The Estate Agent is published by the Real Estate Institute of Victoria.

The Estate Agent is published by the Real Estate Institute of Victoria.

PUBLISHER REIV

335 Camberwell Rd, Camberwell, Victoria 3124

EDITOR

Sarika Bhalla – sbhalla@reiv.com.au

Established in 1936, the Real Estate Institute of Victoria (REIV) is the peak representative body for real estate professionals in Victoria. Our Mission is “To enhance the professional excellence of our members to the benefit of the communities they work within, and to advocate and represent their interests”.

Connect with REIV on social media. Find us on:

facebook.com/REIVictoria

@REIVictoria

REIV

@REI_Victoria

Pagemasters

An REIV discussion paper takes a closer look at the inefficient system stymieing housing availability

17

The increased workload involved in residential property management has caused many members to review the fees for rental providers

18-19

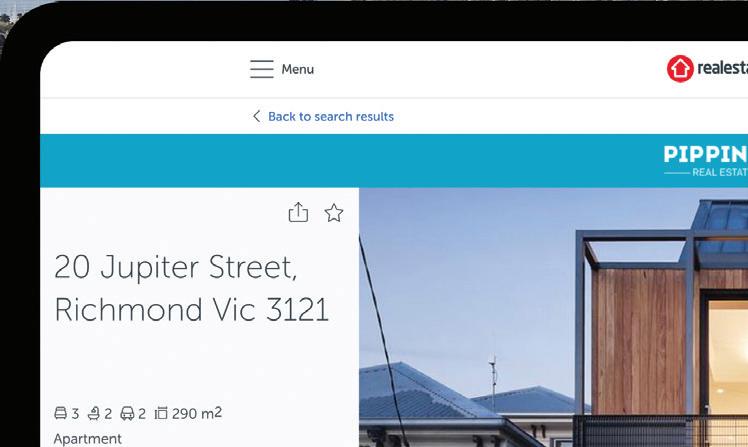

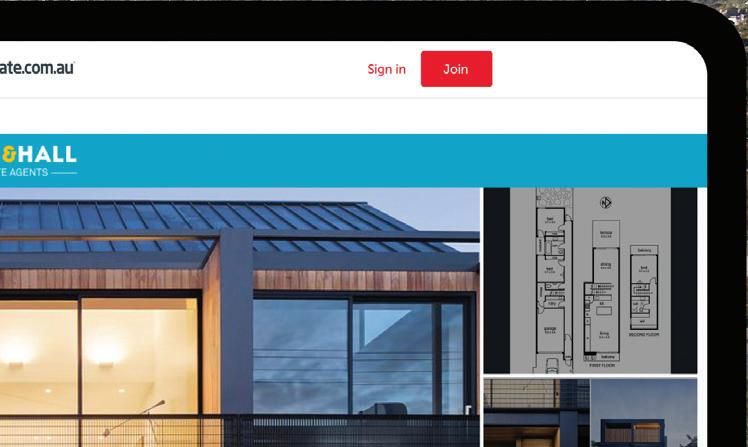

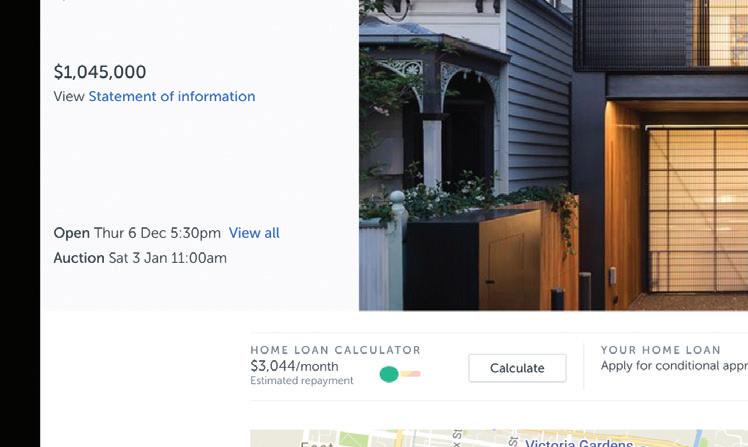

Commentary around residential price quoting has focused on the quoted price range, but there is a range of other important details

20-21

DISCLAIMER

Unless otherwise specifically expressed, the views or opinions appearing in The Estate Agent (EA) are those of the authors and do not represent the views of The Real Estate Institute of Victoria Ltd (REIV). The REIV gives no warranty about the accuracy, completeness, or reliability of the content of EA. The entire content is general information only. It is not advice or intended as advice and in no circumstances should be relied upon as such. Readers and third parties should verify the content and seek their own independent advice before making any decisions, financial or otherwise, based on what they have seen or read in EA. The REIV and EA do not endorse or take any responsibility for material on third party websites referred to in the EA.

As dwelling styles evolve over time, what impact does it have on land value?

30-31

The

continually updates and reviews forms to ensure compliance, protect Members’ interests and reflect Member feedback

28-29

While the real estate industry has always been accustomed to change, the arrival of generative AI is already making waves

I am constantly impressed by the resilience of our Members in challenging times and the efforts you make to achieve great results for your clients.

There is no doubt we need more supply in the market, particularly of affordable rental properties and low-cost housing. This will require all players in the property market to come to the table in a collective manner. The REIV will continue to work to encourage policy settings that help Victorians into affordable homes.

In October 2020, to become an Agent’s Representative in Victoria (an entry-level role) it became mandatory to complete a Certificate IV in Real Estate Practice, which generally takes up to six months full-time. I think that’s a good thing as

I applaud solid education for real estate professionals. The issue is that because of the legislation you cannot do any form of real estate work until after you have fully completed, and passed, the Certificate IV. Imagine a builder’s apprentice not being allowed onto a building site!

The REIV is working to have the legislation amended to allow people undertaking their Certificate IV to take on internship-like duties, which would help address some of the workplace constraints and provide significant relief to the sector with job-ready workers at the completion of their studies.

Early indications are that the Government is in agreement with this approach. The REIV is trying to have this changed as soon as possible as we understand the

limitations the existing legislation places on your businesses.

I was lucky enough to attend the REIV International Women’s Day Lunch on 7 March where we heard from some amazing speakers, including awardwinning sports journalist Caroline Wilson, REIA CEO Anna Neelagama and AFLW senior coach Bec Goddard. This year’s theme was #EmbraceEquity.

Anna posed the question, “Are we giving Australian women in real estate everything they need to be successful?”. This is something that, as a profession, business owners and members of the REIV should all ask ourselves. Whether this is equality of pay, flexible work conditions and a genuine effort to have more women in leadership positions.

I write this President’s report as interest rates hit an 11-year high and property markets around the State continue to suffer severe supply constraints, whether that is sales or rentals.REIV CEO Quentin Kilian takes part in the Listening Tour in Geelong.

This is something I would encourage all of us to reflect on how each of us are contributing to equity in our workplace.

The REIV CEO Quentin Kilian and I will be touring throughout 2023 to talk to as many of our regional members as we can on the following dates:

• Thursday, 11 May @ Horsham

• Thursday, 8 June @ Shepparton

• Thursday, 13 July @ Mildura

• Thursday, 27 July @ Warrnambool

• Thursday, 3 August @ Traralgon

• Thursday, 31 August @ Ballarat

• Thursday, 7 September @ Wodonga

We have already had great meetings in Geelong and Bendigo where Members recommended a return to in-person learning and networking opportunities hosted by the REIV.

We look forward to hearing Member suggestions for engagement in the other regional areas.

The Henley and Villawood Charity House Auction raised an incredible $1,010,000 for The Royal Children’s Hospital, Melbourne. A huge congratulations to all contributors and a special shoutout to REIV Senior Auctioneer of the Year

2022, Luke Banitsiotis for once again proving why he is one of the best in the game.

The REIV is pleased to play a small role in supporting this very worthy cause. The auction is an exciting opportunity to actively support and be involved in the Good Friday Appeal.

As always, I encourage Members to reach out to me anytime with your ideas, suggestions or just for a chat over the phone or coffee.

Andrew Meehan REIV President Quentin Kilian REIV CEO

Quentin Kilian REIV CEO

The REIV was privileged to be the first of the industry or professional groups to meet the new Consumer Affairs Minister, the Hon Danny Pearson. I had a 45-minute meeting with the Minister at the end of January and we covered off several pressing topics. Since then, I have also met with the Shadow Minister for Consumer Affairs Tim McCurdy.

In front of the Minister and progressing (albeit at Government pace), is re-drafting of legislation to accommodate and introduce the Interim Certificate for the Agent’s Representative qualification. Once amended students undertaking the Certificate IV CPP41419 could commence employment, under strict supervision, after completing the 5 Core Units of study, while they complete the remaining units over a 12-month period. When

it’s introduced, this will greatly assist employers to not only engage staff, but have them “job-ready” when they’ve completed their studies.

Coupled with this, we’ve asked the Minister to amend the Victorian “interpretation” of Mutual Recognition laws. Our suggestion has been to use the Tasmanian model which requires an interstate skilled real estate practitioner to undertake study in 2 to 3 units of local (Victorian) legislation, after which they are granted Mutual Recognition of their existing Agents Rep or Licensed status and can commence work in Victoria.

I also spoke with the Minister about changes to Section 55 of the Estate Agents Act, which preclude an Agent from taking commissions where there is a declared interest in the property transaction. We are in the process of gathering evidence to support our argument which we will present to

the Minister for consideration. We’ve made the argument that a Declaration, supported by an Independent Valuation would be sufficient protection for the buyers.

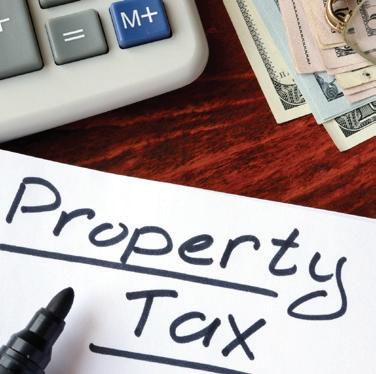

One of the most promising developments in our advocacy efforts has been the recent announcement of an Inquiry into Property Tax called by Parliamentary Member, David Limbrick. After years of advocacy on this topic, it’s great to have an open conversation about change. The REIV has provided a written submission and we expect to be called as a Witness to the Upper House hearing.

Beyond these issues we are:

• Continuing to push for a full review into the RTA. This has gained some traction with the Department, and we are in the process of preparing a list of proposed changes;

• Seeking outcomes from last year’s

CONTINUED ON PAGE 8

We’re well into the new year and there is a lot of activity both happening, and planned, in the advocacy arena.

CONTINUED FROM PAGE 7

Property Market Review, particularly the Government’s preferred position on mandatory CPD across the profession;

• Working with the Government’s Underquoting Taskforce to ensure we are kept abreast of their activities and aims;

• Preparing for a potential review of the Retail Leases Act by working with the C&I, Valuers and Business Brokers committees to prepare our arguments and asks;

• Meeting with the Melbourne City Council to, again, put our case for the highly restrictive rules around signage in their coverage area to be relaxed; and

• We’re working with all of our committees on advocacy, training and social activities that they would like to run throughout the year.

It’s been a busy start to the year and this work is going to continue to keep us busy as we represent and advocate for the real estate sector. Keep an eye out for the REIV in the media and share your views.

By the time you read this we will have held our very successful REIV Conference, the first since 2018. We had just under 300 attendees to this event.

Watch for news of a ‘must-attend’ event where we will have the Director of CAV and her team LIVE at the REIV for a panel session and in-depth discussion.

Don’t forget to tell us what’s on your mind by emailing feedback@reiv.com.au As always, we thank you for your ongoing support of the REIV.

Quentin Kilian REIV CEOIt’s been a busy start to the year and this work is going to continue to keep us busy as we represent and advocate for the real estate sector.

The aim

The aim of this discussion paper is to provide a point of reference for the discussion of the issues surrounding property taxation, and in particular, stamp duty. The information provided within this paper is a critique of extant, publicly available literature. The paper highlights the logic and rationale behind a transition towards a more efficient means of raising government revenue, necessary for provision of services to our community, however the funds are allocated.

To achieve the aims of this paper, an extensive review of government literature, industry and academic publications and consultant reports that discussed various forms of taxes relating to land, including transfer taxes, were sourced, and studied. The output of this study was to identify themes and analyse the strengths and weaknesses of statebased land tax with a particular focus upon transfer tax, namely stamp duty.

Tax is, and has been, a necessary burden for the betterment of society. Adam Smith (1776) in his treatise the “Wealth of Nations” argued tax should have four key elements, these are: fairness, certainty, convenience, and efficiency. These elements are believed to hold true today and should be aimed for in all forms tax, including land related tax. Distortions ought to be highlighted and where possible removed. Distortions in any tax system create imbalances in gathering of tax monies and ultimately distribution of same. A consistent theme that has appeared in the evaluation of Australia’s tax system, is the distortion created by stamp duty tax on land transfers. While a number of publications evaluating tax systems and in particular, stamp duty, refer to all forms of duties, this discussion will focus upon taxes related to land and land transfers within Victoria.

In Victoria, stamp duty equates to approximately 22% of state and local

government revenue. Nationally, all forms of property tax raised state and local governments has increased from approximately 31% in 1998-99 to 52% in 2020-21. This highlights a significant increase in the reliance on land related taxes by governments. Reasons for such increases can only be speculative but given the natural forces that are exerted upon property markets, and the resulting fluctuations, this cannot be considered a reliable source of revenue generation for the provision budgeting.

In developing this discussion paper, the argument for the removal of stamp duty in favour of more reliable and sensible revenue streams, is not aimed at reducing land related tax, but rather, redistributing the generation of the revenue in more balanced and functional manner.

Considerable effort has been given to effectiveness and efficiency of stamp duty. These have not only originated from industry-based sources but also government. For example, the Henry review of 2009 (p48-49) stated, “Stamp duties are a highly inefficient tax on land, while land tax could provide an alternative and more stable source of revenue for the States.”, and “Conveyance stamp duty is highly inefficient and inequitable. It discourages transactions of commercial and residential property and, through this, its allocation to its most valuable use. Conveyance stamp duty can also discourage people from changing their place of residence as their personal circumstances change or discourage people from making lifestyle changes that involve a change in residence. It is also inequitable, as people who need to move more frequently bear more tax, irrespective of their income or wealth.”

These comments are presented here as they crystalise much of the findings and opinions of subsequent research examining the topic of land taxes. More recent publications have taken the position that the removal of stamp duty should no longer be debated, but rather, efforts should be made to examining how to best transition to other land tax

CONTINUED FROM PAGE 9

arrangements. Governments that continue to look towards transfer taxes such as land stamp duty, are not acknowledging the fundamental flaws of the tax and are therefore not earnestly seeking to address the housing issues highlighted by Henry.

As a collective, a resounding message given by researchers is the continuance of transfer taxes unquestionably inhibits governments’ ability to provide appropriate social and affordable housing to those who need it and is precluding access to suitable housing from growing families as we age in place.

Tax is necessary. Efficient tax that is balanced across society and is predictable, enables responsible planning by governments to meet the needs of the society it serves. It is well established in economic literature that stamp duty is one of the most inefficient taxes with an estimated welfare cost of 35 cents lost for every dollar raised (HIA 2011). This loss, referred to as welfare loss, refers to the decrease in social and economic well-being caused by imposition of the transfer of purchasing power from the taxpayer to the taxing authority.

The following is a summary of the issues regarding stamp duty that have been frequently raised in publications. Stamp duty is:

• An inefficient tax,

• Levied at a time when buyers are most financially stretched,

• Inhibiting house market movement, thereby reducing the availability of suitable and needed houses to home buyers. This is because of older people “sitting” on their large houses as it is too expensive to move creating a mismatch of housing,

• Creating house price issues through affecting supply,

• Further creating inequality throughout the spectrum of society,

• Affecting job mobility due to moving costs,

• Probably avoiding because transitioning from transaction-based tax to recurrent tax is considered difficult.

These points are discussed in detail throughout the publications and

meticulous reproduction of such narratives here would serve little purpose. However, to assist with the understanding of the rationale behind these important considerations, Table 1 provides a concise critique of the main points raised.

Another little-known housing fact is that liquidity has fallen while stamp duties as a proportion of median house prices and average earning has risen. Liquidity is defined as the proportion of houses that are on the market as a proportion of housing stock. SQM Research (2021) found in 2012, 3.2% of Melbourne detached housing stock was available for sale. In 2021, this proportion fell to 1.5%. When considering all housing stock, liquidity fell from 3.4% in 2012 to 2.1% in 2021. Over the period 2011-2021, stamp duty as a proportion of median house price rose from 3.2% to 4.2%. As a proportion of annual average earning in Melbourne, stamp duty currently sits at 48.9%. This is up from around 30% some nine years ago. The impact of stamp duty on households at a time of financial vulnerability is obvious. Numerous academic papers have found a link between the existence of stamp duty and the reduction of property turnover. The extent that the removal of stamp duty would have on property markets is subject to modelling but that it will have a positive impact is considered to be established.

Having reviewed the issues regarding stamp duty, it is important to discuss the alternatives. Any transition away from stamp duty should be revenue neutral. Any shortfall in revenue, whether long-term or in transitory period, can only be supplemented through debt, clearly an undesirable strategy. If a revised taxation framework results in additional funds, then a commitment that those funds be directed back to their origin, namely land and its uses should be sought. As properties other than the principal place of residence are already subject to land tax (the $300,000 threshold acknowledged), any transition away from stamp duty must inherently mean taxing the principal place of residence and/or lowering the threshold, although the latter is unlikely to have the same level of revenue to

replace the lost income stream.

In June 2022, the NSW government announced it was moving towards the removal of stamp duty. The federal government Treasurer, Dr Jim Chalmers, stated he would not agree to compensate the NSW government for loss of revenue, highlighting the importance of developing a revenue neutral transition for states. The policy states this option is only available to first home buyers and allows these buyers to choose between paying up front stamp duty or ongoing land tax. All other buyer categories are still required to pay stamp duty. Such an arrangement is somewhat of a “half hearted” attempt to address the recognised issues of stamp duty. The scheme commences in January 2023.

Alternatively, the ACT has chosen to make a stated policy to phase out stamp duty over a 20-year transition period in favour of a broad-based land tax. The aim was to soften the tax revenue loss to the government through the transition. This change has been progressing over a 10-period with government authorities claiming it has a successful progression. The arguments presented by the government for the removal of stamp duty are those stated within this discussion paper, namely to recognise the inefficiencies of stamp duty and implement a tax framework that creates stability, efficiency, equity and simplicity.

Arguments forwarded in literature consistently identify one of two possible replacements to stamp duty. These are adjusting the GST rate or “leveling” the land tax platform to include all property, irrespective of its use. Unlike stamp duty, both are efficient taxation methods and overcome the volatility created by market fluctuations. The merits of each are summarised below.

The argument to replace stamp duties in favour of a broad-based land tax, aka, GST, is a strong one. At 10%, Australia has one of the lower GST rates in the world. One key characteristic of GST is its transparency and in economic terms, efficiency. Also recognised in previous studies is, it is also likely to increase market activity through the removal of the barriers presented by stamp duties. The amount of increase would require

Stamp duties are an inefficient tax because they are narrow based, meaning they infrequently target a small component of society, thereby moving monies away consumption-based taxes. Additionally, they distort the market by adding a significant burden to market participants. Participants may avoid market transactions by renovating, not moving, or not entering the property market. Such options are available to second and subsequent homeowners who may hold onto housing that would otherwise benefit first home buyers.

Levied at a time when buyers are most financially stretched.

The net effect of taxing at the point of purchase is that buyers consider the “entire” cost of acquisition. This has a negative affect on house prices and causes further financial vulnerability upon the buyer. Removal of stamp duty is likely to attract further investment into housing.

Inhibiting house market movement, thereby reducing the availability of suitable and needed houses to home buyers. This is because of older people “sitting” on their large houses as it is too expensive to move creating a mismatch of housing.

Modelling has shown stamp duty reduces mobility. Existing homeowners are discouraged to transact and typically contrast the option of renovation to the cost of moving. In doing so, when renovation is chosen, housing supply to buyer categories is further limited. This in turn can prevent the efficient up-sizing or down-sizing of housing across the market.

Creating house price issues through affecting supply.

Inelastic markets are one where the supply and demand of goods and services are not significantly affected by price changes. Tax structures should aim to ensure minimal impact on markets. Stamp duty has been shown to significantly impact property prices and therefore is seen as a hinderance to market activity.

Further creating inequality throughout the spectrum of society.

The burden of transfer stamp duty is not equally shared across housing markets. Stamp duty, as a proportion of wages has risen. In 2012, Stamp duty as a proportion of the average earnings was 30.5%. In 2021, this rose to 48.9%. This further exacerbates the buying burden and availability of housing.

Affecting job mobility due to moving costs.

Stamp duty increases the cost of moving. This can reduce labour mobility as people may chose to remain in place in favour of further job opportunities due to the costs associated with relocation, of which stamp duty is a significant component. This has a negative effect on productivity within the economy.

Probably avoiding because transitioning from transaction-based tax to recurrent tax is considered difficult.

modelling but should include such an amount that would create budgeted sums of money for social and affordable housing. Consultancies such as Deloitte’s argue strongly for this approach.

In its 2009 Discussion paper – Re-Think, the REIA, noted “The Centre of International Economics in its report, State Business Tax Reform in 2009 showed that the required increase in the GST rate under the reform of abolition of stamp duties on residential and nonresidential property, removal of insurance duties and reform of land taxes and payroll taxes would be 0.45 percentage points. That is, the Australian Government could fund State tax reform by raising the GST rate from 10 per cent to around 10.45 per cent. This calculation takes

Literature has acknowledged the difficulties in transitioning from a transaction based to a broad-based taxation framework. However, it is generally agreed that this should not deter governments from making such a move as the long-term benefits notably outweigh the ephemeral concerns.

into consideration the positive flow-on impacts on the economy that would result in higher revenue collection from other revenue sources as well as the GST through increased consumption.” (pg. 4)

While any increase in GST will attract significant public interest, it is believed the time now right for the debate. The pressure on global economies is significant with unstable geo-political events and the Australian economy is not exempt from these instabilities. The expected benefits that will flow from the removal of inefficient taxes, such as stamp duties, will “loosen” the economic constraints and enable greater activity.

A counter argument to this strategy would be that lower paid people are

being taxed unfairly. As more highly paid workers tend to spend more, this argument doesn’t carry a great deal of validity. Also, the argument that low paid workers and those on social benefits are subsidising wealthier can be offset by the fact that additional revenue can, and should, be directed to providing lower cost housing. As tax is raised to provide social benefits and amenity, arguments against more efficient tax revenues are rather weak.

A potentially held view of state governments is the loss of control over a revenue and the inherent trust that must be given to the federal government. There is no getting around the fact that such an objection would be simply political.

CONTINUED ON PAGE 14

• The REIV REAL Badge

-Ways to use the badge

-Animated badge

-Do’s and Don’ts

•Proud Member Logo and Sticker

-Ways to use the logo

-Usage guidelines

•Your REIV membership profile page

-Enhance, share and generate new leads

CONTINUED FROM PAGE 11

For the purpose of transparency, it is plausible to legislate an allocation of the increase to the provision housing and this, given to states to administer. As it is very likely that state governments use a proportion of stamp duty tax revenue for purposes other housing or associated needs, this also can be documented as a form of guarantee for the states. Nothing is insurmountable if the parties are willing augment their views.

An alternative view for the replacement of stamp duty tax revenue is a broadbased land tax that does not exempt any form of land use. This option has been widely discussed in literature. Arguments for the expansion of such a tax are largely centred around its equity and ease of introduction, namely through the use of municipal rating valuation for its calculation. The transition, however, has confounded officials for some time. The issue that arose from the transition away from stamp duty to land tax was the potential “double hit” for recent house buyers. That is, those who paid stamp duty would potentially become liable for land

tax the following year and thereafter.

The ACT and New South Wales have both recently moved to phase out stamp duty and enact a broad-based land tax. To overcome this, the ACT government has implemented a 20-year transition period where a progressive removal of the requirement to pay stamp duty is replaced with payment of a broad-based land tax. This overcomes the effect of “double dipping” where a household pays stamp duty and is then also required to pay land tax. As is often the case, the transition has required refinement, but there is general acceptance of the need for such a move away from transfer taxes.

A recent NSW Treasury report (2022) modelled the removal of stamp duty in favour of broad-based land tax that levied a tax on the unimproved value of land on all property, including residential. The modelling showed an increase in long-run home-ownership rates would be seen. The report also highlights the importance of broad-based land land tax that is structured in favour of owner-occupiers. This would enable households to shift from rental accommodation to their own homes. Doing so would assist in the

reducing the demand for social housing. Yet another very important pressure point in Australia’s housing landscape.

Another noted issue with the adoption of broad-based land tax is the potential of increasing taxes upon retired and/or poorer households who are landowners. Such a situation may be addressed through the use of means testing, but this would increase burdens upon the system when one aim is to implement efficiency. However, once again, people who are in these situations are likely to have their records within Centrelink and with appropriate security measures, may be made available to taxing authorities for assessment. Such a proposition is really one of least impact on the public purse and society.

The REIV is committed to:

• The removal of stamp duty in favour of a broad-based tax framework

• Equitable tax arrangements that serve the societal needs of Victoria

• Tax collection and distribution that is efficient and provides certainty of revenue income for the provision of housing needs

• Efficient market structures that enable households’ opportunity to access housing that meets their needs

• Tax reform that removes a significant cost obstacle for people wising to “right size” their homes

The arguments regarding the removal of stamp duty as a form of taxation are well established and, due to the population sizes that inherently lead to more property transactions, has particular relevance in Victoria. Such a form taxation is argued to lead to inefficient and detrimental effects upon the economy and should be replaced with a more equitable and efficient form of taxation. That taxation is required for sustained social amenity is acknowledged in this debate. The question of stamp duty removal really centres around with what to replace it with, and how to make

aCT government (2012), aCT Taxation review, aCT government

Australian Government (2015), Re:think – Tax Discussion Paper, Commonwealth of Australia, ISBN 978925220-21-6

National housing and investment Corporation (2021), Stamp Duty reform: Benefits and Challenges, Commonwealth of australia

Business Council of australia (2016), realising our Full potential: Tax Directions for a Transitioning Economy, Business Council of australia

Centre for International Economics (2009), State business tax reform: Seeding the tax reform debate, Centre for International Economics for Business Coalition for Tax Reform

Coates B, and Nolan J, (2019), NSW should swap stamp duties for a broadbased property tax, Grattan Institute submission to the NSW Productivity Commission

Consult australia (2021), Unlocking Stimulus from property Tax reform, Consult australia

the transition. This is where politics has the potential to interfere with good outcomes.

Key arguments for the removal of stamp duty are:

• Reduced purchase costs

• Enhanced mobility of skilled people via the reduction of transfer costs that in turn aids better economic outcomes

• Likelihood of older people moving to more appropriate accommodation and thereby releasing suitable housing stock for younger families

• Improved housing affordability through decreased purchase costs and greater housing liquidity (supply of existing house stock)

• With appropriate measures and intent by governments, increased availability of funds to meet social and affordable housing needs

Cho Y, May Li S, Lawrence U, (2021) Stamping Out Stamp Duty: Property or Consumption Taxes?, CAMA Working Paper 1/2021, Centre for Applied Macroeconomics Analysis, Australian National University

David K, (2017) Replacing stamp duties: Securitisation can hold the key, Financial Policy Brief FPB 2017-10, Centre for Financial Studies, Monash University

Deloitte (2015), The economic impact of stamp duty: Three reform options, Deloitte access Economics, prepared for the property Council of australia

hia (2011), Tax Forum, housing industry association Submission to the Tax Forum

HIA (2021), Housing Australians: Proposed Changes to Victoria’s Property Taxes 2021-2022 Budget, Housing Industry Association

Hughes C, Sayce S, Sheppard E, Wyatt P, (2020), Implementing a land value tax: Considerations on moving from theory to practice’, Land Use Policy, 94

Kusher, K. (2022), Taxation statistics show stamp duty collection reached a record-high in 2020-21, rEa group

• Increase in taxation transparency

• Greater stability in tax revenue modelling for governments

In conclusion, the REIV strongly advocates the removal of stamp duty as a source of taxation revenue. How the removal of this revenue stream is replaced, is open for responsible modelling and debate. The benefits are both obvious and extensive and with proper consideration and implementation, the potential of increase funds for allocation to social and affordable housing will provide more equitable and social outcomes for Victorians.

The REIV urges the Victorian Government to invite stakeholders and experts to contribute to a roadmap that supports home ownership while maintaining an important tax income stream for the state.

NSW Business Chamber (n.d.), Taking on Tax: reforming NSW property Taxes, NSW Business Chamber and NSW Council of Social Service

Warlters M, (2022), property Tax reform and home ownership, NSW Treasury

oECD (2022), housing Taxation in oECD Countries, oECD Tax policy Studies, No.29, oECD publishing, paris

rEia (2015), rEia response to the Tax Discussion paper re:Think, real Estate institute of australia

SgS Economics & planning (2022), give Me Shelter: The long-term costs of providing public, social and affordable housing – Cost-benefit analysis report, SgS Economics and planning prepared for housing all australians

SQM research (2021), Stamp Duty: The relationship to australian housing affordability and Supply, SQM research prepared for the real Estate institute of australia

Vidyattama Y, and Hawkins J, (2021), The Case for Shifting from Stamp Duty to Rates and Land Tax, National Centre for Social and Economic Modelling, University of Canberra

from a person for work done or outgoings incurred unless:

• The agent has an authority signed by the person or their representative; and

• Before the person signed the authority, they were informed that the amounts of commission and outgoings to be paid to the agent are subject to negotiation; and

• Details of the agreed amounts are contained in the authority; and

included in the authority; and

• The rebate statement in the authority includes a statement that the agent is not entitled to retain any rebate and must not charge an amount for any expenses that is more than the cost of those expenses; and

• The authority contains a statement in a form approved by the Director Consumer Affairs Victoria as to where a complaint concerning commission and outgoings can be made; and

• The agent gave the person a copy of the signed authority.

For real estate agents, increasing fees is not as simple as it is for many other service providers, as the Estate Agents Act has onerous provisions which must be complied with.

Section 49A states that an agent must not obtain or seek payment

• If the fee is to be calculated as a percentage, the authority must contain a statement of the fee both as a percentage and a dollar amount payable on the reserve price or any other relevant amount in the authority; and

• A rebate statement in a form approved by the Director of Consumer Affairs is

These requirements cannot be avoided even if there is an agreement between agent and client to operate in a different way. This is serious business, a few years ago a Court ordered an agency to refund over $3 million in commission because it didn’t have proper authorities in place. Sending a notice of a fee increase will not suffice, you’re required to negotiate with each client for a new authority.

The increased workload involved in residential property management has caused many members to review the fees being paid by rental providers.

These requirements apply to residential property listed for sale by real estate agents. Residential property means real estate that is used or intended to be used for residential purposes but does not include real estate used primarily for the purpose of industry, commerce, or primary production.

The authority must contain the agent’s estimate of what they assess buyers are likely to be prepared to pay for the property. It can be a single figure or a range where the top of the range is not

more than 10% above the bottom of the range. The estimate must be based in the prices achieved for three comparable properties, or if there were not three sales of comparable properties there should be some other justification on file to show how the estimate was arrived at.

Comparable properties must be selected because of their similarity to the property being assessed, not because of the price they sold for and they must be identified before the estimate is made. In the case of a Melbourne metropolitan area listing, they must be within 2km and have sold withing the preceding 6 months. In the

case of a listing outside of the Melbourne metropolitan area they must be within 5km and have sold within the preceding 18 months.

As soon as the property is listed, a SoI must be prepared regardless of whether the property is being advertised for sale. It must include:

• The address of the property, not just the suburb or locality; and

• An indicative selling price; and

• The median selling price for residential property in the locality, the type of residential property to which it relates, the period over which it was calculated and the source of the data; and

• The addresses, sale prices and dates of sale for the three most comparable properties (ie those used in arriving

We Sell Businesses Better: With LINK you will be in safe, knowledgeable hands! We are Australia’s largest business brokerage with offices in multiple cities

Concern and commentary around

quoting has focused on the quoted price range. This is important, of course, but there is a range of other details that must be complied with.

at the estimate on the authority), or if three properties could not be identified, a statement to that effect; and

• The date on which the statement was prepared.

If there are one or two comparable properties, they can be listed on the SoI, but the statement that there are not three must still be used. If there is no median price information available for the locality include a statement on the SoI similar to the one suggested in the Consumer Affairs “Underquoting fact sheet”. The SoI can stay as described even though the comparable property sales may become older than 6 months (metropolitan) and 18 months (non-metropolitan). However, changing circumstances may necessitate changes to the paperwork.

If the agent’s estimate on the authority ceases to be reasonable they must notify the vendor in writing and amend both copies of the authority. Any sales of comparable properties used in arriving at the new estimate must have taken place within 6 months (metropolitan) or 18 months (non-metropolitan) of the date on

which the revision is done.

The comparable properties used in arriving at a new estimate on the authority must be shown on a new SoI. A new indicative price may need to be included on a new SoI. It may need to change because the single figure or the lower end of a range must not be less than:

• The agent’s single figure estimate on the sale authority; or

• The lower limit of the agent’s estimated range on the sale authority; or

• The amount of a written offer rejected by the vendor based on price; or

• Any amount the seller has advised (whether orally or in writing) is the amount they will accept.

An updated SoI must contain the date on which it was created and the old SoI must be retained.

Records must be kept for all properties that are for sale and that have been sold.

They should be retained for 7 years as the Director of Consumer Affairs may require the agent to produce documents to substantiate the reasonableness of:

• The estimated price on the authority

• Any revision of the estimated selling price on the authority; and

• Any advice provided to the seller or a purchaser or prospective purchaser by the agent whether orally or in writing in relation to the estimated selling price included in the statement of information; and

• Any determination of the 3 most comparable properties; and

• Any statement of the selling price or likely selling price made by the agent while marketing the property.

Any direction from the vendor which limits the type of offers they are prepared to consider should be obtained in writing and retained on file.

For more information, please refer to the Information Sheet “Price quoting when selling residential real estate”

Talk of property prices rising or falling, dominates conversations, whether it’s backyard barbecues or boardrooms. Most discussions typically focus on dwelling values, which is logical as people are looking for a place to live. But as dwelling styles evolve over time, what impact does it have on land value?

In this story we delve a bit deeper

into changes in land value over recent years. We look at more than vacant land sales. We include land area of reported residential sales for this analysis.

Over the past two years, regional Victoria has consistently outperformed metro Melbourne. This is evident in land values, too. While price per square metre for a home in metro Melbourne remained

stable in 2022, (slight decrease of 0.6 per cent to $1,923 from $1,935 in 2021), land value for homes in regional Victoria increased by 9.7 per cent to $817 from $744 in the previous year.

Metro Melbourne recorded some variation depending on proximity to the CBD. Values in inner and middle ring suburbs depreciated by 2.9 and 2.5 per cent respectively and increased in outer suburbs by 6.9 per cent over 2022.

As the population grows, size of a dwelling tends to reduce however, data shows that the median land size for properties within inner ring suburbs grew in 2022 by 1.1 per cent, while middle and outer Melbourne saw a decline of 0.2 and 3.0 per cent respectively.

Suburbs located in the City of Boroondara and Stonnington often dominate the most expensive suburbs list based on their median house prices, followed by Mornington Peninsula in recent years.

However, when you look at land value

Has land value increased at the same pace as dwelling value? Or are we simply paying a higher proportion towards building costs?

per square metre, those suburbs in close proximity to CBD are the big earners. For example, Toorak is regularly recorded as the most expensive suburb in Victoria based on house prices but takes 11th place when it comes to land value.

Albert Park from Port Phillip has the most expensive land with a median of $14,583 per square metre, followed closely by East Melbourne ($13,415) and Middle Park ($13,316). Toorak sits in 11th place with $9,460.

Suburbs from Nillumbik Shire recorded the most affordable median prices in metro Melbourne, led by Kinglake West – the only suburb with median land price below $100 per square metre, a price that will only get you 1/155 for the same space in Albert Park. Land in Cardinia and Yarra Ranges is more affordable in suburbs such as Beaconsfield Upper ($245) and Kallista ($355).

Regional towns remain more affordable compared to their metro counterparts. Scarsdale and Lockwood South are the most affordable towns based on their median price per square metre with $33 – you have to pay 117 times more in Geelong for a property with similar size. Suburbs from Greater Geelong and surrounding areas have the highest land price per square metre, led by Geelong itself with $3,885.

Golden Plains and Greater Bendigo dominate the top 10 list for most affordable regional homes. Not everything is focused on the western side as Hazelwood North also features with median price of $43 per square metre.

Regional towns remain more affordable compared to their metro counterparts. Scarsdale and Lockwood South are the most affordable towns based on their median price per square metre with $33.Table 2 Top 10 suburbs wiTh The mosT expensive and mosT affordable land in meTropoliTan melbourne (minimum 10 sales in 2022) Table 3

Toorak is regularly recorded as the most expensive suburb in Victoria based on house prices but takes 11th place when it comes to land value.

live training sessions held from 5.30pm to 7.30pm, twice a week

In-person training sessions held from 9am to 4.30pm, once a week at REIV Camberwell

Choose from a range of delivery options to learn and qualify in a format and pace that suits you.

1. New to real estate. Individuals who do not hold any prior real estate qualifications can complete their qualification with online classes or inperson classes or completely self-paced. The CPP41419 can also be completed through a workplace traineeship.

2. Agents’ Representatives with the superseded qualification who wish to upskill to get their licence, can complete the Certificate IV in 3 months using the fast track delivery option.

Please note: Eligibility criteria for Skills First funding has been expanded from 1 January, 2023. Upskilling is no longer an eligibility requirement for Skills First funding. Please contact us to confirm your eligibility.

With online and in-person training available, access to government funding, and the support of Victoria’s peak real estate body, training with the REIV is the best way to kickstart your career in real estate.

For any queries or clarifications, please contact our training team by emailing training@reiv.com.au

contact via phone

• Have successfully completed at least the three units of the CPP40307 Certificate IV in Property Services (Real Estate) i.e., CPPDSM4007A, CPPDSM4008A and CPPDSM4080A

• Have worked in the Real Estate industry for a minimum of 12 months

• Have been registered on the Business Licensing Authority (BLA) in the past 5 years or provide appropriate evidence of employment Trainer contact and support Online live training sessions held from 5.30pm to 7.30pm, once a week

Various studies have shown that we all learn differently – some prefer a classroom environment, while others find learning by themselves a better experience. Whatever your preferred style, the REIV now has a delivery option for you.

time

themselves and their teams.

Ongoing professional development has always been a core purpose of the REIV and it has never been easier to manage and record your PD activity.

For the 2023/24 CPD period, the requirements have been simplified to directly align with hours spent on professional development.

Who needs to comply?

CPD requirements must be met by all REIV Licensed and Representative Members. This includes Honorary Life Members, who are also Licensed Members.

How many CPD hours do I need?

A minimum of 10 CPD hours must be achieved in a CPD year. This must include the prescribed REIV Ethics Module for the year. Up to 5 CPD hours can be accumulated from professional development undertaken outside the REIV.

What contributes to CPD hours?

CPD hours can be attained through a variety of initiatives. This includes activities undertaken with the REIV as well as those undertaken externally. Any activity or service that extends your real estate skills, knowledge and understanding, or supports your business compliance, will be eligible for recognition as CPD hours. Refer to the REIV CPD Table for an overview of CPD approved activity at reiv.com.au/cpd

What is the CPD Year?

1 April – 31 March

I am a new member. Do I still need to achieve 10 hours?

New Members who join between 1 January – 31 March are exempt from CPD requirements for that CPD year. New Members joining between 1 April –31 December will be required to achieve the prorated CPD hours for that CPD year i.e. Member joining in October will be required to achieve 5 REIV CPD hours by 31 March.

The REIV Member Portal allows you to manage and maintain your REIV CPD. REIV events, training and activity will be automatically have the associate hours allocated to the Individual Member. Any eligible external activity can be reported to the REIV via your member portal. Simply log in with your individual member ID and password at members.reiv.com.au and you will have access to:

• Your current hours status, including hours accumulated via the REIV and externally.

• Your recent CPD activity

• Your yearly CPD history

• Downloadable PDF Transcript of each CPD years activity and accumulated hours.

• Adding external CPD for consideration

• Downloadable statements of attendance for REIV activity.

• Alerts and status of any additional requirements such as compulsory modules when they become live.

What happens if I have a shortfall at the end of the year?

If a Member fails to accumulate the

requisite number of CPD hours in the CPD year, they will be required to make up the shortfall in the following CPD year in addition to the 10 CPD hours of the new CPD year. Should the Member not achieve the required number of points in the second year, this could result in a warning from the Board. Failure to comply with the REIV CPD Scheme in the third year could result in disciplinary action or termination of membership.

Can I use the CPD catch-up option if I wish to nominate for positions on REIV Boards and Committees?

The catch-up option cannot be used by Members who wish to nominate for positions on the REIV Board, Chapter or Division Committees. Members must have complied with the CPD Scheme for the prior CPD year at the time of nominating.

To build and maintain the REIV Difference, it is important that Members demonstrate that they are a cut above the rest through their dedication to their ongoing development. The REIV CPD program covers a wide range of activities that all contribute to building a better skilled, more knowledgeable professional real estate sector. The program is designed to be simple, accessible, and flexible.

The REIV Continuing Professional Development (CPD) program provides a framework to recognise the

and effort Members invest in upskilling

Ongoing professional development has always been a core purpose of the REIV and it has never been easier to manage and record your PD activity.

In this highly competitive industry, the REIV Auction Competitions give you an opportunity to stand out, learn from peers and establish your auctioneering skills at the highest level. The REIV hosts two major competitions each year:

The REIV Senior Auctioneering Competition

For auctioneers who are ready to take their auctioneering profile to the next level. The REIV Senior Auctioneer of the Year is inducted as an REIV Master Auctioneer, joining a group of accomplished auctioneers.

The winner and runner-up of the Senior Auctioneering Competition progress to the Australasian competition, representing Victoria at that level.

The REIV Senior Auctioneer of the Year also has an opportunity to call the Good Friday Appeal Charity House Auction.

For new Auctioneers who have called a maximum of 20 public auctions AND have been a public auctioneer for less than 12 months.

The REIV continually updates and reviews forms to ensure compliance, protect Members’ interests and reflect Member feedback.

The Exclusive Sale Authority 002 and the Exclusive Auction Authority 003 have been updated, notable changes include:

The option for a continuing authority period and the associated commission entitlement description has been removed. The agent’s commission entitlement is better protected during the “exclusive” authority period. Members are encouraged to focus on having the exclusive authority period correctly documented. This ensures that Members using REIV forms have the necessary documentation to claim commission as appropriate.

An end date of the exclusive authority

period can now be determined for instances where an auction date is not entered or where an auction is not conducted.

The option for the vendor to give instructions to sell the property on vendor terms has been removed as it some Members found it confusing and was rarely used. The exclusion of this option in the authority does not prevent a vendor terms contract of sale, should that be what the vendor is prepared to accept.

As a reflection of the market, the

As a reflection of the market, the Authority has been updated so instructions from the vendor include an additional option, “with vacant possession or subject to a tenancy”.

Authority has been updated so instructions from the vendor include an additional option, “with vacant possession or subject to a tenancy”. This allows for circumstances where the rental agreement permits vacant possession, and the vendor is open to consider either option.

Please note, all REIV forms and authorities are reviewed by external lawyers before they are made available to Members. These updates are a result of Member feedback shared with REIV Information Officers.

To find out more about REIV VicForms, book an obligation-free demonstration by contacting vicforms@reiv.com.au

Commentators consider the inception of generative AI a game-changer in so many different areas of the property community.

Most of the noise thus far has centred around ChatGPT and the utilisation of that within real estate. Like any other piece of technology, when used correctly this could be a huge time-saving advantage for tech-savvy agents.

Aside from ChatGPT, there are many more areas where generative AI is appearing within the property community and some of them are not quite what, or where, you’d expect them to be.

High-end properties are often staged as a part of the marketing campaign with the help of interior designers. Imagine begin able to come up with a style concept in minutes based on photographs of the existing space for just $2.99. With the help of AI, that’s now possible.

CLICK FOR MORE: Prompt Interior Designs

DALL-E also has an image-editing tool. The image pictured below shows what it did when asked to “remove the light fittings and take out some of the kitchen clutter”.

CLICK FOR MORE: DALL-E Image Editing

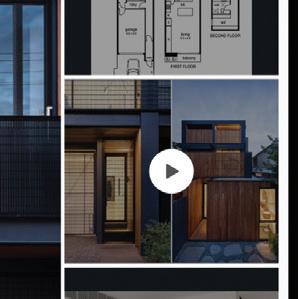

Generative artificial intelligence is set to have a large impact on the building and design process. Most leading architects are tipping that simple functions will be replaced with artificial intelligence guided by parameters.

Opoplan and Maket are two AI companies looking to have an impact on the creation of pre-build/off-the-plan home design. AI such as Grasshopper3d allows architects to look at multiple outcomes for a building design by entering a series of constraints.

CLICK FOR MORE: Opoplan

Maket Grasshopper3d

These outcomes could save months of work and arrive at destinations the architects did not think of. Similarly, town planning looks to be following a similar path.

Closer to home, ListAssist is like a ChatGPT for real estate listings.

CLICK FOR MORE: ListAssist

The New Zealand founders of this tech only need a few basic details about the property for sale or rent. After you hit

‘generate’, that 30 minutes you were going to spend writing listing copy (or were not going to spend) is gone and your copy is done.

In the mortgage industry, generative AI is working to better profile a prospective client faster, which in turn leads to a faster and more reliable outcome for the broker.

Many agents refer directly as the source to the broker, and there is no reason why this tool could not be used to better qualify clients from a real estate perspective, especially in lucrative referral scenarios or ‘in-house’ mortgage services. GPT-3 is an extension of the Open AI framework being used for this purpose.

CLICK FOR MORE:

GPT-3

GPT-4

It’s worth mentioning how generative AI will infiltrate home valuations/appraisals. During the pandemic period, valuers learned how to appraise using many AI tools remotely, as was required at the time.

The biggest issue standing in the way of generative AI and any form of technology disrupting this space is the dataset contained by most engines not being current. For example, ChatGPT is only relevant from the start of 2022.

I’m predicting this industry to be most affected by generative AI as soon as a relevant dataset can be coupled with a functioning generative AI.

Finally, if you’re looking for a way to integrate generative AI into your business right now, one of the most functional ways I have seen is an extension of OpenAI.

While the real estate industry has always been accustomed to change, the arrival of generative AI is already making waves, writes Peter Schravemade.

OpenAI will integrate with Google Spreadsheets or Microsoft Excel. It has use cases in repetitive business operations including, content calendars for social, staffing plans and rosters, sending ‘personalised’ comments to clients on special anniversaries/events and many aspects that just haven’t been considered yet.

Some agents are using it to generate leads, by using OpenAI to drip-feed content to their clients related to their home location, just sold in the area, and market updates factoring in notes within their file (such as a purchased home in 2012). This type of use is not for the faint of heart and needs careful monitoring during setup.

Aside from raising eyebrows, some of these examples are certainly raising

ethical questions for industry peak bodies right now.

The potential for creating inaccurate or deceptive material is one of the main ethical issues with employing generative AI in a Real Estate practice. For instance, an agent or broker may be misleading potential buyers or tenants if they utilise generative AI to build property listings with false or erroneous information, which could result in unethical behaviour and have legal repercussions.

There are broader questions for users of generative AI, especially around copyright and ownership of generated content. Who has ownership of the generated content and by way of extension, does one have the right to use it? A lot of this unease is warranted, especially as the birth and development of new technology hit warp speeds.

Finally, the Achilles heel of generative AI will always be the absence of creativity and originality. When given 30 images of landscapes, gen AI will create a landscape based on amalgamations of those 30 landscapes, but gen AI will not create a completely new concept for a landscape. Even twins are incredibly different and it is this originality that drives us as humans to be who we are.

This article should serve as a piece to remind those fearful, that opportunities are everywhere. And the best protection against disruption is to stay informed and focus on being the best in delivering a service to your client. I haven’t yet seen any form of AI that is better at fostering a human relationship than humans themselves.

Peter Schravemade is the Managing Partner for REACH ASEACommentators consider the inception of generative AI a game-changer in so many different areas of the property community.REACH ASEA Managing Partner Peter Schravemade speaks at the REIV READY23 Conference.

READY23 was all about getting our members ready for that future. There was a palpable feeling of optimism and excitement as members crowded into keynotes and exhibition booths to get insights into what they could expect. In scenes reminiscent of pre-Covid events, it was amazing to see a packed conference full of Members and guests discovering everything the program had to offer.

Start-Up Ally, powered by REACH Australia, was a prime example of the innovation and technological development our industry will enjoy in the future. From automated smoke detectors that can reduce compliance burdens to online sales and property management portals, the technology on display showed how the future of real estate is one that makes

your jobs more manageable and improves your clients’ experience.

Attendees were treated to a fantastic line-up of keynote speakers and breakout sessions. We were given some fascinating economic insights by Nicki Hutley, a look into understanding the next generation of consumers by Jonathan Swift, and an intriguing look into the world of blockchains, AI and cryptocurrency by Peter Schravemade. READY23 also welcomed some expert insights and inspirational stories from the sporting world, with former tennis player Jelena Dokic and Collingwood coach Craig McRae sharing stories about their careers and managing high-performance expectations.

As we wrapped up the day with drinks

and the excited chatter that accompanies shared insights, it was clear that READY23 had succeeded in showcasing some of the exciting technological and social developments that will help take real estate into the future.

The REIV would like to thank the keynote speakers, breakout room contributors and exhibitors for their attendance. We’d also like to thank our major partners, AON, RACV, realestate.com.au and Smarthouse for helping us bring the conference back to our members.

Most importantly, we’d like to thank everyone who attended and helped make READY23 a success. We hope you took away ideas for how you and your business can prepare for the future.

The REIV READY23 Conference marked a triumphant return to the format, as Members filled Crown Promenade for an exciting look at the future of real estate.

Committees play an important role in ensuring that the REIV is aware of the opportunities and challenges affecting all facets of the real estate industry across Victoria, and in supporting the development of REIV services and policy that make a real difference for all Members.

Delegates from Chapter and Division Committees come together with the Board and delegates from the Past Presidents’ Council every two months

AuCtion

Luke Banitsiotis

Harry Li

Alisha Pitts

Raoul Salter

Geoff White

Gloria Ammerlaan

Grita Angelucci

Jamal Dabab

Denise Hall

Fred Samoun

Ian Wollermann

as the REIV Members’ Council.

Chapter Committees are appointed by the REIV Board following calls for expressions of interest from Licensed and Representative Members, every two years. The role of Chapter Committees is to contribute to the development and relevance of REIV product and service offerings by:

• Highlighting issues and opportunities of particular interest to their Chapter;

• Identifying topics and participants for Chapter specific and wider events; and

• Providing Subject Matter Expertise (SME) in support of the REIV for advocacy and representation, professional development, good practice process and documentation.

Thank you to all Members who expressed an interest in joining the REIV Chapter Committees. The committees for 2023 and 2024 are listed below.

Milton Cations

Bernard Corser

Tonya Davidson

Mark Errichiello

Richard Kerr

Paul Murphy

Melissa Opie

Janet Spencer

Eddie Van Pamelen

Michael Di Carlo

William Di Donna

Henry Fields

Marni Lawson

Megan Miles

Tim Mitchell owners CorporAtion

Norman Mermelstein

Michael Nardella

John Ross

Neville Sanders

Alex Starr

Lucas Taylor

Kate Yeowart

Sabina Aldouby

Amy Blackburn

Di Coad

Michael Furlong

Cynthia Hartnett

Carmen Morrow

Zac Muller

Chelci Wynn

Jatinder Singh Aashat

Tracey Dean

Janet Fleet

Christine Henderson

Anthony Molinaro

Chris Snell

Jan Hancock

Martin Fallon

Stephen Miles

Peter Lawrence

Damien Lynch

Nick Walsh

For more information about Chapters, Divisions and their Committees or to provide input to any of the committees, please contact the REIV Membership Team membership@reiv.com.au

EA spoke to Steven Mostafa about his career journey, from hospitality to an REIV Award-winning Business Broker. Another example of a sector that attracts and empowers people from all walks of life.

I didn’t set out to be a business broker. In fact, my first job was in the construction business with Grocon, where I worked for six years.

My family was into hospitality and had bought and sold businesses over the years, so while the profession of business broking was not new for me, I had never considered it as a career for myself. My first interaction with a business broker was when I sold my hospitality business about seven years ago.

The introduction into business broking opened up an exciting set of opportunities. I enjoyed working with people, negotiating, making new connections and the idea of having a different challenge each day; so this profession was ideal for me.

I started my career focusing on the sale or purchase of hospitality businesses. This was something I knew and understood really well. I could relate to the concerns that people have when undertaking such a transaction.

It allowed me to use my experience and knowledge to assist my clients. I could empathise and guide clients accordingly.

Over the years, my experience has broadened and I now work across a range of areas to drive great results for my clients.

At the end of the day, our sector is all about people and relationships. I enjoy connecting with industry professionals who genuinely enjoy providing a quality service to the client and the transaction.

– Steven MostafaInitially, I found that vendors would feel unsure about trusting someone relatively younger. People would make assumptions about my capability before I had the opportunity to present my strategy and insights.

Though it took some work, I developed a strong and loyal client base and created a foundation that has helped me take my business from strength to strength. In fact, client referrals have been an important factor in my business growth.

When I expanded from hospitality to focus on our M&A division, I was once

again faced with the reality that I would need to prove myself in an area where age was often equated with experience.

At the end of the day, our sector is all about people and relationships.

I enjoy connecting with industry professionals who genuinely enjoy providing a quality service to the client and the transaction.

Every client I speak to has a unique story that talks about their passion for their business, the personal drive and sense achievement they feel having built their businesses. It is a very rewarding experience matching such people with the right purchasers who genuinely fit their requirements, interests and goals.

My advice would be to select an industry which you understand, have some knowledge of, experience in or gravitate towards. I originally went into business broking for hospitality as it was an area that I had hands-on experience in. At a later stage of my career, I decided to specialise in a select few industries, for example construction and technology. I had contacts in these industries and after gaining some experience in these areas, I had the ability and experience to build on this client base.

I believe in investing in yourself and constantly developing your skill set. While I gather further experience in M&A, I will soon commence my MBA at Melbourne University. I am really looking forward to this step in my career.

Introduction To Auctioneering: Develop the confidence and skills needed to call a public auction.

Working with experienced auctioneers you will learn the rules, bidding sequence, voice control and personal enhancement required to call a successful public auction.

A series of mock auctions and constructive pinpoint coaching are used to give you hands-on learning experience and prepare you for your auctioneering career.

Tuesday, 9 May 9am to 5pm REIV Camberwell 335 Camberwell Road

$440 for Members

$550 for Non-Members

To make a booking, click here

From October 1, 2022 to January 31, 2023 we welcomed 114 members to the REIV community. Building new relationships through networking is an important aspect of REIV membership. Please find the time to reach out to the new members.

Michael Alessandrino

Daniel Allan

Melissa Anderson

Craig Ashton

Ray Biner

Belinda Bisogno

Trina Bloomfield

Ivan Blow

Aida Bogucanin

Adam Boyce

Jacob Brown

Sharyn Callander

Anthony Carbone

Carly Carter

Keith Chan

Qingfeng Chen

Stephen Chen

Andrew Chhang

Giovanni Chiaramonte

Stephanie Chin

Sam Conquest

Mario Costanzo

Christal Crosdale

Maurice Cruz

Lidiya Davoli

Tracey Dean

Gideon Deane

Julie DeBondt-Barker

Peter Dodd

Ann Drury

Craig Evans

Cena Farahmand

Kate Fisher

Danielle Fordham

Adam Frauman

Nick Garoni

Mohi Gholamy

Wendy Gillies

Patricia Grados

Brooke Grealy

James Hand

Tariq Hayat

Leigh Hayden

Juan Hernandez

Nicole Hiddlestone

Belinda Hocking

Jess Holt

Craig Huckel

Sarah Hutchings

Damian Jens

Kamlesh Kamani

Jaya Kapoor

Saket Katta

Wayne Kobrin

Kristy Kolaitis

Angelo Koupanis

Pranas Kriauza

Brandon Lai

Harry Lai

Charles Lam

Alicia Lecky

Nathan Lihari

Kelvin Loh

Paul Lowe

Isabella Lu

Gee Mahna

Patrick Mammone

Moss Manje

Lee Marks

Tom Maule

Joseph Mavrikos

Michael May

Liam Mercieca

Julia Merrington

Tony Micelotta

Thuy Nguyen

Michael Nincevic

Tania Novembre

Charanjit Pabla

Bob Packer

Manmeet Pangly

Andrew Pricop

Kyle Raven

Sabrina Rechichi

Marni Redmond

Van Ritchie

Renee Scerri

Amir Sharifi

Jackie Shearer

James Siakavelis

Nicholas Sinclair

Harmanpreet Singh

Tony Sun

Gary Tang

Georgia Theos

Peter To

George Trakas

Jarrod Tyler

Rachel Wall

Jun Wang

Kaiquan Wang

Winnie Wang

Xiao Wei

Gil Williams

James Wilson

Kaye Wyndham-Martin

Chelci Wynn

Jerry Yeghichian

Samantha Young

Chloe Zanghi

Terry Zhang

Yanzhe Zhang

Yan Zhong

Dan Zhou

We congratulate the Members who completed important milestone Membership Anniversaries during January-April, 2023.

50 YEARS

Sam PENNISI

40 YEARS

Dannie CORR

Brent FLANNAGAN

Leon GLEESON

Peter HAWKINS

Stan LAWRENCE

Chris LEE

30 YEARS

Rob BASSETT-SMITH

Rosslyn CURNOW

Alex DI RIENZO

Ian DUNGEY

Peter GIBSON

Anthony LEE

Fabian SECATORE

Valerie STAMP

James TOSTEVIN

20 YEARS

Andrew JONES

Jasmine KANNIAPPAN

Bruce McILVRIDE

Jake MESSINA

Gina POPOWICZ

Nicholas RENNA

Gavin RODRIGUES

Anna TENEKETZIS

Kim WILSON

10 YEARS

Jamil ALLOUCHE

Kelly ANDERSON

Nadia BARNES

Diana CASSAR

Nicholas CASSIDY

Stephen COOPER

Gavin COYNE

Michael DALTON

Rebecca EDWARDS

Bill JOYCEY

Narelle KING

Peter LEAHY

Craig LEO

Andrew MACQUEEN

Francesca MARAFIOTI

Andrew MARTIN

Daniel MICMACHER

Andrea O’CONNOR

Tino PARISI

Garry PAVLIS

Brent PETERS

Miranda PIKE

Thomas REARDON

Raj SHAH

Nicole SIMPSON

Peter STEPHENS

Bobby SUNG

Peter SUSMAN

Mark TALBOT

Gabrielle TAYLOR

Dien TRAN

Julia VARDON

Jason WONG