Fastener World no.202/2023 003

Fastener World no.202/2023 005

Fastener World no.202/2023 007

Fastener World no.202/2023 008

Fastener World no.202/2023 010

Fastener World no.202/2023 011

014 Fastener World no.202/2023

Fastener World no.202/2023 016

Fastener World no.202/2023 021

Fastener World no.202/2023 025

026 Fastener World no.202/2023

028 Fastener World no.202/2023

Fastener World no.202/2023 029

030 Fastener World no.202/2023

Fastener World no.202/2023 031

Fastener World no.202/2023 032

Fastener World no.202/2023 033

Fastener World no.202/2023 034

Fastener World no.202/2023 035

Fastener World no.202/2023 036

Fastener World no.202/2023 037

Fastener World no.202/2023 039

Fastener World no.202/2023 040

042 Fastener World no.202/2023

Fastener World no.202/2023 043

Fastener World no.202/2023 045

048 Fastener World no.202/2023

Fastener World no.202/2023 049

050 Fastener World no.202/2023

Fastener World no.202/2023 051

052 Fastener World no.202/2023

Fastener World no.202/2023 053

Fastener World no.202/2023 054

056 Fastener World no.202/2023

058 Fastener World no.202/2023

Fastener World no.202/2023 059

Fastener World no.202/2023 060

Fastener World no.202/2023 061

062 Fastener World no.202/2023

Fastener World no.202/2023 063

064 Fastener World no.202/2023

Fastener World no.202/2023 065

066 Fastener World no.202/2023

Fastener World no.202/2023 067

163 310EXPRESS COMPANY (Japan)

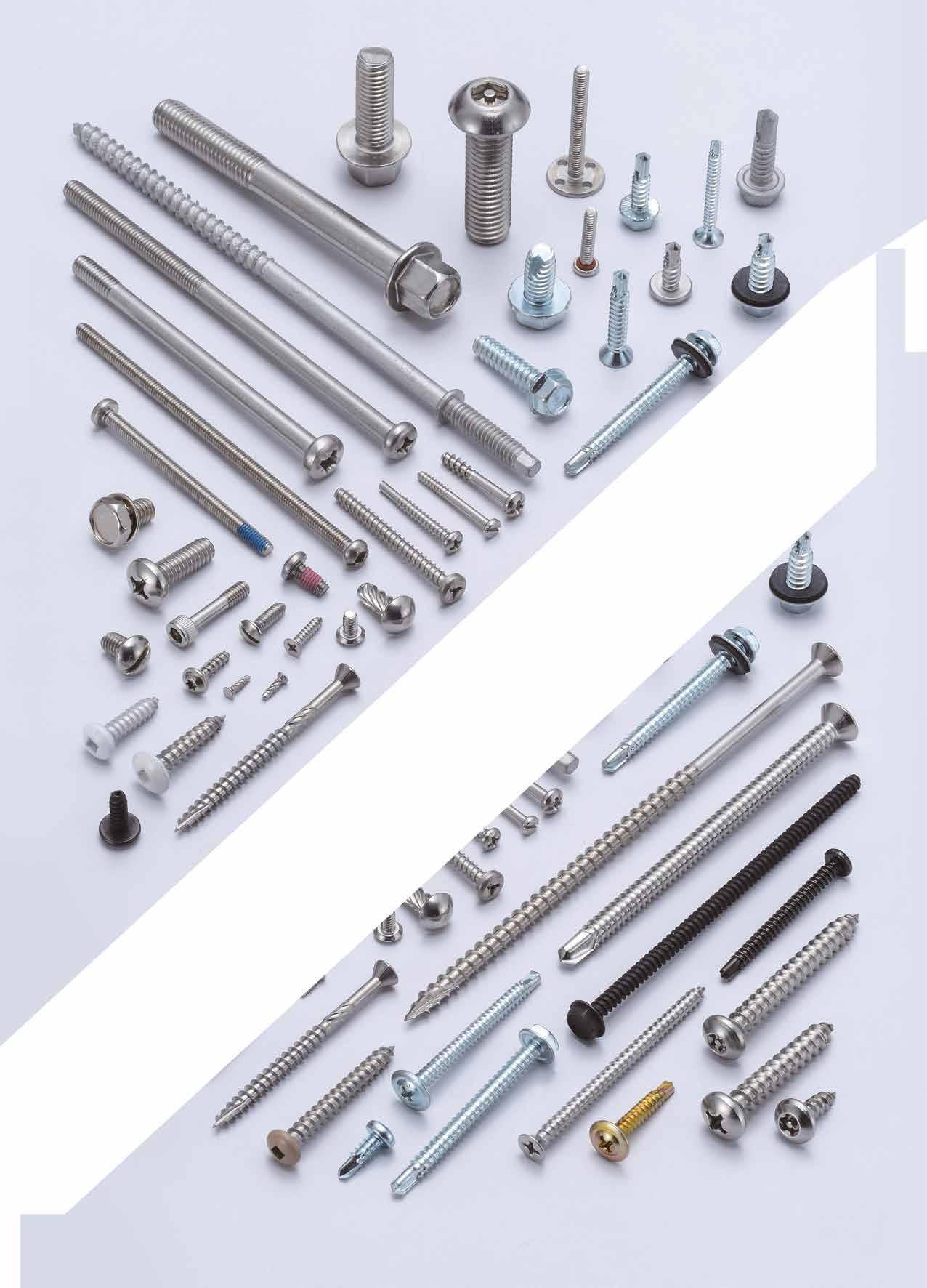

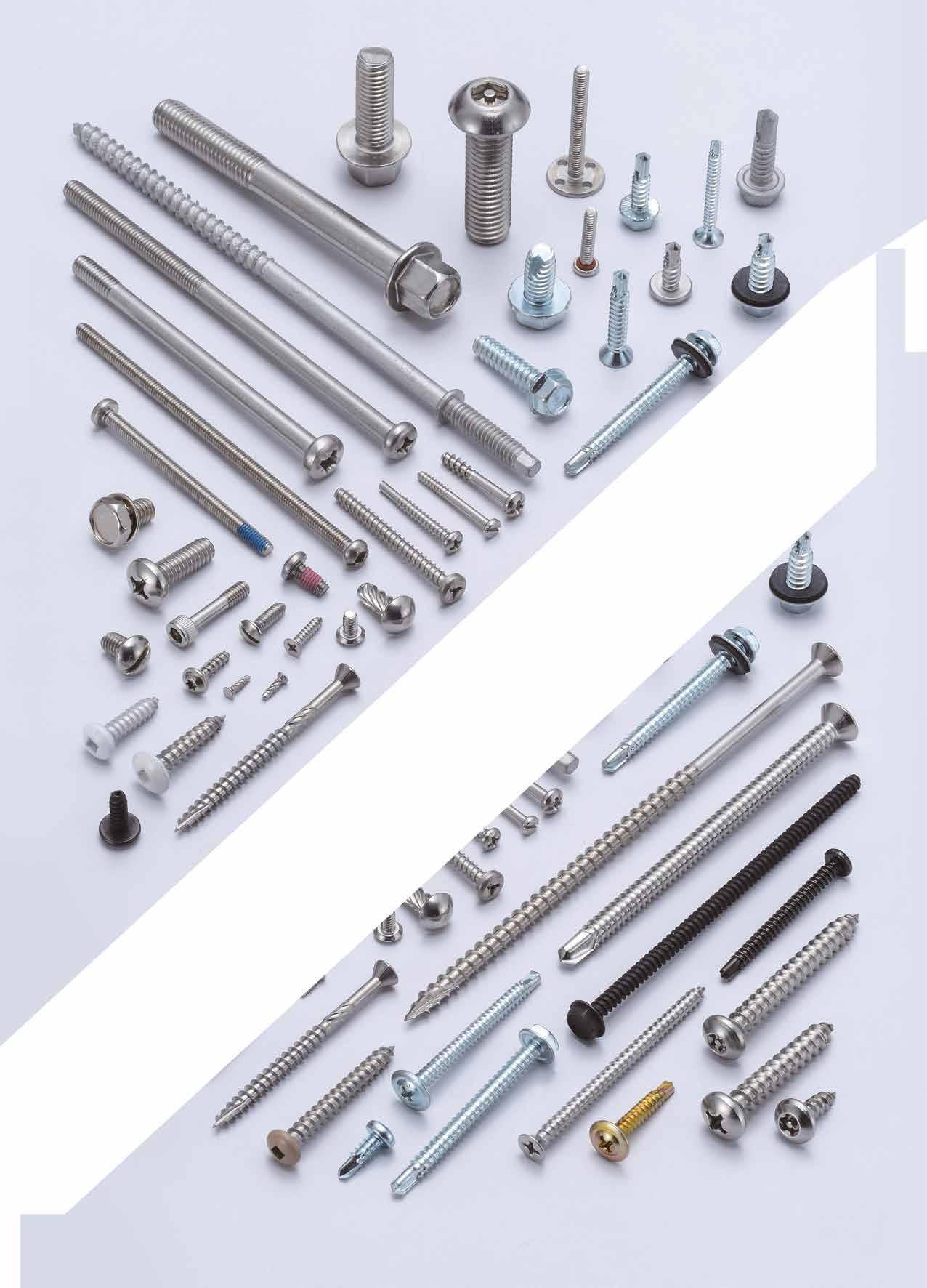

Security, Tamper Proof, Anti-theft Screws...

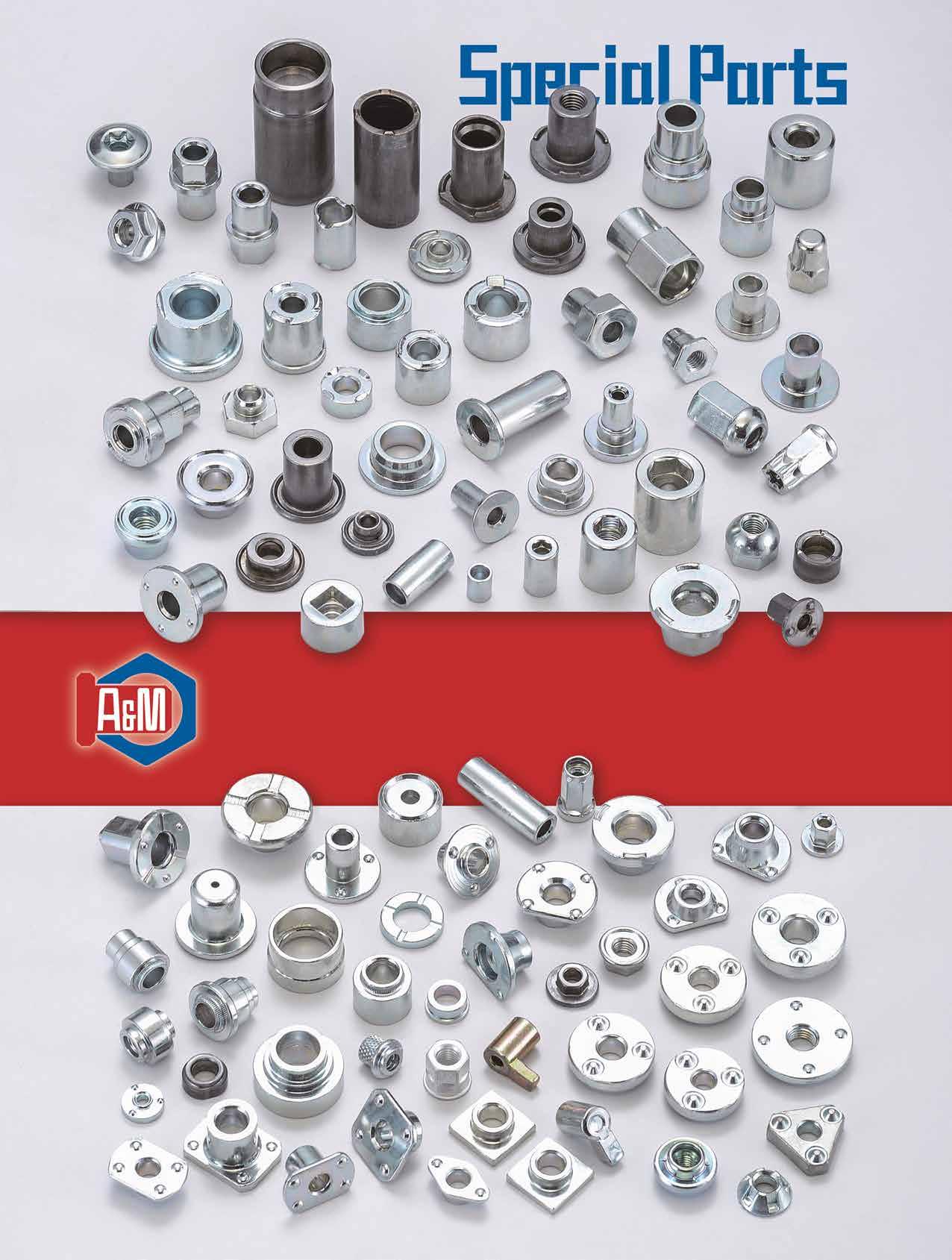

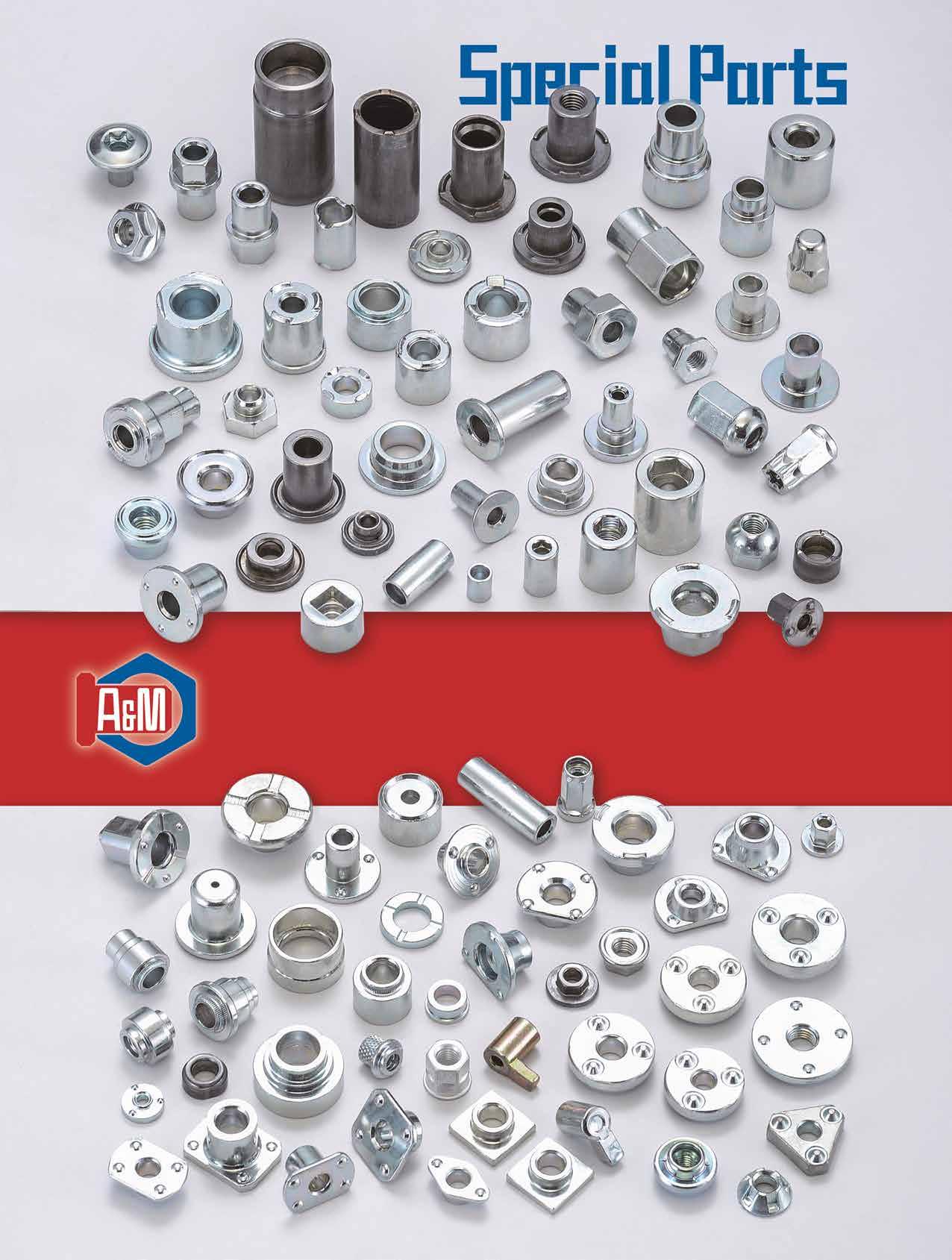

179 A & M PRODUCTS CO., LTD.

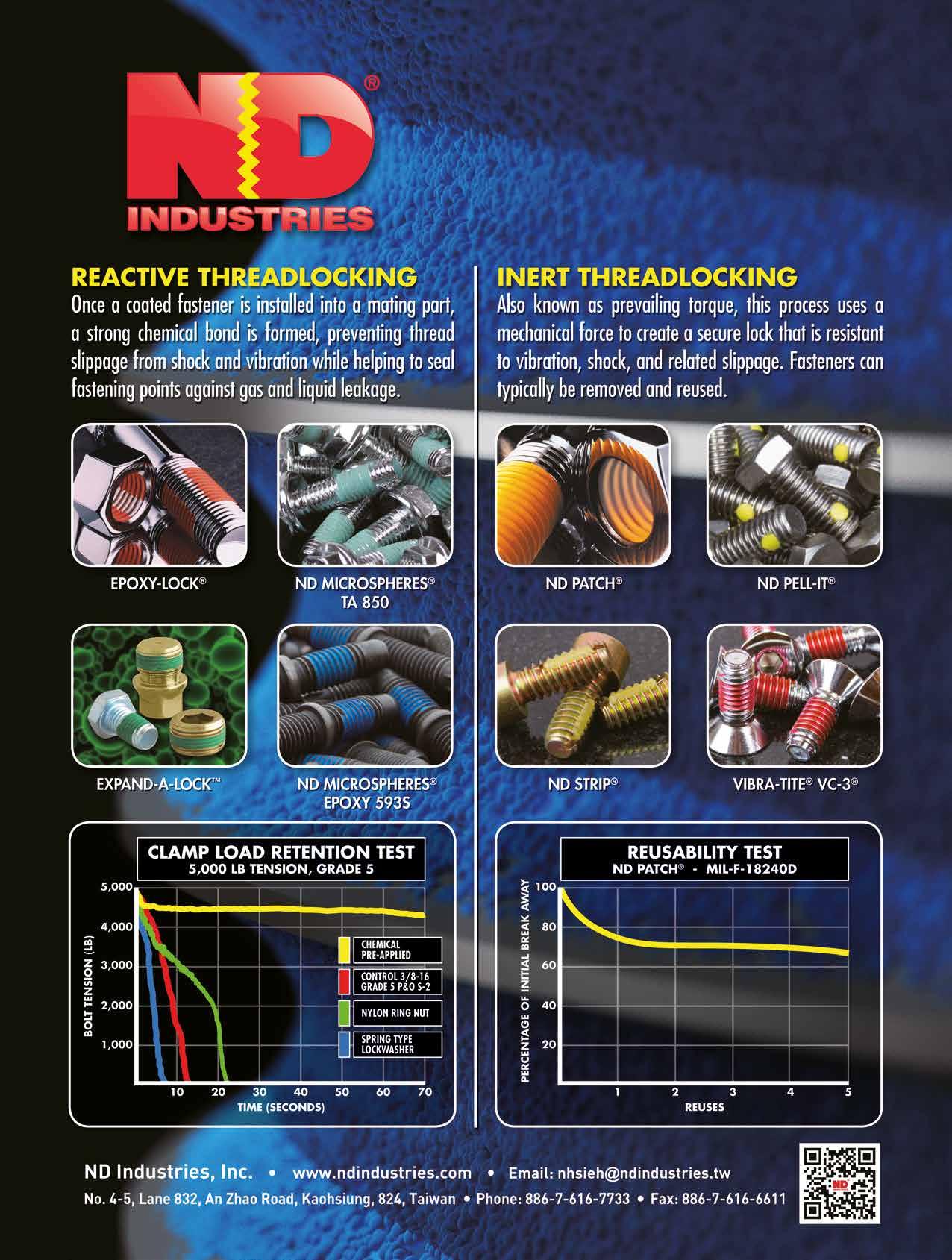

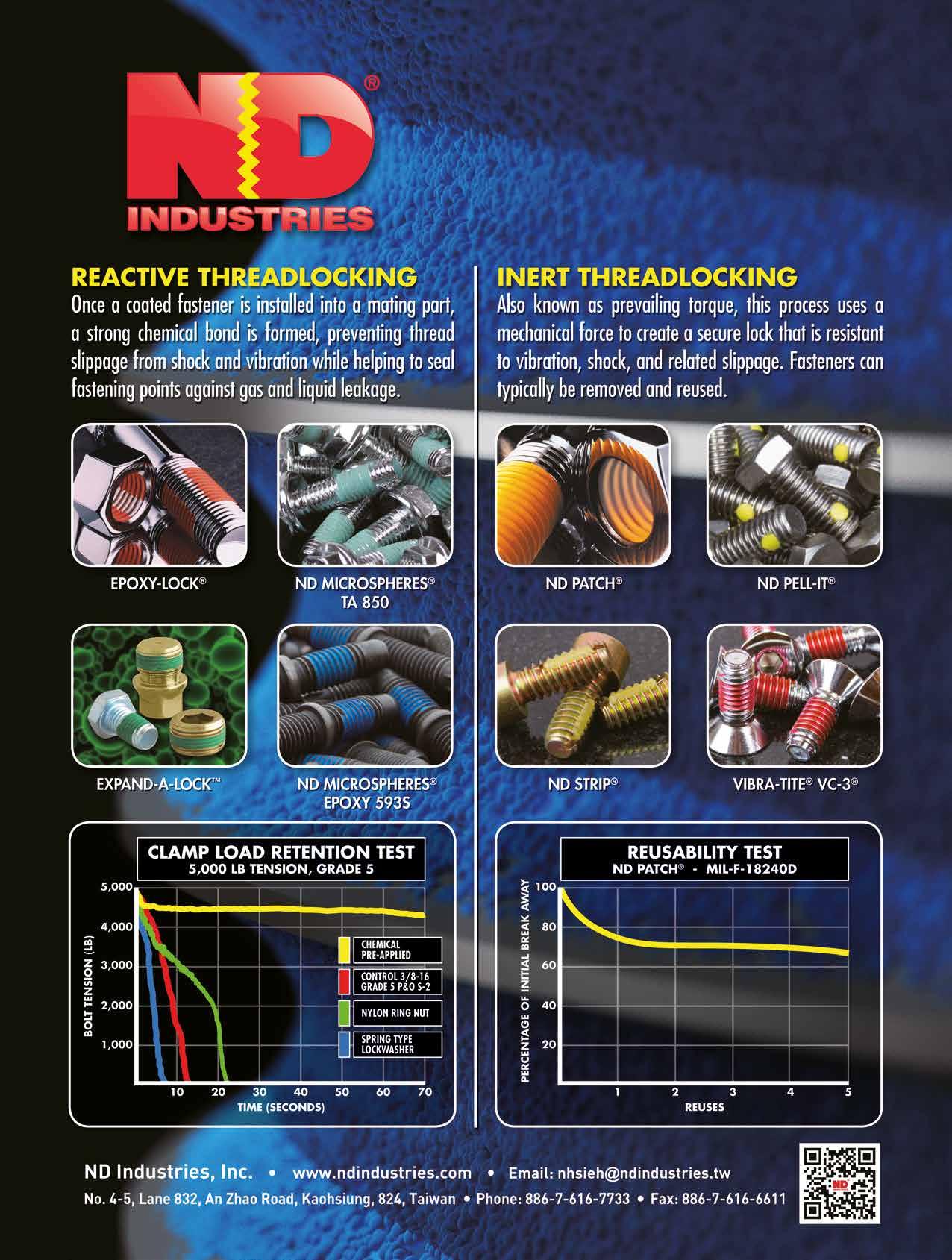

Automotive Fasteners...

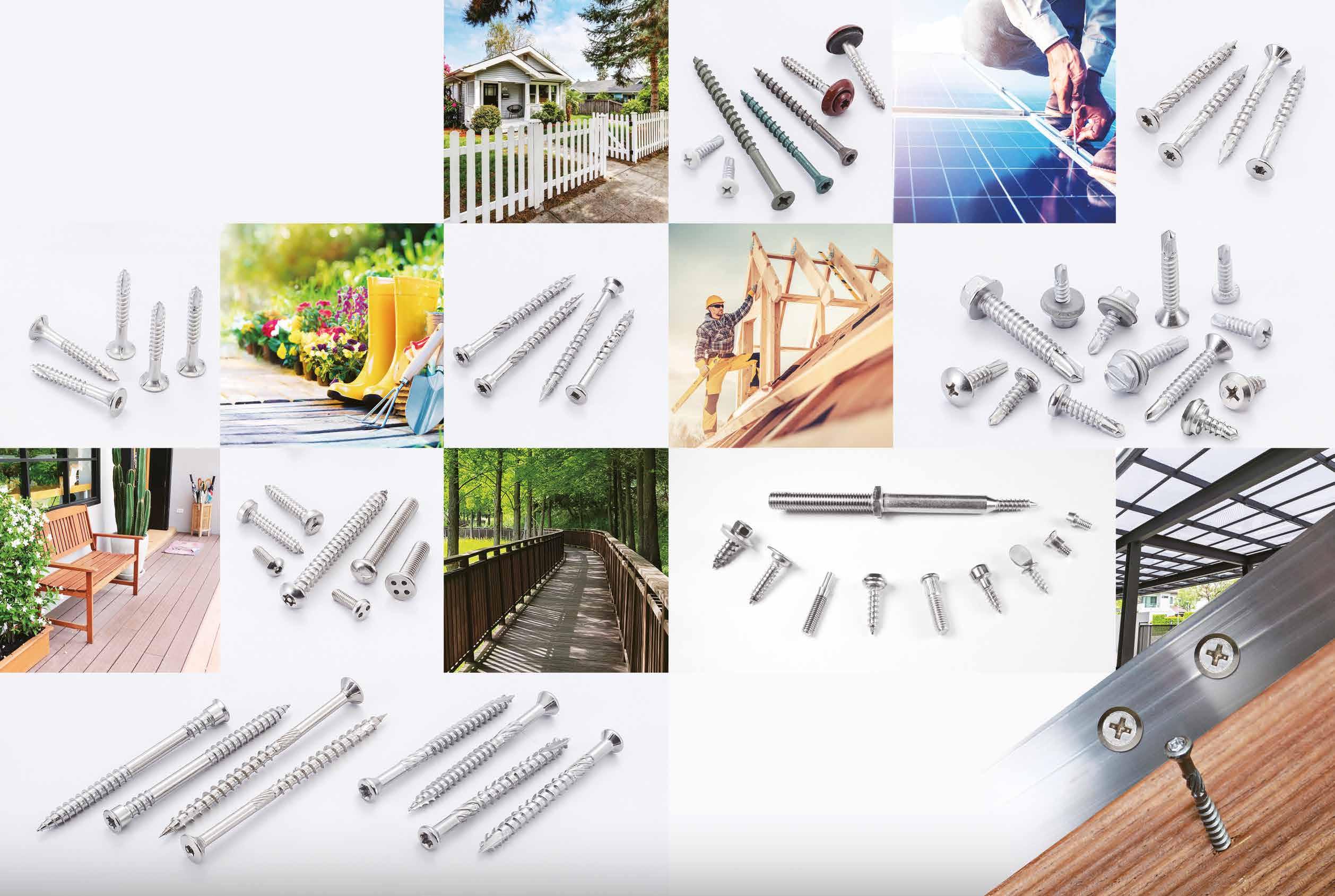

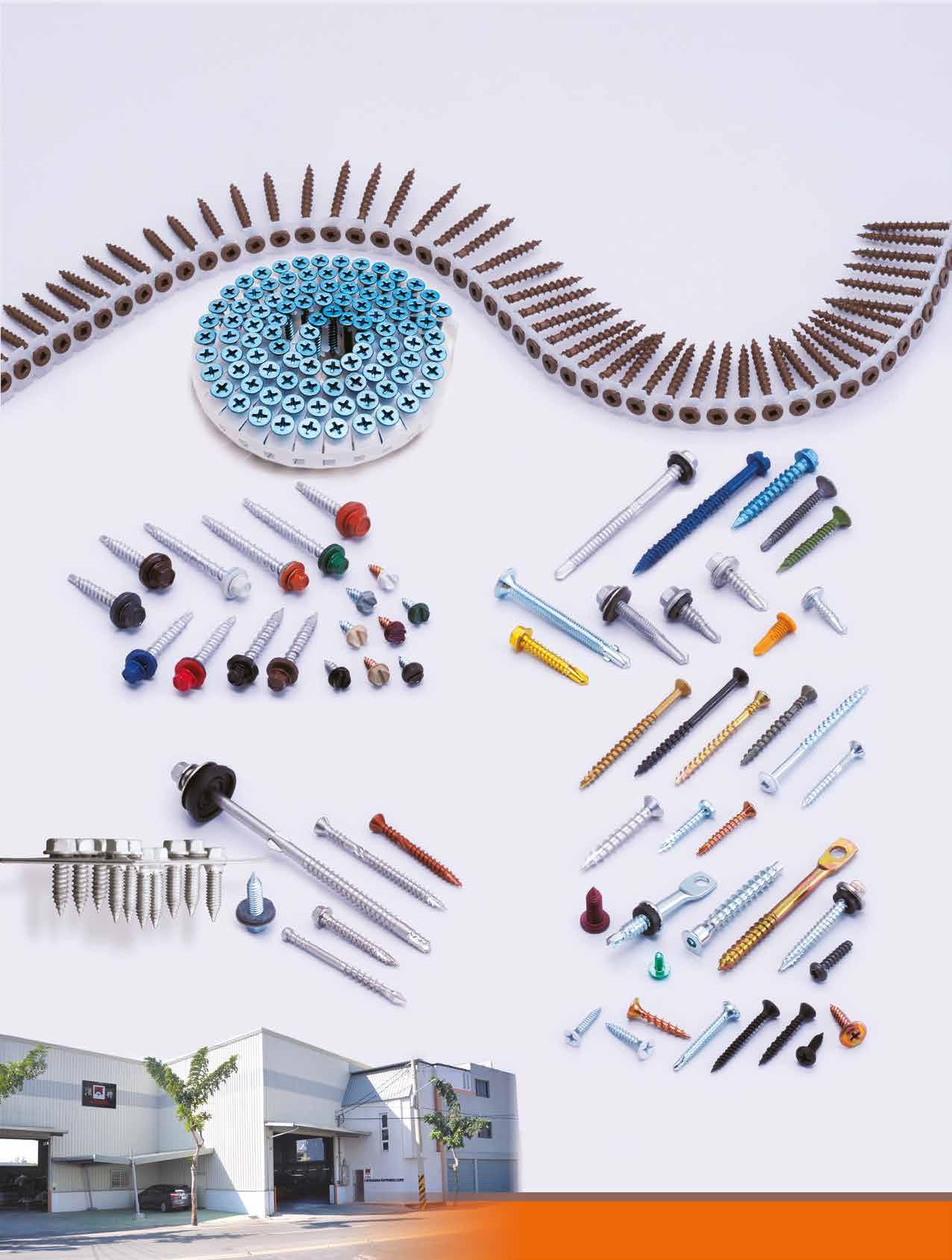

280 A-PLUS SCREWS INC.

Chipboard Screws, Customized Special Screws / Bolts...

159 A-STAINLESS INTERNATIONAL CO., LTD.

Chipboard Screws, Concrete Screws, Deck Screws...

350 ABC FASTENERS CO., LTD.

Drop-in Anchors, Expansion Anchors, Wire Anchors...

129 ABS METAL INDUSTRY CORP.

Elevator Bolts, Flanged Head Bolts, Floorboard Screws...

147 ACHILLES SEIBERT GMBH (Germany)

Tapping Screws, Drilling Screws, Thread Rolling Screws...

170 ADVANCED GLOBAL SOURCING LTD.

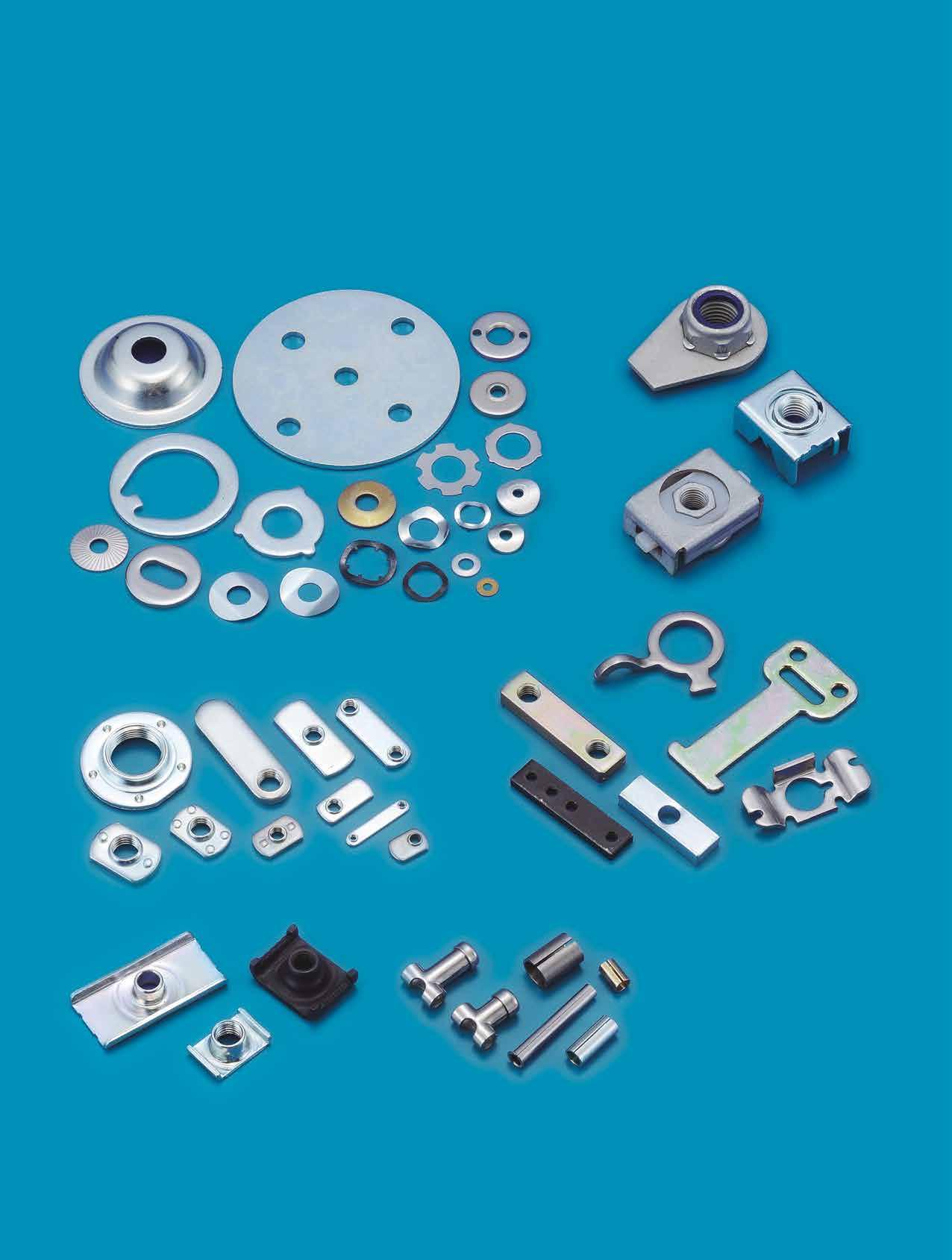

Screw, Nut, Bolt, Machining/Stamping/Spring Parts..

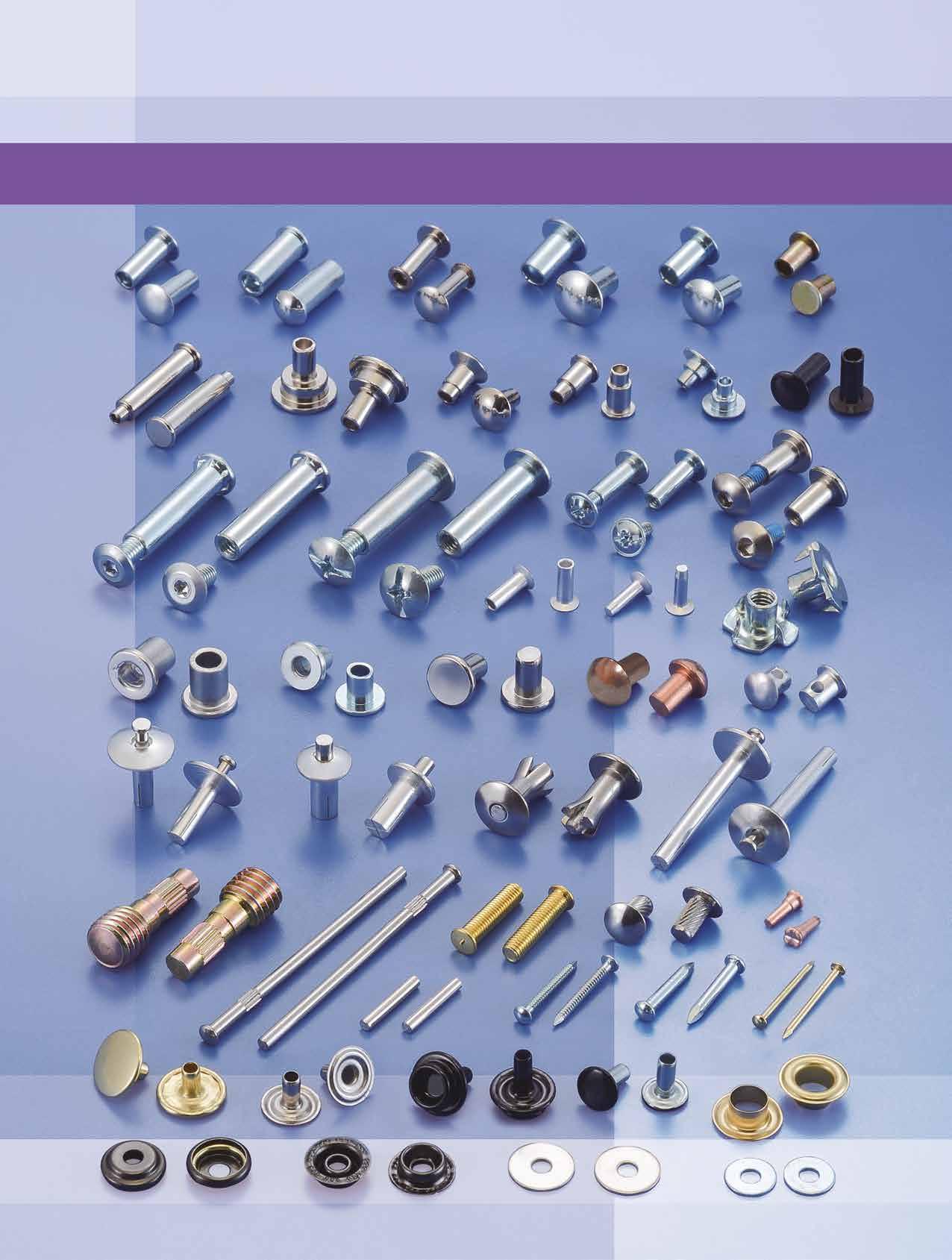

82 AEH FASTEN INDUSTRIES CO., LTD.

Clevis Pins, Dowel Pins, Hollow Rivets...

35 ALEX SCREW INDUSTRIAL CO., LTD.

Button Head Cap Screws, Button Head Socket Cap Screws...

128 ALISHAN INTERNATIONAL GROUP CO., LTD.

Fastener Tools, Bolts, Screws, Nuts, Stamping Parts...

235 AL-PRO METALS CO., LTD.

Special Screws, Clinching Screws, Micro Screws...

80 AMBROVIT S.P.A. (Italy)

Chipboard Screws, Combined Screws, Machine Screws...

58 AMPLE LONG INDUSTRY CO., LTD.

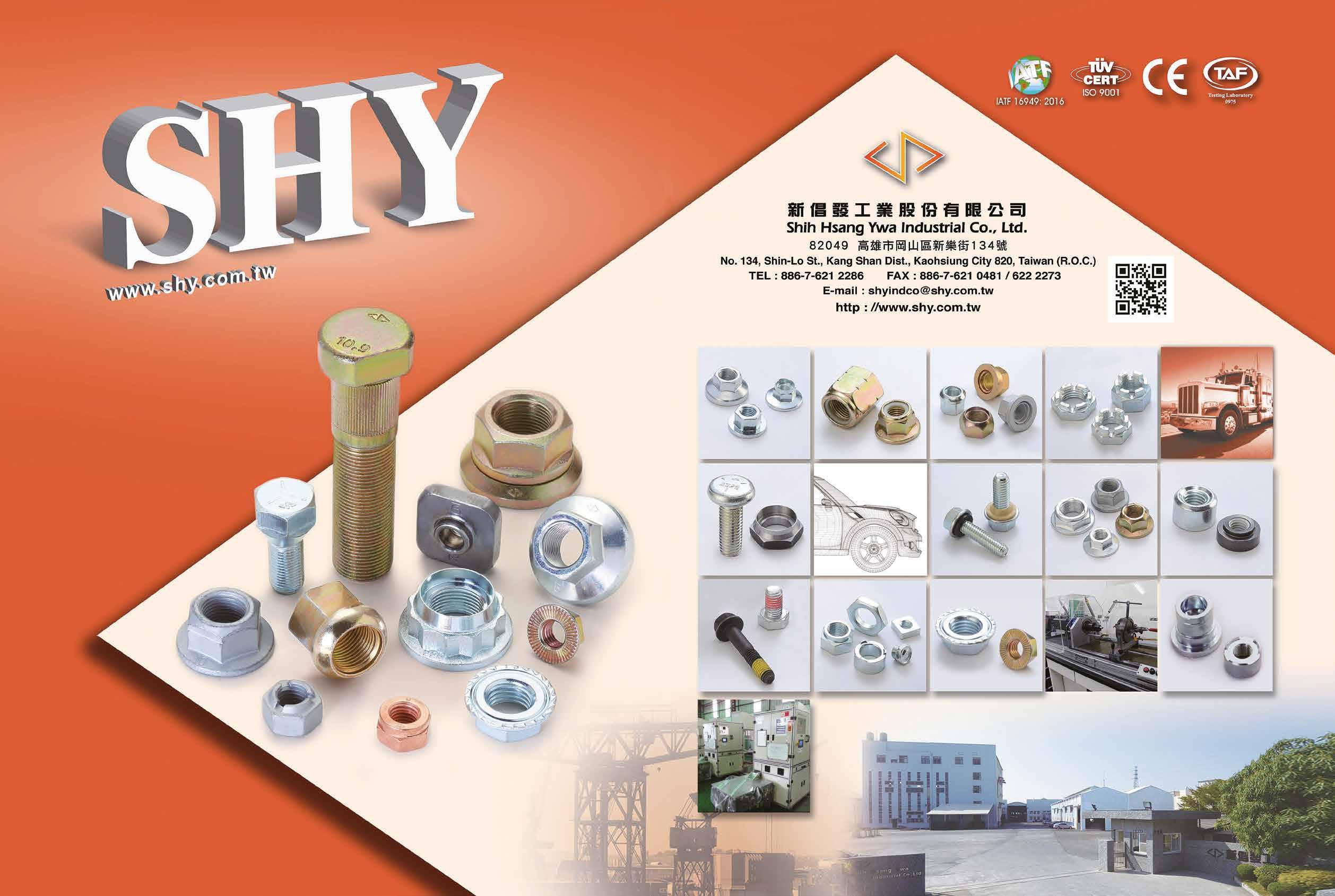

Hollow Rivets, Drive Rivets, Semi-tubular Rivets...

364 ANCHOR FASTENERS INDUSTRIAL CO., LTD.

276 CHANG BING ENTERPRISE CO., LTD. 彰濱 Hook Bolts, Holders / Hooks / Rings, Dowel Screws...

106 CHANG YI BOLT CO., LTD. 長益 6 Cuts/ 8 Cuts Self Drilling Screws, A2 Cap Screws...

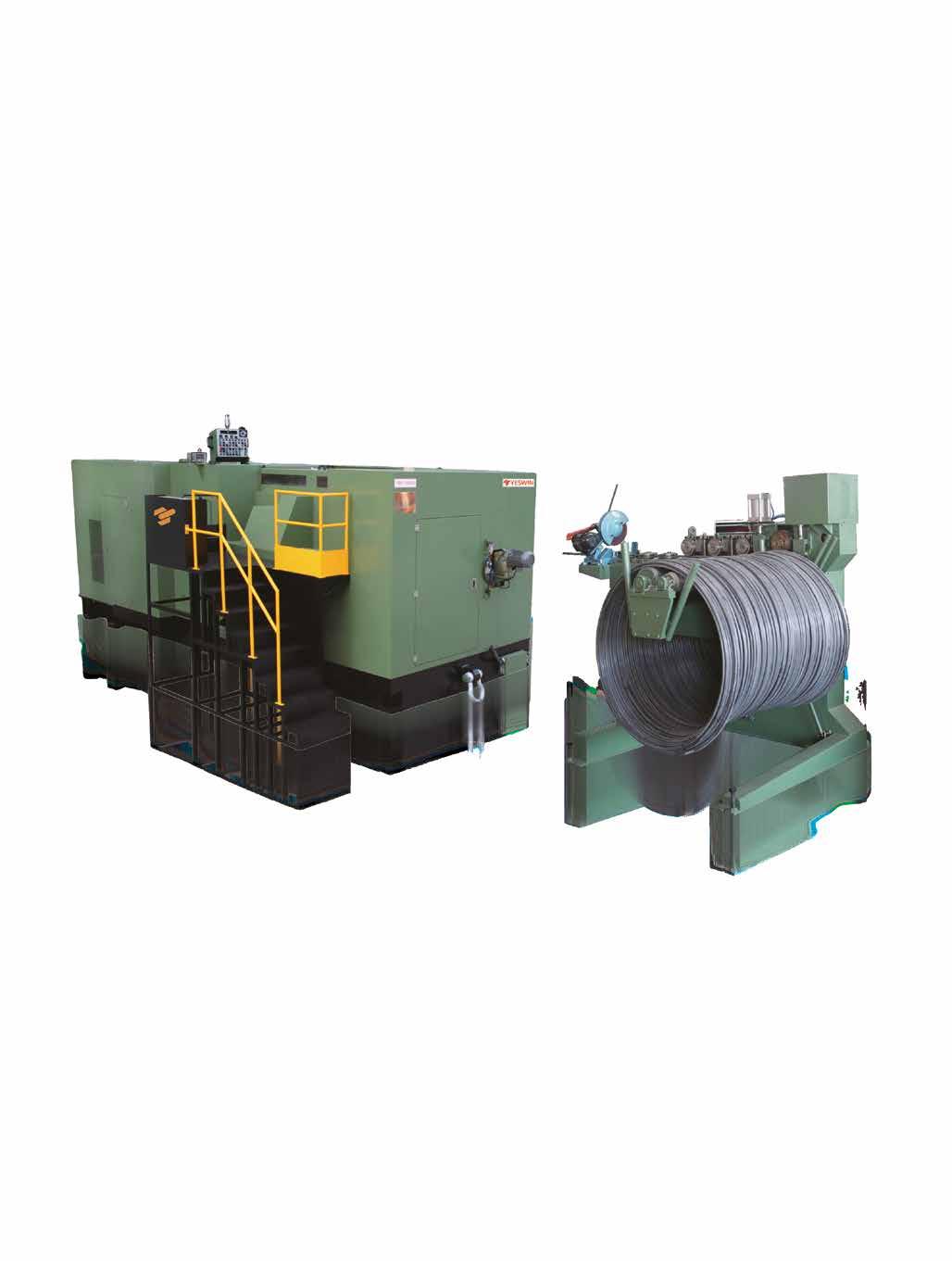

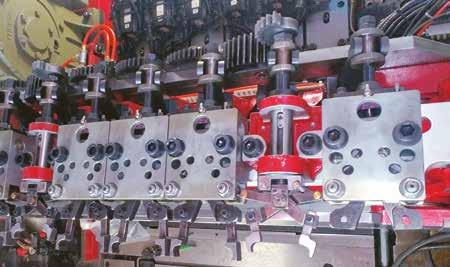

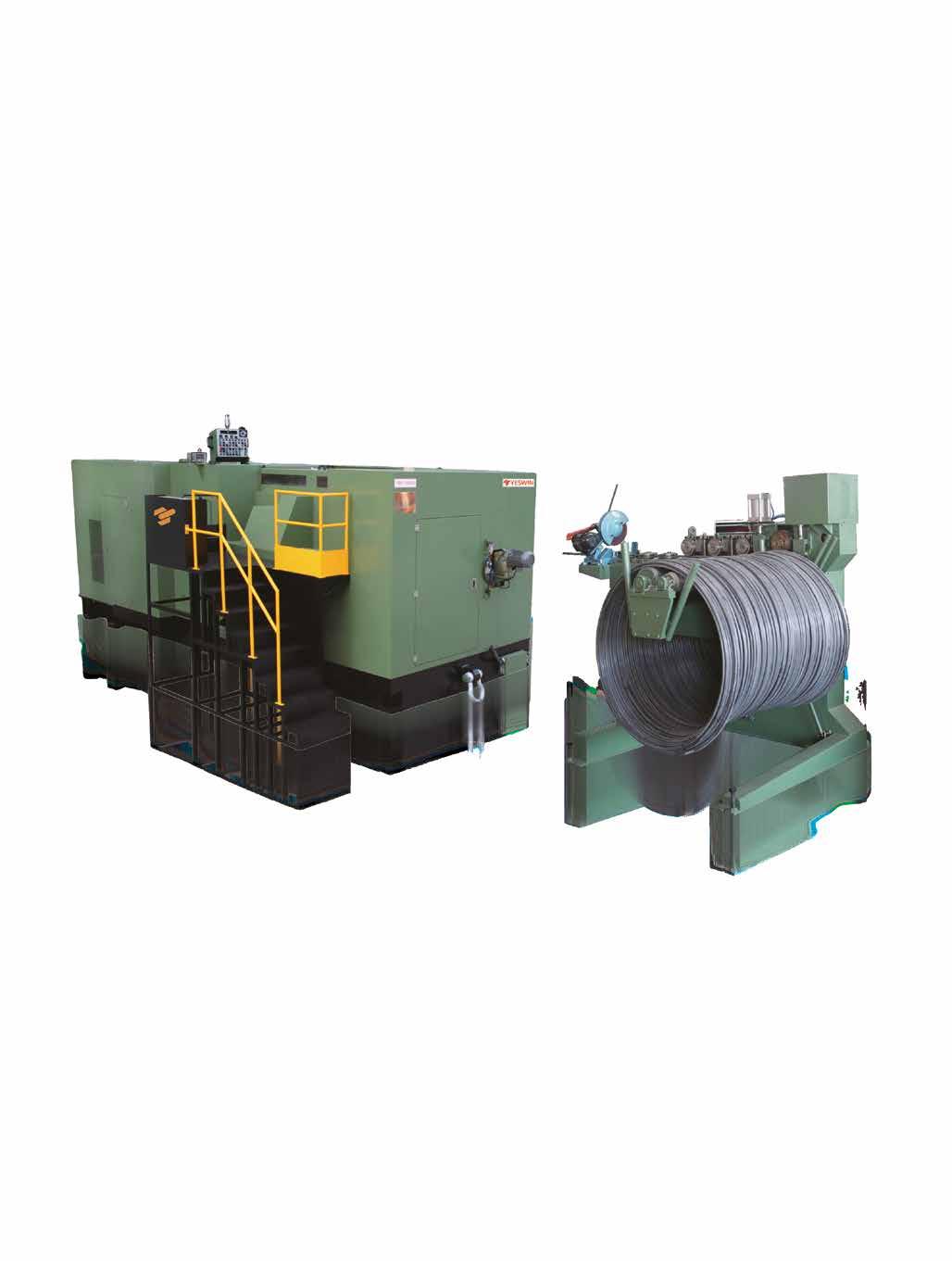

330 CHAO JING PRECISE MACHINES ENTERPRISE 朝璟 Cold Forging Bolt Formers, Thread Rolling Machines...

187 CHI NING COMPANY LTD. 旗林 Machine, Nuts, Tooling...

51 CHIAN YUNG CORPORATION 將運 SEMS Screws

120 CHIAO CHANG PNEUMATIC TOOL CORP. 喬章 Riveter Tools, Rivet Nut Tools, Cutting Tools, Engraving Pen...

181 CHIEH LING SCREWS ENTERPRISE CO., LTD 捷領 Screws, Nuts, Hexagon Keys, Lug Wrenches, Rivets...

219 CHIEN TSAI MACHINERY ENTERPRISE CO., LTD. 鍵財 Thread Rolling Machines

94 CHIN LIH HSING PRECISION ENTERPRISE 金利興 Automotive Nuts, Brass Inserts, Bushes, Bushings...

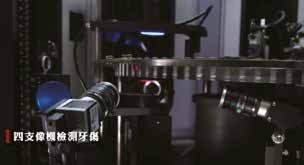

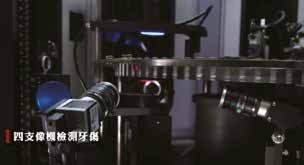

316 CHING CHAN OPTICAL TECHNOLOGY CO., LTD. 精湛 Eddy Current Sorting Machines, Fastener Makers...

169 CHIREK FASTENER CORPORATION 錡瑞 Stainless Steel Fasteners, Self-Drilling Screws, Washers...

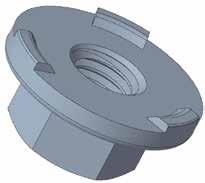

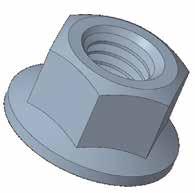

36 CHONG CHENG FASTENER CORP. 宗鉦 Cap Nuts, Coupling Nuts, Conical Washer Nuts...

118 CHUN YU WORKS & CO., LTD. 春雨 Drywall Screws, Socket Head Cap Screws , TC Bolt Sets...

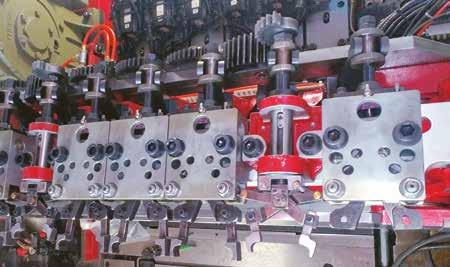

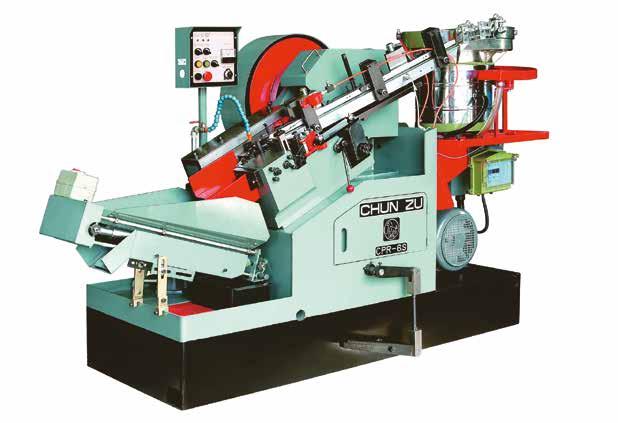

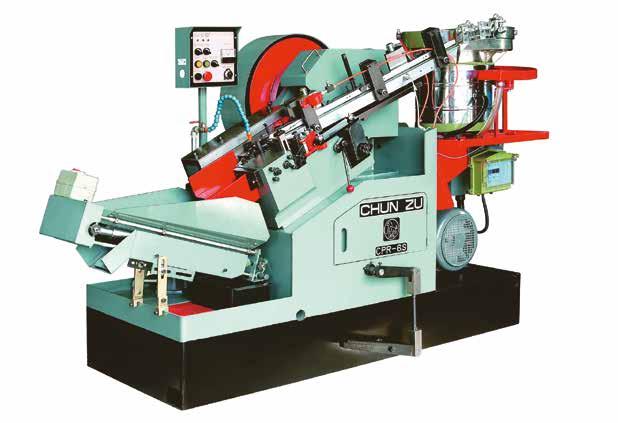

318 CHUN ZU MACHINERY INDUSTRY CO., LTD. 春日 Cold Headers, Header Toolings, Heading Machines...

205 CHUNG HO ENTERPRISE CO., LTD. 鍾和 Customized Fasteners, Multi-Forming Screws, CNC Turning Parts…

239 CONTINENTAL PARAFUSOS S.A. 巴西商友暉 Automotive Part & Nut, Home Appliance Screws, Sems...

285 COPA FLANGE FASTENERS CORP. 國鵬 Hex Nuts, Hex Flange Nuts, Combi Nuts, Weld Nuts...

275 CO-WEALTH ENTERPRISE CO., LTD. 竟丞 Spring Pins, Flange Washers, Sems Washers...

98 CPC FASTENERS INTERNATIONAL CO., LTD. 冠誠

Stainless Steel, Bi-metal Self-drilling Screws...

31 DA YANG ENTERPRISE CO., LTD. 大楊

Special Automotive Nuts, Special Weld Nuts...

203 DAGAN INTERNATIONAL CO., LTD. 美達斯 Nut Former, Thread Rolling Machine, Cold Forging Tooling…

338 DAH-LIAN MACHINE CO., LTD 大連

Fastener Maker, Thread Rolling Machines, Heading Machines...

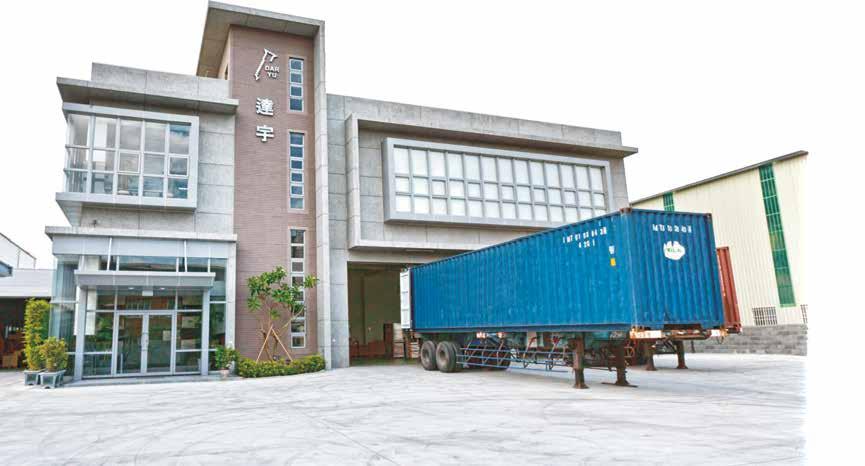

96 DAR YU ENTERPRISE CO., LTD. 達宇 Chipboard Screws, Drywall Screws, Screw Nails…

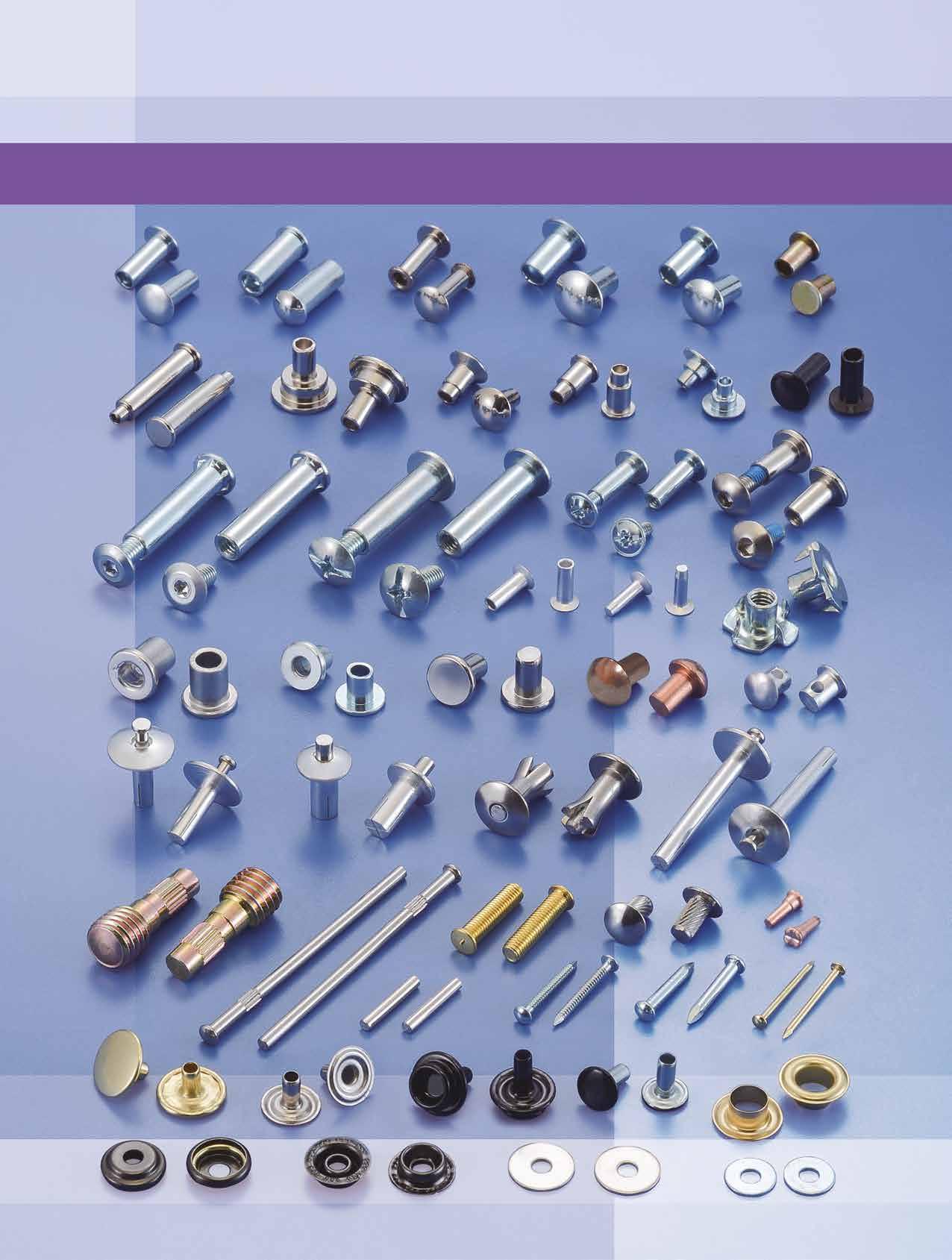

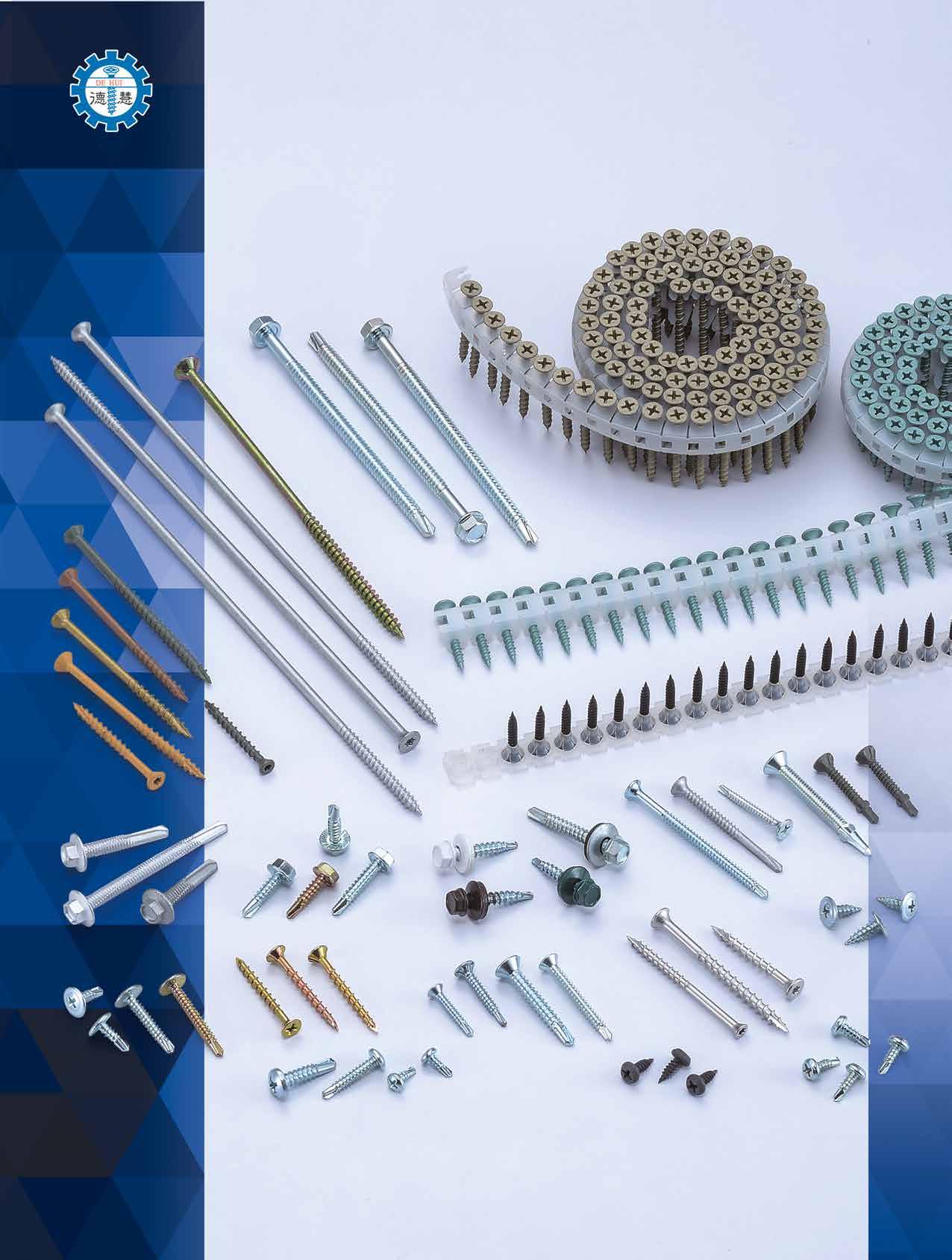

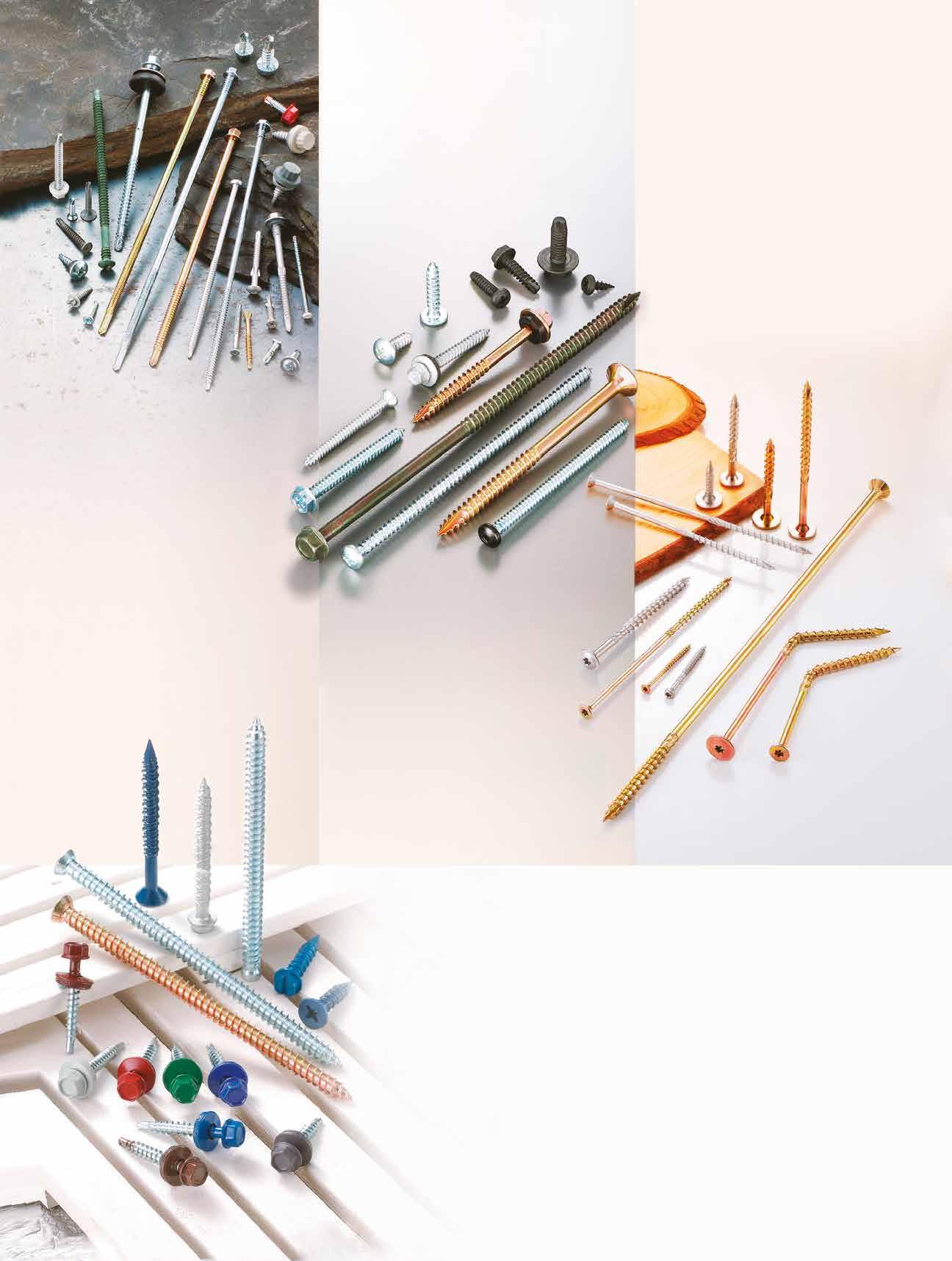

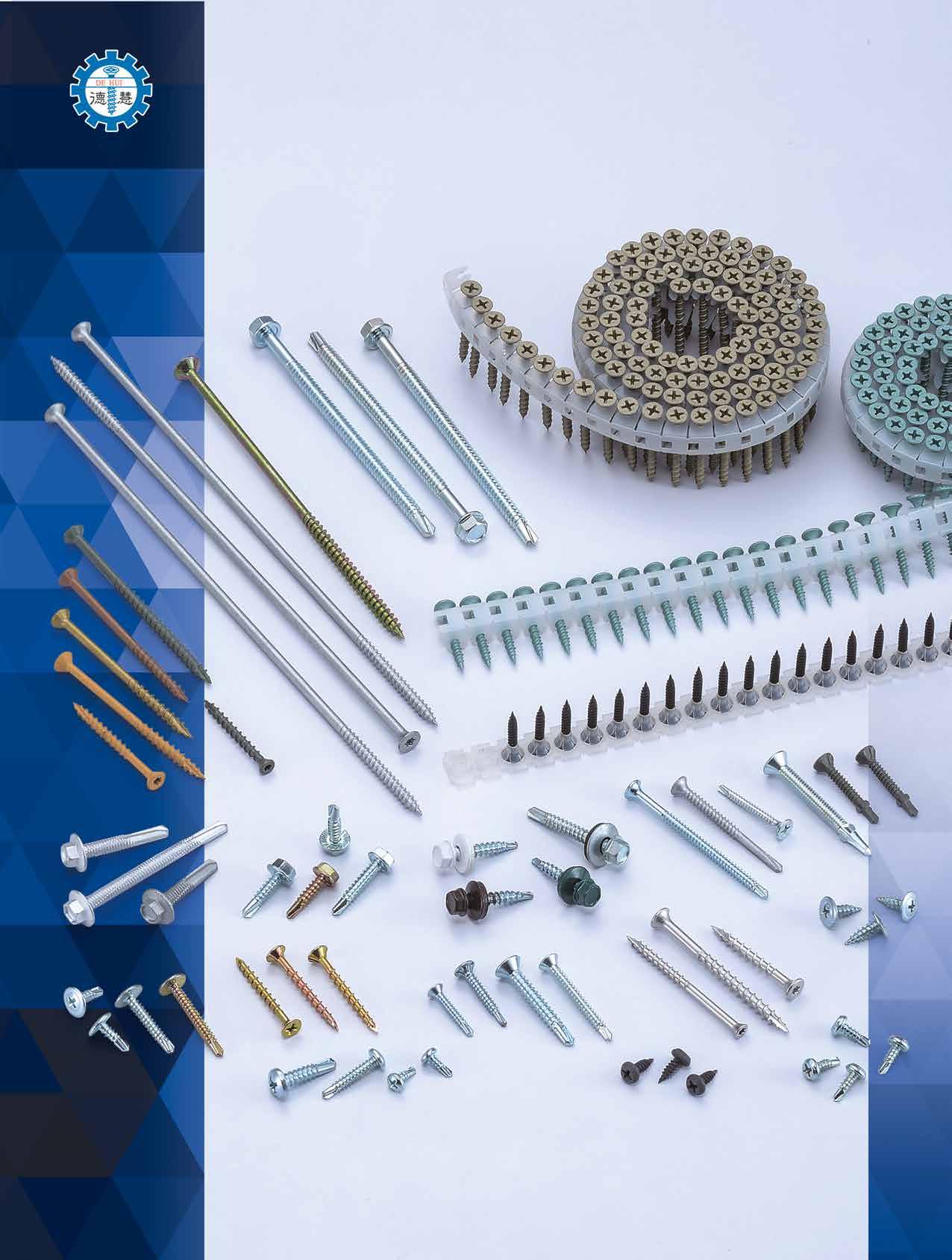

122 DE HUI SCREW INDUSTRY CO., LTD. 德慧 Drywall Screws, Decking Screws, Self-drilling Screws, Roofing Screws... DIING SEN FASTENERS INDUSTRIAL CO., LTD. 鼎昇 Chipboard Screws, Corrosion Resistant Screws...

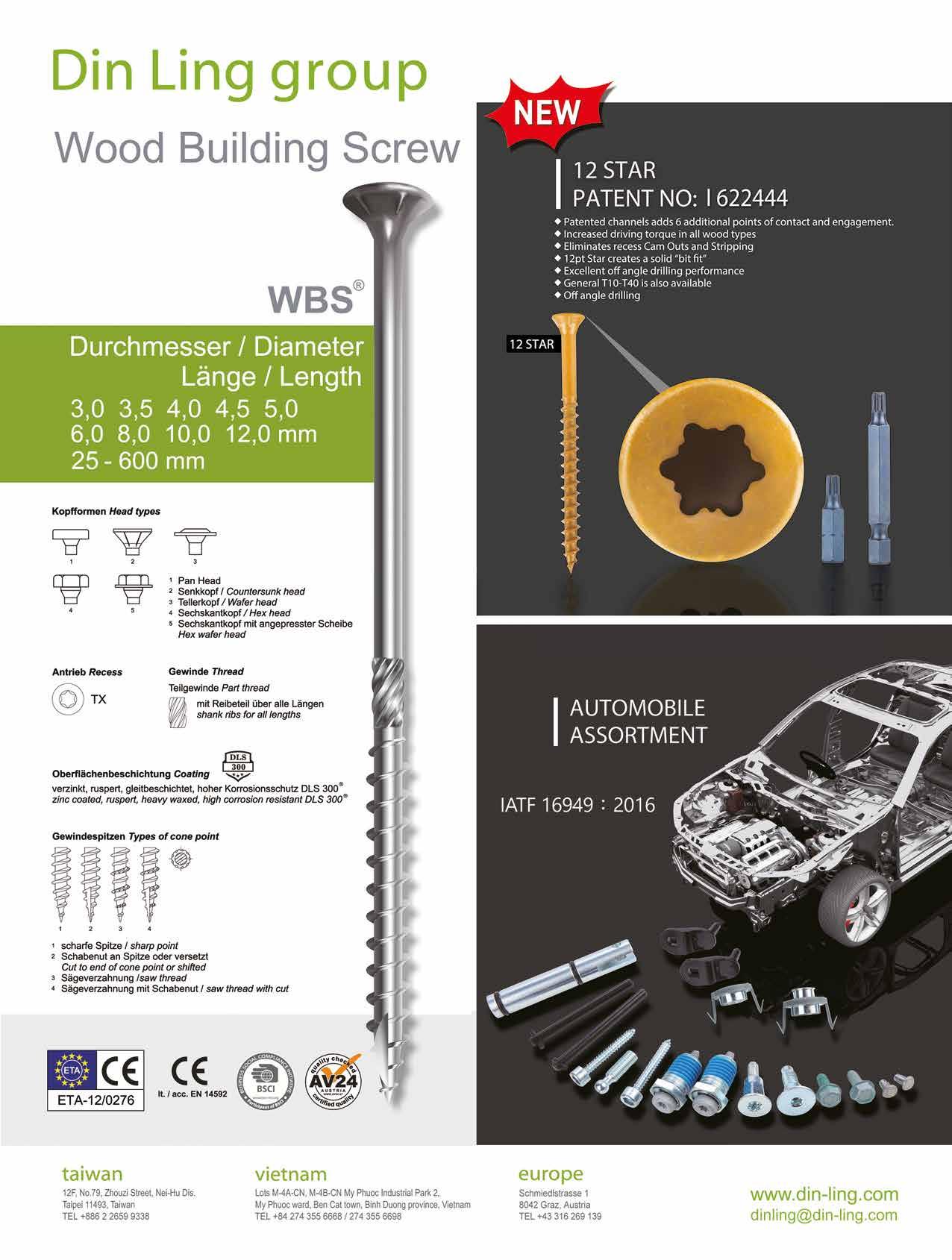

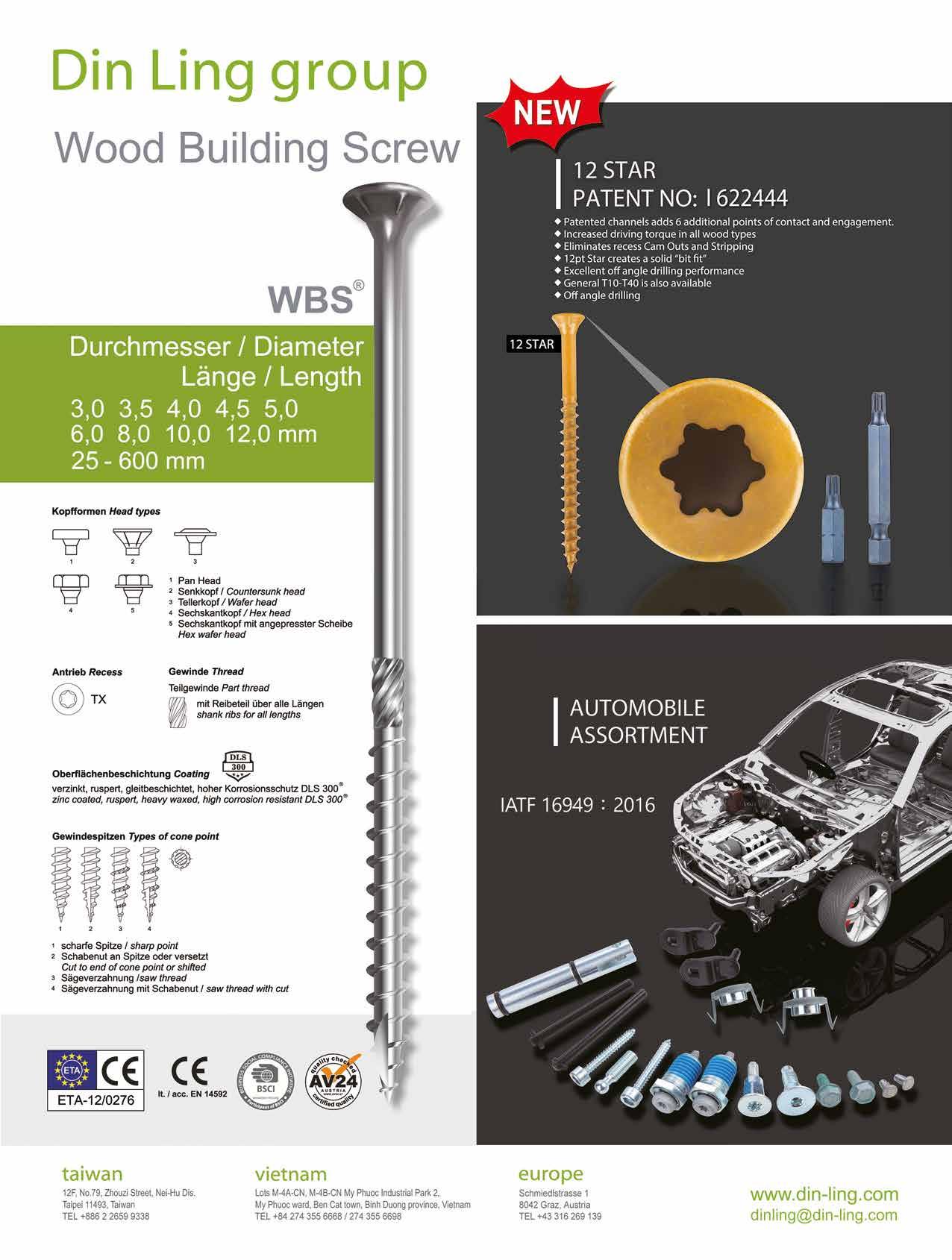

13 DIN LING CORP. 登琳

Chipboard Screws, Drywall Screws, Furniture Screws...

105 DRAGON IRON FACTORY CO., LTD. 龍昌

Bi-metal Self-drilling Screws, Sheet Metal Screws...

121 DRA-GOON FASTENERS INC. 丞曜

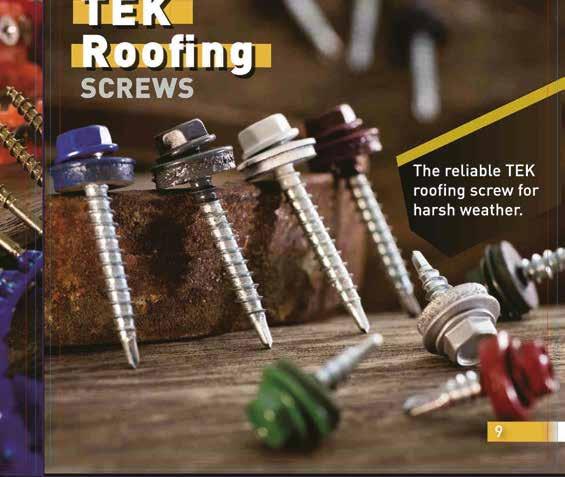

Chipboard Screws, Phillips Head Screws, TEK Screws...

276

149

Bolts, Plastic Injection Parts...

320 CHAN CHANGE MACHINERY CO., LTD. 長薔 Screw Head Machines, Bolt Former, High Performance Former...

134

issue 202 Sep./Oct. 2023

奕瑞

淳康

聯欣

得鈺

金永佳

鉞昌

禾億

奧立康

錦茂

寬長

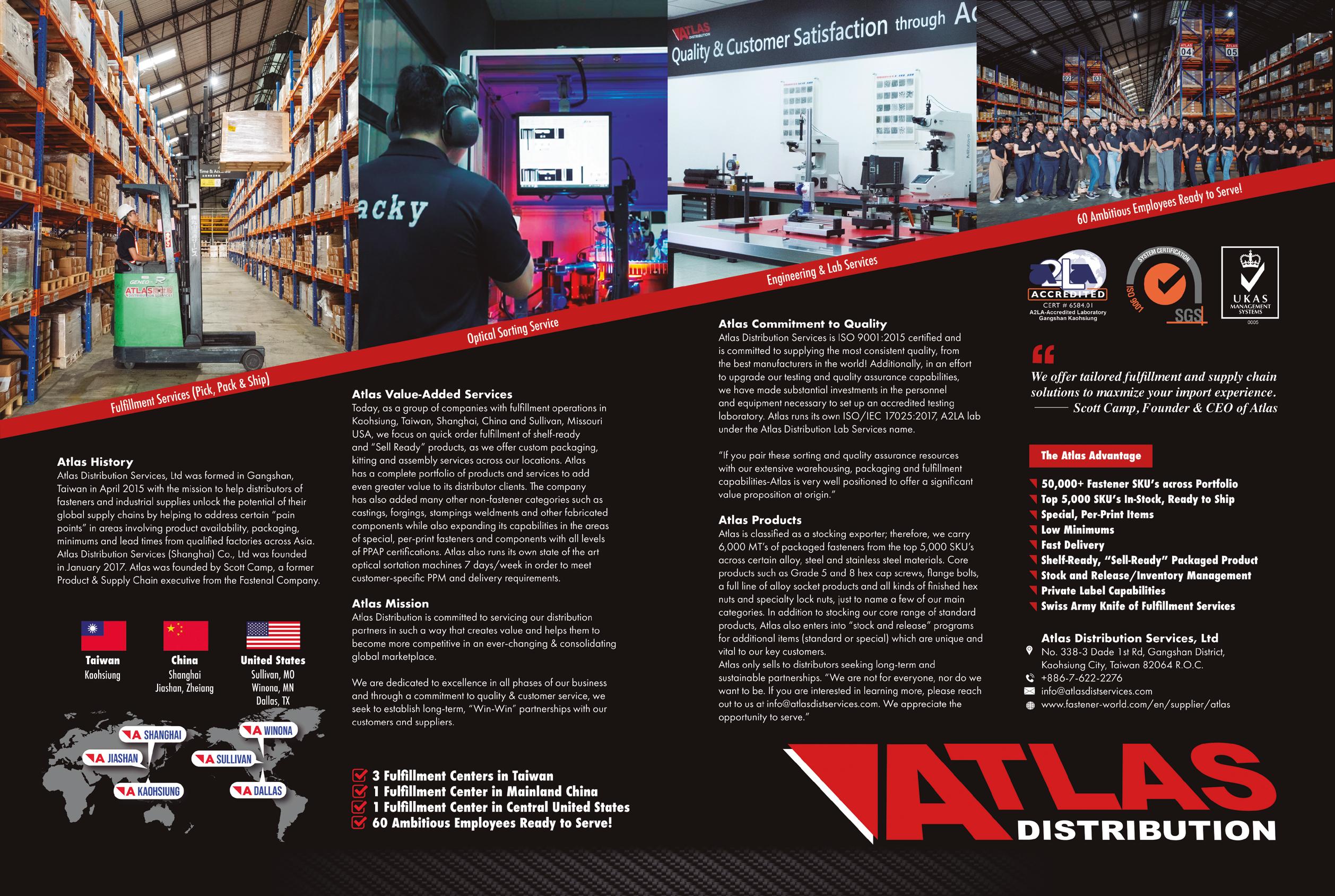

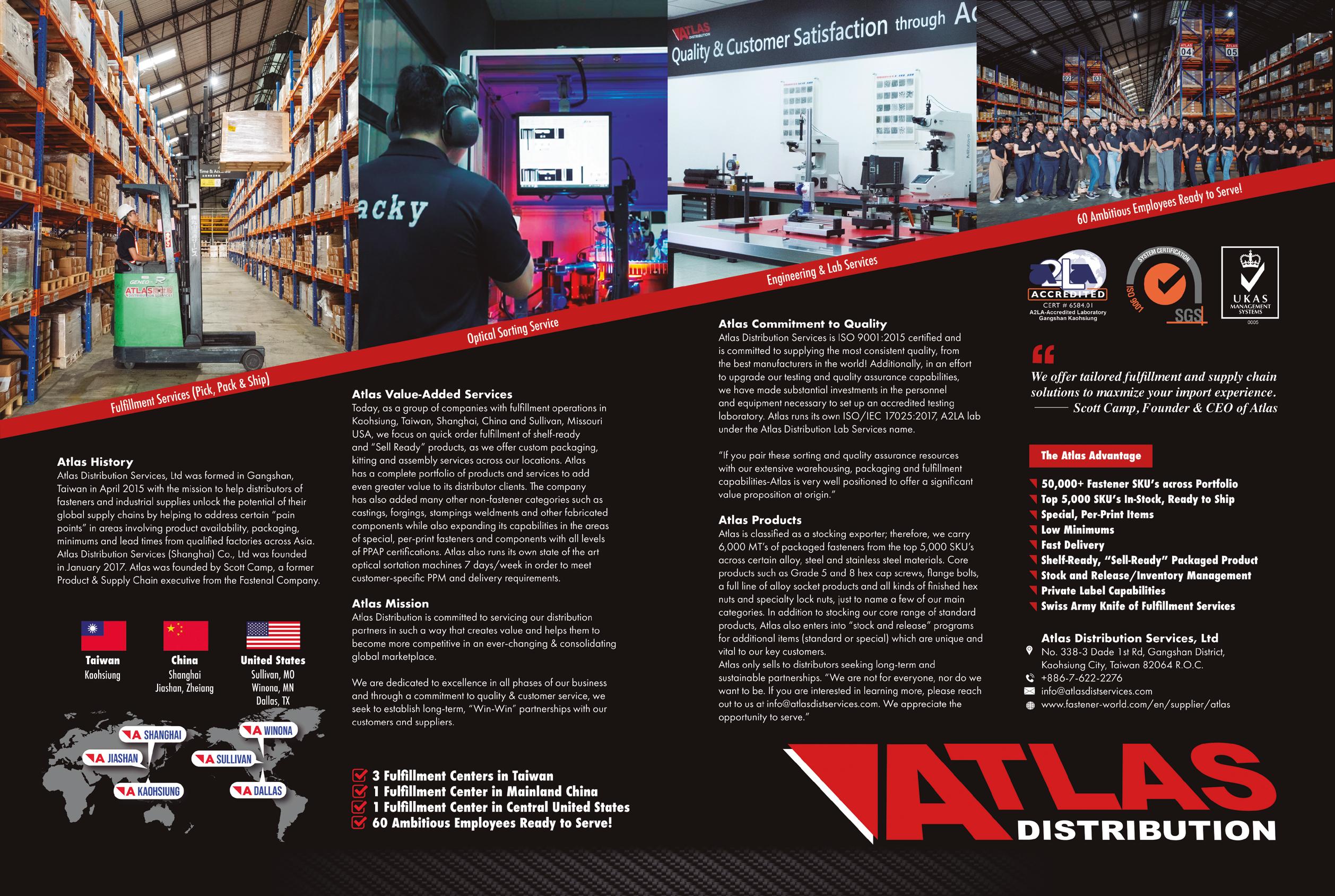

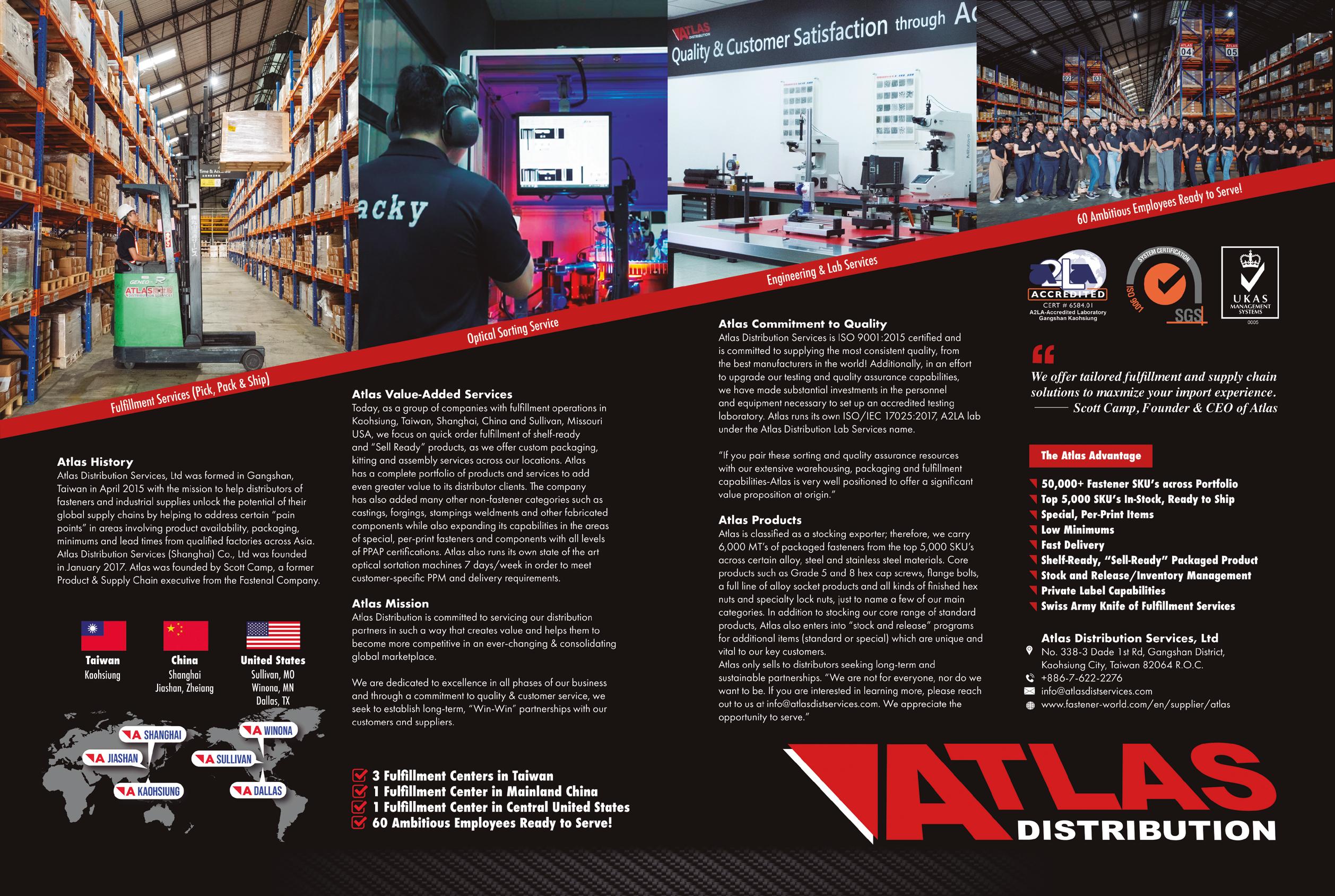

安拓 ETA Series, Anchor Bolts, Anchor Nuts, Automotive Parts... 67 APEX FASTENER INTERNATIONAL CO., LTD. 嵿峰 Nuts, Wing Nuts & Bolts, Turning Parts, Stamping Parts 139 ART SCREW CO., LTD. (Japan) Anti-loosening Screws, Motiontite® 86 ARUN CO., LTD. 鉅耕 Bi-metal Screws, Chipboard Screws, Drywall Screws... 189 ASCCO INTERNATIONAL CO., LTD. 今大唯 Chipboard Screws, Drywall Screws, Wood Screws, Tapping Screws... 176 ATLAS DISTRIBUTION SERVICES LTD. 鷹世服 Tailoring Fulfillment & Supply Chain Solutions 42 AUTOLINK INTERNATIONAL CO., LTD. 浤爵 Automotive Screws, Machine Bolts, Flange Nuts... 95 BCR INC. 必鋮 Automotive Screws, Piston Pins, Weld Bolts (Studs)... 347 BERDAN CIVATA (BOLT) & LABORATORY (Turkey) Standard & Special Fasteners 193 BEST QUALITY WIRE CO., LTD. 上冠品 Ultra S.S. Anti-Corrosion Screws 102 BESTWELL INTERNATIONAL CORP. 凱壹 Eye Bolts, Flanged Head Bolts, Hanger Bolts... 326 BIING FENG ENTERPRISE CO., LTD. 秉鋒 Blind Nut Formers, Multi-station Cold Forming Machines... 20 BI-MIRTH CORP. 吉瞬 Carbon Steel Screws, Chipboard Screws, Concrete Screws... 2 BOLTUN CORPORATION 恒耀工業 Automotive Screws, Bushes, Conical Washer Nuts... 227 BULLS TECHNOLOGY CO., LTD. 波爾澌 Screw/Shoulder Bolt, Nut / Bushing, Open Die Parts… 344 C & H INTERNATIONAL CORP. 友誠 Nuts, Bolts, Screws, Socket Products, Cap Screws... 135 CANATEX INDUSTRIAL CO., LTD. 保力德 Nuts, Turning Parts,

LTD. 敦發

92 DUNFA INTERNATIONAL CO.,

Bushes, Spacers, Automotive Parts, Tubes, Turning Parts...

盈洋

Fasteners...

DYNAWARE INDUSTRIAL INC.

Standard & Non-standard

EASON

LTD. 鈺森

Pins,

Rings...

TECH INDUSTRIAL CO.,

Spring

Cage Nuts, Clip Nuts, Retaining

EASYLINK

LTD. 易連 Automotive Nuts,

Forming Screws... A C C D B Inside front cover E new new new

INDUSTRIAL CO.,

Thread

258 EMEK FASTENERS CO. LTD. (Turkey)

Rivet Nuts, Spacers & Round Nuts, Tubular Rivets, Special Screws...

334 E-UNION FASTENER CO., LTD.

Conveyors, Thread Rolling Machines, Heading Machines...

171 EXCEL COMPONENTS MFG CO., LTD.

Turning Parts, CNC Parts, Forged and Stamped Parts...

117 FAITHFUL ENGINEERING PRODUCTS CO., LTD.

Anchors, Box Nails, Door/Window Accessories...

78 FALCON FASTENER CO., LTD.

Automotive & Motorcycle Special Screws / Bolts...

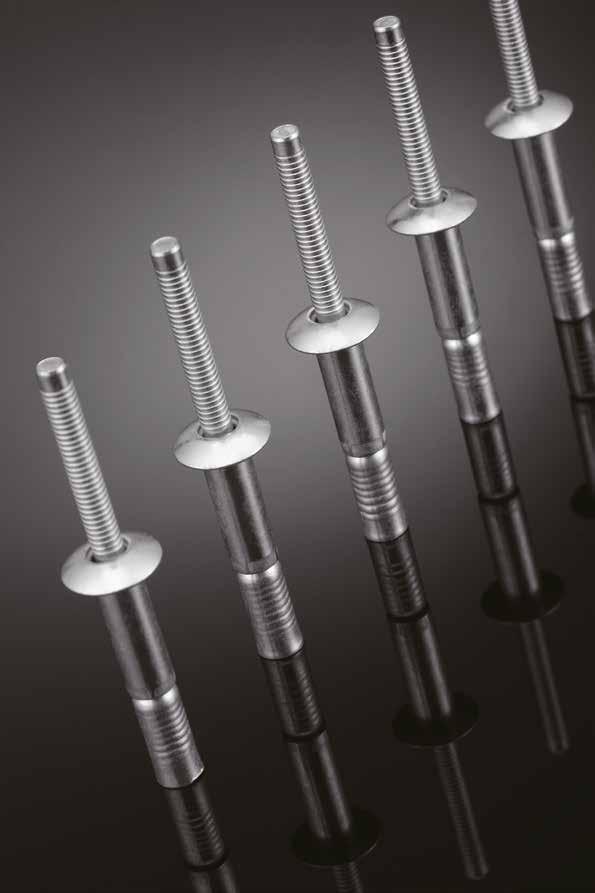

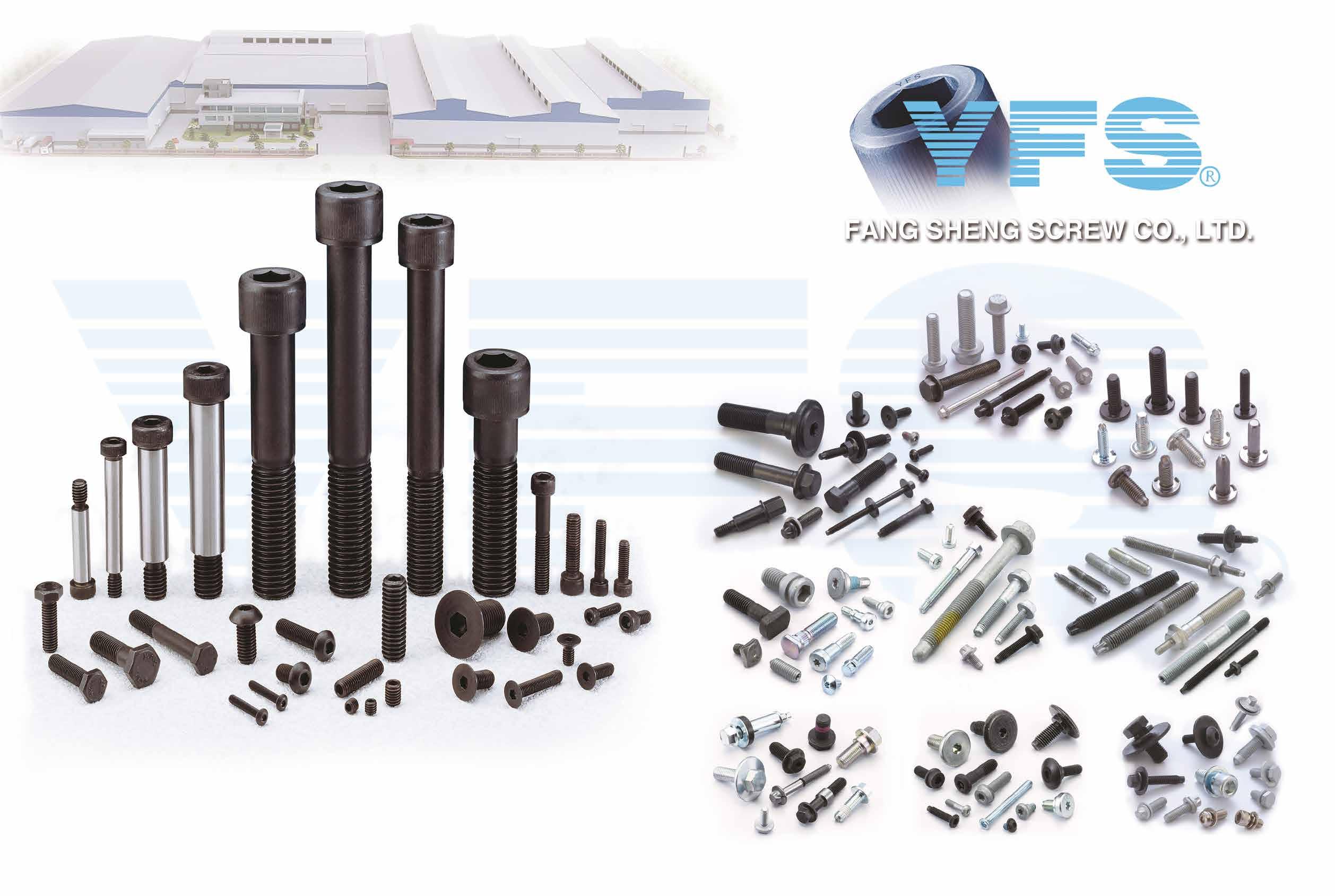

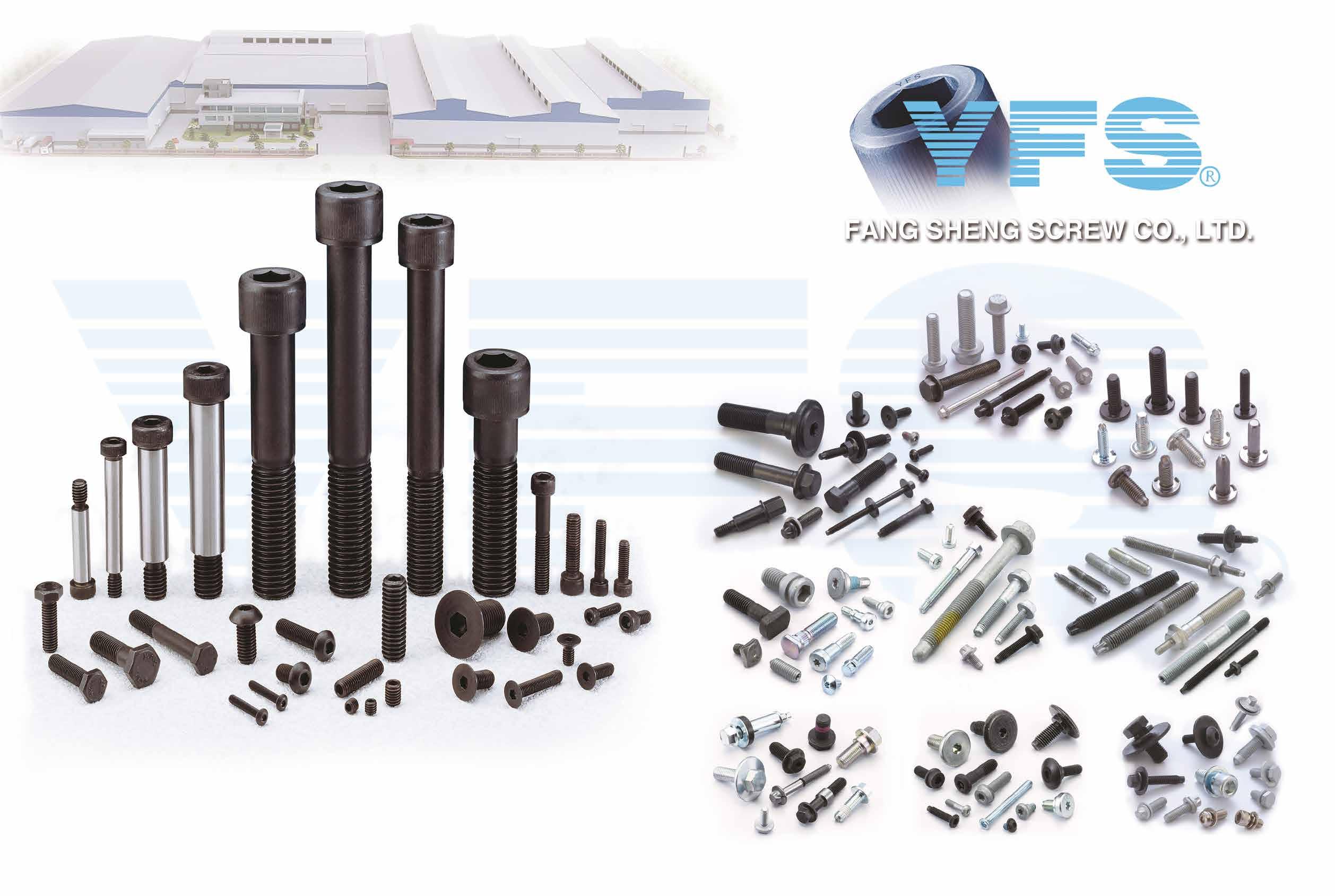

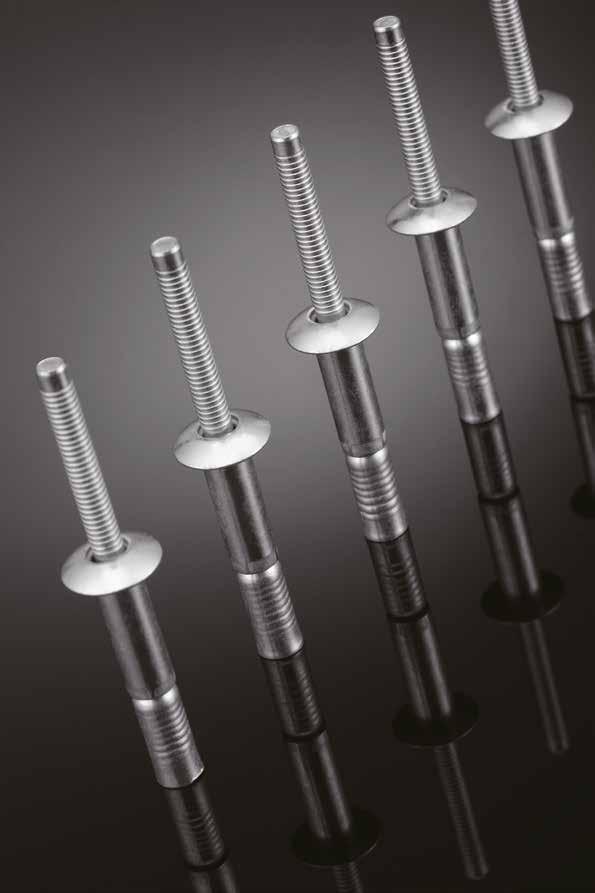

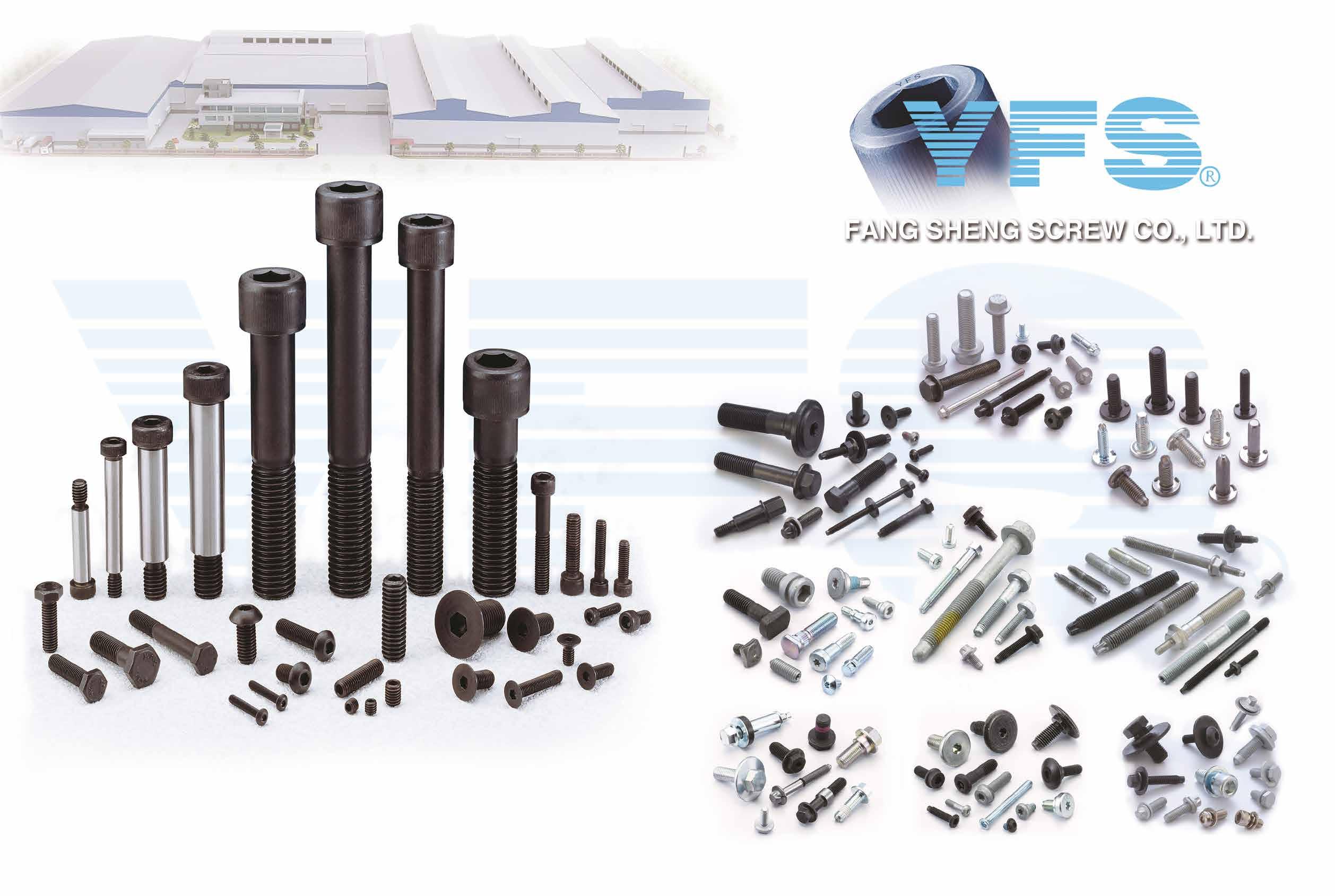

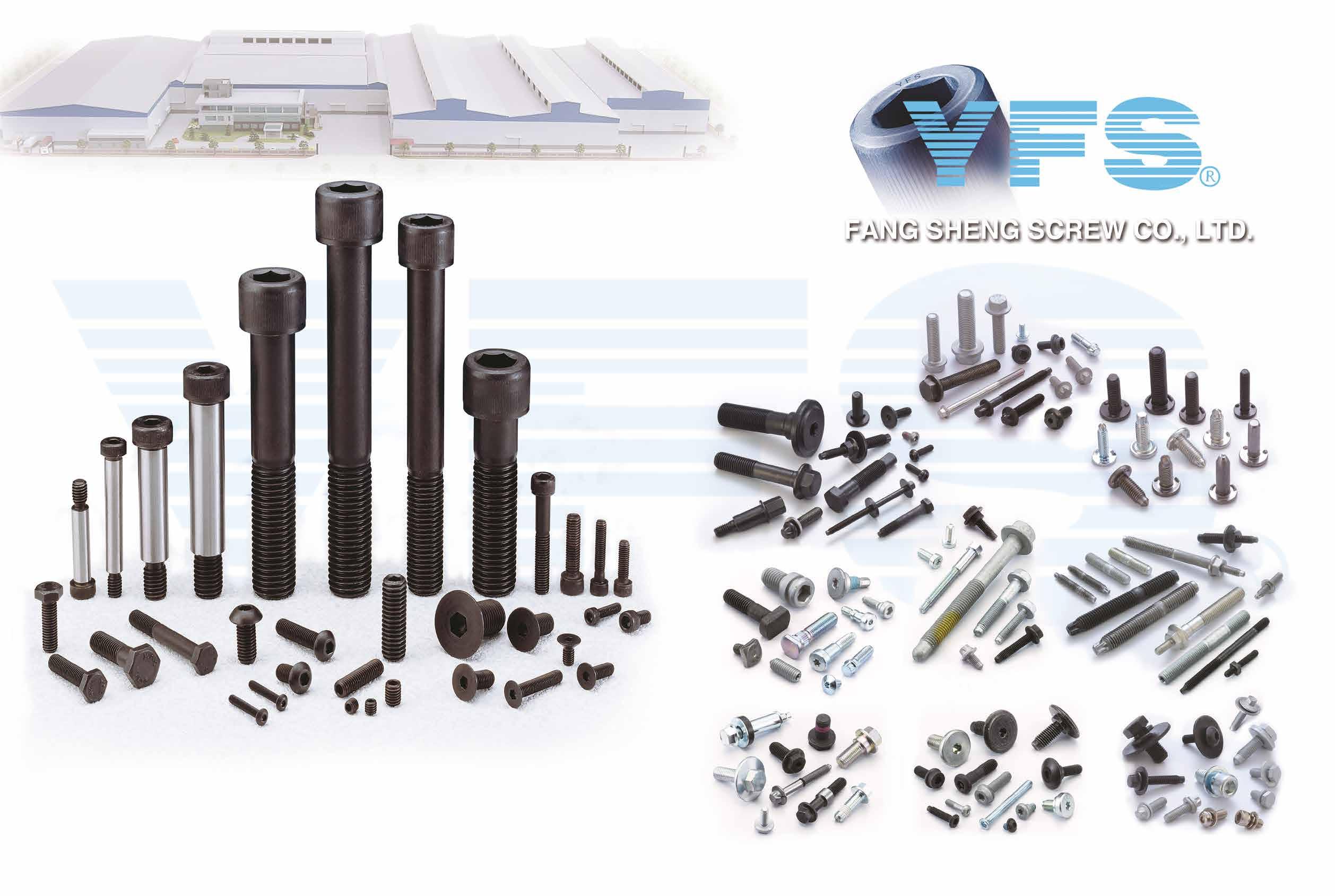

4 FANG SHENG SCREW CO., LTD.

Shoulder Bolts, Button Head Socket Cap Screws..

45 FASTENER JAMHER TAIWAN INC.

Automotive Nuts, Blind Nuts / Rivet Nuts, Bushings...

40 FASTNET CORP.

Dowel Pins, Flange Nuts, Weld Nuts, 4 Pronged T Nuts...

157 FIXI SRL. (Italy)

Rivet Nuts, Blind Rivets, Self-clinching, Welding Studs...

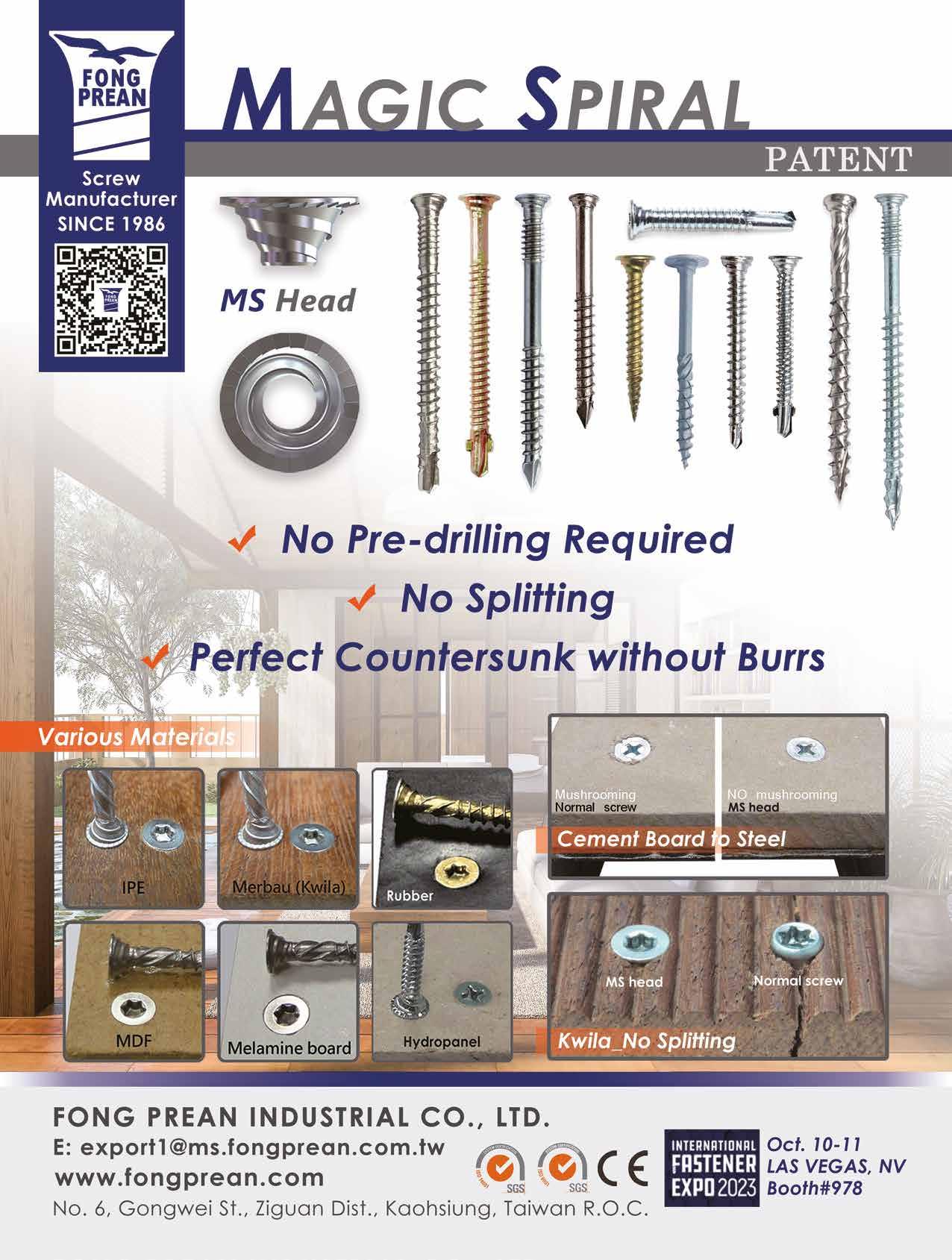

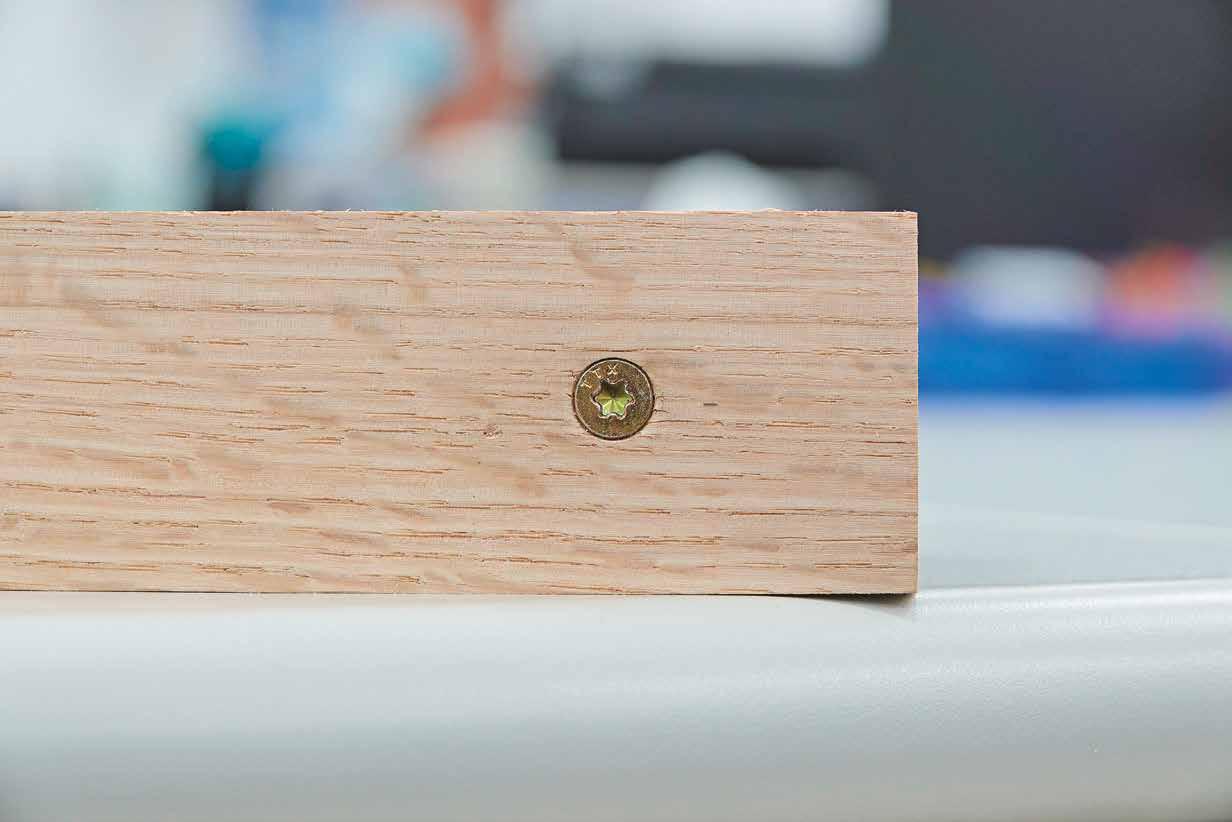

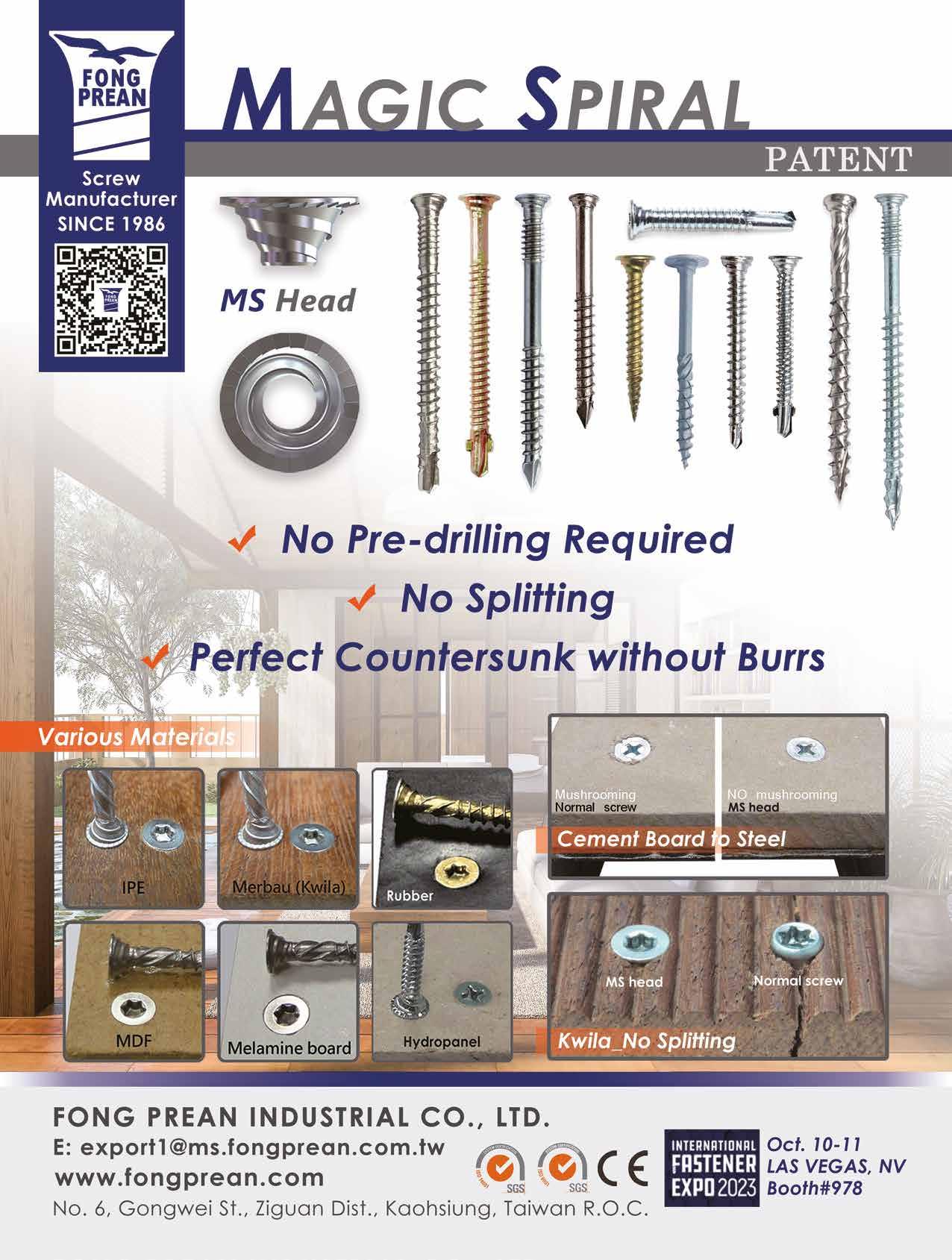

83 FONG PREAN INDUSTRIAL CO., LTD.

Automotive Screws, Bi-metal Screws, Brass & Bronze Screws...

54 FORTUNE BRIGHT INDUSTRIAL CO., LTD.

Cap Nuts, Dome Nuts, Nylon Cap Insert Lock Nuts...

201 FRATOM FASTECH CO., LTD.

Hot Forming Tools, Punches & Sleeves, Dies, Machinery Accssories...

76 FU HUI SCREW INDUSTRY CO., LTD.

Automotive & Motorcycle Special Screws / Bolts...

221 FU KAI FASTENER ENTERPRISE CO., LTD.

Precision Electronic Screws, Special Screws, Weld Screws... 114 FUSHANG CO., LTD.

Carbon Steel Screws, Chipboard Screws, Concrete Screws...

324 GIAN-YEH INDUSTRIAL CO., LTD.

Rivet Dies, Self-drilling Screw Dies, Screw Tip Dies...

162 GINFA WORLD CO., LTD.

Chipboard Screws, Countersunk Screws, Drywall Screws...

161 HSIN YU SCREW ENTERPRISE CO., LTD. 新雨

Acme Screws, Hexagon Head Cap Screws...

41 HU PAO INDUSTRIES CO., LTD. 如保

Automotive Nuts, Flange Nuts, Hexagon Nuts...

353 HUANG JING INDUSTRIAL CO., LTD. 皇晉 Custom Washers, Chipboard Screws, Drywall Screws...

293 HWEI NEN CO., LTD. 輝能 Automotive & Motorcycle Special Screws / Bolts...

329 INFINIX PRECISION CORP. 英飛凌 Customized Punches and Dies

107 INMETCH INDUSTRIAL CO., LTD. 恆鉅 Flanged Head Bolts, Locking Bolts, Stud Bolts...

100 INNTECH INTERNATIONAL CO., LTD. 建豪 All Kinds of Nuts, All Kinds of Screws, Automotive Special Screws...

190 iTAC LABORATORY CO., LTD. 鼎誠 Independent laboratory services for fastener tests

231 J. T. FASTENERS SUPPLY CO., LTD. 金祐昇 Drop-in Anchors, Floating Nuts, Connecting Nuts...

10 J.C. GRAND CORPORATION 俊良

All Kinds of Screws, Chipboard Screws...

59 JAU YEOU INDUSTRY CO., LTD. 朝友

Chipboard Screws, Drywall Screws, High Low Thread Screws...

223 JENG YUH CO., LTD. 政毓

Plastic Injection Products, Plastic Mold R&D…

362 JERN YAO ENTERPRISES CO., LTD. 正曜

Multi-station Cold Forming, Parts Forming Machines...

49 JET FAST COMPANY LIMITED 捷禾

Blind Nuts / Rivet Nuts, Aircraft & Aerospace Washers...

341 JIE LE MACHINERY CO., LTD. 捷仂

Consolidation of Artificial Intelligence Equipment

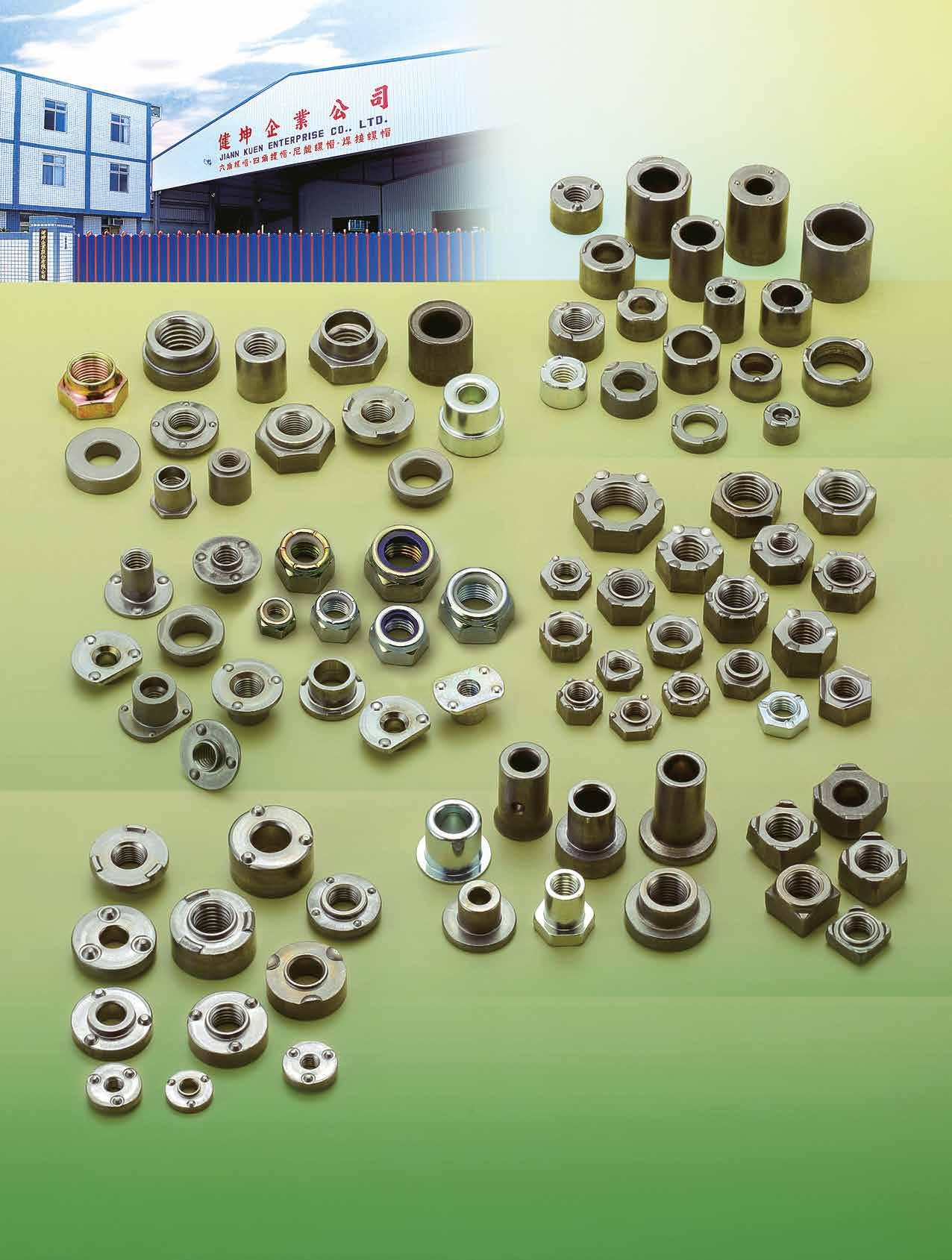

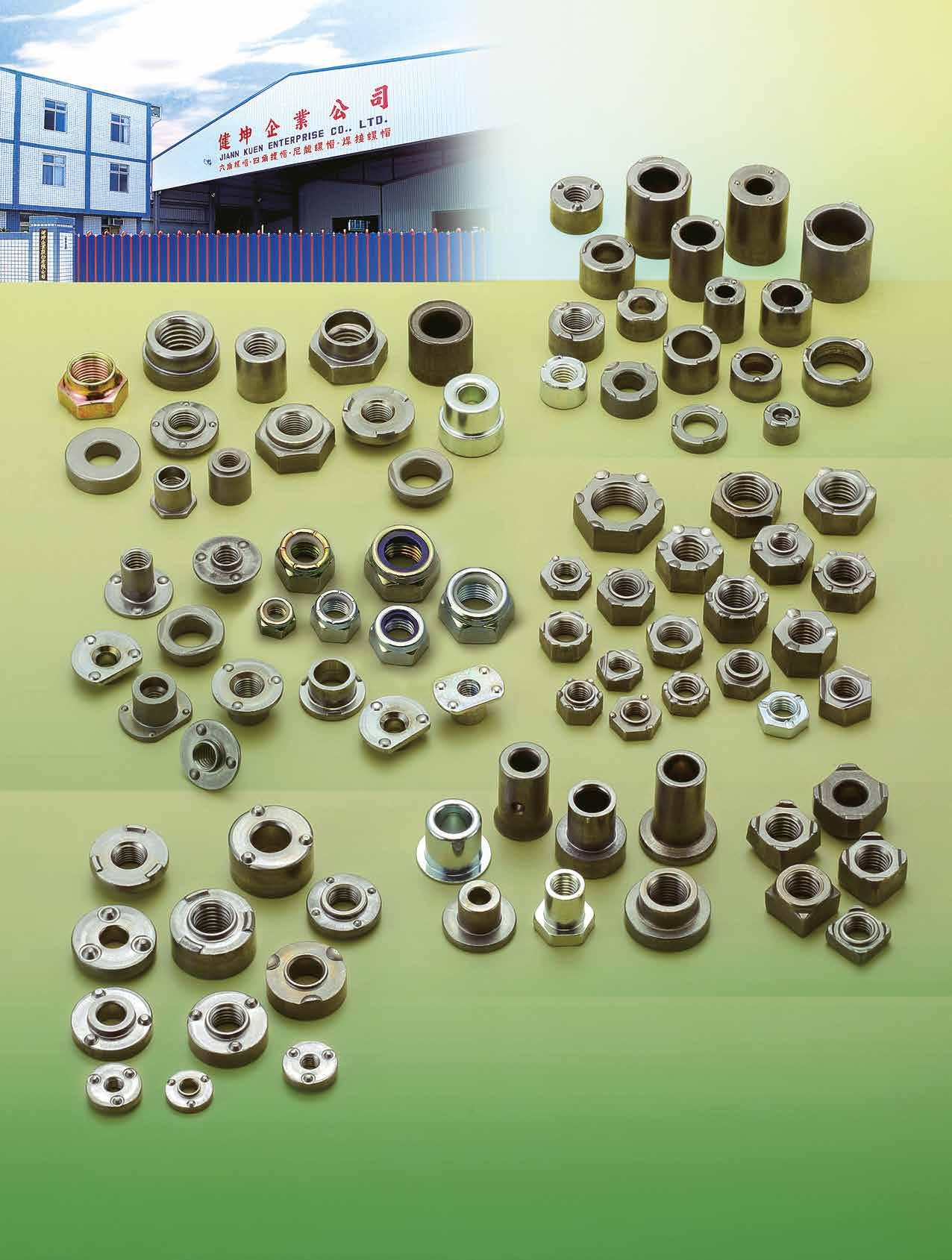

104 JIEN KUEN ENTERPRISE CO., LTD. 健坤

Hexagon Nuts, Nylon Cap Insert Lock Nuts, Square Nuts...

333 JIENG BEEING ENTERPRISE CO., LTD. 精斌

Forming Tool for Nut and Bolt, Dies, Molds...

336 JIN CHI HARDWARE MACHINERY LIMITED 金騏

Heading and Threading Machines / Whole-plant Equipment Planning

164 JINGFONG INDUSTRY CO., LTD. 璟鋒

Hex Nylon Insert Lock Nuts, Wing Nuts with Nylon Insert...

151 JIN-YINGS ENTERPRISE CO.,LTD. 晉營

Special Custom Fasteners, Auto/Motorcycle Fasteners, Special Screws…

303 JOINTECH FASTENERS INDUSTRIAL CO., LTD. 群創

Customized Parts, Bolts, Screws, Nuts, Automotive Parts...

27 JOKER INDUSTRIAL CO., LTD. 久可

Hollow Wall Anchors, Concrete Screws, Jack Nuts...

295 KAN GOOD ENTERPRISE CO., LTD. 鋼固 Fastener, Hardware, Plastic, Instruction Booklet Package in Bags...

348 KAO WAN BOLT INDUSTRIAL CO., LTD. 高旺

Hex Head Cap Screws, Carriage Bolts, Hex Lag Bolts...

142 KATSUHANA FASTENERS CORP. 濱井

Collated Screws, Drywall Screws, Roofing Screws...

166 KEY-USE INDUSTRIAL WORKS CO., LTD. 凱雍

Flanged Head Bolts, Milled Bolts, Rim Bolts, Round Head Bolts...

101 KING CENTURY GROUP CO., LTD. 慶宇

Drop-in Anchors, Self-drilling Anchors, Sleeve Anchors...

335 KING YUAN DAR METAL ENTERPRISE CO., LTD. 金元達

Continuous Type Heat Treating Furnace

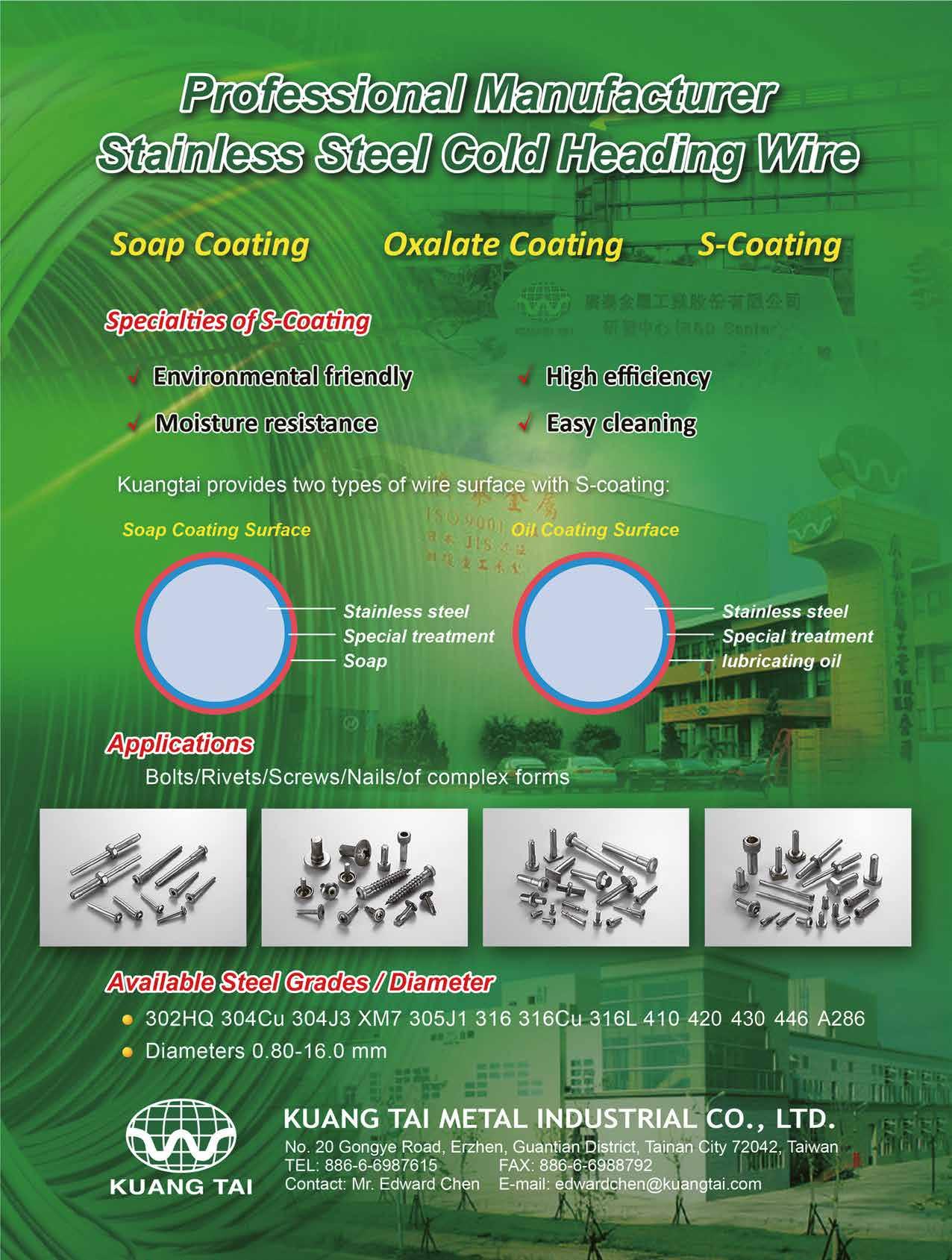

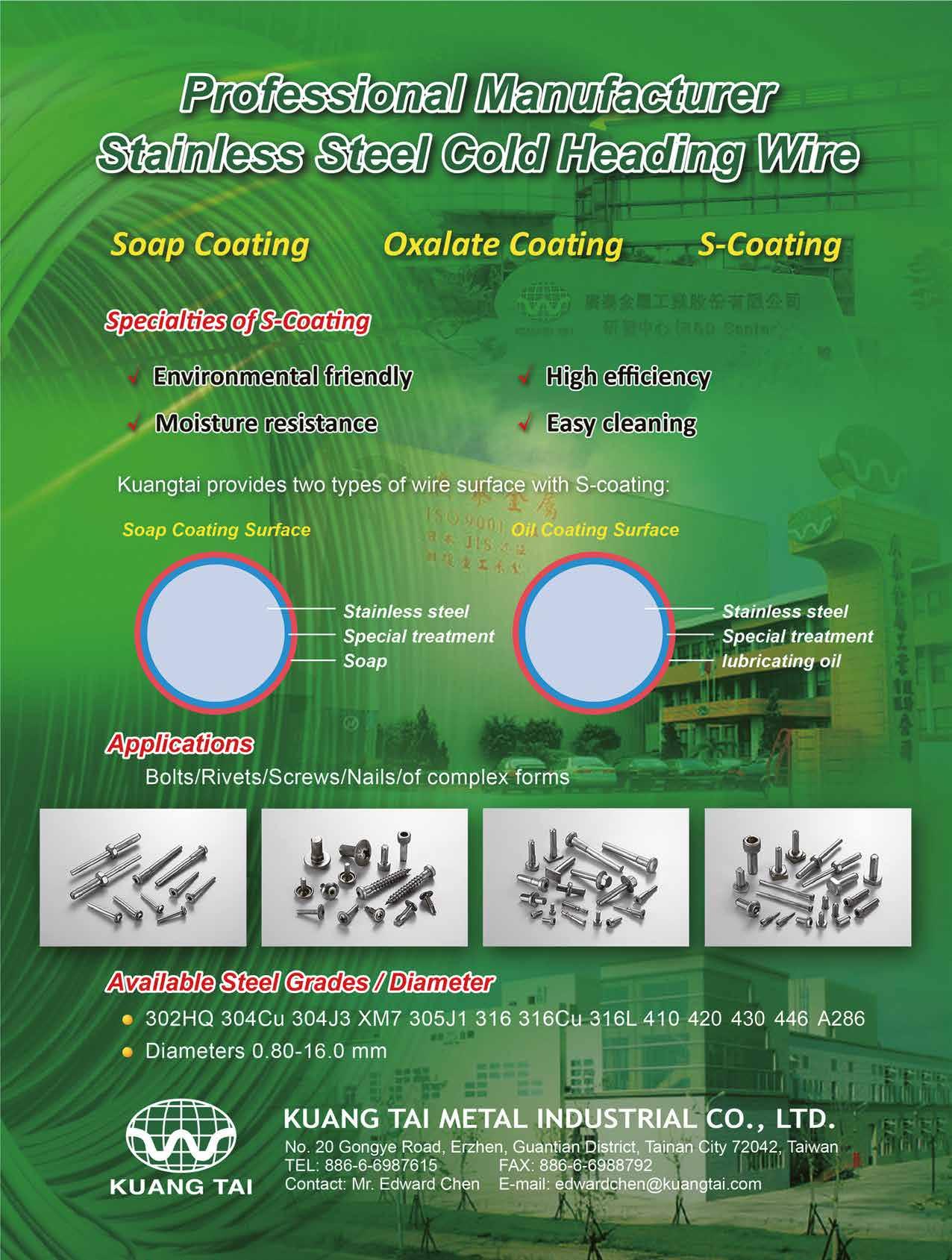

337 KUANG TAI METAL INDUSTRIAL CO., LTD. 廣泰

HONG TENG HARDWARE CO., LTD. 鋐騰

Bi-metal Screws, Carbon Steel and Stainless Steel Screws...

136 HOSHENG PRECISION HARDWARE CO., LTD.

Auto Parts, CNC Machined Parts, Bolts...

241 HSIANG HSING SCREW BOLT CO., LTD.

Ball Screws, Brass & Bronze Screws, Cap Screws, Combined Screws...

172 HSIN CHANG HARDWARE INDUSTRIAL CORP. 欣彰

Anchor Bolts, Anchors, Plastic Fasteners...

46 HSIN JUI HARDWARE ENTERPRISE CO., LTD. 欣瑞 Bushes, Construction Bolts, Special Cold / Hot Forming Parts...

Stainless Steel Cold Heading Wire

74 KWANTEX RESEARCH INC. 寬仕

Chipboard Screws, Drywall Screws, Furniture Screws...

124 L & W FASTENERS COMPANY 金大鼎

Construction Fasteners, Flat Washers, Heavy Nuts...

251 LAIEN CO., LTD. 高昱

Screws, Multi-stroke Forming Screws, CNC Machined Parts...

185 LI YOU SCREW INDUSTRY CO., LTD. 立侑

Automotive / Sems / Nylock / CNC Machined Screws…

奕盟

鑫廣

誠毅

鉮達

芳生

占賀

俊鉞

豐鵬

鋒沐

福敦

福輝

福凱

甫商

健業

濟音發

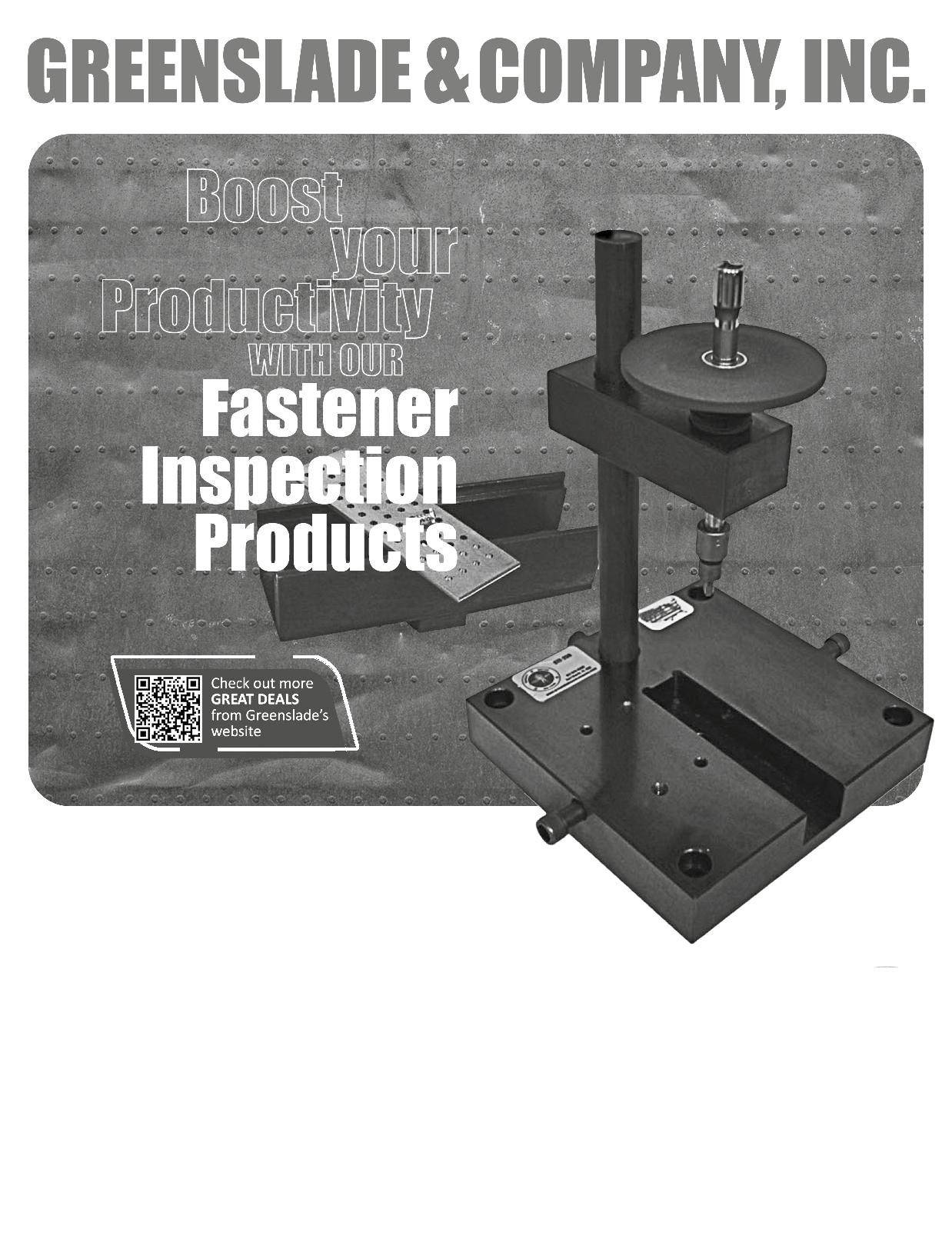

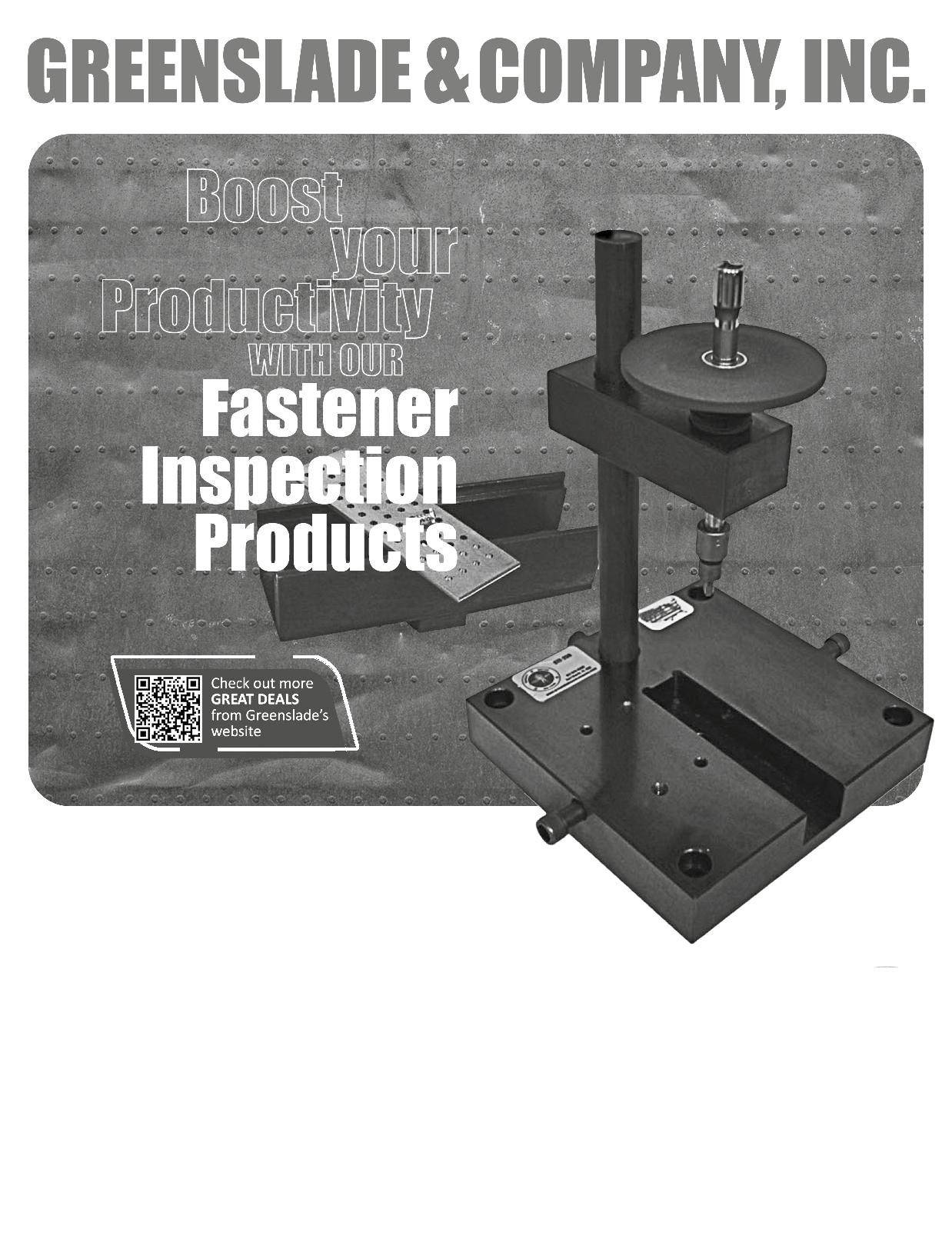

307 GLORBAL SALES COMPANY LIMITED 宗暉 Various Stamping Products, Multi-process Assembly Parts... 327 GREENSLADE & COMPANY, INC. (U.S.A.) Concentricity, Ring Gage, Plug Gage Calibration, Gages... 323 GWO LIAN MACHINERY INDUSTRY CO., LTD. 國聯 Handstand Type Wire Drawing Machines, Non-Stop Coilers... 97 HAO CHENG PLASTIC CO., LTD. 皓正 PP Boxes, PET Jars, ABS Boxes,

110 HARVILLE FASTENERS

豪威爾 Special

Fasteners... 305 HAUR

ENTERPRISE

豪舫 External

Bolts... 282 HEADER

Chipboard

309 HEY

恆勇 Precision

266 HOME

ENTERPRISE CO., LTD. 宏舜 Bit, Bit Holder, Magnetic Nut Setter, Spring Nut Driver... 287 HOMEYU FASTENERS CO., LTD. 宏宇 Cold Forging Stage, Machine Molds, Lathe, CNC Machining... 126 HOMN REEN ENTERPRISE CO., LTD. 宏穎 Bi-metal Screw, Collated Screws, Composite Screws... 331 HONG TAY YUE ENTERPRISE CO.,LTD. 鴻大裕 Wire Straighteners, Hydraulic Clamping Machines... 268

PC Boxes..

LTD.

Screws and Bolts, Sems Screws, Stainless Steel

FUNG

CO., LTD.

Tooth Washers, Long Carriage Bolts, Roofing

PLAN CO. INC.

Screws, Collated Screws, Deck Screws...

YO TECHNOLOGY CO., LTD

Pins, Rollers, Dowel Pins...

SOON

和昇

祥興

F H G L K J H E I

Self-drilling Screws, Stainless Steel Screws, Furniture Screws...

123 PS FASTENERS PTE LTD. (Singapore)

Washers, Socket Set Screws, U Bolts, Alloy Steel Screws...

130 Q-NUTS INDUSTRIAL CORP.

Flange Nuts, Weld Nuts, Special Nuts, Spacers...

48 QST INTERNATIONAL CORP.

Hexagon Head Bolts, Square Head Bolts, Weld Bolts (Studs)...

140 RAY FU ENTERPRISE CO., LTD.

Construction Screws, Automotive Parts, Special Fasteners...

14 REXLEN CORP.

Clinch Nuts, Clinch Studs, CNC Parts, Stamped Parts...

349 S&T FASTENING INDUSTRIAL CO., LTD. 順通

Carbon Steel Screws, Bi-metal Screws, Stainless Steel Screws...

6 SAN SHING FASTECH CORP. 三星

Automotive Nuts, Automotive Parts, Carbide Dies...

79 SCREWTECH INDUSTRY CO., LTD. 銳禾

Machined Parts, Thumb Screws, Micro Screws...

237 SCT FASTENERS CO., LTD. 鑫成星

Decking Screws, Security Screws, Machine Screws, Chipboard Screws

358 SEN CHANG INDUSTRIAL CO., LTD. 昇錩

Customized Special Screws / Bolts, Socket Head Cap Screws...

354 SHANGHAI FAST-FIX RIVET CORP. 飛可斯 Blind Rivets, High Shear Rivets, Closed End Rivets...

191 SHAW GUANG ENTERPRISE CO., LTD. 紹光 Cap Nuts, Conical Washer Nuts, Flange Nuts...

328 SHEEN TZAR CO., LTD. 新讚 Self-Drilling Screw Machines & Dies

246 SHEH FUNG SCREWS CO., LTD. 世豐 Chipboard Screws, Countersunk Screws, Wood Screws...

248 SHEH KAI PRECISION CO., LTD. 世鎧 Bi-metal Concrete Screw Anchors, Bi-metal Screws...

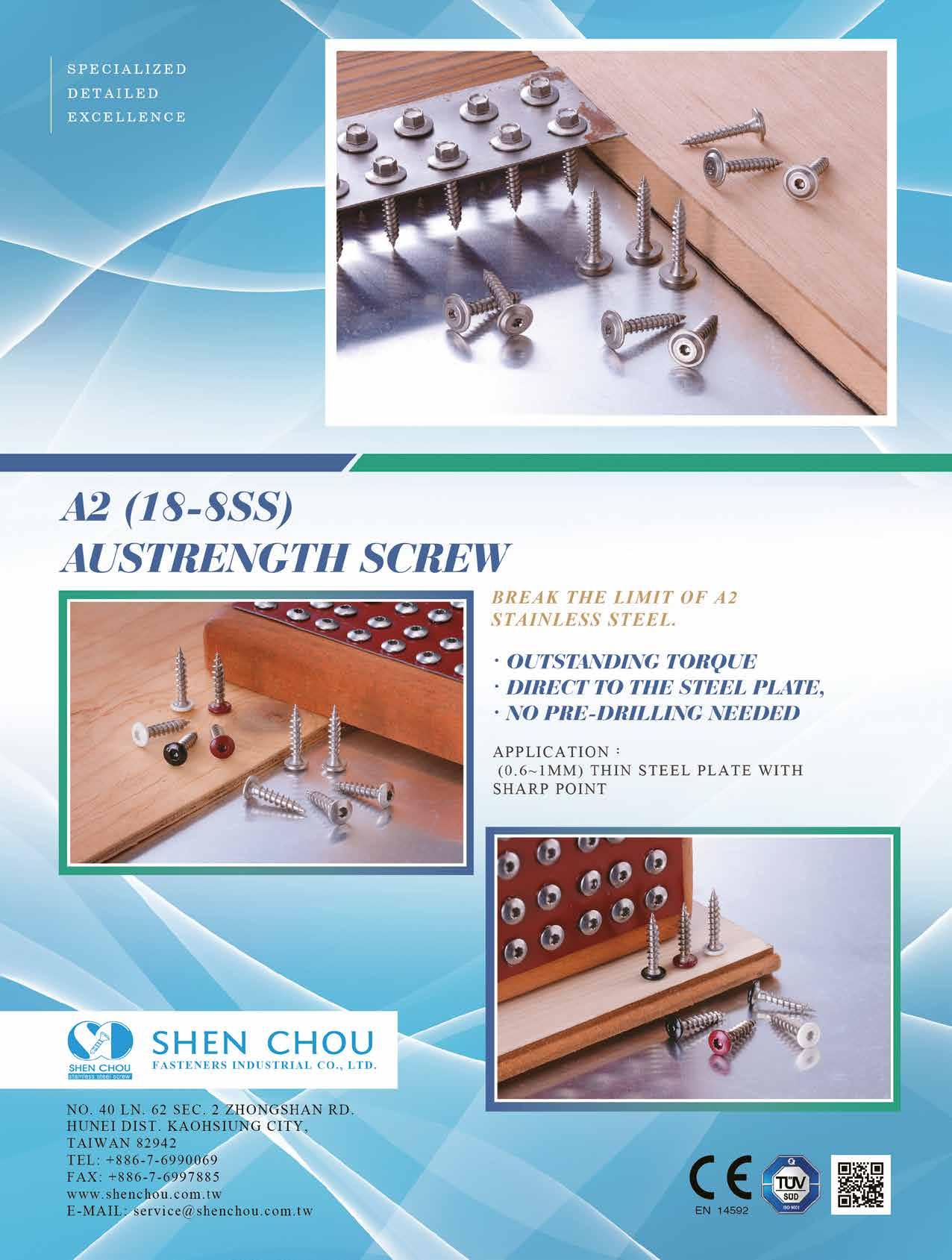

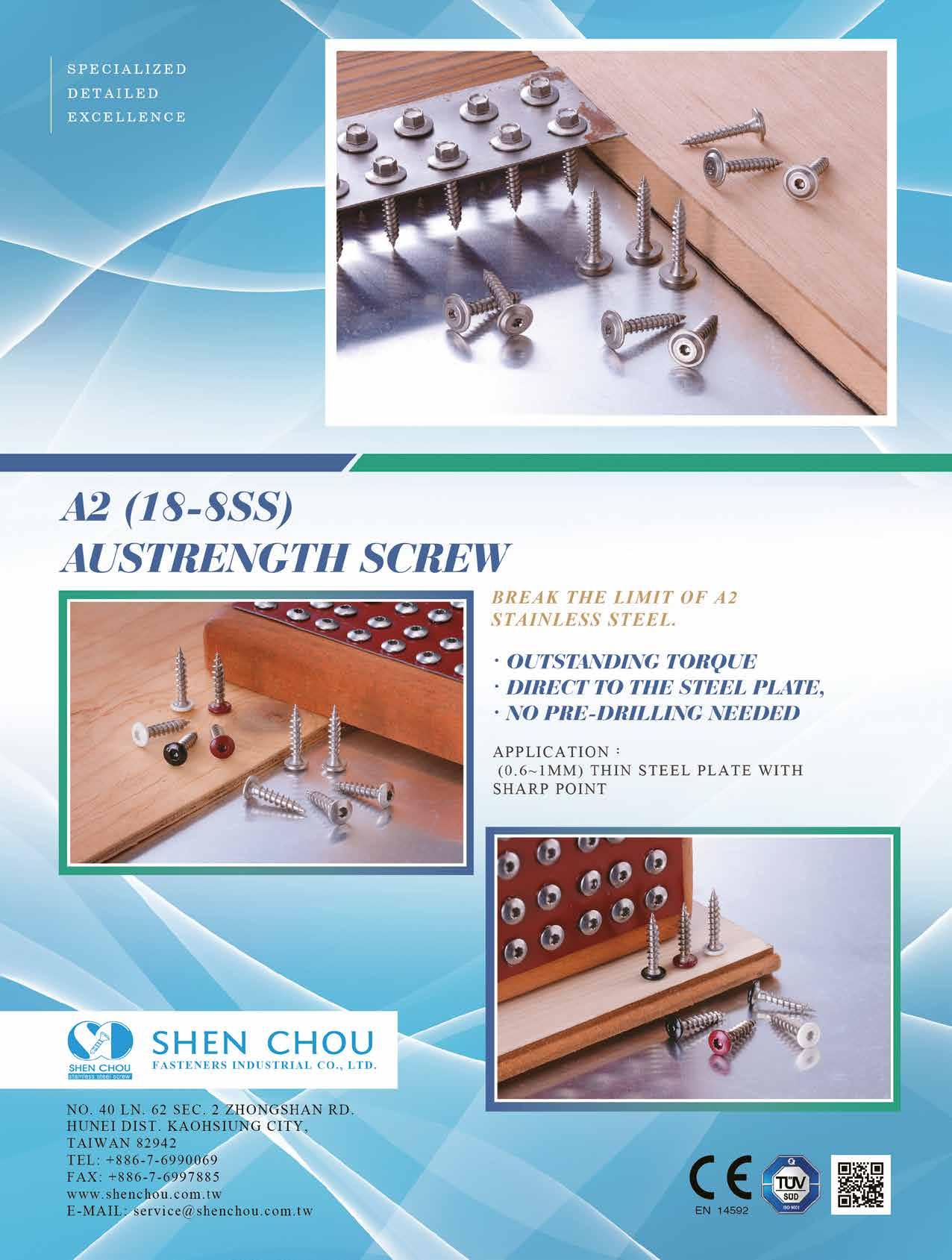

113 SHEN CHOU FASTENERS INDUSTRIAL CO., LTD. 神洲 Button Head Cap Screws, Chipboard Screws...

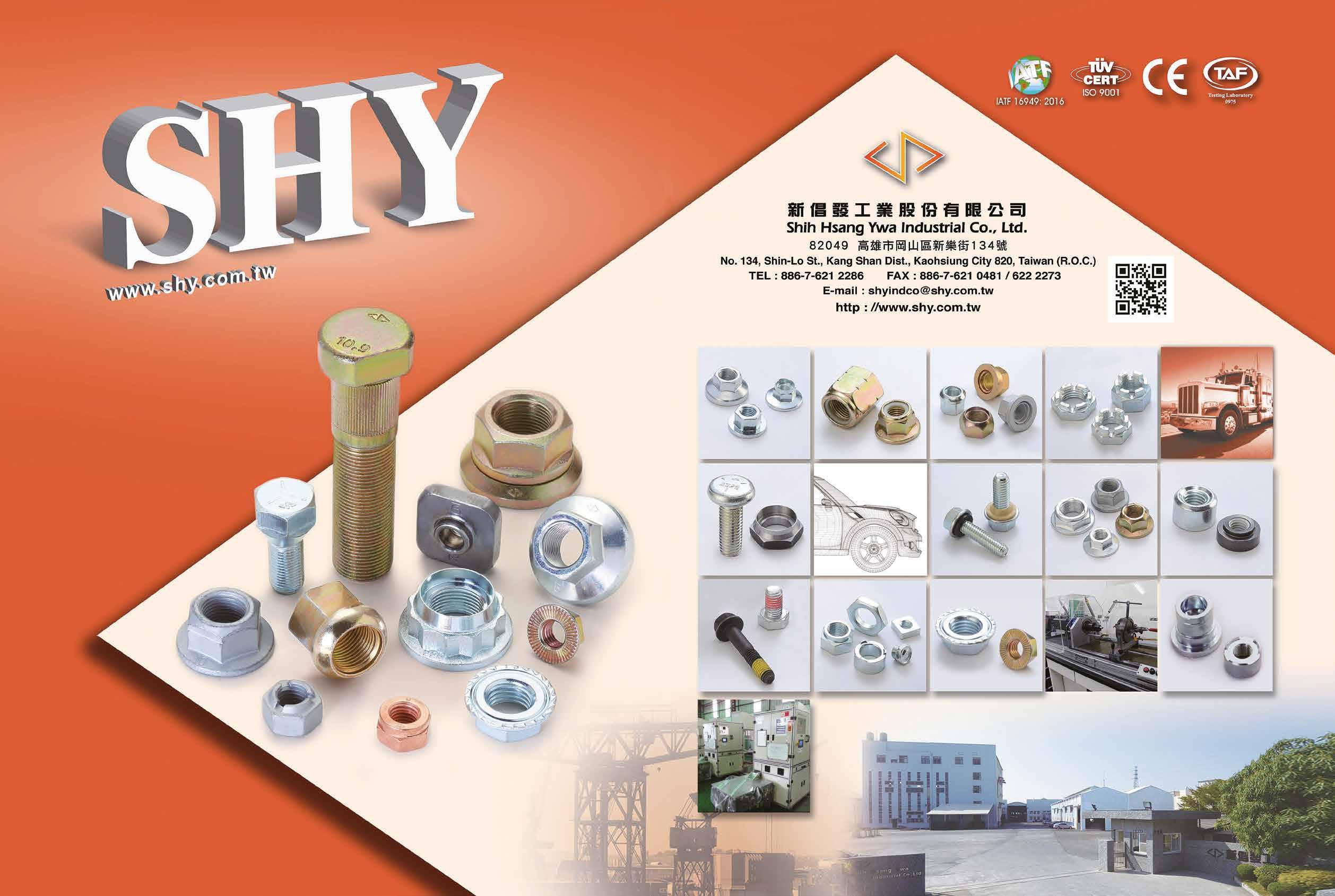

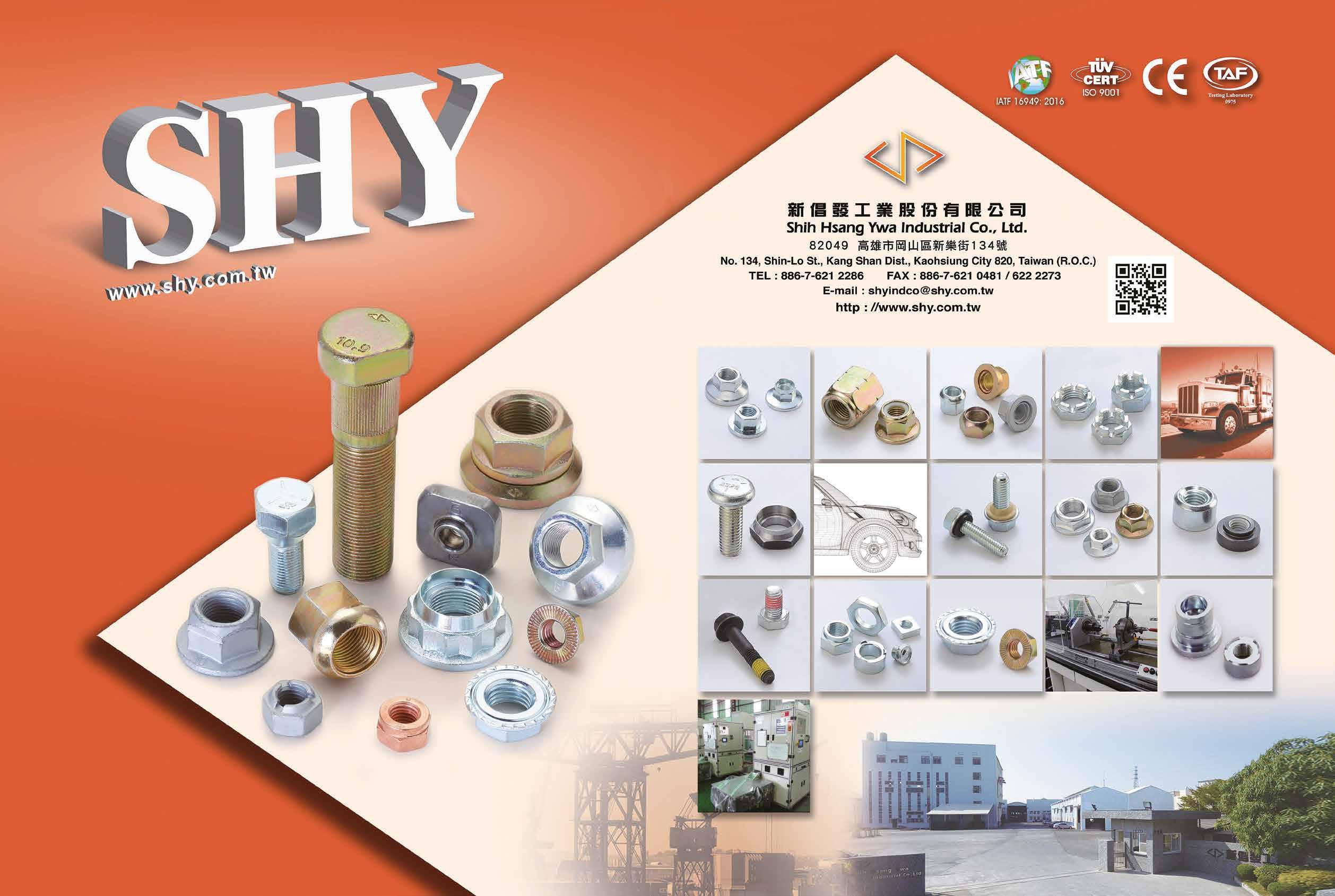

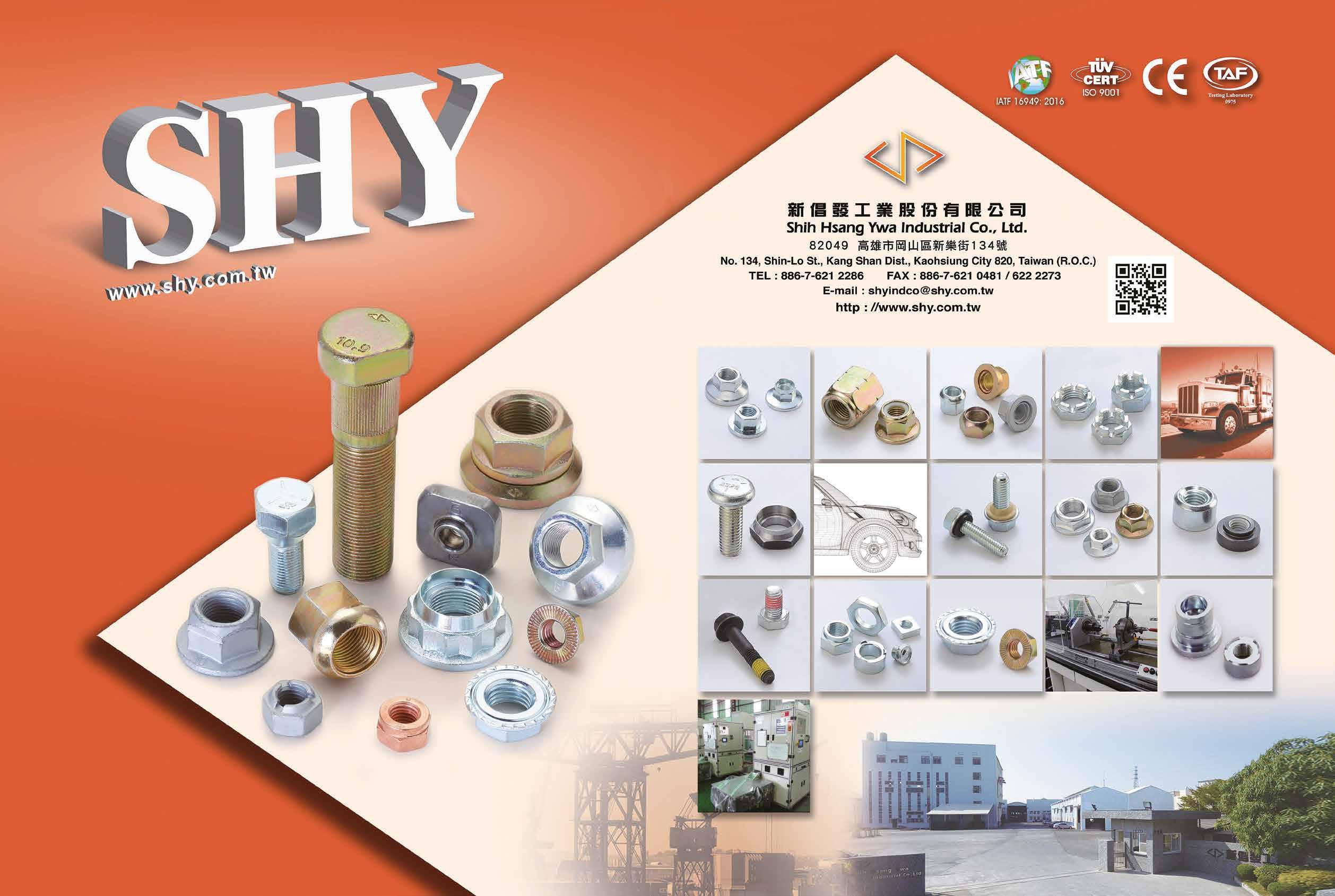

56 SHIH HSANG YWA INDUSTRIAL CO., LTD. 新倡發 Flange Nuts, Flange Nylon Nuts With Washers...

168 SHIN CHUN ENTERPRISE CO., LTD. 昕群 Automotive Screws, Chipboard Screws, Customized Screws...

265 SHIN JAAN WORKS CO., LTD. 新展 Flanged Head Bolts, Long Carriage Bolts, Round Head Bolts...

131 SHUENN CHANG FA ENTERPRISE CO., LTD. 舜倡發 Long Construction Fasteners and Other Modified Fasteners...

322 SHUN HSIN TA CORP. 順興達 Punches, Tungsten Carbide Nut Forming Dies, Special Dies…

263 SIN HONG HARDWARE PTE. LTD. (Singapore) 新豐 Hexagon Nuts, Hexagon Head Bolts, Blind Rivets...

155 SINGHANIA INTERNATIONAL LTD (India) Standard & Custom Fasteners

233 SOON PORT INTERNATIONAL CO., LTD. 鴻錡 Collated Screws, Drywall Screws, Self-Drillig Screws...

28 SPEC PRODUCTS CORP. 友鋮 Lincensee Fasteners, Turned/Machined Parts...

8 SPECIAL RIVETS CORP. 恆昭 Blind Nuts / Rivet Nuts, Blind Rivets, Air Riveters...

240 STRONG JOHNNY INTERNATIONAL CO., LTD. 駿愷 Automotive & Special Parts, Cold-Forged Fasteners...

34 SUN CHEN FASTENERS INC., 展鴻鑫 Cup Washers, Flanged Head Bolts, T-head or T-slot Bolts...

143 SUNCO INDUSTRIES CO., LTD. (Japan) Distributor Specializing in Fasteners

116 SUPER DPD CO., LTD. 三御 All Kinds of Screws, Bi-metal Screws, Carbon Steel Screws...

44 SUPERIOR QUALITY FASTENER CO., LTD. 鑫程椿 Weld Nuts, Turning Parts, Long Screws, Spring Nuts...

339 TAIEAG CORPORATION 順基軒

Designed peripheral equipment suitable for fastener packaging

244 TAIWAN FASTENERS INTEGRATED SERVICE 全聯鑫 Bolts, Screws, Nuts, Precise Mechanical Parts, Stampings...

206 TAIWAN PRECISION FASTENER CO., LTD.

Drywall Screws, Wood Construction Screws, Roofing Screws...

88 TAIWAN SELF-LOCKING CO., LTD. 台灣耐落 Nylok®, Precote®, Nycote®, Nyplas®, Loctite®...

175 TAIWAN SHAN YIN INTERNATIONAL CO., LTD. 慶達 Bi-metal Self-drilling Screws, Chipboard Screws...

141 TANG AN ENTERPRISE CO., LTD. 鏜安

Customized Automotive Parts and Special Fasteners

12 THREAD INDUSTRIAL CO., LTD. 英德

Chipboard Screws, Flange Nuts, Heavy Nuts...

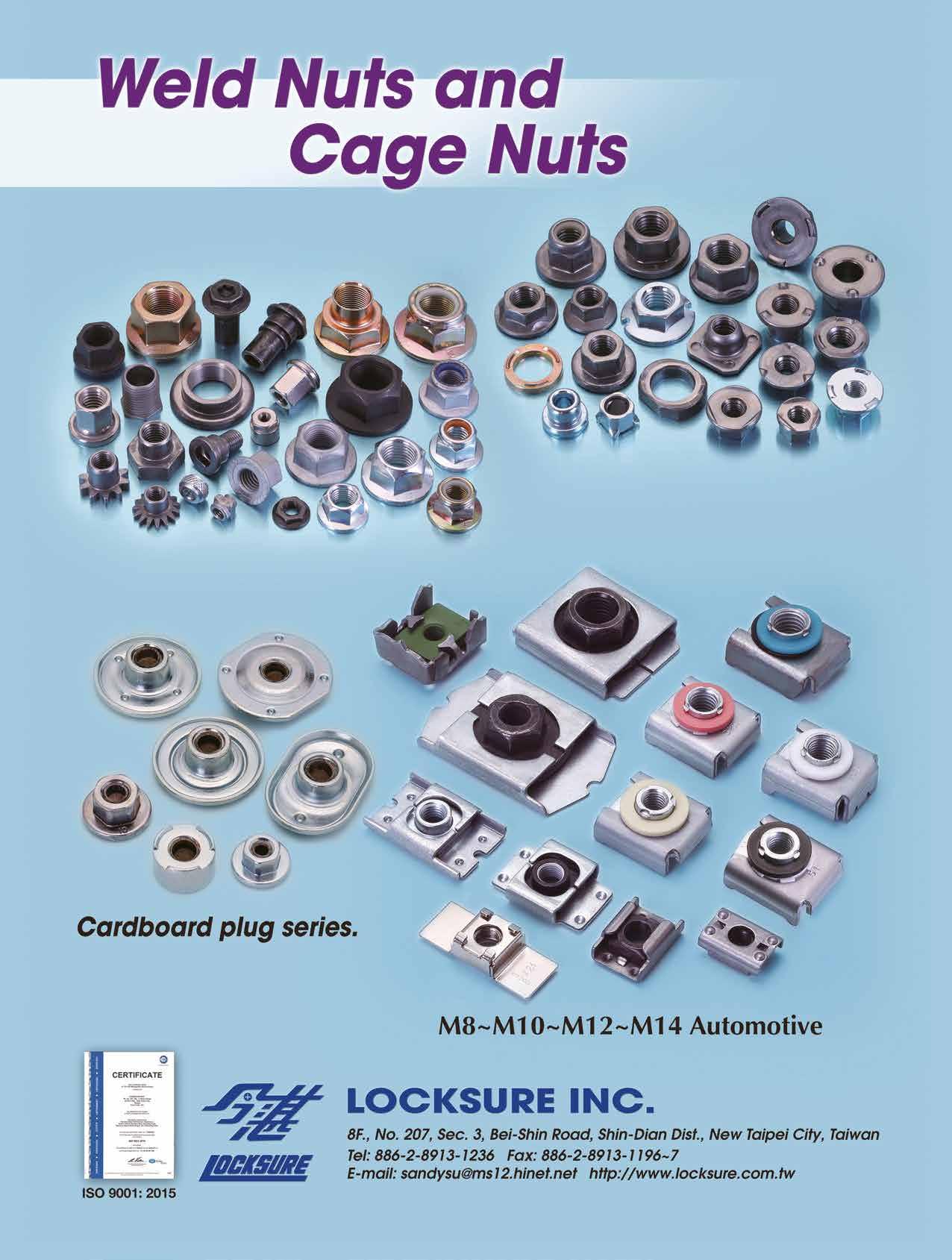

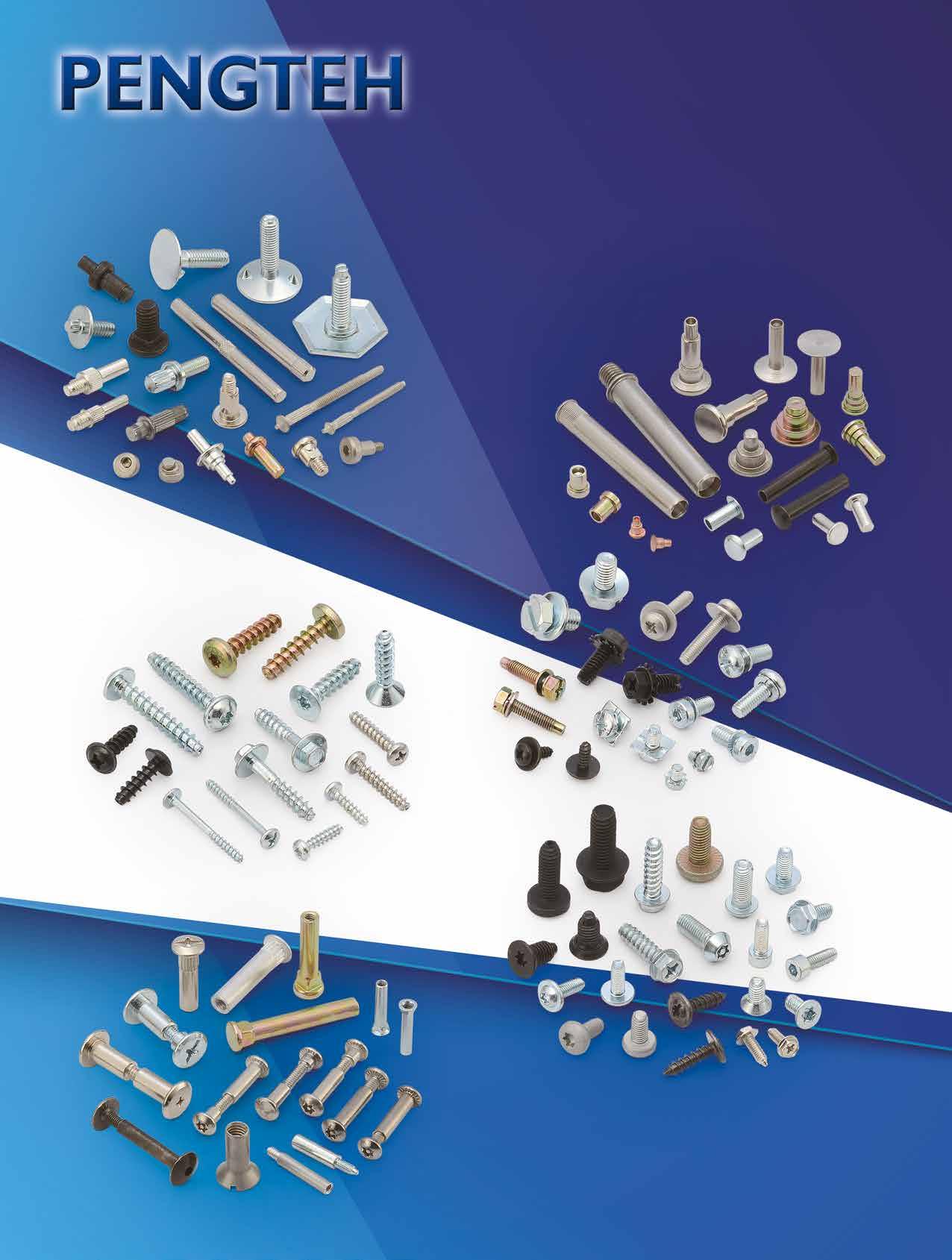

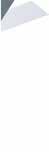

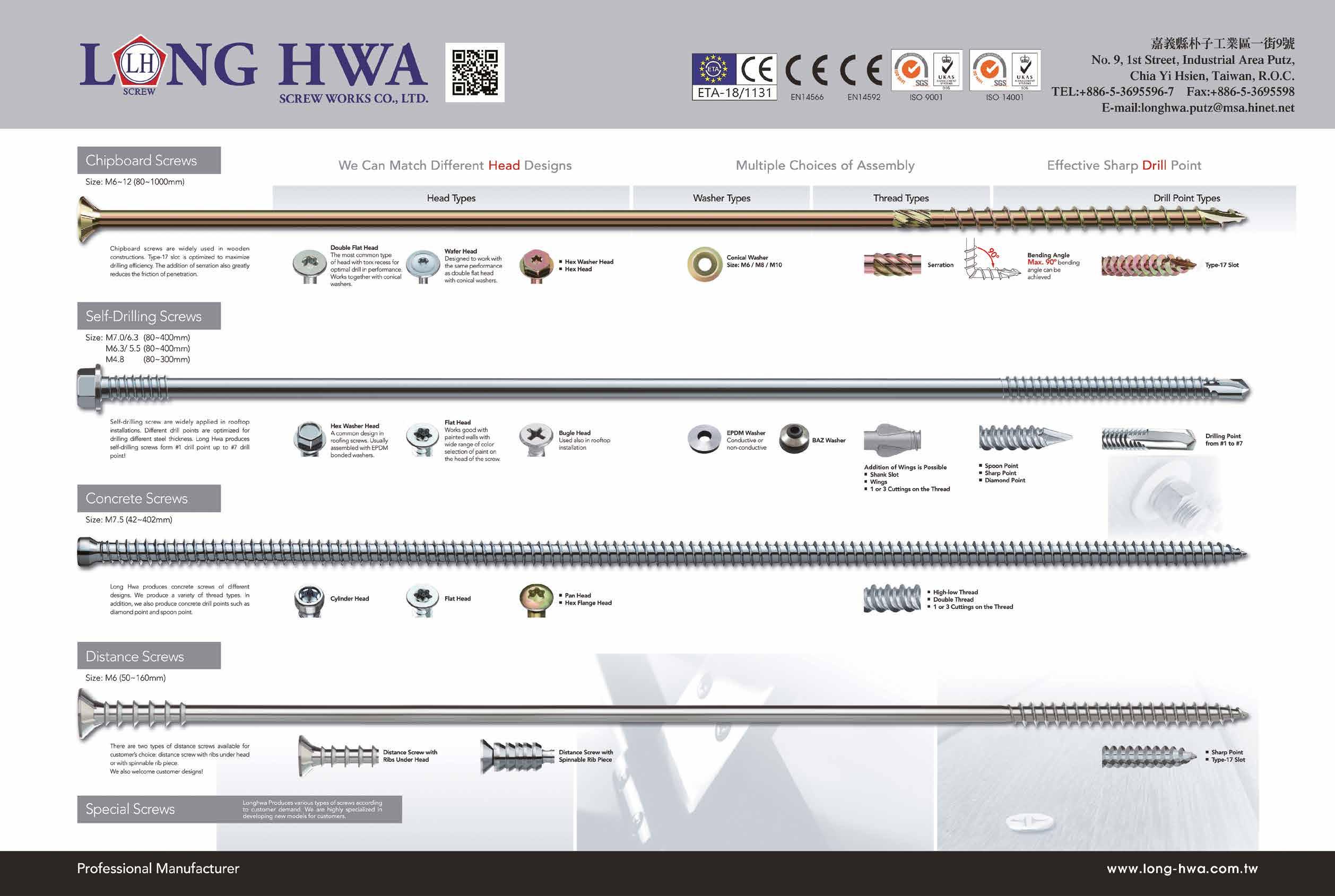

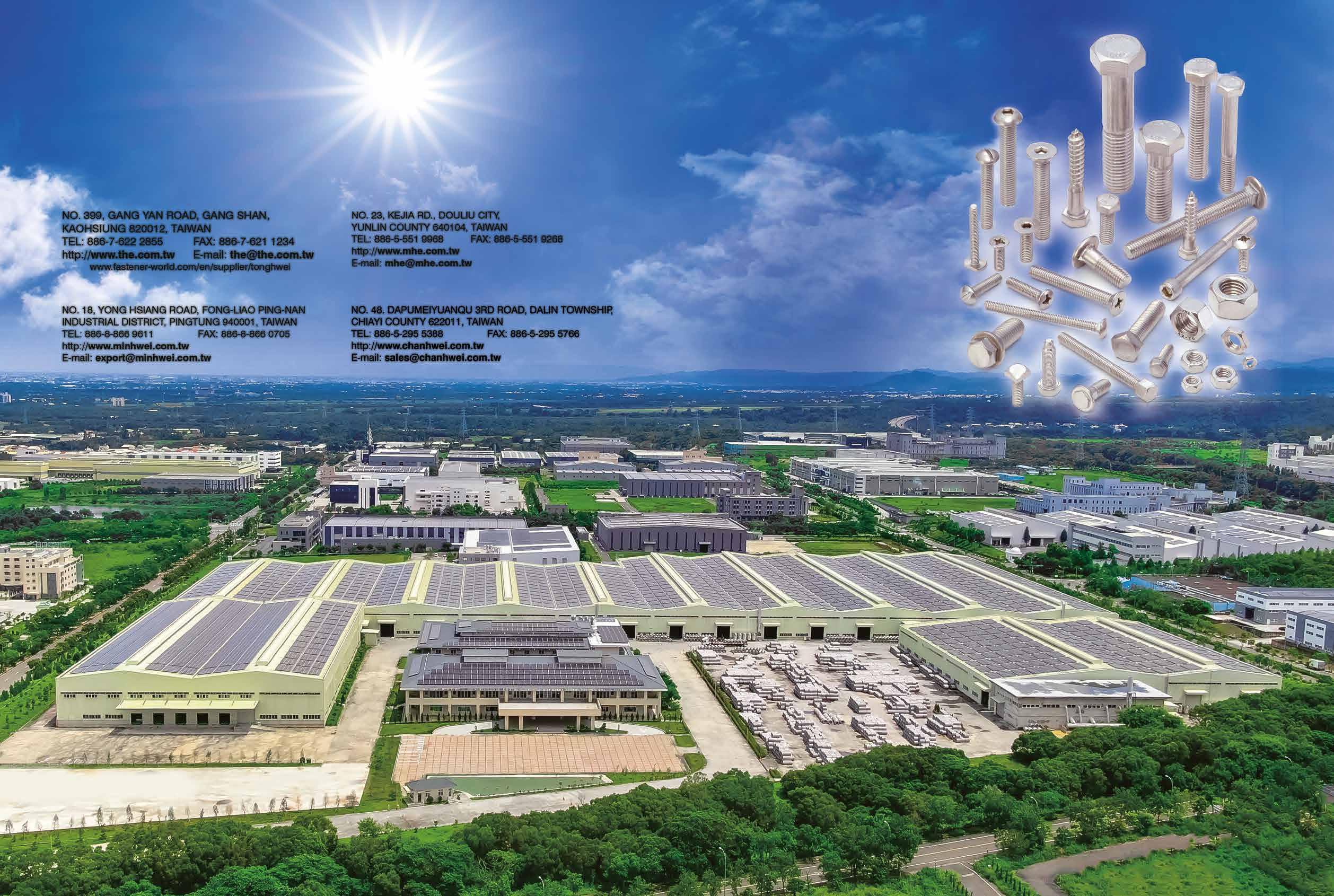

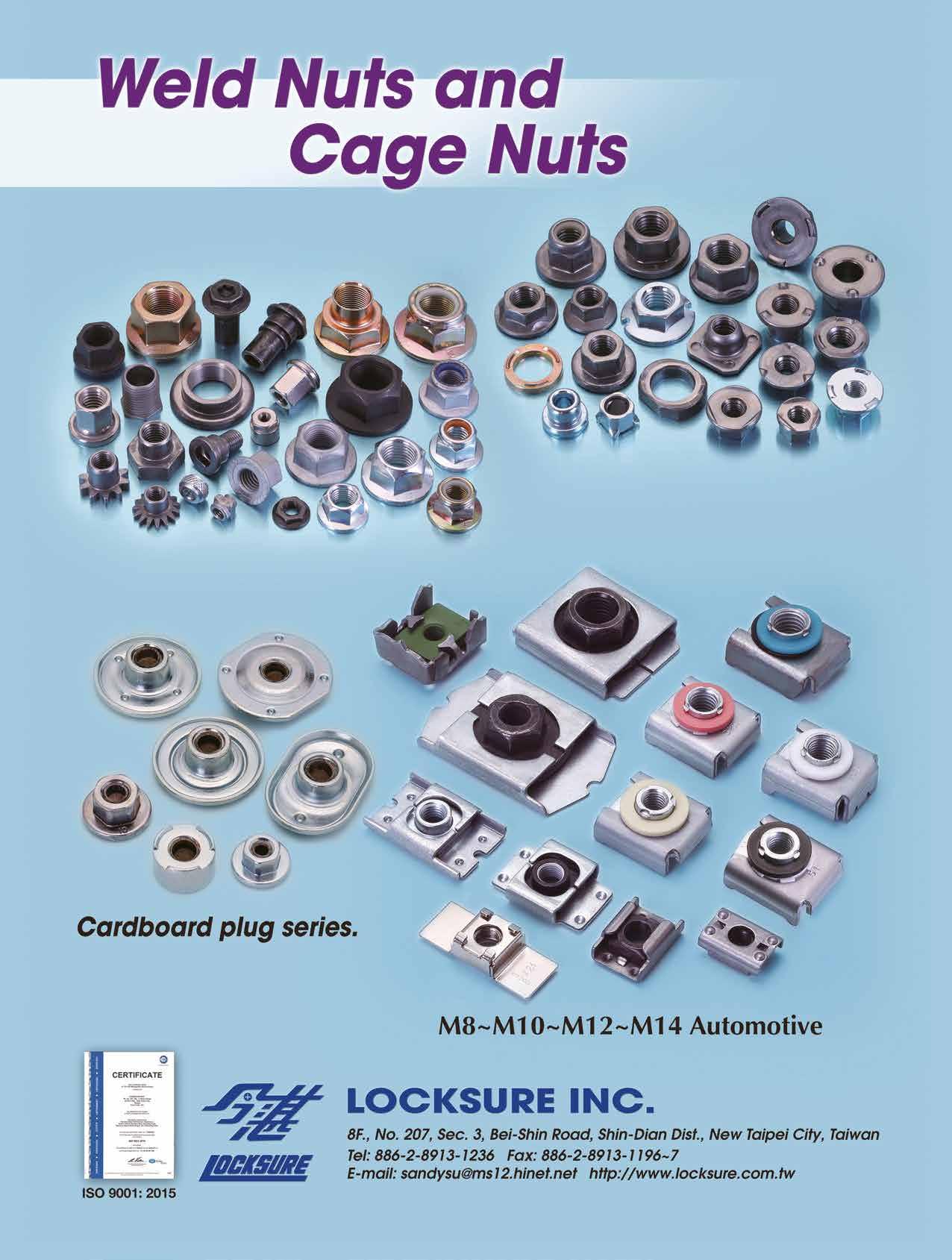

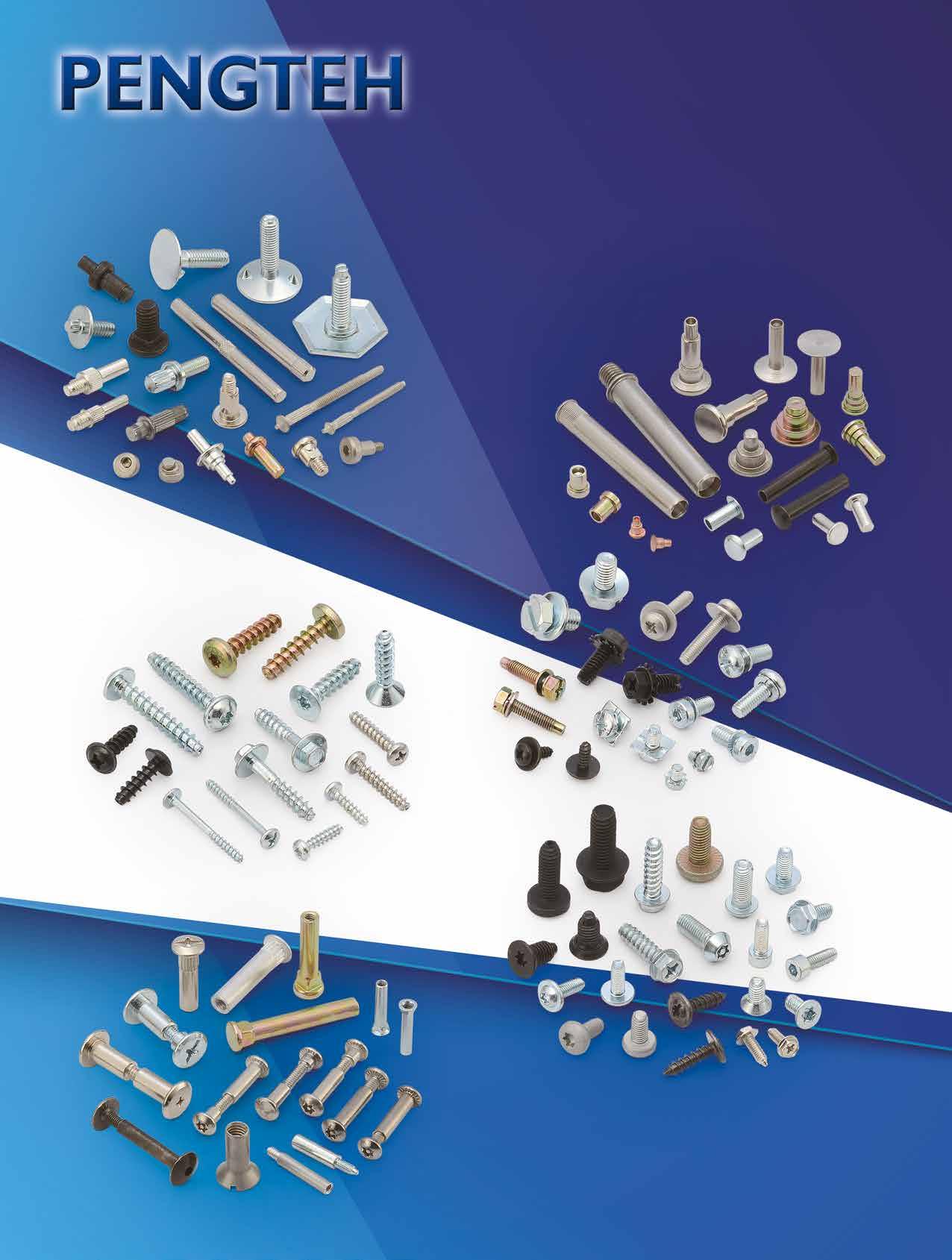

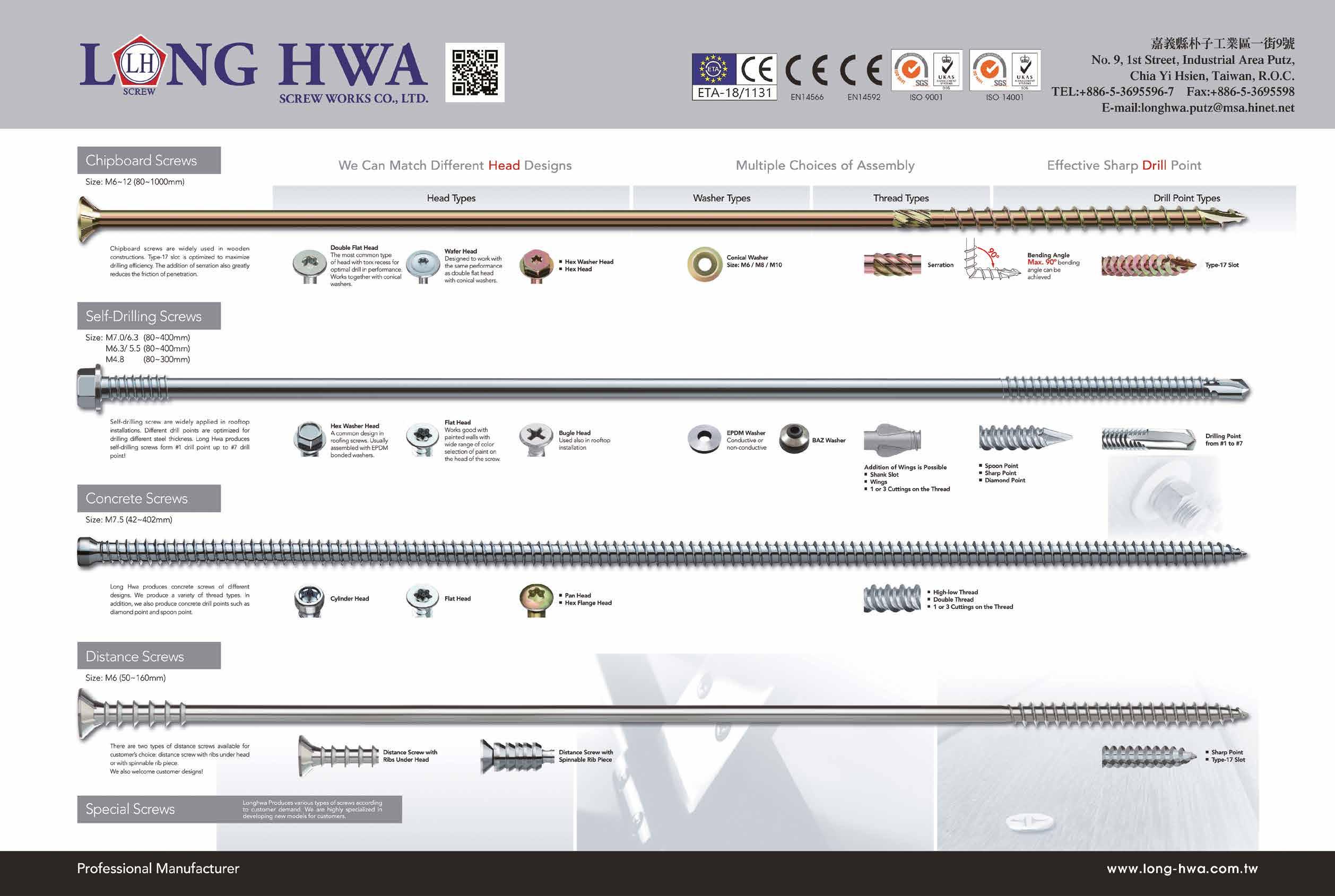

issue 202 Sep./Oct. 2023 153 LIAN CHUAN SHING INTERNATIONAL CO., LTD. 連全興 Weld Nuts, Special Parts, Special Washers, Flat Washers... 356 LIAN SHYANG INDUSTRIES CO., LTD. 連翔 Nut Formers, Nut Tapping Machines 291 LIANG YING FASTENERS INDUSTRY CO., LTD. 展揚 Automotive, Hand Tool, Electronic , OEM, Furniture, Shaft ... 108 LINK-PRO TECH CO., LTD. 超傑 Customized Screws/Nuts, Pressing & Deep Drawing... 366 LINKWELL INDUSTRY CO., LTD. 順承 All Kinds of Screws, Automotive & Motorcycle Special Screws... 26 LOCKSURE INC. 今湛 Custom Washers, Flat Washers, Automotive Screws... 198 LONGHWA SCREW WORKS CO., LTD. 隆華 Chipboard Screws, Concrete Screws, Countersunk Screws... 99 MAC PRECISION HARDWARE CO. 鑫瑞 Turning Parts, Precision Metal Parts, Cold Forged Nuts... 255 MACRO FASTENERS CORP. 宏觀 Multi-Station Screws, Nuts, Washers, Furniture Screws... 224 MAO CHUAN INDUSTRIAL CO., LTD. 貿詮 Professional Stamping Manufacturer 66 MAUDLE INDUSTRIAL CO., LTD. 茂異 Button Head Socket Cap Screws, Flange Washer Head Screws... 183 METAL FASTENERS CO., LTD. 法斯訥 Thread Inserts, Self-Clinching Fasteners... 267 METALINK PRECISION INDUSTRIES CO., LTD. 美聯 Bi-metal Self-drilling Screws, Bi-metal Screws... 16 MIN HWEI ENTERPRISE CO., LTD. 明徽 Button Head Socket Cap Screws, Chipboard Screws... 343 MINI FASTENER DEVELOPER CO., LTD. 迷你豬 Customized Fasteners... 277 MIT INDUSTRIAL ACCESSORIES CORP. 侑威 Stamping Hardware, Bolts, Nuts, CNC Screw Machine Parts... 229 MOLS CORPORATION 冠鑫 Home Appliance Screws, Customized Screws, Thread Forming Screws... 103 MOUNTFASCO INC. 崎鈺 All Kinds of Screws, Alloy Steel Screws, Automotive Screws... 90 NCG TOOLS INDUSTRY CO., LTD. 昶彰 Tools for Fastening Anchors, Blind Nuts / Rivet Nuts... 47 ND INDUSTRIES ASIA INC. 穩得 ND Pre-Applied Processes, Advanced Sealing Technologies... 261 PAKWELL CORPORATION 開懋 Bi-metal Screws 345 PEARSON INDUSTRIAL CO.,LTD. 春郁 Automotive Cold Formed Parts, Self-Clinching Cold Formed Parts... 55 PENGTEH INDUSTRIAL CO., LTD. 彭特 SEMs Screws,

Screws... 342 POINTMASTER MACHINERY CO., LTD. 昶詠 Self-drilling Screw Forming Machines... 84 PPG INDUSTRIES INTERNATIONAL INC. 美商必丕志 Chromium-free Coating, ED Coating... 173 PRO POWER CO., LTD. 鉑川 Screws, Bolts...

PRO-VISA

佾鼎

Special Screws, Binder Screws, PT

111

(LIN) INT'L CORP.

汎昇

友俊

恒耀國際

瑞滬

連宜

S L N Q R P M T new

109 THUNDERBOLT INDUSTRIAL CO., LTD.

Combined Screws, Customized Special Screws/Bolts...

60 TONG HEER FASTENERS (THAILAND) CO., LTD.

Hex Bolts, Stud Bolts, Socket Cap Screws, Hex Nuts…

60 TONG HEER FASTENERS CO., SDN. BHD (Malaysia)

Stainless Steel Metric Screws, Stainless Steel Screws…

271 TONG HO SHING INTERNATIONAL CO.,LTD.

Hex Washer Head Screws, Indent Hex Head Screws...

18 TONG HWEI ENTERPRISE CO., LTD.

A2 Cap Screws, Button Head Socket Cap Screws...

61 TONG MING ENTERPRISE CO., LTD.

Stainless Steel Fasteners, Wire Rods...

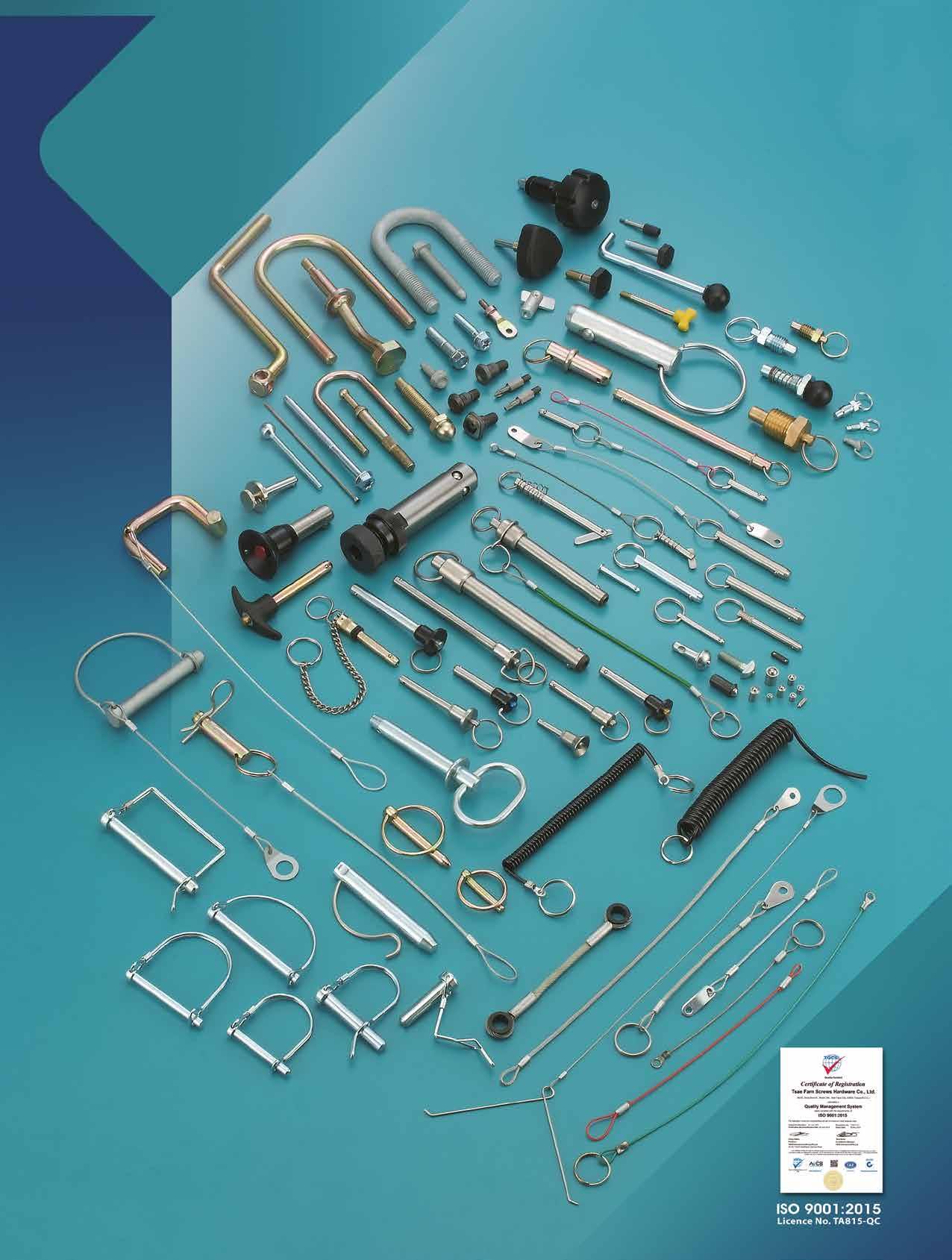

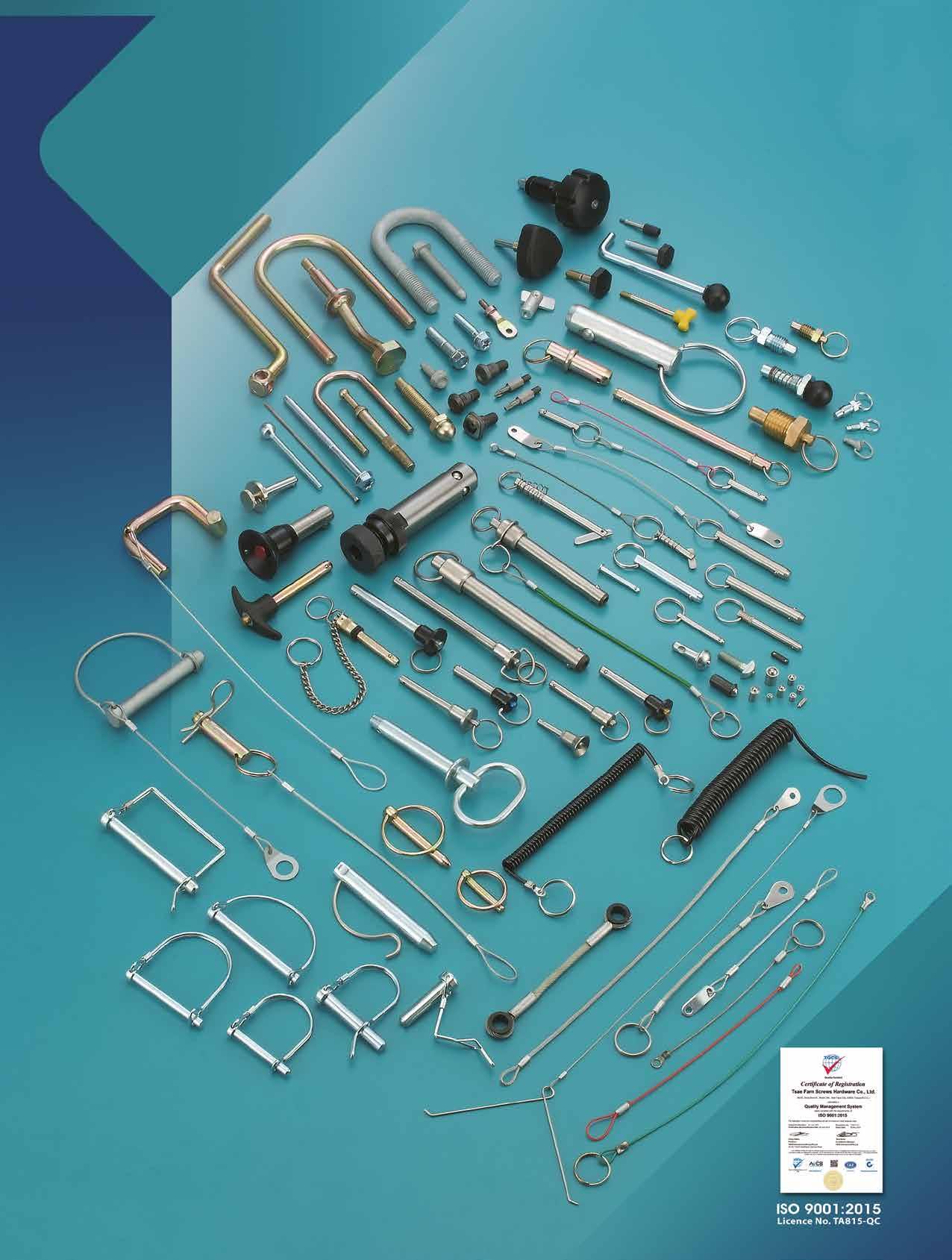

112 TSAE FARN SCREWS HARDWARE CO., LTD.

2 Cap Screws, Aircraft Nails, All Kinds of Screws...

194 TSIN YING METAL INDUSTRY CO., LTD.

Stainless Steel Cold Heading Wire, Oxalate Coating Wire...

325 TZE PING PRECISION MACHINERY CO., LTD.

Open Die Machines, Cold Headers, Cold Forming Machines...

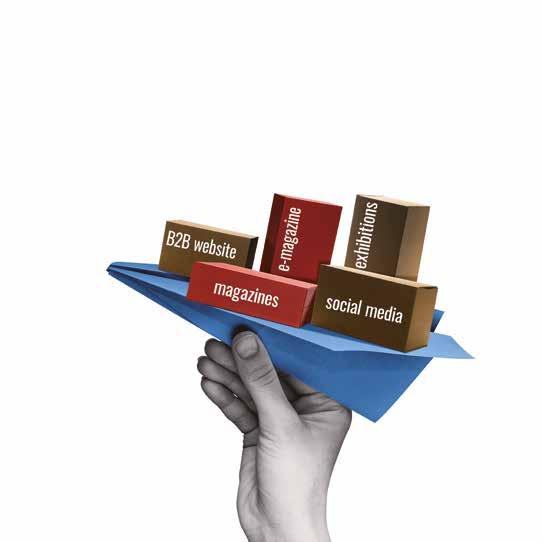

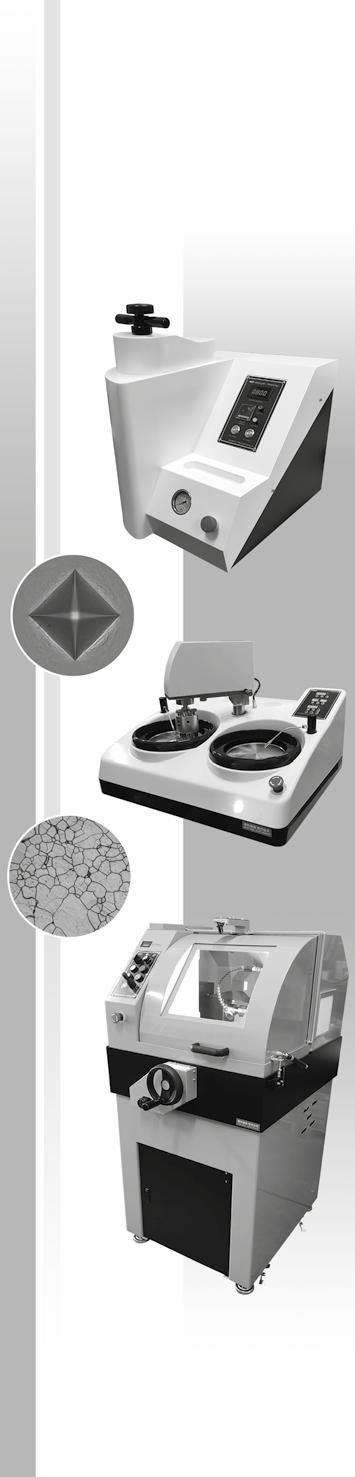

301 U-JUNE-INSTRUMENT CO., LTD.

Hot Mounting Machine, Grinding & Polishing Machine...

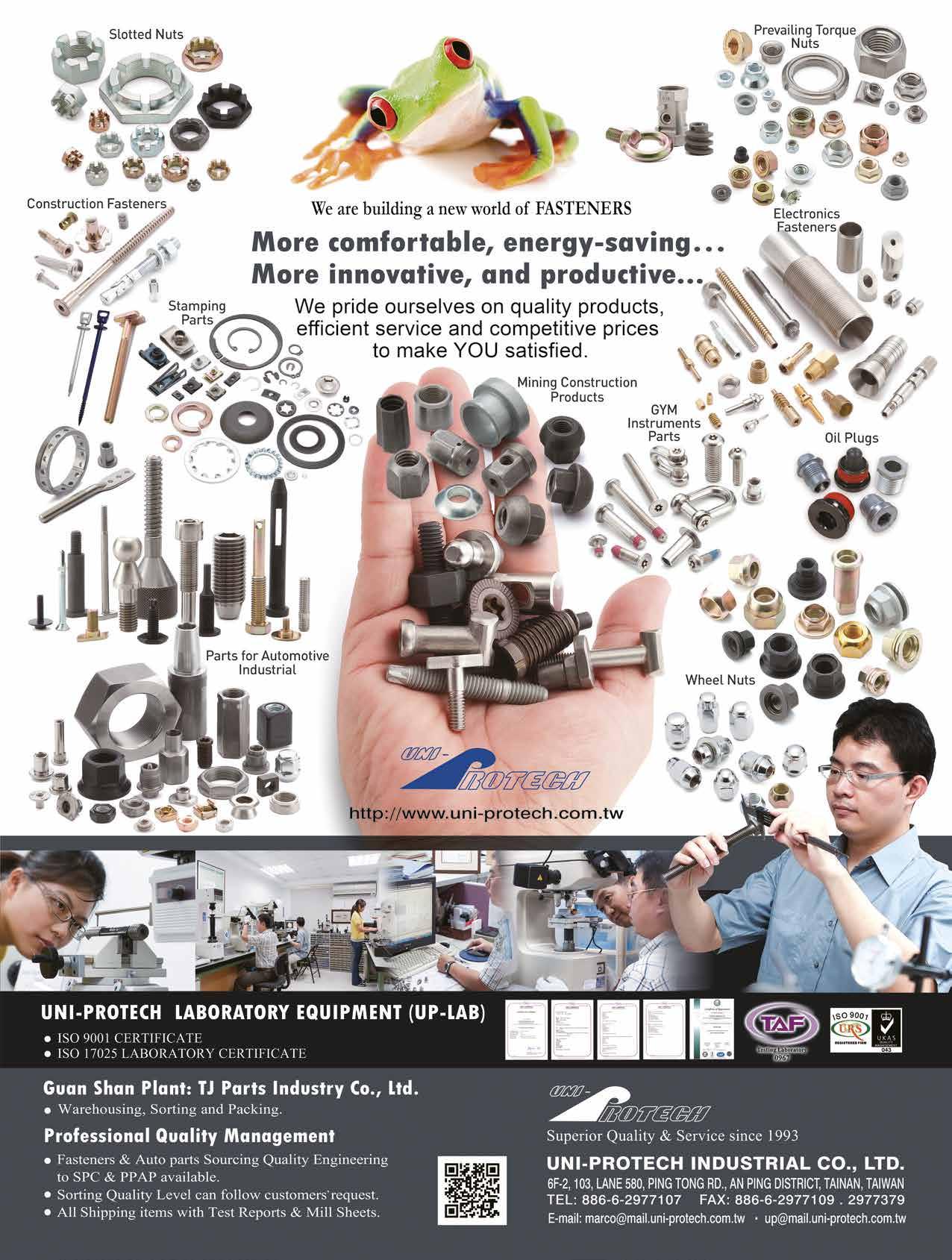

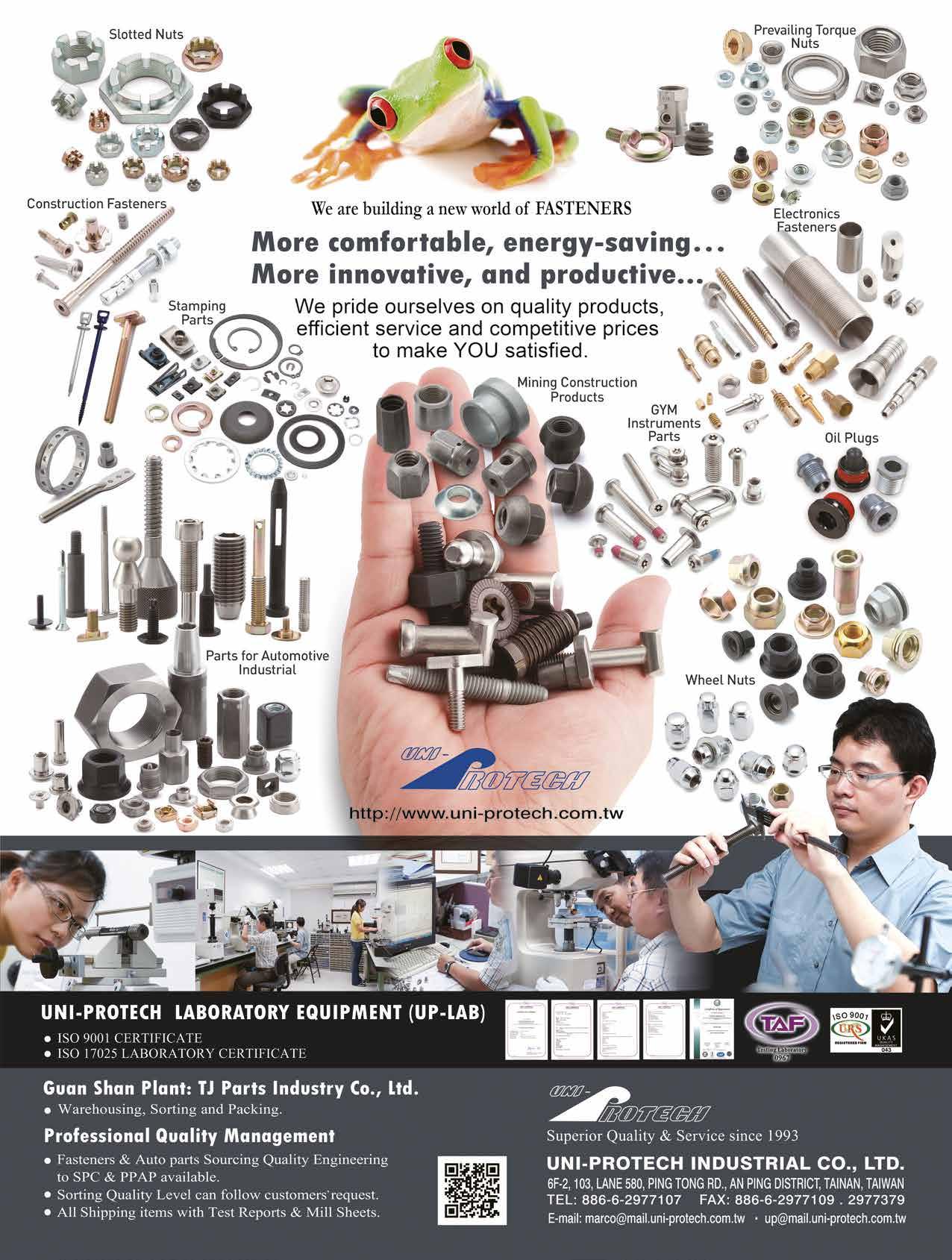

257 UNI-PROTECH INDUSTRIAL CO., LTD.

Slotted Nuts, Construction Fasteners, Automotive Parts…

243 UNIVERSAL PRECISION SCREWS (India)

Dowel Pins and Shoulder Bolts...

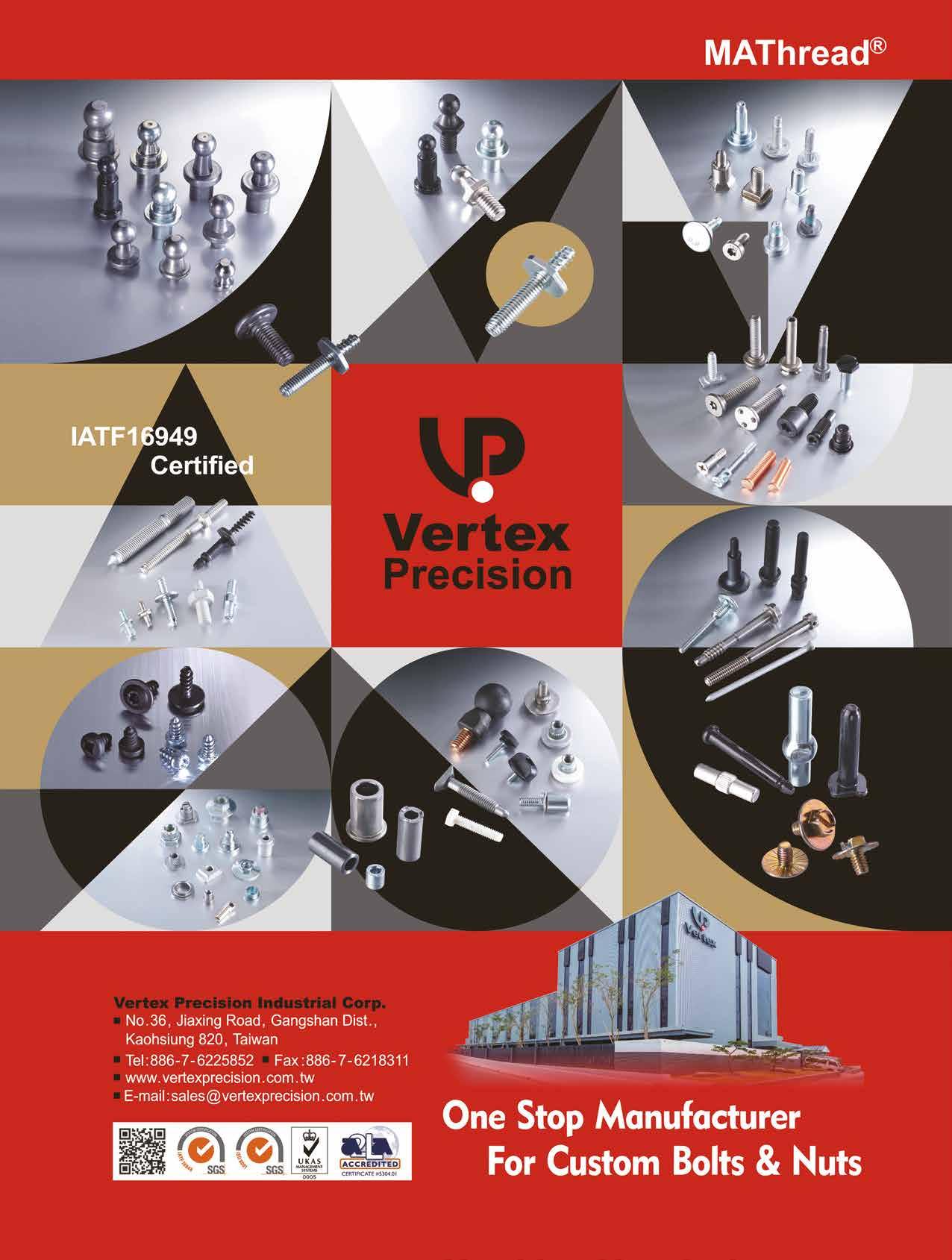

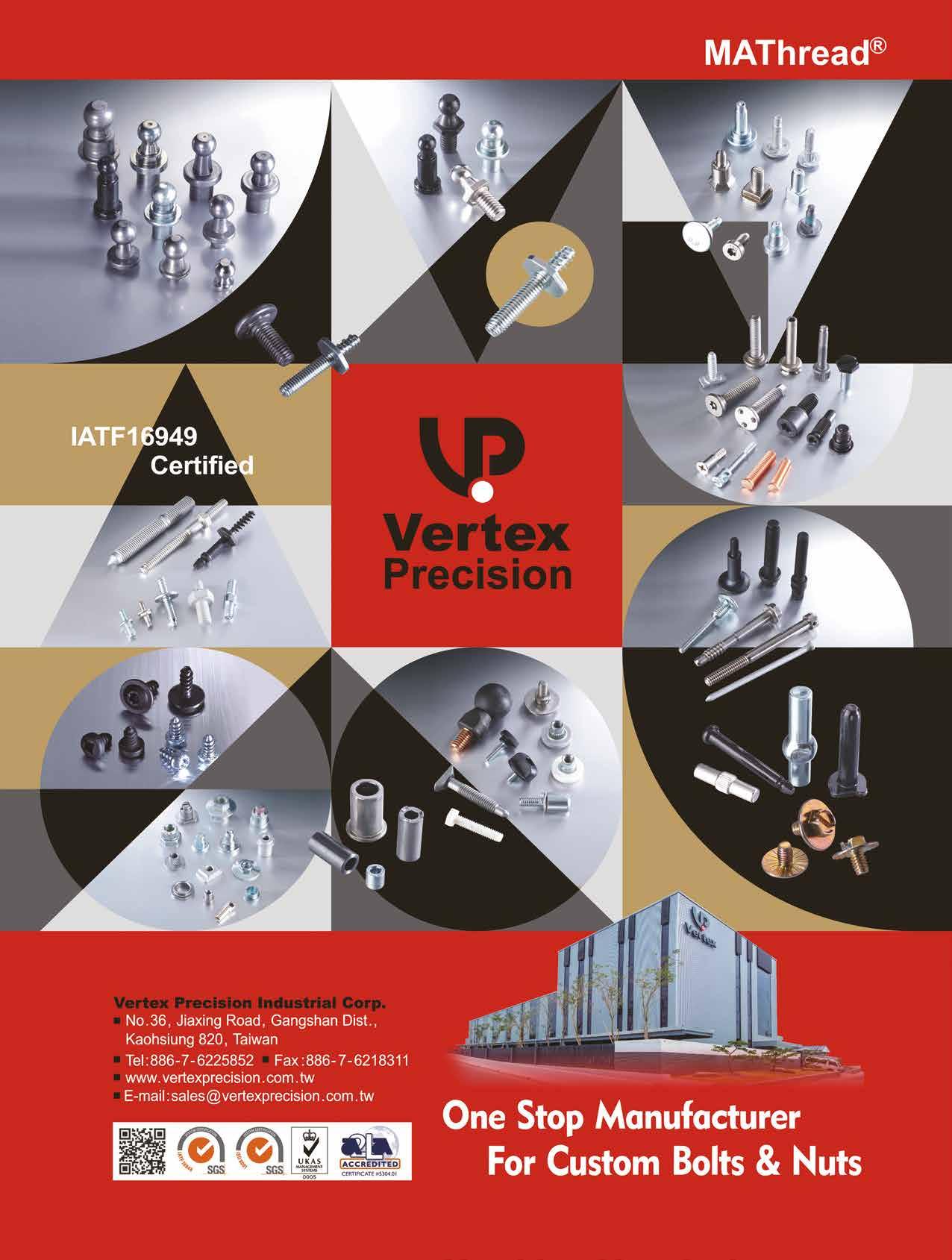

50 VERTEX PRECISION INDUSTRIAL CORP.

6 Cuts/

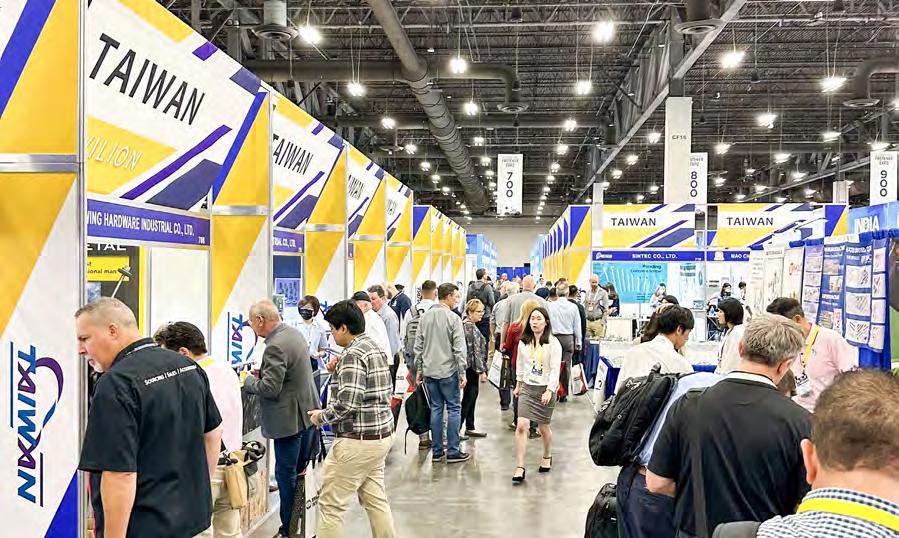

Exhibitions 展覽

U Z W

156 FASTTEC (Russia) 346 FASTENER TRADE SHOW SUZHOU (China)

雷霆

桐和興

東徽

東明

采凡

晉英

智品

宇駿

致韋

緯紘

8 Cuts Self Drilling Screws, Barrel Nuts, Cap Screws 313 WAN IUAN ENTERPRISE CO., LTD. 萬淵 Punches/Dies of Various Nuts, Screws, Sleeves and Socket Boxes 64 WE POWER INDUSTRY CO., LTD. 威力寶 Chipboard Screws, Concrete Screws, Drywall Screws... 273 WEI ZAI INDUSTRY CO., LTD. 葦在 Anchors, Automotive Nuts, Cap Nuts, Flange Nuts... 132 WEIMENG METAL PRODUCTS CO., LTD. 偉盟 Standard / Customized Parts, Machining Parts, Stamping Parts... 63 WINLINK FASTENERS CO., LTD. 岡山東穎 Stainless Steel Screws, Flange Bolts, Security Bolts, SEMS Screws... 32 WYSER INTERNATIONAL CORP. 緯聯 Open-Die Parts, Automotive Parts... 357 YESWIN MACHINERY CO., LTD. 友信 Bolt Formers, Multi-station Cold Forming Machines... 38 YI CHUN ENTERPRISE CO., LTD. 誼峻 Cap Screws, Socket Set Screws, Cage Nuts, Automotive Parts... 138 YI HUNG WASHER CO., LTD. 益弘 Rubber Washers, Plastic Screws, Custom Washers... 52 YING MING INDUSTRY CO., LTD. 穎明 Automotive & Motorcycle Special Screws / Bolts... 87 YING YI CO., LTD. 穎翊 Sems Parts, Special Nuts, Pressed Parts... 137 YOUR CHOICE FASTENERS & TOOLS CO., LTD. 太子 A2 Cap Screws, Bits & Bit Sets, Chipboard Screws... 360 YOW CHERN CO., LTD. 侑城 Flanged Head Bolts, Chipboard Screws, Floorboard Screws... V Y T Y

& Equipment 機械暨周邊設備區 326 BIING FENG ENTERPRISE CO., LTD. 秉鋒 320 CHAN CHANGE MACHINERY CO., LTD. 長薔 330 CHAO JING PRECISE MACHINES ENTERPRISE 朝璟 219 CHIEN TSAI MACHINERY ENTERPRISE CO., LTD. 鍵財 316 CHING CHAN OPTICAL TECHNOLOGY CO., LTD. 精湛 318 CHUN ZU MACHINERY INDUSTRY CO., LTD. 春日 203 DAGAN INTERNATIONAL CO., LTD. 美達斯 338 DAH-LIAN MACHINE CO., LTD 大連 334 E-UNION FASTENER CO., LTD. 奕盟 327 GREENSLADE & COMPANY, INC. (U.S.A.) 323 GWO LIAN MACHINERY INDUSTRY CO., LTD. 國聯 331 HONG TAY YUE ENTERPRISE CO.,LTD. 鴻大裕 362 JERN YAO ENTERPRISES CO., LTD. 正曜 341 JIE LE MACHINERY CO., LTD. 捷仂 336 JIN CHI HARDWARE MACHINERY 金騏 335 KING YUAN DAR METAL ENTERPRISE CO., LTD. 金元達 356 LIAN SHYANG INDUSTRIES CO., LTD. 連翔 342 POINTMASTER MACHINERY CO., LTD. 昶詠 328 SHEEN TZAR CO., LTD. 新讚 339 TAIEAG CORPORATION 順基軒 325 TZE PING PRECISION MACHINERY CO., LTD. 智品 301 U-JUNE-INSTRUMENT CO., LTD. 宇駿 357 YESWIN MACHINERY CO., LTD. 友信 269 Z & D PLATING CO., LTD. 瑞達信 201 FRATOM FASTECH CO., LTD. 福敦 324 GIAN-YEH INDUSTRIAL CO., LTD. 健業 329 INFINIX PRECISION CORP. 英飛凌 333 JIENG BEEING ENTERPRISE CO., LTD. 精斌 322 SHUN HSIN TA CORP. 順興達 313 WAN IUAN ENTERPRISE CO., LTD. 萬淵

工/模具區 62 YUH CHYANG HARDWARE INDUSTRIAL CO., LTD. 鈺強 Automotive & Motorcycle Special Screws / Bolts... 253 YUN CHAN INDUSTRY CO., LTD. 雍昌 Bits & Bit Sets, Hex Keys, Nut Setters, Wrench Sets... 125 YUNG KING INDUSTRIES CO., LTD. 榮金 Dowel Pins, Roll Pins, Self-locking Pins, Cotter Pins, Split Pins... 269 Z & D PLATING CO., LTD. 瑞達信 Precision Barrel Plating Finishes, Zinc & Zinc-Nickel Alloy... 259 ZE XIN FASTENERS 澤馨 Chipboard Screws, Concrete Screws, Self-Drilling Screws... 258 ZOAG LLC DBA K & C INTERNATIONAL (U.S.A.) Fastener Company for Sale new

Machines

Tooling / Dies

076 Fastener World no.202/2023

Fastener World no.202/2023 077

078 Fastener World no.202/2023

Fastener World no.202/2023 079

Fastener World no.202/2023 081

082 Fastener World no.202/2023

Fastener World no.202/2023 084

Fastener World no.202/2023 085

086 Fastener World no.202/2023

Fastener World no.202/2023 087

090 Fastener World no.202/2023

Fastener World no.202/2023 092

Fastener World no.202/2023 093

Fastener World no.202/2023 095

Fastener World no.202/2023 097

Fastener World no.202/2023 099

100 Fastener World no.202/2023

Fastener World no.202/2023 103

Fastener World no.202/2023 105

106 Fastener World no.202/2023

Fastener World no.202/2023 107

Fastener World no.202/2023 109

110 Fastener World no.202/2023

Fastener World no.202/2023 111

114 Fastener World no.202/2023

118 Fastener World no.202/2023

Fastener World no.202/2023 119

120 Fastener World no.202/2023

Fastener World no.202/2023 121

122 Fastener World no.202/2023

Fastener World no.202/2023 123

124 Fastener World no.202/2023

Fastener World no.202/2023 125

128 Fastener World no.202/2023

Fastener World no.202/2023 129

130 Fastener World no.202/2023

132 Fastener World no.202/2023

Fastener World no.202/2023 133

Fastener World no.202/2023 135

136 Fastener World no.202/2023

Fastener World no.202/2023 137

Fastener World no.202/2023 138

Fastener World no.202/2023 141

142 Fastener World no.202/2023

KATSUHANA FASTENERS CORP.

The E.I.F.I. has a New President Interview with Paolo Pozzi

What can we expect from your Presidency?

It is safe to say that Paolo Pozzi has earned his credentials in the field.

With a degree in Aerospace Engineering from the Politecnico Institute of Milan, he joined the Agrati Group in 1995, where he held various positions until becoming General Manager of the parent company "Agrati SpA" and then a member of the Board of Directors. He was appointed Managing Director of the Group in 2008 and CEO in 2016.

Under his leadership and in line with the Presidency, the Agrati Group has undergone a transformation that is clearly visible today through the achievement of important goals. These successes can be summarised by an annual turnover exceeding 680 million euros and a staff of more than 2400 employees operating across 12 manufacturing establishments situated in Europe, the United States and China.

Paolo Pozzi’s innate talent for diplomacy, coupled with his engaging personality, has garnered him recognition and respect within the social sphere of his profession, both nationally and internationally. He has carried out and continues to carry out intense professional and membership activities. Therefore, it came as no surprise when he was unanimously elected as EIFI President for the period of 2023-2027 during the EIFI General Shareholders’ Meeting held on 12 May 2023 in Meissen (Germany).

Thanks to his willingness to make time for us, we (referring to Italian Fasteners Magazine, the same goes hereinafter) had the privilege of meeting the recently appointed President. Here is the interview that followed.

Firstly, I would once again like to express my heartfelt appreciation to all the EIFI Members who elected me as their President. It is with great honour and happiness that I assume this position, particularly as the EIFI is undergoing a significant period of transformation. My hope is to make a significant impact in shaping a new era for the EIFI and facilitating its adaptation to the challenges and profound changes currently affecting all industrial sectors

I believe that it will become increasingly crucial to address these new challenges at the European level in order to effectively represent and safeguard the fasteners industry and its unique characteristics in the years to come.

by Marco A. Guerritore Editor in Chief Italian Fasteners Magazine

by Marco A. Guerritore Editor in Chief Italian Fasteners Magazine

Associaton 144 Fastener World no.202/2023 惠達雜誌

This will necessitate an organisation capable of collaborating closely with national associations, while simultaneously expanding its operations and prominence at a European level. This can be accomplished by cultivating partnerships with institutions in Brussels (EC and Parliament), as well as other trade associations (AEGIS, CLEPA, EUROFER etc.). The present challenges cannot be addressed using the same approaches employed in the past.

What is the current organisational structure of the EIFI?

The current structure consists of a Board, which includes a President, two Vice-Presidents, six members representing the national associations and a General Manager. The term of office for the President and Board has been extended to four years and can be renewed for an additional term. There are three Market Groups:

• Automotive

• General Industry/Distribution

• Aerospace

There are three Operating Committees:

• Public Affairs, Legal, TDI and Membership Development

• Technical, Quality and Innovation

• Marketing and Communication

Two new categories have been introduced within the category of fastener manufacturers:

• Affiliated Members, comprising companies in the fasteners supply chain

• Associated Members, consisting mainly of service and consulting companies

What are your objectives as President during your term?

The objectives include:

1. Enhancing the recognition and visibility of the EIFI throughout Europe

2. Broadening the membership base

3. Strengthening the organisation

However, the fundamental objective remains the same: to effectively represent and protect the interests and unique characteristics of the European fasteners industry.

Is there still a valid role for a European trade association in today’s highly globalised world?

I would argue that because we have been living in a globalised world for more than 30 years, it is crucial to embrace the European dimension in order to tackle new challenges. This principle is applicable not only to trade associations but also to all EU Member States, who sometimes overlook the fact that they are part of a geographic region that represents the world’s largest market, renowned for excellence across all industrial sectors.

Even in the case of fasteners, Europe maintains its position as the world’s largest market, representing 26% of the total value of 90 billion dollars, surpassing the Asia Pacific region, North America and China. I believe it is worthwhile trying to defend and support this market as well as the European companies operating within it.

Are European nuts and bolts competitive at a global level? What potential risks does this sector face in the future?

I would say that European nuts and bolts are indeed competitive globally, particularly when we compare ourselves to countries operating under similar regulations and conditions. Unfortunately, we are well aware that this level playing field is not always guaranteed.

I think that Europe’s position as the world’s leading fastener market can be attributed to the efforts of European manufacturers, and also to the supply chain, which over the years has adapted and evolved alongside market demands, offering manufacturers high-quality materials and services at competitive prices. Let us not forget that the competitiveness and expertise of European fastener manufacturers have allowed them to develop global champions who have also successfully invested in other regions worldwide. In fact, at least five European manufacturers rank among the world’s top ten fastener manufacturers.

The potential risks are partly known and partly new. The known risks include imbalances in relation to WTO regulations, which have led to the imposition of import duties to rebalance the system. The new risks stem from the disparities in the speed and approaches adopted by different regions worldwide to address sustainability concerns.

These concerns primarily revolve around the environment, with the first test case being the implementation of the CBAM (Carbon Border Adjustment Mechanism). However, this issue extends beyond environmental considerations and encompasses broader decisions linked to ESG issues, with each country adopting different approaches in this regard.

What can the EIFI do, particularly for small and medium-sized European companies in the fasteners sector?

In my view, small and medium-sized companies need to be part of an organisation that can effectively represent, defend and guide them in navigating the immense challenges of today. Consider the three major transformations currently taking place in Europe: sustainability, digitisation and the electrification of the automotive sector, which remains a key market for fastener manufacturers. These profound changes are having a significant impact on organisations, and the fact that they are all happening at the same time makes their management very complex and burdensome for large companies, while posing an unsustainable challenge for small and medium-sized enterprises. By sharing these epochal transitions with associations that can provide valuable information, support and guidance on addressing these challenges, I believe we can foster more cohesive and harmonious growth throughout the entire supply chain. This

Associaton 145 Fastener World no.202/2023 惠達雜誌

collaboration can help prevent disruptions and discontinuities that could potentially lead to significant issues, as demonstrated during the pandemic.

Currently,

I do not think that growth is the only way to survive, but it is evident that stagnant or diminished corporate stature does not foster the development of champions capable of competing in a global and rapidly evolving environment such as the one we face today. Without growth, there is no investment and without investment, there is no innovation and no job creation.

Europe stands at the forefront in the battle against pollution in general, but this inevitably means placing limitations on economic and production activities. How do you propose reconciling this contradiction in a positive manner?

I believe that Europe’s environmental choices are correct, and no one, including companies, wants to oppose the transition. However, it appears that there has been an excessive focus on regulation, leaving little room for the development of a comprehensive strategy. While deadlines and potential sanctions have been set, the competitive landscape with American and Chinese companies seems to have been overlooked. The risk we face is that we are creating new rules for the game with highly skilled referees, only to find that others have taken the field ahead of us. This is true not only in the transition to electric vehicles, where Europe trails behind China, Korea and Japan in terms of accumulated battery technology, but also in the high-tech sector, where Europe faces a technological gap and lacks key players compared to countries like the United States and China. This contradiction could be resolved by greater collaboration between the European Commission and trade associations. Together they can work towards defining more comprehensive strategies that take into account the speed of transition and the negative effects it may bring in the short term. A prime example is the new regulations on car emissions with Euro 7 engines scheduled for July 2025. These regulations entail significantly higher costs than those initially estimated by the Commission, while providing limited environmental benefits.

may have seemed implausible a few years ago, has become more feasible. Since 2019 we have seen exponential growth in the market share of electrified vehicles, reaching 21% in 2022, with 9% being fully electric (BEV). Some Northern European countries, such as Norway, have already achieved an impressive 80% penetration rate. Evaluating how these countries have been able to reach such levels today will provide insights into the 2035 sustainability target for the whole of Europe. Uncertainty persists in the short term regarding the overall demand for cars, which will undoubtedly be negatively impacted by reduced credit availability, higher costs, the effects of a potential recession and relatively high price levels of electric vehicles, particularly in segments A and B.

When it comes to the evolution of the car, the EIFI will need to collaborate closely with other national and European automotive trade associations to address industry-specific challenges that may arise during this complex phase. One key challenge lies in effectively managing larger quantities and varieties of products, particularly for fastener manufacturers. This will necessitate diverse skills and the development of new processes to create new materials, coatings and components. Additionally, broader knowledge in areas beyond mechanics and metal materials will be essential. The demand for more diversified products will also lead to greater complexity in logistics management and distribution of products, as well as the need to converge towards standards that have yet to be defined. Lastly, over the coming years, components dedicated solely to internal combustion vehicles will gradually decline in volume, adversely affecting production costs due to diminished economies of scale, following a logic similar to what we have already seen for components used exclusively for diesel powertrains.

In the aftermath of a pandemic

is it possible to maintain optimism and confidence in the future?

Unfortunately, wars and pandemics have always existed in the world and are part of human history and nature. Our generation has been fortunate enough to have avoided experiencing them directly. In particular, in the Western world, we have managed not to have wars for over 70 years, with the exception of the Balkan War in the 1990s. However, we now have one in the heart of Europe that increasingly involves us and seems to be taking on the form of a clash between the West and the rest of the world. This situation is disconcerting and fills us with unease and uncertainty, but I believe that maintaining a healthy balance of realism and optimism is the most prudent approach.

For quite some time now, I have believed that the transition to electric vehicles is irreversible. There is no turning back given the massive investments made by car manufacturers in Europe and globally. Recent growth figures have shown unexpected advancements not only in China but also in Europe, albeit at varying rates between northern and southern countries. The goal of achieving full electric private mobility in Europe by 2035, which

How would you like to conclude this interview?

With a closing remark that carries both a cautionary message and a ray of hope for companies of all sizes.

The world is changing fast. It is no longer a question of big overpowering small, but rather of the fast outpacing the slow.

Associaton 146 Fastener World no.202/2023 惠達雜誌

there is the prevailing belief that growth is the sole means to guarantee a company’s survival. In your opinion, what does this growth actually mean and how should it be achieved?

We are currently witnessing a period of significant change and uncertainty, particularly in the automotive industry. What are your predictions in this regard? What role should the EIFI play in this context?

and with ongoing conflicts in various parts of the world,

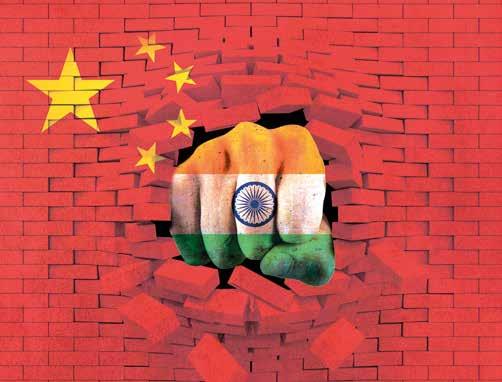

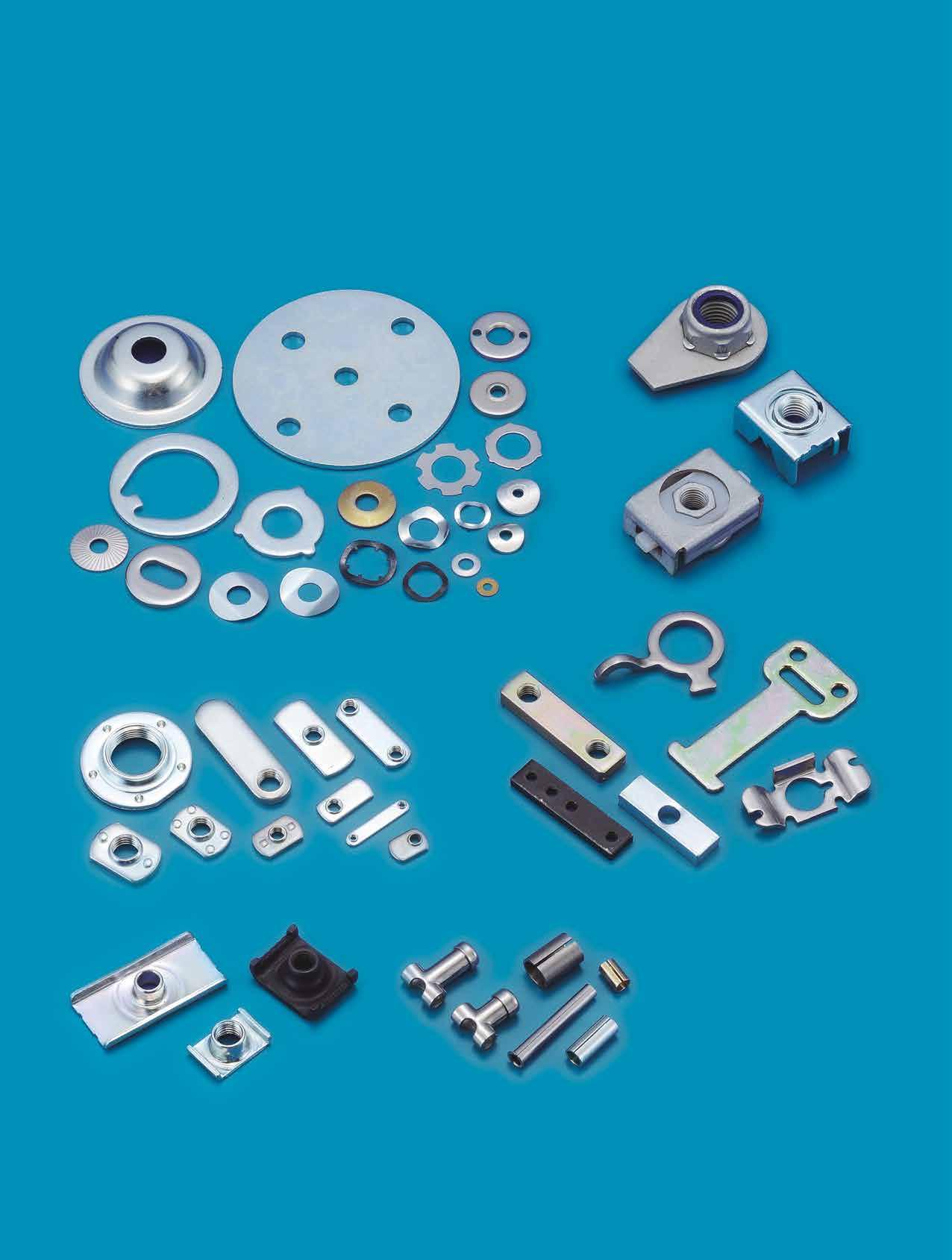

Is Requiring Extra Overseas Plants on Taiwanese Fastener Owners Truly Necessary?

First and Foremost is to Pinpoint Impact Range and Gain Buyers’ Confidence

Are You Tensed up About the Taiwan Strait Tension?

In our interaction with fastener associations, business owners and global exhibitors, we observed that a number of overseas buyers are worried about one thing: "If there is a war in the Taiwan Strait, will the supply chain of Taiwan fasteners be cut off?". These buyers are beginning to hope for Taiwanese owners to establish factories in Southeast Asia or other regions (which forms the concept dubbed as "Taiwan +1", where the plus mark denotes “extra” and “+1” denotes “an extra location”). They expect Taiwanese owners to build production lines in other countries to avoid broken supply chains. The Russian-Ukrainian war has lasted for more than 500 days, leading to global inflation, rising interest rates, soaring prices and public inconvenience. The Global Misery Index pushed up by this war has been deeply felt by everyone. If China starts a war against Taiwan, the index will undoubtedly exceed that of the Russian-Ukrainian war by several times, and it will lead to global chaos. Undeniably, the tension between Taiwan and China is largely influenced by the rivalry and friction between the United States and China, which indirectly leads to the need for Taiwan to make policy choices. China's military and political moves have undisputably added up to the heating up of the "+1" trend. Nevertheless, it is worth clarifying whether this trend affects Taiwan fastener industry. Therefore, this article will share our experiences and a few points for thought through the following different perspectives.

Taiwan Has No Intention and Prerequisites to Provoke China

Taiwan has never wanted a war, nor will it initiate one. Taiwan's status quo is influenced by geopolitics and historical burdens. The people of Taiwan know in their hearts that they do not want to go to war to achieve some kind of goals.

Taiwan has had a very close relationship with China. Over the past 30 years, Taiwan has invested more than US$200 billion in China, and more than 10,000 Taiwanese companies have set up factories in China. There are more than 100 Taiwanese fastener companies operating in China. According to Taiwan’s Ministry of Finance, Taiwan's exports in 2021 reached a record high of about US$446.4 billion, of which 42% (US$187.4 billion) were exported to China, and the trade surplus for Taiwan was nearly US$60 billion, which shows quite a large China's economic contribution to Taiwan.

There are more than 500,000 Taiwanese people working in China and more than 10,000 Chinese people working and studying in Taiwan. According to Taiwanese government’s statistics, there are more than 100,000 registerations of intermarriage between Taiwanese and Chinese people, so a war would only result in the separation of family and bitterness on both sides of the Taiwan Strait. There is complicated sentiment between Taiwan and China, and the economic development they have built together has been very successful, so Taiwan will not make up a reason to go to war. Leaders on both sides of the Taiwan Strait should have the wisdom to choose a way of life that is mutually acceptable and allows for coexistence, rather than destroy decades of development on the spur of the moment.

The Price of War is High

If China were to attack Taiwan, it would first have to face the world's largest maritime war in history. The Taiwan Strait separating the two sides is 77 to 140 kilometers wide, and for those with a military background, it is not difficult to understand the difficulty of such a landing operation. According to official figures, Taiwan currently has 700,000 reservists who can respond immediately in the event of a war. Taiwan has also acquired many fine weapons through the supply of semiconductors and procurement of military weapons, and it is believed that Taiwan has enough power to defend itself. As a saying goes, the winner takes the throne as the king (a hero in history) and the loser rots in the river of history. Many overseas experts have warned of the risks and consequences of a cross-strait war. In the event of a war, Taiwan and China's respective economies would be destroyed, and it would take decades to rebuild. Who can afford such a heavy burden?

Special Feafure 148 Fastener World no.202/2023 惠達雜誌

Fastener World no.202/2023 149

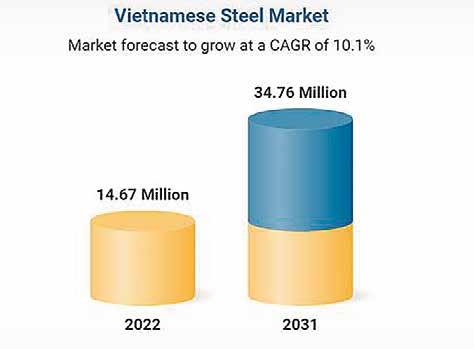

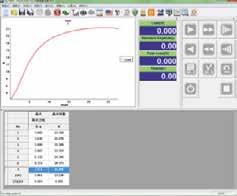

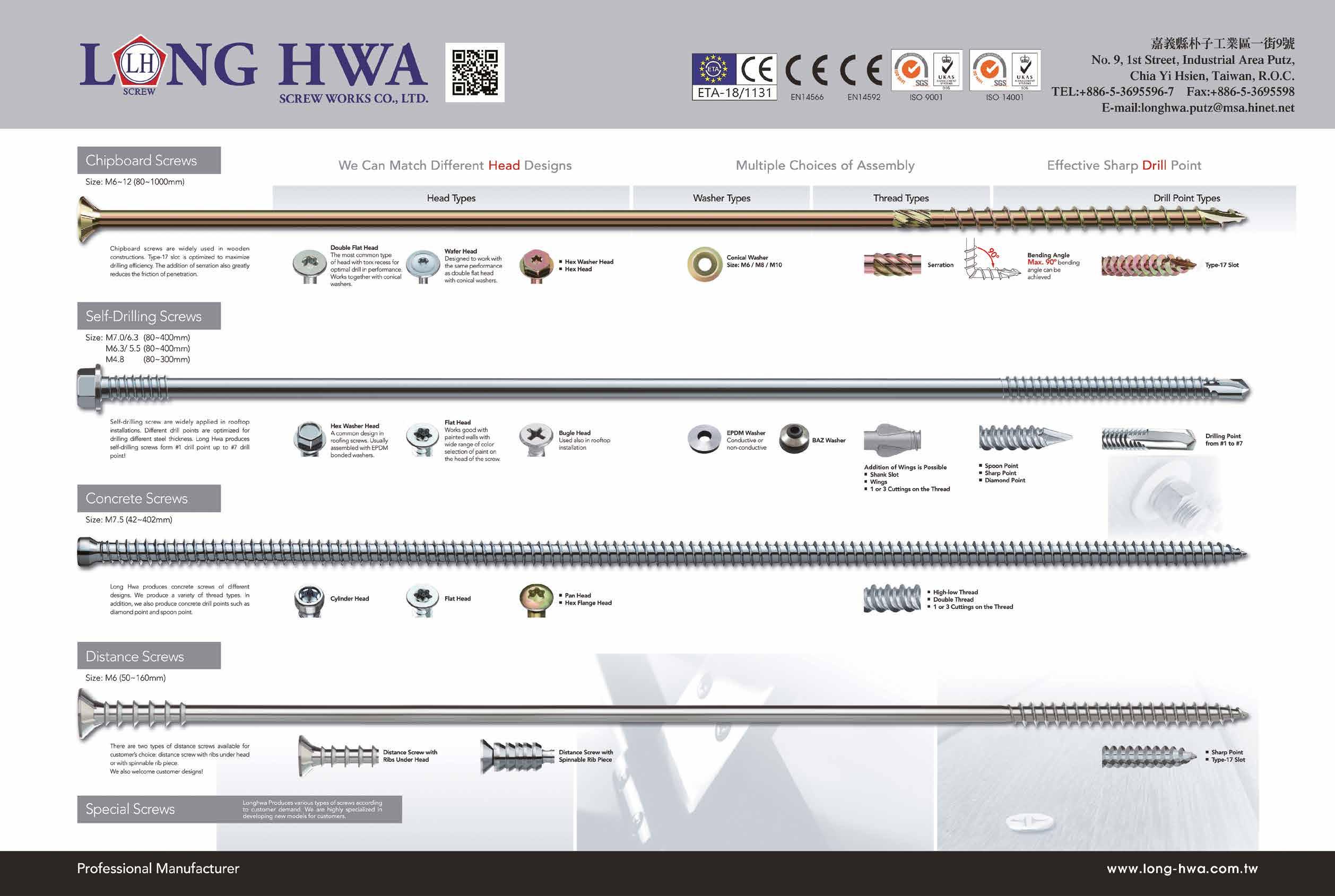

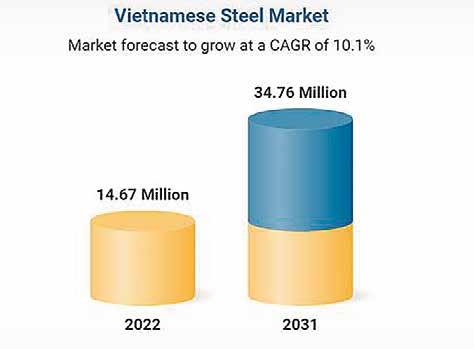

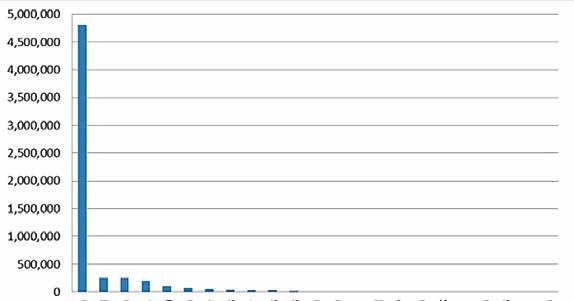

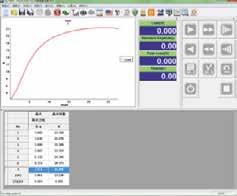

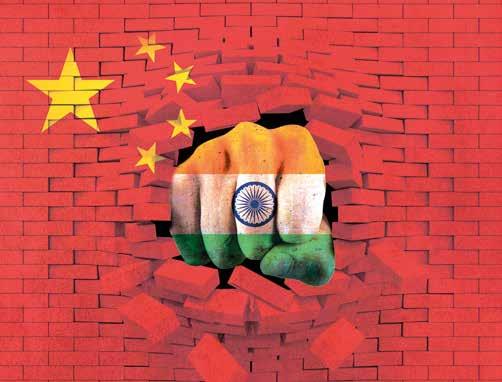

Fig. 1. Taiwan’s Global Fastener Export Value in the Past 20 Years

Fig. 2. Taiwan’s Global Fastener Export Volume in the Past 20 Years

If There is a War Across the Taiwan Strait, Will it Affect the Development of Fastener Industry?

Which Part of Taiwan Fasteners is Replaceable and Which Part is Not?

The global fastener production and sales market size is US$85 billion (20 million tons of fasteners produced), of which Taiwan's size is about US$5 billion (1.5 million tons). Compared to Taiwan's semiconductors which take up 90% of global market share, Taiwan's share of fasteners in the global market is relatively small. Taiwan's fasteners fall in the middle of the price range on average, and in the event of a war, it would not be difficult to find other countries to buy the same level of products as Taiwan. However, it is necessary to point out that, although Taiwan fasteners can be replaced in terms of price, Taiwan’s R&D capability, production management, credibility, its supply chain which is the most complete in the world, as well as high valueadded products and service satisfaction, are Taiwan's unique and irreplaceable features.

Fasteners are Not a Critical Tactical Asset

Fasteners are not an extremely critical and tactical material like semiconductors. If a war breaks out, the possibility of Taiwanese fastener factories being attacked is not high. Taiwan already has experience in establishing a complete supply chain; in addition, many Taiwanese fastener companies have set up bases overseas which have the ability to supply goods, so even if there is a war, they can quickly resume production of fasteners. On the whole, if there is a war, it won’t amount to a nuclear level of destruction on Taiwanese fasteners, and it is less likely to cause a major global panic and a major shortage of goods.

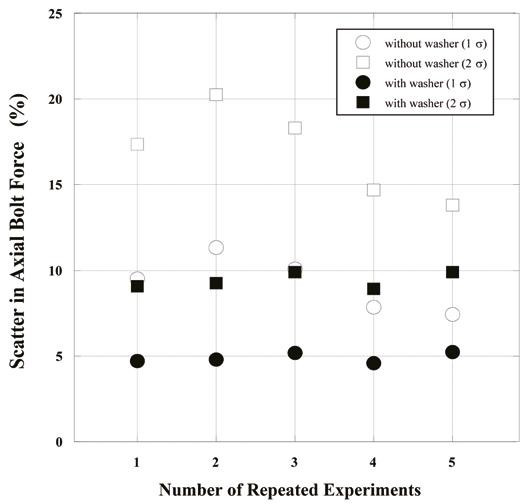

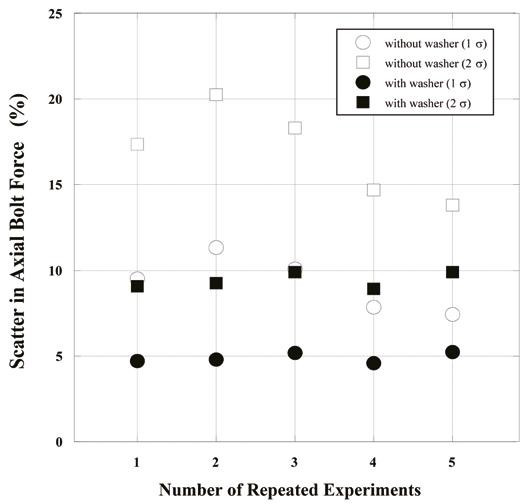

Taiwan's Fastener Trend Line Remains Unaffected

Taiwan's political ground, economic development and social security is very stable. For the past three years this had never been affected by war concerns and COVID. Even in the past 20 years, Taiwan's fastener exports have shown a 20-degree upward trend line (see Figure 1 and 2), which will only be subject to the global economic climate, but not to political and war factors.

Special Feafure 150 Fastener World no.202/2023 惠達雜誌 0 1,000,000,000 2,000,000,000 3,000,000,000 4,000,000,000 5,000,000,000 6,000,000,000 2003 2002 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021Q1-32022 Global Export Value (USD)

0 200,000,000 400,000,000 600,000,000 800,000,000 1,000,000,000 1,200,000,000 1,400,000,000 1,600,000,000 1,800,000,000 Global Export Volume (KG) 2003 2002 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021Q1-32022

Will Adding Overseas Locations Necessarily Translate to Lower Price Offer?

It is undeniable that some of the Taiwanese owners has cooperated with buyers' requests by going to Vietnam, Thailand, Indonesia, Malaysia and other places to build factories in order to diversify the risk. However, Taiwan fastener industry mostly consists of small and medium-sized enterprises (SMEs) which don’t have a high level of manpower, material resources and capital. The global fastener market climate lately is not as good as expected, and this comes with the upcoming carbon tax and costs for environmental protection, so going overseas to set up factories would mean a lot of pressure. In fact, as far as the current situation, the cost of setting up production lines in other countries is no less than the cost of production in Taiwan, which may obstruct Taiwanese owners from providing buyers with better prices and service satisfaction.

Considering all the above factors, there is no longer any requisite for direct friction between Taiwan and China. Taiwan has nothing to gain by starting a war, and furthermore China as the world's largest market is very much in line with Taiwan's economic development needs.

In the Face of Asia-Pacific Tensions, We Need Everyone on Board to Have More Confidence in Taiwanese Fasteners

After clarifying the scope of impact of Taiwan Strait tensions on Taiwan's fastener industry, we believe that buyers don't necessarily need to ask Taiwanese owners to keep up with the "+1" trend because, as already mentioned, doing so won't necessarily lead to better pricing for buyers. That said, it is not unreasonable for buyers to be concerned, and this underscores the many ways in which Taiwanese companies must make buyers feel more confident in the safety, stability and strength of Taiwan's fastener supply. As a medium for communication, Fastener World Magazine takes the responsibility to analyze the scope of impact for suppliers and buyers, hoping to open up more room for communication.

We believe buyers who have visited Taiwan would be aware that there is no war atmosphere in Taiwan. What's more, the New Taiwan Dollar and the US Dollar have become two of the world's most appreciated currencies. The price of land in Taiwan has tripled, and there has been no surge of emigration. In addition, on July 11 the U.S. Department of State maintained Taiwan's Travel Alert Risk at the safest level. Fastener World would like to urge global buyers that Taiwan fasteners are one of the most resilient, endurable and reboundable industries in the world, and we have cited Figures 1 and 2 as evidence of this. Taiwan is stepping out into the world in a way that it never could before, and because of this, we need buyers around the world to see the strengths of Taiwan fasteners and have more confidence in them, so that all of us can together continue to create mutual benefits for Taiwan and the rest of the world.

Article by Dean Tseng, Fastener World

Copyright owned by Fastener World

Copyright owned by Fastener World

Special Feafure 151 Fastener World no.202/2023 惠達雜誌

Fastener World News

compiled by Fastener World

Jim Degnan Elected NFDA President for 2023-2024

Jim Degnan of S. W. Anderson has been elected as the 2023-2024 president of the National Fastener Distributors Association. Scott McDaniel of TR Fastenings will serve as vice president, Mike Robinson of LindFast Solutions Group will serve as associate chair, and Nick Ruetz of AIS will remain on the Board as immediate past president.

Steve Andrasik of Brighton Best International, Alex Goldberg of AMPG, Scott Longfellow of Huyett, and Ed Smith of Wurth Revcar have been elected to serve on the Board of Directors effective June 13, 2023. Continuing on the NFDA Board are Gigi Calfee of Copper State Bolt & Nut, Jake Glaser of Sherex Fastening Solutions, and Melissa Patel of Field.

Recognition was paid during the meeting to retiring Board members Kelly Charles of Sems & Specials, Jon Queenin of Specialty Bolt & Screw, and Kevin Godin of AFC Industries. A special tribute was made in memory of Marc Somers of Mid-States Bolt & Screw.

Becomes Associate Member of BIAFD, British & Irish Association of Fastener Distributors

EazyStock, a leading inventory optimisation software provider, is pleased to announce its recent partnership with the British & Irish Association of Fastener Distributors (BIAFD) as an associate member. This collaboration aims to support the BIAFD’s efforts in keeping their members informed on fastener-related issues and helping the fastener industry streamline operations and increase profitability.

The BIAFD is a well-respected organisation dedicated to promoting the interests of fastener distributors throughout the UK and Ireland. As an associate member, EazyStock is excited to contribute to the association’s mission to enhance the industry’s efficiency and competitiveness.

As inventory optimisation specialists, EazyStock’s experts provide fastener industry professionals with advanced tools and techniques to set the right stock levels, manage stock replenishment, and forecast demand accurately. The result is efficient supply chain management, ensuring crucial components reach their destinations on time.

// Industry Development

U.S. DoC Launches AntiCircumvention Investigation on Carbon Alloy Steel Threaded Rods

On July 12, 2023, the U.S. Department of Commerce announced the initiation of an anticircumvention investigation of steel threaded rods and carbon and alloy steel threaded rods imported from China in response to a petition filed by U.S. firm Vulcan Threaded Products Inc. The investigation was initiated to examine whether carbon and alloy steel threaded rods made from unthreaded pins imported from China and produced in the United States circumvented existing anti-dumping and countervailing measures.

On March 26, 2008, the U.S. initiated an antidumping investigation of steel threaded rods originating in China, and on April 14, 2009, the U.S. formally imposed anti-dumping duties on China's steel threaded rods. Since then, the U.S. has conducted two sunset review investigations, issued two affirmative rulings, and extended the duty period, and the products involved in the case are listed under U.S. tariff numbers 7318.15.5051, 7318.15.5056, 7318.15.5090, and 7318.15.2095.

On March 14, 2019, the U.S. Department of Commerce initiated an anti-dumping investigation of carbon alloy steel screw rods imported from China, India, Taiwan, and Thailand, and also initiated a countervailing investigation of the products involved and imported from China and India. On February 10, 2020, the U.S. Department of Commerce issued affirmative final anti-dumping and countervailing determinations of carbon alloy steel threaded rods imported from China and India. On April 9, 2020, the U.S. Department of Commerce issued an affirmative final anti-dumping determination of carbon alloy steel threaded rods imported from India, and an affirmative final countervailing determination of carbon alloy steel threaded rods imported from India. The U.S. formally imposed anti-dumping duties on China's carbon alloy steel threaded rods and, at the same time, imposed countervailing duties on China's and India's carbon alloy steel threaded rods, which involved the products under U.S. Tariff codes 7318.15.5051, 7318.15.5056, 7318.15.5090, and some of the products under Tariff codes 7318.15.2095, 7318.19.0000, and the products under tariff codes 7318.15.2095, 7318.19.0000, and 7318.19.0000 products.

惠達特搜全球新聞 152 Fastener World no.202/2023 惠達雜誌

// Association News//

//

Fastener World no.202/2023 153

UK Signs Agreement to Join CPTPP, Effective as Soon as H2 2014

After nearly two years of negotiations, the British Minister for Business and Trade, Kemi Badenoch, officially signed to join on July 16th in New Zealand when participating in the ministerial meeting of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

This is the largest trade agreement since UK left the European Union. In the future, more than 99% of UK exports to CPTPP countries will be exempt from tariffs, and together with UK, the combined GDP of CPTPP countries will reach 12 trillion pounds, accounting for 15% of the global GDP. The agreement is expected to come into effect in the second half of next year after it passes the review and legislation of the British Parliament. Meanwhile, the CPTPP member countries are gathering information on other applicant countries, such as Taiwan and China, to determine whether they meet the high standards for membership.

Taiwan Climate Change Agency: EU Must Adjust Free Allocations in CBAM or It Will Create Trade Barrier

CBAM will be launched on a trial basis in October. Initially, no fee will be charged, but importers will be required to submit carbon emission data. The Deputy Director of Preparatory Office of Climate Change Agency (Taiwan) said that CBAM is mostly based on a free allocation system which will be turned into an auction-based system starting in 2034. The price is about 100 euros per ton which is high, but because of the adoption of free allocation for most of the emitted carbon, only a small fraction of about 2 to 3% of the carbon emissions need to pay a carbon fee, which is different from Taiwan which charges a fee on every ton of carbon. Therefore, when CBAM is officially on the road in 2026, the European Union must adjust the free allocation method and integrate with the calculation method of every country, otherwise it will form a different trade barrier.

South Africa Extends Fastener Safeguard Measures for 3 Years

South African International Trade Administration Committee (ITAC) decided, from July 24 this year, to extend the three-year hightariff defense measures on steel or iron screws, bolts and hexagonal nuts. The measure is divided into three phases to respectively levy 48.04%, 46.04% and 44.04% defense duty.

SAFMA's provided information to apply for the extension of the measure includes initial recognition that the South African fastener industry in the original defense measures (August 1, 2020 to July 31, 2023) has carried out industrial adjustment, but if the defense measures are terminated, the South African industry will suffer from the reduction in sales, shrinkage of production capacity, declined market share and labor employment, and reduction in equipment utilization and revenue, among other damages; therefore, it was decided to extend the defense measures and finally a decision on the extension of the defense measures was made.

Malaysian Government Develops Strategic Roadmap to Accelerate Energy Transformation

Malaysia has revised its Nationally Determined Contribution (NDC) to reduce greenhouse gases by 45% by 2030, Prime Minister Anwar Ibrahim said in his keynote speech at the Asian Energy Congress 2023. The country's efforts to realize the NDC have been incorporated into the 12th Malaysia Plan (12MP) and the National Energy Policy 2022-2040 (NEP 2040).

The Malaysian government is in the process of developing several strategic roadmaps, including the National Energy Transformation Roadmap (NETR) and the Hydrogen Economy and Technology Roadmap. The most important of these is the National Energy Transformation Roadmap, which will be supported by the hydrogen economy and the Technology Roadmap and will pave the way for Malaysia to achieve environmental sustainability and long-term energy security through technological innovation. Both roadmaps are expected to be launched in the second half of 2023.

Meanwhile, Malaysia continues to recognize that natural gas plays an important role in the energy mix and is one of the cleanest hydrocarbons for the transition to a low-carbon economy. At the same time, the Malaysian government is committed to joining the Global Methane Pledge to reduce methane emissions by 30% by 2030.

Vietnam to Start Construction of 5 Major Transportation Projects by the End of 2023

Uong Viet Dung, Director of the Office of the Ministry of Transportation of Vietnam, said on July 10, 2023 at a meeting on the Ministry's first-half results and secondhalf work plan, that by the end of this year, the ministry will start five major transportation projects, including the crossroads connecting Cho Chu and Trung Son, a road connecting Rach Soi and Ben Nhat, a road connecting Go Giao and Vinh Thuan, an expressway connecting Hoa Lien and Tuy Loan, and Dai Ngai Bridge, which pass through the roads of Ho Chi Minh City.

Fastener World News 154 Fastener World no.202/2023 惠達雜誌

Director Uong said that in the first half of the year, the ministry has completed and started operating a number of major transportation projects to meet the demand for usage, including the expressway connecting Phan Thiet to Dau Giay, Vinh Hao to Phan Thiet, and Nha Trang to Cam Lam. In addition, the upgrade of the railroads from Hanoi to Vinh City and from Vinh City to Nha Trang City has been completed.

Not Just the Next China! India to Become a Superpower Economy According to Research

Due to the U.S.-China technology war that continues to push India's position in the international market, the U.S. research institute Riedel pointed out that India is not the new China, that it will be in accordance with its own rhythm and pace forward. The institute is optimistic that India will be able to achieve high growth as a super emerging power.

CNBC reported that David Riedel, CEO of Riedel, prefers and is very optimistic about India over China because the Indian economy is much larger than China's. In addition, he believes that India's economy is likely to exceed expectations over the next six months to two years, and he emphasized that "India, whether in the past or the future, is a very different country from China".

However, India also has some problems to solve. India's economy has long been stagnant in the middle-income level, and has not yet entered the ranks of high-income countries, but David Riedel

believes that India will have the opportunity to achieve higher economic growth than expected in the future.

On the other hand, the economic outlook for China is a little bleaker. David Riedel predicts that China will not be as strong in the next five years as it has been in the past five years, as more and more foreign companies decide to move their supply chains and factories out of the country, resulting in more and more young people being unemployed in China, with the unemployment rate of young people between the ages of 16 and 24 climbing to a record high of 20.8% in May, according to statistics.

In addition, China recently released a series of lower-thanexpected economic data, from which we can see that its economic growth trend is gradually slowing down. In addition, China's factory activity has been in contraction for the third consecutive month. China's manufacturing PMI (Purchasing Managers' Index) was 49 in June and non-manufacturing PMI was 53.2, both a record low this year.

Fastener World News 156 Fastener World no.202/2023 惠達雜誌

Indian Steelmakers May be Mandated to Use Partial Capacity for Green Steel Manufacturing

Green steel refers to the production of steel without relying on any fossil fuels. Union Steel Minister Jyotiraditya Scindia hinted that the Indian government may make it mandatory for steelmakers to devote a part of their capacity to green steel manufacturing in the future. The government may also look at ways to ensure greater usage of the green steel in government projects as well, he added.

Scindia said the private sector steel users in India are actually moving towards committing to more and more green steel in their projects and also noted that some manufacturers have already launched branded green steel products. The minister said breakthrough technologies and disruptive innovations like hydrogen-based steelmaking coupled with carbon capture, utilisation and store (CCUS) hold huge promise for the future.

He said India has emerged as the epicentre for the evolution and growth of the steel sector globally and has been able to achieve landmarks like production touching 125 million tonnes and consumption growing over 11 percent in the last nine years. In 2022, even as the global finished steel production declined by 4.2 percent, India could post a 6 percent growth, he said, adding that the per capita steel consumption has now increased to 78 kgs from 57 kgs in 2014.

The overall growth has made investors interested in the sector and the government in March, signed 57 pacts with 27 companies under the production-linked incentive (PLI) scheme, which will add 25 million tonnes to the steel capacity, he said. The capacity addition will see investments of Rs 30,000 crore and also create 60,000 jobs, he added.

New Zealand Subsidizes Green Electricity Steelmaking, Equivalent to Reducing Carbon Emission of 300,000 Cars

On May 21st, 2023, New Zealand announced the implementation of the largest carbon reduction program in the country's history. The government will spend US$140 million to subsidize the steel giant NZ Steel, which expects the steel mill in Glenbrook to switch from coal-based steelmaking to renewable electricity, a policy that the government says is equivalent to cutting carbon emissions from 300,000 running cars.

"The grant program demonstrates the importance the New Zealand Government places on reducing carbon emissions as quickly as possible, and working with NZ Steel on this program will have significant environmental benefits and accelerate New Zealand's decarbonization process. This partnership is only possible because of government funding," said Prime Minister Higgins.

The New Zealand government mentioned that the US$140 million subsidy to NZ Steel was drawn from the Government's Carbon Reduction and Transformation Industry Fund (GIDI).

Fastener World News 157 Fastener World no.202/2023 惠達雜誌

With a total amount of US$650 million, GIDI not only assists New Zealand's R&D in carbon reduction technology, but also works with industry and government to reduce carbon emissions and accelerate the establishment of a zero-carbon energy system.

If this carbon reduction program runs smoothly, it is estimated that New Zealand's carbon emissions will be reduced by 800,000 tons per year, which is equivalent to removing the carbon emissions of all cars in Christchurch, the largest city in New Zealand's South Island.

NZ Steel accounts for 2% of New Zealand's annual greenhouse gas emissions. However, once this decarbonization program is achieved, it will reduce New Zealand's total carbon dioxide emissions by 1%, help New Zealand achieve its Net Zero goal by 2050, and move towards the vision of "limiting global warming to be within 1.5 degrees Celsius".

Climate Change Minister James Shaw believes the program will help the government reduce its carbon tax bill in the long term, saying, "This program will reduce New Zealand's carbon emissions by about 5.3% in the second phase of the carbon budget from 2026 to 2030, and by about 3.4% in the third phase of the carbon budget from 2031 to 2035."

China Sold 3.74 Million New Energy Vehicles in H1 2023

According to the China Association of Automobile Manufacturers (CAAM), China's automobile production reached 13.248 million units and sales reached 13.239 million units in January-June 2023, up 9.3% and 9.8% respectively. Among them, new energy vehicles continued to grow rapidly, with production reaching 3.788 million units and sales reaching 3.747 million units, up 42.4% and 44.1% respectively.

In terms of vehicle types, from January to June, the production of passenger cars reached 11.281 million units, and sales reached 11.268 million units, an increase of 8.1% and 8.8% respectively. During the same period, the production of new energy vehicles reached 3.788 million units and sales reached 3.747 million units, an increase of 42.4% and 44.1% respectively.

China's vehicle exports also increased, reaching 2.14 million units in January-June, up 75.7%. In terms of vehicle types, 1.78 million passenger cars were exported, an increase of 88.4%, while 361 thousand commercial vehicles were exported, an increase of 31.9%. Exports of new energy vehicles amounted to 534 thousand units, an increase of 1.6%.

// Companies Development

Bossard (Shanghai) Introduces a Simulated Assembly Workstation to Increase Test Torque to 350 Nm

NAFCO Orderbook Full Through 2024

Demand in the aerospace market has increased dramatically following the end of the pandemic, boosting sales of fasteners for NAFCO. NAFCO said the shortage of materials has been alleviated, and orderbook is full through next year. In 2022, NAFCO's revenue recovered to 75% to 80% of its pre-epidemic level. It is still difficult to estimate the growth rate of the whole 2023. We will have to wait and see how the market fluctuates.

NAFCO specializes in aerospace and automotive fasteners, with fasteners for aerospace engines in particular being the mainstay. Last year, aerospace fasteners and machined parts accounted for 83.43% of the company's total revenue, while industrial fasteners accounted for 16.57%.

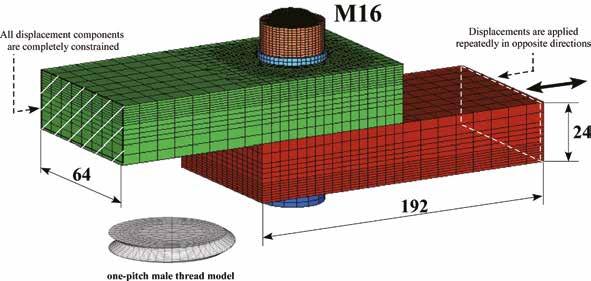

This assembly simulation system is equipped with a robotic arm that simulates actual assembly conditions to obtain the torque and angle relationships of the assembly setup, thus verifying the accuracy of the assembly process.

"The accuracy of the high torque assembly process is important for critical applications in industries such as rail transportation and automotive. The introduction of the simulated assembly workstation means that we are in a position to help these customers solve the problems they may encounter in high torque threaded connection applications by helping them to find and validate suitable solutions," said the engineering department of Bossard Fastening Solutions (Shanghai).

In addition, when coupled with ultrasonic equipment, the simulated assembly system can also obtain fastening parameters such as torque, angle, axis force, coefficient of friction, coefficient of torque, and a variety of assembly parameter curves of the threaded connection during the fastening process, which is conducive to a more detailed analysis of threaded connection.

Fastener World News 158 Fastener World no.202/2023 惠達雜誌

// ®

Fastener World no.202/2023 159

Altenloh, Brinck & Co. Celebrates 200 Year Anniversary

ALTENLOH, BRINCK & CO (ABC) is celebrating an unbelievable milestone of two centuries of existence! Founded in 1823 in the town now known as Ennepetal, Germany, ABC was the first in that country to produce screws on an industrial scale and looks back on a long tradition dedicated to innovative progress. The most well-known product manufactured by the global, family-run company is the SPAX screw, which revolutionized the fastener sector and continues to be one of the most innovative fasteners in the marketplace today.

BUMAX Selected for Demanding Ultrasonic Welding Application

Swedish fastener manufacturer BUMAX has been selected to provide fasteners to be used in machines for ultrasonic metal welding. The client is Schunk Sonosystems, a global leading specialist in the field of ultrasonic metal welding.

German specialist machine maker Schunk Sonosystems has decided to use BUMAX DX 129 screws for all its ultrasonic welding flexure sonotrode products to further improve quality and reliability. The machines are mainly used in the automobile industry.

Vossloh Secures Another Major Contract for the Delivery of Rail Fastening Systems in China

Vossloh has again received a major order to supply rail fastening systems for the construction of a high-speed line in China. The line connects the two cities of Xiong'an in Hebei Province in the north and Shangqiu in the central Chinese province of Henan. The order has a sales volume equivalent to almost €50 million and underlines Vossloh's continued strong market position in the important Chinese market.

With a planned route length of over 600 kilometers and speeds of up to 350 km/h, this line will make a significant contribution to improving the mobility of the population and to the economic development of the region. The deliveries of the rail fastening systems will mostly take place in 2024.

"The contract is further proof of the trust and recognition we enjoy in China," says Oliver Schuster, CEO of Vossloh AG, adding: "This order confirms our technological excellence and our ability to provide innovative and reliable fastening solutions that can withstand the highest loads. Vossloh has been making a significant contribution to the development of modern and sustainable transport infrastructure in China for 17 years now."

The Chinese high-speed network currently covers just over 40,000 kilometers and is set to grow significantly further. By 2035 it is expected to have been extended to over 70,000 kilometers. The Vossloh Group is represented in China, among others, by its subsidiary Vossloh Fastening Systems China Co. Ltd. based in Kunshan. The company employs around 120 employees and is one of the leading local suppliers of rail fastening systems, especially for highly demanding applications on high-speed lines.

Tesla in Talks with India to Locally Produce 500,000 EVs a Year

"Standard steel bolts simply cannot cope with the extreme pulling and bending forces of ultrasonic vibration, so we had to find a bolt that does,” said Stefan Mueller, Head of R&D at Schunk Sonosystems. “Of all the screws we tested, only BUMAX met all our needs. Not only are BUMAX consistent in how they perform and do not break, they last the lifetime of the sonotrode without problem, are not creating abrasion dust on the screw head and do not require rust protection.”

The BUMAX DX 129 (Duplex stainless steel) offers very high tensile strengths of minimum 1,200 MPa and excellent fatigue resistance properties. It deals successfully with extreme forces during the ultrasonic welding process, such as 20,000 vibrations per second.

Tesla is in close discussion with the Indian government on an investment plan, and there is hope for a Tesla plant in India to manufacture electric vehicles, with an estimated annual production capacity of 500,000 units. Tesla intends to expand the electric vehicle market in the IndoPacific region by using India as an export base. Since the automotive industry's supply chain was disrupted by the China's lockdown during the pandemic, many car manufacturers have begun to look for alternative production bases in Asia, favoring India.

Craig Irwin, Managing Director of Roth Capital Partners, said, "Tesla will need to penetrate all regional markets if it is to realize its long-term growth goals. The challenges that Tesla faces in China emphasize the fact that India is the answer to all of Tesla's problems. Tesla needs India."

But Tesla's plan to enter the Indian market has had many twists and turns. Tesla has been planning to sell electric cars in India since a few years ago, but the Indian government has imposed a 100% tax on imported electric cars. Tesla has repeatedly asked India to reduce the import tax, but last year the Indian government rejected the request,

Fastener World News 160 Fastener World no.202/2023 惠達雜誌

Fastener World no.202/2023 161

which led to a deadlock between the two sides. Tesla was originally reluctant to take the risk of manufacturing electric vehicles in India, hoping to export electric vehicles to India to test the waters before considering it. In May this year, India's commerce and industry ministers returned to the negotiating table with Tesla representatives, revealing that the Indian government intends to provide subsidies and tax breaks to allow Tesla to reconsider investing in its India plant.

According to insiders, what Tesla cares most about is not only government subsidies and tax breaks, but also bringing its own supply chain to India, but the Indian government wants Tesla to use the existing supply chain of the local automobile industry in India. "We asked Tesla about their specific needs for parts and tried to convince them to source parts from the Indian EV supply chain, but they already have long-standing suppliers," an Indian official said. We are hoping for a breakthrough in the initial negotiations."

Tong Ming Enterprise Launches Online Tong Ming Plaza

On June 20, 203, Tong Ming Enterprise has put up and officially launched a new platform called Tong Ming Plaza which displays customized fasteners. This trading platform is designed for buyers who need to purchase non-standard fasteners. Buyers and sellers can communicate with each other instantly and conduct transactions online. There are thousands of suppliers on the platform offering customized products, allowing buyers to enjoy one-stop purchase through this platform.

Finework (Hunan) Now Listed on Shenzhen Stock Exchange

On June 15, 2023, Finework (Hunan) New Energy Technology got listed on Shenzhen Stock Exchange. Over the past 11 years, Finework has grown into an enterprise specializing in the R&D and manufacturing of high-end fasteners. Their pre-embedded screws used on wind turbine blades have gained the highest market share in the world, and they have become the world's leading enterprise in fasteners for wind power, with an output value of RMB 1.34 billion in 2022. It is estimated that Finework has already accounted for 15% of the global wind power fastener market. Meanwhile, Finework is rapidly expanding its business to high-end equipment fields such as aerospace, gas turbines and oil, and has made great progress.

Fastener World News 162 Fastener World no.202/2023 惠達雜誌

Commercial Metals Company Acquires EDSCO Fasteners LLC

Commercial Metals Company ("CMC") announced the purchase of EDSCO Fasteners LLC ("EDSCO"), a leading provider of anchoring solutions for the electrical transmission market, from MiddleGround Capital. EDSCO's custom engineered line of anchor cages, bolts, and fasteners are manufactured principally from rebar and used primarily to secure high voltage electrical transmission poles to concrete foundations. EDSCO serves the North American market from four manufacturing plants located in Texas, Utah, Tennessee, and North Carolina. Since its founding in 1985, the company has grown to become the nation's largest provider of anchor cages for concrete reinforcement and has developed a strong reputation for customer service and reliability.

"This acquisition further advances CMC's leadership position in construction reinforcement and extends our capabilities to new and growing applications," said Barbara R. Smith, Chairman of the Board and Chief Executive Officer. "EDSCO's innovative reinforcement solutions are well-positioned to benefit from the long-term transition to renewable energy, which will require extensive investment in electrical transmission capacity and wind power installations."

Bulten Enters into Agreement to Acquire Exim & Mfr Holdings Pte Ltd