Hardware & Fastener Components no.58/2023 002

004 Hardware & Fastener Components no.58/2023

006 Hardware & Fastener Components no.58/2023

008 Hardware & Fastener Components no.58/2023

Hardware & Fastener Components no.58/2023 009

010 Hardware & Fastener Components no.58/2023

Hardware & Fastener Components no.58/2023 013

014 Hardware & Fastener Components no.58/2023

018 Hardware & Fastener Components no.58/2023

Hardware & Fastener Components no.58/2023 019

020 Hardware & Fastener Components no.58/2023

Hardware & Fastener Components no.58/2023 021

022 Hardware & Fastener Components no.58/2023

Hardware & Fastener Components no.58/2023 023

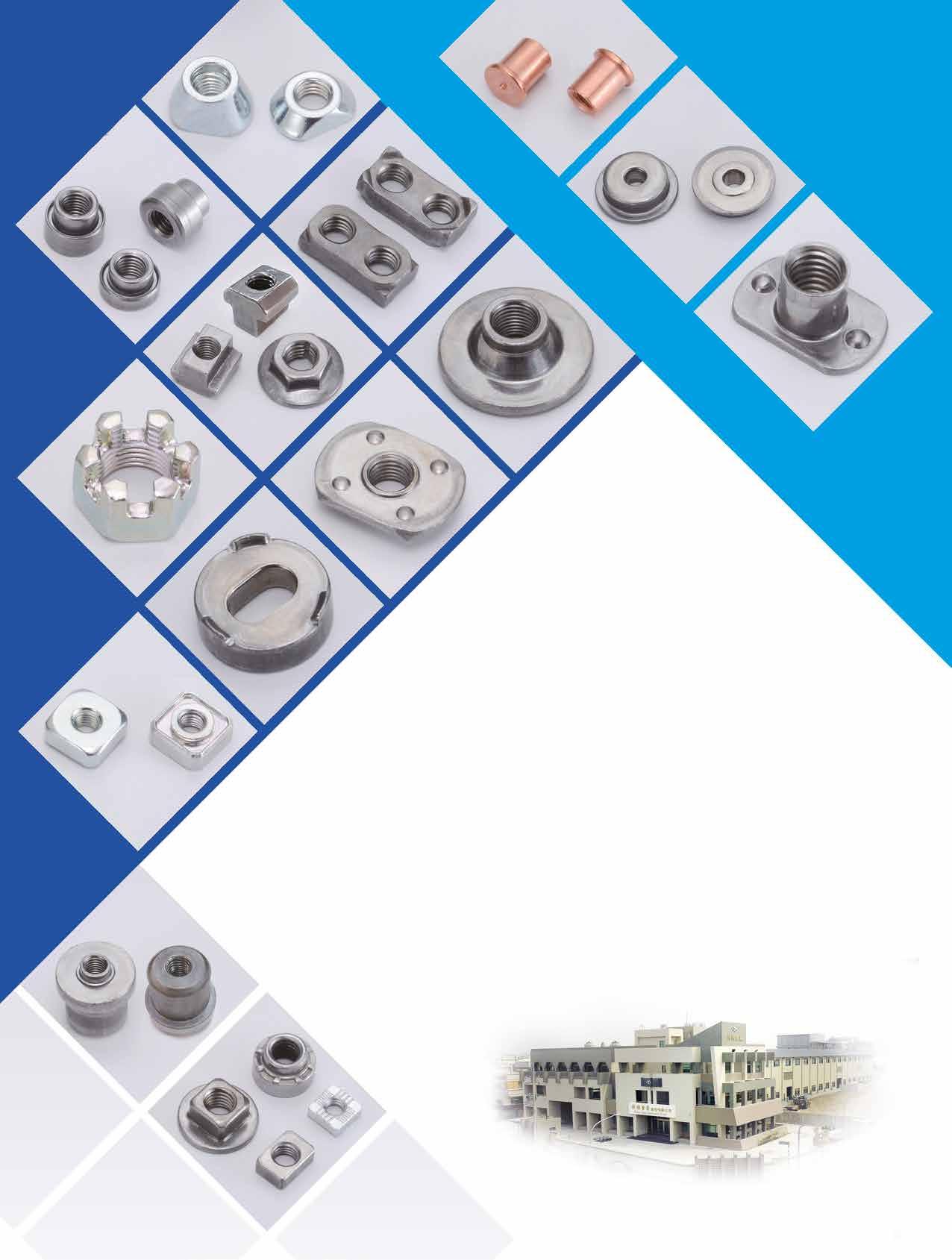

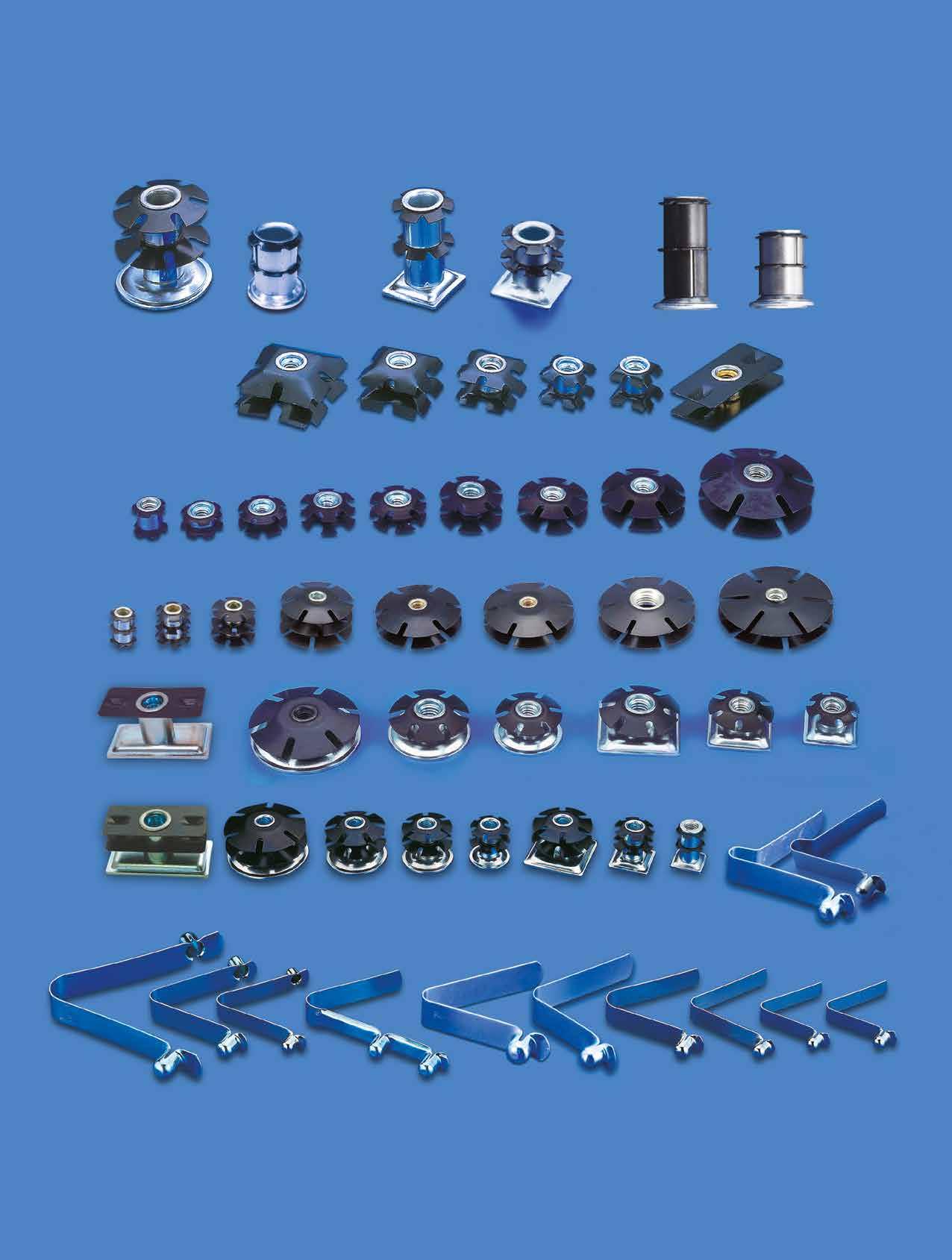

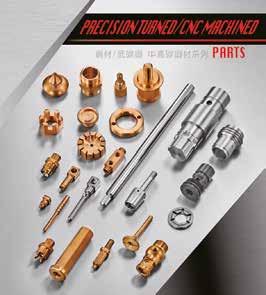

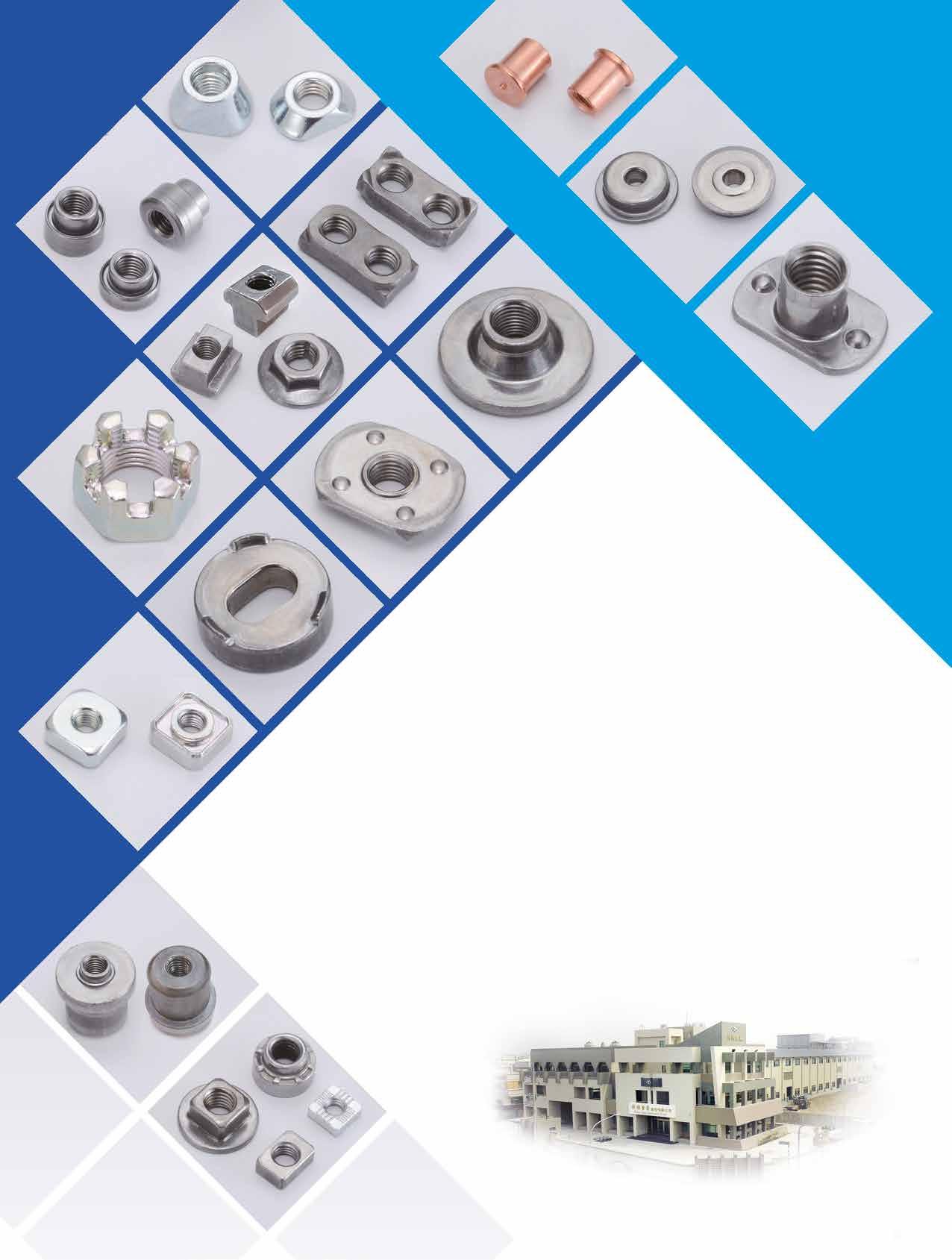

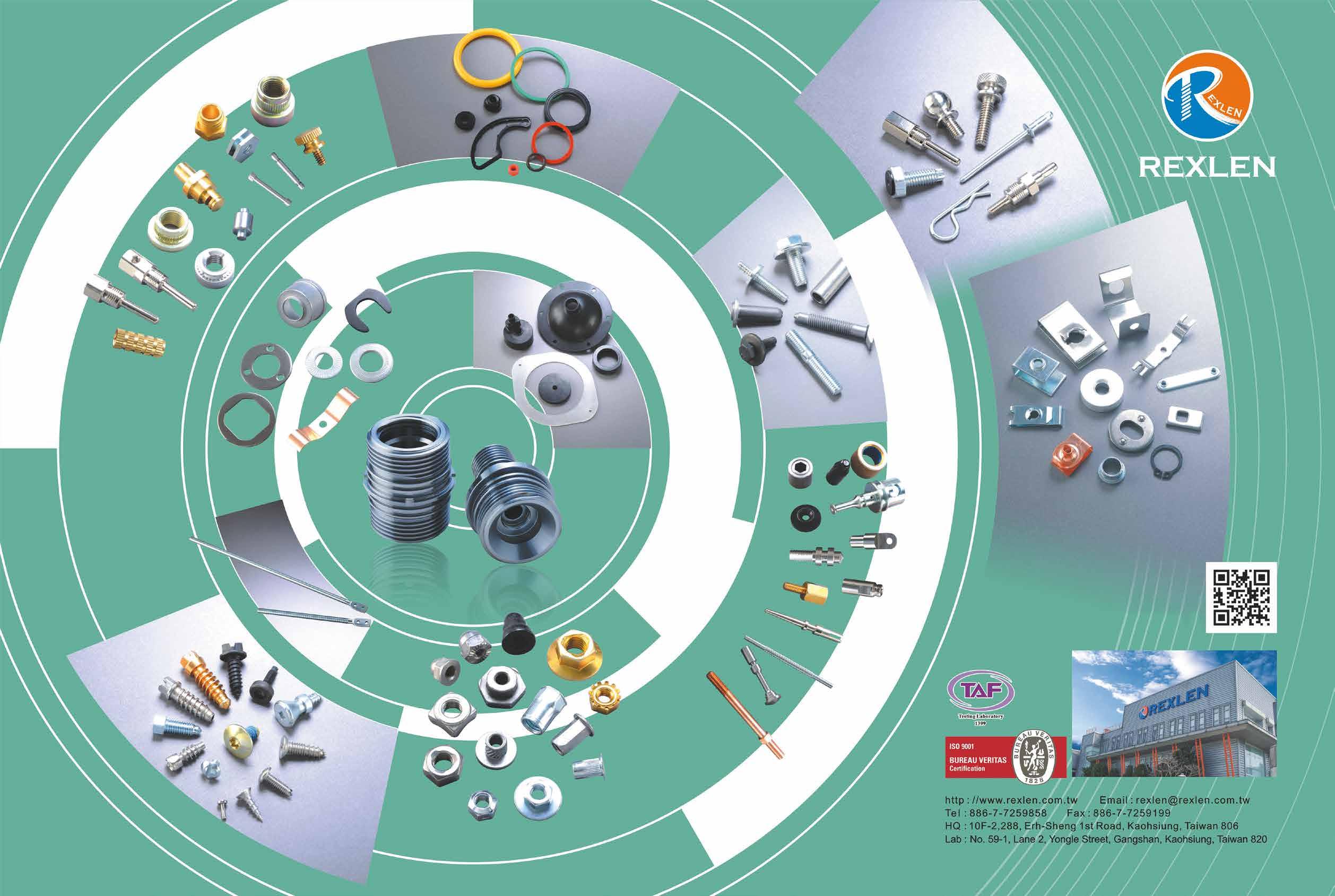

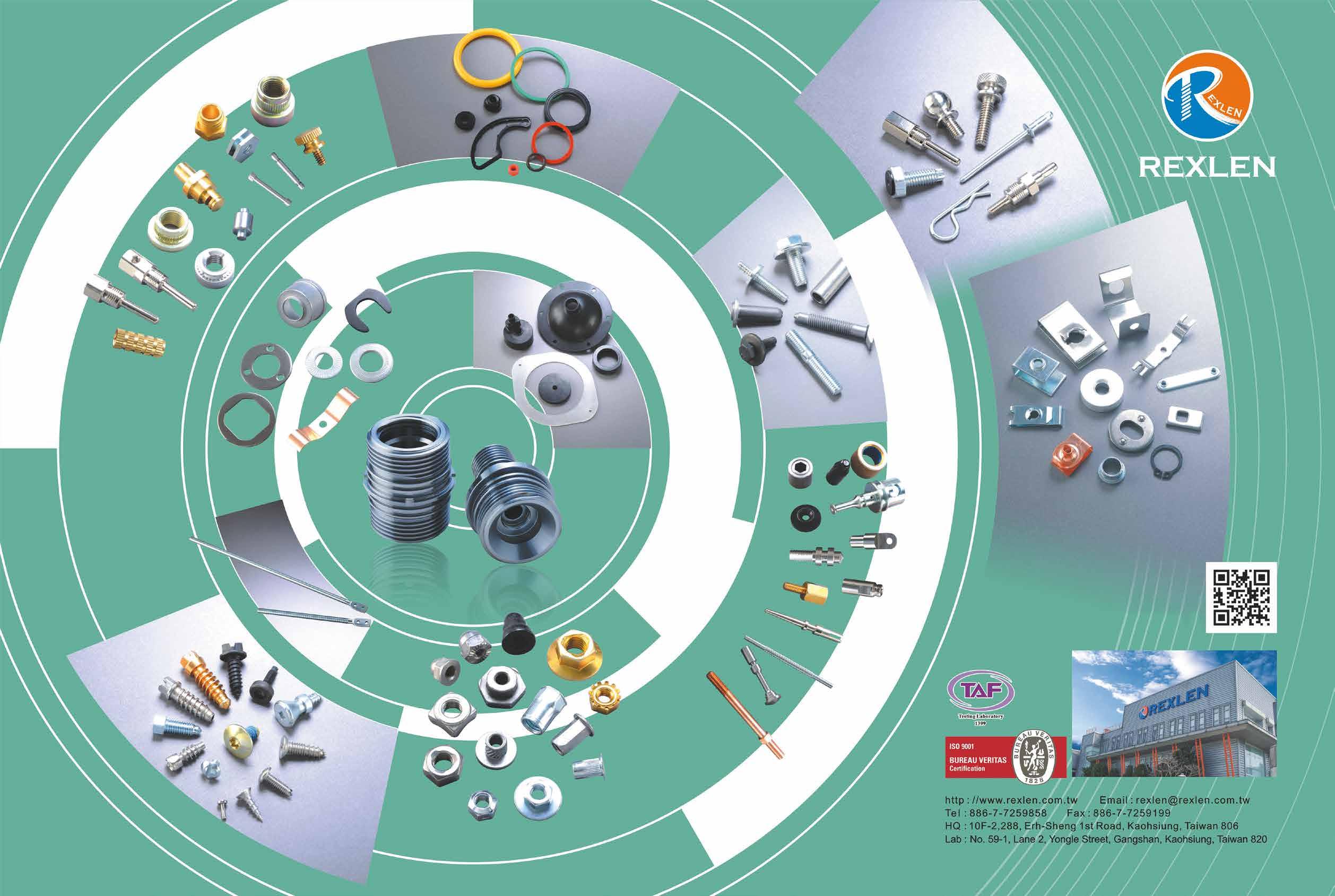

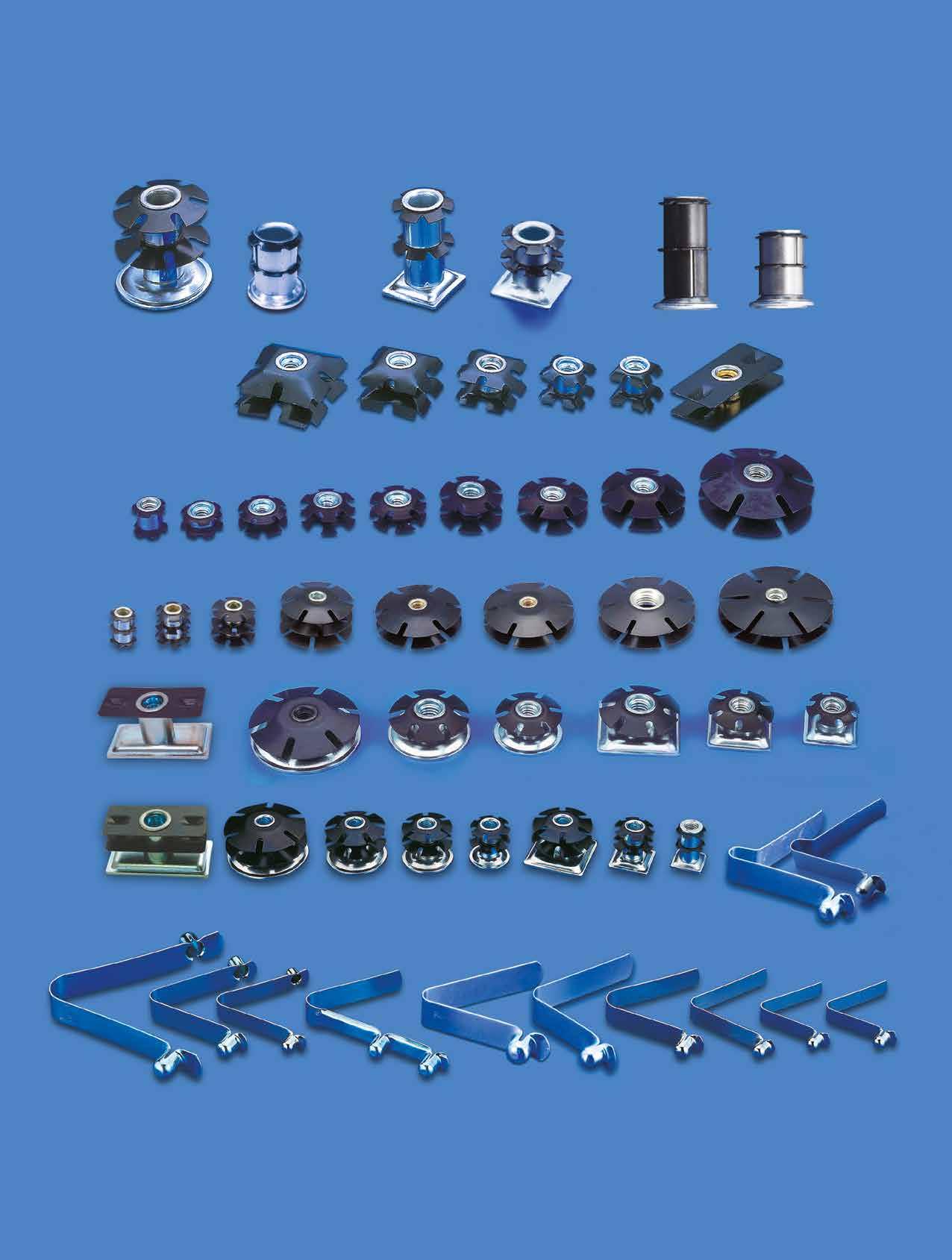

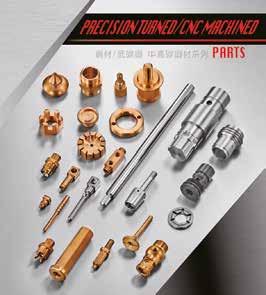

Multi-certified Brass

多認證黃銅螺套、壓鉚扣件——金泰興 精密

Three Mainstream Certificates, Preferred Choice for European and American Buyers

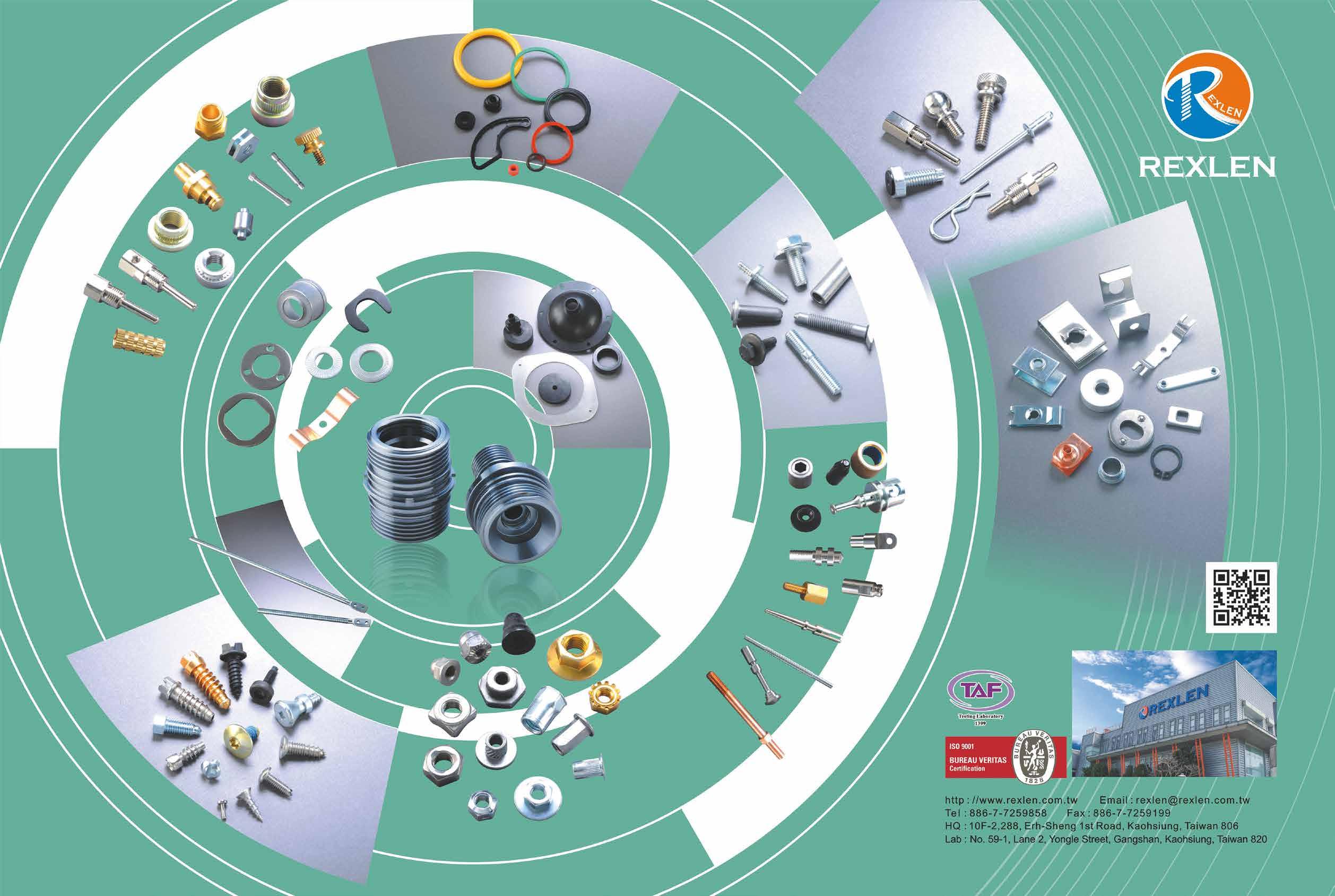

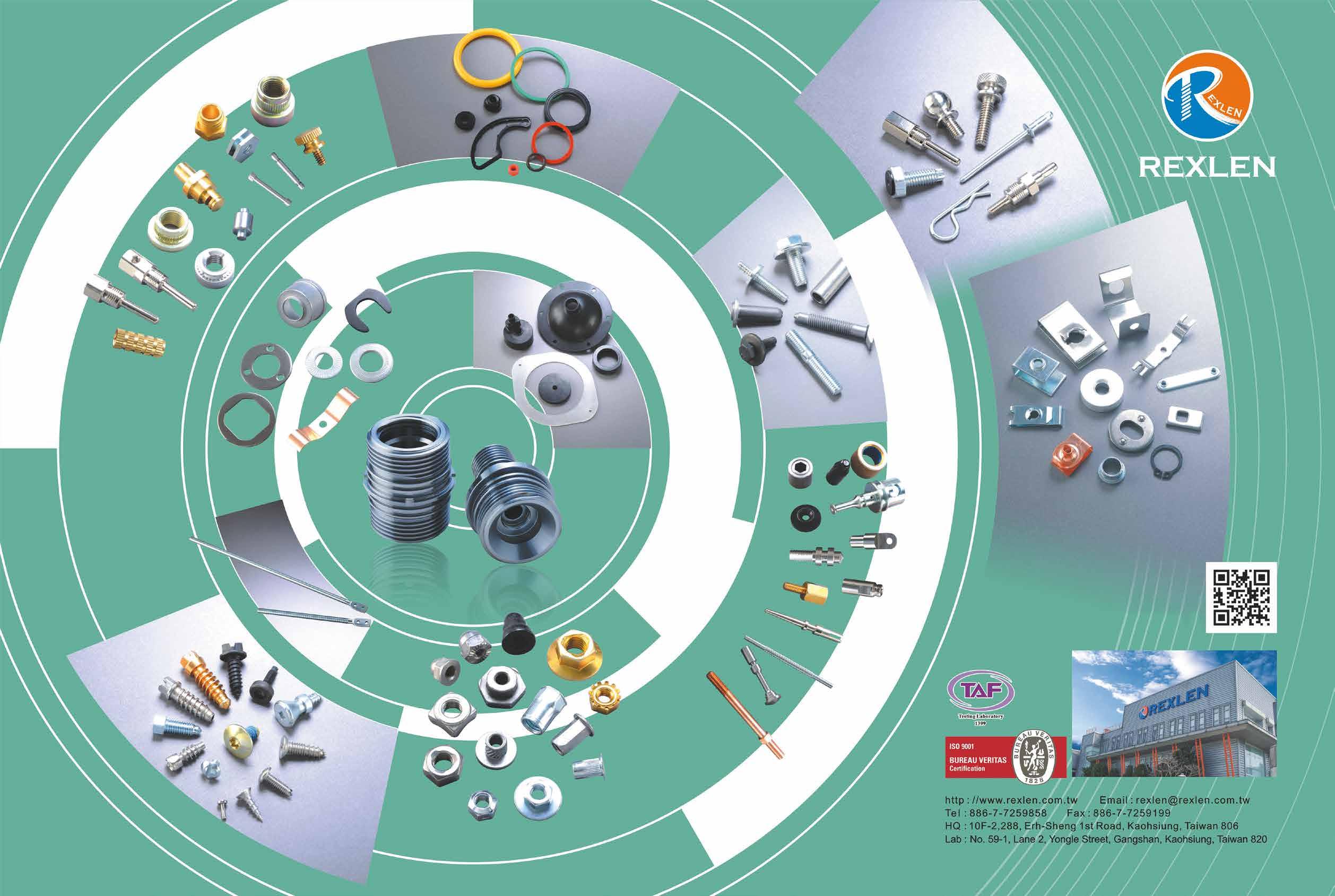

Chin Tai Sing has been supplying brass inserts, standard brass inserts, special brass inserts, self-clinching fasteners and custom parts to Europe, America and Japan for decades, and has become a top supplier in the global automotive and electronic parts supply market. Their attitude of pursuing American and European high quality standards and 0 PPM product yield requirement, has quickly led them to obtain certificates of two major international quality management systems— ISO 9001 and IATF 16949.

The world has recovered from many critical changes in the last three years, still under pressure from heightened costs, but progressing along the trend of higher environmental awareness. The European Union is pushing manufacturers in the automotive supply chain and suppliers of highly polluting components to upgrade and provide cleaner, higher quality products. In this regard, Chin Tai Sing has acquired the RoHS certificate and can provide PPAP documents, IMDS, and IISIR reports for automotive supply chains.

With mainstream certificates in the areas of quality, automotive supply chain, and environmental protection, their standard and custom products as well as parts made of stainless steel, aluminum, and various materials have gained the attention of customers in the global high-end market.

3 Pillars of Manufacturing Gain 100% Client Trust

Their technicians with over 20 years of experience are able to monitor and handle quality abnormalities immediately. They put experienced personnel in charge of quality control. With advanced equipment such as visual measuring instruments, optical sorting machines, and packaging machines, they are able to respond to a large number of orders from customers in the global market while providing high quality products that meet European and American certifications.

They are the first among the peers to have adopted Batch Number Based Manufacturing Management in the manufacturing process, allowing customers to track the progress of orders They handle every customer’s order on the basis of 0 PPM standard, covering from materials to final shipment. “We never compromise on quality, and we ask ourselves to put it into practice with our employees, equipment, and services. This is our core value,” said general manager Lee.

Their monthly capacity of 20 million pieces is attributed to rigorous “manufacturing and quality control process” and “automated high-end equipment”. Another important key is the establishment of Batch Number Based Manufacturing Management that systemizes the manufacturing process and increases clients’ trust to 100%.

Capacity & Tolerance Precision Upgrade

“High quality” and “high performance” are critical product requirements in the European and American markets, and these are also the focus of Chin Tai Sing team’s product development. Nowadays, the market is changing rapidly and customers’ needs are changing, but what remains the same is the strong customization ability of Chin Tai Sing to develop parts that meet customers’ needs and be their support.

As global demand gradually rebounds this year, they continue to increase capacity and quality steadily, and also develop higherprecision products within ± 0.01 tolerance. Looking through 2023, they will upgrade automated production and inspection equipment as needed to provide the world with top-quality threaded inserts, selfclinching fasteners and customized parts.

by Dean Tseng, Fastener World

by Dean Tseng, Fastener World

024 Cover Story >> Hardware & Fastener Componentsno.58/2023

Contact:

Email: inquiry@ctsp-insert.com.tw

Threaded Inserts & Self-clinching Fasteners Chin Tai Sing Precision Manufactory

General manager Lee

Hardware & Fastener Components no.58/2023 025

Jiaxing Haina Fastener

2023 Sales Expected to Breach RMB 200 Million

Contact:

General Manager Tony Fang

Email:tony@hainafastener.com

嘉興海納緊固件

Focused On Stainless Steel Fasteners and Photovoltaic Parts

Established in 2012, Haina Fasteners is located in Jiaxing, a heartland of fasteners. They mainly produce stainless steel fasteners and photovoltaic parts, aluminum profiles and parts, and other products including automotive fasteners, mechanical fasteners, construction fasteners, power plant fasteners, railway fasteners, home appliance fasteners, and chemical fasteners, which are sold to Europe and South America. Their monthly sales volume is about 500 tons and annual production value has reached RMB 150 million.

They have advanced multi-station production equipment to achieve high speed, high quality and customized fastener production. With the management system certified to ISO 9000, SGS, BV International, as well as various quality inspection equipment including stainless steel spectrometers, hardness testers, polishing machines, projectors, and through gauges, they can provide fastener products of various specifications such as DIN, ISO, GB, ASME/ANSI, BS, JIS AS, etc. The products have been highly praised by famous enterprises at home and abroad. The stainless steel fasteners are available in SS201, SS304, SS316, and special stainless steel. They have sufficient stock, a complete range of products, and support fast delivery and various non-standard customization.

In the big market of fasteners, they have turned focus to the booming business opportunities in the photovoltaic industry and included hanging bolts and various solar panel fasteners into their product lineup. “We see the photovoltaic industry as a new energy industry with a promising future in the coming years,” said general manager Tony Fang. “We are able to provide one-stop sourcing and customized design and production for customers around the world who are in need of photovoltaic fasteners. We can supply all the parts used in photovoltaic mounting systems, whether they are fasteners or aluminum profiles and parts. We can offer competitive prices and set no restriction on minimum order quantity.”

High Tensile Strength Supporting Critical Infrastructures

Tony pointed out that the technical advantage of Haina Fasteners is that their large stainless steel threaded rods can reach 800-1000MPa tensile strength. The rods have been used in Hong Kong-Zhuhai-Macau Bridge, Tamburong

Bridge, Samsung Electronics’ Egypt plant, the new train station in Cairo of Egypt, and telecommunication towers in Vietnam, playing a role of undefeated supporter for critical large infrastructures that enable public transportation, as well as guarding the lives of the public. The future of Haina Fasteners’ technical development is bright.

Eyeing Europe and South America Sales to Grow 30%

In 2023, the world opens its doors to global business travelers. In addition to welcoming inquiries and collaboration, Haina Fasteners is taking the initiative to tap into the European and South American markets. “I am very excited about our target markets and believe these years will be a period of high growth,” said Tony. “Looking ahead to the end of this year, I believe we can increase our sales by an additional 30% to reach RMB 200 million. I look forward to potential customers and buyers from all over the world and they are welcome to contact us to create great business opportunities after the pandemic!”

by Dean Tseng, Fastener World

026 Company Focus >> Hardware & Fastener Componentsno.58/2023

2023銷售上看2億人民幣

Hardware & Fastener Components no.58/2023 027

028 Hardware & Fastener Components no.58/2023

World News

compiled by Fastener World

Association News

Fastener Training Institute Announces Würth Sponsorship

The Fastener Training Institute (FTI), has announced Würth Industry North America (WINA) continues as sustaining sponsor in 2023. This will mark the fifth year of partnership between the two organisations.

“Würth’s continued support is instrumental to our ability to offer frequent and robust educational opportunities which enhance knowledge, safety and reliability across the fastener industry,” said John Wachman, Managing Director for FTI. Thanks to Würth’s support, FTI will continue to offer an extensive menu of in-person fastener training classes taught by leading industry expert instructors.

“Our partnership demonstrates our ongoing commitment to the importance of quality fastener education. We are thrilled to move into our fifth year of partnering with the Fastener Training Institute and helping to support the education of seasoned and new professionals within the fastener industry,” said Tracy Lauder, Director of Marketing and Communications for Würth Industry North America.

Industry Development

Taiwan Fastener Companies Girding up Loins for Upcoming CBAM 歐盟碳關稅倒數 岡山「螺絲窟」 減碳備戰

The Carbon Border Adjustment Mechanism (CBAM) is expected to go on trial implementation this October. Taiwan fastener industry emits up to 750,000 tons of CO2e (carbon dioxide equivalent) a year, and it has to improve equipment and speed up on carbon inventory.

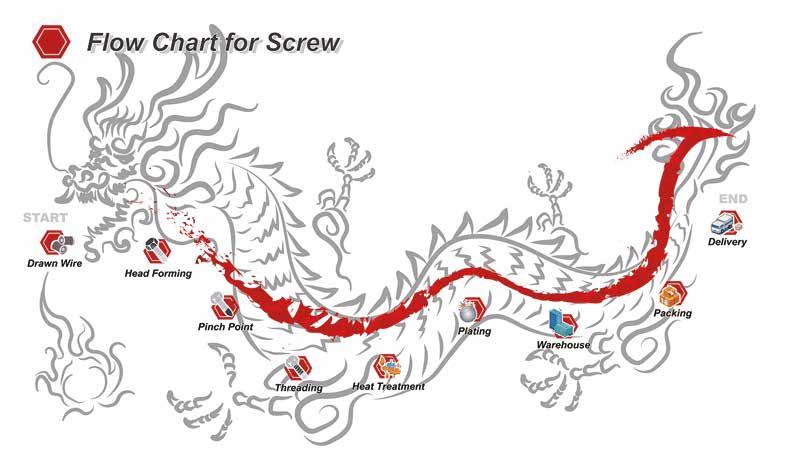

General manager of fastener manufacturer Chun Yu said carbon reduction is a huge work that the industry has to put focus

on. Each company’s products and processes are different, and the entire fastener industry processing chain is long, ranging from material source which is Taiwan CSC manufacturing steel billets, all the way down to a dozen processes such as pickling, annealing, heat treatment, electroplating, each causing carbon emissions. Therefore, the corresponding work on carbon inventory and carbon footprint requires professional assistance.

The director of Taiwan MIRDC (Metal Industries R&D Center) said that CBAM will soon be implemented on a trial basis and importers must report carbon emissions data, but currently there are no clearly specified specifications and form examples. One thing that is certain is that manufacturers should do carbon inventory and carbon footprint tracking as soon as possible.

MIRDC and private entities can help the industry on carbon inventory. The director pointed out that companies can do reports on their own, but if the supply chain requires reports to be verified by third-party labs, domestically it will have to be done by Taiwan Accreditation Foundation (TAF). Taiwan Ministry of Economic Affairs estimates that by the end of this year, there will be about 18 Taiwanese entities that can provide accreditation services. The director said that, in addition to reporting carbon emissions, importers will have to purchase CBAM certificates for products exported to Europe. Plus, Taiwan’s Climate Change Legislation is expected to charge carbon fees on those products. Taiwanese fastener companies hope for the government to make carbon fee regulations compatible with CBAM and provide a way to offset the fees to avoid being charged twice.

U.S. to Impose 200% Tariff on Russian Aluminum 美對俄鋁徵收200%關稅

Aluminum is often used in fuselage, bolts and window and door frames. In a thorough effort to combat Russian circumvention of sanctions, U.S. White House announced a 200% tariff on Russian aluminum and related aluminum products, which has

030 Hardware & Fastener Componentsno.58/2023

五金產業與協會新聞

美國扣件訓練協會宣布獲得伍爾特贊助

been effective since March 10. Russian aluminum accounts for about 1/10 of U.S. imports, and buyers range from the automotive to construction industries. The White House said it is planning to extend the sanctions to Russian metals and mining industries, but the move must be carefully planned to minimize the impact on the market.

Airbus Requests Aeronautical Certifications to Suppliers

of borders, as well as a gradual increase in aerospace customers’ demand. Its consolidated revenue reached NTD2.193 billion, a 53.76% increase compared to the same period last year, marking a three-year high and the third highest in its history, and close to the revenue level in 2018 before the pandemic. Profitability benefited from a higher utilization rate and the appreciation of the U.S. dollar, with gross profit margin of 23.33% last year, an increase of 11.68 percentage points; operating income was NTD127 million turning a loss into a profit, with operating profit margin of 5.78%; net profit after tax was NTD150 million.

Looking at this year, the company said that the demand for aerospace fasteners continues to be strong, with most orders visible for more than a year, and if market conditions do not change much, it is expected to maintain good growth in revenue and profitability this year, and the company will continue to increase production capacity in response to customer demand. In addition to aerospace fasteners, NAFCO has also been actively developing its automotive fastener business in recent years, and the parts and components designed in cooperation with Tier 1 car manufacturers are expected to gradually increase in volume and fuel revenue growth. The company recently announced its March 2023 revenue, which reached NTD263 million in a single month, an annual increase of 78.8%; the cumulative revenue for the first three months reached NTD 696 million, an annual increase of 64.02%.

Airbus is developing its local or regional materials platform for different strategic commodities, but suppliers will need to have the necessary certifications such as AS-9100. “Without those certifications it will be impossible to do business with an aeronautical company like Airbus. And it is very important to have suppliers mainly from Mexico, or from the United States and Canada,” said Carlos Rivera Villalba, the company’s Global Supply Chain Manager.

During the seminar “Be an Aerospace Supplier”, organized by Femia, at CETYS University, Mexicali campus, Rivera added that they are looking for aluminum suppliers in sheets, plates, rivets, nuts, screws and bolts, among others.

Airbus has a presence in Queretaro with a manufacturing plant and a training center in Mexico City and another in Merida. Today there are 150 Airbus aircraft in operation in the country and 200 in the order book and take up 60% of the Mexican market. “It was forecast to close 2022 with 354 aircraft for the different airlines in Mexico, which represents a 12% increase against 2021. The country is part of the top 20 markets,” he said.

Companies Development

Fastener Demand Drives

Q1 Revenue up 64%

Last year NAFCO benefitted from the easing of the pandemic and reopening

OFCO’s Fastener Business Sees Gradual Return of Demand 久陽螺絲本業逐步回溫

According to OFCO, a fastener manufacturer under Taiwan Steel Group, the demand for fasteners will begin to bounce up as customers gradually clear up their inventory. OFCO is also optimistic that the huge reconstruction demand after the Russian-Ukrainian war will trigger another wave of inventory replenishment. With the Group’s continuous integration, the fastener business outlook is promising.

OFCO’s revenue last year was NTD 4.817 billion, an annual increase of 28.1%; the net income after tax was NTD 284 million, an annual increase of 119%, and the EPS was NTD 3, a 10-year high. The revenue of the fastener business increased 87% year on year, and the gross margin came to 23.3%, an increase of 9.5%, boosting the operating profit to NTD 324 million, a YoY increase of nearly 7.6 times.

QST International and Boltun Raise Capital for Plant Expansion to Pursue Transformation 扣件大廠恒耀籌資擴廠 拚轉型

QST International and Boltun Corporation jointly commissioned 3 Taiwanese banks to co-sponsor a NT$12 billion worth ESG-linked syndicated loan project, which was completed on March 1, 2023. In the trend of environmental protection and energy saving, the companies have extended from conventional fasteners to new products combining light metal, engineering plastic and carbon fiber to meet the needs of vehicle manufactur-

031 Hardware & Fastener Components World News >> Hardware & Fastener Componentsno.58/2023

空巴要求對供應商進行航空認證

NAFCO’s

扣件需求強勁,豐達科第一季營收年增64%

Stronger

ers for lightweighting, automatic assembly, reduction of assembly process and energy saving and carbon reduction, and have continued to enhance the value of their products. Leveraging on their experience in EV fasteners and certification by international automakers, the companies are actively participating in customer-collaborative R&D and supplier orientation programs, gradually moving from OEM to ODM.

In view of their long-term development needs and to enhance global flexibility and competitiveness, the companies will set up an overseas production base in Vietnam, acquiring about 35 hectares of land in an industrial zone with an initial investment of US$100 million. Construction of the plant is expected to begin this year and production will begin in the first half of 2024.

Taiwanese Lamvien Winfull in Vietnam Provides High Quality Customized OEM Fasteners 越南台商Lamvien Winfull(林遠永福工業) 提供高品質的客製OEM扣件

Lamvien Winfull Co., Ltd., a Taiwanese manufacturer located in Vinh Phuc Province, Vietnam, serves an extensive list of clients including TOYOTA, Honda, YAMAHA, Kawasaki, Polaris, Vinfast, TOTO, Daikin, Ariston, Sumitomo, Pigaaio, … etc and related T1, T2 customers. It is an IATF16949 / ISO14001 / ISO50001 certified and authorized OEM manufacturer of various customized forging bolts, nuts, screws, pins and patching for worldwide major brands of the automotive, motorcycle, safety parts, heavy industry, home appliance, and electronic fields, and has been specialized in customized precision forging parts for nearly 60 years.

It provides one-stop and in-house manufacturing process including cold forging, threading, machining, heat treatment, de-phosphating, surface treatment, and dehydrogenation for worldwide leading customers. The capability to manufacture specialized fasteners effectively complements its value for achieving quality excellence. Obviously, its experience facilitates the abilities to fulfill more difficult orders, and clearly sets it apart from other fastener providers.

Suzhou Cheersson Sets up a New Branch in Shanghai 蘇州瑞瑪精密在上海設立分公司

Suzhou Cheersson Precision Metal Forming announced to set up a branch in Shanghai in order to meet its business development needs and further optimize its strategic deployment, making it more convenient to get closer to the market and the front

line of technology, and better collect industrial and technical intelligence.

The company’s name is Suzhou Cheersson Precision Metal Forming Co., Ltd. (Shanghai Branch). The scope of business includes: hardware products R&D; technical services, technology development, technology consultation, technical exchange, technology transfer, technology promotion; import & export of goods; sales of dies; sales of communication equipment; hardware products retailing; hardware products wholesaling; electronic components retailing; electronic components wholesaling; fasteners sales; mechanical parts and components sales; metal materials sales.

Zhejiang Mingtai Development Holding Plans to Trade on Shanghai Stock Exchange 浙江明泰控股擬在上交所上市

Zhejiang Mingtai intends to be listed on Shanghai Stock Exchange with a fund raising of RMB 920 million. The raised fund is intended to be used for the R&D and production of Ritai (Shanghai) Auto Standard Component, the annual production of 33,000 tons of new special high strength automotive fasteners, and the construction of the new material fastener R&D center for Ritai (Shanghai) Auto Standard Component.

The company focuses on the R&D, production and sales of fasteners, and has upgraded from supplying bicycle fasteners to motorcycle fasteners, and to automotive fasteners over the past 30 years. The products are mainly used in the automotive field, with high strength, high precision, corrosion-resistant and other high-end fasteners as the main products. The company provides customers with collaborative development, testing, after-sales service, etc.

BYD Japan Responds to the Use of Hexavalent Chromium

BYD uses a solvent containing hexavalent chromium to prevent rusting of bolts, nuts and other parts on its five electric buses, including the J6, a minibus sold in Japan. BYD Japan said it is working with BYD headquarters to investigate whether hexavalent chromium was used in the pure

032 Hardware & Fastener Components World News >> Hardware & Fastener Componentsno.58/2023

比亞迪日本法人回應使用六價鉻問題

Hardware & Fastener Components no.58/2023 033

electric passenger vehicles that went on sale in Japan at the end of January.

Hexavalent chromium is a chemical substance that is widely used in automotive parts for applications such as electroplating to prevent rusting of metal surfaces. It is considered to be highly toxic and harmful to humans. Although there is no domestic law prohibiting the use of chromium in automobiles, Japan Automobile Manufacturers Association has prohibited its use since 2008 as an industry-independent restriction. After the same year, hexavalent chromium is no longer used on new cars in general.

In order to provide greater safety and peace of mind for passengers, BYD Japan said the use of hexavalent chromium will be discontinued on the new models of J6 and K8 electric buses which will be launched by the end of 2023.

Packer Fastener Owner Named CEO

美國Packer Fastener公司人事異動

The Packer Fastener family of companies, including Green Bay-based Packer Fastener and Packer Freight and Chicago area-based Albolt Manufacturing, announced promotions of four key executives.

“Packer Fastener is well-known as having the biggest nuts in town, but our family of companies continues to grow beyond the nuts and bolts of industrial fasteners,” said CEO Terry Albrecht. “Today, we offer a comprehensive range of fasteners and industrial supplies through Packer Fastener, logistics and freight brokerage services through Packer Freight, and the production of customized fastener solutions through Albolt Manufacturing. By restructuring our leadership model and promoting talent from within, we’ve set the foundation for future growth and expansion.”

As part of these changes, Albrecht will continue in his role as principal owner and will now serve as the chief executive officer of the three sister companies. Albrecht was one of the original founding partners of Packer Fastener in 1998. He went on to found Packer Freight in 2019, and Albolt Manufacturing in 2022. His family of companies now employs 155 individuals in 11 different cities throughout the Midwest.

LISI Appoints New Chairman LISI集團任命新主席

Following LISI’s Annual General Meeting of Shareholders, the Board of Directors met today to acknowledge the non-renewal of Mr. Gilles Kohler’s mandate as Chairman due to the age limit set by the company’s bylaws, and to appoint his new Chairman. After 38 years as a member of the Board of Directors and 24 years as Chairman of the Board, the latter thanked Mr. Gilles Kohler for the immense task accomplished during all these years and expressed his gratitude to him. To succeed Mr. Gilles Kohler, the Board of Directors has appointed Mr. Jean-Philippe Kohler as Chairman for the duration of his 4-year term of office. His appointment is effective as of today.

Mr. Jean-Philippe Kohler joined LISI Group in 1991 and since 2016 has been the Deputy Chief Executive Officer of LISI Group in charge of Risk Management, Human Resources and Internal Audit.

In addition, the Board of Directors confirmed the renewal of Mr. Emmanuel Viellard’s mandate as Chief Executive Officer for a period of 4 years. In order to carry out his mission, Mr. Emmanuel Viellard relies on the LISI Group Executive Committee, which he chairs and is composed of:

• Mrs Anne-Delphine Beaulieu, Chief Sustainability Officer & Digital Transformation of LISI Group

• Mrs Cécile Le Corre, General Counsel of LISI Group

• Mr. Christophe Lesniak, Senior VP Industrial & Purchasing manager of LISI Group

• Mr. François Liotard, Chief Executive Officer of LISI AUTOMOTIVE

• Mr. Emmanuel Neildez, Chief Executive Officer of LISI AEROSPACE

• Mr. Alexis Polin, Chief HR Officer of LISI Group

• Mr. Lionel Rivet, Chief Executive Officer of LISI MEDICAL

• Mr. Raphaël Vivet, Chief Financial Officer of LISI Group

This new governance will continue the deployment of the LISI Group’s long-term strategy, which remains focused on innovation and operational excellence.

Acquisitions

Generational Equity

Advises Fasteners, Inc. in its Sale to Monroe Engineering

Generational Equity為Fasteners, Inc.出售給Monroe Engineering提供諮詢

Generational Equity, a leading mergers and acquisitions advisor for privately held businesses, is pleased to announce the sale of its client, Fasteners, Inc. to Monroe Engineering. The acquisition closed January 31, 2023.

Fasteners, Inc., located in Colorado, and founded in 1965, is a wholesale fastener distribution company. The Company’s extensive inventory is available for prompt, accurate delivery or shipment in materials ranging from aluminum to stainless to heat-treated steel.

Headquartered in Michigan Monroe Engineering (Monroe) is an ISO 9001:2015 & AS9100D certified global industrial manufacturing company offering a broad product line and has a diverse customer base of manufacturers and distributors across several vertical markets including aerospace/defense, automotive, medical, transportation and many more.

034 Hardware & Fastener Components World News >> Hardware & Fastener Componentsno.58/2023

Hardware & Fastener Components no.58/2023 035

Good Design Award Winners of 2022 2022

Good Design 設計獎得主

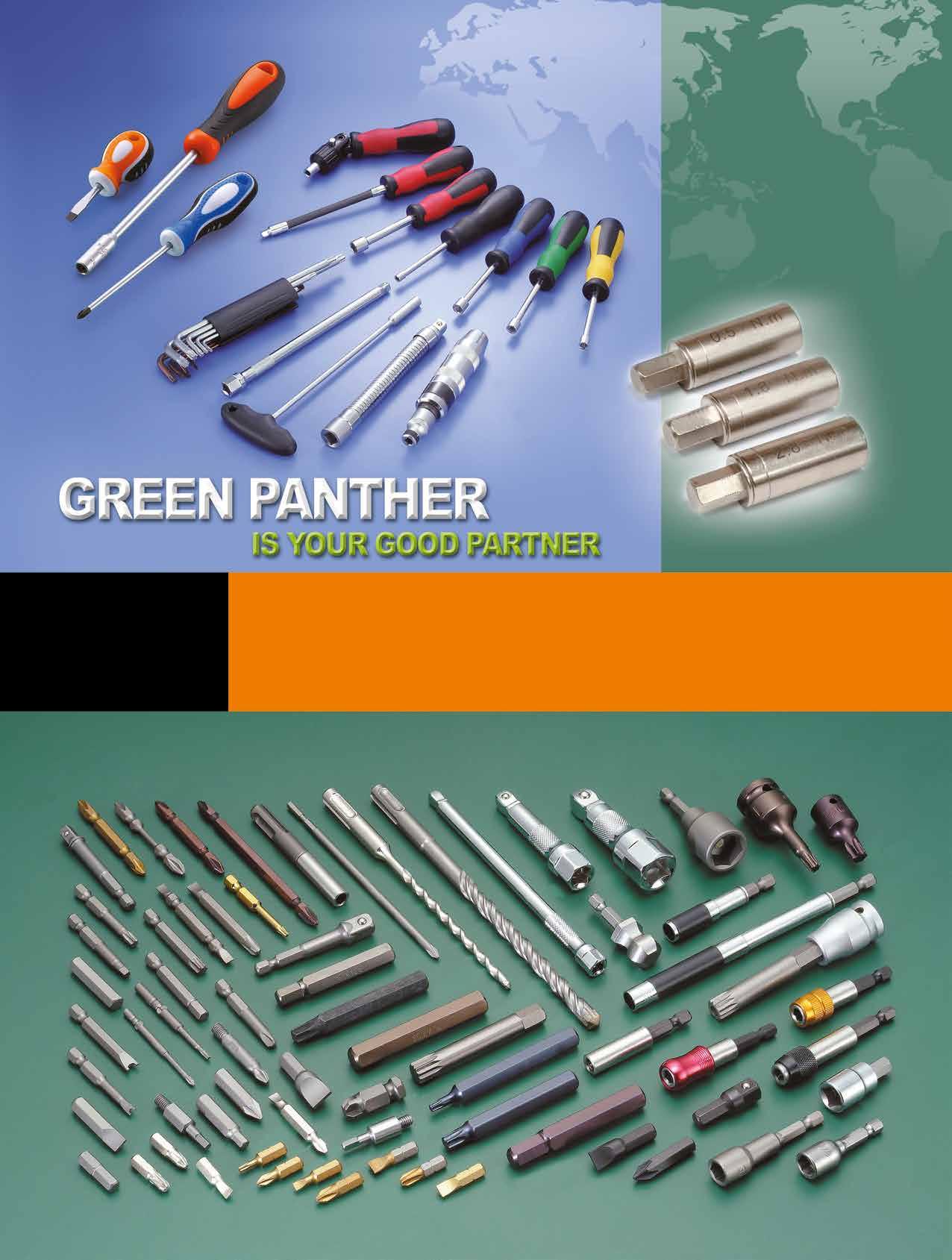

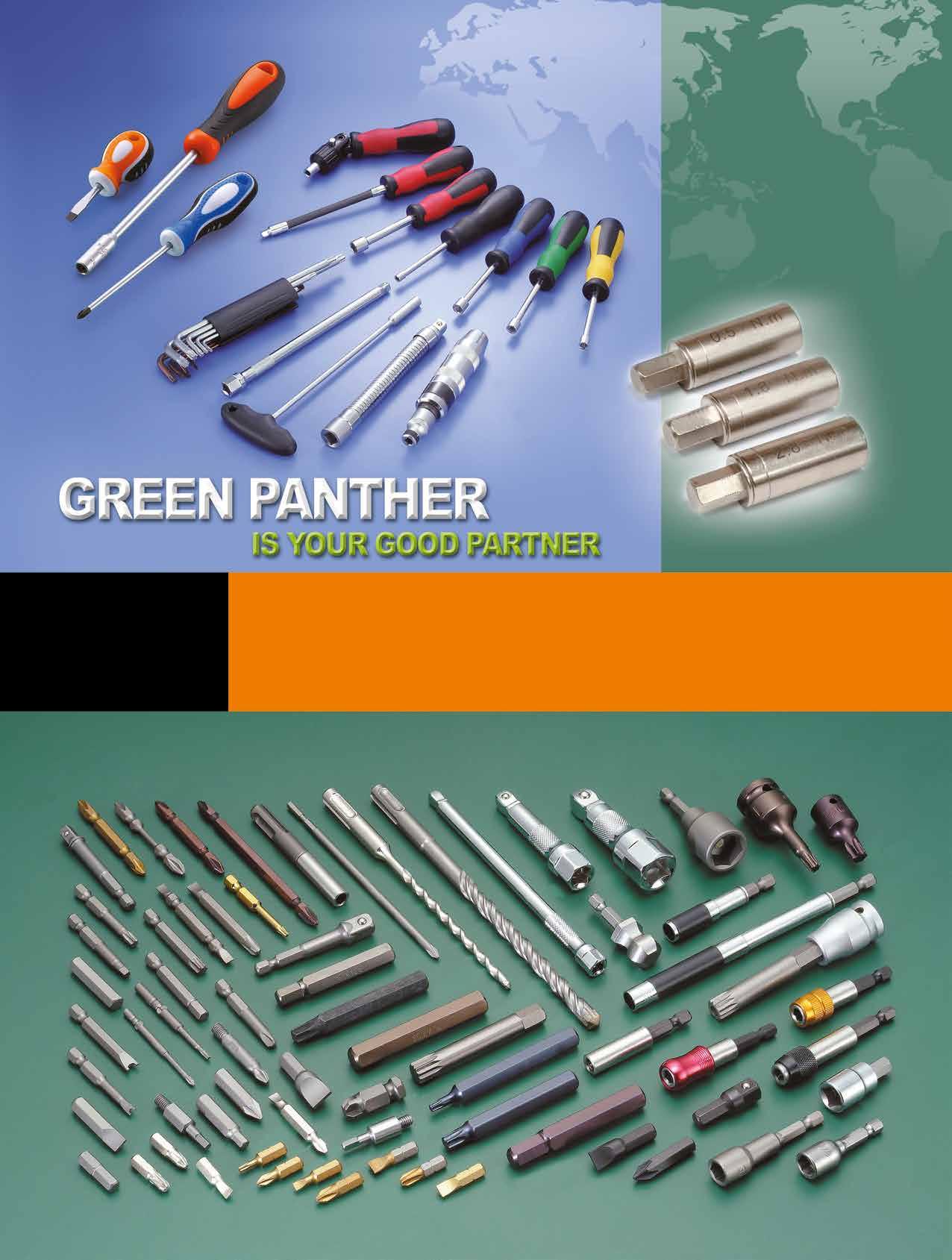

Screwdriver Bit [Slender and Hard Bit]

This product is an ultra-thin shaft driver bit. For example, it is easy to use in “narrow and obstaclesfilled” work places such as around sashes at construction sites, installing handrails, and installing outlet boxes for electrical work, and contributes to improved workability.

Manufacturer: Kaneko Mfg. Co., Ltd.

Standard Ratchet [nepros 3/8”sq. Ratchet Handle NBR390A]

This product is intended for use in automobile maintenance and machine maintenance. Recently, in the workplace where obstacles are increasing due to auxiliary equipment, products with compact and lightweight heads are required. It is necessary to develop a ratchet handle that will satisfy professional mechanics who do not choose working conditions such as tight spaces and heavy loads.

Manufacturer: Kyoto Tool Co., Ltd.

Hexagon Key Wrench With Retaining Ball Type

A colored hexagon key wrench that can hold hexagon socket head bolts. The bolt is held by the action of the spring and the steel ball embedded in the tip. Since it is not necessary to hold the bolt by hand, it contributes to the improvement of work efficiency when the bolt is brought into the screw hole in a deep place or when it is loosened and removed.

Manufacturer: Asahi Metal Industry Co., Ltd.

Compiled by Fastener World

036 Special Feature >> Hardware & Fastener Componentsno.58/2023

Hardware & Fastener Components no.58/2023 037

Round Swivel Head Ratchet [3/8”sq. Round Swivel Head Ratchet]

This product is intended for use in automobile maintenance and machine maintenance. Featuring a compact head that rotates freely in the workplace where obstacles are increasing with modern auxiliary equipment, the small head can be used for work in tight spaces or for quick rotation like a screwdriver. A utility hand tool that can be used for loading and fast-forwarding tasks.

Manufacturer: Kyoto Tool Co., Ltd.

Dust Collection Circular Saw

This electric power tool is mainly for cutting wood and metal materials. Even as a stand-alone product it keeps the work environment clean with extremely high-efficiency dust collection, and its mode to suppress cutting noise is considerate to others nearby. Thorough safety features prevent job-related accidents such as from kickback. The product lets workers safely focus on high-quality results.

Manufacturer: Koki Holdings Co., Ltd.

Pipe Hangers [RAKU-TSURI X]

Raku-Tsuri X achieves manpower and installation time reduction. Comparing with traditional pipe hangers, RakuTsuri X saves about 70% installation man-hours with electrical tools. In Japan construction workers decreased 30% in the last 20 years, and as the aging population progresses, its age composition of over 55 is 34%. Raku-Tsuri X contributes significantly to building equipment business.

Manufacturer: Nichiei Intec Co., Ltd.

Pipe Fitting [TL joint]

(1) A zigzag-design nut has been adopted with the aim of reducing the weight of the material and the rigidity that can withstand wrenching during piping construction work. (2) For high temperature piping, the end face of the nut is designed in red so that it can be identified as heat resistant. (3) The washer, which is the loosening prevention mechanism of the main body, is designed in blue.

Manufacturer: CK Metals Co., Ltd.

038 Special Feature >> Hardware & Fastener Componentsno.58/2023

Hardware & Fastener Components no.58/2023 039

Taiwan Fastening Tools Industry’s 2022 Review and Future Prospects

Foreword

2022年台灣扣件緊固工具產業回顧與未來展望

2022 will be a year of tremendous changes in the global political and economic situation. The major economies around the world have adopted loose monetary policies since 2020, and the low interest rate environment has stimulated the growth of the real estate and durable property markets. In 2021, the global supply chain was tight due to the impact of the epidemic, and China took measures to protect the supply and stabilize the price of coal due to the power shortage crisis, which affected the demand and prices of metal materials. The global economy was expected to continue to recover in 2022, but the military conflict between Russia and Ukraine broke out at the beginning of the year, which led to a sharp rise in global energy and raw material prices, and China took strict control measures due to the epidemic, causing the global supply chain to suffer another blow. Demand from the U.S., Europe and China has declined significantly, and Taiwan’s export growth has slowed, resulting in conservative investment by manufacturers. In the second half of 2022, as the pandemic slowed down, domestic demand and related industries’ export performance improved and shifted from export to domestic demand, maintaining the economic performance for the whole year.

The EU’s proposed Carbon Border Adjustment Mechanism (CBAM) in 2021 reached a provisional agreement in December 2022, which expanded the scope of regulated products from steel, cement, aluminum, fertilizer and electricity, as proposed by the EU Executive Committee, to include hydrogen, some indirect emissions and downstream products (including fasteners). Although fastening tools have not yet been directly included in the list, the relevant industries in Taiwan still need to pay attention to the subsequent development. This article will review the development trend of the fastening tools industry in and outside of Taiwan in 2022 and present the industry development outlook for 2023 as a reference for Taiwan’s fastening toolsrelated industries to respond to the global political and economic changes in the future.

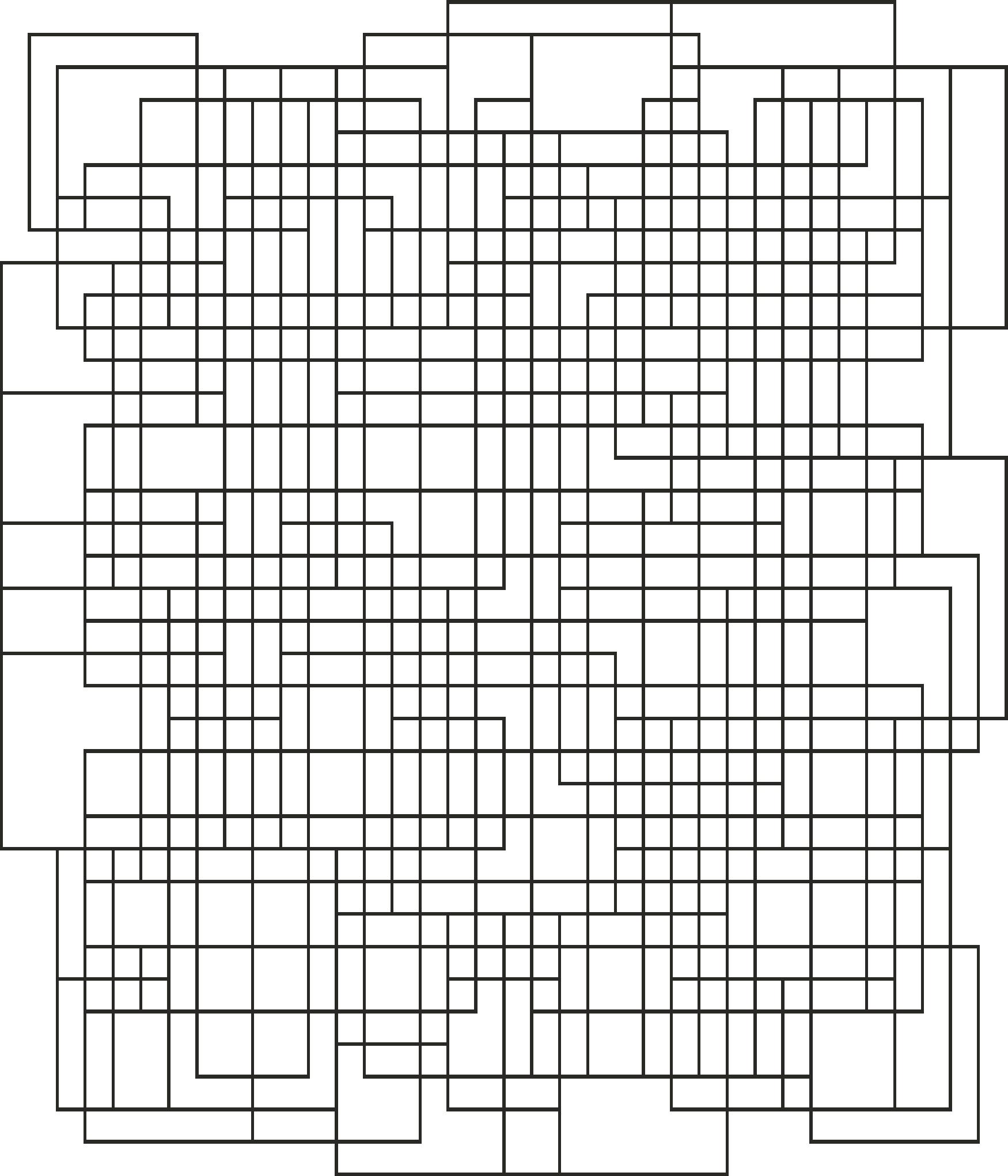

Review and Analysis of Economic and Trade Development Trends of the Global Fastening Tools Industry Import Analysis:

Table 1 shows the main importing countries and import trends of global fastening tools from 2018 to 2021. The import value of global fastening tools products in 2021 was about USD 8.496 billion (about NTD 253.011 billion), and the import value of the top 20 importing countries was USD 6.141 billion, accounting for 72.3% of the global import value. The top five importing countries in order of import value and share were: the U.S. (US$1.433 billion/16.9%), Germany (US$767 million/9.0%), China (US$335 million/3.9%), France (US$332 million/3.9%), and U.K. (US$319

040 Industry Focus >> Hardware & Fastener Componentsno.58/2023

million/3.8%). Although imports are not equal to demand, and the country’s own production must still be considered, the ups and downs of imports also reflect the trend of certain countries’ demand for products, the top 20 importers’ import compound growth rate in the past five years averaged 4.1%, slightly higher than the global CAGR of 3.7%. The U.S. remains the world’s leading fastening tool importer, with the highest import value (US$1.433 billion) and stable compound growth rate (5.6%), playing the role of driving the global fastening tool demand market.

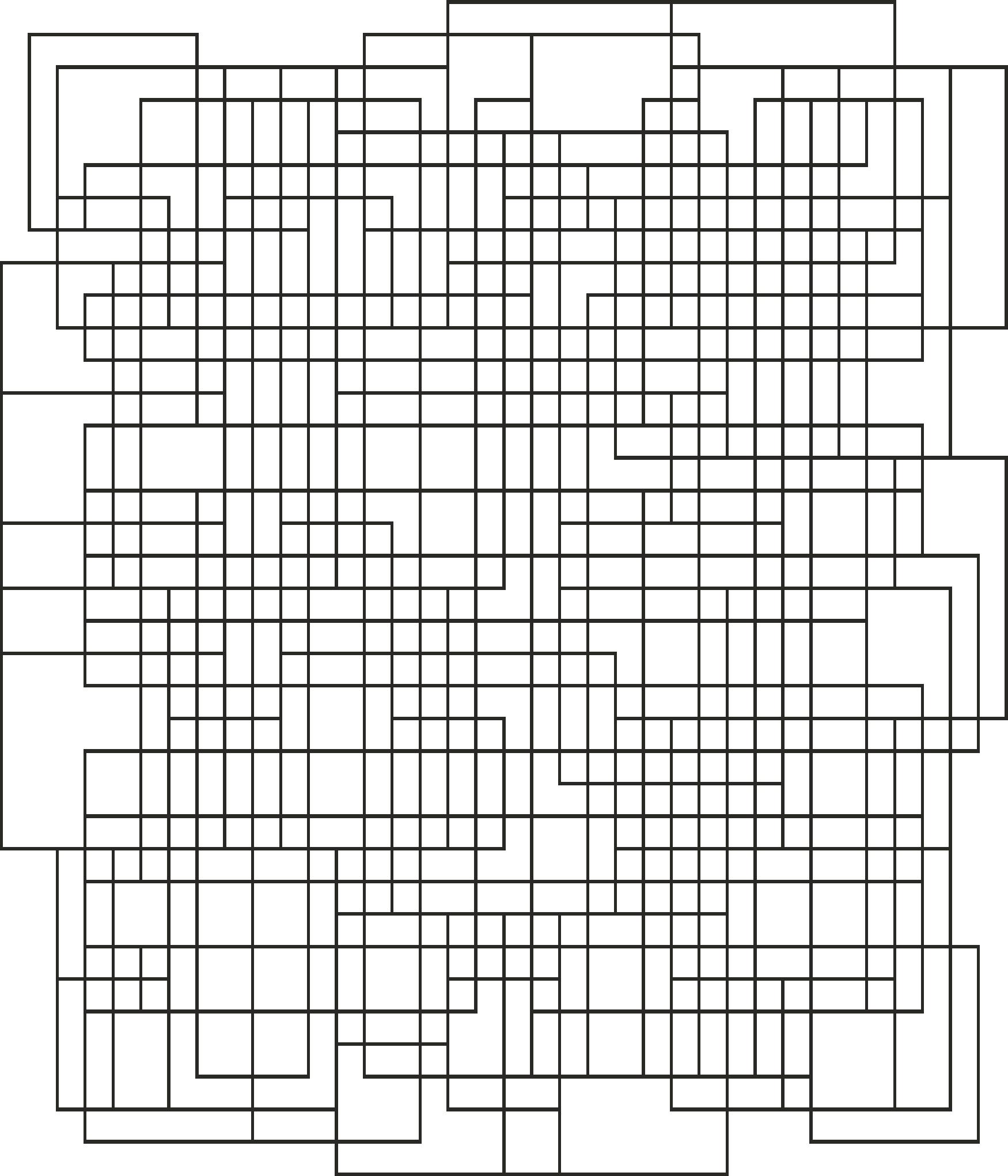

Table 1. Major Fastening Tools Importing Countries and Trends in 2018-2021

Note: The base exchange rate of USD to NTD in 2022 is 29.78

Export Analysis:

Table 2 shows the major exporting countries and export trend of global fastening tools from 2018 to 2021. The export value of global fastening tools in 2021 was about USD 8.016 billion (TWD 238.716 billion), the export value of top 20 exporting countries was USD 7.268 billion, which accounted for 90.7% of the global total export value, and was a highly concentrated export market structure. The top five exporting countries in order of export value and share were: China (US$2.269 billion/28.3%), Germany (US$1.135 billion/14.2%), Taiwan (US$1.033 billion/12.9%), the United States (US$492 million/6.1%), Italy (US$274 million/3.4%). Taiwan is the third largest fastening tool exporter in the world, with a compound growth rate of 9.1% in the past four years, a remarkable performance.

The compound growth rate of the top 20 exporters in the world in the past five years was 5.2% on average, slightly higher than the global compound growth rate of 4.6%. China is still the world's leading fastening tool exporter, and even under the multiple impacts of the U.S.-China trade war, the Russia-Ukraine war and the epidemic, it still ranks first with the highest export value (US$2.269 billion) and a stable compound growth rate (11.1%). It is difficult to shake the fastening tool industry in China under the production advantage of economy of scale and various global variables, while German tools, known for their craftsmanship and quality, are in second place. It is worth mentioning that in recent years, Vietnam's fastening tool exports have grown significantly, although the export amount is not high, the compound growth rate reached 49.6% in the past four years, which is presumed to be related to China's relevant manufacturers in response to the impact of the U.S.-China trade war and the transfer of production bases to Vietnam by the relevant manufacturers in China, therefore, the subsequent development of the Vietnamese market deserves the continuous attention of Taiwanese manufacturers.

Unit: 0.1 bn USD;% Ranking Country 2018 2019 2020 2021 % in 2021 CAGR 1 USA 12.16 12.30 11.01 14.33 16.9% 5.6% 2 Germany 6.57 6.34 5.99 7.67 9.0% 5.3% 3 China 2.70 2.57 2.50 3.35 3.9% 7.5% 4 France 3.63 3.25 2.59 3.32 3.9% -2.9% 5 UK 2.95 2.69 2.47 3.19 3.8% 2.6% 6 Canada 2.52 2.73 2.53 2.90 3.4% 4.8% 7 Netherlands 2.05 2.12 2.14 2.66 3.1% 9.1% 8 Thailand 2.59 2.53 2.10 2.57 3.0% -0.2% 9 Poland 1.96 1.76 1.70 2.35 2.8% 6.1% 10 Russia 1.88 1.98 1.83 2.32 2.7% 7.2% 11 Italy 1.99 1.98 1.88 2.26 2.7% 4.4% 12 Mexico 2.22 2.18 1.72 2.26 2.7% 0.5% 13 Japan 1.72 1.73 1.52 1.79 2.1% 1.2% 14 Spain 1.62 1.41 1.30 1.75 2.1% 2.6% 15 Belgium 1.52 1.49 1.38 1.75 2.1% 4.7% 16 Australia 1.35 1.26 1.28 1.67 2.0% 7.2% 17 India 1.83 1.72 1.26 1.55 1.8% -5.3% 18 Austria 1.54 1.31 1.09 1.49 1.8% -1.1% 19 Luxembourg 0.56 0.38 0.45 1.14 1.3% 26.6% 20 Switzerland 1.01 1.03 0.91 1.10 1.3% 2.9% Subtotal of top 20 54.38 52.77 47.65 61.41 72.3% 4.1% Subtotal of other importing countries 21.86 20.95 19.25 23.56 27.7% 2.5% Total 76.23 73.72 66.90 84.96 100.0% 3.7%

Source: ITC/Compiled by MIRDC

042 Industry Focus >> Hardware & Fastener Componentsno.58/2023

Hardware & Fastener Components no.58/2023 043

Table 2. Major Fastening Tools Exporters and Trends in 2018-2021

Review and Analysis of Economic and Trade Development Trends of Taiwan Fastening Tools Industry

Import & Export Analysis

Table 3 shows the global import & export trend of fastening tools of Taiwan in 2017-2022. In 2022, the fastening tools imported from the world was US$72 million (about NT$2.156 billion), representing a compound import growth rate of 6.4% over the six years, and the fastening tools exported to the world was US$1.070 billion (about NT$31.865 billion). The export compound growth rate was 7.4%, and the surplus amounted to US$998 million, making it an important export product for China to generate foreign exchange.

Table 3. Development Trend of Taiwan Fastening Tools Import and Export from 2017 to 2022

Taiwan's Top 20 Fastening Tools Export Destinations

Table 4 is an analysis of the top 20 export destinations of fastening tools from Taiwan in 2022; the export amounts and shares of the top 5 export destinations of fastening tools from Taiwan were: the United States (NT$14.299 billion/44.9%), China (NT$2.364 billion/7.4%), Germany (NT$1.782 billion/5.6%), Australia (NT$1.195 billion/3.7%), and the Netherlands (NT$1.186 billion/3.7%). The main export desitination was the United States, accounting for almost half of the export market, and the compound growth rate of exports to the United States reached 13.8% in the past four years. In addition to the U.S., the top 20 export destinations with a

Unit: 10,000 USD;% Ranking Country 2018 2019 2020 2021 % in 2021 CAGR 1 China 16.54 16.65 17.08 22.69 28.3% 11.1% 2 Germany 10.37 9.77 9.31 11.35 14.2% 3.1% 3 Taiwan 7.96 8.31 8.04 10.33 12.9% 9.1% 4 USA 5.29 5.22 4.16 4.92 6.1% -2.4% 5 Italy 2.50 2.41 2.05 2.74 3.4% 3.2% 6 India 1.87 1.71 1.52 2.25 2.8% 6.2% 7 France 2.22 2.44 1.74 1.99 2.5% -3.5% 8 Netherlands 1.79 1.82 1.64 1.92 2.4% 2.3% 9 Switzerlands 1.72 1.61 1.41 1.78 2.2% 1.1% 10 Japan 1.42 1.30 1.19 1.44 1.8% 0.7% 11 Belgium 1.19 1.19 1.17 1.43 1.8% 6.1% 12 UK 1.57 1.48 1.25 1.42 1.8% -3.2% 13 Singapore 1.89 1.56 1.52 1.42 1.8% -9.2% 14 Poland 0.95 0.85 1.01 1.37 1.7% 13.0% 15 Czech Rep. 1.12 1.04 1.05 1.33 1.7% 6.1% 16 Spain 1.32 1.24 1.00 1.24 1.6% -2.0% 17 Austria 0.68 0.64 0.53 0.84 1.0% 7.0% 18 Vietnam 0.23 0.36 0.60 0.79 1.0% 49.6% 19 S. Korea 1.15 0.93 0.65 0.73 0.9% -13.9% 20 Thailand 0.72 0.75 0.59 0.70 0.9% -1.0% Subtotal of top 20 62.50 61.30 57.48 72.68 90.7% 5.2% Subtotal of other exporting countries 7.52 6.84 6.40 7.48 9.3% -0.2% Total 70.02 68.14 63.88 80.16 100.0% 4.6%

Note: The base exchange rate of USD to NTD in 2022 is 29.78

Source: ITC/Compiled by MIRDC

Unit: 0.1 bn USD;% Year 2017 2018 2019 2020 2021 2022 CAGR Import 0.53 0.53 0.61 0.70 0.86 0.72 6.4% Export 7.48 7.96 8.31 8.04 10.33 10.70 7.4% Surplus 6.95 7.43 7.70 7.34 9.47 9.98 7.5%

Source: ITC/Taiwan Customs/Compiled by MIRDC

044 Industry Focus >> Hardware & Fastener Componentsno.58/2023

Hardware & Fastener Components no.58/2023 045

compound growth rate of over 10% in the past four years included Australia (19.7%), Russia (16.4%), and Belgium (12.6%), all of which are potential countries for sustainable market expansion.

Table 4. Taiwan's Top 20 Fastening Tools Export Destinations by 2022

Structure Analysis of Various Fastening Tools Export from Taiwan in Recent Years

Table 5 is a structural analysis of Taiwan's exports of various types of fastening tools from 2018 to 2022; the export value and share of Taiwan's fastening tools were: interchangeable socket wrenches (NT$13.838 billion/43.4%), non-adjustable hand operated wrenches (NT$7.363 billion/23.1%), adjustable hand-operated wrenches (NT$3.969 billion/12.5%), other interchangeable tools (NT$3.380 billion/10.6%), screwdrivers (NT$3.323 billion/10.4%), and screwdrivers (NT$2.5 billion/10.4%). The highest export value and share of interchangeable socket wrenches have a stable position in the global export market and are the main fastening tools exported by Taiwan. In the past five years, the compound growth rate of Taiwan's exports of various types of fastening tools was 7.4%, showing a stable growth trend.

Table 5. Structure Analysis of Various Types of Fastening Tools Export in Taiwan in 2018-2022

Unit: 0.1 bn NTD;% Ranking by Year 2022 Country 2019 2020 2021 2022 Share in 2022 CAGR 1 USA 96.91 99.51 123.46 142.99 44.9% 13.8% 2 China 20.75 22.42 27.04 23.64 7.4% 4.4% 3 Germany 16.47 15.20 17.07 17.82 5.6% 2.6% 4 Australia 6.97 6.67 9.24 11.95 3.7% 19.7% 5 Netherlands 10.17 9.14 11.82 11.86 3.7% 5.2% 6 Russia 6.88 5.40 8.63 10.85 3.4% 16.4% 7 Japan 9.61 8.48 9.20 10.31 3.2% 2.4% 8 France 10.48 6.51 9.98 10.06 3.2% -1.4% 9 UK 6.49 5.04 6.05 6.57 2.1% 0.4% 10 Italy 4.78 3.41 5.07 5.68 1.8% 5.9% 11 Sweden 6.42 4.30 4.94 5.27 1.7% -6.3% 12 Canada 4.64 4.27 4.01 5.07 1.6% 3.0% 13 Belgium 2.79 3.07 3.27 3.99 1.3% 12.6% 14 Poland 3.13 2.54 3.15 3.68 1.2% 5.6% 15 Indonesia 2.90 1.61 2.13 2.73 0.9% -2.0% 16 Brazil 2.37 2.09 1.91 2.66 0.8% 3.9% 17 S. Korea 2.34 2.27 2.56 2.61 0.8% 3.7% 18 Vietnam 2.68 3.84 3.62 2.43 0.8% -3.2% 19 Spain 3.04 2.04 1.73 2.40 0.8% -7.6% 20 India 1.94 1.23 1.53 2.05 0.6% 1.8% Subtotal of top 20 221.78 209.06 256.42 284.61 89.3% 8.7% Subtotal of other countries 34.54 27.17 31.66 34.12 10.7% -0.4% Total 256.31 236.23 288.08 318.73 100.0% 7.5%

Source: Taiwan Customs/Compiled by MIRDC

Unit: 0.1 bn NTD;% Product HS Code 2018 2019 2020 2021 2022 % of Export CAGR Non-adjustable Hand Operated Wrenches (Pliers) 820411 54.08 57.56 51.10 61.22 73.63 23.1% 8.0% Adjustable Hand Operated Wrenches (Pliers) 820412 28.23 30.91 29.95 35.05 39.69 12.5% 8.9% Interchangeable Socket Wrenches 820420 107.79 112.74 101.31 129.52 138.38 43.4% 6.4% Screwdrivers 820540 21.97 23.54 23.13 28.45 33.23 10.4% 10.9% Other Interchangeable Tools 820790 27.16 31.56 30.74 33.83 33.80 10.6% 5.6% Total Export Value (0.1 bn NTD) 239.22 256.31 236.23 288.08 318.73 100.0% 7.4%

046

Hardware & Fastener Componentsno.58/2023

Source: Taiwan Customs/Compiled by MIRDC

Industry Focus >>

Hardware & Fastener Components no.58/2023 047

Review of Fastening Tool Issues in China and Measures to Address Them

In 2022, the pandemic stimulus program of 2021 and the transfer effect of the U.S.-China trade war on Taiwan drove the export value of fastening tools in Taiwan to grow significantly by 10.6%, which, of course, covers the factors of inflation and rising raw materials. Overall, it is clear that the U.S. and China are the world’s leading importer and exporter of hand tools, respectively. The U.S. government has provided various incentives to encourage U.S. businesses to return to the U.S. in order to revitalize the local economy and employment. For example, the U.S. government passed the US$1.2 trillion Infrastructure Act in 2021 to strengthen and rebuild the U.S. rail, highway, air, maritime, power and broadband networks, which are important growth drivers for Taiwan, a major exporter to the U.S. The following is a review of the key issues for Taiwan in 2022 and proposes measures to address them:

Geopolitical Impact - Impact of Russia-Ukraine War

The main raw material for the production of fastening tools in Taiwan is steel, mostly sourced domestically, and the main suppliers include Taiwan CSC, Feng Hsin Steel, Yusco, etc. In 2021, Taiwan’s upstream steel industry imported 17.6% and 0.004% of the total steel products (including steel billets and steel materials) from Russia and Ukraine respectively, and the steel billets are 85% self-produced, with Brazil, Vietnam, and Japan as alternative sources. Therefore, there is a low chance of shortage of domestic steel supply due to the conflict between Russia and Ukraine. In addition, Taiwan CSC gives priority

to domestic steel demand in response to market variables, so the supply of steel raw materials required by the fastening tool industry is not yet in shortage, but the industry can continue to introduce new technologies to improve material utilization rates and other technologies to reduce costs and respond to the variables in the global raw material market.

The Impact of Low Carbon Transformation Issues on the Fastening Tool Industry

At present, there is a global consensus of net zero emissions by 2050. In addition to the aforementioned CBAM, carbon control regulations continue to be introduced in various countries, such as the U.S. and Japanese carbon tariff system, etc. Although Taiwan’s fastening tools are mainly exported to the U.S. market and tool products have not yet been included in the list of controls, fastening tool manufacturers are mostly traditional industries, they cannot be ruled out as the U.S. will still fight with the EU for the right to speak about global carbon emission

048 Industry Focus >> Hardware & Fastener Componentsno.58/2023

standards, and Stanley Black & Decker, a major hand tool manufacturer, will achieve the goal of no carbon emission by 2030, and will directly include carbon in the evaluation index of suppliers in the future. It is recommended that the domestic industry respond by carrying out carbon inventory ASAP, expanding the utilization rate of green energy & materials, setting up energy-saving equipment and waste heat and water recycling, and strengthening forging precision to reduce waste.

Trends in the Flexible Industry Supply Chain

In recent years, the U.S.-China trade war and the impact of the epidemic have accelerated the restructuring of the global supply chain, with suppliers reconfiguring their sources of raw material procurement and the layout of their production bases. For instance, Stanley Black & Decker in the U.S. has invested some of its companies in China to set up new factories in Mexico, and U.S. Techtronics Industries has shifted its original focus in China to the U.S, Mexico, Vietnam, etc. Although the fastening tool industry is highly localized in manufacturing and raw material sources, the risk of material breakage is low, especially Taiwan has advantages in technology and quality, which is one of the options for foreign manufacturers to disperse manufacturing risks, strengthen the existing industrial advantages, expand the fastening tool industry chain to resist, withstand and recover from various variables.

China’s Fastening Tools Industry Outlook for 2023

Looking ahead to 2023, in addition to the continuation of the weakness of the global economy in the 2nd half of 2022, the U.S. continues to raise interest rates and drive other countries to follow suit, making economic fluctuations continue and expanding to more countries, also affecting the economic trends of various countries; in addition, it will continue to face global geopolitics, trade conflicts, financial fluctuations (inflation and interest rate increases), climate anomalies, green economy, emerging technologies and other intertwined variables, also making the timing of economic recovery more difficult. In addition, the war between Russia and Ukraine has not yet stopped. Whether the secondary impact on the global supply and demand of raw materials will also affect Taiwan’s economic and trade performance, which is worthy of prior study and attention. Observing the trend of industrial ups and downs in the past 10 years, Taiwan fastening tool industry has been able to overcome several global political and economic variables and impacts smoothly because of its excellent and stable strong industrial structure. Looking ahead to 2023, Taiwan fastening tool industry should be able to steadily face global political and economic variables and show stable and optimistic results.

Article by: Dr. Arthur Hsu

Copyright owned by Fastener World

049 Industry Focus >> Hardware & Fastener Componentsno.58/2023

Hardware & Fastener Components no.58/2023 051

Hardware & Fastener Components no.58/2023 057

058 Hardware & Fastener Components no.58/2023

Hardware & Fastener Components no.58/2023 059

060 Hardware & Fastener Components no.58/2023

Hardware & Fastener Components no.58/2023 061

2022 Global Automobile Production and Model Comparison

Automobile production is one of the reference indicators for evaluating market development momentum, and it is also an important basis for predicting future demand for automotive fasteners and components. In addition, in recent years, the research and development focus of the world's major automakers has gradually moved towards electrification and modularization, which has led to changes in the market's demand for fasteners and demand types. This has also made many fastener manufacturers who focus on the development of automotive fasteners start to seriously think about whether the advent of the electric vehicle era will completely rewrite the layout of the fastener industry. In the following, the author will lead readers to have a glimpse of the current status and future of the automotive industry from the total output of automobiles in major countries around the world and the changes and growth in the output of various mainstream models (including passenger cars, light commercial vehicles, heavy trucks and heavy buses) in each country.

Comprehensive Output

First of all, judging from the latest data released by the International Organization of Motor Vehicle Manufacturers, OICA (see Table 1), global automobile production seems to have maintained a steady growth in the past three years despite the impact of major environmental factors such as the epidemic. From approximately 77.65 million vehicles in 2020, approximately 80.2 million vehicles in 2021, and a substantial increase to approximately 85.01 million vehicles in 2022, an increase of 6% year-on-year. Analyzed by continent, the automobile production in the Asia-Pacific region ranks

by Gang Hao Chang, Vice Editor-in-Chief of Fastener World

first in the world, reaching 50.02 million vehicles in 2022, followed by the Americas with 17.75 million vehicles, and Europe with 16.21 million vehicles. The total production of Europe, America and Asia alone accounts for more than 98% of the world. In the African region, due to the small scale of the automobile manufacturing industry, it only maintains about 1 million vehicles per year.

The top five auto-producing countries in the AsiaPacific region are: China, Japan, India, South Korea, and Thailand. China's record of 27 million vehicles accounts for more than half of the region's share and is growing every year. Japan's sound automobile manufacturing chain will continue to keep it in second place, reaching nearly 8 million vehicles in 2022. It is worth noting that in 2020, South Korea briefly surpassed India to become the third largest automobile producer in the region, but it was overtaken by India to rank fourth in the following two years. India currently ranks third with approximately 5.45 million vehicles. South Korea's production scale is roughly maintained at around 3.5-4 million vehicles. Thailand's production also shows that it is picking up year by year, reaching 1.88 million in 2022. If the market economy gradually improves, it is expected to return to the level of 2 million in 2023.

The top five producing countries in the Americas are, in that order: the United States, Mexico, Brazil, Canada, and Argentina. The United States accounted for more than 56% of the total production in the Americas,

062 Industry Focus >> Hardware & Fastener Componentsno.58/2023

2022全球汽車生產及車型比較

Hardware & Fastener Components no.58/2023 063

Industry Focus >>

Table 1. World Motor Vehicle Production By Country/Region

064

Hardware & Fastener Componentsno.58/2023

All Vehicles Units 2019 2020 2021 2022 Variation 2022/2019 Variation 2022/2020 Variation 2022/2021 Europe 21,531,339 16,904,429 16,338,165 16,216,888 European Union 27 Countries + UK 17,978,353 13,781,659 13,129,583 13,801,210 -23% 0% 5% Germany, Cars and LCV Only 4,947,316 3,742,570 3,308,692 3,677,820 -26% -2% 11% Spain 2,822,632 2,268,185 2,098,133 2,219,462 -21% -2% 6% France, Cars and LCV Only 2,172,515 1,315,997 1,352,226 1,383,173 -36% 5% 2% Czech Republic 1,433,961 1,159,151 1,111,432 1,224,456 -15% 6% 10% Slovakia 1,107,902 990,598 1,030,000 1,000,000 -10% 1% -3% United Kingdom 1,381,405 987,044 932,488 876,614 -37% -11% -6% Italy 915,291 777,057 797,243 796,394 -13% 3% 0% Romania 490,412 438,107 420,755 509,465 4% 16% 21% Poland 649,864 451,382 439,421 483,840 -26% 7% 10% Hungary 498,158 406,497 416,725 441,729 -11% 9% 6% Portugal 345,688 264,236 289,954 322,404 -7% 22% 11% Belgium 285,797 267,293 261,038 276,554 -3% 4% 6% Sweden, Yearly Only 279,000 249,000 258,023 238,955 -14% -4% -7% Austria 179,400 125,000 136,700 107,500 -40% -14% -21% Netherlands, Yearly Only 176,113 127,058 107,021 101,670 -42% -20% -5% Finland, Cars Only 114,785 86,270 85,934 73,044 -36% -15% -15% Slovenia 199,114 141,714 95,797 68,130 -66% -52% -29% Serbia 35,120 23,375 21,263 4,498 -87% -81% -79% CIS (Excluding Belarus) 2,056,631 1,801,527 1,911,188 1,058,532 -49% -41% -45% Belarus 30,494 31,273 29,891 N/A Russia 1,720,487 1,435,551 1,567,007 608,460 -65% -58% -61% Uzbekistan 277,967 284,885 242,104 333,569 20% 17% 38% Kazakhstan 49,400 74,831 92,417 112,540 128% 50% 22% Azerbaijan 2,523 2,058 2,318 2,473 -2% 20% 7% Ukraine 7,266 4,951 8,153 1,490 -80% -70% -82% Turkey 1,461,244 1,297,878 1,276,140 1,352,648 -7% 4% 6% America 20,160,401 15,692,927 16,190,835 17,756,263 -12% 13% 10% NAFTA 16,822,606 13,374,404 13,467,065 14,798,146 -12% 11% 10% USA 10,892,884 8,821,026 9,157,205 10,060,339 -8% 14% 10% Mexico 4,013,137 3,177,251 3,194,858 3,509,072 -13% 10% 10% Canada 1,916,585 1,376,127 1,115,002 1,228,735 -36% -11% 10% South America 3,337,795 2,318,523 2,723,770 2,958,117 -11% 28% 9% Brazil 2,944,988 2,014,055 2,248,253 2,369,769 -20% 18% 5% Argentina, Cars and LCV Only 314,787 257,187 434,753 536,893 71% 109% 24% Colombia 78,020 47,281 40,764 51,455 -34% 9% 26% Asia-Oceania 49,333,841 44,276,549 46,768,800 50,020,793 1% 13% 7% China 25,750,650 25,225,242 26,121,712 27,020,615 5% 7% 3% Japan 9,684,507 8,067,943 7,836,908 7,835,519 -19% -3% 0% India 4,524,366 3,381,819 4,399,112 5,456,857 21% 61% 24% South Korea 3,950,614 3,506,774 3,462,404 3,757,049 -5% 7% 9% Thailand 2,013,710 1,427,074 1,685,705 1,883,515 -7% 32% 12% Indonesia 1,286,848 690,176 1,121,967 1,470,146 14% 113% 31% Iran, Yearly Only 821,060 880,997 894,298 1,064,215 30% 21% 19% Malaysia 571,632 485,186 481,651 702,275 23% 45% 46% Taiwan 251,304 245,615 265,320 261,263 4% 6% -2% Pakistan 186,751 117,375 238,702 235,454 26% 101% -1% Vietnam, Yearly Only 176,203 165,568 167,799 232,410 32% 40% 39% Philippines, Yearly Only 95,094 67,297 85,874 92,223 -3% 37% 7% Australia, Yearly Only 5,606 4,730 5,391 6,077 8% 29% 13% Myanmar, Yearly Only 15,496 10,753 1,957 3,175 -80% -71% 62% Africa (Excluding Egypt) 1,095,151 776,247 907,302 1,022,783 -7% 32% 13% Egypt, Yearly Only 18,500 23,754 N/A N/A South Africa 631,921 447,213 499,087 555,889 -12% 24% 11% Morocco 403,218 328,280 403,007 464,864 15% 42% 15% Algeria 60,012 754 5,208 2,773 -95% 268% -47% Total 92,120,732 77,650,152 80,205,102 85,016,728 -8% 10% 6% Estimate / N/A : Not Available / Source:OICA

Hardware & Fastener Components no.58/2023 065

amounting to 10.06 million vehicles. Mexico, which ranks second, also has 3.5 million vehicles, and Brazil also has 2.37 million vehicles. It can be observed that the focus of car production in North America is still dominated by the United States and Mexico, and Brazil's position in car manufacturing in South America remains unshakable. The data also shows that compared with 2021, the automobile production in the United States, Mexico and Canada has a significant growth of about 10%. Regardless of whether it is North America or South America, its automobile production has shown a trend of increase year by year in the past three years. Originally, the Americas region was the third largest automobile production region in the world, but it successfully overtook Europe to be promoted to second place last year.

The top five producing countries in Europe (including the UK) are: Germany, Spain, France, Czech Republic and Slovenia. Germany, which ranks first, had 3.67 million vehicles in 2022. Although it is lower than 2020, it is still higher than 2021. Spain, which ranks second, also had more than 2 million vehicles in 2022. France, the Czech Republic and Slovenia also roughly maintained the level of 1 million vehicles. Except for several typical automobile production countries in Western Europe, it can be seen that the development of the automobile manufacturing industry in Central and Eastern Europe can be described as blooming everywhere, and there is a trend of gradually catching up from behind. For car manufacturers, the Czech Republic, Slovakia, Romania, Poland, Hungary and Portugal are all attractive investments. Especially in Romania, Poland and Portugal, their performance in 2022 increased by 21%, 10% and 11% respectively compared to 2021. In addition, if Turkey is also counted in Europe, there is also a production scale of about 1.3 million vehicles, which can also set off a certain influence in the European auto supply chain.

The main producing countries in Russia and Central Asia are: Russia, Uzbekistan, Kazakhstan, Belarus and Ukraine. In the past, Russia's average annual production volume was about 1.5 million vehicles, which shrank sharply to 608,000 vehicles in 2022, which may be related to the factors of international economic sanctions and the embargo of raw materials from Western countries. On the contrary, although the production scale of Uzbekistan and Kazakhstan is not large compared with other countries, the production in 2022 showed a significant growth of 38% and 22% respectively compared with

2021. The automobile industries in Belarus, Ukraine, and Azerbaijan are relatively underdeveloped in terms of data, with only a few thousand or tens of thousands of vehicles.

On the whole, if you don't look at the African part (too small), the car production in the Americas has the most significant growth year-on-year, reaching 10%. The AsiaPacific region followed closely behind, also growing by 7%. The European region is roughly the same as in 2021, with only a slight decrease of 1% (if you only look at the part of the EU 27 + the United Kingdom, there will also be a 5% growth).

Passenger Cars

Passenger cars are the mainstream purchases of general car consumers, and global passenger car production has grown year by year in the past three years. Passenger car production in 2022 increased by 8% compared to 2021 to approximately 61.59 million units, accounting for more than 72% of the total global car production. It can be seen that passenger cars are still the largest type of automobile production (see Table 2).

Benefiting from the demographic dividend in the region, about 68% of the passenger car production in the AsiaPacific region reached 42.32 million units, accounting for 84% of the total automobile production in the Asia-Pacific region. Passenger vehicle production in the Asia-Pacific region is highly concentrated in China, Japan, India, South Korea and Indonesia, with 23.83 million, 6.56 million, 4.43 million, 3.43 million and 1.21 million vehicles respectively. In 2022, except for Japan, which experienced a 1% decline, the other five countries had a growth rate of more than 10% compared to 2021, especially Indonesia's 37% growth rate is the most obvious.

The second largest production center for passenger cars is Europe, whose production of passenger cars in 2022 reached 13.72 million units, accounting for about 84% of the total car production in Europe. The top five passenger car producing countries in the region are Germany, Spain, Czech Republic, France and Slovakia, with 3.48 million, 1.78 million, 1.21 million, 1.01 million and 1 million vehicles respectively. Among them, Germany, France and Czech Republic all showed a performance of 10% compared with the previous year.

As for the Americas, which is currently the second largest automobile production region in the world, the production data of passenger vehicles has a very unexpected performance. The production of passenger vehicles in the Americas region in 2022 was approximately 4.83 million units, accounting for less than 30% of its

066 Industry Focus >> Hardware & Fastener Componentsno.58/2023

45488-004 45488-004 63647-001 63647-001 45488-004 45488-004 23258-005 23258-005 Hardware & Fastener Components no.58/2023 067

Industry Focus >>

Table 2. World Passenger Cars Production By Country/Region

total vehicle production (17.75 million units) in the same year, which is a relatively low proportion. The top 5 passenger car producing countries are Brazil, the United States, Mexico, Canada and Argentina in order, with 1.82 million, 1.75 million, 650,000, 289,000 and 257,000 vehicles respectively. Brazil has even surpassed the United States to become the most important passenger car production center in the Americas.

Light Commercial Vehicle

The production of light commercial vehicles is also a very important part of global automobile production. In 2022, the global production of light commercial vehicles reached 19.86 million units, an increase of 7% year-on-year, accounting for about 23% of the total global vehicle production in that year. (See Table 3)

Unlike passenger car production, which is mostly concentrated in the Asia-Pacific region, more than 60% of light commercial vehicle production is concentrated in the Americas (about 12.19 million units in 2022, an increase of 10% compared to 2020, and more than 87 % are concentrated in the United States and Mexico).

Production in the Asia-Pacific region also accounted for more than 26% (about 5.23 million vehicles), and

068

Hardware & Fastener Componentsno.58/2023

Pessenger Cars Units 2019 2020 2021 2022 Variation 2022/2019 Variation 2022/2020 Variation 2022/2021 Europe 18,700,957 14,534,879 13,822,390 13,725,107 -27% -6% -1% European Union 27 Countries + UK 15,835,919 12,045,025 11,338,938 12,025,961 -24% -0.2% 6% Germany 4,663,749 3,515,488 3,096,165 3,480,357 -25% -1% 12% Spain 2,248,291 1,800,664 1,662,174 1,785,432 -21% -1% 7% Czech Republic 1,427,563 1,152,901 1,105,223 1,217,787 -15% 6% 10% France 1,662,963 927,344 918,825 1,010,466 -39% 9% 10% Slovakia 1,107,902 990,598 1,030,000 1,000,000 -10% 1% -3% United Kingdom 1,303,135 920,928 859,575 775,014 -41% -16% -10% Romania 490,412 438,107 420,755 509,465 4% 16% 21% Italy 542,472 451,718 443,819 473,194 -13% 5% 7% Hungary 498,158 406,497 416,725 441,729 -11% 9% 6% Portugal 282,142 211,281 229,221 256,018 -9% 21% 12% Poland 434,700 278,900 260,800 255,100 -41% -9% -2% Sweden 279,000 249,000 258,023 238,955 -14% -4% -7% Belgium 247,020 237,057 224,180 232,100 -6% -2% 4% Austria 158,400 109,500 124,700 107,500 -32% -2% -14% Netherlands 176,113 127,058 107,021 101,670 -42% -20% -5% Finland 114,785 86,270 85,934 73,044 -36% -15% -15% Slovenia 199,114 141,714 95,797 68,130 -66% -52% -29% Serbia 34,985 23,272 21,109 4,358 -88% -81% -79% CIS 1,847,411 1,611,539 1,679,508 883,899 -52% -45% -47% Belarus 20,427 21,295 29,891 N/A - -Russia 1,523,607 1,260,518 1,352,740 448,897 -71% -64% -67% Uzbekistan 271,113 280,080 236,668 328,118 21% 17% 39% Kazakhstan 44,077 64,790 80,679 103,345 135% 60% 28% Azerbaijan 2,360 1,949 2,079 2,049 -13% 5% -1% Ukraine 6,254 4,202 7,342 1,490 -76% -65% -80% Turkey 982,642 855,043 782,835 810,889 -18% -5% 4% America 7,004,767 4,967,015 4,491,915 4,832,901 -31% -3% 8% NAFTA 4,369,893 3,219,558 2,559,194 2,699,108 -38% -16% 6% USA 2,511,711 1,924,398 1,562,717 1,751,736 -30% -9% 12% Mexico 1,396,812 967,479 708,242 658,001 -53% -32% -7% Canada 461,370 327,681 288,235 289,371 -37% -12% 0% South America 2,634,874 1,747,457 1,932,721 2,133,793 -19% 22% 10% Brazil 2,448,490 1,607,175 1,707,851 1,824,833 -26% 14% 7% Argentina 108,364 93,001 184,106 257,505 138% 177% 40% Colombia 78,020 47,281 40,764 51,455 -34% 9% 26% Asia-Oceania 40,650,626 35,822,949 38,188,956 42,324,447 4% 18% 11% China 21,389,833 19,994,081 21,444,743 23,836,083 11% 19% 11% Japan 8,329,130 6,960,411 6,619,245 6,566,356 -21% -6% -1% India 3,629,008 2,836,534 3,631,095 4,439,039 22% 57% 22% South Korea 3,612,587 3,211,706 3,162,727 3,438,355 -5% 7% 9% Indonesia 1,045,666 551,426 889,756 1,214,250 16% 120% 37% Iran, Yearly Only 770,000 826,210 838,251 997,519 30% 21% 19% Malaysia 534,115 457,755 446,431 650,190 22% 42% 46% Thailand 795,254 537,633 594,690 594,057 -25% 11% 0% Taiwan 189,549 180,967 196,749 191,409 1% 6% -3% Pakistan 156,623 95,504 193,991 190,555 22% 100% -2% Vietnam, Yearly Only 129,006 125,235 123,482 162,491 26% 30% 32% Philippines 57,238 37,141 46,278 41,663 -27% 12% -10% Myanmar, Yearly Only 12,617 8,346 1,519 2,480 -80% -70% 63% Australia 0 0 0 0 - -Africa 777,220 538,723 582,814 716,195 -8% 33% 23% Egypt, Yearly Only 18,500 23,754 N/A N/A - -Morocco 368,543 299,753 338,339 404,742 10% 35% 20% South Africa 348,665 238,216 239,267 309,423 -11% 30% 29% Algeria 60,012 754 5,208 2,030 -97% 169% -61% Total - 55,863,566 57,086,075 61,598,650 -8% 10% 8% Estimate / N/A : Not Available

it was mainly concentrated in China and Thailand, with 1.84 million and 1.28 million vehicles respectively.

In contrast, the production of light commercial vehicles in Europe in 2022 was only about 2.14 million, a decrease of 2% from 2021, accounting for only about 10% of the world. Judging from the published data, the most important manufacturers of light commercial vehicles in Europe are Spain, France, Italy, Poland and Germany. The Turkish part has maintained a production scale of 400,000 to 500,000 vehicles in the past few years.

Heavy Truck

The total production of heavy trucks in the world reached more than 4 million units per year from 2019 to 2021, but dropped sharply by 23% to 3.3 million units in 2022, mainly due to the performance of the AsiaPacific region (data showed that in 2022, the heavy-duty trucks in the Asia-Pacific region production fell sharply by 32% year-on-year). See Table 4.

The production of heavy trucks in the Asia-Pacific region in 2022 was 2.28 million units, accounting for nearly 70% of the total global heavy truck production in that year, with China, Japan and India as the main production centers.

The Americas is the second largest production base for heavy trucks. In 2022, the region produced a total of about 680,000 heavy trucks, accounting for about 21% of the global heavy truck production in the same year. Different from the Asia-Pacific region, the production of heavy trucks in the Americas shows

070 Industry Focus >> Hardware & Fastener Componentsno.58/2023

Estimate / N/A : Not Available

Light Units Commercial Vehicle 2019 2020 2021 2022 Variation 2022/2019 Variation 2022/2020 Variation 2022/2021 Europe 2,524,134 2,110,169 2,181,987 2,148,379 -15% 2% -2% European Union 27 Countries + UK 1,953,385 1,590,962 1,605,118 1,580,918 -19% -1% -2% Slovenia N/A N/A N/A N/A - -Finland Confidential Confidential Confidential Confidential - -Netherlands Confidential Confidential Confidential Confidential - -Sweden Confidential Confidential Confidential Confidential - -Hungary Confidential Confidential Confidential Confidential - -Spain 524,504 430,616 383,736 377,779 -28% -12% -2% France 509,552 388,653 433,401 372,707 -27% -4% -14% Italy 312,377 277,067 290,021 268,430 -14% -3% -7% Poland, All CVS 207,802 166,445 173,417 223,680 8% 34% 29% Germany 283,567 227,082 212,527 197,463 -30% -13% -7% United Kingdom 57,442 51,244 55,644 80,210 40% 57% 44% Portugal 58,141 49,855 56,372 60,649 4% 22% 8% Serbia 126 93 145 140 11% 51% -3% Austria 0 0 0 0 - -Belgium 0 0 0 0 - -Czech Republic 0 0 0 0 - -Romania 0 0 0 0 - -Slovakia 0 0 0 0 - -CIS (Only Russia) 122,749 109,468 129,776 83,813 -32% -23% -35% Ukraine 136 51 43 N/A - -Russia 122,749 109,468 129,776 83,813 -32% -23% -35% Azerbaijan 0 0 0 0 - -Belarus 0 0 0 0 - -Kazakhstan 0 0 0 0 - -Uzbekistan 0 0 0 0 - -Turkey 447,874 409,646 446,948 483,508 8% 18% 8% America 12,444,040 10,225,219 11,055,411 12,197,931 -2% 19% 10% NAFTA 11,882,266 9,763,494 10,442,053 11,567,376 -3% 19% 11% USA 8,036,106 6,656,572 7,307,551 7,988,565 -1% 20% 9% Mexico 2,414,256 2,072,699 2,320,239 2,650,345 10% 28% 14% Canada 1,431,904 1,034,223 814,263 928,466 -35% -10% 14% South America 561,774 461,725 613,358 630,555 12% 37% 3% Colombia N/A N/A N/A N/A - -Brazil 355,351 297,539 362,711 351,167 -1% 18% -3% Argentina 206,423 164,186 250,647 279,388 35% 70% 12% Asia-Oceania 5,255,384 4,668,333 5,108,390 5,238,222 0% 12% 3% China 2,002,284 2,151,347 2,174,102 1,846,256 -8% -14% -15% Thailand, All Cvs 1,218,456 889,441 1,091,015 1,289,458 6% 45% 18% Japan 839,582 697,423 708,524 752,774 -10% 8% 6% India 542,860 385,691 486,911 617,398 14% 60% 27% South Korea 258,534 229,040 227,673 245,547 -5% 7% 8% Indonesia 146,150 95,295 157,890 160,171 10% 68% 1% Vietnam 47,197 40,333 44,317 69,919 48% 73% 58% Taiwan 55,896 57,362 58,791 60,758 9% 6% 3% Iran, Yearly Only 40,800 43,778 44,785 53,295 31% 22% 19% Malaysia, All CVs 37,517 27,431 35,220 52,085 39% 90% 48% Philippines, All CVs 37,856 30,156 39,596 50,560 34% 68% 28% Pakistan 25,373 18,629 39,128 39,306 55% 111% 1% Myanmar 2,879 2,407 438 695 -76% -71% 59% Australia 0 0 0 0 - -Africa 289,092 214,218 296,834 275,594 -5% 29% -7% South Africa 254,417 185,691 232,166 215,472 -15% 16% -7% Morocco 34,675 28,527 64,668 60,122 73% 111% -7% Algeria N/A N/A 0 743 - -Egypt 0 0 0 0 - -Total 20,512,650 17,217,939 18,642,622 19,860,126 -3% 15% 7%

Table 3. World Light Commercial Vehicle Production By Country/Region

Hardware & Fastener Components no.58/2023 071

Industry Focus >>

Table 4. World Heavy Truck Production By Country/Region

a trend of annual growth. After a substantial growth of 44% in 2021, it will continue to grow by 11% by 2022. The United States, Mexico and Brazil are the top three major producers of heavy trucks in the region.

The production scale of heavy trucks in Europe is less than half of that in the Americas. In 2022, the production volume of heavy trucks in this region was about 300,000 units, a slight increase from 2021. Compared with the performance in 2020 and 2021, the growth performance of heavy truck production in Europe has a clear slowdown trend. At present, the most important heavy truck production bases in Europe are Spain, Italy, Belgium and the United Kingdom. Türkiye also has a production scale of nearly 40,000 vehicles.

Heavy Buses

Compared with the aforementioned models, the production scale of heavyduty buses is the smallest. In 2022, the global production of heavy-duty buses exceeded 250,000 units, a year-on-year increase of 28%. It also grew by 15% year-on-year before 2021 (see Table 5 ).

The Asia-Pacific region is the most important production base of heavy-duty buses. The output of heavy-duty buses in this region reached more than 170,000 in 2022, a substantial increase of 27% from the previous year, accounting for nearly 70% of the total global heavy-duty bus production in the same year. China and India are the main production centers.

The scale of production in the Americas and Europe

072

Hardware & Fastener Componentsno.58/2023

Heavy Truck Units 2019 2020 2021 2022 Variation 2022/2019 Variation 2022/2020 Variation 2022/2021 Europe 263,013 220,927 298,553 305,319 16% 38% 2% European Union 27 Countries + UK 174,018 133,062 174,154 182,675 5% 37% 5% Austria 21,000 15,500 12,000 N/A - -Slovenia N/A N/A N/A N/A - -Finland Confidential Confidential Confidential Confidential - -France Confidential Confidential Confidential Confidential - -Germany Confidential Confidential Confidential Confidential - -Netherlands Confidential Confidential Confidential Confidential - -Sweden Confidential Confidential Confidential Confidential - -Spain 49,837 36,905 52,223 56,251 13% 52% 8% Italy 60,294 47,937 63,167 54,499 -10% 14% -14% Belgium 38,434 30,070 36,785 44,357 15% 48% 21% United Kingdom 18,883 13,931 16,379 20,507 9% 47% 25% Portugal 5,389 3,039 4,338 5,714 6% 88% 32% Czech Republic 1,181 1,180 1,262 1,347 14% 14% 7% Hungary 0 0 0 0 - -Poland, See LCV 0 0 0 0 - -Romania 0 0 0 0 - -Slovakia 0 0 0 0 - -Serbia 9 10 9 0 - -CIS 69,992 64,615 85,825 76,074 9% 18% -11% Belarus 8,798 8,629 N/A N/A - -Ukraine Confidential Confidential Confidential Confidential - -Russia 60,262 52,103 70,506 63,723 6% 22% -10% Kazakhstan, All CVs 4,247 8,240 10,647 7,833 84% -5% -26% Uzbekistan 5,320 4,163 4,433 4,094 -23% -2% -8% Azerbaijan 163 109 239 424 160% 289% 77% Turkey 19,003 23,250 38,574 46,570 145% 100% 21% America 677,275 479,180 621,087 688,717 2% 44% 11% NAFTA 563,799 388,244 462,277 526,725 -7% 36% 14% USA, Including Buses 345,067 240,056 286,937 320,038 -7% 33% 12% Mexico 195,421 133,965 162,836 195,789 0% 46% 20% Canada 23,311 14,223 12,504 10,898 -53% -23% -13% South America 113,476 90,936 158,810 161,992 43% 78% 2% Argentina Confidential Confidential Confidential Confidential - -Brazil 113,476 90,936 158,810 161,992 43% 78% 2% Colombia N/A N/A N/A N/A - -Asia-Oceania 3,160,164 3,626,520 3,331,219 2,280,468 -28% -37% -32% Philippines N/A N/A N/A N/A - -Thailand N/A N/A N/A N/A - -Vietnam N/A N/A N/A N/A - -China 2,217,847 2,976,459 2,408,249 1,249,268 -44% -58% -48% Japan 506,541 405,451 506,938 512,809 1% 27% 1% India 254,165 122,576 246,407 327,369 29% 167% 33% Indonesia 91,757 41,379 72,983 93,679 2% 126% 28% South Korea 64,758 55,583 65,895 64,896 0% 17% -2% Iran 9,600 10,301 10,538 12,540 31% 22% 19% Taiwan 5,859 7,286 9,780 9,096 55% 25% -7% Australia, Yearly Only 5,606 4,730 5,391 6,077 8% 29% 13% Pakistan 4,031 2,755 5,038 4,734 17% 72% -6% Malaysia 0 0 0 0 - -Myanmar 0 0 0 0 - -Africa 27,840 22,567 26,969 30,249 9% 34% 12% Algeria N/A N/A N/A N/A - -Egypt 0 0 0 0 - -Morocco N/A N/A N/A N/A - -South Africa 27,840 22,567 26,969 30,249 9% 34% 12% Total 4,128,292 4,349,194 4,277,828 3,304,753 -20% -24% -23%

Estimate / N/A : Not Available

Hardware & Fastener Components no.58/2023 073

is similar, probably accounting for nearly 40,000 vehicles. It is worth noting that the production scale of heavy-duty buses in the Americas increased by 71% and 64% in 2021 and 2022, respectively. In particular, Mexico and Brazil almost cover the production of heavyduty buses in the Americas. In Europe, the Czech Republic and Poland are the main production bases for heavy-duty buses.

Summary

Judging from the data in the above tables, the overall global vehicle production volume has not shown a significant downward trend due to the epidemic in the past four years, but has increased year by year. This result may make many previous analysts who were pessimistic about the auto market surprised. However, on the other hand, it may also mean that the demand for cars from global consumers is still strong, which in turn will boost the production willingness of various car manufacturers. Asia (especially China), the United States, Mexico, Brazil, Western European countries and major Central and Eastern European countries will continue to play very critical roles in global automobile production (whether it is passenger cars, light commercial vehicles, heavy trucks, or heavy buses).

This may also be good news for many manufacturers that focus on the production of automotive fasteners. Coupled with the continuous technological improvement of the automobile industry, if the automotive fastener industry can actively strengthen cooperation with customers in major automobile production markets to establish distribution channels, and at the same time grasp the changes and trends in the application of automotive fasteners in the future, automotive fasteners, I believe, will still be a profitmaking shortcut full of business opportunities.

074 Industry Focus >> Hardware & Fastener Componentsno.58/2023