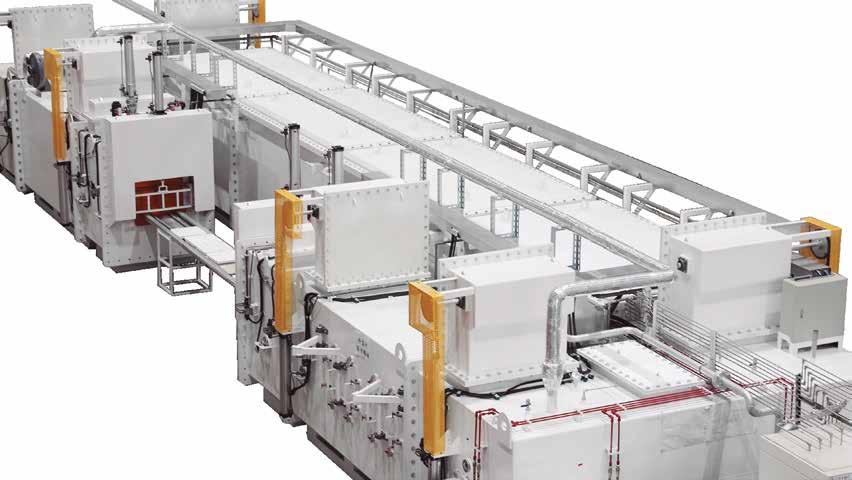

Following the launch of the industry-shaking AI Continuous Batch Green Chamber Furnace and the world's leading AI Vacuum Continuous Cyclic Energy Saving Spheroidizing Furnace in early 2022, Taiwanese heat treatment equipment developer and manufacturer, King Yuan Dar Metal Enterprise Co., Ltd. (KYD), is once again taking the lead in launching a new "Cyclic Continuous Vacuum High Temperature Sintering Furnace" this year, which not only incorporates more excellent features, but also is designed with the concept of energy-saving and carbon reduction as the basis of its development. It is expected to create more amazing production efficiency and product quality for the global industries that have the need for product heat treatment (e.g. fasteners, industrial components, powder metallurgy, etc.).

Developed under the guidance of KYD's GM Chang-Lung Tseng, the new equipment has several features:

• Intuitive operation: Combining the interface of automation and intelligent hardware, the operator on-site only needs to arrange the material feeding and set values to operate.

• Remote and AI monitoring: Management can be carried out through watching remote images. In addition, through the precise monitoring of AI intelligent system, operators can be reminded to check the temperature of the equipment in time when it is abnormal.

• Power transforming system: Helping stabilize the power input to ensure normal operation of the machine.

• Gas control system: It can properly adjust the ratio of gases in the machine to significantly increase the yield rate of workpieces produced.

• Heat Recovery and Recycling System: The continuous production of the machine will transmit, convect, and radiate heat to the workpieces to achieve energy saving and carbon reduction.

• High efficiency, environmental protection and power saving: As more waste heat is recycled and reused, the power consumption of the equipment is further reduced.

• Multiply the capacity and stabilize the quality: Instead of using traditional mesh belts, this machine adopts hydraulic technology to convey parts, allowing it to operate more efficiently, thus doubling the capacity, but at the same time, maintaining the quality of products produced.

“Currently, no other equipment on the market has such core heat treatment technology and design similar to that of this new sintering furnace. Although 80-90% of our sales are in Taiwan at this stage, we expect to expand our global market share in the future by making more people aware of the application advantages of our equipment and one-stop service,” said GM Tseng.

In addition to obtaining the ISO 9001 and IATF 16949 certifications, the oxidation furnace structure, the chamber furnace structure, and the heat recycling system developed by KYD have been also patented in Taiwan, China, Japan, Germany, and the U.S. Its strong R&D capabilities have been internationally recognized and it has cooperated with customers throughout the fastener, automobile, motorcycle, and government sectors.

In the future, KYD will continue to dedicate itself to the development of environmentally-friendly AI heat treatment equipment and provide a 3-in-1 solution integrating heat treatment processing, gas supplies, and equipment manufacturing. In addition to the Luchu, Kaohsiung-based plant, the new plant based in Changhua Coastal Park is also expected to be officially completed by the end of this year, and the Thailand-based plant, close to local automotive supply chains, is expected to be operational next year after the installation of all equipment, which then will be a booster for KYD’s global deployment.

“My long-term goal is to enter the U.S. heat treatment market within two years, and then expand our sales in Taiwan to win a higher market share for our competitive equipment,” said GM Tseng.

Contact: General Manager Chang-Lung Tseng

E-mail: gold.dollar@msa.hinet.net

Article by Gang Hao Chang, Vice Editor-in-Chief of Fastener WorldCopyright owned by Fastener World

In our interaction with fastener associations, business owners and global exhibitors, we observed that a number of overseas buyers are worried about one thing: "If there is a war in the Taiwan Strait, will the supply chain of Taiwan fasteners be cut off?". These buyers are beginning to hope for Taiwanese owners to establish factories in Southeast Asia or other regions (which forms the concept dubbed as "Taiwan +1", where the plus mark denotes “extra” and “+1” denotes “an extra location”). They expect Taiwanese owners to build production lines in other countries to avoid disrupted supply chains.

The Russian-Ukrainian war has lasted for more than 500 days, leading to global inflation, rising interest rates, soaring prices and public inconvenience. The Global Misery Index pushed up by this war has been deeply felt by everyone. If China starts a war against Taiwan, the index will undoubtedly exceed that of the Russian-Ukrainian war by several times, and it will lead to global chaos. Undeniably, the tension between Taiwan and China is largely influenced by the rivalry and friction between the United States and China, which indirectly leads to the need for Taiwan to make policy choices. China's military and political moves have undisputably added up to the heating up of the "+1" trend. Nevertheless, it is worth clarifying whether this trend affects Taiwan fastener industry. Therefore, this article will share our experiences and food for thought through the following different perspectives.

Taiwan has never wanted a war, nor will it initiate one. Taiwan's status quo is influenced by geopolitics and historical burdens. The people of Taiwan know in their hearts that they do not want to go to war to achieve some kind of goals.

Taiwan has had a very close relationship with China. Over the past 30 years, Taiwan has invested more than US$200 billion in China, and more than 10,000 Taiwanese companies have set up factories in China. There are more than 100 Taiwanese fastener companies operating in China. According to Taiwan’s Ministry of Finance, Taiwan's exports in 2021 reached a record high of about US$446.4 billion, of which 42% (US$187.4 billion) were exported to China, and the trade surplus for Taiwan was nearly US$60 billion, which shows quite a large China's economic contribution to Taiwan.

There are more than 500,000 Taiwanese people working in China and more than 10,000 Chinese people working and studying in Taiwan. According to Taiwanese government’s statistics, there are more than 100,000 registerations of transnational marriage between Taiwanese and Chinese people, so a war would only result in the separation of family and bitterness on both sides of the Taiwan Strait. There is complicated sentiment between Taiwan and China, and the economic development they have built together has been very successful, so Taiwan will not make up a reason to go to war. Leaders on both sides of the Taiwan Strait should have the wisdom to

choose a way of life that is mutually acceptable and allows for coexistence, rather than destroy decades of development on the spur of the moment.

If China were to attack Taiwan, it would first have to face the world's largest maritime war in history. The Taiwan Strait separating the two sides is 77 to 140 kilometers wide, and for those with a military background, it is not difficult to understand the difficulty of such a landing operation. According to official figures, Taiwan currently has 700,000 reservists who can respond immediately in the event of a war. Taiwan has also acquired many fine weapons through the supply of semiconductors and procurement of military weapons, and it is believed that Taiwan has enough power to defend itself. As a saying goes, the winner takes the throne as the king (a hero in history) and the loser rots in the river of history. Many overseas experts have warned of the risks and consequences of a cross-strait war. In the event of a war, Taiwan and China's respective economies would be destroyed, and it would take decades to rebuild. Who can afford such a heavy burden?

The global fastener production and sales market size is US$85 billion (20 million tons of fasteners produced), of which Taiwan's size is about US$5 billion (1.5 million tons). Compared to Taiwan's semiconductors which take up 90% of global market share, Taiwan's share of fasteners in the global market is relatively small. Taiwan's fasteners fall in the middle of the price range on average, and in the event of a war, it would not be difficult to find other countries to buy the same level of products as Taiwan. However, it is necessary to point out that, although Taiwan fasteners can be replaced in terms of price, Taiwan’s R&D capability, production management, credibility, its supply chain which is the most complete in the world, as well as high value-added products and service satisfaction, are Taiwan's unique and irreplaceable features.

Fasteners are not an extremely critical and tactical material like semiconductors. If a war breaks out, the possibility of Taiwanese fastener factories being attacked is not high. Taiwan already has experience in establishing a complete supply chain; in addition, many Taiwanese fastener companies have set up bases overseas which have the ability to supply goods, so even if there is a war, they can quickly resume production of fasteners. On the whole, if there is a war, it won’t amount to a nuclear level of destruction on Taiwanese fasteners, and it is less likely to cause a major global panic and a major shortage of goods.

Taiwan's political ground, economic development and social security are very stable. For the past three years this had never been affected by war concerns and COVID. Even in the past 20 years, Taiwan's fastener exports have shown a 20-degree upward trend line (see Figures 1 and 2), which will only be subject to the global economic climate, but not to political and war factors.

It is undeniable that some of the Taiwanese owners have cooperated with buyers' requests by going to Vietnam, Thailand, Indonesia, Malaysia or other places to build factories in order to diversify the risk. However, Taiwan fastener industry mostly consists of small and medium-sized enterprises (SMEs) which don’t have a high level of manpower, material resources and capital. The global fastener market lately is not as good as expected, and this comes with the upcoming carbon tax and costs for environmental protection, so going overseas to set up factories would mean a lot of pressure. In fact, as far as the current situation, the cost of setting up production lines in other countries is no less than the cost of production in Taiwan, which may obstruct Taiwanese owners from providing buyers with better prices and service satisfaction.

Considering all the above factors, there is no longer any requisite for direct friction between Taiwan and China. Taiwan has nothing to gain by starting a war, and furthermore China as the world's largest market is very much in line with Taiwan's economic development needs.

After clarifying the scope of impact of Taiwan Strait tensions on Taiwan fastener industry, we believe that buyers don't necessarily need to ask Taiwanese owners to keep up with the "+1" trend because, as already mentioned, doing so won't necessarily lead to better pricing for buyers. That said, it is not unreasonable for buyers to be concerned, and this underscores many ways in which Taiwanese companies must make buyers feel more confident in the safety, stability and strength of Taiwan's fastener supply. As a medium for communication, Fastener World Magazine takes the responsibility to analyze the scope of impact for suppliers and buyers, hoping to open up more room for communication.

We believe buyers who have visited Taiwan would feel that there is no war atmosphere in Taiwan. What's more, the New Taiwan Dollar and the US Dollar have become two of the world's most appreciated currencies. The price of land in Taiwan has tripled, and there has been no surge of emigration. In addition, on July 11 the U.S. Department of State maintained Taiwan's Travel Alert Risk at the safest level. Fastener World would like for global buyers to know that Taiwanese fasteners are one of the most resilient, endurable and reboundable industries in the world, and we have cited Figures 1 and 2 as evidence of this. Taiwan is stepping out into the world in a way that it never could before, and because of this, we need buyers around the world to see the strengths of Taiwanese fasteners and have more confidence in them, so that all of us can together continue to create mutual benefits for Taiwan and the rest of the world.

fastenerpoland.pl/en

The current year is undoubtedly a period full of challenges for the fastener industry. The complicated political and economic situation, problems related to supply chains and the progressive slowdown on the construction market mean that entrepreneurs once again have to face various challenges. However, industry reports show that despite the difficulties, the industry has a chance for further development, and in the long run, entrepreneurs will be able to turn the current turmoil into profit. It is worth remembering and planning participation in the 6th edition of the FASTENER POLAND® International Trade Fair for Fastener and Fixing Technology, which will take place on October 18-19, invariably at EXPO Krakow.

Exhibitors and visitors from over a dozen of countries, industry news and premieres, many hours of talks, expert conferences, B2B meetings - this is what the FASTENER POLAND ® Trade Fair in Krakow looked like last year. As many as 65% of the exhibitors came from abroad. This year's edition promises to be equally good, as the participation of exhibitors has already been confirmed, e.g. from: Czech Republic, Sweden, Germany, Turkey, Switzerland, Malta, Italy, Hungary, China, Vietnam and Taiwan. The international nature of the event only emphasizes how important trade fair meetings are for the entire industry. And although the fair is an investment, which, especially in difficult times, may seem like a significant burden on the company's budget, its

effects are often visible several months after the end of the event. We know this from our regular exhibitors who return to EXPO Krakow every year to present their offer. Therefore, we encourage you to plan your participation in this year's edition of FASTENER POLAND® Trade Fair now. This gives you the opportunity to choose an attractive booth location and take advantage of additional, free forms of promotion.

The FASTENER POLAND ® Trade Fair is the only international fair of fasteners organized in Central and Eastern Europe. The scope of the exhibition includes, among others: the most modern industrial fasteners and fixing (from bolts to nuts, clamps and rings); building fasteners (anchors, concrete screws, fastening of facades and insulation); advanced assembly and installation systems, as well as technologies for the production of fasteners and devices for their storage and distribution.

The 6th edition of the FASTENER POLAND ® Trade Fair promises to be very good. After 3 years of travel difficulties, this year's participation in the fair is confirmed by exhibitors and guests from the farthest corners of the world. The list of exhibitors is now available at www.fastenerpoland.pl/en. We also invite you to follow the trade fair profiles in social media, where we publish industry news on an ongoing basis and reveal what our exhibitors will present at their stands this year. For those interested in visiting the fair, we have prepared a pool of free admission tickets. To receive them, just complete a short form available on the fair website.

墨西哥螺絲+波蘭螺絲展展前宣傳專輯

Only Taiwanese exhibitors exhibiting through Taiwan's exclusive agent Fastener World are listed.

為了方便統計準確,上述台灣扣件 展團名單以有向本展台灣總代理 商匯達公司報名為準。

foreign@fastener-world.com.tw

Our publication has a circulation of over 10,000 printed copies per issue sent to more than 200 countries and we participate in at least 25 int’l trade shows per year. We are also the exclusive sales agent in Taiwan for Fastener Fair Global, Fastener Fair India, Fastener Fair Mexico, Fastener Fair Turkey, International Fastener Expo, Fastener Poland, etc. We continue to reinforce our service range, add more software/hardware investment, and create more solid competitiveness on the market for customers with the best service quality.

For more info, please visit our website at www.fastener-world.com

chite@chite.com.tw

www.chite.com.tw

Chite Enterprises Co., Ltd, specializes in various fastener products (screws, bolts, nuts as per standards and drawings), exporting fasteners to over 80 countries. We have factories and branch offices in Taiwan, Vietnam and China, providing customers with different options in purchasing and with below advantages.

*With our manufacturing experience and various sources, we provide a wide range of fastener with high quality and competitive prices.

*CE certificate of EN 14566 and EN 14592

*TAF certified QC lab test before each shipment

In order to meet market demand, Chite is dedicated to the supply of solar parts, including solar panels, solar brackets, bolts, nuts & bi-metal screws (sharp point). We provide a wide range of fasteners with high quality and competitive prices.

jcsales@celebritefasteners.com

www.celebritefasteners.com

Celebrite Fasteners Co., Ltd. was established in Taiwan in 2013. We sell various screws, bolts, etc. We are a manufacturing company with a purpose to specialize in manufacturing self drilling screws, tapping screws & patented wing tek screw assembly BAZ washers. Our products are made in Taiwan and we use all materials from China Steel Corp. and are certified to ISO9001 and CE. To customize screws based on your needs is available.

We are a professional self-drilling screws & self-tapping screws manufacturer. Our various self-drilling screws & self-tapping screws with indent hex washer head, pan head or flat head have been provided to the world since 2001. Standards: DIN 7504, 7981, 7982.

LONGHWA SCREW WORKS CO., LTD.

隆華螺絲工廠股份有限公司 www.long-hwa.com.tw

longhwa.putz@msa.hinet.net

Established in 1988, Long Hwa specializes in making long-size screws for chipboard screws, self-drilling screws, concrete screws and distance screws and has been certified by CE 14566 & 14592 and ETA.

Our products include chipboard screws: M6~12 (80-1000mm), self-drilling screws: M7.0/6.3 (80~400mm), M6.3/5.5 (80~400mm), concrete screws: M7.5 (42~402mm), distance screws: M6 (50~160mm).

jensonyeh@chungho.com.tw www.chungho.com.tw

CHUNGHO FASTENER is a professional fastener supplier in Taiwan, adept at producing special screws. With 40 years of experience, we not only manufacture screws but also create trust and satisfaction. Our mission is to solve customers' difficulties in finding fasteners, enabling them to focus on design and production. We provide reasonably priced, high-quality products with stable delivery times. We will be your best partner. Our company specializes in mechanical and construction-related screws. We cater to a diverse range of industries, including motors, machinery, machine tools, sports equipment, bicycles, and electric vehicles. Our product line includes mechanical screws, hexagon socket screws, locking nuts, pressed fasteners, pins and keys. Additionally, we excel in handling special screws, and 40 years of experience have given us excellent processing capabilities.

BOLTUN CORPORATION 恒耀工業股份有限公司

sales@boltun.com.tw www.boltun.com

Boltun is one of the leading manufacturers in metal parts for industrial use in Taiwan, providing a wide range of products from automotive fasteners and components, stamping parts, to wind turbine fasteners. Established in 1988 in Taiwan, Boltun has invested in-house production including forming, tapping, stamping, CNC machining, heat treatment, washing, assembling, and automatic packing. Boltun is also accredited with a number of certificates such as IATF 16949, ISO 9001 and ISO 14001, and ISO-17025 to cover most of the quality testing in house. Our products include welding bolts/nuts, rivet nuts, clinch nuts, T-nuts, nylon insert nuts, and conical washer nuts, special parts, hex. bolts & screws, flange bolts, clinch bolts, T C bolts, bushes, sleeves, stamping parts , CNC machined parts, wind turbine fastener kits: nuts, bolts & washers and truck wheel bolts.

TSUNG YANG INTERNATIONAL CO., LTD.

宗揚國際有限公司 www.tsung-yang.com.tw

Tsung-Yang@hibox.hinet.net

We are a professional exporter in fastener trading in Taiwan and our goods enjoy a high reputation for excellent quality. We have been engaged in this field for 15 years and have good connections with local manufacturers. We are specialized in producing and exporting screws, bolts and washers to overseas customers. We provide the most competitive prices, stable quality and excellent service to our customers.

info@joker.com.tw

www.joker-fastener.com

JOKER is a renowned Taiwanese company established in 1984. Being initially an OEM manufacturer, JOKER has evolved into a leading developer and manufacturer of construction anchors and industrial fasteners. One of JOKER’s patent Sissy Stud Concrete screw is approved ETA option1 directly from EOTA, getting the number ETA-14/0374. JOKER is well-known for its trustworthy quality and reliable partner. JOKER as a professional fastener manufacturer, this year, we bring two news to the market. We launched an excellent performance of stainless steel concrete screw which has been assessed by ETA, and is a solution that delivers unparalleled strength and durability and also offers exceptional resistance to corrosion and rust. In addition, we also passed the IATF 16949 certification, which ensures compliance with quality standards in the automotive industry.

hoplite.ind@msa.hinet.net www.hoplite.com.tw

Hoplite Industry Co., Ltd. is a company specialized in supplying screws, nuts and tools in building, electronic, automotive and general industries areas. Hoplite’s operation is teaming up with medium-size skilled manufacturers combining with our own experienced staffs. Being in the business for 23 years, Hoplite has been successfully collaborating with European companies, a win-win cooperation good for involved parties. Meeting customers’ needs has always been our main focus. Hoplite distinguishes itself through excellent product quality, customer-oriented service and sound advice. Our full hand concept of products and solid solutions creates value for You!

jaden1071022@gmail.com

www.fastener-world.com/en/supplier/jaden

Jaden Co., Ltd. was established in 2018, mainly specializing in all kinds of drill end screws, wood screws and composite screws, and has its own factory for production and manufacturing.

yeswin@twyeswin.com www.twyeswin.com

Yeswin Machinery is a professional manufacturer of cold forging machines for bolts, nuts, various kinds of fastening parts and fixing elements. We provide Bolt Formers with 3-5 stations and Parts Formers with 5-7 stations. Our machines cover a wide range of sizes from M3 up to M30, with the maximum length up to 400mm. The applicable processing materials are stainless steel, low-carbon steel, copper, low alloy steel, aluminum alloy, etc.

dagannet@ms8.hinet.net www.dagan.com.tw

Marketing for- 1. Multi station cold forming machines: bolt former/nut former 2. Flat die thread rolling machine/dual roller rolling machine 3. Nut tapping machine 4. Single die two blow heading machine 5. Washer assembly machine 6. Nut crimping machine 7. Nylon nuts assembly machine 8. Auto lathe (drilling, tapping, machining, chamfering, slotting) 9. Screw shank slotting machine 10. Self pointing screw pointing machine 11. Customized device 12. De-oiling machine 13. Conveyors 14. Vibrator 15. Heat treatment furnace 16. Plating line 17. Wire drawing machine 18. Cold forming toolings (dies, punches, pins, transfer fingers, trimming dies, self screw pointing dies, cutters, nut taps, threading dies, drawing dies 19. Machine parts.

maochuan@maochuan.com.tw www.maochuan.com.tw

MAO CHUAN is a professional stampings manufacturer in Taiwan and has more than 50 years of experiences in O.E.M for the automotive, electronic, and construction industries. MAO CHUAN is qualified with ISO9001, IATF16949, ISO14001 and VDA 6.1. With seasoned skills and a great activity in the stamping field, MAO CHUAN supplies diversified essential materials, surface finishes, and integrated treatments to satisfy individual client requirements and applications. MAO CHUAN provides customized products with the most comprehensive services to integrate the entire production process, which is a single point of contact from design prototyping, assembling, and final sale packing. MAO CHUAN has contributed to the ESG program management. In 2023, we have completed the verification according to ISO 14064-3:2019, and meet the standard requirements of ISO 14064-1:2018.

service@amis-world.com

www.amis-world.com

AMIS collaborates with professional manufacturers located in Kaohsiung, Taiwan. We own advantages of well, complete and experienced supply chain in Kaohsiung area and can provide you with high quality products at competitive prices. AMIS gathers experienced people who can help you solve the problems you may have when working with fasteners. Please feel free to contact us immediately for our professional service.

We offer sandwich panel screws with drilling points from no. 3 to no. 10 with the capacity of drilling a 25mm thick steel plate, and high quality drywall screws that can drill a 0.6mm thick steel plate within 0.5 sec. We also offer special multi-formed parts as per customer’s drawings.

dennis.chou@orangefasteners.com.tw

www.orangefasteners.com.tw

Integrated fastener solution / Manufacturing / Engineering / Quality / Souring.

IATF 16949:2016.

The Orange solution for your special problems.

teacbow@gmail.com

www.rjwfastener.com

RJW International Co., Ltd. established in 2021 is located in Tainan, Taiwan. We have for long supplied and developed for the automotive industry, OEM distribution, building for steel structures, wooden construction houses and DIY market for large chain stores. Screws with customer’s drawings and standard products are also available.

Our main business is supplying construction screws such as drywall, chipboard, self-drilling, decking, concrete, collated, OEM screws and automotive or industrial parts to the oversea market.

CO., LTD. 朝璟精機有限公司

jw.zw@msa.hinet.net

www.chaojing.com.tw

Chao Jing Precise Machines Enterprise Co., Ltd. shows spirit towards innovative technology and offers excellent quality of core competencies to serve customers around the world. We provide the most sophisticated fasteners and the most reasonable prices of products. The "customer and quality first" policy has been implemented in our operation. With several years of industry experience and continuous R&D we then moved toward higher-value products and hi-tech product development. Our principle of profit sharing with our customers helps meet customer demand. Facing the future, we will continue to be in line with the original spirit of service to serve the public. Going toward internationalization and diversification will help us reach the top of the international reputation.

CHIEN TSAI MACHINERY ENTERPRISE CO., LTD.

鍵財機械企業股份有限公司

jiancai@jiancai.com.tw

www.jiancai.com.tw

Chien Tsai Machinery was founded in Taiwan in 1973. Main products are thread rolling machines for screws of the diameter from 1.0mm to 38.0mm and the thread length up to 600mm. Products are exported globally around the world like Europe, Asia, America. Chien Tsai expanded our scale in 2017, acquiring another 30 acres of land in Jiashan, China and establishing Zhejiang Jiancai Machinery Co., Ltd. Our company has passed the ISO9001, ISO14001, and ISO45001 certification. The feature of Automatic Thread Rolling High Speed Machine : CTR8N-4, Product Range: M5-M8, Screw length: 75-100mm , Thread Length: 50-75mm, Rolling dies stationary length: 127/140/25, Main Power: 10HP, Max. Output: 110-350 pcs/min.

TAIWAN INDUSTRIAL FASTENERS INSTITUTE 台灣螺絲工業同業公會

tifi.tw@msa.hinet.net

www.fasteners.org.tw

TIFI founded in 1969 has 700 members at present. TIFI Members include major manufacturers and exporters of the fastener industry in Taiwan. Our publication “Taiwan Fastener” is published with 2 issues every year, and is a “must read” buyers guide for your sourcing from Taiwan. Please visit our stand for your free copy of 2023 Taiwan Fastener Buyers Guide. "

*Free request for buyers "Special Edition 2023" published by Taiwan Industrial Fasteners Institute, it collects products produced by member manufacturers.

*Buyers Guide of TIFI” published by Taiwan Industrial Fasteners Institute includes the basic information and products of member companies.

sales@keyuse.com.tw

www.keyuse.com.tw

Key-Use is a professional manufacturer that began business in 1987. We specialize in the production of fasteners. We are constantly improving technology and facilities that make us take the lead in market development.

Our products include Special Parts / T-Bolt / Automotive Parts / Welding Screws / Pressing Screws / Shoulder Bolts

VERTIGO FORMING SOLUTIONS CO., LTD.

佛帝克企業有限公司

vfs.amychang@gmail.com

www.vertigoformingsolutions.com

With over two decades of professional experience in the cold forging tools and fasteners fields. We strive to serve the customers with the most efficient and cost-effective manufacturing needs, from machinery, machinery tools to fastener manufacturing tooling. Supporting a wide range of fasteners tooling needs, from the field of automotive fastener production, building fasteners to furniture fasteners, and customized high-end and irregular tooling. Our key product categories are: Carbide Dies, Punches, Flat Rolling Dies, Nut Taps, Transfer Fingers, Recess Pins, Carbide Raw Material, Trimming Dies , Cutters. Fasteners. Our professional development and management team devotes unremitting efforts to carry out strict quality control at factories, excellent service to reach the optimum on the cost-effectiveness for our customers.

TAI HUEI SCREW INDUSTRY CO., LTD.

台煇螺絲工業股份有限公司

taihuei.screw@msa.hinet.net

www.taihuei.com

Tai Huei is a professional screw manufacturer in Taiwan established in 1980. We focus on the construction and furniture screws which are made of carbon steel. At present, we have 100 sets of heading and threading machines. The capacity can be a maximum of 600 tons per month. Our products include Drywall Screw (EN14562 CE), Chipboard Screw (EN14592 CE), Timber Construction Screw (EN14592 CE), Self Tapping Screw, Self Drilling Screw, Machine Screw, Concrete Screw, Furniture Screw, Decking Screw, Roofing Screw, Wood Screw, Nail Screw.

FRATOM FASTECH CO., LTD. 福敦科技有限公司

thomas.liu@fratom-fastech.com

www.fratom-fastech.com

Fratom Fastech, located in Kaohsiung, Taiwan, produces all kinds of irregular-shape and customized tooling for the steel forming industry. With a production team of over 25 years with manufacturing experience and a highly trained dynamic team, we are uniquely equipped to satisfy your performance requirements.

foreign@fastener-world.com.tw

Established in 1987, Fastener World Inc. is a worldrenowned marketing media for fasteners, hardware, and industrial components industries. With a team of over 30 years of experience in offering the global industry the most effective marketing solutions and the combination of printed magazines, online B2B platform, representation of leading int’l trade shows, and instantaneous business info service, Fastener World provides the industry with diversified marketing approaches to promote their brand awareness and boost order intake.

Our publications include:

-Fastener World Magazine Bimonthly Edition (released every Jan/Mar/May/Jul/Sep) + Fastener World Magazine

Buyers’ Guide (released every Nov)

-China Fastener World Magazine (released every Feb/ Jun/Oct)

-Hardware & Fastener Components Magazine (released every Feb/May/Aug/Oct)

-Emerging Fastener Markets Magazine (released every Aug)

-Fastener World Europe Special Edition (released annually)

For more info, please visit our website at www.fastener-world.com

petrina@weii-nut.com.tw

www.weii-nut.com.tw

We are an IATF-16949 certified manufacturer located in Kaohsiung, Taiwan. Specialized in forming non-standard nuts for the automotive industry. Our nut size is from M3 to M36 with the overall length up to 105mm. Our nut formers apply short punching distance, suit the part with 0.5~2 times of O.D.. Available materials include carbon steel, alloy steel, stainless steel, brass and aluminum. We’ve had experience in working with the aerospace industry by supplying parts in plain or blank condition. The material types we could work on are 302, 316Ti, 347, A286, and so on. We manufacture special nuts per customer design by cold forming and secondary operations. The majority of our products are supplied to the automotive and aerospace industries, PPAP document is available.

marketing@rexlen.com.tw www.rexlen.com.tw

Rexlen Corporation was founded in 1977, with great experience and knowledge of this sector. The headquarters is located in Kaohsiung (Taiwan), and we have TAF Certified QC Labs and manufacturing subsidiaries in both Taiwan and China. Our company has been certified by:

* IATF-16949 (from the factory) * ISO 9001:2008 (TUV Rheinland). * TAF certification (from our own QC labs.) We offer the products with competitive prices, timely delivery and satisfied services to the United States, European countries, Australia..., etc. Our strength products include cold forging, hot forging, CNC machined, machine screw, rubber and plastic parts, type TT and self tapping screws, teks screws, and roofing screws. We are able to offer not only standard parts, but also custom parts and are able to meet customers' requirements.

kuohsian.sales@gmail.com www.kuohsian.com

Kuo Hsian Fastener was founded in 2016 and is located in Gangshan Dist. of Kaohsiung. We offer fasteners made in Taiwan according to DIN standards. Besides, we also make custommade parts upon our customer’s request and according to special applications. Main Products: DIN931/933/6921/603/571, ISO 4014/4017 with CE marking (EN15048-1), wheel bolts, hammer head bolts, automotive parts, Silo bolts.

Product spec range: M3~M24 Material: Carbon Steel/Stainless Steel

Finish:CR3+ZY, CR3+ZP, Geomet, Delta Coating, H.D.G., Mechanical Zinc Plating. Patch: Nylon Patch/3M/Precote/Dri Lock

erie@mail.yfs.com.tw www.yfs.com.tw

Since its establishment in 1978, Fang Sheng Screw Co. (YFS) established a domestic and foreign distribution network. YFS has continuously upgraded and integrated its manufacturing process. Starting from acid pickling, annealing, wire drawing, forming, thread rolling, heat treatment, and packaging are all manufactured and integrated within the YFS factory. YFS also transformed into a manufacturer of customized special screws for automobiles, trucks, highspeed railways, and heavy machinery industries. YFS provides high tensile 12.9 grade socket screws, button heads, and countersunk screws not only limited to metric size. YFS supports inch size standards such as ASME B18.3, and also provides customized special screws for automobiles, trucks, high-speed railways, and heavy machinery industries.

523

CHIEN TSAI MACHINERY ENTERPRISE CO., LTD. 鍵財機械企業股份有限公司

jiancai@jiancai.com.tw www.jiancai.com.tw

Chien Tsai Machinery was founded in Taipei in 1973 by Mr. Chen Chien Tsai. Chien Tsai Machinery is able to thread screws of the diameter of 1.0mm to 38.0mm with a thread length up to 600mm. Products are exported globally around the world, but not limited to, the mainland China, Japan, Europe and Americas. Chien Tsai Machinery expanded its scale in 2017, acquiring another 30 acres of land in Jiashan, Zhejiang, establishing Zhejiang Jiancai Machinery Co., LTD. Our company has passed the ISO9001, ISO14001, and ISO45001 certifications. Chien Tsai Machinery is one of biggest thread rolling machine manufacturers in the world. CT has over 50 years’ experience in thread rolling machines. We are your best choice.

524

METAL FASTENERS CO., LTD. 法斯訥企業有限公司

sales@fasteners.com.tw www.fasteners.com.tw

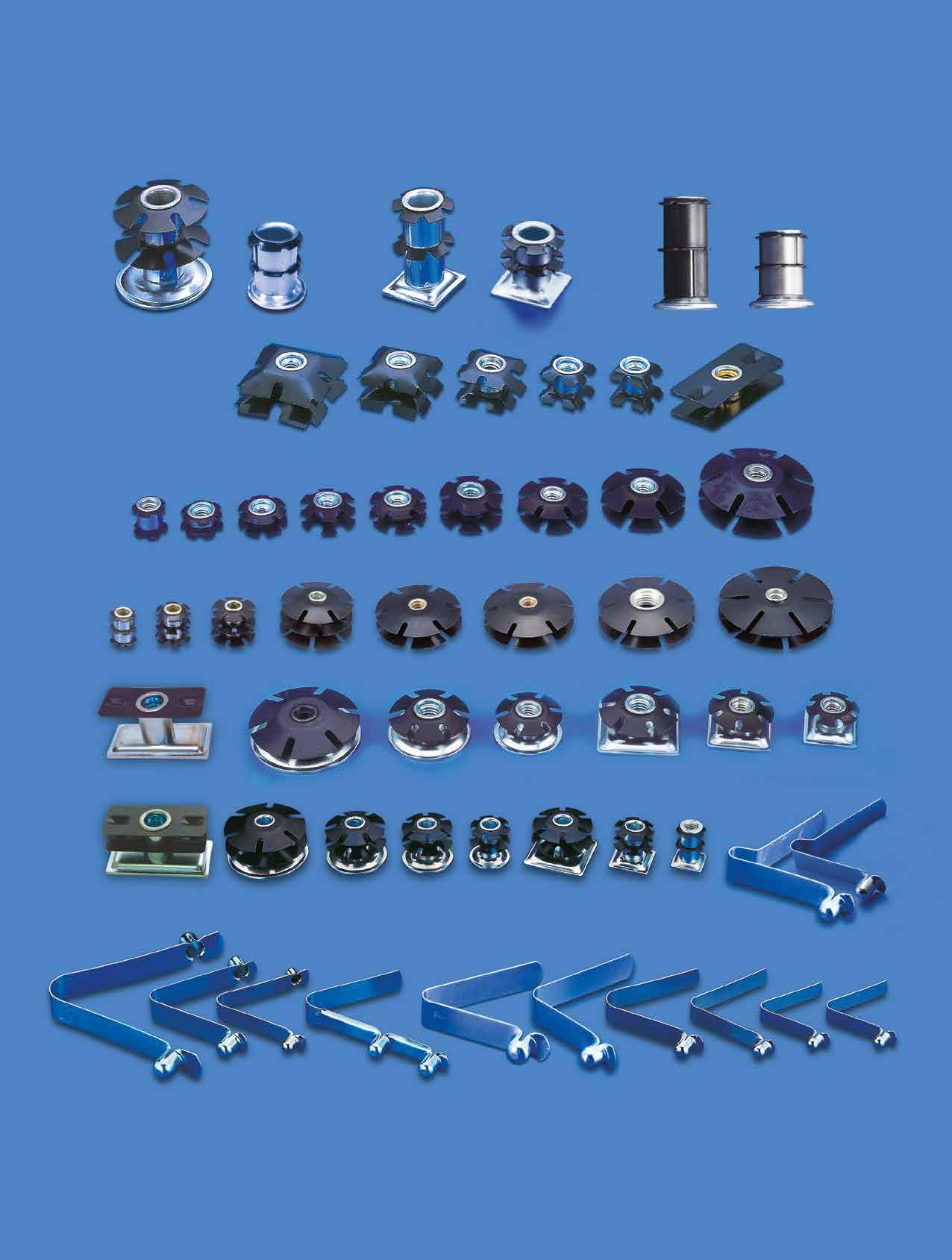

MF can supply professional sheet metal self-fastening parts and injection molded nut parts according to market demand and customer needs. We can provide customized products according to customer requirements for various non-standard screws. New business philosophy, providing excellent products and services that meet customer needs.

MF is your best choice and a supplier for self-clinching fasteners and brass inserts located in Taiwan, because we offer best quality, on-time delivery and competitive prices.

sales@boltun.com.tw www.boltun.com

Boltun is one of the leading manufacturers in metal parts for industrial use in Taiwan, providing a wide range of products from automotive fasteners and components, stamping parts, and wind turbine fasteners. Established in 1988 in Taiwan, Boltun has invested in-house production including forming, tapping, stamping, CNC machining, heat treatment, washing, assembling, and automatic packing. Boltun is also accredited with a number of certificates such as IATF 16949, ISO 9001 and ISO 14001, and ISO-17025 to cover most of the quality testing in house.

Boltun has been a leading supplier in metal parts aiming at industrial usage. We supply a broad range of products, encompassing standard to engineered cold forged parts.

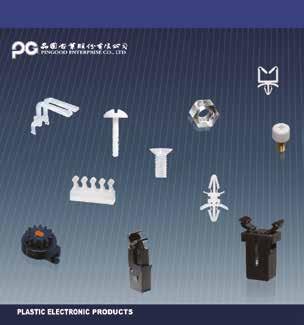

sales@pingood.com.tw www.pingood.com.tw

Since 1982 Pingood Enterprise has been specialized in mechanical plastic injection molded mini parts.

-3 company owned plants, 1 in Taiwan and 2 in China

-More than 15,000 SKUs standard ready parts

-Specialized in custom parts as well.

-ISO 9001, IATF 16949, ISO14001 qualified

-Green procurement of sources: Meet RoHS, REACH, Implement to Halogen Free

-Environmentally friendly (energy saving by using solar energy)

-Facilities (in-house tool shop, injection line, automated processing)

610 TAIWAN METIZ ALLIANCE 羅斯德股份有限公司

info@rgt.tw www.tooling.tw

Taiwan Metiz Alliance, for more than 20 years, has produced and supplied tooling to the biggest fastener producers from all around the world. Our dies and punches are produced using the highest technologies and the most quality materials such as imported Japanese steels and carbides, which allows our tooling to have reliable stability in combination with a long lifetime and reasonable price. Additionally, we have a department, which is focused on offering service for developing turn-key fastener production lines. We want to meet professional partners and will support your organization in all possible ways.

614

L & W FASTENERS COMPANY 金大鼎企業股份有限公司

king-lin@lwfasteners.com.tw

www.lwfasteners.com.tw

L&W Fasteners Company was founded in 1992 and located in Tainan, Taiwan. We are a professional fastener manufacturer of constructions, machines and general industries. The mission of L&W is to bring more additional value-added services to customers through our professional inspectors and experienced sales teamwork. L&W is a reliable fastener supplier that can satisfy your market needs and we have a strong logistics operation team. Welcome to our booth.

DEWALT announced two new sealed head ratchets: the 20V MAX* XR® 3/8 in. and 1/2 in. (DCF510) as well as the XTREME™ 12V MAX* 1/4 in. & 3/8 in. (DCF500). The ratchets are ideal for automotive, electrical and mechanical as well as maintenance, repair and operations (MRO) professionals.

The new Sealed Head Ratchets are designed with features in mind for our user’s most demanding jobs. The innovative sealed head design and glass-filled nylon tool housing helps provide protection against oils and automotive solvents meeting the needs of pros across industries on any jobsite.

The new interchangeable anvil design allows users to quickly switch between square drives in both models in addition to a 1/4 in. quick change hex with the XTREME™ 12V MAX* model to complete a variety of applications. The lowprofile head offers accessibility in tight workspaces, while the variable speed trigger and forward/reverse switch allow users to quickly change speed and direction to maximize productivity. The ratchets also feature a trigger lock that helps prevent accidental activation and an onboard LED work light to help illuminate dark areas.

SPX FLOW’s Bolting Systems has released a new line of NRP Series Pneumatic Torque Wrenches designed to provide customers with high-duty performance, quality materials and a lower cost of ownership. The points to note include:

• The NRP Series of Pneumatic Torque Wrenches offer five models, which generate torques up to nearly 4,500 lb-ft (6,000 Nm).

• The new additions complement the brand’s existing range of hydraulic torque wrenches, including the TWHC, TWLC and TWSL series.

• The NRP series offer fast, continuous nut rotation, ideally suited to wind energy, automotive assembly and maintenance/repair operations.

• Designed with ease of use and operator safety in mind.

• A pistol grip design for easy handling and a fully rotatable drive unit.

• Robust, non-impact transmission that ensures quiet operation with low vibration, which provides greater operator comfort.

• An automatic switch-off function at the desired torque, establishing reliable and repeatable operation.

The new 1/4” Drive Flex-Head TechAngle® Micro Torque Wrench from Snap-on features a 25 percent increase in torque range compared to the previous model.

Designed for precision, the ATECH1FS300 now provides a torque range of 15-300 in-lb with an accuracy of ±2% clockwise and ±3% counterclockwise. This compact (11.6” L x 0.90” dia.) tool offers six measurement modes and four alert modes, including LCD, LED, vibratory, and audible alerts for complete torque control. It also features dual progressive LEDs for visualizing active torque and a patented flexyoke design for better access to fasteners, perfect for tight recesses and close-clearance applications.

With a unique torque-then-angle mode, this wrench allows users to torque fasteners and switch to angle without removing the tool, offering unparalleled convenience. The textured grip ensures a comfortable, non-slip hold, and a flared end that prevents slipping during highleverage applications. Weighing in at only 0.93 lb, the ATECH1FS300 operates with a single AA battery and includes a two-year warranty.

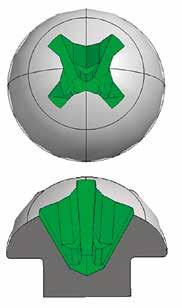

In manual fastening and loosening of screws at construction sites and other workplaces, it is time-consuming to change bits for each screw drive recess, which causes users to disassemble and assemble with a bit that does not fit the recess, thus resulting in a collapsed recess.

To solve this problem, Nitto Seiko (Japan) has developed a “Share Cross” that can be used with bits of similar sizes. “Share Cross” is suited for various types of fastening and improves work efficiency in manufacturing operations.

“Share Cross” is a small cross-recess with another large cross-recess superimposed on it, so that bits of similar sizes (e.g., #2 or # 3) can be used on the same screw head recess. The structure is such that the drive surfaces for transmitting torque can be shared, which achieves optimum fit of the bit and maximizes performance.

Fischer has launched the FAZ II Plus bolt anchor for construction projects. The new product has a higher assessed tensile load-bearing capacity and material strength than the previous generation. The setting process (M8-M24) does not require cleaning the drill hole. This anchor is approved for different types of construction materials, including concrete, sand-lime brick and steel fiber-reinforced concrete. A service life of 120 years allows the anchor to be used for various applications.

At present, trivalent chromates include chromates, unichromates and black variant (chromates are silver white), but they have never appeared yellow like hexavalent chromates. In the past, hexavalent chromium plating was mostly used for yellow colored products. However, in light of the global environmental issues, Heiwa Kaken (Japan) has developed a surface treatment technology that can give a yellow or red color like hexavalent chromate does, even on trivalent products.

Characteristics of Trivalent Yellow:

* Giving a yellow or red interference color as does hexavalent chromate!

* Corrosion resistance is equivalent to trivalent chromate: 72 hours without white rust, 120 hours without red rust!

* No hexavalent dissolution will be detected!

* Used together with trivalent chromate to distinguish minor differences in size and threads.

FAZ II Plus was made for transferring high static and medium dynamic loads in cracked and non-cracked concrete. The anchors are designed for use in sand-lime brick (except for dynamic applications). A European Technical Assessment (ETA) provides added safety. The new ETA confirms the application of diameter versions M16-M24 in galvanized and stainless steel materials for dynamic loads. This requires fewer fastening points and anchors per application and project.

Nitto Seiko (Japan) conducted research using manufacturing and dies making technologies to develop JOISTUD-HT with high anti-rotation capability, JOISTUD-SS with space saving function, JOISTUD-WP with water resistant function and JOISTUD-S with high strength. JOISTUD-WP is a product with water resistant function. Like JOISTUD-S, JOISTUD-HT can be simply pressed onto fastening elements to achieve higher product quality than ever before, providing strong support for customers’ production.

While conventional clinching stud bolts has an evenly thick leaf-shaped protruding anti-rotation part, the JOISTUD series has an anti-rotation protruding part with a ring design only on the edge of the leaf. The anti-rotation part is also designed to prevent buckling of the fastener. In addition, the groove inside the anti-rotation protrusion can accommodate the fastener that is deformed during pressing, preventing the deformed part from protruding toward the screw and forming burrs, and increasing the anti-rotation capability in the rotation direction.

Beginning as a bicycle parts manufacturer in 2017 in Caotun Township of Nantou County (central Taiwan), Yaowei is a rising star in the CNC machining industry. The founder Mr. Peihui Li learned machining and lathe since he was young. With more than 20 years of experience in composite processing including turning, milling, and lathe machining, he is a diligent business owner pursuing exquisite and high precision parts. Soon after the establishment, Yaowei quickly expanded from bicycles to motor vehicles, hydraulics, hand tools, medical, aerospace, automotive parts, and special parts. They expect to go through the ISO 9001-2015 certification by yearend. "Our machining skills are recognized by many clients. The ISO certification will allow us to show our quality to more domestic and overseas customers,” said Mr. Li.

One of Yaowei's features is that they can provide both OEM and ODM services. Especially in ODM, they can cater to clients’ demand for "hard-to-process parts" by discussing product design in the product development phase, saving the unnecessary time wasted on both parties during the manufacturing process. Furthermore, they can offer excellent dimensional tolerances down to 0.01mm O.D. and 0.007mm I.D. while achieving high yields. Mr. Li emphasized he is particular about the products being smooth, burr-free and as close to perfect as a work of art, without scratching users’ hands. For example, the dental screws they handle feel smooth without apparent lathe lines.

They use Swiss Type CNC Lathes with excellent turning and rigidity performance, and provide frequent training for employees. An ERP system is introduced to optimize the manufacturing process by digitized order processing. For quality control, they use Japanese inspection equipment from Keyence and Mitutoyo. "To me, there’s only room for doing better in parts machining. Grey zones are out of the question,” said Li, requiring his employees to be proficient in measurement and on-site inspection, besides using the inspection equipment as a supplement.

On Yaowei’s future, Li said the way to success in today's turbulent times is to cross industry borders. The only thing unchanged is the intention he started with— to develop the market in high precision and high-end industries.

Article by Dean Tseng, Fastener World Copyright owned by Fastener World

Contact: Mr. Pei-hui Li

Email: peihuei@yaowei-tw.com

For the past 23 years, STAFDA has been a co-sponsoring association of the University of Innovative Distribution, or UID, held each March in Indianapolis. It’s a four-day management school for professionals in distribution and the supply chain.

However, at the end of February, the company managing UID terminated their contract, leaving the future of UID in limbo. Because of the value and importance of this program, STAFDA is announcing its “Excellence in Distribution” school for all professionals in the construction and industrial space.

“UID was originally called the University of Industrial Distribution and catered to our industry,” said STAFDA CEO Georgia Foley. “But a management decision was made to expand into other non-industrial channels of distribution and hence the name was changed from ‘industrial’ to ‘innovative.’ This is being reflected in UID surveys. Many people want a return to the core curriculum of distribution and the supply chain. They also want a shorter program and speakers to give their ‘best 90 minutes’ of coursework rather than a half day program dedicated to one subject.

“STAFDA is answering that call and filling that need with the ‘Excellence in Distribution’ program to be held March 12-14 2024 in Nashville,” Foley announced. “The 2.5 days of quality education at the Hilton Nashville will be taught by experts serving our industry covering key topics: outside sales, branch management, HR, profitability, warehousing and inventory, and trending topics like AI. All companies in the construction and industrial channel are encouraged to attend, not just STAFDA members. We’re all in this space together and ‘Excellence in Distribution’ is designed for the betterment of our industry.” Registration will open in late November.

The hand tools market is expected to grow by USD 2.11 billion from 2021 to 2026, according to market research firm Technavio. The market will progress at a CAGR of 3.96%. The introduction of ergonomically designed hand tools is a major trend supporting the global hand tools market share growth.

There have been several innovations in the design and features of hand tools. Vendors are focusing on designing hand tools that improve the operational efficiency of commercial and industrial facilities. Several vendors are also focusing on improving the ergonomics of their hand tools to prevent accidents, which are common in industrial and commercial facilities while using hand tools. To reduce the number of accidents, organizations such as the OSHA and the ANSI have implemented regulations that specify the design and features of hand tools. Such regulations also improve the ergonomics of hand tools. Essentially, such innovations in the design of hand tools will drive the growth of the global hand tools market.

Thai and South Korean Power Tools Market sizes are respectively projected to grow at a CAGR of 8.5% during 2021-2027. Attributed to the presence of a robust industrial sector in South Korea along with a rapidly growing residential sector, the power tools market in the country accounted for a major share of South Korean power tools industry. However, the Thailand power tools market is projected to exhibit the highest growth rate on account of flourishing construction and industrial segments providing immense opportunities for the power tools demand in the country during the forecast period. This will help boost both Thai and South Korean power tools market share.

A rapid shift in consumer preference from hand tools to power tools on account of several factors such as better operational efficiency, durability, precision and convenience has resulted in significant demand for power tools in recent years. The majority of the demand for power tools in Thai and South Korean market could be witnessed in construction, industrial, and transportation.

Thai and South Korean Power Tools Industries are currently being dominated by electric power tools in terms of technology. Electric power tools are of two types, namely, corded and cordless. Electric-powered tools have revolutionized operational efficiency in the automotive industry as they save the time and efforts required for conducting various operations. Also, the introduction of powerful battery packs has resulted in the increased power of electric tools. In addition to these, the features such as light-weight and portability of electric power tools will help these tools to lead the market during the forecast period as well.

Malaysia has revised its Nationally Determined Contribution (NDC) to reduce greenhouse gases by 45% by 2030, Prime Minister Anwar Ibrahim said in his keynote speech at the Asian Energy Congress 2023. The country’s efforts to realize the NDC have been incorporated into the 12th Malaysia Plan (12MP) and the National Energy Policy 2022-2040 (NEP 2040).

The Malaysian government is in the process of developing several strategic roadmaps, including the National Energy Transformation Roadmap (NETR) and the Hydrogen Economy and Technology Roadmap. The most important of these is the National Energy Transformation Roadmap, which will be supported by the hydrogen economy and the Technology Roadmap and will pave the way for Malaysia to achieve environmental sustainability and long-term energy security through technological innovation. Both roadmaps are expected to be launched in the second half of 2023.

Meanwhile, Malaysia continues to recognize that natural gas plays an important role in the energy mix and is one of the cleanest hydrocarbons for the transition to a low-carbon economy. At the same time, the Malaysian government is committed to joining the Global Methane Pledge to reduce methane emissions by 30% by 2030.

不僅是下個中國!研調:印度將成為超強經濟體

Due to the U.S.-China technology war that continues to promote India in the international market position, the U.S. research institute Riedel pointed out that India is not the new China, that it will be in accordance with its own rhythm and pace forward. The institute is optimistic that India will be able to achieve high growth as a super emerging power.

CNBC reported that David Riedel, CEO of Riedel, prefers and is very optimistic about India over China because the Indian economy is much larger than China’s. In addition, he believes that India’s economy is likely to exceed expectations over the next

馬來西亞政府正制定策略路線圖,以加速能源轉型計畫

six months to two years, and he emphasized that “India, whether in the past or the future, is a very different country from China”.

However, India also has some problems to solve. India’s economy has long been stagnant in the middle-income level, and has not yet entered the ranks of high-income countries, but David Riedel believes that India will have the opportunity to achieve higher economic growth than expected in the future.

On the other hand, the economic outlook for China is a little bleaker. David Riedel predicts that China will not be as strong in the next five years as it has been in the past five years, as more and more foreign companies decide to move their supply chains and factories out of the country, resulting in more and more young people being unemployed in China, with the unemployment rate of young people between the ages of 16 and 24 climbing to a record high of 20.8% in May, according to statistics.

In addition, China recently released a series of lowerthan-expected economic data, from which we can see that its economic growth trend is gradually slowing down. In addition, China’s factory activity has been in contraction for the third consecutive month. China’s manufacturing PMI (Purchasing Managers’ Index) was 49 in June and nonmanufacturing PMI was 53.2, both a record low this year.

越南2023年底前將動工興建5個重大交通工程

Uong Viet Dung, Director of the Office of the Ministry of Transportation of Vietnam, said on July 10, 2023 at a meeting on the Ministry’s first-half results and second-half work plan, that by the end of this year, the ministry will start five major transportation projects, including the crossroads connecting Cho Chu and Trung Son, a road connecting Rach Soi and Ben Nhat, a road connecting Go Giao and Vinh Thuan, an expressway connecting Hoa Lien and Tuy Loan, and Dai Ngai Bridge, passing through the roads of Ho Chi Minh City.

Director Uong said that in the first half of the year, the ministry has completed and started operating a number of major transportation projects to meet the demand for usage, including the expressway connecting Phan Thiet to Dau Giay, Vinh Hao to Phan Thiet, and Nha Trang to Cam Lam. In addition, the upgrade of the railroads from Hanoi to Vinh City and from Vinh City to Nha Trang City has been completed.

Green steel refers to the production of steel without relying on any fossil fuels. Union Steel Minister Jyotiraditya Scindia hinted that the Indian government may make it mandatory for steelmakers to devote a part of their capacity to green steel manufacturing in the future. The government may also look at ways to ensure greater usage of the green steel in government projects as well, he added.

Scindia said the private sector steel users in India are actually moving towards committing to more and more green steel in their projects and also noted that some manufacturers have already launched branded green steel products. The minister said breakthrough technologies and disruptive innovations like hydrogen-based steelmaking coupled with carbon capture, utilisation and store (CCUS) hold huge promise for the future.

He said India has emerged as the epicentre for the evolution and growth of the steel sector globally and has been able to achieve landmarks like production touching 125 million tonnes and consumption growing over 11 percent in the last nine years. In 2022, even as the global finished steel production declined by 4.2 percent, India could post a 6 percent growth, he said, adding that per capita steel consumption has now increased to 78 kgs from 57 kgs in 2014.

The overall growth has made investors interested in the sector and the government in March. 57 pacts were signed with 27 companies under the production-linked incentive (PLI) scheme, which will add 25 million tonnes to the steel capacity, he said. The capacity addition will see investments of Rs 30,000 crore and also create 60,000 jobs, he added.

After nearly two years of negotiations, the British Minister for Business and Trade, Kemi Badenoch, officially signed to join on July 16th in New Zealand when participating in the ministerial meeting of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

This is the largest trade agreement since the UK left the European Union. In the future, more than 99% of UK exports to CPTPP countries will be exempt from tariffs, and together with the UK, the combined GDP of CPTPP countries will reach 12 trillion pounds,

accounting for 15% of the global GDP. The agreement is expected to come into effect in the second half of next year after it passes the review and legislation of the British Parliament. Meanwhile, the CPTPP member countries are gathering information on other applicant countries, such as Taiwan and China, to determine whether they meet the high standards for membership.

On May 21st, 2023, New Zealand announced the implementation of the largest carbon reduction program in the country’s history. The government will spend US$140 million to subsidize the steel giant NZ Steel, which expects the steel mill in Glenbrook to switch from coal-based steelmaking to renewable electricity, a policy that the government says is equivalent to cutting carbon emissions from 300,000 running cars.

“The grant program demonstrates the importance the New Zealand Government places on reducing carbon emissions as quickly as possible, and working with NZ Steel on this program will have significant environmental benefits and accelerate New Zealand’s decarbonization process. This partnership is only possible because of government funding,” said Prime Minister Higgins.

The New Zealand government mentioned that the US$140 million subsidy to NZ Steel was drawn from the Government’s Carbon Reduction and Transformation Industry Fund (GIDI). With a total amount of US$650 million, GIDI not only assists New Zealand’s R&D in carbon reduction technology, but also works with industry and government to reduce carbon emissions and accelerate the establishment of a zero-carbon energy system. If this carbon reduction program runs smoothly, it is estimated that New Zealand’s carbon emissions will be reduced by 800,000 tons per year, which is equivalent to removing the carbon emissions of all cars in Christchurch, the largest city in New Zealand’s South Island.

NZ Steel accounts for 2% of New Zealand’s annual greenhouse gas emissions. However, once this decarbonization program is achieved, it will reduce New Zealand’s total carbon dioxide emissions by 1%, help New Zealand achieve its Net Zero goal by 2050, and move towards the vision of “limiting global warming to 1.5 degrees Celsius”. Climate Change Minister James Shaw believes the program will help the government reduce its carbon tax bill in the long term, saying, “This program will reduce New Zealand’s carbon emissions by about 5.3% in the second phase of the carbon budget from 2026 to 2030, and by about 3.4% in the third phase of the carbon budget from 2031 to 2035.”

The main products of Proxene Tools from Taiwan are wrenches and other hand tools. Its export accounts for 81.91% of the total sales and domestic sales takes up 18.09%, with a revenue of NT$904 million in 2022. Its product lineup includes adjustable industrial wrenches, industrial pliers, and industrial general tools. In addition to launching more functional and convenient adjustable wrenches in line with market development and customer demand, Proxene Tools plans to develop other pliers, such as quick push-button tube pliers, in order to complete its product lineup. Proxene Tools applied for listing on Taipei Exchange on June 27th this year.

Sheh Fung Screws reported good news that it shipped a small amount of car seat fasteners to Chrysler. It is also developing battery module fasteners. In addition, new product sales achieved good results with the cumulative order value reaching 70 million NTD from last October to this June. Its Vietnam plant will be completed at the end of this year, which is expected to start manufacturing standard products in Q1 2024 and sell to Europe. The initial production capacity will be 600-800 tons per month, which is estimated to contribute NTD 600 million to Sheh Fung’s revenue a year.

Sheh Fung General Manager Kent Chen said that Taiwan’s fastener prices have gone down last year because of lower raw material prices. The beginning of this year saw a little raise, but the recent market showed the prices were down again. Customers will certainly wait and see, but he believes that the steel market has almost reached the low point. The prices could go lower but not too much. The third quarter of this year is the bottom; the fourth quarter can be better than the third quarter.

On the other hand, Sheh Kai Precision, a major manufacturer of composite screws, has benefited from the promotion of the solar industry by various countries this year, and orders for self-drilling screws are visible through the end of the year. Sheh Kai Precision believes that the uptrend will last at least for 2-3 years and has expanded its production capacity to 7 million pieces per month, aiming to raise it to 15 million pieces. Due to limited space at Sheh Kai Precision’s plant, Chen said he could rent the land of Sheh Fung Screws in Vietnam, and the two companies will combine resources of each other.

穩得工業開發鈷基超合金材料

Specialized in material application technology, ND Industries Asia is the only company in Taiwan that has successfully developed cobalt-based, nickel-based as well as nickel-chromium superalloys that are resistant to high temperatures, wear and corrosion. The demand for heat, wear and corrosion resistant materials in Taiwan is increasing, but at present, most of these materials rely on imports, which not only results in high cost but also inconsistent lead times. In addition, raw material supplies fluctuate due to the war between Russia and Ukraine. It is expected that after ND Industries Asia obtains the certificate for the superalloy, the cost pressure of domestic wire rod manufacturers who have demand for cobalt alloy and cobalt-nickel alloy will be reduced.

Ingersoll Rand任命 Matt Emmerich 為首席資訊長

Grainger宣布新建俄勒岡州經銷中心的計劃

Grainger, the leading broad line distributor of maintenance, repair and operating (MRO) products serving businesses and institutions, announced plans to open a 500,000-square-foot distribution center in Gresham, Oregon in 2025. The new Northwest Distribution Center will enhance customer service across the Pacific Northwest, providing the company with additional capacity to continue delivering best-in-class, next day complete orders across the United States. Grainger plans to break ground this summer.

Grainger’s Northwest Distribution Center is expected to house more than 135,000 industrial supply items such as hand and power tools, heating, ventilation and air conditioning (HVAC) equipment, fluid power solutions, lighting, power transmission equipment, and motors. The company anticipates the new facility will employ approximately 80 team members when complete and over time employ more than 150 people.

Ingersoll Rand has appointed Matt Emmerich as senior vice president and chief information officer (CIO), effective July 17, reporting to Vicente Reynal, chairman, president and chief executive officer.

As CIO, Matt will lead the overall strategy and execution of the company’s global information technology (IT) organization across technology operations, infrastructure, applications and information security. His leadership is critical to accelerating the company’s digital transformation and innovation strategies.

As a proven leader in IT, Matt has extensive experience in manufacturing, driving enterprise technology transformation and M&A integrations. In addition, he has leadership experience at scale in digital innovation, global market operations and cybersecurity. Prior to Ingersoll Rand, Matt served in various leadership positions at Polaris, including CIO and vice president, global digital & information services, and vice president of service, during his more than a decade tenure.

The building will be constructed on a vacant 48-acre parcel of land in an industrial area of Gresham, about 16 miles from Portland. In addition, the company is opening two bulk warehouses in Pennsylvania and Texas in September, plus a third in North Carolina in 2024, to enhance network operations, accommodate a growing product offer and serve more customers. This new facility is in addition to 10 other DC and branch locations that Grainger currently operates in the U.S. Pacific Northwest states of Oregon, Washington, Idaho and Montana.

Vossloh has again received a major order to supply rail fastening systems for the construction of a high-speed line in China. The line connects the two cities of Xiong’an in Hebei Province in the north and Shangqiu in the central Chinese province

德國Vossloh獲新一波中國鐵道緊固系統大單

of Henan. The order has a sales volume equivalent to almost €50 million and underlines Vossloh’s continued strong market position in the important Chinese market.

With a planned route length of over 600 kilometers and speed of up to 350 km/h, this line will make a significant contribution to improving the mobility of the population and to the economic development of the region. The deliveries of the rail fastening systems will mostly take place in 2024.

“The contract is further proof of the trust and recognition we enjoy in China,” says Oliver Schuster, CEO of Vossloh AG, adding: “This order confirms our technological excellence and our ability to provide innovative and reliable fastening solutions that can withstand the highest loads. Vossloh has been making a significant contribution to the development of modern and sustainable transport infrastructure in China for 17 years now.”

The Chinese high-speed network currently covers just over 40,000 kilometers and is set to grow significantly further. By 2035 it is expected to have been extended to over 70,000 kilometers. The Vossloh Group is represented in China, among others, by its subsidiary Vossloh Fastening Systems China Co. Ltd. based in Kunshan. The company employs around 120 employees and is one of the leading local suppliers of rail fastening systems, especially for highly demanding applications on high-speed lines.

The Hilti Group is taking the next strategic step to further expand its software business and plans to acquire 4PS Group, which specializes in providing business management (ERP) solutions for the construction industry. Together, Hilti and the 4PS Group can strengthen their position to drive the digital transformation of the construction industry.

Founded in 2000 in the Netherlands, 4PS is a leading player in its domestic market and has expanded its presence to include the UK, Belgium and Germany. With over 70,000 daily users in the building construction, civil engineering and installation sectors. 4PS has gained a strong reputation for the breadth of its industry expertise.

Both parties have signed the acquisition agreements, subject to approval by oversight authorities. Hilti is committed to retaining the more than 350 team members, including management, in their current roles, where they will continue to develop new solutions. The shareholders of the company, Wim Jansen, André Overeem and Martin Westerink, will remain on the Board of Directors to support the integration in the coming years.

4PS Construct software, offers construction-specific functionalities that enable companies to manage the entire construction project life cycle. This allows construction companies to take control of their profitability by monitoring margins, forecasting results, controlling resources and planning effectively.

Bulten has entered into an agreement to acquire all shares in Exim & Mfr Holdings Pte Ltd, an Asian, Singapore-based distributor of fasteners and other components, for a purchase sum of approximately SGD 66.3 million (SEK 530 million) on a cashfree and debt-free basis. The acquisition affords Bulten a good platform to grow in new sectors, where the distribution stage is a pivotal sales channel.

The acquisition is expected to contribute to Bulten’s development and earnings, and to increase earnings per share. Exim gives Bulten access to a large, broad customer base in growth sectors in a dynamic region. The acquisition is an important part of Bulten’s strategy, which aims for growth outside of the company’s primary customer group of automotive, and to improve risk diversification, as well as margins.

Anders Nyström, President and CEO of Bulten Group, comments: “Our strategy sets out a clear focus on balancing our sales through growth in customer groups beyond the automotive industry. The aim is for these to account for at least 20% of sales by 2025. The acquisition of Exim takes us into the distribution stage, which is a key to profitable growth in new sectors. Exim is a well-managed company with an international customer base and developed processes for distribution and Vendor Managed Inventory (VMI), which is suitable for industries with completely different purchasing patterns than Bulten has historically been used to. Exim’s base in Singapore is also highly attractive. It enables us to take advantage of the strong growth in that region, and we also see potential in using Exim’s sales network to increase sales for our factories in China and Taiwan. Exim will, together with Bulten’s rapidly growing business to consumer electronics customers, constitute the beginning of a new industrial segment.”

On June 1st Einhell Germany AG, the leading manufacturer of cutting-edge DIY tools, took the next major step in pursuit of its long-term growth strategy with the acquisition of a 66.67 percent stake in Thai company Surazinsano Co. Ltd.

Einhell has completed its entry into the Thai do-it-yourself market, which is the largest in Southeast Asia with turnover in the region of EUR 3.8 billion. The acquisition gives Einhell Group access to the Thai market and its local specialty retailers and DIY stores. Alongside the existing brands, Einhell will focus on driving both the introduction of the Power X-Change battery platform and the development of the e-commerce sales channel.

的Howden Roots LLC公司

Ingersoll Rand, a global provider of industrial solutions, has entered into a definitive agreement to acquire Howden Roots LLC from Chart Industries for an all-cash purchase price of approximately US$300 million. Roots is a leading provider of low-pressure compression and vacuum technologies with approximately US$115 million in revenue. This acquisition is expected to close in the third quarter 2023 upon obtaining required regulatory approvals. Upon close, Roots will join Ingersoll Rand’s IT&S segment.

B&F Fastener Supply公司併購Northern States Supply公司

B&F Fastener Supply, a leader in the industrial and construction supply industry, has acquired its respected, long-time competitor, Northern States Supply, to create a regional powerhouse distributor of both industrial and construction supplies in the Midwest.

Established in 1988, B&F is a fast-growing, strategic industrial supply distributor. Its longstanding customer-first culture has resulted in a best-in-class customer experience. Northern States, founded in 1960, has a remarkable track record as a leading distributor of quality industrial and construction supply products with competitive pricing. Built on providing quality customer experiences and rooted in offering the best overall value, Northern States Supply will continue to operate under its name for the time being.

The acquisition will enable both companies to join forces, strengthening their combined workforces, and offer an expanded product and service selection, including inhouse custom machining, in-house custom packaging, vending solutions, power tools, tool accessories.

The combined geographical reach for B&F Fastener Supply will range across Minnesota, North Dakota, South Dakota, Iowa, Wisconsin and Nebraska. Together, with nearly 300 employees and 21 locations, B&F’s footprint will be stronger than ever before.

Both the weight and length of the Hilti SIW 6-22 and SIW 8-22 impact drivers have been significantly reduced in order to maximise versatility and convenience. According to the jury, the compact design makes the cordless impact drivers “extremely practical and easy to use”. The tools are not only equipped with durable, brushless motors, but also very well suited for use in confined spaces. The two speed levels allow for both fast and controlled work. An LED lamp gives the user a clear view of the respective workpiece.

Manufacturer: Hilti Corporation, Schaan, Liechtenstein

The SmartHolder can hold numerous high-quality tools in a minimal amount of space. According to the jury, the design of the compact tool holder impresses with stylish aesthetics and the “use of materials with good tactile feedback, as well as wellthought-out functional details”, including printed pictograms that provide a good overview of the contents. The practical item is also easy to open: two strips slide apart by means of a push-button. Then the tools can be removed intuitively. When closed, however, all individual parts are held securely in place, thanks to a locking mechanism.

Manufacturer:

HAZET-WERK, Remscheid, Germany

The Waterson Self-Closing Swing Clear Hinge combines the functions of a hinge and door closer in one unit. In compliance with accessibility regulations, it allows doors weighing up to 200 kg to be opened with a pressure force of just 2.5 kg (25N) and safely closed automatically after more than five seconds. The L-leaf design also improves user mobility by enlarging door openings. The hinges are made of recyclable stainless steel using an investment casting process. “An innovative contribution to improving the quality of life of people with and without impairments,” the jury said.

Manufacturer:

WATERSON CORP., Douliu, Taiwan

For the SW Stahl Ideallinie Series, a cross-product design language and colour palette were developed that are intended for the brand’s entire automotive tool portfolio, are transferable to a wide variety of tool types and generate a high recognition value. Defined contours and surfaces, as well as a high-quality finish, ensure a professional appearance. Symmetrical lines, along with separations between plastics with different degrees of hardness, ensure an iconic appearance. The jury praised the “successful, harmonious implementation of a comprehensive design concept down to the smallest detail”.

Manufacturer:

SW-Stahl GmbH, Remscheid, Germany

The design approach in the development of the ITB-P is focused on the needs of the user in terms of safety and ergonomics. The compact design of the cordless nutrunner guarantees good accessibility to the respective workpiece, even in hard-to-reach areas. The advantageous weight distribution reduces strain on the wrists, while a wellpositioned display, along with optical and haptic signals for correct handling, allows for user-friendly operation. The jury was impressed with the fact that the ITB-P “successfully integrates aesthetic aspects into a tool that is excellently geared to practical requirements”.

Manufacturer: Atlas Copco Industrial Technique AB, Stockholm, Sweden