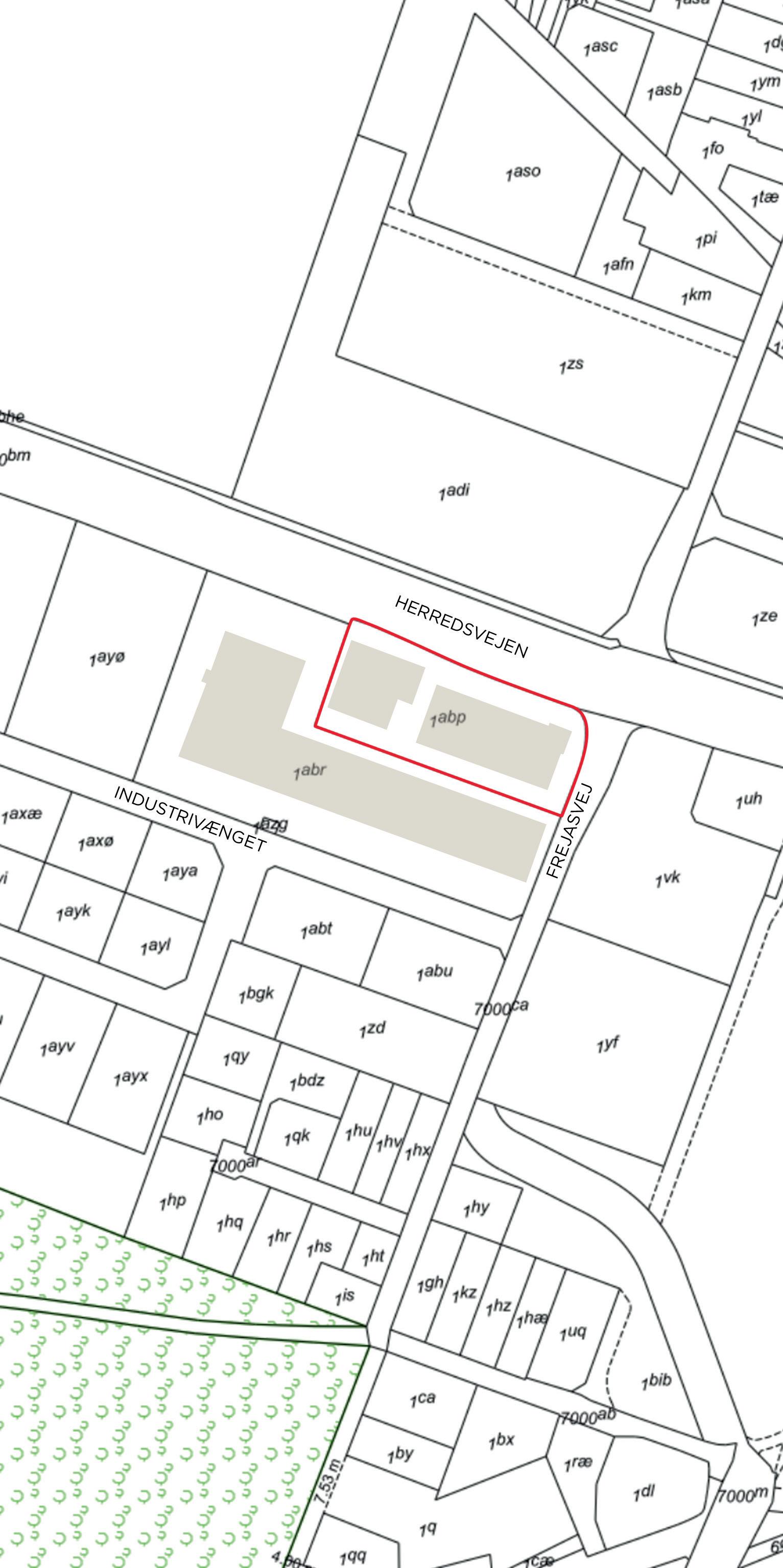

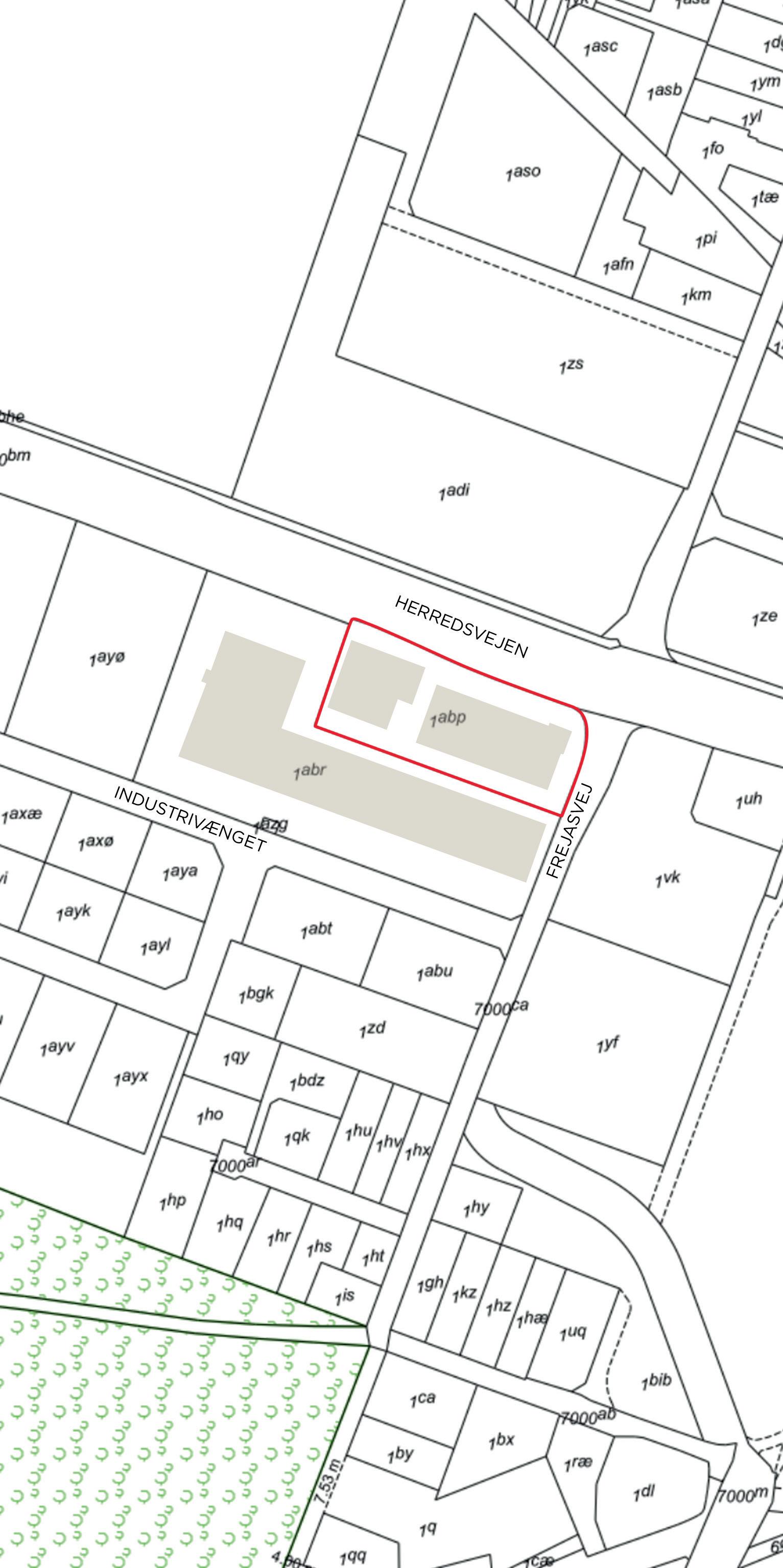

On behalf of JLL Frejasvej ApS & JLL Erhverv ApS, Cushman & Wakefield | RED offers Industrivænget 2 and Frejasvej 40A-C for sale�

The properties consist of three big box buildings com prising a total area of 6,426 m² distributed over eight retail tenants and one stand (land rent) located on the parking lot

There is a consistent kitchen and interior design theme in the properties Industrivænget 2 is let out to Lem vigh Müller, Vordingborg Køkkenet, Hillerød Tæppe center, Kvik A/S, and Designa, while Frejasvej 40A is let out to Norliving, Flügger and Drømmeland

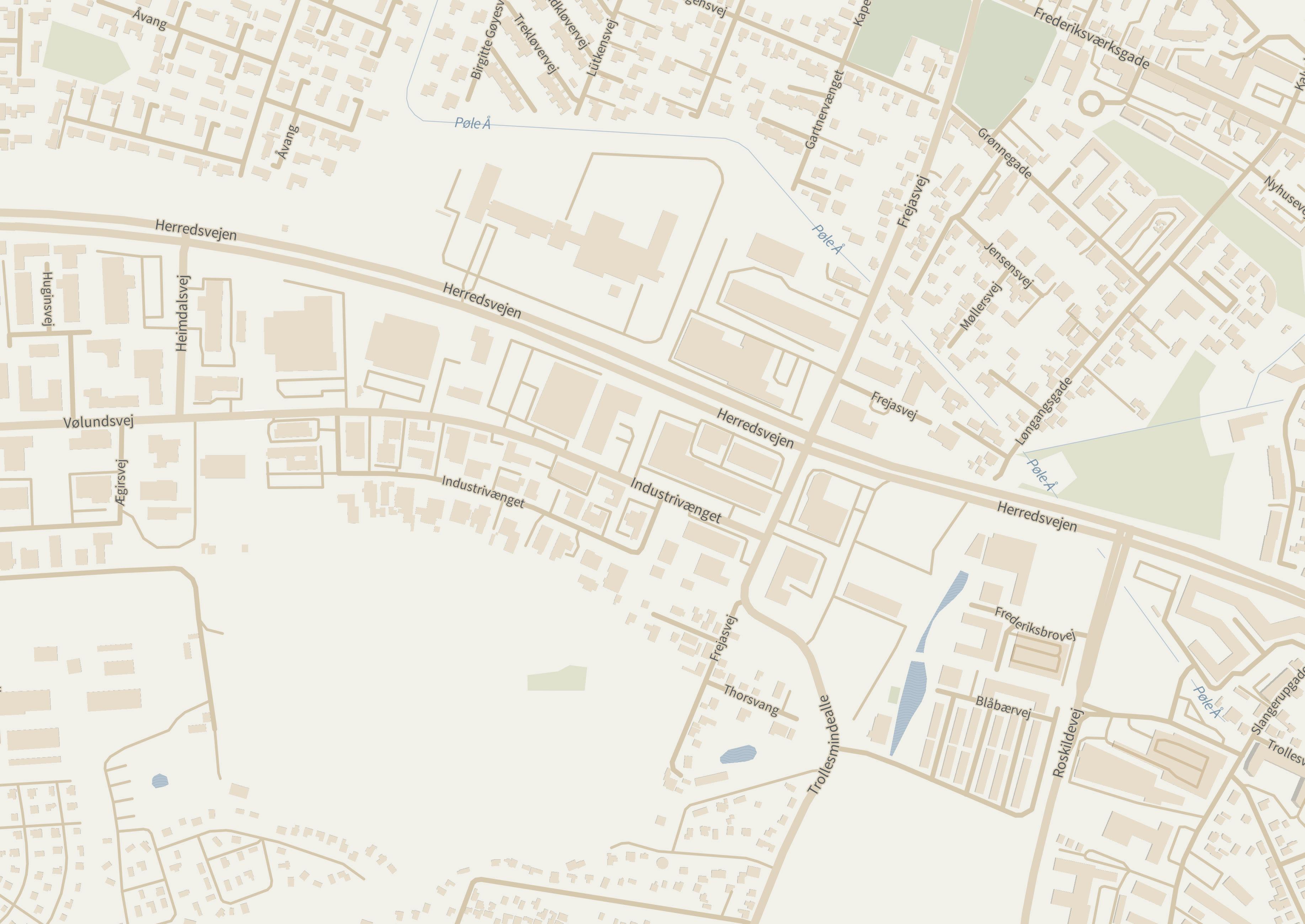

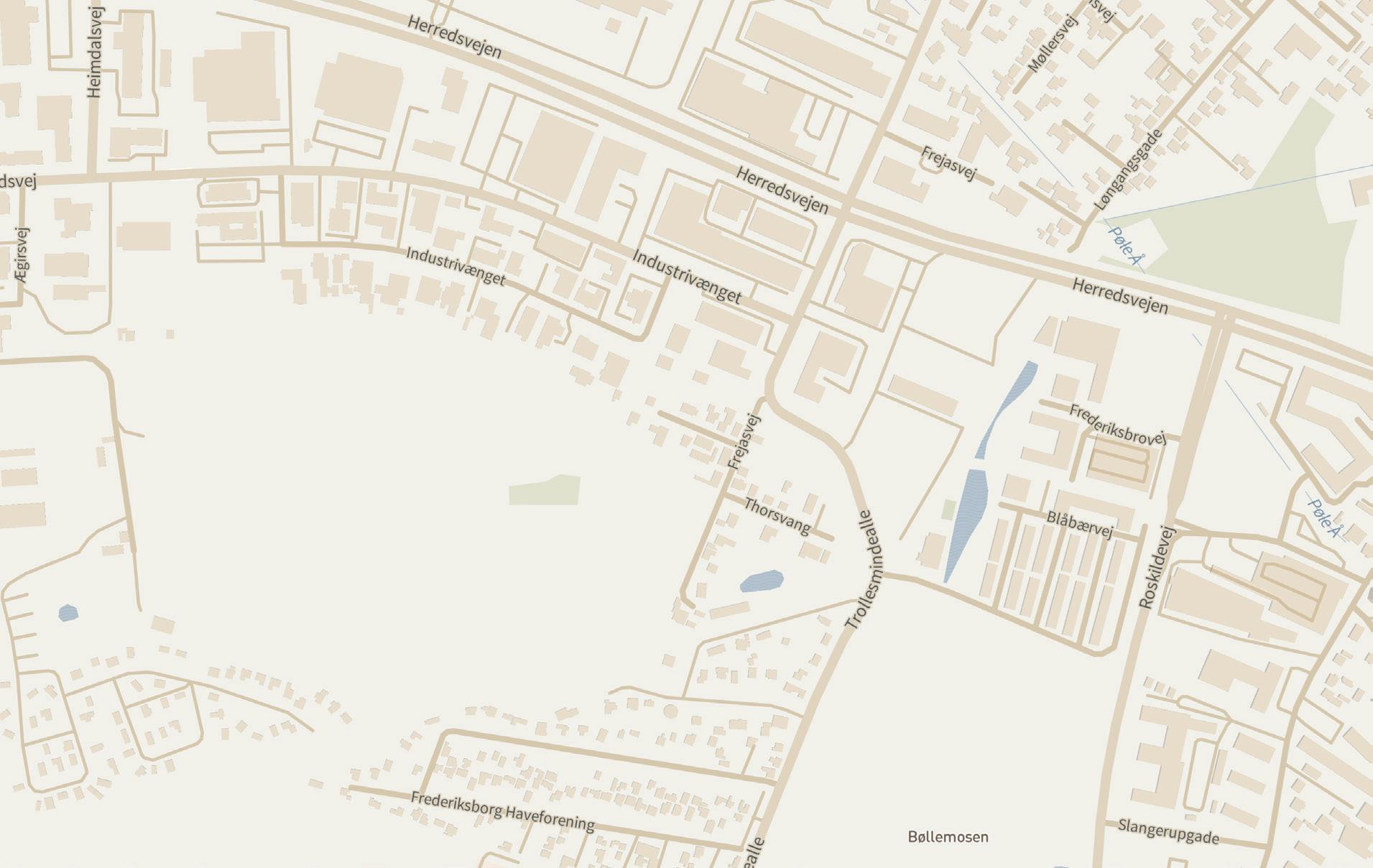

The properties have a good location with great visibi lity from the large flow of cars passing on Herredsvejen in Hillerød�

This is a unique opportunity to acquire an attractive big box property with a strong mix of well-known and loyal retail tenants

The transaction will be carried out as an asset deal

Areas 6,426 m²

Base rental income DKK 7,351,037

Base rent per m² . DKK 1,144

Provisions

DKK 317,792

Landlord-paid OPEX DKK 415,551

NOI DKK 7,253,278

NIY 7.00%

Deposits DKK 2,537,923

Cash price incl. deposits DKK 106,000,000

Cash price per m² DKK 16,500

*Estimated rent and OPEX is per 01-01-2023

Retail tenants in big box properties are often well-established and large capital chains with high solvency ratios and strong creditwor thiness Relatively to other retail assets, the tenants are more resistant to potential losses, ensuring high security for the landlords�

The big box market is particularly transparent compared to other retail assets, with leases being released to the same low rental levels

Big box investors are offered high security in terms of suffering a loss in a re-letting situa tion, and the already modest rental levels also provide a downside protection

The market risk premium for investing in big box properties is high, and the asset ensures an attractive high yield on even the best-lo cated properties with strong tenants

Big box properties are sold at a significant premium compared to other retail properties making the multi-let big box properties more vacancy resilient�

Large product groups have been more resili ent towards e-commerce, and further, during the global pandemic, big box tenants proved strong with record sales through Click-andCollect sales channels In addition, the tenants' products are often complex to buy and return online Instead, customers prefer to feel and see the products in the physical store This makes the asset relevant – both now and in the future

The properties are located in the established shopping area and big box hub just outside the center of Hillerød along Herredsvejen � The area is the largest shopping area in North Zealand with builders merchants, car dealers, interior design, furniture, grocery stores, etc Furthermore, the large garden- and plant store, Plan torama, is located in the area, and along Herredsvejen, there is a large builders merchant, Bauhaus

The properties have an attractive location next to Her redsvejen in Hillerød, which ensures great visibility from the large flow of cars that pass the properties daily

The location ensures great visibility and customer flow from both local residents and commuters to and from Hillerød.

Residential area (Northwest) 1,954

Hillerød Municipality 13,973

Denmark 2,716,983

Residential area (Northwest) 4,297

Hillerød Municipality 30,985

Denmark 5,784,681

Residential area (N/W) DKK 637,500

Hillerød Municipality DKK 683,146

Denmark DKK 591,955

Residential area (N/W) DKK 2,276,312

Hillerød Municipality DKK 2,443,378

Denmark DKK 1,837,080

Residential area (Northwest)

Hillerød Municipality

Denmark

Residential area (Northwest) 16%

Hillerød Municipality 18% Denmark 15%

With a location in a business area that borders several residential areas, Industrivænget 2 and Frejasvej 40A have a large catchment area�

Northwest of the properties is a large residential area, and a new residential district is under development next to the properties This ensures great customer traffic from the local residents and commuters from the surrounding municipalities

Hillerød Municipality holds approx 14,000 households and 31,000 inhabitants, and the catchment area accom modates high-income families, with an average household income 15% higher than the national average

Over 50% of the housing stock in the Municipality is owner-occupied, and the retail stores in the properties thus serve homeowners' refurbishment needs within pain ting work, kitchen and interior design, carpets, etc

A few hundred meters east of the properties, on the Møllebrogrunden, a new residential district, “Frederiks bro”, is under development The construction work has begun, and several tenants have already moved in When the new residential area is fully developed, the district is expected to hold approx 1,300 residential units This will strengthen the big box area with a larger customer base and purchasing power�

Residential area NorthWest and Frederiksbro.

Residential area Frederiksbro.

The development of Frederiksbro strengthens the area with increased density and purchasing power

The property consists of

of which

m² is located in a smaller annexe in the parking lot�

The former industrial property was con verted into a retail property in 2005 and has since been continuously maintained New asphalt was laid a few years ago, and the façade sign is being replaced on an ongoing basis to achieve a more streamli ned look

The property holds a strong tenant mix, as the interior and kitchen theme is consistent and has made the property a

big box shops

there

easily

parking spaces

The property holds a tenant mix of three well-known and attractive retail brands, with Drømmeland, Flügger and Norliving as tenants plements the neighbouring property on Industrivænget, as the interior design theme is further consistent

The tenants behind the brands of Drømmeland and Flügger are the parent companies with strong financial robustness, reflected in their solvency ratios are thus resistant to potential losses and uncertain times, which creates security for the landlord ratio of 117%, Flügger can further meet the company’s short-term financial obligations and absorb contingent liabilities in the short term

Industrivænget holds a consistent kitchen and interior design theme with kitchen brands such as Vording borg Køkkenet, Designa Køkken and Kvik Køkken, making the property a destination for consumers

The remaining tenants, Lemvigh Müller and Hillerød Tæppe & Gulvcenter, sell products within steel and flooring, and the neighbouring property at Frejasvej offers paint, beds and interior design, creating a solid tenant mix with good synergy

Most of Industrivænget’s tenants are large capital chains, and especially Lemvigh Müller, Vordingborg Køkkenet and Kvik are strong tenants with high sol vency ratios and strong creditworthiness The tenants are thus resistant to potential losses and uncertain times, which creates security for the landlord

During the past year, Designa and Hillerød Tæppe & Gulvcenter have expanded their stores on Indu strivænget, and both tenants have committed to a new non-termination period until 2028 The expansion of their leases indicates strong performing tenants

Lemvigh-Müller was founded in 1846 and is today Denmark's most important steel and engineering wholesaler, with 23 stores in Denmark and a revenue of approx DKK 8 5 bn in 2021

• Tenant Lemvigh-Müller A/S

• Area 1,492 m²

• Rent per m²* DKK 1,042

• Years in lease* 3 3 y

• WAULT* 3 7 y

• Liquidity ratio 2021 168%

• Solvency ratio 2021 45%

• Equity DKK 2021 DKK 1,313 M

* Per 1st of January 2023

Kvik was founded in 1983 Today, the company produ ces and sells kitchens, wardrobes, and furniture in more than 180 stores in 13 countries Kvik has been a tenant for +5 years and further rents a plot area for storage for DKK 2,500 excl VAT per month

• Tenant KVIK A/S

• Area 629 m²

• Rent per m²* DKK 1,159

• Years in lease* 5 4 y

• WAULT* Rolling 6 months

• Liquidity ratio 2021 154%

• Solvency ratio 2021 49%

• Equity DKK 2021 DKK 331 M

* Per 1st of January 2023

Vordingborg Køkkenet was founded in 1963 and is a Danish retail chain that produces and sells kitchens

The company has today 27 stores in Denmark

• Tenant Vordingborg Køkkenet A/S

• Area 893 m²

• Rent per m²* DKK 1,015

• Years in lease* 10 3 y

• WAULT* Rolling 6 months

• Liquidity ratio 2021 145%

• Solvency ratio 2021 49%

• Equity DKK 2021 DKK 82 M

* Per 1st of January 2023

The company was founded in 1997 and sells products and services within flooring Hillerød Tæppe & Gulv center has been a tenant for many years (unit 4), and as of 1st January 2023, they have expanded their lease with 221 m² (unit 3)

• Tenant Hillerød Tæppe & Gulvcenter

• Area 221 m² (unit 3) 218 m² (unit 4)

• Rent per m²* DKK 950, DKK 1,080

• Years in lease* 0 0 y, 8 8 y

• WAULT* 5 8 y, 5 0 y

• Liquidity ratio 2021 N/A

• Solvency ratio 2021 N/A

• Equity DKK 2021 N/A

* Per 1st of January 2023

Designa Køkken was founded in 1992 Designa pro duces and sells kitchens and has approx 24 stores in Denmark Designa has been a tenant since 2017 and expanded with 429 m² in March 2022 (unit 7)

• Tenant Designa Hillerød ApS

• Area 445 m² (unit 5), 429 m² (unit 7)

• Rent per m²* DKK 1,177, DKK 1,134

• Years in lease* 5 0 y, 0 8 y

• WAULT* 5 0 y, 5 0 y

• Liquidity ratio 2021 54%

• Solvency

property has previously had a Grill as a tenant in

annexe building in the parking lot However, the annexe is removed due to pipe rerouting, and future rent is estimated as plot rent (stand)

Tenant

The property holds a tenant mix of three well-known and attractive retail brands, with Drømmeland, Flügger and Norliving as tenants plements the neighbouring property on Industrivænget, as the interior design theme is further consistent

The tenants behind the brands of Drømmeland and Flügger are the parent companies with strong financial robustness, reflected in their solvency ratios are thus resistant to potential losses and uncertain times, which creates security for the landlord ratio of 117%, Flügger can further meet the company’s short-term financial obligations and absorb contingent liabilities in the short term

Industrivænget 2 is estimated to generate an annual rental income of approx� DKK 4�7 M as of 1st of January 2023, corresponding to DKK 1,081 per m² The retail leases are all leased to the same low, but market-com pliant, rental levels ranging from DKK 950 - 1,180 per m²

The largest tenant is Lemvigh Müller, generating 33% of the total income, followed by Designa and Vordingborg Køkkenet, with 22% and 19%, respectively�

On average, the tenants in Industrivænget 2 have been in their leases for 5�1 years, and 51% of the total rental income is generated from Vordingborg Køkkenet, which has been a tenant for +10 years, and Hillerød Tæppe & Gulvcenter, Designa and Kvik that go back +5 years

The average WAULT in the property is 3 0 years, where both Designa and Hillerød Tæppe & Gulvcenter have a non-termination period of +5 years and the largest tenant, Lemvigh Müller, has a non-terminability until H2 2026

maintenance

of

total operating expenses

rent Landlord-paid costs

therefore limited

DKK 20,000

administra

operating budget; thus, only

been estimated for additional

Industrivænget

Lemvigh Müller 1,554,939 1,492 1,042 01-09-2019

1st Oct (Oct-Oct), min 1.5% Deposits – 9 mht rent excl. VAT Industrivænget 2 Vordingborg Køkkenet 906,098 893 1,015 01-09-2012 Rolling 6 months

NPI, 1st Jan (Oct-Oct, max 3% Bank guarantee Industrivænget 2 Hillerød Tæppecenter 209,950 221 950 01-01-2023 30-09-2028 9 NPI, Jan 2024 (Oct), min 1.5%, max 4% Deposits – 6 mth rent excl. VAT Industrivænget 2 Hillerød Tæppecenter 235,440 218 1,080 01-03-2014 31-12-2027 6 NPI, 1st Jan (Oct-Oct), min 3% None Industrivænget 2 Designa 523,850 445 1,177 15-12-2017 15-12-2027 12 NPI, 1st Jan (Oct-Oct), min 1.5% Deposits – 6 mth rent excl. VAT Industrivænget 2 KVIK A/S 728,792 629 1,159 01-08-2017 31-07-2023 6 NPI, 1st Jan (Oct-Oct), min 1.5% Bank guarantee Industrivænget 2 KVIK A/S (storage) 30,000 Industrivænget 2 Designa 486,486 429 1,134 01-03-2022 31-12-2027 12 NPI, 1st Jan (Oct-Oct), min 1.5% Deposits – 6 mth rent excl. VAT Industrivænget 2 Stand (plot) - est. 36,000 30 1,200 01-01-2023 n/a n/a NPI, 1st Jan (Oct-Oct), min 1.5% Deposits – 4 mth rent excl. VAT Total 4,711,555 4,357 1,081

The estimated rent per 1 January 2023 is based on the 2022 rent adjusted with est. NPI of 8%, or the maximum regulation cf. what is stated in the individual tenant's lease.

18,500

- -

- -

- -

-

-

- -

- -

- -

-

former industrial property

has

been

Frejasvej 40A-C has an attractive loca tion with a facade towards Herredsve

ensuring great visibility The retail stores are easily accessible, and there are

45 parking spaces for customers

property holds a strong tenant mix that complements the neighbouring pro perty on Industrivænget, as the interior design theme is also consistent here

The property holds a tenant mix of three well-known and attractive retail brands, with Drømmeland, Flügger and Norliving as tenants plements the neighbouring property on Industrivænget, as the interior design theme is further consistent

The tenants behind the brands of Drømmeland and Flügger are the parent companies with strong financial robustness, reflected in their solvency ratios are thus resistant to potential losses and uncertain times, which creates security for the landlord ratio of 117%, Flügger can further meet the company’s short-term financial obligations and absorb contingent liabilities in the short term

The property holds a tenant mix of three well-known and attractive retail brands, with Drømmeland, Flügger and Norliving as tenants The retail mix in the pro perty complements the neighbouring property on Industrivænget, as the interior design theme is further consistent

The tenants behind the brands of Drømmeland and Flügger are the parent companies with strong finan cial robustness, reflected in their solvency ratios With a liquidity ratio of 117%, Flügger can further meet the company’s short-term financial obligations and absorb contingent liabilities in the short term

Drømmeland was founded in 1975 and is today a lea der in specialized bed solutions with 25 stores around the country

• Tenant Drømmeland A/S

• Area 746 m²

Rent per m²* DKK 1,114

Years in lease*

WAULT* Rolling 6 months

Liquidity ratio 2021

Solvency ratio 2021

Equity DKK 2021

Per 1st of January 2023

Flügger A/S was founded in 1948 and is a Danish com pany that manufactures and sells paint, painting tools, wallpaper and wood protection

• Tenant Flügger A/S

Area 320 m²

Rent per m²*

Years in lease*

WAULT*

Liquidity ratio 2021

Solvency ratio 2021

Equity DKK 2021

Per 1st of January 2023

1,397

6 months

Norliving is a retail store with furniture, beds and inte rior design products Frejasvej is the tenant's flagship store

• Tenant MIPA møbler v/Jan Jespersen

• Area 1,003 m²

• Rent per m²* DKK 1 357

Years in lease* 7 3 y

• WAULT* Rolling 12 months

• Liquidity ratio 2021 N/A

• Solvency ratio 2021 N/A

• Equity DKK 2021 N/A

* Per 1st of January 2023

The property holds a tenant mix of three well-known and attractive retail brands, with Drømmeland, Flügger and Norliving as tenants plements the neighbouring property on Industrivænget, as the interior design theme is further consistent

The tenants behind the brands of Drømmeland and Flügger are the parent companies with strong financial robustness, reflected in their solvency ratios are thus resistant to potential losses and uncertain times, which creates security for the landlord ratio of 117%, Flügger can further meet the company’s short-term financial obligations and absorb contingent liabilities in the short term

The property is currently fully let and is estimated to generate an annual rental income of approx� DKK 2�6 M as of 1st of January 2023, corresponding to DKK 1,276 per m²

The furniture store, Norliving, generates 52% of the property’s total rental income, while Drømmeland and Flügger generate 31% and 17%, respectively

On average, the tenants in Frejasvej 40A-C have been in their leases for 8�3 years, and 31% of the total rental income is generated from Drømmeland, which goes back +10 years The tenants of Frejasvej 40A-C are thus loyal tenants that have thus proved resilient during the global pandemic

*Average years in lease is per 1st of January 2023

Listed below

the estimated rent roll and OPEX

Frejasvej 40A-C per 1st of January 2023

Frejasvej

Frejasvej

Flügger

estimated rent per 1

Norliving and Flügger

in addition to the rent the total operating expenses

does not contribute to the operating expenses of property taxes, renovation, pest control and insurance, and these costs are thus covered by the

Jan (Oct) Deposits

(Oct),

4 mth rent

mth rent

1,276

The properties are estimated to generate a total NOI of approx� DKK 7�3 M per 01-01-2023, where DKK 4�6 M is generated from Industrivænget 42, and DKK 2 6 M is gene rated from Frejasvej 40A-C

Industrivænget

and Frejasvej 40A-C

DKK 106,000,000,

offered at a

DKK

Industrivænget 2 Lemvigh Müller 1,492 1,042 1,554,939 1,554,939

Industrivænget 2 Vordingborg Køkkenet 893 1,015 906,098 906,098

Industrivænget 2 Hillerød Tæppecenter 221 950 209,950 209,950

Industrivænget 2 Hillerød Tæppecenter 218 1,080 235,440 235,440

Industrivænget 2 Designa 445 1,177 523,850 523,850

Industrivænget 2 KVIK A/S 629 1,159 728,792 728,792

Industrivænget 2 KVIK A/S (storage) 0 30,000 30,000

Industrivænget 2 Designa 429 1,134 486,486 486,486

Industrivænget 2 Stand (land rent) 30 1,200 36,000 36,000

Frejasvej 40A Norliving 1,003 1,357 1,361,420 1,361,420

Frejasvej 40A Flügger 320 1,397 446,893 446,893

Frejasvej 40A Drømmeland 746 1,114 831,170 831,170

Total rental income 6,426 1,144 4,711,555 2,639,482 7,351,037

Provisions 213,453 97,199 310,652

Provisions – Heating 0 7,140 7,140

Total provsions 213,453 104,339 317,792

Total 4,925,008 2,743,821 7,668,829

125,571 415,551

4,635,028 2,618,250 7,253,278

Cash

66,214,685 37,403,576 103,618,261

1,470,873 1,067,050 2,537,923

Cash

67,500,000 38,500,000 106,000,000

16,500

LIOR KOREN Partner, Capital Markets

For further information or access to data room, please contact Lior Koren, Bo Stevnss or Josefine Pfeiffer DISCLAIMER

1. This investment memorandum is prepared solely for the guidance of prospective purchasers The memorandum is intended to give a fair overall description of the property only

Partner, Capital Markets

26

Senior Associate, Capital Markets

2. Any information contained in this investment memorandum is given by the seller� CUSHMAN & WAKEFIELD | RED declares, that the information to our knowledge is correct and represents the actual parts and aspects of the property at the time when this investment memorandum was prepared Certain aspects may have changed from the preparation of this investment memorandum until the property being sold The buyer is encouraged to do their own commercial, legal and technical due diligence of the property in relation to a prospective purchase�

3. No employee at CUSHMAN & WAKEFIELD | RED has any authority to make or give any representation or warranty whatsoever in relation to the property since this is reserved to the Seller only