社論:CBAM最前線—

台灣因應進行式與歐洲面臨的瓶頸

Taiwan Environmental Information Center reported that on April 29, the Ministry of Environment disclosed three drafts including "Carbon Fee Collection Principles", "Autonomous Reduction Plan Management Principles" and "Greenhouse Gas Reduction Goals Specified for Carbon Fee Collection Targets" in accordance with the Climate Change Response Act. These drafts aim to build a supporting mechanism for the future implementation of carbon fees. They utilize general and preferential rates in hope of encouraging the targets to speed up and increase carbon reduction. The drafts include High Carbon Leakage Risk Coefficient, through which an 80% discount as well as preferential rates are to be applied to carbon emission fees. The drafts are open to the public for comments and suggestions for the Ministry of Environment’s legislative amendments.

According to the drafts, the carbon fee targets large emitters with annual emissions of 25,000 metric tons of carbon dioxide equivalent or more. When calculating emissions, the 25,000 metric tons threshold is deductible. The threshold will gradually be lowered to 15,000 metric tons, and is expected to be 10,000 metric tons by 2030. Enterprises will complete registry of carbon inventory for the previous year at the end of every April and pay the carbon fee for the previous year before the end of May.

There are also transitional measures for industries with high carbon leakage risks, such as the steel and cement industries. If an enterprise applies for a voluntary carbon reduction plan and is approved to be recognized as having high carbon leakage risks, it can enjoy an initial carbon fee discount based on the carbon leakage risk coefficient. At a coefficient value of 0.2, an 80% discount is to be applied on carbon fees. The value will be gradually increased to 0.4 and then 0.6. On top of that, a preferential rate will follow the discount, but the 25,000 metric tons threshold can no longer be deducted from the emissions.

Regarding the preferential rates for voluntary carbon reduction, if an enterprise can meet the designated emission reduction goals, it can submit voluntary reduction plans and enjoy preferential rates. The designated goals will be divided into two approaches. One is to reference the Science Based Targets Initiative (SBTi) which uses 2021 as the base year to set reduction targets up to 2030 for various industries. This approach will provide more preferential treatment. The other one is to aim at 24% carbon emission reduction designated in the Nationally Determined Contributions 2030 and set technical benchmarks for different emission types to specify reduction rates.

From Q3 this year, EU importers will be required to submit actual carbon emissions data of imported products, and it will not be allowed to use default values as the basis for reporting. It means product suppliers will be required by their clients to provide actual data. Suppliers should pay extra attention to CBAM reporting to avoid impact on purchase orders.

CBAM is now the talk of the town and industry players are in urgent need to learn its latest development. This article summarizes the latest progress of Taiwan's regulations in response to CBAM, and examines the challenges for CBAM in Europe to help readers learn a broader landscape and react early.

Questions against the drafts have been raised by environmental protection groups who estimated that a carbon fee income of more than NTD 3.75 billion will be lost just by deducting the 25,000 ton threshold. Coupling that with the discount from the carbon leakage risk coefficient will result in more than NTD 30 billion loss of carbon fee income. That means no external costs on more than 60 million tons of emissions. The Ministry of Environment alleges to provide discounts in alignment with the "free allocation of EU ETS allowances", but the domestic carbon fee rates are still lower than the EU’s set rates. Companies exporting to the EU will still face the pressure of additional carbon tax, and they could dump that burden to downstream companies. Taiwan CSC could become an example of that, passing the pressure to downstream small and medium fastener enterprises and potentially intensifying the impact on industries and the society in Taiwan. Environmental protection groups suggest carbon fees be set at a higher rate in the future to yield substantial carbon reduction benefits. They hope that the Ministry of Environment will stick to the bottom line of NTD 500 charged per ton of emission and the minimum post-discount price of NTD 300 per ton.

On May 7, the Ministry of Environment held the third carbon fee review meeting, where it stated that enterprises must implement a "voluntary reduction plan" before they can obtain preferential rates, which is to force enterprises to reduce carbon emissions. Without emission reductions, the preferential rates will not apply. During the meeting, some members had different opinions on whether to raise or lower the carbon fee rates. Therefore, the Ministry of Environment is trying its best to collect suggestions from all parties and entrusts Chung-Hua Institution for Economic Research to use models to calculate the potential carbon reduction performance, consumer price index and other economic influences under different rates. Related assessment data will also be made public for inspection by everyone.

In addition, Public Construction Commission of Executive Yuan has begun planning and adopting a step-by-step approach to carbon reduction targets for public projects. A database of building materials’ carbon emission intensity has been launched

in the first half of 2024. The Commission will start off from the design and building material aspects to help public projects reduce carbon emissions. The ultimate goal is to roll out carbon reduction guidelines for 8 categories of public projects, including buildings, railway, water facilities, bridges, etc., all of which must comply with carbon reduction standards covering aspects from design to construction. In addition, server rooms consume a lot of electricity, and particularly, Taiwan's electricity usage is higher than in other countries. Therefore, although server rooms are not included in the 8 construction categories, carbon reduction guidelines will be introduced to reduce ineffective power use from the design phase.

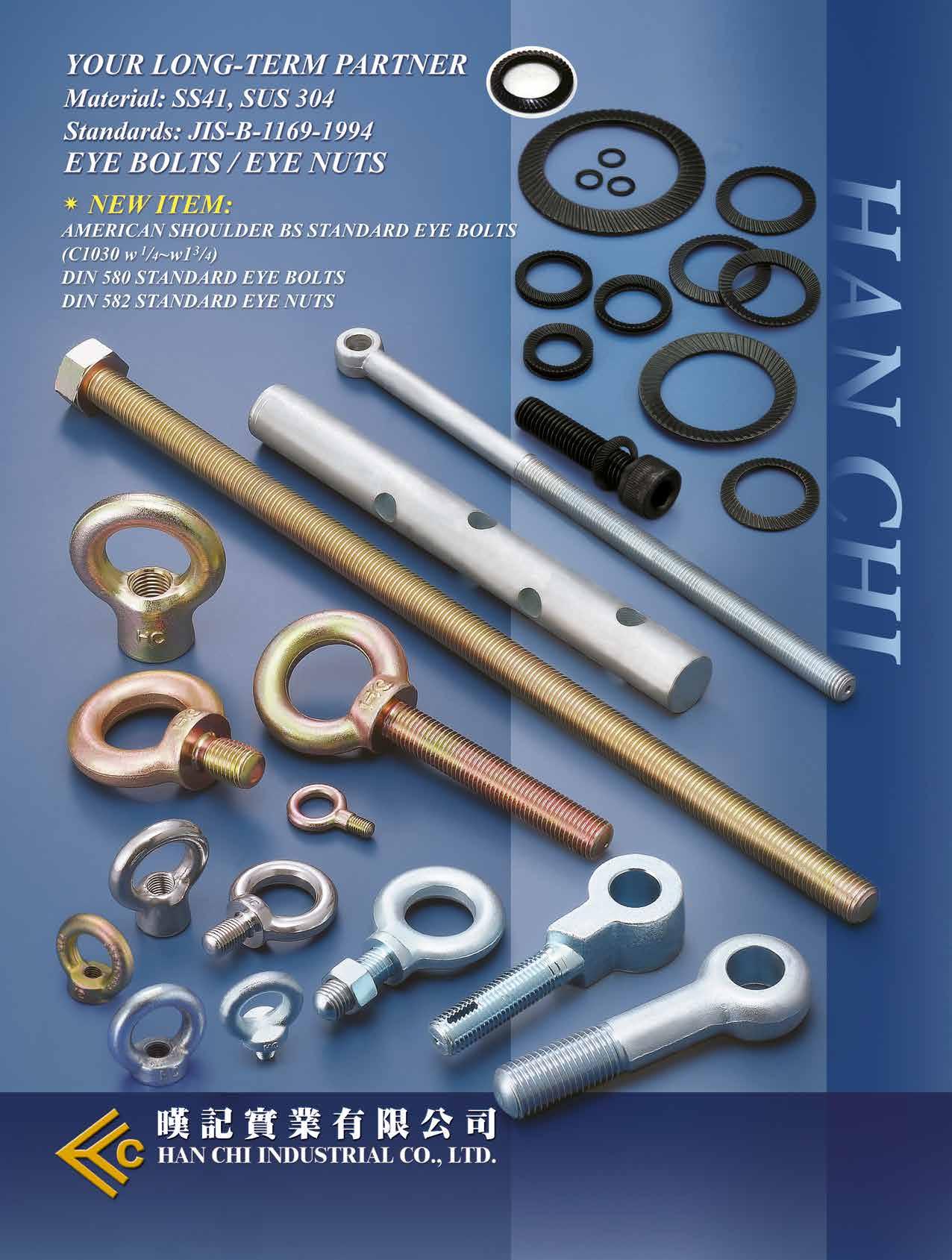

The guidelines are like operation manuals and will become mandatory upon introduction. The standard operation procedures for calculation methods, construction and design will be formulated for government authorities and enterprises to follow. The scope of the guidelines may be expanded to other types of construction in the future. The carbon reduction guidelines for public projects will also compel Taiwanese construction fastener companies to achieve carbon reduction on manufacturing process or launch lowcarbon fastener products. During Taiwan International Fastener Show this June, Alexander Kolodzik, Secretary General of EFDA, flew to Taiwan to explain the implementation progress of CBAM as well as the points to note. On July 8, representatives from EIFI and TIER (Taiwan Economic Research Institute) held a conference inviting industry experts to discuss carbon content calculation of Taiwanese and European fasteners. The conference was held in expectation of helping Taiwanese companies better comply with CBAM regulations and requirements.

Det Norske Veritas (Norway) issued a press release on April 15 stating that during discussions with customers, it was discovered that EU importers encounter many difficulties in sourcing and submitting actual emission data corresponding to their imports, including:

1. They’ve had difficulty tracing back to the third-country operator who manufactured the goods.

2. The third-country operators had difficulties determining the actual emissions according to the new CBAM methodology.

3. They were not confident in the credibility of emission information they received from the operators.

4. The third-country operators hadn’t taken necessary steps to determine actual emissions.

5. They opted for the simplest way of reporting (default values were pre-filled in the CBAM transitional registry).

A report by Bloomberg on April 26 pointed out that some emerging and developing countries brought up questions against CBAM. At the WTO's 13th Ministerial Conference, 66 countries called on the EU and other countries to "refrain from imposing unilateral trade-related environmental measures to prevent such measures from creating unnecessary obstacles to trade." CBAM has been criticized for its lack of exemptions or phased implementation for underdeveloped countries.

According to a report by the Financial Times on March 19, the energy industry warned that the EU's introduction of a new electricity carbon tax will lead to an increase in carbon dioxide emissions in Europe and lead to higher prices for EU consumers. CBAM could also reduce North Sea energy collaboration between the UK and Europe, and hinder investment in renewable energy infrastructure. Energy UK said: "CBAM is becoming a regulatory nightmare."

An analysis by a consulting firm AFRY pointed out that CBAM may reduce the EU's import of green electricity from the UK, leading to an annual increase equivalent to 8.3 million cars' carbon emission in Europe. This would be self-defeating given that both the EU and the UK share the goal of achieving net zero. Research suggests that CBAM's tax on a range of carbon-intensive products will significantly increase the price of electricity traded via interconnecting cables between the UK and the EU.

Danish electricity transmission system operator Energinet said electricity imports from the UK will “fall significantly" once the carbon border tax is imposed. This will make the EU more reliant on domestic production, leading to higher prices and the use of natural gas for electricity generation.

In 2023, a study pointed out that CBAM may lead to a 0.29% decrease in global exports of the metal products industry and a 1.49% decrease in steel industry exports. Exports from South and Central Asia will fall sharply, highlighting the disruption to trade that economies heavily reliant on these industries could face.

CBAM was launched on a trial basis last October. So far, Taiwan ranks fifth in the world in terms of the number of companies having submitted carbon emission data, showing that Taiwanese companies are closely monitoring CBAM. The Taiwanese government is striving to introduce carbon fee next year, and it is currently in a tug of war between enterprises and environmental protection groups regarding the calculation and preferential rates of the carbon fee. Despite that, the future roadmap is already set for Taiwan’s carbon fee regulations. Fastener World interviewed a number of Taiwanese companies and found that Taiwanese fastener companies attach great importance to this issue. Most of them have already carried out carbon reduction transformation and will actively cooperate with Taiwan’s regulations and CBAM regulations. However, outside of Taiwan, CBAM still faces many challenges, including difficulties in data tracing, concerns over the impact on renewable energy development, and trade barriers against underdeveloped countries. Everyone is fumbling for a way out of the CBAM maze. Fastener World will continue to actively monitor the latest news of CBAM and hopes to clear up the haze for readers by sharing information.

P oland's fastening tools sector has experienced significant growth and evolution from 2021 to 2023, driven by technological advancements, trade dynamics, and market innovations. As a pivotal player in the global assembly fastening tool market, valued at over US$3 billion in 2020 and projected to reach US$4.8 billion by 2031, Poland's trade landscape has played a crucial role in shaping the industry growth. This comprehensive analysis explores Poland's integration of smart technologies, increasing demand for fasteners across various industries, and the adoption of battery-powered tools, all within the context of trade dynamics, highlighting key trends, challenges, and opportunities.

Poland's strategic geographical location within Europe has positioned it as a key player in international trade, facilitating market access and expansion. Leveraging its logistical infrastructure and favourable trade agreements, Poland's fastening tools industry has expanded its global reach during the review period. Exportoriented strategies have enabled Polish manufacturers to penetrate new markets, establish strategic partnerships, and diversify their customer base. Participation in international trade fairs and exhibitions has provided platforms for showcasing products, networking, and exploring business opportunities globally. By capitalizing on trade dynamics, Poland's fastening tools industry has enhanced its competitiveness and visibility in the global market, driving sustained growth and market leadership.

Technological advancements have revolutionized the fastening tools market globally, with Poland at the forefront of innovation. The introduction of smart assembly fastening tools, equipped with advanced sensors and connectivity features, has transformed manufacturing processes across industries. In Poland in the 20212023 period, the adoption of smart tools gained momentum, driven by the need for precision, efficiency, and data-driven insights. These tools offered real-time monitoring, error detection, and performance optimization, catering to the rising demand for premium quality output. Polish manufacturers embraced smart technologies, enhancing operational efficiency, and reinforcing their competitive edge in the global market. By leveraging smart tools, Poland's fastening tools industry positioned itself as a leader in technological innovation, driving market growth and competitiveness.

In the same period, Poland's fastening tools market witnessed a surge in demand for assembly fasteners across diverse end-use industries, reflecting global trends. From aerospace & defence to automotive, semiconductor & electronics, and construction sectors, assembly fasteners played a vital role in facilitating permanent and temporary joining, easy assembly, and high load-bearing capacity. Polish manufacturers responded to this demand by ramping up production of fasteners, leveraging cost-efficient manufacturing processes and readily available raw materials. The adoption of assembly fasteners tools for various industrial applications underscored their versatility and reliability, driving their widespread adoption across Poland and beyond. This increasing demand for fasteners fuelled market growth and underscored Poland's significance in the global fastening tools trade.

Battery-powered tools emerged in the same period as a catalyst for market growth and innovation within Poland's fastening tools sector. With a focus on lightweight design, efficiency, and portability, lithium-ion battery-powered tools gained popularity among Polish manufacturers and end-users alike. The adoption of cordless power tools surged, driven by the need to enhance efficiency, productivity, and performance across industries. Technological advancements in assembly fastening tools, coupled with the adoption of lithium-ion batteries, propelled market growth, driving demand for battery-powered solutions. Polish companies invested in research and development to develop cost-effective, high-performance tools, aligning with global market trends and reinforcing Poland's position as a leader in fastening tools innovation. By embracing battery-powered solutions, Poland's fastening tools industry continued to drive market growth, meeting evolving industry demands and customer preferences.

From 2021 to 2023, Poland's imports and exports of fastening tools, categorized under HS Code 8207, witnessed fluctuations, reflecting the evolving trade landscape:

Poland's imports of fastening tools experienced a slight decline from 2021 to 2023, indicating potential shifts in sourcing strategies or changes in domestic demand. Des pite the decrease, imports remained significant, reflecting Poland's reliance on imported inputs to support manufacturing processes and meet market demand.

Conversely, Poland's exports of fastening tools demonstrated resilience, maintaining relatively stable levels during the review period. This underscores the competitiveness of Polish manufacturers in the global market and their ability to meet diverse customer needs.

Poland's fastening tools sector thrives on robust international trade relationships, with key partners

influencing both import and export dynamics. Among these partners, Germany emerged as a paramount player, standing out as the top importer and exporter of fastening tools to and from Poland.

The import data from 2021-2023 reveals significant trends in Poland's fastening tools trade. Germany, as the leading exporter, consistently supplied a substantial volume of fastening tools to Poland. This trend features the strong trade relationship between the two countries and highlights Germany's pivotal role in meeting Poland's demand for fastening tools.

On the contrary, Poland actively exported fastening tools to various countries, with Germany prominently featured as the top destination. The export data from 2021-2023 demonstrates Poland's capacity to supply highquality fastening tools to the German market, reflecting the competitiveness of Polish manufacturers in meeting the international demand.

The comparison between imports and exports data further underscores the symbiotic trade relationship between Poland and Germany in the fastening tools sector. Germany's position as both the largest importer and exporter of fastening tools highlights the interdependence and mutual benefit derived from trade between the two countries. This close partnership not only strengthens economic ties but also fosters collaboration and innovation within the fastening tools industry.

Looking ahead, the forecast for Poland's fastening tools trade with Germany remains promising. With exports to Germany reaching approximately US$79.5 million in 2023 and imports from Germany totalling around US$166 million during the same period, the trade relationship is poised for continued growth and collaboration. Strategic implications include the need for further cooperation, investment in technology, and market expansion initiatives to capitalize on emerging opportunities and sustain mutual benefits for both Poland and Germany in the fastening tools sector.

Looking ahead, several factors are likely to influence Poland's fastening tools trade beyond 2023:

1. Market Expansion: With global demand for fastening tools expected to continue growing, Poland's exports are poised to remain robust, driven by increasing market penetration and product competitiveness.

2. Technological Innovation: The integration of smart technologies and the adoption of battery-powered tools are anticipated to accelerate, further enhancing Poland's position as one of the leaders in fastening tools innovation in Europe.

3. Trade Dynamics: Continued focus on trade diversification, strategic partnerships, and market expansion initiatives will be crucial for Poland to navigate evolving trade dynamics and capitalize on emerging opportunities.

4. Regulatory Environment: Compliance with regulatory requirements and adherence to international standards will remain paramount, ensuring Poland's continued access to the global market and maintaining customer trust and confidence.

From 2021 to 2023, Poland's fastening

advancements, expanding market reach, and maintaining competitiveness, Poland's fastening tools industry is well-positioned for sustained growth and leadership in the global market. As the industry moves forward, continued investment in innovation, trade diversification, and regulatory compliance will be essential for Poland to seize opportunities and navigate uncertainties, driving economic prosperity and industry excellence for the nation.

Sources:

Assembly Fastening Tool Market Report, by Transparency Market Research ITC, Trade Statistics for International Business Development

Copyright owned by Fastener World / Article by Shervin Shahidi Hamedani

Compiled by Fastener World / Updated on July 17, 2024 / Monetary unit in million except for EPS

1,050.762 vs. 985.073

1,628.572 vs. 1,362.907

330.248 vs. 293,814

Eclatorq's 2023 revenue was NTD 480.057 million, up 6.9% from NTD 448.763 million in 2022. The company ended the fiscal year with NTD 133.036 million in net profit in 2023, up 4.5% from NTD 127.252 million in 2022. Total assets increased to NTD 1,050.762 million in 2023 from NTD 985.073 million in 2022.

Proxene's 2023 revenue was NTD 915.526 million, up 1.2% from NTD 904.420 million in 2022. The company ended the fiscal year with NTD 170.228 million in net profit in 2023, down 5.8% from NTD 180.826 million in 2022. Total assets increased to NTD 1,628.572 million in 2023 from NTD 1,362.907 million in 2022.

Jenn Feng Group's 2023 revenue was NTD 194.406 million, down 31.8% from NTD 285.107 million in 2022. The company ended the fiscal year with NTD 28.249 million loss in net profit in 2023, as compared to NTD 27.498 million loss in 2022. Total assets increased to NTD 330.248 million in 2023 from NTD 293,814 million in 2022.

Atlas Copco's 2023 revenue was SEK 172,664 million, up 22.1% from SEK 141,325 million in 2022. The company ended the fiscal year with SEK 28,052 million in net profit in 2023, up 19.4% from SEK 23,482 million in 2022. Total assets increased to SEK 182,684 million in 2023 from SEK 172,301 million in 2022.

Bosch's 2023 revenue was SEK 91,596 million, up 3.8% from SEK 88,201 million in 2022. The company ended the fiscal year with SEK 2,101 million in net profit in 2023, up 61.6% from SEK 1,300 million in 2022. Total assets increased to SEK 108,330 million in 2023 from SEK 100,247 million in 2022.

vs. 100,247

vs. 9,865

16,615 vs. 14,723

9,284 vs. 8,773

602,265 vs. 621,657

19,241 vs. 18,857

Estic's 2024 revenue was JPY 7,127 million, up 6.1% from JPY 6,718 million in 2023. The company ended the fiscal year with JPY 1,133 million in net profit in 2024, up 5.0% from JPY 1,079 million in 2023. Total assets increased to JPY 10,730 million in 2024 from JPY 9,865 million in 2023. The company forecasts 2025 revenue at JPY 7,876 million, up 10.5%.

KTC's 2024 revenue was JPY 8,428 million, up 0.4% from JPY 8,396 million in 2023. The company ended the fiscal year with JPY 645 million in net profit in 2024, up 8.7% from JPY 593 million in 2023. Total assets increased to JPY 16,615 million in 2024 from JPY 14,723 million in 2023. The company forecasts 2025 revenue at JPY 9,800 million, up 16.3%.

Lobster's 2024 revenue was JPY 5,925 million, down 0.4% from JPY 5,950 million in 2023. The company ended the fiscal year with JPY 279 million in net profit in 2024, down 11.0% from JPY 314 million in 2023. Total assets increased to JPY 9,284 million in 2024 from JPY 8,773 million in 2023. The company forecasts 2025 revenue at JPY 6,070 million, up 2.4%.

Makita's 2024 revenue was JPY 741,391 million, down 3.0% from JPY 764,702 million in 2023. The company ended the fiscal year with JPY 43,691 million in net profit in 2024, up 273.3% from JPY 11,705 million in 2023. Total assets decreased to JPY 602,265 million in 2024 from JPY 621,657 million in 2023. The company forecasts 2025 revenue at JPY 710,000 million, down 4.2%.

NS Tool's 2024 revenue was JPY 9,040 million, down 6.4% from JPY 9,656 million in 2023. The company ended the fiscal year with JPY 1,320 million in net profit in 2024, down 10.5% from JPY 1,475 million in 2023. Total assets decreased to JPY 19,241 million in 2024 from JPY 18,857 million in 2023. The company forecasts 2025 revenue at JPY 9,430 million, up 4.3%.

可快速安裝的革命性可調式扳手

The Quick-Fit Jaw by Crescent Tools is engineered to allow you to make quicker fitments on the job. Featuring a 1-degree slope on the lower jaw, the design ensures faster fitment on fasteners, despite differences in dimensions. The new adjustable wrench also features off-corner loading to prevent the rounding of fasteners, a wide jaw design for more access and capacity when in use, as well as a smaller knurl to minimize the risk of accidental back-off.

The Matthews Patriot Wrench combines 7 of the most common cutouts for the professional rigging industry into one low profile tool. Wing nuts, hex nuts and square bolts can be easily adjusted with this thoughtfully designed wrench. A lanyard hole is featured to ensure grid clamps, pipe clamps, bale blocks and more are safely configured when working overhead. The Patriot Wrench is fabricated from 6061-T6 aluminum and is hardcoat type 3 anodized to ensure a lightweight yet durable tool.

The Patriot Wrench features a low-profile wingnut wrench, four hex nut cutouts–7/8” (22mm), 9/16” (14mm), 1/2” (12mm) and 3/8” (9mm)–and two square nut cutouts for pipe clamps in 5/16” (8mm) and 1/2” (12mm) sizes.

用於風力渦輪機組裝和維護的新型扭力扳手

The new BTW-Series Battery Torque Wrench from Enerpac allows operators to quickly move between bolting jobs, while achieving torquing precision. Weighing from just 10 lbs including reaction arm and battery, the BTW-Series is equipped with an integrated digital motor vectoring system delivering accurate and repeatable torque up to 6,000 ft-lbs. Available for 3/4- to 1.5-in. square drive sizes, the BTW-Series Torque Wrench can be used for most bolting scenarios.

The BTW-Series requires just a single operator. Ease of use and compact, handheld, battery-powered design makes it ideal for difficult to reach applications or where physical space is limited. By streamlining bolting workflow, the BTW-Series has the potential to double the productivity of bolting teams.

BTW-Series Torque Wrenches achieve a +/- 5% accuracy across their entire operational range. Using the tool's intuitive LCD display, the required torque in Nm or ft-lbs is set at the touch of a button.

TRUFAST, a leader in residential and commercial building attachments, continues growing its portfolio of TubeSeal self-sealing fasteners and introduced the Thermal-Grip TubeSeal fastener, designed for insulation attachment over an air barrier or WRB.

In a May 17 news release, TRUFAST unveiled its newest TubeSeal product, which is available in lengths for insulation nominal thickness from 1-inch to 4 inches and comes in half-inch increments. Thermal-Grip TubeSeal ensures a tailored fit for various insulation needs. In addition to securely attaching insulation, Thermal-Grip TubeSeal fasteners helps seal blind fastener penetrations of a WRB and/or air barrier while enhancing the overall integrity of the building envelope.

The fastener is suitable for all weather climates with its UV-resistant, semi-rigid tube construction. For added convenience, it is available pre-assembled with various TRUFAST Grip-Deck screws, including SDS (self-drilling) or HiLo thread with various washers for insulation or lath.

HIOS Inc. launched presale of the wireless "HP-100" and "HP-10" torque meters in Japan on April 22. This is the first model in the series to feature the ability to transfer torque data wirelessly.

The HP series is a high-performance torque meter that comes standard with data transfer in addition to basic performance such as high-precision torque measurement, check of measurement errors, and built-in battery. In addition to accuracy and convenience, it supports a wide range of applications from torque measurement of electric screwdrivers to measurement of torque wrenches.

HIOS's high-precision measurement has evolved into three modes. Users can check the "peak value", "waveform", "continuous waveform" and other precision values, or check torque changes via visualized graphs. The HP series takes into account precise and accurate display as well as viewing convenience.

杯形螺栓,彈性帶來高鎖定效果

Nitto Seiko has released a type of Cup Bolt, which is a flange-type locking bolt that can replace bolts incorporating spring washers and flat washers. This new product is currently patent pending.

Conventional locking bolts generally use a combination of a spring washer and a plain washer. The new Cup Bolt has a flange integrally molded on the head with a tapered undercut section extending from the neck to the outer periphery, and a continuous undercut section located at the outermost periphery. It has a cup shape consisting of a flat part. When fastened, this part elastically deforms and acts like a spring washer, so you can get a strong locking effect without using a spring washer or flat washer. Additionally, by reducing the number of parts, the Cup Bolt achieves a weight reduction of approximately 18% compared to conventional models.

Kamiyama Tekkosho has recently developed a one-shot deck screw called BariKiru that does not require pilot hole drilling. Mass production has been launched since February, and a patent has been filed. BariKiru can perform 4 actions in one step:

1. Drilling pilot holes in the deck material,

2. Counterboring,

3. Tightening screws, and

4. Removing burrs after construction.

仕掆 (鵬綱)企業

價格競爭力100%的特殊手工具與金屬代工廠

Shi Gang Enterprise and Peng Kang Enterprise are sister companies. Located in Renwu District (in Kaohsiung City, southern Taiwan) and OEMspecialized, they engage in professional manufacturing and trading various hand tools and hardware tools. Their focus on manufacturing band strappers, clips and straps made of stainless steel have been extended to providing various hand tools (stainless steel strap tightening tools and cutters), hand tool parts and iron band strappers, forming a diverse and customizable lineup spanning various metal processing and OEM industries, industrial parts for public works and plastic industries. Vic Dai, the second-generation successor said, "There is a serious price war in general hand tools and a bigger market change after the pandemic. China is technologically progressing and continues to encroach on the global market. We can survive this price war because my father owns exclusive know-how and perseverance. He and I oversee and validate each product in person. This makes us the designated OEM partner for many major European and American brands. We are 100% confident of providing quality competitiveness exceeding our counterparts!”

Shi Gang (Peng Kang) Enterprise’s Contact: Vic Dai, Factory Director (Manager) Email: peng.kang@seed.net.tw

To provide affordable prices and smooth purchasing experience, they combined forging, casting, heat treatment, stamping, metal processing, assembly plants, and packaging plants to achieve one-stop service covering order placement to shipment. They have continuously optimized the production line, introduced robotic arms, automated feeders, automated punching machines, and computerized management to successfully achieve up to 50% production line automation.

This March, they announced installing roof solar panels to the factory. Inside, the factory reduces carbon emissions and implements digital transformation via automated production lines and various power saving and recycling measures to build up sustainability and gain another 50 years of glory.

Copyright owned by Fastener World / Article by Dean

中國五金製品協會工具五金分會2024年度會長辦公會

在山東召開

On May 13th, China National Hardware Association (CNHA) management meeting was held in Shandong Province. CNHA Chairman, Vice Chairmen, Tools and Hardware Branch President, Executive President, Vice Presidents, and relevant representatives attended the meeting. The meeting started with a report on CNHA's key work in 2024, and the delegates exchanged views on the recent key concerns of the tool industry. The meeting also introduced the standardization work of tools and hardware in detail, hoping to lead the industry to green development and industrial transformation and upgrade, and expanding domestic demand. In addition, in terms of China International Hardware Show (CIHS) organized by CNHA, the association said that it will fully display Chinese hardware and tools products to customers through various information dissemination channels, both online and offline, and carry out global promotion for Chinese tool enterprises.

泰國明年課徵碳稅,每噸200泰銖

Thailand plans to implement carbon tax when the Global Warming Act comes into effect in 2025. The carbon tax rate will be 200 bahts per ton. Thailand’s launch of carbon tax will help integrate with Europe’s CBAM regulations affecting five commodities in 2026.

Ekniti Nitithanprapas, head of Thailand Excise Department, said that the implementation of carbon tax will adopt international standards and emissions will be taxed at the source. For example, in the past, vehicles were levied based on engine exhaust volume, but now they are levied on carbon dioxide emissions. Vehicles with carbon emissions exceeding 200 grams per kilometer are subject to a tax rate of 35%; vehicles with carbon emissions below 150 grams per kilometer are subject to a tax rate of 25%.

英國就2027年碳邊境稅徵求意見

Britain has launched a consultation on how it should apply a new carbon import levy on some products from 2027 to help protect businesses against cheaper imports from countries with less strict climate policies. Britain, which has a target of reaching net zero emissions by 2050, launched an emissions trading system (ETS) in 2021 to charge power plants, factories and airlines for each ton of carbon dioxide they emit as part of the efforts to meet that goal. The planned carbon border adjustment mechanism (CBAM) will apply to imports of carbon-intensive products in the iron and steel, aluminium, fertilizer, hydrogen, ceramics, glass and cement sectors.

Scott McDaniel of Martin Fastening Solutions has been elected as the 2024-2025 president of the National Fastener Distributors Association. Ed Smith of Wurth Revcar will serve as vice president, Christian Reich of Goebel Fasteners will serve as associate chair, and Jim Degnan of S.W. Anderson will remain on the Board as immediate past president. Melissa Patel of Field Fastener, Angela Philippart of AFC Industries, and Christian Reich of Goebel Fasteners has been elected to serve on the Board of Directors effective June 12, 2024.

Continuing on the NFDA Board are Steve Andrasik of Brighton-Best International, Gigi Calfee of Copper State Bolt & Nut, Jake Glaser of Sherex Fastening Solutions, Alex Goldberg of AMPG, and Scott Longfellow of Huyett.

Britain's benchmark ETS carbon contract currently trades around 36 pounds (US$46) per metric ton, while contracts in China's ETS trade around 84 RMB (US$11.67) per ton. Britain proposed using the average auction price of permits in its ETS over the preceding quarter as a reference price for the levy. “Using a quarterly reference ... would allow for the UK CBAM rate to track the changes in the UK ETS price throughout the year,” the document said.

It proposes the first CBAM accounting period should run from Jan 1, 2027, to Dec. 31, 2027, and that from 2028 accounting periods should become quarterly. The consultation was open until June 13 and sought views specifically from tax advisers, professional bodies, importers and businesses from Britain and overseas.

巴西新關稅實施前大量中國電動汽車湧入

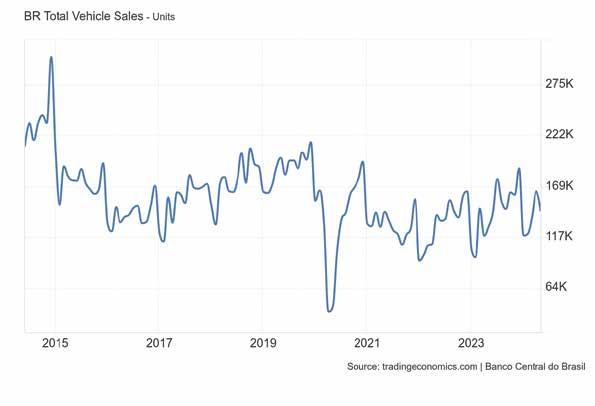

Brazil's car import soared in the first quarter of 2024, driven by an inflow of EVs from China. The data released by the Brazilian Ministry of Development, Industry, Trade and Services showed that from January to March, Brazil's passenger car import increased by 46.4% year-on-year, reaching a market value of USD 1.5 billion. Out of this market value, Chinese cars alone accounted for about 40%, and the import surged by 450% compared with the same period in 2023. The Ministry said the growth in import was driven by cars imported from China, which were mainly pure electric and hybrid vehicles. The import tax on EVs had been reduced to zero since 2015, but Brazilian President Lula reinstates it this year to encourage the development of the domestic auto industry. Starting in January, the import tariff for pure EVs was 10%, increased to 18% in July and will eventually reach 35% in July 2026. Hybrid vehicles were subject to a 15% import tax earlier this year, which rose to 25% in July, and will reach 35% in July 2026.

美國國貿委員會關稅修正: 中國扣件適用不同稅率

According to the recently announced revision to the General Schedule of Tariff Applications of the U.S. International Trade Commission (USITC), certain fasteners from People’s Republic of China under HS Code 7318 and its subcategories will be subject to different tariff rates (and up to 45% for some subcategories), in addition to the preferential rates for certain countries and the normal rates for the rest of the countries. For details of the applicable rates, please visit https://hts. usitc.gov and click “Chapter 73” for further details or download the list.

豐達科航太布局有斬獲

Aerospace fastener manufacturer NAFCO recently announced that it has obtained qualified supplier certification from international aerospace engine manufacturer Pratt & Whitney, which is expected to enhance NAFCO's future development and deployment in the global aerospace market. Pratt & Whitney is a manufacturer of military and civilian aerospace engines and one of the three largest aerospace engine manufacturers in the world. NAFCO is one of the few international aerospace engine fastener manufacturing companies certified by Pratt & Whitney in the Asia-Pacific region. NAFCO is a manufacturer certified to aerospace NADCAP, AS9100 aerospace quality system and IATF16949 automotive management system. It provides various aerospace fasteners and components to major global aerospace engine manufacturers including GE, Pratt & Whitney, Rolls-Royce and Safran Group. NAFCO said that in recent years, it has continued to improve process technology and develop high-value-added precision manufacturing capabilities for machined aerospace products. To date, more than 8,000 NAFCO aerospace products have passed customers’ certification, making it a qualified supplier to four largest aerospace engine manufacturers in the world.

The Fastener Mart平台擴增扣件與五金產品項目

A leading fastener distributor, ASAP Semiconductor is proud to announce its plan to expand the selection of offerings featured on "The Fastener Mart", a leading platform it owns that is dedicated to providing an extensive collection of specialty fasteners and hardware that find use in industrial processes, aviation operations, and other rigorous applications. Presently, The Fastener Mart offers a comprehensive selection of hardware part types, including nuts and bolts, aircraft fasteners, and various forms of industrial hardware. With the planned expansion of offerings made through market analysis and monitoring industry trends, the website will be able to provide access to an even larger inventory, making it easier for customers to find the precise parts they need for their projects.

As the demand for reliable fasteners continues to grow, The Fastener Mart remains at the forefront, offering a wide range of products that meet the highest standards of quality and performance. With its expanded inventory and unwavering commitment to customer satisfaction, The Fastener Mart is poised to continue its growth as a reputable platform for specialty fasteners and industrial hardware.

Fastener SuperStore, a 20-year veteran of online selling and distribution of hardware solutions, has announced the opening of their new headquarters and primary distribution center in Downers Grove, IL. Founded in 2005, Fastener SuperStore's business model focuses on on-demand shipping of bulk industrial fasteners such as screws, bolts, nuts, washers, spacers and standoffs. Fastener SuperStore has recently added services such as kitting, painting and plating to expand their product offerings. While the relocation won't alter the essence of Fastener SuperStore's operations, the expansion into a larger and better-equipped warehouse offers exciting opportunities for availability and productivity. With an increased inventory capacity, the new headquarters will allow Fastener SuperStore's warehouse to better meet the evolving needs of customers.

With the recent expansion, Fields says customers can continue to count on the same level of reliability and quick service that Fastener SuperStore has always delivered. Fastener SuperStore ships more than 95% of online orders same-day and has recently increased their catalog by 1,000+ products. Fastener SuperStore's new headquarters is fully operational starting June 2024.

LISI與Watch Out建立合作 夥伴關係

LISI Group and Watch Out have been partners for nearly 20 years in the field of high-precision machining, and then in the development of a disruptive AI solution for fully autonomous machining which is now operational. LISI Group has decided to support Watch Out in the deployment of this turn-key autonomous precision machining solution now ready for scale-up and thus strengthen its partnership with Watch Out by taking a minority stake in its holding company through a capital increase.

“The Watch Out solution, a technological feat of Machining 4.0, combines all the conventional machining cycles in a perpetual loop with a specific Artificial Intelligence. It is a virtually self-sufficient production machine that constantly self-corrects according to data generated and captured in real time on parts and tools. Much more than just an improvement on the performance offered by previous-generation machine tools, the Watch Out solution represents a dramatic change in industrial paradigm aimed at eliminating the element of randomness in the treatment of chronic failures in the production chain,” said Emmanuel Neildez, CEO of LISI AEROSPACE.

Auto Fasteners, a global supplier of fasteners and metal-engineered components to the automotive sector, has expanded its presence in Southam by leasing 15,000 sq. ft. of space at a new industrial scheme.

Already operating five units in Southam, Auto Fasteners has signed a 10-year lease on three additional units at Sucham Park, facilitating its ongoing growth. These units will serve as a warehouse, assembly, quality inspection, and office space for the company, which supplies parts to a range of automotive manufacturers including Volvo Group, Scania, Daimler Group, Ford, Stellantis, VW Group, Aston Martin, and Jaguar Land Rover.

日本太陽Fastener公司完成德島物流中心

Taiyo Fastener has built a new logistics center near its factory in Tokushima. The Tokushima factory can produce 100 million stainless steel screws per month, including standard products, original brand products, and products with special uses and shapes. Since the existing warehouse space was full, a logistics center was set up nearby and launched in February this year.

The center covers an area of 2,500 square meters and has introduced the latest rack-type fully automatic system, which can accommodate up to 4,000 pallets. Thanks to the adoption of "Warehouse Control System", the Osaka headquarters can transmit orders to the logistics center in real time, prevent shipping errors, and achieve ultra-high speed. The automatic rack is 15 meters high, having 14 levels of storage spaces. The height of the lower spaces is lower than that of the upper spaces. The lower spaces are used to store low storage pallets and empty pallets.

瑞典BUMAX宣布新美國總經銷商

Swedish premium fastener manufacturer BUMAX AB is excited to announce the recent appointment of Star Stainless Screw Company, as its new master distribution partner in the US. The announcement marks a notable step forward in the BUMAX route to market in the US and is part of the company’s ongoing development strategy for the North America region. Established in 1950, Star Stainless Screw Co. has built an unrivaled reputation throughout the US as an importer and distributor of fastener products in a range of stainless steel and other exotic alloy materials. With a network of distribution centers in strategic locations, Star Stainless is well placed to serve its extensive customer base

美國Illinois Tool Works未

達第二季銷售目標

Manufacturing company Illinois Tool Works missed analysts' expectations in Q2 2024, with revenue down 1.2% year on year to US$4.03 billion. It made a GAAP profit of US$2.54 per share, improving from its profit of US$2.48 per share in the same quarter last year. Illinois Tool Works manufactures engineered components and specialized equipment for numerous industries. of fastener and industrial component suppliers across the country. Star Stainless will be responsible for stocking and supplying the extensive BUMAX range of high-strength stainless steel products to fastener distributors and industrial product suppliers throughout the US. This partnership will significantly improve the availability, accessibility and speed of supply of BUMAX products to customers in the US.

由於美國技術人員的工具需求下降,Snap-On 銷售下滑

Snap-On missed Wall Street estimates for secondquarter sales as higher tool prices and steeper borrowing costs dampened demand among US vehicle service and repair technicians.

Snap-On, known for its high-quality tools, faced a chilly reception from the market as US technicians tightened their belts. Tool prices have climbed, and elevated borrowing costs are prompting many to defer purchasing new tools. This has caused a significant slump in sales for Snap-On's core tools segment, which saw an 8% drop to US$482 million in the second quarter ending June 29. Despite robust international sales, Snap-On’s overall net sales dipped by 1% to US$1.18 billion, falling short of the US$1.2 billion forecast by analysts.

While Snap-On struggled domestically, the company’s Commercial and Industrial Group unit saw a 2% sales increase to US$372 million thanks to demand from sectors like military and aerospace. This divergence underscores the complex dynamics at play: while consumer-facing segments are pinching pennies, industrial and commercial sectors might still offer growth opportunities amid economic uncertainties.

TR Chai Yi Precision Fastenings Manufacturing, now part of the Trifast plc group of companies, is celebrating the launch of its Chinese manufacturing facility in the key industrial city of Dongguan, within the Guangdong Province, capitalizing on years of increasing demand in the region.

The new 2,800 sq. metres of manufacturing space houses 44 cold forging machines and 36 thread rolling machines producing 0.6mm to 4mm micro screws and thread forming screws, in steel, stainless and titanium, with an output of around 1 billion pieces per annum.

TR Chai Yi is proud to have achieved the globally recognised ISO 9001 certification demonstrating that TR has met the stringent criteria required for quality, safety and efficiency standards for its products and services to customers in the region. The accreditation affirms that the team is committed to providing the highest level of quality across the organisation and is continually looking at ways to improve. The new China plant is the company’s seventh global manufacturing facility with factories now also in Italy, Singapore, Taiwan and Malaysia.

Blue Ribbon Fastener併購Nationwide Fastener Systems

Blue Ribbon Fastener, a full-service distributor of fasteners and other Class-C components, announced its acquisition of Burlington, Wisconsin-based Nationwide Fastener Systems. Terms of the deal were not disclosed.

For more than three decades, Nationwide Fastener Systems has provided OEM clients with quality Class-C fasteners, inventory management services and other custom solutions that improve supply chain efficiency. The strategic partnership will support growth for Nationwide customers and provide advantages to their clients.

Nationwide Fastener Systems was founded by the late Thomas Lipecki Sr. The family business was purchased and carried on with his son, the late Richard Lipecki, and his wife, Deb.

美國Portland Bolt & Manufacturing公司收購南卡羅 來納州扣件製造商

Portland Bolt & Manufacturing Co., LLC, a leading domestic manufacturer and global provider of anchor bolts and nonstandard, custom fasteners in the U.S., announced it has acquired the South Carolina manufacturing and galvanizing operations of Southern Anchor Bolt Co.

The acquisition highlights Portland Bolt’s strategy to expand its US-based manufacturing footprint into the East, while continuing to offer customers industry-leading delivery times, service, and enhanced dependability. The combined company will offer an increased selection of made-to-order galvanized or plain anchor bolts, rods, studs, and other manufactured and distributed products. Together, the footprint will allow the companies to reach 100% of the US

customers within 2 business days. Leslie Yanizeski, President of Southern Anchor Bolt, will continue to manage the daily operations.

AFC Industries收購加州航太扣 件經銷商

AFC Industries announced that it has acquired Meg Technologies Inc. (MTI), a Southern California distributor of fasteners to the aerospace industry. AFC officials said the deal bolsters its position in the aerospace sector. MTI provides military-standard aerospace fasteners to OEMs, Pentagon contractors, maintenance facilities and other aerospace distributors. MTI officials, meanwhile, said the combination would provide new opportunities for its team. Terms of the deal were not disclosed. AFC, an Ohio-based distributor of fasteners and C-Class components, has pursued a strategy of aggressive merger and acquisition activity in recent years. It acquired seven companies last year alone, and the MTI deal marks its second this year after adding Philadelphia-based Globe International in March.

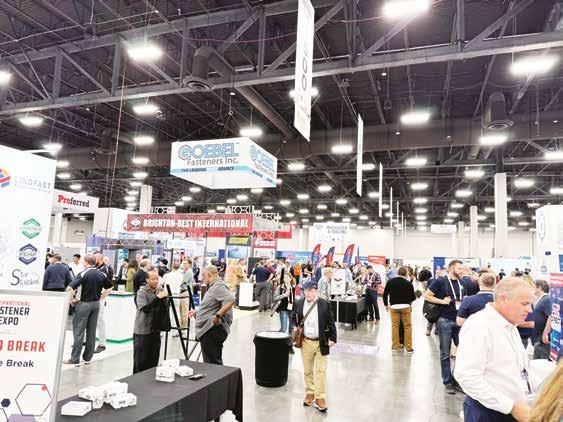

The International Fastener Expo is gearing up for their 2024 show this September 9-11 at Mandalay Bay Convention Center, Halls B & C, in Las Vegas, NV. Each year, thousands of attendees from 30+ countries attend IFE to network and do business with hundreds of suppliers showcasing every type of fastener for several industries including construction, aerospace, military, and automotive. The size, scope, and diversification of the show makes it a go-to event for every stage of the supply chain.

Attendees can look forward to a widespread array of over 600 exhibitors representing the forefront of the fastener industry. From industry giants to innovative startups, the Expo Hall will be a hub of activity, offering a firsthand look at the products and services driving the industry forward. The Expo Hall will be open on September 10 from 9:30AM-4:00PM and September 11 from 9:30AM-3:30PM.

One of the highlights of IFE 2024 is its educational program. Renowned thought leaders will take the stage to share their insights on the current state of the industry and provide valuable perspectives on where it's headed. Topics such as company culture, technology, fastener finishes, electric vehicles (EVs), magnets, mitigating risk, and more are expected to dominate discussions on the Session Stage and Fireside Chat Lounge, offering attendees a deeper understanding of the challenges and opportunities facing the industry. This year ’s event will also include an engaging keynote presentation from Beau Groover, President of The Effective Syndicate, FTI’s full-day training class, and a new 2-hour Marketing Workshop.

Additionally, attendees will be able to connect with the industry by attending networking events, like the annual Golf Tournament, Welcome Reception, and Hall of Fame and Young Fastener Professional of the Year Award Ceremony at the 2024 event.

The countdown to IFE 2024 has officially begun and anticipation is building for what promises to be a transformative event for the fastener industry. There’s no better venue than IFE to foster relationships and connect with new and existing customers.

For more information and to register, please visit www.fastenershows.com.

1848

BI-MIRTH CORPORATION sales@bimirth.com.tw bi-mirth.com

Screws

Bi-Mirth Corporation was founded in 1986, and ever since then our mission has been to strive to be one of the top fastener manufacturers through quality, innovation, and expertise. We have evolved and expanded from a trade company to a manufacturing company based in Gangshan, Kaohsiung with our own forming, electroplating, coating, and packaging plant with approximately 300 employees.

Our company specializes in selfdrilling, self-tapping, wood construction, and concrete screws from diameters M3 to M20 and up to 1,500 mm in length. We're also constantly researching and developing potential products for the market. To ensure our fastener quality, we have a strong quality control team in our company. We currently have CE, C4 and ETA for our European market, and the ICC certification for our American market.

DIN LING CORP. dinling@din-ling.com www.din-ling.com

Chipboard Screws, Drywall Screws, Furniture Screws.

Din Ling Corp.: 35 Years of Excellence in Screw Industry. With a solid track record of over three decades, Din Ling Corp. has consistently provided a wide range of high-quality screws, from Wood Building Screws to Decking Screws and Drywall Screws, and more. Our products enhance your projects with durability and reliability. Trust in our expertise; secure your constructions with our screws. We fix your success!!

DRAGON IRON FACTORY CO., LTD. dragonco@ms9.hinet.net www.dragoniron.com.tw

Screws, Threaded Fasteners.

We, Dragon Iron, are a fastener manufacturer with more than 45 years of experience in the industry, specialized in self-drilling screws, roofing screws and construction screws. Quality and customer service is always the top concern of our company. Be sure to choose Dragon Iron as your source then you will find you are getting the right partner in the fastener field and helping each other grow in the fastener business.

info@patta.com www.patta.com

Screws, Rivets / Rivet Nuts.

PATTA offers comprehensive fasteners and hardware solutions. We prioritize innovation, attention to detail, and uncompromising quality in our services to build trust, enhance customer satisfaction, and earn positive reviews and reputation.

1640

KWANTEX RESEARCH INC.

kwantex@ms18.hinet.net www.kwantex.com.tw

Screws, Fastener Assortments, Threaded Fasteners.

Kwantex Research Inc. was established since 1996 and mainly devotes to Research and Design in the fastener field. We are one of the few enterprises who own the most fastener patents and collaborate with many outstanding fastener companies over the world on innovative products.

Kwantex has in total approximately 175 members of staff and extensive production capacities in Taiwan. Our quality policy is "Products, Delivery and Know-How." Our products mainly focus on high-end fasteners for constructional and industrial applications, and the majority of the patented products have already been massproduced and successfully entered the markets in many advanced countries and areas.

Kwantex will continue to revolutionize new product designs as we plan to present 1~2 new products per year, which helps our agencies or partners not only to update their product line features but also to create new markets. This innovative spirit already provided our customers with higher degree of satisfaction. All of us think, innovation is power and only new products can win.

1649

MOLS CORPORATION

sabrina@molscorp.com.tw www.molscorp.com.tw

Screws

MOLS group has over 30 years of experience in screw manufacturing and operates a supply chain system with screw manufacturing, heattreating and head painting. MOLS manufactures self-tapping screws, metal roofing screws, RV screws, self-drilling screws, home appliance screws, gutter screws, triangular thread screws for various industries like construction, RV, household, wiring devices, HAVC and so on.

With over 30 years of experience to focus on the supply in the US market, MOLS is familiar with what customers' needs and dedicates to quality improvement, and treats customers' comments as treasure. We listen to customers and respond to their needs at our best. MOLS provides our best to all of our customers and uses our valuable resources to create maximum benefits for our customers.

Contact: Sabrina Dai, Senior Marketing Manager

RAY FU ENTERPRISE CO., LTD. export@ray-fu.com www.ray-fu.com

Screws, Bolts, Wire / Wire Forms.

Ray Fu, founded in 2000, is a professional manufacturer and exporter of wires and fasteners. The company's existing wire, screw, packaging and heat treatment plants provide a one-stop service. Ray Fu's products are mainly exported to the construction, household renovation and automotive components markets in Europe, the Americas, and the Asia Pacific.

Ray Fu is extremely demanding of quality, and the company has successively attained various certifications, e.g. ISO 9001, ISO 14001, IATF16949, CE, ETA, and AS9100D, to increase the variety and options of products and provide better customer service.

SPECIAL RIVETS CORP. srcrivet@ms12.hinet.net www.srcrivet.com

Rivets / Rivet Nuts, Air Tools, Hand Tools.

Special Rivets Corp. (SRC) is one of the leading developers and manufacturers of full-line blind rivets, blind rivet nuts and high quality riveting tools. They are also one of the largest rivet manufacturers in Asia. They currently produce over 500 million blind rivets and 100,000 riveting tools per month. A fully automated warehouse and index system ensures accurate and rapid order fulfillment.

Over the past 40 years, they have sold to more than 150 countries and accumulated more than 700 customers worldwide. In addition to their China plant, they have opened a new 45,000 square meter plant in Thailand in 2022 to meet the increased demand for their products in the U.S., Europe, Southeast Asia and around the world.

The Thailand plant has 50% of area currently in use and has about 110 autoforming machines. At this stage, SRC is aiming at a monthly capacity of 100 million pieces of rivets for the Thailand plant, and planning to increase to 300 million pieces of rivets in the future.

1940

AIMREACH ENTERPRISES CO., LTD. sales@aimreachfasteners.com www.aimreachfasteners.com

Screws, Cold Heading / Forming, Specials, Automotive Hardware.

1858

APEX FASTENER

INTERNATIONAL CO., LTD. angel@apex-fastener.com.tw www.apex-fastener.com.tw

1555

DICHA FASTENERS MFG. CO., LTD. service@topseat.com.tw www.dicha.com.tw

Anchoring Devices, Fastener Assortments, Screws.

1948

Cold Heading / Forming, Specials, Nuts & Locknuts, Automotive Hardware.

1743

A-STAINLESS INTERNATIONAL CO., LTD. astainless@hibox.hinet.net a-stainless.com.tw

Screws, Wire / Wire Forms, Electronic Fasteners.

1545

CHIN LIH HSING PRECISION ENTERPRISE CO., LTD. clh@clh.com.tw www.clh.com.tw

CNC Machining, Threaded Inserts, Nuts & Locknuts.

1747

CHIREK FASTENER CORPORATION

kai@chirek.com.tw www.chirek.com.tw

E CHAIN INDUSTRIAL CO., LTD. sqf@sqf.com.tw sales@ech.com.tw www.sqf.com.tw

Screws, Locknuts, Rivets / Rivet Nuts.

1840

EXCEL COMPONENTS MFG CO., LTD. sales02@excelcomponents.com.tw www.excelcomponents.com.tw

CNC Machining, Automotive Hardware, Metal Working.

1647

FANG SHENG SCREW CO., LTD. erie@mail.yfs.com.tw www.yfs.com.tw

1847

HU PAO INDUSTRIES CO., LTD. hupao@hupao.com.tw www.hupao.com.tw

Nuts & Locknuts, Locknuts.

1865

IE PERNG CO., LTD. ieperng.tw@gmail.com www.ieperng.com

Screws, Hand Tools, Cable Ties

1962

J MO ENTERPRISE CO., LTD. service@packcraft.com www.packcraft.com

Packaging, Fasteners, Decoration, Pulling, Casters.

1643

Cold Heading / Forming, Specials, Fastener Assortments, Metric Fasteners.

1853

Bolts, Screws, Threaded Fasteners.

1549

CHITE ENTERPRISES CO., LTD. chite@chite.com.tw www.chite.com.tw

Screws, Cold Heading / Forming, Specials, CNC Machining

1644

CHU WU INDUSTRIAL CO., LTD. sales@chuwu.com.tw www.chuwu.com.tw

Electronic Fasteners, Spacers & Standoffs, CNC Machining.

1656

DAR YU ENTERPRISE CO., LTD. daryu@ms25.hinet.net www.dar-yu.com.tw

Fasteners, DIY Pack.

FENG YI TITANIUM FASTENERS fengyi.ti@msa.hinet.net www.fengyi-ti.com

Hex Head Cap Screws, Cold Heading / Forming, Specials, Metric Fasteners.

1646

GAIN DEN PRECISION CO., LTD. service@gainden.com www.gainden.com/EN

CNC Machining, Metal Working, Screws.

1655

GOFAST COMPANY LTD. fastener@gofast.com.tw www.gofast.com.tw

Cold Heading / Forming, Specials, Threaded Fasteners, Bolts.

1952

HUANG JING INDUSTRIAL CO., LTD. hj-export@umail.hinet.net www.huang-jing.com

Screws, Wire / Wire Forms, Threaded Fasteners.

J. T. FASTENERS SUPPLY CO., LTD. jimmy@jtfasteners.com.tw www.jtfasteners.com.tw

Rivets / Rivet Nuts, Washers & Stampings, Specials.

1947

J.C. GRAND CORPORATION sales@jcgrand.com www.jcgrand.com.tw

Screws, Hex Head Cap Screws.

2056

JENG YUH PLASTICS CO., LTD. jeng.yuh@msa.hinet.net www.plastic-packagingbox.com

Labeling And Packaging Equipment.

1849

JI LI DENG FASTENERS CO., LTD. sales@jldfasteners.com.tw www.jldfasteners.com.tw

Screws, Cold Heading / Forming, Specials, Automotive Hardware.

1755

JUNG SHEN TECHNOLOGY CO., LTD. jungshen@jungshen.com.tw www.jungshen.com.tw

Screws

1942

KATSUHANA FASTENERS CORP. khn.begin@msa.hinet.net www.katsuhana.com.tw

Screws, Threaded Fasteners, Wire / Wire Forms, Specials.

1742

KELLY INTERNATIONAL CORP. angela.chiang@kelly.com.tw www.kelly.com.tw

CNC Machining, Threaded Fasteners, Fastener Assortments.

1964

KENLON INDUSTRIAL CO., LTD. ken.lon@msa.hinet.net www.kenlon.com.tw

Bolts, Cold Heading / Forming, Specials, Rivets / Rivet Nuts.

243

KONFU ENTERPRISE james@konfu.com.tw www.kfanf.com

Tool & Die, Thread Rolling, Cold Heading / Forming, Specials.

1867

KOT UNIONTEK CO., LTD. john@kot.tw www.kot.tw

CNC Machining, Cold Heading / Forming, Specials.

1641

L&W FASTENERS COMPANY king-lin@lwfasteners.com.tw www.lwfasteners.com.tw

Bolts, Nuts & Locknuts, Metric Fasteners.

2052

1563

LINKWELL INDUSTRY CO., LTD. service@linkwell.com.tw www.linkwell.com.tw

Bolts, Screws, Nuts & Locknuts.

1943

LUNA'S LIGHT INTERNATIONAL SOURCING CORPORATION info@lunasinternational.com www.lunasinternational.com

CNC Machining, Electronic Hardware, Automotive Hardware.

2054

LOCKSURE INC. rfq_service@locksure.com.tw www.locksure.com.tw

Cold Heading / Forming, Specials, Nuts & Locknuts, Washers & Stampings.

1953

MAO CHUAN INDUSTRIAL CO., LTD. maochuan@maochuan.com.tw www.maochuan.com.tw

Washers & Stampings, Nuts & Locknuts, Automotive Hardware.

LABEL ONE FASTENER BARCODE. CO., LTD comson@ms22.hinet.net

Labeling And Packaging Equipment.

1949

LINK UPON ADVANCED MATERIAL CORP. maggie.lee@linkupon.com www.linkupon.com

Fastener Assortments, Screws, Metric Fasteners.

1966

ORIMETAL INC. darren@ori-metal.com ori-metal.com

Cold Heading / Forming, Specials, Nuts & Locknuts, CNC Machining.

1954

PINGOOD ENTERPRICE CO., LTD. sales@pingood.com.tw www.pingood.com.tw

Electronic Fasteners, Spacers & Standoffs, Rivets / Rivet Nuts.

1856

PROFESSIONAL FASTENERS DEVELOPMENT COMPANY LIMITED sales.visacom@msa.hinet.net www.visacomfasteners.com.tw Washers & Stampings, Retaining Rings, Cold Heading / Forming, Specials.

1749

REXLEN CORP. marketing@rexlen.com.tw www.rexlen.com.tw

CNC Machining, Metric Fasteners, Washers & Stampings.

1941

SCREWTECH INDUSTRY CO., LTD. sales@screwtech.com.tw www.screwtech.com.tw

Automotive Hardware, Cold Heading / Forming, Specials, Electronic Fasteners.

1855

SHAW GUANG ENTERPRISE CO., LTD. shawguang@yahoo.com.tw www.shawguang.com.tw

Nuts & Locknuts, Metric Fasteners.

2058

SHIN GUANG YIN ENTERPRISE CO., LTD. shin.gyin@msa.hinet.net www.sgy.com.tw

Specials, Cold Heading / Forming, Eye Bolts.

2042

SHIANG GING METAL ENTERPRISE CO., LTD. sgcarbide@sgcarbide.com.tw www.sgmetal.com.tw

Tool & Die, Taps & Dies, Cold Heading / Forming, Specials.

1957

SHYANG SHENG PRECISE INDUSTRY CO., LTD. shyang.her@msa.hinet.net www.splasticinjectionmould.com

Washers & Stampings, Automotive Hardware, Inserts.

1859

SINTEC CO., LTD. sales@sintecmetal.com www.sintecmetal.com

Bolts, Screws, Threaded Fasteners.

1757

SOON PORT INTERNATIONAL CO., LTD. info@soonport.com www.soonport.com

Screws, Fastener Assortments, Threaded Fasteners.

1557

SPEC PRODUCTS CORP. zephyr.chang@spec.com.tw www.spec.com.tw

Screws, Bolts, Automotive Hardware.

1854

STANDING INDUSTRIAL CO., LTD. stddco@ms13.hinet.net www.stddco.com

Screws, Specials, Thread Rolling.

1842

TAIWAN INDUSTRIAL FASTENERS INSTITUTE tifi.tw@msa.hinet.net www.fasteners.org.tw

Screws

1843

TAIWAN PRECISION FASTENER CO., LTD. sales@taiwan-precision-fastener.com www.taiwan-precision-fastener.com

Screws, Threaded Fasteners.

1841

TAIWAN SHAN YIN INTERNATIONAL CO., LTD. ma_dept@shanyin.com.tw www.shanyin.com.tw

Screws

1547

TONE DAR SEEN ENTERPRISE CO., LTD. tdstds.chiao1029@gmail.com en.tdstds.com.tw

Rivets / Rivet Nuts, Screws.

1963

U-WEEN ENTERPRISE CO., LTD. alex@u-ween.com.tw www.u-ween.com.tw

CNC Machining, Cold Heading /

253

VERTIGO FORMING SOLUTIONS vfs.amychang@gmail.com www.vertigoformingsolutions.com

Taps & Dies, Tool & Die, Cold Heading /Forming, Specials. 1654

WATTSON FASTENER GROUP INC. wattsonbell@gmail.com www.wattson.com.tw

Screws

1846

WEI I INDUSTRY CO., LTD. petrina@weii-nut.com.tw www.weii-nut.com.tw

Specials, Nuts & Locknuts,

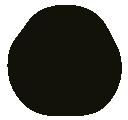

Only Taiwanese exhibitors exhibiting through Taiwan’s exclusive agent Fastener World are listed. 為了方便統計準確,上述台灣扣件展團名單以有向本展台灣總代理商匯達公司報名為準。

North America's mo around the world will be the to network, d meet with suppliers, learn about s and technologies, and do business.

TAIWAN EXHIBITORS

Fastener Fair Mexico is Mexico's main exhibition dedicated to the entire supply chain: distributors, hardware stores, mechanical and industrial design engineers, buyers and manufacturers from different sectors looking for industrial fastening products and solutions.

It attracts exhibitors from the local Mexican fastener related industry, as well as from countries including Taiwan, Israel, China, USA, etc. to present and showcase their latest and innovative fastening, fixing, and assembling products, solutions, and services, which include screws, nuts, bolts, rivets, washers, anchors, fastening tools, molds & dies, machinery, and other peripherals & accessories.

It not only draws the attention of professional fastener industry players to visit and seek further collaboration, but also sees some meaningful and significant visits from other industrial key men and decision makers from the field of hardware and others showing high interest in purchasing or collaborating with each other. In addition to importers, distributors and retailers from Mexico, many potential buyers from neighboring Latin American countries will be in attendance looking for sourcing and collaboration opportunities.

It is the best option to generate high-quality leads and connect with buyers in the short term, obtain brand presence with segmented profiles and reconnect with current clients, strengthening business relationships.

This year, East Hall and South Hall were open to the public, with exhibits focusing on 3D printers, generative AI, DX for back office, factory DX, mechanical components, manufacturing & inspection, unique technologies, production management system, processing technology, accident prevention, ODM/ EMS, global suppliers, 3D scanner, CAD/CAE, and medical technologies, etc. There were also other thematic exhibitions related to design and manufacturing, machining, medical, AI, aerospace and so on. In addition, the organizer provided free shuttle buses between the two halls for exhibitors and visitors.

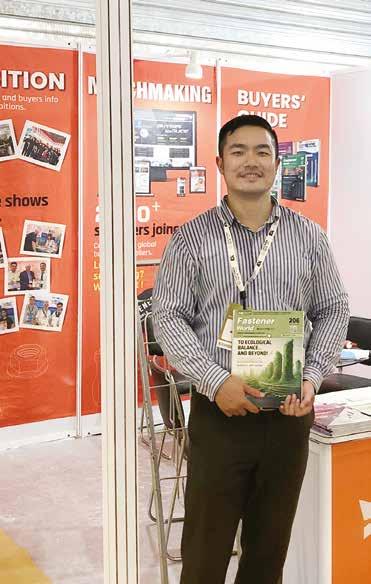

Japan's largest manufacturing-related trade show, Manufacturing World Tokyo, kicked off on June 19-21 at the Tokyo Big Sight. About 2,100 exhibitors from Japan and overseas registered to participate in this annual industry event, and a wide range of fasteners and screwfastening products were on display.

According to the statistics of the organizer, the show attracted around 20,000 visitors per day to explore suppliers, partners and observe the latest technology, products and services of the industry, and attracted nearly 70,000 industry professionals in total over the 3 days. In addition, in order to enrich the experience of exhibitors and visitors, the organizer also arranged more than 20 seminars during the 3-day exhibition period, inviting local and international industry leaders and experts to share their professional observations and insights on current trends, product and technology applications, and future challenges (e.g. automotive, AI, digital transformation, green manufacturing, carbon neutrality).

Fastener World Magazine, which has the largest circulation and the highest marketing coverage in the world, was also present at this year's show. Not only did it distribute its latest publications on-site, but also actively visited potential Japanese exhibitors at the show, hoping to help customers interested in expanding into the Japanese market to continue to step up their promotional efforts and reach out to more potential business opportunities. It is understood that many local buyers are interested in the products of the suppliers after reading our magazines and trying our online B2B platform, and they do not rule out the possibility of further negotiation and cooperation with these manufacturers in the future.

In addition to the series of shows in Osaka, Nagoya and Fukuoka, the organizer has announced that the next Manufacturing World Tokyo will be held on July 9-11, 2025 at Makuhari Messe. For more information, please visit Fastener World’s website at www.fastener-world.com.

Astudy by Straits Research predicts that the Indian industrial fastener market is expected to reach US$17.868 billion by 2030, with a compound annual growth rate of 7.9% until 2030. India has become one of the hot markets for global manufacturing investment in recent years. This year's show was held against this backdrop with the expectations of market investors.

The show was held in Hall 6 of the venue, Pragati Maidan, divided into a threeday fastener show and a four-day parts and components show. Fastener World led 6 Taiwanese exhibitors to the show, including Ray Fu Enterprise, Chite Enterprises, Hurmg Yieh Machinery, L & W Fasteners, Homn Reen Enterprise, and Yih Tieng Machinery, bringing Taiwan's high-quality and well-received fastener and machinery suppliers with high cost performance ratio to the Indian market. Meanwhile, Fastener World introduced many Taiwanese suppliers to Indian visitors through its publications.

Fastener World’s exhibitor observed that a majority of the show’s exhibitors were local Indian companies, with the rest from Japan, China and other countries. The visitors were mainly local fastener importers, distributors and manufacturers. The products that visitors inquired about were mainly fasteners, CNC products, fastening tools, precision parts, and machines. It was quite good considering the number of visitors. In addition to interacting with visitors, many exhibitors took the opportunity to meet long-time customers. Many buyers were very interested in working with Taiwanese and Chinese fastener and machine manufacturers, looking to find more high-quality product sources. The demand for construction fasteners and various industrial parts was high there. Many Indian manufacturers said they once purchased machines from Taiwan. They said Taiwan provides better quality. There were also some Indian manufacturers looking to find Chinese suppliers offering cheaper prices.

印度新德里螺絲展 南亞市場對建築與工業 扣件需求攀高

On another note, BIS certification will pose a future challenge. Initially, only Indian manufacturers were required to have this certification, but in the future, overseas manufacturers who want to sell products to India will also be required to pass this certification. However, the implementation details are currently only drafts and have not yet been officially in force. Companies interested in entering the Indian market must pay more attention to BIS information.

The organizer will announce the next launch of the show. Fastener World will have the latest information and will announce it right away. Log onto Fastener World website at www. fastener-world.com to track the latest development.

United Expo International is the sole agent of this exhibition in Taiwan. Taiwanese exhibitors in this exhibition represented by United Expo included Yow Chern, Your Choice, Younturn, Wan Iuan, U-Ween, Super Nut, Soon Port, Shen Chou, Shaw Guang, Nova. Fastener, Mols, Mao Chuan, Mac Precision, Long G, L & W, King Point, Ji Li Deng, IE PERNG, Hsin Jui, Homeyu, H-Locker, Fontec, Feng Yi, Evereon, Eray, Chite, Chia Long, Canatex, Bi-Mirth and ABS.

Fastener World was also present at the show this year to distribute our magazines to strengthen the promotion and publicity of products and services for customers intending to enter the North American market. According to Fastener World's on-site staff, this year's visitor flow was obviously more than that of the 2023 show, and the crowd was very enthusiastic on the 2-day exhibition. We encountered a lot of new customers who traveled from afar to inquire about products and the latest magazines, and there were also many buyers who came to Fastener World booth to ask for information about suppliers of industrial fasteners, clamps, and other related products.

Fastener Fair USA, one of the most important trade shows in North America dedicated to the fastener industry and its peripheral manufacturing industries, took place at Huntington Convention Center of Cleveland on May 22-23 this year, following the success of the last edition in Nashville, which attracted many exhibitors and buyers, providing an excellent business matching and exchange platform for supply chains and indemand buyers from the U.S. and other countries.

Visitors this year mainly came from advanced manufacturing, agriculture & off-highway, aerospace, industrial machinery, maintenance, appliances, marine, automotive, military, construction, renewable energy, distribution, electronic & telecom...and other industries. A total of 234 exhibitors registered for the show, with the majority of exhibitors from the U.S. Taiwan and China were the only two major overseas exhibitors groups, totaling 35 and 36 exhibitors respectively.

During the event, the organizer also invited industry experts from organizations such as Fastener Training Institute (FTI) to hold seminars to discuss the industry's most concerned issues (e.g. fastener manufacturing, lightweight fastening trends & design, etc.). A tour to Brighton-Best Inc. in the U.S. was also arranged.

The organizer has announced after the show that the next edition of Fastener Fair USA will be held on May 28-29, 2025 in Nashville.

heat treatment companies. In addition, there were overseas exhibitors such as Hyodong Machine from South Korea, Sacma from Italy, and Nedschroef, as well as many renowned fastener products and machine manufacturers from Taiwan. Fastener World was also one the exhibitors this year, distributing publications on-site and introducing the companies in the publications as well as the Fastener World export matchmaking platform to visitors from China and around the world to create export connections.

This

must-visit annual show for fastener professionals across China was held on May 22 to 24. It used two exhibition halls totaling the area up to 42,000 square meters. According to the exhibitor registration statistics by the organizer, 690 fastener and related exhibitors participated in the show, which successfully attracted tens of thousands of visitors from home and abroad within the 3-day event, once again proving its status as the cornerstone for Chinese fastener industry to expand sales. Fastener World also exhibited at the show to bring you first-hand market intelligence.

Fastener World's on-site staff reported that the overseas visitors were mainly from Central and South America, with Mexico being the largest visitor source, and some visitors from the United States coming to meet with Chinese suppliers. In addition, the prices of standard fasteners in China are now very low and competition is intense. The local Chinese market is saturating up, so many local companies are turning to export. Last but not least, due to EU anti-dumping duties and the US-China trade war, Chinese machinery exhibitors have now switched their sales targets from Europe and the U.S. to developing countries such as Mexico, India, and South America.

Fastener World on-site staff observed that the exhibitors could be categorized into fastener products, forming machines, inspection and sorting machines, packaging machines, raw materials & steel, tools and dies, and

As the show closed, the organizer quickly announced that the 2025 edition will be held at Shanghai World Expo Exhibition & Center from May 22 to 24 again, contributing momentum to the development and prosperity of the fastener industry.

For this edition, the organizer planned pavilions of Germany, Taiwan, and China. In addition, an exhibitors exchange meeting titled "The Journey Towards Sustainability and Carbon Neutral in Manufacturing" was held for discussing topics including sustainability, carbon neutrality, greenhouse gases, and ISO 14064 certification.

2024 越南胡志明國際工具機暨金屬加工設備展 當地最大級機床、精密工程與金屬加工技術展會

Exhibition & Convention Center opened its gate for MTA Vietnam from July 2 to 5, 2024. According to the organizer’s released list of exhibitors, there were 322 exhibitors coming from Germany, India, Italy, Japan, Taiwan, South Korea, Malaysia, Poland, China, Singapore, Thailand, Turkey, the U.S. and Vietnam. The products displayed by the exhibitors related to the fastener industry included fasteners and hardware products, metal forming machines, power tools, tool holders, inspection equipment and gauges, packaging technology, dies, heat treatment technology, etc.