SPECIAL TOPIC

SPECIAL TOPIC

EAGE NEWS President’s half-term report

INDUSTRY NEWS Norway maps oil and gas resources

TECHNICAL ARTICLE Machine learning for petrophysical modelling

CHAIR EDITORIAL BOARD

Gwenola Michaud (gmichaud@gm-consult.it)

EDITOR

Damian Arnold (arnolddamian@googlemail.com)

MEMBERS, EDITORIAL BOARD

• Lodve Berre, Norwegian University of Science and Technology (lodve.berre@ntnu.no)

Philippe Caprioli, SLB (caprioli0@slb.com) Satinder Chopra, SamiGeo (satinder.chopra@samigeo.com)

• Anthony Day, PGS (anthony.day@pgs.com)

Ambient noise monitoring and HSE risk mitigation by the deployment of IoT technology on land seismic crews. FIRST BREAK ® An EAGE Publication

• Peter Dromgoole, Retired Geophysicist (peterdromgoole@gmail.com)

• Kara English, University College Dublin (kara.english@ucd.ie)

• Stephen Hallinan, CGG Stephen.Hallinan@CGG.com

• Hamidreza Hamdi, University of Calgary (hhamdi@ucalgary.ca) Clément Kostov, Freelance Geophysicist (cvkostov@icloud.com) Pamela Tempone, Eni (Pamela.Tempone@eni.com)

• Angelika-Maria Wulff, Consultant (gp.awulff@gmail.com)

EAGE EDITOR EMERITUS

Andrew McBarnet (andrew@andrewmcbarnet.com)

MEDIA PRODUCTION

Saskia Nota (firstbreakproduction@eage.org)

PRODUCTION ASSISTANT

Ivana Geurts (firstbreakproduction@eage.org)

ADVERTISING INQUIRIES corporaterelations@eage.org

EAGE EUROPE OFFICE

Kosterijland 48 3981 AJ Bunnik

The Netherlands +31 88 995 5055

• eage@eage.org www.eage.org

EAGE MIDDLE EAST OFFICE

EAGE Middle East FZ-LLC

Dubai Knowledge Village Block 13 Office F-25 PO Box 501711 Dubai, United Arab Emirates

• +971 4 369 3897

• middle_east@eage.org

• www.eage.org

EAGE ASIA PACIFIC OFFICE

UOA Centre Office Suite 19-15-3A No. 19, Jalan Pinang 50450 Kuala Lumpur

Malaysia

• +60 3 272 201 40

• asiapacific@eage.org

• www.eage.org

EAGE AMERICAS SAS Av. 19 #114-65 - Office 205 Bogotá, Colombia

• +57 310 8610709

• +57 (601) 4232948

• americas@eage.org www.eage.org

EAGE MEMBERS CHANGE OF ADDRESS NOTIFICATION

Send to: EAGE Membership Dept at EAGE Office (address above)

FIRST BREAK ON THE WEB www.firstbreak.org

ISSN 0263-5046 (print) / ISSN 1365-2397 (online)

98 Calendar 65

37 Virtual Shear Checkshot from a densely sampled DAS walkaway VSP in a desert environment

Ali Aldawood, Amnah Samarin, Ali Shaiban and Andrey Bakulin.

45 Machine learning for petrophysical modelling: a case study of Groningen gas field, the Netherlands

Xiao Wang

53 Geothermal heat potential for district energy and industrial usage in Europe based on closed-loop well solutions

Kim Gunn Maver, Ola Michael Vestavik and Camille Hanna

59 An integrated approach to Vibroseis sweep design

Tim Dean

65 Ambient noise monitoring and HSE risk mitigation by the deployment of IoT technology on land seismic crews

Andrew Clark, John Archer, Mikaël Garden and Jozsef Orosz

71 Revisiting the single sensor vs array debate in the light of new nodal system technology

Amine Ourabah

79 Has the importance of ‘signal’ been forgotten in the signal-to-noise ratio of land seismic acquisition?

Spencer L Rowse and Robert Heath

85 Understanding land seismic scattering noise through careful simulation

Christof Stork

91 Using advanced fibre-optic point sensors at high temperatures to expand downhole deployment use cases

Brett Bunn and Paul E. Murray

95 Digital sensors – The next steps

C. Jason Criss

Esther Bloem Chair

Andreas Aspmo Pfaffhuber Vice-Chair

Micki Allen Contact Officer EEGS/North America

Adam Booth Committee Member

Hongzhu Cai Liaison China

Deyan Draganov Technical Programme Officer

Wolfram Gödde Liaison First Break

Hamdan Ali Hamdan Liaison Middle East

Vladimir Ignatev Liaison CIS / North America

Musa Manzi Liaison Africa

Myrto Papadopoulou Young Professional Liaison

Catherine Truffert Industry Liaison

Mark Vardy Editor in Chief Near Surface Geophysics

Florina Tuluca Committee member

Yohaney Gomez Galarza Chair

Johannes Wendebourg Vice-Chair

Lucy Slater Immediate Past Chair

Erica Angerer Member

Wiebke Athmer Member

Tijmen Jan Moser Editor-in-Chief Geophysical Prospecting

Adeline Parent WGE & DET SIC liaison

Matteo Ravasi YP Liaison

Jonathan Redfern Editor-in-Chief Petroleum Geoscience

Aart-Jan van Wijngaarden Technical Programme Officer

Carla Martín-Clavé Chair

Giovanni Sosio Vice-Chair

SUBSCRIPTIONS

First Break is published monthly. It is free to EAGE members. The membership fee of EAGE is € 80.00 a year including First Break, EarthDoc (EAGE’s geoscience database), Learning Geoscience (EAGE’s Education website) and online access to a scientific journal.

Companies can subscribe to First Break via an institutional subscription. Every subscription includes a monthly hard copy and online access to the full First Break archive for the requested number of online users.

Orders for current subscriptions and back issues should be sent to First Break B.V., Journal Subscriptions, Kosterijland 48, 3981 AJ Bunnik, The Netherlands. Tel: +31 (0)88 9955055, E-mail: subscriptions@eage.org, www.firstbreak.org.

First Break is published by First Break B.V., The Netherlands. However, responsibility for the opinions given and the statements made rests with the authors.

COPYRIGHT & PHOTOCOPYING © 2024 EAGE

All rights reserved. First Break or any part thereof may not be reproduced, stored in a retrieval system, or transcribed in any form or by any means, electronically or mechanically, including photocopying and recording, without the prior written permission of the publisher.

The publisher’s policy is to use acid-free permanent paper (TCF), to the draft standard ISO/DIS/9706, made from sustainable forests using chlorine-free pulp (Nordic-Swan standard).

EAGE president Edward Wiarda provides a half-term report on his period in office.

The classicists amongst you will know that the month of January is named after the Roman god Janus, usually depicted as having two faces, one looking back, the other forward. In this spirit and allowing for the manageable risk of being called ‘two-faced’, I would like to reflect on 2023 now past as well review the possibilities ahead for 2024.

I believe that last year’s adoption of our Circles nomenclature and birth of our new Sustainable Energy Circle defines a new and robust organisational framework. The three overlapping Circles ensure that the EAGE is ‘future-proof’, flexible, diversified and inclusive. We can confidently continue on our Energy Transition journey that puts sustainable development at the heart of our organisation.

EAGE’s strategy going forward is clear and focused on: 1) Resolving the energy trilemma; 2) Facilitating and accelerating the Energy Transition towards a low-carbon future; and 3) Long-term sustainability providing a safe and just operating space for humanity. In other words, we need to help to produce more energy, emit less carbon, and become more sustainable. This can only be possible with a sustainable membership demography including a healthy influx of younger EAGE members representing

a new generation of geoscientists and engineers.

Obviously, the EAGE Board is increasingly concerned about the steadily declining undergraduate enrollment into university geoscience programmes in many key countries, down 35-43% since 2014/2015. Starting in 2024, the EAGE is planning to roll out a suite of initiatives aimed at restoring the standing of geosciences, the energy sector and the oil and gas E&P industry. This starts by defining mission-driven goals for each EAGE circle. We envisage communication training as well as engagement and strategic sessions with policymakers at various key events.

Unfortunately, 2023 witnessed a string of natural disasters around the world that touched the hearts of geoscientists and engineers, notably the earthquakes in Turkey-Syria and Morocco in February and September respectively. There was a clear connection with the sub- and near-surface and engineering in many of these devastating cases. This highlights the need for our geoscientists and engineers to continue working together and across all borders in the fields of tectonics, seismology, structural geology, (induced) seismicity and earthquake-resistant construction. Similarly the devastating floods in Pakistan and Libya in 2023, and the droughts in the Middle East,

both underlined the urgent need for climate action. In as far as it can EAGE continues its efforts to address the root causes of climate change along with mitigation of its extreme impacts. It is why the work of the Near-Surface Geoscience Circle and relevant communities is so important with expertise on natural hazard analysis, identification, mapping and eventually mitigation.

Energy Circle encompasses CCS, geothermal energy, energy and hydrogen storage, offshore wind and ‘raw materials for the energy transition’ communities. At the same time we must not forget the value of our evolving oil and gas circle. It has the largest membership base and is very much focused on sustainable development of energy resources.

It also follows that a key ambition in 2024 is to further engage with our members. We want to grow our three thriving EAGE Circles by stimulating and initiating the creation of underlying technical and special interest communities and their activities, both new and existing. This has already materialised within the newly created Sustainable

I am also happy to acknowledge our growing global network of active Student Chapters and Local Chapters, which I expect to expand further over the course of 2024 and beyond in numbers, geographic locations and activities. This widening global reach of the EAGE, with the support of our regional offices, means an increase in local-regional events.

This ensures both enhanced engagement with our global member base as well as reducing the need to travel to many specialist events. That said, our flagship EAGE events will remain pivotal in facilitating the transfer of knowledge and sharing of experiences in the business and technologies where are members are represented.

In my term as president so far I have truly enjoyed a very positive collaboration with my fellow Board Members and Board of Directors, and believe we have made some significant decisions enabling the EAGE to follow a clear strategy to meet the challenges of the energy transition era. I look forward to continuing this effective teamwork into 2024, together with our entire global staff whose tireless efforts over the years have never ceased to amaze me.

Also, on behalf of all our members and the Board, I must extend my appreciation and gratitude to all those fantastic individuals and groups who commit their valuable time and seemingly bottomless energy on a voluntary basis to support EAGE’s multi-fold activities, especially our events, publications and educational programmes.

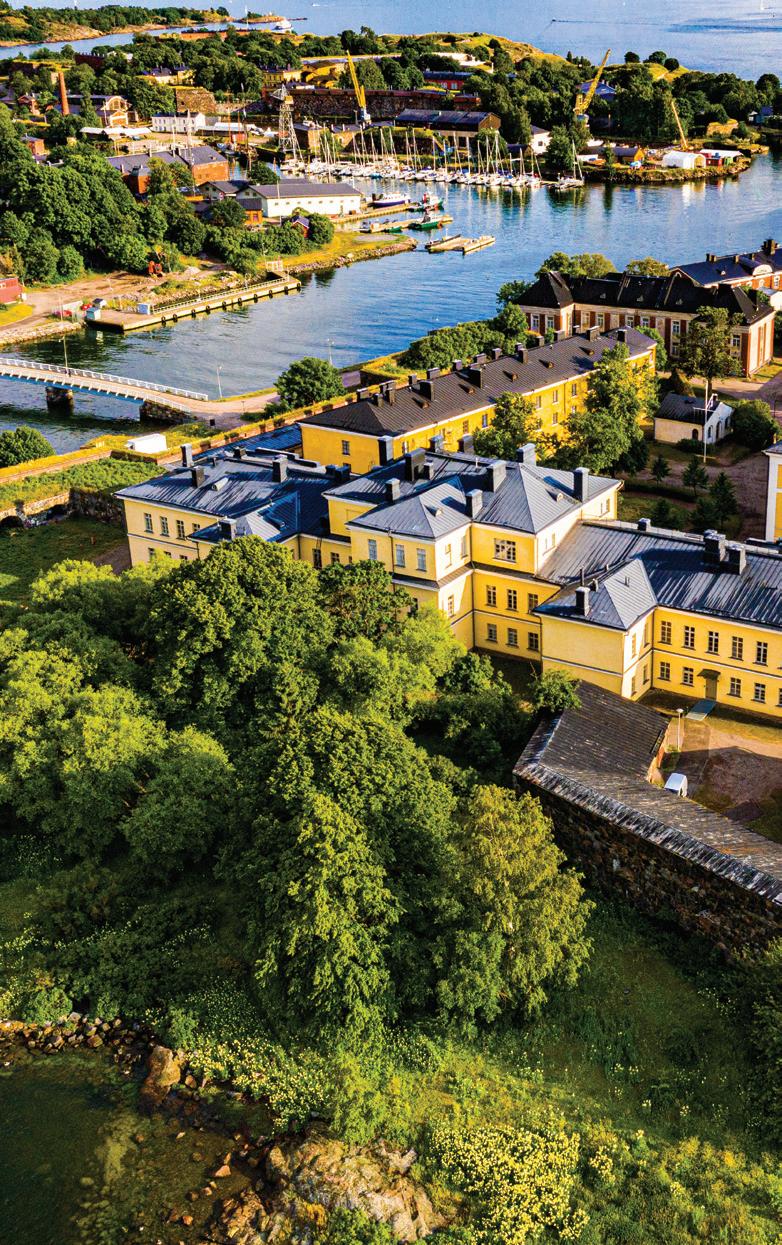

I hope to meet many of you in person in 2024 at various events around the globe and of course at our 85th EAGE Annual Conference & Exhibition in Oslo on 10-13 June 2024. Until then, I wish you all a Happy New Year, or Gelukkig Nieuwjaar in Dutch!

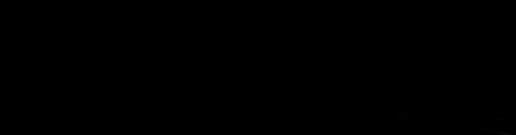

(pre-processing, model building and Kirchhoff depth migration)

(using field-data input)

Equivalent crossplots of simultaneous AVA inversion results

BEX MC3D data courtesy of Multi-Client Resources

Less scatter = less uncertainty!

Quantitative interpretation requires true amplitudes and high signal-to-noise ratio.

DUG Multi-parameter FWI Imaging delivers superior pre-stack reflectivity outputs for lithology and fluid prediction. It’s a complete replacement for the conventional processing and imaging workflow. Ready to work? Send us a signal!

After a record number of proposals, delegates attending the 85th EAGE Annual Conference and Exhibition can look forward to a comprehensive offering with a total of 18 workshops to choose from.

The workshop programme of the EAGE Annual 2024 provides a unique opportunity for participants to share

field. In addition, the workshops emphasise community building within a narrow topic focus and feature a high level of interactivity and discussion.

The workshops scheduled for Oslo reflect the geoscience and technology leadership of Norway and the continuing transformation of the Norwegian

insights and in-depth knowledge in a focused environment. These one-day programmes focus on solving and discussing scientific topics amongst peers in a highly specialised discipline or topic

Continental Shelf (NCS) to a broad energy basin. Topics will range from CCS and energy storage, nuclear waste storage, geophysical acquisition, AI and machine learning, deep sea mining and

offshore renewables, to name a few. In addition, disciplines ranging from geology, geophysics, reservoir engineering, geotechnical, data science and geochemistry will be covered. Aligning with the conference theme, ‘Technology and talent for a secure energy future’, we will also have a non-technical workshop focused on nurturing geoscience talent.

‘We are delighted to offer the delegates a dynamic environment for sharing knowledge and exploring how geoscience can shape the energy transition,’ says Madjid Berraki, leading advisor geophysics, Equinor, and member of the 2024 Local Advisory Committee.

Delegates can take advantage of the All Access Pass registration to benefit from access to the three days of workshop programming in addition to the extensive offering of field trips, courses and other activities.

As the date approaches, make sure to mark your calendar and secure your spot at these engaging workshops. The future of geoscience and engineering awaits, and it’s all happening in Oslo at the EAGE Annual Conference.

Visit eageannual.org/workshops for more details.

Our Annual Meeting this June in Oslo will once again gather a global audience of energy, resource and infrastructure professionals to explore the advancement of knowledge, products and services in the oil and gas and energy industries. You can anticipate a comprehensive Technical Programme featuring multiple sessions that cater to diverse interests, from discipline-specific expertise to the synergies between oil and gas, CCS, renewables and infrastructure geosciences.

Embedded in the Technical Programme are 17 Dedicated Sessions that should resonate with our diverse EAGE Technical Communities, publications and expertise of our members.

The Dedicated Sessions will cover a wide range of topics including petroleum systems, exploration, geology, modelling, critical minerals, rock mechanics, faults seal analysis, monitoring and data assimi-

lation, remote earth observation and energy transition.

One Dedicated Session associated with the Decarbonization and Energy Transition group will present the changes EAGE is undertaking including discussion of the new special interest communities the Association is aiming to host in relation to the increasing interest in energy transition. Energy transition topics will be featured strongly throughout the 2024 Annual with sessions on geothermal, hydrogen, energy storage, CCS and the UN SDGs (sustainable development goals).

In addition, there will be two Dedicated Sessions specifically designed to

showcase some of the best papers recently published in our journals. One session will review the science and technology of the rock-related subsurface disciplines in Petroleum Geoscience journal, while the other session will unveil the non-hydrocarbon energy geoscience and engineering research in the inaugural year of the Geoenergy journal.

If you are interested in contributing content to one of the Dedicated Sessions, you are welcome to email abstracts@ eage.org for more details and availability. Additional information and latest updates on the Dedicated Sessions can be found on www.eageannual.org.

The Call for Abstracts for the EAGE Annual 2024 is still open for submission until 15 January 2024, 23:59 CET. Take advantage of our excellent platform to expose your research to thousands of professionals from academia and industry, build valuable professioxnal connections and receive tonnes of constructive feedback. Hurry up and send in your abstracts at www.eageannual.org, to be considered for oral and poster presentations.

We are excited to announce the release of EAGE’s latest publication entitled Pre-Cambrian to Paleozoic Petroleum Systems of the Arabian Plate, available now on EarthDoc.

Edited by Thomas B. van Hoof (Dutch Science Council), this compilation of abstracts in book form originates from the Seventh EAGE Arabian Plate Geology Workshop in Oman in 2018. It strives to enhance exploration efforts in the Precambrian-Paleozoic geology of the Arabian Plate. From the Silurian Qusaiba

hot shales in Saudi Arabia to the Permo-carboniferous glacigenic Al-Khlata formation in Oman, the book explores diverse hydrocarbon play concepts. Covering four billion years of the Earth’s history, the book reviews structural geology, sedimentology, (tectono-) stratigraphy, and unconventional targets. Visit earthdoc.org to acquire this addition to our bookshop. Active EAGE members can utilise MyEAGE credentials to order and benefit from a 15% member discount.

Pre-Cambrian to Paleozoic Petroleum Systems of the Arabian Plate

All EAGE book titles are available in Epub format, compatible with various e-readers.

Where will your professional path lead you this year? Whether you are contemplating a transition to a different field, looking for a new job, or successfully moving forward with your studies, you can be sure that within EAGE you’ll find a wide community willing to assist you in writing the upcoming chapter of your personal story.

Let us inspire you with Dr Evgeniia Martuganova’s journey. Currently a postdoc researcher at TU Delft, she decided to be part of our Association in 2012, while she was pursuing her Master’s degree: ‘One of the primary motivations for me to join was to keep abreast of the latest knowledge, current issues, and prospects in the field of geoscience. As an early career, being a

member of the EAGE would allow me to connect to senior professionals, an excellent chance for personal career advancement.’

Dr Martuganova has been actively engaged with the EAGE community since then: showcasing her research at our conferences, workshops and in scientific journals, taking advantage of our multiple online education programmes, and being part of the EAGE Local Chapter Netherlands. The feeling of belonging to a community of professionals passionate about their job, is what she highlights as one of the most rewarding aspects of her experience in the Association. ‘This feeling of belonging only grew with time. For example, during the first fibre optical workshop in Amsterdam

in March 2020, I was fascinated to meet many experts whose papers I was reading and studying for my PhD work at that time. Ultimately, this type of connection gives me the drive to seek excellence and be passionate about working in the geoscience field’, she says.

Her commitment was recognised in 2022, when Dr Martuganova received the EAGE Loránd Eötvös Award for the best paper published in Geophysical Prospecting in 2021 on ‘Cable reverberations during wireline distributed acoustic sensing measurements: their nature and methods for elimination’. Written for her doctorate thesis, it was the first paper where she signed as a main author. She proudly recalls: ‘Receiving such an award as a young professional means a lot to me; it means that my hard work is recognised and my ideas are valuable for the geoscience professional community. This makes me feel more confident about my work.’

2024 is a new year full of opportunities and challenges; a perfect occasion to hop on an enriching journey with EAGE. No doubt there are many more inspiring chapters to come in Dr Martuganova’s professional career in which EAGE will always be there to support. What about you? Make sure to renew your membership at eage.org/ membership to benefit from all EAGE has to offer.

THE MARKET-LEADING ONSHORE NODAL TECHNOLOGY PROVIDER >185 SEISMIC SURVEYS ENABLING >45 COUNTRIES IN

>685,000 NODES DELIVERED TO THE MARKET IN JUST 3 YEARS

DELIVERING SEISMIC DATA FOR

11 DIFFERENT APPLICATIONS

Celebrating its 22nd edition, the European IOR+ Symposium convened over 100 professionals across diverse fields in The Hague on 2-4 October and proved to be a pivotal gathering for our vibrant IOR/EOR community.

This year’s conference centred around the imperative of extending the reach of enhanced oil recovery (EOR) while concurrently reducing the carbon footprint of hydrocarbon recovery. Additionally, the symposium explored (re)emerging applications where expertise in IOR/EOR played a vital role, encompassing carbon capture and storage (CCS), hydrogen storage, and geothermal energy. During the symposium, numerous pressing issues in the industry were addressed, including optimising resource utilisation while actively tackling the challenge of carbon emissions reduction.

The comprehensive technical programme covered a wide range of topics, ranging from the future of carbon capture, utilisation, and storage (CCUS) with a focus on fundamental science and mechanisms, modelling challenges, sustainability concerns, and CO2 calculations. The event also shone a spotlight on practical applications in polymer technologies and shared valuable field experiences, offering attendees a holistic view

of the advancements and innovations in the industry.

The programme was enriched by keynote presentations from renowned experts. Each of them fostered discussions on key themes in our technical programme. Presentations by Dawoud Mahrouqi and Hanaa Al Sulaimani from PDO on ‘Chemical EOR in PDO: Charting progress and future outlook’ and by Almohannad A. Alhashboul from Saudi Aramco on ‘Carbon capture, utilization & sequestration (CCUS): R&D to field deployment’ provided in-depth perspectives on advancements and future trajectories in these pivotal areas. David Bruhn from TU Delft and Kristoffer Engenes from the Norwegian Petroleum Directorate shed light on the status, challenges, and critical developments in geothermal and CO2 storage projects.

‘After an initial learning phase, geothermal developments in the Netherlands are now accelerating to provide low-temperature heat for residential heating and cooling and industrial utilisation, especially the greenhouse operations. The sector profits a

lot from advanced research support in the country and the experience of the oil and gas industry,’ David Bruhn said.

Delegates had the unique opportunity to gain first-hand experiences through two exciting field trips. They explored geothermal developments in the Netherlands at the campus geothermal well at TU Delft and learned about sustainable underground energy applications at the Energy Cave in Rijswijk Centre for Sustainable Geo-energy. These excursions allowed attendees to witness innovation in action, complementing the theoretical knowledge shared during the sessions. The symposium’s social programme provided a relaxed atmosphere for delegates to meet and network.

Overall, the symposium fostered a deeper understanding of sustainable practices in the field of CCUS, emphasising both the latest in IOR/EOR technologies and the emerging applications in the energy landscape. This success paves the way for future gatherings, reaffirming the industry’s commitment to progress, collaboration, and engagement.

Join us at the 20 th edition of the European Conference on the Mathematics of Geological Reservoirs (ECMOR) in Oslo, Norway on 2-5 September 2024, consisting of a three-day main event preceded by a one-day introductory workshop on ‘Enabling gigatonne disposal of carbon dioxide in the subsurface’.

For over three decades, bi-annual ECMOR has been a key conference uniting mathematicians, engineers, and geoscientists to promote a multi-disciplinary approach to scientific discovery and the engineering of energy supply systems. It is renowned for featuring significant advances in this important area of applied research.

Chaired by Stephan Matthai (University of Melbourne) and Arne Skorstad (Halliburton), representing academia and industry, respectively, ECMOR 2024 focuses on the enormous technical challenges that lie ahead, inviting long-standing and new participants to engage in discussions about how to address them.

‘We believe that mathematical modelling and simulation of the subsurface play a decisive role for finding the sustainable engineering solutions needed to achieve the United Nations Sustainable Development Goals, particularly ‘Affordable & Clean Energy’ (SDG 7) and ‘Climate Action’ (SDG 13),’ says Matthai, underscoring the conference’s alignment.

At a time when data are produced at an ever-increasing rate, it is crucial that methods and decisions are based on a solid foundation of scientific understanding. ‘ECMOR continues to be an arena to promote such scientific progress’, Skorstad says, underlining the importance of targeting these goals with transparent scientific methods.

Modelling and simulation are indispensable tools underpinning simulation-based engineering science. Hence, they are vital for the engineering of subsurface energy systems not only because they allow the forecasting and optimisation of the performance of engineering undertakings. Their ability to reveal the emergent behaviour of systems largely hidden in the subsurface makes it possible to mitigate unwanted side effects before engineering interventions are

made. Importantly, such insights cannot be obtained with data-driven approaches because the required data simply do not exist yet because the net-zero and hydrogen economies are still in their infancy. At the same time, the increasing complexity of such efforts can only be handled by including statistical analysis supported by AI, machine learning and algorithms.

ECMOR’s technical programme covers a wide array of topics, such as: Physical Modelling including property-, pore scale-, multiphase flow- and geomechanical modelling across relevant time span scales and the

nity of subsurface stakeholders. The expectation is that openness and accessibility will stimulate peer review, raising the standard and rigour of geomodelling, simulation, field development planning, and site management. This increased transparency also reduces the risk that an increasingly competitive use of the subsurface poses. In this context, ECMOR’s goal is to break down communication barriers between different stakeholders such as subsurface storage managers, geothermal energy companies and so forth. Moving toward this goal will raise mutual awareness.

coupling of these processes; Computational Methods emphasising algorithm and method development, high-performance computing complemented by machine learning, and less-numeric methods for sustainability assessment; Uncertainty Quantification and Optimization focusing on geostatistics, risk analysis, and AI approaches to reservoir management; and Engineering of Open Simulation Software which is a new topic area of ever-increasing relevance as computer programming and computing become available to a larger community.

Opening up the toolset and widening public access to site-specific models and simulation approaches that become progressively refined through community involvement, appears as essential to obtain the trust and support of the wider commu-

ECMOR 2024 invites innovative contributions to a wide range of topics falling into the conference’s theme. It is designed to cater to both seasoned professionals and newcomers, creating an effective dialogue across discipline boundaries. This inclusive approach addresses the necessary growth of multi-pronged approaches in tackling arduous problems and the complex challenges associated with the engineering of a carbon neutral economy while keeping the environmental footprint of related subsurface measures to a minimum.

The deadline for abstract submission is 1 February 2024. We encourage you to review the list of topics and start preparing your abstracts. For more detailed information and to begin your submission, please visit www.ecmor.org.

The 3rd EAGE Geoscience Technologies and Applications Conference (GeoTech 2024) in The Hague, Netherlands on 8-10 April 2024 will combine two programmes – one on distributed fibre optic sensing and the other on practical reservoir monitoring – to provide a high value conference with the emphasis on energy transition issues and opportunities.

We aim to provide participants with the opportunity to engage in two dedicated technical programmes, offering a platform for cross-disciplinary knowledge sharing and interactive exchanges. Additionally, the conference features a specialised marketplace for innovative companies in geoscience applications, creating an ideal environment for high-level networking and collaboration.

The 4th EAGE Workshop on Distributed Fibre Optic Sensing will focus on this emerging technology for subsurface mapping offering high-resolution, continuous measurements of acoustic, strain, and temperature distributions. This workshop will cover various energy and industrial applications of these sensors, particularly advancements in geoscience and engineering, including 3C optical sensors. Challenges, business impacts,

and evolving best practices will be dis cussed. Workshop co-chair Mahmoud Farhadiroushan says, ‘the goal is to bring experts from academic and industrial organisations together and learn more about the latest advances in the develop ment of the distributed fibre optic sensing technology and its wide range of appli cations such as reservoir, environmental and earth science monitoring.’

Submissions are welcomed from specialists and enthusiasts across differ ent application areas, especially those offering case studies demonstrating clear business impacts or theoretical and mod elling studies.

An accompanying special course will introduce the foundational elements of fibre optic science and distributed sens ing technology.

The parallel EAGE 4 Practical Reservoir Monitoring will be concentrating on reservoir surveillance techniques. Mark Thompson, senior advisor reservoir geophysics, Equinor, says: ‘The aim is to show how the use of modern reservoir surveillance practices can be applied to ensure safe injection and drainage. We’ll also discuss the benefits of multi-disciplinary data

integration, geophysical and engineering data, and increased digitalization that allow for improved work processes that enhance reservoir monitoring capabilities. Finally, we want to provide an open venue to investigate embryonic ideas and technologies, including future trends in hydrogen and carbon storage, while exploring global perspectives and the new business challenges and opportunities presented by potential coexistence with renewable energy.’

GeoTech 2024 is not merely about current practices but encourages forward-looking, embracing the global shift towards a low-carbon future. It underscores opportunities for geoscientists in areas beyond traditional hydrocarbon reservoirs, including geothermal, mining, engineering, and environmental geophysics.

We invite professionals and researchers to contribute their insights and research to GeoTech 2024. The deadline for abstract submission is 22 January 2024. Ensure you register by 21 January to take advantage of the early bird fees. For more information, visit www.eagegeotech.org.

Last September the seventh edition workshop in Lugano showed once again that the geophysical community continues to be at the frontier of high-performance computing (HPC).

Held in Lugano on the shores of the Ceresio lake, the workshop drew more than 50 representatives from industry and the academic world. For three days, the group discussed a wide range of topics in the field of HPC.

The quest for performance remains inexhaustible, but sustainability of operations has become a key driver as well. As in the past, the answer is to constantly explore new technological solutions which have not been designed to meet the requirements of numerical algorithms. Not surprisingly, new opportunities are coming from the field of accelerators for machine learning applications (TotalEnergies). Exploring such opportunities implies learning new programming models, as well as addressing old well-known problems such as exploiting parallelism, dealing with limited memory, reducing the impact of communications and I/O. Communications and I/O are the bottlenecks that we must face both at level of numerical kernels and at the workflow level (Eni), and machine learning applications are not immune from them (Shell). Data compression is a possible workaround, many alternatives are available, and picking the one that offers the best trade-off between compression loss, compression rate, and speed of compression is not obvious (Aramco).

The benefit of optimising the performance/cost ratio is clear: it enables the use of more complex equations in geophysics. Elastic (TTI) full waveform inversion is now a reality (Shell), but even more conventional and well-established algorithms also take advantage of such advancements. For instance, seismic data regularisation (Aramco), possibly at the price of some code refactoring to adapt, can benefit from accelerators.

Performance comparison and benchmarking remain very important activities that are constantly carried out by our community (CGG, DevitoCodes), and should possibly be better standardised.

HPC is not only about maximising performance, but also about maximising the exploitation of the available computational capacity (AWS). Many applications are not monolithic consuming hundreds of nodehours for a single execution, but rather consist of the execution of workflows, where efficient orchestration of thousands of jobs is as crucial as the performance of each individual job. This scenario is typical, for example, of the use of predictive models and simulations for the design and operation of equipment and processes, which are increasingly recurring in the field of renewables. The latter calls for the availability of orchestration engines, with strong scalability, traceability of workflow execution, ability to manage asynchronous execution as well as fault tolerance.

The workshop’s keynotes contributed to a lively event both for content and discussion they generated. Professor Robertsson from ETH showed a fascinating application of real-time computing to achieve physics-based noise cancellation, by making its wave- based laboratory experimentation anechoic through active noise cancellation driven by the Green’s theorem. The requirement for real-time computation is very strong to guarantee the numerical stability of the approach. Thus, FPGAs were employed to address calculation speed.

Eric Boyer from Genci (France) showed how Europe is actively working on the deployment of the first European exascale system, with an ambitious approach that is not bonded to a single technology

and is including quantum accelerators. Professor Fichtner from ETH showed how to achieve a 10x speedup to make global seismology more of a reality.

Quantum computing was also the subject of keynote speeches and presentations. Analogue versus gate-based quantum computers were discussed. The technology is clearly still in its infancy and probably the main challenge will be to find problems that can fully benefit from its potential. Finally, a dedicated session on HPC for energy transition was held and included three keynotes from Genci, Nrel and Nvidia.

Trying to make this into a new ‘tradition’, for the second time the workshop included the visit to a datacentre. This year, participants had the opportunity to visit the CSCS (Centro Svizzero di SuperCalcolo, Swiss National Supercomputing Centre) datacentre in Lugano, which has the peculiarity of being cooled in a very sustainable way by using cool water taken directly from the lake. We were guided in the tour by the associate CSCS director Maria Grazia Giuffreda. With great competence and passion, he guided us through the datacentre currently hosting Piz Daint, a machine with a 21 PFlops Linpack performance benchmark which ranked third in the top 500 list in 2017. Piz Daint will soon be replaced by its successor called Alps.

Our forthcoming 2024 workshop will be held in Saudi Arabia at KAUST where a tour of the supercomputing facility, with its new supercomputer, will be amongst the conference activities.

The Caribbean, with its diverse landscape and strategic geopolitical position, is poised to become a significant player in the global energy landscape. That’s why the upcoming 1st EAGE Conference on Energy Opportunities in the Caribbean, scheduled for 5-7 November 2024 in Port of Spain, Trinidad & Tobago, promises to be a landmark event that will bring together industry leaders, experts, and stakeholders to discuss and chart the future of energy in the region.

The conference organising committee includes representatives from leading companies such as CNOOC, PGS, S&P Global, Baker Hughes, BP, and others, reflecting the diversity and expertise necessary to address the complex challenges and exciting opportunities in the Caribbean’s energy sector.

The Guyana-Suriname Basin has become a hotspot for exploration and production activities. Industry experts will share insights into the challenges and opportunities in this basin, providing a comprehensive overview of the region’s energy landscape. The conference will also shed light on the gas potential not only in the Guyana-Suriname Basin but also

in the area between Trinidad & Tobago and Venezuela. Examining current projects and future prospects, these sessions will outline the critical role of natural gas in the Caribbean’s energy transition.

The Caribbean is also witnessing a surge in renewable energy projects. Experts will discuss the geothermal potential in the region, examining the technological advancements and regulatory frameworks necessary for its successful integration.

Finally, with a focus on deepwater gas production in Trinidad & Tobago, the conference will provide a deep dive into the

challenges and innovations shaping this critical aspect of the region’s energy industry. The significance of critical infrastructure, including deepwater ports, shore bases, pipelines, platforms, and subsea infrastructure, will be underscored. Industry leaders will deliberate on the necessary investments and strategies to ensure the resilience and sustainability of energy operations in the Caribbean.

This first EAGE conference in the region promises to be a milestone event, fostering collaboration and innovation that will shape the future of energy in the area.

Coming up on 23-25 April in Kuwait City is EAGE’s 1st Workshop on Advances in Carbonate Reservoirs: from Prospects to Development, and not to be missed by anyone involved in reservoir management.

As we all know carbonate reservoirs play a vital role in the petroleum system and are one of the major contributors to glob-

al hydrocarbon reserves. But they present complex challenges in order to maximise recovery from existing mature fields, yet ensuring production sustainability is critical in securing our energy sources for the future.

The workshop addresses the latest technology to efficiently manage these complex reservoirs presenting an excellent opportunity to learn, engage, and connect with industry experts. It is a great space to explore various topics including reservoir modelling and simulation, production optimisation, and reservoir monitoring and management.

Register now and contribute to the conversations to improve our understanding of our planet and its resources.

The EAGE communities in Norway are buzzing with activity in preparation for the coming Annual Conference in Oslo and exploring a multi-disciplinary range of interests in anticipation of vibrant discussions in June.

Last November the Oslo Local Chapter called for an evening talk on ‘AI and exciting advancements in the world of geosciences’. The event took place in the geology building of the University of Oslo and was planned in collaboration with the OSEG (Oslo Society of Exploration Geophysicists).

Kjetil Fagervik, head of products subsurface geoscience, SLB, shared perspectives on ‘Opportunities for AI in subsurface workflows’ and provided a general overview of

the modern trends and technologies in the industry. Lukas Mosser, advanced data scientist, AkerBP, impressed the audience with both the depth of his findings and latest AI tools developments, and the colourful, mind-blowing pictures in his presentation ‘Generative AI and ChatGPT: What, how and why’.

The group concluded a truly insightful and engaging technical session, with many questions and a rich discussion, fuelled by pizza. LC Oslo is looking forward to joining forces with the neighbouring Chapter based in Stavanger and the wider EAGE community in the country for future initiatives. Stay in touch via LinkedIn or by updating your EAGE affiliations!

Geophysical Prospecting (GP) publishes primary research on the science of geophysics as it applies to the exploration, evaluation and extraction of earth resources. Drawing heavily on contributions from researchers in the oil and mineral exploration industries, the journal has a very practical slant. A new edition (Volume 72, Issue 1) will be published within January, featuring 17 articles. This is the Special Issue on ‘Machine Learning Applications in Geophysical Exploration and Monitoring’.

Editor’s Choice articles:

• Deep learning multiphysics network for imaging CO2 saturation and estimating uncertainty in geological carbon storage –E. Um et al.

• A comparison of deep and shallow models for the detection of induced seismicity – D. Gorse & A. Goel

CHECK OUT THE LATEST GP

Kuakata Seabeach, Barishal on the southwestern coast of Bangladesh with its spectacular sunrise and sunsets has unique features which could make it a tourist hub. Unfortunately its fragile ecosystem, coastal erosion, and contamination of ground and surface water pose significant environmental issues.

Rising to the challenge the EAGE Student Chapter at the University of Barishal, with support from the EAGE Student Fund, decided to embark on a project to review proper waste disposal monitoring to make the area more inviting to visitors.

The one day environmental fieldwork project in October involved 30 students, including student chapter executives, 10 members selected

based on their research proposals, guided and supervised by assistant professor Md Abdullah Salman and associate professor Dr Dhiman Kumer Roy from the Department of Geology and Mining at the University of Barishal.

Kuakata Sea Beach, popularly known as the Daughter of the Sea, is 18 km long and 3 km wide. Three primary sources of waste were identified – localised waste, tourist-related debris, and contributions from various agencies. Highlighting the urgent need for waste management, the team observed several categories of waste, ranging from plastic items and cigarette butts to metal cans, glass bottles, abandoned trees, fishing gear, to pharmaceutical waste.

The limited availability of disposal bins exacerbated the issue, making waste monitoring more susceptible to contaminating seawater. The sediment deposition revealed Quaternary deposition in the Kuakata region.

The fieldwork provided valuable hands-on experience in addressing environmental issues, developing problem-solving methods, implementing beach pollution prevention, and managing waste. Sedimentological analysis for tidal influence was conducted using a boring method with a hand auger at six stations per 30 to 50 cm depth variance. The team also utilised a measuring tape to calculate seawater fluctuations during high and low tides and determined the slope angle of Kuakata Sea Beach.

In a global showcase of ingenuity and commitment to environmental stewardship, the Minus CO2 Challenge 2023 brought together 22 teams from universities around the world to revolutionise the landscape of carbon reduction initiatives. It was a memorable contest.

Securing the top spot was the Faculty of Oil and Chemistry at the University M’hamed Bougara Boumerdes in Algeria, a testament to their groundbreaking approach towards sustainable energy solutions. Second place was claimed by IFP School in France, with Technische Universität Clausthal (TU Clausthal) in Germany taking third. Each of these teams showcased exceptional academic prowess and a profound dedication to addressing the pressing challenges of climate change.

At the heart of the success of the self-styled Algerian Decarbo-Nomads team – comprising Merouane Sbaihi, Imad Smaini, Ahmed Guembour, Ibrahim Elkhalil Hadjadj, and Wassim Alalouche

– was a visionary project combining wind and solar energy generation in the North Shore Area and Amherst, respectively. Harnessing the unique environmental attributes of these regions, the integration of 200 MW wind capacity and 100 MW solar capacity promises a robust and sustainable power supply.

What distinguished their project was the intricacy of its combined storage system. This system marries Adiabatic Compressed Air Energy Storage (A-CAES) for short-term energy needs and hydrogen storage for seasonal demands. The A-CAES component, designed to address daily requirements, boasts a storage volume of 198,425 m³, supporting a maximum of 1556 MWh. For seasonal demands, especially during winter, the team anticipates a cumulative energy shortfall of 39,501 MWh over five months. To meet this, a hydrogen storage volume of 598,956 m³ will be engineered.

Annually, the project will contribute with 760 GWh of electricity, translating into $194 million in revenue. Beyond the financials, the initiative is a beacon of environmental stewardship. By harnessing renewable energy sources and implementing efficient storage mechanisms, the project pledges to curtail annual CO2 emissions by approximately 273,645 metric tons for a 300 MW plant when compared to conventional fossil fuel-based electricity generation.

The team’s journey transcends mere participation: it is a testament to the power of collaboration, innovation, and

a shared commitment to ushering in a sustainable and eco-conscious future.

The EAGE Student Fund played a pivotal role in supporting the winning teams, providing travel grants for their participation in the competition, as well as covering their registration fees for the GET 2023 Conference where they received their rewards and had the opportunity to present their projects. As we celebrate the triumphs of these visionary teams, the Minus CO2 Challenge 2023 continues its quest for innovative solutions to combat climate change.

The EAGE Student Fund supports student activities that help students bridge the gap between university and professional environments. This is only possible with the support from the EAGE community. If you want to support the next generation of geoscientists and engineers, go to donate.eagestudentfund.org or simply scan the QR code. Many thanks for your donation in advance!

We would like to thank our sponsors for their generous support to EAGE in 2023!

We thank all our valued advertisers for their loyal support in 2023!

We would like to thank our exhibitors for their generous support to

A Advanced Geosciences Europe S.L. • AgileDD • Alcatel Submarine Networks • Allton • ALSEAMAR • Ambrogeo Instruments • Ampseis • Applied Acoustic Engineering Ltd • Arianelogix • Aspentech • Atlas Fluid Controls • Avalon Sciences Ltd B Baker Hughes • Beicip-Franlab • Bentley Systems International Ltd • BGP Inc. • BGR Bundesanstalt für Geowissenschaften und Rohstoffe • BLUWARE, Inc. C Cegal AS • CGG Services SAS • CoCoLink Corp • Cognite AS • Colchis Petro Consulting (Beijing) Ltd. • CVA Europe Holding D Delft Inversion • Dell Computer S.A. • dGB Earth Sciences • DownUnder GeoSolutions (London)Pty Ltd • Dynamic Graphics Ltd E Earth Science Analytics • Earth Signal Processing Ltd. • EIF Geosolutions • EIWT • Eliis SAS • Elsevier B.V. • EMGS ASA • Engenius Software • EOST Strasbourg • EPI Ltd F fibrisTerre Systems GmbH • Fraunhofer IWES G GB Geotechnics Limited • GEM Systems Advanced Magnometers • Geo Ex Machina • GEO ExPro GeoPublishing Ltd • GEO Resources Consultancy International • GEODEVICE • Geofive Co.,Ltd • Geofizyka Torun S.A. • Geolink Service • GeoLogica Ltd • Geomage • Geomatrix Earth Science Ltd • Geometrics Inc • Geomex Technologies LLC • Geomind AS • Geopartner Geofizyka sp. z o.o. • Geophysical Insights • Geophysical Technology Inc • GeoScienceWorld • GeoSoftware • Geospace Technologies Corp. • Geotec SpA • Geoteric • GeoTomo LLC • Geovista Ltd • Getech • GK Processing • Grepton Informatikai Zrt. • Guideline Geo H Halliburton Landmark • Hefei Guowei Electronics Company Limited • Heriot-Watt University • HGS Products B.V. • HOT Engineering GmbH • HRH Geology I I-GIS A/S • ICS Business International SRL • Ikon Science Ltd • InApril AS • INT Inc. • International Seismic Co (iSeis) • IRIS Instruments K Kadme AS • Katalyst Data Management • KIGAM • King Abdullah University of Science and Technology L League Geophysics • Leobersdorfer Maschinenfabrik GmbH • Lim Logging • LIM SAS • Loupe Geophysics Pty Ltd M Marac Enterprises Inc. • McPhar International Pvt. Ltd. • MIND Technology, Inc N Nimbuc Geoscience • NIS A.D. NOVI SAD • Nissan Chemical Corporation O OMV Exploration & Production GmbH • OPENGOSIM Ltd • OvationData Ltd. • OYO Corporation P PanTerra Geoconsultants BV • Petroleum Experts Limited • Petroskills • PetroStrat Limited • PGS Exploration (UK) Ltd. • Prospectiuni SA • PXgeo Q Qeye R Radar Systems Inc. • RadExPro Seismic Software LLC • Resoptima AS • Rezlytix Technologies Pvt. Ltd • Robertson Geo • Rock Flow Dynamics • RockWave Ltd • ROGII Inc • RoQC Data Management • RPS Energy • RSK Environment Limited S S&P Global Commodity Insights. • SAExploration • Saudi Aramco • Saudi Geophysical Consulting Office • Schlumberger Technology Corp • Seagate Technology • Searcher Seismic • Seequent • Seismeq AS • Seismic Image Processing Ltd • SENSYS - Sensorik & Systemtechnologie GmbH • Sercel • Sharp Reflections AS • Sharp Reflections GmbH • Shearwater Geoservices Limited • Silixa Ltd • Sinopec Geophysical Corporation • Sisprobe • SkyTEM Surveys ApS • SmartSolo Inc. • Society of Petroleum Engineers (SPE) • Sound Oceanics LLC • Sound QI Solutions Ltd. • SPH Engineering • Spotlight • Stryde Limited • StudioX • Subsurface AI Inc. • Suzhou Geophysical Deep Sensing Technology Co., Ltd • Sword IT Solutions Ltd • SYRLINKS T TDI-Brooks International Inc. • Tech Limit • TechnoImaging • TEMcompany ApS • TERRASYS Geophysics GmbH & Co. KG • TGS • The EasyCopy Company • The Open Group • Thermo Fisher Scientific • TOTAL Energies S.E. • Troika International Ltd U UEST • Ulmatec V Verif-i Limited • Visage Technology (OPC) Pvt Ltd • VSProwess Ltd W Weihai Sunfull Geophysical Exploration Equipment • Wildcat Technologies, LLC • Wintershall DEA AG X Xcalibur Multiphysics Group Z Zhaofeng Sensor Equipment Co Ltd

As a young petroleum engineer Gang Han left China for postgrad study in Canada. He is now senior petroleum engineering consultant at Aramco Americas in Houston after periods working with CNPC, Schlumberger, Terralog and Hess on oilfields worldwide.. A champion of geomechanics in all energy fields, he has worked on numerous research projects, published extensively and is current chair of the American Rock Mechanics Association (ARMA), testimony to his belief in the role of professional societies.

Starting point in China

I was born in the Shengli oil field area where both my parents worked. Surrounded by field engineers and ‘Xmas tree’ wellheads, entertained by asphaltene-transformed ‘play doh’, the oil business was imprinted on my childhood. So it was natural for me to become a petroleum engineer after graduating from the China University of Petroleum (East China).

Arriving in Canada

Life is never short of surprises. When the World Petroleum Congress was held in Beijing in 1990s, I volunteered as an English translator. After one technical presentation, the professor I was working with (Prof Maurice Dusseault) came and shook my hand: ‘Great job, young man. Would you like to come and study with me in Canada?’ That’s how I came to obtain my PhD in chemical engineering at University of Waterloo in Ontario, Canada, and my wife and family have all become proud Canadians. Our first child David was born in Canada.

A career of learning

I have experienced many diverse environments, cultures, and people. It has taught me to be humble and appreciate everyone’s uniqueness and perspectives. Skills I acquired outside the petroleum curriculum have been a great benefit. The additional computer and math classes in graduate school expanded my

horizons and landed me with the first job as a developer for SLB, still the largest reservoir simulation software company based in Oxford. Knowledge acquired from the Mars Very Deep Drilling Project with the NASA Jet Propulsion Laboratory would later help me tackle the challenges of working at 30,000 ft water depths in the Gulf of Mexico at the global drilling department of Amerada Hess in Houston.

Geomechanics starts with ‘geo’ and ends with ‘engineering’ and hence is genuinely multi-disciplinary. I have had the fortune to work on many inter-disciplinary applications involving geology, geophysics, drilling, completion, production, and reservoir engineering.

Over the past decade, the success of shale revolution has shone the spotlight on geomechanics, especially hydraulic fracturing. The best practices and lessons learnt from unconventional fields are now being put into practice and benefiting other industries such as geothermal and mineral mining. It means the future of geomechanics could not be brighter.

For me, nothing is more fulfilling than finding like-minded people striving for a shared cause like promoting geomechanics. The American Rock Mechanics

Association (ARMA) is unique in that it is multi-disciplinary involving as mining, petroleum, civil, geothermal, underground storage and utilisation. As the president in 2021-2023, I have worked with colleagues to transform ARMA into a more technological, innovative, diverse, and transparent society contributing to net-zero. One example is the phenomenal growth of ARMA student chapters, from four US schools to 27 universities in North and South America, Middle East, East Asia, South Asia, and Australia.

Collaborating with other societies including EAGE, I am also lucky enough to work with world-class leaders and professionals to develop the International Geomechanics Symposium (IGS) into a global platform for geomechanics technologies and communities.

Not sure if I could ever get away from my accent, but I actually treat the multi-lingual, multi-cultural environment I have experienced as a gift. professionally, socially, and personally.

Running helps me relax, recover, and recharge. It brings a healthy body, a strong mind, and many good friends. Marathon runners say the real race starts at mile 20 (of 26). It is an apt metaphor for many aspects of life.

Get set for a thrilling journey with EAGE in 2024! We’ve curated some key highlights to give you a taste of the excitement awaiting you this year. Keep an eye out for more updates as we unfold our plans.

25-27 Mar Fourth EAGE Digitalization Conference & Exhibition

8-10 Apr Third EAGE Conference on Geoscience Technologies and Applications (GeoTech)

10-13 Jun 85th EAGE Annual Conference & Exhibition

2-5 Sep 20th European Conference on the Mathematics of Geological Reservoirs (ECMOR)

8-12 Sep Near Surface Geoscience Conference & Exhibition 2024 (NSG)

4-7 Nov Fifth EAGE Global Energy Transition Conference & Exhibition (GET)

Paris, France

The Hague, Netherlands

Oslo, Norway

Oslo, Norway

Helsinki, Finland

Rotterdam, Netherlands

12-13 Sep First EAGE Workshop on the Role of Artificial Intelligence in Full Waveform Inversion

Cartagena, Colombia

17-19 Sep Fourth EAGE Conference on Pre-Salt Reservoir Rio de Janeiro, Brazil

3-4 Oct Third EAGE Workshop on EOR

Buenos Aires, Argentina

24-25 Oct Third EAGE Workshop on Advanced Seismic Solutions in the Gulf of Mexico Mexico City, Mexico

5-7 Nov First EAGE Conference on Energy Opportunities in the Caribbean Port of Spain, Trinidad & Tobago

30-31 Jan EAGE/AAPG Workshop on New Discoveries in Mature Basins

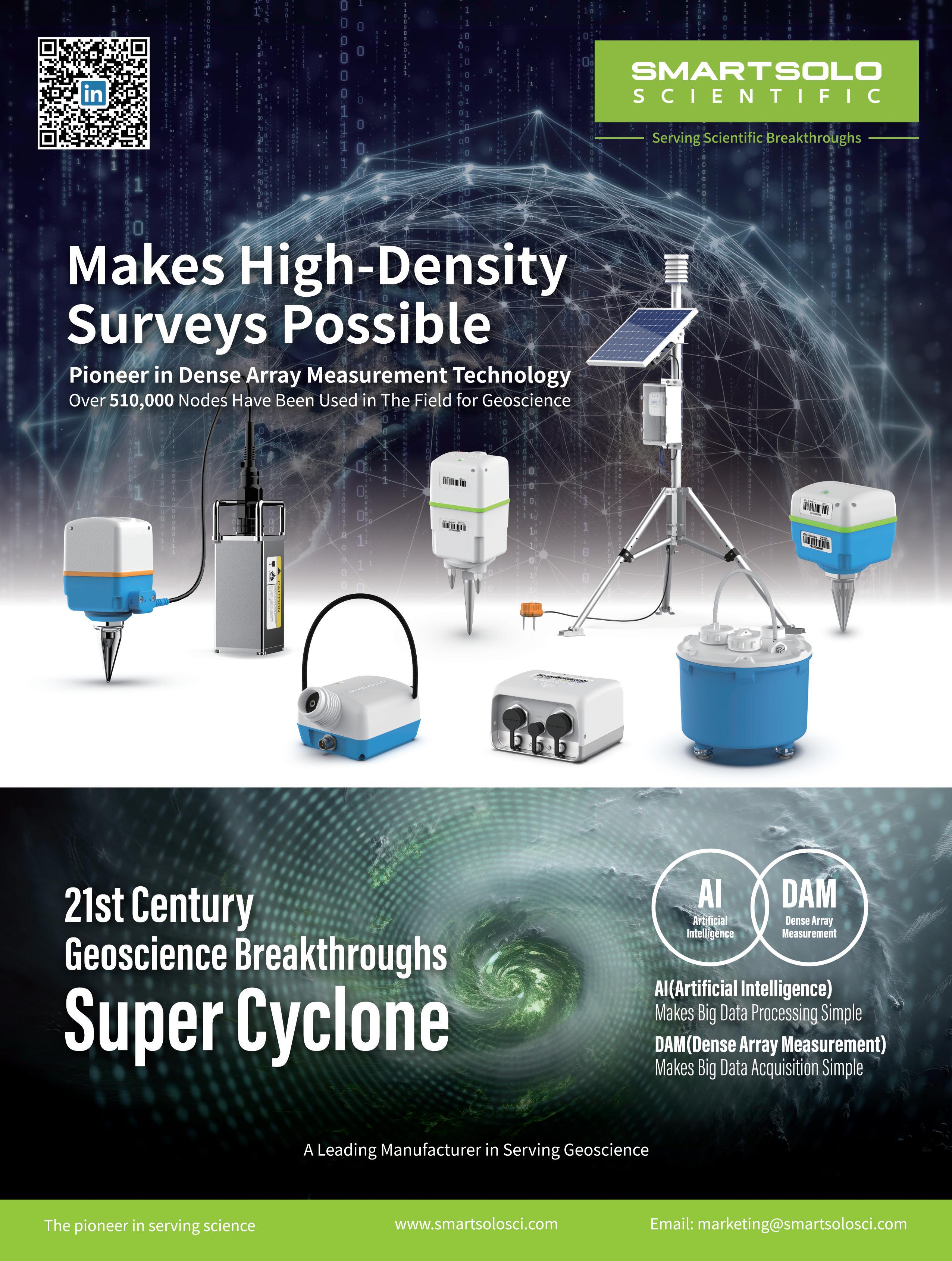

13-15 May Sixth Asia Pacific Meeting on Near Surface Geoscience and Engineering (NSGE)

Kuala Lumpur, Malaysia

Tsukuba, Japan

12-13 Aug Third EAGE Conference on Unlocking Carbon Capture and Storage Potential Perth, Australia

23-24 Sep Asia Petroleum Geoscience Conference & Exhibition (APGCE 2024)

15-16 Oct EAGE Conference on Unleashing Energy Excellence: Digital Twins and Predictive Analytics

26-28 Feb First EAGE Data Processing Workshop Cairo, Egypt

4-6 Mar EAGE Sub-Saharan Africa Energy Forum Windhoek, Namibia

23-25 Apr First EAGE Advances in Carbonate Reservoirs Kuwait City, Kuwait

6-8 Oct Fifth EAGE Workshop on Naturally Fractured Rocks (NFR) Muscat, Oman

21-24 Oct GEO 4.0: Digitalization in Geoscience Symposium Al Khobar, Saudi Arabia

Kuala Lumpur, Malaysia

Kuala Lumpur, Malaysia

BY ANDREW M c BARNET

This month marks 10 years since the Crosstalk column began in the January 2014 issue of First Break, on the initial suggestion of our CEO Marcel van Loon, with a title dreamt up by the late and much missed Neil Goulty, EAGE publications officer at the time. With the disclaimer that EAGE was not responsible for the views expressed, your correspondent has had the privilege of being able to choose a monthly topic and run with it for all these years, no questions asked, so to speak.

By December last year total Crosstalk output amounted to an estimated 195,000 words of one person’s opinion, a salutary statistic. Unsurprisingly, supplying a decade of uninterrupted monthly commentary on subjects of possible interest to the geoscience and engineering community has had it challenges.

But there’s no point in burdening readers with the woes of writers, e.g., struggling to come up with new ideas, trusting your judgment, deadline pressures, etc. Describing the writer’s lot, prolific author J.K. Rowling has noted: ‘The wonderful thing about writing is that there is always a blank page waiting. The terrifying thing about writing is that there is always a blank page waiting.’

an opportunity to revive interest in onshore operations, a number of companies were racing to find the right solution that would persuade oil companies to adopt the new technology. Would it be blind shooting or wireless was the question.

‘A frame of reference for events over the period.’

Looking back through the columns hopefully provides a frame of reference for events over the period, although obviously subject to all the unreliability of one person’s perspective and preoccupations. There do seem to be a number of recurring themes worth sharing. But context first.

The seismic business in 2014 was in a very different place compared with now. The carnage that has reduced the active global towed streamer fleet from more than 60 vessels to around 15 was not yet a threat. The perennial over-capacity issue was rearing its ugly head with the expectation of reduced oil company exploration spending after some good years. It was ominous for the main players like Schlumberger, PGS and CGG along with newcomer Dolphin Geophysical, all of whom had been investing in newbuilds. On land, the less buoyant seismic marketplace was on the threshold of the nodal acquisition revolution. Identifying

Ten years on, the decimation of seismic fleets reflects the view often expressed in this column. As a business proposition marine seismic has always struggled to be consistently viable. Historically, the first consolidations began in the mid-1980s, and have continued ever since, interspersed with a few heady years convincing contractors that the downturns could be survived. Cyclical oil company demand, over-supply of vessels, overhead of vessel ownership, and costly search for illusory technology differentiation have always plagued the industry. Today Shearwater GeoServices and TGS (once it’s takeover of PGS is complete) are effectively the only global providers still standing. The jury is still out as to whether some kind of economic equilibrium has been reached; similarly the profitable application of seabed seismic nodal technology is by no means a slam dunk. One recent surprising trend is the apparent uncertain future of the once successful marine seismic multi-client survey model.

On review it seems that onshore seismic operations have not been accorded a great deal of space. This is most likely because survey demand outside the Middle East has been pretty dismal and hence slowed the advance of nodal technology, now clearly in the ascendant. Otherwise, the business has experienced many of the same ups and downs as marine, mainly downs.

Often pointed out in this column is that a wide spectrum of geoscience-related business, including data processing, is driven by oil company budgets which are subject to extraordinary unpredictability. This has always been a major complication for service companies because uncertainty means risk. Some idea of future spending is required. Yet trying to forecast when, how much and where oil companies are going to spend their dollars is notoriously difficult.

You used to be able to go along with the narrative that oil companies conformed to a pattern of exploration spending followed by a period of new field development and then the next phase of exploration to fill depleting reserves. That scenario is out the window with companies today broadly focused on maximising recovery from existing reserves and focusing on ‘advantaged oil’, thereby dramatically reducing the scale and timing of seismic survey requirements.

It is also the case that the data reprocessing of the extensive available seismic libraries built up over time has impacted the incentive to carry out seismic operations in the field. Casting a shadow over all fresh initiatives to increase global oil supplies is the widespread public sentiment anxious about climate change for which the industry has become the number one scapegoat. Its impact on oil companies is immeasurable, nonetheless a major factor to be taken into account in any calculations about future business.

Of course, oil companies do not operate in a vacuum. Their production is dictated by the global oil market, and that is another whole aggravation. This column has always taken a sceptical view of how much value can be placed on energy forecasts in general, and oil demand and pricing in particular. There has been no telling when Saudi Arabia unilaterally, or in concert with Russia, or united with other OPEC+ member states will turn the oil taps on or off hence determining the price of doing oil business. Analysts can do their best but they cannot take into account the real politik often involved in these major decisions, such as flooding the market to spite the US shale business. And obviously there was no way they could have foreseen the Covid-19 pandemic followed by Russia’s invasion of Ukraine, events which have had a huge impact on global energy supply and demand.

energy and of course carbon capture and storage (CCS) as a climate change mitigation measure. The caveat to serious implementation of virtually all the possibilities at the necessary rate to lower CO2 emissions is the lack of investment. Oil/energy companies have made clear there are limits to their spending on alternative sources of energy. The clear conclusion is that only concerted government measures/direction can seriously accelerate energy transition. That in turn would require overcoming public suspicion of government intervention not to mention reluctance in prosperous countries to undergo potential lifestyle changes in the cause of reducing global warming. If COP28 proceedings are anything to go by, any international agreement to tackle climate change remains problematic with a deep divide between rich and poor nations.

Crosstalk has often pointed out that public understanding of energy issues is remarkably limited, hence the vilification of the oil industry is often based either on ignorance, misunderstanding or blatant hypocrisy, i.e., critics enjoy the lifestyle their oil consumption affords. The geoscience community is never able to explain that its everyday work includes a mission to improve our global environment. That message is easily lost in the era of fake news, facilitated by social media, providing a platform for endless unsubstantiated information and disregard for verifiable scientific evidence.

‘Not confined purely to the heavy stuff.’

Rather the same applies to progress on energy transition, a topic to which Crosstalk has often turned with a degree of scepticism because we just don’t know. A case in point, the International Energy Agency (IEA) in 2021 published Net Zero by 2050: A Roadmap for the Global Energy Sector detailing how each sector energy transition options could develop to meet the Net Zero target. However, in the short time since then, IEA says much has changed citing ‘mostly discouraging developments’. It reports ‘The global economy has rebounded from the Covid-19 pandemic, and the first global energy crisis has seen world energy prices touching record levels in many markets, bringing energy security concerns to the fore.’

Understandably the best IEA can do in its latest update is to offer ‘a comprehensive account of how policymakers and others could respond coherently to the challenges of climate change, energy affordability and energy security.’ The speculative ‘could’ is of course the giveaway word here.

Crosstalk has over time reviewed most of the various existing or emerging energy transition options including some form of nuclear

It has been hard not to speculate whether a new generation of students can be recruited. The news is not all bad. It is said that the decline in geoscience courses in Europe and North America is being partially balanced by student numbers in China and India. Also, there is a significant change underway in the qualifications sought for entrance into energy companies, notably more digital awareness and multi-disciplinary emphasis, already being reflected in the traditional science-oriented universities. Meantime climate change and environmental studies are invigorating the interest in near surface geoscience.

The Crosstalk column has not confined itself purely to the heavy stuff. A column on geoscience and music a few years ago with geologists in mind found that the use of the word ‘rock” in the song title guaranteed a good result in the Eurovision Song Contest registering two wins and a second. Remarkably, a Turkish pop diva was entered into the 1980 competition with a song called Petroleum

Poetry was the topic one month revealing the existence of the somewhat metaphysical study of ‘geopoetics’ and an unusual teaching method in which students have been invited to pen a short poem to summarise the findings of their scientific papers. Oil industry-based board games also got a mention, concluding that the ultimate cut-throat game should be called Turmoil, better than existing titles such as Gusher King Oil, Wildcatter, etc.

Contemplating further Crosstalk columns, pace ChatGPT, the French Nobel Literature prize winning author André Gide had some comforting words, namely ‘Everything that needs to be said has already been said. But, since no one was listening, everything must be said again.’

Views expressed in Crosstalk are solely those of the author, who can be contacted at andrew@andrewmcbarnet.com.

The Norwegian Offshore Directorate (previously Norwegian Petroleum Directorate) has reported vast proven gas resources on the Norwegian shelf which are currently without development plans. Much of this gas is located in tight reservoirs, which cannot normally be produced using conventional wells but the NOD said are increasingly easier to produce because of fast-developing technology.

part of the North Sea is 750 million Sm³ of oil and 90 billion Sm³ of gas. Most of this is located in chalk reservoirs in the Ekofisk, Eldfisk and Valhall area. Producible oil in basement rock has also been proven on the Utsira High. Basement rock consists of hard and tight rocks. However, the basement rock in this area is so fractured and porous that oil has migrated into it.

‘Despite the significant uncertainty associated with how much gas we’re talking about, the cost level and future gas prices, our calculations show that the values involved are substantial,’ said Arne Jacobsen, assistant director of technology, analyses and coexistence.

The estimate for mapped volumes in place in tight reservoirs in the southern

In the northern part of the North Sea, the mapped volume in place in tight reservoirs is estimated at 360 million Sm³ of oil and 80 billion Sm³ of gas. In this area, a considerable percentage of the volumes are located in sandstone reservoirs. However, there are also substantial volumes on Oseberg and Gullfaks in the overlying Shetland Chalk and partly in the Lista Formation.

Test production of oil has been carried out in the Shetland Chalk on Oseberg. Licensees are considering testing the potential of different well stimulation methods. On Gullfaks, production is currently under way from the tight Shetland Chalk. Here they are using water injection and horizontal wells to improve recovery.

Mapped volumes in place in tight reservoirs in the Norwegian Sea are estimated at 130 million Sm³ of oil and 420 billion Sm³ of gas. These volumes are located exclusively in sandstone reservoirs. A large percentage is located in the Tilje and Garn formations, which are deep and have highly variable reservoir properties.

The Lavrans, Linnorm, Noatun and Njord Nordflanken 2 and 3 discoveries all have tight reservoir zones where the licensees are still considering the possibility of development using different technologies to improve profitability. Slim-hole technology has been used in the tight zones in the Garn Formation on Smørbukk Sør. This technology has also been used in several other fields, such as Edvard Grieg, Valhall and Ivar Aasen.

Mapped volumes in place in tight reservoirs in the Barents Sea are estimated at approx. 5 million Sm³ of oil and 270 billion Sm³ of gas. ‘Since the Barents Sea is more of a frontier area than the North Sea and the Norwegian Sea, the resource base is more uncertain,’ said the NPD. The tight

reservoirs in the Barents Sea are sandstone reservoirs from the Triassic.

About 65% of the overall gas resources on the Norwegian shelf have not yet been produced, said the NOD. Some of the remaining gas resources face a variety of challenges in the subsurface, such as tight reservoirs, high pressure and temperature, challenging gas quality and/or low pressure.

Kjersti Dahle, the NOD’s director for technology, analyses and coexistence, said: ‘There are considerable gas resources in discoveries and fields in operation. It

makes sense to think that higher gas prices can drive necessary technology development, coordination and new infrastructure in order to realise this gas, as long as there is the will and ability to do this.’

Addressing the viability of tight reservoir production, the Norwegian Offshore Directorate (NOD) said, ‘So far, various forms of fracturing and multi-branch wells remain the most relevant methods for recovering resources in tight reservoirs.

‘Slim-hole technology is also relevant is several places, where a large number

of slim boreholes in the same well will increase the wells’ contact surface with the reservoir (reservoir exposure) and make it easier for hydrocarbons to flow into the wells.

‘These methods and technologies have all been previously tested and applied on the Norwegian shelf, but are mainly used to extract additional oil. Elsewhere in the world, such as in the Gulf of Mexico, the UK shelf and on certain onshore fields, the technologies have been used to produce gas.’

TGS’ and PGS’ shareholders have approved the proposed merger between the two companies at separate extraordinary general meetings.

The decision to approve the merger will now be filed with the Norwegian Register of Business Enterprises. Completion of the merger remains conditional upon customary closing conditions, compliance with applicable covenants and expiry of statutory waiting periods.

‘All proposals on the agenda were approved with requisite majorities, including the merger plan dated 25 October 2023 and the corresponding share capital increase in the company,’ said TGS.

PGS CEO Rune Olav Pedersen said: ‘The combined company will be uniquely positioned to unlock substantial value for our shareholders, customers and employees.’

The Norwegian Offshore Directorate (formerly known as Norwegian Petroleum Directorate) has said that it is considering a pipeline to connect the Barents Sea to the well-developed pipeline system that runs from the Norwegian Sea to the south and west. ‘This option would make the Norwegian shelf a single petroleum province, tied together with solid and highly-developed infrastructure.’

Another option is to expand capacity at the LNG plant on Melkøya, outside Hammerfest in Finnmark county.

The LNG plant is the sole alternative for delivering gas from the Barents Sea and gas exports in the form of liquified gas are dispatched to markets using

specialised ships. The challenge is that gas from the Snøhvit field alone will continue to occupy all capacity at the LNG plant until 2040.

Without new gas transport capacity, projections indicate that the plant will be fully utilised up to 2050, based on

already proven resources in fields and discoveries.

A third option is to use gas from the Barents Sea to produce ammonia, which is then exported by ship, said the Norwegian Offshore Directorate (NOD).

Fugro has launched a geophysical survey for client RWE off the Danish west coast. Up to three survey vessels will be deployed to carry out a detailed pre-construction survey including a search for unexploded ordnance (UXO) 34 km off the coast of Thorsminde.

The data acquired will define the cable routes and exact turbine locations for RWE’s Thor offshore wind farm. Fugro has already conducted a comprehensive geotechnical site investigation for Thor in 2022.

Günther Fenle, project director Thor offshore windfarm, RWE Offshore Wind, said: ‘We are looking forward to using the data collected by Fugro to finalise the layout of the wind farm and to determine the routes for the inter-array and export cables.’

Marc Kebbel, Fugro’s service line director of hydrography and cable route surveys said: ‘We are using a wide range of survey techniques, comprising offshore and nearshore standard geophysical and UXO surveys techniques, a seismic land refraction survey, and Fugro’s rapid airborne multi-beam mapping system (RAMMS) for comprehensive mapping of the shallow area and beach in the transition zone.

‘The metocean challenges posed by Thor’s exposed offshore location, such as high waves and strong wind in autumn and winter, are adding to the complexity.

With a planned capacity of 1000 megawatts (MW) Thor will be Denmark’s largest offshore windfarm to date. Once fully operational, no later than 2027, Thor will be capable of producing enough green electricity to supply the equivalent of more than one million Danish households.

RWE is already involved in the Danish Rødsand 2 offshore windfarm, which is located south of the Danish island Lolland, 10 km southeast of Rødbyhavn. The windfarm has an installed capacity of 207 MW (RWE share: 20%) and has been in operation since 2010.

Ikon Science has donated RokDoc software to Kansas State University. The software, which has an industry value of $4.6 million annually, supports applied geophysics teaching and research in the university’s geology department in the College of Arts and Sciences.

Kansas State University uses RokDoc as part of its curriculum to train geoscience students to properly understand rock physics, reservoir characterisation, seismic inversion, geopressure and geomechanics to inform subsurface evaluations.

Using the software students can model, predict and integrate multidiscipli-

nary workflows for quantitative interpretation, pore pressure and geomechanics, said Ikon.

‘The U.S. Bureau of Labor Statistics predicts a 5% growth in geoscience jobs between 2019 and 2029, which is higher than average for all occupations,’ said Abdelmoneam Raef, associate professor of exploration and development seismology in Kansas State University’s geology department. ‘The RokDoc suite is a valuable resource for training our students in programs that focus on water and energy resources, which are high priorities at K-State.’

Wood Mackenzie has launched Lens Carbon, a colution that that enables users to screen analyse and value carbon management projects on a global scale. Lens Carbon explores carbon capture utilisation and storage (CCUS), direct air capture (DAC) and carbon offset projects through proprietary data, analysis and benchmarking.

The US Department of Energy (DOE) has announced 66 hydro facilities will receive more than $38 million in incentive payments for electricity generated and sold.

Eni has reached an agreement in principle with the UK Government on terms and conditions for the economic, regulatory and governance model for the transportation and storage of carbon dioxide at the HyNet North West industrial CCS cluster, providing carbon transportation and storage for companies in the North West of England and North Wales.

The US Bureau of Ocean Energy Management (BOEM) has identified a Draft Wind Energy Area (WEA) in the Gulf of Maine, opening a 30-day public review and comment period. The Draft WEA covers approximately 3,519,067 acres offshore Maine, Massachusetts and New Hampshire.