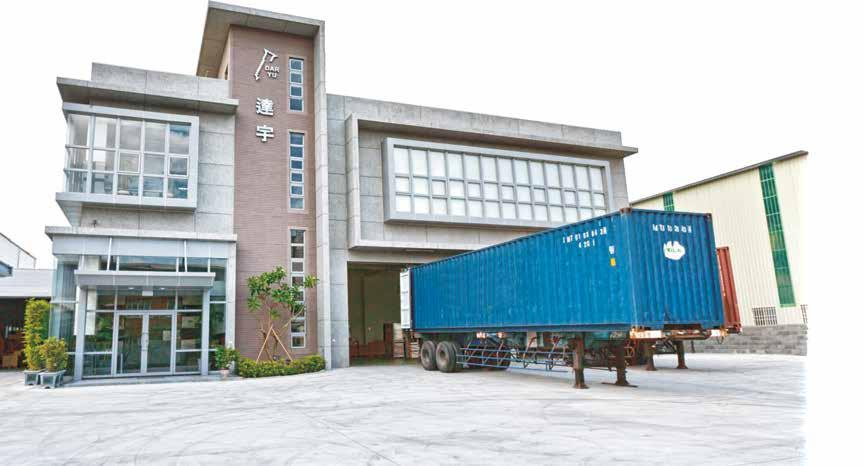

Catch this slogan: “Green Era, Green Bi-Mirth.” It is sure to stay in the memory of global fastener buyers with Low Carbon Tactic 2024 proclaimed by this company which is widely known for construction screw products. Taiwan is one of the first in the Asia Pacific fastener supply chains to have reacted to ESG, carbon reduction and CBAM requirements. On the front line of global customer demand, Bi-Mirth prepared early before the pilot phase of CBAM, and now it is tapping into the GREEN manufacturing, following its two growth pillars. This cover story delves into its latest development.

The company told Fastener World Magazine that almost all its European customers are eager to know if Bi-Mirth is CBAM-ready, and the answer is no doubt affirmative. “We submitted the CBAM report to each customer before the deadline and we are in contact with our customers on how we can modify or improve our CBAM report. On the American side, we are actively monitoring Clean Competition Act which may start this year. We are looking to act accordingly as it comes up in the future.”

Diverse carbon reduction measures have been introduced into the production line. In the past two years, Bi-Mirth invested a lot in the oil filtration system in order to clean and recycle used oil. This process reduces the emission and also helps recycle some oil during the production. This year it is going to implement digitization in the manufacturing process which will include monitoring electric use on each manufacturing process. This way, Bi-Mirth can see where and what is needed to be improved upon to make the process more energy efficient and reduce manufacturing steps, unnecessary wastes and carbon emission.

The production line will systematically implement three guidelines to reduce carbon emission: Diagnosis, Implementation, and Review. Every manufacturing process needs to be diagnosed to locate emission factors, and an action plan is implemented to look for ways to reduce carbon. This is followed by a constant review on how much carbon emission has been reduced to reach lower emission year by year and pave the way to acquire the following two ISO certifications.

“We are looking to lower our carbon footprints because we understand this is the only way to move forward in the fastener industry, said the company. That is why the target this year is to get certified to Greenhouse Gas Accounting and Verification (ISO 14064-1), as well as Energy Management System Certification (ISO 50001). Plus, Bi-Mirth is in the process of installing solar panels on all its factories and is actively finding alternative methods to reduce carbon footprints.”

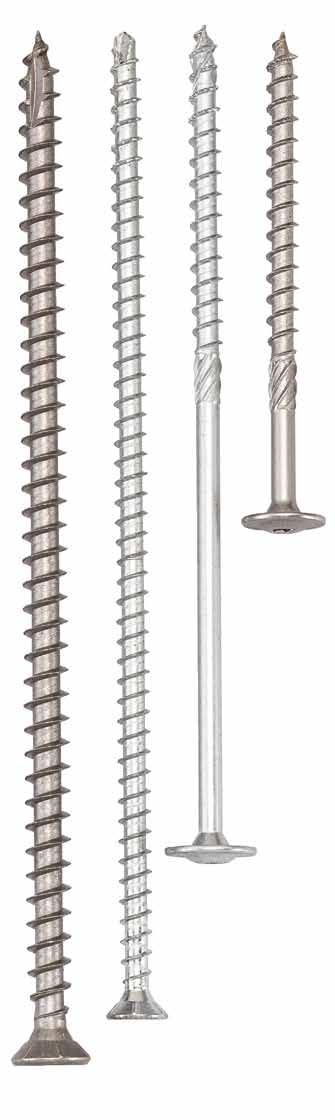

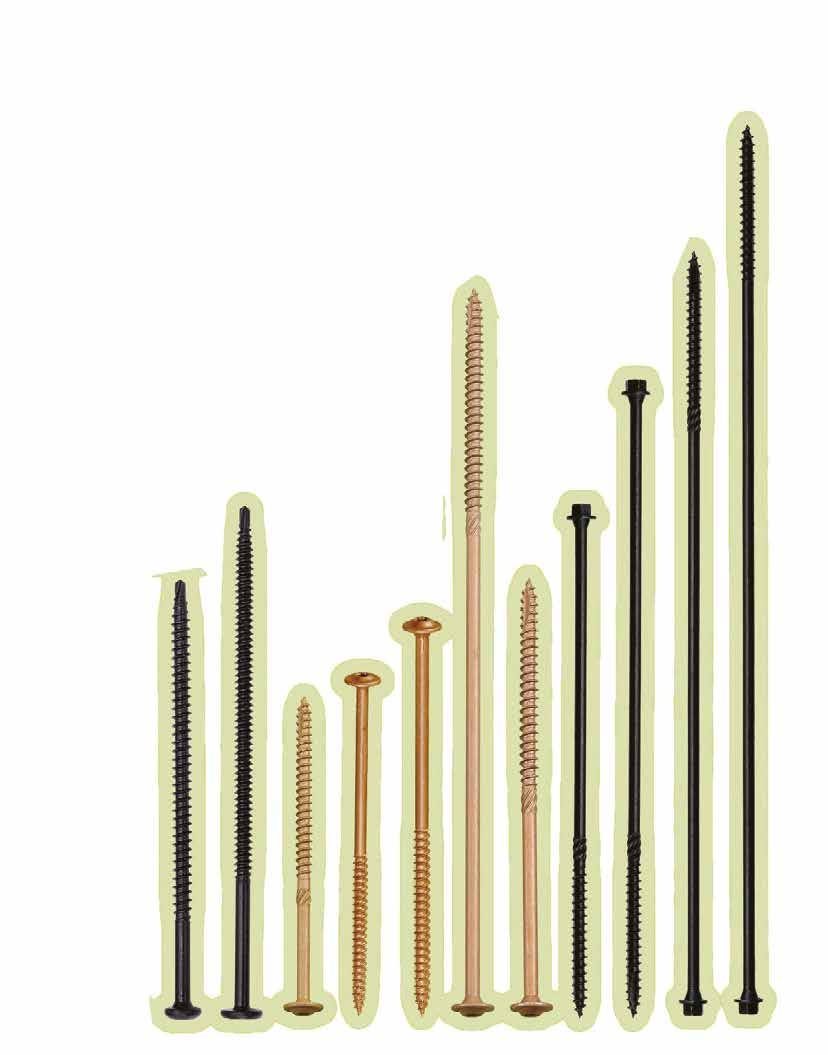

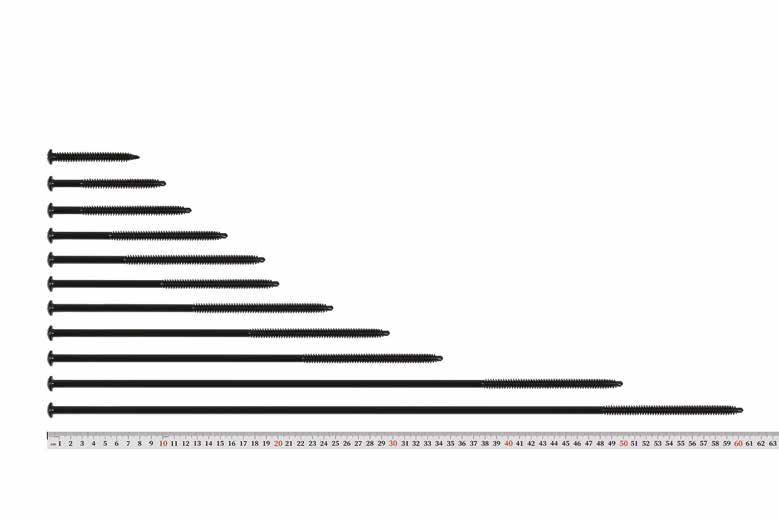

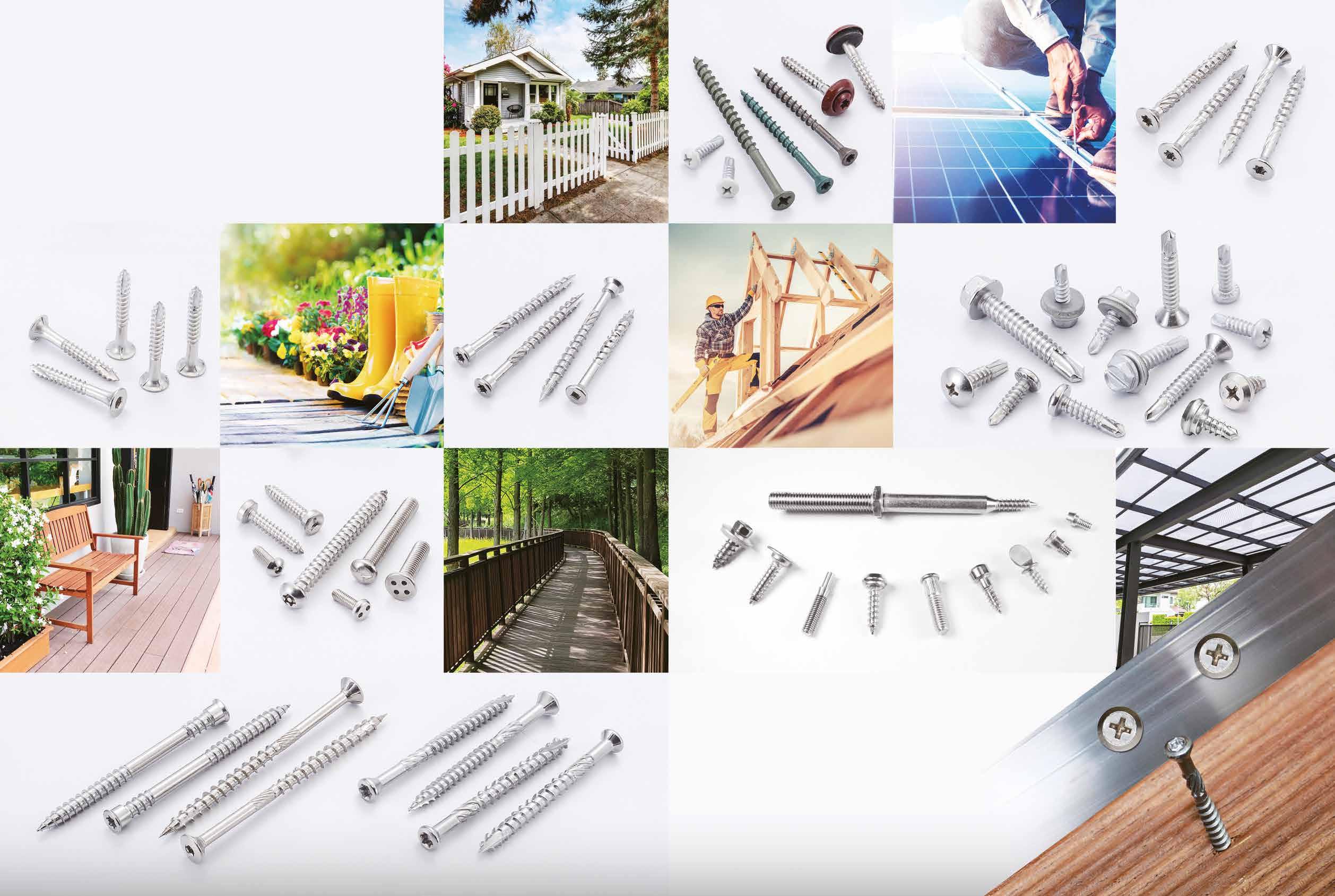

Parallel with low carbon production are Bi-Mirth stainless steel long screws now being featured in 2024. These include chipboard screws, selftapping screws and self-drilling screws, all compliant to international standards and are able to penetrate 1+1 mm steel plates. Other products include long bi-metal self-drilling screws. No matter if the material is carbon steel or stainless steel, the roadmap of the company’s future is to develop special long products.

As Bi-Mirth explained, inventory level remains high at American and European customers’ end, and the inflation has caused market contraction; therefore, demand is yet to return to the level as before. “Customers need screw products in good quality and low price, and that puts the pressure on the manufacturers. This is also why we expand on special carbon steel and stainless steel screws,” said the company.

In response to customers’ demand mentioned above, Bi-Mirth has put up 6 plans for 2024:

● Improve screw product quality and help customers secure market shares with high performing products

● Continuously monitor and roll out products that meet market demands

● Dedication to developing and improving stainless steel screws and new products

● High investment in energy-saving measures and production equipment

● Continuously improve production efficiency

● Diverse optimization to provide the market with acceptable prices

Bi-Mirth stressed its will to bring low-carbon and high value-add products to the world: “In this competitive environment, we have to make new and innovative products, but at the same time, we need to lower our carbon emission in order to be in the fastener industry. If we are not doing any carbon reduction, there is no chance for us to be in the market as the trend is moving towards net zero.” Challenges are lurking around and survival is anything but easy. There is no time for fastener companies to hesitate or linger. Bi-Mirth will continue the path of green manufacturing.

Contact: Bi-Mirth Sales Team

Email:sales@bimirth.com.tw

199 310EXPRESS COMPANY (Japan)

Security, Tamper Proof, Anti-theft Screws...

240 A-PLUS SCREWS INC.

Chipboard Screws, Customized Special Screws / Bolts...

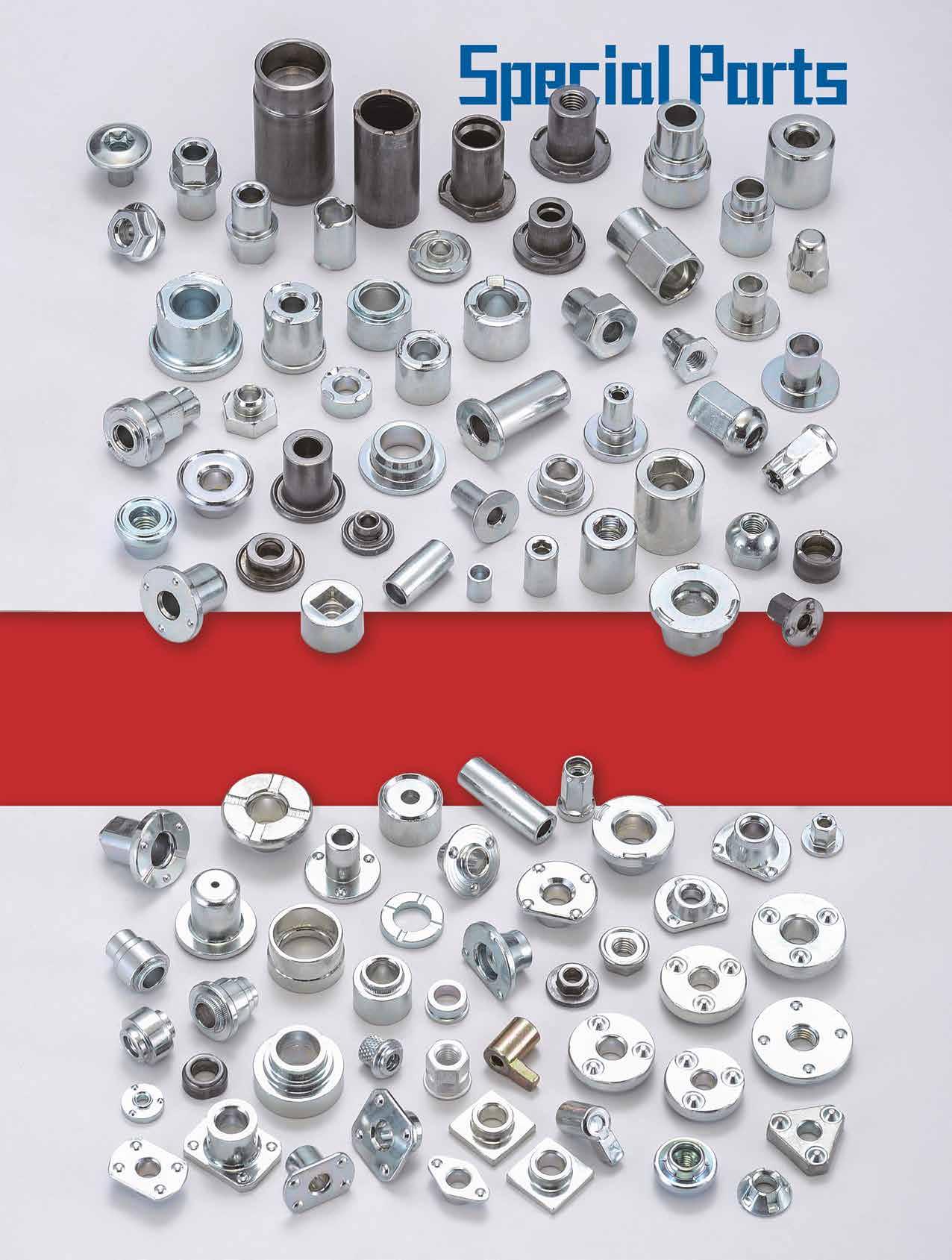

177 A.I.M.Y. CO., LTD. 宸欣

Special Parts...

294 ABC FASTENERS CO., LTD. 聯欣

Drop-in Anchors, Expansion Anchors, Wire Anchors...

183 ACHILLES SEIBERT GMBH (Germany)

Tapping Screws, Drilling Screws, Thread Rolling Screws...

193 ADVANCED GLOBAL SOURCING LTD. 金永佳

Screw, Nut, Bolt, Machining / Stamping / Spring Parts...

96 AEH FASTEN INDUSTRIES CO., LTD. 鉞昌

Clevis Pins, Dowel Pins, Hollow Rivets...

45 ALEX SCREW INDUSTRIAL CO., LTD. 禾億

Button Head Cap Screws, Button Head Socket Cap Screws...

88 AMBROVIT S.P.A. (Italy)

Chipboard Screws, Combined Screws, Machine Screws...

129 AMPLE LONG INDUSTRY CO., LTD. 寬長

Hollow Rivets, Drive Rivets, Semi-tubular Rivets...

306 ANCHOR FASTENERS INDUSTRIAL CO., LTD. 安拓

ETA Series, Anchor Bolts, Anchor Nuts, Automotive Parts...

67 APEX FASTENER INTERNATIONAL CO., LTD. 嵿峰

Nuts, Wing Nuts & Bolts, Turning Parts, Stamping Parts

80 ARUN CO., LTD. 鉅耕

Bi-metal Screws, Chipboard Screws, Drywall Screws...

154 ASCCO INTERNATIONAL CO., LTD. 今大唯

Chipboard Screws, Drywall Screws, Wood Screws, Tapping Screws...

104 AUTOLINK INTERNATIONAL CO., LTD. 浤爵

Automotive Screws, Machine Bolts, Flange Nuts...

143 AVIOUS ENTERPRISE CO., LTD. 艾伯斯

Chipboard Screws, Drywall Screws, Flange Screws...

92 BCR INC. 必鋮

Automotive Screws, Piston Pins, Weld Bolts (Studs)...

205 BEAR FASTENING SOLUTIONS, INC. 雄益

120

IFI, DIN, ISO, JIS standard, Drywall Screws, Decking Screws

BESTWELL INTERNATIONAL CORP. 凱壹

Eye Bolts, Flanged Head Bolts, Hanger Bolts...

252 BIING FENG ENTERPRISE CO., LTD. 秉鋒

Blind Nut Formers, Multi-station Cold Forming Machines...

29 BI-MIRTH CORP. 吉瞬

Stainless Steel Screws, Chipboard Screws, Timber Screws...

2 BOLTUN CORPORATION 恒耀工業

Automotive Screws, Bushes, Conical Washer Nuts...

239 CANATEX INDUSTRIAL CO., LTD 保力德

Nuts, Turning Parts, Bolts, Plastic Injection Parts...

250 CHAN CHANGE MACHINERY CO., LTD. 長薔

Screw Head Machines, Bolt Former, High Performance Former...

145 CHANG BING ENTERPRISE CO., LTD. 彰濱

Hook Bolts, Holders / Hooks / Rings, Dowel Screws...

223 CHANG YI BOLT CO., LTD. 長益

6 Cuts/ 8 Cuts Self Drilling Screws, A2 Cap Screws...

254 CHI NING COMPANY LTD. 旗林 Machine, Nuts, Tooling...

52 CHIAN YUNG CORP. 將運 SEMS Screws

185 CHIEH LING SCREWS ENTERPRISE CO., LTD. 捷領

Screws, Nuts, Hexagon Keys, Lug Wrenches, Rivets...

255 CHIEN TSAI MACHINERY ENTERPRISE CO., LTD. 鍵財

Thread Rolling Machines

91 CHIN LIH HSING PRECISION ENTERPRISE CO., LTD. 金利興 Automotive Nuts, Brass Inserts, Bushes, Bushings...

CHIN TAI SING PRECISION MANUFACTORY 金泰興

Self-clinching Nuts, Brass Inserts...

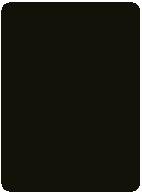

246 CHING CHAN OPTICAL TECHNOLOGY CO., LTD. 精湛

Eddy Current Sorting Machines, Fastener Makers...

134 CHIREK FASTENER CORPORATION 錡瑞

Stainless Steel Fasteners, Self-Drilling Screws, Washers...

60 CHONG CHENG FASTENER CORP. 宗鉦

Cap Nuts, Coupling Nuts, Conical Washer Nuts...

152 CHU WU INDUSTRIAL CO., LTD. 雷堤

Combined Screws, Customized Special Screws/Bolts...

126 CHUN YU WORKS & CO., LTD. 春雨

Drywall Screws, Socket Head Cap Screws , TC Bolt Sets...

212 CONTINENTAL PARAFUSOS S.A. 巴西商友暉

Automotive Part & Nut, Home Appliance Screws, Sems...

147 COPA FLANGE FASTENERS CORP. 國鵬

Hex Nuts, Hex Flange Nuts, Combi Nuts, Weld Nuts...

211 CO-WEALTH ENTERPRISE CO., LTD. 竟丞

Spring Pins, Flange Washers, Sems Washers...

85 CPC FASTENERS INTERNATIONAL CO., LTD. 冠誠

Stainless Steel, Bi-metal Self-drilling Screws...

37 DA YANG ENTERPRISE CO., LTD. 大楊

Special Automotive Nuts, Special Weld Nuts...

266 DAH-LIAN MACHINE CO., LTD. 大連

Fastener Maker, Thread Rolling Machines, Heading Machines...

102 DAR YU ENTERPRISE CO., LTD. 達宇

Chipboard Screws, Drywall Screws, Screw Nails…

289 DE HUI SCREW INDUSTRY CO., LTD. 德慧

Drywall Screws, Decking Screws, Self-drilling Screws, Roofing Screws...

148 DICHA FASTENERS MFG 集財

Expansion Anchors, Sleeve Anchors, Nylon Nail Anchors...

21 DIN LING CORP. 登琳

Chipboard Screws, Drywall Screws, Furniture Screws...

136 DRAGON IRON FACTORY CO., LTD. 龍昌

Bi-metal Self-drilling Screws, Sheet Metal Screws...

132 DRA-GOON FASTENERS INC. 丞曜

Chipboard Screws, Phillips Head Screws, TEK Screws...

86 DUNFA INTERNATIONAL CO., LTD. 敦發

Bushes, Spacers, Automotive Parts, Tubes, Turning Parts...

145 DYNAWARE INDUSTRIAL INC. 盈洋

Standard & Non-standard Fasteners...

50 E CHAIN INDUSTRIAL CO., LTD. 毅程

Chipboard Screws, Drywall Screws, Machine Screws...

192 EASON TECH INDUSTRIAL CO., LTD. 鈺森

Spring Pins, Cage Nuts, Clip Nuts, Retaining Rings...

215 EFFCO FINISHES & TECHNOLOGIES PVT. LTD. (India)

Zinc Flake Coating Technology...

217 EMEK RIVETS & FASTENERS CO. LTD. (Turkey)

Rivet Nuts, Spacers & Round Nuts, Tubular Rivets, Special Screws...

130 FAITHFUL ENGINEERING PRODUCTS CO., LTD. 誠毅

Anchors, Box Nails, Door/Window Accessories...

53 FALCON FASTENER CO., LTD. 鉮達

Automotive & Motorcycle Special Screws / Bolts...

4 FANG SHENG SCREW CO., LTD. 芳生

Shoulder Bolts, Button Head Socket Cap Screws..

79 FASTENER JAMHER TAIWAN INC. 占賀

Automotive Nuts, Blind Nuts / Rivet Nuts, Bushings...

48 FASTNET CORP. 俊鉞

Dowel Pins, Flange Nuts, Weld Nuts, 4 Pronged T Nuts...

159 FILROX INDUSTRIAL CO., LTD. 惠錄

Blind Nuts / Rivet Nuts, Tee or T Nuts, Blind Rivets...

83 FONG PREAN INDUSTRIAL CO., LTD. 豐鵬

Automotive Screws, Bi-metal Screws, Brass & Bronze Screws...

40 FORTUNE BRIGHT INDUSTRIAL CO., LTD. 鋒沐

Cap Nuts, Dome Nuts, Nylon Cap Insert Lock Nuts...

261 FRATOM FASTECH CO., LTD. 福敦

Hot Forming Tools, Punches & Sleeves, Dies, Machinery Accssories...

76 FU HUI SCREW INDUSTRY CO., LTD. 福輝

Automotive & Motorcycle Special Screws / Bolts...

149 FU KAI FASTENER ENTERPRISE CO., LTD. 福凱

Precision Electronic Screws, Special Screws, Weld Screws...

64 FUSHANG CO., LTD. 甫商

Carbon Steel Screws, Chipboard Screws, Concrete Screws...

233 GA-E INDUSTRIAL PRECISION CO., LTD. 鋼義

Titanium Alloy Bolts

257 GIAN-YEH INDUSTRIAL CO., LTD. 健業

Rivet Dies, Self-drilling Screw Dies, Screw Tip Dies...

202 GINFA WORLD CO., LTD. 濟音發

Chipboard Screws, Countersunk Screws, Drywall Screws...

282 GLORBAL SALES COMPANY LIMITED 宗暉

Various Stamping Products, Multi-process Assembly Parts...

133 GOFAST CO., LTD. 喬邁

Open Die Parts, Stamping Parts, Assembly Parts...

270 GREENSLADE & COMPANY, INC. (USA)

Concentricity, Ring Gage, Plug Gage Calibration, Gages...

248 GWO LIAN MACHINERY INDUSTRY CO., LTD. 國聯

Handstand Type Wire Drawing Machines, Non-Stop Coilers...

103 HAO CHENG PLASTIC CO., LTD. 皓正

PP Boxes, PET Jars, ABS Boxes, PC Boxes..

163 HARVILLE FASTENERS LTD. 豪威爾

Special Screws and Bolts, Sems Screws, Stainless Steel Fasteners...

283 HAUR FUNG ENTERPRISE CO., LTD. 豪舫

External Tooth Washers, Long Carriage Bolts, Roofing Bolts...

242 HEADER PLAN CO. INC.

Chipboard Screws, Collated Screws, Deck Screws...

288 HEY YO TECHNOLOGY CO., LTD. 恆勇

Precision Pins, Rollers, Dowel Pins...

290 HISENER INDUSTRIAL CO., LTD. 海迅

Wood Construction Screws, Chipboard Screws, Drywall Screws...

155 HO HONG SCREWS CO., LTD. 合鋒

Alloy Steel Screws, Button Head Cap Screws, Chipboard Screws...

182 HOME SOON ENTERPRISE CO., LTD. 宏舜

Bit, Bit Holder, Magnetic Nut Setter, Spring Nut Driver...

165 HOMEYU FASTENERS CO., LTD. 宏宇

Cold Forging Stage, Machine Molds, Lathe, CNC Machining...

110 HOMN REEN ENTERPRISE CO., LTD. 宏穎

Bi-metal Screw, Collated Screws, Composite Screws...

269 HONG TAY YUE ENTERPRISE CO., LTD. 鴻大裕

Wire Straighteners, Hydraulic Clamping Machines...

95 HOSHENG PRECISION HARDWARE CO., LTD. 和昇

Auto Parts, CNC Machined Parts, Bolts...

98 HSIN CHANG HARDWARE INDUSTRIAL CORP. 欣彰

Anchor Bolts, Anchors, Plastic Fasteners...

49 HSIN JUI HARDWARE ENTERPRISE CO., LTD. 欣瑞

Bushes, Construction Bolts, Special Cold / Hot Forming Parts...

200 HSIN YU SCREW ENTERPRISE CO., LTD. 新雨

Acme Screws, Hexagon Head Cap Screws...

47 HU PAO INDUSTRIES CO., LTD. 如保

Automotive Nuts, Flange Nuts, Hexagon Nuts...

141 HUANG JING INDUSTRIAL CO., LTD. 皇晉

Custom Washers, Chipboard Screws, Drywall Screws...

229 INFINITOOLS CO., LTD. 勝邦

Hand Tools, Construction Tools, Car Maintenance, Plumbing Tools

273 INFINIX PRECISION CORP. 英飛凌

Customized Punches and Dies

121 INNTECH INTERNATIONAL CO., LTD. 建豪

All Kinds of Nuts, All Kinds of Screws, Automotive Special Screws...

10 J.C. GRAND CORPORATION 俊良

All Kinds of Screws, Chipboard Screws...

51 JAU YEOU INDUSTRY CO., LTD. 朝友

Chipboard Screws, Drywall Screws, High Low Thread Screws...

195 JENG YUH PLASTICS CO., LTD. 政毓

Plastic Injection Products, Plastic Mold R&D…

304 JERN YAO ENTERPRISES CO., LTD. 正曜

Multi-station Cold Forming, Parts Forming Machines...

36 JET FAST COMPANY LIMITED 捷禾

Blind Nuts / Rivet Nuts, Aircraft & Aerospace Washers...

213 JI LI DENG FASTENERS CO., LTD. 吉立登

Alloy Steel Screws, Appliance Screws, Automotive Screws...

259 JIE LE MACHINERY CO., LTD. 捷仂

Consolidation of Artificial Intelligence Equipment

139 JIEN KUEN ENTERPRISE CO., LTD. 健坤

Hexagon Nuts, Nylon Cap Insert Lock Nuts, Square Nuts...

263 JIENG BEEING ENTERPRISE CO., LTD. 精斌

Forming Tool for Nut and Bolt, Dies, Molds...

190 JINGFONG INDUSTRY CO., LTD. 璟鋒

Hex Nylon Insert Lock Nuts, Wing Nuts with Nylon Insert...

59 JOKER INDUSTRIAL CO., LTD. 久可

Hollow Wall Anchors, Concrete Screws, Jack Nuts...

224 JUNGSHEN TECHNOLOGY CO., LTD. 榮燊

Bi-metal Screws, Automatic Welding & Automatic Inspection...

268 K. TICHO INDUSTRIES CO., LTD. 帝潮 Nails, Screws, Bolts & Nuts Machinery

238 KAN GOOD ENTERPRISE CO., LTD. 鋼固

Fastener, Hardware, Plastic, Instruction Booklet Package in Bags...

114 KATSUHANA FASTENERS CORP. 濱井

Collated Screws, Drywall Screws, Roofing Screws...

275 KEIUI INTERNATIONAL CO., LTD. 鎧渝

Self-drilling Screw Forming Machines

90 KING CENTURY GROUP CO., LTD. 慶宇

Drop-in Anchors, Self-drilling Anchors, Sleeve Anchors...

267 KING YUAN DAR METAL ENTERPRISE CO., LTD. 金元達

Continuous Type Heat Treating Furnace

74 KWANTEX RESEARCH INC. 寬仕

Chipboard Screws, Wood Construction Screws, Deck Screws...

108 L & W FASTENERS COMPANY 金大鼎

Construction Fasteners, Flat Washers, Heavy Nuts...

171 LI YOU SCREW INDUSTRY CO., LTD. 立侑

Automotive / Sems / Nylock / CNC Machined Screws...

189 LIAN CHUAN SHING INTERNATIONAL CO., LTD. 連全興

Weld Nuts, Special Parts, Special Washers, Flat Washers...

298 LIAN SHYANG INDUSTRIES CO., LTD. 連翔

Nut Formers, Nut Tapping Machines

274 LIAN TENG MACHINERY INDUSTRY CO., LTD. 聯騰

Cold Headers, Self-drilling Screw Forming Machines...

187 LIANG YING FASTENERS INDUSTRY CO., LTD. 展揚

Automotive, Hand Tool, Electronic , OEM, Furniture, Shaft ...

99 LINK-PRO TECH CO., LTD. 超傑

Customized Screws/Nuts, Pressing & Deep Drawing...

308 LINKWELL INDUSTRY CO., LTD. 順承

All Kinds of Screws, Automotive & Motorcycle Special Screws...

17 LOCKSURE INC. 今湛

Custom Washers, Flat Washers, Automotive Screws...

97 LONG THREAD FASTENERS CORP. 長隆順

Bi-metal Self-drilling Screws, Chipboard Screws...

123 LOYAL & BIRCH CO., LTD. 龍業百起

Construction Fasteners and Building Fasteners

81 MAC PRECISION HARDWARE CO. 鑫瑞

Turning Parts, Precision Metal Parts, Cold Forged Nuts...

20 MASTER UNITED CORP. 永傑

Chipboard Screws, Drywall Screws, Furniture Screws...

66 MAUDLE INDUSTRIAL CO., LTD. 茂異

Button Head Socket Cap Screws, Flange Washer Head Screws...

131 METAL FASTENERS CO., LTD. 法斯訥

Thread Inserts, Self-Clinching Fasteners...

287 METECK ENTERPRISES CO., LTD. 商后

Automotive Fasteners, Brass Screws (Bolts), Building Fasteners...

12 MIN HWEI ENTERPRISE CO., LTD. 明徽

Button Head Socket Cap Screws, Chipboard Screws...

153 MOUNTFASCO INC. 崎鈺

All Kinds of Screws, Alloy Steel Screws, Automotive Screws...

116 NCG TOOLS INDUSTRY CO., LTD. 昶彰

Tools for Fastening Anchors, Blind Nuts / Rivet Nuts...

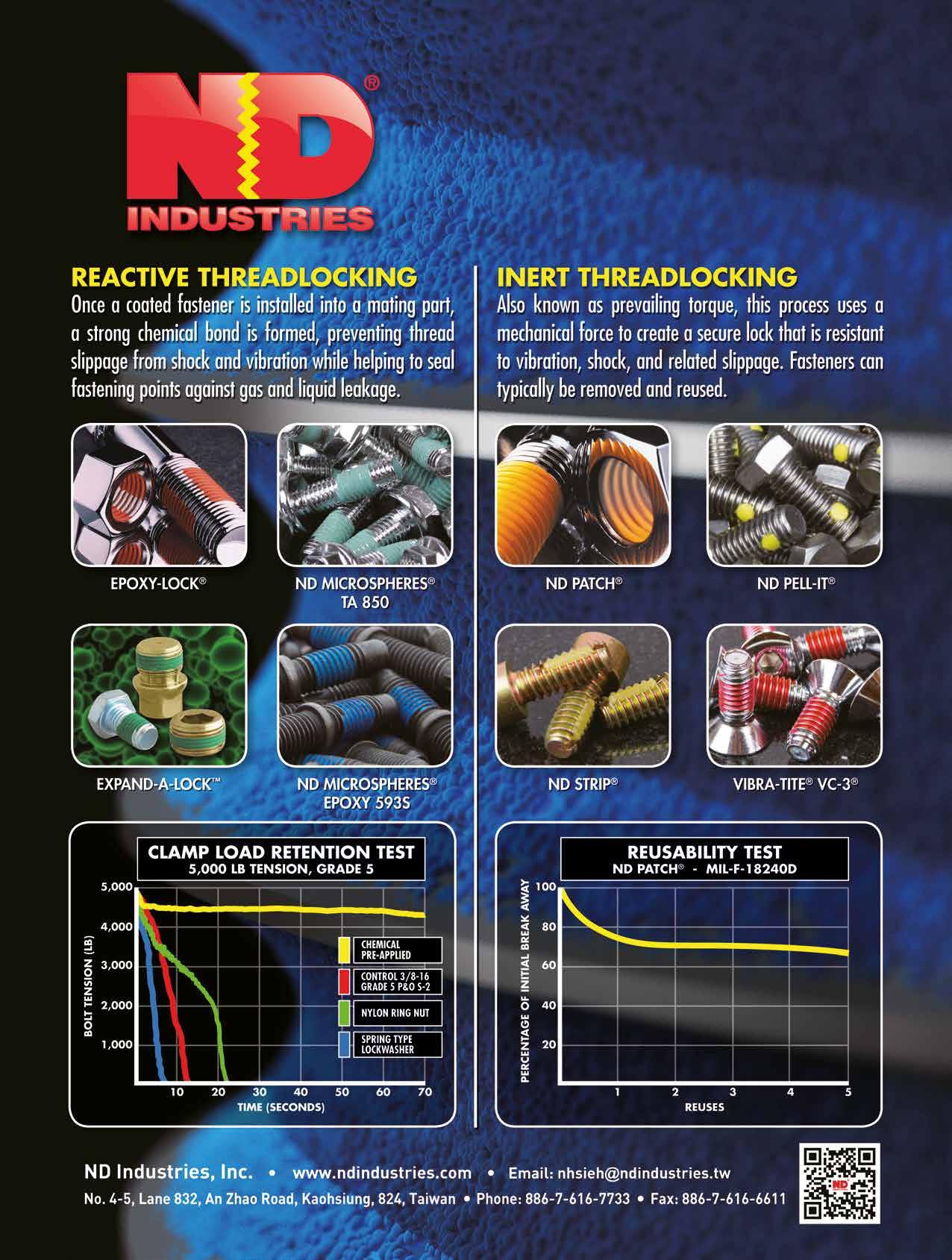

82 ND INDUSTRIES ASIA INC. 穩得

ND Pre-Applied Processes, Advanced Sealing Technologies...

184 PAKWELL CORPORATION 開懋

Bi-metal Screws

194 PEARSON INDUSTRIAL CO., LTD. 春郁

Automotive Cold Formed Parts, Self-Clinching Cold Formed Parts...

58 PENGTEH INDUSTRIAL CO., LTD. 彭特

SEMs Screws, Special Screws, Binder Screws, PT Screws...

272 POINTMASTER MACHINERY CO., LTD. 昶詠

Self-drilling Screw Forming Machines...

135 PPG INDUSTRIES INTERNATIONAL INC. 美商必丕志

Chromium-free Coating, ED Coating...

157 PRO POWER CO., LTD. 鉑川

107

Screws, Bolts...

PS FASTENERS PTE LTD. (Singapore) 汎昇

Washers, Socket Set Screws, U Bolts, Alloy Steel Screws...

186 Q-NUTS INDUSTRIAL CORP. 友俊

Flange Nuts, Weld Nuts, Special Nuts, Spacers...

101 QST INTERNATIONAL CORP. 恒耀國際

Hexagon Head Bolts, Square Head Bolts, Weld Bolts (Studs)...

18 REXLEN CORP. 連宜

Clinch Nuts, Clinch Studs, CNC Parts, Stamped Parts...

179 S&T FASTENING INDUSTRIAL CO., LTD. 順通

Carbon Steel Screws, Bi-metal Screws, Stainless Steel Screws...

6 SAN SHING FASTECH CORP. 三星

Automotive Nuts, Automotive Parts, Carbide Dies...

151 SCREWTECH INDUSTRY CO., LTD. 銳禾

Machined Parts, Thumb Screws, Micro Screws...

300 SEN CHANG INDUSTRIAL CO., LTD. 昇錩

Customized Special Screws / Bolts, Socket Head Cap Screws...

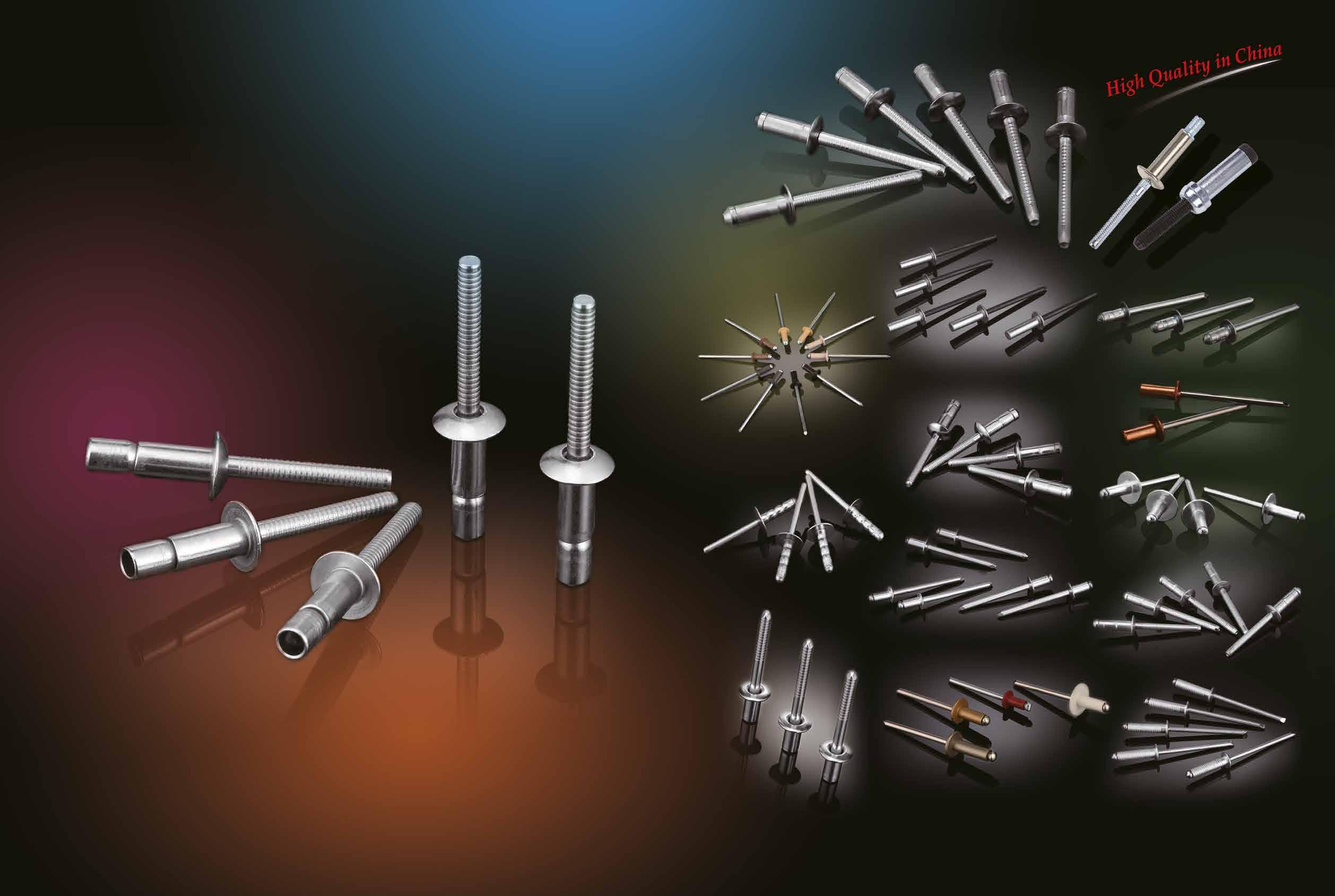

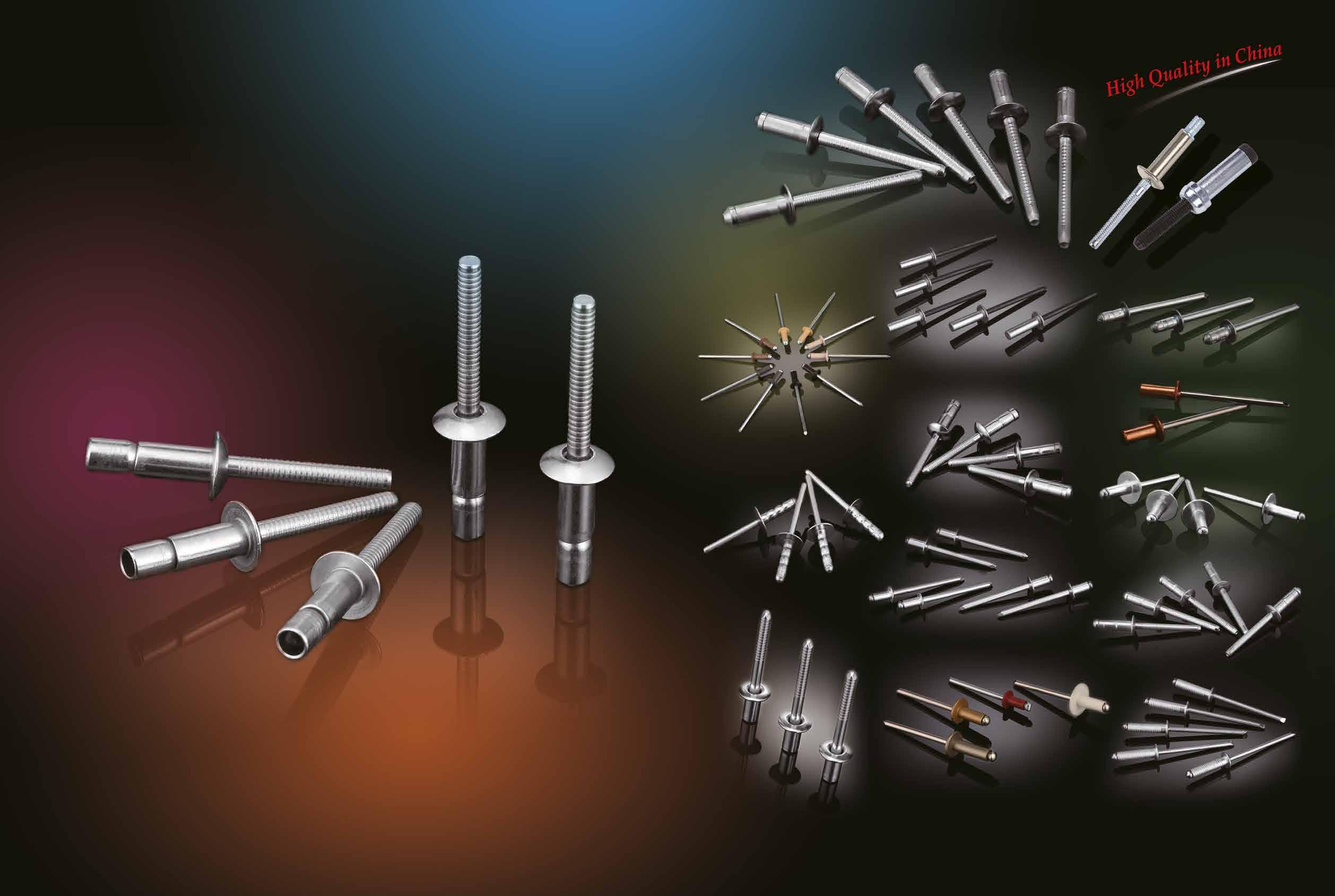

292 SHANGHAI FAST-FIX RIVET CORP. 飛可斯

Blind Rivets, High Shear Rivets, Closed End Rivets...

167 SHAW GUANG ENTERPRISE CO., LTD. 紹光

Cap Nuts, Conical Washer Nuts, Flange Nuts...

260 SHEEN TZAR CO., LTD. 新讚

Self-Drilling Screw Machines & Dies

206 SHEH FUNG SCREWS CO., LTD. 世豐

Chipboard Screws, Countersunk Screws, Wood Screws...

208 SHEH KAI PRECISION CO., LTD. 世鎧

Bi-metal Concrete Screw Anchors, Bi-metal Screws...

78 SHEN CHOU FASTENERS INDUSTRIAL CO., LTD. 神洲

Button Head Cap Screws, Chipboard Screws...

22 SHIH HSANG YWA INDUSTRIAL CO., LTD. 新倡發

Flange Nuts, Flange Nylon Nuts With Washers...

168 SHIN CHUN ENTERPRISE CO., LTD. 昕群

Automotive Screws, Chipboard Screws, Customized Screws...

156 SHUENN CHANG FA ENTERPRISE CO., LTD. 舜倡發

Long Construction Fasteners and Other Modified Fasteners...

122 SIN HONG HARDWARE PTE. LTD. (Singapore) 新豐

Hexagon Nuts, Hexagon Head Bolts, Blind Rivets...

26 SPEC PRODUCTS CORP. 友鋮

Lincensee Fasteners, Turned/Machined Parts...

8 SPECIAL RIVETS CORP. 恆昭

Blind Nuts / Rivet Nuts, Blind Rivets, Air Riveters...

138 SPRING LAKE ENTERPRISE CO., LTD. 春澤

Chipboard Screws, Thread Forming Screws...

221 STRONG JOHNNY INTERNATIONAL CO., LTD. 駿愷

Automotive & Special Parts, Cold-Forged Fasteners...

46 SUN CHEN FASTENERS INC., 展鴻鑫

Cup Washers, Flanged Head Bolts, T-head or T-slot Bolts...

271 SUN FAME MANUFACTURING CO., LTD. 商匯

Shank Slotting Machines, Screw Point Cutting Machine...

44 SUNCO INDUSTRIES CO., LTD. (Japan)

Distributor Specializing in Fasteners

93 SUPER DPD CO., LTD. 三御

All Kinds of Screws, Bi-metal Screws, Carbon Steel Screws...

106 SUPER NUT INDUSTRIAL CO., LTD. 傑螺

Blind / Rivet Nuts, Security Fasteners, Barrel Nuts, Machine Parts...

253 TAIEAG CORPORATION 順基軒

Designed peripheral equipment suitable for fastener packaging

265 TAIWAN INTERNATIONAL TOOL FORM LTD. 祐銓

Nut Forming Dies, Parts Forming Dies, Bolt Forming Dies...

219 TAIWAN LEE RUBBER CO., LTD. 台力

Bonded Washers, E.P.D.M. Vulcanized, Pipe Flashing...

128 TAIWAN PRECISION FASTENER CO., LTD.

Drywall Screws, Wood Construction Screws, Roofing Screws...

124 TAIWAN SELF-LOCKING CO., LTD. 台灣耐落

Nylok®, Precote®, Nycote®, Nyplas®, Loctite®...

235 TAIWAN SHAN YIN INTERNATIONAL CO., LTD. 慶達

Bi-metal Self-drilling Screws, Chipboard Screws...

115 TANG AN ENTERPRISE CO., LTD. 鏜安

Customized Automotive Parts and Special Fasteners

16 THREAD INDUSTRIAL CO., LTD. 英德

Chipboard Screws, Flange Nuts, Heavy Nuts...

54 TONG HEER FASTENERS (THAILAND) CO., LTD.

Hex Bolts, Stud Bolts, Socket Cap Screws, Hex Nuts…

54 TONG HEER FASTENERS CO., SDN. BHD (Malaysia)

Stainless Steel Metric Screws, Stainless Steel Screws…

188 TONG HO SHING INTERNATIONAL CO., LTD. 桐和興

Hex Washer Head Screws, Indent Hex Head Screws...

14 TONG HWEI ENTERPRISE CO., LTD. 東徽

A2 Cap Screws, Button Head Socket Cap Screws...

55 TONG MING ENTERPRISE CO., LTD. 東明

Stainless Steel Fasteners, Wire Rods...

118 TSIN YING METAL INDUSTRY CO., LTD. 晉英

Stainless Steel Cold Heading Wire, Oxalate Coating Wire...

256 TZE PING PRECISION MACHINERY CO.,LTD. 智品

Open Die Machines, Cold Headers, Cold Forming Machines...

84 UNISTRONG INDUSTRIAL CO., LTD. 六曜

Retaining Nuts, Sleeve Nuts, Weld Nuts, Automotive Screws...

217 UNIVERSAL PRECISION SCREWS (India)

Dowel Pins and Shoulder Bolts...

41 VERTEX PRECISION INDUSTRIAL CORP. 緯紘

6 Cuts/ 8 Cuts Self Drilling Screws, Barrel Nuts, Cap Screws

281 WAN IUAN ENTERPRISE CO., LTD. 萬淵

Punches/Dies of Various Nuts, Screws, Sleeves and Socket Boxes

42 WE POWER INDUSTRY CO., LTD. 威力寶

Chipboard Screws, Concrete Screws, Drywall Screws...

112 WEIMENG METAL PRODUCTS CO., LTD. 偉盟

Standard / Customized Parts, Machining Parts, Stamping Parts...

296 WILLIAM SPECIALTY INDUSTRY CO., LTD. 威廉特

Chipboard Screws, Concrete Screws, Drywall Screws...

94 WINLINK FASTENERS CO., LTD. 岡山東穎

Stainless Steel Screws, Flange Bolts, Security Bolts, SEMS Screws...

24 WYSER INTERNATIONAL CORP.

Open-Die Parts, Automotive Parts...

181 YANGJIANG DMSCREW HARDWARE

Stainless Steel Screws, Bi-Metal Screws, Concrete Fasteners...

299 YESWIN MACHINERY CO., LTD.

Bolt Formers, Multi-station Cold Forming Machines...

38 YI CHUN ENTERPRISE CO., LTD.

Cap Screws, Socket Set Screws, Cage Nuts, Automotive Parts...

100 YI HUNG WASHER CO., LTD.

Rubber Washers, Plastic Screws, Custom Washers...

56 YING MING INDUSTRY CO., LTD.

Automotive & Motorcycle Special Screws / Bolts...

62 YOUR CHOICE FASTENERS & TOOLS CO., LTD.

A2 Cap Screws, Bits & Bit Sets, Chipboard Screws...

302 YOW CHERN CO., LTD.

Flanged Head Bolts, Chipboard Screws, Floorboard Screws...

63 YUH CHYANG HARDWARE INDUSTRIAL CO., LTD.

Automotive & Motorcycle Special Screws / Bolts...

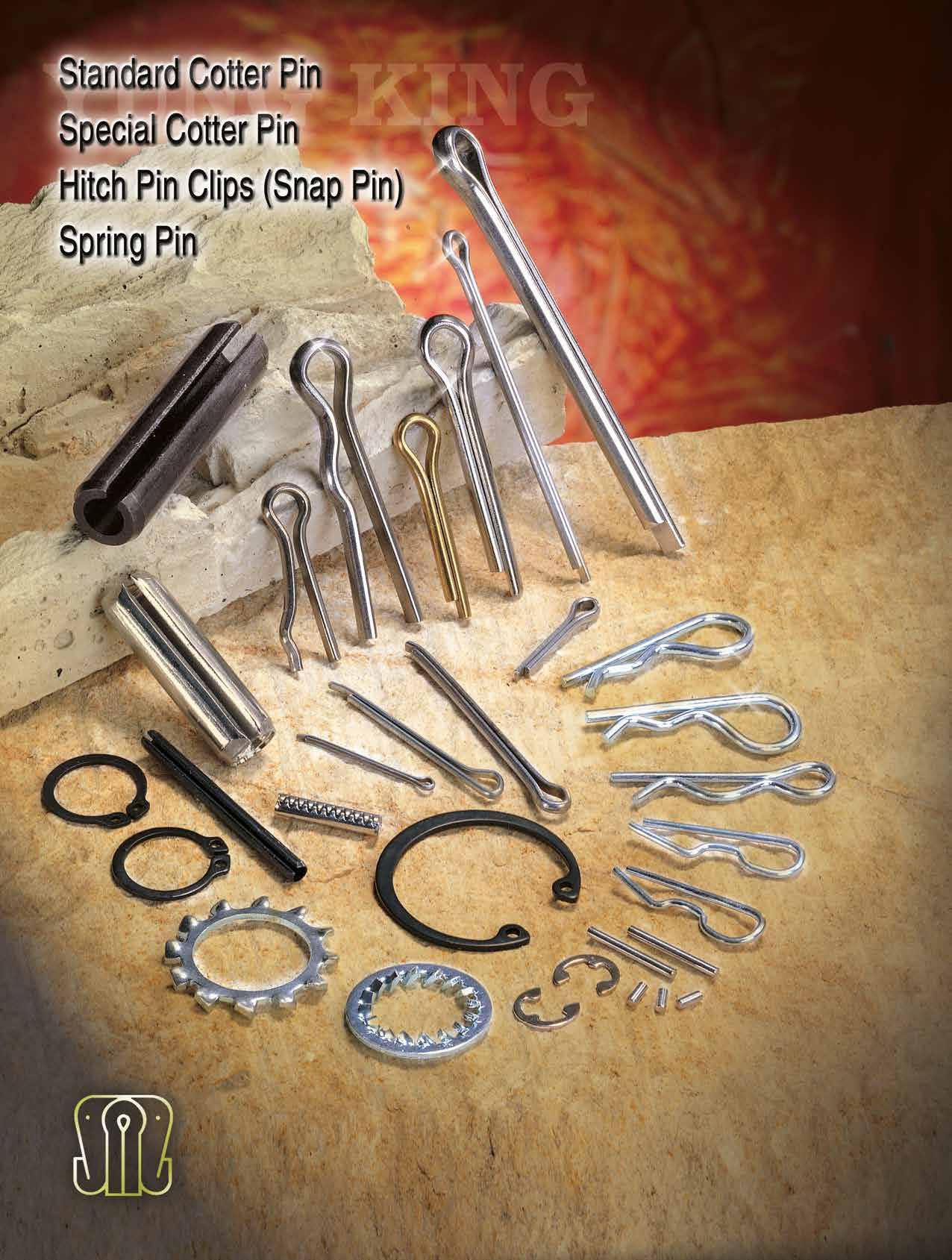

109 YUNG KING INDUSTRIES CO., LTD.

Dowel Pins, Roll Pins, Self-locking Pins, Cotter Pins, Split Pins...

286 Z & D PLATING CO., LTD. 瑞達信 Precision Barrel Plating Finishes, Zinc & Zinc-Nickel Alloy...

137 ZYH YIN ENT. CO., LTD. 至盈 Euro Screws, Dowel Pins, Allen Keys, Confirmat Screws...

機械暨周邊設備區

252 BIING FENG ENTERPRISE CO., LTD. 秉鋒

250 CHAN CHANGE MACHINERY CO., LTD. 長薔

255 CHIEN TSAI MACHINERY ENTERPRISE CO., LTD. 鍵財

246 CHING CHAN OPTICAL TECHNOLOGY CO., LTD. 精湛

266 DAH-LIAN MACHINE CO., LTD. 大連

270 GREENSLADE & COMPANY, INC.

248 GWO LIAN MACHINERY INDUSTRY CO., LTD. 國聯

269 HONG TAY YUE ENTERPRISE CO.,LTD. 鴻大裕

304 JERN YAO ENTERPRISES CO., LTD. 正曜

259 JIE LE MACHINERY CO., LTD. 捷仂

268 K. TICHO INDUSTRIES CO., LTD. 帝潮

275 KEIUI INTERNATIONAL CO., LTD. 鎧渝

267 KING YUAN DAR METAL ENTERPRISE CO., LTD. 金元達

298 LIAN SHYANG INDUSTRIES CO., LTD. 連翔

274 LIAN TENG MACHINERY INDUSTRY CO., LTD. 聯騰

272 POINTMASTER MACHINERY CO., LTD. 昶詠

260 SHEEN TZAR CO., LTD. 新讚

271 SUN FAME MANUFACTURING CO., LTD. 商匯

253 TAIEAG CORPORATION 順基軒

256 TZE PING PRECISION MACHINERY CO., LTD. 智品

299 YESWIN MACHINERY CO., LTD. 友信

286 Z & D PLATING CO., LTD. 瑞達信

254 CHI NING COMPANY LTD. 旗林

261 FRATOM FASTECH CO., LTD. 福敦

257 GIAN-YEH INDUSTRIAL CO., LTD. 健業

273 INFINIX PRECISION CORP. 英飛凌

263 JIENG BEEING ENTERPRISE CO., LTD. 精斌

265 TAIWAN INTERNATIONAL TOOL FORM LTD. 祐銓

281 WAN IUAN ENTERPRISE CO., LTD. 萬淵

227 M-TECH TOKYO

234 MTA VIETNAM

237 HARDWARE EURASIA (Turkey)

279 FASTENER FAIR USA

展覽

In order to enhance the interaction and communication with Taiwan fastener industry and to regularly understand the current situation of the industry's external orders as well as their challenges or dilemmas, Taiwan CSC, the largest wire supplier to Taiwanese fastener manufacturers, held the Production & Sales Meeting for Q2 2024 on March 5 in Gangshan, Kaohsiung. Hundreds of fastener companies participated in this event, hoping to maintain a good and smooth communication channel between the supply and demand sides, and more importantly, to gain more favorable conditions for their own development through such exchanges.

TIFI Chairman Tu-Chin Tsai

TIFI Chairman Tu-Chin Tsai put it bluntly in his opening speech that the current overall market situation can be said to be very poor. Many fastener companies around the world are experiencing a squeeze on profits due to regional conflicts such as the war between Israel and Hamas, the war between Russia and Ukraine, and the higher costs caused by the U.S. 25% tariff on certain steel and aluminum products from China. Many orders for small screws initially made out to Taiwan have been taken over by Chinese or Vietnamese companies, making a difficult situation to Taiwanese manufacturers. Under these market conditions, he hopes that when Taiwan CSC announces its prices for next quarter, it will take into account the fact that it is already very difficult for the industry to receive orders and refrain from raising prices if it can.

In addition, in terms of the global industry's most discussed trends of ESG and energy saving & carbon reduction, Chairman Tsai also reminded the industry to keep up with the net-zero carbon reduction trend, and to pay closer attention to the ISO 14064, ISO 14067, and other carbon management standards, and to implement the relevant netzero carbon emission declarations in accordance with the law and regulations. He also asked Taiwan CSC to provide strong support to help the industry to save energy and reduce carbon emissions, and to produce more wire products that meet the low-carbon trend for the fastener industry. Chairman Tsai believes that although compliance with carbon reduction regulations may indirectly increase manufacturers' costs, he believes that Taiwan's serious and hard-working industry can do a good job. Moreover, when more countries start to propose net-zero carbon reduction measures, it may also create more opportunities for Taiwan fastener industry to receive more orders and establish new collaboration.

Mr. Ming-Yuan Chen, Vice President of Taiwan CSC Commercial Division said that he has observed that the orders of some companies are indeed not good. However, he also mentioned that after 2 years of deinventorying in the global manufacturing industry, reports published by many scholars and experts on the GDP forecasts of most countries have shown an upward sign and the optimistic forecasts about many countries (including Taiwan) are above 3%. Despite the downward trend in the market until Q4 last year, the demand this year should be better than last year as Q2 is traditionally a high season for the industry (statistics also show that the Q2 result has been always the highest of the year for the past decade), and the Q2 industry survey conducted internally by Taiwan CSC also indicates that demand will be 8% higher than Q1 2024. Therefore, even though there is still turbulence in the market, there is no need to be pessimistic as the overall trend is still forecast to "recover gradually". As long as everyone has confidence, works hard, and enhances the company's strengths of all aspects, there’ll be lots of opportunities this year.

It is understood that Taiwan CSC does not have any annual renovation plan at present. Its current capacity can fully meet the subsequent demand of the industry and the lead times are also expected to be advanced. In addition, in response to the trend of energy saving & carbon reduction, Taiwan CSC has provided the carbon emission data of Q4 last year to manufacturers for subsequent CBAM reporting, and will provide the data of the previous quarter to the industry on a regular basis in the first month of each quarter thereafter. If the industry has any needs or questions about carbon reduction, Taiwan CSC also has a team of industry experts and senior colleagues who can provide relevant info with the industry.

According to Taiwan Customs’ import & export data, Taiwan imported 206,000 tons of steel bars in 2023, down 21% from the same period in 2022. The top 5 sources of steel bar imports were China (58%), Japan (25%), South Korea (9%), Vietnam (2%) and Germany (2%). The main import categories were steel bars made of alloy steel (76%), medium carbon steel (14%) and low carbon steel (6%).

In terms of wire rods, Taiwan imported 352,000 tons of wire rods in 2023, a slight decrease of 1% from the same period in 2022. The top 5 import sources were Indonesia (38%), South Korea (22%), Vietnam (13%), China (9%) and Japan (8%). The main import categories were wire rods made of low carbon steel (49%), alloy steel (37%) and high carbon steel (6%).

In terms of fastener export, Taiwan exported 1.275 million tons of fasteners to the world in 2023, a decrease of 23.41% from 2022; the average unit price was US$3.74 per kilogram, also a decrease of 1.93% from 2022. Among them, the export volume of self-drilling screws and bolts appeared the most significant shrinkage (both by at least 25%), and the export volume of wood screws and nuts also shrank by about 15%. If we look at the main export destinations, the top 5 export trading partners were the United States (591,000 tons), Germany (101,000 tons), the Netherlands (84,000 tons), Japan (52,000 tons), and Canada (40,000 tons), all of which have declined by 10%-25% compared with the 2022 level.

To observe the single-month data of January this year, Taiwan exported about 100,000 tons of fasteners (down 11.3% from the same period last year) and its export to the U.S. reached about 52,000 tons (a decrease of 7.9% from the same period in 2022).

Despite the recent downward trend in demand for raw materials and fastener exports from Taiwan, many analysts still believe that the global economy will slowly recover from the crisis. Coupled with the continued easing of inflation in various countries, the recovery of consumption of end products, the gradual return of supply chain inventories (e.g., AI, automotive electronics, etc.) to a healthy level which in turn will boost demand, global automobile sales expected to grow by approx. 2.7% in 2024 compared to 2023, and governments expanding public construction budgets, among other incentives, the global economic performance is expected to improve further, indirectly facilitating the demand for fasteners.

Copyright

The tables below list the companies whose financial year ends at the end of December, except for Torq's which ends at the end of October.

Alcoa's 2023 net sales were USD 10,551 million, down 15.2% from USD 12,451 million in 2022. The company ended the year with a loss of USD 651 million in net income in 2023, compared to a loss of USD 123 million in 2022. Total assets decreased to USD 14,158 million in 2023 from USD 14,756 million in 2022.

Fastenal's 2023 net sales were USD 7,346.7 million, up 5.2% from USD 6,980.6 million in 2022. Net income was USD 1,155.0 million in 2023, up 6.2% from USD 1,086.9 million in 2022. Total assets decreased to USD 4,462.9 million in 2023 from USD 4,548.6 million in 2022.

Nucor's 2023 net sales were USD 34,713.501 million, down 16.3% from USD 41,512.467 million in 2022. Net income was USD 4,524.801 million in 2023, down 40.5% from USD 7,607.337 million in 2022. Total assets increased to USD 35,340.499 million in 2023 from USD 32,479.210 million in 2022. Companies

Bossard’s 2023 net sales grossed 1,069 million in 2023, down 7.3% in CHF currency from 1,153.8 million in 2022. Sales across all regions decreased by a margin between 2.6 to 17.8 percent. Sales in Asia resulted in the largest loss for the group.

(Million JPN)

Torq's revenue increased 6.2% to 21,757 million yens in 2023 from 20,477 million yens in 2022. Net profit increased 58.8% to 845 million yens in 2023 from 532 million yens in 2022. Total assets increased to 32,689 million yens in 2023 from 31,120 million yens in 2022. The company forecasts revenue to grow 5.7% in FY2024.

Compiled by Fastener World / Updated on January 30, 2024

“It is already the a Year of the Dragon!” Although this issue comes out several days after the Lunar New Year holidays, the editorial team would like to take this opportunity to extend our best wishes for the Year of the Dragon to all industry leaders, customers and related partners.

In 2023, the global fastener industry did feel a distinctly gloomy atmosphere under the influence of many external factors such as regional conflicts, inflation, material shortages, rising manufacturing costs, etc., and many companies are facing tough competition and challenges in the part of expanding their export orders, which has made some of them express their worries about this year's overall development forecasts. However, we can also see that a number of industry players have taken advantage of the market downturn, choosing not to retreat but to advance the strategy of continuous layout and investment at home and abroad. Some companies have also introduced new equipment, replaced old ones, carried out other industrial upgrading programs, strengthened the training of staff, or made preparation for ISO 146064, ISO14067, or even ISO14068 and other CBAM-related low-carbon certifications, which shows that there are still a number of industry players who hold a high degree of confidence in the development of the future demand for fasteners. and they hope to make good use of the short order period to grasp a good hand of cards before a bigger challenge comes.

Between the second half of last year and the beginning of this year, a few of leading companies in Taiwan celebrated their anniversaries, including the 25th anniversary of Screwtech Industry, the 40th anniversary of Special Rivets Corp. and the inauguration of its new plant in Thailand, and the 50th anniversary of Jieng Beeing Enterprise. Although each of these companies has a different product range, they all have one thing in common -

they all have very strong competitiveness keeping them in the industry for decades. Some of their competitiveness comes from "deepening and accumulating technological capabilities", "timely upgrading and replacement of facilities/equipment", "mastery and development of key customer markets", "flexible approach and mindset to meet new generation of regulatory requirements", and "reliable services that attract customers to stay with them". How the competitiveness can be integrated to maximize the effect is no doubt these companies’ strengths. "By taking into account the experience of these successful companies, small businesses can definitely create more room for development in the international market. More importantly, it is important to know how to dig out useful resources to add points for yourself. For example, applying for subsidies or business upgrading programs from the Ministry of Economic Affairs (Taiwan) or attending counseling and training courses organized or co-sponsored by professional organizations are all good shortcuts. As the world's most widely circulated magazine in the fastener industry, Fastener World Inc. has cooperated with a NCKU professor and well-known fastener companies to organize a number of seminars and courses related to industry upgrading and CBAM in the past few months, hoping to become a supportive force to enhance the competitiveness of the industry and to enter the international market. We encourage interested companies should actively participate in these courses in the future.

Dr. Wayne Sung, an industry trend analyst in Taiwan, defines the "Carbon Reduction Trend" as an unavoidable war for Taiwan fastener industry in this issue. It is not too much to say that it is a war, because many countries have been forced to participate in it for the sake of sustainable survival and development. Therefore, it is important for Taiwanese companies, whose main export markets are Europe and the United States, to keep up-to-date with CBAM announcements. The European Commission (EC) has recently announced the default values for determining embedded emission for products covered by CBAM valid by the end of 2025, and within the limited period, declarants can report embedded emissions according to the default values announced by the EC. In addition, the EU has also proposed the solution for "delayed submission" due to technical problems encountered on the Registry in reporting carbon emissions. It is understood that whether or not the reporting required by CBAM measures has been thoroughly implemented has become an important evaluation benchmark for many European and U.S. purchasers to assess the qualification of their Taiwanese suppliers for subsequent cooperation. Therefore, relevant industry players who need to report should be sure to

inquire with the relevant units before the deadline to avoid unintentional non-compliance with the regulations.

In addition to magazines, exposure at exhibitions is also an effective shortcut to market development. This year, Fastener World Inc. has also planned nearly 30 international professional exhibitions to help suppliers and buyers create more effective and faster cooperation opportunities in the most direct face-to-face way. In this issue, we also include a special preshow feature focused on "Fastener Fair USA", "wire Düsseldorf" and "INAFASTENER", introducing many Taiwanese high-quality exhibitors who are very competitive in terms of products, technology and service. It is believed that through the presentation of such content, it can promote the exchange and cooperation between Taiwan's supply chain and the international demand market in advance, and increase more ordering opportunities. In addition, in the next May issue of Fastener World Bimonthly Edition, the editorial department also plans to do a Preshow Feature introducing a few of Taiwanese exhibitors in Taiwan International Fastener Show 2024, the largest exhibition event in Taiwan fastener industry. If you unfortunately could not be included in the preshow feature this time, don't miss out on this opportunity. Please be sure to check our official website or contact our sales department at sales@fastenerworld.com.tw to get more information about participation.

Screwtech Industry Co., Ltd., is celebrating its 25th anniversary in 2024. ScrewTech is famous for its production of precision screws in sizes of M1-M14 and for industry leaders in electronic, automotive, and medical fields.

On Jan. 19, a grand celebration was held at Screwtech’s plant located in Benjhou Industrial Park in Gangshan (Kaohsiung). Important partners from major European distributors, industry leaders, employees and their families were invited to witness Screwtech's transformation and growth in a lively atmosphere featuring a wonderful performance by the internationally renowned Dragon and Lion Dance Troupe.

Screwtech has now become a major player in the global precision fastener supply chain after first establishing itself as a major supplier to the high-tech computer industry and later extending its business reach to include the automotive and medical fastener industries.

The remarkable growth and development that can be seen over the past 25 reflects Screwtech's dedication to technological excellence and its commitment to manufacturing high quality products and providing top service to its extensive customer base in European and the American industrial markets.

Screwtech contact: Gerry Johnson

Email: Gerry@screwtech.com.tw

Through its years of experience and know-how, the ScrewTech team has been able to provide strong product support to its customers and answer difficult or complex technical questions. ScrewTech staff are also able to issue inspection reports upon customer request, in an effort to minimize defective rates and related costs, and maximize the efficiency of operation, in order to continue to maintain its competitive edge in the international market.

Even though it has established a firm foothold in the market, Screwtech is still constantly researching and improving related machining technology and customer service, including the launch of “ ScrewTech Buy” online purchasing platform in 2020 which provides customers with a wide range of small quantity items in stock.

Fion Peng, Screwtech General Manager, gave the following heartfelt reflection at the 25th anniversary celebration, "After majoring in economics in the university, I started my career in the fastener industry 25 years ago by chance. The development of Screwtech in early days was actually full of difficulties and challenges. As a result, I truly appreciate the selfless contribution and dedication of many people along the way in supporting us being originally a small factory to reach the current scale. I would also sincerely thank our loyal customers and manufacturers for their long-term support, as well as the dedication and assistance of our several experienced employees."

Screwtech's annual capacity averages about 1 billion pieces. Its headquarters is located in the New Taipei Industrial Park while its factory is in Benjhou Industrial Park in the south of Taiwan. The factory has a number of internationally recognized quality management certificates including ISO9001:2015, IATF16949:2016, and IECQ QC 080000:2017. With its incorporation of environmental, social, and corporate governance (ESG) standards, Screwtech also expects to obtain ISO14001 in 2024 and continue its ESG-driven improvements. In the future, Screwtech will continue to improve its technology and services, and play a strong role in helping the precision fastener industry to enhance its brand value with the best quality products.

Copyright

www.fastener-world.com

May 22 - 23, 2024

Huntington Convention Center of Cleveland, OH

Fastener Fair USA is North America’s fastest-growing trade show and conference event for the fastener industry and the manufacturing sectors it serves. The show is unique in the industry, offering an unrivaled opportunity for the entire supply chain – manufacturers, master distributors, equipment makers, processors, packagers and end users – to meet, collaborate and network. Fastener Fair covers all areas of the fastener and fixing industry and provides real insight into industry trends and key information about the latest developments in this sector. The exhibition is the international platform for manufacturers, wholesalers, distributors and suppliers of fastener and fixing technology.

Networking: Fastener Fair USA provides a unique platform for attendees to network with peers, exchange ideas, and establish new business relationships.

Product Showcase: Attendees can explore the latest products and technologies in the fastener industry and gain insights into emerging trends.

Industry insights: The event features expert-led sessions and workshops that offer valuable insights into the latest industry developments, best practices, and regulatory updates.

Supplier sourcing: Attendees can source new suppliers, evaluate products and services, and compare prices to make informed purchasing decisions.

Professional development: Fastener Fair USA provides opportunities for attendees to enhance their professional skills, expand their knowledge base, and stay abreast of industry trends and advancements.

For 37 years Fastener World Inc. has been committed to establishing diversified product marketing channels, such as purchasing magazines, exhibition stand sales, B2B website development, to help company brand promotion and CIS corporate image building services to promote “fasteners, components, and hardware tools” related industries at home and abroad. In response to CBAM and other industry concerns, we also irregularly invite experts to organize seminars or courses to help industry players quickly keep up with global industry trends and regulations. We provide the most immediate and efficient connected platform for buyers and suppliers in different industries and marketing network, create global market opportunities and let the world see Taiwan.

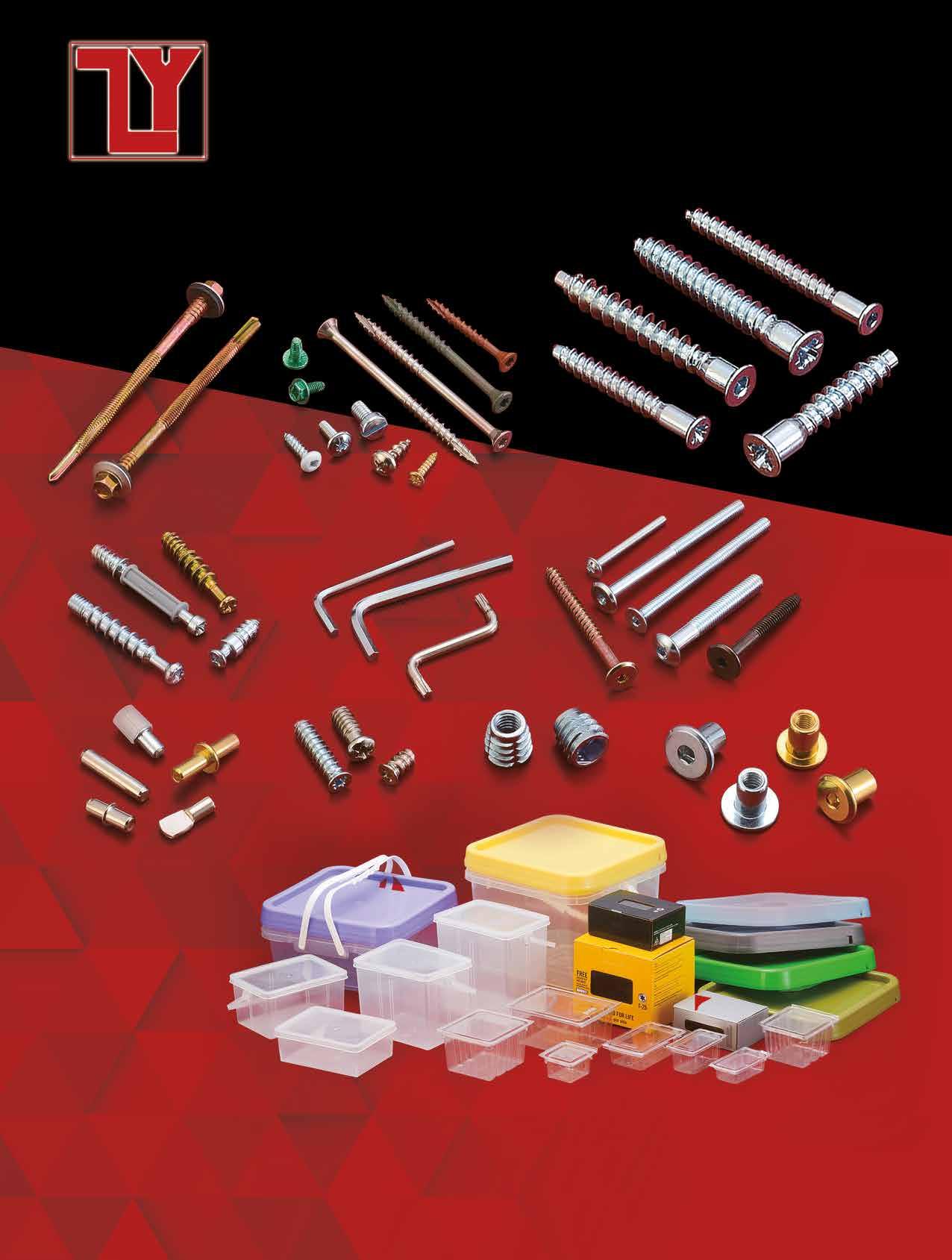

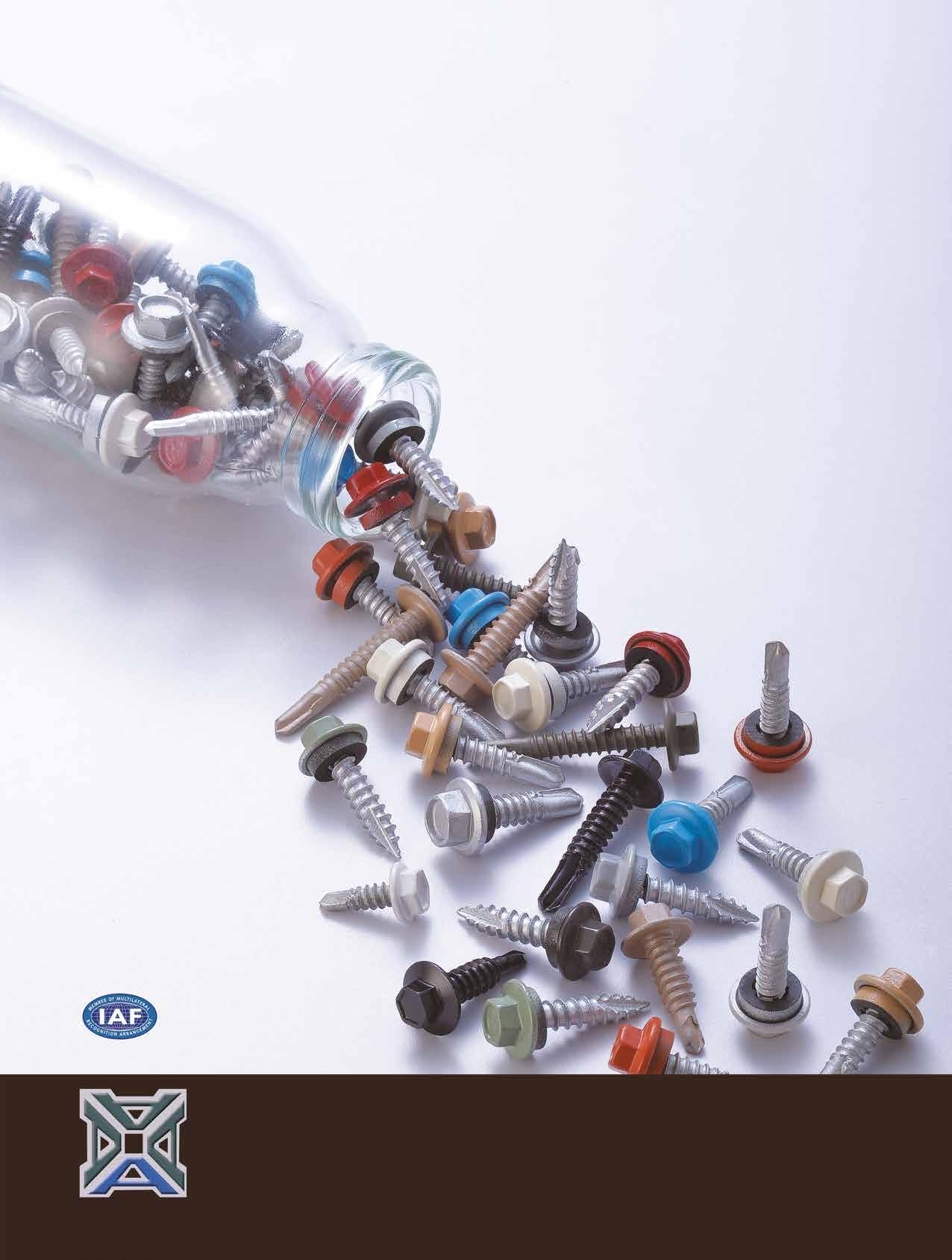

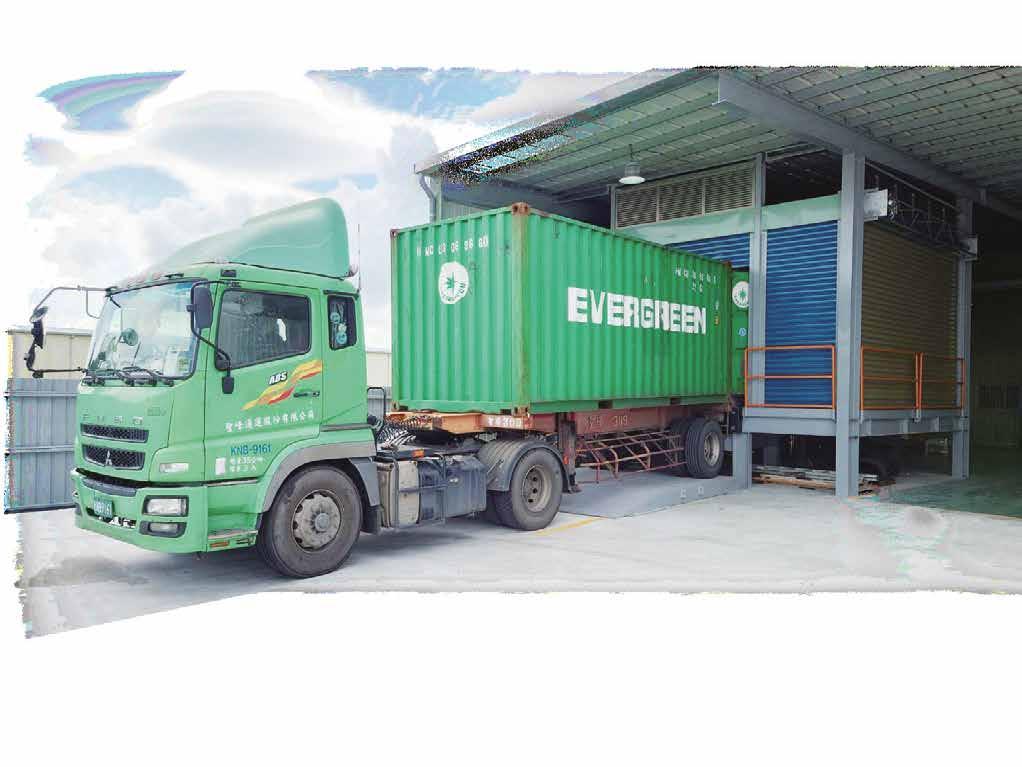

Bi-Mirth is known throughout the world with its highly acclaimed premium wood screws, self-drilling screws and concrete screws. It handles manufacturing, electroplating, painting, packaging (via its own packaging plant), and provides outsourced heat treatment. It masters extraordinary manufacturing capability, specifically good at long wood screws, concrete screws, self-drilling screws and customized screws. On top of the patent Quick Drill Screw series, OEM and ODM service adds up to the list of available capabilities, which all in all culminate in this trump card: Bi-Mirth R&D.

Bi-Mirth is now certified to ETA, CE and ICC. Particularly with ICC, its products are proven to meet quality level for outstanding safety in fastening buildings. For clients, this is an extra protection and gives them peace of mind. Lately they have been asking if other products are certified to ICC, so Bi-Mirth is testing other products with ICC test labs, looking to expand certification coverage.

Additionally, clients are demanding more for product compliance with extreme environments in recent years. To prove the surface-treated and painted screws can endure extreme environments, Bi-Mirth passed C4 certification and now provides robust fastening support against the challenges under global extreme temperatures. This has brought them numerous loyal clients from the U.S. and Europe.

Bi-Mirth is one of the booths attracting many visitors every time it attends international shows. The goal in Cleveland this time is keeping in touch with existing clients, as well as gaining new American clients and exploring their future needs. While fastener importers are the main targets, other visitors demanding construction fasteners are all welcome. For wood screws, Bi-Mirth booth will feature truss head and hexagon washer head screws which are both ICC-certified long screws. “We have been stressing on product development. We deliver great products with quality guarantee. That’s how we are able to gain return customers,” said the company.

Bi-Mirth observes a slower growth in global demand over the last 2 years due to inflation. It is currently monitoring the U.S. market and presidential election coming up in November. Market deployment will be in place accordingly. This year the company will keep the marketing in the U.S. as before and exhibit in International Fastener Expo (Las Vegas) in September. That includes visiting local clients before or after the Cleveland and Las Vegas shows. While the past 4 years saw all walks of life returning to normal conditions, new challenges will arise this year. No matter what, Bi-Mirth continues on the niche and expertise gained in the construction screw market, hoping everyone will find the silver lining in a crisis and arrive at a bright future. Booth

Contact: Ms. Miko Shih

Email: miko@bimirth.com.tw

Homeyu Fasteners Co., Ltd. specializes in construction and automotive fasteners. Over the years it has continued to demonstrate an impressive level of precision and versatility in its fasteners through the legacy of traditional process technologies such as cold forging within one and multi-stroke and the introduction of machining, surface treatment, and many other secondary processing procedures. It once dedicated itself to various collaborations with top academic organizations such as ITRI, NTU, NTHU, and NCTU and also played a role in supplying parts to the semiconductor industry. In recent years, in order to response to the global industry's concern about carbon emissions, environmental protection and climate change, it has begun to focus on the R&D of innovative technologies that are low carbon and environmentally-friendly, with a particular focus on the optimization of the manufacturing process for surface treatment of products, which has resulted in superior performance compared to previous products.

At the upcoming Fastener Fair USA, Homeyu is ready to demonstrate to the international market its products in addressing the issues of global carbon emissions, environmental protection and climate change. First of all, in terms of carbon emissions, Homeyu has introduced water-based plating in its manufacturing process, which not only reduces the process steps of traditional organic-based plating, but also significantly reduces the carbon emissions of the baking process; in terms of environmental protection, Homeyu has developed highlystable Cr3+ yellow zinc electroplating, which not only avoids the use of highly environmentally polluting Cr6+ yellow zinc electroplating, but also eliminates the potential problem of Cr3+ yellow zinc electroplating being prone to peeling off; in response to climate change, it has also introduced the high performance plating that can form a light and dense passivated layer, which on one hand enhances the corrosion resistance of fasteners and on the other hand can adapt to more demanding applications. By integrating these technologies into its products, Homeyu expects to receive more inquiries from buyers in the U.S. market, where green concepts are highly emphasized.

"We once worked with customers from New Zealand, Australia and Brazil to develop highly efficient coating technologies that could address the lack of corrosion resistance in extreme environments, and we provided them with test reports and analysis recommendations, as well as quality assurance through our professional QC staff and equipment. In addition, we also provide customers with corresponding carbon emission data through monitoring the power consumption and working hours of each machine, and develop new technologies to address the carbon emission problems arising from oil consumption and oil/gas emissions of machines, in the hope that they can be introduced into the future production process and further reduce carbon emissions," said Homeyu.

In addition to surface treatments, Homeyu's "Forging Before Machining" approach to customized fasteners creates significant process and cost advantages. "We serve our customers with a policy of 'solving problems before the production schedule' in each step of process and dimensional quality control. The concept of "Forging Before Machining" not only compensates for the technical limitations of ‘all forging’, but also lowers the high cost of "all machining". With our past experience in serving the semiconductor industry, as well as our technological foundation and practical experience in the traditional industry, we are able to meet the needs of our customers in various industries,” said Homeyu.

Despite the lackluster market performance in 2023 and the first quarter of 2024, Homeyu continues to create a niche by steadily developing technologies that address market needs. "We hope to bring these new technologies to end customers to not only create growth for us, but also continue to contribute to the industry,” said Homeyu.

Contact: Ms. Belinda Chang Email: belinda@homeyu.com.tw

Shaw Guang Enterprise Co., Ltd. is one of the most professional manufacturers in Taiwan in terms of technology and quality in the nut manufacturing supply chain. Its 5,950 sq. m plant with more than 100 sets of equipment has an average monthly capacity of 500 tons, mainly producing carbon steel/stainless steel/copper Kep Nuts, Conical Washer Nuts, Flange Conical Washer Nuts, Serration Conical Washer Nuts, Nylon Conical Washer Nuts, Nylon Flange Conical Washer Nuts, Cap Conical Washer Nuts, Conical Washer Nuts With Paint Scraper Groove, Self Locking Nuts- One/Two Ring in sizes of M3-M20. With production locations in Taiwan and China, Shaw Guang has successfully gained entry into many of the world's middle and high end application markets showing large quantities of demand for nuts over the past 25 years through the production of high quality precision nuts.

At Fastener Fair USA in Cleveland, which is to take place this May, Shaw Guang, also an exhibitor, will take advantage of this annual industry exchange platform to show its customization capability and related services for prevailing torque nuts to the visitors. This series of prevailing torque nuts can provide excellent fastening performance in automotive, white goods, solar, mechanical and electronic applications. Shaw Guang's greatest strength is its ability to quickly meet customers' customized needs.

Facing the changes in market demand and industry needs in 2024, Shaw Guang has been actively making lots of efforts in the R&D of nut manufacturing technology and practical applications. "This product is 100% customized with many variations and complexities. In addition to the rich development experience we have accumulated, this year we have also initiated in-house process optimization and upgraded production equipment such as stamping and forming machines, with the goal of providing customers with faster delivery and more stable product quality, and we also hope to find more customers from the white goods, solar, machinery and electronics industries at the exhibition,” said Special Assistant Tom Huang.

Contact: Special Assistant Tom Huang

Email: tom.huang@shawguang.com.tw

Shaw Guang obtained the IATF 16949 certification in 2014, and established a punches & dies department in the same year and a laboratory the following year. In order to strictly control the quality of products, its heat treatment and associate factories are also required to be CQI certified. It even once received an inquiry from a well-known sanitary equipment manufacturer for its complete quality assurance and ability to provide nuts made of different materials. In addition, in order to comply with the EU's carbon reduction requirements, it has also begun ISO 14064 carbon inventory counseling and preparation for ISO 14067, including the installation of smart meters, the replacement of old powerconsuming equipment, the collection of carbon emission data and the requirement for associate companies to provide carbon emission data, etc..

"Last year, the industry was hit hard by the general environment, but I believe that as long as we continue to move forward in our nut profession, the market performance will get better and better. This year, we also hope to promote the application of nuts in more areas, and at the same time, we will actively improve and optimize the production lines. Although it remains to be seen how the world's major markets will perform, I believe that 2024 will definitely be a turning point," added Huang.

Copyright

Booth No. 135

www.abs-metal.com.tw

ABS METAL Industry Corp. is established by a number of experienced and skillful fastener people for more than 20 years. Focus on manufacturing different kinds of fasteners and exporting products to leading distributors and OEMs partners in over 35 countries across Americas, Europe and the rest of the world. We supply quality fastener products to customers for different kinds of applications - Construction, Automobile, Machinery, and Electrical Appliance, and we provide different kinds of solutions to customers so as to meet the requirement of performance economically and environmentally, too.

Booth No. 132

www.canatex.com.tw

CANATEX is specialized in customized parts, both external and internal thread special parts. Our product line involves various production methods, including cold-forging, CNC machining, stamping, deep drawing, sintering, even metal and plastic injection, and we can also integrate different processes. Our products are 100% made in Taiwan, 50% of them are used in the automotive industry. We can assure you the best quality and our fully-equipped laboratory is the strongest backup to control the quality strictly.

Booth No. 232

www.chite.com.tw

CHITE Enterprises, founded in 1994 and located in Taiwan, is a wellknown professional company in the fastener industry. We specialize in various fastener products and have factories in Taiwan, Vietnam and China. With these factories in different countries, we provide a wide range of products to meet customers’ demand and satisfy the purchase strategy of the customers in coping with the rapid change in the fastener industry.

Booth No. 228

www.hsinjui.com.tw

IATF 16949:2016 certified Hsin Jui Hardware Enterprise specializes in producing cold formed parts and customized products mainly for automotive parts, windows/door fits, bicycle parts, and spur gear applications. Its one-stop processing line offers customers the most stable quality. Hsin Jui continues to move forward with R&D of distinctive tooling design, precision and better quality of products, which helps create the most significant value for customers. It can produce products with 3mm-10mm in length and the diameter of Ø5mm to Ø59mm.

Booth No. 233

www.jldfasteners.com.tw

JLD is a Taiwanese supplier and mainly supplies customized/ OEM parts including cold forging, multiple stations parts, weld studs, SEMS screws and so on for the appliances, electronics, and automotive industries. Our dedication to high quality and efficient services has earned our customers' trust and long-term partnerships. "Seeing is believing", we invite you to visit our booth and we will show you our capabilities and products.

Booth No. 222

www.lwfasteners.com.tw

L&W is a professional fastener supplier in Taiwan and China. Our fastening products are used in construction, automarket, machines and general industries. The mission of L&W is to accomplish one-stop-shopping service for saving import cost and provide good quality products for end users to work more efficiently. Base on customer's annual demand, our warehouses hold stock for contractual orders and mill supply. We hope to bring more additional value service to customers through our professional inspectors and experienced sales teamwork.

Booth No. 125

www.machardware.com.tw

Mac Precision Hardware company is an ISO 9001:2015 certified company located in Kaohsiung. We are specialized in manufacturing OEM high-precision CNC parts / Machining parts for more than 40 years. Our products have been widely used in the automobile, electronic, and medical industries for many years, and have obtained well reputation from our customers.

Booth No. 128

LTD.

www.maochuan.com.tw

A professional stamping manufacturer, Mao Chuan is a qualified supplier of Tier 2 automotive supply chain, and is certified with IATF 16949 and VDA 6.1. They have a wide range of products, including automotive metal domes, clips, cable ties, washers, caps, welding nuts, compression limiters and various customized products. All raw materials are from non-conflict mining countries and comply with RoHS and REACH regulations. Taiwan Stamping Manufacturer Mao Chuan is your best partner of fastener solutions.

Booth No. 229

www.molscorp.com.tw

MOLS Group has over 30-year experience in screw manufacturing and operates a supply chain system with screw manufacturing, heat-treating and head painting. MOLS various fasteners such as Roofing Screw, Self-Tapping Screw, RV Screw, Self-Drilling Screw, Home Appliance Screw and Triangular Thread Screw are used in various industries and receives good feedback from customers. MOLS is dedicated to providing competitive pricing, high quality and steady lead time and we use our valuable resources to create maximum benefits for our customers.

Booth No. 122

www.novafastener.com.tw

Founded in 2005, Nova. Fastener is an ISO9001:2015 certified fastener manufacturer, providing One-Stop Fastener Solution by our comprehensive product lines. We are committed to helping our customers achieve efficient manufacturing, and we continue developing new products and enhancing performance at the same time. By our attention to detail and high quality, our products are ETA approved and have been widely used in the European and the US markets.

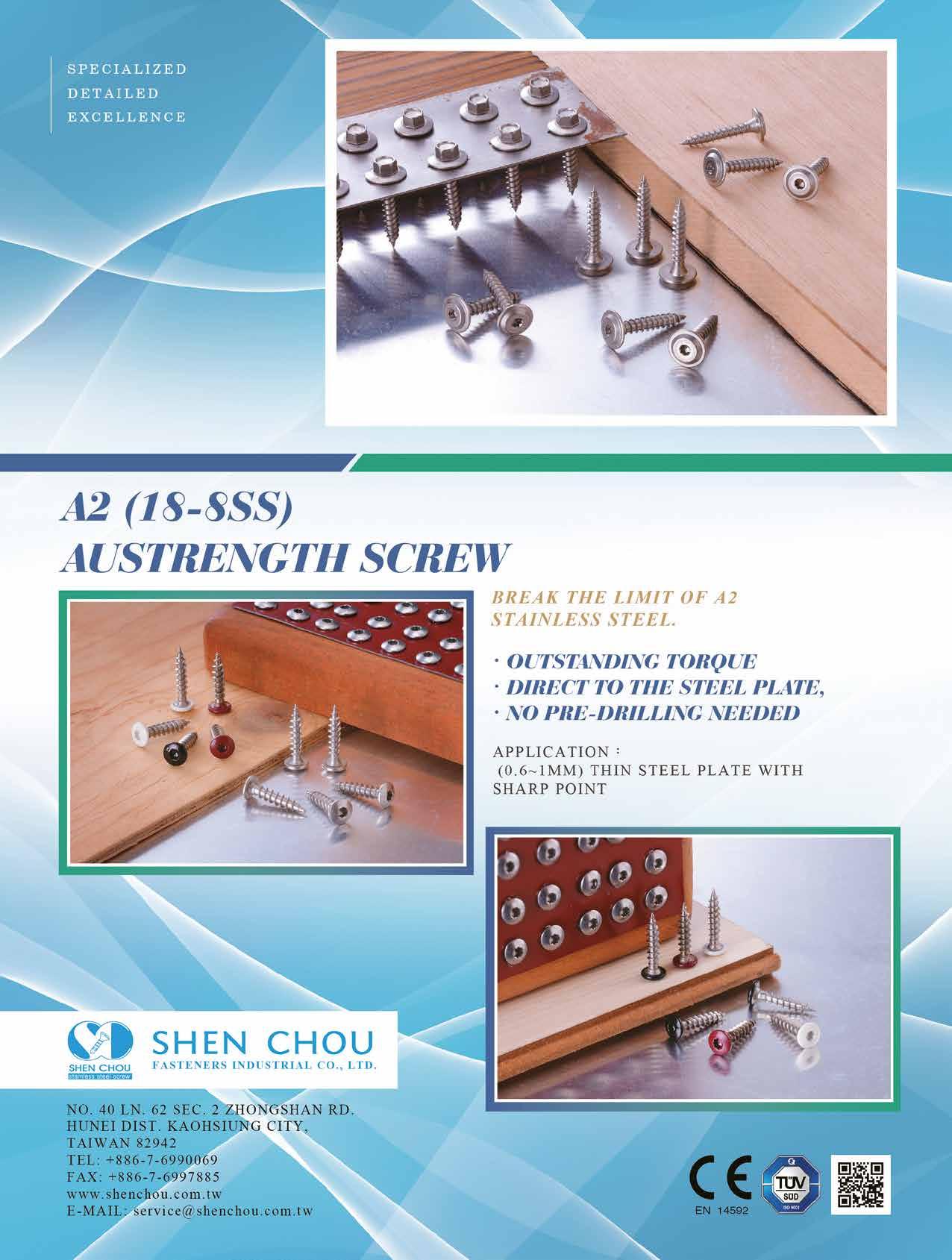

Booth No. 224

www.shenchou.com.tw

SHEN CHOU FASTENERS, founded in 1989 in Kaohsiung, Taiwan, provides quality stainless steel products worldwide, including North America, Europe, Japan, Middle East, etc. Flexible design provision and professional stainless leading manufacturing experience are our best advantages and make us a leading manufacturer in Taiwan. We have been certified to ISO 9001 and CE 14592. Furthermore, we have been ISO 140641 certified since 2024 to fit in global ESG trends. If you are looking for a trust-worthy supplier, please do not hesitate to contact us.

Booth No. 130

www.super-nut.com.tw

We are ISO9001 and IATF16949 certified. Our OEM products serve across market fields in automotive, electronics, home appliance and constructional use. We specialize in multistage cold forming parts production.

Booth No. 332

www.w-i.com.tw

Wan Iuan Enterprise Co., Ltd has a good management and well-trained manufacturing team. To serve our customers with the best quality, our team is committed to the development in technology. Wan Iuan Enterprise Co., Ltd has actively expanded the foreign market since 2001. Our markets include Tawian, Europe, USA, Japan, Southeast Asia, Asia, etc. We own the ISO9001 certification. From raw material, stocking, packing to shipment, we have a strict quality control system in every stage of production.

Booth No. 134

www.ycs.com.tw

Your Choice Fasteners & Tools has devoted itself to the fastener industry since 1992, with its expertise in the fields of construction, automobiles, bicycle, and fitness equipment. It is an ISO9001:2015 and CE certified manufacturer and exporter in Taiwan. With better and more efficient manufacturing processes, Your Choice can achieve a monthly capacity of 800-1,000 tons. Its main products include self-drilling screws, self-tapping screws, roofing screws, window screws, sandwich panel screws, special customized screws, extractor sets, wrenches, bit adapters/holders, etc.

Booth No. 226

YOW CHERN CO., LTD.

www.yowchern.com.tw

Yow Chern Co., Ltd. started with developing, innovating, and manufacturing high-quality screws of Aster screws for construction, furniture, and woodworking. After gaining solid footholds in these markets, Yow Chern expanded manufacturing capabilities to incorporate 50 sets of multi-station machines and 50 sets of CNC multi-axis machines, becoming a qualified automotive fastener supplier.

Booth No. 609

BRIGHTON-BEST INTERNATIONAL, INC.

www.brightonbest.com

Booth No. 124

ERAY TECHNOLOGY

HARDWARE CO., LTD.

www.e-ray.com.tw

Booth No. 225

EVEREON INDUSTRIES, INC.

www.ydsevereon.com

Booth No. 123

FENG YI TITANIUM FASTENERS

www.fengyi-ti.com

Booth No. 129

FONTEC SCREWS CO., LTD.

www.fontec.com.tw

Booth No. 235

H-LOCKER COMPONENTS INC.

www.hlocker.com.tw

Booth No. 126

U-WEEN ENTERPRISE CO., LTD.

www.u-ween.com.tw

April 15 - 19, 2024

Messe Düsseldorf

The sector looks to Düsseldorf with anticipation, where the global No. 1 trade fairs for the wire, cable, tube & pipe industries will be staged from 15 to 19 April 2024.

With immediate effect all exhibiting firms are live at www.wire-tradefair.com, Exhibitors & Products 2024 and www.tubetradefair.com, Exhibitors & Products 2024 presenting their products and trends on the Internet portals.

In less than a month that time will have come and the industries will meet at Düsseldorf Exhibition Centre.

What makes it special: #Sustainability and #Energy Efficiency are even more in focus than in 2022. Daily ecoMetal trails touring the exhibition halls are aimed at convincing visitors of exhibitors’ novel, clean production methods.

Trend forums, expert meetings and themed pavilions for stainless steel, hydrogen, other regenerative energy carriers, separating and cutting, plastic pipes & tubes and finished products for Fastener & Spring Making Technologies will be in focus.

Community building comes care of the daily After-Work Chill Meetings in the outdoor spaces and entrance Nord – here exhibitors can also meet their customers after trade fair hours over drinks and tasty Düsseldorf canapés.

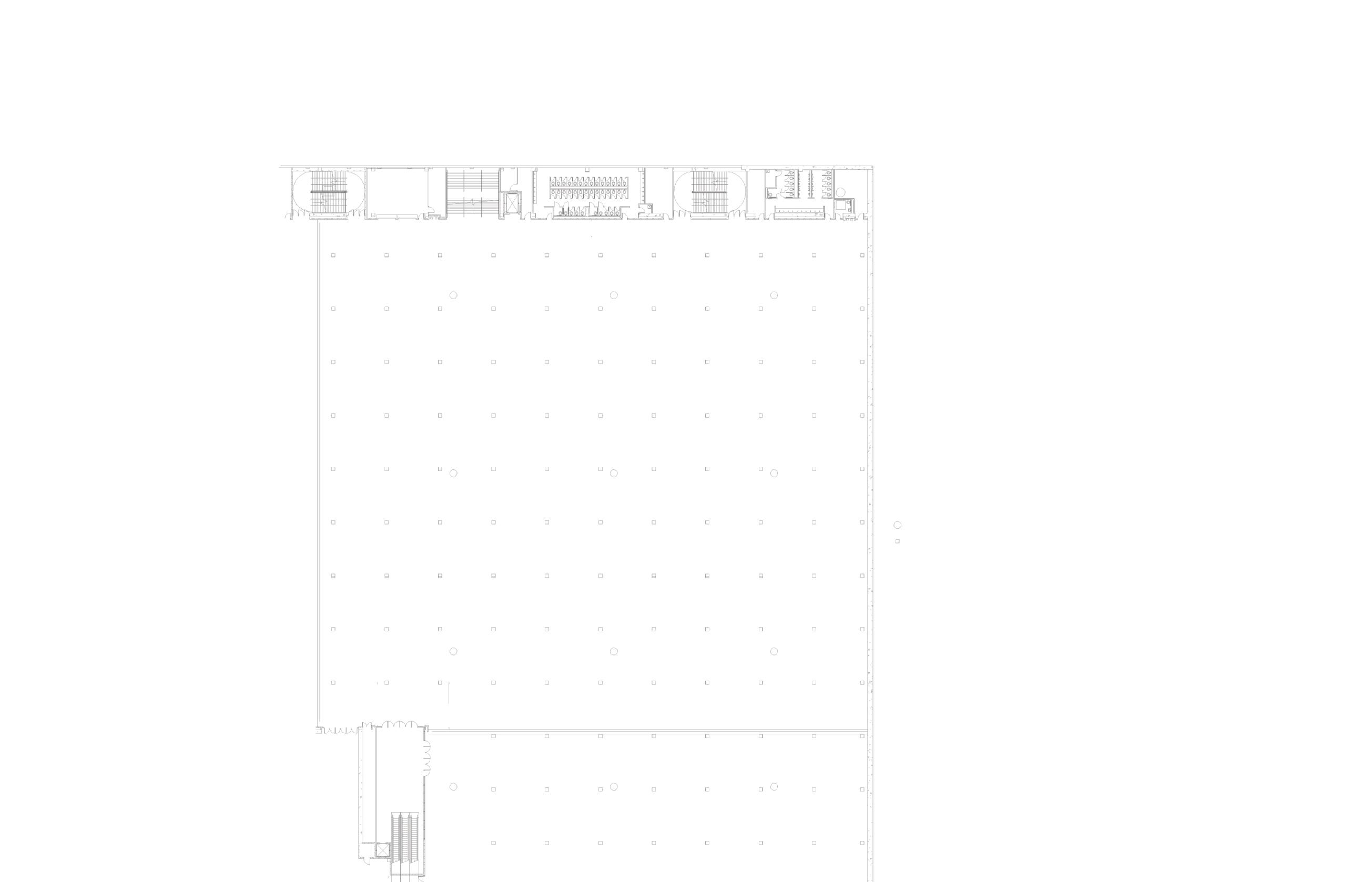

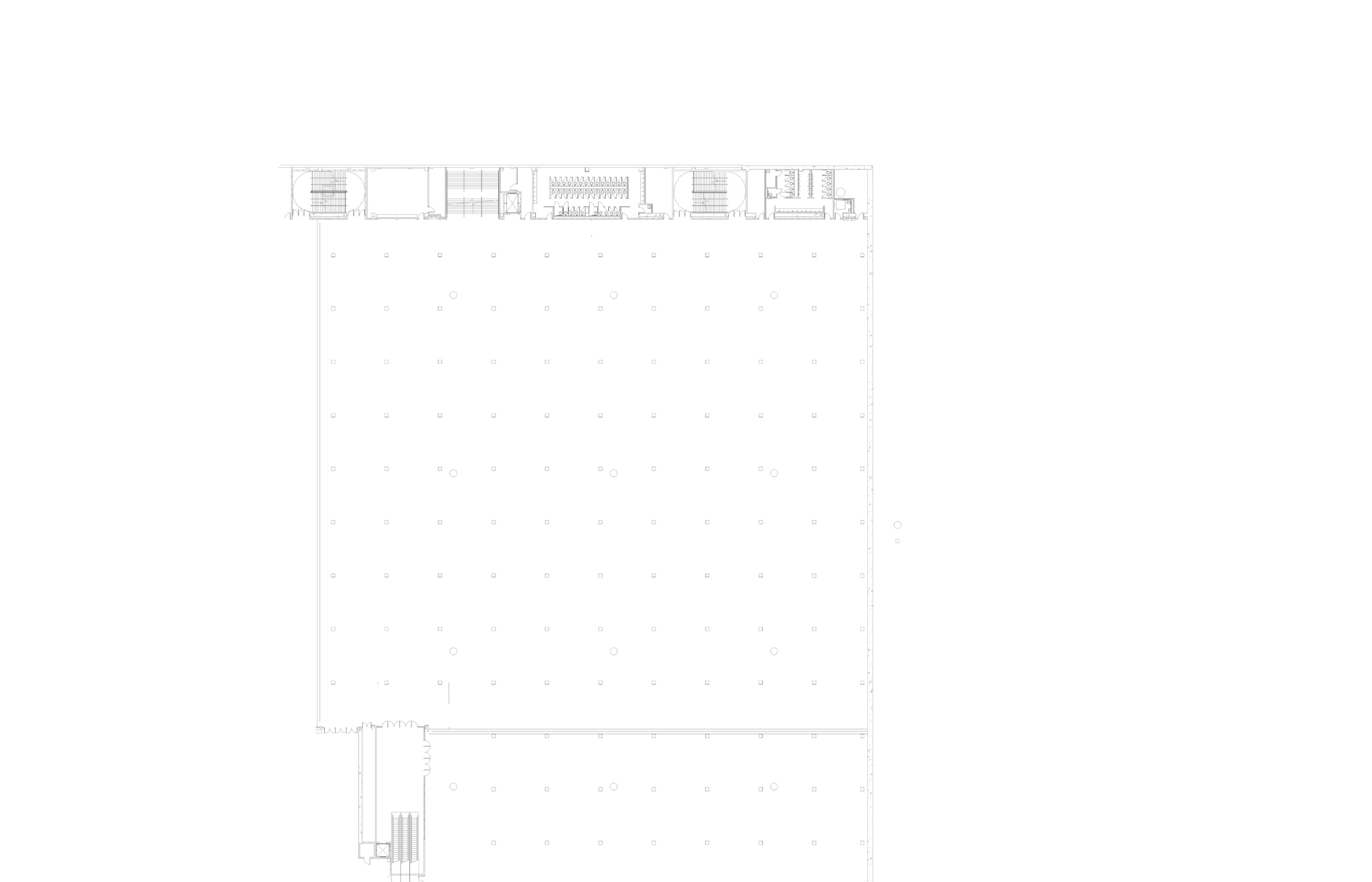

wire will be staged in exhibition halls 9 to 17 in 2024. It will be as big as ever, occupying some 66,900 square metres of exhibition space. With 1,026 exhibitors from 60 countries it will even surpass pre-pandemic levels.

On show will be machinery and equipment for the manufacture and processing of wire, finished products at Fasteners & Springs, tools and auxiliaries for process engineering, materials, glass fibre technologies, special wires and cable as well as innovations from sensor, control and testing technology.

In addition to wire and cable machinery producers, wire and cable products and glass fibre technologies, impressive wire mesh welding machines will be displayed in Hall 17. These pose logistics with particular challenges because thick cables have to be laid and connected in the supply ducts to transport the electric power this heavy machinery requires for its live operations.

Here the complete value chain for fasteners and springs can be found: from raw materials, machinery and equipment to fasteners, connectors and industrial springs. This once again makes #wire Düsseldorf 2024 a highly topical information and order platform for the producers, dealers and buyers of screws, brackets, construction components and fittings, all types of springs and wire bending parts.

Tube also enjoys excellent booking levels. So far, 768 exhibitors from 49 countries have registered. They will occupy a total of 49,600 square metres’ exhibition space in Halls 1 to 7.1.

#Tube 2024 presents the entire process chain of the tube & pipe industry – in a focused and compact array: machinery and equipment for manufacturing pipes and tubes, finishing and processing of pipes & tubes as well as raw materials, plastic pipes, tube products and accessories, used machinery, tools for process engineering, auxiliaries, sensor technology, control, measuring and testing technology all form part of the extensive ranges. This line-up is complemented by tube & pipe, pipeline, OCTG technology and profile trading.

Over a time span of almost 40 years wire and Tube Düsseldorf have developed into the leading trade fairs for their industries – now also “giving birth” to satellite events on the #Wire, #Cable and #Tubes & Pipes themes. In their regions, they are the market leaders and drivers for the local industries and boast high growth potential. Satellites in Turkey, Egypt, Mexico, China, Thailand and India now already form an integral part of the growing portfolio of the Metal and Flow Technologies made by Messe Düsseldorf.

Halls

Halls Hallen 1, 3, 4 Tube Manufacturing and Distribution Rohrhandel, Rohrherstellung

Halls Hallen 4, 5, 6 Bending and Forming Technology Umformtechnik Rohrhandel, Rohrherstellung

Halls Hallen 6, 7a

Pipe and Tube Processing Technology Rohrbearbeitungstechnik Rohrhandel, Rohrherstellung

Hall Halle 7a

Plants and Machinery Maschinen und Anlagen, Rohrhandel, Rohrherstellung

Hall Halle 7 Meet China’s expertise

Booth No. Hall 16 / I52

www.fastener-world.com

Hall Halle 16 Fastener Technology and Spring Making Technology including Products Befestigungstechnik und Federfertigungstechnik inklusive Endprodukte Hall Halle 17 Mesh Welding Technology Gitterschweißtechnik

"For 35 years Fastener World Inc. has been committed to establishing a diversified product marketing channel network, brand promotion and corporate image building services to promote "fasteners, hardware, and components" related industries at home and abroad. We combine three effective brand promotion approaches for buyers and suppliers with different needs and habits, which include exposure on professional international purchasing magazines, participation in worldwide mainstream exhibitions through us, and the access to a 24/7 online global purchasing network. With our most immediate and efficient connected platform, you can reach the most potential market opportunity and let the world see you.

The circulation of our publications covers more than 200 countries on five continents. These publications are: Fastener World bimonthly (Global Edition/Mandarin Edition for Taiwan), China Fastener World, Hardware & Fastener Components, Emerging Fastener Markets, and Europe Special Edition. We are a professional marketing media with the most intensive distribution coverage in the world, which precisely aims and mails magazines to purchasers according to their market attributes and has attracted international associations and overseas B2B platforms to actively contact us and discuss cooperation. We regularly participate in about 30 international exhibitions every year and have left footprints in more than 580 exhibitions since our inception. In addition to individual participation in exhibitions, we also lead Taiwanese manufacturers to take part in exhibitions around the world many times every year to gain competitive edge for Taiwanese industries. Moreover, Fastener World Inc. not only provides abundant industrial technology, market trend analysis articles, and exhibition information, but also offers a B2B buying and selling platform for both sides with more efficient purchase matching business opportunities. Our customized keyword service and tens-of-thousands of potential buyers database are definitely the best choice for your customer development and rapid brand promotion."

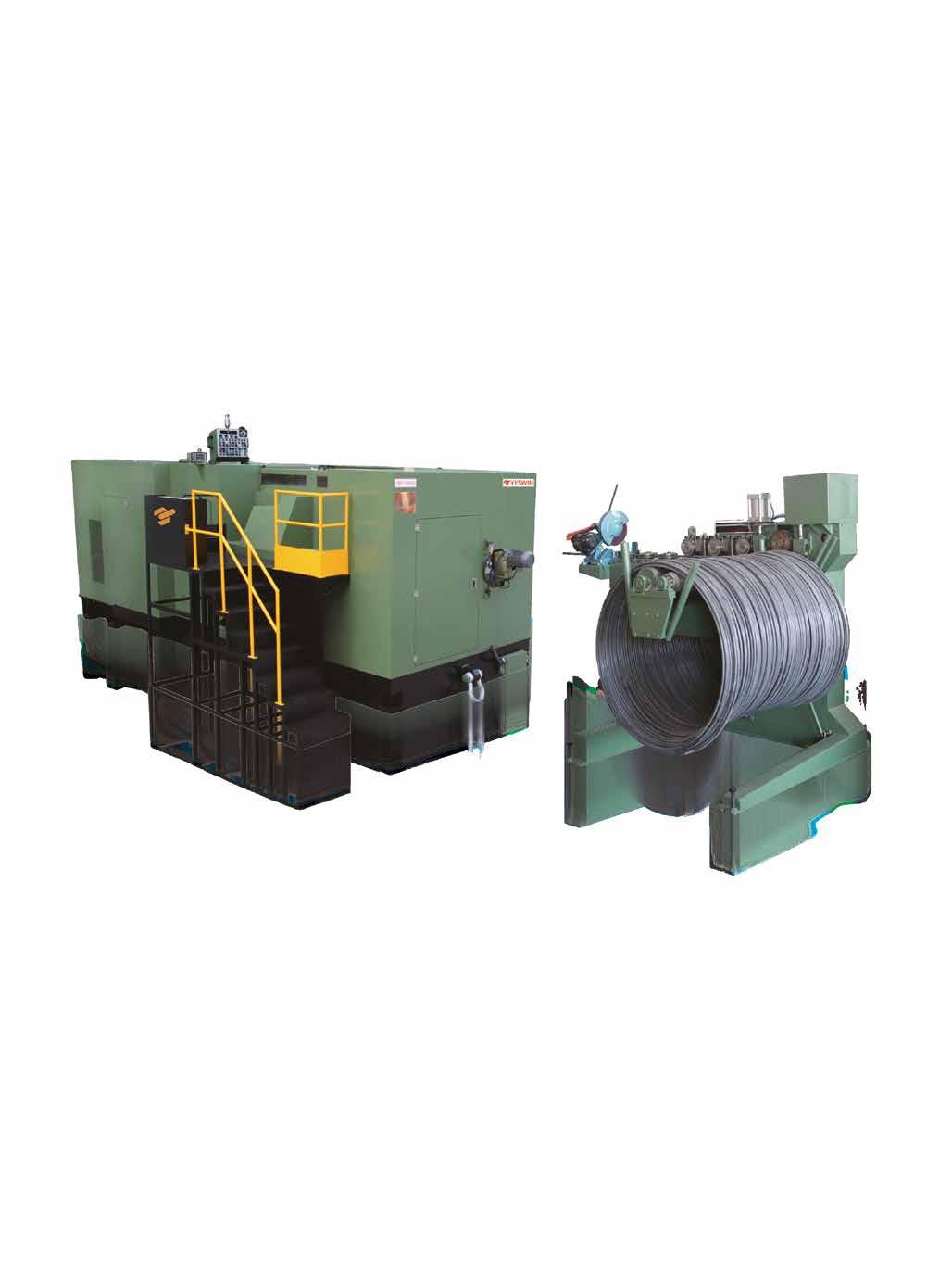

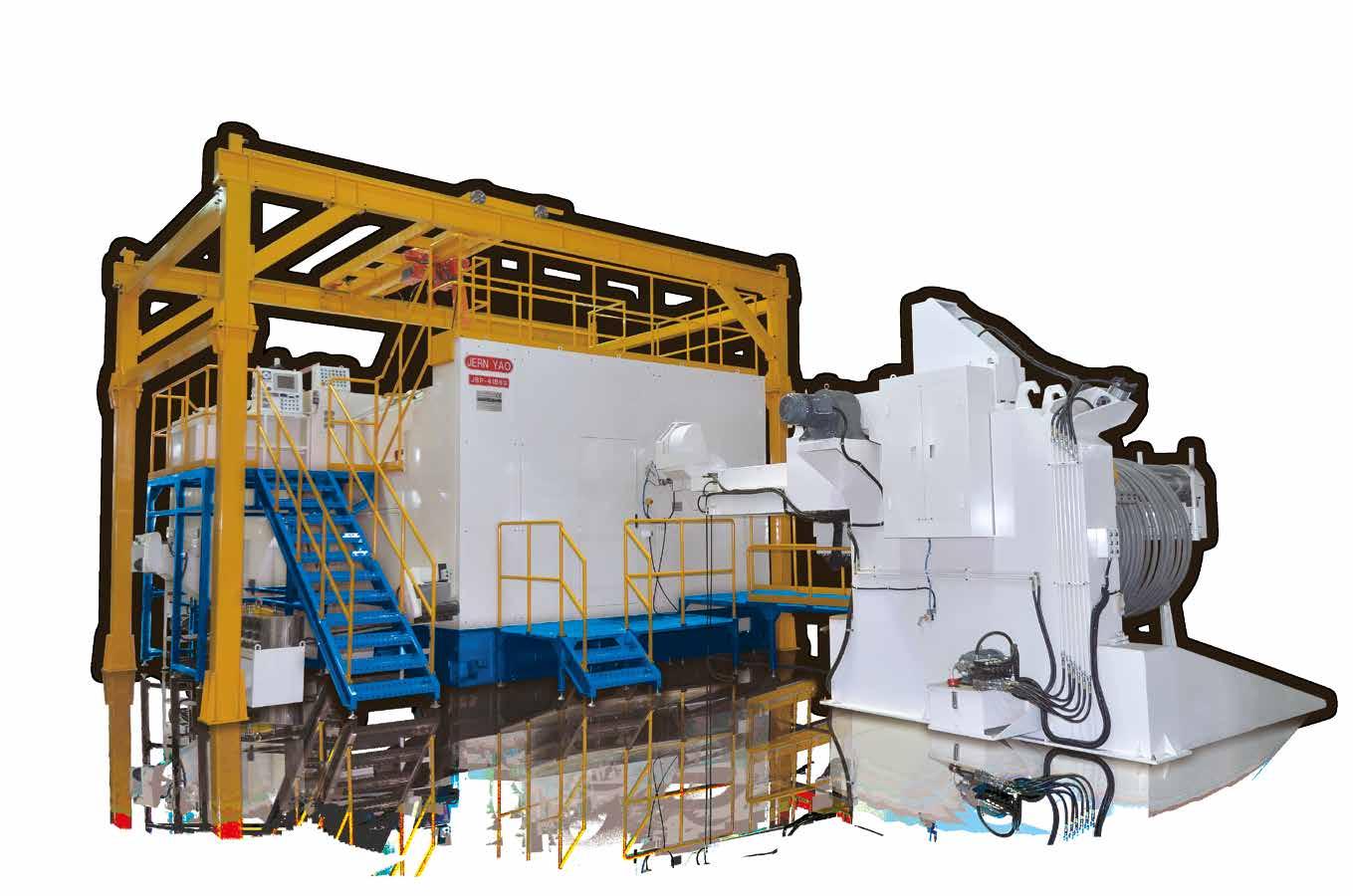

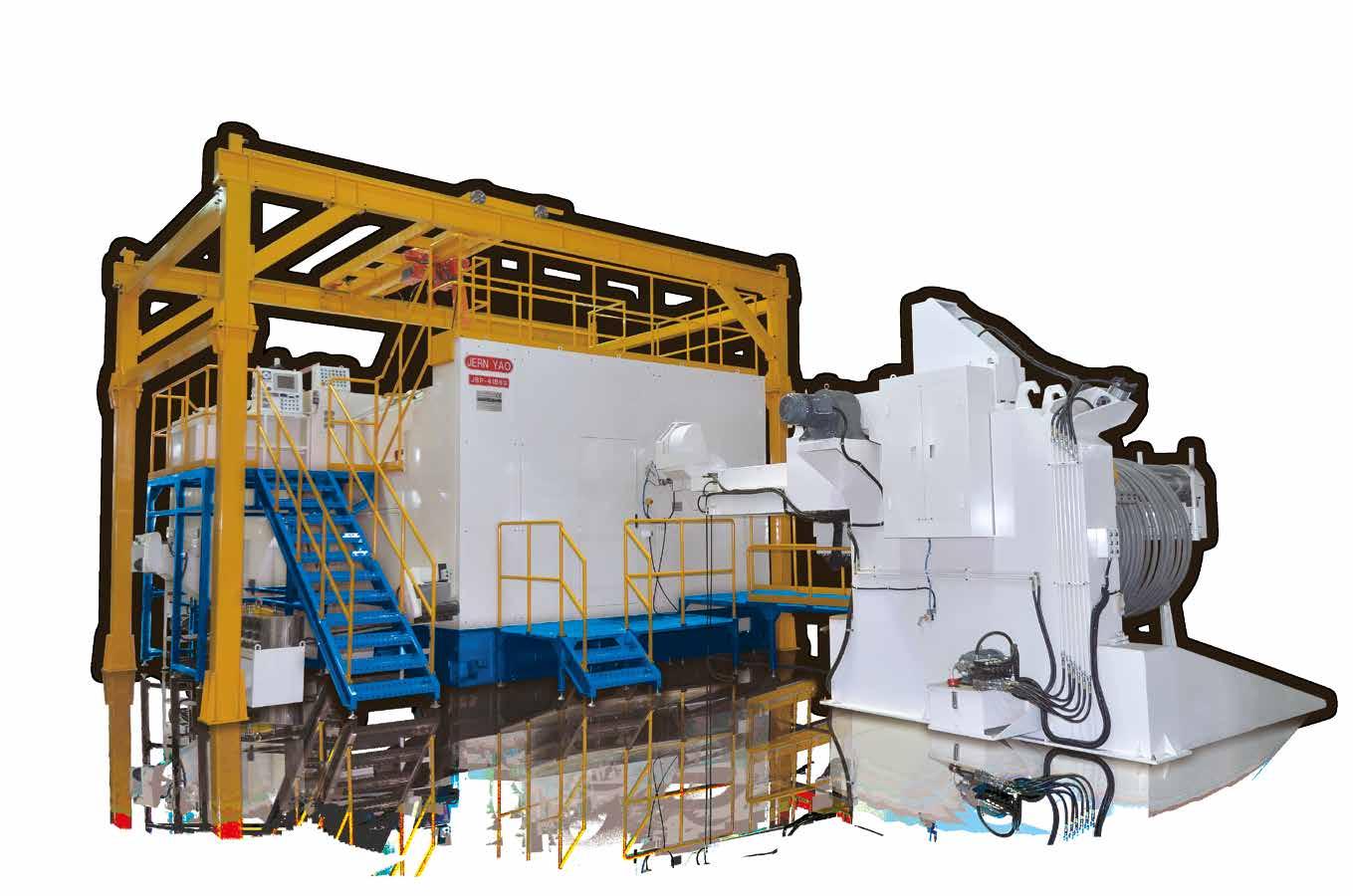

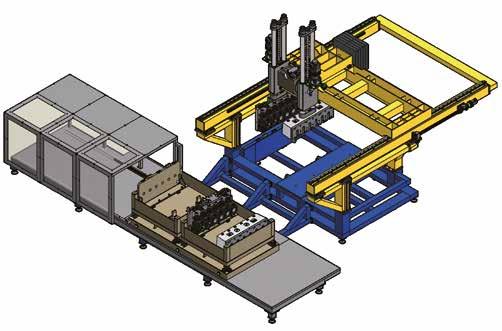

Jern Yao Enterprises Co., Ltd., a Taiwanese bolts, nuts and special parts formers developer and manufacturer, is the first choice of many professional fastener manufacturers around the world when considering the purchase of processing equipment with production efficiency, precision, stability, finished product quality and after-sales service. With an average annual capacity of hundreds of units, it provides fastener manufacturers with reliable and durable equipment, and is an important force in supporting the operation of the global fastener manufacturing industry. In response to the ever-changing needs of the industry, Jern Yao continues to invest in the development of new products, and the JBF-13B4SE Former, which will make a debut in wire Düsseldorf this year, is expected to become popular in conversations among European and American buyers.

In response to the global labor shortage in the manufacturing industry, the new and improved JBF-13B4SE Former can produce 135250 pcs per min. The rigidity of the body and the area of the main crankshaft under stress have been increased by about 10%, which greatly improves the durability. Many upgrades have been made to the equipment, including: new generation of lightweight pneumatic clamps (with high-precision double cams to accurately transfer the clamps to right positions during high-speed production, extending the service life of punches, dies, and parts), 4 plus 1 clamp design (the 5th clamp will take the blanks to the dedicated channel after the product forging is completed, preventing products from being damaged and mixed, thus reducing the defective rate), and the auto kick-out/stopper length adjusting integrated into the human-machine interface (automatic memory and positioning, greatly reducing tooling changeover time), IE-3 energy-saving motors (equipped on all products sold to Europe), digital electricity meter (convenient for calculating carbon emissions), high-efficiency smoke cleaners (reducing air pollution in the factory), and preventive maintenance alerts (instantly reporting production information and abnormal conditions).

In addition, remote monitoring is also installed, allowing Taiwan HQ to assist customers in remotely checking machine conditions and troubleshooting.

"Satisfying customers' demands and investing in growing with them are what Jern Yao has been doing for over 31 years. We have the ability to develop equipment meeting the specific needs of different customers, as well as provide simple solutions or standard equipment based on the nature of the customer's product and cost considerations. We’ve even overcome the inherent limitations of weight and movement of traditional mechanisms to improve the structure of a customer's tooling changeover time (measured in seconds), and successfully met the customer's requirements. We’ve also developed an auto tooling changing robotic arm mechanism to help reduce customers’ reliance on human experience," said Mike Huang, Sales Section Chief.

With many customers in stricter safety regulations countries such as Europe, the U.S. and Japan, Jern Yao has always been committed to improving the safety and automation of its products. In terms of safety and in light of the fact that European customers have been placing more and more emphases on equipment safety and that the governments of those countries have required that imported equipment must be certified to a higher level of CE standard in recent years, Jern Yao has been working hard to lead the industry in obtaining the TÜV NORD

CE certification (MD, LVD, EMC), which is known to be the most stringent and difficult to obtain. In terms of product automation, Jern Yao also offers optional motorized adjustments, such as the quick tooling change mechanism and the one-button adjustment HMI to avoid hours of tooling changeover time, as well as other mechanisms to create flush product surfaces and cleanliness, just to name a few. In addition, unlike other companies that often use parts made in China that has less requirements on material stability and processing precision in order to reduce production costs, Jern Yao has insisted on using only parts made in Taiwan to manufacture equipment since its inception.

Jern Yao's key components are machined in-house. In order to fully control the parts manufacturing process and improve its machining accuracy, Jern Yao is currently building a 12,562 m 2 parts machining plant near its old factory. Upon completion, it will introduce several new high-end CNC machining machines and FOUR 5-Face CNC milling machines that have not yet been introduced to Taiwan fastener industry (machine-part does not need to be relocated after being positioned and they are capable of machining at all angles), thus greatly improving precision and avoiding the risk of subsequent errors associated with traditional machining machines that rely on manual adjustments.

“The new plant is expected to be completed and put into operation around Q3 this year. By that time, our in-house manufacturing rate and processing precision will be greatly enhanced, further increasing our ability to compete with our European and American counterparts in the international market,” added Huang.

The global economy is expected to continue to drive changes in supply and demand for fastener machinery. Jern Yao's overall sales continued to grow last year, and despite a sudden shift in global demand for fasteners to a more conservative pace at the beginning of 2024, Jern Yao remains optimistic about the market's subsequent momentum this year, and does not rule out the possibility of rush orders. Jern Yao is also receiving counseling on ESG to respond to the market's growing interest in energy conservation and carbon reduction.

"When the economy is filled with gloom, we should work hard to improve ourselves and prepare for market changes in advance, so that we can quickly keep up with customers' needs when the economy recovers. If you want to survive in a market where customer demands are changing rapidly, the only way is to work hard to develop new products," said Huang.

Jern Yao contact: Sales Section Chief Mike Huang Email: mike@jernyao.com

Copyright

Booth No. Hall 16 / G29-5

JI LI DENG FASTENERS CO., LTD.

www.jldfasteners.com.tw

JLD is a Taiwanese supplier and mainly supplies customized/OEM parts including cold forging, multiple stations parts, weld studs, SEMS screws and so on for the appliances, electronics, and automotive industries. Our dedication to high quality and efficient services has earned our customers' trust and long-term partnerships. "Seeing is believing", we invite you to visit our booth and we will show you our capabilities and products.

Booth No. Hall 16 / E74

CHEN TAI FASTENER MACHINE CO., LTD.

jenntai.com.tw/en/

Booth No. Hall 11 / C06-4

CHENG I DRAWING MACHINERY CO., LTD.

www.chengi.com.tw

Booth No. Hall 11 / C06-3

CHENG I WIRE MACHINERY CO., LTD.

www.cheng-i.com

Booth No. Hall 16 / D73

CHI NING CO., LTD.

www.nutformer.com.tw

Booth No. Hall 16 / J29