King Yuan Dar

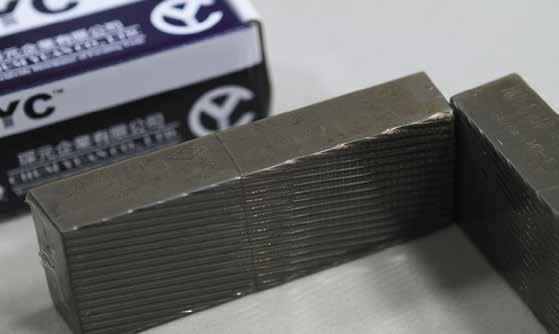

King Yuan Dar Metal Enterprise Co., Ltd. ("KYD") with adequate heat treatment R&D technology and equipment manufacturing experience has been serving customers in the global fasteners, parts and powder metallurgy industries with heat treatment needs for nearly 30 years, and has released a number of eyecatching and innovative products responding to actual industrial needs, including the AI Continuous Batch Green Chamber Furnace and Vacuum Continuous Cyclic Energy Saving Spheroidizing Furnace, both of which have been granted international patents, creating a competitive niche in the international market for its customers. In H2 2023, in response to the global trend of energy saving and carbon reduction, KYD further released the new "Cyclic Continuous Vacuum High-Temperature Sintering Furnace", integrating various excellent features that allow users to streamline production and achieve superior product quality.

The introduction of heat treatment equipment with multiple intelligent functions that meets the concept of green & sustainable development is a main trend of the industrial application, so the new equipment developed by the team of KYD General Manager Chang Lung Tseng has integrated many relevant features in the operating system, including: an intelligent hardware interface allowing on-site personnel to operate it by only setting material feeding values; AI remote image monitoring to alert the operator of temperature abnormalities in a timely manner; voltage stabilization to maintain normal operation; the gas ratio in the machine being properly adjusted to improve the yield of workpieces; heat generated from manufacturing being recycled and reused through conduction/convection/ radiation to further reduce power consumption; and hydraulic push-andfeed improving productivity and stabilizing production quality.

It is understood that the core heat treatment technology of KYD's new sintering furnace is highly innovative among similar products in the current market. "Starting from Taiwan and aiming to expand globally, KYD hopes to draw more customers' attention to the advantages that its equipment can bring to their applications,” said General Manager Tseng.

The oxidation furnace structures, chamber furnace structures and heat recovery systems KYD developed have been patented in Taiwan, China, Germany and the U.S., and the in-house process management is fully compliant with the ISO 9001 and IATF 16949 requirements. In addition, KYD continues to focus on the R&D of environmentally-friendly AI heat treatment equipment and provides comprehensive solutions that integrate heat treatment processing, gas supply, and equipment manufacturing. KYD maintains long-term cooperation with not only fastener customers, but also many others in the automotive and motorcycle industries, as well as government agencies.

"My long-term goal is to enter the U.S. heat treatment market within two years, and then return to Taiwan from overseas to gain a higher market share for KYD's competitive equipment," said General Manager Tseng.

It is expected that with the complementary integration of the existing plant in Luchu (Kaohsiung) and the Changbin plant and the Thailand plant under construction close to the supply chain of automobile factories, KYD will continue to expand its global market in 2024 and provide more complete one-stop services for heat treatment equipment to customers.

23258-005

23258-005

45488-004

45488-004

45488-004

63647-001

63647-001

45488-004

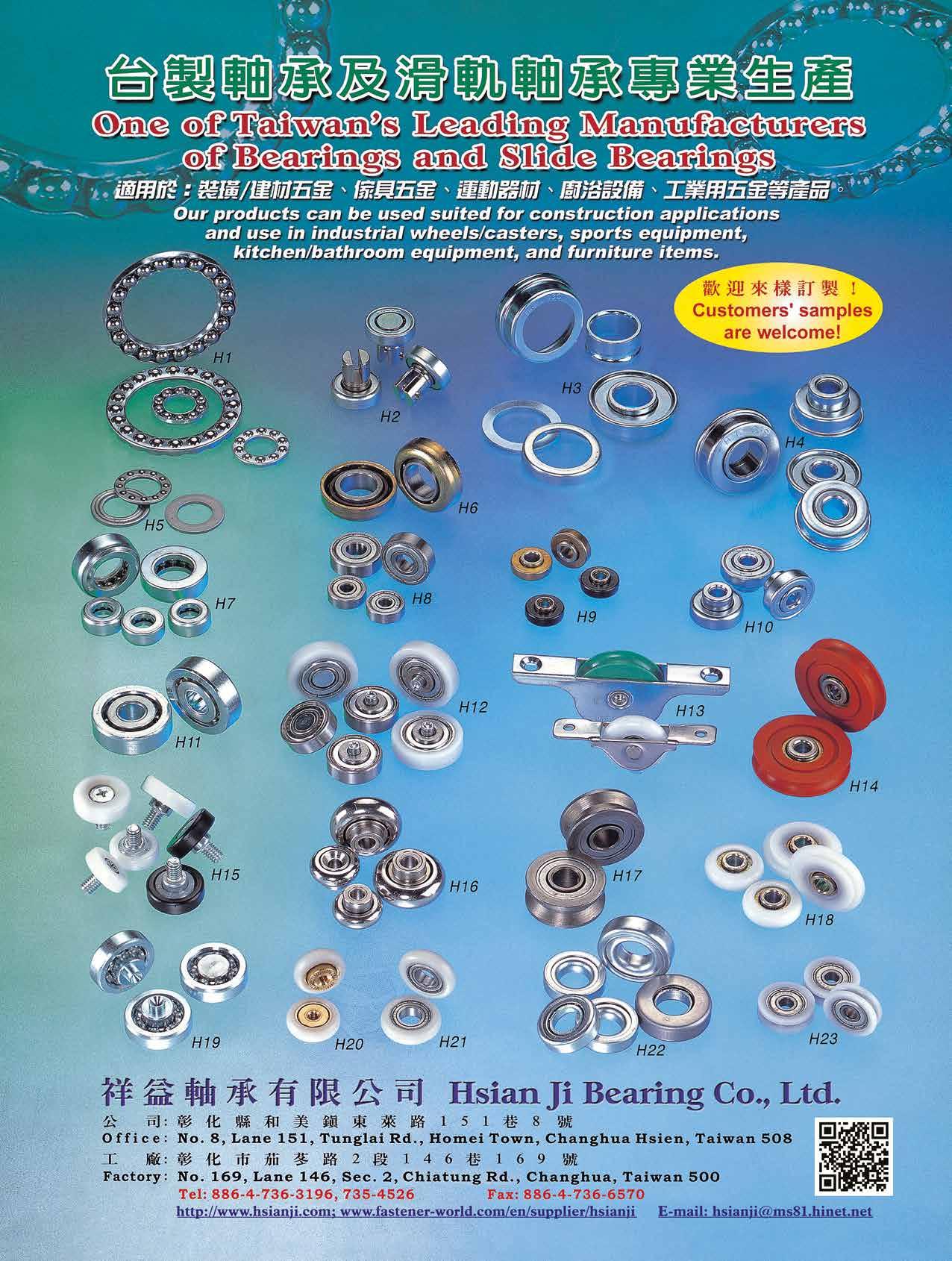

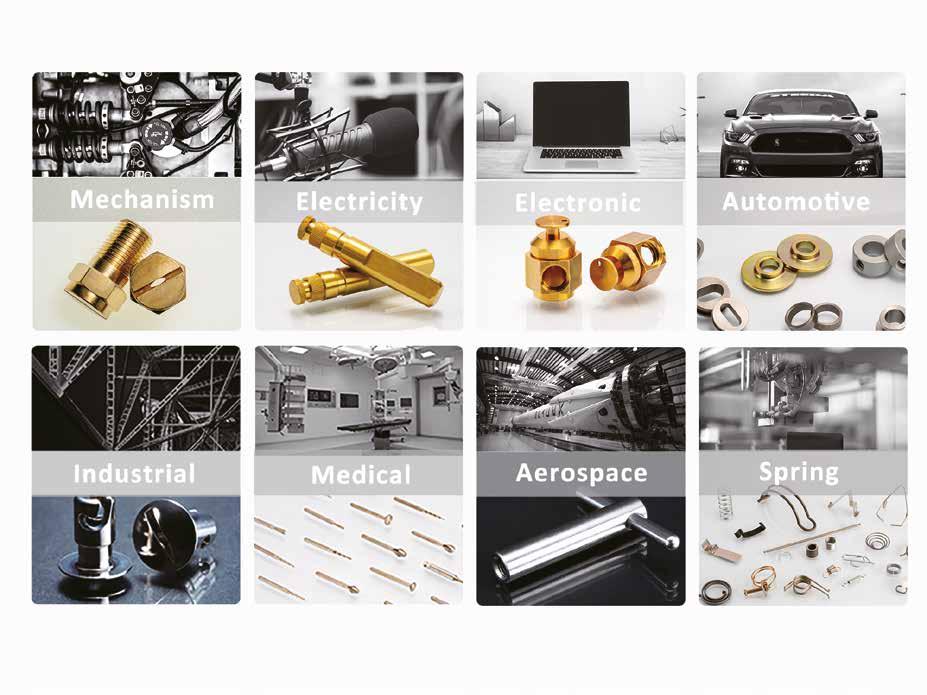

Specialized in high precision parts processing, Ele Shine Metal Industrial Co., Ltd. is one of the most competitive CNC turned and milled precision metal parts manufacturers in Taiwan. With one-stop integrated machining solutions and in compliance with ISO 9001:2018 and RoHS international standards, it has been serving the needs of many customers from the electronics, automotive/motorbike, bicycle, photoelectric, mechanical hardware industries, etc. for 43 years and has become the most reliable partner of its customers. In order to deepen the breadth and depth of customer service and create a niche for the company's future development, Ele Shine's new headquarters project was formally approved last year and the first phase of the project has already been successfully completed. The second phase is expected to be completed and ready for official opening in the second half of 2024

Ele Shine spent NT$250 million building a new headquarters with a total floor space of around 4,630 sq. m, hoping to gradually transform into higherend markets such as aerospace, medical, and semiconductor based on the goals of corporate sustainability and industrial upgrade. In addition to the introduction of robotic arms and automatic feeding systems, a largesize German turning and milling machine “DMG MORI NTX-1000” and a horizontal milling machine “DMG MORI NHX-4000” will be also introduced this October, which will expand the processing capacity on the one hand and secure an early preparation for future applications for the ISO 13485 certification for medical device and AS9100 certification for aerospace on the other hand.

"Intelligent digital management has been a current trend in the industry. Besides introducing stand-alone machines, robotic arms, and fully-automated ultrasonic cleaners in the existing plant, we’ve also set up a central control room in the new headquarters and integrated the concepts of IIoT, carbon inventory, and digitization with large machines and robotic arms, flexible systems and combined turning/milling technology that allow us to manufacture products such as implants, bone nails, embedded parts, military-purpose parts, firing pins, etc., creating our leading edge among other industrial competitors," said Wei Shiang Chen, General Manager of Ele Shine.

Ele Shine's exquisite craftsmanship has even been appointed by Nespresso as its sole aluminum complimentary gifts supplier in Taiwan, assisting them in the development, design, labelling, and assembly of products.

Recognizing that carbon re duction is the key to developing more potential markets in the future, Ele Shine also actively participates in the relevant counselling programs offered by the Metal Electromechanical Industry Division of IDA (MOEA, Taiwan) and National Chin-Yi University of Technology, and continues to carry out and accelerate the upgrading of the company in order to help its customers promote their brand value and competitiveness in the marketplace.

General Manager Chen, a second-generation and responsible for corporate succession, said, "CBAM, ESG, digitalization of systems, and smart manufacturing are issues everyone is facing. In addition, the global industry is changing rapidly, so in order to stabilize the company's operation and achieve sustainability, we’ll actively work in this direction after our new headquarters is open. Ele Shine is also aiming to be a "century-old company" and endeavors to create quality metal products that meet the industry’s expectations.”

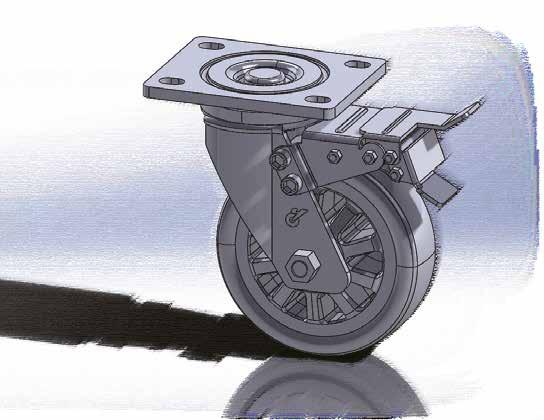

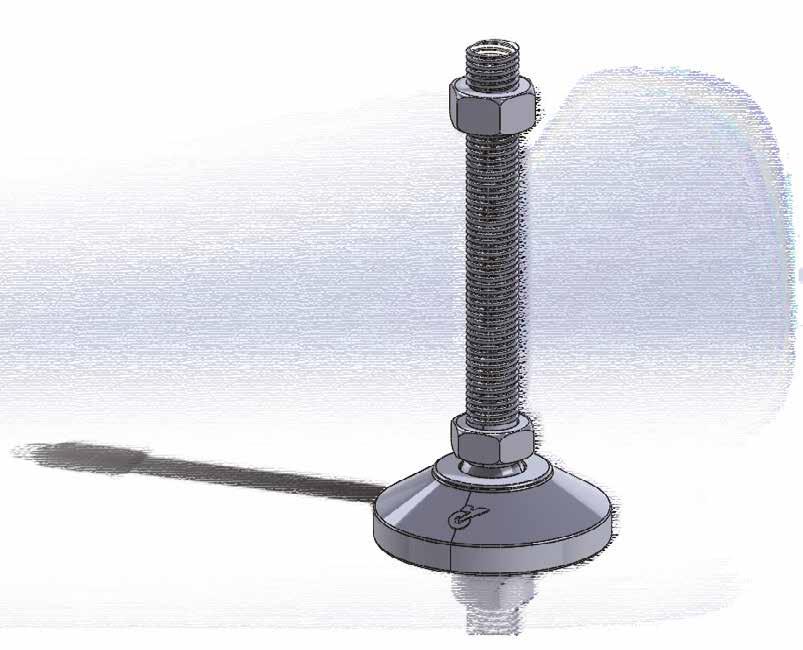

With the business philosophy of "Innovative Design, Reliable Quality, and Attentive Service", Cyun Hong Enterprise Co., Ltd. has been producing professional industrial-use casters and adjustable leveling feet for many years to help the global customers gain presence in their own markets, and is also one of the seemingly insignificant but actually important pillars behind the success stories of many industries.

Headquartered in Taichung, the company has offices throughout the north, central and south of Taiwan, and has an eye on the global market. It mainly manufactures and supplies TPR rubber/PU/nylon/conductive rubber and other high temperatureresistant casters of specifications between 1.5 inches and 8 inches, as well as galvanized, yellow zinc plated, and stainless steel adjustable leveling feet, etc. In addition to standard products, Cyun Hong's professional service team can also provide OEM customized services according to customers' different product design and development characteristics and needs.

Contact: Mr. Chien-Hung Chen

Email: ch.casters@msa.hinet.net

Casters are often used in high load areas such as automated machinery & equipment, industrial manufacturing, transportation and logistics, semiconductors, sports equipment, food processing, etc., and their durability, safety, and service life are the most important concerns of customers. In order to meet the needs of industrial customers, Cyun Hong's products are manufactured with RoHS compliant materials and sent to a third-party organization, SGS, for rigorous testing before leaving the factory to ensure that every product delivered to customers meets the international requirements of various standards and parameters.

"Stability, safety and ease of use have always been our most important considerations. It is our corporate policy to ensure that our customers can use our products with confidence and peace of mind, and to be a good partner of our customers," according to Cyun Hong.

Cyun Hong has been insisting on innovation all along the way, and now owns many patents such as quick release caster structure, caster height adjustment mechanism, caster turntable assembly, contact structure of adjustable leveling feet, etc. Cyun Hong has not only introduced CAE (computer-aided engineering) software into its manufacturing process to help product development analyses and design optimization at an early stage, but also cooperated with many academic institutions to obtain relevant research data to make product development more in line with the actual needs of customers in the ever-changing market, and therefore, Cyun Hong's casters and adjustable leveling feet have delivered excellent data performance in many of the actual product tests.

In two recent test reports, Cyun Hong’s casters demonstrated excellent "less than yield" performance under the 1,000 kg equivalent stress experimental condition, while its adjustable leveling feet also demonstrated "less than yield" performance under the 3,000 kg equivalent stress and 0 degree and 15 degrees loading angles conditions.

Looking forward to 2024, Cyun Hong will not only continue to develop more overseas customers and create opportunities to work with more customers in the industry, but also invest more efforts in the development of high-quality and innovative products, in the hope of providing the market with more quality choices, and developing a wider international market share for its high-quality casters and adjustable leveling feet.

Matpro Seiki Co., Ltd. is a professional manufacturer and supplier of high-precision CNC-turned parts based in central Taiwan and focusing on sales worldwide. With 50+ employees and 43 sets of Japanese-made CNC compound Swiss-type lathes and turning lathes in the factory, Matpro Seiki specializes in the production of high-precision parts for bicycles, automobiles, sensors, and special fasteners. Over the years, in addition to meeting the needs of domestic Taiwanese customers, the company has also extended its services to customers in advanced markets such as the U.S., Europe and Japan, creating an average annual sales of US$4 million.

Matpro Seiki offers mainly CNC composite turning service and is capable of machining up to 52mm OD (max.), 2.5mm OD (min.), and unlimited lengths. Its CNC machining tolerance can be up to ±0.01mm and the geometric tolerance can be up to 0.015mm.

“We have a supply chain that can handle cold/hot forging, extrusion, stamping, die casting, powder metallurgy, flat/circular grinding, heat treatment, surface treatment, laser engraving, and more,” said Steven Pai, Matpro Seiki Technical Manager. “In addition, we will also evaluate engineering drawings provided by customers and additional requirements such as price, function, mechanical properties, etc., to find for customers the best manufacturing procedures to maximize their price competitiveness.”

Matpro Seiki has suggested better machining solutions for customers in many collaborations. For example, it once suggested customers that they change their CNC composite Swiss-type lathes to cold forging and secondary turning. “We have not only significantly reduced customers’ purchasing costs, but also indirectly boosted the volumes of their purchases by adopting more appropriate machining processes,” said Manager Pai.

Matpro Seiki contact: Technical Manager Steven Pai

Email: steven-pai@matpro.com.tw

The majority of Matpro Seiki’s products are supplied to customers in the automotive metal fastener, specialty fastener, bicycle and sensor component markets, accounting for 40%, 25%, 20% and 15% of its sales respectively. In recognition of the high quality requirements of these markets, Matpro Seiki, which is ISO 9001 certified, regularly sends its gauges to a verification unit for service life evaluation every 6 months, conducts internal audits every year, and engages SGS to conduct audits and verifications every 2 years. As for outsourced heat-treatment and surfacetreatment, Matpro Seiki strictly requires that vendors should be ISO-9001 certified for subsequent QC discussions and provision of quality assurance reports. It can also provide PPAP 3, IMDS, VDA6.3 and other related documents to customers upon request.

“In addition to ISO 9001, we will also arrange for our staff to attend ISO 14064 and ISO 14067 courses in 2024 to address the ESG issue of carbon emissions. We are also planning to provide courses and encourage our staff to obtain certificates in order to assist them in upgrading their professionalism in various departments. At present, our customers in Europe are mainly from Germany, and their high quality requirements have enabled us to grow into a factory capable of facing more diversified challenges. Starting from this year, we will make the Japanese market our business development focus, and we are confident that we will be able to handle different quality requirements from different parties on the basis of both technology and equipment, and achieve more competitive costs,” said Manager Pai.

Copyright owned by Fastener World Article by Gang Hao Chang, Vice Editor-in-Chief

Taiwan is well known as a kingdom of both fasteners and hand tools which respectively take up their own market shares that have influence. The increase in the world’s demand for these two Taiwanese industries over the past few years has made Taiwan gain more attention in the global market. This article does a cross analysis of Taiwanese fastener and hand tool export performance, points out the current and future trends, and helps global readers learn Taiwan’s situation and where collaboration is possible.

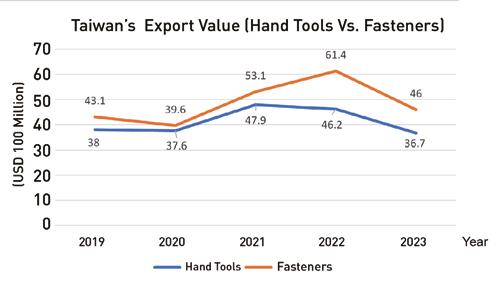

Taiwan's global export of hand tools amounted to USD 3.8 billion in 2019, and after reaching a peak of USD 4.79 billion in 2021, it began a downward trajectory in 2022. The export value reached USD 2.447 billion in the first eight months of 2023, and based on that, the full-year export value for 2023 is currently estimated to land at around USD 3.67 billion. Compared to 2022, the forecast for 2023 is down a whopping 20.5%, virtually canceling out the 27.4% increase in 2021. In other words, Taiwan's hand tool export in 2023 returned to 2019 or 2020 levels.

From this fluctuation in export value, it can be observed that high overseas inventory level started to wreak havoc in Taiwan in 2022 and seriously undermined the export performance of Taiwanese hand tools in 2023. Some local companies revealed that the first half of 2023 was like being in a dark tunnel with no sight of light at the end. However,

they seemed to see a ray of hope around November of that year. Overseas customers are still closely watching their inventories, meaning the the inventory level will remain relatively high in the short term. In addition, with mortgage rates still high, demand in the construction market has been affected, which in turn has impacted demand in the hand tool market. Local companies estimate that incoming order may not increase until the second half of this year. This will affect the performance of Taiwan's global export value of hand tools, making it likely to maintain a downward trend in 2024.

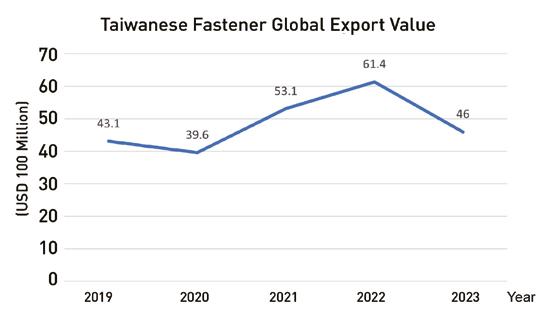

Taiwan's global export of fasteners was USD 4.31 billion in 2019, and bottomed at USD 3.96 billion in 2020 due to the severe impact of the pandemic as well as harbor and supply chain disruption. However, the pandemic brought business opportunities which redirected purchase orders to Taiwanese fastener companies starting from 2021, and the world's demand for Taiwan's fasteners skyrocketed, pushing the export value to the peak at USD 6.14 billion in 2022, but in the same year, some local companies observed the phenomenon of overstocking by overseas customers. In 2023, the overstocking took its toll on the Taiwanese companies and caused a sharp drop in the number of orders. The export value of 2023 fell 25% to USD 4.6 billion, almost back to the level of 2019.

From that, we can tell that the pandemic acted like a doubleedged sword, bringing monumental and record-breaking export records to Taiwanese fastener industry, but also stripped the milestone away from Taiwan as it left. The definitive factor here is the inventory level in the U.S. and Europe and the need to place orders. Still, we can observe high resilience of Taiwan fastener industry that is able to retain a normal export level a little higher than before the Covid outbreak.

Taiwanese fastener companies now look at 2024 in two separate ways. The optimists anticipate ongoing destocking at overseas customers side and believe orders will come in more. The pessimists think, now that Taiwan CSC has raised Q1 price on steels and wire rods, it will lower Taiwan’s fastener price competitiveness and make it more difficult to attract orders even if overseas inventory level drops.

It is not hard to find out the resemblance between hand tools and fasteners while comparing their export value changes. These two industries both heavily rely on export. Their export values both surged in 2020 and plunged in 2023. In other words, high inventory is the Achilles' heel of both industries. On the other hand, the difference is that Taiwan fastener industry’s export surge lasted two years (2021 and 2022), while Taiwan hand tool industry’s export surge lasted one year (2021). The hand tool industry entered a downward spiral in 2022, one year earlier than the fastener industry.

Although the outlook for those two industries is somewhat bleak, there are some who see this period of downturn as an opportunity to create the next breakthrough. Take an iconic Taiwanese hand tool manufacturer Proxene for example, it is undergoing a critical transformation led by a successor of the second generation. In addition to inaugurating a new NTD 900 million plant in Shengang District (Taichung City of Taiwan) in December 2023 to tap into the high-end market, it has introduced MES systems and automated production lines over the years to gradually build a smart factory. Observing that the hand tool industry is facing succession and carbon reduction problems, it believes that now is the best time to horizontally integrate the hand tool industry. Therefore, it will take the lead in forming a "Taiwan Hand Tool Coalition" to increase revenue to USD 159 million in the next five years, and then to USD 319 million through mergers.

Since CBAM explicitly lists fasteners as one of the first carbon border tax targets, Taiwanese fastener companies have been focusing on carbon reduction as the next breakthrough point. Many of them have already conducted GHG inventories and introduced national ESG carbon reduction resources and platforms. Some of them can already provide accurate carbon emissions data to EU importers. Some are also planning to replicate Taiwan's fastener supply chain to Southeast Asian countries while setting up factories in Southeast Asia in order to form an overseas Taiwan fastener coalition.

Reading up to this point, you should find that several years after Fastener World heard the local companies voices and called for a formation of a national coalition, this concept is now in the planning phase in the form of Taiwan’s fastener and hand tool coalitions. Meanwhile, many local companies have recognized “carbon reduction” to be a critical factor for them to survive in the future. Fastener World anticipates to see them combine national coalition and carbon reduction measures into a grand business deployment tactic and use it to break the 2023 deadlock.

Copyright owned by Fastener World Article by Dean Tseng

The 18V Brushless Rivet Nut Gun by Metabo has a quickchange mandrel system that can rivet up to M10 in aluminum, M8 in steel and M6 in stainless steel. It includes an easy setting force adjustment with 99 values and 10 memory settings. In addition, it has an auto-reverse feature that automatically resets the tool for quick reload.

The 18V Brushless Rivet Nut Gun is available as a bare tool and when paired with a compact 4.0 Ah LiHD (Lithium High Density) battery, it can secure 1,800 M5 rivets on a single charge and has a pulling force of 1,500 N or 337 feet per lb. This one-handed rivet gun is extremely fast, lightweight, and well balanced for maximized ergonomics. It also includes safety features, such as a hand protection guard and balancing loop.

The Metabo NMP 18 LTX BL Cordless Rivet Nut Gun is the ideal solution used by roofers, contractors, HVAC technicians and more when connecting flat stock with threaded connections on any jobsite.

Nepros neXT 9.5sq.

Nepros neXT 9.5sq.棘輪扳手

KTC Tools’ Nepros neXT 9.5sq. Ratchet Wrench is designed by observing and studying the posture of the person using the tool, and based on an optimization analysis. It has a compact structure that is lightweight and has the necessary strength designed. It takes into account strength, rigidity, lightness, balance, familiar shape, and it is easy-to-use, optimized for different people, and pursues the ultimate in practicality.

Product Features:

* The handle has been completely remodeled.

* Strength and extreme lightness are achieved through an optimized X structure that spreads the load over the entire ratchet.

* The handle has no edges, the finger grip is flat and the gripping section is rounded.

* The head surface is high-speed shot-peened with ceramic beads to increase surface hardness and strength.

* The size of the ratchet head has been reduced, making it lighter and the balance is optimized for easier use.

* 90 gears and precision grade 8 pawls achieve lightness and strength.

* Total length 180 mm / Head width 25.5 mm / Head thickness 14 mm / Handle ∅ 23 mm / Weight 210 grams.

The M18 FUEL ½” High Torque Impact Wrench with Friction Ring by Milwaukee provides users with the best combination of power and size to maximize productivity. A PowerState Brushless Motor delivers nut-busting torque up to 1,500 ft.-lbs. with a M18 RedLithium XC5.0 Battery and up to 1,600 ft.-lbs. with Milwaukee’s new M18 RedLithium Forge XC6.0 Battery. The Wrench is capable of removing stubborn bolts and nuts. Standing as the lightest and most compact high torque impact wrench on the market, it allows more access in tight spaces and offers increased ease of use in application, with the fastest removal speeds in class.

The M18 FUEL ½” High Torque Impact Wrench with Pin Detent provides professional users with up to 900 ft.-lbs. of fastening torque and delivers up to 1,100 ft.-lbs. of nut-busting torque when paired with a M18 RedLithium XC5.0 Battery pack. Offering more access in tight spaces, this cordless impact wrench measures at the shortest length in its class to deliver the lightest and most compact solution for users.

The SSW 18 LTX 800 BL by Metabo provides a maximum tightening torque of 590 ft-lbs., breakaway torque of 885 ft-lbs., no-load speed of 2,575 rpm, and impact rate of 3,300 BPM – all driven by a ½” square drive with friction ring. It is available as a bare tool (602403840), or as a 2x8.0 LiHD battery kit complete with ASC 55 charger (US602403620). Both versions come standard with belt hook and metaBOX 145 stackable carrying case.

The SSW 18 LTX 800 BL comes with Metabo’s 2nd Generation Brushless Motor which extends run time, maximizes power, and increases motor life. Twelve different speed/torque settings can be easily chosen with a simple push of the thumb dial, including APS Mode (Automatic Power Shift), which automatically downshifts to a lower rpm once breakaway torque is achieved to reduce lug nut spin-off and free-fall. Other safety features include: two integrated LED work lights to illuminate the work area for easier and safer operation, tethering point for lanyard attachment when working at height, and an ergonomic, rubber-coated non-slip grip for impact protection and comfort.

This impact wrench is ideal for nearly every trade, from HVAC, mechanical contractors and carpenters to metalworking, fabrication, and automotive work. They are well-suited for a variety of fastening and anchoring applications in wood, metal and concrete.

Compiled by Fastener World

CBAM risks heightening tensions in steel trade with Latin America, Alejandro Wagner, executive director of Latin American Steelmakers' Association (Alacero), said in an interview with S&P Global Commodity Insights. CBAM could further encourage steel imports into Latin America due to trade diversion from other regions impacted by the new environmental barrier, in particular China, Wagner said. The Asian giant may have already boosted steel exports to Latin America last year.

Steel prices may also rise in some regions, particularly in the EU, as markets become more protected and the costs related to decarbonization and CBAM-related bureaucracies grow.

Adaption to CBAM rules may be a challenge, according to Wagner, even though Alacero and worldsteel data shows Latin America's high percentage of renewable energy in its electricity matrix means its overall carbon emissions in steel are lower than the world average. In Latin America, each metric ton of steel produced emits an average of 1.6 mt of CO2, while the world average is 1.9 mt.

Mills in some parts of Latin America could find new export opportunities in Mexico and the US. Mexico's steel production and demand are growing due to nearshoring projects being undertaken with the US, where steel markets are more competitive, Wagner said.

Handelsblatt reported on September 28, 2023 that "there is still no consensus within the German government as to whether CBAM should be administered by the German Customs Service (under the Federal Ministry of Finance) or the Carbon Emissions Trading Authority (under the Federal Ministry of Economics)". Volker Treier, head of foreign trade at the German Chamber of Industry and Commerce, said that "affected companies are still trying to understand the complicated rules and to inform foreign exporters of the information they should submit."

The situation is confusing because companies have no solutions for their questions. In addition, Dirk Jandura, president of BGA, pointed out that importers have to rely on foreign manufacturers to provide information on the carbon footprint of their products, but the information may not be easy to obtain, and even if it is obtained, there is a lack of experts in the field to certify the reliability and validity of the information, and there are loopholes in the reliability and validity of the information.

On the other hand, although European manufacturers participating in the international market have already received free emission certificates, the number of certificates is not enough to eliminate the cost of CO2 emissions in the entire production process due to the nature of the policy and can only partially reduce the cost of CO2 emissions. In the future, when CBAM fully replaces the free quota, manufacturers will have to bear the full cost of carbon emissions, which will reduce their international competitiveness. The question of how to compensate companies in order to maintain international competitiveness is still under discussion.

The EU plans to ensure the export competitiveness of European companies through international collaboratin and a comprehensive multilateral climate agreement. To this end, German Chancellor Olaf Scholz has promoted the establishment of a "Climate Club" at the G7 summit in the hope of reaching a unified price agreement for carbon dioxide, but it is still far from being achieved. Carsten Rolle of BDI criticized that the implementation of CBAM is imminent, but the EU's complementary measures to protect companies' exports are still far from being realized.

Brighton-Best International與Parker Fasteners宣佈結 成戰略夥伴

Brighton-Best International and Parker Fasteners announced the formation of a strategic partnership, starting in 2024, on Oct. 10. This partnership is likely to revolutionize the fastener industry by having quicker lead times.

Parker Fasteners, a manufacturer with a strong foothold in the U.S. domestic market, has been operational for over a decade and has earned a reputation for being customer-centric. Brighton-Best International has been in business for nearly 100 years and is known for nationally high levels of stock.

The agreement will focus on promoting the expansion of BBI’s stainless steel lines. The partnership is expected to support distributor companies to expand their reach and increase their revenue and product offering of stainless steel.

MPE Partners announced Oct. 19, 2023 an investment in Mid-States Bolt & Screw Co., a value-added distributor of fasteners and MRO products serving a diverse range of end markets. MPE's investment positions Mid-States for accelerated growth while supporting the Company as an industry leader, an employer of choice, and a strategic partner for its customers.

MPE partnered in the transaction with the Somers family, who founded Mid-States more than 50 years ago. Scott Somers, President of Mid-States, said, "On behalf of my family, we are excited to partner with MPE. Since my father's founding of the business over 50 years ago, Mid-States has continued to drive success through our dedication to excellent customer service. We are excited to work with the MPE team to maintain this tradition while pursuing the Company's next phase of growth."

Graham Schena, Partner at MPE, said, "We are looking forward to partnering with the Somers family and the rest of the Mid-States team to accelerate the Company's growth through continued customer service and product availability, as well as organic and inorganic geographic expansion."

Nick Stender, Principal at MPE, added, "The Somers family has built Mid-States into a world-class distributor over the past several decades. We look forward to helping MidStates accelerate its growth while maintaining the culture and tradition of excellence that has made the Company so successful to date."

Solon Manufacturing Company, a premier designer and manufacturer of Belleville spring washers, is proud to announce the celebration of its 75year anniversary. Since its inception in 1949, Solon Manufacturing Co. has been dedicated to excellence, innovation, and customer satisfaction, and this milestone marks a momentous journey of growth and success.

From humble beginnings— four college friends in a 3,000 sq. foot garage in Solon, Ohio, culminating in a move to a 30,000 sq. foot facility just north of the famous Chardon Square in the center of the states' snowbelt. “Celebrating our 75th anniversary is a wonderful opportunity to appreciate our history and how far we’ve come,” said company CEO, Diane Popovich, “Solon has enjoyed significant growth since the early days. Our 50 team members and their commitment to our core values is a testament to our culture— where our customers are the final and most important beneficiaries of outstanding teamwork.”

Solon Manufacturing Co. continues to thrive on the ideals of its founders—refreshing industrialism through creative problem-solving and collaboration across its engineering and manufacturing teams— which makes Solon Manufacturing Co. a recognized name in fastening solutions across many industries. Customers have come to depend on Solon for reliability alongside its projects when it comes to unique industrial bolting applications.

Through a shared corporate core focus of ‘we make bolting better®’, the Solon team remains steadfast in exploring new ways to continuously improve product manufacturability and quality, while enhancing the customer experience.

“We are grateful to our customers, suppliers, and employees for the confidence they have placed in us for the past 75 years. They have established the foundation that positioned us for growth and keep us striving for excellence as we look ahead to the next 75 years,” said Popovich.

Solon’s Belleville washer products are high-performing conicalshaped springs that deflect at a given rate, serving as the cornerstone solution for applications subjected to heavy vibrations, cryogenic processes and extreme temperature cycling found in industries from energy to aerospace.

SPIROL International Holding Corporation Board of Directors announces the unanimous decision to appoint Jeffrey F. Koehl as Chairman of SPIROL International Holding Corporation. Jeff joined the company in 1997, and has been serving as Chairman and Chief Executive Officer of SPIROL International Corporation since his appointment in 2010.

Jeff succeeds his father, Hans H. Koehl, who passed away on November 30, 2023. Serving as Chairman of SPIROL International Holding Corporation since his appointment in 1969, Hans retired from active management of the company in 2004 after 45 of dedicated service. Hans’ vision, dedication, and passion led to the transformation

of SPIROL from being a small, family-owned business in Northeast Connecticut into a worldrenowned manufacturing company with locations on 4 continents and in 13 countries.

Jeff earned his bachelor’s degree in biomedical engineering from Brown University, and his MBA from Boston College. He has over 26 years of experience at SPIROL and has held a number of leadership positions prior to being appointed Chairman and CEO of SPIROL International Corp. Under Jeff’s direction, SPIROL has achieved profound success and growth including the establishment of numerous wholly-owned subsidiaries as well as the recent acquisition of Ford Aerospace in South Shields, England.

Gilbert & Jones公司

Shrieve Chemical Company ("Shrieve"), a portfolio company of Gemspring Capital and a leading, value-added chemicals distributor, announced that it has acquired Gilbert & Jones ("G&J"), a premiere distributor of industrial chemicals throughout North America. Based in New Britain, Connecticut, Gilbert & Jones delivers a broad product offering to customers across a range of industries and applications, including aerospace, water treatment, fasteners, automotive, electronics, and other industries.

"The Gilbert & Jones acquisition aligns perfectly with our long-term growth strategy and allows us to further diversify our product offerings and expand our reach into new markets. Together, we will capitalize on our collective strengths and capabilities to provide unparalleled service and solutions to our customers. We are excited to welcome the Gilbert & Jones team to the Shrieve family and are looking forward to our combined success," commented George Fuller, CEO of Shrieve.

Gilbert & Jones Founder and CEO, George Gilbert, added, "Joining forces with Shrieve represents an exciting chapter for Gilbert & Jones. We have always been dedicated to delivering high quality products and services to our customers. With the support and resources of Shrieve, the existing G&J team is confident that we can take our long history of exceptional service and innovation to the next level."

Snap-on Incorporated, a leading global innovator, manufacturer and marketer of tools, equipment, diagnostics, repair information, and systems solutions for professional users performing critical tasks, announced that it acquired Mountz, Inc. (“Mountz”) for approximately US$40 million in cash on November 1, 2023.

Based in San Jose, California, Mountz is a leading developer, manufacturer, and marketer of high-precision torque tools, including measurement, calibration, and documentation products. The acquisition of Mountz complements and expands Snap-on’s torque offerings to customers in a variety of industries including aerospace, transportation, and advanced manufacturing. Applications range from assembly of electric vehicle batteries to production of charging infrastructure to fabrication of microelectronic componentry, including chips. Mountz will be part of the company’s Commercial & Industrial Group.

PennEngineering® announced the acquisition of Sherex® Fastening Solutions, a global leader in the design, manufacturing, and installation of blind rivet nuts and associated fastening solutions.

Headquartered in Buffalo, New York, Sherex is a premier technical provider of blind rivet nuts, with strong application expertise, and production capabilities worldwide. Sherex has achieved an impressive growth trajectory and continues to grow through technical solutions selling, providing best total installed cost solutions along with industry-leading rivet nut capabilities.

“When combined with our ATLAS® rivet nut brand, the Sherex acquisition positions the company to be the premier provider of rivet nuts worldwide. We are extremely excited to be bringing the expertise of Sherex to the PennEngineering® family,” said Pete George, CEO. “Their entrepreneurial spirit and technical acumen, combined with our ATLAS product line and broader PennEngineering capabilities, will strengthen our ability to quickly deliver innovative, high-quality fastening solutions to our customers around the globe.”

According to Sherex President, Adam Pratt, “teaming up with PennEngineering allows Sherex to provide our customers with additional global manufacturing capability to meet their demands around the world. Our long-standing customer relationships, combined with the reputation and history of PennEngineering will allow us to continue to provide enhanced value to our customers.”

Adam Pratt will assume the role of President of Sherex and ATLAS, reporting to Pete George, CEO of PennEngineering. Alex Hsiao will continue as General Manager, Sherex Taiwan.

Auveco, a leading force in the automotive fastener and body hardware aftermarket, proudly announces its recent acquisition of ClipLizard Systems, headquartered in Spencer, IN. This strategic move solidifies Auveco's position in the Collision and Paint, Body, and Equipment (PBE) markets.

ClipLizard Systems, recognized for its innovation and commitment to quality, specializes in sourcing and distributing automotive clips and fasteners to PBE distributors. Their licensed software solution, Materials Manager, enhances PBE inventory management. The successful transaction, finalized on November 1st last year, marks a pivotal moment for both companies.

Auveco CEO, Jeff Gilkinson, expressed enthusiasm, stating, "The partnership with ClipLizard aligns seamlessly with our values of innovation and exceptional service. This strategic fit will bolster our ability to serve customers across North America."

Ray Wilhoite, CEO of ClipLizard, echoed this sentiment, saying, "Joining forces with Auveco allows us to combine our strengths, offering an enhanced product and service portfolio to our channel partners."

The collaboration opens new channels to market for both Auveco and ClipLizard, providing access to a broader product portfolio. The companies foresee increased opportunities for new product introductions by leveraging core best practices.

Founded in 1916, Auveco has grown to become a predominant provider of automotive fasteners, serving thousands of wholesale distribution customers. ClipLizard, founded in 2003 by Ray Wilhoite, has developed a loyal following through its extensive portfolio of specialty clips and fasteners, catering to the needs of body shops.

Simpson Strong-Tie併購瑞士PMJ-tec

Simpson Strong-Tie, the leader in engineered structural connectors and building solutions, has acquired PMJ-tec, a Swiss roofing and facade fastener manufacturer

specializing in A2, A4 and other high grade corrosion resistant stainless steel products.

PMJ-tec, founded in 1975, has its main office and factory in Switzerland and warehouses as well as sales offices in Germany and the Netherlands. Its products, including bi-metal fasteners, carbon steel fasteners and drainage pipe couplers, are engineered with over 45 years of expertise in the construction fastener industry and manufactured in compliance with rigorous internal and external standards.

“PMJ-tec is known not only for its superior quality products, but also for its commitment to the clients and service as well as innovation-oriented culture, all of which makes it a perfect match for Simpson Strong-Tie. This acquisition introduces bi-metal fasteners to our product portfolio, which is of great strategic importance to us”, explains Fabio Di Clemente, Director EU Strategy at Simpson Strong-Tie.

In recent years, the Philippines has silently but steadily asserted itself as a dominant player in the automotive fastener export market within the ASEAN region. The archipelagic nation, traditionally recognized for its natural beauty and diverse culture, is now making waves as a key contributor to the automotive supply chain. Despite being a relatively small player in the global automotive industry, the Philippines has carved a niche for itself in the production and export of automotive fasteners.

The above table presents a comprehensive overview of the annual world imports from the Philippines in thousand USD from 2012 to 2022, along with the corresponding growth rates.

• A notable decrease in 2013 (-42%) marked a significant decline in Philippine automotive fastener export compared to the previous year.

• Subsequent years witnessed varying trends, with significant growths in 2017 (60%) and 2018 (218%), reaching 149 million USD.

• The years 2013, 2014, 2015, and 2016 saw a decline in Philippine automotive fastener export, reflecting economic and trade dynamics during those periods. The most substantial decline occurred in 2013, attributed to various factors impacting international trade.

The Philippines experienced a remarkable recovery in 2017, marked by a substantial increase in world imports. The peak in 2018, with a 218% growth rate, suggests a period of increased fastener producers’ activities and global demand for Philippine automotive fasteners.

In the most recent years (2020-2022), the above table indicates a fluctuating pattern, with a decrease in 2020 followed by a subsequent increase in 2021, only to decrease slightly in 2022.

Despite the fluctuations, the overall trend suggests a level of stability in recent years, with a marginal 2% decrease in 2022 compared to 2021. The negative growth in 2020 (-35%) can be associated with the global economic slowdown caused by the COVID-19 pandemic, affecting trade worldwide. The subsequent recovery in 2021 and the slight decline in 2022 indicate the resilience of the Philippines in navigating challenging economic environments.

In 2018, Philippine automotive industry faced significant challenges, marking a departure from seven years of notable growth. The decline in car sales during that year was primarily attributed to various factors, including the implementation of the revised new vehicle excise tax as part of the TRAIN law. This adjustment led to higher inflation rates and a weakening peso, creating unfavourable conditions for the domestic automotive market. Amidst these challenges, fastener manufacturers found themselves in a predicament. The automotive market, once a robust driver of their production, experienced a downturn. Faced with the imperative to sustain operations and maintain production levels, fastener manufacturers turned to export as a viable solution. Unable to halt their manufacturing processes, exporting automotive fasteners became a strategic choice to navigate the complexities of the domestic automotive landscape in 2018.

Numbers are in 1,000 USD

The above table provides insights into the annual values of automotive fastener exports from the Philippines to ASEAN, measured in thousand USD. The corresponding growth rates highlight the evolving trends in this specific trade relationship over the analyzed period.

Subsequent years (2018-2020) witnessed fluctuations with negative growth rates, suggesting potential challenges or shifts in demand within the ASEAN market during this period. The year 2021 marked a positive turn with a 29% growth, indicating a renewed interest in Philippine automotive fasteners.

The analysis began in 2012 with an export value of 2,244 thousand USD; however, from 2013 to 2015, a substantial decline occurs, with negative growth rates of -85%, -22%, and -25%, respectively. This period reflects challenges or shifts in the regional automotive fastener market.

A notable recovery is observed in 2016, marked by a 97% growth rate, signalling a resurgence in the demand for Philippine automotive fasteners within ASEAN. The peak of this growth trajectory occurred in 2018, with an impressive 643% growth, indicating a significant rebound and a potential shift in market dynamics.

The most remarkable upswing occurred in 2022, with a growth rate of 140%, reaching an export value of 2,356 thousand USD. This outstanding growth might be attributed to various factors, such as increased demand, market dynamics, or strategic business initiatives.

The fluctuations in growth rates highlight the sensitivity of automotive fastener exports to various factors, including economic conditions, regional market demands, and potential shifts in the automotive industry.

The positive growth in 2021 and the exceptional surge in 2022 suggest potential opportunities for the Philippine automotive fastener industry within the ASEAN market. Monitoring factors that contributed to the outstanding growth in 2022 can provide insights into potential opportunities and challenges that may shape future trade dynamics.

2016: In 2016, vehicle sales in Thailand and Indonesia collectively reached 2 million units, driven by heightened local demand, increased purchasing capabilities, and substantial investments from Japanese automotive firms.

2018: Within the ASEAN region, passenger vehicle sales experienced a remarkable compound annual growth rate of 10.2 percent, surging to 3.1 million units in 2018 from 1.5 million units in 2011. Concurrently, commercial vehicle sales demonstrated robust growth at an annual rate of 9.8 percent, reaching 1.6 million units in 2018 compared to 780,000 units in 2011 (source: AAF). This upward trajectory underscores the expanding automotive market in the ASEAN region, propelled by factors such as rising consumer affluence and strategic investments.

2021-2022: In the period spanning from 2021 to 2022, automotive companies embarked on a journey of recovery following the unprecedented challenges posed by the global COVID-19 pandemic. Initially hit hard by disruptions in production, supply chain constraints, and dampened consumer demand, the automotive industry gradually regained its footing, that it is caused to improve Philippine fastener export.

Philippine automotive fastener producers have earned a reputation for reliability and quality within the ASEAN region, standing out as trusted entities in the automotive manufacturing landscape. Renowned for their commitment to precision engineering and adherence to international standards, these companies have become key contributors to the global automotive supply chain. Their consistent delivery of high-quality fasteners has solidified their standing as reliable partners, garnering recognition both within the ASEAN community and on the world stage.

Copyright owned by Fastener World Article by Behrooz Lotfian

The integration of hand tools in new developments is driven by a combination of tradition and innovation. While advanced technologies such as power tools and automation have become prevalent in various industries, hand tools continue to hold a crucial place in the construction, woodworking, and manufacturing sectors. The tactile feedback, precision, and versatility provided by hand tools remain unparalleled, allowing craftsmen and workers to perform intricate tasks with a level of control that automated machines may struggle to achieve. Moreover, hand tools are often more accessible and cost-effective, making them an attractive choice for both small-scale projects and emerging economies where sophisticated machinery may be less feasible.

Several advancements have been witnessed in the realm of hand tools, reflecting a dynamic evolution in their design, functionality, and applications. The traditional perception of hand tools as simple, manual implements has undergone a significant transformation with the integration of cutting-edge technologies. One notable development lies in the materials used for crafting these tools, with the introduction of innovative alloys and composite materials enhancing durability and performance. Additionally, ergonomic designs have become a focal point, prioritizing user comfort and reducing the risk of fatigue during prolonged use.

Furthermore, the smart revolution has infiltrated the domain of hand tools, ushering in a new era of connected devices. Developments such as sensor integration, wireless connectivity, and data analytics are now embedded within hand tools, enabling users to monitor usage patterns, track performance metrics, and even receive real-time feedback. This fusion of traditional craftsmanship with modern technological features not only elevates the precision and efficiency of hand tools but also positions them at the forefront of the smart tool landscape. These developments collectively redefine the role of hand tools, ensuring they remain indispensable in various industries while adapting to the demands of contemporary workflows.

Manufacturers are investing in research and design to create tools with ergonomically shaped handles, anti-vibration features, and user-friendly grips. These enhancements aim to reduce strain on users' hands and wrists during prolonged use.

• Strengths: Ergonomic designs significantly enhance user comfort, reduce fatigue, and improve overall efficiency. These designs focus on the natural movements of the human body, promoting a healthier work environment. The use of soft grips and anti-vibration features minimizes the risk of repetitive strain injuries.

• Weaknesses: While ergonomic designs address user comfort, they may result in slightly higher production costs. Some users with unique preferences may find certain ergonomic features less suitable, highlighting the challenge of creating universally comfortable designs.

Smart hand tools are incorporating digital features such as Bluetooth connectivity, mobile app integration, and data tracking. This allows users to monitor tool performance, receive usage insights, and enhance overall efficiency.

• Strengths: Smart tools offer real-time data tracking, enabling users to monitor tool performance and receive usage insights. These tools enhance precision and efficiency in various tasks, contributing to a more streamlined workflow. Bluetooth connectivity facilitates seamless integration with mobile devices for convenient control.

• Weaknesses: The integration of digital features increases the complexity of tool designs and may pose challenges for users unfamiliar with technology. Dependence on batteries and electronic components introduces potential issues related to maintenance and durability.

Lightweight materials like titanium, aluminium alloys, and advanced composites are increasingly used in tool construction. This not only reduce the overall weight of tools but also provides durability and strength.

• Strengths: Lightweight materials contribute to reduced user fatigue during prolonged use without compromising tool strength. Advanced alloys and composites provide durability and enhance overall tool performance. Users benefit from tools that are easier to handle and transport.

• Weaknesses: The adoption of high-performance materials may lead to higher production costs. Some lightweight materials might be more prone to wear and tear in certain demanding applications, requiring careful material selection.

Manufacturers are adopting sustainable practices, including the use of recycled materials in tool production. Some companies focus on eco-friendly packaging, reducing waste, and implementing energy-efficient manufacturing processes.

• Strengths: Sustainable practices, including the use of recycled materials and eco-friendly manufacturing processes, appeal to environmentally conscious consumers. Brands adopting these practices showcase corporate responsibility and contribute to a greener industry.

Implementing sustainable practices may initially incur additional costs. Balancing sustainability with the need for durable and reliable tools poses a challenge, as eco-friendly materials may not

Modular hand tool systems allow users to mix and match components to create customized tool sets. This trend provides flexibility for users with specific needs, reducing the need for a large collection of individual tools.

• Strengths: Modular tool systems offer flexibility, allowing users to tailor their toolkits to specific tasks. This versatility minimizes the number of individual tools needed, providing a space-saving and costeffective solution. Users can adapt their tools to changing job requirements.

• Weaknesses: The complexity of modular systems may lead to a steeper learning curve for users unfamiliar with assembly and customization. In some cases, the interconnectivity of modular components may result in potential points of failure.

Cordless power tools with lithium-ion battery technology become more prevalent, offering increased power and longer run times. Brushless motor technology improves efficiency and extends the lifespan of power tools.

• Strengths: Cordless power tools with advanced battery technologies provide portability and convenience. Brushless motor technology enhances efficiency, reduces maintenance requirements, and prolongs tool lifespan. Users benefit from increased power output and longer operational periods.

• Weaknesses: Cordless tools rely on rechargeable batteries, introducing the need for charging infrastructure and potential downtime. Initial costs for high-quality cordless tools and replacement batteries can be higher compared to traditional corded counterparts.

Some manufacturers experiment with AR and VR applications to provide users with interactive training experiences. These technologies are used for maintenance tutorials, assembly instructions, and virtual simulations.

• Strengths: AR and VR applications offer interactive training experiences, improving user skills and efficiency. Virtual simulations allow users to practice complex tasks in a controlled environment, reducing the risk of errors. These technologies enhance the learning curve for new tools.

• Weaknesses: Implementing AR and VR features may require additional investments in technology and training. Users not accustomed to digital interfaces may face challenges in adapting to these immersive technologies.

Collaborative hand tools, especially in industrial settings, are designed to enhance teamwork and efficiency. Examples include multi-functional tools that serve various purposes, reducing the number of tools needed for a task.

• Strengths: Collaborative tools streamline teamwork and enhance overall productivity. Multi-functional tools reduce the need for an extensive toolset, promoting efficiency in various tasks. These tools cater to diverse job requirements and contribute to a more organized workspace.

• Weaknesses: The complexity of multi-functional designs may result in tools with more components, potentially increasing the risk of malfunctions. Users accustomed to traditional single-function tools may require training to adapt to collaborative designs.

The hand tools industry witnessed a surge in online sales through e-commerce platforms. This shift allows consumers to easily compare products, read reviews, and make purchases, contributing to the industry's digital transformation.

• Strengths: E-commerce platforms provide a convenient and accessible way for users to browse, compare, and purchase tools. Reviews and ratings on online platforms offer valuable insights for potential buyers. The digital landscape enhances the reach of tool manufacturers and retailers.

• Weaknesses: The inability to physically inspect tools before purchase may lead to challenges in assessing quality. Shipping and delivery issues, as well as potential delays, can impact the overall customer experience.

Safety-conscious designs include features like improved blade guards on cutting tools, anti-slip surfaces on handles, and advancements in impactresistant materials. Tool manufacturers prioritize user safety to minimize workplace accidents.

• Strengths: Safety-conscious designs prioritize user protection and reduce the risk of accidents. Improved blade guards, anti-slip features, and impact-resistant materials contribute to a safer work environment. Safety-focused tools enhance user confidence and minimize workplace injuries.

• Weaknesses: Incorporating additional safety features may slightly increase the weight or complexity of tools. Striking the right balance between safety and functionality requires careful engineering to ensure optimal performance.

In summary, the evolution of hand tools demonstrates a fusion of tradition and innovation, maintaining their pivotal role in various industries. Recent advancements, such as ergonomic designs, digitization, lightweight materials, sustainability practices, and safety features, underscore the industry's commitment to enhancing efficiency and adaptability. Despite strengths like improved user comfort and precision, challenges include potential cost implications, technology adoption, and a learning curve for users. As the hand tools sector continues to innovate, finding the right balance between embracing new features and addressing associated challenges will be crucial for a seamless integration into daily work practices.

Copyright owned by Fastener World / Article by Sharareh Shahidi Hamedani

Nestled in the heart of Central Europe, the Czech Republic stands as a testament to industrial vigour and economic dynamism. Its landscape is a convergence of manufacturing prowess, innovative construction, and a thriving industrial ecosystem that has consistently drawn the attention of economic observers. In this article, we embark on a concise exploration, spanning three transformative years from 2021 to 2023, to unveil the trade statistics of fastening tools in the Czech Republic. This voyage will uncover import-export dynamics and illuminate the critical industries that rely on these unassuming yet indispensable instruments.

The Czech Republic, positioned as a medium-sized, open economy, derives a significant 72.7 percent of its GDP from exports, primarily propelled by the automotive and engineering sectors. Notably, a substantial 26.3 percent of these exports find their destination in the European Union (EU), with Germany serving as the foremost recipient. Beyond the EU, the United States ranks as Czech Republic's secondlargest non-EU export destination, closely following the United Kingdom.

However, recent economic indicators reveal a shifting landscape. Czech GDP growth, which stood at 3.3 percent in 2021, moderated to 2.4 percent in 2022, as reported by the Czech Statistical Office. This deceleration can be attributed, in significant part, to surging inflation rates. The inflationary surge, primarily fuelled by substantial increases in energy costs resulting from the Russia-Ukraine conflict, has been a significant contributor to the GDP downturn. In 2022, the average inflation rate soared to 15.1 percent, marking the highest level since the Czech Republic's establishment as an independent nation in 1993.

The Ministry of Finance projected a challenging economic scenario in 2023, forecasting a 0.5 percent decline in Czech GDP. This decline is anticipated to persist due to the ongoing impacts of elevated inflation rates, continuing to shape the economic landscape of the Czech Republic.

Fastening tools, often the unsung heroes in the world of industry, form the bedrock of modern construction, manufacturing, automotive, and do-it-yourself (DIY) sectors. These unassuming tools encompass a wide spectrum of components, ranging from screws and bolts to nuts and rivets, as well as the specialized power and hand tools essential for their application. Let's take a closer look at how these tools have played pivotal roles in Czech Republic's key industries during the period from 2021 to 2023.

Czech Republic's construction industry faces challenges due to worsening economic conditions. High energy costs and inflation resulting from the Ukraine conflict are expected to affect construction.

The rising prices of materials and energy, along with disruptions in supply chains, are expected to dampen construction growth in the coming quarters. There's also a shortage of labour in the Czech Republic, making construction costs higher. Furthermore, uncertainty related to the Russia-Ukraine conflict and expected monetary policy tightening are affecting investor confidence, leading to reduced consumption and investment. This decline in demand is likely to impact new orders for the construction industry. Given these challenges, the construction industry was projected to contract by 2.4% in 2023, down from the previous estimate of 3.5%. The market is projected to achieve an AAGR of more than 3% during 2024-2027 supported by developments in the area of transportation, housing and energy sectors.

Czech's manufacturing output is poised for substantial growth, projected to reach €203 billion by 2026, a notable increase from €178 billion recorded in 2021. This signifies a steady annual growth rate of 1.7%. Notably, Czech supply chains have been on an upward trajectory, growing at an average rate of 2.7% per year since the turn of the century.

In terms of global rankings, as of 2021, the Czech Republic secured the 13th position in manufacturing output. In comparison, Austria slightly outpaced the Czech Republic with a manufacturing output of €178 billion. Meanwhile, Italy, France, and the UK secured the 2nd, 3rd, and 4th positions, respectively.

Within this thriving manufacturing landscape, fastening tools have played an indispensable role in upholding precision and efficiency across a diverse spectrum of manufacturing industries.

Czech automotive market is witnessing a strong rebound in demand from the COVID downturn and post-COVID supply chain bottlenecks. The market is expected to grow at a significant CAGR between 2023 and 2030.

Increasing adoptions of electric vehicles and spiking demand for advanced safety, connectivity, convenience, and driver assist features are noted to shape the modern automotive industry in Czech Republic. Increasing battery efficiency and EV charging infrastructure, and handling chip shortages are potential challenges for auto manufacturers.

The global automotive industry was supposed to enjoy a restart in 2021. However, the pandemic, disrupted logistics chains, increased demand for consumer electronics, adverse weather and the technological complexity of production have all contributed to the onset of a global chip shortage. The shortage manifested itself in full in the second half of 2021, slowing down and, in some cases, even halting car production in Czech Republic and other countries.

Despite these extensive challenges, the Czech automotive industry overcame them in 2022 and achieved good results. After three years of declining production volumes, it has also once again recorded an increase in production of +9.4%. From January to December in 2022, a total of 1,249,281 road vehicles were produced in Czech Republic.

Going beyond their traditional industrial roles, fastening tools have found their way into the hands of DIY enthusiasts and homeowners, igniting a remarkable 12% annual upsurge in DIY and home improvement projects. These versatile tools have become the catalysts for individuals to breathe new life into their creative visions, embarking on ventures that encompass everything from substantial home renovations to the assembly of furniture and the resolution of minor repairs.

This surge in DIY activities aligns with broader market trends. In the DIY & Hardware Store market, revenues were projected to reach a significant USD 5.02 billion in 2023. This market exhibits a robust growth trajectory, with an anticipated annual increase of 4.31% (CAGR 2023-2028). On a global scale, the lion's share of revenue is generated in China, where the market was expected to reach a staggering USD 767.20 billion in 2023. When assessed relative to the total population figures, each person was expected to contribute USD 466.90 in revenue in 2023.

This surge in DIY activities not only underscores the growing popularity of hands-on projects but also reflects the expanding role of fastening tools in empowering individuals to tackle a diverse array of tasks, ushering their creative ideas from conception to reality.

Czech Republic's fastening tools trade landscape witnessed significant shifts in 2021 and 2022, affecting both imports and exports. In this analysis, we delve into the key trends, their implications, and their relationship with the top trading partners.

In 2021, Czech Republic's fastening tools exports were valued at USD 335.79 million, which decreased to USD 290.11 million in 2022, reflecting a 13.6% decline. This reduction suggests a changing global landscape for fastening tools trade, possibly influenced by various factors such as market demand and competition.

Imports of fastening tools into Czech Republic decreased by approximately 17.7% from USD 449.04 million in 2021 to USD 369.59 million in 2022 which could be influenced by shifting market dynamics, changes in demand, or other industry-specific factors.

• Germany: Germany, the largest exporter, experienced a 22.21% decrease in exports to Czech Republic in 2022. This decline might be attributed to shifts in demand or competition from other suppliers.

• China and South Korea: China saw a 19.04% increase in exports to Czech Republic, indicating a strengthening market presence. Conversely, South Korea faced a significant 66.43% drop in exports, possibly due to changing market dynamics.

• Italy and Austria: Italy maintained stability in exports, while Austria increased exports by 17.56%. These variations could be influenced by market conditions and competition.

• Poland and France: Poland experienced slight growth, while France saw a considerable decline in exports to Czech Republic. Market preferences and competitive factors may have contributed to these trends.

• Japan, the U.S., and Slovakia: Japan's exports decreased significantly, highlighting a potential shift in market dynamics. The US saw export growth, which might indicate increased demand for US fastening tools in Czech Republic. Slovakia's decline in exports could be attributed to various factors affecting trade between the two countries.

• Hungary, the Netherlands, Switzerland, and Belgium: Hungary's exports grew substantially, indicating competitiveness in the Czech market. The Netherlands, Switzerland, and Belgium experienced declines in exports to Czech Republic, which could be due to changing trade patterns or economic conditions.

Germany , being a neighbouring country and a significant player in manufacturing, continued to be the largest importer of Czech fastening tools. The modest 0.55% increase in imports suggests a stable demand for these tools. This consistency can be attributed to well-established trade relations and the quality of Czech fastening tools.

Italy maintained steady imports, with a 12.45% increase. The stable relationship between the two countries indicates a consistent demand for Czech fastening tools in the Italian market. Czech exporters should focus on maintaining their competitive edge in Italy.

France witnessed a notable 39.49% increase in imports from Czech Republic, indicating an expanding market. This growth can be attributed to the quality and competitiveness of Czech fastening tools. Czech exporters should continue nurturing this market.

Slovakia experienced a 9.67% decrease in imports from Czech Republic. As neighbouring countries, their trade dynamics are closely linked. The decrease may be attributed to shifts in demand or competition. Czech exporters should maintain their strong presence in this key neighbouring market.

The Netherlands saw a 16.65% decline in imports from Czech Republic. This decrease could be attributed to shifting trade patterns within the European Union or changes in the Dutch market. Czech exporters should monitor these changes to adapt their strategies accordingly.

Poland witnessed a substantial 49.05% decrease in imports of fastening tools from Czech Republic in 2022. This decline may be due to evolving supply chain strategies or increased competition from other suppliers. It's essential for Czech exporters to adapt to these changing dynamics to maintain a strong presence in the Polish market.

Austria saw a 19.21% decrease in imports of Czech fastening tools. Economic factors and market conditions likely influenced this decrease. To regain momentum, Czech exporters may need to explore opportunities to meet Austrian market demands.

Switzerland experienced a significant 43.70% decrease in imports from Czech Republic. This decline might be due to changes in trade dynamics or preferences for other suppliers. Czech exporters should explore strategies to regain their position in the Swiss market.

Belgium saw a 46.43% decrease in imports from Czech Republic. Economic factors and market conditions likely played a role in this decline. Czech exporters should focus on understanding and addressing the specific challenges in the Belgian market.

Hungary experienced a significant 47.43% increase in imports of fastening tools from the Czech Republic. This surge suggests that Czech fastening tools are gaining popularity in Hungary, possibly due to their quality and competitive pricing. It's crucial for Czech exporters to continue catering to this growing demand.

In summary, these fluctuations in trade reflect the dynamic nature of the fastening tools industry. Factors such as market conditions, competition, and changing trade dynamics play pivotal roles in shaping these trends. Monitoring these developments can guide strategic decisions in the fastening tools sector.

The fastening tools trade in the Czech Republic for the first half of 2023 showed notable trends, with potential implications for the second half and beyond. Here, we delve into the analysis of this period and provide some forecasts.

During the initial half of 2023, Czech Republic's imports of fastening tools recorded fluctuations. In January, imports amounted to approximately 35.07 million USD, reflecting a 13.1% increase from the December 2022 imports, which were at 31.07 million USD. However, February witnessed a minor decline, with imports totalling about 34.25 million USD, indicating a 2.3% decrease compared to January. March witnessed a notable increase, with imports surging by approximately 20.0% to reach 41.15 million USD. April and May remained relatively stable, hovering around 41.44 million USD and 34.59 million USD, respectively. In June, there was a slight decline, with imports totalling about 39.65 million USD.

On the export front, Czech Republic displayed resilience and growth in the realm of fastening tools during the first half of 2023. Exports to the world witnessed an overall upward trajectory, starting at approximately 24.72 million USD in January. This marked a 39.3% increase compared to December 2022. The positive trend continued, with exports steadily climbing to approximately 29.18 million USD by June, reflecting a 64.3% growth over the six-month period.

These fluctuations and growth trends in both imports and exports underscore the dynamic nature of the fastening tools industry in Czech Republic in the first half of 2023.

While the first half of 2023 showed fluctuations in imports and consistent growth in exports, it's essential to consider potential trends for the second half of the year and beyond. Several factors may come into play:

• Global Economic Conditions: The fastening tools trade can be influenced by the broader global economic situation. Any significant changes in international economic conditions, such as trade disputes or fluctuations in demand, could impact Czech Republic's trade in these tools.

• Continued Demand: The steady growth in exports during the first half of 2023 suggests sustained demand for Czechmade fastening tools. This trend may persist, especially if the global construction and manufacturing sectors continue to thrive.

• Trade Partnerships: Czech Republic's trade relationships, especially with key partners, will be crucial. Monitoring developments in these partnerships will be essential for understanding future trade dynamics.

• Market Adaptation: As global markets evolve, Czech companies may need to adapt to changing customer preferences, regulations, and technologies to remain competitive in the fastening tools industry.

As we look to the future, it's essential to acknowledge potential challenges in the global economic landscape. Factors such as trade disputes, evolving customer preferences, and changing market dynamics may influence the fastening tools trade.

Sources:

• Czech Republic Construction Market Size, Trends and Forecasts by SectorCommercial, Industrial, Infrastructure, Energy and Utilities, Institutional and Residential Market Analysis, 2022-2026

• Czech Republic Automotive Market, Size, Share, Outlook, and Growth Opportunities 2022-2030

• 2023 Investment Climate Statements: Czechia, U.S. Department of States

• DIY & Hardware Store – Czechia, Statista, 2023

• ITC Trade Map, Trade statistics for international business development

In conclusion, Czech Republic's journey in the fastening tools trade from 2021 to 2023 reflected resilience, adaptation, and a commitment to excellence. The insights gained from this analysis serve as a valuable compass for industry stakeholders, emphasizing the importance of continuous monitoring and adaptation in a rapidly evolving trade environment. Czech Republic's performance in the fastening tools trade over these three years highlights its potential for sustained growth and success in the years to come.

As the global economic landscape evolves, Czech Republic's competitive edge and strong trade ties position it well for continued success in the fastening tools industry. Continuous monitoring of these trends will be vital for strategic decisionmaking in the months and years ahead.

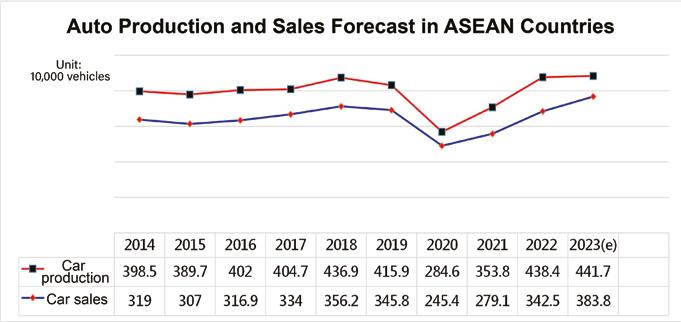

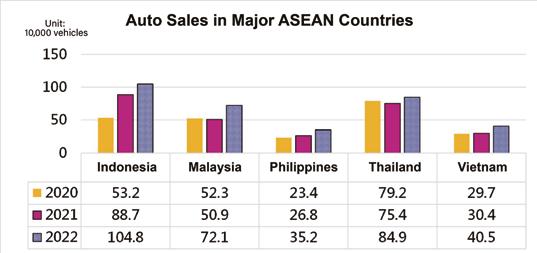

consisting of 10 countries has an area of 4.44 million sq. km, a population of 620 million, and a GDP of over US$3.2 trillion in 2022, making it an emerging regional organization with considerable influence. Among ASEAN 10, Thailand, the Philippines, and Indonesia are open countries in the auto industry, and Indonesia in particular has replaced Thailand to be the largest auto market in ASEAN. However, Thailand is a country with less government intervention and protection for the auto industry. Thailand, having opened up its market, has established technical cooperation or production relationships with other int’l automakers, and is already ahead of other ASEAN countries in terms of manufacturing integration and cost competitiveness.

Compared to Thailand, Malaysia is a country protecting its auto industry. Malaysian government is committed to the development of the local auto industry and is more deeply involved in it, which in turn faces the greatest pressure to reduce tariffs or protective measures and is more resistant to liberalization issues. The main reason that Malaysian government chose to adopt a protective policy for the auto industry is due to the country’s special political and economic background and industrial environment.

Major ASEAN countries have laid the foundation for auto parts manufacturing and assembly and have the capability of

complete vehicle manufacturing and assembly. Global major car manufacturers have set up assembly factories in ASEAN and have begun to take shape due to sufficient labor, low wages, inexpensive land prices, and potentials for the development of the auto industry and market, etc. The auto industry in ASEAN is mainly concentrated in Malaysia, Indonesia, the Philippines, and Thailand. Indonesia, Thailand, Malaysia, the Philippines, Singapore, Vietnam and other ASEAN countries have terminated tariffs on auto imports and exempted auto parts from luxury tax. In

densely populated countries such as Thailand, Indonesia, Vietnam, and the Philippines, the ratio of car ownership per capita (the numbers of cars per 1,000 people in 2022 were 245.8 in Thailand, 91.3 in Indonesia, 17.3 in Vietnam, and 35.8 in the Philippines) is relatively low compared to those of advanced countries, and the future auto parts and components business opportunities have great potential for development, both in the AM and OEM market. Japanese automakers such as Toyota, Suzuki, and Daihatsu are optimistic about the development potential of ASEAN and are actively adjusting ASEAN to become the production bases of Completely Built Unit (CBU), and are placing their business in the ASEAN and emerging countries with Small MultiPurpose Vehicles (MPVs). In comparison with the BRIC countries, vehicle ownership in ASEAN is still on the low side, and most of the citizens still use motorcycles as a means of transportation. In recent years, with the development of the economy and changes in consumer behavior, which has led to an increase in the demand for low-priced small cars, ASEAN will become an important competitive arena for major auto manufacturers in the future in terms of the global market and development trend.