42 minute read

BHS) Permintaan Bahan Bakar Nabati di EU Tetap Stabil, sahut Lipido Santiga (ENG) Biodiesel Demand in the EU to Remain Stable, Says Lipidos Santiga

Permintaan Bahan Bakar Nabati di EU Tetap Stabil, sahut Lipido Santiga

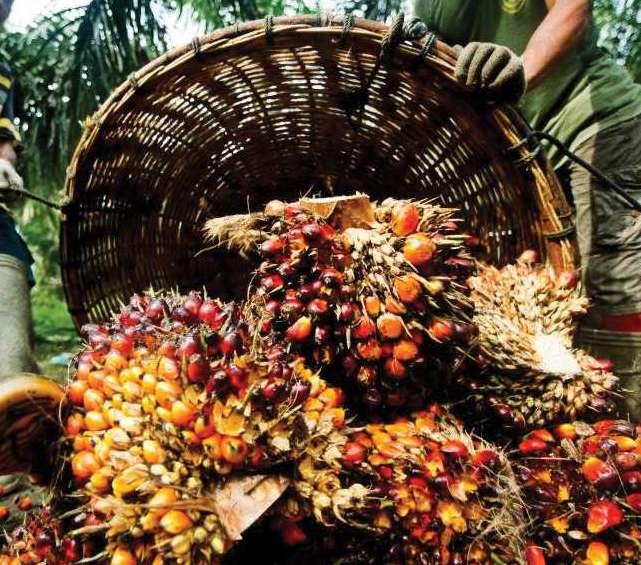

ermintaan bahan bakar nabati yang berasal dari minyak kelapa sawit di Uni Eropa (EU) diperkirakan akan tetap stabil pada tahun ini, menurut sebuah perusahaan minyak nabati terkemuka di Eropa. P Lipidos Santiga SA (Lipsa) mengatakan bahwa secara keseluruhan, penggunaan bahan bakar di EU telah menurun semenjak diberlakukannya penutupan akses keluar masuk untuk menhentikan penyebaran COVID-19. “Sektor bahan bakar nabati dapat merasa senang karena semua truk dan bus umum yang menggunkan bahan bakar membantu mempertahankan tingkat penggunaan bahan bakar selama masa penutupan,” kata direktur penjualan Lipsa, José Angel Olivero Garcia. “Penurunan pemakaian bensin dan bahan bakar pesawat jet jauh lebih tinggi,” tambah Garcia pada sebuah webinar yang diselenggarakan oleh Malaysia Palm Oil Council (MPOC). Dia mengatakan total konsumsi bahan bakar di EU pada tahun 2019 ada di angka 200 juta ton. Dalam halnya bahan bakar nabati, total penggunaan diestimasikan di angka 17 juta hingga 18 juta ton, atau 8.4% kandungan energi dari total produksi bahan bakar. Produksi bahan bakar nabati dalam negeri mencapai 15 juta ton, sementara angka impor bersih mencapai 2.5 juta ton. Garcia mencatat bahwa Spanyol menyaksikan penurunan 60% pada konsumsi bahan bakar, sementara di Eropa Utara, di mana lebih banyak menggunakan bensin daripada bahan bakar, lebih sedikit terpengaruh yang mengakibatkan sekitar 35% hingga 50% penurunan pengguaan bahan bakar. Sebagai akibat dari penutupan akses dan krisis ekonomi di EU, total permintaan bahan bakar diperkirakan akan menurun 10% hingga 20% tahun ini, lanjutnya. “Di sisi lain, positfnya adalah mandat bahan bakar nabati akan meningkat di mana akan mengimbangi tingkat penggunaan bahan bakar yang lebih rendah,” tambahnya. Sementara itu, di sektor pangan, Garcia mencatat bahwa kurangnya pariwisata pada daerah tersebut akan mengurangi konsumsi minyak kelapa sawit.“Banyak hotel yang menawarkan paket all-in, sehingga banyak turis mengambil apa yang bisa mereka ambil,” tambahnya. Selain itu, langkah-langkah menjaga jarak sosial menyebabkan lebih sedikit perayaan dan acara juga menjadi faktor yang merugikan. Ini karena komponen utama dalam kue dan kue kering adalah margarin, yang terbuat dari minyak kelapa sawit, kata Garcia. Dan juga, minyak kelapa sawit memiliki reputasi buruk di daerah ini. “Singkatnya, minyak kelapa sawit akan menjadi bagian kecil di Eropa. Bukan hanya kurangnya pemakaian di dalam makanan, juga karena ia mulai tergantikan di pasar bahan bakar nabati. Jika hal itu terjadi, maka konsumsi minyak kelapa sawit akan menurun,” lanjutnya. Di bawah Pengarahan Energi Terbarukan II (Renewable Energy Directive II) dari EU, penggunaan bahan bakar nabati yang terbuat dari minyak kelapa sawit akan mulai dihapuskan secara bertahap mulai dari 2023 hingga 2030, karena dugaan masalah lingkungan.

Biodiesel Demand in the EU to Remain Stable, Says Lipidos Santiga

Palm oil-derived biodiesel demand in the European Union (EU) is expected to remain stable this year, says a leading European vegetable oils firm. Lipidos Santiga SA (Lipsa) said that on the whole, diesel usage in the EU has declined following the lockdowns instituted to halt the spread of COVID-19. “The biodiesel sector can be happy that all trucks and public buses run on diesel because they helped maintain the usage of diesel during the lockdowns,” said Lipsa sales director José Angel Olivero Garcia. “The collapse in gasoline and jet fuel has been much bigger,” added Garcia in a webinar organised by the Malaysia Palm Oil Council (MPOC). He said the EU’s total diesel consumption in 2019 was 200 million tonnes. In terms of biodiesel, total usage was estimated at 17 million to 18 million tonnes, translating into an energy content of 8.4% of total diesel production. Domestic production of biodiesel stood at 15 million tonnes, while net biodiesel imports totalled 2.5 million tonnes. Garcia noted that Spain saw a 60% decline in diesel consumption, while northern Europe, which uses more gasoline than diesel, was less affected resulting in an estimated 35% to 50% reduction in diesel consumption. As a result of the lockdowns and economic crisis in the EU, total diesel demand is expected to decline by 10% to 20% this year, he said. “On the other hand, a positive is that biodiesel mandates are set to increase and the higher mandates will compensate the lower diesel use,” he added. Meanwhile, in the food sector, Garcia noted that the lack of tourism in the region will hurt palm oil consumption. “Many hotels offered the all-included formula, so many tourists grabbed what they could at the buffet,” he added. Furthermore, social distancing measures which lead to fewer celebrations and outings will also be a detrimental factor. This is because a key component of cakes and pastries is margarine, which is made using palm oil, said Garcia. On top of this, palm oil has a negative reputation in the region. “Shortly, palm oil will be a minor oil in Europe. Not only because of its declining use in food, but also because of it being phased out of biodiesel. If that happens, the consumption of palm oil will come down,” he said. Under the EU’s Renewable Energy Directive II, the usage of palm oil-derived biofuels in the bloc will be gradually phased out starting in 2023 until 2030, due to alleged environmental concerns.

Industri Minyak Nabati India Menginginkan Pembatasan Impor Minyak Kelapa Sawit Murni

EW DELHI: Pemerintah seharusnya tidak mengeluarkan lisensi untuk impor minyak kelapa sawit murni kepada perusahaan untuk melindungi pabrik penyulingan dan petani minyak nabati, kata asosiasi dan analis minyak nabati. N Asosiasi industri minyak nabati Indian Vegetable Oil Producers Association (IVPA) dan The Solvent Extractors Association of India (SEA) telah meminta pemerintah untuk mengatasi masalah ini dan membawakan permasalahan ini kepada Menteri Perdagangan dan Industri Piyush Goyal. Pelaku industri ini juga mengatakan bahwa ketersediaan tenaga kerja untuk pengemasan dan memastikan petani mendapatkan dukungan harga minimum untuk mustar adalah hal yang yang harus diperhatikan untuk saat ini. Minggu lalu, pemerintah mengizinkan impor minyak kelapa sawit murni setelah pembatasan yang diterapkan di bulan Januari, untuk memastikan ketersediaan dan kestabilan harga pasar domestik.“Keputusan untuk mempermudah persyaratan mengimpor minyak kelapa sawit murni mungkin disebabkan oleh penutupan akses keluar masuk yang sedang berlangsung namun keputusan ini akan memiliki dampak buruk pada industri penyulingan minyak nabati domestik dan unit pendukungnya. India memiliki kuantitas dan kapasitas yang cukup untuk proses penyulingan minyak kelapa sawit mentah,” ungkap Sudhakar Desai, presiden IVPA dalam sebuah surat Kementerian Perdagangan. Total permintaan bulanan minyak kelapa sawit senditi telah menurun hampir 80% menjadi 350,000 ton hingga 400,000 ton pasca penutupan akses keluar masuk dikarenakan penjualan yang menurun, kata Atul Chaturvedi, presiden SEA. Permintaan ini dapat dengan mudah dipenuhi oleh kilang penyulingan minyak nabati domestik. Chaturvedi mengatakan, bahwa petani mustar yang sedang memanen hasil panen mendapatkan harga di bawah MSP yaitu 4,410 Rupee India per kuintal dan impor minyak kelapa sawit murni akan memperburuk situasi petani-petani dengan menurunkan realisasi produk mereka. Pada saat ini, harga minyak kelapa sawit mentah berada di 680 Rupee India per 10 kg dalam pasar grosir mirip seperti harga pada bulan lalu, sahut Sandeep Bajoria, presiden direktur firma konsultan minyak Sunvin Group. “Harga sedang berada di batas wajar, permintaan telah menurun dan kami tidak menyarankan impor minyak kelapa sawit murni diizinkan,” tambahnya. India telah mengimpor 15 juta ton minyak nabati dari Indonesia, Malaysia, Ukraina dan Amerika Serikat setiap tahun dan di antaranya termasuk 9 juta ton minyak kelapa sawit.

India’s Edible oil industry wants import of refined palm oil to be restricted

NEW DELHI: The government should not issue licenses for import of refined palm oil to companies to protect local refiners and oilseed growers, said edible oil associations and analysts. Edible oil industry body Indian Vegetable Oil Producers Association (IVPA) and The Solvent Extractors Association of India (SEA) have asked the government to addresses the issue and given representation in this regard to Commerce and Industry Minister Piyush Goyal. The industry also said that labour availability for packing and ensuring farmers get minimum support price for mustard should be the focus for now. Last week, the government had allowed imports of refined palm oil after restricting them in January, to ensure availability and stable prices in the domestic market. “The decision for easing the conditions for import of refined palm oil might be due to the present lock-down situation but this will have an adverse impact on the domestic edible oil refining industry and its ancillary units. India has sufficient quantity and capacities to refine the crude palm oil,” said Sudhakar Desai, president, IVPA in a letter the Commerce ministry. The total monthly demand of palm oil alone has come down by almost 80% to 3.5 to 4 lakh tonne post the lockdown due to drop in institutional sales, said Atul Chaturvedi, president, SEA. This demand can easily be met by the domestic edible oil refining industry, said companies. Chaturvedi said, that mustard farmers who were harvesting the crop were getting prices below the MSP of Rs 4,410 per quintal and import of refined palm oil will further add to the woes of the farmers by way of lower realisation for their produce. Currently, the crude palm oil prices are at Rs 680 per 10 kg in wholesale which is similar to a month ago, said Sandeep Bajoria, chief executive officer of oil consultancy firm Sunvin Group. “Prices are in a reasonable range , demand has dropped and we don’t think it’s advisable to allow refined palm oil import,” he said India has been importing 15 million tonnes of vegetable oils annually from Indonesia, Malaysia, Ukraine and USA and out of this palm oil comprises 9 million tonnes.

Steering the Indonesian Palm Oil Industry out of the Pandemic

I will cover the analysis of challenges and industrial opportunity in the downstream of the palm oil sector in the middle of COVID-19. There are three parts that I would like to discuss the performance in the palm oil industry in Indonesia, the impact of the COVID-19 pandemic in the palm oil industry, and the ways government and companies did so far to minimize the impact of this outbreak to the palm oil industry. We can see that the palm oil industry’s role in our economy is quite high especially in the absorption of the manpower from the upstream to employ 4.3 million workers. The downstream sector employs around 4.2 million workers and there are around 12 million workers involved in the processing of palm oil. The palm oil economy is quite big; from the upstream to downstream absorbs more than 20 million workers. If we assume a household, the palm oil-based economy is providing livelihood to more than 90 million people in Indonesia. In 2019, the export is 21.4 billion USD and the contribution is around 13% to the non-oil and gas. This is one of the biggest single sector income in Indonesia. Starting in 2016, the contribution of our export is more than our oil and gas contribution. The PDB/gross income of the palm oil business provides security to our energy which comes from the biofuel supply. This contribution is for the raw material, such as for the cooking oil. This is the highlight of the Indonesia profile palm oil industry, which we are supported by the plantation with more than 16 million hectares of palm oil plantation in 16 provinces. The production of crude palm oil (CPO) is around 52 million tonnes and this is the increase of non-percent increase compare to 2019. The CPO is around 5.69 million tonnes and the local consumption of palm oil is around 16.7 million tonnes. We also have CPO and derivatives products with around 35.7 million tonnes being exported. The biodiesel of the export country such as China is exported together to the European Union (EU). We have palm oil plantation and factory for CPO and crude palm kernel oil (CPKO), with 86 companies in the refinery industry with capacities up to 56 million tonnes per year. The biodiesel industry consists of 19 industries with capacities of 12 million kl per year. The oleochemical industry is 21 with capacities of 11.3 million tonnes per year. The biodiesel industry in fatty acid methyl ester (FAME) is developing whereas, in 2019, the absorption is around 6.82 million kl. We hope to target around 9.6 million kl in 2020. The biofuel development in Indonesia is endorsed by Indonesian policy. We have government regulation 24, 2015 and we also have presidential regulation 61, 2015 regarding the collection and the utilization of the plantation funding and revised by presidential regulation 66, 2019. The government has provided a policy for the export collection to provide replanting and also to support the renewable from the palm oil. We can see that the impact of COVID-19 in the downstream sectors such as in the industrial operational, mobility disruption, and market access. The industrial operational is still working on the reduction of the capacity and the production utility. We have the policy of large-scale social restrictions (PSBB) here in Indonesia and the government has a secular letter from the ministry of industry number 4, 2020 for the operational license for mobility and utilization. The palm oil industry can continue with implementing the health protocol under PSBB. We still don’t have any layover from the employees in the palm oil industry although there are changes in the way they work because of PSBB and also with the restriction of production to the foreign country. We have limited carriers in the mobility disruption because of the lockdown in the exported countries. For the document of export and import for the inspection, we found the report showing the difficulty of work from home and in the office but only at the beginning of PSBB We also notice the hindrance of mobility problem but it's only at the beginning of PSBB. However, the price of CPO among the farmers' level is still good. The export market access is quite increasing especially for soap, noodles, and the raw material for soap such as fatty acid and (FOH). Food such as cooking oil and padatan is quite slow but the domestic markets such as soap and daily food are increasing. Indonesia's government committed to the policy of B30 or the biodiesel mixture programme, thus we can absorb the production of palm oil although it’s slightly reducing in this pandemic time. Here are several policies that have been issued by the government : i) the ministry of finance regulation regarding tax incentives on number 23 and 22 for parties that are infected by the COVID-19. ii) tax facilitation for article 21 and also the final income text which is bear by the government. iii) tax is being weaved for certain areas for export and import. iv) the ministry of industry has secular letter numbers 4, 7, and 8; all in 2020 provides a license for operational and mobility during the PSBB in this pandemic time. v) the facilitation for the SBE waste management facilities which are letter number 320. vi) the letter from the minister of industry number 368 which is the discount for the industrial electricity price.

Ir. Edy Sutopo, M.SI,

Director for Forest and Agriculture Based Industry, Ministry of Industry Republic of Indonesia.

We provide incentives to reduce the electricity cost which is suggested by the Ministry of the Industry and we also have other policies for the guest. There are also other issues that we are still battling such as; restructure the loan for funding on working. However, this is still in process and we have yet to issue the policy. Indonesian government remained committed to the B30 policy as this programme is beneficial for the palm oil industry in large. The tangible benefit is in the demand management where we can create a demand for biodiesel so we can maintain the CPO global price. The other benefits are the production of B20 in 2019 which is around 6.7 million kl, to employ around 435, 000 plantation workers, to reduce 16 million tonnes of CO2 equivalent, and the import of fuel around 6.64 million kl. This is how we relate the B30 programme on the task and function of the Ministry of the Industry. One of our tasks is to endorse a more conducive business climate, thus we are issuing a policy for the industry and investment to endorse for the development and the downstream palm oil business. The Ministry of the Industry has issued a mobility permit for the palm oil industry which means they can remain in operation during the pandemic time but with maintaining the health protocol. From 2010 until 2020, we recommended eight biodiesel factories to be given text allowance. B30 mandatory policy is a part of our national energy provision road map which starts from biodiesel such as B30 and B40. We have green fuel which is; the green diesel, green gasoline, and greenavtur. We have started the development and try the testing for co-processing in Pertamina. At the moment we are designing for the stand-alone and other programmes concerning this bio-energy policy. We wish for the biodiesel, biofuel, battery, and natural gas to be used in the automotive industry. This is the potential for the palm oil-based renewable energy source that we can save from 70 tonnes in 2008. However, in 2019, it becomes 48 tonnes and we also have the nickel opportunity for the battery. The table roadmap for the development palm oil-based industry discusses; i) B15 for micro and non-PSO transportation and commercial business from April 2015. ii) B25 for electricity/power generation from April 2015. iii) B20 for household, micro-business, industry, and commercial and non-PSO transportation from January 2016 and B30 for power generation. iv) B30 for the biodiesel mixture programme in January 2020. The Indonesian government has stayed in their commitment to the roadmap that in 2020, we need to implement B30 although we have several hindrances such as the pandemic and the reduction in solar demand. We target for B40 in July 2021 thus we can use FAME and fossil solar. In 2021, the green solar can be received by the co-processing under Pertamina but probably the stand-alone won't be available by then. The factories for green fuel in which raw material is 100% CPO, we hope can start by 2024. In recent times, there are several investors such as from Japan who wish to be a part of this. Next, I would like to talk about the export potential of FAME in 2020. From 2009 and 2019, all the domestics need can be fulfilled as APROBI has submitted the proposal for biodiesel export license recommendation. We have responded with the director-general (DG) letter to the DG of renewable energy from the ministry of energy and mineral resources number B/161/IA/IND/2020. We gave support for the biodiesel export during the pandemic of COVID-19. If we give an assumption that there is demand reduction and that COVID-19 will be finished by July 2020, we will have a reduction of demand. However, if the pandemic goes more than July 2020, the reduction will be more significant and this can be an opportunity for Indonesia to export.

Rino Afrino ST, MM, Secretary

General of the Indonesia Palm Oil Smallholder’s Association (APKASINDO)

I will discuss on the Indonesian smallholders versus COVID-19. We are from Indonesia Palm Oil Smallholder’s Association (APKASINDO). APKASINDO is a professional organization of oil palm smallholders. We are 20 years of age our branches are in 22 provinces with 170 regencies throughout Indonesia. We are a part of the Indonesian palm oil industry and it’s been quite a long journey. APKASINDO involves all types of smallholders including independent farmers. The data from the Ministry of Agriculture show that the land coverage of Indonesia oil palm is about 16.38 million hectares and the portion of the land coverage is about 6.72 million hectares. This is from the east to the west; from Acheh province to Papua province. One of the classical issues in people’s oil palm plantation is that productivity has not been optimized yet. The president of Indonesia, Joko Widodo has launched a strategic rejuvenation of oil palm programme to aid the farms that are not productive because of bad seed/not being harvested. 2.8 hectares will become the target of the rejuvenation programme. APKASINDO functions to encourage the growers/farmers to participate in the good programme by the government and for the growers/farmers to have member cards as oil palm farmers. This is as we can help the farmers/growers to become professional so that they have food productivity and sustainability. It’s important how we can bridge the interest of oil palm smallholders, government, and private sectors in the context that which is a win-win situation that doesn’t cause any disadvantages to any parties. Lastly, we also advocate and facilitate the smallholders of anything that may disadvantage them. During the beginning of the pandemic, we conducted a survey to the farmers which spread to 37 provinces on 100 people on a certain platform. We found that in the villages : i) 82.9% of farmers didn't possess positive COVID-19 cases. ii) 62.8% of farmers mentioned that there was no COVID-19 influence or effect daily. iii) There was no significant impact or influence in terms of the total number of yield in routine harvesting iv) 90.2% of farmers stated that the harvesting schedule didn’t change. v) Farmers feel there's no change in terms of pricing/the factories/mills faced with no change in servicing in buying/receiving FFB. vi) Farmers experience price fall although compare to the same month last year, in 2020 the price is relatively higher and better. The data of prices of oil palm farmers in the Riau province shows that start from the B30, biodiesel increase in January but slowly declined from February to March. Nevertheless, it increases from March to April, leading up to the end of Ramadhan and dropped until May. At the end of Ramadhan, the price rebounded. Today, the price is increasing and the average price is about 1500/FFB. Throughout 2019, the price is under 1400 approximately. It is interesting that in 2018, the price tends to be relatively high over 1700Rp. By June 2018, the price started to decline. There was no export in 2019 as the gross and the price remain the same. We are grateful that during the pandemic from January to June, the price condition is relatively stable and well.

vii) 39.5% of farmers are experiencing a reduction of income from their yield whereas the remaining is still the same as the usual price. viii) 57.3% of respondents stated that the mills didn’t comply with the price. ix) Oil palm farmers mostly don't want to receive any assistance due to the pandemic as there actively assist in the form of face mask as well as essential food products to the people living in the community area. Several important points that we would like to convey : i) The price of FFB of farmers are better in 2019 ii) The economic condition of oil palm farmers is quite well. Plus, the mill should not be closed therefore we would like to thank the regional government and the governor as they firmly issued a letter to the mills to remain open to buy FFB from farmers. 32

iii) The oil palm farmers didn’t want to receive any assistance from the government so a lot of them have conducted social events instead of the communities living around the oil palm plantations. iv) There is a bit concern on COVID-19 but the farmers/growers are working with conditions under the sun which is quite hot and adhere to the health protocol wearing a face mask, washing hands, and avoiding crowds. v) The low price of FFB received by the farmers because the mills don’t comply with the pricing determined by the government.

Several important points that we would like to convey; i) The price of FFB of farmers are better in 2019 ii) The economic condition of oil palm farmers is quite well. Plus, the mill should not be closed therefore we would like to thank the regional government and the governor as they firmly issued a letter to the mills to remain open to buy FFB from farmers. iii) The oil palm farmers didn’t want to receive any assistance from the government so a lot of them have conducted social events instead of the communities living around the oil palm plantations. iv) There is a bit concern on COVID-19 but the farmers/growers are working with conditions under the sun which is quite hot and adhere to the health protocol; wearing a face mask, washing hands, and avoiding crowds. v) The low price of FFB received by the farmers because the mills don’t comply with the pricing determined by the government.

The question is how this national strategic programme that has a direct impact on the increase in productivity and strengthening the economy helps the oil palm farmers to continue to operate. The government conducted a programme called the People Oil Palm Rejuvenation Programme and perhaps about 2 million hectares of land belonging to farmers and households will be involved. This functions to increase productivity by twice than before. The next strategic programme is in the process and we will continue the land certification programme for the farmers. This agricultural reformed programme relates to the availability of land that has not to be cleared to the farmers in the forest areas. This follows with the partnership, capacity building, or human resources as well as institutional reinforcement which 1200 smallholders children have been receiving the scholarship. Lastly, we hope that productivity will increase and farmers/growers will be more creative.

Dr. Suroso Rahutomo,

General Manager of Strategic Business of Indonesia Oil Palm Research Institution.

I would like to discuss the expectation of the Indonesian palm oil industry on the COVID-19 pandemic, especially among the smallholders. We will talk on the palm oil industry at a glance, COVID-19 impact, together with the adaptation strategy and challenges. Our export countries in the EU and Asia such as China, India, and Spain are impacted by the pandemic greatly. Thus, more or less it also impacted our export performance to those countries. However, in Indonesia, the provinces that used to be the basis of the palm oil industry are relatively not impacted. Many COVID-19 cases are on Java island but not on the islands of palm oil plantation basis such as North Sumatera and Kalimantan. The two provinces such as Riau and North Sumatera which is the largest palm oil estate is much better to compare with the case of COVID-19 in Java. To compare 2019 and 2020, our export will not change much as the improvement is from domestic consumption. We believe this is related to the government's ongoing B30 programme. We also expect production as it runs from 33.3 million tonnes and for it to have a suitable increase this year of 44.7 million tonnes. There’s a correlation between the pandemic with the CPO export performance. Some of the export drifted product data that we received are increasing and it’s relevant to the need of the global society of certain products related to health and sanitary. However, up until May this year, we received few data for biodiesel export. We saw this significant increase in the export but we have not yet received any data whether this is relevant to the reduction of activities of the export countries of Indonesia biodiesel. This will require further study.

As mentioned by Mr. Rino Afrino previously, they have surveyed COVID-19 impact on smallholder plantation and we also have conducted a similar survey but we compare it to the private companies in several countries. The data that we get shows the impact of what they do concerning activities related to the maintenance of the plants that are not in the production. There’s a reduction in fertilizer application, pruning activities, and LCC management for the non-producing plants' smallholders plantation but this doesn't occur in the big plantation. For the producing

palm oil plants, there are changes in the management on the field, especially among smallholder plantations. There are several growers with good institutional management but some do not. Few of the growers/plantations do not have any affiliations. Nothing has changed for the big plantations as they are still applying fertilizers. This is different from the smallholders during the COVID-19 pandemic as they reduce the fertilizer, activity maintenance, and pest issues. Concerning the turn over with the workers; there’s a big turn over for the smallholders before the pandemic, from 51 respondents before COVID-19 around 51% however there’s not much turnover during the pandemic which means that their workers are not in and out. This is different for the big plantation as the turnover is bigger during the COVID-19 outbreak. They don't do layover or reduce the laborers. Many of the smallholder plantations are reducing the budget for maintenance and fertilizer. In my opinion, the survey is still developing and ongoing. During the outbreak, several respondents have mentioned that there is a decrease in the price so they reduce the fertilizer and maintenance activities. There are several adaptation strategies; from our study that we conducted several months ago before the pandemic, several of our respondents in the smallholders are interested in utilizing the biomass but we’ve yet to explore this further. We hope that the smallholders can mix their plants with other farming if their plants are not in the production which can help their generation to steer out from the situation of where their plants are not in the production or the price is low. We saw that if the institutional capability and management are stronger, the smallholders have resilient and they can adapt and survive in circumstances such as pandemic and price reduction apart from the management side. They also have income generation and support from their affiliation. The respondent is not receiving any social support from the government but several farmers are not strong in institutional management plus affiliation are happy to receive it. Plus, they also expect to have a price subsidy for fertilizer. The places which are far from the fertilizer factory experienced very expensive pricing for fertilizer at the beginning of the pandemic. We also have lots of restrictions during the PSBB thus farther houses from the warehouse will experience an issue regarding this. Therefore, we hope that we will have a partnership between smallholders and big plantations in the future as the price received by smallholders are less than the big plantation. I believe that they’re a lot of potentials that can be developed to improve the downstream industry, especially for smallholder plantations. I hope that we will get into industrialization at the smallholders' level for the new normal. If we can implement CPO to become biodiesel, the smallholders can sell it and not only the raw material. Hopefully, this idea can be achieved and the smallholders can become a player for this downstream level as well. Several challenges that we experience during the pandemic; i) CPO-Fund Export Levy increased to 55 USD MT-1 CPO. The fund disbursement for biodiesel was claimed to have an only subtle impact on smallholder. ii) Palm oil smallholder's population Mapping remains questionable as there are around 40% of the current population. iii) Smallholders Replanting Programme (PSR) realization. iv) Smallholder incompliance to GAP (good agricultural practices) and ability to be certified (ISPO/RSPO). v) Forest Fires anticipation in the upcoming S2 (Q3-4) due to the dry season. We also hope that the government supports the rejuvenation for the smallholders' plantation for them to increase good aggregate practices so they can attain the ISPO/RSPO certification. I would like to stress again between the realization of CPO production tonne/hectares between the actual realization; the gap is still high. If our national average is 3.4 and the variety is around 6-8 tonne/hectare, this has been going on for a long time now since early 1980. The productivity of palm oil is quite different and slowly compare to rice plantation. There’s a policy being introduced in 1980 and they have improved the production. We hope this can be enjoyed by the palm oil plantation and that we can dive into good agricultural practices for palm oil after the pandemic. At the end of this year, we are entering the dry season thus we will face forest fire which is very much directed to the palm oil factory.

To view this webinar in Bahasa Indonesia or join the latest ones, please log on to: www.asiawebinars.com The Indonesia Palm Oil Webinar is organized by Meet The Expert and Palm Oil Today Indonesia is Pround to be an official partner.

Industri 4.0 di Pabrik Minyak Kelapa

Ditulis oleh Hong Wai Onn, Insinyur Teknik Kimia Profesional, Malaysia

alaupun kita masih belum berpindah-pindah dengan roket di punggung kita, namun kehidupan dalam beberapa tahun ini masih sangat berbeda bahkan dengan sepuluh tahun yang lalu, terutama dengan perkembangan W teknologi dan penemuan-penemuan yang kita lihat setiap tahun. Dalam dekade terakhir, menggunakan aplikasi untuk memesan transportasi ataupun mengirim uang ke teman-teman anda atau membeli segala sesuatu hingga pakaian, pengiriman makanan, bahan makanan, dan banyak lagi telah menjadi hal yang biasa dan berbicara dengan pengeras suara untuk menyalakan lampu, memainkan lagu, atau membacakan resep menjadi hal yang normal. Kita memang bener sedang berada di ambang revolusi teknologi yang akan merubah cara kita hidup, bekerja dan berhubungan satu sama lain secara mendasar. Sebelum kita telusuri lebih dalam, mari merefleksikan perkembangan revolusi industri. Revolusi Industri Pertama menggunakan air dan uap sebagai penggerak mesin produksi. Yang Kedua menggunakan tenaga listrik untuk berproduksi secara massal. Yang Ketiga menggunakan perangkat elektronik dan informasi teknologi untuk mengotomasi produksi. Dan pada saat ini Revolusi Industri Keempat dibangun di atas fondasi dari yang Ketiga, revolusi digital yang telah berlangsung sejak pertengahan abad terakhir. Ciri-cirinya adalah perpaduan teknologi yang menghilangkan batas antara fisik, digital dan biologi. Jelas bahwa masa depan teknologi akan terus merevolusi kehidupan kita. Meskipun saya juga tidak tahu persis bagaimana hal itu akan terjadi, namun satu hal yang pasti kita, terlebih lagi industri kelapa sawit, tidak dapat berpaling dari gelombang perubahan. Industri minyak kelapa sawit merupakan kontributor yang signifikan terhadap ekonomi Malaysia dan dalam perihal sumber daya alam berada di peringkat kedua di bawah minyak dan gas. Total ekspor minyak kelapa sawit Malaysia dan turunannya menghasilkan 64.8 miliar Ringgit Malaysia (atau 3.5 persen dari produk domestik bruto) kepada negara di tahun 2019. Untuk berkembang dan tetap kompetitif secara global dan tetap relevan, industri pengolahan minyak kelapa sawit khususnya harus mengadopsi dan melengkapi dirinya dengan teknologi dan inovasi terbaru. Teknologi baru seharusnya menjadi katalis untuk modernisasi seluruh industri, membuatnya menjadi lebih produktif dan efisien sambil meningkatkan pertumbuhan dan penambahan nilai. Saya percaya sangat penting bagu industri untuk terus bergerak maju menuju otomatisasi dan memanfaatkan Industri 4.0, bagian dari Revolusi Industri Keempat yang berhubungan dengan industri tersebut. Penerapan Industri 4.0 tidak hanya akan meningkatkan efisiensi operasional industri pengolahan minyak kelapa sawit secara keseluruhan namun juga menghasilkan pengembangan yang berkelanjutan, di mana presisi dari operasional terlihat dari pengurangan tenaga kerja, pengurangan resiko persediaan, keamanan proses, kualitas dan kontaminasi, serta peningkatan produktivitas.

Sudah jelas kita perlu berubah

Sudah terbukti kalau perubahan pasti terjadi. Namun apakah industri pengolahan minyak kelapa sawit sudah siap menghadapi perubahan? Dengan menggunakan ilmu pengetahuan dan teknologi melalui PORIM (Palm Oil Research Institute of Malaysia) dan pada saat ini melalui MPOB (Malaysian Palm Oil Board), ada banyak sekali peningkatan dan perubahan berbagai unit operasional di pabrik pengolahan minyak kelapa sawit Malaysia, tetapi mereka belum mengalami perubahan yang signifikan semenjak publikasi laporan Mongana oleh ilmuwan Kongo pada tahun 1950-an. Masih ada ruang untuk perkembangan, terutama di bagian kontrol proses dan otomatisasi. Ketika saya menjadi dosen tamu di universitas lokal belum lama ini, seorang mahasiswa teknik kimia bertanya kepada saya mengapa industri pengolahan minyak kelapa sawit jauh tertinggal dari Industri 4.0. Ini sungguh pertanyaan yang bagus. Banyak alasan yang bisa menunda revolusi, tetapi saya berharap bukan disebabkan oleh keengganan berubah. Ada orang yang mungkin akan menolak perubahan karena mereka merasa nyaman dengan margin keuntungan yang ada dan merasa mempertahankan level pada saat ini lebih mudah. Namun kenyataannya ketika kita sedang duduk nyaman berpikir bahwa semua sedang baik-baik saja (misalnya kita adalah perkebunan biji minyak yang paling efisien pada saat ini, kita lebih unggul daripada minyak nabati dan minyak kelapa sawit yang lain), kompetitor kita baru saja membeli mesin baru untuk perahu motor mereka (misalkan hasil panen kedelai di negara-negara penghasil utama meningkat 20 persen dalam 15 tahun terakhir), dan kita bukan hanya ketinggalan, kita juga sudah melenceng dari target. Saya menyukai buku yang merincikan kegagalan dibandingkan dengan buku yang berisi kisah sukses. Biarkan saya berbagi satu cerita tentang kegagalan di dunia bisnis. Kodak adalah raja di dunia fotografi. Secara umum, Kodak menemukan fotografi pada abad ke-20. Mereka menyempurnakan teknologinya dan pada tahun 1990-an kios Kodak dapat ditemukan di mana-mana. Lalu, pada akhir tahun 1990-an fotografi digital mulai menjadi sebuah tren, dan Kodak memilih untuk menghiraukannya. Ada yang akan mengatakan begitulah nasib pemain “lama”, tetapi Nikon dan Canon merangkul perubahan digital dan muncul sebagai pilihan unggulan lagi, sementara Kodak yang terus menerus mengabaikan teknologi baru tersebut akhirnya menyatakan bankrut pada tahun 2012. Meskipun perusahaannya masih ada hingga saat ini, anak-anak muda mungkin tidak ada mengenali nama tersebut. Banyak orang akan mengatakan bahwa ini adalah kasus yang jarang terjadi di mana Kodak gagal melihat peluang baru dan beradaptasi. Benarkah demikian? Bagaimana dengan Yahoo!, Nokia dan BlackBerry?

Perlu ada perubahan paradigma dan saya percaya kita harus bekerja sama membentuk masa depan pengolahan minyak kelapa sawit yang mengutamakan manusia, memberdayakan mereka dan terus menerus mengingatkan diri kita bahwa mengingatkan diri kalau teknologu diciptakan oleh manusia dan untuk manusia. Misalnya, untuk menyederhanakan lingkungan kerja, mengurangi upaya manusia, mengurangi resiko keselamatan, dan lain-lain. Saya mengakui bahwa dalam penelitian industri dan pengembangan, komersialisasi bukanlah hal yang terutama dikarenakan adanya resiko. Pelaku industri perlu memiliki pola pikir yang inovatif sambil mempertimbangkan resiko teknis dan masa pengembangan. Para pengolah perlu diedukasi dan diajak melihat ada banyak solusi di luar sana untuk masalah yang konvensional. Para peneliti dan universitas-universitas harus lebih sering melibatkan para pengolah pada tahap pengembangan untuk mengurangi penundaan. Pada saat ini ada kekurangan dana untuk penelitian dan beberapa universitas meneliti dampak ekonomi terlebih dahulu dengan mencari mitra industri terlebih dahulu. Sementara industri pengolahan minyak kelapa sawit berada di belakang industri penyulingan dan oleokimia dalam hal Industri 4.0, dan sungguh memberikan harapan melihat adanya inisiatif yang dimulai. Sime Darby Plantation telah membangun contoh pabrik pengolahan dengan sensor, alat kontrol, dan spektrofotometer infra merah jarak dekat. Pabrik ini juga menggabungkan teknologi pengawasan dan akuisisi data yang pada saat ini jarang ditemukan di pabrik pengolahan minyak kelapa sawit dan akan membwa industri ke tingkat Industri 3.0, serta berpotensi naik hingga level Industri 4.0. Ada juga contoh pabrik pengolahan minyak kelapa sawit yang dibangun oleh Novozymes Malaysia, sebuah perusahaan bioteknologi global yang berkantor pusat di Bagsværd, di luar Kopenhagen, untuk melakukan percobaan solusi biologi mereka dan mempelajari aliran keseimbangan massa. Mereka juga menggunakan alat digital dan teknik analisis data untuk meneliti proses pengolahan minyak kelapa sawit di pabrik contoh ini. Saya percaya bahwa ini adalah langkah yang tepat untuk industri. Kita seharusnya tidak hanya berinvestasi pada infrastruktur teknis dan kemampuan analisa data, namun menciptakan sistem pengendalian yang cerdas namun sederhana.

Pabrik-pabrik gelap?

“Pak, seperti apa tampak industri di masa depan?” tanya seorang mahasiswa pada saat saya mengakhiri pengajaran saya mengenai Industri 4.0. Saya masih ingat betapa bingungnya mereka pada saat saya menjawa pertanyaan dengan sebuah layar hitam. Saya memberi tahu para mahasiswa, “Pabrik-pabrik gelap mungkin akan menjadi masa depan!” tambah saya, “pabrik-pabrik di masa depan akan beroperasi 24 jam setiap hari dalam kondisi gelap. Mereka tidak memerlukan penerangan karena pekerjanya adalah robot yang diprogram.” Meskipun saya tahu hal ini tidak mungkin terjadi di pabrik minyak kelapa sawit dalam semalaman, Saya berharap kita bisa menyaksikan langkah perubahan revolusi industrim seperti yang telah saya bayangkan selama ini. Sementara ada kisah sukses dalam mengukur kadar minyak minuman keras menggunakan alat analisa infra merah jarak dekat (untuk tujuan mengontrol tingkat dilusi), kita harus memanfaatkan pelajaran ini pada aliran proses yang lain. Saya selalu percaya bahwa suatu hari kita dapat membahas secara ilmiah mitos potensi minyak kelapa sawit yang telah membingungkan industri selama beberapa dekade. Pabrik pengolahan minyak kelapa sawit bisa sepenuhnya diotomatisasi untuk mengurangi upaya manusia, dan juga mengurangi resiko keselamatan karena pekerja akan beroperasi dari ruang kontrol. Alat digitalisasi hars diadopsi untuk membuat keputusan yang lebih baik dan mempermudah pekerjaan kita. Hal ini akan meningkatkan produktivitas dan mengurangi biaya. Tidak mungkin terus menerus ditekankan betapa pentingnya Industri 4.0. Kita perlu mengembangkan pemimpin dengan keterampilan untuk mengatur pabrik pengolahan dan organisasi untuk melalui perubahan drastis ini. Sebagai profesional, kita perlu merangkul perubahan dan sadar kalau pekerjaan kita pada hari ini akan sangat berbeda pada masa depan yang tidak terlalu jauh. Sistem pendidikan dan pelatihan kita perlu beradaptasi agar dapat lebih baik mempersiapkan tenaga kerja dengan hal yang mereka perlukan di tempat kerja pada masa depan, yaitu fleksibilitas dan keterampilan untuk berpikir kritis. * Hong Wai Onn adalah seorang insinyur teknik kimia profesional ** Ini adalah opini pribadi penulis ataupun perusahaan publikasi dan tidak selalu mewakili pandangan Palm Oil Today Indonesia. We may not be zipping around with rockets on our backs, but life in recent years is still remarkably different than it was even a decade ago, especially with constant technological advances and inventions coming out every year. In the last decade, using an app to hail a ride or send money to your friends or make purchases for everything from clothes, food delivery, groceries, and more has become commonplace and talking to smart speakers to turn on lights, play music, or read recipes seems normal. We are indeed standing on the brink of a technological revolution that will fundamentally alter the way we live, work and relate to one another. Before we move on, let’s reflect on the industrial revolution development. The First Industrial Revolution used water and steam to mechanise production. The Second used electric power to create mass production. The Third used electronics and information technology to automate production. And now the Fourth Industrial Revolution is building on the Third, the digital revolution that has been occurring since the middle of the last century. It’s characterised by a fusion of technologies that is blurring the lines between the physical, digital, and biological spheres. It’s obvious that the future of technology will continue to revolutionise our lives. While I do not yet know just how it will unfold, but one thing is clear we, especially palm oil industry, can’t run away from the waves of change. The palm oil industry is a significant contributor to the Malaysian economy and in terms of natural resources is second only to oil and gas. Total exports of Malaysian palm oil and its downstream derivatives in 2019 generated RM64.8 billion revenue (or 3.5 per cent of the gross domestic product) to the country. To progress while remaining globally competitive and relevant, palm oil milling industry particularly must adopt and equip itself with the latest technologies and innovations. New technologies should be the catalyst for modernisation of the whole industry, making it more productive and efficient while enhancing growth and value addition. I believe it’s important for the industry to move towards automation and capitalise on the Industry 4.0, the subset of the Fourth Industrial Revolution that concerns industry. The adoption of Industry 4.0 will not only enhance the overall operational efficiency of the palm oil milling industry but also result in sustainable development, where precision operation is evident in the form of reduced labour inputs, reduced risks in stocks, process safety, quality and contamination, and improved productivity.

It’s obvious we need to change

It’s evident that change is the only constant. But is the palm oil milling industry ready for the change? By placing science and technology through PORIM (Palm Oil Research Institute of Malaysia) and later until today MPOB (Malaysian Palm Oil Board), there were many incremental improvements and changes in various unit operations in Malaysian palm oil mills, but they have not changed significantly since the publication of Mongana report by a team of scientists in Congo in the 1950s. There is still room for improvement, especially on process control and automation. When I guest lectured at a local university not long ago, a chemical engineering student asked me why palm oil milling industry is lagging behind when it comes to Industry 4.0. This is indeed a good question. Many reasons could procrastinate the revolution, but I hope it is not because of reluctance. Some people may resist change simply because they could be complacent due to the high profit margin and feel maintaining the status quo is easier than rocking the boat.

But the truth is while we are sitting comfortably thinking that everything is coasting along fine (e.g. we are ahead of the curve compared to other vegetable oils and oil palm is by far the most efficient oil seed crop in the world), our competition has just brought a new engine for their speed boat (e.g. soybean yield has been increased by more than 20 per cent in the past 15 years in key producing countries), and we’re not only getting left behind, we are drifting off course. I like books that detail failures as more as books that detail success. Let me share with you a failure story from the business world. Kodak was the king of photography. By and large, Kodak invented the photography as we knew it in the 20th century. They perfected the technology and by the 1990s a Kodak kiosk was pretty much on every corner of every city around the world. Then, in the late 1990s digital photography started becoming a thing, and Kodak completely ignored it. Some would say that’s the fate of all “old” players, but Nikon and Cannon embraced digital and emerged as top players again, while Kodak kept dismissing the new technology until in 2012 it filed for bankruptcy. Even though the company is still around, young kids probably won’t even recognise this name. Many people would say this might be an odd case here and there where Kodak failed to spot new opportunities and adapt. Really? How about Yahoo!, Nokia and BlackBerry?

Embracing Industry 4.0 in palm oil mills

There needs to be a paradigm shift and I believe we should together shape the future of palm oil milling that works for all by putting people first, empowering them and constantly reminding ourselves that all of these new technologies are first and foremost made by people for people. For example, simplify the work environment, reduce human efforts, reduce safety risks, to name but a few. I acknowledge that in industry research and development commercialisation is not a priority due to the risk involved. Industry players need to have an innovative mindset bearing in mind technical risks and gestation period. The millers need to be educated and see there are many solutions outside of conventional answer. Researchers and universities should involve the millers at the developing stage to reduce the reservations. There is now less money for research and some universities do an economic impact first which includes finding an industry partner. While palm oil milling industry is trailing behind refinery and oleochemical industry in Industry 4.0, it’s indeed encouraging to see few initiatives have been originated. Sime Darby Plantation has built a pilot mill with a number of sensors, controllers, and near infrared spectrophotometer. This plant incorporates also supervisory control and data acquisition technology which is presently not widely used in palm oil mill and will bring the industry up to Industry 3.0, and potentially Industry 4.0, level. There is also another palm pilot mill built by Novozymes Malaysia, a global biotechnology company headquartered in Bagsværd outside of Copenhagen, to test their biological solutions and study mass balance flows. They also use digitalisation tools and data analysing skill to research the palm oil milling process in this pilot mill. I believe this is the right move for the industry. We should not only invest in technical infrastructure and data analysing capabilities, but also engineer a smart yet simple

system for process control.

Dark factories?

“Sir, what does the future industry look like?” asked a student when I was concluding my guest lecture on Industry 4.0. I remember how puzzling they were to me when I answered the question with a black slide. I told the students, “Dark factories could be the future!” I added, “factories in future will be operating 24 hours 7 days a week in the dark. They require no light as the workers are pre-programmed robot.” While I know this might not possible to realise in palm oil mills overnight, I hope we could at least witness a step change in technological revolution, just as I have daydreamed about. While there was a successful story in measuring press liquor oil content using Near-infrared analyser (for automatic dilution control purpose), we should capitalise this learning in other process streams. I always believe one day in future we can address scientifically the myth of total potential oil that has been puzzling the industry for many decades. Palm oil milling could also be fully automated to not only reduce human efforts, but also reduce safety risks as workers will be operating far from the control room. Digitalisation tools should be adopted for better decision making and make our work easier. This will lead to significant increase in productivity and can reduce costs. It is impossible to repeat too often that Industry 4.0 is important. We need to develop leaders with the skills to manage mills and organisations through these dramatic shifts. As professionals, we need to embrace change and realise that what our jobs are today might be dramatically different in the not too distant future. Our education and training systems need to adapt to better prepare people for the flexibility and critical thinking skills they will need in future workplace. * Hong Wai Onn is a chartered chemical engineer ** This is the personal opinion of the writer or publication and does not necessarily represent the views of Palm Oil Today Indonesia.