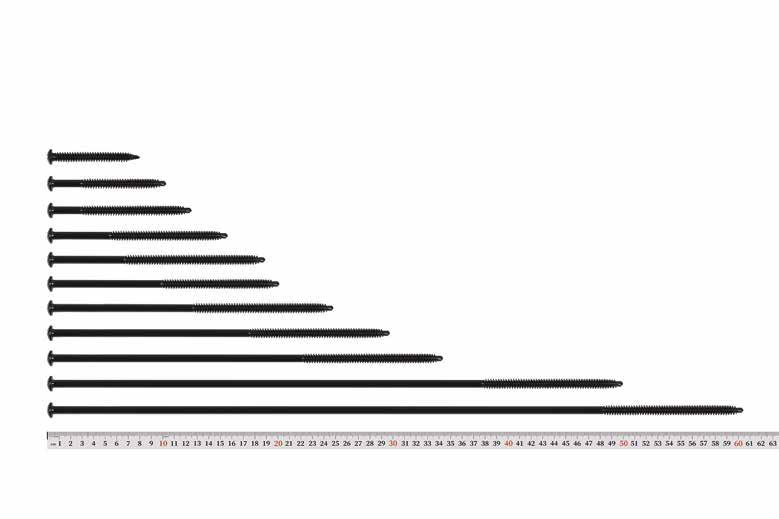

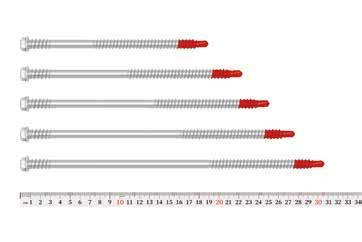

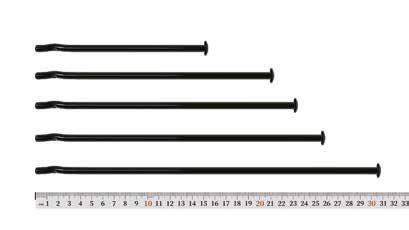

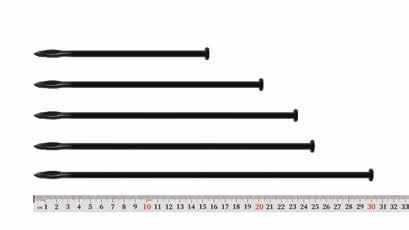

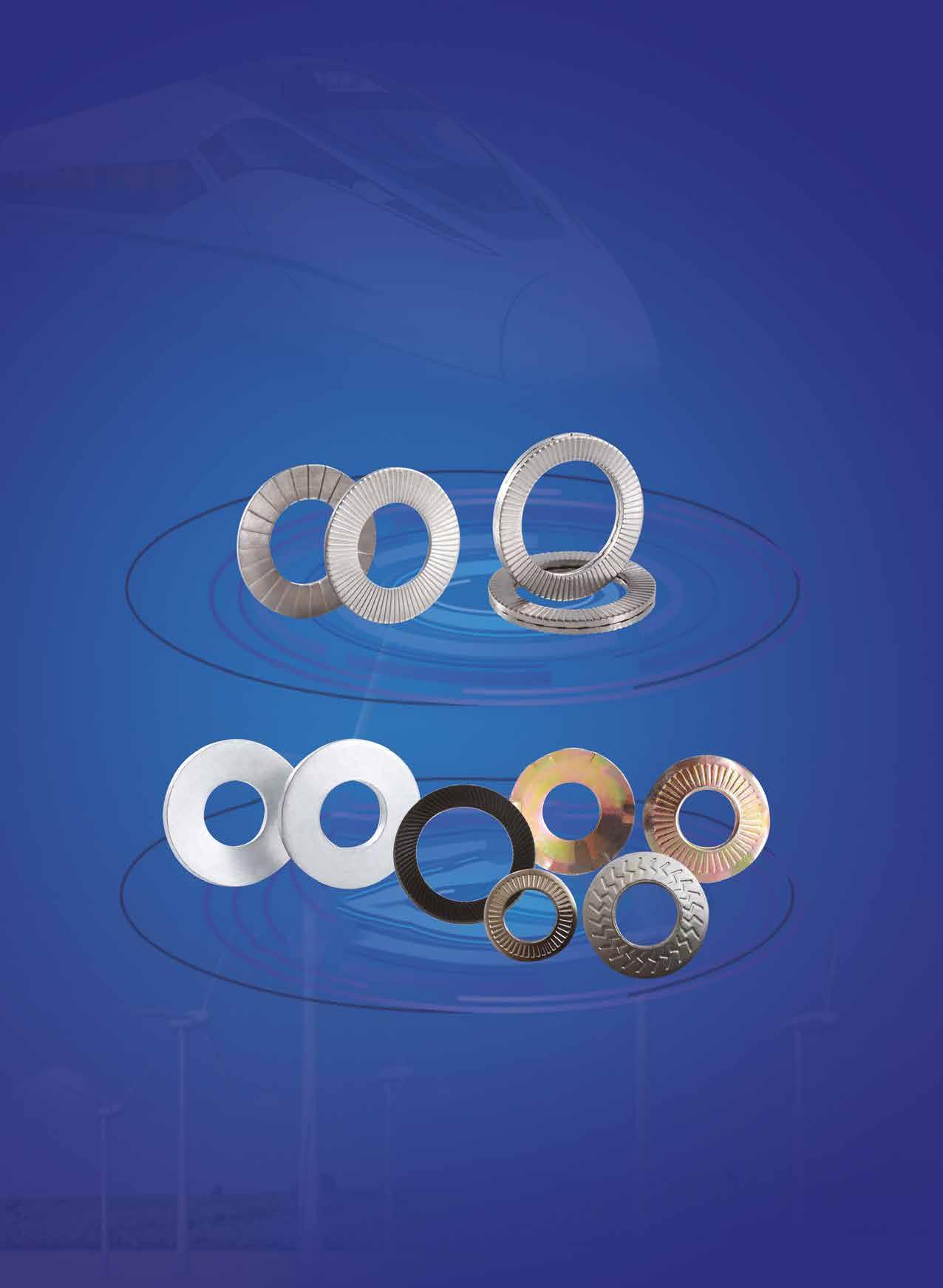

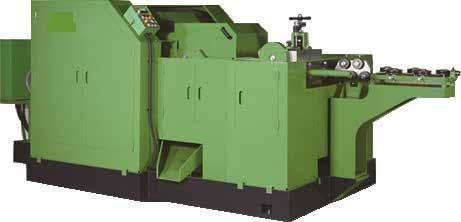

Offering more than 6,000 items, Zhejiang Excellent Industries Co., Ltd. mainly produces carbon and stainless steel drywall screws, chipboard screws, self-tapping screws, machine screws, selfdrilling screws, thread cutting screws, plastic anchors / plastic kits, metallic hollow wall anchors, washers, picture hooks, eye hooks, screw hooks, and stamped parts.

Incepted in 1997 as a small factory with an area of only 300 sq. m and 13 employees, the company has grown year by year, expanded the factory, and increased the number of employees, and in 2010 it officially moved to the current location in Haiyan, Zhejiang Province (China), with an area of 28,000 sq. m, and is now one of the leading fastener manufacturers in China with an annual revenue of US$ 45 million and a workforce of more than 200 employees.

Zhejiang Excellent has 3 workshops for screws, injection molding and stamping to handle customer orders according to different product attributes, with monthly capacities of 800 tons, 60 tons and 80 tons respectively. In order to achieve better product quality and service performance, Zhejiang Excellent introduced the SAP system in 2016 ahead of many Chinese counterparts, and has been introducing various automatic production and packaging equipment since 2018 to create a more complete supply system. In addition, it is also capable of supplying exquisite DIY kits to major building materials providers, with sales of up to 120 containers per month.

Zhejiang Excellent continues to demonstrate a high level of order processing efficiency with the aid of advanced process management. "By using the ERP system to help customers place orders quickly and arrange reasonable production schedules simultaneously, our colleagues in various divisions are able to process customer orders more accurately and efficiently. On the other hand, by integrating the 3D warehouse and MES system, our production has

become more digitalized and visualized, further enhancing product quality and production efficiency," comments Sales Manager Fang Xiang. At this stage, more than 90% of Zhejiang Excellent's products are exported to Europe, N. America and Australia, while sales in China account for approx. 10%.

Zhejiang Excellent has 20+ years of experience in OEM manufacturing and has got nearly 50 patents for product invention and design. It has not only passed the ISO system, safe production and high-tech enterprise certification, but also has been awarded the National Technology-Based SME, Provincial Specialized New Enterprise, and Municipal Enterprise Technology Center, etc. The technical team is capable of providing complete product and packaging design services for customers , and is regarded as an irreplaceable strategic partner by many customers.

“We provide customers with high-quality one-stop fastener/hardware sourcing and OEM/ODM services. The new factory in Vietnam is also expected to become operational next January. In the future, we’ll continue to tap into the European and American markets, and work together with customers to face future challenges. We’re convinced that we’ll be able to make a big difference in the world of small screws,” adds Fang.

Contact: Sales Manager Fang Xiang

Email: fangx@excellenthardware.com

In order to accelerate the improvement of the quality level of China's mechanical basic components industry and promote the depth of exchanges and cooperation between the upstream and downstream of the industry chain, Yanqihu Basic Manufacturing Technology Research Institute, in cooperation with the China General Machine Components Industry Association (CMCA), held the "1st (2nd Round) Meeting of China Mechanical Basic Components Innovation Alliance and the 1st Fasteners and Threading Technology Exchange Meeting" on September 1, 2023 in Beijing. The conference took place with the theme of "Innovation, Quality, Intelligence, and Eco-Friendly" and the attendance of invited leaders, experts, professors and industry professionals from the government, industry, academia, and research institutes to expound upon topics like the technical innovation of components, application of standards, digital empowerment, green development, etc., all of which were expected to promote the use and application of advanced manufacturing technology & equipment, new materials/ processes/products, new testing methods and testing equipment.

The main topics of the meeting were: (1) The new situation of China's manufacturing industrial development trends from the perspectives of scholars and experts; (2) The 1st (2nd round) directors meeting of China Mechanical Basic Components Innovation Alliance; (3) Fasteners and thread standards development trends, fastening theories and design calculations, applications of new materials and new products, smart & green manufacturing technology, advanced forming and heat treatment technology, surface treatment and protection, digital simulation design and reliability & service life analyses and other technical exchanges; (4) "2021 fastening technology forum (incl. excellent fastener-related papers sharing and awarding ceremony"; (5) Demonstration of vertically integrated high-strength fasteners application; (6) Visiting the China National Academy of Mechanical Sciences (Huairou Science and Innovation Base).

On July 25th, Zhejiang Fastener Industry Association (ZFIA) held a meeting of permanent directors at Haiyan Haili Kaiyuan Mingdu Hotel, in which ZFIA Chairman Shen made an association affairs report for the first half of 2023 and at the same time reviewed with the members on-site the association's efforts in strengthening the establishment of standardization, improving the self-service to promote the development of the industry, and promoting the upgrade and advancement of the industry. During the meeting, many representatives from the industry were also invited to give speeches on the current development and trends of the fastener industry and share their point-of-views with the members. The Association also indicated that it will actively play the role of a communication bridge between enterprises and try its best to create more development opportunities for the Association members in the future development of the industry.

In response to the needs of innovation and development, the China General Machine Components Industry Association (CMCA), combining the characteristics of the industry, has launched "the Technical Innovation Award Election and Awarding Ceremony (once every two years)” for more than ten consecutive years, which is aimed at discovering, summarizing, marketing and promoting advanced technologies, excellent products and innovative teams, and is mainly established to promote the spirit of innovation and workmanship in the industry, advance the transformation and upgrade, optimize the industrial structure, and move towards intelligent manufacturing and green development. Thus far, this Award has achieved several good results and has been widely welcomed and supported by enterprises. The due date for final application is November 30, 2023 and the specific time for the awarding ceremony will be announced in due course.

On August 24-25, Chairman Kang-Sheng Xue of the China General Machine Components Industry Association (CMCA) took a delegation consisting of CMCA toprank cadres, experts, consultants, and representatives from the related associations based in Jiangsu, Dainan, Dongtai, and Suzhou to visit leading local fastenerrelated enterprises and give an industry seminar, hoping to gain an in-depth understanding of the current operating conditions and problems encountered by the industry on the one hand and looking forward to promoting the future growth and development of the industry through the exchange of views and interactions during this event on the other hand.

During the two-day event, the delegation visited several benchmark enterprises specialized in manufacturing fasteners, bolts, precision machined parts or professional molds & dies for different industries,

At the industry seminar held after the visit, Chairman Kang-Sheng Xue of CMCA said that the current downturn in the fastener industry continues, so various associations have to pay visits to enterprises to learn more about the overall development of the industry and to find out the difficulties encountered by enterprises. In addition, as the appeals against the anti-dumping duties imposed by the EU and the United States have also been made, it is absolutely necessary to solicit more views from the industry and exchange views with enterprises.

Compiled by Fastener World

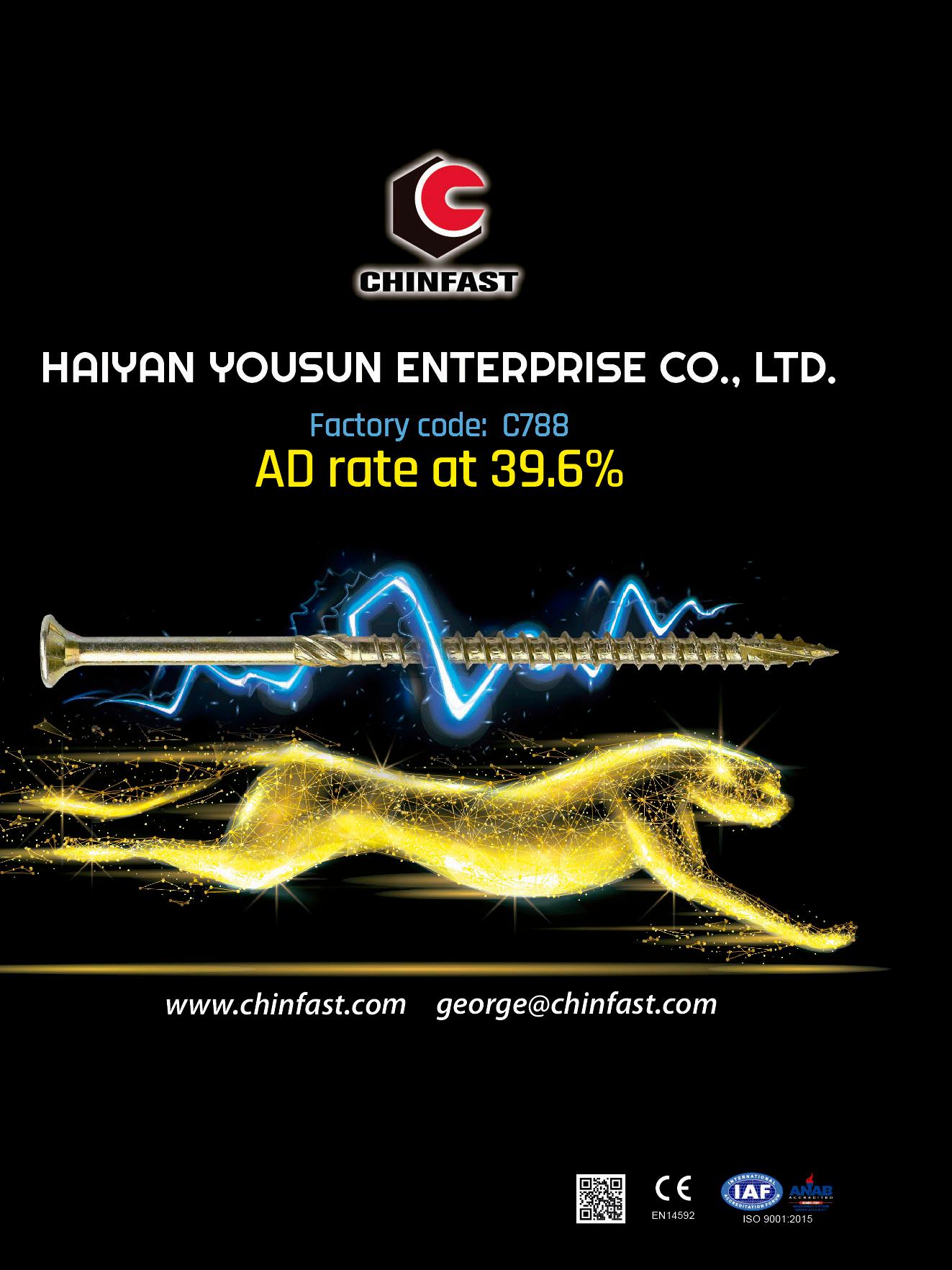

Inorder to further strengthen the link with the demand of first-tier retailers and distributors in Europe and the U.S., CHINFAST, having deeply engaged in the industrial fastener production for nearly 20 years, has been actively expanding its business from the production of advanced multi-purpose screws, timber fixing screws and decking screws made of 10B21 and C1022 to the DIY fasteners packaging service over the past 5 years. In the ever-changing global market, it hopes to create a new milestone for sustainable business development.

Unlike typical mass production lines, DIY fasteners packaging are characterized by small quantities and diverse categories, which are more time-consuming and labor-intensive, and therefore must be adjusted in a timely manner according to product attributes and quantities. In view of this, CHINFAST not only provides various tool boxes, plastic boxes/bins, blisters, blister boxes, cardboards, polybags and various color boxes for customers to choose, but also provides 100% customized service according to customers’ requirements.

“Backed by a strong professional team, we have introduced the ERP smart factory management system from production to packaging to ensure the flexibility and traceability.

All products are controlled by the automated warehouse, and the automatic packaging line with more than 10 semi-automatic packaging machines is also directly connected to the stereoscopic warehouse, and the AGV automatic shuttle vehicles are applied to transport the goods directly to each packaging table, which effectively saves the goods delivery time and enhances the packaging efficiency and flexibility,” said CHINFAST.

CHINFAST has nearly 60 packaging staff with years of experience to assist customers in designing the optimized packaging methods to achieve twice the result with half the effort. At the same time, it has also worked with the automated packaging equipment factory to successfully develop 4 models (totally 12 sets) of packaging equipment which best fit the characteristics of their products, enabling them to significantly improve the packaging efficiency. From production to packaging, it completely follows the ISO 9001 specification. There are 6 QC employees to conduct strict quality inspection from raw materials to finished products, and all testing data are kept in record to ensure traceability.

“As an emerging DIY fastener factory, although DIY fastener packaging service currently only accounts for 6% of our annual export volume and in 2022 our total sales reached 7,500 containers, we are confident that we can perform better in the next few years,” said CHINFAST.

CHINFAST has been active in increasing its competitive edge in recent years. In addition to getting many screws CE certificates, its wholly-owned Haiyan Yousun Enterprise Co.,Ltd (Factory code:C788) has also successfully obtained the favorable 39.6% tax rate in Europe. In the future, if it successfully obtains the ETA certification, together with DIY fastener packaging service, it is expected to increase its proportion and competitiveness of screws exported to Europe.

“With the challenges of global economic contraction, customer demand weakening, unstable raw materials prices and exchange rates, we will continue to refine our capability, cherish every order, provide the best service, and be more dedicated to the DIY fasteners' field.” said CHINFAST.

Contact: Mr. George Yu

Email: george@chinfast.com

Article by Gang Hao Chang, Vice Editor-in-Chief of Fastener World Copyright owned by Fastener World

Article by Marco A. Guerritore, Editor in Chief, Italian Fasteners Magazine

Article by Marco A. Guerritore, Editor in Chief, Italian Fasteners Magazine

It is safe to say that Paolo Pozzi has earned his credentials in the field.

With a degree in Aerospace Engineering from the Politecnico Institute of Milan, he joined the Agrati Group in 1995, where he held various positions until becoming General Manager of the parent company "Agrati SpA" and then a member of the Board of Directors. He was appointed Managing Director of the Group in 2008 and CEO in 2016.

Under his leadership and in line with the Presidency, the Agrati Group has undergone a transformation that is clearly visible today through the achievement of important goals. These successes can be summarised by an annual turnover exceeding 680 million euros and a staff of more than 2,400 employees operating across 12 manufacturing establishments situated in Europe, the United States and China.

Paolo Pozzi’s innate talent for diplomacy, coupled with his engaging personality, has garnered him recognition and respect within the social sphere of his profession, both nationally and internationally. He has carried out and continues to carry out intense professional and membership activities. Therefore, it came as no surprise when he was unanimously elected as EIFI President for the period of 2023-2027 during the EIFI General Shareholders’ Meeting held on 12 May 2023 in Meissen (Germany).

Thanks to his willingness to make time for us, we (referring to Italian Fasteners Magazine, the same goes hereinafter) had the privilege of meeting the recently appointed President. Here is the interview that followed.

Firstly, I would once again like to express my heartfelt appreciation to all the EIFI Members who elected me as their President. It is with great honour and happiness that I assume this position, particularly as the EIFI is undergoing a significant period of transformation. My hope is to make a significant impact in shaping a new era for the EIFI and facilitating its adaptation to the challenges and profound changes currently affecting all industrial sectors.

I believe that it will become increasingly crucial to address these new challenges at the European level in order to effectively represent and safeguard the fasteners industry and its unique characteristics in the years to come.

This will necessitate an organisation capable of collaborating closely with national associations, while simultaneously expanding its operations and prominence at a European level. This can be accomplished by cultivating partnerships with institutions in Brussels (EC and Parliament), as well as other trade associations (AEGIS, CLEPA, EUROFER etc.). The present challenges cannot be addressed using the same approaches employed in the past.

The current structure consists of a Board, which includes a President, two Vice-Presidents, six members representing the national associations and a General Manager. The term of office for the President and Board has been extended to four years and can be renewed for an additional term. There are three Market Groups:

• Automotive

• General Industry/Distribution

• Aerospace

There are three Operating Committees:

• Public Affairs, Legal, TDI and Membership Development

• Technical, Quality and Innovation

• Marketing and Communication

Two new categories have been introduced within the category of fastener manufacturers:

• Affiliated Members, comprising companies in the fasteners supply chain

• Associated Members, consisting mainly of service and consulting companies

The objectives include:

1. Enhancing the recognition and visibility of the EIFI throughout Europe

2. Broadening the membership base

3. Strengthening the organisation

However, the fundamental objective remains the same: to effectively represent and protect the interests and unique characteristics of the European fasteners industry.

I would argue that because we have been living in a globalised world for more than 30 years, it is crucial to embrace the European dimension in order to tackle new challenges. This principle is applicable not only to trade associations but also to all EU Member States, which sometimes overlook the fact that they are part of a geographic region that represents the world’s largest market, renowned for excellence across all industrial sectors.

Even in the case of fasteners, Europe maintains its position as the world’s largest market, representing 26% of the total value of 90 billion dollars, surpassing the Asia Pacific region, North America and China. I believe it is worthwhile trying to defend and support this market as well as the European companies operating within it.

I would say that European nuts and bolts are indeed competitive globally, particularly when we compare ourselves to countries operating under similar regulations and conditions. Unfortunately, we are well aware that this level playing field is not always guaranteed.

I think that Europe’s position as the world’s leading fastener market can be attributed to the efforts of European manufacturers, and also to the supply chain, which over the years has adapted and evolved alongside market demands, offering manufacturers high-quality materials and services at competitive prices. Let us not forget that the competitiveness and expertise of European fastener manufacturers have allowed them to develop global champions who have also successfully invested in other regions worldwide. In fact, at least five European manufacturers rank among the world’s top ten fastener manufacturers.

The potential risks are partly known and partly new. The known risks include imbalances in relation to WTO regulations, which have led to the imposition of import duties to rebalance the system. The new risks stem from the disparities in the speed and approaches adopted by different regions worldwide to address sustainability concerns.

These concerns primarily revolve around the environment, with the first test case being the implementation of the CBAM (Carbon Border Adjustment Mechanism). However, this issue extends beyond environmental considerations and encompasses broader decisions linked to ESG issues, with each country adopting different approaches in this regard.

In my view, small and medium-sized companies need to be part of an organisation that can effectively represent, defend and guide them in navigating the immense challenges of today. Consider the three major transformations currently taking place in Europe: sustainability, digitisation and the electrification of the automotive sector, which remains a key market for fastener manufacturers. These profound changes are having a significant impact on organisations, and the fact that they are all happening at the same time makes their management very complex and burdensome for large companies, while posing an unsustainable challenge for small and medium-sized enterprises. By sharing these epochal transitions with associations that can provide valuable information, support and guidance on addressing these challenges, I believe we can foster more cohesive and harmonious growth throughout the entire supply chain. This collaboration can help prevent disruptions and discontinuities that could potentially lead to significant issues, as demonstrated during the pandemic.

I do not think that growth is the only way to survive, but it is evident that stagnant or diminished corporate stature does not foster the development of champions capable of competing in a global and rapidly evolving environment such as the one we face today. Without growth, there is no investment and without investment, there is no innovation and no job creation.

Europe stands at the forefront in the battle against pollution in general, but this inevitably means placing limitations on economic and production activities. How do you propose reconciling this contradiction in a positive manner?

I believe that Europe’s environmental choices are correct, and no one, including companies, wants to oppose the transition. However, it appears that there has been an excessive focus on regulation, leaving little room for the development of a comprehensive strategy. While deadlines and potential sanctions have been set, the competitive landscape with American and Chinese companies seems to have been overlooked. The risk we face is that we are creating new rules for the game with highly skilled referees, only to find that others have taken the field ahead of us. This is true not only in the transition to electric vehicles, where Europe trails behind China, Korea and Japan in terms of accumulated battery technology, but also in the high-tech sector, where Europe faces a technological gap and lacks key players compared to countries like the United States and China. This contradiction could be resolved by greater collaboration between the European Commission and trade associations. Together they can work towards defining more comprehensive strategies that take into account the speed of transition and the negative effects it may bring in the short term. A prime example is the new regulations on car emissions with Euro 7 engines scheduled for July 2025. These regulations entail significantly higher costs than those initially estimated by the Commission, while providing limited environmental benefits.

For quite some time now, I have believed that the transition to electric vehicles is irreversible. There is no turning back given the massive investments made by car manufacturers in Europe and globally. Recent growth figures have shown unexpected advancements not only in China but also in Europe, albeit at varying rates between northern and southern countries. The goal of achieving full electric private mobility in Europe by 2035, which may have seemed implausible a few years ago, has become more feasible. Since 2019 we have seen exponential growth in the market share of electrified vehicles, reaching 21% in 2022, with 9% being

fully electric (BEV). Some Northern European countries, such as Norway, have already achieved an impressive 80% penetration rate. Evaluating how these countries have been able to reach such levels today will provide insights into the 2035 sustainability target for the whole of Europe. Uncertainty persists in the short term regarding the overall demand for cars, which will undoubtedly be negatively impacted by reduced credit availability, higher costs, the effects of a potential recession and relatively high price levels of electric vehicles, particularly in segments A and B.

When it comes to the evolution of the car, the EIFI will need to collaborate closely with other national and European automotive trade associations to address industryspecific challenges that may arise during this complex phase. One key challenge lies in effectively managing larger quantities and varieties of products, particularly for fastener manufacturers. This will necessitate diverse skills and the development of new processes to create new materials, coatings and components. Additionally, broader knowledge in areas beyond mechanics and metal materials will be essential. The demand for more diversified products will also lead to greater complexity in logistics management and distribution of products, as well as the need to converge towards standards that have yet to be defined. Lastly, over the coming years, components dedicated solely to internal combustion vehicles will gradually decline in volume, adversely affecting production costs due to diminished economies of scale, following a logic similar to what we have already seen for components used exclusively for diesel powertrains.

Unfortunately, wars and pandemics have always existed in the world and are part of human history and nature. Our generation has been fortunate enough to have avoided experiencing them directly. In particular, in the Western world, we have managed not to have wars for over 70 years, with the exception of the Balkan War in the 1990s. However, we now have one in the heart of Europe that increasingly involves us and seems to be taking on the form of a clash between the West and the rest of the world. This situation is disconcerting and fills us with unease and uncertainty, but I believe that maintaining a healthy balance of realism and optimism is the most prudent approach.

With a closing remark that carries both a cautionary message and a ray of hope for companies of all sizes.

The world is changing fast. It is no longer a question of big overpowering small, but rather of the fast outpacing the slow.

Currently, there is the prevailing belief that growth is the sole means to guarantee a company’s survival. In your opinion, what does this growth actually mean and how

currently witnessing a period of significant change and uncertainty, particularly

•

•ETA-22/0584

•

Being one of the largest fastener trading companies in China and one of the world’s largest suppliers of fasteners, Hisener has continued to implement smart and digital manufacturing, as well as optimize production lines and warehousing technology in recent years. In the first half of 2023, Hisener announced the completion of constructing an ERP and WMSconnected smart plant, a 300% increase in production capacity, and expansion of laboratories. In the second half of 2023, they announced completing three major advances and have set out on a great path of achieving corporate social responsibility and sustainability.

In the third quarter of 2022, they added a new manufacturing area for stainless steel products in their new 32,000-square-meter factory and achieved in-house production of such products. This year, they set up a dedicated manufacturing area to develop bi-metal screws. Simon Liang, general manager, said that his purpose is to satisfy existing customers’ demand for diverse products, especially for high-performance screws. He has accumulated many years of manufacturing experience and has mastered the optimal balance between drilling performance of fasteners, price and cost. Combining his stainless steel screws and composite screws with one-stop service will increase Hisener’s global market share.

Simon is officially announcing to the readers through Fastener World Magazine that Hisener carbon steel and stainless steel wood screws are ETA-certified and he has obtained the ETA-22/0584 certificate, a stepping stone for Hisener wood screws to expand market share in Europe. This ETA certificate is not the end but a part of the progression. Simon said that Hisener works with 150 carefully selected partners to provide more than 4,000 types of fasteners to customers in Europe, the U.S., South America and Russia. Hisener will continue to extend quality certification in response to the trend to provide customers around the world with best quality fasteners from China.

Simon pointed out that solar panels have been installed on the 8,000-square-meter roof of his factory to make full use of clean energy. The offices and factories have been converted to LED lighting to reduce energy consumption. Administrative procedures have gone as paperless as possible to minimize the use of paper. Recyclable materials are used for product packaging.

All internal transportation carts in the factory are electric to reduce energy consumption.

On the cover of China Fastener World Magazine this June, Simon chose the image of a polar bear hugging an ESG-driven fastener as his brand-new corporate guideline, which shows his humanistic concern for the ecology and animal conservation, and signals Hisener’s determination to embrace global environmental protection.

Global major economic indicators reveal that positive market demand is to emerge again. Simon has traveled all over the world to introduce his new factory and new technology to customers. Face-to-face communication allows him to understand customers’ pain points, and he wants to solve their problems through new products and smart factories, hoping to deepen the bond of trust and continuously expand international collaboration.

Contact: Simon Liang Email:simon@hisener.com

Article by Dean Tseng, Fastener World Copyright owned by Fastener World 著作權所有:惠達雜誌

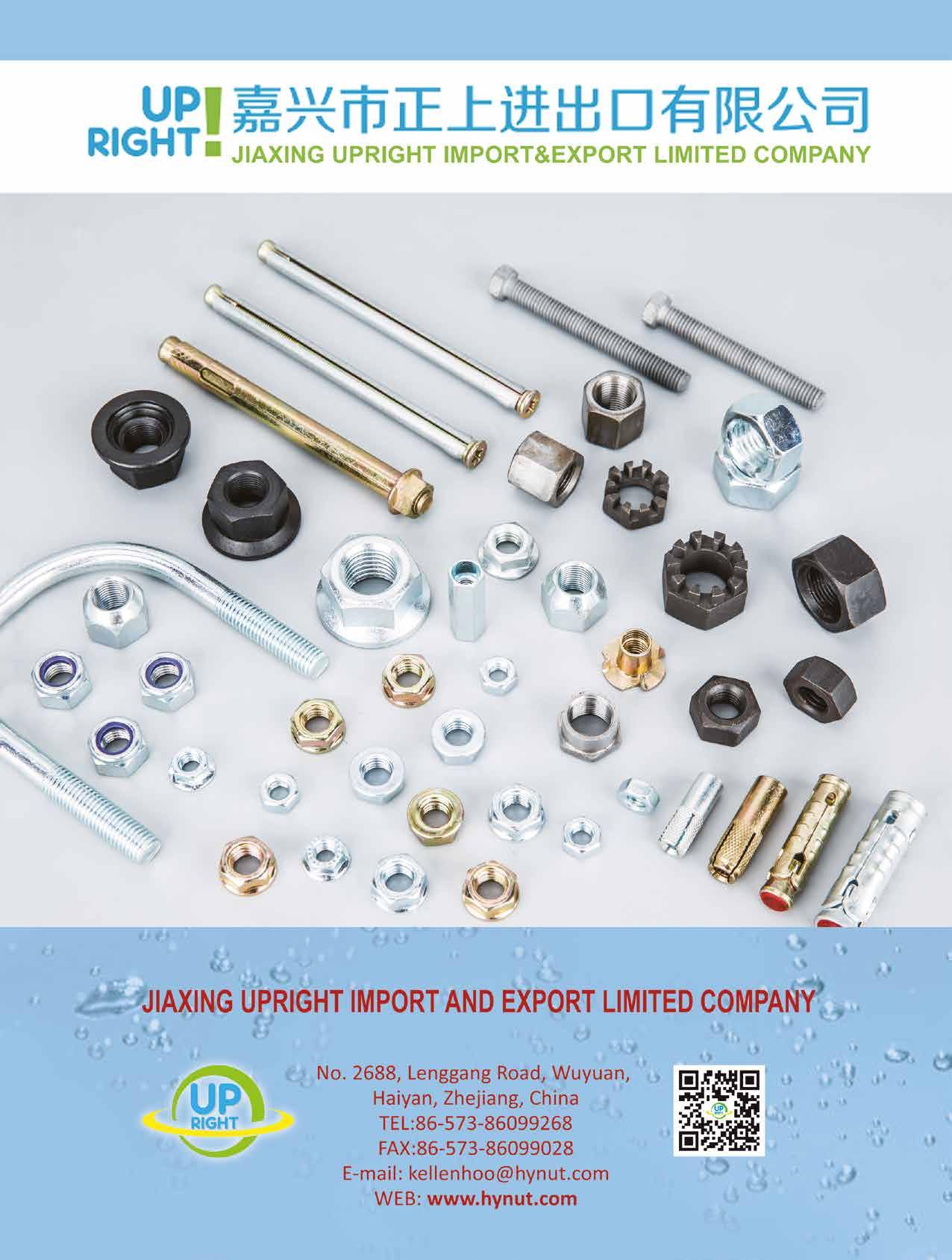

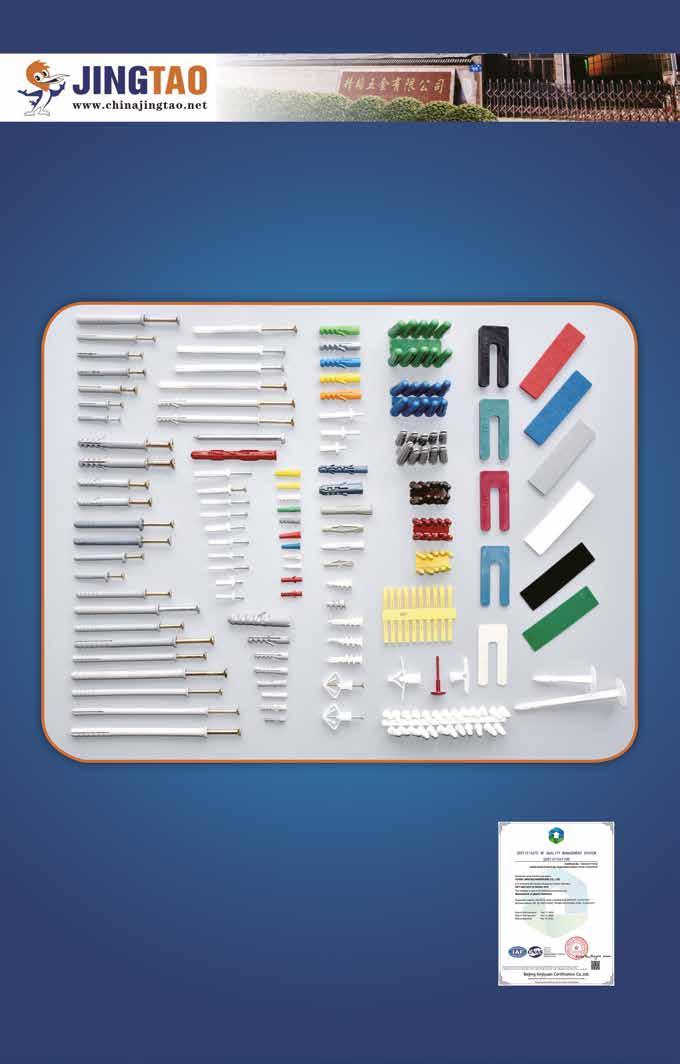

Jiaxing

Aoke Hardware Technology Co., Ltd. ("Aoke") is an industry-recognized professional manufacturer of furniture hardware and architectural hardware anchors. Headquartered in Haiyan Baibu Economic Development Zone, the company is conveniently located just over an hour's drive from Hangzhou and Shanghai. The nearly 4,000 sq. m factory produces a wide range of anchors, screws, nuts, stamped parts, turned parts and non-standard parts to meet the needs of domestic and international industries. Over the past 37 years, Aoke has become a stable and reliable source of supply for many customers, especially in the furniture and construction fields. In 2020, in order to expand its business and meet the needs of customers, it established Jiaxing Aoke Trading Co., Ltd. With the advantages of both production & trading capabilities and the support of many associate factories, it provides more immediate and comprehensive services to its global customers.

Strict quality control, standardized management process and on-time delivery are the three main features of Aoke. Since more than 80% of its products are exported to overseas markets, mainly to Europe, S. America, Russia and many other countries/regions, there is no room for compromise on quality control. Aoke has a professional technical team with years of practical experience and can develop and manufacture dies on their own. With efficient punches, cold heading machines, polishing machines, die processing centers as well as other equipment and surface treatment capabilities, Aoke has the ability to respond to ever-changing customer needs.

“In addition to the introduction of advanced production equipment and management model in the traditional processing lines, we have also completed the construction of automated production lines for furniture hollow wall anchors, and continue to prioritize quality and provide customers with the best service as the ultimate goal,” said General Manager Nick Wang.

Aoke's manufacturing process follows the ISO9001 international quality management system. In addition to providing standard parts, Aoke can also produce non-standard parts according to customers' drawings. Several sets of inspection equipment are readily available for inspection of dimensional specifications, surface treatments, and performance, and inspection reports can be provided to customers upon request. In addition to its OEM capability, which has been recognized by many large European and American companies, Aoke's mature product development capability has also been proven through the acquisition of 10 product patents.

“We’ve traveled to Germany, Vietnam, Indonesia and other countries to participate in exhibitions to let more people learn about our high quality products and services. We sincerely welcome customers to visit our factory and build a bridge of cooperation in the near future to form a mutually beneficial partnership,” said General Manager Wang.

Contact:

General Manager Nick WangEmail: nick@jx-aoke.com

Article by Gang Hao Chang, Vice Editor-in-Chief of Fastener World Copyright owned by Fastener World 著作權所有:惠達雜誌

China's aerospace industry has been soaring to new heights, and it's not just about expanding commercial aviation. The country has made significant strides in developing its aerospace capabilities, including the production of military aircraft, satellites, and space exploration missions. As China continues to assert itself as a major player in the global aerospace sector, the demand for aerospace fasteners has never been higher. For example:

1. Commercial Aircraft Manufacturing: China's aerospace industry has witnessed significant growth in commercial aircraft manufacturing. Companies like COMAC (Commercial Aircraft Corporation of China) have developed and produced advanced commercial aircraft models such as the C919, which aim at competing with established global players like Boeing and Airbus. China's commercial aircraft market was growing rapidly, with the market size projected to be around US$1.2 trillion by 2035, driven by the production and sale of commercial aircraft like the COMAC C919

2. Space Exploration: China has made remarkable strides in space exploration. The successful missions of Chang'e lunar landers and the Tianzhou-2 cargo spacecraft demonstrate China's growing capabilities in space technology and exploration. China's space exploration sector has been steadily increasing its budget and activities. In 2023, China allocated approximately US$12 billion to its space program

3. Satellite Technology: China has become a key player in the global satellite industry. It has launched a wide range of satellites for various purposes, including communication, navigation, Earth observation, and scientific research. China's satellite industry is substantial, with an

estimated market size of over US$25 billion. This includes the production and launch of various types of satellites for communication, navigation, Earth observation, and other purposes.

4. Military Aerospace: China's aerospace industry extends to military applications, with the development of advanced fighter jets like the J-20 and J-31. These aircraft showcase China's efforts to modernize its military capabilities. The market size for China's military aerospace industry is not publicly disclosed, but it is a significant part of the country's overall defence budget, which was approximately US$230 billion in 2023.

5. Commercial Space Sector: China's commercial space sector, including launch services and satellite technology, has seen substantial growth. The exact market size can vary from year to year, but is estimated to be in billions of dollars.

In a simple word China is the 2nd main players in the aerospace industry after USA, therefore; China's aerospace industry has demonstrated a commitment to global cooperation through its active participation in prestigious ventures like the International Space Station (ISS) and strategic partnerships with various countries for space missions. Beyond its contributions to international space endeavours, China's aerospace industry plays a pivotal role in shaping the nation's economy. This impact is multifaceted, fostering job creation, spurring technological advancements, and facilitating lucrative export opportunities. Consequently, China's economic trajectory is significantly bolstered. Remarkably, China's aerospace industry has now emerged as a formidable global competitor, challenging the established giants in the sector. This newfound competitive spirit has injected fresh vitality into the aerospace domain, fostering heightened innovation and driving unprecedented competition within the industry.

Aerospace fasteners are often-overlooked but critical components of any aircraft or spacecraft. These small, yet essential, pieces of hardware hold together the various components and structures of an aerospace vehicle. They are subjected to extreme conditions, including high temperatures, vibrations, and forces, making their reliability and performance paramount. The global aerospace fasteners market size was valued at US$ 5.3 billion in 2022 and is projected to grow from US$6.09 billion in 2023 to US$9.88 billion in 2030, at a CAGR of 7.16%.

The aerospace fastener market in China has been expanding rapidly. While precise figures can be hard to come by, industry experts estimate that China’s market is more than 8% of this number (in 2023 it is more than US$ 480 million) and the market has been growing at an annual rate of approximately 10%.

Several key factors are driving the growth of the aerospace fastener market in China:

1. Rapid Expansion of Civil Aviation: China's domestic aviation market is one of the fastest-growing in the world. With a rising middle class and increased air travel, airlines are expanding their fleets, creating a continuous demand for aircraft and aerospace fasteners.

2. Space Exploration: China's ambitious space programs, including missions to the moon and Mars, have boosted the demand for specialized aerospace fasteners designed for spacecraft. These missions require fasteners that can withstand the harsh conditions of space.

3. Defence Modernization: China's ongoing efforts to modernize its military have led to increased production of military aircraft and equipment. This, in turn, has driven up the demand for aerospace fasteners used in military applications.

4. Technological Advancements: Chinese aerospace manufacturers are investing heavily in research and development to produce more advanced and lightweight aircraft and spacecraft. This requires innovative aerospace fasteners that can meet the stringent performance criteria.

5. Global Trade and Partnerships: China's aerospace industry has been actively seeking international partnerships and collaboration. This has opened up new opportunities for Chinese aerospace fastener manufacturers to enter the global market.

While the aerospace fastener market in China is poised for significant growth, it also faces some challenges:

1. Quality and Certification: The aerospace industry demands the highest levels of quality and safety. Chinese fastener manufacturers must adhere to stringent international standards and obtain necessary certifications to compete in the global market.

2. Competition: The global aerospace fastener market is highly competitive, with established players from Europe and the United States. Chinese companies must differentiate themselves through quality, innovation, and cost-effectiveness.

3. Supply Chain Disruptions: As seen during the COVID-19 pandemic, disruptions in the supply chain can have a significant impact on aerospace manufacturing. Ensuring a resilient supply chain is crucial.

4. Intellectual Property: Developing advanced aerospace fasteners often involves cutting-edge technology and intellectual property considerations. Protecting IP and avoiding infringement are essential.

With all these challenges and opportunities, it must be said that the aerospace fastener market in China is on a steady ascent, driven by a confluence of factors including a booming civil aviation industry, space exploration ambitions, and technological advancements. While challenges such as competition and quality control persist, Chinese aerospace fastener companies are poised for growth as they innovate and expand their global footprint. As the aerospace industry continues to evolve, China's role as a major player in this sector is set to solidify, making it an exciting market to watch.

Article by Sharareh Shahidi Hamedani / Copyright owned by Fastener World

While fasteners may not be the first thing that comes to mind when thinking about sustainability and green development, these seemingly small components play a pivotal role in various industries critical to China's sustainable future. As the country continues to make strides in environmental protection and sustainable growth, the fastener industry is presented with growing opportunities to support these initiatives.

China's transformation toward a greener and more sustainable economy is a multifaceted endeavor that encompasses several key sectors, each with its unique challenges and opportunities. From renewable energy to electric vehicles and sustainable infrastructure, fasteners are integral to ensuring the stability, safety, and longevity of these green applications.

Fasteners are unassuming yet essential components in various industries. They are the unsung heroes that hold together the structures and systems powering China's sustainable future. Let's explore how fasteners contribute to key green sectors in the country:

China's commitment to renewable energy sources, such as wind and solar power, is at the forefront of its green agenda. Wind turbines and solar panel arrays require thousands of fasteners to withstand extreme weather conditions and ensure the longevity of these installations. High-quality, corrosion-resistant, and reliable fasteners are essential to the success of renewable energy projects.

In the solar sector, the demand for fasteners is high, especially in photovoltaic (PV) tracking systems. These systems require fasteners that offer exceptional corrosion resistance and can withstand extreme weather conditions. Additionally, they must meet certification standards to ensure the reliability of solar installations. This presents a substantial market for fastener manufacturers specializing in PV system components.

Concentrated Solar Power (CSP) systems also offer opportunities for fastener industry growth. The assembly of crossbars and collector bars, as well as the connection of collectors within CSP systems, necessitates the use of specialized fasteners. Manufacturers capable

of providing these specific fasteners can tap into the CSP market.

Within the wind energy sector, fasteners are crucial due to the continuous vibration and massive scale of wind turbines. The industry demands fasteners that can withstand the rigors of wind turbine construction, engine housing installation, and wind tower assembly. Fastener manufacturers catering to wind energy applications have a chance to thrive as this sector continues to expand.

As the world's largest producer and consumer of electric vehicles (EVs), China relies on fasteners to assemble the intricate components of these eco-friendly cars. Fasteners in the automotive sector must meet rigorous safety and durability standards. Additionally, lightweight fasteners contribute to the overall efficiency and sustainability of EVs, making them a critical component in China's green transportation future.

The electric vehicle (EV) industry presents promising opportunities for the fastener sector. Fasteners play a vital role in various aspects of EV manufacturing, from securing powertrain and battery components to body construction and chassis assembly. These specialized fasteners need to withstand vibrations and extreme temperatures while maintaining durability.

In powertrains and inverters, fasteners like cable glands and sealing plugs ensure reliable power distribution. EV batteries require robust solutions such as embedded fasteners and sealing nut/washer assemblies. Body-in-white assembly benefits from high-strength fasteners and structural blind rivets. Chassis fasteners must be corrosion-resistant and vibration-proof, and exterior fasteners should facilitate easy replacements. Inside the vehicle, fasteners like clips, grommets, and wire routing solutions meet design and functionality requirements. As the EV industry continues to grow, fastener manufacturers can provide innovative solutions that support the transition to sustainable transportation.

China's construction industry is at the forefront of adopting green building practices and sustainable infrastructure development. Fasteners are integral to this transition as they play a crucial role in constructing eco-friendly buildings and ensuring the secure joining of sustainable materials. The demand for fasteners that align with sustainability criteria is poised for substantial growth as green construction gains momentum.

Fasteners in sustainable construction encompass a wide range of applications. For instance, in the assembly of energy-efficient building components like solar panels and thermal insulation, specialized fasteners are required to maintain structural integrity while minimizing thermal bridging. Additionally, the construction of green roofs and walls, which promote natural insulation and rainwater harvesting, relies on durable fasteners to support vegetation and cladding materials.

Furthermore, as sustainable construction often involves the use of recycled or reclaimed materials, fasteners must adapt to varying material properties. This requires innovation in fastener design and materials to ensure compatibility and longevity. Fastener manufacturers have a unique opportunity to contribute to China's sustainable construction goals by developing products that enhance building performance, reduce energy consumption, and minimize environmental impact.

Efficient waste management and recycling are pivotal components of China's broader environmental objectives. Fasteners are instrumental in the construction of recycling machinery and waste management equipment, where they must endure heavy usage and exposure to a diverse array of materials. In this context, the demand for fasteners that combine robustness with environmental consciousness is paramount.

Fasteners used in waste management equipment, such as balers, shredders, and conveyor systems, need to withstand the rigors of processing materials like plastics, metals, and paper. These fasteners should also prioritize recyclability and corrosion resistance to ensure long-term performance and minimal environmental impact.

Moreover, as the circular economy gains traction in China, fasteners that facilitate disassembly and component replacement will become increasingly essential. Designing fasteners that simplify maintenance and repairs can contribute to extending the lifespan of recycling machinery, reducing overall waste, and conserving resources.

China's resolute commitment to green and sustainable development extends deep into its economy, positioning the transition to a low-carbon future as a strategic imperative. Within this transformative landscape, the demand for specialized fasteners tailored for green applications is experiencing remarkable growth. Notably, this burgeoning demand extends beyond the confines of domestic production, offering unprecedented opportunities for foreign investors and fastener manufacturers alike.

Recent market projections reinforce the significance of China's green-application fastener segment. With China poised to become the world's largest economy, it is estimated that this specific market will expand significantly, reaching a projected size of an astounding US$25.7 billion by 2030. This projection is underpinned by a robust compound annual growth rate (CAGR) of 6% over the analysis period spanning from 2022 to 2030. Such a forecast underscores the dynamism and potential of this niche within the fastener industry.

As the global fastener landscape evolves, foreign fastener companies that boast expertise in crafting eco-friendly, high-performance fasteners have a distinct opportunity to thrive within China's receptive market. However, navigating this dynamic arena effectively hinges on two critical factors: collaboration with local partners and strict adherence to Chinese regulations.

Collaboration with established local entities not only facilitates market entry but also helps in comprehending the unique demands and preferences of the Chinese market. Additionally, local partnerships can expedite the customization of fasteners to align with specific green applications, ensuring that products meet the exacting standards of the burgeoning eco-conscious industries in China.

Moreover, compliance with Chinese regulations is non-negotiable. Demonstrating a commitment to adhering to environmentally focused regulations and standards will be pivotal in securing

Sources:

China’s Green Development in the New Era, The State Council Information Office of the People’s Republic of China, 2023

Stanley Engineered Fastening, Renewable Energy KVT Solutioneeirng, Fastening Elements for Electric Vehicles

Global Industrial Fasteners Market to Reach $127.3 Billion by 2030, ReportLinker

the trust of Chinese consumers and regulatory authorities. Investing in research and development to create fasteners that not only meet but exceed these standards can offer foreign manufacturers a competitive edge.

In the pursuit of its green agenda, China relies on countless fasteners to ensure the success of sustainable initiatives. These unassuming components play a vital role in renewable energy, electric vehicles, sustainable construction, and waste management. The fastener industry holds immense potential to thrive in this evolving landscape, offering both environmental benefits and economic opportunities.

As China advances toward its green and sustainable development goals, fasteners remain an essential part of the equation. These small but crucial components are the unsung heroes that hold together the foundations of a greener, more sustainable future. In conclusion, the future of fasteners in China is undoubtedly green, and the opportunities for growth and innovation within the industry are substantial.

Asia has always been the main base for global production and export of fasteners. Millions of tons of fastener products are exported every year to meet the different needs of global industrial customers, especially China and Taiwan both play an irreplaceable role as the two pillars of the supply chain in this region.

China itself has a huge domestic and export market for fasteners, and the technology and quality of its products are striving to keep pace with the market. In addition to the price advantage of standard parts over other emerging countries, it has also made a lot of progress in recent years in the OEM and R&D of non-standard customized fasteners. Although China's exports of fasteners to the U.S. market is still affected by the trade barriers and trade data are fluctuating, Chinese manufacturers are accelerating steps to ASEAN and other emerging markets to set up production bases, in order to find a way for sustainable corporate development on the basis of risk diversification and explore the potential market opportunities.

The development of Taiwan fastener industry is relatively earlier than those of other latecomers, so it boasts more outstanding product quality, technology, service and industry supply chain integration. The high efficiency created by a complete and centralized fastener production cluster is also rare in the world. The high price/performance ratio also allows many European and American customers to continue to choose Taiwan as their long-term OEM and product development partner in the global supply chain. In addition, Taiwan's exports to Europe and the U.S. are not affected by anti-dumping or circumvention duties, making it the first choice for many important import distributors to consider cooperation.

However, the current global situation is affected by many external factors, which have weakened the production capacity of some industries and indirectly lowered the demand for fastening products in certain regions due to market contraction. The export data in the first seven months of 2023 of the two major fastener manufacturing regions (China and Taiwan) also seem to appear similar signs.

In the first seven months of 2023, China exported a total of approximately 2.56 million tons of fasteners to the world, a decrease of 6.05% from the same period of 2022, while Taiwan exported approximately 760,000 tons of fasteners to the world, a decrease of 25.13% from the same period of the previous year. The size of China's fastener exports is approximately 3.36 times larger than that of Taiwan. Compared with Taiwan's high reliance on the European and U.S. markets, only 30% of China's fasteners are exported to Europe and the U.S., and a large proportion of fasteners are exported to ASEAN/Japan/South Korea/India, as well as other regions outside of Europe and the U.S. In the first seven months of 2023, China's and Taiwan’s fastener exports to Europe, the U.S. and the UK both showed a decline, but China’s exports to ASEAN/Japan/South Korea/India showed a growth of about 3.5% from the same period of 2022.

In terms of export value, Taiwan exported about US$2.91 billion of fasteners to the world in the first seven months of 2023, a decrease of nearly 25% compared with the same period in 2022. China, on the other hand, exported about US$6.4 billion of fasteners to the world, a decrease of about 11.54% from the same period last year. Both Taiwan and China experienced declines in their total fastener exports to various global markets.

In terms of average unit price, Taiwan's fastener exports to Europe and the U.S. were priced at US$3.6-3.8 per kilogram, exports to ASEAN/Japan/S. Korea and India at US$4.1-4.5 per kilogram, and China's exports to the world at US$2.2-3 per kilogram. In the first seven months of 2023, the growth in average unit price for Taiwan's fastener exports to the EU was the most significant at 5.51%, while China's fastener exports to the world during the same period saw a decline of 5-7.5% in average unit price.

In terms of export data, wood screws, self-tapping screws, bolts, nuts and iron & steel nails are the main fastener export items from China and Taiwan. During the period of January - July 2023, China and Taiwan both show different levels of changes in fastener export weight, value and average unit price according to different items and different regions. On the whole, the weight, value and average unit price of all fasteners exported from China and Taiwan were generally on a downward trend when compared to the whole year, but there were still some outstanding counter-trend growth in certain market regions. The following is a comprehensive analysis by product category, weight, value, unit price and market region (see Tables a-e below).

In the first seven months of 2023, China's export weight of wood screws to the U.S. (+9.59%), export weight of self-tapping screws to the 10 ASEAN countries/Japan/S.Korea/India (+1.58%), export weight of bolts to the 10 ASEAN countries/Japan/S. Korea/India (+5.01%), the unit price of nuts to the 10 ASEAN countries/Japan/S. Korea/India (+0.45%), and the unit price of iron & steel nails to the EU including the UK( +0.35%) still maintained a growing trend compared with the same period of the previous year. It is worth noting that while the U.S. still imposes high tariffs on certain steel and aluminum products from China, the weight of wood screws exported from China to the U.S. increased rather than decreased.

On the same timeline (January-July 2023), Taiwan’ s export weight of wood screws to the U.S. (+33.98%), export value of wood screws to the U.S. (+19.55%), the unit price of wood screws exported to the EU including the UK (+5.63%), the unit price of selftapping screws exported to the EU including the UK (+12.11%), the unit price of bolts exported to the EU including the UK (+6.05%), the unit price of bolts exported to ASEAN/Japan/S. Korea/India (+0.81%), the unit price of nuts exported to the U.S. (+1.81%), and

the unit price of iron & steel nails exported to ASEAN/Japan/S. Korea/India (+3.30%) all stayed on the growth curve. Taiwan's export of wood screws to the U.S. has grown significantly, but in another major market, the EU, has shown a significant decline. According to Taiwan CSC’ s latest Q4 price adjustments on Sep. 14, low carbon/medium-high carbon/cold forged/low alloy wire rods were raised by NT$1,000 per metric ton (around US$31.25).

The current weaker-than-expected export performance of major fastener items from China and Taiwan may be related to the overall poor global environment and the tightening of purchasing capacity by international buyers whose inventories are still at a high level. However, the scenario of hundreds of Chinese exhibitors actively participating in many recent international exhibitions shows that many Chinese manufacturers are still optimistic about the future development of export and sales, and through practical actions (such as setting up factories or recruiting regional agents) they continue to expand their export share in many markets (EU, UK, ASEAN, Japan, S. Korea, and India, etc.) which do not impose anti-dumping and countervailing duties against China in order to capture more orders.

Article by Gang Hao Chang, Vice Editor-in-Chief of Fastener WorldCopyright owned by Fastener World 著作權所有:惠達雜誌

Alcoa made USD 12.45 billion in net sales in 2022, a 2.4% growth over the 2021 record at USD 12.15 billion, but rendering a loss of USD 102 million in net income contrasting the USD 429 million net income gain in 2021. H1 2023 net sales were USD 5.354 billion, reaching 43% of full year revenue in 2022.

Fastenal gained 16.1% from USD 6.01 billion to USD 6.98 billion in net sales in 2022. Double-digit growth is seen in gross profit, operating income, as well as net income which made a 17.5% jump to USD 1.08 billion from USD 925 million. H1 2023 net sales were USD 3.7422 billion, reaching 53% of full year revenue in 2022.

Grainger grew 16.9% to USD 15.22 billion in net sales in 2022, compared to USD 13.02 billion recorded in 2021. Gross profit, operating income, and net income marked significant growths of 23.9%, 43.1% and 48.3% respectively. H1 2023 net sales were USD 8.273 billion, reaching 54% of full year revenue in 2022.

Nucor landed at USD 41.51 billion net sales, up 13.7% from USD 36.48 billion. Net income rose 11.4% from USD 6.82 billion to USD 7.60 billion. H1 2023 net sales were USD 18.2332 billion, reaching 43% of full year revenue in 2022.

Simpson Manufacturing hit a 34.5% growth from USD 1.57 billion to USD 2.11 billion. Growth around 24% to 25% was seen in gross profit, operating income, and net income. Net income leaped 25.3% from USD 266 million to USD 333 million. H1 2023 net sales were USD 1.132 billion, reaching 53% of full year revenue in 2022.

The left table lists the companies whose financial year end at the end of March, except for Kyowa Kogyosyo which ends at the end of April.

Amatei's 2023 revenue was 5.48 billion yens, up 7.9% from 5.08 billion yens in 2022. Net profit grew significantly, by 77 million yens, but the company expects a significant decrease in profit for 2024.

KFC 's 2023 revenue fell 12.8% from 25.95 billion yens to 22.62 billion yens, and net profit fell even more, by about 42%, but the company forecasts a 10% increase in revenue in 2024.

In 2023, Kyowa Kogyosyo' revenue increased by 13.3% to 13.21 billion yens, compared to 11.65 billion yens in 2022. Net profit grew by only 0.9% due to a 30% drop in operating profit. The company forecasts a 5% decline in sales in FY2024.

Sanko Techno's revenue increased by 10% to 20.60 billion yens from 18.73 billion yens. Net profit increased by 30% to 1.39 billion yens from 1.07 billion yens, but the company forecasts revenue to grow by only 2% in FY2024.

Nifco's revenue increased by 13.4% to 321.77 billion yens from 283.77 billion yens. Net profit declined by 7.8%. The company is forecasting less than 1% growth in revenue and net profit for FY2024.

Yamashina's revenue increased by 8% to 11.91 billion yens from 11.03 billion yens. Net profit fell 20.7% to 434 million yens from 548 million yens, but the company is forecasting 12.6% growth in revenue and 3.5% growth in net profit for FY2024.

Simmonds Marshall's revenue increased by 16.1% from 1.47 billion INR to 1.70 billion INR. Net profit for the year was a loss of 27.551 million INR.

Sterling Tools' revenue increased by 26.8% from 4.71 billion INR to 5.97 billion INR. Net profit increased by 39.3% to 414.29 million INR from 297.28 million INR, showing the company's significant growth in FY2023.

Sundram Fasteners' revenue increased by 15.5% from 49.02 billion INR to 56.62 billion INR. Net profit increased by 8.3% to 4.94 billion INR from 4.56 billion INR.

China has emerged as a global powerhouse in infrastructure development, and its railway network is a prime example of this growth. The extensive Chinese railway system is not only vital for domestic transportation but also plays a crucial role in facilitating international trade through its ambitious Belt and Road Initiative (BRI). The Chinese railway industry is at the forefront of technological innovation, consistently pushing boundaries to meet the evolving needs of modern railway systems. This unrelenting commitment to advancement extends to the fastener market, a critical component of railway infrastructure. As China's railway sector continues to expand, its influence reverberates throughout the global fastener market, triggering significant shifts and fostering key developments.

The fastener market is a fiercely competitive arena, teeming with both domestic and international players vying for supremacy. To gain a competitive edge, companies must embrace innovation and set themselves apart from the competition. Notably, the ascent of Chinese fastener manufacturers as global contenders has injected new vigour into this industry, rivalry. This heightened competition serves as a catalyst for continuous innovation and the enhancement of product quality.

Global disruptions, exemplified by the COVID-19 pandemic, have laid bare the vulnerabilities inherent in supply chains. For fastener manufacturers, the imperative lies in establishing resilient operational frameworks. China's status as a global manufacturing hub has prompted many international fastener manufacturers to establish operations or forge strategic partnerships within the country. This integration ensures the efficient supply of fasteners to international railway projects, bolstering supply chain stability.

Collaborations between Chinese and international railway industry stakeholders frequently facilitate technology transfer, ushering in a mutually beneficial exchange of expertise in fastener design and production. This symbiotic relationship has yielded several notable advancements:

• Material Innovation: Conventional materials like steel and iron are gradually giving way to advanced alloys and composites, ushering in improved fastener performance. These modern materials offer an array of benefits, including enhanced strength, heightened resistance to corrosion, and reduced weight.

• Environmental Considerations: The mounting pressure to make railway operations more environmentally friendly has spurred the development of eco-friendly fasteners and materials. These innovations are meticulously crafted to minimize environmental impact throughout their lifecycle, from production to disposal.

• Advanced Design and Engineering: Fastener design and engineering have evolved into highly sophisticated disciplines. Employing techniques like Finite Element Analysis (FEA) and Computer-Aided Design (CAD) software, engineers optimize fastener designs to suit specific applications, prioritizing safety and reliability.

• Stringent Testing and Quality Assurance: To ensure compliance with industry standards, fastener manufacturers have implemented rigorous testing and quality assurance protocols. Non-destructive testing methods, such as ultrasonic testing and magnetic particle inspection, are commonplace, ensuring the highest quality standards are met or exceeded.

The adoption of Chinese railway standards, both domestically and within countries participating in the Belt and Road Initiative (BRI), holds sway over global fastener manufacturing practices. Companies seeking involvement in large-scale projects may find it necessary to adapt to these standards. Thus, staying abreast of China's evolving regulatory landscape is pivotal for fastener manufacturers, as adherence to safety and quality standards remains paramount.

China's railway system has witnessed remarkable expansion over the past few decades. The government has invested heavily in constructing high-speed rail networks, connecting cities, regions, and even neighbouring countries. The goal is to boost economic development, improve connectivity, and reduce transportation costs.

• High-speed Rail: China boasts one of the world's most extensive high-speed rail networks, covering over 37,000 kilometres. The demand for fasteners in this sector is substantial as high-speed trains require advanced fastening solutions to ensure safety and efficiency.

• Belt and Road Initiative (BRI): China's ambitious BRI project aims to create a network of infrastructure and economic connections with countries across Asia, Europe, and Africa. This involves building railways, roads, and ports, all of which rely heavily on fasteners for construction and maintenance.

• Urban Rail Transit: China is continuously expanding its urban rail transit systems in major cities to combat traffic congestion and reduce pollution. This expansion fuels the demand for fasteners used in subway and light rail construction.

The global market for rail fasteners estimated at US$36.2 billion in the year 2022, is projected to reach a revised size of US$92.5 billion by 2030, growing at a CAGR of 12.4% over the analysis period 2022-2030. 1

• China, the world's second largest economy, is forecast to reach a projected market size of US$23.9 billion by 2030 trailing a CAGR of 18.6% over the analysis period 2022 to 2030 (China's market size for railway fastener was US$ 7.24 billion in 2022 and will pass US $8.58 billion in 2023).

• The rail fasteners market in the U.S. is estimated at US$9.9 billion in 2022.

• Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at 6.5% and 10.8% respectively over the 2022-2030 period. Within Europe, Germany is forecast to grow at approximately a CAGR of 8%.

1. https://www.researchandmarkets.com/report/rail-fastener

Export Opportunities:

Chinese fastener manufacturers are not only catering to domestic demand but are also exporting their products to international markets. The global demand for high-quality fasteners presents significant export opportunities.

Investment and Innovation:

Fastener manufacturers in China are investing in research and development to produce advanced and cost-effective fastening solutions. This innovation is crucial for staying competitive and meeting the evolving demands of the railway industry.

The Chinese railway industry continues to expand, driven by both domestic needs and international initiatives like the Belt and Road Initiative. This expansion creates significant opportunities for the fastener market, as railways rely on a wide range of fasteners for construction, maintenance, and upgrades.

To thrive in this market, fastener manufacturers must focus on quality, innovation, and sustainability. Adherence to safety and quality standards is paramount, as railway systems must operate efficiently and safely. Furthermore, staying abreast of technological advancements and environmental concerns will position companies for success in this dynamic industry.

As China's railway network continues to grow and evolve, the fastener market will remain a crucial component of the nation's infrastructure development, contributing to its economic and technological advancement on the global stage. The impact of this growth will extend beyond China's borders, influencing the global fastener market and shaping the future of railway transportation.

Article by Behrooz Lotfian / Copyright owned by Fastener World 著作權所有:惠達雜誌

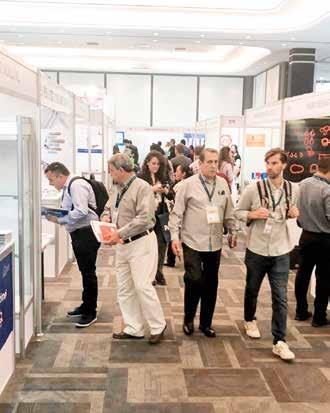

The annually held Fastener Fair Mexico took place on September 7-9, 2023 at Expo Guadalajara, Mexico and attracted nearly 80 exhibitors from the local Mexican fastener related industry, as well as from countries including Taiwan, Israel, China, USA, etc. to present and showcase their latest and innovative fastening, fixing, and assembling products, solutions, and services, which included screw, nuts, bolts, rivets, washers, anchors, fastening tools,

molds & dies, machinery, and other peripherals & accessories.

Fastener Fair Mexico was originally given in the capital of Mexico, Mexico City, before the pandemic. However, due to the change of the fair organizer and its goal to boost the attendance of more visitors and potential buyers from different fastener-related industries, the Fair was then arranged to be colocated with the largest hardware event in the whole Latin American region, Expo Nacional Ferretera in Guadalajara, which is also the second largest city and one of the most pivotal manufacturing heartlands in Mexico.

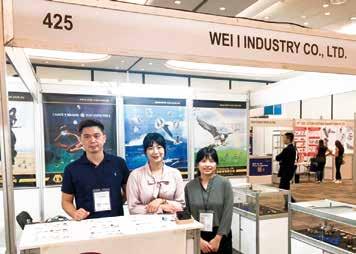

As the exclusive sales agent of FF Mexico, Fastener World Inc. not only went to exhibit again, but also brought 10 Taiwanese exhibitors to participate. These Taiwanese exhibitors featuring high quality products and excellent service were: L&W, PINGOOD, WEI-I INDUSTRY, METAL FASTENERS, FANG SHENG SCREW, KUO HSIAN FASTENER, REXLEN, BOLTUN, CHIEN TSAI MACHINERY, TAIWAN METIZ ALLIANCE. Taiwanese exhibitors said that Mexico is no doubt one of the most important countries in the Latin American

region with vibrant manufacturing industries nationwide, e.g., automotive, furniture, hardware, industrial components processing, aerospace, and that they would like to utilize these advantages to explore more opportunities and establish new business contact with potential industry players from Mexico and surrounding countries. In addition to Taiwanese exhibitors, China was the largest exhibiting group this year.

Mexican manufacturing industries with robust fastener demand and proximity to several large ports used to take advantage of the benefits brought by USMCA (formerly NAFTA) and import a great amount of goods and products from many countries such as USA, Canada, Taiwan, China, and the rest of the world, which the organizer believes would help boost the international industry exchange through giving Fastener Fair Mexico and Expo Nacional Ferretera under one roof.

Co-located with the 30th edition of Expo Nacional Ferretera with the record-breaking number of visitors this year, Fastener Fair Mexico not only drew the attention of professional fastener industry players to visit onsite to seek for further collaboration, but also saw some meaningful and significant visits from other industrial key men and decision makers from the field of hardware and others showing high interest in purchasing or collaborating with each other. In addition to importers, distributors and retailers from Mexico, many potential buyers from neighboring Latin American countries (e.g., Bolivia, Honduras, Brazil, etc.) were also in attendance looking for sourcing and cooperation opportunities.

After the successful industry event this year, the organizer has also announced the dates of the next edition, which will be held again at Expo Guadalajara on September 5-7, 2024.

Note: All countries in the tables are ranked according to values in 2022

Over the past four years, the world has entered an era of restructuring economic entities, forming a global economic structure split into two camps. Against this background, Europe, the United States and Japan have recently shifted the focus of their political and economic collaboration to the South China Sea. In addition to India in South Asia, ASEAN as the world's fifth largest economy has become a hot spot for economic and trade collaboration as well as foreign investment. As the competition in Southeast Asia and ASEAN is turning white hot, what changes have occurred in the trade volume of local fasteners from 2019 to now? Let us dig in with this article.

This article begins with an overview of key economic indicators in ASEAN, followed by an analysis of fastener trade data for six of the ASEAN countries, including Thailand, Malaysia, the Philippines, Indonesia, Vietnam, and Singapore. It should be noted that the data taken from ASEANstats is currently up-to-date until 2022, while the data taken from the Customs offices of several countries have been updated until the first five months of 2023.

To help fastener business owners evaluate the overall market size of ASEAN, a table of economic indicators for the region is presented (see Table 1 ). Last year, the population of ASEAN grew to 669.2 million, GDP grew by 7.7% to US$3.6 trillion, GDP per capita grew by 6.6% to US$5,419, and total trade in all commodities grew by 15% to US$3.8 trillion, of which total exports grew by 14% to US$1.9 trillion, total imports grew by 15% to US$1.8 trillion, and foreign investment grew by 5.5% to US$224.2 billion. Table 1 reveals that the ASEAN market shrank only in 2020, the year of COVID outbreak, but quickly achieved significant growth after the outbreak, making ASEAN an economy with strong momentum.

Next, we will look at ASEAN's overall fastener trade figures. Since the import and export of fasteners from Myanmar, Cambodia, Laos and Brunei are much lower, we are not going to elaborate on them.

In terms of imports ( Table 2), the value of fasteners imported by ASEAN from the world grew by 4.8% to US$3.81 billion last year. Demand was the highest in Thailand, where import fell by 3.6% to US$1.1 billion. The second highest was Vietnam, with import falling 3.2% to US$730 million. The third highest was Malaysia, with import growing by 17.2% to US$612 million. Indonesia's import grew by 22.7% to US$589 million. Singapore's import grew by 10.2% to US$481 million. The Philippines decreased by 2% to US$199 million. Thailand and Vietnam experienced small declines, while Malaysia, Indonesia and Singapore all achieved double-digit growth. Comparing 2022 and 2019, most of the ASEAN countries, with the exception of Myanmar, Laos and Brunei, have already surpassed their pre-pandemic levels of imports after the end of the pandemic.

(Source: Thai Customs)

In terms of exports ( Table 3 ), the value of fasteners exported from ASEAN to the world grew by 12.8% to US$2.34 billion last year. The highest demand was from Vietnam, with export growing by 26.5% to US$680 million. The second highest was Thailand, with export growing by 11.2% to US$672 million. The third highest was Singapore, with export increasing by 12.2% to US$368 million. Malaysia's export decreased by 0.8% to US$360 million. The Philippines' export decreased by 1.6% to US$140 million. Indonesia's export grew by 19.9% to US$116 million. Malaysia and the Philippines experienced small declines, while Thailand, Singapore and Indonesia all achieved double-digit growth. Comparing 2022 and 2019, most of the ASEAN countries, with the exception of the Philippines and Brunei, have already surpassed their pre-pandemic levels of exports after the end of the pandemic.

In 2022, Thailand's global imports of fasteners ( Table 4) grew by 12.7%, surpassing the 1 billion mark to reach US$1.12 billion, and reached US$434 million in the first five months of 2023. Thailand's top five sources of imports in 2022 were Japan (US$433 million, up 3.4%), China (US$260 million, up 32.6%), Taiwan (US$105 million, up 16.8%), Malaysia (US$69.48 million, up 2.1%), and the United States (US$64.28 million, up 58.9%). With the exception of S. Korea, Thailand's imports of fasteners from its top 10 sources are now higher than they were before the outbreak. The increase in Thailand's demand for Chinese and U.S.-made fasteners is noteworthy.

Thailand's global export of fasteners ( Table 5 ) jumped 30% to US$676 million last year and reached US$258 million in the first five months of this year. Thailand's top five export destinations in 2022 were the United States (US$148 million, exceeding the

billion mark, up 34.8%), India (US$64.85 million, up 34.8%), Japan (US$47.91 million, up 12%), Indonesia (US$45.14 million, down 4.2%) and Germany (US$43.45 million, up 32.8%). Thailand's exports of fasteners to the top 10 destinations are all higher than they were before the outbreak. In addition to the surge in demand for U.S. fasteners, Thailand's export of fasteners to the U.S. also increased significantly.

Malaysia's global import of fasteners ( Table 6 ) grew by 22.7% to US$558 million last year and reached US$218 million in the first five months of this year. Malaysia's top five sources of imports in 2022 were China (US$191 million, up 12.3%), Singapore (US$131 million, breaking the 100 million mark and surging 73.1%), Japan (US$61.32 million, up 6.3%), the United States (US$42.26 million, up 25.4%), and Taiwan (US$29.81 million, down 4.2%). Malaysia's imports of fasteners from the top 10 countries of origin are now higher than they were before the outbreak. The notable increase in Malaysia's demand for fasteners made in Singapore and the United States is noteworthy.

Malaysia's global export of fasteners ( Table 7 ) grew by 3.5% to US$327 million last year and reached US$115 million in the first five months of this year. Thailand's top five export destinations in 2022 were Singapore (US$57.77 million, down 10.5%), Thailand (US$51.71 million, down 32%), Germany (US$40.58 million, up 17.9%), the United States (US$32.67 million, up 70.8%) and Turkey (US$15.2 million, up 8.5%). With the exception of Thailand and Japan, Malaysia's exports of fasteners to the top 10 destinations are now higher than they were before the outbreak. The demand for fasteners exported from Malaysia to Singapore and Thailand declined significantly, while demand for fasteners exported to the United States increased significantly.

Philippine global imports of fasteners ( Table 8) grew by 4.3% to US$176 million last year and reached US$50.28 million in the first five months of this year. Philippine top five sources of imports in 2022 were China (US$52.79 million, up 5.2%), Japan (US$44.04 million, down 2.6%), Singapore (US$21.20 million, up 56.1%), Taiwan (US$10.23 million, down 14.8%), and Thailand (US$6.65 million, up 10.2%). With the exception of Taiwan and Hong Kong, Philippine imports of fasteners from the top 10 sources are now higher than they were before the outbreak. The notable increase in Philippine demand for Singapore-made fasteners is noteworthy, while the demand for Taiwan-made fasteners declined significantly.

Philippine global exports of fasteners ( Table 9) grew 26.3% to US$180 million last year and reached US$17.59 million in the first five months of this year. Philippine top five export destinations in 2022 were Japan (US$126 million, up 40.6%), the United States (US$13.93 million, down 2.7%), Germany (US$8.48 million, down 17.8%), South Korea (US$8.1 million, down 2.9%), and France (US$4.56 million, an 18-fold jump). With the exception of Germany and Italy, Philippine exports of fasteners to the top 10 destinations are now higher than they were before the outbreak. Over the past four years, the value of fasteners exported from the Philippines has fluctuated greatly, especially the exports to France, the Netherlands, and Switzerland. Notably, the value of fasteners exported from the Philippines to Italy declined for the fourth consecutive year.