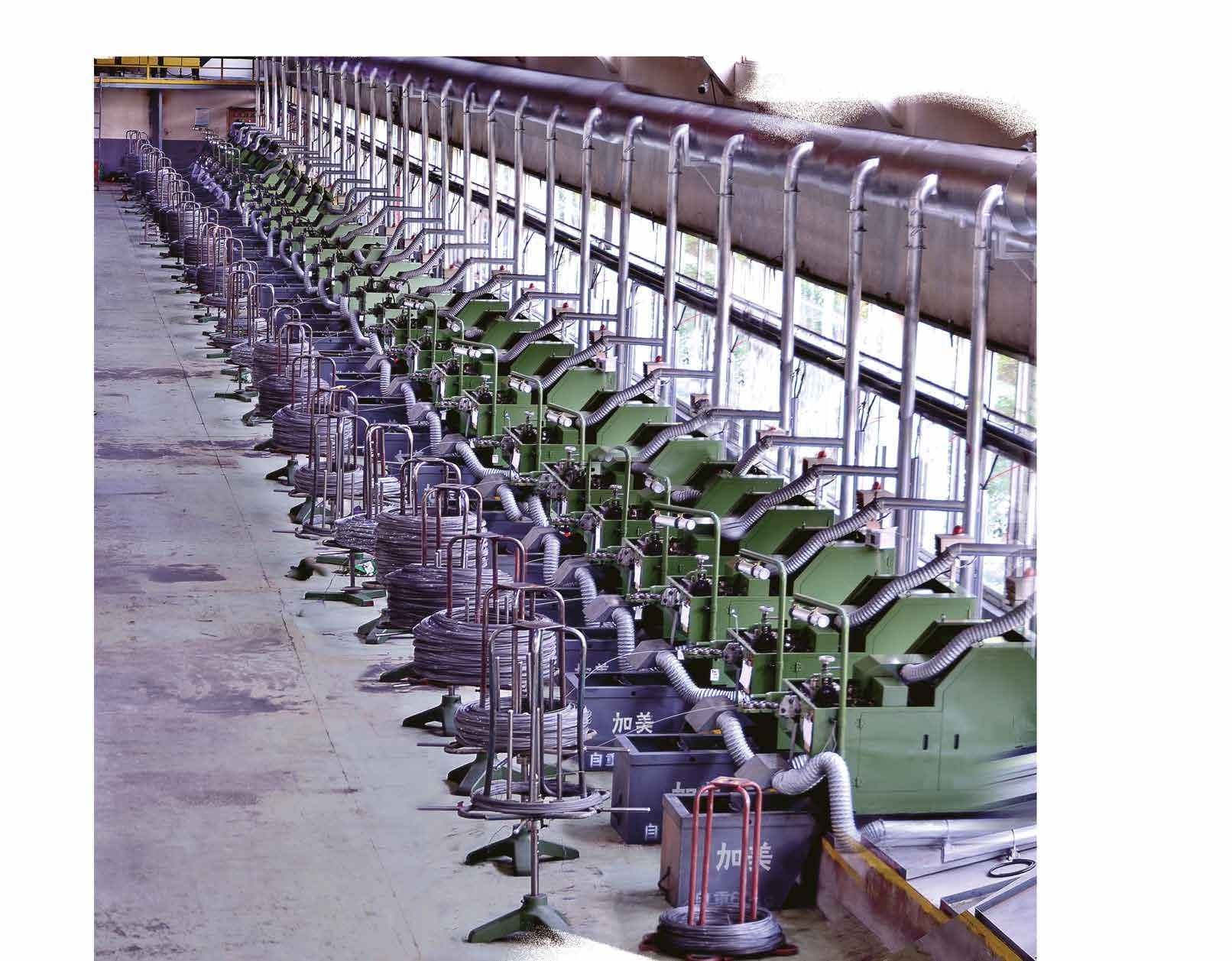

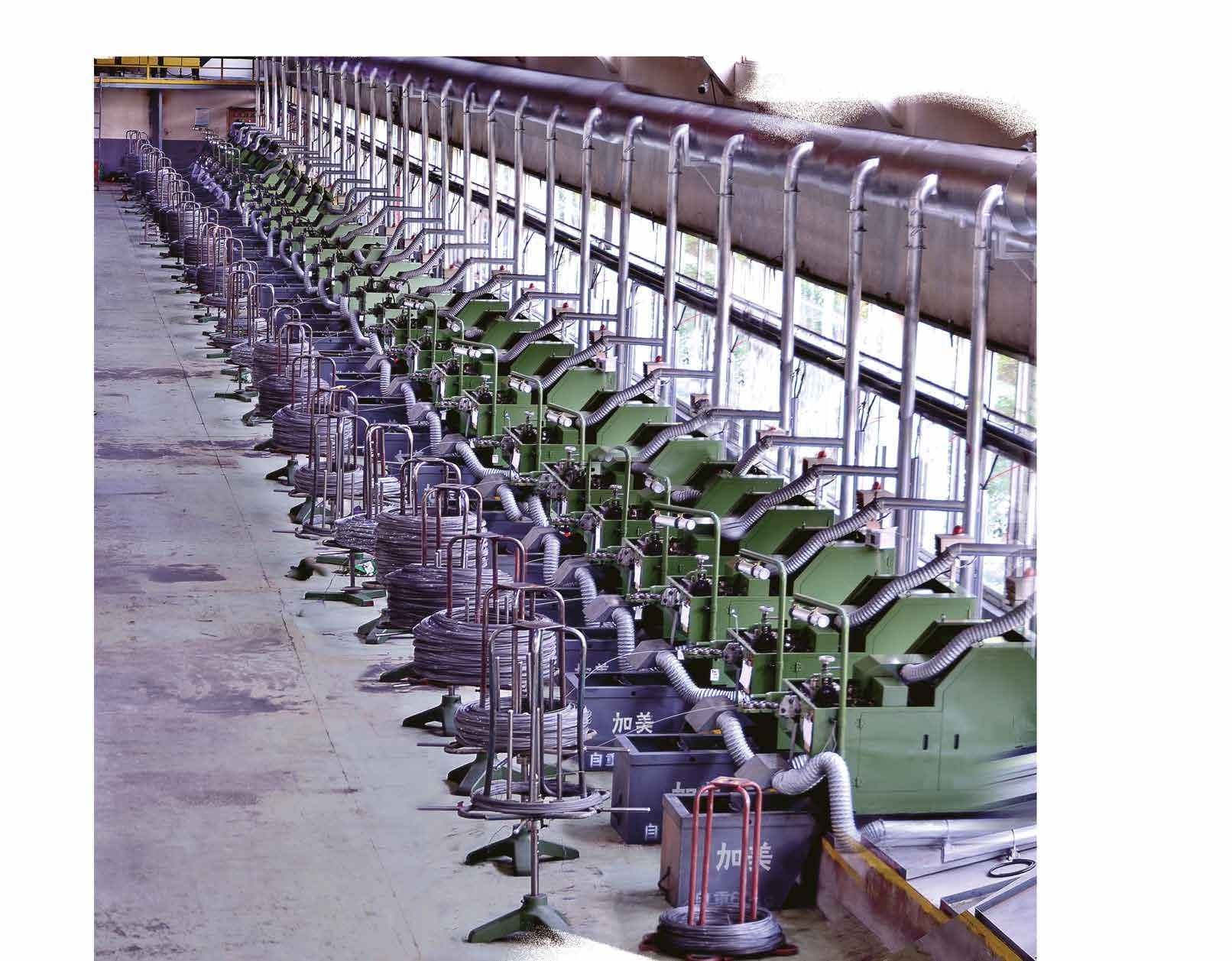

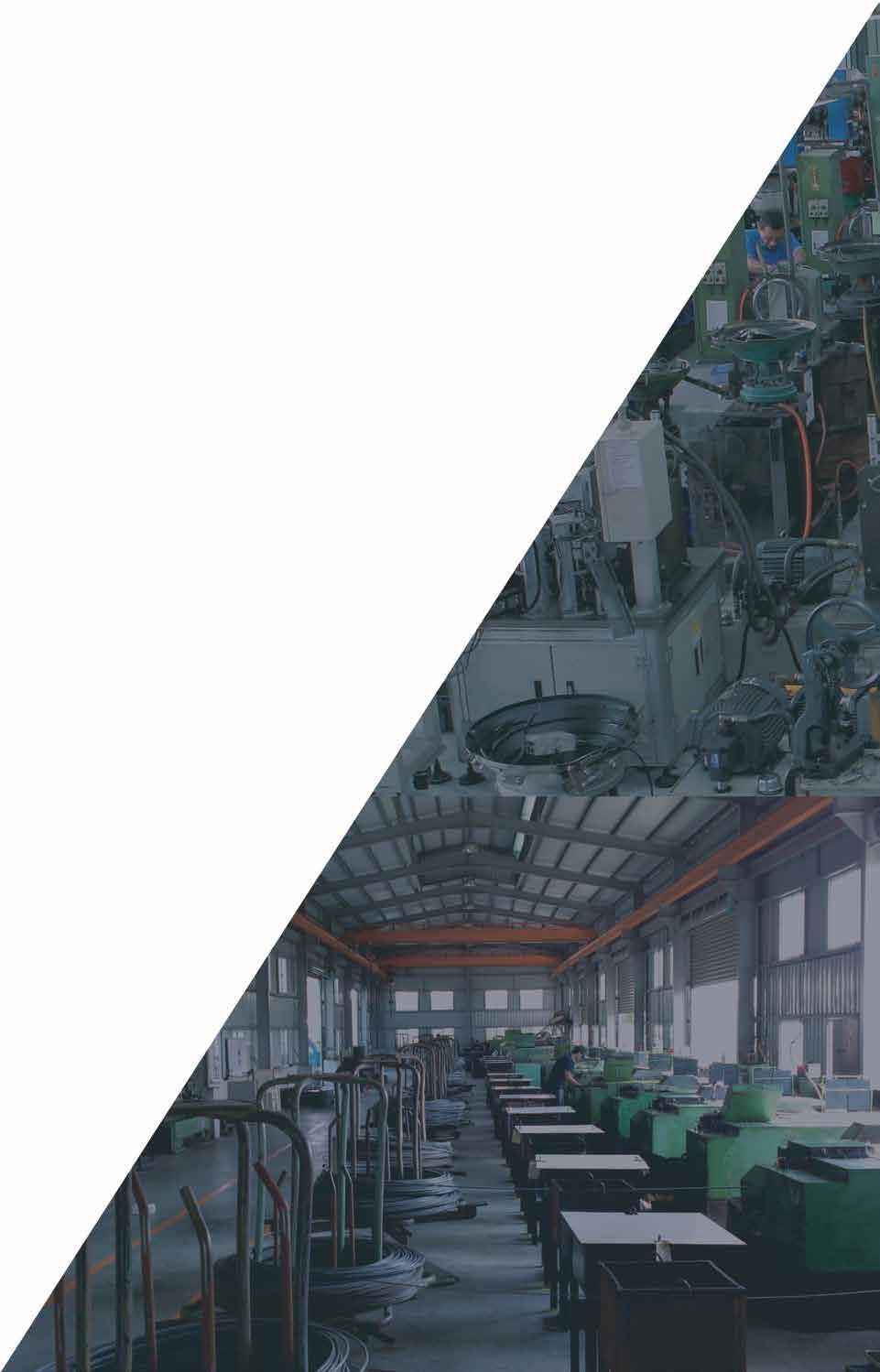

With more than 150 partnering suppliers globally, Hisener is one of the world's largest fastener suppliers. In 2019, the company successfully refined its best-selling wood screws which made a brilliant debut at Fastener Fair Stuttgart. In August 2022, the company completed a new 32,000-square-meter automated and smart factory, housing more than 270 machines to enable triple production capacity, as well as an additional manufacturing line for stainless steel products. In 2023, a dedicated line was built to develop bi-metal screws to meet customer demand for high-performance screws. At this stage, Hisener has perfectly achieved a corporate structure combining manufacturing, trading and R&D, coupled with the previously obtained ISO 9001 and CE certificates to provide over 4,000 types of fasteners to customers in Europe, Russia, the U.S. and South America.

In February 2024, the company released big news that it is all in on an upgrade towards carbon reduction. This makes 2024 “the starting year for Hisener’s green manufacturing", and draws a dividing line in the company’s history to start off into a new GREEN era together with the world's industry leaders, and brings Hisener to a place where it leads the Chinese fastener industry into transformation for low carbon and smart manufacturing. Going ahead at the forefront of global trends, Hisener revealed to Fastener World that they are targeting Southeast Asia in this year's global sales expansion tactic!

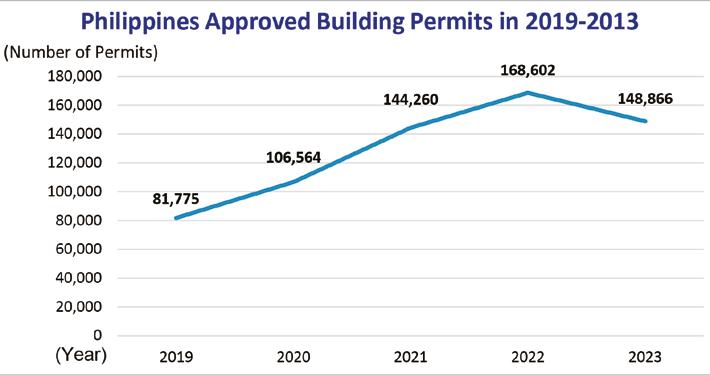

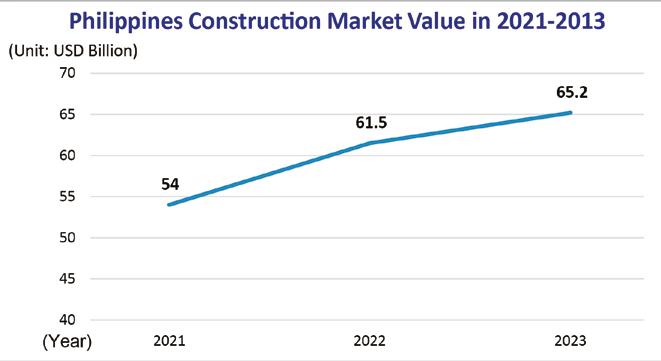

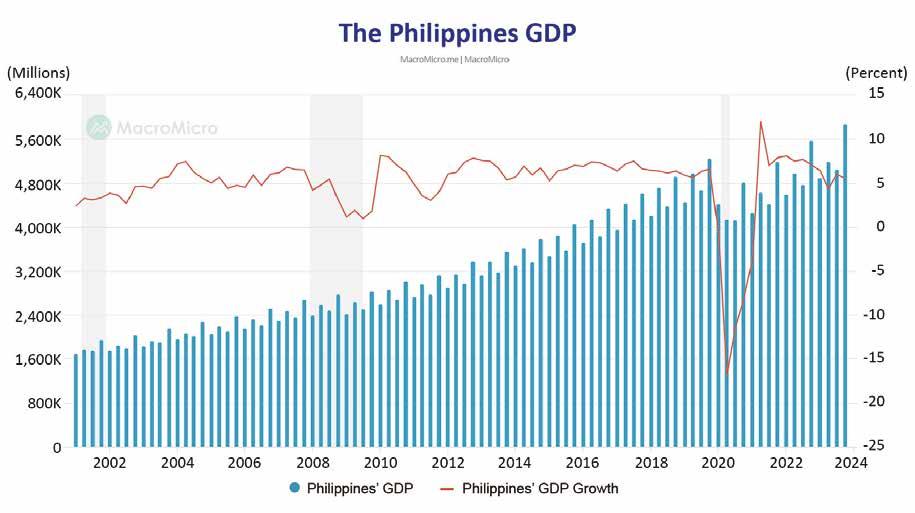

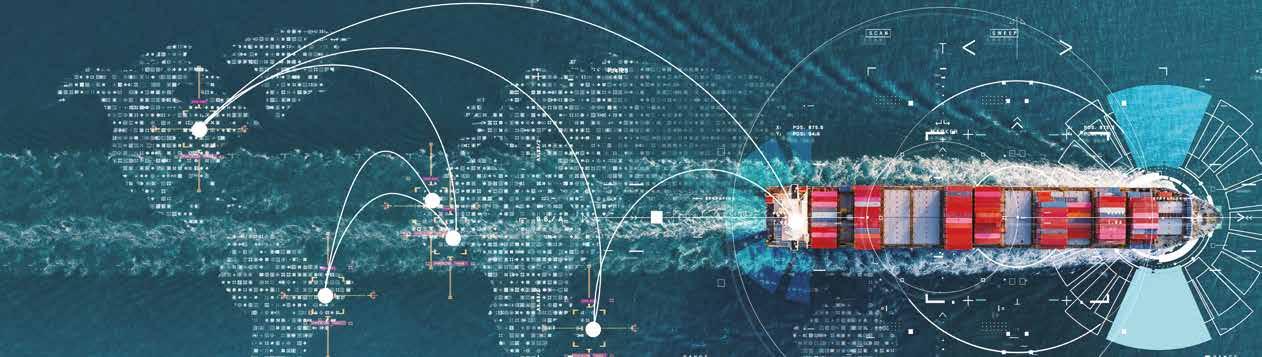

Large-scale construction projects are being carried out in most parts of Southeast Asia to accelerate urbanization and infrastructure development. In the next 10 years, infrastructure investment in Southeast Asia, covering areas such as construction, power generation via renewable energy, power grids, and transportation, will require US$2 trillion in financing to transition into sustainable development. This March, Australian Prime Minister Anthony Albanese announced an investment fund of 2 billion in Australian dollars to support transition into green energy and construction in Southeast Asia. From here, we can pick up a potential increase in demand for infrastructure fasteners in Southeast Asia, as well as a trajectory of transformation towards green manufacturing, which is in line with Hisener's "green manufacturing" initiative. Hisener will expand sales to Southeast Asia and infuse high quality Chinese GREEN fasteners into new business opportunities in Southeast Asia.

Indonesia has officially launched in January 2024 the plan to move the capital from Jakarta to Nusantara. The demand for infrastructure and residential buildings as well as business opportunities radiating to neighboring countries could be very large in potential. In addition, Malaysia's economy will see an upward trend driven by light rail transit, mass rapid transit and highway projects now in motion. These have become one of the drives for Hisener to choose to go south for sales expansion. Southeast Asia is currently the second largest trading partner for China. Hisener continues to increase efforts in Southeast Asia, while actively seeking suitable partners to increase investment and provide more purchase access for Hisener's global clients. The company will also exhibit in Fastener Expo Southeast Asia in Jakarta, Indonesia, from August 21 to 23, and it welcomes global visitors to booth number D22.

In response to the potential rise in construction demand, bi-metal screws will be one of the highlights at Hisener’s booth. This product has an alloy-steel drive portion welded onto a 300 series stainless steel shank, allowing for a maximal 12.5mm penetration to penetrate carbon steel while having the excellent corrosion resistance and ductility of 300 series stainless steel. The alloy steel threads on the drive portion can cut out grooves on a purlin to create effective locking and enhance pullout resistance. Besides performance advantages, the most important thing is that Hisener can offer the best price. The current production capacity of this product is about 50 tons per month, which is not currently completely filled and therefore, there is great room for more capacity to cater to more clients.

After the EU fired the first shot with CBAM, the Clean Energy for America Act is in the making. The British government has promised to roll out the British carbon border regulations by 2027. It is estimated that carbon border tax will be introduced in Asia and many countries in the next decade. Hisenser is one of the earliest big companies in the Chinese fastener industry to put forward a declaration of carbon reduction. For the company, carbon reduction is imperative, so it is currently implementing the “3 Ls Initiative”, with the 3Ls being “Lower carbon, Lower carbon, and further Lower carbon”. The ultimate goal is carbon neutrality. The current ongoing measures are as follows:

1. Increase the use of clean energy. At present, solar power can already meet 30% of Hisener's electricity consumption, and more renewable energy will be purchased in the future.

2. Invest more in optimizing product design and craftsmanship to increase energy efficiency.

3. Reduce energy and material consumption by implementing recycling production methods. Recover energy from waste, such as by filtering waste water and oil and reusing it.

4. Develop emission reduction technologies that suit Hisener and continuously reduce emissions.

5. Focus on green procurement to build a green supply chain. Encourage suppliers to optimize logistics, reduce packaging and use more environmentally friendly packaging materials.

6. Establish a carbon emission verification system, use digital means to complete sustainable carbon verification, and establish full-process supervision tracing carbon footprints from raw materials to final products.

7. Already calculated carbon emissions for 2023 and provided the data to EU clients. Carbon emissions will be calculated per quarter in the future and reported in a timely manner as per CBAM requirements.

8. Hisener will apply for ISO14064 and ISO14067 certification. More actions will be taken in the near future.

The "3 Ls initiative” demonstrates Hisener's determination for green and smart manufacturing which has been officially put into practical action this year. Hisener's mission statement is continuous improvement and pursuit of excellence, so it continues to invest in R&D and craftsmanship. It welcomes global clients to visit and witness its newly established factory and the fruitful achievements of its evolution.

In order to further strengthen the link with the demand of first-tier retailers and distributors in Europe and the U.S., CHINFAST, having deeply engaged in the industrial fastener production for nearly 20 years, has been actively expanding its business from the production of advanced multi-purpose screws, timber fixing screws and decking screws made of 10B21 and C1022 to the DIY fasteners packaging service over the past 5 years. In the ever-changing global market, it hopes to create a new milestone for sustainable business development.

Unlike typical mass production lines, DIY fasteners packaging are characterized by small quantities and diverse categories, which are more time-consuming and labor-intensive, and therefore must be adjusted in a timely manner according to product attributes and quantities. In view of this, CHINFAST not only provides various tool boxes, plastic boxes/bins, blisters, blister boxes, cardboards, polybags and various color boxes for customers to choose, but also provides 100% customized service according to customers’ requirements.

“Backed by a strong professional team, we have introduced the ERP smart factory management system from production to packaging to ensure the flexibility and traceability.

All products are controlled by the automated warehouse, and the automatic packaging line with more than 10 semi-automatic packaging machines is also directly connected to the stereoscopic warehouse, and the AGV automatic shuttle vehicles are applied to transport the goods directly to each packaging table, which effectively saves the goods delivery time and enhances the packaging efficiency and flexibility,” said CHINFAST.

CHINFAST has nearly 60 packaging staff with years of experience to assist customers in designing the optimized packaging methods to achieve twice the result with half the effort. At the same time, it has also worked with the automated packaging equipment factory to successfully develop 4 models (totally 12 sets) of packaging equipment which best fit the characteristics of their products, enabling them to significantly improve the packaging efficiency. From production to packaging, it completely follows the ISO 9001 specification. There are 10 QC employees to conduct strict quality inspection from raw materials to finished products, and all testing data are kept in record to ensure traceability.

“As an emerging DIY fastener factory, although DIY fastener packaging service currently only accounts for 6% of our annual export volume and in 2023 our total sales reached 7,900 containers, we are confident that we can perform better in the next few years,” said CHINFAST.

Contact: Mr. George Yu

Email: george@chinfast.com

Article by Gang Hao Chang, Vice Editor-in-Chief of Fastener WorldCopyright owned by Fastener World

社論:中國緊固件轉型升級前哨站──

The Chinese EV industry made headlines that shocked the world at the beginning of 2024. BYD’s 2023 financial report showed that it sold around 520,000 EVs in Q4, surpassing Tesla’s around 480,000 vehicles. This report made BYD the world’s largest EV manufacturer. This February, BYD increased the proportion of export to 19%, setting a new high. BYD is currently building production lines in Brazil, Indonesia, Mexico, Thailand and other places to quickly expand export to Europe.

Besides passenger cars, Chinese electric buses also achieved great results, accounting for nearly one-third of the market in Europe. At the beginning of 2024, they snatched a large order worth 43 million euros from Belgium, causing the local longestablished bus manufacturer Van Hool to be declared bankruptcy in April. In fact, one-fifth of the electric passenger cars sold in Europe last year came from China, and this year the market share is expected to grow to onequarter. A similar situation exists in the bus industry, where China has leveraged its market scale and low cost to take down European rivals.

Although BYD’s sales of around 300,000 vehicles (down 43%) in Q1 2024 were outrun by Tesla’s sales of around 380,000 vehicles, Tesla also fell 8.5%, far lower than market expectations, triggering investors concerns about Tesla’s outlook. Even so, BYD has proven its ability to seize the throne, and it has caused the biggest shock to the global auto industry this year.

According to the latest data released by a Chinese enterprise database, there are currently 21,048 fastener companies in China, most of which were registered in 2021. The number of registered companies that year was 2,231. The research results of this database show that the number of fastener companies increased significantly in 2021, mainly because the increased production of new energy vehicles in recent years has boosted the demand for related fastener products and increased the number of entrants.

China has faced greater challenges in its domestic economy and export in recent years. Therefore, the local government is vigorously supporting EVs, as well as AI and other high-tech industries. The research result of the aforementioned database is enough to confirm that China’s new energy vehicles have become a key driver for fastener companies to transition to high-end products. China has two trump cards that can shake up the rules of the global market. One is extremely low production costs and prices, and the other is the Chinese government’s subsidy policy. In addition, China has another hidden trump card. The number of patent applications filed by Chinese companies is increasing sharply, making China the first country to exceed 4 million patents. BYD is also frantically applying for patents, and its number of patents is more than 15 times that of Tesla’s, mainly to protect battery technology.

The R&D and innovation on critical components made by EV manufacturers will drive the R&D of EV fasteners. A clear example is TR Fastenings

demonstrating fastener products and new technologies for EVs at a battery exhibition in UK. Even though China’s current fastener R&D technology has not yet caught up with European and American standards, the Chinese EV leader is spearheading towards technological R&D and accordingly, the growth potential of Chinese automotive fastener technology cannot be underestimated in the long run.

China’s vigorous development of new energy vehicles and high technology is stimulating Europe to compete with it in the same field. This can be seen in some of the biggest European exhibitions. Fastener World observed several industry trends at Hannover Messe in Germany. The first is Industry 4.0, smart manufacturing, automation, unmanned operations, robots, and robotic arms. The various metal parts processing technology and precision equipment on display at the exhibition allowed visitors to witness the manufacturers’ efforts to continuously pursue excellence in technology. The second is EVs and peripheral charging/storage equipment. The third is the emphasis on new energy development. Many large manufacturers that are already market leaders are looking at deployment in the next 5 to 10 years and are actively introducing CBAM-compliant carbon reduction and environmental protection. Strategic alliances for new energy technologies have emerged in Europe. Coupled with the ESG and CBAM trends that have followed, the development of new energy policies will change future product design and manufacturing. Facing competition from China, European and American companies must modify their practices as they go, and their pace of transformation cannot stop.

The U.S. is stepping up competition with China in the same field. The White House stated on May 14 that the U.S. will impose tariffs on USD 18 billion worth of goods imported from China, targeting strategic industries such as EVs, EV batteries, and steel. Among them, the tariff rate on EVs is expected to quadruple this year going up to 100%. Besides the U.S., Brazilian President Lula reinstated import tax on EVs this year to protect the development of Brazilian auto industry. Chinese cars account for as much as 40% of the local market share in Brazil. According to Reuters, Brazilian carmakers lobbied for the resumption of import tax on EVs and overcame the opposition from China.

In addition to EVs and technology industries, China’s fastener export has

encountered new obstacles. Mexico has imposed a 35% temporary import tariff on Chinese fasteners, which took effect immediately from April 2. The Mexican press said the move seemed mainly aimed at China.

In the past 30 years, China has perfectly manifested its evolution into becoming the world’s factory, but in the next decade, China may come out with a completely new role. The rise of China has inevitably brought about high-tech competition between China and advanced countries. From the steel trade war to fuel vehicles, semiconductors, AI, carbon reduction, and now to the EV trade war. China and advanced countries have entered a competition cycle to see which one can get the high ground first. It means that China and advanced countries will stimulate each other’s manufacturing industries to go further high-end at close to the speed of light. Due to the interconnected nature of industries, if China’s fastener industry stays content with conventional manufacturing methods, it will be eliminated in the trend of going high-end, and therefore it will eventually head higher. The rapid growth of China’s EV fastener companies is just one example of that. In recent years, there have been many companies in China that focus on developing photovoltaic fasteners, as well as companies such as Finework New Energy Technology that have begun to actively develop aerospace fasteners.

Looking to the future, China has another card yet unveiled, and that is AI technology. Currently, the one to compete with Chinese AI is GPT. The newly released GPT-4o (where “o” stands for omnipotent) this May has broken through the bottleneck. It can respond to questions within 0.3 seconds, already as fast as the response time in human conversation. It can also detect human emotions and respond quickly. It understands up to 50 languages and can handle text, voice and video input at the same time. There are now customized GPTs on the market. At the end of last year, an automotive manufacturer transformed its entire production line with customized GPTs, reducing downtime by 40%. The results are amazing. This means less time repairing and more time producing and designing more cutting-edge products through AI. The introduction of AI into production lines is now in progress.

Europe and the U.S. will gradually introduce AI into production lines in the long run, and China is bound to follow suit. A representative of China’s National People’s Congress has suggested that the authorities should launch special projects as soon as possible to focus on the deployment and application of smart manufacturing system software, mass AI models and general bionic robots as a critical industry breakthrough, and support the integration of mass model-driven AI and manufacturing. In the foreseeable future, when the price of AI becomes more acceptable to enterprises and its introduction becomes easier, it will be simple just like many manufacturers would introduce ERP in the past, and AI will become a standard requirement of factories. By then, Chinese fastener manufacturers will inevitably rush to introduce AI processes, and the speed of technological evolution will be immeasurable, which is expected to write a new chapter for China’s fastener industry.

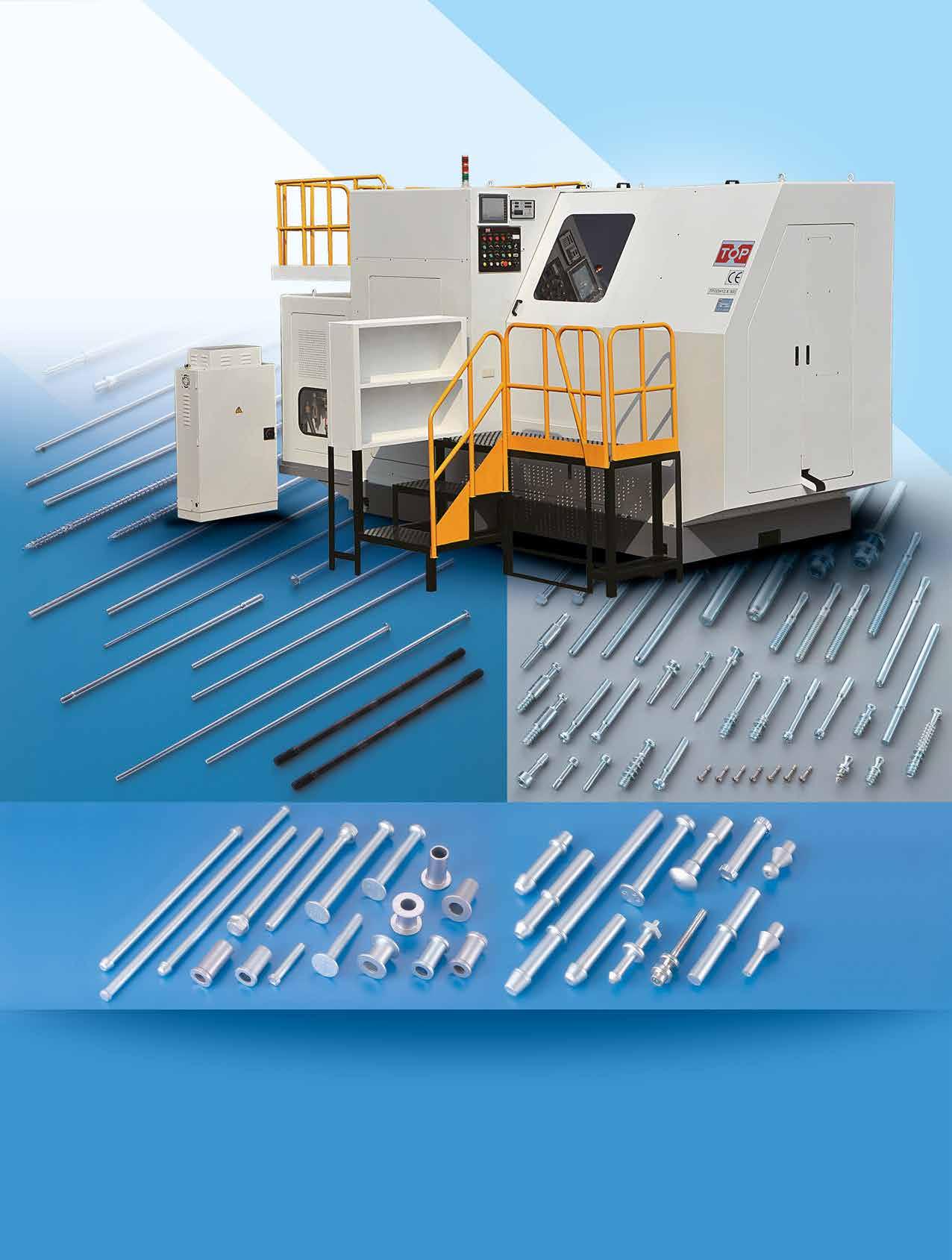

In Foshan City, there stands a company that constantly pursues excellence - Foshan Nanhai Sailuk Rivet Co, Ltd. Since its establishment, Sailuk Rivet has been adhering to the corporate philosophy of “Quality as the Foundation and Innovation as the Soul”, and has been steadily moving forward in the fierce market competition.

In line with its booming business, Sailuk Rivet has made a major strategic change by moving to new premises and significantly expanding its production scale. This move not only enhances the company's production capacity, but also marks a solid step forward in the manufacture of fasteners for the automotive and new energy industry sectors.

In the automotive field, the quality of fasteners is directly related to the safety and durability of the entire vehicle, and Sailuk Rivet understands this relation and has invested a great deal of resources in optimizing production processes and improving product quality. Whether it is the fastening needs

of the engine, the chassis, or the vehicle body, Sailuk Rivet can always provide products that meet the strictest standards.

Meanwhile, facing the transformation of the global Sailuk Rivet is actively involved in the new energy field and has developed a series of highperformance fasteners for new energy vehicles, solar panels, wind power generation and many other industries. Through continuous R&D and technological breakthroughs, Sailuk Rivet is now becoming a reliable partner for the new energy industry.

As a company that values innovation, Sailuk Rivet has a team of technical professionals who are committed to new product development and improvements of existing products. The company also works closely with industry-leading R&D organizations to ensure that its technology and material applications remain at the forefront of the industry.

Looking into the future, Sailuk Rivet will continue to uphold the spirit of craftsmanship, adhere to technological innovation, and strive to become a first-class domestic and international supplier of fasteners. The new production base, advanced production equipment and continuous improvement of technical capabilities will help Sailuk Rivet go further on the road of specialization and internationalization.

Contact: Vice General Manager Roger Wu Email: sales@sailuk-rivet.com

Founded in 1993, Tobon started out with precision screws, supplying them to top 500 companies around the world, including Canon, CASIO and PHILIPS. It passed ISO9000 ahead of its peers in 2000, before continuing to pass ISO14000, QC080000, OHSAS18000 and IATF16949. A saying goes in the industry: "The world will be short of supply if goods get congested in Dongguan." In 2002, Tobon moved to Dongguan and significantly improved its response time, thanks to the city’s complete supply chain and customer base. This laid a solid foundation for supporting world-renowned enterprises! Through self-developed ERP and MES systems as well as information technology combined with software and hardware, the company achieved smart and lean production and improved manufacturing and management levels. Its products are now a preferred choice for world-renowned companies. This year, big news arrived with an announcement that Tobon’s Vietnam plant was completed in May and will start mass-production in Q3 — a new milestone for Tobon’s business.

The Vietnam plant spans 2,500 square meters and employs a dozen employees. It is located in Frasers Real Estate Industrial Park (core area where a large number of world-renowned manufacturing companies gather, only 30 kilometers from Hanoi’s business center). The park has a complete supply chain and supporting facilities, with expectations for booming business opportunities. The plant will bring broader production space and more efficient operating capabilities to Tobon. The planned production line in the first phase will introduce 16 cold heading machines, 12 thread rolling machines and 3 optical sorting machines. The second phase plan in January 2025 will add 15 cold heading machines, 12 thread rolling machines, and 3 optical sorting machines. By then, the monthly output will reach 80 million pieces!

Guided by customer needs, market potential and competitive advantages, Tobon has made it to Vietnam. The company said: "Our critical customers have been in production in Bac Ninh of Vietnam for a decade, and they plan to transfer 50% capacity to Vietnam in the future. At present, our Japanese customers are also moving to Southeast Asia and are in need of local purchase. Our European and American customers also expect us to have plants outside of China. As their local supplier, the Vietnam plant will give us an advantage over competitors. Compared with our China headquarters, the Vietnam plant plays the role of tapping into overseas markets and is tasked with improving production efficiency, optimizing cost control, ensuring product quality, and undertaking the important mission of expanding domestic and international markets.

The Vietnam plant mainly provides products and services to Vietnam and surrounding overseas markets. It is committed to meeting the needs of local customers. Its short-term goal is to stabilize production and expand market share; the midterm goal is to optimize supply chain management and increase brand influence; the long-term goal is to achieve sustainable development and become Tobon's core production base in overseas markets. The Vietnam plant also actively shares resources and cooperates with the China headquarters to develop new products and expand new markets to achieve a win-win.

Tobon has just celebrated its anniversary. "Looking back over the past 30 years, we have walked a journey full of challenges and opportunities. Today, we stand at a new starting point, feeling proud and full of anticipation. At the 30th year, we will expand from our past and continue to strengthen R&D, optimize production process, center on customers, and work together with global partners." Looking ahead, this year Tobon will develop high-end products, actively participate in overseas electronics exhibitions, use green electricity, adhere to a low-carbon, paperless office and green manufacturing, and contribute to environmental protection together with the world's green pioneering enterprises.

Contact:

Copyright owned by Fastener World / Article by Dean Tseng

Contact: CEO, Aimee Wu / Email: aimee@ytfasteners.com

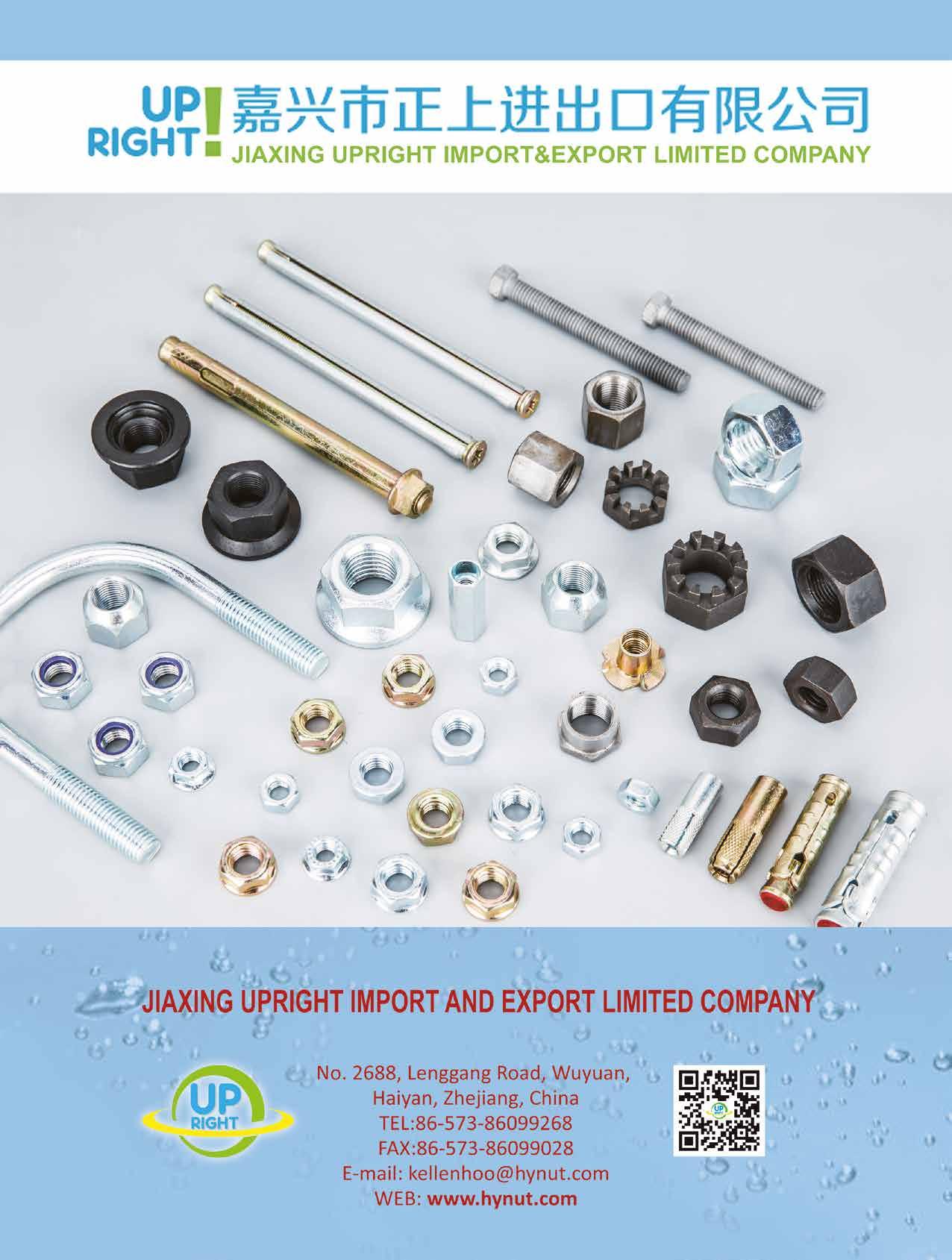

Yongnian District of Handan City in Hebei Province is known as "China’s City of Fasteners". Yuetong with over a decade of history in Yongnian District has expert knowledge of German DIN, American ASTM, British BSI, Indian BIS, Japanese JIS, ISO and other multinational standards. It takes timely shipment, in-factory inspection, quality and customer first as its main focus. Soon it has won the favor of more than 360 international and influential corporate players around the world.

The company specializes in producing threaded rods, flat washers, expansion bolts, hex nuts, hex bolts, sleeve type anchor bolts, and screws, which are supplied to the automotive, power transmission and power distribution, national defense, construction and other industries. Featuring "total fastener solutions" and through more than 10 years of export experience, it provides high-quality and most price competitive OEM services.

The factory is equipped with a total of 62 pieces of fastener production equipment, mainly including cold heading, thread rolling, screw tapping, and drawing machines, using high-quality steel and producing approximately 25,000 tons of standard parts every year.

In addition to providing OEM services on diversified products, the company can provide a variety of customized packaging according to customer needs, including small box packaging, carton

packaging, raffia bag packaging, and bulk packaging, along with high-speed and stable supply capabilities and customer-satisfying packaging services to support global fastener purchasing needs.

Global buyers have increasingly stringent requirements for product performance and quality levels. Yuetong said even though its products are highly price competitive globally, it never skimps on precision and performance. To this end, it set up a dedicated quality inspection unit equipped with professional instruments and personnel to measure product hardness. It timely registers and archives measurement records as required to ensure strict inspection for global customers.

In 2024, product inventory level for overseas customers is coming down, and business opportunities for purchasing from Asia have reappeared. Yuetong's global product supply will not stop. They will further expand their market share on the existing basis and develop new markets and product lines. In the future, the company plans to start participating in international exhibitions and look for more business opportunities through product display. They will also expand their production scale and actively seek collaboration with more partners to make Yuetong's products more accessible internationally!

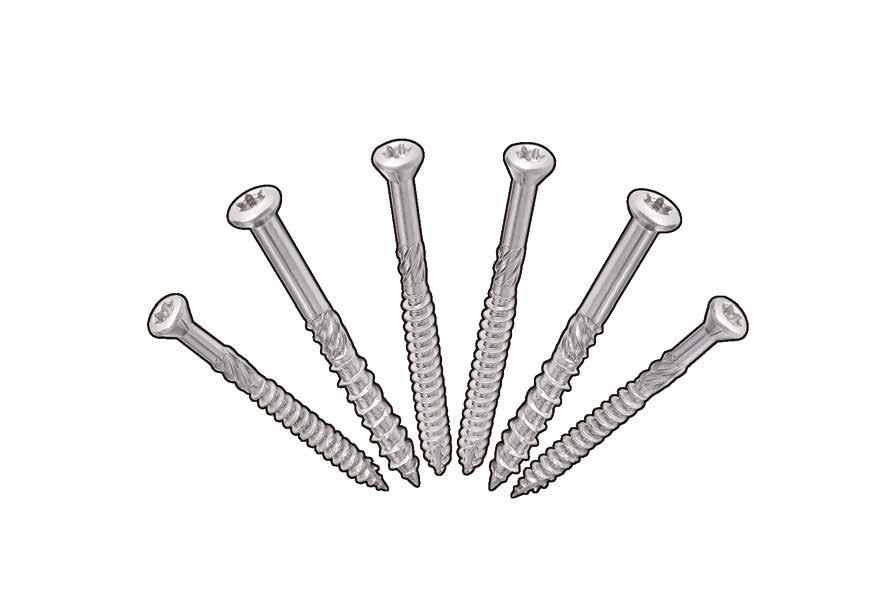

Ruiyi was established in March 2019, formerly Yuyao Zhongtong Hardware Co., Ltd., and has more than 20 years of experience in manufacturing screws and CNC machined products. Focusing on the R&D and manufacturing of stainless steel fasteners and hardware products, the company has a wide lineup, including selfdrilling screws, self-tapping screws, chipboard screws, machine screws, wood screws, and various bearings. For more than a decade, the company has been a recognized second-tier supplier for the world's largest furniture brand "IKEA", and its product quality has been approved by European and American distributors.

The company was founded with a total investment of RMB 20 million, covering an area exceeding 33,300 square meters, and a factory area of 10,000 square meters. It is locatede in the Yangtze River Delta economic circle with beautiful scenery, rich resources, convenient transportation and development potential. It has a very advantageous geographic location as well as natural advantages and conditions for economic development. Through a corporate system that integrates R&D, production and sales, the annual output value reaches approximately US$10 million. So far, the products have been exported to the U.S., Australia, the EU, South Asia and other regions.

Ruiyi adheres to the guideline of quality and service, using high-quality domestic and imported materials. Through a one-stop manufacturing process including cold heading, drilling point forging, threading, heat treatment, and galvanizing, it specializes in products compliant with the Chinese (GB), American (ANSI), British (BSW), German (DIN), Japanese (JIS), and international (ISO) standards. Ruiyi is a recognized manufacturer of high-quality fasteners at home and abroad.

The company has a professionally trained quality inspection team. The factory is equipped with various quality testing equipment, including

hardness testers, tensile testers, surface roughness meters, projectors, thread gauges among others to provide clients with the best quality products. In addition, through customized services, it can also provide consulting and total solutions to help reduce production costs, which has been unanimously praised by customers.

With years of experience in supplying to European and American distributors, Ruiyi can provide delicate packaging for small-volume products suitable for retailers or stores, meeting the high demand for delicate small packaging in emerging countries like the Middle East and other overseas regions.

In addition to wide application in China’s critical construction projects, Ruiyi’s products are exported to international markets such as Europe, America, Southeast Asia, and South Korea. Continuing forward, Ruiyi will provide users with the most excellent products, the best services, and create the best brand as the eternal goal. It will use craftsman-based management, advanced technology, and high-quality products to serve global customers, and it seeks to create a better future together!

Jiaxing Chiayo Import And Export Co., Ltd. is a manufacturer and exporter of fasteners for a wide range of construction applications. Its high quality products, sophisticated technology and reliable services have been well recognized in the global fastener supply chain and are the three pillars that have enabled it to overcome challenges in the face of fierce competition over the years. Despite being one of the leading fastener manufacturers in China, Chiayo continues to enhance its strengths in various ways in order to expand into more overseas markets.

Chiayo offers a wide range of products to meet customers' needs for fasteners of different sizes and lengths. Its main products include various construction screws and selfproduced drywall screws, chipboard screws, self-drilling screws, self-tapping screws, wood screws, roofing screws, insulation nails, expansion nails, concrete screws, window screws, Ruspert® outdoor screws, building screws, stainless steel screws, etc. It’s also capable of exporting various bolts, nuts, threaded rods, washers, machine screws, expansion anchors, concrete bolts, hook screws, riggings, chains & wire ropes, nails, collated screws, etc. Common carbon steel 1022A, Q195, 10B21, SS A2, 304, etc. are all available for production. In addition to a wide range of products, Chiayo can also provide a variety of peripheral services, such as rustproof coating, galvanizing, phosphating and other special surface treatment, or provide small bags, OPP bags, blister packs, plastic boxes/buckets and other color cartons packaging as per customer request. With automated and systematic processes and professional management, Chiayo has an average monthly capacity of 3,000 tons. Its professional technical team is also capable of R&D for customers' drawings to meet their expectations for standard products and customized ones.

“We’ve created a one-stop sourcing service. From raw material drawing to heading, threading, pointing, heat treating, phosphating,

electroplating, painting, packaging/palletizing/delivery, all processes are done in the factory. We also have semifinished product quality inspection, route inspection, and final inspection for finished products, so that we can do a good job of quality control for our customers in every aspect,” according to Chiayo. In response to the current industrial trend of carbon reduction, Chiayo has also increased the use proportion of electricity generated from solar power, and simultaneously used eco-friendly clean energy to reduce energy consumption and pollution in production, demonstrating a firm attitude toward the creation of environmentally friendly processes and the fulfillment of corporate social responsibility.

Chiayo's products are widely used in the construction, railway and bridge sectors and are mainly exported to important markets like Poland, Germany, Italy, Spain, Brazil, USA and Mexico. In addition to consolidating and deepening the relationship with customers, Chiayo also collects information on bestsellers and new products in the market, and feeds back to customers at the first time, so that they can keep abreast of the latest market trends and opportunities! At the same time, Chiayo also actively cooperates with customers in new product modification/ development/sampling/technical improvement to help them maintain their innovation and competitiveness!

“In addition to Europe and the U.S., the Middle East, North Africa and South America, where opportunities and potential exist due to growing populations and urban infrastructure projects, will be also a key focus for us,” according to Chiayo. “We know that every little screw counts, and we’ll continue to do our best for customers in every industry and market.”

Contact: Ms. Sara Gu

Email: sales.a@kocmoc.cn

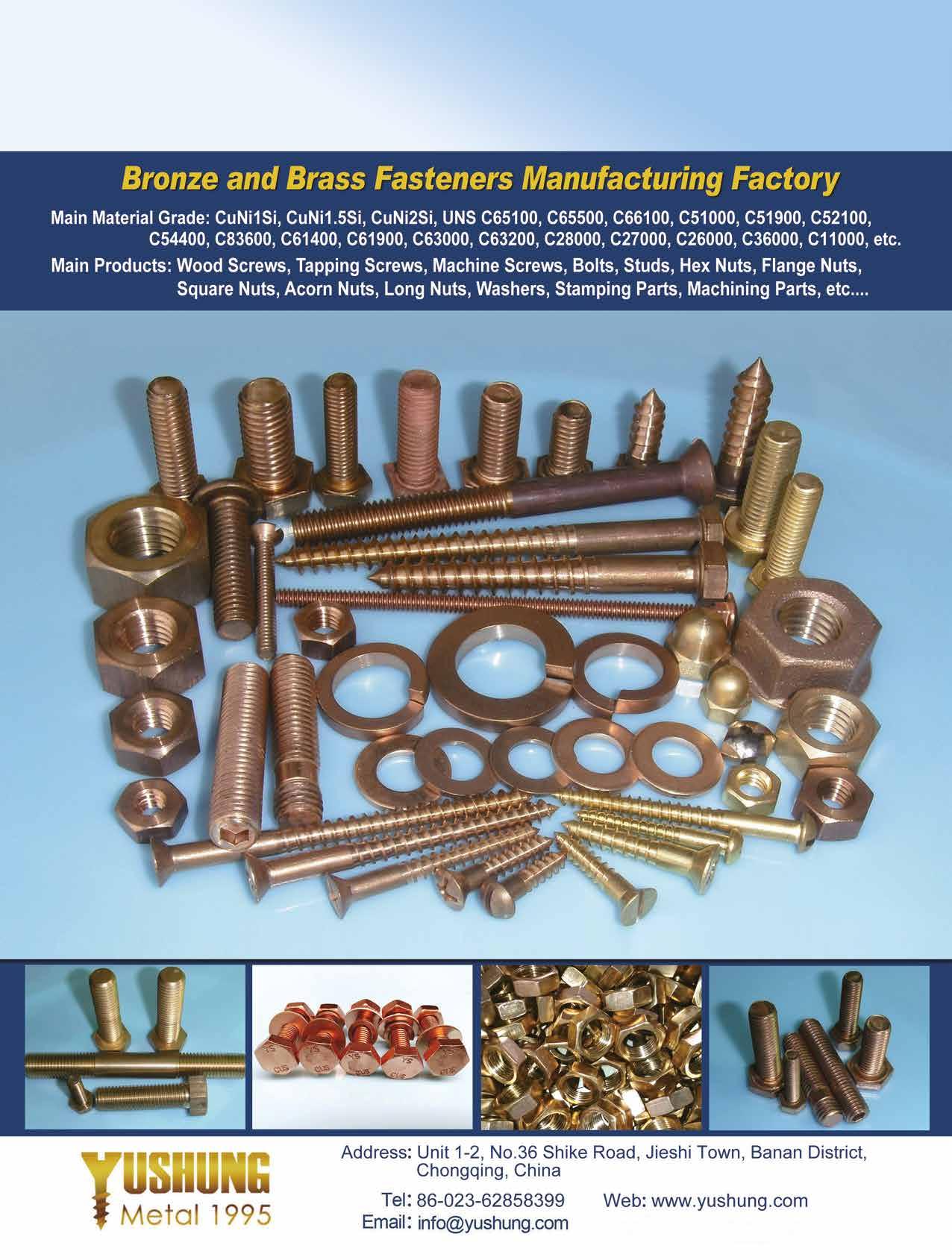

Copper-based alloy fasteners are indispensable for ensuring complete locking and security for many mid- to high-level applications. However, compared to carbon steel or stainless steel, which are more readily available with lower entry barriers, copperbased alloy fasteners often require higher costs and more capital investment, resulting in fewer manufacturers specializing in copperbased alloy fasteners in the market. In order to satisfy the needs of such industrial customers and seize the market opportunities, Chongqing Yushung Non-ferrous Metals Co., Ltd. started to invest in the processing and manufacturing of copper-based alloy fasteners more than 20 years ago to provide an easier access to copperbased alloy fasteners for industrial customers in need.

Yushung's 3,000 sq. m factory has departments for screws, nuts, stamping, and machining, and is equipped with over 200 sets of processing equipment to produce a full range of high-quality copper-based alloy fasteners made of silicon bronze, phosphor bronze, aluminum bronze, and brass, which have been widely used in the marine, petrochemical, electrical, and medical industries. “Customers entrusting us basically don't need to travel around to find the products they need. We also have the most commonly used products and raw materials available for quick delivery.

In addition to standard products, our experienced technical team can provide timely advice and assist in the design and production of costeffective products according to customers' needs,” Yushung General Manager Sunjin says.

In 2016 Yushung was contracted to supply bronze fittings for a seawater cooling tower project of a client in the Middle East valued at over US$200,000, and was required to complete delivery within 45 days! Not only were the products required complex, they were also mostly customized products that required more equipment to process. For dealing with this task almost impossible for many in the industry, Yushung fully mobilized the factory's resources and completed the delivery even 5 days earlier than the customer's request, demonstrating the ability of flexible scheduling management.

In order to maintain quality and enhance efficiency, Yushung has been replacing old equipment with new ones, upgrading equipment automation, and deepening the quality awareness of its staff in recent years. Not only has it obtained the ISO 9001:2015 certification and its products comply with SGS testing standards, but it has also actively applied for the “Chongqing Professional and Innovative Rising Star Enterprise” recognition, aiming to become a market leader and a wellknown enterprise in China and the world.

Yushung's copper-based alloy fasteners exhibit many advantages in application that iron and stainless steel fasteners are unable to provide at once, such as special corrosion and abrasion resistance, high strength, non-sparking, non-magnetic, and good electrical conductivity, etc., which can solve problems that may be encountered when assembling fasteners made of the same material. For example, the problem of “deadlock” occurs when using the same stainless steel screw and nut together, but by using bronze nuts, this problem can be solved successfully.

In addition to deepening and consolidating sales in Europe and the U.S., Yushung has also been actively cultivating dealers and distributors in the Middle East and Southeast Asia in recent years in the hope that more customers in emerging markets will understand and accept its products, and that it will be able to secure more orders. “I am a man of stability. I believe that manufacturing must be specialized, and that we must expand our product line to meet the needs of more customers and continue to pursue the corporate sustainability, which is the goal that every Yushung employee is most proud of and continues to strive for.” said General Manager Sunjin.

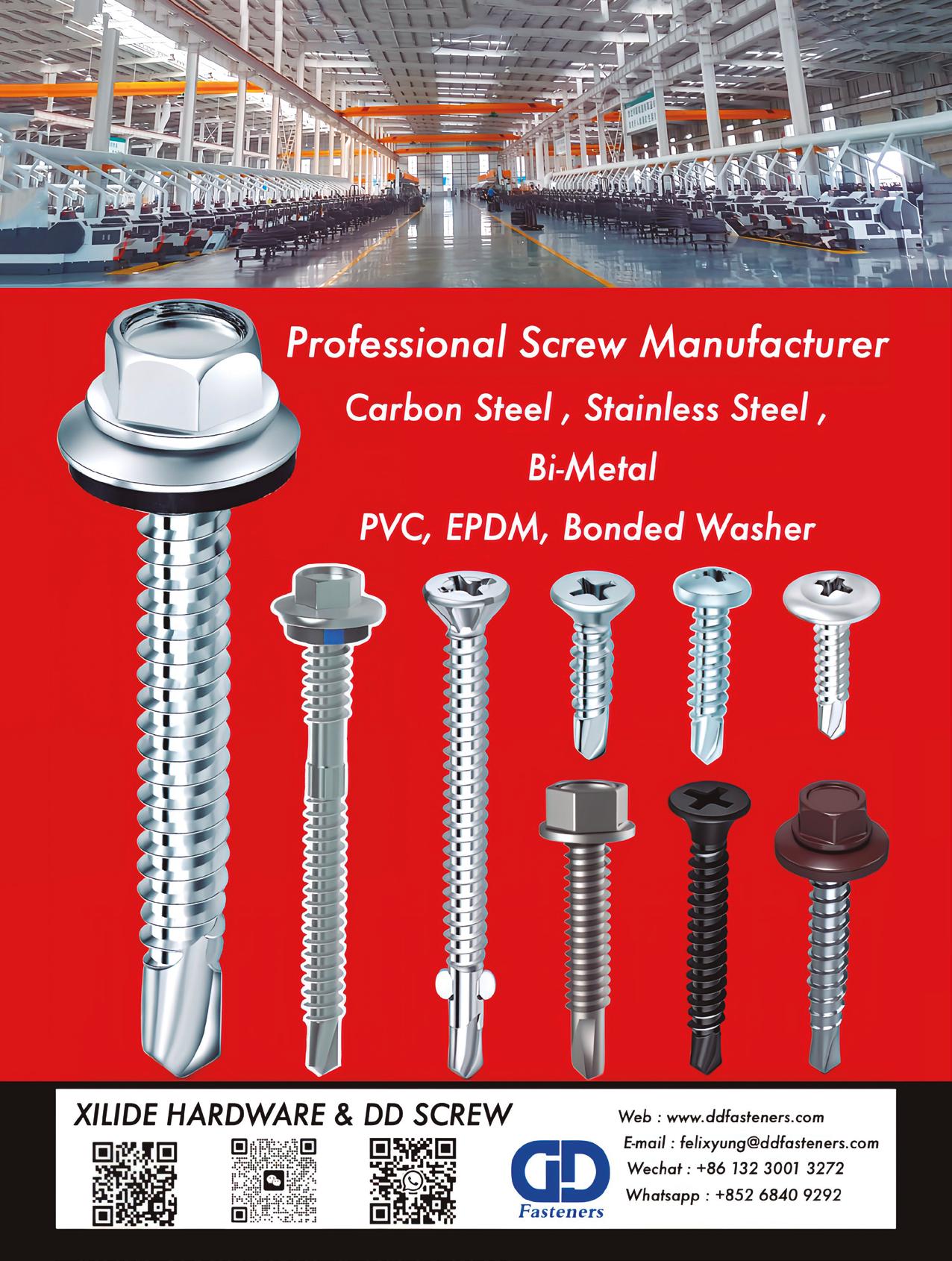

Hebei Xilide, established in July 2003, is one of the early professional manufacturers of self-drilling screws and self-tapping screws in China. Its plant occupies a total area of 400,000 square meters, with a total investment of more than RMB 3.4 billion. After more than ten years of development, the company has built a modern, high standard, full-scale, and complete range of self-drilling screws production lines, and developed into a global and systematic group of companies integrating R&D, production, customization, testing, sales, and promotion.

The company spent a lot of money on introducing manufacturing, heat treatment, inspection and testing equipment from Taiwan and Germany, and provides users around the world with self-drilling screws of various specifications and standard requirements that are of high quality, high standard, and high level. Its annual capacity is more than 60,000 tons and products are exported to more than 20 countries and regions, such as India, Russia, the U.S., Canada, Australia, Kazakhstan, Africa, etc., and have gained the support and trust of users.

The company by far has more than 50 middle and senior managers, 35 professional R&D personnel, 50 technicians, 25 warehouse and logistics staff and 650 basic employees. At present, it has more than 1,000 employees in total.

1. China's largest fully-automated self-drilling screws production line

As the first and largest screw manufacturer in China, it has an automated production line. With advanced and professional technology, modern production, inspection equipment, strict modern management, and advanced manufacturing technique, it can ensure the quality of each product and guarantee the delivery time.

2. Complete product testing process and equipment

The company is equipped with complete production equipment and systems. Its perfect professional testing, strict control, and all-round quality assurance system allow each process, procedure, and link to be under strict quality control, so as to achieve excellent quality.

3. International Quality System Certification

The company has obtained the ISO 9001 quality management system certification and CE certification. All products are strictly in accordance with the international standards (RoHS) of production and certified by the international SGS inspection organization.

Contact: Mr. Felix Yung

Email: felixyung@ddfasteners.com

河北德龍緊固件-專注高端產品研發

Due to the excellent quality, stability and durability of its products, Delong's products not only have been widely used by customers from the construction, installation, steel structure engineering, automobile, machinery, electronics, agricultural machinery and many other industries, but also have been successfully sold into the important markets such as Europe, the U.S., Southeast Asia, and Africa, owing to its excellent and perfect service.

“We’ve always been adhering to the corporate philosophy of ‘integrity-based, quality of survival’, to provide customers with the best products and perfect after-sales service, and sincerely hope to establish a longterm close cooperative relationship with our partners and customers around the world,” according to Delong.

In addition, in terms of quality control, which is the most important issue to its customers, Delong has also imported many first-class production, hi-tech-based and heat treatment equipment from Taiwan region, continuously improving and upgrading production lines and optimizing the product process to ensure that every fastener shipped from Delong meets the international standards and passes the stringent inspection of customers, further helping its customers create more added value for their brands.

“The introduction of advanced processing equipment from Taiwan region has not only greatly increased our production capacity, but also enabled us to achieve better product quality. In addition, our senior staff have been

Headquartered in Yongnian (Handan, China), a famous fastener distribution center, Hebei Delong Fastener Manufacturing Co., Ltd. is a well-known professional manufacturer of fasteners. Since its establishment in 2006, the company has been committed to the R&D and production of various high-end fasteners, providing excellent quality products and the most complete supporting services for the relevant needs of the industry, especially Self-Drilling Screws, Flat Washer and Spring Washers, which continue to show a high price-performance ratio that has enabled it to become the preferred choice of many customers for a long time.

Delong offers a wide range of fastening solutions to meet the diversified needs of market buyers and application trends in different industries. Supported by an average annual capacity of over 8,000 tons, its main available products include: various Self-Drilling Screws Series (hex flange head self-drilling screws, hex self-drilling screws, washer head self-drilling screws, countersunk self-drilling screws, pan head self-drilling screws) and High-Strength Spring Washers (DIN127, DIN7980, etc.), Flat Washers (DIN125, DIN9021, DIN6916, F436, etc.). In addition to the common general specifications, its professional technical team can also provide customized service for a variety of nonstandard fasteners according to customers’ drawings, meeting the special needs of different customers in a comprehensive manner.

working in the plant for more than 10 years and have accumulated rich production experience, so we are able to help our customers do a good job in quality control,” according to Delong.

In order to make more customers gain the opportunity to get to know its high quality fasteners, Delong not only regularly participates in a number of professional fastener exhibitions in China (e.g. Fastener Expo Shanghai), but also arranges 2-3 overseas exhibitions every year to promote its products, hoping to further expand its sales network and open up its brand awareness in different industries through the combination of domestic and overseas sales.

Delong contact: Ms. Cally Wang / Email: sales@delongfastener.com

Copyright owned by Fastener World Article by Gang Hao Chang, Vice Editor-in-Chief

Designed with durability, corrosion-resistance, and ease of installation to cater to different environmental conditions and structural requirements, SSF’s wood connectors, currently available in a wide range of materials including galvanized steel and stainless steel, feature a robust structure that ensures a secure and stable connection between timber components, which are particularly suitable for the applications of construction companies, timber frame builders, and DIYers requiring reliable and high performance connectors for their projects. With high strength, corrosion resistance, and ease of installation as the main advantages, the wood connectors can withstand significant loads, making them ideal for both residential and commercial construction projects, not to mention their compatibility with various timber types and sizes.

“We ventured into the wood connectors market to diversify our product offerings and tap into the growing demand for sustainable and environmentallyfriendly building materials, as we recognized an opportunity to leverage our expertise in metalworking to create high-quality connectors that would support the use of brackets in construction. These products can complement with our existing washers and stamped parts in applications and have been in the process of obtaining relevant certifications,” according to SSF.

環保永續 固特金屬發表新木結構連接件

Boasting the best choice for washers and stampings of customers, the top-notch Chinese assembly & installation solutions provider, SSF Industrial Co., Ltd., has recently moved a step forward and expanded its product portfolio to include the new wood connectors, demonstrating its dedication to cater to the growing demand of customers seeking sustainability and a greener environment.

Contact: Sales Manager Lilian Zheng Email: lilian@ssfwashers.com AD on p154

With an envision to create a smart factory equipped with automated and real-time production monitoring & QC systems, SSF’s investment in establishing new plants to enhance manufacturing capabilities, improve efficiency, support the development of new product lines, and respond to CBAM and relevant carbon reduction initiatives clearly reveals its commitment to sustainability and incorporation of energy-efficient technologies and processes to minimize its carbon footprint.

“Our new facilities are expected to be fully operational by the yearend. Once the plant with the use of renewable energy sources, waste reduction measures, and implementation of green manufacturing practices is inaugurated, it’ll play a crucial role in meeting increasing customer demands and expanding our market presence,” according to SSF.

As an industry-leading manufacturer, SSF continues to maintain or even exceed its target capacity of 1,800 tons/month. Its focus on quality and customer satisfaction has also helped it secure new contracts and expand its presence in Europe and the U.S.

“Aiming at becoming a leading fasteners and connectors supplier, our goal is to continue expanding product offerings and market reach while maintaining the highest standards of quality and customer service. We also expect to strengthen our industrial position through strategic partnerships, continuous manufacturing process improvement, and by staying ahead of market trends and customer needs, in order to achieve sustainable growth and contribute positively to the industries we serve,” according to SSF.

Copyright owned by Fastener World / Article by Gang Hao Chang, Vice Editor-in-Chief

Italy's manufacturing prowess stretches back centuries, and its fastener industry embodies this rich heritage. Renowned for meticulous craftsmanship and a constant drive for innovation, Italian-made fasteners are coveted across the globe. This reputation is no accident. Italy boasts the second-largest manufacturing sector in the eurozone, contributing a staggering €33 billion in Manufacturing Value Added (MVA) – a metric that captures the value created by the manufacturing process. This translates to a robust domestic market that consumes a significant portion of high-quality fasteners. However, Italian ambition extends far beyond its borders. The nation thrives as a global exporter, ranking a mighty sixth globally in terms of MVA. This robust manufacturing base fuels a constant demand for high-quality fasteners, not just domestically, but internationally as well. Italian manufacturers cater to this demand by consistently producing reliable and innovative fastening solutions, solidifying their position as a global leader in the industry.

• 2021: Total exports amounted to US$2,209,000,000

Italian fastener industry has carved a niche for itself on the international stage. Here's a closer look at its position:

Italy is the world's eighth largest exporter. it's the second-largest exporter of iron fasteners in

Italian fastener manufacturers prioritize quality and innovation. This emphasis translates into a reputation for reliable and high-performing products.

EU countries account for nearly two-thirds of Italy's fastener trade, highlighting the strong regional presence.

• 2022: Total exports grew to US$2,283,044,000

• 2023: Total exports further increased to US$2,452,727,000

This translates to a year-on-year growth of:

• 2022: 3.4% increase from 2021

• 2023: 7.4% increase from 2022

While the data doesn't provide individual growth rates for each country, we can observe the following:

The following table shows Italy’s exported fasteners data between 2021-2023, for HS-Code 7318 (the main cluster of fastener category):

• Germany: Throughout the three years, Germany remained the top importer of Italian fasteners, with their purchase share steadily increasing each year. Despite being the largest importer, Germany experienced the slowest growth rate at 4.7% between 2021 and 2023. This could indicate a more mature market in Germany with established import levels. Consistently held the largest share, with a purchase share of approximately 28% in each of the three years.

The data suggests a positive growth trend in Italy's fastener exports between 2021 and 2023. Here's a breakdown of the figures:

Note: Numbers

• France: France also shows a potential increase in imports. France saw a significant increase of 13.9% in its import value, suggesting a growing demand for Italian fasteners in this market. France's share remained around 14-15% throughout the period.

• Poland: Poland's import value also seems to be on an upward trend. Poland stands out with the highest growth rate at a staggering 31.4%, highlighting a rapidly expanding market for Italian fasteners. Poland's share appears to be between 5% and 6%.

• USA: The data suggests a similar increase for the U.S. The U.S. witnessed a healthy growth rate of 16.7, indicating a strong interest in Italian fasteners in these regions. The U.S. share seems to be around 6%.

• Spain: Spain's import value appears to be following a similar trend. Spain witnessed a healthy growth rate of 19.1%, indicating a strong interest in Italian fasteners in these regions. Spain's share fluctuates around 5%.

• Others: The category "Others" represents a combined import value from various countries. The "Others" category saw a moderate growth of 9.9%, suggesting a potential diversification of export destinations for Italian fasteners. The "Others" category represents the remaining share, which increased from 40% in 2021 to 39% in 2023.

The following table shows Italy’s imported fasteners data between 2021-2023, for HS-Code 7318 (the main cluster of fasteners category):

Note: Numbers in Thousand USD

Overall Growth Trend

The data indicate a positive growth trend in Italy's fastener exports from 2021 to 2023. Here's a detailed breakdown of the figures:

• 2021: Total exports amounted to US$1,333,428,000

• 2022: Total exports grew to US$1,428,894,000

• 2023: Total exports further increased to US$1,301,772,000

This translates to a year-on-year growth of:

• 2022: 7.2% increase from 2021

• 2023: -9.0% decrease from 2022

While individual growth rates aren't available for each country, we can observe the following:

• Germany: Germany remained the top exporter to Italy throughout the three years. Italy's purchases share seems to have fluctuated slightly, but generally remained around the same level. Despite being the largest exporter, Germany experienced a slight decline in its export value, with a decrease of 2.5% between 2021 and 2023. This could indicate a stable or potentially saturated market in Italy for German fasteners. Consistently held the largest share, with a purchase share of approximately 29% in each of the three years.

• China: China's export value to Italy shows a significant decline. This could be due to various factors, such as increased domestic consumption of fasteners in China or Italy has replacement countries instead pf China. China's export to Italy significantly decreased from around 20% in 2021 to 16% in 2023.

• Taiwan's export value also appears to be decreasing. Taiwan also witnessed a moderate decrease of 3.8% in its export value, suggesting a potentially slowing demand for Taiwanese fasteners in the Italian market. Taiwan's share also seems to be decreasing, hovering around 8% throughout the period.

• Other Countries: The category "Others" represents a combined export value to various countries. The "Others" category, representing exports of various countries to Italy, saw a moderate growth of 6.4%. This suggests a potential diversification of partners for Italian fastener consumers. The "Others" category represents the remaining share, increasing slightly from 38% in 2021 to 41% in 2023.

The future of Italy's fastener imports and export landscape appears promising, driven by several factors: The global demand for fasteners is expected to grow steadily, fuelled by expanding construction, automotive, and infrastructure sectors.

Italian Innovation: Continued focus on research and development by Italian manufacturers will likely lead to new and improved fastener solutions, maintaining their competitive edge.

• Digitalization: Embracing Industry 4.0 principles, such as automation and data-driven manufacturing, could enhance efficiency and productivity in the Italian fastener industry.

Potential Challenges to Address: Despite the positive outlook, there are also challenges to consider:

• Competition: Intensifying competition from countries like China offering low-cost fasteners could put pressure on Italian manufacturers.

• Raw Material Costs: Fluctuations in the prices of raw materials used in fastener production could impact profitability.

• Sustainability Concerns: The industry will need to address growing environmental concerns by adopting sustainable practices throughout the fastener lifecycle.

By addressing these challenges head-on and capitalizing on its strengths, Italian fastener industry can solidify its position as a dominant force in the global market. Its commitment to quality and a forward-thinking approach will be crucial in ensuring a bright future for "Made in Italy" fasteners.

Copyright owned by Fastener World Article by Behrooz Lotfian

2024印尼雅加達國際緊固件五金展汽機車用緊固件成本屆焦點

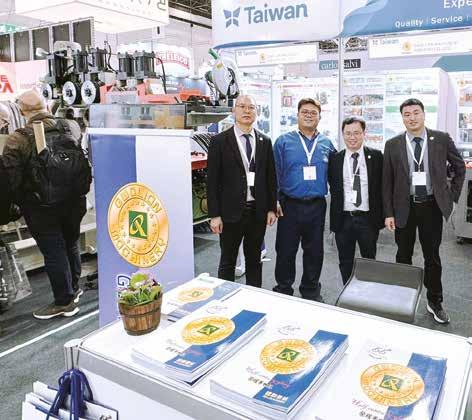

The 6th annual INAFASTENER was held in JIEXPO Kemayoran, Jakarta, the capital city of Indonesia, on May 15-17 this year. It is one of the most important professional fastener and hardware exhibitions in Indonesia and ASEAN region supported by Indonesia Automotive Parts & Components Industries Association (GIAMM), Indonesia Automotive Workshop Association (ASBEKINDO), Indonesia Fastener Association (AFI), and attracts many domestic and overseas industry professionals and buyers to visit and make their inquiries every year. This year, Fastener World also sent our staff to participate in the exhibition on-site in order to build a bridge with the local supply chain and potential customers for those interested in expanding into the Indonesian market and extending their business reach to the neighboring ASEAN markets.

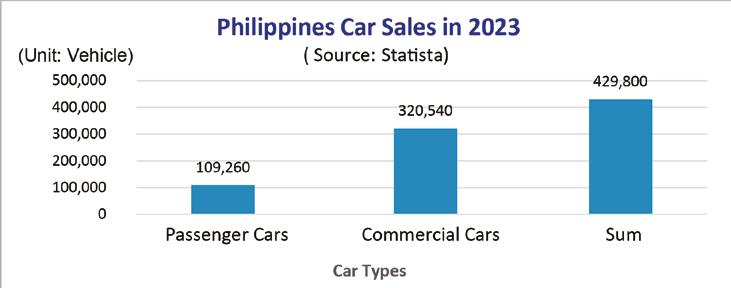

The exhibits on display included a wide range of industrial fasteners and fixings, assembly & installation systems, and storage & logistics services, with fasteners for conventional cars, electric vehicles and motorbikes being the most talked-about products of the show. It is understood that Indonesia's automotive industry has always been an important part of the country's manufacturing development. With the gradual transformation of the automobile industry to promote the development of electric vehicles, the Indonesian government has also set the goal of reaching the production target of 600,000 electric vehicles and 2.45 million motorcycles by 2030. Indonesia is also one of the largest motorcycle markets in the world. The Indonesian government has also set a goal of fully electrifying all new motorcycles sold by 2040, which is part of the Indonesian government's plan to electrify all new cars sold by 2050.

During the 3-day exhibition, Fastener World's booth attracted many local buyers who stopped by to read the latest magazines and ask for relevant supplier information. Many visitors also scanned the QR Code of Fastener World's official website to try out the digital B2B buying & selling platform, and the rich supplier information allowed them to see more purchasing channels and opportunities. This year, there were also several Taiwanese companies exhibiting and showcasing their new products and services that were of great interest to local buyers.

The organizer has not yet announced the date of the next show. For more information, please stay tuned to the official website of Fastener World.

Copyright owned by Fastener World / Article by Gang Hao Chang, Vice Editor-in-Chief

China's housing market stands as a pivotal barometer of its economic health, with new housing starts serving as a key indicator of growth and development. Against the backdrop of a rapidly evolving economic landscape, the hardware and fastener industries play a crucial role in the construction sector, ensuring structural integrity and safety in building projects. This article briefly explores the nuances of China's housing market in 2023 and provides insightful projections for 2024, which might be helpful for those involved in the fastener and hardware industries, offering valuable perspectives on market trends and potential opportunities for strategic positioning.

China's housing market woes have gained significant attention in recent years, reaching a climax with fresh reports towards the end of the previous year. These reports indicated that more than half of listed property developers had either defaulted on their obligations or restructured their public debts. Sales of new residential properties in 2023 were sluggish, amounting to only half the pace witnessed in 2021. Similarly, new residential construction starts experienced a comparable decline

However, amidst the bleak outlook portrayed by these reports, there were some encouraging developments that went unnoticed. In 2023, completions of residential properties saw a notable uptick, surging by 17 percent; however, housing starts have declined by more than 21% compared to 2022. The total area completed reached nearly 725 million square meters, surpassing the pace

of new residential starts for the first time on record. If this trend persists, it has the potential to instil confidence in the property market, fostering a more sustainable pace of development.

The turbulence within China's property sector came into a sharp focus in mid-2021, notably with the emergence of challenges faced by one of the nation's largest property developers. Subsequently, other developers found themselves grappling with similar predicaments.

While these developments posed immediate challenges to China's economic growth, they served to purge risky practices, a crucial step towards fostering a sustainable property market. At the height of the 2021 crisis, a significant portion of the nearly 1.5 billion square meters in residential property purchases were speculative rather than driven by genuine demand.

A key obstacle to the establishment of a sustainable property market lies in the timely completion of presold properties, often paid for in full in advance without a deposit or down payment. Concerns over potential non-delivery of purchased units can deter prospective buyers, thereby undermining property sales.

The preceding year marked a pivotal juncture in addressing this challenge. Despite a halving in new construction starts, and a one-fifth decline in property investment compared to 2021, notable progress was made. A significant factor contributing to this trend is the increasing allocation of property investment towards completing projects initiated in the past, rather than initiating new ones.

These developments represent predominantly positive news for China's economy. Developers have significantly curtailed new construction starts, acknowledging the end of the property boom, and are channelling the bulk of their efforts and resources into completing presold housing units.

In early 2024, China's housing market displayed signs of stabilization, with a moderated decline observed in property investment and sales. Governmental efforts to mitigate the sector's downturn, coupled with strategic interventions, contributed to this tempered decline. Property investment fell by 9% year-on-year in the first two months of 2024, compared to a 24% decline in December 2023. Similarly, property sales witnessed a 20.5% slide in January-February, reflecting a slight improvement from the preceding months.

However, challenges persist, as evidenced by the sector's struggle to stabilize home prices, which declined by 0.3% month-on-month in February. Despite the modest slowdown in investment decline, analysts remain cautious, emphasizing the continued downtrend in the real estate sector. The liquidity crisis facing developers and the ongoing struggle for cash flow underscore the underlying challenges confronting the industry.

In the coming years, China's housing market is expected to face additional obstacles due to underlying changes in its population dynamics. The need for more housing is likely to decrease as population growth slows down and the pace of urbanization also slows. Although significant government subsidies over the past decade facilitated the migration of millions of people to better-quality homes from older, less equipped ones, this demand is anticipated to dwindle. This decline is attributed to reduced revenues from land sales, which constrain local government budgets, along with a decrease in the number of residents occupying older housing units.

Given these changes in both short-term trends and long-term factors, investment in housing is expected to decrease further, remaining low in the near future. Recent forecasts for real estate investment in the medium term, taking into account different scenarios based on changes in demand and supply-

side pressures, suggest a potential decline ranging from 30 percent to 60 percent below the levels seen in 2022. This decline would lead to a gradual recovery similar to what has been seen in other countries experiencing significant slowdowns in housing construction.

Efforts to strengthen spending on affordable housing and urban redevelopment in the current year may partially alleviate the decline in investment. However, these measures are unlikely to adequately address the substantial housing inventory overhang held by financially distressed developers.

A smoother and more expedient transition for the real estate sector can be achieved through market-driven adjustments in home prices and swift restructuring of insolvent developers. Phasing out regulations allowing banks to defer recognition of bad loans to developers is crucial.

Authorities should extend support to viable developers while tightening regulations to mitigate future risk accumulation. Introducing insurance for homebuyers against the risk of developers' failure to complete purchased homes could enhance confidence and alleviate sales pressures. Strengthening escrow rules for presale financing would offer improved legal safeguards for homebuyers. Implementing a nationwide property tax and enhancing pension or alternative saving schemes would reduce households' reliance on housing investment. Fiscal reforms aimed at bridging the structural gap between local government revenues and expenditure obligations are essential to reduce dependence on land sales and property-related activities.

In reaction to challenges faced by the sector, China has ramped up efforts to breathe new life into the property market. These efforts include cutting benchmark mortgage rates and implementing a "whitelist" mechanism. This mechanism allows city governments to recommend residential projects to banks for financial support. Despite these measures, market sentiment remains muted, with trends such as home purchasing, financing, and construction initiations continuing to decline.

As China's housing market faces the challenges brought by economic changes, regulatory shifts, and technological progress, the construction industry stands as a vital component, deeply integrated into the fabric of development projects. Analyzing the trends in new housing starts in 2023 and predictions for 2024 sheds light on the interconnectedness between construction endeavours and the broader economy. As stakeholders navigate this evolving terrain, adaptability, innovation, and strategic planning are essential for seizing emerging opportunities and tackling obstacles within China's dynamic construction sector.

Sources:

China’s Housing Report by Peterson Institute for International Economics

China's Property Investment Report by Reuters

China’s Real Estate Sector Report by Internation Monetary Fund (IMF)

Copyright owned by Fastener World / Article by Shervin Shahidi Hamedani

Copyright owned by Fastener World / Article by Shervin Shahidi Hamedani

Compiled by Fastener World Updated on May 6, 2024 Monetary unit in millions (in USD) 扣件大廠財報

Chicago Rivet's 2023 net sales were USD 31.507 million, down 6.3% from USD 33.646 million in 2022. The company ended the year with a loss of USD 4.401 million in net income in 2023, compared to earning USD 2.867 million in net income in 2022. Total assets decreased to USD 27.830 million in 2023 from USD 33.626 million in 2022.

Trimas' 2023 net sales were USD 893.550 million, up 1.0% from USD 883.830 million in 2022. Net income was USD 40.360 million in 2023, down 39.0% from USD 66.170 million in 2022. Total assets increased to USD 1,341.660 in 2023 from USD 1,305.000 million in 2022.

Sympson Manufacturing's 2023 net sales were USD 2,213.803 million, up 4.6% from USD 2,116.087 million in 2022. Net income was USD 353.987 million in 2023, up 5.9% from USD 333.995 million in 2022. Total assets increased to USD 2,704.724 million in 2023 from USD 2,503.971 million in 2022.

Norma Group's 2023 revenue was € 1,222.8 million, down 1.6% from € 1,243.0 million in 2022. Net profit was € 27.9 million in 2023, down 28.7% from € 39.2 million in 2022. Total assets decreased to €1,493.3 million in 2023 from € 1,560.7 million in 2022.

Bufab's 2023 net sales were SEK 8,680 million, up 2.9% from SEK 8,431 million in 2022. The company ended the year with a net profit of SEK 574 million in 2023, lower than SEK 609 million in 2022. Total assets decreased to SEK 8,600 million in 2023 from SEK 9,436 million in 2022.

Bulten's 2023 net sales were SEK 5,757 million, up 28.6% from SEK 4,474 million in 2022. Net profit was SEK 127 million in 2023, up 71.6% from SEK 74 million in 2022. Total assets increased to SEK 4,852 million in 2023 from SEK 4,356 million in 2022.

Lisi's 2023 revenue was € 1,630.444 million, up 14.4% from € 1,425.212 million in 2022. Net income was € 36.667 million in 2023, down 35.3% from € 56.729 million in 2022. Total assets increased to € 2,058.566 million in 2023 from € 1,999.087 million in 2022.

SFS' 2023 net sales were CHF 3,073.0 million, up 12.2% from CHF 2,738.7 million in 2022. Net income was CHF 268.5 million in 2023, down 0.8% from CHF 270.6 million in 2022. Total assets decreased to CHF 2,546.8 million in 2023 from CHF 2,574.2 million in 2022.

Vossloh's

Tong Heer's 2023 revenue was MYR 598.033 million, down 39.5% from MYR 988.585 million in 2022. Net profit was MYR 9.788 million in 2023, down 88.8% from MYR 87.407 million in 2022. Total assets decreased to MYR 609.003 million in 2023 from MYR 617.099 million in 2022.

JPF 's 2023 revenue was JPY 5,108 million, down 4.6% from JPY 5,354 million in 2022. The company ended the year with a loss of JPY 108 million in net profit in 2023, compared to earning JPY 40 million in net profit in 2022. Total assets decreased to JPY 7,459 million in 2023 from JPY 8,001 million in 2022. The company forecasts 2024 revenue at JPY 5,250 million, up 2.8%.

China High Quality Collaborative Development Industry Alliance for Wind Power Fasteners is Launched

中國風電緊固件高質量協同發展產業聯盟正式成立

On April 8, High Quality Collaborative Development Industry Alliance was established at the Beijing Wind Power Fasteners Technology Exchange Conference. More than 40 companies participated in the meeting and discussed existing issues in all aspects of the entire life cycle of wind power fasteners.

The wind power industry is in a period of rapid development. Fasteners are key components in wind power equipment, and their quality and technological advancement are crucial to the safe operation and long-term stability of equipment. Strengthening exchanges and cooperation across the wind power fastener industry chain, jointly promoting fastener technology innovation and application, and standardizing marketoriented behavior have become urgent for the development of the current wind power fastener industry.

Founding

of

To this end, the National Technical Committee on Fastener Standardization established High Quality Collaborative Development Industry Alliance for Wind Power Fasteners. The committee invited wind power companies, machine manufacturing companies, fastener manufacturers, universities, scientific research institutes and related service agencies to join the alliance to jointly promote the high-quality development of China's wind power fasteners.

中國佛山市緊固件製造行業協會成立大會隆重舉行

美國工業扣件學會選出新任正副理事長

The Industrial Fasteners Institute (IFI) elected new leadership for the organization’s Board of Directors for the 2024-2025 term during its annual meeting March 3-5, 2024 in Bonita Springs, Florida. Dan Curtis of MacLean-Fogg Company was selected to lead the board as Chairman, along with Larry Spelman of J.H. Botts LLC as Vice Chairman, and Gene Simpson of Semblex Corporation as Ex-Officio Chair. In addition to the Board leadership, the Board Representatives and Division chairs were also elected.

On March 27, 2024, the founding meeting and first membership meeting of Foshan Fastener Manufacturing Industry Association was held at Foshan Jinding Taifeng Hotel.

The election results were announced at the conference. The general manager of Foshan Nanhai Weiye High-strenth Standard Parts was elected as the first president of the Association. He stressed that the Association will be committed to promoting cooperation and exchanges among fastener companies, promoting technological innovation and industrial upgrade in the industry, and contributing to the development of the fastener industry in Foshan City. In addition, he said that as the first president of the Association, he will take a positive attitude and pragmatic measures to work with the members to promote the association's work and provide high-quality products, service and support to member companies.

IFI is the leading voice representing the interests of the North American manufacturers of mechanical fasteners and formed parts, as well as the key suppliers to the industry, fostering their working together to shape the future of the industry. IFI represents the industry to its suppliers, customers, the government, and the public-at-large to advance the competitiveness, products, and innovative technology of the Member Companies in a global marketplace.

China Exports 1,215,986 Tons of Fasteners in Q1 2024

2024年第一季度中國緊固件出口重量1,215,986噸

From January to March 2024, China's fastener export weight was 1,215,986 tons, an increase of 165,935 tons (a growth of 17.4%) over the same period last year; the export value was US$2,539.859 million, a decrease of US$517.765 million over the same period last year, and a year-on-year decrease of 11.4%. In March 2024, China's fastener export weight was 381,948 tons and the export value was US$803.263 million.

From January to March 2024, the average export price of Chinese fasteners was US$2,100/ton, and the average export price of fasteners in the same period of 2023 was US$2,900/ton.

In March 2024, China's fastener export weight was 381,948 tons, a decrease of 36,841 tons over the same period last year; the export value was US$803.263 million, a decrease of US$500.829 million over the same period last year.

Million, Up 40.1%

邯鄲市第一季度緊固件出口3.6億元,同比增長40.1%

Chinese Passenger Cars to Breach 4.6 Million Units and

中國乘用車預計突破460萬輛 市場份額 有望達60%

The data published by China Association of Automobile Manufacturers show that starting from 2021, China's passenger car market share has continued to rise in the past three years.

In 2021, China sold 9.543 million units of passenger cars, with a market share of 44.4%. In 2022, China sold 11.766 million units, with a market share of 49.9%. In 2023, China sold 14.596 million units, with a market share of 56%. In the first four months of 2024, the sales volume was expected to exceed 4.6 million units, with the market share expected to reach 60%.

In Q1 2024, the total trade import and export value of Handan City was RMB 6.74 billion, a year-on-year increase of 42.2%, ranking second in all the highest growing provinces. In Q1, Handan City's foreign trade import and export mainly showed several characteristics. The import and export value of foreign-invested enterprises was RMB 1.82 billion, a year-on-year increase of 5.8 times.

In Q1, Handan City's import and export value to India was RMB 1.3 billion, a year-on-year increase of 1.1 times, accounting for 19.3% of the city's total import and export value. Handan's import and export value to ASEAN was RMB 1.01 billion, a year-on-year increase of 96.0%, including export to Vietnam and Thailand, valued at RMB 410 million and RMB 270 million respectively, a year-on-year increase of 3.8 times and 1.1 times respectively. The export value to Australia was RMB 860 million, a year-on-year increase of 57.4%. The import and export value to Brazil was RMB 590 million, a year-on-year increase of 5.9 times. The import and export value to EU amounted to RMB 570 million, a year-on-year increase of 7.3%.

In Q1, Handan City's fastener export achieved double-digit growth. The fastener export value was RMB 360 million, a year-on-year increase of 40.1%. The steel export value was RMB 780 million, accounting for 24.8% of the total export value.

烏克蘭延長對中國鋼鐵緊固件課徵反傾銷稅

Ukraine's Interdepartmental Commission on International Trade has announced the extension of anti-dumping duties on steel fasteners originating from China. The extension came into force immediately on April 17, 2024.

Except for 2 Chinese producers subject to lower AD rates less than 40%, all other Chinese steel fastener producers and exporters will be subject to a rate of 67.4%. The products involved are threaded steel screws, bolts, nuts imported from China, falling within the categories of 7318156990, 7318158190, 7318198169190 and 7318169990. The AD measures were first introduced in Ukraine in 2020 and the AD investigation was launched in Dec. 2019 and completed earlier than expected.

Ukraine also announced the final AD measures against steel wire originating from China last August, which will be valid for 5 years at a rate of 32.6%.

U.S. to Levy USD 1.8 Billion Tariff on Chinese

美將對價值180億美金中國商品加徵關稅 電動車稅率增至100%

The White House stated on May 14 that the U.S. will impose additional tariffs on US$18 billion worth of goods imported from China, targeting strategic industries such as EVs, batteries, steel, and critical minerals. The tariff rate for EVs is expected to

quadruple to 100% this year; the rate for semiconductors is expected to increase from 25% to 50% by the end of 2025.

The White House said in a statement that the above actions are aimed at urging China to eliminate unfair trade practices related to technology transfer, intellectual property and innovation. Trump launched a U.S.-China trade war back in his presidential term and imposed additional tariffs on approximately USD300 billion worth of Chinese goods. The White House made the decision after reviewing the tariffs imposed during the trade war. The main tool used by the Trump administration is the so-called Section 301 Investigation. The Biden administration is taking action based on Section 301 of the U.S. Trade Act.

In addition to EVs and semiconductors, Washington's tariffs on certain steel and aluminum products, as well as lithium-ion EV batteries and battery components, have also increased to about three times their original levels.

China's Ministry of Commerce issued a statement on this result, which states that China firmly opposes and has made strong protest to the U.S. The Commerce said that the U.S. abused the Section 301 tariff review process out of domestic political concerns to further increase the tariffs on some Chinese products, and politicized and instrumentalized economic and trade issues. The Commerce attributes it to typical political manipulation and expresses strong discontent. The Commerce said WTO has already ruled that Section 301 tariffs violate WTO rules, and that China will take resolute measures to defend its rights and interests.

EVs Flock in Brazil Before New Tariff Takes Effect

巴西新關稅實施前大量中國電動汽車湧入

Mexican President López Obrador signed an act to impose temporary import tariffs of 5% to 50% on 544 items, including fasteners, steel, and aluminum. Mexico News Daily reported that new tariffs are imposed on hundreds of imported products from countries with which it has not signed a trade agreement, and said that this move seems to be mainly aimed at China.

The act has been effective since April 23 and will be valid for two years. According to the act, fasteners will be subject to a temporary import tariff of 35%. The fastener products involved include: square head screws, other wood screws, hook screws and ring screws, self-tapping screws.