Hussain Sajwani

D33: An unprecedented economic transformation agenda

Essam Al Tamimi

Significant changes under the new UAE Commercial Transactions Law

Innovative & sustainable approach to capital & trade

With Sunil Kaushal, CEO of Standard Chartered AME

Bahrain . Kuwait . Oman . Qatar . Saudi Arabia . UAE . Egypt . MENA . Asia . Europe . The Americas April 2023

Eric Anzani, president and COO, Crypto.com

With Navneet Dave, Group Managing DirectorProcessing, Middle East & Co- Head Group Processing, Network International Climate initiatives could save up to $2.4 trn annually

Abdulla Almoayed,

Gateway Contents | april 2023 banking & finance Economy Sustainability Crypto.com executive lauds UAE's supportive stance on crypto Exclusive Unlimited scalability, demystifying complexity Circular Economy Rise of Open Banking in MENA Cover Story with Sunil Kaushal, regional CEO Africa & Middle East, Standard Chartered Standard Chartered: Bridging capital and trade in MENA 22 28 26 38 24 16

With

Hussain Sajwani: D33‘s economic transformation agenda

With

founder & CEO, Tarabut

6 conomy middle east APRIL 2023 Contents | april 2023

Renewables, carbon footprint reduction, among ongoing plans

Technology & Innovation lifestyle

Estate Legal review

ESG gaining prominency in

real estate

62 60 55 40

A driving force to be reckoned with Significant changes under the new UAE Commercial Transactions Law Sustainability

Real

TAQA's sustainability agendas in UAE The Defender 130

UAE

Essam Al Tamimi:

Driving Financial Inclusion 44

Fintech focus with Drew Propson, head of Technology & Innovation financial services, World Economic

Forum

Publisher . JOSEPH CHIDIAC

EDITORIAL

Managing Editor . HADI KHATIB

Economy Contributor . HALA SAGHBINI

Editor-at-large, Automotive & Lifestyle . ALP SARPER

Real Estate & Construction Editor . NEHA BHATIA

Tech Editor . MAYANK SHARMA

Digital Editor . ELIAS AL HELOU

CONTRIBUTORS

PR & Content Strategy Director . CYNTIA BSOUSSI

Creative Director . RAYAN BARAKAT

For General Inquiries: info@jcmediagroup.com

For Editorial Inquiries: editorial@jcmediagroup.com

For Advertising Inquiries: commercial@jcmediagroup.com

Publishing House . JC MEDIA GROUP LLC

www.JCmediagroup.com

www.EconomyMiddleEast.com

@economymiddleeast

@economy_me

NOTICE:

HUSSAIN SAJWANI, ESSAM AL TAMIMI, SUZANNA ELMASSAH, RAJA ALAMEDDINE Printed

8 conomy middle east APRIL 2023

at Masar

LLC

Printing and Publishing

be

finished with

magazine, please recycle it. recycle

Opinions and views expressed in this publication are solely those of the contributors and not necessarily those of the publisher. No part of this publication may

reproduced or transmitted in any form or by any means without written permission of the publisher. When you have

this

Banking on innovation: Financial industry's survival hinges on novel technologies

Several years ago, the chairman of a programming company made a remark at the World Economic Forum in Davos, stating that “Speed is the new currency in the business world.”

I didn’t fully comprehend the depth of this statement until COVID-19 swiftly disrupted our lives and the business world. This frightening virus swept across every country, bringing our lives to a halt and imposing new rules for transactions, particularly in the financial sector between banks and their customers.

Banks had to rapidly develop and implement new ideas and technologies to provide services that meet the needs of their customers as well as respond to competitive changes and remain competitive.

In other words, Financial institutions were forced to adopt innovation as the foundation of their business models to maintain their brand excellence, embrace rapid change, and create fresh solutions to meet the expectations of their customers, strengthen their competitive positions and protect market share.

The current global economic climate has placed a greater emphasis on the importance of digital technologies, with

digital capabilities and skills being critical to ensuring the resilience and sustainability of economic growth. In today’s highly competitive market, banks’ chances of survival depend on the speed of development, creativity, and innovation of their work methods. The provision of advanced and innovative products that meet the needs of their customers is also critical in ensuring a competitive advantage.

Given the significance of innovation in achieving long-term success and survival, media reports highlight the investments banks are making in financial technology and digital transformation. These include platforms, applications, blockchain technology for cross-border payments, and artificial intelligence to improve customer service.

At a time when Western banks are struggling to compete and face significant challenges that may delay their investments in financial technology, Gulf banks are taking the lead by investing heavily in their technological infrastructure and introducing innovative products and digital services. These actions align with the ambitious economic visions and development plans of the GCC, aimed at transforming the region into a global financial, economic, and cultural hub. Innovation is no longer an option but a necessity for the banking industry to remain competitive. Banks must continuously renew themselves or face arrested development.

Chief Executive Officer – Publisher

Joe Chidiac

10 conomy middle east APRIL 2023

EDITORIAL LETTER

23 rd EDITION

UAE Central Bank implements Digital Dirham strategy with G42 Cloud and R3

Measure aims to improve financial infrastructure, address payment challenges

The CBUAE recently held a signing ceremony with G42 Cloud and R3 to mark the implementation of its Central Bank Digital Currency (CBDC) Strategy, known as the Digital Dirham. As part of the CBUAE’s Financial Infrastructure Transformation (FIT) Program, the CBDC Strategy is one of nine initiatives aimed at improving financial infrastructure in the UAE.

To bring its CBDC Strategy to fruition, the CBUAE has engaged G42 Cloud and R3 as infrastructure and technology providers, respectively. The first phase of the strategy is expected to take 12 to 15 months and consists of three main pillars. These include the soft launch of mBridge,

which will facilitate real-value cross-border CBDC transactions for international trade settlement. Additionally, proof-ofconcept work for bilateral CBDC bridges with India, a top trading partner of the UAE, will be undertaken. Finally, proof-ofconcept work for domestic CBDC issuance will be conducted, covering both wholesale and retail usage.

After several successful CBDC initiatives, such as Project “Aber” with the Saudi Central Bank in 2020, the CBUAE is ready to implement its CBDC Strategy, which will address issues related to domestic and cross-border payments, enhance financial inclusion, and promote a cashless society. The CBDC will also strengthen the UAE’s payment infrastructure by providing robust payment channels and ensuring a resilient and reliable financial system. Moreover, the CBUAE aims to ensure the UAE is ready to integrate payment infrastructures with the potential future tokenization world of financial and non-financial activities.

Saudi Arabia's PIF invests SAR 5 billion in four national contracting companies

Governor outlines fund’s strategy to invest SAR 1 trillion in new projects in region

Yasir Al-Rumayyan, the Governor of Saudi Arabia’s Public Investment Fund (PIF), announced that the fund has invested SAR 5 billion in four national contracting companies – Nesma and Partners, Al-Saif, Al-Bawani, and Almabani. The capital increase aims to build strong entities in line with the country’s construction ambitions.

Speaking at the PIF Private Sector Forum, Al-Rumayyan outlined the fund’s strategy to invest SAR 1 trillion in new projects in the region. “Within the framework of supporting

national development as one of the most important pillars of PIF’s strategy, the fund decided on a strategy to develop 13 strategic sectors in the Kingdom. It also launched initiatives to develop a clear mechanism to involve the private sector as an investor and partner in those sectors. For instance, [real estate firm] Roshn has created opportunities for the private sector by allocating 30 percent of its land to real estate developers to build promising housing,” AlRumayyan said.

Al-Rumayyan also emphasized the importance of the recycling sector and the fund’s efforts to support it, including the establishment of the Saudi Investment Recycling Company (SIRC) and the creation of specialized companies for joint investment to support the private sector’s growth.

Finally, Al-Rumayyan announced PIF’s plan to increase its contribution to local content to 60 percent by the end of 2025.

12 conomy middle east APRIL 2023 short news

Saudi Arabia signs 14 investment agreements with sports bodies

Deals to benefit sector with top-tier projects such as events, academies and medical clinics

Saudi Arabia’s Minister of Investment, Khalid Al-Falih, has announced the signing of 14 agreements aimed at developing the Kingdom’s sports and entertainment sectors. The deals were signed during Formula One’s Saudi Arabian Grand Prix in Jeddah, and are part of Saudi Vision 2030’s efforts to increase public participation in sports and sponsor talent development pathways.

These agreements are expected to benefit the sports industry, with projects such as events, academies and medical clinics, as well as the construction of infrastructure projects for motor racing circuits and professional training

circuits. The agreements also aim to assist investors in the field of sports studies and consulting.

New partnerships include agreements with BAC Cars and VeloceLife to launch a leading manufacturing facility of BAC sports cars in Saudi Arabia, with PureGym Group to support the expansion of gym and fitness facilities, with Seedorf Group for the establishment of sports academies and sports medical clinics, and with Meritus Formula4 to explore the activation of the Formula 4 academies and hosting championships in Saudi Arabia.

Saudi Arabia’s sports sector has seen significant development in recent years, driven by widespread social transformation and government investment commitments of $2 billion in sports by 2024. The sector’s contribution to non-oil GDP is expected to reach over $22 billion by 2030, with an additional $5 billion in private sector contribution required. This provides significant opportunities for international investors.

Dubai World Cup success reflects UAE's commitment to global excellence

His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE, Ruler of Dubai, attended the 27th Dubai World Cup at the Meydan Racecourse. His Highness was accompanied by His Highness Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum, Crown Prince of Dubai and Chairman of the Executive Council of Dubai, and His Highness Sheikh Maktoum bin Mohammed bin Rashid Al Maktoum, Deputy Ruler of Dubai, Deputy Prime Minister, and Minister of Finance of the UAE.

Speaking on the occasion, H.H. Sheikh Mohammed bin

Rashid Al Maktoum said that the success of the Dubai World Cup reflects the UAE’s determination to be a global role model for achievement and excellence in various fields. The UAE’s superior infrastructure and emergence as a major venue for global tournaments and a magnet for leading international sporting figures have marked the city as one of the world’s greatest sporting destinations, H.H. Sheikh Mohammed added.

His Highness Sheikh Mohammed followed the races of the 27th Dubai World Cup event, which brought together the best racehorses, trainers, and jockeys globally and thousands of spectators.

One of the world’s biggest horse racing tournaments, the prestigious event offered total prize money of $30.5 million. The event’s nine-race card featured 127 horses from 13 countries.

Moreover, H.H. Sheikh Hamdan bin crowned the winner of the main $12 million Group 1 race of the Dubai World Cup, which was sponsored by Emirates Airlines.

13 conomy middle east APRIL 2023

Sheikh Mohammed bin Rashid attends Dubai World Cup 2023

Ransomware attacks remain top threat to businesses, $30 Bn in damages expected by 2023

Cybersecurity firm warns of AI risks to digital ecosystems

Ransomware attacks remain the top threat to businesses of all sizes globally and are projected to cause damages exceeding $30 billion by 2023, according to cybersecurity firm Acronis. In its latest Cyberthreats Report, Acronis notes that it stopped over 100 million cyber-attacks in 2022 and that the average cost of data breaches is expected to reach $5 million in 2023.

In Saudi Arabia, breaches are projected to reach an average cost of $7 million, as the country continues to report one out of every five attacks as being ransomware. Cybersecurity

experts attribute this to weak credentials, phishing emails, and unpatched vulnerabilities, which remain the top vectors for cyberattacks. Meanwhile, in the UAE, targeted organizations lost over $1.4 million in ransomware attacks, forcing over 40 percent of them to shut down.

The accelerated advancement of AI-driven innovations is causing concern, as cybercriminals are expected to use this technology to create more complex cyber threats. Acronis warns that AI and machine learning (ML) technologies could pose a big risk to digital ecosystems that are not protected. Cyber protection experts believe that cybercriminals are likely to take advantage of these new tools to increase the effectiveness of their attacks by crafting harder-to-detect assaults.

Riyadh Air set to serve over 100 destinations, create 200,000 Jobs, add $20 billion to GDP

Saudi Arabia’s Crown Prince Mohammed bin Salman has formally announced the launch of a new national airline, Riyadh Air, in an effort to compete with regional transportation and travel centers. The airline will be chaired by PIF Gov. Yasir Al-Rumayyan and led by industry veteran Tony Douglas as its chief executive. Riyadh Air will operate from the Saudi capital as its hub, and is expected to add $20 billion to the Kingdom’s non-oil GDP growth, while creating over 200,000 direct and indirect jobs.

Riyadh Air aims to leverage the Kingdom’s strategic location between Asia, Africa, and Europe, with plans to serve over 100 locations worldwide by 2030, according to the Vision 2030 official website. Riyadh Air is solely owned by the Public Investment Fund (PIF), which manages more than $600

billion in assets and is driving the country’s efforts to diversify its economy and reduce its dependence on oil.

According to industry sources, Saudi Arabia is in advanced talks with Airbus to purchase over 40 A350 aircraft, while Boeing is also vying for a share of the Kingdom’s growing transportation market. In addition, officials have announced plans for a new airport in the capital city of Riyadh, spanning 57 sq. km, which is set to accommodate 120 million travelers per year by 2030 and 185 million travelers by 2050. Currently, the capacity of the existing Riyadh airport is around 35 million travelers.

14 conomy middle east APRIL 2023

KSA looks to compete with regional transportation hubs with launch of new carrier

short news

Major U.S. banks lead bailout of First Republic

Wall Street comes to the aid with $30 bn in deposits

Attention returned to the United States after three regional banks, namely Silvergate, Silicon Valley, and Signature, failed within a week. The medium-sized First Republic appeared to be facing a similar situation, as its shares experienced a significant drop after the Silicon Valley Bank crash. Following this collapse, Swiss Credit Suisse had to borrow up to $54 billion from the Swiss Central Bank to restore investor confidence and support liquidity.

On March 15, Bloomberg reported that First Republic was contemplating a sale due to a 70 percent drop in its stock value in the previous nine trading sessions. However, Wall Street came to the bank’s aid the next day, depositing $30

billion to help it out of its predicament.

JPMorgan, Bank of America, Citigroup, and Wells Fargo will contribute approximately $5 billion each, while Goldman Sachs and Morgan Stanley will each contribute roughly $2.5 billion. Additionally, Trust, PNC, US Bancorp, State Street, and Bank of New York Mellon will each deposit around $1 billion.

As of March 12, the bank had over $70 billion in available liquidity, not including additional funds from the Federal Reserve’s Bank Term Funding Program. However, this was insufficient to prevent investors from dumping the stock. The bank had approximately $34 billion in cash as of March 15, not including the new $30 billion in deposits.

UBS acquires Credit Suisse in bid to strengthen global banking sector

Merger worth 3 bn Swiss francs aims to boost financial stability

Switzerland’s largest bank, UBS, has acquired struggling rival Credit Suisse in a merger approved by Swiss authorities to prevent further disruption in the global banking sector. The deal is valued at 3 billion Swiss francs (3.02 billion euros) and will be paid in shares, or 0.76 francs per share, based on Credit Suisse’s value of 1.86 Swiss francs on March 17.

The merger was completed before the bourse opened on March 20, to avoid a panic in the markets. Both UBS and Credit Suisse are among the 30 banks deemed “too big to fail.”

Observers hope that the merger will prevent a widespread panic in the markets. This move follows similar efforts in Europe and the United States to support the banking sector in the aftermath of the Silicon Valley and Signature collapses.

After the merger, the Swiss central bank announced it would provide significant liquidity to both banks, with 100 billion Swiss francs in financial aid allocated to UBS and Credit Suisse.

UBS expects to save approximately $7 billion in costs annually by 2027. Credit Suisse shareholders will receive one share in UBS for every 22.48 shares they own in Credit Suisse, equivalent to 0.76 Swiss francs per share.

The finance minister has also confirmed that UBS will benefit from a government guarantee of approximately 9 billion francs to address any issues that may arise in Credit Suisse’s portfolios.

15 conomy middle east APRIL 2023

Standard Chartered

takes innovative and sustainable approach to bridging capital and trade in MENA

Regional CEO Sunil Kaushal asserts lender ‘keen to unlock paths to net zero’

16 conomy middle east APRIL 2023

cover story

Sunil Kaushal, Regional CEO, Africa and Middle East, Standard Chartered

The recent banking crises in the U.S. and Europe have left many searching for a positive story, and Standard Chartered seems to be just that. With an impressive 7 percent increase in operating income to $2.6 billion, thanks in large part to the exceptional economic performance of the GCC, the bank is making strides in bridging capital and investments with trade through digital transformation. Standard Chartered’s AME region delivered recordbreaking performance, and the bank’s future plans include further investment in financial markets and transaction banking businesses that prioritize sustainable practices.

To gain insight into these plans and more, Economy Middle East had the opportunity to speak exclusively with Sunil Kaushal, Chief Executive Officer of Africa and Middle East Region at Standard Chartered. In this interview, we delve into the bank’s strategies for continued growth and its commitment to sustainable practices.

You said earlier that the GCC markets are optimistic about outperforming global growth. What are your expectations for the growth rates they could achieve? What challenges are they facing this year?

2022 was an exceptional year for GCC economies driven by higher oil and gas revenues on the back of increased energy prices. This has further advanced the GCC’s economic diversification agenda, leading to additional growth in non-energy sectors and has in turn supported numerous initiatives such as the Dubai Economic Agenda (D33) and Vision 2030 in the Kingdom.

The region’s strong capitalization, economic and development strategies, as well as government initiatives to support investment, in addition to the efficiency of the banking sector, will continue to be key positive factors. Saudi Arabia and the UAE will continue to drive their economic diversification agenda, while other countries like Bahrain and Oman look to boost talent competitiveness, FDI and fiscal consolidation. For the private sector in the region in particular, we expect companies to continue to be resilient and perform positively, supported by robust balance sheets, substantial funding and healthy earning profiles.

While we expect growth to remain healthy in 2023, a moderation is likely as OPEC oil production increases are reversed. The GCC region stands out among EM peers for its very low funding needs. Non-oil-exporting economies in the Middle East, however, are in a much tougher position as elevated energy and food import bills lead to financing difficulties. Financing is likely to remain challenging in 2023, although multilateral and GCC support should help countries such as Egypt and Jordan meet their funding needs.

While the region faces a limited impact from geopolitical tensions and tightening monetary policy supported by growth in the non-oil economy and moderate inflation, specific challenges exist and cannot be overlooked. We expect inflationary pressures, uncertain global oil demand and recessionary fears to impact growth mildly for the GCC region, compared to 2022. Non-oil sectors across GCC economies are likely to be tested on their ability to compensate for potential pressures that weigh down on oil revenues throughout the year. While higher interest rates continue to be a challenge, weighing on deposits and mortgage growth, its negative implications may be limited for the UAE given that its property transactions are dominated by investor-led non-mortgage transactions.

Furthermore, the UAE’s liberalization of immigration laws will support domestic demand, boosting population growth. Economic growth prospects in the region will continue to be driven throughout the year by national diversification agendas. However, infrastructure investments such as the North Field gas expansion in Qatar, or giga-projects such as NEOM in Saudi Arabia will require substantial financing to plug investment gaps, where sources of funding are diversified across banks, capital markets and FDIs. As an international bank, Standard Chartered plays an important role acting as a bridge and creating opportunities to access capital from overseas into the region to further support economic growth.

Facilitating trade corridors in the world is another thing that differentiates us as a bank. To this end, we expect world trade to slow in 2023 as pent-up demand moderates and tighter monetary policies curbs new demand. Trade conflicts on account of geopolitical tensions may also affect trade flows in the coming months. The WTO predicts that global merchandise trade will grow by a modest 1 percent in 2023, down from 3.5 percent in 2022. That said, world trade could pick up in H2 as growth improves in China, the U.S. and the euro area.

17 conomy middle east APRIL 2023

Facilitating trade corridors in the world is another thing that differentiates us.

How does growth translate into gains for the bank in terms of retail sales, transactional banking and financial markets?

Strong economic growth for the GCC region and positive government confidence has created a strong sense of optimism amongst the private sector, investors and consumers. Supported by robust economic growth, governments in the region have invested in future economic projects and have taken several measures to incentivise the economy. These investments are targeted toward key pillars of the economy ranging from infrastructure, tourism, ease of doing business, private-sector schemes and citizen benefits.

All of this activity requires significant funding. This is where banks, other financial institutions, and capital markets play an integral role in providing the required financial capital. Banks stand to gain from this surge in economic activity, especially in a high-interest-rate environment. The growth of certain sectors, for example, real estate, strengthens profitability for banks through higher demand for mortgages. In addition, strong government confidence attracts high-quality investors and directs substantial FDI into its economies.

The region’s strong economic performance was reflected

in our results for the year, with our underlying operating income of $2,606 million having risen by 7 percent – driven by growth in Transaction Banking, Financial Markets and Retail. As the traditional boundaries between the financial and technology sector continued to blur over the last year, we also listened intently to our customers and invested in transforming our business digitally.

For example, we launched our API platform in Saudi Arabia to better serve our customers and align with the Kingdom’s ambition to be a regional digital hub, and we continue to be a bridge to bring in capital and facilitate trade and investment from overseas. An example of this was in September when we announced $566.4 million of Export Credit Agency-backed Islamic financing for Saudi Electricity Company to support a Saudi-Egypt electricity interconnection project, which allows Saudi Arabia and Egypt to exchange up to 3,000 MW of power.

Our business in the Africa & Middle East region achieved a year of record-breaking performance, recording its highest level since 2015. For the year ahead, we will continue to invest in our world-class financial markets and transaction banking businesses leveraging on the significant opportunities that exist in our region.

18 conomy middle east APRIL 2023

cover story

Sustainability considerations remain central to our growth ambitions and are shaping the future of banking. We take pride in introducing novel concepts to the market and supporting our clients in executing ground-breaking deals. To cite a few instances, we successfully closed the first carbon credit trade for the MENA Voluntary Carbon Market (“MENA VCM”), launched the region’s first Sustainable Supply Chain Finance program in partnership with Majid Al Futtaim, facilitated the signing of the first sustainability-linked loan by a private company, Landmark Group, and most recently, enabled the region’s inaugural Receivables Financing Facility for Siemens in the UAE.

How would you assess this year’s bond and Sukuk markets in Africa and the Middle East following their strong performance in 2022?

For 2023, we expect the bond and Sukuk markets to remain positive throughout the year. In the Middle East, countries such as UAE, Saudi Arabia, Qatar, and Egypt are poised to remain significant players in the capital markets, particularly in GCC countries, which are boosted by robust economic growth and a strong focus on economic diversification. This translates into an increasing number of project and infrastructure deals, bolstered by fixed-income issuances by both corporates and governments. However, factors that could potentially limit growth in the market include the fiscal surpluses that these countries have accumulated over the past year, in addition to higher borrowing costs.

Last year, we once again led the region's bond and Sukuk markets.

Last year, we once again led the region’s bond and Sukuk markets, taking the top spot in the AME league tables. In the Middle East, for example, we were proud to support the UAE Ministry of Finance in its inaugural issuance of the local currency treasury bonds worth AED 1.5 billion –the UAE’s first dirham-denominated treasury bond, which was 6.3 times oversubscribed during the first auction. In

Saudi Arabia, Standard Chartered acted as a Joint Active Bookrunner and Joint Green Structurer for the Public Investment Fund’s (“PIF”) issuance in the form of their $3 billion green bond. Overall, it proved to be a landmark transaction, ultimately achieving the milestone of first Sovereign Wealth Fund to issue a 100-year tranche in history and the largest ESG issuance from the region, fortifying Standard Chartered’s position as the leader in the GCC Debt Capital Markets.

For African markets, we expect renewed bond issuance activity, with the market to be conducive to innovation in different areas of the capital markets, whether it is in Sukuk issuances for sovereigns, partial/guaranteed bonds, or ESG-linked bonds, as the AME region’s syndicated market for green and sustainability-linked bonds and loans continues to deepen and mature.

The West African region is best positioned for Sukuk issuance, having a well-developed legal and regulatory framework for Islamic finance in general and Sukuk issuances in particular. Countries like Nigeria, Senegal, Gambia and Cote d’Ivoire have already issued domestic Sukuk and hence have the flexibility to tap the market when needed. The North African countries such as Egypt, Morocco and Tunisia have also made the necessary regulatory and legal changes and are ready for issuances.

19 conomy middle east APRIL 2023

South Africa too is home to Islamic banks and windows of conventional banks, and having done its debut international Sukuk in 2014, it is well positioned to tap this growing market. The countries of East Africa are at various stages of putting together the necessary infrastructure to issue Sukuks, and once ready, they can also join the growing list of issuers.

On the Islamic banking side, our Saadiq business also performed strongly across its diverse product range and continued to lead the market in innovative deals and transactions. As a result, Saadiq received global recognition as the “best Sukuk Bank” and “Best Islamic Investment Bank” by Global Finance and “Best Islamic Bank for Digital CX” by the Digital Banker. Key highlights include our role as the Sole Sustainability Structurer for Dubai Islamic Bank’s Sustainable Sukuk –the largest by a Middle East financial institution in the international capital markets since 2021. This was in addition to our role as one of the joint lead managers and bookrunners on Sharjah Property developer Arada’s $100 million Islamic bond deal after it tapped into an existing $350 million Sukuk that was issued and listed on the London Stock Exchange in June.

Saudi MCIT and Huawei sign ICT MOU

You showed excitement about the magnitude of the opportunities across the region. In which sectors do you see opportunities for growth and investment?

The growth we are envisaging in the Africa & Middle East region in the next five years is significantly higher than the growth we have had in the past five years. We are wellpositioned to tap into these growth opportunities, and also alongside accelerating our commitment to digitization and sustainability while also focusing on simplifying the business.

Africa is closely watched as the next big growth market –a description that has persisted for a while. The continent boasts the world’s largest free trade area (a market of 1.2 billion people), is the fastest urbanizing continent, and is home to some of the youngest populations in the world. The medium to long-term trajectory remains positive as today’s African citizens continue to build an enabling environment for the future. Sustainable economic development is core to the ongoing success of the continent.

Africa continues to create a digital ecosystem which is particularly crucial as a multiplier of growth, as access to smartphones and other devices enhances consumer information, networking, job-creating resources and even financial inclusion. Countries such as Nigeria, Egypt, Kenya and South Africa are powering the fintech industry in Africa, which is already an established global leader in mobile money. As a result, we see significant opportunities for collaboration and innovation through digital banking, ecosystem banking and blended finance to attract and direct additional capital to our markets.

In the Middle East, we are increasingly seeing markets diversifying their sectors. For example, the UAE is accelerating the country’s industrial sector transformation into a global manufacturing hub. Saudi Arabia, as part of its Vision 2030, continues to grow as a large attractive market that will continue to open and encourage private sector participation thereby enabling our global and regional customers to have the opportunity to participate in sectors like healthcare, education, entertainment and infrastructure.

20 conomy middle east APRIL 2023 cover story

You are involved in several green finance projects, the latest of which is the NEOM Green Finance Company. What is your program in this regard in a year that will witness the UAE hosting COP28, especially since the green concept has become inherent in almost all services and products, from green loans to green deposits, green investments, and others? Who do you think is the most prominent country in the region issuing green bonds and Sukuk? What will its future be?

As the effects of climate change continue to grow, as a bank we are keen to innovate and unlock paths to net zero. We must foster sustainable development which also creates a significant growth opportunity for the financial sector.

When we look at the Middle East, the UAE has made significant progress toward sustainable development. The UAE has closed some notable deals in the ESG segment such as First Abu Dhabi Bank’s green bond issuance, and the DP World’s green revolving credit facility, for which Standard Chartered was the Green Loan Coordinator.

In 2021, the Bank launched the first transition Sukuk, the landmark $600 million Sukuk facilitated Etihad to align with the United Nations Sustainable Development Goals in its carbon reduction targets, by investing in the next generation of fuel-efficient aircraft and developing the use of biofuels. In addition, Saudi Arabia will continue to be a major player in this segment. For example, we have successfully completed the first carbon credit trade for the MENA Voluntary Carbon Market (“MENA VCM”). The underlying transaction involving our key clients in the Kingdom is a clear demonstration of the promising potential of VCM markets globally. As announced by The Public Investment Fund (“PIF”) in September 2021, the MENA VCM is a core pillar of Saudi Arabia’s efforts to reach Net Zero by 2060.

In March 2022, five leading Saudi Arabian firms including Aramco, SAUDIA, ACWA Power, Ma’aden and ENOWA (a subsidiary of NEOM) joined the initiative as the first potential market partners. It’s likely that we will see demand grow as investor confidence in the region’s ESG credentials increases.

In addition to green instruments, it is important to recognize the role of regulators in this market. By providing guiding principles and the appropriate support, they can deliver a framework for the market to continue to grow. There are four key areas that regulators should consider: creating certainty, encouraging collaboration, facilitating awareness and fostering innovation. Supporting the provision of these should be a focus for market participants so that they can be confident in the long-term health of the market.

Ahead of COP 28 this year, we remain committed to integrating environmental and social considerations into our decision-making while supporting the massive shift of capital toward sustainable finance, which has become a priority for investors, companies, and individuals.

Are you combining Fintech, AI and potentially Web3 into your digital banking offering?

At Standard Chartered, fintech partnerships are powering our digital-first banking services that address diverse client needs. These partnerships and new capabilities have helped clients to connect quickly, easily and seamlessly to banking services while improving financial access for their clients and suppliers or other ecosystem members such as institutional investors.

A strong model for an effective bank-fintech partnership involves identifying complementary skillsets and mutually supporting areas of expertise and capabilities that combine into unique value propositions. The resulting propositions, stronger than what a bank or fintech could deliver on its own, aim to solve practical problems and advance strategic objectives for clients and markets. A partnership approach accelerates client access to that innovation. Meanwhile, banking clients can take advantage of the stringent due diligence that banks bring to vetting their fintech partners.

21 conomy middle east APRIL 2023

As a bank, we are keen to innovate and unlock paths to net zero.

Crypto.com executive lauds UAE's supportive stance on crypto, future of finance

Anziani says country at forefront of innovation

Economy Middle East recently had the opportunity to sit down with Eric Anziani, president and COO of Crypto. com, a comprehensive cryptocurrency platform offering a wide range of services including trading, investing, staking, wallets, NFTs, and more. With a vision to make cryptocurrency accessible to everyone, Crypto.com is on a mission to accelerate the world’s transition to digital assets. During our interview on the sidelines of the Investopia event, we discussed the future of finance and the role of crypto, as well as the United Arab Emirates’ initiatives to attract global talent to the field.

It’s been somewhat of an active year for Crypto. How would you define the global landscape moving forward?

Definitely, 2022 has been a very challenging yet interesting year for the world, including the crypto industry. We have seen massive inflation, the conflict in Ukraine, and supply chain disruption, all coming out of the COVID situation, and those are the things that we dealt with. These macro conditions have had an impact on the financial services sector and the crypto industry. We’ve seen some consolidation in the industry as well as some actors who operated a little riskier and faced bankruptcy. It’s tough in the short term but I think good and healthy for the global crypto environment as it prepares for the next phase. At Crypto. com, our focus is on identifying new use cases that can help our customers continue to generate value in the current market conditions and beyond.

22 conomy middle east APRIL 2023

banking & finance

Eric Anziani, President and Chief Operating Officer, Crypto.com

The UAE has fast become a favorable destination for cryptocurrencies. What’s the underlying reason for that?

The UAE has been at the forefront of innovation, always forward looking, which is very important, eyeing new lines of business, studying the next economic opportunities to be built, to grow the country as a hub and benefit all its people. I find the culture here is one that cares about people, which is very close to the philosophy of crypto in terms of building communities and taking care of them. We’ve seen the government being very supportive in putting in place the right environment for growth in our industry. Having a regulatory framework that is fit for purpose is essential for companies to succeed in the industry. It provides clarity on how to operate, and we have been working closely with the VARA team. A few weeks ago, they published a very comprehensive regulatory framework that companies can use as a guide, and that’s very important. In addition, the government’s economic push recognizes the critical role that digital assets and the future of finance will play. The Dubai Economic Agenda 2033 (D33) and the Abu Dhabi Economic Vision 2030 both support digitization, digital assets, and the future of finance. This

supportive government is putting in place the right framework and collaborating with private sector partners to ensure responsible innovation in the space.

You are a key partner at Investopia. What are some of the key synergies that you share with the organizers?

We are very honored to be the founding partner of Investopia. I was there a year ago with His Excellency Abdullah bin Touq Al Marri, UAE minister of economy, to kick start the event. It’s a great platform to bring global leaders to the UAE to look at the challenges and the opportunities arising from them This enables us to leverage global intelligence and build new opportunities in the UAE. Therefore, we are excited to continue participating in this event. As a global player, we are committed to bringing to the table our expertise, best practices, and some of the research our teams have published, to address real transactional problems that people face. Our aim is to lower costs, ensure secure transactions, build new identities in the digital world using NFTs and Web3.0, and integrate games and crypto. These are all exciting topics that will help bring this space to the mainstream.

Crypto.com secures MVP Preparatory License from Dubai’s Virtual Assets Regulatory Authority

Crypto.com has announced that it has received the MVP Preparatory License from Dubai’s Virtual Assets Regulatory Authority (VARA), allowing it to fulfill all pre-conditions required to undertake MVP market operations within the VARA regime. The license will enable Crypto.com to extend its range of regulated virtual assets activities, including crypto exchange services, brokerage, margin/ leverage trading, and OTC offerings around settlements for institutional investors. This comes after Crypto.com received its initial provisional approval from VARA in June 2022. The MVP preparatory license was granted after a detailed review of Crypto.com’s personnel, governance procedures, best-inclass compliance practices, Anti Money Laundering/Countering the Financing of Terrorism (AML/ CFT) capabilities, Know Your Customer (KYC) and Ultimate Beneficial Owner (UBO) policies and procedures, cross-border safety and security measures, and compliance practices.

“We are pleased to welcome Crypto.com to the MVP program preparatory phase,” said VARA’s CEO Henson Orser. “Participation from credible players like Crypto. com will further our mission of delivering a progressive and future-focused regulatory framework.”

Kris Marszalek, CEO of Crypto.com said: “With the MVP Preparatory License, we look forward to continuing to work with regulators in providing customers the most comprehensive and secure crypto.

23 conomy middle east APRIL 2023

Rise of Open Banking in MENA: A Customer-Centric Financial Ecosystem

Leveraging fintech agility & banks’ scope to drive scalable products

Tarabut Gateway made history in December 2019 as the first regulated Open Banking platform to go live in Bahrain with its API infrastructure in the MENA region. Since then, the company has been making waves in the industry, earning significant media attention for its accomplishments.

In 2021, the firm secured a record-breaking $13 million in fintech seed funding, followed by another $12 million later in the year. Notably, Tarabut Gateway became the first open banking platform to obtain both account information services and payment initiation services licenses from the Dubai Financial Services Authority (DFSA) in 2022.

Today, the company has offices in Bahrain, the UAE, and Saudi Arabia. Founder & CEO, Abdulla Almoayed, credits the company’s success to its commitment to Open Banking and the appeal of the sector, which prioritizes giving control back to the customer. In this article, we explore the key strategies behind Tarabut Gateway’s growth and success in the Open Banking space.

What is open banking really about?

At its core, open banking creates a more connected, customer-centric financial ecosystem by leveraging technology that allows customers to regain control of their financial data. With customers’ consent to securely share regulated financial data between banks and approved thirdparty providers, it enables innovative services, including personal finance management tools, investment apps and peer-to-peer lending platforms. Open banking enables banks to provide more personalized services, improve customer experiences, add revenue streams and enhance risk management. For fintech, open banking aids in developing fast, efficient and scalable products. Consumers benefit from greater ease in moving their money, doing it more quickly (mostly in real-time) and securely.

What are the emerging trends that are changing the global openbanking market?

One of the most significant trends is API standardization. Standardization provides a common language for banks and third-party providers to communicate, reducing development costs and simplifying compliance requirements. This is crucial as the open-banking ecosystem expands to include a broader range of stakeholders, such as non-bank financial institutions, fintech startups and other third-party providers. Secondly, regulatory developments are driving adoption of open banking worldwide. Europe’s revised Payment Services Directive (PSD2) has mandated banks to open their APIs to third-party providers. Central Banks across MENA have introduced open banking frameworks to promote competition and innovation in the

financial industry. Finally, AI-powered systems can analyze large volumes of data in real time to detect and prevent fraudulent transactions and provide personalized product recommendations and financial planning tools.

What are the key elements for financial institutions to achieve a successful open-banking system?

Establishing successful open banking is as much psychology as technology. Financial institutions must adopt a mindset embracing change and innovation and prioritize allocating budgets toward regulation and compliance. This includes exploring the use of APIs beyond compliance checkpoints and providing strong API architecture and new premium APIs. Technical implementation is essential, starting with a public-facing API that offers various services using defined

24 conomy middle east APRIL 2023 banking & finance

Abdulla Almoayed, Founder & CEO, Tarabut Gateway

protocols. Financial institutions need to establish isolated testing environments (or “sandboxes”) in which developers can test new code without affecting live platforms.

A developer portal also serves as a central information hub that details API products, documentation and microservices for design teams. A consent management system and a robust customer verification method are essential to ensuring customer data privacy and security.

What is driving the development of open banking in the Middle East? And how strong is this trend in our region?

The Middle East’s open banking market is mainly driven by regulation, similar to Europe. The region’s forwardthinking regulators constantly learn from other markets and support fintech growth. The MENA region has demographic advantages, historically strong entrepreneurialism, a businessfriendly environment and impressive internet connectivity. Nearly 93 percent or 580 million people have access to mobile telecommunications, and by 2025, smartphone penetration is forecast to reach 80 percent in MENA and over 90 percent in the GCC. Open banking aligns with many MENA countries’ 2030 Economic Visions aiming to diversify away from oil and gas reliance. Financial institutions in the region view open banking as an opportunity rather than a threat and understand its potential. There are over 800 fintech start-ups with a total value of $15.5 billion, according to Dealroom.

How important are innovation and technology to the development of the finance industry?

Open banking is a prime example of how new technologies like APIs, data analytics and machine learning create a more connected and efficient financial ecosystem. Open banking is already driving better services and encouraging greater competition in MENA’s financial sector.

Despite substantial progress, there are still gaps in the region’s financial services industry. Standardization

and interoperability between different financial systems are lacking. Some communities have imperfect access to financial services and poor financial literacy. Banks, regulators and fintechs must collaborate to address these gaps.

How does Tarabut Gateway ensure security and protection against fraud?

Our consent management system allows users to consent to share their data with regulated and approved entities, and this can be revoked at any time. We adhere to customer data protection laws in every jurisdiction where we operate and continuously monitor and strengthen our security measures.

Our consent management system uses end-to-end encryption with modern ciphers to ensure data is protected both in transit and at rest. All requests are cryptographically signed and chained using a “public key/ private key” framework.

Tarabut Gateway enables direct

bank-to-bank payments, removing intermediaries and mitigating the risk of credit/debit card data theft.

Can you tell us more about your key achievements and what is next in your business plan?

We were the first licensed openbanking platform both in Bahrain and Dubai. We are grateful for the opportunity to be among the first fintechs to test in the Saudi Central Bank’s sandbox, cementing our position as a leader in the field. Last year, we were selected as the technology platform partner for DIFC’s Open Finance Lab. We have also established partnerships with leading banks and fintechs across the Kingdom of Saudi Arabia and Bahrain, including Alinma Bank, Riyad Bank, Rain and Tamam.

With a particular focus on the KSA, our mission is to provide MENA’s openbanking infrastructure and build a collaborative ecosystem that benefits everyone from banks and fintechs to merchants and consumers.

25 conomy middle east APRIL 2023

Unlimited scalability, demystifying complexity

Network International offers a highly advanced suite of payment products, services

Recently, e& announced a strategic partnership with Mastercard aimed at benefiting consumers and businesses in 16 markets across the Middle East, Asia, and Africa. The collaboration will offer innovative technologies and user-friendly experiences powered by Mastercard’s capabilities when using digital financial services provided by e& operating companies. To enable this initiative, Mastercard is providing a fullyfledged payment processing platform through its partnership with Network International, a leading enabler of digital commerce in the MEA region. To learn more about this strategic partnership and the payments sector, Economy Middle East interviewed Navneet Dave, Group Managing Director - Processing, Middle East & CoHead Group Processing, Network International.

What is Network International’s role as the key payments processor in e& and Mastercard’s partnership?

The collaboration between Network International, e&, and Mastercard marks a significant milestone for the UAE, as it is the first time a telecom company has expanded its offering to become a digital payments player. Network International is playing a crucial role in enabling e& and Mastercard to provide a comprehensive payment processing platform that will revolutionize digital

payments for 10 million consumers in the UAE.

By utilizing Network International’s payment solutions, Mastercard is helping e& to diversify its revenue streams and make a smooth transition to digital commerce, with the exclusive prepaid card enabling payments worldwide. This groundbreaking initiative also highlights how institutions like e& can leverage Network International’s technology infrastructure and capabilities on a large scale to enter the payments space.

Can you highlight Network International’s network capability and technology infrastructure?

We love all the innovative ideas fintechs bring to the table, but we also understand they lack the necessary infrastructure to execute their plans. At Network International, we offer a suite of highly advanced payment products and services to provide fintechs with the resources they need to stay ahead of the game and meet the needs of their end-users.

26 conomy middle east APRIL 2023

banking & finance

Navneet Dave, Group Managing Director - Processing, Middle East & Co- Head Group Processing, Network International

Our open and flexible pan-regional technology platform allows for easy integration with entities through Rest APIs. We prioritize scalability, openness, and availability in our platform’s design, enabling fintechs worldwide to connect to a single Network sandbox with the same set of APIs. Furthermore, we manage data residency requirements by routing requests based on the country of operation to the appropriate localized cloud platform.

We seamlessly span through size and complexity with easy scalability, which means we can accommodate clients whether they have 1,000 or 10 million customers to serve. Most importantly, our exceptional resilience minimizes downtime in processing with nearzero-fault tolerance.

What are the key payment trends for 2023?

In 2023, we anticipate a rise in mobile payments via wallets, virtual and tokenized cards, along with enhanced security features enabled by biometric authentication methods. I also see growing integration of AI and machine learning continuing to expand in payment applications, enabling improved fraud detection and personalized recommendations. In terms of innovation, voice recognition for making payments is gaining momentum, while the advent of virtual reality and metaverse environments will likely result in augmented reality being used to provide shoppers with more tangible online experiences. Furthermore, digital currencies are expected to become more prevalent.

With non-financial institutions and non-banks entering the payments space, how will this develop the payments ecosystem?

This initiative highlights the growing trend of non-banks offering enhanced customer experiences, such as faster onboarding, simpler access to financial services, and features like loading wallets through IBAN,

remittances, B2B and P2P transfers, and more.

As a result, banks can expect to face greater competition as non-banks introduce more compelling Super App propositions, potentially driving them to launch more innovative solutions as well.

Apart from e&, what steps should other major sectors such as energy, travel, and transport take to enter the payments space?

Our robust suite of payment products and services and our infrastructure can serve large fintechs and facilitate the transition to digital payments for any category of clients outside of banking and financial institutions. We are ready to help any business, in any sector, anywhere in the region, effectively transition to digital payments.

We indeed anticipate a growing number of non-banks and financial institutions entering the payments space, driven by global trends toward the adoption of new payment methods. This will allow them to better serve the evolving needs and behaviors of their customers.

Although this presents a significant challenge for financial institutions facing alternative payment players with more extensive relationships, reach, and innovative solutions, it ultimately creates positive disruption for consumers.

The collaboration of Network with the partnership between Mastercard and e& serves as a significant catalyst for

major sectors in the country to explore and adopt digital payments. It demonstrates that non-bank industries can participate in the payments ecosystem, emphasizing the availability and significance of trusted players offering core processing services that enable these industries to explore more business opportunities and enhance competitiveness. Furthermore, it encourages trust in companies like Network, which can simplify the complexity of payments and provide clarity to their clients.

What is Network International’s growth trajectory in the UAE in terms of key focus sectors and markets for 2023 and beyond?

At Network International, our growth strategy centers around diversifying payment and acceptance methods while enhancing value propositions for merchants, financial institutions, fintechs and verticals.

We are actively seeking opportunities to assist our partners in meeting the payment needs of their digitally-driven customers while also working to include unbanked and underserved citizens in the financial services ecosystem. We are intensifying our focus on building new client relationships and adding value to existing ones by investing in machine learning, AI, process automation, data and analytics and other key areas. Our ultimate goal is to establish deep trust within the markets we serve and among our partners.

27 conomy middle east APRIL 2023

D33: An unprecedented economic transformation agenda to reimagine the future of Dubai

DAMAC Group Chairman Hussain Sajwani delves deep into what the newly-launched roadmap represents and how its four key focus areas will help turbocharge Dubai’s growth and development over the next decade

Dubai has a long history of embracing change and fresh thinking, from its early days as a small trading port to its current status as a global hub for tourism, trade, and investment. While the city’s strategic location, advanced infrastructure, abundant resources, and political stability have all contributed to its rapid transformation, it is Dubai’s constant desire and unique ability to reinvent itself that is fueling its exceptional journey.

As it gears up to mark 200 years since its foundation, the city’s forward-thinking leadership led by His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai, has put the Dubai Economic Agenda ‘D33’ in motion, offering us a window into the future of the Middle East and the world.

The recently launched bold and audacious agenda has set its sights high, with several ambitious goals outlined for Dubai to reach during the next decade. It aims to position Dubai among the world’s top three economic cities, top three international destinations for tourism and business, top four global financial hubs, and top five leading logistic hubs, among many other targets. With 100 transformative projects planned to achieve the D33 agenda, Dubai is envisioned to become the most important global business centre when it celebrates its second centenary in 2033.

As with many previous strategies, economic diversification is the underlying theme of the new agenda. While it directs that traditional trade and economic sectors be developed further, the roadmap has a strong focus on increased investment in future growth sectors,

28 conomy middle east APRIL 2023

economy

Hussain Sajwani, Chairman, DAMAC Properties

with sustainable economic growth and self-sufficiency in key sectors and industries being Dubai’s priorities. In the process, the agenda will open up new avenues for the city’s private sector to thrive more and more. With all the new projects and initiatives rolled out, Dubai will see the size of its economy double to AED 32 trillion over the next 10 years. Four key focus areas of this agenda have piqued my interest in particular – partnerships, technology, education, and people empowerment. D33 attaches great importance to expanding Dubai’s partnerships with the rest of the world to enhance foreign trade. The Dubai Economic Corridors 2033 initiative aimed to strengthen existing foreign trade relations with Africa, Latin America and Southeast Asia and the plan to add 400 cities as key trade partners will be a game changer in Dubai’s growth. These initiatives will enable it to harness the strengths of its partners to create new business opportunities while also sharing prosperity with them. One of the key factors that set Dubai apart from other cities is its willingness to embrace and be at the forefront of new technologies. Unsurprisingly, technology finds a prominent place in the D33 agenda. It is promising to see that the leadership is giving much weight to innovation and future technologies to reinforce Dubai’s reputation as a global tech hub. Sandbox Dubai, which aims to make the city a major hub for incubating business innovation by enabling the testing and marketing of new products and technologies, will be a huge step toward this goal as it will attract more tech talents and entrepreneurs to be part of Dubai’s pioneering journey. As befitting the avant-garde economic blueprint, Dubai is hoping to generate a new economic value of AED 100 billion

from digital transformation annually.

Another important aspect of Dubai’s D33 agenda is its focus on education and human capital. Making Dubai a hub for higher education and investing in human development and skillsets are integral components of the agenda. It is worth highlighting that Dubai’s visionary leaders have prioritised the integration of new generations of Emiratis into the private sector. The plan to attract 65,000 young Emiratis into the sector over the next decade will have a profound positive impact on the sustainable growth and development of the UAE’s economy and its society. In line with this exemplary initiative, I was so pleased that the social responsibility arm of DAMAC Group proactively collaborated with The Knowledge Fund Establishment and the Dubai Schools Project to offer scholarships to Emirati children for a 5-year period.

As someone who has closely watched and been a part of Dubai’s growth story over many decades, I believe this D33 agenda has no parallel and is set to turbocharge the growth and development of Dubai in ways unimaginable, with the new wave of opportunities it will unleash in various sectors. Opportunities abound and goals are set. It is just a matter of time to see Dubai bounding down the road to holistic economic development, sustainable prosperity, and global leadership in key sectors and industries.

29 conomy middle east APRIL 2023

Banks face challenge of expanding financial inclusion to achieve growth

Nearly 1 billion women in developing country households remain outside formal financial systems

Over the past decade, various terminologies have emerged, such as sustainable development, good governance, responsible capitalism, and inclusive growth, among others. This highlights the increased awareness among societies and decision-makers that economic policies must consider social dimensions and justice to fulfill the aspirations and needs of people and avoid social and economic instability. Furthermore, the recent discourse on financial inclusion has added to this economic discussion. Research has demonstrated that achieving financial inclusion has a positive correlation with promoting growth and generating job opportunities, as it facilitates a more equitable distribution of capital and risk. Therefore, financial inclusion has gained paramount importance as an essential component for promoting all-encompassing growth and fostering overall economic development in the Middle East and MENA region. The progress towards achieving large-scale financial inclusion has been significantly accelerated by technological advancements and innovations in the banking sector. This underscores the pivotal role that banks and financial institutions are playing in transforming the financial inclusion landscape.

So, what is financial inclusion and why is it important?

Financial inclusion, as defined by the World Bank, refers to the provision of affordable and convenient financial products and services to individuals and businesses to meet their financial needs. These products and services include transactions, payments, savings accounts, credit facilities, loans, insurance services, and more. It is essential that these offerings are delivered in a responsible and sustainable manner to ensure that they are accessible to everyone.

Financial inclusion has been identified as a catalyst for achieving seven of the seventeen Sustainable Development Goals. The World Bank recognizes it as a crucial enabler for eradicating extreme poverty and promoting shared prosperity. Recent data from the World Bank indicates significant progress in financial inclusion, with 76 percent of adults worldwide now

having access to accounts through financial institutions or mobile financial service providers, up from 51 percent in 2011. Developing countries have shown a particularly noteworthy rise in account ownership, with figures increasing from 63 percent to 71 percent in recent years, largely due to increased access to accounts in several developing nations. This growth is a significant departure from the previous period of 2011-2017, where growth occurred primarily in China or India. Mobile money has played a vital role in increasing account ownership in Sub-Saharan Africa. The gender gap in developing economies narrowed from 9 percentage points to 6 percentage points in 2021, according to recent data. The figures show that 74 percent of men and 68 percent of women in developing countries have a bank account. Globally, 78 percent of men and 74 percent of women had bank accounts,

30 conomy middle east APRIL 2023

economy

resulting in a gender gap of just 4 percentage points. However, these statistics also highlight the significant gender inequality that persists in Arab societies. Despite the Arab Monetary Fund’s urging of Central Banks to prioritize financial inclusion and the yearly celebration of the “Arab Day for Financial Inclusion” on April 27, there is still much work to be done to bridge the gender gap in financial access. Despite some progress, financial exclusion remains widespread in Arab countries, as evidenced by various indicators. The Arab Monetary Fund acknowledges that there is still much work to be done to improve financial inclusion metrics, citing recent World Bank data that reflects the efforts of Arab nations to improve access to financial services. The data shows that the proportion of adult males in Arab countries with access to formal financial services has increased on average to 48 percent, while for women, it has only risen to 26 percent. The statistics also reveal a 48 percent increase in access for low-income groups. While these figures do highlight a gender disparity in Arab societies, they also present significant opportunities to enhance financial access in these communities by promoting the social responsibility of financial institutions and implementing appropriate credit policies that target disadvantaged individuals.

The UAE Central Bank has recently launched the Financial Infrastructure Transformation Program to expedite digital transformation in the financial sector. The program’s goals are to support the financial services industry, promote digital transactions, achieve financial inclusion, and introduce secure and effective payment innovations towards a cashless society.

Similarly, in Egypt, the Central Bank of Egypt has made financial inclusion one of its policy objectives and recently announced a strategy for 2022 that aims to expand financial services to individuals who have not previously used banking services, with the goal of achieving economic growth.

Targeting community groups

While it is true that banks are making efforts to provide financial services to more people, targeting specific segments of society, such as young adults aged between 16 to 21 and self-employed women, is crucial for building on the progress made in the region.

This is where the importance of the “Know Your Customer” (KYC) system used by financial institutions comes into play. The system helps banks gain insight into their customers’ goals, needs, and circumstances, and enables them to determine if the customer requires additional support. An official responsible for financial inclusion in an Arab bank emphasizes the need for close cooperation between governments and banks to develop a joint strategy aimed at achieving the highest rates of financial inclusion. Governments should prioritize financial inclusion as a key aspect of their overall development strategies, much like poverty alleviation. For their part, banks should adopt a strategy that expands their customer base, identifies marginalized groups, and prioritizes their financial inclusion.

Inclusion and women

Despite notable advancements in recent years and the efforts of numerous organizations around the world to increase women’s financial inclusion, the gender gap remains.

According to the Global Findex database, almost 1 billion women living in the poorest 40 percent of households in developing countries remain excluded from the formal financial system. However, financial inclusion can significantly contribute to women’s economic empowerment. For instance, access to formal savings accounts can help women manage economic shocks, and digital payments can enable women to have greater control over their income and transactions. Targeting women in financial inclusion policies requires the following steps:

• Conducting a comprehensive market study to gather data on the detailed use of financial services across gender, age, and regional groups.

• Implementing financial education programs specifically designed for women to enhance their financial literacy and promote better financial behavior.

• Strengthening educational curricula to include topics such as social responsibility and financial efficiency.

• Developing new financial instruments that directly target women based on their economic needs.

It’s important to note that the ultimate goal of financial inclusion is not only to improve financial indicators but also to improve economic indicators for society as a whole. Achieving economic inclusion, through various means including financial inclusion, is critical for securing a better future for people.

31 conomy middle east APRIL 2023

Risk management and stress tests: Crucial tools in times of uncertainty

Federal Reserve’s tightening policy contributes to bank losses

What caused the proliferation of bank collapses in the U.S. and how did their consequences extend to other countries and banks? Is this reminiscent of the global financial crisis of 2008?

The root of the current situation can be traced back to the bankruptcies that hit a number of American banks, with far-reaching effects on banks outside the U.S., particularly in Europe.

Three major U.S. banks – Signature, Silvergate Capital Bank and California-based Silicon Valley Bank –declared bankruptcy within a week, making it the largest bank failure since the 2008 financial crisis. This sent shockwaves throughout global financial markets.

As soon as bankruptcies were announced, Speculation that history was repeating itself and that the 2008 crisis was about to engulf the world once more began to circulate. This was compounded by the challenging situation faced by the prestigious “Credit Suisse,” which required a government rescue plan to prevent its collapse.

Let’s examine what occurred in 2008. In September of that year, the crisis erupted with the announcement of the bankruptcy of U.S. bank “Lehman Brothers,” triggering a banking and financial meltdown that was later regarded as the most severe since the Great Depression of 1929.

The crisis initially began in the U.S., but it spread to many countries around the world. In 2008, the number of banks that failed in the U.S. was 19, and it was anticipated that more failures would occur among the remaining 8,400 or so American banks.

32 conomy middle east APRIL 2023 economy

Is this a repeat of 2008 but with a modern-day format?

The current situation cannot be considered a sequel to the 2008 global financial crisis. In response to that crisis, a regulatory system was established, designating the world’s major investment banks as “too big to fail” and requiring them to hold significant amounts of cash or liquid reserves to survive any future financial turmoils.

The reasons behind the current collapse of US banks are apparent, and they are closely linked to the Federal Reserve’s hawkish policies. The Federal Reserve raised interest rates in an attempt to control inflation, which had risen to extremely high levels.

U.S. banks accumulated substantial deposits during the pandemic and invested a large portion of their inflated portfolio of deposits in low-risk Treasury Bonds, but failed to implement adequate preventive measures. This exposed them to interest rate risk, as the rising interest rates eroded the value of their long-term bonds, as in the case of Silicon Valley Bank. As interest rates increased, the value of long-term bonds held by U.S. banks decreased due to their inverse relationship with interest rates. This resulted in significant losses, which were further compounded when bank depositors made substantial withdrawals.

The banking crisis spread to Europe, specifically to Switzerland, where Credit Suisse faced significant setbacks and a decline in its share price, prompting authorities to intervene to save it.

Although the difficulties faced by the Swiss bank differed from those of Silicon Valley and Signature banks, Credit Suisse’s troubles heightened concerns about the overall economy.

Why did this happen?

The current crisis can be attributed, in part, to mismanagement of asset and liability risks by bank officials, which has resulted in a rapid decline in depositors’ confidence. Silicon Valley Bank, in particular, took on excessive risk, as it was not subject to the same level of regulation as other major U.S. banks that adhere to Basel III standards. This lack of regulation was a key contributing factor to the current predicament.

In 2018, then-U.S. President Donald Trump passed a liberalization law that exempted thousands of small banks from strict regulations and relaxed the rules that large banks had to follow. Under this law, the asset limit for “significant financial institutions” was raised from $50 billion to $250 billion. However, Silicon Valley Bank was not subject to stricter regulations that applied to top-rated banks because it was not classified as a significant financial institution.

In other words, Silicon Valley Bank was able to invest billions of dollars of its own deposits in U.S. Treasuries without having to hold sufficient reserves to protect client funds, should markets move against the bank’s interests. This was due to the bank not being subject to the stricter regulations of Basel III standards, unlike other major U.S. banks.

After the 2008 financial crisis, banks were required to maintain 100 percent liquidity coverage, meaning they must hold enough high-quality liquid assets to finance cash outflows for 30 days. Treasury Bonds were among the assets

that banks could hold for liquidity purposes. However, with the Federal Reserve raising interest rates continuously since last year, the value of older, longer-term bonds has fallen, causing significant losses for bondholders.

The repercussions from Silicon Valley Bank’s collapse have increased credit risk globally, as investors fear further failures in corporate debt markets.

The situation creates a “moral hazard” in economics, where a bank or investor has an incentive to increase financial risk because they are shielded from the potential consequences of it.

Many economists argue that moral hazards in financial markets increase the potential of harmful economic activity, while others believe that maintaining incentives to reduce financial exposure can help markets avoid excessive and reckless risk-taking.

Stress tests

Thus, it is crucial that central banks and regulatory bodies carefully consider the potential repercussions of their policies, especially when it comes to raising interest rates. The Federal Reserve’s recent tightening policy has already caused U.S. banks to suffer unrealized losses of $620 billion from yet unsold assets that have lost value according to data from the Federal Deposit Insurance Corporation.

These events underscore the importance of accountability for central banks and regulatory bodies when it comes to hedging risks and preventing crises before they occur. Laws related to banks, such as stress tests, must be strictly enforced to ensure that institutions are adequately prepared for economic and financial shocks.

Stress tests are essential tools for banks’ risk management and are among the most important precautionary safety measures at both the macro and micro levels in the banking sector. They provide a snapshot of financial institutions’ ability to withstand difficult scenarios, allowing regulators and managers to assess their resilience and take appropriate measures such as capital consolidation, procedural modifications, and advanced contingency planning. In times of uncertainty, risk management is paramount.

33 conomy middle east APRIL 2023

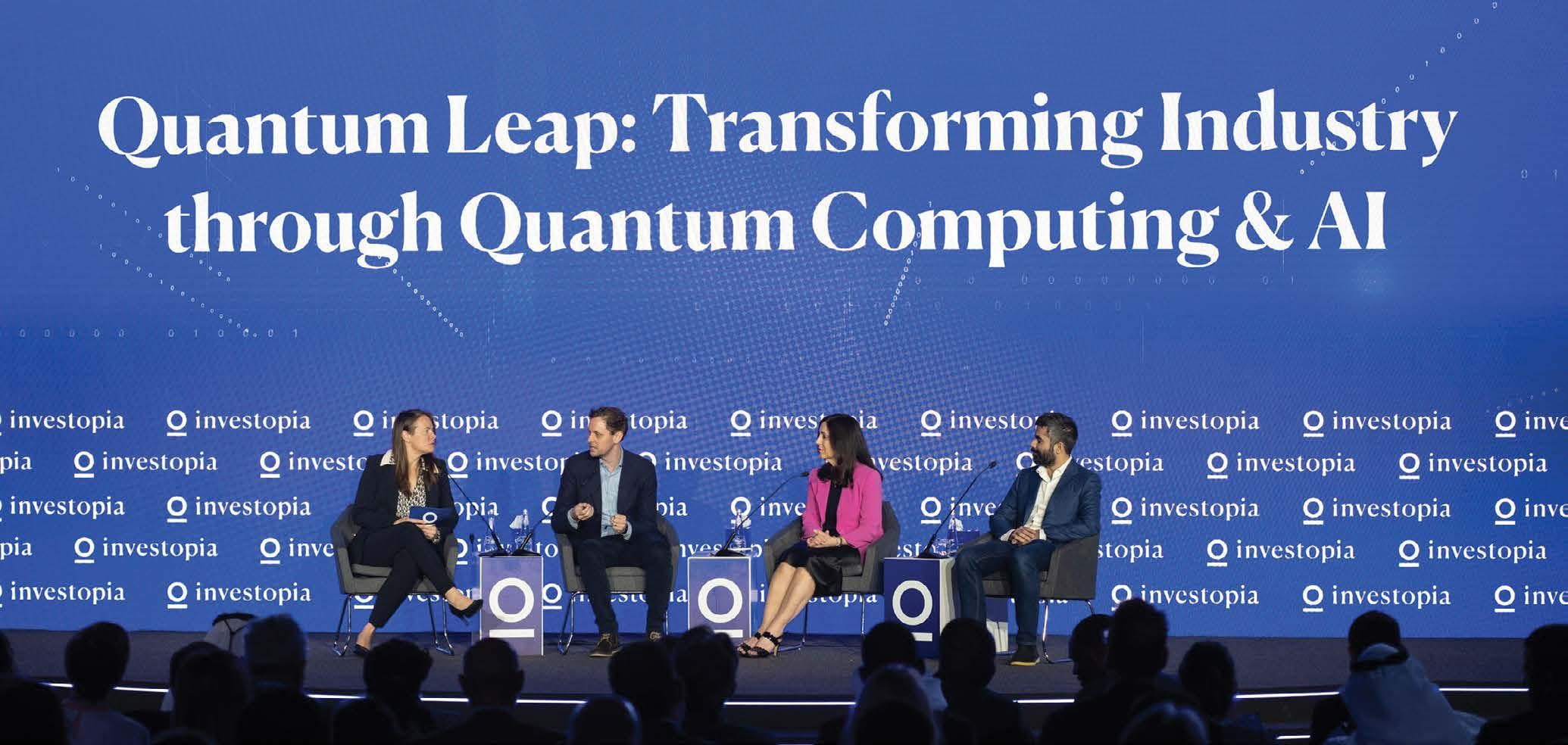

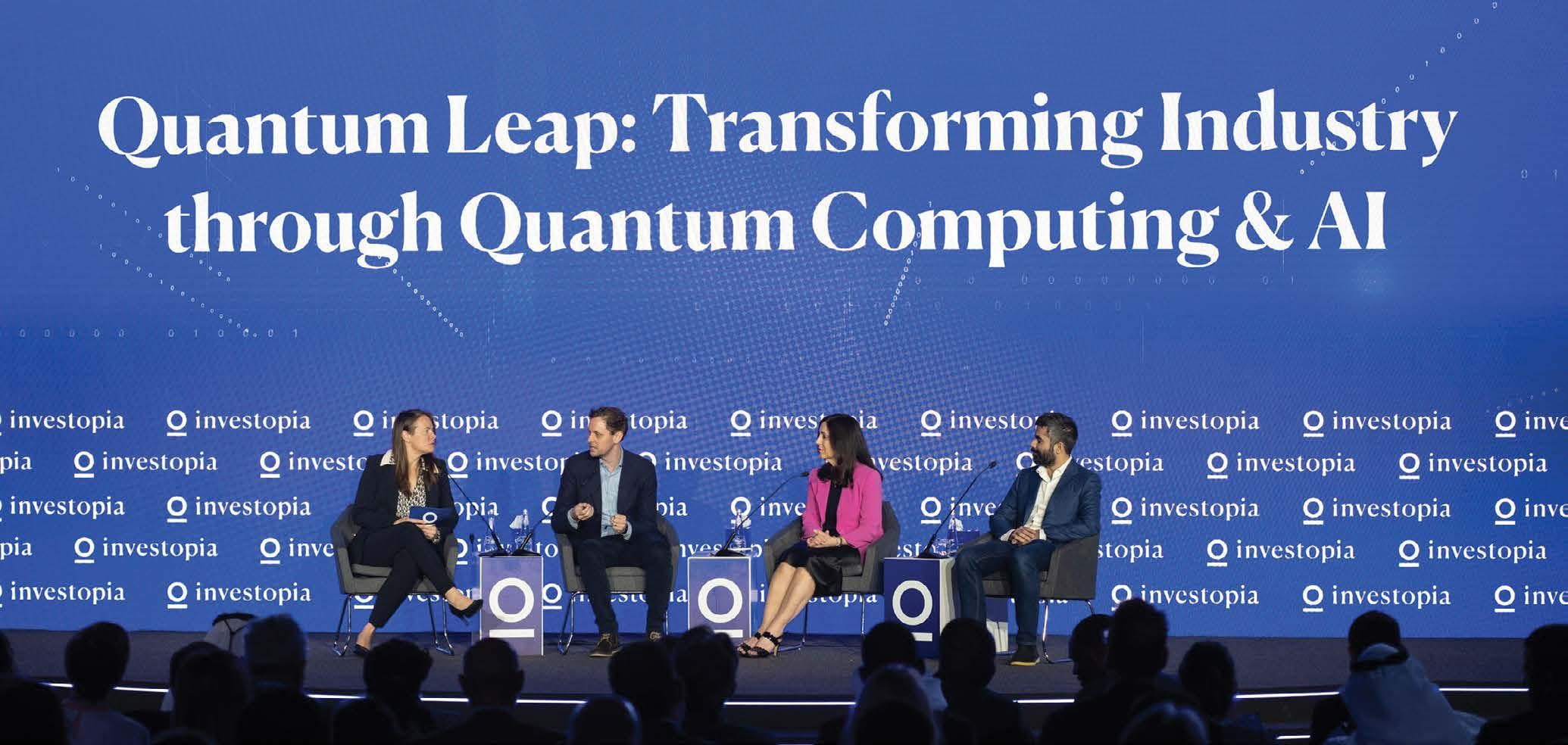

Investopia 2023: Bringing minds over matters Conference tackles global challenges, envisions opportunities

The launch

On March 2nd, H.E. Abdulla bin Touq Al Marri, the Minister of Economy and Chairman of Investopia, launched the second edition of Investopia, a global investment platform that brought together over 2,000 investors, government officials, thought leaders and entrepreneurs. These participants engaged in 35 sessions and roundtables, where more than 100 speakers – including investors, thought leaders, and decision-makers – discussed various topics such as institutional asset allocation, AI, emerging markets, venture investing, digital assets, mobility, biotechnology and more. Of the Investopia participants, 56 percent were from the UAE while 44 percent represented more than 100 nationalities from abroad. Among them, 75 percent were from the private sector, 13 percent from the public sector, 6 percent from academia and students, and 6 percent from other international organizations and diplomatic

missions.

Bin Touq stated, “The UAE is now focused on doubling economic growth, increasing foreign direct investment, and investment outflows. The recent 100 percent foreign ownership policy has led to a significant increase in demand from international companies to operate in the UAE, which is expected to generate revenue of AED 2.2 trillion.”