SPECIAL TOPIC Data Management and Processing

EAGE NEWS New features for Vienna 2023

TECHNICAL ARTICLE Key seismic features in the Orange Basin, South Africa

CROSSTALK Geoscience and Cop 27

EAGE NEWS New features for Vienna 2023

TECHNICAL ARTICLE Key seismic features in the Orange Basin, South Africa

CROSSTALK Geoscience and Cop 27

An EAGE Publication

CHAIR EDITORIAL BOARD

Gwenola Michaud (Gwenola.Michaud@cognite.com)

EDITOR

Damian Arnold (editorfb@eage.org)

MEMBERS, EDITORIAL BOARD

• Lodve Berre, Norwegian University of Science and Technology (lodve.berre@ntnu.no)

Satinder Chopra, SamiGeo (satinder.chopra@samigeo.com)

Anthony Day, PGS (anthony.day@pgs.com)

• Peter Dromgoole, Retired Geophysicist (peterdromgoole@gmail.com)

• Rutger Gras, Consultant (r.gras@gridadvice.nl)

• Stephen Hallinan, CGG

Stephen.Hallinan@CGG.com

• Hamidreza Hamdi, University of Calgary (hhamdi@ucalgary.ca)

• Clément Kostov, Freelance Geophysicist (cvkostov@icloud.com)

John Reynolds, Reynolds International (jmr@reynolds-international.co.uk)

James Rickett, Schlumberger (jrickett@slb.com)

• Peter Rowbotham, Apache (Peter.Rowbotham@apachecorp.com)

• Pamela Tempone, Eni (Pamela.Tempone@eni.com)

• Angelika-Maria Wulff, Consultant (gp.awulff@gmail.com)

EAGE EDITOR EMERITUS

Andrew McBarnet (andrew@andrewmcbarnet.com)

PUBLICATIONS MANAGER

Martha Theodosiou (mtu@eage.org)

MEDIA PRODUCTION

Saskia Nota (firstbreakproduction@eage.org)

PRODUCTION ASSISTANT

Ivana Geurts (firstbreakproduction@eage.org)

ADVERTISING INQUIRIES corporaterelations@eage.org

EAGE EUROPE OFFICE

Kosterijland 48

3981 AJ Bunnik

The Netherlands

+31 88 995 5055

• eage@eage.org www.eage.org

EAGE MIDDLE EAST OFFICE

EAGE Middle East FZ-LLC

Dubai Knowledge Village

Block 13 Office F-25 PO Box 501711

Dubai, United Arab Emirates

• +971 4 369 3897

• middle_east@eage.org

• www.eage.org

EAGE ASIA PACIFIC OFFICE

UOA Centre Office Suite 19-15-3A

No. 19, Jalan Pinang

50450 Kuala Lumpur

Malaysia

• +60 3 272 201 40

• asiapacific@eage.org

• www.eage.org

EAGE AMERICAS SAS

Edificio Centro Ejecutivo Santa Barbara

Av. Cra. 19 #118-95 - Office: 501

• +57 310 8610709

• americas@eage.org

• www.eage.org

EAGE MEMBERS CHANGE OF ADDRESS NOTIFICATION

Send to: EAGE Membership Dept at EAGE Office (address above)

FIRST BREAK ON THE WEB www.firstbreak.org

ISSN 0263-5046 (print) / ISSN 1365-2397 (online)

Estimating reliable earth properties from simultaneous velocity and reflectivity inversion

innovations in data processing are showcased this month.

Esther Bloem Chair

Andreas Aspmo Pfaffhuber Vice-Chair

Micki Allen Contact Officer EEGS/North America

Adam Booth Committee Member

Hongzhu Cai Liaison China

Eric Cauquil Liaison Shallow Marine Geophysics

Deyan Draganov Technical Programme Officer

Wolfram Gödde Liaison First Break

Hamdan Ali Hamdan Liaison Middle East

Vladimir Ignatev Liaison Russia / CIS

Musa Manzi Liaison Africa

Myrto Papadopoulou Young Professional Liaison

Catherine Truffert Industry Liaison

Panagiotis Tsourlos Editor in Chief Near Surface Geophysics

Florina Tuluca Committee member

Lucy Slater Chair

Yohaney Gomez Galarza Vice-Chair

Michael Peter Suess Immediate Past Chair; TPC

Erica Angerer Member

Wiebke Athmer Member

Juliane Heiland TPC

Tijmen Jan Moser Editor-in-Chief Geophysical Prospecting

Adeline Parent WGE SIC Liaison

Francesco Perrone Member

Matteo Ravasi YP Liaison

Jonathan Redfern Editor-in-Chief Petroleum Geoscience

Giovanni Sosio DET SIC Liaison

Aart-Jan van Wijngaarden Technical Programme Officer

SUBSCRIPTIONS

First Break is published monthly. It is free to EAGE members. The membership fee of EAGE is € 80.00 a year including First Break, EarthDoc (EAGE’s geoscience database), Learning Geoscience (EAGE’s Education website) and online access to a scientific journal.

Companies can subscribe to First Break via an institutional subscription. Every subscription includes a monthly hard copy and online access to the full First Break archive for the requested number of online users.

Orders for current subscriptions and back issues should be sent to EAGE Publications BV, Journal Subscriptions, PO Box 59, 3990 DB, Houten, The Netherlands. Tel: +31 (0)88 9955055, E-mail: subscriptions@eage.org, www.firstbreak.org.

First Break is published by EAGE Publications BV, The Netherlands. However, responsibility for the opinions given and the statements made rests with the authors.

COPYRIGHT & PHOTOCOPYING © 2022 EAGE

All rights reserved. First Break or any part thereof may not be reproduced, stored in a retrieval system, or transcribed in any form or by any means, electronically or mechanically, including photocopying and recording, without the prior written permission of the publisher.

PAPER

The publisher’s policy is to use acid-free permanent paper (TCF), to the draft standard ISO/DIS/9706, made from sustainable forests using chlorine-free pulp (Nordic-Swan standard).

The EAGE 84th Annual Conference & Exhibition returns to Vienna on 5-8 June 2023 following the last meeting in 2016. We will be hosted by OMV under the theme ‘Securing a Sustainable Future Together’. Look out for a number of new features aimed at making our flagship event that bit more special. Here are the highlights.

The Opening and Forum sessions in Madrid saw record attendance and proved to be popular with all attendees. The big change in 2023 will be the expansion of these sessions into a full Strategic Programme featuring a wide range of panel discussions and keynote presentations. Top level representatives from industry and academia will discuss

the most relevant issues facing the geoscience and engineering community. Topics will range from Europe’s energy security, exploration strategy, tackling societal engagement and frameworks for building sustainable low carbon businesses, to name a few.

Following your feedback from our post event surveys, we will be returning the poster sessions to a printed poster format. This will allow more differentiation between the oral presentation and poster format. Printed posters will be available for viewing all day which will increase visibility and opportunities for networking. The posters will also have a dedicated presentation slot when the presenters will be able to showcase their work and discuss in small groups.

The International Prospecting Centre (IPC) will feature an expansion this year with dozens of countries expected to participate. In addition to the usual oil and gas prospects, we are also inviting countries and organisations to showcase new opportunities in seabed minerals, geothermal, offshore wind and carbon storage.

Registration for the Annual in 2023 is already open, and we are pleased to announce the new All Access Package. If you sign up for this, you get the opportunity to experience the full event at a reduced rate. This registration option includes access to the full Conference & Exhibition, social events, workshops and field trips, all for one reduced fee.

We recognise the need to reduce the environmental impact of the event and have taken various measures to reduce our carbon footprint. Among other things, this involves increasing local and regional sourcing materials; lanyards for badges will be collected for recycling into new products and some printing replaced with digital signage.

For more details and registration information visit eageannual.org.

As in previous years, the EAGE Annual 2023 will include a programme of one-day workshops, providing participants with the opportunity to gain new skills, insights and in-depth knowledge across a wide range of topics. Workshops will be held before and after the main conference programme, on Sunday 4 June, Monday 5 June, and Friday 9 June 2023.

A total of 18 workshops are being organised with the workshops focused on interactivity, meaning a broad range of

elements including discussions, exercises, activities and practical applications. Topics will cover a wide range of disciplines including geology, geochemistry, geostatistics and geophysics. Energy transition will also feature strongly with workshops on geothermal systems, gold hydrogen, CCS and monitoring techniques. There will also be two innovative programmes on decision quality and building sustainable low carbon businesses.

The EAGE Annual Meeting is dedicated to securing a sustainable future together. In addition to addressing a wide range of geoscience and engineering topics, the workshop programme will explore how our subsur face skills can drive the energy transition and secure our energy supply. The interactive set up of the workshops will give participants the opportunity to share their experience and discuss some of the most relevant topics from a technical point of view.

If you are interested in contributing content to one of the workshops, you are welcome to email abstracts@eage.org for more details and availability. Additional information and latest updates on the workshop programme can be found on www.eageannual.org.

Don’t forget that the Call for Abstracts for the EAGE Annual 2023 is open. Being part of the Technical Programme offers an opportunity to share your expertise and bring attention to your work through our sessions and publication in the conference proceedings.

At www.eageannual.org you will find a full list of topics, guidelines, the submission process, and other relevant information. We look forward to receiving your abstracts by 15 January 2023, 23:59 CET.

Believe it or not we are now staging the 7th EAGE Borehole Geophysics Workshop. The latest event in this popular series will be taking place in Italy on 18-20 September 2023 and will focus on ‘Technologies for securing a reliable and varied energy supply’.

Borehole geophysics measurements have been used for decades in the oil and gas industry to assist geoscientists in key applications, including accurate well-toseismic ties, velocity model calibration for seismic processing and interpretation, drilling assistance and reservoir mon-

itoring. The EAGE plays a vital role in promoting technology and knowledge dissemination and we are confident that our latest Borehole Geophysics Workshop will once again be rewarding for all participants in keeping abreast of rapidly evolving technologies within the field of borehole geophysics. The workshop brings together geoscientists from operating companies, contractors, equipment suppliers, academics and anyone interested in promoting and celebrating borehole geophysics in all its forms. It will allow contributors to present their latest tech-

nologies in the form of oral and poster presentations, and will provide a valuable forum for networking with key individuals and organisations in this field.

The workshop intends to feature interesting topics from borehole data acquisition and greener operations, conventional VSP applications and robust well ties, timelapse VSP monitoring, AVO, anisotropy and inversion, microseismic monitoring and passive seismic and the handling of big data in the field of geophysics. More information on the workshop can be found at the EAGE events website.

Experience the magic of our state-of-the-art multi-parameter FWI imaging technology this holiday season—simultaneous high-resolution velocity updates and least-squares imaging. At high frequency, this revolutionary approach provides reflectivity images for both structural and quantitative interpretation, including angle stacks for AVA analysis. All without the need for a conventional processing and imaging workflow. AVA go at it!

A revolution in seismic imaging!

Geoscience, energy transition, use of renewable resources and impact on health topped the agenda at a series of events on 5-9 July 2022, which were held at National Park Mt Kopaonik, Serbia, organised by AGES (Association of Geophysicists and Environmentalists of Serbia), in collaboration with the SEG/SPE Student Section of the Technical Faculty

Mihajlo Pupin (in Zrenjanin) and with the support of EAGE PACE and National Petroleum Committee of Serbia.

The X International Conference on Biomedicine and Geosciences — Influence of Environment on Human Health and the IV International Students Workshop Pupin Meets Nobel were the key meetings. With reduced Covid-19 restrictions, professionals and students were able to attend in person in increased number. Unlike last year, where all the attendees were only from the Balkan region, participants from the every part of the world were able to attend this year’s conference, to share ideas and also discuss with students.

Students had the opportunity for networking and to present their research papers. The top seven research papers were rewarded free travel grants and free participation at the conference. Six travel grants were provided by the National Petroleum Committee of Serbia and one travel grant by AGES. Six travel grants were awarded to students from the Technical faculty Mihajlo Pupin, Zrenjanin, University of Novi Sad and one to a student from the Faculty of Technology, University of Novi Sad. Stanislava Radojčić, representative of the National

Petroleum Committee of Serbia, presented the awards to the students.

Those students who won their free travel grants were obliged to defend their research papers in the form of an oral presentation. A total of 22 research papers from professionals and 16 student papers were presented at the conference, which proves hard work and dedication pays off.

The main panel discussion on ‘Can we live without oil and gas in the future due to reducing carbon emissions to net zero?’ proved to be a brainstorming session. Different ideas and different solutions were aired coordinated by Prof Dr Vladislav Brkić (RGN Faculty, University of Zagreb, Croatia) and Magdalena Marković (Uppsala University, Sweden). After a two-hour discussion, short-term, medium-term and longterm solutions were defined as the best balance going forward. The beauty of brainstorming was that the main topic changed to something more like ‘Can we live in the world where we don’t use oil and gas and only use renewable resources as the main sources for energy’. In the end, the answer was objective and the

conclusion was that it is really hard to cut 100% of oil and gas use, but with more renewable resources, we can achieve reduced emissions of greenhouse gases. Transition will be long and won’t happen overnight, but it can be done over a period of time.

The student programme proved a productive opportunity to create new links and connections between universities focusing on current state of the industry, opportunities for work and world energy transition.

The organisers now look forward to welcoming everyone at the next edition in July 2023 in more and more increased numbers.

‘Can we live in the world where we don’t use oil and gas and only use renewable resources as the main sources for energy?’

Anticipation is already building for the next EAGE Digital Conference to be held in London on 20-22 March 2023 where the theme will be ‘Technology Driving Innovation for the Future’.

In his event launch statement, Gabriel Guerra, vice president digital ventures, Shell Exploration, and EAGE Digital 2023 conference chair, says, ‘Digitalization continues to be a key topic for our O&G community, with an ever-growing pace of delivery and still attracting significant investment, old and new talent. We see new companies being formed by leveraging digital technologies and new ways of working to disrupt our legacy workflows, and also see the community coming together to solve common problems together (like in the OSDU forum). Current market forces and volatility bring higher uncertainty into our industry, accentuating the need for new approaches and better results faster.

In 2023 we will continue the EAGE journey in this space. Following from Vienna in 2022 where we focused on the leadership aspects needed to enable digitalization and its impact on our business, in 2023 we will take a look at digitalization as a key enabler to innovation and to the industry transformation needed through energy transition. Great

disruptive ideas, at the core of every key industry innovation, are usually made of several smaller good ideas that come together. Your participation in the conference is a critical step in furthering the discussion and generating insights on how our community will continue to innovate and thrive in the future.’

Visit eagedigital.org for more details.

It is undeniable that we are living in a digitalization era, and is definitely a challenge being taken up in Latin America. The associated technologies have come to accelerate our industry, contributing to achieve higher productivity rates, lowering costs and facilitating informed decision-making processes.

Presentations at the 2nd EAGE Workshop on EOR in the Americas examined the possibilities. ‘Cutting edge digital methodology to quantify CEOR schemes potentials in Ecuadorian Fields’ by Ivan Palacios (SLB), ‘Maximizing production and storage in CO2 Injection supported by a Physics Embedded Machine Learning’ by Maria Guadalupe Castaño (Tachyus), and ‘Digital Technologies Applied to

Accelerated EOR Evaluation Using Automated Methodology with CO2 Management’ by Diana Marcela Victoria (SLB) all led the conversation to newly-emerging and related technologies in enhanced oil recovery applications.

One of the sessions at the 1st EAGE Guyana-Suriname Basin Conference was focused on new technology, specifically on its uses in the recent discoveries offshore Guyana, Surinam and adjacent areas, for example, in acquisition techniques, seismic imaging and data analysis.

The list of presentations included ‘Innovative acquisition techniques to help unlock the potential of the Guyana/ Suriname Basin’ by Derek Unger (PGS); ‘Innovations in OBN technologies’ by

Mark Zajac (Magseis Fairfield); ‘A Feat of Collaboration and Early Foresight: The Success Story of an Accelerated 3D Seismic Program in Suriname Block 59 I’ by Erin Conlon (ExxonMobil); ‘Optimizing geophysical workflows; a case history of imaging success in the Guyana Basin’ by Steve Knapp (Hess); ‘Deblending the High Point broadband towed-streamer 3D seismic data using the multistage iterative separation of simultaneous sources’ by Wilson Ibañez (SLB); and ‘Acoustic-Only Limitations for Seismic Imaging in the Guyana Basin: A Synthetic Elastic-Imaging Example’ by Cody Helfrich (Hess).

For more about these and other presentations, check out the event proceedings in EarthDoc.

Dong Zhang (EAGE Local Chapter Netherlands) writes: An encouraging number of geoscience professionals and students joined the latest event held by EAGE Local Chapter Netherlands at Fugro’s Innovation Centre on 15 September 2022. Dr Rik Wemmenhove and Dr Johannes Singer from Fugro Innovation and Technology were invited as keynote speakers to introduce innovation solutions at Fugro and their work on near-surface characterisation for offshore wind farms.

This was followed by an introduction to Fugro’s recently launched uncrewed surface vessels for safe and sustainable survey operations offshore, the marine inspection solution, and the real-time object monitoring with computer vision cameras. The remote operations strategy helps Fugro to improve on safety aspects (less people in exposed working environments) as well as on sustainability by using small uncrewed vessels with much reduced CO2 footprint. Towards the end of his presentation, Dr Wemmenhove shared some insights into Fugro’s passive seismic and 3D ultra-high resolution seismic surveys, and finally touched briefly on techniques for unexploded ordnance detection, classification, and removal.

boulder detection and surface wave ambient noise seismology were briefly introduced as well. Despite the good results, there are still many challenges ahead, e.g., the complexity of acquisition, topography, data acquisition in populated cities, etc.

The evening kicked off with a general introduction to innovation at Fugro by Dr Wemmenhove. With his presentation, it became clear how Fugro combined the building blocks of its advanced technology into integrated geo-data solutions. Dr Wemmenhove first demonstrated geo-data acquisition, which included offshore site characterisation (early-stage offshore development) and marine asset integrity (monitoring phase). He continued to introduce innovative products and solutions for geotechnics and geophysics. Some geotechnical examples were cone penetration test (CPT) measurements, sampling and the remotely controlled tracked vehicles for CPT measurements in hazardous areas onshore.

Dr Singer continued the evening with his introduction to virtual geotechnics (‘geotechnical imaging’), imaging structure and properties of the near surface for building, construction, and monitoring. He began by comparing seismic and geotechnics. Often, near surface is considered rather a problem than a target for seismic, however, geotechnics explicitly investigates the near surface and its properties relevant for construction by digging, poking, and drilling.

Singer explained the similarity of geotechnics to the medical industry from the perspective of cutting the patient open, poking locally, and imaging the body. Besides, shear wave elasticity imaging in ultrasound is equivalent to geotechnical properties in one’s body. Also discussed were the typical data resolution and penetration issues, before presentation of a 2D high resolution and ultra-high resolution seismic image comparison for wind farm applications. The audience was impressed by the direct comparison of the 2D high resolution and ultrahigh resolution seismic images. 3D

Animated discussions followed after the technical talks. Some attendees were very interested in the practical matters, such as the cone diameters and the feasibility of small uncrewed vessels. The role of rock physics to transfer elastic parameters to rock properties was also discussed. Others were curious about what else we could learn from medical imaging. Someone suggested combining EM and gravity methods with seismic to better estimate the elastic parameters for geotechnics. The audience was also wondering about the subsurface monitoring from the perspective of government regulation.

A delightful and successful live event was achieved thanks to the great effort and contribution of the invited speakers and the audience. Stay informed about the chapter activities through the website page www.eagelcnetherlands.org and the LinkedIn page https://www.linkedin. com/groups/13690220/ and/or become a member by sending an email to eageLCNetherlands@gmail.com.

Radar (GPR) numerical modelling research and practice is being planned for Near Surface Geophysics for publication in October 2023. This provides an opportunity to reflect, review and report new advancements on the role of numerical modelling on GPR research and practice. It aims to showcase new research and current innovative practice where advanced numerical modelling, or analytical approaches of many kinds, are contributing to advance various aspects of GPR.

Ground Penetrating Radar (GPR) is well established as a key method in the geophysicist’s toolbox for tackling near surface geophysics problems. GPR applications are broad and diverse, from classic near surface, or shallow depth, geophysics problems covering areas such as the natural environment, geotechnics, and archaeology, to urban geophysics, security, non-destructive testing, and more general infrastructure sensing. There are also specialised applications in extreme environments, and subsurface planetary exploration of Mars and the Moon using GPR systems fitted to autonomous rovers.

GPR data interpretation remains a challenging task for many applications, especially where quantitative information

about the geophysical targets is required. Automatic interpretation approaches using full waveform inversion, or other more restrictive methodologies, are advancing but are not yet commonplace in GPR data analysis. Similarly, processing and imaging approaches, although continually improving, are still limited in the quantitative information they can provide.

The role of realistic GPR simulations is becoming pivotal in advancing the GPR interpretation approaches, for both academic research and practical uses. Increasing computational power is making modelling capability much more efficient and accessible, which is leading to the development of new algorithms, better methodological understanding and education, as well in development of new approaches, new system concepts, and survey modalities. It has particularly benefited machine learning based approaches which have begun to offer some interesting and exciting possibilities for certain applications.

We would like to invite papers that can thematically range from fundamental methodological research, in terms of the underlying numerical modelling techniques, to case studies showcasing innovative and useful contributions of numerical modelling to any of the diverse areas of GPR application, complementing and supporting practical GPR surveying and data interpretation.

START AT ANY TIME VELOCITIES, IMAGING, AND WAVEFORM INVERSION - THE EVOLUTION OF CHARACTERIZING THE EARTH’S SUBSURFACE, BY I.F. JONES (ONLINE EET)

Authors are invited to submit original manuscripts, prepared according to the ‘Author Guidelines’ published on the Near Surface Geophysics website. The online submission system for the journal can be found at: https://wiley.atyponrex. com/journal/NSG.

All manuscripts will be peer-reviewed in accordance with the journal’s established policies and procedures. The final selection of papers will be based on the peer review process as well as reviews by guest editors and the editor-in-chief.

Publication milestones to note: Submission of expression of interest (10-15 lines abstract sent to the guest editors) - 15 December 2022; Submission deadline of the full manuscript - February 2023; Final decision on accepted manuscripts - 15 August 2023; Publication of Special Issue - October 2023.

For specific questions, please contact the Special Issue editors: Prof Antonios Giannopoulos (chair, applied geophysics and computational electrodynamics, University of Edinburgh), a.giannopoulos@ ed.ac.uk; Dr Craig Warren (assistant professor, Northumbria University), warren@ northumbria.ac.uk; or Dr Iraklis Giannakis (lecturer, University of Aberdeen), giannakis@abdn.ac.uk. For questions regarding the submission system and review process, contact the publications coordinator Harsha Ravi (hravi@wiley.com).

* EXTENSIVE SELF PACED MATERIALS AND INTERACTIVE SESSIONS WITH THE INSTRUCTORS: CHECK SCHEDULE OF EACH COURSE FOR DATES AND TIMES OF LIVE SESSIONS

PLEASE VISIT WWW.EAGE.ORG AND WWW.LEARNINGGEOSCIENCE.ORG.

On 7-8 September Mexico City played host to the 2nd EAGE Workshop on Advanced Seismic Solutions in the Gulf of Mexico. The event featured more than

20 presentations given by professionals from different disciplines including acquisition technology, acquisition design, VSP, seismic data processing, imaging and interpretation.

Keynote speakers from the industry were Fons Ten Kroode (Magseis Farfield), Sandeep Kumar (PETRONAS Exploration), Roberto Dias (Petrobras), Nikhil Shah (S-Cube), Marco Arreguín (SLB) and Alfredo Vazquez (PEMEX). Between them they presented a panoramic view of the regional oil industry and seismic challenges.

A poster session at the end of the workshop included presentations from two members of the EAGE Student Chapter Instituto Politécnico Nacional (IPN)

on ‘Shallow seismic reflection MASW: building damage analysis in ESIA Ticomán by earthquake through subsoil characterisation’ and ‘Pore pressure prediction using acoustic impedance’.

Exploration in the Gulf of Mexico poses issues due to different geological environments and a very complex geology that includes salt bodies at Salina del Istmo Basin. On the other hand, the deep-water bottom, oil platforms, and more surface conditions constrain the design and operations. The workshop provided an excellent opportunity for geoscientists, asset teams, and decision-makers from the region and around the world to learn and exchange knowledge improving our ability to image and explore the Gulf of Mexico.

The Fourth EAGE Workshop on Unconventional Resources will take place in Bogota on 1-2 December. Approximately 20 abstracts have been accepted and will be available on EarthDoc two weeks before the event.

The 2 nd EAGE Workshop on Fiber Optics Sensing for Energy Application in Asia Pacific will be hosted in Kuala Lumpur on 5-7 December. The aim is to bring together current and prospective technology endusers and owners; sensor hardware researchers; tools, fibres, cables, interrogators and application experts for seismic imaging; downhole monitoring, etc. in order to feature the latest advances in geological and geophysical sciences, as well as drilling and specific HSE and operational requirements in a difficult environment. Approximately 30 presentations are expected.

Further, the 2 nd EAGE/SEG Workshop on Geophysical Aspects of Smart Cities is scheduled for 6-8 December in Hong Kong. The main aim of the workshop is to demonstrate and discuss lessons learned and progress in geophysical techniques in smart city applications and methods, with an emphasis on inter-disciplinary efforts with civil engineering and digital technologies. Hardware sensor development, remote sensing application, data analytics, and social and environmental impacts of technologies will be covered. Approximately 30 presentations are expected.

Lastly, new issues of Basin Research and Near Surface Geophysics will be published in December.

ferences. These modern advances to traditional methods are likely to play a crucial role in aiding the normally time-consuming act of interpreting seismic data, and generating streamlined approaches to any fault seal analysis. Discussions such as these highlight key advances to research that are required to improve fault analyses.

Just a few short weeks ago, Fault and Top Seals 2022 was well underway with scientists from across the globe, with varying backgrounds from academics, geologists, engineers or geomechanics, getting together to discuss many differing topics such as CO2 storage, geothermal or hydrocarbons. This was the 6th International Conference on Faults and Top Seals held in the historical and beautiful world heritage site of Vienna, Austria, attended by over 90 participants.

Although the effects of Covid probably affected the number of presentations compared pre-pandemic years, a high number of delegates took part in this well-known, highly technical conference.

The 41 talks, including five keynote presentations, and 11 posters retained the high calibre of previous conferences, and spurred many interesting discussions throughout the conference and the many social events. The icebreaker, conference dinner and field trip provided excellent opportunities to network and chat with old and new colleagues, generating fruitful discussions about the ability to advance work and research. Predictably some of these chats would progress to groups walking into the Vienna city to taste some delicious Austrian delicacies.

Although the fundamentals of fault seal remain firmly within the petroleum industry, the race to greener energy was

evident by a large number of presentations with focus on the energy transition, from the applications of fault seal on CO2 and hydrogen storage to geothermal energy. The variety of presentations was refreshing to see, and encouraging that we can use our knowledge from hydrocarbon exploration and production to provide a significant push to greener energies.

The presentations reflect the latest advances in fault seal research and its application. Particularly, many presentations highlighted the application of advancing machine learning technologies, leading to in-depth discussions which had been lacking in earlier con-

The conference was concluded by a one-day field trip into the beautiful Leitha Mountains, including a final stop in Lake Neusiedl, a UNESCO World Heritage cultural landscape. There was plenty of discussion when examining faults that cut various lithologies, including some excellent deformation band exposures within limestones that occurred within a multifunctional quarry often used for international cultural events.

The Technical Committee would like to thank those who made this conference possible including the EAGE event coordination team, conference venue staff, sponsors (Badleys, Equinor, OMV, Petroleum Experts, Shell, Wintershall Dea), session chairs, presenters, keynote speakers and all delegates. We look forward to another exciting Fault and Top Seals event in three years.

The event will be summarised into several publications as a thematic set in Petroleum Geoscience and Geoenergy journals. We welcome and encourage submissions.

Near Surface Geophysics (NSG) is an international journal for the publication of research and developments in geophysics applied to the near surface. The emphasis lies on shallow land and marine geophysical investigations addressing challenges in various geoscientific fields.

A new special edition (Volume 20, Issue 6 - Guest Editors: M. Zhdanov, G. Apostolopoulos and D. DiFrancesco) on near surface geophysics for mineral exploration and mining will be published within December, featuring nine articles.

Editor’s Choice articles:

• Surface deployment of DAS systems: Coupling strategies and comparisons to geophone data — Nicholas Harmon et al.

• Full-waveform inversion of surface waves based on instantaneous-phase coherency — Jianhuan Liu et al.

Basin Research (BR) publishes primary research on the science of geophysics as it applies to the exploration, evaluation and extraction of earth resources. A new edition (Volume 34, Issue 6) will be published in December.

2022 is coming to an end. This means it’s time to secure your 2023 EAGE membership thereby guaranteeing your uninterrupted access to all the benefits we have for you. In addition you maintain your current membership level or advance in the EAGE Membership Recognition Programme.

As an EAGE member, upcoming events that you can attend with special registration fees are for example the 2nd EAGE/SEG Workshop on Geophysical Aspects of Smart Cities in Hong Kong (6-8 December 2022), the 3rd EAGE Digitalization Conference & Exhibition (20-22 March 2023) in London, and the 84th EAGE Annual Conference & Exhibition (5-8 June 2023) in Vienna.

You can also can enhance your professional skills and expertise with EAGE learning materials and short courses, such as the Extensive Online Course ‘Developing Deep Learning Applications for the Oilfield: From theory to real world projects’ presented by Dr Bernard Montaron, starting on 17 January 2023. Bottom line: sign up for our education programmes with discounted registration rates, and don’t miss the free learning resources available to you.

Complement your knowledge with our new co-owned publication, Geoenergy, being launched in January 2023. Its key themes are expected to include energy storage, geothermal energy, subsurface disposal and storage, hydrogen energy, critical minerals and sustainability. A free one-year online subscription to Geoenergy will be added to your membership benefits in January 2023, as well as access to your journal of choice: Petroleum Geoscience, Near Surface Geophysics, Basin Research or Geophysical Prospecting.

Take advantage of our conferences, workshops, courses and publications, and be prepared to keep the pace with the industry’s trending discussions. If you are not an EAGE member yet, you are invited to join our community with a special offer: secure your 2023 membership today and get the remainder of 2022 for free. To begin your application or renew your membership visit: https://eage.org/membership/welcome/.

Students are the first geoscience and engineering ambassadors among their communities. They are eager to know more about our industry and to start applying all what they have learned. That’s why EAGE Student Chapters provide them with a space to be creative, work rigorously and, in the end, go a step ahead in their careers.

According to Leidy Tatiana Ballesteros, president of the EAGE Student Chapter Universidad de América (Colombia): ‘By participating in EAGE events, we are given the first steps in the development of scientific research, as well as becoming acquainted with important figures of the local and

international oil and gas industry. In our chapter we transmit this knowledge by creating initiatives that support students’ career development’. These projects have included a conference with Felipe Bayón, president of the national oil company Ecopetrol, together with webinars, courses and training sessions.

Alejandro Franco, member of the EAGE Student Chapter Universidad Nacional de Colombia (UNAL Bogota, Colombia) adds: ‘I am very interested in geophysics. Our chapter has allowed me to not only broaden my knowledge in the field, but also to expand my professional network and enhance my skills in event management

and logistics’. The Best Student Chapter in 2021-22 developed an Ocean and Climate Geoquiz, a GeoHackathon, machine learning courses, webinars and field trips.

If you want to support our student’s initiatives and keep encouraging their passion for geoscience and engineering, you are cordially invited to donate to the EAGE Student Fund. With your contributions you are helping our youngest members to become the leaders of a new era.

You can donate when registering or renewing your 2023 EAGE membership or, if you prefer, directly in donate.eagestudentfund.org.

Our dynamic student community is connecting student members from all over the world. For example, our Universidad de America (Colombia) student chapter is made up of petroleum and energy engineering students who attend EAGE events to exchange knowledge, share their work and meet with the leaders of international oil and gas companies. On their own, they have also developed professional development initiatives that strengthened the research and technical skills of their fellow colleagues.

So the question is – As a student are you actually making the best out of your membership benefits? If you are keen to find out how the EAGE membership can help your academic goals, continue reading.

If you are working on a class assignment or preparing an interesting paper for an EAGE event, but are struggling to find

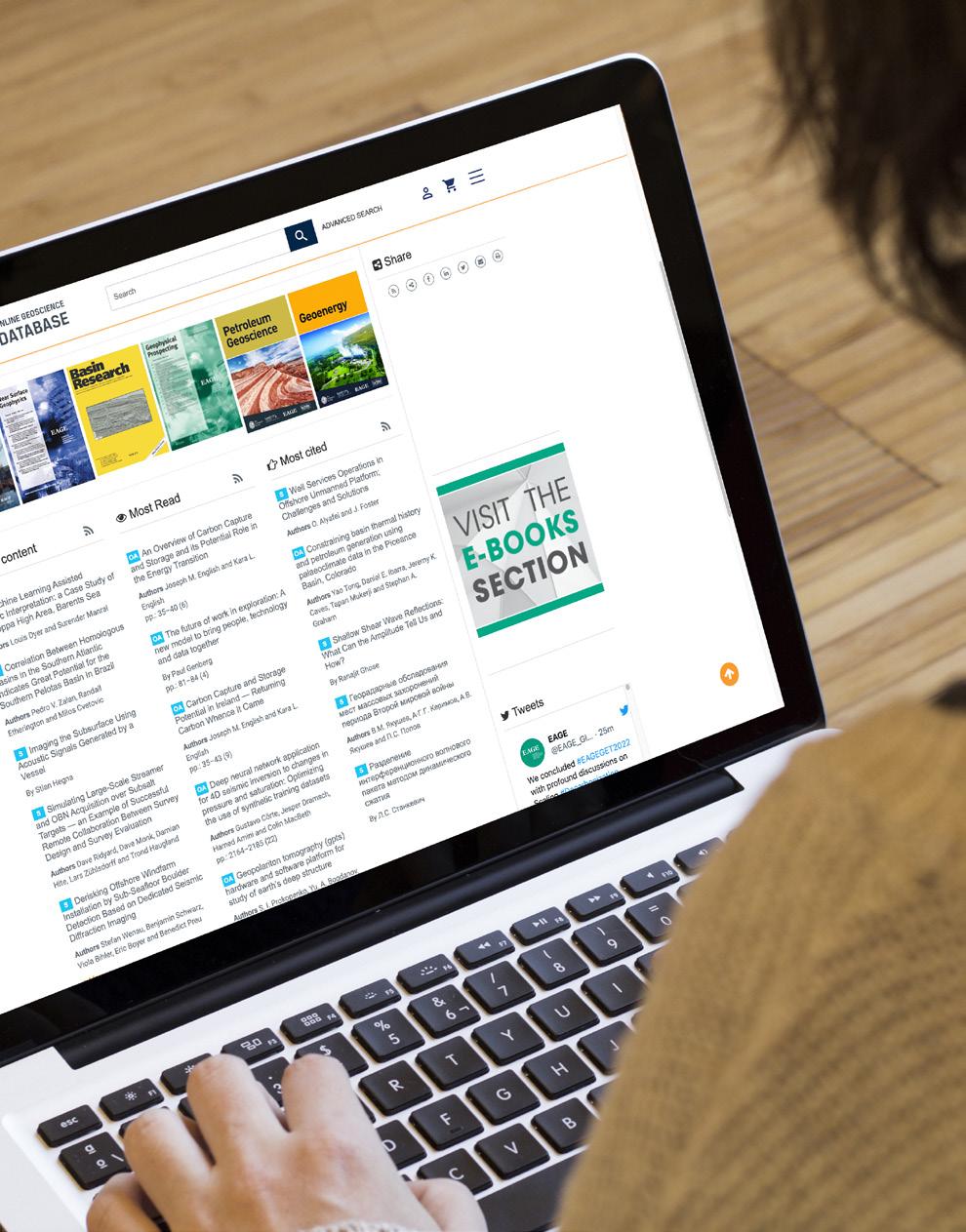

relevant sources to support your arguments, help may be close at hand. This because each student member has access to EarthDoc, EAGE’s online database, providing you with a wealth of knowledge to consult and reference. The database contains over 75,000 indexed titles, many of them providing case studies and new insights presented by our members across the globe.

Through EarthDoc you can also access the entire archive of your journal of choice, along with First Break’s technical papers, providing you with fully developed, peer-reviewed articles on a wide variety of topics. With new editions of our journals being released up to six times per year and our flagship First Break published monthly, there is plenty to keep up with.

A student membership also grants you access to Learning Geoscience, our educa-

tion platform, where you can find online courses with discounted registration fees, as well as free learning resources, such as E-Lecture and Distinguished Lecturer webinars.

If you have questions or remarks about how to take advantage of all your membership benefits, don’t hesitate to contact us at membership@eage.org. Our Membership team is ready to help you.

Nearly 60 students from seven Colombian universities recently tested their programming skills to solve a geoscience technical problem. The occasion was the first UNAL Geo-Hackathon organised by EAGE Student Chapter Universidad Nacional de Colombia (UNAL Bogota).

The contest was divided in two categories: Basic (with 11 teams) and Intermediate (9 teams). The Basic level participants were assigned a climate database (precipitation, air temperature, and net radiation for 2673 gagued river basins worldwide) in order to estimate climate change trends using time series analysis.

Based on well log datasets from 118 wells in the Norwegian Sea, the Interme-

diate teams had to develop a self-learning model for lithofacies prediction. The model’s workflow had to be presented using Dataiku.

Through a computational and a geoscientific view, the jury evaluated the project’s presentation and the model’s performance, in this last case, applying it to an unknown validation dataset. The winner teams, JEA (made up by Andres Villalba, Joel Bernal, Emilio Chaparro and Daniel Vargas from UNAL Bogota) (Basic level) and GEOCANINAS (Michael Guerrero and Fernanda Montañez - UNAL Bogota) (Intermediate level), received a COP$400.000 and a COP$600.000 prize, respectively.

Besides the main competition, the GeoHackathon also included machine learning-related courses such as: Python for geosciences, Introduction to data analysis and visualization, MATLAB, Introduction to Clustering algorithms, Geochemical Data Analysis, Data cleaning in Python, Machine Learning in industrial applications using Dataiku, Fundamentals of Deep Learning in seismic analysis, Machine Learning in the Oil and Gas industry, and Time series analysis.

These activities aimed to strengthen the students programming and problem-solving skills, while connecting them with industry and academic experts. Congratulations are due to the winners and to the Student Chapter for this initiative.

Want to know more about the EAGE Student Chapter UNAL Bogota? Follow LinkedIn: EAGE Student Chapter UNAL or Instagram @eage_unal.

After 12 years at CGG, Habib Al Khatib struck out on his own to co-found SpotLight, a new enterprise based in Paris with novel applications for both oil and gas and energy transition challenges. He reflects on the experience of becoming an entrepreneur and his career to date.

You have an interesting family background?

True, my DNA is upside down, it took roots from Iraq to France! I am half Iraqi (from Bagdad), 25% from Britany and 25% from Auvergne. Funnily enough, my three kids are blonde and two of them have blue eyes! Quite far from my dark curly hair, maybe they’re the only Al Khatibs that look like Vikings.

You are not really a geologist?

Yes, despite a Masters degree in geology with honors (ENSG Nancy), I am a fake geologist because I don’t like rocks! I always preferred 3D subsurface models and numerical geology. But I started my career in CGG, and after 18 years in this domain I can say I became a geophysicist by mistake.

What innovations did you research at CGG?

I had a wonderful 12 years in CGG, first in reservoir characterisation, then in software sales followed by business development for Permanent Reservoir Monitoring (PRM) at group level, and finally as innovation manager for the CTO office. One of my tasks was to promote disruptive innovation. And this is where I got the idea of SpotLight.

What happened to PRM?

I confess I am in love with PRM! For three years, I tried to sell PRM for oil and gas onshore and offshore. Despite undisputed technical success, PRM costs are too high, and so the market remains a niche market. As business developer I was frustrated.

I tried to reduce the cost of installation by partnering with a telecommunication cable installer. Alcatel-Lucent Submarine Networks (ASN) agreed with me… Maybe too much as they purchased Optoplan from Sercel, a good move according to their sales and marketing record.

We enable ‘Predictive maintenance’ for the subsurface to avoid surprises in two steps: Spot: Using subsurface digital twins (flow simulator runs), we identify strategic location (Spots) to frequently focus a seismic measurement on them and know their dynamics to validate/invalidate models. Light: Using existing exploration seismic, we can identify the optimal source/ receiver locations at the surface to focus the measurements on Spot. Ultimately a single source and receivers are needed. With these objectives, the name of our startup was easy.

Originally designed for oil and gas, SpotLight’s key advantages are cost reduction, frequent monitoring and low environmental footprint thereby ticking most CCS monitoring boxes and we see a growing interest in this approach. As example, we’ve been selected as the monitoring solution for Project Greensand CCS project offshore Denmark and demonstrated the technology on two case studies in Canada.

During my studies in Nancy, I was heavily involved in social activities, managing the

cafeteria, organising the school ski trip, and becoming president of the student union. I believe it gave me the willingness to be pro-active. Add to that the fact that I enjoy questioning the status quo, and you have the required ingredient for an entrepreneur. But to become one, you need at least two entrepreneurs, and I would never have started this journey without SpotLight co-founder Elodie Morgan.

I don’t! I spend way more time at work than with my family like most entrepreneurs do. But when I spend time with my family and friends I completely forget about SpotLight and it gives me a priceless mind-rest that restores my stamina. The fact that I enjoy my work and life is also mutually beneficial to both aspects. This is an unbalanced equilibrium.

Happy! And to achieve this, I want SpotLight to be a standard tool used in the subsurface to detect when subsurface numerical models are wrong. Where will I be, it is hard to say. The innovative entrepreneur that I am today will not necessarily be the best CEO for SpotLight in 10 years. What is sure is that I want to make a positive impact in my work (after 12 years of my career in O&G exploration, it’s about time). Looking into our world, it is a given that in 10 years from now, I will unfortunately still find challenges in what matters the most for me: energy transition and gender equality.

With experienced Geophysicists, implementing a full 4D toolbox within Reveal, Shearwater is the trusted partner for your time-lapse seismic.

Scan the QR code to reveal a Shearwater 4D case study.

As we contemplate the year 2023 ahead, geoscientists can legitimately feel a sense of bewilderment about what lies ahead. There can surely be few who doubt the increasingly urgent need to address the impact of climate change and its significant anthropogenic causes.

The obligation to act is increasingly reflected in the education and event initiatives of the EAGE. Exploring the geo technology requirements and possibilities of carbon capture and storage, renewable energy and many other decarbonisation measures have become staples on conference and workshop agendas, and topics in the Association’s publications including the forthcoming Geoenergy journal, a partnership between EAGE and the Geological Society.

At the same time, as the geoscience community is aware, these initiatives have to be squared with securing sufficient supply of fossil fuels to serve mankind during energy transition, preferably in a sustainable manner, although we all know that any production of hydrocarbons is harmful to the environment.

There is nothing new about this dilemma, but what seems more disturbing as the years go by is how uncomfortably powerless individuals have become in hastening the energy transition process. Not only powerless but in developed countries complicit because we all, climate change activists included, continue to experience lifestyles massively enriched by dependence on hydrocarbons. It is also clear that looking to the ‘market’ to bring about change defies the basic priority of capital spending to focus on profitable enterprise. This has a knock on effect on constraining the extent of technology research and development to which many geoscientists are dedicated.

So far commercial investment directly aimed at moving the transition needle (even solar, wind power, etc) has yet to translate into the radical transformation in how the world operates in order to avoid the calamitous outcome predicated by climate analysts. In many cases, the problem is realising a convincing business case to attract the capital needed. The clear implication which governments everywhere have been reluctant to publicly acknowledge

(because the actions necessary are likely to be unpopular) is that only state intervention and regulation can put the world on track to meet the current target of limiting the rise in global temperature to 1.5 C by 2050.

All these considerations have once again been brought into sharp relief at the UN COP27 meeting in Sharm-El-Sheikh (still ongoing at the time of writing) involving representatives from nearly 200 countries, including more than 100 heads of state. Rarely are major decisions and concrete commitments made at these annual gatherings, but their importance should not be underestimated.

It is the one occasion in the year when more or less our entire universe of world governments get together to focus on what is undoubtedly the most pressing global challenge in the decades to come. In theory this should be where common goals backed by the weight of government policy could be agreed. That in itself would be significant progress. Negotiating compliance with the national and international web of commercial and institutional interests likely to be affected by increased regulation is, of course, another matter.

The reality is that we have not come close to concerted government action to mitigate climate change, and the reasons for this are unfortunately made glaringly obvious at the COP meetings. We live in a very complicated and basically inequitable world. The agenda of various countries are often in direct opposition, for example, the opening up of new hydrocarbon provinces.

The biggest takeaway this time has been a growing anger and frustration among leaders of lower and middle-income countries. They are calling out rich countries for their role in the warming of the planet and reneging on promises of compensation for the harm done to their communities.

Those who contributed least to the climate crisis are reaping the whirlwind sown by others, according to UN Secretary General António Guterres in a surprisingly accusatory declamation at the

‘We have not come close to concerted government action.’

start of the meeting. He stated that the world was on ‘a highway to climate hell with our foot on the accelerator’. Hopefully, his warning won’t be consigned to a headline in the news cycle.

Guterres said humanity had the choice: cooperate or perish in a collective suicide. He called for a ‘pact between developed and developing countries that would see all countries taking extra efforts to reduce emissions, wealthier nations and international financial institutions providing assistance to emerging economies, ending dependence on fossil fuels and the building of coal plants, providing sustainable energy for all, and uniting to combine strategy and capacities for the benefit of humankind.’ He noted that the two largest economies – the United States and China – had a particular responsibility to make this pact a reality.

The key issue of so called ‘loss and damage’ could no longer be swept under the rug, according to Guterras. In a repeat of her address to COP26 in Glasgow last year, Mia Mottley, prime minister of Barbados, once again summed up the case for climate justice. Industrialised nations had achieved prosperity at the expense of the poor, she said. Now they are being forced to pay again as victims of climate breakdown they did not cause. Without action there could be a billion climate refugees around the world by the middle of the century, she claimed

You have to look back to COP15 in Copenhagen (2009) to understand exasperation and resentment. At that meeting, wealthier countries made what has turned out to be a somewhat vague pledge to provide vulnerable developing countries $100 billion by 2020 (continuing to 2025) to address impacts of climate change. The caution reflected the reported worry of contributing countries about future potential litigation that would measure alleged climate damage and hence make them potentially liable for huge claims from impacted countries.

The Organisation of Economic Cooperation and Development’s (OECD) latest estimate is that the sums allocated by 2020 amounted to $88.3 billion, well short of the target. Accounting is also complicated involving grants, loans and equity, and private finance making a true determination (almost certainly less) difficult, according to critics. Indisputably the US has contributed a disproportionately low amount considering the size of its economy, less than $3 billion.

Not surprisingly Pakistan’s Climate Minister Sherry Rehman, has been prominent in the plea for more funding to deal with the impact of climate change. Pakistan, with Norway as a co-chair of COP27, also represents the G77 group of developing countries pressing for more money. She told Reuters that Pakistan was trying to recover from $30 billion ‘climate-fuelled’ economic losses while the pace of climate diplomacy was glacial.

Rehman’s remarks fed into the argument that a disproportionate amount of international climate-related aid in the past has been spent on mitigation rather than adaptation, a concern expressed by Guterras. During the conference a number of European countries,

including Germany, Austria, Ireland, Denmark and Scotland, promised millions in support of special funding to help poorer countries suffering climate change harm. President Biden, who made much of his confidence that the US would meet its carbon emission reduction targets by 2030, doubled to $100 million a pledge for the adaptation fund. Less clear was how this would be achieved after the predicted loss of the House in last month’s mid-term US elections.

The ‘loss and damage’ issue is in a sense symbolic, raising the question of good faith on the part of richer countries and the more fundamental question of how seriously is the world taking climate change. Is activist Greta Thunberg (who gave the event a miss) right to refer to COP27 as a greenwashing scam?

It would be safe to conclude that not enough is being done, and acknowledgement of the problem by world leaders at COP27 and elsewhere means little without action. That does not make COP27 a scam. On display were all the hurdles that hinder progress, some more insurmountable than others. That is not such a bad thing.

Most problematic is the future role of oil and gas in energy transition and the contrasting standpoints across the globe. You have governments from unapologetic producers like the US, Norway and the UK coming to the meeting paying allegiance to climate change mitigation objectives. This is not a good look even if it is the reality. There are those less developed countries fully intent on exploiting newfound or existing reserves for much-needed revenue.

Then, there are the OPEC+ countries, currently in control of world oil pricing for revenue generation purposes, unattached to any climate action strategy. They can make the plausible claim that keeping the price high accelerates investment in alternative energy. However, that argument was exploded by the reaction to Russia’s war on Ukraine and the consequent squeeze on supplies of gas to Europe. Energy security has suddenly become the mantra with the ‘dash for gas’ a priority regardless of the climate implications.

In his opening address Guterras stated that the war in Ukraine had exposed the profound risks of our fossil fuel addiction. ‘Today’s urgent crises cannot be an excuse for backsliding or greenwashing. If anything, they are a reason for greater urgency, stronger action and effective accountability.’ He did not stop there, demanding ‘governments to tax the pandemic-driven windfall profits of fossil fuel companies and redirect the money to people struggling with rising food and energy prices and countries suffering loss and damage caused by the climate crisis.’

It is not reported how the fossil fuel lobbyists countered this last suggestion, but there were plenty on the ground to take on the task. The campaign group Global Witness reckoned on a conservative analysis that there were 636 present, a 25% increase on COP26. Easily the most represented region was the United Arab Emirates (UAE), an OPEC diehard.

Next year’s COP28 is scheduled to be held 6-17 November 2023 in the UAE.

‘The choice: cooperate or perish in a collective suicide.’Views expressed in Crosstalk are solely those of the author, who can be contacted at andrew@andrewmcbarnet.com.

Applications:

Urban underground space investigation, geological disaster and harmful geology structure detection, geothermal and water resources exploration, engineering survey, dense array observation, vibration monitoring, etc.

International Sales

Unit 145, 3901-54 Ave, NE

Calgary,AB T3J 3W5 Canada

Tel:+1-403-264 1070

Toll Free:+1-888-604 SOLO(7656)

Email: sales@SmartSolo.com

Web: www.SmartSolo.com

Seismic data companies have reported continued market recovery in the third quarter with healthy operating profits, though this has yet to translate into significant net profits.

PGS was the only big company in the third quarter to report a net profit – $2.6 million on revenues of $198.5 million, compared to a net loss of $61 million on revenues of $141.7 million in Q3 2021.

Operating profit (ex. impairments and other charges, net) was $33.8 million, compared to an operating loss of $28.9 million in Q3 2021.

The company highlighted an upsurge of late sales in the quarter of $72 million, nearly three times as much as Q3 2021 late sales of $25 million. Contract revenues topped $100 million in the quarter.

At the time of writing PGS vessels were fully booked for the rest of the year and ‘building good visibility’ into 2023 with 11 vessel months secured for Q1 2023. Activity and pricing is ‘continuing a positive trend,’ it said.

‘The seismic acquisition market is likely to benefit from a significant reduction of operated vessel supply over several years,’ said PGS in its results statement. ‘In 2022 we see an increasing demand for seismic acquisition services related to carbon capture and storage projects.’

TGS has reported a third quarter net loss of $1.7 million on revenues of

$135 million compared with a net profit of $4 million on revenues of $200 million in Q3 2021. Operating profit of $1 million compared with operating profit of $18 million in Q3 2021. While the company said its results were affected by delays in some projects it pointed to yearon-year growth of 108% in late sales as evidence of a market that is continuing to improve.

‘As a result of high energy prices and concerns about energy security, investments in exploration and production of oil and gas have increased significantly in 2022,’ says the company’s outlook statement. ‘This has resulted in a sharp increase in demand for seismic data, as evidenced by the strong development in multi-client late sales. With the continued high energy prices, the growth in E&P spending is likely to continue into 2023 and TGS is experiencing increasing interest among oil and gas companies to discuss 2023 opportunities.’

The newly acquired TGS company Magseis Fairfield reported a healthy ocean bottom seismic market with Q3 revenues very nearly topping $100 million. The company reported that acquisition activity reached an all-time high in July.

It also won the largest acquisition contract ever awarded to the company. The contract is for ExxonMobil in Guyana, is for at least 14 months. Magseis Fairfield

forecasts a market which will exceed $1 billion in 2023.

CGG reported a third quarter group net loss of $2 million on revenues of $255 million compared with a group net loss of $16 million on revenues of $210 million in Q3 2021. However, operating profit was $28 million compared with $21 million in Q3 2021.

It said that the level of commercial bids for its Sensing and Monitoring division at quarter end was at the highest level since 2016, and several contracts and deliveries in the Middle East and North Africa are expected to come to fruition in 2023.

Sophie Zurquiyah, CGG CEO, said: ‘Throughout the year we continued to see our market environment strengthening globally, mainly driven by increased interest and activity offshore in the western hemisphere and onshore in the Middle East and North Africa.’

All seismic data companies expect continued revenue improvements in 2023 after big oil companies reported huge third quarter profits, which are expected to translate to greater demand for seismic projects as more exploration projects are launched and dusted off. Saudi Aramco reported net income of $42 billion, Equinor $24 billion before tax, Exxon Mobil $19.7 billion, Total Energies $9.9 billion, Shell $9.5 billion and bp $8.5 billion.

TGS has partnered with SAND Geophysics and the Norwegian Geotechnical Institute (NGI) to provide early phase ground condition and geohazard evaluations for offshore wind farm development.

The companies aim to support wind farm front-end engineering design (FEED) studies and survey evaluation and design (SED) through the development of multi-client desktop studies across the global wind market. The partnership will develop joint products with the principal objective of creating an offering that reduces development cycle times at a cost-effective price point.

They will conduct detailed desktop studies utilizing relevant subsurface data to identify existing and upcoming site evaluation opportunities in both mature and frontier markets. The focus will be on optimizing the efficiency and cost-effectiveness of ground model development for foundation and data survey designs.

The cooperation agreement follows a comprehensive desktop study that the NGI-TGS-SAND partnership has jointly provided as a multi-client product to consortia that are currently preparing to bid for offshore wind development rights in Norway.

Ivar Slengesol, VP of new energy solutions at TGS, said, ‘TGS continues to build on its mission to provide data and insights across the entire offshore wind developoment process. With combined expertise in geophysics, geology, geotechnical engineering and environmental geotechnics in combination with long offshore wind experience, this partnership brings unrivalled

capabilities to early-phase ground condition evaluations and risk assessments.’

Mark Vardy, director and head of R&D at SAND, said, ‘There is a tremendous opportunity to leverage information from extant data and share knowledge/understanding between sites, which can only benefit future offshore infrastructure developments and our global shift towards green energy.’

Thomas Langford, director for Offshore Energy at NGI, said: ‘Fulfilling this need starts with desktop studies and survey planning covered by this agreement and follows the interpretation and application of data into detailed engineering design.’

Guyana is auctioning 14 oil blocks for the nation’s first competitive offshore oil and gas licensing round.

As part of this model agreement, the royalty has been increased from the 2% for the Stabroek Block to 10%. The current 75% cost recovery ceiling has been lowered to 65%. Profit sharing after cost recovery remains the currently applied 50/50 system between the contractor and the Government of Guyana. The operator will pay 10% corporate tax.

Minister of natural resources Vickram Bharrat said. ‘These incentives are expected to attract major international oil companies with the necessary finance and expertise to expedite the prospecting and development of oil discoveries within the shortest possible timeframe.’

Of the 14 blocks – ranging from acreages of 1000 km2 to 3000 km2 – 11 are located in shallow water, while the remaining three can be found in ultradeep-water. Bidders will be required to pay a minimum signing bonus of $10 million for shallow blocks while the deep-water blocks carry a signing bonus of $20 million.

Qualified and local companies in the South American country will be given an opportunity to bid for blocks, but must have a proven track record of technical, financial, health and safety, and environmental capabilities. Bidders will be assessed based on their guaranteed work programmes which will be weighed with the offered signing bonus. Local content commitments will also be fully examined.

There will be no restrictions on how many bids a company may submit. However, each successful bidder will be limited to an award of three blocks.

Successful bidders will have to guarantee that they will make good on commitments made under their work agenda. Failure to meet this will result in the government initiating a penalty of the unspent amount of the work programme.

The licensing round process is expected to be concluded by the end of the first quarter of 2023.

Since first oil was struck in the Stabroek Block in 2015, Guyana’s potential resources have been estimated in excess of 25 billion barrels with a proven reserve of 11 billion barrels.

Shearwatear has won a large US Gulf of Mexico ocean bottom node programme, Engagement 3, the second project award under the recently announced global agreement with WesternGeco. The contract secures WesternGeco access for follow-on projects, providing certainty for continued acquisition using this technology in the Gulf of Mexico.

The three-month survey is expected to cover a nodal area of approx. 2400 km2. The project builds on Shearwater’s experience from similar OBN geophysical data acquisition executed in the Gulf of Mexico in 2020.

Shearwater was due to start the project in early November, deploying the seismic

vessels SW Gallien and SW Mikkelsen as source vessels for the project, working in combination with ROV node deployment.

‘Shearwater has the flexibility to reassign our assets towards relevant markets, and by doing this support our clients’ strategies in the growing ocean bottom seismic market,’ said Irene Waage Basili, CEO of Shearwater. ‘Our large high-end fleet of seismic vessels give us a significant competitive advantage, enabling us to evolve rapidly to answer our clients’ needs.’

WesternGeco will combine new OBN data with existing wide azimuth and revolution data, through the use of proprietary enhanced template matching full waveform inversion (ETM FWI). ‘This has proven to deliver a step change in subsurface imaging resolution, accelerating near field development with reduced uncertainty,’ said Shearwater.

Sparse node projects use ultralong-offset OBN data to resolve subsurface imaging challenges by integrating new data with existing wide and full azimuth data to provide new geological insight.

UNLEASH YOUR DATA’S

POTENTIALSM

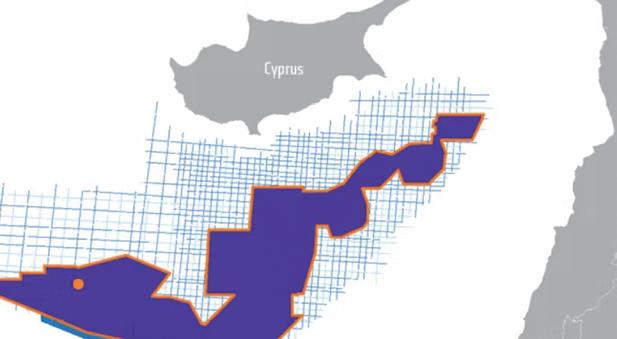

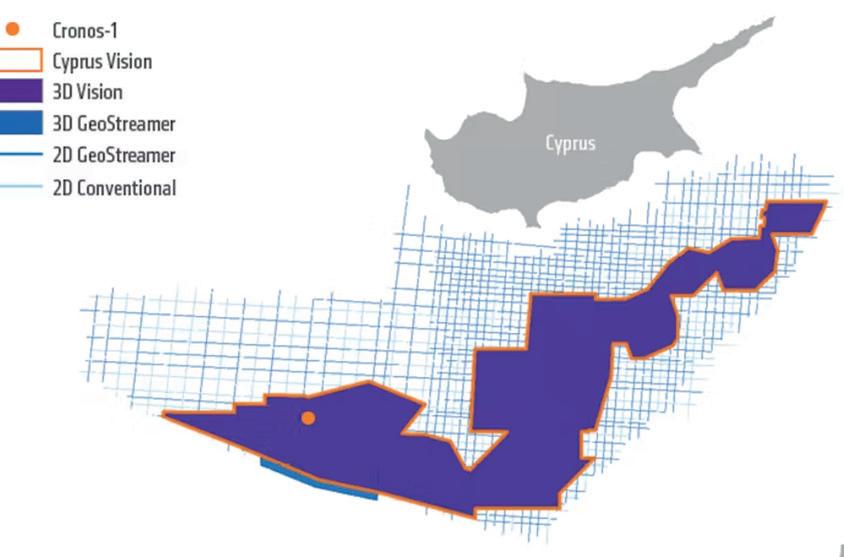

The latest data delivery expands total coverage within the basin to 24,000 km2 covering almost all the available blocks.

‘The image quality is strikingly good, making this rejuvenated dataset perfect for anyone evaluating the potential of UK 33rd Round blocks West of Shetland, as well as considering it as part of application work programmes,’ said Sónia Pereira, VP Data Sales Europe at PGS.

The Faroes Shetland Basin area is characterized by a complex structural and geological history, which gives rise to

multiple petroleum plays but also creates several features obstructing subsurface imaging based on reflection seismic data. Teams evaluating these plays will benefit from access to FSB Vision data, which has been created by merging and broadband reprocessing.

Meanwhile, PGS has won a 3D exploration acquisition contract offshore Namibia from a big energy company. The vessel Ramform Titan will mobilize for this survey and acquisition is expected to complete mid-February 2023. ‘PGS has many years of experience operating in Namibia. The contract secures visibility for the Ramform Titan well into the winter season,’ said president and CEO of PGS, Rune Olav Pedersen.

Cloud Agnostic and OSDU Ready Katalyst’s digital transformation services provide end-to-end subsurface data management solutions to our oil and gas companies.

Katalyst can get you started. Contact us at: sales@katalystdm.com. katalystdm.com

PXGEO has been awarded a project in Asia Pacific region to acquire 3D seismic data for TGS. The seismic vessel PXGEO 2 will mobilize in December 2022 and the project will last for approx. three months.

Magseis Fairfield has signed a global co-operation agreement with Fugro to collaborate on wide-area 3D ultra-high resolution surveys (3D UHR) for the offshore renewables and carbon capture and storage (CCS) markets. They will pursue projects that benefit from the combination of Magseis Fairfield’s Extended High Resolution (XHR) seismic system and Fugro’s geo-data expertise.

PetroTrace and Eco2Power have announced a joint-services partnership agreement to offer integrated seismic services, including survey planning and acquisition, seismic data processing (signal processing, advanced imaging), quantitative interpretation (petrophysics, rock physics, seismic inversion), geomechanics, reservoir modelling and simulation.

Equinor is reported to be considering buying oilfields in the UK North Sea from China’s CNOOC, including a big stake in the huge Buzzard oilfield, in a deal valued at between $1.9 billion-$2.8 billion, according to Reuters.

Shell has completed the sale of its 100% shareholding in Shell Philippines Exploration (SPEX) to Malampaya Energy XP (MEXP), a subsidiary of Prime Infrastructure Capital. SPEX will continue to own a 45% operating interest and be the operator of the Malampaya gas field.

Petronas has signed a production sharing contract with TotalEnergies and Shell for Block 2K, an ultra-deepwater block located off the coast of Sabah. Block SB 2K, with depth up to 3000 m, covering 1952 km2 is in the prolific north-west ultra-deepwater area within a proven hydrocarbon basin with promising hydrocarbon potential. TotalEnergies will be the operator of the block.

TGS has reported a third quarter net loss of $1.7 million on revenues of $135 million compared with a net profit of $4 million on revenues of $200 million in Q3 2021.

It also recorded an operating profit of $1 million compared to an operating profit of $18 million in Q3 2021.

The late sales portion of revenues was $65 million, representing a substantial increase compared to the $31 million reported for Q3 2021. However, early sales of $55 million compared to early sales of $165.5 million in Q3 2021.

The operating result was $1 million compared with $18 million, respectively, in Q3 2021.

Order inflow was $140 million in Q3 2022, compared to $30 million in the same quarter of 2021.

Cash balance totalled $192 million on 30 September 2022 versus $198 million a year earlier.

The company closed the acquisitions of Prediktor and ION Geophysical’s EPTS business during Q3 2022.

‘With year-over-year growth of 108% in lates sales, the strong development we saw in the first half of the year continued

in the third quarter. I’m also pleased that cash flow remains robust. The net cash position was $192 million on 30 September 2022, despite substantial inorganic investments during the quarter. We are excited about welcoming the three recent acquisitions to TGS. Magseis Fairfield, Ion and Prediktor all fit perfectly with our strategy of being the leading provider of data and insights to the energy industry, and will more than double our existing backlog,’ said Kristian Johansen, CEO of TGS.

In its outlook TGS said that it expected multi-client investments of approximately $200 million this year. ‘As a result of high energy prices and concerns about energy security, investments in exploration and production (E&P) of oil and gas have increased significantly in 2022. This has resulted in a sharp increase in demand for seismic data, as evidenced by the strong development in multi-client late sales. With the continued high energy prices the growth in E&P spending is likely to continue into 2023 and TGS is experiencing increasing interest among oil and gas companies to discuss 2023 opportunities.’

The US Bureau of Ocean Energy Management (BOEM) has published its Gulf of Mexico Lease Sale 259: Proposed Notice of Sale on its website (www.boem.gov/sale-259).

Bidders and stakeholders are asked to submit comments and recommendations to BOEM regarding the size, timing and location of the lease sale. The sale will be held by March 31, 2023.

BOEM has also published the Cook Inlet (Alaska) Lease Sale 258: Final Environmental Impact Statement analysing the potential impacts of Cook Inlet OCS Oil and Gas Lease Sale 258.

The final EIS identifies the preferred solution, which would offer for lease 193

unleased OCS blocks (approximately 387,771 hectares). It defers the 17 OCS blocks wholly or partially overlapping beluga whale and northern sea otter critical habitats; and applies additional mitigation measures to reduce potential impacts on the beluga whales and their critical habitat and feeding areas, sea otters and their critical habitat, and the gillnet fishery.

PGS has reported third quarter net income of $2.6 million on revenues of $198.5 million, compared to a net loss of $61 million on revenues of $141.7 million in Q3 2021.

Operating profit (ex. impairments and other charges) was $33.8 million, compared to a loss of $28.9 million in Q3 2021.

Contract seismic revenues of $100 million increased from $67 million in Q3 2021.

Multi-client prefunding was $19.4 million, down from $45 million in Q3 2021. However, late sales of $72 million was nearly three times as much as Q3 2021 late sales of $25 million.

Imaging revenues of $6.6 million were up from $5.2 million in Q3 2021

Cash flow from operations of $177.9 million compared to $114.5 million in Q3 2021. Cash and cash equivalents of $179.1 million, compared to $193 million in Q3 2021.

During the quarter PGS signed a multi-year multi-client library access agreement with Shell and was awarded two big contracts in Asia-Pacific constituting an acquisition campaign of close to five months as well as solid industry

pre-funding for a Q4 multi-client survey in West Africa.

PGS vessels are fully booked for 2022 and ‘building good visibility’ into 2023.

The company completed a share issue, securing ~$14 million of new equity in addition to the ~$85 million private placement completed in Q2. It paid the scheduled $135 million Term Loan B amortization. Liquidity at quarter end was $179 million. PGS will take advantage of favourable market conditions to refinance in the first half of 2023.

Rune Olav Pedersen, PGS president and chief executive officer, said: ‘The positive momentum in the seismic market further strengthened in Q3. We achieved strong vessel utilization and recorded contract revenues of more than $100 million with an increasing EBIT margin.

‘Our multi-client activity increased sequentially, driven by the South Bank multi-client project offshore Canada and a large survey on the northwest shelf of the Norwegian Sea. Our reported pre-funding revenues were modest, however, due to a low volume of projects completed and delivered to clients in the quarter.

Multi-client late sales in the quarter were close to three times Q3 2021 late

sales and were positively impacted by revenue recognition of a large part of the Shell multi-year multi-client access agreement and transfer fees.

‘Our order book remains at healthy levels, and we have been able to transition well from the seasonally stronger summer season to the normally weaker winter season. We are now fully booked for 2022 and have secured 11 vessel months for Q1 2023 with activity and pricing continuing a positive trend.’

In its outlook PGS said that it expects full year 2022 gross cash costs of $500 million and multi-client cash investments of $110 million, down from the $125 million earlier guided. Capital expenditure is expected at $60 million. At quarter end the order book was $320 million.

‘The seismic acquisition market is likely to benefit from a significant reduction of operated vessel supply over several years. In 2022 we see an increasing demand for seismic acquisition services related to carbon capture and storage projects and we expect to generate revenues of approximately $30 million relating to our New Energy business for the full year,’ the company says.

Magseis Fairfield has reported an operating loss of $7.5 million and a net loss of $8.8 million on revenues of $99.3 million in the third quarter of 2022.

The company, now owned by TGS, reported that acquisition activity was high throughout the quarter with July reaching an all-time high. The North Sea season was successfully completed for all crews working in the region, and the company also completed the XHR test on Sleipner CCS. However, technical downtime on a node handler and delayed start-up of a project negatively impacted the results and the company also record-

ed a $7.2 million in one-off costs relating to change of control.

During the quarter, Magseis Fairfield won its largest ever acquisition contract. The contract is for ExxonMobil in Guyana, lasting for at least 14 months using ZXPLR technology, started in Q4 2022.

‘The high activity in the quarter reflects the improved market. Magseis Fairfield is demonstrating leadership as the clear market leader in the OBN market and remains focused on improving contract terms and conditions to balance risk in the current market,’ said Carel Hooijkaas, CEO of Magseis Fairfield.