LEN FRETWELL

Publisher / Managing Editor Digging & Drilling Australasia Magazine

LEN FRETWELL

Publisher / Managing Editor Digging & Drilling Australasia Magazine

LEN FRETWELL

Publisher / Managing Editor Digging & Drilling Australasia Magazine

LEN FRETWELL

Publisher / Managing Editor Digging & Drilling Australasia Magazine

On behalf of our team, I congratulate Woodside Energy Trading Singapore Pte Ltd (Woodside) for negotiating and entering into a long-term sale and purchase agreement with Uniper Global Commodities SE (Uniper) in Europe. Woodside will supply LNG from its global portfolio into Europe, including Germany, for a term up to 2039, commencing in January 2023. This agreement is for the supply of more than 0.8 million tonnes per annum or one billion cubic meters of natural gas to Europe to help cut the continent’s reliance on Russian supplies.

Forecasts predict a looming copper supply shortfall which will present opportunities for expanding and growing copper production and providing an economic boost with investment, creating jobs for mining companies and the mining equipment, technology and services (METs) sector. The current approach to copper production is energy and water intensive, increasing as grades decline and producing ever more emissions and waste products. It won’t be possible to meet future demands for copper merely through recycling. Exploring for new deposits is challenging and takes a long time. It’s a sustainable copper paradox: how do we increase the production of copper needed for a green energy society? To solve this urgent challenge, the proposed Copper For Tomorrow CRC will bring together industry and researchers, to enable the copper industry to hit ESG goals and remain profitable.

Australian oil and gas company Beach Energy has announced a new major development with its first offshore drilling campaign, which has enabled the company to boost its production figures by achieving the first gas from two wells in the Otway Basin offshore Australia. Beach Energy’s environment plan for development drilling and well abandonment in the Otway Basin offshore Australia has been accepted by Australian authorities in 2021. Beach is using the Diamond-owned Ocean Onyx rig for the campaign and the agreement provides for the drilling of up to nine wells (six firm and three options). The development well closest to shore is approximately 54 km from Port Campbell off Victoria’s south-west coast. The proposed development wells and existing subsea wells for abandonment are in water depths ranging from approximately 84 m to 105 m.

Caterpillar Inc. (NYSE: CAT) has announced the successful demonstration of its first battery electric 793 large mining truck and a significant investment to transform its Arizona-based proving ground into a sustainable testing and validation hub of the future. Caterpillar completed development of its first battery electric 793 prototype with support from key mining customers participating in Caterpillar’s Early Learner program. Participants of the program with definitive electrification agreements include BHP, Freeport-McMoRan, Newmont Corporation, Rio Tinto and Teck Resources Limited.

Fully loaded to its rated capacity, the truck achieved a top speed of 60 km/h (37.3 mph). The loaded truck traveled one kilometre (0.62 mile) up a 10% grade at 12 km/h (7.5 mph). The truck also performed a one kilometre (0.62 mile) run on a 10% downhill grade, capturing the energy that would normally be lost to heat and regenerating that energy to the battery. Upon completing the entire run, the truck maintained enough battery energy to perform additional complete cycles.

Andrew and Nicola Forrest commit US$500m to launch US$25bn Ukraine Green Growth Initiative supported by President Zelenskyy. Ukraine President Volodymyr Zelenskyy has welcomed one of Australia’s largest private investment groups, Tattarang, committing US$500 million to seed a minimum US$25 billion Ukraine Green Growth Initiative. The fund is expected to grow to at least US$100 billion. This investment fund will focus on primary infrastructure such as energy and communications to build a digital green grid, so Ukraine can become a model for the world as a leading digital green economy. Dr Andrew Forrest and President Zelenskyy announced the investment by the Tattarang Group at the New Economy Forum in Singapore in November 2022. What a great initiative.

Best regards

Len Fretwell

Len Fretwell Publisher/Managing Editor

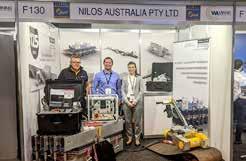

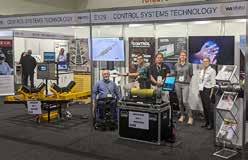

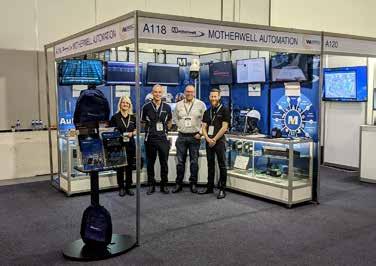

WA Mining 2022’s highly targeted conference uncovered best practices, technologies and strategies advancing mining in WA. The extensive range of conference topics covered cyber security, reducing the environmental footprint, autonomous systems and much more. Leading tech and digital companies also presented at the free-to-attend seminar series.

The 2022 WA Mining Conference and Exhibition connected industry while driving discussion on the big topics that impact the sector’s future. Held at the Perth Convention and Exhibition Centre on 12-13 October 2022, WA Mining’s sold-out exhibition featured over 120 suppliers and 40 conference speakers, with thousands of attendees through the door over the event’s 2 days.

Hon Bill Johnston MLA, WA Minister, Mines and Petroleum, Energy, Corrective Services and Industrial Relations made the opening ministerial address and there were many high profile industry leaders presentations during the conference.

Topics at the conference covered the spectrum from technology thought leadership to practical case studies, with conference chair Ric Gros saying that the conference captured the industry’s current direction and strong future. “The rate of innovation continues to accelerate, across decarbonisation, automation and data science. We’re currently looking at the greatest transformation the mining sector will ever see, and it’s important that we lead and promote conversations on the transition to take the sector on the journey,” said Mr Gros.

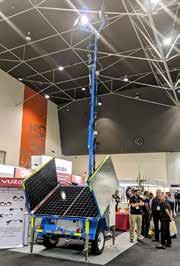

This innovation was particularly evident in presentations like the one from Gold Road Resources and Ultimate Energy Australia, telling the story of how cooperation towards net zero and decarbonisation targets resulted in a 93% reduction in fuel costs at Gold Road Resources’ Yamarna site. With zero maintenance

in 2 years and no permanent footprint, an innovative solar and battery energy hub has

reduced site reliance on diesel generators.

Conference speaker Geoffrey Batt from the Minerals Research Institute of WA said it well: “The future of WA’s mining industry does not look like its past.”

The conference covered more than just decarbonisation, as speakers looked to knowledge-sharing in data-science based maintenance, critical minerals, unlocking autonomy and muchneeded skilled workers. Cooperation and collaboration across the industry were firmly on the agenda.

incredibly

incredibly

Two features of the WA Mining exhibition were a seminar series sponsored by IBM and aimed at upskilling attendees in areas like technology, smart mining and safety, plus the alwayspopular Mining House pavilion, featuring Roy Hill, Northern Star and Rio Tinto.

New exhibitors included SmartTech Australia, Acubis Technologies, Austdac, Accumax Global, Damstra Technology, Hedweld Engineering, IBM, and Field Mining Services Group.

“We had a complete robotic display at our stand which attracted plenty of interest, and the quality of people we talked to has been outstanding,” said Mr Rhind.

Andrew Neaves of standards stalwart SAI Global agreed, saying the atmosphere was ripe for conversation.

Mr Neaves said, “The people we interacted with at WA Mining were decision-makers at the right level – and people were more than happy to engage and have a conversation.”

But it wasn’t all business-to-business – the Mining Pavilion allowed an opportunity for job seekers to connect with recruitment teams from companies including Rio Tinto, Roy Hill and Northern Star.

Prue Orford, Recruitment Coordinator for Northern Star said, “WA Mining exceeded our expectations, and we were impressed by the number and quality of the attendees. We look forward to being back in 2023.”

Perth startup Apex Engineering Technology Group was a first-time exhibitor, showcasing their innovative approach to refurbishing and recoating GET and wear parts using laser technology for increased resilience. Managing Director Daniel Rhind says as a promotional approach for the company, WA Mining provided incredible exposure.

Exhibition

noted that the launch of the show, held for the first time in its expanded format, showed a strong representation for WA’s leading resources technology sector. “The focus of WA Mining is really on technology, and we’ve been privileged to host some excellent conversations about how that technology can help the sector contribute to a more sustainable future.”

Outside the conference, the technology-focused supplier exhibition had a strong buzz across the event’s two days. Innovative exhibits featured virtual reality pods used in training and onboarding, 3D printed parts used to model and demonstrate repairs, and robotic and drone technology on display.

The WA Mining Conference and Exhibition will be back in 2023, on October 11-12 at the Perth Convention and Exhibition Centre.

By any measure, demand is expected to far outstrip supply. Mining companies attempting to find, define and mine copper with enough speed and precision to meet at least some of the demand required for decarbonisation targets, the EV market, power transmission networks and other industrial uses are facing environmental, geological, and government headwinds.

Failure to meet demand could easily cruel economic growth; there is no doubt that we are facing a copper supply crisis, it’s only the size of the crisis that varies. And don’t be lulled into complacency by the likely short-term increase in copper production as some new mines begin production during 2022 and into 2023. A recent S&P Platts report said that if copper shortfalls follow projected trends, climate goals would be “short-circuited and remain out of reach”. BloombergNEF says copper demand is expected to increase 53% by 2040, against an increase in supply of just 16%. This alarming outlook is why IMDEX is supporting Copper for Tomorrow, a dedicated cooperative research centre established to focus on research and development priorities to solve challenges across the copper value chain.

Mining companies able to access reliable data as early as possible at each step of the mining value chain from exploration and drilling, to planning and production, will be in the best position to meet the challenges. It won’t solve the supply deficit, but it may help to ease it and may unlock some of the world’s stranded copper assets.

Author: Dr Dave Lawie -IMDEX Chief Geoscientist. Chief Technologist - MiningAustralia’s alumina refining industry has a credible pathway to achieving net zero emissions by 2050, recently outlined in an industry roadmap report published by the Australian Renewable Energy Agency (ARENA).

The report titled ‘A Roadmap for Decarbonising Australian Alumina Refining’ (Roadmap) was commissioned by ARENA and prepared by Deloitte in consultation with Australia’s three major alumina producers: Alcoa, Rio Tinto and South32. The Roadmap provides a framework for future policy and investment decisions and serves as a call to action for public and private sectors to collaboratively transition this ‘hard-toabate’ sector into an industry at the forefront of the transition to net zero. Australia is the largest exporter of alumina globally, which is expected to contribute $7.5 billion of exports to the Australian economy in 2022.

Alumina is the precursor to aluminium and alumina refining is an energy and emissions intensive step in the aluminium value chain. The industry contributes 3% of Australia’s total emissions and consumes more than 221 petajoules of energy each year. Approximately 95% of emissions are from the onsite consumption of fossil fuels for process heating. The Roadmap identifies four key decarbonisation technologies that could transform the way refineries consume and use energy by uptaking renewable energy and removing the use of fossil fuels.

The technologies are mechanical vapour recompression (MVR), electric boilers, electric calcination, and hydrogen calcination. In combination, these four technologies have the potential to reduce emissions from Australia’s six alumina refineries by up to 98%.

A team of experts from ABB and Perenti will establish recommendations and strategies for net zero emissions mining. Focus areas include electrification of mining operations, power distribution and power management.

The agreement between ABB and mining services group Perenti is to collaborate and explore approaches to support net zero emissions targets for underground and open-pit mines. Experts from the two companies will work together to address electrification in mine hauling operations, power distribution, energy efficiency and power management. Together, the teams plan to explore business models and solutions to

provide wider services for pilot, brownfield and greenfield mining customer projects to support the electrification of operations.

“ABB and Perenti share a vision to develop energy efficient solutions for the mining industry,” said MarkNorwell, Managing Director and CEO, Perenti.

“Mining customers are committed to facing environmental, societal and economic challenges head on as theyaim to decarbonize mining operations,” said Joachim Braun, Division President, Process Industries, ABB.

ABB and Perenti agree to jointly explore solutions to help mining customers decarbonize operations

Woodside Energy Trading Singapore Pte Ltd (Woodside) has entered into a flexible long-term sale and purchase agreement (SPA) with Uniper Global Commodities SE (Uniper) for Woodside to supply LNG from its global portfolio into Europe, including Germany, for a term up to 2039, commencing in January 2023.

The quantity of LNG to be supplied under the new SPA is up to twelve cargoes per year (equivalent to more than 0.8 million tonnes per annum or one billion cubic meters of natural gas) to Europe to help cut the continent’s reliance on Russian supplies. Supply from September 2031 is conditional upon Uniper finalising its long-term strategic capacity bookings in Northwest Europe, expected by March 2023. The LNG deliveries could run until 2039.

Woodside Energy Group CEO Meg O’Neill said about the new agreement built on the company’s existing relationship with Uniper: “Woodside is pleased that this latest agreement with Uniper will provide a new source of LNG for consumers in Europe who are seeking alternatives to Russian gas. It also reflects the increasingly interconnected nature of LNG trade in the Atlantic and Pacific basins as global markets respond to energy security challenges.”

Uniper Group CEO Klaus-Dieter Maubach said “This agreement secures additional LNG supplies for our customers in Europe, which has become ever more important due to recent developments. It will support our security of supply strategy together with the development of our LNG terminal in Wilhelmshaven. “Woodside is one of our biggest LNG suppliers in Asia and we are pleased to extend the cooperation with Woodside to Europe with this deal.”

Reduced Russian gas deliveries have a significant adverse impact on Uniper’s results in the first nine months of 2022. Adjusted EBIT of -€4,755 million and adjusted net income of -€3,220 million significantly under respective prior-year figures. IFRS net loss also adversely affected by the recognition of anticipated likely losses resulting from future gas replacement procurement. Economic net debt is significantly higher, in particular because of negative operating cash flow and details of the stabilization package for Uniper being finalized. Uniper recorded adjusted EBIT of -€4,755 million in the first nine months of the 2022 financial year (9M 2021: €614 million).

Russia recently declared the indefinite suspension of natural gas flows through the Nord Stream 1 pipeline, further squeezing energy prices and recession risks for the Eurozone. European natural gas prices briefly jumped more than 20% to 264 euros after Nord Stream flows were halted. Prices have since pulled back to 222 euros but still up more than 600% in the last 12 months.

“We are expecting record gas prices across UK/Europe next week as the impact of long-term restrictions of Russia gas supply is absorbed by the market following the indefinite shutdown of the Nord Stream 1 pipeline,” said Nathan Piper, an oil and gas analyst at Investec. ‘However, the key and worrying point is that this is in the middle of summer - prices could move higher as demand increases for heating into winter,” he warned.

Uniper CFO Tiina Tuomela said: To ensure customers’ supply security, Uniper has for some time been procuring gas at significantly higher prices and, as is well known, has thus recorded considerable losses because the replacement costs of procuring new gas aren’t being passed through to consumers. Our half-year numbers already indicated that this has left massive scars in our financial results. Implementing the stabilization package therefore has the highest priority. We and the Federal Government are currently finalizing the details of the support measures relating to the suspension of the gas surcharge.

We are also working intensively to restructure our gas portfolio to minimize risks and to end by 2024 the losses resulting from suspended Russian gas deliveries. Uniper will play a key role in ensuring Germany’s supply of power and gas for winter 2022/2023 and subsequent years. Our focus is therefore on making additional amounts of gas and LNG available to Germany and doing everything we can to move forward with the necessary infrastructure, such as the construction of the country’s first LNG import terminal.”

Europe is aggressively filling up its gas storage as it braces for a supply tight winter. “Current storage levels have risen to 144bcm or nearly 80% of capacity, which is within the five-year range. Some countries have managed to boost inventories higher. Storage facilities in Poland and the UK are nearly full, and France’s are over 90%,” ANZ Research recently stated.

“Nevertheless, the situation in Germany is perilous. It’s gas inventories can cover two months of peak demand. As temperatures fall through Autumn, demand for heating fuels will rise significantly above current supply,” the note warned.

“As it stands, the country could run out of gas in early 2023.”

Germany’s Uniper is prepared to swap liquefied natural gas it gets from Australia’s Woodside for US gas, so it can boost supplies in Europe more quickly during the coming winter, it stated.

The strategy reflects efforts by companies and governments across Europe to seek alternative lines of supply and draw up contingency plans for the upcoming winter gas season, fearing Moscow could fully stop supplies of natural gas. In case of supply shortages, Uniper could make available to customers in Europe, US LNG that was earmarked for Asian customers and could be sitting in the Atlantic, speeding up potential supply.

Woodside is a global energy company, proudly Australian with a spirit of innovation and determination. Woodside provides energy that the world needs to heat homes, keep lights on and support industry. The company aims to thrive through the global energy transition with a low-cost, lower-carbon, profitable, resilient and diversified portfolio.

Uniper is a leading international energy company, has around 11,500 employees, and operates in more than 40 countries. The company plans for its power generation business in Europe to be carbon-neutral by 2035. Uniper’s roughly 33 GW of installed generation capacity make it one of the worlds largest electricity producers.

The company’s core activities include power generation in Europe and Russia as well as global energy trading and a broad gas portfolio, which makes Uniper one of Europe’s leading gas companies. In addition, Uniper is a reliable partner for communities, municipal utilities, and industrial enterprises for planning and implementing innovative, lower-carbon solutions on their decarbonization journey. Uniper is a hydrogen pioneer, is active worldwide along the entire hydrogen value chain, and is conducting projects to make hydrogen a mainstay of the energy supply.

The company is based in Düsseldorf and is one of Germany’s largest publicly listed energy supply companies. Together with its main shareholder Fortum, Uniper is also Europe’s thirdlargest producer of zero-carbon energy.

Material Source: Woodside, Uniper Group and ANZ Research

Unlike other systems, Puradigm’s “active” technology means pathogens are not required to pass through its system to actively and safely purify both air and surfaces in any room. Instead, Puradigm replicates nature’s natural process indoors by creating charged particles that seek out and attack pathogens in the air and on exposed surfaces.

Work thousands of times faster than an average filtering device

Gets to the source of contamination

Treats the air in between people, rapidly purifying each and every breath at its source

Proven to reduce the risk of COVID-19 transmissions

Cleans surfaces Effective in the reduction of mould and other pathogens

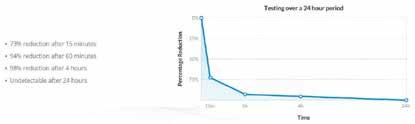

Puradigm has been proven to inactivate a staggering 99% of surface infectious COVID-19 particles in just 4 hours. After 24 hours of operation, it has also been found to eliminate the virus by 100%.

Successfully tested 3 times against the actual SARS-CoV-2 virus (including the original, Beta and Delta variants), Puradigm is the most validated purifier on the market.

Works within seconds - 2400 times faster on airborne pathogens than standard HEPA filters. This allows Puradigm to provide a superior level of air and surface purification to any indoor space.

Puradigm’s air and surface purification systems are considered to be the most technologically advanced on the market.

Partnering with Puradigm, Ai Group are leaders in Artificial Intelligence technology. We are specialists in developing and designing green tech solutions for industries that value the importance of their environment. Bringing Puradigm to Australia helps to address the challenges that industries face because of COVID-19, and indoor air quality in general.

Scientists in Melbourne have used supercomputers to speed up the search for a key ingredient in the next generation of lithium-metal batteries, which could potentially increase storage capacity by 10-fold compared with today’s technology.

The team led by RMIT University, in collaboration with CSIRO, say the work could benefit the development of batteries that allow electric vehicles to drive further and phones to last longer with a single charge.

Senior lead researcher Professor Michelle Spencer from RMIT said the team used supercomputers to develop an ultra-fast way to screen hundreds of potential molecules that could make suitable electrolytes for lithium-metal batteries.

“This work could benefit anyone wanting to use electronic devices, such as mobile phones and laptops, or electrified transportation like electric cars and future electric planes for commercial air travel,” said Spencer, a Professor of Chemistry and the Deputy Director of the STEM Centre for Digital Innovation.

“Our work is only a small component of the large body of work being done in the rechargeable battery space, and electric flight for large-scale domestic and international travel is still a long way off.”

Despite rapid advancements this type of battery still faces several challenges related to the stability of the electrolyte, Spencer said. “The formulation of electrolytes and the nature of their individual components are critical to the ultimate success of this exciting battery technology,” she said.

“Organic-based electrolytes used in lithium-ion batteries are not compatible with batteries using lithium-metal as the anode, as they tend to decompose when exposed to the metal.”

The research, which also involved RMIT PhD scholar Dale Osborne and CSIRO scientists Dr Michael Breedon and Dr Thomas Rüther, is published in the Journal of Materials Chemistry.

“The team can identify specific features or molecules that might perform better and recommend them to experimental groups to test in the lab,” Osborne said.

“We are able to calculate how modifying the chemical structure of the electrolyte molecules in a battery can ultimately increase the effective capacity of lithium-based batteries.”

Osborne said the team can provide key information for reducing research time and costs, beneficial for progressing battery technologies in shorter timeframes. “The computational approach we’ve developed dramatically speeds up the screening process, which would traditionally be prohibitively expensive and time consuming if each candidate molecule were to be experimentally synthesised and tested in the lab,” he said.

The team is investigating further modifications of the electrolyte molecules that might widen their electrochemical stability, pushing the boundaries of battery storage capacity. “We are also investigating modifications to lithium-air battery chemistry, which are still in the developmental phase, but could be even lighter and suitable for cutting-edge applications such as electric flight,” Spencer said.

The researchers use supercomputing facilities at the National Computational Infrastructure (NCI) Facility in Canberra and the Pawsey Supercomputing Centre in Western Australia. “We are also using RMIT’s RACE Hub to analyse our data and produce high-resolution animations that help us to interpret our data and communicate our research findings,” Spencer added.

RMIT is collaborating with Amazon Web Services (AWS) and AARNet to be the first Australian university to implement a dedicated commercial cloud supercomputing facility. Known as RACE Hub, it is enabling true scalable and elastic highpowered computing to support digital innovation.

Author: Will Wright - RMIT University

A team of researchers has discovered a new mechanism to stabilize the lithium metal electrode and electrolyte in lithium metal batteries. This new mechanism, which does not depend on the traditional kinetic approach, has potential to greatly enhance the energy density and the amount of energy stored relative to the weight or volume of batteries. The team published their findings in the journal Nature Energy.

To overcome this problem, scientists have developed functional electrolytes and electrolyte additives that form a surface protective film. This solid electrolyte interphase has an impact on the safety and efficiency of lithium batteries.

The surface protective film prevents direct contact between the electrolyte and lithium metal electrode, thereby kinetically slowing the electrolyte reduction. Yet, until now, scientists had not fully understood the correlation between the solid electrolyte interphase and the Coulombic efficiency.

Lithium metal batteries are a promising technology with potential to meet the demands for high-energy-density storage systems. However, because of the unceasing electrolyte decomposition in these batteries, their Coulombic efficiency is low. The Coulombic efficiency, also called the current efficiency, describes the efficiency by which electrons are transferred in the battery. A battery with a high Coulombic efficiency has a longer battery cycle life.

“This is the first paper to propose electrode potential and related structural features as metrics for designing lithium-metal battery electrolytes, which are extracted by introducing data science combined with computational calculations. Based on our findings, several electrolytes, which enable high Coulombic efficiency, have been easily developed,” said Atsuo Yamada, a professor in the Department of Chemical System Engineering at the University of Tokyo. The team’s work has the potential to provide new opportunities in the design of next-generation electrolytes for lithium metal batteries.

In lithium-ion batteries, the lithium ion moves from the positive electrode to the negative electrode through the electrolyte during charge and back when discharging. By introducing high-energydensity electrodes, the battery’s energy density can be improved. In this context, many studies have been conducted over the past decades to change the graphite negative electrode to lithium metal. However, the lithium metal has a high reactivity, which reduces the electrolyte at its surface. Because of this, the lithium metal electrode shows a poor Coulombic efficiency.

The research team determined that if they could upshift the oxidation-reduction potential of the lithium metal in a specific electrolyte system, they could decrease the thermodynamic driving force to reduce the electrolyte, and thus achieve a higher Coulombic efficiency. This strategy had rarely been applied in developing batteries with lithium metal. “The thermodynamic oxidation-reduction potential of lithium metal, which varies significantly depending on the electrolytes, is a simple yet overlooked factor that influences the lithium metal battery performance,” said Atsuo Yamada.

The team studied the oxidation-reduction potential of lithium metal in 74 types of electrolytes. The researchers introduced a compound called ferrocene into all the electrolytes as an IUPAC (International Union of Pure and Applied Chemistry)recommended internal standard for electrode potentials. The team proved that there is a correlation between the oxidationreduction potential of lithium metal and the Coulombic efficiency. They obtained the high Coulombic efficiency with the upshifted oxidation-reduction potential of lithium metal.

Looking ahead to future work, the research team’s goal is to unveil the rational mechanism behind the oxidation-reduction potential shift in more detail. “We will design the electrolyte guaranteeing a Coulombic efficiency of greater than 99.95%. The Coulombic efficiency of lithium metal is less than 99%, even with advanced electrolytes.

This study was carried out in collaboration with the Nagoya Institute of Technology. Material Source: Yamada & Kitada Lab., Dept. of Chemical System Engineering, The University of Tokyo.

In the wake of significant bilateral trade volatility between Russia and nearly all markets due to the war in Ukraine, India has emerged as a strong trade partner of Russia and is expected to remain so in 2023, according to a new S&P Global Market Intelligence report released today. The newly published 2023 Global Trade Outlook is part of S&P Global Market Intelligence’s Big Picture 2023 Outlook Report Series.

The new report highlights the anticipated shifts in trade due to the Russia–Ukraine conflict as well as positive outlook for containerized trade in 2023 despite a mere 0.7% year-on-year (y/y) growth in 2022 led by the estimated slowdown in the second half.

It also highlights the impact of the new International Maritime Organization (IMO) greenhouse gas reduction measures that will be introduced in 2023.

“The trade value of total imports from Russia has increased in recent months, primarily due to rising oil, gas and coal prices, as well as spikes in Russian imports by several countries.

This group is led by India, which noted a greater than 100% y/y increase in Russian import trade values each month after the Russia-Ukraine conflict started in February 2022,” said Agnieszka Maciejewska, Economics Manager at S&P Global Market Intelligence.

Global shifts in trade: India is forecast to see an acceleration in trade in 2023, thanks to its significant increase in imports from Russia. Its trade value is projected to increase by 3.5% y/y in exports and by 1.3% y/y in imports, while its trade volume is projected to grow 3.8% y/y and 7.3% y/y, respectively.

Mainland China is expected to be the biggest importer from Russia in 2023, followed by Turkey, Belarus and Kazakhstan. However, China’s current economic slowdown adds considerable uncertainty to the outlook.

Western trading partners will lose their significance in Russia’s trade turnover. This trend will become even more visible if Russia cuts gas supplies to Europe in the winter of 2022–23.

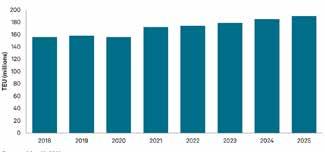

Containerized trade outlook: S&P Global Market Intelligence’s Global Trade Analytics Suite (GTAS) forecasting projects containerized trade to increase by 3.2% y/y in 2023, following a 0.7% y/y growth in 2022.

U.S. container imports is forecast to grow 5.9% y/y in 2022 and 4.2% y/y in 2023.

With U.S. warehouses being full, major carriers started removing capacity on the Asia-US trade lane, although not yet on a massive scale.

With no peak season this year, carriers will take out a significant amount of capacity to protect and boost their rates.

With mainland China’s containerized exports accounting for more than 50% of its total exports, this type of cargo should face significant long-term impacts from the country’s economic challenges, a situation not expected to change anytime soon.

IMO decarbonization goals: Beginning January 1, 2023, the maritime industry, which is highly dependent on fossil fuels, will have to comply with the new short-term greenhouse gas reduction measures implemented by the IMO.

This will likely result in higher average increase in maritime logistics costs and a slowdown, albeit marginally, in global trade and economic growth.

Total container trade

Author: SungHa Park

Total container trade

Author: SungHa Park

Commodities prices for key metals will be battered by the storms buffeting the global economy through much of 2023 but are well positioned to rise through the clouds in the longer term as the energy transition continues apace, according to a new S&P Global Market Intelligence report released today. The newly published 2023 Electric, Natural Gas and Water Utilities Outlook is part of S&P Global Market Intelligence’s Big Picture 2023 Outlook Report series.

With the recently passed Inflation Reduction Act set to increase U.S. renewable energy generation capacity by around 150GW in the coming years and electric vehicle demand set to increase almost 30% annually on a global basis through 2026, metals including copper, lithium, cobalt, and nickel will remain in high demand. The 2023 outlook spans both the U.S. utility and renewable energy sectors, as well as global metals markets.

“The Inflation Reduction Act is providing a rosy outlook for renewable energy development in the U.S., while the energy transition taking place across much of the globe will see demand for the key raw materials such as lithium, nickel and copper start to exceed supply in the years ahead,” said Richard Sansom, Research Director at S&P Global Commodity Insights.

Key findings of the report include:

The Inflation Reduction Act (IRA) is expected to drive the addition of 150GW of additional renewable energy capacity in the U.S. in coming years, providing support for wind, solar and storage projects.

The IRA has come at a time when regulators are facing a challenging confluence of events, with utilities in the midst of a prolonged period of aggressive capital spending on infrastructure, the lingering impacts of the COVID-19 pandemic, more frequent and severe weather events, the war in Ukraine, and rising interest rates and inflation combining to drive historical levels of rate case activity.

Federal legislation designed to support decarbonization initiatives is expected to attract substantial interest from utility investors in the coming years, but regulatory support, in the form of adequate returns on equity and ample cost recovery opportunities, is necessary to ensure that capital continues to flow to the sector.

With global economic conditions taking center stage, 2023 industrial commodities prices covered by S&P Global Market Intelligence’s Commodities Briefing Service are set to average lower than in 2022, with a year-over-year drop ranging from 7% for copper to 33% for lithium.

Growing energy transition and electric vehicle demand for key battery and materials means consumption will outstrip the mining industry’s ability to ramp up supply, resulting in commodity deficits as early as 2024. Addressing ESG concerns while allowing development of new mines crucial to those efforts, will require accommodations among all stakeholders.

High metals prices entering 2022 contributed to global exploration budgets rising 16% for the year, but investors have since shied away from mining companies as metals prices retreated; should this trend continue, S&P Global Market Intelligence expect a 10%-20% decrease in the global exploration budget for 2023.

metals deman to outpace supply starting in 2024

Author: Amanda OeyGovernment of Western Australia Department of the Premier and Cabinet

Minister for Mines and Petroleum; Energy; Corrective Services; Industrial Relations

A 50 per cent royalty rebate for WA potash projects has been extended. The rebate will support industry and create jobs for local communities.

The McGowan Government has announced an extension of the potash industry royalty rebate scheme established in the 2022-23 State Budget.

The extension of the scheme will provide a non-repayable 50 per cent rebate on royalties paid for two years to companies that make first sulphate of potash (SOP) sales before the end of 2027.

No royalty rebate will be paid when the price of SOP exceeds $AUD1,000 per tonne on average over a quarter.

This extension is expected to make the scheme available to a larger number of potential SOP producers in Western Australia.

The McGowan Government’s continued support complements existing assistance for Western Australia’s emerging SOP industry, including concessionary mining lease rents and specific Mining Rehabilitation Fund levy rates.

SOP projects proposed to be developed in the State are expected to be long-life operations spanning 30 to 40 years, that will provide hundreds of jobs and opportunities for communities in regional WA.

Mines and Petroleum Minister Bill Johnston said, “The McGowan Government remains committed to assisting the development of the potash and minerals in brine industry in Western Australia.

“By extending the royalty rebate to help this fledgling industry, we will continue to create jobs and community development opportunities, particularly in remote Aboriginal communities.

“Potash is an essential nutrient in agricultural fertilisers that underpins global agriculture by protecting crops from disease and pests.”

Premier of Western Australia Mark McGowan has signed off on a Northern Australia Infrastructure Facility loan to assist in developing infrastructure for Kalium Lakes’ Beyondie project.

Located southeast of Newman, the sulphate of potash project is on track to become Australia’s first sulphate of potash operation in Australia.

Construction at the project has commenced, which will create 170 jobs, while first production is expected at the end of 2020, creating 70 operational jobs for Western Australians.

This announcement demonstrates that the McGowan Government’s decision to lower rental rates for minerals in brine, such as potash, is producing positive results.

Potash is an essential nutrient used in high-quality fertilisers that protects food crops from disease and pests, and improves water retention, yield, taste and appearance.

Premier Mark McGowan said, “The Beyondie project has a mine life of 30-plus years, so this is a win for local regional communities that we expect will create long-term, sustainable jobs.

“My Government is pleased to support this emerging industry through the introduction of lower rental rates, and the development of this project is another sign that our economy is heading in the right direction.”

Hon. Bill Johnston MLA

Global reliance on China for graphite, a key ingredient in batteries, has emerged as a major obstacle to electric-vehicle makers’ production schedules amid trade disputes and soaring demand.

The average value of natural flake graphite shot up 25% between May 2021 and December 2021, according to Suzanne Shaw, principal analyst and lead graphite expert at Wood Mackenzie. Benchmark Mineral Intelligence assessed the price of flake graphite at about $650 per tonne, up year over year from $540/t, according to its latest price report published Dec. 31, 2021. The price reporting agency has forecast the cost for this feedstock breaking $700/t in 2022.

Flake graphite. Image by Wikimedia Commons.

U.S.-based battery and car companies have urged President Joe Biden to ease trade restrictions or risk impeding the administration’s push to electrify transportation sectors, according to industry experts. Producers trying to break into the market for graphite, the largest component of lithium-ion batteries by volume, have begun building out new production facilities in the U.S. and Canada, but they are years away from production.

“The global anode supply chain is 100% reliant on China at some point within that chain,” Shaun Verner, CEO and managing director of Australian graphite miner Syrah Resources Ltd., said in an interview. The company operates the Balama natural graphite mine in Mozambique and plans to build the first graphite processing facility in the U.S. “That heavy reliance on a single source ought to be quite concerning for [original equipment manufacturers].”

Graphite is an abundant mineral around the world and relatively cheap compared with other battery materials but finding the right quality and type of graphite needed for batteries can be tricky. The global demand for EVs is expected to drive a massive increase in demand for graphite.

The world could be short 80,000 tonnes of the mineral in 2022 as demand from the EV sector rapidly scales up, according to Benchmark Mineral Intelligence. Sales of passenger plug-in EVs are projected to hit 9.6 million units in 2022, according to an S&P Global Market Intelligence forecast published in December 2021.

Meanwhile, the price for 15-micron spherical graphite was $2,800/t, decreasing slightly year over year from $2,825/t, according to the agency. Spherical graphite is battery grade and ranges in particle size from 10 microns to 25 microns.

The price rally will likely continue through early 2022 as the sheer scale of anticipated demand buoys prices. China’s power rationing due to decreased coal supplies could also persist into the second quarter of 2022. The country primarily uses coal to provide energy, but it has been facing supply disruptions from an Indonesian export ban and a prolonged trade dispute with Australia.

“The graphite market is tightening, especially for grades that are suitable for use in batteries as demand rises robustly,” Shaw told Market Intelligence in an email. “In the short term, there is room for Chinese producers to further increase production to meet capacity and alleviate some of the gap, but we believe that a tightening market will increase prices in the coming years and encourage several new producers to come online outside China by the middle of the decade.”

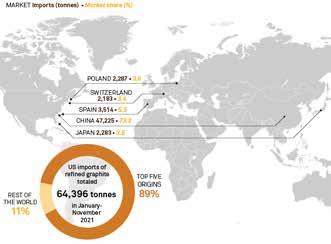

China touches almost all of the world’s graphite along its path to the consumer. The U.S. imported 64,396 tonnes of refined graphite between January and November in 2021, of which 73.3% came from China, according to data from Panjiva, a supply chain-focused business line of Market Intelligence. Even when graphite is mined or manufactured outside of China, such as from Mozambique, it is typically routed to China for processing and refinement. And most graphite refined in places such as Japan comes from China.

A tariff battle within the Biden administration has only exposed the battery industry’s dependence on China for graphite. In 2018, U.S. trade officials slapped tariffs on several products associated with the EV supply chain coming from China, including artificial graphite. The Trump administration eventually allowed companies to apply for certain exclusions, but those exemption opportunities expired in 2021. In public comments, companies bemoaned the impossibility of getting graphite from anywhere but China.

“Tesla has concluded that no company in the United States is currently capable of producing artificial graphite to the required specifications and capacity needed for Tesla’s production,” California-based EV and battery giant Tesla Inc. said in comments filed with the Office of the U.S. Trade Representative and posted on Dec. 1, 2021. Tesla could not be reached for comment.

SK Battery America Inc., a subsidiary of South Korea batterymaker SK Innovation Co. Ltd., also supported the extension of the tariff exclusion on graphite, stating it was “unfeasible” to obtain graphite from the U.S. for use in the manufacturing associated with its $11.4 billion investment in lithium-ion factories in Kentucky and Tennessee in partnership with U.S. automaker Ford Motor Co. as well as its $2.54 billion investment to build battery plants in Georgia.

“Presently, it is not feasible for SK Battery America and BlueOvalSK to obtain graphite from other sources outside of China due to the uniqueness of the product, the incredible risk of entering the graphite industry, and the lack of suppliers that can meet our present needs,” the company wrote in a comment to the U.S. Trade Representative.

The U.S. Trade Administration press office did not respond to multiple requests for comment on the status of the tariffs. Partners at law firm Arent Fox expect the government agency to announce whether the product exclusions will be reinstated in early 2022, according to a Jan. 13 report.

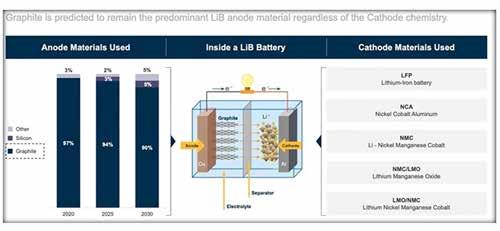

The lithium-ion battery used to power electric vehicles is made of two electrodes - an anode (negative) on one side and a cathode (positive) on the other. At this time, graphite is the only material that can be used in the anode, there are no substitutes. This is because it has very high natural strength and stiffness, graphite is an excellent conductor of heat and electricity. Being the only other natural form of carbon besides diamonds, it is also stable over a wide range of temperatures.

The cathode is where metals like lithium, nickel, manganese and cobalt are used. Depending on the battery chemistry, there are different options available to battery makers (see below).

Graphite is currently considered indispensable to the global shift towards electric vehicles. It is also the largest component in lithium-ion batteries by weight, with each battery containing 20-30% graphite.

Due to losses in the manufacturing process, it actually takes 30 times more graphite than lithium to make the batteries.

According to the World Bank, graphite accounts for nearly 53.8% of the mineral demand in batteries, the most of any. Lithium, despite being a staple across all batteries, accounts for only 4% of demand.

An electric car contains more than 200 pounds (>90 kg) of coated spherical purified graphite (CSPG), meaning it takes 10 to 15 times more graphite than lithium to make a Li-ion battery.

Graphite is so essential to a lithium battery, that Tesla’s Elon Musk famously said, “Our cells should be called Nickel-Graphite, because primarily the cathode is nickel and the anode side is graphite with silicon oxide.”

Syrah Resources revived its Balama graphite mine in Mozambique in early 2021 and plans to ship a portion of the graphite it extracts to its new Vidalia anode processing facility in Louisiana.

The company plans to announce a final investment decision for the construction of Vidalia in January. The majority of the Balama graphite output will still flow to China for processing, but Verner said the company aims to gradually shift more volume to the Western hemisphere for processing.

“We chose the U.S. because we saw that the manufacturing footprint of electric vehicles and batteries was moving out of

Asia,” Verner said. “Manufacturers want their manufacturing base closer to their markets.”

Canadian developer Nouveau Monde Graphite Inc. has plans to erect a battery anode manufacturing hub near Montreal in Quebec and has started construction on a natural graphite mine. The Matawinie mine is expected to produce 42,000 tonnes of battery anode material starting in 2025.

“We cannot rely on China to build it all for us, like in the past,” said Eric Desaulniers, founder, president and CEO of Nouveau Monde Graphite. “We need to streamline permitting.

We need to go back to exploration to find more deposits of all those minerals. And we need to build our own supply chain locally,” Desaulniers added.

In early December 2021, Canadian company Northern Graphite Corp. agreed to purchase the Lac des Iles graphite mine in Quebec from Imerys SA, with plans to produce 15,000 tonnes of graphite concentrate over a three-year period. And Australian Securities Exchange-listed Novonix Ltd. is working to open a synthetic graphite plant in Tennessee.

Tesla is seeking to diversify its own supply of the gray flaky mineral. On Dec. 23, 2021, weeks after Tesla’s comments on the trade dispute, Syrah Resources announced it had signed an off-take agreement to supply 8,000 tonnes of graphite for four years from the facility starting no later than May 2024.

Yet the question remains if companies with new graphite assets in the pipeline will be able to meet the speed of EV demand.

“Supply will struggle to catch up with graphite demand,” said George Miller, a Benchmark Mineral Intelligence analyst.

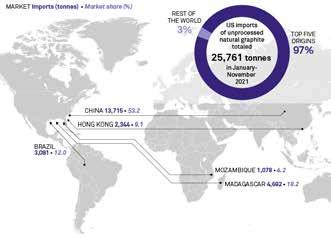

Quarterly US imports of unprocessed natural graphite (tonnes) US imports of unprocessed natural graphite, January-November 2021

Quarterly US imports of unprocessed natural graphite (tonnes) US imports of unprocessed natural graphite, January-November 2021

‘Nautilus,’ developed by Rovula, a company under ARV (a subsidiary of PTTEP), together with Kongsberg Ferrotech, the world’s first subsea pipeline inspection and repair robotic technology, is now ready to serve customers in the petroleum exploration and production industry.

The pipeline inspection and repair tasks normally require specialized skilled divers to board a pressurized submarine diving deep under the sea, which is life-threatening due to weather conditions and dangers that may occur under the water. But now we can send ‘Nautilus’ to do the work instead.

Humans can control the operation from the boat, which improves accuracy and safety by reducing the time for traditional human operation from 7-14 days to less than 48 hours, including reducing the cost of maintenance of underwater pipelines by up to about 50%.

‘Nautilus,’ developed by Rovula, a company under ARV (a subsidiary of PTTEP), together with Kongsberg Ferrotech, also gained international recognition by winning 2 international innovation awards: the Awards for Breakthrough Technological Project of the Year at the ADIPEC Award Excellence in Energy 2020 and the Spotlight on New Technology Awards at the Offshore Technology Conference Asia (OTC Asia).

The Nautilus IMR robot performs the complete process in a single dive - from removing the existing corrosion coating

(e.g., 3LPP), defect sizing, surface preparation, coating, leak sealing, and finally - structural strengthening using carbon fiber - all by robotic means, digitally controlled and fully documented.

The environment in the repair habitat is fully controlled throughout the repair process, and all contaminants are collected and brought back to the surface for safe disposal. Nautilus can optimize accuracy, safety, and remove the need for humans to perform underwater where there are risks of both weather conditions and dangers under the sea.

The operation time will reduce from 7-14 days to less than 48 hours and save more than 50% on the preparation cost for subsea pipeline maintenance.

Throughout four years of development, Nautilus has undergone software and hardware component testing for more than 1,000 hours to ensure the system integrity and quality of the product.

Nautilus also gained international recognition by winning the Awards for Breakthrough Technological Project of the Year at the ADIPEC Awards in 2020 and the Spotlight on New Technology Awards at the Offshore Technology Conference Asia (OTC Asia) in April 2022.

ROVULA and Kongsberg Ferrotech are ready to embrace customers and partners from both the public and private sectors in the subsea oil and gas production and exploration platforms to participate in the service and become partners to share expertise. Watch how Nautilus performs underwater tasks at https://youtu.be/oqmV5JAtMYY

For more information about Nautilus, visit https://lnkd.in/gphsumZQ.

Images Source: Kongsberg Ferrotech

After repairing rust and breaking my back bending over the bonnet of my recently completed 1978 Chevy Camaro restoration project, I decided to buy a fibreglass boat to restore. This 47-foot 2002 Riviera M430 Sports Cruiser looks pretty but needs a lot of work. She doesn’t’ have rust but needs almost everything the Camaro needed fixing. One of its twin 8.1 Litre GM 496 HO MAG V8 petrol engines needs a rebuild plus both stern drives & bow thruster also need work. This is a very neglected vessel.

I have already fitted her out as my new Digging & Drilling Magazine office but the first thing I needed to do was lift her out of the water, get her cleaned up, have a full condition report done and get a Marine Craft Insurance Risk Evaluation report. She needed a couple of fire extinguishers and some offshore flares but everything else was all good.

There were no TV’s in her two bedrooms and the Cockpit had no A/C power outlets at all. I asked Martin from Ocean Systems to install power outlets on both sides of the Cockpit for a smart TV, laptop computer, phone charger and also run a HDMI cable under the floor from the TV across to the seat to enable me to use the TV as a second screen for my laptop computer.

Seagulls were nesting in the anchor chain locker; canvas canopy covers & plastic clears were filthy and neglected but access to the engines and generator using the electric cockpit hatch is amazing compared to bending over under the bonnet of a USA muscle car!

A huge thank you to Dale at Delta Marine for his instruction on how to handle and berth this 14.53 metre boat. I will add new seat & floor covers, stern rails for a BBQ and tender mount and much more in our second boat restoration article featured in our Q1 2023 edition. Kindly contact me at Len.Fretwell@diggingdrilling.com with any suggestions or queries.

Article and Images: Len Fretwell

Over 25 years experience in the Asia Pacific Region. hevilift.com Get In Touch.