Following the previous certifications of D&B, IATF 16949, ISO 9001:2015, and Taiwan Mittelstand Award, Taiwanese customized automotive, special, and lock nuts manufacturer, Hu Pao Industries Co., Ltd. has again obtained the ISO 14064-1:2018 certification for quantification and reporting of greenhouse gas emissions and removals, which is another step forward for its substantial progress towards ESG compliance and becoming a green sustainable fastener enterprise. Getting this certification is also an indirect way for Hu Pao to announce to its global customers that it’s been ready to move towards low carbon manufacturing.

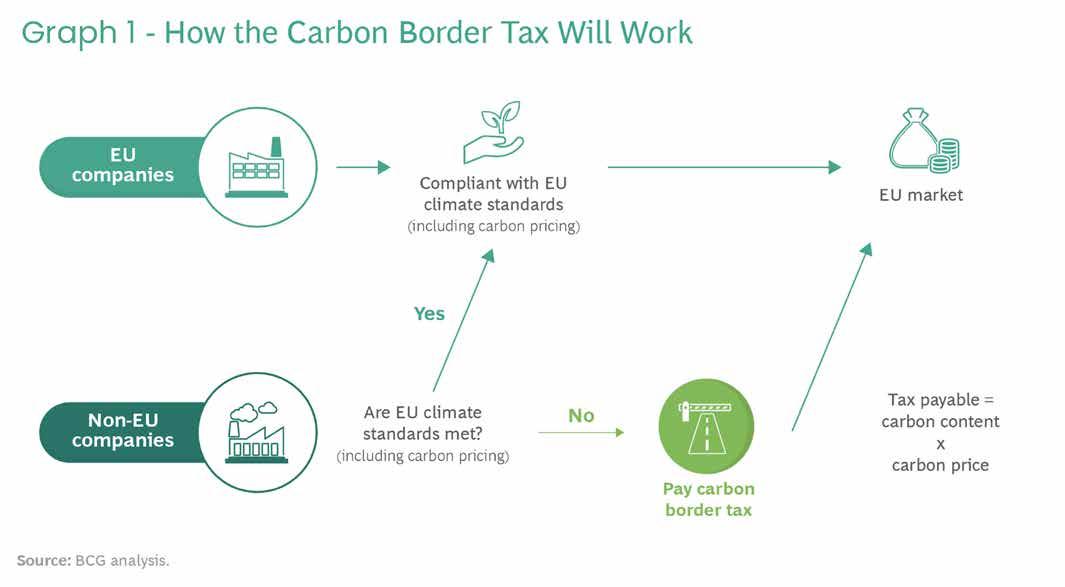

Taiwanese fasteners are mostly exported to Europe and the U.S. With the increasing concern of customers on energy saving and carbon reduction as well as the imminent implementation of EU’s Carbon Border Adjustment Mechanism (CBAM) in 2026, the carbon emission control of enterprises has become an important assessment factor for the smooth entry of future products into the local market, and the ISO 14064-1:2018 is the 1st step to help enterprises understand their carbon emission status. Recognizing the importance of net-zero carbon emissions to corporate sustainability, Hu Pao is leading the industry in initiating GHG Inventory verification in 2021, with senior executives directly involved in cross-departmental integration and focusing on direct emissions, indirect energy emissions and other indirect emissions to compile relevant data and certificates under specifications and produce the organization’s final greenhouse gas emission report, emission inventory and inventory procedure documents, clearly quantifying the organization’s carbon footprint from raw materials to shipments. In April 2023, it officially obtained the ISO 14064-1:2018 certification from Ares International, a third-party certification body.

“We spent a lot of time and manpower collecting the necessary info for certification. During the period, we actively identified the sources of carbon emissions in our factory and strengthened energy saving and carbon reduction in various aspects, such as the introduction of static-electricity waste oil recycling system, installation of smart meters on forming machines, introduction of PM2.5 detection, ERP system integration, improvement of factory energy management according to ISO 50001, data digitalization, free vegetable lunch for employees, etc. I also joined Zero+ College and CJCU Net Zero Transformation Alliance to observe and learn how the 2nd generation of companies are saving energy and reducing carbon emissions. ESG is a confirmed way forward for Hu Pao and reducing carbon emissions is an important part of that. By combining this vision with the company’s goals and allowing employees to fully understand and work together, and at a time when many industry players are clearly lagging behind other industries, Hu Pao takes the lead to set the example, not only enabling us to significantly increase our competitiveness in the market, but also gaining access to the EU market when the carbon tax kicks in,” said Hu Pao Vice President Bill Wang.

Email: bill@hupao.com.tw

In addition to making a profit, Hu Pao constantly reminds itself of what kind of environment it can leave behind for future generations. Achieving ISO 14064-1:2018 is not only a demonstration of its commitment to customers, but it’ll also be a great help to its future development towards ESG. Even though Hu Pao has already submitted a thick ISO 14064-1:2018 report and obtained the certification, it has not stopped collecting carbon emission data to strengthen its improvement. It continues to record carbon emission data every month and hopes to collect the coefficients for 3 years, and then conduct the audit and certification again next year. “After passing the certification, we’ll continue to improve plant efficiency, increase quality & yield, optimize processes, enhance digitalization, and reduce energy waste. In addition to CBAM, the U.S. may also initiate carbon tax measures in 2024. However, we’re already prepared for that. This year we are planning to participate in many US exhibitions to expand our presence there and to let more overseas customers know about our efforts to save energy and reduce carbon emissions, as well as to contribute to the sustainability of the planet,” said Wang. As a model of energy saving and carbon reduction in Taiwan fastener industry, Hu Pao hopes that more industry players can join the ranks and contribute to the Earth. It suggests that before starting GHG inventory verification, it is necessary to involve senior personnel, form a cross-departmental team, familiarize members with regulations, use digital automation tools (e.g. ERP, carbon emission software), and establish int./ext. auditing mechanisms in order to promote it smoothly. “In the future if one wants to enter the European or U.S. markets, carbon reduction is definitely the way to go. Although the process will add lots of intangible investment costs, if one can achieve it through innovative processes without raising costs, that’s where the advantage exists. Taiwan is the 3rd largest fastener producer in the world, but it is highly export-oriented. As energy saving and carbon reduction has become a global industry phenomenon, Taiwan industry must keep up in this elimination race and make good use of government subsidies. Hu Pao will also work with up/mid/downstream collaborators to make our best efforts to contribute to global climate change, energy conservation, and carbon reduction,” said Wang.

by Gang Hao Chang, Vice Editor-in-chief of Fastener World Hu Pao contact: Vice President Bill Wang

226 310EXPRESS COMPANY (Japan)

Security, Tamper Proof, Anti-theft Screws...

242 A-PLUS SCREWS INC.

Chipboard Screws, Customized Special Screws / Bolts...

180 ABC FASTENERS CO., LTD.

Drop-in Anchors, Expansion Anchors, Wire Anchors...

127 ABS METAL INDUSTRY CORP.

Elevator Bolts, Flanged Head Bolts, Floorboard Screws...

150 ACHILLES SEIBERT GMBH (Germany)

Tapping Screws, Drilling Screws, Thread Rolling Screws...

123 ADVANCED GLOBAL SOURCING LTD.

Screw, Nut, Bolt, Machining/Stamping/Spring Parts...

86 AEH FASTEN INDUSTRIES CO., LTD.

Clevis Pins, Dowel Pins, Hollow Rivets...

13 ALEX SCREW INDUSTRIAL CO., LTD. 禾億

Button Head Cap Screws, Button Head Socket Cap Screws...

135 ALISHAN INTERNATIONAL GROUP CO., LTD. 奧立康

Fastener Tools, Bolts, Screws, Nuts, Stamping Parts...

82 AMBROVIT S.P.A. (Italy)

Chipboard Screws, Combined Screws, Machine Screws...

294 ANCHOR FASTENERS INDUSTRIAL

113 CHI HUNG RIVETS WORKS CO., LTD. 吉宏 Blind Rivets, Hollow Rivets, Solid Rivets, Split Rivets...

48 CHIAN YUNG CORPORATION 將運 SEMS Screws

274 CHIEN TSAI MACHINERY ENTERPRISE CO., LTD. 鍵財 Thread Rolling Machines

81 CHIN LIH HSING PRECISION ENTERPRISE 金利興 Automotive Nuts, Brass Inserts, Bushes, Bushings...

266 CHING CHAN OPTICAL TECHNOLOGY CO., LTD. 精湛 Eddy Current Sorting Machines, Fastener Makers...

46 CHONG CHENG FASTENER CORP. 宗鉦 Cap Nuts, Coupling Nuts, Conical Washer Nuts...

284 CHUN CHAN TECH CO., LTD. 浚展 Eddy Current Sorting Machine, Optical Measurement Instrument...

100 CHUN YU WORKS & CO., LTD. 春雨 Drywall Screws, Socket Head Cap Screws , TC Bolt Sets...

268 CHUN ZU MACHINERY INDUSTRY CO., LTD. 春日 Cold Headers, Header Toolings, Heading Machines...

139 CONTINENTAL PARAFUSOS S.A. 巴西商友暉

Automotive Part & Nut, Home Appliance Screws, Sems...

89 CPC FASTENERS INTERNATIONAL CO., LTD. 冠誠 Stainless Steel, Bi-metal Self-drilling Screws...

41 DA YANG ENTERPRISE CO., LTD. 大楊 Special Automotive Nuts, Special Weld Nuts...

54 DAR YU ENTERPRISE CO., LTD.

Chipboard Screws, Drywall Screws, Screw Nails…

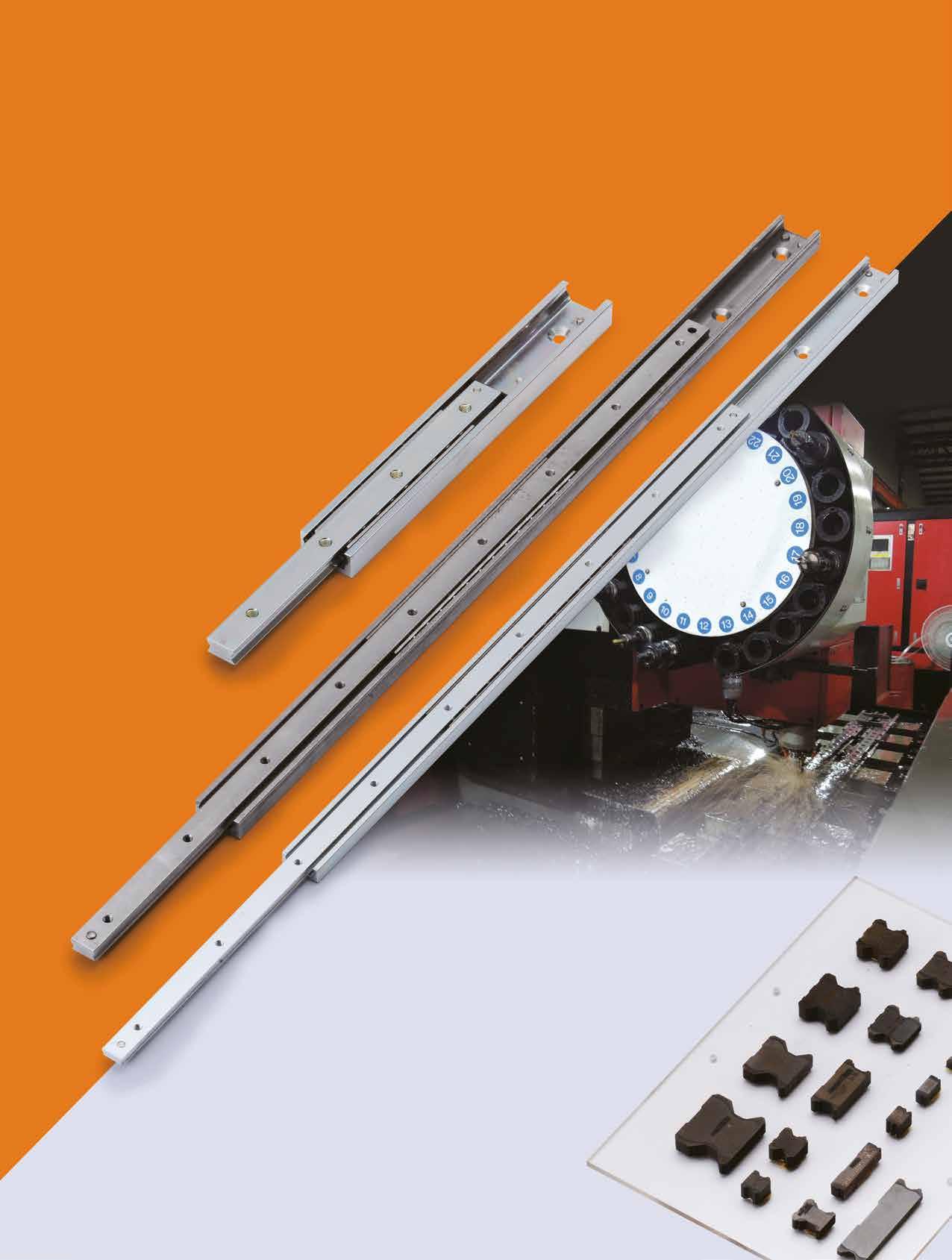

192 DE HUI SCREW INDUSTRY CO., LTD.

Drywall Screws, Decking Screws, Self-drilling Screws, Roofing Screws...

25 DIN LING CORP.

Chipboard Screws, Drywall Screws, Furniture Screws...

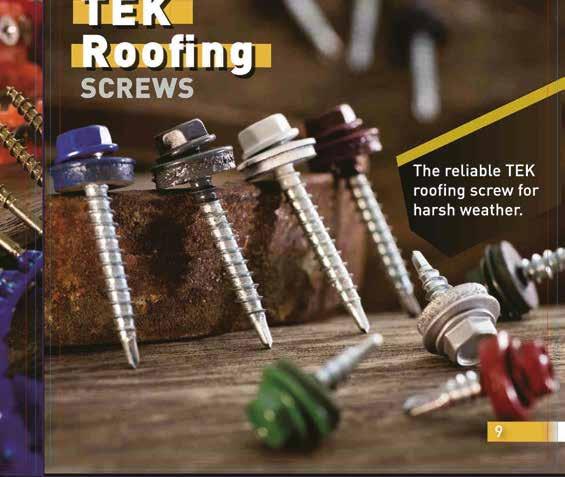

103 DRA-GOON FASTENERS INC.

Chipboard Screws, Phillips Head Screws, TEK Screws...

94 DUNFA INTERNATIONAL CO., LTD. 敦發 Bushes, Spacers, Automotive Parts, Tubes, Turning Parts...

152 EASON TECH INDUSTRIAL CO., LTD. 鈺森 Spring Pins, Cage Nuts, Clip Nuts, Retaining Rings...

191 EXCEL COMPONENTS MFG CO., LTD. 鑫廣 Turning Parts, CNC Parts, Forged and Stamped Parts...

128 FAITHFUL ENGINEERING PRODUCTS CO., LTD. 誠毅 Anchors, Box Nails, Door/Window Accessories...

64 FALCON FASTENER CO., LTD. 鉮達

Automotive & Motorcycle Special Screws / Bolts...

2 FANG SHENG SCREW CO., LTD. 芳生 Shoulder Bolts, Button Head Socket Cap Screws..

129 FASTENER JAMHER TAIWAN INC. 占賀

Automotive Nuts, Blind Nuts / Rivet Nuts, Bushings...

30 FASTNET CORP.

Dowel Pins, Flange Nuts, Weld Nuts, 4 Pronged T Nuts...

106 FILROX INDUSTRIAL CO., LTD. 惠錄

Blind Nuts / Rivet Nuts, Tee or T Nuts, Blind Rivets...

183 FIXI SRL. (Italy)

Rivet Nuts, Blind Rivets, Self-clinching, Welding Studs...

FONG PREAN INDUSTRIAL CO., LTD.

Automotive Screws, Bi-metal Screws, Brass & Bronze Screws...

38 FORTUNE BRIGHT INDUSTRIAL CO., LTD.

Cap Nuts, Dome Nuts, Nylon Cap Insert Lock Nuts...

76 FU HUI SCREW INDUSTRY CO., LTD.

Automotive & Motorcycle Special Screws / Bolts...

179 FU KAI FASTENER ENTERPRISE CO., LTD.

Precision Electronic Screws, Special Screws, Weld Screws...

96 FUSHANG CO., LTD.

Carbon Steel Screws, Chipboard Screws, Concrete Screws...

275 GIAN-YEH INDUSTRIAL CO., LTD.

Rivet Dies, Self-drilling Screw Dies, Screw Tip Dies...

163 GINFA WORLD CO., LTD.

Chipboard Screws, Countersunk Screws, Drywall Screws...

223 GLORBAL SALES COMPANY LIMITED

Various Stamping Products, Multi-process Assembly Parts...

272 GREENSLADE & COMPANY, INC. (U.S.A.)

Concentricity, Ring Gage, Plug Gage Calibration, Gages...

262 GWO LIAN MACHINERY INDUSTRY CO., LTD.

Handstand Type Wire Drawing Machines, Non-Stop Coilers... 288 GWO LING MACHINERY CO., LTD.

Thread Rolling Machines, Slotting Machines...

55 HAO CHENG PLASTIC CO., LTD.

PP Boxes, PET Jars, ABS Boxes, PC Boxes..

91 HARVILLE FASTENERS LTD.

Special Screws and Bolts, Sems Screws, Stainless Steel Fasteners...

222 HAUR FUNG ENTERPRISE CO., LTD.

17 JET FAST COMPANY LIMITED

Blind Nuts / Rivet Nuts, Aircraft & Aerospace Washers...

99 JIEN KUEN ENTERPRISE CO., LTD. 健坤

Hexagon Nuts, Nylon Cap Insert Lock Nuts, Square Nuts...

285 JIENG BEEING ENTERPRISE CO., LTD. 精斌 Forming Tool for Nut and Bolt, Dies, Molds...

148 JINGFONG INDUSTRY CO., LTD. 璟鋒

Hex Nylon Insert Lock Nuts, Wing Nuts with Nylon Insert...

161 JIN-YINGS ENTERPRISE CO.,LTD. 晉營

Special Custom Fasteners, Auto/Motorcycle Fasteners, Special Screws…

171 JOINTECH FASTENERS INDUSTRIAL CO., LTD. 群創

Customized Parts, Bolts, Screws, Nuts, Automotive Parts...

29 JOKER INDUSTRIAL CO., LTD. 久可

Hollow Wall Anchors, Concrete Screws, Jack Nuts...

169 KAN GOOD ENTERPRISE CO., LTD. 鋼固 Fastener, Hardware, Plastic, Instruction Booklet Package in Bags...

217 KAO WAN BOLT INDUSTRIAL CO., LTD. 高旺

Hex Head Cap Screws, Carriage Bolts, Hex Lag Bolts...

156 KINEFAC CORP. (USA)

World Leader in Metal Forming

84 KING CENTURY GROUP CO., LTD. 慶宇 Drop-in Anchors, Self-drilling Anchors, Sleeve Anchors...

199 KUOLIEN SCREW INDUSTRIAL CO., LTD. 國聯螺絲 Advanced Fastener

74 KWANTEX RESEARCH INC. 寬仕 Chipboard Screws, Drywall Screws, Furniture Screws...

108 L & W FASTENERS COMPANY 金大鼎 Construction Fasteners, Flat Washers, Heavy Nuts...

184 LAIEN CO., LTD. 高昱 Screws, Multi-stroke Forming Screws, CNC Machined Parts...

279 LAN DEE WOEN FACTORY CO., LTD. 藍帝 Blind Rivet Heading Machine, Hollow Heading Machine...

185 LIAN CHUAN SHING INTERNATIONAL CO., LTD. 連全興 Weld Nuts, Special Parts, Special Washers, Flat Washers...

286 LIAN SHYANG INDUSTRIES CO., LTD. 連翔 Nut Formers, Nut Tapping Machines

296 LINKWELL INDUSTRY CO., LTD. 順承

All Kinds of Screws, Automotive & Motorcycle Special Screws...

12 LOCKSURE INC. 今湛

Custom Washers, Flat Washers, Automotive Screws...

157 LONG THREAD FASTENERS CORP. 長隆順

Bi-metal Self-drilling Screws, Chipboard Screws...

79 MAC PRECISION HARDWARE CO. 鑫瑞

Turning Parts, Precision Metal Parts, Cold Forged Nuts...

175 MAIZUCO CORPORATION 彥昕

Self Tapping & Key Thread Inserts, Magnetic Grinder…

31 MASTER UNITED CORP. 永傑

Chipboard Screws, Drywall Screws, Furniture Screws...

124 MASTERPIECE HARDWARE INDUSTRIAL CO., LTD. 金全益 Brass Screws, Chipboard Screws, Deck Screws, Double End Screws...

66 MAUDLE INDUSTRIAL CO., LTD. 茂異

Button Head Socket Cap Screws, Flange Washer Head Screws...

130 METAL FASTENERS CO., LTD. 法斯訥

Thread Inserts, Self-Clinching Fasteners...

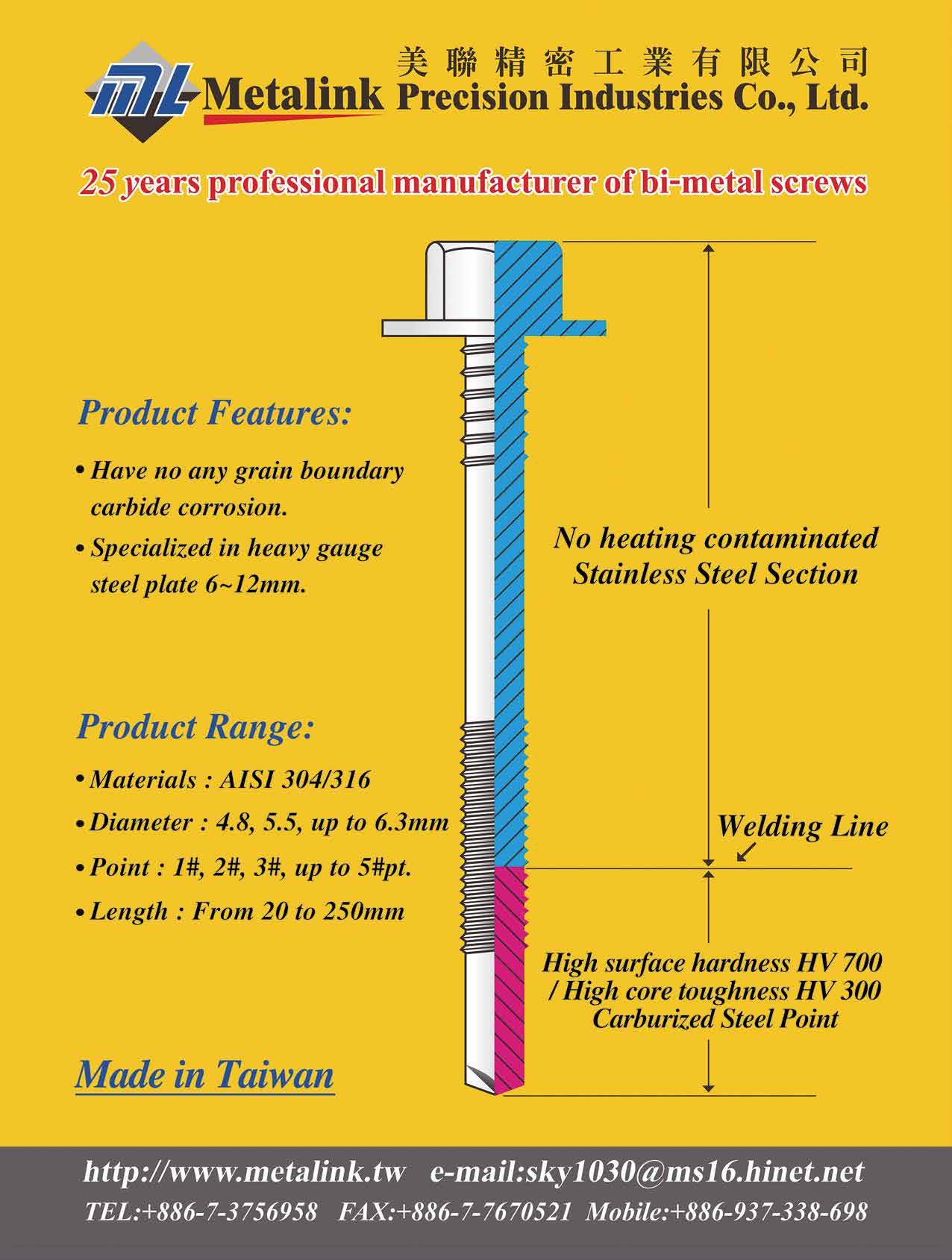

151 METALINK PRECISION INDUSTRIES CO., LTD. 美聯

Bi-metal Self-drilling Screws, Bi-metal Screws...

140 SHEH FUNG SCREWS CO., LTD. 世豐 Chipboard Screws, Countersunk Screws, Wood Screws...

144 SHEH KAI PRECISION CO., LTD. 世鎧 Bi-metal Concrete Screw Anchors, Bi-metal Screws...

115 SHEN CHOU FASTENERS INDUSTRIAL CO., LTD. 神洲 Button Head Cap Screws, Chipboard Screws...

42 SHIH HSANG YWA INDUSTRIAL CO., LTD. 新倡發 Flange Nuts, Flange Nylon Nuts With Washers...

168 SHIN CHUN ENTERPRISE CO., LTD. 昕群 Automotive Screws, Chipboard Screws, Customized Screws...

120 SHIN JAAN WORKS CO., LTD. 新展 Flanged Head Bolts, Long Carriage Bolts, Round Head Bolts...

117 SHUENN CHANG FA ENTERPRISE CO., LTD. 舜倡發 Long Construction Fasteners and Other Modified Fasteners...

282 SHUN HSIN TA CORP. 順興達 Punches, Tungsten Carbide Nut Forming Dies, Special Dies…

131 SIN HONG HARDWARE PTE. LTD. (Singapore) 新豐 Hexagon Nuts, Hexagon Head Bolts, Blind Rivets...

26 SPEC PRODUCTS CORP. 友鋮 Lincensee Fasteners, Turned/Machined Parts...

8 SPECIAL RIVETS CORP. 恆昭 Blind Nuts / Rivet Nuts, Blind Rivets, Air Riveters...

24 SUN CHEN FASTENERS INC., 展鴻鑫 Cup Washers, Flanged Head Bolts, T-head or T-slot Bolts...

53 SUNCO INDUSTRIES CO., LTD. (Japan) Distributor Specializing in Fasteners

85

三御 All Kinds of Screws, Bi-metal Screws, Carbon Steel Screws...

16 SUPERIOR QUALITY FASTENER CO., LTD. 鑫程椿 Weld Nuts, Turning Parts, Long Screws, Spring Nuts...

259 TAIEAG CORPORATION 順基軒 Designed peripheral equipment suitable for fastener packaging

166 TAIWAN FASTENERS INTEGRATED SERVICE 全聯鑫 Bolts, Screws, Nuts, Precise Mechanical Parts, Stampings...

104 TAIWAN SELF-LOCKING FASTENERS IND. 台灣耐落 Nylok®, Precote®, Nycote®, Nyplas®, Loctite®...

102 TANG AN ENTERPRISE CO., LTD. 鏜安

Customized Automotive Parts and Special Fasteners

22 THREAD INDUSTRIAL CO., LTD. 英德

Chipboard Screws, Flange Nuts, Heavy Nuts...

56 TONG HEER FASTENERS (THAILAND) CO., LTD.

Hex Bolts, Stud Bolts, Socket Cap Screws, Hex Nuts...

57 TONG HEER FASTENERS CO., SDN. BHD (Malaysia)

Stainless Steel Metric Screws, Stainless Steel Screws…

173 TONG HO SHING INTERNATIONAL CO., LTD. 桐和興

Hex Washer Head Screws, Indent Hex Head Screws...

20 TONG HWEI ENTERPRISE CO., LTD. 東徽

A2 Cap Screws, Button Head Socket Cap Screws...

57 TONG MING ENTERPRISE CO., LTD. 東明

Stainless Steel Fasteners, Wire Rods…

136 TSIN YING METAL INDUSTRY CO., LTD. 晉英

Stainless Steel Cold Heading Wire, Oxalate Coating Wire...

283 TZE PING PRECISION MACHINERY CO., LTD. 智品

Open Die Machines, Cold Headers, Cold Forming Machines...

With nearly 40 years of history, Homn Reen has made a reputation on construction fasteners. They deliver about 2,500-3,000 tons of fasteners per month to domestic and overseas customers via a total of 320 sets of equipment in Taiwan and Vietnam plants. They used to manufacture using one-die two-punch machines. To provide products of higher values, general manager Jack Lin spent NTD 200 million in upgrading equipment in both plants starting from 2021, replacing old equipment with multipunch machines. The upgraded plants have at least doubled production capacity and speed. In addition, Jack extends the range of workable screw sizes to 4mm400mm. He believes many emerging countries can already provide low-price lowend products and it pushes Taiwan fastener industry to shift to higher-end products to bring elevated values to customers.

Certified to IATF16949, Homn Reen has successfully improved the production system and employees’ quality awareness; therefore, overseas customers, mostly repeat customers, are much satisfied with Homn Reen’s automotive fasteners. Currently the company has made it into Tier-2 supply chains. Additionally, they have the oil and gas filtration system installed on the production line to meet the environmental requirements on manufacturing automotive fasteners. Spanning to the automotive field of higher quality criteria is an integral part in Homn Reen’s transformation to higher product values.

Given EU’s CBAM which will be run on a trial basis and then officially take effect in the future, they took action early and embarked on internal education on carbon reduction with the help of experts. Besides implementing 5S workplace management system to improve efficiency and ensure quality, they are in the process of carbon inventory and taking steps toward carbon footprint and carbon neutrality. They also invested NTD 10 million to install 2,315 square meters of solar panels on Taiwan plant to contribute to global carbon reduction by generating green power. They will continue to increase solar panels whenever they have additional space.

In recent years, the geopolitical factors in Asia have turned many European and American buyers’ attention to Taiwanese and Southeast Asian suppliers, driving Homn Reen's development in Vietnam. According to Jack, both Taiwan and Vietnam plants provide the same products. The 104,132 square meters Vietnam plant in particular has a large young workforce, large manufacturing capacity, and the advantage of providing one-stop shopping. With mutual support between the two plants, Homn Reen can provide high quality products at competitive prices to global customers.

"We have been manufacturing high quality and diverse products in small quantities. Our clients spread across all continents, so we took very little impact from the pandemic and we are still consistently shipping worldwide," recalls Jack. "There’s no definite need to become an industry leader, but it is necessary to find your own industry position. Fastener companies should collaborate to compete like it is a race, not like a boxing match where it’s either you or the opponent down. Make it teamwork. You’ll need luck. You’ll also need to help yourself out and someone else to help you. I hope we can all work together and carry forward Taiwan’s spirit. Jack's closing remarks will provide good guidance for readers, and we look forward to the bright future for Homn Reen.

On March 10th (Friday), Sheh Fung Screws, the pioneer in the development of self-tapping screws in Taiwan, held a 60-table banquet at the Kaohsiung Marriott Hotel to announce the company's 50th year of operation.

The banquet was filled with a large number of distinguished guests. Sheh Fung President Terry Tu, General Manager Kent Chen, former President Chen and some key cadre members from the management raised their glasses on stage and shared with all the guests the joy that Sheh Fung has worked hard over the past 50 years to make a small factory in the north grow and develop into a well-known listed company today.

During the gala dinner, a documentary film about Sheh Fung was continuously played on the large screen, which counted many important moments in the development of Sheh Fung that were worth remembering and commemorating, allowing the guests to witness these important milestones. In the film, President Tu, General Manager Chen, former President Chen, etc. also remembered the contributions of the founder Lucky Tu and other predecessors who had overcome great difficulties. Lots of guests were also moved by the sincere and heartfelt tone of their voice.

"I currently serve as the president of Sheh Fung Screws, Sheh Kai Precision, and HYE Technology. Since Sheh Fung was founded 50 years ago, the company's development has continued to flourish, all of which are due to the efforts of every member of Sheh Fung.” said President Tu.

“The ship-shaped buckets with the Chinese Characters of "Sheh Fung" on them at the entrance of the banquet symbolize the idea of selling screws all over the world, and also represent the spirit of cooperation that Sheh Fung has always insisted on. Thanks to the cooperation with our partners and all the staffs in the company, we are able to deliver the screws one by one to the customers abroad. Therefore, it is with a sense of gratitude that we celebrate the 50th anniversary of Sheh Fung,” said General Manager Kent Chen.

Sheh Fung Screws attaches great importance to the centripetal force of employees. In the gala dinner, a senior employee, who has served the company for 40 years, was specially recognized for her contribution to Sheh Fung. On the other hand, the company also generously donated NT$7 million to the Sheh Fung Charity Foundation for the purpose of donating scholarships to schools and social charities, fulfilling the social responsibility of a successful enterprise of “taking from the society and using it for the society” and promoting the spirit of Sheh Fung.

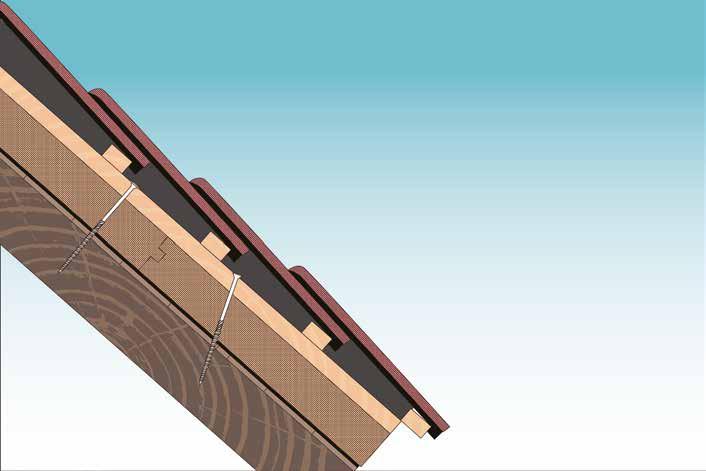

With nearly 300 employees, Sheh Fung Screws is dedicated to the production and development of construction screws such as self-drilling screws, drywall screws, and timber construction screws. It has obtained ISO-9001, ISO-14001, CE and A2LA laboratory certification in the United

States. It is not only the first screw factory in Taiwan to introduce the SAP system, but it also replicated the experience of its Taiwan factory at the end of last year to build Sheh Fung’s first overseas presence in Vietnam, which is expected to be in operation in the fourth quarter of this year.

President Tu also said, “I am quite looking forward to the Group's continuous efforts towards the goal of rapid revenue growth in the next five years.”

by Gang Hao Chang, Vice Editor-in-Chief of Fastener WorldShip-shaped buckets symbolize the idea of export for Sheh Fung's screws

Donating to the Sheh Fung Charity Foundation

Employees of Sheh Fung dance together on stage

Donating to the Sheh Fung Charity Foundation

Employees of Sheh Fung dance together on stage

Yo Technology specializes in SUS300 series (303/304/316), 400 series (416/420) and SUS630 stainless steel needle rollers, rollers, dowel pins, insert nuts, and CNC machined parts. Its ability to produce high-precision dowel pins as thin as a hair at a minimum of 0.6mm has been widely recognized in the market. In addition to dowel pins, it pays more attention to the market niche and includes stainless steel insert nuts as the top product of this year.

Hey Yo provides ISO 2338, ISO 8734, and DIN 6325 dowel pins with an O.D. of 0.6-4mm and a length of 2-45mm. Its average monthly output is more than 5 million pcs. Through the use of automatic grinding equipment, the O.D. grinding precision of its dowel pins can reach 0.003mm and the surface roughness can be better than Ra 0.1. General Manager Gary Chang said, "Dowel pins with the O.D. of less than 1.5mm and the grinding precision of less than 0.005mm are definitely our strengths. Through the use of self-developed dowel pin processing machines to improve waste of materials, increase productivity and stability, we’re able to provide customers with super high CP value and affordable prices." Hey Yo has all sorts of testing equipment for dowel pins, including 2.5D projectors and surface roughness/roundness/ straightness/hardness testing machines, and can provide complete testing reports .

At present, the inserts nuts in Taiwan are mainly made of brass. While users are using these nuts, chipping is very likely to happen during fastening or removing due to the soft texture of brass, and they are also likely to get rusty while used outdoors . Hey Yo, being not afraid of challenges, expanded its product portfolio to hard-to-make stainless steel insert nuts. By utilizing stainless steel's high toughness and rustproof properties, the products can still maintain their function in harsh environments. They are generally used in monitors, cars, drones, and other outdoor products. The spirit of being dedicated to challenges and not afraid of difficulties is Hey Yo's culture, and the continuous acceptance of challenges is also the driving force for General Manager Chang to continuously lead the company to grow.

Hey Yo is currently specialized in two types of insert nuts. One is the stamped insert nut, which is pressed into a metal sheet by stamping, and the material will flow into the undercut section in the form of "cold deformation," thus making the nut a part of the metal sheet. The other is the plastic insert nut used in plastic insertion and the methods used include hot-melting and hot-pressing. The herringbone knurling design can prevent the workpiece from loosening after locking.

General Manager Chang emphasized that Hey Yo has conducted in-depth research on the properties and processing of stainless steel, especially the selection of SUS416, 420, and 630. Hey Yo always feels easy to complete tasks from the basic CNC stainless steel processing tool selection and processing rpm feeding configuration, to the heat treatment processing in the later stage. If one is not familiar with the hardness and processing conditions of stainless steel heat treatment, it will lead to the output of products with insufficient or excessively high hardness that may cause embrittlement. This is where Hey Yo's greatest advantage lies. "The professional knowledge and specifications of the heat treatment industry are not necessarily fully understood by buyers." Mr. Chang uses his professional knowledge of stainless steel processing and heat treatment to evaluate the feasibility of product production for customers, serves as a communication bridge between customers and third-party heat treaters, and provides customized product solutions as a consultant.

Achieving the market segmentation of stainless steel insert nuts and brass insert nuts is a part of Hey Yo's main focus on product differentiation. General Manager Chang cooperates with many superior suppliers to reduce production costs and improve product quality through professional division of labor. He attaches great importance to the communication in product design and the efficiency to solve customers’ problems. Coupled with CNC turning & milling services for peripheral products, as well as the new office inaugurated last year, Hey Yo will continue to explore new business opportunities at home and abroad this year.

by Dean Tseng, Fastener World

Kinefac ® Corporation is a USA-based precision machine tool manufacturer recognized as a world leader in metal forming technology. Since 1962 the ISO 9001:2015 company has continued to build its reputation of technical leadership in cylindrical die thread and form rolling. Kinefac machine tools can be found on all continents of the globe, including Antarctica, producing diverse precision parts and components for global industries making everything from high-precision threaded fasteners for automotive and aerospace applications to micro-sized spring coils for medical device applications.

The Kinefac POWERBOX KINEROLLER TM product line of cylindrical die thread and form rolling machinery is designed for infeed, throughfeed, and incremental cold rolling of threads, knurls, serrations, and grooves on fastener components. Available in vertical and horizontal rolling axis with die load capacities from 111kN to 2,935 kN. Hex bolts, machine screws, socket head cap screws, wood screws, and construction anchor bolts are suited for these machines. Warm rolling systems are also available for high strength alloys.

POWERBOX KINEROLLERTM features high stiffness frames for maximum rolling process stability, double-acting spindles with self-centering work centerline for simplified part handling, precision spindle slide systems for maximum guided stability in the taper and skew planes, single-point size adjustment for accurate and precise size control, independent spindle taper adjustment for symmetric die force distribution, and independent spindle inclination adjustment for optimized tilt angle setting.

Kinefac® CNC system option reduces setup time and improves part quality consistency. KINEFORM cylindrical rolling dies are available in standard and custom thread geometries in various high-performance materials and coatings for a variety of machinery manufacturers.

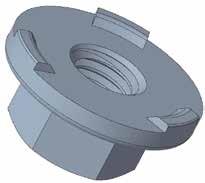

Kinefac ® RP-10 KINECRIMP TM is designed for multi-point radial crimping operations on hex/multi-point/collared nuts and similar configurations. These servo electric machines are available in vertical and horizontal axis with crimp load capacities up to 110 kN. Quick change tooling allows for fast setup of 2, 3, 4-point crimps in the standard die carrier. Other crimp configurations are available on request. Force and position control options are used for the most sensitive thin wall crimping operations. A servo part stop ensures the crimp points are accurately positioned on each nut.

Kinefac® POWERBOX KINEROLLERTM machines and RP-10 KINECRIMPTM machines are available with various automatic part handling systems are also available ranging from simple manual load operations to vibratory bowl loading, robot loading, and pick & pick place loading. In line gaging and inspection is also offered. The company recently added additional temperaturecontrolled die grinding capacity with the latest multi-axis grinding machines to increase precision and productivity. Difficult part geometries, high strength exotic materials, and tightening tolerances are constantly pushing the limits of their expertise.

The U.S. Supreme Court declined to hear a challenge to U.S. steel import tariffs imposed in 2018 under former President Donald Trump, Reuters reports.“ The justices turned away an appeal by a group of U.S.-based steel importers of a lower court's ruling rejecting their challenge to the Trump administration's imposition of tariffs under a Cold War-era trade law,”writes John Kruzel of Reuters.

In March 2018, Trump ordered a 25% tariff on steel imports from most nations and a 10% tariff on aluminum imports - a policy he touted as defending U.S. national security - and largely maintained by President Joe Biden. The tariffs were justified after the Commerce Department reported that steel and aluminum imports “threaten to impair the national security,”as defined by Section 232 of the Trade Expansion Act of 1962.

A subsequent Federal Reserve study found that, while the tariffs reduced competition for some industries in the domestic U.S. market, this benefit was more than offset by rising input costs and retaliatory tariffs.

The Industrial Fasteners Institute warned against the 232 tariffs.“ In our view, the negative effects on downstream consumers of steel and aluminum far outweigh any benefits that may be afforded to the domestic metals industry,”the IFI stated in an official letter sent to the White House in early 2018. “ Specifically, we suggest that the negative impacts from these remedies will do more harm than good to our economy and national security than they will provide benefits to the domestic metals producing industries.”

The IFI joined 14 other trade associations representing over 30,000 US steel-using manufacturers to warn that the entire U.S. steel supply chain“will be damaged by restrictions on steel imports.”

A U.S. federal appeals court upheld higher tariffs on some imported steel products, reversing a lower court ruling that overturned the Trump administration action, Reuters reports.“ Tuesday's 3-0 decision by the U.S. Federal Circuit Court of Appeals in Washington, D.C. covers imports of steel derivatives, such as nails and fasteners, that were subjected to 25% tariffs in a January 2020 proclamation by thenPresident Donald Trump,”writes Jonathan Stempel for Reuters.

At the time, Trump said the new tariffs were needed after capacity utilization had not recovered for an extended period. China retaliated with matching tariffs on an equal amount of U.S. goods, embracing the largest trade war with the West in decades.

In 2021, the U.S. Court of International Trade ruled against the new tariffs, saying the White House missed statutory deadlines to impose them. But the appeals court said a subsequent ruling allowed presidents to impose“contingency-dependent ”tariff increases to fulfill their original national security objectives, assuming those objectives remained valid.

Trump imposed the new tariffs to“close a loophole exploited by steelderivatives importers ... to address a specific form of circumvention,” Circuit Judge Richard Taranto wrote. The Biden administration supported upholding the new tariffs. The tariffs had been challenged by importers Huttig Building Products, Oman Fasteners and PrimeSource Building Products, which said Congress never granted the president broad power over foreign trade to impose them.

The Industrial Fasteners Institute presented its 2023 Soaring Eagle Awards to Bob Hill and Henry Hogue. Nicholas Lessnau of MNP Corporation received the IFI's Joe Greenslade 2023 Young Leadership Award. Lessnau is account manager for MNP in Utica, MI.

The IFI Soaring Eagle Service Award recognizes individuals who have contributed outstanding time and effort in the leadership of the IFI and the entire industrial fastener industry. Hill was the IFI's longtime industrial products division manager, board member and former chairman. The Soaring Eagle technology award was presented posthumously to Hogue (1898-1953),who generated ten patents for fastener manufacturing and equipment design and had been president of Tru-Fit Screw Products.

The technology award recognizes individuals who have made significant contributions to the technological advancement of the industry. Contributions may be through work on fastener standards committees; the publication of widely acclaimed principles or documents; and/ or through the development of fastenerrelated equipment, products or processes which have been widely acknowledged as advancements in fastener technology. Hogue's most impactful inventions were apparatus for wire drawing and separately for nut manufacturing. His innovations led to important and enduring advancements in fastener manufacturing technology and equipment design. These advancements represent a foundational pillar of the state of the art of cold forging and fastener manufacturing today.

Greenslade was IFI technical director from 2007 to 2015. The award recognizes individuals who, early in their career, have contributed in a significant way to the fastener industry. One of Greenslade's passions was to mentor and encourage young people to reach their professional potential.

Fasteners and components manufacturer LoneStar Group has been acquired by private equity firm Epiris LLP. Terms of the deal were not disclosed. Headquartered in the West Midlands, UK, LoneStar Group manufactures and supplies highperformance fasteners, sealing products, precision-engineered components and pipeline packages for the world's industrial and energy markets. Employing more than 1,000 employees across 13 businesses, LoneStar operates facilities in the UK, China, Romania, India, Singapore, Dubai, the U.S. and Australia.

LoneStar supplies high performance fasteners to major OEMs, distributors and end-users in 100 countries. The group maintains a $48 million global stock inventory of finished, semi-finished and raw materials to supply all sizes of SAE, ASTM and ISO fasteners. Fastener companies owned by LoneStar include AmeriBolt, LoneStar Fasteners and Walker Bolt.

“ LoneStar is typical of the kind of business in which we seek to invest,”said Epiris partner Charles Elkington.”It is a high-quality business: a global market leader with scale and clear competitive differentiation.“ It operates in attractive markets, benefiting from growing energy demand in both traditional and renewables. Most importantly, it is one which we believe we can transform by bringing our trademark focus on strategy, operational excellence and M&A.”Founded in 1976, Epiris is based in London.

The Specialty Tools & Fasteners Distributors Association (STAFDA), Elm Grove, WI, USA, has a new face. STAFDA's blue triangle logo with“ Stan the STAFDA Man” was recently updated to give it a more contemporary look. STAFDA's traditional logo has

tremendous brand recognition with Stan and the late '70s groovy script, but for 2023 and beyond, Stan Jr. will now be the face of STAFDA with a modern image and font. STAFDA is transitioning to the new logo for all its branding. The association is also working on a fresh new website that will encourage more member engagement. The updated website debuted in late Q1.

Gene Simpson of Semblex Corporation is the new chairman of the Industrial Fasteners Institute and Dan Curtis of MacLean-Fogg Company is vice chair for the 2023-24 term. Jeff Liter of Wrought Washer Mfg. Inc. is ex-officio chair. Founded in 1931, the IFI represents North American manufacturers of mechanical fasteners and formed parts and key suppliers to customers, government and the public to advance the competitiveness, products, and innovative technology of member companies in the global marketplace.

SPIROL, Danielson, CT, USA, announces that Ford Aerospace Ltd., South Shields, UK will be joining the SPIROL group of companies. Ford Aerospace was founded in 1910 by Robert Ford, and the family business has most recently been led by the founder ’ s greatgrandson, Chris Ford. The company specializes in manufacturing high-precision metal components and subassemblies for the aerospace, industrial and high-technology sectors. The firm has been a leading supplier over its 113year history.

SPIROL is a successful, family-owned company with a rich history also closely tied to aviation development. Founded in 1948, SPIROL has grown from a single manufacturing facility in the USA to a global enterprise with manufacturing or distribution locations in North and South America, Europe and Asia. As an expert in fastening, joining and assembly, SPIROL's well-established global footprint will take Ford Aerospace's products to a wider international market. Also, one of SPIROL's core principles is to continuously reinvest back into the business to ensure long-term, enhanced success and better serve its customers. This principle is also firmly held by Ford Aerospace and so the synergies in markets, products, history and providing value to its customers ties SPIROL and Ford closely together.

Ford Aerospace's technical skills in producing laminated and solid shims that ensure fast, precision tolerance compensation used on products like fuselages, gearboxes and movable components, was key in attracting SPIROL. Such products simplify the assembly process and reduce the cost of the assembly.

In 1994, Fastenal, Winona, MN, USA, opened a sales branch in Stoney Creek, Ontario, Canada. It had two employees and around US$1800 in first-month sales, but it was Fastenal's first branch outside the USA. From this humble beginning, Fastenal's international (nonUSA) business has grown to include sales, service and support teams in 25 countries in the Americas, Europe and Asia. In 2022, these teams achieved an impressive milestone: US$1 billion in annual sales.“ This was not a small accomplishment,”said Jeff Watts, Fastenal EVP of international sales (and one of the first employees in Canada).“ It shows what can be accomplished when we work together as one team with a common goal, and it's humbling to be a part of.”

Martin Inc. is excited to announce the appointment of Kevin Cozine as the new Vice President of Sales for Martin Fastening Solutions. In his new role, Cozine will be responsible for expanding the market share of Martin Fastening Solutions and collaborating with the sales team across all of Martin's lines of business. Cozine brings extensive experience in operations and sales leadership to his new role. He most recently served as the Director of Operational Excellence at Optimas Solutions, where he led the growth of new customer engagement and expanded the customer engagement team's analytical coverage. He has also held leadership positions at MSC Industrial Supply Co. and H&D Distributors, where he developed and grew key accounts. Marc Strandquist, EVP, Fastening, commented on Kevin's appointment,“ We are excited to welcome Kevin to the Martin team. His experience in operations and sales leadership as well as his proven track record of developing and growing key accounts, make him the ideal candidate for this position.”

Shannon King has been named Vice President and General Manager of Beneke Wire Company, located in Louisville, KY, USA. In 2012, Shannon King joined Beneke Wire Company as Plant Manager in charge of the production of round drawn aluminum wire for the cold heading market. King has 28 years' experience in the aluminum wire industry. Beneke is 55-year old manufacturer and global supplier of wire, rod, bar and redraw rod in heat treatable as well as non-heat-treatable aluminum alloys.

Coming to Auto Bolt, Cleveland, OH, USA, in April 2023 is a brand-new Formax FXP54L with the capacity to run 5/8 (M16) to 3/4 (M20) diameters as well as some blueprint specials that fall within those standards. Auto Bolt also announces the arrival of a new Videx Thread Roller with a dual-spindle feature that allows rolling of both threads and knurls on the many wheel bolts the company produces.

News provided by:

John

Wolz, Editor

of FIN (globalfastenernews.com)

Mike McNulty, FTI VP & Editor (www.fastenertech.com)

Mike McNulty, FTI VP & Editor (www.fastenertech.com)

compiled by Fastener World

compiled by Fastener World

The recent show marked the debut of the Brazilian manufacturer on the international stage

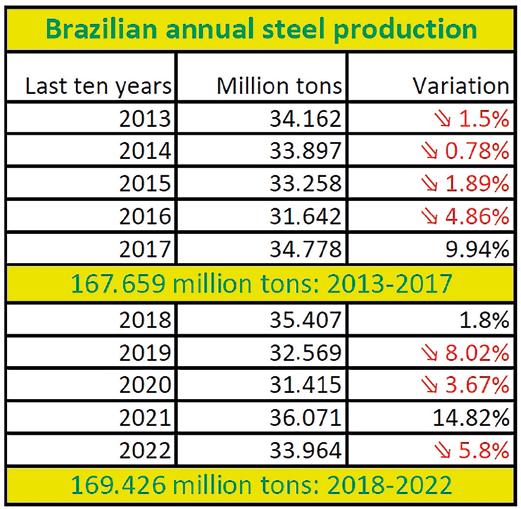

Brazil overcame a barrier with an annual domestic steel production of 36 million tons, but in 2021, the Brazilian domestic production sector dropped 5.84%, with 33.964 million tons total. However, the performance sector was not much different compared to the last five years, as seen in the following table.

During 2012-2017 the aggregated total production reached 167.659 million tons; while the total during 2018-2022 were 169.426 million tons, a little bit higher by 1.05%. The drop in 2022 wasn’t much different from Brazilian reality, in which the annual average has been orbiting around 33.7 million tons per year, bouncing between highs and lows.

Belenus is one of biggest and most important companies in the fastener market in Brazil and South America, with more than 1.9 thousand direct employees. Recently the company has been doing international business with its presence as an exhibitor at Fastener Fair Global 2023 in Stuttgart, Germany, which was a big step.

In addition to being a fastener manufacturer, with monthly product capacity around 10 thousand tons, Belenus has divisions distributing hardware, tools and several types equipment, operating in an unified management model based on sustainability, which values the reduction of carbon emissions, water reuse and waste recycling throughout the process.

Source: www.acobrasil.org.br/site/en

"Belenus tried the European market last year and had good experiences. In 2022, we started to travel to some countries and visit fairs, the reception was surprising, which made us take a step forward, exhibiting at the Stuttgart fair (March 21-23, 2023) for the first time, said Ezio Ruocco, Vice President, concluding, "The show was so good, with only positive points to highlight. We had visitors all the time. The market was excited to have an alternative supply from Brazil that helps them reduce their dependence on Asia. On the other hand, probably the most difficult part was making them believe that in Brazil there was a manufacturer with the size and technological and productive capacity like Belenus”.

Inside total Brazilian GPD of US$ 1.8 trillion, the construction sector represents 6.2% and around 34% of the industrial segment. During April 11-14 2023, the largest trade show about construction and finishing in South America was held in São Paulo City, SP. Feicon had a so huge public, probably many above 2022.

A highlight was the return of some Asian players, including those from fasteners sector. However, there were still so few, but we know that there will be more of them. The Asian exhibitors were mainly from China, a Country that represented 28% (US$ 1 billion) worth of fasteners imported to Brazil in 2022.

News provided by:

The Fastener Training Institute (FTI), has announced Würth Industry North America (WINA) continues as sustaining sponsor in 2023. This will mark the fifth year of partnership between the two organisations.

“Würth’s continued support is instrumental to our ability to offer frequent and robust educational opportunities which enhance knowledge, safety and reliability across the fastener industry,” said John Wachman, Managing Director for FTI. Thanks to Würth’s support, FTI will continue to offer an extensive menu of in-person fastener training classes taught by leading industry expert instructors.

“Our partnership demonstrates our ongoing commitment to the importance of quality fastener education. We are thrilled to move into our fifth year of partnering with the Fastener Training Institute and helping to support the education of seasoned and new professionals within the fastener industry,” said Tracy Lauder, Director of Marketing and Communications for Würth Industry North America.

The Carbon Border Adjustment Mechanism (CBAM) is expected to go on trial implementation this October. Taiwan fastener industry emits up to 750,000 tons of CO2e (carbon dioxide equivalent) a year, and it has to improve equipment and speed up on carbon inventory.

General manager of fastener manufacturer Chun Yu said carbon reduction is a huge work that the industry has to put focus on. Each company's products and processes are different, and the entire fastener industry processing chain is long, ranging from material source which is Taiwan CSC manufacturing steel billets, all the way down to a dozen processes such as pickling, annealing, heat treatment, electroplating, each causing carbon emissions. Therefore, the corresponding work on carbon inventory and carbon footprint requires professional assistance.

The director of Taiwan MIRDC (Metal Industries R&D Center) said that CBAM will soon be implemented on a trial basis and importers must report carbon emissions data, but currently there are no clearly specified specifications and form examples. One thing that is certain is that manufacturers should do carbon inventory and carbon footprint tracking as soon as possible.

MIRDC and private entities can help the industry on carbon inventory. The director pointed out that companies can do reports on their own, but if the supply chain requires reports to be verified by third-party labs, domestically it will have to be done by Taiwan Accreditation Foundation (TAF). Taiwan Ministry of Economic Affairs estimates that by the end of this year, there will be about 18 Taiwanese entities that can provide accreditation services. The director said that, in addition to reporting carbon emissions, importers will have to purchase CBAM certificates for products exported to Europe. Plus, Taiwan’s Climate Change Legislation is expected to charge carbon fees on those products. Taiwanese fastener companies hope for the government to make carbon fee regulations compatible with CBAM and provide a way to offset the fees to avoid being charged twice.

Airbus is developing its local or regional materials platform for different strategic commodities, but suppliers will need to have the necessary certifications such as AS-9100. “Without those certifications it will be impossible to do business with an aeronautical company like Airbus. And it is very important to have suppliers mainly from Mexico, or from the United States and Canada,” said Carlos Rivera Villalba, the company’s Global Supply Chain Manager.

During the seminar “Be an Aerospace Supplier”, organized by Femia, at CETYS University, Mexicali campus, Rivera added that they are looking for aluminum suppliers in sheets, plates, rivets, nuts, screws and bolts, among others.

Airbus has a presence in Queretaro with a manufacturing plant and a training center in Mexico City and another in Merida. Today there are 150 Airbus aircraft in operation in the country and 200 in the order book and take up 60% of the Mexican market. “It was forecast to close 2022 with 354 aircraft for the different airlines in Mexico, which represents a 12% increase against 2021. The country is part of the top 20 markets,” he said.

Aluminum is often used in fuselage, bolts and window & door frames. In a thorough effort to combat Russian circumvention of sanctions, U.S. White House announced a 200% tariff on Russian aluminum and related aluminum products, which has been effective since March 10. Russian aluminum accounts for about 1/10 of U.S. imports, and buyers range from the automotive to construction industries. The White House said it is planning to extend the sanctions to Russian metals and mining industries, but the move must be carefully planned to minimize the impact on the market.

Last year NAFCO benefitted from the easing of the pandemic and reopening of borders, as well as a gradual increase in aerospace customers' demand. Its consolidated revenue reached NTD2.193 billion, a 53.76% increase compared to the same period last year, marking a three-year high and the third highest in its history, and close to the revenue level in 2018 before the pandemic. Profitability benefited from a higher utilization rate and the appreciation of the U.S. dollar, with gross profit margin of 23.33% last year, an increase of 11.68 percentage points; operating income was NTD127 million turning a loss into a profit, with operating profit margin of 5.78%; net profit after tax was NTD150 million.

Looking at this year, the company said that the demand for aerospace fasteners continues to be strong, with most orders visible for more than a year, and if market conditions do not change much, it is expected to maintain good growth in revenue and profitability this year, and the company will continue to increase production capacity in response to customer demand. In addition to aerospace fasteners, NAFCO has also been actively developing its automotive fastener business in recent years, and the parts and components designed in cooperation with Tier 1 car manufacturers are expected to gradually increase in volume and fuel revenue growth. The company recently announced its March 2023 revenue, which reached NTD263 million in a single month, an annual increase of 78.8%; the cumulative revenue for the first three months reached NTD 696 million, an annual increase of 64.02%.

QST International and Boltun Corporation jointly commissioned 3 Taiwanese banks to co-sponsor a NT$12 billion worth ESG-linked syndicated loan project, which was completed on March 1, 2023. In the trend of environmental protection and energy saving, the companies have extended from conventional fasteners to new products combining light metal, engineering plastic and carbon fiber to meet the needs of vehicle manufacturers for lightweighting, automatic assembly, reduction of assembly process and energy saving and carbon reduction, and have continued to enhance the value of their products. Leveraging on their experience in EV fasteners and certification by international automakers, the companies are actively participating in customercollaborative R&D and supplier orientation programs, gradually moving from OEM to ODM.

In view of their long-term development needs and to enhance global flexibility and competitiveness, the companies will set up an overseas production base in Vietnam, acquiring about 35 hectares of land in an industrial zone with an initial investment of US$100 million. Construction of the plant is expected to begin this year and production will begin in the first half of 2024.

Lamvien Winfull Co., Ltd., a Taiwanese manufacturer located in Vinh Phuc Province, Vietnam, serves an extensive list of clients including TOYOTA, Honda, YAMAHA, Kawasaki, Polaris, Vinfast, TOTO, Daikin, Ariston, Sumitomo, Pigaaio, … etc and related T1, T2 customers. It is an IATF16949 / ISO14001 / ISO50001 certified and authorized OEM manufacturer of various customized forging bolts, nuts, screws, pins and patching for worldwide major brands of the automotive, motorcycle, safety parts, heavy industry, home appliance, and electronic fields, and has been specialized in customized precision forging parts for nearly 60 years.

It provides one-stop and in-house manufacturing process including cold forging, threading, machining, heat treatment, de-phosphating, surface treatment, and dehydrogenation for worldwide leading customers. The capability to manufacture specialized fasteners effectively complements its value for achieving quality excellence. Obviously, its experience facilitates the abilities to fulfill more difficult orders, and clearly sets it apart from other fastener providers.

Suzhou Cheersson Precision Metal Forming announced to set up a branch in Shanghai in order to meet its business development needs and further optimize its strategic deployment, making it more convenient to get closer to the market and the front line of technology, and better collect industrial and technical intelligence.

The company's name is Suzhou Cheersson Precision Metal Forming Co., Ltd. (Shanghai Branch). The scope of business includes: hardware products R&D; technical services, technology development, technology consultation, technical exchange, technology transfer, technology promotion; import & export of goods; sales of dies; sales of communication equipment; hardware products retailing; hardware products wholesaling; electronic components retailing; electronic components wholesaling; fasteners sales; mechanical parts and components sales; metal materials sales.

Zhejiang Mingtai intends to be listed on Shanghai Stock Exchange with a fund raising of RMB 920 million. The raised fund is intended to be used for the R&D and production of Ritai (Shanghai) Auto Standard Component, the annual production of 33,000 tons of new special high strength automotive fasteners, and the construction of the new material fastener R&D center for Ritai (Shanghai) Auto Standard Component.

The company focuses on the R&D, production and sales of fasteners, and has upgraded from supplying bicycle fasteners to motorcycle fasteners, and to automotive fasteners over the past 30 years. The products are mainly used in the automotive field, with high strength, high precision, corrosion-resistant and other high-end fasteners as the main products. The company provides customers with collaborative development, testing, after-sales service, etc.

Following LISI's Annual General Meeting of Shareholders, the Board of Directors met today to acknowledge the non-renewal of Mr. Gilles Kohler's mandate as Chairman due to the age limit set by the company's bylaws, and to appoint his new Chairman. After 38 years as a member of the Board of Directors and 24 years as Chairman of the Board, the latter thanked Mr. Gilles Kohler for the immense task accomplished during all these years and expressed his gratitude to him. To succeed Mr. Gilles Kohler, the Board of Directors has appointed Mr. Jean-Philippe Kohler as Chairman for the duration of his 4-year term of office. His appointment is effective as of today. Mr. Jean-Philippe Kohler joined LISI Group in 1991 and since 2016 has been the Deputy Chief Executive Officer of LISI Group in charge of Risk Management, Human Resources and Internal Audit.

In addition, the Board of Directors confirmed the renewal of Mr. Emmanuel Viellard's mandate as Chief Executive Officer for a period of 4 years. In order to carry out his mission, Mr. Emmanuel Viellard relies on the LISI Group Executive Committee, which he chairs and is composed of:

• Mrs Anne-Delphine Beaulieu, Chief Sustainability Officer & Digital Transformation of LISI Group

• Mrs Cécile Le Corre, General Counsel of LISI Group

• Mr. Christophe Lesniak, Senior VP Industrial & Purchasing manager of LISI Group

• Mr. François Liotard, Chief Executive Officer of LISI AUTOMOTIVE

• Mr. Emmanuel Neildez, Chief Executive Officer of LISI AEROSPACE

• Mr. Alexis Polin, Chief HR Officer of LISI Group

• Mr. Lionel Rivet, Chief Executive Officer of LISI MEDICAL

• Mr. Raphaël Vivet, Chief Financial Officer of LISI Group

This new governance will continue the deployment of the LISI Group's long-term strategy, which remains focused on innovation and operational excellence.

According to OFCO, a fastener manufacturer under Taiwan Steel Group, the demand for fasteners will begin to bounce up as customers gradually clear up their inventory. OFCO is also optimistic that the huge reconstruction demand after the Russian-Ukrainian war will trigger another wave of inventory replenishment. With the Group's continuous integration, the fastener business outlook is promising.

OFCO's revenue last year was NTD 4.817 billion, an annual increase of 28.1%; the net income after tax was NTD 284 million, an annual increase of 119%, and the EPS was NTD 3, a 10-year high. The revenue of the fastener business increased 87% year on year, and the gross margin came to 23.3%, an increase of 9.5%, boosting the operating profit to NTD 324 million, a YoY increase of nearly 7.6 times.

BYD uses a solvent containing hexavalent chromium to prevent rusting of bolts, nuts and other parts on its five electric buses, including the J6, a minibus sold in Japan. BYD Japan said it is working with BYD headquarters to investigate whether hexavalent chromium was used in the pure electric passenger vehicles that went on sale in Japan at the end of January.

Hexavalent chromium is a chemical substance that is widely used in automotive parts for applications such as electroplating to prevent rusting of metal surfaces. It is considered to be highly toxic and harmful to humans. Although there is no domestic law prohibiting the use of chromium in automobiles, Japan Automobile Manufacturers Association has prohibited its use since 2008 as an industry-independent restriction. After the same year, hexavalent chromium is no longer used on new cars in general.

In order to provide greater safety and peace of mind for passengers, BYD Japan said the use of hexavalent chromium will be discontinued on the new models of J6 and K8 electric buses which will be launched by the end of 2023.

The Packer Fastener family of companies, including Green Baybased Packer Fastener and Packer Freight and Chicago area-based Albolt Manufacturing, announced promotions of four key executives.

“Packer Fastener is well-known as having the biggest nuts in town, but our family of companies continues to grow beyond the nuts and bolts of industrial fasteners,” said CEO Terry Albrecht. “Today, we offer a comprehensive range of fasteners and industrial supplies through Packer Fastener, logistics and freight brokerage services through Packer Freight, and the production of customized fastener solutions through Albolt Manufacturing. By restructuring our leadership model and promoting talent from within, we’ve set the foundation for future growth and expansion.”

As part of these changes, Albrecht will continue in his role as principal owner and will now serve as the chief executive officer of the three sister companies. Albrecht was one of the original founding partners of Packer Fastener in 1998. He went on to found Packer Freight in 2019, and Albolt Manufacturing in 2022. His family of companies now employs 155 individuals in 11 different cities throughout the Midwest.

Generational Equity, a leading mergers and acquisitions advisor for privately held businesses, is pleased to announce the sale of its client, Fasteners, Inc. to Monroe Engineering. The acquisition closed January 31, 2023.

Fasteners, Inc., located in Colorado, and founded in 1965, is a wholesale fastener distribution company. The Company’s extensive inventory is available for prompt, accurate delivery or shipment in materials ranging from aluminum to stainless to heat-treated steel.

Headquartered in Michigan Monroe Engineering (Monroe) is an ISO 9001:2015 & AS9100D certified global industrial manufacturing company offering a broad product line and has a diverse customer base of manufacturers and distributors across several vertical markets including aerospace/defense, automotive, medical, transportation and many more.

Ministry of Commerce of the People’s Republic of China announced on April 12 to launch a trade barrier investigation on China’s products that Taiwan banned from importing, which currently include minerals and chemicals, agricultural products and textiles. The investigation is expected to last for 9 months and in any unordinary circumstances can be extended to January 12 next year. If it does get extended, January 12, 2024, happens to be the day before the next presidential election of Taiwan. This will have a strong political implication. As pointed out by Taiwan press, the era where Taiwan benefits from the trade surplus from trading with China is likely to come to an end, and the end of the Cross-Straits Economic Cooperation Framework Agreement (ECFA) could ensue. China used to adopt a vague and non-investigative attitude toward Taiwan’s ban on the import of 2,455 products from China, but now the situation is different given the current heightened tensions in the Asia-Pacific region. With China’s own economy in a bad shape and the change of China’s ties with the U.S. and Taiwan, “scratch my back and I’ll scratch yours, or else it will be worse than just an eye for an eye” reflects the current attitude that China has with Taiwan.

Therefore, if China protests against Taiwan through the World Trade Organization (WTO), Taiwan may have to open its imports to products requested by China, based on the principle that both sides should comply with the rules of “mostfavored-nation treatment” and not discriminate against members. Taiwan currently prohibits the import of wire rods and fastener products from China. If China chooses to request allowing the import of China-made wire rods and fasteners into Taiwan, given that wires rods are the raw material for fasteners, what impact will this have on Taiwan’s fasteners?

Everything is up in the air before the announcement of the investigation results, so Taiwan must prepare for the unknown. Since Taiwan now prohibits the import of steel from China, the fastener industry in Taiwan is currently using wire rods supplied by Taiwan CSC; in other words, Taiwan CSC dominates the supply of raw materials for the fastener industry in Taiwan. In the past three years, Taiwan CSC has been increasing wire rod prices in response to the international status, and this leads to increased production costs product prices as well as reduced profit margins for fastener companies in Taiwan. If low-priced wire rods from China make its way into Taiwan in the future, Taiwan CSC will take the brunt of the competition, and there will be a drastic influence on the price competitiveness of Taiwan fastener products that are made of wire rods from Taiwan CSC. The scale of the influence will be profound.

In this regard, Fastener World talked with several anonymous Taiwanese fastener business owners over the phone. It turned out that their views were not entirely pessimistic. First let’s begin with the difficulties that Taiwan may face in the future. Taiwan’s annual domestic sales of 200,000 tons of fasteners will inevitably be subject to competition from fasteners imported from China, and the entire domestic sales channel will also change drastically, so those who run business mostly on selling fasteners domestically in Taiwan must make assessment and prepare ahead. On the other hand, those who use wire rods from Taiwan CSC to produce fasteners will have to add wire rods from China or other countries in the future. The pros and cons of competition in the forthcoming domestic and export markets are yet to be evaluated and delt with. Some of the owners on the phone were optimistic. They believed the way to respond is to use low-priced wire rods imported from China or other countries to produce fasteners that are just usable, up to quality and price competitive, while on the other hand use high quality wire rods from Taiwan CSC to produce fasteners for automotive, medical, aerospace and other applications with high added value and acceptable prices.

An owner proposed another solution. For years, Taiwan fastener industry has set up factories in Southeast Asia and many other countries to diversify risks and reduce production costs. If China’s wire rods enter Taiwan, an option for Taiwanese fastener companies is to separate their factory apart based on the source of wire rods. For example, assigning a specific plant to use only imported wire rods and another plant to use only wire rods from Taiwan CSC. This approach avoids quality problems caused by the mixing of different wires rods and minimizes investment and manufacturing costs for business owners.

Combining the views of multiple owners, our interpretation of the status quo is that Taiwan fastener industry will have to bite the bullets, get through it and grasp the opportunity in the midst of crisis. “The low-price wire rods from China is not entirely a crisis for Taiwan. We should see the advantages of China’s wire rods and turn it into a new business opportunity for us. The fastener industry in Taiwan has experienced various economic crises over the past few decades, and this is how we have been able to overcome the difficulties and survive until now.” Looking ahead, the trade barrier negotiation between Taiwan and China is bound to have a lot of variables and uncertainties with the tensions in Asia Pacific. What Taiwan should do now is to point them out and act accordingly.

by Dean Tseng, Fastener World

"Since the 1980s, when the former U.S. President Reagan and former British Prime Minister Margaret Thatcher advocated the free flow of capital, manpower, trade, and goods from the developed countries to the low-cost developing countries, the supply chain of industries was expanded from the developing countries to the whole world, thus the "global supply chain" took shape and the four countries led by China, India, Brazil, and Russia became the focus of global investment, that is, the BRICs, which started the operation mechanism of high-efficiency production and low-cost cooperation. Under the operation of the "global supply chain", the world has maintained low prices for 30 years and China has become the world's factory, with a large number of products sold from China to the world. China's GDP reached US$6 trillion in 2010, surpassing Japan to become the second largest economy after the United States, and the "global supply chain" ushered in the golden age of China's rapid economic growth.

The "anti-globalization" started in 2016, when the United Kingdom decided to leave the European Union in a referendum, and in 2018, when President Trump of the Republican Party of the United States launched a trade war, imposing high tariffs on U.S. products imported from China, and China also launched a high tariff countermeasure. The high import tariffs between

China and the U.S. have not been eliminated after the Liberal Party's President Biden takes office in 2021, but are still entangled and even getting worse. At the end of 2020, a new virus broke out in Wuhan, China, and the city was sealed off. The export of Chinese products was blocked overnight and the global supply chain was disrupted. Subsequently, due to the container regulation problem, the port of congestion and container shortage caused a disruption in the chain, accompanied by high freight rates on the globalization supply chain and again caused an impact. 2022 has become the last straw to break the camels’ back of globalization. On the one hand, Russia invaded Ukraine, Europe became a war zone, energy and food caused panic, and the world is facing the fear of a third world war again. On the other hand, the U.S. and China have escalated from a trade war to a technology war, with Chinese products such as Huawei, ZTE and Hikvision being banned by the U.S., and then from a technology war to a chip war, with the U.S. completely blocking chip manufacturers from selling their products to China in October 2022. The U.S. announced that all wafer manufacturers worldwide must obtain permission from the U.S. government to export their wafers to China, as long as they use U.S. production equipment or application software and patents. The U.S. also pushed TSMC, the world's largest wafer fabricator, to set up a production plant in the U.S. The "antiglobalization" is officially on the world stage.

On March 16, 2023, during the groundbreaking ceremony for TSMC's Arizona fab, founder Morris Chang said, "Globalization is almost dead, and free trade is almost dead.”In the mind of Chang, the "high efficiency" and "low cost" mindset of the global supply chain has been transformed into "national security", "risk control" and "prevention of chain breakage" under the high uncertainty of the threat of chain breakage and war. The author observes that since the supply chain disruption caused by Covid-19, the food and energy crisis caused by the war between Russia and Ukraine, and the increasingly tense economic conflict between China and the U.S., globalization has gradually become a bipolar development trend, with the U.S. and China at each end of the spectrum, the most obvious of which is the U.S.-China chip war. TSMC is forced to choose a side to the United States and will produce the most advanced three-nanometer process chips in Arizona. Because of the huge difference between the labor force in the U.S. and Taiwan, the cost of wafer production in the U.S. will be several times higher than that of Taiwan products. Imagine if TSMC's U.S. fab is mainly for core national industries such as aerospace, defense, and military. Under the dual conditions of national security and high profitability of the industry itself, a few times higher wafer manufacturing costs will not be a consideration at all.

In fact, since the U.S. launched a trade war against China, globalization has become a bipolar trend, just like the confrontation between the U.S. and the Soviet Union during the Cold War, and in the future, the U.S.-led free trade bloc will gradually form against the China-led national economic bloc in the international trade arena. After the outbreak of the RussianUkrainian war, the supply chains of raw materials, energy, food, etc. have been "cut off" and international procurement is no longer based only on economic factors, but "national security" and "supply chain risk management" are two other important factors that must be considered. Therefore, the globalized supply chain is bound to be adjusted, and any country must create a new supply chain under "national security" and "supply chain risk management". On March 6, 2023, Tesla, the leading electric vehicle manufacturer, announced that it will build a new factory in Nuevo Leon, Mexico, which will be the world's largest electric vehicle factory, covering nearly 4,200 acres, 20 times the size of its Shanghai factory in China, with an estimated production capacity of 20 million vehicles by 2030. Whether it is TSMC's U.S. plant or Tesla's plant in Mexico, both events have a common denominator, which is to bring the production base closer to the U.S. or U.S. neighboring countries. Therefore, in the future, the international supply chain will definitely be readjusted, and each country will form its own alliance and move closer to the two poles of China and the United States, and the world's supply chain ecosystem will be reshuffled.

In the author's opinion, the future "global supply chain" based on economic considerations will not disappear, but rather cooperate with the "regional supply chain" formed by neighboring countries, which is the model of "flexible globalization" and the new thinking of "flexible supply chain". Graph 1 below divides the economic and political considerations into four quadrants. The first quadrant is for industries with high political and economic considerations, such as the chip industry; the second quadrant is for industries with low political and high economic considerations, such as the necessities of life and metal fasteners; the third quadrant is for industries with low political and economic considerations, such as the domestic demand service industry; and the fourth quadrant is for industries with

high political and low economic considerations, such as the aerospace and military industries.

The first quadrant will be based on both economic and political considerations. For example, for wafer production, the country must have sufficient production capacity so that once foreign production stops, the domestic factories can be self-sufficient, and cost is no longer the main factor. The defense industry in the fourth quadrant of the same nature will not consider the cost factor at all, but rather national security, and will definitely keep the industry in the country. In terms of the wafer industry, the U.S. is in the first and fourth quadrants, where high production costs will not be a consideration and a certain amount of domestic production capacity must be maintained. The third quadrant is for industries with low political and economic considerations, such as domestic service industries, which are less likely to be affected by globalization. The second quadrant is the industry with low political consideration but high economic consideration, and the metal fastener industry belongs to this category, unless it is a very special fastener product, the general metal fastener product has high interoperability and low production threshold, and the main consideration is still economic factors, which are just price, freight, insurance, quality, and delivery time. This type of industry is less likely to be affected by political factors.

Since 2018, when the U.S. began to implement de-sinciziation, Taiwan's exports of metal fasteners (HS Code 7318) to the U.S. have increased year after year, accounting for 32.19% of the annual import value of the U.S. in 2018 and increasing significantly to 39.22% in 2022, an increase of 7.03%, while China accounted for 26.96% of the annual import value of the U.S. in 2018 and decreased significantly to 21.68% in 2022, a decline of 5.28%. It is worth observing that India also grew by 1.28% and Vietnam increased by 1.02% from 2018 to 2022, and the fastener industries in India and Vietnam also benefited from the dividends of de-Chineseization. In the article "Analysis of U.S. Steel Fastener Procurement Trends in 2022" in issue no. 193 of Fastener World Magazine, the author analyzed the percentage of steel fasteners exported to the U.S. from 2018 to

2021 from Mexico and Canada, two countries neighboring the U.S. What was more surprising at that time was that Canada and Mexico, two American countries belonging to the "U.S.-Mexico-Canada Agreement" with the U.S., did not gain any significant change in the trade war between China and the U.S, This article reorganizes THE PREMIER SOURCE OF FREE U.S. TRADE & TARIFF data as the following Table 1, the statistical comparison table of U.S. imports of steel fasteners (including customs value, insurance plus freight) from 2018 to 2022. Canada has improved from the 5th place in 2018 to the 4th place, surpassing the value of Germany's imports, and after removing insurance and freight costs as shown in Table 2 , the value of U.S. imports of steel fasteners (customs value) statistics for 2018 to 2022, Mexico also surpassed Thailand to advance to rank 9 th We found a phenomenon, the share of both Canada and Mexico after deducting customs and insurance fees is increased. Table 3 is the 2022 U.S. imports of steel fasteners (including Customs value, insurance fees and freight) statistics. Under the "U.S.-Mexico-Canada Agreement", Canada's freight, insurance and total value is 1.59%, while Mexico's is only 1.19%. Compared with Taiwan's 9.58% and China's 12.57%, the competitive difference is very obvious. The distance between each country and the U.S. affects the freight and insurance costs, and most importantly, the delivery time, and there is a high degree of uncertainty in long-distance transportation.

Under the high uncertainty, if the four quadrants of the industry differentiation diagram in Graph 1 are applied to the "flexible supply chain", the first quadrant will sacrifice some of the economic considerations in favor of political considerations, for example, chip production. The country must have enough capacity to produce, so that if foreign production stops, domestic factories can be self-sufficient, therefore, 20-30% of the capacity will be retained in the country or within the "regional supply chain", while 70%

will be supplied by the "global supply chain" based on economic considerations. The defense industry in the fourth quadrant will remain in the domestic market or within the "regional supply chain" to ensure national security. The third quadrant is for domestic service industries, which will also remain in the "regional supply chain. The second quadrant of industry is the industry with low political consideration but high economic consideration, the main consideration is just price, freight, premium, quality, delivery, etc. This type of industry is less affected by political factors. The metal fastener industry belongs to this category.