JANUARY 2023

RETIREMENT DESIGNED FOR YOU ®

At Legato Financial Group, we believe everyone should be able to live the retirement they’ve always wanted. Our team of professionals will help you by designing a well-thought-out strategy, using our proprietary process called the LFG Retirement Blueprint.

Call us today to schedule a complimentary assessment. 1-877-573-2043

Elizabethtown Office: 2905 Ring Road, Elizabethtown, KY 42701 Louisville Office: 10200 Forest Green Blvd Suite 600, Louisville, KY 40223 VISIT LEGATOFINANCIAL.COM

Learn more about the most important topics impacting your retirement by attending an event. Scan the code or call us at 877.573.2043 to register today!

Legato Financial Group, Inc is an independent financial services firm that utilizes a variety of investment and insurance products. Investment advisory services offered only by duly registered individuals through AE Wealth Management, LLC (AEWM). AEWM and Legato Financial Group are not affiliated companies. 816150 - 3/21

5608 N. Dixie Highway, Elizabethtown I Phone: (270) 765-2141 DEALERSHIP MON - SAT 9:00AM-7:00PM SERVICE & PARTS MON - FRI 7:30AM-5:00PM & SAT 7:30AM-3:00PM COLLISION CENTER MON - FRI 8:00AM-5:00PM www.hardincountyhonda.com

HARDIN COUNTY HONDA

SPEND YOUR TIME ENJOYING THE MOST IMPORTANT THINGS. IRELAND HEATING & COOLING, INC. HAS BEEN YOUR TRUSTED HEATING & AC EXPERT IN HARDIN COUNTY AND THE SURROUNDING COMMUNITIES FOR OVER 50 YEARS. (270) 351-3522 I www.irelandheatingandcooling.com

HEATING COOLING AIR QUALITY MAINTENANCE

KENDALL BREEN NMLS #2212216 MORTGAGE LOAN OFFICER O: 270.982.3003 I C: 502.509.1821 KENDALL.BREEN@MOTTOMORTGAGE.COM

WHERE GREAT ROOMS BEGIN 6727 N. DIXIE, ELIZABETHTOWN I 270-737-5798 I WWW.CORVINS.COM

t

Whether you're nurturing your nest egg, working towards retirement, or leaving a lasting legacy, you could use a plan to accomplish everything you want out of life.

Respective services provided by ARGI Investment Services, LLC, a Registered Investment Adviser, ARGI CPAs and Advisors, PLLC, ARGI Business Services, LLC, and Advisor Insurance Solutions, LLC. All are affiliates of ARGI Financial Group LLC. Trust services provided by ARGI Trust, a division of Advocacy Trust LLC.

F i n a n c i a l P l a n n i n g i s n '

j u s t a b o u t t h e n u m b e r s . F o r u s i t ' s p e r s o n a l .

Contact us and take your next step in finding financial clarity. 270.990.9000 | WWW.ARGI.NET Let us help you navigate your unique financial situation so you can move forward with clarity, confidence, and peace of mind.

Cheers

care, service,

savings! 3046 DOLPHIN DR. SUITE 104, ELIZABETHTOWN, KY 42701 (270) 307-1980 MEMBERMEDICALDPC.COM

to health, wealth, and happiness in the New Year. Now is the right time to learn how Member Medical DPC can help you. We are a full service primary care clinic and pharmacy all in one. Amazing

and

LOVE GALA FOR PROJECT L.E.A.R.N. FEBRUARY

Join us for a valentine’s celebration

Elizabethtown Lifestyle Magazine has partnered with Phillips Grove Event Venue and The Lincoln Trail Home Builders Association to bring you the LOVE Gala. This event precedes the Annual LTHBA Home Design & Remodeling Show and will benefit Project L.E.A.R.N. Project L.E.A.R.N. is an important non-profit in our community providing education and care to adults who are mentally and physically disabled in our community. Local builders have worked over the past year to provide much-needed renovations and repairs at Project L.E.A.R.N.; much is still needed and with this event, we are raising money for both every day operations and renovations. The event will include a wine tasting, Valentine’s cocktails, hors d’oeuvres, dinner, and silent/live auctions. Get dressed up! Wear your best pinks and reds, cocktail attire preferred. Sponsorships are needed and individual tickets are on sale now on EventBrite: https://LOVEGalaProjectLEARN.eventbrite.com

Payments by check should be made payable to Project L.E.A.R.N. and delivered to either Project L.E.A.R.N. or the Lincoln Trail Home Builders Association during business hours.

event timeline

5:00 PM - 6:30PM Cocktail Hour & Red Carpet Photos

6:30 PM Welcome from Ann Borders, Project L.E.A.R.N. President of the Board & Eric Jackson, Lincoln Trail Home Builders Association President

6:45 PM Dinner & Music by Matt McDougal

8:00 PM Silent Auction Ends & Live Auction with Marty Fulkerson

Sponsorship levels

GOING TO THE CHAPEL $10,000

10 Seats I Private VIP Table

Double Page Ad in LOVE Gala Program

Logo On Signage & Credit in Social Media Mentions

Elizabethtown Lifestyle Magazine Feature Mention Full Page Ad April Elizabethtown Lifestyle Logo On Step & Repeat Red Carpet Backdrop

HEAD OVER HEELS $5000

8 Seats I Private VIP Table

Full Page Ad in LOVE Gala Program

Logo On Signage & Credit in Social Media Mentions

Elizabethtown Lifestyle Magazine Feature Mention Logo On Step & Repeat Red Carpet Backdrop

GOING STEADY $3000

6 Seats I Shared Table

Half Page Ad in LOVE Gala Program

Logo On Signage & Credit in Social Media Mentions

Elizabethtown Lifestyle Magazine Feature Mention

IT’S A DATE $2000

4 Seats I Shared Table

Quarter Page Ad in LOVE Gala Program

Logo On Signage & Credit in Social Media Mentions

Elizabethtown Lifestyle Magazine Feature Mention

PURELY PLATONIC $1000

2 Seats I Shared Table

Logo & Mention in LOVE Gala Program

Logo On Signage & Credit in Social Media Mentions

Elizabethtown Lifestyle Magazine Feature Mention

11

TO

PHOTO

THOMAS ISAAC DEATON WWW.THEHOUSEONHELM.COM I EMAIL JOY@THEHOUSEONHELM.COM

SCHEDULE A TOUR!

LOCAL ARTIST FEATURE

“Breaking Dawn” by Painter Dyann Joyce

ELIZABETHTOWN:

TRY THE TRACE RENEWAL THE NEXT TIME YOU’RE AT BBT VISIT US ON FACEBOOK & INSTAGRAM AT @BOURBONBARRELTAVERN FOR INFORMATION ON LIVE MUSIC & UPCOMING EVENTS. HAPPY HOUR SPECIALS WEEKDAYS 4 PM - 7 PM.

(812) 614-4701 I info@thephillipsgrove.com 58 Ernest R. Kouma Boulevard, Radcliff, Kentucky THEPHILLIPSGROVE.COM NEW WEDDING VENUE: SEATS 300+ GUESTS OLIVE & FIG PRODUCTIONS

COVER FEATURE: FRESH FACES IN FINANCE WITH JIM OWEN, JASON WATERS, & JUSTIN JENKINS PAGE 28

SOUTH CENTRAL BANK: WHY ARE MORTGAGE RATES SO HIGH? PAGE 44

WESBANCO BANK DELIVERS OVER 150 YEARS OF STABILITY, STRENGTH & TRUST PAGE 49

THE CECILIAN BANK: ARE CLUB CHECKING ACCOUNTS WORTH THE COST? PAGE 53

WEST POINT BANK: LOCAL BANKING AT ITS FINEST PAGE 56

FEBRUARY IS NATIONAL CHILDREN’S DENTAL HEALTH MONTH PAGE 58

GUIDE TO DINING IN HARDIN COUNTY PAGE 60

PHOTO READY WITH CLAGETT PHOTOGRAPHY PAGE 64

HARDIN COUNTY WEDDINGS PAGE 69

THE HARVEST GALA BENEFITING WARM BLESSINGS PAGE 87

DOWAN LAW OFFICE: HEALTHY DIVORCED FAMILIES PAGE 90

SILVERLEAF FORENSIC ANNEX UPDATE PAGE 97

CLARITY SOLUTIONS PAGE 99

BAPTIST HEALTH FOUNDATION HARDIN RINGING IN A NEW SEASON OF HEALTH & HOPE PAGE 100

VALENTINE’S PARTY INSPIRATION & CRAFT PAGE 104

THE FALL BALL FOR HOPE ACADEMY FOR KIDS PAGE 110

18 elizabethtown lifestyle MAGAZINE. BLOG. SOCIAL MEDIA. EVENTS.

FINE is the Elizabethtown area’s purveyor of tailored and collected home goods and gifts. Sourced with a careful eye and a focus on the timeless, our inventory is built around the concepts of MODERN, TRADITIONAL, COLLECTED and intended for those who seek the same. With a collection ranging from small hostess gifts to custom furniture pieces that fill a room, our wares offer you a gift to yourself or a loved one that provides joy and fruitful conversation, whether over the dining table or while burning a FINE candle.

104 N MANTLE AVE IN ELIZABETHTOWN

FINEHG.COM | 270.300.4488

Staying out of court when resolving family law and child custody matters can save money, time and stress of appearing before a judge. When considering litigation alternatives (also known as alternative dispute resolution or ADR), make sure you work with a proven credentialed professional.

LAW DISCOVER HOW COLLABORATIVE PRACTICES CAN HELP YOUR SITUATION

Avenue, Elizabethtown, KY 42701 I Phone : 270-872-0911 I https://www.dowanlaw.com

COLLABORATIVE

108 East Dixie

Collaborative

Attorneys

DOWAN LAW OFFICES

Law

HAPPY NEW YEAR! So many good things are happening in 2023. Loads of appreciation to all of our readers, followers, advertisers, event sponsors, and everyone in the community for your constant show of support. Elizabethtown Lifestyle Magazine continues to be extraordinary every issue because of YOU. We are blessed to have all of you cheering us on as we continue highlighting the best our Hardin County has to offer in upcoming issues.

With discussions of both growth in our community and recession in our nation, we have taken a different approach to the standard New Years’ resolutions articles we usually share this time of year. Financial health within our community is so important when it comes to the overall success of our area, and we encourage readers to review their financial plans and investing/savings strategies in the new year. The cover feature is Fresh Faces in Finances and gives us insight into finance through local gentlemen of Owen LaRue Financial Group, ARGI, and Legato Financial Group. Supporting features focused on money come from our favorite banks: West Point Bank, South Central Bank, The Cecilian Bank, and WesBanco. We are shining a light on the new bell in the cancer wing at Baptist Health Hardin with a feature on local cancer survivor Charlotte Surratt. With a background in weddings, my favorite topic is always wedding inspiration, and now is the perfect time to showcase some of the beautiful venues in our area with inspiration at Thurman Landing, Phillips Grove, The Haycraft, and The House On Helm. If you’re a parent or much-loved aunt or grandmother, the cutest Valentine’s feature to ever grace our pages has arrived with inspiration sure to make your littles feel loved on VDay. Navigating co-parenting is a challenge, to say the least, but LeeAnna Dowan and Brooke Talley are giving insight this issue on doing what is best.

Our mission at Elizabethtown Lifestyle is to connect citizens of Elizabethtown to local businesses through a curated collection of features and articles in our print publication and blog, up-to-date social media, and featuring and hosting community events. Follow us on Facebook and Instagram for news on upcoming events. Please tag us online when you’re out supporting local businesses of all kinds: Use our hashtag #ElizabethtownLifestyle, and we might just share your posts. Cheers to 2023 Hardin County!

Best,

Giselle Smit h

Publisher, Editor in Chief & Creative Director Giselle Smith

PUBLISHER

EDITOR IN CHIEF CREATIVE DIRECTOR Giselle Smith

EDITOR IN CHIEF CREATIVE DIRECTOR Giselle Smith

PHOTOGRAPHY

Carman Jones Photography

Clagett Photography

Elaina Janes Photography

Kelli Lynn Photography Melissa G Photography Olive & Fig Productions

Riches & Glory Photography Susan Butterworth Photography Thomas Isaac Deaton Tracy Burch Photography

Special thanks to each and every one of the advertisers featured in Issue 14 of Elizabethtown Lifestyle. We appreciate the trust you have given in allowing us to showcase your business and the very best that Hardin County has to offer. This magazine would not be the same without you—Thank you!

ADVERTISING OPPORTUNITIES

info@elizabethtownlifestyle.com

22 KELLI LYNN PHOTOGRAPHY Elizabethtown lifestyle MAGAZINE. BLOG. SOCIAL MEDIA. EVENTS. ISSUE 14 I JANUARY 2023

201 WEST WESTERN AVENUE, SONORA, KENTUCKY VENUE TOURS BY APPOINTMENT I

www.thurmanlanding.com

JANES PHOTOGRAPHY I DENIZEN

(270) 949-1897

ELAINA

BY FERGUSON Closets (270) 268-1624 I www.closetsbyferguson.com

AT HEAD LINERS 1606 N. DIXIE HWY. SUITE 109, ELIZABETHTOWN, KY 42701 MON-SAT BY APPOINTMENT (270) 765-5778 I www.etownheadliners.com

NEW YEAR, FRESH FACE: LUXURIOUS LASHES, FLAWLESS SKIN AND PERFECTLY BLADED BROWS WAXING, LASH LIFTS & EXTENSIONS, SKINCARE & PERMANENT MAKEUP 270-853-0077 I BY APPOINTMENT ONL Y I BOOK ONLINE NOW Facebook @Etown Wax, Lash & Skin Bar Instagram @etown.wax.lash.skin.bar www.etownwaxlashskinbar.com APPOINTMENTS

HELPS KEEP YOU SAFE FROM EVERY ANGLE.

THE LEGEND, DESIGNED FOR THE FUTURE

The 2022 Nissan Rogue

Stay ready for the road ahead and behind in the new Turbocharged 2022 Nissan Rogue. We made Safety Shield ® 360 standard in every 2022 Rogue we make. * That’s more safety features than any other vehicle in its class to help you safely go rogue, no matter where you go in the most powerful Nissan Rogue ever. Shop NissanUSA.com.

The Jeep® Grand Cherokee is ready for tomorrow’s next great adventure. Bring along even more passengers with the third-row Grand Cherokee L. Plus, Grand Cherokee 4xe has a plug-in hybrid electric powertrain offering efficiency and incredible performance both on and off-road.

For more information see www.iihs.org

28

IT IS OUR JOB TO ASSIST YOU IN ACCOMPLISHING YOUR ASPIRATIONS AND WORK TO ELIMINATE ANY ROADBLOCKS AND/ OR ISSUES THAT COULD DERAIL YOUR GOALS.

FRESH FACES IN FINANCE

Owen LaRue Financial is a boutique planning, investment management, and problem-solving firm. We have a strong focus on business owners and those that benefit from deep strategic planning. We work with clients and their families to develop plans specific to their needs, creating impactful benefits and value for this generation and the next.

Deep relationships are a hallmark at Owen LaRue. We have clients that have been with us for nearly thirty years. Long-lasting, quality, respectful, trusting relationships are our stock in trade. This is evident by the fact that more than ninety percent of our new clients are generated via existing client referrals.

You, your family, your business, and your path is unique. While there are often similarities, no two families have the exact same needs. That is why it is crucial to develop a deep understanding of your current situation and where you are striving to go. From there, we will work with you to identify your strengths and areas needing attention.

After these items are identified, it is our job to assist you in accomplishing your aspirations and work to eliminate any roadblocks and/or issues that could derail your goals. Once this is completed, we will work with you to help build the appropriate plan to maintain and further your success. Life is a journey, and we will travel your path with you all the way, adjusting to forks in the road.

Once your plan is created, we take a significant role in helping you develop your team of experts. The better these experts have attuned to your needs, the better the results. Your team will often consist of attorneys, tax professionals, insurance agents, and bankers highly versed in your specific industry/needs.

The benefits of the appropriate team are often immediately realized. These partners will be crucial in maximizing tax savings, estate planning, asset protection, cash flows, as well as other areas of focus.

At Owen LaRue, we understand that we are not the right firm for everyone, and our community is fortunate to have some other fantastic advisory firms. However, if you believe you need high-level, individual planning designed for your needs, Owen LaRue may be the best firm for your future.

At Owen LaRue, you will be treated like a family member. We are trusted. Independent. And family-focused.

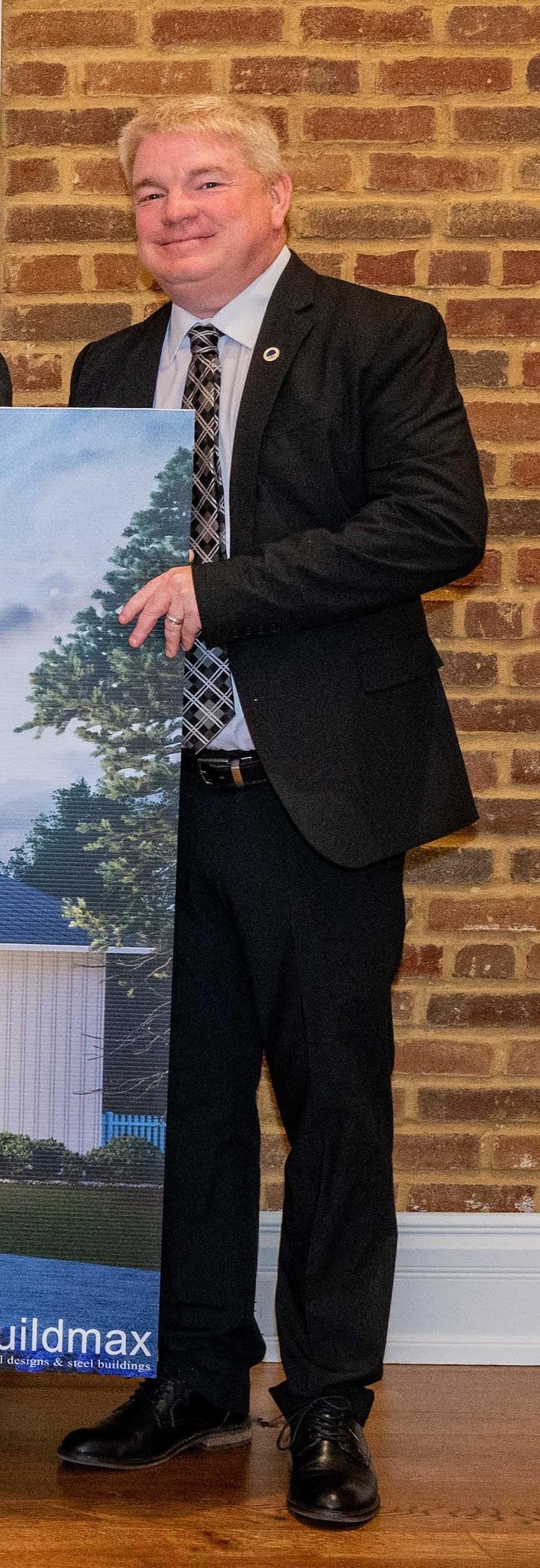

ON THE COVER JIM OWEN OWEN LARUE FINANCIAL GROUP

Cover Photography: Clagett Photography

Trusted. Independent. Family Focused. PHONE: (270) 769-9995 109 W. POPLAR STREET ELIZABETHTOWN www.owenlarue.com

31

32

THROUGH OUR MISSION OF IMPROVING LIVES WITH EVERY RELATIONSHIP, WE’VE HELPED BUSINESS OWNERS, INDIVIDUALS AND FAMILIES BETTER UNDERSTAND THEIR FINANCIAL SITUATION.

The New Year provides an abundance of possibilities – resolutions, goals, and opportunities awaiting us in the months ahead. For many of us, it’s a time to evaluate our relationships – with friends, family, work, and with money. As financial advisors, we’re here to support our clients in navigating the ever more complicated financial landscape.

Inflation, rising interest rates, market volatility, and economic uncertainty in 2022 gave many investors a “run for their money”. While no one can predict the future, historically, markets have bounced back from economic downturns, so understanding your options is critical.

Yet, when markets get unpredictable, anxiety starts to rise. Financial advisors understand that investors are often compelled to make emotional decisions – it’s human nature! And the last few years have been extremely trying. Between the impact of the pandemic, political discourse, and market volatility, it’s no wonder that many people are left wondering what to do next. That’s why ARGI’s team believes that during uncertain times, financial professionals are the best resource for informed guidance to make more educated financial decisions.

It is very clear that no two clients are alike. While one individual may need guidance on tax loss harvesting in a down market, another may want to learn more about how alternative investments might be a good decision for their portfolio. Others may just need a calm sounding board to check in and gauge their risk tolerance when the market is highly volatile. All of these situations are why we believe we must meet people where they are in their financial journey to truly serve their unique needs.

For over 25 years, ARGI’s business has been centered around one thing – service. Through our mission of improving lives with every relationship, we’ve helped business owners, individuals and families better understand their financial situation.

When we opened our Elizabethtown office in 2016, Senior Financial Advisor, Jason Waters, CFP®, had one goal in mind: to build a holistic financial resource for the expanding Central Kentucky community. Waters, an Elizabethtown native, recognized the need to marry tax & accounting with financial planning for both families and businesses. In 2019 this lead to a partnership with veteran Elizabethtown CPA firm, Stiles, Carter & Associates. Together, we have built a community-based, locally focused comprehensive financial solution to support the recent development and success of local business owners and their families.

Over the past few years, our central Kentucky community has seen explosive growth from economic and corporate business development. With an expanding industrial and manufacturing base, a growing tourism industry, and an unflagging entrepreneurial spirit, we believe Elizabethtown’s economic position is brighter than ever. And we recognize that with this growth, also comes opportunity.

Recently, we expanded our Elizabethtown office for fellowship and collaboration with our colleagues, clients, and the community. To support the development of our city, we sought to create a hub for Central Kentuckians to have full access to all areas of financial services. Just like we have illustrated our current growth path in Central Kentucky, we believe that strategic growth is essential to remaining a vibrant, thriving business in the communities we serve. We are committed to our growth path and excited to support our communities’ development with our dedicated team by their side.

Because for us, our business is so much more than crunching numbers – it’s extremely personal. We’ve worked hard to develop a company rooted in connection and relationships. Whether you’re nurturing your nest egg, building your business, or caring for your employees, our firm is here to be a resource for any financial planning needs, backed by an educated team. We make every effort to help our clients, colleagues, and communities feel appreciated and valued for their contributions. This commitment is the driving force behind our mission to constantly improve our service, our advice, our systems, and our people.

JASON WATERS

ON THE COVER

ARGI

i n a n c i a l P l a n n i n g i s n ' t j u s t a b o u t t h e n u m b e r s . F o r u s i t ' s p e r s

a l .

Contact us and take your next step in finding financial clarity. 270 990 9000 | WWW ARGI NET Let us help you navigate your unique financial situation so you can move forward with clarity, confidence, and peace of mind.

F

o n

Whether you're nurturing your nest egg, working towards retirement, or leaving a lasting legacy, you could use a plan to accomplish everything you want out of life Respective services provided by ARGI Investment Services, LLC, a Registered Investment Adviser, ARGI CPAs and Advisors, PLLC, ARGI Business Services, LLC, and Advisor Insurance Solutions, LLC. All are affiliates of ARGI Financial Group LLC. Trust services provided by ARGI Trust, a division of Advocacy Trust LLC.

35

36

YOUR RETIREMENT SHOULDN’T BE IMPACTED BY THE EVER-CHANGING POLITICAL ENVIRONMENT OR TAX ADJUSTMENTS.

WHAT DOES LEGATO FINANCIAL GROUP DO?

We take your retirement savings and apply a strategy that is designed to reduce uncertainty. Let’s assume you’re hearing about the mid-terms, changes in governmental policies or legislation. Further, let’s say you’ve also read about growing inflation, fed rates, or the cost of living. Our product, The LFG Retirement Blueprint, applies strategy and values to your nest egg. The strategy is not only designed to build a portfolio with asset diversification, but also tax diversification. Whatever the agenda, your retirement shouldn’t be impacted by the ever-changing political environment or tax adjustments. We apply the principle of reducing uncertainty by utilizing a variety of vehicles and strategies in a very specific way.

HOW IS LFG DIFFERENT?

We don’t believe in a one-fits-all approach. We are an individual financial firm providing a retirement strategy designed for you. Every decision you made to get to retirement, should be considered when you actually retire.

• When do you claim social security benefits?

• When do you draw off your assets?

• What is your tax responsibility?

• How do you convert your tax deferred accounts?

• What is your longevity?

• What is your legacy plan?

• How much will healthcare account for in my expenses?

These are very specific scenarios that should be built into your plan. Think of it this way, our strategy is more custom than the suits of the guys on the front cover.

WHO IS LEGATO FINANCIAL GROUP?

Legato is owned and operated by Justin Jenkins, a local entrepreneur born in this community and continues to raise his family here. He employs 16 professionals in Elizabethtown and Louisville. The team is comprised of professionals who embody the holistic approach to include:

• Clay Watkins, Certified Financial Planner CFP® and Retirement Income Certified Professional®

• Penny Stewart, Certified Public Accountant

• Insurance Professionals

• Strategic partnership with Duncan Crosby, Estate Attorney of Stoll, Keen, Ogden, PLLC to facilitate estate planning needs

WHO DOES LEGATO FINANCIAL GROUP HELP?

Retirees. Those who are considering retiring, whether early or at an advanced point in retirement. We put your investments to work in a specific plan designed for you, and most importantly considering the 5 important areas of retirement concern: income, investments, tax strategies, healthcare, and legacy. We provide all the resources under one umbrella for our client’s confidence and convenience.

WHAT CAN YOU EXPECT WHEN JOINING LEGATO FINANCIAL GROUP?

Personalized care. It’s overwhelming to think about retiring. There are questions you may ask yourself and even the dreaded ‘what if’ scenarios. Between the moment of your first appointment to your investment review, you will have the opportunity to interview the financial advisor and ask all the questions you’ve considered. Then, if our LFG Retirement Blueprint can be customized and financially beneficial for you, our New Business Coordinator walks with you through every step such as the account transfers, beneficiary forms, custodian calls and everything in between with weekly check-ins for your assurance.

The advisor will conduct an investment meeting to help ensure all documents and investments are in good order, operating as your plan was designed. We conduct reviews throughout the year and make ourselves available with a service advising team to continue ensuring your confidence through retirement.

We pride ourselves on clear communication throughout every step of the journey. We believe it’s the best practice and the most important standard for our industry.

JUSTIN JENKINS

LEGATO FINANCIAL GROUP, INC.

ON THE COVER

WHERE DO CLIENTS BEGIN?

One Visit. In one visit we can assess whether our LFG Retirement Blueprint is going to be the right solution for your retirement. If we believe our plan will work, we utilize a second visit to show you how.

We see ourselves as educators giving analysis and evaluation on where your retirement stands and where it’s heading. Our firm is independent and offers unique products and services to help you decide which suits your financial strategy. There is no cost or commitment to get an evaluation.

Investment advisory products and services made available through AE Wealth Management, LLC (AEWM), a Registered Investment Advisor. Insurance products are offered through the insurance business Legato Financial Group. Legato Financial Group is also an Investment Advisory practice that offers products and services through AE Wealth Management, LLC (AEWM), a Registered Investment Advisor. AEWM does not offer insurance products. The insurance products offered by Legato Financial Group are not subject to Investment Advisor requirements. All investments are subject to risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Any references to guarantees or lifetime income generally refer to fixed insurance products, never securities or investment products. Insurance and annuity product guarantees are backed by the financial strength and claims-paying ability of the issuing insurance company. Neither the firm nor its agents or representatives may give tax or legal advice. Individuals should consult with a qualified professional for guidance before making any purchasing decisions. 1563179 11/22

39 RETIREMENT DESIGNED FOR YOU ® Call us today to schedule a complimentary assessment. 1-877-573-2043 2905 Ring Road Elizabethtown, KY 42701 LEGATOFINANCIAL.COM

NEW CONVENIENT ELIZABETHTOWN LOCATION! 2101 N. DIXIE HWY, STE 100, ELIZABETHTOWN PHONE 270-351-6201 I WWW.SUSANKINGDENTISTRY.COM Susan M. King, D.M.D.

“WHERE MEMORIES ARE BUILT” EXPLORE OUR CUSTOM HOME BUILDING PROCESS AT SMITHFAMILYHOMESINC.COM 270-268-0453

The Brantingham Market Reviw

What a year 2022 was! Here we are at the beginning of 2023, and I can’t wait to watch this year unfold. I hope you made big goals for yourselves, and I know my team has! We strive to constantly improve our service and surprise you with our market knowledge. We aim to be the best we can be to support you and your real estate goals as your Trusted Real Estate Resource! We expect a lot of change this year. Every day we hear about what’s coming to Elizabethtown and its surrounding communities. We are here for it and excited to be a part of it! One thing though that hasn’t changed and continues to stay consistent throughout the years is the incredible people of this community, and we are thankful to call you all friends and family. If you are planning a real estate move in 2023, we would love to be the team that supports you in making that happen!

Active Homes in the Heart of Kentucky MLS in Hardin County on December 15th, 2022: 197 Homes (Duplexes & Single Family Homes)

Current Interest Rate on December 15th, 2022, for a 30 year mortgage: 6.25% Rates

Average Days on Market for a home in Hardin County in December, according to the Heart of Kentucky MLS:

Active Listings by The Brantingham Group on the Heart of Kentucky MLS:

are based on certain assumptions and are subject to change without notice.

A special thank you to our Preferred Lender Tanya Johnson with South Central Bank.

59

Days

17 Listings

Closed

100 Closed + Pending

Sales Price of Closed Listings since

per the

$253,877

The Brantingham Group Real Estate Teams

Homes for the year:

Average

January 2022

Heart of Kentucky MLS:

The Brantingham Group of Keller Williams Heartland YOUR PREMIER REAL ESTATE RESOURCE (270) 401-2801 @ thebrantinghamgroup @ thebrantinghamgroup thebrantinghamgroup@kw.com MELISSA G PHOTOGRAPHY

When the pandemic occurred in early 2020, the 30-year mortgage rate had been trending downward for the past two years due to a low inflation rate in the US. However, as the pandemic occurred, the government increased stimulus in the financial sector to stabilize the economy. One of the stimulus programs was for the government to purchase back its own debt, particularly mortgage-backed securities and treasuries, which created a false sense of demand. Another large purchaser of mortgage back securities and treasuries was banks. As the government rolled out individual stimulus payments and the Payroll Protection Program to small and large businesses, banks around the country saw their deposits and liquidity increase significantly. Because conventional lending decreased during the pandemic, banks around the country deployed their excess liquidity into investments, primary treasuries, and mortgage-backed securities. When the demand for mortgage-backed securities increased, the yield decreased. Therefore, mortgage rates plummeted to historic lows. On December 20, 2020, the 30-year fixed rate dropped to 2.67%.

Throughout 2021, rates remained historically low, staying below 4% on a 30year fixed loan. Simultaneously, inflation increased incrementally. However, it was assumed to be only transitory inflation due to economies being shut down, pent-up demand, and supply chain bottlenecks. In early 2022, the Federal Reserve changed course by concluding that inflation pressures had become embedded and became determined to throttle back the economy.

The Federal Reserve has two mechanisms for slowing the economy down. The first and probably most well-known mechanism is to increase the Federal Funds Rate. Banks must keep a certain amount of their deposits as capital at the federal reserve, along with excess deposits that they do not lend out or invest in securities. When the Fed wants to increase lending and, ultimately, the money supply, they have a low-interest rate to pay to the banks that keep money at the Fed; therefore, it acts as an increased incentive for banks to lend out to the public. Inversely, when the Fed wants to remove money from the system, it raises the Federal Reserve Rate, which ultimately does two things. One, it increases the Wall Street Prime rate, which historically averages about 3% above the Fed Rate. The Wall Street Prime Rate is a base rate that banks use as a margin in determining lending rates from car loans, credit cards, lines of credit, and other consumer lending products. When rates are raised, payments go up, and purchasing power decreases. With an increased Federal Reserve Rate, deposit rates that banks pay customers typically go up and liquidity starts to become tighter, which reduces the amounts of money banks are lending in the system.

The second mechanism that the Federal Reserve utilizes to slow inflation and the economy is to simply stop purchasing its own debt. As previously mentioned, during the pandemic, and to stabilize financial markets, the government became the largest buyer of its own debt, subsequently exploding its own balance sheet and pumping liquidity into the market. Prior to the pandemic, the Federal Reserve’s balance sheet was around $4 trillion; however, at the beginning of 2022, it stood at $9 trillion. As a result, in March of 2022, the federal reserve began a process called Quantitative Tightening, which means they would stop reinvesting or purchasing treasuries or mortgage-backed securities as they matured, to the tune of a combined $47 billion each month.

Since the economic crisis of 2008, most mortgages that originated have some form of government guarantee. Most lenders do not keep long-term fixed loans on their books but instead pool them together into bonds and then sell them to investors as mortgage-backed securities. So why are rates going up? Historically, the 30-year fixed-rate mortgage is closely correlated to the 10-year treasury, as the typical mortgage duration is around seven years. However, this year has been different. The biggest driver of high-interest rates right now is the lack of buyers in the market for mortgage-backed securities, and those who are buying are demanding premium yield. This is our reality; until inflation is more under control, mortgage rates will be at the mercy of the open market.

Why Are Mortgage Rates So High?

Brandon Fogle, Northern Region President of South Central Bank

Brandon Fogle, Northern Region President of South Central Bank

45

SMALL ENOUGH TO KNOW YOU, BIG ENOUGH TO HELP. (270) 737-6000 SouthCentralBank.com

229 N. Miles Street, Elizabethtown, KY 42701 I (270) 982-4663 I www.willharrishomes.com HAPPY NEW YEAR FROM OUR FAMILY TO YOURS

WesBanco Bank Delivers Over 150 Years of StrengthStability, & Trust

Founded in 1870, WesBanco, Inc., is a diversified and balanced financial services company that delivers large bank capabilities with a community bank feel. From the moment we took our very first deposit, right up to today, our story has been one of our customers and of the communities we serve.

Our strong financial performance and employee focus have earned us recognition by Forbes as both one of America’s Best Banks and Best Midsize Employers – the only mid-size bank making the top ten in both rankings.

49

WESBANCO PRIVATE CLIENT SERVICE HAS A SPECIAL PROGRAM JUST FOR PHYSICIANS.

WesBanco cont.

WesBanco’s customer-centric service culture is based on building long-term relationships by pledging to serve financial needs and help grow businesses. We offer a wide variety of personal and business account options, competitive lending services, online and mobile banking options, a full suite of commercial banking products and services, and wealth management (Trust & Investments, Private Client, Securities & Insurance).

We believe that financial planning is an important process to help you and your family reach specific goals. We live in a global economy that is increasingly impacted by geopolitical events. Many individuals do not have the resources and background to be able to anticipate the impact of these events on their financial well-being. In our wealth management area, we offer access to a wide array of funds and separately-managed accounts. Through a disciplined, active investment approach, we are able to design a portfolio strategy that will help you achieve your objectives. Your personal financial plan will be based on your specific family situation, and it will address both immediate and long-range concerns. Periodically we will review your plan with respect to changes in your circumstances to ensure that plan is performing consistently with your overall goals. Our Trust Officers will work with you, your attorney, your accountant, and other appropriate advisors to develop a financial plan that is tailor-made for you.

A most unique offering by WesBanco, Private Banking, is readily available in the Heartland and our other service areas. A WesBanco Private Banker is your singular banking contact, delivering the highest level of personal service that our institution has to offer. That means we’ll come to you! If you want to meet in your office between appointments, after hours, or through electronic means, we will accommodate you on your schedule. Whether you need cash management solutions for your business, specialized personalized lending, business planning, or asset and wealth management services, a WesBanco Private Banker can simplify the process by coordinating a team of experts to help you get results. Your Private Client status with us brings exclusive benefits and rewards designed to supplement your banking relationship with us. These benefits also include retirement, tax, insurance and risk-management, and estate planning. Once we get to know you and your financial needs, all you have to do is place one call to your Private Banker when you need our assistance.

We’ve grown as you’ve grown, and our success has been built on your success. When you’re ready to take advantage of WesBanco’s wealth management services (Trust & Investments, Private Client, Securities & Insurance) or any of our other financial services, we’re happy to sit down and assess your position to generate a plan that will enable you to capitalize on growth opportunities and make the most of your personal and professional funds.

Marilyn Ford, City President of the bank’s Heartland Region, stated “it’s our commitment to the customers and communities we serve that makes the difference. The customers are our neighbors and friends. We live and work in these communities, and what matters to them matters to us.”

We invite you to contact our team of local experts – we welcome the opportunity to serve you today.

WesBanco Bank, Inc. is a Member FDIC. WesBanco Trust and Investment Services, a division of WesBanco Bank, Inc., may invest in insured deposits or nondeposit investment products. Non-deposit investment products are not insured by the FDIC or any other government agency, are not deposit or other obligations of, or guaranteed by any bank affiliate, and are subject to investment risks including the possible loss of the principal amount investment.

WesBanco Securities, Inc., (WSI) is a wholly-owned subsidiary of WesBanco, Inc., and a member of FINRA and SIPC. Securities products offered through WSI are not deposits, are not obligations of, or guaranteed by WesBanco, Inc. or any of its banks or non-bank affiliates. These products are not insured by the FDIC, or any government agency, and are subject to investment risks, including possible loss of the principal amount invested.

Private Client Services are subject to qualifications and credit approval.

50

You’re no stranger to hard work and we aren’t either. At WesBanco, we’re dedicated to helping you plan for your financial goals. Fact is, our strength, stability and experience has served our customers exceptionally well since 1870. Financial Success Takes Teamwork Let our WesBanco Team develop a customized plan to help you reach your financial goals. Marilyn Ford City President Heartland Region (270) 769-5148 Kyle Walters VP & Trust Officer Trust & Investment Services (270) 769-5141 Caroll Perkins SVP & Private Banker Team Lead Private Client Services NMLS#758331 (270) 986-0901 WesBanco Bank, Inc. is a Member FDIC James Watson SVP & Senior Commercial Banker NMLS#607657 (270) 769-5139

Invest in a club checking account packed with exclusive and valuable perks and benefits designed with your active lifestyle in mind! Open your account online today! The Cecilian Bank’s Club Checking Accounts *For information on Choice Gold and Choice 50 Gold fees, disclosures, limitations, and eligibility, please visit www.TheCecilianBank.com.

By Jennifer Palalay

Are Club Checking Accounts Worth the Cost?

The Roman playwright Titus Maccius Plautus once said, “You have to spend money to make money.” This adage may seem counterintuitive when it comes to personal finances. In the world of business, investing in your company is necessary for success. Start-up costs, products and supplies, advertising, and employee wages, are prices you pay before you see any profit. How often do you consider spending money to make money when it comes to your personal finances?

How do you invest in yourself? You invest in your financial health when you earn, save, plan, and live within your means. So, how is spending beneficial to your finances? Consider spending money where it matters. Take, for example, your checking account. Other than an account to deposit and withdraw your money, does your checking account give back in other areas that benefit you and your lifestyle? If the answer to this question is “no,” a club account may be an ideal investment for your finances.

The Cecilian Bank’s club checking accounts, Choice Gold and Choice 50 Gold (for our mature customers), are built with your active lifestyle in mind and offer exclusive and valuable features that you may be paying for already. The value of these benefits and savings you receive as a club account member far outweighs the nominal monthly fee of $8.95 for Choice Gold and $6.95 for Choice 50 Gold.

For example, Choice Gold and Choice 50 Gold club account members receive free personalized checks, saving, on average, $26 per order. The club account cell phone protection offers members up to $300 in reimbursement per claim if their cell phone is broken or lost. Already paying for ID theft protection? It’s included with Choice Gold and Choice 50 Gold club checking accounts, saving you approximately $24 per year. With Nickel Rewards, club account customers earn a nickel for each purchase made with their debit card, earning, on average, $30 per year. The savings are endless with the movie ticket discounts, travel and leisure discounts, 24-hour travel and roadside emergency assistance service, and family health discounts offered with Choice Gold and Choice 50 Gold club checking accounts.

The Cecilian Bank’s club checking accounts have the best value with no hidden fees or minimum transaction requirements and offer many more significant perks, like the ability to earn interest, unlimited checking, notary service, cashier’s checks with no issue fee, monthly statements with check images, and additional discounted fees on various products and services. As you can see, the savings add up with the Choice Gold and Choice 50 Gold club checking accounts, and the monthly fee is worth your investment.

Open a Choice Gold or Choice 50 Gold club checking account online now! Visit www.The CecilianBank.com to open an account and for more information on fees, disclosures, limitations, and eligibility.

* The annual benefits quoted above are averages and values based on the current pricing of these features with our existing vendors or programs.

53

WE’RE GROWING

WELCOMES

H. STEPHEN MAGUIRE, MD

Baptist Health Medical Group Plastic & Reconstructive Surgery, led by Tathyana Fensterer, MD, PhD, and H. Stephen Maguire, MD, offers monthly specials on cosmetic procedures including facials, BOTOX®, dermal fillers and more, to keep you looking refreshed and confident all year long.

Drs. Fensterer and Maguire have more than 45 years of combined experience in plastic and reconstructive surgery and specialize in reconstructive surgery, elective cosmetic procedures and skin care. Baptist Health Medical Group Plastic & Reconstructive Surgery services include arm lift, breast augmentation, face- and neck lift, liposuction, weight loss body contouring, skin rejuvenation, laser/ IPL hair removal and more. Drs. Fensterer and Maguire are board certified in plastic surgery and are here to provide compassionate, patient-centered care.

Tathyana Fensterer, MD, PhD, and H. Stephen Maguire, MD, Board Certified Plastic & Reconstructive Surgery

Baptist Health Medical Group Plastic & Reconstructive Surgery To schedule an appointment, call 270.706.1945.

511 Robinbrooke Blvd, Suite 100 | Elizabethtown, KY 42701 | BaptistHealth.com/CosmeticCare 3950 K resge Way, Suite 103 | Louisville, KY 40207 | BaptistHealthMedicalGroup.com

PLASTIC & RECONSTRUCTIVE SURGERY

BAPTIST HEALTH MEDICAL GROUP

Five Convenient Branch Locations Elizabethtown I Radcliff Glendale I Upton I West Point PHONE 270.763.8282 I WESTPOINTBANK.COM Hometown Banking Made Simple! Come by today to learn more about our FREE CHECKING!

LOCAL BANKING AT ITS FINEST Five Convenient Branch Locations: Elizabethtown I Radcliff Glendale I Upton I West Point PHONE 270.763.8282 WESTPOINTBANK.COM

THE IMPORTANCE OF BANKING LOCAL AND THE RELATIONSHIP ASPECTS OF KNOWING YOUR BANKERS AND THEM KNOWING YOU

At West Point Bank, we treat banking as a relationship business. In all that we do, we strive to build and strengthen relationships with new and existing customers. We ultimately want the best for all of our customers because that oftentimes aligns with what is best for the community, as well as the bank.

As opposed to calling a 1-800 number and reaching an automated system, when you call West Point Bank, you get a real person located right here in Hardin County. At West Point Bank, we promise to answer the phone within three rings when you call, and when you come into one of our branches, you’re going to be greeted by a person with a smiling and friendly face who is eager to help with your banking needs.

The importance of knowing your banker and them knowing you is vital to your success. At West Point Bank, you are not just an account number. We strive to treat each and every customer the way they deserve to be treated. Our goal is to provide excellent banking products to the citizens of our community while also providing them with superior customer service. We know our customers by name and care about them on a personal level. It is important for us to develop that trust with our customers so that they know we care about their finances and have their best interests at heart when making decisions. At the end of the day, it is the relationship that matters most.

AT WEST POINT BANK, OUR EMPLOYEES LIVE AND WORK IN THE COMMUNITY THEY SERVE

By choosing a local bank for your everyday banking, including loans and deposit accounts, you too are supporting the community in which you live. Local banks are the backbone of the community, serving as a place to deposit your hard-earned funds, as well as financing your dream home, that new automobile, or your new business. We want what is best for our communities because we live and work here too! We encourage our staff to be good stewards by serving others, volunteering their time, and giving back to the community in any way they can. At West Point Bank, we feel it is vitally important to support our local charities, non-profits, schools, sports teams, churches, and businesses. Oftentimes, they are not only our customers but our friends, and we want nothing more than for them to be successful.

QUICK DECISIONS AND GETTING THINGS DONE A LOT FASTER

At West Point Bank, all of our decisions are made locally. This means that decisions are oftentimes made faster, allowing our customers to know exactly where they are in the loan approval or account opening process. To us, it is very important that the customer knows exactly where they stand. Whether we can or can’t help that particular customer, we want to inform them of our decision as quickly as possible. It is imperative for us to be open and honest with each customer in each and every situation. Our slogan is “Hometown Banking Made Simple” and each and every day we strive to making banking as simple as possible. The loan process can sometimes feel like a daunting task, and it is our job to make the process as simple and painless as possible. A 15–20-minute conversation with one of our staff members can provide peace of mind. We often hear people say that it is much different banking at West Point Bank. We feel that it is our people that make that difference. We encourage you to see for yourself why West Point Bank truly is “Hometown Banking Made Simple.” We want the best for our customers because that is the best for the community we live in as well.

57

FEBRUARY IS NATIONAL CHILDREN’S DENTAL HEALTH MONTH

We had the pleasure of chatting with dentists at Elizabethtown Dentistry for Children about National Children’s Dental Health Month. They gave us some quick tips on keeping tiny teeth healthy year-round. Read below for sparkling, healthy little smiles:

1. Children should have their first dental exam by age one or at the sight of their first tooth to help to transition early into dental care.

2. Use children’s fluoridated toothpaste beginning at age two, brushing for two minutes twice daily—use fun games or sticker system to encourage good habits of brushing twice daily.

3. Allergy medicine and humidifiers at night are suggested for kids with stuffy noses; mouth breathing will lead to higher rates of tooth decay.

4. Children should start flossing their teeth when they start touching. Molars typically touch before the front teeth; some kids need to floss as early as six months old.

5. Don’t share drinks or eating utensils: Oral bacteria is easily transferred and can cause decay-causing bacteria to be transferred to young children and infants early.

6. Only allow water between meals and snacks; water should be in sippy cups.

7. If your family elects to be fluoride-free, you should consider a “raw” or unprocessed diet to ensure your children won’t suffer from rampant decay.

8. Encourage your children to wiggle loose baby teeth at home to ensure better hygiene and occlusion. Nature is a natural process—let it happen!

9. Adults should be actively engaged in the daily hygiene routines of children younger than nine. They may need help brushing the gum line and flossing molars, as dexterity can be challenging.

10. Limit sugar, processed snacks, sodas, and juices to once a week, with brushing immediately after.

58

1107 Crowne Pointe Drive, Suite 210 Elizabethtown, KY 42701 270-769-3858 I Open Monday-Friday Check us out on Facebook! TO LEARN MORE VISIT WWW.ETOWNDFC.COM

MEET THE DOCTORS LOCAL, ANXIETY-FREE KIDS DENTISTRY KID-FRIENDLY OFFICE SERVING THE CHILDREN OF HARDIN COUNTY.

DR. NICK MURPHY DR. MARIANNE SHEROAN DR. ERIC ABANG

DR. AMANDA GLEASON

guide to dining out in hardin county

Looking for lunch or to grab a drink? We’ve got you covered. What would an issue about fun things to do in Hardin County be without mentioning all of the restaurants we love?

2B Thai

Amazin’ Glazin’ Donuts

Back Home Catering

Back Home Restaurant

Bourbon Barrel Tavern

Bub’s Cafe

Las Chalupas

Claudia’s Tea Room

Deez Butts BBQ

Dewster’s Homemade Ice Cream

The Dreamery

ECTC Culinary Department

El Alcapulco

El Tapatio

Etown Meal Prepping

Family Fun Cafe & Ice Cream

Firefly Nutrition

The Fish House & Grill

Flywheel Brewing

Ginza Hibachi

Goldenrod Tavern

Green Bamboo

Gulf Coast Connection

Gyro House

Heartland Mini Golf

Heartland Sports Pub

Impellizzeri’s Pizza

John O’s Liquor Store

J.R. Neighbors

Juanito’s Street Tacos

Kansai Japanese Steakhouse

Kohli’s Downtown Nutrition

Little Charlie’s Pizza Mark’s Feed Store

Mexico Lindo Mi Jalisco

Mountain Mikes Coffee

Namaste

Nuts About Coffee

Papi’s Tacos & More

SIM Sushi & Steak

Sweet Retreat

Tequila House Bistro & Cantina

The Cafe at Swope

The Cavern Club

Tony York’s On Main Vibe Coffee Shop

Wasabi

Water’s Edge Winery & Bistro

The Whistle Stop

Wicked Eyed Woman

Woo Hoo II

GOLDENROD TAVERN: BROCCOLI CHEDDAR SOUP, CHEESE QUESADILLA, A FULLY DRESSED CHEESEBURGER WITH ONION RINGS & A CLUB SANDWICH WITH SEASONED FRIES

MORE THAN 40 YEARS EXPERIENCE DESIGNING AND BUILDING EXCEPTIONAL CUSTOM HOMES BRANTINGHAM BUILDERS INC www.BrantinghamHomes.com 270-765-5045 MELISSA G PHOTOGRAPHY

SMALL GROUP TRAINING SHORT 25 MINUTE SESSIONS A SUPPORTIVE COMMUNITY DON T LIKE EXERCISE ... A REALISTIC WAY TO ACHIEVE YOUR GOALS! 103 Central Ave, Elizabethtown, KY, 42701 +1 757-277-8710 facebook.com/hitzoneetownky 70 PUBLIC SQUARE, ELIZABETHTOWN HTTPS://CAVERN.CLUB

CARMAN JONES PHOTOGRAPHY I HUNTER SHERWOOD I BRYANT’S RENT-ALL 319 E. Dixie Ave., Elizabethtown I 502-957-6029 I thehaycraftetown@gmail.com I INSTA & FACEBOOK @theHaycraft

PHOTO READY

If you’re an Etown native, you’ve undoubtedly come across a gorgeous photo session by Clagett Photography gracing the walls of fellow locals. Perhaps you even have some of her portraits hanging in your home. These portraits are made for print, and Marnie Clagett has a longstanding reputation as a full-service photographer who captures beautiful, timeless images and then handles measuring walls or mantles, printing, and hanging portraits in your home. It’s the beginning of the new year, and we were lucky enough to get with Marnie on the very best times to schedule your portrait sessions for the upcoming year:

MATERNITY PHOTOS

The best time for Maternity portraits tends to be around 32-35 weeks. That’s the point where your belly is large enough to show off that fabulous baby bump, but you haven’t quite hit those last few weeks of pregnancy where you start to feel uncomfortable.

NEWBORN PHOTOS

If you’re doing a lifestyle session or if you want your baby photographed in your arms primarily, any time works for your baby’s first portrait session. Scheduling your session for around seven to ten days is ideal if you want photos of your baby on their own. Babies are still sleeping most of the time during those first two weeks of life, and it is safest to pose newborns when asleep. But any time is good for baby photos, so don’t worry if you schedule your session when your baby is a month old or older! Your photographer will work with your family to ensure you have beautiful photos of your new little addition, no matter when you choose to have your session.

FIRST BIRTHDAY “CAKE SMASH” SESSION

The timing for a cake smash session depends on when you want to let your baby try cake for the first time. Some parents prefer their baby’s first cake experience to be on their birthday, in front of family and friends. In that case, schedule their cake smash session for after the party.

HIGH SCHOOL SENIOR PORTRAITS

Senior year is filled with SO many activities and special events; finding time for senior portraits can be a challenge. We photograph seniors year-round, including after students have graduated—so parents of the Class of 2023, don’t stress! You still have plenty of time to have your senior’s portraits made. That being said, we find that most of our seniors like to have their portraits made in the summer and fall heading into their senior year when they’re most excited about the year to come. But it depends entirely upon your student. Does she love to wear sundresses and dream about photos by a waterfall? Get her scheduled for summer, for sure. Is he most comfortable in jeans and a flannel shirt? Fall or Spring will be your best bet! If your junior is interested in being part of a Senior Model Team, start looking for photographers to begin recruiting in January and February, typically.

FAMILY PORTRAITS

The best time for Family Portraits is now. Not minus ten pounds from now or when life isn’t quite so busy. Now. With everyone’s busy schedules, it can seem impossible to carve out the time for a Family Portrait. The problem is when you don’t make the time, the years pass by, and your children grow up right before your eyes. Any time is suitable for a family portrait—outdoors or in a studio—it doesn’t matter where. The important thing is that your family deserves to be celebrated at every stage.

ANY PORTRAITS

Make sure you contact your photographer as early as possible, especially if you have a specific time of year you want to book. Some photographers book up three to six months in advance, so as soon as you start thinking about it, go ahead and get on their calendar!

To schedule a photo session with Clagett Photography, Marnie may be reached through the contact form on her website at www.clagettphotography.com or at (270) 312-5305. Her studio is located at 405 N Mulberry Street, Elizabethtown, by appointment only.

64

Planning and designing upscale, southern-crafted event experiences in Kentucky and beyond. WEDDINGS * CORPORATE EVENTS * CHARITY GALAS BIRTHDAY PARTIES * CELEBRATIONS

+

* gg

+ * gg goldenrodandglory.COm

GISELLE SMITH

I LOVELY LEAVES

I MARIE CLAIRE PHOTOGRAPHY

WEDDING & EVENT FLORAL DESIGN www.lovelyleavesweddings.com

ELAINA JANES PHOTOGRAPHY

CONGRATULATIONS! 2023 is looking bright—especially with that NEW sparkly rock on your ring finger. If you got engaged over the holidays, you’re sure to be fielding questions like “what’s your date?” or “where are y’all getting married?” Your friends and family are likely just as excited as you two. We’ve got the inspiration you need for planning your perfect Hardin County wedding celebration. Flip through the pages of this feature to see our favorite local venues.

VENDOR DREAM TEAM

Design, Florals & Stationery: Giselle Smith / Lovely Leaves Photography: Susan Butterworth Photography Linens & Place Settings: Bryant’s Rent-All Wedding Gowns: Twirl Bridal Boutique Lexington Professional Make-Up & Hair: Rachel Todd / Ashley J Salon

Venues in Order: Thurman Landing, Phillips Grove, The Haycraft, and The House On Helm

Hardin County Weddings

69

THURMAN LANDING

71

PHILLIPS GROVE

75

THE HAYCRAFT

79

BASIC WEDDING PLANNING CHECKLIST

Determine a set budget dollar amount perfect for you, your fiancé, and your families. Then, divvy up the total between vendors based on your priorities.

Devise your guest list with your families and collect addresses, emails, and phone numbers. Be sure to set a limit for yourselves and your families.

Hire an event planner.

Contact venues to schedule tours and collect info. Book a venue to set your date!

Select a photographer and take engagement photos.

Determine your wedding style with your planner or by looking through wedding blogs, magazines, or Pinterest. Be sure to save photos you love and collage them together to show that the elements you’re choosing go together aesthetically.

Order Save the Dates from your chosen stationery designer.

Start wedding dress shopping. Allow six to eight months for your gown to arrive from the designer and, at the very least, one month for alterations. You may have to buy off the rack if the lead time is short for a designer gown. It never hurts to choose shoes and accessories early as well.

Ask your wedding party! There are so many fun ideas for this.

Grooms, groomsmen, and fathers get fitted for tuxes. Choose bridesmaid gowns and have your gals order them.

Make a list of 2-3 vendors from each category that fit your style and have glowing reviews. Reach out to vendors via email to collect information on packages and pricing. Compare apples to apples.

If you aren’t hiring a full-service planner, we suggest a day of coordinator to manage your wedding weekend.

Schedule tastings with your caterer and bakery.

Review contracts carefully, checking timing and specific items included. Sign contracts and pay deposits to secure your date with chosen vendors.

Register for gifts at two to three locations.

Book your honeymoon!

Stationery should be ordered three to four months before your wedding and mailed two months prior, allowing 30 days for RSVPs to be returned. Call/email missing RSVPs.

If you have a planner or coordinator, they will send out a detailed wedding timeline to your vendors confirming arrival times, install times, time for detail photos, an order of events with times once the wedding kicks off, and strike times.

Bridal showers and bachelor/bachelorette parties are the perfect excuses to celebrate your upcoming nuptials with your nearest and dearest.

If you plan to order bridal party gifts, parent gifts, favors, or welcome gifts, order one to two months prior to your big day.

At 30 days, finalize numbers with your vendors and pay balances.

Pick up your dress and any last-minute items you may need. Wedding week is the time for final spa treatments, nails, hair, etc.

Pack your bags and enjoy your wedding weekend!

THE HOUSE ON HELM

83

WWW.TWIRLBOUTIQUE.COM

LYNN

KELLI

PHOTOGRAPHY

701 RED MILE ROAD, LEXINGTON, KY 40504 I 859-252-0408 WWW.BRYANTSRENTALL.COM SHINING LIGHT PHOTOGRAPHY

rachel todd, professional Makeup artist look your best 270.304.6064

87

RICHES & GLORY PHOTOGRAPHY I MICHAEL HUDSON

ROUND OF APPLAUSE

HARVEST BLESSING

Nolin Operation Round Up

PUMPKIN

The Houston Family

South Central Bank

Swope Family of Dealerships

CORNBREAD

BuildMax

First Presbyterian Church

Melissa S. Martin, CPA, PLLC

WesBanco

EVENT SPONSORS + VENDORS

The House On Helm

Lovely Leaves

Maillard Kitchen

Matt McDougal

Riches & Glory Photography

Signarama Elizabethtown

Wicked-Eyed Woman

We are thrilled to highlight the first annual The Harvest Gala benefitting Warm Blessings. The October 24th event took place at The House On Helm where guests convened to celebrate the season’s bountiful harvest. The event included cocktail hour, a card pull, a harvest meal, and a cake run. Speakers included Warm Blessings Executive Director Dawn Cash, Mayor Jeff Gregory, Councilwoman Julia Springsteen, Keynote Speaker Price Smith of Nolin Operation Round Up, Steve Heibert from BuildMax, and President Dr. Donielle Lovell. The event announced a new transitional living space soon to be under construction.

WORDS FROM THE PRESIDENT

OF THE BOARD DR.

DONIELLE

LOVELL:

Our vision for transitional living is one that provides a home and the necessary supports for our neighbors to heal and thrive on their own. We will provide a roof for those who may need it for a few nights or who will take part in a long term program to build sustainability in their lives. We will serve all. We will serve families. We will serve the single man who has a story that would break most of us. The single mom terrified of losing her children. The woman who has been through so much it’s hard to believe she’s still standing. All of these neighbors need our love. But, we won’t be stopping our commitment to feeding our neighbors. In fact, with our new building we will expand our ability to meet that need not only within Hardin County, but also in our region. If you want to be involved with this exciting project please reach out to Executive Director Dawn Cash (dawn.cash@warmblessings.org).

Do you love getting involved with local events? We would love to see what you’re up to! Tag us on Instagram when you host or attend local events at @ElizabethtownLifestyle!

THE ADAGES OF “THINKING OF OTHERS FIRST” AND “SAYING NOTHING AT ALL INSTEAD OF SOMETHING UNKIND” ARE MOST CERTAINLY APPLICABLE AND ESSENTIAL IF PARENTS ARE TO ACHIEVE THE HEALTHIEST FUTURE FOR THEIR CHILDREN.

Healthy Divorced Families

Brooke N. Talley, ESQ. & LeeAnna Dowan, ESQ.

What does it mean to be a ‘healthy divorced family’? For most, it means being happy and content, not stressed or worried, but for others, it just means having survived the trauma and discord that seems inherent in the divorce process. Having a healthy divorce is an opportunity wherein the future of the family is an integral part of the divorce itself. Experience and observation lead to the awareness that the healthiest divorced families are those who recognize divorce is not really the end of the family but rather a re-framing of the family unit. In other words, having a healthy divorced family means acknowledging and planning for the family’s future with a different outlook on how the family will coordinate through future birthdays, Christmases, graduations, births of grandchildren yet-to-come and, sadly, even the future passing of loved ones.

The adages of “thinking of others first” and “saying nothing at all instead of something unkind” are most certainly applicable and essential if parents are to achieve the healthiest future for their children. While parents frequently frame their divorce settlement requests as being in their child’s best interest, it is often actually the parent’s own fear that supports their requests in the divorce process. The fear is real and needs to be acknowledged, but it cannot drive the ship. Many times, when one parent realizes the other is giving a concession, it is easier for them then to give a bit of grace in another area. It is challenging to remember that the difficulties the parties have had as partners are not necessarily indicative of each other’s ability to parent their child.

Being a healthy divorced family requires healthy co-parenting. This is both obvious and counterintuitive. Many people recognize that if they could already successfully co-parent, they would not be seeking a divorce. At these times, co-parenting through an app may be helpful, providing the parties time to heal while not destroying their future successes as co-parents. The apps offer the ability to communicate from a distance and still share information with each other while not really having to talk directly.

Being a healthy divorced family also means realizing just how brief the present time really is. Life is short and is valuable. Healthy divorced families are created through purpose and intent. Being healthy as a divorced couple means being acutely aware that, while the parents may make individual decisions about their personal lives, the children do not have those same opportunities. The choices for children are made by their parents. Being a “healthy divorced family” means all parties are invested in the future health of everyone involved. This does not mean that everyone will work toward that healthy future in the same manner, but it does mean everyone is seeking to achieve the same goal for all involved. This is adulting at is toughest.

91

Divorce is as historic as the Declaration of Independence and has been historically tragic. However, history does not have to repeat itself. There are positive ways to achieve the healthiest post-divorce family possible. There are no magic tricks, but there are some tips to achieving this goal. At Dowan Law Offices, our goal is to assist our clients by not encouraging animosity and seeking to move families forward in a positive way. Here are three things to remember if you want to minimize the trauma of the divorce process and have the most healthy, positive outlook possible for your family once the divorce itself is over.

MANAGING EXPECTATIONS

One of the biggest pitfalls for clients is unmanaged expectations. When seeking a lawyer to work with, select someone who is experienced but who also shares your goals. It is imperative you select a lawyer you trust and are compatible with. Be wary of selecting a lawyer only because they tell you what you want to hear. This initial discussion should not be a sales advertisement on how to win your case. Discuss with that lawyer what the law says about the different components of your divorce, including children, property, debts, and separation details. Discuss also how the judge(s) in your county typically rule on these components. Make sure you understand the broad strokes under the law in the beginning. As each case progresses, expectations may change. It is important to have good access to your lawyer to discuss these changes; however, this does not always mean unfettered and immediate access. Reasonableness is essential.

PUT CHILDREN FIRST

This sounds very basic and like a straightforward task. But it bears repeating: Put children first. Before hurt feelings. Before seeking vindication. Before individual goals. Children are not a prize to be won in the divorce process. Children themselves frequently lose.

Time and time again, people come before the court with a vengeance to prove what is best for their child, to demand entitlements or considerations otherwise deserved. Instead of genuinely contemplating the child’s best interests, parents often rely on their own emotions and project these as that of the child, which may result in long-standing emotional trauma. Also, keep in mind that children are not fragile; they are resilient. The more their new reality is normalized, the better they can see life after divorce as normal.

There will always be children who push back against one parent or the other. But this happens in families that are intact also. Children, by nature, rebel. The only way to get through this in a healthy manner is to present a united and unbiased front with the other parent. Create a co-parenting plan and follow it through. Children should not make adult decisions, be involved in adult conversations, or be made to choose sides. Remember, children notice body language, facial expressions, tone of voice, and word choice. There is an undeniable difference in the sentences “It is time to go visit your mom/dad today” and “Oh, I am going to miss you so much while you are with your mom/dad today.”

BEING A HEALTHY DIVORCED FAMILY ALSO MEANS REALIZING JUST HOW BRIEF THE PRESENT TIME REALLY IS. LIFE IS SHORT AND IS VALUABLE. HEALTHY DIVORCED FAMILIES ARE CREATED THROUGH PURPOSE AND INTENT.

DISCOVER HOW COLLABORATIVE PRACTICES CAN HELP YOUR SITUATION 108 East Dixie Avenue, Elizabethtown, KY 42701 I Phone : 270-872-0911 I https://www.dowanlaw.com

COLLABORATIVE LAW

Collaborative Law is a process wherein divorcing couples resolve their differences without becoming involved in acrimonious litigation. When couples decide to part ways, emotions are often at peak levels, feelings are hurt or bitter, and tensions run deep, but that does not always mean couples are interested in dragging themselves and each other through lengthy and expensive court battles, nor are those battles always necessary. Couples who have reached a point in their communication discord where positive or result-based conversations are no longer possible often need outside people to work with who can relay their information and perspective to the other person without causing heated, emotion-fueled battles.

Collaborative Law is a much less stressful method of transitioning families from marriage to divorce. This process assists the parties, their children, and their extended families in moving forward for more positive future interactions. Families do not cease to exist upon the separation of a couple; families simply have a different complexion. Holidays, graduations, future weddings, and future grandchildren’s births are still matters that will occur for couples and their children. The comfort level and success of those future events can be dependent on the trauma caused, or avoided, by the couples’ separation. Collaborative Law is a healthier way to move transitioning families forward.

LEEANNA DOWAN, ESQ.

Ms. Dowan graduated from Brandeis School of Law at the University of Louisville in December 2002 and was sworn into the Kentucky Bar in October 2003. In April 2004, Ms. Dowan opened Dowan Law Offices. She primarily practices family law and is also a trained parenting coordinator, mediator, and collaborative lawyer. Outside the practice of law, Ms. Dowan enjoys teaching and writing. She has taught a number of undergraduate and graduate-level courses at Sullivan University and her article on Dependency, Neglect, and Abuse cases was published in Louisville Bar Briefs Magazine in September 2018. Ms. Dowan has a wonderful husband, three adult children, and seven grandchildren.

BROOKE TALLEY, ESQ.

Ms. Talley is a trained collaborative lawyer and successful mediator. Beginning in 2015, Ms. Talley represented children across the country under limited licenses in California, Ohio, and Kentucky. She was officially sworn into the Kentucky Bar in May 2017 and then joined Dowan Law Offices in September 2017 after relocating to Bardstown, Kentucky with her husband and three dogs. She relies on her own life experiences and dynamic problem-solving ability to find potential outcomes that will meet her clients’ unique needs and leave them better-off at the end of representation.

DOWAN LAW OFFICES Collaborative Law Attorneys

Home Design & Remodeling Show P R E S E N T E D B Y L I N C O L N T R A I L H O M E B U I L D E R S A S S O C I A T I O N 4 1 S T A N N U A L T H E L I N C O L N T R A I L H O M E B U I L D E R S A S S O C I A T I O N S 4 1 S T A N N U A L H O M E D E S I G N A N D R E M O D E L I N G S H O W O F F E R S Y O U R C O M P A N Y T H E O P P O R T U N I T Y T O G A I N E X P O S U R E , H I G H V I S I B I L I T Y A N D N A M E R E C O G N I T I O N T O A L A R G E T A R G E T E D A U D I E N C E O F H O M E O W N E R S I N T E R E S T E D I N B U I L D I N G , F I N A N C I N G , R E M O D E L I N G , O R M A I N T A I N I N G T H E I R H O M E . S P E A K D I R E C T L Y T O P O T E N T I A L N E W C U S T O M E R S , G E N E R A T E S A L E S L E A D S A N D P O S I T I O N Y O U R P R O D U C T O R S E R V I C E F O R F U T U R E S A L E S D U R I N G A N D A F T E R T H E S H O W I T ' S A N E F F E C T I V E W A Y T O R E A C H A L A R G E , T A R G E T E D A U D I E N C E I N A S H O R T P E R I O D O F T I M E at the Pritchard Community Center - Elizabethown, KY F E B R U A R Y 1 8 T H & 1 9 T H 2 0 2 3 B O O T H S P A C E L O C A T I O N S A R E F I R S T C O M E F I R S T S E R V E R E G I S T E R T O R E S E R V E Y O U R S P O T T O D A Y F I N D R E G I S T R A T I O N F O R M I N Q R C O D E

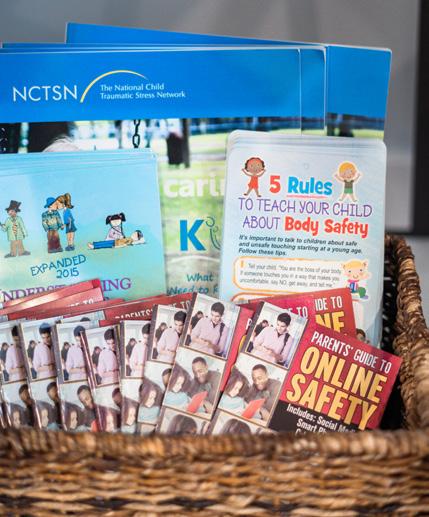

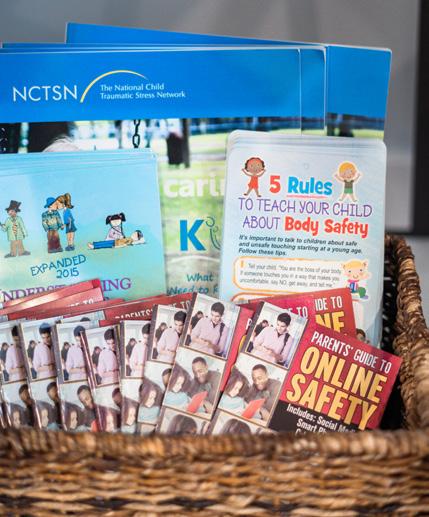

Over the past five years, Silverleaf has seen a steady rise in the number of clients we serve: Victims seeking advocacy, survivors pursuing healing through therapy, and community members requesting education on sexual violence prevention. The demand for services also called for increased staff and square footage. The plan to expand was many years in the making, and we are thrilled to report that today our new building is open and operating.

The new Forensic Annex stands adjacent to our existing Elizabethtown clinic. The purpose of the building is to provide specialized Forensic Interviewing services so that children who have been the victim or witnesses of abuse can receive a structured interview in a comfortable environment. These interviews assist law enforcement and CHFS with investigations of crimes and can ultimately assist with the conviction of perpetrators. In 2021, we provided 446 forensic interviews and are now prepared to offer additional space and services in the future.

Our building was constructed 100% on donations and fundraising. The building costs $578, 680 and we only need $183,600 to pay off the building! We are so thankful for Elizabethtown Lifestyle and all our supporters who have helped this vision come true.

751 SOUTH PROVIDENT WAY ELIZABETHTOWN, KY 42701 270.234.9236 (OFFICE) WWW.SILVERLEAFKY.ORG

Many women Clarity was seeing come through their clinic were also struggling with housing instability; the national housing crisis is close to home right here in our area, and Clarity wanted to do something about it. Clarity wanted these mamas to focus on themselves and their baby during the months of pregnancy and not the stress of where they would sleep tonight. Many of their residents are also food insecure and struggling in many other ways. Clarity wanted residents to have access to individualized case management to help them fill out that job application, go to school, and learn healthy habits—all in the context of a beautiful, loving home environment. So, in July of 2022, The Haven at Clarity opened its doors and is currently housing residents. The Haven is empowering these women by providing security, support, and soul rest so that hope and dignity can be restored for even our littlest Etown residents.

When the stick shows up with two lines (pregnant!) instead of one, but a baby wasn’t in the plans, families in our community have been going to Clarity since 2001 for practical help and loving support.

Clarity offers a myriad of support services for those new moms and dads-to-be. At their free medical appointments, Clients can expect to receive pregnancy testing, an ultrasound, and a nurse consultation to lovingly walk them through what can be a sensitive time of life. Clarity also has an ongoing education program with different tracks that cater to where a woman is at in her journey. There are life-skills classes to help with anything from finance to cooking (can anyone say free crockpot?); prenatal classes show a woman all about what’s happening with her body during pregnancy and how to get ready for delivery, and postpartum classes offer practical support, and all the information new mamas need - like how to get infants to sleep, breastfeeding (taught by a venerated local lactation consultant), and more! Oneon-one mentoring is also an essential part of program participation. Their clients love having someone in their corner, providing a listening ear, a shoulder to cry on, and someone to cheer them on in the first months of parenthood. Mental health is crucial, and Clarity also partners with local Christian counselors when clients are ready to go more in-depth and find healing. Not only do clients receive must-needed education, but through participation in the program, clients can earn free baby items! Many of their clients say they have never had to purchase diapers because they were a part of the program. And clients can even stay in the program until the baby is 18 months old! Clarity has them covered during the time they need it most.

Dads are important to these families, and Clarity has them covered too. Clarity’s “AIM” program is designed with dads in mind, offering dad-specific mentoring and classes. Clarity also enjoys a rich partnership with our local family court system, and Clarity has seen many dads in their program be reunified with their children. Clarity’s not only about helping lives but strengthening families in Elizabethtown.