Paul Kuntz

Paul Kuntz

44-0-0

ESN makes sure crops get the nitrogen they need, when they need it, helping growers make the most of their investment.

ESN granules are 44% nitrogen, contained within a flexible, polymer coating designed to protect the nitrogen from loss and release it in response to soil temperature.

POLYMER OUTERSHELL

44% NITROGEN

50–80 days RELEASE TIME

A wider application window in spring and fall lets farmers apply on their schedule.

ESN helps reduce nitrogen loss, providing substantial environmental benefits.

ESN’s controlled release may reduce lodging by preventing excessive early vegetative growth.

ESN is easy to blend, works well in no-till operations and will not set up in storage.

9-43-0-16S

Smart Nutrition™ MAP+MST ® − delivering sulfur and phosphate to meet crop needs and maximize production.

Smaller particle size for quicker sulfur oxidation and earlier availability to crops.

The slow release ensures crops have sulfur throughout the growing season.

Designed with farm safety in mind; allowing for safer and easier handling, storing and blending.

The high analysis and homogeneous distribution provide consistent delivery at decreased application rates.

Kevin Hursh, P.Ag.

Kevin Hursh is one of the country’s leading agricultural commentators. He is an agrologist, journalist and farmer.

Kevin and his wife Marlene run Hursh Consulting & Communications based in Saskatoon. They also own and operate a farm near Cabri in southwest Saskatchewan growing a wide variety of crops.

Kevin writes for a number of agricultural publications and serves as executive director for the Canary Seed Development Commission of Saskatchewan and the Inland Terminal Association of Canada (ITAC).

Twitter: @KevinHursh1

Upgrading equipment is exciting and scary at the same time. As farmers, it’s something we all have to deal with, but the decisions can be agonizing.

Used combine prices have been relatively soft, but everything else seems to command premium prices these days and prices can be eye-popping. Touring around Ag in Motion in July, most of the mainline farm equipment on display seemed to be beyond the reach of average-sized farmers.

In theory, a dispassionate economic analysis is supposed to determine whether an equipment upgrade will actually make you money over the long term. A friend of mine is a stickler for keeping detailed expense records and determining the cost per acre for each piece of equipment. He has found that when you trade quite regularly, the cost per acre balances out and it doesn’t cost a lot more to be running relatively new equipment.

For most of us, equipment upgrade decisions often don’t get a lot of detailed number crunching because there are just too many assumptions. This is particularly true if you’re running older equipment.

Is your existing unit going to be relatively trouble-free or will major repairs soon be required? The same question can be asked of any used equipment you’re buying. It may look and sound good, but what problems are lurking around the corner?

If you’re buying new and the equipment is on warranty, major repair bills shouldn’t be the same worry. However, new equipment often has bugs that need to be worked out and that can cause frustration and downtime.

If you buy a new-to-you piece of equipment and think you might own it for five or 10 years before trading it off, what salvage value do you assume in any economic analysis? Some equipment has defied gravity and is worth more when you trade it off than when you bought it. Other equipment, like a combine, can see value drop like a rock.

If you run some very old equipment like me, you run the risk of not having any salvage value at all. I have a tandem water truck in that category. It appears to need a major engine overhaul, but the truck isn’t worth the expense. It isn’t good to be a farm where old equipment goes to die.

It doesn’t get simpler than this. Centurion® ADV herbicide delivers the effective grassy weed control you trust, now in a convenient pre-mixed formula with built-in adjuvant. It also offers peace of mind with a Performance Support Guarantee in the unlikely event of weed escapes1. So why mess with anything else? Visit agsolutions.ca/CenturionADV to learn more. New pre-mixed formulation – now available in bulk.

1 When adhering to specified rates outlined in the product label.

Labour, or the lack thereof, is a driving force in equipment upgrades. Tandem grain trucks are no doubt inflated in price because you don’t need a semi licence to drive them. If the tandem has an automatic transmission, so much the better. Employees and/or family members can master it more quickly.

How do you put an accurate value on being able to complete seeding, spraying or harvesting operations in a timelier manner? Some years, there’s oodles of time to complete operations. Other years, it’s a race against the weather.

It’s hard to separate wants from needs. Does the farm really need the equipment upgrade or is it just something you want? Some farms have way more money per seeded acre invested in equipment than their neighbours. There can be legitimate reasons for this. Perhaps they grow certified seed or more special crops. Or perhaps they have irrigated land and their neighbours don’t. Often, however, it’s shiny iron syndrome, an expensive ailment.

Labour, or the lack thereof, is a driving force in equipment upgrades. Tandem grain trucks are no doubt inflated in price because you don’t need a semi licence to drive them. If the tandem has an automatic transmission, so much the better. Employees and/or family members can master it more quickly.

As I write this, I’m wrestling with a couple equipment upgrades. Our two tandem grain trucks are very old with one capable of handling only light loads. Even if I buy something 20 years newer, it will still be relatively old. Even with the assurance of a safety inspection, costly repairs may not be far away.

The second want/need is a larger high-clearance sprayer. Spraying always seems to be a bottleneck, but upgrading is expensive with pluses and minuses to all the various upgrade options.

You can spend a lot of time researching and travelling to test-drive possible options. Looking is kind of fun, but making decisions not so much.

Operators throughout North America rely on Landoll innovation to efficiently remove compaction by resetting soil density caused by limited tillage or continual shallow passes in previous years. Manage residue and cover more acres every pass through the field. That’s Landoll innovation that Producers count on, season after season.

• Cover more acres w/ sizes ranging from 9’ to 31’ cutting widths.

• Level the pass w/ an optional combo harrow

• Blades on 7.5” spacing lead each shank on 15” centers up to 12” deep

• Reset soil density w/ least disturbance on the surface

• Low point attack angle will pull easier and maximize soil lift and fracturing

• 3 thru 16 shank units available on 30” spacing

• Manage residue and compaction in one-pass (most aggressive)

• Adjustable disc gang depth and blades on 10.5” spacing

• 6 thru 13 shank units available on 24” spacing

Scott Shiels

Scott Shiels grew up in Killarney, Man. and has been in the grain industry for 30 years. He has worked with Grain Millers Canada for 10 years and manages procurement for both conventional and organic oats for their Canadian operation.

Scott is an elected board member for Farm and Food Care Saskatchewan and sits on several other committees on both the organic and conventional sides of the oat industry. Scott and his wife Jenn live on an acreage near Yorkton, Sask. Find out more at www. grainmillers.com.

Even with seeding happening a little late in 2024 and June being a cooler month on the Prairies than we needed, the crop still found a way to catch up and improve in quality right through the summer months. Week after week, we watched the U.S. crop reports telling us their conditions year-overyear on the major crops continued to flourish, all while watching our crops improve here in Western Canada. Nothing but bears running around out there. So, how do we find the bulls?

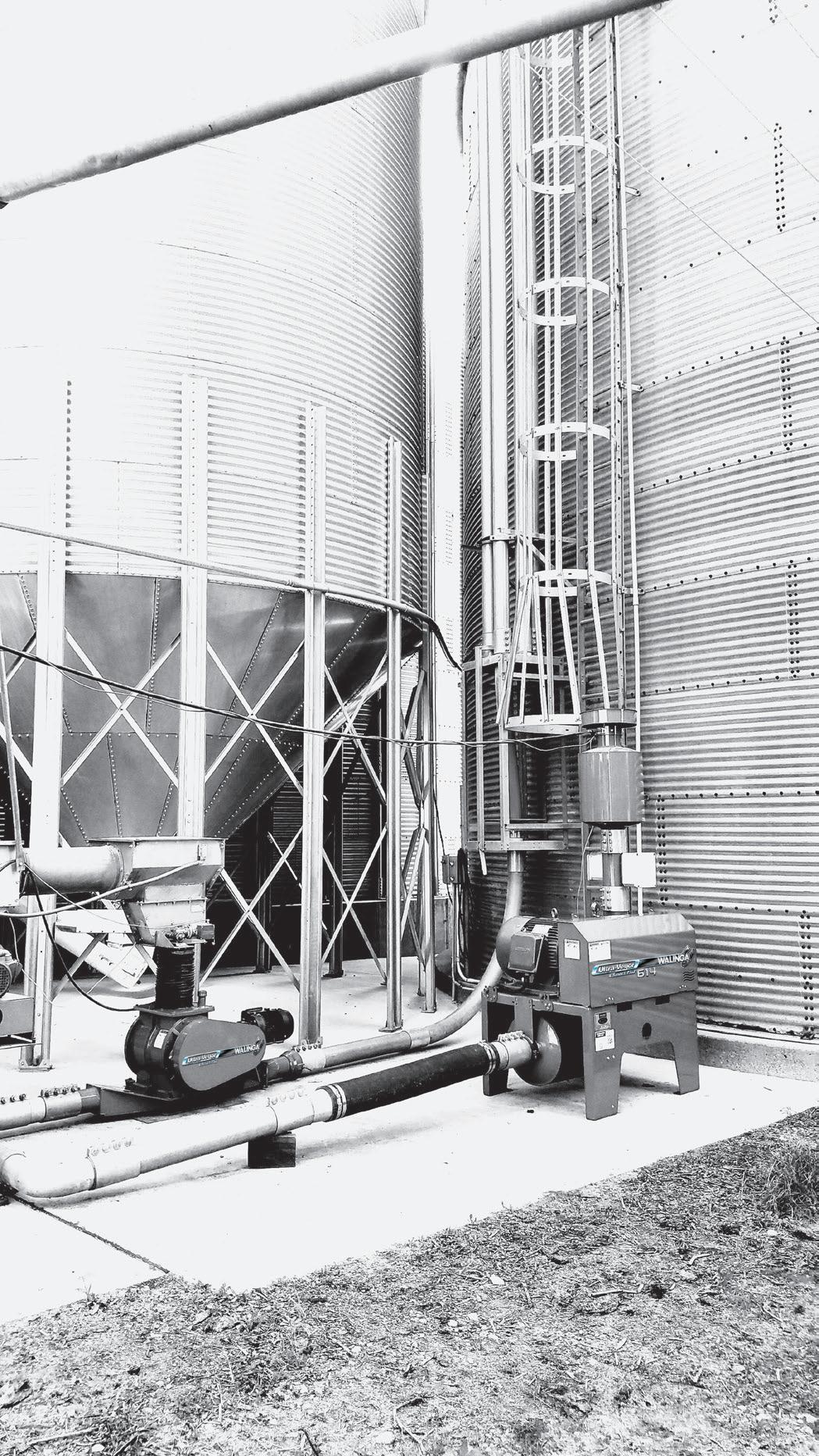

Previously, I have written about specialty programs that can bring you premiums, and harped on and on about building relationships with your buyers so that your name is the first one that pops into their head when they have a premium to offer. These are great ideas that can always work, but in a year where we have a big crop, we not only need to be watching the markets for this season, but the year ahead as well. Opportunities will open up that may make carrying crop from one year to the next more lucrative than selling it now, but extreme diligence, and some very sharp pencils will be required to take advantage of these situations. Not everyone is set up with enough farm storage to exploit these openings, but another thing I have always said is that storage will make you money. If this crop comes off as big as it looked in mid-July, we are in for an oversupply in many commodities, and that definitely is not going to move prices in the right direction for producers.

The next market mover will be based off where this crop finishes, and what that bodes for the coming year as far as where acreage goes. If we see good yields across the board, then most likely we will observe commodities such as oats, barley and flax buying acres for 2025. Flax and barley saw a significant decrease in acreage this year, and oats saw an increase, albeit nowhere near where that market needed it to be. Any hiccups in production will move the needle on that particular crop as far as where we need to be to balance supply and demand going forward, and that will be one bear, or maybe bull, hiding in the woods that you need to be on the lookout for.

As we move into harvest, it really does look like the lows are in for the year, but that’s not to say that markets will move higher to any real extent. The amount they move will very much be determined by this year’s yields, but it does appear that carryout for nearly every crop leaves us tight enough on supply that there is likely a 90/10 upside to downside potential going into this fall. Average to above-average yields will put a cap on the upside, but realistically for some commodities, even a big crop is going to leave the market wanting more.

Farming can be challenging, but like a true community, we pull together, supporting one another and growing stronger together. The path forward becomes easier to navigate when you have someone walking with you.

PROUD TO SUPPORT AGRICULTURE IN ALBERTA

Paul Kuntz

Paul Kuntz is the owner of Wheatland Financial. He offers financial consulting and debt broker services.

Paul is also an advisor with Global Ag Risk Solutions. He can be reached through wheatlandfinancial.ca.

I rarely hope I am wrong when looking into the future, but this is one of those times. Perhaps our grain economy will reverse and profit will be back by the time we harvest this 2024 crop.

For now, we need to deal with facts. In the last five years, we have seen our profits in grain growing go from steady to record-setting highs, and now they appear to be gone. If you held on to inventory from 2023 (like I did), you could also be erasing 2023’s profit in addition to 2024.

As grain prices rose, so did our costs. Most times, our revenue rose faster, creating ample opportunities to be profitable. Most of those higher costs are still here today, but revenue has decreased. This is where we are right now.

In a free market system, losses will happen from time to time. Commodity markets will return a price to the producer that is well above the cost of production. At the same time, commodity markets will also return a price that is well below the cost of production.

To look at some numbers and compare, I went to Saskatchewan Agriculture resources and used the Crop Planning Guide from 2019 and 2024. These guides look at the yield potential of each crop, measure the price of grain to get the revenue, and then examine all the costs to grow that crop. The report is quite in depth and a lot of the expenses may not apply to your farm. I will pick out a few key areas as to why we are hurting right now with a focus on HRSW (hard red spring wheat) and canola.

The first section deals with revenue. The guide is divided into soil zones. Using the black soil zone, yield is estimated based on data received from Sask Crop Insurance. They focus on the fiveyear average of the 80th percentile, so basically only the better yields are chosen. In the past five years, wheat and canola production has dropped. This would be due to lower moisture conditions. Regardless, it is interesting to see that over a five-year period where costs have risen, our yields have decreased.

The final section for revenue is the grain price. In 2019, the guide showed: Canola $11.59/bushel and HRSW $6.75/bushel.

I have not done a deep dive to see if these prices were the average throughout the year. I remember grain prices in 2019 being quite stagnant. There was not a lot of movement, so I think these prices are relevant to the 2019 period. Here is what the guide shows for 2024: Canola $16.06 and HRSW $8.44.

Some producers may have contracts for their 2024 crop that reflect these prices, but I would guess most do not. The markets for fall 2024 are looking more like: Canola $13.50 and HRSW $7.80.

If we put this data together, the following shows what we expected for revenue per acre in 2019 and the current reality in 2024:

fertilizer-chemical-seed costs of $46.63, and the canola numbers are upside down because the $43.96 increase comes with higher fertilizer-chemical-seed costs of $76.87.

Once you factor in all of your costs to run your farm, you will most likely be in a negative income situation for 2024. This cannot be sustained over a period of multiple years.

This data indicates the market will return our farms more revenue in 2024 than 2019 by a value of $55.98/acre on wheat and $43.96/acre on canola.

Before we dive into expenses, I think you can clearly see the level of revenue increase is not enough to cover today’s costs. Your farm will have land rent expenses that have gone up by these values. You will have combine and tractor payments that have doubled. Inputs costs will also chew up a good portion of this.

On the expense side of the equation, let’s highlight the three simplest costs everyone has: seed, fertilizer and chemical. Following is a summary of these costs from the Crop Planning Guide, comparing 2019 to 2024:

Based on this data, your wheat economics show the $55.98 increase in revenue is almost entirely offset by the higher

This leads me to question several aspects of everyday farming:

• Where is the price of cash rent going? Will producers break contracts set at unsustainable levels?

• Can new equipment maintain its asking prices? Will farmers be OK with combines being over $1 million and the header being another $400K?

• If new equipment cannot sustain prices, what happens to the used market?

The previous years have been profitable for a lot of farms. This profit has turned into working capital. Many farms today have a good supply of cash. This money will help farms get through periods where there is not enough revenue generated to pay for all the expenses and loan payments. That type of financial management can only go on so long and then it will end.

This crash in grain prices is affecting Western Canada and the grain growing plains of the U.S. It will have a huge negative impact on the North American agriculture economy.

You must know your costs on your farm and where your cash break-even level is at. If you cannot achieve that level of required revenue with the yield and price of your crop, you need to make sure you have the working capital to cover those cash-flow losses. Going through a year of cash-flow loss is not the end of your farm, but if you do not know you are going through a difficult financial time, you cannot prepare for it.

When you’re racing against time and Mother Nature, the last thing you need is a pump that isn’t up to the job. That’s why it makes sense to put your trust in Ace Pro 5 Series pumps. Choose from Pro 5 FMCSC pumps with severe-duty silicon carbide seals, or Pro 5 FMCWS models with Ace Pump’s exclusive Oasis™ WetSeal Technology. All Pro 5 pumps feature larger bearings for longer pump life. E-coated castings for added corrosion resistance. Standardized components for simplified inventory and maintenance. And optional motors with integrated PWM control valves for precision application. To learn more, please visit us at www.acepumps.com

By Becky Zimmer

Research is ongoing when it comes to finding effective fertilizer reduction strategies in Western Canada. One of these strategies has been the development of enhanced efficiency nitrogen fertilizers (EENFs), products that give the plants more time to utilize fertilizer through urease and nitrification inhibitors or slow-release coatings.

According to Richard Farrell, professor of soils and environment at the University of Saskatchewan, economic and environmental impacts of nitrogen emission reductions have to go hand-in-hand, which is why research into this fertilizer sweet spot – how much can they reduce traditional rates without seeing a reduction in yields – is ongoing throughout the agricultural community.

Farrell, along with researchers at the University of Manitoba and the University of Alberta, are concentrating their efforts on 4R nutrient stewardship, a growing practice among Canadian grain farmers which sees the right rate and source of fertilizer being applied at the right time and to the right place, reported Fertilizer Canada. In their recent Fertilizer Use Survey, 77 per cent of farmers in Ontario and 63 per cent in Western Canada reported a familiarity with the concept in 2021, a significant increase from 2015 percentages.

The 4R benefits of effective EENF use remained top of mind

for Farrell and Reynald Lemke during their 2022 University of Saskatchewan study on the agronomic and environmental outcomes of EENFs, jointly funded by the Saskatchewan Agriculture Development Fund and the Saskatchewan Canola Development Commission. They are continuing to study reduction trends in wheat and canola acres on black soil zones near Melfort, Sask. and brown soil zones near Saskatoon.

Results are quite consistent between sites, reports Lemke, with substantial reduction in emissions and rates before any noticeable yield penalty. “Somewhere around this 80 per cent application rate was the optimum level in terms of reducing emissions without having a measurable impact on yields.”

This number can vary from soil zone to soil zone, and year to year, depending on the weather patterns; with the 2020 and 2021 drought years having a significant impact on Lemke and Farrell’s research. While Farrell has seen that percentage fluctuate to either side, 20 per cent seems to be the sweet spot.

Nobody is currently getting paid to reduce N20 emissions, says Farrell, but there are still benefits to finding these reductions, including a trimming of input costs when less fertilizers are used more effectively. Even when EENF premiums are 15 per cent higher than traditional inputs, that

“If we reduce N20 emissions by 30 per cent, what sort of emissions reduction do we get in terms of N2 reductions? Those N2 losses might be big enough to translate more into an increase in nitrogen use efficiency by the plants, by keeping that nitrogen in a form that the plants can use.”

- Richard Farrell

is still a five per cent savings. While that doesn’t sound like an incredible amount, Farrell can see those margins growing in the future.

“It’s a matter of scale. That premium should start to drop as more people start to use these, which means that even a 10 per cent reduction might be economically viable.”

Farrell sees three forms of EENFs available for Canadian farmers: urea inhibitors, nitrification inhibitors and polymercoated urea.

All three are designed to allow optimal growing conditions to occur before the fertilizer is available to the plant, instead of being broken down by denitrification while waiting for the plant to soak up the available nitrates. A urea inhibitor slows down the hydrolysis process, so that the seeds have a chance to germinate, put out roots and start using that nitrogen, while nitrification inhibitors slow down the nitrification process, which would otherwise occur very rapidly, again giving the plant time to utilize the available nitrate when it needs it.

Not only are both effective on their own, but using them together as a dual inhibitor, like Farrell and Lemke did in their study, reduces both indirect and direct N20 emissions. Indirect emissions are ammonia emissions that go through volatilization, enter the atmosphere and then rain down on other fields to be converted to N20. Nitrification inhibitors do not stop this process, so having the dual inhibitor will reduce this volatilization loss as well as direct N20 emissions, notes Farrell.

The polymer coating protects the urea inside so that optimal moisture conditions are reached before the urea goes through that nitrification process.

Depending on the temperature and weather, inhibitors can last for two to three weeks while the conditions grow favourable, says Farrell. In comparison, the controlled-release products can last for 60 to 80 days.

Due to the need for proper moisture content in the soil, both

for optimal growing conditions as well as efficient use of the EENFs, Farrell says they are seeing better emission reductions on irrigated acres compared to dryland. This past spring, additional rains were also beneficial.

Through a dizzying chain of scientific reactions, three end compounds are formed when fertilizer is applied to cropland and go through hydrolysis; the most important ones being nitrate, the primary requirement for a plant’s growth and development, and nitrous oxide (N20), a significant greenhouse gas that is formed through denitrification. According to the United States Environmental Protection Agency, N20 makes up only six per cent of the world’s greenhouse gas emissions, mostly due to agricultural and industrial activities, combustion of fossil fuels and solid waste, and wastewater treatment. However, it is also 265 times more potent than C02, says Farrell. According to the EPA, C02, which makes up nearly 80 per cent of emissions, stays in the atmosphere for 12 years, compared to 114 years for N20.

This is the reason that N20 emissions are an environmental concern. “While nitrogen losses are relatively small, about one pound per hectare,” says Farrell, “times that on a global scale and there is a much bigger reason to find emissions reductions.”

He adds, “If you’ve got 35 million hectares of cropland out here, all of a sudden, that’s 35 million times one-kilogram times 265, it becomes a very large number.”

Dinitrogen (N2) is also an inert byproduct of denitrification, however, it is harder to measure since 78 per cent of the atmosphere is made up of N2. While N2 emissions are not harmful to the environment compared to N20, it is still fertilizer inputs lost in both time and money. If farmers are reaching for that 30 per cent reduction in N20, a more efficient product could also mean less N2 losses.

“If we reduce N20 emissions by 30 per cent, what sort of emissions reduction do we get in terms of N2 reductions?” asks Farrell. “Those N2 losses might be big enough to translate more into an increase in nitrogen use efficiency by the plants, by

“It’s within everybody’s interests for nitrogen fertilizer use efficiency to improve on a farm. It’s to the benefit of the farmers and it’s to the benefit of society. If everyone can sing that tune, that we’re working towards improving efficiency, that’s something positive everyone can get behind.”

- Miles Dyck

keeping that nitrogen in a form that the plants can use.”

Again, effectiveness is going to depend on growing conditions, according to Miles Dyck, professor of soil science at the University of Alberta. Cold and wet soil in the spring might take up conventional fertilizer more efficiently than EENFs, but on the other hand, late season moisture might mean fertilizer

demands will increase later in the season. Uncertain growing conditions make for uncertain fertilizer needs, and Dyck does a general overapplication of fertilizer across the industry. Researchers are headed in the right direction as they try to improve these 4R practices through EENFs.

“It’s within everybody’s interests for nitrogen fertilizer use efficiency to improve on a farm. It’s to the benefit of the farmers and it’s to the benefit of society. If everyone can sing that tune, that we’re working towards improving efficiency, that’s something positive everyone can get behind.”

Fertilizer Canada is still seeing some barriers to 4R stewardship adoption in Western Canada, including a perceived lack of proven benefits, lack of incentive, and the expense of taking on different fertilizer application processes. On the flip side, farmers are also seeing a number of 4R stewardship benefits, including improved soil quality and nutrient availability, best environmental stewardship practices, and an increase in economic return.

There is always going to be hesitation when a new agricultural practice comes along, says Dyck, especially when there is so much risk management included in agriculture decision-making. There needs to be better communication when it comes to sharing the EENF benefits with farmers, he stresses, and maybe that will take fertilizer companies funding research plots and getting them in front of farmers.

GLYPHOSATE TOLERANT

GLUFOSINATE TOLERANT

TOLERANT + 2.29 + 2.12 + 2.18 bu/ac bu/ac bu/ac TRUFLEX OR OPTIMUM GLY

ADVANCEMENT OVER 2022/23 CLASS

2 HYBRIDS IN 2022/23

2 NEW HYBRIDS IN 2024/25

ADVANCEMENT OVER 2022/23 CLASS 2 HYBRIDS IN 2022/23

2 NEW HYBRIDS IN 2024/25

ADVANCEMENT OVER 2022/23 CLASS 1 HYBRID IN 2022/23

1 NEW HYBRID IN 2024/25

Bring efficient, profitable, and practical harvest methods to your acres with Proven® Seed’s NTACT™ Technology. NTACT hybrids mitigate the risk of shatter loss, enabling more growers to confidently adopt straight cutting and harvest more efficiently while ensuring maximum seed retention. Drive Performance with

By Angela Lovell

That’s the question brothers Bud and Ron Michel have asked themselves (and each other) many times before making decisions about any major changes to the family businesses – a grain farm and a tarp manufacturing facility they run in Saint Gregor, Saskatchewan.

“My theory was as long as I make more good decisions than bad, we’ll be okay,” Bud says. “Some things didn’t work out, but if you don’t try, you’re going to get nowhere. If the worst thing that could happen is losing your business or your farm, that’s too big a risk.”

In 1969, their father, Walter, decided to take a risk and start a manufacturing business on the family farm. He was tired of struggling to throw and strap down tarps on his grain truck, so he came up with a design for a mechanical system to roll the tarp on and off. Today, Michel’s Industries is housed in a large facility in the town and has grown from a few employees to approximately 90 people, selling its tarps (revised and reinvented many times over the years) across North America, the Netherlands and Australia.

The farm has also grown over the last 50 years into a 5,400-acre operation, providing the inspiration for many of Michel’s Industries’ new products and a place to test them out in real-world conditions.

Bud and Ron worked in both of the family’s enterprises growing up, providing them with plenty of opportunity to figure out the roles that would suit them best when it was time to take over from their dad.

Bud, who enjoyed product development and dealing with customers, was a natural fit to manage the manufacturing business, and Ron, who had more interest in farming, took over the farm operation.

Although the farm and the business are separate companies, they run under one umbrella and remain very much a family enterprise. Today, three of Bud’s sons work in the business: Brad (44) is the general manager, Trevor (38) is the CFO and Blair (41) supervises the back shop, while Ron’s son, Jeff (38), manages the farm operation alongside his dad.

“I don’t have much to do with the day-to-day running of Michel’s Industries,” Jeff says. “But we have meetings a few times a year to go over sales, new products and share ideas.”

And it goes the same way with the farm side, says Brad. “We don’t have much to do with the farm anymore, and rely on and respect Jeff’s decisions to run it. While we look at it as two separate ventures, we are still working together.”

The two enterprises complement and support each other and both are stronger because of the other.

“Essentially, the business wouldn’t be here if it wasn’t for the farm,” Brad says. “They have always worked well together. We’re always looking for input from the farm; they do a lot of research and development and testing on the farm for the business.”

It also works well on the financial end. “There have been times where money has been lent back and forth [between the companies],” adds Jeff.

With diverse enterprises to consider, the transition to the next generation is more complicated than an average farm succession (which is complex in its own right), but it’s going smoothly because the family took a proactive approach and started early, long before the older generation was even considering retirement.

“We started having meetings before all of us kids got too involved, and made sure everybody was on the same page about who would do what, and how things were going to get split down the road,” Brad says. “Communication really was key. We always had open discussions, we all get along. Everybody does their own job and worries about their own things and it seems to work for us.”

That’s not to say there isn’t overlap, of course. If they need Jeff’s mechanical expertise in the shop, he’s there, and if he needs extra hands at seeding or harvest, they all try to muck in as much as possible, but they’ve learned over the years that sticking to their own roles is the most productive for everyone.

“We’ve found that it’s tough to run the business if you are spending 12 hours a day on the farm during harvest time,” Jeff says.

It’s also taught them the value of building a team to support the operations for the things they can’t do themselves.

“We have good supervisors, and we leave a lot of things up to them,” Brad explains. “They look after the team very well and make our jobs a lot easier.”

That said, labour is one of the biggest, ongoing challenges they face with both the farm and the business.

“Being rural, there are less people to choose from, and there are a couple of potash mines nearby that pull a lot of people out of the workforce too,” Brad says. “And with farming being a seasonal operation, there’s been times where it’s worked out: employees come to the farm in the summer and then come back to the business in the winter;

Michel’s Industries represented by the second and third generation, Jeff, Ron, Bud,

Brad and Blair.

The X-Treme® grain carts feature a patented front-folding design that angles the auger upward, outward and forward for the easiest unloading and greater visibility of the downspout. This direct line of sight to the downspout from the side window of the tractor cab eliminates the need to twist around during unloading, reducing fatigue and increasing unloading accuracy. Models are available in capacities from 1,500 to 1,000 bushels and include a standard four-way directional downspout, a 21" sump auger that unloads grain up to 650 bushels per minute, and your choice of highflotation single tires or tracked undercarriage.

but not always because it’s hard to find people who are willing to do job sharing full time.”

The Michels have always aimed to maintain growth that is slow and manageable, and that will not change in the future as they start to think about structuring for an eventual transition to the fourth generation.

Jeff’s focus for the farm is to maximize production with the equipment they already have.

“Equipment keeps getting bigger, and we want to make sure we’re making the most of that equipment,” Jeff says. “We always have our eyes open to what’s out there, and although I’m not the guy to try new stuff first – I want to wait and see how it works out before I jump into something – I am always looking for something to improve our yields and profitability, whatever it is.”

For Brad, the challenge going forward is what it has always been: developing new product ideas.

“We have got some products that are on the decline now and we won’t be offering for much longer, so we’re always looking for different things to venture into,” he says.

Sometimes other farmers come to them with ideas for

products, but more often it’s just a lot of legwork – going to trade shows, listening to their customers and trying to keep ahead of new trends in the industry.

Good examples are the company’s new camera arm for semi-trailers that allows the driver to monitor loading from the cab of the truck, and a wireless electric chute opener for grain trailers. Even today’s electric tarps have gone wireless and make it a lot easier for farmers or commercial haulers to cover their loads.

Bud, now semi-retired, has seen a lot of changes in the industry since his dad first rolled out his mechanical tarp idea. He still keeps his finger on the pulse of the business and has input into the decision-making, but he likes to spend more time on the farm these days, driving the combine or helping Ron and Jeff where he can. It’s cathartic for him to be back in the role he started out in as a young man, but his brain is always turning over ideas for new products for the business. His advice remains: “Go for it.”

“People always have ideas, and I would say don’t be scared to take a calculated chance and try it, but learn from your mistakes,” he says. “If you don’t change, you are going backwards.”

During the busy harvest season, you need an equipment partner that you can trust to get the job done. Parker grain handling equipment has built the reputation of being the trusted name in moving grain. The 54-Series double-auger grain carts give operators large carrying capacities with unloading speeds that get you back to the

Grain Carts and Hi-Capacity Grain Wagons

combine faster. The 42-Series and 24-Series single, corner-auger grain carts feature the greatest auger reach and height and use a sump design in the tank for enhanced cleanout. When you’re ready to haul your hard work to the bin or elevator, the Parker 05-Series hi-capacity grain wagons help you get the job done quickly and without worry.

By Nerissa McNaughton

In June 2024, MNP announced that it had joined forces with six leading agronomy companies to benefit the Canadian agriculture market.

Agronomy is the science of soil management and crop production. It involves, among many other aspects, the collection, analysis and interpretation of data. MNP is working with 4R Agronomy, Annex Agro, Arrow Crop Management, Elite Ag, Max Ag Consulting and Sure Growth Solutions in what they are calling “one of the largest agronomy consolidations that Canada has seen.”

MNP’s Marvin Slingerland, senior vice president, agriculture, says, “We are constantly looking for ways to innovate and bring farmers the expertise they need to succeed not just today, but tomorrow and into the future. We currently provide best-in-class services that help our clients to be financially profitable. Adding agronomy specialists to our team enhances our service offering, providing Canadian farmers with a comprehensive solution for optimizing their operations and profitability.”

Slingerland continues, “The six companies joining us represent the start of our journey, rather than the destination. Each of the companies excels in farming expertise, technology management and crop planning. They represent a group of passionate agronomy leaders who bring leading-edge advice to Canadian farmers. All six companies share our values and approach to client service, which in our experience, is always the foundation for successful collaboration.”

Known for finance, what led MNP to invest in agronomy?

“MNP has the largest agriculture professional services practice in Canada, so we hear from Canadian farmers directly, every day, what they need to help their business to grow,” Slingerland says. “Agronomy is an area that many of them talk to us about – more than 34,000 farms in Canada exceed 1,120 acres in size and yet fewer than 20 per cent of these farms have access to professional agronomy services.

“The agronomy specialists joining our team have more than 1.5 million acres of farmland under management across more than 300 farms and are joining a firm with more than 25,000 clients in the agriculture space. This is a move that enables us to reach and support even more Canadian farmers and to provide them with a more holistic range of services that help to support their businesses.”

He is very excited about the venture. “The work that our agronomy team is doing is truly at the forefront of Canadian farming and will provide our clients with a competitive edge, helping them to grow and be more successful both today and in the future. We’re thrilled to be able to offer that support and to help even more Canadian farms with their journeys. All crop producers could benefit from agronomy services. MNP is uniquely placed to serve agricultural enterprises of all sizes, from large corporations to family farms. Our business model has always been designed to support clients in the communities where we live and work regardless of the size of a city or town.”

Mike Palmier, Ag Consulting Ltd., is also excited about the collaboration. “The practice of agronomy doesn’t just involve growing the highest yielding crop possible, it is changing rapidly with the speed of technological change. In order to provide our clients with the best recommendations possible in the field, we need to make data-based decisions on where their money is invested to gain the highest return on investment that we can based off of the conditions that we are given at that point in time.

“Collecting and disseminating the right data to make these decisions is becoming more and more important and is exponentially increasing as we move forward. For us as agronomists, it is important to keep up with the pace of change that we are seeing in the industry and to be able to collaborate with other like-minded individuals and companies to make the best decisions possible. This alone is an important reason why this collaboration between agronomy consulting companies and MNP is important – we will have the resources and expertise needed to lead our customers to successful outcomes in this future state with the many outstanding minds that are working to solve the problem of growing the most nutritious, sustainable and profitable crops.”

Terry Aberhart, founder of Sure Growth Solutions and chief executive of future growth at Aberhart Farms, also knows the importance of ensuring farmers have ready access to agronomy data and benchmarking. He emphasizes the importance of collaboration to effectively serve clients and stay abreast of rapid changes. The decision to partner with MNP was driven by the belief that synergies and benefits would expedite achievement of these long-term goals.

“We are excited about the partnership,” he says. “I work as a farmer and we are also a client of MNP. I feel that the industry needs to do a better job in agronomy access so farmers can make better informed decisions. From this perspective, I see the benefits of a larger group, that has specialists in various areas, working together. We need to do this to keep up with changing technology and to better service clients.”

He concludes, summarizing how the collaboration will have long-reaching impacts far into the future. “Data and technology are bigger than ever before. As individuals, we are working on things, but we can do better things by working together.”

Farm Action Service Team on the farm since 1953. saving you down time.

Farm Action Service Team on the farm since 1953. Our fleet of 10 tire service trucks is on call saving you down time.

Tammy Jones B.Sc., P.Ag

Tammy Jones completed her B.Sc. in crop protection at the University of Manitoba. She has more than 15 years of experience in the crops industry in Manitoba and Alberta, with a focus on agronomy. Tammy lives near Carman, Man., and spends her time scouting for weeds and working with cattle at the family farm in Napinka.

Weed control should be simple. Scout the field, identify the weeds, select the most suitable herbicide that kills the weed spectrum, triple rinse and repeat on the next field. In many cases –despite weather delays, uneven emergence, and too much or too little rain – that actually works. But when it doesn’t, there is often the question, should I respray?

The answer will never be the same on any two fields or for any two farmers or agronomists. A respray decision will depend on a myriad of factors that influence the economic threshold or the potential return on investment: weed density, weed staging, weed competitiveness, crop stage, crop competitiveness, field conditions, yield potential and cost of application. And while all of those factors are important, the laundry list of questions distils down to one … are the weeds dead enough?

Assessing the efficacy of a herbicide application is usually done seven to 21 days after application. In good growing conditions, with contact herbicides, the impact of the herbicides is evident much earlier than systemic herbicides. With bright, sunny days and a moderate relative humidity, symptoms will start to appear within a couple of days, and at seven to 10 days after application, a contact herbicide is likely to have reached the pinnacle of its control. If the weed population is not completely annihilated by this time, the weeds could regrow. Systemic herbicides do tend to take longer to move to the target location and so the effects are likely going to take 14 to 21 days, and sometimes even longer for the full impact. With the herbicide mixtures required for a complex weed population, that 14 to 21 days after treatment is often the time when results are most evident.

Scouting 14 days after spray application allows for the first herbicide application to work, while still allowing for a respray before weeds and the crop get out of stage. Unfortunately, wild oats are often the primary concern and waiting 14 days to respray can often be too long. We know that

Southern Alberta – October 21st to 25th Northern Saskatchewan – October 7th to 11th

Safely dispose of unwanted or obsolete agricultural pesticides and livestock/equine medications – no charge! Take them to the following locations on the dates noted between 9 a.m. and 4 p.m.

Southern Alberta

BARNWELL

Tuesday, Oct. 22

Independent Crop Inputs

Inc.

N.W. of 27-9-17 West of Hwy. 4, 94035 Range Rd. 17-3, T0K 0B0

BARONS

Thursday, Oct. 24

South Country Co-op Ltd.

123014 Range Rd. 234, T0L 0G0

BENALTO

Friday, Oct. 25

Benalto Agri Services Ltd.

38531 Range Rd. 2-4, T0M 0H0

BROOKS

Friday, Oct. 25

South Country Co-op Ltd. 7th St. and Industrial Rd., T1R 1B9

CARSELAND

Monday, Oct. 21

Cargill

263026 Township Rd. 221, Corner Hwy. 24 & Agrium Rd., T0J 0M0

DRUMHELLER

Monday, Oct. 21

Kneehill Soil Services Ltd.

700 South Railway Ave. W., T0J 0Y0

DUNMORE

Thursday, Oct. 24

AgroPlus Inc. 2269 - 2nd Ave., #22, T1B 0K3

FOREMOST

Wednesday, Oct. 23

AgroPlus Inc.

199 1st Ave. W., T0K 0X0

FORT MACLEOD

Wednesday, Oct. 23

Nutrien Ag Solutions 250 Boyle Ave., T0L 0Z0

HANNA

Wednesday, Oct. 23

Hanna UFA Farm & Ranch

Supply Store 601 1st Ave. W., T0J 1P0

HIGH RIVER

Friday, Oct. 25

Nutrien Ag Solutions 498012 – 122 St. E., T1V 1M3

HUSSAR

Tuesday, Oct. 22

Richardson Pioneer 151 Railway Ave., T0J 1S0

INNISFAIL

Thursday, Oct. 24

Central Alberta Co-op 35435 Range Rd. 282, T4G 1B6

LETHBRIDGE COUNTY

Tuesday, Oct. 22

Parrish & Heimbecker

Wilson Siding 75006 Hwy. 845, T1K 8G9

LOMOND

Monday, Oct. 21

South Country Co-op Ltd. 115 Railway Ave., T0L 1G0

OLDS

Wednesday, Oct. 23

Olds UFA Farm & Ranch

Supply Store 4334 46th Ave., T4H 1A2

OYEN

Thursday, Oct. 24

Richardson Pioneer 1 mile East on Hwy. 41, T0J 2J0

THREE HILLS

Tuesday, Oct. 22

Richardson Pioneer 503 - 3rd St. S.W., T0M 2A0

VETERAN

Friday, Oct. 25

Richardson Pioneer 400 Waterloo St., T0C 2S0

WARNER

Monday, Oct. 21

Nutrien Ag Solutions

Junction Hwy. 4 & Hwy. 36, ½ mile N. on the Access Rd., T0K 2L0

BIGGAR

Tuesday, Oct. 8

Parrish & Heimbecker

12 km West of Biggar on Hwy. 14, S0K 0M0

BRODERICK

Friday, Oct. 11

Rack Petroleum Ltd. Broderick Access and Hwy. 15, S0H 0L0

CARROT RIVER

Tuesday, Oct. 8

Richardson Pioneer 265 2nd St., S0E 0L0

HAFFORD

Wednesday, Oct. 9

AgriTeam Services Inc. 11 km West of Hafford on Hwy. 340, Turn North on Jackson Rd., S0J 1A0

HUMBOLDT

Thursday, Oct. 10

Humboldt Co-op

10564 Crawley Rd., S0K 2A0

IMPERIAL

Friday, Oct. 11

Richardson Pioneer 1 mile North on Hwy. 2, S0G 2J0

KINDERSLEY

Wednesday, Oct. 9

Simplot Grower Solutions 907 11th Ave. E., S0L 1S0

MEADOW LAKE

Monday, Oct. 7

Meadow Lake Co-op 513 9th St. W., S9X 1Y5

MELFORT

Wednesday, Oct. 9

Nutrien Ag Solutions 810 Saskatchewan Dr. W., S0E 1A0

NEILBURG

Friday, Oct. 11

Nutrien Ag Solutions

300 Railway Ave. E., S0M 2C0

NORQUAY

Tuesday, Oct. 8

Norquay Co-op 13 Hwy. 49 E., S0A 2V0

NORTH BATTLEFORD

Thursday, Oct. 10

Cargill Ltd. 12202 Durum Ave., S9A 2Y8

PORCUPINE PLAIN

Monday, Oct. 7

Nutrien Ag Solutions Hwy. 23 W., S0E 1H0

PRINCE ALBERT

Thursday, Oct. 10

Lake County Co-op 4075 5th Ave. E., S6W 0A5

ROSETOWN

Thursday, Oct. 10

Rack Petroleum Ltd. 3 miles North East of Rosetown on Hwy. 7, 32 Airport Rd., S0L 2V0

ROSTHERN

Friday, Oct. 11

Blair’s Crop Solutions N.E. 33-42-3 West of the 3rd, 2 km West of Rosthern, S0K 3R0

SPIRITWOOD

Tuesday, Oct. 8

Simplot Grower Solutions ½ mile on Hwy. 24 N., S0J 2M0

WILKIE

Monday, Oct. 7

Nutrien Ag Solutions 1½ miles West of Wilkie on Hwy. 14, S0K 4W0

WYNYARD

Wednesday, Oct. 9

Wynyard Co-op Assoc. Ltd. 571 South Service Rd., S0A 4T0

YORKTON

Monday, Oct. 7

SynergyAG 21 Rocky Mountain Way Rd. (Hwy. 9 S.), S3N 4B2

Partner

• Next Cleanfarms collection in these areas in 2027.

• For collection dates elsewhere, go to: cleanfarms.ca/materials/unwanted-pesticides-animal-meds/

Respraying is challenging to time effectively. There needs to be time to ensure the herbicide has worked, but not so much time the crop or weeds are out of stage.

Group 1 herbicides tend to work relatively quickly and the assessment is to pull on the newest leaf to see if the growing point is being impacted. If the leaf pulls out easily and the base of the leaf is pinching or browning, then the wild oat is not likely to regrow. Group 2 graminicides are slower acting. Leaves start to show yellow stripes, followed by stunting, and eventually turn a dark green colour before dying off. That being said, green does not always mean growing and brown does not always mean dead.

As an example, the wild oat pictured (Figure 1) was sprayed with a Group 2 herbicide, but is it dead enough? The majority of the plant shows signs of chlorosis and death, but there are some white healthy roots and a new small shoot on the left of the plant that may grow and possibly produce seed. Nonetheless, I would not respray! For starters, the crop in the background is reaching the stage of canopy closure and is quite healthy looking, so it will shade out weeds and provide good crop competition. More importantly, there is almost no leaf tissue above ground that is healthy and able to take in herbicide.

Kochia is another driver weed that is often considered for respray. Often kochia, and other broadleafs controlled with Group 4 herbicides, will remain below the crop canopy, stay a dark green and cause panic that they are not dead enough. Thankfully, when you dig up plants like the one pictured in Figure 3, the roots are browning and decomposing and often the stem is brittle, indicating the plant will not recover from the herbicide application. Conversely, the kochia plant in Figure 2 has lots of brown leaves but many of the growing points remain green. This plant is not dead enough. Given the amount of new leaf material, this could benefit from a respray if the weed density across the field is sufficient.

Respraying is challenging to time effectively. There needs to be time to ensure the herbicide has worked, but not so much time the crop or weeds are out of stage. The other key factor is the weed needs to have leaf material to absorb the herbicide and allow that herbicide to do its job. Rushing a respray without knowing if the weed is dead enough may be a waste of time, and more importantly money.

Tom Wolf, PhD, P.Ag. Tom Wolf grew up on a grain farm in southern Manitoba. He obtained his BSA and M.Sc. (Plant Science) at the University of Manitoba and his PhD (Agronomy) at Ohio State University. Tom was a research scientist with Agriculture & Agri-Food Canada for 17 years before forming AgriMetrix, an agricultural research company that he now operates in Saskatoon. He specializes in spray drift, pesticide efficacy and sprayer tank cleanout, and conducts research and training on these topics throughout Canada. Tom sits on the Board of the Saskatchewan Soil Conservation Association, is an active member of the American Society of Agricultural and Biological Engineers and is a member and past president of the Canadian Weed Science Society.

Large trade shows are a great place to get up to date on the latest technology because companies are motivated to showcase their ingenuity. Plus, they often have their top staff in the booth to answer the tougher questions. This year at Ag in Motion, I took the opportunity to extract what I think are some of the noteworthy developments in the sprayer world.

This technology, now in its 30th year in ag, continues to evolve and gain momentum. Several new options are available. Most noteworthy is Precision Planting’s Symphony, their aftermarket PWM product. Precision Planting didn’t just manufacture a new solenoid valve, they designed a whole nozzle body to suit. This one is compact, and has a manual bypass built in should the user choose to bypass the PWM valve (often done with corrosive or abrasive products such as nutrients, or when the flow restriction of the valve, usually around 1.5 gallons per minute or so, is a limitation). Frequencies between one and 20 Hz are user selectable. Boom-mounted modules control four valves each. Symphony uses Precision Planting’s own 20/20 monitor, from which it can upload the field data to the user through their own Panorama portal, which can also make it viewable on John Deere Ops Center or Climate FieldView.

Capstan, who brought PWM to the masses back in the ’90s, continues to innovate. Their new Spitfire solenoid valve is built in-house and features a steel valve seat for better wear resistance, as well as an improved plunger design that provides longer trouble-free use. These coils continue to be offered in seven-watt and 12-watt versions, with the larger ones suited for high flow needs (above 1.5 gpm per valve). Capstan offers a trade-in program until September to receive the new valves at a discount in exchange for a set of older valves. Similar to the Symphony, frequencies are user selectable between one and 20 Hz. Tool-free disassembly is a bonus.

Agrifac distinguishes itself by offering a Gevasol solenoid on its StrictSprayPlus that can operate at up to 100 Hz. Frequencies are selected based on the criteria to never exceed 10 centimetres of spray distance in the off mode. It may never need to go to that frequency because, at high speeds, duty cycles are high enough that the off cycle is minimal. These valves are very sophisticated with a shock-dampening spring built into the plunger face and an ultra-fast three millisecond response time. One downside of the fast response is a flow limit of about four litres per minute, which can be

worked around with an available 10-inch nozzle spacing. A nice feature of the Agrifac nozzle body is that, with the addition of a simple spacer, it fits the Wilger nozzles which have a large selection of tips for PWM, including spot spray angles of 20, 40 and 60 degrees.

Weed-It, who brought their green-on-brown spot sprays to Canada in 2017, is innovating its technology. The Weed-It sensor measures a certain wavelength of reflected light, based on the fact that chlorophyll reflects a certain wavelength from the LED-based lights. This wavelength can be measured with incredible sensitivity, allowing very small living plants to be detected. Sensitivity can be a threshold at five levels to suit a specific field situation. With the aid of some new software, Weed-It sensors can now essentially detect the crop rows and spray weeds in between these rows. This gives the system a pseudo green-on-green capability provided the row spacing is wide enough.

John Deere won’t be offering See & Spray Ultimate (their green-on-green product) any time soon in Western Canada as their development continues to focus on row crops such as corn, soybeans and cotton. However, See & Spray Select, the green-on-brown product, appears to be selling well and

now offers travel speeds up to 16 mph with a 40-degree backwards-inclined nozzle setup. Speeds are measured at the boom and anything over 16 mph will force the boom into fallback (broadcasting) mode. Because boom yaw is inevitable, practical operating speeds will need to be below 16 mph to prevent fallback mode from happening frequently.

Case is offering Augmenta, an NDVI sensor mounted on top of the cab to detect “plant health” up to 138-feet wide. This information then permits variable rate fungicide, growth regulator or nutrition decisions through AIM Command. Future developments of Augmenta involve adding channels to the sensor to permit sectional rate decisions or green-on-brown spot sprays in three-nozzle wide resolution. Case is working with One Smart Spray (the BASF and Bosch collaboration) to eventually bring a green-on-green system to market, called “Sense and Act.” This system is driven by boom-mounted cameras like all other green-on-green systems.

Drones, officially called remotely piloted aircraft systems (RPAS), are selling fast in Canada despite the fact that no agricultural cropland pesticides are labelled for drones at this time. Many resellers were present at Ag in Motion, offering large drones capable of claimed 25 to 30-feet swath widths. There was little talk of issues with pattern uniformity of variances in swath widths that are being revealed by research. Drone tendering systems with powerful diesel generators are being developed, recognizing that fast fill times are essential to productivity when a 40-litre tank can be emptied in six minutes. Although drones can be legally used to apply nutrients or spread seeds, I’m not happy that people are defying the law to use them, or encourage them to be used, for pesticides, regardless of the “need.”

Horsch continues to develop its Leeb VL sprayers at a rapid pace, now offering 150-foot booms in addition to factory recirculating booms, continuous rinse and a host of other ergonomic innovations such as electrochromic glass tinting. Their emphasis on stable boom heights permits wider booms, and allows operators to take the foot off the gas without losing productivity. Low booms reduce drift and improve the utility of angled sprays for specific targeting tasks, while slower speeds reduce fuel consumption and wear and tear. Kudos to them, as well as Agrifac, for being smart and progressive in their sprayer designs to meet farmers’ needs.

Will pull-type sprayers ever make a comeback? With some farms on the edge of needing a second sprayer, these might be the affordable transitional unit. Fast Ag Solutions is one of the

last remaining North American brands, aside from Apache, that offer lower-cost sprayers. Large tanks, recirculating booms and optional PWM are attractive features.

Mojow Autonomous Solutions is a new venture catering to the autonomy revolution in agriculture. Comprised of former Raven Omni staff, their EYEBOX sensor suite can enable autonomy on existing equipment using cameras, artificial intelligence and GPS. They are demonstrating their edge and obstacle detection capabilities across the region. Considering the success of SwarmFarm, the autonomous sprayer company in Australia, general equipment autonomy could address labour and equipment cost issues when proven safe and reliable.

It’s worth attending trade shows, and the large field-based events like Ag in Motion add a very useful practical aspect. Many attendees value the opportunity to see, and in some cases, operate the equipment in their natural environment. Meeting the engineers behind the designs is a rare privilege that is only possible at these larger shows. I appreciate the effort companies make to put these events on and send their staff across the globe. The constant innovation within agriculture, and the rapid adoption of new technologies, never ceases to amaze me.

Nutrien Ag Solutions knows the challenges that canola and grain growers are facing, which is why the company developed its Feeding the Future plan

By Lisa Kopochinski

It is little surprise to canola and grain growers that productionrelated issues – such as weather volatility and pests – continue to be among the biggest challenges the industry faces.

While yields have rebounded quite well following the devastating drought in 2021 – which speaks to the expertise of canola growers and their practices and technologies – Canola Council president and CEO Chris Davison says growers continue to face variable moisture conditions as well as pest management challenges, including flea beetles, sclerotinia stem rot, blackleg and verticillium stripe.

“After some significant heat and drought conditions across the Prairies, canola yields have rebounded to be more in line with historical production levels – which is a testament to canola’s resilience and the skill of Canadian growers. We’ve also recently renewed another five-year canola research partnership with government, growers and industry to help ensure the sector is well-positioned to succeed into the future. Under this partnership, resources will be channelled into new canola research including 4R nutrient management practices, genetics, yield improvements, optimizing inputs and the positive impact of canola meal in dairy cow and aquaculture diet.”

Davison adds that continued research and innovation, genetic advancements, refinements in crop management and sciencebased regulation will help support the continued growth and resilience of Canada’s canola sector.

“Transportation and market access are other important areas of interest, as our entire industry relies on resilient supply chains and a stable and open trade environment. Additionally, other challenges and considerations include interest rates, crop values, and policy and programs that impact canola growers.”

In its effort to keep the industry strong, Davison says that by working together through the Canola Council, the full value chain pools its collective expertise to address shared challenges and pursue new opportunities aimed at helping to keep Canadian canola thriving.

“Our work is guided by the three pillars of our strategic plan, including: 1) sustainable and reliable supply, which includes canola research and knowledge transfer; 2) stable and open trade, which includes policy and advocacy efforts both domestically and internationally to keep our sector competitive; and 3) differentiated value, which includes outreach and market development regarding the benefits of canola and canola products in markets of interest and value.”

He adds that some recent examples of this include efforts to diversify into new markets through the growth and expansion of domestic processing capacity, renewed investments in research and market access and development, increased presence in key markets post-pandemic, and support for the development and implementation of a regulatory framework for plant breeding innovation.

Nutrien Ag Solutions knows all too well the challenges that canola and grain growers are facing, which is why the company developed its Feeding the Future plan that includes sustainability-related commitments, targets, and goals that aim to create economic, social and environmental outcomes.

“Feeding the future is our purpose,” says Michaela Spangler, Nutrien advisor for retail communications. “As an agriculture company, we are aware that by 2050, we’ll need to feed more people than ever with an expected population of nearly 10 billion people. To achieve food security – while still caring for the land that makes this food production possible – we’ve identified several commitments in line with the UN’s 2030 Agenda for Sustainable Development.”

Nutrien has created programs that help and incentivize farmers to adopt sustainable agriculture practices on their land, such as the Sustainable Nitrogen Outcomes Program.

“The agronomic innovation managers and team members of our Canadian branch sites start with customer planning for the next growing season months before the current season has finished,” she explains. “We have started field evaluations of in-crop herbicide applications ensuring our recommendations, both for

“Our team has a high commitment of getting on farm with growers to help with personalized agronomic solutions. We’ve seen a good adoption rate of Echelon this year, with a recorded 2.7 million acres scouted in the app.” - Michaela Spangler, Nutrien

fertility and pest management, are meeting growers’ needs.”

Fall planning starts with 4R nutrient management planning and assisting growers with program applications, such as the On-Farm Climate Action Fund (OFCAF), which has the objective to support farmers in adopting beneficial management practices (BMPs) that store carbon and reduce greenhouse gases, specifically in the areas of nitrogen management, cover cropping and rotational grazing practices.

Crop protection planning works to ensure herbicide applications are targeted, while keeping resistance management at the forefront.

“Our staff participates in programs such as provincial pest monitoring, which predicts the need for pest management, especially insecticides, to make sure that applications of insecticides are warranted.”

To date, Nutrien’s efforts in the implementation of sustainable ag practices are going well, especially with precision ag tools such as Echelon, which allows growers and their crop consultant to monitor field health and access personalized prescription recommendations.

“Our team has a high commitment of getting on farm with growers to help with personalized agronomic solutions. We’ve seen a good adoption rate of Echelon this year, with a recorded 2.7 million acres scouted in the app.”

Nutrien’s commitment over the next five to 10 years inspired the company to create programs to help increase sustainable ag adoption on farms with its customers. From this, its sustainable ag team created the Sustainable Nitrogen Outcomes Program,

which is available in Western Canada.

“This program aims to reduce fertilizer-derived greenhouse gas emissions while paying growers back for their contribution to our environment and the practices they’ve had to adopt,” explains Spangler. “Canola, wheat, barley, oat and corn growers are eligible for the program. We have reached 735,000 acres enrolled in our Agrible sustainability platform through this program that are following 4R nutrient stewardship principles. Of those acres, 300,000 are canola acres in Western Canada, with 80,000 acres located in Alberta. Growers participating in the Sustainable Nitrogen Outcomes Program are also eligible for preferential financing through Nutrien Financial and Scotiabank.”

Davison adds that Nutrien’s mission of Feeding the Future is a good example of the recent development, launch and implementation of a number of different initiatives throughout the agricultural sector that recognize and support the challenges of sustainably feeding a growing and changing global population, and working to address changing consumer and market demands.

“We know Canadian canola is top-of-class and if there are initiatives that can further help emphasize and showcase this

How AI & Machine Learning Changes Everything

• Learn about AgTech on your clients’ farms.

• Learn

• Network to build and

2022 #TopFarms | Nov. 24 | Elbow, SK* Also available virtually

and continue to drive growth, that’s a good thing,” says Davison.

Nutrien also attended this year’s Ag in Motion event from July 16-18, 2024, at Glacier Farm Discovery Farm in Langham, Sask.

“We attended Ag in Motion to build relationships with our current and prospective grower customers, connect with industry contacts, and demonstrate our best-in-class seed and product offerings through the Proven Seed plots on the Discovery Farm Langham,” says Spangler.

As for what is planned for the 2024-25 season, she says the team is dedicated to offering the latest genetics with Proven Seed.

“This commitment ensures that our growers are getting the latest gene technology for their seed choices. We also have the most extensive field-testing program, called field performance checks, which tests our seed genetics across the Prairies and in a variety of environment and adverse conditions to make sure that the seeds will perform and deliver consistent yields in the conditions on our growers’ fields. Our agronomic innovation managers also work closely with suppliers and our proprietary product brand, Loveland Products, to test new biological and nutritional products to incorporate into the 4R planning done at

With prices and land in fluctuation, what’s the outlook for the next generation?

By Nerissa McNaughton

Canada and farming are words that go hand in hand, but the industry of farming has taken on a whole new meaning. Gone are the chuckwagons and early settlers breaking the land in by hand. Here are the mighty machines used to till, sow and reap, along with large conglomerate farms selling locally, nationally and even globally.

Running concurrently with the uptake in technology and progress is a sobering fact. Baby boomers are retiring. Their kids are not always keen on taking over the farm and for those who are, what does changing pricing and access to farmland mean for the new generation?

Darren Sander, Re/Max Saskatoon, Darren Sander Realty, has his eyes on the situation.

“We have a sector of agriculture that has seen substantial shifts since the ’50s, ’70s and ’80s,” he says. “Many kids have left the farm, leading to a lot of people deciding to sell. Neighbours are buying, larger farmers are buying, and immigrants are purchasing for quality-of-life reasons. For the most part, it is farmers buying up other farms.”

The past year has marked notable increases in land values across Saskatchewan.

Sander says, “Land increased an average of 15 per cent across Saskatchewan, one of the highest numbers we have seen in the last five to 10 years – and it is still increasing. We sold some land exceeding $5,000 an acre in Saskatchewan, which is a record high price by almost $700 an acre in that specific rural municipality. Land has been very strong!”

However, “Interest rates are going to have a cooling effect, I predict, to a certain degree on land values.”

Although the numbers are going up, this is not necessarily a bad thing.

“The margins for farmers have been the best in history, which drives the increase in value. Over the past 100 years in Saskatchewan, one can argue that the margins have been the best in the past decade,” says Sander. “Commodities have been higher priced, the genetics of the crops have improved and machinery has become better, all leading to better production. There are lots of factors we have seen in the last decade or so.”

Sander observes a consistent year-over-year increase in land values, ranging from eight per cent to 22 per cent. He believes part of this rise is because of Saskatchewan’s historically low land prices.

“Saskatchewan has been very undervalued. We had some of the lowest priced land in Canada for many decades. The current political climate has been conducive to investment and the quality of life here attracts people.

“Higher prices are due to a variety of factors. However, margins have declined due to drought, inflation and lower commodity prices. What I hear from my clients is a reason for concern. Land values are high and borrowing at the current rates of interest is not conducive to good rates of margins. While we have experienced the best decades historically, there are some reasons to be cautious. What is driving the growth is also driving the costs; and it is not in lockstep.”

Despite these challenges, Sander remains optimistic. “There are positives. Inflation is coming under control. Saskatchewan is a safe and strong place to relocate and invest in. The value is not always just in the money. The safety, security and the opportunities count too.”

Are those opportunities affordable for the next generation of farmers? Jon Neutens, head of agriculture at ATB, offers his perspective.

“Overall, limited farmland changes hands every year, with most land coming for sale less than once in a generation. The good news with retiring farmers holding on to land is it does provide an option for producers to grow their land base through renting where farmland affordability is a challenge.” - Leigh Anderson

matter when or where the farmer or rancher joins the industry. “Starting from scratch is very difficult,” he says, “but every situation is different. ATB looks at the situations and how we can help grow success.”

Farm Credit Canada (FCC) builds relationships and networks while sharing knowledge and expertise across the nation.

FCC’s March 27, 2024 article, Deteriorating Farmland Affordability Presents Challenges, points out that despite a combination of commodity pricing, interest rate changes and severe weather events, among other factors, farm cash receipts grew to 4.4 per cent in 2023 – a new record of $99.6 billion. The article further points out that farmland availability is tight and average farmland values have grown to 11.5 per cent in 2023 (compared to 12.8 per cent in 2022).

However, FCC’s Justin Shepherd, senior economist, knows there are many reasons to be upbeat about the situation.

“Provided producers deploy sound risk management strategies and continue to work towards making their operations more efficient, farm debt overall is still manageable,” he says. “Canada has experienced strong farmland value over the last decade (2014-2023), up 9.1 per cent on average annually. Farmland value increases differed among regions, with Eastern Canada experiencing a higher average annual growth rate of 9.9 per cent, compared to Western Canada averaging eight per cent. Rising farmland values do lead to discussions on affordability of newly

purchased farmland, but affordability of farmland is influenced by a range of factors, including land prices, interest rates, farm income, urban population and farmland supply. Rising farmland prices increase equity for those with existing land.”

Shepherd continues, “The total equity gained nearly eight per cent over 2022 to reach $785 billion in 2023. Western Canada saw equity rise by over seven per cent to reach a high of $472 billion. On the other hand, it does create challenges, especially for young or new entrants to agriculture. With the farmland affordability index hitting a 30-year high in 2023, it shows that farmland values are outpacing revenue generated from farmland.”

Yet, “On average, approximately 85 per cent of Canadian farmland has no debt.”

According to Statistics Canada’s Land Use, Census of Agriculture historical data, there is a proven decline in available farmland. Leigh Anderson, FCC senior economist, has answers.

“On the supply side, due to recent strong margins and a rapidly changing macro environment, there has been less land coming for sale. Even when a farmer retires, not all the land is always put up for sale as some land may enter the rental market. Overall, limited farmland changes hands every year, with most land coming for sale less than once in a generation. The good news with retiring farmers holding on to land is it does provide an option for producers to grow their land base through renting where farmland affordability is a challenge.”

One more niggling thought. Social media, along with today’s “exciting” political climate can be a beast. The messengers of bad news and frightening talebearers are quick to spread misinformation. A prevailing thought in this sphere is that farmland pricing and lack of availability is due to outside interests with deep pockets buying up the land under suspicious circumstances and for nefarious purposes.

No. Trust the experts!

FCC points out firmly, “The vast majority of farmland in Canada is owned by Canadian farmers and their families and new purchases remain predominantly by farmers.”

It comes down to this: prices, capital, land availability – these are all in flux for today’s farmers. However, the situation is far more nuanced with both pressure and positive points. From land to capital, options remain. Higher prices often mean higher equity and other factors like security and quality of life play a big role. It was a great time to be a farmer in the past and it’s a great time to be a farmer now – as long as you take the proper precautions.