Everlake Approaching Retirement Guide

0 Contents Introduction 2 Rethinking Retirement Planning 3 Setting the Scene 3 Spending Assumptions Throughout Retirement 4 Spending Strategies ................................................................................................................................6 Adaptive Spending Strategies .............................................................................................................6 Personal Security.............................................................................................................................7 Lifestyle Security .............................................................................................................................7 Turning Success into Significance 8 Pre-Retirement Decisions 9 Understanding Your Overall Financial Position 9 Understanding Your Starting Position 9 Assessing All Options 9 Approved Retirement Funds (ARF) .................................................................................................9 Annuities .......................................................................................................................................11 Navigating Defined Benefit Schemes – a Client Case Study .........................................................12 Legacy & Estate Planning ..............................................................................................................13 Standard Fund Threshold Planning 13 State pension Deferral 14 Investment Decision Considerations 15 Which is More Important to You - Your Income or Your Capital? 15 The Impact of a Low Interest Rate Environment 16 The Impact of Inflation......................................................................................................................16 The Impact of Longevity Risk ............................................................................................................17 Safe Withdrawal Rates or Not…........................................................................................................18 Sequence of Returns Risk..................................................................................................................20 Managing Sequence of Returns Risk.............................................................................................21 Diversification 23 In Summary 23 Establishing an Optimal Investment Strategy 24 Establishing a ‘Prudent’ Withdrawal Rate 24 Minimising Tax ..................................................................................................................................24 Other Opportunities..........................................................................................................................24 Ongoing Review Process...................................................................................................................25 Frequency of Review.........................................................................................................................25 Cash Flow Modelling.........................................................................................................................26

1 Building Contingency 26 Social Welfare & Social Care Support 26 Powers of Attorney 27 Legacy Planning 27 Summary & Conclusions .......................................................................................................................28 The Next Step….....................................................................................................................................29 Disclaimer................................................................................................................................................0

Introduction

In the past two decades, the landscape of our working lives has undergone a huge shift The rapid advancement in technology has shifted the boundaries of the workplace Remote work, once a rare privilege, has become commonplace.

The rise of technology, automation and more recently AI, has reshaped job roles, demanding a continuous learning mindset and adaptability.

Particularly with younger generations, people rarely remain, or plan to remain, in the same role or company for their entire career, with retraining and switching career paths more commonplace.

How people evaluate their jobs and careers has also developed. For most people ‘work’ is more than just ‘work’ or a salary at the end of every month.

Human connection, creativity, a sense of purpose and other ‘softer’ elements all contribute to how we feel about our jobs and the value we attribute to it.

The past twenty years have not just changed where, when, and how we work, but fundamentally redefined what work means to us. A person's job is more than a means to earn a living; it's a significant part of their identity

It therefore makes sense that how we define retirement has also evolved. From a Financial Planning perspective there is no ‘one size fits all’ retirement plan anymore.

Financially, retirement requires careful planning and foresight. The halting of a regular income when you cease work requires a robust savings plan and prudent, diversified investment strategies to be in place for some time to ensure a comfortable and secure retirement lifestyle. The rising costs of healthcare, the unpredictability of market forces, and the increasing life expectancy can add layers of complexity to this financial equation.

Beyond the financial aspect, the shift from a structured work life to an open-ended retirement can be disorienting. The sudden lack of professional responsibilities, the change in daily routines, and the potential loss of a work-based social network can lead to a sense of loss and uncertainty.

Despite these challenges, retirement offers a wealth of opportunities. It can be a time for personal growth, for exploring new hobbies, for spending quality time with loved ones. It may also be an opportunity to continue working, albeit at a reduced pace or for reduced hours, or to pursue a brandnew career path.

A critical question within this context of change, is how are people supposed to know how much they will need in retirement for a living standard they will deem acceptable to themselves? From a professional financial planning perspective, it is possible to ‘model’ retirement living standards for clients that can give financial clarity and direction to them as they prepare to enter a new phase of their lives.

The financial planning options available to retirees can be complex and daunting.

We're here to guide you through this transition, to help you navigate the financial complexities and to empower you to embrace the opportunities that retirement brings. Because retirement is not just about ending a career it's about beginning a new stage of your life.

2

Rethinking Retirement Planning

Setting the Scene

Research from Loughborough University on Developing Retirement Living Standards (Padley & Shepherd, 2019) describes 3 different models for retirement – a minimum standard, a moderate standard and a reasonably comfortable standard. And whilst this is UK research based, and not specific to Irish standards of living, it does help us model and understand what sufficient income might look like

This table from the research (and adjusted for inflation) puts a numerical income level required to meet the standards they looked at. This figure is net of all taxation.

Minimum and moderate levels aim to meet a ‘personal security’ level of living with but will fall short of what many would like to see in terms of lifestyle security or leaving a legacy to your family or charitable bequests. More on this later.

We believe that retirement is one of the ‘big rocks’ in your life, like getting married or having children. These are life changing events that require an objective and professional assessment of what is in your best interests. We focus on helping you identify your needs, as knowing your needs informs you and us about what decisions to make.

Some of the advice we will ask you to consider may seem counterintuitive to you. Many of the retirement based ‘products’ recommended in Ireland today are focused on capital preservation simply because that is what retirees are mostly asking for, assuming this is the best option.

3

One person Couple Comfortable €46,650 €63,350 Moderate €30,970 €42,800 Minimum € 15,940 €25,450

Spending Assumptions Throughout Retirement

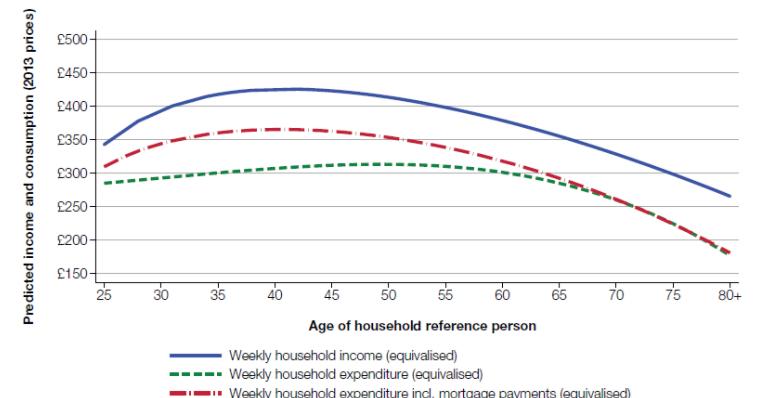

Consumption in retirement generally starts relatively high and ends relatively lower. This pattern has been common over time to both high- and low-income groups and has been robust to the inclusion of factors other than age, but with some recent research showing a change in this pattern in relation to the time period in which the data was collected.

“Our findings suggest that typical consumption in retirement does not follow a U-shaped path –consumption does not dramatically rise at the start of retirement or pick up towards the end of life to meet long-term care related expenditures.” - Dr Brancati, International Longevity Centre.

Of course, many people will need care in later life but consider the following1:

• only 16% of people aged 85+ in the UK live in care homes

• the median period from admission to the care home to death is 462 days. (15 months)

• around 27% of people lived in care homes for more than three years, and

• people had a 55% chance of living for the first year after admission, which increased to nearly 70% for the second year before falling back over subsequent years

More recent research2 identifies that retirees’ total household spending per person remains relatively constant in real terms through retirement, increasing slightly at ages up to around age 80 and remaining flat or falling thereafter. This reflects a change versus historic spending patterns in retirement which indicated that consumption drops and is reflective of the ‘baby boomer’ generation who typically have better pension provision.

We anticipate a return to the historical patterns with the changes in working patterns and less generous employer pension provision.

1 Source Age UK (2016)

2 The Institute for Fiscal Studies, May 2022

4

The composition of spending changes as people age, with per-person spending on food inside the home and on motoring falling steadily, spending on holidays increasing up to age 80 and then decreasing, and spending on household services (which includes spending on home help and domestic cleaning) and household bills increasing in later years of retirement.

The death of one member of a couple will affect per-person spending of the surviving partner as many shared expenditures, such as housing costs, will not fall when a partner dies. When thinking about future spending needs, households thus need to consider how changes in circumstances, in particular the death of a partner, will affect income and spending in order to ensure that resources are available to fund increases in per-person spending. Future retirees, who are less likely to have occupational or state pensions with a survivor’s benefit, will have to decide how to take this into account when deciding speed of drawdowns and whether to buy an annuity that provides survivor’s benefits.

There are differences in spending patterns across different types of households. Households with above-average incomes for their age and birth cohort have an increasing profile of spending in their 60s and 70s (for example, increasing by 7% between ages 67 and 75 for the 1939–43 birth cohort), with spending falling slightly for those in their 80s. On the other hand, those with incomes below median have a slightly declining age profile of spending in their 60s (with the 1939–43 birth cohort seeing a fall of 1% between ages 67 and 75) and spending remains flat at older ages.

5

Spending Strategies

The objectives at retirement can be boiled down to the following:

• an overwhelming need for income and the sustainability of that income

• a secondary (typically less important) need to leave assets for beneficiaries

Income Retirement Objectives Succession

The forces working against the achievement of these objectives can also be boiled down to the following:

• financial market risk, this includes general market risk and timing

• longevity risk, the time horizon in retirement is unknown and this speaks to the real risk of an investor outliving their capital base

We introduce real world constraints in a modelling framework to draw realistic conclusions and guidelines from our research. The largest differentiator of our research is that we used a simulation process to produce portfolios that take any number of different paths possible given the risk and return characteristics of the portfolio.

As opposed to merely back testing a portfolio to what has happened in the past (effectively only one path of returns) we simulated thousands of different paths for each scenario. We feel that this is more robust because it is unlikely that the returns experienced over the last few decades will be repeated over the next few decades

Adaptive Spending Strategies

The overwhelming requirement in retirement is that of a regular income to fund living expenses plus occasional unexpected or large ad hoc expenses such as medical expenses, holidays, car replacements or house maintenance.

Going further than just establishing an income number can go a long way to managing our realistic expectations in retirement. We believe that the most appropriate approach consists of dividing retirement spending into three discreet categories:

• Needs – basic non-discretionary expenditure to provide a baseline standard of living,

• Wants – discretionary expenditure to maintain one’s desired lifestyle,

• Wishes – luxuries that are not necessary to maintain one’s desired lifestyle.

6

This approach immediately creates a more solid framework against which to plan for future expenditure.

For example, I might want to go to the movies twice a week, but I don’t need to. I could equally borrow a book from the local public library for free or at the other extreme (luxury) install a home cinema system.

Framing our income requirements in this way helps manage our retirement income journey and appreciate that from time to time, there may come a requirement to make some sacrifices.

A secondary yet important consideration for many of us is that of passing down a portion of our life savings to beneficiaries.

Within the Needs, Wants and Wishes framework it can be helpful to consider your expectations against the concepts of:

• Personal Security

• Lifestyle Security and

• Turning Success into Significance.

Personal Security

We could define personal security as the minimum level of wealth acceptable to any individual to meet their basic needs. The factors that we consider important to personal security include:

• Personal comfort - This includes the family home and other personal possessions. But also includes strategies for dealing with anxiety and stress in retirement such as downsizing to a smaller property or possibly moving home to be closer to family.

• Cash flow - the income and expenditure requirements of the individual. Having a household budget and good financial management are the foundations of any retirement plan. If you don't know how much income you need, you will have no idea how to invest your capital.

• Old age insurance - seeking to protect against the 50% chance that you might live longer than you are expected to on average and also providing for the cost of medical expenses in retirement.

• Murphy's Law - If it can go wrong, it probably will. Instead of thinking that very rare events are impossible, we should instead think that they are improbable but might still happen anyway. The key to a good retirement plan is to be able to cope and adapt to the unexpected.

Household insurance is a classic example of a policy that is designed to protect against the rare but potentially extremely damaging events that could cause significant harm to our personal security.

Lifestyle Security

We could define lifestyle security as the desired level of income you would like in order to maintain your quality of lifestyle i.e. the cars you drive, where you live, how many holidays you take each year and if you want to turn left when boarding a long-distance flight (into business class) rather than turning right (into economy).

7

For many people in retirement, it will prove impossible to maintain their standard of living by keeping their money on deposit with a bank. The reason for this is that the average rate of return on deposits, after allowing for tax and inflation has always tended to be close to zero.

The relative decline in standard of living relative to the working population is due to the fact that many in retirement are on “fixed incomes” and so cannot increase their take home pay through increased productivity or collective bargaining.

The impact of inflation on our quality of life in retirement can really only be offset by continuing to link our financial capital (our savings) that most of us earned from paid employment back to the productive real economy so that as the quality of life of the working population improves, as retirees we continue to participate directly in the real economy.

The way to do this is by investing in assets such as stocks and bonds and that means understanding the need for more personal investment risk.

Turning Success into Significance

Generally, people have different needs depending on their age ranging from pre-retirement with emphasis on tax planning and capital accumulation, to early retirement with emphasis on sustainable income strategies and to late retirement, where the focus sometimes shifts towards taking care of heirs, estate planning and even charitable bequests.

There is an old saying that there are “no pockets in shrouds” and “no prizes for being the richest person in the graveyard”. Knowing that you have sufficient income to do all the things you both need and want to do in life without fear of ever running out of money is one of the key results of the financial planning process.

“If you realize that you have enough, you are truly rich”. – Lao Tzu, Tao Te Ching

We believe that for most retirees the focus should be on ensuring that you have sufficient personal security to meet your needs, sufficient lifestyle security to meet your wants and that your longer-term focus should be on wealth preservation and ultimately leaving a meaningful legacy to the next generation. Retirees who are confident that they have “enough” are much more comfortable with the concepts of taking care of their heirs and charitable bequests than those who worry if they are going to have enough.

8

Pre-Retirement Decisions

Helping people plan at retirement is very different from helping people save for retirement. We believe that all investors should consider and understand their retirement options well before they actually reach their proposed retirement date and ideally should have an idea of how they plan to deal with the choices that they are going to have to make between say, buying an Annuity compared to an Approved Retirement Fund (ARF). These decisions should be considered at least several years before they retire and ideally at least 5 years before normal retirement date.

The reason for this is that the asset allocation decision for your pre-retirement fund should reflect the likely decisions that you are going to make at retirement.

Understanding Your Overall Financial Position

When we are providing you with advice on your retirement options it therefore requires an understanding of broad context, specifically your wider financial circumstances and needs, given in almost all cases it involves a trade-off between risk and reward as well as tax mitigation decisions.

If you have other sources of guaranteed income (State Pensions and Defined Benefit of Final Salary Pensions), lifetime savings or realisable assets including residential property, these should be considered and, in many cases, might offer up a more tax efficient route compared to withdrawing income from your pension.

Understanding Your Starting Position

As well as understanding your overall financial position, a bespoke approach stemming from establishing your starting position is often critical in ensuring a good retirement outcome. For example, some clients are looking for deferred drawdown, say for example, wanting to take their taxfree cash at age 50, deferring the ARF to age 61, and with a view to paying into another pension product later down the line. Other clients are looking to take the maximum tax efficient income from their pension to bridge the gap until their state retirement pension and/or occupational pensions kick in later.

Assessing All Options

All available options including buying an annuity, phased retirement using PRSAs or an ARF should be considered to arrive at the most suitable outcome.

Approved Retirement Funds (ARF)

The introduction of the Approved Retirement Fund (ARF) as an alternative to the traditional annuity purchase in 1999 was a game changer for the retirement income market in Ireland, moving existing pension savings from a source of income in retirement to a financial planning vehicle. Prior to its implementation, many people in Ireland converted their pension funds to an income stream through an annuity contract, often without exercising their Open Market Option to secure a competitive annuity rate.

9

An ARF allows an individual to take as much or as little (subject to imputed distributions) as they like from their pension arrangements on reaching the normal minimum pension age (or earlier in special circumstances). But just because you might have these options, it doesn’t mean that it is necessarily sensible to exercise them.

Providing you with advice on an ARF itself is increasingly not a binary choice for many in respect of retirement income products, with good practice involving an assessment of the suitability of a full spectrum of retirement income solutions, including phased retirement and blended or hybrid solutions so that current and known/unknown future income needs can be best accommodated.

The ARF should also be benchmarked against the annuity that you would have been purchased at retirement (spouse’s pension, inflation protection etc) and, where appropriate, enhanced annuities. This gives an indication of the investment strategy that the ARF investor needs to pursue to not risk being worse off from the decision not to buy an annuity.

If the ARF portfolio is not sufficiently risky its highly unlikely that the ARF will be able to maintain the level of income that the annuity would have provided, and the client may find themselves worse off in old age.

The decision to invest in an ARF is almost always a balancing act between mitigating risk, receiving returns and retaining some flexibility. A successful ARF strategy involves the ongoing and effective management of any number of risks following not only the establishment of your willingness to take investment risk but more importantly our assessment of your ability to take that risk (known as your risk capacity).

An ARF also requires you to take income annually over a certain age which reduces your total ARF amount – some of which have payment rates as high as 6% per annum

10

Essentially this is about helping you to understand the greater risks associated with drawing down an income from a retirement portfolio, compared with the experience you had while you were saving for retirement, including:

• Sequence of returns risk – where withdrawals during a market downturn can lead to a rapid reduction in the value of a fund from which it may never recover.

• Volatility drag – the risk inherent where a portfolio falls in value and then needs to work harder to go back to its initial value. Example if a fund drops by 10% it needs to climb by a little over 11% to return to the original value. A fund that declines by 50% needs to return 100% to get back to the original value.

• Inflation risk – helping you appreciate how long your portfolio might need to last and a considered view on the impact of inflation (for example, 5% inflation reduces real income by two thirds over a 20-year period). Even relatively benign rates of inflation can have a huge financial impact over increasing years in later life.

• Longevity risk – an assessment of average life expectancy and helping you to understand the probability of living beyond this.

Annuities

Annuities, which had fallen out of fashion in recent years, are an irrevocable single premium contract which provides you with a regular income for life during retirement. The amount of income received depends on the options that are chosen at the time of purchasing the annuity and the size of the pension fund. The interest rate you will receive is fixed for life at the time you decide to purchase this product and is higher for older ages and when interest rates in general are higher.

Your regular income is paid monthly either in advance or in arrears into your bank account. The income is paid in the same way as a salary with tax deducted at source and a PAYE tax credit. Income is taxed at your marginal rate of tax and for many people in retirement this can be extremely low with many people paying an average rate of tax of less than 10%.

With increasing life expectancies, providing a lifetime income guarantee, no matter how long you live is a key consideration for many people. The two biggest risks in retirement are running out of money or dying with too much money – two sides of the same coin. The challenge with both risks is that they are dependent on how long you will live, and of course that is the great unknown.

These risks can be managed by replacing the uncertainty of how long your money will last with the certainty of a guaranteed income for life via an annuity.

While an annuity will dramatically reduce your risk, factors you need to consider in relation to annuities include:

• Irrevocable nature - once the annuity options are chosen, they are irrevocable and cannot be altered.

• No encashment - you cannot encash, redeem, sell, or assign your annuity either in part or full. It provides a regular income while you are alive.

• No lump sum on death - the policy does not provide a lump sum on death. In the absence of a guaranteed period, a dependant’s pension or a children’s pension, your annuity income will cease when you die.

11

Navigating Defined Benefit Schemes – a Client Case Study

Introduction

Navigating the world of pensions can be complex, especially when it comes to defined benefit (DB) schemes. Let’s delve into a recent consultation we had, which sheds light on the intricacies of making informed retirement decisions.

The Client’s Scenario

Recently, a client, who’s turning 60 this year, approached us. She’s part of a defined benefit scheme with a prominent US firm. Her primary concern was whether to accept the benefits proposed by the scheme. As financial advisors, our general stance is to recommend staying within the primary scheme unless there’s a specific advantage tailored to the client’s situation. For instance, someone with severe health concerns might prioritise securing their pension’s value for their family.

The offer on the table for our client was a €65,000 per annum pension, guaranteed for five years, a 50% spouse’s pension, and a lump sum of €174,000. When considering the lifetime allowance, the pension’s estimated value, were she to continue making Additional Voluntary Contributions (AVCs), would be €2.2 million. This means there’s a tax implication since it surpasses the €2 million lifetime allowance. Consequently, our client halted her AVC contributions, leaving her with an AVC fund of €720,000. The cash equivalent of her defined benefit scheme is approximately €1.2 million, bringing the total estimated cash value to about €1.92 million when including the AVCs.

Our Analysis and Recommendations

After thorough evaluation, here’s what we suggested that she opt for Cash Equivalent Transfer Value. We advised her to consider the Cash Equivalent transfer value (around €1.2 million) and combine it with her existing AVC fund of €720,000. This can then be moved into a Personal Retirement Savings Account (PRSA).

Lump Sum Benefits: Under PRSA rules, she can claim a maximum lump sum of 25% of the fund value (up to €500,000). This contrasts with the defined benefit scheme’s maximum of €174,000. From this €500,000, the initial €200,000 is tax-exempt, while the subsequent €300,000 incurs a 20% tax. This means she could potentially receive a net payment of €440,000.

Vested PRSA Benefits: The remaining pension fund, approximately €1.5 million, would be placed in a vested PRSA. This is akin to an Approved Retirement Fund (ARF). Given our client’s risk tolerance and her lack of dependents, we suggested purchasing an annuity with the entire pension fund.

Annuity Insights: At the time of writing (Jan 2024) a joint life annuity offers a rate of 4.52%. This provides a guaranteed lifetime income of €67,800 per annum, an increase of about €2,800 annually compared to the main DB scheme’s offer.

Delaying Annuity Purchase: If she chooses to postpone the annuity purchase, the vested PRSA would function similarly to an ARF. She’d need to draw an annual income of 4% until age 71, after which it would increase to 5%. The initial income would be at least €60,000 per annum.

Additional Voluntary AVC Contributions (AVCs): By following our recommended strategy, she could potentially make an AVC contribution of €84,333. This would attract a 40% income tax relief, bringing her total pension fund value close to €2 million upon retirement.

Conclusion

Every individual’s financial situation is unique, and there’s no one-size-fits-all solution. This case study underscores the importance of personalised financial planning. It’s crucial to move beyond generic advice and consider the specific circumstances at hand. Making informed retirement decisions can significantly impact one’s future, and it’s always best to seek expert guidance.

12

Legacy & Estate Planning

We often speak to people who are approaching retirement and are overly focused on leaving a lasting legacy after their death. However, we believe that the primary purpose of a pension is to provide financial security in your own retirement however long you live, as opposed to worrying about your legacy. Unless you are relatively well off, most people need the income from their pension either to make ends meet or to live a full life.

Of course, that is not to ignore your desire to leave a legacy. Any excess income can often be given away to family completely free of tax by using the annual small gift exemption. You can also tailor your guaranteed income with additional benefits to ensure that your loved ones are financially protected.

Where appropriate, it is also possible to convert part of your pension into an annuity and leave part invested in capital markets via an Approved Retirement Fund (ARF).

Standard Fund Threshold Planning

Revenue have opened a consultation on the Standard Fund Threshold (SFT) of currently €2m. Currently, exceeding this (or technically €2.15m) means that any excess is taxed at 40%, the income is then also taxed at highest marginal rates resulting in a punitive effective tax charge of 71% at the margin.

Many people we speak to believe that it isn’t possible to provide a pension fund greater than €2m tax efficiently but in reality, this isn’t the case. Subject to leaving service, it is possible to transfer an occupational pension overseas at which point it will be tested against the SFT at the time of the transfer. Any growth thereafter would be entirely outside the tax charge. So conceivably a 40-yearold with a pension fund of €1.5m could transfer that pension abroad and grow it to say €5m. They would still be able to add another €500k to an Irish pension, claim tax relief and not exceed the €2m limit.

Alternatively, at age 50 it is possible to retire from a pension and crystallise benefits which again would be tested against the SFT.

If Sean had a pension fund of €2m at age 50 and “retired” these benefits to an ARF he would not be required to take any income until age 61 and any growth between 50 and 61 would not be subject to an excess tax charge.

Finally it is possible for a company to pay an unlimited contribution to a PRSA. Say, my company paid €4m into my PRSA. At age 60 I could retire benefits up to the limit of the SFT at that time (might be different to the current rate) and the balance of my account can remain in a PRSA as an “unvested” pension. There is no obligation on me to touch it until age 75 at which point it would become an ARF and the excess tax charge will be due then, but I will have deferred tax on that money for many decades.

Equally, on death before age 75 the whole pension is paid out free from personal tax entirely and which, if left to a spouse or civil partner, would be entirely free from tax.

(Probably worthwhile to include a table of the various taxation treatments on death)

There are planning opportunities that should be considered where the Standard Fund Threshold is likely to be a factor.

13

State pension Deferral

From January 2024, you can choose to start claiming your State Pension (Contributory) anytime between the ages of 66 and 70. Choosing a later start date is called deferring your pension. You can defer your start date up until you turn 70.

So as with all things the question is does this make sense?

From the published guidance it seems that the additional pension increases by €13 per week between 66 and 67 but €14.50 per week between 67 and 68. Under the current rules when you draw your state pension you stop paying PRSI whereas if you defer you will still have to pay PRSI.

In 2023 Employees are exempt from PRSI on earnings of €352 or less per week. For gross earnings between €352.01 and €424, the amount of the PRSI charged at 4% is reduced by a tapered weekly PRSI Credit. The maximum weekly PRSI Credit of €12.00 applies at gross weekly earnings of €352.01. Unearned income from rents, investments, dividends and interest on deposits and savings is liable to PRSI at 4% since 1 January 2014 on earnings over €5,000. The minimum PRSI charge is €500 giving an effective rate of PRSI of 10% on a passive income of €5000

So the decision to defer your state pension depends on circumstances but let’s consider two relatively extreme ends of the spectrum

a) Less than 10 years contributions - you are currently due to get nothing at all. By continuing to work past 66 and paying more PRSI you will add to your contribution record and potentially increase your State pension. In these circumstances it makes sense to defer.

b) Let’s say you have a full state pension but just want to defer to avoid paying tax. For simplicity let’s assume a marginal rate of income tax of 40% and USC at 8% i.e. income over €70,044pa.

You would reduce your total income by €14,419 saving tax of €6,921. But you would still be liable to PRSI. Assuming a flat 4% deduction you’d pay about €3,376 on that total income giving a net saving of a little over €3,545 in tax.

So looked at through the lens of tax it seems to make sense to defer.

But you didn’t get paid €14,419. Had you taken the payment you would have had say €7,498 net. You didn’t “need it” or you wouldn’t defer it so if you gave that away via the small gift exemption say to two children and they both made pension contributions with 40% tax relief then your family would save 33% CAT on €6k which is €1,980 plus picked up 40% tax relief on 6k of pension payments another €2,400 a total of €4,380 in tax relief.

So you might conclude if you don’t need your State Pension take it anyway and give it to your family.

What about annual increases, do they make any difference?

Like the examples above, there is a payback calculation, and this should be taken into account when doing your retirement planning.

14

Investment Decision Considerations

This section outlines some of the more technical factors that you should be aware of.

Which is More Important to You - Your Income or Your Capital?

When Jane Austin described Mr Darcy in Pride and Prejudice, she didn't say that he was worth £2m, she said he was worth £10,000 pa. This is a really good way of thinking about your money in retirement.

Maintaining your income in retirement is a really important issue for so many people. However, it’s surprising that many people's priority has actually been on maintaining their capital, often at the expense of their quality of life. This tendency was identified by Ron Sandler in the UK3 who was commissioned to review the attitudes of retirees and concluded that many suffered from what he dubbed ‘reckless conservatism’.

Our natural tendency to be more conservative as we get older leads many people to focus on depositbased strategies or capital protected products for their savings. However, falling interest rates over the last 20 years or so has meant that the level of income that can be created from a given sum of capital has declined year on year. The graph below shows the average bank base rate in Ireland since the early 1990s which demonstrates this decline.

As a result many are beginning to question the wisdom of a strategy that seeks to preserve their capital through saving the majority of their retirement funds in traditional bank deposits or similar.

3 The UK Government announced a “review of medium and long-term retail savings in the UK” in 2001, and the subsequent review by Ron Sandler was presented to HM Treasury dated July 2002.

15

The Impact of a Low Interest Rate Environment

Historic investment returns are often used when stress testing a retirement income plan. This is despite many prominent names within the asset management industry continuing to forecast considerably lower returns for the foreseeable future. The capital markets table below includes two sets of 10-to-15-year capital market assumptions from JP Morgan and Vanguard and compares this to the long-term historic average for global equity, fixed interest and a 60/40 portfolio.

When looking at the attractiveness of an ARF through the lens of historic market returns it’s not difficult to see why it has become the default solution. Using the example of a 60/40 portfolio has generated an average return of 6.46% over the last 22 years. The problem is these returns represent a set of economic conditions that no longer apply today.

However, one aspect of today’s investing landscape that historic market returns underplay is the impact of low interest rates.

Traditionally the role of fixed income within portfolios has been to dampen volatility and provide protection during periods of market stress. This protection is provided by yields falling and prices rising. The problem with this is that with yields already at very low levels, they don’t have far to fall, so the protection they offer is limited. As the chart illustrates, with yields at current levels it’s difficult to see how fixed income will generate the kind of returns that some clients will likely need to support their retirement expenditure over a 25-to-35-year planning horizon.

This creates a significant planning challenge. Within the context of retirement planning many clients would benefit from reducing their exposure to the low yielding, low risk assets but are constrained by their risk tolerance.

The Impact of Inflation

In retirement we need a consistent real cash flow of income that not only meets our minimum day to day needs but also ensures that the income maintains its value in real terms allowing for the effects of increases in the cost of living so that we can maintain our standard of living throughout our retirement however long we might live.

16

Most of us might not expect to get richer in retirement, but we certainly shouldn't expect to get poorer each year which can happen as a result of increases in the cost of living.

However, if you design your portfolio based on trying to avoid the risk of short-term losses, that's exactly what is going to happen - a gradual year on year creeping loss of spending power which may be so small as to be imperceptible from one year to the next.

Graph of Consumer Price Inflation in Ireland since 1977

Source: inflation.eu

We can see that currently inflation is well above the trend of the last few decades and at levels not seen since the 1980s. Inflation isn't a risk for those in retirement, it's a statistical certainty.

The Impact of Longevity Risk

Another significant risk for those in retirement is longevity risk. There is no “best before date” on your birth certificate.

In numerous studies 4, retirees have been shown to underestimate their life expectancy and this should be taken into account when considering your retirement options. In one such study, although some retirees did correctly identify average life expectancy at age 65 as around 17 years for men and 20 years for women, far too few appreciate that this means that half of them will live beyond these projections.

Life expectancy is also on average higher for those retired with benefits from an employer-sponsored pension plan.

Source: UK Office of National Statistics

4 For example: 2005 Risks and Process of Retirement Survey SOA UP 1994

17

A 65-Year-Old Today Man Woman 75% chance of living to age 79 82 50% chance of living to age 87 90 25% chance of living to age 94 96 Women have a 14% chance of living to age 100 and men a 9% chance 100 100

Source: UK Office of National Statistics

Safe Withdrawal Rates or Not…

Bill Bengen's Safe Withdrawal Rate (SWR) is a financial concept introduced by financial planner Bill Bengen in the 1990s. It suggests a sustainable rate at which retirees can withdraw funds from their investment portfolios without running out of money during their retirement years. Bengen's research recommended a 4% withdrawal rate as a conservative estimate, based on historical market data, taking into account a 30-year retirement period and a mix of stocks and bonds. The 4% SWR has become a widely referenced guideline in retirement planning.

However, much like driving your car by looking in the rear-view mirror, it isn’t the straight bit of road behind you that will cause you to crash. A study of what may have worked well in the past doesn’t necessarily tell us everything we need to know for the future.

Your start date matters (a lot)

As a doctor said;” once you understand the importance of genetics, you should ensure that you choose your parents well”

The retirement planning equivalent is “be careful when you were born”. That is to say, when you reach retirement is partly a function of when you were born and that accident of history can have a significant impact on your financial expectations in retirement.

In the financial markets, the past is not always a perfect prologue; in fact, the future is often the opposite of what the past would suggest.

At the end of 1981, the average annual return on long-term Treasury bonds over the previous 50 years was 3 percent, nearly eight percentage points worse than the annual return on stocks. And yet the yield on those bonds the actual income they would deliver to investors in 1981 was 14 percent.

From 1982 through to 2003 Long Term Bonds in the USA returned 11.8 percent annually, just two percentage points less than stocks with only a fraction of their turbulence. History is worthless if you forget to filter it with some common sense

18

Starting yields in fixed income and Price-to-Earnings (P/E) ratios play crucial roles in influencing forward-looking expected returns in financial markets.

I. Fixed Income (Bonds):

o Bond Yields are Inversely Related to Price: As bond prices rise, yields fall, and vice versa.

o Starting Yields are a very strong indicator of expected returns: When investors purchase bonds, the starting yield represents the income they can expect relative to the current price. Lower starting yields indicate higher bond prices and therefore lower expected returns and vice versa.

II. Equities (Stocks):

• Price Earnings Ratio: The P/E ratio is a measure of the valuation of a stock. It represents the price investors are willing to pay for each dollar of earnings. A high P/E ratio may suggest a stock is relatively expensive, while a low P/E ratio may indicate it is more reasonably priced.

• Impact on Expected Returns: A lower P/E ratio often implies that investors are paying less for each unit of earnings, potentially leading to higher expected returns. Conversely, a higher P/E ratio may signal lower expected returns.

• Forward-Looking Considerations: Investors often use historical P/E ratios as a reference point, but forward-looking expectations should consider factors like future earnings growth, economic conditions, and market sentiment.

In summary, both in fixed income and equities, starting yields and P/E ratios provide insights into potential future returns. Lower starting yields in fixed income and lower P/E ratios in equities may suggest higher expected returns, while the opposite may indicate lower expected returns. Investors should consider these factors along with other economic and market conditions for a comprehensive view of future return expectations.

Where are we today?

The current yields on fixed interest securities have increased in recent months from the former multi-decade lows as can be seen by making a comparison between the end of 2017 and 2023.

For a view on future expected returns in the equity markets we can look to the GMO 7 year forward looking forecast.

5 Plus inflation adjustments

19

Fund Yield to maturity December 2017 Yield to maturity December 2023 Dimensional Global Ultra Short 0.06% 4.22% Dimensional Global Short Fixed Interest 0.21% 3.98% Dimensional Intermediate Term Inflation linked -0.89% 0.37%5 Vanguard Euro Investment Grade 1.68% 3.25%

GMO 7-Year Asset Class Forecast: 4Q 2023

In summary, GMO is estimating that future real returns (adjusted for inflation) will be lower than the long-term average and especially in the USA and with the highest expected returns from Emerging Markets. As with all predictions, actual returns may turn out very differently. This information is not intended as a recommendation to invest in any particular asset class or strategy or as a promise - or even estimate - of future performance.

Sequence of Returns Risk

Another concept that is very important is sequence of returns risks. It is well understood that the returns from capital markets can be volatile and unpredictable in nature. Sequence risk is the order in which these returns arrive to a portfolio. This is amplified during the retirement phase due to the addition of systematic withdrawals alongside investment volatility.

The sequence of returns experienced early in retirement can have a disproportionate impact on the outcome experienced by the client and results in a much wider range of potential outcomes during the retirement phase. Helping a client to navigate this risk is a significant challenge.

The charts below show the outcomes experienced by two different portfolios which achieve the same five percent average return over a 30-year period.

20

When clients are accumulating wealth, the order in which returns arrive to the portfolio doesn’t alter the final outcome.

When decumulating wealth however, the order in which returns arrive to the portfolio is critical to the outcome experienced by the client, as the withdrawals in poor market conditions crystalise losses, making it more difficult for the portfolio to subsequently recover.

The decumulation example uses the same portfolios as in the accumulation example but this time includes a withdrawal of four percent per annum. This illustrates how the sequence of returns can significantly impact the outcome experienced even if the average return assumption is achieved.

To reduce the impact of sequence risk a lower return assumption can be used within the retirement plan. This improves the probability of the portfolio achieving the return required to make the plan a success, especially early in retirement when sequence risk is heightened. Managing sequence risk in this way increases the cost of funding a client’s retirement objectives, especially when combined with a longer planning horizon to mitigate longevity risk.

Managing Sequence of Returns Risk

The sequence of returns in the markets is something we have no control over. Some investors are blessed with weak returns in the accumulation phase and strong returns when they have more money while others are cursed with brutal bear markets at the outset of retirement or markets that go nowhere when they have a bigger balance.

Luck plays a larger role in investment success than most realise since we each only have one lifetime (our own) in which these things play out for us personally.

21

We have no control over the sequence of returns in the markets but here are some ways to manage this risk:

1. Be flexible. The best part about simulations is they force you to be disciplined (this is also why they’re so difficult to follow in real time). The worst part is they offer little flexibility. Being flexible in terms of spending rates, saving rates, the timing of cash flows and how you treat the spoils of bull markets and pain of bear markets can make a huge difference. You can always adjust these levers depending on how the real world differs from your original projections. A steady savings rate, withdrawal rate or asset allocation may look good in a spreadsheet but will likely have to be adjusted based on how things play out.

2. Be conservative. The best way to give yourself a margin of safety is to set realistic return expectations, inflation projections and how you spend and save your money. A high savings rate means more money when you come to retire and eventually spend down your portfolio. High inflation expectations give you room for error in your personal inflation rate. Not overdoing your spending when market returns are high can help avoid having to cut back when they’re low.

3. Don’t become a forced seller. Sequence of return risk can be painful if you’re on the wrong end of it, but it becomes a double whammy if you end up being a forced seller of stocks when they’re down. This can be avoided through portfolio design, diversification, and intelligent deployment of cash flows. Building up reserves when things are going well to survive when things are going poorly can help.

4. Manage volatility. Volatility is not equal to risk when investing but it can be a tax on your results if you don’t handle it correctly. Reducing portfolio volatility, in at least a portion of your portfolio, is a wise move to be able to survive any major disruptions in the markets, the economy or your personal life. This also includes how you manage the volatility of your emotions when markets are going up or down.

5. Know your place. Managing risk differs depending on where you are in your investment lifecycle. Those just starting out with little in savings are going to have a completely different risk profile and time horizon than those in retirement who need to live off their life savings. Withdrawals from your portfolio are an entirely different animal than building one through periodic savings. Risk matters to some degree when you’re young but not much. Risk really matters when you no longer have human capital and are planning to live off your investment earnings for the remainder of your days.

22

Diversification

Diversification is the only ‘free lunch’ when investing. Although we all know that we should not ‘put all our eggs in one basket’, in practice many investors fail to diversify their investments sufficiently. One of the reasons for this is that often the way to accumulate significant wealth, namely concentrated risky and possibly even leveraged positions for example in property, is not the way to preserve wealth.

Coming up to retirement then, many investors will tend to have significant allocations of aspirational capital such as investment properties, stock options in our employer or our own business. Equally, during the accumulation phase of our lives when we are saving, one of our biggest assets is in our personal or human capital that we generate through our salary.

Proper diversification of your portfolio is one of the most important levers available to influence outcomes.

In Summary

The investment decisions that we make are always about making trade-offs. The notion that capital security is always the most significant priority for all retirees can lead to poor outcomes, in terms of both the income available during retirement and also the prospective legacies for beneficiaries.

We believe that the prudent approach for retirees is to seek to strike a balance between their income requirements and their desire to preserve their capital.

A practical example of how capital and income are really two ends of a spectrum can be seen in the fixed interest or bond market. When investing in bonds, if interest rates go up you feel better off due to increasing income payments, when in fact the capital value of your portfolio is going down. When interest rates go down, you will feel worse off; although the capital value of your portfolio value is going up. In this example, falling interest rates make you worse off and your heirs better off and vice versa.

23

Establishing an Optimal Investment Strategy

As your advisers, we need to consider the requirement for a different investment approach for our clients in the accumulation and decumulation stage. In adverse market environments, volatility combined with withdrawals can result in significant falls in portfolio value so the effective delivery of low volatility growth through a regularly reviewed investment strategy which is periodically rebalanced is a crucial objective for most ARF clients.

Establishing a ‘Prudent’ Withdrawal Rate

Linked to the above, we have in place a robust framework when it comes to advising our clients on what commentators often refer to as a Safe Withdrawal Rate (SWR).

As such, good practice should also extend to the use of more accurate words such as ‘prudent’ or ‘reasonable’ withdrawal rates. Of course, any rule of thumb needs to be adapted to consider individual client circumstances as well as external factors such as inflation.

Minimising Tax

One of the key ways in which we can add value (and increase sustainability of income) is in respect of limiting tax on your retirement income.

Whilst it is possible to take the whole pension fund as a taxable payment, lump sum withdrawals from a pension plan will currently be subject to income tax at your highest marginal rate.

Consideration of strategies to avoid this tax including utilising phased income withdrawal when a large tax-free cash amount is not required is good practice where appropriate.

In addition, we will always raise the issue and assess the impact of the Lifetime Allowance, both on withdrawals and at age 70 or 75 for a PRSA on remaining benefits. Account should be taken of the existence of any ‘protection’ from the ‘lifetime allowance charge’ in respect of the value of benefits built up (and future benefits that may accrue) in excess of the Lifetime Allowance.

Other Opportunities

Where appropriate, we will always consider other planning opportunities related to an ARF, including for example, deferring benefits, the recycling of income and the use of excess income to fund additional pension contributions (e.g. for children or spouse).

24

Ongoing Review Process

Successful retirement strategies require ongoing monitoring to help ensure they meet changing and evolving client circumstances and as clients age.

This requires a consistent review process. Critical questions include:

1. Is the strategy meeting the stated objectives, priorities, and expectations of the client?

2. Is the chosen level of income sustainable over the long term?

3. Is the investment strategy still suitable?

Other important questions to be asked include amongst others:

• How will a client’s health affect the review and outcomes?

• How do you assess whether the client’s objectives are still realistic?

• Has their capacity for loss/attitude to risk changed?

• How are any changes to strategy and investment portfolio identified and actioned?

• Has the time come to consider a partial, phased, or full exit from a drawdown plan (for example, to buy an annuity when a client gets older, and the impact of mortality drag means their drawdown strategy becomes progressively less effective)?

• Is it clear the clients’ minimum income requirements are still being met?

• Have the client’s cognitive abilities deteriorated?

• Does the client have a Power of Attorney in place? Or is the client a Power of Attorney for someone else?

• Review of the nomination/expression of wish into every annual review and following each key life event.

• Changes in relevant legislation?

Frequency of Review

It has always been important to plan on a regular basis. Frequency of review should reflect the complexity of any given clients’ circumstances, but good practice would suggest this should be at least annually and, in some cases, more frequently.

25

Cash Flow Modelling

A good way of understanding the specific needs of a client and help surface whether there are any concerns about outliving retirement savings and help make decisions (especially where trade-offs exist) is the regular use of some form of cash flow modelling.

Good practice should include running cash flow modelling beyond average life expectancy, and we generally default to age 100. This might also involve further modelling of a clients’ overall financial situation to age 75 because at this point it might be better for some individuals to annuitise and remove the risk of outliving their money entirely.

Effective Cash Flow modelling should stress test various scenarios for the client to enable them to decide whether they are able to take the income they require and how it might be affected by certain events such as:

• The need to increase income taken from a portfolio

• The need for any ad hoc withdrawals

• Inflation is higher (or lower) than expected/predicted

• Living longer than expected

• Future returns prove to be lower than expected

• Unpredictable events – a stock market crash, the need to fund long term care etc.

It is good practice for cash flow modelling to be an integral part of the review process

Building Contingency

Its good practice to make sure there is a contingency built into all retirement planning, and to make sure there is significant provision to cover unforeseen problems (such as a major stock market crash, significant unexpected capital expenditure or the death of a partner).

Agreeing to a plan of action in advance will enable action to be taken quickly.

Social Welfare & Social Care Support

It is important that the advisor understands the impact of different choices on drawing down pension funds on current and future entitlement to welfare and social care support. This is especially relevant for those who draw down their pension pot quickly as they may be deemed to have deliberately deprived themselves of income/assets and in so doing reduce or disqualify entitlement to such support at some future point.

26

Powers of Attorney

As well as increased longevity, Ireland will have increasing numbers of people with illnesses, both physical and mental, ranging from mild cognitive decline to dementia. Good practice6 involves highlighting the possibility of loss of a clients’ own ability; for instance, if they lose mental capacity, what are the issues that present in terms of the ongoing management of a drawdown strategy.

Clearly the time to set up a Power of Attorney is well before it is needed, and we recommend that this is put in place at the same time that an ARF or annuity is established.

Legacy Planning

An ARF may be more attractive to some as it can be inherited by the surviving spouse or civil partner, which amongst other things allows for pension wealth to be passed down through family generations. Apart from being good practice, it is important that a member nominates and keeps their nominated beneficiaries up to date if they want them to have access to all death benefit options available under ARF (30% tax on inheritance by an adult beneficiary).

6 Evidencing that the client has the ongoing capacity to make decisions and outsource decisions to third parties, such as discretionary fund managers and their adviser is increasingly important.

27

Summary & Conclusions

Investing in an ARF carries higher risk than annuity purchase as the fund remains invested and may fall as well as rise in value. This in turn may lead to the client receiving less income than they expect. For some clients this is unacceptable.

However, as we have seen, pursuing a deposit-based or “low-risk” fixed income investment strategy within an ARF to avoid investment risk does not guarantee a better outcome and depending on how long the client lives, an Annuity may work out to be better value overall.

Some clients, in the face of a decline in the value of their ARF may subsequently elect to switch to an annuity part way through their retirement; some of these may discover that they would have been better off buying an annuity at outset.

If you need withdrawals from your ARF to maintain your required lifestyle and the withdrawal rate is close to the annuity rate that could currently be secured, you are only going to be able to maintain this income level if a higher level of investment risk is taken.

The decision to invest in an ARF or an annuity is not a simple process and we believe that it is very important for clients to fully understand all the risks that they face.

Equally, it is essential to appreciate that if you pursue a cautious investment strategy (such as investing in a deposit account) with an ARF you will almost certainly fail to meet the critical yield requirement and might actually find out that you would have been better off with the purchase of an annuity (depending on how long you live).

This problem is much too complex to have a single solution for everyone. Relevant factors to consider include the expected time horizon, the tolerance for risk, the desire for smooth consumption from year to year, and the desire to leave a bequest will each have an impact on the outcome.

While there is no single answer, there are several principles which apply uniformly:

• Investors are more likely to maintain living standards in retirement if they have low spending rates and reasonably large stock allocations within their portfolios. A long retirement coupled with a low stock allocation translates into a high probability of declining consumption.

• For shorter time periods, higher spending rates may be justified. However, even over these shorter periods, higher spending rates increase the probability of declining consumption in the future.

• Insisting on a very high degree of “smoothing” of income from one year to the next (i.e. maintaining a relatively constant income) is a recipe for disaster. Imputed distributions are based on 4% or 5% of the remaining fund value and therefore does no subject the fund to this risk.

• Expected bequests are higher for portfolios with high stock allocations, but so is the likelihood of leaving a small bequest. This is a classic risk/return trade-off.

• If historical average returns are reasonable estimates of expected returns, there may be a reasonable expectation of rising real spending levels over time. When the more conservative adjusted means are used, median spending levels indicate a likelihood of declining living standards.

28

The Next Step…

The Everlake team of financial advisors is dedicated to achieving excellent outcomes for our clients. We operate at the frontier of innovation and embody a willingness to challenge the status quo at every turn.

Our high ethical standards apply to every aspect of our relationship with you, and through our culture of continuous learning. Each member of our team is highly qualified and capable of delivering worldclass financial planning solutions to you.

Arrange a meeting with one of our advisors to discuss your retirement planning by emailing enquiries@everlake.ie or book a call directly through Calendly here.

We look forward to working with you.

The Everlake Team

29

The purpose of this guide is to provide investors approaching retirement with an understanding of their retirement options and some of the more important issues to consider.

It also sets out generic guidelines for advisers seeking to advise their clients on retirement planning matters.

Clients looking to access their retirement plans have a number of options available to them and should make some key decisions well before reaching retirement. These decisions are complicated and best served by a discussion with a qualified and experienced financial adviser.

Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. In any event that the content of this brochure may conflict with an individual’s unique personal circumstances, the client’s circumstances should be weighed more heavily.

Advisers are expected to use their Professional skill and judgement to resolve any conflicts between the content of this brochure and a particular client’s requirements.

Although this guide is intended to deal with the main questions facing those about to retire in general terms. As such, it does not attempt to cover every issue which may arise on the subject. It does not purport to be a legal interpretation of the statutory provisions and consequently, responsibility cannot be accepted for any liability incurred or loss suffered as a result of relying on any matter published in it.

The information provided in this brochure has been obtained from sources which we believe to be reliable and is based on our understanding of Irish Tax legislation at the time of writing (October 2022). We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk.

The rates and bases of taxation may change in the future. We recommend that you obtain specific tax advice for your own personal situation.

It should be noted that we are not tax consultants, but we will refer you to a suitably qualified tax consultant on request.

As with any investment strategy, there is potential for profit as well as the possibility of loss. Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors’ interests.

Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies.

We do not guarantee any minimum level of investment performance or the success of any model portfolio or investment strategy. All investments involve risk and investment recommendations will not always be profitable. Fermat Point Ltd trading as Everlake is regulated by the Central Bank of Ireland. The Central Bank of Ireland does not regulate tax advice.

0

Disclaimer

5 Marine Terrace, Dun Laoghaire, Co. Dublin, A96 H9T8 +353 1 539 7246 enquiries@everlake.ie everlake.ie