Retirement Planning – Superannuation

Boosting your super before retirement Most people don’t really think about superannuation during their working life, other than making sure their employer makes regular contributions.

U

sually, ten to fifteen years before retirement is when people suddenly become interested in their superannuation, especially if they want to find out if they are fully prepared to retire at the retirement age and live off their super. At least, that’s definitely what Jennifer Langton, Specialist Advice Manager for Aware Super, has seen over the years. In some cases there may be the realisation that there are not enough funds to live comfortably or be able to retire at the age you would like to. When boosting your super before retirement, you need to consider the

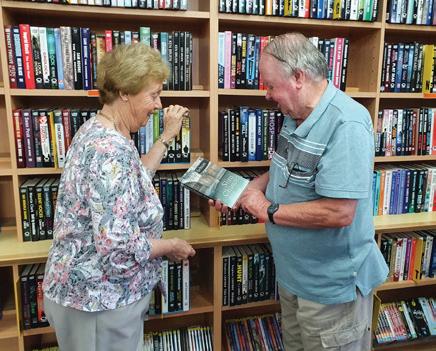

It’s never too late to plan for retirement For Janelle and Steve, planning out their retirement wasn’t at the forefront of their mind. Now that they are both soon to be fully retired, they have engaged a financial planner from Aware Super to get themselves on track and living the lifestyle they want to lead. The pair want to become “grey nomads” and travel as much as possible early into their retirement. Steve retired first and he withdrew his superannuation to pay off their mortgage. He also bought a caravan and 4WD with his super to allow the pair to travel around Australia.

three phases of retirement and how that will impact your funds: ◆ Active phase – You are newly retired and are most likely travelling, spending more on the finer things in life and enjoying your new found freedom. ◆ Quiet phase – Where you are spending more time at home, visiting family and the grandkids, and old age issues are slowly starting to creep in. ◆ Frailty or care years phase – You are requiring more health and personal assistance, and this is often the most expensive stage of your life.

Janelle is now retiring and wants to sort out their financial situation for retirement. They believe they will be able to fund their lifestyle and meet all of their expenses with $50,000 per year The pair has found benefits from engaging a financial planner as they now have a clear direction with what they need to do to reach that goal while also gaining peace of mind that their retirement will be comfortable. Janelle will withdraw part of her super to allow Steve to make a contribution and they will each have an Individual Account Based Pension of $222,000, drawing an income of $25,000 per year. This will fund their lifestyle and expenses. Steve and Janelle don’t consider themselves as “risk takers” but understand that they need to take on some investment risk to achieve market returns and provide for a hedge against inflation.

It’s not just maximising your wealth and travel that you should be thinking about, according to Ms Langton. You also need to take a serious look at what may occur during the frailty years phase of your life, because many older people don’t want to think about the ‘C’ word – Care, or the ‘D’ word – Death. The frailty years, when you might need to be accessing health services, assistance with daily activities and even accessing aged care, can be the most expensive time of your life. In the lead up to your retirement, Ms Langton suggests sitting down with your partner or family

Aware Super has structured their investments so that the impact of significant market movements, like COVID-19, is softened and their retirement assets match their appetite for risk. The couple feel comfortable knowing that their wealth will provide them independence and ownership in retirement, and they also feel reassured that they may be entitled for the age pension when they reach the qualification age and meet the assets and incomes test. They are hooking the van up and heading off on their travels, secure in the knowledge they have ticked all of the boxes for retirement and have access to guidance into the future. Case study provided by Aware Super. This has been prepared for illustrative purposes only, Janelle and Steve are not real clients. Visit aware.com.au for more information.

YourRetirementLiving.com.au

13