Aftermoving into the new 3,636 sq. m plant in 2017, Taiwanese CNC parts machining specialist Yuh Chyang Hardware has continued to improve its technology and services over the past 7 years, and is able to satisfy customers’ needs from different industries for various types of precision components. It has not only made Taiwan's mature CNC machining technology visible to the markets of Europe and the U.S., but also provides a faster path for its customers to pursue the goal of higher value-added products.

Yuh Chyang has been always well known for its CNC machining technology. It is capable of producing products made of various materials, of high hardness, or with machining difficulty, and has taken the lead in the industry in terms of consistent quality and machining precision. In order to meet customers’ demands for the high quality and precision of products, Yuh Chyang uses the most advanced CNC machines of Japan brand, renew its facilities from time to time to achieve its machining precision, and has installed energy-saving and carbonreducing equipment to ensure that the finished products meet the stringent requirements of each customer. Yuh Chyang President Tsay Sheng Tzeng said, "Japanese machines are more stable and require less maintenance, allowing our technicians to serve different customers' processing needs more efficiently and achieve better product quality and yield rate.”

In recent years Yuh Chyang has been successful in establishing its presence in the automotive CNC parts supply chain. In addition to the supply of the critical parts in transmission and heating system for fuel cars, it has also secured a number of orders for charging plugs of EV cars. Through close cooperation with T2 parts, distributors in Europe and the U.S., about 90% of its products are sold to the European and U.S. automotive markets. President Tzeng said, "The rise of the EV market has boosted our performance, and we’ve seen significant growth in the past few months due to continued orders from existing customers, demand for new products, and orders from new customers. We’re pleased with the growth of our sales in these months and are committed to specialization. Even though the entry barrier of the automotive field is relatively high, our experience in acquiring IATF 16949-related certification has been mature, which is why we can continue to generate high customer satisfaction.”

Recognizing that quality can only be achieved with the participation of all employees, Yuh Chyang has put a lot of efforts into production management and employee training. It has not only set up a display board in the plant to report production line problems, customer requirements, and annual goals to remind all employees, but also arranged courses to transfer product design techniques and familiarize employees with the latest industry requirements (e.g., energy saving and carbon reduction).

Yuh Chyang contact: President Tsay Sheng Tzeng

Email: yc.cnc@msa.hinet.net

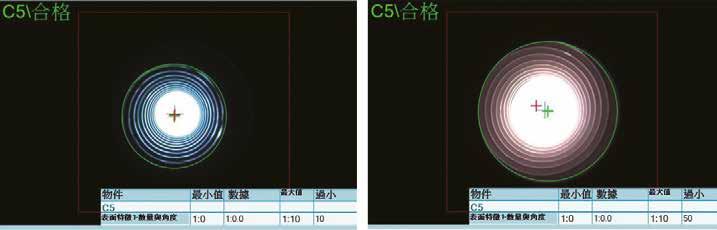

▲ Advanced projector inspection equipment

▲ Advanced 3D inspection equipment

President Tzeng said, "We’ve been always at the forefront of customers' requirements, and emphasize employee participation and self-achievement and are willing to encourage them to achieve customers’ high quality requirements through incentives to further enhance customer confidence. In the future, we hope to continue to let more customers know about our dedication and efforts in pursuing high quality through Fastener World Magazine's international marketing expertise."

181 310EXPRESS COMPANY (Japan)

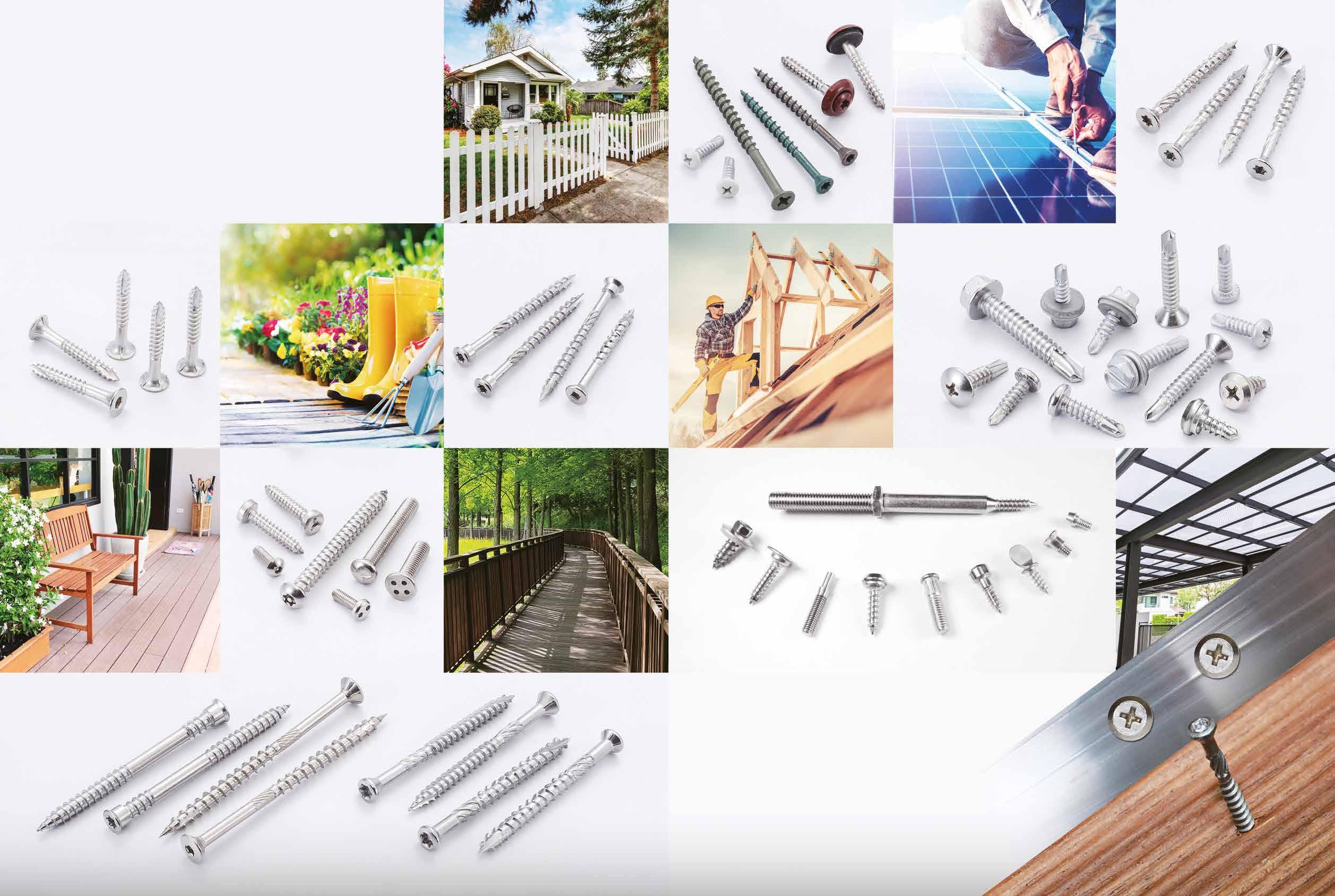

Security, Tamper Proof, Anti-theft Screws...

280 A-PLUS SCREWS INC.

Chipboard Screws, Customized Special Screws / Bolts...

121 A-STAINLESS INTERNATIONAL CO., LTD. 淳康

Chipboard Screws, Concrete Screws, Deck Screws...

215 A. JATE STEEL CO., LTD.

All Kinds of Nuts, All Kinds of Screws, Automotive Screws...

201 A.I.M.Y. CO., LTD.

Special Parts...

正楓

宸欣

318 ABC FASTENERS CO., LTD. 聯欣

Drop-in Anchors, Expansion Anchors, Wire Anchors...

90 ACHILLES SEIBERT GMBH (Germany)

Tapping Screws, Drilling Screws, Thread Rolling Screws...

94 AEH FASTEN INDUSTRIES CO., LTD. 鉞昌

Clevis Pins, Dowel Pins, Hollow Rivets...

41 ALEX SCREW INDUSTRIAL CO., LTD. 禾億

Button Head Cap Screws, Button Head Socket Cap Screws...

88 AMBROVIT S.P.A. (Italy)

Chipboard Screws, Combined Screws, Machine Screws...

92 AMPLE LONG INDUSTRY CO., LTD. 寬長

Hollow Rivets, Drive Rivets, Semi-tubular Rivets...

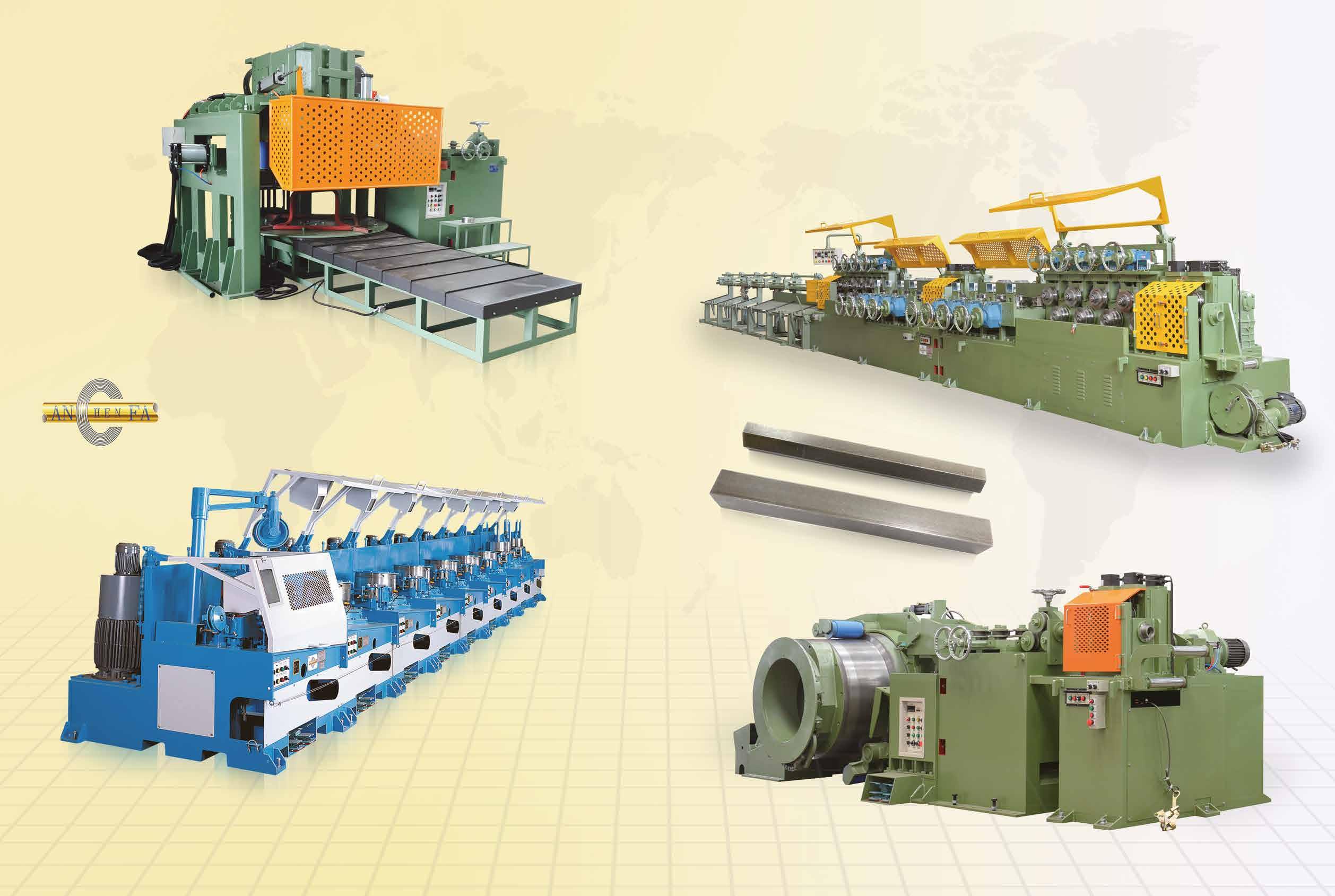

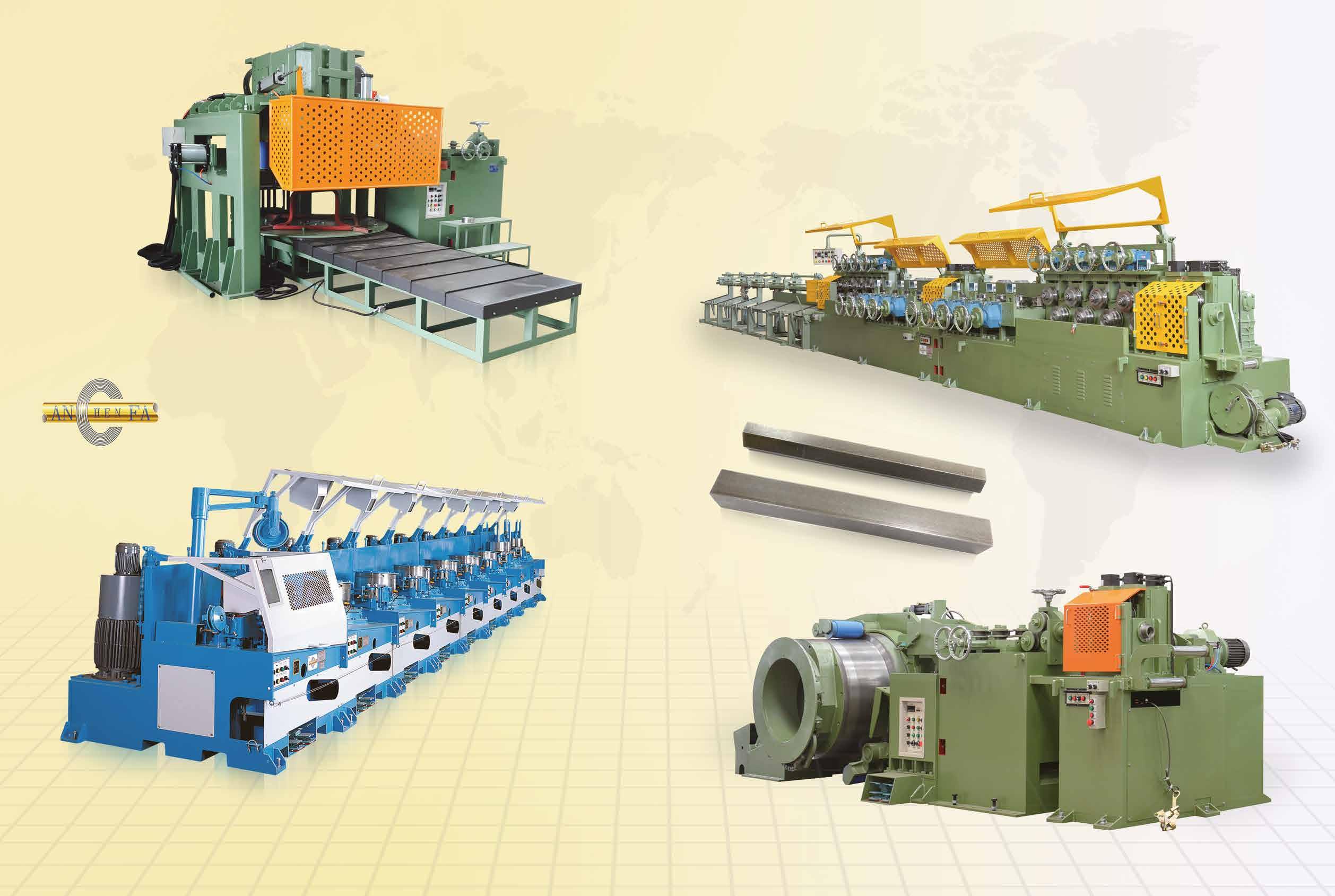

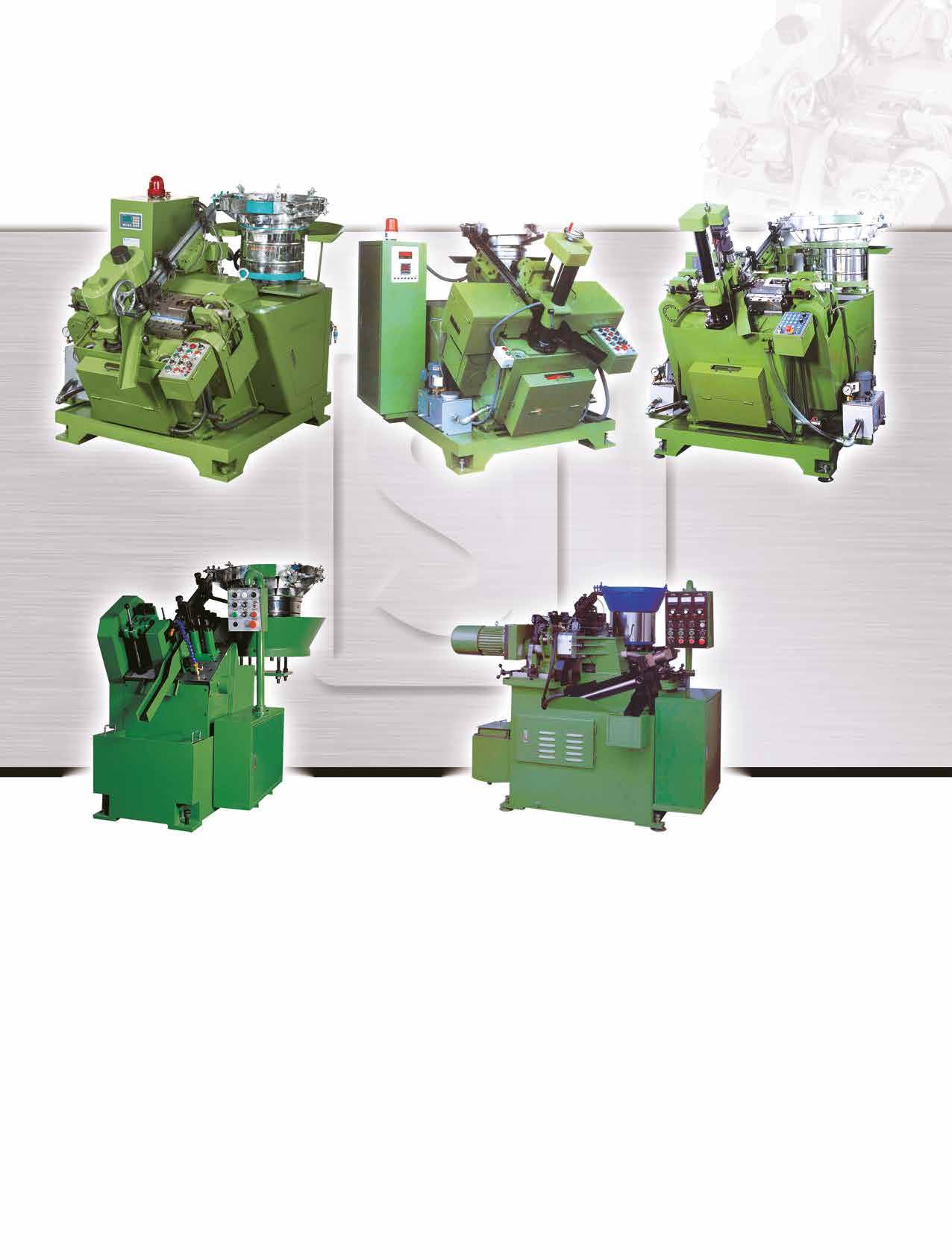

290 AN CHEN FA MACHINERY CO., LTD. 安全發

Straight Line Wire Drawing Machines with Computer Control...

330 ANCHOR FASTENERS INDUSTRIAL CO., LTD. 安拓

ETA Series, Anchor Bolts, Anchor Nuts, Automotive Parts...

67 APEX FASTENER INTERNATIONAL CO., LTD. 嵿峰 Nuts, Wing Nuts & Bolts, Turning Parts, Stamping Parts

44 ARUN CO., LTD. 鉅耕

Bi-metal Screws, Chipboard Screws, Drywall Screws...

128 ASCCO INTERNATIONAL CO., LTD. 今大唯

Chipboard Screws, Drywall Screws, Wood Screws, Tapping Screws...

130 AUTOLINK INTERNATIONAL CO., LTD. 浤爵

Automotive Screws, Machine Bolts, Flange Nuts...

99 BCR INC.

Automotive Screws, Piston Pins, Weld Bolts (Studs)...

必鋮

217 BEAR FASTENING SOLUTIONS, INC. 雄益 IFI, DIN, ISO, JIS standard, Drywall Screws, Decking Screws

137 BERDAN CIVATA SAN. A.S. (Turkey) Standard / Special / Metric / Inch Fasteners

101 BESTWELL INTERNATIONAL CORP. 凱壹 Eye Bolts, Flanged Head Bolts, Hanger Bolts...

297 BIING FENG ENTERPRISE CO., LTD. 秉鋒 Blind Nut Formers, Multi-station Cold Forming Machines...

30 BI-MIRTH CORP. 吉瞬 Stainless Steel Screws, Chipboard Screws, Timber Screws...

4 BOLTUN CORPORATION

Automotive Screws, Bushes, Conical Washer Nuts...

104 CANATEX INDUSTRIAL CO., LTD. 保力德 Nuts, Turning Parts, Bolts, Plastic Injection Parts...

165 CHANG BING ENTERPRISE CO., LTD. 彰濱 Hook Bolts, Holders / Hooks / Rings, Dowel Screws...

82 CHI HUNG RIVETS WORKS CO., LTD. 吉宏 Blind Rivets, Hollow Rivets, Solid Rivets, Split Rivets...

300 CHI NING COMPANY LTD.

Machine, Nuts, Tooling...

50 CHIAN YUNG CORPORATION 將運 SEMS Screws

213 CHIEH LING SCREWS ENTERPRISE CO., LTD. 捷領

Screws, Nuts, Hexagon Keys, Lug Wrenches, Rivets...

294 CHIEN TSAI MACHINERY ENTERPRISE CO., LTD. 鍵財

Thread Rolling Machines

267 CHIN LIH HSING PRECISION ENTERPRISE (CLH) 金利興

Automotive Nuts, Brass Inserts, Bushes, Bushings...

286 CHING CHAN OPTICAL TECHNOLOGY CO., LTD. 精湛

Eddy Current Sorting Machines, Fastener Makers...

197 CHIREK FASTENER CORPORATION 錡瑞

Stainless Steel Fasteners, Self-Drilling Screws, Washers...

58 CHONG CHENG FASTENER CORP.

62

Cap Nuts, Coupling Nuts, Conical Washer Nuts...

CHUN YU WORKS & CO., LTD. 春雨

Drywall Screws, Socket Head Cap Screws , TC Bolt Sets...

153 CONTINENTAL PARAFUSOS S.A. 巴西商友暉

221

98

Automotive Part & Nut, Home Appliance Screws, Sems...

COPA FLANGE FASTENERS CORP.

Hex Nuts, Hex Flange Nuts, Combi Nuts, Weld Nuts...

CPC FASTENERS INTERNATIONAL CO., LTD.

Stainless Steel, Bi-metal Self-drilling Screws...

21 DA YANG ENTERPRISE CO., LTD.

Special Automotive Nuts, Special Weld Nuts...

106 DAR YU ENTERPRISE CO., LTD.

Chipboard Screws, Drywall Screws, Screw Nails…

109 DE HUI SCREW INDUSTRY CO., LTD.

177

Drywall Screws, Decking Screws, Self-drilling Screws, Roofing Screws...

DICHA FASTENERS MFG

Expansion Anchors, Sleeve Anchors, Nylon Nail Anchors...

DIING SEN FASTENERS INDUSTRIAL CO., LTD.

Chipboard Screws, Corrosion Resistant Screws...

47 DIN LING CORP. 登琳

Chipboard Screws, Drywall Screws, Furniture Screws...

83 DRA-GOON FASTENERS CO., LTD.

Chipboard Screws, Phillips Head Screws, TEK Screws...

102 DUNFA INTERNATIONAL CO., LTD.

Bushes, Spacers, Automotive Parts, Tubes, Turning Parts...

24 E CHAIN INDUSTRIAL CO., LTD.

Chipboard Screws, Drywall Screws, Machine Screws...

114 E.U.R.O.TEC GMBH (Germany)

All Kinds of Screws, Bi-metal Self-drilling Screws...

218 EASON TECH INDUSTRIAL CO., LTD.

Spring Pins, Cage Nuts, Clip Nuts, Retaining Rings...

151 EASYLINK INDUSTRIAL CO., LTD.

Automotive Nuts, Thread Forming Screws...

216 EMEK RIVETS & FASTENERS CO. LTD. (Turkey)

Rivet Nuts, Spacers & Round Nuts, Tubular Rivets, Special Screws...

211 EVERWIN PNEUMATIC CORP.

Hidden Deck Fastening System, Coil Nailers, Staplers, Strip Nailers...

175 FAITHFUL ENGINEERING PRODUCTS CO., LTD.

Anchors, Box Nails, Door/Window Accessories...

78 FALCON FASTENER CO., LTD.

Automotive & Motorcycle Special Screws / Bolts...

FANG SHENG SCREW CO., LTD.

Shoulder Bolts, Button Head Socket Cap Screws...

117 FAR SRL (Italy)

Blind Rivets, Rivet Nuts, Riveting Tools...

25 FASTENER JAMHER TAIWAN INC.

Automotive Nuts, Blind Nuts / Rivet Nuts, Bushings...

37 FASTNET CORP.

Dowel Pins, Flange Nuts, Weld Nuts, 4 Pronged T Nuts...

125 FILROX INDUSTRIAL CO., LTD.

Blind Nuts / Rivet Nuts, Tee or T Nuts, Blind Rivets...

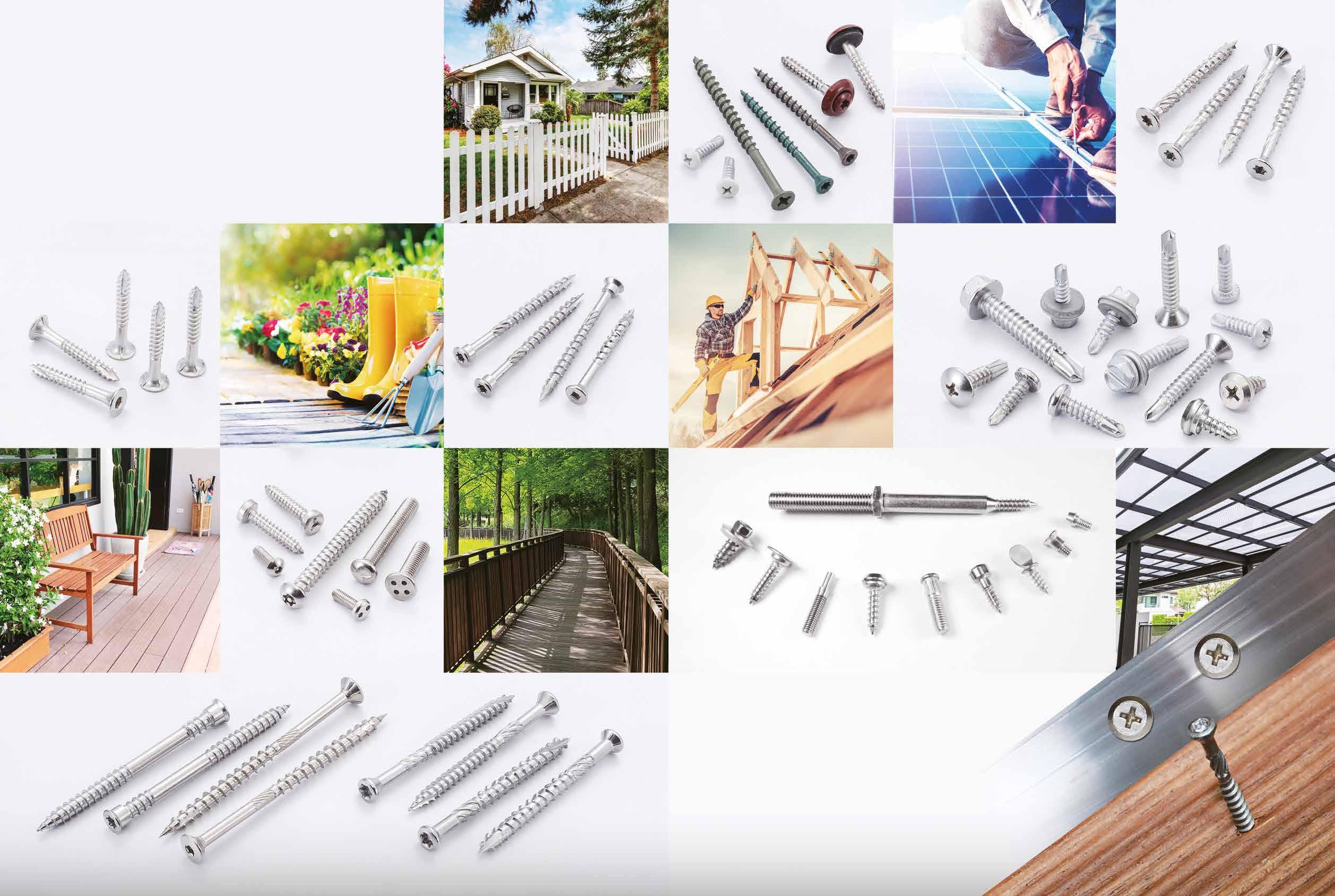

42 FONG PREAN INDUSTRIAL CO., LTD.

Automotive Screws, Bi-metal Screws, Brass & Bronze Screws...

23 FORTUNE BRIGHT INDUSTRIAL CO., LTD.

Cap Nuts, Dome Nuts, Nylon Cap Insert Lock Nuts...

305 FRATOM FASTECH CO., LTD.

Hot Forming Tools, Punches & Sleeves, Dies, Machinery Accssories...

76 FU HUI SCREW INDUSTRY CO., LTD.

Automotive & Motorcycle Special Screws / Bolts...

147 FU KAI FASTENER ENTERPRISE CO., LTD.

Precision Electronic Screws, Special Screws, Weld Screws...

60 FUSHANG CO., LTD.

Carbon Steel Screws, Chipboard Screws, Concrete Screws...

159 GA-E INDUSTRIAL PRECISION CO., LTD.

Titanium Alloy Bolts

295 GIAN-YEH INDUSTRIAL CO., LTD.

Rivet Dies, Self-drilling Screw Dies, Screw Tip Dies...

180 GINFA WORLD CO., LTD. 濟音發

Chipboard Screws, Countersunk Screws, Drywall Screws...

220 GLORBAL SALES COMPANY LIMITED

Various Stamping Products, Multi-process Assembly Parts...

142 GOFAST CO., LTD.

Open Die Parts, Stamping Parts, Assembly Parts...

309 GREENSLADE & COMPANY, INC. (U.S.A.)

Concentricity, Ring Gage, Plug Gage Calibration, Gages...

107 HAO CHENG PLASTIC CO., LTD.

PP Boxes, PET Jars, ABS Boxes, PC Boxes..

189 HARVILLE FASTENERS LTD.

喬邁

303 INFINIX PRECISION CORP. 英飛凌

Customized Punches and Dies

46 INMETCH INDUSTRIAL CO., LTD. 恆鉅

Flanged Head Bolts, Locking Bolts, Stud Bolts...

91 INNTECH INTERNATIONAL CO., LTD. 建豪

All Kinds of Nuts, All Kinds of Screws, Automotive Special Screws...

269 J. T. FASTENERS SUPPLY CO., LTD. 金祐昇 Drop-in Anchors, Floating Nuts, Connecting Nuts...

10 J.C. GRAND CORPORATION 俊良

All Kinds of Screws, Chipboard Screws...

22 JAU YEOU INDUSTRY CO., LTD.

Chipboard Screws, Drywall Screws, High Low Thread Screws...

朝友

195 JENG YUH PLASTICS CO., LTD. 政毓

Plastic Injection Products, Plastic Mold R&D…

328 JERN YAO ENTERPRISES CO., LTD. 正曜

Multi-station Cold Forming, Parts Forming Machines...

36 JET FAST COMPANY LIMITED

捷禾 Blind Nuts / Rivet Nuts, Aircraft & Aerospace Washers...

307 JIE LE MACHINERY CO., LTD.

Consolidation of Artificial Intelligence Equipment

133 JIEN KUEN ENTERPRISE CO., LTD.

捷仂

健坤 Hexagon Nuts, Nylon Cap Insert Lock Nuts, Square Nuts...

254 JINGFONG INDUSTRY CO., LTD.

璟鋒 Hex Nylon Insert Lock Nuts, Wing Nuts with Nylon Insert...

143 JOINTECH FASTENERS INDUSTRIAL CO., LTD.

Customized Parts, Bolts, Screws, Nuts, Automotive Parts...

45 JOKER INDUSTRIAL CO., LTD.

群創

久可 Hollow Wall Anchors, Concrete Screws, Jack Nuts...

134 JUNGSHEN TECHNOLOGY CO., LTD.

Bi-metal Screws, Automatic Welding & Automatic Inspection...

榮燊

皓正

豪威爾

Special Screws and Bolts, Sems Screws, Stainless Steel Fasteners...

205 HAUR FUNG ENTERPRISE CO., LTD. 豪舫

External Tooth Washers, Long Carriage Bolts, Roofing Bolts...

282 HEADER PLAN CO. INC.

Chipboard Screws, Collated Screws, Deck Screws...

209 HEY YO TECHNOLOGY CO., LTD.

Precision Pins, Rollers, Dowel Pins...

166 HISENER INDUSTRIAL CO., LTD.

恆勇

海迅

Wood Construction Screws, Chipboard Screws, Drywall Screws...

241 HOMEYU FASTENERS CO., LTD. 宏宇

Cold Forging Stage, Machine Molds, Lathe, CNC Machining...

301 HONG TAY YUE ENTERPRISE CO., LTD. 鴻大裕

Wire Straighteners, Hydraulic Clamping Machines...

148 HOSHENG PRECISION HARDWARE CO., LTD. 和昇

Auto Parts, CNC Machined Parts, Bolts...

93 HSIN JUI HARDWARE ENTERPRISE CO., LTD. 欣瑞

Bushes, Construction Bolts, Special Cold / Hot Forming Parts...

178 HSIN YU SCREW ENTERPRISE CO., LTD. 新雨

Acme Screws, Hexagon Head Cap Screws...

51 HU PAO INDUSTRIES CO., LTD. 如保

Automotive Nuts, Flange Nuts, Hexagon Nuts...

191 HUANG JING INDUSTRIAL CO., LTD. 皇晉

Custom Washers, Chipboard Screws, Drywall Screws...

183 HWEI NEN CO., LTD. 輝能

Automotive & Motorcycle Special Screws / Bolts...

288 K. TICHO INDUSTRIES CO., LTD.

帝潮 Nails, Screws, Bolts & Nuts Machiner

229 KAN GOOD ENTERPRISE CO., LTD.

鋼固 Fastener, Hardware, Plastic, Instruction Booklet Package in Bags...

239 KAO WAN BOLT INDUSTRIAL CO., LTD.

高旺 Hex Head Cap Screws, Carriage Bolts, Hex Lag Bolts...

96 KING CENTURY GROUP CO., LTD.

慶宇 Drop-in Anchors, Self-drilling Anchors, Sleeve Anchors...

313 KING SHANG YUAN MACHINERY CO., LTD. 金上源 Hydraulic Press for Lock Nut, Assembly

296 KING YUAN DAR METAL ENTERPRISE CO., LTD. 金元達 Continuous Type Heat Treating Furnace

289 KUANG TAI METAL INDUSTRIAL CO., LTD. 廣泰 Stainless Steel Cold Heading Wire

74 KWANTEX RESEARCH INC.

寬仕 Chipboard Screws, Wood Construction Screws, Deck Screws...

124 L & W FASTENERS COMPANY

Construction Fasteners, Flat Washers, Heavy Nuts...

219 LI YOU SCREW INDUSTRY CO., LTD.

金大鼎

立侑 Automotive / Sems / Nylock / CNC Machined Screws...

179 LIAN CHUAN SHING INTERNATIONAL CO., LTD. 連全興 Weld Nuts, Special Parts, Special Washers, Flat Washers...

322 LIAN SHYANG INDUSTRIES CO., LTD. 連翔 Nut Formers, Nut Tapping Machines

244 LIANG YING FASTENERS INDUSTRY CO., LTD. CNC Machining, CNC Milling, Turned Parts...

193 LINK-PRO TECH CO., LTD.

超傑 Customized Screws/Nuts, Pressing & Deep Drawing...

332

LINKWELL INDUSTRY CO., LTD.

All Kinds of Screws, Automotive & Motorcycle Special Screws...

順承

15 LOCKSURE INC. 今湛

Custom Washers, Flat Washers, Automotive Screws...

171 LOYAL & BIRCH CO., LTD. 龍業百起

Construction Fasteners and Building Fasteners

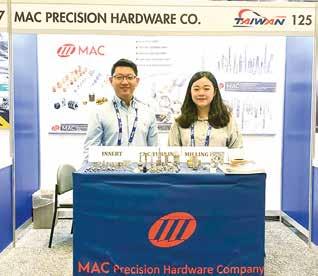

95 MAC PRECISION HARDWARE CO.

Turning Parts, Precision Metal Parts, Cold Forged Nuts...

20 MASTER UNITED CORP.

Chipboard Screws, Drywall Screws, Furniture Screws...

66 MAUDLE INDUSTRIAL CO., LTD.

Button Head Socket Cap Screws, Flange Washer Head Screws...

165 MAXTOOL INDUSTRIAL CO., LTD.

Plastic Screws, Drop-in Anchors, Expansion Anchors...

鑫瑞

永傑

茂異

系格

187 METECK ENTERPRISES CO., LTD. 商后

Automotive Fasteners, Brass Screws (Bolts), Building Fasteners...

16 MIN HWEI ENTERPRISE CO., LTD. 明徽

Button Head Socket Cap Screws, Chipboard Screws...

279 MIT INDUSTRIAL ACCESSORIES CORP.

Stamping Hardware, Bolts, Nuts, CNC Screw Machine Parts...

246 MOLS CORPORATION

侑威

冠鑫

Home Appliance Screws, Customized Screws, Thread Forming Screws...

132 MOUNTFASCO INC. 崎鈺

All Kinds of Screws, Alloy Steel Screws, Automotive Screws...

126 NCG TOOLS INDUSTRY CO., LTD.

Tools for Fastening Anchors, Blind Nuts / Rivet Nuts...

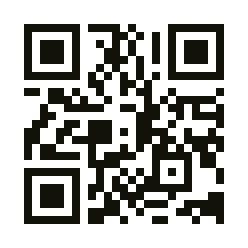

81 ND INDUSTRIES ASIA INC.

ND Pre-Applied Processes, Advanced Sealing Technologies...

185 NOVA. FASTENER CO., LTD.

Hexagon Nuts, Square Nuts, Wood Screws, Chipboard Screws...

172 PAKWELL CORPORATION

Bi-metal Screws

108 PENGTEH INDUSTRIAL CO., LTD.

SEMs Screws, Special Screws, Binder Screws, PT Screws...

穩得

鑫星

324 SEN CHANG INDUSTRIAL CO., LTD. 昇錩 Customized Special Screws / Bolts, Socket Head Cap Screws...

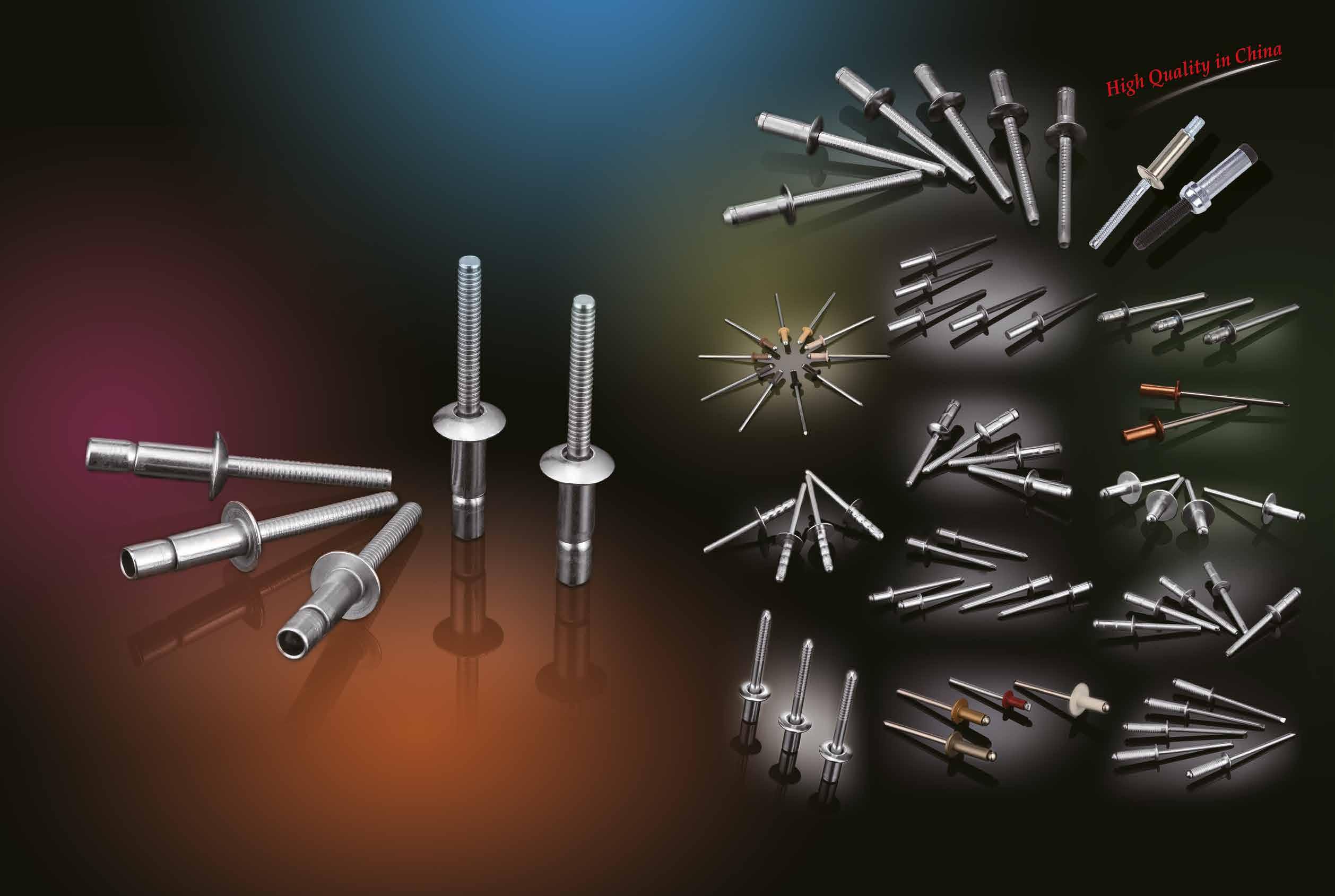

316 SHANGHAI FAST-FIX RIVET CORP. 飛可斯

Blind Rivets, High Shear Rivets, Closed End Rivets...

136 SHAW GUANG ENTERPRISE CO., LTD. 紹光

Cap Nuts, Conical Washer Nuts, Flange Nuts...

293 SHEEN TZAR CO., LTD. 新讚

Self-Drilling Screw Machines & Dies

222 SHEH FUNG SCREWS CO., LTD.

224

97

48

84 PPG INDUSTRIES INTERNATIONAL INC. 美商必丕志

Chromium-free Coating, ED Coating...

173 PRO POWER CO., LTD.

鉑川 Screws, Bolts...

123 PS FASTENERS PTE LTD. (Singapore) 汎昇 Washers, Socket Set Screws, U Bolts, Alloy Steel Screws...

150 Q-NUTS INDUSTRIAL CORP.

Flange Nuts, Weld Nuts, Special Nuts, Spacers...

141 QST INTERNATIONAL CORP.

Hexagon Head Bolts, Square Head Bolts, Weld Bolts (Studs)...

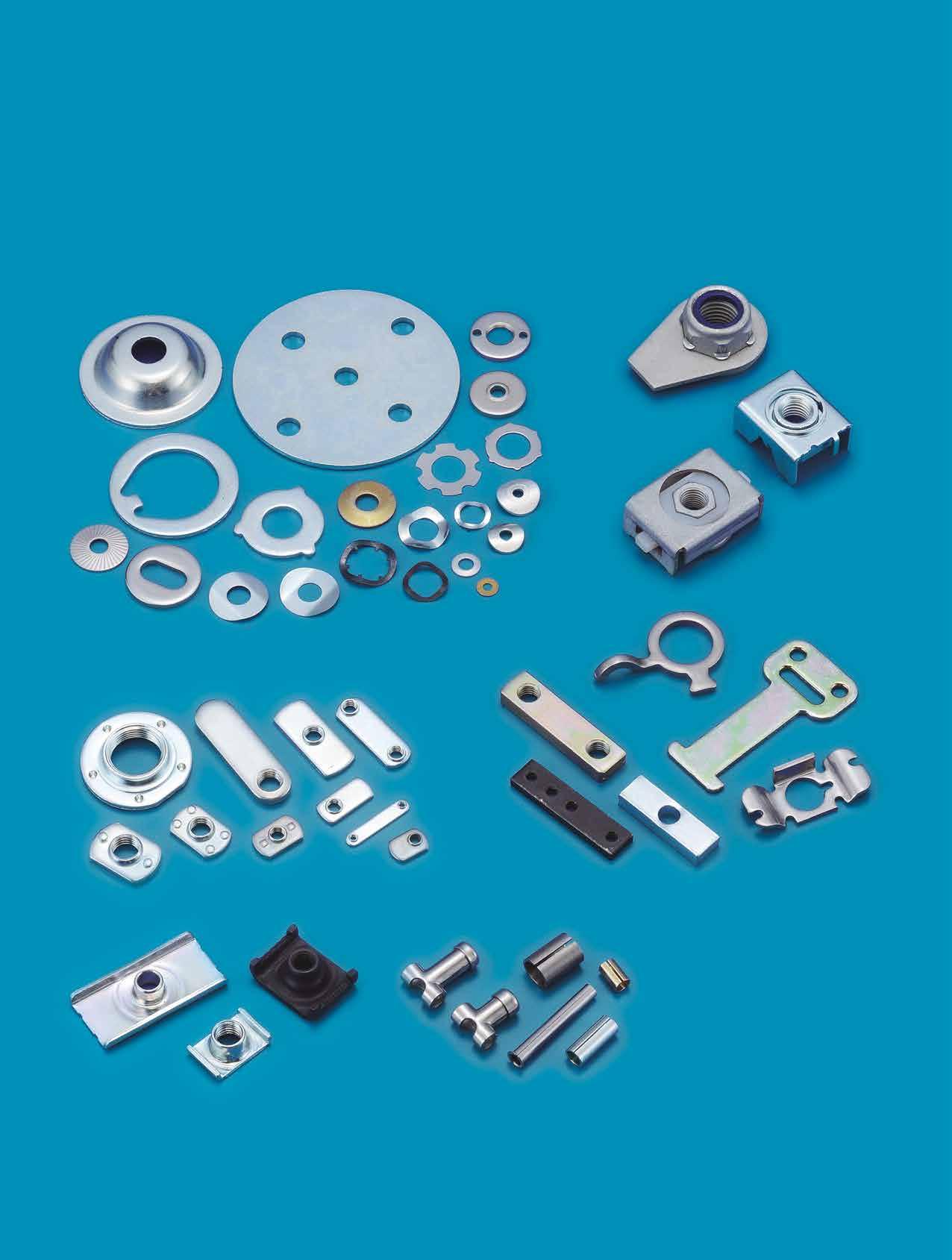

8 REXLEN CORP. 連宜 Clinch Nuts, Clinch Studs, CNC Parts, Stamped Parts...

243 S&T FASTENING INDUSTRIAL CO., LTD.

Carbon Steel Screws, Bi-metal Screws, Stainless Steel Screws...

2 SAN SHING FASTECH CORP.

Automotive Nuts, Automotive Parts, Carbide Dies...

265 SCREWTECH INDUSTRY CO., LTD.

Machined Parts, Thumb Screws, Micro Screws...

Chipboard Screws, Countersunk Screws, Wood Screws...

SHEH KAI PRECISION CO., LTD. 世鎧

Bi-metal Concrete Screw Anchors, Bi-metal Screws...

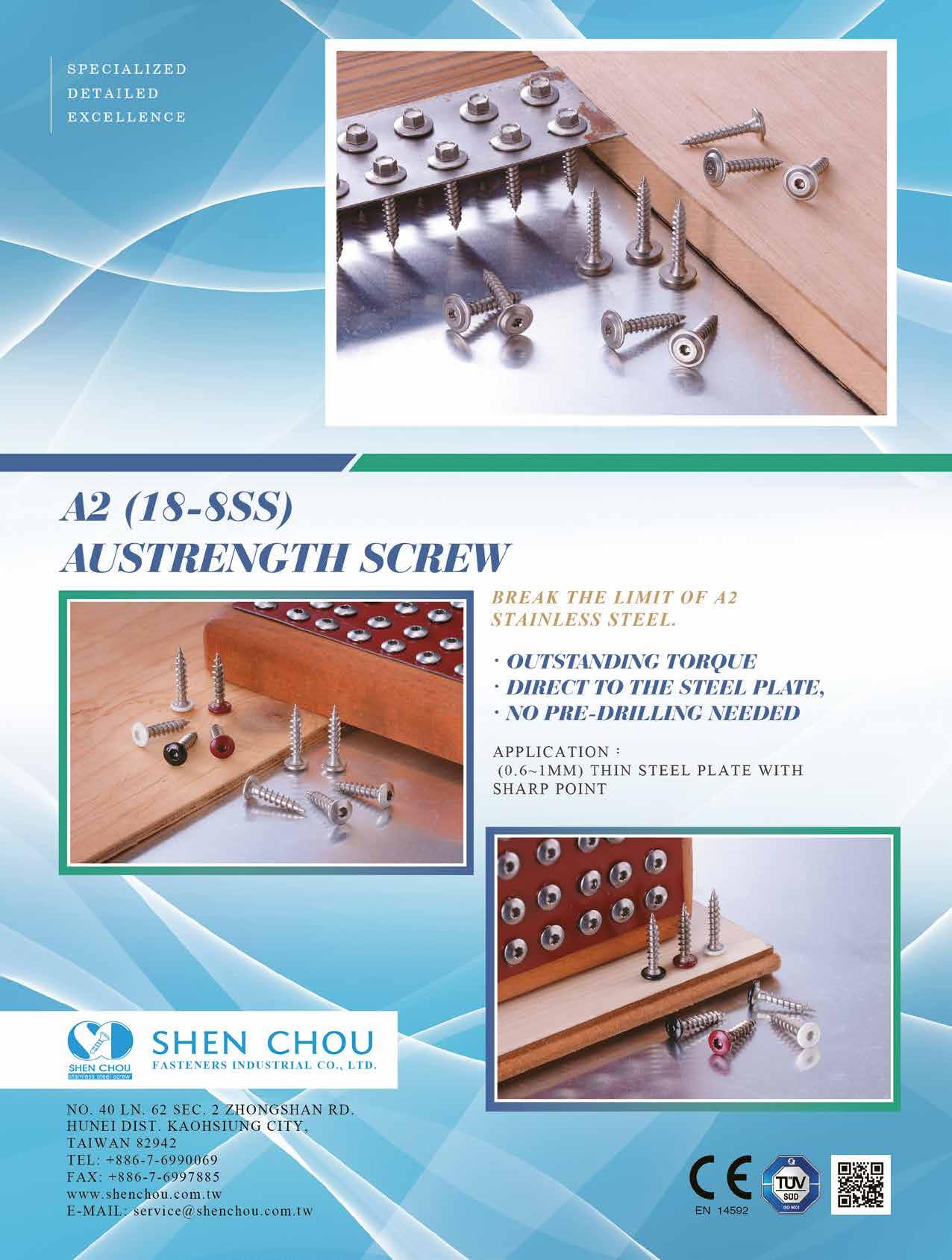

SHEN CHOU FASTENERS INDUSTRIAL CO., LTD. 神洲 Button Head Cap Screws, Chipboard Screws...

SHIH HSANG YWA INDUSTRIAL CO., LTD. 新倡發 Flange Nuts, Flange Nylon Nuts With Washers...

168 SHIN CHUN ENTERPRISE CO., LTD.

Automotive Screws, Chipboard Screws, Customized Screws...

140 SHIN JAAN WORKS CO., LTD.

Flanged Head Bolts, Long Carriage Bolts, Round Head Bolts...

112 SHUENN CHANG FA ENTERPRISE CO., LTD. 舜倡發

Long Construction Fasteners and Other Modified Fasteners...

163 SIN HONG HARDWARE PTE. LTD. (Singapore)

26

Hexagon Nuts, Hexagon Head Bolts, Blind Rivets...

SPEC PRODUCTS CORP. 友鋮

Lincensee Fasteners, Turned/Machined Parts...

12 SPECIAL RIVETS CORP.

Blind Nuts / Rivet Nuts, Blind Rivets, Air Riveters...

155 SPRING LAKE ENTERPRISE CO., LTD. 春澤 Chipboard Screws, Thread Forming Screws...

43 SUN CHEN FASTENERS INC., 展鴻鑫 Cup Washers, Flanged Head Bolts, T-head or T-slot Bolts...

315 SUN FAME MANUFACTURING CO., LTD. 商匯

Shank Slotting Machines, Screw Point Cutting Machine...

149 SUN THROUGH INDUSTRIAL CO., LTD.

Bi-Metal Screws, Carbon Steel Screws, Stamped Parts...

80 SUNCO INDUSTRIES CO., LTD. (Japan)

Distributor Specializing in Fasteners

79 SUPER DPD CO., LTD.

All Kinds of Screws, Bi-metal Screws, Carbon Steel Screws...

157 SUPREME FASTENER CORP. 至晟

Bolt & Screw, Special Fastener, Sems, Copper Bolt...

306 TAIEAG CORPORATION

Designed peripheral equipment suitable for fastener packaging

308 TAIWAN INTERNATIONAL TOOL FORM LTD.

Nut Forming Dies, Parts Forming Dies, Bolt Forming Dies...

161 TAIWAN LEE RUBBER CO., LTD. 台力

Bonded Washers, E.P.D.M. Vulcanized, Pipe Flashing...

203 TAIWAN PRECISION FASTENER CO., LTD.

Drywall Screws, Wood Construction Screws, Roofing Screws...

52 TAIWAN SELF-LOCKING CO., LTD. (TSLG) 台灣耐落 Nylok®, Precote®, Nycote®, Nyplas®, Loctite®...

116 TANG AN ENTERPRISE CO., LTD. 鏜安

Customized Automotive Parts and Special Fasteners

14 THREAD INDUSTRIAL CO., LTD. 英德 Chipboard Screws, Flange Nuts, Heavy Nuts...

113 THUNDERBOLT INDUSTRIAL CO., LTD. 雷霆 Combined Screws, Customized Special Screws/Bolts...

54 TONG HEER FASTENERS (THAILAND) CO., LTD.

Stainless Steel Metric Screws, Stainless Steel Screws…

54 TONG HEER FASTENERS CO., SDN. BHD (Malaysia)

Hex Bolts, Stud Bolts, Socket Cap Screws, Hex Nuts…

207 TONG HO SHING INTERNATIONAL CO., LTD. 桐和興

Hex Washer Head Screws, Indent Hex Head Screws...

18 TONG HWEI ENTERPRISE CO., LTD. 東徽

A2 Cap Screws, Button Head Socket Cap Screws...

55 TONG MING ENTERPRISE CO., LTD. 東明

Stainless Steel Fasteners, Wire Rods…

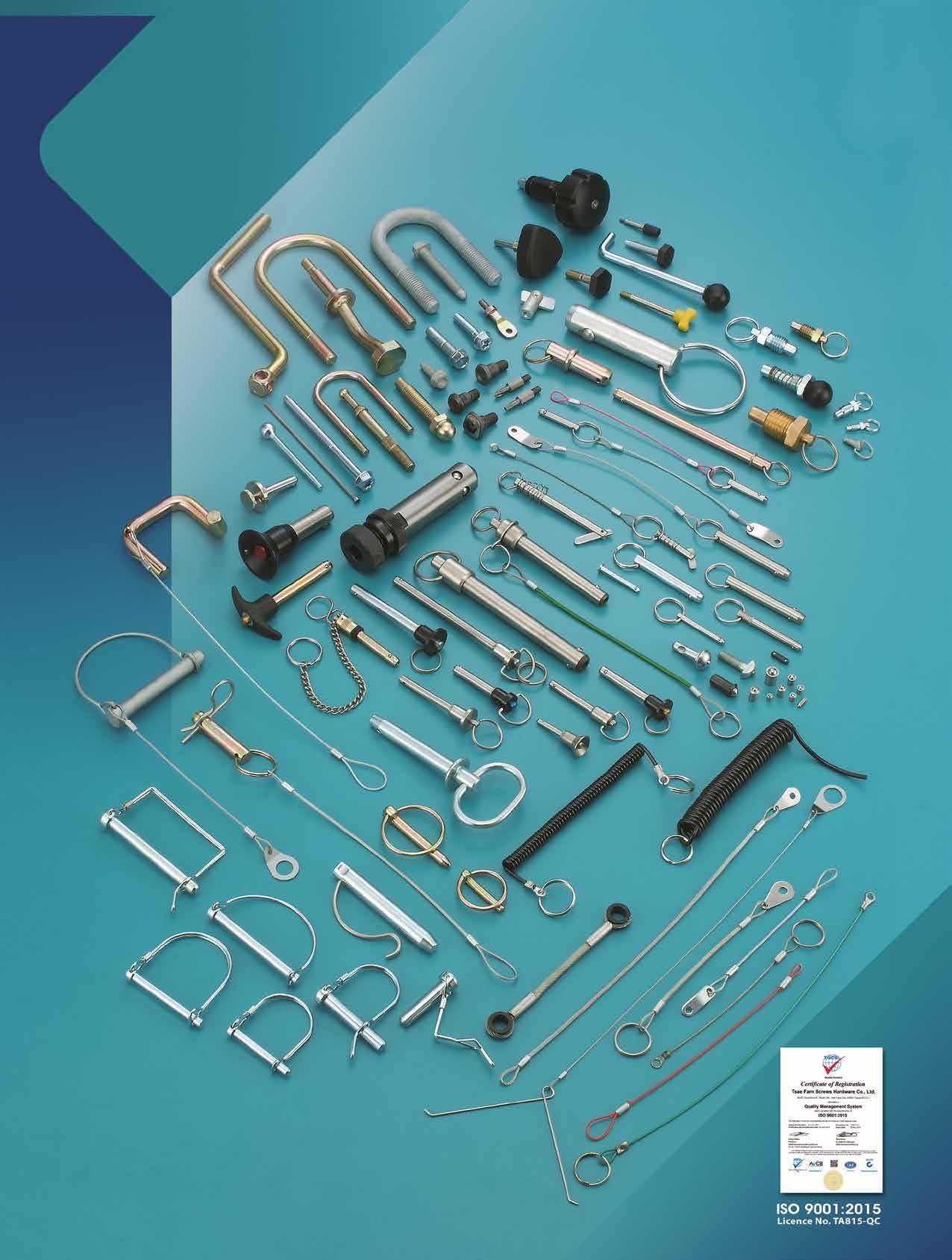

120 TSAE FARN SCREWS HARDWARE CO., LTD. 采凡

2 Cap Screws, Aircraft Nails, All Kinds of Screws...

138 TSIN YING METAL INDUSTRY CO., LTD. 晉英

Stainless Steel Cold Heading Wire, Oxalate Coating Wire...

292 TZE PING PRECISION MACHINERY CO., LTD. 智品

Open Die Machines, Cold Headers, Cold Forming Machines...

211 U.S. FASTENER IMPORT & TRADING (U.S.A.)

Standard and OEM Fasteners

129 UNISTRONG INDUSTRIAL CO., LTD. 六曜

Retaining Nuts, Sleeve Nuts, Weld Nuts, Automotive Screws...

216 UNIVERSAL PRECISION SCREWS (India)

Dowel Pins and Shoulder Bolts...

40 VERTEX PRECISION INDUSTRIAL CORP. 緯紘

6 Cuts/ 8 Cuts Self Drilling Screws, Barrel Nuts, Cap Screws

186 WAN IUAN ENTERPRISE CO., LTD. 萬淵 Punches/Dies of Various Nuts, Screws, Sleeves and Socket Boxes 56 WE POWER INDUSTRY CO., LTD.

Chipboard Screws, Concrete Screws, Drywall Screws... 118 WEIMENG METAL PRODUCTS CO., LTD.

Standard / Customized Parts, Machining Parts, Stamping Parts... 199 WEI-SHEN INDUSTRIAL FACTORY

Split Rivets, Bifurcated Rivets...

320 WILLIAM SPECIALTY INDUSTRY CO., LTD.

Chipboard Screws, Concrete Screws, Drywall Screws...

WINKEP INDUSTRIAL CO., LTD.

K-Lock Nuts, Nylon Flange Conical Washer Nuts... 38 WYSER INTERNATIONAL CORP.

Open-Die Parts, Automotive Parts... 323 YESWIN MACHINERY CO., LTD.

Bolt Formers, Multi-station Cold Forming Machines...

YI CHUN ENTERPRISE

Cap Screws, Socket Set Screws, Cage Nuts, Automotive Parts...

Rubber Washers, Plastic Screws, Custom Washers...

110 YING MING INDUSTRY CO., LTD.

Automotive & Motorcycle Special Screws / Bolts...

100 YING YI CO., LTD.

Sems Parts, Special Nuts, Pressed Parts...

29 YOUR CHOICE FASTENERS & TOOLS CO., LTD.

A2 Cap Screws, Bits & Bit Sets, Chipboard Screws... 326 YOW CHERN CO., LTD.

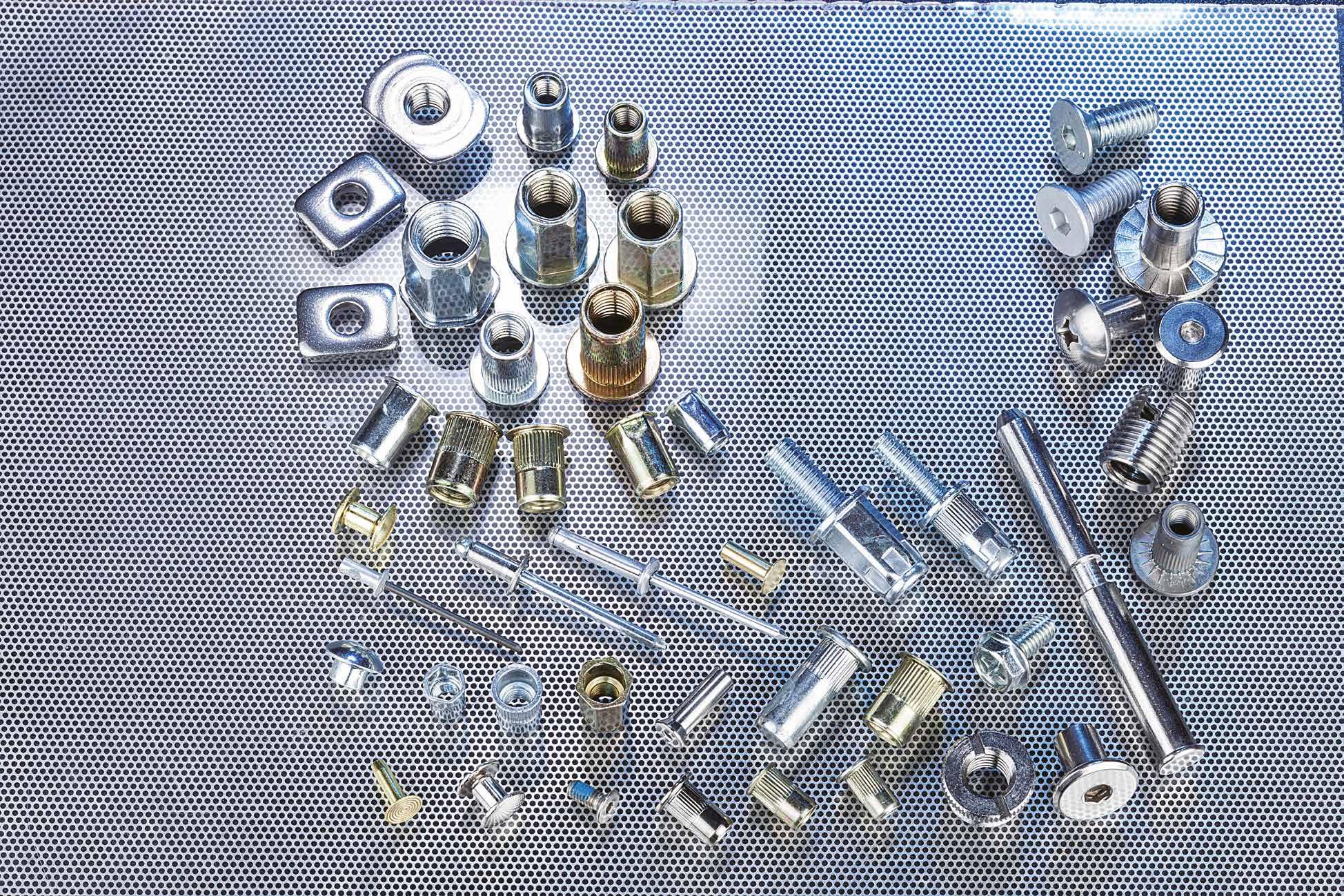

Flanged Head Bolts, Chipboard Screws, Floorboard Screws... 65 YUH CHYANG HARDWARE INDUSTRIAL CO., LTD. 鈺強

Automotive & Motorcycle Special Screws / Bolts...

314 YUH HER PRECISION CO., LTD.

Drill-Point Dies

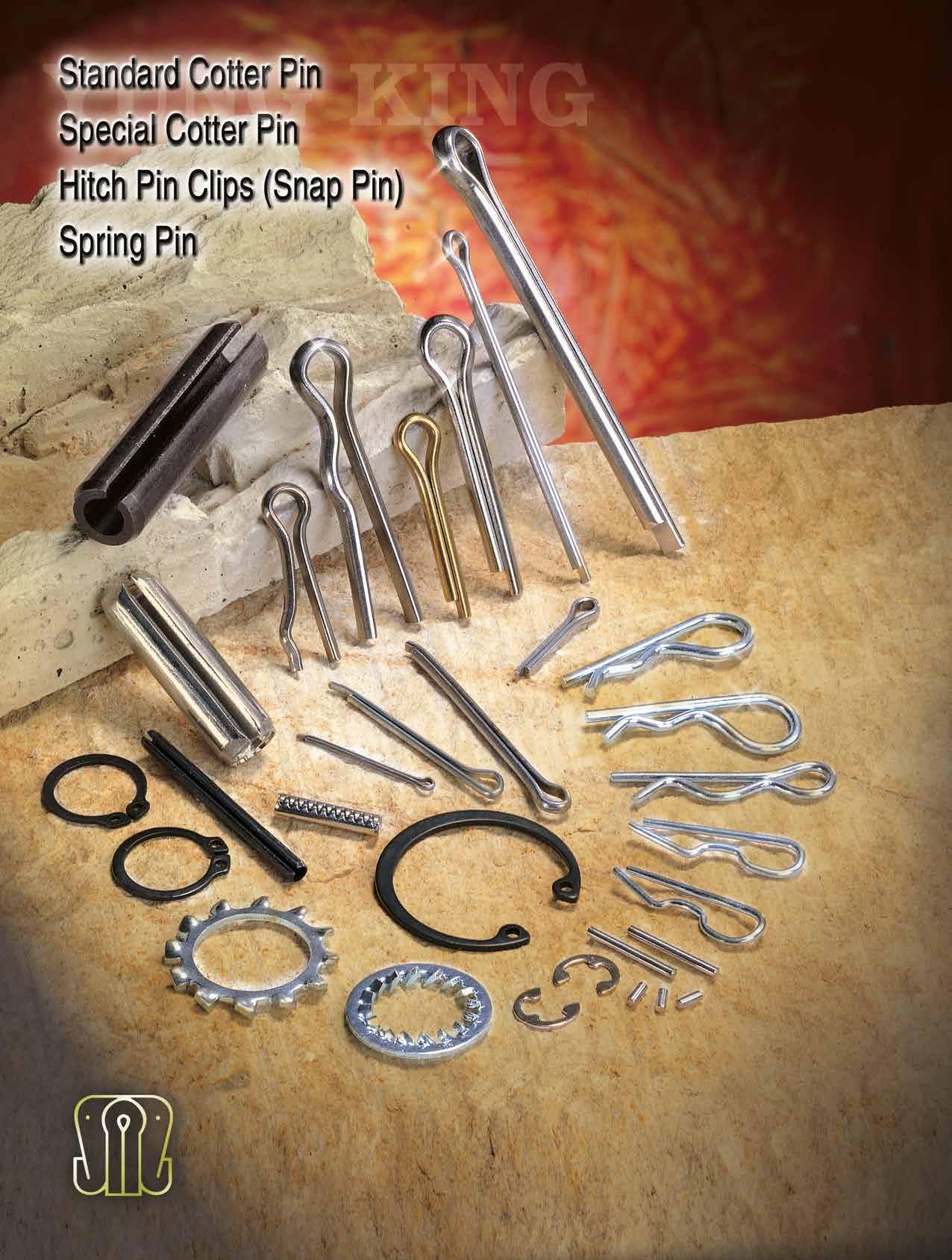

122 YUNG KING INDUSTRIES CO., LTD.

Dowel Pins, Roll Pins, Self-locking Pins, Cotter Pins, Split Pins...

290 AN CHEN FA MACHINERY CO., LTD. 安全發

297 BIING FENG ENTERPRISE CO., LTD. 秉鋒

294 CHIEN TSAI MACHINERY ENTERPRISE CO., LTD.

286 CHING CHAN OPTICAL TECHNOLOGY CO., LTD.

309 GREENSLADE & COMPANY, INC. (U.S.A.)

301 HONG TAY YUE ENTERPRISE CO., LTD.

328 JERN YAO ENTERPRISES CO., LTD.

JIE LE MACHINERY CO., LTD.

K. TICHO INDUSTRIES CO., LTD.

KING SHANG YUAN MACHINERY CO., LTD.

KING YUAN DAR METAL ENTERPRISE CO., LTD.

KUANG TAI METAL INDUSTRIAL CO.,

TZAR CO., LTD.

FAME MANUFACTURING CO.,

Globally-known PPG is an industry-leading coatings provider. They have shaped the industry’s cutting-edge R&D technology and provide complete offerings to serve clients in the construction, manufacturing, auto and consumer product markets. Headquartered in Pittsburgh, USA, PPG has a footprint in more than 70 countries around the world.

In 1976, PPG was ahead of the curve when it successfully developed an electrocoating technology using cathodic epoxy electrocoat to replace the anodic ecoat technolgy and introduced it in the automotive industry. In 2001, PPG introduced a product standard using this technology specifically for the fastener industry. Today this technology is widely used in the construction fastener, automotive and industrial markets.

In 2006, PPG entered Taiwan as its first stronghold in Asia. They established PPG AllTech Engineered Finishes in Kaohsiung to bring electrocoating technology to Taiwan’s fastener market and supplement value into Taiwan's industrial and automotive fastener products. PPG AllTech now plays a key role in stabilizing the quality of Taiwan's fastener supply chain.

Serving Taiwanese clients for many years, PPG sees Fastener Taiwan as an important fastener show to interact with Taiwanese clients. The clients also bring their overseas partners to the show to discuss needs and market trends with PPG. Fastener Taiwan is the go-to show for PPG to exhibit.

In an exclusive interview, PPG revealed to Fastener World that it specifically targets clients of customized small screws and construction screws at this show because PPG utilizes a different and unique processing method called electrocoating. Electrocoat is deposited uniformly to lay an even film build on all areas of the screw, including recess walls and thread crests. This is the key feature for maintaining highly loyal clients in Taiwan. "We are best at coating customized small screws and construction screws, because these screws have many variations of shape and can best take advantage of our coating service. We can perfectly handle other types of fastener products as well. We can provide the best surface protection and help your products maximize performance,” said PPG.

PPG’s electrocoating technology has four characteristics that stand out in the industry.

1. Corrosion and Acid Resistant, Doubled Product Life: Typical salt spray tests (ASTM B117) show increased corrosion resistance up to more than 2,000 hours. Acid resistance up to 30 cycles in an acid rain test. Passed Nordic NORDTEST-method NT MAT 003 C4 and ASTM G85 Annex-5 500 cycles tests.

2. Precise, No Recess Fill, No Thread Galling: The cathodic epoxy electrocoating technology produces paint particles that adhere and evenly deposit on the surface of fasteners through electrophoresis. A consistent film is formed and evenly covers the gaps and corners of the fastener. Film build can be precisely controlled to prevent recess fill and thread galling.

3. No Hydrogen Embrittlement, Meeting Specified Torque Requirement: PPG’s ElectropolysealTM III coating uses a thin film of phosphate as a primer to release hydrogen ions from pores of the surface to prevent hydrogen embrittlement. Torque modification is also added so that fasteners can meet the torque requirements of automotive and construction customers.

Contact: Business Director Julia Lin Email: julialin@ppg.com

4. Chromium-free & Eco-friendly Technology: PPG meets all the ever changing quality and environmental requirements throughout the world today.

PPG has found in recent years customer fastener inventory levels are starting to burn off after the pandemic, so the number of rush orders has increased, affecting the order acceptance and profit margin of Taiwan's fastener industry. PPG has pivoted and improved our efficiencies. As such, PPG has remained strong as the industry's demand for fastener electrocoating remains high. "From a global perspective, we also observed that the highest overseas demand for electrocoating is mainly from the US, while the demand and understanding of electrocoating in Europe is relatively low. Therefore, in the next five years, we will steadily tap into Europe and increase the local demand. In addition, we can work with Taiwanese companies to provide comprehensive consultation and electrocoating for all overseas clients. We can also provide on-site services at Fastener Taiwan or even at clients’ factories. Our technology is fully compliant with RoHS, and we hope for you to protect and beautify the world using our services!”

Copyright owned by Fastener World / Article by Dean Tseng

Taiwan Industrial Fasteners Institute (TIFI), whose number of members has grown to 690, held the 20th term of new chairmen election and the 1st general members meeting of 2024 at HI-LAI Banquet in Kaohsiung on (Thu.) June 27, inviting representatives of the members from Northern, Central, and Southern Taiwan to join the event. In the Board of Directors meeting held earlier on the same day, Jinn Her Enterprise President Yung-Yu Tsai, who was formerly the Vice Chairman of TIFI, was voted by the board of directors to officially take over the position of the 20th term of Chairman from former TIFI Chairman Tu-Chin Tsai.

Chairman Yung-Yu Tsai, who has been fully involved in TIFI's affairs and operation for the past years, said, "Thanks to all members and guests for your participation in this meeting. The general meeting of members is the annual important and meaningful event of TIFI. This year we have been busy with CBAM and Net Zero Emission issues, which have increased costs, and the economy is not doing well, but this is both a crisis and a turning point for the better. In addition, we would like to thank the Ministry of the Interior (Taiwan), Ministry of Economic Affairs (Taiwan), TAITRA, Chinese National Federation of Industries, MIRDC, Taiwan CSC and other related organizations for their counseling and support to the fastener industry, which have enabled Taiwan fastener industry to continuously enhance the competitiveness in the international market. Taiwan International Fastener Show has been successfully held in June this year, and the International Fastener Expo in Las Vegas will be held in September this year, so we ask all members to continue to support the activities of TIFI, and we hope that with the support of all member manufacturers and directors & supervisors, TIFI can continue to progress and develop."

During the members meeting this time, Kaohsiung Mayor Chen ChiMai also came to congratulate new Chairman Tsai on his appointment and praised Taiwan fastener industry for its contribution to Taiwan's economic development, and encouraged the industry to make good use of TIFI and the resources provided by the government to cope with the current CBAM and more challenges in the future. Mayor Chen said, "The market and international trade regulations are changing rapidly, and digital transformation and netzero transformation have become very important for the industry. In response to the needs of the fastener industry, the “Net Zero Academy”of Kaohsiung City Government has organized special courses and provided subsidies for students. We also hope that the fastener industry can seek assistance from the relevant units of the city government through the association if they need any administrative assistance in the future."

The 20th term of Chairman, Vice Chairmen, Directors and Supervisors are as follow: NAME COMPANY

CHAIRMAN YUNG-YU TSAI JINN HER ENTERPRISE CO., LTD.

PRESIDENT

VICE CHAIRMAN ANN HONG SHIH HSANG YWA INDUSTRIAL CO., LTD. GENERAL MANAGER

VICE CHAIRMAN TENG-HUNG, LIN FONG PREAN INDUSTRIAL CO., LTD.

PRESIDENT

VICE CHAIRMAN CHI TAI CHEN CHUN YU WORKS & CO., LTD. CHAIRMAN

DIRECTOR TEA REN SUN JAU YEOU INDUSTRY CO., LTD.

DIRECTOR MARK WU BOLTUN CORPORATION

PRESIDENT

PRESIDENT

DIRECTOR SONG NAN HUANG LU CHU SHIN YEE WORKS CO., LTD. ASSISTANT MANAGER

DIRECTOR HSIANG, SUN HWANG SHIANG IND. CO., LTD.

PRESIDENT

DIRECTOR JIMMY KO TONG HWEI ENTERPRISE CO., LTD. DEPUTY GENERAL MANAGER

DIRECTOR TSENG MING TAO DAAO CHI INDUSTRY CORP. PRESIDENT

DIRECTOR JAMES TANG COAE BOLTS WORKS CO., LTD. CHAIRMAN

DIRECTOR DAVID CHEN CHU HUA INDUSTRY CO., LTD. FACTORY DIRECTOR

DIRECTOR CHIN-TE CHEN DE HUI SCREW INDUSTRY CO., LTD.

PRESIDENT

DIRECTOR TSAN JUNG TIEN WA TAI INDUSTRIAL CO., LTD. CHAIRMAN

DIRECTOR CHIA PAO HUANG SHIN JAAN WORKS CO., LTD.

PRESIDENT

DIRECTOR JACK CHUANG FONG YIEN INDUSTRIAL CO., LTD. QUALITY MANAGER

DIRECTOR WILSON CHEN SPECIAL FASTENERS ENGINEERING CO., LTD. PRESIDENT

DIRECTOR JEN-DER SHIN YING MING INDUSTRY CO., LTD. VICE PRESIDENT

DIRECTOR JOHNSON CHANG ANCHOR FASTENERS INDUSTRIAL CO., LTD. VICE GENERAL MANAGER

DIRECTOR JEFF CHANG RODEX FASTENERS CORP. GENERAL MANAGER

DIRECTOR MING-CHIN CHEN HIGH POINT ENTERPRISE CO., LTD CHAIRMAN

DIRECTOR CHAO RUEI WANG LIH TA FASTENERS CO., LTD. VICE GENERAL MANAGER

DIRECTOR PETER CHEN BEN YUAN ENTERPRISE CO., LTD.

DIRECTOR TSAI CHE WANG JWU SHENG ENTERPRISE CO., LTD.

DIRECTOR FRANK LIN CHIA YI FASTENER CO., LTD.

DIRECTOR ANDY WANG SUN THROUGH INDUSTRIAL CO., LTD.

DIRECTOR CHU-YEN WU OFCO INDUSTRIAL CORP.

SUPERVISOR TU-CHIN TSAI SUN BEAM TECH INDUSTRIAL CO., LTD.

SUPERVISOR YEN CHUNG JEN THREAD INDUSTRIAL CO., LTD.

SUPERVISOR ALBERT CHEN SAN SHING FASTECH CORP.

SUPERVISOR SANDY YU CHONG CHENG FASTENER CORP.

SUPERVISOR STANLEY C.T. WANG QUINTAIN STEEL CO., LTD.

SUPERVISOR TSUNG-MING CHIANG CHUN MU WORKS CO., LTD.

SUPERVISOR YUNG CHANG CHU SHUENN CHANG FA ENTERPRISE CO., LTD.

SUPERVISOR YEN-WEN HO CHUN ZU MACHINERY INDUSTRY CO., LTD.

SUPERVISOR HENRY LIN CHAN HSIUNG FACTORY CO., LTD.

GENERAL MANAGER

PRESIDENT

PRESIDENT

GENERAL MANAGER

GENERAL MANAGER

PRESIDENT

PRESIDENT

GENERAL MANAGER

PRESIDENT

PRESIDENT

PRESIDENT

PRESIDENT

SPECIAL ASSISTANT

PRESIDENT

Taiwan fastener industry has been quite busy in recent months. Besides the smooth chairman handover ceremony of Taiwan Industrial Fasteners Institute (TIFI) held right after the perfect closure of Taiwan International Fastener Show this June, the discussions among reps of relevant organizations and units from Taiwan and the EU for the CBAM implementation progress and details are also in full swing. In addition, in order to assist the industry under the influence of many external factors to cope with the challenges in the future, Fastener World will invite Taiwanese industry players interested in setting up overseas factories or sourcing in Vietnam to visit the local and Taiwaneseinvested plants this August. What's more, in this issue we also include post-show market observation reports of Taiwan International Fastener Show and other international exhibitions, as well as pre-exhibition promotional feature for exhibitors. All these will pave a more solid foundation for the development and upgrade of Taiwan fastener industry, and also create more opportunities for the industry to compete in the international market.

TIFI has always been an important bridge for Taiwan fastener industry to seek more resources from Taiwan CSC or governmental agencies and to convey the voice of the industry. First of all, we ’ d like to congratulate Jinn Her Enterprise President Yung-Yu Tsai on his election as the new TIFI Chairman, and we believe that TIFI will continue to prosper under his leadership. In the past few years, Taiwan fastener industry has been affected by EU CBAM, Russia-Ukraine war, market inflation and competition from China, indirectly causing the overall export to shrink by about 20%, and such a predicament has also left some Taiwanese industry players at a loss. Under such circumstances, I believe that it would be most suitable for Jinn Her Enterprise President, whose screw plant is said to be the largest in Taiwan (with a monthly production capacity of 10,000 tons) and with more than 4 decades of experience in the fastener industry and sufficient experience in multinational enterprise investment, to lead the 690 members of TIFI. It is also expected that under the leadership of TIFI Chairman Tsai, who has in-depth understanding of the global market conditions, TIFI will be able to fight for more favorable competitive conditions for the industry, so that Taiwan fastener industry can accelerate its way out of the recession and find its own niche market.

Since the implementation of CBAM in October 2023, Taiwanese manufacturers should have gained a better understanding of the requirements of the measure and become more familiar with the reporting process. Despite many challenges in the market, Taiwanese manufacturers have been the most active and engaged in CBAM reporting and participation among Asian countries. However, it is important to note that from the Q3 this year, EU importers will be required to submit the actual carbon emission data of imported products, and will no longer be able to use the previous default values as the basis for reporting, which means that Taiwanese manufacturers

will be also required by their customers to submit the actual data. In order to avoid the impact on the subsequent orders, the industry is reminded to be careful in the next CBAM reporting. During the Taiwan International Fastener Show, Alexander Kolodzik, Secretary General of EFDA, flew to Taiwan to explain the implementation process of EU CBAM and the key points to be noted, and representatives of EIFI and Taiwan Economic Research Institute (TIER) organized a seminar on "Carbon Content Calculation Mechanism of Fasteners for Taiwan-EU Fastener Industry" on July 8, inviting industry experts to participate in the discussion. It is believed that these exchanges will help Taiwanese industry to have a more accurate direction to comply with the CBAM regulations and requirements. We also encourage industry players to pay more attention to these messages from the industry's key figures, and to accelerate the upgrade of the industry through the close cooperation between Taiwan and Europe.

Fastener Fair Vietnam represented by Fastener World in Taiwan will be officially launched on August 7-9 in Hanoi, Vietnam, and a number of Taiwanese exhibitors will be also present. In order to help Taiwanese companies interested in knowing more about the current market situation and investment environment in Vietnam to have a more in-depth observation and understanding of Vietnam, as well as to assist them in finding order opportunities under the challenges of fierce market competition and customers' urge to set up factories overseas, Fastener World has arranged the Investment Visit & Plant Tour, including visits to the plants of Sheh Fung Screws and Thread Industrial in Vietnam, the local industrial park, FF Vietnam and local fastener factories in Vietnam. Sheh Fung Screws, an OTCtraded company in Taiwan, has not only been investing heavily in Taiwan in the past few years, but has also set up a plant in Vietnam, while Thread Industrial has been also investing in Vietnam for more than a decade, and will be building its third factory in Vietnam in the near future. Both companies have considerable experience in investing in Vietnam, and I believe that their sharing of experience will be very fruitful for the participants.

In this issue, we have included the post-show exhibitors feature for Taiwan International Fastener Show and the pre-show exhibitors feature for “IFE in the U.S., FF Mexico, FF India and FF Vietnam.” We hope that through these "exhibitor-only" promotion packages, we can help these exhibitors obtain better advertising and marketing results before and after the shows, and to gain more opportunities for cooperation. Over the past 37 years, Fastener World has built up a huge database of the global fastener industry through multiple approaches such as mailing printed magazines directly to buyers, on-line B2B marketing and exhibiting worldwide, etc. The data collected from the industry also allows us to analyze the industry more effectively and provide better services to manufacturers through the results of the reports and the observations of our professional marketing team on the market trends. Such promotional packages will continue to be proposed in the future, and we sincerely welcome those who want to enhance brand visibility and strengthen international marketing to apply for participation.

Last but not least, the content of this issue is very rich. It not only includes articles on Mexico, Canada, Brazil, Indonesia, and many other markets, but also new updates on many industry concerns (e.g., CBAM, U.S.-China trade war, metal corrosion, IATF 16949, etc.). Through the professional analyses and in-depth observation of these experts and scholars, it is believed that readers can keep up with the industry trend faster.

Copyright owned by Fastener World / Article by Gang Hao Chang, Vice Editor-in-Chief

Supreme Fastener is a manufacturing trader which has earned a reputation in Europe and the U.S. for high-quality customized fasteners. They specialize in providing customized OEM fastener products, including bolts, screws, nuts, washers, etc., as well as Torx, Torx Plus, Taptite II, Remform and other authorized products. The primary materials include steel, stainless steel, aluminum and brass. 70% of the products are sold to the U.S. and Canada, and 30% are sold to Europe. For the target industries, 70% of the products are supplied to the automotive industry, and 30% to the industrial and electronic industries.

One of Supreme Fastener's strengths is their exquisite customized services that cater to requirement on delivery speed. They manufacture products according to clients’ drawings and requirements, putting customer satisfaction first. Their customer service team streamlines the ordering process, enabling faster delivery and response. “In a world where time is of the essence, we understand the importance of saving time while keeping the quality intact. That is why we are committed to providing clients with fast and reliable solutions for all their fastening needs, making their one-stop shopping easy. From minor repairs to large

projects, we can satisfy your demand. You can rest assured that our products always provide reliable and safe fastening. Your fastening demand will be satisfied through our utmost efficiency,” said Supreme Fastener.

Another advantage is their considerate VMI planned production service. Supreme Fastener understands clients’ specific needs for each product, production methods, as well as the requested time and quantity, before planning production. In addition, they use their own warehouse to manage inventory for clients. The clients they serve include end users and Tier 1 suppliers to carmakers, making it necessary to supply diverse products. Supreme Fastener's unique VMI planned production service can ensure real-time supply for clients to claim products anytime.

With the advantages of the above two value-added services. Supreme Fastener has doubled the order volume this year and received large orders from major American automakers. Supreme Fastener said to have benefited from a large number of orders redirected from Europe and the U.S. in the past two years thanks to global geopolitical factors, allowing the company to gain sales growth during the pandemic. This year, the company bucks the trend with American automaker clients adding up the number of orders. The future looks very promising.

Supreme Fastener stands a good chance of increasing equipment and production capacity upheld by sales growth. They said: "Our ultimate goal is to provide value-added services and enhance clients' competitiveness in the fastener industry. Our business expansion plans will set in and we will continue to provide excellent solutions according to your specific requirements!”

Copyright owned by Fastener World / Article by Dean Tseng

Scott McDaniel of Martin Fastening Solutions has been elected as the 2024-2025 president of the National Fastener Distributors Association. Ed Smith of Würth Revcar will serve as vice president, Christian Reich of Goebel Fasteners will serve as associate chair, and Jim Degnan of S.W. Anderson will remain on the Board as immediate past president.

Melissa Patel of Field Fastener, Angela Philippart of AFC Industries, and Christian Reich of Goebel Fasteners have been elected to serve on the Board of Directors effective June 12, 2024.

Continuing on the NFDA Board are Steve Andrasik of Brighton-Best International, Gigi Calfee of Copper State Bolt & Nut, Jake Glaser of Sherex Fastening Solutions, Alex Goldberg of AMPG, and Scott Longfellow of Huyett.

Recognition was paid during the meeting to retiring Board members Mike Robinson of LindFast Solutions Group and Nick Ruetz of AIS.

Taiwan CSC held a meeting on June 20, 2024 for the third quarter steel pricing. It was pointed out in the meeting that the global economy has shown a moderate trend of recovery, but since the third quarter is the off-season for industrial demand and considering the changes in the overall global trade situation, in order to ensure the momentum of downstream order intake, the pricing principle of "following the trend to make suitable pricing and ensure industrial stability" will be adopted. It was resolved that the quarterly prices for bar steel & wire rod (low carbon, medium-high carbon, cold-forged, low alloy) will remain flat, while the prices for automotive materials will be adjusted upward by NT$800 per metric ton.

CBAM will be officially in effect in 2026. To prevent CBAM from becoming an obstacle for Taiwanese companies in exporting to Europe, Morten Højberg, representative of the Danish Energy Agency and the CBAM Committee of the European Commission, came to Taiwan to clear doubts. He said that Taiwan is actively establishing regulations for carbon emissions and carbon fee collection, compliant to EU’s CBAM initiative. If Taiwan levies a carbon fee, it can be deducted in the EU. As for more details of the deduction, the regulations are expected to be released in 2025.

Mexico has successively imposed temporary anti-dumping duties on screws imported from China, and this will help increase orders for Taiwanese fastener companies. Without low-price competition from China, Taiwanese fastener companies think the price of Taiwanese screws exported to Mexico can remain at an acceptable level. The total export value is expected to rebound and will benefit Taiwan fastener industry.

At the end of last year, Mexico imposed a provisional antidumping tax of 8.02% to 48.08% on fasteners imported from China. From April 23 this year, Mexico imposed a provisional tariff of 35% on bolts and nuts from China for a period of

two years. This move has led to an increase in export of Taiwanese fasteners to Mexico. According to statistics, Taiwan's fastener export to Mexico in Q1 this year totaled 8,800 tons, up 27% year-on-year. This March, the export volume soared to 3,782 tons, an annual increase of 47.6% and up 79% from February. However, in terms of export price, it was US$4.16 per kilogram in Q1 this year, a yearon-year decrease of 5.23%.

Last year, Taiwan's fastener export to Mexico totaled 31,500 tons, a year-on-year decrease of 5.12%. The export price was US$4.31 per kilogram, an annual increase of 8.13%. Prices have increased for nine consecutive years. The total export value was US$136 million, a year-on-year decrease of 2.31%.

Thailand plans to implement carbon tax when the Global Warming Act comes into effect in 2025. The carbon tax rate will be 200 baht per ton. Thailand’s launch of carbon tax will help integrate with Europe’s CBAM regulations affecting five commodities in 2026.

Ekniti Nitithanprapas, head of Thailand Excise Department, said that the implementation of carbon tax will adopt international standards and emissions will be taxed at the source. For example, in the past, vehicles were levied based on engine exhaust volume, but now they are levied on carbon dioxide emissions. Vehicles with carbon emissions exceeding 200 grams per kilometer are subject to a tax rate of 35%; vehicles with carbon emissions below 150 grams per kilometer are subject to a tax rate of 25%.

Brazil's car import soared in the first quarter of 2024, driven by an inflow of EVs from China.

The data released by the Brazilian Ministry of Development, Industry, Trade and Services showed that from January to March, Brazil's

passenger car import increased by 46.4% year-on-year, reaching a market value of USD 1.5 billion.

Out of this market value, Chinese cars alone accounted for about 40%, and the import surged by 450% compared with the same period in 2023. The Ministry said the growth in import was driven by cars imported from China, which were mainly pure electric and hybrid vehicles.

The import tax on EVs had been reduced to zero since 2015, but Brazilian President Lula reinstated it this year to encourage the development of the domestic auto industry. Starting in January, the import tariff for pure EVs was 10%, which increases to 18% in July and will eventually reach 35% in July 2026. Hybrid

stainless steel screws per month, including standard products, original brand products, and products with special uses and shapes. Since the existing warehouse space was full, a logistics center was set up nearby and launched in February this year.

The center covers an area of 2,500 square meters and has introduced the latest rack-type fully automatic system, which can accommodate up to 4,000 pallets. Thanks to the adoption of "Warehouse Control System", the Osaka headquarters can transmit orders to the logistics center in real time, prevent shipping errors, and achieve ultra-high speed. The automatic rack is 15 meters tall, having 14 levels of storage spaces. The height of the lower spaces is lower than that of the upper spaces. The lower spaces are used to store low storage pallets and empty pallets.

Swedish premium fastener manufacturer BUMAX makes further energy, water and cost savings in its ambitious long term effort to reduce the company’s environmental impact. After more than halving its electricity use between 2007 and 2019, the latest investments at the BUMAX factory in Åshammar in central Sweden annually save an additional 90 MWh of electricity. It is part of the company’s work to strive for cleaner, greener and more efficient stainless steel fastener manufacturing.

“We have sourced 100 percent renewable electricity for our operations at Åshammar since 2011 and we continuously work to optimize energy efficiency,” explained Anders Sjölund, Manager Production Projects & Production IT at BUMAX. “Two of our recent investments have not only significantly reduced our electricity use, but also made water and cost savings.” The 90 MWh electricity savings from these two investments are equivalent to around 7 percent of the site’s total electricity use in 2023 and are enough to power four and a half typical Swedish family homes each year.

BUMAX installed a new fastener carrier coating bath in the autumn of 2022 that is super insulated to reduce heating demand and is fully enclosed to minimize evaporation. The investment is part of the ongoing improvements in its operations. In its first full year in operation in 2023, the bath saved BUMAX around 50 MWh and more than 70,000 liters of water compared with its old bath. The carrier coating bath has fully automated heating and ventilation systems with energy saving modes. A pump stirs the bath solution, which is much more energy efficient than the pressurized air circulation system in the old bath.

BUMAX also replaced its central domestic hot water electric boiler with four smaller boilers that produce hot water close to where it is consumed. The hot water is used for the kitchen, washrooms and showers at the BUMAX factory in Åshammar, Sweden. The new boilers save around 40 MWh of electricity per year compared with the old central boiler.

Fastener SuperStore, a 20year veteran of online selling and distribution of hardware solutions, has announced the opening of their new headquarters and primary distribution center in Downers Grove, IL. Founded in 2005, Fastener SuperStore's business model focuses on on-demand shipping of bulk industrial fasteners such as screws, bolts, nuts, washers, spacers and standoffs.

Fastener SuperStore has recently added services such as kitting, painting and plating to expand their product offerings. While the relocation won't alter the essence of Fastener SuperStore's operations, the expansion into a larger and betterequipped warehouse offers exciting opportunities for availability and productivity. With an increased inventory capacity, the new headquarters will allow Fastener SuperStore's warehouse to better meet the evolving needs of customers.

With the recent expansion, Fields says customers can continue to count on the same level of reliability and quick service that Fastener SuperStore has always delivered. Fastener SuperStore ships more than 95% of online orders same-day and has recently increased their catalog by 1,000+ products. Fastener SuperStore's new headquarters has been fully operational since June 2024.

A leading fastener distributor, ASAP Semiconductor is proud to announce its plan to expand the selection of offerings featured on The Fastener Mart, a leading platform it owns that is dedicated to providing an extensive collection of specialty fasteners and hardware that find use in industrial processes, aviation operations, and other rigorous applications.

Presently, The Fastener Mart offers a comprehensive selection of hardware part types, including nuts and bolts, aircraft fasteners, and various forms of industrial hardware. With the planned expansion of offerings made through market analysis and monitoring industry trends, the website will be able to provide access to an even larger inventory, making it easier for customers to find the precise parts they need for their projects.

As the demand for reliable fasteners continues to grow, The Fastener Mart remains at the forefront, offering a wide range of products that meet the highest standards of quality and performance. With its expanded inventory and unwavering commitment to customer satisfaction, The Fastener Mart is poised to continue its growth as a reputable platform for specialty fasteners and industrial hardware.

Auto Fasteners, a global supplier of fasteners and metal-engineered components to the automotive sector, has expanded its presence in Southam by leasing 15,000 sq ft of space at a new industrial scheme.

Already operating five units in Southam, Auto Fasteners has signed a 10-year lease on three additional units at Sucham Park, facilitating its ongoing growth. These units will serve as a warehouse, assembly, quality inspection, and office space for the company, which supplies parts to a range of automotive manufacturers including Volvo Group, Scania, Daimler Group, Ford, Stellantis, VW Group, Aston Martin, and Jaguar Land Rover.

Scott Simpson, founder and managing director of Auto Fasteners, said: “We’re growing with our long-term customers and gaining new customers too, which has contributed to year-on-year turnover growth and a need for more space to support our expansion. It gives us the option to keep expanding and explore new opportunities. We have business in North America, Brazil, India, Japan and all over Europe.”

“We are currently going through the process of opening a facility in North America, but our headquarters will always remain here in Southam, Warwickshire. The location of Sucham Park is perfect for us, it’s a stone’s throw from our existing space in Southam and the units are a good size for what we are looking to do.”

Alabama Aerospace, a Birmingham Fastener company, is expanding to California with the opening of a facility, Alabama Aerospace West, in Santa Fe Springs. This new facility will help businesses in the western United States that have aerospace, military and rocket projects access inventory quicker.

Alabama Aerospace West will distribute quality parts used in aircrafts, manned spacecrafts, missiles, land vehicles and more. It is conveniently located in between Los Angeles and Anaheim. The facility specializes in locating hard-to-find items while providing an extensive inventory of manufacturer-specific parts such as screws, bolts, nuts, washers and more.

Michael Dominguez will lead the team as site manager. He has over 25 years of experience in manufacturing, supply chain and

logistics, including previously supervising a distribution center with 120+ employees.

Alabama Aerospace West is AS9100 compliant and working toward achieving the certification for its quality management system. The facility also offers fast turnaround on customizable kitting and assembly services.

Blue Ribbon Fastener, a full-service distributor of fasteners and other Class-C components, announced its acquisition of Burlington, Wisconsin-based Nationwide Fastener Systems. Terms of the deal were not disclosed.

For more than three decades, Nationwide Fastener Systems has provided OEM clients with quality Class-C fasteners, inventory management services and other custom solutions that improve supply chain efficiency. The strategic partnership will support growth for Nationwide customers and provide advantages to their clients.

Nationwide Fastener Systems was founded by the late Thomas Lipecki Sr. The family business was purchased and carried on with his son, the late Richard Lipecki, and his wife, Deb.

AFC Industries announced that it has acquired Meg Technologies Inc. (MTI), a Southern California distributor of fasteners to the aerospace industry. AFC officials said the deal bolsters its position in the aerospace sector. MTI provides military-standard aerospace fasteners to OEMs, Pentagon contractors, maintenance facilities and other aerospace distributors. MTI officials, meanwhile, said the combination would provide new opportunities for its team. Terms of the deal were not disclosed.

AFC, an Ohio-based distributor of fasteners and C-Class components, has pursued a strategy of aggressive merger and acquisition activity in recent years. It acquired seven companies last year alone, and the MTI deal marks its second this year after adding Philadelphia-based Globe International in March.

Portland Bolt & Manufacturing Co., LLC, a leading domestic manufacturer and global provider of anchor bolts and nonstandard, custom fasteners, announced it has acquired the South Carolina manufacturing and galvanizing operations of Southern Anchor Bolt Co.

The acquisition highlights Portland Bolt’s strategy to expand its US-based manufacturing footprint into the East, while continuing to offer customers industry-leading delivery times, service, and enhanced dependability. The combined company will offer an increased selection of made-to-order galvanized or plain anchor bolts, rods, studs, and other manufactured and distributed products. Together, the footprint will allow the companies to reach 100% of the US customers within 2 business days.

Leslie Yanizeski, President of Southern Anchor Bolt, will continue to manage the daily operations.

Threaded Fasteners Inc. announced the acquisition of Ricco Fasteners, located in Thomasville, Georgia. This move marks the seventeenth branch location for Threaded Fasteners and elevates its mission to create value in and for the people they serve, as they continually position themselves for additional growth and innovation.

Founded in 1998, Ricco Fasteners has been a steadfast member of the fastener community recognized not only for its commitment to excellence but its dedication to its team and community. The acquisition will mark Ricco Fasteners' transition into a Threaded Fasteners branch and manufacturing location. As a member of the fastener industry for over 26 years, Ricco Fasteners' primary focus has been to provide its customers with the products they need to run their operations and a level of service that helps them meet their goals.

“This acquisition marks a milestone in our continued plans to invest in additional distribution and manufacturing locations across the country," said Threaded Fasteners COO Jerrad Douberly. "Together, we plan to utilize the current wide range of Ricco’s inventory and manufacturing capabilities to further expand our product offerings to the Thomasville and greater Georgia area. We are grateful for the opportunity to invest in such a wonderful team and community."

The Automotive Industry Association (OSD) of Turkey announced the data for the first quarter of 2024. Compared to the same period of the previous year, the total production increased by 3 percent and amounted to 377 thousand 70 units. Together with tractor production, the total production increased to 390,925 units. In the commercial vehicle group, the production decreased by 4 percent in the first quarter of the year, and in the light commercial vehicle group by 5 percent, while there was a 1 percent increase in the heavy commercial vehicle group. Compared to the first quarter of 2023, the commercial vehicle market increased by 2 percent, the light commercial vehicle market increased by 3 percent, while the heavy commercial vehicle market increased by 1 percent. In the first quarter of the year, compared to the same period of the previous year, the total automotive exports increased by 1 percent on a unit basis. In this period, the total exports amounted to 256,511 units. Capacity utilization rates on the basis of vehicle group were 77 percent in light vehicles (cars + light commercial vehicles), 78 percent in the truck group, 64 percent in the midibus group and 74 percent in the tractor group.

Tractor exports, on the other hand, decreased by 13 percent compared to the same period of 2023 and amounted to 4,562 units. According to the data of the Turkish Exporters Assembly, the total automotive industry exports maintained their top position in the sectoral export ranking with 14 percent in the first quarter of 2024. According to the data of Uluda ğ Exporters' Associations (UIB), the total automotive exports in the first three months increased by 5 percent compared to the same period of 2023 and reached 9.2 billion US dollars. In euro terms, it increased by 3 percent to 8.5 billion euros. In this period, the main industry exports increased by 6 percent in dollar terms, while the supply industry exports increased by 3 percent.

In the first month of 2024, Turkey's exports increased in total, while the iron and steel sector accounted for 10.3 percent of exports. While the global decline in ferrous and non-ferrous metals also had an effect in January, there was an increase of 2.1 percent in the steel sector as a result of the increasing demand. The positive start of the year to the sector, which declined in the 12 months of last year, made the sector smile. Both sectors predict that the postponed demands will come especially in the second half of the year and that exports will increase further in this period. Stating that they started the year with an export performance in line with their expectations, Mediterranean Ferrous and Non-Ferrous Metals Exporters' Association (ADMIB) President Fuat Tosyalı stated that the increase in the steel sector gave morale to the sector. Stating that 2023 was a difficult year in the steel industry, Tosyalı said that they expect exports to be better in both ferrous and non-ferrous metals and the steel sector in 2024.

Turkey's exports made a positive start to 2024. In January, exports increased by 3.6 percent to more than US$20 billion. In that month, Turkey's exports of ferrous and nonferrous metals decreased by 10.5 percent to 940 million US dollars, while steel exports increased by 2.1 percent to 1.1 billion US dollars. The increase in the steel sector, which declined in the 12 months of last year, after a 1-year decline period, also increased the hopes of the sector for 2024.

Ferrous and non-ferrous metals exports had a share of 4.7 percent in Turkey's total exports, while the share of steel exports was 5.6 percent.

In January, the ferrous and non-ferrous metals exports of the ADMIB decreased by 8.5 percent to 63 million US dollars, while steel exports reached 121 million US dollars with a record increase of 32.3 percent.

In January, the Turkish top steel exporter was Germany with 178 million USD, followed by Italy with 113 million USD and Romania with 105 million USD. Among the top 10 markets, the most striking increases were seen in exports to Spain with 42 percent, Romania with 32 percent and the United Kingdom with 28 percent.

In ADMIB's exports, it was seen that Algeria ranked first with an export of 16.9 million USD, followed by Iraq with 16.3 million USD and Germany with 12.3 million USD. Among the top 10 markets, increases of 465 percent were recorded in Greece, 260 percent in Algeria, 90 percent in Romania and 79 percent in the United Kingdom.

Evaluating the export data for January, ADMIB President Fuat Tosyalı made the following statements: "We had a 17 percent increase in the January exports of our iron and steel sectors on a quantity basis. It is pleasing that the number of orders we receive is increasing. Especially in our steel sector, we could not increase exports last year, and starting this year with an increase gave morale to our sector. We can compete with the whole world with our quality. If we can add the competitiveness in price to this, we think that the demand will increase more. Considering today's conditions, we anticipate that our iron and steel sectors will receive more demand, especially in the second half of the year, and therefore will reach a higher export performance compared to the first half of the year. However, instead of waiting for the demand to come, we need to create an environment that will meet the demand. On the one hand, we focus on compliance with the EU Green Deal; on the other hand, we think that we will meet every demand that may come with increases in our capacities. We believe that the investments of many of our companies in our sector last year will make a positive contribution to both production and exports this year. Our goal is to increase our share in world trade with the revival of demand and to contribute to our country's economy at the highest level."

News

provided by Irem Yaren BAYSAL, Editor of Fastener Europe Magazine www.fastenereurope.com

Established in 2003 to meet the high standards of Norm Fasteners in the field of cold forging tooling, Norm Tooling took a step further in 2006 by starting special parts production through die manufacturing and machining for fasteners with its IATF 16949 and ISO 9001 quality management system certificates. With its dynamic structure, Norm Tooling rapidly expanded, and as of 2018, it began offering sheet metal forming services for the automotive and related industries, providing its customers with more comprehensive solutions. Today, operating in the fields of cold forging tooling, machining, and sheet metal forming, Norm Tooling employs a young and experienced team of 350 people in a total of 15,000 square meters of closed area in Izmir and Salihli.

Serving a wide range of industries including automotive main and sub industries, spare parts, white goods, electronics, technology, furniture, construction, aviation, defense, and machinery sectors in Turkey, Europe, America, and the Far East, Norm Tooling is a pioneering solution partner in its sector with its innovative R&D center and state-of-the-art production infrastructure. With cutting-edge equipment such as high vacuum furnaces with a capacity of 1000 kg/charge, vacuum tempering furnaces, cryogenic cabin and induction bench, Norm Tooling provides customized heat treatment services to meet customer needs, enabling the hardening of hot and cold working tool steels as well as high-speed steels.

Norm Tooling, due to its customer oriented service philosophy, offers its solution partners high-quality services at affordable prices and on time (JIT). It manufactures cold forming dies using next-generation production technologies, a wide, modern machine park, and a team of experts in their fields.

With an annual average production capacity of 50,000 hard metal dies and 250,000 steel parts, it meets the needs of its customers through various departments such as CNC, sinker EDM, wire EDM, grinding, vertical processing, pressing, polishing, and marking, utilizing a total of 140 high-tech machines.

Norm Tooling produces cold-formed special parts used in the automotive main industry, from raw material to packaging, in robotic automated Lanbi line with automatic measurement and crack control system integration. With special cameras and sensor systems, Norm Tooling, capable of performing dimensional and crack controls of various product groups, thus ensures 100% accurate product delivery to its business partners.

In the machining area, for processing materials like aluminium, copper and brass, there are 27 single-spindle automatic lathes, 1 multi-spindle automatic lathe, 42 CNC lathes and 22 sorting machines. With the capability of rapid investment based on projects, the machining facility has the capacity to produce an average of 50,000,000 parts annually and to sort an average of 60,000,000 parts annually with automatic sorting machines.

Norm Tooling is capable of processing low, medium, and high carbon steel as well as stainless steel with 20 mechanical presses with capacities from 80 tons to 400 tons, 4 deburring and 7 automatic camera sorting machines in the sheet metal forming area.

The sheet metal forming facility has the capacity to produce an annual average of 1 billion sheet metal parts with various geometries ranging from diameters of 5 to 80 and thicknesses from 0.5 mm to 8 mm, including flat, conical, shaped, and plastered sheet metal parts.

The Office of the U.S. Trade Representative (USTR) list includes:

7318.11.00 - Iron or steel, coach screws

7318.12.00 - Iron or steel, wood screws (o/than coach screws)

7318.13.00 - Iron or steel, screw hooks and screw rings

7318.15.50 - Iron or steel, threaded studs

7318.14.10 - Iron or steel, self-tapping screws, w/shanks or threads less than 6 mm in diameter

7318.14.50 - Iron or steel, self-tapping screws, w/shanks or threads 6 mm or more in diameter

7318.15.20 - Iron or steel, bolts and bolts & their nuts or washers, imported in the same shipment

7318.15.40 - Iron or steel, machine screws (o/than cap screws), 9.5 mm or more in length and 3.2 mm in diameter

7318.21.00 - Iron or steel, spring washers and other lock washers

7318.22.00 - Iron or steel, washers (o/than spring washers and other lock washers)

7318.23.00 - Iron or steel, rivets

7318.24.00 - Iron or steel, cotters and cotter pins

7318.15.60 - Iron or steel, screws and bolts, nesoi, having shanks or threads less than 6 mm in diameter

7318.15.80 - Iron or steel, screws and bolts, nesoi, having shanks or threads 6 mm or more in diameter

7318.19.00 - Iron or steel, threaded articles similar to screws, bolts, nuts, coach screws & screw hooks, nesoi

7318.29.00 - Iron or steel, nonthreaded articles similar to rivets, cotters, cotter pins, washers and spring washers

U.S. President Joe Biden announced new tariffs on goods from China. The measure imposes tariffs between 25% and 100% of the value of the imported item, applicable to US$18 billion worth of goods. The tariffs extend to semiconductors, electric vehicles, batteries, critical minerals, solar cells, ship-to-shore cranes, medical products, and steel and aluminum. Tariffs for steel and aluminum tripled to 25%, making it likely that imported fastener costs will increase. The Section 301 tariffs were imposed in 2018 under the Trump administration on US$300 billion in Chinese products. The tariffs include 25% duties on bolts, screws and other fasteners (HTS subheadings 7318.11.00 to 7318.29.00) manufactured in China and 15% on all Chinese iron and steel nuts (HTS subheading 7318.16.00).

The Industrial Fasteners Institute has published the 12th Edition of the IFI Book of Fastener Standards. The IFI Standards text serves as the industry’s resource and is a compilation of the most commonly used fastener standards for inch fasteners and non-ISO metric fasteners. In addition to the book's 96 standards, 30 of which are updated, the latest edition now includes IFI 171, which covers thread dimensions for the assembly of bolts, studs, and nuts in the steel construction industry.

The 12th edition is US$675 and can be ordered online. It represents 83 years of continuous development in fastener standards since the first edition was published in 1941. The Fastener Standards have been distributed to manufacturing and construction interests throughout the world.

“IFI’s Book of Fastener Standards is known throughout the world as a go-to resource and is really unique because it combines the most requested fastener standards from ASTM, ASME, SAE and IFI in one convenient resource,” said Salim Brahimi, IFI’s director of

engineering & technology. “It also represents a tremendous cost savings, because purchasing those standards separately would cost more than US$3,000. It would also require someone to source and organize the standards for their engineering or quality personnel so the book saves you time,” Brahimi said.

In addition to the Book of Fastener Standards, IFI also offers the IFI Technology Connection, which is an online tool that utilizes the latest data found in the standards to generate tables and specification sheets for requested parts that can be used by sales, engineering and quality professionals. IFI also hosts numerous education and training events throughout the year that are available to the public through the IFI website. The IFI represents North American manufacturers of mechanical fasteners and formed parts, and suppliers to the industry. The IFI represents the industry to its suppliers, customers, the government, and the public-at-large to advance the competitiveness, products, and innovative technology of the Member Companies in a global marketplace.

The global industrial vending machine market is expected to grow from US$1.6 billion in 2024 to US$2.5 billion by 2029, at a CAGR of 10.1%, according to a Markets & Markets report. The report analyzed the projected value of industrial vending machines by type (vertical lift, coil, carousel scale, locker or drawer) and found that the carousel vending machine is expected to experience the most growth in value due to its ability to have compartments of various sizes and the fact that it can provide access to products by item, employee or designation. Additionally, the carousel machine has fewer moving parts, reducing overall maintenance cost.

The report also revealed that the aerospace segment is expected to be one of the major adopters of industrial vending machine technology as a way to reduce foreign object debris (FOD). These machines will keep track of items and manage critical assets such as radios, scanners and airport ramp operations.

Europe is showing significant growth in adopting industrial vending machines. The growing emphasis on sustainability within the UK manufacturing sector. Vending machines can minimize waste and ensure optimal utilization of resources. The UK government has initiatives promoting Industry 4.0 adoption in manufacturing. This includes potential funding or tax breaks for companies with industrial vending machines that contribute to a more connected and automated factory environment. Industrial vending machines are finding applications beyond traditional manufacturing sectors like automotive or aerospace and hence, they are also being used in healthcare and construction sites.

Major pureplay adhesives company, H.B. Fuller Company, St. Paul, MN, USA, has acquired ND Industries Inc., Detroit, MI, USA, a top provider of specialty adhesives and fastener locking and sealing solutions for users in the automotive, electronics, aerospace and other industries. The acquisition will accelerate H.B. Fuller’s growth priorities, along with its strategy to drive capital allocation to the highest growth market segments within the functional coatings, adhesives, sealants and elastomer (CASE) industry. Also, ND’s Vibra-Tite® brand will be added to H.B. Fuller’s existing epoxy, cyanoacrylate, UV curable and anaerobic product range. ND Industries specializes in materials applied on fasteners and assemblies to aid in critical locking, sealing, masking, lubricating and vibration dampening. ND also has a network of processing centers providing in-house engineered coating application and a world-leading line of small pack technologies for MRO.

LISI Group strengthened its partnership with Watch-Out by acquiring a minority stake in its holding company. LISI Group and WatchOut have partnered for nearly 20 years in the field of high-precision machining, and are now developing a disruptive AI solution for fully autonomous machining.

“We have decided to support Watch-Out in the deployment of this turn-key autonomous precision machining solution now ready for scale-up,” the group stated. The Watch-Out solution combines all conventional machining cycles in a perpetual loop with a specific Artificial Intelligence — Machining 4.0. It is a virtually self-sufficient production machine that constantly self-corrects according to data generated and captured in real time on parts and tools.

More than just an improvement on previous-generation machine tools, the WatchOut solution “represents a dramatic change in industrial paradigm aimed at eliminating the element of randomness in the treatment of chronic failures in the production chain,” said LISI Aerospace CEO Emmanuel Neildez. LISI Aerospace is part of France-based LISI Group, which manufactures fasteners and assembly components for the aerospace, automotive and medical industries.

Aerospace distributor Aeromed Group named Todd Sider as executive director for strategic sourcing. Sider has 30+ years in aerospace and commercial markets. He has been with Century Fasteners Corp., Heads & Threads International, Federal Bolt & Nut Supply and Reynolds Fasteners. Aeromed president Declan Grant noted Sider’s experience in strategic sourcing and supply chain management will be “instrumental in driving our procurement initiatives and developing and growing with our strategic partners. North Carolina-based Aeromed is an alliance of aerospace distribution companies.