According to Taiwan Customs, the export value of Taiwanese fastening hand tools and their parts (including wrenches, screwdrivers, interchangeable tools, sockets, hereafter referred to as Taiwanese hand tools) has grown over the past five years (Figure 1), up 20.5% (2023 compared to 2019), generally showing an upward trend, though fell by 7.1% in the single year of 2023. Taiwanese hand tools grew by 34.5% during the pandemic (2020 to 2022), slowing down in 2023, but still higher than the 2019 level. It is worth noting that the export value exceeded USD 1 billion in 2021 and continued to 2023.

The export value in H1 2024 was USD 468,464,766, reaching 46.8% of the 2023 level, most of which went to the U.S. and European countries. If we calculate based on this value accumulation, the export value for the 12 months of 2024 may be around USD936 million, below the USD 1 billion mark but there is still a chance to cross the mark. Taiwan's Ministry of Economic Affairs stated this April that, especially in the field of power hand tools, its output value has turned from negative to positive growth since Q4 last year. The export value in Q1 this year was USD 171 million, an annual increase of 5.2%, ending two consecutive years of negative growth. As such, the Ministry is optimistic that this industry could regain growth momentum this year.

In terms of import value (Figure 2), it has fluctuated sharply in the past five years, peaking at USD85.66 million in 2021, an increase of 41.0% over 2019, but then has declined sharply for two consecutive years, down 28.9% over 2023, going back to the 2019 level. The import value in H1 2024 was USD34,352,111, reaching 56.4% of the 2023 level, most of which came from China and Vietnam. By this value accumulation, the import value in the 12 months of 2024 could reach around USD68.7 million. From here we can tell that Taiwan’s normal demand for overseas hand tools is at around USD60 million, and that a demand gap caused by extreme circumstances like the pandemic triggers a shortterm large-scale imports.

The import and export graphs signify that Taiwanese hand tools are export-oriented. The central region of Taiwan has the most complete supplier cluster in the world, and therefore the export value can resist decline and even grow against it in extreme economic environments, returning to normal levels when extreme conditions subside. Taiwanese hand tool industry has proven its resilience with actual data which shows that it stays steady amid shocks.

Despite sitting on solid ground, Taiwanese hand tool industry has sounded an alarm in the face of CBAM which will put another test on Taiwan hand tools in finding whether they have the resilience to hold steady.

There are more than 2,000 hand tool manufacturers in Taiwan, more than 90% of which are exporters, making Taiwan the third largest exporter of hand tools in the world. The impact of CBAM has not reached the hand tool industry, but since hand tools use a large number of steel materials with high carbon emissions, Taiwanese hand tool manufacturers have presumed they will be very likely to be levied carbon taxes in the future. They are paying close attention to the latest developments of EU CBAM. (For details, read the article【CBAM Frontline】Roundup: Countermeasures for the CBAM Adjustment Period included in this magazine). Taiwan's Ministry of Environment stated in September that it will assign a dedicated person to be stationed in the EU early next year to keep abreast of the latest developments in CBAM and participate in negotiations. On the other hand, Taiwanese government’s regulations on levying carbon fees on domestic businesses will be demystified by the end of this year, and there is also a plan to launch cap and trade within four years.

Taiwan's Ministry of Environment announced three sublaws on carbon fees at the end of August, including "Carbon Fee Charging Measures", "Autonomous Reduction Plan Management Measures", and "Specified Greenhouse Gas Reduction Targets for Carbon Fee Collection Targets". The rate of the carbon fees will be reviewed and announced by yearend. The sub-laws will take effect on January 1, 2025,

country of origin, it can be deducted by submitting documents of proof. The detailed regulations for the deduction will not be known until mid-2025 when details on deducting carbon pricing paid by third countries as well as accommodating differences between EU ETS free allocation and CBAM are announced.

An industry research and market strategy analyst said the Ministry of Environment does not provide 100% exemption for Taiwanese companies from the beginning. Instead, it gradually increases carbon fees by letting companies use coefficient values (in other words, discounts) of 0.2, 0.4, and 0.6 in three respective phases, which gives companies a strong incentive to reduce carbon emissions. Judging from this, the most stringent and fraud-proof carbon pricing policy in the world, which puts the larg pressure on companies.

According to Taiwan's "Carbon Fee Charging Measures", the targets are manufacturing industries with carbon emissions exceeding 25,000 tons. about 150 million tons of carbon emissions in Taiwan will be charged carbon fees. We can take a glimpse at the impact of carbon fee costs on companies by checking out the size of fees that could be levied on some major Taiwanese companies. The National Federation of Industry (Taiwan) estimates a NTD 1.22 billion fee for Formosa Petrochemical Corporation, NTD 9.5 billion for Taiwan CSC, NTD 5.5 billion for TSMC, and NTD 2.2 billion for TCC Group Holdings (formerly Taiwan Cement Corporation), on a measure of their amount of emissions in

and companies will have to file reports in May 2025 and start paying carbon fees in May 2026. The Carbon Fee Rate Review Committee recommends a tax range of NTD 300 to 500 per ton of carbon which is expected to increase to NTD 1,200 to 1,800 by 2030. The Ministry of Environment has formulated supporting measures such as applicable preferential rates for those who submit independent reduction plans to achieve designated targets, and application for adjusting emission coefficients which is open for high carbon-leaking industries having submitted independent reduction plans. These measures are meant to reduce the impact of carbon fees on industries. If all carbon fee payers can submit independent reduction plans, the Ministry of Environment estimates a reduction of 37 million metric tons of CO2e by 2030, equivalent to 14% of 2005’s emissions.

In addition, the Ministry of Environment reiterated that according to the official text of CBAM announced by the EU on May 17, 2023, Taiwan’s carbon fee is included as one of the effective carbon price forms defined by EU CBAM and it can be deducted. If a product regulated by CBAM is entitled to the free emission quota in the EU, the corresponding emissions will not bear carbon costs; if the carbon fee (including carbon tax, carbon fee, emissions trading) of the product has been paid for in its

2022 and on condition that the rate is NTD 500 per ton without applying preferential rates.

The National Federation of Industry says if the carbon fee exceeds NTD 300, and if a target company fails to meet the designated goals and cannot obtain the discounts regarding

The CEO of the Research Center for Taiwan Economic Development says carbon fee means an increase in production costs. In the future, the costs will reflect on product prices, pushing up inflation. A 2% to 2.5% annual growth rate of Taiwan Consumer Price Index could be the new normal. An employee working in the steel industry did a math. On a calculation basis of NTD 500 per ton of carbon emission, the carbon fee could push up the price of billet steel by as much as 19.5%, which will significantly impact the competitiveness of fasteners and hand tool products made of billet steel. Despite strong resilience of Taiwan's fastener and hand tool exports, owners must beware that the impact of carbon fees on competitiveness could be potentially large. They should explore sources of profit as early as possible to reserve operating and working capital, and start planning carbon-reducing practices.

The Strategic Planning and Promotion Unit of MIRDC (Taiwan) have rounded up and posted carbon-reducing practices of major Taiwanese and overseas hand tool manufacturers. The following section excerpts some of those practices.

◆ Start with equipment:

1. Change air compressors to a variable frequency model, saving up to 60% of electricity consumption.

2. Renew refractory bricks in furnaces to improve heat storage efficiency.

3. Set up solar power generation systems and solar charging stations for use by employees.

4. Install new-generation burners.

◆ Start with manufacturing process:

1. Improve surface coating and metal die-casting processes to reduce natural gas usage.

2. Improve process parameters.

3. 100% recycling of scrap steel, paper, plastic and waste heat.

◆ Start with materials:

1. Use low-carbon emission materials to replace magnesium and high greenhouse-effect gases such as sulfur hexafluoride.

2. Use packaging boxes made from 100% recycled materials.

3. Recycle scrap steel to produce low carbon steel.

◆ Start with supply chain:

1. Increase proportion of domestic procurement to above 95%.

It is only a matter of time before the scope of CBAM expands. The most effective solution is to carry out independent carbon reduction as early as possible to reduce the impact of future increases in carbon costs and product prices.

Copyright owned by Fastener World / Article by Dean Tseng

【CBAM最前線】CBAM磨合期的因應措施總整理

The EU is making adjustments on the go in the abrupt progression of CBAM. Business owners are learning the ropes of CBAM by doing and feeling overwhelmed. CBAM is still a whirlpool with unknown depth, and there could be quite some variables in the modification of the rules. Owners must have ready resources to respond to potential changes in CBAM before it takes full effect in 2026, in order to prevent depletion of workforce and capital.

This article explores the progress of EU CBAM disclosed this September by the overseas press and institutions. It will get you to know what is happening in the adjustment period of CBAM, the external doubts and recommended countermeasures, and help you examine the situation of your own company and the paths you can take in the future.

Since CBAM entered the transitional phase last October, importers have encountered many difficulties when using the designated CBAM interim reporting platform, which delayed the submission of the first report. Therefore, the European Commission extended the deadline for fulfilling CBAM reporting obligations originally scheduled for January 31 this year, and did not punish importers who were unable to submit reports in time due to technical issues.

To resolve the difficulties, the International Chamber of Commerce (ICC) issued an open letter to the European Commission. In addition to requesting to simplify the exchange of information and processes, ICC made three specific requests:

1. That the deadline for submitting reports be extended to the end of 2025.

2. Allowing submitting reports on platforms other than the designated reporting platform.

3. That importers from third countries submit information taking into account carbon emission directly to the CBAM portal, due to the fact that importers found suppliers and operators from third countries are reluctant to share the information.

CBAM has been on trial run for a year and the transitional period is still here to stay. There remains to be a lot of opinions provided by external parties, which may eventually change the details of CBAM. It could be a sudden change and requires more attention.

The Asian Development Bank (ADB) has questioned that the EU carbon tax has only limited effectiveness in improving climate change and has limited economic impact on the Asia-Pacific region. According to the ADB's statistical model in 2024, CBAM can help reduce less than 0.2% of global carbon emissions. In addition, according to the Asian Economic Integration Report (AEIR), CBAM may cause global exports to the EU to decrease by approximately 0.4%, and Asian exports to the EU to decrease by approximately 1.1%.

ADB pointed out that "carbon pricing initiatives can only limit part of carbon leakage. In order to significantly reduce global carbon emissions, carbon pricing initiatives need to be expanded to other regions outside the EU, especially to Asia with a high proportion of carbon-intensive exports towards Europe". Carbon emissions in Asia are growing faster than in other regions. In addition to China and India, manufacturing investment in Southeast Asia has increased significantly in recent years, and therefore there is room for increase in carbon emissions in the future there. In this regard, both Thailand and Vietnam plan to levy carbon taxes in 2025.

When CBAM is expanded to other industries, the free quotas for certain local manufacturers in the EU will also be phased out. However, among EU's import sources for industries subject to CBAM, nearly three-quarters come from EU member states. Take the steel industry for example, among EU’s import sources, the 27 EU countries account for as much as 77.3% (data source: World Bank), China only for 5.2%, India for 2.6%, UK for 2.5%, and the U.S. for 1.2%. This means that phasing out the free quotas may lead to increased production costs in EU member states.

If the scope of CBAM is not expanded to cover carbon emissions from downstream industries, CBAM at the current stage may disproportionately harm the competitiveness of EU manufacturers. ADB points out that CBAM may help combat carbon leakage as a result of the EU emissions trading system by bringing manufacturing back to the EU, but CBAM may cause EU downstream manufacturers to move part of their production outside the EU, and in turn increase carbon leakage.

EU is one of the world's largest producers of automobiles and machinery. CBAM and the gradual phasing-out of free quotas will lead to an increase in steel prices, which may have a major impact on production costs and exports of the automotive, machinery and other industries, thereby undermining the competitiveness of EU manufacturers.

It is already known to everyone that carbon tax will become a new massive expenditure in global trade, with a huge financial impact. While the financial impact of CBAM is expected to become visible by 2026, it is critical to prepare right now. Thomson Reuters recommends that future potential legal and financial risks can be mitigated by taking steps in advance, including:

1. Hire dedicated personnel or analytical experts to help your company determine the scope of impact.

2. Deploy your company's global supply chain. Assess and identify affected suppliers and identify those that comply with CBAM regulations.

3. Modify the terms and conditions in supplier contracts to require accurate and timely embedded emissions data for CBAM commodities. Require working with suppliers on data improvement, clearly define suppliers’ responsibility for CBAM compliance, specify which party is responsible for carbon certificate fees, and outline the consequences for non-compliance. Consider adding provisions regarding confidentiality and data storage.

4. Develop CBAM reporting process. Establish processes for collecting and storing embedded emissions data, including who in the supply chain holds this information, who will contact suppliers, and who will work with suppliers.

5. Identify products with lower embodied emissions. Assess and analyze your supply chain to identify additional sourcing options for products that could have lower carbon emissions.

6. Exporters selling to Europe should also take measures. Exporters should proactively identify products that are subject to CBAM and should be reported. They should review the methods used to calculate emissions and ensure that they have methods to collect the necessary data. They should ensure that there is a process for collecting, storing, calculating and sharing the required information.

It is less than a year and three months before CBAM takes full effect. CBAM carbon tax will be one of the largest tax expenditures on the planet. The impact on manufacturing and trading costs is yet to be accurately quantified and assessed. Responding in advance is the best defensive strategy to deploy stop-loss in advance, and the best offensive strategy to win orders in the future.

Copyright owned by Fastener World / Article by Dean Tseng

The Industrial Supply Association (ISA) appointed several industry leaders from distribution, manufacturing and manufacturer representatives to its Board of Directors for the 2024-2025 term. Beginning July 1, the following volunteer leaders are responsible for charting ISA’s strategic direction while overseeing initiatives that drive the advancement of the industry and the association.

ISA 2024-25 Executive Chairs

• Chair: Joyce Lansdale, Vallen USA Vice President of Industrial Sales

• Vice Chair: Keith Mudge, Kennametal Vice President of Sales in the Americas

• Treasurer: Brent Williams, US Tool Group President

• Secretary: Patrick Baliva, Saint-Gobain Abrasives' Executive Sales Director of North America

• Immediate Past Chair: Rob Keenan, Seco Tools President

ISA 2024-25 Directors

• Mike Page, R.S. Hughes Chief Marketing Officer

• Jessica Yurgaitis, Industrial Supply Company CEO

• Jim Biel, BlackHawk Industrial Vice President Product Management

• Bill Davis, Snap-on Industrial Vice President of Industrial Distribution Sales

• Jim Johnson, LineDrive President

• Teresa Wu, 3M Industrial Channel Vice President for United States and Canada's Safety and Industrial Business Group

• Jim Terry, CEO/Owner of P.F. Markey

• Matt Sisco, Safety Products Global Executive Vice President

“This group of leaders brings a fresh perspective and a wealth of experience that will be instrumental in driving our strategic initiatives forward,” ISA CEO Brendan Breen said. “I look forward to working closely with them to foster collaboration, innovation, and growth within our association and the entire industrial supply industry.”

Evergreen Supply Network

The Evergreen Supply Network recognized five distribution members and five manufacturers as 2023 Distributor Members or Preferred Suppliers of the Year. The awards were presented during the Evergreen Conference in San Antonio, TX on Sept. 10.

The 2023 Distributor Members of the Year include:

• Colony Hardware Corp. of Orange, CT (Tier 1)

• Darragh Company of Little Rock, AR (Tier 2)

• Pro Tool & Supply of Waltham, MA (Tier 3)

• Whitehead Hardware Co. – Div. of Miller Hardware of Valdosta, GA (Tier 4)

• Phillips Bros. Supply of Amherst, NY (Tier 5)

The 2023 Preferred Suppliers of the Year include:

• Milwaukee Tool (Tier 1)

• Werner Co. (Tier 2)

• Diamond Products (Tier 3)

• United Abrasives (Tier 4)

• Ergodyne (Tier 5)

Distributors were ranked based on factors such as their contribution to the group, growth, participation and feedback from members and suppliers.

劉鎮東:「馬來西亞必須在2026 年歐盟正式實行CBAM前開始碳定價和徵稅」

Malaysia is about to introduce carbon pricing to promote carbon trading and will explore the imposition of a carbon tax, according to Mr. Liew Chin Tong, Deputy Minister of Investment, Trade and Industry. Liew stressed that the revenue from these initiatives should be used for green investment, especially in the green steel sector. He also said: "Carbon pricing, trading and taxation are key steps in the decarbonization agenda. Malaysia must implement carbon pricing and taxation before the EU's 2026 carbon border tax kicks in." Liew explained that the implementation of CBAM means that steel and other products exported by Malaysia will be taxed by the EU unless Malaysia imposes a similar tax.

英國與歐盟碳邊境調整機制整

British industries are affected by CBAM, especially the steel industry, which exports about 75% of its products to the EU. Corporations have recently expressed dissatisfaction with the significant bureaucratic differences between the EU and the UK. The British CBAM is mainly regarded as a tax system similar to VAT, administered by HM Revenue & Customs and requiring businesses to provide quarterly reports as with VAT. However, the EU CBAM is a customs system managed by national customs authorities and will require local companies to provide annual reports when it comes into force in 2026.

To further complicate matters, the UK decides to include glass and ceramics in its CBAM (building materials are a major source of emissions) due to domestic factors, whereas the EU does not and includes electricity in a slightly separate CBAM regime.

In the early days of Brexit, compliance with the EU's CBAM by UK exporters, with the exception of Northern Ireland, was thought to have no significant impact. This was because the CBAM only applied to the difference in carbon prices between the EU and the exporting countries, and the UK carbon price at the time was close to the EU's, but the situation today is very different. The carbon price difference between the UK and the EU is currently about 30 euros. A recent report by Frontier Economics, an economy analysis company, shows that the difference in carbon prices between the UK and Europe may result in a revenue loss of 3.5 billion to 8 billion pounds for the British treasury between 2025 and 2030.

The most obvious solution is to integrate the UK and EU emissions trading systems (ETS). After all, the UK was part of the EU ETS before Brexit, and the UK-EU Trade and Cooperation Agreement makes it clear that both parties should seriously consider integrating each other's systems.

中鋼協:今年9月中旬鋼鐵企 業鋼材庫存1,565萬噸,環比 上升4.5%

Data from China Iron and Steel Association shows that in midSeptember, the steel inventory level of steelmakers was 15.65 million tons, up 680,000 tons or 4.5% from the previous month; an increase of 3.29 million tons or 26.6% over the beginning of the year.

印度新報告出爐揭示南半球國

The report by the Centre for Science and Environment (CSE) of India estimated that at a rate of €100 (or US $106) per tonne of carbon dioxide equivalent, CBAM would impose an average tax burden of 25% annually over and above the value of CBAM-covered goods exported to the EU by India. The report shared recommendations on how developing countries can proactively take steps to mitigate CBAM's liability, while also transforming their manufacturing sectors to shift towards lowcarbon processes.

In line with their demand for financing, developing countries must have sectoral mitigation plans in place outlining specific measures and targets for emissions reductions in key emitting sectors of their economies, the report suggested. In order to lessen the effects of paying the tax to the EU (or any other nation enforcing a similar mechanism), developing nations should tax their exports domestically and reinvest the proceeds into a decarbonisation fund under government management, the report recommended.

This strategy does not interfere with fair trading conditions with the EU and satisfies the EU's demand for the establishment of a domestic carbon pricing system, in this case, a carbon tax. Additionally, it keeps the money in the developing nation. The report suggested that emerging nations take into consideration varied production techniques for various markets and trade partners as a stopgap strategy. Using green production methods for products going to areas with CBAMs may be a temporary measure while the nation's manufacturing sector progressively becomes less carbon-intensive.

The report said that if climate policies are to permeate trade agreements, climate justice must be at the core of this development. In this light, the report proposed a system where developing countries could impose a ‘historical polluter tax’ on trade partners to fund their own decarbonization efforts. Trade partners who have contributed a specific amount to the total historical CO2 emissions since the pre-industrial era may be subject to this tax.

印度盧迪亞納城扣件業者對財政部長 的信任徹底崩潰

The trust of Ludhiana-based industrialists got shattered as Finance Minister Nirmala Sitharaman did not announce relaxation in the 45-day payment rule for the micro, small and medium enterprises (MSMEs). During the campaigning for the Lok Sabha poll, the industrialists had met Sitharaman, who had promised a rollback of the rule. Further, the Finance Minister’s decision to reduce the Budget of the Ministry of Micro, Small and Medium Enterprises from Rs 23,177 crore to Rs 21,549 crore has taken the industrial hub by surprise.

Badish Jindal, president, Federation of Punjab Small Industries Association, said, “Finance Minister Nirmala Sitharaman didn’t speak a word on Section 43B (45-day payment rule), which she had promised to roll back while campaigning in Ludhiana. MSMEs are feeling cheated throughout India. Instead of announcing subsidies or incentives, the Budget of the Ministry has been reduced. The only saving grace is that one can avail loan up to Rs 20 lakh instead of Rs 10 lakh,” said Jindal.

Gurmeet Kular, chief of the Federation of Industrial and Commercial Undertaking, said the industrialists had appealed to the Finance Minister to review the 45-day payment rule due to the cancellation of contracts by buyers and suppliers who need to pay tax on delayed payments. “This new clause came into effect from April 1. The Finance Minister had promised to review it, but nothing has been done in this regard,” he added.

Even the Fastener Manufacturers’ Association of India is extremely disappointed. Narinder Bhamra, president, Fastener Manufacturers' Association of India, said, “There is nothing much for the MSMEs. They should have taken steps to form a steel regulatory authority, upgradation of credit linked capital subsidy scheme, reduction in import duty on machinery and provisions of social security for taxpayers. There is no fresh subsidy or support in the Budget for the MSMEs. There is no word on withdrawal of Section 43B, which is hurting the MSMEs.” Several schemes such as the Pradhan Mantri Mudra Yojana, credit support to the MSMEs during stress period and credit guarantee scheme for the MSMEs in the manufacturing sector existed only on paper, said Bhamra.

Livermore, CA-based Ebbert Pacific is a manufacturer’s representative agency that connects constructions brands to distributors. The company offers sales and field support to distribution partners in Northern California, Northern Nevada and Hawaii.

“As leaders in American manufacturing of professional and tools, we trust this representation will bring tremendous value to both our organizations and more importantly to our customers,” Wright President and Co-owner Tom Futey said in a September news release.

Founded in 1927, Wright holds three patented technologies: Wright Grip 2.0, Wright Drive 2.0, and Wright Square. The company’s main product categories consist of wrenches, sockets, ratchets and attachments, offering over 4,000 SKUs, including impact sockets.

“We’re excited to provide service, support and safety training to distributors and users on Wright’s product offerings,” Ebbert Pacific President Trevor Ebbert said. “At Ebbert Pacific, we’re passionate about educating the industry, and we believe we can position Wright for success in our markets.”

Metalworking and MRO supplies distributor MSC Industrial Supply appointed Martina McIsaac to President and Chief Operating Officer, effective Sept. 23. McIsaac previously served as Executive VP and COO for MSC.

“Over the past two years, Martina has made significant improvements to our internal and external operations,” MSC CEO Erik Gershwind said in a Sept. 24 news release. “She has elevated the customer experience by improving service levels, executed strategic initiatives across our Supply Chain and further improved our working capital efficiencies. Over this time, she has shown an ability to execute large, complex initiatives to guide the business to be more focused operationally and strategically.”

In her new role, McIsaac will oversee daily operations, which include — sales, marketing, solutions, supply chain management, category management, supplier relations, sustainability and information technology.

“This move tightens the connection and improves our ability to capture synergies between our technology functions and the operations of our business,” Gershwind added. “It also allows me to put greater focus on our long-term strategic direction and cultivating the next generation of MSC’s competitive advantage, business development, and talent development.”

McIsaac joined the company in October 2022 after nine years at Hilti Corporation, where she served as Regional Head and CEO. She also held various roles at Avery Dennison in sales, marketing and operations across Mexico, Argentina, Chile, Canada and the U.S. before becoming VP and General Manager of the Performance Polymers Division.

MRO and other industrial supplies distributor Grainger reported its Q2 2024 financial results on Aug. 1, showing a continued deceleration in year-over-year sales growth and a lowered full-year outlook.

Chicago-based Grainger posted Q2 total sales of US$4.312 billion, up 3.1% year-over-year, with daily, organic sales up 5.1%.

Grainger's Q2 2024 gross margin was 39.3%, which was flat compared to the second quarter of 2023 and flat from Q1 2024. The company’s Q2 2024 operating profit of US$649 million was down 1.8% year-over-year, with an operating margin of 15.1%, down 70 basis points year-over-year. Grainger had a Q2 2024 net profit of US$490 million — flat compared to a year earlier.

Acme Tools 領導人

Daniel Kuhlman 去世,

Acme Tools executive

Daniel Kuhlman, who served as President of the tools and equipment distributor for over 50 years, died on Sept. 9. He was 82.

In 1962, Kuhlman joined his father at Acme Electric and expanded the family-owned company into tool sales across the Upper Midwest. Kuhlman continued to expand operations into North Dakota, adding stores in Bismarck, Fargo, Minot and Williston.

The Tool Crib of the North Branch was created by Kuhlman and used to launch the company’s first eCommerce website in 1999 — sold the same year to Amazon. In 2010, he invested in new eCommerce technology and re-launched as AcmeTool.com.

Additionally, Kuhlman founded Acme Rents in 1995 and later established Acme Equipment in 2013. He also contributed to the advisory board of Stanley Black & Decker, among other tool and equipment manufacturers. The company celebrated its 75th anniversary in 2023.

印度Sundram Fasteners奪下400億盧比電動車訂單

Sundram Fasteners Ltd, a leading auto parts manufacturer, is experiencing significant growth in its electric vehicle order book. The company currently holds around 4,000 crore worth of EV orders, with more contracts in the pipeline. Despite some challenges, the transition to EV technology in India is accelerating, fueled by government subsidies, increased awareness, and more frequent product launches across various categories. Consequently, Sundram Fasteners has seen a robust inflow of orders for EV parts.

The Chennai-headquartered company supplies components such as fasteners, hot-forged machine parts like bevel gears and pinions, battery coolant caps, and various types of shafts to OEMs in the EV sector. Additionally, it is developing an electric water pump. The current 4,000-crore order book is to be fulfilled over the next 5-6 years. The order book is expected to grow as Sundram Fasteners negotiates with several customers for new EV orders.

Atlas Copco, through Atlas Copco Construction Mining Technique USA LLC, has acquired Pneumatic Holdings Inc., a U.S. provider of pneumatic light construction tools. Pneumatic Holdings, based in Santa Fe Springs, CA, provides tools including paving breakers, chipping hammers, rivet busters and rock drills. The company has 16 employees and had 2012 sales of US$10.8 million. Its main customer segments consist of contractors and rental companies within the construction industry.

Ingersoll Rand completed its previously announced acquisition of ILC Dover for USD 2.325 billion, and acquired three other manufacturers for about USD150 million combined.

The acquisition of ILC will expand Ingersoll Rand’s addressable market to a total of approximately USD65 billion in highly fragmented market segments with “significant and sustainable growth opportunities,” company officials said.

The Bossard Group has signed an agreement to acquire the French Aero Negoce International Group (ANI).

Aero Negoce International SAS, headquartered in Béziers, France, employs 33 people and expects net sales of around EUR 25 million for the current financial year. ANI is a leading French distributor of fastening solutions and provider of logistics services in the aerospace industry. The company also has locations in the USA and Malaysia. Through the contemplated acquisition, Bossard will significantly expand its market presence in the strategically important aerospace industry and in France. In combination with Boysen (now Bossard Aerospace Germany), acquired in 2019, Bossard would become a leading distributor of fastening systems and provider of logistics services in the European aerospace industry.

“The intended acquisition of Aero Negoce International SAS is an important step to accelerate our growth strategy in the aerospace industry and strengthens our strategic presence in the Aerospace Valley in France. In addition, we see great market opportunities in the cooperation with Bossard Aerospace Germany, which will further strengthen our position in the European aerospace industry,” says Daniel Bossard, CEO of the Bossard Group. “We are thrilled about this transaction. The Bossard Group's backing will provide Aero Negoce International SAS with a great opportunity to continue its growth trajectory while preserving the service-oriented ethos that has defined our family business since its inception,” said Patrick and Nathalie Bianchini, who led the company in the second generation.

The closing of the transaction is expected within 2024 and is subject to the approval of the regulatory authorities and other customary closing conditions. The acquisition will be financed through the use of existing credit facilities.

Steelmasters Group is a leading Australasian supplier and manufacturer of industrial and speciality fasteners through its network of 12 branches (four in New Zealand and eight in Australia) with its head office in Auckland, New Zealand. Coventry Group Ltd announced the completion of the acquisition of SteelMasters Auckland Limited for AUD42.1 million on May 1. The acquisition will:

• Increase Coventry Group’s customer base and industry exposure;

• Broaden the trade distribution segment's scale and reach through an additional 12 locations (8 in Australia and 4 in New Zealand);

• Expand the specialized fastener product range and add manufacturing capability.

Coventry Group will operate Steelmasters Group as a separate division of trade distribution to minimize integration risk and the division will continue to be run by Steelmasters Group’s existing management team.

機器人專用新型衝擊扳手

Panasonic will launch the Robotic Impact, an impact wrench for collaborative robots that supports assembly work in factories, in Dec. 2024.

In recent years, the manufacturing industry has to respond to changes in the business environment. Among them include “labor shortages,” “carbon neutrality,” and “energy and material shortages.” The labor shortage problem is particularly serious. Mainly, hiring new personnel is not only expensive, but even after hiring, it takes time and resources from existing employees to train them and make them fully capable.

With this background, along with deregulation and technological innovation progressing in recent years, an increasing number of companies are introducing collaborative robots that do not require safety fences and can work in the same space as humans. As the population continues to age and the birthrate falls, the number of veteran workers decreases and inexperienced workers increases. Accordingly, this market is expected to continue growing as it can address issues such as technology transfer, stable production, and production quality that arise from this.

Product Features:

1. Low reaction force and high output, connectivity to small collaborative robots;

2. Fastening work data (torque value, waveform, work time, etc.) can be recorded wirelessly;

3. Various work assistance functions such as “bolt galling detection” can be set by wireless communication control.

20V MAX* XR® 3/4 in. and 1/2 in. High Torque Impact Wrenches

For tough jobs demanding power, DEWALT introduces its highest-rated max torque impact wrenches: the new 20V MAX* XR® 3/4 in. High Torque Impact Wrench (DCF964) and 20V MAX* XR® 1/2 in. (DCF961) High Torque Impact Wrench with expanded capabilities. To maximize jobsite productivity, the new DCF964 provides up to 102% more torque for use in tough applications and is the industry’s highest rated max torque cordless 3/4 in. impact wrench.

For heavy duty 1/2 in. fastening applications, the DCF961 provides users with even more performance with up to 28% more torque when paired with the XR POWERSTACK™ Oil-Resistant 5 Ah Battery and is the industry’s highest rated max torque cordless 1/2 in. impact wrench.

Both tools feature a glass-filled nylon housing to help protect against oils and solvents. Other features include PRECISION WRENCH™ mode, which helps prevent overtightening and fastener run-off, and a four-mode push button switch to easily change speeds and LED brightness.

20V MAX* XR® 1/4 in. Quiet Hydraulic Impact Driver

The new 20V MAX* XR® 1/4 in. Quiet Hydraulic Impact Driver (DCF870) is DEWALT’s quietest impact driver as well as the industry’s highest rated max torque hydraulic impact driver designed for noise-sensitive environments. Ideal for framing, cabinetry, and other applications in tight areas, the impact driver delivers up to 40% faster driving with consistent performance in demanding applications and cold temperatures. The tool also features nine built-in LEDs and a 20-minute work light mode to help illuminate dark workspaces.

多花鍵螺絲拔出器

Snap-on® Mutispline Screw Extractors, now in a 13-piece set, are designed to remove damaged or broken screws effectively. The American-made set is compatible with wrenches, ratchets, and pliers, and its compact design eases application in tight spaces. Crafted from special alloy steel, the REX13C Set ensures exceptional strength and long-lasting thread life, making it the go-to solution for automotive technicians. The left-hand threads provide superior gripping power, enabling the removal of damaged screws with ease. To further enhance usability, each extractor is stamped with markings for easy identification, streamlining application.

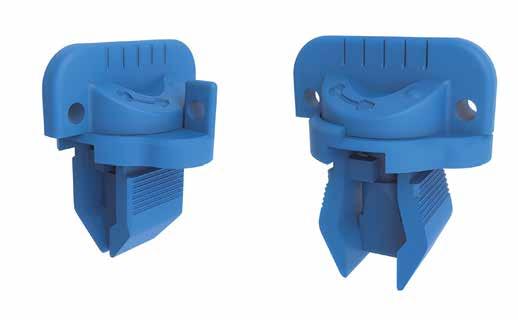

The plastic quarter turn panel fastener by Euro Locks is manufactured from high strength PA6 GF15 V0 material, making it corrosion and fire resistant to level V0.

The ergonomic design allows for easy installation and removal of cover panels without the use of additional tools, making it the perfect fastener for rack and data cabinets, or any enclosure in the power industry where a durable fastener with a high V0 fire resistance level is required.

Fixtureworks has augmented its One-Touch Fastener lineup with the addition of a heavy-duty version of the retractable clamping/knob locking fastener. The heavy-duty version provides a high clamping force up to 450 lb. (2000N) and a holding force up to ll20 lb. (5000N). These heavy-duty retractable fasteners provide positive locking in quick change applications where there is frequent insertion and removal of a fixture.

The retractable pin feature allows the fastener to safely slide off from the base without interference, making it ideal for slide and door applications. The new fasteners will not release until the knob is turned to the “OFF” position, allowing the balls to retract into the shank and allowing the shank to be raised out of the way of the base plate for no interference.

Compiled by Fastener World

Fastener Import Statistics

Let’s dive in the changes in demand for fasteners imported by the EU from around the world in the past six years (Figure 1). The trends in import value and import weight are similar. After hitting the bottom in 2020, the import value rebounded by 71.3%

* Target Products:

HS code 7318 - Iron and steel screws, bolts, nuts, washers, etc.

820411 - Non-adjustable manual wrenches, wrenches and parts

820412 - Adjustable manual wrenches, wrenches and parts

820420 - Interchangeable wrench sockets with or without handles

820540 - Screwdrivers

820790 - Other interchangeable tools

The following tables are in descending order by weight in 2023. to a peak of 8.05 billion euros in 2022. It went downward by 18.9% in 2023 to 6.52 billion euros, and approached the prepandemic level in 2019 (5.42 billion euros). It can be seen that the EU 's fastener import demand reversed downwards after 2022 and was returning sharply to normal levels. The drop margin in 2023 was close to half of the growth rate ranging from 2020 to 2022, so we can speculate that the import demand may completely return to normal levels starting from the end of 2024 to the first half of 2025.

Narrowing the scope to the past three years, let’s look at EU's top ten fastener import sources ( Table 1). The top five sources were China, Taiwan, Turkey, India, and Vietnam. China and Taiwan remain each other's main rivals in the European market. Interestingly, as the global visibility and importance of the South Asian and Southeast Asian markets have greatly increased since last year, India and Vietnam are among the top five in the rankings, and Thailand is the sixth. These three countries are currently highly potential markets for fastener investment.

It should be noted that Figure 2 shows EU's demand for fasteners from Taiwan and China declined significantly in 2023 , and its demand for Vietnam, India and Turkey also declined, but the demand for Thailand steadily increased.

Changes in EU's global exports of fasteners in the past six years (Figure 3) show that export value and export weight have divergent trends. After hitting the bottom in 2020, the export value rebounded to a peak of 5.57 billion euros in 2023, up 29.0%, far exceeding the level in 2019 before the pandemic (4.75 billion euros). It is worth noting whether EU's fastener export value will reach a new high in 2024. The export weight continues to swing between the 5.6 billion and 6.5 billion euro mark. Overall, the changes are not significant, and it is not much affected by dramatic changes such as the pandemic.

As shown in Table 2, EU's top ten fastener export destinations in the past three years were the U.S., China, UK, Mexico, and Turkey. The U.S., China and UK were the primary competitors for each other in the European market. Besides exporting to advanced countries, quite a portion of EU fasteners were also exported to emerging countries such as Mexico, Turkey, Brazil, and India.

Table 2. EU’s Fastener Export Value and Weight in the Past 3 Years (By Country)

Figure 4 shows the weight of fasteners exported by the EU to the U.S., China, UK, Switzerland, Brazil, and Norway all decreased in 2023. On the contrary, a relatively larger increase for three consecutive years existed in the weight of exports to Mexico and Turkey, and a relatively smaller increase for three consecutive years existed in the weight of exports to India and Morocco.

Comparing EU's fastener import and export values in the past six years (Figure 5), it is not hard to find that EU fasteners are mostly import-oriented. The import and export values both bottomed out in 2020, but the difference is that the import value rose sharply through to 2022 and peaked in that year before trending downward in 2023, while the export value rose steadily and relatively slightly after hitting the bottom and then continued hitting highs through 2023.

Figure 6 shows EU's fastening tool imports bottomed out in 2020, rose to a new high in 2022, and returned to the level close to 2019 in 2023. From 2020 to 2022, the import value increased by as much as 47.2%, and the import weight increased by 25.7%. In 2023, the import value dropped by as much as 18.8%, and the import weight drop dropped by 18.3%. Both the import value and weight returned to normal levels in 2023. The next statistical results released by the EU for 2024 will be the key to determining whether the EU's future demand for global fastening tools will trend up or down.

Figure 7 shows both export value and weight bottomed out in 2020. The difference is that the export value continued to grow to a peak in 2023, while the export weight peaked in 2021 and then declined through 2023. Overall, the export value was on the rise and the export weight was in a decline.

Fastening Tool Import and Export Weight (Kg) in the Past Three Years (By Country) Table 3. HS Code 820411 - Non-adjustable Manual Wrenches, Wrenches and Parts

Table 5. HS Code 820420 - Interchangeable Wrench Sockets With

Table 6. HS Code 820540 - Screwdrivers

Onto Table 3 to Table 7, in 2023, the EU's fastening tool imports were highly dependent on China and Taiwan. Particularly the demand for China was much higher than for Taiwan. Interestingly, the EU also had quite a lot of demand for fasteners from emerging countries such as India and Turkey. In the same year, the main export destinations for EU fastening tools were the U.S. and UK.

Figure 8 shows EU fastening tools are mostly import-oriented. Both the import and export values bottomed out in 2020. The import value rose sharply in 2022 and peaked before trending in 2023. The export value rose steadily after

hitting the bottom and continued to hit highs through 2023. This trend is very similar to fasteners as shown in Figure 5, which verifies high correlation of trade performance between EU fastening tools and fasteners.

Copyright owned by Fastener World / Article by Dean Tseng

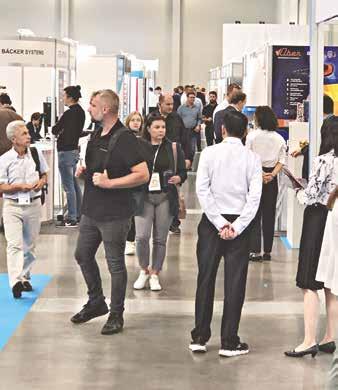

美國拉斯維加斯螺絲暨機械設備展

International Fastener Expo (IFE), a B2B trade show in the North American market for manufacturers of fasteners, machinery, tooling and peripheral fastening products, took place on September 10-11, 2024, at the Mandalay Bay Convention Center Halls B & C.

More than 600 booths from 35 countries/regions (including the United States, Belgium, Brazil, Canada, China, Germany, India, Indonesia, Hong Kong, Italy, Japan, South Korea, Malaysia, Mexico, Spain, Taiwan, Thailand, Turkey, the UAE, and Vietnam) came to exhibit a wide range of standard/customized products and services for industrial fastening applications on-site (about 380 international exhibitors), and seize the opportunity to secure sales orders, increase brand awareness and explore more opportunities for cooperation.

Fastener World, the organizer’s exclusive sales agent in Taiwan, also brought 60 exhibitors to exhibit this year, including Chin Lih Hsing, Tone Dar Seen, Kwantex, Chu Wu, Gain Den, Chite, L & W, J. T. Fasteners, Kelly International, Fang Sheng, Mols, Special Rivets, A-Stainless, Excel Components, TIFI, Chirek, Wei I, Rexlen, Bi-Mirth, Taiwan Shan Yin, Aimreach, Taiwan Precision, Katsuhana, Screwtech, Luna's Light, Shiang Ging, J.C. Grand, Link Upon, Dragon Iron, E Chain, Hu Pao, Ji Li Deng, Dicha, Spec Products, Wattson, Dar Yu, Gofast, Meteck, Jungshen, Soon Port, Standing Industrial, Professional Fasteners Development, Apex, Feng Yi, Huang Jing, Shaw Guang, Pingood, Sintec, Mao Chuan, Shyang Sheng, King Point, Linkwell, Ray Fu, U-Ween, J Mo, Ie Perng, KOT, Kenlon, Orimetal, Shin Guang Yin, Locksure, Jeng Yuh, Label One, Vertigo, and Konfu. Taiwanese exhibitors also formed one of the major international pavilions this year, along with the others from India and China.

The show attracted executive management, sales and marketing and purchasing representatives from fastener distributors and manufacturers, mostly from industrial, construction, automotive, assembly production and aerospace applications.

In order to promote industry exchanges and market opportunities, the organizer also invited industry professionals to hold a number of industry seminars. These included 9 presentations on topics such as AI, technology trends, fastener finishes, applications and marketing, 4 fireside chats and 2 workshops (now available for online listening on the show’s official website). IFE Show Director Morgan Wilson said in an interview: “We had a great golf tournament and a welcome party the day before the show, and the first day of the show went very well! Not only did we have a number of region and industry-specific networking events that everyone could not miss, bringing together professionals from aerospace, automotive and a variety of other industries, but we also had a Espresso Bar offering free coffee. There were also the annual Hall of Fame and Young Fastener Professional Awards, as well as new marketing workshops. We are thrilled with this year’s success and look forward to raising the bar even higher for next year.”

According to a market research report, the U.S. remains one of the world's largest importers of fasteners. The U.S. market is expected to show a similar growth trend, given the high demand for automation, aerospace and other related industrial applications in the global market. In addition, due to the rising demand for lightweight vehicles and aircraft, many companies are moving away from standard fasteners to customized products, which will stimulate further growth and expansion of the U.S. market for related fasteners. At a time when the U.S. continues to impose a tariff of at least 25% on Chinese fasteners, Taiwan's high-quality fasteners exported to the U.S. without being affected by anti-dumping duties are bound to show a relatively competitive advantage in the eyes of U.S. buyers.

“Through participating at this show, we not only met with our existing customers to understand the current local market situation, but also promoted our main products to some unfamiliar customers. Under the influence of the global economic downturn, the most important thing that our customers are concerned about in terms of procurement is not only the competitive price, but also whether the delivery time can meet their demand. Thanks to Fastener World's assistance, our two-day show could go smoothly,” said Ms. Peggy Chang, who exhibited on behalf of J. T. Fasteners at the show. However, there are a few short-term phenomena in the U.S. market that we should pay special attention to. “I observed that the inventory level of U.S. customers is still high,” said General Manager Bill Wang of Hu Pao Industries, also an exhibitor this year. Taiwan exported about 640,000 tons of fasteners to the world in the first half of this year, of which nearly 300,000 tons (47.1%) were exported to the U.S., an increase of 1.77% over the same period last year. The top exported fasteners included Other Screws, Bolts (73181590), Nuts (73181600), Self-tapping Screws (73181400), and Wood screws (73181200). Manufacturers who are interested in expanding into the U.S. market are advised to develop more customers for these products.

The organizer announced that the next show will be held on September 15-17, 2025 at Mandalay Bay Convention Center Halls E & F. Interested exhibitors are invited to reserve their booths by contacting the sales department of Fastener World, the exclusive sales associates of the show in Taiwan (Email: foreign@fastener-world.com.tw)

墨西哥瓜達拉哈拉螺絲展

Fastener Fair Mexico, which was relocated to be held the year before last in Guadalajara, a major commercial city in Mexico, was held in conjunction with Expo Nacional Ferretera at Expo Guadalajara from September 5 to 7 this year. About 80 exhibitors registered to participate in the event, and most of them came from China, in addition to a few exhibitors from Mexico and Taiwan. With a total floorplan of 3,000 sq. m, this show was regarded as a more professional exhibition platform for fasteners and hardware products in Latin America and a channel to promote communication and exchange with local buyers.

Copyright owned by Fastener World

Article by Gang Hao Chang, Vice Editor-in-Chief

The exhibitors this year mainly showcased fastening products for automotive, construction & engineering, hardware products, energy-related and mechanical metal processing applications. Fastener World, the show’s exclusive stand sales agent in Taiwan, led six Taiwanese fastener manufacturers, namely Hurmg Yieh Machinery, Kay Tai, Konfu, L&W, Spec Products, and Chi Ning, to exhibit a variety of high value-added and cost-effective products and services, and meet faceto-face with buyers from Mexico and neighboring Spanish-speaking countries. However, perhaps due to the indirect impact of external unfavorable factors such as global political and economic changes or the periodic industrial demand adjustments within the region, the 3-day exhibition attracted about 2,000 visitors according to the show organizer’s statistics. There is still a lot of room for growth in the number of visitors compared to the original expectation.

According to the on-site observation of Fastener World's staff, the visitors coming to Fastener World's booth this year mainly inquired about automotive and construction fasteners, and preferred collaborating with suppliers who have already established a deep-rooted presence in the Latin American markets. In addition, since Spanish is the main medium of communication among local manufacturers, those who are interested in entering the local markets should pay special attention to the availability of professionals who can communicate in Spanish.

In the section on import duty rates, in order to curb unfair competition from countries/regions that do not have a free trade agreement with Mexico, on April 22, 2024, the Mexican federal government announced another revision of the duty rates on specific product items, including fasteners. Originally, the ad valorem duty rate of the involved fasteners (falling within HS codes 7318.11.01 / 7318.12.91 / 7318.13.01 / 7318.14.01 / 7318.15.04 / 7318.15.99 / 7318.16.06 / 7318.19.99

was 25% per kilogram. Starting from April 23, 2024 to April 23, 2026, the rate will be temporarily adjusted to 35%.

The organizer has also announced that the next edition will be held on September 4-6, 2025 at the same venue. For more information about this show or if you are interested in exploring the American market, please contact the sales dept. of Fastener World, the show’s exclusive sales agent in Taiwan (Email: foreign@fastenerworld. com.tw) for more information.

Fastener Poland, the annual professional event for the fastener industry in Central and Eastern Europe, was held at Expo Krakow on Sep. 25-26. More than 140 exhibitors from Poland, Germany, Italy, China, the Czech Rep., Taiwan, the UK, Turkey, Pakistan, Malta, the U.S., the UAE, Denmark, and India registered for the show, with Taiwan and China being the largest overseas pavilions of the show. The exhibits included industrial fasteners and fixings, building fasteners, assembly and installation systems, fastener manufacturing technology, storage and distribution equipment, and related services.

Krakow, once the capital of Poland, has played an important role in Poland's history and is now one of the country's major business, culture and science centers. Poland's proximity to Ukraine, Germany, the Czech Rep., Slovakia, Belarus, and Lithuania makes it a key hub for trade among countries in Central and Eastern Europe. Coupled with the rapid economic development and GDP growth of Central and Eastern European countries in recent years, the demand for construction and automotive fasteners continues to increase. In the first 8 months of 2024, Poland ranked as Taiwan's 9th largest fastener export partner. Taiwan exported nearly 20,000 metric tons of fasteners to Poland, showing a significant increase of 31.69% over the same period of last year. Poland also had the highest YoY increase among Taiwan's top 10 fastener export partners.

Optimistic about the future economic development of the Central and Eastern European market, Fastener World also led nearly 30 Taiwanese exhibitors to exhibit and exchange with local buyers face-to-face this year, including De Hui, Gold Head, Ie Perng, Lin-Yu, Loyal & Birch, Ray Fu, Shiang Ging, SPEC, Sprout Tooling, Taiwan Precision Fastener, TIFI, Wa Tai, Yuding, Yeswin, Joker, Jiele, Homn Reen, Hoplite, Konfu, Mao Chuan, Riu Fastener, San Yung, Tai Huei, Chite, and Chen Tai. On the first day of the show, many local buyers from Poland came to look for potential exhibiting suppliers. As there were many exhibitors from Taiwan and China this year, it was also more convenient for local buyers wanting to purchase high quality or competitively priced fasteners or even machinery & equipment from Asia.

On the first day of the show, the organizer also invited several industry experts to give speeches on market trends.

Although this show is relatively a regional exhibition for the Central & East European market, Fastener World's on-site staff also met visitors from Iceland, the UAE, the UK, and even Ukraine coming to inquire about specific customized products, in addition to inquiries from local buyers. A few Taiwanese exhibitors told Fastener World that they had heard that the Polish market is a new star in the Central and Eastern European market, so in addition to exchanging ideas with local buyers during the show, they also arranged to meet with a few local manufacturers after the show in the hope of bringing more orders back to Taiwan through this business trip. Timo Scholle, Managing Director of Achilles Seibert, a famous fastener importer from Germany, who also participated in this year's show, told Fastener World that it was their first time to participate in Fastener Poland and they hoped to know more about the Polish market and expect more cooperation opportunities.

The organizer has announced that the next edition will be held on Oct. 15-16 at the same venue. For more details about the show, please stay tuned for the latest info at www. fastener-world.com.

Metalex Vietnam is an annual exhibition for precision engineering and manufacturing professionals on metal processing and related equipment applications, and is the more representative exhibition for precision machinery, metal tools and equipment in the South Vietnam region, which was held from October 2 to 4 at S.E.C.C. in Ho Chi Minh City. The theme of the show this year was “FROM LINES TO CYCLE - BUIDLING A CARBON NEUTRAL MANUFACTURING LEGACY”, hoping to offer a one-stop destination for all world-class technology providers and local industrialists to exchange breakthrough ideas and business know-how.

The show this year had a total of 188 exhibitors from 14 countries/regions including Vietnam, China, Japan, Germany, Taiwan, South Korea, Italy, Afghanistan, Hong Kong, India, Malaysia, Singapore, Thailand, and USA. Vietnam, China, Japan and Germany were the major groups of exhibitors. The products on display were mostly about sheet metal working, precision engineering, molds and dies, automation, machine centers, robotic, metrology & testing device, pumps and valves, raw materials handling & storage, welding, surface treatment,

painting, chemical, packaging, hand tools, safety equipment, software systems, wires and tubes, jigs, and so on.

The show this year presented lots of latest high-tech precision engineering and machining technologies, attracting many relevant professionals. According to the observation of our staff on-site, who interacted with some visitors during the 3-day exhibition, this year's visitors were mostly importers and manufacturers from the field of precision metal processing parts, engineering fastening components, and machine tools, whose demand for these products mainly focused on satisfying the local manufacturing industry of Vietnam. Fastener World’s booth was also visited by the purchasing representatives of some leading fastener-related companies such as Böllhoff.

According to statistics, Vietnam relies on imports for more than 70% of its machinery and equipment, and is now the world's 8th largest importer of machine tools. Benefiting from the growth of Vietnam's automobile/ motorcycle and consumer electronics manufacturing industries, Vietnam is also a very important export partner for Taiwan's machine tools. Vietnam Association of Mechanical Industries (VAMI) estimates that, from 2019 to 2030 the market demand for machinery will reach about US$310 billion.

The organizer has not yet announced the date and venue for the next edition. For more information, please stay tuned to Fastener World’s website at www.fastener-world.com.

Copyright owned by Fastener World Article by Gang Hao Chang, Vice

Editor-in-Chief

Source: ITC

Africa is one of the fastest growing economies in the world, with an economic growth rate above the global average in recent years. In order to facilitate economic development, African countries have been actively building a friendly investment environment to attract foreign investment to accelerate development and transformation, and the scale of middle-class consumption has been expanding. In addition, the African Continental Free Trade Area (AfCFTA) has come into effect since 2021, and so far 90% of the product tariffs have been reduced, and more countries will try to implement tariff-free trade from 2023 onwards, which will accelerate the integration of the region. Africa is also actively developing manufacturing and exporting value-added products to reduce reliance on raw material exports and imports of large quantities of finished products. Africa's integration and transformation is definitely one of the potential business opportunities for Taiwanese manufacturers; since tool products have long been Taiwan's export advantage and an important foreign exchange earning category, this article will analyze the development of the fastening tool industry in South Africa, Morocco, Algeria, and offers advice to the industry.

a. Import

Table 1 shows the trend of Africa's fastening tools import from 2019 to 2023. US$236 million fastening tools were imported into Africa in 2023 and the top three importing countries were South Africa (US$36.228 million), Morocco (US$24.345 million), and Algeria (US$23.182 million). Senegal and Congo, respectivety in the seventh and nineth places in terms of import value, had respective compound growth rates (CAGR) of 50.1% and 42.7%, which are countries with potential demand for fastening tools. Africa's share of fastening tools imports in the world is low (only 2.9%), but its compound growth rate of 4.6% in the past five years is still higher than the global 2.5%.

Table 2 shows the trend of Africa's fastening tools exports from 2019 to 2023. Africa's exports of fastening tools amounted to about US$27.342 million, with a CAGR of about 7.1% over the past five years, higher than the global rate of 3.9%; the top three exporting countries of fastening tools in 2023 were South Africa (US$16.788 million), Egypt (US$3.46 million), and Burkina Faso (US$1.413 million), among which South Africa's exports accounted for more than 60% of the total, and the CAGRs of Egypt and Togo over the past five years were also quite impressive. Overall, Africa's fastening tools export value and share are still low, accounting for only 0.34% of the global export.

Table 3 shows the trend of Taiwan's fastening tools export to Africa from 2019 to 2023; in recent years, Taiwan's fastening tools export to Africa have been mainly exported to South Africa, Algeria and Libya, with South Africa's share reaching 48.7% (NT$108 million). However, the CAGRs of the top three export destinations in the past five years have all declined slightly, indicating that Taiwan's fastening tools exports have been affected by the competing countries, which is a warning on Taiwan's competitive edge in product exports.

Table 4 shows the trend of South Africa's import of fastening tools from 2019 to 2023. South Africa imported US$36.228 million worth of fastening tools from the world in 2023, and the CAGR of import in the last five years was about -2.1%. The top three sources of imports were China (US$13.022 million), Taiwan (US$7.761 million) and Germany (US$3.144 million). The top 10 import origins have accounted for 86.3% of South Africa's fastening tools import; Taiwan is the second largest source of South Africa's fastening tools imports, with a CAGR of -0.2% in the past five years, indicating that Taiwan's fastening tools advantage in South Africa is still stable, and that China is the main competitor against Taiwan in South Africa's fastening tools market.

Table 5 shows the types and amounts of fastening tools imported by South Africa from 2019 to 2023. The types and amounts of fastening tools imported by South Africa from the world in 2023 are shown as follows: Other Interchangeable Tools (US$13.192 million) and Non-adjustable Hand-operated Wrenches (US$9.726 million). These two products accounted for more than 60%; the products with a positive CAGR were hand-operated wrenches and spanners. South Africa's demand in the short term should remain in the category of interchangeable fastening tools.

South Africa's fastening tool related industries include: automobile maintenance & repair industry, medical materials, etc.; of which the automobile maintenance & repair industry shows business opportunities for fasteners and fastening tools. In addition, the South African government-led special economic zone program also strengthened investment in the metal manufacturing industry and hardware tools for the civil construction industry, which is a business opportunity for Taiwanese manufacturers to focus on.

Table 6 shows the trend of imported fastening tools in Morocco from 2019 to 2023. US$24.345 million worth of fastening tools were imported into Morocco in 2023, with a CAGR of 9.1% over the past five years. The top three fastening tools import sources of Morocco were France (US$7.590 million), China (US$5.342 million), and Israel (US$4.023 million). The top 10 import origins accounted for more than 90% of the total, and France occupied a position in Morocco for both fasteners and fastening tools, because the quality, type, item, and pricing could meet the needs of Morocco, and the import share reached 31.2%. Taiwan was the sixth largest source of Morocco's imports, but its CAGR has been declining year by year, and the other top five import origins were all growing, indicating that Taiwan's Moroccan market was being compressed by competing countries.

Table 7 shows the types and amounts of fastening tools imported by Morocco from 2019 to 2023; the types and amounts of fastening tools imported by Morocco from the world in 2023 were as follows: Other Interchangeable Tools (US$15.888 million) and Non-adjustable Handoperated Wrenches and Spanners (US$3.625 million). Interchangeable tools showed the highest import value and CAGR, and were potential products in the Moroccan market, together with screwdrivers.

Morocco’s fastening tools related industries include: traditional automotive, construction, etc. As the Moroccan government has a certain demand for infrastructure, the construction of houses and new towns, high-speed railways and ports and other transportation led by the Moroccan government have the potential to generate demand for fastening tools. In addition, Morocco has signed FTAs with Europe and the U.S., which means that Taiwan's fastening tools industry mainly exporting to the U.S. can take advantage of the FTA which Morocco has signed with the EU as a springboard to enter the EU, or through the EU countries that have been purchasing fastening tools from Taiwan to enter the Moroccan market.

Table 8 shows the trend of imported fastening tools in Algeria from 2019 to 2023. The amount of fastening tools imported by Algeria from the world in 2023 was US$ 23.182 million, and the CAGR of import in the past five years was about 1.2%. The top three import origins and amounts were China (US$10.046 million), Taiwan (US$2.336 million), and the U.S. (US$ 2.152 million). Taiwan was the second largest import origin of Algeria with a steady growth, but China was still the largest supplier in Algeria in 2023 in terms of market share, while France and Italy's shares were declining, the U.S. and other countries were growing steadily, and the shares of imports from emerging suppliers such as Turkey, Spain, and S. Korea were rising significantly.

Table 8. The Trend of Imported Fastening Tools in Algeria from 2019 to 2023

US$10,000;%

Table 9 shows the types and amounts of imported fastening tools in Algeria from 2019 to 2023; In 2023, Algeria's imports of fastening tools from the world were: Adjustable Wrenches and Spanners (US$7.712 million) and Screwdrivers (US$5.972 million); the products with the highest CAGR were Screwdrivers (11.1%) and Non-Adjustable Wrenches and Spanners (9.9%). Algeria’s fastening tools related industries include: steel products, automobiles, construction materials, etc.; the local automobile and construction industries have fastening tools demand. Hardware tools are listed as one of the manufacturing industries suitable to be invested in Algeria by Taiwan's MOEA. Algeria is one of the most important markets in Africa and considered to be the gateway to the African market. It is recommended that Taiwanese businessmen conduct a comprehensive assessment before investing or expand business cooperation through reliable local trading partners.

Taiwan's fastening tools have long been exported to the U.S. as the main export destination. Although the U.S.-China trade war has significantly increased Taiwan’s exports to the U.S., it seems that Taiwanese fastening tools suppliers (mainly SMEs) rely too much on a single market. In the face of China's similar fastening tool industry to expand market share in various countries, Taiwanese industry should think about where the market with less Chinese competitors’ presence and high growth rates are, such as Africa; It is suggested that Taiwanese fastening tool industry should make good use of AfCFTA, assess the market demand in African countries with stable investment environment and sound logistics infrastructure, for example, by utilizing the marketing strategy of Japanese hand tools brands or cooperating with local manufacturers to expand the brand image and product sales, in order to lay a solid foundation for Taiwanese fastening tools industry in Africa.

產品安全作為企業文化的外在體現

As shown in Table 1, there are five reasons why screw connections must be secured and safe. Their disintegration is due to vibrations and dynamic stress, mechanical overload, theft and vandalism:

Table 1. Reasons for secure screw connections

SECURITY/SAFETY Against:

Disintegration Mechanical Destruction Corrosion Theft Vandalism

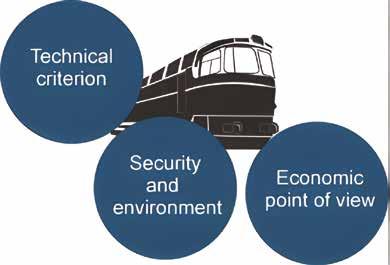

To provide secure products is a complicated and demanding process. The observing of regulations itself does not give a guarantee of the secure and commercially successful product. It is not possible to prescribe safety and security, or to program it. It has to be constructed and designed. If we do not count the stochastic cases of the crashes, then the following general criteria are valid for the safe structure (Fig. 1):

▲Fig. 1. General criteria for safe structure

As shown in Figure 1, it is not just the security and the impact on the environment which have to be factored in each structure by the designer. A successful and competitive product has to offer the required technical and economical parameters. Product reliability is always a compromise between the costs and the technical parameters. The design and manufacture have an irreplaceable role to find an optimal solution in confrontation of these two opposing factors. Besides these, there are other significant design criteria, such as a technology-oriented design and construction and last but not least the product appearance.

In the EU conditions, various legislative regulations have been approved, especially the standard ISO 13849-2015: “Safety of machinery, Part 1: General principles for design”. This standard provides safety requirements and guidance on the principles for the design of safety-related parts. The quality assurance is the mark - (European Conformity) as a symbol of free marketability in the European Economic Area. Of course, there are many other legally binding regulations which have to be accepted not only in the EU conditions. The most important one is the EN 10204 standard “Metallic product – Types of inspection documents” with four levels of inspection reports:

(1) Type 2.1 Declaration of compliance with the order

(2) Type 2.2 Test report

(3) Type 3.1 Inspection certificate - Statement of compliance with the order, with indication of results of specific inspection

(4)Type 3.2 Inspection certificate with indication of results of specific inspection. The manufacturer’s authorized inspection representative independent of the manufacturing department and either the purchaser’s authorized inspection representative or the inspector designated by the official regulations.

The CE-marking (and the declaration of conformity) is the signal to the public and the market supervisory authorities that manufacturers believe their products meet all basic safety requirements.

Bolted joints are not an exception in this respect. Quite the opposite, as already said, they do not have to be the weakest part of the structure. The reason is simple. Any kind of failure could result in the destruction of the whole structure with possible catastrophic consequences. The trailer hitch serves as an example of it. In this case the locking system used was not effective enough and therefore the joint is being progressively loosened and by the influence of the repeated alternating dynamic stress, a fatigue fracture has occurred (Fig. 2) . You can easily guess what can be caused by an automobile trailer which is torn off and being rushed at high speed in an uncontrolled way down the road. It is clear that the given structure hasn’t met it.

Everything is governed by the causeand-effect principle. Assuming correct assembly and a defect-free product, there are two levels of design measures against the risk of a crash:

(1) Crash protection

(2) Eliminating the cause (source) of danger which is the requirements of the “failsafe” principle.

Obviously, the accident of the towing device from Fig. 2 was caused by insufficient securing of the screw connection with an effective insurance system. Due to the action of alternating dynamic stress, the prestress dropped to zero value, and as a result of which the joint ceased to fulfil its function and a fatigue fracture subsequently occurred. In this case, it was not possible to eliminate the source of danger, i.e. to prevent dynamic stress.

On the other hand, the deformation of the fastening screws of the car wheel (Fig. 3), which came loose during driving, could be prevented by respecting the permissible load of the vehicle. This relatively common ailment of drivers has already resulted in more than one serious accidents with fatal consequences. The safety screws in Fig. 4a and 4b only protect against theft, but not against free loosening.

Despite the driving lever position of the water jet drives FULLS BACK, no effect of this maneuver was noticed - Consequences: 6 seriously injured, 43 slightly injured people. The cause was a loose small screw on the steering system (Fig. 5). For the same reasons, the doors on the expressway fell out while driving (Fig. 6)

The role of screw connections is not only to connect, but also to prevent the disintegration of already connected parts so that the above-mentioned cases of accidents can never occur.

◆ Assembly

This, seemingly simple, technological operation tends to be the biggest source of bolted joints failure and the cause of the whole construction crashes. The role of a constructor is not only to construct the product but also to prescribe the way and parameter of assembly. The prescribed assembly procedure is for the production obligatory. The essential precondition of the secure product is the application of the controlled assembly which assures necessary screw pre-stress. The exactness of tightening tools defined as the maximal and minimal assembly force ratio and the intensity of friction between the threads under the nut head and under the nut are important. The higher friction coefficient µ, the more energy is consumed while tightening to overcome it and the less is used to create pre-stress FV.

Most producers and distributors state the recommended tightening values of the specific bolted joints in relation to the friction coefficient in technical documents. There is only approximate information without the influence of operating forces. It is a competence of the constructor to consider these forces and to evaluate their influence. The rule is that the pre-stress forces must not decrease under specific values to prevent damaging of the joint and they must not overcome steel solidity.

◆ Construction and Design

On condition that the assembly is correct, and the product is immaculate, there are two construction measures against the danger of crash:

1. Elimination of the danger source/cause

2. Crash security

It is clear that the crash of the trailer from Fig. 2 was caused by an insufficiently bolted joint security with an effective locking system. By the alternating dynamical stress, the pre-stressing force has decreased to zero, causing the joint to stop to fulfil its function and the fatigue fracture occurred. In this case it was not possible to eliminate the source of danger, i.e. to prevent dynamical stress. On the other hand, it was possible to prevent the deformation of the tightening screws on the automobile wheel (Fig. 3) which had been loosened during the drive. It would be enough to respect the allowed vehicle loading. A good example of the cause elimination is the application of fitted hardened pins, e.g. according to EN ISO 8736 or screws with fitted shaft according to ISO 7379. Their role is to intercept transversal dynamical impacts. This measure is often used for pressing tools.