8 minute read

On global tissue markets, pulp demand, and the looming recession

Article by Hawkins Wright

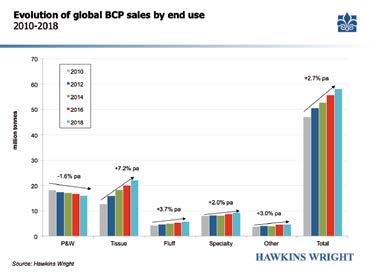

Since 2009, the use of bleached chemical market pulp in the tissue sector has grown from 13Mt to 23.6MT; tissue has accounted for 95% of BCP demand growth in the last ten years. This remarkably steady expansion over the past decade is driven in part by supportive global consumer trends and economic growth, but also because the tissue production is largely non-integrated.

Advertisement

Since 2009, the use of bleached chemical market pulp in the tissue sector has grown from 13Mt to 23.6MT; tissue has accounted for 95% of BCP demand growth in the last ten years. Some 40% of all bleached chemical market pulp shipments went to the tissue industry last year as the sector’s global output surpassed 38Mt. This compares to just 27% of all BCP shipments in 2009, when tissue production totalled 28.4Mt worldwide. This remarkably steady expansion over the past decade is driven in part by supportive global consumer trends and economic growth, but also because the tissue production is largely non-integrated.

With the world on the brink of a major recession, the fate of pulp markets looks more tied to that of tissue markets than ever before. Even during the re- cession of 2009, tissue production grew by 0.5%, and quickly recovered to average 3.4% p.a. in the decade that followed. In this month’s Industry Focus, we offer an overview of the sector’s fundamentals and try to gauge the extent to which tissue can shield pulp markets from a protracted downturn.

MARKET GROWTH

Tissue markets can be segmented either by region or by end-use: at-home (AH) or away-from-home (AfH). Regional differences abound, particularly between mature and emerging markets. Note that we use production figures (as reported by associations, complemented with our own estimates) as

a proxy for demand because shipments statistics are scarce and it is usually safe to assume that production equals demand over the long run.

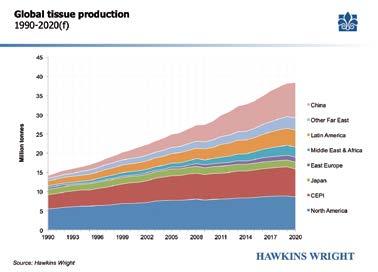

Amongst mature markets, the North American market remains the largest, with production of almost 9Mt last year. Production in Europe (as defined by CEPI) amounted to 7.6Mt last year, while in Japan output totalled 1.8Mt. Excluding Japan – for which growth has been virtually zero over the past decade – growth in these mature markets has averaged 1.3% p.a. over the past decade. This steady expansion is a result of sizeable investments in AH private labels and AfH capacity which have steadily taken market share away from incumbent branded products.

The rest of the world is categorised as emerging, and for good reason: growth in these countries has averaged approximately 6% p.a. since 2010, and they account for 82% of global growth during this period. China alone accounts for 38% of global growth, with output reaching 8.7Mt last year, com- pared to just 5Mt in 2010 (+6.9% p.a.) Latin America is the second biggest market but has the slowest growth rate of the group – at 4.4% p.a. during the past decade. Other Asia, the Middle East & Africa and Eastern Europe together represent the remaining 2.8Mt of growth, expanding from 4Mt in 2010 to 6.8Mt last year. The tissue segment’s growth in these emerging markets are driven by population growth, rising income levels and increased product penetration – these stand to drive further growth in the years ahead.

OVERCAPACITY AND TRADE

Following a slowdown in tissue capacity investment through 2016 and 2017 after years of oversupply across most markets, capacity growth surged in 2018, reaching a record-high +2.5Mty. Following a period of low operating rates and tight margins during 2018, the pace of investment has cooled significantly. For example, last year global tissue capacity additions amounted to +1.7Mt whilst this year we expect growth of just 1.2Mt This includes large investments from Sofidel and First Quality Tissue in the US, Kimberly-Clark in Brazil, and APP Hongye, OJI Nepia and Mancheng Paper in China.

One of the symptoms of the overcapacity during the past few years has been rapid growth in tissue exports, with local suppliers increasingly having to compete for market share with offshore producers.

Global trade of jumbo rolls (HS code 4803) has thus expanded from just under 2Mt in 2010 to almost 3.2Mt last year, growing by 51% in the ten-year period, at +5.4% p.a. Even if Italy remains one of the largest exporters, growth from Indonesia (+13.2% p.a.) and Turkey (+22.2% p.a.) have relegated it to second or even third place in some years. In fact, Indonesia’s staggering export growth since 2015 has made it the top exporting country, with volumes reaching 0.8Mt last year. This is the result of aggressive capacity expansions on the part of integrated players in Indonesia, such as APP. The situation is clearly unsustainable for some as the fight for market share rages on. Since 2017, there has been virtually no growth in the global trade of jumbo rolls. Exports from countries included under “Other” in the chart, and from Canada, Germany, Sweden, and even Turkey and China have declined by 0.23Mt – meanwhile Indonesia’s exports have increased by… 0.23Mt

LOOMING RECESSION?

It will be many months before the short- and long- term economic implications of the global Covid-19 pandemic can be fully appraised and appreciated. What is clear is that a global economic recession is at hand, one that will likely surpass the fallout of the global financial crisis of 2008-09. Supermarket shelves empty of sanitary products such as toilet paper or facial tissues suggest that consumers have succumbed to a degree of panic buying, fearing a shortage of daily necessities and anticipation of home confinement.

Until now, reports from the market suggest that these fears of a shortage are largely unsubstantiated, as tissue operations worldwide have been uninterrupted. Even in China at the height of the crisis, only mills located within the Hubei province were shut by government mandate, but these comprised mostly small-scale local players with total capacity of about 1Mt of tissue. Elsewhere mills continued running full, some even helped by the authorities keen to ramp-up the output of sanitary products in their fight against the spread of the virus.

The epicentre is now located in Europe, and governments have enacted restrictive measures ranging from the nation-wide confinement of their population to the closing of borders or declaring a full-blown state of national emergency. While these restrictions promise to cripple the economies of Europe and cause logistical bottlenecks for many months to come, tissue mills are deemed strategic and are benefitting from increased demand over the near-term. Even in Italy, the worst afflicted nation at the time of writing, all tissue producers are reporting very high operating rates and extremely strong demand. Producers in Germany, France, Spain, the UK, and Eastern Europe are all reporting a similar trend. To cope with demand, some are even reducing the number of articles produced and are selling the same product to all their private label customers, who are willing to ignore the usual specifications

Although there as long as the product keeps coming. Mills that are more labour-intensive seems to be are reporting a slight loss in productivity associated with the imposition of no imminent more stringent safety measures which obliges them to reschedule shifts, threat to tissue keep workers two meters apart, wear masks etc – but overall, the sector is operations, there churning out tissue at a record pace. are certain risks Logistical challenges are the biggest near-term risk to operations. Not to consider. only are outbound logistics congested due to the high demand, but any cross-border traffic, both in- and out-bound, is suffering delays as border checks even within the Schengen Area have been imposed. Truck drivers are having to wait in line for hours, and some countries have even decided not to let Italian trucks in. This has forced some Italian producers to establish new distribution hubs in countries where their trucks can still go in order to ultimately tranship the goods to their final destination. For now, this is only increasing costs for tissue producers, but any further restrictions could ultimately pose a greater risk to the flow of goods.

Although there seems to be no imminent threat to tissue operations, there are certain risks to consider. For starters, the short-term boost to demand is driven by increased purchasing of AH products and at hospitals is at least partially offset by plummeting demand from the AfH segment as bars, restaurants, hotels, schools, offices etc. Furthermore, many suppliers are bracing themselves for an almost symmetrical downturn to hit once the effects of the panic buying subsides. There will likely follow a period where consumers that have hoarded sanitary products during the early weeks of the outbreak will revert to normal buying habits once their stocks are depleted, implying weakness in demand relative to consumption. Some of this may be offset by a recovery in demand for AfH products, which is bound to occur as and when restrictions are lifted, and life returns to normal. Some also believe that there may be scope for improved demand in the medium- to long-term as some of the more stringent hygiene measures adopted by consumers during the crisis may persist.

Before the coronavirus crisis, tissue prices were at best stagnating or even coming under pressure in most markets around the world, as cheap pulp prices bolstered margins and exacerbated oversupply across local and export markets. Already the crisis has staved off any near-term deflationary pressures, and even if tissue suppliers could possibly increase prices in response to the exceptional demand scenario, most prefer not to be seen benefiting from the crisis and understand that this may well be short-lived. Still, rising logistical costs throughout the supply chain could prompt some pricing upticks, especially if pulp prices rebound. Ultimately, this will also depend on the quickly deteriorating macroeconomic out- look, on currency movements, and on the fate of other P&B segments that are likely to be more impacted from a protracted economic downturn.