IT'S NEARLY HERE...

Issue 09 of 2023

E XCE LL ENCE IS D OIN G

ORD IN A R Y THING S

E XT R AO RD I N A RI LY

W E L L

– John W. Gardner

– John W. Gardner

Issue 09 of 2023

E XCE LL ENCE IS D OIN G

ORD IN A R Y THING S

E XT R AO RD I N A RI LY

W E L L

– John W. Gardner

– John W. Gardner

Time has the ability to both crawl (try doing the plank) or to fly by. Sometimes we are aware of it. Like when the December holidays come around and we wonder where the year went. Other times we are caught in the day to day of it all and time seems to drag. Or at least, we are so busy we don’t even get to think about it.

Parents are exposed to the effects of time more often as they have to go shopping for their kids as they grow. New shoes, new shirts, new… well, new everything. It never seems to stop.

They say as you age, you begin to put a day, a week, a month into perspective with your entire life to date. Which is why time may seem to move faster when we are young. But then the ticking clock that is aging can really stress you out too so, who knows?

With debt review time also has this elastic type of quality. When you first start the process, everything happens so quickly. One day you are stressed out by scary letters and the next you are talking about a court order to protect your assets.

With debt review you have to learn new ways of doing things, new terms and jargon like PDAs and 17.2 letters. It can all fly by in a blur and then…then fortunately it all slows down.

But the day to day, month to month drudge of paying off your debt can be hard for some people to handle. Time can begin to crawl even though you are in fact making progress each month.

A similar thing happens with the Debt Review Awards team. We are a mixture of paid staff and volunteers and everyone has their own things on the go. Each year once the Awards comes and goes, the new rounds of reviews start to go out and time seems to crawl. Slow and steady it goes for months. Then a random burst of activity and then…slow again. Until the last few months of the process roll around and time begins to fly. Arrangements get made for the Gala, the Audit team starts to chase us for certain things and suddenly time flies. And before you know it… its almost here.

We have a look at all the arrangements in this issue so please check those out and whoever you are, please do join us on the YouTube live stream on the 20th October to watch all the action.

We also talk about what to do if you were recently affected by the storms and flooding. We have tips for consumers, tips for Debt Counsellors and credit providers, advice, updates, news and more. We hope you enjoy it all.

All we can say, is that if your debt review feels like it is flying by, don’t panic. It will calm down and things will find a new equilibrium in your life as you adjust.

If, on the other hand, it feels you’re your debt review is crawling and your debts are taking forever to get paid up, “just keep swimming” (to quote a certain fish themed movie). Time is a funny old thing and before you know it you will be debt free.

This is a form that is sent by Debt Counsellors to credit providers when a consumer experiences a sudden or temporary change in circumstances.

Though you won’t find the form mentioned in the National Credit Act (the law makers forgot that life happens and you might need to make a temporary agreement or change) the form is widely used across the industry.

We’ll get your interest rates right down. You’ll make one consolidated payment a month. You’ll have more cash to live on. Your assets will be legally protected. Sorted.

0861 365 910

www.debtbusters.co.za

info@debtbusters.co.za

Debtfree Magazine considers its sources reliable and verifies as much information as possible. However, reporting inaccuracies can occur, consequently readers using this information do so at their own risk. Debtfree Magazine makes content available with the understanding that the publisher is not rendering legal services or financial advice. Although persons and companies mentioned herein are believed to be reputable, neither Debtfree Magazine nor any of its employees, sales executives or contributors accept any responsibility whatsoever for their

activities. Debtfree Magazine contains material supplied to us by advertisers which does not necessarily reflect the views and opinions of the Debtfree Magazine team. No person, organization or party can copy or re-produce the content on this site and/or magazine or any part of this publication without a written consent from the editors’ panel and the author of the content, as applicable. Debtfree Magazine, authors and contributors reserve their rights with regards to copyright of their work.

Paying it all back is not.

Dealing with demands from credit providers or collections agents can be very stressful. It can very negatively impact on your feelings.

Stress, depression and anxiety are very common when dealing with debt. More than that, these feelings can also cause additional problems for us at work or at home.

Many people who are struggling to deal with debt report feelings of frustration, low self-esteem and even impaired cognitive functioning.

Employers often notice that staff members, who have high levels of debt stress, begin to struggle to be as productive at work. Sleepless nights also don’t help.

Those dealing with debt stress are also more likely to snap and be harsh with those around them. This can negatively impact on family life. Debt has often been linked to the end of many relationships.

Research has found that worrying about debt triggers stress. Stress then drives what they call ‘negative behavioural patterns’. These patterns drive some consumers to spend without restraint.

You may have heard of people doing some retail therapy. People often spend to feel powerful and free, even when they can’t really afford to do so. And unfortunately, this can drive a person into more debt just as fast as a car accident or medical emergency.

Being in debt is stressful but it really doesn’t have to take all the joy out of your life. There are many ways to deal successfully with debt.

Talk to someone and make a plan to deal with your debt. Make some more changes to help reduce spending and save where you can and try to remain positive by focussing on the good things in your life.

Don’t let debt dominate your entire life. Rather, get it sorted out and you will immediately begin to feel better.

DC Partner is a proud service provider and registered payment distribution agency to the national debt industry. Our focus is on the need of each individual business, and our system can accommodate your needs.

To us you as the Debt Counsellors are not merely a number. DC Partner works to ensure that each of our business partners feel like an integral part of the DC Partner team.

Find someone to discuss your debt situation with.

Someone who you can be totally honest with about your situation and the feelings you have.

If that’s not family or friends, why not a Debt Counsellor who is trained to help?

Even if you have made a budget in the past and have adjusted your spending, things change over time. Prices go up and (good news) new cheaper options do also become available.

So, review your spending and make needed changes to free up funds for essentials and dealing with debt. A few changes can go a long way.

This is no time to hide your head in the sand.

Rather, figure out your actual situation (write everything down and use a calculator) and then speak to either your credit providers or a Debt Counsellor.

Also, it can be good to inform your family (with age appropriate details for the kids) of your situation and the plan you have of how to deal with it.

5 TIPS FOR DEALING WITH FINANCIAL STRESSDoing nothing will not help you feel better. Get up and get out and about. Avoid shopping for fun. Avoid any more new accounts. Rather try other activities.

Why not start doing a little exercise? Why not take the dog for a walk?

Fresh air and some activity can really boost your feelings.

TIPS

TIPS

Focus on the good things in your life rather than fixate on the challenges you face.

If you take stock of your entire situation (once you have made a plan to deal with your debt) you will quickly realise there is lots of good in your life, including your family and friends.

5 TIPS FOR DEALING WITH FINANCIAL STRESS

5 TIPS FOR DEALING WITH FINANCIAL STRESS

Finwise is an all-inclusive Debt Management System, designed for proficient Debt Data Management. The Finwise System is linked to a registered Payment Distribution Agency (DC Partner), and operates in accordance with the NCA and Regulations, fortifying compliance.

Finwise is a web-based system, and can be used on any mobile device, PC, or tablet. The exceptional workflow and innovative task manager tools saves the user valuable time, through multiple consumer data reporting and easy management. Several integrations such as Legasys, iDOCS, Drex, facilitate effortless administering, and handling of multiple transactions and tasks within one system.

Debt Review is a legal process with time frames, and Finwise is the market leading platform for debt counsellors to keep track of the debt review process and tasks easily.

info@finwise.biz

www.web.finwise.biz

The auditing team will now take over, and we can all look forward to some excitement in the days ahead.

At the start of October, we will announce the Top 10 in the different Debt Counsellor size categories.

We will also learn the names of the Top 10 candidates in the Technology Adoption category, which is brought to us by Slipstream Technology.

The Top 5 and ultimate highest rated will be announced on the day of the Debt Review Awards Gala.

This year, the Gala is being held during the day (Friday afternoon) so that all who wish, can tune in via live streaming (on YouTube) and watch the festivities.

Guests from across the country will put on their fancy clothes and gather to hear the results in the Sandton area (Gauteng) this year.

The Awards Gala is being held on Friday the 20th of October 2023.

With over 80 different candidates, seats at the venue quickly fill up. But don’t be disappointed if you are not able to attend in person. In an effort to make the event available to as many people as possible, the Awards will once again be live streamed via YouTube.

Sign up to the channel so long to get notifications when we go live on the 20th.

Countrywide, both Debt Counsellors and credit providers offices arrangements will be made (incl. with the IT dept who control YouTube access) to watch the speeches, presentations and Award announcements live.

Many offices make arrangements for refreshments, team photographs and even their own internal staff awards for the same day.

On Friday the 20th of October, just before the start of the Awards Gala, extra industry specific content has been prepared for those who work in debt review. This includes presentations from the NCR, NCT, various credit providers such as Nutun, Old Mutual and service providers such as DCCP.

There will also be some current industry updates and information about what is happening at CIF as we catch up with DCASA and ABSA.

With the inclusion of a new legal section in the Awards this year, there will also be discussions about what makes a “good” attorney and advice for both consumers and Debt Counsellors when working with attorneys.

The Industry Pre Show will also be streamed over YouTube and will run from 12 Noon on the same day (Friday, 20th October). All senior staff at the various Credit Providers and Debt Counsellors offices are invited to tune in for the Pre Show.

Sign up to the channel so long to get notifications when we go live on the 20th.

(Brought to you by ABSA)

Debt Review Awards is working closely with ABSA, DCCP, DCASA and others service providers to bring Debt Counsellors and credit providers together on the 19th of October. This is on the day prior to the Debt Review Awards Gala.

ABSA have generously made a venue available in JHB CBD, and arrangements are being made to invite both local Debt Counsellors and those who are traveling up to the Awards (on the 20th) to this ancillary event.

The DC|CP Meet Up presents Debt Counsellors the chance to engage directly with senior staff from various credit provider debt review departments. It is a chance for both sides of the industry to meet and put a face to the names they see so often in emails or voices they hear on the phone. There will be speeches, presentations, engagements sessions, a panel discussion and opportunities to network during the 4 hour function (and food, there will be snacks and drinks, don’t worry).

There will be a dedicated space on the day for those wishing to register on or update information on the various industry portals as well as chances to meet with various service providers to the industry such as the PDAs, software providers and insurance providers.

Representatives from the NCT, BASA and both DCASA and the NDCA will attend and be available to engage with attendees.

Seats are limited so if you would like to attend please email: meetup@debtfreedigi.co.za

The Debt Review Awards would like to say THANK YOU to our generous sponsors who help make the event possible each year.

A Special Thanks To Hyphen

DCCP | Capital Data

FNB | Consumer Friend | ONE

We also wish to thank

ABSA | DC Partner

iPDA | Nedbank |

Steyn Coetzee | Old Mutual

And we want to also thank all those who participated in the reviews this year. All the BASA, MFSA, DCASA, NDCA members and all the other DCs out there. This process reflects your voice. We look forward to learning the results of the reviews on the 20th of October 2023.

Image by Freepik www.freepik.com

If you were recently affected by the storms in the Western Cape or extreme weather along the coast then we want to extend our sympathies.

Extreme weather events are becoming more common than ever before and they can really disrupt or threaten our lives.

Recently, extreme high tides and devastating downpours left many areas flooded, properties and possessions damaged, cars destroyed and severely impacted on power supplies and internet services.

As a result of the flooding and damage, some businesses were also unable to open for several days and many people were simply not able to get to work.

If you have been affected by one of these recent events then you may also now be stressing about making your regular debt repayments at the end of the month while still dealing with the fall out of these severe events.

If you were affected then it is recommended that you reach out to your Debt Counsellor urgently and ask them to speak to your credit providers about a reduced or delayed payment.

If you can provide photographs or documents from work and a motivation for the delay or reduction it might be possible to work something out with most of your credit providers. It is also good to provide a plan to catch up missed payments if you can, even if this takes several months.

If you have insurance on your debts (such as through ONE or DCCP) you might also be able to claim from credit life insurance cover, depending on the benefits included. This might cover any missed debt review repayment for the month. Speak to your broker or your Debt Counsellor about this.

CAN’T PAY BECAUSE OF STORM DAMAGE

Please do not simply miss a payment and try ignore your debt review obligations. This could result in credit providers wanting to start new legal collections processes that are both stressful and costly to fight. It is better to reach out to them and make an arrangement if possible.

Remember your Debt Counsellor is there to try and assist you and your credit providers are also aware of the storms. Many of their staff were similarly affected.

Ask your Debt Counsellor about the 17.3 process and if anything can be done. While they are not miracle workers, they will reach out to your credit providers and see what can be done to help cushion the blow.

Remember that the things you own change value over time. Some things (like jewellery) become more valuable, while other things (like a car or computer) might be worth less than before as they are older now.

Why not talk to your FAIS broker about your current situation and see if your premiums can come down a little? If you don’t ask…you won’t get.

They may even suggest a shift in your policies that could save you funds that might help you cover daily costs or could be used towards your debts.

Have you applied to go under debt review? Are you restructuring your monthly expenses? Would you like to insure your debt?

Why not insure all your outstanding accounts in a single ONE Credit Protection Policy?

Have you applied to go under debt review? Are you restructuring your monthly expenses? Would you like to insure your debt?

BENEFITS OFFERED:

• Death – we settle the account

Why not insure all your outstanding accounts in a single ONE Credit Protection Policy?

• Temporary Disability – we pay your installment for 12 months

• Permanent Disability – we settle the account

BENEFITS OFFERED:

• Critical Illness – we pay your installments for 3 months

• Death – we settle the account

• Retrenchment – we pay your installments for 12 months

• Temporary Disability – we pay your installment for 12 months

• Permanent Disability – we settle the account

At a rate of R2.95 per R1000 unsecured/short-term credit and R2.00 per R1000 on mortgages and you can now insure your debt for less.

• Critical Illness – we pay your installments for 3 months

• Retrenchment – we pay your installments for 12 months

The following financial obligations or debt can be covered on the ONE Credit Protection Policy:

• Credit Cards

• Overdrafts

At a rate of R2.95 per R1000 unsecured/short-term credit and R2.00 per R1000 on mortgages and you can now insure your debt for less.

• Personal Loans

• Home Loans

• Retail Accounts

The following financial obligations or debt can be covered on the ONE Credit Protection Policy:

• Rental Agreement

• Credit Cards

• Maintenance Orders

• Overdrafts

• Personal Loans

For further information please speak to your Broker, Debt Counsellor or alternatively contact your regional ONE office.

• Home Loans

• Retail Accounts

• Rental Agreement

0861 266 562 admin.debt@one.za.com

• Maintenance Orders

Terms and Conditions Apply

For further information please speak to your Broker, Debt Counsellor or alternatively contact your regional ONE office.

0861 266 562

There are currently 7 NCR registered Alternative Dispute Resolution Agents in South Africa (Sept 2023). These are known as ADRAs.

Some people get confused, but ADRAs are not the same as Debt Counsellors. Though both are found in the National Credit Act and are referred to in the scary Section 129 letters to consumers, they perform different functions.

ADRAs help deal with complaints

disputes about credit accounts.

Any consumer can submit a complaint to the NCR about an alleged contravention of the Act or a complaint concerning an allegation of reckless credit (where the consumer didn’t

understand what they were getting themselves into or were not fully informed of the obligations and cost or could not really afford to repay the debt).

However, as an alternative, Section 134(1)(b) (ii) of the National Credit Act (NCA) says that instead of filing reckless lending accusations or complaints to the NCR, these can rather be referred to an ADR for resolution of the disputes. This would possibly be done through conciliation, mediation or arbitration.

So, the two parties would basically discuss it with the ADRA (in one set up or another) and try to agree to a solution or have someone decide on a solution in the case of arbitration.

If they can’t agree then things would be referred to the NCR or even the NCT instead.

You may have seen people offering to sort out consumers’ debt via mediation.

This was popularised by the National Debt Mediation Association when the NCA and debt review was first introduced. As a result, many consumers were successfully diverted away from the legal debt review process at the time.

Obviously, owing money is not a ‘dispute’ or a ‘complaint’ (although we may complain about it to our friends). So, mediation by ADRAs would not cover restructuring debts. That would best be done via debt review or in a voluntary agreement with a credit provider by the consumer direct or via a Debt Counsellor as allowed for in the National Credit Act.

Note: At present, this is one of the topics sitting with the Credit Industry Forum (CIF) who are trying to define guidelines relating to ADRAs.

If you have a complaint about a credit provider then why not reach out to a NCR registered ADRA and see if they can help you and the credit provider resolve the matter rather than end up at court or in front of an Ombud or the NCT?

If you are faced with a sudden change in circumstances (either big or small) that can impact on your budget and ability to repay your debts.

If it is something smaller like, a broken appliance or dent in your car, then when you discuss the matter with your Debt Counsellor, they may suggest that you consider: Can you wait to fix the issue?

This is because with some planning you may be able to still pay your debts and save towards sorting out the problem. It may take a little while but maybe it can wait.

More serious changes may mean your entire review and repayment plan need to be revisited and maybe a new court order obtained.

We understand the importance of having a reliable and efficient attorney to represent you in court, attend to matters urgently and handle cases that require specialised knowledge.

We

based

We offer:

• A cloud-based solution

• Collections, with various methods available

• Timeous Distributions

• Comprehensive Reporting

• Management Reporting;

• Operational Reporting and;

• Consumer Management Reporting

Why settle for the ordinary when you can embrace the exceptional?

Supercharge your Debt

Counseling business with the iPDA

Discovery Bank will be working with SA Home Loans to offer clients property finance.

SA Home Loans have been offering bonds for nearly 25 years and Discovery Bank has been in operation since 2019. Discovery Bank already offer a wide range of products and see home loans as the next logical step.

Much like other offerings across the brand there will be incentives and benefits linked to a holistic approach to good living and sound financial habits. The loans (with up to 30 years term) could qualify for as much as a 1.5% discount for clients who manage their money well. Over 30 years that could be very significant.

Discovery Bank are hoping to attract new home owners but also those with existing bonds who may want to migrate their finance.

The new product will become available to the general client base at the start of 2024.

Recently, Debt Counsellors have been moaning about various aspects of Capitec Bank’s marketing relating to debt review. At Debt Counsellors meetings there is a buzz in the air when the topic is raised and many have been complaining.

Representatives from the Debt Counsellors Association of South Africa have recently had the chance to meet with Capitec Bank Senior staff and engage on the topic. DCASA were able to share information from internal research that was conducted among members and were able to get to hear what it is that Capitec Bank are concerned about.

A lot seemingly relates to the behavior of some clients when they suddenly switch Debt Counsellors who entice them with lower repayment offers (not a good idea. Rather engage with your current Debt Counsellor if you are struggling). This small group of new Debt Counsellors are often called “rogue” Debt Counsellors by the association. Such behavior is being reported to the NCR who are also aware of such behavior.

The meeting was described as highly productive and that armed with better understanding on both sides there should be a way forward. Further discussions will happen about issues such as terminations etc but for the moment it seems that things have moved one step closer to being amicably resolved.

‘‘The reason Zero Debt are industry leaders is that they get 80% acceptances on their initial proposals to credit providers, right away. They also make excellent use of the DCRS proposal system in negotiations with credit providers.

Zero Debt regularly succeeds in convincing credit providers to reduce their high interest rates down to less than 5% on their client’s debts.

This means that Zero Debt clients obtain their court orders and can pay off their debts quickly. They ensure dedicated clients get their clearance certificates and are soon able to start their debt free life.

Recently, the MFC portfolio migrated into the Nedbank portfolio.

Debt Counsellors should note that, as a result, going forward COBs and proposals will include both MFC and Nedbank products in one document.

All requests for information and enquiries for MFC accounts will be routed to one contact point and MCF and Nedbank say they hope that this allows for faster and even more efficient resolution of matters.

Though the portfolios have already merged the systems have not, for now. Once the systems are migrated, MFC and Nedbank will just be using the one entry point for all correspondence to and from Debt Counsellors. MFC and Nedbank will communicate the changed process and all the new contact points once the system migration is finalised.

The National Credit Regulator (NCR) host a forum called the Credit Industry Forum (CIF).

The idea behind the forum is to bring industry role players together to meet and discuss industry issues. These discussions and agreements reached help the NCR formulate guidelines (or non binding opinions) which they share with the industry on various topics.

The hope is that these non binding opinions help shape the decisions of the industry role players when dealing with matters not directly covered in the National Credit Act.

One such item is how much debt review services should cost. The Act and Regulations are silent on the topic.

Over the years only the Debt Counsellors Association of South Africa (DCASA) and the NCR have issued a suggested fee structure. Most practices voluntarily stick to these guidelines.

The NCR are now looking at their fee structure again and have called on the CIF for input as they reconsider their non binding opinion on the topic.

The NCR have concerns related to the use of legal fees and the high number of consumers who drop out of the process in the first few months. The NCR hope to make suggestions that guide the industry to address these topics. Though the NCR has no jurisdiction of the legal fraternity or over consumers behavior directly they hope to drive or incentivise Debt Counsellors to try adjust the behavior of both attorneys and consumers.

At present, the discussions are in the very early phases (like agreeing what different terms mean).

Debt Counsellors suggestions are normally submitted to the CIF via DCASA, NDCA or the IDDC. If you have suggestions, please approach the NCR or one of these parties to submit them in advance of future discussions.

Our members are invited to attend the Debt Review Awards DC|CP Meet Up on 19 October 2023.

Please enquire about details.

facebook.com/groups/allprodc

www.allprodc.org

Our members are invited to attend the Debt Review Awards DC|CP Meet Up on 19 October 2023.

Please enquire about details.

Email: Alanm@moneyclinic.co.za

Our members are invited to attend the Debt Review Awards DC|CP Meet Up on 19 October 2023.

Regional Meeting

Free State - 10 Nov

Gauteng - 14 Nov

KZN - 10 Nov

W Cape - 14 Nov

email: dcasa@dcasa.co.za

www.dcasa.co.za

NDCA are ready to help consumers who are struggling with debt. Visit our site for more information. ndca.org.za

Tel: +27 12 140 0602

Email: info@collectnetpda.co.za

Web: www.collectnetpda.co.za

We are a passionate and dedicated team of attorneys based in Paarl, South Africa, committed to providing topquality legal services to our clients. Our firm is predominantly women-led, bringing a unique perspective and approach to our services At our core, we embody the values of trustworthiness, reliability, approachability, professionalism, innovation, and energy

Clients choose us for our debt counseling and correspondent services because of our personalised approach, unwavering integrity, and extensive expertise, as our registered debt counselors provide compassionate support by negotiating manageable payment terms with creditors, while our efficient assistance as correspondents to lawyers across South Africa ensures prompt execution and reliable solutions for a variety of legal matters, ultimately leading to client satisfaction and peace of mind.

Are you a debt counsellor, searching for a reliable attorney firm to swiftly secure debt review court orders? Look no further A de Bruyn Attorneys is your dedicated partner, ensuring accurate and timely approval for your clients. With extensive knowledge and experience in debt counselling, we streamline the process, delivering dependable service and prioritising your clients' best interests. Reach out today to discuss how we can secure debt review court orders swiftly and effectively. Let's make a difference together.

We pride ourselves in providing efficient and reliable correspondent services for lawyers. We handle legal matters with precision and promptness, from filing to court arrangements. Count on us for seamless document delivery and a quick turnaround Contact us today for unparalleled, world-class service

Part of the NCR’s mandate is to check that registrants are doing everything correctly and in line with the National Credit Act.

This is why the NCR conduct regular compliance monitoring visits. During such visits they will check on a few things (are certificates displayed, stickers by the door etc). They will also then ask for a random selection of client files to see how you handle matters.

It is important to cooperate with the NCR during such mandatory visits. Recently, the NCR had some difficulty when trying to visit a Debt Counsellor or two in the Western Cape. A break down in communication led to the Debt

Counsellors staff not believing it really was the NCR at the door. Voices were raised, threats were made and eventually the Cops were called in to help force the issue. Things got really out of control and it resulted in great difficulty for all involved.

This is the kind of thing all Debt Counsellors and credit providers want to avoid as it can escalate all the way to the NCT and possible deregistration.

Here are a few simple tips that can help things run smoothy during a NCR monitoring visit:

• Cooperate with the process

• Treat the NCR officials with respect.

• Prepare and get all relevant staff and records ready

• Stick to appointments

• Provide requested documents and files asap.

• Settle any non-compliance matters straight away. Don’t delay.

• If things don’t go well and a contentious issue comes up get legal advice asap.

• Take these visits seriously as you could end up deregistered.

If the NCR are investigating complaints, then it is also important to make as much information as possible available to the NCR. Also be sure to provide detailed explanations in a clear and simple way so that they can properly evaluate the complaint and find the way forward.

Don’t hold back and don’t minimise complaints. Yes, it can result in a lot of extra work but it can help you avoid being referred to the NCT for a fine or worse.

DREX simplifies the exchange of data and makes managing the debt review process less admin intensive.

The below links take you to step-by-step guides on how to use the DC Portal on DREX.

How to Register on the DC Portal

Introduction to the DC Portal

Accessing a Consumer's Profile

EASTERN CAPE

Effective Intelligence

sardagh@e-intelligence.com

Fides Cloud Technologies craig@fidescloud.co.za

Finch Technologies chris@finchinvestments.co.za

I-Bureau Services abrie@ibureau.services

IDR South Africa

shane@v-report.co.za

iFacts

sonya@ifacts.co.za

Inoxico support@inoxico.com

Kudough Credit Solutions

chrisjvr@kudough.co.za

Lexisnexis Risk Management kim.bastick@lexisnexis.co.za

Lightstone chrisb@lightstone.co.za

Loyal1

tshepiso@loyal1.co.za

Managed Integrity Evaluation

marelizeu@mie.co.za

Maris IT Development marius@marisit.co.za

National Validation Services info@nvs-sa.co.za

Octagon Business Solutions gregb@octogon.co.za

Omnisol Information Technology info@verifyid.co.za

Payprop Capital johette.smuts@payprop.co.za

PBSA seanb@PBSA.CO.ZA

Right Cover Online cto@rightcover.co.za

Searchworks 360 skumandan@searchworks360. co.za

Smart Information Bureau

info@smartbureau.net

ThisisMe juan@thisisme.com

TPN Group michelle@tpn.co.za

Trans Africa Credit Bureau clintonc@transafricacb.co.za

Transaction Capital Credit Health

DavidD1@tcriskservices.co.za

VeriCred Credit Bureau sumein@vccb.co.za

WeconnectU

johann@weconnectu.co.za

Zoia Consulting sipho@dots.africa

C O N T A C T D E T A I L S

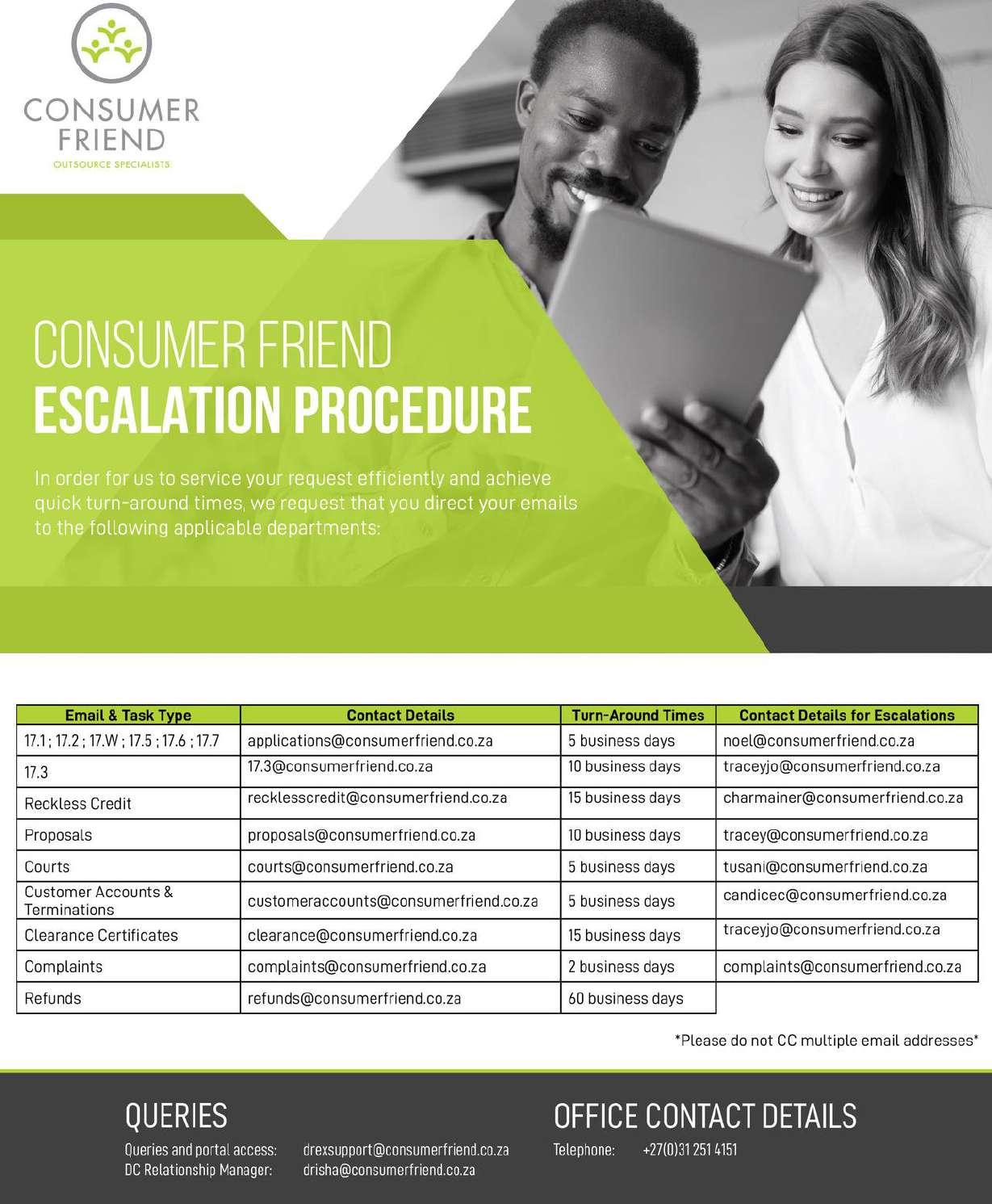

This letter serves to communicate to the Credit industry to use the following contact details for the Nimble Group when processing Debt Review related applications, enquiries, queries and, complaints escalation process.

Kindly take note Nimble Group hereby consents to service all legal documents applicable to Debt review herein by way of email.

Email & Task Type

Forms 17 1 and 17 7

Forms 17 2, Proposal Summaries, Cascade plans & Court orders

Forms 17.2 Rejection, 17.W & Form 19

Forms 17 3, General queries, settlements, balance, refunds, statements, Paid up letter request & reckless lending allegations, payment allocation queries & Complaints

DEBT REVIEW INBOUND CONTACT NUMBERS:

+27 87 250 5533

+27 21 8300 711

DEBT REVIEW ENQUIRIES ESCALATION MANAGEMENT ORDER CONTACT DETAILS

Kindly note that escalations must only be done once you have sent your request to the above-mentioned contact email addresses and if your requests are out of SLA in lieu Debt Review forms response business days stipulated in the NCR Act

Kind Regards,

Contact Details

drcob@nimblegroup co za

drproposal@nimblegroup co za

drtermintation@nimblegroup.co.za

drqueries@nimblegroup co za

1st line escalation

Aletta Tokollo Molelekeng

Debt Review: Team Manager

D: +27 11 285 7247

E: AlettaM@normanbissett co za

2nd line escalation

Denvor Rank

Operations Manager: Process Recoveries

O: +27 21 830 0750 (Ext 6062)

E: denvorr@nimblegroup co za

3rd Line escalation

Zivia Koff

Specialised Process Manager

D: +27 21 492 4554

E: ziviak@nimblegroup co za

Denvor Rank

Operations Manager: Process Recoveries

We trust this communication finds you well and that it will improve our service to you

It

Further

Table

Order of Escalation

Person Designation

Forms 17s, Court documents

1 Jolene Pieters

E-mail address

Team Leader: Debt Review (Court Orders/Forms/Inclusions) JolenePieters@capitecbank.co.za

2 Cindy Mauritz Manager: Debt Review CindyMauritz@capitecbank.co.za

3 Carolina Visser Manager: Process Recoveries CarolinaVisser@capitecbank.co.za

Proposals

1 Meghan Bruiners Team Leader: (Proposals) MeghanBruiners@capitecbank.co.za

2 Cindy Mauritz Manager: Debt Review CindyMauritz@capitecbank.co.za

3 Carolina Visser Manager: Process Recoveries CarolinaVisser@capitecbank.co.za

General Enquiries, Refund/cancellation requests , Termination queries, Updated COB’s, Payment queries

1 Nathan Slaverse Team Leader: Enquires Nathanslaverse@capitecbank.co.za

2 Carolina Visser Manager: Process Recoveries CarolinaVisser@capitecbank.co.za

Insurance replacements

1 Mfundo Xaba Officer: Market Conduct Oversight MfundoXaba@capitecbank.co.za

2 Dries Olivier Manager: Market Conduct and Oversight DriesOlivier@capitecbank.co.za

Reckless Lending Queries

1 Whitney Jardine Team Leader: Recoveries Risk Support WhitneyJardine@capitecbank.co.za

2 Zayaan Jurgens Manager: Recoveries Risk Support ZayaanJurgens@capitecbank.co.za

Credit insurance claims

1 Grant Griffith Jessica Rademeyer Kanyisa Mbiza

Team Leader: Insurance Claims GrantGriffiths@capitecbank.co.za JessicaRademeyer@capitecbank.co.za KanyisaMbiza@capitecbank.co.za

2 Brigitte October Performance ManagerInsurance Claims BrigitteOctober@capitecbank.co.za

Telephonic queries lodged

1 Laetitia Pretorius Team Leader: CCS Queries LaetitiaPretorius@capitecbank.co.za

2 Tracey Govender Manager: Recoveries Administration TraceyGovender@capitecbank.co.za

Sincerely,

086 066 7783

17.1, 17.2, Proposals, General correspondence: debtcounselling@africanbank.co.za

To register for Legal Web Access: lwac@africanbank.co.za

Reckless Lending investigations: RLA@africanbank.co.za

DETAILS COMING SOON

NEDBANK DRRS

Debt Counselling Query Resolution Contact Points and Escalation Process

Email submissions (Level1) Email: DebtCounsellingQueries@nedbank.co.za

To be used as a first point of contact for all written communication

Call centre (Level 1: Alternative) Tel: 0860 109 279

To be used as a first point of contact for all telephonic communication

Attended to by Queries Specialist (Level 2: First Escalation) dcescalation1@nedbank.co.za

To be used only where no resolution is found from first point of contact after 5 business days

Attended to by Team Leader and Queries Specialist (Level 3: Second Escalation) dcescalation2@nedbank.co.za

To be used only where no resolution is found from the first escalation after 5 Business days

Attended to by Support and Escalation Manager (Level 4: Final escalation) nbdcescalations@nedbank.co.za

To be used only where no resolution is found from the second escalation after 5 Business days