世鎧雙熱水泥螺紋錨栓

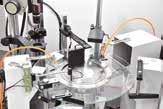

started out with premium bi-metal screws and bi-metal anchors, and then branched out to concrete fastening. It has successively developed large carbon steel concrete anchors and bi-metal stainless steel anchors, as well as the exclusive double heat treatment technology to precisely handle hardness distribution and increase product safety and service life. Now it is announcing that the double heat-treated cement threaded anchors have passed ICC certification. These anchors come with hole-drilling diameters ranging from 1/4" to 3/4", covering all common sizes on the market.

1. High strength: fixed firmly in cement and other hard materials.

2. Easy to install: only needs to use one screwdriver or electric screwdriver in most cases.

3. High tensile strength: withstands external tensile and maintains a stable connection.

4. High seismic performance: remains stable under earthquakes or other vibrations.

5. Versatility: Shallow to deep embedment options to cope with various applications such as fastening building structures, mechanical equipment, pipelines, etc.

6. Reliability: provides reliable fixation. Hard to loosen or fail.

7. Adaptability: Suitable for cement edge and close-range installation.

8. Removability: This product is completely removable.

The double heat-treated cement threaded anchors have made it into the North American market. They are also purchased by many customers in Central and South America. According to customer comments, this product helps save a lot of manpower during installation. Furthermore, the ICC certificate helps Sheh Kai eliminate competition from low-end products and improve the company's market competitiveness.

Cement Bolts

Sheh Kai has completed the ETA C1 seismic test and started writing an evaluation report. Soon, the company will pass this certification. ETA certification already includes seismic tests but these are simulated using non-cracking cement and do not provide safety data for installation to cracked cement. The C1 grade seismic test comes into play to evaluate product safety data when there is a 0.5mm crack. Getting verified by this test will expand product applicability. The company said the reason for applying for the certification is to give customers confidence in the products. Providing certified data allows architects to design buildings based on proof, ensure safety and avoid risks of users’ misuse.

The company has completed the ETA test and assessment report for this product, along with the audit completed in March 2024. The report is on its way to the certification authorities of EU member states for approval. The certification clearly defines the safety data of existing products and systematically provides the data to architects. This strengthens customer confidence and provides correct data to avoid risks of users’ misuse.

The company revealed it has completed carbon inventory and will apply for certification to verify the inventory data. Currently they use energy-efficient air compressors, improve the insulation performance of building structures, and use more energy-efficient equipment

and machines. Sheh Kai is reducing greenhouse gas emissions and energy consumption in the manufacturing sector by improving manufacturing processes, increasing resource utilization efficiency, and using cleaner manufacturing technologies.

The company observed stock level is still high at European customers' locations, but the customers are slowly coming back to purchase from Taiwan. Sheh Kai is using the void to upgrade its ERP system and equipment, focusing on carbon reduction and carbon inventory of the manufacturing process to make full preparations for future full implementation of CBAM and economic recovery.

Contact: Manager Barry Tsai

引進CNC智能製造走向減碳未來

"CNC

"We fulfill what others can't."

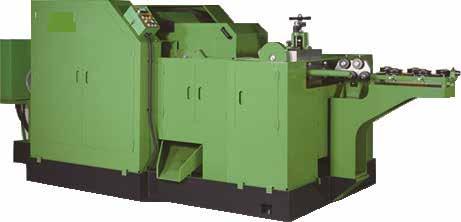

Fast forward back 40 years of corporate history. Iou Good Jyi mainly relied on table lathes and each person was in charge of one machine in the company’s early days. They earned just a meager profit from OEM, and saved every penny from it until it added up to a portion of funds with which they purchased the first automated lathe. The funds kept increasing until there were 10 lathes. That was a time of most intense competition, where they were in an industry in need of high craftsmanship. Everything from cam design to tool grinding and selection were all technical tasks. Back then, most Taiwanese competitors were just focused on processing easy-to-cut materials such as copper, aluminum, and free-cutting steel. In contrast, Iou Good Jyi was dedicated to difficult-tocut materials like alloy steel, tool steel, stainless steel, and titanium alloys that others didn’t want to process, and that is what shaped the company’s manufacturing technique that stands out from the crowd. Now they supply precision hydraulic components as well as automobile, bicycle, optical, aerospace, medical parts and customized special parts. They manage and save costs for clients in the design phase, providing complete solutions on manufacturing methods as well as the most competitive prices.

Then came the automation and computerization trends that brought a different change to them. Customers were requiring higher precision which dictated the use of CNC machines. They purchased various machines with different functions, from Swiss Type CNC Lathe models 16, 20, 32 and 42 to CNC Turning Lathe models 25, 42, 52, etc., in order to meet various customers’ needs. Additionally, inspection equipment was added to the line, from horizontal projectors to vertical projectors, CNC 3D image measuring machines, surface roughness testers, roundness gauge, metallographic cutting machines, etc. They also introduced ISO 9001 certification in 2008 and had been widely praised by customers in satisfaction surveys over the years. Their products are sold across the world, such as EU, Japan, the U.S., and the Middle East.

In response to high global awareness of energy conservation and carbon reduction, they have already implemented equipment for recycling and reusing oil, and most of their tools can be reground and reused. They also cooperate with clients to calculate carbon content of the manufacturing process as required in CBAM, and they reduce the carbon footprints from transportation of incoming materials. To contribute to the Earth, they have planted 500 trees since 2000 and continue to plant more.

The company has weathered several economic downturns since the establishment in 1984, each time inspiring their evolution towards better crisis management and preventive measures to ensure zero risk for clients. To efficiently achieve small-volume and diverse production, they introduced a flagship product by DP Technology, a smart manufacturing solution designed for CNC programming, process optimization and physical simulation. Looking ahead, with higher price and lack of materials as well as high personnel costs, the company will continue to transform into a smart green factory to join the future trend of carbon reduction and AI.

Contact: Ms. Lisa Huang

Email: igj.ltd@msa.hinet.net

Copyright owned by Fastener World / Article by Dean Tseng

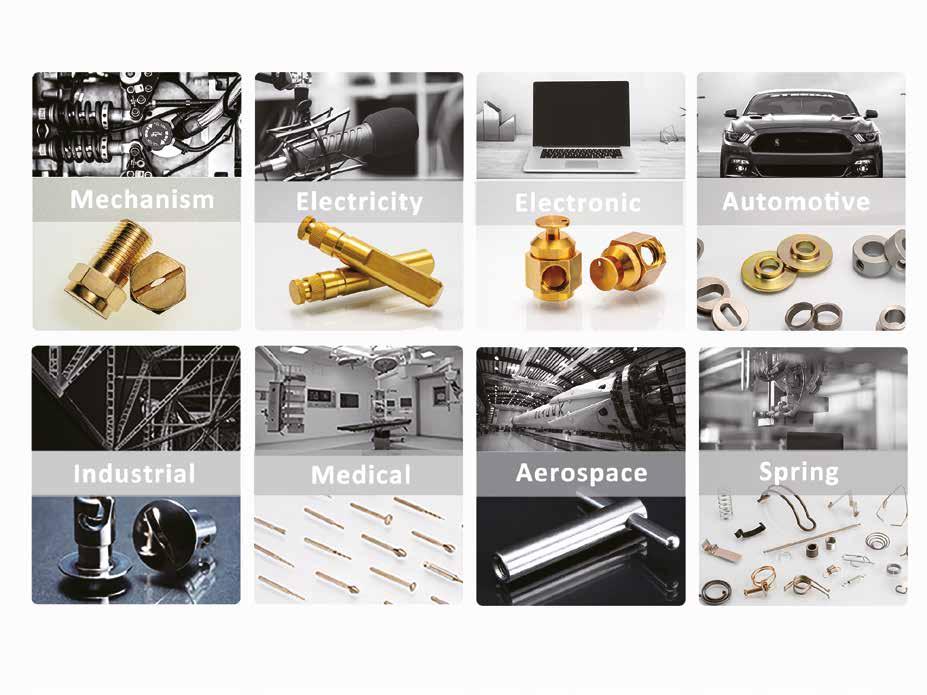

Excellent quality parameters and superior precision performance are the two keys for CNC precision lathe machining companies to gain customers' favor in the industry, which are also the biggest advantages that Kanon Precision Co., Ltd. has been able to stand in the midst of many competitions in the past 30 years. Under the business philosophy of "creating maximum benefits for customers and achieving a win-win situation," Kanon started from developing the domestic market gradually and then moved towards export sales, and simultaneously introduced high-end production equipment and cultivated human resources and technology, thus successfully expanding its market share in the field of CNC precision lathe machining in just a few years. More than two years ago, it even started to focus on the international market in order to provide more customers around the globe having the demand for CNC precision lathe machined products with complete, efficient and reliable one-stop service.

Kanon specializes in the customization of CNC precision lathe machined parts, and many of its customers are from the electronics, medical, mechanical, automotive, and other industrial fields with high requirements for product quality. In addition to installing several CNC sliding/fixed head processing machines to meet different needs, its plant has recently added 6 computerized composite machines and 2 optical sorting machines to improve the process and control the quality, and has also imported Japanese Nomura's full-complex machining equipment, which is capable of completing sophisticated processing like drilling and tapping holes on small-size turning products with precision tolerances. With rich experience, mature technology and advanced equipment, Kanon's precision tolerance can be controlled within +/- 0.005mm. "The introduction of the composite machines allows us to complete the drilling and milling process with a single machine, avoiding the displacement error caused by multiple clamping of workpieces between different machines, and realizing the results of high precision and efficiency," according to Kanon.

With an average monthly capacity of 3 million pieces, Kanon can provide the size ranging from 2mm (min.) to 50mm (max.) and the materials available are turning materials (12L14, 1215), alloy steel (1144, 4140, SCM435, 52100), aluminum (2011, 6061-T6, 6063, 6082), copper alloys (1100, 36000, 3601, 3602, 3603, 3604. 69300), and stainless steel (303, 316, 416, 420 SS).

In order to ensure that the quality of its products meets customers' requirements, Kanon has paid special attention to the APQP process and feasibility assessment, and this year it has arranged internal education and training on the five core tools of PPAP, so that it can do a complete quality management and assessment before accepting orders. Thanks to the focus on communication with customers, Kanon has also succeeded in obtaining many large orders. "We once worked with a customer to develop tooth grinding instruments, and through continuous communication and

discussions, we not only helped to overcome technical difficulties, but also made customers more satisfied with the products, and finally decided to place a large order,” according to Kanon. Recognizing that it is an inevitable trend for factories to go international and communicate directly with customers face to face, Kanon began its transformation to develop the European and American markets from the 2nd half of 2022 in the hope of improving customer service more accurately and efficiently with its 30 years of experience. In 2025, Kanon will also participate in Fastener Fair Global in Germany. In addition to promoting its product technology to increase the company's exposure, the company is also looking forward to cooperating with more customers in developing new products, which will help Kanon win more inquiries and development opportunities. "Please don't hesitate to give us a chance to work with you, we will give you the best quality and service," according to Kanon.

Copyright owned by Fastener World Article by Gang Hao Chang, Vice Editor-in-Chief

從美國手工具供應鏈危機,

檢視台灣手工具產業發展

Last March, Stanley Black & Decker announced it was closing the highly automated hand tool manufacturing plant in Fort Worth, Texas, which had been established for 3 and a half years and cost 90 million U.S. dollars, mainly producing the "Craftsman" tools which is a brand acquired by Stanley. This move is to save US$2 billion in costs. Before long, this March, Stanley announced the closure of the US$31 million manufacturing plant in Fort Mill, South Carolina (which produces "DeWalt" brand tools), also for cutting costs. Words emerged that Stanley was looking to reduce its bases in Asia. The Wall Street Journal devoted an article to explore why the leading American hand tool company cannot produce hand tools in the United States. It said the company just can't figure out how to make wrenches, and criticized that the Fort Worth factory sought to use unprecedented high automation and efficient production to bring the luster of "Made in America" back to the United States, but that in the end it proved to be a huge failure due to slow production speed and equipment problems.

In fact, Stanley was not the one that fired the first shot. In 2020, Ideal Industries announced the closure of its Western Forge brand (once the largest screwdriver manufacturer in the United States) and its U.S. factory. In 2017, Apex Tool Group announced the closure of the Armstrong brand and South Carolina factory.

Back to the Stanley case. Internal sources pointed out that the Fort Worth factory was originally going to produce high-quality hand tool products that could compete with "Chinese prices" through the development of unique automation technologies new to the industry. These technologies aimed to convert manual manufacturing processes into automated production and at the same time significantly improve product yields, but something went wrong in the process. Wrenches and ratchets become misshapen after passing through the press, resulting in millions of dollars spent on equipment adjustments. There is also the issue of sockets not being fully punched. In other words, the yield target couldn’t be reached. Another problem was losing experienced senior craftsmen with in-depth knowledge of tool making at the time, which added to the predicament. This reveals the problem of technical talent gap at the Fort Worth plant.

Automation technology can solve many problems in this challenging era, but successful technology research and development must be supported by talents with professional manufacturing knowledge. In the manufacturing of hand tools such as wrenches, even with automated machines, "human-owned craftsmanship" is still critical. Developing and tuning automated machines may sound simple to laymen, but in fact, whether it is forging or heat treating, the professional knowledge and flexible thinking of human brains are often something that automated machines cannot easily simulate or match. It is quick and simple to think with a human brain, but it will be very complicated to convert into a computer program. Therefore, experienced talents are indispensable.

Beyond that, there are structural issues. A long time ago, "Made in the U.S." once dominated the manufacturing market, but now manufacturing in places outside the United States has become the norm. For years, U.S. manufacturing has spread production overseas to reduce costs, which comes at the cost of sacrificing an intact domestic supply chain. Just like the fastener industry chain, hand tools also require a specialized industry

chain. The key competitiveness brought by a domestic industrial chain is the rapid acquisition and exchange of technical knowledge, raw materials and tools domestically, the improvement of overall price competitiveness through a mechanism of coexistence and mutual benefits, and the ability to provide complete supporting services. This is the key piece of the puzzle that the U.S. hand tool industry does not possess. Even if U.S. manufacturing has returned in recent years, rebuilding the U.S. hand tool supply chain is not something that can be accomplished in the short term.

In addition, more and more people just want to buy hand tools with lower cost, and there are many imported low-price hand tools in the U.S. market. Amid low-price competition from overseas peers, it is a big challenge for American hand tool companies to find a balance between high labor costs and price reduction.

Taiwan's hand tool manufacturers are in sharp contrast to the Fort Worth factory. There are approximately 2,400 hand tool manufacturers in Taiwan with nearly 50,000 employees. Seventy percent of these manufacturers gather in central Taiwan to form a very special industrial cluster in the world which comes with a complete supply chain, covering dies making, heat treatment, forging, electroplating, assembly, as so on from processing to finished products. This cluster creates an output value exceeding NT$130 billion a year. More than half of the hand tool products supplied by international brands are actually made in Taiwan. For example, Yih Cheng Factory based in Taiwan is the leading OEM manufacturer of American screwdrivers, with an annual output of more than 35 million screwdrivers.

Although Taiwan faces shortages in water, electricity, workforce, land, and funds, its hand tool industry still possesses sufficient "craftsmanship". Even if it does not have the most advanced automated production technology comparable to European and American counterparts, it can respond to various demand from global customers in real time. Coupled with the support of a complete supply chain, finished products in full sets can be provided to overseas buyers. Craftsmanship and supply chain are the keys to the success of Taiwanese hand tools. On another note, the Hannover Messe this year can also give us some inspiration. This exhibition showcased the latest technologies in the fields of automated robotic arms, smart manufacturing, and Industry 4.0. Upon the requirements of unmanned, automated and systematized manufacturing, the manufacturing industry is facing cost pressures for upgrade and transformation. However, the industry can’t afford to stop the pace of transformation, so companies must modify their practices as they go. Strategic alliances for new energy technologies have emerged in Europe, and coupled with the ESG and CBAM trends that have followed, the development of new energy policies will change the design and manufacturing of tools in the future. Should it be regarded as a crisis or a turning point? That is for you to make a judgement upon.

To that, the big players of Taiwan hand tool industry have been upgrading themselves to create high-value products for high-end industries. For example, Proxene Tools continues to delve into technology and has launched adjustable wrenches for the U.S. defense and aerospace industries. In addition, it introduced robotic arms into its factory, redesigned its workstation flow, introduced automated warehousing, and successfully set up a smart production line that increases production capacity by 30%. Today, Proxene Tools is one of the top three industrial adjustable wrench manufacturers in the world, accounting for a quarter of the market.

In recent years, there has been little growth in the production capacity of hand tools in Europe and Japan, and some of the major American factories have closed down, so some orders have been redirected to Proxene Tools. Even so, that doesn’t mean Taiwan hand tool manufacturers have no tough competitors. China's “red supply chain” has caused intense low-price competition with Taiwan. The price of Chinese DIY hand tools is only half the price in Taiwan. Therefore, the big players of Taiwan hand tool industry are transitioning to high-end professional-grade tools and carbon reduction.

Not only that, Taiwan is using its supply chain advantages to build an all-star alliance of hand tools. Machan International will be the leader in forming a strategic alliance with six well-known Taiwanese hand tool manufacturers, including K&W Tools, Kuang Yuang Industrial, Gong Maw Enterprise, Proxene Tools, LuckyBrand Industrial and Yih Cheng Factory. They will be collaborating to provide solutions to global buyers. On another note, these companies are advised to learn from the successful experience of Taiwan fastener industry. The fastener industry in Taiwan has begun to shift from pure manufacturing to marketing, and the overall scale of this industry is larger than that of the hand tool industry. Among all fastener manufacturers in Taiwan, more than 35 companies account for 50% of Taiwan's total fastener export value, including many large companies with a turnover above 100 million US dollars. Only when a company is large in scale can it have enough capital to step out of the box of pure manufacturing and go ahead with mergers and acquisitions, as well as create brands or establish marketing and warehousing bases overseas. If Taiwan hand tool industry can cultivate large-scale enterprises of international scale, they can drive the positive development of small and medium enterprises in the entire hand tool supply chain.

Taiwan and China are actively filling the gap left by American hand tool manufacturing. The lesson to take away from this story is to cultivate a specialized supply chain. U.S. Secretary of Commerce Gina Raimondo was interviewed in the CBS News program "60 Minutes", where she told the host: "We have the most sophisticated semiconductors in the world." The host asked her if 'we' include Taiwan. She replied it's "fair" to include Taiwan in her use of “we.” The same revelation has occurred in the U.S. semiconductor industry, which many readers have already witnessed. The importance for the hand tool industry to maintain its own intact supply chain is self-evident.

Copyright owned by Fastener World / Article by Dean

A special tool for attaching and detaching special screws that secure electric meters (smart meters, etc.). The special screw has a shallow fit with a normal flat-blade screwdriver, and was sometimes dropped and lost during work. This product can smoothly perform a series of tasks such as removing screws, catching them, storing them, and reinstalling them, contributing to increased efficiency.

Manufacturer: ANEXTOOL CO., LTD.

Compiled by Fastener World

This product is intended for use in automobile maintenance and machine maintenance. Recently, in the workplace where obstacles are increasing due to auxiliary equipment, products with compact and lightweight heads are required. It is necessary to develop a ratchet handle that will satisfy professional mechanics who do not choose working conditions such as tight spaces and heavy loads.

Manufacturer: KYOTO TOOL CO., LTD.

Obtained JIS standards while thoroughly reducing weight. The same strength as conventional work tools has been achieved. The weight reduction is effective in improving workability, making the tool easier to carry, and reducing fatigue. In addition, the light weight of the handle part is different from existing tools. Name tags and grips can be easily attached, allowing for easy customization.

Manufacturer: ASAHI METAL INDUSTRY CO., LTD.

An evolution of the "Soft Touch" series that has been around since 1988. <Sustainable design born for those who build the future and those who support the future.> We have introduced materials, shapes, and mechanisms that are not bound by conventional tool concepts. Tsubame Sanjo founded brand in 1940 created high-quality tools made entirely Japan together with customer feedback.

Manufacturer: IPS PLIERS CO., LTD.

By changing the shape of use and making it lighter, we are able to shorten the working time and save the battery consumption of the electric tools used.

Manufacturer: ALLEANZA JAPAN CO., LTD.

The impact driver that reviews the suitability of power tools and combines high power with ease of use. The brushless motor provides sufficient performance and enables to downsize the housing. The functions are selected to suit userfriendliness, and the components have optimized shapes, designed to draw out the inherent strength and create the appearance standing out from conventional products.

Manufacturer: TAKAGI CO., LTD.

This product is a saddle band for fixing piping. Accommodates multiple pipe sizes.

Manufacturer: ONDA MFG. CO., LTD.

There was a risk of injury when removing the pilot hole awl from the impact driver because it was "a cutting tool" and "heated due to the friction of drilling". This product has a plastic grip so it can be removed safely, and the color of the grip makes it easy to identify the size.

Manufacturer: ANEXTOOL CO., LTD.

DoC

美國商務部公告對台特定鋼釘反 傾銷稅行政複查結果

The U.S. Department of Commerce (DoC) issued a Federal Register notice on February 1 announcing the final results of its administrative review of the antidumping duties on certain steel nails imported from Taiwan. The anti-dumping review period was from July 1, 2021 to June 30, 2022. Based on the results of the investigation, the U.S. Department of Commerce determined that the weighted-average dumping margin of Your Standing International, Inc. is 26.28 percent, the weighted-average dumping margin of Shang Jeng Nail Co. Ltd. and World Kun Company Limited is 78.17%, and the weighted-average dumping margin of A-Jax Enterprise Limited and 130 other manufacturers is 26.28%.

Please visit http://tinyurl.com/47wyc5w6 to view the original notice.

墨西哥對中國鋼釘課徵臨時反傾銷稅

According to the latest announcement of the Mexican Federal Government, on July 27, 2023, Clavos Nacionales Mexico S.A. de C.V. applied to the Mexican Ministry of Economy for an anti-dumping investigation of steel nails (Mexican tariff number 73170099) imported from China. In September of the same year, the Mexican government formally initiated an anti-dumping investigation on the product (the period of the dumping investigation was from May 1, 2022 to April 30, 2023. The period of the injury investigation was from May 1, 2020 to April 30, 2023).

Based on the results of the investigation, Mexico announced on March 15, 2024 that it has preliminarily determined that

Compiled by Fastener World

the quantity of the products imported into Mexico from China and its market share in the Mexican market are likely to continue to increase in the future, which will have a negative impact on the Mexican industry; and therefore, a temporary anti-dumping duty of 31% will be levied on top of the original 25% tariff, which will take effect on and after the date of the announcement.

According to International Trade Administration (ITA) of Ministry of Economic Affairs (Taiwan)'s newly released "Analysis of Taiwan's Exports from January to December 2023", Taiwan's fastener export from January to December 2023 amounted to approximately US$4.6 billion, down 25% year-on-year from the 2022 figure of US$6.14 billion. Exports of hand tools amounted to US$3.78 billion, down 18% year-on-year from US$4.62 billion in 2022. The margins of the export decline in both product categories deteriorated from the 2022 figures, mainly due to the impact of geopolitical conflicts, inflation, and slowing economic growth, which led to conservative orders from customers and thus affected export performance.

However, according to another "International Economic and Trade Situation Analysis Report for January-December 2023" published by ITA, S&P Global forecasts that the growth of global exports and imports will turn positive in 2024 at 5.4% and 6.7%, respectively, with major Asian countries such as China, S. Korea, Japan and Taiwan showing a more significant growing trend of over 5%. In terms of metal prices, due to the gradual realization of the benefits of production reductions by steel mills in the U.S., Europe and China, coupled with the increasing steel prices in Europe and the U.S., the Asian steel market is warming up, and iron and steel prices are expected to stop declining and rebound from the fourth quarter of 2023 onwards.

中國五金製品協會與德國工具協會於 德國科隆舉行會見活動

On March 5th, China National Hardware Association (CNHA) and Association of German Tool Manufacturers met during the International Hardware Fair Cologne. Chairman Zhang, Vice Chairmen and Secretary General of CNHA and Managing Director Stefan Horst of German Tool Manufacturers Association participated in the meeting.

Both sides respectively talked about the current tool industrial development of China and Germany, as well as changes in their respective market demand, and also discussed the further cooperation between the two sides in the future. The meeting of Chinese and German tool industries this time not only strengthened the communication between both sides and promoted the info exchange and cooperation between the industry and enterprises, but also laid the foundation for resource sharing at international exhibitions and created more opportunities for corporate development in the future.

國際鐵釘工具協會擴大服務涵蓋範疇至 電池驅動扣件鎖固工具

One of ISANTA’s business priorities in 2023 was to review ISANTA’s scope and assess the impact of the emergence of new product lines. Respondents to the 2023 ISANTA membership survey expressed support for expanding scope to be inclusive of battery powered fastener driving tools. During their October 2023 meeting, the ISANTA Board of Directors took action to include Battery Powered Fastener Driving Tools as part of ISANTA’s scope. This was presented to the membership during the 2023 ISANTA annual business meeting in Denver. While pneumatic tools will remain ISANTA’s primary focus, ISANTA will look to provide complementary services that support battery powered tools as well.

Thomas F. Murphy獲粉末冶金產業聯盟頒發Kempton H. Roll冶金終生成就獎

Thomas F. Murphy, FAPMI, Senior Scientist, Research and Development, Hoeganaes Corporation, has been selected to receive the Kempton H. Roll Powder Metallurgy (PM) Lifetime Achievement Award by the Metal Powder Industries Federation (MPIF). The award will be presented during the combined PowderMet2024

(International Conference on Powder Metallurgy & Particulate Materials) and AMPM2024 (Additive Manufacturing with Powder Metallurgy) conferences, in Pittsburgh, Pennsylvania, during the Opening General Session on Monday, June 17.

Murphy is one of the few recognized experts in the field of ferrous PM microscopy throughout the world. He has been instrumental in developing sample preparation, characterization methods, and testing for both metal powders and PM components. He continues to perform a vital role in educating the industry about the effects of microstructure on the entire PM process. More recently, his research efforts have expanded to include the effects of microstructure with the additive manufacturing process.

The Lifetime Achievement Award, named in honor of Kempton H. Roll, founding executive director of MPIF, was established in 2007 to recognize individuals with outstanding accomplishments and achievements who have devoted their careers and a lifetime of involvement in the field of PM and related technologies. This will only be the fifth time the award has been given since its inception.

MPIF installed new presidents at the conclusion of the 2023 PM Management Summit and 79th Annual MPIF Business Meeting.

The new MPIF President is Michael Stucky. MPIF Executive Director/CEO James Adams presented the Crystal Award to Past President Rodney Brennen.

Michael Stucky, Business Unit Director, Norwood Medical, Bellbrook, Ohio, has been elected the 32nd president of the Metal Powder Industries Federation, succeeding Rodney Brennen, Metco Industries, Inc., St. Marys, Pennsylvania. His two-year term began at the conclusion of the Federation’s 79th annual MPIF Business Meeting, October 28–30, in Louisville, Kentucky.

Stucky has worked at Norwood for the past 11 years. Previously, he worked for 11 years at NetShape Technologies and 10 years at PCC Airfoils, Inc. Mike is very active within MPIF and the Metal Injection Molding Association (MIMA), having served on the MPIF Board of Governors as MIMA President. He is Chairman of the MIMA Standards Committee, MIMA representative on the MPIF Technical Board, and was a co-chair of the PowderMet2023, MIM2017, and MIM2018 conferences. Over the years he has served on the PowderMet and AMPM Technical Program Committees. Mike received the Distinguished Service to Powder Metallurgy Award in 2019.

Elemental Connectors成為國際鐵釘工具協會 (ISANTA)新會員

Elemental Connectors specializes in the manufacturing of galvanized wire & collated nails for a broad variety of industrial applications, ranging from infrastructure, fencing to housing construction industry. Established as the result of investors, talented professionals come together to plan, build and operate trustworthy systems for superior customer experience.

With its integrated manufacturing facility in Hyderabad India, Elemental Connectors strives for excellence in wire products, establishing a formidable presence in both domestic and international markets across North America as true partner of choice.

Nord-Lock集團獲Fastenal

Nord-Lock® wedge-locking washers have always been an exceptional choice for manufacturers when looking for the safest, most reliable bolt-securing solution. And to ensure that the washers get to those who need them, Nord-Lock has always put a lot of effort into maintaining and streamlining productive, reciprocal collaborations with its partners and distributors. During the Fastenal’s 2023 Supplier Award, that strive was recognized by honoring the North American team with the prestigious “Supplier of the Year” award.

Based on a thorough scorecard evaluating 25 different metrics, such as order acknowledgment, labeling, and a range of others, Nord-Lock came out on top in a category consisting of 97 suppliers. So, in addition to their superior washers, the award serves to recognize Nord-Lock's simultaneous marketleading position for providing smooth, customer-oriented supply and customer services. A more detailed look at 2023 shows that the Nord-Lock team outperformed the competition in ten of twelve months.

"When you pair a superior product with an incredible team, amazing things happen," says Shea Usher, Head of Sales North America. “So proud of my team and their

accomplishment of being named 2023’s best-in-class supplier at Fastenal’s Supplier Awards".

The award marks a remarkable milestone in the over 20-year-long partnership between Nord-Lock and Fastenal. With the award, NordLock’s North America division heads into 2024 with an energizing tailwind, inspired to improve on its already market-leading position in everything supply-related while continuing to offer the world’s safest bolting solutions.

Sales revenue reached €1,630.4 M (+14.4% compared to 2022), driven by sustained organic growth identical to that of 2022 (+15.5%) and increases in sales prices in the Group's three lines of business;

• At €90.7 M, EBIT is €1.6 M higher than in 2022;

• The operating Free Cash Flow is positive at + €22.2 M, thanks to the strong performances of the LISI AUTOMOTIVE and LISI MEDICAL divisions.

• Future outlook: The Group should benefit from the positive dynamics of the various markets in which it is well positioned; In an environment where inflationary pressure is expected to subside, the Group aims to improve its key financial indicators: EBIT and Free Cash Flow.

The Würth Group, the global market leader in the development, production and sale of assembly and fastening materials reported annual sales of more than EUR 20 billion for the first time in its corporate history according to its preliminary financial statements on the 2023 fiscal year. Despite the tense global economic and political situation, the Group was able to grow again, even though the difficult conditions had an impact on the operating result. Sales grew by 2.4 percent. Adjusted for currencies, sales growth came out at 3.5 percent. The operating result is expected to remain below last year’s result at EUR 1.4 billion (2022: EUR 1.6 billion), the second-best result in the history of the Group.

“Given the cooling global economy, we are satisfied with the past fiscal year. The sales mark of EUR 20 billion is a special milestone for us. We were able to double our sales volume over the past nine years,” said Robert Friedmann, Chairman of the Central Management Board of the Würth Group. “Last year, the Group’s heterogeneous structure across different industries and regions and our business model were once again the basis of our success. The construction sector, an important industry for the Würth Group, showed a slow sales development, which could be compensated for by other strategic

business units such as the Electrical Wholesale unit.”

In addition to the ongoing conflict between China, Taiwan, and the US, the wars in Ukraine and the Middle East, inflation-driven cost increases, especially for energy and raw materials, and high lending rates that hampered demand in the construction industry also had a negative impact on the result.

“Achieving these results in such an environment shows that our more than four million customers greatly appreciate our products and services. They trust us and that is our most important objective. The Würth Group has proven in the past that it can overcome major challenges successfully. The solidarity of our employees and the support of the family, especially by Prof. Reinhold Würth and Bettina Würth, give us the necessary stability,” emphasized Robert Friedmann.

喜利得集團挑戰中依舊表現亮眼

With the sales growth of 9.0 percent in local currencies (2.7 percent in Swiss francs), the Hilti Group closed 2023 with a turnover of more than CHF 6.5 billion. With this result, Hilti clearly outperformed the market and gained market share. Once again, the appreciation of the Swiss franc led to a significantly negative currency impact of 6.3 percentage points on sales. The operating result grew by 5.3 percent and reached CHF 770 million. Despite economic and geopolitical uncertainties, Hilti significantly invested into sales capacity, innovation and long-term strategic projects.

“2023 was a successful year for the Hilti Group. We achieved strong growth in local currencies and increased our operating result, despite the challenging economic environment, the strong Swiss franc

and the continued high level of investment. As we enter 2024, we are confident that we can continue to grow faster than the market”, summarizes CEO Jahangir Doongaji.

At a regional level, Europe managed to close the year with sales growth of 8.7 percent in local currencies, primarily driven by the strong contribution from Southern Europe. The Americas region grew by 9.1 percent, while Asia/Pacific was at 13.8 percent. China recovered slowly from COVID-19 lockdowns, while the rest of the region achieved solid growth rates. The ongoing war in Ukraine had an impact on the entire Eastern Europe / Middle East / Africa region, resulting in a growth of 3.1 percent.

An important growth driver was the completion of the global rollout of the new cordless platform Nuron. In addition to more than 70 tools launched in 2022, 30 new tools were brought to the market. Investment into research and development reached CHF 454 million (+3,9%), equal to 7.0 percent of the Group’s sales and underlining Hilti’s strong focus on innovation. Following the acquisition of Fieldwire Inc. in 2021, Hilti acquired 4PS Group in 2023, a Netherlands-based local market leader in developing and providing business

management solutions for the construction industry. As of the end of the year, Hilti Group had 34,111 team members, an addition of 1,624 (+5.0%) compared to the previous year.

The operating result increased by 5.3 percent to CHF 770 million while net income decreased by 0.9 percent to CHF 560 million. The return on sales (ROS) improved by 0.3 percentage points, reaching 11.8 percent (2022: 11.5%). The return on capital employed (ROCE) increased by 0.1 percentage points to 13.3 percent (2022: 13.2%).

Construction market forecasts point to a further softening with negative real growth in several geographies. The ongoing geopolitical tensions and the volatility in the financial markets will likely lead to a further appreciation of the Swiss franc and hence, another year of significantly negative currency impacts. To live up to the Group’s purpose of “Making Construction Better”, Hilti will continuously invest in driving innovation in both hardware and software solutions and building up its market reach resources. In 2024, the Hilti Group expects mid-single-digit sales growth in local currencies and a similar ROS level in Swiss francs compared to 2023.

印度Sterling Tools與韓國 Yongin Electronics簽署合作 備忘錄

Indian automotive fastener producer, Sterling Tools Limited, has recently signed an MoU for EV components facility with S. Korean key component supplier, Yongin Electronics Co., Ltd., through its subsidiary, Motor Control Units (MCUs) in India.

According to Sterling Tools, the agreement signed by both sides will play an important role in advancing the domestic manufacturing of EV and electronics components in India, and a new facility for EV components will also be set up soon. Yongin’s technological expertise will also benefit the growing EV industry sector in India.

“This MoU demonstrates Sterling’s commitment to developing the EV and Electronics ecosystem and contributing to “Make In India”. We are one step closer to our goal of strengthening our presence and offerings as a provider of green energy solutions in the automotive industry,” said Anish Agarwal, Director from Sterling Tools Limited.

“We recognize the significant potential within the Indian EV market. It brings us great pleasure to announce our partnership with Sterling through the signing of an MoU. We are prepared to embark on a journey of mutual growth and collaboration within the Indian EV industry, contributing positively to its advancement,” said CEO KH Kim of Yongin Electronics.

Stanley Black & Decker完成出售連接工具事業部門給 Epiroc AB

Stanley Black & Decker announced that it has completed the previously announced sale of STANLEY Infrastructure to Epiroc AB for US$760 million in cash. Stanley Black & Decker expects to utilize the cash proceeds, net of modest taxes, to reduce debt.

Headquartered in the USA, Stanley Black & Decker is a worldwide leader in Tools and Outdoor, operating manufacturing facilities globally. The company's more than 50,000 diverse and highperforming employees produce innovative end-user inspired power tools, hand tools, storage, digital jobsite solutions, outdoor and lifestyle products, and engineered fasteners to support the world's builders, tradespeople and DIYers. The company's world class portfolio of trusted brands includes DEWALT ®, CRAFTSMAN ®, STANLEY ® , BLACK+DECKER®, and Cub Cadet®

Martin Supply, one of the nation’s leading providers of customtailored solutions for maintenance, repair, operation, and production supplies, proudly announces its acquisition of Trinity Hardware Headquarters (THHQ) from Agrisolutions (AGS), a leading global manufacturer of wear parts, components, and accessories.

Based in Waukesha, Wisconsin, THHQ specializes in the supply of standard and custom components through catalog distribution, customized inventory management programs and product delivery services. This acquisition marks a significant milestone in Martin Supply’s dedication to bolstering its presence within the fastening market and growing in this geographic region.

Commenting on the acquisition, Douglas Ruggles, Co-CEO of Martin Supply, stated, “We are excited to welcome THHQ to Martin Supply. This acquisition aligns seamlessly with our mission to deliver unparalleled quality and service to our valued customers. We are committed to upholding the legacy of excellence that THHQ has established.”

The transition from AGS to Martin Supply promises continuity and reliability for customers. With meticulous planning and attention to detail, Martin Supply guarantees minimal disruption to the services customers depend on. Utilizing industry leading technology, Martin will drive the flow of products, services and information across the supply chain resulting in excellence in operations.

Reflecting on the acquisition, Demi Mantas, Sales Director, Hardware at AGS, expressed confidence in the transition, stating, “We are confident that Martin Supply will uphold the same level of quality and commitment our customers have come to expect. With Martin’s 90-year history, expertise, and commitment to excellence, we anticipate even greater value and innovation for our customers.”

House-Hasson簽署收購美國中西部五金批發商Bostwick-Braun意向書

House-Hasson Hardware, America's largest independent regional hardware distributor, has signed a letter of intent to acquire BostwickBraun Hardware, a Midwestern U.S. wholesale hardware distributor, officials of both companies have announced. The acquisition will include warehouses and inventory.

Steve Henry, president and CEO of House-Hasson, and Pete Richichi, CEO of Bostwick-Braun, said the letter of intent was signed Tuesday, March 19.

House-Hasson's main warehouse is at its Knoxville, Tenn., corporate headquarters; a second warehouse is in Prichard, W. Va. With the addition of Bostwick-Braun's West Helena, Ark., and Ashley, Ind., warehouses, House-Hasson will have more than 1.1 million square feet of warehouse, receiving and shipping space.

The acquisition described in the letter of intent will be complete after a period of due diligence. The pending acquisition's cost is being privately handled between the two companies.

The 56,000 stock keeping units (SKU) in Bostwick-Braun's warehouses will be incorporated into House-Hasson's system. House-Hasson presently has 55,000 SKUs in its two warehouses.

TFC併購

Supaseal UK

TFC, a leading provider of vendor managed inventory solutions and technical engineering products, has made a further acquisition in the O-Rings and Seals market, acquiring Midlands-based Supaseal UK Ltd.

Supaseal is a major player in the rubber seals industry, growing a business which started in 1991 to now supplying a wide range of O-Rings, Rotary Shaft Seals, Bonded Seals, Circlips, and associated products to customers in the UK, Europe, the U.S., Middle and Far East.

TFC, an AFC Industries Company, had already acquired EAP Seals located in Manchester in April 2023 and this move adds to TFC’s market share in rubber sealing products and strengthens the technical components category.

Supaseal currently have more than 50,000 inventory lines and 15,000 live stock lines supplying a varied customer base having developed strong relationships with a variety of manufacturing partners in the UK and overseas. They offer non-stock products as well as off-the-shelf products. Their complementary products include specially moulded parts and bespoke kits to client specification.

The company will continue to be run by its current management team and operate out of its existing premises in Market Harborough, Leicestershire.

8,047.900

2,503.971

2024漢諾威工業展

聚焦能源、工業4.0議題

Hannover Messe in Germany, the annual event for all industries, kicked off on April 22, 2024 at Messe Hannover and attracted industry professionals from all over the world to visit the 5-day event. Since it was first organized in 1947, the trade fair has become one of the most important international platforms for the global industries to explore innovative products and observe the latest technologies and trends. This year, 15 exhibition halls were open for the show and attracted more than 4,000 exhibitors from the production and R&D fields of industrial manufacturing, mechanical engineering, automation, electronic engineering, digital industry, innovative materials and components, and energy-related industries, showcasing more than 14,000 products and sustainable solutions for industrial applications with outstanding performance.

The show this year focused on “Energizing a Sustainable Industry”, with special emphases on AI & machine learning, carbon neutral production, energy, Industry 4.0/Manufacturing-X, and hydrogen & fuel cells technology trends and developments. Through this annual event, exhibitors and visitors looked forward to creating further synergy and cooperation, fostering progress and development, stimulating more eco-friendly and innovative production, getting to know more technology trends, increasing industry competitiveness, and establishing successful networking contacts.

The organizer also invited many well-known figures from the industry, government and academia to give speeches. President of the European Commission Ursula von der Leyen and Chancellor of Germany Olaf Scholz were also on the invited guests list, demonstrating the official support of the European Union and German Government for the development of industrial upgrading and other related trends.

Copyright owned by Fastener World Article by Gang Hao Chang, Vice Editor-in-Chief

The housing market in the EU witnessed a blend of challenges and opportunities in 2023, setting the stage for a nuanced outlook in the coming year. This analysis delves into the key trends that shaped the EU housing landscape in 2023 and offers insights into what lies ahead in 2024, with a particular focus on Germany and France, two pivotal markets within the region.

The year commenced with a sense of cautious optimism, notably in Germany, the EU's economic powerhouse. Early indicators suggested a modest uptick in construction permits, hinting at potential growth opportunities. However, this upward trend was not uniformly observed across the EU. A significant factor contributing to the subdued growth was the swift escalation in interest rates. After years of historically low borrowing costs, the European Central Bank (ECB) embarked on a tightening cycle to counter inflationary pressures. This surge in interest rates adversely impacted mortgage affordability, particularly for first-time homebuyers, potentially dampening the demand for new housing units across the EU, including in France, another major market.

Several additional factors compounded the slowdown in new housing starts in the EU:

• Supply Chain Disruptions: Ongoing global supply chain disruptions continued to reverberate across the construction sector, causing shortages of essential building materials and skilled labour. These disruptions led to project delays and escalated construction costs continent-wide.

• Geopolitical Uncertainty: The conflict in Ukraine and broader geopolitical tensions cast a shadow of economic uncertainty, denting investor confidence and prompting developers in Germany and France to adopt a cautious stance.

• Disparities in Housing Demand: Housing needs varied significantly across the EU. While Germany grappled with a shortage of affordable housing, particularly in major urban centres like Berlin and Munich, France contended with an oversupply of vacation homes in rural areas. This disconnection between supply and demand further complicated market dynamics in both countries.

Market Dynamics: Germany's housing market is characterized by a strong demand for affordable housing, particularly apartments. This demand is driven by a growing urban population, with an estimated 87% of Germans living in urban areas1. Additionally, Germany has a large aging population, with over 28% of the population aged 65 or above2. This demographic requires accessible and affordable housing options. However, rising construction costs and a shortage of skilled labour pose challenges for developers. Construction costs in Germany increased by 17.6% year-on-year in the third quarter of 20233

Government Initiatives: The German government has implemented policies to address affordability concerns:

• Rent control: In some cities, rent increases are capped to a specific percentage above the local rent index.

• Tax breaks: First-time buyers can benefit from tax breaks on property purchases, such as a reduced value-added tax (VAT) rate on renovations.

• Focus on energy efficiency: The German government offers subsidies and incentives for developers to construct energyefficient buildings, promoting sustainability in the housing market.

Market Dynamics: The French housing market is more diverse, with a mix of urban and rural properties. While demand remains strong in major cities like Paris, affordability concerns are rising. A 2023 study by the Notaires de France, a national association of notaries, revealed that the average price per square meter in Paris reached a record high of €10,600 (US$11,233).

Additionally, there's an oversupply of vacation homes in some rural areas. According to INSEE, the French National Institute

1. Statista (2023). Share of urban population in Germany from 1950 to 2023. https://www.statista.com/statistics/1056970/ urbanization-in-germany/

2. The World Bank (2023). Population 65 and over, total (% of total population) - Germany. https://data.worldbank.org/ indicator/SP.POP.65UP.TO.ZS?locations=DE

3. Destatis Statistisches Bundesamt (Federal Statistical Office of Germany) (2023). Construction price index - Germany https://www.destatis.de/EN/Themes/Economy/Prices/Producer-Price-Index-For-Industrial-Products/_node.html

of Statistics and Economic Studies, there were over 600,000 vacant second homes in France in 2022.

Government Initiatives: The French government has also introduced measures to address affordability:

• Tax breaks: First-time buyers can benefit from tax breaks on property purchases, similar to Germany.

• Social housing projects: The government invests in the development and maintenance of social housing units, providing affordable options for low-income residents.

• Renovation focus: There's a growing emphasis on renovating existing housing stock to improve energy efficiency. The government offers grants and tax credits to encourage homeowners to undertake energyefficient renovations.

While both Germany and France face challenges in their housing markets, some key differences exist:

• Demand Focus: Germany grapples with a shortage of affordable housing, particularly in urban areas. France, on the other hand, has a more diverse market with both affordability concerns in major cities and an oversupply issue in specific rural segments.

• Policy Focus: Both countries offer tax breaks for firsttime buyers, but Germany additionally utilizes rent control mechanisms in some cities. France places a stronger emphasis on social housing projects to address affordability.

Despite the current challenges, both Germany and France are likely to see a continued focus on:

• Affordable Housing Solutions: Government initiatives and developer strategies catering to specific needs in their respective markets will be crucial for ensuring housing accessibility.

• Sustainable Construction: The emphasis on energyefficient buildings and renovations is likely to continue, driven by rising energy costs and environmental concerns.

By adapting to these trends and addressing affordability concerns, Germany and France can work towards a more balanced and sustainable housing market in the future. Signs of Resilience: Underlying Demand and Policy Initiatives.

Despite the prevailing headwinds, there are glimmers of hope for the EU housing market, including Germany and France, as it transitions into 2024. Here are some notable trends to monitor:

• Demographic Imperatives: Demographic shifts within the EU underscore a sustained, long-term demand for new housing units. Population growth, particularly in urban hubs, coupled with an aging populace necessitating accessible housing solutions, will continue to underpin demand in both Germany and France.

• Policy Support: Several EU member states, including Germany and France, are rolling out measures to address affordability concerns, potentially injecting momentum into the market.

• Emphasis on Sustainability: There is a growing emphasis on sustainable construction practices across the EU. This trend could incentivize developers to prioritize energy-efficient housing solutions, appealing to environmentally conscious buyers and curbing long-term operating expenses for homeowners.

Industry experts offer nuanced perspectives on the EU housing market's trajectory in 2024. While a full-fledged recovery may remain elusive in the near term, certain segments, particularly in Germany and France, could witness renewed stability and growth. Here's a breakdown of key forecasts:

• Segmental Variations: The luxury and high-end housing segments are anticipated to remain relatively resilient, buoyed by sustained demand from discerning buyers in both Germany and France. However, the affordable housing segment might face more pronounced challenges due to escalating costs and financing constraints.

• Continued Emphasis on Renovation: Renovation and refurbishment endeavours targeting existing housing stock are poised to gain prominence in 2024, encompassing both Germany and France. This trend is driven by various factors, including:

Energy Efficiency Imperatives: Escalating energy expenses and mounting environmental concerns have amplified the focus on enhancing the energy efficiency of buildings. Renovation projects aimed at upgrading insulation, windows, and heating systems offer compelling cost-saving opportunities for homeowners.

Sluggish New Construction: A potential deceleration in new construction activities could pivot attention towards renovation initiatives, particularly in locales characterized by aging housing stock in need of modernization.

Regional Dynamics: Market performance is expected to diverge across different EU member states.

The EU housing market, with a spotlight on Germany and France, stands at a crossroads in 2024. While challenges abound, underlying drivers of resilience and adaptability offer grounds for cautious optimism. By zeroing in on bespoke housing solutions, sustainable practices, and fostering an environment conducive to economic stability, stakeholders can play a pivotal role in nurturing a balanced and sustainable housing ecosystem in the years ahead.

Copyright owned by Fastener World / Article by Behrooz Lotfian

The U.S. housing market in 2023 presented a story of resilience amidst challenges. After a period of rapid growth fuelled by historically low mortgage rates, new housing starts experienced a period of fluctuation. This article analyzes the key trends of 2023 and explores the expectations for the housing market in 2024.

The year began with a sense of cautious optimism. While builder confidence, as measured by the National Association of Home Builders (NAHB) Housing Market Index (HMI), had dipped to 44 in December 2022, it rose steadily in the first half of 2023. By June 2023, the HMI reached 55, exceeding pre-pandemic levels observed in September 2020 (at 51) . This significant improvement suggests a cautiously optimistic outlook among builders, despite ongoing market challenges.

Note that: Builder confidence reflects how optimistic home builders are about the housing market. They consider factors like buyer demand, affordability, and construction costs. The NAHB Housing Market Index (HMI) is a survey that gauges this confidence, with a score above 50 indicating a positive outlook. High builder confidence leads to more new construction projects and a stable market. It's important because it influences housing inventory and overall market health.

However, a key indicator, building permits, painted a more complex picture. Though May 2023 saw a 4.8% increase from the previous month, it still represented a 13.2% decline compared to May 2022. This suggested a potential slowdown in new construction activity. The second half of 2023 witnessed a more pronounced slowdown in new housing starts. Data from the U.S. Census Bureau revealed a

significant drop in January 2024, marking the lowest level since August 2020. This 14.8% month-over-month decline surprised analysts and signalled a potential correction in the market.

Several factors contributed to the slowdown in new housing starts in 2023:

• Rising Mortgage Rates: A significant factor was the rise in mortgage rates. After years of historically low rates, the 30-year fixed mortgage rate climbed above 7.79% in 2023, significantly impacting affordability for potential buyers. This squeezed buyer budgets and led to a decrease in demand for new homes.

• Supply Chain Issues: The ongoing global supply chain disruptions continued to affect the housing industry. Shortages of building materials and labour hampered construction activity, causing delays and pushing up construction costs.

• Inflation: Broader inflationary pressures also played a role. The rising costs of materials and labor further squeezed builder margins and contributed to a more cautious approach to new construction projects.

Despite the challenges of 2023, there are reasons for cautious optimism in 2024. Here are some key trends to watch:

• Mortgage Rate Fluctuations: Mortgage rates have shown some signs of stabilization and even a slight decline in recent months. If this trend continues, it could improve affordability and stimulate buyer demand. The Federal Reserve's monetary policy decisions will significantly influence mortgage rates in the coming months.

• Stable Builder Confidence: Though not at pre-pandemic levels, builder confidence has remained relatively stable compared to the lows of 2022. This indicates that builders are not overly pessimistic about the market's long-term prospects.

• Underlying Housing Demand: Demographics continue to point towards a sustained demand for housing. Population growth and millennial generation entering prime homeownership age suggest a long-term need for new housing units.

Industry experts hold a mixed view on the housing market in 2024. The National Association of Realtors (NAR) forecasts a slight increase in total housing starts, with single-family starts reaching 1,020,000 by Q2 2024. However, they also acknowledge the continued impact of affordability challenges. (Single-family starts: This refers to the initiation of construction on new homes designed for single families, meaning they are not attached to other units like condominiums or townhouses.)

While there are reasons for optimism, there are also potential headwinds for the housing market in 2024:

• Economic Uncertainty: The broader economic climate remains uncertain. Geopolitical tensions and potential recessionary fears could dampen consumer confidence and impact housing demand.

• Inventory Levels: Existing home inventory levels are slowly rising, which could put downward pressure on new home sales, especially if mortgage rates remain elevated.

The U.S. housing market in 2024 is likely to be one in transition. The era of supercharged demand and rapid price growth may be over, replaced by a more balanced market with a focus on affordability. Builders will need to adapt to changing consumer preferences and prioritize value for money. Technology and innovation in construction methods could play a role in improving efficiency and reducing costs. Additionally, a focus on sustainable building practices and energy-efficient homes could attract a new generation of buyers.

The U.S. housing market in 2024 is likely to be a story of cautious optimism. While challenges remain, such as rising interest rates and economic uncertainty, there are also underlying factors that suggest a potential rebound. Demographics and a long-term need for housing will continue to drive demand.

Here are some key takeaways for different stakeholders in the market:

• Builders:

o Affordability: In a market with rising interest rates and potentially fewer buyers, builders will need to prioritize affordability. This could involve offering smaller floor plans, utilizing more cost-effective building materials, or streamlining construction processes to reduce costs.

o Value Engineering: The concept of value engineering involves optimizing designs to deliver the most value for the price. Builders can focus on features that are most important to buyers, such as functional layouts and energy efficiency, while minimizing unnecessary frills.

o Niche Markets: Catering to specific buyer groups can be a successful strategy. First-time homebuyers, for example, might be attracted to smaller, starter homes with lower price points. Another growing niche is the market for energyefficient homes. Builders can offer features like improved insulation, high-performance windows, and energyefficient appliances, which can attract environmentally conscious buyers and potentially lead to lower utility bills for homeowners.

• Buyers:

o Competitive Market: The market in 2024 might be more competitive than recent years due to a potential rise in inventory and fewer buyers competing with historically low mortgage rates. Buyers should be prepared to potentially submit multiple offers and be flexible on some aspects of their search.

o Careful Budgeting: Careful budgeting is crucial in any housing market, but especially in a scenario with rising interest rates. Buyers should factor in not just the purchase price, but also closing costs, property taxes, and ongoing maintenance expenses. Having a realistic understanding of these costs will help them determine a comfortable price range.

o Long-Term Perspective: Buying a home is a long-term investment. While affordability is important in the short term, buyers should also consider the long-term value of their purchase. Factors like location, school district, and potential for appreciation can also be important considerations.

• Policymakers:

o Affordability Programs: Down payment assistance programs can help make homeownership more accessible to first-time buyers or those with limited savings. Policymakers can explore implementing or expanding such programs to stimulate demand in the market.

o Economic Stability: A stable economic environment is vital for a healthy housing market. Policies that promote job growth and economic stability can indirectly benefit the housing market by increasing consumer confidence and purchasing power. The coming months will be crucial in determining the trajectory of the U.S. housing market in 2024. With careful planning and adaptation, all stakeholders can navigate the changing landscape and contribute to a more sustainable and balanced housing market.

China's housing market stands as a pivotal barometer of its economic health, with new housing starts serving as a key indicator of growth and development. Against the backdrop of a rapidly evolving economic landscape, the hardware and fastener industries play a crucial role in the construction sector, ensuring structural integrity and safety in building projects. This article briefly explores the nuances of China's housing market in 2023 and provides insightful projections for 2024, which might be helpful for those involved in the fastener and hardware industries, offering valuable perspectives on market trends and potential opportunities for strategic positioning.

China's housing market woes have gained significant attention in recent years, reaching a climax with fresh reports towards the end of the previous year. These reports indicated that more than half of listed property developers had either defaulted on their obligations or restructured their public debts. Sales of new residential properties in 2023 were sluggish, amounting to only half the pace witnessed in 2021. Similarly, new residential construction starts experienced a comparable decline

However, amidst the bleak outlook portrayed by these reports, there were some encouraging developments that went unnoticed. In 2023, completions of residential properties saw a notable uptick, surging by 17 percent; however, housing starts have declined by more than 21% compared to 2022. The total area completed reached nearly 725 million square meters, surpassing

the pace of new residential starts for the first time on record. If this trend persists, it has the potential to instil confidence in the property market, fostering a more sustainable pace of development.

Starts and Completions in China in 2021-2023 (Millions of Square Meters)

The turbulence within China's property sector came into a sharp focus in mid-2021, notably with the emergence of challenges faced by one of the nation's largest property developers. Subsequently, other developers found themselves grappling with similar predicaments.

While these developments posed immediate challenges to China's economic growth, they served to purge risky practices, a crucial step towards fostering a sustainable property market. At the height of the 2021 crisis, a significant portion of the nearly 1.5 billion square meters in residential property purchases were speculative rather than driven by genuine demand.

A key obstacle to the establishment of a sustainable property market lies in the timely completion of pre-sold properties, often paid for in full in advance without a deposit or down payment. Concerns over potential non-delivery of purchased units can deter prospective buyers, thereby undermining property sales.

The preceding year marked a pivotal juncture in addressing this challenge. Despite a halving in new construction starts, and a one-fifth decline in property investment compared to 2021, notable progress was made. A significant factor contributing to this trend is the increasing allocation of property investment towards completing projects initiated in the past, rather than initiating new ones.

These developments represent predominantly positive news for China's economy. Developers have significantly curtailed new construction starts, acknowledging the end of the property boom, and are channelling the bulk of their efforts and resources into completing pre-sold housing units.

In early 2024, China's housing market displayed signs of stabilization, with a moderated decline observed in property investment and sales. Governmental efforts to mitigate the sector's downturn, coupled with strategic interventions, contributed to this tempered decline. Property investment fell by 9% year-onyear in the first two months of 2024, compared to a 24% decline in December 2023. Similarly, property sales witnessed a 20.5% slide in January-February, reflecting a slight improvement from the preceding months.

However, challenges persist, as evidenced by the sector's struggle to stabilize home prices, which declined by 0.3% monthon-month in February. Despite the modest slowdown in investment decline, analysts remain cautious, emphasizing the continued downtrend in the real estate sector. The liquidity crisis facing developers and the ongoing struggle for cash flow underscore the underlying challenges confronting the industry.

In the coming years, China's housing market is expected to face additional obstacles due to underlying changes in its population dynamics. The need for more housing is likely to decrease as population growth slows down and the pace of urbanization also

slows. Although significant government subsidies over the past decade facilitated the migration of millions of people to betterquality homes from older, less equipped ones, this demand is anticipated to dwindle. This decline is attributed to reduced revenues from land sales, which constrain local government budgets, along with a decrease in the number of residents occupying older housing units.

Given these changes in both short-term trends and long-term factors, investment in housing is expected to decrease further, remaining low in the near future. Recent forecasts for real estate investment in the medium term, taking into account different scenarios based on changes in demand and supply-side pressures, suggest a potential decline ranging from 30 percent to 60 percent below the levels seen in 2022. This decline would lead to a gradual recovery similar to what has been seen in other countries experiencing significant slowdowns in housing construction.

Efforts to strengthen spending on affordable housing and urban redevelopment in the current year may partially alleviate the decline in investment. However, these measures are unlikely to adequately address the substantial housing inventory overhang held by financially distressed developers.

A smoother and more expedient transition for the real estate sector can be achieved through market-driven adjustments in home prices and swift restructuring of insolvent developers. Phasing out regulations allowing banks to defer recognition of bad loans to developers is crucial.

Authorities should extend support to viable developers while tightening regulations to mitigate future risk accumulation. Introducing insurance for homebuyers against the risk of developers' failure to complete purchased homes could enhance confidence and alleviate sales pressures. Strengthening escrow rules for presale financing would offer improved legal safeguards for homebuyers. Implementing a nationwide property tax and enhancing pension or alternative saving schemes would reduce households' reliance on housing investment. Fiscal reforms aimed at bridging the structural gap between local government revenues and expenditure obligations are essential to reduce dependence on land sales and property-related activities.

In reaction to challenges faced by the sector, China has ramped up efforts to breathe new life into the property market. These efforts include cutting benchmark mortgage rates and implementing a "whitelist" mechanism. This mechanism allows city governments to recommend residential projects to banks for financial support. Despite these measures, market sentiment remains muted, with trends such as home purchasing, financing, and construction initiations continuing to decline.

As China's housing market faces the challenges brought by economic changes, regulatory shifts, and technological progress, the construction industry stands as a vital component, deeply integrated into the fabric of development projects. Analyzing the trends in new housing starts in 2023 and predictions for 2024 sheds light on the interconnectedness between construction endeavours and the broader economy. As stakeholders navigate this evolving terrain, adaptability, innovation, and strategic planning are essential for seizing emerging opportunities and tackling obstacles within China's dynamic construction sector.

Sources: China’s Housing Report by Peterson Institute for International Economics China's Property Investment Report by Reuters

As we step into 2024, the U.S. cordless power tools market beckons with promises and challenges that have shaped its trajectory through 2022 and 2023. In this exploration, we delve into the intricate tapestry of this dynamic market, from technological advancements and DIY culture to regional dominance, collaborative ventures, and nuanced market insights.

The U.S. cordless power tools market is entrenched in a technological odyssey, primarily driven by the rapid evolution of battery technologies. The market witnessed a paradigm shift with the ascendancy of Lithium-ion (Li-ion) batteries, heralding a new era characterized by enhanced energy density, faster charging speeds, and prolonged cycle durability. These advancements have not only met performance expectations but have also aligned with environmental considerations, resonating well with conscious consumers.

The surge in the Do-It-Yourself (DIY) culture has been a potent force propelling the cordless power tools market. The DIY home improvement market surpassed the US$ 667.9 billion mark in 2019, with North America, especially the United States, playing a pivotal role. Cordless power tools, with their freedom from cords and enhanced portability, have become indispensable for modern DIY enthusiasts. The appeal lies in the ability to undertake projects ranging from simple repairs to complex renovations with ease.

In the dynamic and competitive landscape of cordless power tools, collaborative ventures and strategic acquisitions have emerged as pivotal drivers of growth and innovation. Companies, steering through this landscape, have engaged in partnerships to foster innovation, expand their product portfolios, and gain a competitive edge. As the market evolves, these collaborations position themselves as catalysts, shaping the industry's future and meeting the evolving needs of professionals and DIY enthusiasts in the U.S. market.

As we delve into the intricate dynamics of the cordless power tools market, North America, spearheaded by the United States, emerges as an indomitable force, shaping the industry's narrative. In 2022, the market size within this region reached an impressive US$ 4.7 billion, setting the stage for a trajectory that would solidify its dominance. With a projected market size of US$ 9.2 billion by 2023 , North America continued to fortify its influence, marking a resilient year of growth.

As we step into 2024, reflections on 2023 underscore the industry's resilience and growth, attributing much of this success to factors such as technological advancements, collaborative ventures, and the resounding echo of the DIY culture. The market size of US$ 9.2 billion in 2023 is not merely a numerical milestone; it signifies the robustness of the cordless power tools market in North America, particularly in the United States.

Moving beyond the broader strokes, let's delve into market projections and nuanced insights that define the U.S. cordless power tools landscape. In 2022, the market was valued at USD 24.50 billion, set to reach USD 37.87 billion by 2028, growing at a CAGR of 7.53%. These numbers reflect the convergence of Industry 4.0 practices, IoT integration, and stringent government regulations against noise pollution. As the U.S. witnesses a surge in infrastructure projects and construction endeavours, the demand for cordless power tools becomes a consistent undercurrent, shaping the market's recent past and future.

Within the U.S. cordless power tools market, understanding the dynamics of segmentation and user preferences becomes paramount. Drilling and fastening tools, including drills, impact wrenches, and screwdrivers, hold the lion's share of popularity. The mass category, catering to cleaning and maintaining moderate-sized homes or yards, is set for significant growth. In the motor landscape, brushed motors currently dominate, but the shift towards brushless motors, offering higher operational life and ease of maintenance, hints at a transformative trend.

As we navigate through 2023-2024, these insights into the dominance of drilling and fastening tools, the surge in the mass category, and the motor evolution signify a period of transformative trends. The U.S. cordless power tools market is not just witnessing growth but is undergoing a nuanced shift in user preferences, emphasizing efficiency, versatility, and longevity. Stakeholders and enthusiasts alike need to be attuned to these dynamics to navigate this period successfully, ensuring they are in sync with the pulse of the market as it evolves and shapes the tools of tomorrow.