Property Probst

Nurse-turned-realtor, Elle Probst makes care the key to her success

6 Points of Interest

UNFAIR

MADE IN THE USA: How Americans feel about American-made goods

QUICKHOOKS: Intuit warns of a new phishing scheme

GOAL GETTERS: Our favorite bagel baron Jeff Perera opens a second location

SHARE: A small business owner’s story of social media fraud

16

Your Business, With Love

From

When you use Profit First, your business gives you a thank-you gift every quarter. Employee Spotlight

21 For What it’s Worth Audit-Proof

tips for

your record-keeping

9 16 21 10 Property Probst

nurse-turned-realtor, Elle Probst. gofigureaccounting.net / 3

Alyssa Hunter knows good bread. CPA Q&A Rachel answers your pressing tax planning questions.

Seven

streamlining

to be prepared in the event of an audit—or, even better, prevent that audit from happening.

Meet

Owner, Small Business Development Expert

Charity Fundraising Event Benefiting: February 18, 2023 LAKESHORE CENTER OCOEE CENTRALFLORIDACHILICOOKOFF . COM IT'S NOT WHAT YOU TAKE FROM THE WORLD, IT'S WHAT YOU LEAVE BEHIND! Contribute today at LegacyEventsForED.org PROVIDING GRANTS & SCHOLARSHIPS FOR STUDENTS AND SCHOOLS IN WESTERN ORANGE COUNTY CHILI SAMPLES • CORNHOLE TOURNAMENT • VIP ZONE KIDS ENTERTAINMENT ZONE • BARS AND FOOD VENDORS Tickets on Sale Now! PRODUCED BY Jamie Ezra Mark Creative Director Heather Anne Lee Editor Rheya Tanner Art Director Josh Clark Designer Wendy Mak Designer Andrew Ontko Designer Evan Miklosey Web 407-573-6061 hello@emagency.com emagency.com @EMagencyinc Goals is published quarterly by Go Figure Accounting. Volume 1 Number 4 Copyright© 2023 Go Figure Accounting. All rights reserved. Reproduction in whole or in part without written permission is prohibited. Opinions expressed in the articles are those of the authors and do not necessarily represent the opinions of Go Figure Accounting. FIRST QUARTER 2023 A PUBLICATION OF 4 / goals / first quarter 2023

Crystalyn Truax, Joslyn Jones, Kirstin Pastorick

Prices are up

all over the place

—at the gas pump, at the grocery store, at the car lot. Last year, the federal government reported a 7.5% increase in the cost of goods all across the board compared to the year prior. The consumer price index showed a 4% rise in housing, a 12% increase in the price of meat, and the cost to buy a used car is up more than 40%. Meanwhile, economists say the world could be sliding toward recession.

But here’s another reality: While families are dealing with sticker shock, profits for companies are skyrocketing. At the national level, data from the U.S. Commerce Department shows that corporate profit margins are the largest they’ve been in 70 years.And that’s on trend with what we’re seeing with our clients at Go Figure. As we go to press, one of our clients, with an incredibly consistent track record over 10 years, just posted their biggest revenue-generating month yet. And not by a small amount—nearly triple!

They aren’t the only ones. More than 75% of our clients are posting profits at a record rate. That’s not to downplay the fact that there are many small businesses that are struggling—they are—but profit seems to be more prevalent than recession, and for that we’re very grateful.

Which just goes to show that our capacity to recover quickly from difficulties, e.g., global pandemics, is a vital ingredient to how to approach running a small business. It’s difficult to imagine achieving success, however you may define it, without also suffering scrapes and bruises along the way. The trick is never doubting your capacity to rally.

Consider Elle Probst, realtor extraordinaire and this issue’s cover story. This kind, soft-spoken woman is the mother of reinvention, pivoting her life and her businesses in extraordinary ways over the years. Today, she can literally save your life, and save your deals, and now she’s learning to leverage Profit First to create the life and business she’s always dreamed of. Isn’t that beautiful?

So here’s to all the small business owners doing hard things, without any guarantee of success. Here’s to the hardworking teams building the ship as we’re steering it, with the grace and confidence to learn from our inevitable missteps.And here’s to walking into 2023 with a profit-first mindset and the audacity to dream big and make a difference in the world.Just like Elle.

Rachel Siegel, CPA rachel@gofigureaccounting.net

Rachel Siegel, CPA rachel@gofigureaccounting.net

gofigureaccounting.net / 5

More than 75% of our clients are posting profits at a record rate. That’s not to downplay the fact that many small businesses that are struggling—they are— but profit seems to be more prevalent than recession, and for that we’re very grateful.

POINTS OF

$770 million

The amount US consumers lost in social media scams in 2021, up 18x from 2017.

SOURCE: FTC

Unfair Share

ing,” says Dr. Donita McCants, owner of a concierge mobile veterinary practice in central Florida. “At first, it was a few hundred dollars — something a business owner wouldn’t think twice about. You see a charge for Facebook Advertising and you think, ‘yes, sure, that makes sense.’ But really, I was only spending half of that.”

Cramming an entire veterinary office inside the back of a trickedout Mercedes Benz Sprinter van was not a childhood dream of Dr. Donita’s, but taking care of animals certainly was. “I was always one of those kids putting popsicle sticks on baby birds. I’ve pushed for this dream since I was 5 years old. Now the dream is real.”

And the process of turning that dream into reality was one she documented on Facebook and TikTok. She never would have imagined that sharing her story would come at such a high cost— to the tune of $20,000 in fraud.

Social media has become almost an extension of the self; we use it to stay in touch, meet people, plan our weekends, shop, relax, or kill a few minutes while we’re sitting in the drive-thru. But a recent influx of fraud reports to the Federal Trade Commission indicate that

this online social life is the newest target for scammers.

And we’re not talking about some run-of-the-mill pickpocketing. “They literally mirrored my accounts, siphoning money out from my checking and PayPal accounts without me even know-

It wasn’t until she brought her books to Rachel Siegel for help reconciling the accounts that the pieces finally started to make sense.

“I just felt like my numbers were draining, and I didn’t know what was going on. It took Rachel literally 24 hours to sort it out. She’s absolutely incredible. I’m so grateful.”

Social media fraud cost one small business owner more than she bargained for.

6 / goals / first quarter 2023

It may have taken 24 hours to identify the gap, but it would take months to finally say the problem was solved. “The scammers are just that good,” Donita says. “They were so deep into my accounts that even when I turned off PayPal and disabled my linked accounts, they had already accessed my bank accounts. At one point, they changed all my passwords, and when I fixed it, they did it again!”

It took starting from scratch— new bank, new accounts, each with new double- and triple-authentication—to put an end to the sieve. While the worst may be over, there’s no way to undo what’s been done; Dr. Donita won’t recoup a single cent of what she lost. It’s a painful lesson for a first year in business. But Dr. Donita, ever the optimist, just wants others to learn from her mistake.

First and foremost, Donita says: Have a great accountant. “Go Figure has been so instrumental in repairing the damage and helping me stay afloat during this time.”

Second: Don’t rely on automated systems to tell you what, where, and when you’re spending. “Write down what you spend or authorize on social media advertising. Only use one tool to place your ads. No third-party anything.”

And finally: Keep a strangle hold on your accounts, even if it’s inconvenient. “I have one account linked to my social media advertising account and that’s it. And set your fraud alerts to the highest level. Sure, it’s a pain to triple-authenticate every time you purchase something, but it’s worth every penny.”

MADE IN THE USA

According to the Wall Street Journal, American companies are on pace to bring back 350,000 jobs from overseas—the most since tracking data started in 2010, when only 6,000 jobs were returned. Some reasons for the boom in reshoring include supply chain havoc from Covid and the war in Ukraine, as well as new government incentives for domestic production. So, how important is buying American to Americans in 2022? One of our favorite newsletters, Retail Brew, teamed up with Harris Poll and surveyed 1,986 US adults to find out.

72%

of US consumers seek out American-made products very often or somewhat often.

64%

said inflation has negatively impacted their preference for domestic goods. 26% of those said inflation has a lot of negative impact.

48%

are willing to pay 10% to 20% more for American-made goods over imported goods.

“At first, it was a few hundred dollars — something a business owner wouldn’t think twice about. You see a charge for Facebook Advertising and you think, ‘yes, sure, that makes sense.’ But really, I was only spending half of that.”

gofigureaccounting.net / 7

– Dr. Donita McCants, client

Quick Hooks

AN APPLE A DAY

With a market size of $4 trillion, health care accounts for about 20% of the entire US economy. That may be why Apple released a 60-page report outlining why health care will be a major focus for the company going forward.

And it’s not the only tech giant getting in on the health care craze; Amazon recently turned-andcoughed up $3.9 billion to buy primary care provider One Medical.

Intuit

Accounting and tax software provider Intuit sent emails warning users of its subsidiary accounting software, QuickBooks, to be on the lookout for phishing emails purporting to be from the company.

The emails appear to be official messages from Intuit, with logos and all, telling people there are issues with their account, such as being unable to verify some information and asking them to click a link that collects personal data.

The company says it will never send an email with a supposed “software update” or “software download” attachment, nor will it send an email asking the recipient to send sign-in or password details, ask for bank or credit card details, or ask business users for confidential information about employees in an email.

$554 BILLION

The current total value of the accounting industry; by 2025, that value will be $736 billion.

90%

The percentage of accountants who feel there was a cultural shift in the industry.

1/2

The number of accountants who feel that providing financial advice is part of the job.

79%

The percentage of accounting forms that offer Covidrelated services.

10-15 YEARS

The average time taken to make partner in accountancy companies.

Riddle Me This

First appearing in Life magazine in 1962, the Zebra Puzzle is about one very colorful neighborhood. Each house is painted a different color and lived in by a person of a different nationality. Each person owns a pet, drinks a beverage, and smokes a brand of cigarettes, and none of them owns, drinks, or smokes the same thing.

The puzzle itself has 15 “pieces,” which are each facts about this neighborhood:

1 There are five houses.

2 The English person lives in the red house.

3 The Spanish person owns the dog.

4 Coffee is drunk in the green house.

5 The Ukrainian person drinks tea.

6 The green house is immediately to the right of the ivory house.

7 The Old Gold smoker owns snails.

8 Kools are smoked in the yellow house.

9 Milk is drunk in the middle house.

10 The Norwegian person lives in the first house.

11 The person who smokes Chesterfields lives in the house next to the person with the fox.

12 Kools are smoked in the house next to the house where the horse is kept.

13 The Lucky Strike smoker drinks orange juice.

14 The Japanese person smokes Parliaments.

15 The Norwegian person lives next to the blue house.

And so, the final question— two questions, actually: Who drinks water?

And who owns the zebra?

FACTS & FIGURES

warns of new phishing attack against QuickBooks customers.

8 / goals / first quarter 2023

GOING UP

IRS interest rates increased again. Here is how they compare to the federal shortterm interest rate, which currently sits at 3%:

Non-Corporate Taxpayers: +3 (6%) for underpayments and overpayments.

Corporations +3 (6%) for underpayments

+2 (5%) for overpayments.

Large Corporations +5 (8%) for underpayments

+0.5 (3.5%) for overpayments exceeding $10,000.

GOAL GETTERS Double the Dough

Jeff’s Bagel Run is our tastiest small business success story.

Quick recap: After moving to Winter Garden in 2016, Jeff and Danielle Perera began searching for the perfect bagel. Unfortunately, finding a morning bagel in Florida that appeased the two New York natives proved nearly impossible. So, Jeff did the only sensible thing—he started making his own.

That spark ignited a business, and Jeff’s hobby turned into sharing joy with the community in the form of a pop-up shop featuring hand-rolled, always boiled, fresh daily, delicious bagels!

Turns out, the entire community was hungry

for something better. (Including Go Figure—Jeff’s Bagel Run is our breakfast of choice, and we did a little happy dance when Jeff and Danielle first became clients nearly two years ago.) They struggled

to keep up with demand, often selling out of a day’s worth of bagels in minutes. They tried adding more pop-ups to get more bagels into the community. When even that wasn’t enough, the pair did what any budding young business would do and turned to Kickstarter.

Their digital fundraising campaign helped them successfully establish their first brick-and-mortar location in July 2021, and their second location in July 2022. When you pair passion with good finances, anything is possible!

POINTS OF INTEREST

gofigureaccounting.net / 9

Property Probst Nurse-turned-realtor Elle Probst firsthand that in the business of health and homes, care is the key to success.

HEATHER ANNE

PHOTOGRAPHY

LOPEZ 10 / goals / fourth quarter 2022

STORY

LEE

FRED

Property

get to step into people’s lives and help them with one of the biggest financial decisions they’ll ever make. I get to help the growing family find that extra bedroom and the veteran who’s been all over the world find a place to call home. I get to be a shoulder to cry on when it’s a family home being sold after someone’s passing. It’s as honorable as when I was at the bedside of a sick patient. Helping people is helping people, and that makes me happy.”

That’s Elle in a nutshell.

A registered nurse and certified realtor with The Property Pros, Elle Probst is humble and kind, giving the best of herself to everyone around her. “In both industries, health care and real estate, people need an advocate. They need someone who’s compassionate and who’s listening to them. I believe that’s my role as an agent, just as it was when I was a nurse.”

Nursing is, quite literally, in Elle’s blood. Her great-aunt was one of the founders of the second oldest hospice in America—Hospice of Northern Virginia, established in 1973—and helped grow the program throughout the U.S. and the Philippines.

“She was an oncologist,” Elle says. “But she saw more and more patients struggling with what to do at the end of life: Where do you go when every other option is exhausted? She wanted them to have every comfort at every stage of life.”

Year later, she rallied for Blue Cross Blue Shield to accept hos-

pice as a paying source for end-oflife care. It is thanks at least in part to Elle’s great-aunt that hospice care is widely available today.

Wealth in Health

Obviously proud of her legacy, it’s no surprise that hospice care was Elle’s health care passion— something she herself wouldn’t discover right away. “First, I was a children’s hospital nurse, but that only lasted six months because it was so heart wrenching, to see the kids suffer,” she says. “From there I spent five years as a cardiac nurse in Williamsport, Pennsylvania, before returning to the Alexandria/Falls Church area, where I became the nurse liaison for hospice patients. That’s when I first fell in love with hospice care.”

But life has a funny way of altering our plans. In 2004, Elle found herself relocating to Orlando, Florida, to take a job in the cardiac catheterization lab at Sand Lake Hospital, where her trajectory rapidly changed. “Sand Lake was a little community hospital at the time. I was working per diem, and they asked me to come on as an assistant nurse manager. And my career just grew from there.”

The hospital had already opened a second cath lab before a fateful merger with Orlando Health led to Elle’s team suddenly managing nine hospitals throughout the region.

In this role, she helped develop the open heart backup program at Orlando Regional Medical Center and earned her nurse practitioner degree before turning her

focus to her new role as heart failure program coordinator.

Her goal? To reduce readmissions from 26.7% to under 16%.

“I developed a trial where each patient was screened coming in through the emergency room, went through our protocol, and received their medications before they got discharged,” she says. Within two months, readmissions had decreased to 14.6%, and would ultimately settle at less than 12%. “It was an overwhelming success!”

So overwhelming, in fact, that the program was replicated at a number of regional hospitals, and Elle was tasked with developing a similar outpatient program. All told, these programs were the seeds that would eventually grow into the wildly successful Orlando Health Heart Institute.

The Art of the Deal

While the heart program was her biggest career accomplishment, it also quickly became her greatest stressor. “The work was incredibly rewarding, but I was working nonstop and losing time with my son. I had no life outside of work. I was completely burned out.”

On Dec. 8, 2015, Elle stepped out of nursing and into entrepreneurship, becoming a franchisee of Painting with a Twist. “I had no idea how to run a business, or a franchise,” she says with a smile. “But it looked fun, and I wanted something completely different.

She built a location in Clermont and, in typical Elle fashion, was incredibly successful. “The franchise model is a

12 / goals / first quarter 2023

I

gofigureaccounting.net / 13

“In both industries, health care and real estate, people need an advocate. They need someone who’s compassionate and who’s listening. I believe that’s my role as an agent, just as it was when I was a nurse.”

“Here’s what I love most: I wake 14 / goals / first quarter 2023

up every day unemployed. Every day, I need to find new business, and that keeps me motivated.”

great way to get that experience because it’s like a floor plan; they give you the tools to succeed—if you’re willing to do the work,” she says. “I got a crash course in business development, from the construction buildout to finances and monies, and hiring people, and bookkeeping, and how to get an alcohol license. I didn’t know it at the time, but it really set me up for my real estate career.”

She was named Painting with a Twist’s 2016 Rookie of the Year, and secured the rights to a Winter Garden location. But as fun as it was, it still didn’t give her the flexible lifestyle she wanted. So when she had the opportunity to sell in January 2019, she took it, changing course yet again to take on real estate full time.

Like many new agents, she cut her teeth working in model homes for a builder, KB Home. She didn’t stay long, but she did refine her knowledge of the market and negotiating skills while she was there. In her first year as a bona fide realtor, she only sold one home. But she was undeterred, and by year two, that number grew to eight, and then the third year was 20. This year,ambitious as ever, her goal is to sell 30 to 40 homes.

“Here’s what I love most: I wake up every day unemployed,” she says. “Every day, I need to find business, and that keeps me motivated. You see a lot of new

agents drop off really quickly because they don’t treat it like a job. The ones who actually succeed are ones that treat it like a business. Success doesn’t happen over night.”

A House in Order

Elle is both talented and experienced at the human side of her job—networking, negotiating, and client relations. What she admits to being not-so-good at is the business and finance side.

“And that’s where Rachel comes in,” she says.

She’s referring to Rachel Siegel, owner of Go Figure Accounting, whom she first started working with in 2019. “In the beginning, it was as simple as separating personal and business accounts. I was always mixing my money, so that’s the first thing Rachel taught me,” she says. “Then she helped me get the business organized the right way, as an S-Corp instead of an LLC. I ended up paying a lot of taxes my first year. It was painful.But then I actually got money back the next year.”

Thanks to both better business planning and implementing Profit First to further improve her cash flow, Elle finally enjoys the flexibility she has worked three separate careers to achieve—and even has enough in the bank to start planning for retirement.

“Rachel makes it so easy. She lets you do anything you want in terms of how you handle your business. If you want to do all the bookkeeping yourself, you

can. Of course, for me, it’s not my expertise, so I put my faith in her to set up the bank accounts and allocations. She helped me thrive financially, in a way I never imagined possible.”

Elle credits the Profit First plan for all her, well, profits. But she also acknowledges that it takes some getting used to. “At first, it’s confusing. But I’ve been learning more in the last two years, and now I understand why there are different accounts for owner’s comp and operating expenses and taxes. And paying myself—I can’t tell you how freeing it is to have my money working for me! Now I’m not waiting for a deal to close to be able to pay my bills.”

Patients Are a Virtue

Today, Elle is living the life of her dreams. She has the freedom to travel and work from anywhere, and the financial protocols in place to move forward with confidence. As Rachel often likes to say, Elle finally gets to work on her business, rather than just working in her business.

“I don’t tell a lot of people that I make more in real estate than I ever did in my nursing job. In my second year, I made my nursing salary in the first four months,” Elle says. “Still, I truly miss my patients. Patient care was my number one priority. But now I treat clients like patients, so it’s a different spinoff—the best of both worlds. Which is why I always say, ‘I can save your life … and your deals!’”

gofigureaccounting.net / 15

TAKEN INTO

16 / goals / first quarter 2023

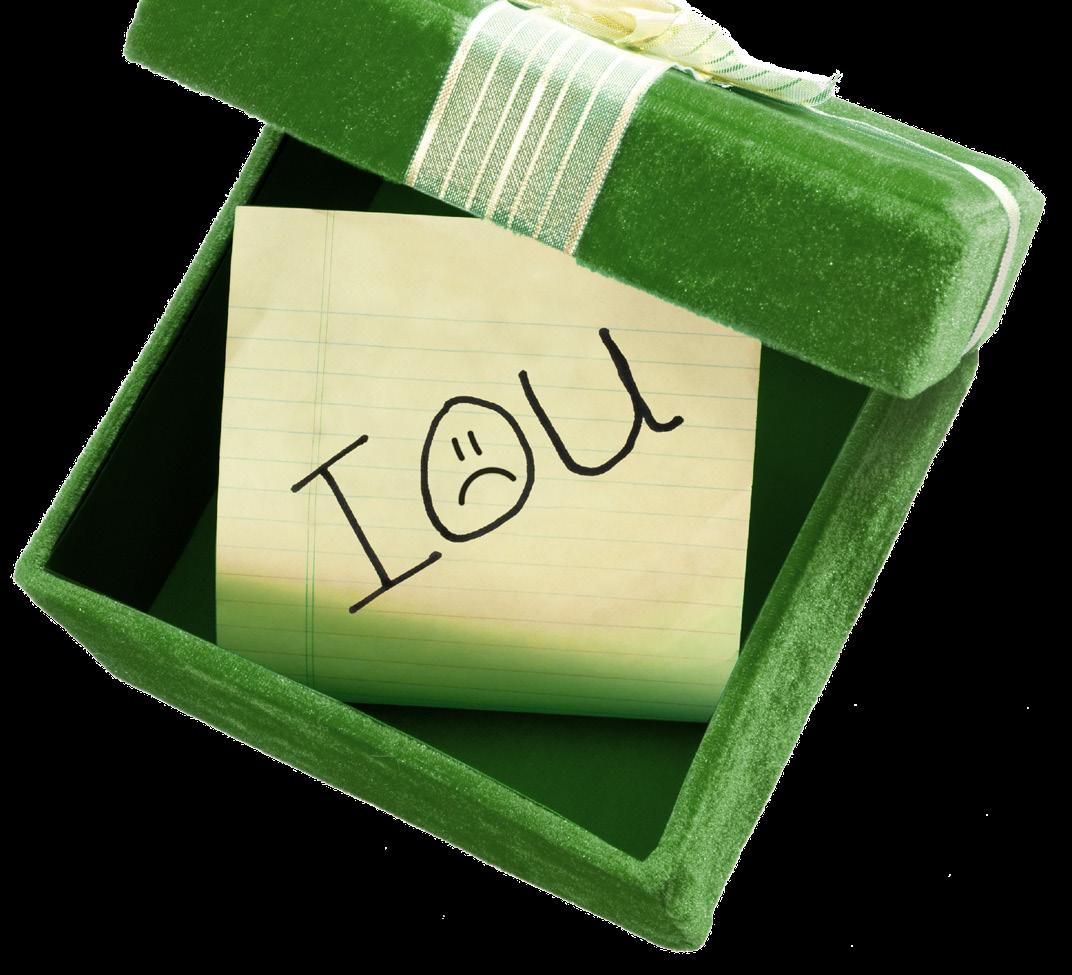

You did it. You made it through another year. And it’s high time to treat yourself to a little extra Because you know what? You deserve it. You’ve been working in and on your business, day in and day out, year after year. What’s the point of all that time and effort if you never get to enjoy it?

Believe it or not, your business knows how hard you’ve been working. You’ve been practicing Profit First diligently and have taught your business how to run more effectively. Now your business wants to give back, above and beyond what it already gives you. How? With a quarterly profit distribution.

Not to be confused with Owner’s Pay, which is treated as a salary, the quarterly profit distribution is more like a bonus. This is your business’s gift to you as the owner for always going the extra mile to keep it healthy. And rather than only getting that gift once a year, you get it every. three. months.

Good Things

Come in Quarters

Surely we’ve talked to death about the Profit First process and its five bank accounts: Income, Tax, Operating Expenses, Owner Pay, and (our favorite) Profit. The main purpose of the Profit account speaks for itself, but it also serves some other, secondary purposes:

• Growth metric. As your business grows, your profit grows in kind. The Profit account, then, is almost a small-scale model of your success.

• Cash reserve. Ideally, you only ever draw from this account when you want to, but, ready or not, emergencies happen. In those cases, the Profit account is the big, fluffy cash cushion that gets you through it.

• Quarterly reward. On the first day (or first business day) of the quarter, equity owners draw from this account as a thank-you for having the courage and risk tolerance to start and maintain the business.

It’s this third function that we’re homing in on here—the “reward” part, of course, but also the “quarterly” part. Some people choose to take their distribution more or less often. But in our experience, quarterly is the sweet spot; it’s long enough between distributions that they don’t feel like part of your income, but still frequent enough that you can enjoy the benefits of business ownership, not just “every now and then,” but here and now.

It’s best to follow the financial quarter, rather than counting the months from the first day you begin implementing Profit First. Let’s say your Profit First practice began August 12. You’d still take your distribution on October 1, the first day of Q4 It doesn’t matter whether you started on July 3 or September 26; what matters is that you get into a rhythm that’s as easy to track as possible.

Profit, Meet Pocket

On to the good stuff. Drawing your quarterly profit distribution takes three simple steps: 1. Tally the total in your Profit

Turn Extra Into Extra Extra

Part of the Profit First Process involves converting more of your expenses into profit. Each quarter, you evaluate your current percentages and move them closer to your target. Just one caveat: Never take a step back.

If you are adjusting and tweaking your percentages conservatively, we suggest that you account for three percentage points each quarter. Meaning you could move your Profit Account from 5% to 8%. Or you could move your Tax Account from 11% to 12%, Profit from 5% to 6%, and Owners Comp from 23% to 24%.

gofigureaccounting.net / 17

In our experience, quarterly is the sweet spot; it’s long enough between distributions that they don’t feel like part of your income, but still frequent enough that you can enjoy the benefits of business ownership, not just “every now and then,” but here and now.

An Extra Layer: Debt

The percentages used in this article assume you don’t have any debt. Debt ties you to the past and prevents momentum. It’s important to keep your cash flowing for present expenses and future growth.

We encourage business owners to prioritize their debt—take on as little and pay down as much as possible. However, we also recognize that’s easier said than done. The beauty of Profit First is it can help you get rid of debt while still giving you profit to take home.

So, when you withdraw that 50% from your profit account at the top of the quarter, we suggest you take 98% of it and throw it at your debt! From our earlier $5,000 example, you would withdraw $2,500, put $2,450 toward your debt (Do you feel that? It’s the feeling of your success punching your debt in the face.) and take the remaining $50 as profit.

It’s important to enjoy the fruits of your labor; even if it’s a small portion, it still gives you more confidence than if you’d kept nothing. Only have enough to buy a Big Mac? It’ll be the best Big Mac you’ve ever had.

account.

So what do you do with those funds? Whatever you want! Your profit distribution is that little extra you can put toward all the other extras of your life. There is, however, one exception: You can never put your distribution back into the company.

Your business gave you a gift that it doesn’t want back. Even if

Account as of the last day of the previous quarter. If it came in this quarter, it doesn’t count.

2. Take half of the money (that’s right:50%) as profit.

3. Leave the other half in the account so it can keep serving its other functions, growth metric and cash reserve. Let’s say, for example, you had $5,000 in your Profit account

on September 30. If you are the sole owner, you’ve got $2,500 in your pocket on October 1. If you share ownership (ex., you own 60%, a partner owns 35%, and an angel investor owns 5%), then you would distribute the profit according to each owner’s share ($1,500, $875, and $125, respectively). In either case, $2,500 stays in the Profit

you try to dress it in fancy terms like “reinvest” or “profit retention,” you can’t cover up the fact that you are robbing Peter to pay Paul. Your business needs to run off the money it generates in its operating expenses. Full stop.

Always take your profit, and always treat it like profit.Use it on whatever gives you joy: A nice dinner for your family; a vacation; that new Tesla.

And if you could’t take enough profit distributions last year, make it a goal to have good habits and take more for 2023 and forward.

18 / goals / first quarter 2023

Always take your profit, and always treat it like profit. Use it on whatever gives you joy.

to walk into her office, with your nose welcomed by the peanuty aroma of freshly baked cookies, and your ears blessed with the soft, sensuous tune of classical music floating through her door. Her classic vibe sets just the right tone for anyone who may be unsure of where to go for their accounting needs.

Expert problem solver and travel enthusiast, Alyssa obtained her accounting degree from Indian River State College in Indiantown and is currently working toward her Business Management degree at UF. Alyssa married her companion, Chris, just about 9 years ago, and together they share the love from two fur babies.

This methodical Go Figure accountant takes great pride in everything she does, which is evident—just try her homemade gluten-free goodies to see what we mean!

Alyssa Knows All

Whether you’re looking for an organized mind, an empathetic soul, or a really good fresh-baked dessert, Alyssa Hunter is the

What’s your official title?

What’s your specialty?

I work with new clients and take care of setting them up. I also handle the bookkeeping cleanup.

What’s the best part of your job?

Looking for that needle in a haystack, solving the puzzle that leaves others stumped, helping clients by giving them a clean set of books so they know how their business is doing. There are so many things I love about this job; I can’t pick just one, but those are the top three by far.

What is your favorite hobby or pasttime?

Baking is my top hobby. It’s relaxing to me, and I enjoy seeing the happy faces when people eat my food. There’s always a new challenge (like baking a gluten free cupcake

from scratch) or something new to try. The two things I’m famous for: apple pie and peanut butter cookies!

Photography is one of my other favorite hobbies. I’ve traveled all over the country, been to almost all 50 states, and fell in love with photography along the way. The best form of photography is the black and white, with a film camera, not digital.

What is your family like?

I have been married for 9 years. My husband, Chris, and I have two dogs, Xena (like the warrior princess) and Brie (like the cheese).

What is something about you that people may not know or expect?

I am an old soul. I listen to classical music. I knit. I read. I love sitting on the back porch with a cup of tea listening to the birds chirping and the wind moving through the trees.

SPOTLIGHT gofigureaccounting.net / 19

The people that put the “go” in Go Figure TEAM

Tactics for Taxes

year-end business questions.

Rachel Siegel, CPA

This has been a great year for our company, posting profits we never anticipated. But that makes us nervous about tax season. What can we do to offset these gains?

Great question! Truth be told, being proactive and doing tax planning throughout the year is the best thing to do. You may have been able to offset more of your tax liability had we addressed this earlier, but better now than never! Here are three strategies to consider.

Time your income & expenses

When it comes to year-end tax reduction strategies, many businesses that use cash-basis accounting start with the practice of accelerating deductions into the current tax year and deferring income into the next year. Accelerating deductions could be paying bills or employee bonuses due in 2023 before year-end or deferring income by holding off on invoicing until early January.

Maximize your QBI deduction

Certain self-employed individuals and owners of pass-through entities (that is, sole proprietors, partnerships, LLCs, and S corpo-

rations) can deduct up to 20% of their qualified business income (QBI), subject to certain limitations based on W-2 wages paid, the unadjusted basis of qualified property and taxable income. The deduction, created by the Tax Cuts and Jobs Act (TCJA), is set to expire after 2025, so make the most of it while you can.

If the W-2 wage or property lim-

its are capping your deduction, you could increase your deduction by increasing wages or accelerating the purchase of capital assets. Of course, these moves usually have other consequences, such as higher payroll taxes, that you should weigh with all other business considerations before proceeding.

Accelerate depreciation

The TCJA also increased the Section 168(k) first-year bonus depreciation to 100% of the purchase price, through 2022. Beginning next year, the allowable deduction will drop to 80% of the purchase price, then by an additional 20% each subsequent year until it evaporates altogether in 2027 (again, absent congressional action). Combining bonus depreciation with the Section 179 deduction can produce substantial tax savings for 2022.

Under Sec. 179, you can deduct 100% of the purchase price of new and used eligible assets in the year you place them in service — even if they’re only in service for a day or two. Eligible assets include machinery, office and computer equipment, software, and certain business vehicles. The deduction also is available for some improvements to nonresidential property.

CPA Q&A

Rachel answers your most pressing

20 / goals / first quarter 2023

The good news is that you don’t have to decide now. As long as you placed qualified property in service by December 31, 2022, you have the option of choosing the most advantageous approach when you file your tax return in 2023.

First thing’s first: Don’t lose sleep over the latest small business boogeyman. Contrary to the fears and rumors among many US small business owners, the IRS is, in fact, not raising an army of auditors that will be coming to get you next tax season.

It’s true that the IRS is hiring; the Inflation Reduction Act that passed in mid-August does indeed call for the hiring of

up to 87,000 new agents. But these hires are mostly to keep up with modern tax demands and an increasing US population, and to replace retiring agents (an estimated 50,000 by 2028). Plus, those “agents” aren’t even necessarily auditors. At the end of October, the IRS reported that it has hired 4,000 agents—all of whom are customer service representatives

tasked with answering inquiries and (hopefully) unclogging its notoriously impenetrable telephone assistance lines.

In short, no, an audit is not inevitable. However, an audit is always possible, and there’s no better way to invite that possibility than sloppy bookkeeping. So, since the topic is on everyone’s mind anyway, let’s brush up on best practices for

tracking those business expenses.

The IRS recommends what is called a “contemporaneous approach,” basically organizing and tracking your expenses as they occur (aka, “contemporaneously”). Here are seven ways to help you ensure you are prepared in case of an audit—or, better yet, to hopefully prevent an audit from occurring.

FOR WHAT IT’S WORTH

Seven tips for keeping your business expenses and record-keeping organized.

gofigureaccounting.net / 21

KNOW WHAT TO TRACK— THEN TRACK IT.

For a truly airtight expense record, you’ll need a specific tracking strategy for:

• Cash flow

• Expenses

• Charitable giving.

Some business owners prefer to develop these strategies and track them all themselves, to save some money at the cost of time. Others prefer to outsource it to a bookkeeper. However you decide to do it, it is an absolute must that you commit to doing it consistently.

Those in the do-ityourself camp tend to let things slip after a while, often leading to nightmarish tax prep as they scramble to remember and record all their expenses at once—or, worse, they find the IRS knocking on their door. In our opinion, the savings just aren’t worth the headache.

1KNOW WHAT TO KEEP TOGETHER.

The only thing worse that forgetting what you spent is forgetting where you stashed away the forms that tell you what you spent. If you want to avoid tearing your office apart in search of a missing receipt, you’ll store all your financial information in one place.This includes past tax records, as businesses are required by law to keep at least three years of tax documentation on hand in case of an audit.

Prefer physical copies? Assign one drawer or folder to the task of storing your expenses. Hate all the paper? Keep digital records instead, either locally or within the cloud. You might also store your expenses within your subscription service app.

2KNOW WHAT TO KEEP APART.

They say you should never mix business with pleasure, and the IRS agrees: Keep your business and personal accounts separate. And by “separate,” we mean “as separate as possible.” Separate credit cards. Separate bank accounts. Maybe even separate banks, if you are especially prone to this habit.

The more your expenses overlap—say your personal vehicle doubles as a work vehicle, or you bring your family along on a business trip and put it all on the company card—the more your expense reports will raise an auditor’s eyebrows.

AUTOMATE AS MUCH AS YOU CAN.

Once upon a time, professionals kept all their business receipts in a manila envelope. This is still a good practice (see #2), but nowadays there are many apps and software options that can augment or even replace that envelope. Sync all your accounts, upload photos of receipts, write and deposit checks remotely, and enroll in autopay for recurring bills and invoices. The future is awesome. Keep in mind, though, that technology is not infallible; it’s wise to review your transactions regularly to make sure your money is being moved where and how it should. An unwatched account is at a greater risk of fraud (see “Unfair Share” on page 6).

34

FOR WHAT IT’S WORTH 22 / goals / first quarter 2023

GET YOUR DEDUCTIBLES IN A ROW.

This is one of the key areas that triggers disputes, so it’s critical to understand what does and does not qualify as a deductible. According to the IRS, business deductions should be both ordinary and necessary In other words, any expense that is common for businesses in your industry and is necessary for keeping your business running can be a deductible. Pretty straightforward. Except not really. The danger is in the expenses that seem deductible, but come with caveats (e.g., home office space, work lunches, capital expenses) or aren’t deductible at all (e.g., commuting costs, insurance, legal fees, business attire). When in doubt, ask your accountant. Aren’t you glad you have one?

KEEP YOUR EXPENSES TO YOURSELF.

However much your personal finances can complicate your expense reports, your employees’ finances can complicate them even more. Remember: Only businesses can make business deductions. Employees cannot make business deductions on their personal taxes. This is a relatively new change, within the past few years, so some people may find the consequences confusing. But the long and short of it is, if an employee incurs a personal expense on behalf of your business, they can only be reimbursed through your business. If your employees are frequently making business purchases, consider giving them a company credit card. It’s less hassle for everyone and makes those purchases more trackable to boot.

RECORD CHARITY WITH CLARITY.

Even if they are given in your business’s name, charitable contributions are not a business expense if you are a sole proprietor reporting your business income on a Schedule C. But they could potentially be an itemized deduction on your personal return. If the contribution is in exchange for a sponsorship, it can be categorized as advertising or marketing rather than charity.

56

7

gofigureaccounting.net / 23

BUSINESS I PERSONAL CONSULTING • BOOKKEEPING • TAX PREP • QUICKBOOKS gofigureaccounting.net I 407-855-6648 Expert business planning from the word

Rachel Siegel, CPA rachel@gofigureaccounting.net

Rachel Siegel, CPA rachel@gofigureaccounting.net