Deschutes County Property Information

Report Date: 8/4/2022 8:52:07 AM

Disclaimer

The information and maps presented in this report are provided for your convenience. Every reasonable effort has been made to assure the accuracy of the data and associated maps. Deschutes County makes no warranty, representation or guarantee as to the content, sequence, accuracy, timeliness or completeness of any of the data provided herein. Deschutes County explicitly disclaims any representations and warranties, including, without limitation, the implied warranties of merchantability and fitness for a particular purpose. Deschutes County shall assume no liability for any errors, omissions, or inaccuracies in the information provided regardless of how caused. Deschutes County assumes no liability for any decisions made or actions taken or not taken by the user of this information or data furnished hereunder.

Account Summary

GOSS, WILLIAM J

5701 W HWY 126, REDMOND, OR 97756

GOSS, WILLIAM J

5701 W HWY 126

REDMOND, OR 97756

Subdivision:

Lot:

Block:

Property Class: 551 -- FARM

Warnings, Notations, and Special Assessments

Assessor's Office Notations

EXCLUSIVE FARM USE POTENTIAL ADDITIONAL TAX LIABILITY

Review of digital records maintained by the Deschutes County Assessor’s Office, Tax Office, Finance Office, and the Community Development Department indicates that there are County tax, assessment, or property development related notations associated with this account and that have been identified above. Independent verification of the presence of additional Deschutes County tax, assessment, development, and other property related considerations is recommended. Confirmation is commonly provided by title companies, real estate agents, developers, engineering and surveying firms, and other parties who are involved in property transactions or property development. In addition, County departments may be contacted directly to discuss the information.

Valuation History All values are as of January 1 of each year. Tax year is July 1st through June 30th of each year.

Account Information Ownership

Mailing Address: Map and Taxlot: Account:

Situs Address: Mailing Name: Tax Status: 1512130000300 129060

Assessable

Acres: Property Taxes Assessment Tax Code Area: Current Tax Year: 2004 $4,088.59 24.82 Valuation $287,290 $375,210 Land Structures Total $662,500 Real Market Values as of Jan. 1, 2021 N/A $264,845 Maximum Assessed Assessed Value Veterans Exemption

Assessed Values:

Assessor

Current

2017 - 2018 2018 - 2019 2019 - 2020 2020 - 2021 2021 - 2022 Real Market Value - Land $217,090 $210,690 $247,900 $284,480 $287,290 Real Market Value - Structures $268,350 $300,540 $354,640 $407,840 $375,210 Total Real Market Value $485,440 $511,230 $602,540 $692,320 $662,500 Maximum Assessed Value N/A N/A N/A N/A N/A Total Assessed Value $236,275 $243,105 $250,135 $257,385 $264,845 Veterans Exemption $0 $0 $0 $0 $0

Deschutes County Property Information Report, page 1

Sales History

Sale Date Seller Buyer Sale Amount Sale Type Recording Instrument 03/26/2010 GOSS, WILLIAM & ZWICKERGOSS, JENNIFER GOSS, WILLIAM J 06-GRANTEE IS RELATED/FRIENDS/BUSINES S ASSOCIATES 2010-12869 06/22/2007 GOSS, WILLIAM J & ZWICKER, JENNIFER V GOSS, WILLIAM & ZWICKERGOSS, JENNIFER 08-GRANTOR/GRANTEE ARE THE SAME 2007-35894 01/10/2005 KORCEK,SHERRY L GOSS, WILLIAM J & ZWICKER, JENNIFER V $552,247 22-SPECIALLY ASSESSED 2005-2239 12/08/1995 KORCEK,WALTER F JR KORCEK,WALTER F JR $0 14-RERECORDING/OTHER/CONSID ERATION UNDER $500 1995-3940959

Structures Stat Class/Description Improvement Description Code Area Year Built Total Sq Ft 110 - RESIDENCE: Other Improvements General Purpose Bld, General Purpose Bld, GP SHED, GP SHED, GARAGE Det/Low Cost, Chain Link Fence 20040 Stat Class/Description Improvement Description Code Area Year Built Total Sq Ft 151 - RESIDENCE: One story 200419812,468 Floor Description Comp % Sq Ft First Floor 100 2,468 Living Dining Kitchen Nook Great Family Bed Full Bath Half Bath Bonus Utility Den Other 1 1 1 0 0 0 3 2 1 0 1 0 0 Rooms Floor Description Comp % Sq Ft Deschutes County Property Information Report, page 2 (For Report Disclaimer see page 1)

Garage-Attached-Low Cost 100 576 BATHTUB W/FIBRGL SHWR 1 BEAMED CEILING CARPET DISHWASHER 1 DRYWALL FORCED AIR HEATING 2,468 FOUNDATION - CONCRETE HOOD-FAN 1 KITCHEN SINK 1 LAUNDRY TUB 1 LAVATORY 3 LOG ROOF - GABLE ROOF CVR - CONC/CLAY TILE 2,468 SHOWER WDOOR, TILE 1 SIDING - LOG TOILET 3 VINYL FLOOR WATER HEATER 1 WINDOWS - DOUBLE/THERMAL PANE WINDOWS - METAL WOOD STOVE 1 Improvement Inventory Accessory Description Sq Ft Quantity DECK COVER - AVERAGE 320 FENCE - LINK 240 CONCRETE-PAVING 2,200 DECK-AVERAGE 1,284 Stat Class/Description Improvement Description Code Area Year Built Total Sq Ft 300 - FARM BLDG: GP Building GP Building - CLASS 4 200419051,600 Floor Description Comp % Sq Ft Building Structure 100 1,600 Stat Class/Description Improvement Description Code Area Year Built Total Sq Ft 300 - FARM BLDG: GP Building GP Building - CLASS 4 200419254,000 Floor Description Comp % Sq Ft Building Structure 100 4,000 Stat Class/Description Improvement Description Code Area Year Built Total Sq Ft 301 - FARM BLDG: GP Shed GP Shed - CLASS 4 20041920240 Floor Description Comp % Sq Ft Deschutes County Property Information Report, page 3 (For Report Disclaimer see page 1)

Ownership

Related Accounts

Related accounts apply to a property that may be on one map and tax lot but due to billing have more than one account. This occurs when a property is in multiple tax code areas. In other cases there may be business personal property or a manufactured home on this property that is not in the same ownership as the land.

No Related Accounts found.

Development Summary

Building Structure 100 240 Stat Class/Description Improvement Description Code Area Year Built Total Sq Ft 301 - FARM BLDG: GP Shed GP Shed - CLASS 4 20041925408 Floor Description Comp % Sq Ft Building Structure 100 408

Characteristics Land Description Acres Land Classification Exclusive Farm Use Zoned 1.00 D8: DRY GROUND - SOIL CLASS 8 Exclusive Farm Use Zoned 12.00 W3: IRRIGATED GROUND - SOIL CLASS 3 Farm Site 1.00 Exclusive Farm Use Zoned 10.82 D7: DRY GROUND - SOIL CLASS 7

Land

Name Type Name Ownership Type Ownership Percentage OWNER GOSS, WILLIAMJ OWNER 100.00%

Category Name Phone Address COUNTY SERVICES DESCHUTES COUNTY (541) 388-6570 1300 NW WALL ST, BEND, OR 97703 FIRE DISTRICT REDMOND FIRE AND RESCUE (541) 504-5000 341 NW DOGWOOD AVE, REDMOND, OR 97756 SCHOOL DISTRICT REDMOND SCHOOL DISTRICT (541) 923-5437 145 SE SALMON AVE, REDMOND, OR 97756 ELEMENTARY SCHOOL ATTENDANCE AREA SAGE ELEMENTARY SCHOOL (541) 316-2830 2790 SW WICKIUP, REDMOND, OR 97756 MIDDLE SCHOOL ATTENDANCE AREA OBSIDIAN MIDDLE SCHOOL (541) 923-4900 1335 SW OBSIDIAN, REDMOND, OR 97756 HIGH SCHOOL ATTENDANCE AREA RIDGEVIEW HIGH SCHOOL (541) 504-3600 4555 SW ELKHORN AVE, REDMOND, OR 97756 EDUCATION SERVICE TAX DISTRICT HIGH DESERT EDUCATION SERVICE DISTRICT (541) 693-5600 145 SE SALMON AVE, REDMOND, OR 97756 COLLEGE TAX DISTRICT CENTRAL OREGON COMMUNITY COLLEGE (541) 383-7700 2600 NW COLLEGE WAY, BEND, OR 97703 PARK & RECREATION DISTRICT REDMOND AREA PARK & RECREATION DISTRICT (541) 548-7275 465 SW RIMROCK DR, REDMOND, OR 97756 LIBRARY DISTRICT DESCHUTES PUBLIC LIBRARY (541) 617-7050 601 NW WALL ST, BEND, OR 97703 LIVESTOCK DISTRICT DESCHUTES COUNTY LIVESTOCK DISTRICT NUMBER 6 (541) 388-6623 1300 NW WALL ST, BEND, OR 97703 IRRIGATION DISTRICT CENTRAL OREGON IRRIGATION DISTRICT (541) 548-6047 1055 SW LAKE CT, REDMOND, OR 97756 GARBAGE & RECYCLING SERVICE HIGH COUNTRY DISPOSAL (541) 548-4984 1090 NE HEMLOCK AVE, REDMOND, OR 97756 Service Providers Please contact districts to confirm. County Zone Description EFUTRB EXCLUSIVE FARM USE - TUMALO/REDMOND/BEND SUBZONE LM LANDSCAPE MANAGEMENT COMBINING ZONE

Planning Jursidiction: Urban Reserve Area: Urban Growth Boundary: Deschutes County No No Deschutes County Property Information Report, page 4 (For Report Disclaimer see page 1)

County Development Details Wetland (National or Local): Conservation Easement: TDC/PRC Restrictive Covenant: FEMA 100 Year Flood Plain: Yes No Conservation Easement Recorded No TDC/PRC Restrictive Covenant Found Not Within 100 Year Flood Plain Ground Snow Load: 36 #/sq. ft. Deschutes County Permits Permit ID Permit Type Applicant Application Date Status 247-B8171 Building KORCEK,WALTER & SHERRY 09/01/1980Finaled 247-E107128 Electrical GOSS,WILLIAM J 09/29/2010Finaled 247-E83789 Electrical GOSS,WILLIAM 07/29/2005Finaled 247-E110206 Electrical GOSS,WILLIAM J 05/18/2012Finaled 247-19-002675MECH Mechanical GOSS, WILLIAM J 05/15/2019Finaled 247-M02914 Mechanical KORCEK, WALTER 02/18/1986Finaled 247-M31598 Mechanical GOSS,BILL & ZWICKER,JENNIFER 02/11/2005Finaled 247-FS1971 Septic KORCEK,WALTER JR 09/03/1980Finaled 247-S2526 Septic KORCEK,WALTER & SHERRY 09/01/1980Expired Deschutes County Property Information Report, page 5 (For Report Disclaimer see page 1)

STATEMENT OF TAX ACCOUNT

2021ADVALOREM$0.00$0.00$0.00$0.00$4,088.59Nov15,2021

2020ADVALOREM$0.00$0.00$0.00$0.00$3,894.50Nov15,2020

2019ADVALOREM$0.00$0.00$0.00$0.00$3,716.42Nov15,2019

2018ADVALOREM$0.00$0.00$0.00$0.00$3,630.92Nov15,2018

2017ADVALOREM$0.00$0.00$0.00$0.00$3,553.55Nov15,2017

2016ADVALOREM$0.00$0.00$0.00$0.00$3,460.63Nov15,2016

2015ADVALOREM$0.00$0.00$0.00$0.00$3,214.85Nov15,2015

2014ADVALOREM$0.00$0.00$0.00$0.00$3,049.91Nov15,2014

2013ADVALOREM$0.00$0.00$0.00$0.00$2,586.11Nov15,2013

2012ADVALOREM$0.00$0.00$0.00$0.00$2,654.74Nov15,2012

2011ADVALOREM$0.00$0.00$0.00$0.00$2,592.54Nov15,2011

2010ADVALOREM$0.00$0.00$0.00$0.00$2,564.15Nov15,2010

2009ADVALOREM$0.00$0.00$0.00$0.00$3,436.53Nov15,2009

2008ADVALOREM$0.00$0.00$0.00$0.00$3,041.62Nov15,2008

2007ADVALOREM$0.00$0.00$0.00$0.00$2,900.59Nov15,2007

2006ADVALOREM$0.00$0.00$0.00$0.00$2,743.21Nov15,2006

2005ADVALOREM$0.00$0.00$0.00$0.00$3,263.48Nov15,2005

2004ADVALOREM$0.00$0.00$0.00$0.00$2,673.53Nov15,2004

2003ADVALOREM$0.00$0.00$0.00$0.00$2,496.41Nov15,2003

2002ADVALOREM$0.00$0.00$0.00$0.00$2,386.73Nov15,2002 2001ADVALOREM$0.00$0.00$0.00$0.00$2,275.48Nov15,2001 2000ADVALOREM$0.00$0.00$0.00$0.00$2,250.54Nov15,2000 1999ADVALOREM$0.00$0.00$0.00$0.00$2,213.53Nov15,1999 1998ADVALOREM$0.00$0.00$0.00$0.00$2,134.15Nov15,1998 1997ADVALOREM$0.00$0.00$0.00$0.00$2,085.27Dec15,1997 1996ADVALOREM$0.00$0.00$0.00$0.00$2,029.58Nov15,1996

DESCHUTES COUNTY TAX COLLECTOR DESCHUTES SERVICES BUILDING BEND OR 97703 (541) 388-6540 4-Aug-2022 Tax129060 Account# AccountStatus RollType SitusAddress A Real 5701WHWY126REDMOND97756 LTS-CGBAgrifinancial Tax Summary Tax Year Tax Type Total Due Current Due Interest Due Discount Available Original Due Due Date 2004 Aug4,2022 LenderName LoanNumber PropertyID InterestTo $0.00$0.00$0.00$0.00 Total Deschutes County Property Information Report, page 6 (For Report Disclaimer see page 1)

CDD COVER SHEET FOR LEL

H 1 II 1 1 1

10/ 18/ 2002 08: 38: 30 II III II II

II II II II 1 1 1 1 II II 1 H 1 II 1 II 1 II 1 1 11 FILE ID 1512130000300PL20021018083830 TAXMAP 1512130000300 SERIAL 129060 DIVISION PL SITUS 5701 W HWY 126 HOUSE# 5701 STREET HWY 126 CONTENT LOT LINE ADJ LTRS RECORD ID LL0220 LOCATED IN DATE FILE 1 1 II II II

PL 9 PAGES

CERTIFICATE OF NOTICE BY MAIL

FILE NUMBER: LL -02- 20

DOCUMENT MAILED: Decision Letter

I certify that on 4TH day of June, 2002, the attached decision letter, dated June 4, 2002, was mailed by first class mail, postage prepaid, to the person( s) and address( es) set forth on the attached list.

DATED this 4th day of June, 2002.

COMMUNITY DEVELOPMENT DEPARTMENT

Sherry Korcek

5701 W. Highway 126 Redmond, OR 97756

Povey & Associates Land Surveyors

P. O. Box 131 Redmond, OR 97756

Corey Wright

1835 S. Highway 97 Redmond, OR 97756

CC: County Assessor

DESCHUTES COUNTY PLANNING DIVISION 117 NW Lafayette Avenue, Bend, OR 97701 541) 388- 6575 FAX 385- 1764

2.002 MAILED DESCHUTES COUNTY

JUN

Quality Services Performed with Pride

June 4, 2002

Sherry Korcek

5701 W. Highway 126 Redmond, OR 97756

Corey Wright

1835 S. Highway 97 Redmond, OR 97756

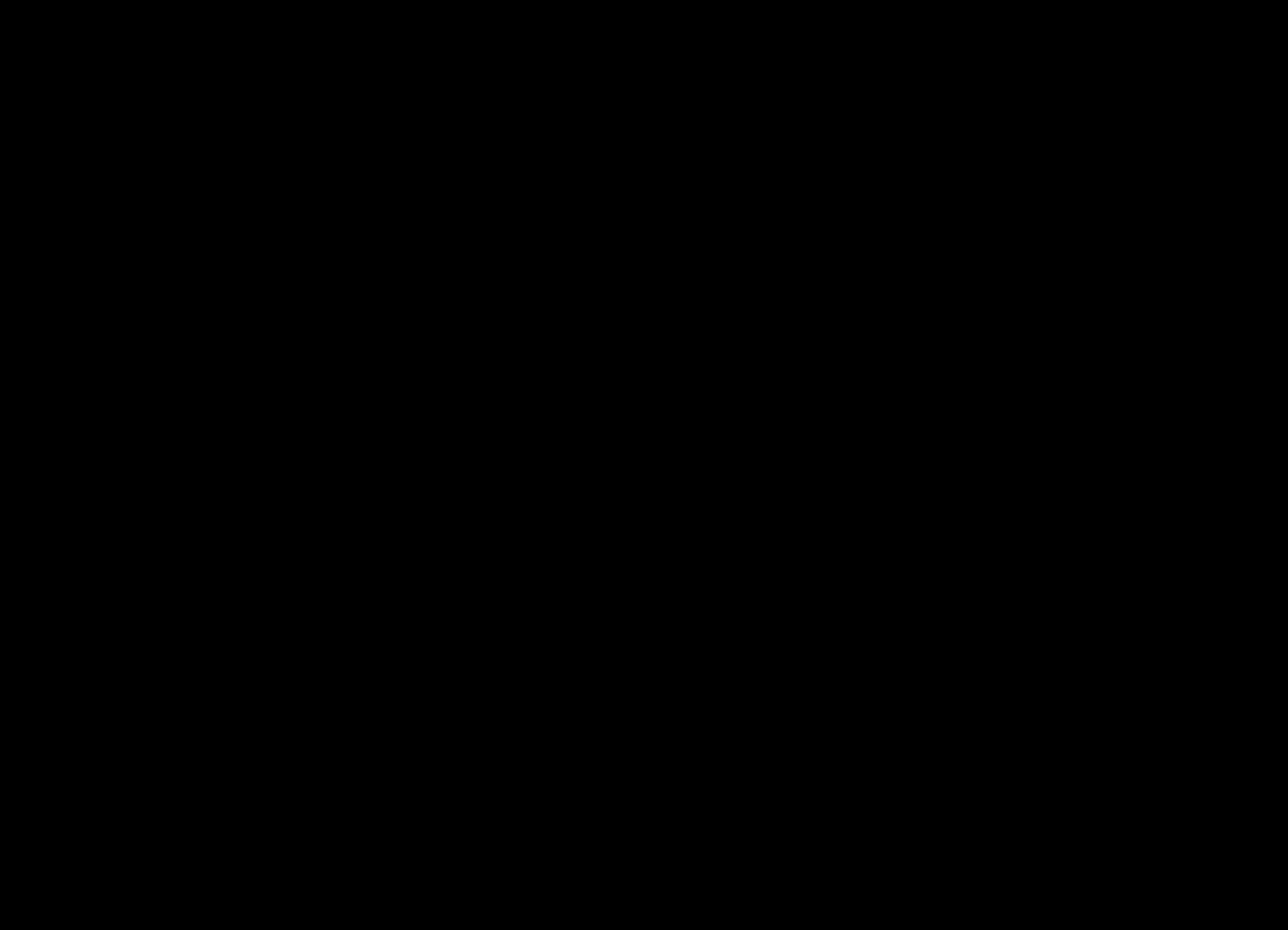

RE: Lot Line Adjustment, LL -02- 20; 15- 12- 13, tax lot 300 and 15- 12- 12D, tax lot 700

Dear Applicants:

The Deschutes County Planning Division has reviewed your application for a lot line adjustment.

A lot line adjustment as defined by Section 17. 08. 540 of Title 17 of the Deschutes County Code, Subdivision and Partition Ordinance is:

An adjustment of a property line by the relocation of a common boundary where an additional unit of land is not created and where the existing unit of land reduced in size by the adjustment complies with any applicable zoning ordinance."

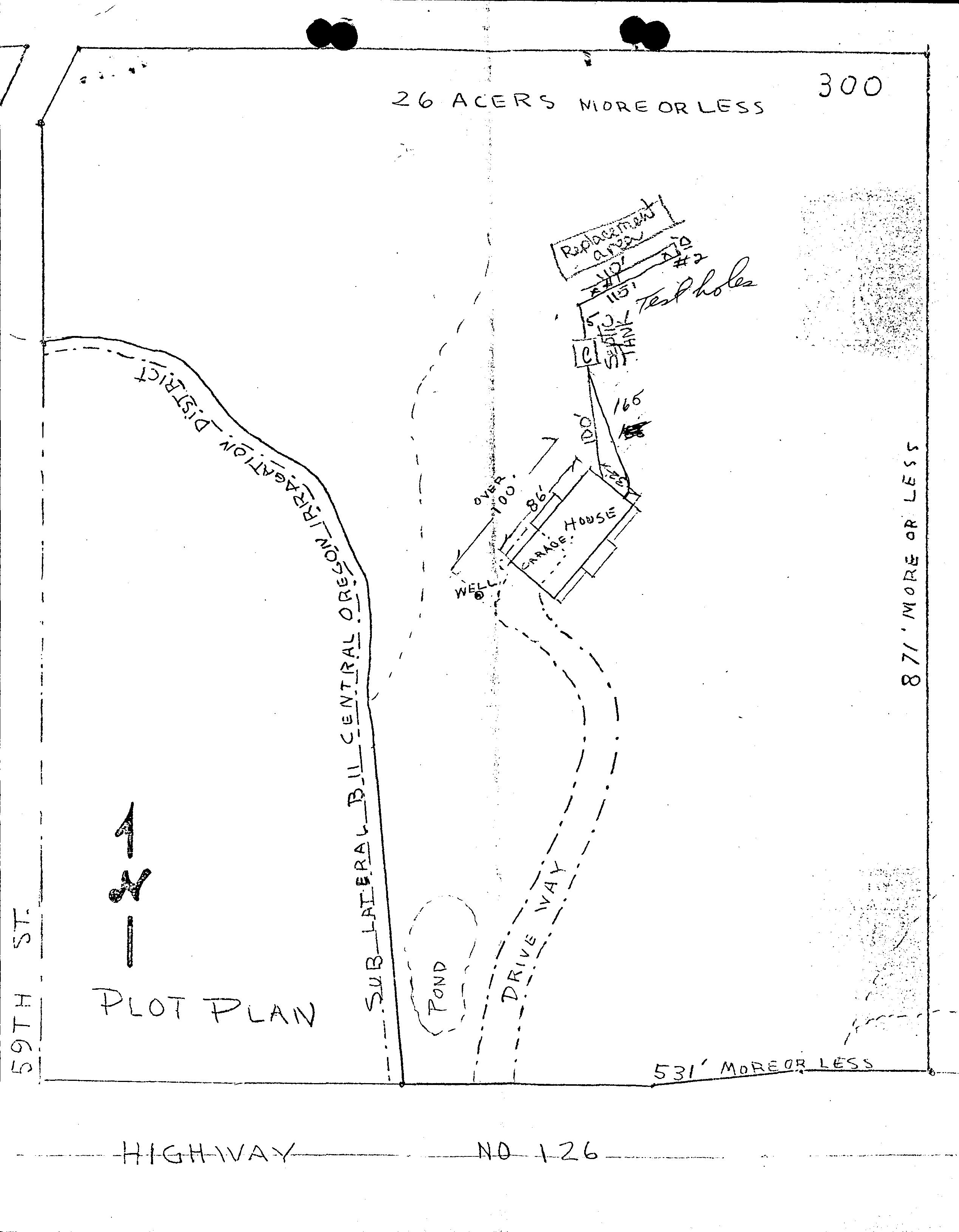

You have requested a lot line adjustment between the parcels identified on County Assessor' s maps 15- 12- 13, as tax lot 300 and 15- 12- 12D, tax lot 700. The subject tax lots are considered legal lots of record pursuant to existing county records. The zoning for these parcels is Exclusive Farm Use — Tumalo/ Redmond/ Bend ( EFU- TRB) subzone, and Multiple Use Agricultural ( MUA- 10), respectively, with a Landscape Management LM) combining zone for both. All standards contained in these zones apply to the subject properties.

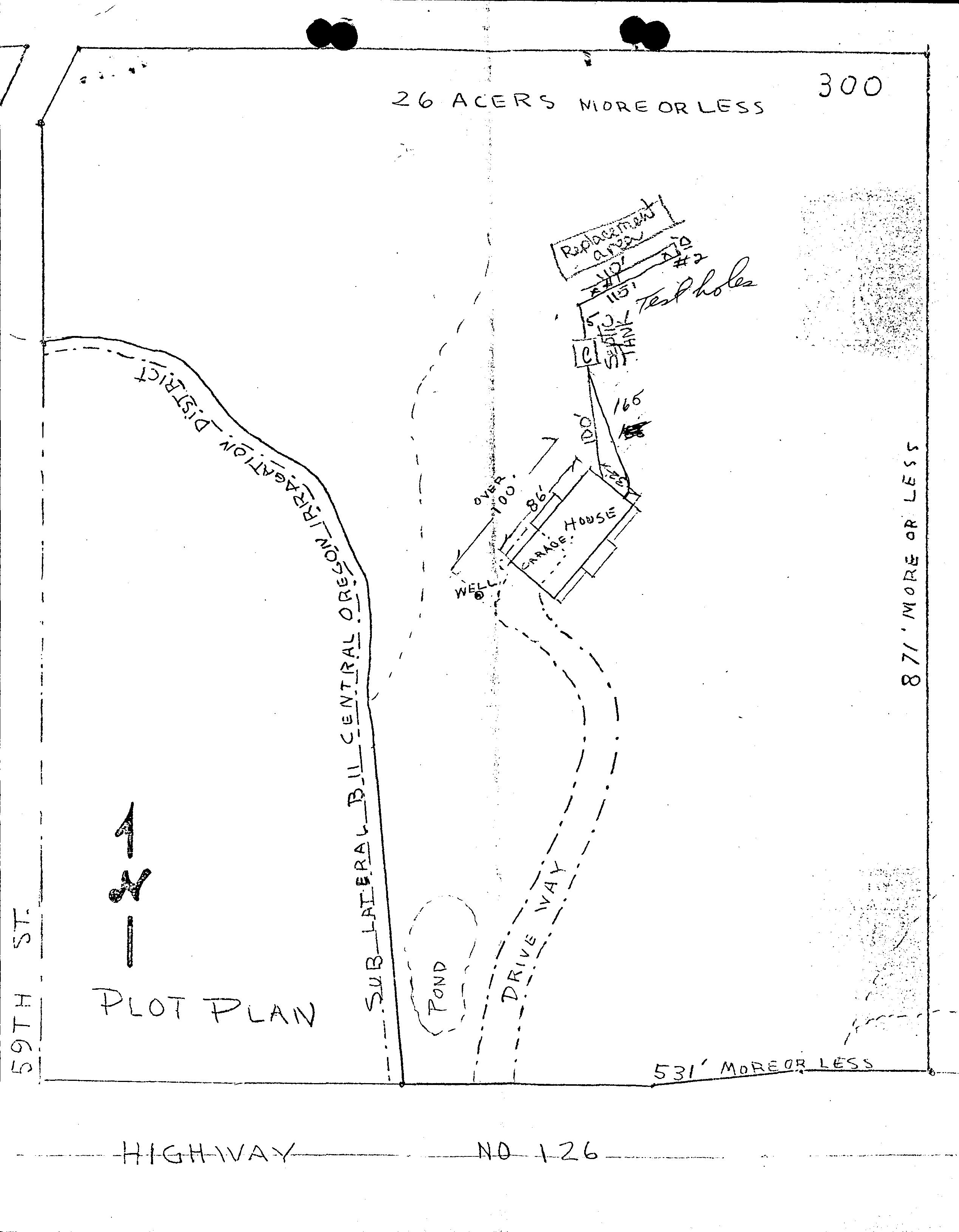

The original size of parcel 15- 12- 13- 300 is 26 acres ( 10. 5 acres irrigation water rights) and the original size of parcel 15- 12- 12D- 700 is 5. 3 acres. After the adjustment, the parcels will be 24. 8 acres ( 9. 5 acres irrigation water rights) and 6. 5 acres in size, respectively. The irrigated acres in this instance is only important with respect to the EFU- zoned parcel.

017 S

Planning Division Building Safety Division Environmental Health Division 117 NW Lafayette Avenue Bend Oregon 97701- 1925 541) 388- 6575 FAX ( 541) 385- 1764 http:// www. co. deschutes. or. us/ cdd/

Community Development Department

Quality Services Performed with Pride

The proposed parcel adjustments are within the allowed limits. This application meets the requirements as established and has been tentatively approved by the Deschutes County Planning Division. This tentative approval only confirms that the proposed adjustment meets the current zoning criteria necessary for lot line adjustments.

In order to obtain final approval:

1. The adjusted property lines shall be surveyed and monumented by a registered professional land surveyor and a survey complying with ORS 209. 250, shall be filed with the County Surveyor. A copy of the recorded survey shall be submitted to the Planning Division.

2. Written accurate legal descriptions of the adjusted parcels shall be submitted to the Planning Division.

3. New deeds, reflecting the parcels in their new configuration, shall be recorded with the Deschutes County Clerk, and a copy of the recorded deeds shall be submitted to the Planning Division.

4. All taxes on all parcels involved must be current prior to final approval.

5. All structures shall meet all required setbacks from the new lot lines.

A lot line adjustment may have an affect on any completed septic feasibilities for the parcels involved. You may wish to check with the Environmental Health Division regarding this matter. A lot line adjustment may also affect any water rights appurtenant to your property. If you have a water right, you should contact your irrigation district before the lot line adjustment is surveyed.

DURATION OF APPROVAL:

The applicant shall meet all conditions of this preliminary approval within two ( 2) years following the date this decision becomes final, or obtain an extension of time pursuant to Section 22. 36. 010 of the County Code, or this approval shall be void.

This decision becomes final twelve ( 12) days from the date of mailing of this letter, unless appealed. In order to appeal it is necessary to submit a Notice of Intent to Appeal, on a form provided by the County, a $ 250. 00 appeal fee and a statement describing the reason( s) for the appeal. If you have any questions, please feel free to call me at the Planning Division office.

Sincerely,

DESCHUTES

COUNTY PLAN ING DIVISION

Paul Blikstad, Associate Planner

PaJ

PEB LL -02- 20 Page 2

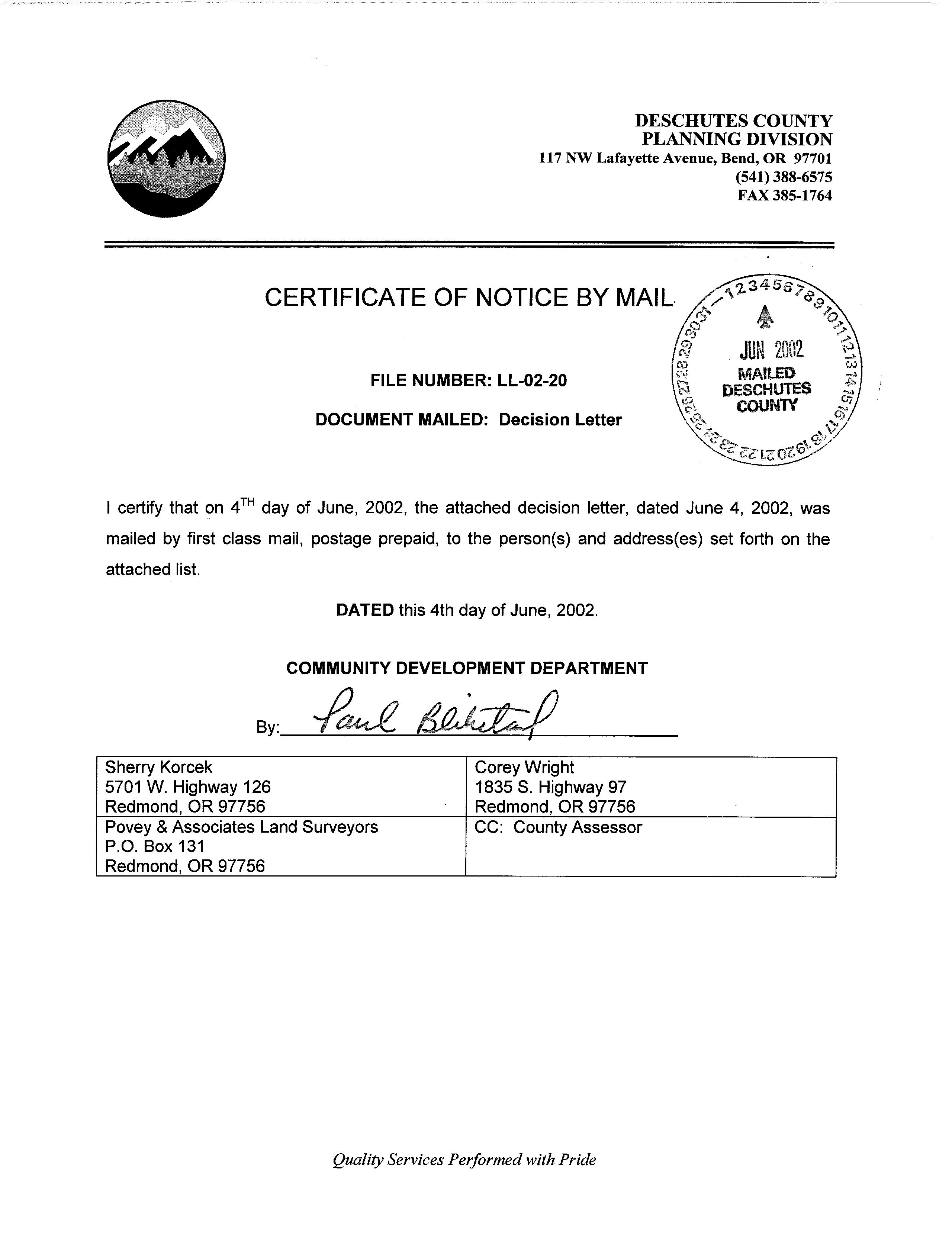

INFORMATION IS NOT WARRANTED OR GUARANTEED ACCURATE.

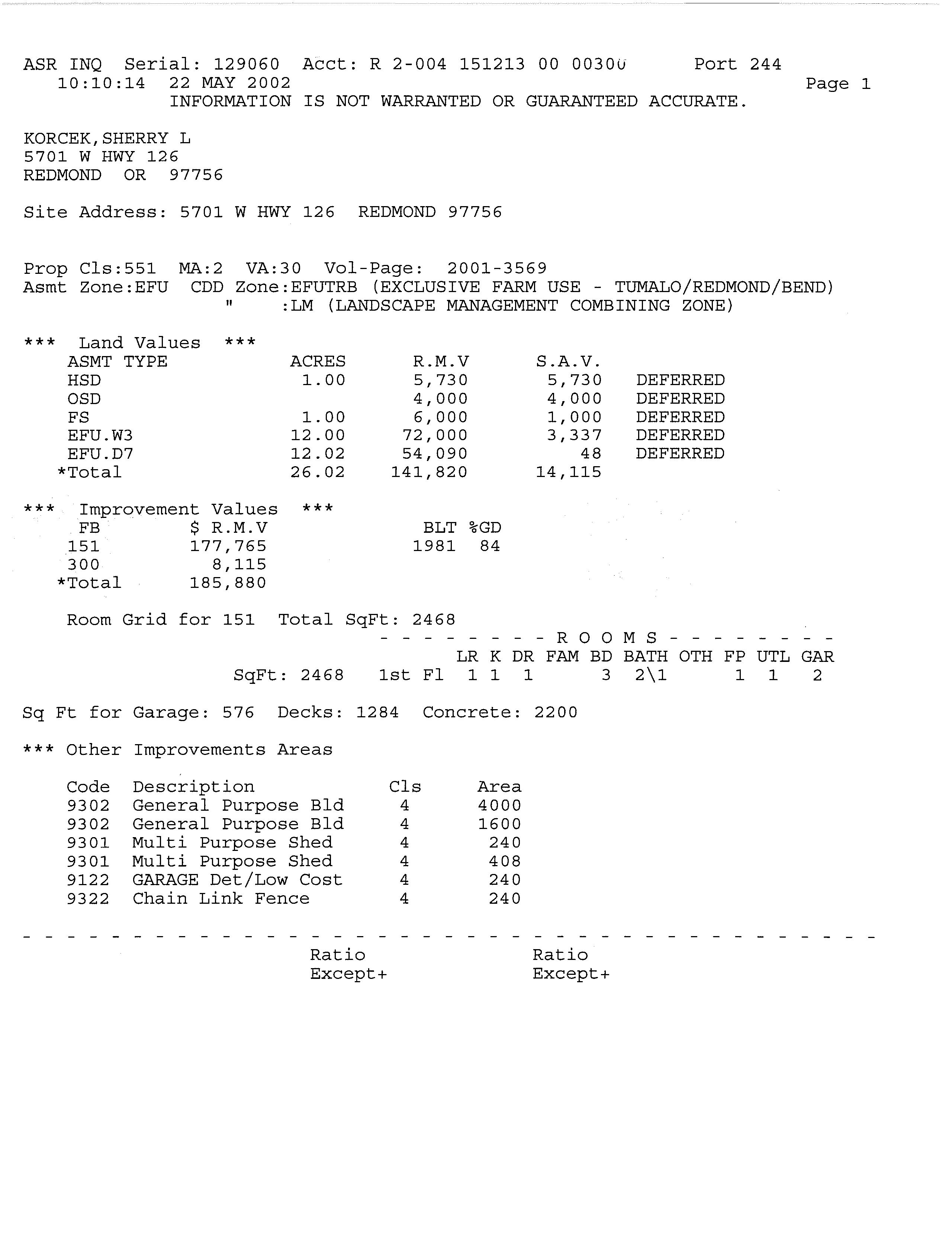

ASR INQ Serial: 129060 Acct: R 2- 004 151213 00 0030u 10: 10: 14 22 MAY 2002

Port 244 KORCEK, SHERRY L 5701 W HWY 126 REDMOND OR 97756 Site Address: 5701 W HWY 126 REDMOND 97756 Page 1 Prop Cls: 551 MA: 2 VA: 30 Vol - Page: 2001- 3569 Asmt Zone: EFU CDD Zone: EFUTRB ( EXCLUSIVE FARM USE - TUMALO/ REDMOND/ BEND) LM ( LANDSCAPE MANAGEMENT COMBINING ZONE) Land Values ASMT TYPE HSD OSD FS EFU. W3 EFU. D7 Total Improvement Values FB $ R. M. V 151 177, 765 300 8, 115 Total 185, 880 ACRES R. M. V 1. 00 5, 730 4, 000 1. 00 6, 000 12. 00 72, 000 12. 02 54, 090 26. 02 141, 820 BLT 95 - GD 1981 84 Room Grid for 151 Total SqFt: 2468 Sq Ft for Other Code 9302 9302 9301 9301 9122 9322 S. A. V. 5, 730 4, 000 1, 000 3, 337 48 14, 115 DEFERRED DEFERRED DEFERRED DEFERRED DEFERRED ROOMS LR K DR FAM BD BATH OTH FP UTL GAR SqFt: 2468 1st Fl 1 1 1 3 2\ 1 1 1 2 Garage: 576 Decks: 1284 Concrete: 2200 Improvements Areas Description General Purpose Bld General Purpose Bld Multi Purpose Shed Multi Purpose Shed GARAGE Det/ Low Cost Chain Link Fence Cls 4 4 4 4 4 4 Area 4000 1600 240 408 240 240 Ratio Except+ Ratio Except+

Community Development Department

May 22, 2002

Sherry Korcek 5701 W. Highway 126

Redmond, OR 97756

Corry Wright 1835 S. Highway 97

Redmond, OR 97756

Re: LL -02- 20, Lot line adjustment for two parcels

Dear Applicants:

You have submitted an application for a lot line adjustment in an EFU- TRB zone. The County Zoning Ordinance allows only a maximum 10 percent reduction in the size of a substandard parcel ( a parcel that does not meet minimum lot size requirements).

In this instance, tax lot 300 is being reduced in size, and according to the County Assessor' s records, has approximately 12 acres of water rights. We will need confirmation from the irrigation district of the exact amount of existing water rights on the property. If this 12 -acre figure is accurate, this means that tax lot 300 can only be reduced in size by 1. 2 irrigated acres, which appears to be what you are proposing. There is no information in the submitted application materials indicating where the water rights on this tax lot are located. Without this information, the lot line adjustment application cannot be processed or reviewed.

In addition to the above, the application form submitted is a copy and not an original. In order to complete the review process, the original application form must be submitted to this office.

The Planning Division has determined that your application is incomplete. As per section 22. 08. 030 of Title 22 of the Deschutes County Code, the County Procedures Ordinance, you have 30 days within which to submit the required information. If this information is not submitted within the 30 -day time period, your application will be reviewed as submitted.

If you should have any questions, feel free to contact me at this office.

Sincerely, DESCHUTES COUNTY PLANNING

DIVISION

Paul Blikstad, Associate Planner

fES

Planning Division • Building Safety Division • Environmental Health Division r -- nuttaral fr Rik WV 117 NW Lafayette Avenue • Bend, Oregon • 97701- 1925 541) 388- 6575 • FAX ( 541) 385- 1764 http:// www. co. deschutes. orus/ cdd/

PaUt

Quality Services Performed with Pride

DIVISION 117 NW Lafayette Avenue, Bend, OR 97701

Phone: ( 541) 388- 6575 Fax: ( 541) 385- 1764 http:// newberry. deschutes. org

LOT LINE ADJUSTMENT APPLICATION

1. Submit written, accurate, legal descriptions of the adjusted or consolidated parcels.

2. Submit map or drawing to scale showing lot line changes, all existing structures, and any on- site sewage disposal systems.

3. Submit filing fee.

4. All properties involved in a lot line adjustment or consolidation must be recognized by the County as legal lots of record. Also all property taxes must be paid up to date.

5. Lot consolidations require that the ownership ( fee title) of all affected properties be in exactly the same name.

INCOMPLETE APPLICATIONS WILL NOT BE ACCEPTED

LOT LINE ADJUSTMENT FEE: 7S LOT CONSOLIDATION FEE:

APPLICANT ( Name - print): 6W2-y- rA Vciv-UX SIGNATURE: C•

MAILING ADDRESS: SIC)/ ,) + Ito 1 LZ_62

CITY: 12--stiSL\AA. STATE: C> re ZIP: 7jS, PHoNE ( I() 5-43- Vs2.°

PROPERTY DESCRIPTION FOR PARCELS TO BE ADJUSTED OR CONSOLIDATED:

PARCEL 1: Township 1 S Range ( Section 1: 3 Tax Lot: aoc) Present Zone: ER- Te4

Lot of Record? ( State reason):

Current Size , g42, 07-- Size after adjustment , g

PROPERTY OWNER: r 4-vce.K.-SIGNATURE: 1" i2..NryL. Kbve- k

If different from applicant) I

MAILING ADDRESS: CITY: STATE: ZIP:

PARCEL 2: Township 15- Range 1Z- Section Tax Lot: 700 Present Zone: 4- 10

Lot of Record? ( State reason):

Current Size 5 .S0 Size after adjustment ( a ,\S 0

PROPERTY OWNER: - Pi IGNATUR

If different from applicant)

MAILING ADDRESS: I e'SC CITY: RcziLcokI

PARCEL 3: Township

Lot of Record? ( State reason):

tf( ( 4, 1 41' 1 STATE: OR -- ZIP: 111L Range Section Tax Lot: Present Zone:

Current Size Size after adjustment

PROPERTY OWNER: If different from applicant)

SIGNATURE: 4 2002

MAILING ADDRESS: CITY: STATE: ZIP:

REASON FOR THE ADJUSTMENT OR CONSOLIDATION: CeNZ-iL41 itiJi)-71/ 4) 1" S - ft) AD t.)

DESCHUTES COUNTY PLANNING

1

1/ 99

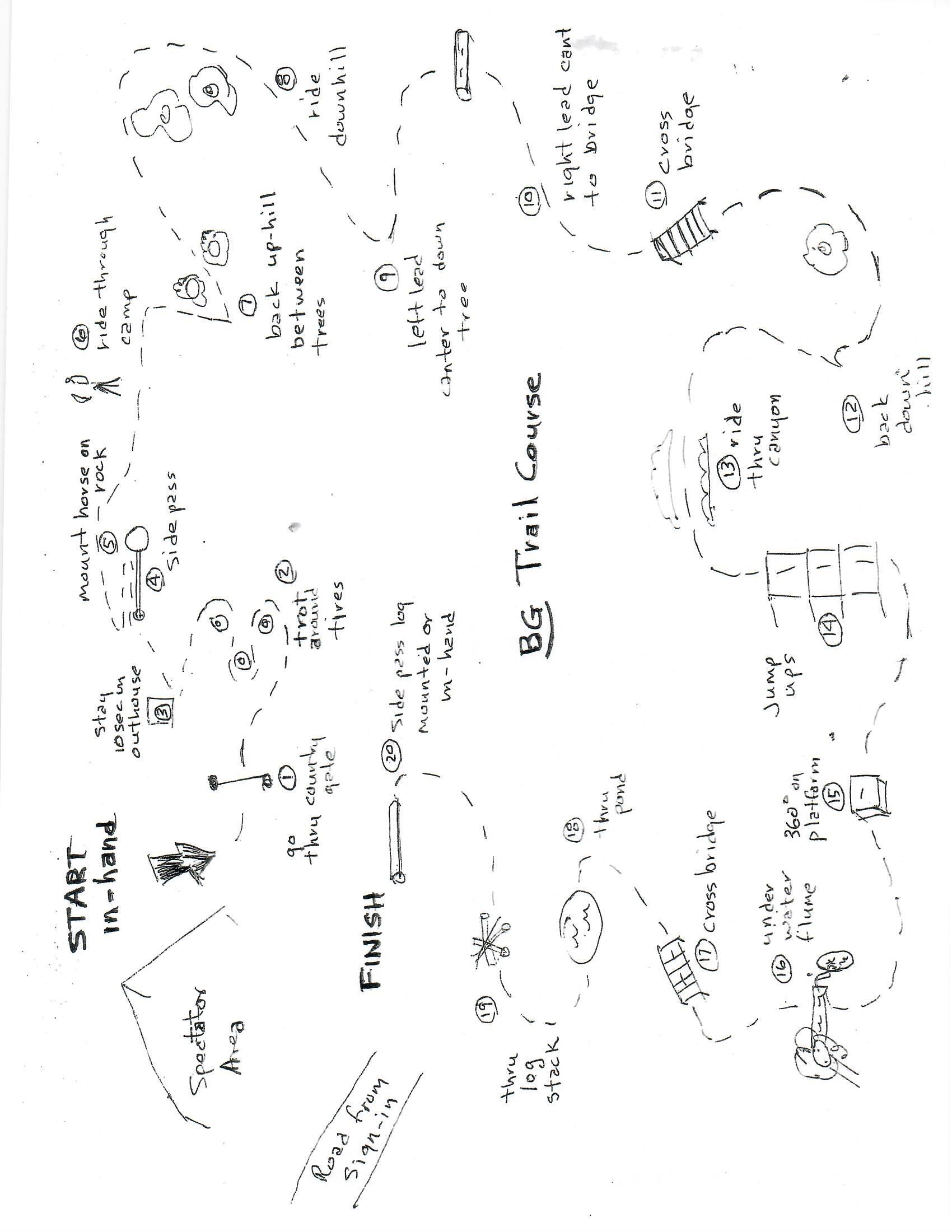

14- La- AC4e- t-4 . 4o4-1 ma - 110c4sc-- — ro fro vh-tis) pec f]A