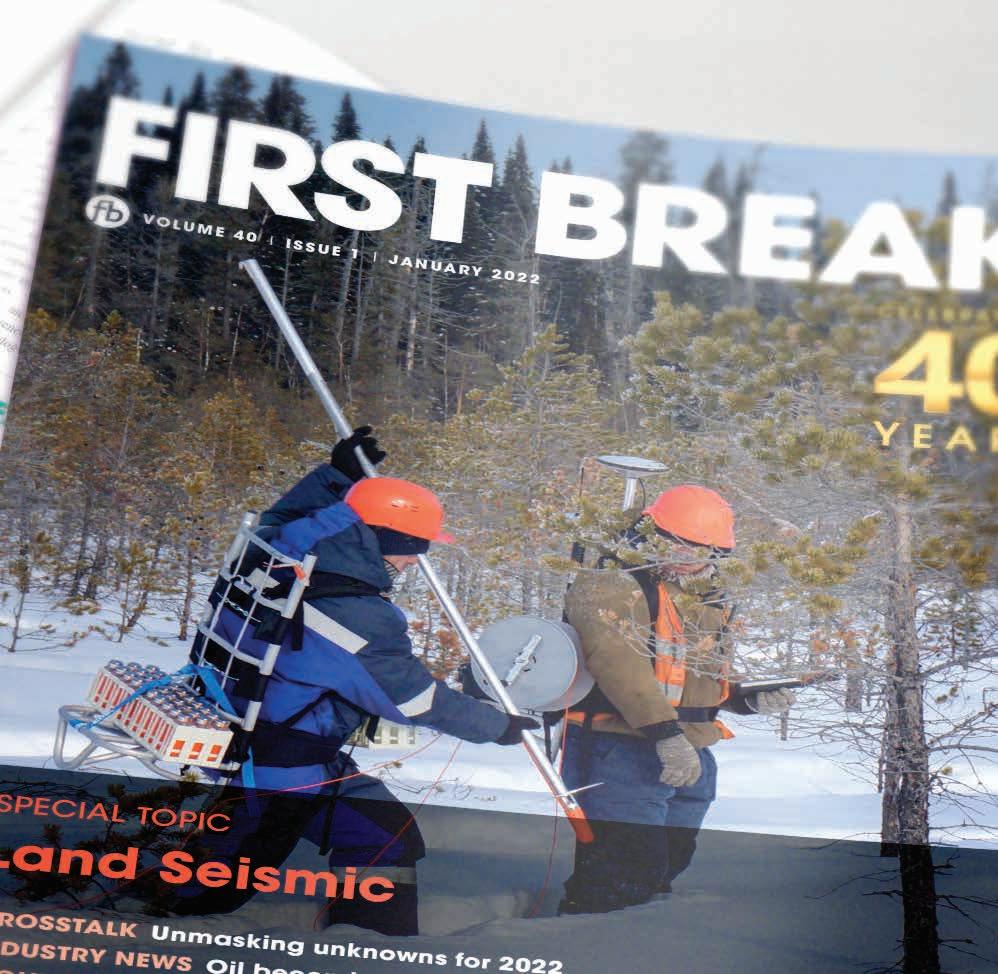

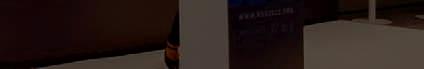

SPECIAL TOPIC

Land Seismic

EAGE NEWS President’s new year message

TECHNICAL ARTICLE The Dutch SCAN geothermal exploration project

CROSSTALK What 2023 has in store for geoscenice

VOLUME 41 I ISSUE 1 I JANUARY 2023

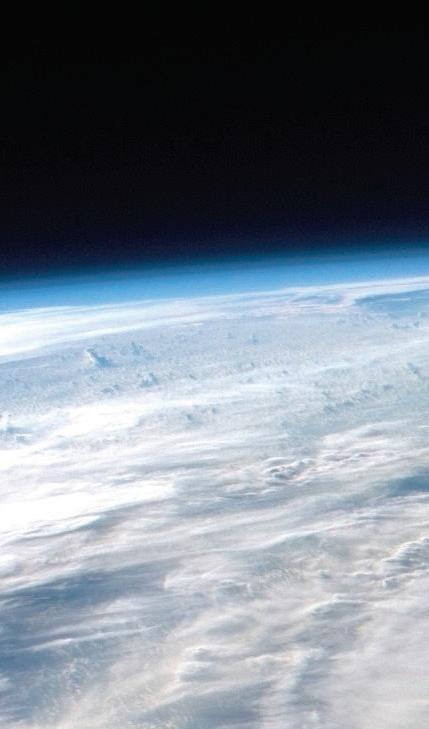

OUR PLANET. FROM A NEW PERSPECTIVE.

cgg.com/geoverse

SE E THINGS DI FF ERE NT LY

CHAIR EDITORIAL BOARD

Gwenola Michaud (Gwenola.Michaud@cognite.com)

EDITOR

Damian Arnold (editorfb@eage.org)

MEMBERS, EDITORIAL BOARD

• Lodve Berre, Norwegian University of Science and Technology (lodve.berre@ntnu.no)

• Satinder Chopra, SamiGeo (satinder.chopra@samigeo.com)

• Anthony Day, PGS (anthony.day@pgs.com)

• Peter Dromgoole, Retired Geophysicist (peterdromgoole@gmail.com)

• Rutger Gras, Consultant (r.gras@gridadvice.nl)

• Stephen Hallinan, CGG Stephen.Hallinan@CGG.com

• Hamidreza Hamdi, University of Calgary (hhamdi@ucalgary.ca)

• Clément Kostov, Freelance Geophysicist (cvkostov@icloud.com)

• John Reynolds, Reynolds Geo-Solutions Ltd (jmr@reynolds-geo.com)

• James Rickett, Schlumberger (jrickett@slb.com)

• Peter Rowbotham, Apache (Peter.Rowbotham@apachecorp.com)

• Pamela Tempone, Eni (Pamela.Tempone@eni.com)

• Angelika-Maria Wulff, Consultant (gp.awulff@gmail.com)

EAGE EDITOR EMERITUS

Andrew McBarnet (andrew@andrewmcbarnet.com)

PUBLICATIONS MANAGER

Martha Theodosiou (mtu@eage.org)

MEDIA PRODUCTION

Saskia Nota (firstbreakproduction@eage.org)

PRODUCTION ASSISTANT

Ivana Geurts (firstbreakproduction@eage.org)

ADVERTISING INQUIRIES corporaterelations@eage.org

EAGE EUROPE OFFICE

Kosterijland 48

3981 AJ Bunnik

The Netherlands

• +31 88 995 5055

• eage@eage.org

• www.eage.org

EAGE MIDDLE EAST OFFICE

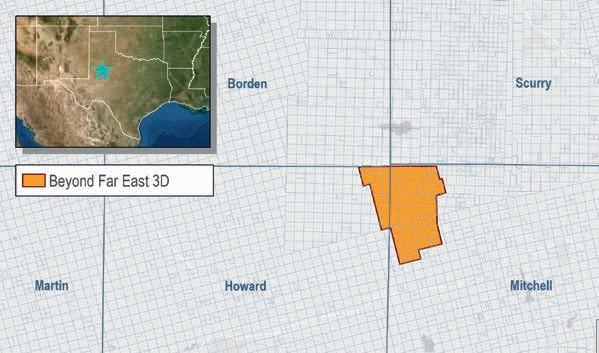

EAGE Middle East FZ-LLC

Dubai Knowledge Village

Block 13 Office F-25 PO Box 501711

Dubai, United Arab Emirates

• +971 4 369 3897

• middle_east@eage.org

• www.eage.org

EAGE ASIA PACIFIC OFFICE

UOA Centre

Office Suite 19-15-3A

No. 19, Jalan Pinang

50450 Kuala Lumpur

Malaysia

• +60 3 272 201 40

• asiapacific@eage.org

• www.eage.org

EAGE AMERICAS SAS

Edificio Centro Ejecutivo Santa Barbara

Av. Cra. 19 #118-95 - Office: 501

• +57 310 8610709

• americas@eage.org

• www.eage.org

EAGE MEMBERS CHANGE OF ADDRESS NOTIFICATION

Send to: EAGE Membership Dept at EAGE Office (address above)

FIRST BREAK ON THE WEB www.firstbreak.org

Editorial Contents

33

Dutch SCAN Geothermal Exploration Programme — The first three years of 2D seismic acquisition and (re)processing Johannes Rehling, Gitta Zaalberg-Metselaar, Rutger Peenstra, Johannes van den Akker and Marten ter Borgh

Sp ecial Topic: Land Seismic

44 Using ‘Noise-Corrected OVT Fold’ to optimise land seismic acquisition risk, costs, and quality Christof Stork

51 Time-Lapse, multi-component seismic monitoring of geomechanical changes in reservoirs

Tom Davis

59 Signal-to-noise, energy sources, and acquisition techniques: a commentary

S.L. Rowse and Bob Heath

65 Revival of faltered drilling campaign in a marginal field in Barmer Basin, India

Mohammed Soyeb Allam, Beauty Kumari, Srimanta Chakraborty and Sreedurga Somasundaram

73 The key to increasing resolution with acquisition

Jason Criss

77 The use of miniaturised seismic sources for reduced environmental impact

Andrea Crook, Mostafa Naghizadeh, Peter Vermeulen, Devin Gagnier and Carl Reine

85 Reducing (or at least quantifying) the weather-related risk of onshore seismic surveys

Tim Dean and Pieter Claassen

FIRST BREAK I VOLUME 41 I JANUARY 2023 1 FIRST BREAK ® An EAGE Publication

ISSN 0263-5046 (print) / ISSN 1365-2397 (online)

and quality.

12 Using ‘Noise-Corrected OVT Fold’ to optimise land seismic acquisition risk, costs,

cover: Sercel Nomad 65 Neo broadband vibrator operating in desert conditions. 3 EAGE News 17 Personal Record Interview 20 Crosstalk 23 Industry News Technical Article

The

90 Calendar

Near Surface Geoscience Division

European Association of Geoscientists & Engineers Board 2022-2023

Esther Bloem Chair

Andreas Aspmo Pfaffhuber Vice-Chair

Micki Allen Contact Officer EEGS/North America

Adam Booth Committee Member

Hongzhu Cai Liaison China

Eric Cauquil Liaison Shallow Marine Geophysics

Deyan Draganov Technical Programme Officer

Wolfram Gödde Liaison First Break

Hamdan Ali Hamdan Liaison Middle East

Vladimir Ignatev Liaison Russia / CIS

Musa Manzi Liaison Africa

Myrto Papadopoulou Young Professional Liaison

Catherine Truffert Industry Liaison

Panagiotis Tsourlos Editor in Chief Near Surface Geophysics

Florina Tuluca Committee member

Oil & Gas Geoscience Division

Lucy Slater Chair

Yohaney Gomez Galarza Vice-Chair

Michael Peter Suess Immediate Past Chair; TPC

Erica Angerer Member

Wiebke Athmer Member

Juliane Heiland TPC

Tijmen Jan Moser Editor-in-Chief Geophysical Prospecting

Adeline Parent WGE SIC Liaison

Francesco Perrone Member

Matteo Ravasi YP Liaison

Jonathan Redfern Editor-in-Chief Petroleum Geoscience

Giovanni Sosio DET SIC Liaison

Aart-Jan van Wijngaarden Technical Programme Officer

SUBSCRIPTIONS

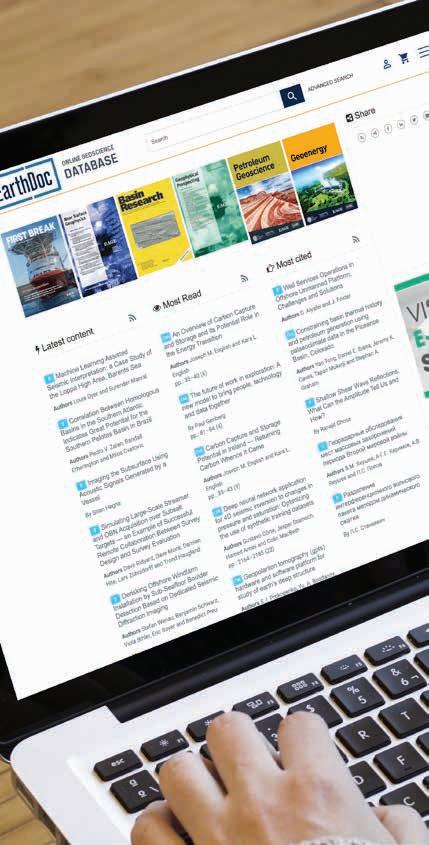

First Break is published monthly. It is free to EAGE members. The membership fee of EAGE is € 80.00 a year including First Break, EarthDoc (EAGE’s geoscience database), Learning Geoscience (EAGE’s Education website) and online access to a scientific journal.

Companies can subscribe to First Break via an institutional subscription. Every subscription includes a monthly hard copy and online access to the full First Break archive for the requested number of online users.

Orders for current subscriptions and back issues should be sent to EAGE Publications BV, Journal Subscriptions, PO Box 59, 3990 DB, Houten, The Netherlands. Tel: +31 (0)88 9955055, E-mail: subscriptions@eage.org, www.firstbreak.org.

First Break is published by EAGE Publications BV, The Netherlands. However, responsibility for the opinions given and the statements made rests with the authors.

COPYRIGHT & PHOTOCOPYING © 2023 EAGE

All rights reserved. First Break or any part thereof may not be reproduced, stored in a retrieval system, or transcribed in any form or by any means, electronically or mechanically, including photocopying and recording, without the prior written permission of the publisher.

PAPER

The publisher’s policy is to use acid-free permanent paper (TCF), to the draft standard ISO/DIS/9706, made from sustainable forests using chlorine-free pulp (Nordic-Swan standard).

2 FIRST BREAK I VOLUME 41 I JANUARY 2023

Caroline Le Turdu Membership and Cooperation Officer

Peter Rowbotham Publications Officer

Pascal Breton Secretary-Treasurer

Aart-Jan van Wijngaarden Technical Programme Officer

Esther Bloem Chair Near Surface Geoscience Division

Lucy Slater Chair Oil & Gas Geoscience Division

Edward Wiarda Vice-President

Jean-Marc Rodriguez President

Maren Kleemeyer Education Officer

Looking forward to a better year in 2023

May I as your Association president take this moment to wish a very Happy New Year to all our members, partners, and friends as we begin 2023!

these fundamental issues particularly in the energy field. I can tell you that your Board takes very seriously the responsibility implied. Reflecting the changing composition of our membership, EAGE’s strategy going forward is clear. We need to pursue a path that puts sustainable development at the heart of our organisation and decisions. The task can be simply defined: help to produce more energy, emit less carbon, and become more sustainable. By focusing on sustainable development as the key to the evolution of our association, we are making a statement to society about how we intend to act for a better future.

clear how EAGE can organise to meet the needs of the energy transition era.

In the meantime at the start of this New Year I would like to particularly acknowledge the many individuals who give of their time on a voluntary basis to make our association such a valuable professional community. On behalf of all members, I would like to thank all those who serve on our many committees including event organisation, contributors to our education initiatives, and the editors and reviewers of our growing portfolio of publications.

2022 was anything but a normal year. We have faced substantial headwinds. To cite just a few, we are dealing with the aftermath of the Covid-19 pandemic; the effects of the Russia-Ukraine war; the subsequent energy crisis and inflation rates at a 30-year high.

However, the challenge to all of us has not changed. Each and every year, we should start the year with the same resolution: to grow in resilience as individuals and as a society. No one said this is always easy, but I am hopeful that 2023 can bring some positive solutions to the issues we face.

As part of a professional society our members are deeply involved in some of

Our ambition in 2023 is to make sure that our members are the heart of this transformation. Together we will be better – not just a quick fix, but a change of paradigm, a leap into the future. In this respect the Board is coming forward with some proposals (see P. 12 for details of Special AGMM in February) which make

I must also express my personal appreciation for the positive collaboration I have experienced with my fellow Board members and of course with our entire staff whose work over the year has been quite admirable.

I sincerely hope I will see many of you at our Annual Meeting in Vienna. In the meantime, allow me in my native tongue to wish everyone, Bonne Année!

FIRST BREAK I VOLUME 41 I JANUARY 2023 3 GET advances transition vision 08 LC Aberdeen year in focus 10 Entries sought for Photo Contest 12 HIGHLIGHTS

Jean-Marc Rodriguez, president, EAGE.

Dedicated Sessions will be a key feature of Vienna Annual Meeting

to make a contribution to share your expertise to thousands of professionals and academics. You have until 15 January, 23:59 CET to submit your papers at eageannual.org.

• Going Big – Scaling machine learning applications in geoscience and engineering

Our Annual Meeting in Vienna this year will once again bring together some of the greatest minds in our community to showcase the latest developments, newest technologies, state-of-the-art products and innovative services in the oil and gas and energy industries.

The Technical Programme of EAGE Annual 2023 will feature engaging presentations with topics ranging from geophysics and geology, mining and infrastructure, integrated subsurface and reservoir engineering, to digitalisation and energy transition. This is clearly reflected in the Call for Abstracts which is still open for submissions. Don’t miss your chance

An added feature of the Technical Programme will be a series of more than ten Dedicated Sessions being organised to cover a range of disciplines. Most of the Dedicated Sessions will be led by representatives of our various EAGE Technical Communities – the network of dedicated and energetic members committed to promoting innovation and technical progress in their respective fields. These sessions include:

• Energy Transition and Net Zero Emissions: The role of geoscience and engineering to tackle climate change and ensuring energy safety for future generations

• Deep-Sea Minerals – Thinking outside the standard exploration box

• Petroleum Systems of Central and Eastern Europe

• Future of Basin Modelling in the Energy Transition

• Risk Assessment of Geohazards: Multidisciplinary novel approaches and technologies

• Drone Remote Sensing and Drone Geophysics for Near-Surface Applications

Some other Dedicated Sessions will be conducted by professors and experts in the field, namely:

• Exploration of the Moon, Mars and Beyond Using Geophysical Methods

• Advances in Digital Rock Physics

• Characterisation of Geological Risks in Geothermal Projects

• Post-Mining in Energy Transition

• Legacy Wells: Threats and opportunities for energy and CO2 storage

There will also be one Dedicated Session specifically designed to showcase some of the best papers published recently in the Petroleum Geoscience journal.

If you are interested in contributing content to one of the Dedicated Sessions, you are welcome to email abstracts@ eage.org for more details and availability. Additional information and latest updates on the Dedicated Sessions can be found on eageannual.org.

4 FIRST BREAK I VOLUME 41 I JANUARY 2023 EAGE NEWS

Season’s Greetings and a Happy New Year! 23062-Seasons Greetings 2022/2023_FINAL (filler).indd 1 14/12/2022 08:48 ADVERTISEMENT

Presentation in a conference dome, Madrid 2022.

SUPERIOR IMAGING. INTUITIVE VISUALISATION. DUG INSIGHT.

Modern workflows need modern software. DUG Insight is a full-service, interactive software platform for advanced seismic data processing and imaging, interpretation, visualisation and QI—across land, marine and ocean-bottom surveys. DUG Wave FWI provides revolutionary least-squares imaging solutions. User experience is our priority. Software must be intuitive. DUG Insight feels like a single package designed by a single team, built on a single platform. Because it is.

Let DUG Insight's state-of-the-art technology help you make your next discovery.

•ISO 27001• OC M PASSASSURANCESERV SEC •ISO 9001• OC M PASSASSURANCESERV SEC

dug.com/insight For more information contact info@dug.com

Community and Student activities high on the agenda at the EAGE Annual in Vienna

With a new year comes the next edition of our highly-anticipated 84th EAGE Annual Conference & Exhibition! And as always, exciting Community and Student programmes are being planned for you. Here are some of the highlights.

Career Advice Centre

Our Community Programme starts with career development opportunities that will help you stand out from the crowd, such as the CV Check, while the Speed Mentoring will offer a great possibility to connect with other professionals from all over the world across various disciplines of geoscience and engineering.

Are you ready to face the energy transition challenges? This year we will feature a new interactive session dedicated to guide your journey. Learn more about the skills required to navigate the changes demanded by the industry with our Decarbonisation and Energy Transition Technical Community and company representatives.

Additionally, if you are already participating in the EAGE Mentoring Programme 2022, you will also have a space to meet your mentor or mentee. And if you would like to contribute to the life of the Association and make a difference in your field, you can learn how you can get involved by visiting our Volunteering Corner at the EAGE Community Hub.

Special Interest Communities

The EAGE Women in Geoscience and Engineering community will be featuring a special session focused on women’s leadership role in transitioning to a more sustainable future. The session will also cover topics that showcase how women contribute to achieving sustainable development goals and what it means in tackling energy transition.

The Young Professionals community is preparing a special session to discuss specific challenges and opportunities for those aged under 35 who are already making, or may soon need to make, important decisions for their future careers. Meet leaders and peers from all over the world, and take home some constructive ideas for your upcoming professional steps.

Geosecrets of Austria

Whether you are returning to Vienna or visiting for the first time, you will find the ‘City of Dreams’ can claim an exciting scientific atmosphere and a rich geoscience landscape. Together with a team of local experts we will be exploring some of its most interesting features

EAGE

Hackathon 2023

If you are passionate about machine learning, this challenge is for you. Guided by the EAGE AI Committee, you are welcome to join a team and explore innovative solutions over the course of two creative and fun days.

Student Programme

Students will enjoy a dedicated programme aimed at helping them to build their careers, network with potential future employers, test their knowledge and have fun.

If you are one of our younger members, get better acquainted with the industry by meeting a selection of exhibiting companies and finding out what they have in store during our Exhibition Tour. In addition, at the Education Hunt, you will have the chance to win great prizes.

You are also invited to join a Networking Cafe, where you can connect with professionals and company representatives in an informal atmosphere. You may enhance your experience with a fascinating halfday field trip to the OMV Innovation & Technology Centre in Gänserndorf, Austria.

This is also call for all EAGE Student Chapters worldwide. Your representatives are invited to meet and talk about their experiences and best practices in our Annual Student Chapter Meeting. Held fully in-person, it will offer great opportunities for social interaction with your peers.

In addition to all this, the final round of the Laurie Dake Challenge 2023 and the EAGE Geo-Quiz will be held during the Annual, so start preparing now and don’t miss the chance to be part of the world’s best student teams or to watch them in action.

Start planning your trip to Vienna and don’t forget to visit the EAGE Community Hub!

6 FIRST BREAK I VOLUME 41 I JANUARY 2023 EAGE NEWS

Student Geo-Quiz contest underway.

Career development opportunities, student competitions and special sessions are scheduled for you.

Chapter hears talks on Dutch dike safety

Dong Zhang (EAGE Local Chapter Netherlands) writes: EAGE Local Chapter Netherlands invited geoscientists and students to join our inspiring live event held at Deltares on 12 October 2022. The keynote speakers from Deltares, Chris Bremmer and Marc Hijma, reviewed the current shallow geophysical research done by Deltares, and the importance of geology for dike safety with case studies.

Bremmer focused on geophysical applications which offer innovative solutions for shallow subsurface imaging for water management and sustainable infrastructure design. Some of the technical challenges include the transition from laboratory experiments to larger scale areas, the utilisation of data fusion and data science, the uncertainty and value of information, and the principles behind new sensors and their measurement. Bremmer showcased a series of case studies on how Deltares addresses these challenges, e.g., advanced testing facilities for new geophysical tools, different platforms to enhance the scale for field surveying, drone measurements for dike safety, distributed acoustic sensing using fibre optics for rail maintenance, data fusion for the characterisation of levees, and multi-sensor surveying for sinkhole detection in the city centre of Amsterdam.

Marc Hijma spoke on the importance of geology in dike safety. He started by describing the fundamental concept of backward erosion piping, an important failure mechanism for flood defences. He then explained that current assessment models in the Netherlands for backward erosion piping are based on tests using homogeneous sieved sands. This completely ignores the actual geology surrounding dikes since, in large parts of the Netherlands, the sand below flood defences is composed of tidal sand. Finally, Hijma presented small-scale pilot tests and two field studies in Hedwigepolder. These tests showed the different behaviour of tidal sands, which resulted in more resistance to piping than fluvial sand. He concluded that understanding the sand types, fluvial systems, and geological structure of the subsurface in dike areas is key to assessing dike safety, emphasising how the answers lie in the field.

Many questions and animated discussions followed the technical talks. Some attendees were curious about the details of fibre optics for rail maintenance. Others were interested in the logistics when Deltares applied sinkhole detection methods in the city centre of Amsterdam. The dike safety case study interested most of the audience, and many detailed field implementations were asked.

EAGE Online Education Calendar

Stay informed about the EAGE

Local Chapter Netherlands activities through the website page www.eagelcnetherlands.org or the LinkedIn page www.linkedin.com/ groups/13690220/. Become a member by sending an email to eageLCNetherlands@gmail.com.

FOR THE

25-27

FIRST BREAK I VOLUME 41 I JANUARY 2023 7 EAGE NEWS

FOR THE FULL CALENDAR, MORE INFORMATION AND REGISTRATION

VISIT WWW.EAGE.ORG AND WWW.LEARNINGGEOSCIENCE.ORG. * EXTENSIVE SELF

MATERIALS AND INTERACTIVE SESSIONS

THE INSTRUCTORS:

START AT ANY TIME VELOCITIES, IMAGING, AND WAVEFORM INVERSION - THE EVOLUTION OF CHARACTERIZING THE EARTH’S SUBSURFACE,

I.F. JONES

SELF PACED COURSE 6 CHAPTERS OF 1 HR GEOSTATISTICAL RESERVOIR MODELING, BY D. GRANA SELF PACED COURSE 8 CHAPTERS OF 1 HR CARBONATE RESERVOIR CHARACTERIZATION,

L. GALLUCCIO SELF

COURSE 8 CHAPTERS OF 1 HR 16-18 JAN SUB-SURFACE UNCERTAINTY EVALUATION (SUE) BY MANISH AGARWAL IOSC 4 HRS/DAY - 4 MODULES 17 JAN17 FEB DEVELOPING DEEP LEARNING APPLICATIONS

THEORY

PLEASE

PACED

WITH

CHECK SCHEDULE OF EACH COURSE FOR DATES AND TIMES OF LIVE SESSIONS

BY

(ONLINE EET)

BY

PACED

OILFIELD: FROM

TO REAL WORLD

PROJECTS

BY BERNARD MONTARON

EXTENSIVE ONLINE COURSE

16 HRS (INCL. 5 WEBINARS OF 1-2 HRS EACH)

JAN SEISMIC DIFFRACTION – MODELING, IMAGING AND APPLICATIONS BY TIJMEN JAN MOSER IOSC

4 HRS/DAY 5 MODULES

Chris Bremmer and Marc Hijma presenting at Deltares for LC Netherlands.

GET 2022 advances the energy transition vision

Conference co-chairs Giovanni Sosio (SLB), Léon Beugelsdijk (Shell) and Tobias Rudolph (THGA) share their thoughts on the recently concluded 3rd EAGE Global Energy Transition Conference & Exhibition (GET 2022).

players – not only service and product providers but also research institutions. Most significantly for the participants, it enabled different modes of participation, much in line with the EAGE’s desire to couple the sharing of technical knowledge with a broader discussion on the skills and solutions available in the geoscientific community that are needed to realise the energy transition.

The third edition of the EAGE’s flagship conference on energy transition, held on 7-9 November in The Hague, has many reasons to stand out. First of all, much to our delight as co-chairs, it has been the first to be held as a physical event, after two editions online; secondly, it has been supported not only by the generosity of the sponsors, but also by the commitment of our sister society, SPE, and its local section; and finally, it proposed a wide

roster of keynote speakers and three dynamic panel discussions to foster the exchange of thoughts and views beyond the more traditional scientific debates.

The opportunity to meet in person attracted more than 250 delegates, visibly enjoying the renewed occasion for networking – but also for more lively discussions around the presentations and panels. The event was also able to host an exhibition from a diverse set of

The two dedicated sessions in the conference, in particular, deserve a description. During the session on ‘Navigating Career Challenges and Opportunities’, three members of the EAGE’s special interest community on Decarbonization and Energy Transition (DET) introduced its coaching initiative – soon to be rolled out as a training course by EAGE – to help geoscientists and engineers face the career changes inherent in the energy transition: far from being a dry presentation of the course programme, it engaged participants by sharing and comparing experiences openly and so succeeded in its objective to establish a positive community environment.

What participants had to say

‘This was an ideal place to get up to speed in what is happening in the energy transition regarding geoscience and engineering topics. It was also an opportunity to meet the community, and particularly after two years where we had to keep it to an online event, it has been very exciting to finally meet people face to face. People are utilising this opportunity, which was one of the main drivers for GET, namely, to interact across different applications, across disciplines and seek collaboration opportunities. That’s just great to experience.’ – Karin de Borst, geomechanicist, Shell.

‘I’m looking very much forward to see how EAGE will continue to address the different segments of the future energy system.’ – Jeroen Schuppers, deputy head of unit for clean energy transition, European Commission – DG Research & Innovation.

‘The GET conference was very well organised and extremely productive for me. I ended up with many more new contacts and opportunities than I expected. It was also nice to visit The Hague again.’ – Dr Gehrig Schultz, chief operating officer, geoscience, EPI Group.

8 FIRST BREAK I VOLUME 41 I JANUARY 2023 EAGE NEWS

Great attention from the audience.

A follow-up coaching session at the Community Hub was also scheduled for participants. The Closing Session, organised by the young professionals (YP) of the Netherlands section of SPE, put the delegates to work together again, interacting to distil the findings of three days of debates and identify the most impactful items to continue the discussion – and the work.

The involvement of the sponsors –Shell and SLB – and of SPE was reflected in the contribution of these players, committed to the energy transition, as members of the technical committee, speakers in the technical programme, and panellists during the plenary sessions. SPE also contributed their point of view on sus-

tainability, with the participation of its members in several panels, energising the audience with an interactive and insightful closure of the conference.

More than 60 technical talks and 20 posters in the programme reflected the solid technical tradition of EAGE. Geophysics, not surprisingly, took the lion’s share of the geoscientific presentations with insights on risks, sustainability, and social aspects of the transition to a different energy mix.

To crown the technical debate, six speakers provided their points of view in front of the plenary audience, driven by three key topics – sustainability and social license to operate, knowledge development and training, and the role of the industry. Their keynote talks were complemented by three lively panels, brilliantly moderated to involve the audience in the debate.

learn more about what activities they currently have planned. Likewise, interested mentees and mentors present at GET 2022 signed up for the EAGE Mentoring Programme 2022 during the conference.

The Icebreaker Reception on the exhibition floor and Conference Evening at Madurodam, the Dutch miniature themed park, marked opportunities for the full community to meet and network outside the technical sessions.

As EAGE is strengthening its engagement with energy transition, it will aim to share with its members the technical knowledge needed to accelerate transition, together with broader support for geoscience applications which can ensure that transition happens in a sustainable, just and truly global way. The GET conference seems to be the perfect forum for this sharing, even more so when we’re getting

Jean-Marc Rodriguez, EAGE president and vice president exploration, Asia Pacific at TotalEnergies, said: ‘I’m very pleased to be here and to see all the energy. We are at EAGE actively working on different domains to progress the transition: the DET which is a community dedicated to the energy transition, and Geoenergy journal to be launched early next year. We also want to be member centric and dedicate our time to help the existing generation and also the young professionals and future graduates to see all the interest in geoscience for the energy transition. I’m sure that GET will be far more extended in terms of contribution and participation. And I hope we will have new topics also.’

In the framework of GET 2022, Geoenergy – the new co-owned journal of EAGE and the Geological Society – was introduced during the opening address, encouraging presenters to submit their fully developed conference abstracts. Two journal sessions were organised at the Community Hub where attendees had the opportunity to ask questions about all EAGE publications. Most questions had to do with Geoenergy. All in all, there was a lot of interest, which is very encouraging.

Participants were also given a chance to meet with the representatives from the EAGE Local Chapter Netherlands and Decarbonization and Energy Transition community at the Community Hub to

The exhibition floor provided an excellent opportunity for networking.

together; and it’s been both a pleasure and an honour to be serving as chairpersons for this crucial edition.

If you missed the event, take a look at the recap on eageget.org.

FIRST BREAK I VOLUME 41 I JANUARY 2023 9 EAGE NEWS

Edésio Miranda-Barbosa (Svåheia Eiendom) talked about the impact of policy on geoscience and engineering.

L-R: Giovanni Sosio, Jean-Marc Rodriguez, Léon Beugelsdijk and Tobias Rudolph.

OUR JOURNALS THIS MONTH

Aberdeen Local Chapter’s year in focus

Completing our fourth 2022 evening lecture (and third in-person event) in November, Aberdeen Local Chapter can look back on a variety of topics covered. We started the year with an eye-opening talk from Russell Gray (TotalEnergies) discussing the surprising differences in well depth definitions and their associated uncertainties – drillers/logging while drilling versus wireline. Drillers/LWD depth taken as a tally of pipe lengths is nearly always shallow to true depth without accounting for pipe stretch, whereas wireline stretch correction is more commonly applied. The result of incorrect mixing of depth definitions can have significant impact on field/prospect volumes, and the audience were pleased to share their own horror stories.

a dataset that was used in a 2019 Kaggle competition. Ibe-Enyindah showed us machine learning methods for pre-processing well log data.

We teamed up with the PESGB for our final event in 2022, an evening lecture from Matt Brettle and Dan Holden from the Sand Injectite Research Group based at Aberdeen University. Brettle started with an introduction to

Geophysical Prospecting (GP) publishes primary research on the science of geophysics as it applies to the exploration, evaluation and extraction of earth resources. Drawing heavily on contributions from researchers in the oil and mineral exploration industries, the journal has a very practical slant. A new edition (Volume 71, Issue 1) will be published within January, featuring 11 articles.

Editor’s Choice articles:

• Elastic wave velocities in a granitic geothermal reservoir — Colin

Michael Sayers

• Approaches to decomposing acoustic data — Jakob B.U. Haldorsen

In June we met in person with Ryan Williams (Geoteric) who presented his Distinguished Lecture on AI Seismic Interpretation of vintage seismic data with implications for CCS site characterisation. This talk highlighted the rich seismic database that exists in the UK National Data Repository, and the application of the latest technology to reveal new features. To mark our first physical meeting for two years and the Local Chapter’s fifth birthday, we celebrated with a post-talk curry at Rishi’s (Aberdeen’s top Indian restaurant, no connection with the UK government!).

In September, we tried something new by hearing the end of project presentations from two graduating MSc students – Theo White and Emmanuel Ibe-Enyindah. One of the Local Chapter’s roles is to encourage links with Aberdeen University; the September period represents the sweet spot for catching departing and arriving students, and we were pleased to see a good turnout of students and professionals. White’s talk introduced us to machine learning techniques for predicting earthquake times, based on

injectites, the challenges in creating geocellular models to represent them, and their past and future importance in both oil and gas and geostorage applications. The last slide of Holden’s talk on seismic modelling of these complex geometries very astutely anticipated the audience’s questions on seismic noise, the use of machine learning, and modelling when interpreting the synthetic data to identify the features that can be pulled out.

10 FIRST BREAK I VOLUME 41 I JANUARY 2023 EAGE NEWS

CHECK OUT THE LATEST GP

A great evening lecture from Matt Brettle and Dan Holden on all things sand injectites.

Starting your 2023 journey with EAGE

lications of your journal of preference in EarthDoc, i.e., Basin Research, Geophysical Prospecting, Near Surface Geophysics or Petroleum Geoscience

If you like what you are reading right now, keep in mind that the subscription to First Break, our monthly magazine, is also included in your membership with the objective of keeping you informed with industry news, technical articles and the latest EAGE updates.

Happy New Year and thanks for being part of the EAGE community in 2022! If you haven’t already done so, now’s the time to renew your membership, especially if your resolutions include taking a course, presenting your work at any international conferences or publishing in scientific journals.

Start ticking your checklist by joining us in Vienna, Austria, for the 84th EAGE Annual Conference & Exhibition. Enjoy the reduced member registration fees and connect with geoscience and engineering professionals from all over the world for our flagship meeting entitled ‘Securing a sustainable future together’. Other events where you can save on your attendance are the 2023 EAGE Digital in London next March, or the 2023 Near Surface Geoscience Conference and Exhibition in Edinburgh in September, just to name a few.

Move on with your resolutions by making the most out of the discounted registration rates in our education programmes. Interactive Online Short Courses on ‘Seismic Diffraction – Modelling, Imaging and Applications’ by Tijmen Jan Moser (25-27 January), and ‘Land Seismic Survey Design’ by Paul Ras (8-10 February) are now accepting registrations. Remember that Education Packages are still available for all your learning needs.

By renewing your membership you also support the creation of free learning content, for example the E-Lecture Webinars ‘Unlocking unprecedented seismic resolution with FWI Imaging’ by Zhiyuan Wei and ‘Active and passive 3D seismic survey around the Scrovegni Chapel using

autonomous nodes’ by Ilaria Barone. Such presentations can help you update your knowledge in less than an hour at a time convenient to you. Go to learninggeoscience.org to check them out.

You should also know that, if you start today, your membership will include a free one-year online subscription to Geoenergy, our new co-owned journal. Take advantage of this bonus benefit and learn more about subsurface geoscience and the emerging energy transition field. Geonergy takes its place alongside pub-

Expanding your professional network may be another of your 2023 goals. As an EAGE member, you can join one or more of the EAGE technical communities dedicated to share know-how, experience and latest advances covering a wide range of interests. Check out our website for details.

Last but not least, don’t forget that by renewing your membership, you will maintain your current membership level or advance in the EAGE Membership Recognition Programme. The more consecutive years you are part of our Association, the more benefits you will receive.

Make these New Year Resolutions!

Volunteer with EAGE — There are plenty of opportunities where you can make a difference with your expertise and ideas. Let us know you are interested by contacting communities@eage.org.

Take part in student activities

Join a Community

Our technical communities are continuously expanding. Connect with groups in your field(s) of interest to join conversations, grow your professional network and find relevant initiatives for your career development. Engage with our two new communities, Geohazards and UAV!

Read our new journal Get ready for a brand new technical journal starting this month. With its multi-disciplinary approach to research and case studies in sustainable energies, Geoenergy is bound to become a favorite for many members.

Keep engaged with the EAGE community by engaging with your Student Chapter and joining this year’s exciting activities: the Laurie Dake and the Minus CO2 challenges, the EAGE Geo-Quiz, and our exclusive student webinars and E-Summits.

Support your community

By joining or renewing your EAGE membership you can also donate to the EAGE Student Fund and Green Fund. Doing so will help us develop more activities for the next generation of scientists. Through the EAGE Ukraine Professional Development Fund, you may also support the continuous professional development of Ukrainian students and academic community at this time of crisis.

FIRST BREAK I VOLUME 41 I JANUARY 2023 11 EAGE NEWS

Sharing knowledge at EAGE event.

Invitation to a Special Members Meeting to consider Constitution change

From

Pascal Breton, Secretary-Treasurer, EAGE.

On behalf of the Board, I would like to make this formal invitation to all members to a Special Members Meeting which will take place online on 16 February at 15:00 CET.

As announced during the AGMM 2022 earlier this year, the EAGE Board decided to reconsider our Divisions structure to be more inclusive. We are

proposing an organisation of three Circles of which one will be the Sustainable Energy Circle. To make this happen, the Constitution of the Association needs to be adjusted accordingly for which the approval of the members is needed.

During the Special Members Meeting the Board will introduce modifications

to the EAGE Constitution needed in line with these changes and members will have a possibility to deliberate and ask questions before a vote. Proposed changes to the Constitution and registration to the meeting will be circulated to members and published on the Association website by 15 January.

Entries open for the EAGE/EFG Photo Contest 2023

It’s time to showcase your talent for capturing extraordinary images reflecting any field of geoscience. Entries are now open for the EAGE/EFG Photo Contest 2023.

Held under the theme ‘Legends of Geoscience’, all members of EAGE and EFG’s national associations are invited to submit their photos in the following six subcategories:

Sustainability in Geosciences – images depict how geosciences and society are directly interlinked in addressing sustainability issues, including the responsible use of natural resources, ensuring global health and resilience, improving energy efficiency, processing raw materials, etc.

Women Geoscientists – images focus on women who chose a career in different fields of geosciences.

Landscape and Environment – images portray the beauty and variety of the fascinating geoscience world.

Working together in Geosciences –images show impressions of 2-3 persons collaborating on a topic.

Digitalization and Innovation – images focus on the latest ground-breaking technologies that enable innovation and industry transformation.

The New Generation of Geoscientists – images portray students and young professionals working in different fields of geoscience.

Keep in mind that you may only submit a maximum of two photos. They must be copyright free and meet the following technical quality requirements: high resolution (300 dpi) and minimum 1920 × 1080 pixels. We will also ask you for a nice title for your photograph, when and where the picture was taken, as well as a little story behind the shoot.

Submissions are open from 1 January to 17 March 2023. All entries will be

reviewed by experts considering their relevance to the theme and, of course, the technical quality. After this process, the accepted photos will be published online, and all members of EAGE and EFG will have the opportunity to cast their votes in two rounds: first, for choosing the 12 finalists, and then, for the top three photographs. The 12 best photos of the year will be featured in our communication channels.

The winners will be announced in September 2023, with the images being awarded the ‘Legends of Geoscience’ title, along with great prizes. Start looking for the best shoot and join this year’s Photo Contest!

12 FIRST BREAK I VOLUME 41 I JANUARY 2023 EAGE NEWS

More

available on our website! 30 JAN LAURIE DAKE CHALLENGE FIRST SUBMISSION ONLINE 28 FEB EAGE STUDENT CHAPTER RENEWAL ONLINE EAGE Student Calendar FOR MORE INFORMATION AND REGISTRATION PLEASE CHECK THE STUDENT SECTION AT WWW.EAGE.ORG

information is

Welcome to the 2023 Near Surface Geoscience Conference & Exhibition in Edinburgh

Esther Bloem, NSG Division chair, writes: On behalf of the EAGE Near Surface Geoscience (NSG) Division, I cordially invite you to attend the Near Surface Geoscience Conference & Exhibition 2023 (NSG2023) to be held in Edinburgh, UK, 3-7 September 2023.

We are pleased that the conference will be hosted for the first time in Edinburgh, Scotland’s capital since the 15th century. The city has a medieval Old Town and an elegant Georgian New Town with gardens and neoclassical buildings.

Alongside the 29th European Meeting of Environmental and Engineering Geophysics, will be the 2nd Conference on Hydrogeophysics, the 3rd Conference on Geophysics for Infrastructure Planning, Monitoring and BIM and the 1st Conference on Sub-surface Characterisation for Offshore Wind. Our annual meeting provides a platform to discuss the near surface challenges the world is currently facing. With changing energy sources and an increased awareness of environment and climate, the focus on the near surface as a resource and the wish for minimal negative impact on the near surface has been growing. It makes the conference highly relevant to society as a whole. Topics for the meeting include mining, geotechnics, engineering geology, hydrology, geothermal investigation, environment, archaeology, forensics and soil science.

Over the last years the NSG Division has introduced parallel focused conferences in response to the needs of our

members to provide an environment to move the science and technology forward while also addressing the needs of our society. To continue this success, this year the two topics which are highlighted in two parallel conferences are: hydrogeophysics and infrastructure challenges.

After a successful first Hydrogeophysics parallel conference in Bordeaux 2021, we are happy to continue the discussion around water, environment, agriculture and natural resources in a rapidly changing climate and their implications to build a resilient society. The Hydrogeophysics parallel conference aims to connect the science with the public sectors and governmental entities.

The Infrastructure Planning, Monitoring and BIM (Building Information Modelling) conference joins Edinburgh with a strong regional relevance with several large projects on their way in the UK, e.g., one of the country’s (and Europe’s) largest ever construction projects, the high speed rail connection line between London - Birmingham and further north;

the Lower Thames Crossing, a new highway tunnel crossing the Thames on the east side of London; and the Thames Tideway, a 25 km super sewer for the city of London, built under the river Thames. These projects require mapping archaeology, structural investigation of existing infrastructure, testing ground engineering, and monitoring hydrogeology and tunnelling activity using geophysical and non-destructive testing/monitoring instruments. It is therefore a great opportunity to welcome newcomers including design and civil engineers, city planners and geotechnical communities to take an active role in this conference after successful presences in the Hague 2019 and Bordeaux 2021.

More details on the 1st Conference on Sub-surface Characterisation for Offshore Wind to follow in the next issue, so stay tuned!

Join us and discover both the city and how the near-surface geosciences have advanced, meet your colleagues, expand your network and enjoy the great atmosphere of our event.

If you are interested in participating in the Technical Programme of NSG2023, we encourage you to submit your abstracts for any of the parallel conferences by 25 April 2023. Visit eagensg.org for more information on the topics, submission guidelines and all this year’s event has to offer.

FIRST BREAK I VOLUME 41 I JANUARY 2023 13 EAGE NEWS

DONATE TODAY!

The EAGE Student Fund supports student activities that help students bridge the gap between university and professional environments. This is only possible with the support from the EAGE community. If you want to support the next generation of geoscientists and engineers, go to donate.eagestudentfund.org or simply scan the QR code. Many thanks for

your donation in advance!

Esther Bloem during the opening session at NSG2022.

14 FIRST BREAK I VOLUME 41 I JANUARY 2023 EAGE NEWS We would like to thank our sponsors for their generous support to EAGE in 2022! C100 M90 Y10 M100 Y80 K10 K100

FIRST BREAK I VOLUME 41 I JANUARY 2023 15 EAGE NEWS We thank all our valued advertisers for their loyal support in 2022! PANTONE Re ex Blue C PANTONE 347 C

# 45-8 Group A Aarhus Geoinstruments • Aarhus Geosoftware • Advanced Geosciences Europe S.L. • AgileDD • Alcatel Submarine Networks • Allton • ALSEAMAR • Ambrogeo Instruments • Ampseis • Arianelogix • ARK CLS Ltd • Atlas Fluid Controls • Avalon Sciences Ltd B Beicip-Franlab • BGP Inc C Cegal AS • CGG Services SAS • CoCoLink Corp • Cognite • Colchis Petro Consulting (Beijing) Ltd. • CVA Europe Holding D Delft Inversion • DownUnder GeoSolutions (London)Pty Ltd • Dynamic Graphics Ltd E Earth Science Analytics • EIF Geosolutions • EIWT • Eliis SAS • Elsevier B.V. • EMergo srl • Emerson • EMGS ASA • Engenius Software • EOST Strasbourg • EPI Ltd • ET Works AS • ETAP-Entreprise Tunisienne d’Activités

Pétrolières • EURL Martin Neumaier F FEBUS OPTICS • FEI SAS as part of Thermo Fisher • Fraunhofer IWES • Fugro G GEM

Systems Advanced Magnometers • Geo Ex Machina • GEO ExPro GeoPublishing Ltd • GEO Resources Consultancy

International • GEODEVICE • Geofizika d.o.o. • Geofizyka Torun S.A. • Geolitix Technologies Inc • Geometrics Inc. • Geomind AS • Geomodeling Technology Corp. • Geopartner Geofizyka sp. z o.o. • Geophysical Insights • Geophysical Technology Inc • GeoSoftware • Geospace Technologies Corp. • Geotec SpA • Geoteric • GeoTomo LLC • Geotomographie GmbH • Geovista Ltd • Getech H Halliburton Landmark • HGS Products B.V. I I-GIS A/S • Ikon Science Ltd • ImpulseRadar Sweden

AB • InApril AS • INOVA Geophysical • INOVA Geophysical, Inc. • INT Inc. • ION • Iraya Energies Sdn.Bhd • IRIS Instruments

K Kappa Offshore Solutions • Katalyst Data Management • King Abdullah University of Science and Technology • Kontur

L Leobersdorfer Maschinenfabrik GmbH • Loupe Geophysics Pty Ltd M Marac Enterprises Inc. • MIND Technology, Inc N National Oil Distribution Company AGIL S.A • NIS-Naftagas O Ocean Floor Geophysics • OPENGOSIM LTD •

OvationData Ltd. • OYO Corporation P PANATEC, S.L. • Perenco Tunisie Company Limited • Petroleum Experts Limited • Petrosys Europe Ltd • PetroTrace Limited • PGS Exploration (UK) Ltd. • PXgeo Q Qeye R RadExPro Europe • Repsol Exploracion SA • Resoptima AS • Rock Flow Dynamics • ROGII Inc • RoQC Data Management • Royal Society Publishing • RPS Energy S S&P Global Commodity Insights • SAExploration • Saudi Geophysical Consulting Office • Seamap UK Limited • Searcher Seismic • Seequent • Seismic Image Processing Ltd • Seismic Source Company • SEISQUARE Holding

SA • SENSYS - Sensorik & Systemtechnologie GmbH • Sercel • Sharp Reflections AS • Sharp Reflections GmbH • Shearwater

Geoservices Limited • SkyTEM Surveys ApS • SLB • SmartSolo Inc. • Soildata sp. z o.o. • Sound QI Solutions Ltd. • SPE

Netherlands Section • SPH Engineering • Spotlight • Stryde Limited • SYRLINKS T TDI-Brooks International Inc. • Teledyne

Marine • TERRASYS Geophysics GmbH & Co. KG • Theia Energy • TotalEnergies S.E. • Troika International Ltd • Tunisian Drilling Company (Compagnie Tunisienne de Forage) U Ulmatec Baro AS V Verif-i Limited • VSProwess Ltd W Weihai Sunfull

Geophysical Exploration Equipment X Xcalibur Geophysics Spain S.L • Xcalibur MPH Spain SL

16 FIRST BREAK I VOLUME 41 I JANUARY 2023 EAGE NEWS

We would like to thank our exhibitors for their generous support to EAGE in 2022!

Personal Record Interview

A life of farming and geoscience sustained

Farm boy to geoscientist?

I went to a one-room school-house in the country for my first six grades. By grade 7, I knew I wanted to be a scientist. By high school I had the whole class (eight of us) taking physics. Come engineering at University of Saskatchewan, I was the only geophysical engineer in the class. I guess you could say I was ‘driven’ by picking rocks on the farm.

Oil biz to academic: what happened?

Being at the right place at the right time is my best answer. I had just finished my doctorate degree at Colorado School of Mines intending to rejoin Amoco in Calgary. The Geophysics Department head sat in on my defence. At the end he offered me a job as they urgently needed someone to teach seismic exploration. The Canadian government meanwhile had introduced the National Energy Bill requiring all foreign companies to have 50% Canadian ownership. So no job at Amoco anymore. One door closed and another door opened.

What drives your research?

The goal to work alongside industry drove me to form the Reservoir Characterization Project (RCP). The project is still in existence after thirty-some years thanks to industry colleagues, mentors, and foremost some very bright and talented students who are now industry and academic leaders. Why RCP? Simply the recovery factor of our oil and gas reservoirs is low and the best place to find ‘new’ oil and

gas is in existing reservoirs with new ideas and new technologies.

What are you most proud of?

The students. The project was designed to be student-driven, focused on making an impact using new multi-component 3D and 4D technologies. Together with industry we conducted the first seismic surveys in the world over old fields and found new reserves. The industry made proposals to us which was previously unheard of. Students came from all over the world and well over a couple of hundred have graduated from the programme with advanced degrees.

Consulting assignment highlights?

I have had the opportunity to teach short courses to industry around the world. The courses and consultancy assignments were encouraged by CSM because of its close relationship with industry and the potential to attract students. I also got an insight into the needs of the industry which might impact the future direction of our profession. I have travelled to over 90 countries, embraced new cultures and most of all the people. It is a small world.

What about the next generation of geoscientists?

The sky is the limit. New exploration frontiers reside on our planet and beyond. We need to inspire the next generation to engage in new avenues of exploration. Education is still the foundation for inspiration. That means providing future generations

the opportunity to engage in science and engineering at a young age and encourage them to take on the challenges of tomorrow.

You kept the farm going?

Farming has changed. It is still the most noble profession in the world and will continue to be. It teaches you to be innovative and most of all humble. To keep a farm going you need family, friends and a respect for the land. Hard work never killed anyone, but after a hard day’s work it provides solitude and satisfaction of a job well done. Farming can teach you a lot about yourself and how to live life to the fullest. I have learned to accept that ‘living off the land’ is a give-and-take proposition. What you take has a lot to do with what you give back to the land.

You’re an oil mogul?

If by a mogul you mean, have I gotten my hands dirty? The answer is yes, in finding oil throughout the world and on my farm. Oil is still the life blood of our industry and farming. As an old farmer once put it – ‘It enables me to keep on farming one more year.’

Still on the curling rink and ice hockey?

What is a Canadian farm boy in Saskatchewan going to do in the winter time except shovel off the dugout and get the skates on? Winter sports have a calling that is hard to resist when you are a young boy or an old guy looking for the fountain of youth. Just remember that when you fall or get knocked down ‘get back up and keep going’.

FIRST BREAK I VOLUME 41 I JANUARY 2023 17 PERSONAL RECORD INTERVIEW

Tom Davis is the Canadian farm boy who became emeritus professor of geophysics at the Colorado School of Mines. He co-founded and headed the Reservoir Characterisation Project from 1983-2016. These days he consults and continues his lifelong commitment to farming, curling and ice hockey.

Tom Davis

Make sure you’re in the know EAGE MONTHLY UPDATE

2023 will be another exciting year with EAGE. We‘ve selected a few highlights about what to expect this year. More to follow, keep an eye on us.

FIRST BREAK I VOLUME 41 I JANUARY 2023 18 15-17 Feb Fifth Naturally Fractured Reservoirs Workshop Aix-enProvence, France 20-22 Mar Third EAGE Digitalization Conference & Exhibition London, UK 3-7 Sep Near Surface Geoscience

& Exhibition 2023 Edinburgh, UK 10-15 Sep 31st International Meeting

Montpellier, France 18-20 Sep Second EAGE Seabed Seismic Workshop Lake Como, Italy 27-30 Nov Fifth EAGE Conference on Petroleum Geostatistics Porto, Portugal

4th EAGE Global Energy

Conference & Exhibition Paris, France

Symposium

Utilisation

The Hague,

Conference

on Organic Geochemistry

Fall

Transition

Fall 22nd European

on Innovative and Optimised Resource

(IOR+)

Netherlands

AMERICAS 16-18 Aug First EAGE Conference on Offshore Brazil Equatorial Margin Rio de Janeiro, Brazil 31 Aug1 Sep First EAGE Workshop on Hydrogen & Carbon Capture Sequestration in LATAM Medellin, Colombia 20-22 Sep First EAGE Conference on Offshore Energy Resources in the South Atlantic Montevideo, Uruguay 19-20 Oct First EAGE Workshop on Water Footprint Bogota, Colombia 11-16 Nov Second EAGE Workshop on Geothermal in Latin America Guanacaste, Costa Rica 30 Nov1 Dec Third EAGE Workshop on Mineral Exploration in Latin America: ”The Role of Mining in the Energy Transition“ Santiago de Chile, Chile

EUROPE

MIDDLE EAST & AFRICA

SHOWCASE YOUR RESEARCH

AT THE LARGEST MULTIDISCIPLINARY GEOSCIENCE & ENGINEERING EVENT

!

DEADLINE: 15 JANUARY 2023

CONNECT WITH EAGE

LOCAL CHAPTERS NEAR

ASIA PACIFIC

FIRST BREAK I VOLUME 41 I JANUARY 2023 19

1-3 Mar IPTC 2023 Bangkok, Thailand 6-9 Mar 5th Asia Pacific Meeting on Near Surface Geoscience & Engineering Taipei, Taiwan 15-16 Aug 2nd EAGE Workshop on Fluid Flow in Faults and Fracture Canberra, Australia 22-23 Aug EAGE Workshop on Unlocking Carbon Capture and Storage Potential Kuala Lumpur, Malaysia 12-13 Sep EAGE Conference on the Future of Energy - Role of Geoscience in the Energy Transition Kuala Lumpur, Malaysia 17-18 Oct EAGE Workshop on Data Science - From Fundamentals to Opportunities Kuala Lumpur, Malaysia 19-21 Feb MEOS-GEO Manama, Bahrain October Fifth EAGE Borehole Geology Workshop Dhahran, Saudi Arabia

Geosteering

Workshop Abu Dhabi, UAE

EAGE/AAPG Hydrocarbon Seals Workshop Dhahran, Saudi Arabia CHECK ALL EVENTS

November Fourth SPE/EAGE

and Well Placement

November

YOU

CROSSTALK

BY ANDREW M c BARNET

BY ANDREW M c BARNET

What shall we call 2023?

What constitutes an ‘annus horribilis’ is a matter of perspective. From a global point of view, the last three years of political and economic turmoil against the backdrop of the Covid pandemic must surely qualify for the label. The fearful must wonder whether 2023 will add to the sequence.

We owe the popular use of the expression to the late Queen Elizabeth II. At a dinner to mark the 40th anniversary of her accession to the throne, held in the City of London Guildhall, she famously referred to 1992 (which was coming to an end) as her ‘annus horribilis’. In addition to a series of Royal Family scandals, a fire broke out at Windsor Castle. After her legendary speech that November, the year got even worse in December when the official separation of Prince Charles and Princess Diana was confirmed.

In her speech Her Majesty was gracious enough to acknowledge that the expression ‘annus horribilis’ came from one of her ‘more sympathetic correspondents’ (now known to have been a former assistant private secretary). It is a play on the Latin ‘annus mirabilis’, translatable as ‘wonderful year’ or ‘year of wonders’ and can be traced back to the title of a 1667 publication by the poet John Dryden. In it he celebrates how disasters in London in 1666 (plague, fire, war) were overcome, including some significant English military victories in their war against the Dutch.

First known reference of ‘mirabilis’ turning into ‘horribilis’ is said to date back to 1891. A Protestant periodical used the term to describe 1870, the year when papal infallibility was declared as dogma by the Roman Catholic church. More recently in 1985 a book review in the British newspaper The Guardian described the tumultuous year of 1968 as ‘annus mirabilis, annus horribilis’.

An extraordinary variety of significant unknowns will determine our global fate in 2023 and how good or bad it will be, much of it focused on energy supply and demand. Ironically, even embarrassingly, one of the more confident expectations is

that the geoscience community can look forward to steady if not improved business – it’s an ill wind that blows nobody any good.

Much of what happens will continue to be determined by the continuing turmoil created by Russia’s unfathomable determination to inflict maximum damage to Ukraine in the face of the country’s heroic resistance and international condemnation, these days including rebuke from previously non-committal governments such as China and India.

No media information can relate the true state of the actual conflict and thus a clue to any possible cessation of the violence and destruction. In one sense it will be tragic that the longer the hostilities continue, the more successful governments around the world will be in finding ways to combat the effect on energy resources as well as the general economic and social impact of sky-rocketing fuel prices, raging inflation and supply chain issues. The priority in Europe in the short term will simply be to get through the winter without too much hardship, some developing countries will fare worse even catastrophically.

Looking further ahead, the International Energy Agency paints a surprisingly optimistic picture headlining its World Energy Outlook 2022 published in October with the claim that global energy could be reaching a ‘historic turning point towards a cleaner more secure future’.

Alongside short-term measures to try to shield consumers from the impacts of the crisis, many governments are now taking longer-term steps. IEA says some are seeking to increase or diversify oil and gas supplies, and many are looking to accelerate structural changes. It cites measures worldwide including the US Inflation Reduction Act, the EU’s Fit for 55 package and REPowerEU, Japan’s Green Transformation (GX) programme, Korea’s aim to increase the share of nuclear and renewables in its energy mix, and ambitious clean energy targets in China and India.

IEA’s analysis is not all that rosy, however. It does predict coal use falls back within the next few years, natural gas demand

20 FIRST BREAK I VOLUME 41 I JANUARY 2023

BUSINESS • PEOPLE • TECHNOLOGY

‘Significant unknowns will determine our global fate in 2023.’

reaches a plateau by the end of the decade, and rising sales of electric vehicles (EVs) mean that oil demand levels off in the mid-2030s before ebbing slightly to mid-century. But the conclusion is not that great, i.e., total demand for fossil fuels declines steadily from the mid-2020s to 2050 by an annual average roughly equivalent to the lifetime output of one large oil field. Furthermore, according to IEA in its Stated Policies Scenario (STEPS), the share of fossil fuels in the global energy mix falls from around 80% to just above 60% by 2050. Global CO2 emissions fall back slowly from a high point of 37 billion tonnes per year to 32 billion tonnes by 2050. It says ‘this would be associated with a rise of around 2.5°C in global average temperatures by 2100, far from enough to avoid severe climate change impacts.’ In other words, much more needs to be done.

In 2023, as noted by analysts such as Deloitte, the vexatious options posed by the energy trilemma of energy security, supply diversification, and low-carbon transition will once again head the conversation. One can do no better than crib from Westwood Global Energy Group’s November commentary Energy Transition Insights to get a clue as to where we are immediately headed. As we all know, higher commodity prices have reinvigorated the E&P business: to what extent is the question. Most pertinently Westwood asks what the supermajors (BP, Chevron, Exxon, Shell, and TotalEnergies) are going to do with their shovel loads of cash. They come up with some pretty interesting numbers.

When comparing the cash profiles for the first nine months of last year against this year, operating cash flow has increased by 70% and Capex has increased by over 25%. However, shareholder pay-outs have more than doubled at the same time. Westwood finds that the supermajors had a surplus of $65 billion in the first nine months of 2022 providing them with considerable scope to increase Capex, shareholder pay-outs and/or debt repayments. On current trends, the supermajors in aggregate could have zero net debt by the end of 2023 if cash continues to build-up on their balance sheets at current rates and governments go light on windfall taxes.

Westwood is sceptical about how far the big companies can pivot towards spending on energy transition because of limited sizeable investment opportunities. Key growth areas such as carbon capture and storage and hydrogen are still at a nascent stage of development, it states.

Meantime E&P spending forecasts are notoriously fickle. Traditionally, oil industry investment paralleled oil price so you would expect a torrent of new expenditure. OPEC+ seems to be in charge of keeping oil supply/price at a premium, partly facilitated by an under-performing US shale industry (although this could change rapidly). However, for numerous reasons, notably recession fears, the impact of China’s slowing economy on energy demand plus oil companies’ conflicting spending choices, the

value of the old price calculation has been dulled. Factor in too that 65% of remaining discovered oil and gas around the world is owned by national oil companies. They also discovered 41% of global added conventional resources since 2011 with that share rising since 2018, according to Wood Mackenzie.

Early announcements from companies such as Chevron, ExxonMobil, Petrobras and Ecopetrol indicate that some of the excess revenue generated from profitable 2022 operations will be allocated to bigger E&P budgets. Even so IOCs seem intent on maintaining capital discipline focusing on advantaged oil and infrastructure-led exploration (ILEX).

We can safely conclude that the geoscience service sector seems set to benefit. Likely newer targets for marine seismic surveys include the Guyana-Suriname basin, offshore Brazil, eastern Canada, offshore Namibia and South Africa, while offshore Norway, the UK and the Gulf of Mexico will continue to be revisited.

Anecdotally the price of surveys is creeping up, but so far not by leaps and bounds as the demand for towed-streamer surveys has yet to explode. If this market does take off, then marine seismic contractors could be scrambling for vessels in good shape and particularly for enough spare streamer capacity, a lot of which has been used up as replacements in the last few bleak years.

For now, ocean bottom nodes seismic continues to be where the action is as companies continue to exploit existing and nearfield possibilities to maintain or build their reserves. This same cautious strategy is reflected in something of a bonanza for the seismic processing sector as oil companies sift through existing data to locate hidden or overlooked oil and gas reserves. In fact ‘it’s all about the data’ is becoming something of a cliché in the business as oil companies embrace the digitalisation era of big data, cloud computing, machine learning, artificial intelligence, digital twins, etc, in the belief that this will introduce significant efficiencies and cost savings.

Typically when the marine seismic market hots up, investors, especially in Norway, look for the chance to participate. The number of players is now very restricted and the cost of entry probably prohibitive, but you never know. That said, the biggest contractor by far – Shearwater Geoservices – is privately held and therefore a potential IPO candidate should its Norwegian owners feel inclined.

Overall, the geoscience community does not look under threat of an annus horribilis in 2023. Oil and gas operations are in a recovery mode, for how long is unclear, and the renewables sector can only expand offering opportunities for geoscientists, albeit not as well remunerated. If there are glitches in the coming years, the need to recruit a new generation of geoscientists and engineers would be one. The other is the need for more research funding in geoscience, once reliably provided from the coffers of the oil industry.

FIRST BREAK I VOLUME 41 I JANUARY 2023 21 CROSSTALK

‘E&P spending forecasts are notoriously fickle.’

Views expressed in Crosstalk are solely those of the author, who can be contacted at andrew@andrewmcbarnet.com.

Designed to enable 100,000 + channels and data deliverables from highproductivity source techniques

SCALABLE ON TIME & LOW-COST

Access seismic equipment faster than ever before at a significantly reduced price point

EFFICIENT HIGH-DENSITY

Efficiently enhance seismic resolution and fast-track access to subsurface insights

REDUCED HSE RISK

Reduce crew size, risk exposure hours, vehicles and logistics to minimise HSE risk

Transformlandseismic acquisitionwith

L e a d i n g t h e t r a n s i t i o n t o n o d a l a c q u i s i t i o n w i t h s y s t e m s d e s i g n e d t o s c a l e

First fully autonomous, semi-autonomous ocean bottom node moves closer

Blue Ocean Seismic Services has completed seismic trials of its fully autonomous, self-repositioning ocean bottom node underwater vehicles as it prepares to disrupt the seismic acquisition market in 2024.

Financially backed by bp Ventures, Woodside Energy and Blue Ocean Monitoring, the UK/Australian tech company, is developing the world’s first fleet of autonomous low-impact subsea nodes for capturing seismic data from the ocean floor for multiple applications such as offshore wind, oil and gas, and CCS.

‘These underwater vehicles will transform the offshore seismic sector to become more affordable, faster, safer, more environmentally friendly and significantly less carbon intensive,’ said Blue Ocean Seismic Services.

The company has undertaken substantial further passive and active testing in Plymouth on the UK south coast, the North Sea and Australia to confirm the performance of the command and control systems, underwater flight performance, seismic coupling and active seismic data acquisition.

In the recent North Sea active seismic trial, the company achieved its technology and data collection objectives, including: acquiring additional cycles of active seismic data with its alpha vehicles (AP-OBSrV) alongside conven-

tional ocean-bottom nodes (OBNs); and confirming the ability of the AP-OBSrV to maintain a close seismic coupling with the seabed, especially where cross currents exist.

With geophysical performance on track, the company will continue its rapid progression towards launch of commercial operations in 2024, starting with the assembly of up to 250 OBSrV version 1 nodes (based on the AP-OBSrV design) in batches, with pre-commercial trials in H2 2023.

Before commencing pre-commercial trials in H2 2023, the company is progressing discussions with industry partners and pre-qualifying for future tender opportunities. It also plans to open a new office in Houston, Texas, in Q1 2023.

Simon Illingworth, managing director and chief executive officer, Blue Ocean Seismic Services said: ‘We will continue with the operational scale up of the business, engaging with government regulators in our key initial markets and begin commercial operations in 2024. Substantial investment is also being made in securing components for our initial inventory of pre-commercial vehicles.

Blue Ocean Seismic Services has appointed Fabio Mancini as chief geophysicist. Mancini, who has played a significant role in developing the

technology, has joined from Woodside Energy where he was chief geophysicist from 2018. He spent five years at TotalEnergies in R&D and operations, working on projects covering both

seismic processing and acquisition. He subsequently moved to Hess, where he was in charge of Hess’s seismic activities for the eastern hemisphere. Mancini then moved to Australia to join Woodside.

‘As a leading figure in the subsea exploration sector, it is a huge endorsement to have someone of Fabio’s calibre join the business. He will bring considerable expertise and experience to the team as we move to the next phase of our development,’ added Illingworth.

Mancini said: ‘As one of the co-inventors I look forward to realising the vision of transforming seismic acquisition in the years ahead.’

FIRST BREAK I VOLUME 41 I JANUARY 2023 23 HIGHLIGHTS INDUSTRY NEWS

Deepwater

60% 25

31 US holds Pacific wind auction

exploration to rise

TGS and PGS team up in Brazil

24

TGS and PGS team up for 3D survey offshore Brazil

TGS and PGS have secured pre-funding for the Santos Sul multi-client 3D project in the southwest Santos Basin offshore Brazil.

The survey will cover more than 15,000 km2 of both open acreage made available by ANP via the new Permanent Offer (POR) mechanism and the exploration blocks recently awarded in the 17th

Concession bid round and third Cycle of the POR.

The vessel Ramform Tethys will mobilise for the survey in January 2023, and acquisition is scheduled to complete in August 2023.

‘This joint venture with PGS further strengthens our 3D data library and position in Brazil. The Santos Sul 3D

project will be instrumental in providing invaluable data and actionable insights into new and emerging plays outside the Pre-Salt, allowing our clients to de-risk their exploration activities in the region for active and future licensing rounds,’ said CEO of TGS, Kristian Johansen.

‘We experience continued exploration interest offshore Brazil where the combination of the Ramform-designed vessels and GeoStreamer technology is in strong demand. The Santos Sul multi-client survey expands PGS and TGS 3D data coverage in Brazil and will provide high quality data essential for the exploration of these newly awarded blocks. The PGS/TGS collaboration in this portion of the Santos basin also provides coverage over a wider area available through the permanent offer licensing round,’ said president and CEO of PGS, Rune Olav Pedersen.

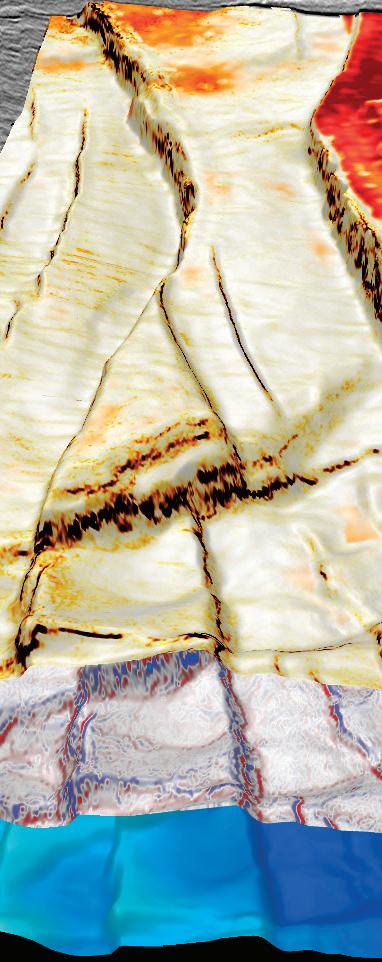

CGG wins extension of seismic imaging contract

in Brunei

CGG has won a multi-year contract extension from Brunei Shell Petroleum Company (BSP) to continue operating a dedicated seismic imaging centre at its head office in Seria, Brunei.

Peter Whiting, EVP, Geoscience, CGG, said: ‘This renewal of our dedicated centre contract builds on six years of

technical excellence and demonstrates the trust BSP has in our imaging team and high-end technology.’

In the past six years, CGG has delivered land, marine, transition zone, OBC and high-density OBN seismic imaging results at the BSP centre. ‘The in-house team will continue to apply its propri-

Magseis Fairfield wins CCS monitoring contract in North Sea

Magseis Fairfield has secured a data acquisition contract for a CCS monitoring project in the North Sea using its ocean bottom node and source technology. Data acquisition will commence in Q4 2022, utilising the MASS III ocean bottom nodes and modular source technology.

Meanwhile, Magseis has signed an agreement with a repeat customer for a

4D OBN project in the North Sea with options for additional work. The project is scheduled to start in Q2 2023, with an expected duration of approx. one month, using Z700 technology.

Finally, TGS’ has acquired all outstanding stock units of Magseis Fairfield at a price of 8.08 NOK per share ($0.81) to complete its takeover.

etary technologies, such as Time-lag FWI, Q-FWI, least-squares migration and shallow imaging, to address the specific regional challenges posed by the presence of widely distributed shallow gas clouds, channels, gas-charged silts, and complex fault structures around the discovered fields,’ said CGG.

24 FIRST BREAK I VOLUME 41 I JANUARY 2023 INDUSTRY NEWS

Ramform Tethys is mobilising for the survey this month.

MASS III ocean bottom nodes are being deployed.

Deepwater exploration set to grow more than 60% by 2030, says Wood Mackenzie

Land Seismic Noise Specialists

Deepwater is the fastest-growing upstream oil and gas resource, according to research from Wood Mackenzie.

From just 300,000 barrels of oil equivalent per day (boe/d) in 1990, production is expected to hit 10.4 million boe/d in 2022. By the end of the decade, that figure should pass 17 million boe/d.

Deepwater production is set to increase by more than 60% between 2022 and 2030, growing from 6% to 8% of overall upstream production. Ultra-deepwater production from depths of 1500 m and above is growing fastest. By 2024 it will account for more than half of all deepwater production (defined as 400 m of water depth or above).

Brazil remains the leading deepwater producer, accountling for around 30% of current global capacity and will continue to grow. Guyana, the most significant new entrant, will be producing one million boe/d within the next five years. In total, 14 other countries will contribute to the deepwater supply mix in the coming years.

Just eight companies account for 65% of deepwater production and 67% of the remaining project value.

Petrobras and the seven majors dominate deepwater production, operating 22 of the top 25 deepwater assets. Petrobras’ deepwater portfolio is around twice as big as its nearest peer, Shell, which stands out among the majors for leading production and cash flow. ExxonMobil and TotalEnergies show the highest rates of growth this decade.

‘Typically, only the best subsurface plays become commercial in water this deep. Deepwater basins therefore tend to be hyper productive, recovering huge vol-

umes of oil and gas from each well. This translates into high economic returns and low Scope 1 and 2 emissions intensities relative to most other oil and gas resource themes,’ said Wood Mackenzie.

‘But there is still room for emissions improvement. The energy majors are focused on cutting deepwater emissions by reducing flaring and methane leaks, optimising operations at existing platforms and, where possible, facility electrification.’

There is a robust pre-FID project pipeline, offering plenty of investment opportunities across a range of jurisdictions, says the report. Average investment returns in Wood Mackenzie’s global database of deepwater development projects are 24%, at $60/bbl Brent, but the bookends are far apart. The best returns are generated by smaller oil fields which can be tied back to nearby infrastructure. The lowest are long lead-time gas supply projects.

Service companies have made huge fleet reductions for key equipment such as floating rigs and productions systems since the peaks of the 2010s. With activity levels growing, equipment and services availability will be a constraint, said Wood Mackenzie.

Cost inflation will continue to risk project economics. In some regions deepwater rig costs have doubled compared to 2021 day rates. It has hit global hotspots such as the US GoM and Brazil hardest. Gato do Mato in the Brazilian pre-salt for example, will be delayed by up to two years due to rising costs.

Constraints in the global deepwater supply chain will, with time, increase lead times and unit costs across the board.

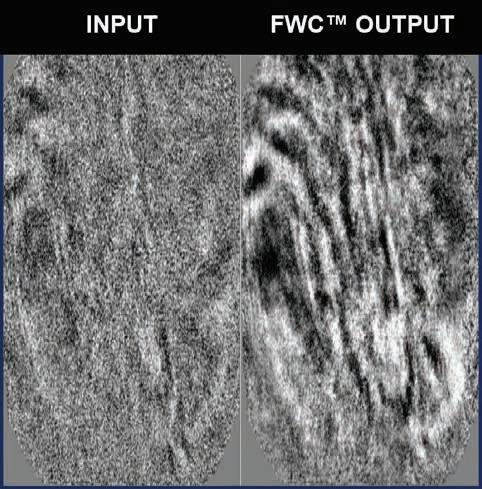

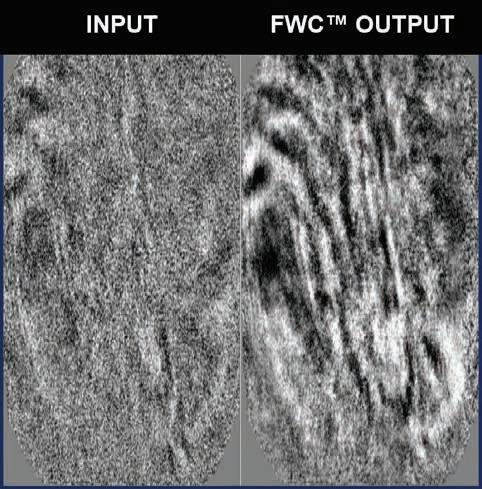

FIRST BREAK I VOLUME 41 I JANUARY 2023 25 INDUSTRY NEWS Our Full-Wave Correction (FWCTM) Technology Can Address Surface Scattering and Improve Your Challenging Seismic Data N��� ���������� �������

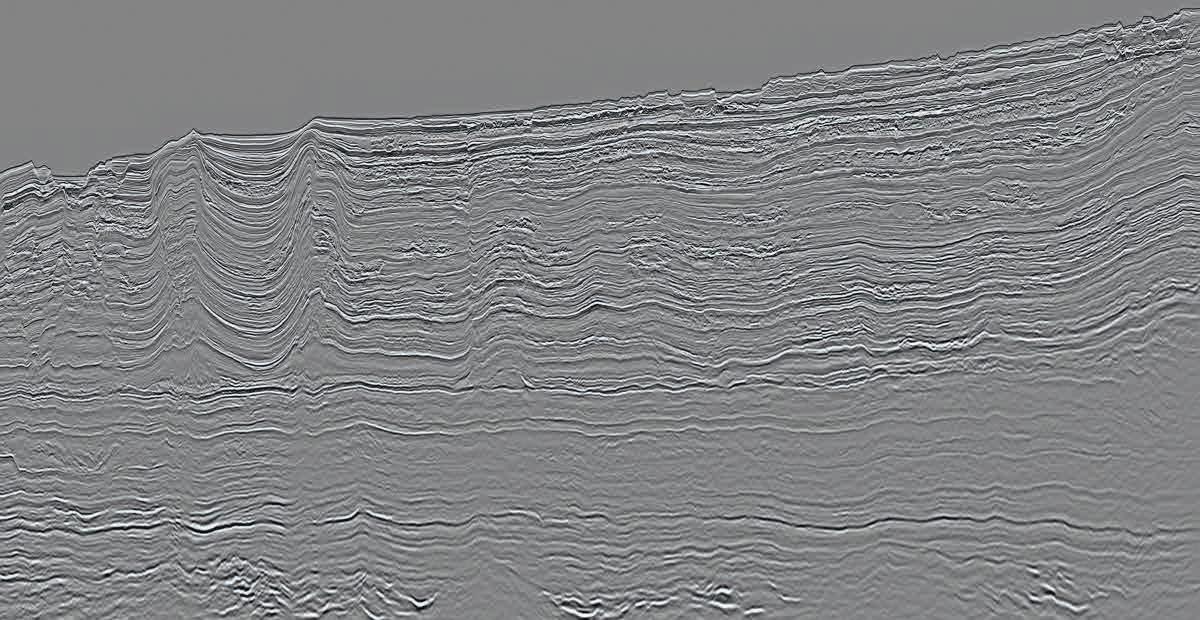

PGS releases 3D Nigeria shale data

Shale Formation. The eastern part of the dataset is in the transitional detachment fold zone and contains subtle faulting along with low wavelength folding of Eocene to Quaternary stratigraphy. The west of the survey, situated in the outer fold and thrust belt, is dominated by closely spaced thrust faults.