DUBAI KEYNES SOCIETY NEWSLETTER

A Dubai College Initiative

“Practical men, who believe themselves to be quite exempt from any intellectual influences, are usually the slaves of some defunct economist.”

John Maynard Keynes (1883-1946)

“Practical men, who believe themselves to be quite exempt from any intellectual influences, are usually the slaves of some defunct economist.”

John Maynard Keynes (1883-1946)

Mr. Christopher and Mr. Lambert's Forewords ..............................................................

Heads' Foreword

Session Summary ...........................................................................................................

Trumponomics 2.0 ................................................................................ Aryav Odhrani

Chinese Trade Outlook ........................................................................Mustafa Alp Ata

Beating GDP .........................................................................................RaghavJasuja

Generational Wealth Gap.........................................................................Sanaaya Patel

Prospect Theory in Lotteries.......................................................................Jiawen Zhu

Black Swan Events and Emerging Markets .........................................Demir Erkovan

Trump’s Tariff Gamble...............................................................................SaraWhabi

Game Theory in Business......................................................................Mikail Hashmi

Sentiment Analysis in Financial Markets..................................................Aarav Dave Greenflation..........................................................................................Darsh Jethwani

TechnicalAnalysis in Trading .......................................................A.li-Mansur Valiyev

AI and Monetary Policy.......................................................................Simran Dosanjh

Trump’s Re-election and the US Stock Market .........................................Omar Labib

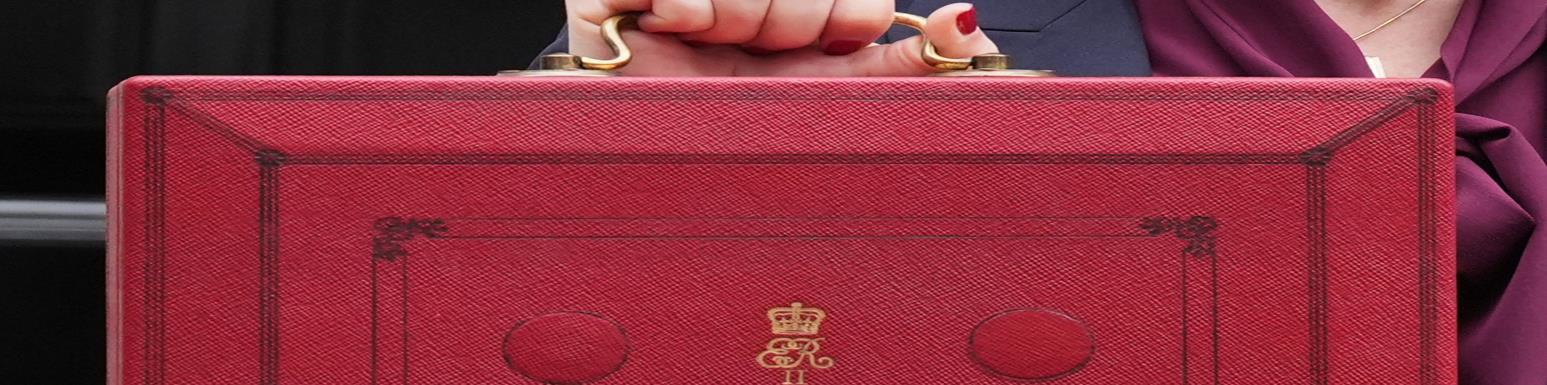

UK Budget 2024 and Inequality ..............................................................Alizé Zobairi

Behavioral Biases and Marketing ................................................................Aarush Vij

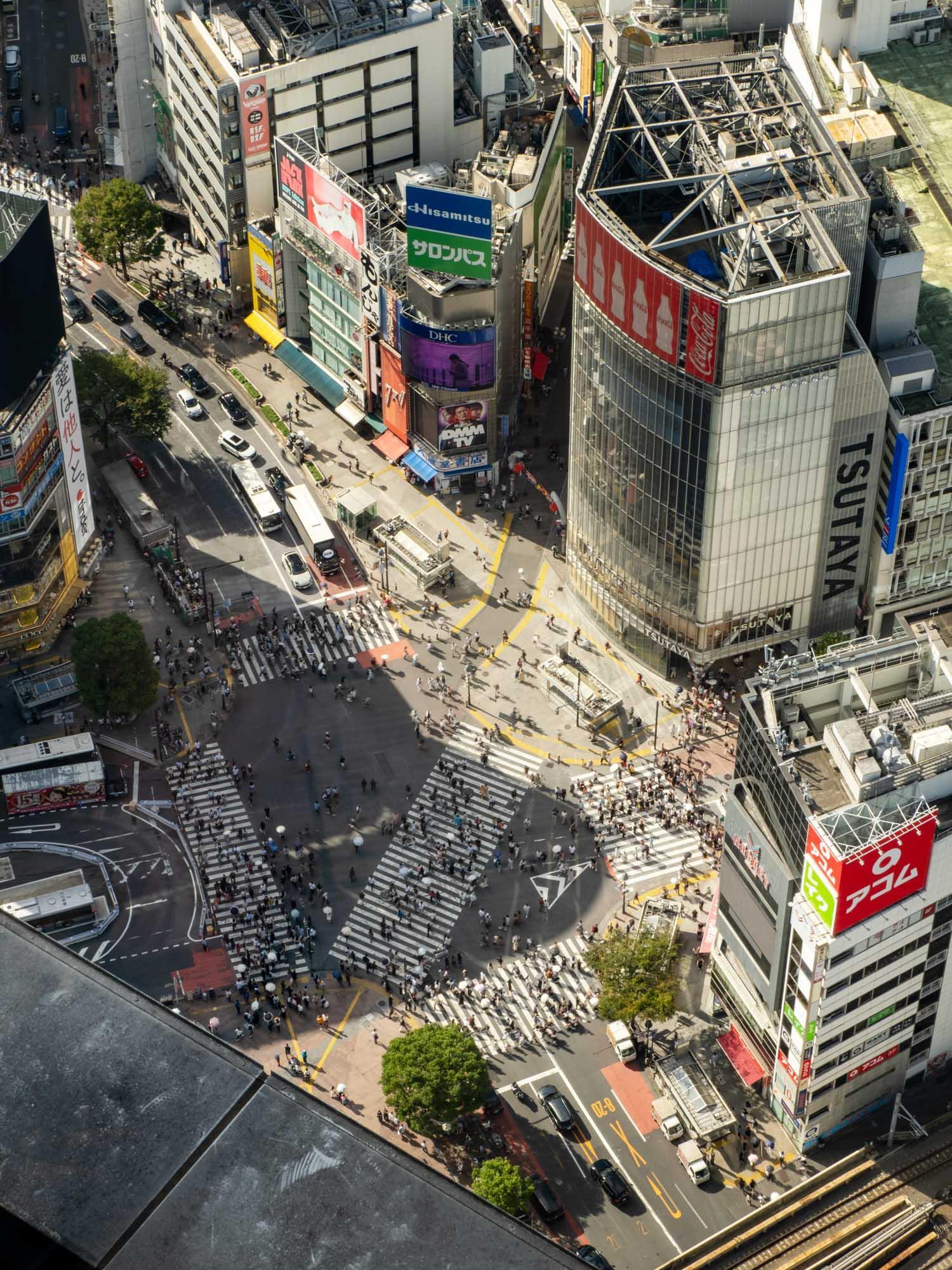

E-Commerce Growth ..........................................................................Donghoon Woo

Allowances and a Teenager’s Financial Skills............................................Ben Ashton

The Scitovsky Paradox...........................................................................Mayher Tyagi

DKS Quiz .....................................................................................................................

This term at DKS has been a remarkable one, thanks to the exceptional leadership of our student heads. The breadth of engagement across economics, business, and finance has been impressive, with highlights including Andrew Hallam’s talk on personal finance, Bishoy Azmy’s insights into the construction industry, and inspiring contributions from DC alumni like Rob Carver and economists like Jahangir Aka. I was delighted to give a talk myself and thoroughly enjoyed the enthusiasm and curiosity of the students. I look forward to seeing how the society continues to thrive and grow in the terms ahead.

- Mr. Lambert

What a jam-packed term! The array of guest speakers is almost impossible to pick from. Some standout sessions were Jahangir Aka's 11th consecutive DKS session on global perspectives, or Bishoy Azmy's session speaking about his career as a CEO, just to name two. Of course, we cannot forget the outstanding work of our DKS Heads, who have spent many an hour finding recruiting speakers and organising sessions to provide for the society.

This has never been an easy role, and they have had big boots to fill, but they have maintained the high standard throughout. Many a thanks Raghav, Alp, Sanaaya and Aryav! We look forward to seeing all of you back in January!

- Mr. Christopher

As we approach the winter break, we can look back on another successful term for the Dubai Keynes Society, with the society growing in number. We have had the pleasure of listening to various speakers from a plethora of backgrounds. These sessions have ranged from 'How to Define Success' from Andrew Hallam to Robert Carver's session on his trading strategies. Students attending the sessions have participated in 2 interactive sessions, including a quiz (attached at the bottom of this newsletter) and a debate.

We are elated to announce that this term's rendition of the newsletter has had more articles than ever before! We would thus sincerely thank everyone who has submitted an article this term, as well as everyone who has spoken in our Wednesday sessions! Additionally, we must thank Mr. Christopher, whose willingness to consistently help us DKS Heads out is greatly appreciated Finally, we cannot forget the economic aficionados attending our sessions! It is all of you who keep our society running, and we cannot thank you enough for it!

Wishing everyone celebrating a Merry Christmas and a Happy New Year!

- Raghav, Alp, Aryav, and Sanaaya

19/09/24

26/09/24

02/10/24

Introductory Session

DKS Heads: Elasticity

Jahangir Aka Neuberger Berman

23/10/24

30/10/24

Student Quiz

Vedant Bhansali DC Alumnus

6/11/24

Bishoy Azmy

CEO and Founder of the Innovo Group

Welcome Back, with the first DKS Session of the year! The Heads introduced themselves and discussed topical current affairs

This week, the Team delivered an engaging presentation about the economics of elasticity, giving examples in our modern world, from surge pricing and Oasis to air travel!

We were excited to welcome Mr Aka – who delivered his 11th session for our society He provided us with an insightful global perspective on current events and his experience working at the investment bank Neuberger Berman.

Interactive Quiz Time for our members!

We welcomed Vedant Bhansali, a third-year university student studying Financial Economics at Columbia University, and ex DKS Head who provided his insights into his time studying an Economics degree

This week we were delighted to host Mr Azmy, Founder and CEO of the Innovo Group, a construction and realestate business based in Dubai, an industry especially pivotal in Dubai's success He spoke about his career, experiences, and the built environment which exhibits some of the most important concepts of economics

13/11/24

Khwaish Lakhiani DC Alumn

We welcomed ex-DKS Head Khwaish Lakhiani, offering her valuable insights and experience studying Finance at the Wharton School, University of Pennsylvania

20/11/24

Michael Lambert DC Headmaster

We were extremely lucky to host our very own Head, Mr Lambert, who shared his experience in the investment management sector, in an inspiring and engaging session on stacking the odds of life in your favour

27/11/24

Rob Carver DC Alumnus and financial economist

This week we had the pleasure of hosting Mr Carver, an extremely successful financial economist, expert in quantitative finance and systematic trading, author of several books, as well as an ex-hedge fund manager at AHL, derivatives trader at Barclays Capital, and a research manager at the Centre of Economic Policy Research

4/10/24

Student Debate

Interactive session where students had the opportunity to debate and offer their perspectives on the impacts of a 2nd Trump term on the global economy

10/12/24

Andrew Hallam Bestselling Finance Author

For our final session this term, we were delighted to welcome Mr Hallam, a bestselling personal finance author of the renowned ‘Millionaire Teacher’ and global speaker This was a Q&A session where students were able to ask him how he built up his net-worth coming from a background of teaching, and received his advice for investing early as well as success in life

With Donald Trump’s recent election victory over Kamala Harris, the global economy is preparing for a ‘macro shock ’ President Trump’s radical outlook on economic policies, if put into practice, will have massive effects on many aspects of the US economy. Given the US’s position as an economic superpower dominating in terms of world trade, dollar dominance, and provision of financial services the world will likely be affected by Trump’s policies

The First Trump Administration

Trumponomics, which refers to Donald Trump’s economic principles, revolves largely around an ‘America First’ approach In his first term (2016-2020), President Trump put into place several policies characterised by tax cuts, tariffs, and deregulation One of the most significant actions of the first Trump administration was the ‘Tax Cuts and Jobs Act’ (TCJA) The 2017 Act lowered average individual income tax rates for all income groups, including reducing the top marginal rate from 39 6% to 37 0% (Tax Foundation, 2024)

TCJA also lowered the corporate income tax (CIT) rate from 35% to 21%. This was supported by the act’s measure of allowing full and immediate expensing of short-lived capital investment expensing for 5 years. This meant that businesses could deduct the full cost of investments from tax payments, incentivising increased investment In the long run, Trump’s tax cuts aimed to raise worker productivity and create more jobs Indeed, excluding the pandemic months, the US added 6 7 million jobs during the Trump presidency, and in 2019, the US’s unemployment rate fell to its lowest level in 50 years, at 3 5% (AP News, 2024) Foreign direct investment also picked up by around 15% in 2018, only to fall in 2019 (BEA, 2020) This may be indicative of a partial failure of the TCJA or a result of Trump's aggressive international-relation policies and trade wars

Another aspect of Trump’s ‘Make America Great Again’ plan was increased trade protectionism In October 2024, Trump remarked that ‘the most beautiful word in the dictionary is tariff.’ True to this sentiment, his first administration imposed tariffs on thousands of products (Investopedia, 2024) and on trade partners including Canada, Mexico, and the EU. Importantly, Trump started a trade war with the world’s largest exporter and the US’s biggest supplier of imported goods: China Trump has long accused China of following unfair trading practices including exploitation of labour and intellectual property theft to mass-export cheap goods to the West (BBC, 2020) In turn, China believes that America has been trying to prevent China’s rise as a global superpower A second Trump administration might lead to animosity and even economic warfare as American views of China have hit record lows (Chicago Council, 2024)

Despite his aggressive tariff policies, which should theoretically have passed increased prices to consumers, US inflation remained low during Trump’s first term While there was a severe recession brought on by the COVID-19 pandemic, Trump maintained steady price level growth throughout most of his term, averaging a 1 9% year-onyear inflation rate (Investopedia, 2024)

Now, the world looks forward to what can be expected from Trump in his newest administration Already, Trump has picked a cabinet of radical right-wingers, each of whom are loyal hardliners following Trump’s outlook The world’s richest man, Elon Musk, and entrepreneur Vivek Ramaswamy will lead the new Department of Government Efficiency (DOGE), working to reduce bureaucracy and ‘slash excess regulations ’ DOGE allows for Trump to cut the federal budget and reduce government operational costs, supposedly making things better for everyday Americans

While Musk claims that DOGE could cut at least $2 trillion of the $6.5 trillion budget, former Treasury Secretary Larry Summers said that there is a limited scope for curbing spending waste and that cutting even $200 billion may be difficult (CNN, 2024) Glenn Hubbard, former dean of Columbia University’s Business School and former chairman of the US Council of Economic Advisers in the George W Bush administration, is also a sceptic of the benefits of introducing DOGE, saying that it is ‘mathematically impossible to find $2 trillion’ to cut (CNN, 2024)

Trump has a difficult task ahead of him, as the US’s government system makes it very difficult to reduce red tape In fact, if DOGE’s true aim is to increase government efficiency, then they may need to encourage government involvement Certain rising industries like AI and cryptocurrency require greater regulatory clarity and predictability AI has the potential to boost the US workforce’s productivity and is vital to national security On the other hand, the medical industry is riddled with barriers and regulatory requirements of clinical and safety trials These prevent the transfer of scientific discovery (like advances in vaccine and cancer treatment development) into accessible medicine. Likewise, the energy industry is struggling to build nuclear, solar, and wind power to boost green energy in the US. It is important that Trump's ‘epic deregulation’ plans preserve financial stability and deal with the equityefficiency tradeoff (Bloomberg, 2024)

Tariffs and Inflation

One of the most controversial policies that Trump plans to introduce in his second term relates to tariffs Trump has proposed a 60% tariff on all goods from China and 10-20% on other imports (Business Insider, 2024) While this is intended to support American manufacturing by making domestic firms more price competitive, there are risks of inflation Tariffs on imported goods could raise the cost of production for firms importing raw and production materials from outside of the US This may transfer the burden of tariffs onto consumers in the form of higher prices

According to economic theory, a tariff directly causes price rises. This happens because tariffs increase foreign firms’ costs of production and thus decrease their supply at all price levels. Since foreign supply can be modelled as being perfectly price elastic, an upward shift of supply decreases the quantity of goods and services imported from Q4 to Q3 Tariffs also benefit the country imposing them, increasing domestic producer surplus in region 1 and providing government revenue in region 3

Trump’s previous tariffs have had mixed results For instance, the 2018 tariff on imported washing machines caused laundry item prices to rise (New York Times, 2019), but Trump’s 30-50% tariffs on Chinese imports were found not to be inflationary. Since the effects of Trump’s tariff plans cannot be predicted definitively, it will cause uncertainty in the market

For instance, the potential inflationary pressure caused by tariff-resulting consumer price rises would clash with the Federal Reserve’s proposal to cut interest rates over the coming year In fact, Trump’s tariffs could shrink the US’s GDP by 0 8% (Tax Foundation, 2024) and reduce consumers’ spending power by up to $78 billion annually (National Retail Federation, 2024) The tariff plans would retrace expectations of the Federal Reserve cutting rates, which would have greater implications on US consumer confidence, hot money, and stock markets Tariffs may also negatively impact the already fragile Eurozone economy The ECB may accelerate their interest rate cuts to stimulate growth in response to the US’s production cost-increasing tariffs, causing further divergence between the US and Europe’s interest rates

Following Trump's clear-cut election victory, the US stock markets have surged to record highs. As investors look forward to expectations of tax cuts and deregulation, the Dow Jones Industrial Average closed above 44,000 for the first time ever on November 11th (Google Finance, 2024) The S&P 500 also had its best week of the year, reaching an all-time high of 6017 on November 11th Various sectors of the stock market each have their reasons for loving the election: Big bank stocks have spiked, hoping for deregulation; SMEs hope for increased competitiveness due to tariffs on foreign goods, and cryptocurrency is booming with President Trump being a strong supporter

On the contrary, the bond market is worried about potential deficits, national debt, and inflation This has caused US Treasuries and bonds to sell before and throughout the election Treasury rates have surged 0 4% in 2024, ¾ of which is due to the election (CNN, 2024). This has made mortgages and debts become more expensive, possibly curbing future economic growth.

On a smaller scale, individual investors should be wary of changing their financial strategies: the initial US stock rally fuelled by the election is now stumbling, with the S&P 500 falling 2% in the week of November 11th, erasing more than half its post-election gains (Reuters, 2024)

It is already clear that President Trump’s election on the US economy has had widely varying results The same can be expected over the next four years, so businesses, investors, and global economies should prepare for shifts in the US’s economic policy The EU may need to step up in defence spending as Trump could stop funding Ukraine in the war against Russia China has already launched a $1 4 trillion debt package to support local governments and stimulate consumption ahead of Trump’s tariff pressures (Reuters, 2024) Energy firms must review and renew climate-change efforts as Trump may dismantle related regulations. Countries should also expect shifting relations with the US given Trump’s aggressive geopolitical stances. The new administration will aim to provide stability to the war-torn regions of Eastern Europe and the Middle East, allowing for new countries to join a US-based alliance

While a president’s legislations and policies certainly impact the state of the economy, numerous other factors affect an economy’s performance Actions that have significant influence on the economy include the decisions of central banks (such as the US Federal Reserve) and private industries, as well as global events like the RussiaUkraine war and the COVID-19 pandemic The US should certainly expect strong growth in the coming years, but the question remains: Could such growth be attributed to President Trump’s policies, or is it simply the intrinsic nature of the US to grow continually and autonomously?

Mustafa Alp Ata

China is currently the world's largest exporter, with a global share of 14.2%. In the 21st century, China has rapidly grown into one of the largest economic powerhouses and a global trade centre Due to its large land area, high population, and low minimum wage, China was deemed the hub for multinational corporations to manufacture their products Despite China’s consistent strength in global trade, recently we have seen a slowdown and a myriad of challenges to China’s economic and export growth China’s exports saw a decline of 4 6% from 2022 to 2023, which could reflect the slowing demand for China’ due to the anti-China stigma present around the world

China is certainly likely to face challenges in the foreseeable future An example is Trump's proposal while campaigning for his second term of presidency: 60% tariffs on Chinese imports Although it is not certain, a tariff policy like this will seriously harm China’s trade and economic activity as, in 2023, China’s exports to the USA totalled over 400 billion USD, making the USA by far the largest importer of Chinese goods and services Decreased trade with the USA could have a severe impact on China’s total exports and trade balance, especially if other countries follow suit and impose tariffs or reduce their trade with China. Another example of anti-China policies is the 45% tariff by the EU on Chinese EVs to prevent unfair competition, as Chinese EVs are backed by state subsidies China has been antagonised worldwide due to its dominance in the global trade scene As tensions rise, China will face more difficulties in growing its exports as countries become more focused on growing their domestic industries to move away from globalisation.

Although China’s trade outlook may look bleak compared to the past, there are still many opportunities present for trade to flourish. One way is to focus on innovation and invest in growing industries For example, China accounts for more than 90% of the world’s production capacity for solar glass, which is a product that is likely to see an increase in demand as renewable energy becomes a larger market Electric vehicles have developed drastically in the last few years, along with the demand for them from consumers. China currently has a 76% market share in the industry, and their extreme levels of innovation and competitive offerings have been part of what led to retaliation from trade partners, as domestic EV manufacturers cannot compete with China. Finally, China’s trade growth could be revitalised by the Belt and Road Initiative. Under this policy, China is investing in infrastructure across Asia, Europe, and Africa, aiming to allow for greater connectivity and cheaper, easier trade To supplement this, there is also the development of a digital silk road with high-speed 5G and fibre optic cables to push digitalisation, allowing for more e-commerce trade and easier expansion of domestic companies online.

In the early 21st century, China set an economic growth target of 10% annually, which was consistently met in the 2000s and early 2010s Yet in recent years, China’s growth has slowed down, leading to a new target of 5% in 2024. Due to negative signs in the first two quarters, the Chinese government aggressively implemented easing strategies, including a stimulus of 114 billion USD and a series of rate cuts to increase economic growth to reach the 5% target Still, China’s economy has the potential to grow at a high rate due to a developed manufacturing sector, an immense population, rapid innovation, and advanced technology. China can capitalise on its massive domestic industry by continuing to push and subsidise local firms Although exports are essential to the economy, 1 4 billion people is a large market that must be prioritized China can achieve this through a dual circulation strategy For example, they could strengthen trade relations around the world through initiatives like the Belt and Road while still driving innovation in the domestic market A key focus for China could be its population demographics, as currently there is an ageing population with declining birth rates They must prioritise the young population by giving them opportunities to encourage couples to have more children. By providing tax grants or education and childcare subsidies, China’s government can make having children more attractive, which can increase the birth rate A surge of young people can fuel innovation in sectors like technology and AI to incite economic growth

All in all, China is one of the most powerful countries in the world, both economically and politically They have achieved this through strict regimens, a large working force, and forging powerful trade relations As the leading exporter in the world, China’s exports account for over a fifth of GDP. Due to China’s dominance in global trade, other countries have started to retaliate with protectionist measures to protect their domestic industries. Despite the impact this will have, China, through forming new relations and restructuring its trade scheme, has the potential to overcome this challenge to maintain its position of power and continue to flourish economically

Raghav Jasuja

Gross Domestic Product (GDP) is defined as ‘a monetary measure of the market value of all the final goods and services produced in a specific time period by a country’ (Wikipedia, 2024). This statistic is universally used by countries as a means of comparing economic growth (in terms of volume and value of goods and services produced within the borders of a nation), due to its relative simplicity of garnering information, as compared to other measures of economic output. As a country’s GDP expands, the country is said to have grown economically, which may bring with it advantages to an economy and population, such as lower unemployment and improvements in trade and the current account

However, solely relying upon GDP as a measure of a country’s success may harm several parties, including the environment This is because GDP fails to incorporate negative externalities such as carbon dioxide emissions from factory production Due to economic growth, more production and economic activity will be occurring within the borders of a country, which will result in a greater volume of fossil fuels being combusted, leading to increased carbon emissions, a greenhouse gas that leads to higher average global temperatures As a result of increased temperatures on Earth, habitats may be destroyed, and resources that a nation may require (such as crops) may become depleted. Not only would this result in harming the planet, but such instances of economic growth may correlate with a country’s future productive potential plummeting, particularly with developing nations that rely heavily on the primary sector as a means of producing goods that can be sold locally or internationally. Personally, I would like to see GDP being adjusted to account for environmental impact as a principal priority for countries, judging from the already severe environmental situation of the planet Many scientists believe that carbon neutrality by 2050 is inadequate, being labelled as ‘too little too late’ (Marsh, 2021) Studies have also found that several countries are currently unable to meet commitments to net-zero carbon emissions by 2050 (KPMG, 2023) As a result, I believe that GDP should be adjusted massively Whilst economic output and growth are still significant macroeconomic objectives for a nation, there should be greater weight placed on environmental protection as a means of social success, and simply as a duty to the planet we live on.

A further issue with GDP is that it may negatively impact standards of living, contrary to what is taught in the British secondary school system One such way is with increased externalities, such as carbon dioxide emissions, as explained above. Yet, there are disadvantages to people on a personal level, as increased carbon dioxide emissions may result in more health conditions An increase in health conditions will result in people being at work for less time, and if these labourers are on wage-based pay, this may result in their annual income falling. If this were to occur on a national level, average income would fall, leading to lower consumer confidence, which could adversely impact a nation in terms of lower aggregate demand, which could cause economic output to contract in the future

In addition to this, GDP and even real (inflation-adjusted) GDP are not reliable indicators for the standard of living (SOL), as they only measure quantifiable factors impacting it. An example of an unquantifiable factor impacting SOL is mental health wellbeing – an issue becoming more profound in our society Whilst economic growth could lead to decreases in unemployment, it could also lead to inflation, and this erosion of the purchasing power could lead to individuals becoming more conscious and stressed about the state of the economy, having adverse mental impacts A comprehensive measure would incorporate social, cultural, mental and economic improvements of a nation, whilst GDP only accounts for one factor

As a result, I would propose a measurement such as the Genuine Progress Indicator (GPI), grouped into 3 categories (social, environmental and economic) It encompasses 26 other indicators, including all the components of GDP (Wikipedia, 2024), and is considered to be more integrated than GDP. Whilst this indicator is certainly not perfect, it includes the environmental and social factors that determine a nation’s success as well I believe that these factors should be weighted based on the most prevalent issues A nation’s commitment to tackling environmental challenges should be prioritised foremost, followed by economic factors, then finally social factors. Climate change is an urgent challenge, and economic progress is the very essence of GDP, so the economic situation of a country should still be recognised in an alternative metric to GDP, for the metric to even be acknowledged by nations and global entities

However, it must also be acknowledged that there are difficulties associated with moving away from GDP as a measure of economic output The main reason why GDP is used in the first place is due to its simplicity as a means of comparison between countries Moving away from GDP requires greater collection of information, requiring more people to be employed to collect this data, which many nations would consider a waste of scarce resources and a factor of production.

Nevertheless, these disadvantages associated with moving away from GDP as an indicator are trivial in comparison to the urgent obstacles facing the environment and planet on the whole. Change is on the horizon, and inertia must not cloud the judgements of nations. Therefore, what better way is there to protect the future of our planet than by implementing a metric that attaches a country’s successes to its preservative capabilities?

The IMF has cited a “growing divide between a more prosperous older generation and a struggling younger generation” (Luxton, 2016) as the generational wealth gap Over the past few decades, shifts in the economy have led to disparities in economic well-being between age groups Those born between 1946 and 1964 are the wealthiest generation on the planet (Board of Governors of the Federal Reserve, 2024) Until the past few decades, it was widely established that you were likely to enjoy a better quality of life than your predecessors But this is no longer the case for today’s population

After the Second World War, the older generations experienced significant increases in prosperity, the ‘good old days’ (Society, 2023), driven from stable jobs, rising incomes, and accessible home ownership The Baby Boomers and Generation X accumulated substantial wealth through these conditions. In contrast, the younger generations today must face economic challenges, including uncertainty, increased income inequality, prolonged unemployment, greater levels of student burden, higher tax burdens, and less stable incomes This current economic landscape limits their ability to generate wealth.

A key factor contributing to the wealth divide is home ownership; for most households, their largest asset is their home Younger generations are much less likely to own their own home than older generations at the same age (Luxton, 2016). They face a housing market with soaring prices, which has discouraged them from purchasing big-ticket items like homes, leading them to remain renters This means younger generations must save more to afford a deposit for a house, delaying their entry into the housing market For example, the average age of a first-time buyer in 1960 was 23 in the UK; now it is 33 (Coggan, 2024). In 1979, the “Nationwide House Price Index was 941.1… The index is now 14102.4” (Coggan, 2024), while average earnings have not risen nearly at the same rate Furthermore, the supply of homes has not kept up with growing demand, exacerbating higher prices and the wealth divide between generations as homeowners accumulate more wealth. As a result, younger people are increasingly dependent on their parents for financial stability and taking longer to leave their homes. According to a YouGov survey in the UK, between 2015 and 2020, 54 4% of first-time buyers in the UK received financial assistance (Paz-Pardo, 2022)

So this means that older people are becoming wealthier and so are their children, leading to greater inequality. Baby boomers, who have much higher rates of home ownership, and in the US, over half of the nation’s wealth, have benefitted greatly from property price rises They are now in their retirement age and transferring their wealth to their children, who will benefit from the substantial inheritance. This influx of wealth will have a significant impact on their economic wellbeing and ability to generate wealth, limiting the social mobility of others and perpetuating unequal opportunities This is illustrated by the Institute for Fiscal Studies, which found that parental earnings and wealth are becoming stronger predictors of their children’s income and wealth (Paz-Pardo, 2022). Also, income inequality has risen among the top percentage of (mostly older) income holders, entrenching their wealth and making it more difficult for others to climb up the wealth ladder As these lower-income people feel stuck in their ability to advance, this reinforces existing social inequalities

It is critical for governments to address the widening generational wealth gap, but with any policy come unintended consequences One approach is to target those who own multiple properties for investment purposes, particularly where the wealthy accumulate numerous high-value properties Another is to increase the housing stock, focusing on making it affordable for the younger, lower, and middle classes. Additionally, promoting schemes focused on financial literacy (WarwickChing, 2024) can provide greater financial confidence and resilience to the younger generation and lower class, empowering them to reach better decisions that can break the cycle of inequality. Reforms, such as lower tax burdens, can also be made by governments to make it easier to buy properties for first-time buyers. Overall, there need to be better opportunities for younger generations to build their own wealth

We are suffering from climate change, deglobalisation, and geopolitical tension. The generational wealth gap is another complex issue on top of this; the world for the young is miserable Peter Coggan, in his article, stated that Disraeli, the first Conservative Prime Minister, described two nations: one that is unburdened by debt and able to purchase their home and the other with little ability to save enough to buy their property; that this is not dissimilar to the current situation of younger and older generations (Coggan, 2024) However, if governments act to promote equal possibilities for wealth building, it might not all be doom and gloom

Jiawen Zhu

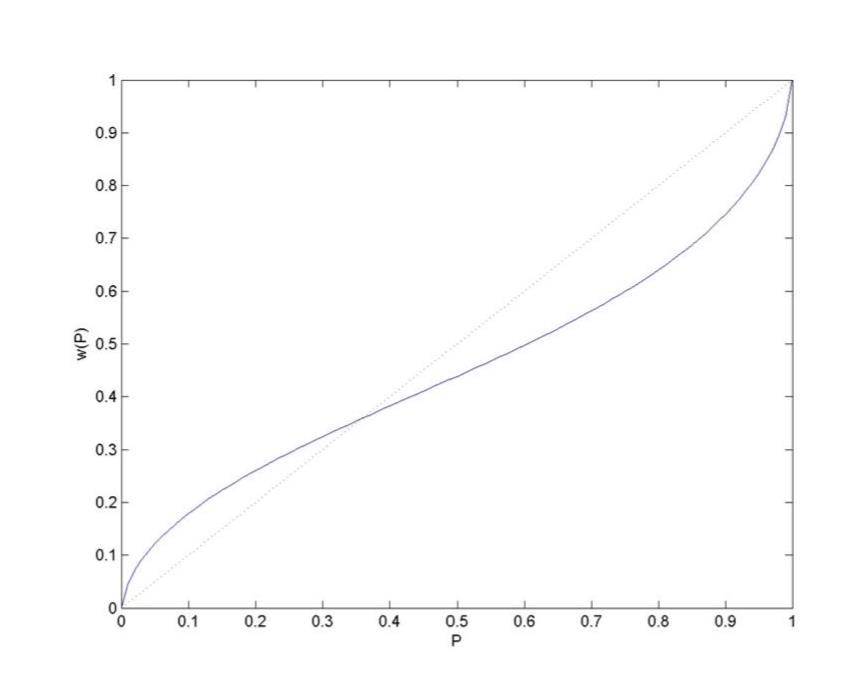

In 1979, Israeli psychologists Daniel Kahneman and Amos Tversky, renowned for their pioneering work on judgment heuristics, published their ground-breaking paper, “Prospect Theory: An Analysis of Decision under Risk,” in the journal Econometrica. Unlike traditional Expected Utility Theory, it emphasizes that individuals have many preconditioned heuristics and biases Examples include evaluating potential outcomes relative to a reference point, exhibiting loss aversion (valuing losses more heavily than equivalent gains), overweighting small probabilities, and underweighting high probabilities.

Above is the value function in Prospect Theory which is key to understanding why people are drawn to lotteries The graph is concave for gains, which signifies diminishing marginal utility (meaning that as gains increase, the increase in utility that consumers feel falls) For example, winning $100 when you have $0 means a lot, but winning $100 when you already have $1000 is less impactful. This can explain why people are risk-averse on gains. Between a 100% chance of $50 and a 50% chance of $100, most people choose the certain $50 even though the expected value of this gamble is equal With lotteries, the steepness of the graph near the reference point can signify that people value the chance of a significant, life-changing gain even more than the expected value would license.

In contrast, the shape of the value function is convex for losses, which shows that as losses increase, the subjective pain from the loss diminishes at a decreasing rate. This represents that people are risk-seeking for losses. This is seen as when someone faces a guaranteed of $100, they would prefer to gamble (which could result in a larger loss, because they are driven by the desire to avoid realising the loss, leading to risk-seeking behaviour) Similarly, the convex shape also shows that as magnitude of the loss grows, the pain of each additional loss becomes less hurtful which means that the willingness to take risks persists

Another component of prospect theory is the probability weighting function. In prospect theory, people do not weight outcomes by the objective probability (P in the graph above), but instead by a weighted probability (w(P) in the graph above) The solid line represents the weighting function presented by Tversky and Kahneman while the dotted line shows the expected utility benchmark As shown, the weighting function overweight low probabilities and underweight high probabilities. This leads to individuals especially over/under weighting the tails of the function. For example, people prefer a 0 01% chance of a $5000 gain to a certain gain of $5, even though the expected value is higher for the $5 In the individual’s mind, the small chance of gaining the $5000 is overweighted, which can often explain behaviour in the gambler’s perspective.

Other key principles from prospect theory include loss aversion and the endowment affect Loss aversion presents an individual’s preference to avoid losses rather than acquiring gains of same magnitude. In fact, Kahneman and Tversky demonstrated that individuals are around twice as sensitive to losses than to gains, which can severely influence decision making This effect can explain why individuals may enter a lottery in hopes of winning a large prize as they fear missing out on a chance to win, as it impacts their mentality more than the likely outcome of losing money for the ticket.

The endowment effect consequently is a manifestation of loss aversion where people place more value on goods they own compared to the identical goods they do not own When an individual buys the lottery ticket, they overvalue it due to the endowment effect, which can make them more willing to hold onto the ticket and take the risk. This can then lead to people overestimating their likelihood of winning and continue buying more tickets despite a negative expected value

In conclusion, Prospect Theory provides a full basis for understanding why people are drawn to lotteries despite their negative expected value. By emphasizing psychological factors like loss aversion, diminishing sensitivity to gains, and the overweighting of small probabilities, the theory explains why individuals are willing to take risks for a small chance of a large reward Together, these insights from Prospect Theory reveal the complex decision-making processes that drive lottery participation. The Prospect Theory has had a profound impact on the field of behavioural economics, influencing a wide range of applications, from consumer behaviour to policy design, and contributing to the development of strategies that account for human biases in decisionmaking.

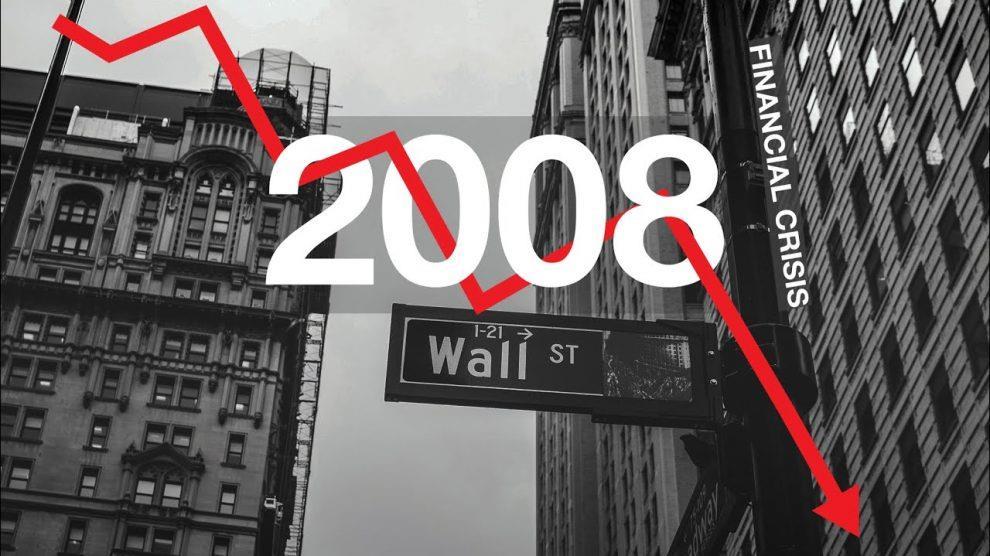

Demir Erkovan

Black swan events are often described as high-impact events that come as a surprise and are believed to be difficult to predict. This theory was developed by the Lebanese American writer and mathematical statistician Nassim Nicholas Taleb Emerging economies suffer a disproportionate number of vulnerabilities that lead to black swans, creating a disproportionate impact on emerging economies, supported with a case study.

Generally, emerging economies tend to work with a tighter fiscal space and higher levels of debt This means that during crises, emerging economies struggle to apply wide-scale stimulus measures. For example, during the COVID-19 pandemic, advanced economies responded by spending an average of 8.6% of their GDP on discretionary fiscal measures; this is compared to a mere 2 8% in emerging economies The difference in spending highlights the limited capacity of emerging economies to support their economies during crises

Emerging economies tend to face the same levels of limitations when it comes to monetary policy Their central banks frequently have to deal with inflationary pressures that limit their capacity to cut interest rates in times of crisis For instance, Argentina was unable to apply the monetary relaxation policies used by developed economies due to its inflation rate, which was over 50% during the COVID-19 pandemic. Many emerging economies rely on the export of their commodities or their tourism sector, which are very vulnerable to shocks For example, the COVID-19 pandemic caused a global fall in oil prices due to lockdowns spanning across the world. This was very impactful on countries like Nigeria, where oil contributes to about 80% of its exports and 50% of its government revenue The drop in oil prices led to a fall in Nigeria’s predicted government revenue from 8% of GDP in 2019 to 5% in 2020

Black swan occurrences in developing economies are worsened by relatively weaker institutions and poor infrastructure For example, the COVID-19 pandemic exposed several flaws in India’s healthcare institutions. Firstly, India spent 2.1 percent of GDP on healthcare in 2021–2022, up from 1.8 percent in 2020–21 and 1.3 percent in 2019–20. Additionally, India’s healthcare infrastructure was not properly equipped for the second wave of cases in 2021, which resulted in severe shortages in ventilators, oxygen supply, and ICU beds This could be explained by India’s lack of investment in the healthcare sector compared to other countries; for example, in 2019, member countries of the OECD spent an average of 8.8% of their GDP on healthcare, and this figure continued to rise due to increased healthcare demands during the pandemic This shows that the severity of the impacts of black swan events is also determined by the quality of an economy’s infrastructure and institutions.

Another one of the factors that disproportionately impacts emerging economies compared to developed economies is the idea of capital flight. This refers to when assets or money rapidly flow out of a country This tends to affect mostly emerging economies; this is because some emerging economies have sectors such as tourism that contribute a large amount towards the GDP However, these sectors are very reliant on the global world; therefore, during a crisis, these sectors could experience major falls in revenue, which will have severe impacts. This means that investors will perceive emerging economies as a riskier environment to place assets in during a crisis because of the volatile industries that tend to be present within emerging economies Instead, investors may choose to invest in assets like US treasury bonds or gold that are relatively safer in a turbulent landscape. A historical example of capital flight occurred during the 2008 global financial crisis, where, according to the IMF, emerging markets experienced a net capital outflow of $68 billion in portfolio investments over a period of only three months Increased capital outflow then leads to problems relating to currency depreciations. Using South Africa as an example, during the 2008 global financial crisis, investors exited emerging markets such as South Africa due to the perceived risk associated with emerging markets The outflow in capital flooded the forex market with the South African rand, leading to a depreciation of the currency by 30%. Depreciating currencies worsen the impacts of a black swan event by increasing inflation and making imports more expensive, thus making it harder for emerging economies to then recover from crises

Through the 2008 financial crisis we can explore the difference in the impacts of one of the largest black swan events in history on emerging and developed economies.

GDP Contractions for Emerging Economies: Emerging economies experienced large contractions in their GDP during the 2008 financial crisis For example, Mexico’s GDP decreased by 6 5% in 2009, and Russia’s GDP contracted by 7.8% due to a fall in the price of their exported commodities such as oil

Currency Depreciations for Emerging Economies: Emerging markets experienced steep depreciations in their currencies due to large-scale capital outflows, such as the South African rand, which depreciated by 30% Additionally, Brazil’s real fell 25% against the US dollar at the time

Emerging Economies' Dependence on Global Trade and Commodities: Emerging economies that rely on the export of their commodities, like Brazil and Indonesia, saw massive revenue losses due to falling global demand and following price drops The changes in oil prices during the 2008 financial crisis severely impacted export-led economies like those in the Middle East. This is because oil prices fell from $147 per barrel in mid-2008 to $30 per barrel in early 2009.

GDP contractions for developed economies: Developed economies did experience GDP contractions but not on a comparable level to emerging economies For example, the US GDP contracted by 2 6% in 2009, and the Eurozone shrunk by 4 3% To add to this, developed economies experienced a much faster recovery because of their larger fiscal and monetary capacity, which meant that they could implement measures such as the $700 billion TARP, which was managed by the U S Department of Treasury, or the quantitative easing programs implemented by the Federal Reserve to stabilise markets

Currency Changes: Even though many developed countries suffered a depreciation in the value of their currency at the beginning of the financial crisis, some developed countries benefitted from the capital outflow of assets out of emerging markets For example, the yen appreciated significantly against many currencies during the crisis. This is because many investors had to reverse their carry trades, and in the process of converting the high-yield currencies or assets back into the Japanese yen, the demand for the yen increased, which caused the value of the yen to appreciate This is evident through the fall in the exchange rate between USD/JPY; in 2007, 117 yen equated to one dollar, whereas, by the end of 2008, 90 yen equated to one dollar. Ultimately, a black swan event can have mixed effects on the exchange rate of developed economies.

It is evident that emerging economies suffered greater impacts due to the lack of fiscal and monetary space, which prevented the countries from implementing strong stimulus measures to recover the economy Additionally, the export-driven nature of many emerging economies leads to further uncertainty and complications In contrast, while developed economies were hit hard by the financial crisis, the impacts weren’t on the same scale as those on emerging economies Moreover, developed economies were able to bounce back quickly due to larger fiscal capacities for stimulus and greater investment than in emerging economies, which appreciated the value of their currencies

In conclusion, emerging economies experience disproportionate impacts from black swan events due to both global and domestic factors There are key characteristics that separate emerging and developed economies, which in turn cause one to benefit while the other suffers The disparity highlights the measures that emerging economies must implement in the future to mitigate the impacts of another black swan event.

Sara Whabi

Former president and current Republican nominee, Donald Trump, also famously known as the ‘Tariff Man,’ aims to assert additional tariffs (import taxes) globally. With an additional 60% tariff on Chinese imports (currently 25%) and an additional 20% tax on goods for the rest of the world (around 10-25% currently), this approach may sound appealing, but economists and critics warn such a high tariff can do more harm than good In this article, I will delve into whether this vision strengthens the American economy or ends up “shooting the U.S. in the foot

One significant advantage of implementing tariffs is boosting domestic production. As tariffs are import taxes, increased tariffs cause imported goods to become much more expensive; this means that people are encouraged to buy domestically For example, the tariff for imported electric vehicles from China was raised to 100%, causing the price to double This led to a significant increase in the demand for domestic EVs, with a surge of approximately ‘30% in sales,’ according to the Washington Post Therefore, in theory, with additional tariffs implemented, there would be greater job creation as there will be increased demand for domestic goods and stimulate economic growth

As Trump stated in an interview, “We must bring back jobs and industries that have been shipped overseas, reducing the trade deficits ’ Historically, the U S has imported more than it has exported, leading to a trade deficit. Financing a trade deficit often involves borrowing from other countries, leading to an increased foreign debt and dependency on foreign investors. The deficit can also cause the US to create inflationary pressures, as the government may need to print money to pay off the debts, leading to a decreased value in the currency and thus inflation Trump argues that a high tariff would make American goods more competitive, as people are more inclined to buy domestically, causing the trade imbalance to reduce

But do these advantages outweigh the harmful consequences of implementing additional tariffs?

One of the main consequences of a high tariff is the instant increase in consumer prices. According to the Microsoft network, various economic models have shown that consumers have "borne the brunt" of this protectionist measure, with the lowest-income households paying the largest proportion of their income In 2024, the bottom 25% of U S households typically earn around $40,000 annually With Trump’s proposed tariffs, it would cost a household around $2600 per year (according to ABC news), 65% of the income earned by the bottom 25%! Higher costs for imported materials and parts would also impact American manufacturers who rely on global supply chains, which could lead to inflation and reduce consumers’ purchasing power

Additionally, imposing high tariffs can cause retaliation from other countries, leading to a potential trade war Other nations might respond by imposing tariffs on American exports, making it difficult for U.S. businesses to sell their products abroad, which could lead to a further trade imbalance. According to ABC News, ‘Economists who spoke to ABC News said Trump's tariff proposals would all but certainly trigger a global trade war, diminishing sales for U S exporters, which account for about 10% of the nation's economy ’ According to Robert Lawrence, a professor at Harvard University, “Trump is likely to isolate the U.S. and drive other countries to do business with each other ” Even though Trump's vision aims to protect jobs, tariffs can significantly impact U S workers in a negative way With many industries in the U S that depend on imported components and raw materials, higher tariffs would increase their production costs, which could potentially lead to layoffs or even closures of companies that cannot bear the sudden additional expenses.

While Trump proposes these additional tariffs to help America, protect jobs, and reduce the trade imbalance in the U.S., the consequences are deemed as more significant by many renowned economists like Paul Krugman (a Nobel laureate and economist) and Gregory Mankiw (a Harvard economist) Higher consumer prices, trade wars, and a dampened economy could offset any gains in domestic production

Mikail Hashmi

Game theory is a branch of mathematics and economics that studies decision-making in situations where multiple players, such as, in the real world, people, companies, or organisations, interact The ‘game’ refers to any scenario where the outcome depends on the choices of all participants In the real world, this could involve businesses competing in the market, countries negotiating trade deals, or even you choosing partners for your economics group project By studying game theory, we gain access to a framework for understanding the best strategies in order to adapt to different situations We can use this in business to anticipate competitors’ actions, make informed decisions, and maximise outcomes, such as profit This will be a very brief look into the world of Game Theory.

Before looking into game theory in the real world, we must look at the key ideas in game theory Game Theory consists of players, strategies, and payoffs In game theory, players can be businesses, customers, or governments. Each player has several possible actions that they can take The payoffs in game theory are the results of these actions, such as profits or losses

Another key idea is the Prisoner’s Dilemma. This is a popular example used in game theory, which shows how two players might not cooperate, even when it may be in their best interest. An example of this is if two companies keep prices high, both make good profits, and if one company lowers prices to attract more customers, the other loses out But if both lower prices, they might end up making less profit overall. This example helps to teach businesses about the risk of aggressive competition, like price wars, where both parties might end up worse off. Understanding this through game theory helps businesses cooperate more efficiently or know when to compete

Another key idea is the Nash Equilibrium, which describes a situation where no player can benefit by changing their strategy if others stick to theirs (ceteris paribus – assuming all other factors remain constant). Businesses use the Nash Equilibrium to stabilise pricing or production strategies For example, in industries where companies do not want to engage in price cuts, they can stick to agreed price levels that maintain profitability for all, such as price matching in some UK supermarkets.

Now that we have covered some of the key concepts in game theory, we can look at how we can adapt the findings of game theory to a business setting An example of when this can be used is in oligopoly markets. These are markets with a few major players, most often telecommunication or airline markets. These companies often use game theory to avoid price wars that could hurt the profits of everyone This is extremely common in the airline industry, where companies avoid drastic price cuts, knowing that if one company starts, the others will follow, leading to lower profits for all. Game theory can also help businesses decide the best time to launch new products. For example, tech companies often use it to decide whether to be the first to market new products or develop them further They may get a competitive edge from being first but can also avoid the mistakes of competitors by waiting Game theory also helps online retailers like Amazon with their pricing strategies. Through the use of dynamic pricing, they adjust prices based on competitors' actions and consumer demand

Overall, game theory continues to shape industries in today’s business world, such as green energy, where companies collaborate and compete to provide renewable resources. Companies use game theory to negotiate joint projects to build electric vehicle charging stations, finding a balance between competition and cooperation Game theory helps businesses make smarter decisions by predicting how the other players will react, helping companies to thrive in complex markets.

The use of data science in financial markets has grown beyond standard quantitative data, with sentiment analysis increasingly being utilised to gauge public mood and forecast market movement Sentiment analysis employs data from social media, news outlets, and other public platforms to gauge investor sentiment, nicely combining economics and psychology. This article will explore how data science applies sentiment analysis to markets, demonstrating the significance of human behaviour and psychology on financial trends

Sentiment analysis in finance employs advanced data science techniques in the area of natural language processing (NLP) and machine-learning algorithms to analyse large volumes of unstructured textual data from social media platforms like Twitter or Reddit, news articles, and financial reports The algorithms classify words and phrases as positive, negative, or neutral

For example, a rise in positive mentions of a company on Twitter might mean that investor confidence is returning and could presage a price increase. Through data science tools, sentiments of millions of posts or articles can be analysed in real time, and trends in sentiment detected almost instantaneously By quantifying public sentiment, data scientists can model the likely impact on stock prices something that may be invisible through traditional market analysis.

Social media has proved to be a good source for sentiment data, as it offers real-time, often unfiltered insight into public opinion Huge datasets exist on Twitter, Reddit, and Facebook, where investors go through the trends in the market, sharing their opinions and expressing optimism or anxiety over specific stocks. It's the form of sentiment analysis that first gained widespread attention with events like the GameStop surge in early 2021, where users on Reddit collectively drove up the stock price to illustrate how powerful social sentiment can be

Data scientists then employ machine learning algorithms to mine social media for keywords and phrases, such as “buy,” “sell,” “bullish,” or “bearish,” along with specific stock names or marketrelated terms

They analyse the sentiment of these words by measuring the frequencies and contexts in which they appear and then derive a score that reflects investor mood. Positive sentiment may signal the possibility of buying, while negative sentiment could warn of a sell-off Their findings increasingly help inform trading strategies and risk management decisions by institutional hedge funds, asset managers, and individual retail investors.

News sentiment analysis forms another critical component of sentiment analysis in financial markets. News articles, press releases, and financial reports shape investor perception and behaviour with considerable impacts on stock prices For example, headlines about a company's earnings can quickly drive price movements as investors buy on news of perceived success or sell on news of perceived failure.

Data scientists use NLP to analyse the sentiment of news articles marking them as positive, negative, or neutral. They also track how often certain themes or keywords appear, like "growth," "loss," "merger," or "scandal " That's how, by quantifying such sentiment trends, financial analysts develop models that estimate probabilities for market movement according to the tone and topic of news coverage.

Sentiment analysis catches more than just economic fundamentals; it taps into investor psychology, which has a lot to say about the dynamics of financial markets. The concepts of herding behaviour and market sentiment show how psychology can influence economic decisions Herding happens when investors act as one, very often contrary to independent judgments. This may create momentum that causes prices to move higher or lower based only on group behaviour perception.

The "fear and greed index" is just one of the ways in which sentiment reflects psychological drivers in the market. Extreme optimism may lead to overvaluation, while fear may lead to excessive selling and undervaluation. Sentiment analysis provides a way for investors to measure these emotional states and subsequently decide about their course of action

While useful, there's a limit to sentiment analysis; the language used in social media and news is often colloquial, given to slang, irony, or even sarcasm, and subject to misinterpretation by algorithms. For example, if someone tweeted, "This stock is on fire!" it could be positive, but in another context, it might mean exactly the opposite

A second challenge could be an overreliance on sentiment data, since the sentiment-driven type of predictions usually are short-term and therefore probably miss consideration of the true economic fundamentals Sentiment analysis can amplify volatility as traders react to sudden shifts in sentiment, creating price swings that, in the short term, have nothing to do with intrinsic value

The future of sentiment analysis in finance indeed lies in developing more complex and accurate models, which would get the nuances that come with human language. Advances in machine learning and NLP continue to elevate the ability of algorithms to interpret complex language, enabling more accurate sentiment scoring However, ethical considerations arise The ability of large investors or trading firms to leverage sentiment analysis may further deepen inequality, as they can react to sentiment changes faster due to their resources.

Moreover, the sheer influence wielded by social media on financial decisions raises questions about market manipulation and transparency Finally, one of the powerful tools in the financial markets is sentiment analysis, which combines data science and psychology to uncover insights into public mood and possibly market trends It allows for comprehension and prediction of the psychological drivers of investor behaviour through sentiment analysis, helping make more reactive, data-driven investment strategies However, balancing the sentiment data with economic fundamentals.

Darsh Jethwani

In recent years, the global economy has encountered a new challenge: greenflation This term refers to rising prices of goods and services driven by the increasing demand for eco-friendly technologies and stricter environmental policies aimed at combating climate change. While the transition to sustainability is essential and long overdue, greenflation creates significant challenges for both consumers and businesses Striking a balance between achieving environmental goals and maintaining sustainable economic growth is crucial to addressing these issues.

The shift to a greener economy is resource-intensive, requiring large-scale investments in renewable energy, electric vehicles, and sustainable infrastructure. One major driver of greenflation is the rising cost of essential raw materials, such as lithium, cobalt, and nickel, which are critical for renewable energy sources For instance, the price of lithium surged by over 500% between 2021 and 2023 due to limited supply and rising demand as countries accelerated their sustainability efforts.

Government policies also contribute significantly to greenflation Carbon taxes and stricter environmental regulations have made fossil fuels more expensive, encouraging the adoption of cleaner but often pricier alternatives. At the same time, global supply chain disruptions, worsened by the COVID-19 pandemic and geopolitical tensions like the Ukraine war, have delayed the production and distribution of green technologies

Greenflation presents diverse challenges that affect economies at multiple levels For consumers, higher costs for energy-efficient products, like EVs and solar panels, can make sustainable lifestyles less accessible, particularly for low-income households This creates a paradox where sustainability efforts, meant to benefit society, could unintentionally deepen socioeconomic inequalities For businesses, rising costs of raw materials and energy are squeezing profit margins, especially in energy-intensive industries like manufacturing and transportation Small businesses are particularly vulnerable, as they often lack the resources to quickly adapt to or absorb the higher costs of raw materials. Policymakers face the difficult task of balancing inflation control with the need to encourage green investments Raising interest rates to combat inflation could slow the development of renewable energy projects, affecting progress towards climate goals.

While greenflation is an inevitable part of the energy transition, its negative impacts can be mitigated with the right strategies Governments and private companies need to invest in scaling up the production of critical minerals and developing alternatives to scarce and costly resources. For example, advancements in battery technology, such as solid-state batteries, could reduce dependency on materials like lithium and cobalt Furthermore, governments can use green subsidies and tax incentives to make sustainable products more affordable for consumers, accelerating their adoption while reducing the financial burden.

Greenflation is a natural side effect of transitioning to a sustainable future However, by addressing its root causes and impacts strategically, governments and businesses can manage the transition effectively, ensuring that environmental goals and economic growth go hand in hand With thoughtful planning, the journey toward a greener world can be one that benefits the entire economy

Trading is at the core of the financial markets, driving the purchasing of various assets around the world Simply put, trading is the buying and selling of various financial instruments, with the goal of profiting from price movements Unlike investing, which primarily looks at long-term accumulation of wealth, trading takes a different perspective. By using short- to medium-term movements in the market, trading makes sure to capitalize on factors like changes in price that investing may not be able to capture

The rapid and quick nature of trading has made it appealing for people all around the world looking to make money In the previous decades, the creation of advanced trading platforms available to people all around the world has led to more people than ever partaking in trading Nowadays, anyone with access to a mobile phone can access global markets with ease, place orders, and make or lose their savings in seconds. This widespread accessibility to different markets globally has led to a surge of people who view trading as simply being ‘speculative’ and not being a reliable way to make an extra income Yet, this surge in popularity has also brought a new way of looking at the markets technical analysis. This newfound perspective on the markets around the world aims to bring order to the chaos of trading. The tools and techniques that come from technical analysis have empowered traders to use data, identify trends, and make more informed decisions ultimately becoming the driving force behind many strategies in trading today.

The initial emergence of technical analysis traces back to the 17th century Japanese rice traders developed the early form of candlestick charts during this time to track the rice markets in greater depth. Its goal? To bring a more scientific and logical approach to trading. Over time, trading practices began to evolve much further. In Europe, the concept of price action analysis started to gain traction This period in the 18th century saw various traders looking at prices, analyzing their movements, and trying to predict where they were headed in the future In the early 19th century, there were various notable developments that were made by analysts who began to systematically record price movements and use the insights from these moves to identify patterns and trends in the markets This eventually led to a standardized approach being developed, which helped traders analyze market behavior in a more accurate way In the late 19th century, Charles Dow laid the basic groundwork for modern technical analysis to flourish. He pioneered various theories on price movements, as well as market trends This led to the creation of the Dow Theory, one of the most famous and well-known trading theories to date

Overall, technical analysis is said to be built on three main theories:

1. Market action discounts everything: All available information is reflected in the price of an asset.

2. Price moves in trends: Market movements are not random but instead tend to follow identifiable trends.

3. History tends to repeat itself: Patterns observed in the past can indicate future price movements.

These three main concepts are the basis of technical analysis. Using these three main ideas, an innovative way of viewing the markets has been developed Instead of using financial reports and studying a company in depth, people worldwide can look at price patterns and trends and predict the direction of price movements Almost all technical analysis strategies today rely on various tools, such as charts and trading indicators. By combining a multitude of powerful market analysis techniques, traders can better understand and predict market movements consistently, leading to them making a profit Firstly, traders use different types of charts to get unique perspectives on price dynamics in various markets. These charts include line charts, bar charts, and candlestick charts, along with many others. These charts are used to look at price in different ways and get different information out of how price moves For example, the shape and magnitude of a candlestick can help traders identify the significance of a move in price, identify a potential reversal in the markets, and determine overall sentiment within a certain period.

Another large portion of technical analysis stems from the use of technical indicators Technical indicators are tools that traders utilise to gain extra information based on two key metrics: price and volume. Simply using the historical and current price of an asset, as well as the number of shares and contracts traded over a given time, traders can create powerful indicators to help interpret what the market is doing

An example of an indicator is a moving average (MA). Being one of the most popular indicators, MA smooths out price data to show the average value of an asset over a specified period. This helps traders identify where price is in context to historical data, which can help traders understand where price is now and where it could go in the future This simple concept and calculation is what forms the basis of many, more complex technical strategies used in the markets. Another key technical indicator is the Relative Strength Index (RSI) This measures the magnitude of recent price changes compared to historical price movements, which is used to understand if an asset is overbought or oversold This can provide insights for traders on whether it is a good time to buy or sell an asset, helping them understand when best to place an order. There are also volume indicators, such as On-Balance Volume (OBV), which highlight the intensity and power behind price movements, understanding if there is momentum coming into the market Two simple pieces of information price and volume have evolved into countless indicators throughout the years. The multitude of tools that stem from these two simple metrics is astounding. Each of these tools provides unique guidance for traders with different needs and experiences, helping all people have a better understanding of the market and making more informed decisions as a result

Although trading may seem like an easy task, simply putting in orders based on how you interpret the charts, the difficulties are much deeper than they seem. Mark Douglas' work, Trading in the Zone, underscores the significant importance that a trader’s mindset has when trying to make a profit by trading According to Douglas, the true edge when trading lies in not merely the analysis but instead in understanding probabilities, managing your risk when trading, and fostering psychological discipline during your trades. This means that no matter how good your technical analysis is, if you do not have the discipline and intent to stick by your strategy and execute trades in the same way each time, you will never be successful in the markets Some of Douglas’ most famous quotes are: "An edge is nothing more than an indication of a higher probability of one thing happening over another" and "Every moment in the market is unique." These ideas emphasize that trading success hinges on a probabilistic mindset, recognizing that while patterns and tools provide an edge, there are no certainties in the market These ideas proposed by Douglas put a clear emphasis on the fact that trading success hinges on a mindset that is probabilistic. Traders need to recognize that while using trading patterns and tools can provide an edge, there are no certainties in the market Even if your strategy has a 90% win rate, it can though improbable lose 100 times in a row The market is unpredictable, and therefore trading the market requires emotional discipline, a skill that many traders do not possess

Modern technical analysis has come a significant way from the era of Japanese rice traders The rapid evolution that technical analysis has undergone now makes it a key part of trying to make a profit in the markets It provides unique tools and insights that plain fundamental analysis cannot It helps traders better navigate movements in price and make a profit as they do so. The debate around whether trading is synonymous with speculation still remains; however, technical analysis provides a more structured and cohesive approach to understanding the markets This approach mitigates risk and allows for more calculated decisions to be made by traders all around the world. Ultimately, trading success doesn’t simply involve tools and analysis. Instead, it requires the individual trader to have a multifaceted approach when faced with the challenge of understanding the markets As emphasised by Mark Douglas, a trader needs to master both their technical edge and psychology to truly master and thrive in the complex, ever-evolving financial markets

Monetary policy is a set of tools that a nation's central bank has available to promote sustainable economic growth by controlling the overall supply of money that is available to the nation's banks, its consumers, and its businesses. Economic statistics such as gross domestic product (GDP), the rate of inflation, and industry and sector-specific growth rates influence monetary policy strategy As artificial intelligence (AI) continues to transform various sectors in different ways, its potential to enhance the effectiveness of monetary policy cannot be overlooked. While AI offers numerous benefits for central banks, including increased efficiency, risk management, and significant cost savings, it also poses challenges such as data quality issues, bias, ethical concerns, and cybersecurity risks

It is obvious that artificial intelligence is also transforming the financial sector by enabling predictive analytics, automated trading, and enhanced customer service, with AI systems in finance projected to reach $97 billion by 2027. AI can play a crucial role in helping central banks make informed decisions about monetary policy. By simulating different economic scenarios, AI allows policymakers to explore potential outcomes before they put any changes into action For instance, with advanced modelling techniques, AI can shed light on how adjustments in interest rates might influence various sectors of the economy or how strategies like quantitative easing could impact financial markets. One of the significant advantages of using AI is its ability to estimate the time lag between when a policy change is made and when its effects are felt such as on inflation or employment These insights are vital since they can help central banks time their actions more effectively, allowing them to tweak interest rates based on how the economy is responding. This ultimately leads to better decision-making and more stable economic conditions.

AI enables central banks to process and analyse real-time data, helping them make timely adjustments to monetary policy This includes analysing market sentiment and consumer behaviour to gauge economic conditions more accurately Traditionally, monetary policy decisions have relied on lagging indicators such as GDP growth and inflation rates, which are often updated only every quarter or annually However, with AI being able to process vast amounts of economic data with unprecedented speed and accuracy, it can analyse real-time data. This means that data can be collected at a faster rate and can enhance the accuracy of monetary policy decisions, generating significant economic value through its data analysis capabilities The ability to perform real-time analysis of economic indicators allows central banks to make more timely and informed policy decisions in the realm of monetary economics An example of this can be seen in the work of the Bank of England (BoE). The BoE has employed AI algorithms to analyse vast amounts of economic data, including consumer spending patterns and credit card transactions These additional data collection methods help the BoE estimate the responsiveness of consumers and businesses to changes in interest rates more accurately

While AI offers multiple benefits, its integration into monetary policy can also pose many challenges Conceptually, AI can be thought of as a filter through which information is gathered, analysed, and assessed; therefore, this can present multiple risks External hackers, or malicious actors, may use sophisticated hacking tools to gain access to the enterprise artificial intelligence system; they may impersonate central banks through identity theft Artificial intelligence systems are prone to data attacks at the data training stage, as hackers may add destructive or disruptive elements to the training dataset to undermine the accuracy of artificial intelligence algorithms Moreover, before implementing AI, central banks do need to take into account the cybersecurity risks that may arise from the adoption of artificial intelligence systems in central banking operations and decision-making