Hi, Felicia!

How Felicia Reed creates her own picture of success

4

Top Story

Is AI the future of photography?

Trends

Three pro tips for 2023; SPARE and the power of marketing; finding the unicorn

8

At the Heart of Lawyering Stephanie Hon on clients, compassion, and growth

Q&Accounting

Venus answers your most pressing business questions.

22

Straight Talk: CRMs

Time is money. Money is freedom. Freedom comes from great CRMs

Myth Mash

Busting five Profit First myths.

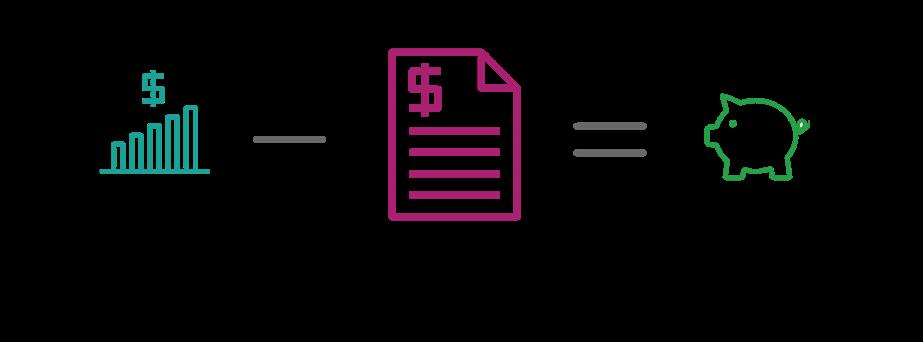

In this model, your business’s profits are whatever money will be left over. It’s simple in theory, but it is more likely to leave you with less profit—if you have any at all.

Why? Because you’re human, and humans aren’t good at keeping leftovers. If you have food to eat, you eat it. If you have money to spend, you spend it.

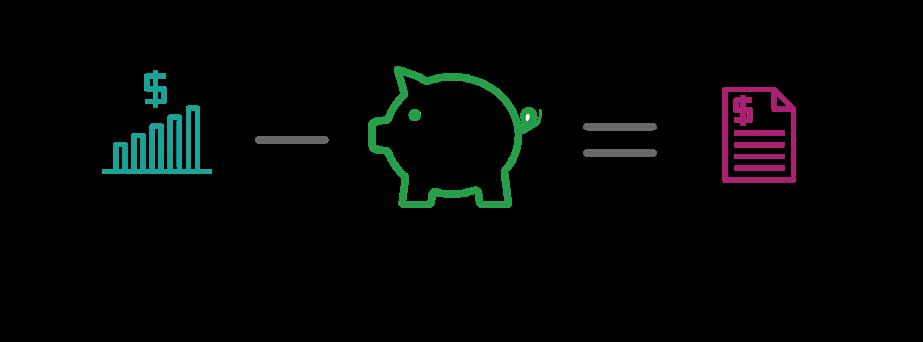

What you need is a formula that prioritizes your profit, so that you know at the beginning of the year how much money you want left. By deciding up front how much you want to have at the end of the year, you force yourself to find ways to get the same things done for less money.

How

you define growth? This is one question I always ask when onboarding new clients. And it amazes me to hear the diverse range of answers

Many associate growth with more revenue, higher profits, and bigger business value. But with our clients, we hear more often that growth is about more than money. They want to grow as individuals, to improve their workplace for their employees, to be successful enough to enjoy their lives with their families.

For your business to grow, there are a massive number of tasks that must be completed daily. Often these smaller, seemingly trivial tasks can have a substantial cumulative effect on your bottom line. This is where we come in.

At One21, we help entrepreneurs master their financial lives. We do your bookkeeping and Profit First planning — so you can focus on running your business! In fact, we’re proud to work with an eclectic mix of small businesses, photographers, legal professionals, and entrepreneurs. Some have been around for decades; others are just getting started. No matter where they land, we are honored to play a vital role in their growth and success.

This premier issue of In The Zone is filled with growth stories that we hope resonate and inspire you to revisit your definition of growth. While these inaugural pages are filled with personalities and practical financial tips, the goal is to get to know you better, our clients, and future clients.

I’d love to know: what does growth mean to you? Email me or tell us about it on Instagram or Facebook. And let’s get “In The Zone” together!

We’re proud to work with an eclectic mix of small businesses, photographers, legal professionals, and entrepreneurs.

It may seem like sci-fi, but AI photography tech is right here for all of us to use in 2023.

Photography is a technology that is constantly evolving. Every camera runs on some kind of computer. Every computer runs on some kind of software. And the newest, groundbreaking progression is the incorporation of artificial intelligence (AI). Except, it’s not really “new.”

Manufacturers have been integrating AI into photography for years now. If you have a smartphone, you already have AI facial recognition, autofocusing, and portrait mode tech at your fingertips.

AI is also coming in handy for professional photographers. Adobe Lightroom’s new AI masking feature saves tremendous time on precise adjustments; Capture One’s smart adjustments feature uses AI to analyze images and assist with exposure adjustments and color correction; Adobe Photoshop’s neural filters can turn a frown upside-down, or even adjust the age of your portrait subject, in seconds rather than hours; and Topaz Gigapixel does the previously impossible—enlarge an image without visual degradation.

Photographers are using AI mood boards to plan shoots, AI stock images to create the perfect asset, and everything in between. In responsible hands, AI artwork is both powerful and accessible, giving artists more control and non-artists the ability to turn that vision in their head into a reality.

But the innovation is not without its controversies. Because AI art generators are developed through data gathered from real-world art—without the owners’ consent or knowledge—intellectual property concerns and accusations of copyright infringement are bubbling to the surface as photographers and artists grapple with how much, if any, AI art could be called “original.”

Many art aggregates are taking measures against the bigger problems of AI. Getty Images has banned AI-generated content altogether, citing these ongoing copyright concerns. DeviantArt allows their users to opt their images out of any future AI use.

45%

The percentage of organizations that believe AI will improve remote work.

75M The low-end estimate of the number of employees who will have to reskill and/ or change careers by 2030 thanks to AI. The high-end estimate is 375M

SOURCE: HUBSPOT

7in10

The proportion of consumers who harbor some fear of AI.

1/4

The proportion of consumers who are worried machines will take over the world.

8.4B

The estimated number of digital voice assistants that will be used worldwide by 2024.

However, other sites, such as Adobe and Shutterstock, have granted official support for AI-generated submissions, giving a whole new generation of artists the ability to profit off of what many consider to be other artists’ work. Shutterstock has even collaborated with OpenAI (the makers of the wildly popular AI art program DALL-E) to develop its very own image generator.

One21 believes that investing in AI as a tool to enhance your creative vision will only improve your business in 2023. But while it can certainly make some tasks easier and more efficient, it cannot replace the artistic eye and creative vision of a skilled photographer. What do you think? Is artificial intelligence ‘ruining’ photography? Or are you already taking advantage of AI photography?

Bookkeeping is the process of tracking all financial transactions involving your business. Using these records (they used to be physical “books,” but most modern businesses use accounting software), you can create reliable financial reports, such as income and expenditure statements, which tell you whether your business is making a profit during a given time frame. These statements, in conjunction with cash flow statements and balance sheets, paint a detailed picture of your company’s current financial health, allowing you to make more informed business decisions.

ONE 2 WATCH

Need help demystifying Google? Search for the Solutions 8 YouTube channel. Trust me, and you’re welcome.

To start a new Google Doc, don’t go through the hassle of navigating to docs.google.com and clicking the “new blank document” button. Instead, just type docs.new into the URL bar. (Also works with Google Sheets.)

If you only do three things for your business this year, make it these.

Stop doing stuff you hate! Instead, make a list of all the things you loathe doing and start outsourcing them one by one until they’re all off your plate. Then sit back and watch your profits soar as you have more and more time for marketing and delighting your clients.

When you outsource your hate list you have more time to spend on the tasks you love doing and the tasks that actually make you money.

What you charge is up to you; don’t let anyone price-shame you. Price is not the number that matters. Focus on profit and the time it takes you to earn it. And then build your business accordingly. Make this the year you get cozy with your numbers. Write down what you want to earn each month. Detail every single cost you have associated with your business. Work out how many hours you want to work.

You might decide to do a custom, high-end shoot for just one luxury client per week. Or, maybe you’re a people person and prefer to do quick, basic studio shoots for 10 budget clients per week. Whichever type of photographer you are, you could work exactly the same number of hours for exactly the same profit.

What happens when you regularly keep in touch with a list of engaged subscribers who know, like, and trust you? A full schedule—that’s what happens.

In 2023, email and messenger marketing is still going to be huge. Unlike your Instagram or TikTok or LinkedIn, your mailing list is the one marketing channel that you, as a business owner, actually own. Your email list is already filled with your raving fans. All you have to do to stay relevant and top-of-mind is communicate with them.

Make 2023 the year you create a list of subscribers who wouldn’t dream of using or recommending another photographer. Remember: a small, engaged list is far more powerful than a huge list of people who couldn’t care less.

This isn’t a book review. And we aren’t weighing in on which royal we’re championing (cough, cough, H&M). We’re simply saying that SPARE may just be the best title of the year. Why? Because when you read it, you instantly get it. There’s emotional weight to it. It makes you feel something. And that’s what marketing should do. Every. Single. Time. Your message doesn’t have to be fancy, but it does have to do a job. Depending on where the message is, the job changes. If it’s on your socials, the job is to get a follow. If it’s an email, the job is to get the click. If it’s a sales page, the job is to get the sale. The message doesn’t change; the way you use it does.

It’s some of the most valuable digital real estate you own, yet it’s one of the hardest places to write a compelling message: Your website’s home page. It’s partly because it’s so valuable that many businesses make the same mistake with their home page: they start summarizing instead of selling. What’s the difference? One is a description (“Hi, let’s talk about me”), while the other is an

argument (“Hi, let’s talk about an idea”).

One of our favorite ways to get started thinking about your home page as a sales argument is with this sixsection formula:

Section 1 The big message. What category do you own?

Section 2 The results. What does this help me do?

Section 3 The process. How does this product/service work?

Section 4 The ideal. How cool will it be when…?

Section 5 The objection crusher. I know what you’re worrying about, but here’s why you don’t have to.

Section 6 The call to action. Here’s what I want you to do next.

It’s basically a mini sales page, structured like a home page and designed to give visitors not just a description of why you’re awesome, but a compelling reason to care—which may make the difference between a $50,000 year and a $500,000 one. A “spare” detail that pays in spades.

When a little girl writes to your business, you respond. That’s what LA County Animal Control department did when 6-year-old Madison asked to keep a unicorn in her backyard. Their delightful response informs her that unicorns can be kept under certain conditions, including giving it regular access to moonbeams and rainbows, and polishing its horn monthly. Enclosed with the letter was a preapproved “unicorn license” and a toy unicorn to keep “in the meantime, because they are indeed very rare to find.”

Just a healthy reminder that humor and empathy go a long way in business. Read the full letter at rb.gy/shsjdx

SPARE may just be the best title of the year. Why? Because when you read it, you instantly get it. There’s emotional weight to it. It makes you feel something. And that’s what marketing should do. Every. Single. Time.

Four things you may not know about Stephanie Hon: She loves banana slugs. Her favorite color is orange. She’s empathetic, yet unapologetically honest. And she didn’t always want to be a lawyer.

“I went to law school with the intention of going into the FBI, but after I passed the bar and was submitting my FBI application, they went on a hiring freeze. That’s when I got into litigating and I was in court a lot. When my application was reinstated several years later, I was pregnant with my daughter. Dreams change, and that’s a good thing. Now I’m thankful that that didn’t happen because I really love what I do.”

Today, Stephanie runs a small boutique estate planning practice. “A lot of my focus is

helping families really avoid the conflict that comes with death and incapacity. And I really truly focus on making sure that my clients know during their life that they’re protected, their best interests are protected, and what they wish for their family is what’s going to happen so that they don’t have to fight over things later.”

Since then, she’s expanded her practice to include elder law. Something she’s become particularly passionate about, especially in the wake of COVID-19. “2020 sparked a lot of change for me,” says Stephanie. “It’s the year I met and started working with Venus Michael and One21 Acccount-Ability. But it’s also the year that I really became passionate about elder law.

“During COVID, we saw so many people struggling to find a way to care for their loved ones. Almost overnight, we watched an entire generation try to figure out how to care for their parents … it really impacted me. But the real catalyst was one of my clients. At 74 years old, she was still vivacious and in good health, but she realized she didn’t know what was going to happen to her if she became ill—how she would pay for things, who would take care of her, what her options were. I realized that there needs to be kind, genuine people that advocate and help these individuals—and their children, because a lot of times when a parent gets sick, their kids have no idea what to do. Helping these men and women feel confident with their options, and knowing that their wishes will be taken care of when they can’t take care of it themselves … it’s so rewarding.”

Indeed, many of us are thinking more keenly about our own mortality as well as that

“Helping these men and women feel confident with their options, and knowing that their wishes will be taken care of when they can’t take care of it themselves … it’s so rewarding.”

of our loved ones—and understandably so, given the last few years. But it never hurts to be prepared. Because preparing— whether that means helping a partner get their end-of-life affairs in order, or making sure you’ve got your own final arrangements dealt with—will make life (and death) a lot easier when the time comes.

Preparing also makes running a business that much easier, which is something Stephanie has discovered since meeting Venus at a BNI Networking Group in 2020.

“Working with Venus changed everything about my business,” says Stephanie. “She’s not just someone that goes into the books, reconciles the numbers, and hands your profit and loss. It’s so much more. She’ll go over my expenses and ask, ‘How is this helping? Is this something that will help you grow?’ During COVID, she had me track all of my time in a week. What an eye-opener! She helped me realize that my time is more valuable doing attorney things, and not the tasks—like bookkeeping—that can be delegated or freelanced out. She really makes you analyze how you’re operating your business with your finances to make sure that you’re succeeding in your business. So, it’s not just numbers; it’s more like business coaching. And that’s really allowed me to leverage, to value, my time in bigger, better, and more profitable ways.

The song you have on repeat right now: Zach Bryan, “Something in the Orange.” And Taylor Swift’s “Antihero.” The kids love that song.

Where you find inspiration: My son, Reid, who is 8, and my daughter, Kennedy, who is 13. Seeing the smiles on their faces; even some of the struggles my kids go through learning how to navigate life and friendships. They inspire me, I guess, to do what I do; they really make me want to help other families feel safe and secure. And my husband, Austin. We’ve been married 17 years … just knowing I have his support, it inspires me to keep growing and building. Dogs or cats: Dogs; I have two. Molly, she’s a rat terrier. And Blair, who is a black lab mix.

One audacious goal for 2023: Oooh, good question. Professionally, I would love to double my business. And personally, we’re trying to plan a trip to Europe with the kids. I want them to experience other cultures.

Is Profit First going to help you get that trip? It is. [laughs] It is.

Words your friends would use to describe you: Trustworthy. Sincere. Empathetic. And honest—maybe

Absolutely! This is one of the most common pain points for photographers.

At its surface, cost of goods sold (COGS) seems easy to calculate—it’s simply the amount you spent to create and deliver your goods or services over a given time period. But when you really start digging, it can sometimes be hard to distinguish between COGS and a normal business expense.

Think of COGS as expenses you wouldn’t otherwise have if you hadn’t performed the service or produced the product. This includes direct costs (like raw materials, merchandise for resale, and packaging) and indirect costs (like the labor required to create the product and costs to store the products).

Conversely, if it’s something you would purchase whether you have one or 100 clients (like office space or a software subscription), it doesn’t count as COGS.

Marketing costs also don’t fit into this category since those are less about individual products and more about customer acquisition. Here is a real-world example: Sophie runs a photo studio. For an upcoming project, she needs new dresses for the models. Since she only needs them for the one photo shoot, she rents them from Rent the Runway. In this case, the expense counts as COGS; she would not have otherwise bought the dresses if it weren’t for that photo shoot. (However, if Sophie chose to purchase the dresess instead of renting, they’d become part of inventory and supplies, and are no longer COGS.)

Why does it matter? Knowing your COGS can help you determine the absolute lowest price to sell a product to break even; if you aren’t tracking your COGS, you aren’t tracking your profit.

How do I know which one I should be using?

The difference is simply the interest—how much it accrues and who gets it. An IOLTA account collects the interest, then transfers the interest to the state

bar. (Lawyers are not allowed to earn interest on client funds by law, so the interest generated on these accounts is automatically channeled to the respective state IOLTA board. This board will then use the funds for a cause, such as supporting a charity or educational programs, providing legal civil help to the poor, and improving the administration of justice. Asking yourself a few basic questions will help ensure compliance:

• Is the balance in your IOLTA trust bank account the same as the balance in your IOLTA trust liability account?

• What is the detailed ledger for each client’s trust balance, showing each inflow and outflow transaction?

• Last but not least, does the total amount reflected on each client’s IOLTA trust account balance in your firm’s books equal the amount reflected in your IOLTA bank account?

To ensure your firm doesn’t run afoul of these rules, make sure you keep track of client funds every day. By comparison, an attorney trust account may or may not be interest-bearing. If the account accumulates interest, the interest will be transferred to the customer.

I’m confused about when certain purchases count as a cost of goods sold and when they don’t. Can you break that down?

Fierce, fearless and financially secure—how Felicia Reed transformed a hobby into a profitable, six-figure brand.

STORY HEATHER ANNE LEE PHOTOGRAPHY FELICIA REEDSimple. Direct. Honest. That’s Felicia Reed—she gets right to the point. “I was a mom with a camera. That’s how it all started,” she says. “I didn’t set out with a big audacious plan to be the next Annie Leibovitz. I was just a 40-year-old woman looking to take better photos of her kids. I didn’t have a feminist agenda. My interest in photographing women, mothers specifically, came from the simple fact that I am one. That commonality of experience is at the heart of what I do as an artist.”

That humble beginning launched Felicia Reed Photography in 2014. Now, at age 50, Felicia’s reimagined life includes a profitable, six-figure career, a standalone studio, speaking engagements, and an online coaching academy. Meanwhile, her gorgeously crafted, choreographed images blur the lines between portraiture and empowerment.

The thread that ties each portrait, each subject, together is the determination and resilience to show up every day for their dreams. These women went for it. At their most vulnerable, they trusted Felicia and challenged themselves. Felicia’s hope is that through seeing their photos, you see pieces of yourself, too.

In the Zone sat down with Felicia to get her perspective on how authenticity, artistry, and financial stability tie into her picture of success.

So how did it all start?

My first career was in the medical field. I did ultrasound for 15 years, and it was fun. But I was a mom, too. I had small kids at the time, and I was taking all kinds of classes—cake decorating classes, sewing classes, and photography classes.

My second child was born in 2004 and I wanted to photograph his journey of growing up. I missed out on those years with my oldest because I was in school and trying to build my career. A little older, a little wiser, this was my chance to do it differently. So I started taking photos.

Why women? Why mothers?

I wanted something different, not your typical pictures. I love black-and-white, documentary-style, and portraits, of course. But I quickly realized that while I loved taking photos of my own kids, I didn’t love taking pictures of other people’s kids. (laughs)

I, on the other hand, wanted badly for someone to take a great photo of me, but it rarely happened. There’s a difference between a “nice” photo and a portrait that captures the soul, the essence of a person.

I started to notice that there was a void. As moms, we celebrated and focused on our kids and families, and yet we rarely took photos of ourselves. We hid behind the camera, partly because we didn’t like the way we looked and didn’t think we were worthy to exist in photos for some reason.

At first, it was about me and my experience—quitting my job at 40 and starting over. I was transitioning my life. My life wasn’t over—it was just beginning. Although culture doesn’t tell us that; culture says women over 40 are old. The truth is that women over 40 deserve to be celebrated. We are too experienced to not be heard and too beautiful not to be celebrated.

That’s when Felicia Reed Photography was born, in 2014. I wanted to change the way the world defines aging, and empower moms and women, maybe those who have lost themselves along the way, to see their own power and beauty.

What has been the most meaning ful part of your work?

Seeing these women transformed! Almost every single one comes in shy and nervous, wildly uncomfortable in their own bodies, let alone in front of the camera. And they leave feeling empowered, strong, radiant, and confident—in themselves as well as in showing up for their business.

How does that happen? How do you empower women to embrace their uniqueness?

It’s a multiple-step process. First, when they book, we schedule a wardrobe and planning session one month before their session. I send them a questionnaire to fill out so I can get to know what they love and don’t love about themselves,

“I wanted to change the way the world defines aging, and empower moms and women, maybe those who have lost themselves along the way, to see their own power and beauty.”

what do they want to wear, who are they inspired by, and so forth. We connect so much better when I see their face.

We have a five-hour day set aside just for them. We have their favorite music playing. We have a hair and makeup artist on set to make them look and feel like the best version of themselves.

During the photoshoots, I take my time with them, encouraging them and coaching them through all the poses. I show them the back of my camera to get instant feedback. I am essentially their hype girl on set. It’s my energy—a gift I have for putting people at ease

and helping bring out the best in them.

You know who also has that gift? Venus Michael.

How did you first connect with Venus?

We first met through a networking event in 2016, but didn’t start working together until late 2017, early 2018. I was stubborn … I thought I could do everything on my own. And honestly, I didn’t think I could afford her. But what I realized is that I couldn’t afford not to hire her.

How so? What did she bring to the table that you didn’t realize before?

Oh my gosh, so many things. But receipts! I hate paper and clutter, and receipts are the devil. She introduced me to Receipt Bank. Pure magic!

Oh, and then Miles IQ to track my mileage. Square to take payments in my business. And QuickBooks, obviously. She really streamlined that whole aspect of running a business, and it freed up so much time. For the first time since starting my business, I really felt like a professional.

After that I was sold. I hired Venus to do all my bookkeeping and we’ve been working together ever since.

Let’s talk about growing your business. What were some of the pain points from those early years?

Definitely having clients pay me. It was terrible. So many clients would hire me for a photo shoot and then wouldn’t pay at all, or asked for a payment plan. So that was a big, big pain point. I know a lot of photographers deal with that, and at first I thought it was just part of the business.

But Venus helped me see that it was OK to ask for money upfront, whether that’s a large deposit, or series of deposits leading up to the photo shoot.

The second challenge was learning to adjust my mindset. One month I asked Venus, “how come I’m not making $80,000 a month like all these other people?” And it wasn’t all these other people, it was like one or two people in my mastermind. But you know, “all these people” are making “all this money.”

Venus was like, “Felicia, stay out of the Facebook groups. Stop comparing yourself to other people. Now let’s look at your numbers, compare yourself to yourself. Going back to 2018 and looking at your September numbers, you made $6,000 the whole month. This September, you made $40,000, I think you’re doing a good job.”

She was coaching me and demonstrating that positive mindset. What was different between September 2018 and September 2019? Mindset. Period. That’s all.

When my energy is better,

my client flow is better. It doesn’t matter whether it’s your career, your emotional, your physical, whatever. Energy doesn’t discriminate. So if you have negative energy in one aspect of your life, it affects all aspects of your life.

I imagine that positive mindset really helped you deal with your cancer diagnosis in 2020. Absolutely. One thing I know is when hard times come or adversity hits, it doesn’t last long and there is always something even greater on the other side. I have lived long enough to know this. I am a very spiritual person and have an incredible relationship with God. I had to lean in on all his promises and keep my eye on something amazing to look forward to, such as building my new studio.

I stayed in prayer. I always asked for time, so this was the time that I worked on myself. I had more time to work out, eat healthier to help me through chemo, cut back on my hours, and focus on myself. I stayed busy—I’m not one to lay around because I know I would just be pitying myself. I had to live with purpose, and that was to serve these incredible women God put in my life.

I want to be an example to others that no matter what life throws at you, you have a choice. I choose joy and happiness despite my circumstances.

How did you balance your photography business and serious medical treatment?

Well, first, I had the business and bookkeeping tools in place that Venus showed me. And I had to choose. I had to make the decision that I’m going to choose health, I’m going to choose happiness, I’m going to choose joy. I’m going to choose to succeed through this whole thing, to believe that I can run a business and have cancer at the same time.

And I did. I don’t have my final numbers yet, but I can tell you that I worked less, made more time for my health and family, and I still made about $350,000. And I opened a studio with the money I leveraged from Profit First, and I created an online coaching academy.

Cancer sucks, but it’s been such a blessing, too. I found balance in harmony in life and business. I spend time cooking in the kitchen and dancing in the kitchen and having fun with my family, and I’m at peace. So, I’m winning.

What is giving you joy in this exact moment of your life?

I’m just proud of myself, where I’ve come from. Looking back at what I’ve gone through and what I’ve done, it gives me so much joy and security that moving forward, no matter what adversity hits me, I’m going to make it no matter what, and it’s all for the good.

You know, I can’t look at this cancer journey and say it was

“My interest in photographing women,mothers specifically, came from the simple fact that I am one. That commonality of experience is at the heart of what I do as an artist.”

a bad thing and it impacted me badly. Yeah, it was a bumpy road, but I rolled right over like anything else and I kept going. I have the power to remind myself, “Did you have cancer? Did you make it? Are you making some excuses that you can’t succeed?”

The joy of allowing myself to be vulnerable and share my story and empower other people is unmatched. I just have a different kind of energy—like there’s no stress, there’s no worry, there’s nothing, I rely totally on God getting me through this. Anything, anything, I’m good.

“I want to be an example to others that no matter what life throws at you, you have a choice. I choose joy and happiness despite my circumstances.”

Truth: Choosing the right Client Relationship Management software (CRM) for your photography business is challenging. Even downright frustrating. There are so many options that promise to solve all your contact management problems, that it’s easy to get distracted by great marketing and miss the actual features.

So what do you do when you need a functional CRM that checks as many boxes as possible? You have to know what boxes you want checked in the first place. Here are four tips to choosing the best CRM for your business.

Step One: Make a list. Before you begin typing “best CRM for photographers” in that search bar, ask yourself: What is most

important my business: Lead management and pipelines or automation, workflows, and templates? Do you need social media scheduling and email marketing? Or is it more important to organize files, quotes, contracts, and other documents?

There is no right or wrong an swer. Every business has differ ent needs, but automation of any kind is critical for running lean and fast. As a solopreneur or small team, repetitive tasks will eat up valuable time in your day. Simultaneously, it’s so important to keep a high level of customer service at the forefront of your business. If you can do both well, you will set your business apart from your competitors and cre ate sticky customers.

The goal is to find the CRM that can be the foundation of

your data and communication management. The key word here is foundation. You won’t find one tool that does it all; it doesn’t exist. Instead, you have to choose the foundation that will allow you to grow over time with integrations and apps (i.e., Zapier or APINation).

The more specific you make your priority list, the easier it will be to identify which CRMs make the initial cut.

Step 2: Separate the list into two groups. Once you have list, start putting it in priority order. It doesn’t have to be perfectly sorted. Try to separate it into two categories. Non-negotiable and Wish List. This will help you know what features you consider novelties and which ones are necessities. This is the most useful tool you can have when evaluating which CRMs are worth testing and which ones are not.

PRO TIP: Put this list into a spreadsheet and begin ordering and ranking them, then create columns for each CRM you evaluate. Check the boxes and compare. You can even give each item a score so you can tally across or down the spreadsheet and give each CRM an overall score based on your recommendations

Step 3: Consider the costs. It’s important that you understand your budget and return on investment. Spending money on this system is not wasted if

it produces results, helps you effectively convert leads, stay up to date on clients, and save time. But it’s easy to over invest to get access to features you won’t get around to using. You can do some quick calculations to figure out the foundational costs, but there may be some hidden costs you overlook up front. For example:

• The cost of SMS fees or emails (depending on the service provider)

• Outsourcing the customizations to get set up quickly

• The combined cost of multiple single feature tools vs. the single cost of a comprehensive tool

• The need for an integration software like Zapier or APINation

It can be time-consuming to get a system set up, so you need to consider how much you want to do on your own versus hiring someone who can learn about your business and handle the setup for you. Ultimately, it’s a time/value equation: Will the CRM keep you from having to hire help so soon? Will it save you hours of time thanks to automations? Or will it be so consuming to set up and maintain that you lose time doing higher value tasks.

PRO TIP: Know your personal hourly value so you can quickly determine what your time is worth. This is a perfect place to suggest that if your technical

skills are limited, or your time is limited, you will likely want to consider outsourcing the tasks of customizing your CRM so you can focus on income-producing activities that will pay for the cost of the setup time.

Step 4: Understand the exit strategy. Every software company will go out of their way to help you get your contacts into their software, and some handle more of the migration and setup than others. But what happens if you decide to change CRMs or do something different? Who owns your data? And what about software failure or attack—are you protected? Is your clients’ data protected?

No matter what CRM system you choose, being able to export your data and/or have a backup of your data is absolutely vital.

Like most things in business, if you ask 10 people for their opinion, you will get at least 13 answers. Regardless of the software that makes your short list, these steps should help you make the most informed decision for your specific business. The good news? As you continue to use any system, you will build efficiencies and improve what you already have and that will produce a really great return every time. Cheers to more time and freedom, thanks to great technology.

There’s a lot of buzz surrounding Profit First, and for good reason. It’s a gamechanger for cash flow management and has been embraced by more than half a million businesses of all sizes.

However, for all the hype, there are also plenty of misconceptions. Some folks believe that Profit First is too difficult

or too restrictive. Some say that this or that aspect of the system is wrong or counterproductive (and of course, that their way of doing it is much better). Some go so far as to claim that not only do you not need the five foundational bank accounts Profit First is built on, but that no bank would even open such accounts.

Wrong. Wrong. Wrong. There are as many Profit First myths as there are practitioners. But the most common ones can be the most harmful to those just starting out. To take on the naysayers, it helps to know where these myths come from and why they are so widespread. Let’s break it down, shall we?

Don’t go through the trouble of making all those bank accounts.

Profit First works just as well on a spreadsheet.

Let’s debunk the spreadsheet myth for good. Profit First is more than a data spread; Profit First is a habit.

You constantly check your bank accounts, right? With Profit First, you pre-allocate money for its intended use. So when you check your bank account, you clearly see what the money’s use is specifically for.

For years business owners were told not to log into their bank accounts. Rather, they were to log into their account ing system and reconcile income statements and balance sheets. Sure, managing those things is important, and you will manage your business well if you consistently do them.

But do you? Of course not! It’s just not realistic for a business owner to maintain.

Profit First works because it’s a behavioral intercept — you are going to look at your bank balance. By having the five accounts (or eight as One21 rec ommends), you have a more ac curate picture of your finances.

Seeing all those accounts is intimidating at first, but that’s why we are here. When you establish a habit of Profit First behaviors and see how they work in your business, you will have a whole new apprecia tion for what Profit First will do for you.

You don’t need to wait; you can go ahead and claim your distributions early. Again, Profit First leverages our natural behavior. Can you take out your distributions early? Technically, yes. But should you? It’s not in your best interest. A 90-day rhythm builds momentum. When you receive your share of the profits at the end of the 90days, it feels like a reward! It’s a reward for building that saving muscle, which is a key muscle

Profit First is a set-it-andforget-it system.

Profit First is a dynamic system. Work with a Profit First professional that you can meet with quarterly to assess your CAPs –current allocation percentages. Then, adjust them as needed. Say your target allocation percentage for operating expenses is 70%, meaning you would ideally use 70% of your total funds for operating expenses. However, “ideal” and “real” don’t always align, do they? Let’s say in actuality you are using 90% of your funds for operational expenses. You need to lower your operating expenses so that your operating account will only need 70%, not 90%, of your total funds. However, going from 90% to 70% is a hefty change, so pace yourself. Aim to lower your expenses gradually. Aim to reduce your allocation from 90% to 85% in the next quarter, 80% in the quarter after that, and so on until you’ve reached your target.

The bottom line is that businesses change and evolve over time, so expect to adjust allocations periodically based on your goals and circumstances. Working with a Profit First professional will help you work toward your goal at a reasonable and healthy pace.

MYTH #4

Profit First can’t work for everyone.

If you hear someone say Profit First doesn’t work, ask about their experience implementing it. Feedback isn’t valid unless they have personal experience. Learn from people who have actually operated with Profit First. But like with anything of value, you get out of it what you put into it. If you set it up and never make the allocations on a regular basis and adjust the percentages based on your business and your goals, it won’t work. You’ll fall back into the same habits you had before. It’s a fantastic way to manage your business, but autopilot isn’t available.

Sometimes, people are hesitant to try a new system because it feels overwhelming and intimidating. Once you understand the principles behind Profit First, you’ll see just how liberating this way of accounting is for you and your business!

MYTH #5

Anyone can teach or support Profit First.

This one is, technically, true. Once you master the habits, anyone can do it. But at what level?

To maximize the advanced principles of Profit First, you want/need a certified Profit First Professional — someone with experience and certification who is consistently learning to help you be accountable and to profitably scale your business.

Think of it like a personal trainer at the gym. A Certified Profit First Professional like us is the ultimate accountability partner, one who has a deep knowledge base and expertise to help you achieve your results faster and more efficiently. Want to learn more about Profit First? Schedule a complimentary consultation and let’s revolutionize your cash flow so you can keep more of your profits in your pocket.

With Profit First, you’re always looking forward to something exciting, growing, expanding, experiencing as opposed to always worrying about what bills are left to pay.